-

@ 04c915da:3dfbecc9

2025-02-25 03:55:08

Here’s a revised timeline of macro-level events from *The Mandibles: A Family, 2029–2047* by Lionel Shriver, reimagined in a world where Bitcoin is adopted as a widely accepted form of money, altering the original narrative’s assumptions about currency collapse and economic control. In Shriver’s original story, the failure of Bitcoin is assumed amid the dominance of the bancor and the dollar’s collapse. Here, Bitcoin’s success reshapes the economic and societal trajectory, decentralizing power and challenging state-driven outcomes.

### Part One: 2029–2032

- **2029 (Early Year)**\

The United States faces economic strain as the dollar weakens against global shifts. However, Bitcoin, having gained traction emerges as a viable alternative. Unlike the original timeline, the bancor—a supranational currency backed by a coalition of nations—struggles to gain footing as Bitcoin’s decentralized adoption grows among individuals and businesses worldwide, undermining both the dollar and the bancor.

- **2029 (Mid-Year: The Great Renunciation)**\

Treasury bonds lose value, and the government bans Bitcoin, labeling it a threat to sovereignty (mirroring the original bancor ban). However, a Bitcoin ban proves unenforceable—its decentralized nature thwarts confiscation efforts, unlike gold in the original story. Hyperinflation hits the dollar as the U.S. prints money, but Bitcoin’s fixed supply shields adopters from currency devaluation, creating a dual-economy split: dollar users suffer, while Bitcoin users thrive.

- **2029 (Late Year)**\

Dollar-based inflation soars, emptying stores of goods priced in fiat currency. Meanwhile, Bitcoin transactions flourish in underground and online markets, stabilizing trade for those plugged into the bitcoin ecosystem. Traditional supply chains falter, but peer-to-peer Bitcoin networks enable local and international exchange, reducing scarcity for early adopters. The government’s gold confiscation fails to bolster the dollar, as Bitcoin’s rise renders gold less relevant.

- **2030–2031**\

Crime spikes in dollar-dependent urban areas, but Bitcoin-friendly regions see less chaos, as digital wallets and smart contracts facilitate secure trade. The U.S. government doubles down on surveillance to crack down on bitcoin use. A cultural divide deepens: centralized authority weakens in Bitcoin-adopting communities, while dollar zones descend into lawlessness.

- **2032**\

By this point, Bitcoin is de facto legal tender in parts of the U.S. and globally, especially in tech-savvy or libertarian-leaning regions. The federal government’s grip slips as tax collection in dollars plummets—Bitcoin’s traceability is low, and citizens evade fiat-based levies. Rural and urban Bitcoin hubs emerge, while the dollar economy remains fractured.

### Time Jump: 2032–2047

- Over 15 years, Bitcoin solidifies as a global reserve currency, eroding centralized control. The U.S. government adapts, grudgingly integrating bitcoin into policy, though regional autonomy grows as Bitcoin empowers local economies.

### Part Two: 2047

- **2047 (Early Year)**\

The U.S. is a hybrid state: Bitcoin is legal tender alongside a diminished dollar. Taxes are lower, collected in BTC, reducing federal overreach. Bitcoin’s adoption has decentralized power nationwide. The bancor has faded, unable to compete with Bitcoin’s grassroots momentum.

- **2047 (Mid-Year)**\

Travel and trade flow freely in Bitcoin zones, with no restrictive checkpoints. The dollar economy lingers in poorer areas, marked by decay, but Bitcoin’s dominance lifts overall prosperity, as its deflationary nature incentivizes saving and investment over consumption. Global supply chains rebound, powered by bitcoin enabled efficiency.

- **2047 (Late Year)**\

The U.S. is a patchwork of semi-autonomous zones, united by Bitcoin’s universal acceptance rather than federal control. Resource scarcity persists due to past disruptions, but economic stability is higher than in Shriver’s original dystopia—Bitcoin’s success prevents the authoritarian slide, fostering a freer, if imperfect, society.

### Key Differences

- **Currency Dynamics**: Bitcoin’s triumph prevents the bancor’s dominance and mitigates hyperinflation’s worst effects, offering a lifeline outside state control.

- **Government Power**: Centralized authority weakens as Bitcoin evades bans and taxation, shifting power to individuals and communities.

- **Societal Outcome**: Instead of a surveillance state, 2047 sees a decentralized, bitcoin driven world—less oppressive, though still stratified between Bitcoin haves and have-nots.

This reimagining assumes Bitcoin overcomes Shriver’s implied skepticism to become a robust, adopted currency by 2029, fundamentally altering the novel’s bleak trajectory.

-

@ 6e0ea5d6:0327f353

2025-02-21 18:15:52

"Malcolm Forbes recounts that a lady, wearing a faded cotton dress, and her husband, dressed in an old handmade suit, stepped off a train in Boston, USA, and timidly made their way to the office of the president of Harvard University. They had come from Palo Alto, California, and had not scheduled an appointment. The secretary, at a glance, thought that those two, looking like country bumpkins, had no business at Harvard.

— We want to speak with the president — the man said in a low voice.

— He will be busy all day — the secretary replied curtly.

— We will wait.

The secretary ignored them for hours, hoping the couple would finally give up and leave. But they stayed there, and the secretary, somewhat frustrated, decided to bother the president, although she hated doing that.

— If you speak with them for just a few minutes, maybe they will decide to go away — she said.

The president sighed in irritation but agreed. Someone of his importance did not have time to meet people like that, but he hated faded dresses and tattered suits in his office. With a stern face, he went to the couple.

— We had a son who studied at Harvard for a year — the woman said. — He loved Harvard and was very happy here, but a year ago he died in an accident, and we would like to erect a monument in his honor somewhere on campus.

— My lady — said the president rudely —, we cannot erect a statue for every person who studied at Harvard and died; if we did, this place would look like a cemetery.

— Oh, no — the lady quickly replied. — We do not want to erect a statue. We would like to donate a building to Harvard.

The president looked at the woman's faded dress and her husband's old suit and exclaimed:

— A building! Do you have even the faintest idea of how much a building costs? We have more than seven and a half million dollars' worth of buildings here at Harvard.

The lady was silent for a moment, then said to her husband:

— If that’s all it costs to found a university, why don’t we have our own?

The husband agreed.

The couple, Leland Stanford, stood up and left, leaving the president confused. Traveling back to Palo Alto, California, they established there Stanford University, the second-largest in the world, in honor of their son, a former Harvard student."

Text extracted from: "Mileumlivros - Stories that Teach Values."

Thank you for reading, my friend!

If this message helped you in any way,

consider leaving your glass “🥃” as a token of appreciation.

A toast to our family!

-

@ fd208ee8:0fd927c1

2025-02-15 07:02:08

E-cash are coupons or tokens for Bitcoin, or Bitcoin debt notes that the mint issues. The e-cash states, essentially, "IoU 2900 sats".

They're redeemable for Bitcoin on Lightning (hard money), and therefore can be used as cash (softer money), so long as the mint has a good reputation. That means that they're less fungible than Lightning because the e-cash from one mint can be more or less valuable than the e-cash from another. If a mint is buggy, offline, or disappears, then the e-cash is unreedemable.

It also means that e-cash is more anonymous than Lightning, and that the sender and receiver's wallets don't need to be online, to transact. Nutzaps now add the possibility of parking transactions one level farther out, on a relay. The same relays that cannot keep npub profiles and follow lists consistent will now do monetary transactions.

What we then have is

* a **transaction on a relay** that triggers

* a **transaction on a mint** that triggers

* a **transaction on Lightning** that triggers

* a **transaction on Bitcoin**.

Which means that every relay that stores the nuts is part of a wildcat banking system. Which is fine, but relay operators should consider whether they wish to carry the associated risks and liabilities. They should also be aware that they should implement the appropriate features in their relay, such as expiration tags (nuts rot after 2 weeks), and to make sure that only expired nuts are deleted.

There will be plenty of specialized relays for this, so don't feel pressured to join in, and research the topic carefully, for yourself.

https://github.com/nostr-protocol/nips/blob/master/60.md

-

@ 0fa80bd3:ea7325de

2025-02-14 23:24:37

#intro

The Russian state made me a Bitcoiner. In 1991, it devalued my grandmother's hard-earned savings. She worked tirelessly in the kitchen of a dining car on the Moscow–Warsaw route. Everything she had saved for my sister and me to attend university vanished overnight. This story is similar to what many experienced, including Wences Casares. The pain and injustice of that time became my first lessons about the fragility of systems and the value of genuine, incorruptible assets, forever changing my perception of money and my trust in government promises.

In 2014, I was living in Moscow, running a trading business, and frequently traveling to China. One day, I learned about the Cypriot banking crisis and the possibility of moving money through some strange thing called Bitcoin. At the time, I didn’t give it much thought. Returning to the idea six months later, as a business-oriented geek, I eagerly began studying the topic and soon dove into it seriously.

I spent half a year reading articles on a local online journal, BitNovosti, actively participating in discussions, and eventually joined the editorial team as a translator. That’s how I learned about whitepapers, decentralization, mining, cryptographic keys, and colored coins. About Satoshi Nakamoto, Silk Road, Mt. Gox, and BitcoinTalk. Over time, I befriended the journal’s owner and, leveraging my management experience, later became an editor. I was drawn to the crypto-anarchist stance and commitment to decentralization principles. We wrote about the economic, historical, and social preconditions for Bitcoin’s emergence, and it was during this time that I fully embraced the idea.

It got to the point where I sold my apartment and, during the market's downturn, bought 50 bitcoins, just after the peak price of $1,200 per coin. That marked the beginning of my first crypto winter. As an editor, I organized workflows, managed translators, developed a YouTube channel, and attended conferences in Russia and Ukraine. That’s how I learned about Wences Casares and even wrote a piece about him. I also met Mikhail Chobanyan (Ukrainian exchange Kuna), Alexander Ivanov (Waves project), Konstantin Lomashuk (Lido project), and, of course, Vitalik Buterin. It was a time of complete immersion, 24/7, and boundless hope.

After moving to the United States, I expected the industry to grow rapidly, attended events, but the introduction of BitLicense froze the industry for eight years. By 2017, it became clear that the industry was shifting toward gambling and creating tokens for the sake of tokens. I dismissed this idea as unsustainable. Then came a new crypto spring with the hype around beautiful NFTs – CryptoPunks and apes.

I made another attempt – we worked on a series called Digital Nomad Country Club, aimed at creating a global project. The proceeds from selling images were intended to fund the development of business tools for people worldwide. However, internal disagreements within the team prevented us from completing the project.

With Trump’s arrival in 2025, hope was reignited. I decided that it was time to create a project that society desperately needed. As someone passionate about history, I understood that destroying what exists was not the solution, but leaving everything as it was also felt unacceptable. You can’t destroy the system, as the fiery crypto-anarchist voices claimed.

With an analytical mindset (IQ 130) and a deep understanding of the freest societies, I realized what was missing—not only in Russia or the United States but globally—a Bitcoin-native system for tracking debts and financial interactions. This could return control of money to ordinary people and create horizontal connections parallel to state systems. My goal was to create, if not a Bitcoin killer app, then at least to lay its foundation.

At the inauguration event in New York, I rediscovered the Nostr project. I realized it was not only technologically simple and already quite popular but also perfectly aligned with my vision. For the past month and a half, using insights and experience gained since 2014, I’ve been working full-time on this project.

-

@ e3ba5e1a:5e433365

2025-02-13 06:16:49

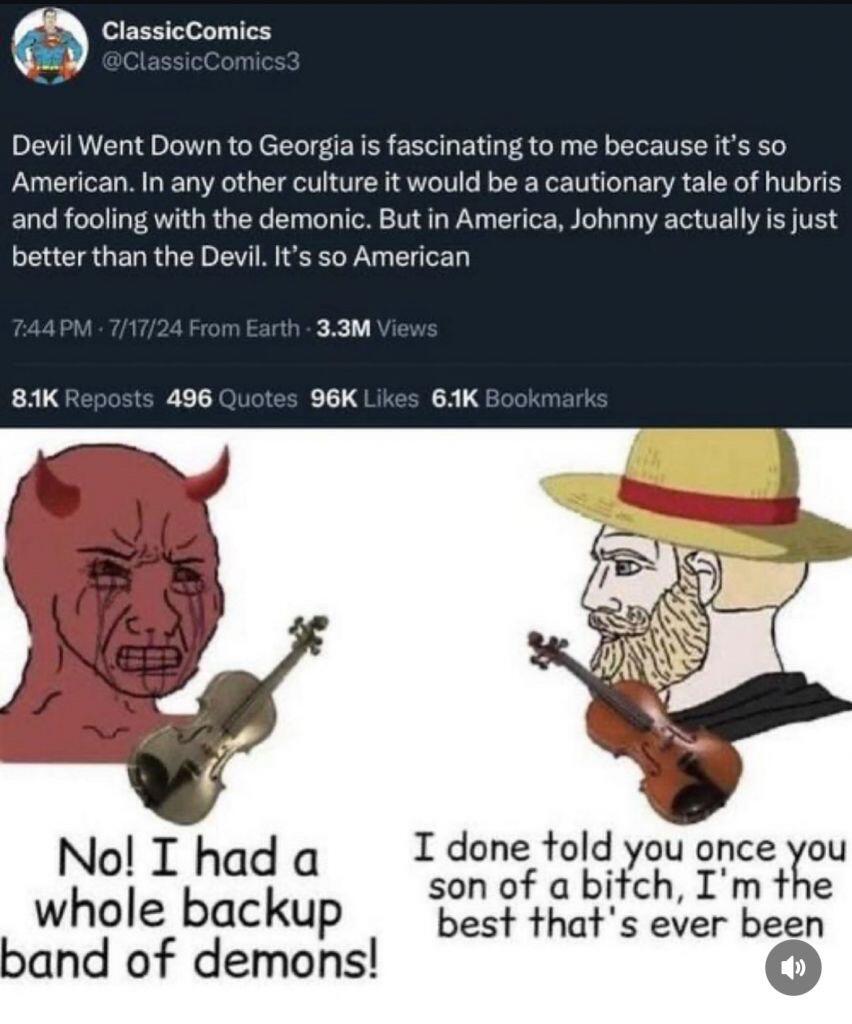

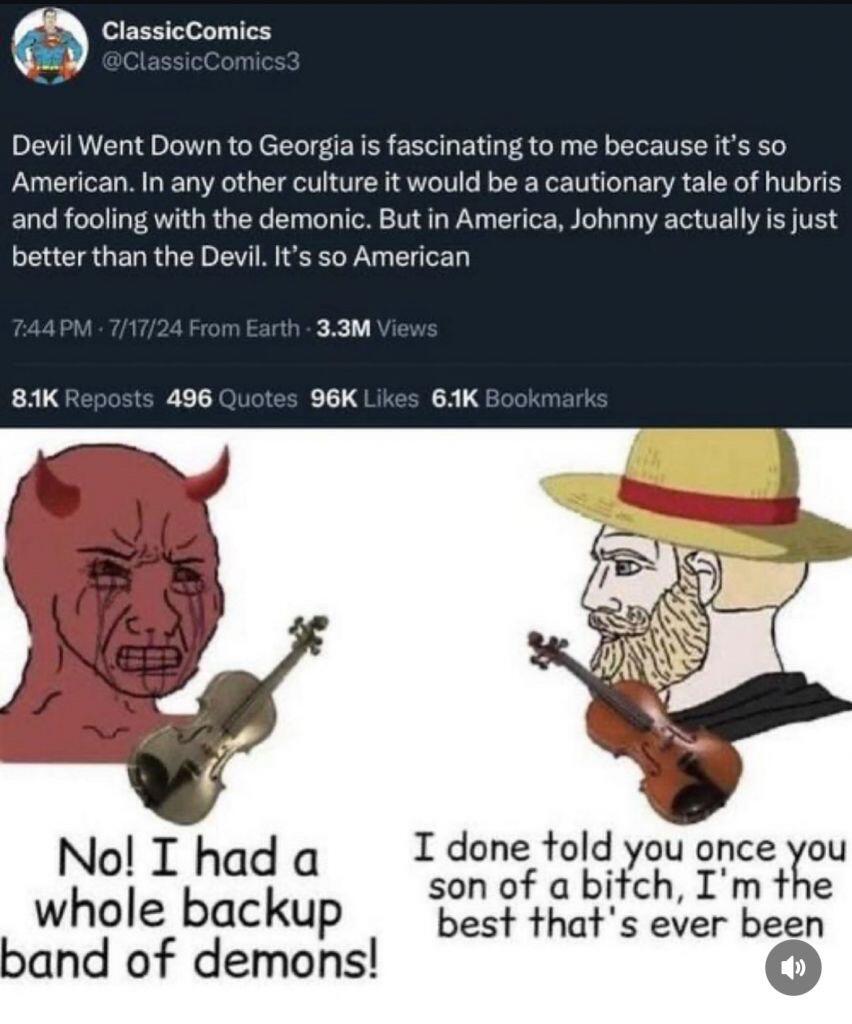

My favorite line in any Marvel movie ever is in “Captain America.” After Captain America launches seemingly a hopeless assault on Red Skull’s base and is captured, we get [this line](https://www.youtube.com/shorts/kqsomjpz7ok):

“Arrogance may not be a uniquely American trait, but I must say, you do it better than anyone.”

Yesterday, I came across a comment on the song [Devil Went Down to Georgia](https://youtu.be/ut8UqFlWdDc) that had a very similar feel to it:

America has seemingly always been arrogant, in a uniquely American way. Manifest Destiny, for instance. The rest of the world is aware of this arrogance, and mocks Americans for it. A central point in modern US politics is the deriding of racist, nationalist, supremacist Americans.

That’s not what I see. I see American Arrogance as not only a beautiful statement about what it means to be American. I see it as an ode to the greatness of humanity in its purest form.

For most countries, saying “our nation is the greatest” *is*, in fact, twinged with some level of racism. I still don’t have a problem with it. Every group of people *should* be allowed to feel pride in their accomplishments. The destruction of the human spirit since the end of World War 2, where greatness has become a sin and weakness a virtue, has crushed the ability of people worldwide to strive for excellence.

But I digress. The fears of racism and nationalism at least have a grain of truth when applied to other nations on the planet. But not to America.

That’s because the definition of America, and the prototype of an American, has nothing to do with race. The definition of Americanism is *freedom*. The founding of America is based purely on liberty. On the God-given rights of every person to live life the way they see fit.

American Arrogance is not a statement of racial superiority. It’s barely a statement of national superiority (though it absolutely is). To me, when an American comments on the greatness of America, it’s a statement about freedom. Freedom will always unlock the greatness inherent in any group of people. Americans are *definitionally* better than everyone else, because Americans are freer than everyone else. (Or, at least, that’s how it should be.)

In *Devil Went Down to Georgia*, Johnny is approached by the devil himself. He is challenged to a ridiculously lopsided bet: a golden fiddle versus his immortal soul. He acknowledges the sin in accepting such a proposal. And yet he says, “God, I know you told me not to do this. But I can’t stand the affront to my honor. I am the greatest. The devil has nothing on me. So God, I’m gonna sin, but I’m also gonna win.”

*Libertas magnitudo est*

-

@ daa41bed:88f54153

2025-02-09 16:50:04

There has been a good bit of discussion on Nostr over the past few days about the merits of zaps as a method of engaging with notes, so after writing a rather lengthy [article on the pros of a strategic Bitcoin reserve](https://geek.npub.pro/post/dxqkgnjplttkvetprg8ox/), I wanted to take some time to chime in on the much more fun topic of digital engagement.

Let's begin by defining a couple of things:

**Nostr** is a decentralized, censorship-resistance protocol whose current biggest use case is social media (think Twitter/X). Instead of relying on company servers, it relies on relays that anyone can spin up and own their own content. Its use cases are much bigger, though, and this article is hosted on my own relay, using my own Nostr relay as an example.

**Zap** is a tip or donation denominated in sats (small units of Bitcoin) sent from one user to another. This is generally done directly over the Lightning Network but is increasingly using Cashu tokens. For the sake of this discussion, how you transmit/receive zaps will be irrelevant, so don't worry if you don't know what [Lightning](https://lightning.network/) or [Cashu](https://cashu.space/) are.

If we look at how users engage with posts and follows/followers on platforms like Twitter, Facebook, etc., it becomes evident that traditional social media thrives on engagement farming. The more outrageous a post, the more likely it will get a reaction. We see a version of this on more visual social platforms like YouTube and TikTok that use carefully crafted thumbnail images to grab the user's attention to click the video. If you'd like to dive deep into the psychology and science behind social media engagement, let me know, and I'd be happy to follow up with another article.

In this user engagement model, a user is given the option to comment or like the original post, or share it among their followers to increase its signal. They receive no value from engaging with the content aside from the dopamine hit of the original experience or having their comment liked back by whatever influencer they provide value to. Ad revenue flows to the content creator. Clout flows to the content creator. Sales revenue from merch and content placement flows to the content creator. We call this a linear economy -- the idea that resources get created, used up, then thrown away. Users create content and farm as much engagement as possible, then the content is forgotten within a few hours as they move on to the next piece of content to be farmed.

What if there were a simple way to give value back to those who engage with your content? By implementing some value-for-value model -- a circular economy. Enter zaps.

Unlike traditional social media platforms, Nostr does not actively use algorithms to determine what content is popular, nor does it push content created for active user engagement to the top of a user's timeline. Yes, there are "trending" and "most zapped" timelines that users can choose to use as their default, but these use relatively straightforward engagement metrics to rank posts for these timelines.

That is not to say that we may not see clients actively seeking to refine timeline algorithms for specific metrics. Still, the beauty of having an open protocol with media that is controlled solely by its users is that users who begin to see their timeline gamed towards specific algorithms can choose to move to another client, and for those who are more tech-savvy, they can opt to run their own relays or create their own clients with personalized algorithms and web of trust scoring systems.

Zaps enable the means to create a new type of social media economy in which creators can earn for creating content and users can earn by actively engaging with it. Like and reposting content is relatively frictionless and costs nothing but a simple button tap. Zaps provide active engagement because they signal to your followers and those of the content creator that this post has genuine value, quite literally in the form of money—sats.

I have seen some comments on Nostr claiming that removing likes and reactions is for wealthy people who can afford to send zaps and that the majority of people in the US and around the world do not have the time or money to zap because they have better things to spend their money like feeding their families and paying their bills. While at face value, these may seem like valid arguments, they, unfortunately, represent the brainwashed, defeatist attitude that our current economic (and, by extension, social media) systems aim to instill in all of us to continue extracting value from our lives.

Imagine now, if those people dedicating their own time (time = money) to mine pity points on social media would instead spend that time with genuine value creation by posting content that is meaningful to cultural discussions. Imagine if, instead of complaining that their posts get no zaps and going on a tirade about how much of a victim they are, they would empower themselves to take control of their content and give value back to the world; where would that leave us? How much value could be created on a nascent platform such as Nostr, and how quickly could it overtake other platforms?

Other users argue about user experience and that additional friction (i.e., zaps) leads to lower engagement, as proven by decades of studies on user interaction. While the added friction may turn some users away, does that necessarily provide less value? I argue quite the opposite. You haven't made a few sats from zaps with your content? Can't afford to send some sats to a wallet for zapping? How about using the most excellent available resource and spending 10 seconds of your time to leave a comment? Likes and reactions are valueless transactions. Social media's real value derives from providing monetary compensation and actively engaging in a conversation with posts you find interesting or thought-provoking. Remember when humans thrived on conversation and discussion for entertainment instead of simply being an onlooker of someone else's life?

If you've made it this far, my only request is this: try only zapping and commenting as a method of engagement for two weeks. Sure, you may end up liking a post here and there, but be more mindful of how you interact with the world and break yourself from blind instinct. You'll thank me later.

-

@ e3ba5e1a:5e433365

2025-02-05 17:47:16

I got into a [friendly discussion](https://x.com/snoyberg/status/1887007888117252142) on X regarding health insurance. The specific question was how to deal with health insurance companies (presumably unfairly) denying claims? My answer, as usual: get government out of it!

The US healthcare system is essentially the worst of both worlds:

* Unlike full single payer, individuals incur high costs

* Unlike a true free market, regulation causes increases in costs and decreases competition among insurers

I'm firmly on the side of moving towards the free market. (And I say that as someone living under a single payer system now.) Here's what I would do:

* Get rid of tax incentives that make health insurance tied to your employer, giving individuals back proper freedom of choice.

* Reduce regulations significantly.

* In the short term, some people will still get rejected claims and other obnoxious behavior from insurance companies. We address that in two ways:

1. Due to reduced regulations, new insurance companies will be able to enter the market offering more reliable coverage and better rates, and people will flock to them because they have the freedom to make their own choices.

2. Sue the asses off of companies that reject claims unfairly. And ideally, as one of the few legitimate roles of government in all this, institute new laws that limit the ability of fine print to allow insurers to escape their responsibilities. (I'm hesitant that the latter will happen due to the incestuous relationship between Congress/regulators and insurers, but I can hope.)

Will this magically fix everything overnight like politicians normally promise? No. But it will allow the market to return to a healthy state. And I don't think it will take long (order of magnitude: 5-10 years) for it to come together, but that's just speculation.

And since there's a high correlation between those who believe government can fix problems by taking more control and demanding that only credentialed experts weigh in on a topic (both points I strongly disagree with BTW): I'm a trained actuary and worked in the insurance industry, and have directly seen how government regulation reduces competition, raises prices, and harms consumers.

And my final point: I don't think any prior art would be a good comparison for deregulation in the US, it's such a different market than any other country in the world for so many reasons that lessons wouldn't really translate. Nonetheless, I asked Grok for some empirical data on this, and at best the results of deregulation could be called "mixed," but likely more accurately "uncertain, confused, and subject to whatever interpretation anyone wants to apply."

https://x.com/i/grok/share/Zc8yOdrN8lS275hXJ92uwq98M

-

@ 91bea5cd:1df4451c

2025-02-04 17:24:50

### Definição de ULID:

Timestamp 48 bits, Aleatoriedade 80 bits

Sendo Timestamp 48 bits inteiro, tempo UNIX em milissegundos, Não ficará sem espaço até o ano 10889 d.C.

e Aleatoriedade 80 bits, Fonte criptograficamente segura de aleatoriedade, se possível.

#### Gerar ULID

```sql

CREATE EXTENSION IF NOT EXISTS pgcrypto;

CREATE FUNCTION generate_ulid()

RETURNS TEXT

AS $$

DECLARE

-- Crockford's Base32

encoding BYTEA = '0123456789ABCDEFGHJKMNPQRSTVWXYZ';

timestamp BYTEA = E'\\000\\000\\000\\000\\000\\000';

output TEXT = '';

unix_time BIGINT;

ulid BYTEA;

BEGIN

-- 6 timestamp bytes

unix_time = (EXTRACT(EPOCH FROM CLOCK_TIMESTAMP()) * 1000)::BIGINT;

timestamp = SET_BYTE(timestamp, 0, (unix_time >> 40)::BIT(8)::INTEGER);

timestamp = SET_BYTE(timestamp, 1, (unix_time >> 32)::BIT(8)::INTEGER);

timestamp = SET_BYTE(timestamp, 2, (unix_time >> 24)::BIT(8)::INTEGER);

timestamp = SET_BYTE(timestamp, 3, (unix_time >> 16)::BIT(8)::INTEGER);

timestamp = SET_BYTE(timestamp, 4, (unix_time >> 8)::BIT(8)::INTEGER);

timestamp = SET_BYTE(timestamp, 5, unix_time::BIT(8)::INTEGER);

-- 10 entropy bytes

ulid = timestamp || gen_random_bytes(10);

-- Encode the timestamp

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(ulid, 0) & 224) >> 5));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(ulid, 0) & 31)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(ulid, 1) & 248) >> 3));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(ulid, 1) & 7) << 2) | ((GET_BYTE(ulid, 2) & 192) >> 6)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(ulid, 2) & 62) >> 1));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(ulid, 2) & 1) << 4) | ((GET_BYTE(ulid, 3) & 240) >> 4)));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(ulid, 3) & 15) << 1) | ((GET_BYTE(ulid, 4) & 128) >> 7)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(ulid, 4) & 124) >> 2));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(ulid, 4) & 3) << 3) | ((GET_BYTE(ulid, 5) & 224) >> 5)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(ulid, 5) & 31)));

-- Encode the entropy

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(ulid, 6) & 248) >> 3));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(ulid, 6) & 7) << 2) | ((GET_BYTE(ulid, 7) & 192) >> 6)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(ulid, 7) & 62) >> 1));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(ulid, 7) & 1) << 4) | ((GET_BYTE(ulid, 8) & 240) >> 4)));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(ulid, 8) & 15) << 1) | ((GET_BYTE(ulid, 9) & 128) >> 7)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(ulid, 9) & 124) >> 2));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(ulid, 9) & 3) << 3) | ((GET_BYTE(ulid, 10) & 224) >> 5)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(ulid, 10) & 31)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(ulid, 11) & 248) >> 3));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(ulid, 11) & 7) << 2) | ((GET_BYTE(ulid, 12) & 192) >> 6)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(ulid, 12) & 62) >> 1));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(ulid, 12) & 1) << 4) | ((GET_BYTE(ulid, 13) & 240) >> 4)));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(ulid, 13) & 15) << 1) | ((GET_BYTE(ulid, 14) & 128) >> 7)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(ulid, 14) & 124) >> 2));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(ulid, 14) & 3) << 3) | ((GET_BYTE(ulid, 15) & 224) >> 5)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(ulid, 15) & 31)));

RETURN output;

END

$$

LANGUAGE plpgsql

VOLATILE;

```

#### ULID TO UUID

```sql

CREATE OR REPLACE FUNCTION parse_ulid(ulid text) RETURNS bytea AS $$

DECLARE

-- 16byte

bytes bytea = E'\\x00000000 00000000 00000000 00000000';

v char[];

-- Allow for O(1) lookup of index values

dec integer[] = ARRAY[

255, 255, 255, 255, 255, 255, 255, 255, 255, 255,

255, 255, 255, 255, 255, 255, 255, 255, 255, 255,

255, 255, 255, 255, 255, 255, 255, 255, 255, 255,

255, 255, 255, 255, 255, 255, 255, 255, 255, 255,

255, 255, 255, 255, 255, 255, 255, 0, 1, 2,

3, 4, 5, 6, 7, 8, 9, 255, 255, 255,

255, 255, 255, 255, 10, 11, 12, 13, 14, 15,

16, 17, 1, 18, 19, 1, 20, 21, 0, 22,

23, 24, 25, 26, 255, 27, 28, 29, 30, 31,

255, 255, 255, 255, 255, 255, 10, 11, 12, 13,

14, 15, 16, 17, 1, 18, 19, 1, 20, 21,

0, 22, 23, 24, 25, 26, 255, 27, 28, 29,

30, 31

];

BEGIN

IF NOT ulid ~* '^[0-7][0-9ABCDEFGHJKMNPQRSTVWXYZ]{25}$' THEN

RAISE EXCEPTION 'Invalid ULID: %', ulid;

END IF;

v = regexp_split_to_array(ulid, '');

-- 6 bytes timestamp (48 bits)

bytes = SET_BYTE(bytes, 0, (dec[ASCII(v[1])] << 5) | dec[ASCII(v[2])]);

bytes = SET_BYTE(bytes, 1, (dec[ASCII(v[3])] << 3) | (dec[ASCII(v[4])] >> 2));

bytes = SET_BYTE(bytes, 2, (dec[ASCII(v[4])] << 6) | (dec[ASCII(v[5])] << 1) | (dec[ASCII(v[6])] >> 4));

bytes = SET_BYTE(bytes, 3, (dec[ASCII(v[6])] << 4) | (dec[ASCII(v[7])] >> 1));

bytes = SET_BYTE(bytes, 4, (dec[ASCII(v[7])] << 7) | (dec[ASCII(v[8])] << 2) | (dec[ASCII(v[9])] >> 3));

bytes = SET_BYTE(bytes, 5, (dec[ASCII(v[9])] << 5) | dec[ASCII(v[10])]);

-- 10 bytes of entropy (80 bits);

bytes = SET_BYTE(bytes, 6, (dec[ASCII(v[11])] << 3) | (dec[ASCII(v[12])] >> 2));

bytes = SET_BYTE(bytes, 7, (dec[ASCII(v[12])] << 6) | (dec[ASCII(v[13])] << 1) | (dec[ASCII(v[14])] >> 4));

bytes = SET_BYTE(bytes, 8, (dec[ASCII(v[14])] << 4) | (dec[ASCII(v[15])] >> 1));

bytes = SET_BYTE(bytes, 9, (dec[ASCII(v[15])] << 7) | (dec[ASCII(v[16])] << 2) | (dec[ASCII(v[17])] >> 3));

bytes = SET_BYTE(bytes, 10, (dec[ASCII(v[17])] << 5) | dec[ASCII(v[18])]);

bytes = SET_BYTE(bytes, 11, (dec[ASCII(v[19])] << 3) | (dec[ASCII(v[20])] >> 2));

bytes = SET_BYTE(bytes, 12, (dec[ASCII(v[20])] << 6) | (dec[ASCII(v[21])] << 1) | (dec[ASCII(v[22])] >> 4));

bytes = SET_BYTE(bytes, 13, (dec[ASCII(v[22])] << 4) | (dec[ASCII(v[23])] >> 1));

bytes = SET_BYTE(bytes, 14, (dec[ASCII(v[23])] << 7) | (dec[ASCII(v[24])] << 2) | (dec[ASCII(v[25])] >> 3));

bytes = SET_BYTE(bytes, 15, (dec[ASCII(v[25])] << 5) | dec[ASCII(v[26])]);

RETURN bytes;

END

$$

LANGUAGE plpgsql

IMMUTABLE;

CREATE OR REPLACE FUNCTION ulid_to_uuid(ulid text) RETURNS uuid AS $$

BEGIN

RETURN encode(parse_ulid(ulid), 'hex')::uuid;

END

$$

LANGUAGE plpgsql

IMMUTABLE;

```

#### UUID to ULID

```sql

CREATE OR REPLACE FUNCTION uuid_to_ulid(id uuid) RETURNS text AS $$

DECLARE

encoding bytea = '0123456789ABCDEFGHJKMNPQRSTVWXYZ';

output text = '';

uuid_bytes bytea = uuid_send(id);

BEGIN

-- Encode the timestamp

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(uuid_bytes, 0) & 224) >> 5));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(uuid_bytes, 0) & 31)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(uuid_bytes, 1) & 248) >> 3));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(uuid_bytes, 1) & 7) << 2) | ((GET_BYTE(uuid_bytes, 2) & 192) >> 6)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(uuid_bytes, 2) & 62) >> 1));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(uuid_bytes, 2) & 1) << 4) | ((GET_BYTE(uuid_bytes, 3) & 240) >> 4)));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(uuid_bytes, 3) & 15) << 1) | ((GET_BYTE(uuid_bytes, 4) & 128) >> 7)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(uuid_bytes, 4) & 124) >> 2));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(uuid_bytes, 4) & 3) << 3) | ((GET_BYTE(uuid_bytes, 5) & 224) >> 5)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(uuid_bytes, 5) & 31)));

-- Encode the entropy

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(uuid_bytes, 6) & 248) >> 3));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(uuid_bytes, 6) & 7) << 2) | ((GET_BYTE(uuid_bytes, 7) & 192) >> 6)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(uuid_bytes, 7) & 62) >> 1));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(uuid_bytes, 7) & 1) << 4) | ((GET_BYTE(uuid_bytes, 8) & 240) >> 4)));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(uuid_bytes, 8) & 15) << 1) | ((GET_BYTE(uuid_bytes, 9) & 128) >> 7)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(uuid_bytes, 9) & 124) >> 2));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(uuid_bytes, 9) & 3) << 3) | ((GET_BYTE(uuid_bytes, 10) & 224) >> 5)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(uuid_bytes, 10) & 31)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(uuid_bytes, 11) & 248) >> 3));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(uuid_bytes, 11) & 7) << 2) | ((GET_BYTE(uuid_bytes, 12) & 192) >> 6)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(uuid_bytes, 12) & 62) >> 1));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(uuid_bytes, 12) & 1) << 4) | ((GET_BYTE(uuid_bytes, 13) & 240) >> 4)));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(uuid_bytes, 13) & 15) << 1) | ((GET_BYTE(uuid_bytes, 14) & 128) >> 7)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(uuid_bytes, 14) & 124) >> 2));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(uuid_bytes, 14) & 3) << 3) | ((GET_BYTE(uuid_bytes, 15) & 224) >> 5)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(uuid_bytes, 15) & 31)));

RETURN output;

END

$$

LANGUAGE plpgsql

IMMUTABLE;

```

#### Gera 11 Digitos aleatórios: YBKXG0CKTH4

```sql

-- Cria a extensão pgcrypto para gerar uuid

CREATE EXTENSION IF NOT EXISTS pgcrypto;

-- Cria a função para gerar ULID

CREATE OR REPLACE FUNCTION gen_lrandom()

RETURNS TEXT AS $$

DECLARE

ts_millis BIGINT;

ts_chars TEXT;

random_bytes BYTEA;

random_chars TEXT;

base32_chars TEXT := '0123456789ABCDEFGHJKMNPQRSTVWXYZ';

i INT;

BEGIN

-- Pega o timestamp em milissegundos

ts_millis := FLOOR(EXTRACT(EPOCH FROM clock_timestamp()) * 1000)::BIGINT;

-- Converte o timestamp para base32

ts_chars := '';

FOR i IN REVERSE 0..11 LOOP

ts_chars := ts_chars || substr(base32_chars, ((ts_millis >> (5 * i)) & 31) + 1, 1);

END LOOP;

-- Gera 10 bytes aleatórios e converte para base32

random_bytes := gen_random_bytes(10);

random_chars := '';

FOR i IN 0..9 LOOP

random_chars := random_chars || substr(base32_chars, ((get_byte(random_bytes, i) >> 3) & 31) + 1, 1);

IF i < 9 THEN

random_chars := random_chars || substr(base32_chars, (((get_byte(random_bytes, i) & 7) << 2) | (get_byte(random_bytes, i + 1) >> 6)) & 31 + 1, 1);

ELSE

random_chars := random_chars || substr(base32_chars, ((get_byte(random_bytes, i) & 7) << 2) + 1, 1);

END IF;

END LOOP;

-- Concatena o timestamp e os caracteres aleatórios

RETURN ts_chars || random_chars;

END;

$$ LANGUAGE plpgsql;

```

#### Exemplo de USO

```sql

-- Criação da extensão caso não exista

CREATE EXTENSION

IF

NOT EXISTS pgcrypto;

-- Criação da tabela pessoas

CREATE TABLE pessoas ( ID UUID DEFAULT gen_random_uuid ( ) PRIMARY KEY, nome TEXT NOT NULL );

-- Busca Pessoa na tabela

SELECT

*

FROM

"pessoas"

WHERE

uuid_to_ulid ( ID ) = '252FAC9F3V8EF80SSDK8PXW02F';

```

### Fontes

- https://github.com/scoville/pgsql-ulid

- https://github.com/geckoboard/pgulid

-

@ 91bea5cd:1df4451c

2025-02-04 05:24:47

Novia é uma ferramenta inovadora que facilita o arquivamento de vídeos e sua integração com a rede NOSTR (Notes and Other Stuff Transmitted over Relay). Funcionando como uma ponte entre ferramentas de arquivamento de vídeo tradicionais e a plataforma descentralizada, Novia oferece uma solução autônoma para a preservação e compartilhamento de conteúdo audiovisual.

### Arquitetura e Funcionamento

A arquitetura de Novia é dividida em duas partes principais:

* **Frontend:** Atua como a interface do usuário, responsável por solicitar o arquivamento de vídeos. Essas solicitações são encaminhadas para o backend.

* **Backend:** Processa as solicitações de arquivamento, baixando o vídeo, suas descrições e a imagem de capa associada. Este componente é conectado a um ou mais relays NOSTR, permitindo a indexação e descoberta do conteúdo arquivado.

O processo de arquivamento é automatizado: após o download, o vídeo fica disponível no frontend para que o usuário possa solicitar o upload para um servidor Blossom de sua escolha.

### Como Utilizar Novia

1. **Acesso:** Navegue até [https://npub126uz2g6ft45qs0m0rnvtvtp7glcfd23pemrzz0wnt8r5vlhr9ufqnsmvg8.nsite.lol](https://npub126uz2g6ft45qs0m0rnvtvtp7glcfd23pemrzz0wnt8r5vlhr9ufqnsmvg8.nsite.lol).

2. **Login:** Utilize uma extensão de navegador compatível com NOSTR para autenticar-se.

3. **Execução via Docker:** A forma mais simples de executar o backend é através de um container Docker. Execute o seguinte comando:

```bash

docker run -it --rm -p 9090:9090 -v ./nostr/data:/data --add-host=host.docker.internal:host-gateway teamnovia/novia

```

Este comando cria um container, mapeia a porta 9090 para o host e monta o diretório `./nostr/data` para persistir os dados.

### Configuração Avançada

Novia oferece amplas opções de configuração através de um arquivo `yaml`. Abaixo, um exemplo comentado:

```yaml

mediaStores:

- id: media

type: local

path: /data/media

watch: true

database: /data/novia.db

download:

enabled: true

ytdlpPath: yt-dlp

ytdlpCookies: ./cookies.txt

tempPath: /tmp

targetStoreId: media

secret: false

publish:

enabled: true

key: nsec

thumbnailUpload:

- https://nostr.download

videoUpload:

- url: https://nostr.download

maxUploadSizeMB: 300

cleanUpMaxAgeDays: 5

cleanUpKeepSizeUnderMB: 2

- url: https://files.v0l.io

maxUploadSizeMB: 300

cleanUpMaxAgeDays: 5

cleanUpKeepSizeUnderMB: 2

- url: https://nosto.re

maxUploadSizeMB: 300

cleanUpMaxAgeDays: 5

cleanUpKeepSizeUnderMB: 2

- url: https://blossom.primal.net

maxUploadSizeMB: 300

cleanUpMaxAgeDays: 5

cleanUpKeepSizeUnderMB: 2

relays:

- ws://host.docker.internal:4869

- wss://bostr.bitcointxoko.com

secret: false

autoUpload:

enabled: true

maxVideoSizeMB: 100

fetch:

enabled: false

fetchVideoLimitMB: 10

relays:

- <a relay with the video events to mirror>

match:

- nostr

- bitcoin

server:

port: 9090

enabled: true

```

**Explicação das Configurações:**

* **`mediaStores`**: Define onde os arquivos de mídia serão armazenados (localmente, neste exemplo).

* **`database`**: Especifica o local do banco de dados.

* **`download`**: Controla as configurações de download de vídeos, incluindo o caminho para o `yt-dlp` e um arquivo de cookies para autenticação.

* **`publish`**: Configura a publicação de vídeos e thumbnails no NOSTR, incluindo a chave privada (`nsec`), servidores de upload e relays. **Atenção:** Mantenha sua chave privada em segredo.

* **`fetch`**: Permite buscar eventos de vídeo de relays NOSTR para arquivamento.

* **`server`**: Define as configurações do servidor web interno de Novia.

### Conclusão

Novia surge como uma ferramenta promissora para o arquivamento e a integração de vídeos com o ecossistema NOSTR. Sua arquitetura modular, combinada com opções de configuração flexíveis, a tornam uma solução poderosa para usuários que buscam preservar e compartilhar conteúdo audiovisual de forma descentralizada e resistente à censura. A utilização de Docker simplifica a implantação e o gerenciamento da ferramenta. Para obter mais informações e explorar o código-fonte, visite o repositório do projeto no GitHub: [https://github.com/teamnovia/novia](https://github.com/teamnovia/novia).

-

@ 9e69e420:d12360c2

2025-02-01 11:16:04

Federal employees must remove pronouns from email signatures by the end of the day. This directive comes from internal memos tied to two executive orders signed by Donald Trump. The orders target diversity and equity programs within the government.

CDC, Department of Transportation, and Department of Energy employees were affected. Staff were instructed to make changes in line with revised policy prohibiting certain language.

One CDC employee shared frustration, stating, “In my decade-plus years at CDC, I've never been told what I can and can't put in my email signature.” The directive is part of a broader effort to eliminate DEI initiatives from federal discourse.

-

@ e83b66a8:b0526c2b

2025-01-30 16:11:24

I have a deep love of China. It probably started in 1981, when my Father visited China on the first trade mission from the UK to open up trading between the 2 nations.

As a family, we have historically done a lot of business in Asia starting with our company Densitron, who’s Asian headquarters were in Tokyo, through to Taiwan where we had factories leading to investing in Vbest, now Evervision an LCD manufacturer. They have admin offices in Taiwan and a factory in Jiangsu, China.

I have always hated the western narrative that China is the “enemy” or that China’s Communist / Capitalist system is “evil”.

Without understanding history, geography, cultural biases, and indoctrination it is as difficult to remove those beliefs in the same way it is difficult to convert “normies” to understand the freedom and power of Bitcoin.

I have tried and had some success, but mostly failed.

However the recent ban on TikTok and the migration of the west to the Chinese owned “rednote” app has overnight created more cultural exchanges and understanding than the previous 40+ years has ever managed to achieve. That along with the recent disclosure about Chinas advancements in AI have also deflated some of the western hubris.

If you wish to go down the rabbit hole of China from a cultural view, this YouTuber has given me a much better framework than I could ever provide as an outsider.

She is a Chinese girl, who came to the UK to study at University only to return with a mixed understanding of both cultures. She is doing a far better job of explaining the culture from a western perspective than I ever could.

https://www.youtube.com/@SimingLan

Here are 4 videos of hers that help explain a lot:

This is a lighthearted look at the recent TikTok ban

TikTok ban completely backfired on US! and it's been hilarious

https://www.youtube.com/watch?v=A7123nG5otA

More in-depth insights are:

My complicated relationship with China.

https://www.youtube.com/watch?v=BEaw0KAuNBU

China's Biggest Problem with Free Speech Rhetoric

https://www.youtube.com/watch?v=V7eSyKPbg_Y

What the West Doesn't Get about China's Rise

https://www.youtube.com/watch?v=hmb1_HfflCA

-

@ 0fa80bd3:ea7325de

2025-01-30 04:28:30

**"Degeneration"** or **"Вырождение"**

![[photo_2025-01-29 23.23.15.jpeg]]

A once-functional object, now eroded by time and human intervention, stripped of its original purpose. Layers of presence accumulate—marks, alterations, traces of intent—until the very essence is obscured. Restoration is paradoxical: to reclaim, one must erase. Yet erasure is an impossibility, for to remove these imprints is to deny the existence of those who shaped them.

The work stands as a meditation on entropy, memory, and the irreversible dialogue between creation and decay.

@ 04c915da:3dfbecc9

2025-02-25 03:55:08Here’s a revised timeline of macro-level events from *The Mandibles: A Family, 2029–2047* by Lionel Shriver, reimagined in a world where Bitcoin is adopted as a widely accepted form of money, altering the original narrative’s assumptions about currency collapse and economic control. In Shriver’s original story, the failure of Bitcoin is assumed amid the dominance of the bancor and the dollar’s collapse. Here, Bitcoin’s success reshapes the economic and societal trajectory, decentralizing power and challenging state-driven outcomes. ### Part One: 2029–2032 - **2029 (Early Year)**\ The United States faces economic strain as the dollar weakens against global shifts. However, Bitcoin, having gained traction emerges as a viable alternative. Unlike the original timeline, the bancor—a supranational currency backed by a coalition of nations—struggles to gain footing as Bitcoin’s decentralized adoption grows among individuals and businesses worldwide, undermining both the dollar and the bancor. - **2029 (Mid-Year: The Great Renunciation)**\ Treasury bonds lose value, and the government bans Bitcoin, labeling it a threat to sovereignty (mirroring the original bancor ban). However, a Bitcoin ban proves unenforceable—its decentralized nature thwarts confiscation efforts, unlike gold in the original story. Hyperinflation hits the dollar as the U.S. prints money, but Bitcoin’s fixed supply shields adopters from currency devaluation, creating a dual-economy split: dollar users suffer, while Bitcoin users thrive. - **2029 (Late Year)**\ Dollar-based inflation soars, emptying stores of goods priced in fiat currency. Meanwhile, Bitcoin transactions flourish in underground and online markets, stabilizing trade for those plugged into the bitcoin ecosystem. Traditional supply chains falter, but peer-to-peer Bitcoin networks enable local and international exchange, reducing scarcity for early adopters. The government’s gold confiscation fails to bolster the dollar, as Bitcoin’s rise renders gold less relevant. - **2030–2031**\ Crime spikes in dollar-dependent urban areas, but Bitcoin-friendly regions see less chaos, as digital wallets and smart contracts facilitate secure trade. The U.S. government doubles down on surveillance to crack down on bitcoin use. A cultural divide deepens: centralized authority weakens in Bitcoin-adopting communities, while dollar zones descend into lawlessness. - **2032**\ By this point, Bitcoin is de facto legal tender in parts of the U.S. and globally, especially in tech-savvy or libertarian-leaning regions. The federal government’s grip slips as tax collection in dollars plummets—Bitcoin’s traceability is low, and citizens evade fiat-based levies. Rural and urban Bitcoin hubs emerge, while the dollar economy remains fractured. ### Time Jump: 2032–2047 - Over 15 years, Bitcoin solidifies as a global reserve currency, eroding centralized control. The U.S. government adapts, grudgingly integrating bitcoin into policy, though regional autonomy grows as Bitcoin empowers local economies. ### Part Two: 2047 - **2047 (Early Year)**\ The U.S. is a hybrid state: Bitcoin is legal tender alongside a diminished dollar. Taxes are lower, collected in BTC, reducing federal overreach. Bitcoin’s adoption has decentralized power nationwide. The bancor has faded, unable to compete with Bitcoin’s grassroots momentum. - **2047 (Mid-Year)**\ Travel and trade flow freely in Bitcoin zones, with no restrictive checkpoints. The dollar economy lingers in poorer areas, marked by decay, but Bitcoin’s dominance lifts overall prosperity, as its deflationary nature incentivizes saving and investment over consumption. Global supply chains rebound, powered by bitcoin enabled efficiency. - **2047 (Late Year)**\ The U.S. is a patchwork of semi-autonomous zones, united by Bitcoin’s universal acceptance rather than federal control. Resource scarcity persists due to past disruptions, but economic stability is higher than in Shriver’s original dystopia—Bitcoin’s success prevents the authoritarian slide, fostering a freer, if imperfect, society. ### Key Differences - **Currency Dynamics**: Bitcoin’s triumph prevents the bancor’s dominance and mitigates hyperinflation’s worst effects, offering a lifeline outside state control. - **Government Power**: Centralized authority weakens as Bitcoin evades bans and taxation, shifting power to individuals and communities. - **Societal Outcome**: Instead of a surveillance state, 2047 sees a decentralized, bitcoin driven world—less oppressive, though still stratified between Bitcoin haves and have-nots. This reimagining assumes Bitcoin overcomes Shriver’s implied skepticism to become a robust, adopted currency by 2029, fundamentally altering the novel’s bleak trajectory.

@ 04c915da:3dfbecc9

2025-02-25 03:55:08Here’s a revised timeline of macro-level events from *The Mandibles: A Family, 2029–2047* by Lionel Shriver, reimagined in a world where Bitcoin is adopted as a widely accepted form of money, altering the original narrative’s assumptions about currency collapse and economic control. In Shriver’s original story, the failure of Bitcoin is assumed amid the dominance of the bancor and the dollar’s collapse. Here, Bitcoin’s success reshapes the economic and societal trajectory, decentralizing power and challenging state-driven outcomes. ### Part One: 2029–2032 - **2029 (Early Year)**\ The United States faces economic strain as the dollar weakens against global shifts. However, Bitcoin, having gained traction emerges as a viable alternative. Unlike the original timeline, the bancor—a supranational currency backed by a coalition of nations—struggles to gain footing as Bitcoin’s decentralized adoption grows among individuals and businesses worldwide, undermining both the dollar and the bancor. - **2029 (Mid-Year: The Great Renunciation)**\ Treasury bonds lose value, and the government bans Bitcoin, labeling it a threat to sovereignty (mirroring the original bancor ban). However, a Bitcoin ban proves unenforceable—its decentralized nature thwarts confiscation efforts, unlike gold in the original story. Hyperinflation hits the dollar as the U.S. prints money, but Bitcoin’s fixed supply shields adopters from currency devaluation, creating a dual-economy split: dollar users suffer, while Bitcoin users thrive. - **2029 (Late Year)**\ Dollar-based inflation soars, emptying stores of goods priced in fiat currency. Meanwhile, Bitcoin transactions flourish in underground and online markets, stabilizing trade for those plugged into the bitcoin ecosystem. Traditional supply chains falter, but peer-to-peer Bitcoin networks enable local and international exchange, reducing scarcity for early adopters. The government’s gold confiscation fails to bolster the dollar, as Bitcoin’s rise renders gold less relevant. - **2030–2031**\ Crime spikes in dollar-dependent urban areas, but Bitcoin-friendly regions see less chaos, as digital wallets and smart contracts facilitate secure trade. The U.S. government doubles down on surveillance to crack down on bitcoin use. A cultural divide deepens: centralized authority weakens in Bitcoin-adopting communities, while dollar zones descend into lawlessness. - **2032**\ By this point, Bitcoin is de facto legal tender in parts of the U.S. and globally, especially in tech-savvy or libertarian-leaning regions. The federal government’s grip slips as tax collection in dollars plummets—Bitcoin’s traceability is low, and citizens evade fiat-based levies. Rural and urban Bitcoin hubs emerge, while the dollar economy remains fractured. ### Time Jump: 2032–2047 - Over 15 years, Bitcoin solidifies as a global reserve currency, eroding centralized control. The U.S. government adapts, grudgingly integrating bitcoin into policy, though regional autonomy grows as Bitcoin empowers local economies. ### Part Two: 2047 - **2047 (Early Year)**\ The U.S. is a hybrid state: Bitcoin is legal tender alongside a diminished dollar. Taxes are lower, collected in BTC, reducing federal overreach. Bitcoin’s adoption has decentralized power nationwide. The bancor has faded, unable to compete with Bitcoin’s grassroots momentum. - **2047 (Mid-Year)**\ Travel and trade flow freely in Bitcoin zones, with no restrictive checkpoints. The dollar economy lingers in poorer areas, marked by decay, but Bitcoin’s dominance lifts overall prosperity, as its deflationary nature incentivizes saving and investment over consumption. Global supply chains rebound, powered by bitcoin enabled efficiency. - **2047 (Late Year)**\ The U.S. is a patchwork of semi-autonomous zones, united by Bitcoin’s universal acceptance rather than federal control. Resource scarcity persists due to past disruptions, but economic stability is higher than in Shriver’s original dystopia—Bitcoin’s success prevents the authoritarian slide, fostering a freer, if imperfect, society. ### Key Differences - **Currency Dynamics**: Bitcoin’s triumph prevents the bancor’s dominance and mitigates hyperinflation’s worst effects, offering a lifeline outside state control. - **Government Power**: Centralized authority weakens as Bitcoin evades bans and taxation, shifting power to individuals and communities. - **Societal Outcome**: Instead of a surveillance state, 2047 sees a decentralized, bitcoin driven world—less oppressive, though still stratified between Bitcoin haves and have-nots. This reimagining assumes Bitcoin overcomes Shriver’s implied skepticism to become a robust, adopted currency by 2029, fundamentally altering the novel’s bleak trajectory. @ 6e0ea5d6:0327f353

2025-02-21 18:15:52"Malcolm Forbes recounts that a lady, wearing a faded cotton dress, and her husband, dressed in an old handmade suit, stepped off a train in Boston, USA, and timidly made their way to the office of the president of Harvard University. They had come from Palo Alto, California, and had not scheduled an appointment. The secretary, at a glance, thought that those two, looking like country bumpkins, had no business at Harvard. — We want to speak with the president — the man said in a low voice. — He will be busy all day — the secretary replied curtly. — We will wait. The secretary ignored them for hours, hoping the couple would finally give up and leave. But they stayed there, and the secretary, somewhat frustrated, decided to bother the president, although she hated doing that. — If you speak with them for just a few minutes, maybe they will decide to go away — she said. The president sighed in irritation but agreed. Someone of his importance did not have time to meet people like that, but he hated faded dresses and tattered suits in his office. With a stern face, he went to the couple. — We had a son who studied at Harvard for a year — the woman said. — He loved Harvard and was very happy here, but a year ago he died in an accident, and we would like to erect a monument in his honor somewhere on campus. — My lady — said the president rudely —, we cannot erect a statue for every person who studied at Harvard and died; if we did, this place would look like a cemetery. — Oh, no — the lady quickly replied. — We do not want to erect a statue. We would like to donate a building to Harvard. The president looked at the woman's faded dress and her husband's old suit and exclaimed: — A building! Do you have even the faintest idea of how much a building costs? We have more than seven and a half million dollars' worth of buildings here at Harvard. The lady was silent for a moment, then said to her husband: — If that’s all it costs to found a university, why don’t we have our own? The husband agreed. The couple, Leland Stanford, stood up and left, leaving the president confused. Traveling back to Palo Alto, California, they established there Stanford University, the second-largest in the world, in honor of their son, a former Harvard student." Text extracted from: "Mileumlivros - Stories that Teach Values." Thank you for reading, my friend! If this message helped you in any way, consider leaving your glass “🥃” as a token of appreciation. A toast to our family!

@ 6e0ea5d6:0327f353

2025-02-21 18:15:52"Malcolm Forbes recounts that a lady, wearing a faded cotton dress, and her husband, dressed in an old handmade suit, stepped off a train in Boston, USA, and timidly made their way to the office of the president of Harvard University. They had come from Palo Alto, California, and had not scheduled an appointment. The secretary, at a glance, thought that those two, looking like country bumpkins, had no business at Harvard. — We want to speak with the president — the man said in a low voice. — He will be busy all day — the secretary replied curtly. — We will wait. The secretary ignored them for hours, hoping the couple would finally give up and leave. But they stayed there, and the secretary, somewhat frustrated, decided to bother the president, although she hated doing that. — If you speak with them for just a few minutes, maybe they will decide to go away — she said. The president sighed in irritation but agreed. Someone of his importance did not have time to meet people like that, but he hated faded dresses and tattered suits in his office. With a stern face, he went to the couple. — We had a son who studied at Harvard for a year — the woman said. — He loved Harvard and was very happy here, but a year ago he died in an accident, and we would like to erect a monument in his honor somewhere on campus. — My lady — said the president rudely —, we cannot erect a statue for every person who studied at Harvard and died; if we did, this place would look like a cemetery. — Oh, no — the lady quickly replied. — We do not want to erect a statue. We would like to donate a building to Harvard. The president looked at the woman's faded dress and her husband's old suit and exclaimed: — A building! Do you have even the faintest idea of how much a building costs? We have more than seven and a half million dollars' worth of buildings here at Harvard. The lady was silent for a moment, then said to her husband: — If that’s all it costs to found a university, why don’t we have our own? The husband agreed. The couple, Leland Stanford, stood up and left, leaving the president confused. Traveling back to Palo Alto, California, they established there Stanford University, the second-largest in the world, in honor of their son, a former Harvard student." Text extracted from: "Mileumlivros - Stories that Teach Values." Thank you for reading, my friend! If this message helped you in any way, consider leaving your glass “🥃” as a token of appreciation. A toast to our family! @ fd208ee8:0fd927c1

2025-02-15 07:02:08E-cash are coupons or tokens for Bitcoin, or Bitcoin debt notes that the mint issues. The e-cash states, essentially, "IoU 2900 sats". They're redeemable for Bitcoin on Lightning (hard money), and therefore can be used as cash (softer money), so long as the mint has a good reputation. That means that they're less fungible than Lightning because the e-cash from one mint can be more or less valuable than the e-cash from another. If a mint is buggy, offline, or disappears, then the e-cash is unreedemable. It also means that e-cash is more anonymous than Lightning, and that the sender and receiver's wallets don't need to be online, to transact. Nutzaps now add the possibility of parking transactions one level farther out, on a relay. The same relays that cannot keep npub profiles and follow lists consistent will now do monetary transactions. What we then have is * a **transaction on a relay** that triggers * a **transaction on a mint** that triggers * a **transaction on Lightning** that triggers * a **transaction on Bitcoin**. Which means that every relay that stores the nuts is part of a wildcat banking system. Which is fine, but relay operators should consider whether they wish to carry the associated risks and liabilities. They should also be aware that they should implement the appropriate features in their relay, such as expiration tags (nuts rot after 2 weeks), and to make sure that only expired nuts are deleted. There will be plenty of specialized relays for this, so don't feel pressured to join in, and research the topic carefully, for yourself. https://github.com/nostr-protocol/nips/blob/master/60.md

@ fd208ee8:0fd927c1

2025-02-15 07:02:08E-cash are coupons or tokens for Bitcoin, or Bitcoin debt notes that the mint issues. The e-cash states, essentially, "IoU 2900 sats". They're redeemable for Bitcoin on Lightning (hard money), and therefore can be used as cash (softer money), so long as the mint has a good reputation. That means that they're less fungible than Lightning because the e-cash from one mint can be more or less valuable than the e-cash from another. If a mint is buggy, offline, or disappears, then the e-cash is unreedemable. It also means that e-cash is more anonymous than Lightning, and that the sender and receiver's wallets don't need to be online, to transact. Nutzaps now add the possibility of parking transactions one level farther out, on a relay. The same relays that cannot keep npub profiles and follow lists consistent will now do monetary transactions. What we then have is * a **transaction on a relay** that triggers * a **transaction on a mint** that triggers * a **transaction on Lightning** that triggers * a **transaction on Bitcoin**. Which means that every relay that stores the nuts is part of a wildcat banking system. Which is fine, but relay operators should consider whether they wish to carry the associated risks and liabilities. They should also be aware that they should implement the appropriate features in their relay, such as expiration tags (nuts rot after 2 weeks), and to make sure that only expired nuts are deleted. There will be plenty of specialized relays for this, so don't feel pressured to join in, and research the topic carefully, for yourself. https://github.com/nostr-protocol/nips/blob/master/60.md @ 0fa80bd3:ea7325de

2025-02-14 23:24:37#intro The Russian state made me a Bitcoiner. In 1991, it devalued my grandmother's hard-earned savings. She worked tirelessly in the kitchen of a dining car on the Moscow–Warsaw route. Everything she had saved for my sister and me to attend university vanished overnight. This story is similar to what many experienced, including Wences Casares. The pain and injustice of that time became my first lessons about the fragility of systems and the value of genuine, incorruptible assets, forever changing my perception of money and my trust in government promises. In 2014, I was living in Moscow, running a trading business, and frequently traveling to China. One day, I learned about the Cypriot banking crisis and the possibility of moving money through some strange thing called Bitcoin. At the time, I didn’t give it much thought. Returning to the idea six months later, as a business-oriented geek, I eagerly began studying the topic and soon dove into it seriously. I spent half a year reading articles on a local online journal, BitNovosti, actively participating in discussions, and eventually joined the editorial team as a translator. That’s how I learned about whitepapers, decentralization, mining, cryptographic keys, and colored coins. About Satoshi Nakamoto, Silk Road, Mt. Gox, and BitcoinTalk. Over time, I befriended the journal’s owner and, leveraging my management experience, later became an editor. I was drawn to the crypto-anarchist stance and commitment to decentralization principles. We wrote about the economic, historical, and social preconditions for Bitcoin’s emergence, and it was during this time that I fully embraced the idea. It got to the point where I sold my apartment and, during the market's downturn, bought 50 bitcoins, just after the peak price of $1,200 per coin. That marked the beginning of my first crypto winter. As an editor, I organized workflows, managed translators, developed a YouTube channel, and attended conferences in Russia and Ukraine. That’s how I learned about Wences Casares and even wrote a piece about him. I also met Mikhail Chobanyan (Ukrainian exchange Kuna), Alexander Ivanov (Waves project), Konstantin Lomashuk (Lido project), and, of course, Vitalik Buterin. It was a time of complete immersion, 24/7, and boundless hope. After moving to the United States, I expected the industry to grow rapidly, attended events, but the introduction of BitLicense froze the industry for eight years. By 2017, it became clear that the industry was shifting toward gambling and creating tokens for the sake of tokens. I dismissed this idea as unsustainable. Then came a new crypto spring with the hype around beautiful NFTs – CryptoPunks and apes. I made another attempt – we worked on a series called Digital Nomad Country Club, aimed at creating a global project. The proceeds from selling images were intended to fund the development of business tools for people worldwide. However, internal disagreements within the team prevented us from completing the project. With Trump’s arrival in 2025, hope was reignited. I decided that it was time to create a project that society desperately needed. As someone passionate about history, I understood that destroying what exists was not the solution, but leaving everything as it was also felt unacceptable. You can’t destroy the system, as the fiery crypto-anarchist voices claimed. With an analytical mindset (IQ 130) and a deep understanding of the freest societies, I realized what was missing—not only in Russia or the United States but globally—a Bitcoin-native system for tracking debts and financial interactions. This could return control of money to ordinary people and create horizontal connections parallel to state systems. My goal was to create, if not a Bitcoin killer app, then at least to lay its foundation. At the inauguration event in New York, I rediscovered the Nostr project. I realized it was not only technologically simple and already quite popular but also perfectly aligned with my vision. For the past month and a half, using insights and experience gained since 2014, I’ve been working full-time on this project.

@ 0fa80bd3:ea7325de

2025-02-14 23:24:37#intro The Russian state made me a Bitcoiner. In 1991, it devalued my grandmother's hard-earned savings. She worked tirelessly in the kitchen of a dining car on the Moscow–Warsaw route. Everything she had saved for my sister and me to attend university vanished overnight. This story is similar to what many experienced, including Wences Casares. The pain and injustice of that time became my first lessons about the fragility of systems and the value of genuine, incorruptible assets, forever changing my perception of money and my trust in government promises. In 2014, I was living in Moscow, running a trading business, and frequently traveling to China. One day, I learned about the Cypriot banking crisis and the possibility of moving money through some strange thing called Bitcoin. At the time, I didn’t give it much thought. Returning to the idea six months later, as a business-oriented geek, I eagerly began studying the topic and soon dove into it seriously. I spent half a year reading articles on a local online journal, BitNovosti, actively participating in discussions, and eventually joined the editorial team as a translator. That’s how I learned about whitepapers, decentralization, mining, cryptographic keys, and colored coins. About Satoshi Nakamoto, Silk Road, Mt. Gox, and BitcoinTalk. Over time, I befriended the journal’s owner and, leveraging my management experience, later became an editor. I was drawn to the crypto-anarchist stance and commitment to decentralization principles. We wrote about the economic, historical, and social preconditions for Bitcoin’s emergence, and it was during this time that I fully embraced the idea. It got to the point where I sold my apartment and, during the market's downturn, bought 50 bitcoins, just after the peak price of $1,200 per coin. That marked the beginning of my first crypto winter. As an editor, I organized workflows, managed translators, developed a YouTube channel, and attended conferences in Russia and Ukraine. That’s how I learned about Wences Casares and even wrote a piece about him. I also met Mikhail Chobanyan (Ukrainian exchange Kuna), Alexander Ivanov (Waves project), Konstantin Lomashuk (Lido project), and, of course, Vitalik Buterin. It was a time of complete immersion, 24/7, and boundless hope. After moving to the United States, I expected the industry to grow rapidly, attended events, but the introduction of BitLicense froze the industry for eight years. By 2017, it became clear that the industry was shifting toward gambling and creating tokens for the sake of tokens. I dismissed this idea as unsustainable. Then came a new crypto spring with the hype around beautiful NFTs – CryptoPunks and apes. I made another attempt – we worked on a series called Digital Nomad Country Club, aimed at creating a global project. The proceeds from selling images were intended to fund the development of business tools for people worldwide. However, internal disagreements within the team prevented us from completing the project. With Trump’s arrival in 2025, hope was reignited. I decided that it was time to create a project that society desperately needed. As someone passionate about history, I understood that destroying what exists was not the solution, but leaving everything as it was also felt unacceptable. You can’t destroy the system, as the fiery crypto-anarchist voices claimed. With an analytical mindset (IQ 130) and a deep understanding of the freest societies, I realized what was missing—not only in Russia or the United States but globally—a Bitcoin-native system for tracking debts and financial interactions. This could return control of money to ordinary people and create horizontal connections parallel to state systems. My goal was to create, if not a Bitcoin killer app, then at least to lay its foundation. At the inauguration event in New York, I rediscovered the Nostr project. I realized it was not only technologically simple and already quite popular but also perfectly aligned with my vision. For the past month and a half, using insights and experience gained since 2014, I’ve been working full-time on this project. @ e3ba5e1a:5e433365

2025-02-13 06:16:49My favorite line in any Marvel movie ever is in “Captain America.” After Captain America launches seemingly a hopeless assault on Red Skull’s base and is captured, we get [this line](https://www.youtube.com/shorts/kqsomjpz7ok): “Arrogance may not be a uniquely American trait, but I must say, you do it better than anyone.” Yesterday, I came across a comment on the song [Devil Went Down to Georgia](https://youtu.be/ut8UqFlWdDc) that had a very similar feel to it:  America has seemingly always been arrogant, in a uniquely American way. Manifest Destiny, for instance. The rest of the world is aware of this arrogance, and mocks Americans for it. A central point in modern US politics is the deriding of racist, nationalist, supremacist Americans. That’s not what I see. I see American Arrogance as not only a beautiful statement about what it means to be American. I see it as an ode to the greatness of humanity in its purest form. For most countries, saying “our nation is the greatest” *is*, in fact, twinged with some level of racism. I still don’t have a problem with it. Every group of people *should* be allowed to feel pride in their accomplishments. The destruction of the human spirit since the end of World War 2, where greatness has become a sin and weakness a virtue, has crushed the ability of people worldwide to strive for excellence. But I digress. The fears of racism and nationalism at least have a grain of truth when applied to other nations on the planet. But not to America. That’s because the definition of America, and the prototype of an American, has nothing to do with race. The definition of Americanism is *freedom*. The founding of America is based purely on liberty. On the God-given rights of every person to live life the way they see fit. American Arrogance is not a statement of racial superiority. It’s barely a statement of national superiority (though it absolutely is). To me, when an American comments on the greatness of America, it’s a statement about freedom. Freedom will always unlock the greatness inherent in any group of people. Americans are *definitionally* better than everyone else, because Americans are freer than everyone else. (Or, at least, that’s how it should be.) In *Devil Went Down to Georgia*, Johnny is approached by the devil himself. He is challenged to a ridiculously lopsided bet: a golden fiddle versus his immortal soul. He acknowledges the sin in accepting such a proposal. And yet he says, “God, I know you told me not to do this. But I can’t stand the affront to my honor. I am the greatest. The devil has nothing on me. So God, I’m gonna sin, but I’m also gonna win.” *Libertas magnitudo est*

@ e3ba5e1a:5e433365

2025-02-13 06:16:49My favorite line in any Marvel movie ever is in “Captain America.” After Captain America launches seemingly a hopeless assault on Red Skull’s base and is captured, we get [this line](https://www.youtube.com/shorts/kqsomjpz7ok): “Arrogance may not be a uniquely American trait, but I must say, you do it better than anyone.” Yesterday, I came across a comment on the song [Devil Went Down to Georgia](https://youtu.be/ut8UqFlWdDc) that had a very similar feel to it:  America has seemingly always been arrogant, in a uniquely American way. Manifest Destiny, for instance. The rest of the world is aware of this arrogance, and mocks Americans for it. A central point in modern US politics is the deriding of racist, nationalist, supremacist Americans. That’s not what I see. I see American Arrogance as not only a beautiful statement about what it means to be American. I see it as an ode to the greatness of humanity in its purest form. For most countries, saying “our nation is the greatest” *is*, in fact, twinged with some level of racism. I still don’t have a problem with it. Every group of people *should* be allowed to feel pride in their accomplishments. The destruction of the human spirit since the end of World War 2, where greatness has become a sin and weakness a virtue, has crushed the ability of people worldwide to strive for excellence. But I digress. The fears of racism and nationalism at least have a grain of truth when applied to other nations on the planet. But not to America. That’s because the definition of America, and the prototype of an American, has nothing to do with race. The definition of Americanism is *freedom*. The founding of America is based purely on liberty. On the God-given rights of every person to live life the way they see fit. American Arrogance is not a statement of racial superiority. It’s barely a statement of national superiority (though it absolutely is). To me, when an American comments on the greatness of America, it’s a statement about freedom. Freedom will always unlock the greatness inherent in any group of people. Americans are *definitionally* better than everyone else, because Americans are freer than everyone else. (Or, at least, that’s how it should be.) In *Devil Went Down to Georgia*, Johnny is approached by the devil himself. He is challenged to a ridiculously lopsided bet: a golden fiddle versus his immortal soul. He acknowledges the sin in accepting such a proposal. And yet he says, “God, I know you told me not to do this. But I can’t stand the affront to my honor. I am the greatest. The devil has nothing on me. So God, I’m gonna sin, but I’m also gonna win.” *Libertas magnitudo est* @ daa41bed:88f54153