-

@ Colin Gifford

2024-09-02 06:33:01

@ Colin Gifford

2024-09-02 06:33:01The most challenging aspect of running a successful company is risk mitigation. At any time, due to events which are often unforeseen, a bad year or quarter mixed with poor treasury management can make a company insolvent.

Defined as the process of overseeing an organization's liquidity, financial instruments, banking, and disbursement activities, treasury management ultimately revolves around one key question: How can a company use its already received cash flows to mitigate unforeseen risks?

Failing to address this can lead to adverse liquidity issues, even for companies that excel in their own operations. In this paper, I will explore the reasons why the imminent devaluation of fiat currency through inflation automatically places businesses at a disadvantage whilst also subjecting investors to unwarranted risks, and highlight why bitcoin can be a potential solution.

**Section 1: The issue with current treasury strategy **

A downturn in an economy always reinforces the fundamental rule of business: cash is king.

Only cash can pay creditors, payroll and expenditures, and at first thought one would assume that a company should accumulate as much as possible to protect against potential downturns.

However, what we learn from a relatively early age is that idled cash loses purchasing power each year through inflation. Even a thriving company generating $1 billion in annual sales and holding this amount on its balance sheet will lose $70 million of purchasing power at a 7 per cent inflation rate.

Inflation therefore creates a powerful and direct incentive for companies to hold as little endowment as possible and decapitalise into short term investments which offer some form of yield to combat this.

The rules of the game are simple. Whatever alternative chosen still has to be low risk and liquid enough so current liabilities can be paid when they fall due. The irony of the situation is companies need a cash-like instrument but cannot in any way hold cash.

The next best alternative becomes sovereign debt, or at the very least high-grade company bonds as they are both relatively safe and liquid, but this strategy runs into many of the same problems as holding cash in a bank account.

Taking the current US 10 Year Treasury Note as an example with a coupon rate sitting at 4.7%, we can see this doesn’t actually fix the problem inflation causes. This strategy only gives investors a taxable yield of 470 basis points, which is more likely a 350-bps yield after tax. Again, if investors have parted with their capital and taken on additional risk through debt purchasing their money should be outpacing inflation.

It is self-evident that the risk-free rate is far from acceptable for investors, nor should it be.

As an investor deciding to forgo the risk-free rate and opt to invest in the stock market, you are doing so in pursuit of an additional (market risk) premium which comes with the added risk.

Since the market risk premium puts the investor’s return expectation around the 12-14% mark, company CFOs face the daunting task of delivering this annual return with interest rates at 5% and inflation at 7%.Understanding if they do nothing they are diluting value, corporate teams now have to decapitalise in other ways, so how do they do it?

The three strategies predominantly used by publicly listed companies to decapitalise and accrete value are 1) Issue dividends 2) Stock/Share buybacks 3) Acquire other companies.

**1. Issue Dividends ** If the objective is to distribute money to shareholders, why not simply give the money directly to them? This approach is particularly favourable for large blue-chip companies.

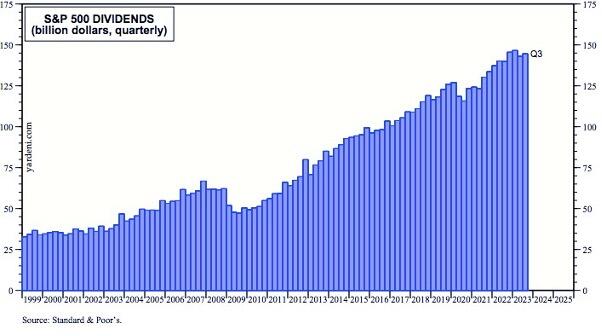

Dividend expectations become sticky, making it challenging for CFOs to disburse funds sporadically, especially when the company performs well and sets strong expectations for future disbursement. For this reason, we see dividends ultimately increase overtime as seen below.

The bigger issue however is that issuing dividends doesn't help accrete Earnings Per Share (EPS).

S&P 500 Dividends from 1999 to 2023. Source: Included

S&P 500 Dividends from 1999 to 2023. Source: Included **2. Stock/Share Buyback ** A more realistic treasury strategy for CFOs seeking EPS accretion is a share buyback.

Buying back a company's stock reduces the denominator in the EPS calculation, thereby increasing the overall figure. A company can either borrow or issue debt yielding around 4% and repurchase shares, which may appreciate by 10% in a year, primarily due to inflation.

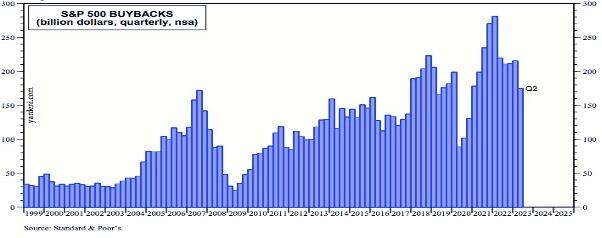

This approach can result in an immediate 6% EPS increase which satisfies shareholders. The focus of the treasury team in this game revolves more around the actual cost of the debt issuance than generating inherent value.As shown below, stock buybacks exhibit a strong correlation with the ebbs and flows of credit cycles. These cycles are influenced by artificially low interest rates, which lead to easily accessible funds.

This further underscores the point made earlier that financial professionals are astute and will always respond to incentives. Share buybacks tend to peak when money is cheap, historically occurring in 2007, 2009-2019, and 2020.

S&P 500 Stock Buybacks from 1990 to 2023. Source: Included

S&P 500 Stock Buybacks from 1990 to 2023. Source: Included **3. Acquisition of companies ** A third alternative available to companies is to acquire other businesses.

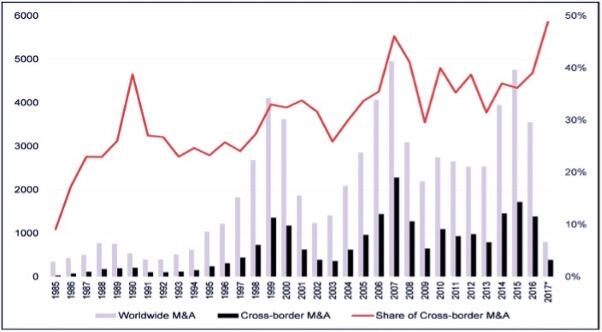

A merger or acquisition (M&A) accomplishes EPS growth through numerator increase which is opposite to a share buyback. Through M&A deals, earnings per share for each shareholder increase, assuming all other factors remain constant.

Since M&A transactions are predominantly financed through debt, it's no coincidence that the pattern of M&A deals follows that of the short-term business cycle, as illustrated below.

The concern with the three strategies above is the imminent infusion of leverage. Substantial debt may be optimal for our largest companies in the current economy, but for most this doesn’t outweigh the substantial insolvency and liquidity risk it brings.

Investors need an alternative which can still accrete value and isn’t at the whim of short term credit cycles.

*Section 2: How Bitcoin Can Change This *

Bitcoin stands as the antithesis to the treasury strategies of the last half-century. It presents a method that genuinely rewards companies for maintaining endowments and setting aside capital for future needs. Instead of resorting to borrowing and navigating the yield curve in search of a suboptimal taxable return, why not invest in the most exceptional store of value ever created?

Bitcoin offers the best of both worlds: the utility of a monetary asset with unrivalled scarcity, all while avoiding the credit and counterparty risks associated with sovereign debt.

Bitcoin's ease of transfer and global acceptability allow for rapid movement, sale, and exchange worldwide, serving as an effective hedge against liquidity risk or a means to reduce tax burdens imposed by resourceful governments.

Only a handful of companies worldwide possess a strategic advantage in terms of the products or services they offer.

Most technology or pharmaceutical businesses churn out similar products at competitive prices, often indistinguishable from their rivals. However, an optimal treasury strategy cannot be forged, manipulated, or concealed over extended periods.

For instance, if a CFO at a tech company listed in the S&P 500 simply wants to invest in sovereign debt or exchange-traded funds (ETFs), why should any investor, let alone an institution, entrust their funds to that company? Businesses aiming to set themselves apart from competitors must provide a service which enhances enterprise value.

The prevailing argument against S&P500 companies using Bitcoin as a treasury asset is its volatility, which at first glance appears valid. Corporate finance teams, along with a multitude of advisors, bankers, and consultants, are handsomely compensated to employ various financial instruments to mitigate volatility and guard against downside risk, so why would anyone willingly increase their exposure to the potential of a sudden market drop?

The answer lies in a fair comparison of Bitcoin's potential as a treasury asset against relevant financial instruments like sovereign or corporate debt, as discussed in the previous section. When you claim allocating 1% of your portfolio to Bitcoin is too risky, yet you're willing to leverage your company significantly with debt to acquire another firm, hoping to time the market correctly and avoid disaster, it raises the question: How do we define risk?

Expanding on this Bitcoin-debt comparison, it must be acknowledged that companies often hold these instruments for extended periods, which mitigates much of the short-term volatility. Bitcoin's primary advantage over debt securities is that it provides a tax-deferred return well above inflation, let alone the market's risk-premium hurdle rate.

Examining the annual return chart since 2010 below, it's evident that Bitcoin's price has increased by a staggering 83% since its peak in 2017.

| 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | | --- | --- | --- | --- | --- | --- | --- | | 1,331% | -73% | 95% | 301% | 90% | -81% | 146% | Bitcoin yearly ROI

It's possible the annual volatility of the past seven years will be too high for some investors.

But, what if I told you about a treasury asset that consistently delivered positive returns, surpassing market expectations, all without overleveraging a company's risk tolerance? What if I said this asset was fungible, durable, portable, easy to value and verify, and liquid enough to be sold within minutes? You might find this hard to believe, as you'd likely argue such an asset would already be priced correctly and wouldn't offer room for significant value gains. It’s these characteristics which make Bitcoin a desirable treasury asset for companies however it’s still priced incorrectly.

We are still in the early stages of Bitcoin's ascent, and volatility is an inherent characteristic of an asset which hasn't been fully priced for its utility. Bitcoin's utility value hasn't changed since October 2008; it's merely the market value catching up.

The strict limits of scarcity, such as Bitcoin's hard cap of 21 million coins, have never been seen before. CFOs must ask themselves whether they have the risk tolerance to allocate just 1% in this relatively nascent market. The reason not all companies have done so already is simple: current accounting rules are negatively biased against Bitcoin. But this won't last for long.

**Section Three: The Leap to Fair Value Accounting **

For the past decade, one of the main criticisms against Bitcoin as a treasury asset has been the challenge of accurately representing it in a company's financial statements. The good news? This is about to change. Effective from December 2024, publicly traded companies in the United States will adjust how they measure Bitcoin from Indefinite Intangible Accounting to Fair Value Accounting. To simplify for those less familiar with accounting, let's break this down.

Currently, both Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS) view Bitcoin through the lens of Indefinite Intangible Accounting under IAS 38 (IFRS 138). Under this standard, Bitcoin is measured on the balance sheet at cost (the total amount spent on purchasing Bitcoin in dollars) and is only revalued if the price of Bitcoin decreases during the accounting period. This conservative accounting approach is designed to assess the value of assets such as patents, copyrights, goodwill, and intellectual property.

However, this restrained method of measurement has discouraged CFOs from adopting Bitcoin. It has also posed challenges for investors.

Suppose two companies acquire Bitcoin at different times; in that case, their financial statements aren't comparable, creating discrepancies between them.

Table 1 - Balance Sheet Effect (Intangible Accounting)

| | Company A | Company B | | --- | --- | --- | | Bitcoin Bought| 10 | 8 | | Date of Purchase | 10 March 2023| 16 April 2023 | | Price at Purchase Date (USD) | $20,200 | $30,500 | | Value on Balance Sheet (16 April) | $202,000 | $244,000 |

The table above reveals several important points. From an investor's perspective, Company A seems to hold less Bitcoin compared to Company B, despite the reality being the opposite. Furthermore, when examining Profit and Loss, the current accounting system attributes any markdown in the value of Bitcoin on the balance sheet as an operating expense.

As someone with a background in auditing, I recognise EBITDA is not a Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS) metric and isn't typically included in most income statements. However, investors often seek EBITDA for a clearer understanding of a company's overall financial health, considering its operational and financing value.

To illustrate this with another example, suppose both Company A and Company B have the same operating income, but Company A has experienced a $100,000 loss on Bitcoin since the last reporting period.

An overview of the income statement would appear as follows:

Table 2 - Profit and Loss Effect (Profit and Loss Accounting)

| | Company A | Company B | | --- | --- | --- | | Operating Income | $550,000 | $500,000 | | Operating Expenses | $400,000 | $300,000 | | EBITDA | $150,000 | $200,000 | | Other Gains and Losses | - | - | | Net Profit | $150,000 | $200,000 | Included in this figure is the $100,000 loss on Bitcoin

From this perspective, Company A's operations might appear to have underperformed by $50,000. However, this doesn't provide an accurate picture of a company's actual operational performance. It can lead to the incorrect allocation of capital and misguided investment decisions.

IFRS 13 Fair Value Accounting addresses these issues. Under IFRS 13, assets are marked both up and down on the balance sheet at the end of each reporting period. While assets are still initially measured at cost when purchased by the company, their fair value is measured using a revaluation account that is presented alongside the asset on the balance sheet. This change ensures investors can always discern which companies own more Bitcoin at the end of a reporting period.

The revised table below illustrates this concept:

Table 3 - Balance Sheet Effect (Fair Value Accounting) | | Company A | Company B | | --- | --- | --- | | Bitcoin Bought | 10 | 8 | | Date | 10 March 2023 | 16 April 2023 | | Price at Purchase Date | $20,200 | $30,500 | | Value on Balance Sheet Purchase Date | $202,000 | $244,000 | | Value on Balance Sheet (16th April) | $305,000 | $244,000 |

Fair Value Accounting from the perspective of Profit and Loss modifies how investment gains or losses are reflected in net income. Instead of booking losses against operating profit, they are now categorized under 'other gains or losses'. This change enhances transparency for investors regarding a company's operational health.

When we adjust Table 2 to apply Fair Value Accounting principles, we can observe Table 4 still shows a lower net profit, but it provides users of the financial statements with more insight into the reasons behind this.

An investor might recognize that Company A is a more attractive investment than Company B because the lower net profit is primarily due to losses related to Bitcoin, rather than the core operating performance of the business.

Table 4 - Profit and Loss Effect (Fair Value Accounting)

| | Company A | Company B | | --- | --- | --- | | Operating Income | $550,000 | $500,000 | | Date | $300,000 | $300,000 | | Price at Purchase Date | $250,000 | $200,000 | | Value on Balance Sheet Purchase Date | ($100,000) | - | | Value on Balance Sheet (16th April) | $150,000 | $200,000 | We would expect a note next to this in Financial Statements outlining where the loss comes from

Emerging from this change in accounting standard a new opportunity for shareholders to encourage management to hold Bitcoin.

As diversification in a portfolio reduces the emphasis placed on a single company’s correlation coefficient, as finance theory teaches, we should encourage the CFOs of companies in our portfolios to take calculated risks and explore new strategies for increasing EPS without burdening themselves with significant debt.

I expect at first these positions should be small (around 1%), but over time Bitcoin can help deleverage our public markets and decrease risk for everyday investors.

Colin Gifford

November 2023

**References ** Author: The Bitcoin Layer

Video Title: Bitcoin Revolutionizes Corporate Finance | Michael Saylor

Date of Publication: October 7th

Website or Platform: YouTube

URL: https://www.youtube.com/watch?v=RTiRf1NDEr8&t=3772s