-

@ Alejandro

2023-11-19 02:18:56

@ Alejandro

2023-11-19 02:18:56"26.5% of Spanish people and 29.5 % of Italian people between the ages of 30 and 34 years old still live with their parents."

— The Mediterranean youth and the challenges of the permanent crisis

The Esade Center for Economic Policy and the Friedrich Naumann Foundation For Freedom just released an study (English, Spanish) conducted in Spain, Italy, Jordan, Lebanon, Morocco, Portugal, and Tunisia covering people between the ages of 18 and 34.

Money is seriously broken when one out of every three people 30 to 34 years old can't afford to buy or rent a home.

The study is a very interesting read to understand the current situation in Mediterranean countries.

The recommendations it provides to address the permanent crisis of the people born between 1980 and 2005 shows how oblivious the establishment is to the root cause of the problem.

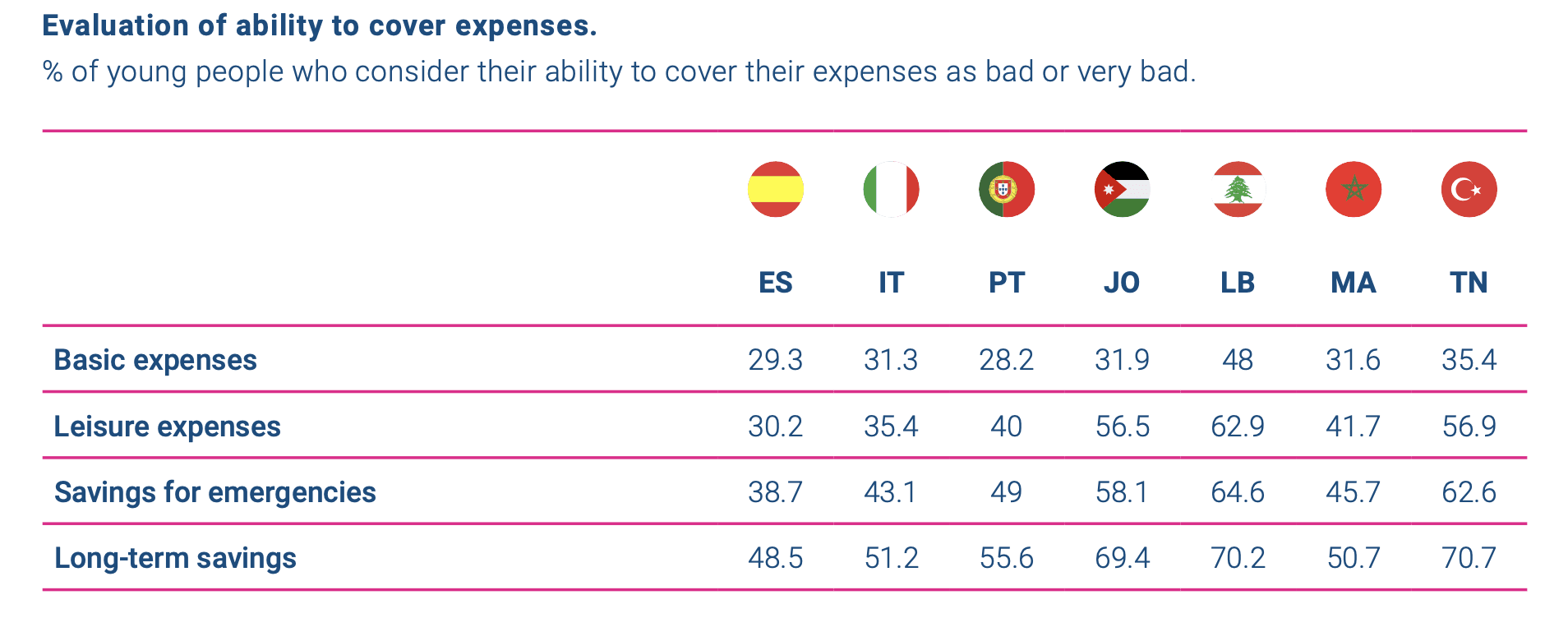

Ability to cover expenses and save

Less than half, in some cases, less than one third of the youth in this countries feels that they can cover their basic expenses.

When you look at their ability to save, you can see the dichotomy of short term vs. long term forecasting. Most youth don't find themselves capable to save for an emergency yet they think that they can save long term (housing and retirement).

The reality is that if you can't save for an emergency, you can't save for long term, but people tend to look at the future with rosier lenses.

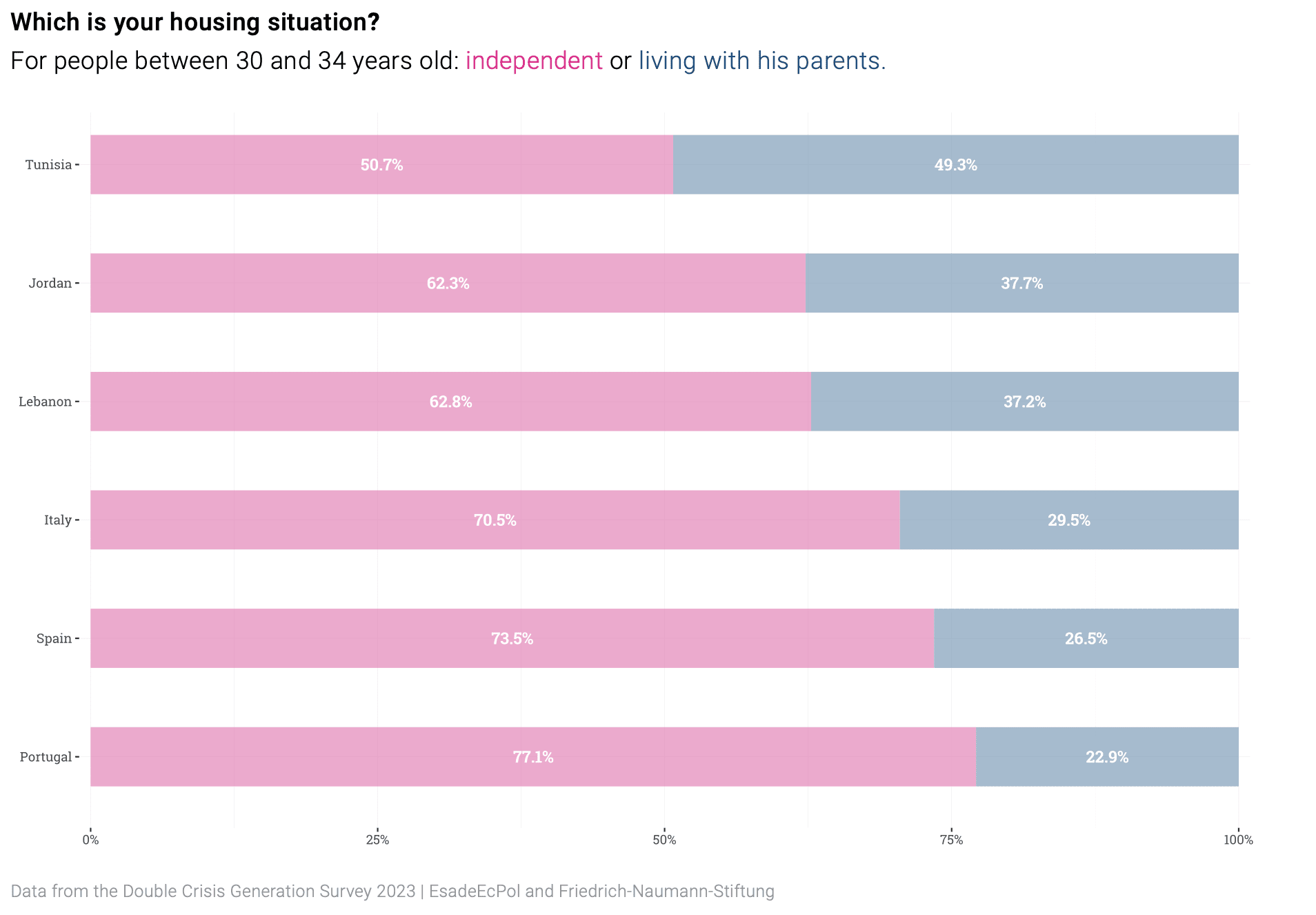

Becoming independent

It is very common for younger people in Mediterranean countries to live with their parents while studying at college or university. That is why this study specifically broke down the housing results by ages and the results are shocking.

Half of the young Tunisians ages 30 to 34 still live with their parents! That number is 30% for Italy and 27% for Spain. The main cited reason: lack of own income.

And for those who were able to move out, the majority did so with financial support from their parents, the boomer generation. Or as I call them, the last generation with sound money.

The bogus solutions

You would think that this would be obvious by now but apparently not.

I believe that most people don't see that the money is broken because their mind can't conceive such a possibility. They only know fiat and when looking for solutions, money is not even on their list of candidates.

What do these esteemed economists think that we should do to solve the problem?

Here is their list: - Improve higher level education: better access to, and more funds for public universities - Minimum living income payments and savings accounts managed and partially funded by the government - Expand public housing and simplify regulations for builders

The real reasons: the monetary premium that homes carry and the loss of real purchasing power by these generations are never mentioned. Inflation is mentioned in the opening statements and apparently it's Putin's fault.

Last week I ended my article with this statement and this week I'm repeating myself:

It's our duty to help people understand why they are how they are. Introduce them to sound money and the future that it can give us whenever you can.

Notable notes

nostr:nevent1qqszw547ja5rvtnrsd4tknyuyn08kpjthfhm0s59xpfk3xfsaarg83cdy7fz3

Recommendations

Fortune

This is an RSS feed of the Fortune website. A great way to stay up to date on news once you ditch X and go Nostr only 😀

You can follow the account at nostr:npub1zy2ent5mwdft3lw3lc4x5wdn5uc3dml25209nremv4g3kcwk3k7sw26tfz

What did you think of today's newsletter?

Your feedback helps me create the best newsletter possible for you.

Please leave a comment and checkout comments from other subscribers and readers. I love hearing from the Bitcoin For Families community ❤️ 🙏🏻

See you again next week! — Alejandro

This newsletter is for educational purposes. It does not represent financial advice. Do your own research before buying Bitcoin.