-

@ Teem

2024-12-09 11:26:51

@ Teem

2024-12-09 11:26:51Bitcoin, the world's first and most well-known cryptocurrency, has taken the financial world by storm. Its decentralized nature, secure transactions, and potential for high returns have attracted millions of investors. However, the volatile nature of the market and regulatory uncertainties have also raised concerns.

The Pros of Bitcoin 1. Decentralization: Bitcoin operates on a decentralized network, meaning no single entity controls it. This makes it resistant to censorship and manipulation. 2. Security: Bitcoin transactions are secured by blockchain technology, a robust system that records transactions in a transparent and immutable way. 3. Potential for High Returns: Bitcoin's price has experienced significant fluctuations, leading to substantial gains for early investors. 4. Global Accessibility: Bitcoin can be accessed by anyone with an internet connection, regardless of geographic location or financial status. 5. Privacy: Bitcoin transactions can be conducted pseudonymously, providing a level of privacy not offered by traditional financial systems.

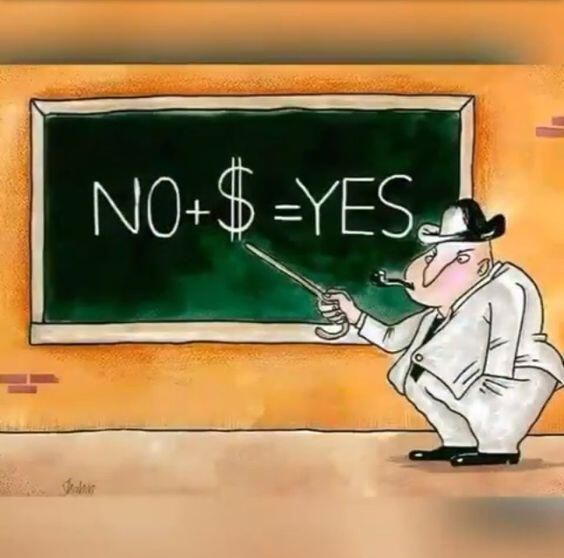

The Cons of Bitcoin 1. Volatility: Bitcoin's price is highly volatile, making it a risky investment. Price fluctuations can be drastic, and investors may lose significant amounts of money. 2. Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is still evolving, and governments around the world are taking different approaches. This uncertainty can create legal and tax complications for investors. 3. Energy Consumption: Bitcoin mining requires significant amounts of energy, raising concerns about its environmental impact. 4. Security Risks: While blockchain technology is secure, individuals can still be vulnerable to hacking and scams. 5. Limited Practical Use Cases: Bitcoin's primary use case remains as a speculative asset rather than a widely accepted means of payment. Should You Invest in Bitcoin?

The decision to invest in Bitcoin is a personal one that should be carefully considered. It is essential to conduct thorough research and understand the risks involved. If you're considering investing, here are some tips: 1. Diversify Your Portfolio: Don't put all your eggs in one basket. Diversify your investments across various asset classes to mitigate risk. 2. Start Small: Begin with a small investment to test the waters and gain experience. 3. Long-Term Perspective: Bitcoin is a long-term investment. Don't get caught up in short-term price fluctuations. 4. Stay Informed: Keep up-to-date with the latest news and developments in the cryptocurrency market. 5. Consult a Financial Advisor: Seek advice from a qualified financial advisor to get personalized guidance.

Ultimately, the future of Bitcoin remains uncertain. While it has the potential to revolutionize the financial industry, it also faces significant challenges. As technology continues to evolve, it is likely that cryptocurrencies will play an increasingly important role in the global economy. However, investors should approach this emerging market with caution and a clear understanding of the risks involved.

Reference: https://ssoemsisd.com/depomin82-an-overview-of-cryptocurrency-and-its-investment-potential/