-

@ Yaël

2025-02-05 20:41:31

When a consumer has an account at their bank or another financial service closed on them, it’s a maddening experience.

These notices usually appear seemingly out of the blue, giving the customer just a few weeks to empty their funds from the account to move them elsewhere.

Sometimes, it’s because of fraudulent activity or suspicious transactions. It may also be because of a higher risk profile for customer, including those who often pay their bills late or let their account go negative too many times.

These customers will necessarily be categorized as much riskier to the bank’s operations and more liable to have their accounts closed.

But what if accounts are shut down not because of any true financial risk, but because the banks believe their customers are a *regulatory* risk?

Perhaps you buy and sell cryptocurrencies, partake in sports betting, or own and operate a cannabis dispensary in a state where it’s legal? While each of these categories of financial transactions are not suspicious nor illegal in themselves, they increase the scrutiny that regulators will place on banks that take on such customers.

While any reasonable standard of risk management applied to banking will discriminate against accounts that rack up fees or clearly participate in fraud, the notion of inherent risk due to regulatory punishment doled out to banks is a separate and concerning issue.

As Cato Institute Policy Analyst Nick Anthony [rightly sketches out](https://www.cato.org/blog/two-types-debanking-operational-governmental), this creates a dichotomy between what he deems “operational” debanking and “governmental” debanking, where the former is based on actual risk of default or fraud while the latter is due only to regulatory risk from government institutions and regulators.

**The Bank Secrecy Act and Weaponization**

The law that creates these mandates and imposes additional liabilities on banks is called the **Bank Secrecy Act,** originally signed into law in 1970.

Though banking regulation has existed in some form throughout the 19th and [20th centuries](https://tile.loc.gov/storage-services/service/ll/fedreg/fr010/fr010111/fr010111.pdf), the BSA imposed new obligations on financial institutions, mandating **Know Your Customer** and **Anti-Money Laundering** programs to fully identify bank customers and surveil their transactions to detect any potentially illegal behavior.

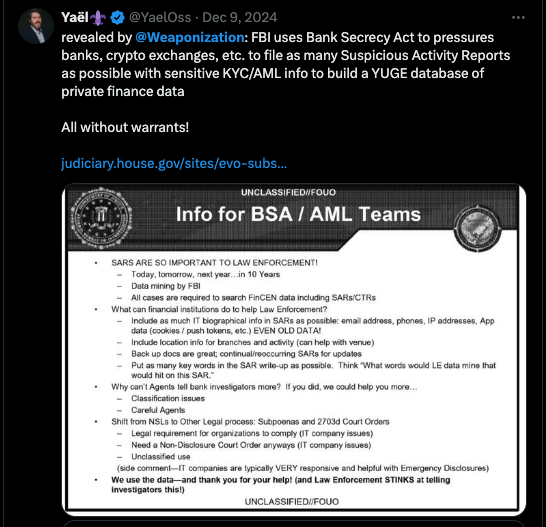

Without any requirements for warrants or judicial orders, banks are forced to report the “suspicious” transactions of their customers directly to the Financial Crimes Enforcement Network (FinCEN), what is called a “Suspicious Activity Report”. The grounds for filing this could be anything from the name of the recipient, whether the amount is over $10,000, or perhaps even any note or description in the bank transfer that may allude to some criminal activity. If the banks do not file this pre-emptively, they could be on the hook for massive penalties from regulators.

As the House Weaponization Subcommittee [revealed](https://judiciary.house.gov/sites/evo-subsites/republicans-judiciary.house.gov/files/2024-12/2024-12-05-Financial-Surveillance-in-the-United-States.pdf) in one of its final reports, the Bank Secrecy Act and SARs were ramped up specifically to target political conservatives, MAGA supporters, and gun owners.

The consequences of the BSA and its imposed surveillance have reaped unintended havoc on millions of ordinary Americans. This is especially true for those who have undergone “debanking”.

Many Bitcoin and cryptocurrency entrepreneurs, for example, have been debanked on the [sole grounds](https://www.axios.com/2024/12/01/debanked-crypto-andreessen-joe-rogan) of being involved in the virtual currency industry, while millions of others have been swept up in the dragnet of the BSA and financial regulators forcibly deputizing banks to cut off customers, often without explanation.

According to FinCEN guidance, financial institutions are [compelled](https://www.fincen.gov/resources/advisories/fincen-advisory-fin-2010-a014) to keep suspicious activity reports confidential, even from customers, or face criminal penalties. This just makes the problems worse.

**Further reading**

The [excellent research](https://www.cato.org/policy-analysis/revising-bank-secrecy-act-protect-privacy-deter-criminals) by the team at the Cato Institute’s Center for Monetary and Financial Alternatives provides reams of data on these points. As put by Cato’s **Norbert Michel**, “People get wrapped up in BSA surveillance for simply spending their own money”.

My colleagues and I have written [extensively](https://consumerchoicecenter.org/de-banking-is-an-avoidable-consequence-of-strict-financial-regulation/) about why we need reforms to undue the financial surveillance regime that only accelerates debanking of Americans. It’s even worse for those who are interested in the innovative world of Bitcoin and its crypto-offspring as [I explain here](https://www.btcpolicy.org/articles/downgrading-the-bank-secrecy-act-is-a-powerful-reform-for-bitcoin).

It’s one reason why the [Consumer Choice Center supports the **Saving Privacy Act**](https://consumerchoicecenter.org/reform-the-bank-secrecy-act-to-better-protect-consumer-financial-privacy/) introduced by Sens. Mike Lee and Rick Scott, which would vastly reform the Bank Secrecy Act to remove the pernicious and faulty Suspicious Activity Report system.

As the Senate Banking Committee [holds a hearing](https://www.banking.senate.gov/newsroom/majority/scott-announces-witnesses-for-debanking-hearing) on debanking in February 2025, we hope they will zero-in on the issue of excessive financial surveillance required by financial regulators and the harmful and likely unconstitutional impact of the **Bank Secrecy Act**. With renewed interest and motivation, American leaders can reform these rules to ensure that our financial privacy and freedom to transact are restored and upheld.

@ Yaël

2025-02-05 20:41:31When a consumer has an account at their bank or another financial service closed on them, it’s a maddening experience. These notices usually appear seemingly out of the blue, giving the customer just a few weeks to empty their funds from the account to move them elsewhere. Sometimes, it’s because of fraudulent activity or suspicious transactions. It may also be because of a higher risk profile for customer, including those who often pay their bills late or let their account go negative too many times. These customers will necessarily be categorized as much riskier to the bank’s operations and more liable to have their accounts closed. But what if accounts are shut down not because of any true financial risk, but because the banks believe their customers are a *regulatory* risk? Perhaps you buy and sell cryptocurrencies, partake in sports betting, or own and operate a cannabis dispensary in a state where it’s legal? While each of these categories of financial transactions are not suspicious nor illegal in themselves, they increase the scrutiny that regulators will place on banks that take on such customers. While any reasonable standard of risk management applied to banking will discriminate against accounts that rack up fees or clearly participate in fraud, the notion of inherent risk due to regulatory punishment doled out to banks is a separate and concerning issue. As Cato Institute Policy Analyst Nick Anthony [rightly sketches out](https://www.cato.org/blog/two-types-debanking-operational-governmental), this creates a dichotomy between what he deems “operational” debanking and “governmental” debanking, where the former is based on actual risk of default or fraud while the latter is due only to regulatory risk from government institutions and regulators. **The Bank Secrecy Act and Weaponization** The law that creates these mandates and imposes additional liabilities on banks is called the **Bank Secrecy Act,** originally signed into law in 1970. Though banking regulation has existed in some form throughout the 19th and [20th centuries](https://tile.loc.gov/storage-services/service/ll/fedreg/fr010/fr010111/fr010111.pdf), the BSA imposed new obligations on financial institutions, mandating **Know Your Customer** and **Anti-Money Laundering** programs to fully identify bank customers and surveil their transactions to detect any potentially illegal behavior. Without any requirements for warrants or judicial orders, banks are forced to report the “suspicious” transactions of their customers directly to the Financial Crimes Enforcement Network (FinCEN), what is called a “Suspicious Activity Report”. The grounds for filing this could be anything from the name of the recipient, whether the amount is over $10,000, or perhaps even any note or description in the bank transfer that may allude to some criminal activity. If the banks do not file this pre-emptively, they could be on the hook for massive penalties from regulators. As the House Weaponization Subcommittee [revealed](https://judiciary.house.gov/sites/evo-subsites/republicans-judiciary.house.gov/files/2024-12/2024-12-05-Financial-Surveillance-in-the-United-States.pdf) in one of its final reports, the Bank Secrecy Act and SARs were ramped up specifically to target political conservatives, MAGA supporters, and gun owners.  The consequences of the BSA and its imposed surveillance have reaped unintended havoc on millions of ordinary Americans. This is especially true for those who have undergone “debanking”. Many Bitcoin and cryptocurrency entrepreneurs, for example, have been debanked on the [sole grounds](https://www.axios.com/2024/12/01/debanked-crypto-andreessen-joe-rogan) of being involved in the virtual currency industry, while millions of others have been swept up in the dragnet of the BSA and financial regulators forcibly deputizing banks to cut off customers, often without explanation. According to FinCEN guidance, financial institutions are [compelled](https://www.fincen.gov/resources/advisories/fincen-advisory-fin-2010-a014) to keep suspicious activity reports confidential, even from customers, or face criminal penalties. This just makes the problems worse. **Further reading** The [excellent research](https://www.cato.org/policy-analysis/revising-bank-secrecy-act-protect-privacy-deter-criminals) by the team at the Cato Institute’s Center for Monetary and Financial Alternatives provides reams of data on these points. As put by Cato’s **Norbert Michel**, “People get wrapped up in BSA surveillance for simply spending their own money”. My colleagues and I have written [extensively](https://consumerchoicecenter.org/de-banking-is-an-avoidable-consequence-of-strict-financial-regulation/) about why we need reforms to undue the financial surveillance regime that only accelerates debanking of Americans. It’s even worse for those who are interested in the innovative world of Bitcoin and its crypto-offspring as [I explain here](https://www.btcpolicy.org/articles/downgrading-the-bank-secrecy-act-is-a-powerful-reform-for-bitcoin). It’s one reason why the [Consumer Choice Center supports the **Saving Privacy Act**](https://consumerchoicecenter.org/reform-the-bank-secrecy-act-to-better-protect-consumer-financial-privacy/) introduced by Sens. Mike Lee and Rick Scott, which would vastly reform the Bank Secrecy Act to remove the pernicious and faulty Suspicious Activity Report system. As the Senate Banking Committee [holds a hearing](https://www.banking.senate.gov/newsroom/majority/scott-announces-witnesses-for-debanking-hearing) on debanking in February 2025, we hope they will zero-in on the issue of excessive financial surveillance required by financial regulators and the harmful and likely unconstitutional impact of the **Bank Secrecy Act**. With renewed interest and motivation, American leaders can reform these rules to ensure that our financial privacy and freedom to transact are restored and upheld.

@ Yaël

2025-02-05 20:41:31When a consumer has an account at their bank or another financial service closed on them, it’s a maddening experience. These notices usually appear seemingly out of the blue, giving the customer just a few weeks to empty their funds from the account to move them elsewhere. Sometimes, it’s because of fraudulent activity or suspicious transactions. It may also be because of a higher risk profile for customer, including those who often pay their bills late or let their account go negative too many times. These customers will necessarily be categorized as much riskier to the bank’s operations and more liable to have their accounts closed. But what if accounts are shut down not because of any true financial risk, but because the banks believe their customers are a *regulatory* risk? Perhaps you buy and sell cryptocurrencies, partake in sports betting, or own and operate a cannabis dispensary in a state where it’s legal? While each of these categories of financial transactions are not suspicious nor illegal in themselves, they increase the scrutiny that regulators will place on banks that take on such customers. While any reasonable standard of risk management applied to banking will discriminate against accounts that rack up fees or clearly participate in fraud, the notion of inherent risk due to regulatory punishment doled out to banks is a separate and concerning issue. As Cato Institute Policy Analyst Nick Anthony [rightly sketches out](https://www.cato.org/blog/two-types-debanking-operational-governmental), this creates a dichotomy between what he deems “operational” debanking and “governmental” debanking, where the former is based on actual risk of default or fraud while the latter is due only to regulatory risk from government institutions and regulators. **The Bank Secrecy Act and Weaponization** The law that creates these mandates and imposes additional liabilities on banks is called the **Bank Secrecy Act,** originally signed into law in 1970. Though banking regulation has existed in some form throughout the 19th and [20th centuries](https://tile.loc.gov/storage-services/service/ll/fedreg/fr010/fr010111/fr010111.pdf), the BSA imposed new obligations on financial institutions, mandating **Know Your Customer** and **Anti-Money Laundering** programs to fully identify bank customers and surveil their transactions to detect any potentially illegal behavior. Without any requirements for warrants or judicial orders, banks are forced to report the “suspicious” transactions of their customers directly to the Financial Crimes Enforcement Network (FinCEN), what is called a “Suspicious Activity Report”. The grounds for filing this could be anything from the name of the recipient, whether the amount is over $10,000, or perhaps even any note or description in the bank transfer that may allude to some criminal activity. If the banks do not file this pre-emptively, they could be on the hook for massive penalties from regulators. As the House Weaponization Subcommittee [revealed](https://judiciary.house.gov/sites/evo-subsites/republicans-judiciary.house.gov/files/2024-12/2024-12-05-Financial-Surveillance-in-the-United-States.pdf) in one of its final reports, the Bank Secrecy Act and SARs were ramped up specifically to target political conservatives, MAGA supporters, and gun owners.  The consequences of the BSA and its imposed surveillance have reaped unintended havoc on millions of ordinary Americans. This is especially true for those who have undergone “debanking”. Many Bitcoin and cryptocurrency entrepreneurs, for example, have been debanked on the [sole grounds](https://www.axios.com/2024/12/01/debanked-crypto-andreessen-joe-rogan) of being involved in the virtual currency industry, while millions of others have been swept up in the dragnet of the BSA and financial regulators forcibly deputizing banks to cut off customers, often without explanation. According to FinCEN guidance, financial institutions are [compelled](https://www.fincen.gov/resources/advisories/fincen-advisory-fin-2010-a014) to keep suspicious activity reports confidential, even from customers, or face criminal penalties. This just makes the problems worse. **Further reading** The [excellent research](https://www.cato.org/policy-analysis/revising-bank-secrecy-act-protect-privacy-deter-criminals) by the team at the Cato Institute’s Center for Monetary and Financial Alternatives provides reams of data on these points. As put by Cato’s **Norbert Michel**, “People get wrapped up in BSA surveillance for simply spending their own money”. My colleagues and I have written [extensively](https://consumerchoicecenter.org/de-banking-is-an-avoidable-consequence-of-strict-financial-regulation/) about why we need reforms to undue the financial surveillance regime that only accelerates debanking of Americans. It’s even worse for those who are interested in the innovative world of Bitcoin and its crypto-offspring as [I explain here](https://www.btcpolicy.org/articles/downgrading-the-bank-secrecy-act-is-a-powerful-reform-for-bitcoin). It’s one reason why the [Consumer Choice Center supports the **Saving Privacy Act**](https://consumerchoicecenter.org/reform-the-bank-secrecy-act-to-better-protect-consumer-financial-privacy/) introduced by Sens. Mike Lee and Rick Scott, which would vastly reform the Bank Secrecy Act to remove the pernicious and faulty Suspicious Activity Report system. As the Senate Banking Committee [holds a hearing](https://www.banking.senate.gov/newsroom/majority/scott-announces-witnesses-for-debanking-hearing) on debanking in February 2025, we hope they will zero-in on the issue of excessive financial surveillance required by financial regulators and the harmful and likely unconstitutional impact of the **Bank Secrecy Act**. With renewed interest and motivation, American leaders can reform these rules to ensure that our financial privacy and freedom to transact are restored and upheld.