@ TFTC

2025-02-13 22:56:08

## Marty's Bent

I must admit, I have been thoroughly impressed with the work the Trump administration has done since taking the reins from the Biden admin 23 days ago. Over the course of the first eight years of this newsletter there were multiple books-worth of words written about the rampant government corruption in the United States and the negative effects it was having on the economy, freedom and the psyche of the American people. The emergence of DOGE, its rag-tag team of autistic Gen Z'ers and the blatant fraud that has been surfaced is equally gratifying and infuriating.

For the longest time any American taxpayer with the smallest shred of common sense has known that they've been getting screwed by the federal government. We've said it for many years; taxes are a humiliation ritual in which the Common Man works his ass off for a meager wage, the government takes one third of it, and then lines their own pockets. We were reaching levels of corruption that rivaled Soviet Russia.

*“We know that they are lying, they know that they are lying, they even know that we know they are lying, we also know that they know we know they are lying too, they of course know that we certainly know they know we know they are lying too as well, but they are still lying. In our country, the lie has become not just moral category, but the pillar industry of this country.”* - Aleksandr Solzhenitsyn

The fact that all of the corruption that has been building up for decades in the United States is being brought to the light is extremely encouraging. We're not out of the woods yet, but it looks like we're actually making material progress to unveil the parasites in Washington DC. Hopefully DOGE's actions will lead to their eradication from American politics and a shrinking of the federal government to its smallest viable form. Nothing proves that DOGE is over the target more than the pearl clutching and screeching that is coming from the halls of Congress. FEED ME the crocodile tears of Elizabeth Warren, Maxine Waters and Mitch McConnell. These people are criminals and deserve nothing but the utmost contempt from the American people. The louder the screams coming from these individuals and others in similar positions should only be seen as confirmation that they are scared and are attempting to evade justice by screaming "CoNsTiTuTiOnAl CrIsIs" as many times as is humanly possible.

With all of that being said, DOGE should be seen as a mechanism to identify corruption, root it out, and salvage what they can of the American taxpayers' money. It's an admirable endeavor that should be lauded, but it only goes so far. Unfortunately for the United States, you can't DOGE the debt. via TFTC

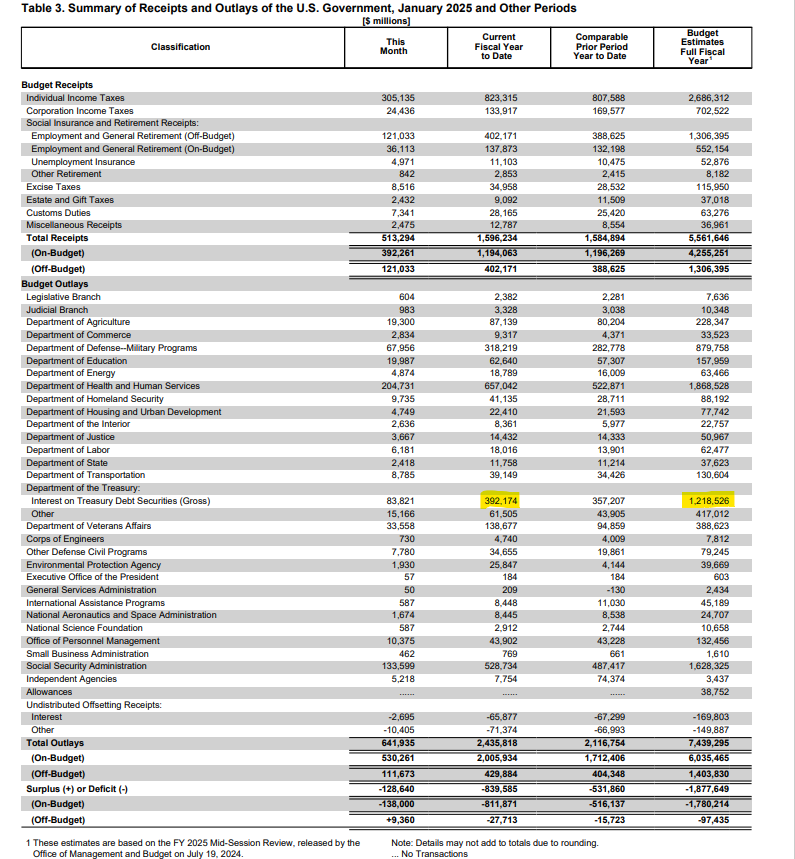

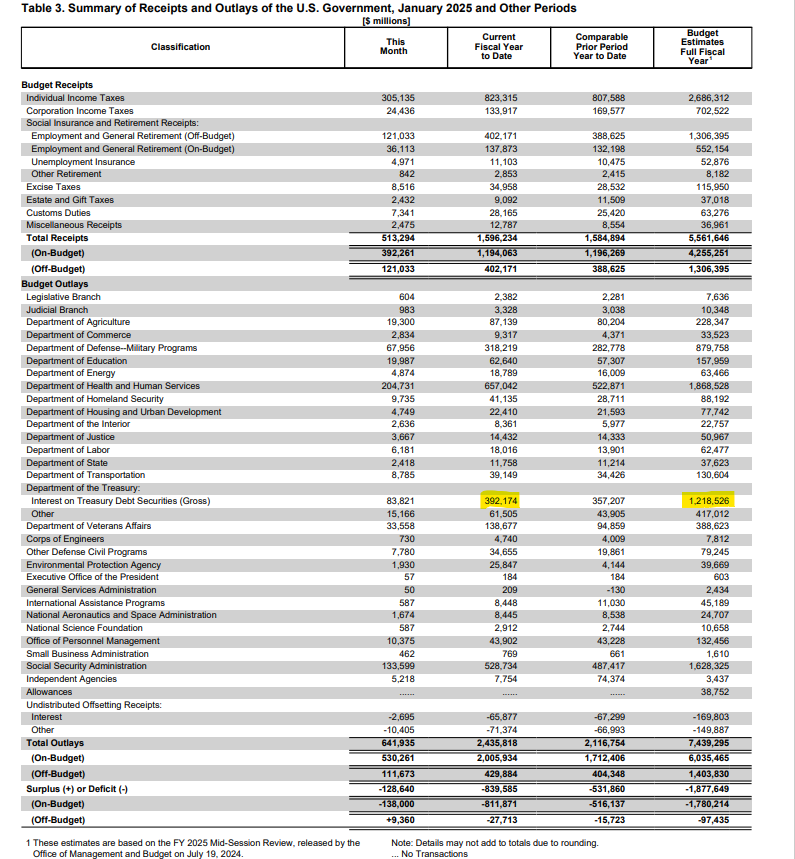

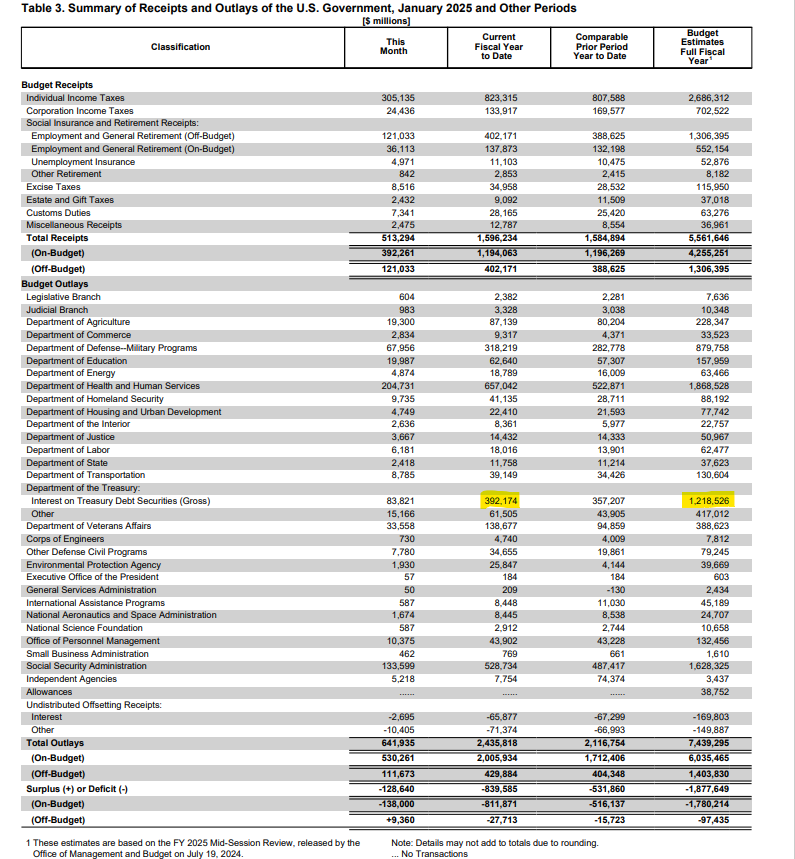

What you are looking at is a block of 10-year US Treasuries that need to be rolled over in a couple of days. Particularly, $66B 10Ys that were issued in February 2015 when interest rates were 2.00%. They'll be rolling over in a few days at 4.55%, representing an additional $1.67B in interest expense on the debt per year. While that may not seem a lot in a world where governments and central banks throw trillions around like their going out of style, it is important to realize that this is just one block of bonds that needs to be rolled over this year. If my memory serves me correctly, the Treasury needs to roll over ~$6 TRILLION in debt in the first half of this year. Using some back of the napkin Marty math skills, if all that debt rolled over at the same interest rate, that would add another ~$150B to the annual expense we pay on the interest on that debt. And in case you missed it, earlier this week the United States surpassed an incredible milestone; we are now paying $100B a MONTH in interest expense on the debt and $1.2T per year.

If all of the debt that needs to be rolled over in the first half of the year is rolled over where interest rates stand today, it will increase the annual debt expense by more than 10%. Not great, Bob!

The actions of DOGE are incredible to see, but you simply can't eliminate debt that has already been accrued by raiding the Treasury and ousting corrupt bureaucrats. The United States has an obligation to pay back those who hold our debt and the only way to do that is to produce a surplus that allows the government to pay down what has been accrued or issue new debt at wherever rates find themselves at the time of roll over to pay it back. While spending cuts are being made we, unfortunately do not find ourselves reaping the benefits of a government surplus at the moment, so we'll have to roll over the debt.

With interest rates where they are, the increase on the debt expense may put the United States government in a position where it becomes impossible to take care of the debt issue without printing their way out of it or getting all of the world's leaders around the table for a Bretton Woods-like monetary reset. We'll see how it plays out.

One thing I know for damn sure is that no matter how the US decides to deal with the debt issue, bitcoin is going to benefit massively. If they print their way out people are going to flee to scarce assets, and bitcoin is the scarcest asset on the planet outside of time. If they reset the monetary order people are going to flee to bitcoin due to the certainty of its monetary policy and its relative inability to be corrupted.

Now for...

## An Incredibly Simple Yet Powerful Quote

As discussed in my recent conversation with Porter Stansberry, the mounting U.S. government debt problem has created an intriguing dynamic for Bitcoin holders. Porter articulated a compelling perspective: government debt, which threatens most people's savings and financial security, actually becomes an asset for Bitcoin owners. The logic is straightforward – as debt levels become unsustainable, more people will be forced to flee the traditional financial system, driving demand for alternative stores of value like Bitcoin.

*"Their debt is your problem until you own Bitcoin. And then the moment you own bitcoin their debt is your greatest asset."* - Porter Stansberry

This thesis becomes even more relevant when considering the staggering numbers we discussed. The U.S. currently faces $37 trillion in on-balance-sheet debt, plus an additional $190 trillion in unfunded liabilities from Medicare, Medicaid, and Social Security. These obligations, as Porter and I agreed, are mathematically impossible to fulfill without significant monetary debasement. This reality creates a powerful tailwind for Bitcoin adoption, as it positions the asset as one of the few viable escape hatches from a system drowning in debt.

[Check out the full podcast](https://www.youtube.com/watch?v=2f8LWO_RmtU&ab_channel=TFTC) here for more on Trump's economic strategy, the commercial real estate crisis, and the future of energy markets in America.

## Headlines of the Day

Bitcoin's Realized Cap Reaches Record High - via [X](https://x.com/TFTC21/status/1889831485701833056)

Texas Bill Removes $500M Cap on State Bitcoin Purchases - via [X](https://x.com/BitcoinPierre/status/1889821134021075012)

ETF Demand Outpaces Mining Production - via [X](https://x.com/TFTC21/status/1889779939982840185)

U.S. Interest Expense on the National Debt Hits $1.2T - via [X](https://x.com/TFTC21/status/1889764204208324764)

## Bitcoin Lesson of the Day

Bitcoin transactions work by sending entire "outputs" (batches of bitcoin) rather than spending partial amounts. When spending bitcoin, the entire output must be used and split into new outputs. For example, if you have a 25 BTC output and want to spend 1 BTC, you'd create two new outputs: 1 BTC to the recipient and 24 BTC back to yourself as change. The original 25 BTC output becomes spent and unusable.

When making a payment that exceeds any single output you own, multiple outputs can be combined as inputs in a transaction. For instance, to spend 4.2 BTC, you might combine outputs of 1 + 0.5 + 2 + 1 BTC as inputs, creating new outputs of 4.2 BTC (payment) and 0.3 BTC (change).

Transaction fees are created by making the total output amount slightly less than the input amount. The difference becomes the fee, which miners collect when including the transaction in a block. The balance of a bitcoin address is the sum of all its unspent transaction outputs (UTXOs).

[Outputs | What is a Transaction Output?

A simple explanation of transaction outputs and how they work.](https://learnmeabitcoin.com/beginners/guide/outputs/)

ICYMI Fold opened the waiting list for the new Bitcoin Rewards Credit Card. Fold cardholders will get unlimited 2% cash back in sats.

[Get on the waiting list](https://foldapp.com/credit-card?r=BgwRS) now before it fills up!

$200k worth of prizes are up for grabs.

Ten31, the largest bitcoin-focused investor, has deployed $150M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at [ten31.vc/funds](ten31.vc/funds).

@ TFTC

2025-02-13 22:56:08## Marty's Bent I must admit, I have been thoroughly impressed with the work the Trump administration has done since taking the reins from the Biden admin 23 days ago. Over the course of the first eight years of this newsletter there were multiple books-worth of words written about the rampant government corruption in the United States and the negative effects it was having on the economy, freedom and the psyche of the American people. The emergence of DOGE, its rag-tag team of autistic Gen Z'ers and the blatant fraud that has been surfaced is equally gratifying and infuriating. For the longest time any American taxpayer with the smallest shred of common sense has known that they've been getting screwed by the federal government. We've said it for many years; taxes are a humiliation ritual in which the Common Man works his ass off for a meager wage, the government takes one third of it, and then lines their own pockets. We were reaching levels of corruption that rivaled Soviet Russia. *“We know that they are lying, they know that they are lying, they even know that we know they are lying, we also know that they know we know they are lying too, they of course know that we certainly know they know we know they are lying too as well, but they are still lying. In our country, the lie has become not just moral category, but the pillar industry of this country.”* - Aleksandr Solzhenitsyn The fact that all of the corruption that has been building up for decades in the United States is being brought to the light is extremely encouraging. We're not out of the woods yet, but it looks like we're actually making material progress to unveil the parasites in Washington DC. Hopefully DOGE's actions will lead to their eradication from American politics and a shrinking of the federal government to its smallest viable form. Nothing proves that DOGE is over the target more than the pearl clutching and screeching that is coming from the halls of Congress. FEED ME the crocodile tears of Elizabeth Warren, Maxine Waters and Mitch McConnell. These people are criminals and deserve nothing but the utmost contempt from the American people. The louder the screams coming from these individuals and others in similar positions should only be seen as confirmation that they are scared and are attempting to evade justice by screaming "CoNsTiTuTiOnAl CrIsIs" as many times as is humanly possible. With all of that being said, DOGE should be seen as a mechanism to identify corruption, root it out, and salvage what they can of the American taxpayers' money. It's an admirable endeavor that should be lauded, but it only goes so far. Unfortunately for the United States, you can't DOGE the debt. via TFTC  What you are looking at is a block of 10-year US Treasuries that need to be rolled over in a couple of days. Particularly, $66B 10Ys that were issued in February 2015 when interest rates were 2.00%. They'll be rolling over in a few days at 4.55%, representing an additional $1.67B in interest expense on the debt per year. While that may not seem a lot in a world where governments and central banks throw trillions around like their going out of style, it is important to realize that this is just one block of bonds that needs to be rolled over this year. If my memory serves me correctly, the Treasury needs to roll over ~$6 TRILLION in debt in the first half of this year. Using some back of the napkin Marty math skills, if all that debt rolled over at the same interest rate, that would add another ~$150B to the annual expense we pay on the interest on that debt. And in case you missed it, earlier this week the United States surpassed an incredible milestone; we are now paying $100B a MONTH in interest expense on the debt and $1.2T per year. If all of the debt that needs to be rolled over in the first half of the year is rolled over where interest rates stand today, it will increase the annual debt expense by more than 10%. Not great, Bob!  The actions of DOGE are incredible to see, but you simply can't eliminate debt that has already been accrued by raiding the Treasury and ousting corrupt bureaucrats. The United States has an obligation to pay back those who hold our debt and the only way to do that is to produce a surplus that allows the government to pay down what has been accrued or issue new debt at wherever rates find themselves at the time of roll over to pay it back. While spending cuts are being made we, unfortunately do not find ourselves reaping the benefits of a government surplus at the moment, so we'll have to roll over the debt. With interest rates where they are, the increase on the debt expense may put the United States government in a position where it becomes impossible to take care of the debt issue without printing their way out of it or getting all of the world's leaders around the table for a Bretton Woods-like monetary reset. We'll see how it plays out. One thing I know for damn sure is that no matter how the US decides to deal with the debt issue, bitcoin is going to benefit massively. If they print their way out people are going to flee to scarce assets, and bitcoin is the scarcest asset on the planet outside of time. If they reset the monetary order people are going to flee to bitcoin due to the certainty of its monetary policy and its relative inability to be corrupted. Now for... ## An Incredibly Simple Yet Powerful Quote As discussed in my recent conversation with Porter Stansberry, the mounting U.S. government debt problem has created an intriguing dynamic for Bitcoin holders. Porter articulated a compelling perspective: government debt, which threatens most people's savings and financial security, actually becomes an asset for Bitcoin owners. The logic is straightforward – as debt levels become unsustainable, more people will be forced to flee the traditional financial system, driving demand for alternative stores of value like Bitcoin. *"Their debt is your problem until you own Bitcoin. And then the moment you own bitcoin their debt is your greatest asset."* - Porter Stansberry This thesis becomes even more relevant when considering the staggering numbers we discussed. The U.S. currently faces $37 trillion in on-balance-sheet debt, plus an additional $190 trillion in unfunded liabilities from Medicare, Medicaid, and Social Security. These obligations, as Porter and I agreed, are mathematically impossible to fulfill without significant monetary debasement. This reality creates a powerful tailwind for Bitcoin adoption, as it positions the asset as one of the few viable escape hatches from a system drowning in debt. [Check out the full podcast](https://www.youtube.com/watch?v=2f8LWO_RmtU&ab_channel=TFTC) here for more on Trump's economic strategy, the commercial real estate crisis, and the future of energy markets in America. ## Headlines of the Day Bitcoin's Realized Cap Reaches Record High - via [X](https://x.com/TFTC21/status/1889831485701833056) Texas Bill Removes $500M Cap on State Bitcoin Purchases - via [X](https://x.com/BitcoinPierre/status/1889821134021075012) ETF Demand Outpaces Mining Production - via [X](https://x.com/TFTC21/status/1889779939982840185) U.S. Interest Expense on the National Debt Hits $1.2T - via [X](https://x.com/TFTC21/status/1889764204208324764) ## Bitcoin Lesson of the Day Bitcoin transactions work by sending entire "outputs" (batches of bitcoin) rather than spending partial amounts. When spending bitcoin, the entire output must be used and split into new outputs. For example, if you have a 25 BTC output and want to spend 1 BTC, you'd create two new outputs: 1 BTC to the recipient and 24 BTC back to yourself as change. The original 25 BTC output becomes spent and unusable. When making a payment that exceeds any single output you own, multiple outputs can be combined as inputs in a transaction. For instance, to spend 4.2 BTC, you might combine outputs of 1 + 0.5 + 2 + 1 BTC as inputs, creating new outputs of 4.2 BTC (payment) and 0.3 BTC (change). Transaction fees are created by making the total output amount slightly less than the input amount. The difference becomes the fee, which miners collect when including the transaction in a block. The balance of a bitcoin address is the sum of all its unspent transaction outputs (UTXOs). [Outputs | What is a Transaction Output? A simple explanation of transaction outputs and how they work.](https://learnmeabitcoin.com/beginners/guide/outputs/) ICYMI Fold opened the waiting list for the new Bitcoin Rewards Credit Card. Fold cardholders will get unlimited 2% cash back in sats. [Get on the waiting list](https://foldapp.com/credit-card?r=BgwRS) now before it fills up! $200k worth of prizes are up for grabs. Ten31, the largest bitcoin-focused investor, has deployed $150M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at [ten31.vc/funds](ten31.vc/funds).

@ TFTC

2025-02-13 22:56:08## Marty's Bent I must admit, I have been thoroughly impressed with the work the Trump administration has done since taking the reins from the Biden admin 23 days ago. Over the course of the first eight years of this newsletter there were multiple books-worth of words written about the rampant government corruption in the United States and the negative effects it was having on the economy, freedom and the psyche of the American people. The emergence of DOGE, its rag-tag team of autistic Gen Z'ers and the blatant fraud that has been surfaced is equally gratifying and infuriating. For the longest time any American taxpayer with the smallest shred of common sense has known that they've been getting screwed by the federal government. We've said it for many years; taxes are a humiliation ritual in which the Common Man works his ass off for a meager wage, the government takes one third of it, and then lines their own pockets. We were reaching levels of corruption that rivaled Soviet Russia. *“We know that they are lying, they know that they are lying, they even know that we know they are lying, we also know that they know we know they are lying too, they of course know that we certainly know they know we know they are lying too as well, but they are still lying. In our country, the lie has become not just moral category, but the pillar industry of this country.”* - Aleksandr Solzhenitsyn The fact that all of the corruption that has been building up for decades in the United States is being brought to the light is extremely encouraging. We're not out of the woods yet, but it looks like we're actually making material progress to unveil the parasites in Washington DC. Hopefully DOGE's actions will lead to their eradication from American politics and a shrinking of the federal government to its smallest viable form. Nothing proves that DOGE is over the target more than the pearl clutching and screeching that is coming from the halls of Congress. FEED ME the crocodile tears of Elizabeth Warren, Maxine Waters and Mitch McConnell. These people are criminals and deserve nothing but the utmost contempt from the American people. The louder the screams coming from these individuals and others in similar positions should only be seen as confirmation that they are scared and are attempting to evade justice by screaming "CoNsTiTuTiOnAl CrIsIs" as many times as is humanly possible. With all of that being said, DOGE should be seen as a mechanism to identify corruption, root it out, and salvage what they can of the American taxpayers' money. It's an admirable endeavor that should be lauded, but it only goes so far. Unfortunately for the United States, you can't DOGE the debt. via TFTC  What you are looking at is a block of 10-year US Treasuries that need to be rolled over in a couple of days. Particularly, $66B 10Ys that were issued in February 2015 when interest rates were 2.00%. They'll be rolling over in a few days at 4.55%, representing an additional $1.67B in interest expense on the debt per year. While that may not seem a lot in a world where governments and central banks throw trillions around like their going out of style, it is important to realize that this is just one block of bonds that needs to be rolled over this year. If my memory serves me correctly, the Treasury needs to roll over ~$6 TRILLION in debt in the first half of this year. Using some back of the napkin Marty math skills, if all that debt rolled over at the same interest rate, that would add another ~$150B to the annual expense we pay on the interest on that debt. And in case you missed it, earlier this week the United States surpassed an incredible milestone; we are now paying $100B a MONTH in interest expense on the debt and $1.2T per year. If all of the debt that needs to be rolled over in the first half of the year is rolled over where interest rates stand today, it will increase the annual debt expense by more than 10%. Not great, Bob!  The actions of DOGE are incredible to see, but you simply can't eliminate debt that has already been accrued by raiding the Treasury and ousting corrupt bureaucrats. The United States has an obligation to pay back those who hold our debt and the only way to do that is to produce a surplus that allows the government to pay down what has been accrued or issue new debt at wherever rates find themselves at the time of roll over to pay it back. While spending cuts are being made we, unfortunately do not find ourselves reaping the benefits of a government surplus at the moment, so we'll have to roll over the debt. With interest rates where they are, the increase on the debt expense may put the United States government in a position where it becomes impossible to take care of the debt issue without printing their way out of it or getting all of the world's leaders around the table for a Bretton Woods-like monetary reset. We'll see how it plays out. One thing I know for damn sure is that no matter how the US decides to deal with the debt issue, bitcoin is going to benefit massively. If they print their way out people are going to flee to scarce assets, and bitcoin is the scarcest asset on the planet outside of time. If they reset the monetary order people are going to flee to bitcoin due to the certainty of its monetary policy and its relative inability to be corrupted. Now for... ## An Incredibly Simple Yet Powerful Quote As discussed in my recent conversation with Porter Stansberry, the mounting U.S. government debt problem has created an intriguing dynamic for Bitcoin holders. Porter articulated a compelling perspective: government debt, which threatens most people's savings and financial security, actually becomes an asset for Bitcoin owners. The logic is straightforward – as debt levels become unsustainable, more people will be forced to flee the traditional financial system, driving demand for alternative stores of value like Bitcoin. *"Their debt is your problem until you own Bitcoin. And then the moment you own bitcoin their debt is your greatest asset."* - Porter Stansberry This thesis becomes even more relevant when considering the staggering numbers we discussed. The U.S. currently faces $37 trillion in on-balance-sheet debt, plus an additional $190 trillion in unfunded liabilities from Medicare, Medicaid, and Social Security. These obligations, as Porter and I agreed, are mathematically impossible to fulfill without significant monetary debasement. This reality creates a powerful tailwind for Bitcoin adoption, as it positions the asset as one of the few viable escape hatches from a system drowning in debt. [Check out the full podcast](https://www.youtube.com/watch?v=2f8LWO_RmtU&ab_channel=TFTC) here for more on Trump's economic strategy, the commercial real estate crisis, and the future of energy markets in America. ## Headlines of the Day Bitcoin's Realized Cap Reaches Record High - via [X](https://x.com/TFTC21/status/1889831485701833056) Texas Bill Removes $500M Cap on State Bitcoin Purchases - via [X](https://x.com/BitcoinPierre/status/1889821134021075012) ETF Demand Outpaces Mining Production - via [X](https://x.com/TFTC21/status/1889779939982840185) U.S. Interest Expense on the National Debt Hits $1.2T - via [X](https://x.com/TFTC21/status/1889764204208324764) ## Bitcoin Lesson of the Day Bitcoin transactions work by sending entire "outputs" (batches of bitcoin) rather than spending partial amounts. When spending bitcoin, the entire output must be used and split into new outputs. For example, if you have a 25 BTC output and want to spend 1 BTC, you'd create two new outputs: 1 BTC to the recipient and 24 BTC back to yourself as change. The original 25 BTC output becomes spent and unusable. When making a payment that exceeds any single output you own, multiple outputs can be combined as inputs in a transaction. For instance, to spend 4.2 BTC, you might combine outputs of 1 + 0.5 + 2 + 1 BTC as inputs, creating new outputs of 4.2 BTC (payment) and 0.3 BTC (change). Transaction fees are created by making the total output amount slightly less than the input amount. The difference becomes the fee, which miners collect when including the transaction in a block. The balance of a bitcoin address is the sum of all its unspent transaction outputs (UTXOs). [Outputs | What is a Transaction Output? A simple explanation of transaction outputs and how they work.](https://learnmeabitcoin.com/beginners/guide/outputs/) ICYMI Fold opened the waiting list for the new Bitcoin Rewards Credit Card. Fold cardholders will get unlimited 2% cash back in sats. [Get on the waiting list](https://foldapp.com/credit-card?r=BgwRS) now before it fills up! $200k worth of prizes are up for grabs. Ten31, the largest bitcoin-focused investor, has deployed $150M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at [ten31.vc/funds](ten31.vc/funds).