-

@ Felipe

2024-09-10 05:41:55

@ Felipe

2024-09-10 05:41:55🧠Quote(s) of the week:

"You will spend 40,000 hours of your life trying to make money; it's worthwhile to spend 100 hours figuring out how to keep it." -Michael Saylor on Bitcoin

🧡Bitcoin news🧡

On the 2nd of September:

➡️El Salvador now HODLS 5,859 Bitcoin worth $343m. They continue buying one BTC every day.

That's what we call conviction!

On the 3rd of September:

➡️'Wall Street has more control over Bitcoin price after introducing ETFs, per hedge fund manager Mark Yusko. He argues that institutions are dumping the price by shorting Bitcoin in futures markets, a common tactic used for price manipulation.' - Bitcoin News

➡️ Marathon Digital: 'Our 2-megawatt pilot project in Finland is repurposing heat from digital asset computing to warm a community of 11,000 residents.'

This is the kind of innovation that makes sense. A lot of people can't comprehend the multitude of it. Imagine mining the hardest form of money while warming your community!

On the 4th of September:

➡️Japan to lower the maximum tax rate on #Bitcoin and crypto from 55% to 20%, in line with financial assets.

I am happy for my Japanese Bitcoin family! Eventually, it will go even lower. Larger governments will compete for Bitcoin immigration (read capital).

➡️The largest Swiss Canton bank now offers Bitcoin to 1.5m customers.

On the 5th of September:

➡️Leader of Venezuelan Opposition María Corina Machado proposes using Bitcoin as a national reserve asset. Bitcoin is a "lifeline" and "vital means of resistance". If you read my Weekly Recap regularly you know I am not that positive on politicians. They need votes and use Bitcoin to achieve that goal. But in this case...well since 2016, Venezuela's inflation has surged over 8 million %, wiping out people's savings. The government controls banks and freezes accounts. Already so many Venezuelans have turned to Bitcoin to protect their money & escape since it can't be controlled by the government. Bitcoin is financial inclusion, Bitcoin is freedom (money).

The upcoming decade will be interesting, especially for countries in Latin America & Central America (yes, also globally!).

El Salvador makes Bitcoin legal tender, we now have a US presidential candidate suggesting to have Bitcoin strategic Reverse, Venezuelan political leader proposes Bitcoin as a national reserve asset.

Hello, game theory!

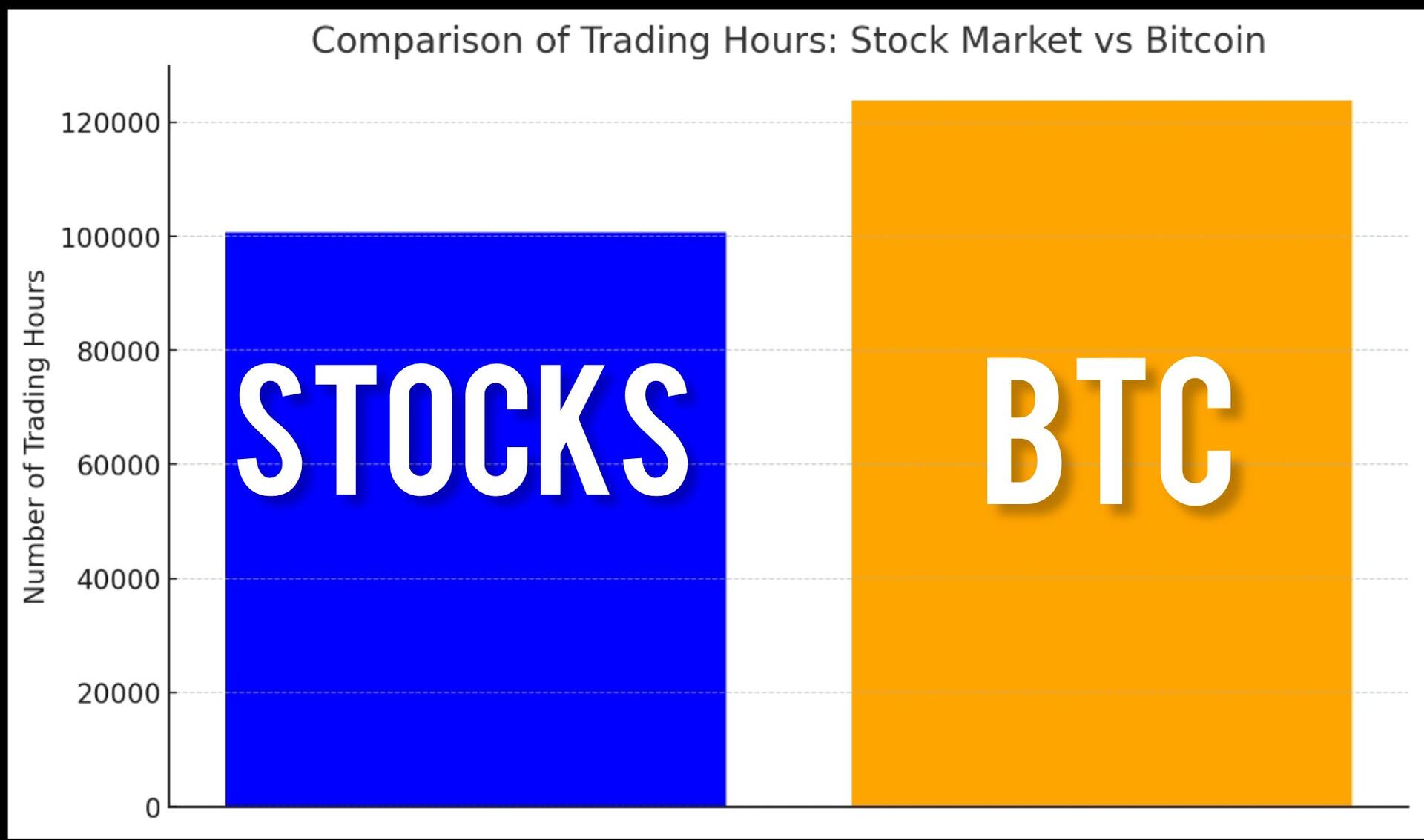

➡️Bitcoin has had more trading hours since launching in 2009 than the stock market since 1971.

Talk about a secure system, Un-Hackable, Un-Corruptible 24/7/365; Bitcoin

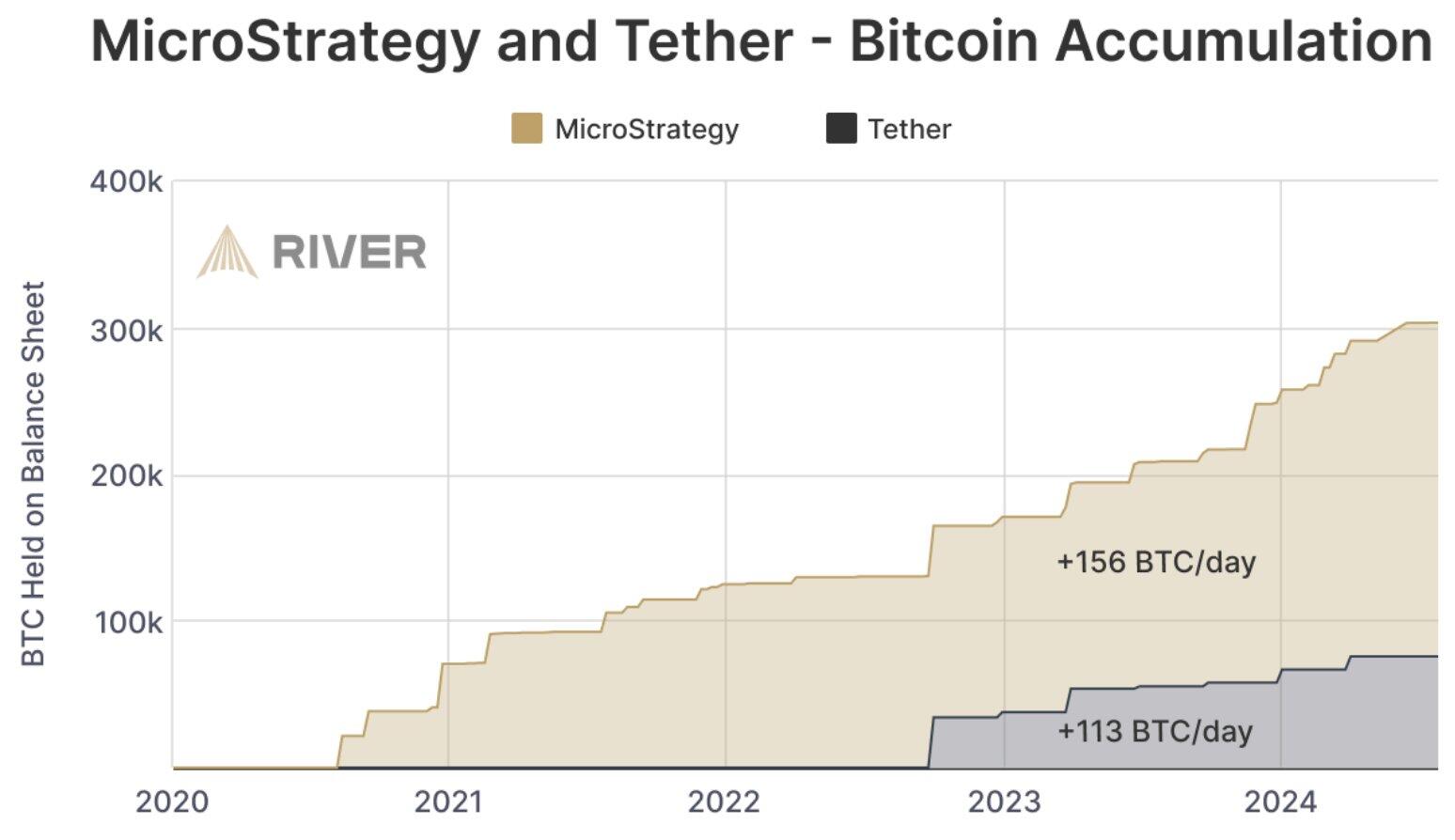

➡️Bitcoin miners produce 450 new BTC/day. Microstrategy and Tether alone have been purchasing a whopping 60% of that daily supply.' I have a feeling what will happen. The USA will adopt a 'Bitcoin Strategic Reserve'...eventually. Tether is among the top buyers of U.S. Treasury securities, and they are effectively starting to back the USD with 'hard money'.

➡️Another River stat! Companies have grown their Bitcoin holdings by 587% over the past four years. The institutions are buying

On the 6th of September:

➡️Bitcoin ETFs have recorded over $1 billion worth of outflows since August 27th.

On the 7th of September:

➡️Happy Bitcoin Legal Tender Day On September, 7th 2021, El Salvador became the first country to officially adopt Bitcoin.

➡️'Chris Larsen, Ripple, and XRP are pushing for CBDCs. They are anti-freedom and want to ban Bitcoin. They bribed Greenpeace to try to attack proof-of-work but they failed, so now they are backing Kamala out of desperation as XRP/BTC is -50% over the past year.' - Pierre Rochard

➡️On September 7, the Bitcoin network’s 7-day average mining hash rate hit a new record, surpassing 740 exahashes per second.

➡️$1.4 trillion worth of BTC settled on the decentralized ledger in August 2024

💸Traditional Finance / Macro:

On the 3rd of September:

👉🏽Sanergy collapses 98.4% after people discover 98.4% of shares are held by insiders. If 98% owned by insiders then who the fuck sold it?

👉🏽'Magnificent 7 stocks have now erased $550 BILLION of market cap today. Nvidia is on track for its largest daily drop since April 2024.' -TKL

In total, on this day over $1.05 trillion was wiped out from the US stock market.

On the 4th of September:

👉🏽'Swiss luxury watchmakers are turning to the government for financial aid to help them weather a downturn in demand' -Bloomberg Markets Are you freaking kidding me? What's next? Let's bail out Lamborghini, Rolex, Patek Phillipe, and Louis Vuitton. Let them all ask for government assistance. You can't make this shit up...hello socialism?

Anyway Bitcoin is Time, and Time is money...Please read: https://dergigi.com/2021/01/14/bitcoin-is-time/

👉🏽'The Government Accountability Office estimates the federal government loses between $233 billion to $521 billion annually to fraud based on data from 2018 - 2022. That’s ~2% of America’s GDP stolen every year & a trillion dollars lost for those years.'

But hey! If you don't report the 600 bucks Venmo transfer a SWAT team will invade your home.

Source: https://www.gao.gov/products/gao-24-105833

On the 6th of September:

👉🏽The S&P 500 has now erased $2.2 trillion of market cap in the first week of September.

On the 7th of September:

👉🏽'Only Fans revenue explodes to $7 billion. Profits rise to 700 million. Only Fans have made more money than all the Silicon Valley AI startups combined Powered by Ass. Not AI.' -Trader

Lmao that is a helluva quote! Not sure about the part that OF made more money, but dammnnn that quote!

Massive simp pandemic! And remember 1 guy owns 100% of the company! Regarding AI, do you know what will happen in about 2-5 years? OnlyFans models will be completely 'promoted' by AI. Simps (men) cannot tell the difference between an AI OF and a human OF channel. Maybe even in the near future, we will have the same shit as that crazy sex scene in Demolition Man (Yes, I am that old!), as Sly Stallone and Sandra Bullock have an orgasmic fit online while sitting several feet away from each other.

Imagine an OF channel and wearing a VR headset, upload (via AI) the girl of your dreams, dressed provocatively, moves forward slowly. She comes closer and closer until her cheek is next to yours, you can almost feel her. And she whispers softly into your ear, like Monica Bellucci in The Matrix (kiss scene): 'I'm here for you, kiss me, and you can do anything with me!'

🏦Banks: 👉🏽No news

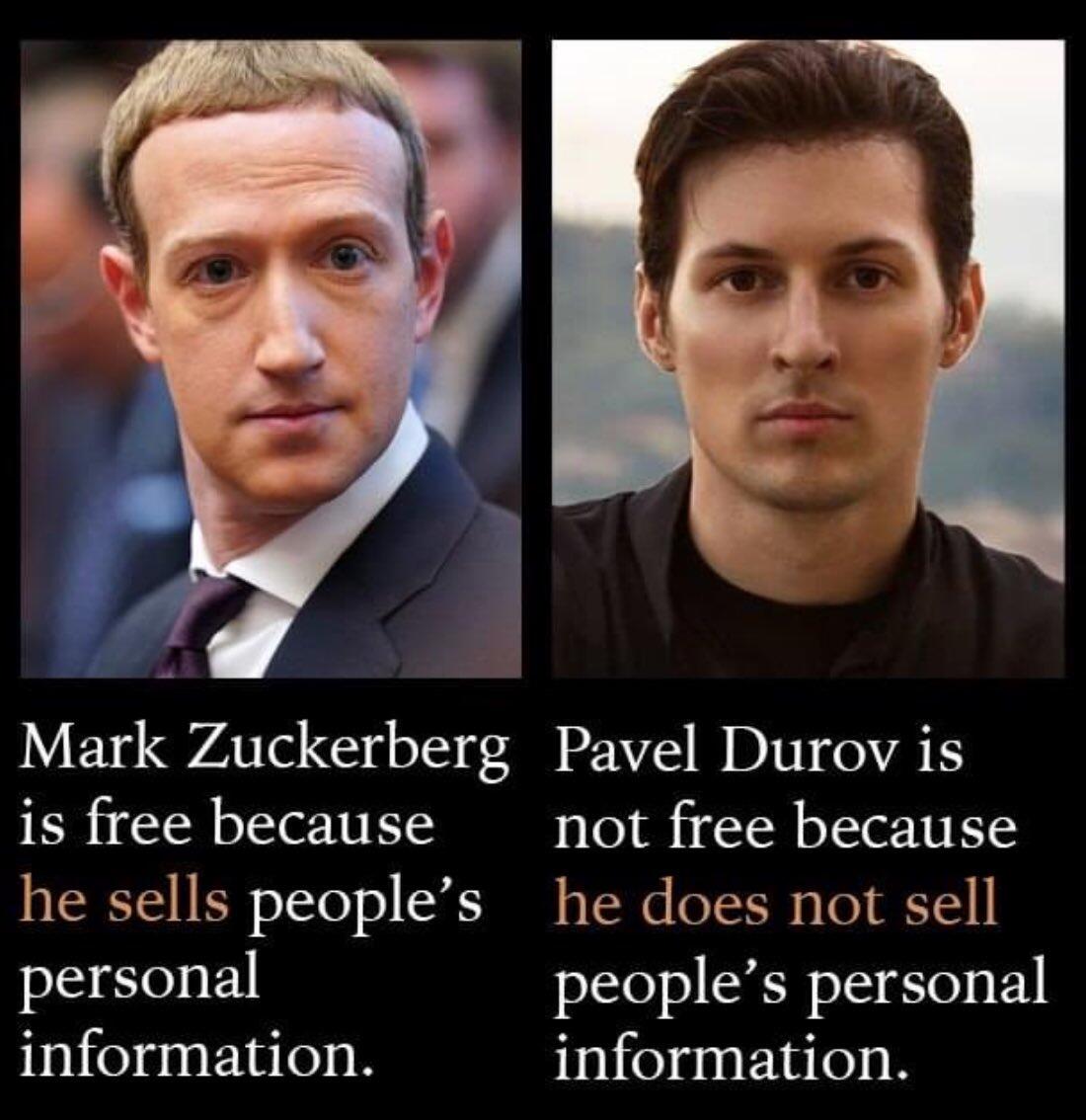

🌎Macro/Geopolitics: Last week I shared the story of the arrest of Pavel Durov.

I really want to emphasize that you should try Nostr before you need Nostr. 'Similar to how Bitcoin is purging money from the state’s control…. NOSTR is purging centralized media and speech from the government puppet media sources…there’s no NOSTR CEO to summon & testify in front of the elected clowns…' -Preston Pysh

If there is a throat to choke, it will be choked.

If there is a head to cut off, it will be cut off.

Platform owners that bend the knee to totalitarianism will censor and deplatform you. Platform owners that do not comply will be arrested and threatened with the full force of “The Law.”

You cannot kill Nostr. There is no single throat to choke, no one head to cut off. Succeed in cutting off one head and two will grow in its place.

On the 1st of September:

👉🏽'Global net gold purchases by central banks reached 483 tonnes in the first half of 2024, the most on record.

This is 5% higher than the previous record of 460 tonnes set in the first half of 2023. In Q2 2024, central banks bought 183 tonnes of gold, marking a 6% year-over-year increase.

On the other hand, this was 39% lower than the 300 tonnes of purchases seen in Q1. The largest buyers were the National Bank of Poland, the Reserve Bank of India, and the Central Bank of Turkey.' -TKL

The East (China, India, Russia, Saudi, etc.) no longer trusts owning Western reserve assets. Even the West (artikel no longer trusts owning US bonds)

Let's say Central Banks are betting against their current system by buying gold. What could go wrong and why don't you have any Bitcoin? Just study Bitcoin to start with.

👉🏽A German far-right party (AfD) is projected to win in regional elections for the first time since 1945, exit polls show. Great! Well done Europe, Germany is circling the drain again, innit!? This worked out so well the last time...in 1930-1945.

👉🏽5-7% unemployment in the U.S. in 2025 will be a reality - zero doubt! 'US consumers' perceptions of the labor market have weakened to the worst level since 2021.

The difference between the share of Americans saying that jobs are plentiful minus those saying they are hard to get declined is down to 16.4%. In previous business cycles, has been a leading indicator of unemployment. It now suggests that the unemployment rate may increase to 5.5% in the coming months. The labor market is trending toward a recession.' -TKL

Trump (or Kamala) may be handed over one of the worst economic conditions since the Great Recession of 2007-2009.

On the 2nd of September:

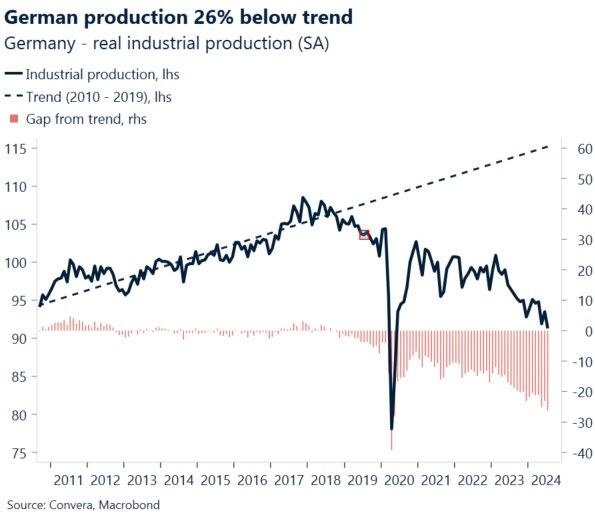

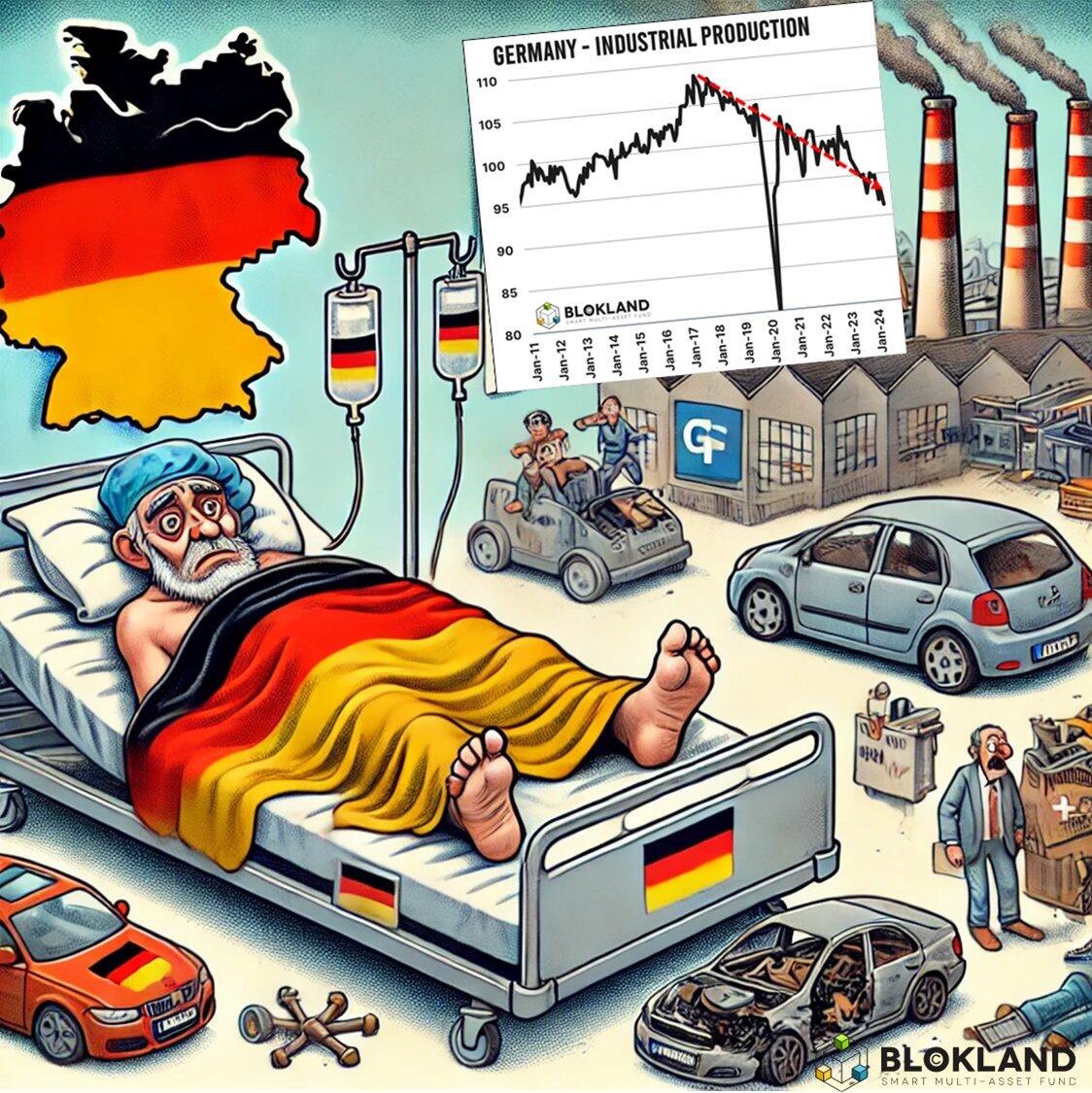

👉🏽Volkswagen is considering unprecedented factory closures in Germany in a bid for deeper cutbacks in another blow to Chancellor Olaf Scholz’s govt. Any shutdowns would mark the 1st closures in Germany during the company’s 87y history, setting VW up for a clash with powerful unions.' -Holger Zschaepitz

No shit Sherlock! Manufacturing is energy-intensive. Industry will move elsewhere if a place has persistently high energy prices. Germany self-sabotaged its own energy as it chose to deindustrialize to remain part of the West. Consumers suffer from high energy prices too. Hello Europe!

VW CEO: "We might go bankrupt." (Debt levels going in the same direction as China's Evergrande..) Union: "We demand a 7.7% salary increase and reduced working hours." Welcome to the German social system.

German deindustrialization has just brought its industrial production to the 2006 level. All degrowth enthusiasts must be happy. You don't believe me. Germany's industrial production level made another low. Down 16% from its peak, no growth since 2010, up 0.3% annually over the past 20 years.

A huge 2.4% drop in industrial production in July. Much worse than expected. Production is now 2.2% lower than its average level in Q2 and 9.5% below February 2023. Still below 2019 levels.

'The German business model was based on: 1. Cheap energy from Russia 2. Cheap subcontractors in Eastern Europe 3. Steadily growing exports to China 4. Free defense from the U.S.

1-3 are gone. The consequences are clear.' - Gabor Gurbacs

Now don't get me wrong they (VW) also falling behind in innovation, products are outdated and don't sell anymore.

https://x.com/TuurDemeester/status/1832438221491597579

On the 3rd of September:

👉🏽Weak U.S. manufacturing data affected the markets last week: 'The market is reacting negatively this morning to extremely poor ISM manufacturing data.

The TL;DR: Demand fell, inventories rose (due to unsold stock), and prices rose (due to labor and shipping costs). This is the definition of stagflation. The Fed’s worst nightmare.' -James Lavish

You already know what will happen. End of September the first-rate cuts will hit us, just before we slide into a full recession. By doing so this will let inflation run hot again.

On the 4th of September:

👉🏽Brussels holds its breath for Draghi’s delayed report. 'Former European Central Bank President Mario Draghi – “the man who saved the eurozone” – presented his much-anticipated report on the future of European competitiveness to EU diplomats and leaders of the European Parliamentary groups on Wednesday 4th of September.

"According to several EU officials, the report remains a closely guarded secret even within the Commission, as only economy-related DGs have it at their disposal."

So it is first presented behind closed doors, after being lifted over the elections. This report proposes radical changes (according to Draghi). You can’t do this like that. Why no livestream? Why just not 'open source'?

Closed doors & secrets = antidemocratic to the core.

Eventually, the report can be found here: https://archive.ph/MjbBe

'Former ECB President Mario Draghi called on the EU to invest as much as €800bn extra a year to make the bloc more competitive and to commit to the regular issuance of common bonds to compete w/China and the US. Draghi said that Europe will need to boost investment by about 5ppts of the bloc’s GDP – a level not seen in > 50 years – to transform its economy so that it can remain competitive. Draghi also pitched an adaptation of the EU’s competition policy so that “it does not become a barrier” to the bloc’s industrial goals.'

On the 5th of September:

👉🏽Last week I already explained how freaking stupid the proposed corporate tax was by Kamala Harris. 'Kamala Harris says she would raise the corporate tax rate to 28% if she is elected president.'

Please go back to that Weekly Recap and read the whole bit on that segment.

Now this week: 'KAMALA PROPOSES TO RAISE CAPITAL GAINS TAX TO 33%, FAR ABOVE GLOBAL AVERAGES' This is significantly higher than China’s 20% and Europe’s average of 18%.

This hike would bring the combined federal-state rate above 40% in many states and could severely impact small business owners and families.

I will quote James Lavish on this one: 'So here is how it works: The overall system forces you to take risks by investing to keep up with the relentless inflation that is caused by the system. If you are fortunate enough to succeed in your investments, the 'Harris System' will then take 1/3 of that success from you.'

As mentioned last week: Now don't get me wrong. I do not support Trump or any politician (I am based in the EU), but for the love of god, we the people need to start thinking and use that tool called BRAINS!

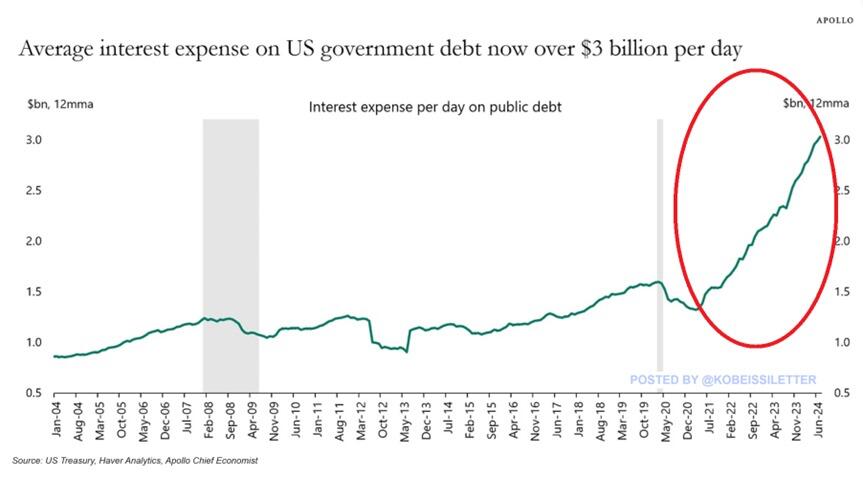

👉🏽'Interest expense on US Federal debt is now at a record $3 billion PER DAY. This is TRIPLE the amount paid 10 years ago and has DOUBLED in just 2.5 years. Total annual interest costs on Federal debt reached a whopping $1.1 trillion in Q2 2024. Even if the Fed cuts rates by 1% and all government bond yields decline by 1%, daily interest expense will still be $2.5 billion. That would be more than double the average paid in 2009-2019.

The debt crisis is an understatement.' -TKL

Great quote by Joe Consorti, just to give you some perspective: 'The US government pays more interest on its debt every 2 seconds than the average American salary. $1,089,100,000,000 per year $2,983,835,616 per day $34,535 per second The average US salary is $59,384.'

The U.S. government spends money as if there is a crisis The deficit hit $1.5 trillion in the first 10 months of Fiscal 2024. This is larger than all years before the COVID Crisis including 2009 - the last year of the Financial Crisis when the deficit was $1.4T. Once a US president, Ronald Reagan said the following on government deficits: “We do not face large DEFICITS because American families are undertaxed [but] because the federal government OVERSPENDS."

Anyway, before COVID-19, the US paid $1 billion in debt interest per day; during COVID it was $2 billion. Today, it is $3 billion every day.

Just to make it even worse, and again no doom or gloom from my side just stats published by the BLS (government body)

👉🏽'The US labor force participation rate is set to decline to 61.2% over the next decade, according to the BLS. This would mark the lowest percentage since the 2020 pandemic and the second lowest in ~50 years. These expectations are driven by the aging population and lower population growth projections. The BLS anticipates the population excluding prisoners and people in military service will rise by 16.4 million through 2033, 5 million fewer people than over the past decade.

This puts us on track for the slowest population growth rate since the BLS began publishing the data in 1948. Slowing population growth is a crisis.' -TKL

👉🏽Global Liquidity breaks out new all-time high $90.57 trillion M2 Money Supply

👉🏽The United Arab Emirates completes the first nuclear power plant in the ‘Arab world’.

👉🏽'Chinese banks have built a $100bn short against the US dollar to prop up the yuan — and hedge funds are eager to get in on the trade. At the center of it all are transactions known as FX swaps. These have quietly become a key tool for state-run Chinese banks seeking to prop up the yuan during periods of outsized selling pressure.' -Bloomberg

Source: https://archive.ph/uxZ7y

Short team gain for long-term pain.

On the 6th of September:

👉🏽'The June and July jobs reports were just revised lower by an additional 86,000 jobs. This is the SECOND TIME that the June jobs report was revised lower. 6 out of the last 7 jobs reports have now been revised LOWER, per ZeroHedge. 11 out of the last 15 jobs reports have now been revised lower. We are talking about MILLIONS in jobs revisions over the last two years.' -TKL I will say it again...if the US government can't have a grip on the jobs reports, why on earth do you believe other figures? For example the inflation number.

BLS (Bureau of Labor Statistics) stat from August: Foreign-born workers: +635K in August Native-born workers: -1.325 MILLION in August Yes, 1.3 million NATIVE-BORN Americans lost a job in August

👉🏽The UK's economy has stagnated since 2008. In terms of GDP per capita - economic output divided by the number of people in a country - they have gone backward. Great thread: https://x.com/sam_bidwell/status/1832062722412015803

👉🏽Never forget what they stole from you with inflation.

🎁If you have made it this far I would like to give you a little gift: Lyn Aldens latest newsletter is out, as always deep and simple

https://www.lynalden.com/september-2024-newsletter/

It discusses ongoing fiscal dominance and its investing implications. Lyn on Bitcoin:

'I don’t have a firm view on the bitcoin price over the next few months, but I am bullish with a 2-year view and beyond.'

Credit: I have used multiple sources!

My savings account: Bitcoin The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. (Please only use it till the 31st of October - after that full KYC) Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.⠀⠀ ⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple.⠀⠀⠀⠀ ⠀⠀⠀⠀ Do you think this post is helpful to you? If so, please share it and support my work with sats.

⭐ Many thanks⭐

Felipe - Bitcoin Friday! ▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃