@ Bitcoin Friday

2024-08-14 05:33:49

# 🧠Quote(s) of the week:

'People should not be afraid of their governments. Governments should be afraid of their people.' - V -

'A simple plan: Manipulate the data. Manipulate the media. Manipulate the money.

A simple response: Resist manipulation and think for yourself.' - James Lavish

## 🧡Bitcoin news🧡

The UK is losing its grip on democracy: 'We do have dedicated police officers who are scouring social media to look for this material, and then follow up with arrests.'

Tim Walz (He is the Democratic Party's nominee for vice president in the 2024 U.S. presidential election): “There’s no guarantee to free speech on misinformation or hate speech and especially around our democracy.”

Your thoughts, writings, and communications (with or without machine intelligence) can only be private if they are never held by any central party. It is time you learn and discover Nostr. Study, use Nostr, start now.

Freedom of speech is one of the most precious things in life and society. We lose it at our peril.

**On the 6th of August:

➡️ Morgan Stanley's 15,000 wealth advisors, and $4.8 trillion under management, started pitching clients to buy Bitcoin ETFs by BlackRock and Fidelity on the 7th of August.

Several sources believe that Wells Fargo will quickly follow Morgan Stanley with Bitcoin ETF approvals.

The Bitcoin ecosystem will gain 15,000+ professional salespeople who have relationships with a trillion dollars of managed wealth. Ignore the noise and focus on the signal.

➡️'Tether’s Q2 2024 attestation reveals they hold $4.7 billion in Bitcoin. They also announced a new all-time high in direct and indirect U.S. Treasury holdings at $97.6 billion, surpassing Germany, the UAE, and Australia.' - Bitcoin News

➡️$5.2B worth of Bitcoin was moved by short-term holders within a week.

In contrast, long-term holders largely held onto their BTC. Of the $850M in realized losses, only $600K originated from long-term holders. Don't sell your precious corn to BlackRock.

Now, read the statement above again and think about it. Only 0.07% of the $850M losses were incurred by long-term holders. Jepp, we don't freaking sell our Bitcoin! Only (the new) paper hands got frightened and shook out.

➡️'Bitcoin is in the "Extreme Fear" phase of the Fear & Greed Index at a score of 17/100.

We've been this fearful 3 times in the last 5 years:

• 2019 bottom

• 2020 bottom

• 2022 bottom

Plenty of blood-curdling screams in the streets. Excellent buying opportunity.' -Joe Consorti

➡️Lifehack: 'Airbnb host catches guests running a Bitcoin mining farm on his property.

He was tipped off when the power company notified him that the renters used a month's worth of electricity in just 4 days.' -Bitcoin News

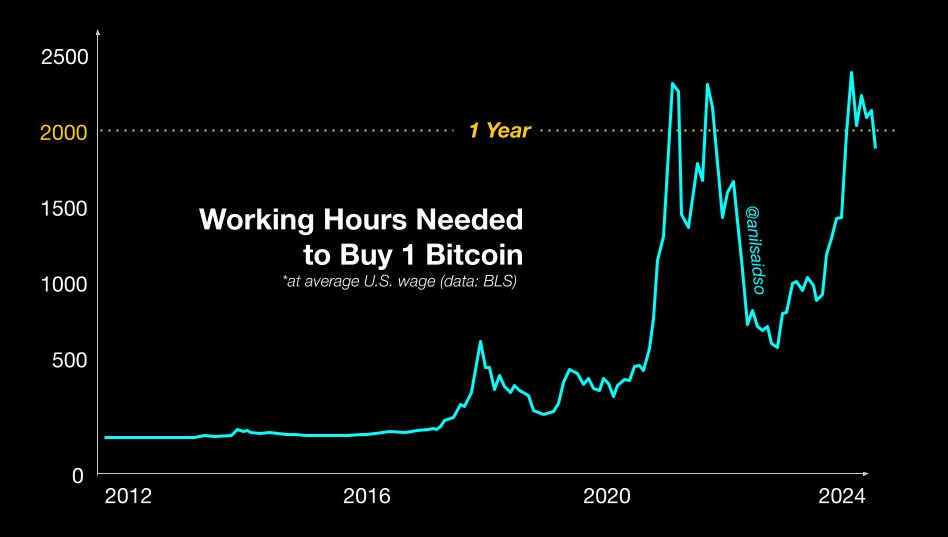

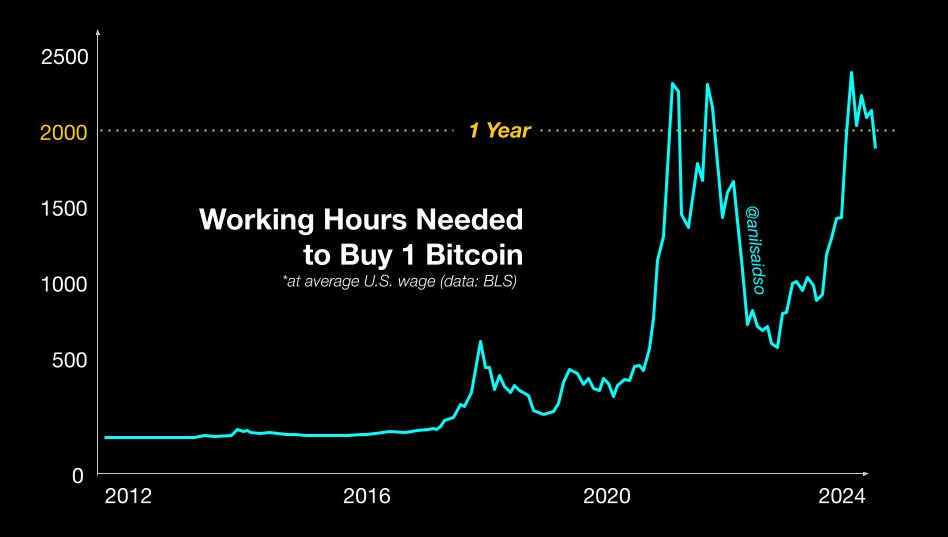

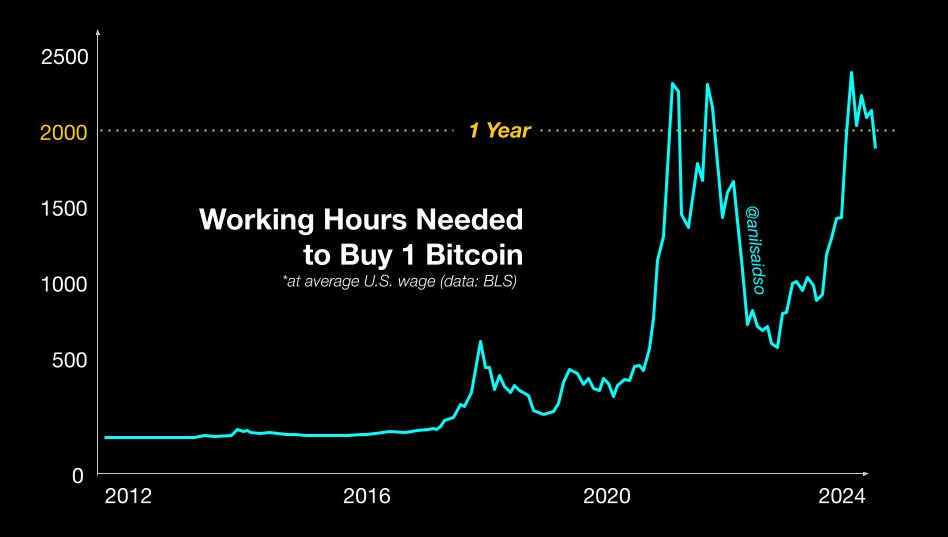

➡️'It currently takes 1,880 hrs (47 weeks) of work to buy 1 Bitcoin. Said another way:

1 Bitcoin currently buys 1 FTE (at avg. US wage).' -Anilsaidso

Now this is before income tax. If you take that into account it would be closer to 1.5 years.

On the 7th of August:

➡️'In Bitcoin over the last decade, the average return for the top 10 days each year was 184%, and the average return (loss) for all of the remaining days each year was −10%.' - James Lavish

This is why you don't trade Bitcoin. Time in the market beats timing the market. Just buy with a 4+ year horizon and go live your life. Spend time with your family & friends.

➡️Metaplanet is raising $70M to increase its Bitcoin holdings.

The company plans to allocate $58.76M of the funds directly to Bitcoin, aiming to hedge against currency depreciation.

➡️Michael Saylor says “I own at least 17,732 Bitcoin and can’t see a better place to put money”

On the 8th of August:

➡️21,000 Bitcoins were taken off exchanges last week.

➡️Metaplanet secures ¥1 billion 0.1% APR loan; proceeds to fund additional purchases of $BTC.

➡️Bloomberg's Balchunas: '99.5% of the money invested in Bitcoin ETFs held firm despite a -14% drop on Monday and a -21% decline for the week.

IBIT saw no outflows at all — a total freak. I’m very bullish on ETF investors’ resilience, but even I’m surprised by this.'

On the 10th of August:

➡️The number of Bitcoin nodes has increased 20% yoy.

On the 11th of August:

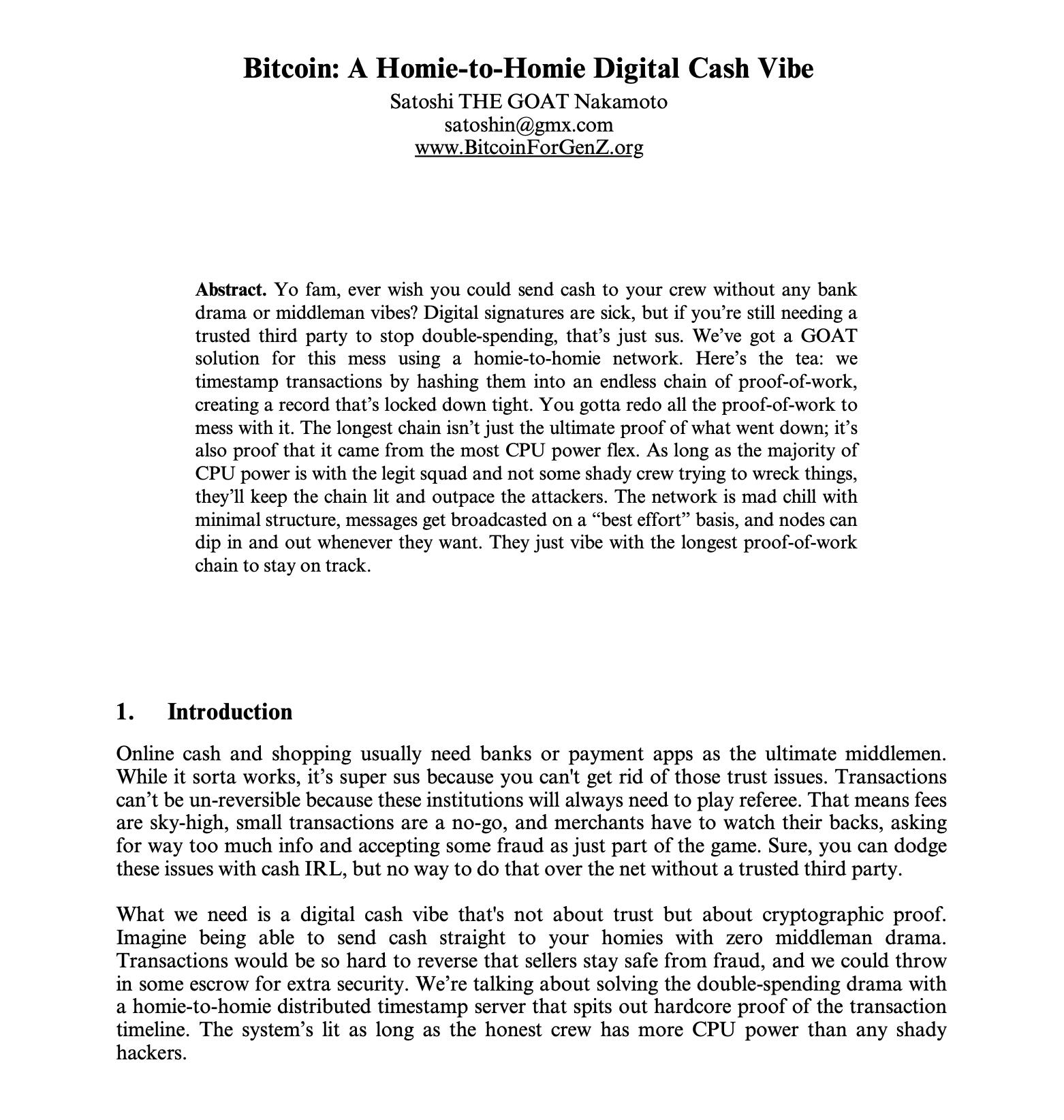

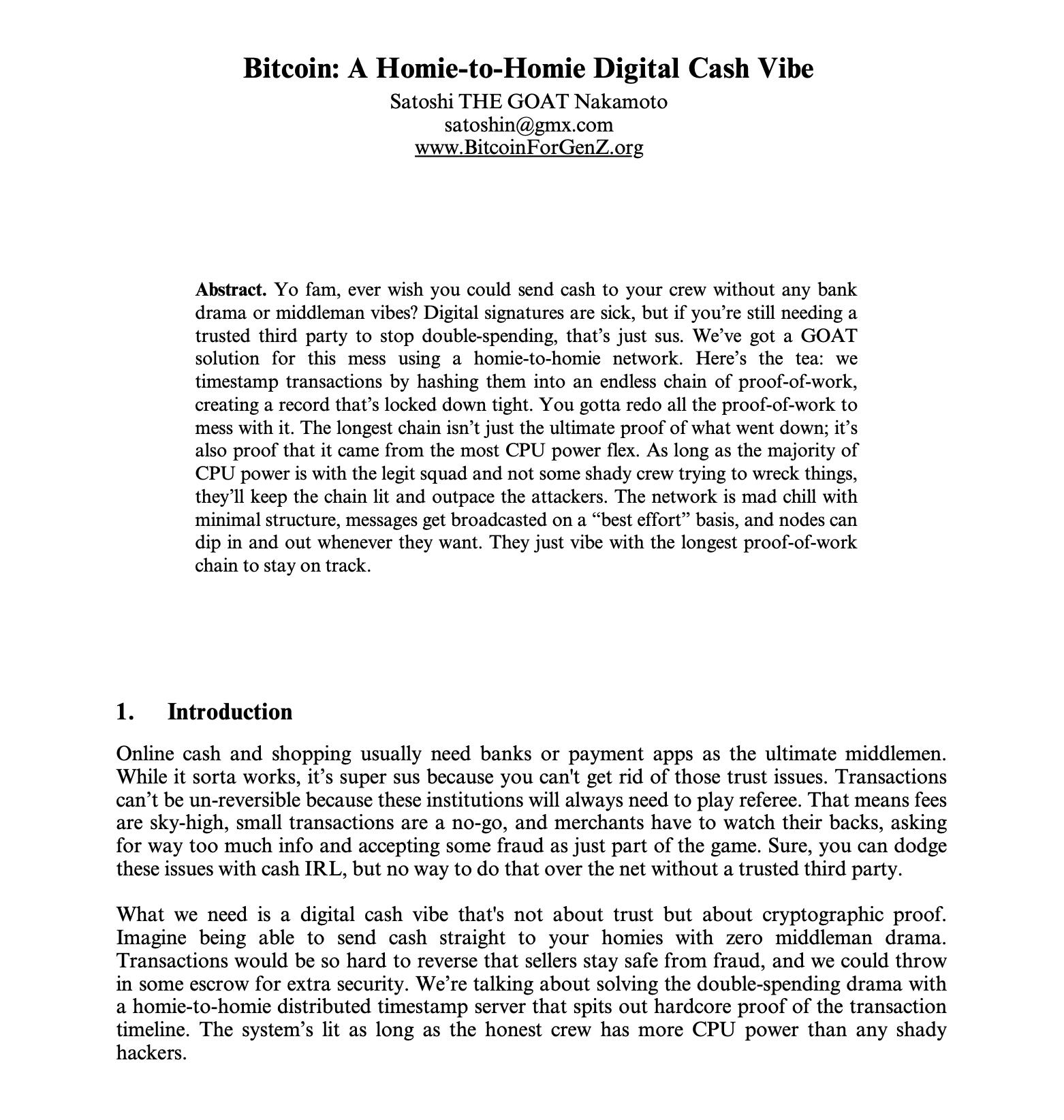

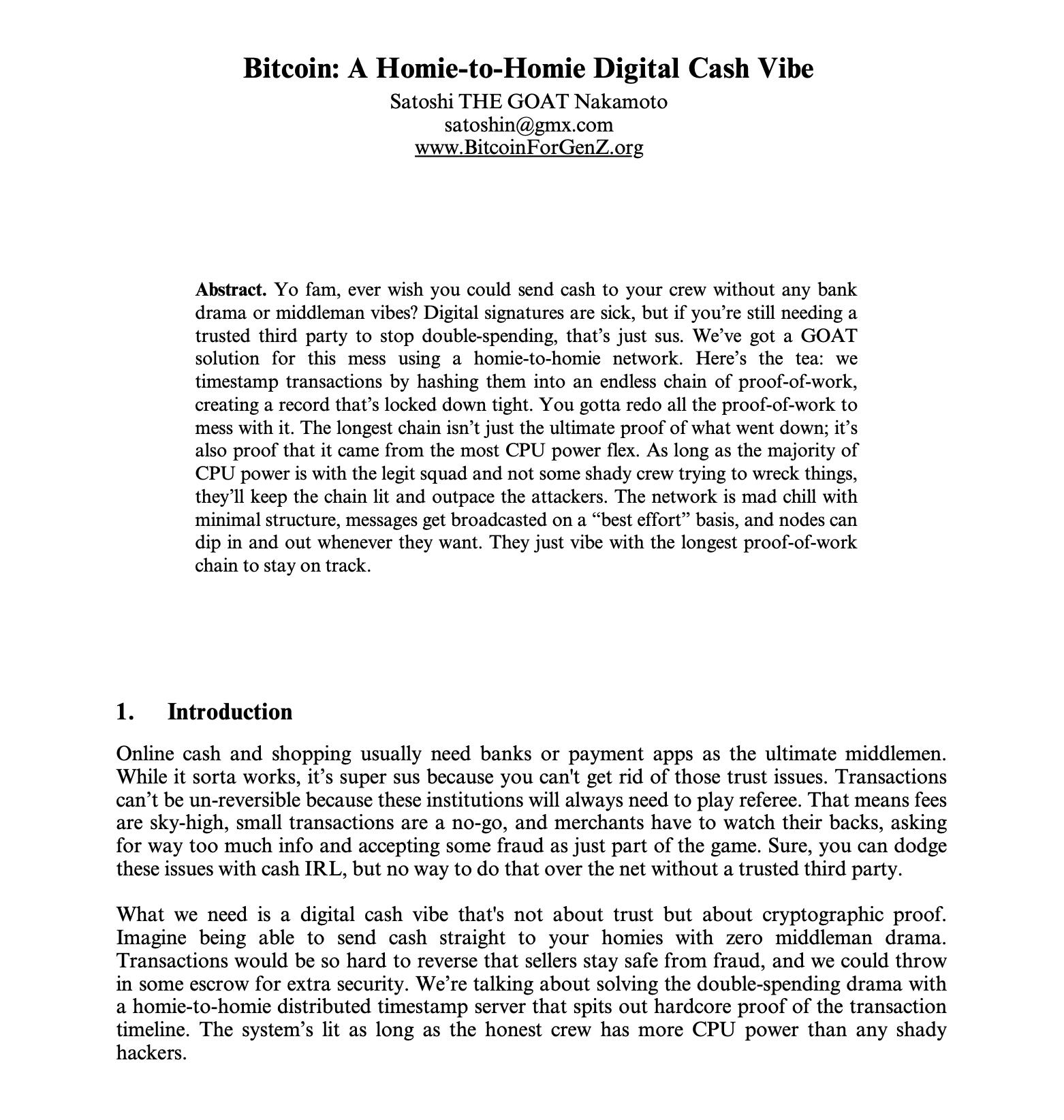

➡️The Bitcoin White paper, but explained in Gen Z Language.

Original [source](https://bitcoinforgenz.org):

➡️'3 years ago, Bitcoin's market cap was ~$835B.

Same for all the crypto stuff w/o stablecoins.

Today, Bitcoin's market cap is up 37% ($1.15T)

And the other stuff? -11% (not adjusted for inflation)

It’s an insightful statistic to present to people who blindly “diversify”.' -Sam Wouters

Bitcoin, not CrYpTO (aka. altcoins).

On the 12th of August:

➡️Remember my statement on Trump after the Bitcoin Conference in Nashville? (Stop larping, politicians need votes, etc., etc.)

President Trump has announced his 20 Core Promises to the American people.

We (Bitcoin) are not even a top 20 priority issue in Trump's agenda.

You know what is on #13: Keep the U.S. Dollar as the world's reserve currency.

"end inflation" and "keep the U.S. Dollar as the world's reserve currency" are diametrically opposed and are diabolical.

If you don't believe me, scroll down a bit and read the segment Macro-Economics.

For all the people on Twitter or other platforms, stop bootlicking, stop larping.

You can’t say “Don’t trust verify” AND trust politicians or go full fangirl.

➡️Bitcoinminer Marathon to raise $250m to buy more Bitcoin.

'Marathon Digital Holdings, Inc. Announces Proposed Private Offering of $250 Million of Convertible Senior Notes. Proceeds to be used primarily to acquire Bitcoin and for general corporate purposes.'

They bought $100m in July and currently HODL 20,000 Bitcoin.

## 💸Traditional Finance / Macro:

On the 6th of August:

👉🏽'JP Morgan says Institutions bought the dip while Retail panic-sold aggressively.

Retail sold -$1 BILLION

-2.5 standard deviations BELOW the 12m average

Institutions bought +$14 billion.

+2.9 std dev ABOVE the 12m average' - Rader

Maybe it's because trading platforms were down for retail investors?

Market manipulation at its finest.

On the 8th of August:

👉🏽Investors Pull $2.2 Billion From ARKK In 2024 As Cathie Wood Underperforms Nasdaq By -30% YTD

👉🏽$6.4 TRILLION wiped out from global stock markets in just 4 weeks - Bloomberg

### 🏦Banks:

👉🏽No news

## 🌎Macro/Geopolitics:

Going to start this segment with a great quote by Luke Gromen:

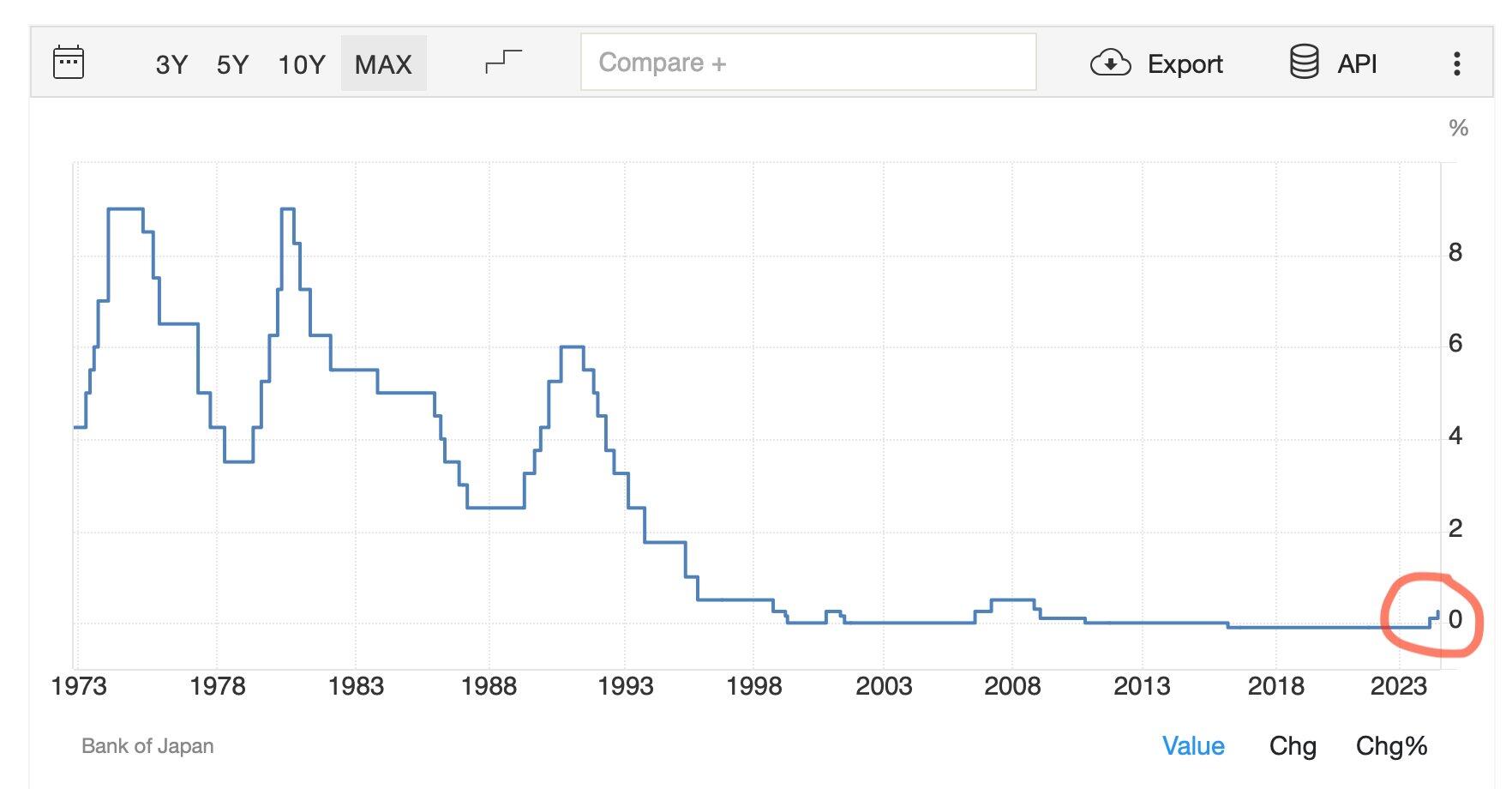

'JPY "too strong" = global market dysfunction, which quickly leads to UST dysfunction.

USD "too strong" = UST market dysfunction, which quickly leads to global market dysfunction.

Powell ultimately only has a choice of how he wants to lose the long end - "fire" or "ice"?'

This is what triggered a global-scale sell-off of every major asset class.

This is how unstable the system is. To add a great James Lavish quote:

'And one might say the root cause *before* the trigger, and the reason for instability was this (15 years of *free money*).'

On the 6th of August:

👉🏽M2 money supply update: On the 7th of August the US Treasury starts Treasury buy-backs again at $30 billion a month.

The US Treasury will begin buying back up to $50 billion worth of outstanding government securities by the end of October, primarily to provide liquidity support.

- $8.5B buyback in August

- $31.5B buyback in September

- $10B buyback in October

Hello liquidity, the printers are back on!

Remember:

USD in circulation (M2): 21T

US Government Debt: 35.1T*

More debt than their money in circulation.

* The US Debt just hit 35.1 Trillion. Up 0.1 Trillion in a week.

*

[

](https://image.nostr.build/2dbf21409da89e46405526d03d96114b888e675eb3cb9b6a98ec56f4af424588.jpg)

It is kicking the goddamnnn can down the road.

The U.S. Now Has:

1. Record $17.8 trillion in household debt

2. Record $12.5 trillion in mortgages

3. Record $1.6 trillion in auto loans

4. Near record $1.6 trillion in student loans

5. Record $1.14 trillion in credit card debt (with the average person owing $6,218 at a 20%+ rate. Making minimum payments, it will take them over 18 years and an *additional* $9K+ to pay off that debt.)

Total household debt is now up 53% over the last 10 years and total credit card debt is up 50% since 2020.

Meanwhile, delinquency rates on credit cards and auto loans are nearing the highs seen in 2008

[](https://image.nostr.build/3a111d3130c4780b49f906a14b7b75158da45b33a669fde656b1c161be31f5e1.jpg)

"Who could defeat the US military?"

Compounding interest

is defeating the US military

& compounding interest is undefeated v. hegemons.

Buy LT USTs if you think the US will lose Cold War 2.0 for lack of printing enough USDs to finance this; if not, buy gold, BTC, & stocks.' - Luke Gromen

No doom and gloom, just facts.

Anyway: "Amateurs talk about tactics, but professionals study logistics" - General Omar Bradley

Omar Nelson Bradley was a senior officer of the United States Army during and after World War II, rising to the rank of General of the Army.

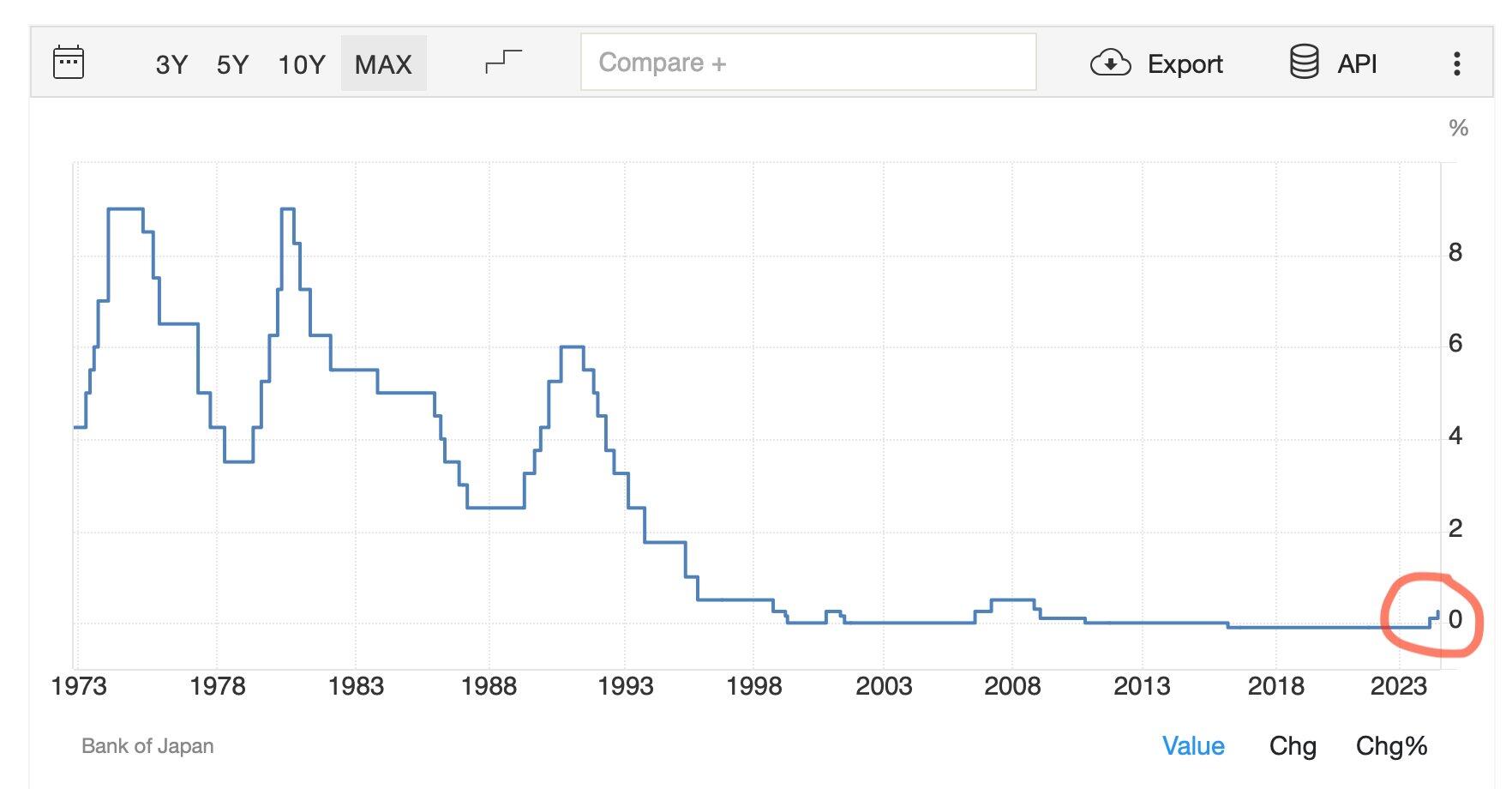

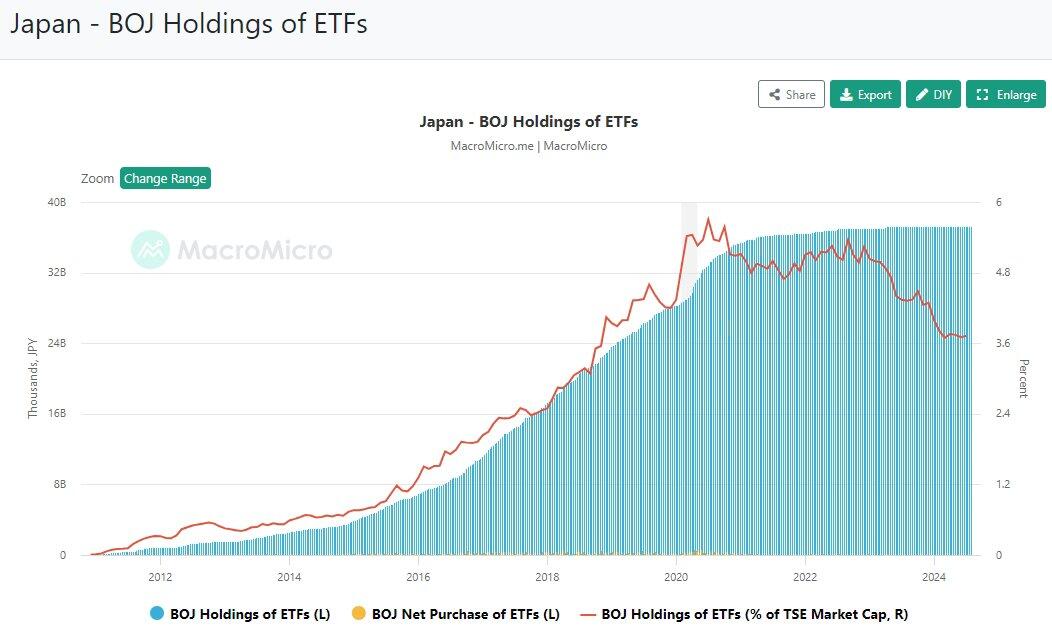

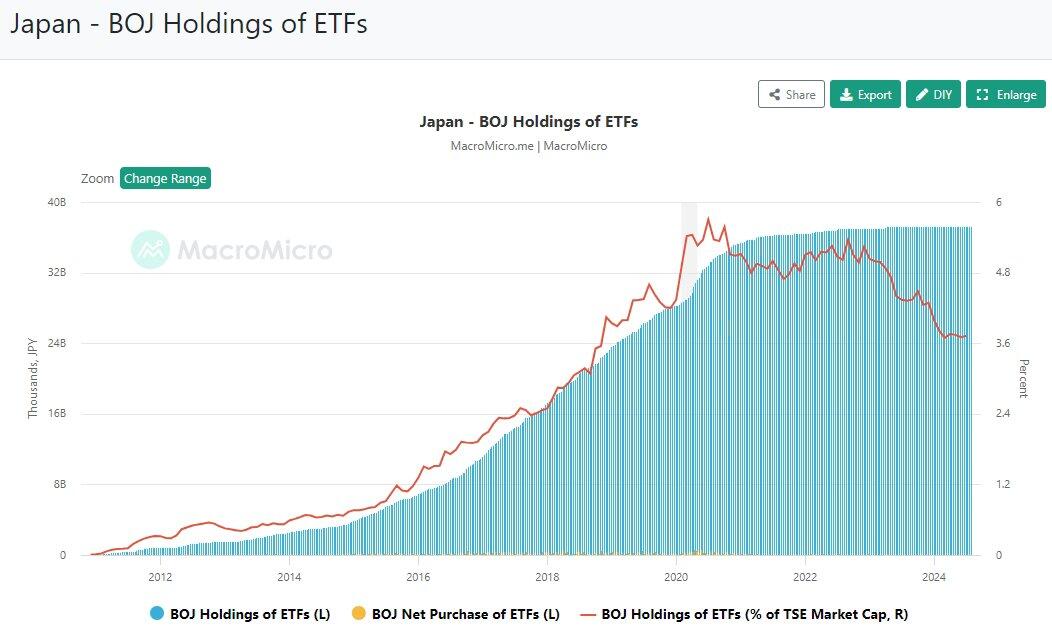

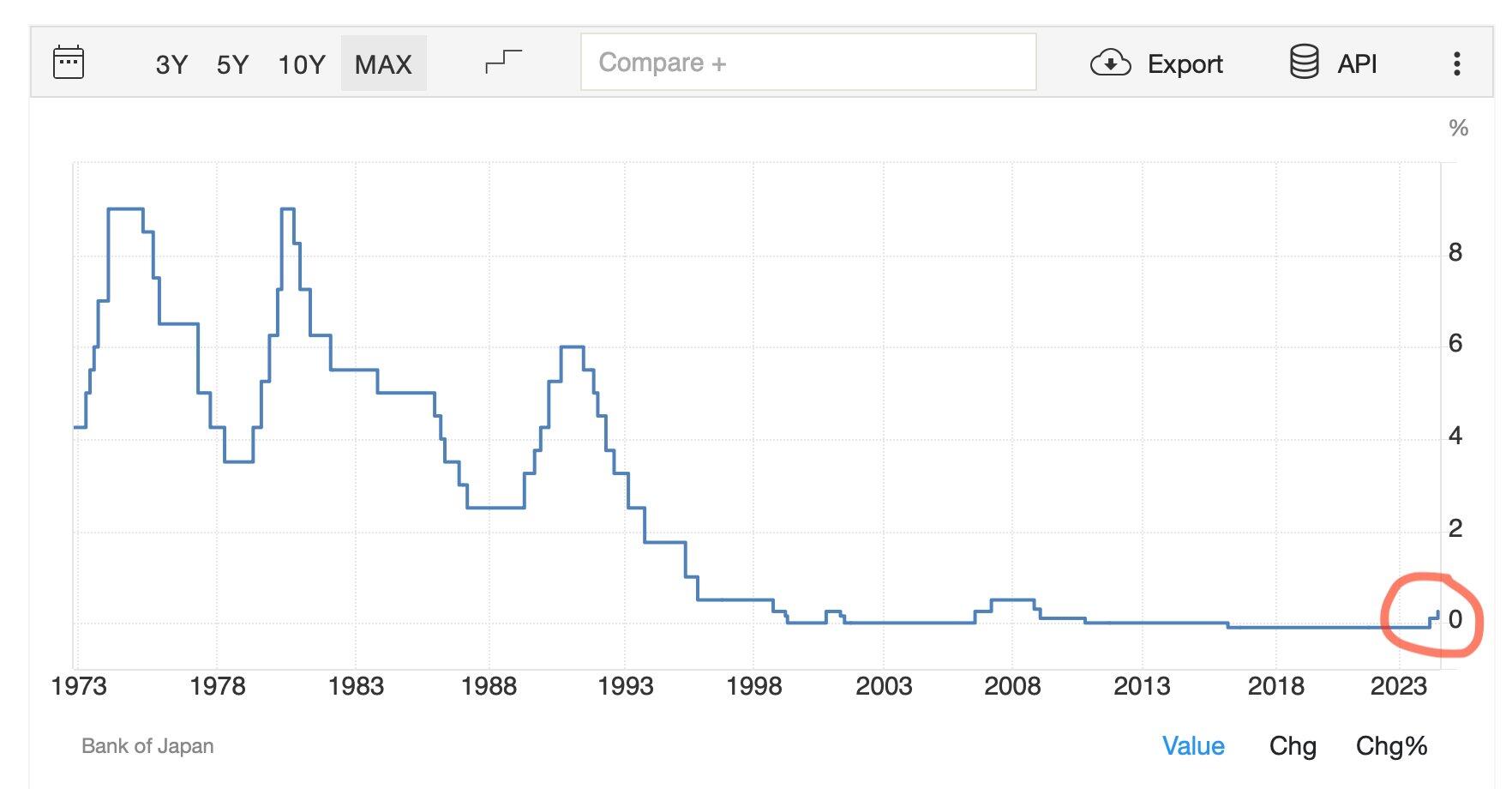

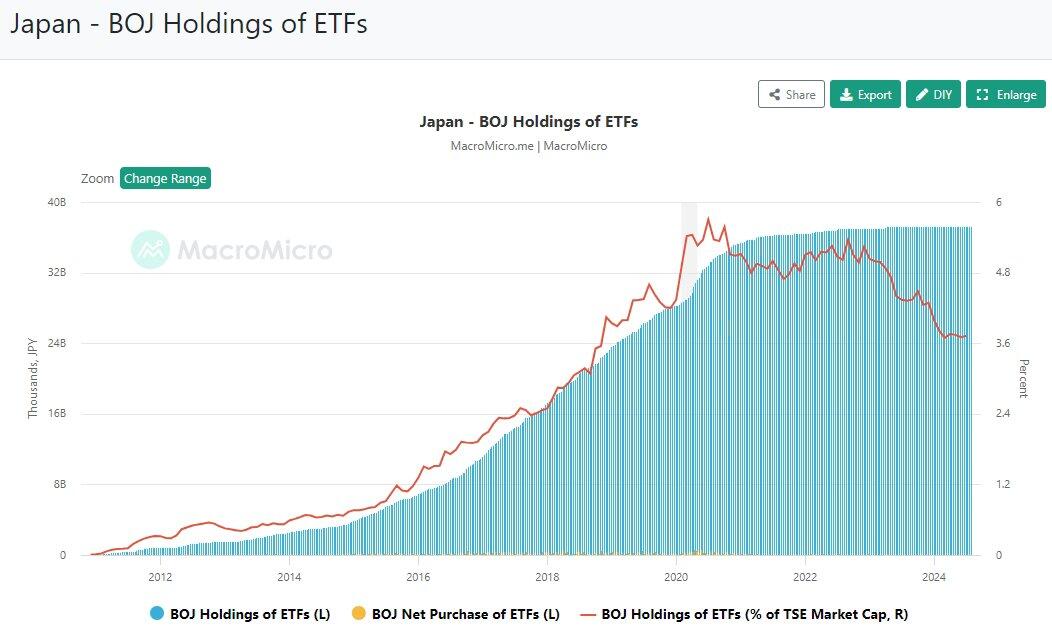

👉🏽Again a great explanation of the situation in Japan:

Bank of Japan (BoJ)

1. Prints insane amounts of money.

2. Becomes the largest holder of ETFs in the Nikkei, incentivizing investors to purchase Japanese ETFs borrowing in yen.

3. Yen falls to 40-year lows

4. BOJ blames "speculators". A classic.

5. BOJ spends billions stabilizing the yen

6. Yen rises, market declines, margin calls jump, Nikkei plummets. Black Monday.

You think this is a "free market".

Classic interventionist economics by the BoJ.

Explanation:

'Now what does this mean:

1. Treasury buybacks improve liquidity in the bond market that has been living on life support over the last few years as high inflation made bonds unappealing

2. This may be deflationary if the amount of money taken out is larger than the amount we are spending to aid in economic expansion I hope this helps you.

3. This will likely lead to a lowering of interest rates later on.

4. This will improve US credit ratings as it shows that we are paying down our debts, hopefully, faster than we are creating new debts.

I hope this helps.' -Tim

👉🏽Bank of Japan to hold an emergency meeting to discuss International Financial Markets - Reuters

The Bank of Japan said it, the Ministry of Finance, and the Financial Services Agency will meet from 3 pm on the 6th of August in Tokyo to discuss international markets.

After the meeting: 'No more rate hikes in the near term due to market volatility.' BoJ

On the 7th of August:

👉🏽 Germany's industrial production was up in June. But looking at the chart and the previous month's revised down (3.1% decline), it's a bit too early to call for a revival of Europe's former Manufacturing 'Powerhouse.'

Germany has had no growth for five years. As a matter of fact, German industrial production has been constantly declining since 2017. Grotesque overregulation and energy suicide are accelerating deindustrialization, and some left weirdos are even celebrating degrowth nonsense.

Meanwhile the number of bankruptcies in Germany "unexpectedly" rose in July to the highest level in about ten years.

👉🏽'The US unemployment rate has risen for 4 consecutive months, the longest streak since the 2008 Financial Crisis.

Over the last 75 years, every time unemployment rose for 4 consecutive months, the US economy entered recession.

The jobless rate has surged from 3.8% in March to 4.3% in July, its highest level since October 2021.

Meanwhile, the US hires rate declined to 3.4% in July, its lowest level since the 2020 Pandemic and below the pre-pandemic average of 3.8%.

The US labor market is contracting.' -TKL

👉🏽 11% of credit card balances in the US are now 90+ days delinquent, the highest in over a decade. Probably nothing!

👉🏽'We do have dedicated police officers who are scouring social media to look for this material, and then follow up with arrests.'

The director of public prosecutions of England and Wales warns that sharing online material of riots could be an offense.

This is not something I just made up. He is saying no free speech. the British government is completely corrupt, and anyone who points this out is a target as sharing videos is now a crime. Is it even a democracy then?

Tim Walz (He is the Democratic Party's nominee for vice president in the 2024 U.S. presidential election): “There’s no guarantee to free speech on misinformation or hate speech and especially around our democracy.”

Remember what Jacinda Ardern, then Prime Minister of New Zealand said in 2020:

"We will continue to be your single source of truth…Remember, unless you hear it from us it is not the truth."

OpenAI has an ex-NSA director on its Board;

The new Dutch Prime Minister is a Former Dutch intelligence chief;

How convenient!

Now don't get me wrong. People should think before they post or repost something on social media. But arresting people for creating online content or reposting that contact is just vile.

V for Vendetta was supposed to be just a graphic novel... not real life! A reminder that V for Vendetta is based in the UK!

Again, you should start using Nostr.

And it is not just in the UK, also EUROPE is going crazy. Read the bit on the 12th of August.

On the 8th of August:

👉🏽Bank of England expected to lose £254 BILLION from the QE money printing program since December 2021 - The Economist

On the 10th of August:

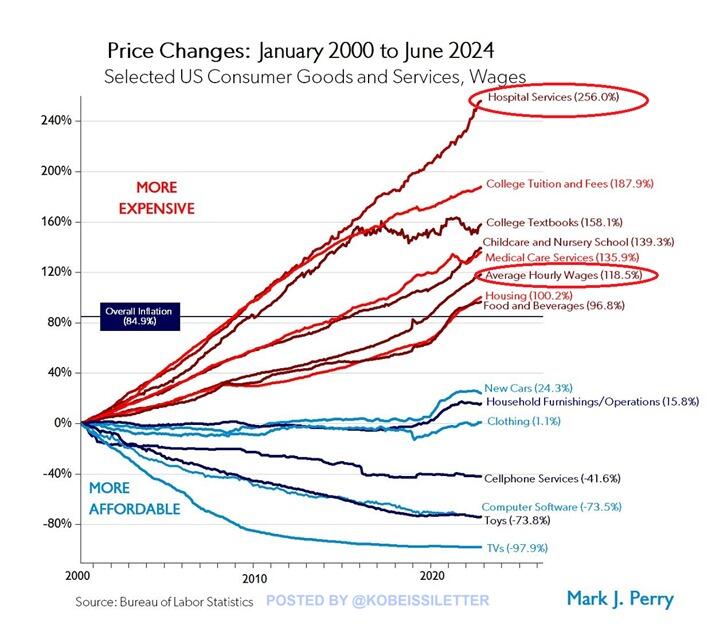

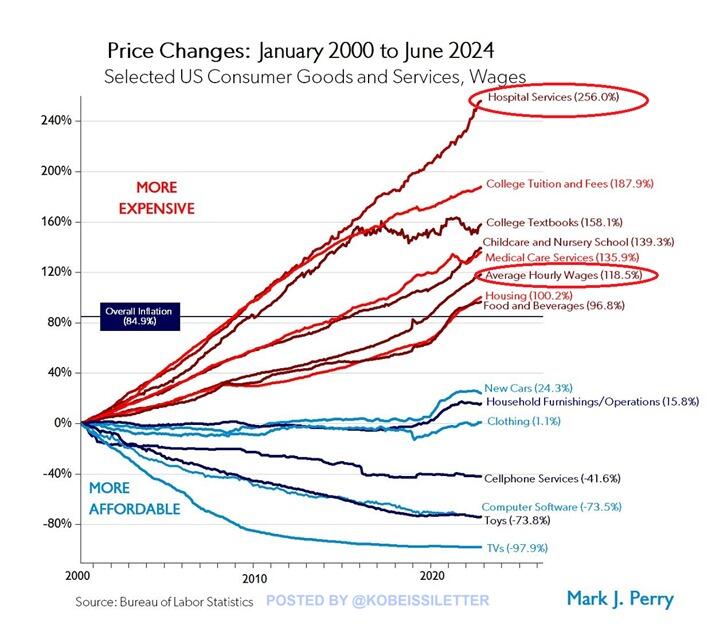

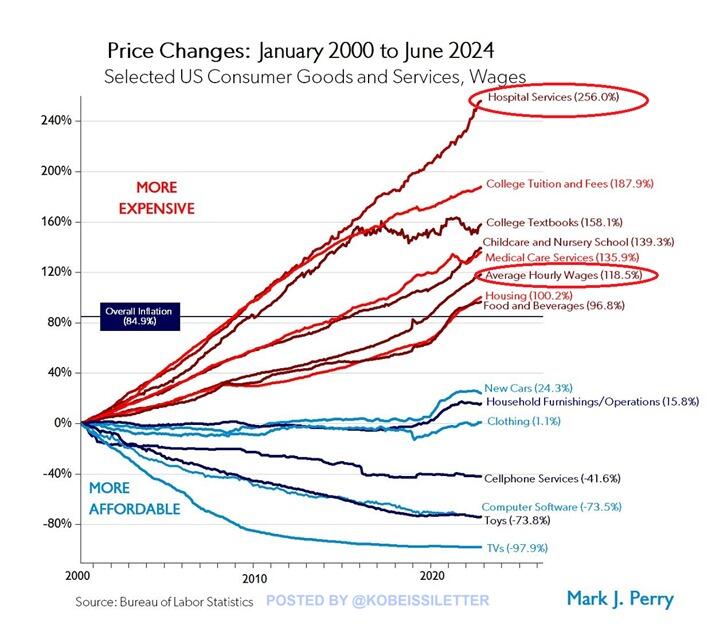

👉🏽'How much have prices increased over the last 24 years?

US hospital services prices have skyrocketed by 256% since the beginning of this century.

At the same time, College Tuition and Fees, as well as College Textbooks spiked by 188% and 158%, respectively.

Moreover, the prices of Childcare or Nursery School and Medical Care Services rose by 139% and 136%.

On the other hand, TVs, Toys, and computer software prices declined by 98%, 74%, and 74%, respectively.

To put this into perspective, average hourly wages are up 119% since 2000.

Wage growth is struggling to keep up with many items.' -TKL

Our society and our economy are driven by debt. CPI is a structural understanding of actual inflation. Everything the government subsidizes goes up by 1 to 300 percent. More protocols, less competition, less disruption, less efficiency; Ergo more inflation. (you can sum up the last part in one word: EUROPE)

The industries where governments stay out are private competition, ergo drives pricing down. Competition is deflationary, when will people realize that?

👉🏽'The rich are getting richer faster than ever before:

The top 40% of US income earners hold 83% of the total net worth, near an all-time record.

The top 20% account for 71% of the total net worth, up 10 percentage points over the last 2 decades.

On the other hand, the bottom 40% of income households hold only 8% of the wealth.

Moreover, the bottom 20% of earners reflect just 3% of total US wealth.

Over the last few years, the rich have gotten a lot richer.' - TKL

This makes perfect sense. If you can hold assets in an inflationary economy/environment, well assets and wealth will go up. The consequences of central banks all around the world printing trillions. The money inevitably flows into asset classes creating bubbles in equity markets, real estate, luxury goods, and many more. The wealthy being the largest owners of these assets simply benefit the most.

What do we call that? It’s called the Cantillon effect.

On the 12th of August:

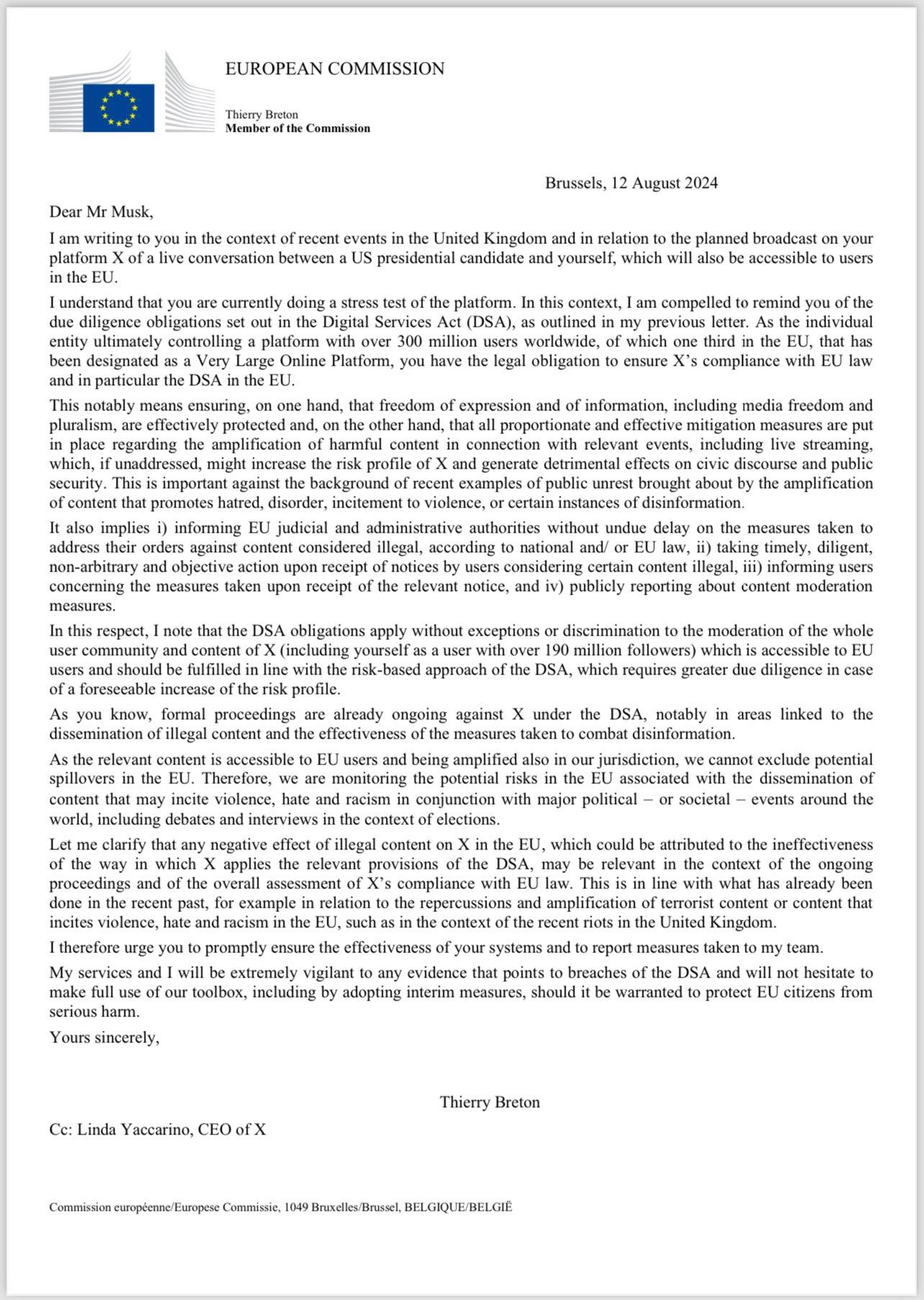

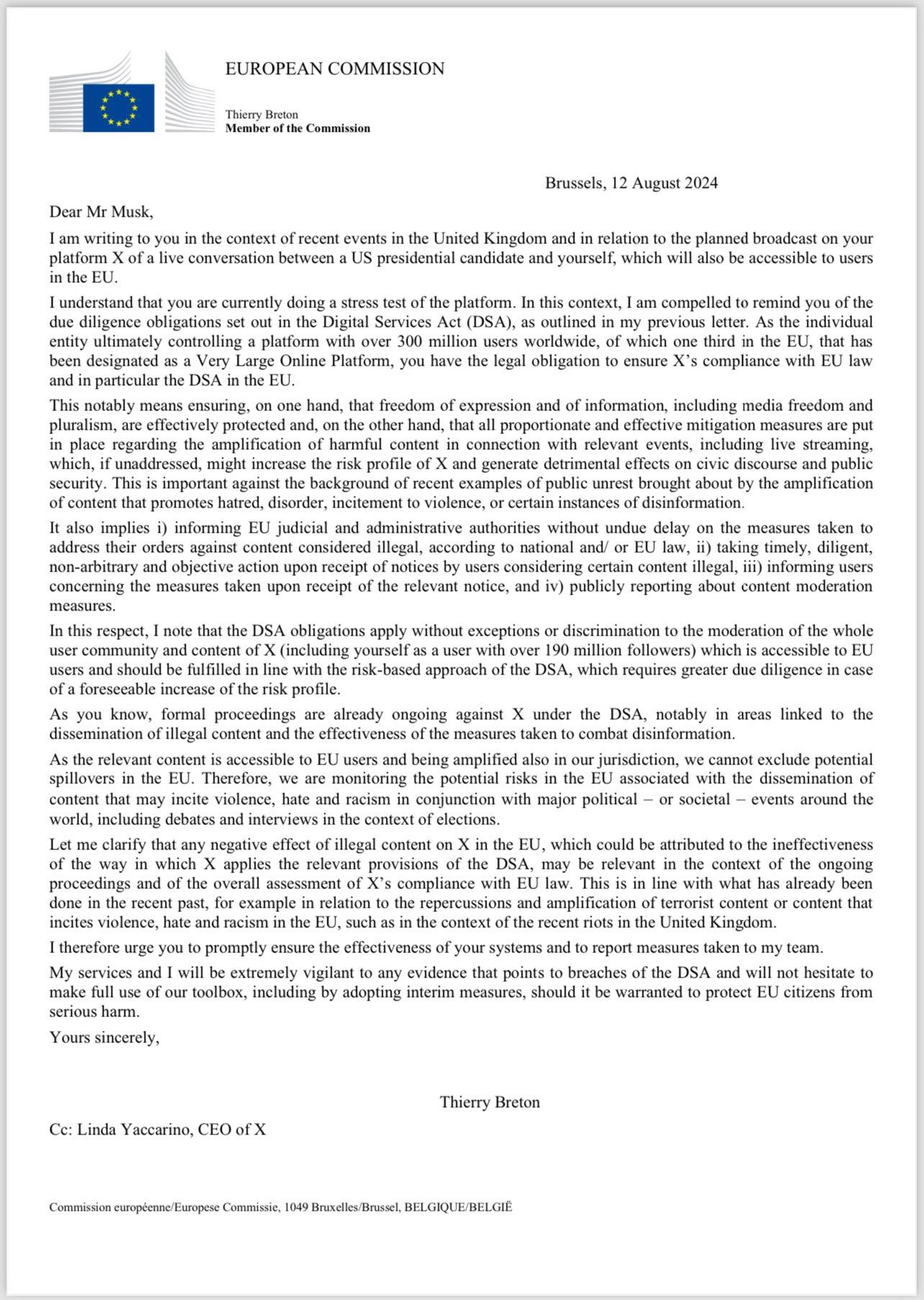

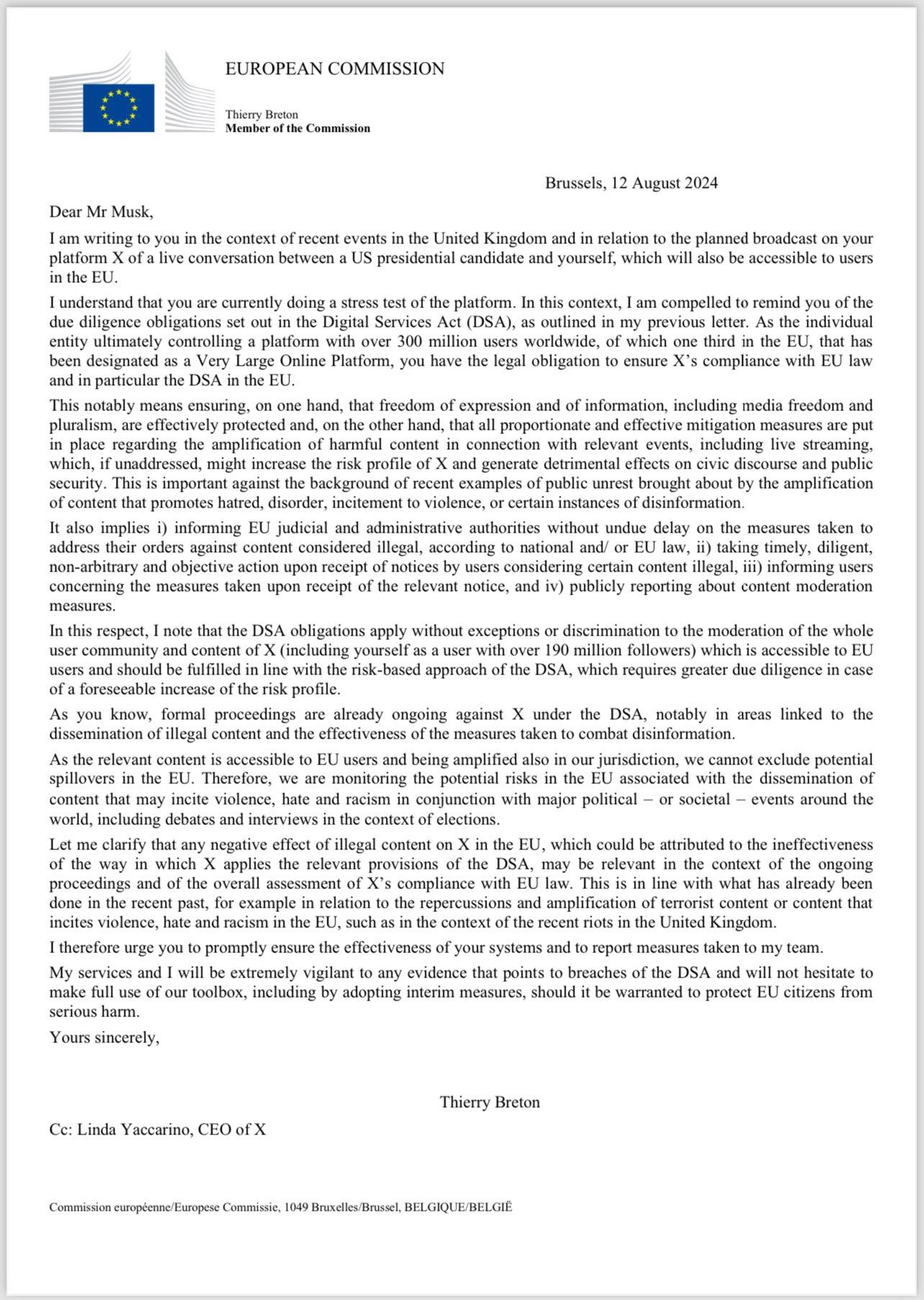

👉🏽Freedom of speech is one of the most precious things in life and society.

'It's amazing how everything they say, is always the opposite: "ensuring freedom of expression and information are protected" = "censor anything we, an unelected group of ultrawealthy technocrats, disagree with". - ZeroHedge

I couldn't have said it better...Jeroen Blokland:

'Europe has completely lost it. European ‘politicians’, who are not leaders, increasingly act from an ideologist perspective, which is incompatible with democratic and socially supported policy making. To send a threatening letter to Elon Musk, compelling him to censor(!) his meeting with Trump is another example of how the aging, declining, and weakening European ‘power’ unrightfully believes it can force its subjective moral standard onto others. Not only does that create friction with many other parts of the world, which outperform Europe in many areas, it also causes massive polarization on the European continent.'

"There is no crueler tyranny than that which is perpetuated under the shield of law and in the name of justice." - Montesquieu

"The welfare of the people has always been the alibi of tyrants, and it provides the servants of tyranny a good conscience." - Albert Camus

Really you should study Bitcoin & Nostr!

'Paradoxically, the Cantillon Effect means that the very last people to understand the need for BTC & technologies like Nostr will be those in and closest to western technocratic & banking centers.' - Luke Gromen

🎁If you have made it this far I would like to give you a little gift:

Great book, great podcast: Resistance Money with Andrew Bailey, Bradley Rettler, & Craig Warmke

'Andrew Bailey, is a Professor of Philosophy at Yale-NUS College, Bradley Rettler is a Professor of Philosophy at the University of Wyoming and Craig Warmke is a Professor of Philosophy at Northern Illinois University. In this episode we discuss their book Resistance Money and the global net-benefits of Bitcoin.'

“When asking a question like this…it’s tempting to replace it with the question ‘is Bitcoin good for me?’, and then you’re off to bag-pumping or bag-dumping; so what we tried to do here is to give a bit more precision to the question: ‘is Bitcoin good for the world?’”

— Andrew Bailey

[](https://youtu.be/OtEp9lZKWvA?si=sOQC7fIB0UEtVhze)

Credit: I have used multiple sources!

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. (Please only use it till the 31st of October - after that full KYC)

Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple.

⠀⠀⠀⠀⠀⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with sats.

Many thanks for reading the Weekly Recap, see you all next week!

Felipe - Bitcoin Friday

@ Bitcoin Friday

2024-08-14 05:33:49# 🧠Quote(s) of the week: 'People should not be afraid of their governments. Governments should be afraid of their people.' - V - 'A simple plan: Manipulate the data. Manipulate the media. Manipulate the money. A simple response: Resist manipulation and think for yourself.' - James Lavish ## 🧡Bitcoin news🧡 The UK is losing its grip on democracy: 'We do have dedicated police officers who are scouring social media to look for this material, and then follow up with arrests.' Tim Walz (He is the Democratic Party's nominee for vice president in the 2024 U.S. presidential election): “There’s no guarantee to free speech on misinformation or hate speech and especially around our democracy.” Your thoughts, writings, and communications (with or without machine intelligence) can only be private if they are never held by any central party. It is time you learn and discover Nostr. Study, use Nostr, start now. Freedom of speech is one of the most precious things in life and society. We lose it at our peril. **On the 6th of August: ➡️ Morgan Stanley's 15,000 wealth advisors, and $4.8 trillion under management, started pitching clients to buy Bitcoin ETFs by BlackRock and Fidelity on the 7th of August. Several sources believe that Wells Fargo will quickly follow Morgan Stanley with Bitcoin ETF approvals. The Bitcoin ecosystem will gain 15,000+ professional salespeople who have relationships with a trillion dollars of managed wealth. Ignore the noise and focus on the signal. ➡️'Tether’s Q2 2024 attestation reveals they hold $4.7 billion in Bitcoin. They also announced a new all-time high in direct and indirect U.S. Treasury holdings at $97.6 billion, surpassing Germany, the UAE, and Australia.' - Bitcoin News ➡️$5.2B worth of Bitcoin was moved by short-term holders within a week. In contrast, long-term holders largely held onto their BTC. Of the $850M in realized losses, only $600K originated from long-term holders. Don't sell your precious corn to BlackRock. Now, read the statement above again and think about it. Only 0.07% of the $850M losses were incurred by long-term holders. Jepp, we don't freaking sell our Bitcoin! Only (the new) paper hands got frightened and shook out. ➡️'Bitcoin is in the "Extreme Fear" phase of the Fear & Greed Index at a score of 17/100. We've been this fearful 3 times in the last 5 years: • 2019 bottom • 2020 bottom • 2022 bottom Plenty of blood-curdling screams in the streets. Excellent buying opportunity.' -Joe Consorti ➡️Lifehack: 'Airbnb host catches guests running a Bitcoin mining farm on his property. He was tipped off when the power company notified him that the renters used a month's worth of electricity in just 4 days.' -Bitcoin News ➡️'It currently takes 1,880 hrs (47 weeks) of work to buy 1 Bitcoin. Said another way: 1 Bitcoin currently buys 1 FTE (at avg. US wage).' -Anilsaidso Now this is before income tax. If you take that into account it would be closer to 1.5 years.  On the 7th of August: ➡️'In Bitcoin over the last decade, the average return for the top 10 days each year was 184%, and the average return (loss) for all of the remaining days each year was −10%.' - James Lavish  This is why you don't trade Bitcoin. Time in the market beats timing the market. Just buy with a 4+ year horizon and go live your life. Spend time with your family & friends. ➡️Metaplanet is raising $70M to increase its Bitcoin holdings. The company plans to allocate $58.76M of the funds directly to Bitcoin, aiming to hedge against currency depreciation. ➡️Michael Saylor says “I own at least 17,732 Bitcoin and can’t see a better place to put money” On the 8th of August: ➡️21,000 Bitcoins were taken off exchanges last week. ➡️Metaplanet secures ¥1 billion 0.1% APR loan; proceeds to fund additional purchases of $BTC. ➡️Bloomberg's Balchunas: '99.5% of the money invested in Bitcoin ETFs held firm despite a -14% drop on Monday and a -21% decline for the week. IBIT saw no outflows at all — a total freak. I’m very bullish on ETF investors’ resilience, but even I’m surprised by this.' On the 10th of August: ➡️The number of Bitcoin nodes has increased 20% yoy. On the 11th of August: ➡️The Bitcoin White paper, but explained in Gen Z Language.  Original [source](https://bitcoinforgenz.org): ➡️'3 years ago, Bitcoin's market cap was ~$835B. Same for all the crypto stuff w/o stablecoins. Today, Bitcoin's market cap is up 37% ($1.15T) And the other stuff? -11% (not adjusted for inflation) It’s an insightful statistic to present to people who blindly “diversify”.' -Sam Wouters Bitcoin, not CrYpTO (aka. altcoins). On the 12th of August: ➡️Remember my statement on Trump after the Bitcoin Conference in Nashville? (Stop larping, politicians need votes, etc., etc.) President Trump has announced his 20 Core Promises to the American people. We (Bitcoin) are not even a top 20 priority issue in Trump's agenda. You know what is on #13: Keep the U.S. Dollar as the world's reserve currency. "end inflation" and "keep the U.S. Dollar as the world's reserve currency" are diametrically opposed and are diabolical. If you don't believe me, scroll down a bit and read the segment Macro-Economics. For all the people on Twitter or other platforms, stop bootlicking, stop larping. You can’t say “Don’t trust verify” AND trust politicians or go full fangirl. ➡️Bitcoinminer Marathon to raise $250m to buy more Bitcoin. 'Marathon Digital Holdings, Inc. Announces Proposed Private Offering of $250 Million of Convertible Senior Notes. Proceeds to be used primarily to acquire Bitcoin and for general corporate purposes.' They bought $100m in July and currently HODL 20,000 Bitcoin. ## 💸Traditional Finance / Macro: On the 6th of August: 👉🏽'JP Morgan says Institutions bought the dip while Retail panic-sold aggressively. Retail sold -$1 BILLION -2.5 standard deviations BELOW the 12m average Institutions bought +$14 billion. +2.9 std dev ABOVE the 12m average' - Rader Maybe it's because trading platforms were down for retail investors? Market manipulation at its finest. On the 8th of August: 👉🏽Investors Pull $2.2 Billion From ARKK In 2024 As Cathie Wood Underperforms Nasdaq By -30% YTD 👉🏽$6.4 TRILLION wiped out from global stock markets in just 4 weeks - Bloomberg ### 🏦Banks: 👉🏽No news ## 🌎Macro/Geopolitics: Going to start this segment with a great quote by Luke Gromen: 'JPY "too strong" = global market dysfunction, which quickly leads to UST dysfunction. USD "too strong" = UST market dysfunction, which quickly leads to global market dysfunction. Powell ultimately only has a choice of how he wants to lose the long end - "fire" or "ice"?'  This is what triggered a global-scale sell-off of every major asset class. This is how unstable the system is. To add a great James Lavish quote: 'And one might say the root cause *before* the trigger, and the reason for instability was this (15 years of *free money*).' On the 6th of August: 👉🏽M2 money supply update: On the 7th of August the US Treasury starts Treasury buy-backs again at $30 billion a month. The US Treasury will begin buying back up to $50 billion worth of outstanding government securities by the end of October, primarily to provide liquidity support. - $8.5B buyback in August - $31.5B buyback in September - $10B buyback in October Hello liquidity, the printers are back on! Remember: USD in circulation (M2): 21T US Government Debt: 35.1T* More debt than their money in circulation. * The US Debt just hit 35.1 Trillion. Up 0.1 Trillion in a week. * [ ](https://image.nostr.build/2dbf21409da89e46405526d03d96114b888e675eb3cb9b6a98ec56f4af424588.jpg) It is kicking the goddamnnn can down the road. The U.S. Now Has: 1. Record $17.8 trillion in household debt 2. Record $12.5 trillion in mortgages 3. Record $1.6 trillion in auto loans 4. Near record $1.6 trillion in student loans 5. Record $1.14 trillion in credit card debt (with the average person owing $6,218 at a 20%+ rate. Making minimum payments, it will take them over 18 years and an *additional* $9K+ to pay off that debt.) Total household debt is now up 53% over the last 10 years and total credit card debt is up 50% since 2020. Meanwhile, delinquency rates on credit cards and auto loans are nearing the highs seen in 2008 [](https://image.nostr.build/3a111d3130c4780b49f906a14b7b75158da45b33a669fde656b1c161be31f5e1.jpg) "Who could defeat the US military?" Compounding interest is defeating the US military & compounding interest is undefeated v. hegemons. Buy LT USTs if you think the US will lose Cold War 2.0 for lack of printing enough USDs to finance this; if not, buy gold, BTC, & stocks.' - Luke Gromen No doom and gloom, just facts. Anyway: "Amateurs talk about tactics, but professionals study logistics" - General Omar Bradley Omar Nelson Bradley was a senior officer of the United States Army during and after World War II, rising to the rank of General of the Army. 👉🏽Again a great explanation of the situation in Japan: Bank of Japan (BoJ) 1. Prints insane amounts of money. 2. Becomes the largest holder of ETFs in the Nikkei, incentivizing investors to purchase Japanese ETFs borrowing in yen. 3. Yen falls to 40-year lows 4. BOJ blames "speculators". A classic. 5. BOJ spends billions stabilizing the yen 6. Yen rises, market declines, margin calls jump, Nikkei plummets. Black Monday. You think this is a "free market".  Classic interventionist economics by the BoJ. Explanation: 'Now what does this mean: 1. Treasury buybacks improve liquidity in the bond market that has been living on life support over the last few years as high inflation made bonds unappealing 2. This may be deflationary if the amount of money taken out is larger than the amount we are spending to aid in economic expansion I hope this helps you. 3. This will likely lead to a lowering of interest rates later on. 4. This will improve US credit ratings as it shows that we are paying down our debts, hopefully, faster than we are creating new debts. I hope this helps.' -Tim 👉🏽Bank of Japan to hold an emergency meeting to discuss International Financial Markets - Reuters The Bank of Japan said it, the Ministry of Finance, and the Financial Services Agency will meet from 3 pm on the 6th of August in Tokyo to discuss international markets. After the meeting: 'No more rate hikes in the near term due to market volatility.' BoJ On the 7th of August: 👉🏽 Germany's industrial production was up in June. But looking at the chart and the previous month's revised down (3.1% decline), it's a bit too early to call for a revival of Europe's former Manufacturing 'Powerhouse.' Germany has had no growth for five years. As a matter of fact, German industrial production has been constantly declining since 2017. Grotesque overregulation and energy suicide are accelerating deindustrialization, and some left weirdos are even celebrating degrowth nonsense. Meanwhile the number of bankruptcies in Germany "unexpectedly" rose in July to the highest level in about ten years.  👉🏽'The US unemployment rate has risen for 4 consecutive months, the longest streak since the 2008 Financial Crisis. Over the last 75 years, every time unemployment rose for 4 consecutive months, the US economy entered recession. The jobless rate has surged from 3.8% in March to 4.3% in July, its highest level since October 2021. Meanwhile, the US hires rate declined to 3.4% in July, its lowest level since the 2020 Pandemic and below the pre-pandemic average of 3.8%. The US labor market is contracting.' -TKL 👉🏽 11% of credit card balances in the US are now 90+ days delinquent, the highest in over a decade. Probably nothing! 👉🏽'We do have dedicated police officers who are scouring social media to look for this material, and then follow up with arrests.' The director of public prosecutions of England and Wales warns that sharing online material of riots could be an offense. This is not something I just made up. He is saying no free speech. the British government is completely corrupt, and anyone who points this out is a target as sharing videos is now a crime. Is it even a democracy then? Tim Walz (He is the Democratic Party's nominee for vice president in the 2024 U.S. presidential election): “There’s no guarantee to free speech on misinformation or hate speech and especially around our democracy.” Remember what Jacinda Ardern, then Prime Minister of New Zealand said in 2020: "We will continue to be your single source of truth…Remember, unless you hear it from us it is not the truth." OpenAI has an ex-NSA director on its Board; The new Dutch Prime Minister is a Former Dutch intelligence chief; How convenient! Now don't get me wrong. People should think before they post or repost something on social media. But arresting people for creating online content or reposting that contact is just vile. V for Vendetta was supposed to be just a graphic novel... not real life! A reminder that V for Vendetta is based in the UK! Again, you should start using Nostr. And it is not just in the UK, also EUROPE is going crazy. Read the bit on the 12th of August. On the 8th of August: 👉🏽Bank of England expected to lose £254 BILLION from the QE money printing program since December 2021 - The Economist On the 10th of August: 👉🏽'How much have prices increased over the last 24 years? US hospital services prices have skyrocketed by 256% since the beginning of this century. At the same time, College Tuition and Fees, as well as College Textbooks spiked by 188% and 158%, respectively. Moreover, the prices of Childcare or Nursery School and Medical Care Services rose by 139% and 136%. On the other hand, TVs, Toys, and computer software prices declined by 98%, 74%, and 74%, respectively. To put this into perspective, average hourly wages are up 119% since 2000. Wage growth is struggling to keep up with many items.' -TKL  Our society and our economy are driven by debt. CPI is a structural understanding of actual inflation. Everything the government subsidizes goes up by 1 to 300 percent. More protocols, less competition, less disruption, less efficiency; Ergo more inflation. (you can sum up the last part in one word: EUROPE) The industries where governments stay out are private competition, ergo drives pricing down. Competition is deflationary, when will people realize that? 👉🏽'The rich are getting richer faster than ever before: The top 40% of US income earners hold 83% of the total net worth, near an all-time record. The top 20% account for 71% of the total net worth, up 10 percentage points over the last 2 decades. On the other hand, the bottom 40% of income households hold only 8% of the wealth. Moreover, the bottom 20% of earners reflect just 3% of total US wealth. Over the last few years, the rich have gotten a lot richer.' - TKL This makes perfect sense. If you can hold assets in an inflationary economy/environment, well assets and wealth will go up. The consequences of central banks all around the world printing trillions. The money inevitably flows into asset classes creating bubbles in equity markets, real estate, luxury goods, and many more. The wealthy being the largest owners of these assets simply benefit the most. What do we call that? It’s called the Cantillon effect. On the 12th of August: 👉🏽Freedom of speech is one of the most precious things in life and society.  'It's amazing how everything they say, is always the opposite: "ensuring freedom of expression and information are protected" = "censor anything we, an unelected group of ultrawealthy technocrats, disagree with". - ZeroHedge I couldn't have said it better...Jeroen Blokland: 'Europe has completely lost it. European ‘politicians’, who are not leaders, increasingly act from an ideologist perspective, which is incompatible with democratic and socially supported policy making. To send a threatening letter to Elon Musk, compelling him to censor(!) his meeting with Trump is another example of how the aging, declining, and weakening European ‘power’ unrightfully believes it can force its subjective moral standard onto others. Not only does that create friction with many other parts of the world, which outperform Europe in many areas, it also causes massive polarization on the European continent.' "There is no crueler tyranny than that which is perpetuated under the shield of law and in the name of justice." - Montesquieu "The welfare of the people has always been the alibi of tyrants, and it provides the servants of tyranny a good conscience." - Albert Camus Really you should study Bitcoin & Nostr! 'Paradoxically, the Cantillon Effect means that the very last people to understand the need for BTC & technologies like Nostr will be those in and closest to western technocratic & banking centers.' - Luke Gromen 🎁If you have made it this far I would like to give you a little gift: Great book, great podcast: Resistance Money with Andrew Bailey, Bradley Rettler, & Craig Warmke 'Andrew Bailey, is a Professor of Philosophy at Yale-NUS College, Bradley Rettler is a Professor of Philosophy at the University of Wyoming and Craig Warmke is a Professor of Philosophy at Northern Illinois University. In this episode we discuss their book Resistance Money and the global net-benefits of Bitcoin.' “When asking a question like this…it’s tempting to replace it with the question ‘is Bitcoin good for me?’, and then you’re off to bag-pumping or bag-dumping; so what we tried to do here is to give a bit more precision to the question: ‘is Bitcoin good for the world?’” — Andrew Bailey [](https://youtu.be/OtEp9lZKWvA?si=sOQC7fIB0UEtVhze) Credit: I have used multiple sources! My savings account: Bitcoin The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. (Please only use it till the 31st of October - after that full KYC) Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info. ⠀⠀⠀⠀ Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀⠀⠀⠀⠀⠀⠀⠀ Do you think this post is helpful to you? If so, please share it and support my work with sats. Many thanks for reading the Weekly Recap, see you all next week! Felipe - Bitcoin Friday

@ Bitcoin Friday

2024-08-14 05:33:49# 🧠Quote(s) of the week: 'People should not be afraid of their governments. Governments should be afraid of their people.' - V - 'A simple plan: Manipulate the data. Manipulate the media. Manipulate the money. A simple response: Resist manipulation and think for yourself.' - James Lavish ## 🧡Bitcoin news🧡 The UK is losing its grip on democracy: 'We do have dedicated police officers who are scouring social media to look for this material, and then follow up with arrests.' Tim Walz (He is the Democratic Party's nominee for vice president in the 2024 U.S. presidential election): “There’s no guarantee to free speech on misinformation or hate speech and especially around our democracy.” Your thoughts, writings, and communications (with or without machine intelligence) can only be private if they are never held by any central party. It is time you learn and discover Nostr. Study, use Nostr, start now. Freedom of speech is one of the most precious things in life and society. We lose it at our peril. **On the 6th of August: ➡️ Morgan Stanley's 15,000 wealth advisors, and $4.8 trillion under management, started pitching clients to buy Bitcoin ETFs by BlackRock and Fidelity on the 7th of August. Several sources believe that Wells Fargo will quickly follow Morgan Stanley with Bitcoin ETF approvals. The Bitcoin ecosystem will gain 15,000+ professional salespeople who have relationships with a trillion dollars of managed wealth. Ignore the noise and focus on the signal. ➡️'Tether’s Q2 2024 attestation reveals they hold $4.7 billion in Bitcoin. They also announced a new all-time high in direct and indirect U.S. Treasury holdings at $97.6 billion, surpassing Germany, the UAE, and Australia.' - Bitcoin News ➡️$5.2B worth of Bitcoin was moved by short-term holders within a week. In contrast, long-term holders largely held onto their BTC. Of the $850M in realized losses, only $600K originated from long-term holders. Don't sell your precious corn to BlackRock. Now, read the statement above again and think about it. Only 0.07% of the $850M losses were incurred by long-term holders. Jepp, we don't freaking sell our Bitcoin! Only (the new) paper hands got frightened and shook out. ➡️'Bitcoin is in the "Extreme Fear" phase of the Fear & Greed Index at a score of 17/100. We've been this fearful 3 times in the last 5 years: • 2019 bottom • 2020 bottom • 2022 bottom Plenty of blood-curdling screams in the streets. Excellent buying opportunity.' -Joe Consorti ➡️Lifehack: 'Airbnb host catches guests running a Bitcoin mining farm on his property. He was tipped off when the power company notified him that the renters used a month's worth of electricity in just 4 days.' -Bitcoin News ➡️'It currently takes 1,880 hrs (47 weeks) of work to buy 1 Bitcoin. Said another way: 1 Bitcoin currently buys 1 FTE (at avg. US wage).' -Anilsaidso Now this is before income tax. If you take that into account it would be closer to 1.5 years.  On the 7th of August: ➡️'In Bitcoin over the last decade, the average return for the top 10 days each year was 184%, and the average return (loss) for all of the remaining days each year was −10%.' - James Lavish  This is why you don't trade Bitcoin. Time in the market beats timing the market. Just buy with a 4+ year horizon and go live your life. Spend time with your family & friends. ➡️Metaplanet is raising $70M to increase its Bitcoin holdings. The company plans to allocate $58.76M of the funds directly to Bitcoin, aiming to hedge against currency depreciation. ➡️Michael Saylor says “I own at least 17,732 Bitcoin and can’t see a better place to put money” On the 8th of August: ➡️21,000 Bitcoins were taken off exchanges last week. ➡️Metaplanet secures ¥1 billion 0.1% APR loan; proceeds to fund additional purchases of $BTC. ➡️Bloomberg's Balchunas: '99.5% of the money invested in Bitcoin ETFs held firm despite a -14% drop on Monday and a -21% decline for the week. IBIT saw no outflows at all — a total freak. I’m very bullish on ETF investors’ resilience, but even I’m surprised by this.' On the 10th of August: ➡️The number of Bitcoin nodes has increased 20% yoy. On the 11th of August: ➡️The Bitcoin White paper, but explained in Gen Z Language.  Original [source](https://bitcoinforgenz.org): ➡️'3 years ago, Bitcoin's market cap was ~$835B. Same for all the crypto stuff w/o stablecoins. Today, Bitcoin's market cap is up 37% ($1.15T) And the other stuff? -11% (not adjusted for inflation) It’s an insightful statistic to present to people who blindly “diversify”.' -Sam Wouters Bitcoin, not CrYpTO (aka. altcoins). On the 12th of August: ➡️Remember my statement on Trump after the Bitcoin Conference in Nashville? (Stop larping, politicians need votes, etc., etc.) President Trump has announced his 20 Core Promises to the American people. We (Bitcoin) are not even a top 20 priority issue in Trump's agenda. You know what is on #13: Keep the U.S. Dollar as the world's reserve currency. "end inflation" and "keep the U.S. Dollar as the world's reserve currency" are diametrically opposed and are diabolical. If you don't believe me, scroll down a bit and read the segment Macro-Economics. For all the people on Twitter or other platforms, stop bootlicking, stop larping. You can’t say “Don’t trust verify” AND trust politicians or go full fangirl. ➡️Bitcoinminer Marathon to raise $250m to buy more Bitcoin. 'Marathon Digital Holdings, Inc. Announces Proposed Private Offering of $250 Million of Convertible Senior Notes. Proceeds to be used primarily to acquire Bitcoin and for general corporate purposes.' They bought $100m in July and currently HODL 20,000 Bitcoin. ## 💸Traditional Finance / Macro: On the 6th of August: 👉🏽'JP Morgan says Institutions bought the dip while Retail panic-sold aggressively. Retail sold -$1 BILLION -2.5 standard deviations BELOW the 12m average Institutions bought +$14 billion. +2.9 std dev ABOVE the 12m average' - Rader Maybe it's because trading platforms were down for retail investors? Market manipulation at its finest. On the 8th of August: 👉🏽Investors Pull $2.2 Billion From ARKK In 2024 As Cathie Wood Underperforms Nasdaq By -30% YTD 👉🏽$6.4 TRILLION wiped out from global stock markets in just 4 weeks - Bloomberg ### 🏦Banks: 👉🏽No news ## 🌎Macro/Geopolitics: Going to start this segment with a great quote by Luke Gromen: 'JPY "too strong" = global market dysfunction, which quickly leads to UST dysfunction. USD "too strong" = UST market dysfunction, which quickly leads to global market dysfunction. Powell ultimately only has a choice of how he wants to lose the long end - "fire" or "ice"?'  This is what triggered a global-scale sell-off of every major asset class. This is how unstable the system is. To add a great James Lavish quote: 'And one might say the root cause *before* the trigger, and the reason for instability was this (15 years of *free money*).' On the 6th of August: 👉🏽M2 money supply update: On the 7th of August the US Treasury starts Treasury buy-backs again at $30 billion a month. The US Treasury will begin buying back up to $50 billion worth of outstanding government securities by the end of October, primarily to provide liquidity support. - $8.5B buyback in August - $31.5B buyback in September - $10B buyback in October Hello liquidity, the printers are back on! Remember: USD in circulation (M2): 21T US Government Debt: 35.1T* More debt than their money in circulation. * The US Debt just hit 35.1 Trillion. Up 0.1 Trillion in a week. * [ ](https://image.nostr.build/2dbf21409da89e46405526d03d96114b888e675eb3cb9b6a98ec56f4af424588.jpg) It is kicking the goddamnnn can down the road. The U.S. Now Has: 1. Record $17.8 trillion in household debt 2. Record $12.5 trillion in mortgages 3. Record $1.6 trillion in auto loans 4. Near record $1.6 trillion in student loans 5. Record $1.14 trillion in credit card debt (with the average person owing $6,218 at a 20%+ rate. Making minimum payments, it will take them over 18 years and an *additional* $9K+ to pay off that debt.) Total household debt is now up 53% over the last 10 years and total credit card debt is up 50% since 2020. Meanwhile, delinquency rates on credit cards and auto loans are nearing the highs seen in 2008 [](https://image.nostr.build/3a111d3130c4780b49f906a14b7b75158da45b33a669fde656b1c161be31f5e1.jpg) "Who could defeat the US military?" Compounding interest is defeating the US military & compounding interest is undefeated v. hegemons. Buy LT USTs if you think the US will lose Cold War 2.0 for lack of printing enough USDs to finance this; if not, buy gold, BTC, & stocks.' - Luke Gromen No doom and gloom, just facts. Anyway: "Amateurs talk about tactics, but professionals study logistics" - General Omar Bradley Omar Nelson Bradley was a senior officer of the United States Army during and after World War II, rising to the rank of General of the Army. 👉🏽Again a great explanation of the situation in Japan: Bank of Japan (BoJ) 1. Prints insane amounts of money. 2. Becomes the largest holder of ETFs in the Nikkei, incentivizing investors to purchase Japanese ETFs borrowing in yen. 3. Yen falls to 40-year lows 4. BOJ blames "speculators". A classic. 5. BOJ spends billions stabilizing the yen 6. Yen rises, market declines, margin calls jump, Nikkei plummets. Black Monday. You think this is a "free market".  Classic interventionist economics by the BoJ. Explanation: 'Now what does this mean: 1. Treasury buybacks improve liquidity in the bond market that has been living on life support over the last few years as high inflation made bonds unappealing 2. This may be deflationary if the amount of money taken out is larger than the amount we are spending to aid in economic expansion I hope this helps you. 3. This will likely lead to a lowering of interest rates later on. 4. This will improve US credit ratings as it shows that we are paying down our debts, hopefully, faster than we are creating new debts. I hope this helps.' -Tim 👉🏽Bank of Japan to hold an emergency meeting to discuss International Financial Markets - Reuters The Bank of Japan said it, the Ministry of Finance, and the Financial Services Agency will meet from 3 pm on the 6th of August in Tokyo to discuss international markets. After the meeting: 'No more rate hikes in the near term due to market volatility.' BoJ On the 7th of August: 👉🏽 Germany's industrial production was up in June. But looking at the chart and the previous month's revised down (3.1% decline), it's a bit too early to call for a revival of Europe's former Manufacturing 'Powerhouse.' Germany has had no growth for five years. As a matter of fact, German industrial production has been constantly declining since 2017. Grotesque overregulation and energy suicide are accelerating deindustrialization, and some left weirdos are even celebrating degrowth nonsense. Meanwhile the number of bankruptcies in Germany "unexpectedly" rose in July to the highest level in about ten years.  👉🏽'The US unemployment rate has risen for 4 consecutive months, the longest streak since the 2008 Financial Crisis. Over the last 75 years, every time unemployment rose for 4 consecutive months, the US economy entered recession. The jobless rate has surged from 3.8% in March to 4.3% in July, its highest level since October 2021. Meanwhile, the US hires rate declined to 3.4% in July, its lowest level since the 2020 Pandemic and below the pre-pandemic average of 3.8%. The US labor market is contracting.' -TKL 👉🏽 11% of credit card balances in the US are now 90+ days delinquent, the highest in over a decade. Probably nothing! 👉🏽'We do have dedicated police officers who are scouring social media to look for this material, and then follow up with arrests.' The director of public prosecutions of England and Wales warns that sharing online material of riots could be an offense. This is not something I just made up. He is saying no free speech. the British government is completely corrupt, and anyone who points this out is a target as sharing videos is now a crime. Is it even a democracy then? Tim Walz (He is the Democratic Party's nominee for vice president in the 2024 U.S. presidential election): “There’s no guarantee to free speech on misinformation or hate speech and especially around our democracy.” Remember what Jacinda Ardern, then Prime Minister of New Zealand said in 2020: "We will continue to be your single source of truth…Remember, unless you hear it from us it is not the truth." OpenAI has an ex-NSA director on its Board; The new Dutch Prime Minister is a Former Dutch intelligence chief; How convenient! Now don't get me wrong. People should think before they post or repost something on social media. But arresting people for creating online content or reposting that contact is just vile. V for Vendetta was supposed to be just a graphic novel... not real life! A reminder that V for Vendetta is based in the UK! Again, you should start using Nostr. And it is not just in the UK, also EUROPE is going crazy. Read the bit on the 12th of August. On the 8th of August: 👉🏽Bank of England expected to lose £254 BILLION from the QE money printing program since December 2021 - The Economist On the 10th of August: 👉🏽'How much have prices increased over the last 24 years? US hospital services prices have skyrocketed by 256% since the beginning of this century. At the same time, College Tuition and Fees, as well as College Textbooks spiked by 188% and 158%, respectively. Moreover, the prices of Childcare or Nursery School and Medical Care Services rose by 139% and 136%. On the other hand, TVs, Toys, and computer software prices declined by 98%, 74%, and 74%, respectively. To put this into perspective, average hourly wages are up 119% since 2000. Wage growth is struggling to keep up with many items.' -TKL  Our society and our economy are driven by debt. CPI is a structural understanding of actual inflation. Everything the government subsidizes goes up by 1 to 300 percent. More protocols, less competition, less disruption, less efficiency; Ergo more inflation. (you can sum up the last part in one word: EUROPE) The industries where governments stay out are private competition, ergo drives pricing down. Competition is deflationary, when will people realize that? 👉🏽'The rich are getting richer faster than ever before: The top 40% of US income earners hold 83% of the total net worth, near an all-time record. The top 20% account for 71% of the total net worth, up 10 percentage points over the last 2 decades. On the other hand, the bottom 40% of income households hold only 8% of the wealth. Moreover, the bottom 20% of earners reflect just 3% of total US wealth. Over the last few years, the rich have gotten a lot richer.' - TKL This makes perfect sense. If you can hold assets in an inflationary economy/environment, well assets and wealth will go up. The consequences of central banks all around the world printing trillions. The money inevitably flows into asset classes creating bubbles in equity markets, real estate, luxury goods, and many more. The wealthy being the largest owners of these assets simply benefit the most. What do we call that? It’s called the Cantillon effect. On the 12th of August: 👉🏽Freedom of speech is one of the most precious things in life and society.  'It's amazing how everything they say, is always the opposite: "ensuring freedom of expression and information are protected" = "censor anything we, an unelected group of ultrawealthy technocrats, disagree with". - ZeroHedge I couldn't have said it better...Jeroen Blokland: 'Europe has completely lost it. European ‘politicians’, who are not leaders, increasingly act from an ideologist perspective, which is incompatible with democratic and socially supported policy making. To send a threatening letter to Elon Musk, compelling him to censor(!) his meeting with Trump is another example of how the aging, declining, and weakening European ‘power’ unrightfully believes it can force its subjective moral standard onto others. Not only does that create friction with many other parts of the world, which outperform Europe in many areas, it also causes massive polarization on the European continent.' "There is no crueler tyranny than that which is perpetuated under the shield of law and in the name of justice." - Montesquieu "The welfare of the people has always been the alibi of tyrants, and it provides the servants of tyranny a good conscience." - Albert Camus Really you should study Bitcoin & Nostr! 'Paradoxically, the Cantillon Effect means that the very last people to understand the need for BTC & technologies like Nostr will be those in and closest to western technocratic & banking centers.' - Luke Gromen 🎁If you have made it this far I would like to give you a little gift: Great book, great podcast: Resistance Money with Andrew Bailey, Bradley Rettler, & Craig Warmke 'Andrew Bailey, is a Professor of Philosophy at Yale-NUS College, Bradley Rettler is a Professor of Philosophy at the University of Wyoming and Craig Warmke is a Professor of Philosophy at Northern Illinois University. In this episode we discuss their book Resistance Money and the global net-benefits of Bitcoin.' “When asking a question like this…it’s tempting to replace it with the question ‘is Bitcoin good for me?’, and then you’re off to bag-pumping or bag-dumping; so what we tried to do here is to give a bit more precision to the question: ‘is Bitcoin good for the world?’” — Andrew Bailey [](https://youtu.be/OtEp9lZKWvA?si=sOQC7fIB0UEtVhze) Credit: I have used multiple sources! My savings account: Bitcoin The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. (Please only use it till the 31st of October - after that full KYC) Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info. ⠀⠀⠀⠀ Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀⠀⠀⠀⠀⠀⠀⠀ Do you think this post is helpful to you? If so, please share it and support my work with sats. Many thanks for reading the Weekly Recap, see you all next week! Felipe - Bitcoin Friday