@ Teem

2025-01-05 17:10:34

On January 3, 2025, Bitcoin celebrated its 16th birthday, marking another year of resilience, innovation, and transformation in the world of finance. Born from the ashes of the 2008 financial crisis, Bitcoin was introduced to the world by the enigmatic Satoshi Nakamoto through a whitepaper titled "Bitcoin: A Peer-to-Peer Electronic Cash System." Since then, this cryptocurrency has evolved from a niche experiment to a fundamental component of the digital economy, challenging traditional financial systems and redefining the concept of money.

**The Genesis Block: A Message of Change

**

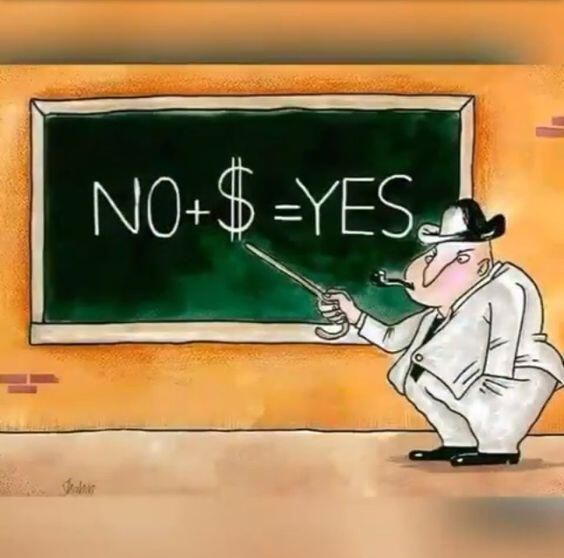

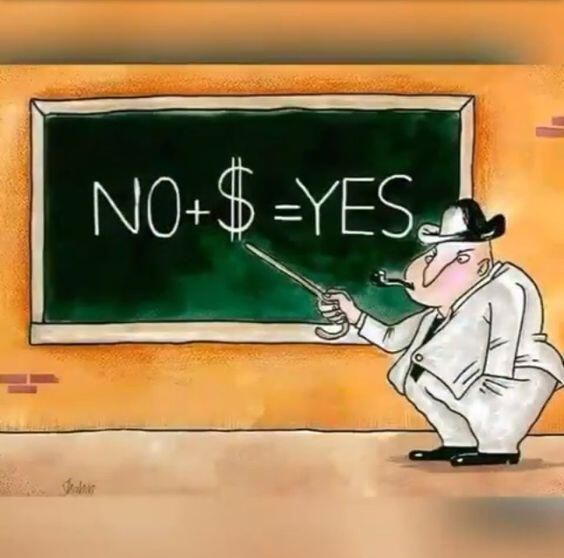

The first Bitcoin block, known as the Genesis Block, was mined on January 3, 2009, with a message embedded within it, a headline from The Times newspaper: "Chancellor on brink of second bailout for banks." This message was not just a timestamp but a statement of Bitcoin's purpose - to offer an alternative to the centralized financial systems that had failed so many.

**From Obscurity to Mainstream**

In its early years, Bitcoin was largely the domain of tech enthusiasts and libertarians. Transactions were slow, the infrastructure was basic, and the value of Bitcoin was negligible. However, as more people began to understand its potential, Bitcoin's price and adoption began to soar. The first significant price increase came in 2010 when Bitcoin's value jumped from pennies to dollars, and by 2017, it reached thousands.

**Surviving the Volatility**

Bitcoin's journey hasn't been without turbulence. From the infamous Mt. Gox collapse to the dramatic price swings, Bitcoin has weathered storms that would have sunk other financial ventures. Yet, each crisis has only served to strengthen the network, with developers and users continuously improving security, scalability, and usability. These challenges have also brought about significant technological advancements, like the Lightning Network, which promises to solve some of Bitcoin's scalability issues.

**Institutional Adoption and Regulatory Scrutiny**

As Bitcoin matured, so did the interest from institutional investors and governments. Today, major companies like Tesla and MicroStrategy hold Bitcoin on their balance sheets, and financial giants like Fidelity offer Bitcoin services to their clients. This institutional embrace has been a double-edged sword, however, bringing with it regulatory scrutiny that seeks to balance innovation with consumer protection and financial stability.

**Cultural Impact and Future Prospects**

Bitcoin has not only influenced finance but also culture. It has given rise to a whole lexicon ("HODL", "to the moon"), inspired countless memes, and even influenced music, art, and literature. Looking forward, Bitcoin's role in the future of money could be pivotal. With countries like El Salvador adopting it as legal tender, and others exploring central bank digital currencies (CBDCs) inspired by its technology, Bitcoin's influence on global financial systems seems set to expand.

**Challenges Ahead**

Despite its successes, Bitcoin faces significant challenges. Environmental concerns related to its energy consumption, the need for better user experience to achieve mass adoption, and the ongoing debate about its scalability are still hurdles to overcome. Moreover, the question of how Bitcoin will integrate with or fend off future technological advancements in blockchain and beyond remains open.

Conclusion: A Teenager with a Legacy

At 16, Bitcoin is no longer just a rebellious teen in the financial world; it's a young adult with a legacy. It has proven that a decentralized, trustless system can function and thrive. As we look to the future, Bitcoin's journey will continue to be one of the most fascinating stories in economic history, potentially reshaping our understanding of value, trust, and financial sovereignty. Here's to Bitcoin, at 16 - may its next years be as revolutionary as the last.

@ Teem

2025-01-05 17:10:34On January 3, 2025, Bitcoin celebrated its 16th birthday, marking another year of resilience, innovation, and transformation in the world of finance. Born from the ashes of the 2008 financial crisis, Bitcoin was introduced to the world by the enigmatic Satoshi Nakamoto through a whitepaper titled "Bitcoin: A Peer-to-Peer Electronic Cash System." Since then, this cryptocurrency has evolved from a niche experiment to a fundamental component of the digital economy, challenging traditional financial systems and redefining the concept of money. **The Genesis Block: A Message of Change ** The first Bitcoin block, known as the Genesis Block, was mined on January 3, 2009, with a message embedded within it, a headline from The Times newspaper: "Chancellor on brink of second bailout for banks." This message was not just a timestamp but a statement of Bitcoin's purpose - to offer an alternative to the centralized financial systems that had failed so many. **From Obscurity to Mainstream** In its early years, Bitcoin was largely the domain of tech enthusiasts and libertarians. Transactions were slow, the infrastructure was basic, and the value of Bitcoin was negligible. However, as more people began to understand its potential, Bitcoin's price and adoption began to soar. The first significant price increase came in 2010 when Bitcoin's value jumped from pennies to dollars, and by 2017, it reached thousands. **Surviving the Volatility** Bitcoin's journey hasn't been without turbulence. From the infamous Mt. Gox collapse to the dramatic price swings, Bitcoin has weathered storms that would have sunk other financial ventures. Yet, each crisis has only served to strengthen the network, with developers and users continuously improving security, scalability, and usability. These challenges have also brought about significant technological advancements, like the Lightning Network, which promises to solve some of Bitcoin's scalability issues. **Institutional Adoption and Regulatory Scrutiny** As Bitcoin matured, so did the interest from institutional investors and governments. Today, major companies like Tesla and MicroStrategy hold Bitcoin on their balance sheets, and financial giants like Fidelity offer Bitcoin services to their clients. This institutional embrace has been a double-edged sword, however, bringing with it regulatory scrutiny that seeks to balance innovation with consumer protection and financial stability. **Cultural Impact and Future Prospects** Bitcoin has not only influenced finance but also culture. It has given rise to a whole lexicon ("HODL", "to the moon"), inspired countless memes, and even influenced music, art, and literature. Looking forward, Bitcoin's role in the future of money could be pivotal. With countries like El Salvador adopting it as legal tender, and others exploring central bank digital currencies (CBDCs) inspired by its technology, Bitcoin's influence on global financial systems seems set to expand. **Challenges Ahead** Despite its successes, Bitcoin faces significant challenges. Environmental concerns related to its energy consumption, the need for better user experience to achieve mass adoption, and the ongoing debate about its scalability are still hurdles to overcome. Moreover, the question of how Bitcoin will integrate with or fend off future technological advancements in blockchain and beyond remains open. Conclusion: A Teenager with a Legacy At 16, Bitcoin is no longer just a rebellious teen in the financial world; it's a young adult with a legacy. It has proven that a decentralized, trustless system can function and thrive. As we look to the future, Bitcoin's journey will continue to be one of the most fascinating stories in economic history, potentially reshaping our understanding of value, trust, and financial sovereignty. Here's to Bitcoin, at 16 - may its next years be as revolutionary as the last.

@ Teem

2025-01-05 17:10:34On January 3, 2025, Bitcoin celebrated its 16th birthday, marking another year of resilience, innovation, and transformation in the world of finance. Born from the ashes of the 2008 financial crisis, Bitcoin was introduced to the world by the enigmatic Satoshi Nakamoto through a whitepaper titled "Bitcoin: A Peer-to-Peer Electronic Cash System." Since then, this cryptocurrency has evolved from a niche experiment to a fundamental component of the digital economy, challenging traditional financial systems and redefining the concept of money. **The Genesis Block: A Message of Change ** The first Bitcoin block, known as the Genesis Block, was mined on January 3, 2009, with a message embedded within it, a headline from The Times newspaper: "Chancellor on brink of second bailout for banks." This message was not just a timestamp but a statement of Bitcoin's purpose - to offer an alternative to the centralized financial systems that had failed so many. **From Obscurity to Mainstream** In its early years, Bitcoin was largely the domain of tech enthusiasts and libertarians. Transactions were slow, the infrastructure was basic, and the value of Bitcoin was negligible. However, as more people began to understand its potential, Bitcoin's price and adoption began to soar. The first significant price increase came in 2010 when Bitcoin's value jumped from pennies to dollars, and by 2017, it reached thousands. **Surviving the Volatility** Bitcoin's journey hasn't been without turbulence. From the infamous Mt. Gox collapse to the dramatic price swings, Bitcoin has weathered storms that would have sunk other financial ventures. Yet, each crisis has only served to strengthen the network, with developers and users continuously improving security, scalability, and usability. These challenges have also brought about significant technological advancements, like the Lightning Network, which promises to solve some of Bitcoin's scalability issues. **Institutional Adoption and Regulatory Scrutiny** As Bitcoin matured, so did the interest from institutional investors and governments. Today, major companies like Tesla and MicroStrategy hold Bitcoin on their balance sheets, and financial giants like Fidelity offer Bitcoin services to their clients. This institutional embrace has been a double-edged sword, however, bringing with it regulatory scrutiny that seeks to balance innovation with consumer protection and financial stability. **Cultural Impact and Future Prospects** Bitcoin has not only influenced finance but also culture. It has given rise to a whole lexicon ("HODL", "to the moon"), inspired countless memes, and even influenced music, art, and literature. Looking forward, Bitcoin's role in the future of money could be pivotal. With countries like El Salvador adopting it as legal tender, and others exploring central bank digital currencies (CBDCs) inspired by its technology, Bitcoin's influence on global financial systems seems set to expand. **Challenges Ahead** Despite its successes, Bitcoin faces significant challenges. Environmental concerns related to its energy consumption, the need for better user experience to achieve mass adoption, and the ongoing debate about its scalability are still hurdles to overcome. Moreover, the question of how Bitcoin will integrate with or fend off future technological advancements in blockchain and beyond remains open. Conclusion: A Teenager with a Legacy At 16, Bitcoin is no longer just a rebellious teen in the financial world; it's a young adult with a legacy. It has proven that a decentralized, trustless system can function and thrive. As we look to the future, Bitcoin's journey will continue to be one of the most fascinating stories in economic history, potentially reshaping our understanding of value, trust, and financial sovereignty. Here's to Bitcoin, at 16 - may its next years be as revolutionary as the last.