-

@ Aris

2025-05-17 22:46:33

@ Aris

2025-05-17 22:46:33Bitcoin 101: The Ultimate Guide for Beginners. Unlock the Future of Finance

Bitcoin has revolutionized the way we think about money, offering a decentralized alternative to traditional banking. Whether you’re curious about investing, technology, or the future of finance, this guide will demystify Bitcoin and show you why it’s more than just “digital gold.” Let’s dive in and stick around for actionable tips to start your Bitcoin journey.

What is Bitcoin? Bitcoin is the world’s first decentralized digital currency. Created in 2009 by the pseudonymous Satoshi Nakamoto, it operates without banks, governments, or middlemen. Instead, it relies on a groundbreaking technology called blockchain which is a public ledger that records every transaction securely and transparently.

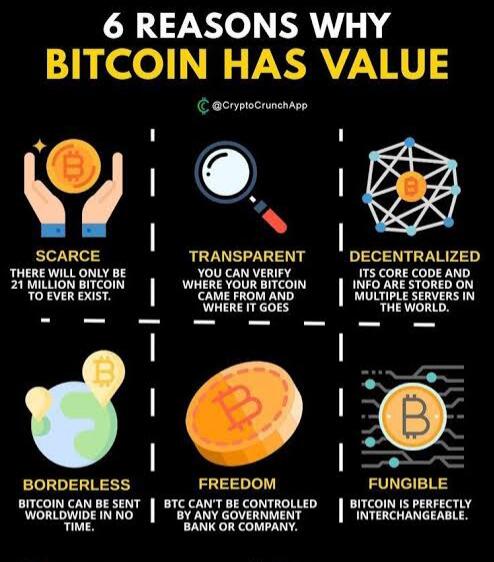

- Decentralization: No single entity controls Bitcoin. It’s maintained by a global network of computers.

- Scarcity: Only 21 million Bitcoins will ever exist, making it immune to inflation.

- Borderless: Send value anywhere in the world, instantly and at low cost.

How Does Bitcoin Work? The Blockchain Every Bitcoin transaction is grouped into a “block” and added to a chain of previous transactions (hence blockchain). This ledger is public, immutable, and verified by thousands of computers (nodes) worldwide.

Mining and Security Miners use powerful computers to solve complex puzzles, validating transactions and securing the network. In return, they earn newly minted Bitcoin, a process called proof-of-work. This system ensures trust without intermediaries.

Wallets To hold Bitcoin, you need a digital wallet. Each wallet has: - A public key (like an email address, shared to receive funds). - A private key (like a password, kept secret to authorize transactions).

Pro Tip: Never share your private key.

Why Bitcoin Has Value Bitcoin’s value stems from its unique properties: 1.Scarcity: With a fixed supply, it’s often called “digital gold.” 2.Decentralization: Resistant to censorship or seizure. 3.Utility: Fast, global transactions with minimal fees. 4.Adoption: Major companies like Tesla, PayPal, and Microsoft now accept Bitcoin.

In 2010, one Bitcoin was worth $0.08. Today, it’s valued at tens of thousands of dollars. While volatile, its long-term growth has outpaced traditional assets.

How to Get Started with Bitcoin 1.Choose a Wallet - Hardware wallets (e.g., Ledger, Trezor) for maximum security. - Mobile/desktop wallets (e.g., Exodus, Electrum) for convenience. - Avoid keeping crypto on exchanges long term.

2.Buy Bitcoin Use platforms like Coinbase, Binance, or Kraken to purchase Bitcoin with fiat currency.

3.Secure Your Investment - Enable two factor authentication (2FA). - Store backup phrases offline.

4.Use Bitcoin Spend it at merchants, hold it as savings, or explore decentralized finance (DeFi).

Debunking Bitcoin Myths 1.Bitcoin is for criminals. Less than 1% of transactions are illicit far lower than cash. Blockchain’s transparency actually aids law enforcement.

2.It’s a bubble. While volatile, Bitcoin has survived multiple “bubbles” and grown stronger, gaining institutional adoption.

3.It’s bad for the environment. Over 50% of Bitcoin mining now uses renewable energy. Compare this to the environmental cost of traditional banking.

The Future of Bitcoin Bitcoin is evolving rapidly: -Institutional adoption: Hedge funds, ETFs, and corporations are adding Bitcoin to their balance sheets. -Layer 2 solutions: The Lightning Network enables instant, near free micropayments. - Global regulation: Governments are crafting frameworks to integrate Bitcoin safely.

Ready to Go Deeper? Bitcoin is more than an investment. it’s a movement toward financial freedom. Whether you’re hodling for the long term or exploring blockchain tech, staying informed is key.

Follow my profile for advanced guides on: - Mastering blockchain technology. - Building a crypto portfolio. - Navigating market cycles like a pro.

The future of money is here. Don’t just watch from the sidelines be part of it.