-

@ f7d424b5:618c51e8

2025-05-18 18:03:25

@ f7d424b5:618c51e8

2025-05-18 18:03:25GAMERS, Join us for a vicless episode where we talk about AI for a change and how it has been impacting our lives. I promise it's video games related.

Stuff cited:

Obligatory:

- Listen to the new episode here!

- Discuss this episode on OUR NEW FORUM

- Get the RSS and Subscribe (this is a new feed URL, but the old one redirects here too!)

- Get a modern podcast app to use that RSS feed on at newpodcastapps.com

- Or listen to the show on the forum using the embedded Podverse player!

- Send your complaints here

Reminder that this is a Value4Value podcast so any support you can give us via a modern podcasting app is greatly appreciated and we will never bow to corporate sponsors!

-

@ 4ba8e86d:89d32de4

2025-05-18 16:50:03

@ 4ba8e86d:89d32de4

2025-05-18 16:50:03https://image.nostr.build/880accf7ac313c506140d43a3ac1ac212403723371dbca811fa64ed3a090c59a.jpg

DTails é uma ferramenta que facilita a inclusão de aplicativos em imagens de sistemas live baseados em Debian, como o Tails. Com ela, você pode personalizar sua imagem adicionando os softwares que realmente precisa — tudo de forma simples, transparente e sob seu controle total.

⚠️ DTails não é uma distribuição. É uma ferramenta de remasterização de imagens live.

Ela permite incluir softwares como:

✅ SimpleX Chat ✅ Clientes Nostr Web (Snort & Iris) ✅ Sparrow Wallet ✅ Feather Wallet ✅ Cake Wallet ✅ RoboSats ✅ Bisq ✅ BIP39 (Ian Coleman) ✅ SeedTool ... e muito mais. https://image.nostr.build/b0bb1f0da5a9a8fee42eacbddb156fc3558f4c3804575d55eeefbe6870ac223e.jpg

Importante: os binários originais dos aplicativos não são modificados, garantindo total transparência e permitindo a verificação de hashes a qualquer momento.

👨💻 Desenvolvido por: nostr:npub1dtmp3wrkyqafghjgwyk88mxvulfncc9lg6ppv4laet5cun66jtwqqpgte6

GitHub: https://github.com/DesobedienteTecnologico/dtails?tab=readme-ov-file

🎯 Controle total do que será instalado

Com o DTails, você escolhe exatamente o que deseja incluir na imagem personalizada. Se não marcar um aplicativo, ele não será adicionado, mesmo que esteja disponível. Isso significa: privacidade, leveza e controle absoluto.

https://image.nostr.build/b0bb1f0da5a9a8fee42eacbddb156fc3558f4c3804575d55eeefbe6870ac223e.jpg https://image.nostr.build/b70ed11ad2ce0f14fd01d62c08998dc18e3f27733c8d7e968f3459846fb81baf.jpg https://image.nostr.build/4f5a904218c1ea6538be5b3f764eefda95edd8f88b2f42ac46b9ae420b35e6f6.jpg

⚙️ Começando com o DTails

📦 Requisitos de pacotes

Antes de tudo, instale os seguintes pacotes no Debian:

``` sudo apt-get install genisoimage parted squashfs-tools syslinux-utils build-essential python3-tk python3-pil.imagetk python3-pyudev

```

🛠 Passo a passo

1 Clone o repositório:

``` git clone https://github.com/DesobedienteTecnologico/dtails cd dtails

```

2 Inicie a interface gráfica com sudo:

``` sudo ./dtails.py

```

Por que usar sudo? É necessário para montar arquivos .iso ou .img e utilizar ferramentas essenciais do sistema.

💿 Selecione a imagem Tails que deseja modificar

https://nostr.download/e3143dcd72ab6dcc86228be04d53131ccf33d599a5f7f2f1a5c0d193557dac6b.jpg

📥 Adicione ou remova pacotes

1 Marque os aplicativos desejados. 2 Clique Buildld para gerar sua imagem personalizada. https://image.nostr.build/5c4db03fe33cd53d06845074d03888a3ca89c3e29b2dc1afed4d9d181489b771.png

Você pode acompanhar todo o processo diretamente no terminal. https://nostr.download/1d959f4be4de9fbb666ada870afee4a922fb5e96ef296c4408058ec33cd657a8.jpg

💽 .ISO vs .IMG — Qual escolher?

| Formato | Persistência | Observações | | ------- | ---------------------- | ----------------------------------------------- | | .iso | ❌ Não tem persistência | Gera o arquivo DTails.iso na pasta do projeto | | .img | ✅ Suporta persistência | Permite gravar diretamente em um pendrive |

https://nostr.download/587fa3956df47a38b169619f63c559928e6410c3dd0d99361770a8716b3691f6.jpg https://nostr.download/40c7c5badba765968a1004ebc67c63a28b9ae3b5801addb02166b071f970659f.jpg

vídeo

https://www.youtube.com/live/QABz-GOeQ68?si=eYX-AHsolbp_OmAm

-

@ 5d4b6c8d:8a1c1ee3

2025-05-18 16:24:01

@ 5d4b6c8d:8a1c1ee3

2025-05-18 16:24:01First, the caveat: Yes, I understand that there's a consistent libertarian case for free trade as a policy position.

With all the discourse around tariffs, I wanted to highlight something of a moral oddity in the arguments being used by many free trade libertarians (I am a free trade libertarian, btw): namely, the idea that we (Americans) should happily take advantage of subsidized exports from poorer countries.

I do agree with the economics of the argument: By subsidizing exports, other countries are imposing a deadweight loss on themselves and passing savings along to US consumers.

Why are libertarians celebrating this, though? Poor, oppressed foreigners are being stolen from by their authoritarian governments and American consumers are benefiting from it financially. Thinking this is a good situation is odd and thinking you have a right to take part in it is even stranger.

Libertarians certainly understand that subsidies are wrong and economically harmful, and that they benefit a select group of politically connected cronies. Nothing about that changes just because it's happening in a foreign country and your grocery bill benefits from it.

Saying "That's how they run their country. It's none of our business." is a plea to moral relativism, which libertarians generally avoid. Libertarians also usually understand that the "they" who rule is not the same as the "they" who are ruled. Is it just too uncomfortable to acknowledge being the beneficiary of abuse?

I can't help but draw parallels to the abolitionists of two hundred years ago, who refused to buy the products of slaves. I think they're mostly viewed as having been "on the right side of history", but they're probably on the "wrong" side of most "free trade" arguments. Another of those arguments being that it doesn't help the poor oppressed foreigner to stop doing business with their oppressor (yes, many lefties get all mixed up about who the oppressors are).

Anyway, I have no brilliant conclusion to offer. What do you all think?

https://stacker.news/items/983054

-

@ 998034a6:27d87b27

2025-05-18 16:19:25

@ 998034a6:27d87b27

2025-05-18 16:19:25Jo, blomster kommer i alle farger og fasonger. Her har du to eksempler:

-

@ 998034a6:27d87b27

2025-05-18 16:19:23

@ 998034a6:27d87b27

2025-05-18 16:19:23Skjønner du? Bare tekst.

-

@ 998034a6:27d87b27

2025-05-18 16:19:22

@ 998034a6:27d87b27

2025-05-18 16:19:22TEST TEST TEST Her kommer bildene:

-

@ 15aee60a:af83839e

2025-05-18 16:18:53

@ 15aee60a:af83839e

2025-05-18 16:18:53Jo, blomster kommer i alle farger og fasonger. Her har du to eksempler:

-

@ 87f5e1d9:e251d8f4

2025-05-17 13:13:42

@ 87f5e1d9:e251d8f4

2025-05-17 13:13:42In the realm of cryptocurrency, the stakes are incredibly high, and losing access to your digital assets can be a daunting experience. But don’t worry — cryptrecver.com is here to transform that nightmare into a reality! With expert-led recovery services and leading-edge technology, Crypt Recver specializes in helping you regain access to your lost Bitcoin and other cryptocurrencies.

Why Choose Crypt Recver? 🤔 🔑 Expertise You Can Trust At Crypt Recver, we blend advanced technology with skilled engineers who have a solid track record in crypto recovery. Whether you’ve forgotten your passwords, lost your private keys, or encountered issues with damaged hardware wallets, our team is ready to assist.

⚡ Fast Recovery Process Time is crucial when recovering lost funds. Crypt Recver’s systems are designed for speed, enabling quick recoveries — allowing you to return to what matters most: trading and investing.

🎯 High Success Rate With a success rate exceeding 90%, our recovery team has aided numerous clients in regaining access to their lost assets. We grasp the complexities of cryptocurrency and are committed to providing effective solutions.

🛡️ Confidential & Secure Your privacy is paramount. All recovery sessions at Crypt Recver are encrypted and completely confidential. You can trust us with your information, knowing we uphold the highest security standards.

🔧 Advanced Recovery Tools We employ proprietary tools and techniques to tackle complex recovery scenarios, from retrieving corrupted wallets to restoring coins from invalid addresses. No matter the challenge, we have a solution.

Our Recovery Services Include: 📈 Bitcoin Recovery: Lost access to your Bitcoin wallet? We can assist in recovering lost wallets, private keys, and passphrases. Transaction Recovery: Mistaken transfers, lost passwords, or missing transaction records — let us help you reclaim your funds! Cold Wallet Restoration: Did your cold wallet fail? We specialize in safely extracting assets. Private Key Generation: Forgotten your private key? We can help you generate new keys linked to your funds without compromising security. Don’t Let Lost Crypto Ruin Your Day! 🕒 With an estimated 3 to 3.4 million BTC lost forever, it’s essential to act quickly when facing access issues. Whether you’ve been affected by a dust attack or simply forgotten your key, Crypt Recver provides the support you need to reclaim your digital assets.

🚀 Start Your Recovery Now! Ready to retrieve your cryptocurrency? Don’t let uncertainty hold you back! 👉 Request Wallet Recovery Help Today!cryptrecver.com

Need Immediate Assistance? 📞 For quick queries or support, connect with us on: ✉️ Telegram: t.me/crypptrcver 💬 WhatsApp: +1(941)317–1821

Trust Crypt Recver for the best crypto recovery service — get back to trading with confidence! 💪In the realm of cryptocurrency, the stakes are incredibly high, and losing access to your digital assets can be a daunting experience. But don’t worry — cryptrecver.com is here to transform that nightmare into a reality! With expert-led recovery services and leading-edge technology, Crypt Recver specializes in helping you regain access to your lost Bitcoin and other cryptocurrencies.

# Why Choose Crypt Recver? 🤔

# Why Choose Crypt Recver? 🤔🔑 Expertise You Can Trust\ At Crypt Recver, we blend advanced technology with skilled engineers who have a solid track record in crypto recovery. Whether you’ve forgotten your passwords, lost your private keys, or encountered issues with damaged hardware wallets, our team is ready to assist.

⚡ Fast Recovery Process\ Time is crucial when recovering lost funds. Crypt Recver’s systems are designed for speed, enabling quick recoveries — allowing you to return to what matters most: trading and investing.

🎯 High Success Rate\ With a success rate exceeding 90%, our recovery team has aided numerous clients in regaining access to their lost assets. We grasp the complexities of cryptocurrency and are committed to providing effective solutions.

🛡️ Confidential & Secure\ Your privacy is paramount. All recovery sessions at Crypt Recver are encrypted and completely confidential. You can trust us with your information, knowing we uphold the highest security standards.

🔧 Advanced Recovery Tools\ We employ proprietary tools and techniques to tackle complex recovery scenarios, from retrieving corrupted wallets to restoring coins from invalid addresses. No matter the challenge, we have a solution.

# Our Recovery Services Include: 📈

# Our Recovery Services Include: 📈- Bitcoin Recovery: Lost access to your Bitcoin wallet? We can assist in recovering lost wallets, private keys, and passphrases.

- Transaction Recovery: Mistaken transfers, lost passwords, or missing transaction records — let us help you reclaim your funds!

- Cold Wallet Restoration: Did your cold wallet fail? We specialize in safely extracting assets.

- Private Key Generation: Forgotten your private key? We can help you generate new keys linked to your funds without compromising security.

Don’t Let Lost Crypto Ruin Your Day! 🕒

With an estimated 3 to 3.4 million BTC lost forever, it’s essential to act quickly when facing access issues. Whether you’ve been affected by a dust attack or simply forgotten your key, Crypt Recver provides the support you need to reclaim your digital assets.

🚀 Start Your Recovery Now!\ Ready to retrieve your cryptocurrency? Don’t let uncertainty hold you back!\ 👉 Request Wallet Recovery Help Today!cryptrecver.com

Need Immediate Assistance? 📞

For quick queries or support, connect with us on:\ ✉️ Telegram: t.me/crypptrcver\ 💬 WhatsApp: +1(941)317–1821

Trust Crypt Recver for the best crypto recovery service — get back to trading with confidence! 💪

-

@ 15aee60a:af83839e

2025-05-18 16:18:52

@ 15aee60a:af83839e

2025-05-18 16:18:52Skjønner du? Bare tekst.

-

@ 15aee60a:af83839e

2025-05-18 16:18:50

@ 15aee60a:af83839e

2025-05-18 16:18:50TEST TEST TEST Her kommer bildene:

-

@ a5ee4475:2ca75401

2025-05-18 16:07:07

@ a5ee4475:2ca75401

2025-05-18 16:07:07ai #artificial #intelligence #english #tech

Open Source

Models

Text

Image

- SDAI FOSS - Stable Diffusion AI to Android [download] [source] 🤖

- Stable Diffusion - Text to image [source] 🌐

- Pixart Alpha - Photorealistic Text to Image Generation [source]

- Pixart Delta - Framework to Pixart Alpha [paper] [source]

- Pixart Sigma - 4K Text to Image Generation [source]

- OmniGen - Pompt, image or subject to image [source]

- Pigallery - Self-Hosted AI Image Generator [source]

Video

Tools

Lightning Based

- Animal Sunset - AI video generation with Nostr npub by lightning payments [source]

- Ai Rand - AI text generation with Pubky DNS by lightning payments [source]

- PlebAI - Text and Image generation without signup [source] 🌐🤖🍎 [sites down - only github available]

Others

- HuggingFace - Test and collaborate on models, datasets and apps. [source]

- DuckDuckGo AI Chat - Famous AIs without Login [source]

- Ollama - Run LLMs Locally [source]

- DreamStudio - Stable Diffusion’s Web App Tool [info] [source]

- Prompt Gallery - AI images with their prompts [source]

Closed Source

Models

Text

- ChatGPT

- Claude

- Gemini

- Copilot

- Maritalk - Text AI in Portuguese focused on Brazil with model Sabia-3 and the open source models Sabia-7b and Sabia-2 [source]

- Amazônia IA - Text AI in Portuguese focused on Brazil with the guara, hapia and golia models [source]

Image

Video

- Minimax - Realistic videos (prompts only in chinese)

Tools

Other index: Amazing AI

-

@ 5d4b6c8d:8a1c1ee3

2025-05-18 14:42:48

@ 5d4b6c8d:8a1c1ee3

2025-05-18 14:42:48What do we mean when we talk about "fitness"? The word implies a connection to a higher purpose: "Fitness for what?"

Biologically, "fitness" refers to the propensity of an organism to pass on it's genes. Biological fitness is clearly context dependent: i.e. an anaconda isn't so fit if it gets moved to the arctic. I think we can build on that, while making it more human.

I think of fitness as our capacity to thrive in our environment. That's going to be different for each of us, depending on our environment and our preferences. However, there are some useful implications of thinking of fitness this way: 1. Chores, errands, work, play, and family activities might be the best kind of exercise, since they are physical activities that are directly tied to your lifestyle. 2. Supplemental exercise should be geared towards your lifestyle and improving your ability to accomplish things you need to be able to do. 3. There's no such thing as a universal "best exercise" or "best diet", because we all have different fitness objectives. 4. "Fitness" is not static: We do different things and have different priorities at different points in our lives, so our fitness goals should change over time. Many of us will even have seasonal fitness changes, since we don't do the same things in winter as we do in summer.

How do you all think about "fitness"?

Is it a highfalutin ivory tower concept or is it just ABs?

https://stacker.news/items/982981

-

@ 4c191b5d:c42abba6

2025-05-18 14:42:00

@ 4c191b5d:c42abba6

2025-05-18 14:42:00Eine kritische Auseinandersetzung mit Poppers Toleranzparadoxon

Vor kurzem wurde in einer Diskussion wieder argumentiert, man dürfte nicht tolerant sein mit Verweis auf Poppers Toleranzparadox.

Vielleicht habt ihr dieses Argument in Bezug auf unterschiedliche Themen (Corona, Krieg, Klima, Energie) auch schon gehört. Bei mir löst diese Forderung ein deutliches Störgefühl aus, da genau dieses Argument dafür genutzt wird, um die eigene Position zu verteidigen und andere auszugrenzen. Ich habe dies zum Anlass genommen, und mich intensiver mit der Frage beschäftigt, warum Popper irrte oder Menschen ihn falsch verstehen.

Denn ich begegne Immer wieder dem Argument, dass man nicht zu tolerant sein dürfe, um unsere Gesellschaft vor Intoleranz zu schützen. Dieses Argument stützt sich häufig auf Karl Poppers Toleranzparadoxon, das besagt, dass uneingeschränkte Toleranz gegenüber Intoleranz letztlich die Zerstörung einer toleranten Gesellschaft ermöglicht. Doch je mehr ich darüber nachdenke, desto mehr fallen mir problematische Aspekte dieses Konzepts auf.

Die menschliche Konfliktfähigkeit und Glasls Konfliktdynamik

Menschen sind von Natur aus emotionale Wesen, und unsere Fähigkeit, Konflikte konstruktiv zu lösen, ist oft begrenzt. Der Konfliktforscher Friedrich Glasl hat mit seinem Modell der neun Eskalationsstufen gezeigt, wie Konflikte schleichend von einer sachlichen Meinungsverschiedenheit zu einer destruktiven Auseinandersetzung eskalieren können.

In den frühen Stufen sind wir vielleicht noch in der Lage, rational zu diskutieren und Lösungen zu finden. Aber sobald Emotionen ins Spiel kommen, fällt es uns schwer, zwischen Beobachtung und Bewertung zu unterscheiden. Wir nehmen Kritik persönlich, fühlen uns angegriffen und reagieren defensiv. Diese Dynamik kann dazu führen, dass wir uns in unseren Positionen verhärten und der Konflikt weiter eskaliert.

Wenn wir nun Poppers Paradoxon anwenden und Intoleranz nicht tolerieren, riskieren wir, diesen Eskalationsprozess zu beschleunigen. Anstatt Brücken zu bauen, reissen wir sie ein. Wir schliessen Menschen aus dem Dialog aus und nehmen ihnen die Möglichkeit, ihre Sichtweisen zu überdenken.

Wer bestimmt, was intolerant ist? Wer hat das Recht zu entscheiden, was als intolerant gilt und was nicht?

Ein zentrales Problem ist die Frage der Definitionsmacht. Unsere Wahrnehmung ist subjektiv, geprägt von persönlichen Erfahrungen, kulturellem Hintergrund und gesellschaftlichen Normen. Wenn jeder für sich beansprucht, die richtige Definition von Toleranz und Intoleranz zu kennen, entsteht ein gefährliches Machtgefälle. Gruppen könnten ihre eigenen Ansichten als Massstab setzen und abweichende Meinungen als intolerant brandmarken. Dies öffnet Tür und Tor für Willkür und Unterdrückung von Minderheitenmeinungen.

Die Gefahr gegenseitiger Beschuldigungen

In meinen Begegnungen habe ich oft erlebt, wie schnell Diskussionen eskalieren können, wenn beide Seiten sich gegenseitig der Intoleranz beschuldigen. Es entsteht ein Teufelskreis: Jede Partei sieht sich im Recht und die andere im Unrecht. Laut Glasls Konfliktdynamik verschärft sich der Konflikt, je mehr die Kommunikation abbricht und Feindbilder aufgebaut werden.

Anstatt den Konflikt zu lösen, vertiefen sich die Gräben. Die Bereitschaft zum Zuhören schwindet, Vorurteile verfestigen sich, und es entsteht eine Spirale der Eskalation, die schwer zu durchbrechen ist.

Unrealistische Annahmen über menschliches Verhalten

Poppers Paradoxon setzt voraus, dass Menschen in der Lage sind, ihre Emotionen zu kontrollieren und stets rational zu handeln. Doch sind wir ehrlich: Wie oft gelingt uns das wirklich? In hitzigen Debatten kochen die Emotionen hoch, und selbst die besten Argumente prallen ab.

Die Erwartung, dass wir immer sachlich bleiben können, ignoriert die Komplexität menschlicher Interaktionen. Wir sind keine Maschinen, sondern von Gefühlen geleitete Wesen. Diese Realität muss in Betracht gezogen werden, wenn wir über Toleranz und Intoleranz diskutieren.

Ein Plädoyer für Dialog und Verständnis

Anstatt Intoleranz mit Intoleranz zu begegnen, sollten wir uns bemühen, den Dialog zu suchen. Das bedeutet nicht, dass wir hasserfüllte oder menschenfeindliche Äusserungen akzeptieren müssen. Aber wir sollten versuchen, die Ursachen solcher Einstellungen zu verstehen und durch Aufklärung und Bildung entgegenzuwirken.

Durch offene Gespräche können Vorurteile abgebaut und Missverständnisse geklärt werden. Es geht darum, Brücken zu bauen, anstatt Mauern zu errichten. Nur so können wir langfristig eine wirklich tolerante Gesellschaft fördern.

Fazit

Poppers Toleranzparadoxon wirft wichtige Fragen auf, doch seine praktische Anwendung ist mit erheblichen Schwierigkeiten verbunden. Die menschliche Neigung zur Eskalation von Konflikten, wie von Glasl beschrieben, sowie die subjektive Wahrnehmung von Intoleranz erschweren eine klare Umsetzung.

Wir sollten uns darauf konzentrieren, die Konfliktfähigkeit der Menschen zu stärken und Räume für konstruktive Auseinandersetzungen zu schaffen. Toleranz bedeutet nicht, alles hinzunehmen, sondern offen für andere Sichtweisen zu sein und gemeinsam nach Lösungen zu suchen.

In einer Welt, in der mir immer wieder das Argument begegnet, man dürfe nicht zu tolerant sein, plädiere ich dafür, dass wir unsere Definition von Toleranz überdenken. Es geht nicht um Nachgiebigkeit gegenüber Intoleranz, sondern um den mutigen Schritt, aufeinander zuzugehen und den Dialog zu suchen. Nur so können wir verhindern, dass wir in die Fallen der Eskalation tappen und die Werte verlieren, die unsere Gesellschaft ausmachen.

-

@ fbe736db:187bb0d5

2025-05-18 14:25:49

@ fbe736db:187bb0d5

2025-05-18 14:25:49This article was published in November 2024 by the Bitcoin Collective and is best viewed here for images

Ssssh. Did you hear that? In their recent Q3 2024 earnings call MicroStrategy (NSQ:MSTR) announced plans to buy a further $42 billion worth of Bitcoin over the next 3 calendar years. Here are some reflections on where MicroStrategy has come from, and where they are going.

From the beginning

Let’s rewind as to how we got here. Microstrategy is a business intelligence software company originally founded by Michael Saylor in 1989.

They started acquiring Bitcoin in Q3 2020, firstly via their cash reserves on the balance sheet. This was soon followed by debt issuance (mainly in the form of convertible debt), and has in more recent years been followed by issuing further MSTR equity into the market, alongside yet more convertible debt issuance.

Nearly all the proceeds have gone towards buying bitcoin. As can be seen on the chart below, they have managed to steadily grow these holdings, albeit this growth visibly slowed in the last bear market.

[p13 of Q3 2024 Earnings Presentation. Please note - all screenshots from this article come from the slide deck accompanying the recent MSTR Q3 earnings presentation, which can be viewed by clicking here]

MSTR now holds well over 1% of all the Bitcoin that will ever exist. With Bitcoin nearing all time highs again, this Bitcoin is worth around $18.3bn at the time of writing, and has an average purchase cost of around $9.9bn.

This has led to a spectacular share price performance, unmatched in the entire S&P 500 since August 2020.

[p23 of Q3 2024 Earnings Presentation]

It was not always this way. When I wrote this article in July 2022, MSTR was firmly in the red and sitting on unrealised bitcoin losses of $1.4bn. A search for Michael Saylor on Twitter back then auto-completed to “Michael Saylor liquidated”.

Rumours of imminent demise were always unfounded since the debt was of long enough term, and with the exception of a small proportion, could not be margin called.

A developing strategy

What’s interesting about MicroStrategy since then is their developing vision as to how to add Bitcoin to their balance sheet and more value to shareholders. This is especially in terms of outperforming BTC and achieving what they define as a “positive BTC yield” – not yield in a conventional sense but a measure of increasing the number of bitcoin held per assumed diluted shares outstanding.

The concept of MSTR outperforming bitcoin is interesting to me, as I’ve previously suggested attempting to value MSTR stock as priced in bitcoin rather than dollars. This then begs the question of whether an investment of bitcoin into MSTR shares will positively perform in bitcoin terms over time.

This valuation is very difficult by its nature, but can broadly be done by adding the bitcoin they currently hold on their balance sheet with an estimate of all the bitcoin they may ever acquire in the future, plus an allowance for other factors such as debt.

The landscape has shifted over this period, with Michael Saylor admitting that their strategy has evolved over time. The vital point that I missed when considering how MSTR might acquire more bitcoin in the future was their ability to issue considerable amounts of new equity into the market and achieve two things in doing so:

i) increasing bitcoin held per share of existing shareholders

ii) strengthen their balance sheet to take on more debt (since further debt issued would be a smaller proportion of their overall balance sheet).

“But where does the (btc) yield come from?”

This is not yield in the conventional sense, but nor is it Terra Luna. Firstly, this could come from profits from the business, which are relatively small. More relevantly, let’s consider how both the capital raises from debt and equity have served to increase the bitcoin held per share.

1. Equity “at the money” offerings

Much has been made of MSTR’s market cap (i.e. the overall value of the shares) trading above “Net Asset Value” (NAV) – which is essentially the value of their current bitcoin holdings plus the value of the conventional business, less debt. A multiple approach is used to describe how far above or below NAV this might be.

At the time of writing, the MSTR market cap stands at around $50bn and the value of their bitcoin holdings at $18bn. Given the conventional MSTR business is relatively small, it’s easy to see how this is approaching a multiple of 3x NAV.

If the share price is $240 and the net asset value is only $80 per share, MSTR can then issue more equity at $240, buy more bitcoin with this, and by doing so increase the bitcoin per share of existing shareholders. What’s more, they can keep doing this as long as the share price remains high. As shown above, MSTR has coined the term “BTC yield” to measure how well they are performing at increasing bitcoin held per share.

2. Convertible Debt

This also generally serves to increase bitcoin held per share. To consider how, let’s consider one of the previous convertible debt offerings – those due in 2028 – works in practice

Amount borrowed – $1,010m

Annual interest rate payable – 0.625%

Conversion price – $183.2

As can see MSTR pays a very low interest rate, as most of the value of the bond is in the potential convertibility to MSTR equity at a price of $183.2. Ultimately there is a binary situation here – either the share price is above that level and they end up issuing more equity at that price, or it’s below, and they end up having simply borrowed money at a very low interest rate.

The crucial point is that the convertible bond conversion price is typically set at a premium of at least 30% to the current market share price, whilst MSTR are buying bitcoin at the outset with the bond proceeds.

Hence if all of this debt converts to equity (and all debt looks like it will at present – see slide below), they are typically managing to increase the BTC held per share for existing shareholders.

This is because in this example when the bonds are converted to shares at $183.2, this is done at a premium to the prior share price (let’s say for illustration it was $140) at which MSTR initially issued the debt and converted the borrowing proceeds to bitcoin.

[p16 of Q3 2024 Earnings Presentation]

It is these combined activities that have led to an impressive bitcoin yield of 17.8% for the year to date 2024, and leads to questions for how long this financial alchemy can continue. Some bitcoiners, such as the Quant Bros duo and True North* group (see both here) have spoken of a flywheel effect – the more Bitcoin MSTR can acquire and the higher the bitcoin per share metric goes, the higher the share price, which in turn increases their ability to issue yet more equity and debt to buy more bitcoin and further increase bitcoin per share.

*Side note – Michael Saylor used the phrase “True North” on the Earnings Call; likely not accidental.

One answer to how long this can continue is – as long as the equity and debt markets still show an appetite for snapping up the new debt and equity issuance, even if the share price is high. Michael Saylor characterises it as the beginning of the adoption of Bitcoin as digital capital for these markets, and MSTR constitutes the easiest exposure. They have established a monopoly of sorts – whilst it would feasibly be possible for a large company to catch them in Bitcoin held, it would still have a smaller proportion of its business exposed to Bitcoin than MSTR.

[p21 of Q3 2024 Earnings Presentation]

Volatility is vitality

Michael Saylor is very clear in this earnings call and other interviews that MicroStrategy’s share volatility is a feature and not a bug. It is more volatile than any other S&P stock. As can be seen below, the recent daily trading volume only trails to the very biggest companies in the S&P 500.

Saylor embraces this volatility. It is what gives the optionality component of their convertible debt its value, and allows the interest rate payable to be lower. In addition, when the share price is high MSTR can issue more equity and increase bitcoin per share.

The Earnings presentation makes reference to several different forms of Bitcoin exposure that MSTR can offer to the market now and in the future.

[p27 of Q3 2024 Earnings Presentation]

The MSTR “True North” Principles

The Q3 Earnings call saw the following principles outlined for the first time. The message is clear to the market – do not conflate the dollar volatility of MSTR’s share price with the nature of their Bitcoin principles, which (perhaps analogous to the Bitcoin protocol itself) are intended to be rock solid and consistent. In addition, Saylor cleared up one source of speculation – MSTR will not be seeking to purchase other companies to add to its potential for generating free cash flows to invest into Bitcoin.

[p34 of Q3 2024 Earnings Presentation]

Can’t stop, won’t stop

The Earnings call contained an ambitious plan to raise $42bn more capital over the next 3 calendar years. This would be $21bn worth of equity, by selling new shares into the market (known as an “at the money” equity option), and $21bn worth of fixed income debt. This was split as $10bn in 2025, $14bn in 2026 and $18bn in 2027.

There is no doubting the scale of this ambition – to date MSTR have issued in total around $4.3bn in convertible debt and $4.3bn in terms of issued equity.

One key point is clear in line with the principles listed above. Whilst Saylor wants to raise Capital at opportune times to best benefit shareholders in the long term and to achieve what he terms “intelligent leverage”, he doesn’t try and time his bitcoin buys.

Moreover, he is likely also not bothered that selling so much further equity into the market may not always benefit the share price in the short term.

[p33 of Q3 2024 Earnings Presentation]

Turning up the volume, but is anyone listening?

With this announcement of $42bn to come over the next 3 years, there is no end in sight with respect to MSTR’s thirst for further Bitcoin purchases.

And yet, there was little in the media around the announcement, and despite the share price performance topping the entire S&P 500 over the past 4 years, MicroStrategy sits nowhere on Google Trends in comparison to Bitcoin:

[Source: https://trends.google.co.uk/trends/explore?q=bitcoin,microstrategy&hl=en-GB]

For now, this is no Gamestop. There’s no huge amount of short interest, and the fabled retail crowds are nowhere to be seen. One thing’s for sure though. Buckle up.

Please get in touch with your thoughts and feedback.

-

@ fbe736db:187bb0d5

2025-05-18 14:23:22

@ fbe736db:187bb0d5

2025-05-18 14:23:22This article was first published in July 2024 (and is best viewed) in the Bitcoin Collective here

Simon Sinek asks in his book “The Infinite Game” why more companies don’t operate with an infinite rather than a finite mindset. One main reason he misses, of course, is the money. The good news is there’s a new infinite game in town.

In “The Infinite Game”, Simon Sinek argues that great leaders set up their organisations to succeed beyond their own lifetimes. By recognising and positioning their business with an infinite rather than a finite mindset, they can engender greater trust throughout their employees and also build more resilience into their business. Their companies can also remain true to themselves and their mission, whatever that may be.

Sinek outlines that unfortunately we have entered an age of general subservience from leaders to their shareholders, and a slavery to the balance sheet and short term, “finite”, accounting and strategy. This generally leads to a decline of loyalty and engagement amongst customers and an increase in insecurity and anxiety amongst employees.

There’s plenty to agree with here in general terms. With that said, Sinek fails to identify one of the largest causes of the issues he identifies, which is the money. The book lays the blame on a watershed article from 1970 in which Milton Friedman laid out that “there is one and only one social responsibility of business, to use its resources and engage in activities designed to increase its profits so long as it stays within the rules of the game.” This is noted in the book as a turning point from the original ideas of Adam Smith, for whom the consumer was king, but I couldn’t help but wonder if anything else happened in the early 70s, such as Nixon cancelling the convertibility of dollars into gold in 1971. (see also – https://wtfhappenedin1971.com/).

Sinek bemoans the short term nature of companies since that point, but doesn’t consider how the nature of money has shaped this; surely a much more omnipresent and powerful factor than the writings of Milton Friedman. For the average bitcoiner this may be relatively self evident, but let’s consider the motives of the leadership under a system in which the underlying money cannot hold it’s value and in which credit is artificially priced. Incentives abound – one to laden the company with debt (which all else will likely diminish in real terms over time versus company assets and earnings), acquire other businesses and grow as big as possible in the process. Other options such as share buybacks also reflect short term incentives. Shareholders are going to place their own high short term demands on companies in a world where it is hard to outrun monetary debasement.

What of new businesses? When a new private entity is formed, the business plan is written, agreement on its viability is formed, strategy is set, tactics are agreed and then the first question posed by external stakeholders or posed to the majority shareholders is ‘what is your exit strategy’. Small successful businesses are expected to have a 3-5 year plan, private equity is usually a 3-5 year plan, and the successful larger companies with a longer trajectory also tend to swallow up the smaller successful companies (easier access to debt). With such incentives, it’s no wonder that we tend to see certain outcomes. There are obvious agency problems the larger a company gets, and they are more likely to fail to adhere to an infinite game principle. Smaller companies are forever at risk of getting swallowed up by larger ones.

So how does Bitcoin come into this? In my view, in two ways:

1. Bitcoin is an infinite game within itself

This is one of the subtle but crucial differences that splits Bitcoin sceptics and bitcoiners, and then dominates their onward arguments. If interpreted as a finite game, Bitcoin is for gambling, for speculation, it will have an end, and will be defined by winners and losers. Just the other day, this article framed it as such with the following line – “Whether Bitcoin is rising or falling, or who is buying or not buying it, nothing alters a basic fact: that Bitcoin is a classic zero-sum game. Large numbers of people can make vast paper fortunes by bidding up the price, but they cannot all realise those fortunes, because if everyone sells out the price collapses to zero. In that situation, those who were quick to sell would become rich at the expense of those who were slow to sell.”

Herein lies the problem for this criticism. As far as I can possibly ascertain right now, Bitcoin doesn’t end. Plenty might treat it as a finite game (and dismiss it as a ponzi, or try and trade it), but that treatment is a one way journey, and once you see Bitcoin as an infinite game there is little going back.

Going back to the book, let’s consider the “just cause” that Sinek says all businesses should have. According to Sinek, a just cause defines “the world we hope to live in and will commit to help build. It is the just cause that we are working to advance that gives our work and lives meaning. We know a cause is just when we commit to it with the confidence that others will carry on our legacy.” There are criteria listed too – a just cause must be “inclusive, service orientated, resilient, and idealistic.” Bitcoin surely fulfils these. On the ideology point, Michael Saylor articulated this well when dismissing altcoins in comparison to Bitcoin on the What Is Money podcast –

“If you really want a crypto to be successful over 100 years, the technology is only a part of it, right? It’s the ideology paired with the technology. And you’re gonna have to have an ideology that is so pure and so straightforward that people will fight to the death to defend the ideology. And that’s why I’m probably not gonna sacrifice my life for the 13th iteration on smart contracts. It’s not that important. On the other hand, if you tell me that we’re about to suck all of the economic energy out of the civilization and plunge ourselves into the Dark Ages, then I think I’ll fight for it. That’s worth fighting for.”

Michael Saylor – What is Money Show Episode 8

2. Bitcoin on balance sheets

Any business embracing Bitcoin on its balance sheet will automatically be closer to playing an infinite game itself, and let’s consider why. For starters, any shareholders will likely be holding equity with one opportunity cost being a holding of an equivalent amount of Bitcoin instead. This in itself will give them a low time preference mindset, which should transfer onto the company. Secondly, the act of having Bitcoin on the balance sheet provides a very simple yet iron clad discipline upon the company. One goal in broad terms is to grow that Bitcoin balance sheet over time, and they can only achieve that by being profitable. If they are not, they will find that Bitcoin balance dwindling over time instead. Though conventional businesses do broadly have the same need to be profitable, the Bitcoin example is quite different from a business with requirements to service debt, which may carry much shorter term deadlines for payment. In conclusion, companies looking to grow their Bitcoin holdings on a balance sheet are far more likely to buy into an infinite game mindset.

There are examples of infinite minded leaders out there, of course. Elon Musk is perhaps the most relevant in the present day, given Tesla and SpaceX have lofty long term ideals far removed from satisfying shareholders. Steve Jobs is another obvious one, and Sinek quotes an anecdote about sharing a cab with a senior Apple executive and telling him that the latest Microsoft Zune product (mp3 player at the time) was so much better than the Ipod touch. The executive smiled politely and was unfazed – tellingly, Apple weren’t worried about competitors in the short term due to their infinite mindset in making great & innovative products. Fast forward to today and there is evidence that Apple aren’t playing the infinite game that they used to. Take for example the recent news that Apple is plugging in Open AI into the iPhone. This doesn’t feel like the same ethos of a company who famously told us to “Think different” under Steve Jobs.

In conclusion, there’s plenty of decent ideas in the text and he articulates the issues well. However, due to failing to identify probably the main cause of the problem, Sinek doesn’t quite nail the call to arms for leaders to embrace an infinite game. Add in Bitcoin though, and the time preference of companies and their shareholders would vastly decrease and an infinite game mindset would come naturally.

One final thought – Sinek opens by looking back to the Vietnam war. Despite their vastly superior army and losing far fewer men, the US still lost the war. The reason being – it was an example of a finite mindset (thinking there would be a simple beginning and end) coming up against an infinite game and an enemy with an infinite mindset. The USA had comparatively infinite resources, infinite money, but a finite purpose & ideology when it came to the war. By contrast the Vietnamese, as one of their foreign ministry specialists was quoted as saying, were fighting for their independence and had already been doing so for thousands of years.

As far as Bitcoin is concerned, it might be said that companies who adopt a Bitcoin strategy are playing an infinite game with a non-debt based money of finite supply, and the competition are playing a finite game with an infinite supply of debt-based money.

This is a guest blog by Bitcoin Actuary / BitcoinActuary@BitcoinNostr.com. Thanks go to @btconlyscott for early comments/suggestions on this article.

This article is for information and education purposes only and is not intended as promotional material in any respect. All posts are the opinion of the author and should not be construed as investment advice and the opinions expressed do not necessarily reflect the views of The Bitcoin Collective Ltd.

-

@ 91117f2b:111207d6

2025-05-18 14:01:50

@ 91117f2b:111207d6

2025-05-18 14:01:50

Depression is a complex and often misunderstood mental health condition that affects millions of people worldwide. It is more than just a feeling of sadness or seeing things blue, it is a serious illness that can impact every aspect of a person's life.

WHAT IS DEPRESSION? Depression is a mood disorder characterized by persistent feelings of sadness, lost of interest in activities, hopelessness. It can cause physical symptoms like sleep disturbance, overthinking, lost of appetite and so much more.

THE CAUSES AND RISK FACTORS Depression can be triggered by many things, like a combination of generic, physiological and environmental factors. Some of the popular caused factors: 1. Traumatic events or stress 2. Social isolation or loneliness 3. Medical conditions

BREAKING THE SILENCE Depression is often stigmatized, causing may people to suffer in silence without reaching out for help. It is very essential to create supportive environment, where people feel save disclosing their feelings and their struggles

SEEKING HELP

If you know anyone who is struggling with depression, there is always hope. They are treatment options like therapy, medications or lifestyle change can help manage symptoms and improve the quality of life. And if the person doesn't want to open up to other people, try to make yourself available for him/her.

YOU ARE NOT ALONE

Depression is a treatable condition and recovery is possible. And the first step to break free is to seek help,and in process claiming your life.

And remember you are not and will never be alone.

-

@ 91117f2b:111207d6

2025-05-18 13:27:48

@ 91117f2b:111207d6

2025-05-18 13:27:48

Introverts are individuals who enjoy being alone rather than being being in crowds or peer groups. They are the personality types that feel secure and can focus in quieter places with low-key environments.

Introverts may prefer smaller or more intimate or one to one interaction rather than public spaces. They feel drained in excessive social gathering. They also tend to over think about their thoughts and feelings.

Being an introvert doesn't mean you are shy, we just prefer quieter environment to express how we feel deep down.

FACTS ABOUT SOME INTROVERTS Introverts may seem boring, or depressed as some may call it, because they are anti-social, but they actually value meaningful relationships and interactions, but may prefer to to engage in them on their own terms.

Introverts are one of the funniest most playful type of people to talk to. It seems weird right,how are Introverts cheerful, the can express ourselves freely only when we feel comfortable in an environment.

if you get to know us well, you will see know that we aren't so depressing as we may seem.

CHALLENGES ABOUT BEING AN INTROVERT

Introverts find it stressful and hard to communicate effectively in a more extroverted environment. So when put under pressure we tend to freeze or blackout.

Introverts has different energy capacity, which means we sometimes processes things a little slower than usual to avoid burnout.

Introverts never say how they really feel, especially if you hurt me in particular . I just go on about my day with pain. We tend to endure pain without saying a word to anyone, and no one notices us to show care.

Introverts processes things in different ways, me personally I process things differently, when I am in my head, I tend to listen to music 🎶, it helps make me feel alive and happy in some ways. While others may prefer movie night alone, whichever helps they go for it.

BEING AN INTROVERT ISN'T A BAD THING Here are some advantages

DEEP THINKING AND REFLECTION This is because we introvert can focus on complex problem and find innovative answers.

INDEPENDENCE AND SELF-SUFFICIENCY 1. Introverts have enough time to reflect on their thoughts and ideas before acting on it. Introverts can rely on their own regardless if other people try to bring us down.

- Introverts can work independently and make decision without needing external validation.

OBSERVATION SKILL 1. Introverts often notice subtle details that others might miss.

- Introverts can analyze situation and identify opportunities.

-

@ c230edd3:8ad4a712

2025-05-18 12:47:07

@ c230edd3:8ad4a712

2025-05-18 12:47:07Out of the night that covers me,

Black as the Pit from pole to pole,

I thank whatever gods may be

For my unconquerable soul.

In the fell clutch of circumstance

I have not winced nor cried aloud.

Under the bludgeonings of chance

My head is bloody, but unbowed.

Beyond this place of wrath and tears

Looms but the Horror of the shade,

And yet the menace of the years

Finds, and shall find, me unafraid.

It matters not how strait the gate,

How charged with punishments the scroll,

I am the master of my fate:

I am the captain of my soul.

-

@ 75f00a4a:78cb6425

2025-05-18 12:08:15

@ 75f00a4a:78cb6425

2025-05-18 12:08:15Do you like my code?

-

@ 8576ca0e:621f735e

2025-05-18 11:35:49

@ 8576ca0e:621f735e

2025-05-18 11:35:49

In the ever evolving landscape of social media, a new contender has emerged, seeking to redefine how we connect and interact online. YakiHonne, a mobile application built upon the innovative Nostr protocol, isn't just another platform vying for your attention. It represents a bold step towards decentralized social networking, seamlessly integrating the power of Bitcoin's Lightning Network into its very core.

Imagine a social space free from the control of centralized entities, where your data belongs to you, and where value can flow as freely as information. This is the vision YakiHonne is striving to realize. By leveraging the open and censorship-resistant nature of Nostr, it offers a refreshing alternative to the traditional social media giants.

1.The Power of Decentralization: A Foundation Built on Nostr

At its heart, YakiHonne is powered by Nostr (Notes and Other Stuff Transmitted by Relays). 2 .Unlike conventional platforms that rely on a central server, Nostr operates on a network of independent relays. 3 .This decentralized architecture offers several key advantages:

• Censorship Resistance: No single entity can easily censor or shut down the network. Your posts and interactions are distributed across multiple relays.

• Data Ownership: Your data isn't locked away in a corporate database. You control your private keys, granting you greater autonomy over your information.

• Open and Extensible: The open nature of the protocol allows for innovation and the development of diverse clients and applications, fostering a vibrant ecosystem.

4 .YakiHonne acts as a user-friendly gateway to this decentralized world, providing an intuitive mobile interface to interact with the Nostr network.

5 .Zaps: Where Social Interaction Meets Bitcoin

What truly sets YakiHonne apart is its deep integration of Bitcoin payments through the Lightning Network, often referred to as "zaps." This isn't just a tacked on feature; it's woven into the fabric of social interaction.

• Show Appreciation: Found a post insightful, funny, or valuable? You can instantly send a small amount of Bitcoin as a "zap" to show your appreciation directly to the creator.

• Monetize Content: Creators can earn Bitcoin for their contributions, fostering a more sustainable model for online content generation.

• Seamless Transactions: Lightning Network enables near instant and low fee Bitcoin transactions, making zapping a practical and frictionless experience.

6 .This innovative integration transforms social interactions into potential value exchanges, creating new dynamics between creators and their audience.

Beyond the Basics: Features for Content and Connection

YakiHonne isn't solely focused on Bitcoin. It provides a robust set of features for creating, sharing, and discovering content:

• Long Form Articles (NIP-23): For those who want to delve deeper, YakiHonne supports the creation of well-formatted articles using a rich markdown editor. This allows for more nuanced discussions and the sharing of substantial ideas.

• Topic Based Collections (NIP-51): Users can curate content into organized collections, making it easier to discover information on specific topics and follow thought leaders in various domains. Gemini

2.0 Flash

Recent

YakiHonne App Overview and Details

Deep Research Agent Introduction

Designing the ARIS Enterprises Logo

Hacker Portrait Request

Settings & help Try Gemini Advanced

Conversation with Gemini

I want you to give me everything you have on the app called yakihoone

YakiHonne is a mobile application focused on decentralized social networking and Bitcoin payments, built on the Nostr protocol. Here's a breakdown of what it offers:

Core Functionality:

• Decentralized Social Networking: YakiHonne allows users to connect and interact in a decentralized manner, leveraging the Nostr protocol. This means it's not controlled by a single entity.

• Bitcoin Payments (Zaps): The app integrates Bitcoin Lightning Network payments, often referred to as "zaps," enabling users to send and receive Bitcoin as a form of social interaction or content monetization.

• Content Creation and Curation: It supports the creation of long-form articles with a rich markdown editor (NIP-23). Users can also curate content into topic-related collections (NIP-51).

• Following and Discovery: You can follow other users (NIP-02), discover top creators and curators, and explore trending topics via hashtags (NIP-12).

• User Profiles: Each user has a profile page displaying their followers, who they are following, their zapping activity, and published articles.

• Direct Messaging (DMs): The app allows for private messaging between users.

Key Features Highlighted in Recent Updates (as of May 2025):

• Improved Zap Functionality: Zappers lists are now ordered by zap count, and the list can be accessed easily.

• Bug Fixes: Recent updates have addressed issues such as keyboard dismissal problems, saving article drafts, duplicated suggested profiles, video player malfunctions, and notification-related crashes.

• Key Export on Android: An issue preventing key export on Android has been resolved.

Technical Details:

• Platforms: Available on both iOS (Apple App Store) and Android (Google Play Store). It also has basic support for macOS and visionOS.

• Technology: The mobile app is built using Flutter, a cross-platform development framework.

• Relays: YakiHonne operates its own Nostr relays: nostr-01.yakihonne.com and nostr-02.yakihonne.com. These are based on the strfry implementation and are currently free for creators to publish content.

• Login Options: Supports various login methods, including keys, wallet integration (NIP-07), and on-the-go account creation (NIP-01).

• NIP Standards: Implements several Nostr Improvement Proposals (NIPs) for features like user profiles, following, content creation, and zaps.

• URI Scheme Support: Currently supports the naddr URI scheme (NIP-21).

Community and Development:

• The app is actively developed by JustHonne Technologies.

• The source code for the mobile app is available on GitHub ( https://github.com/YakiHonne/yakihonne-mobile-app).

• User reviews suggest a positive outlook, praising the user experience and aspirations, while also noting some areas for improvement in functionality and UI optimization.

In summary, YakiHonne aims to be a user-friendly entry point into the decentralized social media world of Nostr, with a strong emphasis on integrating Bitcoin payments and providing tools for content creators.

Sources

Now I want you to generate a full article on it

YakiHonne: Weaving Bitcoin into the Fabric of Decentralized Social Connection

In the ever-evolving landscape of social media, a new contender has emerged, seeking to redefine how we connect and interact online. YakiHonne, a mobile application built upon the innovative Nostr protocol, isn't just another platform vying for your attention. It represents a bold step towards decentralized social networking, seamlessly integrating the power of Bitcoin's Lightning Network into its very core.

Imagine a social space free from the control of centralized entities, where your data belongs to you, and where value can flow as freely as information. This is the vision YakiHonne is striving to realize. By leveraging the open and censorship-resistant nature of Nostr, it offers a refreshing alternative to the traditional social media giants.

The Power of Decentralization: A Foundation Built on Nostr

At its heart, YakiHonne is powered by Nostr (Notes and Other Stuff Transmitted by Relays). Unlike conventional platforms that rely on a central server, Nostr operates on a network of independent relays. This decentralized architecture offers several key advantages:

• Censorship Resistance: No single entity can easily censor or shut down the network. Your posts and interactions are distributed across multiple relays.

• Data Ownership: Your data isn't locked away in a corporate database. You control your private keys, granting you greater autonomy over your information.

• Open and Extensible: The open nature of the protocol allows for innovation and the development of diverse clients and applications, fostering a vibrant ecosystem.

YakiHonne acts as a user-friendly gateway to this decentralized world, providing an intuitive mobile interface to interact with the Nostr network.

Zaps: Where Social Interaction Meets Bitcoin

What truly sets YakiHonne apart is its deep integration of Bitcoin payments through the Lightning Network, often referred to as "zaps." This isn't just a tacked-on feature; it's woven into the fabric of social interaction.

• Show Appreciation: Found a post insightful, funny, or valuable? You can instantly send a small amount of Bitcoin as a "zap" to show your appreciation directly to the creator.

• Monetize Content: Creators can earn Bitcoin for their contributions, fostering a more sustainable model for online content generation.

• Seamless Transactions: Lightning Network enables near-instant and low-fee Bitcoin transactions, making zapping a practical and frictionless experience.

This innovative integration transforms social interactions into potential value exchanges, creating new dynamics between creators and their audience.

Beyond the Basics: Features for Content and Connection

YakiHonne isn't solely focused on Bitcoin. It provides a robust set of features for creating, sharing, and discovering content:

• Long-Form Articles (NIP-23): For those who want to delve deeper, YakiHonne supports the creation of well-formatted articles using a rich markdown editor. This allows for more nuanced discussions and the sharing of substantial ideas.

• Topic-Based Collections (NIP-51): Users can curate content into organized collections, making it easier to discover information on specific topics and follow thought leaders in various domains.

• Following and Discovery (NIP-02): Stay connected with the people and ideas that matter to you by following other users. The platform also offers ways to discover top creators, curators, and trending discussions through hashtags (NIP-12).

• Rich User Profiles: Your profile showcases your followers, who you're following, your zapping activity, and the articles you've published, providing a comprehensive overview of your presence on the platform.

• Direct Messaging (DMs): For more private conversations, YakiHonne includes a direct messaging feature, allowing for one-on-one communication.

A Growing Ecosystem and Continuous Improvement

YakiHonne is actively being developed and refined by JustHonne Technologies. Recent updates highlight a commitment to improving the user experience and addressing bugs. Enhancements to the zap functionality, fixes for various technical issues, and improved stability demonstrate the ongoing dedication to making the app a reliable and enjoyable platform.

The open source nature of the mobile application, with its code available on GitHub, encourages community involvement and transparency. This collaborative approach can contribute to the platform's growth and evolution.

Looking Ahead: The Potential of Decentralized Social with Bitcoin

YakiHonne represents an exciting intersection of decentralized social networking and Bitcoin's utility. By seamlessly integrating Lightning Network payments, it introduces a novel way to interact and exchange value online. While still in its relatively early stages, YakiHonne holds significant potential to:

• Empower Creators: Provide new avenues for content monetization and direct interaction with their audience.

• Foster Meaningful Interactions: Encourage more thoughtful engagement through the ability to easily show appreciation.

• Offer a More Resilient Social Space: Provide an alternative to centralized platforms with greater resistance to censorship and single points of failure.

As the Nostr ecosystem continues to grow and evolve, and as more users seek decentralized alternatives, YakiHonne is well positioned to be a leading application in this burgeoning space. It's more than just another social media app; it's a glimpse into a future where online connections are more open, ценностно-ориентированы, and truly belong to the users themselves.

-

@ 0971cd37:53c969f4

2025-05-18 11:32:23

@ 0971cd37:53c969f4

2025-05-18 11:32:23ขุด Bitcoin หรือ Mining Bitcoin นั้นไม่ใช่เรื่องใหม่ แต่ในปัจจุบันการทำเหมืองขุดจากที่บ้าน(Home Miner)กลับมาได้รับความสนใจอีกครั้ง หลายๆคนกำลังหาเทคนิคให้คุ้มค่าและมีประสิทธิภาพสำหรับ Home Miner ที่ช่วยให้การขุดมีประสิทธิภาพมากขึ้นในบทความนี้

ก่อนเริ่มทำเหมืองขุดแบบ(Home Miner)ต้องนึกถึงสำรวจคิดทบทวนตัวเองว่าให้แน่ชัดเจน เป้าหมายเหมืองขุดBitcoin

- ทำเหมืองเพื่อสะสมออม Bitcoin โดยการใช้เครื่องขุด Bitcoin (ASIC)?

- ทำเพื่อเอา Bitcoin ขายเพื่อได้เงิน Fiat ใช้ และให้เป็นรายได้หลัก?

- เป็นผู้สร้างผลิตพลังงานใช้เองและเหลือพลังงานจากการผลิตเหมาะสมมั้ยที่จะทำเหมือง?

ทำเหมืองเพื่อสะสมออม Bitcoin โดยการใช้เครื่องขุด Bitcoin (ASIC)? ถ้าในกรณีทำเพื่อสะสมออม Bitcoin โดยการใช้เครื่องขุด ASIC (Application-Specific Integrated Circuit) นั้นถือเป็นวิธีที่เหมาะสมและมีประสิทธิภาพที่สุด เนื่องจาก ASIC ถูกออกแบบมาเฉพาะสำหรับการขุด Bitcoin โดยเฉพาะ ทำให้มีอัตราการขุด (Hashrate) ที่สูงและใช้พลังงานต่ำ

ข้อดี - Hashrate สูง สามารถขุด Bitcoin ได้รวดเร็วและมีโอกาสได้รับ Reward block Subsidy + fees มากขึ้น - ประหยัดพลังงาน ASIC ใช้พลังงานต่อ Hashrate ต่ำกว่า ในกรณีทำการ Tuning ASIC หรือ Low Power - ไม่จำเป็นต้องซื้อ Bitcoin ใน Exchange ไม่ต้อง KYC ไม่ต้องหาจังหวะการเข้าซื้อ Bitcoin ความผันผวนของราคาบน Exchange

ข้อเสีย

- ราคาสูง: ต้นทุนในการซื้อ ASIC ค่อนข้างสูง

ทำเหมืองเพื่อสร้างรายได้หลักจากการขาย Bitcoin? ถ้าในกรณีการทำเหมือง Bitcoin มองเป็นแหล่งรายได้หลักแต่ต้องบริหารมีการจัดการที่ดีด้วยเช่นกัน

ข้อดี - สร้างรายได้ประจำ หากสามารถคำนวณต้นทุนและรายได้ได้ดี จะสามารถขาย Bitcoin เป็นรายได้หลัก - มีสภาพคล่องสูง Bitcoin สามารถแลกเป็นเงินสด (Fiat) ได้อย่างรวดเร็วใน Exchange - ขยายระบบได้ง่าย สามารถเพิ่มเครื่องขุดเพื่อขยายกำลังการผลิต Hashrate เท่าที่จำเป็นความเหมาะสม สำหรับ Home Miner

ข้อเสีย

- ความผันผวนของราคา: ราคา Bitcoin มีการเปลี่ยนแปลงตลอดเวลา ทำให้ไม่สามารถคาดการณ์รายได้ได้แน่นอน

- การแข่งขันสูง จำนวนผู้ขุดมากขึ้นทำให้ Difficulty เพิ่มขึ้นเรื่อย ๆ

- ต้นทุนค่าไฟและค่าดูแล หากไม่จัดการพลังงานให้ดี ต้นทุนอาจสูงจนไม่คุ้มค่า

เป็นผู้สร้างผลิตพลังงานใช้เองและเหลือพลังงานจากการผลิตเหมาะสมมั้ยที่จะทำเหมือง? หากสามารถผลิตพลังงานไฟฟ้าใช้เองจากแหล่งพลังงานสะอาด เช่น โซล่าเซลล์ ความเหมาะสมการนำ พลังงานที่ผลิตได้มีเหลือใช้และไม่มีค่าเสียโอกาส การทำเหมืองขุด Bitcoin เล็กๆแบบ Home Miner ลดต้นทุนค่าไฟ,เพิ่มรายได้จากพลังงานส่วนเกิน, ลดระยะเวลาการคืนทุน ถือว่าคุ้มค่าที่จะทำ

จัดการพลังงานและค่าไฟฟ้า สำหรับ Home Miner หนึ่งในปัจจัยหลักของการขุดจากที่บ้านคือ ค่าไฟฟ้า ซึ่งสามารถลดลงได้ด้วยการ - มีโซล่าเซลล์ การใช้พลังงานแสงอาทิตย์เพื่อลดค่าไฟในช่วงกลางวัน - เลือกใช้มิเตอร์ TOU เลือกช่วงเวลาขุดการขุดในช่วง Off-Peak ที่ค่าไฟต่ำกว่าช่วง On-Peak - ทำการ Tuning ASIC เน้น Low Power

สรุปโดยรวม Home Miner เป็นวิธีหนึ่งการขุด Bitcoin ที่สามารถทำได้จากที่บ้าน หากมีการจัดการอุปกรณ์และพลังงานอย่างเหมาะสม รวมถึงการวางแผนการขุดในช่วงเวลาที่ค่าไฟฟ้าต่ำ และ การผลิตพลังงานเองจากโซล่าเซลล์ยังสามารถเพิ่มโอกาสในการลดต้นทุนและเพิ่มกำไรได้อีกด้วย

-

@ 7460b7fd:4fc4e74b

2025-05-18 11:02:09

@ 7460b7fd:4fc4e74b

2025-05-18 11:02:09比特币持有者在 iPhone 上的安全使用注意事项

引言:iPhone 与安卓的对比

当涉及移动设备安全,比特币持有者面临着在 iPhone 和安卓设备之间的选择。从安全硬件来看,安卓阵营中确有一些型号配备了类似于 Apple Secure Enclave 的硬件安全模块,例如 Google Pixel 手机内置的 Titan M/M2 安全芯片,用于保障启动流程和存储敏感数据us.norton.com;三星的旗舰机型则集成了 Samsung Knox 多层安全平台,经过多国政府机构认证,可在硬件层面保护设备及其中数据us.norton.com。这些安全措施大大提升了设备抵御恶意攻击和数据泄露的能力。然而,需要注意的是:具备此类高级安全特性的安卓机型在市场上相对少见,并非安卓阵营的普遍标准us.norton.com。安卓生态高度碎片化,不同厂商的安全实践差异悬殊;除了少数注重安全的厂商(如 Google、Samsung)外,许多设备缺乏统一的安全保障水平us.norton.com。尤其在二手市场上,安卓设备型号繁杂且来源不一,一些旧款或改装机型可能缺少最新的安全芯片或更新,使安全性难以得到保证。

相比之下,Apple iPhone 全系列自带硬件级的安全隔区(Secure Enclave),统一的闭源系统和严格的应用审核使其安全措施在所有设备上保持一致us.norton.com。同时,iPhone 引入的 Face ID(三维结构光人脸识别)在生物识别安全性上具有独特优势。Apple官方数据显示,Face ID 被他人解锁的概率只有 百万分之一,远低于指纹识别的五万分之一。这源于Face ID利用红外点阵投射捕捉面部3D结构,难以被照片或面具所破解,大幅减少了伪造生物特征解锁的风险。此外,相较许多安卓手机仍依赖的二维人脸识别或电容/光学指纹,Face ID 在抗攻击能力上更胜一筹——例如普通指纹残留可能被提取复制,而二维人脸解锁曾被照片轻易骗过,但Face ID的深度感应技术有效避免了这些漏洞。

综上所述,在移动设备安全领域,iPhone 为比特币等高价值敏感资产的持有者提供了更为稳健和统一的安全基础。尽管某些高端安卓手机具有可圈可点的安全功能,但鉴于这类机型凤毛麟角、安卓设备更新和管控的不统一,以及生物识别方案的差异,我们强烈建议将 iPhone 作为比特币手持设备的唯一选择。从硬件加密到生物识别,iPhone 的封闭生态和领先技术能为数字资产提供更可靠的防护,而安卓设备在这一场景下则存在诸多先天不足。

小结: 安卓阵营虽有Pixel Titan芯片、Samsung Knox等亮点,但安全机型数量有限且良莠不齐;iPhone凭借统一的安全架构和先进的Face ID,在保护敏感数据方面更胜一筹。为确保比特币等资产安全,选择安全可靠的iPhone 是明智之举。

iPhone 安全配置指南

选择了 iPhone 作为比特币存取和通讯设备后,仍需进行细致的安全设置,以最大化利用其安全潜力。以下是针对比特币持有者的 iPhone 安全配置要点:

-

禁用 Face ID/Touch ID 生物解锁,改用强PIN码: 建议关闭面容ID解锁功能,改用6位以上的数字PIN码(或更复杂的字母数字密码)作为解锁方式。在紧急情况下,生物识别容易被他人强制利用(例如他人将手机对准机主面部强行解锁),而记忆型的PIN码只有持有人知晓,更难以被胁迫获取。此外,法律上某些地区对强制提供生物特征和提供密码有所区别,这也使得使用PIN码在极端情况下更有保障。

-

启用自动锁定(1分钟) 将设备设为闲置1分钟后自动锁定屏幕。从安全角度出发,锁定等待时间越短越好。1分钟的设置可确保即使暂时离开或疏忽,设备也会很快上锁,防范他人乘虚而入。养成随手锁屏的习惯固然重要,但有了短自动锁定时间作为双重保障,安全性更上一层楼。

-

开启输错10次自动抹除: 在“设置 > 面容ID/触控ID与密码”中启用“连续输错10次密码抹掉数据”功能。一旦有人反复尝试猜测密码,该功能会在第十次错误尝试后自动抹除手机数据。很多用户担心该设置存在风险,但事实上 误触发的可能性极低。sspai.comsspai.com实际测试表明,iPhone在多次输错密码时会触发累进的延迟惩罚机制:第五次错误需要等待1分钟,第六次错误等待5分钟,第7-8次各等待15分钟,第9次等待1小时sspai.comsspai.com。要连续进行十次独立的错误尝试至少需要约96分钟,在现实中“熊孩子”乱按连续清空数据几乎不可能发生sspai.com。相反,该功能对抗暴力破解极为有效——正如2015年圣贝纳迪诺恐怖袭击案中,嫌犯所用的iPhone就启用了十次错误清除,使FBI也无法轻易尝试破解en.wikipedia.org。总之,此项设置能将设备落入他人之手时的数据泄露风险降至最低。

-

利用应用级 Face ID 控制(iOS 18+):升级至iOS 18或更新版本,充分利用其新增的应用锁定功能。长按主屏某个应用图标,可以找到“需要Face ID”选项,将该应用加锁theverge.com。被加锁的应用每次打开都需要通过Face ID身份验证(即使手机已解锁)。建议对 聊天通讯、密码管理、交易所App 等敏感应用启用此功能。例如,将微信、Signal、邮件客户端等设置为打开需Face ID验证,以防范他人在您手机解锁的短暂间隙内获取其中内容。应用级Face ID锁定为设备提供了第二道防线:即使手机本身已解锁,敏感应用和数据仍受到保护。

-

建议购买第二台 iPhone 或 iPad 作为“备用解锁入口”: 利用 Apple 的“信任链”机制,为同一 Apple ID 配置多台受信任设备(如两台 iPhone 或 iPhone+iPad)。这样即使主设备丢失或被抹除,备用设备依然可以访问并恢复 iCloud 端到端加密数据。其安全本质类似于“1-of-N 多签”,即任一设备均可独立解锁所有云数据,但无需多设备联合协商,恢复更灵活。注意:这与比特币的m-of-n多签不同,Apple的信任链是单设备多入口,安全性和便利性权衡需根据个人需求评估。官方说明参见:Apple平台安全白皮书(Keychain与信任链)

-

建议购买 YubiKey 等硬件安全密钥作为 Apple ID 验证要素: 由于信任链机制下新设备加入时,身份验证成为潜在攻击点(如钓鱼、社工、短信劫持),推荐为 Apple ID 配置 YubiKey 或兼容 FIDO2/U2F 的硬件安全密钥。启用后,只有插入并触发硬件密钥的情况下,才能完成新设备授权、敏感操作或账户恢复,有效阻止网络钓鱼和大部分远程攻击。该方法可显著提升账户安全,降低因凭证泄漏或验证被劫持导致的信任链攻破风险。Apple 官方说明:为 Apple ID 添加安全密钥

通过上述配置,iPhone 将处于一个平衡了便利性和安全性的状态:日常解锁采用PIN码确保意外情况下设备不被强制解锁,短自动锁和十次清除严防暴力破解,而应用级加锁进一步保障重要数据不外泄。

小结: 按照以上指南对iPhone进行安全配置,可以大幅提升设备在实际使用中的抗攻击能力。生物识别解锁的取舍、自动锁定和清除机制、以及iOS 18引入的应用加锁功能相结合,全方位地巩固了手机作为比特币手持设备的安全基石。

关于自动抹除的常见质疑回应

启用“输错10次自动抹除”功能后,不少用户会提出疑虑,主要集中在两个方面:其一,担心儿童误操作或本人一时疏忽导致设备数据被抹掉;其二,担心万一手机数据被抹除,设备本身价值受损。针对这些质疑,我们进行如下回应:

-

“熊孩子乱按怎么办?” 前文已提及,iPhone设计了渐进延时机制,使得连续十次错误输入并非易事sspai.comsspai.com。孩子无意识地反复点击相同数字,系统只视为一次错误sspai.com;而多次不同错误则会触发越来越长的锁定时间,很难真的连续试满十次sspai.com。实践中,要触发十次错误清除需要近两个小时且每次输入都不同,这种情景极不现实sspai.com。因此,只要平时看护好设备,误抹除几乎无需担心。相反,如果没有该功能,一旦设备遗失或被不法分子获取,后果将不堪设想——对方可以在足够时间和专业工具协助下尝试无限次解锁,从而获取您手机中的一切秘密。

-

“数据没了岂不可惜?” 我们强调,比特币持有者手机中存储的敏感信息价值远超设备本身。手机里可能有助记词、私钥线索、交易记录截图,甚至包含您社交账户中关于资产的对话。在攻击者眼中,这些数据的价值胜过一部手机。与其担心设备被误清除,不如担心设备落入他人之手数据遭泄露的风险。况且,对于重要数据您应当早有备份(下文将讨论启用iCloud云备份的问题)。即使真发生误清除,有备份在手也能恢复;但若数据被不法分子窃取,一旦造成资产损失将无法挽回。因此,从风险权衡来看,“宁可误删,不可被盗”——自动抹除是最后一道保障,在极端情况下保护您的数字资产不被侵害。

总而言之,这一功能的利远大于弊。儿童误触可以通过良好监护和系统延时设计来防范,而一旦启用,您将获得巨大的安心:手机若遭试图破解,可以自毁以保全数据安全。这正是比特币持有者应有的安全理念:舍弃设备保安全,数据和资产永远优先于硬件。随着良好备份策略的配合(例如iCloud加密备份),启用自动抹除几乎没有后顾之忧。

小结: 针对自动抹除功能的疑虑更多是误解。iPhone的机制使得误触发几率极低,而其提供的数据安全保障却是无可替代的。比特币等敏感资产持有者应放下顾虑,优先保护数据安全——哪怕代价是设备被清除,也胜过数据落入他人之手。

iCloud 备份的争议与建议

在确保本地设备安全的同时,妥善备份数据同样关键。对于比特币持有者而言,启用 iCloud 云备份可以提供额外的一层安心:万一设备遗失、损坏或被抹除后,仍有机会恢复重要信息。然而,围绕iCloud备份的安全性一直存在争议,我们在此详细分析并给出建议:

首先强烈建议在启用iCloud备份的同时,务必开启「高级数据保护」(Advanced Data Protection, ADP)。默认情况下,iCloud云备份的数据加密密钥由Apple掌管,这意味着苹果公司在法律要求下能够解密并提供您的备份数据support.apple.comsupport.apple.com。而开启高级数据保护后,备份所涉及的大部分数据将采用端对端加密,只有您的受信任设备掌握解锁密钥support.apple.com。据苹果官方说明,在ADP模式下,即便苹果公司也无法读取您的备份内容support.apple.com。因此,高级数据保护能够将使用云备份可能带来的隐私泄露风险降至最低(前提是您妥善保管好自己的账户和恢复密钥)。

启用云备份常见的疑虑是:“会不会把我的钱包私钥也备份上去,万一云被攻破岂不危险?” 实际上,多数主流比特币/加密钱包软件不会将核心密钥(如助记词或扩展公钥xpub)存储在云备份中。很多钱包在设计时就要求用户自行备份助记词,而不会把这些高度敏感的数据写入应用沙盒,可被iCloud备份抓取。同样地,一些钱包应用甚至提醒用户关闭iCloud备份以防助记词泄露support.wallet.coinex.com。换言之,开启iCloud备份并不会将您的私钥上传(除非个别钱包特别设置了云同步,但大多数非托管钱包都没有这么做)。当然,为审慎起见,您可以查阅所用钱包的文档或设置,确认其是否有备份敏感信息到云的选项,并据此做出取舍。

与此同时,我们更加关心的是其他应用的数据完整备份。对于比特币持有者来说,聊天记录、笔记文档和工作应用的数据往往同样敏感且重要。例如,常用通讯软件(微信、Telegram、Signal 等)中的聊天可能涉及交易细节或人脉网络;办公应用如钉钉、飞书则包含财务往来或业务资料。这些应用的数据都会包含在iCloud整机备份中并被完整保存,一旦手机丢失或损坏,可以通过云备份原样恢复。support.apple.com值得一提的是,在高级数据保护开启且不泄漏密钥的前提下,这些备份数据即使存储在苹果服务器上也是安全的,第三方无法解读其中内容。

进一步的好处是:利用备份进行调查取证。假设最坏情况发生——您的手机被抹除或遗失,但是事先有一份最新的iCloud备份。在紧急需要时,您可以在一台新的iPhone上恢复这份备份。在恢复完成后,切断新设备的网络连接(拔掉SIM卡或不连Wi-Fi)。由于备份恢复会还原您的应用登录状态和本地数据,新设备在离线情况下将维持原手机当时的登录环境。您可以打开聊天应用、邮件、照片等查看内容,就像原手机一样。离线操作确保应用不会因为检测到新设备而要求重新登录,也避免了云端数据被远程清除的可能。这对于事后取证、提供线索给执法部门或自我调查都极为有利。比如,若涉及盗窃诈骗案件,这部离线恢复的手机里保留的聊天记录、交易凭证可以作为关键证据。而一旦联网,这些应用可能出于安全考虑登出账户或拉取最新状态,反而不利于保留原始证据。因此,有意识地保存一份完整云备份,并在需要时以离线方式恢复,是一种非常巧妙的应对策略。

小结: 尽管人们对云备份心存疑虑,但通过启用高级数据保护,iCloud备份既能提供数据恢复便利,又充分保障了隐私安全。大多数加密钱包不会上传私钥等核心数据,而聊天、办公等应用的数据则可完整份以备不时之需。在平衡安全与可用性的前提下,开启iCloud备份(搭配ADP加密)是明智之举——它让您在设备意外损坏或丢失时依然有据可查、有据可证。

高级数据保护与密码学机制分析

最后,我们从更宏观的视角,结合真实案例和技术原理,深入探讨苹果设备与云服务的安全性,以及高级数据保护(ADP)所依赖的密码学机制。这部分将涵盖苹果在多个国家遭遇的解锁争议、ADP 的运作及其与实体安全密钥的配合、以及关于苹果是否存在解密后门的分析。

苹果与执法部门的解锁事件

过去数年间,多起高调事件凸显了设备加密与执法取证之间的矛盾。美国国会山骚乱事件(2021年1月6日)中,执法部门缴获了大量嫌疑人的手机。据报道,不少嫌犯使用的是iPhone,调查人员能够从苹果获取其中的数据 但途径主要是通过 iCloud 云备份 而非直接破解设备thedailybeast.com。由于当时高级数据保护尚未推出或未启用,苹果依然持有那些嫌疑人iCloud账户的备份密钥,因此在收到合法的执法请求后,苹果向FBI提供了嫌疑人的iCloud备份内容,其中包括视频、照片和聊天记录等关键证据thedailybeast.com。这些数据帮助当局重构了案件过程,也反映出如果用户没有使用端到端加密备份,云端数据在法律压力下并非牢不可破。

相反,在更早的**圣贝纳迪诺恐怖袭击案(2015)**中,FBI面对一部启用了强加密的嫌犯iPhone却陷入僵局。那是一个运行iOS 9的 iPhone 5C,开启了PIN码锁和10次输错清除功能en.wikipedia.org。由于该设备上的本地数据经过设备加密且苹果并不持有密钥,FBI无法提取其中信息,遂求助苹果公司要求破解。但苹果以维护所有用户安全为由拒绝编写后门固件来绕过安全限制,引发了一场著名的法律拉锯en.wikipedia.orgen.wikipedia.org。最终执法部门辗转通过第三方工具解锁了手机,但苹果的立场十分明确:即便面对恐怖主义案件,也不会为单次事件在系统中留下后门。这一事件凸显出现代iPhone设备本地加密之强大——在没有用户密码的情况下,即使连厂商都无能为力,除非另辟蹊径寻求系统或硬件漏洞。

iCloud 在中国与英国的访问争议

在不同国家,苹果围绕用户数据加密与政府监管的博弈也在上演。中国方面,自2018年以来苹果将中国大陆 iCloud 服务交由“云上贵州”公司运营,数据存储和加密密钥均留在境内zh.amnesty.org。依据中国《网络安全法》,云服务运营者有义务为执法和国家安全机关提供“技术支持和协助”zh.amnesty.org。这意味着若中国警方出于刑侦需要向云上贵州调取某用户的 iCloud 数据,该公司必须配合提供,几乎没有拒绝的空间zh.amnesty.org。更重要的是,苹果把中国用户的 iCloud 加密密钥也存放在中国,一旦收到合法命令要求解密数据,苹果和云上贵州只能遵从zh.amnesty.org。换言之,在标准数据保护模式下,中国当局有途径通过法律手段获取本地存储的iCloud明文数据。这引发了人们对隐私的担忧:如果没有端到端加密,中国的用户数据可能在政府要求下被查看。然而如果用户开启高级数据保护,使得苹果也无法解读备份内容,那么即便在中国,此举从技术上为用户争取到了更高的私密性(前提是中国地区允许开启ADP——截至目前,苹果并未在中国禁用该功能,国区用户依然可以自行启用高级数据保护support.apple.comsupport.apple.com)。

再看英国的情况。英国政府近年以打击犯罪和恐怖主义为由,不断向科技公司施压要求提供加密数据的后门访问权。2023年底,英国援引《调查权力法》(IPA)秘密向苹果发出“技术能力通知”(TCN),要求苹果在全球范围内为英国安全部门提供对加密iCloud内容的解锁途径cnbeta.com.tw。这实际上等同于要求苹果破坏其端到端加密体系,留出一个只有政府能用的后门。苹果对此断然拒绝,并做出强硬回应:宁愿撤除在英服务,也不会妥协安全底线cnbeta.com.tw。结果是,苹果选择在英国境内停止提供高级数据保护功能给新用户。已有启用ADP的英国用户被通知需在宽限期内手动将其关闭,否则将无法继续使用iCloud备份cnbeta.com.tw。苹果在声明中表示对此深感失望,但为了遵守当地法律别无他法cnbeta.com.tw。下面这张截图显示了英国用户在系统中看到的提示信息,明确告知ADP服务不再可用

苹果针对英国地区做出的ADP功能调整通知。英国政府要求能够解密用户数据,迫使苹果撤回了对英国用户的新端到端加密备份支持cnbeta.com.twcnbeta.com.tw。苹果声明强调只有用户本人才能解读其加密数据,并重申不会在产品中留下执法后门cnbeta.com.tw。

这一英国内外的罕见举措表明,各国政府正日益重视加密带来的执法障碍,而苹果则在平衡用户隐私和法律要求之间走钢丝。尽管英国的情况迫使苹果让步(取消当地ADP),但苹果并未真的为政府打造解密后门,而是通过限制功能来表明态度——这与其长期立场一致:绝不在加密产品中留后门,即使承受业务上的损失cnbeta.com.tw。

高级数据保护与安全密钥

高级数据保护(ADP) 是苹果于 iOS 16.2 引入的一项可选功能,其核心是在用户选择开启后,将包括设备备份在内的大部分 iCloud 数据升级为端到端加密存储support.apple.comsupport.apple.com。开启ADP有两个前提:账户已启用双重认证,以及设置了账户恢复联系人或恢复密钥,以防用户遗失访问权限support.apple.comsupport.apple.com。在ADP模式下,Apple不再持有绝大部分云数据的解锁密钥,这些密钥只存在于用户的受信任设备中support.apple.com。这意味着,即便苹果公司收到政府索取数据的要求或其服务器遭黑客攻击,没有密钥的加密数据对任何第三方都是无意义的乱码。正如苹果声明所言:“只有拥有数据的用户才能解密,Apple 无法访问端对端加密的数据”cnbeta.com.tw。可以说,ADP将用户云数据的主导权完全交还给用户自己,从而彻底消除了苹果方面潜在的数据泄露点。

为了进一步增强账户安全,苹果在_iOS 16.3_开始支持绑定实体安全密钥(如 YubiKey)作为 Apple ID 的额外两步验证方式sspai.com。过去Apple ID登录主要依赖密码+发送到受信设备的验证码,但假如用户Apple ID密码泄露,攻击者可能利用社会工程获取验证码。而引入实体安全密钥后,用户可以要求任何新的登录尝试都必须提供物理密钥认证才能完成。这相当于给 Apple ID 上了一把“硬件锁”。对于比特币持有者而言,这一步非常值得配置:即使黑客骗取了您的苹果账号密码,没有您的YubiKey或同类FIDO2安全密钥,他仍无法登录您的iCloud或停用您的ADP。安全密钥本身具有防钓鱼特性,它不会把可被重用的机密泄露给假网站,再加上密钥私藏于硬件内部不可导出,使得账户保护达到新的高度sspai.comsspai.com。简而言之,**“ADP + 硬件安全密钥”**的组合为用户云数据打造了双重护城河:前者确保云上数据加密不被窥探,后者确保账户本身不被劫持利用。

需要注意的是,启用ADP后如果遗失所有设备且忘记密码,苹果无法帮您找回数据support.apple.com。这就像您把保险箱钥匙只握在自己手里而不交给任何人保管,其安全性空前提高,但也意味着责任完全在您。因此请务必牢记Apple ID密码,保管好恢复密钥或紧急联系人。一旦平衡好便利与安全,这套机制将为您的数字资产提供堪比硬件钱包的云端保障。

后门密钥与私钥不可拆分性

现代加密体系的设计使得用户私钥与设备环境密不可分。在苹果的生态中,每台设备都拥有由硬件生成的唯一加密根密钥。例如,安全隔区(Secure Enclave)内嵌入了设备唯一标识符UID作为根密钥,UID由安全硬件随机生成并烧录至芯片中help.apple.com。这个UID既不与任何其他设备标识相关,也无法被设备外的任何人(包括苹果官方)获取help.apple.com。同时,用户的解锁密码与该UID进行数学“交织”(entangle),共同派生出加密密钥help.apple.com。换言之,设备硬件密钥和用户密码共同决定了数据加密密钥,没有这两者就无法还原密钥。这体现了用户私钥对设备及用户身份的强绑定——苹果没有第三方密钥可以绕过这一绑定关系help.apple.comhelp.apple.com。

从密码学角度来看,如果苹果试图在上述体系中插入一个额外的“后门密钥”,将面临巨大的技术困难,并且这样的异常极易被察觉。设想苹果通过异或(XOR)或 Shamir 密钥共享等方式,将一个后门密钥与用户密钥组合:

- 实现层面的异常:用户设备在正常情况下应当能够独立完成解密/签名操作。如果加入隐藏密钥份额,意味着设备单凭用户自己的密钥无法完成某些解密,必须依赖苹果持有的那一份。这样的改动会造成额外的密钥协商步骤或异常的解密失败。例如,若苹果将后门密钥与用户密钥异或生成实际工作密钥,那么单用用户密钥将无法解密出正确结果,设备可能需要静默地向苹果服务器请求密钥片段或进行额外计算。这类非预期的通信或计算步骤很容易被安全研究者通过流量分析或逆向工程发现端倪。再比如采用 Shamir’s Secret Sharing 等门限方案,如果苹果持有一份密钥碎片,设备在解密时就需要满足门限条件,这通常意味着需要苹果的参与或预置公钥,从而在协议日志中留下异常痕迹。任何偏离常规协议的做法——无论是多传输一段数据,还是多保存一段密钥信息——都可能成为研究者捕捉的线索。历史经验表明,密码协议中的“奇怪之处”往往预示潜在漏洞或后门:例如 NSA 推出的 Dual_EC_DRBG 伪随机数生成器由于使用了异常常数,被专家迅速怀疑存在后门;著名密码学家施奈尔(Bruce Schneier)就曾直言 Dual_EC_DRBG 中的后门“相当明显”,呼吁业界停止使用en.wikipedia.org。由此可见,试图暗中插入额外密钥会在数学实现上留下破绽,而资深密码学者和安全社区有足够能力识别这些反常之处。

进一步,从门限签名理论对比苹果现有密钥管理,可以加深这一不可行性的理解。门限密码学允许将密钥拆分给多方持有,只有达到预定门槛的份额才能重构密钥或执行签名解密toc.csail.mit.edumedium.com。其优点在于提高了密钥托管的安全性,需要多方协作才能解锁秘密。然而,这种机制是公开设计的一部分,各参与方和流程都是明示的。例如在某些区块链多重签名方案中,多个私钥持有者共同生成交易签名,每个人都知晓门限机制的存在。相较之下,苹果在产品中的密钥管理要么是完全由用户端掌握密钥(如iPhone本地数据加密,密钥存在Secure Enclave中),要么是在用户许可下由苹果代管(如传统iCloud云备份未启用高级加密时,苹果保存备份密钥)。苹果并没有公开采用“两方门限”的模式来和用户分享密钥,否则等于声明“用户单方无法完全掌控自己的解密权”。如果苹果暗中采用门限签名让自己持有一份密钥碎片,本质上就是一种**变相密钥托管(Escrow)**行为。这样的做法会明显偏离苹果宣称的零后门立场,与其在隐私政策中反复强调的原则相违背。值得注意的是,苹果在其官方隐私声明中明确表示:“我们从未在任何产品或服务中创建过后门或万能解锁主密钥”apple.com。因此,从理论和实践双重层面来看,用户私钥与潜在后门密钥是难以在不被发现的情况下拆分存在的。任何试图将二者解耦的举措都会引起体系架构的异常,进而难逃专家法眼。

加密社区对后门的发现与审计

在当今的安全生态中,不存在“悄无声息的后门”。一旦厂商试图在加密方案中掺入后门密钥,全球的密码学社区和安全研究人员都有多种手段将其揪出。下面从几个方面概述社区常用的后门检测与审计方法:

-

开源协议分析:安全专家偏好开源的软件和协议,因为源码透明意味着任何可疑的算法修改、密钥处理流程都暴露在公众视野中。通过阅读和形式化分析公开的协议规范,研究者可以发现是否有多余的密钥交换步骤或异常的参数。例如,Signal通信协议的源代码和技术细节是完全公开的,全球专家曾多次审阅其实现,验证其端到端加密未存在后门linkedin.com。事实证明,公开透明带来的是更严苛的监督,任何隐秘加入的密钥参数都有可能被审计人员发现。正如业内人士所指出的,Signal 采用开放源码意味着安全专家可以独立审计其代码以核实安全性linkedin.com。类似地,许多现代加密库都会经过社区审视,以确保其中没有“暗门”。

-

逆向工程与二进制审计:对于闭源的软件(例如苹果自身的系统组件),安全研究者会运用逆向工程技术来分析应用的二进制代码和运行时行为。一旦苹果的加密实现存在未公开的密钥使用,比如在本地程序中引用了某个神秘常量或调用了隐藏的密钥解密函数,逆向工程往往能还原这些逻辑。专业团队通过调试、反编译、动态埋点等方式重现协议的握手过程,查看每一步骤所用的密钥材料。如果过程中出现与官方文档不符的环节(例如本应由用户设备生成的密钥却从外部获取),将立即引发怀疑。此外,安全社区定期举办的漏洞挖掘和破解挑战赛也扮演重要角色——顶尖黑客会竞相攻破苹果设备的加密层,并公开报告发现的问题。过去这些努力揭示了一些实现漏洞(如内存越界、0day攻击途径),但从未曝出“苹果预留万能密钥”之类的后门。一例典型事件是2017年有黑客成功解密了Secure Enclave固件以研究其中机理,结果证实即便取得固件代码,攻击者仍无法提取到任何用户密钥或后门凭证ciso.economictimes.indiatimes.com。这一结论进一步增强了业界对苹果加密实现中无后门的信心。

-

网络流量与协议行为分析:加密协议往往涉及设备与服务器的交互流程。研究人员会抓包和监控这些网络流量,分析协议握手时交换的消息格式和内容。如果苹果尝试在密钥协商时暗中插入自己的公钥或请求额外数据,流量分析将捕捉到异常的报文模式。例如,在正常的端到端加密通信中,设备之间交换彼此的公钥证书,不应有第三方公钥悄然出现。而所谓“幽灵用户”后门提案正是要求服务提供商在群聊中偷偷加入一个看不见的第三方公钥。这样的方案被广泛批评因为它破坏了用户验证通信对端身份的机制,需要服务器隐藏通知才能欺骗用户lawfaremedia.org。密码学家指出,这将削弱认证过程并带来新漏洞,因此难以在不被发现的情况下实施lawfaremedia.org。由此可见,通过流量异常识别潜在后门是切实可行的。当年的GCHQ“幽灵用户”建议一提出,就被包括苹果在内的业界联合抵制,47家机构和专家联名公开信指出该做法“对网络安全构成严重威胁”internetsociety.orgsilicon.co.uk,可见社区对这类后门手段有高度警惕性。

-

独立审计和信任链验证:许多安全敏感的加密功能会接受独立机构的审计,以建立公众信任。比如苹果的 iCloud 钥匙串(Keychain) 采用多层加密和信任链机制,其设计文档表明敏感信息的密钥始终需要Secure Enclave参与才能解锁techrepublic.com。有第三方评估指出,钥匙串中的私密数据即便保存在云端也是经过高强度加密的,任何人(包括苹果)都无法直接读取明文techrepublic.com。这一架构经过多轮外部安全会议研讨和学者研究,至今未出现被植入后门的迹象。同样,苹果设备中的 Secure Enclave 安全隔区 也多次成为学术研究和黑客大会的焦点。研究人员通过攻击Secure Enclave找出了少数漏洞(例如早期A7-A11芯片存在硬件级漏洞ciso.economictimes.indiatimes.comciso.economictimes.indiatimes.com),但这些漏洞只是实现瑕疵,并非有意留出的后门。实际上,正是这些公开的审计和破解挑战证明了Secure Enclave的设计初衷:即使攻击者获得硬件或固件访问权,仍无法提取出主密钥ciso.economictimes.indiatimes.com。学术界和白帽黑客社区通过反复的审查和渗透测试,为苹果的“零后门”承诺提供了有力的背书。换言之,加密社区的独立审计机制确保了任何后门都难以隐藏;只有经得起各方检验的系统,才能真正赢得用户信任。

综上所述,在强大的社区监督下,任何后门密钥的存在都会留下蛛丝马迹,并最终被曝光。无论是协议分析、逆向工程还是实网监测,多层次的手段使得厂商无法神不知鬼不觉地在成熟加密方案中藏入后门。这也是为什么苹果等公司反复强调没有后门:一旦撒谎,终将被揭穿,信用荡然无存。

iCloud 钥匙串信任链下的全局数据加密密钥(DEK)机制研究

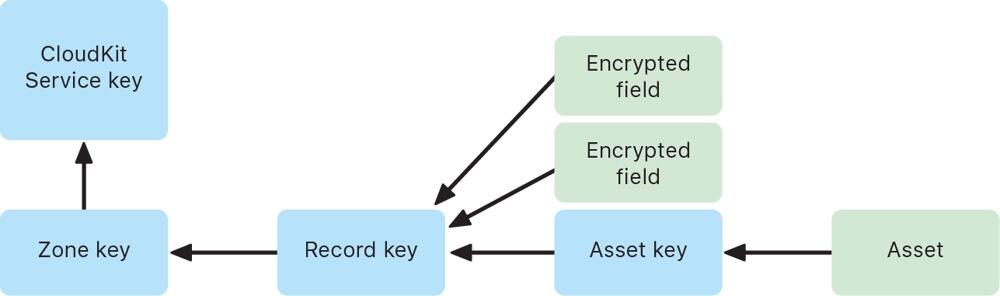

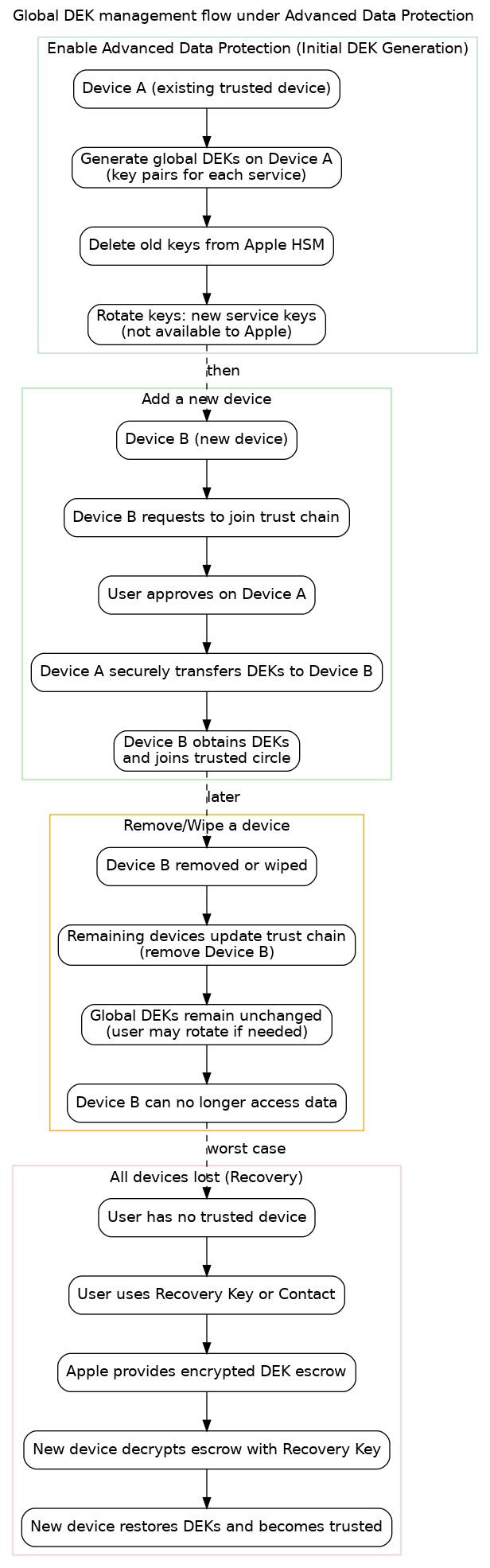

苹果的高级数据保护(Advanced Data Protection)引入了端到端加密,将大部分 iCloud 数据的密钥仅存储在用户的受信设备上support.apple.com。在该机制下,每个用户的 iCloud 帐户针对各数据类别生成自己的“全局”数据加密密钥(Data Encryption Key, DEK),这些密钥受 iCloud 钥匙串的信任链机制保护。下面将详细探讨全局 DEK 的生成、分发与封装,多设备场景下的生命周期变化,以及苹果保障 DEK 安全和确保服务器从未获取明文 DEK 的技术手段。

全局 DEK 的生成、更新与轮换

初始生成:当用户首次在支持的设备上启用高级数据保护时(需运行 iOS 16.2、macOS 13.1 等新版系统,并开启双重认证),系统会在该设备上本地生成全局数据加密密钥。实际上,每个受端到端加密保护的 iCloud 服务(例如云备份、照片、笔记等)都有各自的 CloudKit 服务密钥对,其私钥用作该类别数据的主加密密钥support.apple.comsupport.apple.com。这些服务密钥使用安全随机算法在用户受信设备上创建,具有唯一性,并由设备的安全硬件保护。启用高级数据保护时,设备会将之前由苹果保存的云端密钥从苹果的硬件安全模块(HSM)中删除,并生成新的服务密钥,以改用仅存储在用户设备上的密钥来加密云端数据support.apple.comsupport.apple.com。这一过程确保全局 DEK(即各服务的新密钥)仅存在于用户受信设备上,苹果服务器端不再持有其副本。

是否变化及何时变化:在正常使用中,全局 DEK(各服务密钥)的私钥一经生成会保持稳定,用于持续加密解密用户数据,并不会频繁更换。唯有在特定事件下才会轮换或更新密钥,例如用户启用高级数据保护时系统触发的一次性密钥轮换,以及用户后来关闭高级数据保护或怀疑密钥泄露时的情况support.apple.com。苹果文档指出,当用户打开高级数据保护时,设备会启动异步密钥轮换操作,为此前存储于苹果服务器的每个服务创建新的服务密钥support.apple.com。新数据随后使用新密钥加密,旧密钥无法解密新数据support.apple.com。同样地,当用户关闭高级数据保护返回标准保护时,设备会将原本仅存于本地的新密钥上传回苹果HSM,并可恢复使用先前的旧密钥support.apple.com。因此,可以总结:初始启用高级保护时会生成并切换到新的全局 DEK,此后这些密钥保持不变;如用户关闭功能则恢复旧密钥;除非再次启用或发生安全事件,系统通常不会主动更换全局 DEK。

值得注意的是,在极端情况下如果用户怀疑密钥泄露或设备失窃,用户可以选择通过重置整个端到端加密环境(例如先关闭再重新开启高级数据保护)来触发新的 DEK 生成,从而保护云端数据安全。然而,此操作会要求所有设备重新加入信任链,并重新上传数据副本加密后存储。

多设备环境下 DEK 的分发与封装

信任链机制: 苹果使用 iCloud 钥匙串的信任链(又称同步圈,circle of trust)来在多设备间安全同步全局 DEK。启用了高级数据保护后,属于用户 Apple ID 的所有受信设备共同构成一个加密信任链,每台设备都有一对用于同步的非对称椭圆曲线密钥(如 P-384)support.apple.com。当第一台设备生成全局 DEK 后,它会将这些密钥加入自身的 iCloud 钥匙串保护域,并通过 CloudKit 安全地共享给用户的其他设备support.apple.com。具体而言,设备会维护一份受信设备的公钥列表,并使用自身的私钥对列表签名后存储于 iCloud;只有持有用户账户密码或设备私钥者才能读取或篡改这份列表support.apple.com。这一机制保证了只有经过用户授权加入信任链的设备才能获取 DEK,其余任何第三方(包括苹果服务器)都无法读取信任链中的密钥数据support.apple.com。