-

@ c9badfea:610f861a

2025-05-20 19:49:20

@ c9badfea:610f861a

2025-05-20 19:49:20- Install Sky Map (it's free and open source)

- Launch the app and tap Accept, then tap OK

- When asked to access the device's location, tap While Using The App

- Tap somewhere on the screen to activate the menu, then tap ⁝ and select Settings

- Disable Send Usage Statistics

- Return to the main screen and enjoy stargazing!

ℹ️ Use the 🔍 icon in the upper toolbar to search for a specific celestial body, or tap the 👁️ icon to activate night mode

-

@ 04c915da:3dfbecc9

2025-05-20 15:53:48

@ 04c915da:3dfbecc9

2025-05-20 15:53:48This piece is the first in a series that will focus on things I think are a priority if your focus is similar to mine: building a strong family and safeguarding their future.

Choosing the ideal place to raise a family is one of the most significant decisions you will ever make. For simplicity sake I will break down my thought process into key factors: strong property rights, the ability to grow your own food, access to fresh water, the freedom to own and train with guns, and a dependable community.

A Jurisdiction with Strong Property Rights

Strong property rights are essential and allow you to build on a solid foundation that is less likely to break underneath you. Regions with a history of limited government and clear legal protections for landowners are ideal. Personally I think the US is the single best option globally, but within the US there is a wide difference between which state you choose. Choose carefully and thoughtfully, think long term. Obviously if you are not American this is not a realistic option for you, there are other solid options available especially if your family has mobility. I understand many do not have this capability to easily move, consider that your first priority, making movement and jurisdiction choice possible in the first place.

Abundant Access to Fresh Water

Water is life. I cannot overstate the importance of living somewhere with reliable, clean, and abundant freshwater. Some regions face water scarcity or heavy regulations on usage, so prioritizing a place where water is plentiful and your rights to it are protected is critical. Ideally you should have well access so you are not tied to municipal water supplies. In times of crisis or chaos well water cannot be easily shutoff or disrupted. If you live in an area that is drought prone, you are one drought away from societal chaos. Not enough people appreciate this simple fact.

Grow Your Own Food

A location with fertile soil, a favorable climate, and enough space for a small homestead or at the very least a garden is key. In stable times, a small homestead provides good food and important education for your family. In times of chaos your family being able to grow and raise healthy food provides a level of self sufficiency that many others will lack. Look for areas with minimal restrictions, good weather, and a culture that supports local farming.

Guns

The ability to defend your family is fundamental. A location where you can legally and easily own guns is a must. Look for places with a strong gun culture and a political history of protecting those rights. Owning one or two guns is not enough and without proper training they will be a liability rather than a benefit. Get comfortable and proficient. Never stop improving your skills. If the time comes that you must use a gun to defend your family, the skills must be instinct. Practice. Practice. Practice.

A Strong Community You Can Depend On

No one thrives alone. A ride or die community that rallies together in tough times is invaluable. Seek out a place where people know their neighbors, share similar values, and are quick to lend a hand. Lead by example and become a good neighbor, people will naturally respond in kind. Small towns are ideal, if possible, but living outside of a major city can be a solid balance in terms of work opportunities and family security.

Let me know if you found this helpful. My plan is to break down how I think about these five key subjects in future posts.

-

@ 662f9bff:8960f6b2

2025-05-20 18:52:01

@ 662f9bff:8960f6b2

2025-05-20 18:52:01April already and we are still refugees from the madness in HK. During March I had quite a few family matters that took priority and I also needed to work for two weeks. April is a similar schedule but we flew to Madeira for a change of scene and so that I could have a full 2-weeks off - my first real holiday in quite a few years!

We are staying in an airBnB in Funchal - an experience that I can totally recommend - video below! Nice to have an apartment that is fully equipped in a central location and no hassle for a few weeks. While here we are making the most of the great location and all the local possibiliites.

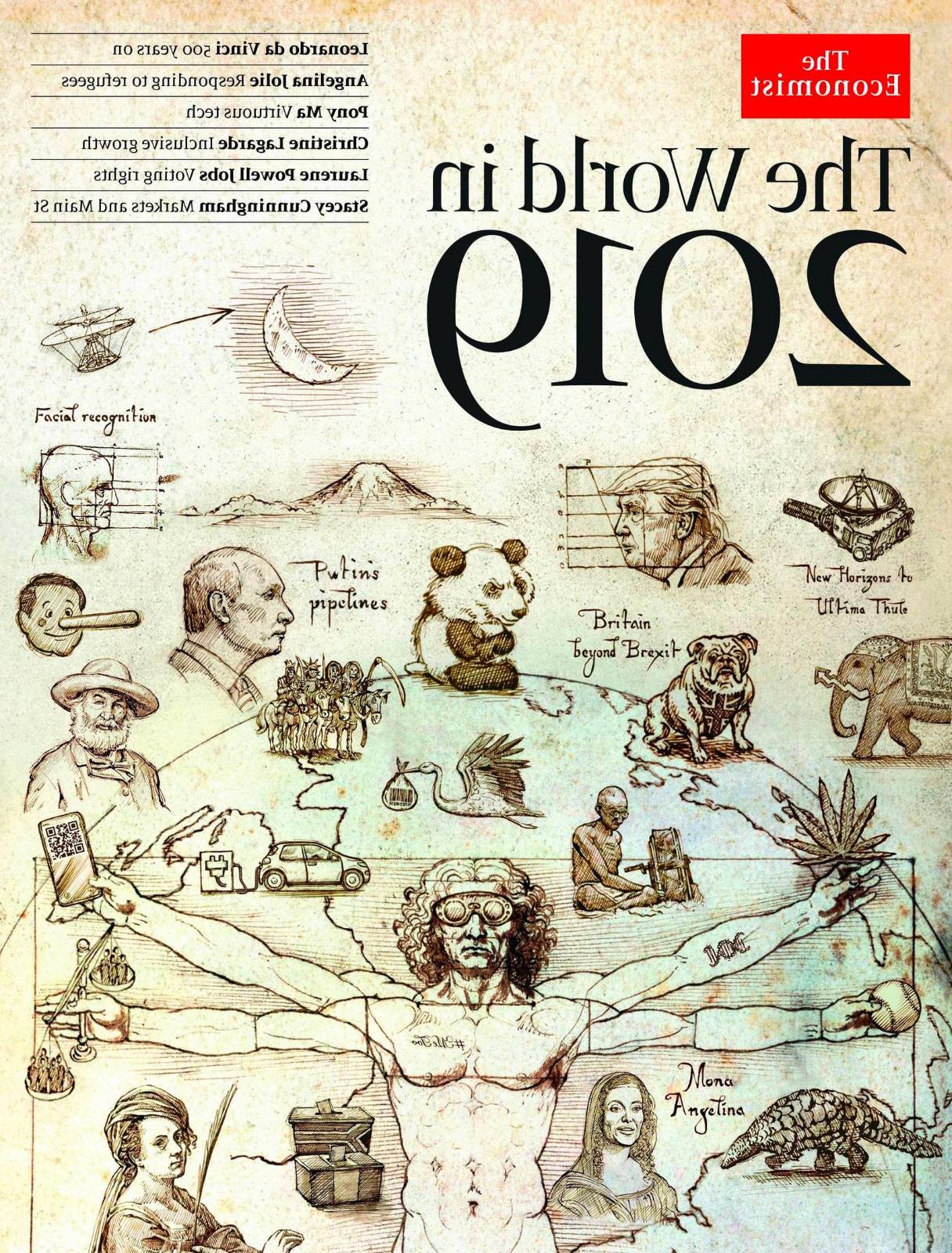

Elsewhere in the world

Things are clearly not going great around the world. If you are still confused as to why these things are happening, do go back and read the previous Letter from HK section "Why? How did we get here?"

You should be in no doubt that the "Great Reset" with its supporting "Great Narrative" is in full swing.. This is it - it is not a drill. For additional insights the following are recommended.

-

Jeff Booth discusses clearly and unemotionally with Pomp - Inflation is theft from humanity by the world governments

-

James' summary of Day 2 of the Miami conference - Peter Thiel (wow) and a fantastic explainer from Saifedean on the costs of the current corrupt financial system

-

James' summary of Day 3 of the Miami conference - listen in particular to the words of wisdom from Michael Saylor and Lyn Alden

-

Layered Money - The corruption of the system will blow your mind once you understand it…

-

This is BIG: Strike Is Bringing Freedom To Retail Merchants

-

Mark summarises Ray's book: Things will go faster and slower than you want!

-

Thoughtful words from George - evil is at work - be in no doubt..

-

Wow - My mind is blown. Must listen to John Carvalho - what clear ambition and answers to every question!

-

Related to the John Carvalho discussion. Likely these two options will end up complementing each other

On the personal and inspirational side

Advantage of time off work is that I have more time to read, listen and watch things that interest me. It really is a privilege that so much high quality material is so readily available. Do not let it go to waste. A few fabulous finds (and some re-finds) from this past week:

-

Ali Abdaal's bookshelf review just blew my mind! For the full list of books with links see the text under his video. So many inspirations and his delivery is perfect.

-

Gotta recommend Ali's 21 Life Lessons. I have been following him since he was student in Cambridge five years ago - his personal and professional growth and what he achieves (now with his team) is truely staggering.

-

Also his 15 books to read in 2022 - especially this one!

-

I also keep going back to Steve Jobs giving the 2005 Stanford Commencement address Three stories from his life - listen and be inspired - especially story #3

You will know that I am a fan of Audio Books and also Kindle - recently I am starting to use Whispersync where you get the Kindle- and Audio-books together for a nice price. This makes it easier to take notes (using Mac or iPad Kindle reader) while getting the benefit of having the book read to you by a professional reader.

I have also been inspired by a few people pushing themselves to do more reading - like this girl and Ali himself with his tips. Above all: just do it and do not get stuck on something that does not work for you!

Books that I am reading - Audio and Kindle!

-

The Final Empire: Mistborn, Book 1 - this is a new genre for me - I rather feel that it might be a bit too complicated for my engineering mind - let's see

-

Die with Zero: Getting All You Can from Your Money and Your Life - certainly provocative and obvious if you think about it but 99% do the opposite!

-

Chariots of the Gods - a classic by Erich von Daniken (written in 1968) - I have been inspired by his recent YT video appearances. Thought provoking and leads you to many possibilities.

So what's it like in Funchal, Madeira?

Do check out HitTheRoadMadeira's walking tour around Funchal

My first impressions of Funchal

and see my day out on Thursday!

Saturday - Funchal and Camar de Lobos

That's it!

No one can be told what The Matrix is.\ You have to see it for yourself.**

Do share this newsletter with any of your friends and family who might be interested.

You can also email me at: LetterFrom@rogerprice.me

💡Enjoy the newsletters in your own language : Dutch, French, German, Serbian, Chinese Traditional & Simplified, Thai and Burmese.

-

-

@ 04c915da:3dfbecc9

2025-05-20 15:47:16

@ 04c915da:3dfbecc9

2025-05-20 15:47:16Here’s a revised timeline of macro-level events from The Mandibles: A Family, 2029–2047 by Lionel Shriver, reimagined in a world where Bitcoin is adopted as a widely accepted form of money, altering the original narrative’s assumptions about currency collapse and economic control. In Shriver’s original story, the failure of Bitcoin is assumed amid the dominance of the bancor and the dollar’s collapse. Here, Bitcoin’s success reshapes the economic and societal trajectory, decentralizing power and challenging state-driven outcomes.

Part One: 2029–2032

-

2029 (Early Year)\ The United States faces economic strain as the dollar weakens against global shifts. However, Bitcoin, having gained traction emerges as a viable alternative. Unlike the original timeline, the bancor—a supranational currency backed by a coalition of nations—struggles to gain footing as Bitcoin’s decentralized adoption grows among individuals and businesses worldwide, undermining both the dollar and the bancor.

-

2029 (Mid-Year: The Great Renunciation)\ Treasury bonds lose value, and the government bans Bitcoin, labeling it a threat to sovereignty (mirroring the original bancor ban). However, a Bitcoin ban proves unenforceable—its decentralized nature thwarts confiscation efforts, unlike gold in the original story. Hyperinflation hits the dollar as the U.S. prints money, but Bitcoin’s fixed supply shields adopters from currency devaluation, creating a dual-economy split: dollar users suffer, while Bitcoin users thrive.

-

2029 (Late Year)\ Dollar-based inflation soars, emptying stores of goods priced in fiat currency. Meanwhile, Bitcoin transactions flourish in underground and online markets, stabilizing trade for those plugged into the bitcoin ecosystem. Traditional supply chains falter, but peer-to-peer Bitcoin networks enable local and international exchange, reducing scarcity for early adopters. The government’s gold confiscation fails to bolster the dollar, as Bitcoin’s rise renders gold less relevant.

-

2030–2031\ Crime spikes in dollar-dependent urban areas, but Bitcoin-friendly regions see less chaos, as digital wallets and smart contracts facilitate secure trade. The U.S. government doubles down on surveillance to crack down on bitcoin use. A cultural divide deepens: centralized authority weakens in Bitcoin-adopting communities, while dollar zones descend into lawlessness.

-

2032\ By this point, Bitcoin is de facto legal tender in parts of the U.S. and globally, especially in tech-savvy or libertarian-leaning regions. The federal government’s grip slips as tax collection in dollars plummets—Bitcoin’s traceability is low, and citizens evade fiat-based levies. Rural and urban Bitcoin hubs emerge, while the dollar economy remains fractured.

Time Jump: 2032–2047

- Over 15 years, Bitcoin solidifies as a global reserve currency, eroding centralized control. The U.S. government adapts, grudgingly integrating bitcoin into policy, though regional autonomy grows as Bitcoin empowers local economies.

Part Two: 2047

-

2047 (Early Year)\ The U.S. is a hybrid state: Bitcoin is legal tender alongside a diminished dollar. Taxes are lower, collected in BTC, reducing federal overreach. Bitcoin’s adoption has decentralized power nationwide. The bancor has faded, unable to compete with Bitcoin’s grassroots momentum.

-

2047 (Mid-Year)\ Travel and trade flow freely in Bitcoin zones, with no restrictive checkpoints. The dollar economy lingers in poorer areas, marked by decay, but Bitcoin’s dominance lifts overall prosperity, as its deflationary nature incentivizes saving and investment over consumption. Global supply chains rebound, powered by bitcoin enabled efficiency.

-

2047 (Late Year)\ The U.S. is a patchwork of semi-autonomous zones, united by Bitcoin’s universal acceptance rather than federal control. Resource scarcity persists due to past disruptions, but economic stability is higher than in Shriver’s original dystopia—Bitcoin’s success prevents the authoritarian slide, fostering a freer, if imperfect, society.

Key Differences

- Currency Dynamics: Bitcoin’s triumph prevents the bancor’s dominance and mitigates hyperinflation’s worst effects, offering a lifeline outside state control.

- Government Power: Centralized authority weakens as Bitcoin evades bans and taxation, shifting power to individuals and communities.

- Societal Outcome: Instead of a surveillance state, 2047 sees a decentralized, bitcoin driven world—less oppressive, though still stratified between Bitcoin haves and have-nots.

This reimagining assumes Bitcoin overcomes Shriver’s implied skepticism to become a robust, adopted currency by 2029, fundamentally altering the novel’s bleak trajectory.

-

-

@ 6ad3e2a3:c90b7740

2025-05-20 13:49:50

@ 6ad3e2a3:c90b7740

2025-05-20 13:49:50I’ve written about MSTR twice already, https://www.chrisliss.com/p/mstr and https://www.chrisliss.com/p/mstr-part-2, but I want to focus on legendary short seller James Chanos’ current trade wherein he buys bitcoin (via ETF) and shorts MSTR, in essence to “be like Mike” Saylor who sells MSTR shares at the market and uses them to add bitcoin to the company’s balance sheet. After all, if it’s good enough for Saylor, why shouldn’t everyone be doing it — shorting a company whose stock price is more than 2x its bitcoin holdings and using the proceeds to buy the bitcoin itself?

Saylor himself has said selling shares at 2x NAV (net asset value) to buy bitcoin is like selling dollars for two dollars each, and Chanos has apparently decided to get in while the getting (market cap more than 2x net asset value) is good. If the price of bitcoin moons, sending MSTR’s shares up, you are more than hedged in that event, too. At least that’s the theory.

The problem with this bet against MSTR’s mNAV, i.e., you are betting MSTR’s market cap will converge 1:1 toward its NAV in the short and medium term is this trade does not exist in a vacuum. Saylor has described how his ATM’s (at the market) sales of shares are accretive in BTC per share because of this very premium they carry. Yes, we’ll dilute your shares of the company, but because we’re getting you 2x the bitcoin per share, you are getting an ever smaller slice of an ever bigger overall pie, and the pie is growing 2x faster than your slice is reducing. (I https://www.chrisliss.com/p/mstr how this works in my first post.)

But for this accretion to continue, there must be a constant supply of “greater fools” to pony up for the infinitely printable shares which contain only half their value in underlying bitcoin. Yes, those shares will continue to accrete more BTC per share, but only if there are more fools willing to make this trade in the future. So will there be a constant supply of such “fools” to keep fueling MSTR’s mNAV multiple indefinitely?

Yes, there will be in my opinion because you have to look at the trade from the prospective fools’ perspective. Those “fools” are not trading bitcoin for MSTR, they are trading their dollars, selling other equities to raise them maybe, but in the end it’s a dollars for shares trade. They are not selling bitcoin for them.

You might object that those same dollars could buy bitcoin instead, so they are surely trading the opportunity cost of buying bitcoin for them, but if only 5-10 percent of the market (or less) is buying bitcoin itself, the bucket in which which those “fools” reside is the entire non-bitcoin-buying equity market. (And this is not considering the even larger debt market which Saylor has yet to tap in earnest.)

So for those 90-95 percent who do not and are not presently planning to own bitcoin itself, is buying MSTR a fool’s errand, so to speak? Not remotely. If MSTR shares are infinitely printable ATM, they are still less so than the dollar and other fiat currencies. And MSTR shares are backed 2:1 by bitcoin itself, while the fiat currencies are backed by absolutely nothing. So if you hold dollars or euros, trading them for MSTR shares is an errand more sage than foolish.

That’s why this trade (buying BTC and shorting MSTR) is so dangerous. Not only are there many people who won’t buy BTC buying MSTR, there are many funds and other investment entities who are only able to buy MSTR.

Do you want to get BTC at 1:1 with the 5-10 percent or MSTR backed 2:1 with the 90-95 percent. This is a bit like medical tests that have a 95 percent accuracy rate for an asymptomatic disease that only one percent of the population has. If someone tests positive, it’s more likely to be a false one than an indication he has the disease*. The accuracy rate, even at 19:1, is subservient to the size of the respective populations.

At some point this will no longer be the case, but so long as the understanding of bitcoin is not widespread, so long as the dollar is still the unit of account, the “greater fools” buying MSTR are still miles ahead of the greatest fools buying neither, and the stock price and mNAV should only increase.

. . .

One other thought: it’s more work to play defense than offense because the person on offense knows where he’s going, and the defender can only react to him once he moves. Similarly, Saylor by virtue of being the issuer of the shares knows when more will come online while Chanos and other short sellers are borrowing them to sell in reaction to Saylor’s strategy. At any given moment, Saylor can pause anytime, choosing to issue convertible debt or preferred shares with which to buy more bitcoin, and the shorts will not be given advance notice.

If the price runs, and there is no ATM that week because Saylor has stopped on a dime, so to speak, the shorts will be left having to scramble to change directions and buy the shares back to cover. Their momentum might be in the wrong direction, though, and like Allen Iverson breaking ankles with a crossover, Saylor might trigger a massive short squeeze, rocketing the share price ever higher. That’s why he actually welcomes Chanos et al trying this copycat strategy — it becomes the fuel for outsized gains.

For that reason, news that Chanos is shorting MSTR has not shaken my conviction, though there are other more pertinent https://www.chrisliss.com/p/mstr-part-2 with MSTR, of which one should be aware. And as always, do your own due diligence before investing in anything.

* To understand this, consider a population of 100,000, with one percent having a disease. That means 1,000 have it, 99,000 do not. If the test is 95 percent accurate, and everyone is tested, 950 of the 1,000 will test positive (true positives), 50 who have it will test negative (false negatives.) Of the positives, 95 percent of 99,000 (94,050) will test negative (true negatives) and five percent (4,950) will test positive (false positives). That means 4,950 out of 5,900 positives (84%) will be false.

-

@ 6e0ea5d6:0327f353

2025-05-20 01:35:20

@ 6e0ea5d6:0327f353

2025-05-20 01:35:20**Ascolta bene! ** A man's sentimental longing, though often disguised in noble language and imagination, is a sickness—not a virtue.

It begins as a slight inclination toward tenderness, cloaked in sweetness. Then it reveals itself as a masked addiction: a constant need to be seen by a woman, validated by her, and reciprocated—as if someone else's affection were the only anchor preventing the shipwreck of his emotions.

The man who understands the weight of leadership seeks no applause, no gratitude, not even romantic love. He knows that his role is not theatrical but structural. He is not measured by the emotion he evokes, but by the stability he ensures. Being a true man is not ornamental. He is not a decorative symbol in the family frame.

We live in an era where male roles have been distorted by an overindulgence in emotion. The man stopped guiding and began asking for direction. His firmness was exchanged for softness, his decisiveness for hesitation. Trying to please, many have given up authority. Trying to love, they’ve begun to bow. A man who begs for validation within his own home is not a leader—he is a guest. And when the patriarch has to ask for a seat at the table he should preside over and sustain, something has already been irreversibly inverted.

Unexamined longing turns into pleading. And all begging is the antechamber of humiliation. A man who never learned to cultivate dignified solitude will inevitably fall to his knees in desperation. And then, he yields. Yields to mediocre presence, to shallow affection, to constant disrespect. He smiles while he bleeds, praises the one who despises him, accepts crumbs and pretends it’s a banquet. All of it, cazzo... just to avoid the horror of being alone.

Davvero, amico mio, for the men who beg for romance, only the consolation of being remembered will remain—not with respect, but with pity and disgust.

The modern world feeds the fragile with illusions, but reality spits them out. Sentimental longing is now celebrated as sensitivity. But every man who nurtures it as an excuse will, sooner or later, pay for it with his dignity.

Thank you for reading, my friend!

If this message resonated with you, consider leaving your "🥃" as a token of appreciation.

A toast to our family!

-

@ 3f770d65:7a745b24

2025-05-19 18:09:52

@ 3f770d65:7a745b24

2025-05-19 18:09:52🏌️ Monday, May 26 – Bitcoin Golf Championship & Kickoff Party

Location: Las Vegas, Nevada\ Event: 2nd Annual Bitcoin Golf Championship & Kick Off Party"\ Where: Bali Hai Golf Clubhouse, 5160 S Las Vegas Blvd, Las Vegas, NV 89119\ 🎟️ Get Tickets!

Details:

-

The week tees off in style with the Bitcoin Golf Championship. Swing clubs by day and swing to music by night.

-

Live performances from Nostr-powered acts courtesy of Tunestr, including Ainsley Costello and others.

-

Stop by the Purple Pill Booth hosted by Derek and Tanja, who will be on-boarding golfers and attendees to the decentralized social future with Nostr.

💬 May 27–29 – Bitcoin 2025 Conference at the Las Vegas Convention Center

Location: The Venetian Resort\ Main Attraction for Nostr Fans: The Nostr Lounge\ When: All day, Tuesday through Thursday\ Where: Right outside the Open Source Stage\ 🎟️ Get Tickets!

Come chill at the Nostr Lounge, your home base for all things decentralized social. With seating for \~50, comfy couches, high-tops, and good vibes, it’s the perfect space to meet developers, community leaders, and curious newcomers building the future of censorship-resistant communication.

Bonus: Right across the aisle, you’ll find Shopstr, a decentralized marketplace app built on Nostr. Stop by their booth to explore how peer-to-peer commerce works in a truly open ecosystem.

Daily Highlights at the Lounge:

-

☕️ Hang out casually or sit down for a deeper conversation about the Nostr protocol

-

🔧 1:1 demos from app teams

-

🛍️ Merch available onsite

-

🧠 Impromptu lightning talks

-

🎤 Scheduled Meetups (details below)

🎯 Nostr Lounge Meetups

Wednesday, May 28 @ 1:00 PM

- Damus Meetup: Come meet the team behind Damus, the OG Nostr app for iOS that helped kickstart the social revolution. They'll also be showcasing their new cross-platform app, Notedeck, designed for a more unified Nostr experience across devices. Grab some merch, get a demo, and connect directly with the developers.

Thursday, May 29 @ 1:00 PM

- Primal Meetup: Dive into Primal, the slickest Nostr experience available on web, Android, and iOS. With a built-in wallet, zapping your favorite creators and friends has never been easier. The team will be on-site for hands-on demos, Q\&A, merch giveaways, and deeper discussions on building the social layer of Bitcoin.

🎙️ Nostr Talks at Bitcoin 2025

If you want to hear from the minds building decentralized social, make sure you attend these two official conference sessions:

1. FROSTR Workshop: Multisig Nostr Signing

-

🕚 Time: 11:30 AM – 12:00 PM

-

📅 Date: Wednesday, May 28

-

📍 Location: Developer Zone

-

🎤 Speaker: nostr:nprofile1qy2hwumn8ghj7etyv4hzumn0wd68ytnvv9hxgqgdwaehxw309ahx7uewd3hkcqpqs9etjgzjglwlaxdhsveq0qksxyh6xpdpn8ajh69ruetrug957r3qf4ggfm (Austin Kelsay) @ Voltage\ A deep-dive into FROST-based multisig key management for Nostr. Geared toward devs and power users interested in key security.

2. Panel: Decentralizing Social Media

-

🕑 Time: 2:00 PM – 2:30 PM

-

📅 Date: Thursday, May 29

-

📍 Location: Genesis Stage

-

🎙️ Moderator: nostr:nprofile1qyxhwumn8ghj7mn0wvhxcmmvqy08wumn8ghj7mn0wd68yttjv4kxz7fwv3jhyettwfhhxuewd4jsqgxnqajr23msx5malhhcz8paa2t0r70gfjpyncsqx56ztyj2nyyvlq00heps - Bitcoin Strategy @ Roxom TV

-

👥 Speakers:

-

nostr:nprofile1qyt8wumn8ghj7etyv4hzumn0wd68ytnvv9hxgtcppemhxue69uhkummn9ekx7mp0qqsy2ga7trfetvd3j65m3jptqw9k39wtq2mg85xz2w542p5dhg06e5qmhlpep – Early Bitcoin dev, CEO @ Sirius Business Ltd

-

nostr:nprofile1qy2hwumn8ghj7mn0wd68ytndv9kxjm3wdahxcqg5waehxw309ahx7um5wfekzarkvyhxuet5qqsw4v882mfjhq9u63j08kzyhqzqxqc8tgf740p4nxnk9jdv02u37ncdhu7e3 – Analyst & Partner @ Ego Death Capital

Get the big-picture perspective on why decentralized social matters and how Nostr fits into the future of digital communication.

🌃 NOS VEGAS Meetup & Afterparty

Date: Wednesday, May 28\ Time: 7:00 PM – 1:00 AM\ Location: We All Scream Nightclub, 517 Fremont St., Las Vegas, NV 89101\ 🎟️ Get Tickets!

What to Expect:

-

🎶 Live Music Stage – Featuring Ainsley Costello, Sara Jade, Able James, Martin Groom, Bobby Shell, Jessie Lark, and other V4V artists

-

🪩 DJ Party Deck – With sets by nostr:nprofile1qy0hwumn8ghj7cmgdae82uewd45kketyd9kxwetj9e3k7mf6xs6rgqgcwaehxw309ahx7um5wgh85mm694ek2unk9ehhyecqyq7hpmq75krx2zsywntgtpz5yzwjyg2c7sreardcqmcp0m67xrnkwylzzk4 , nostr:nprofile1qy2hwumn8ghj7etyv4hzumn0wd68ytnvv9hxgqgkwaehxw309anx2etywvhxummnw3ezucnpdejqqg967faye3x6fxgnul77ej23l5aew8yj0x2e4a3tq2mkrgzrcvecfsk8xlu3 , and more DJs throwing down

-

🛰️ Live-streamed via Tunestr

-

🧠 Nostr Education – Talks by nostr:nprofile1qy88wumn8ghj7mn0wvhxcmmv9uq37amnwvaz7tmwdaehgu3dwfjkccte9ejx2un9ddex7umn9ekk2tcqyqlhwrt96wnkf2w9edgr4cfruchvwkv26q6asdhz4qg08pm6w3djg3c8m4j , nostr:nprofile1qy2hwumn8ghj7etyv4hzumn0wd68ytnvv9hxgqg7waehxw309anx2etywvhxummnw3ezucnpdejz7ur0wp6kcctjqqspywh6ulgc0w3k6mwum97m7jkvtxh0lcjr77p9jtlc7f0d27wlxpslwvhau , nostr:nprofile1qy88wumn8ghj7mn0wvhxcmmv9uq3vamnwvaz7tmwdaehgu3wd33xgetk9en82m30qqsgqke57uygxl0m8elstq26c4mq2erz3dvdtgxwswwvhdh0xcs04sc4u9p7d , nostr:nprofile1q9z8wumn8ghj7erzx3jkvmmzw4eny6tvw368wdt8da4kxamrdvek76mrwg6rwdngw94k67t3v36k77tev3kx7vn2xa5kjem9dp4hjepwd3hkxctvqyg8wumn8ghj7mn0wd68ytnhd9hx2qpqyaul8k059377u9lsu67de7y637w4jtgeuwcmh5n7788l6xnlnrgssuy4zk , nostr:nprofile1qy28wue69uhnzvpwxqhrqt33xgmn5dfsx5cqz9thwden5te0v4jx2m3wdehhxarj9ekxzmnyqqswavgevxe9gs43vwylumr7h656mu9vxmw4j6qkafc3nefphzpph8ssvcgf8 , and more.

-

🧾 Vendors & Project Booths – Explore new tools and services

-

🔐 Onboarding Stations – Learn how to use Nostr hands-on

-

🐦 Nostrich Flocking – Meet your favorite nyms IRL

-

🍸 Three Full Bars – Two floors of socializing overlooking vibrant Fremont Street

| | | | | ----------- | -------------------- | ------------------- | | Time | Name | Topic | | 7:30-7:50 | Derek | Nostr for Beginners | | 8:00-8:20 | Mark & Paul | Primal | | 8:30-8:50 | Terry | Damus | | 9:00-9:20 | OpenMike and Ainsley | V4V | | 09:30-09:50 | The Space | Space |

This is the after-party of the year for those who love freedom technology and decentralized social community. Don’t miss it.

Final Thoughts

Whether you're there to learn, network, party, or build, Bitcoin 2025 in Las Vegas has a packed week of Nostr-friendly programming. Be sure to catch all the events, visit the Nostr Lounge, and experience the growing decentralized social revolution.

🟣 Find us. Flock with us. Purple pill someone.

-

-

@ 04c915da:3dfbecc9

2025-05-20 15:50:48

@ 04c915da:3dfbecc9

2025-05-20 15:50:48For years American bitcoin miners have argued for more efficient and free energy markets. It benefits everyone if our energy infrastructure is as efficient and robust as possible. Unfortunately, broken incentives have led to increased regulation throughout the sector, incentivizing less efficient energy sources such as solar and wind at the detriment of more efficient alternatives.

The result has been less reliable energy infrastructure for all Americans and increased energy costs across the board. This naturally has a direct impact on bitcoin miners: increased energy costs make them less competitive globally.

Bitcoin mining represents a global energy market that does not require permission to participate. Anyone can plug a mining computer into power and internet to get paid the current dynamic market price for their work in bitcoin. Using cellphone or satellite internet, these mines can be located anywhere in the world, sourcing the cheapest power available.

Absent of regulation, bitcoin mining naturally incentivizes the build out of highly efficient and robust energy infrastructure. Unfortunately that world does not exist and burdensome regulations remain the biggest threat for US based mining businesses. Jurisdictional arbitrage gives miners the option of moving to a friendlier country but that naturally comes with its own costs.

Enter AI. With the rapid development and release of AI tools comes the requirement of running massive datacenters for their models. Major tech companies are scrambling to secure machines, rack space, and cheap energy to run full suites of AI enabled tools and services. The most valuable and powerful tech companies in America have stumbled into an accidental alliance with bitcoin miners: THE NEED FOR CHEAP AND RELIABLE ENERGY.

Our government is corrupt. Money talks. These companies will push for energy freedom and it will greatly benefit us all.

-

@ 04c915da:3dfbecc9

2025-05-20 15:50:22

@ 04c915da:3dfbecc9

2025-05-20 15:50:22There is something quietly rebellious about stacking sats. In a world obsessed with instant gratification, choosing to patiently accumulate Bitcoin, one sat at a time, feels like a middle finger to the hype machine. But to do it right, you have got to stay humble. Stack too hard with your head in the clouds, and you will trip over your own ego before the next halving even hits.

Small Wins

Stacking sats is not glamorous. Discipline. Stacking every day, week, or month, no matter the price, and letting time do the heavy lifting. Humility lives in that consistency. You are not trying to outsmart the market or prove you are the next "crypto" prophet. Just a regular person, betting on a system you believe in, one humble stack at a time. Folks get rekt chasing the highs. They ape into some shitcoin pump, shout about it online, then go silent when they inevitably get rekt. The ones who last? They stack. Just keep showing up. Consistency. Humility in action. Know the game is long, and you are not bigger than it.

Ego is Volatile

Bitcoin’s swings can mess with your head. One day you are up 20%, feeling like a genius and the next down 30%, questioning everything. Ego will have you panic selling at the bottom or over leveraging the top. Staying humble means patience, a true bitcoin zen. Do not try to "beat” Bitcoin. Ride it. Stack what you can afford, live your life, and let compounding work its magic.

Simplicity

There is a beauty in how stacking sats forces you to rethink value. A sat is worth less than a penny today, but every time you grab a few thousand, you plant a seed. It is not about flaunting wealth but rather building it, quietly, without fanfare. That mindset spills over. Cut out the noise: the overpriced coffee, fancy watches, the status games that drain your wallet. Humility is good for your soul and your stack. I have a buddy who has been stacking since 2015. Never talks about it unless you ask. Lives in a decent place, drives an old truck, and just keeps stacking. He is not chasing clout, he is chasing freedom. That is the vibe: less ego, more sats, all grounded in life.

The Big Picture

Stack those sats. Do it quietly, do it consistently, and do not let the green days puff you up or the red days break you down. Humility is the secret sauce, it keeps you grounded while the world spins wild. In a decade, when you look back and smile, it will not be because you shouted the loudest. It will be because you stayed the course, one sat at a time. \ \ Stay Humble and Stack Sats. 🫡

-

@ 57d1a264:69f1fee1

2025-05-20 06:15:51

@ 57d1a264:69f1fee1

2025-05-20 06:15:51Deliberate (?) trade-offs we make for the sake of output speed.

... By sacrificing depth in my learning, I can produce substantially more work. I’m unsure if I’m at the correct balance between output quantity and depth of learning. This uncertainty is mainly fueled by a sense of urgency due to rapidly improving AI models. I don’t have time to learn everything deeply. I love learning, but given current trends, I want to maximize immediate output. I’m sacrificing some learning in classes for more time doing outside work. From a teacher’s perspective, this is obviously bad, but from my subjective standpoint, it’s unclear.

Finding the balance between learning and productivity. By trade, one cannot be productive in specific areas without first acquire the knowledge to define the processes needed to deliver. Designing the process often come on a try and fail dynamic that force us to learn from previous mistakes.

I found this little journal story fun but also little sad. Vincent's realization, one of us trading his learnings to be more productive, asking what is productivity without quality assurance?

Inevitably, parts of my brain will degenerate and fade away, so I need to consciously decide what I want to preserve or my entire brain will be gone. What skills am I NOT okay with offloading? What do I want to do myself?

Read Vincent's journal https://vvvincent.me/llms-are-making-me-dumber/

https://stacker.news/items/984361

-

@ 57d1a264:69f1fee1

2025-05-20 06:02:26

@ 57d1a264:69f1fee1

2025-05-20 06:02:26Digital Psychology ↗Wall of impact website showcase a collection of success metrics and micro case studies to create a clear, impactful visual of your brand's achievements. It also displays a Wall of love with an abundance of testimonials in one place, letting the sheer volume highlight your brand's popularity and customer satisfaction.

And like these, many others collections like Testimonial mashup that combine multiple testimonials into a fast-paced, engaging reel that highlights key moments of impact in an attention-grabbing format.

Awards and certifications of websites highlighting third-party ratings and verification to signal trust and quality through industry-recognized achievements and standards.

View them all at https://socialproofexamples.com/

https://stacker.news/items/984357

-

@ 7e538978:a5987ab6

2025-05-20 14:55:07

@ 7e538978:a5987ab6

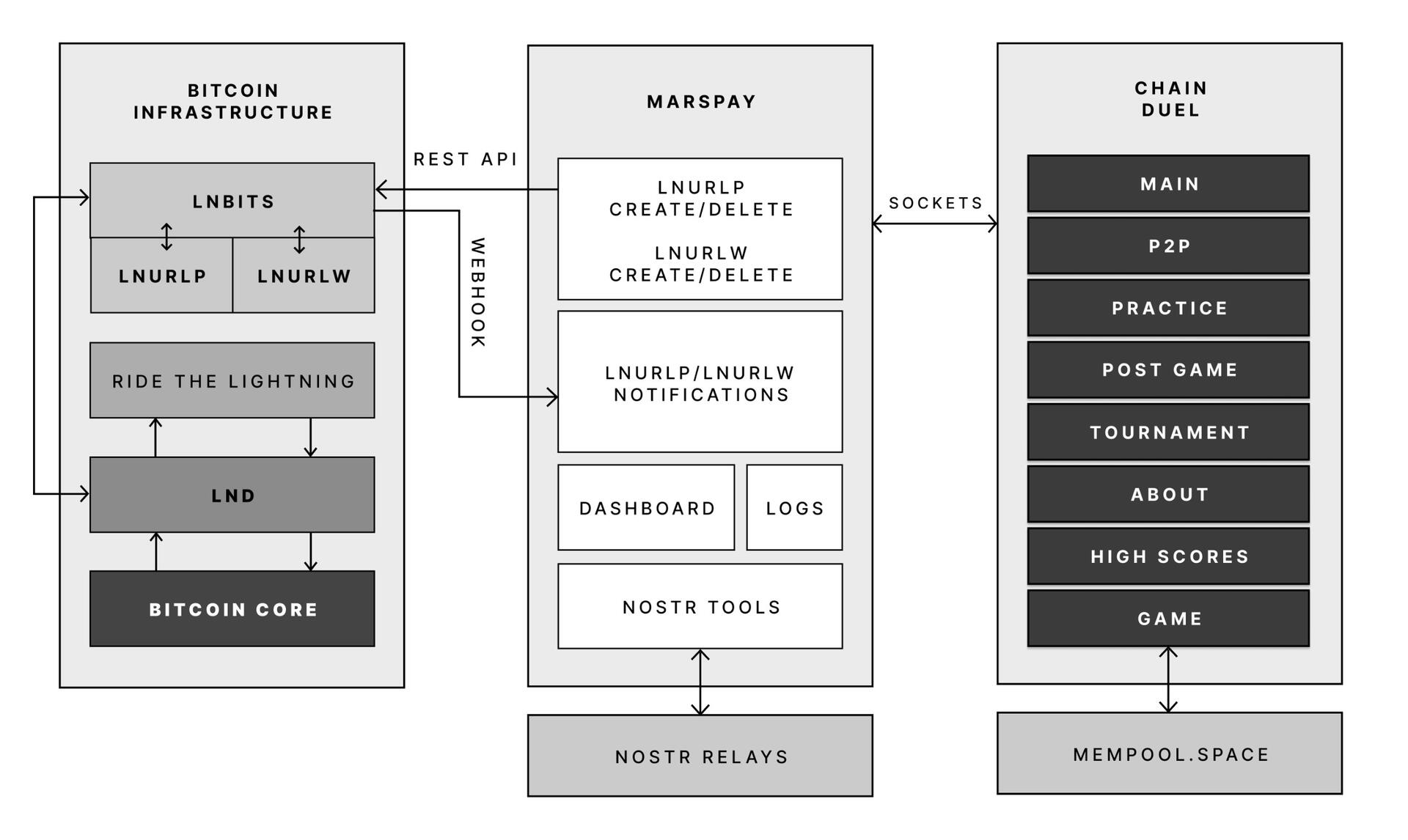

2025-05-20 14:55:07Chain Duel, a fast paced PvP game that takes inspiration from the classic snake game and supercharges it with Bitcoin’s Lightning Network. Imagine battling another player for dominance in a race to collect blocks, where the length of your chain isn’t just a visual cue. It represents real, staked satoshis. The player with the most Proof of Work wins, but it’s not just about gameplay; it’s about the seamless integration of the Lightning Network and real-time payments.

But how does Chain Duel manage these instant transactions with such efficiency? That’s where LNbits comes in. LNbits, an open-source wallet and payment infrastructure, handles all in-game payments making it easy for developers to focus on gameplay while LNbits takes care of everything from microtransactions to automated splits for developers and designers. In this article, we’ll dive deep into how Chain Duel leverages LNbits to streamline in-game payments and how other developers can take advantage of this powerful toolset to build the future of Lightning-powered gaming.

Let’s explore how LNbits transforms payment processing and why it’s quickly becoming a must-have for game developers working in the Bitcoin space.

Overview of Chain Duel

Chain Duel is a unique Lightning Network-inspired game that reimagines the classic snake game with a competitive twist, integrating real-time payments. Two players face off in real-time, racing to "catch" blocks and extend their chains. Each block added to the chain represents Proof of Work, and the player with the most Proof of Work wins the duel. The stakes are high, as the game represents satoshis (small units of Bitcoin) as points, with the winner taking home the prize.

The game is designed to be Lightning-native, meaning all payments within Chain Duel are processed through the Lightning Network. This ensures fast payments, reducing latency and making gameplay smooth. With additional features like practice mode, tournaments and highscores, Chain Duel creates an engaging and competitive environment for Bitcoin enthusiasts and gamers alike.

One of the standout aspects of Chain Duel is its deeper integration with the Lightning Network even at a design level. For example, actual Bitcoin blocks can appear on screen during matches, offering bonus points when mined in sync with the game. The game’s current version, still in beta, has already drawn attention within the Bitcoin community, gaining momentum at conferences and with a growing user base through its social networks. With its innovative combination of gaming, the Lightning Network, and competitive play, Chain Duel offers a glimpse into the future of Lightning-based gaming.

How LNbits is Used in Chain Duel

Seamless Integration with LNbits

At the core of Chain Duel’s efficient payment processing is LNbits, which handles in-game transactions smoothly and reliably. Chain Duel uses the LNbits LNURL-pay and LNURL-withdraw extensions to manage payments and rewards between players. Before each match, players send satoshis using LNURL-pay, which generates a static QR code or link for making the payment. LNURL-pay allows users to attach a note to the payment, which Chain Duel creatively uses as a way to insert the player name in-game. The simplicity of LNURL-pay ensures that users can quickly and easily initiate games, with fresh invoices being issued for every game. When players win, LNURL-withdraw enables them to seamlessly pull their earnings from the game, providing a quick payout system.

These extensions make it easy for players to send and receive Bitcoin with minimal latency, fully leveraging the power of the Lightning Network for fast and low-cost payments. The flexibility of LNbits’ tools means that game developers don’t need to worry about building custom payment systems from scratch—they can rely on LNbits to handle all financial transactions with precision.

Lightning Tournaments

Chain Duel tournaments leverage LNbits and its LNURL extensions to create a seamless and efficient experience for players. In Chain Duel tournaments, LNbits plays a crucial role in managing the overall economics. LNbits facilitates the generation of LNURL QR codes that participants can scan to register quickly or withdraw their winnings. LNbits allows Chain Duel to automatically handle multiple registrations through LNURL-pay, enabling players to participate in the tournament without additional steps. The Lightning Network's speed ensures that these payments occur in real-time, reducing wait times and allowing for a smoother flow in-game.

Splitting Payments

LNbits further simplifies revenue-sharing within Chain Duel. This feature allows the game to automatically split the satoshis sent by players into different shares for the game’s developer, designer, and host. Each time a payment is made to join a match, LNbits is used to automattically pay each of the contributors, according to pre-defined rules. This automated process ensures that everyone involved in the development and running of the game gets their fair share without manual intervention or complex bookkeeping.

Nostr Integration

Chain Duel also integrates with Nostr, a decentralized protocol for social interactions. Players can join games using "Zaps", small tips or micropayments sent over the Lightning Network within the Nostr ecosystem. Through NIP-57, which enables Nostr clients to request Zap invoices, players can use LNURL-pay enabled Zaps to register in P2P matches, further enhancing the Chain Duel experience. By using Zaps as a way to register in-game, Chain Duel automates the process of fetching players' identity, creating a more competitive and social experience. Zaps are public on the Nostr network, further expanding Chain Duel's games social reach and community engagement.

Game and Payment Synchronization

One of the key reasons Chain Duel developers chose LNbits is its powerful API that connects directly with the game’s logic. LNbits allows the game to synchronize payments with gameplay in real-time, providing a seamless experience where payments are an integrated part of the gaming mechanics.

With LNbits managing both the payment process and the Lightning Network’s complex infrastructure, Chain Duel developers are free to concentrate on enhancing the competitive and Lightning Network-related aspects of the game. This division of tasks is essential for streamlining development while still providing an innovative in-game payment experience that is deeply integrated with the Bitcoin network.

LNbits proves to be an indispensable tool for Chain Duel, enabling smooth in-game transactions, real-time revenue sharing, and seamless integration with Nostr. For developers looking to build Lightning-powered games, LNbits offers a powerful suite of tools that handle everything from micropayments to payment distribution—ensuring that the game's focus remains on fun and competition rather than complex payment systems.

LNBits facilitating Education and Adoption

This system contributes to educating users on the power of the Lightning Network. Since Chain Duel directly involve real satoshis and LNURL for registration and rewards, players actively experience how Lightning can facilitate fast, cheap, and permissionless payments. By incorporating LNbits into Chain Duel, the game serves as an educational tool that introduces users to the benefits of the Lightning Network. Players gain direct experience using Lightning wallets and LNURL, helping them understand how these tools work in real-world scenarios. The near-instant nature of these payments showcases the power of Lightning in a practical context, highlighting its potential beyond just gaming. Players are encouraged to set up wallets, explore the Lightning ecosystem, and eventually become familiar with Bitcoin and Lightning technology. By integrating LNbits, Chain Duel transforms in-game payments into a learning opportunity, making Bitcoin and Lightning more approachable for users worldwide.

Tools for Developers

LNbits is a versatile, open-source platform designed to simplify and enhance Bitcoin Lightning Network wallet management. For developers, particularly those working on Lightning-native games like Chain Duel, LNbits offers an invaluable set of tools that allow for seamless integration of Lightning payments without the need to build complex custom solutions from scratch. LNbits is built on a modular and extensible architecture, enabling developers to easily add or create functionality suited to their project’s needs.

Extensible Architecture for Customization

At the core of LNbits is a simple yet powerful wallet system that developers can access across multiple devices. What makes LNbits stand out is its extensible nature—everything beyond the core functionality is implemented as an extension. This modular approach allows users to customize their LNbits installation by enabling or building extensions to suit specific use cases. This flexibility is perfect for developers who want to add Lightning-based services to their games or apps without modifying the core codebase.

- Extensions for Every Use Case

LNbits comes with a wide array of built-in extensions created by contributors, offering various services that can be plugged into your application. Some popular extensions include: - Faucets: Distribute small amounts of Bitcoin to users for testing or promotional purposes.

- Paylinks: Create shareable links for instant payments.

- Points-of-sale (PoS): Allow users to set up shareable payment terminals.

- Paywalls: Charge users to access content or services.

- Event tickets: Sell tickets for events directly via Lightning payments.

- Games and services: From dice games to jukeboxes, LNbits offers entertaining and functional tools.

These ready-made solutions can be adapted and used in different gaming scenarios, for example in Chain Duel, where LNURL extensions are used for in game payments. The extensibility ensures developers can focus on building engaging gameplay while LNbits handles payment flows.

Developer-Friendly Customization

LNbits isn't just a plug-and-play platform. Developers can extend its functionality even further by creating their own extensions, giving full control over how the wallet system is integrated into their games or apps. The architecture is designed to make it easy for developers to build on top of the platform, adding custom features for specific requirements.

Flexible Funding Source Management

LNbits also offers flexibility in terms of managing funding sources. Developers can easily connect LNbits to various Lightning Network node implementations, enabling seamless transitions between nodes or even different payment systems. This allows developers to switch underlying funding sources with minimal effort, making LNbits adaptable for games that may need to scale quickly or rely on different payment infrastructures over time.

A Lean Core System for Maximum Efficiency

Thanks to its modular architecture, LNbits maintains a lean core system. This reduces complexity and overhead, allowing developers to implement only the features they need. By avoiding bloated software, LNbits ensures faster transactions and less resource consumption, which is crucial in fast-paced environments like Chain Duel where speed and efficiency are paramount.

LNbits is designed with developers in mind, offering a suite of tools and a flexible infrastructure that makes integrating Bitcoin payments easy. Whether you’re developing games, apps, or any service that requires Lightning Network transactions, LNbits is a powerful, open-source solution that can be adapted to fit your project.

Conclusion

Chain Duel stands at the forefront of Lightning-powered gaming, combining the excitement of competitive PvP with the speed and efficiency of the Lightning Network. With LNbits handling all in-game payments, from microtransactions to automated revenue splits, developers can focus entirely on crafting an engaging gaming experience. LNbits’ powerful API and extensions make it easy to manage real-time payments, removing the complexity of building payment infrastructure from scratch.

LNbits isn’t just a payment tool — it’s a flexible, developer-friendly platform that can be adapted to any gaming model. Whether you're developing a fast-paced PvP game like Chain Duel or any project requiring seamless Lightning Network integration, LNbits provides the ideal solution for handling instant payments with minimal overhead.

For developers interested in pushing the boundaries of Lightning-powered gaming, Chain Duel is a great example of how LNbits can enhance your game, letting you focus on the fun while LNbits manages real-time transactions.

Find out more

Curious about how Lightning Network payments can power your next game? Explore the following:

- Learn more about Chain Duel: Chain Duel

- Learn how LNbits can simplify payment handling in your project: LNbits

- Dive into decentralized communication with Nostr: Nostr

- Extensions for Every Use Case

-

@ 58537364:705b4b85

2025-05-20 14:22:05

@ 58537364:705b4b85

2025-05-20 14:22:05Ikigai means "the meaning of life" or "the reason for being." Why were we born? What are we living for? When work is not seen as something separate from life.

The Japanese believe that everyone has their own ikigai. Those who discover it find meaning and value in life, leading to greater happiness, better moods, and a more fulfilling world.

Today, there are many books about ikigai, but the first one written by a Japanese author is:

“The Little Book of Ikigai: The Secret Japanese Way to Live a Happy and Long Life” by Ken Mogi (Thai translation by Wuttichai Krisanaprakankit)

Come explore the true world of ikigai through this Japanese neuroscientist’s insights, conveyed through conversations that challenge the idea of ikigai as something grand—showing instead that it starts with small personal joys.

Ken Mogi says that Jiro Ono, a 94-year-old sushi chef who still makes sushi today, was his inspiration for writing the book.

This sushi chef did not start the job out of passion or talent—but he dedicated every piece of sushi to bring happiness to his customers. That, Ken says, is the essence of ikigai.

Strangely, the word “ikigai” is not often used in daily conversations in Japan.

Because it’s something so natural that it doesn’t need to be said. In today’s world, we often talk about how to succeed, how to get promoted, how to become a CEO. But for the Japanese, success isn’t everything.

For example, many Japanese people are deeply passionate about hobbies or have kodawari. Others might not care what those hobbies are—as long as the person seems happy, that’s enough. Some are obsessed with trains, manga, or anime. These people don’t need fame or recognition from society. If they’re happy in their own way, that’s perfectly okay.

Kodawari means a deep dedication or meticulous attention to something. For example, someone obsessed with stationery might spend a lot of time selecting the perfect pens, notebooks, or pencils. They’ll research, analyze, and experiment to find the tools they love most.

Everyone’s ikigai can be different, because people value different things and live differently.

Ikigai is about diversity. Japanese society encourages children to discover their own ikigai. They don’t tell kids to pursue jobs only because they pay well. If you ask students what jobs they want, they rarely say it’s about money first.

Ikigai is not the same as "success." The Japanese know that life isn’t just about being successful. Ikigai matters more. You could be successful but lack ikigai. Conversely, you might not be “successful” but still have ikigai—and you might be happier.

Ken Mogi defines success as something society acknowledges and rewards. But ikigai comes from your own heart and personal happiness. Others may not recognize it as success, but that doesn’t matter.

Ikigai is personal. We can be happy in our own way. We don’t judge others’ happiness—let them find joy in their own path.

The key to ikigai is finding small moments of happiness, even from little things. For example, when Ken was a child, he loved studying butterflies. Now, when he’s out jogging and sees a beautiful butterfly, he feels ikigai. Or sometimes, it comes from small amusing moments—like hearing a child tell his dad, “Dad, you have to do it this way!”

So, if we want to find our own ikigai, where do we start? Start with noticing small pleasures in daily life. That’s the easiest place to begin.

In the brain, there's a chemical called dopamine. When we achieve even small things, dopamine is released, creating happiness. That’s why enjoying small things is so important.

For some, ikigai might seem hard to grasp—especially if life is difficult, if they feel hopeless or lack self-worth. So begin with tiny moments of joy.

Is it the same as positive thinking? Ikigai is a part of that. But when we talk about “positive thinking,” it can feel like pressure to some people. So instead, just notice small joys: making your morning coffee, running in the rain.

Lessons from Ken Mogi:

-

Ikigai is not about chasing success or wealth, but about feeling happiness in your own life, which gives your life personal meaning.

-

Ikigai is not defined by society. Everyone’s ikigai is different. Each person can be happy in their own way.

-

**Don’t judge or force others—**children, partners—to live how you think is right. Respect diversity.

-

Smile at people who are enjoying their ikigai, and support them if they struggle.

-

Ikigai exists on two levels:

-

Big ikigai: life purpose or work values.

-

Small ikigai: tiny joys in everyday life.

-

Ikigai starts with noticing small pleasures today.

Source: From the Cloud of Thoughts column An interview by Ajarn Katewadi from Marumura with Ken Mogi, author of the first Japanese book on ikigai.

-

-

@ 662f9bff:8960f6b2

2025-05-20 13:44:39

@ 662f9bff:8960f6b2

2025-05-20 13:44:39Currently, and for the last three weeks, I am in Belfast. With the situation in HK becoming ever more crazy by the day we took the opportunity to escape from Hong Kong for a bit - I escaped with V and 3 suitcases. I also have some family matters that I am giving priority to at this time. We plan to stay a few more weeks in Northern Ireland and then after some time in Belgium we will be visiting some other European locations. I do hope that HK will be a place that we can go back to - we will see...

What's happening?

Quite a few significant events have happened in the last few weeks that deserve some deeper analysis and checking than you will ever get from the media propaganda circus that is running full force at the moment. You should be in no doubt that the "Great Reset" with its supporting "Great Narrative" is in full swing.

In most of the world the C19 story has run its course - for now. Most countries seem to have have "declared victory" and "moved on". Obviously HK is an exception (nothing happened there for the last two years) and I fear they will get to experience the whole 2-year thing in the coming 3-4 months. Watch out - the politicians everywhere are looking to permanently establish the "emergency controls" as "normal" - see previous Letter for some examples in Ireland and EU.

Invasion of Ukraine has led to so many lines being crossed - to the extent that clearly things will never be the same again in our lifetime.

Why? How did we get here?

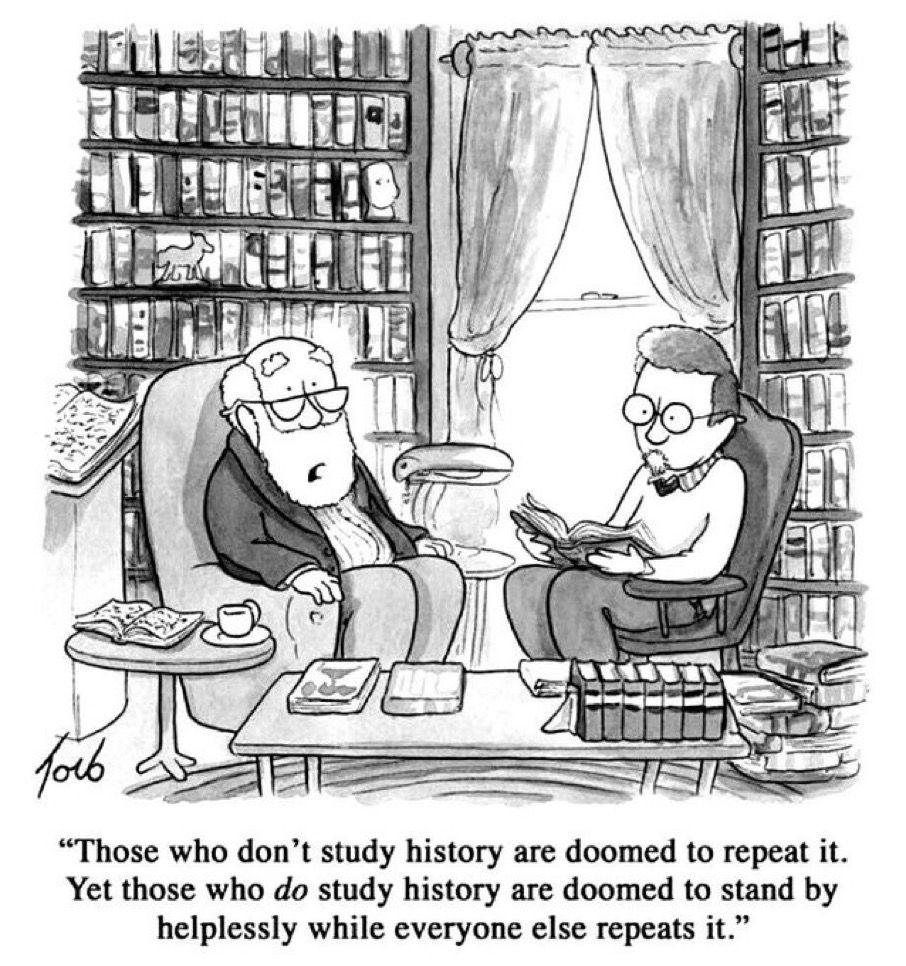

I do not claim to know all the answers but some things are fairly clear if you look with open eyes and the wisdom that previous generations and civilisations have made available to us - even if most choose to ignore it (Plato on the flaws of democracy). Those who do not learn from history are doomed to repeat it and even those who learn will have litle choice but to go along for much of the ride.

Perhaps my notes and the links below will help you to form an educated opinion rather than the pervasive propaganda we are all being fed.

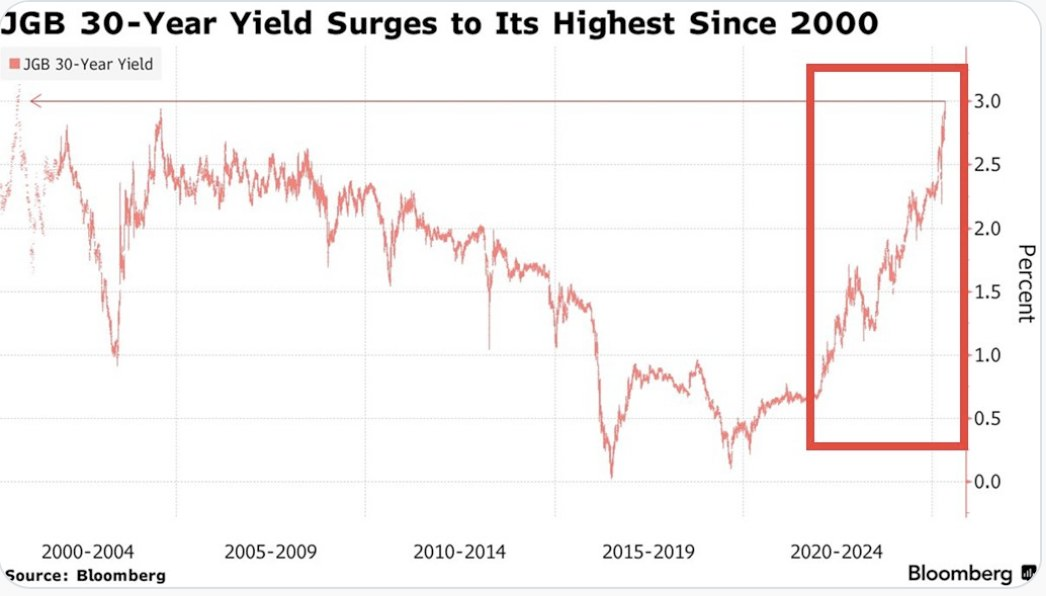

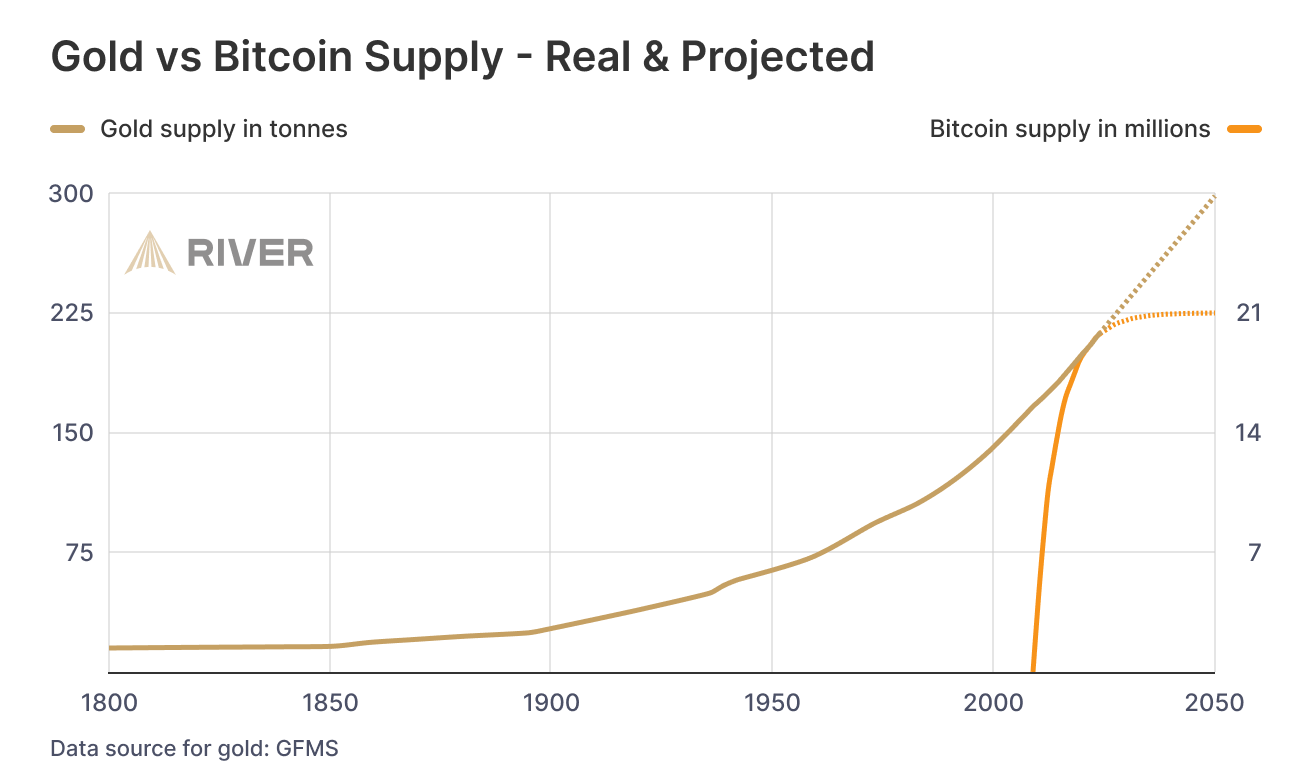

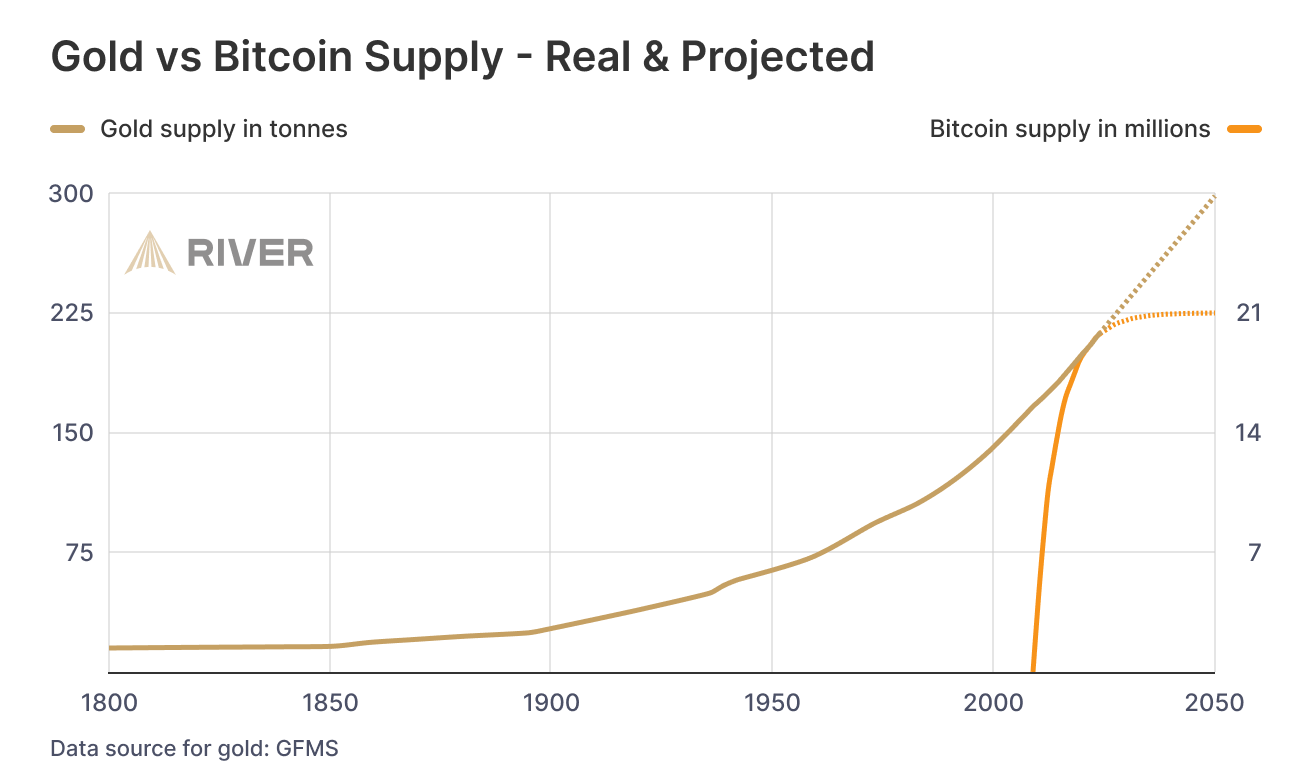

The current situation is more than 100 years in the making and much (if not most) of what you thought was true is less veracious than you could ever imagine. No doubt we could (and maybe should) go back further but let's start in 1913 when the British Government asked the public no longer to request exchange of their pounds for gold coins at the post office. This led to the issuing of War Bonds and fractional reserve accounting that allowed the Bank of England essentially to print unlimited money to fight in WW1; without this devious action they would have been constrained to act within the limits of the country's reserves and WW1 would have been shorter. Read The Fiat Standard for more details on how this happened. Around this time, and likely no coincidence, the US bankers were scheming how to get around the constitutional controls against such actions in their own country - read more in The Creature from Jekyll Island.

Following WW1, Germany was forced to pay war reparations in Gold (hard money). This led to a decade of money printing and extravagant excesses and crashes as hyperinflation set in, ending in the bankrupting of the country and the nationalism that fed WW2 - the gory details of devaluation and hyperinflation in Weimar Germany are described in When Money Dies. Meanwhile the US bankers who had been preparing since 1913 stepped in with unlimited money printing to fund WW2 and then also in their Marshal Plan to cement in place the Bretton Woods post-war agreement that made US Dollar the global reserve currency.

Decades of boom and bust followed - well explained by Ray Dalio who portrays this as perfectly normal and to be expected - unfortunately it is for soft (non-hard) money based economies. The Fourth Turning will give many additional insights to this period too as well as cycles to watch for and their cause and nature. In 1961 Eisenhower tried to warn the population in his farewell address about the "Military Industrial Complex" and many believe that Robert Kennedy's assassination in 1963 may well be not entirely unrelated.

Things came to a head in August 1971 when the countries of the world realised that the US was (contrary to all promises) printing unlimited funds to (among other things) fight the Vietnam war and so undermining the expected and required convertibility of US dollars (the currency of global trade) for Gold (hard money). A French warship heading to NY to collect France's gold was the straw that caused Nixon to default on US Debt convertibility and "close the gold window".

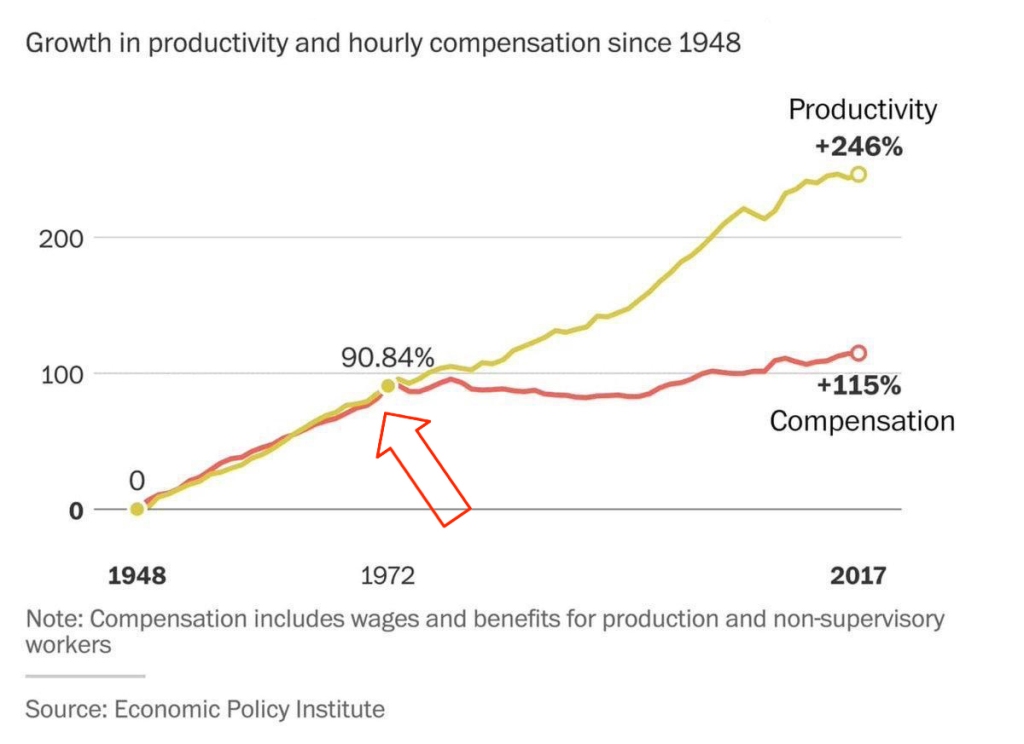

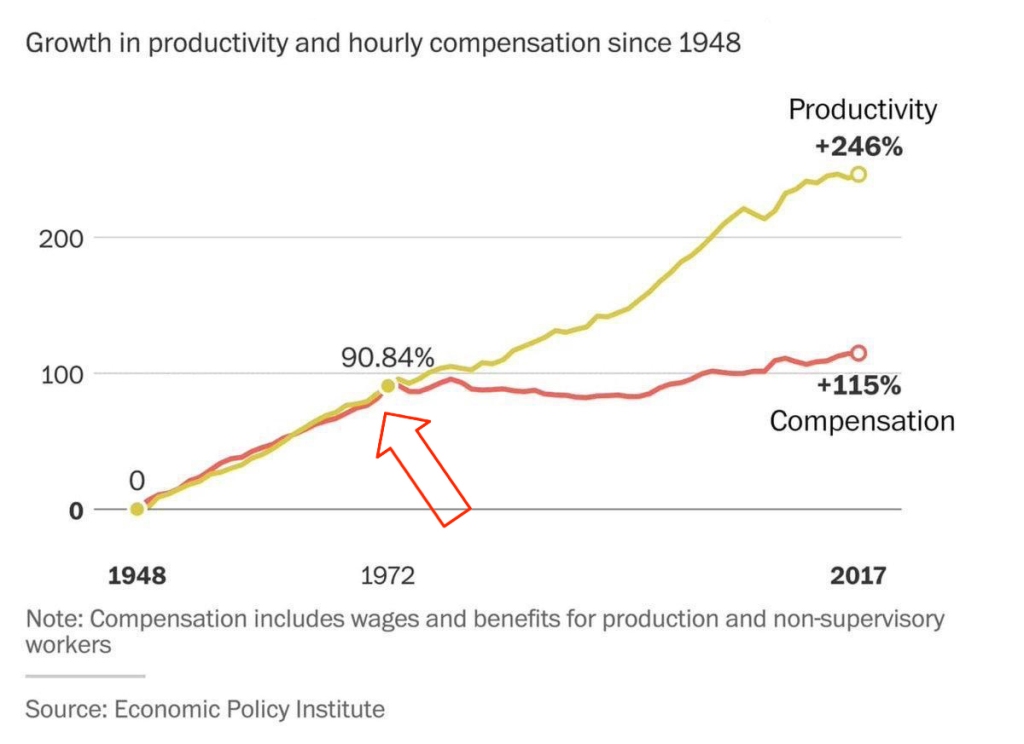

This in turn led to further decades of increasing financialization, further fuelled (pun intended) by the PetroDollar creation and "exorbitant priviledge" that the US obtained by having the global reserve currency - benefiting those closest to the money supply (Cantillon effect) while hollowing out the US manufacturing and eventually devastating its middle and working classes (Triffin dilemma) - Arthur Hayes describes all this and much more as well as the likely outlook in his article - Energy Canceled. Absolutely required reading or listen to Guy Swan reading it and giving his additional interpetation.

Zoltan Pozsar of Credit Suisse explains how the money system is now being reset following the events of last few weeks and his article outlines a likely way forward - Bretton Woods III. His paper is somewhat dense, heavy reading and you might prefer to listen to Luc Gromen's more conversational explainer with Marty

All of this was well known to our forefathers

The writers of the American Constitution understood the dangers of money being controlled by any elite group and they did their best to include protections in the US constitution. It did take the bankers multiple decades and puppet presidents to circumvent these but do so they did. Thomas Jefferson could not have been more clear in his warning.

" If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around(these banks) will deprive the people of all property until their children wake up homeless on the continent their fathers conquered."

Islamic finace also recognised the dangers - you will likely be aware of the restrictions that forbid interest payments - read this interesting article from The Guardian

You will likely also be aware from schooldays that the Roman Empire collapsed because it expanded too much and the overhead became unbearable leading to the debasement of its money and inability to extract tax payments to support itself. Read more from Mises Institute. Here too, much of this will likely ring familiar.

So what can you do about it?

In theory Governments should respect Consent of the Governed and the 1948 Universal Declaration of Human Rights states that "The will of the people shall be the basis of the authority of government".

For you to decide if and to what extent governments today are acting in line with these principles. If not, what can you do about it?

The options you have are basically - Loyalty, Voice or Exit. 1. You can be loyal and accept what you are told - 2. you may (or may not) be able to voice disagreement and 3. you may (or may not!) be able to exit. Authoritarian governments will make everything except Loyalty difficult or even impossible - if in doubt, read George Orwell 1984 - or look just around at recent events today in many countries.

I'll be happy to delve deeper into this in subsequent letters if there is interest - for now I recommend you to read Sovereign Individual. It is a long read but each chapter starts with a summary and you can read the summaries of each chapter as a first step. Also - I'm happy to discuss with you - just reach out and let me know!

For those who prefer a structured reading list, check References

That's it!

No one can be told what The Matrix is.\ You have to see it for yourself.**

Do share this newsletter with any of your friends and family who might be interested.

You can easily ask questions or discuss any topics in the newsletters in our Telegram group - click the link here to join the group.\ You can also email me at: LetterFrom@rogerprice.me

💡Enjoy the newsletters in your own language : Dutch, French, German, Serbian, Chinese Traditional & Simplified, Thai and Burmese.

-

@ 6ad3e2a3:c90b7740

2025-05-20 13:44:28

@ 6ad3e2a3:c90b7740

2025-05-20 13:44:28I https://www.chrisliss.com/p/mstr a few months ago with the subtitle “The Only Stock,” and I’m starting to regret it. Now, it was trading at 396 on January 20 when I posted it and 404 now (even if it dipped 40 percent to 230 or so in between), but that’s not why I regret it. I pointed out it was not investable unless you’re willing to stomach large drawdowns, and anyone who bought then could exit with a small profit now had they not panic-sold along the way.

The reason I regret it is I don’t want to make public stock predictions because it adds stress to my life. I have not sold any of my shares yet, but something I’ve noticed recently has got me thinking about it, and stock tips are like a game of telephone wherein whoever is last in the chain might find out the wrong information and too late. And while every adult has agency and is responsible for his own financial decisions, I don’t want my readers losing money on account of anything I write.

My base case is still that MSTR becomes a trillion-dollar company, destroys the performance of the S&P, the Mag-7 and virtually any other equity portfolio most people would assemble. Michael Saylor is trading an infinitely-printable asset (his shares) for humanity’s best-ever, finite-supply digital gold, and that trade should be profitable for him and his shareholders in perpetuity.

I don’t know exactly what he plans to do when that trade is no longer available to him — either because no one takes fiat currency for bitcoin anymore or because his mNAV (market-cap-to-bitcoin-holding ratio) goes below one — but that’s not my main concern, either. At that point he’ll have so much bitcoin, he’ll probably become the world’s first and largest bitcoin bank and profit by making his pristine collateral available to individuals and institutions. Even at five percent interest, half a trillion in bitcoin would yield $25B in profits every year. Even at a modest 10x valuation, the stock would more than double from here.

I am also not overly concerned with Saylor’s present amount of convertible debt which is at low or zero rates and is only https://www.strategy.com/. He’s been conservative on that front and only issuing on favorable terms. I don’t doubt Saylor’s prescience, intelligence or business sense one bit.

What got me thinking were some Twitter posts by a former Salomon Brothers trader/prophet Josh Mandell https://x.com/JoshMandell6/status/1921597739458339193 recently. In November when bitcoin was mooning after the election, he predicted that on March 14th it would close at $84,000, and if it did it would then go on an epic run up to $444,000 this cycle.

A lot of people make predictions, a few of them come true, but rarely do they come true on the dot (it closed at exactly $84K according to some exchanges) and on such a specific timeframe. Now, maybe he just got lucky, or maybe he is a skilled trader who made one good prediction, but the reason he gave for his prediction, insofar as he gave one, was not some technical chart or quantitative analysis, but a memory he had from 30 years ago that got into his mind that he couldn’t shake. He didn’t get much more specific than that, other than that he was tuned into something that if he explained fully would make too many people think he had gone insane. And then the prediction came true on the dot months later.

Now I believe in the paranormal more than the average person. I do not think things are random, and insofar as they appear that way it’s only because we have incomplete information — even a coin toss is predictable if you knew the exact force and spin that was put on the coin. I think for whatever reason, this guy is plugged into something, and while I would never invest a substantial amount of money on that belief — not only are earnestly-made prophecies often delusions or even if correct wrongly interpreted — that he sold makes me think.

He gave more substantive reasons for selling than prophecy, by the way — he seems to think Saylor’s perpetual issuance of shares ATM (at the market) to buy more bitcoin is putting too much downward pressure on the stock. Obviously, selling shares — even if to buy the world’s most pristine collateral at a 2x-plus mNAV — reduces the short-term appreciation of those shares.

His thesis seems to be that Saylor is doing this even if he would be better off letting the price appreciate more, attracting more investors, squeezing more shorts, etc because he needs to improve his credit rating to tap into the convertible debt market to the extent he has promised ($42 billion more over the next few years) at favorable terms. But in doing this, he is souring common stock investors because they are not seeing the near-term appreciation they should on their holdings.

Now this is a trivial concern if over the long haul MSTR does what it has the last couple years which is to outperform by a wide margin not only every large cap stock and the S&P but bitcoin itself. And the bigger his stack of bitcoin, the more his stock should appreciate as bitcoin goes up. But markets do not operate linearly and rationally. Should he sour prospective buyers to a great enough extent, should he attract shorts (and supply them with available shares to borrow) to a great enough extent, perhaps there might be an mNAV-crushing cascade that drives people into other bitcoin treasury companies, ETFs or bitcoin itself.

Now Saylor as first mover and by far the largest publicly-traded treasury company has a significant advantage. Institutions are far less likely to invest in size in smaller treasury companies with shorter track records, and many of them are not allowed to invest in ETFs or bitcoin at all. And even if a lot of money did go into any of those vehicles, it would only drive the value of his assets up and hence his stock price, no matter the mNAV. But Josh Mandell sold his shares prior to a weekend where bitcoin went from 102K to 104K, the US announced a deal with China, the mag-7 had a big spike (AAPL was up 6.3 percent) and then MSTR’s stock went down from 416 to 404. As I said, he is on to something.

So what’s the real long-term risk? I don’t know. Maybe there’s something about the nature of bitcoin that long-term is not really amenable to third-party custody and administration. It’s a bearer asset (“not your keys, not your coins”), and introducing counterparty risk is antithetical to its core purpose, the separation of money and state, or in this case money and bank.

With the bitcoin network you can literally “be your own bank.” To transact in digital dollars you need a bank account — or at least a stable coin one mediated by a centralized entity like Tether. You can’t hold digital dollars in your mind via some memorized seed words like you can bitcoin, accessible anywhere in the world, the ledger of which is maintained by tens of thousands of individually-run nodes. This property which democratizes value storage in the way gold did, except now you can wield your purchasing power globally, might be so antithetical to communal storage via corporation or bank that doing so is doomed to catastrophe.

We’ve already seen this happen with exchanges via FTX and Mt. Gox. Counterparty risk is one of the problems bitcoin was created to solve, so moving that risk from a fractionally reserved international banking system to corporate balance sheets still very much a part of that system is probably not the seismic advancement integral to the technology’s promise.

But this is more of a philosophical concern rather than a concrete one. To get more specific, it’s easy to imagine Coinbase, if indeed that’s where MSTR custodies its coins, gets hacked or https://www.chrisliss.com/p/soft-landing, i.e., seized by an increasingly desperate and insolvent government. Or maybe Coinbase simply doesn’t have the coins it purports like FTX, or a rogue band of employees, working on behalf of some powerful faction for “https://www.chrisliss.com/national-security-and-public-healt” executes the rug pull. Even if you deem these scenarios unlikely, they are not unfathomable.

Beyond outright counterparty malfeasance, there are other risks — what if owning common stock in an enterprise that simply holds bitcoin falls out of favor? Imagine if some new individual custody solution emerges wherein you have direct access to the coins themselves in an “even a boomer can do this” kind of way wherein there’s no compelling reason to own common stock with its junior claims to the capital stack in the event of insolvency? Why stand in line behind debt holders and preferred shares when you can invest in something that’s directly withdrawable and accessible if world events spike volatility to a systemic breaking point?

Things need not even get that rocky for this to be a concern — just the perception that they might could spook people into realizing common stock of a corporate balance sheet might be less than ideal as your custody solution.

Moreover, Saylor himself presents some risk. He could be compromised or blackmailed, he could lose his cool or get into an accident. These are low-probability scenarios, but also not unfathomable as any single point of failure is a target, especially for those factions who stand to lose unimaginable wealth and power should his speculative attack on the system succeed at scale.

Finally, even if Saylor remains free to operate as he sees fit, there is what I’d call the Icarus risk — he might be too ambitious, too hell-bent on acquiring bitcoin at all costs, too much of a maniac in service of his vision. Remember, he initially bought bitcoin during the covid crash and concomitant massive money print upon his prescient realization that businesses providing goods and services couldn’t possibly keep pace with inflation over the long haul. He was merely playing defense to preserve his capital, and now, despite his sizable lead and secured position is still throwing forward passes in the fourth quarter rather than running out the clock and securing the W.

Saylor is now arguably less a bitcoin maximalist and advocate, articulately making the case for superior money and individual sovereignty, but a corporate titan hell-bent on world domination via apex-predator-status balance sheet. When is enough enough? Many of the greatest conquerors in history pushed their empires too far until they fractured. In fact, 25 years ago MSTR was a big winner before the dot-com crash during which its stock price and most of Saylor’s fortune were wiped out when he was sued by the SEC for accounting fraud (he subsequently settled).

Now it’s possible, he learned from that experience, got up off the mat and figured out how to avoid his youthful mistakes. But it’s also possible his character is such that he will repeat it again, only this time at scale.

But as I said, my base case is MSTR is a trillion-dollar market cap, and the stock runs in parallel with bitcoin’s ascendance over the next decade. Saylor has been https://www.strategy.com/, prescient, bold and responsible so far over this iteration. I view Mandell’s concerns as valid, but similar to Wall St’s ones about AMZN’s Jeff Bezos who relentlessly ignored their insistence on profitability for a decade as he plowed every dollar into building out productive capacity and turned the company into the $2T world-dominating retail giant it is now.

Again, I haven’t (yet) sold any of my shares or even call options. But because I posted about this in January I felt I should at least follow-up with a more detailed rundown of what I take to be the risks. As always, do your own due diligence with any prospective investment.

-

@ 5d4b6c8d:8a1c1ee3

2025-05-20 13:39:22

@ 5d4b6c8d:8a1c1ee3

2025-05-20 13:39:22https://youtu.be/US9iYJNTOkU

I had no idea Tosh was still doing anything, much less that he talks about sports.

https://stacker.news/items/984547

-

@ 6ad3e2a3:c90b7740

2025-05-20 13:38:04

@ 6ad3e2a3:c90b7740

2025-05-20 13:38:04When I was a kid, I wanted to be rich, but found the prospect of hard work tedious, pointless and soul-crushing. Instead of studying for exams, getting some job and clawing your way up the ladder, I wondered why we couldn’t just build a device that measured your brain capacity and awarded you the money you would have made had you applied yourself. Eliminate the middleman, so to speak, the useless paper pushing evoked by the word “career.”

But when you think about it, it’s not really money you’re after, as money is but purchasing power, and so it’s the things money can provide like a nice lifestyle and the peace of mind that comes from not worrying about it. And it’s not really the lifestyle or financial independence, per se, since moment to moment what’s in your bank account isn’t determining your mental state, but the feeling those things give you — a sense of expansiveness and freedom.

But if you did have such a machine, and it awarded you the money, you probably wouldn’t have that kind of expansiveness and freedom, especially if you did nothing to achieve those things. You would still feel bored, distracted and unsatisfied despite unrestricted means to travel or dine out as you saw fit. People who win the lottery, for example, tend to revert to their prior level of satisfaction in short order.

The feeling you really want then is the sense of rising to a challenge, negotiating and adapting to your environment, persevering in a state of uncertainty, tapping into your resourcefulness and creativity. It’s only while operating at the edge of your capacity you could ever be so fulfilled. In fact, in such a state the question of your satisfaction level would never come up. You wouldn’t even think to wonder about it you’d be so engrossed.

So what you really crave is a mind device that encourages you to adapt to your environment using your full creative capabilities in the present moment, so much so you realize if you do not do this, you have the sense of squandering your life in a tedious, pointless and soul-crushing way. You need to be totally stuck, without the option of turning back. In sum, you need to face reality exactly as it is, without any escape therefrom.

The measure of your mind in that case is your reality itself. The device is already with you — it’s the world you are presently creating with the consciousness you have, providing you avenues to escape, none of which are satisfactory, none that can lead to the state you truly desire. You have a choice to pursue them fruitlessly and wind up at square one, or to abandon them and attain your freedom. No matter how many times you go down a false road, you wind up at the same place until you give up on the Sisyphean task and proceed in earnest.

My childhood fantasy was real, it turns out, only I had misunderstood its meaning.

-

@ cefb08d1:f419beff

2025-05-20 13:26:14

@ cefb08d1:f419beff

2025-05-20 13:26:14https://www.youtube.com/watch?v=jIydjo4B25U

The GWM Catch Up Day 2: Western Australia pushes CT to the ultimate test in all or nothing bouts:

https://www.youtube.com/watch?v=4zwuqs6iTPg

Women and Men Results:

https://stacker.news/items/984538

-

@ 472f440f:5669301e

2025-05-20 13:01:09

@ 472f440f:5669301e

2025-05-20 13:01:09Marty's Bent

via me