-

@ 04ce30c2:59ea576a

2025-05-20 04:19:25

@ 04ce30c2:59ea576a

2025-05-20 04:19:25Em uma sociedade verdadeiramente livre, o indivíduo tem o direito de escolher como guardar e transferir valor. Isso inclui a liberdade de escolher qual moeda usar, sem coerção, monopólios ou imposições estatais. A concorrência entre moedas permite que as melhores propriedades monetárias prevaleçam de forma natural e voluntária.

Moeda imposta é controle

Quando uma única moeda é forçada por lei, seja por decreto estatal ou por exigências institucionais, o usuário perde a soberania sobre seu próprio patrimônio. Isso abre espaço para inflação arbitrária, bloqueios de transações, congelamento de fundos e vigilância massiva.

Concorrência monetária é essencial

A liberdade monetária implica a coexistência de várias moedas competindo entre si. Cada uma traz suas características e vantagens específicas. A escolha deve estar nas mãos do usuário, não em autoridades centralizadas.

A melhor moeda tende a se tornar o padrão

No longo prazo, a moeda com melhores propriedades monetárias, como previsibilidade, descentralização, auditabilidade e liquidez, tende a ser adotada como padrão de referência para precificação, poupança e comércio global.

O Bitcoin é a moeda mais forte nesse sentido. Mas isso não impede que outras moedas coexistam como ferramentas complementares em contextos específicos.

Conversão é liberdade

Se o usuário quiser por exemplo mais privacidade ao comprar um café ou pagar uma conta, ele pode facilmente trocar seus bitcoins por monero e usá-los conforme sua necessidade. A possibilidade de trocar entre moedas é parte essencial da liberdade financeira.

Uma sociedade livre permite a escolha. O padrão monetário deve emergir do consenso do mercado, não de imposições. Que o Bitcoin se torne o padrão não por decreto, mas por mérito. E que outras moedas existam para servir à liberdade individual em toda sua complexidade.

-

@ 7953d1fa:69c8039d

2025-05-20 02:39:56

@ 7953d1fa:69c8039d

2025-05-20 02:39:56No mundo digital em constante evolução, plataformas de entretenimento online vêm ganhando espaço entre os brasileiros que buscam diversão, emoção e recompensas. Uma das opções que tem se destacado recentemente é a KK999, uma plataforma moderna, segura e repleta de oportunidades para jogadores de todos os níveis. Com uma ampla gama de jogos envolventes e uma experiência de usuário otimizada, o KK999 está conquistando cada vez mais adeptos no Brasil.

Introdução à Plataforma KK999 O KK999 se diferencia por oferecer uma experiência completa e intuitiva desde o primeiro acesso. A interface da plataforma foi cuidadosamente projetada para ser amigável, permitindo que novos usuários se cadastrem rapidamente e naveguem com facilidade. Tudo é pensado para garantir que o jogador tenha uma experiência fluida, sem complicações e com total transparência.

Além disso, o kk999se destaca por sua forte infraestrutura de segurança. Utilizando tecnologia de criptografia de ponta, os dados dos usuários são protegidos em todas as transações, garantindo tranquilidade para quem deseja apenas se divertir. Outro ponto importante é o suporte ao cliente, que está disponível 24 horas por dia, com atendimento em português, pronto para auxiliar com qualquer dúvida ou necessidade.

Variedade de Jogos para Todos os Gostos Um dos grandes atrativos do KK999 é a impressionante variedade de jogos disponíveis. Desde os tradicionais jogos de cartas até opções modernas com gráficos avançados, a plataforma atende todos os estilos de jogadores. Entre os destaques, estão as famosas roletas virtuais, jogos de pesca interativa, slot machines com temas variados e jogos ao vivo que simulam a sensação de estar em uma sala de jogos física.

Os slots, por exemplo, são um sucesso entre os brasileiros, oferecendo desde títulos clássicos com frutas e números até aventuras temáticas com bônus emocionantes. Os jogos de cartas também têm grande popularidade, incluindo versões modernas de pôquer, bacará e outros jogos estratégicos que desafiam a mente do jogador.

Para quem gosta de competir em tempo real, o KK999 oferece jogos ao vivo com crupiês reais e interatividade instantânea, proporcionando uma experiência imersiva e cheia de adrenalina. Tudo isso com transmissões de alta qualidade e conexão estável.

Experiência do Jogador: Diversão e Confiabilidade A experiência do jogador é uma das maiores prioridades do KK999. Desde o primeiro cadastro até as jogadas mais avançadas, a plataforma investe em funcionalidades que aumentam o conforto e a confiança do usuário. A navegação é rápida, os jogos carregam com eficiência e as recompensas são distribuídas com agilidade.

Outro fator que atrai muitos jogadores é o sistema de bônus e promoções. O KK999 frequentemente disponibiliza ofertas especiais para novos membros e prêmios para usuários frequentes, incentivando a fidelidade e aumentando ainda mais as chances de ganhar.

Além disso, o KK999 oferece uma experiência totalmente otimizada para dispositivos móveis. Seja no celular ou tablet, o jogador pode acessar todos os recursos da plataforma de qualquer lugar, a qualquer momento, sem perder desempenho ou qualidade.

Conclusão O KK999 se consolida como uma das principais plataformas de entretenimento digital no Brasil, reunindo inovação, segurança e uma variedade impressionante de jogos. Ideal tanto para iniciantes quanto para jogadores experientes, o site oferece tudo o que é necessário para transformar momentos comuns em experiências emocionantes.

-

@ 7953d1fa:69c8039d

2025-05-20 02:39:23

@ 7953d1fa:69c8039d

2025-05-20 02:39:23O cenário do entretenimento online no Brasil vem evoluindo rapidamente, e uma das plataformas que mais se destaca atualmente é a 8CC. Com uma proposta moderna, intuitiva e voltada para a melhor experiência do usuário, a 8CC conquistou a confiança de milhares de jogadores que buscam diversão, praticidade e oportunidades de ganhos reais em um ambiente seguro.

Conhecendo a Plataforma 8CC A 8CC é uma plataforma digital desenvolvida para atender tanto iniciantes quanto jogadores experientes. Sua interface amigável e bem organizada facilita a navegação mesmo para quem nunca teve contato com esse tipo de entretenimento antes. Compatível com computadores, tablets e celulares, o site é totalmente responsivo, o que significa que você pode se divertir de qualquer lugar, a qualquer hora.

Um dos diferenciais da 8cc é o seu compromisso com a segurança dos usuários. A plataforma utiliza tecnologia de criptografia de ponta para garantir a proteção de dados pessoais e transações financeiras. Além disso, o suporte ao cliente está sempre disponível para tirar dúvidas, resolver problemas e oferecer o melhor atendimento possível.

Diversidade de Jogos para Todos os Gostos Na 8CC, os jogadores têm acesso a uma vasta seleção de jogos online, desenvolvidos pelos principais provedores do mercado internacional. Isso garante alta qualidade gráfica, mecânicas inovadoras e excelente desempenho.

Entre os jogos mais populares da plataforma estão:

Slots (caça-níqueis): com temas variados, rodadas bônus e jackpots progressivos que proporcionam grandes emoções.

Jogos de mesa clássicos: como roleta, blackjack e bacará, com versões que imitam perfeitamente a experiência de jogo ao vivo.

Jogos com crupiês em tempo real: transmitidos com qualidade HD, esses jogos trazem interatividade e realismo, permitindo que o jogador se sinta dentro de um ambiente físico de alto padrão.

A plataforma também disponibiliza jogos de habilidade e apostas esportivas ao vivo, oferecendo uma experiência ainda mais completa e personalizada de acordo com o perfil de cada usuário.

Experiência do Jogador na 8CC Quem já experimentou jogar na 8CC sabe o quanto a plataforma valoriza o conforto e a satisfação de seus usuários. Desde o momento do cadastro até o resgate de ganhos, tudo é feito de forma simples, rápida e segura. O processo de registro é intuitivo, exigindo apenas alguns dados básicos, e os métodos de pagamento são variados, aceitando transferências bancárias, carteiras digitais e até criptomoedas.

Outro destaque é o sistema de recompensas e promoções. A 8CC frequentemente oferece bônus de boas-vindas, rodadas grátis e campanhas especiais para usuários fiéis, o que aumenta ainda mais as chances de ganhar e prolonga a diversão. Além disso, a plataforma promove torneios e desafios semanais com prêmios atrativos, incentivando a competição saudável entre os jogadores.

Por Que Escolher a 8CC? Existem muitas razões para escolher a 8CC como sua principal plataforma de jogos online:

Confiabilidade e segurança em todas as operações;

Variedade de jogos para todos os perfis;

Interface moderna e de fácil navegação;

Promoções e bônus frequentes;

Atendimento ao cliente eficiente e disponível 24 horas.

Se você busca uma experiência diferenciada, com diversão garantida e a possibilidade de transformar seu tempo livre em momentos empolgantes, a 8CC é a escolha certa. Descubra agora mesmo tudo o que essa plataforma inovadora tem a oferecer e junte-se à comunidade que está revolucionando o entretenimento digital no Brasil.

-

@ 502ab02a:a2860397

2025-05-20 01:22:31

@ 502ab02a:a2860397

2025-05-20 01:22:31พอพูดถึงบริษัทอย่าง Formo ที่ทำชีสโดยไม่ใช้วัวเลย คนส่วนใหญ่จะนึกถึงคำว่า “นวัตกรรม” “ยั่งยืน” “ลดโลกร้อน” กันเป็นด่านแรก แต่พอเฮียมองทะลุม่านควันพวกนี้ไป จะเห็นทุนรายใหญ่ที่หนุนหลังอยู่ ซึ่งหลายเจ้าก็ไม่ใช่ผู้พิทักษ์โลก แต่เป็นผู้เล่นตัวจี๊ดในอุตสาหกรรมอาหารโลกมายาวนาน

หนึ่งในนั้นคือบริษัทจากเกาหลีใต้ชื่อ CJ CheilJedang ซึ่งอาจฟังดูไกลตัว แต่จริงๆ แล้ว เฮียว่าชื่อนี้โผล่ตามซองอาหารสำเร็จรูปในครัวคนไทยหลายบ้านโดยไม่รู้ตัว

ถ้าจะเข้าใจ Formo ให้ถึงแก่น เราต้องมองไปถึงทุนที่ “ใส่เงิน” และ “ใส่จุดยืน” ลงไปในบริษัทนั้น และหนึ่งในผู้ถือหุ้นรายสำคัญก็คือ CJ CheilJedang บริษัทเกาหลีใต้ที่ก่อตั้งมาตั้งแต่ปี 1953 โดยเริ่มจากการเป็นโรงงานผลิตน้ำตาล จากนั้นก็กินรวบแทบทุกวงจรอาหารของเกาหลี

โปรไฟล์ CJ แค่เห็นภาพรวมก็ขนลุกแล้วครับ ลูกพี่เราแข็งแกร่งขนาดไหน - เป็นเจ้าของแบรนด์ Bibigo ที่เราอาจจะคุ้นในสินค้า กิมจิ และ CJ Foods ที่มีขายทั่วโลก -เป็นผู้ผลิต กรดอะมิโน รายใหญ่ของโลก เช่น ไลซีน, ทรีโอนีน, ทริปโตแฟน ที่ใช้เป็นวัตถุดิบในอาหารสัตว์ แต่ตอนนี้หลายบริษัทเอาไปใส่ใน Plant-based food แล้วเคลมว่าเป็นโปรตีนสมบูรณ์ -เป็นเจ้าของโรงงานผลิต แบคทีเรียสายพันธุ์พิเศษ สำหรับการหมักหลายประเภท -ขึ้นชื่อเรื่อง bioscience โดยเฉพาะ precision fermentation ซึ่งเป็นเทคโนโลยีเดียวกับที่ Formo ใช้ผลิตเคซีน (โปรตีนในนมวัว)

แปลว่า CJ ไม่ได้มาลงทุนใน Formo แบบ “หวังผลกำไรเฉยๆ” แต่เขามองเห็น “อนาคตใหม่ของอาหาร” ที่ตัวเองจะเป็นเจ้าของต้นน้ำยันปลายน้ำ

คำถามก็คือเบื้องลึกการลงทุนใน Formo ใครได้อะไร? Formo ปิดรอบระดมทุน Series A ได้ประมาณ 50 ล้านดอลลาร์สหรัฐ เมื่อปี 2021 โดยมีนักลงทุนหลายเจ้า เช่น EQT Ventures, Elevat3 Capital, Atomico แต่ CJ CheilJedang ก็เป็นหนึ่งในผู้ลงทุนเชิงกลยุทธ์ (strategic investor) ที่เข้ามาแบบไม่ใช่แค่ลงเงิน แต่เอา เทคโนโลยี + เครือข่ายโรงงาน + ซัพพลายเชนระดับโลก มาเสริมให้ Formo ขยายได้เร็วขึ้น

การจับมือกันครั้งนี้มีนัยยะสำคัญครับ -Formo ได้ เทคโนโลยีหมักจุลินทรีย์ (ที่ CJ ถนัดมาก) และช่องทางกระจายสินค้าในเอเชีย -CJ ได้ ถือหุ้นในบริษัทที่กำลังจะเปลี่ยนภาพ “ผลิตภัณฑ์จากนม” ให้กลายเป็นสิ่งที่ไม่ต้องมีสัตว์อีกต่อไป ซึ่งจะเป็นกลยุทธ์สำคัญในการสร้างแบรนด์อาหารแห่งอนาคต ที่นมจะต้องมาจากโรงงานผลิตเท่านั้นจึงจะมีคุณสมบัติที่ดีทั้งสารอาหารและความสะอาด

CJ เองก็เคยประกาศต่อสื่อว่า อยากเป็น “Global Lifestyle Company” ซึ่งฟังดูเบาๆ แต่จริงๆ คือแผนใหญ่ในการ เปลี่ยนวิธีการกินของคนทั้งโลกได้เลยเช่นกัน -จาก “อาหารจริง” ไปเป็น “อาหารสังเคราะห์” (synthetic food) -จาก “ฟาร์มสัตว์” ไปเป็น “ถังหมักจุลินทรีย์” -จาก “ความหลากหลายตามธรรมชาติ” ไปเป็น “สูตรกลาง” ที่ควบคุมได้ในระดับโมเลกุล

การหนุนหลัง Formo จึงไม่ใช่เรื่องบังเอิญ แต่เป็นอีกหนึ่งหมากในกระดานใหญ่ที่ CJ วางไว้ เพื่อเป็นเจ้าของอาหารอนาคตแบบไม่ต้องเลี้ยงหมู ไก่ วัว แต่ครองเทคโนโลยีแทน

คำถามคือแล้วผู้บริโภคจะรู้ทันไหมว่า เบื้องหลังชีสที่ไม่มีวัว อาจมี “ทุนที่อยากครองโลกอาหาร” คำที่เคลมว่า “ยั่งยืน” อาจสร้างระบบอาหารใหม่ที่ยิ่งห่างจากธรรมชาติเข้าไปทุกที

คนที่เคย “กลัวสารเคมี” ในอาหารแปรรูป กลับกลืนผลิตภัณฑ์จากห้องแล็บ โดยคิดว่า “มันคือความสะอาดและอนาคต” #pirateketo #กูต้องรู้มั๊ย #ม้วนหางสิลูก #siamstr

-

@ 472f440f:5669301e

2025-05-20 02:00:54

@ 472f440f:5669301e

2025-05-20 02:00:54Marty's Bent

https://www.youtube.com/watch?v=p0Sj1sG05VQ

Here's a great presentation from our good friend nostr:nprofile1qyx8wumn8ghj7cnjvghxjmcpp4mhxue69uhkummn9ekx7mqqyz2hj3zg2g3pqwxuhg69zgjhke4pcmjmmdpnndnefqndgqjt8exwj6ee8v7 , President of The Nakamoto Institute titled Hodl for Good. He gave it earlier this year at the BitBlockBoom Conference, and I think it's something everyone reading this should take 25 minutes to watch. Especially if you find yourself wondering whether or not it's a good idea to spend bitcoin at any given point in time. Michael gives an incredible Austrian Economics 101 lesson on the importance of lowering one's time preference and fully understanding the importance of hodling bitcoin. For the uninitiated, it may seem that the hodl meme is nothing more than a call to hoard bitcoins in hopes of getting rich eventually. However, as Michael points out, there's layers to the hodl meme and the good that hodling can bring individuals and the economy overall.

The first thing one needs to do to better understand the hodl meme is to completely flip the framing that is typically thrust on bitcoiners who encourage others to hodl. Instead of ceding that hodling is a greedy or selfish action, remind people that hodling, or better known as saving, is the foundation of capital formation, from which all productive and efficient economic activity stems. Number go up technology is great and it really matters. It matters because it enables anybody leveraging that technology to accumulate capital that can then be allocated toward productive endeavors that bring value to the individual who creates them and the individual who buys them.

When one internalizes this, it enables them to turn to personal praxis and focus on minimizing present consumption while thinking of ways to maximize long-term value creation. Live below your means, stack sats, and use the time that you're buying to think about things that you want in the future. By lowering your time preference and saving in a harder money you will have the luxury of demanding higher quality goods in the future. Another way of saying this is that you will be able to reshape production by voting with your sats. Initially when you hold them off the market by saving them - signaling that the market doesn't have goods worthy of your sats - and ultimately by redeploying them into the market when you find higher quality goods that meet the standards desire.

The first part of this equation is extremely important because it sends a signal to producers that they need to increase the quality of their work. As more and more individuals decide to use bitcoin as their savings technology, the signal gets stronger. And over many cycles we should begin to see low quality cheap goods exit the market in favor of higher quality goods that provide more value and lasts longer and, therefore, make it easier for an individual to depart with their hard-earned and hard-saved sats. This is only but one aspect that Michael tries to imbue throughout his presentation.

The other is the ability to buy yourself leisure time when you lower your time preference and save more than you spend. When your savings hit a critical tipping point that gives you the luxury to sit back and experience true leisure, which Michael explains is not idleness, but the contemplative space to study, create art, refine taste, and to find what "better goods" actually are. Those who can experience true leisure while reaping the benefits of saving in a hard asset that is increasing in purchasing power significantly over the long term are those who build truly great things. Things that outlast those who build them. Great art, great monuments, great institutions were all built by men who were afforded the time to experience leisure. Partly because they were leveraging hard money as their savings and the place they stored the profits reaped from their entrepreneurial endeavors.

If you squint and look into the future a couple of decades, it isn't hard to see a reality like this manifesting. As more people begin to save in Bitcoin, the forces of supply and demand will continue to come into play. There will only ever be 21 million bitcoin, there are around 8 billion people on this planet, and as more of those 8 billion individuals decide that bitcoin is the best savings vehicle, the price of bitcoin will rise.

When the price of bitcoin rises, it makes all other goods cheaper in bitcoin terms and, again, expands the entrepreneurial opportunity. The best part about this feedback loop is that even non-holders of bitcoin benefit through higher real wages and faster tech diffusion. The individuals and business owners who decide to hodl bitcoin will bring these benefits to the world whether you decide to use bitcoin or not.

This is why it is virtuous to hodl bitcoin. The potential for good things to manifest throughout the world increase when more individuals decide to hodl bitcoin. And as Michael very eloquently points out, this does not mean that people will not spend their bitcoin. It simply means that they have standards for the things that they will spend their bitcoin on. And those standards are higher than most who are fully engrossed in the high velocity trash economy have today.

In my opinion, one of those higher causes worthy of a sats donation is nostr:nprofile1qyfhwumn8ghj7enjv4jhyetvv9uju7re0gq3uamnwvaz7tmfdemxjmrvv9nk2tt0w468v6tvd3skwefwvdhk6qpqwzc9lz2f40azl98shkjewx3pywg5e5alwqxg09ew2mdyeey0c2rqcfecft . Consider donating so they can preserve and disseminate vital information about bitcoin and its foundations.

The Shell Game: How Health Narratives May Distract from Vaccine Risks

In our recent podcast, Dr. Jack Kruse presented a concerning theory about public health messaging. He argues that figures like Casey and Callie Means are promoting food and exercise narratives as a deliberate distraction from urgent vaccine issues. While no one disputes healthy eating matters, Dr. Kruse insists that focusing on "Froot Loops and Red Dye" diverts attention from what he sees as immediate dangers of mRNA vaccines, particularly for children.

"It's gonna take you 50 years to die from processed food. But the messenger jab can drop you like Damar Hamlin." - Dr Jack Kruse

Dr. Kruse emphasized that approximately 25,000 children per month are still receiving COVID vaccines despite concerns, with 3 million doses administered since Trump's election. This "shell game," as he describes it, allows vaccines to remain on childhood schedules while public attention fixates on less immediate health threats. As host, I believe this pattern deserves our heightened scrutiny given the potential stakes for our children's wellbeing.

Check out the full podcast here for more on Big Pharma's alleged bioweapons program, the "Time Bank Account" concept, and how Bitcoin principles apply to health sovereignty.

Headlines of the Day

Aussie Judge: Bitcoin is Money, Possibly CGT-Exempt - via X

JPMorgan to Let Clients Buy Bitcoin Without Direct Custody - via X

Get our new STACK SATS hat - via tftcmerch.io

Mubadala Acquires 384,239 sats | $408.50M Stake in BlackRock Bitcoin ETF - via X

Take the First Step Off the Exchange

Bitkey is an easy, secure way to move your Bitcoin into self-custody. With simple setup and built-in recovery, it’s the perfect starting point for getting your coins off centralized platforms and into cold storage—no complexity, no middlemen.

Take control. Start with Bitkey.

Use the promo code “TFTC20” during checkout for 20% off

Ten31, the largest bitcoin-focused investor, has deployed 158,469 sats | $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

I've been walking from my house around Town Lake in Austin in the mornings and taking calls on the walk. Big fan of a walking call.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ 8bad92c3:ca714aa5

2025-05-20 01:45:00

@ 8bad92c3:ca714aa5

2025-05-20 01:45:00Marty's Bent

Here's a great presentation from our good friend Michael Goldstein, President of The Nakamoto Institute titled Hodl for Good. He gave it earlier this year at the BitBlockBoom Conference, and I think it's something everyone reading this should take 25 minutes to watch. Especially if you find yourself wondering whether or not it's a good idea to spend bitcoin at any given point in time. Michael gives an incredible Austrian Economics 101 lesson on the importance of lowering one's time preference and fully understanding the importance of hodling bitcoin. For the uninitiated, it may seem that the hodl meme is nothing more than a call to hoard bitcoins in hopes of getting rich eventually. However, as Michael points out, there's layers to the hodl meme and the good that hodling can bring individuals and the economy overall.

The first thing one needs to do to better understand the hodl meme is to completely flip the framing that is typically thrust on bitcoiners who encourage others to hodl. Instead of ceding that hodling is a greedy or selfish action, remind people that hodling, or better known as saving, is the foundation of capital formation, from which all productive and efficient economic activity stems. Number go up technology is great and it really matters. It matters because it enables anybody leveraging that technology to accumulate capital that can then be allocated toward productive endeavors that bring value to the individual who creates them and the individual who buys them.

When one internalizes this, it enables them to turn to personal praxis and focus on minimizing present consumption while thinking of ways to maximize long-term value creation. Live below your means, stack sats, and use the time that you're buying to think about things that you want in the future. By lowering your time preference and saving in a harder money you will have the luxury of demanding higher quality goods in the future. Another way of saying this is that you will be able to reshape production by voting with your sats. Initially when you hold them off the market by saving them - signaling that the market doesn't have goods worthy of your sats - and ultimately by redeploying them into the market when you find higher quality goods that meet the standards desire.

The first part of this equation is extremely important because it sends a signal to producers that they need to increase the quality of their work. As more and more individuals decide to use bitcoin as their savings technology, the signal gets stronger. And over many cycles we should begin to see low quality cheap goods exit the market in favor of higher quality goods that provide more value and lasts longer and, therefore, make it easier for an individual to depart with their hard-earned and hard-saved sats. This is only but one aspect that Michael tries to imbue throughout his presentation.

The other is the ability to buy yourself leisure time when you lower your time preference and save more than you spend. When your savings hit a critical tipping point that gives you the luxury to sit back and experience true leisure, which Michael explains is not idleness, but the contemplative space to study, create art, refine taste, and to find what "better goods" actually are. Those who can experience true leisure while reaping the benefits of saving in a hard asset that is increasing in purchasing power significantly over the long term are those who build truly great things. Things that outlast those who build them. Great art, great monuments, great institutions were all built by men who were afforded the time to experience leisure. Partly because they were leveraging hard money as their savings and the place they stored the profits reaped from their entrepreneurial endeavors.

If you squint and look into the future a couple of decades, it isn't hard to see a reality like this manifesting. As more people begin to save in Bitcoin, the forces of supply and demand will continue to come into play. There will only ever be 21 million bitcoin, there are around 8 billion people on this planet, and as more of those 8 billion individuals decide that bitcoin is the best savings vehicle, the price of bitcoin will rise.

When the price of bitcoin rises, it makes all other goods cheaper in bitcoin terms and, again, expands the entrepreneurial opportunity. The best part about this feedback loop is that even non-holders of bitcoin benefit through higher real wages and faster tech diffusion. The individuals and business owners who decide to hodl bitcoin will bring these benefits to the world whether you decide to use bitcoin or not.

This is why it is virtuous to hodl bitcoin. The potential for good things to manifest throughout the world increase when more individuals decide to hodl bitcoin. And as Michael very eloquently points out, this does not mean that people will not spend their bitcoin. It simply means that they have standards for the things that they will spend their bitcoin on. And those standards are higher than most who are fully engrossed in the high velocity trash economy have today.

In my opinion, one of those higher causes worthy of a sats donation is The Nakamoto Institute. Consider donating so they can preserve and disseminate vital information about bitcoin and its foundations.

The Shell Game: How Health Narratives May Distract from Vaccine Risks

In our recent podcast, Dr. Jack Kruse presented a concerning theory about public health messaging. He argues that figures like Casey and Callie Means are promoting food and exercise narratives as a deliberate distraction from urgent vaccine issues. While no one disputes healthy eating matters, Dr. Kruse insists that focusing on "Froot Loops and Red Dye" diverts attention from what he sees as immediate dangers of mRNA vaccines, particularly for children.

"It's gonna take you 50 years to die from processed food. But the messenger jab can drop you like Damar Hamlin." - Dr Jack Kruse

Dr. Kruse emphasized that approximately 25,000 children per month are still receiving COVID vaccines despite concerns, with 3 million doses administered since Trump's election. This "shell game," as he describes it, allows vaccines to remain on childhood schedules while public attention fixates on less immediate health threats. As host, I believe this pattern deserves our heightened scrutiny given the potential stakes for our children's wellbeing.

Check out the full podcast here for more on Big Pharma's alleged bioweapons program, the "Time Bank Account" concept, and how Bitcoin principles apply to health sovereignty.

Headlines of the Day

Aussie Judge: Bitcoin is Money, Possibly CGT-Exempt - via X

JPMorgan to Let Clients Buy Bitcoin Without Direct Custody - via X

Get our new STACK SATS hat - via tftcmerch.io

Mubadala Acquires $408.5M Stake in BlackRock Bitcoin ETF - via X

Take the First Step Off the Exchange

Bitkey is an easy, secure way to move your Bitcoin into self-custody. With simple setup and built-in recovery, it’s the perfect starting point for getting your coins off centralized platforms and into cold storage—no complexity, no middlemen.

Take control. Start with Bitkey.

Use the promo code *“TFTC20”* during checkout for 20% off

Ten31, the largest bitcoin-focused investor, has deployed 158,469 sats | $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

I've been walking from my house around Town Lake in Austin in the mornings and taking calls on the walk. Big fan of a walking call.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

@media screen and (max-width: 480px) { .mobile-padding { padding: 10px 0 !important; } .social-container { width: 100% !important; max-width: 260px !important; } .social-icon { padding: 0 !important; } .social-icon img { height: 32px !important; width: 32px !important; } .icon-cell { padding: 0 4px !important; } } .mj-column-per-33-333333333333336 { width: 25% !important; max-width: 25%; } .moz-text-html .mj-column-per-33-333333333333336 { width: 25% !important; max-width: 25%; } /* Helps with rendering in various email clients */ body { margin: 0 !important; padding: 0 !important; -webkit-text-size-adjust: 100% !important; -ms-text-size-adjust: 100% !important; } img { -ms-interpolation-mode: bicubic; } /* Prevents Gmail from changing the text color in email threads */ .im { color: inherit !important; }

[ @ 6e0ea5d6:0327f353

2025-05-20 01:35:20

@ 6e0ea5d6:0327f353

2025-05-20 01:35:20**Ascolta bene! ** A man's sentimental longing, though often disguised in noble language and imagination, is a sickness—not a virtue.

It begins as a slight inclination toward tenderness, cloaked in sweetness. Then it reveals itself as a masked addiction: a constant need to be seen by a woman, validated by her, and reciprocated—as if someone else's affection were the only anchor preventing the shipwreck of his emotions.

The man who understands the weight of leadership seeks no applause, no gratitude, not even romantic love. He knows that his role is not theatrical but structural. He is not measured by the emotion he evokes, but by the stability he ensures. Being a true man is not ornamental. He is not a decorative symbol in the family frame.

We live in an era where male roles have been distorted by an overindulgence in emotion. The man stopped guiding and began asking for direction. His firmness was exchanged for softness, his decisiveness for hesitation. Trying to please, many have given up authority. Trying to love, they’ve begun to bow. A man who begs for validation within his own home is not a leader—he is a guest. And when the patriarch has to ask for a seat at the table he should preside over and sustain, something has already been irreversibly inverted.

Unexamined longing turns into pleading. And all begging is the antechamber of humiliation. A man who never learned to cultivate dignified solitude will inevitably fall to his knees in desperation. And then, he yields. Yields to mediocre presence, to shallow affection, to constant disrespect. He smiles while he bleeds, praises the one who despises him, accepts crumbs and pretends it’s a banquet. All of it, cazzo... just to avoid the horror of being alone.

Davvero, amico mio, for the men who beg for romance, only the consolation of being remembered will remain—not with respect, but with pity and disgust.

The modern world feeds the fragile with illusions, but reality spits them out. Sentimental longing is now celebrated as sensitivity. But every man who nurtures it as an excuse will, sooner or later, pay for it with his dignity.

Thank you for reading, my friend!

If this message resonated with you, consider leaving your "🥃" as a token of appreciation.

A toast to our family!

-

@ c296b5f7:c7282b53

2025-05-19 23:35:17

@ c296b5f7:c7282b53

2025-05-19 23:35:17testee

-

@ c296b5f7:c7282b53

2025-05-19 23:18:42

@ c296b5f7:c7282b53

2025-05-19 23:18:42 -

@ c296b5f7:c7282b53

2025-05-19 23:17:49

@ c296b5f7:c7282b53

2025-05-19 23:17:49https://curtlink.com/user/login powerdigital f1950610#@

-

@ c296b5f7:c7282b53

2025-05-19 23:16:33

@ c296b5f7:c7282b53

2025-05-19 23:16:33enter in leaders group https://chat.whatsapp.com/EhI9fGsMbGPHd2cF5KQwC9

-

@ 85fb39c4:81498307

2025-05-19 23:14:21

@ 85fb39c4:81498307

2025-05-19 23:14:21teste

-

@ 85fb39c4:81498307

2025-05-19 23:07:11

@ 85fb39c4:81498307

2025-05-19 23:07:11It's my first post

-

@ 4ba8e86d:89d32de4

2025-05-19 22:33:46

@ 4ba8e86d:89d32de4

2025-05-19 22:33:46O que é Cwtch? Cwtch (/kʊtʃ/ - uma palavra galesa que pode ser traduzida aproximadamente como “um abraço que cria um lugar seguro”) é um protocolo de mensagens multipartidário descentralizado, que preserva a privacidade, que pode ser usado para construir aplicativos resistentes a metadados.

Como posso pronunciar Cwtch? Como "kutch", para rimar com "butch".

Descentralizado e Aberto : Não existe “serviço Cwtch” ou “rede Cwtch”. Os participantes do Cwtch podem hospedar seus próprios espaços seguros ou emprestar sua infraestrutura para outras pessoas que buscam um espaço seguro. O protocolo Cwtch é aberto e qualquer pessoa é livre para criar bots, serviços e interfaces de usuário e integrar e interagir com o Cwtch.

Preservação de privacidade : toda a comunicação no Cwtch é criptografada de ponta a ponta e ocorre nos serviços cebola Tor v3.

Resistente a metadados : O Cwtch foi projetado de forma que nenhuma informação seja trocada ou disponibilizada a ninguém sem seu consentimento explícito, incluindo mensagens durante a transmissão e metadados de protocolo

Uma breve história do bate-papo resistente a metadados Nos últimos anos, a conscientização pública sobre a necessidade e os benefícios das soluções criptografadas de ponta a ponta aumentou com aplicativos como Signal , Whatsapp e Wire. que agora fornecem aos usuários comunicações seguras.

No entanto, essas ferramentas exigem vários níveis de exposição de metadados para funcionar, e muitos desses metadados podem ser usados para obter detalhes sobre como e por que uma pessoa está usando uma ferramenta para se comunicar.

Uma ferramenta que buscou reduzir metadados é o Ricochet lançado pela primeira vez em 2014. Ricochet usou os serviços cebola Tor v2 para fornecer comunicação criptografada segura de ponta a ponta e para proteger os metadados das comunicações.

Não havia servidores centralizados que auxiliassem no roteamento das conversas do Ricochet. Ninguém além das partes envolvidas em uma conversa poderia saber que tal conversa está ocorrendo.

Ricochet tinha limitações; não havia suporte para vários dispositivos, nem existe um mecanismo para suportar a comunicação em grupo ou para um usuário enviar mensagens enquanto um contato está offline.

Isto tornou a adoção do Ricochet uma proposta difícil; mesmo aqueles em ambientes que seriam melhor atendidos pela resistência aos metadados, sem saber que ela existe.

Além disso, qualquer solução para comunicação descentralizada e resistente a metadados enfrenta problemas fundamentais quando se trata de eficiência, privacidade e segurança de grupo conforme definido pelo consenso e consistência da transcrição.

Alternativas modernas ao Ricochet incluem Briar , Zbay e Ricochet Refresh - cada ferramenta procura otimizar para um conjunto diferente de compensações, por exemplo, Briar procura permitir que as pessoas se comuniquem mesmo quando a infraestrutura de rede subjacente está inoperante, ao mesmo tempo que fornece resistência à vigilância de metadados.

O projeto Cwtch começou em 2017 como um protocolo de extensão para Ricochet, fornecendo conversas em grupo por meio de servidores não confiáveis, com o objetivo de permitir aplicativos descentralizados e resistentes a metadados como listas compartilhadas e quadros de avisos.

Uma versão alfa do Cwtch foi lançada em fevereiro de 2019 e, desde então, a equipe do Cwtch dirigida pela OPEN PRIVACY RESEARCH SOCIETY conduziu pesquisa e desenvolvimento em cwtch e nos protocolos, bibliotecas e espaços de problemas subjacentes.

Modelo de Risco.

Sabe-se que os metadados de comunicações são explorados por vários adversários para minar a segurança dos sistemas, para rastrear vítimas e para realizar análises de redes sociais em grande escala para alimentar a vigilância em massa. As ferramentas resistentes a metadados estão em sua infância e faltam pesquisas sobre a construção e a experiência do usuário de tais ferramentas.

https://nostrcheck.me/media/public/nostrcheck.me_9475702740746681051707662826.webp

O Cwtch foi originalmente concebido como uma extensão do protocolo Ricochet resistente a metadados para suportar comunicações assíncronas de grupos multiponto por meio do uso de infraestrutura anônima, descartável e não confiável.

Desde então, o Cwtch evoluiu para um protocolo próprio. Esta seção descreverá os vários riscos conhecidos que o Cwtch tenta mitigar e será fortemente referenciado no restante do documento ao discutir os vários subcomponentes da Arquitetura Cwtch.

Modelo de ameaça.

É importante identificar e compreender que os metadados são omnipresentes nos protocolos de comunicação; é de facto necessário que tais protocolos funcionem de forma eficiente e em escala. No entanto, as informações que são úteis para facilitar peers e servidores também são altamente relevantes para adversários que desejam explorar tais informações.

Para a definição do nosso problema, assumiremos que o conteúdo de uma comunicação é criptografado de tal forma que um adversário é praticamente incapaz de quebrá-lo veja tapir e cwtch para detalhes sobre a criptografia que usamos, e como tal nos concentraremos em o contexto para os metadados de comunicação.

Procuramos proteger os seguintes contextos de comunicação:

• Quem está envolvido em uma comunicação? Pode ser possível identificar pessoas ou simplesmente identificadores de dispositivos ou redes. Por exemplo, “esta comunicação envolve Alice, uma jornalista, e Bob, um funcionário público”.

• Onde estão os participantes da conversa? Por exemplo, “durante esta comunicação, Alice estava na França e Bob estava no Canadá”.

• Quando ocorreu uma conversa? O momento e a duração da comunicação podem revelar muito sobre a natureza de uma chamada, por exemplo, “Bob, um funcionário público, conversou com Alice ao telefone por uma hora ontem à noite. Esta é a primeira vez que eles se comunicam.” *Como a conversa foi mediada? O fato de uma conversa ter ocorrido por meio de um e-mail criptografado ou não criptografado pode fornecer informações úteis. Por exemplo, “Alice enviou um e-mail criptografado para Bob ontem, enquanto eles normalmente enviam apenas e-mails de texto simples um para o outro”.

• Sobre o que é a conversa? Mesmo que o conteúdo da comunicação seja criptografado, às vezes é possível derivar um contexto provável de uma conversa sem saber exatamente o que é dito, por exemplo, “uma pessoa ligou para uma pizzaria na hora do jantar” ou “alguém ligou para um número conhecido de linha direta de suicídio na hora do jantar”. 3 horas da manhã."

Além das conversas individuais, também procuramos defender-nos contra ataques de correlação de contexto, através dos quais múltiplas conversas são analisadas para obter informações de nível superior:

• Relacionamentos: Descobrir relações sociais entre um par de entidades analisando a frequência e a duração de suas comunicações durante um período de tempo. Por exemplo, Carol e Eve ligam uma para a outra todos os dias durante várias horas seguidas.

• Cliques: Descobrir relações sociais entre um grupo de entidades que interagem entre si. Por exemplo, Alice, Bob e Eva se comunicam entre si.

• Grupos vagamente conectados e indivíduos-ponte: descobrir grupos que se comunicam entre si através de intermediários, analisando cadeias de comunicação (por exemplo, toda vez que Alice fala com Bob, ela fala com Carol quase imediatamente depois; Bob e Carol nunca se comunicam).

• Padrão de Vida: Descobrir quais comunicações são cíclicas e previsíveis. Por exemplo, Alice liga para Eve toda segunda-feira à noite por cerca de uma hora. Ataques Ativos

Ataques de deturpação.

O Cwtch não fornece registro global de nomes de exibição e, como tal, as pessoas que usam o Cwtch são mais vulneráveis a ataques baseados em declarações falsas, ou seja, pessoas que fingem ser outras pessoas:

O fluxo básico de um desses ataques é o seguinte, embora também existam outros fluxos:

•Alice tem um amigo chamado Bob e outro chamado Eve

• Eve descobre que Alice tem um amigo chamado Bob

• Eve cria milhares de novas contas para encontrar uma que tenha uma imagem/chave pública semelhante à de Bob (não será idêntica, mas pode enganar alguém por alguns minutos)

• Eve chama essa nova conta de "Eve New Account" e adiciona Alice como amiga.

• Eve então muda seu nome em "Eve New Account" para "Bob"

• Alice envia mensagens destinadas a "Bob" para a conta falsa de Bob de Eve Como os ataques de declarações falsas são inerentemente uma questão de confiança e verificação, a única maneira absoluta de evitá-los é os usuários validarem absolutamente a chave pública. Obviamente, isso não é o ideal e, em muitos casos, simplesmente não acontecerá .

Como tal, pretendemos fornecer algumas dicas de experiência do usuário na interface do usuário para orientar as pessoas na tomada de decisões sobre confiar em contas e/ou distinguir contas que possam estar tentando se representar como outros usuários.

Uma nota sobre ataques físicos A Cwtch não considera ataques que exijam acesso físico (ou equivalente) à máquina do usuário como praticamente defensáveis. No entanto, no interesse de uma boa engenharia de segurança, ao longo deste documento ainda nos referiremos a ataques ou condições que exigem tal privilégio e indicaremos onde quaisquer mitigações que implementámos falharão.

Um perfil Cwtch.

Os usuários podem criar um ou mais perfis Cwtch. Cada perfil gera um par de chaves ed25519 aleatório compatível com Tor.

Além do material criptográfico, um perfil também contém uma lista de Contatos (outras chaves públicas do perfil Cwtch + dados associados sobre esse perfil, como apelido e (opcionalmente) mensagens históricas), uma lista de Grupos (contendo o material criptográfico do grupo, além de outros dados associados, como apelido do grupo e mensagens históricas).

Conversões entre duas partes: ponto a ponto

https://nostrcheck.me/media/public/nostrcheck.me_2186338207587396891707662879.webp

Para que duas partes participem de uma conversa ponto a ponto, ambas devem estar on-line, mas apenas uma precisa estar acessível por meio do serviço Onion. Por uma questão de clareza, muitas vezes rotulamos uma parte como “ponto de entrada” (aquele que hospeda o serviço cebola) e a outra parte como “ponto de saída” (aquele que se conecta ao serviço cebola).

Após a conexão, ambas as partes adotam um protocolo de autenticação que:

• Afirma que cada parte tem acesso à chave privada associada à sua identidade pública.

• Gera uma chave de sessão efêmera usada para criptografar todas as comunicações futuras durante a sessão.

Esta troca (documentada com mais detalhes no protocolo de autenticação ) é negável offline , ou seja, é possível para qualquer parte falsificar transcrições desta troca de protocolo após o fato e, como tal - após o fato - é impossível provar definitivamente que a troca aconteceu de forma alguma.

Após o protocolo de autenticação, as duas partes podem trocar mensagens livremente.

Conversas em Grupo e Comunicação Ponto a Servidor

Ao iniciar uma conversa em grupo, é gerada uma chave aleatória para o grupo, conhecida como Group Key. Todas as comunicações do grupo são criptografadas usando esta chave. Além disso, o criador do grupo escolhe um servidor Cwtch para hospedar o grupo. Um convite é gerado, incluindo o Group Key, o servidor do grupo e a chave do grupo, para ser enviado aos potenciais membros.

Para enviar uma mensagem ao grupo, um perfil se conecta ao servidor do grupo e criptografa a mensagem usando a Group Key, gerando também uma assinatura sobre o Group ID, o servidor do grupo e a mensagem. Para receber mensagens do grupo, um perfil se conecta ao servidor e baixa as mensagens, tentando descriptografá-las usando a Group Key e verificando a assinatura.

Detalhamento do Ecossistema de Componentes

O Cwtch é composto por várias bibliotecas de componentes menores, cada uma desempenhando um papel específico. Algumas dessas bibliotecas incluem:

- abertoprivacidade/conectividade: Abstração de rede ACN, atualmente suportando apenas Tor.

- cwtch.im/tapir: Biblioteca para construção de aplicativos p2p em sistemas de comunicação anônimos.

- cwtch.im/cwtch: Biblioteca principal para implementação do protocolo/sistema Cwtch.

- cwtch.im/libcwtch-go: Fornece ligações C para Cwtch para uso em implementações de UI.

TAPIR: Uma Visão Detalhada

Projetado para substituir os antigos canais de ricochete baseados em protobuf, o Tapir fornece uma estrutura para a construção de aplicativos anônimos.

Está dividido em várias camadas:

• Identidade - Um par de chaves ed25519, necessário para estabelecer um serviço cebola Tor v3 e usado para manter uma identidade criptográfica consistente para um par.

• Conexões – O protocolo de rede bruto que conecta dois pares. Até agora, as conexões são definidas apenas através do Tor v3 Onion Services.

• Aplicativos - As diversas lógicas que permitem um determinado fluxo de informações em uma conexão. Os exemplos incluem transcrições criptográficas compartilhadas, autenticação, proteção contra spam e serviços baseados em tokens. Os aplicativos fornecem recursos que podem ser referenciados por outros aplicativos para determinar se um determinado peer tem a capacidade de usar um determinado aplicativo hospedado.

• Pilhas de aplicativos - Um mecanismo para conectar mais de um aplicativo, por exemplo, a autenticação depende de uma transcrição criptográfica compartilhada e o aplicativo peer cwtch principal é baseado no aplicativo de autenticação.

Identidade.

Um par de chaves ed25519, necessário para estabelecer um serviço cebola Tor v3 e usado para manter uma identidade criptográfica consistente para um peer.

InitializeIdentity - de um par de chaves conhecido e persistente:i,I

InitializeEphemeralIdentity - de um par de chaves aleatório: ie,Ie

Aplicativos de transcrição.

Inicializa uma transcrição criptográfica baseada em Merlin que pode ser usada como base de protocolos baseados em compromisso de nível superior

O aplicativo de transcrição entrará em pânico se um aplicativo tentar substituir uma transcrição existente por uma nova (aplicando a regra de que uma sessão é baseada em uma e apenas uma transcrição).

Merlin é uma construção de transcrição baseada em STROBE para provas de conhecimento zero. Ele automatiza a transformação Fiat-Shamir, para que, usando Merlin, protocolos não interativos possam ser implementados como se fossem interativos.

Isto é significativamente mais fácil e menos sujeito a erros do que realizar a transformação manualmente e, além disso, também fornece suporte natural para:

• protocolos multi-round com fases alternadas de commit e desafio;

• separação natural de domínios, garantindo que os desafios estejam vinculados às afirmações a serem provadas;

• enquadramento automático de mensagens, evitando codificação ambígua de dados de compromisso;

• e composição do protocolo, usando uma transcrição comum para vários protocolos.

Finalmente, o Merlin também fornece um gerador de números aleatórios baseado em transcrição como defesa profunda contra ataques de entropia ruim (como reutilização de nonce ou preconceito em muitas provas). Este RNG fornece aleatoriedade sintética derivada de toda a transcrição pública, bem como dos dados da testemunha do provador e uma entrada auxiliar de um RNG externo.

Conectividade Cwtch faz uso do Tor Onion Services (v3) para todas as comunicações entre nós.

Fornecemos o pacote openprivacy/connectivity para gerenciar o daemon Tor e configurar e desmontar serviços cebola através do Tor.

Criptografia e armazenamento de perfil.

Os perfis são armazenados localmente no disco e criptografados usando uma chave derivada de uma senha conhecida pelo usuário (via pbkdf2).

Observe que, uma vez criptografado e armazenado em disco, a única maneira de recuperar um perfil é recuperando a senha - como tal, não é possível fornecer uma lista completa de perfis aos quais um usuário pode ter acesso até inserir uma senha.

Perfis não criptografados e a senha padrão Para lidar com perfis "não criptografados" (ou seja, que não exigem senha para serem abertos), atualmente criamos um perfil com uma senha codificada de fato .

Isso não é o ideal, preferiríamos confiar no material de chave fornecido pelo sistema operacional, de modo que o perfil fosse vinculado a um dispositivo específico, mas esses recursos são atualmente uma colcha de retalhos - também notamos, ao criar um perfil não criptografado, pessoas que usam Cwtch estão explicitamente optando pelo risco de que alguém com acesso ao sistema de arquivos possa descriptografar seu perfil.

Vulnerabilidades Relacionadas a Imagens e Entrada de Dados

Imagens Maliciosas

O Cwtch enfrenta desafios na renderização de imagens, com o Flutter utilizando Skia, embora o código subjacente não seja totalmente seguro para a memória.

Realizamos testes de fuzzing nos componentes Cwtch e encontramos um bug de travamento causado por um arquivo GIF malformado, levando a falhas no kernel. Para mitigar isso, adotamos a política de sempre habilitar cacheWidth e/ou cacheHeight máximo para widgets de imagem.

Identificamos o risco de imagens maliciosas serem renderizadas de forma diferente em diferentes plataformas, como evidenciado por um bug no analisador PNG da Apple.

Riscos de Entrada de Dados

Um risco significativo é a interceptação de conteúdo ou metadados por meio de um Input Method Editor (IME) em dispositivos móveis. Mesmo aplicativos IME padrão podem expor dados por meio de sincronização na nuvem, tradução online ou dicionários pessoais.

Implementamos medidas de mitigação, como enableIMEPersonalizedLearning: false no Cwtch 1.2, mas a solução completa requer ações em nível de sistema operacional e é um desafio contínuo para a segurança móvel.

Servidor Cwtch.

O objetivo do protocolo Cwtch é permitir a comunicação em grupo através de infraestrutura não confiável .

Ao contrário dos esquemas baseados em retransmissão, onde os grupos atribuem um líder, um conjunto de líderes ou um servidor confiável de terceiros para garantir que cada membro do grupo possa enviar e receber mensagens em tempo hábil (mesmo que os membros estejam offline) - infraestrutura não confiável tem o objetivo de realizar essas propriedades sem a suposição de confiança.

O artigo original do Cwtch definia um conjunto de propriedades que se esperava que os servidores Cwtch fornecessem:

• O Cwtch Server pode ser usado por vários grupos ou apenas um.

• Um servidor Cwtch, sem a colaboração de um membro do grupo, nunca deve aprender a identidade dos participantes de um grupo.

• Um servidor Cwtch nunca deve aprender o conteúdo de qualquer comunicação.

• Um servidor Cwtch nunca deve ser capaz de distinguir mensagens como pertencentes a um grupo específico. Observamos aqui que essas propriedades são um superconjunto dos objetivos de design das estruturas de Recuperação de Informações Privadas.

Melhorias na Eficiência e Segurança

Eficiência do Protocolo

Atualmente, apenas um protocolo conhecido, o PIR ingênuo, atende às propriedades desejadas para garantir a privacidade na comunicação do grupo Cwtch. Este método tem um impacto direto na eficiência da largura de banda, especialmente para usuários em dispositivos móveis. Em resposta a isso, estamos ativamente desenvolvendo novos protocolos que permitem negociar garantias de privacidade e eficiência de maneiras diversas.

Os servidores, no momento desta escrita, permitem o download completo de todas as mensagens armazenadas, bem como uma solicitação para baixar mensagens específicas a partir de uma determinada mensagem. Quando os pares ingressam em um grupo em um novo servidor, eles baixam todas as mensagens do servidor inicialmente e, posteriormente, apenas as mensagens novas.

Mitigação de Análise de Metadados

Essa abordagem permite uma análise moderada de metadados, pois o servidor pode enviar novas mensagens para cada perfil suspeito exclusivo e usar essas assinaturas de mensagens exclusivas para rastrear sessões ao longo do tempo. Essa preocupação é mitigada por dois fatores:

- Os perfis podem atualizar suas conexões a qualquer momento, resultando em uma nova sessão do servidor.

- Os perfis podem ser "ressincronizados" de um servidor a qualquer momento, resultando em uma nova chamada para baixar todas as mensagens. Isso é comumente usado para buscar mensagens antigas de um grupo.

Embora essas medidas imponham limites ao que o servidor pode inferir, ainda não podemos garantir resistência total aos metadados. Para soluções futuras para esse problema, consulte Niwl.

Proteção contra Pares Maliciosos

Os servidores enfrentam o risco de spam gerado por pares, representando uma ameaça significativa à eficácia do sistema Cwtch. Embora tenhamos implementado um mecanismo de proteção contra spam no protótipo do Cwtch, exigindo que os pares realizem alguma prova de trabalho especificada pelo servidor, reconhecemos que essa não é uma solução robusta na presença de um adversário determinado com recursos significativos.

Pacotes de Chaves

Os servidores Cwtch se identificam por meio de pacotes de chaves assinados, contendo uma lista de chaves necessárias para garantir a segurança e resistência aos metadados na comunicação do grupo Cwtch. Esses pacotes de chaves geralmente incluem três chaves: uma chave pública do serviço Tor v3 Onion para o Token Board, uma chave pública do Tor v3 Onion Service para o Token Service e uma chave pública do Privacy Pass.

Para verificar os pacotes de chaves, os perfis que os importam do servidor utilizam o algoritmo trust-on-first-use (TOFU), verificando a assinatura anexada e a existência de todos os tipos de chave. Se o perfil já tiver importado o pacote de chaves do servidor anteriormente, todas as chaves são consideradas iguais.

Configuração prévia do aplicativo para ativar o Relé do Cwtch.

No Android, a hospedagem de servidor não está habilitada, pois essa opção não está disponível devido às limitações dos dispositivos Android. Essa funcionalidade está reservada apenas para servidores hospedados em desktops.

No Android, a única forma direta de importar uma chave de servidor é através do grupo de teste Cwtch, garantindo assim acesso ao servidor Cwtch.

Primeiro passo é Habilitar a opção de grupo no Cwtch que está em fase de testes. Clique na opção no canto superior direito da tela de configuração e pressione o botão para acessar as configurações do Cwtch.

Você pode alterar o idioma para Português do Brasil.Depois, role para baixo e selecione a opção para ativar os experimentos. Em seguida, ative a opção para habilitar o chat em grupo e a pré-visualização de imagens e fotos de perfil, permitindo que você troque sua foto de perfil.

https://pomf2.lain.la/f/eprhj0u3.mp4

Próximo passo é Criar um perfil.

Pressione o + botão de ação no canto inferior direito e selecione "Novo perfil" ou aberta no botão + adicionar novo perfil.

-

Selecione um nome de exibição

-

Selecione se deseja proteger

este perfil e salvo localmente com criptografia forte: Senha: sua conta está protegida de outras pessoas que possam usar este dispositivo

Sem senha: qualquer pessoa que tenha acesso a este dispositivo poderá acessar este perfil.

Preencha sua senha e digite-a novamente

Os perfis são armazenados localmente no disco e criptografados usando uma chave derivada de uma senha conhecida pelo usuário (via pbkdf2).

Observe que, uma vez criptografado e armazenado em disco, a única maneira de recuperar um perfil é recuperando a chave da senha - como tal, não é possível fornecer uma lista completa de perfis aos quais um usuário pode ter acesso até inserir um senha.

https://pomf2.lain.la/f/7p6jfr9r.mp4

O próximo passo é adicionar o FuzzBot, que é um bot de testes e de desenvolvimento.

Contato do FuzzBot: 4y2hxlxqzautabituedksnh2ulcgm2coqbure6wvfpg4gi2ci25ta5ad.

Ao enviar o comando "testgroup-invite" para o FuzzBot, você receberá um convite para entrar no Grupo Cwtch Test. Ao ingressar no grupo, você será automaticamente conectado ao servidor Cwtch. Você pode optar por sair do grupo a qualquer momento ou ficar para conversar e tirar dúvidas sobre o aplicativo e outros assuntos. Depois, você pode configurar seu próprio servidor Cwtch, o que é altamente recomendável. https://pomf2.lain.la/f/x4pm8hm8.mp4

Agora você pode utilizar o aplicativo normalmente. Algumas observações que notei: se houver demora na conexão com outra pessoa, ambas devem estar online. Se ainda assim a conexão não for estabelecida, basta clicar no ícone de reset do Tor para restabelecer a conexão com a outra pessoa.

Uma introdução aos perfis Cwtch.

Com Cwtch você pode criar um ou mais perfis . Cada perfil gera um par de chaves ed25519 aleatório compatível com a Rede Tor.

Este é o identificador que você pode fornecer às pessoas e que elas podem usar para entrar em contato com você via Cwtch.

Cwtch permite criar e gerenciar vários perfis separados. Cada perfil está associado a um par de chaves diferente que inicia um serviço cebola diferente.

Gerenciar Na inicialização, o Cwtch abrirá a tela Gerenciar Perfis. Nessa tela você pode:

- Crie um novo perfil.

- Desbloquear perfis.

- Criptografados existentes.

- Gerenciar perfis carregados.

- Alterando o nome de exibição de um perfil.

- Alterando a senha de um perfil Excluindo um perfil.

- Alterando uma imagem de perfil.

Backup ou exportação de um perfil.

Na tela de gerenciamento de perfil:

-

Selecione o lápis ao lado do perfil que você deseja editar

-

Role para baixo até a parte inferior da tela.

-

Selecione "Exportar perfil"

-

Escolha um local e um nome de arquivo.

5.confirme.

Uma vez confirmado, o Cwtch colocará uma cópia do perfil no local indicado. Este arquivo é criptografado no mesmo nível do perfil.

Este arquivo pode ser importado para outra instância do Cwtch em qualquer dispositivo.

Importando um perfil.

-

Pressione o +botão de ação no canto inferior direito e selecione "Importar perfil"

-

Selecione um arquivo de perfil Cwtch exportado para importar

-

Digite a senha associada ao perfil e confirme.

Uma vez confirmado, o Cwtch tentará descriptografar o arquivo fornecido usando uma chave derivada da senha fornecida. Se for bem-sucedido, o perfil aparecerá na tela Gerenciamento de perfil e estará pronto para uso.

OBSERVAÇÃO Embora um perfil possa ser importado para vários dispositivos, atualmente apenas uma versão de um perfil pode ser usada em todos os dispositivos ao mesmo tempo. As tentativas de usar o mesmo perfil em vários dispositivos podem resultar em problemas de disponibilidade e falhas de mensagens.

Qual é a diferença entre uma conexão ponto a ponto e um grupo cwtch?

As conexões ponto a ponto Cwtch permitem que 2 pessoas troquem mensagens diretamente. As conexões ponto a ponto nos bastidores usam serviços cebola Tor v3 para fornecer uma conexão criptografada e resistente a metadados. Devido a esta conexão direta, ambas as partes precisam estar online ao mesmo tempo para trocar mensagens.

Os Grupos Cwtch permitem que várias partes participem de uma única conversa usando um servidor não confiável (que pode ser fornecido por terceiros ou auto-hospedado). Os operadores de servidores não conseguem saber quantas pessoas estão em um grupo ou o que está sendo discutido. Se vários grupos estiverem hospedados em um único servidor, o servidor não conseguirá saber quais mensagens pertencem a qual grupo sem a conivência de um membro do grupo. Ao contrário das conversas entre pares, as conversas em grupo podem ser conduzidas de forma assíncrona, para que todos num grupo não precisem estar online ao mesmo tempo.

Por que os grupos cwtch são experimentais? Mensagens em grupo resistentes a metadados ainda são um problema em aberto . Embora a versão que fornecemos no Cwtch Beta seja projetada para ser segura e com metadados privados, ela é bastante ineficiente e pode ser mal utilizada. Como tal, aconselhamos cautela ao usá-lo e apenas o fornecemos como um recurso opcional.

Como posso executar meu próprio servidor Cwtch? A implementação de referência para um servidor Cwtch é de código aberto . Qualquer pessoa pode executar um servidor Cwtch, e qualquer pessoa com uma cópia do pacote de chaves públicas do servidor pode hospedar grupos nesse servidor sem que o operador tenha acesso aos metadados relacionados ao grupo .

https://git.openprivacy.ca/cwtch.im/server

https://docs.openprivacy.ca/cwtch-security-handbook/server.html

Como posso desligar o Cwtch? O painel frontal do aplicativo possui um ícone do botão "Shutdown Cwtch" (com um 'X'). Pressionar este botão irá acionar uma caixa de diálogo e, na confirmação, o Cwtch será desligado e todos os perfis serão descarregados.

Suas doações podem fazer a diferença no projeto Cwtch? O Cwtch é um projeto dedicado a construir aplicativos que preservam a privacidade, oferecendo comunicação de grupo resistente a metadados. Além disso, o projeto também desenvolve o Cofre, formulários da web criptografados para ajudar mútua segura. Suas contribuições apoiam iniciativas importantes, como a divulgação de violações de dados médicos em Vancouver e pesquisas sobre a segurança do voto eletrônico na Suíça. Ao doar, você está ajudando a fechar o ciclo, trabalhando com comunidades marginalizadas para identificar e corrigir lacunas de privacidade. Além disso, o projeto trabalha em soluções inovadoras, como a quebra de segredos através da criptografia de limite para proteger sua privacidade durante passagens de fronteira. E também tem a infraestrutura: toda nossa infraestrutura é open source e sem fins lucrativos. Conheça também o Fuzzytags, uma estrutura criptográfica probabilística para marcação resistente a metadados. Sua doação é crucial para continuar o trabalho em prol da privacidade e segurança online. Contribua agora com sua doação

https://openprivacy.ca/donate/

onde você pode fazer sua doação em bitcoin e outras moedas, e saiba mais sobre os projetos. https://openprivacy.ca/work/

Link sobre Cwtch

https://cwtch.im/

https://git.openprivacy.ca/cwtch.im/cwtch

https://docs.cwtch.im/docs/intro

https://docs.openprivacy.ca/cwtch-security-handbook/

Baixar #CwtchDev

cwtch.im/download/

https://play.google.com/store/apps/details?id=im.cwtch.flwtch

-

@ 6b0a60cf:b952e7d4

2025-05-19 22:33:33

@ 6b0a60cf:b952e7d4

2025-05-19 22:33:33タイトルは釣りです。そんなこと微塵も思っていません。 本稿はアウトボックスモデルの実装に関してうだうだ考えるコーナーです。 ダムスに関して何か言いたいわけではないので先にタイトル回収しておきます。

- NIP-65を守る気なんかさらさら無いのにNIP-65に書いてあるkind:10002のReadリレーの意味を知っていながら全然違う使い方をしているのは一部の和製クライアントの方だよね

- NIP-65を守る気が無いならkind:10002を使うべきではなく、独自仕様でリレーを保存するべきだよね

- アウトボックスモデルを採用しているクライアントからすれば仕様と異なる実装をしてしまっているクライアントが迷惑だと思われても仕方ないよね

- と考えればダムスの方が潔いよね

- とはいえkind:3のcontentは空にしろって言われてんだからやっぱダムスはゴミだわ

- やるとしたらRabbitみたいにローカルに保存するか、別デバイス間で同期したいならkind:30078を使うべきだよね

アウトボックスモデルはなぜ人気がないのか

言ってることはとてもいいと思うんですよ。 欠点があるとすれば、

- 末端のユーザーからすればreadリレーとwriteリレーと書かれると直感的にイメージされるものとかけ離れている

- 正しく設定してもらうには相当の説明が必要

- フォローTLを表示しようとすれば非常にたくさんのリレーと接続することになり現実的ではない

- なるほど完璧な作戦っスねーっ 不可能だという点に目をつぶればよぉ~

余談ですが昔irisでログインした時に localhost のリレーに繋ごうとしてiris壊れたって思ったけど今思えばアウトボックスモデルを忠実に実装してたんじゃないかな…。

現実的に実装する方法は無いのか

これでReadすべきリレーをシミュレーションできる。 https://nikolat.github.io/nostr-relay-trend/ フォローイーのWriteリレーを全部購読しようとすると100個近いリレー数になるので現実的ではありません。 しかしフォローイーのWriteリレーのうち1個だけでよい、とする条件を仮に追加すると一気にハードルが下がります。私の場合はReadリレー含めて7個のリレーに収まりました。 Nos Haikuはとりあえずこの方針でいくことにしました。

今後どうしていきたいのか

エンドユーザーとしての自分の志向としては、自分が指定したリレーだけを購読してほしい、勝手に余計なリレーを読みに行かないでほしい、という気持ちがあり、現状の和製クライアントの仕様を気に入っています。 仮にNos Haikuでアウトボックスモデルを採用しつつ自分の決めたリレーに接続するハイブリッド実装を考えるとすれば、

あなたの購読するリレーはこれですよー - Read(inbox) Relays (あなたへのメンションが届くリレー) - wss://relay1.example.com/ - wss://relay2.example.com/ - wss://relay3.example.com/ - Followee's Write Relays (フォローイーが書き込んでいるリレー) - wss://relay4.example.com/ - wss://relay5.example.com/ - wss://relay6.example.com/って出して、チェックボックス付けてON/OFFできるようにして最終的に購読するリレーをユーザーに決めてもらう感じかな……って漠然と考えています。よほど時間を持て余したときがあればやってみるかも。

あとリレーを数は仕方ないとしてリレーごとにフォローイーの投稿だけを取得するようにした方が理にかなってるよね。全部のリレーから全部のフォローイーの投稿を取得しようとしたら(実装はシンプルで楽だけど)通信量が大変だよね。 rx-nostr の Forward Strategy ってリレーごとにREQかえて一度に購読できるっけ?

常にひとつ以下の REQ サブスクリプションを保持します。

って書いてあるから無理なのかな? あとReadリレーは純粋に自分へのメンション(pタグ付き)イベントのみを購読するようにした方がいい気がする。スパム対策としてかなり有効だと思うので。スパムはNIP-65に準拠したりはしていないでしょうし。 まぁ、NIP-65に準拠していないクライアントからのメンションは届かなくなってしまうわけですが。

-

@ cae03c48:2a7d6671

2025-05-19 22:21:46

@ cae03c48:2a7d6671

2025-05-19 22:21:46Bitcoin Magazine

BitMine Launches Bitcoin Treasury Advisory Practice, Secures $4M Deal with First ClientToday, BitMine Immersion Technologies, Inc. (OTCQX: BMNRD) announced the launch of its Bitcoin Treasury Advisory Practice and a $4 million deal with a U.S. exchange-listed company. The deal saw Bitmine surpass its last year’s total revenue in that single transaction alone, according to the announcement.

BitMine ( OTCQX: $BMNRD $BMNR) launches Bitcoin Treasury Advisory Practice and secures $4M deal with first client.

This single transaction exceeds our 2024 revenue and sets the stage for major growth.

Read now: https://t.co/R89K3WXdZZ pic.twitter.com/5vIvlYPZUY

— Bitmine Immersion Technologies, Inc. (@BitMNR) May 19, 2025

BitMine will provide “Mining as a Service” (MaaS) by leasing 3,000 Bitcoin ASIC miners to the client through December 30, 2025, in a $3.2 million lease deal, with $1.6 million paid upfront. Additionally, the client has signed an $800,000 consulting agreement for one year focusing on Bitcoin Mining-as-a-Service and Bitcoin Treasury Strategy.

“Currently, there are almost 100 public companies that have adopted Bitcoin as a treasury holding. We expect this number to grow in the future. As more companies adopt Bitcoin treasury strategies, the need for infrastructure, revenue generation, and expert guidance grows along with it,” said Jonathan Bates, CEO of BitMine. “This single transaction is greater than our entire 2024 fiscal year revenue, and we feel there is an opportunity to acquire more clients in the near future as interest in Bitcoin ownership grows.”

BitMine’s first quarter 2025 results showed strong revenue growth, with GAAP revenue rising approximately 135% to $1.2 million, up from $511,000 in Q1 2024, supported by an expanded mining capacity of 4,640 miners as of November 30, 2024, compared to 1,606 the previous year. Despite this growth, the company reported a net loss of $3.9 million in Q1 2025, primarily due to a one-time, non-cash accounting adjustment related to preferred stock; excluding this charge, the adjusted loss was approximately $975,000, consistent with the prior year’s results.

$BMNR reports a 135% revenue increase YOY for Q1 2025 and tripled self-mining capacity with 3,000 new miners! CEO Jonathan Bates credits a team-driven approach and creative financing for this growth.

Read the full release here: https://t.co/slNrZv8Ocn pic.twitter.com/Gb4tk1UfAO— Bitmine Immersion Technologies, Inc. (@BitMNR) January 13, 2025

BitMine’s new Bitcoin Treasury Advisory Practice, along with the $4 million deal, joins a trend among public companies exploring Bitcoin not just as a treasury asset but also as a source of revenue.

This post BitMine Launches Bitcoin Treasury Advisory Practice, Secures $4M Deal with First Client first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ bf47c19e:c3d2573b

2025-05-19 21:41:37

@ bf47c19e:c3d2573b

2025-05-19 21:41:37Originalni tekst na bitcoin-balkan.com.

Pregled sadržaja

- Šta je Bitcoin?

- Šta Bitcoin može da učini za vas?

- Zašto ljudi kupuju Bitcoin?

- Da li je vaš novac siguran u dolarima, kućama, akcijama ili zlatu?

- Šta je bolje za štednju od dolara, kuća i akcija?

- Po čemu se Bitcoin razlikuje od ostalih valuta?

- kako Bitcoin spašava svet?

- Kako mogu da saznam više o Bitcoin-u?

Bitcoin čini da štednja novca bude kul – i praktična – ponovo. Ovaj članak objašnjava kako i zašto.

Šta je Bitcoin?

Bitcoin se naziva digitalno zlato, mašina za istinu, blockchain, peer to peer mreža čvorova, energetski ponor i još mnogo toga. Bitcoin je, u stvari, sve ovo. Međutim, ova objašnjenja su često toliko tehnička i suvoparna, da bi većina ljudi radije gledala kako trava raste. Što je najvažnije, ova objašnjenja ne pokazuju kako Bitcoin ima bilo kakve koristi za vas.

iPod nije postao kulturološka senzacija jer ga je Apple nazvao „prenosnim digitalnim medijskim uređajem“. Postao je senzacija jer su ga zvali “1,000 pesama u vašem džepu.”

Ne zanima vas šta je Bitcoin. Vas zanima šta on može da učini za vas.

Baš kao i Internet, vaš auto, vaš telefon, kao i mnogi drugi uređaji i sistemi koje svakodnevno koristite, vi ne treba da znate šta je Bitcoin ili kako to funkcioniše da biste razumeli šta on može da učini za vas.

Šta Bitcoin može da učini za vas?

Bitcoin može da sačuva vaš teško zarađeni novac.

Bitcoin je stekao veliku pažnju u 2017. i 2018. godini zbog svoje spekulativne upotrebe. Mnogi ljudi su ga kupili nadajući se da će se obogatiti. Cena je naglo porasla, a zatim se srušila. Ovo nije bio prvi put da je Bitcoin uradio to. Međutim, niko nikada nije izgubio novac držeći bitcoin duže od 3,5 godine – ćak i ako je kupio na apsolutnim vrhovima.

Zašto Bitcoin konstantno raste? Ljudi počinju da shvataju koliko je Bitcoin moćan, kao način uštede novca u svetu u kojem je ’novac’ poput dolara, eura i drugih nacionalnih valuta dizajniran da gubi vrednost.

Ovo čini Bitcoin odličnom opcijom za štednju novca na nekoliko godina ili više. Bitcoin je bolji od štednje novca u dolarima, akcijama, nekretninama, pa čak i u zlatu.

Zato pokušajte da zaboravite na trenutak na razumevanje blockchaina, digitalne valute, kriptografije, seed fraza, novčanika, rudarstva i svih ostalih nerazumljivih termina. Za sada, razgovarajmo o tome zašto ljudi kupuju Bitcoin: razlog je prostiji nego što vi mislite.

Zašto ljudi kupuju Bitcoin?

Naravno, svako ima svoj razlog za kupovinu Bitcoin-a. Jedan od razloga, koji verovatno često čujete, je taj što mu vrednost raste. Ljudi žele da se obogate. Uskoče kao spekulanti, krenu u vožnju i najverovatnije ih prodaju ubrzo nakon kupovine.

Međutim, čak i kada cena krene naglo prema gore i strmoglavo padne nazad, mnogi ljudi ostanu i nakon tog pada. Otkud mi to znamo? Broj aktivnih novčanika dnevno, koji je otprilike sličan broju korisnika Bitcoin-a, nastavlja da raste. Takođe, nakon svakog balona u istoriji Bitcoin-a, cena se nikada ne vraća na svoju cenu pre balona. Uvek ostane malo višlja. Bitcoin se penje, a svaka masovna spekulativna serija dovodi sve više i više ljudi.

Broj aktivnih Bitcoin novčanika neprekidno raste

„Aktivna adresa“ znači da je neko tog dana poslao Bitcoin transakciju. Donji grafikon je na logaritamskoj skali.

Izvor: Glassnode

Izvor: GlassnodeCena Bitcoina se neprestano penje

Kroz istoriju Bitcoin-a možemo videti divlje kolebanje cena, ali nakon svakog balona, cena se ostaje višlja nego pre. Ovo je cena Bitcoin-a na logaritamskoj skali.

Izvor: Glassnode

Izvor: GlassnodeTo pokazuje da se ljudi zadržavaju: potražnja za Bitcoin-om se povećava. Da je svaki masovni rast cena bio samo balon koji su iscenirali prevaranti koji žele brzo da se obogate, cena bi se vratila na nivo pre balona. To se dogodilo sa lalama, ali ne i sa Bitcoin-om.

I zašto se onda cena Bitcoin-a stalno povećava? Sve veći broj ljudi čuva Bitcoin dugoročno – oni razumeju šta Bitcoin može učiniti za njihovu štednju.

Zašto ljudi štede svoj novac u Bitcoin-u umesto na štednim računima, kućama, deonicama ili zlatu? Hajde da pogledajmo sve te metode štednje, i zatim da ih uporedimo sa Bitcoin-om.

Da li je vaš novac siguran u dolarima, kućama, akcijama ili zlatu?

Tokom mnogo godina, to su bile pristojne opcije za štednju. Međutim, sistem koji podržava vrednost svega ovoga je u krizi.

Dolari, Euri, Dinari

Dolari i sve ostale „tradicionalne“ valute koje proizvode vlade, stvorene su da izgube vrednost kroz inflaciju. Banke i tradicionalni monetarni sistem uzrokuju inflaciju stalnim stvaranjem i distribucijom novog novca. Kada Američke Federalne Rezerve objave ciljanu stopu od 2% inflacije, to znači da žele da vaš novac svake godine izgubi 2% od svoje vrednosti. Čak i sa inflacijom od samo 2%, vaša štednja u dolarima izgubiće polovinu vrednosti tokom 40-godišnjeg radnog veka.

Izveštena inflacija se danas opasno povečava, uprkos rastućem „buretu sa barutom“ koji bi mogao da explodira i dovede do masivne hiperinflacije. Što je više valute u opticaju, to je više baruta u buretu.

Naše vlade su ekonomiju napunile valutama da bankarski sistem ne bi propao nakon finansijske krize koja se dogodila 2008. godine. Od tada je većina glavnih centralnih banaka postavila vrlo niske kamatne stope, što pojedincima i korporacijama omogućava dobijanje jeftinijih kredita. To znači da mnogi pojedinci i korporacije podižu ogromne kredite i koriste ih za kupovinu druge imovine poput deonica, umetničkih dela i nekretnina. Sve ovo pozajmljivanje znači da stvaramo tone novog novca i stavljamo ga u opticaj.

Računi za podsticaje (stimulus bills) COVID-19 za 2020. godinu unose trilione u sistem. Ovoliko stvaranje valuta na kraju dovodi do inflacije – velikog gubitka u vrednosti valute.

Količina američkog dolara u opticaju gotovo se udvostručila od marta 2020. godine. Izvor

Količina američkog dolara u opticaju gotovo se udvostručila od marta 2020. godine. IzvorRačuni za podsticaje su bez presedana, toliko da je neko izmislio meme da opiše ovu situaciju.

Resurs koji vlade mogu da naprave u većem broju da bi platile svoje račune? Ne zvuči kao dobro mesto za štednju novca.

Kuće

Kuće su tokom prošlog veka bile pristojan način štednje novca. Međutim, pad cena nekretnina 2007. godine doveo je do toga da su mnogi vlasnici kuća izgubili svu ušteđevinu.

Danas su kuće gotovo nepristupačne za prosečnog čoveka. Jedan od načina da se ovo izmeri je koliko godišnjih zarada treba prosečnom čoveku da zaradi ekvivalent vrednosti prosečne kuće. Prema CityLab-u, publikaciji Bloomberg-a koja pokriva gradove, porodica može da priuštiti određenu kuću ako košta manje od 2,6 godišnjih prihoda domaćinstva te porodice.

Međutim, prema RZS (Republički zavod za statistiku) prosečan prihod porodičnog domaćinstva u Srbiji iznosi oko 570 EUR mesečno ili otprilike 7.000 EUR godišnje. Nažalost, samo najjeftinija područja van gradova imaju srednje cene kuća od oko 2,6 prosečnih godišnjih prihoda domaćinstva. U većim gradovima poput Beograda i Novog Sada srednja cena kuće je veća od 10 prosečnih godišnjih prihoda jednog domaćinstva.

Ako nekako možete sebi da priuštite kuću, ona bi mogla biti pristojna zaliha vrednosti. Dokle god ne doživimo još jedan krah i izvršitelji zaplene ovu imovinu mnogim vlasnicima kuća.

Akcije

Berza je u prošlosti takođe dobro poslovala. Međutim, sporo i stabilno povećanje tržišta događa se u dosadnom, predvidljivom svetu. Svakog dana vidimo sve manje toga. Nakon ubrzanja korona virusa, videli smo smo najbrži pad američke berze u istoriji od 25% – brži od Velike depresije.

Neki se odlučuju za ulaganje u obveznice i drugu finansijsku imovinu, ali ’prinosi’ za tu imovinu – procenat kamate zarađene na imovinu iz godine u godinu – stalno opada. Sve veći broj odredjenih imovina ima čak i negativne prinose, što znači da posedovanje te imovine košta! Ovo je veliki problem za sve koji se oslanjaju na penziju. Plus, s obzirom na to da su akcije denominovane u tradicionalnim valutama poput dolara i evra, inflacija pojede prinos koji investitor dobije.

Najgore od svega je to što ti isti ekonomski krahovi koji uzrokuju masovna otpuštanja i teško tržište rada takođe znače i nagli pad cena akcija. Čuvanje ušteđevine u akcijama može značiti i gubitak štednje i gubitak posla zbog recesije. Teška vremena mogu da vas prisile da svoje akcije prodate po vrlo malim cenama samo da biste platili svoje račune.

A to nije baš siguran način štednje novca.

Zlato

Vrednost zlata neprekidno se povećavala tokom 5000 godina, obično padajući onda kada berza obećava jače prinose.

Evidencija vrednosti zlata je solidna. Međutim, zlato nosi i druge rizike. Većina ljudi poseduje zlato na papiru. Oni fizički ne poseduju zlato, već ga njihova banka čuva za njih. Zbog toga je zlato veoma podložno konfiskaciji od strane vlade.

Zašto bi vlada konfiskovala nečije zlato, a kamoli u demokratskoj zemlji u „slobodnom svetu“? Ali to se dešavalo i ranije. 1933. godine Izvršnom Naredbom 6102, predsednik Roosevelt naredio je svim Amerikancima da prodaju svoje zlato vladi u zamenu za papirne dolare. Vlada je iskoristila pretnju zatvorom za prikupljanje zlata u fizičkom obliku. Znali su da se zlato više poštuje kao zaliha vrednosti širom sveta od papirnih dolara.

Ako posedujete svoje zlato na nekoj od aplikacija za trgovanje akcijama, možete se kladiti da će vam ga država oduzeti ako joj zatreba. Čak i ako posedujete fizičko zlato, onda ga izlažete mogućnosti krađe – od strane kriminalca ili vaše vlade.

Vaša uštedjevina nije bezbedna.

Rast cena svih gore navedenih sredstava zavisi od našeg trenutnog političkog i ekonomskog sistema koji se nastavlja kao i tokom proteklih 100 godina. Međutim, danas vidimo ogromne pukotine u ovom sistemu.

Sistem ne funkcioniše dobro za većinu ljudi.

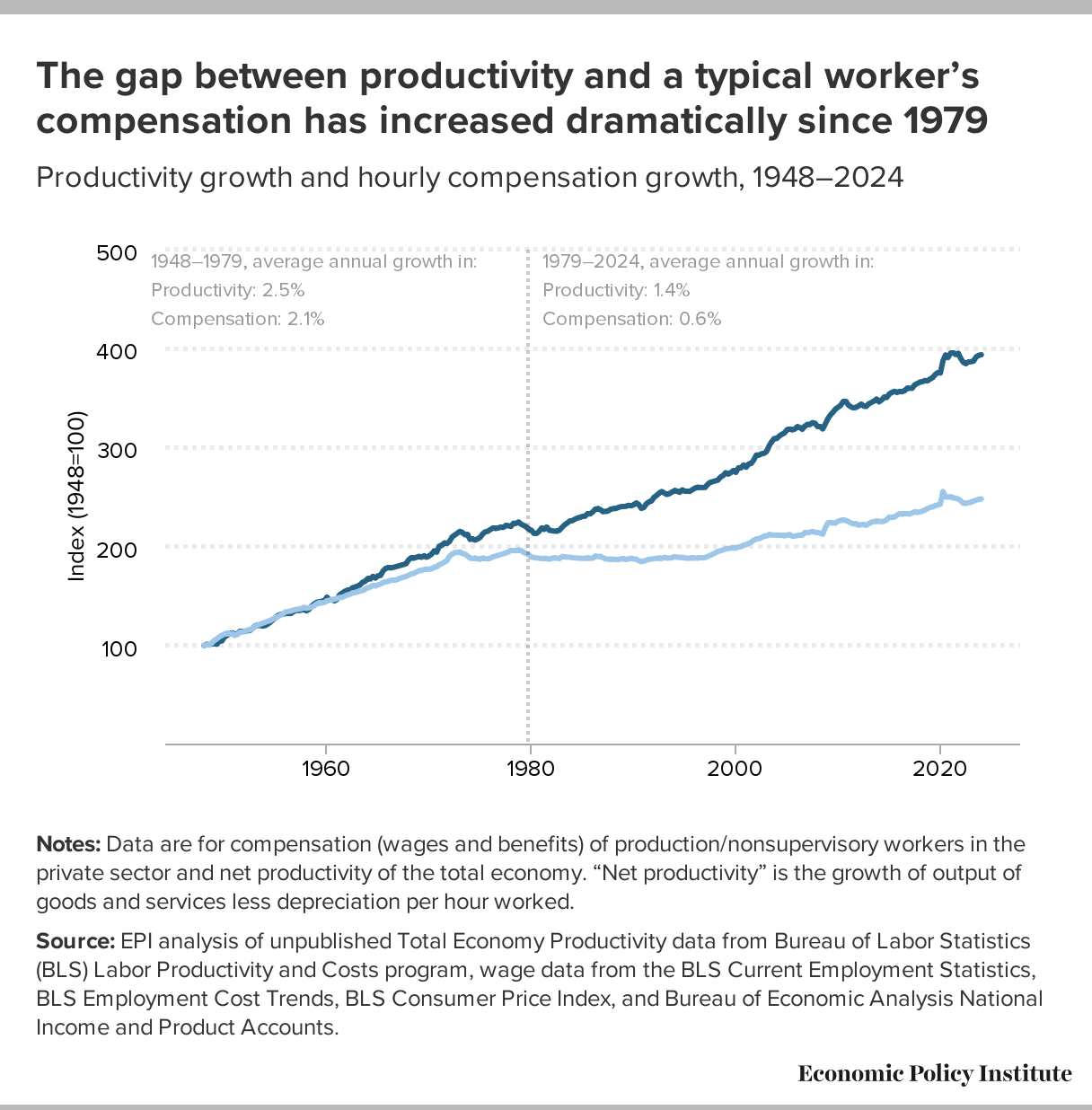

Od 1971. plate većine američkih radnika nisu rasle. S druge strane, bogatstvo koje imaju najbogatiji u društvu nalazi se na nivoima koji nisu viđeni više od 80 godina. U međuvremenu, ljudi sve manje i manje veruju institucijama poput banaka i vlada.

CBPP Nejednakost Bogatstva Tokom Vremena