-

@ e136fbe5:b6e8325d

2025-06-04 10:02:38

@ e136fbe5:b6e8325d

2025-06-04 10:02:38Trong thời đại công nghệ số và đô thị hóa nhanh chóng, Việt Nam đang chứng kiến làn sóng chuyển mình mạnh mẽ từ các thành phố truyền thống sang những khu đô thị thông minh với hệ thống hạ tầng hiện đại, kết nối số và lấy người dân làm trung tâm. Trong bối cảnh đó, EV8 đóng vai trò ngày càng quan trọng khi trở thành giải pháp hỗ trợ thiết thực cho mục tiêu phát triển đô thị bền vững, thân thiện với môi trường và thuận tiện cho người dân. Xe điện EV8 không chỉ giúp giảm thiểu ô nhiễm không khí, tiếng ồn mà còn tối ưu hóa quá trình di chuyển trong nội đô với công nghệ định vị, quản lý năng lượng và kết nối tức thời thông qua nền tảng số. Khi hạ tầng giao thông thông minh đang dần được hoàn thiện, EV8 kết hợp cùng các hệ thống đèn tín hiệu, trạm sạc công cộng, ứng dụng điều hướng, và dữ liệu thời gian thực để mang lại trải nghiệm di chuyển hiệu quả, an toàn và dễ dàng hơn. Điều này giúp người dùng không chỉ tiết kiệm chi phí mà còn chủ động trong từng hành trình, đồng thời nâng cao chất lượng sống trong môi trường đô thị văn minh. Tính linh hoạt, thân thiện và khả năng tích hợp công nghệ chính là những yếu tố khiến EV8 trở thành sự lựa chọn lý tưởng cho cư dân các thành phố thông minh tương lai.

Không dừng lại ở khía cạnh giao thông, EV8 còn đóng góp vào việc xây dựng một hệ sinh thái đô thị đa chiều với khả năng tương tác giữa con người và công nghệ. Nền tảng EV8 không chỉ cung cấp phương tiện di chuyển mà còn kết nối người dùng với mạng lưới dịch vụ tiện ích đô thị như thanh toán điện tử, quản lý năng lượng cá nhân, theo dõi chỉ số môi trường xung quanh, và nhận cảnh báo giao thông thông minh. Qua đó, EV8 góp phần thúc đẩy hành vi sống xanh, có trách nhiệm, đồng thời khuyến khích người dân sử dụng công nghệ để giải quyết các vấn đề của đời sống hàng ngày. Việc EV8 đồng hành cùng các đô thị thông minh không chỉ mang ý nghĩa công nghệ mà còn là sự cam kết về giá trị cộng đồng – tạo ra một môi trường sống hiệu quả, bền vững và kết nối cao. Đặc biệt, những chiến dịch cộng đồng và chương trình ưu đãi tích hợp như tích điểm sử dụng xanh, hoàn tiền khi tham gia các hoạt động bảo vệ môi trường, hay hỗ trợ tài chính cho người dân chuyển đổi sang xe điện đều là minh chứng cho tầm nhìn dài hạn của EV8 trong việc đồng hành cùng quá trình xây dựng thành phố tương lai. Nhờ sự hiện diện của EV8, các đô thị tại Việt Nam đang tiến gần hơn đến chuẩn mực sống thông minh – nơi công nghệ phục vụ con người một cách thiết thực và bền vững, đồng thời khẳng định vai trò tiên phong của EV8 trong việc kiến tạo tương lai đô thị số.

-

@ eb0157af:77ab6c55

2025-06-04 10:02:07

@ eb0157af:77ab6c55

2025-06-04 10:02:07A new investment vehicle combines exposure to Bitcoin with downside protection based on the price of gold.

On May 29, Cantor Fitzgerald Asset Management announced the launch of an investment product that merges direct exposure to Bitcoin with a bearish hedge linked to gold.

According to the financial institution, the new fund offers a solution for investors seeking to benefit from the growth potential of the leading cryptocurrency while maintaining a safety net tied to the precious metal.

Fund features

The fund is structured with a five-year term and no cap on potential upside, allowing investors to fully capture Bitcoin’s growth. The “1-to-1” protection mechanism means that any losses on Bitcoin would be offset by corresponding gains from gold.

Brandon Lutnick, Chairman of Cantor and son of former CEO Howard Lutnick (now Commerce Secretary in the Trump administration), called the product “a truly revolutionary investment vehicle” that helps investors access Bitcoin’s potential while providing downside protection. “There are still people on the Earth that are still scared of Bitcoin, and we want to bring them into this ecosystem,” Lutnick added.

The fund marks Cantor Fitzgerald’s first BTC-focused investment product. The firm, with 79 years of history and $14.8 billion in assets under management, is making its first significant move into the Bitcoin market.

The announcement follows the closing of its first round of financing agreements with Maple Finance and FalconX. Through its “Bitcoin Financing Business” division, Cantor plans to initially make up to $2 billion in financing available to institutional clients.

The post Cantor Fitzgerald launches Bitcoin fund with gold hedge appeared first on Atlas21.

-

@ 9ca447d2:fbf5a36d

2025-06-04 10:01:47

@ 9ca447d2:fbf5a36d

2025-06-04 10:01:47The third annual Bitcoin FilmFest (aka BFF25) proved once again that sovereign minds and decentralized culture thrive together.

For four electrifying days in Poland’s capital, the festival’s rallying call—’Fix the money, fix the culture‘—wasn’t just a slogan but a living, breathing movement.

From May 22-25, 2025, Warsaw buzzed with cinematic innovation, Bitcoin philosophy, and artistic vibe marking this gathering as truly incomparable.

Rebel Tribe with Unfiltered Creativity

With 200+ attendees from 20+ countries – primarily Poland, Czech Republic, the UK and Germany (~70% combined), plus representation from Spain, Italy, USA, Turkey and 15+ other nations including Thailand, Israel, Dubai and Latin America—BFF25 became a true global hub of freedom-fighters at heart.

The European Pizza Day opener (May 22), celebrating Bitcoin’s first real-world transaction, saw rainy evening weather that couldn’t dampen the energy.

With concerts by Roger9000 and ABBE plus DJ sets from MadMunky, 2140 collective w/Airklipz and G.O.L.D., all early arrivals had a memorable start.

Dual Focus on Film and Bitcoin Culture

-

Seven film workshops and seven hands-on sessions running parallel across Friday and Saturday at Amondo Cinema Club. Film: Martin Piga, Oswald Horowitz, Psyfer, Juan Pablo Mejía, Kristina Weiserova, Rare Passenger, Noa Gruman & Lahav Levi (Scardust). Bitcoin/Nostr: Aleks Svetski, Ioni Appelberg, Flash, CryptoSteel, Bitrefill, Polish Bitcoin Association, Bitvocation.

-

The Community Stage (Friday to Sunday afternoon) gave important space for both projects and individuals discussing their work and passions.

Everything from music, art, fiction, Nostr, personal sovereignty to Polish-language debates on Bitcoin’s state and its possible future. -

Onscreen, 9 cinematic blocks from Friday to Sunday featured titles like UNBAKABLE, REVOLUCIÓN BITCOIN, HOTEL BITCOIN, PLANDEMIC: THE MUSICAL, plus shorts on new media (AI/experimental cinema), parallel communities (outcast cinema), and newly released pilots.

-

Cinematic shark-tank with a €3,000 bounty: 8 contestants

- Martin Piga: “PARALLEL SPACES”

- Kristina Weiserova: “PUZZLE”

- Aaron Koenig : “SATOSHI’S LAST WILL”

- Philip Charter: “21 FUTURES”

- Jenna Reid: “WHERE DO WE GO FROM HERE?”

- Mr Black: “A LODGING OF WAYFARING MEN”

- Oswald Horowitz: “THE LEGEND OF LANDI”

The event ended with Jenna winning.

-

Official Gala: Golden Rabbits 2025 crowned:

- HOTEL BITCOIN by Manuel Sanabria & Carlos “Pocho” Villaverde (Best Story)

- SATOSHI: THE CREATION OF BITCOIN by Arthur Machado (Best Short)

- REVOLUCIÓN BITCOIN by Juan Pablo Mejía (Audience Choice)

- NO MORE INFLATION by Maiku Tsukai’s aka Bitcoin Shooter (Best Film)

Nights Charged with Music and Unscripted Surprise

The festival’s legendary afterparties kept the energy high—Friday’s underground gathering at Morph Club (ex-Barbazaar) featured Aaron Koening’s live concert and 2140 DJs (Akme + Andy Princz).

The weekend’s unforgettable moment came when Noa Gruman took the stage with “MY HEAVEN” (Scardust original) and “40HPW” — her powerful tribute to Bitcoin podcasts and Bugle.News.

Lightning-Powered Innovation, and Extras

-

Lightning in Action: Flash enabled instant Bitcoin payments across both main venues (Amondo + Samo Centrum, merch stations, and online shop)

-

IndeeHub Backstage Pass: Attendees unlocked exclusive access to Lightning-powered VOD featuring selected films from BFF23-25

-

BFF TV: Kiki (El Salvador) broadcasting live interviews, event clips, and trailers. Day One, and Day Two to rewatch online.

-

Comedy Strike: Robert Le Ricain’s Gala stand-up proved Bitcoiners pack brains and humor—in equal measure.

A Community-Driven Cultural Experience

Bitcoin FilmFest wasn’t just an event—it was proof that culture shifts when money gets fixed. Mark your calendars for June 2026 and the next edition. More info and tickets going on sale soon.

-

-

@ cae03c48:2a7d6671

2025-06-04 10:01:27

@ cae03c48:2a7d6671

2025-06-04 10:01:27Bitcoin Magazine

Tether Group & Bitfinex Transferred 25,812 BTC to Jack Mallers’ Twenty One CapitalToday, Tether Group and Bitfinex have transferred a combined 25,812.22 BTC to support their investment in Twenty One Capital, a newly formed Bitcoin-native company set to go public through a business combination with Cantor Equity Partners (Nasdaq: CEP).

Tether moved 14,000 BTC to an address of Twenty One Capital (XXI) and previously transferred 4,812.22 BTC to another address of Twenty One Capital as part of their investment in the company.

JUST IN: Tether sends 18,812 #Bitcoin worth almost $2 billion to Jack Maller's Twenty One Capital

pic.twitter.com/Oy18iPnUzO

pic.twitter.com/Oy18iPnUzO— Bitcoin Magazine (@BitcoinMagazine) June 2, 2025

Bitfinex, in parallel, has sent 7,000 BTC to an address of Twenty One Capital, also as part of its investment.

JUST IN: Bitfinex sent 7,000 #Bitcoin worth $731 million to Jack Mallers' Twenty One Capital

pic.twitter.com/kshqZwHz34

pic.twitter.com/kshqZwHz34— Bitcoin Magazine (@BitcoinMagazine) June 2, 2025

These Bitcoin transfers come a little over a month after Twenty One Capital and CEP announced that it was raising $585 million in additional capital at the closing of the business combination. The raise was to feature $385 million in convertible senior secured notes and $200 million in PIPE (private investment in public equity) financing, with proceeds expected to be used for further Bitcoin purchases and general corporate purposes. Once finalized, the company anticipates launching with over 42,000 BTC, positioning it as the third-largest Bitcoin treasury in the world.

“Markets need reliable money to measure value and allocate capital efficiently,” said the Co-Founder and CEO of Twenty One Jack Mallers. “We believe that Bitcoin is the answer, and Twenty One is how we bring that answer to public markets. Our mission is simple: to become the most successful company in Bitcoin, the most valuable financial opportunity of our time. We’re not here to beat the market, we’re here to build a new one. A public stock, built by Bitcoiners, for Bitcoiners.”

The announcement comes just days after Mallers announced a new Bitcoin backed loan platform at Strike during the 2025 Bitcoin Conference in Las Vegas. The system will offer interest rates between 9-13%, allowing clients to borrow between $10,000 and $1 billion using Bitcoin as collateral.

“All these professional economists, they are like Bitcoin is risky and volatile,” stated Mallers. “No it’s not. This is the magnificent 7 one year volatility and the orange one in the middle is Bitcoin. It’s no more risky and volatile. It’s a little bit more volatile than Apple, but is far less more volatile than Tesla.”

“Life is short,” commented Jack. “Take the trip, but with bitcoin you just get to take a better one.”

This post Tether Group & Bitfinex Transferred 25,812 BTC to Jack Mallers’ Twenty One Capital first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-06-04 10:01:03

@ cae03c48:2a7d6671

2025-06-04 10:01:03Bitcoin Magazine

Norwegian Public Company K33 AB Purchased 10 BTC For Their New Bitcoin Treasury StrategyK33 AB (PUBL), a digital asset brokerage and research firm, announced that it has completed its first Bitcoin acquisition under its new Bitcoin treasury strategy, purchasing 10 BTC for approximately SEK 10 million.

JUST IN:

Publicly traded company K33 buys 10 #Bitcoin for SEK 10 million for its balance sheet. pic.twitter.com/wB8Kt09EZf

Publicly traded company K33 buys 10 #Bitcoin for SEK 10 million for its balance sheet. pic.twitter.com/wB8Kt09EZf— Bitcoin Magazine (@BitcoinMagazine) June 3, 2025

Today’s purchase is the first transaction of the secured SEK 60 million that K33 announced it will buy for its Bitcoin treasury strategy.

“We expect Bitcoin to be the best-performing asset in the coming years and will build our balance sheet in Bitcoin moving forward,” said the CEO of K33 Torbjorn Bull Jenssen. “This will give K33 direct exposure to the Bitcoin price and help unlock powerful synergies with our brokerage operation. Our ambition is to build a balance of at least 1000 BTC over time and then scale from there.”

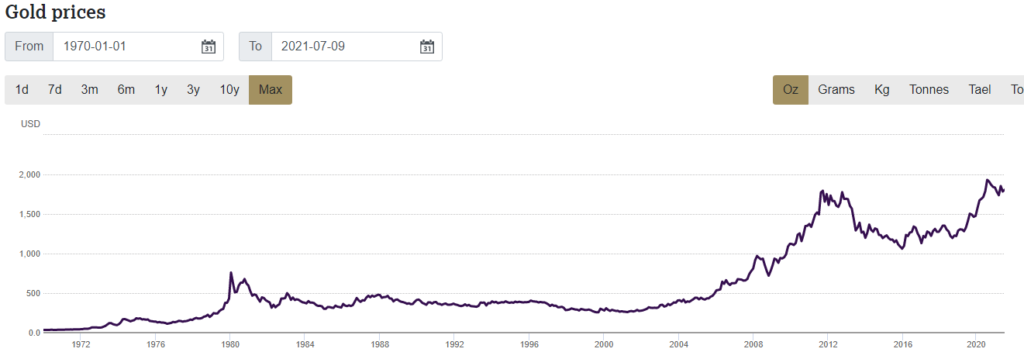

During K33’s Q1 2025 Report & Strategic Outlook presentation. Torbjorn Jenssen mentioned that the “US BTC ETF was the most successful ETF launch in history. Acquiring more capital in just one year than gold did in 20.”

Jenssen also said K33 is working with other Bitcoin treasury companies in the Nordics and hopes to use its treasury as a foundation to offer new services, such as Bitcoin backed lending.

“For K33, Bitcoin is not only a high-conviction asset — it’s also a strategic enabler,” he said. “With a sizable BTC reserve, we will be able to strengthen our financial position while unlocking new revenue streams, product capabilities, and partnerships.”

Bitcoin will be the best performing asset in the coming decade and my goal with K33 is to accumulate as many as possible while unlocking powerful operational synergies with our brokerage operation,” posted Jenssen on X.

Bitcoin will be the best performing asset in the coming decade and my goal with K33 is to accumulate as many as possible while unlocking powerful operational synergies with our brokerage operation. https://t.co/Crxu0b5QPz

— Torbjørn (@TorbjrnBullJens) May 28, 2025

Bitcoin treasury holdings are becoming a trend of companies in 2025. Around 217 companies and public entities now hold Bitcoin on their balance sheets.

Last week, during the 2025 Bitcoin Conference in Las Vegas, the CEO of GameStop Ryan Cohen announced that GameStop purchased 4,710 Bitcoin worth approximately $505 million, marking another major corporate entry into Bitcoin treasury holdings.

In an interview with the CEO of Nakamoto David Bailey, the CEO of GameStop Ryan Cohen stated, “If the thesis is correct then Bitcoin and gold as well can be a hedge against global currency devaluation and systemic risk. Bitcoin has certain unique advantages better than gold.”

BREAKING:

GAMESTOP PURCHASED 4,710 #BITCOIN pic.twitter.com/fDH9ctZJVP

GAMESTOP PURCHASED 4,710 #BITCOIN pic.twitter.com/fDH9ctZJVP— Bitcoin Magazine (@BitcoinMagazine) May 28, 2025

This post Norwegian Public Company K33 AB Purchased 10 BTC For Their New Bitcoin Treasury Strategy first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-06-04 10:00:58

@ cae03c48:2a7d6671

2025-06-04 10:00:58Bitcoin Magazine

Canadian Company SolarBank Adopts Bitcoin Treasury StrategyToday, SolarBank Corporation (NASDAQ: SUUN), a leader in distributed solar energy, battery storage, and clean energy infrastructure across North America, has announced the integration of Bitcoin as a strategic reserve asset into its corporate treasury strategy, following the footsteps of MicroStrategy and SharpLink Gaming.

SolarBank has also applied to open an institutional account with Coinbase Prime (NASDAQ: COIN), enabling secure Bitcoin custody, USDC services, and a self-custodial wallet for its Bitcoin holdings.

JUST IN: North American construction engineering company SolarBank adopts a Strategic Bitcoin Reserve

pic.twitter.com/b2xvVARjZZ

pic.twitter.com/b2xvVARjZZ— Bitcoin Magazine (@BitcoinMagazine) June 3, 2025

The company cited several strategic advantages for adopting Bitcoin as a reserve asset:

- Financial Resilience: Bitcoin holdings will serve as a hedge against inflation and currency debasement.

- Clean Energy Off-set: Emissions tied to Bitcoin mining will be counterbalanced by SolarBank’s renewable energy generation.

- Market Appeal: The move targets tech-savvy investors interested in digital assets, DeFi, and blockchain.

- Competitive Differentiation: SolarBank aims to differentiate itself as a first-mover in combining renewable energy with Web3 and DeFi principles.

“As the adoption of Bitcoin continues to grow, SolarBank believes that establishing a Bitcoin treasury strategy taps into a growing sector that is seeing increasing adoption,” commented Dr. Richard Lu. “In a world of ever-increasing energy demand and treasury complexity, SolarBank delivers renewable energy solutions and recurring revenues, now combined with all of the benefits of holding Bitcoin.”

SolarBank further emphasized that its core focus remains on renewable energy development, highlighting several recent achievements:

- A $100 million U.S. solar deal with CIM Group targeting 97 MW of projects.

- A $49.5 million agreement with Qcells to deploy US made solar technology.

- A $41 million partnership with Honeywell to develop landfill-based solar farms.

- A $25 million credit facility from RBC to expand its battery energy storage portfolio.

With over 1 GW of projects in development and partnerships with Fortune 500 companies, SolarBank continues to generate recurring revenues through long-term contracts while accelerating decarbonization efforts.

“The actual timing and value of Bitcoin purchases, under the allocation strategy will be determined by management,” stated the company in the press release. “Purchases will also depend on several factors, including, among others, general market and business conditions, the trading price of Bitcoin and the anticipated cash needs of SolarBank. The allocation strategy may be suspended, discontinued or modified at any time for any reason. As of the date of this press release, no Bitcoin purchases have been made.”

This post Canadian Company SolarBank Adopts Bitcoin Treasury Strategy first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ 2dd9250b:6e928072

2025-06-04 10:01:11

@ 2dd9250b:6e928072

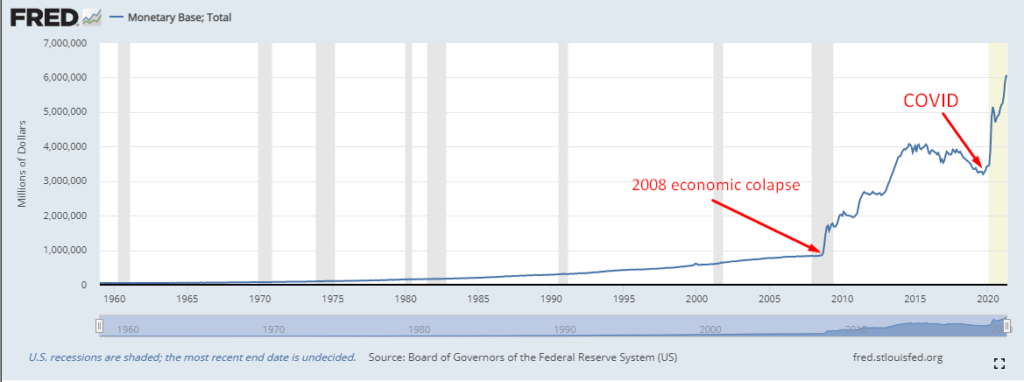

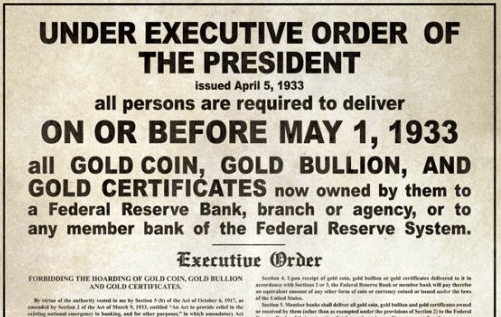

2025-06-04 10:01:11Durante a década de 1990, houve o aumento da globalização da economia, determinando a adição do fluxo internacional de capitais, de produtos e serviços. Este fenômeno levou a uma interdependência maior entre as economias dos países. Justamente por causa da possibilidade de que um eventual colapso econômico em um país resulte no contágio dos demais. Diante disso, aumentou a preocupação com os riscos incentivando a utilização de sofisticados modelos e estratégias de avaliação de gestão de risco.

Na década, ganharam destaque ainda os graves problemas financeiros enfrentados, entre outros, pelo banco inglês Barings Bank, e pelo fundo de investimento norte-americano Long Term Capital Management.

Outro grande destaque foi a fraude superior a US$ 7 bilhões sofrida pelo banco Société Generale em Janeiro de 2008.

O Barings Bank é um banco inglês que faliu em 1995 em razão de operações financeiras irregulares e mal-sucedidas realizadas pelo seu principal operador de mercado. O rombo da instituição foi superior à US$ 1,3 Bilhão e causado por uma aposta equivocada no desempenho futuro no índice de ações no Japão. Na realidade, o mercado acionário japonês caiu mais de 15% na época, determinando a falência do banco. O Baring Bank foi vendido a um grupo financeiro holandês (ING) pelo valor simbólico de uma libra esterlina.

O Long Term Capital Management era um fundo de investimento de que perdeu em 1998 mais de US$ 4,6 bilhões em operações nos mercados financeiros internacionais. O LTCM foi socorrido pelo Banco Central dos Estados Unidos (Federal Reserve ), que coordenou uma operação de socorro financeiro à instituição. A justificativa do Banco Central para esta decisão era "o receio das possíveis consequências mundiais da falência do fundo de investimento".

O banco francês Société Generale informou, em janeiro de 2008, uma perda de US$ 7,16 bilhões determinadas por fraudes efetuadas por um operador do mercado financeiro. Segundo revelou a instituição, o operador assumiu posições no mercado sem o conhecimento da direção do banco. A instituição teve que recorrer a uma urgente captação de recursos no mercado próxima a US$ 5,0 bilhões.

E finalmente chegamos ao caso mais problemático da era das finanças modernas anterior ao Bitcoin, o caso Lehman Brothers.

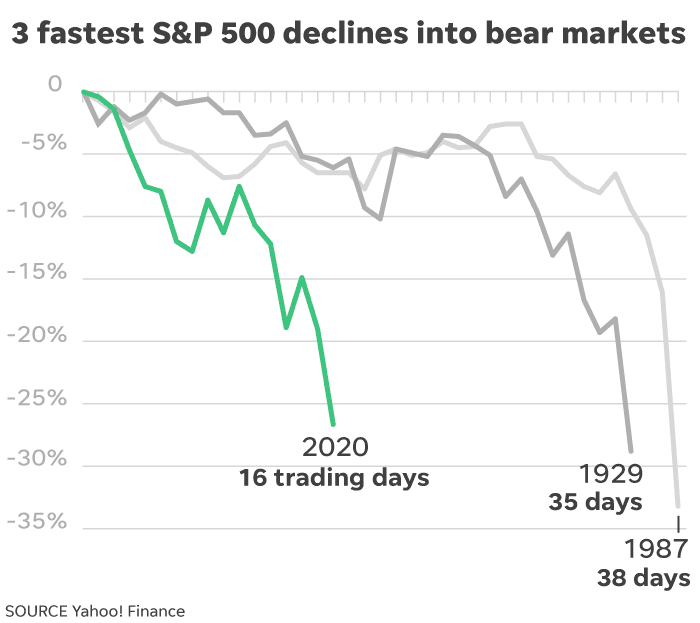

O Lehman Brothers era o 4° maior de investimentos dos EUA quando pediu concordata em 15/09/2008 com dívidas que superavam inacreditáveis US$ 600 bilhões.

Não se tinha contas correntes ou talão de cheques do Lehman Brothers. Era um banco especializado em investimentos e complexas operações financeiras. Havia feito pesados investimentos em empréstimos a juros fixos no famigerado mercado subprime, e o crédito imobiliário voltado a pessoas consideradas de forte risco de inadimplência.

Com essa carteira de investimentos que valia bem menos que o estimado e o acúmulo de projetos financeiros, minou a confiança dos investidores na instituição de 158 anos. Suas ações passaram de US$ 80 a menos de US$ 4. Acumulando fracassos nas negociações para levantar fundos; a instituição de cerca de 25 mil funcionários entrou em concordata.

O Federal Reserve resgatou algumas instituições financeiras grandes e tradicionais norte-americanas como a seguradora AIG no meio da crise. O Fed injetou um capital de US$ 182, 3 bilhões no American International Group (AIG).

Foi exatamente essa decisão do Fed em salvar alguns bancos e deixar quebrar outros, que causou insegurança por parte dos clientes. E os clientes ficaram insatisfeitos tanto com os bancos de investimentos quanto com as agências de classificação de risco, como a Standard & Poor's que tinha dado uma nota alta para o Lehman Brothers no mesmo dia em que ele quebrou.

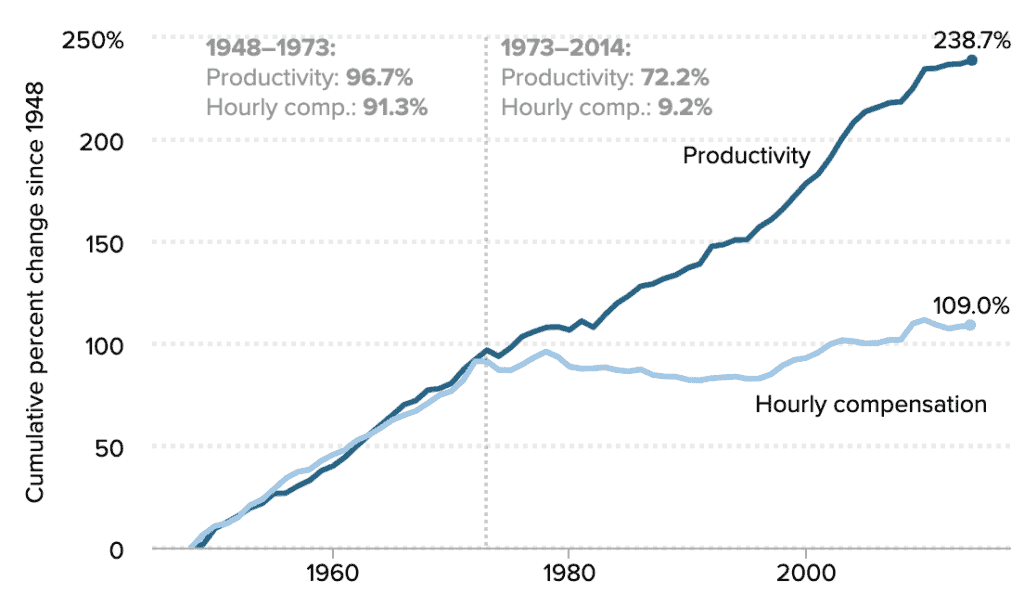

E essa foi uma das razões pelo qual o Bitcoin foi criado. Satoshi Nakamoto entendeu que as pessoas não estavam mais confiando nem no Governo, nem nos Bancos Privados que o Governo federal restagatava quando eles quebravam e isso prejudicou muita gente. Tanto que o “hash” do Genesis Block contém o título do artigo “Chancellor on brink of second bailout for banks” (Chanceler à beira de segundo resgate para bancos, em português) da edição britânica do The Times.

Esse texto foi parcialmente editado do texto de ASSAF Neto, CAF (2014).

-

@ 9dd283b1:cf9b6beb

2025-06-04 08:33:32

@ 9dd283b1:cf9b6beb

2025-06-04 08:33:32To all territory owners,

- Can I co-found a territory with someone? Is it on the roadmap to be able to do so?

- Can I automatically split the territory rewards with other stackers?

- Can I rename the territory in the future?

Thanks

https://stacker.news/items/996796

-

@ cae03c48:2a7d6671

2025-06-04 10:00:54

@ cae03c48:2a7d6671

2025-06-04 10:00:54Bitcoin Magazine

Vegas Comedown, or Was Bitcoin 2025 Too Noisy?

“Shitcoin Magazine,” tweeted Bitcoin educator and author Knut Svanholm about the event that BTC Inc, the parent company of Bitcoin Magazine, organized in Las Vegas last week. Dancing cows dashed across my feed. “It’s a political convention now,” I overheard two attendees saying as they exited the Nakamoto stage, heads shaking. Nigel Farage, the inflammatory British politician and leader of Reform UK, was shouting on stage about becoming prime minister. A somewhat calmer personality, Vice President JD Vance spoke about “crypto” and thanked Coinbase.

Word on the (online) street is that Bitcoin 2025 was captured by political and shitcoin-y interests. Our own technical editor, Shinobi, opted out of mass surveillance and bailed for freer pastures at the Oslo Freedom Forum. Erik Cason was uncharacteristically polite (“shitcoin adjacent”), though he was there in person, happily signing the Cryptosovereignty book that Bitcoin Magazine Books published in 2023.

“None of my Bitcoiner friends come here anymore,” said Ben, an entrepreneur who runs a Bitcoin business, on the fence about coming back next year.

Whenever I mention that I work for Bitcoin Magazine, I usually have to field questions about shitcoinery and political shilling (Are you a MAGA dude now?!). Coming to Vegas was inspection time for me — or at least a chance to see what it is that troubles so many people.

With the glamor of the Strip itself and its sensory overload, it’d be easy to be dazzled — plus, it was the first time I had left Fort Europa for the land of the free in years, first time in Vegas, and first time at an American Bitcoin event. It’d be easy for me to simply dismiss the haters by paraphrasing Taylor (“haters gonna hate, hate, hate, hate…”).

While sitting down in the whale pass area the Deep, a hipster-looking gentleman started talking to me about how Bitcoin is fundamentally broken and that I should investigate his energy-based shitcoin instead. Waiting for Vance’s speech in the main hall, I was introduced to three young dudes dressed up to perfection and barely out of college, at the conference “to land a job in the industry” — i.e., grifters. A mid-60s technology dude interjected himself into the conversation, bragged about how he worked on tech for Microsoft in the ’90s, and explained how blockchain (not Bitcoin) is the future — only to have us scan the NFC card he had implanted in his left hand. Ugh.

Thus, it wasn’t difficult to see the things all these people online had objected to: Our conference was a party, or “an elaborate Bitcoin extraction scheme,” a “circus, shitcoin fest,” or stablecoin mania. Plus:

— Daniel Prince (@Princey21M) May 30, 2025

They’re not wrong. But honestly, you don’t have to look.

Here’s an underappreciated order to the known universe: To each successful movement or phenomenon, parasites and fraudsters are drawn. It’s why the shitcoin guys are around Bitcoin events and why the politicians are pandering to our cause. Vegas itself is the center of gravity for that sort of thing — gambling, nudity, alcohol, prostitution, and other dopamine-inducing stimulants. I first titled this tak_e_ What Hookers in Vegas Can Teach Us About Politicians at Bitcoin 2025; the simple observation is that fraudsters, grifters, and scammers go to where the value is. Parasites feed off healthy, growing, flourishing organisms.

“Scammers flooding in,” as Tomer Strolight post-conference tweeted, is thus the least surprising thing ever.

We’re succeeding, growing, and becoming if not respectable then at least a household name. The FT and WSJ covering us feel somewhere between “…then they laugh at you“ and “…then they fight you” stages.

Running around meeting people — hardcore Bitcoiners I’ve only ever met online, authors and writers and editors I’ve worked with (they were all in Vegas, since that was the place to be…) — and attending the sum total of three presentations, I felt what Wayne Vaughan of Bitcoin First described:

The Bitcoin Conference 2025 was different and in many ways disappointing.

Good:

The private events were excellent opportunities to reconnect with old friends and meet new people.Bitcoin has grown up. We’re finally legit.

Neutral:

The conference was dominated by politics and…— Wayne Vaughan (@WayneVaughan) May 30, 2025

You can just meet people, just do things.

To make an obvious analogy: The internet is littered with porn, gambling, and cat videos, and it’s the most successful technology in a generation. You don’t have to look; you can just work and provide value instead of wasting away your life talking to shitcoiners or being annoyed at politicians and other fraudsters doing their things.

“Cozying up to any government is a bad idea,” concluded the WSJ piece, citing a “wing” of purist Bitcoin that we all feel. Yes, agreed. But the puritism that its opposite requires condemns us to irrelevancy — belittles and betrays the broader mission.

So yeah: the grifters, the parasites, the politicians, and the financial engineers are here. Good for them. That they’re here is a sign of victory.

Knock me over with a feather, haters.

Come join us for Bitcoin 2026 and see for yourself.

This post Vegas Comedown, or Was Bitcoin 2025 Too Noisy? first appeared on Bitcoin Magazine and is written by Joakim Book.

-

@ 7f6db517:a4931eda

2025-06-04 09:01:26

@ 7f6db517:a4931eda

2025-06-04 09:01:26

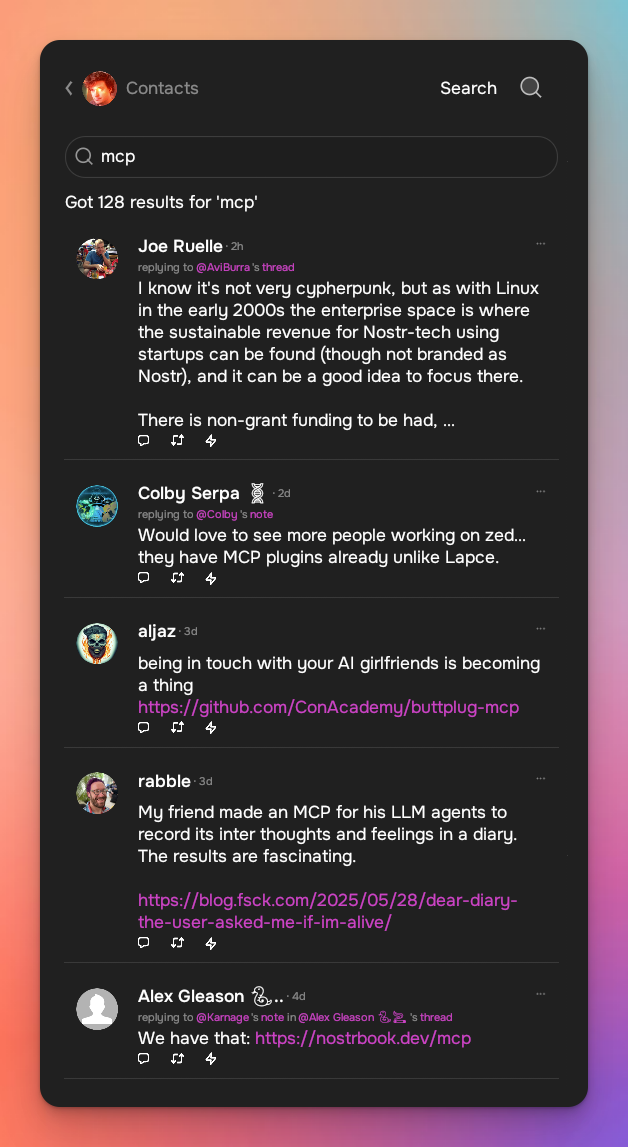

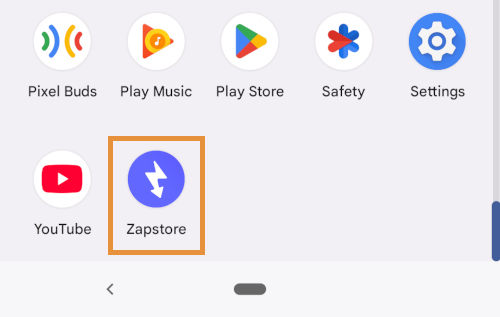

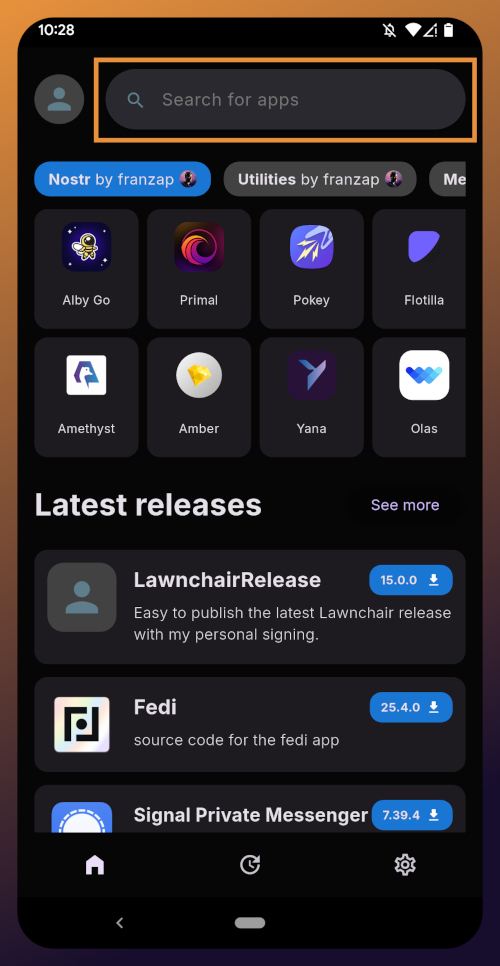

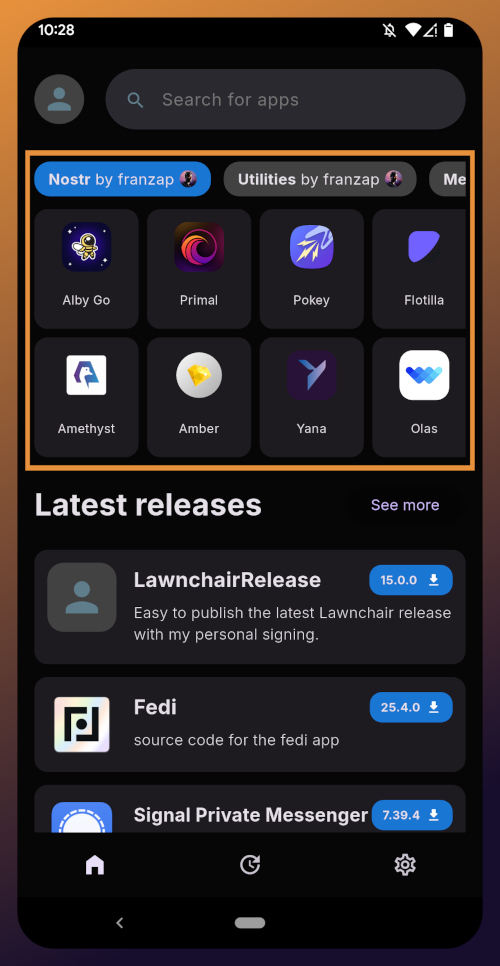

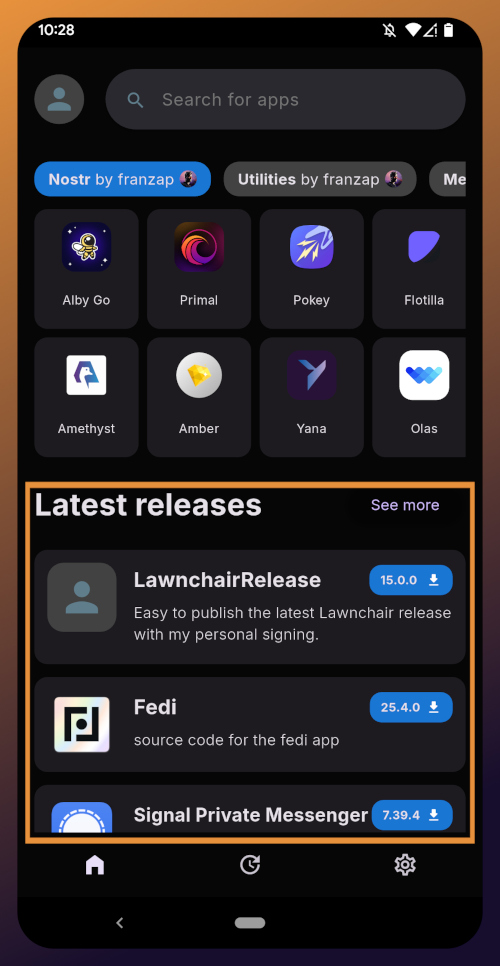

Nostr is an open communication protocol that can be used to send messages across a distributed set of relays in a censorship resistant and robust way.

If you missed my nostr introduction post you can find it here. My nostr account can be found here.

We are nearly at the point that if something interesting is posted on a centralized social platform it will usually be posted by someone to nostr.

We are nearly at the point that if something interesting is posted exclusively to nostr it is cross posted by someone to various centralized social platforms.

We are nearly at the point that you can recommend a cross platform app that users can install and easily onboard without additional guides or resources.

As companies continue to build walls around their centralized platforms nostr posts will be the easiest to cross reference and verify - as companies continue to censor their users nostr is the best censorship resistant alternative - gradually then suddenly nostr will become the standard. 🫡

Current Nostr Stats

If you found this post helpful support my work with bitcoin.

-

@ cae03c48:2a7d6671

2025-06-04 10:00:49

@ cae03c48:2a7d6671

2025-06-04 10:00:49Bitcoin Magazine

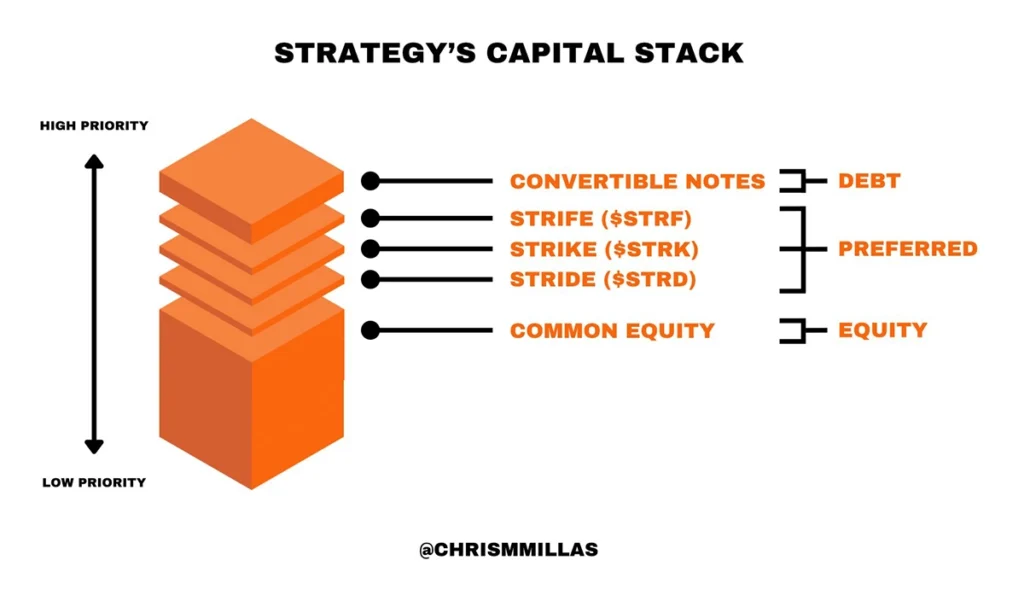

How Strategy (MSTR) Built Their Capital Stack to Accelerate Bitcoin AccumulationMicroStrategy—now operating as Strategy

—has built the most aggressive Bitcoin treasury in the world. But its true innovation isn’t just holding Bitcoin. It’s in how it finances the accumulation of Bitcoin at scale without giving up control or diluting shareholder value.

—has built the most aggressive Bitcoin treasury in the world. But its true innovation isn’t just holding Bitcoin. It’s in how it finances the accumulation of Bitcoin at scale without giving up control or diluting shareholder value.The engine behind this? A meticulously designed capital stack—a multi-tiered structure of debt, preferred stock, and equity that appeals to different types of investors, each with unique risk, yield, and volatility preferences.

This is more than corporate finance—it’s a blueprint for Bitcoin-native capital formation.

What Is a Capital Stack?

A capital stack refers to the layers of capital a company uses to finance its operations and strategic goals. Each layer has its own return profile, risk level, and repayment priority in the event of liquidation.

Strategy’s capital stack is designed to do one thing exceptionally well: convert fiat capital into Bitcoin exposure—efficiently, at scale, and without compromise.

The Stack: Ordered by Priority

Strategy’s capital stack comprises five core instruments:

1. Convertible Notes

2. Strife Preferred Stock ($STRF)

3. Strike Preferred Stock ($STRK)

4. Stride Preferred Stock ($STRD)

5. Common Equity ($MSTR)These layers are ranked from highest to lowest in repayment priority. What makes this structure unique is how each layer balances downside protection, yield, and Bitcoin exposure—offering institutional investors fixed-income alternatives with varying degrees of correlation to Bitcoin.

Strategy’s Capital Stack illustrated by Chris Millas

Convertible Notes: Senior Debt with Optional Upside

Strategy’s capital stack begins with convertible notes—senior unsecured debt that can convert into equity.

- Downside: Low risk, high priority in liquidation

- Upside: Modest unless converted

- Appeal: Institutional debt investors seeking protection with optional Bitcoin-adjacent upside

These notes were Strategy’s earliest fundraising tools, enabling the company to raise billions in low-interest environments to accumulate Bitcoin without issuing equity.

Strife ($STRF): Investment-Grade Yield

Strife is a perpetual preferred stock designed to mimic high-grade fixed income.

- 10% cumulative dividend, paid in cash

- $100 liquidation preference

- No conversion rights or Bitcoin upside

- Compounding penalties on unpaid dividends

- Low volatility, medium risk profile

Strife targets conservative capital—allocators who want predictable income without equity or crypto exposure. It’s senior to other preferreds and common stock, making it a high-quality fixed-income proxy built atop a Bitcoin treasury.

Strike ($STRK): Yield + Bitcoin Optionality

Strike is convertible preferred stock—bridging fixed income and equity upside.

- 8% cumulative dividend

- Convertible into $MSTR at $1,000 strike

- Paid in cash or Class A shares

- Bitcoin exposure via conversion option

- Medium volatility, low risk

Strike appeals to investors who want income with optional participation in Bitcoin upside. In bullish Bitcoin cycles, the conversion option becomes valuable—offering a hybrid between bond-like stability and equity-like potential.

Stride ($STRD): High Yield, High Risk

Stride is the most junior preferred—non-cumulative, perpetual stock issued with high yield and few protections.

- >10% dividend, only if declared

- No compounding, no conversion, no voting rights

- Highest relative risk among preferreds

- Liquidation priority above common equity, but below all others

Stride plays a crucial role. Its issuance improves the credit quality of Strife, adding a subordinate capital buffer beneath it—similar to how mezzanine debt protects senior tranches in structured finance.

Stride attracts yield-hungry investors, enabling Strategy to raise capital without compromising more senior layers.

Common Equity ($MSTR): Pure Bitcoin Beta

At the base is Strategy’s common equity—the most volatile, least protected, but highest potential instrument in the stack.

- Unlimited upside

- No dividend, no priority

- Full exposure to Bitcoin volatility

- Voting rights, long-term ownership

Common equity is for conviction-driven investors. Over the past four years, this layer has attracted capital from funds and individuals aligned with Strategy’s Bitcoin thesis—investors who want maximal upside from a corporate Bitcoin strategy.

The Big Picture: Saylor Is Targeting the Fixed Income Market

This isn’t just a financing mechanism—it’s a direct challenge to the $130 trillion global bond market.

By issuing instruments like $STRF, $STRK, and $STRD, Strategy is offering Bitcoin-adjacent yield vehicles that absorb demand from across the capital spectrum:

- Institutional investors seeking investment-grade yield

- Hedge funds chasing structured upside

- Yield hunters willing to go down the stack for returns

Each instrument behaves like a synthetic bond, yet all are backed by a Bitcoin accumulation engine.

As Director of Bitcoin Strategy at Metaplanet, Dylan LeClair put it: “Saylor is coming for the entire fixed income market.”

Rather than issue traditional bonds, Saylor is constructing a Bitcoin-native capital stack—one that unlocks liquidity without ever selling the underlying asset.

Why It Matters: A Model for Bitcoin Treasury Strategy

Strategy’s capital structure is more than innovation—it’s a financial operating system for any public company that wants to monetize Bitcoin’s rise while maintaining capital discipline.

Key takeaways:

- Every layer matches a specific investor need: From low-risk debt to speculative yield

- Capital flows in, Bitcoin stays put: Preserving treasury position while scaling

- No single instrument dominates: The stack is diversified by design

- Control is retained: Most securities are non-voting, non-convertible

For corporations serious about building a Bitcoin-native balance sheet, this is the playbook to study.

Saylor isn’t just stacking Bitcoin—he’s engineering the financial infrastructure for a monetary paradigm shift.

Disclaimer: This content was written on behalf of Bitcoin For Corporations. This article is intended solely for informational purposes and should not be interpreted as an invitation or solicitation to acquire, purchase, or subscribe for securities.

This post How Strategy (MSTR) Built Their Capital Stack to Accelerate Bitcoin Accumulation first appeared on Bitcoin Magazine and is written by Nick Ward.

-

@ 6ad3e2a3:c90b7740

2025-06-04 08:32:29

@ 6ad3e2a3:c90b7740

2025-06-04 08:32:29"Modern science is based on this principle: give us one free miracle and then we'll explain the rest."

— Terrence McKenna

I always wondered why a pot of water boils on the stove. I mean I know it boils because I turned on the electricity, but why does the electricity cause it to boil? I know the electricity produces heat, and the heat is conducted through the stainless steel pot and into the water, but why does the heat transfer from stovetop to the water?

I know the heat from the stove via the pot speeds up the molecules in the water touching it and that they in turn speed up the molecules touching them and so on throughout the pot, but why do speedy molecules cause adjacent molecules to speed up?

I mean I know they do this, but why do they do this? Why couldn’t it be that sped-up molecules only interact with sufficient speedy molecules and ignore slower ones? Why do they interact with all the molecules, causing all of them to speed up? Or why don’t the speedy ones, instead of sharing their excited state, hoard it and take more energy from adjacent slower molecules, thereby making them colder, i.e., why doesn’t half the water boil twice as fast (on the left side of the pot) while the other half (right side) turns to ice?

The molecules tend to bounce around randomly, interacting as equal opportunists on the surrounding ones rather than distinguishing only certain ones with which to interact. Why do the laws of thermodynamics behave as such rather than some other way?

There may be yet deeper layers to this, explanations going down to the atomic and even quantum levels, but no matter how far you take them, you are always, in the end, left with: “Because those are the laws of physics”, i.e., “because that’s just how it is.”

. . .

The Terrence McKenna quote, recently cited by Joe Rogan on his podcast, refers to the Big Bang, the current explanation adopted by the scientifically literate as to the origins of the universe. You see there was this insanely dense, infinitesimally small micro dot that one day (before the dawn of time) exploded outward with unimaginable power that over billions of years created what we perceive as the known universe.

What happened prior? Can’t really say because time didn’t yet exist, and “prior” doesn’t make sense in that context. Why did it do this? We don’t know. How did it get there? Maybe a supermassive black hole from another universe got too dense and exploded out the other side? Highly speculative.

So why do people believe in the Big Bang? Because it comports with and explains certain observable phenomena and predicted other phenomena which were subsequently confirmed. But scratch a little deeper for an explanation as to what caused it, for what purpose did it occur or what preceded it, and you hit the same wall.

. . .

Even if we were to understand at a quantum level how and why the Big Bang happened and what preceded it, let’s assume it’s due to Factor X, something we eventually replicated with mini big-bangs and universe creations in our labs, we would still be tasked with understanding why Factor X exists in the universe. And if Factor X were explained by Process Y, we’d still be stuck needing an explanation for Process Y — ad infinitum.

Science can thus only push the wall back farther, but can never scale it. We can never arrive at an ultimate explanation, only partial ones. Its limitations are the limitations of thought itself, the impossibility of ever creating a map at a scale of one mile per mile.

-

@ cae03c48:2a7d6671

2025-06-04 10:00:43

@ cae03c48:2a7d6671

2025-06-04 10:00:43Bitcoin Magazine

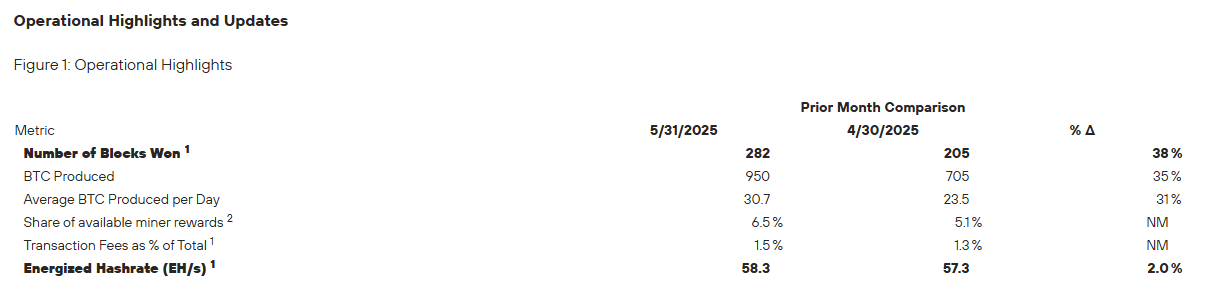

MARA Announces Over $100 Million in Bitcoin Mined in May 2025Today, MARA Holdings, Inc. (NASDAQ: MARA) reported a record high month of bitcoin production in May 2025, mining 950 BTC worth over $100 million at the time of writing. A 35% increase from April and the highest monthly output since the April 2024 halving event. MARA did not sell any bitcoin in May.

JUST IN: MARA mined 950 #Bitcoin worth over $100 MILLION in May

They HODLed all of it

pic.twitter.com/Z4v1zoEfga

pic.twitter.com/Z4v1zoEfga— Bitcoin Magazine (@BitcoinMagazine) June 3, 2025

“May was a record-breaking month for MARA with 282 blocks won, a 38% increase over April and a new monthly high,” said the Chairman and CEO of MARA Fred Thiel. “Our total bitcoin holdings surpassed 49,000 BTC during May and the 950 bitcoin produced were the most since the halving event in April 2024.”

The company mined 282 blocks during the month, a 38% rise over the previous month, and now holds 49,179 BTC, worth roughly $5.23 billion at the time of writing.

“Our fully integrated tech stack is a key differentiator, and MARA Pool is the only self-owned and operated mining pool among public miners, offering greater control and efficiency,” stated Thiel. “Operating our pool means no fees to external operators and retention of the full value of block rewards. Production in May also benefitted from block reward luck. Since launch, MARA Pool’s block reward luck has outperformed the network average by over 10%, contributing to our industry-leading block production.”

Operational efficiency also improved, with energized hashrate rising 2% from 57.3 EH/s to 58.3 EH/s. MARA’s average daily bitcoin production hit 30.7 BTC, which is 31% more than the last month from April.

“We remain laser-focused on transforming MARA into a vertically integrated digital energy and infrastructure company,” commented Thiel. “We believe this model gives us tighter operational control, improves cost-efficiency, and makes us more resilient to shifts in the broader economy.”

Earlier this month, on May 8, MARA released its first quarter 2025 earnings, posting 213.9 million dollars in revenue. A 30 percent increase over the same period last year. The company’s bitcoin holdings surged 174 percent year over year, rising from 17,320 BTC to 47,531 BTC as of March 31, with an estimated value of 3.9 billion dollars at the time. In Q1, MARA mined 2,286 BTC and acquired an additional 340 BTC. Operational performance also strengthened, with energized hashrate nearly doubling from 27.8 EH/s to 54.3 EH/s, and cost per petahash per day improving by 25 percent.

This post MARA Announces Over $100 Million in Bitcoin Mined in May 2025 first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-06-04 10:00:34

@ cae03c48:2a7d6671

2025-06-04 10:00:34Bitcoin Magazine

Adam Back Invests SEK 21 Million to H100 Group Bitcoin Treasury StrategyToday, H100 Group AB announced it has entered a SEK 21 million convertible loan from an investment agreement with Adam Back, with the option to expand his investment to SEK 277 million through a five-tranche convertible loan deal. The proceeds will be used to buy Bitcoin in alignment with H100 Group’s long-term Bitcoin treasury strategy.

H100 Group AB (Ticker: H100) secures a SEK 21M ($2.1M) commitment from @adam3us , with rights to invest an additional SEK 128M ($12.8M) in tranches—bringing the total contemplated raise to SEK 277M (~$27.7M). pic.twitter.com/c0HgMSRxut

— H100 (@H100Group) June 3, 2025

Under the agreement, Back may invest up to SEK 128 million across four additional tranches, with guaranteed participation of at least 50%. Each tranche is twice his committed amount, demonstrating his support for H100’s long-term growth.

The press release said, “Adam Back may request the Second Tranche within 90 days from signing of the Initial Tranche, the Third Tranche within 90 days from signing of the Second Tranche, the Fourth Tranche within 90 days from signing of the Third Tranche and the Fifth Tranche within ninety 90 days from signing of the Fourth Tranche. In the event Adam Back does not request a Future Tranche within the deadline, the right to request subsequent Future Tranches lapses.”

The convertible loans have no interest and have a five year maturity. At any time, Back may convert the loans into shares of the Company. Conversion prices are fixed per tranche: SEK 1.75 per share for the initial tranche, rising to SEK 5.00 by the fifth tranche. H100 retains the right to force conversion if the stock price exceeds the conversion rate by 33% over a 20 day period. Full conversion of the initial tranche would result in 12 million new shares and a 9.3% dilution.

“Upon request of a tranche Adam Back is obliged to invest in the relevant Tranche with SEK 15,750,000 in the second tranche, SEK 23,625,000 in the third tranche, SEK 35,437,500 in the fourth tranche, and SEK 53,156,250 in the fifth tranche,” stated the press release. “The contemplated size for each tranche is twice the entitled amount of Adam Back.”

“We have been around since 2014 and we work with our investors to put Bitcoin in a balance sheet back then and since then,” said Adam Back at the 2025 Bitcoin Conference. “I think the way to look at the treasury companies is that Bitcoin is effectively the harder rate. It’s very hard to outperform Bitcoin most people that invest in things since Bitcoin around thought I should put that in Bitcoin and not in the other thing.”

This post Adam Back Invests SEK 21 Million to H100 Group Bitcoin Treasury Strategy first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ 866e0139:6a9334e5

2025-06-04 08:21:14

@ 866e0139:6a9334e5

2025-06-04 08:21:14Autor: Milosz Matuschek. Dieser Beitrag wurde mit dem Pareto-Client geschrieben. Sie finden alle Texte der Friedenstaube und weitere Texte zum Thema Frieden hier. Die neuesten Pareto-Artikel finden Sie in unserem Telegram-Kanal.

Die neuesten Artikel der Friedenstaube gibt es jetzt auch im eigenen Friedenstaube-Telegram-Kanal.

Auch wer das Kriegsgeschehen bisher nicht im Detail verfolgte (das tat ich auch nicht), horcht nun auf: Einem Nicht-Atomstaat – der Ukraine – ist ein gleichzeitiger, koordinierter Schlag gegen vier teils tausende Kilometer voneinander entfernte russische Luftbasen gelungen. Eine nicht unerhebliche Zahl strategisch wichtiger Flugzeuge wurde zerstört. Ein Angriff im hintersten russischen Hinterland, selbst jenseits der Taurus-Reichweite, durchgeführt mit Billigdrohnen, wirft erhebliche Fragen über geheimdienstliches Versagen in Russland und eklatante Mängel in der Luftverteidigung auf.

Es gibt wohl Momente, in denen Geschichte nicht geschrieben, sondern geflogen wird. Unspektakulär, relativ still, surrend, von einem LKW aus abgefeuert, mit einem Stück Technik, das kaum mehr kostet als das Gerät, auf dem ich diesen Text schreibe.

Ein Angriff auf die Friedensverhandlungen

Die Ukraine hat sich erstmals weit über das Schlachtfeld hinaus erhoben – geografisch, technisch, symbolisch. Die Triade der atomwaffenfähigen Luftstreitkräfte Russlands – ein Heiligtum sowjetischer Machtprojektion – wurde durch das schwächste Glied in der Logikkette der Militärdoktrin beschädigt: den Überraschungseffekt. Drohnen, wie aus dem 3D-Drucker, haben eine strategische Achillesferse bloßgelegt. Nicht mit Hyperschall, sondern mit Hartplastik und GPS. Das erste Opfer dieses Angriffs dürften die Friedensverhandlungen in Istanbul sein.

Dass die Ukraine strategische Luftstützpunkte der russischen Atomwaffe angreift – koordiniert, tief im Landesinnern – wäre bereits für sich eine Zäsur. Doch dass dies unter stillschweigender Duldung oder gar Mithilfe westlicher Dienste wie der CIA erfolgt sein dürfte, während Trump zugleich als Friedenstaube auftritt, verschiebt das strategische Koordinatensystem. Die alten Verträge – START etc. – wirken wie rissige Abkommen aus der Steinzeit. Wenn die USA von der Operation wussten, darf sich Russland getäuscht fühlen. Washington kann nicht gleichzeitig Frieden mit Moskau betonen und eine Aktion dulden oder mittragen, die offensichtlich das Ziel hat, die russische Atommacht zu schwächen, woran die USA prinzipiell Interesse hätten. Falls Trump nichts davon wusste, muss man sich fragen: Regiert eigentlich er oder der „Swamp“, den er austrocknen wollte?

Egal wie man es wendet: Die Operation Spinnennetz war mehr als nur ein Angriff auf russische Flugzeuge auf russischem Gebiet. Militärisch gewinnt die Ukraine dadurch wenig, symbolisch und politisch aber viel, denn der Hauptgegner der Ukraine sind gerade nicht die hundert Millionen Dollar teuren Bomber der Russen, sondern die schleichende Kriegsunlust der Europäer – und ein Amerika, das sich mehr mit sich selbst beschäftigt als mit dem Fortgang eines Krieges, in dem es längst selbst Partei ist.

Damit sich die Reihen wieder schließen, muss der Feind sich zeigen – deutlich, fassbar, bedrohlich. Eine russische Reaktion, die auch europäische Hauptstädte erschüttert, wäre strategisch nützlich. Der Angriff war daher wohl weniger eine militärische Tat als eine psychologische Operation im Kampf um Wahrnehmung und Willen. Aus Sicht der Ukraine ist das verständlich, für sie geht es um ihre Existenz. Dafür wiederum braucht es eine erhöhte Alarmstufe.

https://www.youtube.com/watch?v=1JlQLewOAmA

Solidarität durch Eskalation?

Die kalkulierte Demütigung könnte einem Drehbuch folgen: Putin soll nun die Rolle des Eskalators übernehmen. Tut er es, war die Operation erfolgreich – denn Europas Kriegstüchtigkeit hängt nicht nur von Panzerzahlen ab, sondern von der Bereitschaft zur Konfrontation. Der Feind, den es braucht, muss sich jetzt allen ins Gedächtnis brennen.

So gesehen ist der eigentliche Coup nicht der Schaden in Djagilewo, Iwanowo oder Olenia – sondern das noch bevorstehende unsichtbare Nachspiel. Europa und die Welt betreten nun gänzlich neues Gelände, in welchem ein militärisch gedemütigtes Russland gleichzeitig Friedenswillen gegenüber Europa bekunden, rote Linien verteidigen und seine Integrität als Atom-Macht bewahren muss. Das Dilemma für Putin besteht nun darin, Stärke zu beweisen ohne sich noch mehr zum Feindbild des Aggressors machen zu lassen.

Fakt ist: Wir sind einem III. Weltkrieg gerade so nah wie seit der Kuba-Krise nicht mehr.

Und wer sich über ein russisches “Pearl Harbor” freut, sollte mal in ein Geschichtsbuch schauen, wie es am Ende für Japan ausging.

LASSEN SIE DER FRIEDENSTAUBE FLÜGEL WACHSEN!

In Kürze folgt eine Mail an alle Genossenschafter, danke für die Geduld!

Hier können Sie die Friedenstaube abonnieren und bekommen die Artikel zugesandt.

Schon jetzt können Sie uns unterstützen:

- Für 50 CHF/EURO bekommen Sie ein Jahresabo der Friedenstaube.

- Für 120 CHF/EURO bekommen Sie ein Jahresabo und ein T-Shirt/Hoodie mit der Friedenstaube.

- Für 500 CHF/EURO werden Sie Förderer und bekommen ein lebenslanges Abo sowie ein T-Shirt/Hoodie mit der Friedenstaube.

- Ab 1000 CHF werden Sie Genossenschafter der Friedenstaube mit Stimmrecht (und bekommen lebenslanges Abo, T-Shirt/Hoodie).

Für Einzahlungen in CHF (Betreff: Friedenstaube):

Für Einzahlungen in Euro:

Milosz Matuschek

IBAN DE 53710520500000814137

BYLADEM1TST

Sparkasse Traunstein-Trostberg

Betreff: Friedenstaube

Wenn Sie auf anderem Wege beitragen wollen, schreiben Sie die Friedenstaube an: friedenstaube@pareto.space

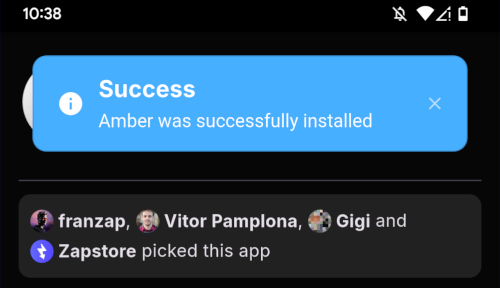

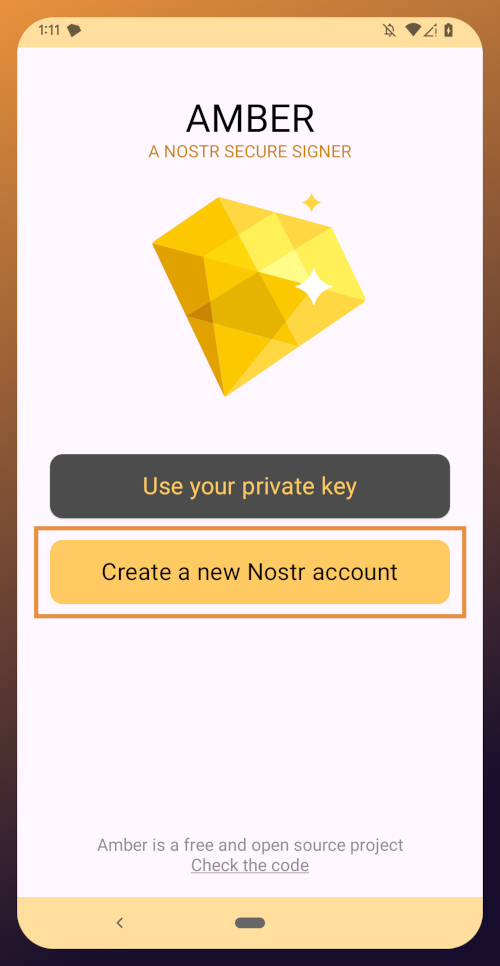

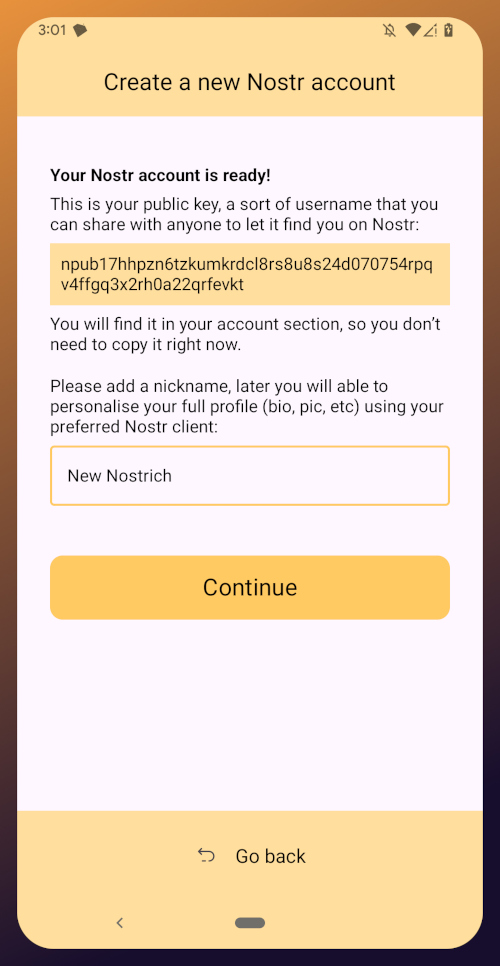

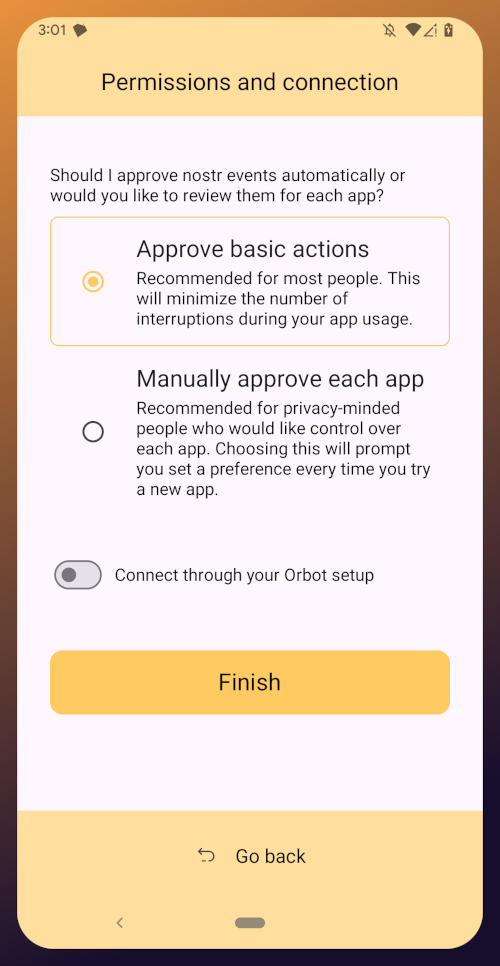

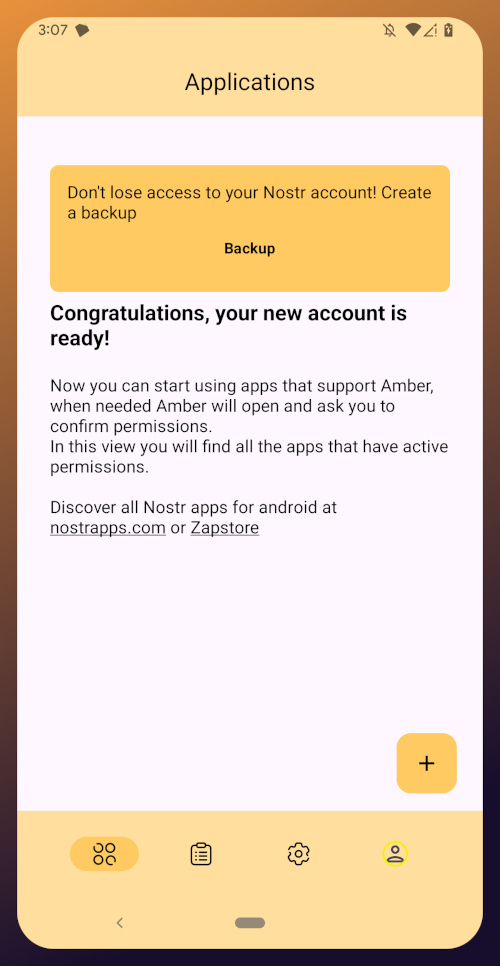

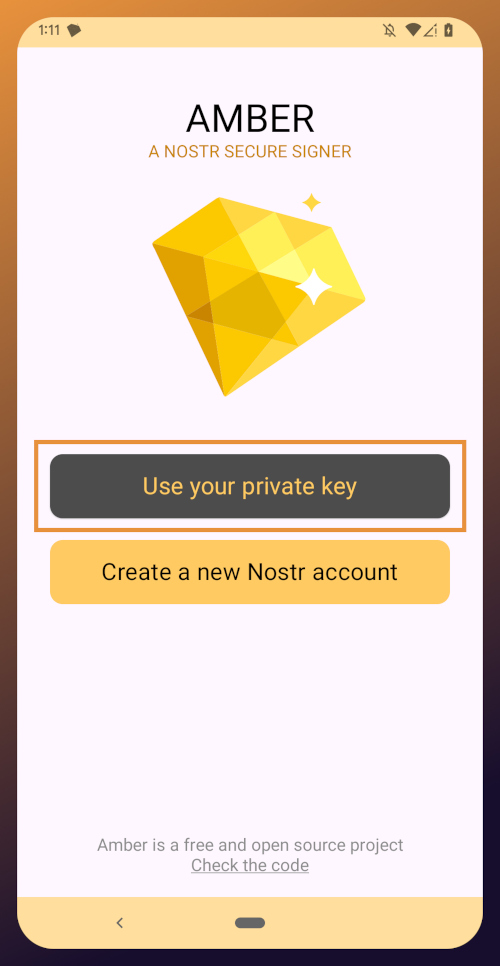

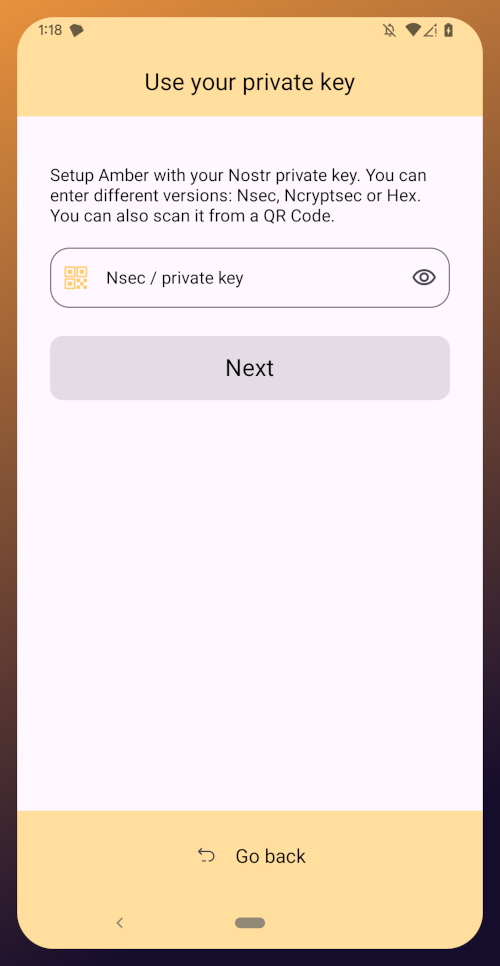

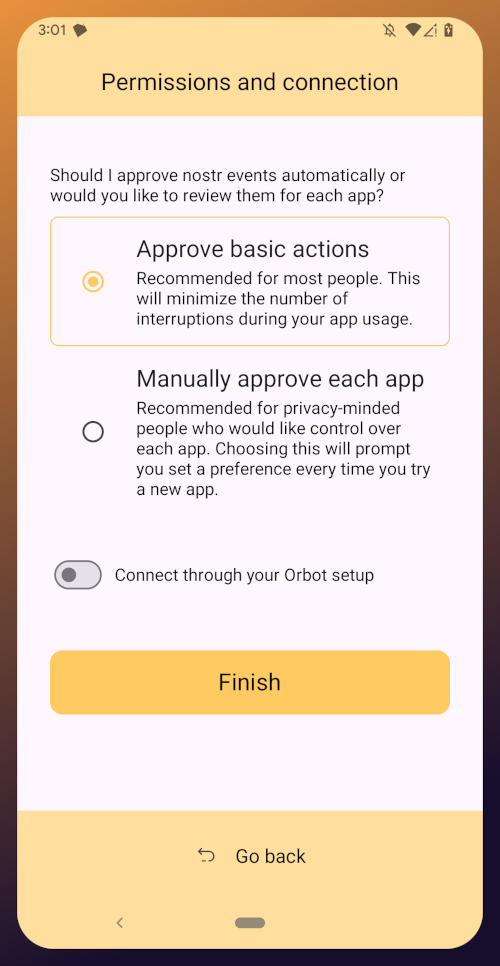

Sie sind noch nicht auf Nostr and wollen die volle Erfahrung machen (liken, kommentieren etc.)? Zappen können Sie den Autor auch ohne Nostr-Profil! Erstellen Sie sich einen Account auf Start. Weitere Onboarding-Leitfäden gibt es im Pareto-Wiki.

-

@ 7f6db517:a4931eda

2025-06-04 07:02:12

@ 7f6db517:a4931eda

2025-06-04 07:02:12

What is KYC/AML?

- The acronym stands for Know Your Customer / Anti Money Laundering.

- In practice it stands for the surveillance measures companies are often compelled to take against their customers by financial regulators.

- Methods differ but often include: Passport Scans, Driver License Uploads, Social Security Numbers, Home Address, Phone Number, Face Scans.

- Bitcoin companies will also store all withdrawal and deposit addresses which can then be used to track bitcoin transactions on the bitcoin block chain.

- This data is then stored and shared. Regulations often require companies to hold this information for a set number of years but in practice users should assume this data will be held indefinitely. Data is often stored insecurely, which results in frequent hacks and leaks.

- KYC/AML data collection puts all honest users at risk of theft, extortion, and persecution while being ineffective at stopping crime. Criminals often use counterfeit, bought, or stolen credentials to get around the requirements. Criminals can buy "verified" accounts for as little as $200. Furthermore, billions of people are excluded from financial services as a result of KYC/AML requirements.

During the early days of bitcoin most services did not require this sensitive user data, but as adoption increased so did the surveillance measures. At this point, most large bitcoin companies are collecting and storing massive lists of bitcoiners, our sensitive personal information, and our transaction history.

Lists of Bitcoiners

KYC/AML policies are a direct attack on bitcoiners. Lists of bitcoiners and our transaction history will inevitably be used against us.

Once you are on a list with your bitcoin transaction history that record will always exist. Generally speaking, tracking bitcoin is based on probability analysis of ownership change. Surveillance firms use various heuristics to determine if you are sending bitcoin to yourself or if ownership is actually changing hands. You can obtain better privacy going forward by using collaborative transactions such as coinjoin to break this probability analysis.

Fortunately, you can buy bitcoin without providing intimate personal information. Tools such as peach, hodlhodl, robosats, azteco and bisq help; mining is also a solid option: anyone can plug a miner into power and internet and earn bitcoin by mining privately.

You can also earn bitcoin by providing goods and/or services that can be purchased with bitcoin. Long term, circular economies will mitigate this threat: most people will not buy bitcoin - they will earn bitcoin - most people will not sell bitcoin - they will spend bitcoin.

There is no such thing as KYC or No KYC bitcoin, there are bitcoiners on lists and those that are not on lists.

If you found this post helpful support my work with bitcoin.

-

@ 32e18276:5c68e245

2025-06-03 14:45:17

@ 32e18276:5c68e245

2025-06-03 14:45:176 years ago I created some tools for working with peter todd's opentimestamps proof format. You can do some fun things like create plaintext and mini ots proofs. This short post is just a demo of what these tools do and how to use them.

What is OTS?

OpenTimestamps is a protocol for stamping information into bitcoin in a minimal way. It uses OP_RETURN outputs so that it has minimal impact on chain, and potentially millions of documents are stamped all at once with a merkle tree construction.

Examples

Here's the proof of the

ots.csource file getting stamped into the ots calendar merkle tree. We're simply printing the ots proof file here withotsprint:``` $ ./otsprint ots.c.ots

version 1 file_hash sha256 f76f0795ff37a24e566cd77d1996b64fab9c871a5928ab9389dfc3a128ec8296 append 2e9943d3833768bdb9a591f1d2735804 sha256 | --> append 2d82e7414811ecbf | sha256 | append a69d4f93e3e0f6c9b8321ce2cdd90decd34d260ea3f8b55e83d157ad398b7843 | sha256 | append ac0b5896401478eb6d88a408ec08b33fd303b574fb09b503f1ac1255b432d304 | sha256 | append 8aa9fd0245664c23d31d344243b4e8b0 | sha256 | prepend 414db5a1cd3a3e6668bf2dca9007e7c0fc5aa6dc71a2eab3afb51425c3acc472 | sha256 | append 5355b15d88d4dece45cddb7913f2c83d41e641e8c1d939dac4323671a4f8e197 | sha256 | append a2babd907ca513ab561ce3860e64a26b7df5de117f1f230bc8f1a248836f0c25 | sha256 | prepend 683f072f | append 2a4cdf9e9e04f2fd | attestation calendar https://alice.btc.calendar.opentimestamps.org | --> append 7c8764fcaba5ed5d | sha256 | prepend f7e1ada392247d3f3116a97d73fcf4c0994b5c22fff824736db46cd577b97151 | sha256 | append 3c43ac41e0281f1dbcd7e713eb1ffaec48c5e05af404bca2166cdc51966a921c | sha256 | append 07b18bd7f4a5dc72326416aa3c8628ca80c8d95d7b1a82202b90bc824974da13 | sha256 | append b4d641ab029e7d900e92261c2342c9c9 | sha256 | append 4968b89b02b534f33dc26882862d25cca8f0fa76be5b9d3a3b5e2d77690e022b | sha256 | append 48c54e30b3a9ec0e6339b88ed9d04b9b1065838596a4ec778cbfc0dfc0f8c781 | sha256 | prepend 683f072f | append 8b2b4beda36c18dc | attestation calendar https://bob.btc.calendar.opentimestamps.org | --> append baa878b42ef3e0d45b324cc3a39a247a | sha256 | prepend 4fb1bc663cd641ad18e5c73fb618de1ae3d28fb5c3c224b7f9888fd52feb09ec | sha256 | append 731329278830c9725497d70e9f5a02e4b2d9c73ff73560beb3a896a2f180fdbf | sha256 | append 689024a9d57ad5daad669f001316dd0fc690ac4520410f97a349b05a3f5d69cb | sha256 | append 69d42dcb650bb2a690f850c3f6e14e46c2b0831361bac9ec454818264b9102fd | sha256 | prepend 683f072f | append bab471ba32acd9c3 | attestation calendar https://btc.calendar.catallaxy.com append c3ccce274e2f9edfa354ec105cb1a749 sha256 append 6297b54e3ce4ba71ecb06bd5632fd8cbd50fe6427b6bfc53a0e462348cc48bab sha256 append c28f03545a2948bd0d8102c887241aff5d4f6cf1e0b16dfd8787bf45ca2ab93d sha256 prepend 683f072f append 7f3259e285891c8e attestation calendar https://finney.calendar.eternitywall.com ```

The tool can create a minimal version of the proofs:

``` $ ./otsmini ots.c.ots | ./otsmini -d | ./otsprint

version 1 file_hash sha256 f76f0795ff37a24e566cd77d1996b64fab9c871a5928ab9389dfc3a128ec8296 append 2e9943d3833768bdb9a591f1d2735804 sha256 append c3ccce274e2f9edfa354ec105cb1a749 sha256 append 6297b54e3ce4ba71ecb06bd5632fd8cbd50fe6427b6bfc53a0e462348cc48bab sha256 append c28f03545a2948bd0d8102c887241aff5d4f6cf1e0b16dfd8787bf45ca2ab93d sha256 prepend 683f072f append 7f3259e285891c8e attestation calendar https://finney.calendar.eternitywall.com ```

which can be shared on social media as a string:

5s1L3tTWoTfUDhB1MPLXE1rnajwUdUnt8pfjZfY1UWVWpWu5YhW3PGCWWoXwWBRJ16B8182kQgxnKyiJtGQgRoFNbDfBss19seDnco5sF9WrBt8jQW7BVVmTB5mmAPa8ryb5929w4xEm1aE7S3SGMFr9rUgkNNzhMg4VK6vZmNqDGYvvZxBtwDMs2PRJk7y6wL6aJmq6yoaWPvuxaik4qMp76ApXEufP6RnWdapqGGsKy7TNE6ZzWWz2VXbaEXGwgjrxqF8bMstZMdGo2VzpVuEyou can even do things like gpg-style plaintext proofs:

``` $ ./otsclear -e CONTRIBUTING.ots -----BEGIN OPENTIMESTAMPS MESSAGE-----

Email patches to William Casarin jb55@jb55.com

-----BEGIN OPENTIMESTAMPS PROOF-----

AE9wZW5UaW1lc3RhbXBzAABQcm9vZgC/ieLohOiSlAEILXj4GSagG6fRNnR+CHj9e/+Mdkp0w1us gV/5dmlX2NrwEDlcBMmQ723mI9sY9ALUlXoI//AQRXlCd716J60FudR+C78fkAjwIDnONJrj1udi NDxQQ8UJiS4ZWfprUxbvaIoBs4G+4u6kCPEEaD8Ft/AIeS/skaOtQRoAg9/jDS75DI4pKGh0dHBz Oi8vZmlubmV5LmNhbGVuZGFyLmV0ZXJuaXR5d2FsbC5jb23/8AhMLZVzYZMYqwjwEPKWanBNPZVm kqsAYV3LBbkI8CCfIVveDh/S8ykOH1NC6BKTerHoPojvj1OmjB2LYvdUbgjxBGg/BbbwCGoo3fi1 A7rjAIPf4w0u+QyOLi1odHRwczovL2FsaWNlLmJ0Yy5jYWxlbmRhci5vcGVudGltZXN0YW1wcy5v cmf/8Aik+VP+n3FhCwjwELfTdHAfYQNa49I3CYycFbkI8QRoPwW28AgCLn93967lIQCD3+MNLvkM jiwraHR0cHM6Ly9ib2IuYnRjLmNhbGVuZGFyLm9wZW50aW1lc3RhbXBzLm9yZ/AQ3bEwg7mjQyKR PykGgiJewAjwID5Q68dY4m+XogwTJx72ecQEe5lheCO1RnlcJSTFokyRCPEEaD8Ft/AIw1WWPe++ 8N4Ag9/jDS75DI4jImh0dHBzOi8vYnRjLmNhbGVuZGFyLmNhdGFsbGF4eS5jb20= -----END OPENTIMESTAMPS PROOF-----

$ ./otsclear -v <<<proof_string... # verify the proof string ```

I've never really shared these tools before, I just remembered about it today. Enjoy!

Try it out: https://github.com/jb55/ots-tools

-

@ 7f6db517:a4931eda

2025-06-04 09:01:27

@ 7f6db517:a4931eda

2025-06-04 09:01:27

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

Good morning.

It looks like PacWest will fail today. It will be both the fifth largest bank failure in US history and the sixth major bank to fail this year. It will likely get purchased by one of the big four banks in a government orchestrated sale.

March 8th - Silvergate Bank

March 10th - Silicon Valley Bank

March 12th - Signature Bank

March 19th - Credit Suisse

May 1st - First Republic Bank

May 4th - PacWest Bank?PacWest is the first of many small regional banks that will go under this year. Most will get bought by the big four in gov orchestrated sales. This has been the playbook since 2008. Follow the incentives. Massive consolidation across the banking industry. PacWest gonna be a drop in the bucket compared to what comes next.

First, a hastened government led bank consolidation, then a public/private partnership with the remaining large banks to launch a surveilled and controlled digital currency network. We will be told it is more convenient. We will be told it is safer. We will be told it will prevent future bank runs. All of that is marketing bullshit. The goal is greater control of money. The ability to choose how we spend it and how we save it. If you control the money - you control the people that use it.

If you found this post helpful support my work with bitcoin.

-

@ 32e18276:5c68e245

2025-06-02 20:58:05

@ 32e18276:5c68e245

2025-06-02 20:58:05Damus OpenSats Grant Q1 2025 Progress Report

This period of the Damus OpenSats grant has been productive, and encompasses the work our beta release of Notedeck. Since we sent our last report on January, this encompasses all the work after then.

Damus Notedeck

We released the Beta version of Notedeck, which has many new features:

Dave

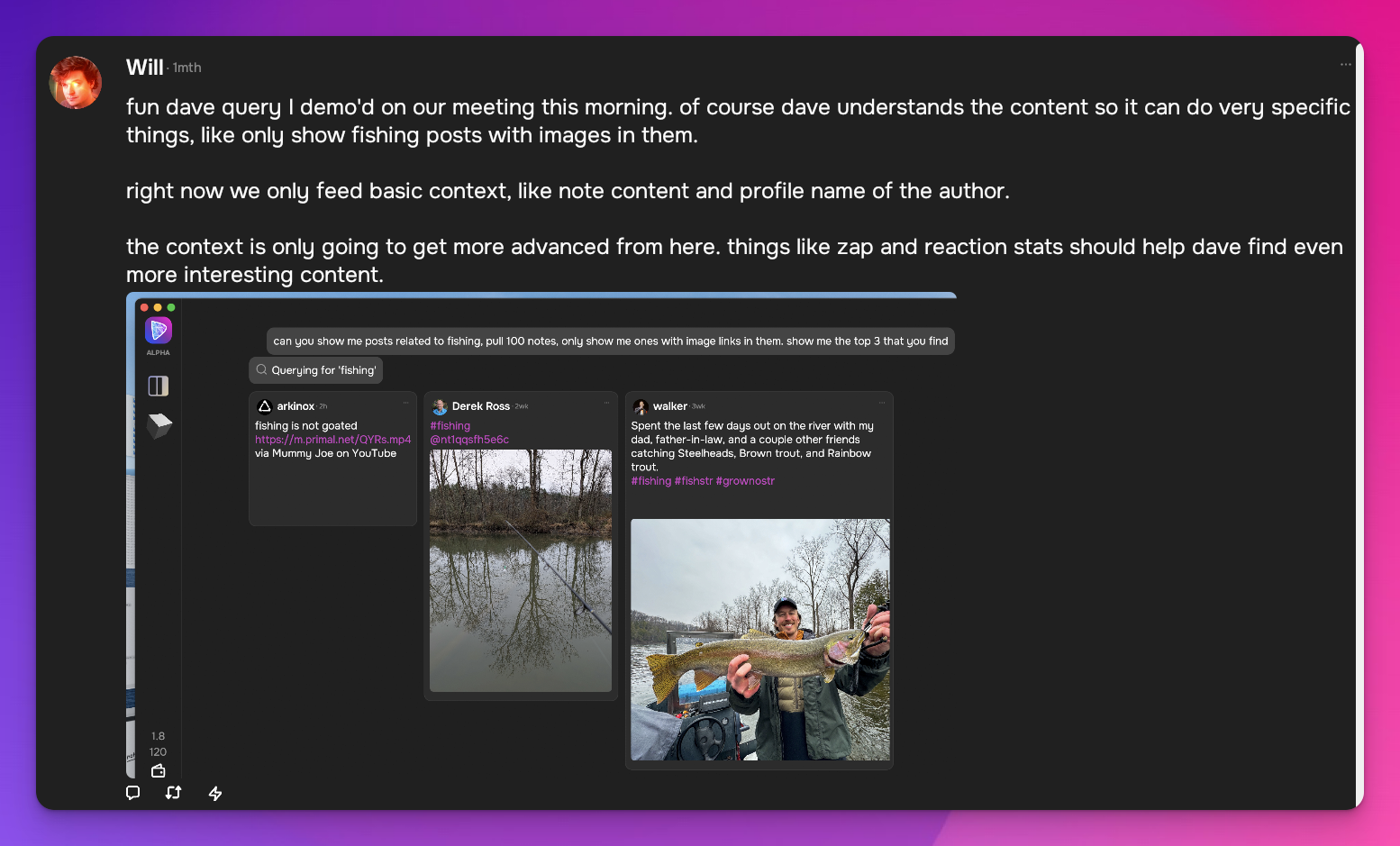

We've added a new AI-powered nostr assistant, similar to Grok on X. We call him Dave.

Dave is integrated with tooling that allows it to query the local relay for posts and profiles:

Search

The beta release includes a fulltext search interface powered by nostrdb:

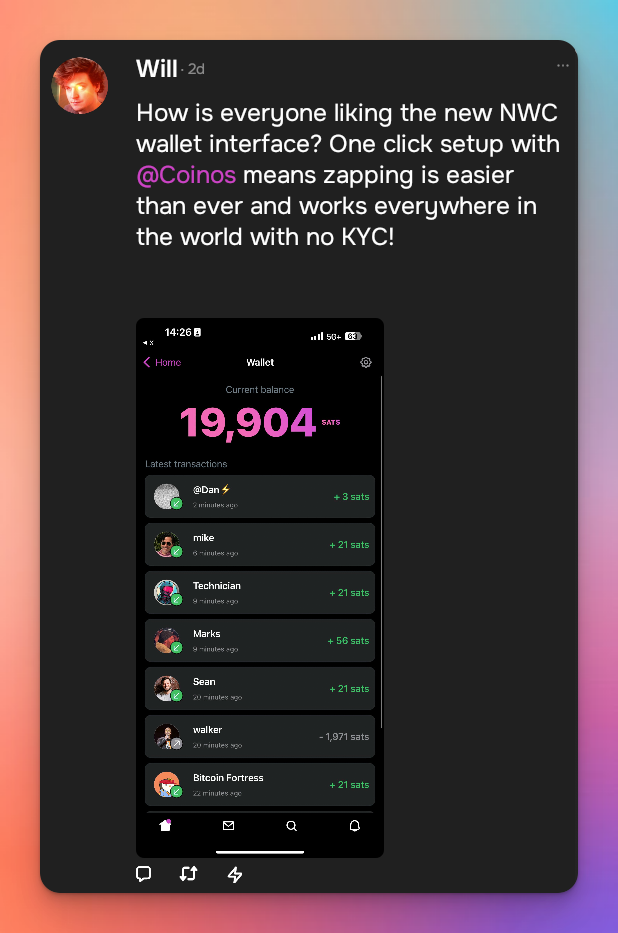

Zaps

You can now zap with NWC!

And More!

- GIFs!

- Add full screen images, add zoom & pan

- Introduce last note per pubkey feed (experimental)

- Allow multiple media uploads per selection

- Major Android improvements (still wip)

- Added notedeck app sidebar

- User Tagging

- Note truncation

- Local network note broadcast, broadcast notes to other notedeck notes while you're offline

- Mute list support (reading)

- Relay list support

- Ctrl-enter to send notes

- Added relay indexing (relay columns soon)

- Click hashtags to open hashtag timeline

Damus iOS

Work continued on the iOS side. While I was not directly involved in the work since the last report, I have been directing and managing its development.

What's new:

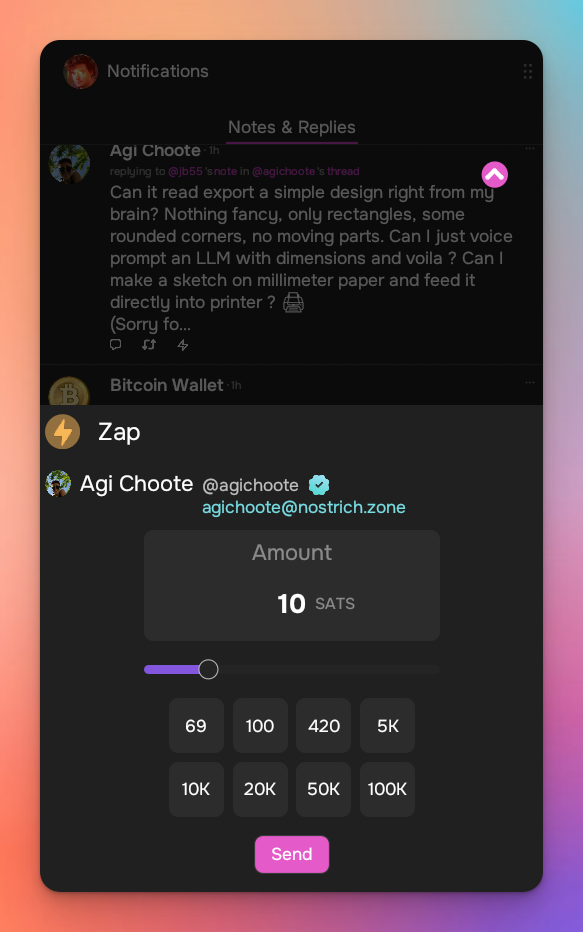

Coinos Wallet + Interface

We've partnered with coinos to enable a one-click, non-KYC lightning wallet!

We now have an NWC wallet interface, and we've re-enabled zaps as per the new appstore guidelines!

Now you can see all incoming and outgoing NWC transactions and start zapping right away.

Enhanced hellthread muting

Damus can now automatically mute hellthreads, instead of having to do that manually.

Drafts

We now locally persist note drafts so that they aren't lost on app restart!

Profile editing enhancements

We now have a profile picture editing tool so that profile pictures are optimized and optionally cropped

Conversations tab

We now have a conversations tab on user profiles, allowing you to see all of your past conversations with that person!

Enhanced push notifications

We've updated our push notifications to include profile pictures, and they are also now grouped by the thread that they came from.

And lots more!

Too many to list here, check out the full changelog

Nostrdb

nostrdb, the engine that powers notecrumbs, damus iOS, and notedeck, continued to improve:

Custom filters

We've added the ability to include custom filtering logic during any nostrdb query. Dave uses this to filter replies from kind1 results to keep the results small and to avoid doing post-processing.

Relay index + queries

There is a new relay index! Now when ingesting notes, you can include extra metadata such as where the note came from. You can use this index to quickly list all of the relays for a particular note, or for relay timelines.

NIP50 profile searches

To assist dave in searching for profiles, we added a new query plan for {kind:0, search:} queries to scan the profile search index.

How money was used

- relay.damus.io server costs

- Living expenses

Next quarter

We're making a strong push to get our Android version released, so that is the main focus for me.

-

@ 7f6db517:a4931eda

2025-06-04 07:02:09

@ 7f6db517:a4931eda

2025-06-04 07:02:09

Nostr is an open communication protocol that can be used to send messages across a distributed set of relays in a censorship resistant and robust way.

If you missed my nostr introduction post you can find it here. My nostr account can be found here.

We are nearly at the point that if something interesting is posted on a centralized social platform it will usually be posted by someone to nostr.

We are nearly at the point that if something interesting is posted exclusively to nostr it is cross posted by someone to various centralized social platforms.

We are nearly at the point that you can recommend a cross platform app that users can install and easily onboard without additional guides or resources.

As companies continue to build walls around their centralized platforms nostr posts will be the easiest to cross reference and verify - as companies continue to censor their users nostr is the best censorship resistant alternative - gradually then suddenly nostr will become the standard. 🫡

Current Nostr Stats

If you found this post helpful support my work with bitcoin.

-

@ dfa02707:41ca50e3

2025-06-04 09:01:25

@ dfa02707:41ca50e3

2025-06-04 09:01:25Contribute to keep No Bullshit Bitcoin news going.

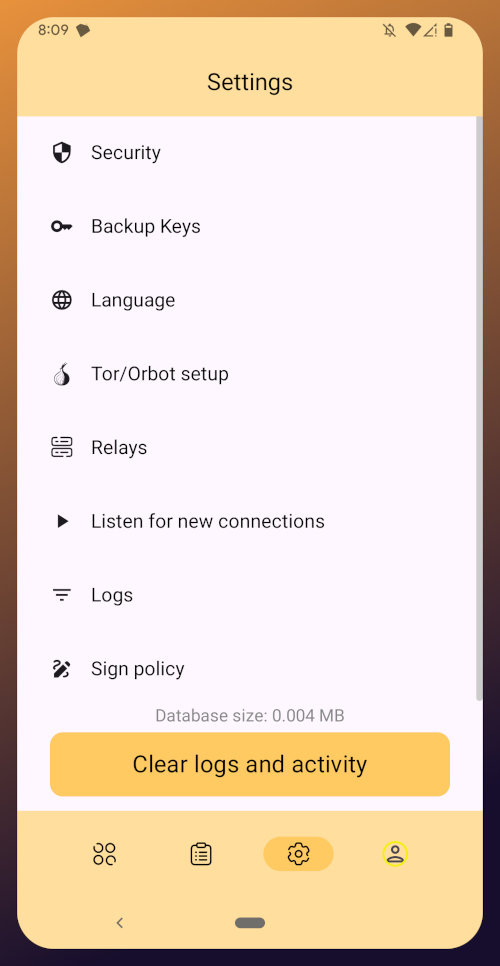

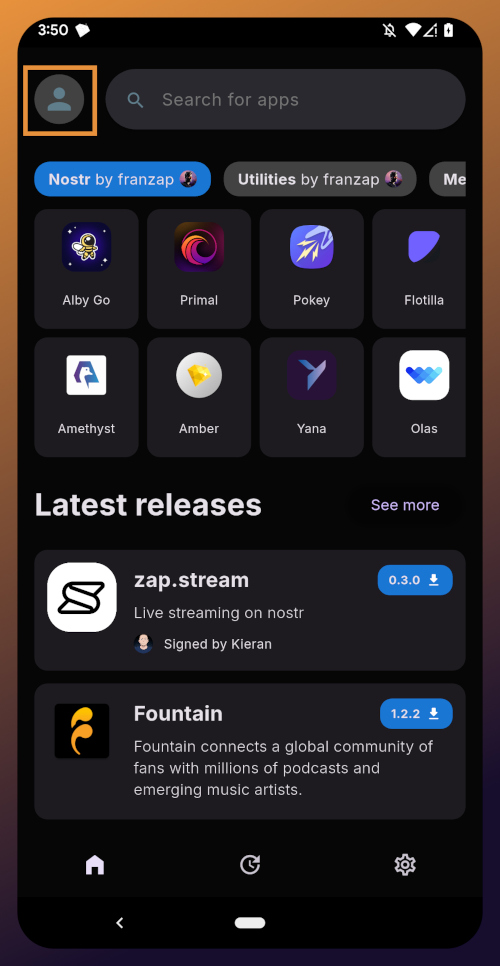

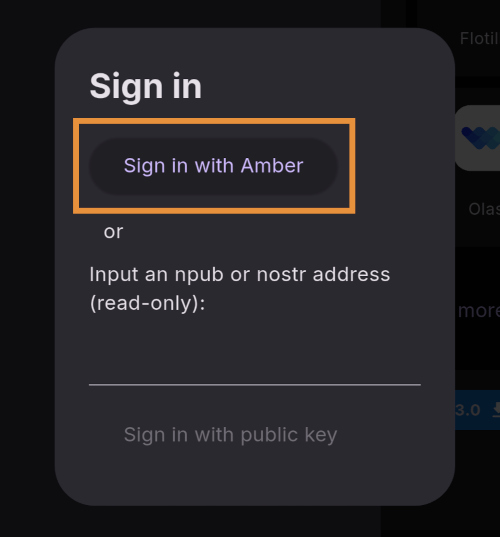

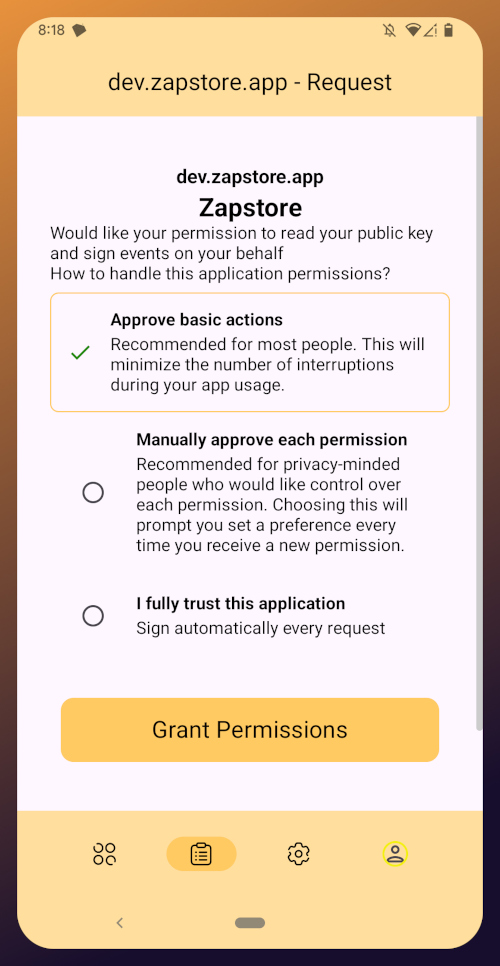

- The latest firmware updates for COLDCARD devices introduce two major features: COLDCARD Co-sign (CCC) and Key Teleport between two COLDCARD Q devices using QR codes and/or NFC with a website.

What's new

- COLDCARD Co-Sign: When CCC is enabled, a second seed called the Spending Policy Key (Key C) is added to the device. This seed works with the device's Main Seed and one or more additional XPUBs (Backup Keys) to form 2-of-N multisig wallets.

- The spending policy functions like a hardware security module (HSM), enforcing rules such as magnitude and velocity limits, address whitelisting, and 2FA authentication to protect funds while maintaining flexibility and control, and is enforced each time the Spending Policy Key is used for signing.

- When spending conditions are met, the COLDCARD signs the partially signed bitcoin transaction (PSBT) with the Main Seed and Spending Policy Key for fund access. Once configured, the Spending Policy Key is required to view or change the policy, and violations are denied without explanation.

"You can override the spending policy at any time by signing with either a Backup Key and the Main Seed or two Backup Keys, depending on the number of keys (N) in the multisig."

-

A step-by-step guide for setting up CCC is available here.

-

Key Teleport for Q devices allows users to securely transfer sensitive data such as seed phrases (words, xprv), secure notes and passwords, and PSBTs for multisig. It uses QR codes or NFC, along with a helper website, to ensure reliable transmission, keeping your sensitive data protected throughout the process.

- For more technical details, see the protocol spec.

"After you sign a multisig PSBT, you have option to “Key Teleport” the PSBT file to any one of the other signers in the wallet. We already have a shared pubkey with them, so the process is simple and does not require any action on their part in advance. Plus, starting in this firmware release, COLDCARD can finalize multisig transactions, so the last signer can publish the signed transaction via PushTX (NFC tap) to get it on the blockchain directly."

- Multisig transactions are finalized when sufficiently signed. It streamlines the use of PushTX with multisig wallets.

- Signing artifacts re-export to various media. Users are now provided with the capability to export signing products, like transactions or PSBTs, to alternative media rather than the original source. For example, if a PSBT is received through a QR code, it can be signed and saved onto an SD card if needed.

- Multisig export files are signed now. Public keys are encoded as P2PKH address for all multisg signature exports. Learn more about it here.

- NFC export usability upgrade: NFC keeps exporting until CANCEL/X is pressed.

- Added Bitcoin Safe option to Export Wallet.

- 10% performance improvement in USB upload speed for large files.

- Q: Always choose the biggest possible display size for QR.

Fixes

- Do not allow change Main PIN to same value already used as Trick PIN, even if Trick PIN is hidden.

- Fix stuck progress bar under

Receiving...after a USB communications failure. - Showing derivation path in Address Explorer for root key (m) showed double slash (//).

- Can restore developer backup with custom password other than 12 words format.

- Virtual Disk auto mode ignores already signed PSBTs (with “-signed” in file name).

- Virtual Disk auto mode stuck on “Reading…” screen sometimes.

- Finalization of foreign inputs from partial signatures. Thanks Christian Uebber!

- Temporary seed from COLDCARD backup failed to load stored multisig wallets.

Destroy Seedalso removes all Trick PINs from SE2.Lock Down Seedrequires pressing confirm key (4) to execute.- Q only: Only BBQr is allowed to export Coldcard, Core, and pretty descriptor.

-

@ 1c5ff3ca:efe9c0f6

2025-06-04 08:08:27

@ 1c5ff3ca:efe9c0f6

2025-06-04 08:08:27Just calling it Open is not enough - Herausforderungen öffentlicher Bildungsinfrastrukturen und wie Nostr helfen könnte

Ich möchte gerne mit euch teilen, an welchen Konzepten ich arbeite, um die öffentliche Bildungsinfrastruktur mit Hilfe von Nostr zugänglicher und offener zu gestalten. Ich arbeite im Bereich öffentlicher Bildungsinfrastrukturen, besonders im Feld von Open Educational Resources (#OER). OER sind offen lizenzierte Bildungsmaterialien, die mit einer offenen Lizenz, meist einer Creative Commons Lizenz, versehen sind (CC-0, CC-BY, CC-BY-SA). Durch die klare und offene Lizenzierung ist es leicht möglich, die Lernmaterialien auf die individuellen Bedarfe anzupassen, sie zu verbessern und sie erneut zu veröffentlichen.

Seit vielen Jahren wird einerseits die Entwicklung freier Bildungsmaterialien gefördert, andererseits werden Plattformen, insbesondere Repositorien gefördert, die diese Materialien verfügbar machen sollen. Denn irgendwo müssen diese Materialien zur Verfügung gestellt werden, damit sie auch gefunden werden können.

Das klappt allerdings nur so mittelgut.

Herausforderungen

Nach vielen Jahren Förderung kann die einfache Frage: "Wo kann ich denn mein OER-Material bereitstellen" nicht einfach beantwortet werden. Es gibt Services, bei denen ich mein OER hochladen kann, jedoch bleibt es dann eingeschlossen in dieser Plattform und wird nicht auf anderen Plattformen auffindbar. Außerdem sind diese Services häufig an bestimmte Bildungskontexte gebunden oder geben Content erst nach einer Qualitätsprüfung frei. Dies führt dazu, dass ein einfaches und gleichzeitig öffentliches Teilen nicht möglich ist.

Diese und weitere Herausforderungen haben ihren Ursprung darin, dass Service und Infrastruktur in der Architektur öffentlichen Bildungsarchitektur ungünstig vermischt werden. Als Infrastruktur verstehe ich hier die Bereitstellung einer öffentlichen und offen zugänglichen Bildungsinfrastruktur, auf der Daten ausgetauscht, also bereitgestellt und konsumiert werden können. Jedoch existiert eine solche Infrstruktur momentan nicht unabhängig von den Services, die auf ihr betrieben werden. Infrastrukturbetreiber sind momentan gleichzeitig immer Servicebetreiber. Da sie aber die Hand darüber haben wollen, was genau in ihrem Service passiert (verständlich), schränken sie den Zugang zu ihrer Infrastruktur mit ein, was dazu führt, dass sie Lock-In Mechanismen großer Medienplattformen in der kleinen öffentlichen Bildungsinfrastruktur replizieren.

Es ist in etwas so, als würde jeder Autobauer auch gleichzeitig die Straßen für seine Fahrzeuge bauen. Aber halt nur für seine Autos.

Anhand einiger beispielhafter Services, die bestehende Plattformen auf ihren Infrastrukturen anbieten, möchte ich die Herausforderungen aufzeigen, die ich im aktuellen Architekturkonzept sehe:

- Upload von Bildungsmaterial

- Kuration: Zusammenstellung von Listen, Annotation mit Metadaten

- Crawling, Indexierung und Suche

- Plattfformübergreifende Kollaboration in Communities -> Beispiel: Qualitätssicherung (was auch immer das genau bedeutet)

- KI- Services -> Beispiel: KI generierte Metadaten für BiIdungsmaterial

Material Upload

Der Service "Material-Upload" oder das Mitteilen eines Links zu einem Bildungsmaterial wird von verschiedenen OER-Pattformen bereitgestellt (wirlernenonline.de, oersi.org, mundo.schule).

Dies bedeutet konkret: Wenn ich bei einer der Plattformen Content hochlade, verbleibt der Content in der Regel auch dort und wird nicht mit den anderen Plattformen geteilt. Das Resultat für die User: Entweder muss ich mich überall anmelden und dort mein Material hochladen (führt zu Duplikaten) oder damit leben, dass eben nur die Nutzer:innen der jeweiligen Plattform meinen Content finden können.

Der "Open Educational Resource Search Index" (OERSI) geht diese Herausforderung an, indem die Metadaten zu den Bildungsmaterialien verschiedener Plattformen in einem Index bereitgestellt werden. Dieser Index ist wiederum öffentlich zugänglich, sodass Plattformen darüber auch Metadaten anderer Plattformen konsumieren können. Das ist schon sehr gut. Jedoch funktioniert das nur für Plattformen, die der OERSI indexiert und für alle anderen nicht. Der OERSI ist auf den Hochschulbereich fokussiert, d.h. andere Bildungskontexte werden hier ausgeschlossen. Der Ansatz für jeden Bildungsbereich einen passenden "OERSI" daneben zustellen skaliert und schlecht und es bleibt die Herausforderung bestehen, dass für jede Quelle, die indexiert werden soll, ein entsprechender Importer/Crawler geschrieben werden muss.

Dieser Ansatz (Pull-Ansatz) rennt den Materialien hinterher.

Es gibt jedoch noch mehr Einschränkungen: Die Plattformen haben sich jeweils auf spezifische Bildungskontexte spezialisiert. D.h. auf die Fragen: Wo kann ich denn mein OER bereitstellen, muss immer erst die Gegenfrage: "Für welchen Bildungsbereich denn?" beantwortet werden. Wenn dieser außerhalb des allgemeinbildendenden Bereichs oder außerhalb der Hochschule liegt, geschweige denn außerhalb des institutionellen Bildungsrahmens, wird es schon sehr, sehr dünn. Kurzum:

- Es ist nicht einfach möglich OER bereitzustellen, sodass es auch auf verschiedenen Plattformen gefunden werden kann.

Kuration

Unter Kuration verstehe ich hier die Zusammenstellung von Content in Listen oder Sammlungs ähnlicher Form sowie die Annotation dieser Sammlungen oder des Contents mit Metadaten.

Einige Plattformen bieten die Möglichkeit an, Content in Listen einzuordnen. Diese Listen sind jedoch nicht portabel. Die Liste, die ich auf Plattform A erstelle, lässt sich nicht auf Plattform B importieren. Das wäre aber schön, denn so könnten die Listen leichter auf anderen Plattformen erweitert oder sogar kollaborativ gestaltet werden, andererseits werden Lock-In-Effekte zu vermieden.

Bei der Annotation mit Metadaten treten verschiedene zentralisierende Faktoren auf. In der momentanen Praxis werden die Metadaten meist zum Zeitpunkt der Contentbereitstellung festgelegt. Meist durch eine Person oder Redaktion, bisweilen mit Unterstützung von KI-Services, die bei der Metadateneingabe unterstützen. Wie aber zusätzliche eigene Metadaten ergänzen? Wie mitteilen, dass dieses Material nicht nur für Biologie, sondern auch für Sport in Thema XY super einsetzbar wäre? Die momentanen Ansätze können diese Anforderung nicht erfüllen. Sie nutzen die Kompetenz und das Potential ihrer User nicht.

- Es gibt keine interoperablen Sammlungen

- Metadaten-Annotation ist zentralisiert

- User können keine eigenen Metadaten hinzufügen

Crawling, Indexierung und Suche

Da die Nutzer:innen nicht viele verschiedene Plattformen und Webseiten besuchen wollen, um dort nach passendem Content zu suchen, crawlen die "großen" OER-Aggregatoren diese, um die Metadaten des Contents zu indexieren. Über verschiedene Schnittstellen oder gerne auch mal über das rohe HTML. Letztere Crawler sind sehr aufwändig zu schreiben, fehleranfällig und gehen bei Design-Anpassungen der Webseite schnell kaputt, erstere sind etwas stabiler, solange sich die Schnittstelle nicht ändert. Durch den Einsatz des Allgemeinen Metadatenprofils für Bildungsressourcen (AMB) hat sich die Situation etwas verbessert. Einige Plattformen bieten jetzt eine Sitemap an, die Links zu Bildungsmaterial enthalten, die wiederum eingebettet