-

@ 90c656ff:9383fd4e

2025-05-31 17:54:42

@ 90c656ff:9383fd4e

2025-05-31 17:54:42Since its creation, Bitcoin has been one of the most hotly debated assets in the financial world—both by passionate supporters and skeptics. Its extreme volatility and the impact it has had on the traditional financial system have made it a constant subject of speculation. Over time, Bitcoin’s adoption has grown, sparking ongoing discussions about its future—both in terms of price and integration into the global financial system. In this context, multiple scenarios have been proposed, ranging from optimistic to cautious, depending on factors like regulation, institutional adoption, and technological innovation.

Bitcoin’s price: forecasts and influencing factors

01 - Institutional Adoption: The growing use of Bitcoin by major companies and institutional investors has been seen as a bullish driver. Companies like Tesla, MicroStrategy, and Square have added Bitcoin to their balance sheets, boosting confidence in it as a store of value. As more businesses follow suit, demand for Bitcoin could increase, pushing the price upward.

02 - Government Regulation: How governments respond to Bitcoin is one of the biggest sources of uncertainty. Heavy-handed regulation could restrict access and dampen interest, while a more favorable approach could boost adoption and support price growth. Countries like El Salvador have shown positive trends by adopting Bitcoin as legal tender, though in many others, regulation remains a significant challenge.

03 - Limited Supply: With a maximum supply of 21 million coins, Bitcoin is immune to inflationary money printing. This scarcity makes it especially attractive as a store of value, particularly during times of global economic uncertainty, potentially supporting long-term price appreciation.

04 - Technology and Scalability: Innovations like the Lightning Network and Taproot, aimed at improving scalability and transaction efficiency, could help increase Bitcoin's utility—making it more accessible for daily use and positively impacting its market value.

Global adoption of Bitcoin: The path toward financial inclusion

Bitcoin adoption is rising globally, especially in regions where traditional financial systems are inefficient or inaccessible. Countries facing economic instability, such as those plagued by high inflation or currency crises, are increasingly viewing Bitcoin as a viable alternative. Financial inclusion is a key driver of this adoption, as Bitcoin offers financial services to people excluded from the traditional banking sector.

01 - Emerging Markets: In countries like Brazil, Argentina, Nigeria, and others, demand for Bitcoin has grown as people seek to protect their assets from the devaluation of local currencies. In these regions, Bitcoin functions as both a store of value and a medium of exchange free from central authority control.

02 - Adoption by Governments and Businesses: As more companies and even governments embrace Bitcoin, its integration into the global economy could accelerate. El Salvador, for example, has shown it’s possible to adopt Bitcoin as an official currency, while more businesses are accepting it as a payment method—further legitimizing its role in global commerce.

03 - Education and Accessibility: As more people understand how Bitcoin works and appreciate its advantages—such as security, privacy, and financial freedom—adoption is likely to grow. Easier-to-use exchanges and improved wallet interfaces are making it simpler for everyday users to access and use Bitcoin.

Future scenarios: Optimism or caution?

Bitcoin's future remains uncertain, but several possible outcomes are taking shape. The optimistic scenario foresees greater price appreciation and widespread global adoption, driven by technological innovation, increased institutional trust, and the search for a decentralized alternative to the traditional financial system. In this case, Bitcoin could become a widely accepted form of payment and a global store of value, with prices reaching new all-time highs.

On the other hand, the more cautious scenario suggests that obstacles like government regulation, competition from other digital currencies, and potential technical shortcomings could prevent Bitcoin from becoming central to the financial system. Furthermore, price volatility could deter those seeking stability and security.

In summary, predictions about Bitcoin’s price and global adoption are undeniably complex and influenced by a wide range of factors. Bitcoin’s future will depend on how society, governments, and businesses respond to this new form of money. While the potential for appreciation is significant, the risks and volatility involved cannot be ignored. As global adoption increases and technology continues to evolve, it will be essential to closely monitor the developments shaping Bitcoin’s role in the global financial landscape.

Thank you very much for reading this far. I hope everything is well with you, and sending a big hug from your favorite Bitcoiner maximalist from Madeira. Long live freedom!

-

@ 90c656ff:9383fd4e

2025-05-31 17:49:25

@ 90c656ff:9383fd4e

2025-05-31 17:49:25With the growing digitalization of money, governments around the world have begun developing Central Bank Digital Currencies (CBDCs) in response to the rising popularity of Bitcoin. While Bitcoin represents a decentralized and censorship-resistant financial system, CBDCs are digital versions of fiat currencies, directly controlled by central banks. This emerging competition could shape the future of money and define the balance between financial freedom and state control.

Key differences between Bitcoin and CBDCs

Bitcoin and CBDCs differ in nearly every fundamental aspect:

01 - Centralization vs Decentralization: Bitcoin operates on a decentralized network where no government or entity can change the rules or censor transactions. CBDCs, on the other hand, are issued and managed by central banks, enabling greater control over the circulation and use of money.

02 - Fixed Supply vs Controlled Inflation: Bitcoin has a fixed supply of 21 million units, making it a scarce and deflationary asset. CBDCs can be issued without limits, much like traditional fiat currencies, and are subject to inflationary monetary policies.

03 - Privacy vs Surveillance: Bitcoin allows pseudonymous transactions, ensuring a certain degree of financial privacy. CBDCs may be designed to track every transaction, enabling full governmental oversight—and potentially, control over how citizens spend their money.

04 - Censorship Resistance vs State Control: Bitcoin enables anyone to transact without needing third-party approval. CBDCs, being centralized, could be used by governments to restrict undesirable transactions or even freeze funds at the press of a button.

What are governments aiming for with CBDCs?

The introduction of CBDCs is often promoted with benefits such as:

01 - Greater efficiency in financial transactions by removing intermediaries and reducing banking costs.

02 - Easier implementation of economic policies, such as direct stimulus payments or automated taxation.

03 - Enhanced ability to combat illegal activities through real-time transaction tracking.

However, these justifications raise serious concerns about the erosion of financial privacy and the expansion of government power over the monetary system.

Bitcoin as an alternative to CBDCs

The rise of CBDCs may, in fact, reinforce Bitcoin’s position as the true alternative to state-controlled money. As citizens become aware of the risks associated with a fully centralized financial system, demand for a decentralized, censorship-resistant asset like Bitcoin may increase.

01 - Protection from state control: Bitcoin empowers users with full sovereignty over their money, free from arbitrary freezes or confiscations.

02 - Preservation of financial privacy: Unlike CBDCs, which may monitor every transaction, Bitcoin offers a level of anonymity that shields individuals from excessive surveillance.

03 - Store of value against inflation: While governments can endlessly issue CBDCs, Bitcoin’s guaranteed scarcity positions it as a hedge against irresponsible monetary policy.

In summary, the competition between Bitcoin and CBDCs is set to become one of the defining financial battles of the future. As governments seek to reinforce their control through centralized digital currencies, Bitcoin remains the leading option for those who value financial independence and protection from state surveillance. The choice between a free, decentralized financial system and a monitored, government-controlled one may determine the course of the digital economy for decades to come.

Thank you very much for reading this far. I hope everything is well with you, and sending a big hug from your favorite Bitcoiner maximalist from Madeira. Long live freedom!

-

@ bf47c19e:c3d2573b

2025-05-31 17:12:24

@ bf47c19e:c3d2573b

2025-05-31 17:12:24Originalni tekst na bitcoin-balkan.com.

Pregled sadržaja

- Koji Bitcoin Novčanici su Dostupni?

- Šta je Mnemonic Oporavak ili Seed Fraza sa 12 ili 24 Reči?

- Kako Čuvati Seed Frazu

- Saveti za Osiguravanje Vaše Seed Fraze

- Šta će se Desiti sa Vašim Bitcoin-om Nakon što Umrete?

- Kako Koristite Seed Frazu za Oporavak Vašeg Novčanika?

- Ako je Vaša Seed Fraza Sigurna, Biće i Vaša Sredstava!

Za one koji tek ulaze u igru sa kriptovalutama, šansa da vaša Bitcoin sredstva ne budu sigurna i zaštićena može biti pomalo zastrašujuća. Srećom, postoji mnogo user-friendly Bitcoin novčanika, i svaki od njih ima izvrsnu funkciju rezervne kopije, koja vam omogućava trenutan povraćaj Bitcoin sredstava, ako vaš uređaj na kome se nalazi novčanik ikada bude zagubljen ili izgubljen. Ova funkcija, poznata kao „seed fraza“, ili seed fraza za oporavak, predstavlja jedinstveni niz reči koje će vaš novčanik generisati, i koje deluju kao password za vaše lične Bitcoin podatke. Ovaj skup reči omogućava trenutni povraćaj vaših bitcoin sredstava.

Iako možete lako zapostaviti svoju seed frazu, misleći da ćete se kasnije pozabaviti sa njom, uvek je najbolje biti proaktivan kada je reč o osiguranju zaštite vaše fraze za oporavak. Fraza za oporavak je vaša rezervna kopija – pa iako vam neće trebati svaki dan, biće kritična u slučaju da vam se novčanik pokvari. Takođe, fraza za oporavak može da omogući svima pristup vašem bitcoin-u, pa je zato veoma važno da se ona čuva na sigurnom.

U ovom članku, prikazaću vam:

- Spisak glavnih Bitcoin hardware novčanika koje možete koristiti za skladištenje vaših Bitcoin-a.

- Sveobuhvatan pregled mnogih metoda koje možete koristiti za čuvanje vaše seed fraze

- Razne prednosti i mane za svaku od njih

- Saveti koje možete da koristite da biste maksimizirali ukupnu sigurnost svoje seed fraze

- Kako sigurno čuvati vašu seed frazu

- Kako proslediti svoj Bitcoin u slučaju vaše smrti

Kada završite sa čitanjem, trebalo bi da ste na dobrom putu da čuvate svoju seed frazu koristeći najsigurnija i najpouzdanija dostupna sredstva, obezbeđujući najveću zaštitu svojih Bitcoin sredstava bez obzira na to šta se sa vama ili vašim digitalnim uređajima dogodi u budućnosti. Za početak ćemo dati brzi pregled hardware novčanika i šta tačno predstavlja fraza za oporavak.

Koji Bitcoin Novčanici su Dostupni?

Ispod ćete pronaći listu od nekoliko najpopularnijih novčanika koji su dostupni danas. Softverski novčanici rade na vašem telefonu ili računaru, dok su hardware novčanici namenski delovi hardvera (poput specijalizovanog fleš diska) koji omogućavaju lak i siguran pristup vašem bitcoin-u uz jaku sigurnost.

- Coldcard (hardverski novčanik)

- Blockstream Jade (hardverski novčanik)

- Electrum (softverski novčanik)

- Sparrow (softverski novčanik)

Svaki od ovih novčanika će vam dati seed frazu, koja se sastoji od 12 ili 24 reči, što će vam omogućiti pristup svim bitcoin adresama povezanim sa vašim novčanikom – a samim tim i svim vašim sredstvima.

Šta je Mnemonic Oporavak ili Seed Fraza sa 12 ili 24 Reči?

Najjednostavnije rečeno, seed fraza je niz određenih reči u kojima se nalaze sve potrebne informacije kako bi se u potpunosti povratila vaša Bitcoin sredstva. Koji god novčanik odlučite da koristite, generisaće jedinstvenu seed frazu, posebno za vas, a taj softver će vas uputiti da čuvate seed frazu na neki način, gde će biti dostupna u slučaju nužde. Seed fraza će biti jedinstvena i obično sadrži od 12 ili 24 reči, od kojih se neke mogu ponoviti. Pre nego što sačuvate seed frazu, pročitajte odeljak 4) sa našim savetima!

Seed fraza omogućava pristup vašim bitcoin sredstvima svima koji je poseduju- omogućavajući vam da povratite sredstava ako vam se novčanik pokvari, ili omogućavajući lopovu da dobije pristup vašim bitcoin-ima.

To čini vašu seed frazu vrednom poput zlatne poluge. Zbog toga je pravilno čuvanje vaše seed fraze veoma važno – morate uravnotežiti lak način oporavka i sigurnost protiv krađe i hakovanja. Međutim, s obzirom da je vaša seed fraza samo niz reči, ona se može snimati i skladištiti na mnogo jednostavniji način (i mnogo jeftinije!) od zlatne poluge – čineći je potencijalno mnogo sigurnijom.

Primarna svrha seed fraze je da ima neku vrstu fizičkog sredstva za povraćaj Bitcoin sredstava ako vas izneveri novčanik. To uključuje ako vam se sruši sistem na računaru, ako vam se ošteti hard disk, izgubite telefon ili razbijete hardware novčanik – u svakom slučaju gde vaš novčanik postane nepristupačan.

Seed fraze zasnivaju se na specifikacijama otvorenog koda kompatibilnim sa Bitcoin protokolom, što znači da dok god imate svoju seed frazu, možete koristiti mnoge druge vrste novčanika da biste povratili pristup svom bitcoin-u. Recimo da danas posedujete Trezor, ali za 10 godina vam se uređaj pokvari ili Trezor prestane da posluje – možete jednostavno kupiti drugačiji hardware novčanik ili skinuti novčanik na svoj telefon, i pomoću svoje seed fraze povratiti pristup svojim bitcoin-ima.

Kako seed fraza funkcioniše?

Seed fraze funkcionišu slično kao i bilo koji drugi oblik koda, pri čemu svaka reč predstavlja numeričku vrednost koju novčanik razume. Fraze se generišu nasumično na osnovu unapred određene baze reči. Iako ponekad imate mogućnost da smislite sopstvenu seed frazu, omogućavanje novčaniku da generiše seed frazu je najbolja opcija za vašu sigurnost.

Jedna od prednosti koja je svojstvena prirodi seed fraza je ta što se u njima koriste stvarne prepoznatljive reči na engleskom jeziku koje se mogu izvesti i upamtiti bez obzira na male greške kao rezultat ružnog rukopisa. Ovo je suprotno od mnogih drugih nasumično generisanih passworda, gde svaki karakter mora biti jasno čitljiv da bi se password mogao pravilno kreirati, jer su oni jednostavno niz slučajnih karaktera. Stoga seed fraze imaju i prednosti randomizacije, kao i prednosti lako prepoznatljivih i uobičajenih reči.

Zašto Niko Ne Može da Predpostavi Seed Frazu?

Mogli biste da pomislite da bi niz od 24 reči možda bio lak nekome da ga pretpostavi, ili da bi nekome bilo isplativo da napravi računarski ciklus mogućih kombinacija, dok ne pronadje novčanik koji sadrži neke bitcoin-e kako bi mogao da ih ukrade.

Reči za frazu za oporavak ili seed frazu dolaze sa liste koja se sastoji od 2048 reči – pa čak i seed od 12 reči za Bitcoin novčanik ima 2048^12 kombinacija ili 2^132. Procenjuje se da u univerzumu postoji 10^21 zvezda, pa je nepotrebno reći da ovo predstavlja mnogo mogućih kombinacija. Čak i kada bi svaki čovek na Zemlji danas imao 1.000.000 novčanika (čak i bez adresa), to bi iznosilo samo 7.800.000.000.000.000 novčanika – što je oko 2^53. Ovo čini negde oko polovine mogućih kombinacija, ali to bi sakrilo snagu eksponencijalnog rasta.

Kada bi svi na svetu imali po 1.000.000 bitcoin novčanika, mi bismo i dalje koristili samo 0.000000000000000000000001654% od svih mogućih novčanika. To je neuporedivo teže nego pronaći jedno određeno zrno peska u celokupnom pesku koji se nalazi na Zemlji.

Čak i taj pronalazak određenog zrna peska na ovoj plaži bila bi kao šetnja parkom nasuprot pogađanju bilo koje random seed fraze.

Dakle, prilično je sigurno reći da niko uskoro neće pokušati da pogadja bitcoin novčanike. Bila bi potrebna vojska računara i veoma dugačak vremenski period da se pronadje samo jedan novčanik sa sredstvima u tom prostranstvu.

Kako Čuvati Seed Frazu

Neverovatno je važno kako zapisujete i skladištite svoju seed frazu, s obzirom na ogromnu količinu moći koju će oni koji je poseduju imati nad vašim Bitcoin sredstvima. Takođe, budući da je poenta seed fraze da bude lako dostupna gde i kada vam zatreba, čuvanje na nekom sigurnom, ali i pristupačnom mestu, je neophodno. Specifična metoda koju koristite za transkripciju vaše seed fraze je takođe važna, bez obzira na to kako se čuva, jer se neke metode transkripcije pokazale mnogo sigurnijim od drugih.

Pogledajte naš odeljak sa savetima, pre nego što zapišete svoju seed frazu!

Preporučujemo vam da fizički sačuvate svoju seed frazu nakon što vam je softver ili hardware novčanik isporuči. Fizičko skladištenje čini vašu seed frazu manje otvorenom za hakere koji bi mogli da vam ukradu frazu za oporavak iz digitalne memorije vašeg računara ili pametnog telefona.. Međutim, mnogi ljudi će i dalje odabrati neki oblik digitalnih sredstava za čuvanje svojih seed fraza, bilo zato što je to dominantno sredstvo ili jednostavno kao dodatni oblik rezervne kopije. Hajde da pogledajmo kako fizička, a tako i digitalna sredstva koja možete koristiti za čuvanje vaše seed fraze, kako se ona koriste, i specifične prednosti i nedostatke svake od njih.

Zapisivanje Vaše Seed fraze – na Papiru ili Digitalno

Zapisivanje Vaše Seed Fraze na Papir

Naravno, najočigledniji metod unošenja vaše digitalne seed fraze u fizički svet je isti onaj metod koji biste obično koristili za unošenje bilo kog drugog oblika pisanja u fizički svet – olovkom i papirom. Jednostavno zapisivanje vaše seed fraze na papir u potpunosti može biti dovoljno da vam pruži sigurnost koju želite. Međutim, postoje neka upozorenja oko upotrebe olovke i papira koja ovu najjednostavniju metodu čine ne baš tako idealnom za čuvanje nečega toliko važnog kao što je seed fraza.

Kao prvo, sam papir je lako uništiv, a o mastilu da i ne govorimo. U slučaju poplave ili požara, papir će biti uništen, što znači da će i vaša seed fraza biti uništena zajedno sa njim. Naravno, ovo su loše vesti i za svakoga ko verovatno gubi i sav svoj hardver i opremu u požaru ili poplavi. Kao drugu stvar, papir je neverovatno lako zagubiti. Može se oduvati, pomešati sa otpadom ili jednostavno pomešati sa nečim drugim i negde izgubiti, i nikada ga više nećete videti. Iz ovih i više drugih razloga, oni koji žele da zapišu svoju seed frazu u fizički svet, često traže sredstva koja su izdržljivija i trajnija od papira.

Graviranje Vaše Seed Fraze na Čeličnoj Back-Up Ploči

Back-up ploče od nerđajućeg čelika su stvorene kako bi korisnici Bitcoin-a imali način da trajnije urežu svoje seed fraze u fizički svet od puke olovke i papira. Napravljene su od nerđajućeg čelika, na koje se vaša seed fraza može trajno urezati. Budući da je gravura napravljena na čeliku, ona će u slučaju požara ili poplave moći da traje mnogo duže od papira. Ploča može biti bilo šta, od male kartice koju možete držati u novčaniku do većeg komada koji se može trajno čuvati kod kuće ili u sefu.

Bilo koju veličinu pločice da izaberete, možete je kupiti zajedno sa alatima za samograviranje (koji nisu uvek u kompletu), što znači da korisnik ne mora da deli svoju seed frazu sa onima od kojih je kupio ploču. Budući da su ove ploče stvorene posebno za potrebe izdržavanja katastrofe, obično sadrže brojne garancije o njihovoj trajnosti, otporne su na bilo koje elemenate koje možete baciti na njih, od vode do vatre, kao i od prekomernog korišćenja i habanja.

Što se tiče back-up ploča od nerđajućeg čelika, svaki proizvođač nudi svoj jedinstveni spin. Pogledajmo 5 najboljih proizvođača back-up ploča od nerđajućeg čelika na tržištu i da vidimo kako su se pokazali:

Cryptosteel

Sa sedištem u Velikoj Britaniji, Cryptosteel nudi čelične „Kapsule“ i „Kasete“ sa cenom u eurima, s tim da je kapsula približno veličine laserskog pokazivača, a kaseta je veličine, pa, kasete. Kapsula košta 74 eura, a kaseta 108 eura, mada se nude popusti za velike narudžbine. Umesto da zahtevaju gravuru, svaka Kaseta ili Kapsula dolazi sa odredjenom količinom čeličnih pločica koje se mogu staviti prema redosledu vaše seed fraze.

Blockplate

Blockplate nudi čelične back-up ploče po ceni od 69 USD za dve – svaka ploča sadrži 12 reči. Njihove verzija jedne ploče, koja izgleda identično, košta 49 USD po paru. Potpuno četvrtaste i malo manje od podmetača, ove ploče vam omogućavaju da svoju seed frazu sačuvate na mreži koristeći samo prosti udarac u sredinu, nisu potrebne pločice sa slovima.

Coldbit

Coldbit nudi heavy-duty kartice sa futrolama po ceni od 69 eura i setove za graviranje za dodatnih 20 eura. Takođe se možete odlučiti da sami uradite graviranje pomoću alata koji imate kod kuće, a koji može urezati čelik, poput dijamantske Dremel burgije. Oslanjajući se na čistu doslovnu transkripciju sličnu Hodlinox pločama, ove ploče ipak nude malo veću zaštitu i neke sjajne dizajne.

Billfold by Privacy Pros

Preimenovan u Privacy Pros, brend Billfold je i dalje dostupan po ceni od 89 USD. Koristi dizajn kartice vrlo sličan Cryptosteel Kaseti, sa malim pločicama koje slažete da biste formirali svoju seed frazu.

Kriptovanje Vaše Seed Fraze i Njeno Digitalno Skladištenje

Iako se generalno preporučuje da svoju seed frazu ne skladištite digitalno, oni koji su bolje upućeni u digitalnu bezbednost, ovo mogu videti kao floskulu koja se može ignorisati. Iako laici sigurno ne bi smeli da šalju i primaju svoje seed fraze e-mailom, pravilno digitalno kriptovanje i skladištenje sredstvima poput cloud-a ili USB fleš memorije mogu biti jednako sigurna i bezbedna sredstva za skladištenje, kao i fizička sredstva, poput čeličnih back-up ploča. Takođe, kada se oba sredstva koriste zajedno, to vam pruža krajnju mrežu rezervnih kopija u slučaju bilo kakvih hitnih slučajeva.

Kriptovanje možda nije nešto što je lako za svakoga, ali postoje mnoge treće strane koji će se pobrinuti da odrade kriptovanje za vas. Obavezno diskonektujte računar sa Interneta dok unosite seed u računar i izvodite kriptovanje – ne verujte online uslugama kriptovanja!

Odatle, na vama ostaje da odlučite kako ćete da je čuvate, bilo na cloud-u ili na USB fleš memoriji. Prednost čuvanja na cloud-u je u tome što podaci nisu povezani ni sa jednim fizičkim uređajem i može im se pristupiti sa bilo kog mesta pomoću passworda na cloud-u. Međutim, to takođe znači da su podaci nešto pristupačniji nego da se čuvaju na USB fleš memoriji. Zapamtite da ako se odlučite za USB fleš memoriju, ona možda neće moći da se izdrži protiv požara i vode, baš kao što to mogu prosti nefizički podaci na cloud-u. Fleš memorija koja se koristi na USB-u takođe nije dizajnirana da traje duže od 10 godina, pa imajte i to na umu.

Digitalno čuvanje seed fraze preporučujem isključivo informatičarima tj ljudima sa dosta iskustva u kriptiranju informacija. Za 99% nas čekič i čelična pločica koju čuvamo na 2 ili 3 mesta + dodatna 13. ili 25. reč je najbolje rešenje.

Gde i Kako Čuvati Svoju Seed Frazu

Bez obzira da li ste odlučili da svoju seed frazu sačuvate na čeličnoj ploči, USB-u ili jednostavno na parčetu papira, moraćete da je stavite negde – a idealno bi bilo da je stavite na više mesta u slučaju da se jedna uništi ili izgubi.

Najbolji savet koji mogu da vam dam je gde ne trebate da čuvate svoju seed frazu. Na kraju, mesto na koje stavite svoju seed frazu najbolje je da sačuvate za sebe, i zato evo nekoliko mesta na koja definitivno ne želite da stavite seed frazu, ako želite da izbegnete da upadne u pogrešne ruke.

Ne Čuvajte Svoju Seed Frazu u…

- Sef u Banci: Izgleda kao odlično mesto, zar ne? Pogrešno – banke prave greške, a kako sefovi postaju sve manje popularni, one prave još više grešaka!

- Sef u Kući: Opet se čini kao odlično mesto – međutim, ovo je prvo mesto koje će provalnik potražiti. Čak i ako ne mogu da otvore sef, većinu malih kućnih sefova moguće je lako premestiti i odneti u kolicima, i kasnije ih razbiti.

- Ispod Kreveta ili Dušeka: Klasično mesto za skrivanje novca, takođe je jedno od prvih mesta koje će provalnik pogledati.

- U Frižideru: Možda mislite da maskiranje vašeg seed-a u posudi za hranu izgleda kao dobar način zabune, ali ovo je uobičajena taktika za skrivanje dragocenosti, pa bi provalnici mogli potražiti i ovde.

- Ormarić za Nakit ili Fioke za Veš: To su uobičajena mesta za čuvanje drugih vrsta dragocenosti, pa će ih provalnik brzo pokrasti.

Budite kreativni, ali ne toliko kreativni da izgubite seed frazu, jer ne možete da se setite gde ste je sakrili.

Takođe je važno razmotriti i mogućnost pravljenja rezervnih kopija vašeg seed-a na više lokacija. Na taj način, čak i ako je jedno mesto potpuno uništeno (recimo da vam oluja odnese kuću), i dalje ćete da imate vaš seed na drugoj lokaciji.

Shamir-ovo Tajno Deljenje – Širite Vašu Frazu za Oporavak

Shamir-ovo Tajno Deljenje (eng. Shamir Secret Sharing), je algoritam koji vam omogućava da svoj seed podelite na više seed-ova koji su sami po sebi beskorisni. Međutim, njihovim rekombinovanjem vratićete vaš seed za oporavak.

Ovo je dobar korak ukoliko želite da podelite vaš seed sa vašim advokatom, računovođom, članovima porodice itd. – jer obezbeđuje da niko od njih nema pristup vašem celom seed-u.

Način na koji Shamir deluje je to što deli vaš seed na više manjih seed-ova koje možete predati pouzdanim pojedincima. Kada postavite Shamir-ov backup, odlučujete koliko ‘deljenja’ želite da kreirate i koliko delova je potrebno za oporavak vašeg celog seeda – na primer, možete da napravite 5 deljenja i kažete da su bilo koja 3 dela potrebna za oporavak vašeg seed-a.

Neki hardware novčanici, poput Trezor Model T, podržavaju Shamir Backups na user-friendly način.

Saveti za Osiguravanje Vaše Seed Fraze

Postoji mnogo opštih stvari koje morate imati na umu kada je reč o držanju vaše seed fraze na sigurnom. Neke od ovih stvari su samo zdrav razum, dok većini ljudi možda ništa neće pasti na pamet bez nečije pomoći. Neće sve metode biti praktične za sve čitaoce, ali imajte na umu da što više bezbednosnih metoda vežbate, vaša seed fraza će biti sigurnija. Učinite koliko god možete da vaša seed fraza bude sigurna i ona će vam biti pri ruci kada vam zatreba.

Ne Pravite Slike ili Screenshotove Vaše Seed Fraze

Ne slikanje vaše seed fraze je dovoljno jednostavno. Svaka slika koju napravite stvara dodatnu spoljnu datoteku koja se može duplirati, izgubiti ili ukrasti. Što je manji digitalni otisak vaše seed fraze, to je bolje. Međutim, postoji mnogo različitih načina na koje se mogu ukrasti fotografije vaše seed fraze, što može iznenaditi prosečnog čitaoca. Prvo, hakeri i ostale treće strane mogu da preuzmu sliku vaše seed fraze putem sigurnosnih kamera, poput onih na bankomatima. Takođe, kamere na računaru, telefonu i drugim ličnim uređajima mogu predstavljati još veći rizik. Iz ovih razloga, umanjivanje ukupne vidljivosti i izloženosti vaše seed fraze, i pre i posle dokumentovanja u fizičkom svetu, je apsolutna potreba.

Ne Izgovarajte Svoju Seed Frazu Naglas – Nikad!

Ako ste ikada razgovarali telefonom i Google Assistant vas je prekinuo, onda znate da vas stalno slušaju. Bilo da ste napolju u javnosti ili ste sami kod kuće, treće strane slušaju. Ako su te treće strane zainteresovane, možda će moći da dobiju pristup vašim ličnim podacima. Iz tog razloga, uzdržavanje od izgovaranja naglas vaše seed fraze treba smatrati vitalnim delom zaštite vaše seed fraze. Lakše je špijunirati nekoga preko zvuka, nego što je to slučaj sa vizuelnim elementima, pa izgovaranje naglas vaše seed fraze čini je mnogo podložnijom presretanju od strane onih koji je mogu zloupotrebiti.

Ne Čuvajte Svoju Seed Frazu u Password Menadžeru

Čuvanje vaše seed fraze u password menadžeru može se činiti sigurnim i prikladnim načinom izrade rezervnih kopija, ali to nosi velike rizike. Seed fraza se mnogo razlikuje od password za recimo vaš Facebook nalog. To je zato što su passwordi samo alati za potvrdu identiteta za centralizovane usluge – što znači da ako izgubite pristup računu ili budete hakovani, možete kontaktirati broj podrške i proći kroz neke korake da biste povratili kontrolu nad svojim nalogom.

Kod Bitcoin-a, prema njegovom dizajnu, ne postoji broj podrške. Ne postoji centralna stranka koja kontroliše Bitcoin transakcije, čineći ga neverovatno slobodnim i otvorenim – ali to takođe znači da morate vrlo ozbiljno da preuzmete odgovornost za svoju seed frazu. Ako padne u pogrešne ruke jer je vaš password menadžer hakovan, možete izgubiti svoje bitcoin-e.

Ne Koristite Online Usluge Oporavka Seed-a

Ako vam neki website traži da unesete svoju seed frazu – čak i ako vam se čini kao pouzdan – dobro razmislite pre nego što to učinite. Većina „usluga online oporavka“ su maskirane prevare, usresredjene samo na kradju seed fraza nevinih ljudi! Ne budi jedan od njih.

Koristite Pristupnu Frazu(dodatnu reč) da Biste Dodali još Sigurnosti

Trezor podešavanje pristupne fraze | Ledger podešavanje pristupne fraze

Ako vaš novčanik podržava dodavanje pristupne fraze, trebalo bi da je koristite. Pristupna fraza je password koji dodate svom seed-u i funkcioniše kao 13. ili 25. reč u vašoj seed frazi. Zbog toga je vaš novčanik mnogo teže ukrasti. Ako se pristupna fraza čuva na drugačijoj lokaciji od vašeg seed-a, vaši bitcoin-i su sigurni čak i ako neko dobije pristup vašoj seed frazi.

Zaštitite Svoju Seed Frazu

Bez obzira da li svoju seed frazu čuvate u digitalnom oblaku ili na čeličnoj ploči, postojanje nekog načina čuvanja koji štiti seed frazu od elemenata kao što su požar i poplava, mora se smatrati obaveznim. Kao što je već rečeno, čelične ploče mogu se napraviti da izdrže većinu katastrofa, a skladištenje na cloud-u pruža nefizička sredstva koja mogu biti jednako sigurna kao i druga sredstva ako koristite pravu enkripciju. Upotreba jednog ili oba ova sredstva može vam pomoći da vam garantuje maksimalnu zaštitu bez obzira na to šta se dogodi.

Koristite Više Metoda za Pravljenje Rezervnih Kopija Kad God Možete

Korišćenje nekoliko različitih metoda za čuvanje vaše seed fraze ima puno prednosti, ali ima i neke nedostatke ako im ne pristupite sa dovoljno pažnje. Iako vam više načina za skladištenje pruža veću zaštitu, to takođe proširuje vaš celokupni profil, što znači da postoji više područja koja su otvorena za napad. Ipak, korišćenje najmanje dve odvojene metode za pravljenje rezervnih kopija obično se smatra dobrom idejom, jer imate rezervne kopije za slučaj da vam se nešto desi! Nikad ne znate šta će se dogoditi, a u tome i jeste poenta seed fraza.

Ograničite Pristup Vašoj Seed Frazi što je Više Moguće

Naravno, neki ljudi mogu da se odluče da svoju seed frazu podele sa pouzdanom trećom stranom, kao sredstvo radi osiguranja njene zaštite, ali, generalno, što je manji broj ljudi sa kojima delite svoju seed frazu, time bolje. Vaša je lična odluka s kim ćete deliti svoju seed frazu, i u vašem je najboljem interesu da to pravo mudro koristite.

Ne Pričajte o Količini Bitcoin-a Koje Posedujete

Nekima je ovo možda najteži savet, ali možda i najvažniji. Ako niko ne zna da imate bitcoin, i koliko ga imate, smanjujete verovatnoću da će neko pokušati da dodje do vaše seed fraze ili novčanika. Zato držite jezik za zubima!

Šta će se Desiti sa Vašim Bitcoin-om Nakon što Umrete?

Kao i sa bilo kojim drugim sredstvom, trebalo bi da imate predstavu o tome kako će se postupati sa vašim Bitcoin-om nakon što umrete. S obzirom da je ovo relativno nova tema, nema puno presedana kada je reč o prenošenju i nasleđivanju Bitcoin-a. Iako mnogi mogu da pomisle da moraju da angažuju advokata, prenošenje Bitcoin-a zaista podrazumeva samo puko prenošenje vaše seed fraze, zajedno sa nekim vašim konkretnim srestvima.

Prilikom pripreme za prosleđivanje vaše seed fraze u slučaju vaše smrti, važno je zapamtiti da prosledite i detaljan zapis o svojoj digitalnoj imovini. Za razliku od fizičkih materijala, digitalna sredstva se ne mogu lako kvantifikovati fizičkom procenom. Ukoliko nije svesna da postoji, ta osoba možda neće znati šta tačno prima. Stoga, ona možda neće zaista primiti ono što ste joj namenili da nasledi. To je takođe razlog zašto bi svi trebali da drže svu svoju imovinu sažetom i što organizovanijom, u slučaju nužde.

Ako razumete engleski jezik preporučujem da pročitate knjigu: Cryptoasset Inheritance Planning od Pamela Morgan

Kako Koristite Seed Frazu za Oporavak Vašeg Novčanika?

Za većinu novčanika, upotreba seed fraze jednostavna je poput pritiskanja pravih tipki i kucanja iste. Odatle, seed fraza će vratiti sav sadržaj i podatke novčanika na bilo koji uređaj koji koristite. Na ovaj način, korišćenje seed fraze znači da možete imati novčanik kod sebe gde god da krenete, bez obzira na sve, čak i ako se novčanik izgubi ili uništi – sve što vam zaista treba je vaša seed fraza.

Opet, ne koristite nikakve online usluge za seed frazu! U najvećem broju slučajeva to su prevare.

Bez obzira da li koristite mobilni novčanik kao što je Muun ili hardware novčanik kao što su Trezor ili Ledger, sredstva za upotrebu vaše seed fraze su u osnovi ista – jedina razlika je hardver koji koristite za to. Kod aplikacija poput Muun jednostavno pokrenete aplikaciju i ona vam daje mogućnost oporavka prethodnog novčanika. Zatim ćete odabrati dužinu svoje seed fraze i uneti je tačno onako kako je prikazana.

Uz hardware novčanike poput onih koje je izradio Trezor, dobićete istu opciju za povratak kada pokrenete uređaj i instalirate firmware. Dobićete isti izbor da odredite dužinu svoje seed fraze, a zatim će zatražiti od vas da je unesete potpuno isto.

Ako je moguče uvjek koristite isti hardware/software wallet prilikom oporavka vaše seed fraze kao što ste koristili kad ste je pravili.

Ako je Vaša Seed Fraza Sigurna, Biće i Vaša Sredstava!

Na kraju dana, važno je da zapamtite da što više brige ulažete u pravilno skladištenje i zaštitu svoje seed fraze, to će vaša sredstva biti sigurnija i za vas i za vaše voljene. Digitalno doba predstavlja širok spektar novih opasnosti, a svet kriptovaluta je leglo za većinu njih.

Ako želite da preduzmete proaktivne mere u obezbeđivanju najveće zaštite vašeg bitcoin-a, čuvanje vaše seed fraze na sigurnom i pristupačnom mestu je neophodno. Vaša seed fraza možda sada ne izgleda kao velika stvar, ali će izgledati kao velika stvar kada dođe vreme da je upotrebite. Ukoliko želite da vi i vaša Bitcoin sredstva budete zaštićeni u slučaju nužde ili čak u slučaju vaše smrti, preduzimanje odgovarajućih sredstava za čuvanje i zaštitu vaše seed fraze je osnovni prvi korak.

-

@ 2dd9250b:6e928072

2025-05-31 16:23:22

@ 2dd9250b:6e928072

2025-05-31 16:23:22Durante a década de 1990, houve o aumento da globalização da economia, determinando a adição do fluxo internacional de capitais, de produtos e serviços. Este fenômeno levou a uma interdependência maior entre as economias dos países. Justamente por causa da possibilidade de que um eventual colapso econômico em um país resulte no contágio dos demais. Diante disso, aumentou a preocupação com os riscos incentivando a utilização de sofisticados modelos e estratégias de avaliação de gestão de risco.

Na década, ganharam destaque ainda os graves problemas financeiros enfrentados, entre outros, pelo banco inglês Barings Bank, e pelo fundo de investimento norte-americano Long Term Capital Management.

Outro grande destaque foi a fraude superior a US$ 7 bilhões sofrida pelo banco Société Generale em Janeiro de 2008.

O Barings Bank é um banco inglês que faliu em 1995 em razão de operações financeiras irregulares e mal-sucedidas realizadas pelo seu principal operador de mercado. O rombo da instituição foi superior à US$ 1,3 Bilhão e causado por uma aposta equivocada no desempenho futuro no índice de ações no Japão. Na realidade, o mercado acionário japonês caiu mais de 15% na época, determinando a falência do banco. O Baring Bank foi vendido a um grupo financeiro holandês (ING) pelo valor simbólico de uma libra esterlina.

O Long Term Capital Management era um fundo de investimento de que perdeu em 1998 mais de US$ 4,6 bilhões em operações nos mercados financeiros internacionais. O LTCM foi socorrido pelo Banco Central dos Estados Unidos (Federal Reserve ), que coordenou uma operação de socorro financeiro à instituição. A justificativa do Banco Central para esta decisão era "o receio das possíveis consequências mundiais da falência do fundo de investimento".

O banco francês Société Generale informou, em janeiro de 2008, uma perda de US$ 7,16 bilhões determinadas por fraudes efetuadas por um operador do mercado financeiro. Segundo revelou a instituição, o operador assumiu posições no mercado sem o conhecimento da direção do banco. A instituição teve que recorrer a uma urgente captação de recursos no mercado próxima a US$ 5,0 bilhões.

E finalmente chegamos ao caso mais problemático da era das finanças modernas anterior ao Bitcoin, o caso Lehman Brothers.

O Lehman Brothers era o 4° maior de investimentos dos EUA quando pediu concordata em 15/09/2008 com dívidas que superavam inacreditáveis US$ 600 bilhões.

Não se tinha contas correntes ou talão de cheques do Lehman Brothers. Era um banco especializado em investimentos e complexas operações financeiras. Havia feito pesados investimentos em empréstimos a juros fixos no famigerado mercado subprime, e o crédito imobiliário voltado a pessoas consideradas de forte risco de inadimplência.

Com essa carteira de investimentos que valia bem menos que o estimado e o acúmulo de projetos financeiros, minou a confiança dos investidores na instituição de 158 anos. Suas ações passaram de US$ 80 a menos de US$ 4. Acumulando fracassos nas negociações para levantar fundos; a instituição de cerca de 25 mil funcionários entrou em concordata.

O Federal Reserve resgatou algumas instituições financeiras grandes e tradicionais norte-americanas como a seguradora AIG no meio da crise. O Fed injetou um capital de US$ 182, 3 bilhões no American International Group (AIG).

Foi exatamente essa decisão do Fed em salvar alguns bancos e deixar quebrar outros, que causou insegurança por parte dos clientes. E os clientes ficaram insatisfeitos tanto com os bancos de investimentos quanto com as agências de classificação de risco, como a Standard & Poor's que tinha dado uma nota alta para o Lehman Brothers no mesmo dia em que ele quebrou.

E essa foi uma das razões pelo qual o Bitcoin foi criado. Satoshi Nakamoto entendeu que as pessoas não estavam mais confiando nem no Governo, nem nos Bancos Privados que o Governo federal restagatava quando eles quebravam e isso prejudicou muita gente. Tanto que o “hash” do Genesis Block contém o título do artigo “Chancellor on brink of second bailout for banks” (Chanceler à beira de segundo resgate para bancos, em português) da edição britânica do The Times.

Esse texto foi parcialmente editado do texto de ASSAF Neto, CAF (2014).

-

@ 6c05c73e:c4356f17

2025-05-31 16:14:38

@ 6c05c73e:c4356f17

2025-05-31 16:14:38Análise Detalhada das Melhores Ações para Junho 2025

O mercado financeiro está em constante movimento, e identificar oportunidades de investimento é crucial para o sucesso. Exploraremos uma seleção de ações promissoras para junho de 2025. Analisaremos cada ativo individualmente, destacando seus pontos fortes e fracos para auxiliar investidores na tomada de decisões informadas. As ações a seguir foram selecionadas com base em análises de mercado e potencial de crescimento, e incluem nomes como ALOS3, RECV3, AZUL4, USO, USDBRL, BIDU, REXR, PR, GPN e CIVI.

Análise Individual das Ações

ALOS3

Essa é uma empresa que já falei aqui e está sempre voltando ao radar. Vou deixar ela em primeiro lugar, porque para mim é. Não existe empresa imobiliária tão saudável quanto ela.

Ponto Forte: ALOS3 tem demonstrado um crescimento consistente no setor de tecnologia, com inovações e expansão de mercado. A empresa possui uma forte base de clientes e uma estratégia sólida para o futuro.

Ponto Fraco: A alta volatilidade do setor tecnológico pode impactar o desempenho de ALOS3, tornando-o um investimento de maior risco em comparação com setores mais estáveis.

RECV3

Essa empresa apareceu no meu radar esse mês. Nem sabia da sua existência. Mas, isso porque seu IPO foi em 2021. E sua especialidade está em otimização de produção e revitalização de campos de petróleo.

Ponto Forte: RECV3 se destaca no setor de varejo, com uma rede de distribuição bem estabelecida e uma marca reconhecida. A empresa tem apresentado resultados financeiros positivos e um plano de expansão ambicioso.

Ponto Fraco: A concorrência acirrada no varejo e as flutuações na economia podem afetar as margens de lucro de RECV3.

AZUL4

A empresa anunciou essa semana que entrou em recuperação judicial. Contudo, o setor aéreo é sempre uma incógnita. Na minha visão, a operação de crédito da empresa é o diamante escondido.

Ponto Forte: AZUL4 é uma das principais companhias aéreas do Brasil, com uma vasta rede de rotas e uma frota moderna. A empresa tem se beneficiado da recuperação do setor de viagens e do aumento da demanda.

Ponto Fraco: O setor aéreo é altamente sensível a fatores externos como preços de combustível e crises econômicas, o que pode gerar instabilidade para AZUL4.

USO

Com os preços do petróleo em queda, devido ao aumento de produção divulgado pela OPEC. Enxergamos uma oportunidade de médio prazo. Pois, se faz muitos produtos com petróleo. Da um Google e pesquisa aí.

Ponto Forte: USO é um fundo de investimento ligado ao petróleo, que pode se beneficiar do aumento dos preços do petróleo devido a tensões geopolíticas ou aumento da demanda global.

Ponto Fraco: O preço do petróleo é extremamente volátil e sujeito a eventos imprevisíveis, tornando o USO um investimento de alto risco.

USDBRL

Não é novidade para ninguém que o dólar está previsto em R$6 para logo menos. A julgar pela impressão monetária, juros e inflação. Não vai ser difícil chegar lá. O P O R T U N I D A D E !

Ponto Forte: USDBRL representa a taxa de câmbio entre o dólar americano e o real brasileiro. Investir nesse ativo pode ser uma forma de se proteger contra a desvalorização do real e diversificar a carteira.

Ponto Fraco: A taxa de câmbio é influenciada por inúmeros fatores econômicos e políticos, tornando-a altamente volátil e difícil de prever.

BIDU

O maior motor de busca na China está derretendo. Em partes pelos avanços das IA. Que agora são amplamente usadas para pesquisas.

Ponto Forte: BIDU é uma das maiores empresas de tecnologia da China, com forte presença no mercado de buscas e inteligência artificial. A empresa tem um grande potencial de crescimento no mercado asiático.

Ponto Fraco: As regulamentações governamentais na China e a concorrência com outras gigantes da tecnologia podem limitar o crescimento de BIDU.

REXR

Empresa californiana focada em desenvolvimento imobiliário. Com excelentes resultados e fundamentos.

Ponto Forte: REXR é uma empresa do setor imobiliário com um portfólio diversificado e um histórico de crescimento constante. A empresa tem se beneficiado do aquecimento do mercado imobiliário em algumas regiões.

Ponto Fraco: O mercado imobiliário é sensível a taxas de juros e ciclos econômicos, o que pode impactar o desempenho de REXR em momentos de crise.

PR

Cara, essa empresa chama muito a atenção. Pelos números robustos. A empresa administra petróleo e campos de gás.

Ponto Forte: A empresa PR atua no setor de recursos naturais e tem se beneficiado do aumento da demanda por commodities. A empresa possui ativos valiosos e uma operação eficiente.

Ponto Fraco: A volatilidade dos preços das commodities e questões ambientais podem afetar negativamente o desempenho de PR.

GPN

A empresa tem excelentes fundamentos e está sentada sobre uma pilha de dinheiro em caixa que excede e muito a real necessidade da empresa. Olho nela!

Ponto Forte: GPN é uma empresa do setor financeiro, com destaque para serviços de pagamento e tecnologia financeira. A empresa tem apresentado crescimento consistente e inovação em seus produtos.

Ponto Fraco: A concorrência no setor financeiro e as regulamentações podem impactar as margens de lucro de GPN.

CIVI

Para concluir nossa lista. Temos essa empresa de construção civil que derreteu caixa. Mas, tem seu valor patrimonial bem abaixo do esperado.

Ponto Forte: CIVI é uma empresa do setor de construção civil, com projetos de infraestrutura e desenvolvimento urbano. A empresa tem se beneficiado de investimentos governamentais e crescimento populacional.

Ponto Fraco: O setor de construção civil é sensível a crises econômicas e atrasos em projetos, o que pode gerar instabilidade para CIVI.

Resumo da ópera:

Investir em ações requer pesquisa e análise cuidadosa. Cada uma das empresas listadas apresenta pontos fortes e fracos que devem ser considerados. ALOS3 se destaca pela sua excelente gestão nos shoppings e imóveis. BIDU se destaca no setor de tecnologia, enquanto RECV3 e AZUL4 oferecem oportunidades nos setores de varejo e aviação. USO e USDBRL são investimentos mais voláteis, ligados ao petróleo e câmbio, respectivamente. REXR e CIVI representam o setor imobiliário e construção civil, enquanto PR e GPN atuam nos setores de recursos naturais e financeiro. Esperamos que esta análise tenha sido útil. Boa sorte em seus investimentos!

Disclaimer

Lembre-se: este não é um conselho de investimento. Faça sua própria pesquisa antes de investir. Resultados passados não garantem lucros futuros. Cuide do seu dinheiro!

Bio

Apaixonado por investimentos e pela transformação que eles podem trazer, a equipe threedolar dedica-se a desmistificar o mundo financeiro e guiar seus leitores rumo à independência financeira. Acreditamos que o conhecimento é a chave para o sucesso nos investimentos.

Links

-

@ 2e8970de:63345c7a

2025-05-31 11:54:55

@ 2e8970de:63345c7a

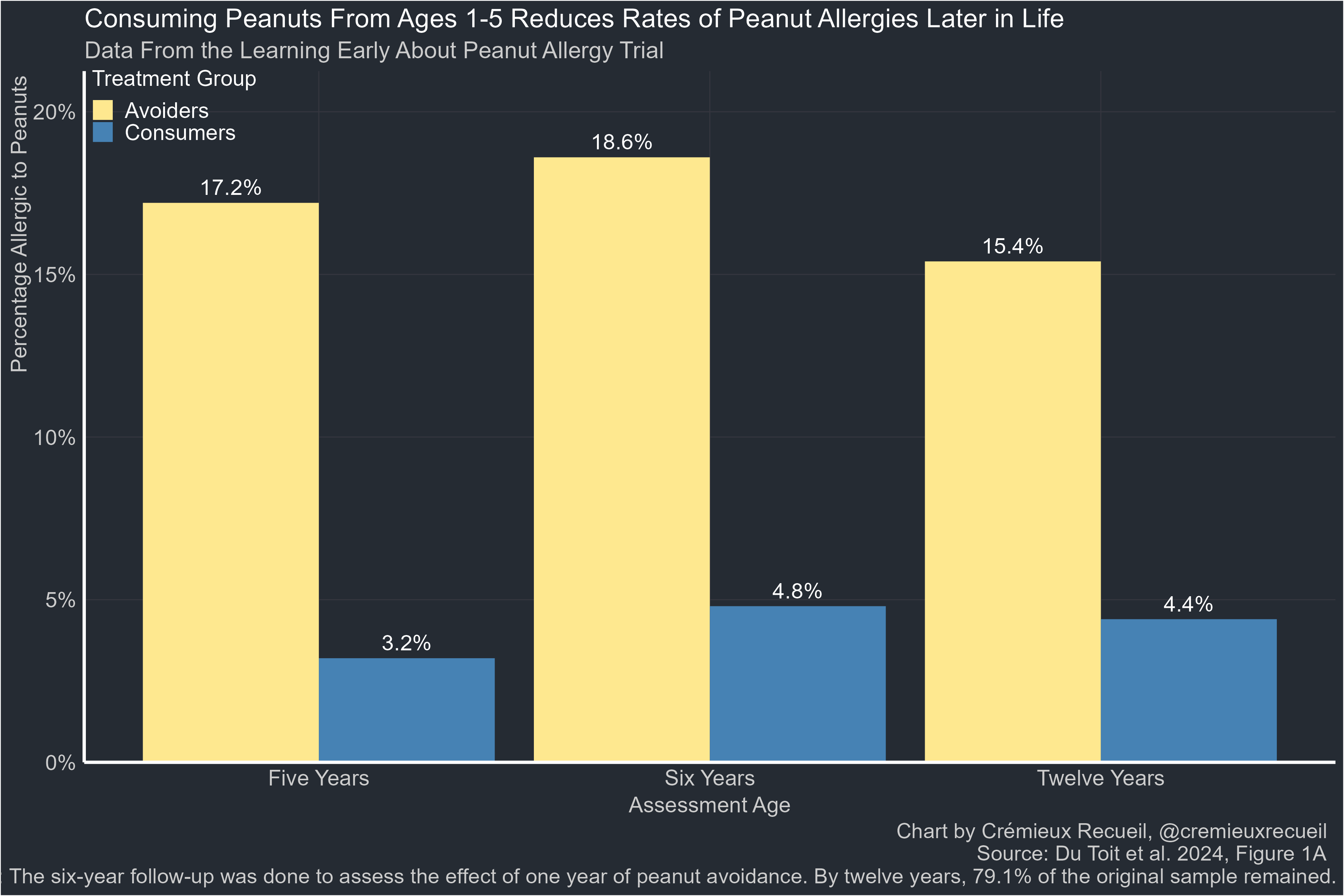

2025-05-31 11:54:55https://evidence.nejm.org/doi/full/10.1056/EVIDoa2300311

The solution to peanut allergy? Import Bamba!

https://stacker.news/items/993440

-

@ 005bc4de:ef11e1a2

2025-05-31 10:55:47

@ 005bc4de:ef11e1a2

2025-05-31 10:55:47LUV and Hivebits/HBIT/Wusang pause tl;dr LUV and HBIT (aka, Hivebits and the Wusang game) are on a pause at the moment, taking a break. https://files.peakd.com/file/peakd-hive/crrdlx/23x1SY8Vx8j1mVGnDFtq7ebuzKNGd8K9Ssex51AEerxks1VYikxGPShM7bjNhmSrEZ2wf.png Image from pixabay.com Why? There are odd things going on. I have a theory, but here's what is known... May 28, 2025, at about 1:30 pm GMT (8:30 AM EDT), a second attack (for lack of better term) hit HBIT in about a week. It seemed to start with @tyler45 with this comment https://peakd.com/blog/@tyler45/comment-20250528125108033 tx: https://he.dtools.dev/tx/7e7d4126196ca5b6dbe0a04dcded0e25d3bcc7f4 See tyler45's activity at https://he.dtools.dev/@tyler45 Notice the reply and WUSANG command is to a post by @olivia897 and how many of the other WUSANG comments on the explorer are in reply to olivia897. It seems these are all auto-generated accounts. The names and "birthdates" and interactions all point to automation. Once initiated, things happened very fast on the back end, clearly not being done manually. In this way, this seems rather sophisticated technically. I estimate just over 400 HBIT were pilfered the other day from the @Hivebits account before I noticed and was able to shut things down. Just for a little background, after the first attack May 21, 2025. I wrote a small bit of info: https://peakd.com/hivebits/@crrdlx/hbit-resource-credits A couple of days ago this post by @holoz0r was interesting: https://peakd.com/hive-133987/@holoz0r/text-analytics-reveal-thirty-two-percent-of-comments-on-hive-are-not-unique-and-at-least-ten-percent-add-no-value-to-discussion The thing that caught my eye was that the WUSANG comment was the largest by far, along with BBH (hello @bradleyarrow), because the attackers used both commands. Then, a few days later, things happened again: sudden start, repetitive bot attack, until I shut things down. So, a pause This is a period in my personal calendar where I simply don't have time to sit down at a computer for an extended period and try fiddle with this stuff. So, for now @Luvshares and @Hivebits (HBIT) and the @Wusang game are on hold. Plus, there's other fun stuff to do. https://files.peakd.com/file/peakd-hive/crrdlx/AJL43SREA1EuyqPXhydmqaq1RHhRVoYd12PfiBN5vDMu2WSKUtGeYWgKJyuRwV8.jpg I go by @crrdlx or "CR" for short. See all my links or contact info at https://linktr.ee/crrdlx.

Originally posted on Hive at https://peakd.com/@crrdlx/luv-and-hivebitshbitwusang-pause

Auto cross-post via Hostr v0.1.48 (br) at https://hostr-home.vercel.app

-

@ dfa02707:41ca50e3

2025-05-31 17:01:29

@ dfa02707:41ca50e3

2025-05-31 17:01:29Contribute to keep No Bullshit Bitcoin news going.

- The latest firmware updates for COLDCARD devices introduce two major features: COLDCARD Co-sign (CCC) and Key Teleport between two COLDCARD Q devices using QR codes and/or NFC with a website.

What's new

- COLDCARD Co-Sign: When CCC is enabled, a second seed called the Spending Policy Key (Key C) is added to the device. This seed works with the device's Main Seed and one or more additional XPUBs (Backup Keys) to form 2-of-N multisig wallets.

- The spending policy functions like a hardware security module (HSM), enforcing rules such as magnitude and velocity limits, address whitelisting, and 2FA authentication to protect funds while maintaining flexibility and control, and is enforced each time the Spending Policy Key is used for signing.

- When spending conditions are met, the COLDCARD signs the partially signed bitcoin transaction (PSBT) with the Main Seed and Spending Policy Key for fund access. Once configured, the Spending Policy Key is required to view or change the policy, and violations are denied without explanation.

"You can override the spending policy at any time by signing with either a Backup Key and the Main Seed or two Backup Keys, depending on the number of keys (N) in the multisig."

-

A step-by-step guide for setting up CCC is available here.

-

Key Teleport for Q devices allows users to securely transfer sensitive data such as seed phrases (words, xprv), secure notes and passwords, and PSBTs for multisig. It uses QR codes or NFC, along with a helper website, to ensure reliable transmission, keeping your sensitive data protected throughout the process.

- For more technical details, see the protocol spec.

"After you sign a multisig PSBT, you have option to “Key Teleport” the PSBT file to any one of the other signers in the wallet. We already have a shared pubkey with them, so the process is simple and does not require any action on their part in advance. Plus, starting in this firmware release, COLDCARD can finalize multisig transactions, so the last signer can publish the signed transaction via PushTX (NFC tap) to get it on the blockchain directly."

- Multisig transactions are finalized when sufficiently signed. It streamlines the use of PushTX with multisig wallets.

- Signing artifacts re-export to various media. Users are now provided with the capability to export signing products, like transactions or PSBTs, to alternative media rather than the original source. For example, if a PSBT is received through a QR code, it can be signed and saved onto an SD card if needed.

- Multisig export files are signed now. Public keys are encoded as P2PKH address for all multisg signature exports. Learn more about it here.

- NFC export usability upgrade: NFC keeps exporting until CANCEL/X is pressed.

- Added Bitcoin Safe option to Export Wallet.

- 10% performance improvement in USB upload speed for large files.

- Q: Always choose the biggest possible display size for QR.

Fixes

- Do not allow change Main PIN to same value already used as Trick PIN, even if Trick PIN is hidden.

- Fix stuck progress bar under

Receiving...after a USB communications failure. - Showing derivation path in Address Explorer for root key (m) showed double slash (//).

- Can restore developer backup with custom password other than 12 words format.

- Virtual Disk auto mode ignores already signed PSBTs (with “-signed” in file name).

- Virtual Disk auto mode stuck on “Reading…” screen sometimes.

- Finalization of foreign inputs from partial signatures. Thanks Christian Uebber!

- Temporary seed from COLDCARD backup failed to load stored multisig wallets.

Destroy Seedalso removes all Trick PINs from SE2.Lock Down Seedrequires pressing confirm key (4) to execute.- Q only: Only BBQr is allowed to export Coldcard, Core, and pretty descriptor.

-

@ 866e0139:6a9334e5

2025-05-31 10:45:03

@ 866e0139:6a9334e5

2025-05-31 10:45:03Autor: Marcel Bühler. Dieser Beitrag wurde mit dem Pareto-Client geschrieben. Sie finden alle Texte der Friedenstaube und weitere Texte zum Thema Frieden hier. Die neuesten Pareto-Artikel finden Sie in unserem Telegram-Kanal.

Die neuesten Artikel der Friedenstaube gibt es jetzt auch im eigenen Friedenstaube-Telegram-Kanal.

In einem Artikel in der NZZ vom 27. Mai mit dem Titel "Trump nennt Putin verrückt" wird über den laut Kiew grössten russischen Drohnenangriff seit Beginn des Krieges auf ukrainische Städte berichtet. Dabei sollen am vergangenen Wochenende 355 Drohnen und 69 Raketen auf Kiew, Odessa, Ternipol (Westukraine) und andere Städte gesteuert bzw. abgefeuert worden sein. 288 Drohnen und 9 Raketen konnten laut Kiew von der ukrainischen Luftverteidigung abgeschossen werden. Was der Artikel verschweigt: bereits in der Woche davor, am 20. - 22. Mai hatte die Ukraine 485 Drohnen gegen russische Städte wie Kursk, Belgorod oder Brijansk geflogen, 63 davon erreichten die Region Moskau. Auch am Wochenende schickten die Ukrainer 205 Drohnen gegen russische Städte, 13 davon erreichten Moskau. Auch hier konnte die Luftverteidigung die meisten Drohnen unschädlich machen, eine davon hatte gar den Helikopter von Präsident Putin (!) im Visier. Als Reaktion darauf erklärte Präsident Putin, dass in der ukrainischen Region Sumy bzw. Tschernihiw im Norden eine Sicherheitszoneeingerichtet werden soll da die meisten Drohnen von hier aus gestartet wurden. Auch am 27./28. Mai schickte die Ukraine wieder 296 Drohnen Richtung Moskau, offenbar soll die russische Luftverteidigung damit überlastet werden um später westliche Cruise Missiles wie "Storm shadows", "Skalp" oder die umstrittenen deutschen "Taurus" effektiver einsetzen zu können. Der neue Bundeskanzler Friedrich Merz hat dafür rund 5 Milliarden Euro in Aussicht gestellt um solche Waffensysteme in der Ukraine selber zusammenbauen zu können.

Diese Gewaltspirale hat eine lange Geschichte: diese begann 2007 mit der 43. Münchner Sicherheitskonferenz, in der Präsident Putin sich gegen die unilaterale Weltordnung der USA und ihrer Verbündeten aussprach. Auch erteilte er den NATO-Osterweiterungen seit 1991 eine deutliche Absage, da diese entgegen (mündlich) gemachten Zusicherungen vollzogen wurden (siehe im Anhang die Rede im Wortlaut). Bei anderer Gelegenheit bezeichnete er vor allem einen möglichen NATO-Beitritt der (ehemals russischen) Ukraine als die "rote Linie", da es hier im Osten eine gemeinsame Grenze zu Russland über weit mehr als tausend Kilometer gebe und zudem Millionen von russischstämmigen Bürgern in der Ukraine lebten welche durch die Unabhängigkeit des Landes von ihrem Mutterland getrennt seinen. Im mittlerweile umstrittenen Budapester Memorandum von 5.12.1994 hatten zudem die Signatarmächte USA, GB und die Russische Föderation in getrennten Dokumenten die Unabhängigkeit und territoriale Integrität der Ukraine garantiert, wenn diese ein neutraler Pufferstaat zwischen der NATO und der Russischen Föderation sei und auf ihre Atomwaffen aus der sowjetischen Zeit verzichte (die Neutralität war in der ukrainischen Verfassung verankert). Trotzdem erklärten am darauffolgenden NATO-Gipfel in Bukarest im April 2008 die versammelten Staats- und Regierungschefs der 26 NATO-Staaten: "Die NATO begrüßt die euro-atlantischen Bestrebungen der Ukraine und Georgiens, die dem Bündnis beitreten wollen. Wir kamen heute überein, dass diese Länder NATO-Mitglieder werden." Zudem wurde die Unabhängigkeitserklärung des Kosowo vorbehaltlos anerkannt, dies nach einer völkerrechtswidrigen militärischen Intervention (d.h. ohne eine entsprechende UN-Resolution) der NATO gegen die Republik Serbien im Jahr 1999 (Staatsgrenzen dürfen also unter Umständen verändert werden).

Die Gewalt begann schon wenige Monate danach, als der durch die "Rosenrevolution" 2003 mit Unterstützung der USA in Tiflis an die Macht gekommene Exil-Georgier, Michail Saakaschwili, in der Nacht auf den 8.8.2008 einen militärischen Angriff auf die seit 1992/93 abtrünnigen Südosseten bzw. deren Hauptstadt Zchinwali befahl und dabei auch russische Friedenstruppen (als Schutzmacht der Osseten) unter Beschuss gerieten. Dies nachdem die Regierung Bush jr. die georgische Armee durch NATO-Offiziere ausgebildet und aufgerüstet hatte. Laut einem NZZ-Artikel vom 1.10.2009 kam eine von der EU eingesetzte Untersuchungskommission unter der Schweizer Diplomatin Heidi Tagliavini 2009 zum Schluss, dass zuvor von beiden Seiten Provokationen in Form von Terroranschlägen, Entführungen und Morde begangen worden waren. Zudem hatte Russland jahrelang an willige Osseten und Abchasen russische Pässe ausgegeben, was völkerrechtswidrig sei, da dies die Staatlichkeit Georgiens untergrabe (Abchasien ist eine weitere abtrünnige Region Georgiens am schwarzen Meer). Saakaschwili wollte offenkundig mit dem überraschenden Angriff auf die Osseten die volle Kontrolle der Zentralregierung über das Gebiet wieder erlangen, da die Satzungen der NATO nur die Aufnahme von Ländern erlauben in denen keine ungelösten territorialen Konflikte vorhanden sind. Den Abchasen hätte also das gleiche Schicksal gedroht wenn die Aktion erfolgreich gewesen wäre. Da die Russen aber aufgepasst hatten, lief innert 24 Stunden eine russische Gegenoffensive welche die georgischen Verbände und ihre amerikanischen Berater innert wenigen Tagen bis nach Gori (Geburtsort von Stalin) zurückwarf. Präsident Saakaschwili verlor bald darauf in Tiflis die Macht und setzte sich in die Ukraine ab. Die heutige georgische Regierung unterhält wieder politische und wirtschaftliche Beziehungen zu Russland und verzichtet auf einen NATO-Beitritt. Siehe dazu das Interview von Roger Köppel mit dem aktuellen georgischen Regierungschef Kobachidse (auf englisch mit deutschen Untertiteln):

https://www.youtube.com/watch?v=xWh6bAfLdhw

In der Ukraine begann die Gewalt mit dem rechtswidrigen Sturz des 2010 legal gewählten Präsidenten Wiktor Janukowitsch, der zwischen der EU und Russland hin und her gerissen war und daher die Unterzeichnung eines EU-Assoziierungsabkommens auf unbestimmte Zeit vertagte. Nach den folgenden wochenlangen Protesten und Krawallen auf dem Maidan in Kiew ("Euromaidan") unterschrieb er unter Vermittlung Deutschlands, Frankreichs und Polens am 21.2.2014 einen Vertrag mit der Opposition und versprach baldige Neuwahlen. Trotzdem wurde er am Tag darauf durch einen regelrechten Putsch gestürzt und in die Flucht getrieben, indem unbekannte Heckenschützen aus verschiedenen Positionen zuerst auf die "Berkut"-Polizei und anschliessend auf militante Demonstranten schossen, welche die "Institutskaja" hinauf das durch eine Strassensperre der Polizei geschützte Regierungsviertel stürmen wollten.

Dabei kamen insgesamt 104 Menschen ums Leben, darunter 34 Polizisten und Vertreter der Regierung. Nach dem Putsch wurde der zuvor völlig unbekannte Exil-Ukrainer Arsenij Jazenjuk Chef der neuen Übergangsregierung, von dem die Europagesandte des US-Statedepartements, Victoria Nuland, bereits einige Tage davor in einem abgehörten Telefongespräch mit dem amerikanischen Botschafter in Kiew, Geoffrey Pyatt, gesprochen hatte ("Jaz is our man"). Die mit rund 600 Mann unter Führung von Andrij Parubi während Wochen auf dem Maidan präsenten militanten und teilweise bewaffneten Kräfte des "Prawi sektor" ("Rechter Sektor") und der "Swoboda" ("Freiheit") weigerten sich zuerst, der neuen Regierung ihre Waffen auszuhändigen. Mitglieder der "Swoboda" unter Oleh Tjahibok besetzten aber anfangs im Kabinett das Aussen-, Innen-, Verteidigungs- sowie das Ministerium für Kultur und "strategische" Kommunikation (Propaganda), während die Mitglieder des "Prawi sektor" unter Dmitro Jarosch eine Zusammenarbeit mit der neuen Regierung verweigerten. Als eine der ersten Amtshandlungen nach dem Putsch wurde in der ganzen Ukraine die russische Sprache als offizielle Amtssprache und als Unterrichtssprache in den Schulen verboten (auch in den mehrheitlich von russischstämmigen Menschen bewohnten Regionen im Osten und Süden des Landes).

DIE FRIEDENSTAUBE FLIEGT AUCH IN IHR POSTFACH!

Hier können Sie die Friedenstaube abonnieren und bekommen die Artikel zugesandt, vorerst für alle kostenfrei, wir starten gänzlich ohne Paywall. (Die Bezahlabos fangen erst zu laufen an, wenn ein Monetarisierungskonzept für die Inhalte steht). Sie wollen der Genossenschaft beitreten oder uns unterstützen? Mehr Infos hier oder am Ende des Textes.

Als erste Reaktion auf den rechtswidrigen Umsturz wurde in Simferopol auf der Krim das lokale Parlament von prorussischen Aktivisten besetzt und russische Soldaten verliessen illegal den Flottenstützpunkt in Sewastopol und besetzten strategische Positionen auf der ganzen Krim bzw. blockierten die ukrainischen Kasernen. Unter dem Schutz dieser "grünen Männchen" konnte dann am 16.3.2014 ein Referendum über den zukünftigen Status der Krim durchgeführt werden. Rund 70% der Bevölkerung stimmten für eine Wiedervereinigung mit Russland, was ungefähr dem Anteil der ethnischen Russen auf der Krim entspricht. Der Kommandant der ukrainischen Flotte in Sewastopol lief mit dem Grossteil der Matrosen zu den Russen über, so dass fast die gesamte Flotte im Kriegshafen verblieb (die Schwarzmeerflotte war anfang der 90er Jahre zwischen Russland und der Ukraine aufgeteilt worden). Die restlichen Matrosen und Soldaten durften später in die Ukraine heimkehren. Angesichts der klaren Machtverhältnisse auf der Krim verzichteten die ukrainischen Ultra-Nationalisten auf die angedrohte Entsendung von "Zügen der Freundschaft" (mit bewaffneten Schlägern) nach Simferopol.

Auch in den Städten Lugansk, Donezk und Mariupol in der Ostukraine besetzten prorussische Aktivisten analog den Vorgängen einige Monate zuvor in der Westukraine Regierungs- und Verwaltungsgebäude und hissten russische Fahnen auf vielen Gebäuden. Auch hier gab es am 11. bzw. 12.5.2014 Referenden über die zukünftige Zugehörigkeit dieser Gebiete, doch konnten dabei nur ungefähr die Hälfte der Bevölkerungen überhaupt darüber abstimmen, weil die Separatisten nicht die volle Kontrolle über die jeweiligen Bezirke hatten. Auch in anderen ukrainischen Städten wie Odessa und Charkow gab es prorussische Demonstrationen, doch wurden diese von den ukrainischen Behörden unterdrückt. In Odessa kam es am 2.5.2014 zu einem Massaker, als prorussische Aktivisten von mit Zügen aus Kiew angereisten Rechtsradikalen und Hooligans in ein Gewerkschaftshaus abgedrängt wurden welches dann kurzerhand abgefackelt und mit Handfeuerwaffen beschossen wurde. Rund 50 Menschen verloren dabei ihr Leben während die ukrainische Polizei untätig herumstand.

Die am 12.4.2014 von der neuen Regierung in Kiew verkündete "Antiterror-Operation" gegen die Separatisten im Osten wurde anfangs nur zaghaft umgesetzt, da viele russischstämmige Soldaten auch hier mit den Aufständischen sympathisierten und teilweise mitsamt dem Material überliefen. Erst nachdem sich der "Spreu vom Weizen" getrennt hatte und nach der Bildung von Freiwilligenverbänden wie "Donbas","Asow" oder "Aidar" - welche in der ukrainischen Nationalgarde (dem Innen- und nicht dem Verteidigungsministerium unterstellt) zusammengefasst wurden - gewann die ukrainische Offensive an Kraft, so dass bereits im Mai/Juni 2014 die Hafenstadt Mariupol vom Asow'schen Bataillon (später ein Regiment bzw. neu die 12. Brigade für spezielle Aufgaben) und einer Marinebrigade zurückerobert und bis zur vollständigen Kapitulation im berühmten Stahlwerk "Asowstal" nach der russischen Intervention vom 24.2.2022 besetzt werden konnte. Bei den heftigen Kämpfen im Frühjahr 2022 mussten die Zivilisten wochenlang im Keller ausharren, da die Stadtverwaltung die rechtzeitige Evakuierung der Zivilbevölkerung versäumt hatte). Nach den Kesselschlachten von Ilowaisk im Juli/Aug. 2014 bzw. von Debaltsewoim Jan./Feb. 2015, bei denen weit über tausend ukrainische Soldaten und hunderte von Kämpfern der neu aufgestellten Donezker- und Lugansker Volksmilizen sowie vermutlich rund 100 russische Soldaten ihr Leben verloren (laut Kiew beteiligten sich mehrere russische Bataillone an den Kämpfen), wurde am 12.2.2015 das Minsker Abkommen (Minsk II) unter Vermittlung von Weissrussland, Deutschland und Frankreich unterzeichnet. Vertragspartner als Unterzeichnende waren: der frühere Präsident der Ukraine Leonid Kutschma, der Botschafter der Russischen Föderation in der Ukraine Michail Surabow, die Milizenführer der selbstproklamierten Volksrepubliken Igor Plotnizki und Alexander Sachartschenko sowie die OSZE-Beauftragte Heidi Tagliavini. Der Waffenstillstand und die vertrauensbildenden Massnahmen (wie z.B. der Rückzug der schweren Waffen von der Frontlinie) wurden dabei von beiden Seiten wiederholt verletzt. Am 18.2.2017 unterzeichnete der russische Präsident Wladimir Putin ein Dekret, nach dem Pässe und andere Papiere der Volksrepubliken Donezk und Lugansk von Russland offiziell als gültig anerkannt wurden, was wiederum die Staatlichkeit der Ukraine untergrub und daher dem Minsker Abkommen widersprach, wonach die abtrünnigen Gebiete weiterhin zur Ukraine gehörten. Insgesamt verloren in dem jahrelangen Konflikt bis 2022 rund 14'000 Menschen ihr Leben, darunter ca. 3'500 Zivilisten inkl. 200 Kinder, besonders in der Stadt Donezk und Umgebung welche von der ukrainischen Armee immer wieder mit Artillerie (Granaten und Raketen) oder durch Scharfschützen beschossen wurde.

Nachdem eine von NATO-Offizieren jahrelang gut ausgebildete und mit modernen Waffen aufgerüstete ukrainische Elitearmee von rund 130'000 Mann ab Sommer 2021 vor dem Donbas aufmarschiert war um den Konflikt offenkundig gewaltsam zu lösen und seit Anfang 2022 auch der ukrainische Beschuss von Donezk und dessen Umland wieder verstärkt wurde, unterzeichnete Präsident Putin am 21.2.2022 ein Freundschafts- und Beistandsabkommen mit den ostukrainischen Volksrepubliken und anerkannte ausdrücklich deren Unabhängigkeitvon Kiew. Das Minsker Abkommen habe keine Zukunft mehr. Am 24.2.2022 intervenierte die russische Armee mit anfangs "nur" rund 190'000 Mann in der Ukraine da die rund 40'000 Mann der Donezker- und Lugansker Volksmilizen einem Angriff der ukrainischen Elitearmee nicht mehr hätten standhalten können. Zuvor hatte die Russische Föderation im Dez. 2021 den USA noch einmal Verhandlungen über den Abschluss eines gesamteuropäischen Sicherheitsabkommen unter Berücksichtigung des Konflikts in der Ukraine vorgeschlagen, was aber von der Regierung Biden abgelehnt wurde. Bei Beginn der "speziellen Militäroperation" erklärte Joe Biden öffentlich, das politische Ziel sei der Sturz des Regimes in Moskau.

Mit dem Beginn der russischen Sommeroffensive an allen Frontabschnitten dürften die ukrainischen Kräfte endgültig überdehnt werden. Da der Oberbefehlshaber der Ukraine, Alexander Syrskij, aus der Region Sumy und Charkow verschiedene Verbände wie die 36. Marinebrigade, die 43. Artilleriebrigade, die 44. mechanisierte Brigade, die 82. Air Assault Brigade sowie die berüchtigte 12. Brigade "Asow" nach Südosten verlegen musste, um die Lage um den wichtigen Logistikpunkt Pokrowsk bzw. die Stadt Konstantinowka zu stabilisieren, dürften die Russen auch bei der oben erwähnten Einrichtung einer Sicherheitszone im Norden rasche Fortschritte machen. Rund 50'000 russische Soldaten werden dort eingesetzt um die zukünftige Bedrohung durch ukrainische Drohnen zu minimieren.

Zusammenfassend kann gesagt werden, dass in dem jahrelangen Konflikt alle Seiten das Völkerrecht missachtetoder zum eigenen Vorteil interpretiert haben. Angefangen damit hat aber klar der Westen (NATO und EU), der mit der finanziellen und politischen Unterstützung des rechtswidrigen Putsches in Kiew 2014 die Gewaltspirale in der Ukraine in Gang setzte und mit den anhaltenden Waffenlieferungen und Geheimdienstinformationen für den Tod von weit mehr als einer Million Soldaten auf beiden Seiten und unzähligen Zivilisten entscheidend mitverantwortlichist. Zudem wurde zumindest im Falle der Ukraine mit der NATO-Erklärung von 2008 zu deren Aufnahme als Beitrittskandidat der Geist des Budapester Memorandums von 1994 verletzt. In einem erstaunlich offenen, zweiseitigen Interview in der NZZ vom 6. Mai hat der amerikanische Politikwissenschaftler Prof. John Mearsheimervon der Universität Chicago erklärt, er hätte anstelle von Präsident Putin "die Ukraine schon viel früher überfallen". Und: "Der Westen ist der Bösewicht. Aber das wollen die USA und die Europäer natürlich nicht hören". Er glaube, dass dieser Krieg auf dem Schlachtfeld entschieden werde und dass wir am Ende einen eingefrorenen Konflikt haben werden (ähnlich wie in Georgien).

Über das Problem des ukrainischen Faschismus und Ultra-Nationalismus, der letztlich die multiethnische Ukraine in ihren Grenzen von 1991 zerstört hat, äusserte er sich nicht. Stattdessen hat die EU gerade die ersten 150 Milliarden Euro zum Aufbau einer eigenen Rüstungsindustrie beschlossen. Der neue Vorsteher des Schweizer Verteidigungsdepartementes, Bundesrat Martin Pfister, hat in einem NZZ-Artikel vom 27. Mai erklärt, die Kooperation mit der EU und der NATO müsse intensiviert werden, "stets in Vereinbarkeit mit der Neutralität". In der gleichen NZZ-Ausgabe wurde auch berichtet, dass die Schweiz den Spitzendiplomaten Gabriel Lüchinger nach Moskau schicke um für Friedensgespräche in der Schweiz zu sondieren (Bürgenstock II).

Ob der während Jahren provozierte und stigmatisierte "russische Bär" darauf noch eingeht?

(Der Beitrag folgt der Schweizer Rechtschreibung)

LASSEN SIE DER FRIEDENSTAUBE FLÜGEL WACHSEN!

In Kürze folgt eine Mail an alle Genossenschafter, danke für die Geduld!

Hier können Sie die Friedenstaube abonnieren und bekommen die Artikel zugesandt.

Schon jetzt können Sie uns unterstützen:

- Für 50 CHF/EURO bekommen Sie ein Jahresabo der Friedenstaube.

- Für 120 CHF/EURO bekommen Sie ein Jahresabo und ein T-Shirt/Hoodie mit der Friedenstaube.

- Für 500 CHF/EURO werden Sie Förderer und bekommen ein lebenslanges Abo sowie ein T-Shirt/Hoodie mit der Friedenstaube.

- Ab 1000 CHF werden Sie Genossenschafter der Friedenstaube mit Stimmrecht (und bekommen lebenslanges Abo, T-Shirt/Hoodie).

Für Einzahlungen in CHF (Betreff: Friedenstaube):

Für Einzahlungen in Euro:

Milosz Matuschek

IBAN DE 53710520500000814137

BYLADEM1TST

Sparkasse Traunstein-Trostberg

Betreff: Friedenstaube

Wenn Sie auf anderem Wege beitragen wollen, schreiben Sie die Friedenstaube an: friedenstaube@pareto.space

Sie sind noch nicht auf Nostr and wollen die volle Erfahrung machen (liken, kommentieren etc.)? Zappen können Sie den Autor auch ohne Nostr-Profil! Erstellen Sie sich einen Account auf Start. Weitere Onboarding-Leitfäden gibt es im Pareto-Wiki.

-

@ a4043831:3b64ac02

2025-05-31 10:20:02

@ a4043831:3b64ac02

2025-05-31 10:20:02Money can be complicated. You work hard, save diligently, and try to make smart choices. But when it comes to long-term financial security, is that enough? That’s where wealth management services come in. They help you plan, invest, and secure your financial future. But are they the right fit for you?

Let’s find out.

What Is Wealth Management?

Wealth management isn’t just about investing. It’s about creating a strategy that covers all aspects of your financial life—retirement, taxes, healthcare, and even the legacy you want to leave behind.

At Passive Capital Management, wealth management is designed to help you navigate life’s financial twists and turns with confidence. Whether you’re planning for retirement, growing your assets, or protecting what you’ve built, a structured approach can make all the difference.

Do You Need Wealth Management?

Not everyone needs a wealth manager. But if you answer “yes” to any of these questions, it might be time to consider it:

- Do you worry about outliving your retirement savings?

- Are you unsure how to structure your investments for long-term security?

- Do you want a plan that adapts as your life changes?

- Are tax implications of your income and investments confusing?

- Do you want to leave behind a financial legacy for your family?

If any of these concerns sound familiar, a wealth management service could help you create a roadmap for financial success.

The Key Benefits of Wealth Management

1. Retirement Planning: More Than Just Saving

Retirement isn’t just about putting money aside. It’s about ensuring you can live comfortably once your regular income stops. Passive Capital Management helps clients create a sustainable retirement strategy, ensuring they have enough to cover daily expenses, healthcare, and even the fun things—like travel or hobbies.

By assessing income sources like pensions, social security, and investments, they build a tailored plan that matches your lifestyle and long-term goals.

2. Investment Strategies: Making Your Money Work for You

Investing can feel overwhelming. Stocks, bonds, real estate—where do you even begin? Wealth management helps you make informed choices based on your risk tolerance, time horizon, and financial objectives.

Rather than chasing trends, a well-planned investment strategy focuses on steady, long-term growth while minimizing unnecessary risks.

3. Tax Planning: Keeping More of What You Earn

No one likes to pay more taxes than necessary. But without a strategy, you might be doing just that.

Wealth managers help structure your income, retirement withdrawals, and investments in a tax-efficient way. Whether it's maximizing tax-free accounts or minimizing liabilities, they ensure you keep more of what you’ve earned.

4. Healthcare and Long-Term Care Planning

As you age, healthcare becomes a bigger concern—and a bigger expense. Without proper planning, medical costs can quickly eat into your savings.

A solid financial plan includes strategies to manage these costs, whether through insurance, savings, or investment strategies. This way, you get the care you need without financial stress.

5. Estate and Legacy Planning

Do you want to leave something behind for your loved ones? Wealth management ensures your assets are distributed according to your wishes, minimizing tax burdens and avoiding unnecessary legal complications.

Whether you’re thinking about passing on wealth to family or contributing to a cause you care about, having a plan in place ensures your money makes the impact you want.

When Should You Start?

The best time to start planning? Yesterday. The second-best time? Today.

Wealth management isn’t just for retirees or the ultra-rich. It’s for anyone who wants financial security and a clear plan for the future. Whether you’re in your 30s and just starting to build wealth or in your 50s preparing for retirement, having expert guidance can help you make smarter financial decisions.

Final Thoughts: Is It Right for You?

If you want peace of mind about your financial future, wealth management might be a great fit. It helps you grow your money, protect your assets, and ensure a comfortable life—now and in the years to come.

At Passive Capital Management, the goal is simple: to help you achieve financial freedom with confidence. If that sounds like something you want, it might be time to explore how wealth management can work for you.

Ready to take the next step? Let’s talk.

-

@ 8bad92c3:ca714aa5

2025-05-31 17:01:22

@ 8bad92c3:ca714aa5

2025-05-31 17:01:22Marty's Bent

It's been a pretty historic week for the United States as it pertains to geopolitical relations in the Middle East. President Trump and many members of his administration, including AI and Crypto Czar David Sacks and Treasury Secretary Scott Bessent, traveled across the Middle East making deals with countries like Qatar, Saudi Arabia, the United Arab Emirates, Syria, and others. Many are speculating that Iran may be included in some behind the scenes deal as well. This trip to the Middle East makes sense considering the fact that China is also vying for favorable relationships with those countries. The Middle East is a power player in the world, and it seems pretty clear that Donald Trump is dead set on ensuring that they choose the United States over China as the world moves towards a more multi-polar reality.

Many are calling the events of this week the Riyadh Accords. There were many deals that were struck in relation to artificial intelligence, defense, energy and direct investments in the United States. A truly prolific power play and demonstration of deal-making ability of Donald Trump, if you ask me. Though I will admit some of the numbers that were thrown out by some of the countries were a bit egregious. We shall see how everything plays out in the coming years. It will be interesting to see how China reacts to this power move by the United States.