-

@ e2c72a5a:bfacb2ee

2025-06-05 17:14:50

@ e2c72a5a:bfacb2ee

2025-06-05 17:14:50The silent revolution: Ethereum's pivot to 'digital oil' could redefine crypto's future. While Bitcoin grabs headlines as digital gold, Ethereum is quietly transforming into something potentially more valuable—the essential infrastructure powering our digital economy. Ryan Berckmans reveals Ethereum's strategic shift from being just another cryptocurrency to becoming the foundation for stablecoins, tokenized assets, and global financial systems. With $480 billion in stablecoin volume and institutional players entering the space, Ethereum isn't just competing with Bitcoin—it's creating an entirely different value proposition. The question isn't whether ETH will hit $3K, but whether we're underestimating its long-term potential as the backbone of digital finance. Are you positioning yourself for the real crypto revolution happening right under our noses?

-

@ dfa02707:41ca50e3

2025-06-05 13:01:36

@ dfa02707:41ca50e3

2025-06-05 13:01:36Contribute to keep No Bullshit Bitcoin news going.

- RoboSats v0.7.7-alpha is now available!

NOTE: "This version of clients is not compatible with older versions of coordinators. Coordinators must upgrade first, make sure you don't upgrade your client while this is marked as pre-release."

- This version brings a new and improved coordinators view with reviews signed both by the robot and the coordinator, adds market price sources in coordinator profiles, shows a correct warning for canceling non-taken orders after a payment attempt, adds Uzbek sum currency, and includes package library updates for coordinators.

Source: RoboSats.

- siggy47 is writing daily RoboSats activity reviews on stacker.news. Check them out here.

- Stay up-to-date with RoboSats on Nostr.

What's new

- New coordinators view (see the picture above).

- Available coordinator reviews signed by both the robot and the coordinator.

- Coordinators now display market price sources in their profiles.

Source: RoboSats.

- Fix for wrong message on cancel button when taking an order. Users are now warned if they try to cancel a non taken order after a payment attempt.

- Uzbek sum currency now available.

- For coordinators: library updates.

- Add docker frontend (#1861).

- Add order review token (#1869).

- Add UZS migration (#1875).

- Fixed tests review (#1878).

- Nostr pubkey for Robot (#1887).

New contributors

Full Changelog: v0.7.6-alpha...v0.7.7-alpha

-

@ dfa02707:41ca50e3

2025-06-05 13:01:35

@ dfa02707:41ca50e3

2025-06-05 13:01:35Contribute to keep No Bullshit Bitcoin news going.

-

Version 1.3 of Bitcoin Safe introduces a redesigned interactive chart, quick receive feature, updated icons, a mempool preview window, support for Child Pays For Parent (CPFP) and testnet4, preconfigured testnet demo wallets, as well as various bug fixes and improvements.

-

Upcoming updates for Bitcoin Safe include Compact Block Filters.

"Compact Block Filters increase the network privacy dramatically, since you're not asking an electrum server to give you your transactions. They are a little slower than electrum servers. For a savings wallet like Bitcoin Safe this should be OK," writes the project's developer Andreas Griffin.

- Learn more about the current and upcoming features of Bitcoin Safe wallet here.

What's new in v1.3

- Redesign of Chart, Quick Receive, Icons, and Mempool Preview (by @design-rrr).

- Interactive chart. Clicking on it now jumps to transaction, and selected transactions are now highlighted.

- Speed up transactions with Child Pays For Parent (CPFP).

- BDK 1.2 (upgraded from 0.32).

- Testnet4 support.

- Preconfigured Testnet demo wallets.

- Cluster unconfirmed transactions so that parents/children are next to each other.

- Customizable columns for all tables (optional view: Txid, Address index, and more)

- Bug fixes and other improvements.

Announcement / Archive

Blog Post / Archive

GitHub Repo

Website -

-

@ b1ddb4d7:471244e7

2025-06-05 13:00:55

@ b1ddb4d7:471244e7

2025-06-05 13:00:55When Sergei talks about bitcoin, he doesn’t sound like someone chasing profits or followers. He sounds like someone about to build a monastery in the ruins.

While the mainstream world chases headlines and hype, Sergei shows up in local meetups from Sacramento to Cleveland, mentors curious minds, and shares what he knows is true – hoping that, with the right spark, someone will light their own way forward.

We interviewed Sergei to trace his steps: where he started, what keeps him going, and why teaching bitcoin is far more than explaining how to set up a node – it’s about reaching the right minds before the noise consumes them. So we began where most journeys start: at the beginning.

First Steps

- So, where did it all begin for you and what made you stay curious?

I first heard about bitcoin from a friend’s book recommendation, American Kingpin, the book about Silk Road (online drug marketplace). He is still not a true bitcoiner, although I helped him secure private keys with some bitcoin.

I was really busy at the time – focused on my school curriculum, running a 7-bedroom Airbnb, and working for a standardized test prep company. Bitcoin seemed too technical for me to explore, and the pace of my work left no time for it.

After graduating, while pursuing more training, I started playing around with stocks and maximizing my savings. Passive income seemed like the path to early retirement, as per the promise of the FIRE movement (Financial Independence, Retire Early). I mostly followed the mainstream news and my mentor’s advice – he liked preferred stocks at the time.

I had some Coinbase IOUs and remember sending bitcoin within the Coinbase ledger to a couple friends. I also recall the 2018 crash; I actually saw the legendary price spike live but couldn’t benefit because my funds were stuck amidst the frenzy. I withdrew from that investment completely for some time. Thankfully, my mentor advised to keep en eye on bitcoin.

Around late 2019, I started DCA-ing cautiously. Additionally, my friend and I were discussing famous billionaires, and how there was no curriculum for becoming a billionaire. So, I typed “billionaires” into my podcast app, and landed on We Study Billionaires podcast.

That’s where I kept hearing Preston Pysh mention bitcoin, before splitting into his own podcast series, Bitcoin Fundamentals. I didn’t understand most of the terminology of stocks, bonds, etc, yet I kept listening and trying to absorb it thru repetition. Today, I realize all that financial talk was mostly noise.

When people ask me for a technical explanation of fiat, I say: it’s all made up, just like the fiat price of bitcoin! Starting in 2020, during the so-called pandemic, I dove deeper. I religiously read Bitcoin Magazine, scrolled thru Bitcoin Twitter, and joined Simply Bitcoin Telegram group back when DarthCoin was an admin.

DarthCoin was my favorite bitcoiner – experienced, knowledgeable, and unapologetic. Watching him shift from rage to kindness, from passion to despair, gave me a glimpse at what a true educator’s journey would look like.

The struggle isn’t about adoption at scale anymore. It’s about reaching the few who are willing to study, take risks, and stay out of fiat traps. The vast majority won’t follow that example – not yet at least… if I start telling others the requirements for true freedom and prosperity, they would certainly say “Hell no!”

- At what point did you start teaching others, and why?

After college, I helped teach at a standardized test preparation company, and mentored some students one-on-one. I even tried working at a kindergarten briefly, but left quickly; Babysitting is not teaching.

What I discovered is that those who will succeed don’t really need my help – they would succeed with or without me, because they already have the inner drive.

Once you realize your people are perishing for lack of knowledge, the only rational thing to do is help raise their level of knowledge and understanding. That’s the Great Work.

I sometimes imagine myself as a political prisoner. If that were to happen, I’d probably start teaching fellow prisoners, doctors, janitors, even guards. In a way we already live in an open-air prison, So what else is there to do but teach, organize, and conspire to dismantle the Matrix?

Building on Bitcoin

- You hosted some in-person meetups in Sacramento. What did you learn from those?

My first presentation was on MultiSig storage with SeedSigner, and submarine swaps through Boltz.exchange.

I realized quickly that I had overestimated the group’s technical background. Even the meetup organizer, a financial advisor, asked, “How is anyone supposed to follow these steps?” I responded that reading was required… He decided that Unchained is an easier way.

At a crypto meetup, I gave a much simpler talk, outlining how bitcoin will save the world, based on a DarthCoin’s guide. Only one person stuck around to ask questions – a man who seemed a little out there, and did not really seem to get the message beyond the strength of cryptographic security of bitcoin.

Again, I overestimated the audience’s readiness. That forced me to rethink my strategy. People are extremely early and reluctant to study.

- Now in Ohio, you hold sessions via the Orange Pill App. What’s changed?

My new motto is: educate the educators. The corollary is: don’t orange-pill stupid normies (as DarthCoin puts it).

I’ve shifted to small, technical sessions in order to raise a few solid guardians of this esoteric knowledge who really get it and can carry it forward.

The youngest attendee at one of my sessions is a newborn baby – he mostly sleeps, but maybe he still absorbs some of the educational vibes.

- How do local groups like Sactown and Cleveland Bitcoiners influence your work?

Every meetup reflects its local culture. Sacramento and Bay Area Bitcoiners, for example, do camping trips – once we camped through a desert storm, shielding our burgers from sand while others went to shoot guns.

Cleveland Bitcoiners are different. They amass large gatherings. They recently threw a 100k party. They do a bit more community outreach. Some are curious about the esoteric topics such as jurisdiction, spirituality, and healthful living.

I have no permanent allegiance to any state, race, or group. I go where I can teach and learn. I anticipate that in my next phase, I’ll meet Bitcoiners so advanced that I’ll have to give up my fiat job and focus full-time on serious projects where real health and wealth are on the line.

Hopefully, I’ll be ready. I believe the universe always challenges you exactly to your limit – no less, no more.

- What do people struggle with the most when it comes to technical education?

The biggest struggle isn’t technical – it’s a lack of deep curiosity. People ask “how” and “what” – how do I set up a node, what should one do with the lightning channels? But very few ask “why?”

Why does on-chain bitcoin not contribute to the circular economy? Why is it essential to run Lightning? Why did humanity fall into mental enslavement in the first place?

I’d rather teach two-year-olds who constantly ask “why” than adults who ask how to flip a profit. What worries me most is that most two-year-olds will grow up asking state-funded AI bots for answers and live according to its recommendations.

- One Cleveland Bitcoiner shows up at gold bug meetups. How valuable is face-to-face education?

I don’t think the older generation is going to reverse the current human condition. Most of them have been under mind control for too long, and they just don’t have the attention span to study and change their ways.

They’re better off stacking gold and helping fund their grandkids’ education. If I were to focus on a demographic, I’d go for teenagers – high school age – because by college, the indoctrination is usually too strong, and they’re chasing fiat mastery.

As for the gold bug meetup? Perhaps one day I will show up with a ukulele to sing some bitcoin-themed songs. Seniors love such entertainment.

- How do you choose what to focus on in your sessions, especially for different types of learners?

I don’t come in with a rigid agenda. I’ve collected a massive library of resources over the years and never stopped reading. My browser tab and folder count are exploding.

At the meetup, people share questions or topics they’re curious about, then I take that home, do my homework, and bring back a session based on those themes. I give them the key takeaways, plus where to dive deeper.

Most people won’t – or can’t – study the way I do, and I expect attendees to put in the work. I suspect that it’s more important to reach those who want to learn but don’t know how, the so-called nescient (not knowing), rather than the ignorant.

There are way too many ignorant bitcoiners, so my mission is to find those who are curious what’s beyond the facade of fake reality and superficial promises.

That naturally means that fewer people show up, and that’s fine. I’m not here for the crowds; I’m here to educate the educators. One bitcoiner who came decided to branch off into self-custody sessions and that’s awesome. Personally, I’m much more focused on Lightning.

I want to see broader adoption of tools like auth, sign-message, NWC, and LSPs. Next month, I’m going deep into eCash solutions, because let’s face it – most newcomers won’t be able to afford their own UTXO or open a lightning channel; additionally, it has to be fun and easy for them to transact sats, otherwise they won’t do it. Additionally, they’ll need to rely on

-

@ 20e7c953:3b8bcb21

2025-06-05 10:32:40

@ 20e7c953:3b8bcb21

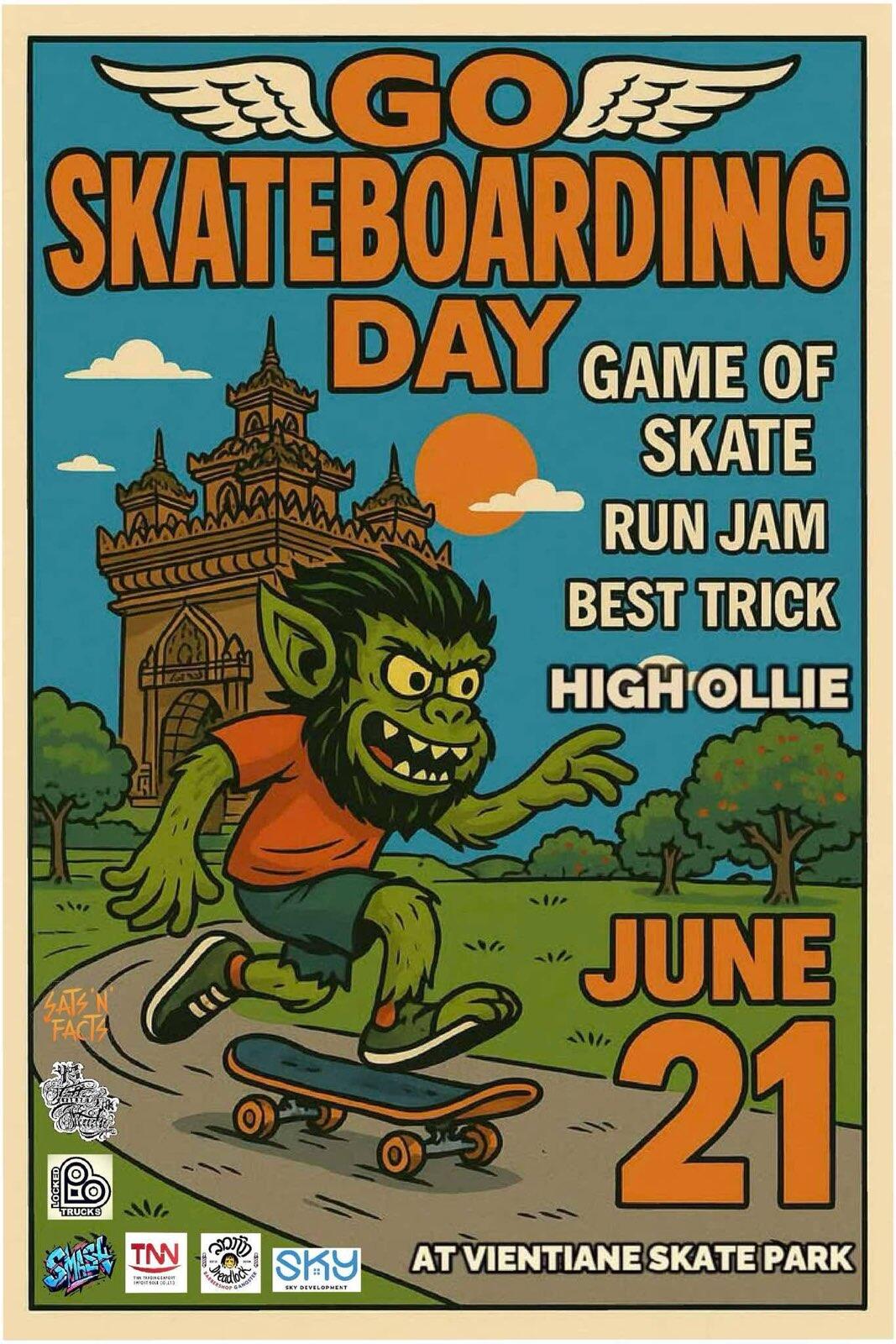

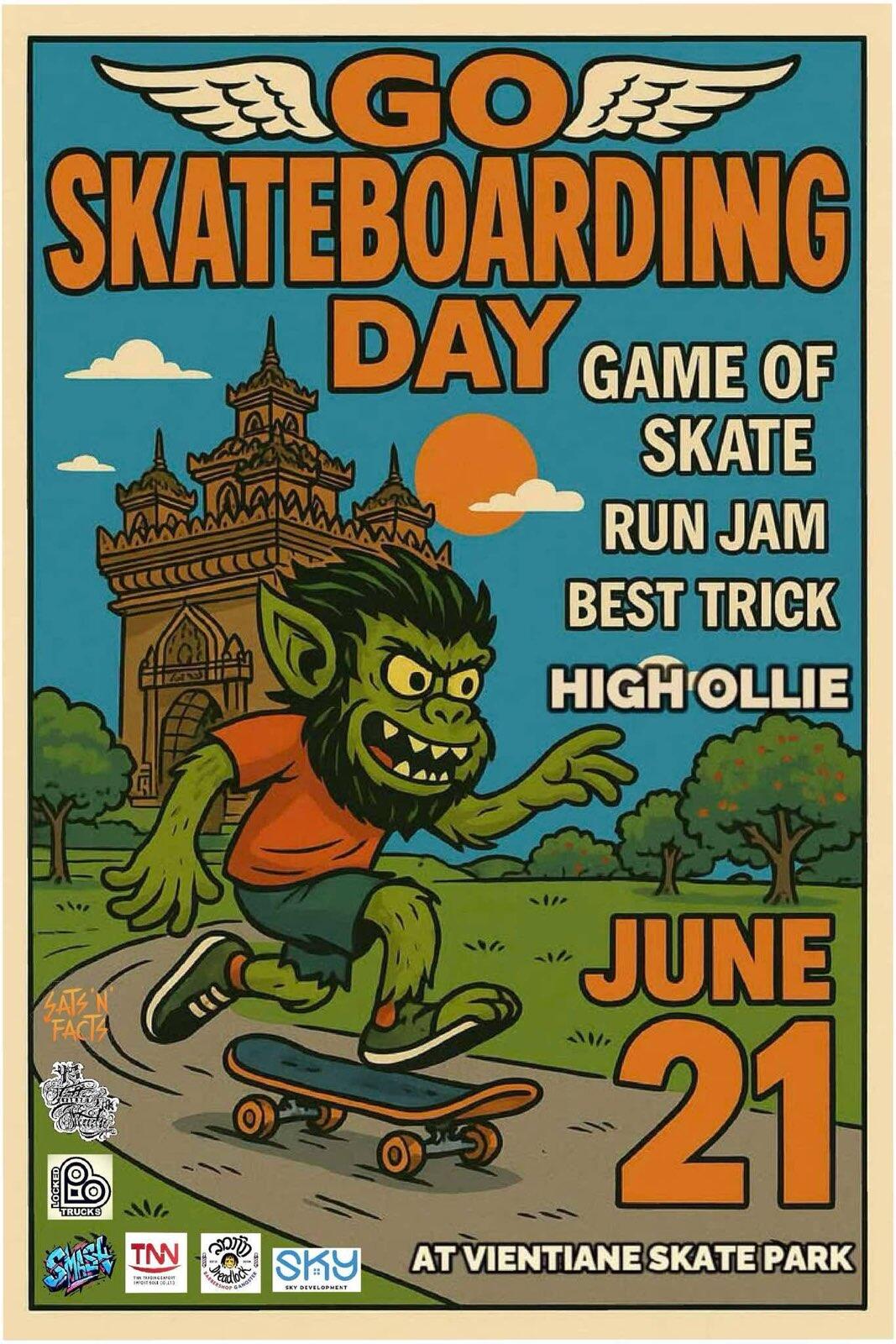

2025-06-05 10:32:4021… That number means something. A reminder that limits create value - both in Bitcoin and in life.

Every June 21st, skaters around the world remind us that freedom is something you make yourself - one push at a time only constrained by your own limitations.

This year in Vientiane, we’re proud to support one of the few real skate spots in Laos. A place built and held together by skaters for skaters.

Expect around 50 locals - from young kids to older heads - showing up not just to skate, but to hold space for each other. No ego, no filters, just boards, fun and respect.

Bircoiners have lots to learn from these communities on this regard. Go skate and you'll find out.

SnF

Laostr

Skateboardingisfun

Skate4Fun

-

@ e4950c93:1b99eccd

2025-06-05 10:23:39

@ e4950c93:1b99eccd

2025-06-05 10:23:39Marques

Nordkidz est une marque allemande qui crée à la demande des vêtements et linges pour les bébés, les enfants, et un peu pour leurs parents.

Matières naturelles utilisées dans les produits

⚠️ Attention, certains produits de cette marque contiennent des matières non naturelles, dont :

Catégories de produits proposés

Cette marque propose des produits intégralement en matière naturelle dans les catégories suivantes :

Vêtements

- Tailles vêtements : bébés, enfants, unisexe

- Hauts : pulls, t-shirts

- Bas : pantalons, pantalons de survêtement, shorts

- Tête et mains : bonnets, écharpes

Maison

- Linge : housses de pouf, langes, ponchos de bain

Autres informations

👉 En savoir plus sur le site de la marque

Où trouver leurs produits ?

- Nordkidz (en allemand, zone de livraison : Allemagne et Union Européenne) 💚 Via ce lien vous soutenez directement la marque.

📝 Tu peux contribuer à cette fiche en suggérant une modification en commentaire.

🗣️ Tu utilises des produits de cette marque ? Partage ton avis en commentaire.

⚡ Heureu-x-se de trouver cette information ? Soutiens le projet en faisant un don pour remercier les contribut-eur-ice-s.

-

@ 9ca447d2:fbf5a36d

2025-06-05 12:01:56

@ 9ca447d2:fbf5a36d

2025-06-05 12:01:56Trump Media & Technology Group (TMTG), the company behind Truth Social and other Trump-branded digital platforms, is planning to raise $2.5 billion to build one of the largest bitcoin treasuries among public companies.

The deal involves the sale of approximately $1.5 billion in common stock and $1.0 billion in convertible senior secured notes.

According to the company, the offering is expected to close by the end of May, pending standard closing conditions.

Devin Nunes, CEO of Trump Media, said the investment in bitcoin is a big part of the company’s long-term plan.

“We view Bitcoin as an apex instrument of financial freedom,” Nunes said.

“This investment will help defend our Company against harassment and discrimination by financial institutions, which plague many Americans and U.S. firms.”

He added that the bitcoin treasury will be used to create new synergies across the company’s platforms including Truth Social, Truth+, and the upcoming financial tech brand Truth.Fi.

“It’s a big step forward in the company’s plans to evolve into a holding company by acquiring additional profit-generating, crown jewel assets consistent with America First principles,” Nunes said.

The $2.5 billion raise will come from about 50 institutional investors. The $1 billion in convertible notes will have 0% interest and be convertible into shares at a 35% premium.

TMTG’s current liquid assets, including cash and short-term investments, are $759 million as of the end of the first quarter of 2025. With this new funding, the company’s liquid assets will be over $3 billion.

Custody of the bitcoin treasury will be handled by Crypto.com and Anchorage Digital. They will manage and store the digital assets.

Earlier this week The Financial Times reported Trump Media was planning to raise $3 billion for digital assets acquisitions.

The article said the funds would be used to buy bitcoin and other digital assets, and an announcement could come before a major related event in Las Vegas.

Related: Bitcoin 2025 Conference Kicks off in Las Vegas Today

Trump Media denied the FT report. In a statement, the company said, “Apparently the Financial Times has dumb writers listening to even dumber sources.”

There was no further comment. However, the official $2.5 billion figure, which was announced shortly after by Trump Media through a press release, aligns with its actual filing and investor communication.

Trump Media’s official announcement

This comes at a time when the Trump family and political allies are showing renewed interest in Bitcoin.

President Donald Trump who is now back in office since the 2025 election, has said he wants to make the U.S. the “crypto capital of the world.”

Trump Media is also working on retail bitcoin investment products including ETFs aligned with America First policies.

These products will make bitcoin more accessible to retail investors and support pro-Trump financial initiatives.

But not everyone is happy.

Democratic Senator Elizabeth Warren recently expressed concerns about Trump Media’s Bitcoin plans. She asked U.S. regulators to clarify their oversight of digital-asset ETFs, warning of investor risk.

Industry insiders are comparing Trump Media’s plans to Strategy (MSTR) which has built a multi-billion dollar bitcoin treasury over the last year. They used stock and bond sales to fund their bitcoin purchases.

-

@ dfa02707:41ca50e3

2025-06-05 17:01:36

@ dfa02707:41ca50e3

2025-06-05 17:01:36Contribute to keep No Bullshit Bitcoin news going.

- RoboSats v0.7.7-alpha is now available!

NOTE: "This version of clients is not compatible with older versions of coordinators. Coordinators must upgrade first, make sure you don't upgrade your client while this is marked as pre-release."

- This version brings a new and improved coordinators view with reviews signed both by the robot and the coordinator, adds market price sources in coordinator profiles, shows a correct warning for canceling non-taken orders after a payment attempt, adds Uzbek sum currency, and includes package library updates for coordinators.

Source: RoboSats.

- siggy47 is writing daily RoboSats activity reviews on stacker.news. Check them out here.

- Stay up-to-date with RoboSats on Nostr.

What's new

- New coordinators view (see the picture above).

- Available coordinator reviews signed by both the robot and the coordinator.

- Coordinators now display market price sources in their profiles.

Source: RoboSats.

- Fix for wrong message on cancel button when taking an order. Users are now warned if they try to cancel a non taken order after a payment attempt.

- Uzbek sum currency now available.

- For coordinators: library updates.

- Add docker frontend (#1861).

- Add order review token (#1869).

- Add UZS migration (#1875).

- Fixed tests review (#1878).

- Nostr pubkey for Robot (#1887).

New contributors

Full Changelog: v0.7.6-alpha...v0.7.7-alpha

-

@ 7f6db517:a4931eda

2025-06-05 09:02:08

@ 7f6db517:a4931eda

2025-06-05 09:02:08

What is KYC/AML?

- The acronym stands for Know Your Customer / Anti Money Laundering.

- In practice it stands for the surveillance measures companies are often compelled to take against their customers by financial regulators.

- Methods differ but often include: Passport Scans, Driver License Uploads, Social Security Numbers, Home Address, Phone Number, Face Scans.

- Bitcoin companies will also store all withdrawal and deposit addresses which can then be used to track bitcoin transactions on the bitcoin block chain.

- This data is then stored and shared. Regulations often require companies to hold this information for a set number of years but in practice users should assume this data will be held indefinitely. Data is often stored insecurely, which results in frequent hacks and leaks.

- KYC/AML data collection puts all honest users at risk of theft, extortion, and persecution while being ineffective at stopping crime. Criminals often use counterfeit, bought, or stolen credentials to get around the requirements. Criminals can buy "verified" accounts for as little as $200. Furthermore, billions of people are excluded from financial services as a result of KYC/AML requirements.

During the early days of bitcoin most services did not require this sensitive user data, but as adoption increased so did the surveillance measures. At this point, most large bitcoin companies are collecting and storing massive lists of bitcoiners, our sensitive personal information, and our transaction history.

Lists of Bitcoiners

KYC/AML policies are a direct attack on bitcoiners. Lists of bitcoiners and our transaction history will inevitably be used against us.

Once you are on a list with your bitcoin transaction history that record will always exist. Generally speaking, tracking bitcoin is based on probability analysis of ownership change. Surveillance firms use various heuristics to determine if you are sending bitcoin to yourself or if ownership is actually changing hands. You can obtain better privacy going forward by using collaborative transactions such as coinjoin to break this probability analysis.

Fortunately, you can buy bitcoin without providing intimate personal information. Tools such as peach, hodlhodl, robosats, azteco and bisq help; mining is also a solid option: anyone can plug a miner into power and internet and earn bitcoin by mining privately.

You can also earn bitcoin by providing goods and/or services that can be purchased with bitcoin. Long term, circular economies will mitigate this threat: most people will not buy bitcoin - they will earn bitcoin - most people will not sell bitcoin - they will spend bitcoin.

There is no such thing as KYC or No KYC bitcoin, there are bitcoiners on lists and those that are not on lists.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-05 09:02:03

@ 7f6db517:a4931eda

2025-06-05 09:02:03

People forget Bear Stearns failed March 2008 - months of denial followed before the public realized how bad the situation was under the surface.

Similar happening now but much larger scale. They did not fix fundamental issues after 2008 - everything is more fragile.

The Fed preemptively bailed out every bank with their BTFP program and First Republic Bank still failed. The second largest bank failure in history.

There will be more failures. There will be more bailouts. Depositors will be "protected" by socializing losses across everyone.

Our President and mainstream financial pundits are currently pretending the banking crisis is over while most banks remain insolvent. There are going to be many more bank failures as this ponzi system unravels.

Unlike 2008, we have the ability to opt out of these broken and corrupt institutions by using bitcoin. Bitcoin held in self custody is unique in its lack of counterparty risk - you do not have to trust a bank or other centralized entity to hold it for you. Bitcoin is also incredibly difficult to change by design since it is not controlled by an individual, company, or government - the supply of dollars will inevitably be inflated to bailout these failing banks but bitcoin supply will remain unchanged. I do not need to convince you that bitcoin provides value - these next few years will convince millions.

If you found this post helpful support my work with bitcoin.

-

@ dfa02707:41ca50e3

2025-06-05 17:01:34

@ dfa02707:41ca50e3

2025-06-05 17:01:34Contribute to keep No Bullshit Bitcoin news going.

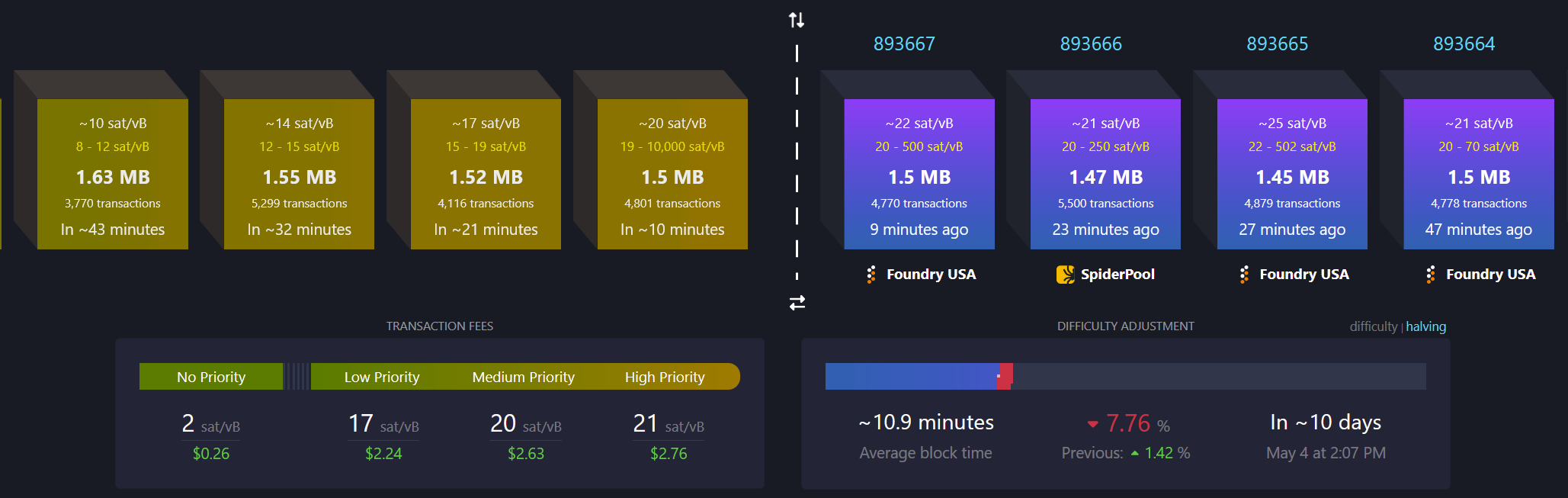

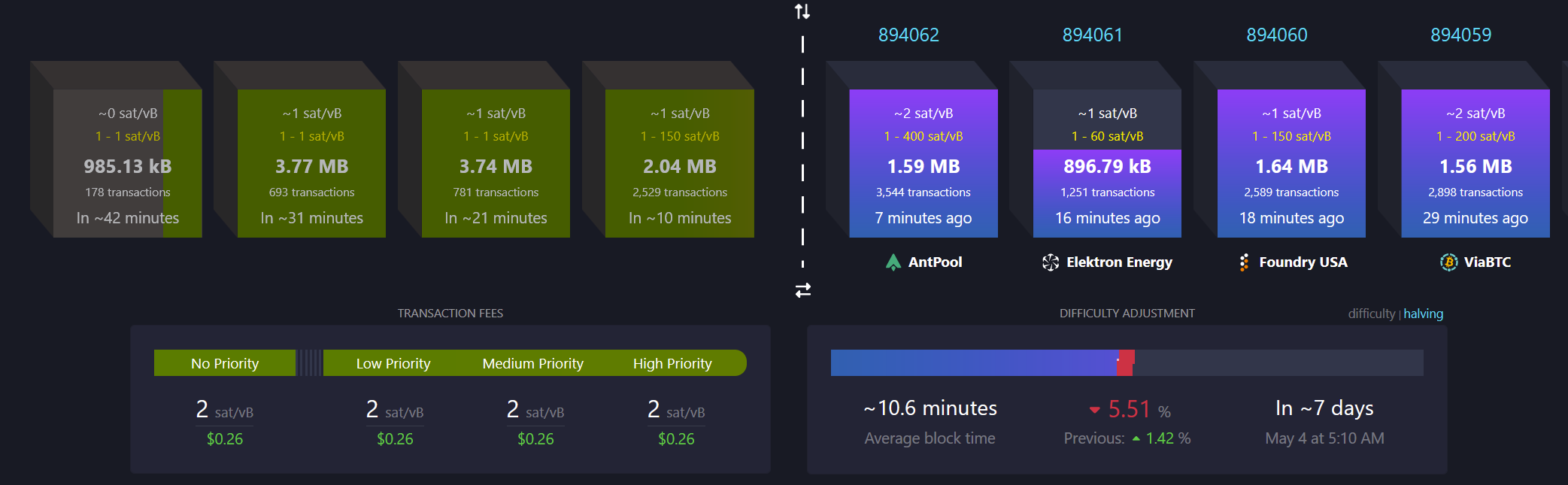

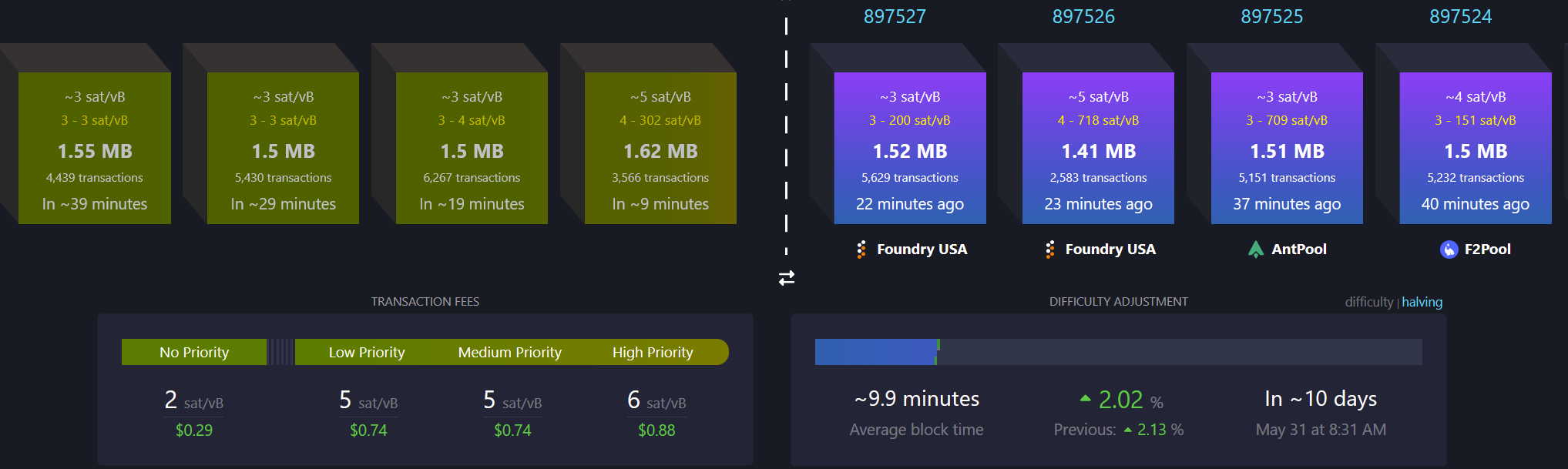

This update brings key enhancements for clarity and usability:

- Recent Blocks View: Added to the Send tab and inspired by Mempool's visualization, it displays the last 2 blocks and the estimated next block to help choose fee rates.

- Camera System Overhaul: Features a new library for higher resolution detection and mouse-scroll zoom support when available.

- Vector-Based Images: All app images are now vectorized and theme-aware, enhancing contrast, especially in dark mode.

- Tor & P2A Updates: Upgraded internal Tor and improved support for pay-to-anchor (P2A) outputs.

- Linux Package Rename: For Linux users, Sparrow has been renamed to sparrowwallet (or sparrowserver); in some cases, the original sparrow package may need manual removal.

- Additional updates include showing total payments in multi-payment transaction diagrams, better handling of long labels, and other UI enhancements.

- Sparrow v2.2.1 is a bug fix release that addresses missing UUID issue when starting Tor on recent macOS versions, icons for external sources in Settings and Recent Blocks view, repackaged

.debinstalls to use older gzip instead of zstd compression, and removed display of median fee rate where fee rates source is set to Server.

Learn how to get started with Sparrow wallet:

Release notes (v2.2.0)

- Added Recent Blocks view to Send tab.

- Converted all bitmapped images to theme aware SVG format for all wallet models and dialogs.

- Support send and display of pay to anchor (P2A) outputs.

- Renamed

sparrowpackage tosparrowwalletandsparrowserveron Linux. - Switched camera library to openpnp-capture.

- Support FHD (1920 x 1080) and UHD4k (3840 x 2160) capture resolutions.

- Support camera zoom with mouse scroll where possible.

- In the Download Verifier, prefer verifying the dropped file over the default file where the file is not in the manifest.

- Show a warning (with an option to disable the check) when importing a wallet with a derivation path matching another script type.

- In Cormorant, avoid calling the

listwalletdirRPC on initialization due to a potentially slow response on Windows. - Avoid server address resolution for public servers.

- Assume server address is non local for resolution failures where a proxy is configured.

- Added a tooltip to indicate truncated labels in table cells.

- Dynamically truncate input and output labels in the tree on a transaction tab, and add tooltips if necessary.

- Improved tooltips for wallet tabs and transaction diagrams with long labels.

- Show the address where available on input and output tooltips in transaction tab tree.

- Show the total amount sent in payments in the transaction diagram when constructing multiple payment transactions.

- Reset preferred table column widths on adjustment to improve handling after window resizing.

- Added accessible text to improve screen reader navigation on seed entry.

- Made Wallet Summary table grow horizontally with dialog sizing.

- Reduced tooltip show delay to 200ms.

- Show transaction diagram fee percentage as less than 0.01% rather than 0.00%.

- Optimized and reduced Electrum server RPC calls.

- Upgraded Bouncy Castle, PGPainless and Logback libraries.

- Upgraded internal Tor to v0.4.8.16.

- Bug fix: Fixed issue with random ordering of keystore origins on labels import.

- Bug fix: Fixed non-zero account script type detection when signing a message on Trezor devices.

- Bug fix: Fixed issue parsing remote Coldcard xpub encoded on a different network.

- Bug fix: Fixed inclusion of fees on wallet label exports.

- Bug fix: Increase Trezor device libusb timeout.

Linux users: Note that the

sparrowpackage has been renamed tosparrowwalletorsparrowserver, and in some cases you may need to manually uninstall the originalsparrowpackage. Look in the/optfolder to ensure you have the new name, and the original is removed.What's new in v2.2.1

- Updated Tor library to fix missing UUID issue when starting Tor on recent macOS versions.

- Repackaged

.debinstalls to use older gzip instead of zstd compression. - Removed display of median fee rate where fee rates source is set to Server.

- Added icons for external sources in Settings and Recent Blocks view

- Bug fix: Fixed issue in Recent Blocks view when switching fee rates source

- Bug fix: Fixed NPE on null fee returned from server

-

@ e2c72a5a:bfacb2ee

2025-06-05 17:11:03

@ e2c72a5a:bfacb2ee

2025-06-05 17:11:03The $220 million crypto heist that took just minutes reveals a fatal flaw in DeFi security. While blockchain tech promises trustless transactions, the Cetus DEX exploit on Sui exposed how a single undetected bug in a math library became catastrophic. What's truly alarming isn't the hack itself but the revelation from Curve's founder that professional hackers-for-hire are now coordinating sophisticated cross-platform attacks. This signals a dangerous evolution in crypto threats where vulnerabilities aren't just discovered—they're hunted by organized teams with specialized skills. The industry faces a stark choice: invest aggressively in preventative security or watch as billions more vanish in seconds. Is your crypto truly safe, or just waiting for the right hacker to find its weakness?

-

@ b1ddb4d7:471244e7

2025-06-05 17:00:56

@ b1ddb4d7:471244e7

2025-06-05 17:00:56When Sergei talks about bitcoin, he doesn’t sound like someone chasing profits or followers. He sounds like someone about to build a monastery in the ruins.

While the mainstream world chases headlines and hype, Sergei shows up in local meetups from Sacramento to Cleveland, mentors curious minds, and shares what he knows is true – hoping that, with the right spark, someone will light their own way forward.

We interviewed Sergei to trace his steps: where he started, what keeps him going, and why teaching bitcoin is far more than explaining how to set up a node – it’s about reaching the right minds before the noise consumes them. So we began where most journeys start: at the beginning.

First Steps

- So, where did it all begin for you and what made you stay curious?

I first heard about bitcoin from a friend’s book recommendation, American Kingpin, the book about Silk Road (online drug marketplace). He is still not a true bitcoiner, although I helped him secure private keys with some bitcoin.

I was really busy at the time – focused on my school curriculum, running a 7-bedroom Airbnb, and working for a standardized test prep company. Bitcoin seemed too technical for me to explore, and the pace of my work left no time for it.

After graduating, while pursuing more training, I started playing around with stocks and maximizing my savings. Passive income seemed like the path to early retirement, as per the promise of the FIRE movement (Financial Independence, Retire Early). I mostly followed the mainstream news and my mentor’s advice – he liked preferred stocks at the time.

I had some Coinbase IOUs and remember sending bitcoin within the Coinbase ledger to a couple friends. I also recall the 2018 crash; I actually saw the legendary price spike live but couldn’t benefit because my funds were stuck amidst the frenzy. I withdrew from that investment completely for some time. Thankfully, my mentor advised to keep en eye on bitcoin.

Around late 2019, I started DCA-ing cautiously. Additionally, my friend and I were discussing famous billionaires, and how there was no curriculum for becoming a billionaire. So, I typed “billionaires” into my podcast app, and landed on We Study Billionaires podcast.

That’s where I kept hearing Preston Pysh mention bitcoin, before splitting into his own podcast series, Bitcoin Fundamentals. I didn’t understand most of the terminology of stocks, bonds, etc, yet I kept listening and trying to absorb it thru repetition. Today, I realize all that financial talk was mostly noise.

When people ask me for a technical explanation of fiat, I say: it’s all made up, just like the fiat price of bitcoin! Starting in 2020, during the so-called pandemic, I dove deeper. I religiously read Bitcoin Magazine, scrolled thru Bitcoin Twitter, and joined Simply Bitcoin Telegram group back when DarthCoin was an admin.

DarthCoin was my favorite bitcoiner – experienced, knowledgeable, and unapologetic. Watching him shift from rage to kindness, from passion to despair, gave me a glimpse at what a true educator’s journey would look like.

The struggle isn’t about adoption at scale anymore. It’s about reaching the few who are willing to study, take risks, and stay out of fiat traps. The vast majority won’t follow that example – not yet at least… if I start telling others the requirements for true freedom and prosperity, they would certainly say “Hell no!”

- At what point did you start teaching others, and why?

After college, I helped teach at a standardized test preparation company, and mentored some students one-on-one. I even tried working at a kindergarten briefly, but left quickly; Babysitting is not teaching.

What I discovered is that those who will succeed don’t really need my help – they would succeed with or without me, because they already have the inner drive.

Once you realize your people are perishing for lack of knowledge, the only rational thing to do is help raise their level of knowledge and understanding. That’s the Great Work.

I sometimes imagine myself as a political prisoner. If that were to happen, I’d probably start teaching fellow prisoners, doctors, janitors, even guards. In a way we already live in an open-air prison, So what else is there to do but teach, organize, and conspire to dismantle the Matrix?

Building on Bitcoin

- You hosted some in-person meetups in Sacramento. What did you learn from those?

My first presentation was on MultiSig storage with SeedSigner, and submarine swaps through Boltz.exchange.

I realized quickly that I had overestimated the group’s technical background. Even the meetup organizer, a financial advisor, asked, “How is anyone supposed to follow these steps?” I responded that reading was required… He decided that Unchained is an easier way.

At a crypto meetup, I gave a much simpler talk, outlining how bitcoin will save the world, based on a DarthCoin’s guide. Only one person stuck around to ask questions – a man who seemed a little out there, and did not really seem to get the message beyond the strength of cryptographic security of bitcoin.

Again, I overestimated the audience’s readiness. That forced me to rethink my strategy. People are extremely early and reluctant to study.

- Now in Ohio, you hold sessions via the Orange Pill App. What’s changed?

My new motto is: educate the educators. The corollary is: don’t orange-pill stupid normies (as DarthCoin puts it).

I’ve shifted to small, technical sessions in order to raise a few solid guardians of this esoteric knowledge who really get it and can carry it forward.

The youngest attendee at one of my sessions is a newborn baby – he mostly sleeps, but maybe he still absorbs some of the educational vibes.

- How do local groups like Sactown and Cleveland Bitcoiners influence your work?

Every meetup reflects its local culture. Sacramento and Bay Area Bitcoiners, for example, do camping trips – once we camped through a desert storm, shielding our burgers from sand while others went to shoot guns.

Cleveland Bitcoiners are different. They amass large gatherings. They recently threw a 100k party. They do a bit more community outreach. Some are curious about the esoteric topics such as jurisdiction, spirituality, and healthful living.

I have no permanent allegiance to any state, race, or group. I go where I can teach and learn. I anticipate that in my next phase, I’ll meet Bitcoiners so advanced that I’ll have to give up my fiat job and focus full-time on serious projects where real health and wealth are on the line.

Hopefully, I’ll be ready. I believe the universe always challenges you exactly to your limit – no less, no more.

- What do people struggle with the most when it comes to technical education?

The biggest struggle isn’t technical – it’s a lack of deep curiosity. People ask “how” and “what” – how do I set up a node, what should one do with the lightning channels? But very few ask “why?”

Why does on-chain bitcoin not contribute to the circular economy? Why is it essential to run Lightning? Why did humanity fall into mental enslavement in the first place?

I’d rather teach two-year-olds who constantly ask “why” than adults who ask how to flip a profit. What worries me most is that most two-year-olds will grow up asking state-funded AI bots for answers and live according to its recommendations.

- One Cleveland Bitcoiner shows up at gold bug meetups. How valuable is face-to-face education?

I don’t think the older generation is going to reverse the current human condition. Most of them have been under mind control for too long, and they just don’t have the attention span to study and change their ways.

They’re better off stacking gold and helping fund their grandkids’ education. If I were to focus on a demographic, I’d go for teenagers – high school age – because by college, the indoctrination is usually too strong, and they’re chasing fiat mastery.

As for the gold bug meetup? Perhaps one day I will show up with a ukulele to sing some bitcoin-themed songs. Seniors love such entertainment.

- How do you choose what to focus on in your sessions, especially for different types of learners?

I don’t come in with a rigid agenda. I’ve collected a massive library of resources over the years and never stopped reading. My browser tab and folder count are exploding.

At the meetup, people share questions or topics they’re curious about, then I take that home, do my homework, and bring back a session based on those themes. I give them the key takeaways, plus where to dive deeper.

Most people won’t – or can’t – study the way I do, and I expect attendees to put in the work. I suspect that it’s more important to reach those who want to learn but don’t know how, the so-called nescient (not knowing), rather than the ignorant.

There are way too many ignorant bitcoiners, so my mission is to find those who are curious what’s beyond the facade of fake reality and superficial promises.

That naturally means that fewer people show up, and that’s fine. I’m not here for the crowds; I’m here to educate the educators. One bitcoiner who came decided to branch off into self-custody sessions and that’s awesome. Personally, I’m much more focused on Lightning.

I want to see broader adoption of tools like auth, sign-message, NWC, and LSPs. Next month, I’m going deep into eCash solutions, because let’s face it – most newcomers won’t be able to afford their own UTXO or open a lightning channel; additionally, it has to be fun and easy for them to transact sats, otherwise they won’t do it. Additionally, they’ll need to rely on

-

@ dfa02707:41ca50e3

2025-06-05 17:01:34

@ dfa02707:41ca50e3

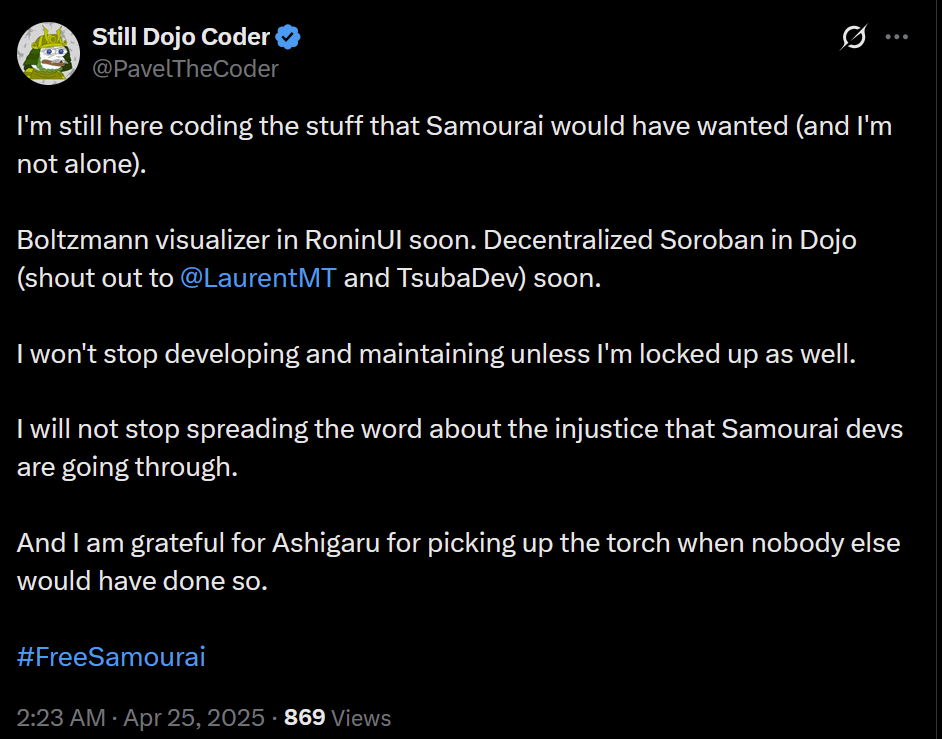

2025-06-05 17:01:34- This version introduces the Soroban P2P network, enabling Dojo to relay transactions to the Bitcoin network and share others' transactions to break the heuristic linking relaying nodes to transaction creators.

- Additionally, Dojo admins can now manage API keys in DMT with labels, status, and expiration, ideal for community Dojo providers like Dojobay. New API endpoints, including "/services" exposing Explorer, Soroban, and Indexer, have been added to aid wallet developers.

- Other maintenance updates include Bitcoin Core, Tor, Fulcrum, Node.js, plus an updated ban-knots script to disconnect inbound Knots nodes.

"I want to thank all the contributors. This again shows the power of true Free Software. I also want to thank everyone who donated to help Dojo development going. I truly appreciate it," said Still Dojo Coder.

What's new

- Soroban P2P network. For MyDojo (Docker setup) users, Soroban will be automatically installed as part of their Dojo. This integration allows Dojo to utilize the Soroban P2P network for various upcoming features and applications.

- PandoTx. PandoTx serves as a transaction transport layer. When your wallet sends a transaction to Dojo, it is relayed to a random Soroban node, which then forwards it to the Bitcoin network. It also enables your Soroban node to receive and relay transactions from others to the Bitcoin network and is designed to disrupt the assumption that a node relaying a transaction is closely linked to the person who initiated it.

- Pushing transactions through Soroban can be deactivated by setting

NODE_PANDOTX_PUSH=offindocker-node.conf. - Processing incoming transactions from Soroban network can be deactivated by setting

NODE_PANDOTX_PROCESS=offindocker-node.conf.

- Pushing transactions through Soroban can be deactivated by setting

- API key management has been introduced to address the growing number of people offering their Dojos to the community. Dojo admins can now access a new API management tab in their DMT, where they can create unlimited API keys, assign labels for easy identification, and set expiration dates for each key. This allows admins to avoid sharing their main API key and instead distribute specific keys to selected parties.

- New API endpoints. Several new API endpoints have been added to help API consumers develop features on Dojo more efficiently:

- New:

/latest-block- returns data about latest block/txout/:txid/:index- returns unspent output data/support/services- returns info about services that Dojo exposes

- Updated:

/tx/:txid- endpoint has been updated to return raw transaction with parameter?rawHex=1

- The new

/support/servicesendpoint replaces the deprecatedexplorerfield in the Dojo pairing payload. Although still present, API consumers should use this endpoint for explorer and other pairing data.

- New:

Other changes

- Updated ban script to disconnect inbound Knots nodes.

- Updated Fulcrum to v1.12.0.

- Regenerate Fulcrum certificate if expired.

- Check if transaction already exists in pushTx.

- Bump BTC-RPC Explorer.

- Bump Tor to v0.4.8.16, bump Snowflake.

- Updated Bitcoin Core to v29.0.

- Removed unnecessary middleware.

- Fixed DB update mechanism, added api_keys table.

- Add an option to use blocksdir config for bitcoin blocks directory.

- Removed deprecated configuration.

- Updated Node.js dependencies.

- Reconfigured container dependencies.

- Fix Snowflake git URL.

- Fix log path for testnet4.

- Use prebuilt addrindexrs binaries.

- Add instructions to migrate blockchain/fulcrum.

- Added pull policies.

Learn how to set up and use your own Bitcoin privacy node with Dojo here.

-

@ e2c72a5a:bfacb2ee

2025-06-05 17:00:01

@ e2c72a5a:bfacb2ee

2025-06-05 17:00:01Forget Lambos, think real estate tokens.

A European fund just dropped $3.4 million on tokenized real estate, marking the first time big money directly bought retail available tokens. This isn't just about crypto hype; it's about institutions embracing regulated crypto assets. Real World Assets (RWAs) are booming, up 260% this year, fueled by clearer US crypto rules. This surge pushes the tokenization sector past $23 billion.

Is this the start of crypto's mainstream moment?

-

@ b1ddb4d7:471244e7

2025-06-05 17:00:50

@ b1ddb4d7:471244e7

2025-06-05 17:00:50“Not your keys, not your coins” isn’t a slogan—it’s a survival mantra in the age of digital sovereignty.

The seismic collapses of Mt. Gox (2014) and FTX (2022) weren’t anomalies; they were wake-up calls. When $8.7 billion in customer funds vanished with FTX, it exposed the fatal flaw of third-party custody: your bitcoin is only as secure as your custodian’s weakest link.

Yet today, As of early 2025, analysts estimate that between 2.3 million and 3.7 million Bitcoins are permanently lost, representing approximately 11–18% of bitcoin’s fixed maximum supply of 21 million coins, with some reports suggesting losses as high as 4 million BTC. This paradox reveals a critical truth: self-custody isn’t just preferable—it’s essential—but it must be done right.

The Custody Spectrum

Custodial Wallets (The Illusion of Control)

- Rehypothecation Risk: Most platforms lend your bitcoin for yield generation. When Celsius collapsed, users discovered their “held” bitcoin was loaned out in risky strategies.

- Account Freezes: Regulatory actions can lock withdrawals overnight. In 2023, Binance suspended dollar withdrawals for U.S. users citing “partner bank issues,” trapping funds for weeks.

- Data Vulnerability: KYC requirements create honeypots for hackers. The 2024 Ledger breach exposed 270,000 users’ personal data despite hardware security.

True Self-Custody

Self-custody means exclusively controlling your private keys—the cryptographic strings that prove bitcoin ownership. Unlike banks or exchanges, self-custody eliminates:- Counterparty risk (no FTX-style implosions)

- Censorship (no blocked transactions)

- Inflationary theft (no fractional reserve lending)

Conquering the Three Great Fears of Self-Custody

Fear 1: “I’ll Lose Everything If I Make a Mistake”

Reality: Human error is manageable with robust systems:

- Test Transactions: Always send a micro-amount (0.00001 BTC) before large transfers. Verify receipt AND ability to send back.

- Multi-Backup Protocol: Store seed phrases on fireproof/waterproof steel plates (not paper!). Distribute copies geographically—one in a home safe, another with trusted family 100+ miles away.

- SLIP39 Sharding: Split your seed into fragments requiring 3-of-5 shards to reconstruct. No single point of failure.

Fear 2: “Hackers Will Steal My Keys”

Reality: Offline storage defeats remote attacks:

- Hardware Wallets: Devices like Bitkey or Ledger keep keys in “cold storage”—isolated from internet-connected devices. Transactions require physical confirmation.

- Multisig Vaults: Bitvault’s multi-sig system requires attackers compromise multiple locations/devices simultaneously. Even losing two keys won’t forfeit funds.

- Air-Gapped Verification: Use dedicated offline devices for wallet setup. Never type seeds on internet-connected machines.

Fear 3: “My Family Can’t Access It If I Die”

Reality: Inheritance is solvable:

- Dead Man Switches: Bitwarden’s emergency access allows trusted contacts to retrieve encrypted keys after a pre-set waiting period (e.g., 30 days).

- Inheritance Protocols: Bitkey’s inheritance solution shares decryption keys via designated beneficiaries’ emails. Requires multiple approvals to prevent abuse.

- Public Key Registries: Share wallet XPUBs (not private keys!) with heirs. They can monitor balances but not spend, ensuring transparency without risk.

The Freedom Dividend

- Censorship Resistance: Send $10M BTC to a Wikileaks wallet without Visa/Mastercard blocking it.

- Privacy Preservation: Avoid KYC surveillance—non-custodial wallets like Flash require zero ID verification.

- Protocol Access: Participate in bitcoin-native innovations (Lightning Network, DLCs) only possible with self-custodied keys.

- Black Swan Immunity: When Cyprus-style bank bailins happen, your bitcoin remains untouched in your vault.

The Sovereign’s Checklist

- Withdraw from Exchanges: Move all BTC > $1,000 to self-custody immediately.

- Buy Hardware Wallet: Purchase DIRECTLY from manufacturer (no Amazon!) to avoid supply-chain tampering.

- Generate Seed OFFLINE: Use air-gapped device, write phrase on steel—never digitally.

- Test Recovery: Delete wallet, restore from seed before funding.

- Implement Multisig: For > $75k, use Bitvault for 2-of-3 multi-sig setup.

- Create Inheritance Plan: Share XPUBs/SLIP39 shards with heirs + legal documents.

“Self-custody isn’t about avoiding risk—it’s about transferring risk from opaque institutions to transparent, controllable systems you design.”

The Inevitable Evolution: Custody Without Compromise

Emerging solutions are erasing old tradeoffs:

- MPC Wallets: Services like Xapo Bank shatter keys into encrypted fragments distributed globally. No single device holds full keys, defeating physical theft.

- Social Recovery: Ethically designed networks (e.g., Bitkey) let trusted contacts restore access without custodial control.

- Biometric Assurance: Fingerprint reset protocols prevent lockouts from physical injuries.

Lost keys = lost bitcoin. But consider the alternative: entrusting your life savings to entities with proven 8% annual failure rates among exchanges. Self-custody shifts responsibility from hoping institutions won’t fail to knowing your system can’t fail without your consent.

Take action today: Move one coin. Test one recovery. Share one xpub. The path to unchained wealth begins with a single satoshi under your control.

-

@ dfa02707:41ca50e3

2025-06-05 11:03:56

@ dfa02707:41ca50e3

2025-06-05 11:03:56- This version introduces the Soroban P2P network, enabling Dojo to relay transactions to the Bitcoin network and share others' transactions to break the heuristic linking relaying nodes to transaction creators.

- Additionally, Dojo admins can now manage API keys in DMT with labels, status, and expiration, ideal for community Dojo providers like Dojobay. New API endpoints, including "/services" exposing Explorer, Soroban, and Indexer, have been added to aid wallet developers.

- Other maintenance updates include Bitcoin Core, Tor, Fulcrum, Node.js, plus an updated ban-knots script to disconnect inbound Knots nodes.

"I want to thank all the contributors. This again shows the power of true Free Software. I also want to thank everyone who donated to help Dojo development going. I truly appreciate it," said Still Dojo Coder.

What's new

- Soroban P2P network. For MyDojo (Docker setup) users, Soroban will be automatically installed as part of their Dojo. This integration allows Dojo to utilize the Soroban P2P network for various upcoming features and applications.

- PandoTx. PandoTx serves as a transaction transport layer. When your wallet sends a transaction to Dojo, it is relayed to a random Soroban node, which then forwards it to the Bitcoin network. It also enables your Soroban node to receive and relay transactions from others to the Bitcoin network and is designed to disrupt the assumption that a node relaying a transaction is closely linked to the person who initiated it.

- Pushing transactions through Soroban can be deactivated by setting

NODE_PANDOTX_PUSH=offindocker-node.conf. - Processing incoming transactions from Soroban network can be deactivated by setting

NODE_PANDOTX_PROCESS=offindocker-node.conf.

- Pushing transactions through Soroban can be deactivated by setting

- API key management has been introduced to address the growing number of people offering their Dojos to the community. Dojo admins can now access a new API management tab in their DMT, where they can create unlimited API keys, assign labels for easy identification, and set expiration dates for each key. This allows admins to avoid sharing their main API key and instead distribute specific keys to selected parties.

- New API endpoints. Several new API endpoints have been added to help API consumers develop features on Dojo more efficiently:

- New:

/latest-block- returns data about latest block/txout/:txid/:index- returns unspent output data/support/services- returns info about services that Dojo exposes

- Updated:

/tx/:txid- endpoint has been updated to return raw transaction with parameter?rawHex=1

- The new

/support/servicesendpoint replaces the deprecatedexplorerfield in the Dojo pairing payload. Although still present, API consumers should use this endpoint for explorer and other pairing data.

- New:

Other changes

- Updated ban script to disconnect inbound Knots nodes.

- Updated Fulcrum to v1.12.0.

- Regenerate Fulcrum certificate if expired.

- Check if transaction already exists in pushTx.

- Bump BTC-RPC Explorer.

- Bump Tor to v0.4.8.16, bump Snowflake.

- Updated Bitcoin Core to v29.0.

- Removed unnecessary middleware.

- Fixed DB update mechanism, added api_keys table.

- Add an option to use blocksdir config for bitcoin blocks directory.

- Removed deprecated configuration.

- Updated Node.js dependencies.

- Reconfigured container dependencies.

- Fix Snowflake git URL.

- Fix log path for testnet4.

- Use prebuilt addrindexrs binaries.

- Add instructions to migrate blockchain/fulcrum.

- Added pull policies.

Learn how to set up and use your own Bitcoin privacy node with Dojo here.

-

@ 7f6db517:a4931eda

2025-06-05 09:02:02

@ 7f6db517:a4931eda

2025-06-05 09:02:02

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

Good morning.

It looks like PacWest will fail today. It will be both the fifth largest bank failure in US history and the sixth major bank to fail this year. It will likely get purchased by one of the big four banks in a government orchestrated sale.

March 8th - Silvergate Bank

March 10th - Silicon Valley Bank

March 12th - Signature Bank

March 19th - Credit Suisse

May 1st - First Republic Bank

May 4th - PacWest Bank?PacWest is the first of many small regional banks that will go under this year. Most will get bought by the big four in gov orchestrated sales. This has been the playbook since 2008. Follow the incentives. Massive consolidation across the banking industry. PacWest gonna be a drop in the bucket compared to what comes next.

First, a hastened government led bank consolidation, then a public/private partnership with the remaining large banks to launch a surveilled and controlled digital currency network. We will be told it is more convenient. We will be told it is safer. We will be told it will prevent future bank runs. All of that is marketing bullshit. The goal is greater control of money. The ability to choose how we spend it and how we save it. If you control the money - you control the people that use it.

If you found this post helpful support my work with bitcoin.

-

@ a74cf7d3:37b9b82e

2025-06-05 17:03:04

@ a74cf7d3:37b9b82e

2025-06-05 17:03:04Lava is the most secure way to borrow against your bitcoin. Lava Loans allow you to borrow dollars using your bitcoin as collateral, all without giving up self-custody. No need to wait days, sign paperwork, bridge your bitcoin, or trust third-party custodians to take out a loan. All you have to do is set the terms of your loan within your Lava Vault, and you can get your loan capital within seconds.

Unlike other bitcoin-backed lending options, Lava is entirely self-custodial. You control your own keys and never have to transfer your bitcoin to a third party. Historically, most bitcoin-backed lending solutions required users to trust custodians with their bitcoin, exposing them to hacks, rehypothecation risk, insolvency, and seizures. This resulted in more than $24B in user funds lost in 2022 alone. Lending protocols on other chains like Ethereum or Solana require users to bridge their bitcoin, introducing additional custodial, bridge, smart contract, and platform risks. Both options are clunky, risky, and slow.

Lava Loans introduces a better model. We’ve built a borrowing protocol that works entirely on native bitcoin. Taking out a loan on Lava takes seconds, doesn't require paperwork, and allows you to maintain self-custody. Lava is the best option for simple, low-cost, and safe bitcoin-backed loans.

In this article we’ll dive into the key features of Lava Loans, how it is different from other borrowing options on the market, and explain how it works at a technical level.

Key Features of Lava

-

Instant loans: No paperwork. Just answer 2 questions and get your loan within seconds.

-

Low cost: We minimize costs by reducing loan risk, allowing us to offer the lowest rates on the market. All fees are made transparent at the start.

-

Flexible amounts: Borrow exactly what you need.

-

No Custodial Risk: Your BTC never leaves your control. There’s no risk of hacks, seizure, or rehypothecation. You can verify this yourself on-chain. Lava is the only loan product where you can independently verify—on-chain and in real time—that your bitcoin is not being rehypothecated.

-

No Loan Initiation Risk: Using atomic swaps, your collateral only moves if your loan capital is already secured.

-

No Repayment Risk: Repay your loan and your BTC is automatically returned, guaranteed by cryptography.

-

Reduced Liquidation Risk: You choose your own blinded, off-chain price source, minimizing the chance of unfair liquidation.

-

Bug-Minimized: Lava uses formally verified smart contracts on bitcoin (Discreet Log Contracts), meaning all contract outcomes are known and signed ahead of time. Execution is private and secure.

How It Works

The Lava Loans Protocol is built on top of bitcoin-native smart contracts, called Discreet Log Contracts (DLCs). DLCs enable conditional (oracle-based) contracts on bitcoin, meaning they can execute transactions based on pre-specified and approved conditions. Lava Loans are executed via custom DLCs that allow the borrower and lender to agree to the terms of a loan, enter into a contract based on those terms, and have the contract enforce the terms on-chain— all without requiring a third-party custodian.

DLCs allow for a trust-minimized borrowing experience, and they avoid many of the risks inherent with smart contracts on other platforms like Ethereum. DLCs operate on Bitcoin itself— you don’t need to move your coins to another chain or layer. They also mitigate bug risk because they are formally verified, meaning the output conditions of the contract are known from the beginning. This helps to avoid the exploits commonly seen in Ethereum. Because the contracts use off-chain oracles, they aren't susceptible to oracle manipulation by miners. Not only that, but these contracts are private, customizable (choose your own oracle), and scalable (minimal on-chain cost because execution happens off-chain).

Lava Loans are on-chain contracts between borrowers and lenders. The borrower and the lender agree on a loan amount (in USD), a collateral amount (in BTC), the loan duration, the interest rate, the loan-to-value (LTV) ratio at which liquidation happens, and a data feed (oracle) that will provide the Bitcoin price. When the contract is initialized, the collateral is locked and the loan capital is transferred to the borrower. The oracle feeds the price of Bitcoin into the contract on a continuous basis, and the contract executes according to its pre-defined parameters. As long as the borrower maintains a healthy LTV and repays their loan, their collateral is automatically returned to them upon completion.

Each Lava Loan goes through three phases:

Phase 1: Loan Initiation

- The loan is initialized via an atomic swap; the bitcoin collateral is locked in the smart contract and the loan capital is transferred from the lender to the borrower. Because this is done via an atomic swap, the borrower and lender do not have to trust one another or use an escrow. The collateral moves into the smart contract, and the loan capital is automatically sent to the borrower.

Phase 2: Active Loan

-

Once the atomic swap is complete, the loan is active. The bitcoin collateral remains locked in the smart contract, and the borrower has access to their loan capital.

-

While the loan is active, the oracle feeds the bitcoin price into the contract on an ongoing basis. This allows the contract to monitor the LTV.

Phase 3: Loan Termination

Once the loan is active, it can terminated in one of the following ways:

-

Repaid: If the borrower repays the loan, the collateral is released to the borrower atomically.

-

Liquidated: If the loan value reaches a pre-determined LTV or the borrower misses a payment, the collateral is immediately released to the lender for liquidation.

-

Expired: If the borrower does not repay the loan before the loan term ends, some of the collateral, equivalent to principal plus interest, is released to the lender, and the rest is sent to the borrower.

-

Fail-Safe: In rare scenarios where the loan process cannot be completed as expected due to unresponsive oracles, the protocol has built-in fail-safe mechanisms. These mechanisms ensure that the collateral is not lost.

As you can see, all of the loan terms and conditions are built into the smart contract. The borrower and lender agree on the terms, enter into the loan, and then the contract executes the pre-specified and approved transactions based on either the actions taken by the borrow/lender, or the price changes in BTC. As a user, you can verify at any point that your collateral sits on-chain, is locked in the contract, and isn’t being used or rehypothecated in any way.

Security

Lava Loans are designed to be the most secure option for Bitcoiners who want to borrow against their holdings. Lava’s approach is trust-minimized, bug-minimized, and verifiable for users.

Trust-Minimized

-

Traditional platforms expose you to bridge, custodian, or bank risk. Lava lets you borrow against native-BTC directly in your vault. This means there can’t be rehypothecation, funds lost in custodial hacks, or asset confiscation.

-

While other platforms require blind trust during loan initiation, Lava uses atomic swaps to ensure your BTC collateral only moves to the escrowed smart contract once the loan is in your hands.

-

The uncertainty of receiving collateral post-repayment is a concern with many platforms. Lava uses cryptographic guarantees to ensure that once you fulfill your repayment, your BTC is promptly returned.

-

You don’t have to trust a lender who can liquidate your BTC unjustly. With Lava, you choose your off-chain, blinded oracles per loan to provide price data, drastically reducing risks from malicious entities.

Bug-Minimized

-

Lava’s bitcoin smart contract is formally-verified, meaning the output conditions to the contract are known ahead of time, minimizing technical risk. DLCs, the underlying technology Lava uses, use pre-signed, encrypted transactions to specify the output conditions to a contract ahead of time. Since all the output conditions to the contract are specified ahead of time, and then encrypted using adaptor signatures, the output conditions are known (money can only move to borrower/lender).

-

Lava’s contracts have been audited by the best auditors in the industry, Antoine Riard from thelab31 and Conduition, as well as the core contributors to the cryptography behind DLCs.

Verifiable

-

Lava is the only loan product where you can independently verify—on-chain and in real time—that your bitcoin is not being rehypothecated. When you borrow using Lava, you have cryptographic proof, not just legal or reputational assurances, that your collateral is secure.

-

Lava’s oracle implementation is open-source.

-

Lava’s oracles make daily attestations and calculate a median price across various price feeds to avoid flash crash and unreliable margin call risk.

How Lava Compares

Loan Payments + Fees

Users who take out a Lava Loan pay a one-time origination fee (currently 2%) to open a loan, and each loan has a determined, fixed interest rate for the duration of the loan. Interest rates depend on the length of the loan, but they currently start at 5% annually. Users can also extend their loan by paying an extension fee (currently 2%) at the time that the loan is extended.

Loans that are longer than one month in duration require users to make monthly payments on their loans. Because the terms of Lava Loans are set programmatically in the smart contract, users must make their monthly payments on time in order to avoid being liquidated. You can make your monthly payments using digital dollars (either those held in your Lava Vault, or by depositing USDC into the vault) or via bank transfer. Bank transfers may take several days to clear, so it’s important to plan ahead in order to make the payments on time. Lava offers notifications in advance of payment deadlines in order to allow you sufficient time to plan and make payments.

FAQ

What are oracles?

Oracles are independent data feeds that attest to the price of Bitcoin and feed that price into the contract. At Lava, we’ve built Sibyls, an open-source oracle implementation for bitcoin. Users can choose their own oracles, and oracles have zero knowledge about the contracts they influence. In the case of the Lava Loans Protocol, oracles also make off-chain attestations, and in doing so, this helps us avoid the increased fees and miner manipulation that comes from on-chain oracles. You can learn more about our oracles here.

Why does Lava use digital dollars?

To ensure a fast, trust-minimized loan, Lava uses smart contracts that require HTLC compatibility. Fiat doesn’t support this, so we use digital dollars (like USDC on Solana) — which you can instantly withdraw to your bank account.

What are bitcoin smart contracts?

Bitcoin smart contracts (also known as discreet log contracts) enable conditional (oracle-based) contracts on bitcoin. The way it works is that each party to a contract creates and shares encrypted signatures for each output condition to the contract. Each counterparty has confidence they can decrypt the encrypted signatures and use them correctly at the right time because they can verify the encryption: verify when they can decrypt the signatures and that the signatures are valid.

Bitcoin smart contracts are a better way to do smart contracts because they are secure, private, customizable, and scalable. They mitigate bug risk because they are formally verified, meaning the output conditions of the contract are known from the beginning. This helps avoid exploits you constantly see in Ethereum. Since these contracts use off-chain oracles, they aren't susceptible to oracle manipulation by miners. Not only that, but these contracts are private, customizable (choose your own oracle), and scalable (minimal on-chain cost because execution happens off-chain).

These contracts are zero knowledge in that the blockchain has zero knowledge about the contract, the oracles have zero knowledge about the contract, and the counterparty can verify the encryption without needing the decrypted material.

Where can I learn more?

If you want to learn more about the Lava Loans Protocol, check out the loans paper here: https://github.com/lava-xyz/loans-paper/tree/main

Ready to borrow? Download the Lava Vault on iOS or Android and take out your first bitcoin-secured loan in seconds.

-

-

@ 8bad92c3:ca714aa5

2025-06-05 11:03:44

@ 8bad92c3:ca714aa5

2025-06-05 11:03:44Key Takeaways

Michael Goldstein, aka Bitstein, presents a sweeping philosophical and economic case for going “all in” on Bitcoin, arguing that unlike fiat, which distorts capital formation and fuels short-term thinking, Bitcoin fosters low time preference, meaningful saving, and long-term societal flourishing. At the heart of his thesis is “hodling for good”—a triple-layered idea encompassing permanence, purpose, and the pursuit of higher values like truth, beauty, and legacy. Drawing on thinkers like Aristotle, Hoppe, and Josef Pieper, Goldstein redefines leisure as contemplation, a vital practice in aligning capital with one’s deepest ideals. He urges Bitcoiners to think beyond mere wealth accumulation and consider how their sats can fund enduring institutions, art, and architecture that reflect a moral vision of the future.

Best Quotes

“Let BlackRock buy the houses, and you keep the sats.”

“We're not hodling just for the sake of hodling. There is a purpose to it.”

“Fiat money shortens your time horizon… you can never rest.”

“Savings precedes capital accumulation. You can’t build unless you’ve saved.”

“You're increasing the marginal value of everyone else’s Bitcoin.”

“True leisure is contemplation—the pursuit of the highest good.”

“What is Bitcoin for if not to make the conditions for magnificent acts of creation possible?”

“Bitcoin itself will last forever. Your stack might not. What will outlast your coins?”

“Only a whale can be magnificent.”

“The market will sell you all the crack you want. It’s up to you to demand beauty.”

Conclusion

This episode is a call to reimagine Bitcoin as more than a financial revolution—it’s a blueprint for civilizational renewal. Michael Goldstein reframes hodling as an act of moral stewardship, urging Bitcoiners to lower their time preference, build lasting institutions, and pursue truth, beauty, and legacy—not to escape the world, but to rebuild it on sound foundations.

Timestamps

00:00 - Intro

00:50 - Michael’s BBB presentation Hodl for Good

07:27 - Austrian principles on capital

15:40 - Fiat distorts the economic process

23:34 - Bitkey

24:29 - Hodl for Good triple entendre

29:52 - Bitcoin benefits everyone

39:05 - Unchained

40:14 - Leisure theory of value

52:15 - Heightening life

1:15:48 - Breaking from the chase makes room for magnificence

1:32:32 - Nakamoto Institute’s missionTranscript

(00:00) Fiat money is by its nature a disturbance. If money is being continually produced, especially at an uncertain rate, these uh policies are really just redistribution of wealth. Most are looking for number to go up post hyper bitcoinization. The rate of growth of bitcoin would be more reflective of the growth of the economy as a whole.

(00:23) Ultimately, capital requires knowledge because it requires knowing there is something that you can add to the structures of production to lengthen it in some way that will take time but allow you to have more in the future than you would today. Let Black Rockck buy the houses and you keep the sats, not the other way around.

(00:41) You wait until later for Larry Frink to try to sell you a [Music] mansion. And we're live just like that. Just like that. 3:30 on a Friday, Memorial Day weekend. It's a good good good way to end the week and start the holiday weekend. Yes, sir. Yes, sir. Thank you for having me here. Thank you for coming. I wore this hat specifically because I think it's I think it's very apppropo uh to the conversation we're going to have which is I hope an extension of the presentation you gave at Bitblock Boom Huddle for good. You were working on

(01:24) that for many weeks leading up to uh the conference and explaining how you were structuring it. I think it's a very important topic to discuss now as the Bitcoin price is hitting new all-time highs and people are trying to understand what am I doing with Bitcoin? Like you have you have the different sort of factions within Bitcoin.

(01:47) Uh get on a Bitcoin standard, get on zero, spend as much Bitcoin as possible. You have the sailors of the world are saying buy Bitcoin, never sell, die with your Bitcoin. And I think you do a really good job in that presentation. And I just think your understanding overall of Bitcoin is incredible to put everything into context. It's not either or.

(02:07) It really depends on what you want to accomplish. Yeah, it's definitely there there is no actual one-sizefits-all um for I mean nearly anything in this world. So um yeah, I mean first of all I mean there was it was the first conference talk I had given in maybe five years. I think the one prior to that uh was um bit block boom 2019 which was my meme talk which uh has uh become infamous and notorious.

(02:43) So uh there was also a lot of like high expectations uh you know rockstar dev uh has has treated that you know uh that that talk with a lot of reference. a lot of people have enjoyed it and he was expecting this one to be, you know, the greatest one ever, which is a little bit of a little bit of a uh a burden to live up to those kinds of standards.

(03:08) Um, but you know, because I don't give a lot of talks. Um, you know, I I I like to uh try to bring ideas that might even be ideas that are common. So, something like hodling, we all talk about it constantly. uh but try to bring it from a little bit of a different angle and try to give um a little bit of uh new light to it.

(03:31) I alsove I've I've always enjoyed kind of coming at things from a third angle. Um whenever there's, you know, there's there's all these little debates that we have in in Bitcoin and sometimes it's nice to try to uh step out of it and look at it a little more uh kind of objectively and find ways of understanding it that incorporate the truths of of all of them.

(03:58) uh you know cuz I think we should always be kind of as much as possible after ultimate truth. Um so with this one um yeah I was kind of finding that that sort of golden mean. So uh um yeah and I actually I think about that a lot is uh you know Aristotle has his his concept of the golden mean. So it's like any any virtue is sort of between two vices um because you can you can always you can always take something too far.

(04:27) So you're you're always trying to find that right balance. Um so someone who is uh courageous you know uh one of the vices uh on one side is being basically reckless. I I can't remember what word he would use. Uh but effectively being reckless and just wanting to put yourself in danger for no other reason than just you know the thrill of it.

(04:50) Um and then on the other side you would just have cowardice which is like you're unwilling to put yourself um at any risk at any time. Um, and courage is right there in the middle where it's understanding when is the right time uh to put your put yourself, you know, in in the face of danger um and take it on. And so um in some sense this this was kind of me uh in in some ways like I'm obviously a partisan of hodling.

(05:20) Um, I've for, you know, a long time now talked about the, um, why huddling is good, why people do it, why we should expect it. Um, but still trying to find that that sort of golden mean of like yes, huddle, but also what are we hodling for? And it's not we're we're not hodddling just merely for the sake of hodddling.

(05:45) There there is a a purpose to it. And we should think about that. And that would also help us think more about um what are the benefits of of spending, when should we spend, why should we spend, what should we spend on um to actually give light to that sort of side of the debate. Um so that was that was what I was kind of trying to trying to get into.

(06:09) Um, as well as also just uh at the same time despite all the talk of hodling, there's always this perennial uh there's always this perennial dislike of hodlers because we're treated as uh as if um we're just free riding the network or we're just greedy or you know any of these things. And I wanted to show how uh huddling does serve a real economic purpose.

(06:36) Um, and it does benefit the individual, but it also does uh it it has actual real social um benefits as well beyond merely the individual. Um, so I wanted to give that sort of defense of hodling as well to look at it from um a a broader position than just merely I'm trying to get rich. Um uh because even the person who uh that is all they want to do um just like you know your your pure number grow up go up moonboy even that behavior has positive ramifications on on the economy.

(07:14) And while we might look at them and have uh judgments about their particular choices for them as an individual, we shouldn't discount that uh their actions are having positive positive effects for the rest of the economy. Yeah. So, let's dive into that just not even in the context of Bitcoin because I think you did a great job of this in the presentation.