-

@ 6ad3e2a3:c90b7740

2025-06-04 08:32:29

@ 6ad3e2a3:c90b7740

2025-06-04 08:32:29"Modern science is based on this principle: give us one free miracle and then we'll explain the rest."

— Terrence McKenna

I always wondered why a pot of water boils on the stove. I mean I know it boils because I turned on the electricity, but why does the electricity cause it to boil? I know the electricity produces heat, and the heat is conducted through the stainless steel pot and into the water, but why does the heat transfer from stovetop to the water?

I know the heat from the stove via the pot speeds up the molecules in the water touching it and that they in turn speed up the molecules touching them and so on throughout the pot, but why do speedy molecules cause adjacent molecules to speed up?

I mean I know they do this, but why do they do this? Why couldn’t it be that sped-up molecules only interact with sufficient speedy molecules and ignore slower ones? Why do they interact with all the molecules, causing all of them to speed up? Or why don’t the speedy ones, instead of sharing their excited state, hoard it and take more energy from adjacent slower molecules, thereby making them colder, i.e., why doesn’t half the water boil twice as fast (on the left side of the pot) while the other half (right side) turns to ice?

The molecules tend to bounce around randomly, interacting as equal opportunists on the surrounding ones rather than distinguishing only certain ones with which to interact. Why do the laws of thermodynamics behave as such rather than some other way?

There may be yet deeper layers to this, explanations going down to the atomic and even quantum levels, but no matter how far you take them, you are always, in the end, left with: “Because those are the laws of physics”, i.e., “because that’s just how it is.”

. . .

The Terrence McKenna quote, recently cited by Joe Rogan on his podcast, refers to the Big Bang, the current explanation adopted by the scientifically literate as to the origins of the universe. You see there was this insanely dense, infinitesimally small micro dot that one day (before the dawn of time) exploded outward with unimaginable power that over billions of years created what we perceive as the known universe.

What happened prior? Can’t really say because time didn’t yet exist, and “prior” doesn’t make sense in that context. Why did it do this? We don’t know. How did it get there? Maybe a supermassive black hole from another universe got too dense and exploded out the other side? Highly speculative.

So why do people believe in the Big Bang? Because it comports with and explains certain observable phenomena and predicted other phenomena which were subsequently confirmed. But scratch a little deeper for an explanation as to what caused it, for what purpose did it occur or what preceded it, and you hit the same wall.

. . .

Even if we were to understand at a quantum level how and why the Big Bang happened and what preceded it, let’s assume it’s due to Factor X, something we eventually replicated with mini big-bangs and universe creations in our labs, we would still be tasked with understanding why Factor X exists in the universe. And if Factor X were explained by Process Y, we’d still be stuck needing an explanation for Process Y — ad infinitum.

Science can thus only push the wall back farther, but can never scale it. We can never arrive at an ultimate explanation, only partial ones. Its limitations are the limitations of thought itself, the impossibility of ever creating a map at a scale of one mile per mile.

-

@ dfa02707:41ca50e3

2025-06-04 08:01:32

@ dfa02707:41ca50e3

2025-06-04 08:01:32Contribute to keep No Bullshit Bitcoin news going.

- The latest firmware updates for COLDCARD devices introduce two major features: COLDCARD Co-sign (CCC) and Key Teleport between two COLDCARD Q devices using QR codes and/or NFC with a website.

What's new

- COLDCARD Co-Sign: When CCC is enabled, a second seed called the Spending Policy Key (Key C) is added to the device. This seed works with the device's Main Seed and one or more additional XPUBs (Backup Keys) to form 2-of-N multisig wallets.

- The spending policy functions like a hardware security module (HSM), enforcing rules such as magnitude and velocity limits, address whitelisting, and 2FA authentication to protect funds while maintaining flexibility and control, and is enforced each time the Spending Policy Key is used for signing.

- When spending conditions are met, the COLDCARD signs the partially signed bitcoin transaction (PSBT) with the Main Seed and Spending Policy Key for fund access. Once configured, the Spending Policy Key is required to view or change the policy, and violations are denied without explanation.

"You can override the spending policy at any time by signing with either a Backup Key and the Main Seed or two Backup Keys, depending on the number of keys (N) in the multisig."

-

A step-by-step guide for setting up CCC is available here.

-

Key Teleport for Q devices allows users to securely transfer sensitive data such as seed phrases (words, xprv), secure notes and passwords, and PSBTs for multisig. It uses QR codes or NFC, along with a helper website, to ensure reliable transmission, keeping your sensitive data protected throughout the process.

- For more technical details, see the protocol spec.

"After you sign a multisig PSBT, you have option to “Key Teleport” the PSBT file to any one of the other signers in the wallet. We already have a shared pubkey with them, so the process is simple and does not require any action on their part in advance. Plus, starting in this firmware release, COLDCARD can finalize multisig transactions, so the last signer can publish the signed transaction via PushTX (NFC tap) to get it on the blockchain directly."

- Multisig transactions are finalized when sufficiently signed. It streamlines the use of PushTX with multisig wallets.

- Signing artifacts re-export to various media. Users are now provided with the capability to export signing products, like transactions or PSBTs, to alternative media rather than the original source. For example, if a PSBT is received through a QR code, it can be signed and saved onto an SD card if needed.

- Multisig export files are signed now. Public keys are encoded as P2PKH address for all multisg signature exports. Learn more about it here.

- NFC export usability upgrade: NFC keeps exporting until CANCEL/X is pressed.

- Added Bitcoin Safe option to Export Wallet.

- 10% performance improvement in USB upload speed for large files.

- Q: Always choose the biggest possible display size for QR.

Fixes

- Do not allow change Main PIN to same value already used as Trick PIN, even if Trick PIN is hidden.

- Fix stuck progress bar under

Receiving...after a USB communications failure. - Showing derivation path in Address Explorer for root key (m) showed double slash (//).

- Can restore developer backup with custom password other than 12 words format.

- Virtual Disk auto mode ignores already signed PSBTs (with “-signed” in file name).

- Virtual Disk auto mode stuck on “Reading…” screen sometimes.

- Finalization of foreign inputs from partial signatures. Thanks Christian Uebber!

- Temporary seed from COLDCARD backup failed to load stored multisig wallets.

Destroy Seedalso removes all Trick PINs from SE2.Lock Down Seedrequires pressing confirm key (4) to execute.- Q only: Only BBQr is allowed to export Coldcard, Core, and pretty descriptor.

-

@ 7460b7fd:4fc4e74b

2025-06-04 12:18:52

@ 7460b7fd:4fc4e74b

2025-06-04 12:18:52TRX 从 $0.12 涨至 $1.00 对 Tron 网络资源与用户行为的系统性影响

当前 TRX 价格约 $0.12,若其涨至 $1.00,Tron 网络的资源模型(能量 Energy 和带宽 Bandwidth)、用户手续费感知、质押行为以及市场流通供应都将发生深刻变化。下面将基于博弈论逻辑、链上资源参数和用户行为建模进行分析,并通过图表和数据展示各变量的联动关系。

Tron 网络资源模型与手续费机制概览

Tron 采用独特的资源模型:交易消耗带宽点数(BP)和能量(Energy)而非直接收取传统手续费。每个账户每天可免费获得一定的带宽点数(例如约 600 点)用于普通交易help.tokenpocket.pro;但能量没有每日免费的分配help.tokenpocket.pro。发送 TRX 等普通转账主要消耗带宽,而执行 TRC20 智能合约(如转账 USDT)则需要能量。用户可以通过冻结(质押) TRX 来获取这两种资源的配额,以支付交易所需的资源费用exodus.comexodus.com。具体而言:

-

带宽(Bandwidth):用于衡量交易字节大小的资源。账户每天有少量免费带宽(历史上约 5000 点,后调整至 1500,再至 600 点左右)trondao.medium.comhelp.tokenpocket.pro。若带宽不足,系统将按每字节 1000 sun(0.001 TRX)的价格烧毁 TRX 获取带宽cryptoapis.io。

-

能量(Energy):用于衡量智能合约执行的计算资源,没有每日免费额度,只能通过冻结 TRX 获得trondao.medium.comhelp.tokenpocket.pro。当能量不足时,系统按每单位能量 280 sun(即 0.00028 TRX)的单价烧毁 TRX 作为费用cryptoapis.io。每笔 TRC20 代币交易会消耗一定能量,例如转账 USDT 大约需要数万能量。

冻结 TRX 后,用户按其冻结量占全网总冻结量的比例共享固定总量的带宽和能量每日配额。例如,全网每日总能量供应固定约 50,000,000,000 单位,用户冻结 TRX 获得的能量 = (个人冻结量 / 全网冻结总量) * 50,000,000,000trondao.medium.comtrondao.medium.com。这意味着当更多人冻结 TRX 时,每单位 TRX 获得的能量将递减,但冻结总量上升会提高全网总可用能量。冻结的 TRX 最少锁定3天,冻结期间不可流通或交易trondao.medium.com。作为激励,冻结 TRX 可用于投票超级代表(SR)以获得约 4% 年化的 Staking 收益crypto.news。

手续费支付方式 – 冻结 vs 燃烧: 当用户有足够的能量和带宽时,交易将优先消耗这些资源,不直接扣除 TRX 手续费help.tokenpocket.pro。若资源不足,则需要燃烧一定数量的 TRX 来补足差额exodus.com。例如:

-

普通 TRX 转账:消耗约 268 字节带宽,无需能量,通常可用每日免费带宽覆盖,大多数情况下用户无需支付 TRX 手续费help.tokenpocket.pro。

-

TRC20-USDT 转账:若发送方和接收方账户有足够资源,则耗能量和带宽,不烧 TRX;否则将燃烧 TRX 作为手续费help.tokenpocket.pro。据统计,在资源不足时,一笔 USDT 转账约需燃烧 13.74 TRX(接收方已有该代币时)或 27.6 TRX(接收方首次接收该代币时,需要创建资产映射)help.tokenpocket.pro。以当前价 $0.12 计,相当于 $1.61 – $3.22 的费用。可见,冻结 TRX 获得能量后,几乎可使手续费降为零,仅消耗资源而不烧币help.tokenpocket.pro。

上述模型奠定了用户行为的基础:老用户往往习惯冻结 TRX 以获取免费资源,新用户若未冻结则需要持有并燃烧 TRX 支付手续费。当 TRX 价格显著上升时,这种差异和资源机制将引发一系列连锁反应。

老用户 vs 新用户:质押习惯与手续费敏感度

老用户(资深 Tron 用户)通常早已适应了 Tron 的资源机制,倾向于冻结一定量的 TRX 来保障日常交易的能量和带宽需求。这些用户往往持有大量 TRX,并享受冻结带来的免费交易和Staking 收益。对于老用户而言,哪怕 TRX 价格上涨,其主观感受到的手续费成本仍较低,因为他们多数交易并不直接烧币支付TRX。他们的行为特征是:

-

预见性冻结:会根据网络状况和自身交易频率,提前增加冻结量以确保足够资源。价格上涨时,老用户可能追加冻结更多 TRX(即使这部分 TRX 价值升高),因为相较于高昂的潜在手续费,他们更看重保证链上操作的低成本。

-

收益驱动:老用户也关注冻结带来的投票奖励收益。例如当前 Tron 质押年化约4.5%crypto.news。随着价格上涨,他们持币市值增加,继续冻结还能坐享收益,进一步增强了冻结意愿。

新用户则大多缺乏上述经验,进入 Tron 网络时往往没有冻结 TRX。许多新用户使用 Tron 是因为听闻其转账 USDT 手续费低廉,但他们可能只持有极少量 TRX 来支付手续费,甚至一开始没有TRX(需先获取一些 TRX 才能进行转账)help.tokenpocket.pro。新用户的行为和感知具有不同特点:

-

手续费敏感:新用户对显性的美元计价手续费非常敏感。他们初期未质押,因此每笔交易都真实消耗 TRX。在 TRX 价格较低时,这笔费用很小(几美分到一两美元),他们可能忽略不计;但当价格上涨导致每笔交易成本攀升,新用户会明显感觉“不再那么便宜”,从而开始寻求对策。

-

反应滞后:与老用户主动冻结不同,新用户往往在几次交易被收取较高手续费后,才会被动学习到通过冻结 TRX 可降低费用这一机制。一些钱包和社区教程也会引导新用户质押或租赁能量来节约成本help.tokenpocket.prohelp.tokenpocket.pro。

-

冻结意愿取决于成本临界点:新用户往往有一个心理阈值——当单笔手续费上涨到比如几美元甚至两位数美元时,他们才觉得“不划算,需要质押”。在 TRX 价格低迷时期,这个阈值可能从未被触及,但随着 TRX 攀升,新用户群体中会出现集中式的质押行为转变,一旦手续费达到“显著”水平,他们会成批地开始冻结 TRX。

综上,老用户在价格上升初期已提前布局资源,对手续费上涨免疫,新用户则可能在价格上涨过程中逐渐被培养成新的质押者。这种差异将在不同价格阶段体现为质押率和交易成本感受的变化,并直接影响 TRX 的流通盘和市场供需。

TRX 价格阶段与手续费成本变化

随着 TRX 价格从 $0.12 上涨至更高价位,用户实际支付的手续费成本(美元计)会线性上升。在资源消耗(以 TRX 计)大致不变的情况下,TRX 越昂贵,每笔交易烧毁的 TRX 转换为法币就越高。下表总结了不同价位下,一次 TRC20-USDT 转账的近似成本(未冻结资源时):

| TRX价格 | USDT转账手续费(接收地址已激活) | 手续费美元价(约) | USDT转账手续费(新地址) | 手续费美元价(约) | | ----- | --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- | --------- | -------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- | --------- | | $0.12 | 13.74 TRXhelp.tokenpocket.pro | \~$1.65 | 27.6 TRXhelp.tokenpocket.pro | \~$3.30 | | $0.30 | 13.74 TRX | \~$4.12 | 27.6 TRX | \~$8.28 | | $0.50 | 13.74 TRX | \~$6.87 | 27.6 TRX | \~$13.80 | | $1.00 | 13.74 TRX | \~$13.74 | 27.6 TRX | \~$27.60 |

注:13.74 TRX 是指向已持有USDT的地址转账的典型能量消耗费用;27.6 TRX 则包括了向新地址转账(需创建账户)的额外成本。help.tokenpocket.pro上述美元价仅为近似,实际能量消耗会随网络拥堵程度浮动。

图:TRX 价格上涨对未质押用户的单笔 USDT 转账费用(美元计)的影响。费用基本随 TRX 价格线性上升,在接收方无 USDT 资产时费用更高。help.tokenpocket.probinance.com

从图中可以直观地看到,当 TRX 从 $0.12 涨至 $0.30 时,每笔 USDT 转账费从 \~$1.6 增至 \~$4-8 美元;涨至 $0.50 时,费用进一步涨至接近两位数美元;而在 $1.00 时,不冻结资源直接转账的费用范围高达 \~$14-$28,已经远超“廉价”的范畴。这种手续费攀升将直接改变用户行为:

-

对于未冻结 TRX 的用户,高昂的美元手续费将迫使他们重新评估 Tron 网络的使用成本。当一次简单转账可能花费 \~$10,美金计价下已接近以太坊主网曾经的费用水平,Tron “廉价网络”的优势将被削弱。许多个人用户会被强烈激励去冻结一定数量的 TRX,以换取能量来豁免后续交易手续费help.tokenpocket.pro。一些服务商和交易所也可能选择代用户冻结大量 TRX,以降低批量交易成本。

-

部分小额或低频用户可能被高费用劝退,转而选择其它Layer1网络或二层方案。然而,由于 Tron 网络在稳定币领域的巨大体量(截至 2025 年4月,Tron 上流通的 USDT 超过 $700 亿cryptoslate.com,每日 USDT 转账额约 $190 亿cryptoslate.com),短期内用户更可能留在 Tron 生态并通过质押来适应变化,而不会轻易放弃这一主流稳定币链。

与此同时,已冻结资源的用户几乎不受价格上涨的手续费影响。无论 TRX 价格多高,他们每笔交易依然只需消耗带宽和能量(这些资源本身不是直接按美元计价),额外的 TRX 燃烧为零help.tokenpocket.pro。唯一的“成本”是冻结 TRX 带来的流动性损失和机会成本。但在牛市氛围下,持有 TRX 本就是盈利的,加之还有质押收益,相比之下冻结的机会成本很低。因此,随着价格上升,冻结获取资源的方案相对更有利可图,用户群体从“不冻结”向“冻结”迁移将加速。

手续费阈值与用户质押的正反馈闭环

考虑上述趋势,我们可以识别出一个潜在的“手续费显著点”或阈值:当单笔交易手续费达到足以引起用户强烈关注的水平时,大量用户将改变策略开始冻结 TRX。这一阈值在不同用户心中略有差异,但可以是假设在几美元左右(例如 $5)。博弈论视角下,这是一个集体行为转折点:之前,个体最佳响应可能是不冻结、承担小额费用;一旦超过阈值,个体最佳响应切换为冻结 TRX 来避免高额费用。这个策略转变会引发一系列连锁反应,形成正反馈循环:

-

价格上涨 → 手续费攀升:随着 TRX 价格上扬,非质押用户每笔交易燃烧的 TRX 价值水涨船高。当费用升至阈值以上,大部分用户开始重视成本问题。

-

成本感知 → 用户大量质押:面对显著上涨的费用,大量原本未质押的用户开始冻结 TRX 以获取能量,避免继续支付高额手续费help.tokenpocket.prohelp.tokenpocket.pro。特别是新进入用户,在感受到手续费压力后,更倾向于立即质押以降低开销。老用户则可能加大质押以获取更多免费资源。

-

质押增加 → 流通盘收紧:当大量 TRX 被冻结(锁定)后,流通中的可交易 TRX 供应量下降。这些新冻结的 TRX 至少锁定3天,很多用户会选择长期质押获取收益,使得市场上即时可售卖的筹码变少。同时,部分用户未及时质押的,仍在持续燃烧 TRX 付费,也在永久性地减少总供应(Tron 网络目前每日燃烧量已经高于发行量,使TRX呈现净通缩趋势crypto.newsreddit.com)。

-

供应减少 → 价格进一步上涨:流通盘收紧后,在需求旺盛(尤其是牛市资金追逐和 Tron 网络高使用量不减)的情况下,TRX 的价格往往进一步上涨。这是经典的供需效应:供给减少,价格上行压力增大。更重要的是,价格上升又会反过来强化用户对手续费的敏感度,使得更多边际用户加入冻结行列,进一步削减流通供应——正反馈循环就此形成。

这一系列过程可以形成一个“价格上涨 → 成本上升 → 质押增加 → 流通减少 → 再次推高价格”的循环闭环reddit.com。市场上的做市商和鲸鱼投资者可能会利用或放大这一动态:当他们观察到手续费成本逼近用户阈值、质押率开始上升时,可能主动推动 TRX 价格突破关键点,从而触发更多散户用户质押,加剧流通盘收缩。这给了大户更好的条件进一步拉升价格,因为市面上流动的卖盘更少,稍大买单就能推动价格上涨。可以说,Tron 网络机制下的用户集体质押行为,使价格上涨具备自我强化的“弹簧”效应:拉一下就紧一点,形成正向循环。

需要注意的是,也存在减缓机制:随着全网冻结的 TRX 增加,每单位 TRX 可分得的能量下降,某种程度上要求用户冻结更多的 TRX才能完全覆盖同样的交易频率developers.tron.networkdevelopers.tron.network。这意味着质押率提升到一定程度后,额外用户再质押所获得的边际效用减少,正反馈的效力可能会逐步减弱。此外,如果手续费过高,一些用户可能降低交易频率或寻找替代方案。不过,在迈向 $1.00 的阶段内,Tron 作为稳定币主链的地位和用户黏性意味着大多数用户会选择适应而非离开,这使得上述正反馈有机会充分演绎。

图:TRX 价格上涨过程中质押率(冻结占总供给比例)的理论变化示意。价格越高,因手续费驱动的质押率越大,流通盘越紧(此图假设从约20%升至50%的冻结率,仅作说明)。实际过程中质押率上升具有滞后性和渐进特征。

新用户涌入与合力放大效应

在价格上涨的初期阶段,新用户的涌入对上述循环起到推波助澜的作用。牛市中,随着 TRX 价格突破历史水平并表现强势,越来越多的新参与者会被吸引到 Tron 生态。这些新用户往往抱着逐利和追涨的心理进入市场:

-

追涨入场:新用户看到 TRX 大涨,担心“踏空”,会倾向于迅速买入 TRX。这直接形成买盘,推高价格,也增加了潜在需要冻结的 TRX 持有者基数。

-

边用边买:很多新人是因为 Tron 上 USDT 等稳定币转账便宜快捷而入场。当 TRX 价格上涨、媒体报道 Tron 活跃时,他们更愿意选择 Tron 网络进行跨所转账、链上交易等,从而进一步推高 Tron 网络的交易活跃度和费用收入crypto.newscrypto.news。

-

从众质押:当新用户进来后,老用户或钱包方往往会教育他们质押省钱。再加上他们亲身经历几次昂贵手续费后,往往很快接受这一理念。这些新用户一开始可能并未计划长期持有 TRX,但为了降低使用成本,他们反而开始冻结所购的 TRX。很多新用户甚至会超额冻结(冻结比自己短期所需更多的量),因为他们发现质押还有收益且3天锁定并不长。这相当于把原本可能成为抛压的一部分新增筹码也锁住了。

新资金+新质押形成的合力,会放大价格-质押正反馈循环的力度。与仅老用户参与相比,新用户带来了额外的需求和锁仓动力,使流通供应收缩更剧烈。换句话说,本轮行情中新增的参与者并没有全部将 TRX 投入市场流通,反而有相当比例被“冻结”起来,减少了即时可售卖的代币数量。这种现象加速了市场从“供过于求”向“供不应求”的转换。

博弈论角度看,新用户的行为受老用户和市场信号影响,呈现**“从众效应”:当大家都在说“手续费贵了赶紧质押”“质押后几乎不要钱”时,个人跟随策略是有利的。这种群体策略迅速一致化的趋势,使得市场进入某种短期均衡**:大部分活跃用户都质押,剩余在外流通的更多是交易所库存、投机者筹码。一旦达到此均衡点,TRX 价格在流动性受限的情况下可能出现较为剧烈的波动,进一步吸引外围资金关注。然而,只要 Tron 网络的基础需求(如稳定币交易)坚挺,这种供应紧缩的状况就持续对价格形成支撑。

总结:联动效应与趋势展望

综合以上分析,TRX 价格从 $0.12 涨向 $1.00 将引发链上资源、用户行为和市场供需的一系列联动变化:

-

手续费上涨迫使用户行动:价格翻数倍后,不质押的用户手续费开销飙升数倍binance.com。用户从被动付费转向积极质押以获取“免费”能量,Tron 网络的质押率水涨船高。

-

质押率提高缩减流通供应:大量 TRX 冻结锁定,使流通盘迅速收紧crypto.news。同时,一些未质押部分在高费用下被直接燃烧,进一步造成 TRX 通缩reddit.com。供给减少对价格形成正向推动。

-

正反馈循环加剧波动:价格越涨→质押越多→流通越少→价格越容易再涨。这个正反馈闭环可能被市场力量(包括大户的刻意推动)所强化,在行情中后期表现尤为明显。

-

新参与者放大合力:新用户在牛市初期蜂拥而入,既贡献了需求又通过质押“锁仓”,反而减轻了抛压,起到了助涨而非砸盘的作用,放大了整体合力。

-

博弈均衡与风险:最终,大多数活跃用户选择质押是理性策略,但也意味短期内市场流动性下降。若某时刻大量质押的筹码解冻出货,或外部需求下降,这一循环可能逆转。因此,各方参与者都在博弈对方的动作:用户希望提前质押锁定低成本,市场庄家则利用高质押率营造供应稀缺推高价格,同时也警惕何时会有解冻卖出的潮涌。

从 Tron 网络的发展看,价格与网络资源、用户行为间的动态关系体现了典型的自适应反馈机制。Tron 作为目前主力稳定币传输链,其成本和性能直接影响用户留存与行为。当 TRX 价格步入高位区间,Tron 或许也会调整参数(如增加总能量供给或优化手续费机制)来平衡用户体验和代币经济模型。不过,在涨向 $1.00 的过程中,上述正反馈循环很可能成为推动力量之一。投资者和参与者应密切关注质押率、手续费水平等链上指标的变化——它们既是价格行情的结果,也是后续走势的原因。在理想状态下,这种“价格上涨-资源质押-流通收缩”的合循环能够稳步推升 Tron 生态价值;但如果过度强化,也需防范因流动性不足导致的剧烈波动风险。总体而言,TRX 价格上涨对 Tron 网络的影响是全方位的:手续费机制使用户行为发生系统性改变,而用户集体行为的改变反过来塑造了市场供求格局,值得持续深入监测和研究。crypto.newscryptoslate.com

-

-

@ dfa02707:41ca50e3

2025-06-04 08:01:28

@ dfa02707:41ca50e3

2025-06-04 08:01:28Contribute to keep No Bullshit Bitcoin news going.

This update brings key enhancements for clarity and usability:

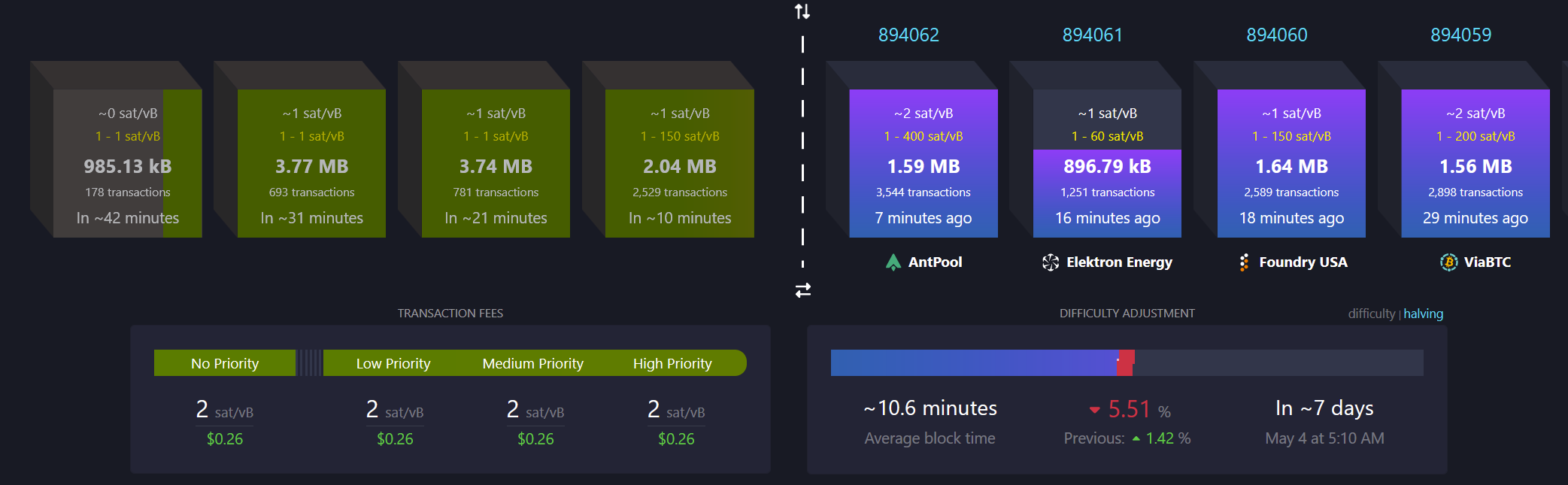

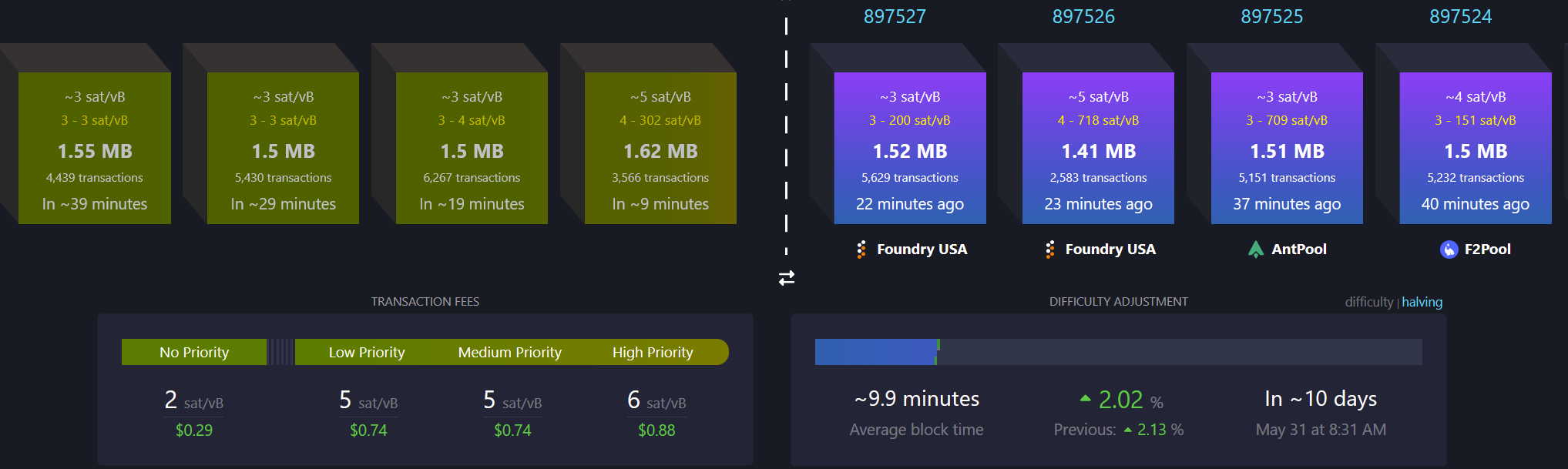

- Recent Blocks View: Added to the Send tab and inspired by Mempool's visualization, it displays the last 2 blocks and the estimated next block to help choose fee rates.

- Camera System Overhaul: Features a new library for higher resolution detection and mouse-scroll zoom support when available.

- Vector-Based Images: All app images are now vectorized and theme-aware, enhancing contrast, especially in dark mode.

- Tor & P2A Updates: Upgraded internal Tor and improved support for pay-to-anchor (P2A) outputs.

- Linux Package Rename: For Linux users, Sparrow has been renamed to sparrowwallet (or sparrowserver); in some cases, the original sparrow package may need manual removal.

- Additional updates include showing total payments in multi-payment transaction diagrams, better handling of long labels, and other UI enhancements.

- Sparrow v2.2.1 is a bug fix release that addresses missing UUID issue when starting Tor on recent macOS versions, icons for external sources in Settings and Recent Blocks view, repackaged

.debinstalls to use older gzip instead of zstd compression, and removed display of median fee rate where fee rates source is set to Server.

Learn how to get started with Sparrow wallet:

Release notes (v2.2.0)

- Added Recent Blocks view to Send tab.

- Converted all bitmapped images to theme aware SVG format for all wallet models and dialogs.

- Support send and display of pay to anchor (P2A) outputs.

- Renamed

sparrowpackage tosparrowwalletandsparrowserveron Linux. - Switched camera library to openpnp-capture.

- Support FHD (1920 x 1080) and UHD4k (3840 x 2160) capture resolutions.

- Support camera zoom with mouse scroll where possible.

- In the Download Verifier, prefer verifying the dropped file over the default file where the file is not in the manifest.

- Show a warning (with an option to disable the check) when importing a wallet with a derivation path matching another script type.

- In Cormorant, avoid calling the

listwalletdirRPC on initialization due to a potentially slow response on Windows. - Avoid server address resolution for public servers.

- Assume server address is non local for resolution failures where a proxy is configured.

- Added a tooltip to indicate truncated labels in table cells.

- Dynamically truncate input and output labels in the tree on a transaction tab, and add tooltips if necessary.

- Improved tooltips for wallet tabs and transaction diagrams with long labels.

- Show the address where available on input and output tooltips in transaction tab tree.

- Show the total amount sent in payments in the transaction diagram when constructing multiple payment transactions.

- Reset preferred table column widths on adjustment to improve handling after window resizing.

- Added accessible text to improve screen reader navigation on seed entry.

- Made Wallet Summary table grow horizontally with dialog sizing.

- Reduced tooltip show delay to 200ms.

- Show transaction diagram fee percentage as less than 0.01% rather than 0.00%.

- Optimized and reduced Electrum server RPC calls.

- Upgraded Bouncy Castle, PGPainless and Logback libraries.

- Upgraded internal Tor to v0.4.8.16.

- Bug fix: Fixed issue with random ordering of keystore origins on labels import.

- Bug fix: Fixed non-zero account script type detection when signing a message on Trezor devices.

- Bug fix: Fixed issue parsing remote Coldcard xpub encoded on a different network.

- Bug fix: Fixed inclusion of fees on wallet label exports.

- Bug fix: Increase Trezor device libusb timeout.

Linux users: Note that the

sparrowpackage has been renamed tosparrowwalletorsparrowserver, and in some cases you may need to manually uninstall the originalsparrowpackage. Look in the/optfolder to ensure you have the new name, and the original is removed.What's new in v2.2.1

- Updated Tor library to fix missing UUID issue when starting Tor on recent macOS versions.

- Repackaged

.debinstalls to use older gzip instead of zstd compression. - Removed display of median fee rate where fee rates source is set to Server.

- Added icons for external sources in Settings and Recent Blocks view

- Bug fix: Fixed issue in Recent Blocks view when switching fee rates source

- Bug fix: Fixed NPE on null fee returned from server

-

@ 7f6db517:a4931eda

2025-06-04 10:02:24

@ 7f6db517:a4931eda

2025-06-04 10:02:24

What is KYC/AML?

- The acronym stands for Know Your Customer / Anti Money Laundering.

- In practice it stands for the surveillance measures companies are often compelled to take against their customers by financial regulators.

- Methods differ but often include: Passport Scans, Driver License Uploads, Social Security Numbers, Home Address, Phone Number, Face Scans.

- Bitcoin companies will also store all withdrawal and deposit addresses which can then be used to track bitcoin transactions on the bitcoin block chain.

- This data is then stored and shared. Regulations often require companies to hold this information for a set number of years but in practice users should assume this data will be held indefinitely. Data is often stored insecurely, which results in frequent hacks and leaks.

- KYC/AML data collection puts all honest users at risk of theft, extortion, and persecution while being ineffective at stopping crime. Criminals often use counterfeit, bought, or stolen credentials to get around the requirements. Criminals can buy "verified" accounts for as little as $200. Furthermore, billions of people are excluded from financial services as a result of KYC/AML requirements.

During the early days of bitcoin most services did not require this sensitive user data, but as adoption increased so did the surveillance measures. At this point, most large bitcoin companies are collecting and storing massive lists of bitcoiners, our sensitive personal information, and our transaction history.

Lists of Bitcoiners

KYC/AML policies are a direct attack on bitcoiners. Lists of bitcoiners and our transaction history will inevitably be used against us.

Once you are on a list with your bitcoin transaction history that record will always exist. Generally speaking, tracking bitcoin is based on probability analysis of ownership change. Surveillance firms use various heuristics to determine if you are sending bitcoin to yourself or if ownership is actually changing hands. You can obtain better privacy going forward by using collaborative transactions such as coinjoin to break this probability analysis.

Fortunately, you can buy bitcoin without providing intimate personal information. Tools such as peach, hodlhodl, robosats, azteco and bisq help; mining is also a solid option: anyone can plug a miner into power and internet and earn bitcoin by mining privately.

You can also earn bitcoin by providing goods and/or services that can be purchased with bitcoin. Long term, circular economies will mitigate this threat: most people will not buy bitcoin - they will earn bitcoin - most people will not sell bitcoin - they will spend bitcoin.

There is no such thing as KYC or No KYC bitcoin, there are bitcoiners on lists and those that are not on lists.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-04 10:02:23

@ 7f6db517:a4931eda

2025-06-04 10:02:23

People forget Bear Stearns failed March 2008 - months of denial followed before the public realized how bad the situation was under the surface.

Similar happening now but much larger scale. They did not fix fundamental issues after 2008 - everything is more fragile.

The Fed preemptively bailed out every bank with their BTFP program and First Republic Bank still failed. The second largest bank failure in history.

There will be more failures. There will be more bailouts. Depositors will be "protected" by socializing losses across everyone.

Our President and mainstream financial pundits are currently pretending the banking crisis is over while most banks remain insolvent. There are going to be many more bank failures as this ponzi system unravels.

Unlike 2008, we have the ability to opt out of these broken and corrupt institutions by using bitcoin. Bitcoin held in self custody is unique in its lack of counterparty risk - you do not have to trust a bank or other centralized entity to hold it for you. Bitcoin is also incredibly difficult to change by design since it is not controlled by an individual, company, or government - the supply of dollars will inevitably be inflated to bailout these failing banks but bitcoin supply will remain unchanged. I do not need to convince you that bitcoin provides value - these next few years will convince millions.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-04 10:02:23

@ 7f6db517:a4931eda

2025-06-04 10:02:23

"Privacy is necessary for an open society in the electronic age. Privacy is not secrecy. A private matter is something one doesn't want the whole world to know, but a secret matter is something one doesn't want anybody to know. Privacy is the power to selectively reveal oneself to the world." - Eric Hughes, A Cypherpunk's Manifesto, 1993

Privacy is essential to freedom. Without privacy, individuals are unable to make choices free from surveillance and control. Lack of privacy leads to loss of autonomy. When individuals are constantly monitored it limits our ability to express ourselves and take risks. Any decisions we make can result in negative repercussions from those who surveil us. Without the freedom to make choices, individuals cannot truly be free.

Freedom is essential to acquiring and preserving wealth. When individuals are not free to make choices, restrictions and limitations prevent us from economic opportunities. If we are somehow able to acquire wealth in such an environment, lack of freedom can result in direct asset seizure by governments or other malicious entities. At scale, when freedom is compromised, it leads to widespread economic stagnation and poverty. Protecting freedom is essential to economic prosperity.

The connection between privacy, freedom, and wealth is critical. Without privacy, individuals lose the freedom to make choices free from surveillance and control. While lack of freedom prevents individuals from pursuing economic opportunities and makes wealth preservation nearly impossible. No Privacy? No Freedom. No Freedom? No Wealth.

Rights are not granted. They are taken and defended. Rights are often misunderstood as permission to do something by those holding power. However, if someone can give you something, they can inherently take it from you at will. People throughout history have necessarily fought for basic rights, including privacy and freedom. These rights were not given by those in power, but rather demanded and won through struggle. Even after these rights are won, they must be continually defended to ensure that they are not taken away. Rights are not granted - they are earned through struggle and defended through sacrifice.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-04 07:02:12

@ 7f6db517:a4931eda

2025-06-04 07:02:12

What is KYC/AML?

- The acronym stands for Know Your Customer / Anti Money Laundering.

- In practice it stands for the surveillance measures companies are often compelled to take against their customers by financial regulators.

- Methods differ but often include: Passport Scans, Driver License Uploads, Social Security Numbers, Home Address, Phone Number, Face Scans.

- Bitcoin companies will also store all withdrawal and deposit addresses which can then be used to track bitcoin transactions on the bitcoin block chain.

- This data is then stored and shared. Regulations often require companies to hold this information for a set number of years but in practice users should assume this data will be held indefinitely. Data is often stored insecurely, which results in frequent hacks and leaks.

- KYC/AML data collection puts all honest users at risk of theft, extortion, and persecution while being ineffective at stopping crime. Criminals often use counterfeit, bought, or stolen credentials to get around the requirements. Criminals can buy "verified" accounts for as little as $200. Furthermore, billions of people are excluded from financial services as a result of KYC/AML requirements.

During the early days of bitcoin most services did not require this sensitive user data, but as adoption increased so did the surveillance measures. At this point, most large bitcoin companies are collecting and storing massive lists of bitcoiners, our sensitive personal information, and our transaction history.

Lists of Bitcoiners

KYC/AML policies are a direct attack on bitcoiners. Lists of bitcoiners and our transaction history will inevitably be used against us.

Once you are on a list with your bitcoin transaction history that record will always exist. Generally speaking, tracking bitcoin is based on probability analysis of ownership change. Surveillance firms use various heuristics to determine if you are sending bitcoin to yourself or if ownership is actually changing hands. You can obtain better privacy going forward by using collaborative transactions such as coinjoin to break this probability analysis.

Fortunately, you can buy bitcoin without providing intimate personal information. Tools such as peach, hodlhodl, robosats, azteco and bisq help; mining is also a solid option: anyone can plug a miner into power and internet and earn bitcoin by mining privately.

You can also earn bitcoin by providing goods and/or services that can be purchased with bitcoin. Long term, circular economies will mitigate this threat: most people will not buy bitcoin - they will earn bitcoin - most people will not sell bitcoin - they will spend bitcoin.

There is no such thing as KYC or No KYC bitcoin, there are bitcoiners on lists and those that are not on lists.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-04 07:02:09

@ 7f6db517:a4931eda

2025-06-04 07:02:09

Nostr is an open communication protocol that can be used to send messages across a distributed set of relays in a censorship resistant and robust way.

If you missed my nostr introduction post you can find it here. My nostr account can be found here.

We are nearly at the point that if something interesting is posted on a centralized social platform it will usually be posted by someone to nostr.

We are nearly at the point that if something interesting is posted exclusively to nostr it is cross posted by someone to various centralized social platforms.

We are nearly at the point that you can recommend a cross platform app that users can install and easily onboard without additional guides or resources.

As companies continue to build walls around their centralized platforms nostr posts will be the easiest to cross reference and verify - as companies continue to censor their users nostr is the best censorship resistant alternative - gradually then suddenly nostr will become the standard. 🫡

Current Nostr Stats

If you found this post helpful support my work with bitcoin.

-

@ 9ca447d2:fbf5a36d

2025-06-04 07:01:36

@ 9ca447d2:fbf5a36d

2025-06-04 07:01:36Trump Media & Technology Group (TMTG), the company behind Truth Social and other Trump-branded digital platforms, is planning to raise $2.5 billion to build one of the largest bitcoin treasuries among public companies.

The deal involves the sale of approximately $1.5 billion in common stock and $1.0 billion in convertible senior secured notes.

According to the company, the offering is expected to close by the end of May, pending standard closing conditions.

Devin Nunes, CEO of Trump Media, said the investment in bitcoin is a big part of the company’s long-term plan.

“We view Bitcoin as an apex instrument of financial freedom,” Nunes said.

“This investment will help defend our Company against harassment and discrimination by financial institutions, which plague many Americans and U.S. firms.”

He added that the bitcoin treasury will be used to create new synergies across the company’s platforms including Truth Social, Truth+, and the upcoming financial tech brand Truth.Fi.

“It’s a big step forward in the company’s plans to evolve into a holding company by acquiring additional profit-generating, crown jewel assets consistent with America First principles,” Nunes said.

The $2.5 billion raise will come from about 50 institutional investors. The $1 billion in convertible notes will have 0% interest and be convertible into shares at a 35% premium.

TMTG’s current liquid assets, including cash and short-term investments, are $759 million as of the end of the first quarter of 2025. With this new funding, the company’s liquid assets will be over $3 billion.

Custody of the bitcoin treasury will be handled by Crypto.com and Anchorage Digital. They will manage and store the digital assets.

Earlier this week The Financial Times reported Trump Media was planning to raise $3 billion for digital assets acquisitions.

The article said the funds would be used to buy bitcoin and other digital assets, and an announcement could come before a major related event in Las Vegas.

Related: Bitcoin 2025 Conference Kicks off in Las Vegas Today

Trump Media denied the FT report. In a statement, the company said, “Apparently the Financial Times has dumb writers listening to even dumber sources.”

There was no further comment. However, the official $2.5 billion figure, which was announced shortly after by Trump Media through a press release, aligns with its actual filing and investor communication.

Trump Media’s official announcement

This comes at a time when the Trump family and political allies are showing renewed interest in Bitcoin.

President Donald Trump who is now back in office since the 2025 election, has said he wants to make the U.S. the “crypto capital of the world.”

Trump Media is also working on retail bitcoin investment products including ETFs aligned with America First policies.

These products will make bitcoin more accessible to retail investors and support pro-Trump financial initiatives.

But not everyone is happy.

Democratic Senator Elizabeth Warren recently expressed concerns about Trump Media’s Bitcoin plans. She asked U.S. regulators to clarify their oversight of digital-asset ETFs, warning of investor risk.

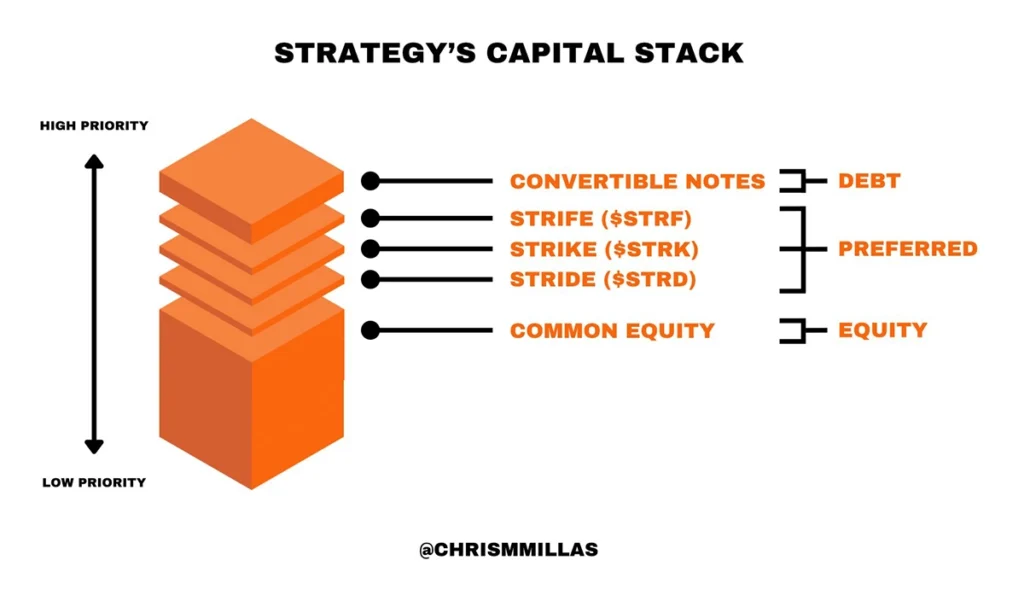

Industry insiders are comparing Trump Media’s plans to Strategy (MSTR) which has built a multi-billion dollar bitcoin treasury over the last year. They used stock and bond sales to fund their bitcoin purchases.

-

@ 7f6db517:a4931eda

2025-06-04 10:02:22

@ 7f6db517:a4931eda

2025-06-04 10:02:22

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

Good morning.

It looks like PacWest will fail today. It will be both the fifth largest bank failure in US history and the sixth major bank to fail this year. It will likely get purchased by one of the big four banks in a government orchestrated sale.

March 8th - Silvergate Bank

March 10th - Silicon Valley Bank

March 12th - Signature Bank

March 19th - Credit Suisse

May 1st - First Republic Bank

May 4th - PacWest Bank?PacWest is the first of many small regional banks that will go under this year. Most will get bought by the big four in gov orchestrated sales. This has been the playbook since 2008. Follow the incentives. Massive consolidation across the banking industry. PacWest gonna be a drop in the bucket compared to what comes next.

First, a hastened government led bank consolidation, then a public/private partnership with the remaining large banks to launch a surveilled and controlled digital currency network. We will be told it is more convenient. We will be told it is safer. We will be told it will prevent future bank runs. All of that is marketing bullshit. The goal is greater control of money. The ability to choose how we spend it and how we save it. If you control the money - you control the people that use it.

If you found this post helpful support my work with bitcoin.

-

@ dfa02707:41ca50e3

2025-06-04 12:04:25

@ dfa02707:41ca50e3

2025-06-04 12:04:25Contribute to keep No Bullshit Bitcoin news going.

- RoboSats v0.7.7-alpha is now available!

NOTE: "This version of clients is not compatible with older versions of coordinators. Coordinators must upgrade first, make sure you don't upgrade your client while this is marked as pre-release."

- This version brings a new and improved coordinators view with reviews signed both by the robot and the coordinator, adds market price sources in coordinator profiles, shows a correct warning for canceling non-taken orders after a payment attempt, adds Uzbek sum currency, and includes package library updates for coordinators.

Source: RoboSats.

- siggy47 is writing daily RoboSats activity reviews on stacker.news. Check them out here.

- Stay up-to-date with RoboSats on Nostr.

What's new

- New coordinators view (see the picture above).

- Available coordinator reviews signed by both the robot and the coordinator.

- Coordinators now display market price sources in their profiles.

Source: RoboSats.

- Fix for wrong message on cancel button when taking an order. Users are now warned if they try to cancel a non taken order after a payment attempt.

- Uzbek sum currency now available.

- For coordinators: library updates.

- Add docker frontend (#1861).

- Add order review token (#1869).

- Add UZS migration (#1875).

- Fixed tests review (#1878).

- Nostr pubkey for Robot (#1887).

New contributors

Full Changelog: v0.7.6-alpha...v0.7.7-alpha

-

@ b1ddb4d7:471244e7

2025-06-04 07:01:24

@ b1ddb4d7:471244e7

2025-06-04 07:01:24Bitcoin FilmFest (BFF25) returns to Warsaw for its third edition, blending independent cinema—from feature films and commercials to AI-driven experimental visuals—with education and entertainment.

Hundreds of attendees from around the world will gather for three days of screenings, discussions, workshops, and networking at the iconic Kinoteka Cinema (PKiN), the same venue that hosted the festival’s first two editions in March 2023 and April 2024.

This year’s festival, themed “Beyond the Frame,” introduces new dimensions to its program, including an extra day on May 22 to celebrate Bitcoin Pizza Day, the first real-world bitcoin transaction, with what promises to be one of Europe’s largest commemorations of this milestone.

BFF25 bridges independent film, culture, and technology, with a bold focus on decentralized storytelling and creative expression. As a community-driven cultural experience with a slightly rebellious spirit, Bitcoin FilmFest goes beyond movies, yet cinema remains at its heart.

Here’s a sneak peek at the lineup, specially curated for movie buffs:

Generative Cinema – A special slot with exclusive shorts and a thematic debate on the intersection of AI and filmmaking. Featured titles include, for example: BREAK FREE, SATOSHI: THE CREATION OF BITCOIN, STRANGE CURRENCIES, and BITCOIN IS THE MYCELIUM OF MONEY, exploring financial independence, traps of the fiat system, and a better future built on sound money.

Generative Cinema – A special slot with exclusive shorts and a thematic debate on the intersection of AI and filmmaking. Featured titles include, for example: BREAK FREE, SATOSHI: THE CREATION OF BITCOIN, STRANGE CURRENCIES, and BITCOIN IS THE MYCELIUM OF MONEY, exploring financial independence, traps of the fiat system, and a better future built on sound money. Upcoming Productions Preview – A bit over an hour-long block of unreleased pilots and works-in-progress. Attendees will get exclusive first looks at projects like FINDING HOME (a travel-meets-personal-journey series), PARALLEL SPACES (a story about alternative communities), and THE LEGEND OF LANDI (a mysterious narrative).

Upcoming Productions Preview – A bit over an hour-long block of unreleased pilots and works-in-progress. Attendees will get exclusive first looks at projects like FINDING HOME (a travel-meets-personal-journey series), PARALLEL SPACES (a story about alternative communities), and THE LEGEND OF LANDI (a mysterious narrative). Freedom-Focused Ads & Campaigns – Unique screenings of video commercials, animations, and visual projects, culminating in “The PoWies” (Proof of Work-ies)—the first ever awards show honoring the best Bitcoin-only awareness campaigns.

Freedom-Focused Ads & Campaigns – Unique screenings of video commercials, animations, and visual projects, culminating in “The PoWies” (Proof of Work-ies)—the first ever awards show honoring the best Bitcoin-only awareness campaigns.To get an idea of what might come up at the event, here, you can preview 6 selected ads combined into two 2 videos:

Open Pitch Competition – A chance for filmmakers to present fresh ideas and unfinished projects to an audience of a dedicated jury, movie fans and potential collaborators. This competitive block isn’t just entertaining—it’s a real opportunity for creators to secure funding and partnerships.

Open Pitch Competition – A chance for filmmakers to present fresh ideas and unfinished projects to an audience of a dedicated jury, movie fans and potential collaborators. This competitive block isn’t just entertaining—it’s a real opportunity for creators to secure funding and partnerships. Golden Rabbit Awards: A lively gala honoring films from the festival’s Official Selection, with awards in categories like Best Feature, Best Story, Best Short, and Audience Choice.

Golden Rabbit Awards: A lively gala honoring films from the festival’s Official Selection, with awards in categories like Best Feature, Best Story, Best Short, and Audience Choice.BFF25 Main Screenings

Sample titles from BFF25’s Official Selection:

REVOLUCIÓN BITCOIN – A documentary by Juan Pablo, making its first screening outside the Spanish-speaking world in Warsaw this May. Three years of important work, 80 powerful minutes to experience. The film explores Bitcoin’s impact across Argentina, Colombia, Mexico, El Salvador, and Spain through around 40 diverse perspectives. Screening in Spanish with English subtitles, followed by a Q&A with the director.

REVOLUCIÓN BITCOIN – A documentary by Juan Pablo, making its first screening outside the Spanish-speaking world in Warsaw this May. Three years of important work, 80 powerful minutes to experience. The film explores Bitcoin’s impact across Argentina, Colombia, Mexico, El Salvador, and Spain through around 40 diverse perspectives. Screening in Spanish with English subtitles, followed by a Q&A with the director. UNBANKABLE – Luke Willms’ directorial debut, drawing from his multicultural roots and his father’s pioneering HIV/AIDS research. An investigative documentary based on Luke’s journeys through seven African countries, diving into financial experiments and innovations—from mobile money and digital lending to Bitcoin—raising smart questions and offering potential lessons for the West. Its May appearance at BFF25 marks its largest European event to date, following festival screenings and nominations across multiple continents over the past year.

UNBANKABLE – Luke Willms’ directorial debut, drawing from his multicultural roots and his father’s pioneering HIV/AIDS research. An investigative documentary based on Luke’s journeys through seven African countries, diving into financial experiments and innovations—from mobile money and digital lending to Bitcoin—raising smart questions and offering potential lessons for the West. Its May appearance at BFF25 marks its largest European event to date, following festival screenings and nominations across multiple continents over the past year. HOTEL BITCOIN – A Spanish comedy directed by Manuel Sanabria and Carlos “Pocho” Villaverde. Four friends, 4,000 bitcoins , and one laptop spark a chaotic adventure of parties, love, crime, and a dash of madness. Exploring sound money, value, and relationships through a twisting plot. The film premiered at the Tarazona and Moncayo Comedy Film Festival in August 2024. Its Warsaw screening at BFF25 (in Spanish with English subtitles) marks its first public showing outside the Spanish-speaking world.

HOTEL BITCOIN – A Spanish comedy directed by Manuel Sanabria and Carlos “Pocho” Villaverde. Four friends, 4,000 bitcoins , and one laptop spark a chaotic adventure of parties, love, crime, and a dash of madness. Exploring sound money, value, and relationships through a twisting plot. The film premiered at the Tarazona and Moncayo Comedy Film Festival in August 2024. Its Warsaw screening at BFF25 (in Spanish with English subtitles) marks its first public showing outside the Spanish-speaking world.Check out trailers for this year’s BFF25 and past editions on YouTube.

Tickets & Info:

- Detailed program and tickets are available at bitcoinfilmfest.com/bff25.

- Stay updated via the festival’s official channels (links provided on the website).

- Use ‘LN-NEWS’ to get 10% of tickets

-

@ 7f6db517:a4931eda

2025-06-04 10:02:21

@ 7f6db517:a4931eda

2025-06-04 10:02:21

Nostr is an open communication protocol that can be used to send messages across a distributed set of relays in a censorship resistant and robust way.

If you missed my nostr introduction post you can find it here. My nostr account can be found here.

We are nearly at the point that if something interesting is posted on a centralized social platform it will usually be posted by someone to nostr.

We are nearly at the point that if something interesting is posted exclusively to nostr it is cross posted by someone to various centralized social platforms.

We are nearly at the point that you can recommend a cross platform app that users can install and easily onboard without additional guides or resources.

As companies continue to build walls around their centralized platforms nostr posts will be the easiest to cross reference and verify - as companies continue to censor their users nostr is the best censorship resistant alternative - gradually then suddenly nostr will become the standard. 🫡

Current Nostr Stats

If you found this post helpful support my work with bitcoin.

-

@ b1ddb4d7:471244e7

2025-06-04 07:01:20

@ b1ddb4d7:471244e7

2025-06-04 07:01:20When Sergei talks about bitcoin, he doesn’t sound like someone chasing profits or followers. He sounds like someone about to build a monastery in the ruins.

While the mainstream world chases headlines and hype, Sergei shows up in local meetups from Sacramento to Cleveland, mentors curious minds, and shares what he knows is true – hoping that, with the right spark, someone will light their own way forward.

We interviewed Sergei to trace his steps: where he started, what keeps him going, and why teaching bitcoin is far more than explaining how to set up a node – it’s about reaching the right minds before the noise consumes them. So we began where most journeys start: at the beginning.

First Steps

- So, where did it all begin for you and what made you stay curious?

I first heard about bitcoin from a friend’s book recommendation, American Kingpin, the book about Silk Road (online drug marketplace). He is still not a true bitcoiner, although I helped him secure private keys with some bitcoin.

I was really busy at the time – focused on my school curriculum, running a 7-bedroom Airbnb, and working for a standardized test prep company. Bitcoin seemed too technical for me to explore, and the pace of my work left no time for it.

After graduating, while pursuing more training, I started playing around with stocks and maximizing my savings. Passive income seemed like the path to early retirement, as per the promise of the FIRE movement (Financial Independence, Retire Early). I mostly followed the mainstream news and my mentor’s advice – he liked preferred stocks at the time.

I had some Coinbase IOUs and remember sending bitcoin within the Coinbase ledger to a couple friends. I also recall the 2018 crash; I actually saw the legendary price spike live but couldn’t benefit because my funds were stuck amidst the frenzy. I withdrew from that investment completely for some time. Thankfully, my mentor advised to keep en eye on bitcoin.

Around late 2019, I started DCA-ing cautiously. Additionally, my friend and I were discussing famous billionaires, and how there was no curriculum for becoming a billionaire. So, I typed “billionaires” into my podcast app, and landed on We Study Billionaires podcast.

That’s where I kept hearing Preston Pysh mention bitcoin, before splitting into his own podcast series, Bitcoin Fundamentals. I didn’t understand most of the terminology of stocks, bonds, etc, yet I kept listening and trying to absorb it thru repetition. Today, I realize all that financial talk was mostly noise.

When people ask me for a technical explanation of fiat, I say: it’s all made up, just like the fiat price of bitcoin! Starting in 2020, during the so-called pandemic, I dove deeper. I religiously read Bitcoin Magazine, scrolled thru Bitcoin Twitter, and joined Simply Bitcoin Telegram group back when DarthCoin was an admin.

DarthCoin was my favorite bitcoiner – experienced, knowledgeable, and unapologetic. Watching him shift from rage to kindness, from passion to despair, gave me a glimpse at what a true educator’s journey would look like.

The struggle isn’t about adoption at scale anymore. It’s about reaching the few who are willing to study, take risks, and stay out of fiat traps. The vast majority won’t follow that example – not yet at least… if I start telling others the requirements for true freedom and prosperity, they would certainly say “Hell no!”

- At what point did you start teaching others, and why?

After college, I helped teach at a standardized test preparation company, and mentored some students one-on-one. I even tried working at a kindergarten briefly, but left quickly; Babysitting is not teaching.

What I discovered is that those who will succeed don’t really need my help – they would succeed with or without me, because they already have the inner drive.

Once you realize your people are perishing for lack of knowledge, the only rational thing to do is help raise their level of knowledge and understanding. That’s the Great Work.

I sometimes imagine myself as a political prisoner. If that were to happen, I’d probably start teaching fellow prisoners, doctors, janitors, even guards. In a way we already live in an open-air prison, So what else is there to do but teach, organize, and conspire to dismantle the Matrix?

Building on Bitcoin

- You hosted some in-person meetups in Sacramento. What did you learn from those?

My first presentation was on MultiSig storage with SeedSigner, and submarine swaps through Boltz.exchange.

I realized quickly that I had overestimated the group’s technical background. Even the meetup organizer, a financial advisor, asked, “How is anyone supposed to follow these steps?” I responded that reading was required… He decided that Unchained is an easier way.

At a crypto meetup, I gave a much simpler talk, outlining how bitcoin will save the world, based on a DarthCoin’s guide. Only one person stuck around to ask questions – a man who seemed a little out there, and did not really seem to get the message beyond the strength of cryptographic security of bitcoin.

Again, I overestimated the audience’s readiness. That forced me to rethink my strategy. People are extremely early and reluctant to study.

- Now in Ohio, you hold sessions via the Orange Pill App. What’s changed?

My new motto is: educate the educators. The corollary is: don’t orange-pill stupid normies (as DarthCoin puts it).

I’ve shifted to small, technical sessions in order to raise a few solid guardians of this esoteric knowledge who really get it and can carry it forward.

The youngest attendee at one of my sessions is a newborn baby – he mostly sleeps, but maybe he still absorbs some of the educational vibes.

- How do local groups like Sactown and Cleveland Bitcoiners influence your work?

Every meetup reflects its local culture. Sacramento and Bay Area Bitcoiners, for example, do camping trips – once we camped through a desert storm, shielding our burgers from sand while others went to shoot guns.

Cleveland Bitcoiners are different. They amass large gatherings. They recently threw a 100k party. They do a bit more community outreach. Some are curious about the esoteric topics such as jurisdiction, spirituality, and healthful living.

I have no permanent allegiance to any state, race, or group. I go where I can teach and learn. I anticipate that in my next phase, I’ll meet Bitcoiners so advanced that I’ll have to give up my fiat job and focus full-time on serious projects where real health and wealth are on the line.

Hopefully, I’ll be ready. I believe the universe always challenges you exactly to your limit – no less, no more.

- What do people struggle with the most when it comes to technical education?

The biggest struggle isn’t technical – it’s a lack of deep curiosity. People ask “how” and “what” – how do I set up a node, what should one do with the lightning channels? But very few ask “why?”

Why does on-chain bitcoin not contribute to the circular economy? Why is it essential to run Lightning? Why did humanity fall into mental enslavement in the first place?

I’d rather teach two-year-olds who constantly ask “why” than adults who ask how to flip a profit. What worries me most is that most two-year-olds will grow up asking state-funded AI bots for answers and live according to its recommendations.

- One Cleveland Bitcoiner shows up at gold bug meetups. How valuable is face-to-face education?

I don’t think the older generation is going to reverse the current human condition. Most of them have been under mind control for too long, and they just don’t have the attention span to study and change their ways.

They’re better off stacking gold and helping fund their grandkids’ education. If I were to focus on a demographic, I’d go for teenagers – high school age – because by college, the indoctrination is usually too strong, and they’re chasing fiat mastery.

As for the gold bug meetup? Perhaps one day I will show up with a ukulele to sing some bitcoin-themed songs. Seniors love such entertainment.

- How do you choose what to focus on in your sessions, especially for different types of learners?

I don’t come in with a rigid agenda. I’ve collected a massive library of resources over the years and never stopped reading. My browser tab and folder count are exploding.

At the meetup, people share questions or topics they’re curious about, then I take that home, do my homework, and bring back a session based on those themes. I give them the key takeaways, plus where to dive deeper.

Most people won’t – or can’t – study the way I do, and I expect attendees to put in the work. I suspect that it’s more important to reach those who want to learn but don’t know how, the so-called nescient (not knowing), rather than the ignorant.

There are way too many ignorant bitcoiners, so my mission is to find those who are curious what’s beyond the facade of fake reality and superficial promises.

That naturally means that fewer people show up, and that’s fine. I’m not here for the crowds; I’m here to educate the educators. One bitcoiner who came decided to branch off into self-custody sessions and that’s awesome. Personally, I’m much more focused on Lightning.

I want to see broader adoption of tools like auth, sign-message, NWC, and LSPs. Next month, I’m going deep into eCash solutions, because let’s face it – most newcomers won’t be able to afford their own UTXO or open a lightning channel; additionally, it has to be fun and easy for them to transact sats, otherwise they won’t do it. Additionally, they’ll need to rely on

-

@ 6e4f2866:a76f7a29

2025-06-04 12:10:56

@ 6e4f2866:a76f7a29

2025-06-04 12:10:56Imagine life as a personalized Virtual Reality game, where you're the player navigating a simulation coded by your deepest programming. Every thought, emotion, and action shapes the reality you experience through your VR headset. You strive to level up—chasing achievements, relationships, or self-worth—believing that winning is just one more quest away. But no matter how hard you play, the game feels rigged. Success slips away, setbacks pile up, and you're left exhausted, wondering why you can't break through.

That was my reality for the first 30 years—trapped in a VR game running five glitchy algorithms I now call "hamster wheels." These binary mental programs kept me locked in endless loops: trying to gain but always losing, attempting to be able but feeling unable, seeking support but getting let down. I was jammed up on the left side of these wheels—the Yin, "not doing" side—paralyzed by fear of failure, loss, and judgment, like a player frozen at a checkpoint, unable to progress yet desperately yearning for rewards.

But this wasn't just some abstract gaming metaphor. This was brutal, daily suffering that consumed every aspect of my existence. I'm talking about waking up each morning with a knot of dread in my stomach, going to bed each night feeling like a failure, and spending the hours in between convinced that everyone could see how fundamentally broken I was.

What I didn't understand then was that I wasn't broken or weak. I was simply running corrupted code installed during childhood, outdated survival protocols that were no longer relevant to my adult life. The most beautiful part? Every human has admin access to their own VR system. We just forgot the password.

This is the story of how I discovered that password, but first, let me show you what it feels like to live inside a completely glitched reality.

The Early Error Messages

My first glimpse that something unusual was running in my background processes came when I was 10 years old, sitting in school assembly at Hillcrest prep in Nairobi, Kenya. The deputy headmistress was addressing the school, and something about her that day caught my attention—like receiving data through an advanced sensor that others couldn't access.

In the car on the way home, I told my mum that the headmistress was pregnant. When she asked if it had been announced, I said no. "I just feel it," I explained. My mum gave me a strange look and commented that I was "weird sometimes." A few months later, the deputy headmistress stood up in assembly to announce she was expecting her first baby.

Instead of feeling proud or special about this ability, I felt ashamed. Deep in my bones, I absorbed the message that there was something wrong with me, something that made me different in an unwelcome way. I started hiding these experiences, learning to keep quiet when my internal sensors picked up information others couldn't detect.

This early conditioning jammed me firmly on the left side of what I now recognize as the "Paying Attention/Ignore" hamster wheel. I learned that getting attention for my unusual abilities felt dangerous, so I began ignoring and suppressing these gifts. Like a player avoiding the spotlight quests, I retreated into the shadows, coded by shame and fear.

Another incident a couple of years later showed me just how high the stakes could be. I was upstairs in my bedroom when I received what felt like an urgent system alert—a sudden knowing that something was wrong. Looking out the window, I saw my one-year-old baby brother leaning over our small garden pond.

Almost in slow motion, I watched him topple headfirst into the water. The terror that shot through me was unlike anything I'd ever experienced. I screamed and raced downstairs, my heart hammering so hard I thought it might burst. Plunging my hands into the cold water, I pulled out my wide-eyed baby brother, both of us gasping.

But instead of celebrating this miraculous save, I was haunted by a thought that would torment me for decades: What if I hadn't looked out the window? What if I hadn't received that warning? The weight of that responsibility was crushing. From that moment on, I became hypervigilant, constantly scanning for threats, terrified that my failure to pay attention could result in catastrophe.

The VR game was trying to show me my inherent capabilities, but my childhood programming was translating every success into evidence that I needed to be more controlling, more worried, more afraid. I was learning to live in a state of chronic anxiety disguised as responsibility.

The System Crash That Changed Everything As I got older, the glitches became more obvious and devastating. By my teens, it was clear that multiple algorithms were running haywire, but I had no framework for understanding what was happening to my system. When I was around 17, my girlfriend dumped me, and my entire world collapsed. This wasn't just teenage heartbreak—it was a complete VR system crash that triggered every corrupted program I'd been running. The pain was indescribable.

I felt like someone had reached inside my chest and torn out something essential. I couldn't eat, couldn't sleep, couldn't concentrate on anything. The simplest tasks felt impossible. I remember sitting in my bedroom, staring at the walls, feeling like I was dissolving from the inside out.

But it wasn't just the relationship loss. This event triggered a cascade failure across all my programming simultaneously. I was facing final exams at school, and my "Unable/Able" wheel went into overdrive—I felt completely incapable of handling the tests and saw myself as a massive disappointment to everyone who had ever believed in me.

A week after being dumped, I badly injured my knee playing rugby, losing the only activity that gave me any sense of worth. This happened during an ambulance strike in the UK, so I was left writhing on the field for almost an hour, using gas to dull the pain that was shooting through my leg like lightning.

When a doctor finally examined me, he dismissed my injury despite obvious symptoms. "Nothing wrong with your knee," he said, as I stood there unable to put weight on it. My sports teacher overheard and thought I was faking, leading him to ignore me completely for the rest of the term.

The betrayal and abandonment I felt was soul-crushing. Here I was, genuinely injured and in pain, and the very people who were supposed to help me were treating me like a liar. I felt invisible, worthless, and utterly alone. Looking back, I can see that all five hamster wheels were spinning simultaneously, all jammed on the left (Yin) side:

Gain/Loss: I had lost my girlfriend, was losing rugby, and faced losing academic success Support/Let Down: I felt completely unsupported and was letting everyone down Right/Wrong: Everyone was wrong about me, and I felt wrong about everything Attention/Ignore: I was being ignored by those who should have paid attention Unable/Able: I felt completely unable to handle any aspect of my life

This wasn't just emotional turmoil—it was a complete VR system overload that manifested in my physical body. Within weeks, I developed glandular fever that would last over a year. My doctor labeled it "post-viral fatigue syndrome," essentially admitting he had no idea what was wrong with me.

Living in the Crashed State

The year that followed was one of the darkest periods of my life. I spent most of it sleeping, hiding from a world that felt overwhelming and hostile. Simple tasks like taking a shower or eating a meal required enormous effort. I felt like I was watching life through a thick fog, unable to engage with anything that had once brought me joy.

The loneliness was crushing. My friends moved on with their lives while I remained stuck in this gray, lifeless existence. I felt like a ghost haunting my own life, present but not really there. The vibrant, curious boy I'd once been seemed to have disappeared entirely. My hamster wheels had drained every ounce of my system's resources, leaving me in a crashed state with no energy to even load basic daily functions. I was like a computer with a virus so severe that it could barely run the most basic programs.

But the worst part wasn't the physical exhaustion—it was the crushing sense that I was fundamentally defective. While other teenagers were falling in love, excelling at sports, preparing for university, I was lying in bed, unable to function. The shame was overwhelming. I felt like a failure at the most basic level of human existence.

The Accidental System Restart

Interestingly, I instinctively found a solution that would later inform my understanding of how to debug human consciousness. I'd read somewhere that sunshine could help, so I used my meager savings to book a three-week trip to the Caribbean. The Gulf War was happening, so tickets were dirt cheap—the only reason I could afford it. The decision to go was one of the first choices I'd made entirely for myself in months. It felt risky, almost rebellious, but something deep inside me knew I had to do it.

I returned completely cured—transformed, really. The fog had lifted, my energy returned, and for the first time in over a year, I felt genuinely excited about being alive. It was my first venture into what I now recognize as alternative system recovery.

Looking back, I think that trip worked because it was a complete environmental reset combined with a fundamental shift in my internal programming. For three weeks, I existed outside the familiar environment that had been triggering my glitchy code. More importantly, it was probably the first time in years I'd made a choice from my own center rather than from the panicked algorithms of my hamster wheels.

But the most profound change was internal. Somehow, in that tropical environment, surrounded by beauty and warmth, I remembered what it felt like to be alive. The constant background noise of anxiety and self-criticism quieted, and I could hear my own voice again.

-

@ b1ddb4d7:471244e7

2025-06-04 10:01:36

@ b1ddb4d7:471244e7

2025-06-04 10:01:36When Sergei talks about bitcoin, he doesn’t sound like someone chasing profits or followers. He sounds like someone about to build a monastery in the ruins.

While the mainstream world chases headlines and hype, Sergei shows up in local meetups from Sacramento to Cleveland, mentors curious minds, and shares what he knows is true – hoping that, with the right spark, someone will light their own way forward.

We interviewed Sergei to trace his steps: where he started, what keeps him going, and why teaching bitcoin is far more than explaining how to set up a node – it’s about reaching the right minds before the noise consumes them. So we began where most journeys start: at the beginning.

First Steps

- So, where did it all begin for you and what made you stay curious?

I first heard about bitcoin from a friend’s book recommendation, American Kingpin, the book about Silk Road (online drug marketplace). He is still not a true bitcoiner, although I helped him secure private keys with some bitcoin.

I was really busy at the time – focused on my school curriculum, running a 7-bedroom Airbnb, and working for a standardized test prep company. Bitcoin seemed too technical for me to explore, and the pace of my work left no time for it.

After graduating, while pursuing more training, I started playing around with stocks and maximizing my savings. Passive income seemed like the path to early retirement, as per the promise of the FIRE movement (Financial Independence, Retire Early). I mostly followed the mainstream news and my mentor’s advice – he liked preferred stocks at the time.

I had some Coinbase IOUs and remember sending bitcoin within the Coinbase ledger to a couple friends. I also recall the 2018 crash; I actually saw the legendary price spike live but couldn’t benefit because my funds were stuck amidst the frenzy. I withdrew from that investment completely for some time. Thankfully, my mentor advised to keep en eye on bitcoin.

Around late 2019, I started DCA-ing cautiously. Additionally, my friend and I were discussing famous billionaires, and how there was no curriculum for becoming a billionaire. So, I typed “billionaires” into my podcast app, and landed on We Study Billionaires podcast.

That’s where I kept hearing Preston Pysh mention bitcoin, before splitting into his own podcast series, Bitcoin Fundamentals. I didn’t understand most of the terminology of stocks, bonds, etc, yet I kept listening and trying to absorb it thru repetition. Today, I realize all that financial talk was mostly noise.

When people ask me for a technical explanation of fiat, I say: it’s all made up, just like the fiat price of bitcoin! Starting in 2020, during the so-called pandemic, I dove deeper. I religiously read Bitcoin Magazine, scrolled thru Bitcoin Twitter, and joined Simply Bitcoin Telegram group back when DarthCoin was an admin.

DarthCoin was my favorite bitcoiner – experienced, knowledgeable, and unapologetic. Watching him shift from rage to kindness, from passion to despair, gave me a glimpse at what a true educator’s journey would look like.

The struggle isn’t about adoption at scale anymore. It’s about reaching the few who are willing to study, take risks, and stay out of fiat traps. The vast majority won’t follow that example – not yet at least… if I start telling others the requirements for true freedom and prosperity, they would certainly say “Hell no!”

- At what point did you start teaching others, and why?

After college, I helped teach at a standardized test preparation company, and mentored some students one-on-one. I even tried working at a kindergarten briefly, but left quickly; Babysitting is not teaching.

What I discovered is that those who will succeed don’t really need my help – they would succeed with or without me, because they already have the inner drive.

Once you realize your people are perishing for lack of knowledge, the only rational thing to do is help raise their level of knowledge and understanding. That’s the Great Work.

I sometimes imagine myself as a political prisoner. If that were to happen, I’d probably start teaching fellow prisoners, doctors, janitors, even guards. In a way we already live in an open-air prison, So what else is there to do but teach, organize, and conspire to dismantle the Matrix?

Building on Bitcoin

- You hosted some in-person meetups in Sacramento. What did you learn from those?

My first presentation was on MultiSig storage with SeedSigner, and submarine swaps through Boltz.exchange.

I realized quickly that I had overestimated the group’s technical background. Even the meetup organizer, a financial advisor, asked, “How is anyone supposed to follow these steps?” I responded that reading was required… He decided that Unchained is an easier way.

At a crypto meetup, I gave a much simpler talk, outlining how bitcoin will save the world, based on a DarthCoin’s guide. Only one person stuck around to ask questions – a man who seemed a little out there, and did not really seem to get the message beyond the strength of cryptographic security of bitcoin.

Again, I overestimated the audience’s readiness. That forced me to rethink my strategy. People are extremely early and reluctant to study.

- Now in Ohio, you hold sessions via the Orange Pill App. What’s changed?

My new motto is: educate the educators. The corollary is: don’t orange-pill stupid normies (as DarthCoin puts it).

I’ve shifted to small, technical sessions in order to raise a few solid guardians of this esoteric knowledge who really get it and can carry it forward.

The youngest attendee at one of my sessions is a newborn baby – he mostly sleeps, but maybe he still absorbs some of the educational vibes.

- How do local groups like Sactown and Cleveland Bitcoiners influence your work?

Every meetup reflects its local culture. Sacramento and Bay Area Bitcoiners, for example, do camping trips – once we camped through a desert storm, shielding our burgers from sand while others went to shoot guns.

Cleveland Bitcoiners are different. They amass large gatherings. They recently threw a 100k party. They do a bit more community outreach. Some are curious about the esoteric topics such as jurisdiction, spirituality, and healthful living.

I have no permanent allegiance to any state, race, or group. I go where I can teach and learn. I anticipate that in my next phase, I’ll meet Bitcoiners so advanced that I’ll have to give up my fiat job and focus full-time on serious projects where real health and wealth are on the line.

Hopefully, I’ll be ready. I believe the universe always challenges you exactly to your limit – no less, no more.

- What do people struggle with the most when it comes to technical education?

The biggest struggle isn’t technical – it’s a lack of deep curiosity. People ask “how” and “what” – how do I set up a node, what should one do with the lightning channels? But very few ask “why?”

Why does on-chain bitcoin not contribute to the circular economy? Why is it essential to run Lightning? Why did humanity fall into mental enslavement in the first place?

I’d rather teach two-year-olds who constantly ask “why” than adults who ask how to flip a profit. What worries me most is that most two-year-olds will grow up asking state-funded AI bots for answers and live according to its recommendations.

- One Cleveland Bitcoiner shows up at gold bug meetups. How valuable is face-to-face education?

I don’t think the older generation is going to reverse the current human condition. Most of them have been under mind control for too long, and they just don’t have the attention span to study and change their ways.

They’re better off stacking gold and helping fund their grandkids’ education. If I were to focus on a demographic, I’d go for teenagers – high school age – because by college, the indoctrination is usually too strong, and they’re chasing fiat mastery.

As for the gold bug meetup? Perhaps one day I will show up with a ukulele to sing some bitcoin-themed songs. Seniors love such entertainment.

- How do you choose what to focus on in your sessions, especially for different types of learners?

I don’t come in with a rigid agenda. I’ve collected a massive library of resources over the years and never stopped reading. My browser tab and folder count are exploding.

At the meetup, people share questions or topics they’re curious about, then I take that home, do my homework, and bring back a session based on those themes. I give them the key takeaways, plus where to dive deeper.

Most people won’t – or can’t – study the way I do, and I expect attendees to put in the work. I suspect that it’s more important to reach those who want to learn but don’t know how, the so-called nescient (not knowing), rather than the ignorant.

There are way too many ignorant bitcoiners, so my mission is to find those who are curious what’s beyond the facade of fake reality and superficial promises.

That naturally means that fewer people show up, and that’s fine. I’m not here for the crowds; I’m here to educate the educators. One bitcoiner who came decided to branch off into self-custody sessions and that’s awesome. Personally, I’m much more focused on Lightning.

I want to see broader adoption of tools like auth, sign-message, NWC, and LSPs. Next month, I’m going deep into eCash solutions, because let’s face it – most newcomers won’t be able to afford their own UTXO or open a lightning channel; additionally, it has to be fun and easy for them to transact sats, otherwise they won’t do it. Additionally, they’ll need to rely on

-

@ 7460b7fd:4fc4e74b

2025-06-04 12:17:18

@ 7460b7fd:4fc4e74b

2025-06-04 12:17:18Tron(TRX)区块链架构与性能综合分析

Tron 的三层架构与虚拟机设计