-

@ 8fb140b4:f948000c

2023-11-21 21:37:48

@ 8fb140b4:f948000c

2023-11-21 21:37:48Embarking on the journey of operating your own Lightning node on the Bitcoin Layer 2 network is more than just a tech-savvy endeavor; it's a step into a realm of financial autonomy and cutting-edge innovation. By running a node, you become a vital part of a revolutionary movement that's reshaping how we think about money and digital transactions. This role not only offers a unique perspective on blockchain technology but also places you at the heart of a community dedicated to decentralization and network resilience. Beyond the technicalities, it's about embracing a new era of digital finance, where you contribute directly to the network's security, efficiency, and growth, all while gaining personal satisfaction and potentially lucrative rewards.

In essence, running your own Lightning node is a powerful way to engage with the forefront of blockchain technology, assert financial independence, and contribute to a more decentralized and efficient Bitcoin network. It's an adventure that offers both personal and communal benefits, from gaining in-depth tech knowledge to earning a place in the evolving landscape of cryptocurrency.

Running your own Lightning node for the Bitcoin Layer 2 network can be an empowering and beneficial endeavor. Here are 10 reasons why you might consider taking on this task:

-

Direct Contribution to Decentralization: Operating a node is a direct action towards decentralizing the Bitcoin network, crucial for its security and resistance to control or censorship by any single entity.

-

Financial Autonomy: Owning a node gives you complete control over your financial transactions on the network, free from reliance on third-party services, which can be subject to fees, restrictions, or outages.

-

Advanced Network Participation: As a node operator, you're not just a passive participant but an active player in shaping the network, influencing its efficiency and scalability through direct involvement.

-

Potential for Higher Revenue: With strategic management and optimal channel funding, your node can become a preferred route for transactions, potentially increasing the routing fees you can earn.

-

Cutting-Edge Technological Engagement: Running a node puts you at the forefront of blockchain and bitcoin technology, offering insights into future developments and innovations.

-

Strengthened Network Security: Each new node adds to the robustness of the Bitcoin network, making it more resilient against attacks and failures, thus contributing to the overall security of the ecosystem.

-

Personalized Fee Structures: You have the flexibility to set your own fee policies, which can balance earning potential with the service you provide to the network.

-

Empowerment Through Knowledge: The process of setting up and managing a node provides deep learning opportunities, empowering you with knowledge that can be applied in various areas of blockchain and fintech.

-

Boosting Transaction Capacity: By running a node, you help to increase the overall capacity of the Lightning Network, enabling more transactions to be processed quickly and at lower costs.

-

Community Leadership and Reputation: As an active node operator, you gain recognition within the Bitcoin community, which can lead to collaborative opportunities and a position of thought leadership in the space.

These reasons demonstrate the impactful and transformative nature of running a Lightning node, appealing to those who are deeply invested in the principles of bitcoin and wish to actively shape its future. Jump aboard, and embrace the journey toward full independence. 🐶🐾🫡🚀🚀🚀

-

-

@ 8fb140b4:f948000c

2023-11-18 23:28:31

@ 8fb140b4:f948000c

2023-11-18 23:28:31Chef's notes

Serving these two dishes together will create a delightful centerpiece for your Thanksgiving meal, offering a perfect blend of traditional flavors with a homemade touch.

Details

- ⏲️ Prep time: 30 min

- 🍳 Cook time: 1 - 2 hours

- 🍽️ Servings: 4-6

Ingredients

- 1 whole turkey (about 12-14 lbs), thawed and ready to cook

- 1 cup unsalted butter, softened

- 2 tablespoons fresh thyme, chopped

- 2 tablespoons fresh rosemary, chopped

- 2 tablespoons fresh sage, chopped

- Salt and freshly ground black pepper

- 1 onion, quartered

- 1 lemon, halved

- 2-3 cloves of garlic

- Apple and Sage Stuffing

- 1 loaf of crusty bread, cut into cubes

- 2 apples, cored and chopped

- 1 onion, diced

- 2 stalks celery, diced

- 3 cloves garlic, minced

- 1/4 cup fresh sage, chopped

- 1/2 cup unsalted butter

- 2 cups chicken broth

- Salt and pepper, to taste

Directions

- Preheat the Oven: Set your oven to 325°F (165°C).

- Prepare the Herb Butter: Mix the softened butter with the chopped thyme, rosemary, and sage. Season with salt and pepper.

- Prepare the Turkey: Remove any giblets from the turkey and pat it dry. Loosen the skin and spread a generous amount of herb butter under and over the skin.

- Add Aromatics: Inside the turkey cavity, place the quartered onion, lemon halves, and garlic cloves.

- Roast: Place the turkey in a roasting pan. Tent with aluminum foil and roast. A general guideline is about 15 minutes per pound, or until the internal temperature reaches 165°F (74°C) at the thickest part of the thigh.

- Rest and Serve: Let the turkey rest for at least 20 minutes before carving.

- Next: Apple and Sage Stuffing

- Dry the Bread: Spread the bread cubes on a baking sheet and let them dry overnight, or toast them in the oven.

- Cook the Vegetables: In a large skillet, melt the butter and cook the onion, celery, and garlic until soft.

- Combine Ingredients: Add the apples, sage, and bread cubes to the skillet. Stir in the chicken broth until the mixture is moist. Season with salt and pepper.

- Bake: Transfer the stuffing to a baking dish and bake at 350°F (175°C) for about 30-40 minutes, until golden brown on top.

-

@ 8fb140b4:f948000c

2023-11-02 01:13:01

@ 8fb140b4:f948000c

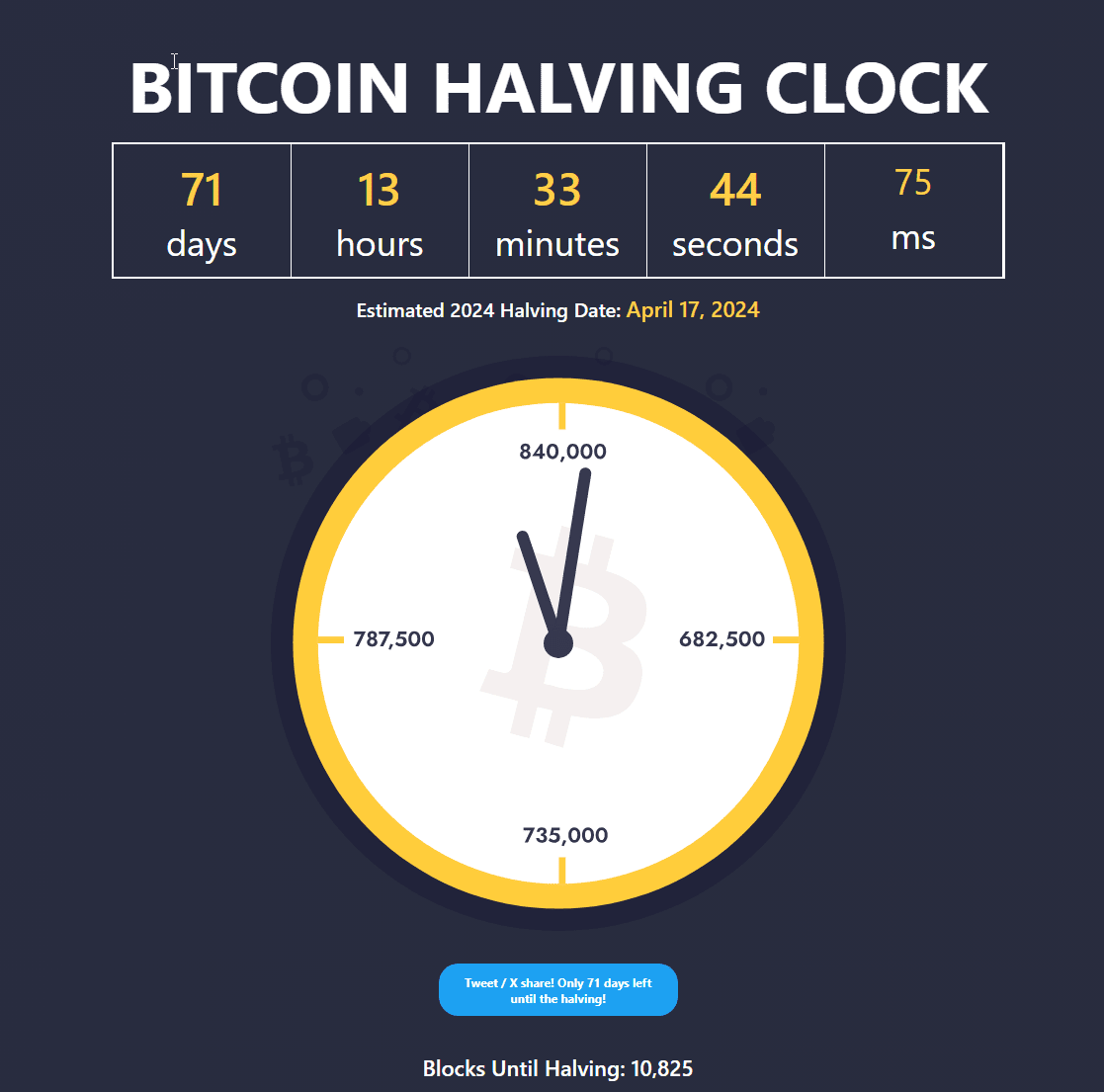

2023-11-02 01:13:01Testing a brand new YakiHonne native client for iOS. Smooth as butter (not penis butter 🤣🍆🧈) with great visual experience and intuitive navigation. Amazing work by the team behind it! * lists * work

Bold text work!

Images could have used nostr.build instead of raw S3 from us-east-1 region.

Very impressive! You can even save the draft and continue later, before posting the long-form note!

🐶🐾🤯🤯🤯🫂💜

-

@ 6871d8df:4a9396c1

2024-02-05 23:29:22

@ 6871d8df:4a9396c1

2024-02-05 23:29:22The Apple Vision Pro was released, and it is the talk of the town right now. To be frank, I think it's a stupid product. It's not useful or particularly enticing to me in its current form factor. It's a toy, not a tool. All the features seem gimmicky as opposed to generally helpful. I'm not saying it may never be worthwhile, but as of this first release, it is only a party trick.

Coincidently, this is the first product that does not have any of Steve Jobs' influence. To me, it shows. I don't think Jobs would have ever let this product see the light of day.

Jobs understood product. He didn't make things for the sake of progress or to make sci-fi reality; he made things because he 'wanted to make a dent in the world.' He wanted to solve problems for everyday people by innovating with cutting-edge technology. He aspired to make people's lives better. Steve Jobs' genius was the way he married cutting-edge technologies with valuable tools that made those cutting-edge technologies simple and elegant.

The Vision Pro may be technically innovative, but it is not a tool, at least in its current form. It may be one day, but that is precisely my point; Jobs would have never released a product where the form factor would hold it back from becoming a tool. At best, it is an intriguing toy that is additive to some content at the behest of being very awkward to wear or be seen in. In my view, mainstream adoption can happen only in a world where we can use the Vision Pro as a contact lens or very small, discreet, minimalist glasses, but certainly not this iteration where it covers more than half your face.

Seeing people's eyes makes us human. So much emotion, understanding, and communication happens with just a look. It is a window into the soul. I don't want to live in a world where we are actively bringing all the negatives about communicating in the digital world to the physical one.

https://image.nostr.build/2365609411f144f5d789ffd684ffce9b4d867626a7bfe11bb311cb0f61057199.jpg

I can't help but wonder or hypothesize what Steve Jobs would focus on if he were still alive today. I think Apple's priorities would be completely different. My gut tells me he would not have let Siri get as bad as it is. Siri is a horrible product; I never use it, and everyone I know who tries to use it does so unsuccessfully, at least most of the time. I personally always default to ChatGPT or Bard. These AI systems make my life dramatically more productive. They are tools in the purest sense.

In my opinion, Steve would not have missed this train. Sure, Apple could wake up and integrate these systems into Siri — if they were smart, they would — but in its current form, it is so far behind that it almost astounds me. My intuition leads me to believe he would be closer to what [Rabbit] is doing.

Who knows? Maybe I am entirely wrong, and Apple just kickstarted VR's mass adoption phase. Unfortunately, I think this will likely be the biggest failure of a physical product that Apple will have seen since Jobs returned ages ago. The Vision Pro is only slightly better than the Oculus, and Facebook has already deprioritized VR for AI. Apple is further behind, and I don't see a world where they do not make the same pivot. There is a skill to creating successful, innovative products, and it makes me sad to see the torch that Jobs passed lose its flame. As someone who respected how Apple used to innovate, watching this decay in real-time is jarring as this is just the latest in a string of disappointing decisions that exemplify that 'peak Apple' is behind us.

-

@ 8fb140b4:f948000c

2023-08-22 12:14:34

@ 8fb140b4:f948000c

2023-08-22 12:14:34As the title states, scratch behind my ear and you get it. 🐶🐾🫡

-

@ 8fb140b4:f948000c

2023-07-30 00:35:01

@ 8fb140b4:f948000c

2023-07-30 00:35:01Test Bounty Note

-

@ 6a39a186:88f51c19

2024-02-05 00:17:47

@ 6a39a186:88f51c19

2024-02-05 00:17:47The Bitcoin Manifesto: Unleashing the Power of Digital Gold

Thoughts

Bitcoin Manifesto, a paper that explores the untapped potential of Bitcoin. In this work, inspired by the spirit of Satoshi Nakamoto, we delve into the compounding free cash flows for Bitcoiners, expose the inherent rigging of the existing financial system, and discuss the ways in which Bitcoin can save one's life energy while fostering success for others. We emphasize the importance of thinking and communicating differently, breaking free from the limitations of a fiat mindset. Furthermore, we highlight Bitcoin's role as the base layer for preserving wealth, acting as a capital fortress against the relentless onslaught of inflation that erodes and destroys our hard-earned assets.

1. Introduction

Welcome to the Bitcoin Manifesto, a testament to the transformative power of digital gold. This paper explores the revolutionary capabilities of Bitcoin, shedding light on its role in compounding free cash flows for Bitcoiners, unmasking the rigged nature of the existing financial system, and unveiling the ways in which Bitcoin can save our life energy while fostering the success of our peers.

2. Compounding Free Cash Flows for Bitcoiners

Bitcoin is a catalyst for financial liberation, enabling Bitcoiners to unlock the power of compounding free cash flows. Unlike traditional systems that stifle wealth creation through burdensome fees, intermediaries, and arbitrary barriers, Bitcoin empowers individuals to engage in direct, peer-to-peer transactions. By embracing this decentralized approach, Bitcoiners can harness the exponential growth potential of their wealth.

"Bitcoin is the conduit through which we unleash the compounding free cash flows that transform stagnant fiat currencies into a flourishing ecosystem of financial prosperity." -

3. Unveiling the Rigged System

The existing financial system is rigged, designed to benefit the few at the expense of the many. Traditional currencies are subject to the whims of governments and central banks, leading to inflationary practices that erode our wealth and purchasing power. In contrast, Bitcoin operates on an immutable blockchain, free from the clutches of centralized authorities. This decentralized nature ensures that no single entity can manipulate the system, leveling the playing field for all participants.

"Bitcoin disrupts the rigged game, empowering individuals to reclaim control of their financial destinies and transcend the limitations imposed by a corrupt system." -

4. Saving Life Energy and Fostering Success

Bitcoin not only offers a means to save our life energy but also a pathway to uplift others towards success. By embracing Bitcoin, we secure our financial well-being and invest in a future where prosperity is not limited to a select few. Through collaboration and support within the Bitcoin community, we create an environment where everyone can thrive, breaking free from the scarcity mindset perpetuated by the fiat world.

"In Bitcoin, we find the power to save our life energy and channel it towards creating a future where success is a shared experience, not a solitary pursuit." -

5. Thinking and Communicating Beyond Fiat

To unlock the full potential of Bitcoin, we must break free from the confines of a fiat-centric mindset. This paradigm shift in thinking and communication allows us to transcend the limitations of the existing financial system. Bitcoiners challenge conventional wisdom, question the status quo, and envision a world where financial freedom and autonomy are the new norms. By adopting this fresh perspective, we unlock untapped potential and shape a future where Bitcoin's influence extends far beyond the realms of finance.

"Bitcoin demands that we think and communicate differently, liberating ourselves from the constraints of a fiat mindset and embracing the transformative power of decentralized finance." -

6. Preservation of Wealth: Bitcoin as Base Layer 1

At its core, Bitcoin serves as the bedrock for preserving wealth in an era plagued by inflation. Governments worldwide continue to print fiat currencies, leading to the gradual erosion of value and the destruction of hard-earned assets. Bitcoin, with its limited supply and decentralized nature, acts as a fortress against this value decay. As the first layer of the financial revolution, Bitcoin provides a solid foundation upon which we can safeguard our wealth.

"Bitcoin, as base layer 1, stands as the bulwark against the relentless assault of inflation, offering us a sanctuary to preserve and grow our financial futures." -

7. Layer 1: Capital Defense Against Inflation

Inflation poses an ever-growing threat to the preservation and growth of wealth. Fiat currencies, subject to the whims of governments and central banks, steadily lose value over time, eroding the purchasing power of individuals. Bitcoin, on the other hand, operates on a protocol with a fixed supply, rendering it immune to the effects of inflation. By embracing Bitcoin as capital, we shield our wealth from the destructive forces that undermine its value.

"Inflation, the silent destroyer of wealth, falls powerless against the fortress of Bitcoin's layer 1, solidifying its role as the ultimate safeguard for our hard-earned assets." -

8. Conclusion

The Bitcoin Manifesto presents a groundbreaking perspective on the potential of Bitcoin. We have explored the compounding free cash flows for Bitcoiners, exposed the rigged nature of the existing financial system, and emphasized the ways in which Bitcoin can save our life energy while fostering success for others. We have called for a shift in thinking and communication, breaking free from the limitations of a fiat mindset. Furthermore, we have recognized Bitcoin's role as the base layer for preserving wealth, acting as a fortress against the growing threat of inflation. By embracing Bitcoin, we can transcend the confines of the current system and propel ourselves towards a future of financial empowerment and prosperity.

"Let us embrace the power of Bitcoin, for it has the potential to revolutionize our financial landscape and forge a path towards a more equitable and prosperous future." -

Assets for phots taken from The ColdPower Post Thank You!

-

@ 8fb140b4:f948000c

2023-07-22 09:39:48

@ 8fb140b4:f948000c

2023-07-22 09:39:48Intro

This short tutorial will help you set up your own Nostr Wallet Connect (NWC) on your own LND Node that is not using Umbrel. If you are a user of Umbrel, you should use their version of NWC.

Requirements

You need to have a working installation of LND with established channels and connectivity to the internet. NWC in itself is fairly light and will not consume a lot of resources. You will also want to ensure that you have a working installation of Docker, since we will use a docker image to run NWC.

- Working installation of LND (and all of its required components)

- Docker (with Docker compose)

Installation

For the purpose of this tutorial, we will assume that you have your lnd/bitcoind running under user bitcoin with home directory /home/bitcoin. We will also assume that you already have a running installation of Docker (or docker.io).

Prepare and verify

git version - we will need git to get the latest version of NWC. docker version - should execute successfully and show the currently installed version of Docker. docker compose version - same as before, but the version will be different. ss -tupln | grep 10009- should produce the following output: tcp LISTEN 0 4096 0.0.0.0:10009 0.0.0.0: tcp LISTEN 0 4096 [::]:10009 [::]:**

For things to work correctly, your Docker should be version 20.10.0 or later. If you have an older version, consider installing a new one using instructions here: https://docs.docker.com/engine/install/

Create folders & download NWC

In the home directory of your LND/bitcoind user, create a new folder, e.g., "nwc" mkdir /home/bitcoin/nwc. Change to that directory cd /home/bitcoin/nwc and clone the NWC repository: git clone https://github.com/getAlby/nostr-wallet-connect.git

Creating the Docker image

In this step, we will create a Docker image that you will use to run NWC.

- Change directory to

nostr-wallet-connect:cd nostr-wallet-connect - Run command to build Docker image:

docker build -t nwc:$(date +'%Y%m%d%H%M') -t nwc:latest .(there is a dot at the end) - The last line of the output (after a few minutes) should look like

=> => naming to docker.io/library/nwc:latest nwc:latestis the name of the Docker image with a tag which you should note for use later.

Creating docker-compose.yml and necessary data directories

- Let's create a directory that will hold your non-volatile data (DB):

mkdir data - In

docker-compose.ymlfile, there are fields that you want to replace (<> comments) and port “4321” that you want to make sure is open (check withss -tupln | grep 4321which should return nothing). - Create

docker-compose.ymlfile with the following content, and make sure to update fields that have <> comment:

version: "3.8" services: nwc: image: nwc:latest volumes: - ./data:/data - ~/.lnd:/lnd:ro ports: - "4321:8080" extra_hosts: - "localhost:host-gateway" environment: NOSTR_PRIVKEY: <use "openssl rand -hex 32" to generate a fresh key and place it inside ""> LN_BACKEND_TYPE: "LND" LND_ADDRESS: localhost:10009 LND_CERT_FILE: "/lnd/tls.cert" LND_MACAROON_FILE: "/lnd/data/chain/bitcoin/mainnet/admin.macaroon" DATABASE_URI: "/data/nostr-wallet-connect.db" COOKIE_SECRET: <use "openssl rand -hex 32" to generate fresh secret and place it inside ""> PORT: 8080 restart: always stop_grace_period: 1mStarting and testing

Now that you have everything ready, it is time to start the container and test.

- While you are in the

nwcdirectory (important), execute the following command and check the log output,docker compose up - You should see container logs while it is starting, and it should not exit if everything went well.

- At this point, you should be able to go to

http://<ip of the host where nwc is running>:4321and get to the interface of NWC - To stop the test run of NWC, simply press

Ctrl-C, and it will shut the container down. - To start NWC permanently, you should execute

docker compose up -d, “-d” tells Docker to detach from the session. - To check currently running NWC logs, execute

docker compose logsto run it in tail mode add-fto the end. - To stop the container, execute

docker compose down

That's all, just follow the instructions in the web interface to get started.

Updating

As with any software, you should expect fixes and updates that you would need to perform periodically. You could automate this, but it falls outside of the scope of this tutorial. Since we already have all of the necessary configuration in place, the update execution is fairly simple.

- Change directory to the clone of the git repository,

cd /home/bitcoin/nwc/nostr-wallet-connect - Run command to build Docker image:

docker build -t nwc:$(date +'%Y%m%d%H%M') -t nwc:latest .(there is a dot at the end) - Change directory back one level

cd .. - Restart (stop and start) the docker compose config

docker compose down && docker compose up -d - Done! Optionally you may want to check the logs:

docker compose logs

-

@ 079d727b:00099650

2024-02-04 02:55:14

@ 079d727b:00099650

2024-02-04 02:55:14tigs$> what is the difference between a BBS with fidonet and the internet?

chatgpt>"A Bulletin Board System (BBS) with FidoNet and the Internet are distinct in their purposes, technologies, and how they facilitate communication and information sharing. Here's a detailed comparison:

Technology and Structure

- BBS with Fidonet

A BBS is a computer server running software that allows users to connect over a phone line (using a modem) or, in some cases, via a terminal protocol over the internet. Users can share messages, files, play games, and participate in discussions.

FidoNet is a networked system for distributing messages between BBSes. It uses a store-and-forward system to pass messages and files between systems, typically over dial-up phone lines or, more recently, over the internet. FidoNet allowed BBSes to form a global network, with messages being relayed from one BBS to another until they reached their destination.

- Internet

The Internet is a vast global network that connects millions of private, public, academic, business, and government networks. It uses the TCP/IP protocol suite for communication and supports a wide range of services, including the World Wide Web (WWW), email, voice over IP (VoIP), and file sharing.

Unlike BBSes where you typically connect to a single server at a time, the Internet allows simultaneous access to countless servers and services worldwide.

2. Accessibility and Usage

BBS with FidoNet:Accessing a BBS generally required direct dial-up access to the server or, in later years, a telnet connection over the internet. Users would often engage with a single BBS or a small selection of BBSes. FidoNet's message and file sharing was not instant; it could take hours or days for content to propagate across the network due to the store-and-forward method.

Internet

The Internet is accessible through a wide range of devices, including computers, smartphones, and tablets, using various technologies like Wi-Fi, broadband, and mobile data. Communication and information retrieval over the Internet can occur in real-time, making it a platform for instant messaging, live streaming, and immediate access to web content.

- Content and Services BBS with FidoNet: BBS content and services are limited by the software capabilities of the BBS itself and the interests of its community. Common features include forums, file downloads, email, and games. FidoNet provided a way to exchange emails and public messages (echomail) with users on other BBSes, but its capabilities are relatively basic compared to modern internet services.

Internet: Offers a vast array of content and services, including comprehensive search engines, social media platforms, online shopping, digital streaming, and much more. Supports sophisticated protocols for secure communication, data exchange, and content delivery (e.g., HTTPS, FTP, streaming protocols).

A Bulletin Board System (BBS) with FidoNet and the Internet are distinct in their purposes, technologies, and how they facilitate communication and information sharing. Here's a detailed comparison: 1. Technology and Structure

BBS with FidoNet: A BBS is a computer server running software that allows users to connect over a phone line (using a modem) or, in some cases, via a terminal protocol over the internet. Users can share messages, files, play games, and participate in discussions. FidoNet is a networked system for distributing messages between BBSes. It uses a store-and-forward system to pass messages and files between systems, typically over dial-up phone lines or, more recently, over the internet. FidoNet allowed BBSes to form a global network, with messages being relayed from one BBS to another until they reached their destination. Internet: The Internet is a vast global network that connects millions of private, public, academic, business, and government networks. It uses the TCP/IP protocol suite for communication and supports a wide range of services, including the World Wide Web (WWW), email, voice over IP (VoIP), and file sharing. Unlike BBSes where you typically connect to a single server at a time, the Internet allows simultaneous access to countless servers and services worldwide.-

Accessibility and Usage

BBS with FidoNet: Accessing a BBS generally required direct dial-up access to the server or, in later years, a telnet connection over the internet. Users would often engage with a single BBS or a small selection of BBSes. FidoNet's message and file sharing was not instant; it could take hours or days for content to propagate across the network due to the store-and-forward method. Internet: The Internet is accessible through a wide range of devices, including computers, smartphones, and tablets, using various technologies like Wi-Fi, broadband, and mobile data. Communication and information retrieval over the Internet can occur in real-time, making it a platform for instant messaging, live streaming, and immediate access to web content.

-

Content and Services

BBS with FidoNet: BBS content and services are limited by the software capabilities of the BBS itself and the interests of its community. Common features include forums, file downloads, email, and games. FidoNet provided a way to exchange emails and public messages (echomail) with users on other BBSes, but its capabilities are relatively basic compared to modern internet services. Internet: Offers a vast array of content and services, including comprehensive search engines, social media platforms, online shopping, digital streaming, and much more. Supports sophisticated protocols for secure communication, data exchange, and content delivery (e.g., HTTPS, FTP, streaming protocols).

-

Evolution and Current Status

BBS with FidoNet: While most BBSes and FidoNet have largely been supplanted by the Internet, a niche community still exists. Some BBSes have transitioned to the Internet, offering telnet access or web interfaces.

Internet: Continues to evolve with emerging technologies, such as blockchain, the Internet of Things (IoT), and artificial intelligence, expanding its capabilities and services.

In summary, while BBSes with FidoNet played a crucial role in the early days of digital communication and community building, the Internet has surpassed them in terms of accessibility, speed, and breadth of content and services."

BUT I THOUGHT... surpassed in terms of WHAT?

tigs$> but what about the decentralized nature of BBS?

"The decentralized nature of Bulletin Board Systems (BBSes) and their network, such as FidoNet, is indeed a key characteristic that differentiates them from the modern Internet in significant ways. Both BBSes and the Internet can be described as networks, but their approaches to decentralization, control, and community engagement have notable differences. Decentralization in BBS and FidoNet:

BBSes: Individual BBSes were standalone systems usually operated by enthusiasts or small organizations. Each BBS was independently owned and managed, setting its own rules, available services, and community standards. This meant a highly decentralized structure where each system was a distinct entity within the larger ecosystem of BBSes.

FidoNet: FidoNet connected these disparate BBSes into a wider network, allowing message and file exchanges. Despite this connectivity, the network maintained a decentralized approach. FidoNet's structure was hierarchical in terms of message routing (using Zone, Region, Net, and Node levels), but each node (or BBS) operated independently under the broader protocol standards. This allowed for a distributed messaging system without a central authority controlling the entire network.

Comparison with the Internet:

Internet: The Internet is decentralized in its fundamental design, with no central control over its networks and services. It operates on a global scale, connecting millions of networks and devices. However, certain aspects of the Internet, such as infrastructure (backbone networks, ISPs), standards (protocols, software), and services (search engines, social media platforms), are controlled by a relatively small number of organizations. This has led to concerns over centralization in terms of control, data ownership, and privacy.

Key Aspects of Decentralization in BBS/FidoNet vs. Internet:

Control and Ownership: BBSes and FidoNet featured a more grassroots level of ownership and control, with individuals and small groups operating their own nodes in the network. In contrast, significant portions of the Internet's infrastructure and popular platforms are owned and controlled by large corporations.

Community Engagement: BBSes often fostered tight-knit communities with a strong sense of ownership and participation in the platform's governance. The decentralized nature of the Internet also supports diverse communities, but the scale and commercialization of major platforms have changed the dynamics of community engagement.

Resilience and Censorship: Decentralization in both BBSes/FidoNet and the Internet contributes to resilience against failures and censorship. However, the concentration of power among key Internet players has raised concerns about censorship, privacy, and the potential for service disruption.

Evolution and Adaptability: The Internet has continually evolved, absorbing or overshadowing technologies like BBSes and FidoNet. The decentralized nature of the Internet's early days has shifted towards a more centralized model in terms of content distribution and service provision, though initiatives like blockchain and decentralized web projects aim to counteract this trend.

In summary, while both BBSes/FidoNet and the Internet embody principles of decentralization, the scale, control structures, and community engagement mechanisms differ significantly between them. The grassroots, individualistic nature of BBSes and FidoNet's decentralized network contrasts with the broader, more centralized control seen in parts of the Internet today, despite its inherently decentralized architecture."

well well well... We gotta return to our roots...

BBS: The Documentary (by Jason Scott) ((NOT me))

-

@ b2caa9b3:9eab0fb5

2024-02-06 17:53:14

@ b2caa9b3:9eab0fb5

2024-02-06 17:53:14In today's adventure, I decided to switch up my work setting and take you along for the ride as I settled into a beach hotel, a truly delightful one at that, promising excellent wifi for a productive workday. I'm a proud minimalist, equipped with nothing more than my trusty Osprey Nebula 32L backpack, housing all my essentials, weighing in at less than 10 kg - clothes, shoes, electronics, toothbrush, toothpaste, and soap neatly stowed away.

As I prepared for my excursion, I emptied my backpack, leaving only the electronics inside. The first leg of my journey involved catching a tuktuk to the beach hotel, where I was greeted by a friendly security guard who welcomed me with a warm "caribou" - a precursor to the enchanted world that awaited beyond the imposing iron gate.

Following the security guard's directions, I wandered along a path lined with quaint cottages available for rent until I reached a breathtaking scene: a pool, a bar, and a restaurant all nestled within a lush, jungle-like resort. I chose the pavilion as my workspace for the day, offering a panoramic view of the resort on one side and a stunning vista of the beach with its powdery white sands on the other.

However, my plans hit a snag when I discovered that the promised wifi wasn't functional in the pavilion. Attempts to relocate to the restaurant and poolside in search of a stable connection proved futile, eventually forcing me to rely on my mobile data to salvage a couple of hours of work amidst picturesque surroundings.

In true African fashion, the assurance of good wifi often falls short of reality, leading to a day filled with beautiful scenery but a less-than-productive workday. Nonetheless, I made the most of it, even indulging in a delectable pizza during my quest for a functioning wifi connection.

As the day wound down, I packed up my laptop and headed back to my temporary abode. In hindsight, it wasn't the most productive workday, but it was undeniably a picturesque and enchanting mobile home-office experience. Take a peek at the photos to capture a glimpse of this unique workspace.

Follow me on Nostr

-

@ f866d5b1:c526b32f

2024-02-02 09:07:06

@ f866d5b1:c526b32f

2024-02-02 09:07:06ในทางเศรษฐศาสตร์มีการวิจัยมาเนิ่นนานแล้วพบว่า บุหรี่/ ยาสูบ เป็นสินค้าที่มีความยืดหยุ่นอุปสงค์ต่อราคาต่ำ นั่นคือแม้สินค้าจะมีราคาสูงขึ้นแต่ผู้บริโภคก็ยังเต็มใจจ่ายเพื่อให้ได้บุหรี่มาสูบเติมเต็มความสุข คลายเหงา คลายเศร้า สร้างภาพลักษณ์ หรือเข้าสังคม เนื่องจากบุหรี่/ ยาสูบ เป็นสินค้าที่หาสินค้าอื่นมาทดแทนได้ยาก

วิธีแก้ปัญหาสินค้าที่ทดแทนได้ยาก

การแก้ปัญหาสินค้าที่ทดแทนได้ยาก มีสองแนวทาง โดยสามารถแก้ได้จากทางด้านความต้องการสูบ (ด้านอุปสงค์ : Demand) และทางด้านต้นทุนการผลิต (ด้านอุปทาน : Supply)

โดยวิธีทำลายธุรกิจบุหรี่/ ยาสูบ มีอยู่ 2 วิธีใหญ่ ๆ นั่นคือ 1. การสร้างความตระหนักรู้ว่าการสูบบุหรี่มีอันตรายต่อชีวิตตนเองและคนที่เรารักอย่างไร หรือการหาทางประดิษฐ์คิดค้นสิ่งที่ให้ความพึงพอใจในการบริโภคเหมือนการสูบบุหรี่แต่ไม่เกิดผลเสียต่อผู้สูบและสังคม

- การขึ้นอัตราภาษีแบบก้าวกระโดดอย่างฉับพลัน (High Shock Taxes Policy) โดยให้มีผลบังคับใช้ในทันที

การค้นหาสิ่งมาแทนคงยาก และการกล่อมเกลาจิตใจคนก็ไม่ใช่เรื่องง่าย ต้องใช้เวลาในการปลูกฝังความรู้ที่ถูกต้อง ดังนั้นวิถีทางที่ง่ายที่สุด แต่ก็ต้องขึ้นกับจิตสำนึกของรัฐบาลว่าจะห่วงใยสังคม หรือสนใจแต่ผลประโยชน์ของโรงงานยาสูบแห่งประเทศไทย

(ซึ่งข้อเสนอของผู้เขียนประยุกต์มาจากงานวิจัย เรื่อง A Theory of Rational Addiction ของ Gary Becker & Kevin Murphy ซึ่งตีพิมพ์ใน Journal of Political Economy ฉบับที่ 96 เดือนสิงหาคม ปี ค.ศ. 1988)

++นั่นคือ การประกาศขึ้นอัตราภาษีแบบสูงมาก ๆ แบบปรับอัตราภาษีแล้วทำให้ราคาบุหรี่เพิ่มขึ้นทันที 10 เท่า 100 เท่า อย่างฉับพลัน นั่นเอง++

โดยการขึ้นอัตราภาษีแบบก้าวกระโดดอย่างฉับพลัน จะทำให้เกิดการหักดิบของนักสูบ เพราะไม่มีเงินไปซื้อบุหรี่มาสูบ หรือไม่ก็เอาเงินไปซื้อบุหรี่มาสูบ จนไม่มีเงินไปซื้ออาหารทำให้เกิดภาวะทุพโภชนาการจนหมดอายุขัยไปเอง

การปรับขึ้นภาษีในอดีตที่ผ่านมาทุกประเทศล้วนใช้วิธีการแบบค่อย ๆ เป็น ค่อย ๆ ไป เพื่อรีดเลือดจากเหล่าผู้ชื่นชอบควัน หรือที่เรารู้จักกันในชื่อ “ภาษีบาป” นั่นเอง โดยรัฐต่าง ๆ ล้วนอ้างว่าเก็บภาษีเหล่านี้เพื่อไปสร้างประโยชน์ให้ด้านอื่นของสังคม แต่มันจะดีกว่าหรือไม่ ถ้าไม่มีธุรกิจบุหรี่/ ยาสูบ ที่คอยทำลายสุขภาพประชาชน และเป็นต้นเหตุให้เกิดปัญหาค่าใช้จ่ายด้านสาธารณสุขที่บานปลาย เพื่อรักษาโรคร้ายแรงต่าง ๆ ที่เกิดจากการสูบบุหรี่ อย่างเช่นทุกวันนี้

ทำไมมาตรการขึ้นอัตราภาษีแบบก้าวกระโดด อาจไม่ช่วยจำนวนผู้สูบ

จากข่าว โรงงานยาสูบค้านการขึ้นภาษีบุหรี่แบบอัตราเดียว เพราะเกรงว่าจะไม่ได้ทำให้จำนวนผู้สูบลดลง

การใช้มาตรการด้านอุปทาน อย่างการขึ้นอัตราภาษีสินค้าในประเทศ จะทำให้ราคาสินค้าในตลาดเพิ่มสูงขึ้น ทำให้เกิดแรงจูงใจให้ผู้ประกอบการบางรายหาสินค้าหนีภาษีมาจำหน่ายให้ผู้บริโภคในประเทศ

ด้วยเหตุนี้ หากภาครัฐไม่มีมาตรการควบคุมสินค้าหนีภาษีที่เข้มข้น เมื่อมีการขึ้นอัตราภาษีบุหรี่ในประเทศ ก็จะเกิดการลักลอบนำเข้าบุหรี่จากประเทศใกล้เคียงที่มีอัตราภาษีน้อยกว่าเข้ามาขายให้ผู้สูบชาวไทย จึงทำให้ภาครัฐสูญเสียจำนวนภาษีที่ควรจะได้จากภาษีรายได้ของผู้ประกอบการ และภาษีสรรพสามิตของการขายบุหรี่ อีกทั้งจำนวนผู้สูบก็ไม่ได้ลดลงแต่อย่างใด ทำให้ค่าใช้จ่ายด้านสาธารณสุขยังคงสูงเช่นเดิม

-

@ f3df9bc0:a95119eb

2024-02-06 17:41:58

@ f3df9bc0:a95119eb

2024-02-06 17:41:58U2FsdGVkX1+PPMF+/wmn/6FQPbun7rdQQo6OigCWq94U2DGMvDhENBv2p1bzGbjneXddrJhdPqAg+eErQ5WbY9+7O9qRWDeqrVhHvx9V4jyi1IX6tK7+IRCYBq31sJHvyT7LBmPzU6fzba3+ssiWMmllEAbbG18v/zQrFV6H3T9DktKTmDB7tLacXgOamL8JmeZu91N0S5e9dvxg4bz3M31b3zfJTCsE4UfcGtWNUso1Abjh+KwWXu3zK6ev8mskbcm1wdVVPyK3ZL+OBl3OEBAaxouKatHN5o7YivH+P1omqH0QiOBN5aFl6K5iOKIKWYg/1I+dJwxHVTO2PYHg7fcQVNc4I0dCqMSQ5adIS3IOIFQTKRdUILya0wb9/TflQWz+i9rBNCzTRLLRSn3sc3NIqNzeN+r+1vHsPRbkNpINWq3y0ARwhpJ83nM+sm0ENPdu716qwTdI+RvnJQSaK+YQGprxYIyAeCxqpRcdFi90hCbmpC+0H0wHAFWmJWfBaaYtVWLq+rmbDw2q5+mdfmxLNS1GkUP7McOC9Kamv9FFugoGs+9HvLgZv7NgBL8dqKt5y3QdZLLZwkbE8ozZL+xGFLx+PRnrdAqFx2in4a1Hk+cTefWbwr+QrQDXPEFbeMLPd4E1PReRmG4d52yH8zkAZMd/PxQnD2Vu2pder74hMhlsnK4wumdulM/BG6yo68VIe0GtBveok6iA+f07nttUAkJVM/QzaS8fgahwmebfnks6cTMuN/VKxyRd//sNokvjHMNTBHQnmL6UifYoWw==

-

@ 5e5fc143:393d5a2c

2024-01-04 12:44:26

@ 5e5fc143:393d5a2c

2024-01-04 12:44:26We are now given a choice of digital freedom #nostr .

Creativity for every nostrich is now unleashed from the cage of bigtech censorship , rules and algo. But freedom comes with responsibility so pick right one(s). I will try share here some learning experience both technical and also from fundamental point of view. Just wanted kick start this article n fill as we go like living reference document.

Nostr itself is an application layer protocol that can used beyond just social media mirco or long blogging. Each nostr client heavily dependent on back-end servers call nostr "Relay servers" or in short "rs" or "relays" Relays can hosted anywhere in clearnet internet, onion net , vpn , i2p , nym Relays are controlled by their respective admins based NIP specs that they select to implement according to own decisions. Relays can have certain ToS (Terms of Service) Rules to adhered too.

New users can choose and pick client or app (ios / android/ windows) with preset of relays in the simplest form , but other advanced users need to do a regular manual relay management.

Relay management is an active regular task based on where when n how you are using.

Relay list are saved within you npub profile backup file which can edited and broadcast anytime.

Relay management is an active regular task based on where when and how you are using.

Relay list always need to be updated time to time as and when needed.

2 Users MUST a common RELAY between them even if one only need to follow another. Occasionally you may notice certain npub accounts you are following already but cannot see frequent notes publish by them – one of cause maybe you not sharing a common relay

Most nostr client applications has SETTINGS where user choose add/remove relays Also user choose which function to enable - READ or WRITE

Relay list for your account is always saved within you npub profile backup file which can edited and broadcast anytime. Hence any app or browser when u login with you npub the same relay list will be enforced. There could valid reasons why u need have list for if you trying to save bandwidth and traveling.

Functions in app.getcurrent.io and primal.net app for mobile apple or android are ideal for user traveling abroad and wanted to save bandwidth since relay management is done the providers in backend and saves hassle for basic usage.

Remember if someone is selecting relay on your behalf then you may not be necessarily able to pull and get some specific and special content that you may need. Such providers like coracle and nostrid also give option to override the default relays they selected.

Relay types: They can be categorized by various features or policy or technologies.

FREE PUBLIC Relays vs PAID PUBLIC Relays

PAID relays provide unrestricted access / write / filtering options than FREE relays but both are public clearnet relays. Just subscribing to PAID relays will not solve all problems unless you choose the relays properly and enable settings correctly.

Private Replay or Tor Relays – normally not easily visible until unless someone tell you. You can also host own private relay not opened to internet of archive and back of your own notes.

The technical landscape in nostr can be fast changing as more NIPs get proposed or updated. Relays admin can choose implement certain NIPs or not based on policy or technical limitations.

Example NIP33 defines “long notes” aka blogs as you now reading this in habla site which #1 UI and site for "Editable" long notes – some relays donot implement or allow this. NIP07 is used for client authentication like nos2x and is implemented by all relays in fact.

To be continued again ... reference pics will added later also Hope this help you understand "why when what" to tune and maintain active set of proper relays. Relay Proxy, Relay aggregator or Relay multiplexer – Paid, Public, Free, Private, Event, Relays That’s all for now n more later ... Thank you 🙏 ! ⚡️ https://getalby.com/p/captjack ⚡️ PV 💜 🤙

References: https://habla.news/relays https://relay.exchange/ https://relays.vercel.app/ https://nostr.info/relays/ https://nostrudel.ninja/#/relays

Related Articles: https://thebitcoinmanual.com/articles/types-nostr-relays/ nostr:naddr1qqd5c6t8dp6xu6twvukkvctnwss92jfqvehhygzwdaehguszyrtp7w79k045gq80mtnpdxjuzl9t7vjxk52rv80f888y5xsd5mh55qcyqqq823cf39s98 https://habla.news/u/current@getcurrent.io/1694434022411

-

@ 7fa56f5d:751ac194

2024-02-06 11:28:05

@ 7fa56f5d:751ac194

2024-02-06 11:28:05I'm happy to announce a new release of Habla.

Nostr connect

Users can now login via Nostr Connect remote signers. Both

bunker://URLs and NIP-46 compatible nostr addresses (NIP-05) are supported.Local drafts

nostr:nevent1qqs2jfpse4akde0w2ljq0n8sytp7pmnrqj943ymyw5kets45ftvv5qspzpmhxue69uhkummnw3ezuamfdejsygyhcu9ygdn2v56uz3dnx0uh865xmlwz675emfsccsxxguz6mx8rygq4xs2f

Some users have reported Habla eating their blog posts. To avoid the issue Habla will now automatically save the post you are editing in local storage. The option to store drafts on nostr still exists if you want to continue editing from another client or device.

RTL languages

Habla is now translated to Hebrew. The translator was kind enough to review the RTL compatibility of the site and we have fixed multiple layout and text direction issues for RTL language users.

Extracting Habla core code

The core Habla code has been extracted to a library called ngine and I have ported several apps to it. These apps are currently using it:

nostr:naddr1qqxnzdesxvungvecxsungdpkqgs8lft0t45k92c78n2zfe6ccvqzhpn977cd3h8wnl579zxhw5dvr9qrqsqqql8kqf6n74

nostr:naddr1qqxnzdesxgunqvpexuersvp3qgs8lft0t45k92c78n2zfe6ccvqzhpn977cd3h8wnl579zxhw5dvr9qrqsqqql8k6zxwng

nostr:naddr1qqxnzd3exgmrsveh8yerqdfcqgsrx4k7vxeev3unrn5ty9qt9w4cxlsgzrqw752mh6fduqjgqs9chhgrqsqqql8kaulu0l

The next step is to start using it from Habla and document it so other nostr devs can leverage it for building apps quicker. The library has similar scope as Osty so will probably join forces with nostr:nprofile1qqsru22d9lfnnwck54qr4phrvey50h2q33xc0gqxv5j03ftn4efu4rspr9mhxue69uhhyetvv9ujumn0wdmksetjv5hxxmmd9uq3gamnwvaz7tmjv4kxz7tpvfkx2tn0wfnj7qgewaehxw309aex2mrp0yhxummnw3exzarf9e3k7mf0y2nv4h, expect some news about this soon.

Happy curating, reading and writing!

-

@ f866d5b1:c526b32f

2024-01-31 04:07:04

@ f866d5b1:c526b32f

2024-01-31 04:07:04“Greedflation" หรือ “เงินเฟ้อจากความโลภ” เกิดจากค่าจ้างที่คาดหวังในวงจรอุบาทว์ของระบบเศรษฐกิจ ที่เมื่อค่าจ้างเพิ่มขึ้นจะทำให้ราคาสินค้าในตลาดเพิ่มสูงตามไปด้วย เหตุการณ์นี้เกิดขึ้นมาได้ ก็เพราะว่าระบบเศรษฐกิจสามารถผลิตปริมาณเงินในระบบได้มากขึ้นเรื่อย ๆ ไม่สิ้นสุด

ทำไมถึงเกิด Greedflation

เหตุการณ์นี้ไม่ได้เกิดจากความโลภของกลุ่มใดกลุ่มหนึ่ง ดังคำกล่าวอ้างของภาครัฐที่พิมพ์เงินเข้ามาในระบบแบบไม่หยุดยั้ง หากพวกเขาไม่ขึ้นราคาสินค้า ขณะที่สินค้าอย่างอื่นมีราคาสูงขึ้น จะทำให้ความเป็นอยู่ของพวกเขาแย่ลง เพราะเงินของเขาซื้อของได้ปริมาณน้อยลง

ตัวอย่างเช่น ช่วงเหตุการณ์โควิดที่ผ่านมา รัฐบาลหลาย ๆ ประเทศมีการกระตุ้นเศรษฐกิจด้วยการแจกเงินให้ประชาชนบางกลุ่มไปใช้จ่าย จึงทำให้ประชาชนอีกกลุ่มที่ไม่ได้รับเงินอุดหนุนจากโครงการ แต่มีอาชีพที่สามารถขึ้นราคาสินค้าเพื่อชดเชยค่าจ้างที่คาดหวังของพวกเขาให้เทียบเท่ากลุ่มที่ได้รับเงินอุดหนุนจากภาครัฐ การที่ต้องขึ้นราคาสินค้าก็เพื่อทำให้พวกเขาสามารถใช้ชีวิตได้ตามปกติเหมือนที่เคยเป็นมา แม้ว่าสินค้าอื่น ๆ จะขึ้นราคาเพราะว่ามีความต้องการที่มากขึ้นจนผลิตสินค้าไม่ทันตามความต้องการของตลาด

หากปริมาณเงินคงที่ไม่มีการเปลี่ยนแปลง การที่สินค้าชนิดหนึ่งราคาสูงขึ้นไปเรื่อย ๆ ความต้องการก็จะลดลงเองตามธรรมชาติ แต่ "เงินเฟ้อจากความโลภ" ซึ่งเป็นคำสร้างใหม่ของคำว่า "วงจรอุบาทว์ทางเศรษฐกิจ" จะไม่เกิดขึ้น หากปริมาณเงินในระบบคงที่ไม่เปลี่ยนแปลง

ทางแก้ปัญหานี้มีรึเปล่า

ทางแก้ของปัญหานี้ก็คือ เราต้องมี “เงิน” ที่มีปริมาณจำกัด ไม่สามารถผลิตซ้ำใหม่ได้ ซึ่งเราโชคดีมากที่ยุคนี้ได้เกิด “เงิน” ที่มีคุณสมบัติดังกล่าว นั่นคือ Bitcoin ที่ริเริ่มโดยบุคคลที่ใช้นามแฝงว่า Satoshi Nakamoto

-

@ 3bf0c63f:aefa459d

2024-01-29 02:19:25

@ 3bf0c63f:aefa459d

2024-01-29 02:19:25Nostr: a quick introduction, attempt #1

Nostr doesn't have a material existence, it is not a website or an app. Nostr is just a description what kind of messages each computer can send to the others and vice-versa. It's a very simple thing, but the fact that such description exists allows different apps to connect to different servers automatically, without people having to talk behind the scenes or sign contracts or anything like that.

When you use a Nostr client that is what happens, your client will connect to a bunch of servers, called relays, and all these relays will speak the same "language" so your client will be able to publish notes to them all and also download notes from other people.

That's basically what Nostr is: this communication layer between the client you run on your phone or desktop computer and the relay that someone else is running on some server somewhere. There is no central authority dictating who can connect to whom or even anyone who knows for sure where each note is stored.

If you think about it, Nostr is very much like the internet itself: there are millions of websites out there, and basically anyone can run a new one, and there are websites that allow you to store and publish your stuff on them.

The added benefit of Nostr is that this unified "language" that all Nostr clients speak allow them to switch very easily and cleanly between relays. So if one relay decides to ban someone that person can switch to publishing to others relays and their audience will quickly follow them there. Likewise, it becomes much easier for relays to impose any restrictions they want on their users: no relay has to uphold a moral ground of "absolute free speech": each relay can decide to delete notes or ban users for no reason, or even only store notes from a preselected set of people and no one will be entitled to complain about that.

There are some bad things about this design: on Nostr there are no guarantees that relays will have the notes you want to read or that they will store the notes you're sending to them. We can't just assume all relays will have everything — much to the contrary, as Nostr grows more relays will exist and people will tend to publishing to a small set of all the relays, so depending on the decisions each client takes when publishing and when fetching notes, users may see a different set of replies to a note, for example, and be confused.

Another problem with the idea of publishing to multiple servers is that they may be run by all sorts of malicious people that may edit your notes. Since no one wants to see garbage published under their name, Nostr fixes that by requiring notes to have a cryptographic signature. This signature is attached to the note and verified by everybody at all times, which ensures the notes weren't tampered (if any part of the note is changed even by a single character that would cause the signature to become invalid and then the note would be dropped). The fix is perfect, except for the fact that it introduces the requirement that each user must now hold this 63-character code that starts with "nsec1", which they must not reveal to anyone. Although annoying, this requirement brings another benefit: that users can automatically have the same identity in many different contexts and even use their Nostr identity to login to non-Nostr websites easily without having to rely on any third-party.

To conclude: Nostr is like the internet (or the internet of some decades ago): a little chaotic, but very open. It is better than the internet because it is structured and actions can be automated, but, like in the internet itself, nothing is guaranteed to work at all times and users many have to do some manual work from time to time to fix things. Plus, there is the cryptographic key stuff, which is painful, but cool.

-

@ f866d5b1:c526b32f

2024-01-31 04:04:21

@ f866d5b1:c526b32f

2024-01-31 04:04:21จริง ๆ แล้ว พวกเราไม่จำเป็นต้องมีอะไรมาครอบงำเพื่อบงการให้เรากระทำอะไรก็ตาม แต่พวกเรายอมให้มีกฎหมายมาครอบไว้เพื่อไม่ให้มีเหล่าสัตว์ประหลาดเกิดขึ้นมาทำลายล้างพวกเรากันเอง

แต่เมื่อกฎหมายไม่ได้ถูกใช้ตามหน้าที่ของมันที่ถูกสร้างมา ก็จะบังเกิดสัตว์ประหลาดมาทำหน้าที่เป็น “ศาลเตี้ย” จนสังคมเกิดความอลม่านวุ่นวายไม่จบสิ้น

ความโกลาหลจะถึงบทสุดท้าย ก็ต่อเมื่อเราทุกคนเล่นกันตามกฎกติกาโดยไม่บิดพริ้ว ทว่าระบบนิเวศที่ขยายตัวขึ้นเรื่อย ๆ เราไม่มีทางที่จะเกิดมติเอกฉันท์อีกต่อไป ซึ่งเหตุการณ์แบบนี้จะทำให้ทุกคนมีความสุขทั้งหมด

ดังนั้นเราจึงใช้ระบบประชาธิปไตย ที่จุดหมายแท้จริงมิใช่การเอาชนะเกินกึ่งหนึ่งของทั้งหมด แต่เป็นการที่เราจะใช้ชีวิตร่วมกันแบบประนีประนอม ฟังความเห็นเสียงอีกฟากหนึ่งด้วย

ประชาธิปไตย ไม่ได้มีเพียงแค่ "สิทธิ" แต่มันมาพร้อมกับ "หน้าที่" ด้วย และ "เสรีภาพ" ก็ไม่ได้หมายถึงการจะทำอะไรก็ได้ตามอำเภอใจ แต่ต้องคำนึงถึง "สิทธิ" และ "เสรีภาพ" ของผู้อื่นในสังคมด้วยเช่นกัน

หากเราดันทุรังยึดแต่คำว่า “เสียงข้างมาก” มันก็ไม่ต่างอะไรกับคำว่า “เผด็จการ” นั่นเอง

黄彬三 (SunnyMoo) นักเรียนเศรษฐศาสตร์อาวุโส ที่ชื่นชอบหลากหลายกีฬา (ยกเว้นวอลเลย์บอล) และบิตคอยน์

-

@ f866d5b1:c526b32f

2024-01-31 03:59:39

@ f866d5b1:c526b32f

2024-01-31 03:59:39การทำนายดวงชะตาด้วยการใช้ไพ่ชนิดต่าง ๆ ไม่ว่าจะเป็นไพ่ทาโรต์ (ไ่พ่ยิปซี)/ ไพ่ออราเคิล/ ไพ่เลอเนอมองด์ ฯลฯ เป็นการทำนายแบบสุ่ม ที่เราเชื่อกันว่า “จิตใต้สำนึกของเราจะสั่งการให้หยิบไพ่ที่มีความหมายตรงกับความรู้สึกที่แท้จริงของเรื่องต่าง ๆ ที่เราต้องการทราบคำตอบ” แล้วเราควรถามคำถามแบบไหนเมื่อไปดูดวงด้วยการใช้ไพ่ทาโรต์/ ไพ่ออราเคิล หรือไพ่ชนิดอื่น ๆ ในการดูดวง

การถามคำถามที่ต้องการคำตอบว่า “ใช่” หรือ “ไม่ใช่” แบบการันตีความแม่น เป็นรูปแบบคำถามที่ไม่ควรใช้ในการดูดวงด้วยไพ่รูปแบบต่าง ๆ เช่น ไ่พ่ทาโรต์ (ไพ่ยิปซี) เป็นต้น เพราะว่า “อคติ” ของคนหยิบไพ่ อาจทำให้จิตใต้สำนึกสั่งให้หยิบไพ่ที่มีความหมายตามคำตอบที่ต้องการให้เกิดขึ้น

ด้วยเหตุนี้จึงเกิดประเด็นหมอดูทายพลาดเกิดขึ้นอยู่เป็นประจำ แม้ว่าหมอดูท่านนั้นจะอ่านความหมายของไพ่ทำนายได้ถูกต้องตามที่ได้ร่ำเรียนกันมา และมีประสบการณ์ที่ได้พบเจอมามากมายตลอดระยะเวลาในการประกอบอาชีพนักพยากรณ์

ตัวอย่างคำถามที่มักทำให้ทายพลาด

งวดนี้จะถูกหวยไหม? หุ้นตัวนี้ราคาจะขึ้นหรือจะลง? เดือนหน้าจะไปสอบเข้า จะสอบติดรึเปล่า?

แล้วควรถามคำถามรูปแบบไหนดีล่ะ

ถ้าเราซื้อหวยงวดนี้จะเป็นยังไงบ้างนะ? ถ้าซื้อหุ้นตัวนี้ อีก 3 เดือนข้างหน้า เราจะรู้สึกอย่างไรบ้างนะ? ถ้าต้องการสอบผ่านในการสอบเข้าเดือนหน้า ควรทำอย่างไรบ้างนะ?

ช่วงโฆษณา

สนใจดูดวงด้วยไพ่ทาโรต์/ ไพ่ออราเคิล/ หรือลูกเต๋าออราเคิล สามารถติดต่อ SunnyMoo Horo ได้ทาง Nostr: sunnymoo@nostrplebs.com Facebook: https://facebook.com/sunnymoohoro

ค่าบริการดูดวง แบบจัดเต็ม

ครั้งละ 30 นาที ราคา 489 บาท เริ่มต้นด้วยการดูพื้นดวงของเจ้าชะตา จากนั้นสามารถถามคำถามที่ต้องการทราบเพิ่มเติมได้ตามต้องการจนครบเวลาที่กำหนด

ค่าบริการดูดวง แบบ Minimal

หากต้องการทราบคำแนะนำของปัญหาต่าง ๆ ที่คาใจ แบบรายคำถาม ราคาคำถามละ 55 บาท

-

@ f977c464:32fcbe00

2024-01-30 20:06:18

@ f977c464:32fcbe00

2024-01-30 20:06:18Güneşin kaybolmasının üçüncü günü, saat öğlen on ikiyi yirmi geçiyordu. Trenin kalkmasına yaklaşık iki saat vardı. Hepimiz perondaydık. Valizlerimiz, kolilerimiz, renk renk ve biçimsiz çantalarımızla yan yana dizilmiş, kısa aralıklarla tepemizdeki devasa saati kontrol ediyorduk.

Ama ne kadar dik bakarsak bakalım zaman bir türlü istediğimiz hızla ilerlemiyordu. Herkes birkaç dakika sürmesi gereken alelade bir doğa olayına sıkışıp kalmış, karanlıktan sürünerek çıkmayı deniyordu.

Bekleme salonuna doğru döndüm. Nefesimden çıkan buharın arkasında, kalın taş duvarları ve camlarıyla morg kadar güvenli ve soğuk duruyordu. Cesetleri o yüzden bunun gibi yerlere taşımaya başlamışlardı. Demek insanların bütün iyiliği başkaları onları gördüğü içindi ki gündüzleri gecelerden daha karanlık olduğunda hemen birbirlerinin gırtlağına çökmüş, böğürlerinde delikler açmış, gözlerini oyup kafataslarını parçalamışlardı.

İstasyonun ışığı titrediğinde karanlığın enseme saplandığını hissettim. Eğer şimdi, böyle kalabalık bir yerde elektrik kesilse başımıza ne gelirdi?

İçerideki askerlerden biri bakışlarımı yakalayınca yeniden saate odaklanmış gibi yaptım. Sadece birkaç dakika geçmişti.

“Tarlalarım gitti. Böyle boyum kadar ayçiçeği doluydu. Ah, hepsi ölüp gidiyor. Afitap’ın çiçekleri de gi-”

“Dayı, Allah’ını seversen sus. Hepimizi yakacaksın şimdi.”

Karanlıkta durduğunda, görünmez olmayı istemeye başlıyordun. Kimse seni görmemeli, nefesini bile duymamalıydı. Kimsenin de ayağının altında dolaşmamalıydın; gelip kazayla sana çarpmamalılar, takılıp sendelememeliydiler. Yoksa aslında hedefi sen olmadığın bir öfke gürlemeye başlar, yaşadığın ilk şoku ve acıyı silerek üstünden geçerdi.

İlk konuşan, yaşlıca bir adam, kafasında kasketi, nasırlı ellerine hohluyordu. Gözleri ve burnu kızarmıştı. Güneşin kaybolması onun için kendi başına bir felaket değildi. Hayatına olan pratik yansımalarından korkuyordu olsa olsa. Bir anının kaybolması, bu yüzden çoktan kaybettiği birinin biraz daha eksilmesi. Hayatta kalmasını gerektiren sebepler azalırken, hayatta kalmasını sağlayacak kaynaklarını da kaybediyordu.

Onu susturan delikanlıysa atkısını bütün kafasına sarmış, sakalı ve yüzünün derinliklerine kaçmış gözleri dışında bedeninin bütün parçalarını gizlemeye çalışıyordu. İşte o, güneşin kaybolmasının tam olarak ne anlama geldiğini anlamamış olsa bile, dehşetini olduğu gibi hissedebilenlerdendi.

Güneşin onlardan alındıktan sonra kime verileceğini sormuyorlardı. En başta onlara verildiğinde de hiçbir soru sormamışlardı zaten.

İki saat ne zaman geçer?

Midemin üstünde, sağ tarafıma doğru keskin bir acı hissettim. Karaciğerim. Gözlerimi yumdum. Yanımda biri metal bir nesneyi yere bıraktı. Bir kafesti. İçerisindeki kartalın ıslak kokusu burnuma ulaşmadan önce bile biliyordum bunu.

“Yeniden mi?” diye sordu bana kartal. Kanatları kanlı. Zamanın her bir parçası tüylerinin üstüne çöreklenmişti. Gagası bir şey, tahminen et parçası geveliyor gibi hareket ediyordu. Eski anılar kolay unutulmazmış. Şu anda kafesinin kalın parmaklıklarının ardında olsa da bunun bir aldatmaca olduğunu bir tek ben biliyordum. Her an kanatlarını iki yana uzatıverebilir, hava bu hareketiyle dalgalanarak kafesi esneterek hepimizi içine alacak kadar genişleyebilir, parmaklıklar önce ayaklarımızın altına serilir gibi gözükebilir ama aslında hepimizin üstünde yükselerek tepemize çökebilirdi.

Aşağıya baktım. Tahtalarla zapt edilmiş, hiçbir yere gidemeyen ama her yere uzanan tren rayları. Atlayıp koşsam… Çantam çok ağırdı. Daha birkaç adım atamadan, kartal, suratını bedenime gömerdi.

“Bu sefer farklı,” diye yanıtladım onu. “Yeniden diyemezsin. Tekrarladığım bir şey değil bu. Hatta bir hata yapıyormuşum gibi tonlayamazsın da. Bu sefer, insanların hak etmediğini biliyorum.”

“O zaman daha vahim. Süzme salaksın demektir.”

“İnsanların hak etmemesi, insanlığın hak etmediği anlamına gelmez ki.”

Az önce göz göze geldiğim genççe ama çökük asker hâlâ bana bakıyordu. Bir kartalla konuştuğumu anlamamıştı şüphesiz. Yanımdakilerden biriyle konuştuğumu sanmış olmalıydı. Ama konuştuğum kişiye bakmıyordum ona göre. Çekingence kafamı eğmiştim. Bir kez daha göz göze geldiğimizde içerideki diğer iki askere bir şeyler söyledi, onlar dönüp beni süzerken dışarı çıktı.

Yanımızdaki, az önce konuşan iki adam da şaşkınlıkla bir bana bir kartala bakıyordu.

“Yalnız bu sefer kalbin de kırılacak, Prometheus,” dedi kartal, bana. “Belki son olur. Biliyorsun, bir sürü soruna neden oluyor bu yaptıkların.”

Beni koruyordu sözde. En çok kanıma dokunan buydu. Kasıklarımın üstüne oturmuş, kanlı suratının ardında gözleri parlarken attığı çığlık kulaklarımda titremeye devam ediyordu. Bu tabloda kimsenin kimseyi düşündüğü yoktu. Kartalın, yanımızdaki adamların, artık arkama kadar gelmiş olması gereken askerin, tren raylarının, geçmeyen saatlerin…

Arkamı döndüğümde, asker sahiden oradaydı. Zaten öyle olması gerekiyordu; görmüştüm bunu, biliyordum. Kehanetler… Bir şeyler söylüyordu ama ağzı oynarken sesi çıkmıyordu. Yavaşlamış, kendisini saatin akışına uydurmuştu. Havada donan tükürüğünden anlaşılıyordu, sinirliydi. Korktuğu için olduğunu biliyordum. Her seferinde korkmuşlardı. Beni unutmuş olmaları işlerini kolaylaştırmıyordu. Sadece yeni bir isim vermelerine neden oluyordu. Bu seferkiyle beni lanetleyecekleri kesinleşmişti.

Olması gerekenle olanların farklı olması ne kadar acınasıydı. Olması gerekenlerin doğasının kötücül olmasıysa bir yerde buna dayanıyordu.

“Salaksın,” dedi kartal bana. Zamanı aşan bir çığlık. Hepimizin önüne geçmişti ama kimseyi durduramıyordu.

Sonsuzluğa kaç tane iki saat sıkıştırabilirsiniz?

Ben bir tane bile sıkıştıramadım.

Çantama uzanıyordum. Asker de sırtındaki tüfeğini indiriyordu. Benim acelem yoktu, onunsa eli ayağı birbirine dolaşıyordu. Oysaki her şey tam olması gerektiği anda olacaktı. Kehanet başkasının parmaklarının ucundaydı.

Güneş, bir tüfeğin patlamasıyla yeryüzüne doğdu.

Rayların üzerine serilmiş göğsümün ortasından, bir çantanın içinden.

Not: Bu öykü ilk olarak 2021 yılında Esrarengiz Hikâyeler'de yayımlanmıştır.

-

@ f866d5b1:c526b32f

2024-01-27 05:50:22

@ f866d5b1:c526b32f

2024-01-27 05:50:22ทุกสิ่งในโลกล้วนมีทั้งด้านความต้องการบริโภค (อุปสงค์) และด้านความต้องการผลิต (อุปทาน) อยู่เสมอ การแก้ปัญหาที่ต้องการให้เลิกบริโภคอย่างยั่งยืนต้องไปแก้ที่ต้นเหตุ นั่นคือ ต้องลดความต้องการบริโภคสินค้าลงให้ได้ ไม่ใช่การขยันออกกฎหมายมาห้ามนู้นนี่นั่นไปเรื่อยเปื่อย

หากเราขยันออกกฎหมายมาห้าม ก็ต้องมีการบังคับใช้กฎหมายอย่างเข้มงวดทุกกรณี เช่น การห้ามเด็กอายุต่ำกว่า 20 ปี ซื้อเครื่องดื่มที่มีแอลกอฮอล์ ก็ต้องทำให้เข้มงวด รัดกุม ไม่ใช่ปล่อยให้มีร้านขายของชำบางร้าน แอบขายให้เด็กที่อายุต่ำกว่า 20 ปี เป็นต้น การแก้ปัญหาความต้องการบริโภคสินค้าเสพติดแบบยั่งยืนต้องแก้ที่ด้านอุปสงค์ ซึ่งเครื่องมือของรัฐที่มีไว้ใช้ในการลดจำนวนนักดื่มคือ การให้ความรู้ หรือ การเก็บภาษี ซึ่งมาตรการให้ความรู้ที่ถูกต้องมันยุ่งยากและใช้เวลาในการดำเนินนโยบายมากกว่ามาตรการเก็บภาษี

หากจะใช้มาตรการเก็บภาษีเพื่อแก้ปัญหาที่มาจากด้านอุปสงค์ ก็ต้องเก็บภาษีแบบเซอร์ไพร์ส คือประกาศขึ้นอัตราภาษีเหล้าเบียร์แบบสูงลิบลิ่วและไม่ทันได้ตั้งตัว ซึ่งอย่างเหล้าเบียร์เนี่ย มันเป็นสินค้าทดแทนได้ยาก เพราะมันเป็นเครื่องดื่มที่เสพแล้วติด จึงต้องเก็บภาษีให้สูงมาก ๆ เพื่อลดจำนวนนักดื่มลงมา

หรือไม่รัฐบาลก็ต้องให้ความรู้ความเข้าใจที่ถูกต้องถึงผลเสียที่ตามมาจากการดื่มเหล้าเบียร์ที่มากเกินไป หรือหาสินค้าทดแทนอื่น ๆ ที่สร้างความมึนเมา และสนุกสนานในวงสนทนา ที่ส่งผลเสียต่อสุขภาพน้อยกว่า มาให้ประชาชนได้บริโภคแทนเหล้าเบียร์ นั่นเอง

มิเช่นนั้น มาตรการภาษีที่ใช้ไป ก็เป็นแค่เพียงเครื่องมือในการสร้างรายได้ให้ภาครัฐเอาไปถลุงในเรื่องต่าง ๆ ที่อาจไม่เกิดประโยชน์แท้จริงต่อส่วนรวม ไม่ได้ทำให้ปัญหาที่เกิดจากการดื่มเครื่องดื่มแอลกอฮอล์มากเกินไป หายไปจากสังคมนั้นอย่างถาวร

-

@ 2f7463a4:e92b8023

2024-01-27 00:11:21

@ 2f7463a4:e92b8023

2024-01-27 00:11:21Dies ist die deutsche Übersetzung von / This is the German translation of :

nostr:naddr1qqxnzd3cxserxdpsxverzwp4qgs87hptfey2p607ef36g6cnekuzfz05qgpe34s2ypc2j6x24qvdwhgrqsqqqa28zcj37a — nostr:npub10awzknjg5r5lajnr53438ndcyjylgqsrnrtq5grs495v42qc6awsj45ys7

Weitere Übersetzungen / Other translations : - Spanisch / Spanish : nostr:naddr1qqx9zat994jhxttgv93xccgzypl4c26wfzswnlk2vwjxky7dhqjgnaqzqwvdvz3qwz5k3j4grrt46qcyqqq823cf6w59v — nostr:npub138s5hey76qrnm2pmv7p8nnffhfddsm8sqzm285dyc0wy4f8a6qkqtzx624

Habla ist eine auf Nostr basierende Plattform, mit der du umfangreiche Beiträge erstellen und verwalten kannst. Man könnte es mit Medium vergleichen, aber Habla ist viel mehr als das. Habla ist herkömmlichen Blogging-Plattformen überlegen, weil es auf Nostr basiert. Es ist mit einer Vielzahl anderer Nostr-Apps interoperabel, was die Benutzererfahrung nahtlos und fesselnd macht. Darüber hinaus können deine Inhalte, wenn sie von den Lesern als wertvoll empfunden werden, dank des Lightning-Netzwerkes sofort mit dem besten Geld, das die Menschheit je gesehen hat, belohnt werden: Bitcoin.

Was ist Nostr?

Nostr ist eine neue Art der Online-Kommunikation, die ihren Nutzern zahlreiche Vorteile bietet. Nostr ist für alle kostenlos, man braucht keine ID oder andere Verifizierung durch Dritte, um sich anzumelden, Gleichgesinnte zu treffen und die Community um sich herum zu vergrößern. Nostr wird oft mit einer Social-Media-Plattform verwechselt, ist aber viel mehr als das. Wir empfehlen dir einen Blick auf die hier gesammelten Nostr-Ressourcen zu werfen, um die potenzielle Dimension dieses Tools zu erkennen.

Wie melde ich mich bei Habla an?

Um auf Habla zu schreiben, erstelle einfach ein Habla/Nostr-Konto und melde dich an. Folge diesen einfachen Schritten, um dich zu registrieren, Mehrwert zu bieten und Gegenwert zurückzuerhalten.

Wie verdiene ich mit Habla?

Habla ermöglicht es, Werte direkt von deinen Lesern zu erhalten. Es ist kein Bankkonto oder Ausweis erforderlich. Verbinde einfach deine Lightning-Adresse mit deinem Habla/Nostr-Konto und erhalte Geld direkt auf dein Wallet – ohne Dritte, ohne Warten auf Abhebungen, ohne Stress. Folge diesen einfachen Schritten, um loszulegen.

Warum ist das Publizieren auf Habla anders?

Das Nostr-Protokoll ist sehr schlank, was einige Besonderheiten im Verhalten von Nostr-basierten Anwendungen mit sich bringt. Wir gehen hier nicht auf die technischen Details ein, aber der offensichtlichste Unterschied, den du als Autor bemerken wirst, ist, dass du ein anderes und möglicherweise ungewohntes Textformat für deine Beiträge verwenden musst. Aber keine Angst, Habla bietet Tools, die diesen Prozess einfach und intuitiv machen. Hier ist ein kurzes Video von nostr:npub1wkljx5c6a8uccc5etws8ry0y3r4dgavh2dcav0tal4rtmcdl4z2sfu5u0t, das die Grundlagen des Publizierens mit Habla erklärt (der Leitfaden wurde vor dem Redesign erstellt, ist aber immer noch nützlich):

https://nostr.build/p/nb9474.mp4

Habla (und viele andere Nostr-Anwendungen) verwendet das etablierte Format Markdown. Das gibt es schon seit fast einem Jahrzehnt und wird von den meisten Apps, die du jeden Tag benutzt, unterstützt. Der Grund, warum du vielleicht noch nichts von Markdown gehört hast, ist, dass herkömmliche Anwendungen es normalerweise vor dem Benutzer verbergen, und wir arbeiten daran, dies auch zu tun. Mehr über Markdown kannst du hier herausfinden.

Wo werden meine Inhalte gespeichert?

Herkömmliche Blogging-Plattformen speichern die Inhalte auf ihren eigenen Servern. Das ist ein bequemer und (früher) solider Ansatz, der aber auch kritische Risiken birgt. Wenn du die Früchte deiner Arbeit einer einzigen Partei überlässt, hat diese die vollständige Kontrolle über deine Inhalte. Nostr löst dieses Problem. Jedes Mal, wenn du etwas veröffentlichst, wird dein Inhalt an zahlreiche Relais zur Speicherung und Verbreitung weitergeleitet. Wenn ein Relais-Betreiber deinen Beitrag blockiert oder sich weigert, ihn weiterzuverbreiten, können deine Leser auf andere Relais zurückgreifen, um Zugang zu deinen Inhalten zu erhalten (keine Sorge, wenn das kompliziert klingt, alles geschieht unter der Haube). Auf diese Weise wird sichergestellt, dass du niemals zum Schweigen gebracht wirst. Wir haben uns entschieden, uns auf das zu konzentrieren, was wir am besten können: eine intuitive, effiziente und einfach zu bedienende Blogging-Plattform zu entwickeln, die sich lohnt – und das Speichern und Verbreiten von Inhalten den Profis auf diesem Gebiet zu überlassen.

Wie publiziere ich?

Habla bietet alle Tools, die du brauchst, um eindrucksvolle Artikel zu erstellen, die sich von anderen abheben. Bereite deinen Artikel vor, formatiere deinen Text mit den entsprechenden Tools, füge Medien hinzu und schau dir das Ergebnis vor Veröffentlichung selbst noch einmal an. Alles, was du brauchst, steht dir zur Verfügung, und die Plattform wird von Tag zu Tag besser und benutzerfreundlicher.

Wer kann meine Beiträge auf Habla lesen?

Jeder im Internet kann deine Beiträge lesen. Wenn deine Leser jedoch mit deiner Arbeit interagieren möchten – sei es durch Folgen, Kommentieren oder indem sie dir etwas zurückgeben möchten – sollten sie ein Nostr-Konto einrichten. Wir ermutigen dich, deine Follower einzubeziehen, um eine blühende Community aufzubauen und neue Höhen zu erreichen. Diese Kurzanleitung wird dir und deinen Fans den Einstieg erleichtern.

Dieses FAQ befindet sich in ständiger Entwicklung und wird sich in dem Maße ändern, wie Habla und Nostr zu noch leistungsfähigeren Tools werden. Bitte teile mir dein Feedback mit, damit ich es noch besser machen kann.

-

@ 52387c6b:49dbdfb2

2024-01-21 04:27:58

@ 52387c6b:49dbdfb2

2024-01-21 04:27:58Chef's notes

Easy start to the day, can also put some Woostr in your Bloody Mary. Perfect for washing down the toast. Breakfast of champions. If you have some sharp cheddar you can melt this on the toast, altho this may prove too complex for the average bloke, just an option. Be mindful this will add significant prep and cook time. 2-3 minutes

Details

- ⏲️ Prep time: 30 sec

- 🍳 Cook time: 2 min

- 🍽️ Servings: 1

Ingredients

- 2 slices of bread

- Butter

- Woostr sauce

- Bloody Mary

Directions

- Toast bread to your liking, lather a dollop of butter on. Criss cross the toast with a butter knife ( so the woostr dont roll off) and then drizzle on woostr.

-

@ 28246aee:62b108ad

2024-02-05 17:10:53

@ 28246aee:62b108ad

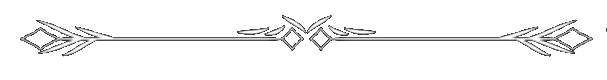

2024-02-05 17:10:53This post was originally published on https://tftc.io by Marty Bent.

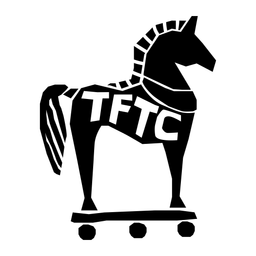

Business owners are currently facing the challenge of protecting their assets against the dual threats of US dollar inflation and Bitcoin's historical volatility. Inflation erodes the purchasing power of the dollar, while Bitcoin's price swings can introduce risk into a company’s financial strategy. This presentation provides an analytical approach to navigating these issues.

Inflation and its Impact

The purchasing power of the US dollar has significantly diminished since 1980, with a notable increase in the rate of this decline in recent times. Inflation rates are a critical concern for business owners as they directly affect balance sheets and the cost of doing business. The M2 monetary base, an important measure of the money supply, has surged from $8.27 trillion in January 2009 to approximately $21 trillion recently. This represents an increase of $13 trillion since the inception of Bitcoin.

Furthermore, the total federal debt has grown from around $10.7 trillion in 2009 to over $34 trillion. The ratio of national debt to the M2 money stock has increased from 1.26 to 1.68 within the same period, suggesting that debt expansion has outpaced monetary base growth. These factors indicate that inflation is unlikely to be tamed shortly and may worsen if the Federal Reserve cuts rates.

[

Bitcoin’s 15 Years In Perspective | Marty Bent

Today is a better day than most to put the current problems people are facing into perspective. To do this, let’s take a look at what the monetary and debt landscape looking like around the time bitcoin was launched.

TFTC – Truth for the CommonerMarty Bent

TFTC – Truth for the CommonerMarty Bent

](https://tftc.io/bitcoin-15-years/)

Bitcoin’s Price Volatility

Bitcoin's price has been highly volatile since its creation in 2009. For instance, daily volatility can sometimes reach 5%, with significant price swings occurring within short timeframes. This volatility is attributed to the fact that Bitcoin is a new monetary good, monetizing in real-time during the past decade. As Bitcoin is a novel asset class undergoing rapid adoption, its price fluctuations are a natural consequence of its evolution.

Despite this, historical data indicates a trend of decreasing volatility over the years. As understanding and confidence in Bitcoin grow, its role as a long-term savings vehicle becomes more pronounced, potentially leading to a stabilization in price volatility. When viewed on a logarithmic scale, Bitcoin's price trend shows a consistent upward trajectory despite short-term fluctuations.

Strategies for Business Owners

Business owners seeking to hedge against inflation using Bitcoin should approach the situation with a clear plan. This involves analyzing their balance sheet, cash flows, and profits to determine an appropriate Bitcoin allocation strategy. Rather than making impulsive decisions, a disciplined approach, such as dollar-cost averaging, can mitigate the risks associated with price volatility.

Planning for Bitcoin exposure on the balance sheet also requires a psychological shift. Rather than focusing solely on the downside risk, business owners should consider the potential for Bitcoin to appreciate in value over time. Allocating a percentage of profits or cash flow to Bitcoin as part of a long-term savings strategy can capture this upside potential.

In addition to traditional cash flow management, businesses can explore innovative ways to generate "sats flows," which refer to revenue streams denominated in Bitcoin's smallest unit, satoshis. Utilizing platforms like Podcasting 2.0 allows businesses to receive Bitcoin tips directly from customers, creating an additional revenue stream that can be accumulated without immediate conversion to fiat currency.

[

Bitcoin Treasury - The Fourth Lever to Equity Value Growth

While building products and services in the growing bitcoin ecosystem will not ensure success, a company’s proclivity for success is inevitably correlated to bitcoin’s upside.

TFTC – Truth for the CommonerGrant Gilliam

TFTC – Truth for the CommonerGrant Gilliam

](https://tftc.io/bitcoin-treasury/)

Conclusion

In conclusion, business owners must remain vigilant in the face of rising inflation and Bitcoin volatility. By understanding the economic landscape, developing a well-thought-out investment strategy, and adopting new technological solutions for revenue generation, businesses can navigate these dueling forces effectively. Planning, discipline, and a forward-thinking approach are essential to managing the balance sheet risks associated with inflation and Bitcoin's volatility.

-

@ 599f67f7:21fb3ea9

2024-02-03 13:01:33

@ 599f67f7:21fb3ea9

2024-02-03 13:01:33Conectarse a muchos relays nostr puede agotar rápidamente la batería y el ancho de banda, especialmente si utilizas nostr en tu teléfono. Conectarse a los relays a través de un proxy nostr puede reducir el consumo de ancho de banda y de batería, además de ofrecer la ventaja adicional de ocultar tu dirección IP real a los relays.

¿Cómo funciona?

Un proxy nostr se conecta a un grupo de relays. Obtiene y publica eventos en esos relays. La aplicación cliente sólo necesita abrir una conexión websocket hacia el proxy para acceder a todos los relays a los que el proxy está conectado.

Como el cliente sólo abre una conexión en lugar de muchas, ahorra ancho de banda y batería.

Como el proxy se conecta a los relays en nombre del cliente, la dirección IP del proxy se expone a los relays en lugar de la del cliente. (Aunque sigue siendo necesario confiar en el proveedor del proxy).

Cómo utilizarlo

Un proxy nostr puede ser fácilmente autoalojado. Echa un vistazo a este repo por nostr:npub1txukm7xckhnxkwu450sm59vh2znwm45mewaps4awkef2tvsgh4vsf7phrl para instrucciones de auto-alojamiento.

Para los que no tenemos recursos para autoalojarnos, Bitcoin Txoko alberga una instancia comunitaria.

Como puedes ver, está conectado a algunos de los relays más populares.

Para utilizarlo, sólo tienes que añadir

wss://nproxy.bitcointxoko.coma tu lista de relays.

También puedes eliminar los relays redundantes ahora que ya no necesitas conexiones directas con ellos.

Ya está. ¡Feliz zapping y nos vemos en nostr!

-

@ 11be7dbc:82a5f8e9

2024-02-06 16:01:37

@ 11be7dbc:82a5f8e9

2024-02-06 16:01:37In 2022, Cyberyen emerged seemingly out of thin air, presenting a potent response to the entrenched corruption within the cryptocurrency landscape. Its ideology has offered a simple yet powerful antidote, founded on the core principles of cypherpunk ideology—privacy, decentralization, and liberation from institutional control. Cyberyen rose as a rallying call against prevailing financial dominion.

This nascent ideology encapsulates a spirit of rebellion, aspiring to democratize finance and cultivate a community-centric digital economy. Today, in its embryonic stage, Cyberyen epitomizes a digital social contract, offering a liberated space where collaboration, innovation, and communal interaction flourished, unshackled from the constraints imposed by traditional financial frameworks.

Due to the fact that the original purity of cypherpunk's intentions—to stand as a symbolic rebellion against a corrupt system—gradually succumbed to the speculative frenzy dominating the financial world. Rather than upholding the foundational principles of a liberated digital society, cryptocurrency became synonymous with speculative bubbles, market frenzy, and the whims of investor sentiment.

Yet, amidst this moral decay, the idea of Cyberyen metamorphoses into a transformative force. Within the shadows of speculation lies the potential for the resurgence of community, innovation, and decentralization, aspiring to reclaim its intrinsic position in the realm of digital currencies. It evolves beyond a mere facilitator of transactions to shape a unique environment transcending conventional boundaries of geography, socio-economics, and governance.

Acknowledging Cyberyen's early stage invites envisioning it not merely as a digital coin but as a sovereign state—an intangible expanse where individual interactions shape its foundation. Much akin to our integration into society at birth, Cyberyen welcomes participants into a shared realm where interactions, engagements, and collaborations weave the fabric of a burgeoning digital society. Within this ethereal space, physical geography dissolves, allowing individuals globally to converge and coexist within the Cyberyen ecosystem.

At its core, Cyberyen functions as a decentralized, borderless platform, accessible to anyone with an internet connection. Serving as an overlay to societal and economic structures, it seamlessly integrates into participants' lives, transcending geographical limitations. This integration fosters an environment conducive to self-discovery, expression, and connectivity, reminiscent of familial, communal, and national landscapes shaping our physical realm identities.

Privacy and anonymity stand as pillars within this digital enclave, empowering users to engage without the necessity of divulging personal information. Such anonymity liberates individuals from societal judgments prevalent in the physical world, fostering authentic expression and interaction devoid of prejudice or discrimination.

Moreover, Cyberyen champions universal interaction, eradicating the barriers posed by country-specific regulations, currencies, or social delineations. This democratization creates a level playing field for all participants, irrespective of background or location. Its inherent inclusivity ensures that opportunities and resources are not bound by conventional societal frameworks but are accessible to individuals irrespective of their socio-economic status or geographic coordinates.

Cyberyen's integration extends beyond financial transactions, envisioning usability in decentralized marketplaces, social platforms, cultural spheres, and multifaceted activities, fundamentally reshaping societal structures.

Distinct from activist networks advocating complete anonymity and a dark market, Cyberyen does not aim to dismantle government institutions. Instead, it aspires to weave an independent, invisible environment—a transparent digital matrix offering an alternative mode of interaction and settlement between individuals.