-

@ 42342239:1d80db24

2024-09-26 07:57:04

@ 42342239:1d80db24

2024-09-26 07:57:04The boiling frog is a simple tale that illustrates the danger of gradual change: if you put a frog in boiling water, it will quickly jump out to escape the heat. But if you place a frog in warm water and gradually increase the temperature, it won't notice the change and will eventually cook itself. Might the decline in cash usage be construed as an example of this tale?

As long as individuals can freely transact with each other and conduct purchases and sales without intermediaries[^1] such as with cash, our freedoms and rights remain secure from potential threats posed by the payment system. However, as we have seen in several countries such as Sweden over the past 15 years, the use of cash and the amount of banknotes and coins in circulation have decreased. All to the benefit of various intermediated[^1] electronic alternatives.

The reasons for this trend include: - The costs associated with cash usage has been increasing. - Increased regulatory burdens due to stricter anti-money laundering regulations. - Closed bank branches and fewer ATMs. - The Riksbank's aggressive note switches resulted in a situation where they were no longer recognized.

Market forces or "market forces"?

Some may argue that the "de-cashing" of society is a consequence of market forces. But does this hold true? Leading economists at times recommend interventions with the express purpose to mislead the public, such as proposing measures who are "opaque to most voters."

In a working paper on de-cashing by the International Monetary Fund (IMF) from 2017, such thought processes, even recommendations, can be found. IMF economist Alexei Kireyev, formerly a professor at an institute associated with the Soviet Union's KGB (MGIMO) and economic adviser to Michail Gorbachov 1989-91, wrote that:

- "Social conventions may also be disrupted as de-cashing may be viewed as a violation of fundamental rights, including freedom of contract and freedom of ownership."

- Letting the private sector lead "the de-cashing" is preferable, as it will seem "almost entirely benign". The "tempting attempts to impose de-cashing by a decree should be avoided"

- "A targeted outreach program is needed to alleviate suspicions related to de-cashing"

In the text, he also offered suggestions on the most effective approach to diminish the use of cash:

- The de-cashing process could build on the initial and largely uncontested steps, such as the phasing out of large denomination bills, the placement of ceilings on cash transactions, and the reporting of cash moves across the borders.

- Include creating economic incentives to reduce the use of cash in transactions

- Simplify "the opening and use of transferrable deposits, and further computerizing the financial system."

As is customary in such a context, it is noted that the article only describes research and does not necessarily reflect IMF's views. However, isn't it remarkable that all of these proposals have come to fruition and the process continues? Central banks have phased out banknotes with higher denominations. Banks' regulatory complexity seemingly increase by the day (try to get a bank to handle any larger amounts of cash). The transfer of cash from one nation to another has become increasingly burdensome. The European Union has recently introduced restrictions on cash transactions. Even the law governing the Swedish central bank is written so as to guarantee a further undermining of cash. All while the market share is growing for alternatives such as transferable deposits[^1].

The old European disease

The Czech Republic's former president Václav Havel, who played a key role in advocating for human rights during the communist repression, was once asked what the new member states in the EU could do to pay back for all the economic support they had received from older member states. He replied that the European Union still suffers from the old European disease, namely the tendency to compromise with evil. And that the new members, who have a recent experience of totalitarianism, are obliged to take a more principled stance - sometimes necessary - and to monitor the European Union in this regard, and educate it.

The American computer scientist and cryptographer David Chaum said in 1996 that "[t]he difference between a bad electronic cash system and well-developed digital cash will determine whether we will have a dictatorship or a real democracy". If Václav Havel were alive today, he would likely share Chaum's sentiment. Indeed, on the current path of "de-cashing", we risk abolishing or limiting our liberties and rights, "including freedom of contract and freedom of ownership" - and this according to an economist at the IMF(!).

As the frog was unwittingly boiled alive, our freedoms are quietly being undermined. The temperature is rising. Will people take notice before our liberties are irreparably damaged?

[^1]: Transferable deposits are intermediated. Intermediated means payments involving one or several intermediares, like a bank, a card issuer or a payment processor. In contrast, a disintermediated payment would entail a direct transactions between parties without go-betweens, such as with cash.

-

@ 104f6f7d:220bf499

2024-09-26 05:01:05

@ 104f6f7d:220bf499

2024-09-26 05:01:05“He is free to make the wrong choice, but not free to succeed with it. He is free to evade reality, he is free to unfocus his mind and stumble blindly down any road he pleases, but not free to avoid the abyss he refuses to see.” - Ayn Rand

-

@ 1739d937:3e3136ef

2024-09-13 21:09:24

@ 1739d937:3e3136ef

2024-09-13 21:09:24This is the seventh in a series of weekly(ish) updates detailing progress on bringing MLS protocol DMs and group messaging to Nostr.

Previous Updates

Progress this week

I was told recently that my update walls of text are too much. So, I'll try to keep things concise this week. 😅

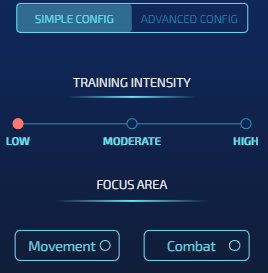

This week has been all about building the reference implementation, which is quickly becoming a full-fledged client instead of just a reference implementation. I've not quite gotten to the MLS portion of the client yet but it does already support multiple accounts (including ephemeral accounts) and loads legacy (NIP-04) chats and full contact lists. So far, I've not implemented NIP-104 so there's not yet any updates to the MLS spec or other dependencies.

If you've got experience with using messengers in hostile environments (authoritarian regimes, you've been de-platformed, etc.) please get in touch. I'd love to hear more about what you'd like to see in a communication tool.

In the meantime, I'll be over here in the corner coding with my headphones on. 👨💻

Onward and Upwards!

-

@ 3bf0c63f:aefa459d

2024-09-06 12:49:46

@ 3bf0c63f:aefa459d

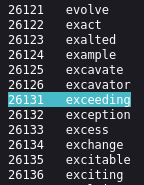

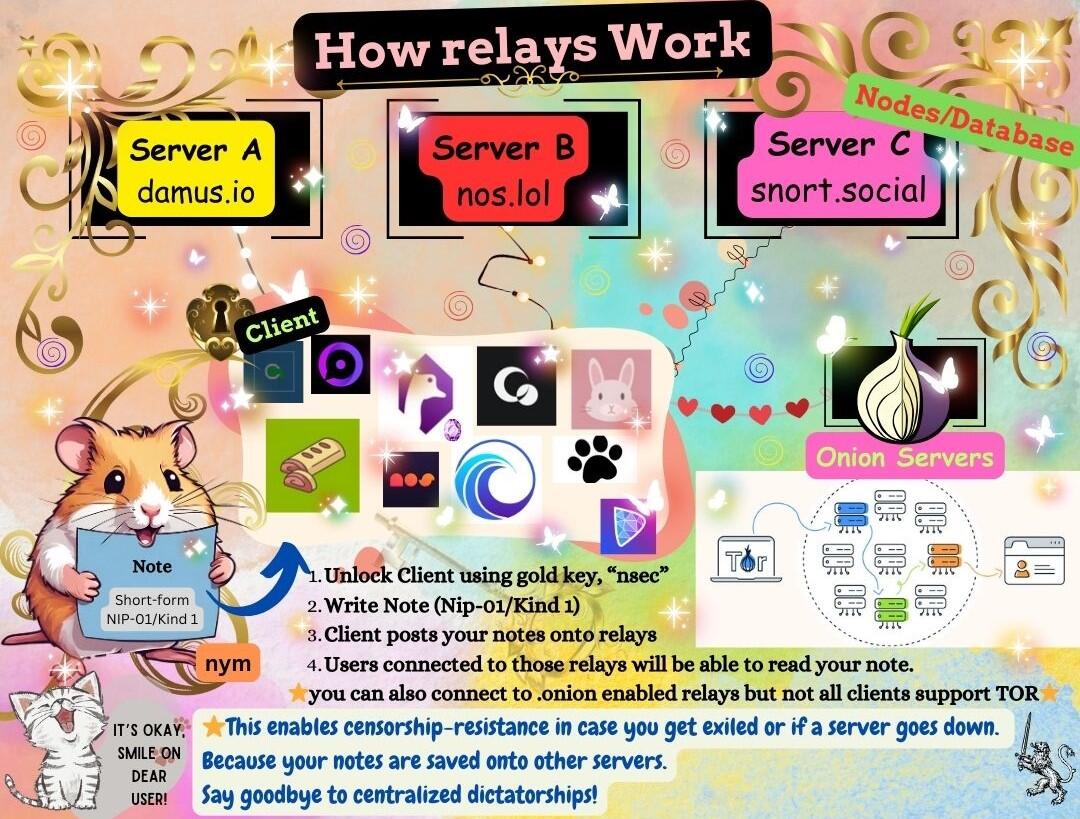

2024-09-06 12:49:46Nostr: a quick introduction, attempt #2

Nostr doesn't subscribe to any ideals of "free speech" as these belong to the realm of politics and assume a big powerful government that enforces a common ruleupon everybody else.

Nostr instead is much simpler, it simply says that servers are private property and establishes a generalized framework for people to connect to all these servers, creating a true free market in the process. In other words, Nostr is the public road that each market participant can use to build their own store or visit others and use their services.

(Of course a road is never truly public, in normal cases it's ran by the government, in this case it relies upon the previous existence of the internet with all its quirks and chaos plus a hand of government control, but none of that matters for this explanation).

More concretely speaking, Nostr is just a set of definitions of the formats of the data that can be passed between participants and their expected order, i.e. messages between clients (i.e. the program that runs on a user computer) and relays (i.e. the program that runs on a publicly accessible computer, a "server", generally with a domain-name associated) over a type of TCP connection (WebSocket) with cryptographic signatures. This is what is called a "protocol" in this context, and upon that simple base multiple kinds of sub-protocols can be added, like a protocol for "public-square style microblogging", "semi-closed group chat" or, I don't know, "recipe sharing and feedback".

-

@ 469fa704:2b6cb760

2024-09-05 15:06:49

@ 469fa704:2b6cb760

2024-09-05 15:06:49The Evolution of Web 3.0: Bitcoin's Role in Decentralizing the Internet

Introduction to Web 3.0

Web 3.0, often referred to as the decentralized web, represents the next phase in the evolution of the internet. Unlike its predecessors, Web 3.0 aims to redistribute control from centralized entities back to individual users through technologies like blockchain, cryptocurrencies, and decentralized applications (dApps). This shift promises a more democratic internet where users control their data, identity, and digital destiny.

The Bitcoin Protocol: A Foundation for Web 3.0

Bitcoin's Influence on Decentralization

Bitcoin, introduced in 2008, can be seen as a precursor to Web 3.0 due to its decentralized nature. The Bitcoin protocol introduced the world to blockchain technology, a decentralized ledger that records all transactions across a network of computers. This technology underpins Web 3.0's ethos by:

- Promoting Decentralization: Bitcoin's network operates without a central authority, showcasing how internet services could run on similar principles, reducing the power of centralized tech giants.

- Enhancing Security and Privacy: Through cryptographic means, Bitcoin ensures that transactions are secure and pseudonymus, a feature integral to Web 3.0's vision of user-controlled data.

Scalability and Functionality Challenges

However, Bitcoin's protocol wasn't designed on the base layer with the complex applications of Web 3.0 in mind. Its primary function as a digital currency means:

- Scalability Issues: Bitcoin's blockchain has limitations in transaction speed and volume, which might not suffice for a fully realized Web 3.0 environment where millions of micro-transactions could occur seamlessly.

- Limited Smart Contract Capabilities: Bitcoin's scripting language isn't as versatile as platforms like Ethereum, which are designed to support a broader range of decentralized applications.

Expanding Bitcoin's Role with Layer 2 Solutions

To bridge these gaps, developers are working on Layer 2 solutions like the Lightning Network for faster transactions, and projects like Stacks aim to bring smart contract functionality directly to Bitcoin. These innovations suggest that while Bitcoin might not be the sole backbone of Web 3.0 yet, it can significantly contribute to its infrastructure. In the long term, the question is whether we need more than one network, I mean, we don't have multiple Internets today. The market will probably decide in favor of the strongest and most secure network, and Bitcoin is by far that.

Web 3.0 Beyond Bitcoin

A Broader Blockchain Ecosystem

At the moment Web 3.0 encompasses by far more than just Bitcoin. It includes:

- Ethereum and Smart Contracts: Ethereum's introduction of smart contracts has been pivotal, allowing for decentralized applications that can interact in complex ways, far beyond simple transactions.

- Other Blockchains: Platforms like Solana, Sui, and Near are gaining traction for their high throughput and lower costs, addressing some of Bitcoin's limitations on the base layer.

The Cultural and Economic Shift

The move towards Web 3.0 isn't just technological but cultural. There's a growing sentiment, reflected in posts on platforms like X, that users are ready for a change where they own their digital presence. Here's some background based on general knowledge and trends up to 2024:

Cultural Shift:

- Distrust in Centralized Institutions: There's been a growing distrust in traditional centralized institutions like banks, governments, and large corporations. This distrust stems from various scandals, data breaches, privacy concerns, and perceived inefficiencies or corruption. Posts on platforms like X or even more on Nostr reflect this sentiment, where users often discuss the diminishing trust in these institutions.

- Rise of Individual Empowerment: Culturally, there's a move towards empowerment of the individual, facilitated by technology. Social media, blockchain, and other decentralized technologies give individuals tools to bypass traditional gatekeepers in finance, media, and more. This shift champions the idea that individuals should have more control over their data, finances, and digital identity.

- Identity and Community: Decentralization also touches on identity politics and community governance. There's a trend towards localism or regionalism where communities seek more control over their governance, which can be seen in movements for local autonomy or even secessionist sentiments in various parts of the world.

- Cultural Movements: Movements like the maker culture, DIY (Do It Yourself), open-source software, and even the gig economy reflect a cultural shift towards decentralization where individuals or small groups can produce, create, or work independently of large entities.

Economic Shift:

- Decentralized Finance (DeFi): DeFi represents one of the most tangible shifts, aiming to recreate and potentially improve financial systems outside of traditional banking. This includes lending, borrowing, and earning interest in a trustless, permissionless environment, primarily using blockchain technology.

- Cryptocurrencies and Tokenization: The rise of cryptocurrencies like Bitcoin and Ethereum symbolizes a move away from centralized monetary systems. Tokenization of assets, from art (NFTs - Non-Fungible Tokens) to real estate, embodies this shift, allowing for fractional ownership and reducing the barriers to investment.

- Globalization vs. Localism: While globalization has interconnected economies, there's a counter-trend where economic decentralization supports local economies. This can be seen in the push for local currencies, community-supported agriculture, or local energy production like solar microgrids.

- Work and Employment: The gig economy, remote work, and digital nomadism are part of this economic shift. Platforms enabling freelance work decentralize employment, moving away from traditional office environments and 9-to-5 jobs.

General Observations:

- Technology as an Enabler: Blockchain, the internet, and advancements in communication technology are pivotal in this shift. They provide the infrastructure necessary for decentralization to occur at scale.

- Political Implications: Economically, this shift maybe challenges existing power structures, potentially leading to regulatory battles as seen with cryptocurrencies. Culturally, it might lead to a redefinition of nationalism, community, and individual rights in the digital age.

- Challenges: Despite its promise, decentralization faces hurdles like scalability issues, regulatory pushback, the digital divide, and the potential for new forms of centralization (e.g., large crypto exchanges becoming new central authorities).

Conclusion: Bitcoin's Place in Web 3.0

Bitcoin's protocol ignited the spark for a decentralized internet, but Web 3.0 is evolving into a multifaceted ecosystem where Bitcoin might play a crucial, though not yet exclusive, role. The integration of Bitcoin with newer technologies and platforms could see it becoming a fundamental layer in the Web 3.0 stack, particularly in areas of value transfer and as a store of value within decentralized finance (DeFi).

As we progress, the synergy between Bitcoin's proven security and stability, combined with the innovation of other blockchain technologies, might just be the blend needed for Web 3.0 to achieve mainstream adoption, ensuring the internet becomes more open, secure, and user-centric. As stated before, the market will probably decide in favor of the strongest and most secure network, and Bitcoin is by far that.

-

@ 469fa704:2b6cb760

2024-09-04 15:22:28

@ 469fa704:2b6cb760

2024-09-04 15:22:28Money Printing in general

First of all, we need to make a distinction between money creation by central banks and fractional-reserve banking. Usually, the term money printing or “printer goes brrrrrr” refers to the creation of new central bank money, which is primarily created by central banks through:

- Open Market Operations: Buying government securities, which injects money into the banking system by increasing bank reserves. This is often done electronically, not by physically printing money.

- Quantitative Easing (QE): Purchasing assets to inject money directly into the economy, aiming to stimulate economic activity by increasing the money supply.

- Setting Reserve Requirements: Although less about creating money, lowering reserve requirements can indirectly influence money creation by allowing banks to lend more, but as of recent policy changes, this has been set to zero in some systems, shifting focus to interest rates.

- Interest on Reserves: By adjusting the interest rate paid on reserves, central banks influence how much banks are willing to lend, thereby indirectly affecting money creation.

This is the first step of money creation, although printing money is usually connected to one of the aforementioned processes, the second step creates much more money through the expansion of credit.

The Mechanics of Fractional-Reserve Banking

The Concept

In fractional-reserve banking, banks accept deposits from customers and only keep a small fraction of these deposits in reserve, lending out the rest. This practice essentially creates new money because:

- Deposits: When you deposit money, say $1,000, into a bank, that money doesn't just sit there.

- Reserves: If the reserve requirement is 10%, the bank keeps $100 as reserves.

- Loans: The remaining $900 can be loaned out. Here's where money creation begins.

Note: Current reserve requirements of the FED (Source) and the ECB (Source) are set at 0% respectively 1%.

Example Calculation of Money Creation

- Initial Deposit: You deposit $1,000 into Bank A.

- Bank A's Action:

- Keeps $10 (1%) as reserve.

-

Loans out $990 to another customer.

-

The $990 Loan: This $990, when spent, might end up in Bank B as someone's deposit.

- Bank B's Action:

- Keeps $9.9 (1% of $990) as reserve.

-

Can loan out $980.1

-

Continuation: This process repeats, with each cycle creating new deposits from loans.

The Deposit Multiplier (m) can be calculated as: * m = 1 divided by Reserve Ration = 1 / Reserve Ration

If the reserve ratio is 1%: * m = 1 / 1% = 1 / 0.01 = 100

This means, theoretically, an initial deposit of $1,000 could expand to:

- $1,000 times 100 = $100,000

- However, in practice, this is tempered by factors like cash holdings, loan demand, and banks holding excess reserves.

Historical and Economic Context

- Evolution from Goldsmiths: The system has its roots in the practices of goldsmiths who issued notes for gold deposits, which eventually circulated as money. This practice evolved into the modern banking system where notes (now digital entries) represent claims on money.

- Regulation and Central Banking: Over time, central banks like the Federal Reserve in the U.S. were established to regulate this process, provide stability, and act as lenders of last resort. The Fed's tools include setting reserve requirements, though this has become less relevant with the shift to a 0% reserve requirement.

Criticisms and Alternatives

- Risk of Bank Runs: Critics argue that fractional-reserve banking makes the system vulnerable to bank runs, where too many depositors demand their money back at once, which the bank cannot cover since most of the money is loaned out.

- Vollgeld Initiative and Full-Reserve Banking: Movements like Switzerland's Vollgeld Initiative have proposed shifting to full-reserve banking, where banks must hold 100% of deposits in reserve, preventing them from creating money through lending. However, this would significantly alter how banks operate and make profits. *** Modern Adjustments**: The move to a 0% reserve requirement in the U.S. reflects a shift towards using other monetary policy tools like interest rates on reserves to control money creation and economic stability.

Real-World Implications

- Money Supply Control: While banks create money through loans, central banks like the Federal Reserve influence this through monetary policy, adjusting how much money banks can create.

- Economic Stability: The zero reserve requirement might seem to allow infinite money creation, but in reality, banks are constrained by capital requirements, risk assessments, and economic conditions.

Conclusion

Fractional-reserve banking is a dynamic system that significantly influences economic growth by expanding the money supply through debt. While it allows for economic expansion, it also introduces risks of instability, which central banks attempt to mitigate through various policy tools. Understanding this system helps demystify how money flows and grows within an economy, showcasing both its capacity for economic stimulation and its inherent risks. As we move forward, debates continue on how best to balance these aspects to foster economic stability and growth. In 2009, a new system called Bitcoin emerged that could redefine the rules for money creation.

-

@ 469fa704:2b6cb760

2024-09-04 12:07:53

@ 469fa704:2b6cb760

2024-09-04 12:07:53Unified Login Across Platforms

With Nostr, you use one login for all services, and your followers are seamlessly integrated. So you don't have start anew on every single platform. I think this is a real advantage of Nostr even for people not accustomed to Bitcoin or decentralization in general.

Value for Value (V4V) Model

Embrace the V4V principle where value is exchanged directly between users. Meaning if you find something useful or anohter nostr user was able to help you then you can simply zap him or her some Sats.

Blogging Platforms

- Habla or Yakihonne: Since joining Nostr 8 days ago, I've started blogging using Habla, which I found incredibly user-friendly. You can check out my articles directly on some clients like noStrudel, where they appear under my profile. Habla also serves as a great community explorer. Yakihonne, another comprehensive client with an integrated blog editor, caught my eye too, although it didn't sync all my Habla posts, possibly due to relay issues.

- Highlighter.com: Offers a sleek interface for reading articles. On noStrudel, articles are tucked away under the "More" menu.

Presentations

- Slidestr.net: This tool transforms your notes into a slideshow, making revisiting old notes quite entertaining.

Video Content

- Flare.pub: If you're looking for a YouTube-like experience, Flare.pub is the closest you'll get on Nostr. You can upload, watch videos, and curate playlists. Remember, since Nostr is fundamentally text-based, videos are hosted on traditional servers, but the interface remains decentralized. There's definitely room for more video content, so start creating!

Live Streaming

- Zapstream: Offers a smooth streaming experience with a fee of 10 Sats per minute to cover server costs. You can watch streams on clients like Amethyst or noStrudel.

Music and Podcasts

- Wavlake and Tunestr: Ideal for artists to share music or podcasts. Listeners can enjoy content freely or support creators via zaps, adhering to the V4V model.

Lists and Grouping

- Listr: A tool for organizing everything from regional user groups to thematic notes or hashtags. You can also follow lists created by others in the Nostr community.

Culinary Arts

- zap.cooking: A haven for aspiring or seasoned chefs, offering a plethora of recipes in a blog format. It's well-organized, allowing you to browse through different categories of recipes.

Marketplaces

- Plebian Market: Reminiscent of eBay's early days, this marketplace allows easy buying and selling among users.

Community Features

- Many clients like noStrudel, Habla, and Amethyst support community functionalities, enhancing user interaction within Nostr.

-

@ 469fa704:2b6cb760

2024-09-03 10:20:09

@ 469fa704:2b6cb760

2024-09-03 10:20:09In traditional investment wisdom, diversification is the mantra chanted by financial advisors worldwide. It's the strategy to spread risk across various assets to mitigate losses. However, when it comes to Bitcoin, some argue this principle might not apply in the same way. Here's why:

1. Bitcoin's Unique Value Proposition

Bitcoin, often dubbed "digital gold," has several attributes that set it apart from other investments:

- Finite Supply: With a cap at 21 million coins, Bitcoin's scarcity is programmed into its code, mirroring the scarcity of gold but with even more certainty. This scarcity can drive value as demand increases over time, especially in an economic environment where fiat currencies are subject to inflation.

- Decentralization: Unlike stocks or real estate, Bitcoin isn't tied to any central authority or physical asset that can fail or be manipulated by a single entity. This decentralization reduces the risk of systemic failure that affects traditional markets.

- Global Liquidity and Accessibility: Bitcoin can be bought, sold, and transferred anywhere in the world, 24/7, with internet access. This global liquidity means Bitcoin can be more easily converted to other assets if needed, somewhat reducing the need for diversification.

2. The Risk-Reward Balance

- Volatility as Opportunity: While Bitcoin's volatility is often cited as a risk, for the informed investor, this volatility represents opportunities for significant gains. Those who understand Bitcoin's cycles might prefer to ride these waves rather than dilute potential gains through diversification into less volatile assets.

- Long-term Appreciation: Historical data suggests Bitcoin has provided substantial returns over the long term compared to most traditional investments. If one believes in Bitcoin's future as a dominant store of value, holding a diversified portfolio might mean missing out on Bitcoin's potential upside.

3. Bitcoin as a Diversifier

Ironically, Bitcoin itself serves as a diversification tool within traditional investment portfolios. Its price movements have shown low correlation with stocks, bonds, and even gold at times, suggesting that Bitcoin can diversify an investment portfolio on its own.

4. The Philosophical Shift

- Trust in Code Over Corporations: Investing heavily in Bitcoin might reflect a philosophical shift towards trusting mathematical algorithms over corporate governance or government policy. Here, diversification within the crypto space might seem less necessary if one views Bitcoin as the pinnacle of what cryptocurrency should be.

- A Bet on a New Financial System: Holding Bitcoin exclusively can be seen as a bet on a new financial paradigm where Bitcoin becomes the standard. In this vision, diversification into other assets might be counterproductive.

5. Potential Result

Upon reviewing the arguments and characteristics, one might conclude that Bitcoin is pursuing a dual trajectory. Firstly, its value increases partly because it remains a novel asset, not yet mainstream among the general populace. Secondly, Bitcoin is poised to absorb the value preservation function from other assets. This means that individuals who invest in stocks, bonds, real estate, commodities, etc., primarily for their value storage capabilities rather than their intrinsic utility (such as residing in a property), might transition to Bitcoin. This shift could consequently diminish the demand for these traditional assets and increase the value of Bitcoin respectively.

6. Caveats and Considerations

- Not Without Risks: This approach isn't without its perils. Bitcoin's future is not guaranteed, and regulatory, technological, or market shifts could impact its value negatively.

- Liquidity Needs: Individual financial situations might require liquidity or income generation that Bitcoin alone might not provide efficiently.

- Emotional Discipline: A Bitcoin-only strategy requires immense discipline and conviction, as the emotional toll of not diversifying can be high during market downturns.

Conclusion

The argument for not diversifying if you hold Bitcoin hinges on its unique properties, the potential for high returns, and its role as a hedge against inflation and traditional financial systems. However, this strategy suits those with a high risk tolerance, a deep understanding of Finance, Economics and Investments, and a belief in Bitcoin's future dominance. For everyone else, while Bitcoin can be a significant part of a portfolio, traditional diversification might still offer peace of mind and stability. Remember, investment strategies should align with personal financial goals, risk tolerance, and market understanding. Always consider consulting with a financial advisor for personalized advice.

-

@ 469fa704:2b6cb760

2024-09-02 06:11:43

@ 469fa704:2b6cb760

2024-09-02 06:11:43I joined Nostr a week ago and wanted to recap it for myself and also give other newbies a simple introduction. Maybe this will help you get started too.

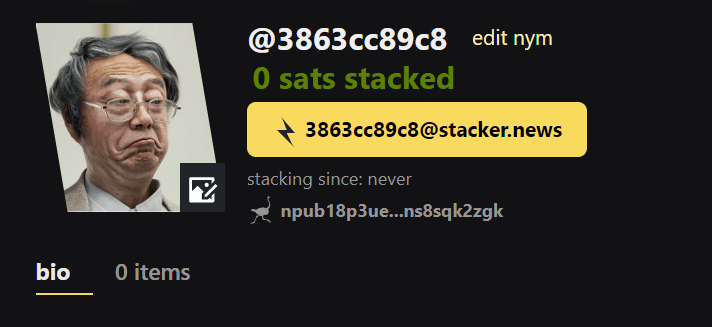

Step 1: Create your identity and get your private key for a browser extension

I started with the Snort client on my local home server. It created my private/public key pair and I was good to go. Then I transferred the private key to Amethyst, a pretty good Android-based client. Before looking at various clients and other nostr-based websites, I tried transferring my private key into a browser extension. I looked at Alby and nos2x. I chose the latter because I wanted to keep my Lightning wallet separate from my identity management. You don't have to, I just found it easier.

Step 2: If you're confused, always check your feed settings

I tried many different clients and was very confused at first. Due to its decentralized nature, Nostr relies on relays, which are just small servers, and to each one you can connect to, all your data is stored. When you post a message, write a note, an article like this or simply who you follow. The main reason and benefit for this is that there is no single point of failure or server-like entity that could be censored. The side effect of this, combined with using different clients, was that not only did it look different everywhere, but the content was also very different. This was simply because I wasn't connected to all my different clients with the same relays. But the main reason why each feed looks different on each client is usually because you can choose different variations of feeds and some clients even offer filters for the feeds.

Scroll down to get a small overview of the clients I've tried.

Step 3: Set up your lightning wallet with something like Wallet of Satoshi

I made my Bitcoin Lightning wallet independent of my identity. That's why I just went with the number one Lightning wallet on the market: Satoshi's Wallet. It's very simple and provides you with a Lightning address that resembles and has the format of an email address. You can add this address to your Nostr profile description and you're ready to receive Sats. Anyone can send them to you, e.g. for a good message or something else they find valuable on Nostr (like a podcast, a video, an article, ...). Just be aware that Satoshi's wallet contains your key and the sats you have there are not really your sats. So only leave a small amount there or no more than you need for your nostr experience.

Step 4: Set up your Nostr address

I set up a unique NIP-05 identifier that is human readable and also looks like an email address. For me, that's tobiya@nostrplebs.com, also called a nostr address. It's much easier to read, share and remember than your public key, which is just a long, unwieldy string of characters.

Some popular services are: * NostrVerified * Alby * Iris * Primal * Snort * nostrplebs.com

Most offer free services or at least a free tier. I chose nostrplebs.com because it links my Nostr address (tobiya@nostrplebs.com) to my Lightning wallet. ⚡

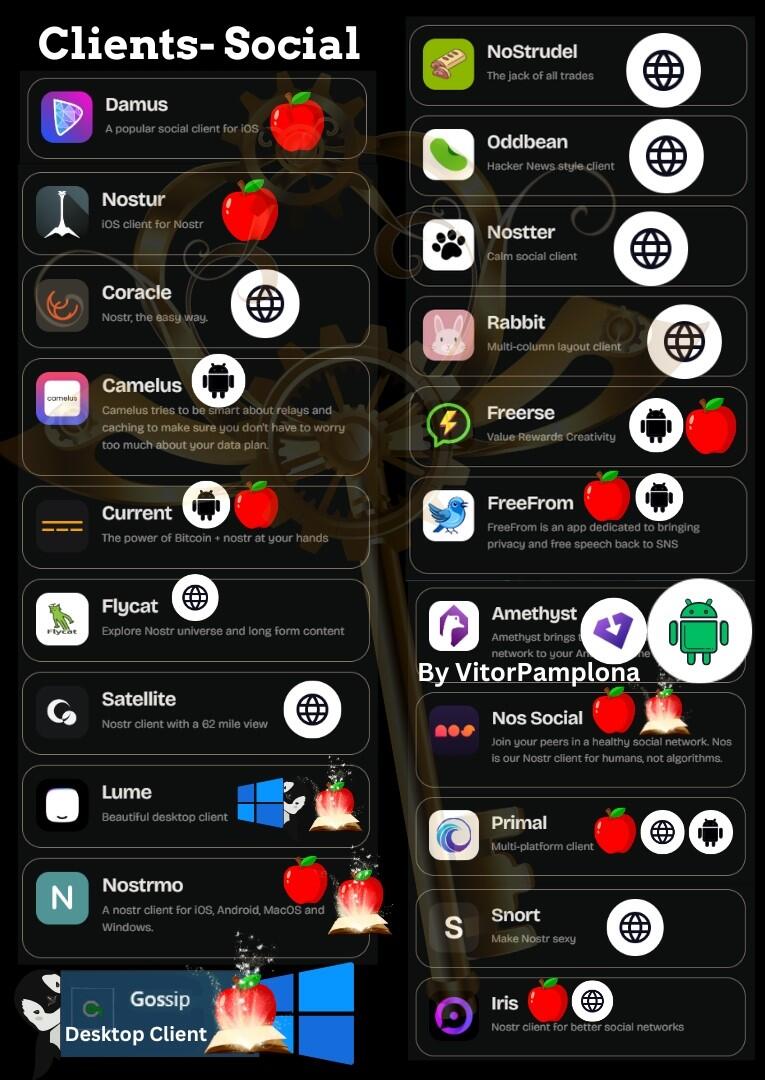

Brief overview of the clients (I have tested)

Web/Browser:

- Primal: Fast, user-friendly, nice looking, easy to use

- Coracle: Focuses on decentralized reputation, privacy and trust metrics. Also well organized and structured

- noStrudel: The most comprehensive I've found, has everything

- Rabbit: Designed like X (Twitter) Pro, focuses on everything at once

- Nostter: Clearly structured, easy to find what you're looking for

- Snort: Fast web client for those who prefer simplicity and speed.

iOS

I'm not an iPhone user, but everything I've discovered says that Damus is the best app for iOS.

Android:

- Amethyst: Feature rich for Android, I only tried this program because it gives me everything I currently need on my phone.

- Primal: Works seamlessly with Primal on the web, which is a pretty convenient starting point if you only want to use one client.

As for the web clients, I'm still figuring out which one will be my favorite. But I think they're all good in their own way. In the time of writing, I am mainly using Primal on Android and Web, Amethyst and noStrudel.

Let's have fun!!

-

@ a6e6a54b:8aca70c6

2024-09-26 04:41:21

@ a6e6a54b:8aca70c6

2024-09-26 04:41:21Outline

- Introduction.

- Setting the Ground with Definitions: UFO, UAP and The Phenomenon.

- About the Author: Luis Elizondo.

- Skeptical Approach.

- Non-Skeptical Approach.

- Spiritual-Metaphysical Component of UAP.

- Worldview Frameworks.

- Making Sense of UAP.

- The Stickiness of The Phenomenon.

- Possibilities for UAP.

- Spiritual-Metaphysical Beings.

- Human Nature.

- UAP Intentions.

- Psyop Hypothesis.

- Conclusions.

- References.

From Lights in the Sky to the Fallen

Expanding the Conversation from Imminent by Luis Elizondo

### 1. Introduction

Man’s mind, once stretched by a new idea, never regains its original dimensions. -Oliver Wendell Holmes.

During the past few years, there has been a resurgence of interest in the UFO-UAP topic. If you have been paying attention, you know by now that the phenomenon is real: there has been an acknowledgment of what people have been saying for years. However, if you are not aware of the current state of affairs, you might need to catch up. Imminent by Luis Elizondo [1] summarizes the latest events and his role in them. I think this book is not for UAP beginners, and I still consider myself as one. For this reason, it was not the book I was expecting, but it was the book I needed to challenge my approach to this topic. I had to make a mental shift in order to think about this issue more broadly. I will elaborate more on the challenges I faced later.

Luis “Lue” Elizondo explains his role as the Head of AATIP (Advanced Aerospace Threat Identification Program) run by the Pentagon and why he resigned due to the secrecy. As you can imagine, it is very difficult to make sense of someone else’s experiences, especially when they also involve the phenomenon. From my perspective, the book brings to the forefront yet another layer of this mystery —the spiritual and metaphysical component of UAP—, which is hard to process (it certainly was for me). I initially planned to write a review of the book, but I have decided instead that I will continue the conversation that Lue started, specifically about this aspect of UAP.

Keep in mind that whether you believe they live among us or think it is all nonsense, you may already have a strong bias that confirms your beliefs and dismisses any new information. This is part of what makes this topic so strange—most people seem to fall into one of two categories: either fully invested or completely indifferent. In my experience, the most common nuanced opinion among those who have not delved deeply into the subject but still want to appear open-minded is: “Of course, there are aliens somewhere in the universe, but it is ridiculous to think they have already visited us.” However, if you look closely at the discussions over the past few years, people are not necessarily talking about aliens visiting Earth—that is just one possibility being considered. I think claiming that aliens exist somewhere but have not shown up yet, and probably never will, is a comfort zone stance.

Furthermore, I am not inclined to convince anyone that this topic is relevant. But, if you already think that transparency is worth your time, then let’s think about the puzzle together!

Notes: 1. I think you should read the book, but if you prefer a summary and review of the key points made by Lue, I recommend watching Richard Dolan’s video: https://www.youtube.com/watch?v=uazfN6CqUeQ. 2. I have been careful with the quotes I am sharing here. Having listened to several hours of Lue’s interviews and podcasts, I have only included quotes he has publicly discussed. 3.

2. Setting the Ground with Definitions: UFO, UAP and The Phenomenon

I want clarify the meanings of UFO, UAP and the phenomenon, as I understand them:

- UFO: Unidentified Flying Object. This is a well-known acronym, often associated with flying saucers. It carries a lot of stigma, taboo, and conspiracy theories. Because of the recent surge of interest in the topic, the term "UFO" is not as commonly used anymore; instead, most people now refer to UAP. Additionally, the term UFO does not encompass the full range of the phenomenon.

-

UAP: Unidentified Anomalous Phenomena[^1]. It was previously defined as Unidentified Aerial Phenomena, but the phenomenon is not only aerial; it is transmedium (moving through air, space, and water—USO refers to Unidentified Submerged Object), and possibly transdimensional. Therefore, “anomalous” is a more accurate word, as it better captures the broader nature of the phenomenon.

-

The Phenomenon: This is the core of the issue and what we are trying to understand. The way that I see it, the phenomenon involves the interaction[^2] between humans and a non-human intelligence, which may be more advanced than us. The elements of interaction include:

Objects: These are observed in the sky, in the ocean, or coming from outer space. Objects can also be inserted into the human body. Examples include crafts, lights, and drone-like objects. These objects may appear tangible or not.

Entities or Beings: These are sometimes seen near or inside the objects, or on their own. They may communicate messages through unusual means. Their origin is uncertain—whether material or metaphysical in nature.

To summarize:

From a human perspective, the interaction with the phenomenon can be both material—occurring through devices, human senses, and visible changes in the body with biological effects—and psychological. Even more puzzling is that the phenomenon may enclose what some refer to as paranormal activity[^3].

Whatever the phenomenon is, it seems to have both material and non-material components. So, when we talk about evidence (photos, videos, vehicles, etc.) we might only be seeing one side of the coin, not the whole picture. I am being very deliberate in using the terms material and non-material because I am referring to the materialistic interpretation of the universe. I will expand more about this later.

[^1]: As for the word "phenomena," I do not think it is necessary to use "UAPs" to refer to the plural form. However, it is very common to see “UAPs” used everywhere. I will just stick with "UAP" in this discussion. [^2]: If they are seen or detected, that counts as interaction. When I mentioned earlier that some people say that “life exists somewhere else in the universe”, they are missing the point. The life forms that might exist elsewhere, which we do not yet know about, are not interacting with humans. [^3]: Some suggest that a subset of what we call paranormal activity can be caused or related to the phenomenon. Therefore, in the end, certain instances of paranormal activity could have a material explanation.

3. About the Author: Luis Elizondo

Luis Elizondo was recruited as a senior intelligence officer to help establish counterintelligence and security for the Advanced Aerospace Weapons System Applications Program (AAWSAP), which later became the Advanced Aerospace Threat Identification Program (AATIP). This program was focused on “unconventional technologies” (p. 6), “unusual phenomena” and investigated unidentified aircraft, specifically ones that seem to display beyond-next-generation technology and capabilities—what we now call unidentified anomalous phenomena, or UAP, or what were long referred to as UFOs (p. 8).

Some interesting details discussed at the podcast Theories of Everything with Curt Jaimungal [2] include: * Lue still keeps his security clearance. * Lue’s book went through a year-long review process by the Pentagon, resulting in certain parts being redacted.

Due to these factors, some speculate that he could be a disinformation agent. However, I do not agree with this notion, as other whistleblowers[^4] have come forward and support some of Lue’s claims. Additionally, Lue’s coming out appears to have caused an internal struggle within the Pentagon. It is very confusing to say the least.

[^4]: Lue does not view himself as a whistleblower but rather as a “patriot”. The fact that he retains his security clearance and continues to work as a government consultant makes people wonder who is really behind this disclosure movement. He has stated that: I would never in a million years violate my security oath. The damage inflicted by people such as Bradley (now Chelsea) Manning and, later, Edward Snowden arguably did more harm than good. Yes, the truth got out, but people lost their lives, and intelligence was compromised in the process (p. 193).

In my opinion, the most important claim made by Lue is the following: Unidentified craft with beyond-next-generation technology—including the ability to move in ways that defy our knowledge of physics and to do so within air, water, and space—have been operating with complete impunity all over the world since at least World War II. These crafts are not made by humans. Humanity is in fact not the only intelligent life in the universe, and not the alpha species… While there are valid reasons for secrecy around some aspects of UAP, I do not think humanity should be kept in the dark about the fundamental fact that we are not the only intelligent life in the universe. The United States government and other major governments have decided its citizens do not have a right to know, but I could not disagree more. You might be thinking this all sounds crazy. I’m not saying it doesn’t sound crazy, I’m saying that it’s real (pp. 1-2).

4. Skeptical Approach

In seeking truth you have to get both sides of a story. -Walter Cronkite.

Before sharing my opinions, assuming that the claims made by Lue and others are true, I need to outline some of the reasons for skepticism about the information being presented (in his book and in general during this disclosure process):

-

Lack of evidence: Lue has not provided concrete evidence, only his personal testimony. The Pentagon denies his claims.

-

Quality of evidence: The evidence that is presented is often of poor quality: blurry pictures and out of context videos that could be anything.

- Lue Elizondo’s Credentials: Right after the release of the book, there was considerable debate on #UFOTwitter regarding his position at AATIP.

- Government secrecy: Many think that it is impossible for a government to keep a big secret like this one from the public for so many years. They argue that the cover-up and secrecy are just conspiracy theories.

- Persistent Claims of Imminent Disclosure: Ufologists keep claiming, for decades, that disclosure is just about to happen any day now.

- Questionable Sources: A lot of the reported encounters come from people who might be unstable, seeking attention, or trying to scam others. Even those who seem genuine might be misinterpreting what they experienced.

5. Non-Skeptical Approach

The eye sees only what the mind is prepared to comprehend. -Henri Bergson.

The goal here is not to focus on the skeptic view. I am well aware that one can just say “Show me the evidence”, and move on if no one points to anything convincing and irrefutable. Also, given the fact that there are many other relevant issues affecting our daily life—like inflation, climate change, geopolitical instability, wars, and surveillance— dedicating mental energy to the UAP issue seems like a waste of time. It is totally reasonable to set this discussion aside due to other priorities.

However, I think it is unfair to dismiss the UAP issue as unscientific, nonsense and full of fraudsters (and there are definitely some of those) without spending a decent amount of time trying to understand what it is really about before criticizing it. Ridiculing a subject you do not know much about and do not understand is not scientific. In my opinion, one of the best critics in this area is Dr. Michael Shermer^5. He is a well-known skeptic with a deep knowledge of various UFO cases, has read a vast amount of information and talked to experiencers and witnesses. I recommend following his work.

In the previous section, I mentioned that some people think it is impossible for a government to keep a big secret[^6] like this for so long. I agree with that perspective and it seems that whistleblowers are starting to come forward. Not just one, but several whistleblowers with military backgrounds have been sharing their stories. It is up for you to decide how trustworthy you think they are. They have appeared in interviews, podcasts and some have even testified before the US Congress. While it is possible that they could all be lying or working together, I am going to assume for now that this is not the case so I can focus on the information they are providing.

[^6]: Some people believe that if there was anything significant to the UAP issue, we would have seen it revealed in Wikileaks by now. Interestingly, the “Podesta emails” include exchanges between Tom DeLonge and John Podesta, both of whom are mentioned in the book because of their interest in the topic.

Sometimes it is important to state the obvious: if something is engaging humanity, we do not need any government to tell us whether it is real or not. As Dr. Avi Loeb^7, Head of the Galileo Project^8, puts it: The sky and oceans are not classified and we can survey them ourselves [3]. People all around the world have been sharing their experiences on this topic for years. Sure, some of these people might be fraudsters, attention seekers, or simply confused, but others might be recounting genuine experiences of events that truly happened to them (even if we do not agree on their nature). That is why the testimonies of whistleblowers who have encountered unusual phenomena during their military service are very significant. Their credibility and training to identify anomalies while staying objective make their accounts worth considering.

There are also people who have had more intriguing encounters with the phenomenon, often referred to as experiencers[^9]. If you’re a good listener, you might have heard some unusual stories from people you know, and you might even know someone who falls into this category. For those who might be unaware, experiencers do exist, and many of them choose to stay quiet. As Dr. Garry Nolan^10, Executive Director of the Sol Foundation^11, points out: I think that what [ridiculing] does is a disservice to people who come forward with stories because they have a double trauma, they have the trauma of seeing something they do not understand and doesn’t fit with their worldview, and then they have the trauma of everyone making fun of them [4]. [^9]: I think this term was originally reserved for abductees, but recently, I have heard it used more broadly to refer to anyone who has had an experience related to the phenomenon. So, I’ll use “experiencers” in this broader context.

6. Spiritual-Metaphysical Component of UAP

It is not the answer that enlightens but the question. -Eugène Ionesco.

Worldview Frameworks

To ensure we are all on the same page, let’s take a moment to discuss Materialism, which is the predominant worldview among scientists and philosophers for explaining the nature of reality.

Materialism holds that the universe is entirely physical and governed by the laws of physics.

Reductive Materialism refers to the notion that all mental states—such as emotions, beliefs, perceptions, desires—can be reduced to physical phenomena, hence, mental states correspond to physical states. Most Materialists identify with Reductive Materialism.

Eliminative Materialism takes a step further by suggesting that mental phenomena do not exist at all.

Mental phenomena is an interesting case of study because it seems to be something different. However, most scientists argue that mental states can be explained through materialistic means, suggesting, there is no need to postulate another substance[^12] or property. Nevertheless, consciousness does not seem to be reconciled in a materialistic way due to its subjective nature and we still lack a clear definition of it. This is one of science's greatest mysteries, sparking extensive debate among philosophers, psychologists, and neurologists. In recent decades, computer scientists have also joined the conversation, due to the advances in Artificial Intelligence. I mention this because, as we explore the unknown characteristics of the phenomenon later, some have proposed that moving beyond a materialistic interpretation might be necessary, especially since the phenomenon seems to interact directly with human consciousness.

[^12]: Cartesian dualism divides the world in two parts: the physical and the mental, leading us to the mind-body problem—how does the interaction occur? We have shifted toward a form of monism, assuming that the world is only made of physical stuff (materialism), thus dismissing the mind-body problem, by claiming that the mind is material (reductionism). However, phenomenal consciousness—the realm of subjective experiences or qualia—seems to escape materialism, drawing us back to reconsider dualism and other flavors of it. This scientific challenge has been famously formulated as the Hard Problem of Consciousness by the philosopher Dr. David Chalmers.

Professor Dr. Mark Harris, physicist and theologian, in his essay Faith and physics states that: Physics is widely said to have a unique ability to shine light on physical reality at its most fundamental level. But in order to do so, physicists must make many assumptions. Indeed, the widespread assumption that physics is the most fundamental of the natural sciences, and that all others relate to it, is a consequence of reductionism, a metaphysical belief which can’t itself be established empirically in any direct way. Moreover, whether theorists or experimentalists, most physicists assume a form of realism –in spite of the fact that quantum physics has led to various anti-realist challenges– and a strong belief in the uniformity of nature, that physical reality is systematic, regular and patterned everywhere, and that these patterns may be understood rationally (the idea that is often expressed as the ‘laws of nature/physics’). This requires reliance on physical models to explain or summarise observations. A model is effectively a scientific metaphor, or an analogy, a way of explaining something we don’t understand in terms of something we do… The next assumption is that the uniform patterns we think we see in nature, which we try to describe using models, are universal. This means that we can eliminate local variables. For instance, in an experiment we discard the vast array of data we observe which are not universally systematic in favour of those (usually much sparser) data that are. Note that this means that we inevitably bring theoretical expectations to the lab: we can’t perform an experiment without having a pre-conceived theoretical framework already in place. This is often summarised by the famous phrase of N. R. Hanson that, ‘All data are theory-laden’. In other words, our observations come with theoretical baggage which already goes some way towards interpreting them [5].

Hence, the scientific lenses through which we understand reality are also grounded in suppositions or metaphysical beliefs because we cannot prove: materialism, realism (reality exists independent of the observer), determinism and reductionism, and that all reality can be understood by rational means. These notions certainly help us effectively interpret, understand and predict the physical world we are familiar with. There is a common belief that if something appears to be outside this worldview, it is either because: 1) We have not yet discovered the scientific explanation for it, or 2) It simply does not exist. I find the first possibility compelling, as we should indeed strive to understand the world around us. However, if we encounter phenomena that truly[^13]defy scientific explanation and challenge our established notions of reality (such as the concept of God), dismissing them as non-existent might reflect a personal bias or attachment to a specific worldview rather than an objective search for truth. I do not think that we should just abandon ourselves to all possible explanations every chance we get, but if after a thorough examination of the issue following the scientific method we remain puzzled, maybe, it is time to consider alternative perspectives.

[^13]: We cannot be sure about this.

Making Sense of UAP

Once you find true knowledge, ignorance is no longer an option. And if the knowledge you find is unusual then strange becomes a way of life. -Thomas Campbell.

The UAP issue challenges our scientific understanding in two significant ways:

1. Behavior of UAP: The behavior of UAP do not align with our current understanding of physics. This discrepancy leads many to speculate that we might be encountering intelligence and technology far more advanced than our own. This idea often implies that these phenomena could originate from a more technologically advanced civilization, potentially from somewhere else in the universe. In this regard, Lue mentions the 6 observables that should be explained (p. 156): * Instantaneous acceleration. * Hypersonic velocity. * Low observability. * Transmedium travel. * Antigravity. * Biological effects. *

2. Interaction with Humans: The way experiencers describe their interactions with UAP could challenge our materialistic worldview. This aspect introduces what I refer to as the spiritual-metaphysical component.

When I used to think about the UAP issue, I never felt the need to consider anything beyond science. I was comfortable sticking to a materialistic interpretation of the world (although I do not subscribe to it as the ultimate explanation of reality), and this was reflected in my approach to the phenomenon—I would just ignore anything metaphysical. I was aware of some of the claims but they seemed too overwhelming to process. I also thought that once we understood ‘the observables’, we would be able to explain the rest. While I have not completely changed my perspective on how to study this topic, I am now open to the idea that we need to explore the spiritual-metaphysical side in parallel.

As I was reading and Lue mentioned Robert Bigelow^14 in the first few pages, I thought to myself “Oh no, please don’t go there…” But sure enough, he did touch on the paranormal aspects later in the book. I was disappointed and felt he might be making a mistake: if he wanted to draw attention to this topic from a broader audience, focusing only on concrete data—such as sensor readings, the capabilities of the crafts, and how they seem to defy our understanding of physics—would be more effective. Introducing the more unusual aspects of the topic might turn off physicists and the scientific community, potentially leading them to dismiss the discussion.

To be fair, Lue does not imply that the phenomenon cannot be explained materialistically and it is spiritual in nature. In fact, he references Arthur C. Clarke’s idea that “any sufficiently advanced technology is indistinguishable from magic”, and he appears frustrated with the attitude of some Christian fundamentalists in government regarding this topic. But I will address this in more detail later.

I believe that Lue is intentional with his choice of words and the information he presents as he retains his security clearance. Early in the book, he mentions: Over time, my colleagues and I gained insight into how these mysterious UAP operate (p. 2). From this, I concluded: * He is signaling to a certain group. The book is not meant for beginners looking for a general overview of the UAP issue. * The spiritual-metaphysical aspect of the phenomenon is so significant that it cannot be ignored. * He may be an experiencer himself (he refers to personal experiences), and by acknowledging them, he is validating others, encouraging them to come forward.

Now that the spiritual-metaphysical part of this issue was brought front and center, I had to confront it as well, even though I had been mentally resisting it.

Remote Viewing and Orbs

Lue dedicates a whole chapter to remote viewing: Recruits were trained to spy upon enemies, but not in the usual way. Stargate trained “supersoldiers” to spy on hard targets using their psychic gifts. No, I am not kidding, this was an official US government program. They called the highly controversial technique “remote viewing.” The program, pioneered at Stanford University in the late 1960s, was led by none other than Hal Puthoff, whom I met at the dinner meeting I described earlier. Hal had been a Stanford University researcher and an employee of the NSA when he and his colleague Russell Targ were approached by the CIA and told that Russia had a remote-viewing program. The US needed to catch up and beat their efforts. That’s how it all started. Extrasensory perception had won over supporters in government who were initially dubious, then shocked that the technique worked. No one understood the mechanism. The CIA didn’t care why it worked; the only thing that mattered was that it did (p. 33). This whole story is really captivating but I was under the impression that it was unnecessary for the reader who is only interested to learn about UAP.

It turns out that Lue connects his involvement in AATIP to some unusual incidents that were occurring to him, his family and colleagues. He explains that they started seeing orbs in their homes: I was shocked to find that a lot of my colleagues and I began experiencing firsthand some of these orbs at our homes...The object behaved as if guided by some intelligence. It parked itself in the air, then drifted off down the hall before disappearing entirely (p. 68).

For those of you who do not know about orbs this is how he describes them: One of the most common types of UAP that are often reported is what we call orbs, which are small, luminous balls of light or, in some cases, smooth and metallic spheres. This is nothing new. In World War II, orbs were reported regularly in and around Allied and Axis aircraft, so much so that they were nicknamed “foo fighters” (p. 67). The orbs have been reported: by commercial pilots or military pilots or by eyewitnesses on the ground, particularly around military test ranges and sensitive US military facilities. This is not just a military phenomenon. Now, with the pervasiveness of home security systems and advancements in cell phone cameras, private civilians are capturing these orbs, just like the military is (p. 67). At this point, I was quite surprised because I remembered being part of a conversation with some colleagues in an academic setting where they expressed how much they would like to study orbs. I had no idea what orbs were, and I had never heard about them before, let alone their potential connection to UAP. Reading that chapter made a lot of things from that old conversation click into place. I wish I could go back and ask more questions about orbs, but they sounded too esoteric for my taste back then, and I was not in the right mindset to show genuine curiosity.

There is another interesting point he makes about orbs: The classification of these orbs really varies quite a bit. There are different colors and sizes; some of the colors reported were white, yellow, blue, red, and green. Reports I have seen suggested the blue orbs in particular had a very negative biological consequence, meaning if you got close to one of these, you could expect to be injured (p. 67). This example highlights that the phenomenon is not entirely harmless.

The way I see it, the connection between remote viewing and orbs in the book (not that these two are necessarily related) is that they might both be some kind of surveillance mechanism and ways to collect intel (this much information we have with remote viewing in a military context). This raises interesting questions about the nature of both remote viewing and orbs, as we venture into the blurry area between physics and metaphysics. I was under the impression that remote viewing was debunked, but Lue says that it works and is still used by the CIA, which does not care why it works but just that it does. What is going on here?

Stickiness of The Phenomenon

At the beginning of Lue’s involvement in UAP related work, he was warned that: “You should be prepared for the possibility that some of that strangeness will impact your personal life. These portfolios are sticky” (p. 12). Later, he linked this initial warning to his experience with orbs. I had heard about the Hitchhiker^15 effect but it took me a while to make the connection.

In a particularly eye-opening section of the conversation about Imminent in the podcast hosted by Post Disclosure World, the guests Christopher Sharp and James Iandoli, clearly highlight the concept of stickiness: If you engage with the phenomenon the phenomenon engages back. They raise an intriguing argument against widespread disclosure or confirmation of UAPs: There is this idea that we should not disclose because if we disclose that’s going to open a door for the phenomena to start engaging us in a much more proactive and unambiguous way. Do we want to all wake up at 3 am and see green orbs in our bedroom like Lue Elizondo and his family experience?[6]. Isn’t this a fascinating question?

There does seem to be a reactive aspect to the phenomenon. Personally, I lean towards the idea of transparency. After all, many of us have wondered whether we are alone in the universe and if human intelligence is the highest form. While the stickiness of the phenomenon might be a consequence of this new knowledge, we would eventually learn how to manage it. However, it is easier said than done. No one wants to live in fear, and this reactive part of the phenomenon appears to exacerbate that emotion. Additionally, in times of collective anxiety, there is always the risk of powers emerging “for our protection”—as Winston Churchill famously said, “Never let a good crisis go to waste.”

On the other hand, how deeply do you need to engage with the topic for it to become sticky? I am not sure. I have not had any experience myself.

I have noticed a common pattern among those who have opened up to me about their experiences: they often express confusion, shame, and fear. Many of them wish to forget what happened to them entirely. None of the experiences shared so far have been described as positive or exciting. But I recognize I cannot draw broad conclusions.

Possibilities for UAP

We sometimes get all the information but we refuse to get the message. -Cullen Hightower.

This classification is where things start to get even stranger. Physicist Dr. Harold Puthoff (mentioned several times by Lue), in his paper titled “Ultraterrestrial Models”, published in the Journal of Cosmology, states: It is currently unknown whether the phenomenon is exclusively extraterrestrial, extradimensional, crypto-terrestrial, demonic/djinn, proto/ancient human, time-travelers, etc., or some combination or mutation of any or all of these. However, it appears highly likely that the phenomenon per se is not constituted exclusively of members of the current human population [7]. At this point, I do not even want to speculate on what we are dealing with. The current information available to the public makes it almost impossible to even guess.

Professor Dr. Kevin Knuth[^16], physicist and member of the Advisory Board of the Sol Foundation, in his podcast appearance with the Scientific Coalition for UAP studies shares his thoughts to the very interesting question: How do you empirically study something where the very definition of just kind of a question mark, we don’t know what it is, it’s a phenomenon, it’s a thing, it's an object in the traditional sense at all? [Answer]: The first thing we need to do is to develop some kind of taxonomy. We need to come up with a way to classify things whether it's based on appearance, behavior and situation… We are faced with the difficulty in that there is a stigma attached to one of the hypotheses of what some of these things might be: the extraterrestrial hypothesis, which to me I don’t actually see very unlikely anymore, I think that’s actually very probable. But once you develop some kind of taxonomy then you can start to tease apart what you’re looking at and what you’re trying to study. These things aren’t clearly not all alien spacecraft: some of them are weather balloons, atmospheric phenomena that we don’t know anything about, pictures of birds…. It’s a very interesting and complicated problem, there is a lot to be discovered here. They are not just one thing… I’ll sometimes joke, I’m only interested in the ones that are craft, you cannot always tell which ones are craft and which ones aren’t, it’s not that simple…. We’re in a position where we really don’t know much at all and it really is smart to keep all the hypotheses on the table: the natural phenomena, the craft phenomena, the extraterrestrial hypothesis, the ultraterrestrial hypothesis, time travelers (from the past and future). There’s a lot of possibilities and there could be several of these hypotheses being true, which can be confounding and it'll be difficult to sort things out [8].

[^16]: https://www.albany.edu/physics/faculty/kevin-knuth https://thesolfoundation.org/people/

I know I mentioned things were getting weird, but now they are about to get even weirder. Lue recounts a conversation that left him stunned: “Lue, you know we already know what these things are, right?” …“It’s demonic,” he said to me. “There is no reason we should be looking into this. We already know what they are and where they come from. They are deceivers. Demons.” I couldn’t believe what I was hearing. This was a senior intelligence official putting his religious beliefs ahead of national security. (p. 84, 85). I guess you are not disappointed by how bizarre things have become with this twist.

I was not entirely surprised by this interpretation. I agree with Lue that a senior officer’s religious beliefs should not be more important than national security. The real question is whether this officer arrived at this conclusion purely based on his religious beliefs, or if there is additional information that is being withheld from the public and from special agents like Lue, who were investigating this topic from within the government.

Spiritual-Metaphysical Beings

Believe those who are seeking truth. Doubt those who find it. -André Gide.

Tucker Carlson shared his views, and it is worth noting his perspective because of his significant influence on public discourse. In this conversation he appears with another important public figure, Joe Rogan. Also, what Carlson says is how I expect many people to react and interpret the nature of the entities associated with the phenomenon.

Carlson says: They are spiritual beings, it’s a binary, they are either team good or team bad… The template that you’re using to understand this is, science fiction or an advanced race of beings from somewhere else but the template that every other society before us has used is the spiritual one. There is a whole world that we can’t see that acts on people, the supernatural world, it’s acting on us all the time for good and bad. Every society has thought this before ours, in fact, every society in all recorded history has thought that until, I'll be specific, August 1945 when we dropped the atom bombs in Hiroshima and Nagasaki, and all of the sudden the West is just officially secular, we’re God, there is no God but and that’s the world we have grown up. But, that’s an anomaly, no one else has ever thought that… Once you discard your very recent assumptions about how the world works, well, that kind of seems like the obvious explanation [9]. I applaud Carlson for openly talking about this, especially bringing up the spiritual beings interpretation. However, amidst the confusion, we should apply caution when listening to people who emphatically tell us with certainty what they are.

On the other hand, Dr. Avi Loeb expresses his stance on this discussion: Shawn asked whether I believe that UAPs have a spiritual component. I explained that spirituality or consciousness are likely an emergent phenomenon of complex systems, like the human brain and advanced AI systems. Their behavior is difficult to predict because they have a large number of degrees of freedom and are influenced by input from uncontrolled environments. Whether there are intelligent UAPs remains to be documented by the Galileo Project. If such UAPs exist, I would add psychologists to our research team, because they are trained to deal with intelligent systems [3].

We can analyze the nature of these beings from different angles: 1. Non-Materialistic Point of View: I have not gone into a deep level of study of the UAP beings —commonly known as aliens—but I have heard people talk about these entities. They seem to be embodied although their appearances vary. When they interact with humans, some people report both physical and psychological effects, such as body marks, paralysis, telepathic communication, missing time, memory loss, and fear. This does not suggest they are intrinsically spiritual beings, such as angels and demons (the fallen ones) from the Bible. These entities seem to have a dual nature. But one could argue that angels and demons are spiritual in essence and they also have the ability to materialize, and this observation would lead us into theological territory. This shows how easy things get messy when trying to relate something unknown with something else that we think we know. 2. Materialistic Point of View: Let’s forget all the spiritual stuff and demons, nothing of that exists, and even if it does, these entities could just be material. In this case I would say pretty much what Lue keeps repeating “any sufficiently advanced technology is indistinguishable from magic”. Maybe these creatures have learned how to access our consciousness in a way that we do not even think it is possible.

In my opinion, we are dealing with a mix of different types of entities although I cannot say anything about their ontology. I would not rule out the spiritual beings, demons, or dual nature entities interpretation. For those who have experienced encounters with these beings, sharing their experiences is crucial so we can gather enough data to better understand and categorize them[^17]. But unfortunately, there is always the fear of ridicule. We need to understand what is and isn’t part of the phenomenon. I would also like to hear what other religions and traditions think.

[^17]: Esoteric groups have already developed some taxonomy, but the information they have gathered falls into the category of revelation (by the beings themselves) rather than an accumulation of data.

Reality is merely an illusion, albeit a very persistent one. -Albert Einstein.

For example, Dr. John E. Mack^18, a renowned psychiatrist from Harvard who tragically passed away in a car accident in 2004, made significant contributions to the field. I first encountered his work through a documentary about the Ariel School UFO landing. Dr. Mack was deeply interested in speaking with the children who witnessed this traumatic event and sought to understand it. His book, Abduction, explores UFO abductions and encounters with these beings. It is important to point out that he was also a well-regarded expert on nightmares.

In an interview, journalist Ralph Blumenthal^19, who wrote a biography about Dr. Mack titled The Believer, noted that Dr. Mack's research highlighted fundamental differences between experiences of the "old hag syndrome" and UFO abductions. The former often involves reports of an evil presence that sits on the bed and causes suffocation, while abductees typically describe being given information telepathically and undergoing medical procedures.

Although these accounts are disturbing, they provide valuable insights by helping us distinguish between similar but distinct experiences. However, the question of the ontology of these beings and their origins still remains unresolved. Blumenthal adds: What are we to draw from this? Well, first of all, there is a whole kind of anomalous experiences that seem to operate in a world that we do not recognize, another reality, that penetrates our world, as John Mack said, somehow, in ways we can’t explain, we have a clear idea of reality, we think we do; reality is what you can see, smell, taste, and touch, knock on the table, feel it... So maybe there are other dimensions, aspects to the universe that we don’t understand” [10]. In addition, Professor Dr. Garry Nolan, whom I mentioned earlier, says the following: It’s interesting, religions have been dealing with extra dimensions and non-human intelligences for centuries: angels and demons, the spirits of the forest, the jinn of the Quran, etc. Where is heaven and hell? It’s another dimension. Are heaven and hell even in the same dimension? Are they different places altogether? Religion struggled with these ideas and the human mind can already encompass the possibility that they exist and had done so since the most primitive of men. That’s amazing to me [4].

This naturally leads us to ask: Are these realities and dimensions “real”? And more importantly, What do we understand by “real”?

About experiencers, Lue expresses that: In the end, abductees report feeling that these beings did not care one way or another if they lived or died. Many experiencers reported feeling completely vulnerable, helpless, and afraid. As a former special agent, if a witness reported being whisked away against their will, I would consider that an act of kidnapping, a federal crime. And if the witness said they were touched against their will, I would consider that assault, yet another crime in human terms (p. 173). I totally agree with Lue on his opinion right here.

I now think it is a mistake to rely solely on physicists, astronomers, and engineers for answers, yet that is where most people tend to focus. The phenomenon we are dealing with is not just about lights in the sky, mysterious crafts, or extraterrestrial beings. The problem is far more complex, and narrowing the scope to only the physical aspects limits our understanding. To fully grasp what is happening, we need insights from a much broader range of perspectives—psychologists, psychiatrists, philosophers, theologians, heads of different religions, anthropologists, and historians. Each of these fields offers a piece of the puzzle, whether it is understanding human consciousness, exploring ancient interpretations of similar phenomena, or delving into the spiritual implications. It is only by bringing together all of these viewpoints that we can begin to form a more complete picture of the UAP phenomenon.

Human Nature

When the student is ready, the teacher will appear. Ancient Buddhist proverb.

I also believe that we need to start looking inwards and understand our true nature—what makes us humans.

- *Materialistic Point of View: We have the poetic words of the physicist Sean Carroll, PhD: I want to argue that, though we are part of a universe that runs according to impersonal underlying laws, we nevertheless matter. This isn’t a scientific question — there isn’t data we can collect by doing experiments that could possibly measure the extent to which a life matters. It is at heart a philosophical problem, one that demands that we discard the way that we’ve been thinking about our lives and their meaning for thousands of years. By the old way of thinking, human life couldn’t possibly be meaningful if we are “just” collections of atoms moving around in accordance with the laws of physics. That’s exactly what we are, but it is not the only way of thinking about what we are. We are collections of atoms, operating independently of any immaterial spirits or influences, and we are thinking and feeling people who bring meaning into existence by the way we live our lives* [11].