-

@ fd208ee8:0fd927c1

2024-09-27 11:32:25

@ fd208ee8:0fd927c1

2024-09-27 11:32:25A fortnight of being real on Nostr

It's been over two weeks, since I announced that I would primarily be noting from my lesser-known Silberengel npub, and it's been an interesting experience. As with anything I ever do, I clicked around a lot, tested out a lot, and tried out a lot. Mostly, I observed.

Let me share, what I've learned

- Nostr-related products are increasingly useless, if you don't follow anyone, or only follow a handful of people. Everything is geared to follows and you usually really do need to follow gobs of people, to have an interesting feed, by capturing the most-active people (about 10% of the people you follow). Those people tend to quote and boost other people's notes into your stream, allowing you to follow those additional people and so on, like a snowball scheme. This means that follows are actually a feed-management mechanism, rather than any indication of a relationship between npubs. It also means that 10% of the npubs decide what everyone will look at.

- Many people collect followers, by being active for a very short time, following lots and lots of people and getting follow-backs, then they unfollow the smaller npubs or abruptly change their tone or the content (this is common with spammers and scammers). Then they have a high WoT score. What, precisely, is being trusted here? (Also, centering WoT on follows is influencer-maxxing for plebs, KWIM?)

- Why are individuals never unfollowing these npubs? Because nobody unfollows anyone who hasn't seriously upset them. Follow-inertia is rampant and the follow lists are so long that most people don't even know who they are following. So long as the "bad npub" doesn't spam the people who are following them directly, they don't notice anything. That means following spam can inadvertently protect you from spam, whilst the same spammers throw crap at your own frens, all damned day.

- Most relay owners/operators don't ever look directly at the feed from their own relay, so it's usually full of enormous amounts of garbage. Your clients and personal/private relays are often downloading and broadcasting all of that garbage indiscriminately, so the garbage gets passed around, like a social media virus. Many of you just haven't noticed, because you also don't look at the feed from your relays (see 1).

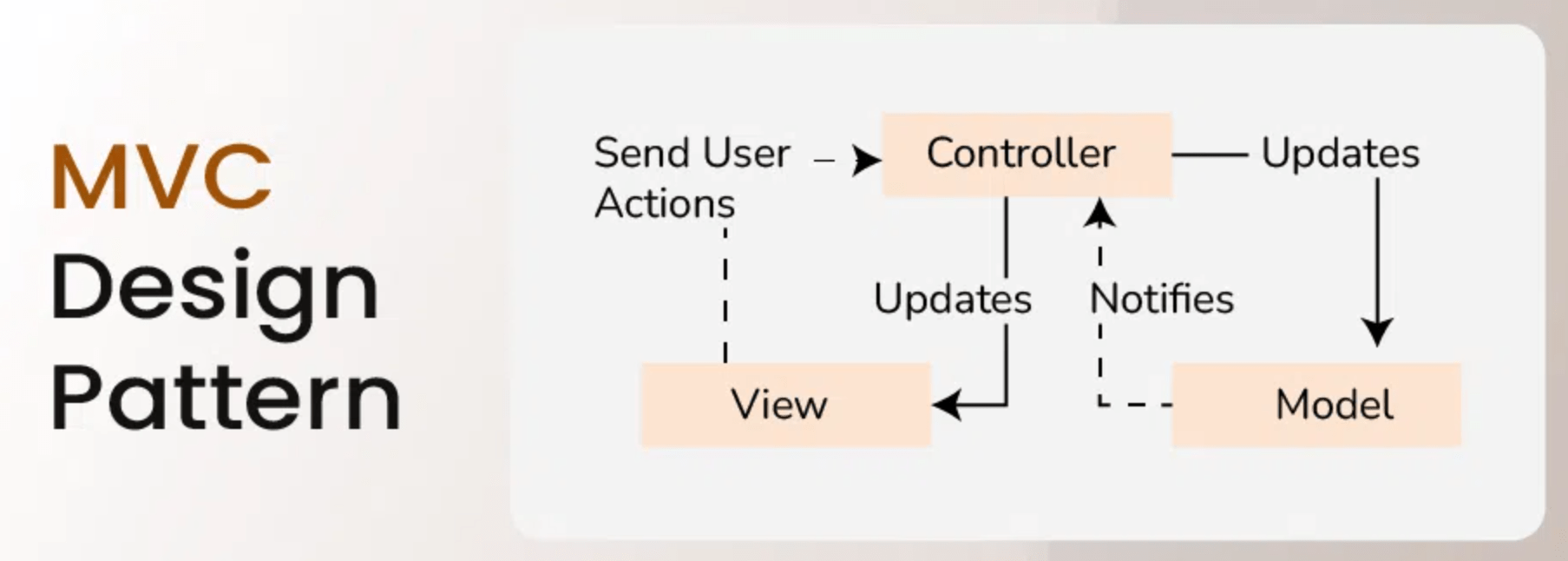

- Almost all business logic (the controls, in the classic model-view-controller setup) has been placed on the client-side. This is great, if you're a client developer, as it makes relays superfluous and traps your customers in your app, by making moving to a different app more onerous. Every move requires a period of readjustment and fiddling, before they can see their feed the way that they are used to seeing it. This is less great, if you're a user and are interested in trying out a different app.

- When I began, two weeks ago, the concept of topical, private, and personal relays interacting were mostly a pipe dream (pun intended), but I've been pleased to see, that some other people are beginning to catch on to the appeal of decentralizing and specializing the model layer. A diverse, sprawling network of relays, connected through the outbox model and negentropy syncing, is really next-generation communication, and essential for ensuring censorship-resistance, while supporting smooth interaction.

- Once you get above a few hundred followers (which I already have, That went fast!), additional followers are increasingly spam or inactive/bot npubs, and once you get a few thousand followers, that Bot Effect goes parabolic, as your notes are spread more widely onto spammy relays. You won't notice, yourself, as anything over a few hundred becomes Some Big Number and you'll eventually stop even looking to see who they are, or caring about them, at all. Which leads directly to my next point...

- The number of followers a person has, correlates with an increase in their disdain for people who care about follower counts, likes, reactions, or even zaps. This noblesse oblige says nothing about the usefulness or information any of these signals carry. You will please also notice that they never change npubs and rarely change profile pics because of reasons I don't need to elaborate on, further.

- On-boarding is a lonely experience because nobody looks at the feed, and you initially have no followers. Even if you reply to people, they often can't see what you wrote because of your low WoT score. That is, unless you already know someone there, who can vouch for you. Or are lucky to get discovered by the Nostr Welcoming Committee and end up one of the biggest npubs overnight, which is like winning the follower lottery. For most new npubs, the experience is terrible and they eventually give up, for a handful the experience is absolutely fantastic and they are hooked. Obvious lesson: nobody should onboard, who doesn't know at least 1 other person: so invites only. Unlike Those Other Protocols, Nostr doesn't need a centrally-determined invite, as every client or relay can offer their own version, geared to a different audience. The goal simply needs to be: get off 1.

- I don't get many zaps or reactions, anymore, but I still have interesting conversations, and I no longer face the surreal situation of every cough, hiccup, or sneeze I emit being front-page news. Nostr feels more like Nostr, again, and less like Twitter, and now I want communities and forums even harder.

-

@ fd208ee8:0fd927c1

2024-09-27 07:10:40

@ fd208ee8:0fd927c1

2024-09-27 07:10:40Let's talk about baking bread

I've mentioned a few times, how large-scale central planning leads inevitably to artificial scarcity and rising prices. Allow me to illustrate -- using a completely invented allegory about bread -- that has absolutely no parallels to any economy you may already be familiar with.

We start with 20

Let us say, there is a group of 20 people in a village doing something that requires some niche skill and interest, but not inordinate amounts of talent or uncommon knowledge, such as baking loaves of bread containing emmer wheat. This is not an easy thing to do, and you'd have to read up on it and practice, to begin with, but it's not an insurmountably-high barrier for anyone who already knows how to bake.

Now, they're not baking all that much of this bread, as the market for people who want to eat it, is still rather small. But, they're happy to bake the bread, and sell it below cost (at $10), as they can see that the market is steadily growing and they know that there is a possibility of recuperating their investments, and maybe even turning some profit. They hope to eventually profit either directly (through the selling of the bread), or indirectly (as A Person Who Helped Invent Emmer Bread), or ideally some combination of the two.

They are baking away, and honing their baking skills, and scrounging up the money for bigger and better ovens or cleverly-arranging discounted contracts for slightly-larger deliveries of wheat, and more and more bakers see this activity and wander over to their village, to see how this bread is made. Well, the current bakers are starting to sink under all of the bread orders they are receiving, and customers are complaining of late deliveries, so they start to ask the 10 visiting bakers, if they would like to also set up a bakery and take some of the production off of their hands.

We now have 25 bakers

The visiting bakers consider it and 5 agree and the rest wander off again, as they already are quite busy baking the bread they've always baked, and they aren't as certain of the possibility of growth, for this new type of bread.

The 5 additional bakers take a while to setup shop and assemble staff and place wheat orders and etc., but after a few weeks or months, they are also adding to the bread supply. There are now 25 bakers, all completely booked-out, producing bread. The price of bread has fallen, to $8/loaf.

And the bread they produced! All of the bakers competing for orders and expanding their product lines and customer base quickly lead to the white emmer bread being followed by whole-grain emmer bread, emmer dinner rolls, emmer-raisin bread, and even one rebel daring to bake spelt-emmer pretzels because... Well, why not? The customer, (who, at this point, is the person eating the bread), gets to decide which bread will be baked, and the pretzels sell like hotcakes.

The emmer hotcakes also sell like hotcakes.

No baker is making much (or any) money off of the baking, but they all can see where this will end up, so they are still highly motivated and continue to invest and innovate at breathtaking speed. We now have emmer baking mixes, "We luv emmer" t-shirts, emmer baking crowd-sourcing, all-about-emmer recipe books and blogs, etc. The bakers see this all as an investment, and cross-finance their fledgling businesses through selling other bread types, their spouse's day job, burning through their savings, or working Saturday night, stocking shelves at the grocery.

Everyone can be a winner! Everyone can find their niche-in-niche! Everyone can specialize! Private enterprise for every baker, who rises and falls on his own efforts alone! And although everyone was competing with everyone else, there was no bitterness, as everyone could clearly see that effort and reward were in some sort of balance.

We are now short 3

But, alas, that was not meant to be. The joy and harmony is short-lived.

A gigantic, wealthy foundation, who is dedicated to "ensuring much emmer bread will be baked, by financially supporting emmer bakers" enters the chat.

"We have seen that there is much baking going on, here, but just think how much better and more baking could be done, if we financed your baking! Isn't that clever? Then you could really concentrate on baking, instead of having to worry about financing your business or marketing your products. All you have to do, is apply to receive our baker's grant, by signing this form, acknowledging that you will only bake products containing nothing but emmer and you will otherwise support our mission. We promise to pay you $100/loaf."

The 2 people making spelt-emmer pretzels, and the 1 person making spelt-emmer cookies, refuse to sign on, and slink off, as they are very convinced of the rightness of including spelt. One emmer-purist baker refuses on some economic principle that nobody comprehends, and immediately turns around and goes back to work in their bakery, with their shoulders hunched. But the remaining 21 bakers happily apply for a baker's grant. The mixed-grain bakers are upset about the breakup of the emmer market, and spend some time sulking, before wandering off to the new, much-smaller, spelt bread market, that is setting up, down the street. Where they sell their bread for $6 and slowly go bankrupt.

And then there were 10

2 weeks go by. 4 weeks go by. Baking has slowed. The grant hopefuls hold a meeting, where they discuss the joys of baking. Baking slows further.

Everyone is too excited, to find out if their new Universal Customer will be paying for the bread they bake. $100 a loaf! Just think of it! All of the bakers quickly do the math and realize that they not only will turn a profit, they can buy themselves a nice house and a new car and...

Nobody listens to the complaints from The Old Customers, who are the useless individual people only paying $8, despite them slaving away, all day, in front of a hot oven. They should be happy that they are getting bread, at all! Instead they complain that the bread is dry, that the delivery is late, that the bottoms are burnt. Ingrates.

And, then, the big day arrives, and the foundation happily announces that they will be giving 10 lucky bakers a grant.

The bakers are stunned. It had seemed that all of the bakers would be getting the grants, not only part of them. But, of course, the Universal Customer looked through the applications and tried to spend its money wisely. Why give grants to 5 bakers, who all produce the same type of olive-emmer bread? Give it to one, and then tell him to produce 5 times as much bread. He is then the olive-emmer bread expert and they will simply keep loose tabs on him, to nudge him to bake the bread in a sensible manner. And, of course, he shall always focus on baking olive bread, as that is what the grant is for.

The bakers stroll off, to their bakeries. Those who baked olive bread and received no grant, close up shop, as they can see which way the wind is blowing. The other grantless bakers reformulate their bakery plans, to see if they can somehow market themselves as "grant-free bakers" and wonder at how long they can stand the humiliation of selling to demanding, fickle customers at $8/loaf, when others are selling at $100/loaf, to an indifferent customer who doesn't even eat it.

The happiest 10 bakers leave for another conference, and while they are gone, their bakeries burn down. Their grants continue to flow, regardless, and the actual bread eaters are now standing in line at the last few bakeries, paying $20/loaf.

The End.

-

@ fd208ee8:0fd927c1

2024-09-27 07:09:57

@ fd208ee8:0fd927c1

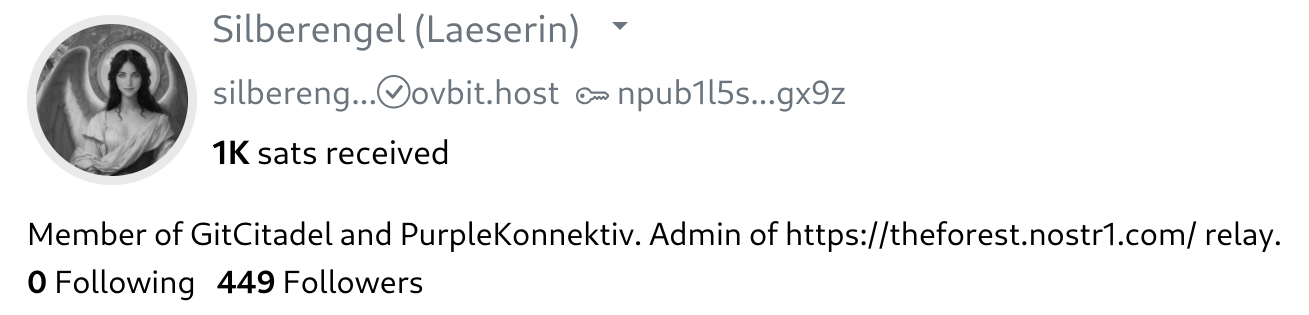

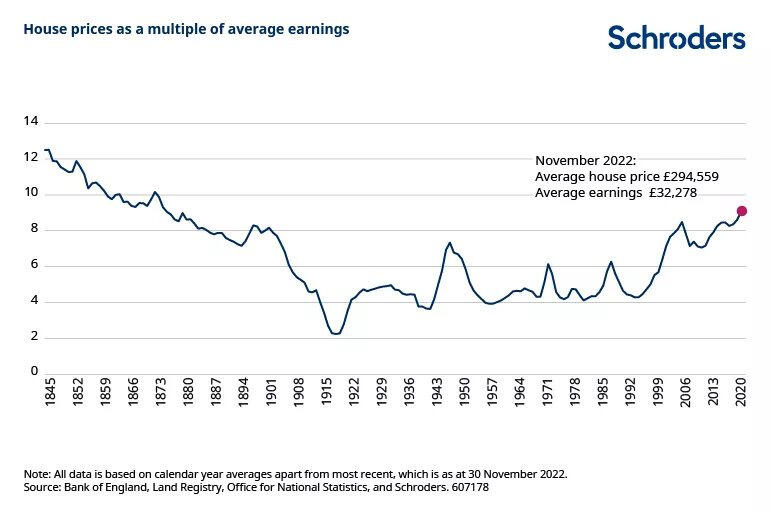

2024-09-27 07:09:57Young people, in Europe and America, started moving out at the turn of the last century. It wasn't a tradition, in those countries. Housing was formerly multigenerational, but people became steadily more transient, with industrialization and the following rise of office work and the concentration closer to cities.

Prior to then, housing (including rents) was prohibitively expensive, so everyone tried to stay in their parents' or employers' home, for as long, as possible. Both the "Go west!" and "Lebensraum!" slogans hint at that crowded past. People risked their lives, en mass, trying to find enough cheap land, to build their own home. Many people left Germany, and similarly crowded countries, to move to places like Texas, where you could own your own home and therefore marry without your employers' or parents' permission.

It is still common to have inheritance fueds, here, in Bavaria, with the children squabbling over who gets to "keep" the house and how much "payout" the other children will receive, as compensation. Because you cannot always simply move to a different home in the same area (there is little available land for building and nothing to rent), leaving the ancestral home can result in de facto banishment from the entire region.

Wages increased, after WWI created a tighter labor market, and governments and large corporations (receiving government subsidies) began building or subsidizing massive amounts of homes, while the size of each home shrank dramatically. Those factors combined to lower the relative cost of housing, to the individual purchaser.

But the resulting Baby Boom construction explosion so overwhelmed the housing and mortgage markets, that housing is a very unappealing long-term investment, now, as there is hardly anyone around, to move into those many homes, when the Boomers pass. Their children and grandchildren (if they have any) are much poorer than they are, and much fewer in number, which guarantees that the housing market in most areas will eventually begin to collapse, in real terms, as Boomers pass away, or attempt to downsize.

To stabilize prices and prevent fires or delinquency, governments will begin demolishing empty houses, as they already sometimes do, in the former East Germany. Former West Germany dealt with steadily-falling house prices by mass-importing foreigners and paying for their rent at above-market prices, to artificially reinflate the housing market, but it appears that the easterners had a more politically- and economically- sustainable model for ridding themselves of excess homes.

But the era of cheap housing is over, and will continue to be so, for the next 10-15 years, so young people increasingly stay home, well into adulthood. As some cultures now have "moving out", as a prerequisite to dating, their childrens' marriage rate has plummeted and, consequently, so has the birth rate.

-

@ 01d0bbf9:91130d4c

2024-09-26 17:58:10

@ 01d0bbf9:91130d4c

2024-09-26 17:58:10Chef's notes

Amazingly tangy, firey hot, but still mellow and bright.

I use this on everything– Use it to dress salads, dip (honey mustard) for fried chicken, elevate your taco nights, heck a spoonful first thing in the morning will wake you up better than coffee!

Don't forget to use up those delicious chilis and garlic, they are so good!

Details

- ⏲️ Prep time: 20 min

- 🍳 Cook time: 1-2 weeks

- 🍽️ Servings: (12x) 8oz jars

Ingredients

- 16oz fresh chili peppers

- 8oz red onion

- 8oz garlic

- 96oz honey

- Fresh thyme

Directions

- Thinly slice peppers, garlic, shallots and fresh thyme

- Add chopped ingredients to the honey

- Leave to ferment (loosely covered) for 1-2 weeks

- Drizzle that amazing pungent firey gold liquid over EVERYTHING. (Don't forget to use up those amazing chilis and garlic too.)

-

@ d6affa19:9110b177

2024-09-24 18:31:42

@ d6affa19:9110b177

2024-09-24 18:31:42i'm in the upstairs office. lost in some project i've been tinkering with. i feel driven with purpose.

the door is cracked open. i always leave the door open.

Her footsteps echo up the stairway. but my focus is intense; a solution just beyond my fingertips.

the door creaks open, a soft whisper of a sound.

i instantly feel Her presence. a sweet vanilla scent wraps around me, thick and intoxicating.

Her fingers brush through my hair, a gentle caress.

She grips my hair, then releases it— over and over again. it feels good.

a soothing warmth envelops me.

Her fingers glide, each stroke igniting my senses. a chill races down my spine.

the monitor becomes a bit distant.

"You're really focused, hmm?" She teases, leaning closer. "I'm just checking in on my sweet boy." Her tone alluring, already drawing me in.

"of course, my Queen." i reply, my eyes glued to the screen, struggling to concentrate. "thank You," my voice hints at annoyance. "i'm so close to finishing this up."

just when i near a breakthrough, She appears, a siren pulling me from my path. how does She know..? the quiet signals that betray my focus— that reveal my yearning.

"Hmmmm," She playfully muses.

ugh, i need to concentrate. but the way this feels...

it pulls me deeper.

Her fingers drift by my ear, lingering around my neck. nails grazing my skin, sending shivers through me.

my heart begins to race. the screen blurs, reality separates.

"Okay, sweet boy." Her voice is a soft command. Her nails dig in, a mixture of pain and pleasure. a sharp contrast to the softness of Her touch. "I'll be downstairs while you finish."

yet She remains. i close my eyes, drowning in the sensation. i should be finishing this project...

but each press feels like a silent command, an urge to abandon my thoughts, to succumb to the pull of Her presence.

the way She easily captures my attention... it makes me feel so vulnerable...

Her grip finally loosens, and slowly leaves my neck. it wants more...

i barely hear Her leave. but the air feels colder. the warmth of Her presence is fading. an aching emptiness fills the space...

the weight of Her absence settles in, another reminder of how easily She commands my thoughts...

desperately, i take in the remnants of Her scent.

i stare at my monitor. focus shattered, thoughts scattered like leaves.

i linger for a moment. fighting the urge to chase after Her.

the pull of Her absence is heavy in the air. i'm unable to resist. i rise from my seat.

the door is slightly open. She always leaves the door open.

i make my way downstairs, lost in the thoughts of serving Her. my true purpose...

-

@ a9434ee1:d5c885be

2024-09-26 10:42:52

@ a9434ee1:d5c885be

2024-09-26 10:42:521. Relay = Community?

If spinning up a relay is getting easier and cheaper by the day, why can't the relays literally be the group/community?

Then: * Any relay is by default a public community. The more restricted read- or write-access is, the more it becomes a private group. * Any publication targeted at (h-tag) and stored, and thus accepted, by a relay can be seen as a publication in that community. * All-in-1 hosting solutions (integrated blossom servers, lightning nodes, ...) are made easier.

2. Why invent new kinds?

Why can't Kind 1 posts that are targeted and accepted by a relay (i.e. community) just be the forum-posts of that community? Why create new kinds for this? And even weirder, why create a new kind with that exclusively serves as a reply to that new kind? Why not just use generic replies (kind 1111) and take the #otherstuff (event kinds and apps) as an opportunity to introduce those?

For chat messages, however, I get it. You need a kind + reply-kind for those.

3. Community VS Private group

It seems like the only distinction you really need, both for the user and the apps implementing all this, is:

1. Public Community: anyone can read and follow this community but for writing the admins can set limits (pricing, white listings, ...) 2. Private group: only the profiles that even know this relay (i.e. group) exists can interact with it. Read-access has to be granted (invite, pricing, ...) and admins can set limits for writing too. Beyond this distinction it's a bit naive to try to categorize them. Open vs Closed doesn't really mean much for example, since technically all groups/communities set limits and are thus closed. It's more interesting to look the ways in which they can be closed and build on the simplest distinctions you can make there.The difference between Public communities and private groups is the most important one because they both have very different UX and specification requirements:

Memberlist

Communities: None existent

Anyone can read and follow. It just has limits on who can publish what, when. So the most interesting thing to surface is probable something like a list of most active members or a highlighted set of profiles that have special characteristics within this community (top supporter, god-mode, resident artist, ...).

Private Groups: Necessary for it's existence

The whitelisted npubs for read-access are the members.Moderation actions

Both types of groups need a way for the admin(s) to:

* Block/remove users * Remove events * Edit metadata (name, description, guidelines...) * Specify who can write publish what, under what conditionOnly private groups need a way for the admin(s) to:

* Add/approve new members → specify who has read-access, under what conditionGeneralizing too many actions like

add member,join request, etc... that are only applicable to one of these categories just creates bad UX for the other one. You don't "add a member" to a public community. People can follow it without asking anyone's permission (ok yes, some will AUTH for reading but that's besides the point). Some of its followers will then just choose to publish something there and the admin either allows them or not.Having a common protocol for specifying the conditions for this write-access interoperably (as mentioned above) is what I would like to see instead: * Both Communities and Private groups need it anyway * You have to assume admins need granularity in the conditions they set for publishing in their group/community: Who, what, under what condition, ... * You don't want to link out to custom websites (or similar) explaining their allowance schemes

Sidenote: we need a similar kind of spec for the services that allow you to spin up your hosting solution (relay, server, node, ...) so that, when you click "Create new community" in an app, those services can be surfaced. With their business models (including options to self-host parts of it) just there, in the app, without linking out. Same for the lines of communication and payments that are needed to make those business models work from within any app.

Publication and Discovery

Only Communities allow for the exciting possibility of publishing something in multiple overlapping communities at once. Someone writing about how Bees are Capitalists can target their article at the communities that most overlap with its content (and with the author's means and write-access of course). Members of a community around beekeeping can organically discover content and communities on Austrian economics relevant to them.

With Private groups publication happens only in the group and discovery is blocked on purpose.

-

@ ee11a5df:b76c4e49

2024-09-11 08:16:37

@ ee11a5df:b76c4e49

2024-09-11 08:16:37Bye-Bye Reply Guy

There is a camp of nostr developers that believe spam filtering needs to be done by relays. Or at the very least by DVMs. I concur. In this way, once you configure what you want to see, it applies to all nostr clients.

But we are not there yet.

In the mean time we have ReplyGuy, and gossip needed some changes to deal with it.

Strategies in Short

- WEB OF TRUST: Only accept events from people you follow, or people they follow - this avoids new people entirely until somebody else that you follow friends them first, which is too restrictive for some people.

- TRUSTED RELAYS: Allow every post from relays that you trust to do good spam filtering.

- REJECT FRESH PUBKEYS: Only accept events from people you have seen before - this allows you to find new people, but you will miss their very first post (their second post must count as someone you have seen before, even if you discarded the first post)

- PATTERN MATCHING: Scan for known spam phrases and words and block those events, either on content or metadata or both or more.

- TIE-IN TO EXTERNAL SYSTEMS: Require a valid NIP-05, or other nostr event binding their identity to some external identity

- PROOF OF WORK: Require a minimum proof-of-work

All of these strategies are useful, but they have to be combined properly.

filter.rhai

Gossip loads a file called "filter.rhai" in your gossip directory if it exists. It must be a Rhai language script that meets certain requirements (see the example in the gossip source code directory). Then it applies it to filter spam.

This spam filtering code is being updated currently. It is not even on unstable yet, but it will be there probably tomorrow sometime. Then to master. Eventually to a release.

Here is an example using all of the techniques listed above:

```rhai // This is a sample spam filtering script for the gossip nostr // client. The language is called Rhai, details are at: // https://rhai.rs/book/ // // For gossip to find your spam filtering script, put it in // your gossip profile directory. See // https://docs.rs/dirs/latest/dirs/fn.data_dir.html // to find the base directory. A subdirectory "gossip" is your // gossip data directory which for most people is their profile // directory too. (Note: if you use a GOSSIP_PROFILE, you'll // need to put it one directory deeper into that profile // directory). // // This filter is used to filter out and refuse to process // incoming events as they flow in from relays, and also to // filter which events get/ displayed in certain circumstances. // It is only run on feed-displayable event kinds, and only by // authors you are not following. In case of error, nothing is // filtered. // // You must define a function called 'filter' which returns one // of these constant values: // DENY (the event is filtered out) // ALLOW (the event is allowed through) // MUTE (the event is filtered out, and the author is // automatically muted) // // Your script will be provided the following global variables: // 'caller' - a string that is one of "Process", // "Thread", "Inbox" or "Global" indicating // which part of the code is running your // script // 'content' - the event content as a string // 'id' - the event ID, as a hex string // 'kind' - the event kind as an integer // 'muted' - if the author is in your mute list // 'name' - if we have it, the name of the author // (or your petname), else an empty string // 'nip05valid' - whether nip05 is valid for the author, // as a boolean // 'pow' - the Proof of Work on the event // 'pubkey' - the event author public key, as a hex // string // 'seconds_known' - the number of seconds that the author // of the event has been known to gossip // 'spamsafe' - true only if the event came in from a // relay marked as SpamSafe during Process // (even if the global setting for SpamSafe // is off)

fn filter() {

// Show spam on global // (global events are ephemeral; these won't grow the // database) if caller=="Global" { return ALLOW; } // Block ReplyGuy if name.contains("ReplyGuy") || name.contains("ReplyGal") { return DENY; } // Block known DM spam // (giftwraps are unwrapped before the content is passed to // this script) if content.to_lower().contains( "Mr. Gift and Mrs. Wrap under the tree, KISSING!" ) { return DENY; } // Reject events from new pubkeys, unless they have a high // PoW or we somehow already have a nip05valid for them // // If this turns out to be a legit person, we will start // hearing their events 2 seconds from now, so we will // only miss their very first event. if seconds_known <= 2 && pow < 25 && !nip05valid { return DENY; } // Mute offensive people if content.to_lower().contains(" kike") || content.to_lower().contains("kike ") || content.to_lower().contains(" nigger") || content.to_lower().contains("nigger ") { return MUTE; } // Reject events from muted people // // Gossip already does this internally, and since we are // not Process, this is rather redundant. But this works // as an example. if muted { return DENY; } // Accept if the PoW is large enough if pow >= 25 { return ALLOW; } // Accept if their NIP-05 is valid if nip05valid { return ALLOW; } // Accept if the event came through a spamsafe relay if spamsafe { return ALLOW; } // Reject the rest DENY} ```

-

@ 1d5357bf:1bdf0a52

2024-09-24 15:49:11

@ 1d5357bf:1bdf0a52

2024-09-24 15:49:11If Bitcoin Is in Its Infancy, Nostr Is Still in Its Nursing Stage Skepticism is healthy, especially within the Bitcoin community. At the moment, Nostr users are predominantly Bitcoiners, and it's understandable that people are cautious about adopting new technologies. However, based on my limited experience over the last few months, Nostr has shown immense potential and is evolving at a breakneck pace.

The Speed of Development: A Double-Edged Sword The rate at which new functionality is being rolled out on Nostr is staggering. On the one hand, this rapid development brings constant innovation and new tools for users to explore. On the other hand, it often means that many implementations still need refinement, or at the very least, better documentation. It's exciting, but there are still bumps in the road that need to be ironed out. Censorship Resistance and Relay-Based Architecture One of Nostr’s most appealing features is its decentralized architecture, which revolves around relays. This design ensures that the protocol is censorship-resistant. If you’re tech-savvy enough, you can even run your own relay, allowing you to retain full control of your notes. This distributed system empowers users by giving them the tools to protect their content and stay independent of centralized entities.

A Protocol, Not a Platform Nostr is not a platform—it's a protocol. This distinction is crucial because it enables a high degree of interoperability, which can pave the way for a diverse ecosystem of applications. This opens up a world of possibilities and allows for network effects to take hold as more people and applications begin to interact with the protocol.

Privacy and Control Another advantage is the ability to manage your privacy more effectively. With Nostr, you can use multiple nsec/npub keys, giving you more control over your identity and interactions. This flexibility is a game-changer in a world where privacy is often compromised by centralized platforms.

Areas for Improvement Of course, Nostr is not without its challenges. Many of the available applications feel unpolished, and spam is a growing issue (the infamous "reply guy" problem). The ephemeral nature of the content also presents a challenge—once you post something, you can't "put the toothpaste back in the tube," sort to speak.

Enjoying the Ride Despite its growing pains, I’ve found Nostr to be an enjoyable experience so far. There are no algorithms dictating what you see, which results in a signal-rich environment with minimal toxicity—for now, at least. It’s refreshing to engage in conversations that aren’t manipulated by unseen forces, and I look forward to seeing where Nostr goes from here.

-

@ 3bf0c63f:aefa459d

2024-09-06 12:49:46

@ 3bf0c63f:aefa459d

2024-09-06 12:49:46Nostr: a quick introduction, attempt #2

Nostr doesn't subscribe to any ideals of "free speech" as these belong to the realm of politics and assume a big powerful government that enforces a common ruleupon everybody else.

Nostr instead is much simpler, it simply says that servers are private property and establishes a generalized framework for people to connect to all these servers, creating a true free market in the process. In other words, Nostr is the public road that each market participant can use to build their own store or visit others and use their services.

(Of course a road is never truly public, in normal cases it's ran by the government, in this case it relies upon the previous existence of the internet with all its quirks and chaos plus a hand of government control, but none of that matters for this explanation).

More concretely speaking, Nostr is just a set of definitions of the formats of the data that can be passed between participants and their expected order, i.e. messages between clients (i.e. the program that runs on a user computer) and relays (i.e. the program that runs on a publicly accessible computer, a "server", generally with a domain-name associated) over a type of TCP connection (WebSocket) with cryptographic signatures. This is what is called a "protocol" in this context, and upon that simple base multiple kinds of sub-protocols can be added, like a protocol for "public-square style microblogging", "semi-closed group chat" or, I don't know, "recipe sharing and feedback".

-

@ bf95e1a4:ebdcc848

2024-09-24 13:40:45

@ bf95e1a4:ebdcc848

2024-09-24 13:40:45This is the full AI-generated transcript of Bitcoin Infinity Show #127 featuring George Manolov!

If you'd like to support us, check out https://bitcoininfinitystore.com/ for our books, merch, and more!

Welcoming George Manolov

Luke: George, welcome to the Bitcoin Infinity Show, thank you for joining us.

George: Thank you, Knut.

Knut: Good to have you here, George.

George: to be here, yeah.

you're here to tell us about the city that I was most surprised by ever. Like, I've never heard of the city before I went to Bulgaria, Yeah, time flies.

Knut: So Plovdiv, Bulgaria, which was amazing, this rich, Thousands of years of history plays with a lot of different eras and different styles of architecture and stuff, really enjoyed Plovdiv, and you have a football team there.

George: yeah, indeed.

George Manolov and Botev Plovdiv

George: Please give us the story about George and Plovdiv Yeah, sure.

Knut: Plovdiv.

George: Sure, sure. So, Plovdiv is, well, I would say it's the oldest living city in Europe, so continuously inhabited. Like you say, not many people know it. I guess, like, we don't have good enough marketing, but, that's probably part of my job right now, right? To spread the word about it. so it's, like the second largest city in the country.

And, yeah, it's just this, it's very, like, I love how you put it because almost nobody has really heard of Plovdiv, right? Most people, when they hear of Bulgaria, they've probably heard of Sofia but Sofia is, okay, but Plovdiv is kind of the chill place, Plovdiv is the place that is actually worth visiting, the place where, people just enjoy going there.

I was born there, right? and, grew up there till 18 or so, then, Studied, lived in Sofia most of the time. And, last year, in kind of summer, I was already kind of way deeper into Bitcoin. I decided I'm going to go full time into Bitcoin, just commit all my time in Bitcoin at the time, educating, publishing books in Bulgarian about Bitcoin, creating my own educational platform.

And then I got, reached out and connected really to the owner of the football club in the city, which is also the oldest football club in the country, Botev Plovdiv, who was, well, he got introduced into Bitcoin himself and he realized it's going to be a very big, project. You know, going to play a central role in where the world is going.

Knut: What is this the owner of the club?

George: That's right. The owner of the club. was like, Hey, I think we can do something unique with Bitcoin because, you know, the club is really a company, right? It's a business on the one hand, but it's a special type of business, it's not where just you produce a certain product or service.

It's really a living organism where people are involved into it, for very emotional reasons. people feel like it's their own and it's not like a small group of people. It's a very large group of people. In our case, we have tens of thousands, arguably more than a hundred, 200, 000 people who care, who watch, who follow the club.

And so on the one hand, like there's many different ways in which we can look into this, but on the one hand. It's for me, what really inspired me and what got me like, Oh my God, like, is this really happening is that we can bring the conversation about Bitcoin from a completely different angle into society to a group of people who for the most part would never really They would like this, they would never listen to podcasts like this, they would never get to any of the kind of places and things we listen to, watch, consume, right?

and people go, You know, people go kind of for bread and circus, right,

Knut: yeah, yeah.

George: for the games. That's what really football is, right? It's fun and it's emotion, it's enjoyment, but then we push them censorship resistance and hard money, right?

And we don't really push it, you know, that's the thing, right? Because are like consistently, progressively, gradually over time, introducing it and finding the best way and the most appropriate way to, yeah, plant that seed. To the minds of the people, into the views of the people and so on and so forth.

so it's really like, you know, what we're trying to build is, we feel we're in a very privileged position, right? because we've been, the first really professional sports club globally, I would say, to have, uh, crypto Bitcoin, you know, people, departments, who is actually full time employed to, you know, think of a way to grow the business, to think of a way to integrate Bitcoin natively, within the various aspects of, of, of the organization, which obviously initially includes like accepting payments and so on and so forth.

But, um, but there's so much more you can do exactly with this type of, Like organization, again, like not, not, not just a business in a traditional sense.

Knut: Yeah. And, uh, won the league, right? Is that, is that right?

George: Yeah, man, like it's, uh, yeah, so we, um, when I started last year, things were super bad. Like exactly one year ago, I was there for the, for one of the first games. It was horrible. Like, I was like, okay, this is a great idea, but if the team is doing so bad and if, uh, if they keep losing and if the fans keep getting, you know, being unhappy, Um, it's not gonna go anywhere, but still, I gave it a, I gave it a go, right, because I was like, okay, I just hope that the sports side guys are going to do their, their part, and I have my opportunity here, um, to, to just like push, to educate, to, To do what, what, what life is giving me an opportunity to do.

And, uh, very fortunately, as we started working, the team started performing better and better and better. We got a completely new coach. We got a new sports director. We, we had a lot of key staff changes across the organization, which, Um, relatively quickly started showing results. So, uh, yeah, like, 10 months later in May, we won the Bulgarian Cup.

Luke: Is that the cup or the league? Like, uh,

George: it's the cup, it's the cup. So, so, I was saying, like, we started very bad in the league. And so, we were doing better and better, but still, like, we finished 9th in the league out of 16 clubs at the end of the day. But which was still okay, because, like, when I joined, like, we were, like,

Luke: Worried about relegation or something like that?

George: there. I mean,

Knut: We're complete, uh, like I've tried to take an interest to football, but like, uh, my ADD just, the brain just wanders away after five minutes and I can't concentrate anymore. So I don't

Luke: a basketball fan.

Knut: Am I now?

Football for Noobs

Knut: Uh, so, uh, what's the difference between the cup and the league? Let's begin there. That's, that's how much of a football noob I

George: So, so pretty much in every country is the same, right? You have a league or a championship where you have, in our case, 16 teams, and every team plays twice against every other team. So home game, away game, and then, you know, you either win three points when you win, or you lose, or you draw, and you, you, you win one point.

And then, so after you play, after you play, in our case, this, what is it, games? You know,

Luke: 30.

George: yeah, about 30. Yeah, right. You're better than Matt, it's obvious. So, um, so once you play these 30 games, um, you, um, yeah, like the team with the most points wins, right? Whereas, uh, the cup is direct elimination

Knut: So quarterfinals, semifinals, all that.

George: exactly. So it's the easier way. So this was the way for us to due to the bad start of the season. This was the way for us to, to achieve something in this season and to achieve something important because what the Cubs gives us as an opportunity and gave us was to play in the European Leagues.

So UEFA Leagues. And we just did that. We played six games. Uh, for the Europe, uh, Europe League and the Europe Conference League.

Knut: Okay. But to, to be in the champions league, that's a totally, you have to, yeah, yeah. You have to win the league and you have to win all sorts of stuff. Like how does that work?

George: yeah. You have to win the league. And then in our case, so in every country it's different, but in our case, we have to win, like we go to qualifications for the Champions League. So it's like, I mean, three to four games. And if we win that, we go to the Champions League.

Knut: Alright,

George: That's the current state of affairs, although that can change over the years.

Knut: alright, uh, it all makes sense to me now, that's a lie, but anyway.

Luke: No, uh, I'll definitely, we'll acknowledge here that I'm more of the, the sports fan, uh, generally here, and I, I follow football, I like, uh, I like European, uh, football, uh, well, and obviously I'm using the correct, uh, term despite my, um, my pseudo American accent, uh. Yeah, anyway, um, uh, no, it's fantastic to see, and I mean, yeah, for the non sports fans, uh, listening to this, I get that

Knut: Well, I am a sports fan, it's just that Starcraft 2 is my sport, and yeah, yeah,

Luke: yeah,

George: eSports.

Knut: yeah, yeah, so I watch, watch Starcraft 2 games. That's what I do for procrastination sometimes.

Luke: valid sports, I'm not going to compare it to other things that aren't

Knut: breakdancing? Is that a valid sport?

Luke: Breakdancing is, um, hmm, interesting. I think anything with points, that judges give points, is kind of not a sport, it's an activity.

Knut: yeah.

Luke: but, yeah, anyway,

Knut: thing to do.

Luke: is a thing to do, yes, definitely, but back to, back to, um, um, Botev Plod, is it Botev, Botev, what's, what's, Botev, Botev Plod, yeah, so, so, um, yeah, yeah, like, the, the, the achievement, winning, winning the cup, I mean, the, The cups are sort of more difficult.

They're both difficult in their own way, right? Like, the cup, you lose one game, you're out, basically, right? But, I mean, the league is like this endurance, achievement, right? You have to perform well over the course of the whole season. But the cheat code, so to say, and I probably subconsciously used the other football team's terminology, who's in the space, Real Bedford, um,

Botev Plovdiv's Bitcoin Strategy

Luke: The, the idea right, if, if I'm getting it, is that you guys would, would keep the Bitcoin in the, in the, the treasury, the, the company, and then over the course of time it's just gonna do the number go up thing and, and the, the club will have more resources.

Right. Is that, is that the idea you're thinking with the, the bitcoin strategy?

George: There's actually many, many things to it. And this is kind of the most, let's say, vanilla type of approach. Yeah, like just buy Bitcoin and hold it on the balance sheet, which is, which is great. But there's actually so many other things you can do. And that's where, because if you just do that, frankly, like, I mean, you don't need me involved, right, much.

I mean, just call Coinbase, whatever, wire the money, crack in and, buy. but with us it's like, really, uh, we see a huge opportunity to, first of all, align our brand with the Bitcoin brand, which is a royalty free, uh, The biggest brand in finance, for sure. One, uh, like it's going to be the biggest brand in the world for sure at some point.

Right. So that's, that's one play. And to do this, it's not enough for you to just buy Bitcoin and hold it on a balance sheet. It's what you need to do is proof of work, right? You need to do things that nobody has ever done. You need to really kind of be creative. Uh, and, and, um, to push the boundaries of what anyone has ever done before, right?

So, so that is, uh, that is my kind of job and it's a lot of, um, a lot of just like, let's, let's think of what, what new things we can do with Bitcoin and sports and football that nobody has ever done. Just because others are focused on the short term things, they're focused on, hitting those, those quick wins, those quick goals, which is why, for example, like a lot of the sports and, and that have, you know, interact, they haven't really interacted outside of Bedford with Bitcoin, right?

It's mostly been crypto because it's just, okay, let's make some quick money. Um,

Luke: usually, it's usually just sponsorships, right?

Knut: yeah,

George: yes. Um, and for us, because on the one hand, like, we're not like Manchester United, right? We're not Chelsea. So we don't have that much to monetize immediately. Like we're a large club, but.

Luke: You're a large club in a local league, which is, which is different from the, it's not one of the leagues that is internationally positioned like that. But, but, I mean, the, the difference between you guys and Bedford that I, that I think is, is really interesting. Like, McCormack, what he, Peter McCormack, what he's doing, I mean, he's, he's taking a club from the bottom and aiming for the top.

But who knows how long that's going to take him to get there, right? But you guys are already in the top of your league, right? Like, in the top league.

George: right, yeah, and also there's, there's different in this, we're in the top of our league. My goal, personally, is to go to Champions League, but this is very hard, right? Because, like, okay, when you start from Peter's ground, like, it's easy, okay, every year you level up, you level up, or, I mean, I'm not gonna say it's easy, but it's easier than, uh, than once you're, you know, at our level.

For us, it's important to play currently every year in European leagues like we've done so far and to every year consistently, like, increase the level of the sports, level of the business department bit by bit, and, but like breaking that point where we, you know, win the league, Where we win several more games and enter the Champions League, that, that's really hard.

I mean, because you're already at that stage where everybody, like, so many teams are so strong, right? So it's um, it takes just a lot of ingredients for you to, to, to hit, uh, in order to win. But we're gonna get there.

Knut: and does the club self custody it's bitcoin? And if so, is it a something out of 11 multisig, that sounds like a football thing?

George: Why so? Ah, yeah, an 11? Nah, nah, fuck that. I mean Nah, even, even 7 Motosick is a, is a killer, but no. Um, yeah, I can't really speak too much about this at this point. Yeah. Um, but, um, but yeah, I mean, we do, of course we do self custody. So that's, that's the approach that we've chosen with kind of a lot of, um, we've chosen to go really pure, pure Bitcoin in terms of the strategy.

And that's how we set ourselves apart. That's how we believe we win the long game because for instance, like we Bitcoin with BTC pay server. Which in my mind they don't even have competition. It's the only like, real, solid, autonomous, sovereign way to accept payments. And it's also the way which makes sense for like, Frankly, any standard business, because like, man, we're selling scarves, we're selling, um, membership boat cards, we're selling jerseys, we're selling basic merch, and if we are to sell it with basically any other service out there, outside of BTC Pay Server, we have to basically, uh, indirectly do KYC, right?

Like, we have to go through KYC, we have to go through KYB, which is ridiculous, um, in my mind. And so, um, so that's why we're exceptionally thankful to B2C Pay Server guys, uh, for what they've built. Uh, it's been like an absolute pleasure to, um, to use their product, to use their service. Uh, we have, you know, outside of B2C Pay, we, uh, we are the first, uh, sports club on Nostr.

Where, uh, we have, uh, actively been posting, exploring, you know, meeting people here. Kind of thinking of what we could do from our angle again, like first, first time on Nostr.

Aqua WAllet

George: Um, we have partnered with, uh, Aqua, JAN3's Aqua wallet, which has a, a Botive skin mode now. So if you go to settings, you can turn Botive mode and then it turns into the colors of the club and, you know, have the picture of the stadium there.

Um,

Luke: I'm using Aqua right now because, uh, uh, usually I like to use Aqua as like a sort of a middle wallet, uh, uh, because it's still slightly slower than other lightning wallets because they, they, the, everything actually lives on, on liquid and then they, they, uh, go out via bolts. Uh, so it's slightly slower than a faster, um, like, like than other, um, more direct lightning wallets.

And so usually when I come to a conference, I'm going to load up a, like a temporary. I don't know, Blink or something like that, but I forgot to do that, so I'm just using my Aqua wallet, and you know what, it's been great here, it's been working, uh, so yeah, we're big fans of Aqua wallet and what

Knut: Yeah, and a BTC pay server. I mean, uh, we can echo everything you said that we, BitcoinInfinity. com, like, and the store here We just fired up. Everything is powered by a BTC pay server, and we just love it. Yes.

Luke: So what was your question about, uh, Aqua?

George: If yours is on BOTEV mode.

Luke: Uh, I don't think I've gone into the settings and changed it to Vaudev mode, I'll have to do that, maybe we'll take

George: It's dark mode,

but cooler.

Luke: Doc dark mode, but cooler. Okay. Okay. Actually that's a, that's a, that's a good point. That's a good point. Yeah. We'll take a, we'll take a picture after, uh, after the episode and we'll de proof, bot, uh, bot e mode, and, uh, uh, post that on Nostr.

How does that sound?

George: Let's go.

Knut: Yeah. Nostr. Um, is there a connection there between both a plot and Nostr while you're doing Nostr stuff as well?

History and Freedom

George: Yeah. Well, look, um, a lot of these things is like, so What Botev Plovdiv stands for, um, very importantly, so the club was named after Hristo Botev, who's, uh, like, one of the most Bulgarians, if the most famous Bulgarian revolutionaries, like, historical figure, uh, he was a poet, he was a revolutionary, he fought for Bulgaria's freedom back in the day,

Luke: Which, which day, which, what day did you

George: uh, 110, uh, what is it, like, 50 years ago or so?

Yeah.

Knut: Mm-Hmm?

Luke: Okay. So, so

Knut: before the Commes.

Luke: ottoman, uh,

George: Yeah, yeah, yeah. He, he, he, he fought for the, for the liberation of Bulgaria from, from the Ottoman Empire. And a lot of what he stands for is this fight for freedom, his fight for liberty. Um, and this, this lives until this very day into the identity of the club and to what we stand for into the songs, into the, into the music.

Um, you know, um, the kind of like what, what our fans also resonate with, um, and, and what they sing like in many, in many ways. Right. So, um, Freedom of speech, freedom of, uh, of like freedom in general is, is a value that is deeply ingrained into kind of like what the club stands for. Um, and, uh, you know, that's why I'm into Bitcoin.

That's why I believe. And that's, that's why I saw this even bigger opportunity. Oh my God, like, how is this happening? There's so many, sometimes, you know, some like weird things happen in life and you have no explanation why and how all these things align. But, but for me, it's like this club was made really to.

to be aligned with BOTEF and to be, uh, to, to, to be aligned with Bitcoin and with Nostr. If I look at all the other clubs in Bulgaria, right, like just in Bulgaria, none of the others, like, there's no this contextual historical background that you can make these connections. But with us, we have it, and what a chance that, like, we have this owner, and he got, like, introduced to it, and then we got connected.

Like, how the hell does this happen, man? I don't know,

Luke: We like to say this, the surreal doesn't end, you know, and like, uh, my, my whole story, I've been talking about this, uh, at the, the conference here is like two years ago was the first time I ever met Bitcoiners here in Baltic Honeybadger. We, we met for the, for the first time, uh, all three of us, uh, met for the first time two years ago, I've been in Baltic Honeybadger and it's like, things, things happen so fast.

Uh, I've, I've, uh, I've thought it was been awesome just following, uh, what you've been doing with the, the club and the story. So great to, Great to get to talk about it, but, uh,

Bitcoin in Football

George: Yeah. No, for, for me, like really the, the most exciting part is really even coming forward. So, uh, because, so now it's been, so we, a long, we announced, uh, publicly that we're doing this, uh, 31st October last year. So the anniversary of the, of the, uh, Bitcoin White paper, um, we've built a lot right. And very, very importantly, I'm super proud, like, I don't know if you saw this, but like a month ago, we played on European League, the UEFA League with Bitcoin straight on our jerseys, which was like, like, when I saw this, I'm like, dude, it's crazy that this is happening.

But, but the best is really yet to come, like, like we like to say. Um, so I, I think we, we're, we have, um, we have still so much more to do. So for me, the next big part, which I'm super excited about literally in the coming month as, uh, as I go back. So is to finally get some of our. Players or at least one or two to get to do something publicly about this, because at the end of the day, that's why for me, the more I do, the more I, uh, play in this arena, I realized this is really a Trojan horse for us to bring Bitcoin into the conversation, into the minds, like I said, of people who otherwise wouldn't and, and our players, you know, especially a few of them, they're really influencers, right?

Um, a lot of people follow them. A lot of people respect them. And, um, and if they do, uh, you know, something meaningful, something cool, something impactful, this is going to have a huge impact onto our forwards. This could very well have impact onto, um, other sportsmen, other football people, other football clubs, right?

Uh, so that's why I'm doing it, right? Really?

Luke: No, this is fantastic, and actually this was exactly where I was hoping to go next, so thank you for queuing that up. But, no, no, the game theory of all this, right? Like, one club getting, Positioning as the, as the Bitcoin club in a league, uh, really means that eventually all the other clubs are going to need to adopt Bitcoin.

If they're going to be able to compete, because if play playing out the game theory, number go up, whatever it is, Bitcoin strategy plays out, you guys are going to be the most financially capable club. Financially sustainable in not very long, you know, assuming everything plays out the way we're thinking it will, right?

So, so other, other clubs then would become incentivized to also adopt Bitcoin. So what, what do you, what do you think about that? Like you, do you, do you see that, uh, happening as well?

George: Yeah, I'm not really sure if it would happen to me. That fast, to be fair. Like, I think it's inevitable, right, obviously, but I think it, yeah, like, I think this definitely takes at least three, four years, maybe more. Um,

Luke: That's, that's still pretty fast.

George: yeah, I guess. I mean, I mean, like, okay, let me define it better. It takes three, four years.

So, for other clubs within our league to start doing something like this, uh, maybe it takes less time for other clubs to realize it, but I think for them to do it, it also depends on our actions, right? So because like, we don't have like a treasury of microstrategy or something, so it's not, and we're not doing like a

Luke: you don't?

George: monthly like leverage on top of leverage on top of another leverage, you know, uh, we're not in, in Michael's privileged position. but we can do other cool things, right? Uh, one of the, um, so this is not yet live and this is not yet happening, but one of the, like two, two projects, let's say, I'm gonna briefly, like, tease here that, that I'm working on that I hope to have very large impact is first, uh, building this, uh, simple tool Uh, called like a Bitcoin, uh, football salary calculator that, uh, it's like really a DCA tool, but like looking back and like tailoring it to our niche where I want to, for us to visually and emotionally Show, um, to players, but also to fans of ours, like what Bitcoin could have done for their remuneration, if you look one year back in time, two years back in time, three years back in time, four years back in time, and for them to really realize, Oh my God, this is a no brainer.

Right? I want to make this mess. And this is hard, right? Um, because like, there's so many tools and like, but I want to be, because the audience is very wide, very different types of audience. I want to make this so that you can consume it in like two, three, four minutes. And you're like, okay, I need to learn more about this.

This actually is interesting. There's like, that's so much dense and emotional and compact information that you're like, Whoa. Why am I not doing this? How did I miss this?

Knut: What, what, what was the name of that website? I, I don't know if it's still up, but bitcoin or shit.com or something like that. So, so it lists if you bought this item when it came out, an iPhone five or whatever, uh, and if you had bought b bitcoin instead.com, I think that that's the, that's the name. So if you bought, uh, if you bought Bitcoin instead, it shows you how much, how much more money you'd have now and how many iPhones you

George: Yeah. Yeah. And of course there's many of these tools, obviously like we've all see them and we all like like them and retweet them and repost them. And it's all great. But I think, at least I hope that we can do something impactful with this. If we really tailor it, compact it to a specific type of niche audience with a specific message designed for them.

And because this audience is also like. A type of audience who can also like, um, you know, bring it to other bubbles that we ourselves are not part of, right? So that's, for example, one like, uh, one like project I'm very, very excited about and I hope we can, um, yeah, we'll bring forward relatively soon.

There's a few moving elements, but definitely in the coming month or two, uh, at most. And then, uh, and then, you know, speaking of the other clubs, what, what I want us to do is what we're working is next year, we're targeting to do, I hope we could do the world's first, uh, Bitcoin, uh, Cup tournament. Uh, for youth players, 70 year old boys who are, you know, right there before they sign their first professional contract, start earning money, for them, first of all, like, it's a Bitcoin football cup, like, it's the first time this, this could potentially ever happen And then it's, it's a football first tournament, right?

This is the, we want to make it like top quality, like really the highest quality when it comes to sports, but then you have Bitcoin involved all over the place, right? In terms of brand, in terms of rewards, in terms of, um, in terms of like plays, um, like, like games and, and interactions, activations, uh, throughout, before, throughout, and after the, And after the event, and for this, I'm targeting to get really like, like big clubs.

I mean, because it's academies, right? I mean, I cannot get the Manchester United first team, just maybe we could get the Manchester United 17 year old team or, you know, another big club. We get some of these, and then like we get their brands, we get them on the focus of Bitcoin. And we drive the conversation faster, you know, not three, four years from now, but Less

Knut: what about, um, like right now there's you and there's, um, you guys and there's a real bed for it, right? Those are the two I know of in Europe. Are you aware of any other clubs that are doing a Bitcoin strategy? I mean, is this virus spreading? Like, have you heard anything like,

George: Um, Oh, there's, uh, there's the Austrian Admira Vakir who have done some integration. So it's a second tier, uh, second league, uh, second league, uh, club that have, uh, that have, uh, you know, they've also had Bitcoin on the, their second team jersey. And, um, and they, they also accept Bitcoin payments, uh, here and there, but you know, the thing is, there's some other clubs, um, there's a Miami, um, not Miami, um, a Hawaiian club that, that is doing, uh, that is doing like their Bitcoin gig,

Knut: yeah, there are other, other sports, right, other sports team and sports teams in other sports that are doing it. But, but for football specifically,

George: which ones?

Knut: Uh, I'm so bad with sports, but wasn't there like a hockey team or a basketball team or

Luke: I'm not aware of any others, actually. Yeah, like, uh, there's been some attempts at

Knut: it's

Luke: an orange colored team or something like

Knut: more the individual athletes,

Luke: Yeah, yeah, there have been individual

Knut: for instance, a

Luke: have been individual

Knut: player, and there was some American football player.

George: There's been individual athletes, a lot of them. There's been, I was asking if you know, but there's been a baseball club in Australia, the Port Heat. Uh, who did kind of a Bitcoin strategy. Uh, but very unfortunately that didn't work out. They kind of started this at the peak of the last bull cycle. And, um, and as I understand, uh, there wasn't like a strong alignment between the owners and the management in terms of like understanding that this is a long game.

So that's why this kind of flopped. Um, but yeah, like I, I think the reason why it's not happening in more, unfortunately, and, and, and I see this even, even within our club, uh, you know, but, but definitely no other clubs because Fiat has permitted sports as well. Right. So all the sports club, uh, clubs or the vast majority in football, for sure.

They're like, you know, on the hamster wheel themselves.

Knut: They're indebted,

George: They're indebted.

Knut: to an extreme level,

George: yeah, like, like fighting for every dollar for every income. So it's, it's hard for you to like, Oh yeah, we're going to have this long term Bitcoin strategy that's going to take like two, three, four, five years to play out.

And we can benefit a lot from it. It's very, very hard in, you know, unfortunately for a large organizations, sports club in particular to To have this realization, to map this out, to get others on board. That's why it's not so popular and uh, and that's why I'm grateful and keep pushing that we have this chance.

Luke: I mean, you make a great point here about essentially the, it's the organizational alignment, right? Like the, the, these are companies, sports clubs are companies. They just have this large, the business is involved around getting fans to come in and consume this sort of marketing. Product, essentially. So it's, it's a certain kind of company that's run a certain way, but just like any other company, you need, you need alignment from the management.

So it's, it's fantastic that, uh, Boteb Plovdiv has, has the, uh, alignment and is, is putting their, their trust in you to, to move this thing forward. And I mean, from the, from the perspective of this thing, Playing out, right? The, the best part that, uh, I think one of the best parts that you, you mentioned again was the, the influencers.

Like you get, you get some players, there's, there's so many angles to, to reach people through this. I think it's, I think it's fantastic. The, uh, orange pilling a player and then they move to another club, but they, they, maybe they don't get to get paid in Bitcoin, but maybe they still put, put their money in, in Bitcoin.

Maybe they even ask their club to, to, uh, pay them in Bitcoin, something like that. And then the, the Questions start getting, uh, asked and all this.

5 Year Goals

Luke: So what, what is the, the goal in, in five years, for example, where, where do you see the club in the five year mark?

George: Oh man. Yeah, in five years, I think we definitely have to be in Champions League. Like in my mind, you know, like people around me like, oh, you're too ambitious. I'm like, man, yeah, like in five years, we definitely have to be in Champions League. Uh, that's, that's my personal goal. On our internal Slack, I have the Champions League icon there.

That's why I'm there, right? Um, so, uh, it's a lot of hard work. Like, it's really a lot of hard work. And it's also not completely dependent on me and my work, to be fair. Like, because, at all. I mean, really, like, uh, I mean, at the end of the day, the most important part is the sports department, right? Uh, in the club.

Um, so that has to continue going well. But, but I think We're going in a good direction there too, because we have the, they're the long term view as well, right. We have our academy internally, which is, yeah, it's one of the best academies. It's the best really academy in terms of infrastructure in the country.

That's why we're also can't afford to think of this Bitcoin Cup tournament, because we have the infrastructure, we have like a super cool stadium, that's crazy. If we can, if we can do a final for, for such a tournament there. Um, so, so we have all the things in place in terms of In terms of assets, I would say, uh, it's just a lot of moving parts.

a lot of work, consistency, and a bit of luck. Always it comes, you know, when, when it comes to, when it comes to football and sports, but, but five years from now, I want us to be in the champions league. I want us to be the absolute, you know, international professional level, uh, Bitcoin level, Bitcoin sports club.

and, uh, and I want for this tournament that I start to be like a, like, like to have the fourth edition by then. Uh, and, and I want to have clubs, but five years is a lot of time, you know, as you say, like, I also want to have other clubs following us by then. I think that's absolutely, absolutely is going to be doable.

Knut: What, what are the, what are the tax laws around Bitcoin in Bulgaria? Like what, are there any issues there? Or like what, is it easy enough,

George: It's kind of okay. Uh, it's kind of okay. So if you just buy Bitcoin and hold it, like you don't, uh, you don't, uh, incur taxes, uh, until you sell it, if you accept Bitcoin for payments, um, and if you don't sell it, you can just, uh, keep it as inventory on your balance sheet. So again, no,

Knut: but there's a capital gains tax or something if you sell it. Yeah, yeah, yeah. Alright.

George: 10%. So it's, it's, uh,

Knut: Pretty good.

George: Yeah, I mean, it's not like El Salvador. Okay. Uh, but, but it's, uh, it's, it's way better than many other places. Um, and, uh, yeah, so we've been looking, looking actually, so I was in El Salvador a couple of months ago, because we've been looking very much to do stuff there.

And we've been, uh, yeah. Um, because we've been, we've been thinking of what to do more with Bitcoin, right? So that's why I said, like, it's not just about buying and accepting Bitcoin. It's about corporate strategies, about branding strategies, about how to make money. Um, it's about education strategies. It's, there's so much around it.

So in terms of corporate strategy, I was, uh, we're very attracted by El Salvador, um, and their, uh, capital markets regulation, because they're basically striving to build capital markets on top of Bitcoin. Bitcoin is legal tender there. They have all kinds of, tax incentives for companies to issue debt or to sell equity.

on their capital, on their, um, well, let's say nascent upcoming capital markets, because it's not like it's, you know, hustling and bustling yet. Um, but, but they're, they've put a lot of the rails, uh, um, or they're building a lot of the rails to, um, to really enable the, the, the creation of Bitcoin based capital markets.

So, um, we've had great talks there. We have meetings with, uh, um, we have. Yeah, with the Bitcoin office, right? Um, so, ideally, like, we're striving to build some connection there and to do something, interesting and world first again from a corporate perspective. It's just that, as many things, it's a little harder than you would expect it to be, or it takes a little more time than, Then you would hope to do it.

But my idea or long term vision, frankly, like what we want to do with Bitcoin, uh, and with the club is to enable our current fans and global fans to become co owners of the club. And that's why, you know, I have big hopes for, uh, for us being able to do this out of El Salvador and through El Salvador, because this would, like from a tax perspective, from a branding perspective, from legal security perspective would be, would be ideal.

It's just that, again, um, my enthusiasm is a little over, uh, ahead of kind of like how, uh, how, how advanced and set up everything there is, but, uh, but we're, we're very actively talking to them. We're working with many parties there, so. Just maybe we can have big news there too.

International and Local Effects

Luke: Well, no, and, and you actually said something great about global fans. I think this is a, a fantastic thing, right? A a again, Bedford is, is similar. They've, they've got, they've got fans all over the world and, and I think for you guys it's like who is going to tune into the Bulgarian football league outside of Bulgaria before, well, not too many people, but now a bunch of Bitcoiners.

If they're into, if they're into football or, or not even, because this is the funny thing. There were, there were a lot of people posting about that. They, they've got, they, they don't usually follow, follow sports at all, but, but they'll follow the Bitcoin team. So the, the funny thing is, I think, I think the first, the first club to adopt Bitcoin in every league is going to get all of these global fans.

And maybe the, maybe the, the second one, the third one, maybe can get some kind of other support, but it's really the first one in every

George: really.

Luke: That, that

George: Not

Luke: That's that. I, I completely agree with you there. It's the, it's the first one

Knut: first mover advantage.

Luke: mover advantage. It's gonna get, it is gonna get all of the, all of the Bitcoiners are gonna now be, be supporting and, uh, uh, yeah.

I mean, have, have you seen, uh, some, some uptick in, uh, kind of international

George: yeah, yeah. So, international but also local. Like, local is very important. Like, we have, like, so many people in the country who's like, just what you say, like, I didn't care about sports or football, like, forever, or at all, ever, but now I follow, now I buy merch, now I come, you know, every now and then they come to games, so

Luke: Well, because there's the bread and circuses thing that you said, it gets tossed around in the Bitcoin world and also some other places on kind of the Twitter sphere and whatever, it's like it's a distraction, that sports is sort of a distraction from clown world basically and it's a way of people to sort of Uh, forget about what's going on around them, but I think that's also missing the, the positives, which it, it's a, it's a community builder, it brings people together, there's a, there's a sense of, of pride in, in something local succeeding, everyone, everyone's happy, there's, there's real economic, uh, effects usually when a, when a local sports team wins, and so, so from, from my perspective, I, I, I think, I think sport is a good thing, and it's, and it's, it's something that, that people can rally around, and so,

George: an amazing thing.

Luke: Yeah.

And, and so what, what are, what are you looking at locally? Like what, what do you hope to have the effect, uh, uh, locally in, in piv?

George: Yeah. Um, yeah, no, look, uh, for me, sports, like, for us, the, the, the, the, about Plovdiv, for me, that's what I realized, like, we're kind of very much into Bitcoin and stuff, obviously, that's our interest, but I think when we go on a Bitcoin standard, Right. And, uh, in general, people start feeling wealthier, opposed to, like, being in the grind.

You're just going to have more time for fun stuff, right? Like playing football, I mean, or volleyball, or whatever your sport is, or, like, going and cheering your team, and, uh, and being part of such a community. And I think that's really what, you know, even Nostr is about. Like it's, Being part of these communities, because that's fun, and like, we as humans, at the end of the day, we are living to be part of communities, right?

And you find your community, you're an active part of it, you contribute to it, you evolve it, right? You build it in one way or another. And unfortunately, you know, today in the fiat world, this is just like A stress valve in many ways, or like you say, like Brothers and Sisters, whatever. Um, but, uh, but I think it can be so much more, right?

It is, but it can be so much more for a larger amount of people and so on and so forth. uh, but yeah, well, back in Plovdiv, man, like, I have big hopes. I really have big, big ambitions there. I want to get Bitcoin into the wallets of, uh, of like tens of thousands of people. I want people to wake up. I want people to see.

Luke: big is piv? How many

George: It's like three, four hundred thousand people. So it's a lot. Uh, our stadium is, uh, 21, 000 seats stadium. I'm kidding. I'm kidding. It's, it's 19. I wish it was 21.

Luke: Yeah. You'll have to add 2000 more

George: Maybe, yeah, we'll, we'll think of some additional construction.

Luke: the, make the infinity stand when

George: Right. Right. But, uh, but yeah, like the setting was super cool. Like, it's really cool.

Like when it's feel like, man, the atmosphere is amazing. Um, and so it's, and it's really this community that you can feel that people are involved. So it's, it's like consistency and it's social engineering in one way or another, right?

Knut: one of our favorite words,

George: but in a positive way.

Knut: in a positive way, okay.

George: So it's social engineering for us to ingrain Bitcoin and make it part of kind of what people see, do, have, own, interact with, right?

So, uh, I think exactly because of this community element, exactly because, Because, you know, football is a football club and there's this unique living organism we can, we can create this and, you know, it's fascinating. I'm so much into this and there's other people who are so much into this. Oh my god, like, we can make such a big difference.

And, and like in the country. You know, on a political and economic level, they don't get it. Like, they don't see it. They just are in their, you know, like, oh, are we going to accept the euro? Oh, what's happening with the war? I'm like, who cares? Let's build.

Bulgarian Currency Situation

Knut: Yeah, Bulgaria has its own shitcoin, I almost forgot about that, but uh, what's it called again?

George: Kinda. Um, but not quite, to be fair. It's, it's a good coin, uh, not for investing, but, but for medium of exchange is actually decent. Uh, Lev, Lev

Knut: Lev, yeah, yeah, yeah. Yeah,

George: and I recently got educated about this. So, uh, the lev is pegged to the euro. So, um, uh, so, so that, that is super cool for, for us, for me as a consumer, for businesses, because like the fixed rate.