-

@ f33c8a96:5ec6f741

2024-11-25 23:43:20

@ f33c8a96:5ec6f741

2024-11-25 23:43:20 -

@ f33c8a96:5ec6f741

2024-11-25 23:41:06

@ f33c8a96:5ec6f741

2024-11-25 23:41:06 -

@ f33c8a96:5ec6f741

2024-11-25 23:27:06

@ f33c8a96:5ec6f741

2024-11-25 23:27:06 -

@ 3c7dc2c5:805642a8

2024-11-25 22:05:54

@ 3c7dc2c5:805642a8

2024-11-25 22:05:54🧠Quote(s) of the week:

'Most people don't understand how difficult it is to hold something that has gone up 10x, let alone 100x or 1000x. It takes extreme conviction, internal fortitude, and patience. Bitcoin greatly rewards those who have these qualities.' - Vijay Boyapati

'1) You spend 1000+ hours understanding Bitcoin and at the end of it you realize what an incredible godsend it is. You start buying like a madman while telling everybody (even people you don’t care about). You get ridiculed and belittled by almost everyone.

2) Thanks to your deep understanding of this incredible invention/discovery you hodl firmly despite the price going down 70%. Then the price goes nowhere for 6 months. Eventually, 3 long years later you had tripled your money. Everyone around you calls you lucky.' - Bitman_PoW

🧡Bitcoin news🧡

Let me start this week's Weekly Recap with the following tweet by Sam Baker (macromule):

The US dollar has peaked and will never recover. This is because we can't save dollars, we only spend them. River's thesis unveils the past, present, and future of money in society Let's start with how we got here:

Read the full thread here: https://x.com/macromule/status/1857106408203759674

On the 18th of November:

➡️We are still THIS early to Bitcoin. Enjoy the ride people, buckle up.

Fun fact. Bitcoin now has as many users as the internet did in 1997. You're still early!

➡️Bitcoin's blockchain was used to uphold electoral integrity in the latest US Elections. No other cryptocurrency can do this without reproducing the same centralization/trust issues they are trying to solve.

Screven County, Georgia made history on November 5, 2024, when it became the first county in the United States to use the Bitcoin blockchain to safeguard the results of its elections.

Full story: https://www.forbes.com/sites/frankcorva/2024/11/16/bitcoin-blockchain-used-to-secure-election-results-in-georgia-county/

➡️Global healthcare group Cosmos Health adopts Bitcoin as a treasury reserve asset.

➡️MicroStrategy demonstrated that you can put $4.6 BILLION into Bitcoin without moving the market.

These signs of market maturity will encourage bigger players like sovereign wealth funds to buy Bitcoin.

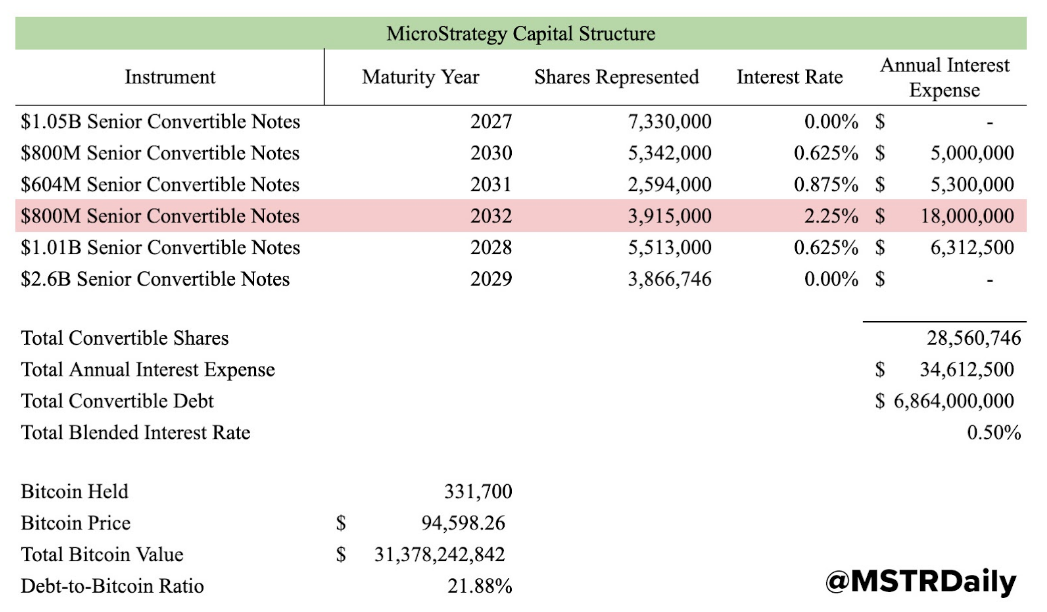

At a 0% yield, MicroStrategy's $1.75bn convertible note is currently priced as being more risk-free than every tenor on the US Treasury curve.

Investors are demanding a negative risk premium from the company that is literally just using their money to smash buy Bitcoin.

On the 19th of November:

➡️Michael Saylor to help Rumble CEO add Bitcoin to its balance sheet. Let's go!

➡️Bitcoin miner reserves hit new yearly lows.

➡️Shareholder activists have secured Saylor a 3-minute slot to present to the Microsoft board on adding Bitcoin to their treasury.

Sam Callahan: 'The big story here is how a single small shareholder managed to get the board of one of the largest public companies to consider a Bitcoin strategy—simply by submitting a proposal. I get the sense that the cyberhornets are about to take shareholder activism to a whole new level.'

Microsoft has $523 billion in assets on its balance sheet—which is 28% of Bitcoin's market cap.

➡️Another All-Time High: Bitcoin mining sustainable energy use hits 56.75%

Up a massive 67.7% in four years (since the same point in the last halving cycle). No other industry has done this. And as of today, no other industry can.

Daniel Batten: 'By using Bitcoin as a method of transaction you reduce net emissions by avoiding its less sustainable precursor, the banking sector By using Bitcoin as a store of value, you reduce net emissions by avoiding its less sustainable precursor, the gold industry. '

➡️'Bhutan has mined over $1 billion worth of Bitcoin using its previously stranded hydropower resources. My country, Norway, also has abundant, stranded hydropower. When will we start a national bitcoin mining project?' - Jaran Mellerud

His country, like mine and the whole EU, is more focused on printing more € to feed their NGOs that the politicians control, and they still don't care about mining Bitcoin. By the way, that $1 billion worth of Bitcoin is 34% of Buthan's TOTAL GDP!

➡️'Bitcoin euphoria is here. 99.3% of UTXOs are in profit now. Everyone's happy. This euphoric phase typically lasts 3–12 months (except the Nov '21 bull trap). This started 2 weeks ago. Shorting now could be either catching the top—or shorting at the bottom of a parabolic bull run.' -Ki Young Ju

➡️Dennis Porter: "I can officially confirm that I have been asked to speak before members of Congress/Parliament in two different nation-states about implementing a ‘Strategic Bitcoin Reserve’. One in Europe. One in LATAM."

Pro Bitcoin cantor CEO Howard Lutnick names U.S. Secretary of Commerce. He has "hundreds of millions"invested in Bitcoin.

➡️AnchorWatch, a pioneering insurance provider specializing in bitcoin custody, proudly announces its designation as a Lloyd’s of London Coverholder. This milestone solidifies AnchorWatch’s position as a leader in the emerging insured bitcoin custody solutions market. The company will officially open for business in December 2024 with binding authority of up to $100M per customer, helping to secure the wealth of American retail and institutional investors.

Source: https://www.businesswire.com/news/home/20241118360660/en/AnchorWatch-Becomes-Lloyds-of-London-Coverholder-Set-to-Begin-Operations-in-December-2024

Huge news! One small step for Bitcoin, one giant leap for adoption. This will enable a lot more Bitcoin independent holders to exist and help Bitcoin decentralization from centralized (qualified) custodians. I think it's hard to understate how important this piece of the puzzle will be. Incredible accomplishment by Rob Hamilton and the team of AnchorWatch!

➡️Bitcoin is now worth more than JPMorgan, Visa, and MasterCard COMBINED! The world's biggest bank and the world's biggest payment processor. AND...

➡️ It surpasses the Great British Pound (GBT) to become the 5th largest currency in the world.

Or

Bitcoin is now worth more than the Top 3 Global Banks combined: • Bitcoin: $1.85 trillion • JPMorgan Chase: $684 billion • Bank of America: $356 billion • IC Bank of China: $280 billion

➡️ETH is down 56% relative to BTC from the cycle bottom—over the same time BTC is up 455%. Ain't that a bitch, REKT!

No financial advice and quoting Samson Mow: "Just a note of caution to all the shitcoin speculators: what is happening to Ethereum now will happen to whatever thing you’re currently excited about. This is how it has always been and this is how it always will be. Sell it and buy Bitcoin while you still can."

Again no financial advice just some facts. It has been unprofitable to hold ETH over Bitcoin for 2,113 days, which is 62% of its trading history.

Unless you were around in 2016 til mid-2017, or bought the bottom in 2019-20, you would have been better off holding the orange rock.

On the 20th of November:

➡️MicroStrategy is now in the top 100 US publically traded companies. MicroStrategy has now outperformed NVIDIA over a 5-year time frame and it only adopted Bitcoin as a treasury asset 4 years ago. MicroStrategy: 2,749% NVIDIA: 2,683%

And on this day they announced the pricing of convertible senior notes offering. $2.6 billion. 0% coupon. 55% conversion premium. Due 2029.

And MicroStrategy was the 3rd most traded stock yesterday. More than Apple, Microsoft, and Amazon combined.

Here is the kicker. MicroStrategy's Bitcoin holdings are now worth over $15 BILLION in profit.

➡️Publicly traded biopharmaceutical company Hoth Therapeutics to purchase up to $1M in Bitcoin adopting it as a treasury asset.

➡️ Someone just moved 50 Bitcoins they've been HODLing for 12 years. They turned $200 into $5,000,000.

➡️Tyrone Ross, 401 Financial CEO: “There is a frustration that the advisors typically cannot discuss [Bitcoin] with clients. They can't bring it up. They're admonished not to say anything at all, and they are embarrassed by that. It just makes them look silly.” If your financial advisor cannot even bring up Bitcoin, how the F are they a financial advisor?

Joe Carlasare: "You’re a financial advisor. For years, every time a client asked about Bitcoin, you shut it down. ‘Too risky,’ you said. ‘Not backed by anything. Not a serious investment.’ Maybe you even chuckled at the idiots buying it. Now, the higher-ups at your firm—the ones who set your marching orders—have greenlit Bitcoin ETFs for your clients.

Imagine that call. You’ve got to bring up Bitcoin, unprompted, to the same clients you dismissed and ridiculed for even considering it. You’ve got to explain why their instincts were right all along. And why a 5% allocation makes sense. And then brace yourself for the obvious question: ‘If you missed this, why should I even listen to you? Why do I need you?’

On the 21st of November:

• Gensler announces resignation as SEC Chair • Trump unveils advisory council to set up Strategic Bitcoin Reserve • Bitcoin reaches the $100,000 mark

➡️Satoshi Nakamoto’s 1m Bitcoin is now worth $97.4 BILLION, making him the 12th richest person in the world.

➡️German government sold 50,000 Bitcoin at $55,000 Bitcoin is up 85% since then. Missed out on a cool $2.35 BILLION.

➡️Another record volume day for Metaplanet with ¥27 billion ($174.43 million). Good for #23 today in Japan, ahead of Honda and Nintendo. Saylor playbook in action.

➡️Dennis Porter: 'Texas lawmaker declares “I want Texas to have a Strategic Bitcoin Reserve first”.

Game theory is playing out. Texas has a $2.6 trillion economy and is the 8th largest economy in the world.

Texas launching a Strategic Bitcoin Reserve would send shockwaves across the globe and increase the FOMO of a National Strategic Bitcoin Reserve.'

➡️'If you hold 0.1 Bitcoin: - There are only 21M coins, placing you among the wealthiest 210M people globally (top 2.63%). - With 4M+ Bitcoin lost forever, you’re actually in the top 2.13%. - But here’s the kicker: some own more than 0.1 Bitcoin. Only 4.5M addresses hold more than 0.1 coins, putting you in the top 0.56%.' -Simply Bitcoin

➡️El Salavdor’s Bitcoin holdings now top over half a billion dollars. Excellent. El Salvador’s President Bukele takes to Instagram to show off the country’s 113% gains on its Bitcoin holdings.

Meanwhile the IMF: "We beg you to stop the adoption of Bitcoin because ultimately we cannot blackmail you anymore to push through our totalitarian undemocratically one world government agenda." - CarlBMenger

➡️Bitcoin miner MARA just raised $1 BILLION to buy more Bitcoin. Again, Saylor's playbook is in action.

➡️$9 Trillion Charles Schwab to get into Spot Bitcoin and crypto ETF sales - Bloomberg 'Schwab CEO Says He "Feels Silly" For Not Buying Crypto; Announces that Schwab Will Enter Spot Crypto Markets.'

➡️Publicly traded AI company Genius Group bought another $14 million Bitcoin after buying $10m BTC just 3 days ago.

➡️Bitcoin is on track to close the biggest monthly candle EVER!

On the 22nd of November:

➡️Bitcoin exchange balance continues to drop have reached an all-time low, according to data from CryptoQuant. No one is prepared for what is coming.

➡️Hashrate going absolutely ballistic. The network has never been more secure. Very bullish!

➡️Social media where you can choose your own algorithm, including from a third-party algorithm marketplace or making your own.

Sovereign content discovery. The future is here: Nostr! Primal 2.0 is here: http://primal.net/downloads

Nostr is still in its early adopter phase, just give it a try. I am using Nostr and only Nostr to share my Weekly Recap and earn some Bitcoin, Value4Value, for my content.

➡️Newmarket Capital CEO explains on CNBC how Bitcoin-backed loans reduce their risk. Newmarket manages $2B in assets. Bitcoin collateralized mortgages are clearly coming. I am not going to use this in the upcoming decade. But this will be the future.

➡️'US Bitcoin ETFs now hold a record 1.1 million Bitcoins. The number of Bitcoins held by US ETFs has DOUBLED over the last year. To put this into perspective, there are now ~20 million Bitcoins in circulation out of the total supply of 21.0 million. In other words, ETFs hold 5.5% of all Bitcoins mined.' -TKL

➡️Germany's biggest insurance company, and Europe's 2nd largest insurance company, Allianz SE, bought ~25% of MicroStrategy’s 2031 convertible note. Wait until other global insurance companies figure this out.

➡️ Something that pops up every now and then. Criminals prefer Bitcoin', or 'Bitcoin is used by criminals'. blabla

Daniel Batten: 'Yes, Bitcoin is used by criminals... The 0.3% of cybercriminals who conduct ransomware attacks prefer Bitcoin. The other 99.7% of cybercriminals prefer traditional (fiat) currency.

Source: https://batcoinz.com/do-cybercriminals-prefer-fiat-or-bitcoin-the-data-is-clear/

➡️Senator Lummis says: We have a gold strategic reserve. We have an oil strategic reserve. Bitcoin is digital gold and should be one of our reserve assets. "We could cut our debt by HALF in 20 years with a Bitcoin Strategic Reserve."

➡️Bitcoin miner MARA buys another $551m Bitcoin.

'With our 0% convertible note offering: - We acquired 5,771 BTC so far, at an average price of $95,554 per BTC. - 35% BTC Yield Per Share - Total owned BTC: ~33,875 BTC, currently valued at $3.4B based on a spot BTC price of $99k.' -Mara

➡️Trump's Secretary of Treasury nominee Scott Bessent: "I think everything is on the table with Bitcoin."

ON BITCOIN: "One of the most exciting things about Bitcoin is that it brings in young people and those who have not participated in markets before" Bessent also praised Bitcoin's ability to cultivate "a market culture in the U.S." while making users believe in a "system that works for them"

Trump’s favored pick to be the next SEC chair just posted “Make crypto great again” Bitcoin adoption is accelerating.

On the 23rd of November:

➡️'Today the block reward is 3.125 BTC. This costs $305k. In 2044 the block reward will be 0.0976 BTC. This costs $9.5k today.' -Bitcoin For Freedom

On the 24th of November:

➡️Only 1,003,525 addresses have more than 1 Bitcoin.

➡️UK’s The Times discusses whether pensions should invest in Bitcoin. Thomas Shelby's voice: 'Welcome to the FOOKING party lads!'

➡️'Cantor Fitzgerald has reportedly struck a deal to invest in Tether, with its $600 million stake representing about 5% ownership, according to the Wall Street Journal. Cantor CEO Howard Lutnick has also been appointed by Trump as Commerce Secretary.' -Bitcoin News

➡️Bitcoin spot ETFs bought around 34,860 $BTC this week while only 3,150 were mined. Pac-Man mode activated.

On the 25th of November:

➡️MicroStrategy has acquired 55,500 BTC for ~$5.4 billion at ~$97,862 per Bitcoin and has achieved a BTC Yield of 35.2% QTD and 59.3% YTD. As of 11/24/2024, they hodl 386,700 Bitcoin acquired for ~$21.9 billion at ~$56,761 per Bitcoin.

💸Traditional Finance / Macro:

On the 20th of November:

👉🏽'Total US stock market capitalization has hit $60 TRILLION for the first time in history. Over the last 4 years, the value of the US market has DOUBLED. By comparison, Asian and European stock markets are worth ~$18 and $15 trillion, respectively. If this trend continues, the US market will be TWICE as large as Asia and Europe combined as early as next year. To put this into perspective, the US stock market accounts now for 202% of the US GDP, the most on record. The US market is incredibly hot.' - TKL

On the 23rd of November:

👉🏽'US stock valuations are at 2001 levels: The US stock market's P/E ratio relative to global stocks reached 1.8x, the highest since the 2000 Dot-Com bubble. In other words, investors now have to pay nearly twice as much for US stocks than for their global counterparts for the same earnings. Over the last 15 years, the relative valuation of US stocks has DOUBLED. Since 2009, the S&P 500 and Nasdaq have returned 447% and 786%, massively beating the MSCI World ex-USA index gain of 52%.' -TKL

🏦Banks:

👉🏽 No news

🌎Macro/Geopolitics:

On the 18th of November:

'The Japanese Yen just hit 155 against the Dollar, its weakest level since July. The USD-JPY currency pair has risen 11% over the last 2 months, now near levels where Japan’s Ministry of Finance intervened this year. Japan spent a record 9.8 trillion Yen ($62 billion) to support the currency in late April and early May. In July, Japan spent an additional 5.5 trillion Yen ($36 billion) to support its currency. This came after the Japanese Yen hit its lowest level in 38 years.' - TKL

👉🏽 Ukraine has hit Russia with US long-range missiles - Russian state media This is concerning and unprecedented in the conflict so far. It’s a direct consequence of the Biden administration authorizing US long-range missiles & strikes into Russian territory.

👉🏽Jeroen Blokland: 'ECB President Lagarde: 'We can no longer see ourselves as a loose club of independent economies. That perspective is outdated in a world that is fragmenting into geopolitical blocs centered around the largest economies. Today we need to see ourselves as a single, large economy with predominantly shared interests.' It reads like she has zero notion that the Eurozone members seem to be moving in the exact opposite direction, stifled by centralized biased and unrealistic policies.' I hope we can select a candidate with a less EU-collective mindset at the next ECB elections. Oh wait, they don't get elected by public vote!

On the 19th of November:

👉🏽'Gold funds recorded $1.6 BILLION of outflows last week, the most since July 2022. This was also one of the largest weekly outflows over the last decade. Interestingly, this came after the second-largest inflow on record. As a result, gold prices fell ~7% in two weeks in a well-overdue technical correction. Gold prices are still up 24% year-to-date and are on track to record one of its best years this century. Gold markets are poised for a wild 2025.' -TKL

On the 20th of November:

👉🏽The ECB in its Financial Stability Review sounds the alarm over a return of market concerns over sovereign debt sustainability. These concerns are self-fulfilling, especially when they come from the ECB, which has to provide a credible government bond market backstop.

👉🏽US national debt reaches an all-time high of $36,000,000,000,000. Splendid job US!

'Since the start of this year, total US debt is now up by a whopping $2 TRILLION. In other words, the US has added an average of $6.3 billion of debt PER DAY for the last 316 days in a row. This means that the US government now holds $108,000 in debt for EVERY American. Deficit spending as a % of GDP is currently up to World War 2 levels while the Fed calls for a "soft landing." We are in desperate need of a change right now, we are on an unsustainable fiscal path.' -TKL

👉🏽 Last week I mentioned that the US budget deficit jumped by a massive $257 BILLION in October 2024.

By comparison, last October the US budget deficit came in at $67 billion, marking a 287% year-over-year increase. To put this in perspective, economists expected the October deficit to come in at $73 billion. This puts the actual budget deficit 252% higher than what economists projected. Just to elaborate on that with a haunting stat: Government spending per capita. $6,771 to $26,679 is a pretty big jump.

Source: https://www.federalbudgetinpictures.com/total-government-spending-quadruples/

On the 21st of November:

👉🏽'US bankruptcies in 2024 have officially surpassed 2020 pandemic levels. 570 large US companies have declared bankruptcy year-to-date, the most in 14 years. Over the last 3 months alone, a whopping 182 corporate bankruptcies have been filed. The consumer discretionary sector has been hit the hardest, experiencing 90 large bankruptcies year-to-date. This is followed by 68 filings in industrials and 59 in healthcare. Bankruptcies are surging as if we are in a crisis.' -TKL

I will repeat the statement by Fed chair Powell once more: 'In the case of a financial stability event, the Fed can use emergency tools.' Ergo: print the shit out of it!

👉🏽'Global central banks now own 13% of total gold reserves, the most since the 1990s. This share has DOUBLED over the last 10 years. Over the same period, foreign ownership of US Treasuries has declined from 34% to 24%.

This comes as purchases of Treasuries from overseas have not kept up with massive government debt issuance. At the same time, more countries have been increasingly diversifying their currency reserves by adding more gold. Are foreign governments losing confidence in US Treasuries?' -TKl

👉🏽Inflation in Argentina stood at 25.5% when Milei came into office on December 10th last year. Since then: January: 20.6% February: 13.9% March: 11% April: 8,8% May: 4.2% June: 4.6% July: 4% August: 4.2% September: 3.5% The figure for October just came in - 2.7%

Now bear in mind these are the monthly changes. The trend is in the right direction, still way too high! But Milei has demonstrated the effectiveness of economic freedom to recover an Argentina ruined by socialism. Governments create inflation! No one else. Deregulation and reducing government spending eventually lead to prosperity.

On the 22nd of November:

👉🏽The EURO plunges below $1.04, the lowest level in 2 years as bets on ECB rate cuts surge following weak econ numbers in Eurozone. The euro has been posting the worst spot returns among major currencies since late October.

👉🏽' The US government has been hiring an average of 50,000 workers per month for the past 2 years

Which is one of the highest rates in 30 years. This hiring spree has strengthened the labor market, likely delaying a recession. But, high levels of government job creation have rarely prevented recessions.' - Bravos Research Freaking half of the fucking jobs were just Biden trying to hide a market collapse with debt.

On the 23rd of November:

👉🏽In FY2023, the U.S. Government spent $6.16. trillion while only bringing in $4.47 trillion. The last budget surplus was in 2001.

On the 24th of November:

👉🏽Chinese geologists discover 1,000 tons of gold! That’s an extra 0.5% added to the global supply of Gold. There's a virtually unlimited supply of gold but there will only ever be 21 million Bitcoin.

👉🏽Janet Yellen, head of the US Treasury, has just resigned.

On the 25th of November:

👉🏽In Q3 2024, Japan sold a net $61.9 billion of Treasuries, the most on record. This was the second consecutive quarter of selling after $40.5 billion in Q2. At the same time, China dumped $51.3 billion, the second largest amount ever recorded. China has now sold Treasuries in 6 out of the last 7 quarters and its total holdings fell below $800 billion for the first time in 16 years. 2 of the world's biggest foreign holders of US government debt are selling like never before.' -TKL

Now who is going to buy the massive amount required to fund the enormous deficit? (scroll back up). And it may have something to do with the freezing and seizing of sovereign reserves. Just a thought. Or devil's advocate. Both need money, as their economy is flawed and desperate in need of some stimulant, and the USD is now at a high. Time to offload some assets at a high, that would make sense.

I want to end this week's Weekly Recap with a picture and a statement by BitPaine:

'The average DCA price over the last four years was about $30,000. If you listened to the maxis, you could have obtained 2.1 BTC at a savings rate of $43 per day ($15,700 / y) or 21 BTC at a savings rate of $430 per day ($157,000 / y). The latter was very accessible for those with high-income professions (or existing savings) willing to save (or redirect) a large proportion of their income/savings. The former was accessible for the median American household. Never before in history was generational wealth accessible for so many. …if you listened to the maxis. Now it is much more difficult.'

🎁If you have made it this far I would like to give you a little gift:

Once in a while, I go back to old videos. In this video, 3-year-old, Lyn Alden is absolutely demolishing Alex de Vries.

https://www.youtube.com/watch?v=6LP8G-oZnEs

Credit: I have used multiple sources!

My savings account: Bitcoin The tool I recommend for setting up a Bitcoin savings plan: PocketBitcoin especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Use the code BITCOINFRIDAY

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple.⠀⠀⠀⠀⠀⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with sats.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe -Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

-

@ 468f729d:5ab4fd5e

2024-11-25 21:46:31

@ 468f729d:5ab4fd5e

2024-11-25 21:46:31Course Mission

Welcome to the PlebDevs starter course! I'm Austin, the founder of PlebDevs, and I'll be walking you through this short intro starter course that will get you up and running and interacting with the rest of the content on the platform. If you're here, I'm assuming you're new to coding or just starting out. If you already have experience and have your bearings down, there's lots more intermediate and advanced content on the platform. This course is designed for absolute beginners.

Course Goals

Overall PlebDevs Goals

- Learn how to code

- Build Bitcoin/Lightning/Nostr apps

- Become a developer

This is a big journey with a lot of pieces and things to learn. The starter course is going to get you on that path as quickly as possible and make it a smooth journey.

Starter Course Objectives

- Give you an easy, high-level overview of the dev journey

- Get you set up and comfortable in a development environment where you'll write and ship code

- Give you basic experience in the languages covered in our courses and workshops

There's lots of material out there that will just tell you exactly what to do and not explain why but I want you to actually understand for yourself. I want you to have a good mental model of what this journey is going to be like, what it's going to be like actually writing and pushing code. And then we're going to start getting our hands dirty and gain real experience.

What is a PlebDev?

Origins and Philosophy

I started using the term "PlebDev" a few years ago to describe a unique approach to learning development in the Bitcoin space. It represents:

- Inclusive Learning: Anyone can become a developer, regardless of background

- Growth Mindset: Embracing the journey from beginner to professional

- Practical Focus: Emphasizing real-world application development

- Community Support: Learning and growing together

Key Characteristics

- 🌱 Growth-Focused: PlebDevs are always learning and improving

- 🎯 App-Centric: Focus on building applications rather than protocol development

- 🆕 Embrace Being New: Being a new developer is infinitely better than being on the sidelines

- 🤝 Community-Driven: Bitcoin/Lightning/Nostr ecosystem needs more plebdevs like you!

Our Learning Approach

Core Principles

- Lower Barriers

- Simplify complex concepts

- Focus on practical understanding

-

Build confidence through action

-

Project-Based Learning

- Learn by doing

- Create real applications

-

Build a portfolio as you learn

-

MVP (Minimum Viable Product) Focus

- Start with core functionality

- Get things working first

-

Iterate and improve

-

Actionable Knowledge

- Focus on the 20% that delivers 80% of results

- Learn what you can use right away

- Build practical skills

Teaching Methods

- Detailed concept breakdowns

- Line-by-line code explanations

- Interactive learning

- 1:1 support available

- Community-driven progress

Course Structure

The Learning Path

Instead of the traditional bottom-up approach, we use a project-focused method:

🏔️ Advanced Skills 🏔️ Projects & Practice 🏔️ Core Concepts 🏔️ Development Environment 🏔️ Getting StartedWe'll create checkpoints through projects, allowing you to: - Verify your understanding - Build your portfolio - See real progress - Have reference points for review

Student Expectations

What We Expect From You

- High Agency: Take ownership of your learning journey

- Active Participation: Engage with the material and community

- Persistence: Push through challenges

- Curiosity: Ask questions and explore concepts

What You Can Expect From Us

- Clear, practical instruction

- Comprehensive support

- Real-world applications

- Community backing

Getting Started

Next Steps

- Ensure you're ready to commit to learning

- Set up your development environment (next lesson)

- Join our community

- Start building!

Resources and Support

Where to Get Help

- plebdevs.com

Tips for Success

- Push code daily, even if it is small.

- Focus on understanding rather than memorizing.

- Build projects that interest you.

- Engage with the community.

- Don't be afraid to ask questions.

Remember

You don't need to become a "10x developer" overnight. The goal is to start writing code, build useful things, and gradually improve. Every expert was once a beginner, and the journey of a thousand miles begins with a single line of code.

Ready to begin? Let's dive into the next lesson where we'll set up your development environment! 🚀

-

@ 468f729d:5ab4fd5e

2024-11-25 21:44:44

@ 468f729d:5ab4fd5e

2024-11-25 21:44:44Course Mission

Welcome to the PlebDevs starter course! I'm Austin, the founder of PlebDevs, and I'll be walking you through this short intro starter course that will get you up and running and interacting with the rest of the content on the platform. If you're here, I'm assuming you're new to coding or just starting out. If you already have experience and have your bearings down, there's lots more intermediate and advanced content on the platform. This course is designed for absolute beginners.

Course Goals

Overall PlebDevs Goals

- Learn how to code

- Build Bitcoin/Lightning/Nostr apps

- Become a developer

This is a big journey with a lot of pieces and things to learn. The starter course is going to get you on that path as quickly as possible and make it a smooth journey.

Starter Course Objectives

- Give you an easy, high-level overview of the dev journey

- Get you set up and comfortable in a development environment where you'll write and ship code

- Give you basic experience in the languages covered in our courses and workshops

There's lots of material out there that will just tell you exactly what to do and not explain why but I want you to actually understand for yourself. I want you to have a good mental model of what this journey is going to be like, what it's going to be like actually writing and pushing code. And then we're going to start getting our hands dirty and gain real experience.

What is a PlebDev?

Origins and Philosophy

I started using the term "PlebDev" a few years ago to describe a unique approach to learning development in the Bitcoin space. It represents:

- Inclusive Learning: Anyone can become a developer, regardless of background

- Growth Mindset: Embracing the journey from beginner to professional

- Practical Focus: Emphasizing real-world application development

- Community Support: Learning and growing together

Key Characteristics

- 🌱 Growth-Focused: PlebDevs are always learning and improving

- 🎯 App-Centric: Focus on building applications rather than protocol development

- 🆕 Embrace Being New: Being a new developer is infinitely better than being on the sidelines

- 🤝 Community-Driven: Bitcoin/Lightning/Nostr ecosystem needs more plebdevs like you!

Our Learning Approach

Core Principles

- Lower Barriers

- Simplify complex concepts

- Focus on practical understanding

-

Build confidence through action

-

Project-Based Learning

- Learn by doing

- Create real applications

-

Build a portfolio as you learn

-

MVP (Minimum Viable Product) Focus

- Start with core functionality

- Get things working first

-

Iterate and improve

-

Actionable Knowledge

- Focus on the 20% that delivers 80% of results

- Learn what you can use right away

- Build practical skills

Teaching Methods

- Detailed concept breakdowns

- Line-by-line code explanations

- Interactive learning

- 1:1 support available

- Community-driven progress

Course Structure

The Learning Path

Instead of the traditional bottom-up approach, we use a project-focused method:

🏔️ Advanced Skills 🏔️ Projects & Practice 🏔️ Core Concepts 🏔️ Development Environment 🏔️ Getting StartedWe'll create checkpoints through projects, allowing you to: - Verify your understanding - Build your portfolio - See real progress - Have reference points for review

Student Expectations

What We Expect From You

- High Agency: Take ownership of your learning journey

- Active Participation: Engage with the material and community

- Persistence: Push through challenges

- Curiosity: Ask questions and explore concepts

What You Can Expect From Us

- Clear, practical instruction

- Comprehensive support

- Real-world applications

- Community backing

Getting Started

Next Steps

- Ensure you're ready to commit to learning

- Set up your development environment (next lesson)

- Join our community

- Start building!

Resources and Support

Where to Get Help

- plebdevs.com

Tips for Success

- Push code daily, even if it is small.

- Focus on understanding rather than memorizing.

- Build projects that interest you.

- Engage with the community.

- Don't be afraid to ask questions.

Remember

You don't need to become a "10x developer" overnight. The goal is to start writing code, build useful things, and gradually improve. Every expert was once a beginner, and the journey of a thousand miles begins with a single line of code.

Ready to begin? Let's dive into the next lesson where we'll set up your development environment! 🚀

-

@ 5bfb38cb:2b999aa7

2024-11-25 21:20:53

@ 5bfb38cb:2b999aa7

2024-11-25 21:20:53BTX2024

Open Interest:

There are no significant changes in OI as we have moved to premium.

Institutional Order Flow Sponsorship:

The IOF is bullish above the all-time high. The structure must be maintained away from the high to continue the trend.

Weekly Profile:

The week presents relevant news on Tuesday and Wednesday with FOMC news, with a short week due to the holiday on Thursday. A seek and destroy pattern is likely.

Classic Technical Analysis:

We have consolidated a new ATH; although the momentum is bullish, a delay to gain momentum is probable. We have tried to reach the magic number of 100,000 with low volume, anticipating weakness.

Market Structure:

The structure is bullish.

Trading Range:

87005 to 100170. Currently in Premium.

Equilibrium:

93590.

Key Price Levels:

I do not expect closes below 88955 to remain bullish at daily.

Daily BIAS:

Bullish. Possible delay to gain momentum.

Daily Target:

Delay to 89990.

"The market is never wrong; opinions often are." - Richard Wyckoff 🔮

-

@ 5bfb38cb:2b999aa7

2024-11-25 21:04:55

@ 5bfb38cb:2b999aa7

2024-11-25 21:04:55BTX2024

Relative Strength Analysis:

The 3 indices have had a bullish recovery with volume without reaching historical highs again, with the YM being the strongest. Classic Technical Analysis:

In terms of conventional technical analysis, BTC remains in an Elliott structure fulfilling a minor wave 5 and a major wave 3. We have had a consolidation structure since March 2024 with a breakout to the upside. The context is strongly bullish.

COT:

The progression of contracts nearing expiration is at a premium. The 12-month COT is in a positive program and in positive hedging.

Banks are buying Bitcoin futures contracts and are not in a bearish position, being the counterpart to leveraged short investment funds. Market Sentiment:

Market sentiment in general retail news is bullish following the FED's rate cut and in response to the US elections, although with some moderation.

The Williams %R remains in oversold territory and avoids a bearish divergence.

Intermarket Analysis:

The 3 indices present a bullish reversal. No close above last week's highs. With greater strength in the YM and less strength in the NQ.

The 3 bonds, ZN, ZF, and ZB, show an absorption bar with significant volume. Confirmation is needed in a discount context. The reverse interests in a premium context.

The DYX has another bullish week reaching a monthly target in premium. Peripheral currencies maintain another week with bearish closes, with greater weakness in the EUR.

In commodities, BTC has maximum bullish extension, reaching just a few dollars from a macro target. The GC has a complete reversal bar with a bullish close. The CL presents a bullish reversal in one week but is still in a consolidation environment.

In conclusion, we have a stock market that marks a bullish retracement with significant volume, especially the YM. The DYX has a bullish context but the possibility of a trend end. Weakness in peripheral currencies. Commodities show strongness in BTC and GC. The CL in a consolidative context.

Market Profile:

The market is currently bullish. It needs to move significantly away from the all-time high to continue this movement. Although some significant delay can be expected to take liquidity after such a sharp movement since the US elections.

Market Structure:

The value 65775.00 maintains price control. The weekly context is bullish.

Trading Range:

65775 to 100170. Currently at a premium in the range.

Equilibrium:

80141

Key Price Levels:

79300 do not expect closes below this structure to remain bullish.

Weekly BIAS:

Bullish. Consider a probable delay to gain momentum.

Weekly Objective:

Retracement to 89755.

The stock market is filled with individuals who know the price of everything, but the value of nothing." - Philip Fisher. 🔮

-

@ a56ff0bd:904daa79

2024-11-25 20:43:08

@ a56ff0bd:904daa79

2024-11-25 20:43:08Prova prova

-

@ 7c765d40:bd121d84

2024-11-25 20:20:18

@ 7c765d40:bd121d84

2024-11-25 20:20:18This is not a story about Ron Jeremy. This is a story about a man and his company going ALL IN shorting the fiat system. I've been talking about microstrategy for a while now on the channel. I have been fascinated by the strategy and the balls on Saylor. But today will be the last time. Why? Because I believe it's a distraction. I think people should be focused on buying, earning, and protecting their bitcoin. In a few months from now, you will be competing against the US government for bitcoin. Building your own strategic bitcoin reserve should be the top priority. There are also two big risk involved with owning MSTR shares: 1. Microstrategy holding bitcoin on your behalf 2. Your stock broker holding MSTR shares on your behalf Bitcoin has no counterparty risk. Does that mean I'm selling my MSTR shares? Absolutely not. I see MSTR just like bitcoin - HODL for a very very long time. Bitcoin is designed to go up forever. And MSTR is adding rocket fuel to that. But unlike bitcoin, I am not attached to MSTR. I plan on keeping about 50% of my shares forever, and using the other half as needed. For a yacht or something. So without any technical discussion or NAV debate, here's why I would consider grabbing a few MSTR shares: 1. They are shorting the fiat system. A system that was designed to fail and about 20 years past it's expiry date. 2. They are using the greatest asset in history to short the worst asset in history. 3. They already have 330,000 bitcoins. No other entity on earth will be able to catch them. 4. They are front-running nation states. If bitcoin becomes the world reserve currency, and MSTR has more than most (or all) nation states, think of the implications. 5. Most people - including your financial advisor - have not figured this out. Which is where the opportunity lies. 6. They will be added to the QQQ index and likely the S&P500 sometime in the next year or so. This will create massive (and passive) demand and move shares into long-term storage. 7. You can hold these shares in a tax sheltered account. Your capital can ride the bitcoin wave without having to worry about paying tax on the gains. 8. This is only the beginning. They have MUCH bigger plans for MSTR. They will utilize bitcoin and lightning in their current operations. They will either start or acquire a bank and deal in bitcoin. They will offer fixed income bonds on the bitcoin. They will start or acquire insurance companies who currently own ZERO bitcoin. There is no limit to what this amount of collateral can do. Saylor will continue taking on debt to buy bitcoin as long as the spread and demand stays high. Eventually the big money will realize that they should be holding their own multi generational wealth in bitcoin. The rules will change so they can hold bitcoin. But by this time, MSTR will already be the #1 company on earth and will have insane amounts of constant buy pressure from the funds. That's when Saylor will shift gears and starts putting his collateral to work - to earn more bitcoin. Nobody understands how truly scarce bitcoin is. But we are about to find out. Moral(s) of the story: - NEVER SELL YOUR BITCOIN - If you have some capital in a retirement fund, move it to MSTR There will absolutely be a movie made about this. In the big short, Michael Burry made $800 million. Michael Saylor is already well above $8 billion on this trade. And will likely become the world's first trillionaire - by shorting the fiat system. Jump on and buckle up.

PS - Microstrategy bought another 55,500 bitcoins while I was typing this. Bringing their new total to 386,700 bitcoins.

-

@ 4fcac000:d2b37988

2024-11-25 19:58:54

@ 4fcac000:d2b37988

2024-11-25 19:58:54🌱 В Тюмени объявлен старт программы "Зеленый маршрут", направленной на создание сети экологически чистых транспортных коридоров, соединяющих ключевые точки города.

Яркие факты 👇 Экологические коридоры: Новые маршруты будут включать велодорожки, пешеходные зоны и зеленые насаждения, способствуя улучшению качества воздуха. Общественный транспорт: Программа предполагает интеграцию с экологически чистыми видами транспорта, такими как электробусы и трамваи. Социальные инициативы: В рамках программы планируются мероприятия по обучению горожан экологии и устойчивому транспорту.

Тюмень 2040 года стала примером устойчивого развития, где экология и комфорт идут рука об руку! 🌍🚶♀🚲

-

@ 6bae33c8:607272e8

2024-11-25 19:19:58

@ 6bae33c8:607272e8

2024-11-25 19:19:58Week 12 got off to a good start — I had one player going in the under-16 Portugal girls basketball league, and she went bananas — 33 and 19 with six steals in a game they won 55-34. And yes, I was counting her stats from the bleachers. It was crazy because our team has only six players, and two fouled out with six minutes left, so they had to play 4 on 5. Granted it was a soft opponent, but it was thrilling nonetheless. Sasha is more Angel Reese than Caitlin Clark, basically just bullying and bodying people while driving hard to the hole. Probably went to the line 15 times, making about five of them. Steph Curry she is not.

The rest of the day was a mixed bag. I was 1-3 ATS (pending Ravens -2.5) and damn lucky to get the 1 with the Bears +3.5 — though I was one inch away from getting the Raiders, a game I stayed up watching for no reason. Would it kill them to throw the ball to Brock Bowers? And I know Minshew got hurt, but FFS get rid of the damn ball!

One of my teams was dead to rights due to the bye weeks. I never pay attention to them while drafting, but this was extreme:

That’s my first, second, third and fifth round picks on the bench, plus my QB Joe Burrow. (Fourth-rounder was Stefon Diggs.) I even had to drop the Younghoe, though my awful starting lineup managed 99 points thanks in large part to his replacement Wil Lutz. That team is still in third place and could quality for the postseason with a strong stretch run.

That’s my first, second, third and fifth round picks on the bench, plus my QB Joe Burrow. (Fourth-rounder was Stefon Diggs.) I even had to drop the Younghoe, though my awful starting lineup managed 99 points thanks in large part to his replacement Wil Lutz. That team is still in third place and could quality for the postseason with a strong stretch run.My first place team balled out — I picked up Lutz there too, and I have Jonnu Smith everywhere, actually played him in the flex with Bowers. That team has Tua Tagovailoa and Jaylen Waddle too. Miami stack minus Tyreek Hill for the win!

The Primetime team did okay, pending JK Dobbins tonight. It’s in eighth place, but only 13 points out of fifth and 73 out of second. I think it’s good enough to go on a run down the stretch.

-

Saquon Barkley posted the nine-highest rushing total in NFL history and had 302 yards from scrimmage (10th most). I’m bummed to see it happen for another team (especially Philly), but he was the NFL’s Mike Trout and deserved better. (Actually, it’s way worse to be that guy in football, because at least everyone knows how great Trout was.)

-

AJ Brown makes it look so easy. I’d give him 15 targets a game if I were the Eagles, but obviously when your back averages 9.8 YPC there’s no need to throw.

-

Puka Nacua seems like the No. 1 now that both players are fully healthy. I actually had to use Demarcus Robinson in the bye-week league, and he scored a TD for me.

-

What happened to Justin Jefferson? It’s not like teams weren’t already trying to double him for the last three years. I guess he had a long TD called back due to a penalty, but it’s shocking to have Darnold go for 330 and Jefferson only 27. If I still played DFS I’d use him everywhere next week, and I haven’t even checked the matchup.

-

I didn’t watch much of this game, but had the Bears +3.5, was overjoyed when they cut it to three only to see them actually make the onside kick and send it to overtime! What are you doing? You had the cover locked up! Now you’re going to make me sweat OT? Luckily they got the ball first, but you never know.

-

I took the Colts +7.5 as a sell high on the Lions and got what I deserved. They were a sell-high, but you don’t step in the way of a freight train.

-

Anthony Richardson had bad stats, but he had a couple intermediate pass plays called back due to penalties, threw the ball well and didn’t turn it over. He also had 61 rushing yards. He’s not the guy that was totally lost early in the year.

-

Jonnu Smith is a top-five TE now. He’s my Stefon Diggs replacement as I have him everywhere now too.

-

Waddle had a monster game, and frankly it was overdue. They’ll probably get Hill more involved next week.

-

The problem with Rhamondre Stevenson is the offense often bogs down, and he’s not getting enough receptions to make up for it. In the first-place league, I had him in over Bucky Irving.

-

In my home picking pool (in which I had a horrible week), I took the Bucs -6. I almost *never* go against the Giants because at low stakes it’s not worth it, but Tommy DeVito might as well be Danny DeVito. After the game Malik Nabers criticized Brian Daboll for not getting him a target in the first half, and Daboll seeemed sympathetic to him. I have to think going DeVito over Drew Lock is purposeful tanking too. Watch Danny Dimes go somewhere decent and pull a Darnold.

-

Irving is the Bucs best back even if the GigaRachaad is good on passing downs.

-

The Cowboys-Killer Redskins game was one of the craziest of all time. Halfway through the fourth quarter, the score was 13-9. The final total was 60!

-

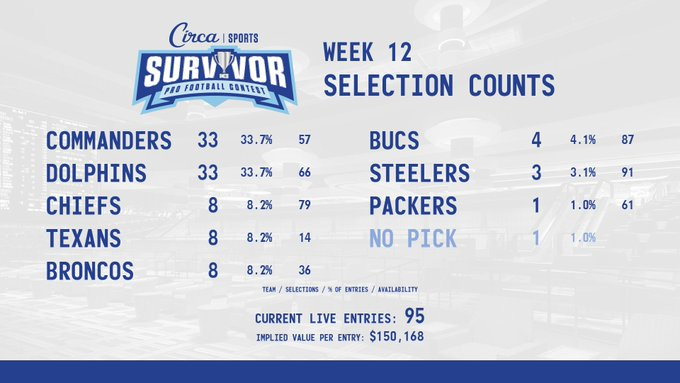

The KaVontae Turpin spin move kick return TD was so sick, as was the 86-yard TD to Terry McLaurin. Just insane plays in a game where 33 people in Circa Survivor (entries valued at $150K each) had the KRs in Survivor. To sweat the fourth quarter TD drive to cut it to three, see Turpin house it on the kickoff, then get the McLaurin miracle TD only to lose a chance for OT on a missed PAT is too much. Defenestration-level shit.

-

One of my favorite things about Circa Survivor is there’s always that real man who neglects to enter his pick. I mean it’s $1K to enter, so even Week 1 this is bad, but when each entry has $150K in equity? Ultimate respect for the No Pick TeraChad.

- The Chiefs play close games with everyone and inflict maximum frustration on fantasy owners.

- The Chiefs play close games with everyone and inflict maximum frustration on fantasy owners.-

Why bother activating Jonathon Brooks for two carries?

-

Both Richardson and Bryce Young are looking much more credible than earlier in the year. Low bar, I realize.

-

I started Richardson over C.J. Stroud this week after doing the reverse last week, and of course Stroud throws a TD on the first place from scrimmage. But in the end, even though Stroud had two TDs and 150 yards in the first half, and Richardson’s team failed to score a TD, Stroud finished with only 7.5 more points. The Texans offense is that miserable. At least Joe Mixon finally got stuffed.

-

The Titans are such a random team. Maybe they should throw to Chig Okonkwo every now and then?

-

Hopefully you didn’t overEstime the role of a particular Denver running back.

-

Bo Nix and Courtland Sutton are startable almost every week, but don’t mess with the rest of this rotating cast of randoms.

-

There’s really nothing to say about the Raiders. Why are they even scheduling games at this point?

-

I took the Cardinals in Circa as a sell-high on Seattle after their win over the 49ers, but turns out it was Arizona I should have sold instead. The Seahawks defense is nothing special, so why did Kyler Murray have so much trouble?

-

Jaxon Smith-Njigba is ahead of DK Metcalf now, it seems, but that was an ugly game all around.

-

Josh Jacobs was such an obvious draft target on a decent team (though I passed him up for Diggs and others every time.) Ignore all the metrics dorks who try to extrapolate stats from hopeless situations to good ones. They were saying Barkley was ordinary too.

-

The 49ers are still in the thick of the NFC West race, believe it or not. They kind of need Brock Purdy and Nick Bosa though.

-

-

@ 4fcac000:d2b37988

2024-11-25 18:42:14

@ 4fcac000:d2b37988

2024-11-25 18:42:14В Тюмени объявлен старт программы "Зеленый маршрут", направленной на создание сети экологически чистых транспортных коридоров, соединяющих ключевые точки города.

Яркие факты 👇 Экологические коридоры: Новые маршруты будут включать велодорожки, пешеходные зоны и зеленые насаждения, способствуя улучшению качества воздуха. Общественный транспорт: Программа предполагает интеграцию с экологически чистыми видами транспорта, такими как электробусы и трамваи. Социальные инициативы: В рамках программы планируются мероприятия по обучению горожан экологии и устойчивому транспорту.

Тюмень 2040 года стала примером устойчивого развития, где экология и комфорт идут рука об руку! 🌍🚶♀🚲

-

@ 4fcac000:d2b37988

2024-11-25 17:57:48

@ 4fcac000:d2b37988

2024-11-25 17:57:48В Тюмени запускаются инновационные образовательные программы, направленные на подготовку специалистов для "города будущего". Эти программы ориентированы на развитие навыков в области устойчивого развития, IT и экологии.

Участников ждут: - Курсы по устойчивому развитию. Программы включают обучение методам экологического проектирования и управления ресурсами. - IT-инициативы: Студенты смогут участвовать в стартапах и проектах, связанных с умными технологиями для города. - Сотрудничество с бизнесом: Программы разработаны в партнерстве с местными предприятиями, что обеспечивает практическую направленность обучения.

Тюмень готовится стать городом, где знания и инновации формируют будущее! 📚

-

@ 4874b840:31b0b8c0

2024-11-25 17:47:07

@ 4874b840:31b0b8c0

2024-11-25 17:47:07https://www.spreaker.com/episode/podkast-kaliningrad-2040-vzglad-v-budusee--63002904

-

@ 4874b840:31b0b8c0

2024-11-25 17:43:33

@ 4874b840:31b0b8c0

2024-11-25 17:43:3315 декабря в Калининграде официально открылся сезон катания на коньках. Городской каток на площади Победы начал свою работу с 10:00 утра, а также заработала служба проката коньков, предлагающая новые модели с улучшенной амортизацией и системой фиксации.

На катке уже собрались первые любители зимних видов спорта. Анна поделилась своими впечатлениями: «Я жду этого момента весь год! Ничто не сравнится с ощущением свободы на льду». Рядом с ней катались дети, которые с восторгом пробовали свои силы. «Это так весело! Я научился кататься всего за пару часов», — сказал Максим.

Служба проката работает без перебоев, и очередь на получение коньков растет. Менеджер проката Сергей отметил: «Мы подготовили около 500 пар коньков, и, судя по всему, их хватит на весь день».

На катке звучит музыка, а вокруг установлены яркие огни, создающие праздничную атмосферу. Вечером планируется открытие сезона с выступлениями местных фигуристов.

-

@ 4874b840:31b0b8c0

2024-11-25 17:41:52

@ 4874b840:31b0b8c0

2024-11-25 17:41:52Сегодня утром — Калининград оказался под толстым слоем снега из-за сильного снегопада. Сотрудники ЖЭКа устроили забастовку в знак протеста против низкой зарплаты и ухудшающихся условий труда. Они требуют повышения заработной платы и улучшения социальных гарантий, что оставило город без уборки.

Роботы-уборщики не справляются с задачей, а тракторы на автопилоте закапывают друг друга из-за сбоя в навигации. Жители города начали делиться своими переживаниями в социальных сетях и организовывать инициативы по очистке улиц.

«Мы не можем просто сидеть и ждать, пока кто-то решит наши проблемы. Мы сами должны взять ситуацию в свои руки», — говорит местный житель Алексей, который вышел с лопатой, чтобы помочь очистить тротуары. Власти пока не сделали официальных заявлений. Горожане, вооружившись лопатами, выходят на улицы, чтобы вернуть Калининграду его привычный облик.

-

@ 4dc2e570:7b8126f9

2024-11-25 17:39:08

@ 4dc2e570:7b8126f9

2024-11-25 17:39:08Chef's notes

Pickled pearl onions can usually be found at a middle eastern grocery store.

Details

- ⏲️ Prep time: 30 - 45 minutes

- 🍳 Cook time: 2 hours and 30 minutes

- 🍽️ Servings: 6

Ingredients

- 2.5 lbs stew meat

- 4 cloves Garlic

- 2 onions

- 6oz Bacon, chopped

- 4 Carrots (cut in 1/2 in pieces)

- 3 celery sticks (cut in 1 in pieces)

- 5 or so small gold potatoes, quartered

- 3ish tbps Flour

- 4 tbsp tomato paste

- 14 oz Guinness Beer

- 3 cups chicken stock

- 1 tsp Thyme

- 2 bay leaves

- Ghee

- Salt and pepper

Directions

- Pat dry then salt and pepper the beef. Melt 1/2 tbsp ghee over high med-high heat. Brown the beef on each side well, makes the stew tasty. This takes patience. Do some breath work while you're at it. :) Add ghee as necessary so browny bits on bottom dont burn. Put meat aside.

- In same pan, sauté onion and garlic for a few min. Throw in bacon till browned. Put in carrot and celery.

- Add 3tbsp flour (or a bit more, basically till oil is soaked up) and stir for a minute. Add tomato paste. Stir a couple more minutes.

- Add thin layer of beer and scrape yummy bits from bottom of pan. Mix everything well. Add rest of beer, broth, and herbs.

- Carmelize the pickled pearl onion on low med heat with a lil olive oil and stirring occasionally.

- Simmer covered for 2 hours. Add potatoes. Simmer for a further 30 minutes uncovered to let the sauce reduce a bit. Salt and pepper as you like. Add in some pearl onions. Enjoy.

-

@ fff19d35:43344a0b

2024-11-25 17:23:46

@ fff19d35:43344a0b

2024-11-25 17:23:46Here are the benefits of Bitcoin:

- Decentralized and Autonomous: Bitcoin operates independently of central banks and governments, giving users full control over their funds.

- Limited Supply: The total supply of Bitcoin is capped at 21 million, which helps to prevent inflation and maintain the value of each coin.

- Fast and Global Transactions: Bitcoin enables fast and secure transactions worldwide, without the need for intermediaries like banks.

- Low Transaction Fees: Compared to traditional payment systems, Bitcoin transaction fees are significantly lower.

- Security and Transparency: Bitcoin's blockchain technology ensures that all transactions are secure, transparent, and tamper-proof.

- Investment Opportunities: Bitcoin has been a lucrative investment option for many, with its value increasing significantly over the years.

- Financial Inclusion: Bitcoin provides access to financial services for people in countries with unstable currencies or limited access to traditional banking.

- Diversification: Bitcoin offers a unique asset class for diversifying investment portfolios.

- Growing Adoption: Increasing acceptance and adoption of Bitcoin by businesses, governments, and institutions.

-

@ ec951079:533d29e7

2024-11-25 17:10:28

@ ec951079:533d29e7

2024-11-25 17:10:28Need for Youth Empowerment in Underdeveloped Environments

The world's future lies in the hands of its youth. However, in underdeveloped environments, young people often face significant challenges that hinder their ability to reach their full potential. Youth empowerment is crucial in these environments to break the cycle of poverty, promote economic growth, and foster sustainable development.

Challenges Faced by Youth in Underdeveloped Environments

Youth in underdeveloped environments face numerous challenges, including:

- Limited Access to Education: Inadequate educational infrastructure, lack of qualified teachers, and unaffordable school fees hinder young people's ability to acquire knowledge and skills.

- Unemployment and Poverty: High levels of unemployment and poverty force many young people to engage in menial jobs or migrate to urban areas in search of better opportunities.

- Lack of Opportunities for Skill Development: Inadequate vocational training programs and limited access to technology and resources hinder young people's ability to acquire marketable skills.

- Social and Cultural Barriers: Traditional norms and cultural practices often limit young people's participation in decision-making processes and access to resources.

Why Youth Empowerment is Crucial

Empowering youth in underdeveloped environments is essential for several reasons:

- Demographic Dividend: Young people constitute a significant proportion of the population in underdeveloped environments. Empowering them can lead to a demographic dividend, where a large, educated, and skilled workforce drives economic growth.

- Breaking the Cycle of Poverty: Empowering youth can help break the cycle of poverty by providing them with the skills, knowledge, and resources needed to secure better-paying jobs and improve their socio-economic status.

- Fostering Sustainable Development: Empowered youth can contribute to sustainable development by promoting innovative solutions to environmental challenges, advocating for social justice, and supporting community development initiatives.

- Promoting Peace and Stability: Empowering youth can help promote peace and stability by providing them with alternatives to violence and extremism, and encouraging them to become active citizens who contribute to their communities.

Strategies for Empowering Youth

To empower youth in underdeveloped environments, the following strategies can be employed:

- Improve Access to Education: Invest in educational infrastructure, provide scholarships, and offer vocational training programs to equip young people with marketable skills.

- Provide Opportunities for Skill Development: Offer training programs in areas such as entrepreneurship, technology, and leadership to help young people develop the skills needed to succeed in the modern economy.

- Foster Entrepreneurship: Provide young people with access to capital, mentorship, and business training to encourage entrepreneurship and job creation.

- Promote Youth Participation in Decision-Making: Encourage young people to participate in decision-making processes at the local, national, and international levels to ensure that their voices are heard and their concerns addressed.

- Support Youth-Led Initiatives: Provide funding and technical support to youth-led initiatives that focus on education, entrepreneurship, and community development.

Conclusion

Empowering youth in underdeveloped environments is crucial for promoting economic growth, fostering sustainable development, and breaking the cycle of poverty. By providing young people with access to education, skill development opportunities, and entrepreneurship support, we can unlock their potential and create a brighter future for generations to come.

-

@ f8a5df57:b7a58cd4

2024-11-25 16:58:12

@ f8a5df57:b7a58cd4

2024-11-25 16:58:12Тecnológicos парки в Москве будут выглядеть совершенно иначе, чем сейчас, благодаря стремительному развитию технологий и изменению общественных потребностей.

Технологические парки смогут представлять собой масштабные экосистемы с интеграцией искусственного интеллекта, интернета вещей и устойчивых технологий. Компании будут работать в синергии, минимизируя экологический след и используя возобновляемые источники энергии. Такие парки станут частью глобальной сети инновационных центров, где стартапы и исследовательские лаборатории из разных стран совместно решают мировые проблемы. Рабочие места будут организованы в формате многофункциональных пространств, где команды из разных областей будут работать бок о бок, способствуя кросс-дисциплинарному сотрудничеству.

Открытие технологических парков в Москве действительно может стать уникальным проектом, который объединит передовые технологии, экологические инициативы, культурные аспекты и человеческие ценности. Эти парки могут стать центрами инноваций, где стартапы и исследовательские группы будут работать над решениями, направленными на улучшение качества жизни горожан.

Автор: Ксения Данилова

-

@ f8a5df57:b7a58cd4

2024-11-25 16:47:39

@ f8a5df57:b7a58cd4

2024-11-25 16:47:39 -

@ f8a5df57:b7a58cd4

2024-11-25 16:43:21

@ f8a5df57:b7a58cd4

2024-11-25 16:43:21Пока другие страны накладывают санкции на Россию, Китай продолжает активно сотрудничать с нами в различных сферах, что способствует укреплению двусторонних отношений и экономического партнерства. Вот несколько ключевых аспектов, в которых Москва и Китай взаимодействуют:

• Торговля: Москва и Пекин увеличивают объем взаимной торговли, включая экспорт и импорт товаров. Китай является одним из крупнейших торговых партнеров России. Теперь доставка из Китая осуществляется на прямую с Россией.

• Инвестиции: Китайские компании активно инвестируют в различные отрасли экономики Москвы, включая недвижимость, инфраструктуру и высокие технологии.

• Транспортные коридоры: Развитие транспортных маршрутов, таких как «Новый шелковый путь», способствует улучшению логистики и ускоряет грузоперевозки между двумя странами.

• Совместные проекты: Реализация крупных инфраструктурных проектов, включая строительство мостов, дорог и железнодорожных линий.

• Исследования и разработки: Совместные научные проекты в области технологий, медицины и экологии. Обмен опытом и знаниями между научными учреждениями двух стран.

• Образование: Увеличение числа студентов, обучающихся в вузах Москвы и Китая. Программы обмена студентами и преподавателями.

• Культурные мероприятия: Проведение выставок, фестивалей и культурных мероприятий, способствующих взаимопониманию и дружбе между народами. Наиболее популярные фестивали: "Мир вокруг нас: обмен опытом и инновациями", "Мы вместе: налаживаем партнерские связи".

Сотрудничество Москвы и Китая охватывает широкий спектр областей, что способствует развитию обоих регионов. Углубление партнерства открывает новые возможности для бизнеса, науки и культуры, укрепляя стратегическое взаимодействие между двумя странами.

Автор: Рината Ситникова

-

@ 3f0702fa:66db56f1

2024-11-25 16:24:27

@ 3f0702fa:66db56f1

2024-11-25 16:24:27https://psv4.userapi.com/s/v1/d/IPZi6_1mpGHakkmxL2bukxBFQHeLmi77n46dmvwdQZ6zl9o4ggmciZ3MNnKjgdKriaE1kt5-a6CsJySL0Vi6mQs-7zlbl2o9F0C9mIqUNml2Nnr3CLihsw/Untitled_3.mp4

45news

Курган2040

-

@ 3f0702fa:66db56f1

2024-11-25 16:23:33

@ 3f0702fa:66db56f1

2024-11-25 16:23:33https://psv4.userapi.com/s/v1/d/IPZi6_1mpGHakkmxL2bukxBFQHeLmi77n46dmvwdQZ6zl9o4ggmciZ3MNnKjgdKriaE1kt5-a6CsJySL0Vi6mQs-7zlbl2o9F0C9mIqUNml2Nnr3CLihsw/Untitled_3.mp4

45news

Курган2040

-

@ f8a5df57:b7a58cd4

2024-11-25 16:18:27

@ f8a5df57:b7a58cd4

2024-11-25 16:18:27Содержание сюжета:

В 2040 году Красная площадь, сердце Москвы и символ российской истории, пережила масштабную реставрацию, которая вернула ей былую красоту и величие. Проект, инициированный правительством и поддержанный международными экспертами в области архитектуры и истории, стал важным шагом к сохранению культурного наследия страны.

🔍 Что изменилось?

-

Архитектурные детали: В ходе реставрации были восстановлены уникальные архитектурные элементы, которые со временем утратили свою яркость. Ремонт стен ГУМа, восстановление оригинальных цветовых решений и деталей оформления Кремля стали приоритетными задачами.

-

Новые технологии: Использование современных технологий, таких как 3D-моделирование и виртуальная реальность, позволило создать точные копии утраченных элементов и обеспечить высокое качество работ.

-

Экологические инициативы: В рамках проекта была внедрена концепция "зеленой площади". Установлены новые системы озеленения, которые не только украсили пространство, но и улучшили его экологическую ситуацию.

🌍 Международное сотрудничество

Проект реставрации стал примером успешного международного сотрудничества. Архитекторы и историки из разных стран объединили усилия для создания единой концепции, учитывающей как местные традиции, так и международный опыт.

🎉 Возвращение к жизни

Красная площадь вновь стала центром культурной жизни Москвы. Здесь проходят концерты, выставки и праздники, привлекающие тысячи туристов и местных жителей. Площадь стала не только историческим объектом, но и живым пространством для общения и творчества.

🔔 Заключение

Реставрация Красной площади в 2040 году — это не просто восстановление исторического памятника, это шаг к будущему, где история и современность сосуществуют в гармонии. Мы гордимся тем, что можем передать это наследие следующим поколениям!

КраснаяПлощадь #Реставрация #Культура #Москва #История #Наследие

Автор: Рината Ситникова

-

-

@ e97aaffa:2ebd765d

2024-11-25 16:16:48

@ e97aaffa:2ebd765d

2024-11-25 16:16:48https://www.youtube.com/watch?v=pQ7fjpqzUS4

Uma excelente entrevista de Natalie Brunell a Michael Saylor, aconselho a sua visualização.

Sem dúvida alguma, Saylor é muito inteligente, mas algo que sempre me inquietou ou gerou muitas dúvidas, é o seu ponto de vista sobre o Bitcoin como meio de troca(MoE). O seu pensamento (como MoE) sempre foi muito abstrato, evitava falar do assunto, era quase um tabu. Eu acreditava que essa atitude era devido a ter receio das autoridades dos EUA.

Mas nesta entrevista, ele falou mais do assunto, defendendo um mundo onde o Bitcoin como uma reserva de valor(SoV) e o dólar como a MoE, uma moeda global. Ou seja, o pensamento geral dos milionários de Wall Street, que só vê EUA, não tem a mínima noção da realidade ao seu redor, de como vivem os mais pobres em todo o mundo. Quando viajam, só vão para hotéis de 5 estrelas ou para condomínios de luxo ou fechados, não conhecem a realidade.

Não faz qualquer sentido, o dólar ser uma moeda oficial de todos os países, utilizada por todas as pessoas do mundo. Certamente algumas beneficiaram, mas no geral não haveria benefícios, a não ser para o EUA, que poderia financiar-se inesgotável e exportar diretamente inflação para todos os países. Se hoje em dia, o dólar como moeda de reserva mundial, indiretamente consegue exportar inflação, como MoE global, seria bem pior. Era o mundo inteiro a financiar um único governo, um único país. Os países do mundo e os seus cidadãos ficariam escravos, dependente das opiniões e da atitude do governo dos EUA. Seria um Franco CFA global.

É claro que o mundo beneficiaria com a existência de uma MoE global, mas este tem que ser neutro politicamente e economicamente, ter inflação zero é fulcral.

Saylor nunca escondeu que só olha para o Bitcoin como uma SoV, descartando o MoE e a auto-custódia.

Eu tenho opinião contrária, a meu ver, o que é revolucionário no bitcoin é o MoE, permitir a qualquer indivíduo do mundo ser livre, ter acesso a uma conta bancária, ter um dinheiro que não é monitorizado ou controlado por um governo. Permitir aos mais podres, que a sua única riqueza, são meia dúzia de moedas, que permitem apenas comprar a refeição do dia seguinte, não ser roubado pelo seu governo através da desvalorização cambial ou inflação.

É claro que o Bitcoin necessita de ser uma boa SoV, mas ao mesmo tempo também tem que ser uma MoE. Este é o principal problema das moedas FIAT, não são uma boa SoV, foram projectadas para perder poder de compra continuamente. Ter as duas características em simultâneo e ser acessível para todos os cidadãos do planeta, é que é revolucionário.

Na maneira como o Saylor olha para o Bitcoin, no meu ponto de vista, faria mais sentido ele ter apostado no ouro. Ele olha para o Bitcoin, apenas com as mesmas caraterísticas que o ouro, mas Bitcoin vai muito mais além disso. Em todas as características onde o Bitcoin é melhor que o ouro, o Saylor não usa/gosta. A divisibilidade, portabilidade, verificabilidade, fungibilidade, sem contra-parte e a soberania são características especialmente úteis para quem usa o bitcoin como MoE.

As caraterísticas onde (agora) o ouro é melhor que o Bitcoin, como a história e a adoção, sobretudo nos bancos centrais e no mundo financeiro, é apenas isto que o Saylor procura, possivelmente faria muito mais sentido ter apostado no ouro.

Volto a frisar, eu compreendo que o Saylor evite defender publicamente o Bitcoin como MoE, por ter medo de represálias, mas não faz qualquer sentido defender o dólar como moeda global. É completamente legítimo alguém querer apenas o Bitcoin como SoV, não querer utilizá-lo como moeda. Cada um é livre de fazer o que quer da sua vida e do seu património. Mas o Saylor ao dizer que o dólar é melhor que o Bitcoin, como MoE, só demonstra que ele não reconhece o real valor do Bitcoin.

MicroStrategy

O Saylor, ao mesmo tempo que defende o sistema financeiro FIAT, aproveita-se dele para fazer um ataque especulativo, ao próprio sistema. Aproveita as lacunas, do crédito barato existente, para comprar mais Bitcoin. Na entrevista, reafirma, que a MicroStrategy é um ativo alavancado de Bitcoin.

É curioso como ele o descreve, é alavancado mas sem a chamada de margem.

Pode não ter chamada de margem, mas continua a ser alavancado, continua a existir um risco, as notas conversíveis tem que ser devolvidas. É provável que no fim das maturidades das notas, o Bitcoin valerá mais que hoje, neste caso não existirá grande problema. Apesar de ser pouco provável, pode acontecer o contrário e se isso acontecer, será problemático.

O Saylor não pára de comprar Bitcoin, os créditos são cada vez mais elevados. A MicroStrategy começa a ser um problema. O curioso, é que o mercado está extremamente confiante e continua a comprar as notas conversíveis, na última emissão foram com uma maturidade de 2029 e com taxa de juro de 0%.

Enquanto escrevia este artigo, mais uma emissão: https://image.nostr.build/8857844f7ce5ac64b53f6d39df22a201825f1c26a2e7412b2061f91771e4627e.jpg

Ativos digitais

Outro ponto que gerou alguma controvérsia, é o Sayler defender os RWAs. Alguns bitcoiners criticaram-no e disseram que ele deixou de ser maximalista e os shitcoiners começaram a comemorar.

Neste ponto, eu compreendo o seu ponto de vista e até concordo com o Saylor, o sistema financeiro necessita de se modernizar, de estar disponível 24 por 7. Eu acredito que o futuro do sistema financeiro vai passar pela blockchain, mas será algo muito diferente daquilo que os shitcoiners imaginam. Os RWAs não vão ser em Solana ou Ethereum, não haverá tokens nativos ou tokens dos protocolos.

Eu vejo a BlockRock a criar uma blockchain própria, um sistema que fará concorrência direta à bolsa de New York, mas esse ecossistema terá como tokens nativos um sistémico do dólar, uma stablecoin. Tudo será monitorizado e controlado pela BlockRock, incluindo as regras de consenso da rede e os validadores, KYC e a emissão dos RWAs.

Blockchain é uma tecnologia que poderá ser muito útil, quando bem utilizada. O grande problema, é que os shitcoiners utilizam a tecnologia apenas para enriquecer, para vender tokens nativos ou tokens de protocolos ou tokens de governança, são tokens por tudo e por nada, isto é que não faz qualquer sentido. E como Saylor voltou a frisar: “There is no second best”.

-

@ 3f0702fa:66db56f1

2024-11-25 16:00:30

@ 3f0702fa:66db56f1

2024-11-25 16:00:30К 2042 году в городе планируют открытие нового современного бассейна, который станет не только центром водных видов спорта, но и примером внедрения искусственного интеллекта в спортивную инфраструктуру.

-

Инновационные технологии Новый бассейн будет оснащен системами искусственного интеллекта, которые помогут оптимизировать процессы управления водными ресурсами и поддерживать идеальные условия для плавания. AI будет контролировать температуру воды, уровень хлора и другие параметры, обеспечивая максимальный комфорт для посетителей.

-

Персонализированные тренировки С помощью технологий AI будут разработаны персонализированные программы тренировок для спортсменов и любителей плавания. Умные системы смогут анализировать результаты плавания и предлагать рекомендации по улучшению техники.

-

Безопасность и мониторинг Искусственный интеллект также будет использоваться для обеспечения безопасности на территории бассейна. Системы видеонаблюдения с функцией распознавания лиц помогут следить за ситуацией и предотвращать возможные инциденты.

-

Экологические инициативы В рамках проекта будут внедрены экологически чистые технологии для очистки воды и энергосбережения, что позволит снизить воздействие на окружающую среду.

-

Доступность для всех Бассейн будет доступен для людей с ограниченными возможностями. Специальные входы и оборудование обеспечат комфортное посещение всем желающим.

45news

Курган2040

-

-

@ 4fcac000:d2b37988

2024-11-25 15:57:45

@ 4fcac000:d2b37988

2024-11-25 15:57:45В Тюмени запускается уникальная инициатива "Тюмень 2040: Город идей", которая призвана превратить мечты и идеи молодежи в реальные проекты. Это масштабное событие объединит молодых людей, предпринимателей и экспертов для разработки и реализации инновационных решений, направленных на улучшение городской жизни.

📅 Дата и место: Дата: 15-16 мая 2040 года Место: Центральный парк Тюмени

🛠 Формат мероприятия:

Идеатон: В течение двух дней участники будут работать в командах над своими проектами, получая поддержку от менторов и экспертов. Выставка идей: Все проекты будут представлены на выставке, где жители смогут проголосовать за лучшие инициативы.

Гранты на реализацию: Лучшие идеи получат финансирование от городской администрации и местных бизнесменов для их реализации в жизнь.

🌍 Темы для проектов: Устойчивое развитие и экология Социальные инициативы Инновационные технологии для города Культура и искусство

Это событие станет платформой для вдохновения, обмена опытом и создания нового будущего Тюмени, где голос молодежи будет услышан! Присоединяйтесь к нам и станьте частью изменений! 🚀✨

-

@ e31e84c4:77bbabc0

2024-11-25 15:00:17

@ e31e84c4:77bbabc0

2024-11-25 15:00:17The "Fools" Golden Generation was Written By Iain Taylor. If you enjoyed this article then support his writing, directly, by donating to his lightning wallet: noisycyclone54@walletofsatoshi.com

Nobody wants to work anymore. Millennials need to grow up and stop spending all their money on avocado toast. We had double-digit inflation in our day, but we still managed to get by just fine. Younger generations are just lazy.