-

@ eac63075:b4988b48

2024-11-09 17:57:27

@ eac63075:b4988b48

2024-11-09 17:57:27Based on a recent paper that included collaboration from renowned experts such as Lynn Alden, Steve Lee, and Ren Crypto Fish, we discuss in depth how Bitcoin's consensus is built, the main risks, and the complex dynamics of protocol upgrades.

Podcast https://www.fountain.fm/episode/wbjD6ntQuvX5u2G5BccC

Presentation https://gamma.app/docs/Analyzing-Bitcoin-Consensus-Risks-in-Protocol-Upgrades-p66axxjwaa37ksn

1. Introduction to Consensus in Bitcoin

Consensus in Bitcoin is the foundation that keeps the network secure and functional, allowing users worldwide to perform transactions in a decentralized manner without the need for intermediaries. Since its launch in 2009, Bitcoin is often described as an "immutable" system designed to resist changes, and it is precisely this resistance that ensures its security and stability.

The central idea behind consensus in Bitcoin is to create a set of acceptance rules for blocks and transactions, ensuring that all network participants agree on the transaction history. This prevents "double-spending," where the same bitcoin could be used in two simultaneous transactions, something that would compromise trust in the network.

Evolution of Consensus in Bitcoin

Over the years, consensus in Bitcoin has undergone several adaptations, and the way participants agree on changes remains a delicate process. Unlike traditional systems, where changes can be imposed from the top down, Bitcoin operates in a decentralized model where any significant change needs the support of various groups of stakeholders, including miners, developers, users, and large node operators.

Moreover, the update process is extremely cautious, as hasty changes can compromise the network's security. As a result, the philosophy of "don't fix what isn't broken" prevails, with improvements happening incrementally and only after broad consensus among those involved. This model can make progress seem slow but ensures that Bitcoin remains faithful to the principles of security and decentralization.

2. Technical Components of Consensus

Bitcoin's consensus is supported by a set of technical rules that determine what is considered a valid transaction and a valid block on the network. These technical aspects ensure that all nodes—the computers that participate in the Bitcoin network—agree on the current state of the blockchain. Below are the main technical components that form the basis of the consensus.

Validation of Blocks and Transactions

The validation of blocks and transactions is the central point of consensus in Bitcoin. A block is only considered valid if it meets certain criteria, such as maximum size, transaction structure, and the solving of the "Proof of Work" problem. The proof of work, required for a block to be included in the blockchain, is a computational process that ensures the block contains significant computational effort—protecting the network against manipulation attempts.

Transactions, in turn, need to follow specific input and output rules. Each transaction includes cryptographic signatures that prove the ownership of the bitcoins sent, as well as validation scripts that verify if the transaction conditions are met. This validation system is essential for network nodes to autonomously confirm that each transaction follows the rules.

Chain Selection

Another fundamental technical issue for Bitcoin's consensus is chain selection, which becomes especially important in cases where multiple versions of the blockchain coexist, such as after a network split (fork). To decide which chain is the "true" one and should be followed, the network adopts the criterion of the highest accumulated proof of work. In other words, the chain with the highest number of valid blocks, built with the greatest computational effort, is chosen by the network as the official one.

This criterion avoids permanent splits because it encourages all nodes to follow the same main chain, reinforcing consensus.

Soft Forks vs. Hard Forks

In the consensus process, protocol changes can happen in two ways: through soft forks or hard forks. These variations affect not only the protocol update but also the implications for network users:

-

Soft Forks: These are changes that are backward compatible. Only nodes that adopt the new update will follow the new rules, but old nodes will still recognize the blocks produced with these rules as valid. This compatibility makes soft forks a safer option for updates, as it minimizes the risk of network division.

-

Hard Forks: These are updates that are not backward compatible, requiring all nodes to update to the new version or risk being separated from the main chain. Hard forks can result in the creation of a new coin, as occurred with the split between Bitcoin and Bitcoin Cash in 2017. While hard forks allow for deeper changes, they also bring significant risks of network fragmentation.

These technical components form the base of Bitcoin's security and resilience, allowing the system to remain functional and immutable without losing the necessary flexibility to evolve over time.

3. Stakeholders in Bitcoin's Consensus

Consensus in Bitcoin is not decided centrally. On the contrary, it depends on the interaction between different groups of stakeholders, each with their motivations, interests, and levels of influence. These groups play fundamental roles in how changes are implemented or rejected on the network. Below, we explore the six main stakeholders in Bitcoin's consensus.

1. Economic Nodes

Economic nodes, usually operated by exchanges, custody providers, and large companies that accept Bitcoin, exert significant influence over consensus. Because they handle large volumes of transactions and act as a connection point between the Bitcoin ecosystem and the traditional financial system, these nodes have the power to validate or reject blocks and to define which version of the software to follow in case of a fork.

Their influence is proportional to the volume of transactions they handle, and they can directly affect which chain will be seen as the main one. Their incentive is to maintain the network's stability and security to preserve its functionality and meet regulatory requirements.

2. Investors

Investors, including large institutional funds and individual Bitcoin holders, influence consensus indirectly through their impact on the asset's price. Their buying and selling actions can affect Bitcoin's value, which in turn influences the motivation of miners and other stakeholders to continue investing in the network's security and development.

Some institutional investors have agreements with custodians that may limit their ability to act in network split situations. Thus, the impact of each investor on consensus can vary based on their ownership structure and how quickly they can react to a network change.

3. Media Influencers

Media influencers, including journalists, analysts, and popular personalities on social media, have a powerful role in shaping public opinion about Bitcoin and possible updates. These influencers can help educate the public, promote debates, and bring transparency to the consensus process.

On the other hand, the impact of influencers can be double-edged: while they can clarify complex topics, they can also distort perceptions by amplifying or minimizing change proposals. This makes them a force both of support and resistance to consensus.

4. Miners

Miners are responsible for validating transactions and including blocks in the blockchain. Through computational power (hashrate), they also exert significant influence over consensus decisions. In update processes, miners often signal their support for a proposal, indicating that the new version is safe to use. However, this signaling is not always definitive, and miners can change their position if they deem it necessary.

Their incentive is to maximize returns from block rewards and transaction fees, as well as to maintain the value of investments in their specialized equipment, which are only profitable if the network remains stable.

5. Protocol Developers

Protocol developers, often called "Core Developers," are responsible for writing and maintaining Bitcoin's code. Although they do not have direct power over consensus, they possess an informal veto power since they decide which changes are included in the main client (Bitcoin Core). This group also serves as an important source of technical knowledge, helping guide decisions and inform other stakeholders.

Their incentive lies in the continuous improvement of the network, ensuring security and decentralization. Many developers are funded by grants and sponsorships, but their motivations generally include a strong ideological commitment to Bitcoin's principles.

6. Users and Application Developers

This group includes people who use Bitcoin in their daily transactions and developers who build solutions based on the network, such as wallets, exchanges, and payment platforms. Although their power in consensus is less than that of miners or economic nodes, they play an important role because they are responsible for popularizing Bitcoin's use and expanding the ecosystem.

If application developers decide not to adopt an update, this can affect compatibility and widespread acceptance. Thus, they indirectly influence consensus by deciding which version of the protocol to follow in their applications.

These stakeholders are vital to the consensus process, and each group exerts influence according to their involvement, incentives, and ability to act in situations of change. Understanding the role of each makes it clearer how consensus is formed and why it is so difficult to make significant changes to Bitcoin.

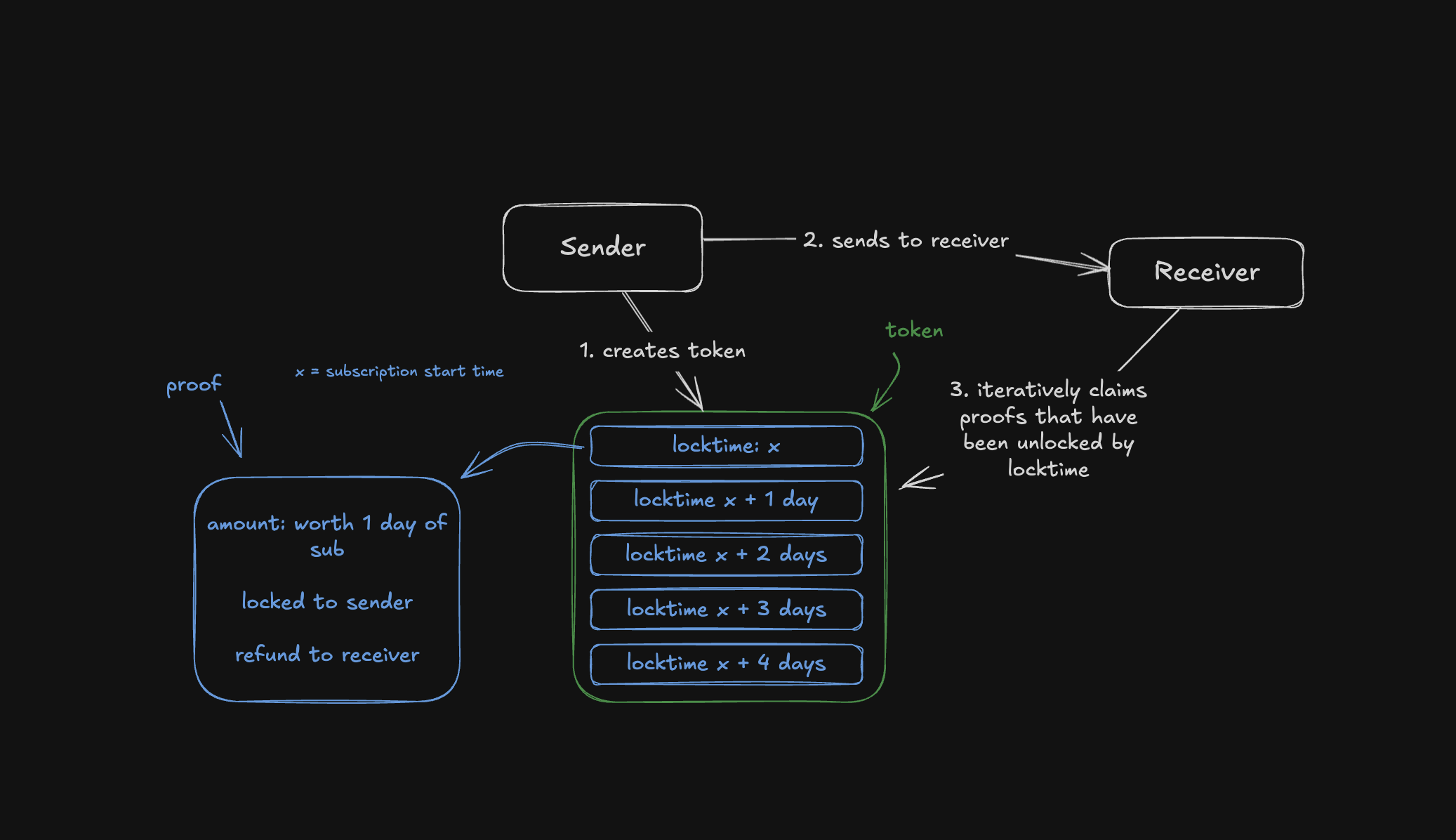

4. Mechanisms for Activating Updates in Bitcoin

For Bitcoin to evolve without compromising security and consensus, different mechanisms for activating updates have been developed over the years. These mechanisms help coordinate changes among network nodes to minimize the risk of fragmentation and ensure that updates are implemented in an orderly manner. Here, we explore some of the main methods used in Bitcoin, their advantages and disadvantages, as well as historical examples of significant updates.

Flag Day

The Flag Day mechanism is one of the simplest forms of activating changes. In it, a specific date or block is determined as the activation moment, and all nodes must be updated by that point. This method does not involve prior signaling; participants simply need to update to the new software version by the established day or block.

-

Advantages: Simplicity and predictability are the main benefits of Flag Day, as everyone knows the exact activation date.

-

Disadvantages: Inflexibility can be a problem because there is no way to adjust the schedule if a significant part of the network has not updated. This can result in network splits if a significant number of nodes are not ready for the update.

An example of Flag Day was the Pay to Script Hash (P2SH) update in 2012, which required all nodes to adopt the change to avoid compatibility issues.

BIP34 and BIP9

BIP34 introduced a more dynamic process, in which miners increase the version number in block headers to signal the update. When a predetermined percentage of the last blocks is mined with this new version, the update is automatically activated. This model later evolved with BIP9, which allowed multiple updates to be signaled simultaneously through "version bits," each corresponding to a specific change.

-

Advantages: Allows the network to activate updates gradually, giving more time for participants to adapt.

-

Disadvantages: These methods rely heavily on miner support, which means that if a sufficient number of miners do not signal the update, it can be delayed or not implemented.

BIP9 was used in the activation of SegWit (BIP141) but faced challenges because some miners did not signal their intent to activate, leading to the development of new mechanisms.

User Activated Soft Forks (UASF) and User Resisted Soft Forks (URSF)

To increase the decision-making power of ordinary users, the concept of User Activated Soft Fork (UASF) was introduced, allowing node operators, not just miners, to determine consensus for a change. In this model, nodes set a date to start rejecting blocks that are not in compliance with the new update, forcing miners to adapt or risk having their blocks rejected by the network.

URSF, in turn, is a model where nodes reject blocks that attempt to adopt a specific update, functioning as resistance against proposed changes.

-

Advantages: UASF returns decision-making power to node operators, ensuring that changes do not depend solely on miners.

-

Disadvantages: Both UASF and URSF can generate network splits, especially in cases of strong opposition among different stakeholders.

An example of UASF was the activation of SegWit in 2017, where users supported activation independently of miner signaling, which ended up forcing its adoption.

BIP8 (LOT=True)

BIP8 is an evolution of BIP9, designed to prevent miners from indefinitely blocking a change desired by the majority of users and developers. BIP8 allows setting a parameter called "lockinontimeout" (LOT) as true, which means that if the update has not been fully signaled by a certain point, it is automatically activated.

-

Advantages: Ensures that changes with broad support among users are not blocked by miners who wish to maintain the status quo.

-

Disadvantages: Can lead to network splits if miners or other important stakeholders do not support the update.

Although BIP8 with LOT=True has not yet been used in Bitcoin, it is a proposal that can be applied in future updates if necessary.

These activation mechanisms have been essential for Bitcoin's development, allowing updates that keep the network secure and functional. Each method brings its own advantages and challenges, but all share the goal of preserving consensus and network cohesion.

5. Risks and Considerations in Consensus Updates

Consensus updates in Bitcoin are complex processes that involve not only technical aspects but also political, economic, and social considerations. Due to the network's decentralized nature, each change brings with it a set of risks that need to be carefully assessed. Below, we explore some of the main challenges and future scenarios, as well as the possible impacts on stakeholders.

Network Fragility with Alternative Implementations

One of the main risks associated with consensus updates is the possibility of network fragmentation when there are alternative software implementations. If an update is implemented by a significant group of nodes but rejected by others, a network split (fork) can occur. This creates two competing chains, each with a different version of the transaction history, leading to unpredictable consequences for users and investors.

Such fragmentation weakens Bitcoin because, by dividing hashing power (computing) and coin value, it reduces network security and investor confidence. A notable example of this risk was the fork that gave rise to Bitcoin Cash in 2017 when disagreements over block size resulted in a new chain and a new asset.

Chain Splits and Impact on Stakeholders

Chain splits are a significant risk in update processes, especially in hard forks. During a hard fork, the network is split into two separate chains, each with its own set of rules. This results in the creation of a new coin and leaves users with duplicated assets on both chains. While this may seem advantageous, in the long run, these splits weaken the network and create uncertainties for investors.

Each group of stakeholders reacts differently to a chain split:

-

Institutional Investors and ETFs: Face regulatory and compliance challenges because many of these assets are managed under strict regulations. The creation of a new coin requires decisions to be made quickly to avoid potential losses, which may be hampered by regulatory constraints.

-

Miners: May be incentivized to shift their computing power to the chain that offers higher profitability, which can weaken one of the networks.

-

Economic Nodes: Such as major exchanges and custody providers, have to quickly choose which chain to support, influencing the perceived value of each network.

Such divisions can generate uncertainties and loss of value, especially for institutional investors and those who use Bitcoin as a store of value.

Regulatory Impacts and Institutional Investors

With the growing presence of institutional investors in Bitcoin, consensus changes face new compliance challenges. Bitcoin ETFs, for example, are required to follow strict rules about which assets they can include and how chain split events should be handled. The creation of a new asset or migration to a new chain can complicate these processes, creating pressure for large financial players to quickly choose a chain, affecting the stability of consensus.

Moreover, decisions regarding forks can influence the Bitcoin futures and derivatives market, affecting perception and adoption by new investors. Therefore, the need to avoid splits and maintain cohesion is crucial to attract and preserve the confidence of these investors.

Security Considerations in Soft Forks and Hard Forks

While soft forks are generally preferred in Bitcoin for their backward compatibility, they are not without risks. Soft forks can create different classes of nodes on the network (updated and non-updated), which increases operational complexity and can ultimately weaken consensus cohesion. In a network scenario with fragmentation of node classes, Bitcoin's security can be affected, as some nodes may lose part of the visibility over updated transactions or rules.

In hard forks, the security risk is even more evident because all nodes need to adopt the new update to avoid network division. Experience shows that abrupt changes can create temporary vulnerabilities, in which malicious agents try to exploit the transition to attack the network.

Bounty Claim Risks and Attack Scenarios

Another risk in consensus updates are so-called "bounty claims"—accumulated rewards that can be obtained if an attacker manages to split or deceive a part of the network. In a conflict scenario, a group of miners or nodes could be incentivized to support a new update or create an alternative version of the software to benefit from these rewards.

These risks require stakeholders to carefully assess each update and the potential vulnerabilities it may introduce. The possibility of "bounty claims" adds a layer of complexity to consensus because each interest group may see a financial opportunity in a change that, in the long term, may harm network stability.

The risks discussed above show the complexity of consensus in Bitcoin and the importance of approaching it gradually and deliberately. Updates need to consider not only technical aspects but also economic and social implications, in order to preserve Bitcoin's integrity and maintain trust among stakeholders.

6. Recommendations for the Consensus Process in Bitcoin

To ensure that protocol changes in Bitcoin are implemented safely and with broad support, it is essential that all stakeholders adopt a careful and coordinated approach. Here are strategic recommendations for evaluating, supporting, or rejecting consensus updates, considering the risks and challenges discussed earlier, along with best practices for successful implementation.

1. Careful Evaluation of Proposal Maturity

Stakeholders should rigorously assess the maturity level of a proposal before supporting its implementation. Updates that are still experimental or lack a robust technical foundation can expose the network to unnecessary risks. Ideally, change proposals should go through an extensive testing phase, have security audits, and receive review and feedback from various developers and experts.

2. Extensive Testing in Secure and Compatible Networks

Before an update is activated on the mainnet, it is essential to test it on networks like testnet and signet, and whenever possible, on other compatible networks that offer a safe and controlled environment to identify potential issues. Testing on networks like Litecoin was fundamental for the safe launch of innovations like SegWit and the Lightning Network, allowing functionalities to be validated on a lower-impact network before being implemented on Bitcoin.

The Liquid Network, developed by Blockstream, also plays an important role as an experimental network for new proposals, such as OP_CAT. By adopting these testing environments, stakeholders can mitigate risks and ensure that the update is reliable and secure before being adopted by the main network.

3. Importance of Stakeholder Engagement

The success of a consensus update strongly depends on the active participation of all stakeholders. This includes economic nodes, miners, protocol developers, investors, and end users. Lack of participation can lead to inadequate decisions or even future network splits, which would compromise Bitcoin's security and stability.

4. Key Questions for Evaluating Consensus Proposals

To assist in decision-making, each group of stakeholders should consider some key questions before supporting a consensus change:

- Does the proposal offer tangible benefits for Bitcoin's security, scalability, or usability?

- Does it maintain backward compatibility or introduce the risk of network split?

- Are the implementation requirements clear and feasible for each group involved?

- Are there clear and aligned incentives for all stakeholder groups to accept the change?

5. Coordination and Timing in Implementations

Timing is crucial. Updates with short activation windows can force a split because not all nodes and miners can update simultaneously. Changes should be planned with ample deadlines to allow all stakeholders to adjust their systems, avoiding surprises that could lead to fragmentation.

Mechanisms like soft forks are generally preferable to hard forks because they allow a smoother transition. Opting for backward-compatible updates when possible facilitates the process and ensures that nodes and miners can adapt without pressure.

6. Continuous Monitoring and Re-evaluation

After an update, it's essential to monitor the network to identify problems or side effects. This continuous process helps ensure cohesion and trust among all participants, keeping Bitcoin as a secure and robust network.

These recommendations, including the use of secure networks for extensive testing, promote a collaborative and secure environment for Bitcoin's consensus process. By adopting a deliberate and strategic approach, stakeholders can preserve Bitcoin's value as a decentralized and censorship-resistant network.

7. Conclusion

Consensus in Bitcoin is more than a set of rules; it's the foundation that sustains the network as a decentralized, secure, and reliable system. Unlike centralized systems, where decisions can be made quickly, Bitcoin requires a much more deliberate and cooperative approach, where the interests of miners, economic nodes, developers, investors, and users must be considered and harmonized. This governance model may seem slow, but it is fundamental to preserving the resilience and trust that make Bitcoin a global store of value and censorship-resistant.

Consensus updates in Bitcoin must balance the need for innovation with the preservation of the network's core principles. The development process of a proposal needs to be detailed and rigorous, going through several testing stages, such as in testnet, signet, and compatible networks like Litecoin and Liquid Network. These networks offer safe environments for proposals to be analyzed and improved before being launched on the main network.

Each proposed change must be carefully evaluated regarding its maturity, impact, backward compatibility, and support among stakeholders. The recommended key questions and appropriate timing are critical to ensure that an update is adopted without compromising network cohesion. It's also essential that the implementation process is continuously monitored and re-evaluated, allowing adjustments as necessary and minimizing the risk of instability.

By following these guidelines, Bitcoin's stakeholders can ensure that the network continues to evolve safely and robustly, maintaining user trust and further solidifying its role as one of the most resilient and innovative digital assets in the world. Ultimately, consensus in Bitcoin is not just a technical issue but a reflection of its community and the values it represents: security, decentralization, and resilience.

8. Links

Whitepaper: https://github.com/bitcoin-cap/bcap

Youtube (pt-br): https://www.youtube.com/watch?v=rARycAibl9o&list=PL-qnhF0qlSPkfhorqsREuIu4UTbF0h4zb

-

-

@ eac63075:b4988b48

2024-10-26 22:14:19

@ eac63075:b4988b48

2024-10-26 22:14:19The future of physical money is at stake, and the discussion about DREX, the new digital currency planned by the Central Bank of Brazil, is gaining momentum. In a candid and intense conversation, Federal Deputy Julia Zanatta (PL/SC) discussed the challenges and risks of this digital transition, also addressing her Bill No. 3,341/2024, which aims to prevent the extinction of physical currency. This bill emerges as a direct response to legislative initiatives seeking to replace physical money with digital alternatives, limiting citizens' options and potentially compromising individual freedom. Let's delve into the main points of this conversation.

https://www.fountain.fm/episode/i5YGJ9Ors3PkqAIMvNQ0

What is a CBDC?

Before discussing the specifics of DREX, it’s important to understand what a CBDC (Central Bank Digital Currency) is. CBDCs are digital currencies issued by central banks, similar to a digital version of physical money. Unlike cryptocurrencies such as Bitcoin, which operate in a decentralized manner, CBDCs are centralized and regulated by the government. In other words, they are digital currencies created and controlled by the Central Bank, intended to replace physical currency.

A prominent feature of CBDCs is their programmability. This means that the government can theoretically set rules about how, where, and for what this currency can be used. This aspect enables a level of control over citizens' finances that is impossible with physical money. By programming the currency, the government could limit transactions by setting geographical or usage restrictions. In practice, money within a CBDC could be restricted to specific spending or authorized for use in a defined geographical area.

In countries like China, where citizen actions and attitudes are also monitored, a person considered to have a "low score" due to a moral or ideological violation may have their transactions limited to essential purchases, restricting their digital currency use to non-essential activities. This financial control is strengthened because, unlike physical money, digital currency cannot be exchanged anonymously.

Practical Example: The Case of DREX During the Pandemic

To illustrate how DREX could be used, an example was given by Eric Altafim, director of Banco Itaú. He suggested that, if DREX had existed during the COVID-19 pandemic, the government could have restricted the currency’s use to a 5-kilometer radius around a person’s residence, limiting their economic mobility. Another proposed use by the executive related to the Bolsa Família welfare program: the government could set up programming that only allows this benefit to be used exclusively for food purchases. Although these examples are presented as control measures for safety or organization, they demonstrate how much a CBDC could restrict citizens' freedom of choice.

To illustrate the potential for state control through a Central Bank Digital Currency (CBDC), such as DREX, it is helpful to look at the example of China. In China, the implementation of a CBDC coincides with the country’s Social Credit System, a governmental surveillance tool that assesses citizens' and companies' behavior. Together, these technologies allow the Chinese government to monitor, reward, and, above all, punish behavior deemed inappropriate or threatening to the government.

How Does China's Social Credit System Work?

Implemented in 2014, China's Social Credit System assigns every citizen and company a "score" based on various factors, including financial behavior, criminal record, social interactions, and even online activities. This score determines the benefits or penalties each individual receives and can affect everything from public transport access to obtaining loans and enrolling in elite schools for their children. Citizens with low scores may face various sanctions, including travel restrictions, fines, and difficulty in securing loans.

With the adoption of the CBDC — or “digital yuan” — the Chinese government now has a new tool to closely monitor citizens' financial transactions, facilitating the application of Social Credit System penalties. China’s CBDC is a programmable digital currency, which means that the government can restrict how, when, and where the money can be spent. Through this level of control, digital currency becomes a powerful mechanism for influencing citizens' behavior.

Imagine, for instance, a citizen who repeatedly posts critical remarks about the government on social media or participates in protests. If the Social Credit System assigns this citizen a low score, the Chinese government could, through the CBDC, restrict their money usage in certain areas or sectors. For example, they could be prevented from buying tickets to travel to other regions, prohibited from purchasing certain consumer goods, or even restricted to making transactions only at stores near their home.

Another example of how the government can use the CBDC to enforce the Social Credit System is by monitoring purchases of products such as alcohol or luxury items. If a citizen uses the CBDC to spend more than the government deems reasonable on such products, this could negatively impact their social score, resulting in additional penalties such as future purchase restrictions or a lowered rating that impacts their personal and professional lives.

In China, this kind of control has already been demonstrated in several cases. Citizens added to Social Credit System “blacklists” have seen their spending and investment capacity severely limited. The combination of digital currency and social scores thus creates a sophisticated and invasive surveillance system, through which the Chinese government controls important aspects of citizens’ financial lives and individual freedoms.

Deputy Julia Zanatta views these examples with great concern. She argues that if the state has full control over digital money, citizens will be exposed to a level of economic control and surveillance never seen before. In a democracy, this control poses a risk, but in an authoritarian regime, it could be used as a powerful tool of repression.

DREX and Bill No. 3,341/2024

Julia Zanatta became aware of a bill by a Workers' Party (PT) deputy (Bill 4068/2020 by Deputy Reginaldo Lopes - PT/MG) that proposes the extinction of physical money within five years, aiming for a complete transition to DREX, the digital currency developed by the Central Bank of Brazil. Concerned about the impact of this measure, Julia drafted her bill, PL No. 3,341/2024, which prohibits the elimination of physical money, ensuring citizens the right to choose physical currency.

“The more I read about DREX, the less I want its implementation,” says the deputy. DREX is a Central Bank Digital Currency (CBDC), similar to other state digital currencies worldwide, but which, according to Julia, carries extreme control risks. She points out that with DREX, the State could closely monitor each citizen’s transactions, eliminating anonymity and potentially restricting freedom of choice. This control would lie in the hands of the Central Bank, which could, in a crisis or government change, “freeze balances or even delete funds directly from user accounts.”

Risks and Individual Freedom

Julia raises concerns about potential abuses of power that complete digitalization could allow. In a democracy, state control over personal finances raises serious questions, and EddieOz warns of an even more problematic future. “Today we are in a democracy, but tomorrow, with a government transition, we don't know if this kind of power will be used properly or abused,” he states. In other words, DREX gives the State the ability to restrict or condition the use of money, opening the door to unprecedented financial surveillance.

EddieOz cites Nigeria as an example, where a CBDC was implemented, and the government imposed severe restrictions on the use of physical money to encourage the use of digital currency, leading to protests and clashes in the country. In practice, the poorest and unbanked — those without regular access to banking services — were harshly affected, as without physical money, many cannot conduct basic transactions. Julia highlights that in Brazil, this situation would be even more severe, given the large number of unbanked individuals and the extent of rural areas where access to technology is limited.

The Relationship Between DREX and Pix

The digital transition has already begun with Pix, which revolutionized instant transfers and payments in Brazil. However, Julia points out that Pix, though popular, is a citizen’s choice, while DREX tends to eliminate that choice. The deputy expresses concern about new rules suggested for Pix, such as daily transaction limits of a thousand reais, justified as anti-fraud measures but which, in her view, represent additional control and a profit opportunity for banks. “How many more rules will banks create to profit from us?” asks Julia, noting that DREX could further enhance control over personal finances.

International Precedents and Resistance to CBDC

The deputy also cites examples from other countries resisting the idea of a centralized digital currency. In the United States, states like New Hampshire have passed laws to prevent the advance of CBDCs, and leaders such as Donald Trump have opposed creating a national digital currency. Trump, addressing the topic, uses a justification similar to Julia’s: in a digitalized system, “with one click, your money could disappear.” She agrees with the warning, emphasizing the control risk that a CBDC represents, especially for countries with disadvantaged populations.

Besides the United States, Canada, Colombia, and Australia have also suspended studies on digital currencies, citing the need for further discussions on population impacts. However, in Brazil, the debate on DREX is still limited, with few parliamentarians and political leaders openly discussing the topic. According to Julia, only she and one or two deputies are truly trying to bring this discussion to the Chamber, making DREX’s advance even more concerning.

Bill No. 3,341/2024 and Popular Pressure

For Julia, her bill is a first step. Although she acknowledges that ideally, it would prevent DREX's implementation entirely, PL 3341/2024 is a measure to ensure citizens' choice to use physical money, preserving a form of individual freedom. “If the future means control, I prefer to live in the past,” Julia asserts, reinforcing that the fight for freedom is at the heart of her bill.

However, the deputy emphasizes that none of this will be possible without popular mobilization. According to her, popular pressure is crucial for other deputies to take notice and support PL 3341. “I am only one deputy, and we need the public’s support to raise the project’s visibility,” she explains, encouraging the public to press other parliamentarians and ask them to “pay attention to PL 3341 and the project that prohibits the end of physical money.” The deputy believes that with a strong awareness and pressure movement, it is possible to advance the debate and ensure Brazilians’ financial freedom.

What’s at Stake?

Julia Zanatta leaves no doubt: DREX represents a profound shift in how money will be used and controlled in Brazil. More than a simple modernization of the financial system, the Central Bank’s CBDC sets precedents for an unprecedented level of citizen surveillance and control in the country. For the deputy, this transition needs to be debated broadly and transparently, and it’s up to the Brazilian people to defend their rights and demand that the National Congress discuss these changes responsibly.

The deputy also emphasizes that, regardless of political or partisan views, this issue affects all Brazilians. “This agenda is something that will affect everyone. We need to be united to ensure people understand the gravity of what could happen.” Julia believes that by sharing information and generating open debate, it is possible to prevent Brazil from following the path of countries that have already implemented a digital currency in an authoritarian way.

A Call to Action

The future of physical money in Brazil is at risk. For those who share Deputy Julia Zanatta’s concerns, the time to act is now. Mobilize, get informed, and press your representatives. PL 3341/2024 is an opportunity to ensure that Brazilian citizens have a choice in how to use their money, without excessive state interference or surveillance.

In the end, as the deputy puts it, the central issue is freedom. “My fear is that this project will pass, and people won’t even understand what is happening.” Therefore, may every citizen at least have the chance to understand what’s at stake and make their voice heard in defense of a Brazil where individual freedom and privacy are respected values.

-

@ a42048d7:26886c32

2024-12-27 16:33:24

@ a42048d7:26886c32

2024-12-27 16:33:24DIY Multisig is complex and 100x more likely to fail than you think if you do it yourself: A few years ago as an experiment I put what was then $2,000 worth Bitcoin into a 2 of 3 DIY multisig with two close family members holding two keys on Tapsigners and myself holding the last key on a Coldcard. My thought was to try and preview how they might deal with self custodied multisig Bitcoin if I died prematurely. After over a year I revisited and asked them to try and do a transaction without me. Just send that single Utxo to a new address in the same wallet, no time limit. It could not possibly have failed harder and shook my belief in multisig. To summarize an extremely painful day, there was a literally 0% chance they would figure this out without help. If this had been for real all our BTC may have been lost forever. Maybe eventually a family friend could’ve helped, but I hadn’t thought of that and hadn’t recommended a trusted BTC knowledge/help source. I had preached self sovereignty and doing it alone and my family tried to respect that. I should’ve given them the contact info of local high integrity bitcoiners I trust implicitly. Regardless of setup type, I highly recommend having a trusted Bitcoiner and online resources your family knows they can turn to to trouble shoot. Bookmark the corresponding BTCSessions video to your BTC self custody setup. Multisig is complicated as hell and hard to understand. Complexity is the enemy when it comes to making sure your BTC isn’t lost and actually gets to your heirs. Many Bitcoiners use a similar setup to this one that failed so badly, and I’m telling you unless you’re married to or gave birth to a seriously hardcore maxi who is extremely tech savvy, the risk your Bitcoin is lost upon your death is unacceptably high. My family is extremely smart but when the pressure of now many thousands of dollars was on the line, the complexity of multisig torpedoed them. Don’t run to an ETF! There are answers: singlesig is awesome. From observing my family I’m confident they would’ve been okay in a singlesig setup. It was the process of signing on separate devices with separate signers, and moving a PSBT around that stymied them. If it had been singlesig they would’ve been okay as one signature on its own was accomplished. Do not besmirch singlesig, it’s incredibly powerful and incredibly resilient. Resilience and simplicity are vastly underrated! In my opinion multisig may increase your theoretical security against attacks that are far less likely to actually happen, e.g. an Oceans Eleven style hack/heist. More likely your heirs will be fighting panic, grief, and stress and forget something you taught them a few years back. If they face an attack it will most likely be social engineering/phishing. They are unlikely to face an elaborate heist that would make a fun movie. While I still maintain it was a mistake for Bitkey to not have a separate screen to verify addresses and other info, overall I believe it’s probably the best normie option for small BTC holdings(yes I do know Bitkey is actually multisig, but the UX is basically a single sig). This incident scared me into realizing the importance of simplicity. Complexity and confusion of heirs/family may be the most under-considered aspects of BTC security. If you’ve made a DIY multisig and your heirs can’t explain why they need all three public keys and what a descriptor is and where it’s backed up, you might as well just go have that boating accident now and get it over with.

Once you get past small amounts of BTC, any reputable hardware wallet in singlesig is amazing security I would encourage folks to consider. In a singlesig setup - For $5 wrench attack concerns, just don’t have your hardware signer or steel backup at your home. You can just have a hot wallet on your phone with a small amount for spending.

If you get a really big stack collaborative multisig is a potentially reasonable middle ground. Just be very thoughtful and brutally honest about your heirs and their BTC and general tech knowledge. Singlesig is still great and you don’t have to move past it, but I get that you also need to sleep at night. If you have truly life changing wealth and are just too uncomfortable with singlesig, maybe consider either 1) Anchorwatch to get the potential benefits of multisig security with the safety net of traditional insurance or 2) Liana wallet where you can use miniscript to effectively have a time locked singlesig spending path to a key held by a third party to help your family recover your funds if they can’t figure it out before that timelock hits, 3) Bitcoin Keeper with their automatic inheritance docs and mini script enabled inheritance key. The automatic inheritance docs are a best in class feature no one else has done yet. Unchained charges $200 for inheritance docs on top of your $250 annual subscription, which imho is beyond ridiculous. 4) Swan vault, I’ve generally soured on most traditional 2 of 3 collaborative multisig because I’ve always found holes either in security (Unchained signed a transaction in only a few hours and has no defined time delay, and still doesn’t support Segwit, seriously guys, wtf?), only support signers that are harder to use and thus tough for noobs, or the overall setups are just too complex. Swan Vault’s focus on keeping it as simple as possible really stands out against competitors that tack on unneeded confusion complexity.

TLDR: For small amounts of BTC use Bitkey. For medium to large amounts use singlesig with a reputable hardware wallet and steel backup. For life changing wealth where you just can no longer stomach sinsglesig maybe also consider Anchorwatch, Bitcoin Keeper, Sean Vault, or Liana. Don’t forget your steel backups! Be safe out there! Do your own research and don’t take my word for it. Just use this as inspiration to consider an alternative point of view. If you’re a family of software engineers, feel free to tell me to go fuck myself.

-

@ 8fb140b4:f948000c

2023-11-21 21:37:48

@ 8fb140b4:f948000c

2023-11-21 21:37:48Embarking on the journey of operating your own Lightning node on the Bitcoin Layer 2 network is more than just a tech-savvy endeavor; it's a step into a realm of financial autonomy and cutting-edge innovation. By running a node, you become a vital part of a revolutionary movement that's reshaping how we think about money and digital transactions. This role not only offers a unique perspective on blockchain technology but also places you at the heart of a community dedicated to decentralization and network resilience. Beyond the technicalities, it's about embracing a new era of digital finance, where you contribute directly to the network's security, efficiency, and growth, all while gaining personal satisfaction and potentially lucrative rewards.

In essence, running your own Lightning node is a powerful way to engage with the forefront of blockchain technology, assert financial independence, and contribute to a more decentralized and efficient Bitcoin network. It's an adventure that offers both personal and communal benefits, from gaining in-depth tech knowledge to earning a place in the evolving landscape of cryptocurrency.

Running your own Lightning node for the Bitcoin Layer 2 network can be an empowering and beneficial endeavor. Here are 10 reasons why you might consider taking on this task:

-

Direct Contribution to Decentralization: Operating a node is a direct action towards decentralizing the Bitcoin network, crucial for its security and resistance to control or censorship by any single entity.

-

Financial Autonomy: Owning a node gives you complete control over your financial transactions on the network, free from reliance on third-party services, which can be subject to fees, restrictions, or outages.

-

Advanced Network Participation: As a node operator, you're not just a passive participant but an active player in shaping the network, influencing its efficiency and scalability through direct involvement.

-

Potential for Higher Revenue: With strategic management and optimal channel funding, your node can become a preferred route for transactions, potentially increasing the routing fees you can earn.

-

Cutting-Edge Technological Engagement: Running a node puts you at the forefront of blockchain and bitcoin technology, offering insights into future developments and innovations.

-

Strengthened Network Security: Each new node adds to the robustness of the Bitcoin network, making it more resilient against attacks and failures, thus contributing to the overall security of the ecosystem.

-

Personalized Fee Structures: You have the flexibility to set your own fee policies, which can balance earning potential with the service you provide to the network.

-

Empowerment Through Knowledge: The process of setting up and managing a node provides deep learning opportunities, empowering you with knowledge that can be applied in various areas of blockchain and fintech.

-

Boosting Transaction Capacity: By running a node, you help to increase the overall capacity of the Lightning Network, enabling more transactions to be processed quickly and at lower costs.

-

Community Leadership and Reputation: As an active node operator, you gain recognition within the Bitcoin community, which can lead to collaborative opportunities and a position of thought leadership in the space.

These reasons demonstrate the impactful and transformative nature of running a Lightning node, appealing to those who are deeply invested in the principles of bitcoin and wish to actively shape its future. Jump aboard, and embrace the journey toward full independence. 🐶🐾🫡🚀🚀🚀

-

-

@ 8fb140b4:f948000c

2023-11-18 23:28:31

@ 8fb140b4:f948000c

2023-11-18 23:28:31Chef's notes

Serving these two dishes together will create a delightful centerpiece for your Thanksgiving meal, offering a perfect blend of traditional flavors with a homemade touch.

Details

- ⏲️ Prep time: 30 min

- 🍳 Cook time: 1 - 2 hours

- 🍽️ Servings: 4-6

Ingredients

- 1 whole turkey (about 12-14 lbs), thawed and ready to cook

- 1 cup unsalted butter, softened

- 2 tablespoons fresh thyme, chopped

- 2 tablespoons fresh rosemary, chopped

- 2 tablespoons fresh sage, chopped

- Salt and freshly ground black pepper

- 1 onion, quartered

- 1 lemon, halved

- 2-3 cloves of garlic

- Apple and Sage Stuffing

- 1 loaf of crusty bread, cut into cubes

- 2 apples, cored and chopped

- 1 onion, diced

- 2 stalks celery, diced

- 3 cloves garlic, minced

- 1/4 cup fresh sage, chopped

- 1/2 cup unsalted butter

- 2 cups chicken broth

- Salt and pepper, to taste

Directions

- Preheat the Oven: Set your oven to 325°F (165°C).

- Prepare the Herb Butter: Mix the softened butter with the chopped thyme, rosemary, and sage. Season with salt and pepper.

- Prepare the Turkey: Remove any giblets from the turkey and pat it dry. Loosen the skin and spread a generous amount of herb butter under and over the skin.

- Add Aromatics: Inside the turkey cavity, place the quartered onion, lemon halves, and garlic cloves.

- Roast: Place the turkey in a roasting pan. Tent with aluminum foil and roast. A general guideline is about 15 minutes per pound, or until the internal temperature reaches 165°F (74°C) at the thickest part of the thigh.

- Rest and Serve: Let the turkey rest for at least 20 minutes before carving.

- Next: Apple and Sage Stuffing

- Dry the Bread: Spread the bread cubes on a baking sheet and let them dry overnight, or toast them in the oven.

- Cook the Vegetables: In a large skillet, melt the butter and cook the onion, celery, and garlic until soft.

- Combine Ingredients: Add the apples, sage, and bread cubes to the skillet. Stir in the chicken broth until the mixture is moist. Season with salt and pepper.

- Bake: Transfer the stuffing to a baking dish and bake at 350°F (175°C) for about 30-40 minutes, until golden brown on top.

-

@ a4a6b584:1e05b95b

2024-12-26 17:13:08

@ a4a6b584:1e05b95b

2024-12-26 17:13:08Step 1: Secure Your Device

- Install an Antivirus Program

Download and install a trusted antivirus program to scan files for potential malware. - For Linux: Calm Antivirus

-

For Windows: CalmWin Antivirus

-

Install a VPN

A VPN is essential for maintaining privacy and security. It will encrypt your internet traffic and hide your IP address. -

Recommended: Mullvad VPN, which accepts Bitcoin for anonymous payment.

-

Install a Torrent Program

You’ll need a torrent client to download files. -

Recommended: Deluge

-

Install the Tor Browser

To access The Pirate Bay or its proxies, you’ll need the privacy-focused Tor Browser.

Step 2: Prepare Your Setup

- Ensure your VPN is running and connected.

- Open the Tor Browser.

- Launch Deluge to have your torrent client ready.

Step 3: Using Tor Go to The Pirate Bay via Onion Service or Find a Trusted Pirate Bay Proxy

Accessing The Pirate Bay directly can be challenging due to restrictions in some regions. Proxy sites often fill the gap. - The Pirate Bay Onion service: http://piratebayo3klnzokct3wt5yyxb2vpebbuyjl7m623iaxmqhsd52coid.onion - Or find a trusted proxy: Use a site like Pirateproxy or a reliable Tor directory for updated lists.

Step 4: Search for Linux Distros

- On The Pirate Bay, navigate to the "OtherOS" category under the Applications section.

- Enter your desired Linux distro in the search bar (e.g., "Ubuntu," "Arch Linux").

Step 5: Select a Torrent

- Filter the Results:

- Look for torrents with the highest seeders (SE) and the fewest leechers (LE).

-

Trusted users are marked with a green skull icon—these are usually safe uploads.

-

Copy the Magnet Link:

- Right-click on the magnet icon next to the trusted torrent and select "Copy Link."

Step 6: Start the Download

- In Deluge, paste the copied magnet link into the “Add Torrent” box.

- Click OK to start the download.

- Monitor the progress until the download completes.

Step 7: Scan the Downloaded File

Once the file is downloaded: 1. Scan for viruses: Right-click the file and use Calm or CalmWin to verify its integrity.

2. If the file passes the scan, it’s ready for use.

Step 8: Manage Your File

- Seed or Remove:

- To help the torrent community, keep seeding the file by leaving it in your torrent client.

-

To stop seeding, right-click the file in Deluge and remove it.

-

Move for Long-Term Storage: Transfer the file to a secure directory for regular use.

Notes on Safety and Ethics

- Verify Legitimacy: Ensure the torrent you are downloading is for an official Linux distribution. Torrents with unusual names or details should be avoided.

- Support the Developers: Consider visiting the official websites of Linux distros (Ubuntu, Arch Linux) to support their work directly.

By following these steps, you can safely and privately download Linux distributions while contributing to the open-source community.

- Install an Antivirus Program

-

@ 8fb140b4:f948000c

2023-11-02 01:13:01

@ 8fb140b4:f948000c

2023-11-02 01:13:01Testing a brand new YakiHonne native client for iOS. Smooth as butter (not penis butter 🤣🍆🧈) with great visual experience and intuitive navigation. Amazing work by the team behind it! * lists * work

Bold text work!

Images could have used nostr.build instead of raw S3 from us-east-1 region.

Very impressive! You can even save the draft and continue later, before posting the long-form note!

🐶🐾🤯🤯🤯🫂💜

-

@ fd208ee8:0fd927c1

2024-12-26 07:02:59

@ fd208ee8:0fd927c1

2024-12-26 07:02:59I just read this, and found it enlightening.

Jung... notes that intelligence can be seen as problem solving at an everyday level..., whereas creativity may represent problem solving for less common issues

Other studies have used metaphor creation as a creativity measure instead of divergent thinking and a spectrum of CHC components instead of just g and have found much higher relationships between creativity and intelligence than past studies

https://www.mdpi.com/2079-3200/3/3/59

I'm unusually intelligent (Who isn't?), but I'm much more creative, than intelligent, and I think that confuses people. The ability to apply intelligence, to solve completely novel problems, on the fly, is something IQ tests don't even claim to measure. They just claim a correlation.

Creativity requires taking wild, mental leaps out into nothingness; simply trusting that your brain will land you safely. And this is why I've been at the forefront of massive innovation, over and over, but never got rich off of it.

I'm a starving autist.

Zaps are the first time I've ever made money directly, for solving novel problems. Companies don't do this because there is a span of time between providing a solution and the solution being implemented, and the person building the implementation (or their boss) receives all the credit for the existence of the solution. At best, you can hope to get pawned off with a small bonus.

Nobody can remember who came up with the solution, originally, and that person might not even be there, anymore, and probably never filed a patent, and may have no idea that their idea has even been built. They just run across it, later, in a tech magazine or museum, and say, "Well, will you look at that! Someone actually went and built it! Isn't that nice!"

Universities at least had the idea of cementing novel solutions in academic papers, but that: 1) only works if you're an academic, and at a university, 2) is an incredibly slow process, not appropriate for a truly innovative field, 3) leads to manifestations of perverse incentives and biased research frameworks, coming from 'publish or perish' policies.

But I think long-form notes and zaps solve for this problem. #Alexandria, especially, is being built to cater to this long-suffering class of chronic underachievers. It leaves a written, public, time-stamped record of Clever Ideas We Have Had.

Because they are clever, the ideas. And we have had them.

-

@ 6e468422:15deee93

2024-12-21 19:25:26

@ 6e468422:15deee93

2024-12-21 19:25:26We didn't hear them land on earth, nor did we see them. The spores were not visible to the naked eye. Like dust particles, they softly fell, unhindered, through our atmosphere, covering the earth. It took us a while to realize that something extraordinary was happening on our planet. In most places, the mushrooms didn't grow at all. The conditions weren't right. In some places—mostly rocky places—they grew large enough to be noticeable. People all over the world posted pictures online. "White eggs," they called them. It took a bit until botanists and mycologists took note. Most didn't realize that we were dealing with a species unknown to us.

We aren't sure who sent them. We aren't even sure if there is a "who" behind the spores. But once the first portals opened up, we learned that these mushrooms aren't just a quirk of biology. The portals were small at first—minuscule, even. Like a pinhole camera, we were able to glimpse through, but we couldn't make out much. We were only able to see colors and textures if the conditions were right. We weren't sure what we were looking at.

We still don't understand why some mushrooms open up, and some don't. Most don't. What we do know is that they like colder climates and high elevations. What we also know is that the portals don't stay open for long. Like all mushrooms, the flush only lasts for a week or two. When a portal opens, it looks like the mushroom is eating a hole into itself at first. But the hole grows, and what starts as a shimmer behind a grey film turns into a clear picture as the egg ripens. When conditions are right, portals will remain stable for up to three days. Once the fruit withers, the portal closes, and the mushroom decays.

The eggs grew bigger year over year. And with it, the portals. Soon enough, the portals were big enough to stick your finger through. And that's when things started to get weird...

-

@ 8fb140b4:f948000c

2023-08-22 12:14:34

@ 8fb140b4:f948000c

2023-08-22 12:14:34As the title states, scratch behind my ear and you get it. 🐶🐾🫡

-

@ fd208ee8:0fd927c1

2024-12-20 06:58:48

@ fd208ee8:0fd927c1

2024-12-20 06:58:48When the shit just don't work

Most open-source software is now so badly written and sloppily-maintained, that it's malware.

That's why the governments are getting involved. They try using OS, to save money and improve quality (and to market themselves as "hip"), and then it blows up their system or opens them up to hackers.

Now, they're pissed and want support (but the dev with the handle SucksToBeYou has disappeared) or someone to sue, but most OS projects have no identifiable entity behind them. Even well-known anon devs are often groups of anons or accounts that change hands.

The software cracks have moved on

There is simply no evidence that OS alone produces higher-quality software. The reason it seemed that way, at the beginning, was because of the caliber of the developers working on the projects, and the limited number of projects. This resulted in experienced people actively reviewing each others' code.

OS used to be something the elite engaged in, but it's mostly beginners practicing in public, now. That's why there are now millions of OS projects, happily offered for free, but almost all of them are garbage. The people now building OS usually aren't capable of reviewing other people's code, and they're producing worse products than ChatGPT could. Their software has no customers because it has no market value.

If everything is OS, then nothing is.

Another paradigm-changer is that all software is de facto OS, now that we can quickly reverse-engineer code with AI. That means the focus is no longer on OS/not-OS, but on the accountability and reputation of the builders.

It is, once again, a question of trust. We have come full-circle.

-

@ 8fb140b4:f948000c

2023-07-30 00:35:01

@ 8fb140b4:f948000c

2023-07-30 00:35:01Test Bounty Note

-

@ 8fb140b4:f948000c

2023-07-22 09:39:48

@ 8fb140b4:f948000c

2023-07-22 09:39:48Intro

This short tutorial will help you set up your own Nostr Wallet Connect (NWC) on your own LND Node that is not using Umbrel. If you are a user of Umbrel, you should use their version of NWC.

Requirements

You need to have a working installation of LND with established channels and connectivity to the internet. NWC in itself is fairly light and will not consume a lot of resources. You will also want to ensure that you have a working installation of Docker, since we will use a docker image to run NWC.

- Working installation of LND (and all of its required components)

- Docker (with Docker compose)

Installation

For the purpose of this tutorial, we will assume that you have your lnd/bitcoind running under user bitcoin with home directory /home/bitcoin. We will also assume that you already have a running installation of Docker (or docker.io).

Prepare and verify

git version - we will need git to get the latest version of NWC. docker version - should execute successfully and show the currently installed version of Docker. docker compose version - same as before, but the version will be different. ss -tupln | grep 10009- should produce the following output: tcp LISTEN 0 4096 0.0.0.0:10009 0.0.0.0: tcp LISTEN 0 4096 [::]:10009 [::]:**

For things to work correctly, your Docker should be version 20.10.0 or later. If you have an older version, consider installing a new one using instructions here: https://docs.docker.com/engine/install/

Create folders & download NWC

In the home directory of your LND/bitcoind user, create a new folder, e.g., "nwc" mkdir /home/bitcoin/nwc. Change to that directory cd /home/bitcoin/nwc and clone the NWC repository: git clone https://github.com/getAlby/nostr-wallet-connect.git

Creating the Docker image

In this step, we will create a Docker image that you will use to run NWC.

- Change directory to

nostr-wallet-connect:cd nostr-wallet-connect - Run command to build Docker image:

docker build -t nwc:$(date +'%Y%m%d%H%M') -t nwc:latest .(there is a dot at the end) - The last line of the output (after a few minutes) should look like

=> => naming to docker.io/library/nwc:latest nwc:latestis the name of the Docker image with a tag which you should note for use later.

Creating docker-compose.yml and necessary data directories

- Let's create a directory that will hold your non-volatile data (DB):

mkdir data - In

docker-compose.ymlfile, there are fields that you want to replace (<> comments) and port “4321” that you want to make sure is open (check withss -tupln | grep 4321which should return nothing). - Create

docker-compose.ymlfile with the following content, and make sure to update fields that have <> comment:

version: "3.8" services: nwc: image: nwc:latest volumes: - ./data:/data - ~/.lnd:/lnd:ro ports: - "4321:8080" extra_hosts: - "localhost:host-gateway" environment: NOSTR_PRIVKEY: <use "openssl rand -hex 32" to generate a fresh key and place it inside ""> LN_BACKEND_TYPE: "LND" LND_ADDRESS: localhost:10009 LND_CERT_FILE: "/lnd/tls.cert" LND_MACAROON_FILE: "/lnd/data/chain/bitcoin/mainnet/admin.macaroon" DATABASE_URI: "/data/nostr-wallet-connect.db" COOKIE_SECRET: <use "openssl rand -hex 32" to generate fresh secret and place it inside ""> PORT: 8080 restart: always stop_grace_period: 1mStarting and testing

Now that you have everything ready, it is time to start the container and test.

- While you are in the

nwcdirectory (important), execute the following command and check the log output,docker compose up - You should see container logs while it is starting, and it should not exit if everything went well.

- At this point, you should be able to go to

http://<ip of the host where nwc is running>:4321and get to the interface of NWC - To stop the test run of NWC, simply press

Ctrl-C, and it will shut the container down. - To start NWC permanently, you should execute

docker compose up -d, “-d” tells Docker to detach from the session. - To check currently running NWC logs, execute

docker compose logsto run it in tail mode add-fto the end. - To stop the container, execute

docker compose down

That's all, just follow the instructions in the web interface to get started.

Updating

As with any software, you should expect fixes and updates that you would need to perform periodically. You could automate this, but it falls outside of the scope of this tutorial. Since we already have all of the necessary configuration in place, the update execution is fairly simple.

- Change directory to the clone of the git repository,

cd /home/bitcoin/nwc/nostr-wallet-connect - Run command to build Docker image:

docker build -t nwc:$(date +'%Y%m%d%H%M') -t nwc:latest .(there is a dot at the end) - Change directory back one level

cd .. - Restart (stop and start) the docker compose config

docker compose down && docker compose up -d - Done! Optionally you may want to check the logs:

docker compose logs

-

@ ebdee929:513adbad

2024-12-28 14:46:21

@ ebdee929:513adbad

2024-12-28 14:46:21Blue light is not inherently bad, just bad in the wrong context.

Blue light provides wakefulness, stimulation, and sets our internal body clock (circadian rhythm).

When we go outside in the sun, we get bathed in blue lightblue light is not inherently bad, just bad in the wrong context.

Blue light sets the human rhythm.

However, sunlight never gives us blue light without the rest of the visible rainbow + infrared.

Light from screens & LED bulbs do not contain any infrared, and has a unnaturally high proportion of blue light.

LEDs = unbalanced & blue light dominant

Light from artificial sources is especially disruptive at night time, where the high blue light component can interfere with melatonin production and sleep quality at a greater rate than lower energy colors of light. Blue Light has a Dark Side

This doesn't mean that red light is completely innocent of disrupting sleep either

It is both the spectrum of light AND the intensity of light that contributes to sleep disruption. See this tweet from Huberman.

We took all of this into account when building the DC-1 to be the world's first blue light free computer.

The DC-1 has a reflective screen that:

• emits ZERO light during the day

• can be used easily outside in direct sunlight

& a backlight that:

• can be 100% blue light free

• has a broad spectrum of light

• can be seen at very low brightness

Our Live Paper™ display technology feels like a magic piece of paper

During the day, that piece of paper is illuminated by sunlight. At night, that piece of paper is illuminated by candle light.

(backlight is converging with a candle light spectrum)

The two sources of natural light are sunlight & fire.

We are trying to reproduce this experience for the most enjoyable, healthy, and least invasive technology experience for humanity.

Root cause problem solving by emulating nature.

"But can't I just put a red light screen filter on my MacBook?"

Absolutely you can, and we advocate for it

Software screen filters are great, but anyone who has changed their screen to full “red mode” to get rid of the blue light knows the downsides to this…

You can barely see anything and you end up having to crank up the brightness in order to see any contrast.

This is because of the highly isolated nature of LED emissive screens, you can only isolate a very narrow band of colors.

Going full red is not something your eyes have ever been used to seeing.

You need a broad spectrum light solution, and that is what we have in our amber backlight while still being blue light free.

This means you can have a better visual experience, turn down the brightness, and get minimal sleep/circadian disruption.

What about FLICKER?

Nearly all LEDs flicker. Especially when changing in brightness due to Pulsed Width Modulation (PWM) LED driver control

Our LED backlight uses DC dimming & is expert verified flicker-free.

This can only be achieved through hardware changes, not software screen filters.

& Blue Light Blocking Glasses?

They need to be tinted orange/red to block all of the blue light.

Thus the same issues as screen filters (bad visual experience, not solving flicker) + average joe would never wear them.

We still love blue blockers, they just aren't a root cause solution.

We made a computer that is healthier and less stimulating, with a low barrier to entry

Whether you are a staunch circadian health advocate or just like the warm vibes of amber mode and being outside...the DC-1 just feels good because it doesn't make you feel bad :)

Learn more here and thanks for reading.

-

@ 7ed7d5c3:6927e200

2024-12-18 00:56:48

@ 7ed7d5c3:6927e200

2024-12-18 00:56:48There was a time when we dared not rustle a whisper. But now we write and read samizdat and, congregating in the smoking rooms of research institutes, heartily complain to each other of all they are muddling up, of all they are dragging us into! There’s that unnecessary bravado around our ventures into space, against the backdrop of ruin and poverty at home; and the buttressing of distant savage regimes; and the kindling of civil wars; and the ill-thought-out cultivation of Mao Zedong (at our expense to boot)—in the end we’ll be the ones sent out against him, and we’ll have to go, what other option will there be? And they put whomever they want on trial, and brand the healthy as mentally ill—and it is always “they,” while we are—helpless.

We are approaching the brink; already a universal spiritual demise is upon us; a physical one is about to flare up and engulf us and our children, while we continue to smile sheepishly and babble:

“But what can we do to stop it? We haven’t the strength.”

We have so hopelessly ceded our humanity that for the modest handouts of today we are ready to surrender up all principles, our soul, all the labors of our ancestors, all the prospects of our descendants—anything to avoid disrupting our meager existence. We have lost our strength, our pride, our passion. We do not even fear a common nuclear death, do not fear a third world war (perhaps we’ll hide away in some crevice), but fear only to take a civic stance! We hope only not to stray from the herd, not to set out on our own, and risk suddenly having to make do without the white bread, the hot water heater, a Moscow residency permit.

We have internalized well the lessons drummed into us by the state; we are forever content and comfortable with its premise: we cannot escape the environment, the social conditions; they shape us, “being determines consciousness.” What have we to do with this? We can do nothing.

But we can do—everything!—even if we comfort and lie to ourselves that this is not so. It is not “they” who are guilty of everything, but we ourselves, only we!

Some will counter: But really, there is nothing to be done! Our mouths are gagged, no one listens to us, no one asks us. How can we make them listen to us?

To make them reconsider—is impossible.

The natural thing would be simply not to reelect them, but there are no re-elections in our country.

In the West they have strikes, protest marches, but we are too cowed, too scared: How does one just give up one’s job, just go out onto the street?

All the other fateful means resorted to over the last century of Russia’s bitter history are even less fitting for us today—true, let’s not fall back on them! Today, when all the axes have hewn what they hacked, when all that was sown has borne fruit, we can see how lost, how drugged were those conceited youths who sought, through terror, bloody uprising, and civil war, to make the country just and content. No thank you, fathers of enlightenment! We now know that the vileness of the means begets the vileness of the result. Let our hands be clean!

So has the circle closed? So is there indeed no way out? So the only thing left to do is wait inertly: What if something just happens by itself?

But it will never come unstuck by itself, if we all, every day, continue to acknowledge, glorify, and strengthen it, if we do not, at the least, recoil from its most vulnerable point.

From lies.

When violence bursts onto the peaceful human condition, its face is flush with self-assurance, it displays on its banner and proclaims: “I am Violence! Make way, step aside, I will crush you!” But violence ages swiftly, a few years pass—and it is no longer sure of itself. To prop itself up, to appear decent, it will without fail call forth its ally—Lies. For violence has nothing to cover itself with but lies, and lies can only persist through violence. And it is not every day and not on every shoulder that violence brings down its heavy hand: It demands of us only a submission to lies, a daily participation in deceit—and this suffices as our fealty.

And therein we find, neglected by us, the simplest, the most accessible key to our liberation: a personal nonparticipation in lies! Even if all is covered by lies, even if all is under their rule, let us resist in the smallest way: Let their rule hold not through me!

And this is the way to break out of the imaginary encirclement of our inertness, the easiest way for us and the most devastating for the lies. For when people renounce lies, lies simply cease to exist. Like parasites, they can only survive when attached to a person.

We are not called upon to step out onto the square and shout out the truth, to say out loud what we think—this is scary, we are not ready. But let us at least refuse to say what we do not think!

This is the way, then, the easiest and most accessible for us given our deep-seated organic cowardice, much easier than (it’s scary even to utter the words) civil disobedience à la Gandhi.

Our way must be: Never knowingly support lies! Having understood where the lies begin (and many see this line differently)—step back from that gangrenous edge! Let us not glue back the flaking scales of the Ideology, not gather back its crumbling bones, nor patch together its decomposing garb, and we will be amazed how swiftly and helplessly the lies will fall away, and that which is destined to be naked will be exposed as such to the world.

And thus, overcoming our timidity, let each man choose: Will he remain a witting servant of the lies (needless to say, not due to natural predisposition, but in order to provide a living for the family, to rear the children in the spirit of lies!), or has the time come for him to stand straight as an honest man, worthy of the respect of his children and contemporaries? And from that day onward he:

· Will not write, sign, nor publish in any way, a single line distorting, so far as he can see, the truth;

· Will not utter such a line in private or in public conversation, nor read it from a crib sheet, nor speak it in the role of educator, canvasser, teacher, actor;

· Will not in painting, sculpture, photograph, technology, or music depict, support, or broadcast a single false thought, a single distortion of the truth as he discerns it;

· Will not cite in writing or in speech a single “guiding” quote for gratification, insurance, for his success at work, unless he fully shares the cited thought and believes that it fits the context precisely;

· Will not be forced to a demonstration or a rally if it runs counter to his desire and his will; will not take up and raise a banner or slogan in which he does not fully believe;

· Will not raise a hand in vote for a proposal which he does not sincerely support; will not vote openly or in secret ballot for a candidate whom he deems dubious or unworthy;

· Will not be impelled to a meeting where a forced and distorted discussion is expected to take place;

· Will at once walk out from a session, meeting, lecture, play, or film as soon as he hears the speaker utter a lie, ideological drivel, or shameless propaganda;

· Will not subscribe to, nor buy in retail, a newspaper or journal that distorts or hides the underlying facts.

This is by no means an exhaustive list of the possible and necessary ways of evading lies. But he who begins to cleanse himself will, with a cleansed eye, easily discern yet other opportunities.

Yes, at first it will not be fair. Someone will have to temporarily lose his job. For the young who seek to live by truth, this will at first severely complicate life, for their tests and quizzes, too, are stuffed with lies, and so choices will have to be made. But there is no loophole left for anyone who seeks to be honest: Not even for a day, not even in the safest technical occupations can he avoid even a single one of the listed choices—to be made in favor of either truth or lies, in favor of spiritual independence or spiritual servility. And as for him who lacks the courage to defend even his own soul: Let him not brag of his progressive views, boast of his status as an academician or a recognized artist, a distinguished citizen or general. Let him say to himself plainly: I am cattle, I am a coward, I seek only warmth and to eat my fill.

For us, who have grown staid over time, even this most moderate path of resistance will be not be easy to set out upon. But how much easier it is than self-immolation or even a hunger strike: Flames will not engulf your body, your eyes will not pop out from the heat, and your family will always have at least a piece of black bread to wash down with a glass of clear water.