-

@ c1e9ab3a:9cb56b43

2025-02-25 22:49:38

@ c1e9ab3a:9cb56b43

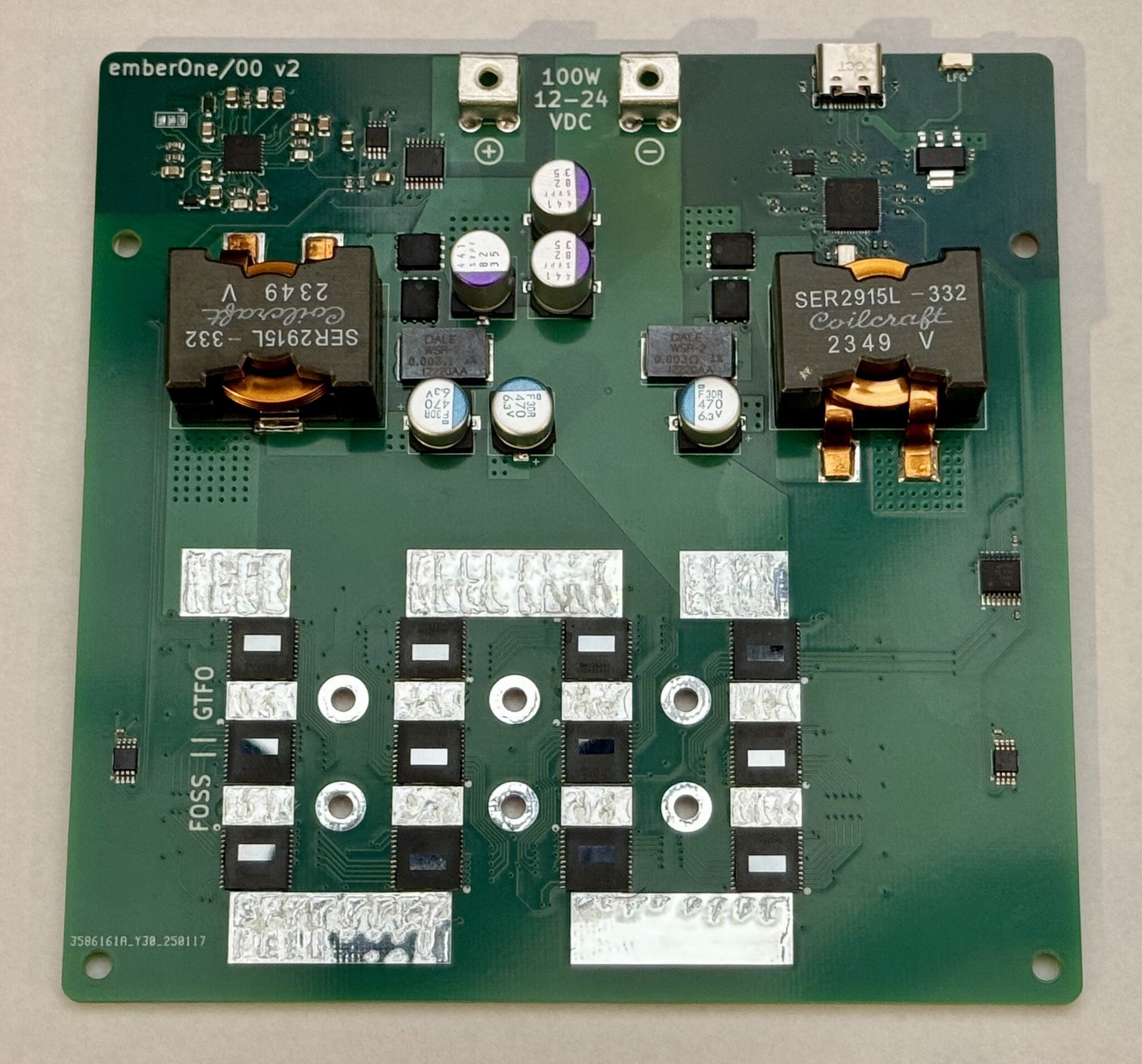

2025-02-25 22:49:38Election Authority (EA) Platform

1.1 EA Administration Interface (Web-Based)

- Purpose: Gives authorized personnel (e.g., election officials) a user-friendly way to administer the election.

- Key Tasks:

- Voter Registration Oversight: Mark which voters have proven their identity (via in-person KYC or some legal process).

- Blind Signature Issuance: Approve or deny blind signature requests from registered voters (each corresponding to one ephemeral key).

- Tracking Voter Slots: Keep a minimal registry of who is allowed one ephemeral key signature, and mark it “used” once a signature is issued.

- Election Configuration: Set start/end times, provide encryption parameters (public keys), manage threshold cryptography setup.

- Monitor Tallying: After the election, collaborate with trustees to decrypt final results and release them.

1.2 EA Backend Services

- Blind Signature Service:

- An API endpoint or internal module that receives a blinded ephemeral key from a voter, checks if they are authorized (one signature per voter), and returns the blind-signed result.

-

Typically requires secure storage of the EA’s blind signing private key.

-

Voter Roll Database:

- Stores minimal info: “Voter #12345 is authorized to request one ephemeral key signature,” plus status flags.

-

Does not store ephemeral keys themselves (to preserve anonymity).

-

(Optional) Mix-Net or Homomorphic Tally Service:

- Coordinates with trustees for threshold decryption or re-encryption.

- Alternatively, a separate “Tally Authority” service can handle this.

2. Auditor Interface

2.1 Auditor Web-Based Portal

- Purpose: Allows independent auditors (or the public) to:

- Fetch All Ballots from the relays (or from an aggregator).

- Verify Proofs: Check each ballot’s signature, blind signature from the EA, OTS proof, zero-knowledge proofs, etc.

- Check Double-Usage: Confirm that each ephemeral key is used only once (or final re-vote is the only valid instance).

-

Observe Tally Process: Possibly see partial decryptions or shuffle steps, verify the final result matches the posted ballots.

-

Key Tasks:

- Provide a dashboard showing the election’s real-time status or final results, after cryptographic verification.

- Offer open data downloads so third parties can run independent checks.

2.2 (Optional) Trustee Dashboard

- If the election uses threshold cryptography (multiple parties must decrypt), each trustee (candidate rep, official, etc.) might have an interface for:

- Uploading partial decryption shares or re-encryption proofs.

- Checking that other trustees did their steps correctly (zero-knowledge proofs for correct shuffling, etc.).

3. Voter Application

3.1 Voter Client (Mobile App or Web Interface)

-

Purpose: The main tool voters use to participate—before, during, and after the election.

-

Functionalities:

- Registration Linking:

- Voter goes in-person to an election office or uses an online KYC process.

- Voter obtains or confirms their long-term (“KYC-bound”) key. The client can store it securely (or the voter just logs in to a “voter account”).

- Ephemeral Key Generation:

- Create an ephemeral key pair ((nsec_e, npub_e)) locally.

- Blind (\npub_e) and send it to the EA for signing.

- Unblind the returned signature.

- Store (\npub_e) + EA’s signature for use during voting.

- Ballot Composition:

- Display candidates/offices to the voter.

- Let them select choices.

- Possibly generate zero-knowledge proofs (ZKPs) behind the scenes to confirm “exactly one choice per race.”

- Encryption & OTS Timestamp:

- Encrypt the ballot under the election’s public (threshold) key or produce a format suitable for a mix-net.

- Obtain an OpenTimestamps proof for the ballot’s hash.

- Publish Ballot:

- Sign the entire “timestamped ballot” with the ephemeral key.

- Include the EA’s blind signature on (\npub_e).

- Post to the Nostr relays (or any chosen decentralized channel).

- Re-Voting:

- If the user needs to change their vote, the client repeats the encryption + OTS step, publishes a new ballot with a strictly later OTS anchor.

- Verification:

- After the election, the voter can check that their final ballot is present in the tally set.

3.2 Local Storage / Security

- The app must securely store:

- Ephemeral private key ((nsec_e)) until voting is complete.

- Potential backup/recovery mechanism if the phone is lost.

- Blind signature from the EA on (\npub_e).

- Potentially uses hardware security modules (HSM) or secure enclaves on the device.

4. Nostr Relays (or Equivalent Decentralized Layer)

- Purpose: Store and replicate voter-submitted ballots (events).

- Key Properties:

- Redundancy: Voters can post to multiple relays to mitigate censorship or downtime.

- Public Accessibility: Auditors, the EA, and the public can fetch all events to verify or tally.

- Event Filtering: By design, watchers can filter events with certain tags, e.g. “election: 2025 County Race,” ensuring they gather all ballots.

5. Threshold Cryptography Setup

5.1 Multi-Seg (Multi-Party) Key Generation

- Participants: Possibly the EA + major candidates + accredited observers.

- Process: A Distributed Key Generation (DKG) protocol that yields a single public encryption key.

- Private Key Shares: Each trustee holds a piece of the decryption key; no single party can decrypt alone.

5.2 Decryption / Tally Mechanism

- Homomorphic Approach:

- Ballots are additively encrypted.

- Summation of ciphertexts is done publicly.

- Trustees provide partial decryptions for the final sum.

- Mix-Net Approach:

- Ballots are collected.

- Multiple servers shuffle and re-encrypt them (each trustee verifies correctness).

- Final set is decrypted, but the link to each ephemeral key is lost.

5.3 Trustee Interfaces

- Separate or integrated into the auditor interface—each trustee logs in and provides their partial key share for decrypting the final result.

- Possibly combined with ZK proofs to confirm correct partial decryption or shuffling.

6. OpenTimestamps (OTS) or External Time Anchor

6.1 Aggregator Service

- Purpose: Receives a hash from the voter’s app, anchors it into a blockchain or alternative time-stamping system.

- Result: Returns a proof object that can later be used by any auditor to confirm the time/block height at which the hash was included.

6.2 Verifier Interface

- Could be part of the auditor tool or the voter client.

- Checks that each ballot’s OTS proof is valid and references a block/time prior to the election’s closing.

7. Registration Process (In-Person or Hybrid)

- Voter presents ID physically at a polling station or a designated office (or an online KYC approach, if legally allowed).

- EA official:

- Confirms identity.

- Links the voter to a “voter record” (Voter #12345).

- Authorizes them for “1 ephemeral key blind-sign.”

- Voter obtains or logs into the voter client:

- The app or website might show “You are now cleared to request a blind signature from the EA.”

- Voter later (or immediately) generates the ephemeral key and requests the blind signature.

8. Putting It All Together (High-Level Flow)

- Key Setup

- The EA + trustees run a DKG to produce the election public key.

- Voter Registration

- Voter is validated (ID check).

- Marked as eligible in the EA database.

- Blind-Signed Ephemeral Key

- Voter’s client generates a key, blinds (\npub_e), obtains EA’s signature, unblinds.

- Voting

- Voter composes ballot, encrypts with the election public key.

- Gets OTS proof for the ballot hash.

- Voter’s ephemeral key signs the entire package (including EA’s signature on (\npub_e)).

- Publishes to Nostr.

- Re-Voting (Optional)

- Same ephemeral key, new OTS timestamp.

- Final ballot is whichever has the latest valid timestamp before closing.

- Close of Election & Tally

- EA announces closing.

- Tally software (admin + auditors) collects ballots from Nostr, discards invalid duplicates.

- Threshold decryption or mix-net to reveal final counts.

- Publish final results and let auditors verify everything.

9. Summary of Major Components

Below is a succinct list:

- EA Admin Platform

- Web UI for officials (registration, blind signature issuing, final tally management).

- Backend DB for voter records & authorized ephemeral keys.

- Auditor/Trustee Platforms

- Web interface for verifying ballots, partial decryption, and final results.

- Voter Application (Mobile / Web)

- Generating ephemeral keys, getting blind-signed, casting encrypted ballots, re-voting, verifying included ballots.

- Nostr Relays (Decentralized Storage)

- Where ballots (events) are published, replicated, and fetched for final tally.

- Threshold Cryptography System

- Multi-party DKG for the election key.

- Protocols or services for partial decryption, mix-net, or homomorphic summation.

- OpenTimestamps Aggregator

- Service that returns a blockchain-anchored timestamp proof for each ballot’s hash.

Additional Implementation Considerations

- Security Hardening:

- Using hardware security modules (HSM) for the EA’s blind-signing key, for trustee shares, etc.

- Scalability:

- Handling large numbers of concurrent voters, large data flows to relays.

- User Experience:

- Minimizing cryptographic complexity for non-technical voters.

- Legal and Procedural:

- Compliance with local laws for in-person ID checks, mandatory paper backups (if any), etc.

Final Note

While each functional block can be designed and deployed independently (e.g., multiple aggregator services, multiple relays, separate tally servers), the key to a successful system is interoperability and careful orchestration of these components—ensuring strong security, a straightforward voter experience, and transparent auditing.

nostr:naddr1qqxnzde5xq6nzv348yunvv35qy28wue69uhnzv3h9cczuvpwxyargwpk8yhsygxpax4n544z4dk2f04lgn4xfvha5s9vvvg73p46s66x2gtfedttgvpsgqqqw4rs0rcnsu

-

@ 712d0fec:3e5d56c8

2025-02-25 22:04:48

@ 712d0fec:3e5d56c8

2025-02-25 22:04:48Autor: Pablito.eth

Tweet Original: Ver TweetSe Recomienda Leer el Tweet Original

Aunque este artículo proporciona un resumen de los consejos de Pablito.eth, se recomienda encarecidamente leer el tweet original para obtener todos los detalles directamente del autor. El tweet contiene matices y ejemplos que pueden complementar la información presentada aquí

Introducción

En un mundo donde nuestros dispositivos móviles contienen tanta información personal y sensible, perder un celular puede ser un verdadero dolor de cabeza. El incidente reciente de Pablito.eth en Palermo nos ofrece enseñanzas valiosas sobre cómo estar preparados para este desafortunado escenario. Aquí te comparto un resumen y análisis de sus recomendaciones.

Resumen del Tweet

Pablo expuso los siguientes puntos para proteger tu celular en caso de robo o perdida:

- Activar la Protección contra Robo:

-

Usa "Theft protection" en Android o "Stolen device protection" en iOS.

-

Seguridad del SIM:

- Pon un PIN al chip de la SIM para evitar su uso no autorizado.

-

Si tienes la tarjeta original, guarda el código PUK para emergencias.

-

Localización del Dispositivo:

- Activa "Find my device" o "Find my Android" para localizar el celular.

-

Comparte tu ubicación en tiempo real con alguien de confianza.

-

Bloqueo de Aplicaciones:

-

Usa PIN, huella digital o FaceID en apps con información sensible: bancos, fintechs, crypto, email, fotos, mensajerías, etc.

-

Revisión de Seguridad:

-

Revisa qué información puede acceder un criminal sin biometría. Elimina o protege datos sensibles.

-

Gestión de Aplicaciones:

-

Desinstala apps que no uses diariamente para reducir riesgos.

-

Copia de Seguridad:

-

Duplica tu celular en un dispositivo viejo y guárdalo de forma segura, con batería y apagado.

-

Protección para Mensajería:

-

Aplica FaceID o huella digital para abrir WhatsApp y Telegram cada vez.

-

Número de Recuperación:

-

Evita usar tu número de celular como número de recuperación para cuentas.

-

Listados de Emergencia:

- Crea un documento con números de teléfono importantes para bloquear el chip, bancos, etc.

Citas

Pablito.eth enfatizó:

"Gracias a que estaba preparado para este escenario, no pudieron hacer absolutamente nada con el mismo (ni formatearlo). Van un par de recomendaciones simples que les evitarán un dolor de cabeza si algún día les sucede.""Estos puntos a tener en cuenta son los más básicos pero les van a permitir estar un 95% seguros."

Conclusión

La experiencia de Pablito.eth nos recuerda que tomar medidas preventivas puede ahorrarnos muchos problemas si nuestro celular llega a caer en las manos equivocadas. Implementar estas estrategias no solo protege nuestra información sino que también disuade a los potenciales ladrones de acceder a nuestros datos personales.

Referencias y Créditos

Puedes seguir a Pablito.eth en Twitter para más consejos y experiencias sobre seguridad informática.

-

@ 67403b2c:27b48c7a

2025-02-25 21:55:42

@ 67403b2c:27b48c7a

2025-02-25 21:55:42Sexual identity—how one thinks of oneself in terms of romantic and sexual attraction—is among the most profound aspects of human experience. Understanding and accepting one's orientation often involves a complex journey of self-discovery that deserves compassion and patience.

Sexual orientation exists on a spectrum rather than in rigid categories, encompassing heterosexual, homosexual, bisexual, asexual, and other identities that reflect human diversity. For many, this identity may be fluid and evolve over time. While some people report knowing their orientation from a young age, others may not fully realize it until later in life, often experiencing periods of questioning and uncertainty—especially if their identity differs from familial or societal expectations.

The path to self-acceptance frequently requires overcoming internalized negative messages from family, religious backgrounds, or cultural sources. Support systems are crucial in this process, whether through accepting family members, supportive friends, LGBTQ+ communities, or professional counseling. These connections provide safe spaces for exploration and validation.

Education about human sexuality's diversity, including biological and psychological research, helps combat harmful myths and normalize varying orientations. Coming out—sharing one's identity with others—should happen on one's own timeline, with safety and readiness as primary considerations. Some choose to come out widely, others selectively, and both approaches are valid.

True self-acceptance doesn't mean eliminating all doubt, but rather developing a fundamentally positive attitude toward one's identity while acknowledging that challenges may arise. This acceptance often leads to more authentic relationships and stronger self-awareness.

While society's understanding of diverse sexual identities has grown significantly, discrimination persists, making internal acceptance and resilience crucial. The intersection of sexual identity with race, culture, religion, and gender adds complexity, as individuals navigate multiple cultural contexts and varying community attitudes.

Research consistently shows that LGBTQ+ individuals who achieve greater self-acceptance experience better mental health outcomes, highlighting the importance of supportive environments and accessible resources.

Conclusion

The journey of understanding and accepting one's sexual identity, while sometimes challenging, leads to more authentic relationships and fuller self-expression. Everyone deserves support, respect, and the freedom to be exactly who they are, wherever they are in their journey.

-

@ 67403b2c:27b48c7a

2025-02-25 21:54:41

@ 67403b2c:27b48c7a

2025-02-25 21:54:41Key Takeaways:

- Understanding the difference between revolutionaries and rebels

- Exploring mindful rebellion through acceptance and flow

- Practical approaches to authentic living and personal freedom

- Natural resistance versus ideological revolution

- Mindfulness and present-moment awareness in rebellion

Introduction: The Nature of True Rebellion

"Don't become a revolutionary; become a rebel. A rebel is one who has no ideology, no ideals, who has nothing to impose upon himself, who takes life as it comes and takes it easily, who enjoys it, dances it and sings it." ― Osho

What Makes a Rebel Different from a Revolutionary?

I am not a revolutionary. The weight of ideology holds no power over me, nor do I carry grand visions to force upon an unwilling world. I am, simply and profoundly, a rebel – one who embraces life's raw essence, unburdened by the shackles of ideals or the compulsion to remake what is.

Where revolutionaries march with fury toward tomorrow, I dance in the eternal now. Their hearts burn with the need to demolish and rebuild, to reshape reality according to their dreams. But I have learned the art of being, the wisdom of acceptance, the freedom found in surrender to life's endless flow.

Understanding the Art of Being Present

Embracing Life's Natural Flow

I take life as it appears before me – a vast tapestry of moments, each thread essential to the whole. In joy, I soar; in sorrow, I dive deep. Beauty fills my senses, while pain teaches its ancient lessons. I stand witness to it all, neither fighting against perceived injustices nor struggling to craft utopia from chaos. For in the pursuit of perfection, we lose the profound beauty of the imperfect present.

Mindful Experience and Emotional Intelligence

Each experience washes over me like waves on the shore, leaving its mark before receding into memory. I taste life's flavors fully – bitter and sweet, subtle and overwhelming. When laughter bubbles up, I let it ring; when tears fall, I let them flow. When love fills my heart, I become love itself; when hurt finds me, I embrace it as another face of living. This is the wholeness I seek – not a carefully curated existence, but life in all its messy, glorious entirety.

The Path of Natural Resistance

Finding Freedom Through Acceptance

Free from the burden of ideals, I need not contort myself to match another's vision of righteousness. Like water finding its path downhill, I flow naturally through the landscape of existence, adapting to what lies before me rather than demanding the mountain step aside.

Living the Rebel's Way

This, then, is the rebel's way – not to lead armies of change or craft manifestos of revolution, but to move in harmony with life's own rhythm. My rebellion lies not in resistance but in acceptance, not in fighting but in flowing, not in changing the world but in fully inhabiting it. I dance to the music of my own heart's truth, and in this simple act lies all the rebellion I will ever need.

Conclusion: A Personal Declaration of Freedom

This is my manifesto. Not carved in stone or written in fire, but flowing like water, changing like clouds, free like the wind. This is my rebellion – to simply, radically be.

Related Topics:

- Mindfulness and presence

- Personal freedom

- Authentic living

- Natural resistance

- Flow state

- Emotional wisdom

- Self-acceptance

[ [Author's Note: This manifesto explores the distinction between revolutionary ideology and authentic rebellion, offering insights into mindful living and personal freedom. It draws from philosophical traditions of mindfulness, Taoism, and contemporary personal development practices.]

Support the Rebellion

In the spirit of authentic rebellion, this manifesto flows freely like water – available to all who seek it. If these words have touched your spirit or shifted your perspective, consider supporting this ongoing exploration of freedom and consciousness.

Your support helps maintain this space of authentic expression and enables more rebels to find their path to freedom.

"Every drop joins the ocean of change."

-

@ 67403b2c:27b48c7a

2025-02-25 21:53:01

@ 67403b2c:27b48c7a

2025-02-25 21:53:01Have you ever wondered why Jewish people often say "Hashem" instead of "God"? This thoughtful practice goes far beyond simple word choice—it reveals profound insights about respect, spirituality, and the sacred nature of language in Judaism.

What Does "Hashem" Mean?

Hashem—literally meaning "the Name" in Hebrew—represents a tradition built on reverence and deep spiritual understanding. This practice stems from a fundamental Jewish belief: God's true name is too sacred for everyday use. When practitioners say Hashem, they acknowledge something profound about divinity—that it transcends human comprehension.

The Spiritual Impact of Sacred Language

Think about how you speak about someone you deeply respect. You likely choose your words carefully, right? The use of Hashem works similarly. Each time this substitute name is spoken, it creates a powerful reminder: we stand before something far greater than ourselves. This mindful approach to sacred language creates a unique space for spiritual connection—intimate yet respectful, close yet maintaining appropriate distance.

Understanding Hashem in a Global Context

Different religions worldwide have their own special names and titles for the divine. Each reveals unique perspectives on humanity's relationship with the sacred. Hashem offers a fascinating example of how language shapes spiritual experience and opens doors for meaningful interfaith dialogue.

Why This Matters for Everyone

Even if you're not Jewish, this practice offers valuable insights into spirituality and language. It demonstrates how our word choices can profoundly impact our spiritual awareness and relationship with the sacred. Whether you're speaking about God, contemplating the divine, or discussing matters of faith, the language you choose shapes your experience.

The Universal Message of Hashem

The practice of saying Hashem transcends religious boundaries. It touches on universal human experiences we all share:

- Our sense of awe before the infinite

- Our struggle to express the inexpressible

- Our quest to find appropriate ways to speak about what we hold most sacred

Learn More About Jewish Traditions

Understanding practices like using Hashem helps build bridges between different faiths and cultures. It reminds us that despite our different traditions, we share common human experiences in our spiritual journeys.

Did you find this guide helpful? Support more articles like this: ☕ Buy Me a Coffee

Share this article with others interested in spiritual practices and interfaith understanding!

-

@ 67403b2c:27b48c7a

2025-02-25 21:51:16

@ 67403b2c:27b48c7a

2025-02-25 21:51:16Quick Summary

- Location: Tampa Bay, Florida

- Urgent Need: $500 for extended stay housing

- Deadline: 48 hours (move-in by Wednesday/Thursday)

- Recent Victory: Job secured at ARS Rescue Rooter

- Current Status: Third night on streets

- Housing Solution: West Wing extended stay apartments near USF

The Journey So Far

My first experience with homelessness began on January 11, 2022. Now, facing my fourth bout of homelessness in Tampa Bay, each return to the streets becomes increasingly dangerous. I've survived three separate attacks while homeless, and the constant vigilance required to stay safe takes a devastating toll.

Breaking News: Job Secured

After countless applications and interviews, I've secured a position as HD Store Sales Associate at ARS Rescue Rooter! The background check is in progress, with work beginning February 13th. This isn't just employment – it's a chance to break the cycle of homelessness.

The Housing Crisis: By the Numbers

- 500,000+ Americans experience homelessness nightly

- 27% caught in chronic homelessness

- Average 1-bedroom apartment requires $40,000/year income

- Only 25% of eligible households receive housing assistance

- Current hotel rates: $88-100/day, $120+ weekends

The Immediate Challenge

I've found an affordable solution at West Wing extended stay apartments:

- Weekly rate: $500 (all utilities included)

- Monthly option: $1,400

- Location: Near USF campus

- Move-in ready: Yes

- Management: Willing to work with my situation

- Need: $500 for immediate move-in

Why This Is Critical

- Physical Safety: Nearly collapsed from exhaustion yesterday

- Job Security: Need stable base before starting work

- Financial Stability: Weekly pay will maintain housing once started

- Breaking the Cycle: Opportunity to end homelessness permanently

Financial Strategy for Stability

The path to sustainable housing requires careful planning. Here's the strategic approach:

Initial Housing Buffer

- Need: $1,000 for two weeks' extended stay

- Purpose: Create financial cushion through first paycheck

- Timing: Move in before job starts February 13th

- Goal: Avoid costly temporary hotel stays ($88-100/night)

Payment Timeline Strategy

- Week One: Community-supported housing payment ($500)

- Week Two: Job begins, first week worked ($500 buffer active)

- Week Three: First paycheck received, begins regular payment cycle

- Week Four: Establish stable weekly payment pattern

Cost Comparison

Traditional Hotels vs. Extended Stay:

- Hotels: $88-100/night ($616-700/week)

- Weekend rates: $120+/night

- Extended Stay: $500/week all-inclusive

- Monthly option: $1,400 (additional savings)

Why Two Weeks Matter

- First week: Secure immediate housing

- Second week: Buffer during pay period transition

- Prevents falling back to expensive hotels

- Ensures stable foundation for job success

- Avoids gaps in housing security

- Transition from weekly to monthly payments

- Save $200+ per month vs. weekly rates

- Establish rental history for future housing

- Create non-profit organization focused on:

- Ending homelessness worldwide

- Providing immediate housing solutions

- Developing sustainable support systems

- Sharing lived experience expertise

- Building community-based intervention programs

- Breaking cycles of homelessness globally

- Creating replicable housing solutions

- Advocating for systemic change

This strategic approach ensures:

- No gaps in housing during job transition

- Maximum cost efficiency

- Path to long-term stability

- Foundation for future independence

- Platform to help others escape homelessness

- Opportunity to transform personal struggle into global impact

How You Can Help

Immediate Actions:

- Contribute through Buy Me a Coffee

- Share this story on social media

- Follow updates on Twitter @adontaim

- Connect with resources or housing solutions

Related Resources

Learn more about homelessness in Tampa Bay:

- The Hidden Dimensions of Homelessness - An exploration of the often-overlooked aspects of homeless life and the daily realities faced by those experiencing it.

- Surviving Florida's Anti-Homeless Laws - A detailed look at the legal challenges and systemic barriers that make escaping homelessness increasingly difficult in Florida.

- Surviving the In-Between - A personal account of navigating the challenging transition periods between housing and homelessness.

- Surviving Homelessness Alone - An intimate look at the unique challenges and strategies for surviving homelessness without a support system.

- Invisible Battles: The Silent Struggle - A deep dive into the unseen mental and emotional challenges faced while experiencing homelessness.

These pieces provide additional context to my ongoing journey and highlight the complex intersections of personal struggle, public policy, and societal attitudes toward homelessness. Your engagement with these stories helps raise awareness about the real challenges faced by people experiencing homelessness in our community.

Thank you for taking the time to understand and share these experiences.

Updates and Progress

Follow real-time updates across platforms:

- Twitter/X: @adontaim

- Facebook: facebook.com/adontai

- Support Page: buymeacoffee.com/adontai

Take Action Now

Every hour counts in this 48-hour window. Your support could be the difference between:

- Starting a new job from stable housing

- Continuing to sleep on the streets

- Breaking the cycle of homelessness

- Building a sustainable future

Share this story with anyone who might be able to help. Together, we can transform this opportunity into lasting stability.

#TampaBay #Homelessness #CommunitySupport #EmergencyHousing #MutualAid

-

@ 67403b2c:27b48c7a

2025-02-25 21:38:26

@ 67403b2c:27b48c7a

2025-02-25 21:38:26The inconvenient truth about success that productivity gurus don't want you to know

"Just work harder."

If you're like me, you've heard this advice hundreds of times. It's plastered across LinkedIn posts, echoed in graduation speeches, and whispered in performance reviews. But here's what nobody tells you: it might be the most damaging piece of career advice ever given.

The Religion of Hard Work

From an early age, we're indoctrinated into what I call "the religion of hard work." Its commandments are simple:

- Thou shalt hustle 24/7

- Thou shalt glorify the grind

- Thou shalt feel guilty about rest

We worship at the altar of productivity porn, sharing stories of self-made millionaires and pioneering entrepreneurs who "made it" through sheer force of will. The gospel is clear: work harder than everyone else, and success will follow.

But here's the inconvenient truth: it's mostly fiction.

The Data Tells a Different Story

Let's look at what research actually shows:

- A 2022 study found that socioeconomic background was twice as predictive of career advancement as work ethic

- 77% of professionals report burnout at their current jobs

- Productivity plummets after 50 hours of work per week

- Working longer hours directly correlates with increased rates of depression and anxiety

Think about that for a second. We're killing ourselves for a promise that data shows isn't even true.

The Real Success Stories Nobody Talks About

The tech industry—my world for the past decade—provides the perfect case study. For every "overnight success" story about a founder who worked 100-hour weeks, there are dozens of equally hard-working teams that failed. The difference? Usually not effort, but timing, connections, or plain old luck.

Remember Friendster? They worked just as hard as Facebook. MySpace? They grinded just like Twitter. The difference wasn't effort—it was everything else.

The Nordic Model: Working Less, Achieving More

Here's what really bakes my noodle: the countries with the shortest working hours often have the highest productivity and happiness levels. Take Denmark and Norway:

- Shorter workweeks

- More vacation time

- Higher productivity per hour

- Consistently ranked among the world's happiest nations

They've cracked the code that we're still trying to figure out: working smarter beats working harder.

A Better Way Forward

Instead of measuring success in hours worked or sacrifices made, what if we measured it in:

- Mental health preserved

- Relationships strengthened

- Creative projects completed

- Life experiences gained

Companies like Buffer and Basecamp aren't just experimenting with this approach—they're proving it works. Their four-day workweeks and "calm company" philosophies haven't hurt their bottom lines; they've helped them.

The Real Revolution

The next time someone tells you to "just work harder," remember this: hard work has its place, but it's just one ingredient in a complex recipe. The real revolution isn't in grinding ourselves down—it's in building a life where success doesn't require sacrifice.

Because maybe, just maybe, the smartest thing we can do is stop working so hard at working hard.

If this resonated with you, hit the subscribe button below. I write weekly about rethinking traditional career advice and finding better ways to define and achieve success.

-

@ 67403b2c:27b48c7a

2025-02-25 21:37:22

@ 67403b2c:27b48c7a

2025-02-25 21:37:22The heat was relentless—a suffocating force that offered no refuge. Our world shrank to the confines of portable toilets and the fleeting mercy of a mobile shower truck. Even the simple dignity of clean clothes hung precariously on the whims of a laundry service that weaponized access as a form of control.

We lived under the weight of an institutional facade, where arbitrary rules served not order but power. Minutes late to retrieve laundry? The facility would shut down for the day. Showers became bargaining chips, withdrawn for imagined infractions. The computer room, our sole sanctuary of climate control, stood as a cruel mirage—perpetually promised, perpetually denied. Only the Wi-Fi remained steadfast, a digital umbilical cord to the world beyond our suspended reality.

In this liminal space between citizen and prisoner, I discovered an unexpected salvation in vulnerability. The act of opening up to my family about my circumstances didn't just halve the burden—it restored a piece of my humanity. Yet even now, with those days behind me, the memories trigger visceral responses that ripple through my body like aftershocks of trauma.

The path to homelessness is a gradual unraveling. One moment, you're maintaining a precarious balance of employment and housing; the next, you're watching that fragile stability dissolve. The stress manifests physically—a constant companion that transforms into waves of terror and overwhelming dread. Even now, recounting these experiences summons that familiar tide of panic, threatening to pull me under.

Survival mode rewires your priorities with brutal efficiency. When shelter becomes uncertain, the body's response is primal and absolute:

- Communications fade to white noise

- Basic needs become luxury items

- The world contracts to a single imperative: find safety

In these moments of acute crisis, even fundamental human needs—food, connection, dignity—become secondary concerns. Shelter becomes an obsession, sought in any form: a public restroom, a quiet corner, any space that offers temporary reprieve from exposure.

The myth of multitasking crumbles when basic survival consumes every ounce of mental energy. Each day balances precariously on the edge of catastrophe, where the slightest disruption can trigger a cascade of survival responses. These aren't conscious choices but reflexive adaptations—often destructive, always necessary.

Walking through society wearing the invisible marks of homelessness teaches you about humiliation, but also about resilience. There's something profoundly dehumanizing about having your existence reduced to pure survival, yet within that stripped-down reality, hope persists—stubborn and essential as a heartbeat. Every step forward becomes an act of reclaiming identity, even as worn clothes and weathered dignity remind you of the distance still to travel.

This narrative transcends personal testimony—it illuminates how survival consciousness reshapes human experience. My coping mechanisms, however imperfect, represent more than individual strategies; they reflect the universal human drive to preserve dignity in the face of systematic degradation. Through this lens, physical deprivation and emotional trauma reveal a deeper truth: resilience isn't about thriving, but about maintaining our essential humanity when circumstances conspire to strip it away.

Garden of Modern Eden

Every Sunday, Adon watched Elder Clark stand at the pulpit, his voice carrying across the congregation like thunder. The elder preached about strength, about what made a "real man"—always with those air quotes that made Adon's stomach turn.

After service one morning, Adon overheard Clark counseling another young man. "Stand alone. That's what men do. We don't need help, we don't ask for it." The words felt like stones dropping into Adon's chest, each one heavier than the last.

Adon thought about Steve waiting in their apartment, about the strength it took to be themselves in a world that seemed determined to deny their existence. He thought about Clark's daughter, who had transitioned years ago and now lived states away, sending only Christmas cards that were never acknowledged.

"Funny," Adon whispered to himself as he walked home that day, "how some people trust G_d with everything except the beautiful diversity of His creation." He smiled, finally understanding that true strength wasn't in standing alone—it was in standing proudly as the person you were meant to be, even when others refused to see you. his voice carrying across the congregation like thunder. The elder preached about strength, about what made a "real man"—always with those air quotes that made Adon's stomach turn.

After service one morning, Adon overheard Clark counseling another young man. "Stand alone. That's what men do. We don't need help, we don't ask for it." The words felt like stones dropping into Adon's chest, each one heavier than the last.

Adon thought about Steve waiting in their apartment, about the strength it took to be themselves in a world that seemed determined to deny their existence. He thought about Clark's daughter, who had transitioned years ago and now lived states away, sending only Christmas cards that were never acknowledged.

"Funny," Adon whispered to himself as he walked home that day, "how some people trust G_d with everything except the beautiful diversity of His creation." He smiled, finally understanding that true strength wasn't in standing alone—it was in standing proudly as the person you were meant to be, even when others refused to see you.

Love what you see? Support my work! ☕

Your coffee donations help fuel new content and keep this project going. I'd love to hear your thoughts and feedback too!

-

@ 9c565c1b:25f42470

2025-02-25 20:43:52

@ 9c565c1b:25f42470

2025-02-25 20:43:52 -

@ 3ad01248:962d8a07

2025-02-25 20:35:10

@ 3ad01248:962d8a07

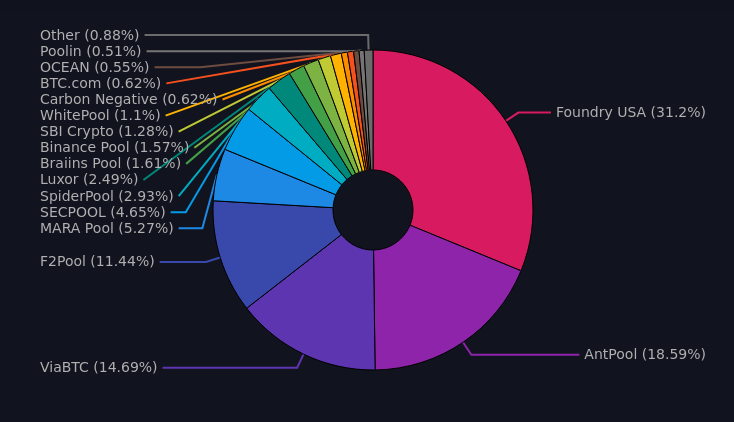

2025-02-25 20:35:10It has almost been a month since the Bitcoin friendly Trump administration has been in power. The Bitcoin price was riding high days before and after the election with Bitcoin reaching a new all time high of 109k. It sure seem like surely once Trump got into office the price would skyrocket and everyone finally would have lambos and girlfriends.

Sadly for the number go up crowd this didn't happen. There are no lambos to be found and no girlfriends. All we get is some sideways price action and a promise to look at creating a Strategic Bitcoin Reserve (BSR) or some kind of sovereign wealth fund.

If you are in Bitcoin for the right reasons and understand what you hold, this is the perfect time to stack sats before the price goes parabolic. I say this because Bitcoin sure seems to be poised to make a massive run. If you look past the current price of Bitcoin you can see a storm of dollars flowing into Bitcoin from the traditional fiat economy. The signs are there if you start looking for them.

US States Creating Bitcoin Strategic Reserves

Guess how many states are considering creating a state level Bitcoin reserve of their own? Lots. Here is a list of states that are thinking about creating a reserve for their state:

- Alabama

- Arizona

- Florida

- Kansas

- Illinois

- Iowa

- Massachusetts

- Michigan

- Missouri

- Montana

- New Hampshire

- New Jersey

- New Mexico

- North Carolina

- North Dakota

- Ohio

- Pennsylvania

- South Dakota

- Texas

- Utah

- Wisconsin

- Wyoming

Each state is at some varying degree of interest in creating a reserve. Texas and Arizona are by far have made the most progress on making a Bitcoin reserve a reality. Texas is currently holding a public hearing on this at the time of this writing. There is strong political will to create a reserve so I definitely can see them being first movers on this and once Texas makes it a reality the other state will move in short order.

Arizona's strategic reserve bill passed the senate finance committee on a 5-2 which is a big deal in itself but still has a long way to go before it becomes policy. If it passes the Senate it still has to pass the Arizona House of Representatives and signed by Democrat Governor Katie Hobbs, so the odds of this becoming law is slim. Arizona Democrats seem to be anti-Bitcoin in general and any bills coming from Republicans will likely be shoot down or watered down.

Analysts believe that $23 billion could flow into Bitcoin from government reserves which equates to 247k Bitcoin going into government cold storage. I have reservations about governments creating BSR's but if we are going to have them I much rather them be at the state level where it can benefit citizens the most. Especially state pension funds that so many of our firefighters, police and first responders depend on for retirement.

We will probably see a state level BSR created by the end of the year if not sooner. Time will tell.

SAB 121 Repeal

What is SAB 121? SAB 121 or Staff Accounting Bulletin 121 made it problematic for financial institutions to custody digital assets such as Bitcoin for their customers. SAB 121 required institutions to record their holdings as a liability and not an asset.

Naturally banks and other financial institutions didn't see an upside to custody digital assets if it meant taking on liability and having an administration that was hostile to crypto in general. Why take the chance to piss off the government and give them a reason to go after you is probably the reasoning of most bank executives. SAB 121 achieved the goal the Biden administration set out to accomplish, namely stymie Bitcoin adoption by banks and individuals as long as possible.

President Trump swiftly issued a executive order rescinding SAB 121 and with that ushering a new era in the realm of Bitcoin and digital assets in general. Financial institutions now have the ability to explore Bitcoin custody solutions that fit their customer's need without fear of having to record a liability on their books.

As more and more people and business learn about Bitcoin third party custody options are going to be popular. Think about it from a small business owner perspective for a second. They are in the business of selling their widgets for Bitcoin but they don't want to manage the complexity that comes with accounting, taxes etc.. In steps in their local bank that they have been with for years if not decades and starts providing Bitcoin management services. Small business owners would be all over that idea. In the long run I think the repeal of SAB 121 is going to be a bigger deal than states creating Bitcoin strategic reserves.

FASB

Financial Accounting Standards Board or FASB for short has applied fair value accounting rules on Bitcoin and other digital assets. This is a huge deal because it will allow business to realize profit and losses of Bitcoin based on market prices. It also makes it easier for investors who evaluate businesses that hold Bitcoin on their balance sheet. Overall it treats Bitcoin like any other asset that a business would hold.

This accounting rule change will pave the way for more businesses to put Bitcoin on their balance sheet further driving demand for Bitcoin.

Lightning Companies Leading The Way

We all know that L1 Bitcoin can not scale to the entire world and that in order to bring more people into Bitcoin that layer two solutions would have to be built. This has largely been done with the creation of the lightning network which enables seamless peer to peer micropayments in the blink of an eye.

Base layer Bitcoin will certain not be used to buy your daily coffees or gym memberships but lightning will be used for that purpose. Businesses small and large will demand one click on demand solutions to help them accept Bitcoin payments for their businesses. There are plenty of Bitcoin business ready to help business adopt a Bitcoin standard.

Businesses such as Opennode, Zaprite, Voltage, Breez make switching over to a Bitcoin standard easy for businesses to do.

So when you take a step back and really look at the Bitcoin ecosystem it is a lot more mature than most give it credit for and will slowly eat away at fiat currency dominance around the world.

The best thing that you can do is be patient, stack as many sats as you can and educate others about Bitcoin. We all know how fiat currencies end. Our time will come.

-

@ c1e9ab3a:9cb56b43

2025-02-25 19:49:28

@ c1e9ab3a:9cb56b43

2025-02-25 19:49:281. Introduction

Modern election systems must balance privacy (no one sees how individuals vote) with public verifiability (everyone can confirm the correctness of the tally). Achieving this in a decentralized, tamper-resistant manner remains a challenge. Nostr (a lightweight protocol for censorship-resistant communication) offers a promising platform for distributing and archiving election data (ballots) without relying on a single central server.

This paper presents a design where:

- Each voter generates a new ephemeral Nostr keypair for an election.

- The election authority (EA) blind-signs this ephemeral public key (npub) to prove the voter is authorized, without revealing which voter owns which ephemeral key.

- Voters cast encrypted ballots to Nostr relays, each carrying an OpenTimestamps proof to confirm the ballot’s time anchor.

- Re-voting is allowed: a voter can replace a previously cast ballot by publishing a new ballot with a newer timestamp.

- Only the latest valid ballot (per ephemeral key) is counted.

We combine well-known cryptographic primitives—blind signatures, homomorphic or mix-net encryption, threshold key management, and time anchoring—into an end-to-end system that preserves anonymity, assures correctness, and prevents double-voting.

2. Roles and Components

2.1 Voters

- Long-Term (“KYC-bound”) Key: Each voter has some identity-verified Nostr public key used only for official communication with the EA (not for voting).

- Ephemeral Voting Key: For each election, the voter locally generates a new Nostr keypair ((nsec_e, npub_e)).

- This is the “one-time” identity used to sign ballots.

- The EA never learns the real identity behind (\npub_e) because of blinding.

2.2 Election Authority (EA)

- Maintains the official voter registry: who is entitled to vote.

- Blind-Signs each valid voter’s ephemeral public key to authorize exactly one ephemeral key per voter.

- Publishes a minimal voter roll: e.g., “Voter #12345 has been issued a valid ephemeral key,” without revealing which ephemeral key.

2.3 Nostr Relays

- Decentralized servers that store and forward events.

- Voters post their ballots to relays, which replicate them.

- No single relay is critical; the same ballot can be posted to multiple relays for redundancy.

2.4 Cryptographic Framework

- Blind Signatures: The EA signs a blinded version of (\npub_e).

- Homomorphic or Mix-Net Encryption: Ensures the content of each ballot remains private; only aggregate results or a shuffled set are ever decrypted.

- Threshold / General Access Structure: Multiple trustees (EA plus candidate representatives, for example) must collaborate to produce a final decryption.

- OpenTimestamps (OTS): Attaches a verifiable timestamp proof to each ballot, anchoring it to a blockchain or other tamper-resistant time reference.

3. Protocol Lifecycle

This section walks through voter registration, ephemeral key authorization, casting (and re-casting) ballots, and finally the tally.

3.1 Registration & Minimal Voter Roll

- Legal/KYC Verification

- Each real-world voter proves their identity to the EA (per legal procedures).

-

The EA records that the voter is eligible to cast one ballot, referencing their long-term identity key ((\npub_{\mathrm{KYC}})).

-

Issue Authorization “Slot”

- The EA’s voter roll notes “this person can receive exactly one blind signature for an ephemeral key.”

- The roll does not store an ephemeral key—just notes that it can be requested.

3.2 Generating and Blinding the Ephemeral Key

- Voter Creates Ephemeral Key

- Locally, the voter’s client generates a fresh ((nsec_e, npub_e)).

- Blinding

-

The client blinds (\npub_e) to produce (\npub_{e,\mathrm{blinded}}). This ensures the EA cannot learn the real (\npub_e).

-

Blind Signature Request

- The voter, using their KYC-bound key ((\npub_{\mathrm{KYC}})), sends (\npub_{e,\mathrm{blinded}}) to the EA (perhaps via a secure direct message or a “giftwrapped DM”).

- The EA checks that this voter has not already been issued a blind signature.

-

If authorized, the EA signs (\npub_{e,\mathrm{blinded}}) with its private key and returns the blinded signature.

-

Unblinding

- The voter’s client unblinds the signature, obtaining a valid signature on (\npub_e).

-

Now (\npub_e) is a blinded ephemeral public key that the EA has effectively “authorized,” without knowing which voter it belongs to.

-

Roll Update

- The EA updates its minimal roll to note that “Voter #12345 received a signature,” but does not publish (\npub_e).

3.3 Casting an Encrypted Ballot with OpenTimestamps

When the voter is ready to vote:

- Compose Encrypted Ballot

- The ballot can be homomorphically encrypted (e.g., with Paillier or ElGamal) or structured for a mix-net.

-

Optionally include Zero-Knowledge Proofs (ZKPs) showing the ballot is valid (one candidate per race, etc.).

-

Obtain OTS Timestamp

- The voter’s client computes a hash (H) of the ballot data (ciphertext + ZKPs).

- The client sends (H) to an OpenTimestamps aggregator.

-

The aggregator returns a timestamp proof verifying that “this hash was seen at or before block/time (T).”

-

Create a “Timestamped Ballot” Payload

-

Combine:

- Encrypted ballot data.

- OTS proof for the hash of the ballot.

- EA’s signature on (\npub_e) (the blind-signed ephemeral key).

- A final signature by the voter’s ephemeral key ((nsec_e)) over the entire package.

-

Publish to Nostr

- The voter posts the complete “timestamped ballot” event to one or more relays.

- Observers see “an event from ephemeral key (\npub_e), with an OTS proof and the EA’s blind signature,” but cannot identify the real voter or see the vote’s contents.

3.4 Re-Voting (Updating the Ballot)

If the voter wishes to revise their vote (due to coercion, a mistake, or simply a change of mind):

- Generate a New Encrypted Ballot

- Possibly with different candidate choices.

- Obtain a New OTS Proof

- The new ballot has a fresh hash (H').

- The OTS aggregator provides a new proof anchored at a later block/time than the old one.

- Publish the Updated Ballot

- Again, sign with (\npub_e).

- Relays store both ballots, but the newer OTS timestamp shows which ballot is “final.”

Rule: The final vote for ephemeral key (\npub_e) is determined by the ballot with the highest valid OTS proof prior to the election’s closing.

3.5 Election Closing & Tally

- Close Signal

- At a specified time or block height, the EA publishes a “closing token.”

-

Any ballot with an OTS anchor referencing a time/block after the closing is invalid.

-

Collect Final Ballots

- Observers (or official tally software) gather the latest valid ballot from each ephemeral key.

-

They confirm the OTS proofs are valid and that no ephemeral key posted two different ballots with the same timestamp.

-

Decryption / Summation

- If homomorphic, the system sums the encrypted votes and uses a threshold of trustees to decrypt the aggregate.

- If a mix-net, the ballots are shuffled and partially decrypted, also requiring multiple trustees.

-

In either case, individual votes remain hidden, but the final counts are revealed.

-

Public Audit

- Anyone can fetch all ballots from the Nostr relays, verify OTS proofs, check the EA’s blind signature, and confirm no ephemeral key was used twice.

- The final totals can be recomputed from the publicly available data.

4. Ensuring One Vote Per Voter & No Invalid Voters

- One Blind Signature per Registered Voter

- The EA’s internal list ensures each real voter only obtains one ephemeral key signature.

- Blind Signature

- Ensures an unauthorized ephemeral key cannot pass validation (forging the EA’s signature is cryptographically infeasible).

- Public Ledger of Ballots

- Because each ballot references an EA-signed key, any ballot with a fake or duplicate signature is easily spotted.

5. Security and Privacy Analysis

- Voter Anonymity

- The EA never sees the unblinded ephemeral key. It cannot link (\npub_e) to a specific person.

-

Observers only see “some ephemeral key posted a ballot,” not the real identity of the voter.

-

Ballot Secrecy

- Homomorphic Encryption or Mix-Net: no one can decrypt an individual ballot; only aggregated or shuffled results are revealed.

-

The ephemeral key used for signing does not decrypt the ballot—the election’s threshold key does, after the election.

-

Verifiable Timestamping

- OpenTimestamps ensures each ballot’s time anchor cannot be forged or backdated.

-

Re-voting is transparent: a later OTS proof overrides earlier ones from the same ephemeral key.

-

Preventing Double Voting

- Each ephemeral key is unique and authorized once.

-

Re-voting by the same key overwrites the old ballot but does not increase the total count.

-

Protection Against Coercion

- Because the voter can re-cast until the deadline, a coerced vote can be replaced privately.

-

No receipts (individual decryption) are possible—only the final aggregated tally is revealed.

-

Threshold / Multi-Party Control

- Multiple trustees must collaborate to decrypt final results, preventing a single entity from tampering or prematurely viewing partial tallies.

6. Implementation Considerations

- Blind Signature Techniques

- Commonly implemented with RSA-based Chaumian blind signatures or BLS-based schemes.

-

Must ensure no link between (\npub_{e,\mathrm{blinded}}) and (\npub_e).

-

OpenTimestamps Scalability

- If millions of voters are posting ballots simultaneously, multiple timestamp aggregators or batch anchoring might be needed.

-

Verification logic on the client side or by public auditors must confirm each OTS proof’s integrity.

-

Relay Coordination

- The system must ensure no single relay can censor ballots. Voters may publish to multiple relays.

-

Tally fetchers cross-verify events from different relays.

-

Ease of Use

-

The user interface must hide the complexity of ephemeral key generation, blind signing, and OTS proof retrieval—making it as simple as possible for non-technical voters.

-

Legal Framework

-

If law requires publicly listing which voters have cast a ballot, you might track “Voter #12345 used their ephemeral key” without revealing the ephemeral key. Or you omit that if secrecy about who voted is desired.

-

Closing Time Edge Cases

- The system uses a block/time anchor from OTS. Slight unpredictability in block generation might require a small buffer around the official close. This is a policy choice.

7. Conclusion

We propose an election system that leverages Nostr for decentralizing ballot publication, blinded ephemeral keys for robust voter anonymity, homomorphic/mix-net encryption for ballot secrecy, threshold cryptography for collaborative final decryption, OpenTimestamps for tamper-proof time anchoring, and re-voting to combat coercion.

Key Advantages:

- Anonymity: The EA cannot link ballots to specific voters.

- One Voter, One Credential: Strict enforcement through blind signatures.

- Verifiable Ordering: OTS ensures each ballot has a unique, provable time anchor.

- Updatability: Voters can correct or override coerced ballots by posting a newer one before closing.

- Decentralized Audit: Anyone can fetch ballots from Nostr, verify the EA’s signatures and OTS proofs, and confirm the threshold-decrypted results match the posted ballots.

Such a design shows promise for secure, privacy-preserving digital elections, though real-world deployment will require careful policy, legal, and usability considerations. By combining cryptography with decentralized relays and an external timestamp anchor, the system can uphold both individual privacy and publicly auditable correctness.

-

@ 6e0ea5d6:0327f353

2025-02-25 19:39:35

@ 6e0ea5d6:0327f353

2025-02-25 19:39:35People naturally gravitate toward what they are already good at, often neglecting the development of complementary essential skills—creating an asymmetric growth. However, this common imbalance is a mistake we don’t have to repeat.

To stand out, one must seek completeness.

If you possess natural intelligence, don’t rely solely on it—strengthen your body through physical training or martial arts.

If you are naturally athletic, nourish your mind with great books and intellectual content.

Aspiring to excellence demands this balance:

When your ambition is to be a king, you must first become a warrior-scholar.

Staying on the throne depends precisely on this deliberate fusion of seemingly opposite strengths.

"The society that separates its scholars from its warriors will have its thinking done by cowards and its fighting done by fools." — Thucydides

"If your son is quiet and intelligent, emphasize boldness, leadership, and physicality. If your son is tall and impulsive, emphasize learning, mindfulness, and critical thinking. You cannot be a complete man when you only have 50% of the equation."

Thank you for reading, my friend!

If this message resonated with you, consider leaving your "🥃" as a token of appreciation.

A toast to our family!

-

@ 8da249fe:ecc00e09

2025-02-25 18:25:37

@ 8da249fe:ecc00e09

2025-02-25 18:25:37É um sistema eletrônico de dinheiro P2P, ou seja, é uma forma de dinheiro essencialmente digital, onde as pessoas podem transacionar sem precisar de um intermediário ou estar sujeito a autoridades centralizadas (Sistema Financeiro Governamental).

Ou seja, não há nenhuma existe de "Casa da Moedas" que façam o controle de dinheiro circulante e factíveis a movimentos artificiais de manejo de crises econômicas que pioram o processo de estabilização financeira. Para que o Bitcoin não seja alvo de fraudes e golpes o controle é feito por um sistema colaborativo de todos os usuários que validam suas transferências em um sistema de audição que chamamos de blockchain.

Como o Bitcoin funciona?

A moeda Bitcoin é um item eletrônico colecionável criando de forma de ser induplicável e não copiável. Este tipo de "arquivo" eletrônico tem propriedades de dinheiro, quando há o envio deste arquivo é retirado do seu local de armazenamento e transferido para outro sem gerar cópia. Todas as transferências deste tipo de "arquivo" são registradas em um livro contábel que tem o nome de blockchain.

Por isso que o Bitcoin é de fato uma moeda e não algo que possa ser um método de estelionato. Pois há uma auditoria voluntária de todos os usuários na Blockchain garantindo que não haja fraude e injeção de Bitcoin de forma artificial no sistema.

-

@ dbb19ae0:c3f22d5a

2025-02-25 18:20:15

@ dbb19ae0:c3f22d5a

2025-02-25 18:20:15Using Nostr_sdk 0.39 (Latest) module to send dm

```python

test with 0.39

working

import asyncio from nostr_sdk import Client, NostrSigner, Keys, PublicKey, init_logger, LogLevel

async def send_direct_message(nsec, recipient_npub, message): init_logger(LogLevel.INFO) sender_keys = Keys.parse(nsec) sender_client = NostrSigner.keys(sender_keys) client = Client(sender_client) public_key = sender_keys.public_key() print(f"From Public key (npub): {public_key.to_bech32()}")

await client.add_relay("wss://relay.damus.io") await client.connect()print(f"to Public key (npub): {recipient_npub}") await client.send_private_msg(PublicKey.parse(recipient_npub), message, []) await asyncio.sleep(10) print(f"Message sent")if name == 'main': nsec = "nsec1 ... replace with your nsec" recipient_npub = "npub ... replace with npub to send dm" message = "Hello there, this is a message!" asyncio.run(send_direct_message(nsec, recipient_npub, message))

```

-

@ 7a7d16c9:1a700636

2025-02-25 17:39:16

@ 7a7d16c9:1a700636

2025-02-25 17:39:16Watched an awesome video from one who I subscribe on YT.

I've been trying to put my finger on what it is that I don't like about the major social media platforms. Alec Watson gave me the answer in one of his latest videos: "Algorithmic Complacency".

TLDR: Rather than read, watch, and collaborate with those I follow online, modern social media platforms like to tell me what content I should consume. Nostr, Bluesky, and Mastodon don't do this - I can see what I want and what I don't, without relying on a computer algorithm to tell me.

This got me thinking about my own use of social media platforms and my recent adoption of the Fedi-verse to circumvent the machine telling me how I should consume online content.

I don't subscribe to any one platform. I've not found one that addresses all my online social needs, nor one that feature the diverse audiences I follow. Here's a rundown of what I use:

YouTube - the easiest of the bunch. YT has become my new binge TV. Initially a frequented site for learning how to replace a garbage disposal or to learn some of the tricks with Davinci Resolve, YT quickly became my platform of choice for learning and entertainment content. Yes, YT has an algorithm and provides recommendations - it's how I found Technology Connections - but I like that I can use the subscriptions feed to just see content that I follow in addition to that which YT recommends.

Facebook - the favorite with the old guard. TBH, I've never liked big tech owning my voice on the Internet. I'd have deleted my FB account along with X and Instagram, long ago, except that it's the one platform that my family uses. My mother uses Facebook, so do my distant cousins, but only a subset use the other platforms, and none use the Fedi-verse. FB remains as the one platform for me to post the occasional vacation photo and to find out that my cousin got married last week - and no I didn't get an invite.

Vero - I'm a photographer and love to post some of my more interesting art pieces online for feedback, so I can improve my craft. I used to use Instagram, until it went over to the algorithm dark side and filled my feed with short-form video. Vero maintains to be what Instagram used to be. I've not checked out Pixelfed (yet).

Mastodon - After Musk took over Twitter and rebranded it to X, I swiftly left and moved to Mastodon. I hate the idea of a single business entity owning my content and right to free speech online. Like many, I have my own issues with Musk and his business practices and shouldn't have to deal with them as part of my online presence. Mastodon was and still is, the place where I get to collaborate with people I've never met in person on likeminded topics of interests. Mastodon relies on federated servers, which people own; so, there's that to consider. I've managed to find a server that caters to my interests and fulfills my desire to collaborate online.

Then comes Nostr...

My friend _@briangreen.net introduced me to Nostr. As a long-term orange-pill advocate, I was thrilled to join Nostr to collaborate on the latest Bitcoin and Crypto news. I will say that Nostr appears less diverse in topics but that's rapidly changing as I am now seeing a lot of posts on photography, meshtastic, and other personal interests of mine. I love that Nostr is not so much a platform, but a federated protocol. I don't have to subscribe to any one app and web site to post and read content. For now, I use both Mastodon and Nostr to scratch my online collab itch. A nice thing about the Fedi-verse is that there's plenty of cross-posting apps. I use OpenVibe to post and consume content in one place. Their app is slick and works as advertised.

How do you use social media? Is Nostr your only platform, or do you still use the traditional ones?

-

@ 2e8970de:63345c7a

2025-02-25 17:16:37

@ 2e8970de:63345c7a

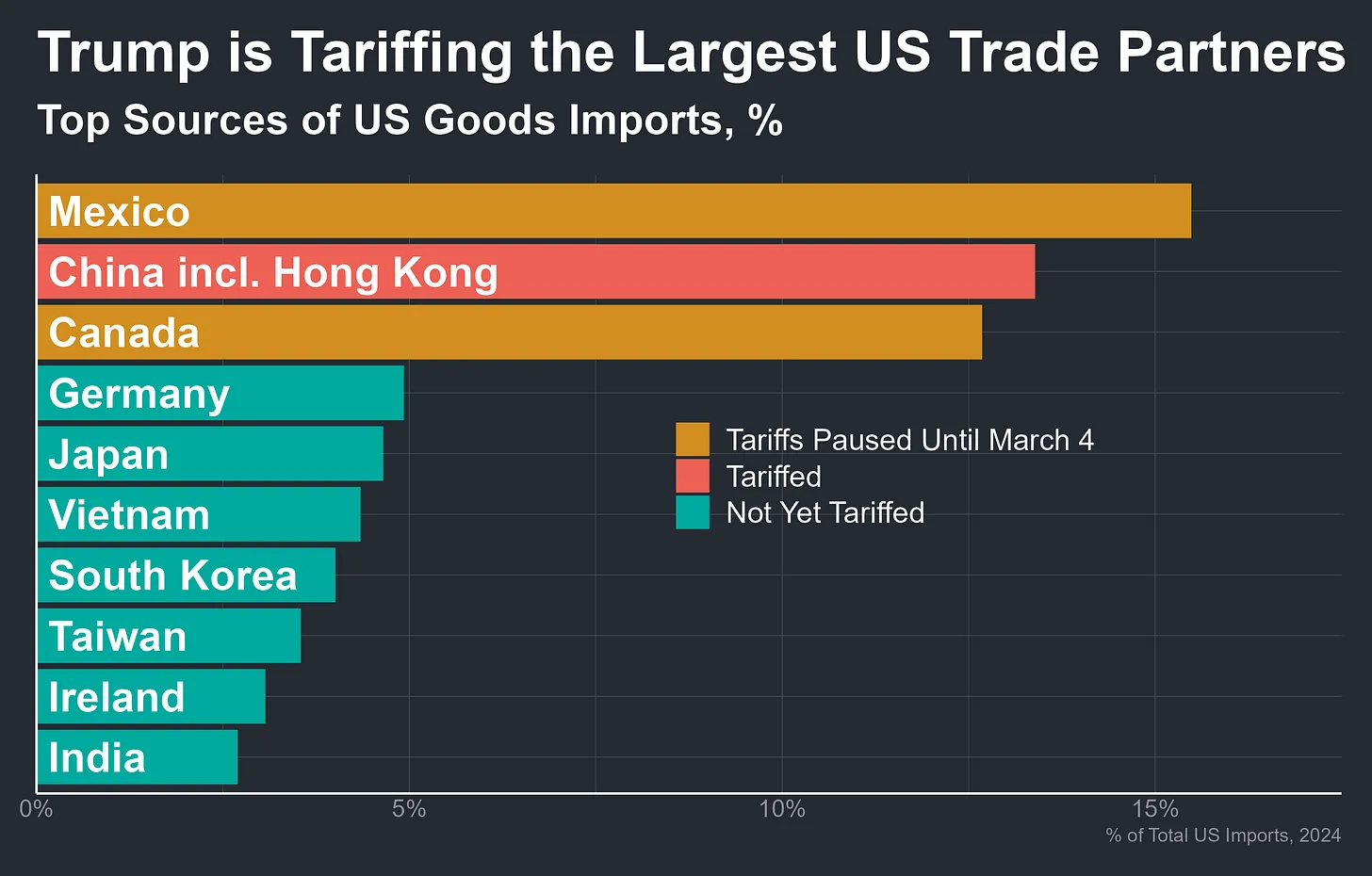

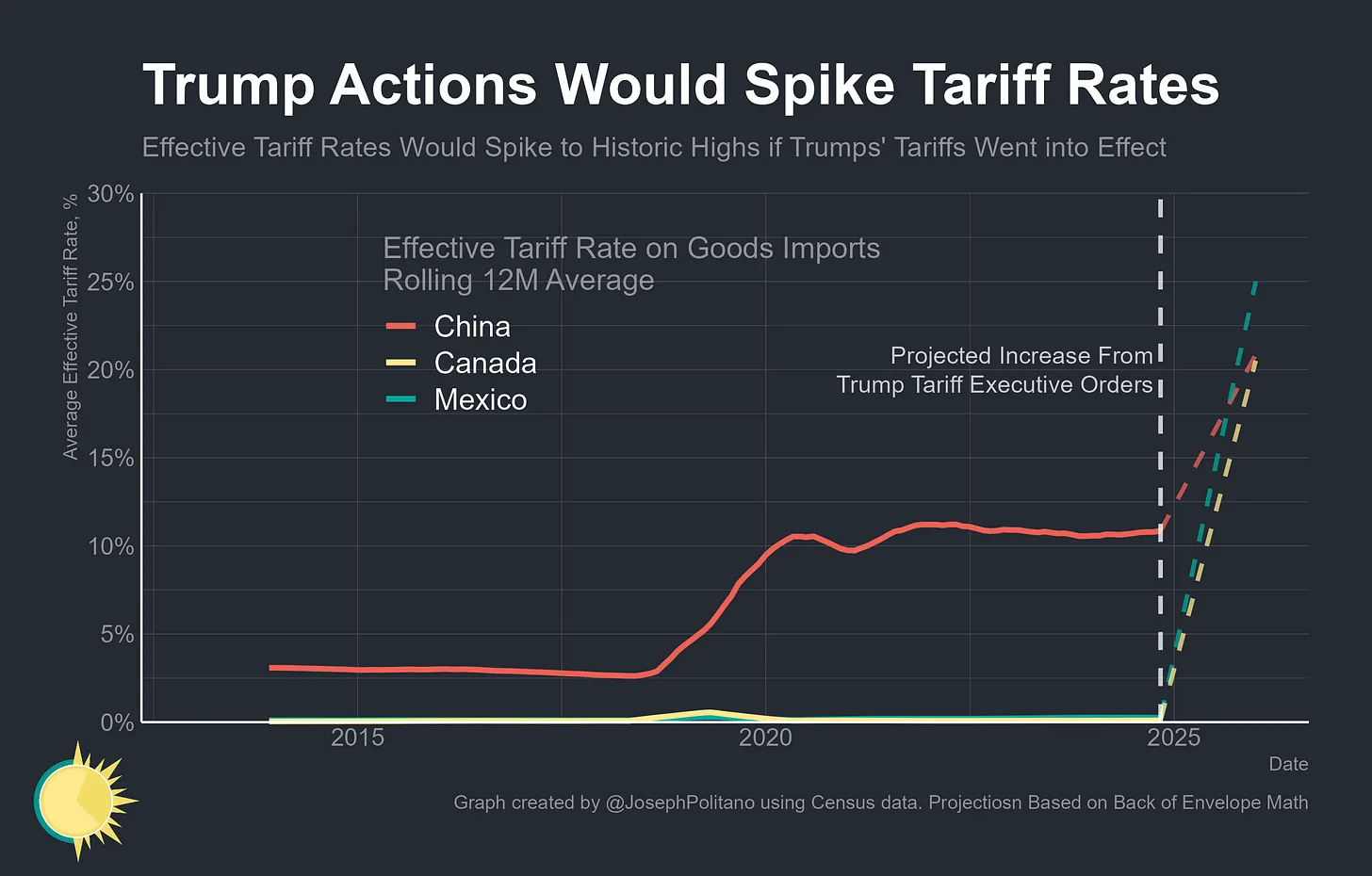

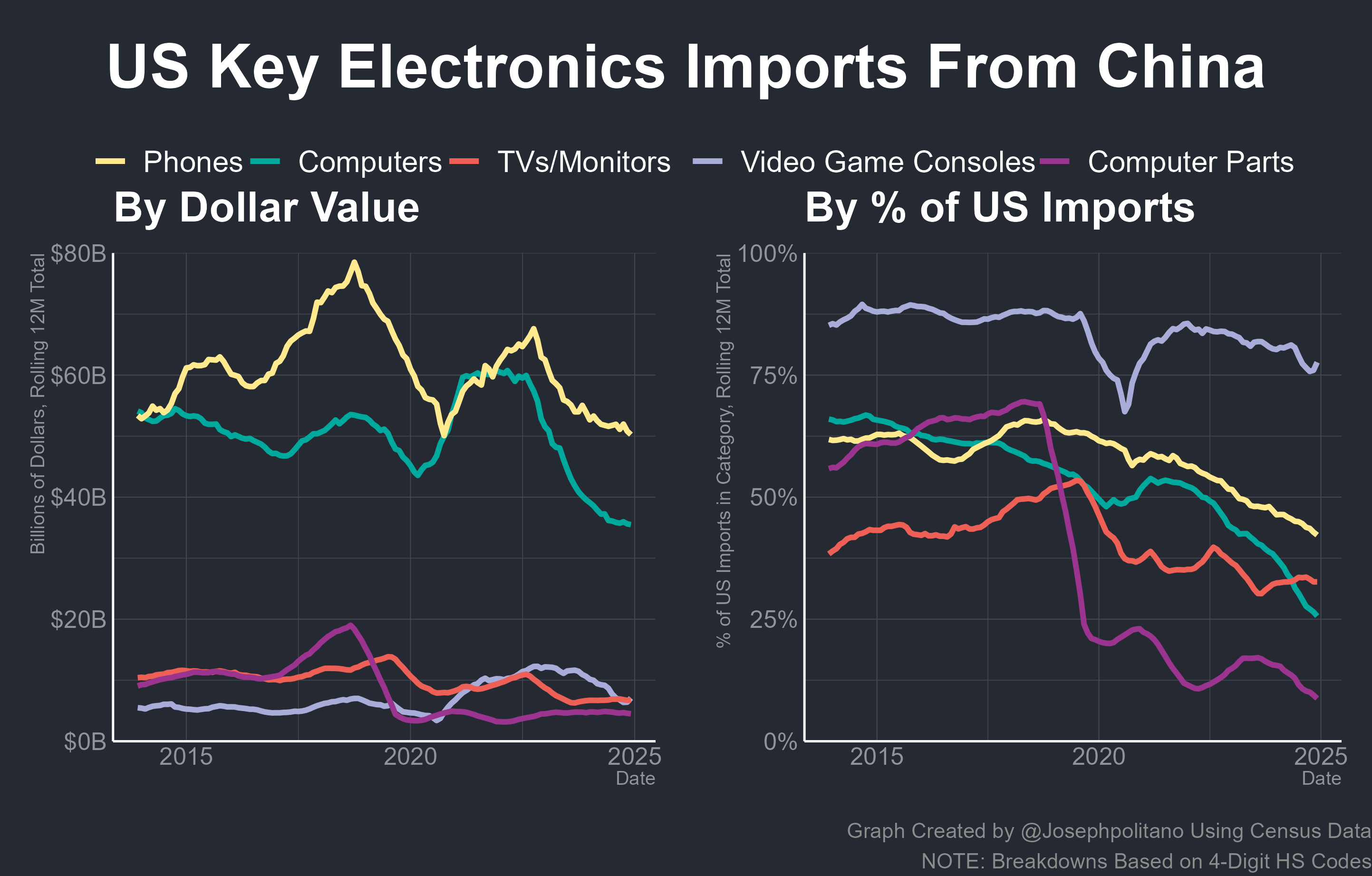

2025-02-25 17:16:37A Detailed Look at the Economic Impacts of Trump's Wide Ranging New Tariffs on China, Mexico, Canada, Steel, Aluminum, and Much More

https://www.apricitas.io/p/trumps-2nd-trade-war-begins

If you're interested in global trade I recommend looking at the article. It's a real deep dive into many perspectives of US trade esp. with China. What gets imported from China, many individual product categories, what happened in round 1 in 2018 and so so much more. And lots of charts!

originally posted at https://stacker.news/items/896850

-

@ f16854d5:3d7ad874

2025-02-25 16:25:46

@ f16854d5:3d7ad874

2025-02-25 16:25:46In October 2024, I revisited Messier 33, also known as the Triangulum Galaxy, the third-largest member of our Local Group of galaxies. This galaxy holds special significance for me, as it was among the first celestial objects I photographed three years prior. Taking advantage of a moonless evening, I aimed to capture its intricate details once more.

The imaging session proceeded smoothly, albeit with slightly below-average seeing conditions. Guiding performance remained relatively stable throughout the evening, fluctuating between 0.5 and 0.8. To enhance image sharpness, I adjusted the automated refocusing interval from 1°C to 0.75°C, a setting I plan to maintain for future sessions.

Processing was conducted using Stellarmate OS for capture, with subsequent refinement in PixInsight and Affinity Photo.

For a detailed account and to view the high-resolution image, you can visit my post here: https://astrocamp.eu/en/astrophoto-messier-33-10-24/

-

@ 6a6be47b:3e74e3e1

2025-02-25 14:14:41

@ 6a6be47b:3e74e3e1

2025-02-25 14:14:41Hi frens, While drawing this fly 🪰 👇🏻

nostr:nevent1qgsx56ly0wcj7gwasrc7707l9px39g5nzn82p35akhkdqj448e6w8cgqyrrnhgtqqfvcvf007gtxmffrhd8zw5j0t93cuxc3yrykl2dzyp3tvj4hcjx

I started thinking about how to make my art stand out. Maybe I should focus on making it more appealing—or at least improving its presentation. Don’t get me wrong, I’m not against making my work more consumable, but the marketing side of things takes so much time away from actually creating art. It’s sad that sometimes it feels less about delivering high-quality work and more about turning it into “content.” Honestly, that can be exhausting. Like Fall Out Boy said, “all this effort to make it look effortless.”It’s not really my style to turn my art—or the process of creating it—into content. That’s why I sometimes struggle with crafting or presenting it in a way that fits today’s trends. Sometimes, the pressure to make my art presentable is so overwhelming that it makes me feel like not creating at all. And when it doesn’t yield the kind of recognition or financial support I hope for after all that effort, it can be really disappointing. It’s like watching all that hard work slowly erode my soul. It’s tough to keep going when it feels like my art isn’t being valued in the way I wish it could be. I want to be clear: this isn’t me dissing anyone. You do you, and I’ll do me. As Crowley would say, “Do what thou wilt.” What I’m really trying to figure out is how to find that sweet spot—where I can keep up with the times and make my art more appealing without losing my soul in the process. I’m trying my best, and I know I’ll make mistakes along the way, but I’ll keep going. I just wanted to share these thoughts with you because I’m usually pretty upbeat here—maybe even a little superficial at times—but this is me being more real with you. Art is such a huge part of my life, and through my work, I’m already sharing something raw and personal with you. But now you also know why my presentation might sometimes feel simple or plain. I’m working on finding that balance, and I’ll get there eventually. Godspeed, my frens

-

@ 67403b2c:27b48c7a

2025-02-25 15:47:23

@ 67403b2c:27b48c7a

2025-02-25 15:47:23Michael Laitman, a world-renowned Kabbalist and spiritual teacher, recently introduced a groundbreaking concept on Facebook called "No Death." This transformative Kabbalistic teaching explains how death is not an ending but a spiritual transformation of consciousness. For those seeking answers about life after death, Laitman's perspective offers both ancient wisdom and modern understanding.

Understanding Kabbalah's View on Death and Consciousness

The Kabbalistic concept of "No Death" builds on centuries of mystical Jewish wisdom. While traditional views see death as final, Kabbalah teaches that reality extends far beyond our physical world. Similar to Einstein's theory that energy cannot be destroyed but only transformed, Kabbalistic wisdom suggests consciousness continues after physical death.

How Kabbalistic Teachings View Consciousness and Physical Reality

According to Laitman's Kabbalistic teachings, consciousness exists independently of our physical brain. This fundamental principle of Kabbalah suggests that our true essence—our spiritual consciousness—transcends the temporary nature of our physical bodies. This understanding aligns with both ancient spiritual wisdom and emerging scientific theories about consciousness.

Practical Applications of Kabbalistic Wisdom in Daily Life

This spiritual perspective transforms how we approach:

- Personal relationships and their eternal nature

- Daily challenges and spiritual growth

- Anxiety about death and mortality

- Life's deeper meaning and purpose

Modern Relevance of Kabbalistic Teaching

In today's fast-paced digital world, Laitman's spiritual insights offer valuable guidance for:

- Managing death anxiety

- Finding life purpose

- Building meaningful relationships

- Understanding consciousness

- Exploring spiritual growth

Impact on Personal Growth and Spiritual Development

Laitman's teaching extends beyond theoretical knowledge into practical spiritual development. By viewing death as transformation rather than termination, practitioners of Kabbalah develop:

- Enhanced spiritual awareness

- Deeper compassion for others

- Stronger personal relationships

- Greater life purpose

- Reduced fear of death

Connecting Ancient Wisdom with Modern Understanding

While many spiritual teachers discuss life after death, Laitman's approach uniquely bridges:

- Traditional Kabbalistic wisdom

- Contemporary scientific understanding

- Practical daily application

- Personal spiritual growth

- Universal life questions

Conclusion: Embracing Spiritual Transformation

Michael Laitman's exploration of "No Death" provides essential insights for anyone interested in:

- Kabbalistic teachings

- Spiritual development

- Life after death

- Consciousness studies

- Personal transformation

About About the Author: This comprehensive guide explores Dr. Michael Laitman's Kabbalistic teachings on life, death, and spiritual transformation. Drawing from his recent social media insights and decades of Kabbalistic study, this article connects ancient wisdom with modern understanding.

💝 Support This Work If you found this article valuable, consider supporting more content like this with a small contribution: Buy Me a Coffee

#Kabbalah #MichaelLaitman #SpiritualTeachings #LifeAfterDeath #KabbalisticWisdom #SpiritualGrowth #Consciousness #SpiritualTransformation

About the Author: This piece explores the profound teachings of Michael Laitman, drawing from his recent social media insights and long-standing work in Kabbalistic wisdom. The article aims to bridge ancient spiritual knowledge with contemporary understanding, offering readers a new perspective on life, death, and continuity.

Philosophy #Kabbalah #MichaelLaitman #LifeBeyondDeath #SpiritualAwakening

-

@ eaef5965:511d6b79

2025-02-25 14:14:11

@ eaef5965:511d6b79

2025-02-25 14:14:11Another quarter, another update on the global money supply.

I remember three years ago yesterday, texting my Ukrainian friends for updates as they fled with their families for safety from Putin's full-scale, unprovoked attack on their country. Three years on, they continue to fight incredibly bravely, for if they do not, there will be no Ukraine. Europe has drip-fed them enough support to not lose, but not enough to win. America now demands repayment for its aid to the victim in the form of mineral rights, and will not recognize the aggressor as the aggressor. The era of Reagan-style, speak softly while carrying a big stick approach to dictators seems no more, for now, from the new US admin. The world order is changing rapidly, and Europe is quickly finding out what the Baltics and Poland have known for 200 years: the threat from the East does not share its values; it is simply uncompromising.

As this next round of political theater plays out, and one can only hope for just, lasting peace and security with clear eyes from all democratic allies, the printing presses will do as instructed. But as we look through this update, you will see that we are actually at very low, relative-levels of money printing historically, even slight negative money growth.

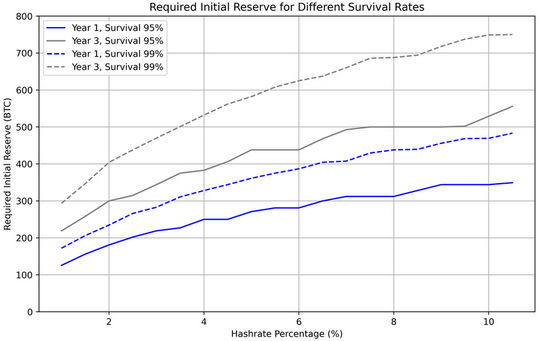

Bitcoin continues on, and as of 31 December 2024, its $1.8 trillion market cap was 7.2% of the global monetary base. That means that the global monetary base, for this update, is $25.5 trillion.

Why the global monetary base?

It is the only money supply that is economically analogous to bitcoins, digital store of value today, and to gold and silver ounces, store of values from the past.

The monetary base is central bank money, comprised of two supplies:

- Physical currency: Notes and coins, or “cash;”

- Bank reserves: The “Master account” that each commercial bank holds with its central bank.

Now, why do I refer to this as Central bank money?

This is because, unlike all other money supplies in the fiduciary banking world (like M1/M2/M3), the Monetary base is the sole and ultimate money supply controlled by the central bank. It is, literally, the printing press. What follows won't be a lesson in reserve ratios or monetary economics. The point is that you simply understand that there is a money supply that central banks solely control, and of course (of course!) this is what Bitcoin's 21 million are up against.

The monetary base is to the core of the entire fiat financial system, as 21 million bitcoins are to the core of the Bitcoin protocol. One is open and permissionless, and one is not. By the way, the monetary base is essentially (though not entirely) analogous to the total liabilities of a central bank, so we can (basically) say that the monetary base is the "balance sheet" of each central bank.

On cash. Quick notes on the above. Certainly you understand what "cash" is, and it is indeed an instrument that has been fully monopolized by each central bank in each nation around the world--only they can print it. Even though it is true that banks in more free banking societies in the past could freely print and strike notes and coins, the central bank (or state) monopoly has been around for a long time. Kublai Khan was the first to do it 750 years ago.

On bank reserves. Don't stress your brain on this too much, but this is the main "settlement money" that banks use between each other, when they want to settle their debts. It is digital now (Fedwire in US, CHAPS in UK), but it doesn't technically have to be, and of course before modern technology took over even a few decades ago, it was not. These two stacks of retail and wholesale cash, stacks of central bank money, are what make up the Monetary base. This is the printing press. Only this compares to 21 million bitcoins. And gold, and silver by the way.