-

@ 5f078e90:b2bacaa3

2025-04-24 20:37:29

@ 5f078e90:b2bacaa3

2025-04-24 20:37:29Bird story 3

This is a test post, 5-600 characters, no md or html. Should become kind 30023.

Dawn Sparrow flitted over dewy grass, eyes sharp for a wriggling worm. The meadow hummed with life, but her quarry hid well. She hopped, pecked, and tilted her head, listening for the faintest squirm. A rustle! Her beak darted into soft earth, pulling up a plump worm. Triumph! She soared to her nest, breakfast secured, as the sun warmed the fields. Her chicks chirped, eager for the meal. Dawn’s keen hunt ensured their strength, a small victory in the endless dance of survival. Each day, she’d search again, tireless, for the worms that sustained her family’s song.

Originally posted on Hive at https://hive.blog/@hostr/bird-story-3

Cross-posted using Hostr at https://github.com/crrdlx/hostr, version 0.0.1

-

@ 0e67f053:cb1d4b93

2025-04-24 19:42:00

@ 0e67f053:cb1d4b93

2025-04-24 19:42:00How to Be an Anti-Fascist: A Gentle Rebuttal to Billionaire Strongmen and Their Twitter Cosplays

By Carl Tuckerson

Good evening, radiant souls.

Tonight, I want to talk about something serious—but not in a shouty, vein-popping way. In a warm, clear-eyed, candle-lit kind of way. Let’s talk about fascism. And more importantly, how to stand firmly, nonviolently, and stylishly against it.

First, a definition. Fascism isn’t just people yelling on the internet or wearing weird hats. It’s a political disease—authoritarianism drenched in nationalism, allergic to diversity, and obsessed with power. It’s rigid. It’s cruel. It thrives on fear.

History, of course, gave us the ultimate case study: Adolf Hitler. A man who turned wounded ego and racist paranoia into a genocidal regime. Let’s be uncomfortably clear: fascism starts with rhetoric and ends in blood. It wears suits at first. Then it builds camps.

Which brings us to the now. To a peculiar blend of self-pitying billionaires and spray-tanned demagogues playing dictator on easy mode.

Let’s start with Elon Musk.

Here’s a man who once inspired us with rockets and electric cars—and now spends his time posting “anti-woke” memes like a Reddit troll who just discovered Ayn Rand. Elon claims to love “free speech,” unless that speech critiques him or his companies, in which case he’ll fire you, shadowban you, or awkwardly reply with a meme of Pepe the Frog.

You can’t be a free speech absolutist and also an insecure billionaire who throws tantrums when journalists ask questions. That’s not libertarianism. That’s narcissism with a Wi-Fi signal.

Then there’s Donald Trump.

The man who said he’d “drain the swamp” and instead held cocktail parties in it. Who said he loved “the people” but spent four years helping billionaires and banning brown kids. Who said he was “tough on crime” while pardoning white-collar felons and cozying up to actual Nazis at campaign rallies.

You don’t get to call yourself a patriot while trying to overthrow democracy. You don’t get to wrap yourself in the flag while selling fascist cosplay to a base too traumatized to see the grift. And no, calling your opponents “fascists” doesn’t make you less of one. That’s what projection looks like, not principle.

So… what does it actually mean to be anti-fascist?

It’s not just wearing black or smashing Starbucks windows (though I get the temptation). It means:

-

Refusing to dehumanize. Even when it’s easier.

-

Defending institutions of democracy while pushing them to do better.

-

Confronting power with truth—especially when that power has a blue checkmark and a bunker.

-

Building diverse communities where all people—not just rich white dudes with podcasts—have a voice.

-

Educating yourself. Read. Listen. Learn from those who’ve lived through real authoritarianism. Hint: it wasn’t your uncle who got suspended from X.

And look, I get it. It's easy to feel hopeless. To doomscroll and despair. But the antidote to fascism isn’t more fear. It’s radical hope. It’s showing up. It's organizing mutual aid. It's hugging someone at a protest. It's running a book club. It’s standing in solidarity instead of standing by.

So if you’re wondering how to be anti-fascist?

Start by being anti-ego. Anti-greed. Anti-cruelty. Anti-lie. And yes, sometimes that means being anti-Musk. Anti-Trump. Anti-anyone who thinks oppression is a branding opportunity.

We’ve tried letting billionaires be our heroes. It didn’t work. Maybe it’s time to try being each other’s heroes instead.

Stay soft. Stay loud. Stay antifascist.

We’ll see you tomorrow.

— Radical Kindness Carl

originally posted at https://stacker.news/items/957123

-

-

@ e691f4df:1099ad65

2025-04-24 18:56:12

@ e691f4df:1099ad65

2025-04-24 18:56:12Viewing Bitcoin Through the Light of Awakening

Ankh & Ohm Capital’s Overview of the Psycho-Spiritual Nature of Bitcoin

Glossary:

I. Preface: The Logos of Our Logo

II. An Oracular Introduction

III. Alchemizing Greed

IV. Layers of Fractalized Thought

V. Permissionless Individuation

VI. Dispelling Paradox Through Resonance

VII. Ego Deflation

VIII. The Coin of Great Price

Preface: The Logos of Our Logo

Before we offer our lens on Bitcoin, it’s important to illuminate the meaning behind Ankh & Ohm’s name and symbol. These elements are not ornamental—they are foundational, expressing the cosmological principles that guide our work.

Our mission is to bridge the eternal with the practical. As a Bitcoin-focused family office and consulting firm, we understand capital not as an end, but as a tool—one that, when properly aligned, becomes a vehicle for divine order. We see Bitcoin not simply as a technological innovation but as an emanation of the Divine Logos—a harmonic expression of truth, transparency, and incorruptible structure. Both the beginning and the end, the Alpha and Omega.

The Ankh (☥), an ancient symbol of eternal life, is a key to the integration of opposites. It unites spirit and matter, force and form, continuity and change. It reminds us that capital, like Life, must not only be generative, but regenerative; sacred. Money must serve Life, not siphon from it.

The Ohm (Ω) holds a dual meaning. In physics, it denotes a unit of electrical resistance—the formative tension that gives energy coherence. In the Vedic tradition, Om (ॐ) is the primordial vibration—the sound from which all existence unfolds. Together, these symbols affirm a timeless truth: resistance and resonance are both sacred instruments of the Creator.

Ankh & Ohm, then, represents our striving for union, for harmony —between the flow of life and intentional structure, between incalculable abundance and measured restraint, between the lightbulb’s electrical impulse and its light-emitting filament. We stand at the threshold where intention becomes action, and where capital is not extracted, but cultivated in rhythm with the cosmos.

We exist to shepherd this transformation, as guides of this threshold —helping families, founders, and institutions align with a deeper order, where capital serves not as the prize, but as a pathway to collective Presence, Purpose, Peace and Prosperity.

An Oracular Introduction

Bitcoin is commonly understood as the first truly decentralized and secure form of digital money—a breakthrough in monetary sovereignty. But this view, while technically correct, is incomplete and spiritually shallow. Bitcoin is more than a tool for economic disruption. Bitcoin represents a mythic threshold: a symbol of the psycho-spiritual shift that many ancient traditions have long foretold.

For millennia, sages and seers have spoken of a coming Golden Age. In the Vedic Yuga cycles, in Plato’s Great Year, in the Eagle and Condor prophecies of the Americas—there exists a common thread: that humanity will emerge from darkness into a time of harmony, cooperation, and clarity. That the veil of illusion (maya, materiality) will thin, and reality will once again become transparent to the transcendent. In such an age, systems based on scarcity, deception, and centralization fall away. A new cosmology takes root—one grounded in balance, coherence, and sacred reciprocity.

But we must ask—how does such a shift happen? How do we cross from the age of scarcity, fear, and domination into one of coherence, abundance, and freedom?

One possible answer lies in the alchemy of incentive.

Bitcoin operates not just on the rules of computer science or Austrian economics, but on something far more old and subtle: the logic of transformation. It transmutes greed—a base instinct rooted in scarcity—into cooperation, transparency, and incorruptibility.

In this light, Bitcoin becomes more than code—it becomes a psychoactive protocol, one that rewires human behavior by aligning individual gain with collective integrity. It is not simply a new form of money. It is a new myth of value. A new operating system for human consciousness.

Bitcoin does not moralize. It harmonizes. It transforms the instinct for self-preservation into a pathway for planetary coherence.

Alchemizing Greed

At the heart of Bitcoin lies the ancient alchemical principle of transmutation: that which is base may be refined into gold.

Greed, long condemned as a vice, is not inherently evil. It is a distorted longing. A warped echo of the drive to preserve life. But in systems built on scarcity and deception, this longing calcifies into hoarding, corruption, and decay.

Bitcoin introduces a new game. A game with memory. A game that makes deception inefficient and truth profitable. It does not demand virtue—it encodes consequence. Its design does not suppress greed; it reprograms it.

In traditional models, game theory often illustrates the fragility of trust. The Prisoner’s Dilemma reveals how self-interest can sabotage collective well-being. But Bitcoin inverts this. It creates an environment where self-interest and integrity converge—where the most rational action is also the most truthful.

Its ledger, immutable and transparent, exposes manipulation for what it is: energetically wasteful and economically self-defeating. Dishonesty burns energy and yields nothing. The network punishes incoherence, not by decree, but by natural law.

This is the spiritual elegance of Bitcoin: it does not suppress greed—it transmutes it. It channels the drive for personal gain into the architecture of collective order. Miners compete not to dominate, but to validate. Nodes collaborate not through trust, but through mathematical proof.

This is not austerity. It is alchemy.

Greed, under Bitcoin, is refined. Tempered. Re-forged into a generative force—no longer parasitic, but harmonic.

Layers of Fractalized Thought Fragments

All living systems are layered. So is the cosmos. So is the human being. So is a musical scale.

At its foundation lies the timechain—the pulsing, incorruptible record of truth. Like the heart, it beats steadily. Every block, like a pulse, affirms its life through continuity. The difficulty adjustment—Bitcoin’s internal calibration—functions like heart rate variability, adapting to pressure while preserving coherence.

Above this base layer is the Lightning Network—a second layer facilitating rapid, efficient transactions. It is the nervous system: transmitting energy, reducing latency, enabling real-time interaction across a distributed whole.

Beyond that, emerging tools like Fedimint and Cashu function like the capillaries—bringing vitality to the extremities, to those underserved by legacy systems. They empower the unbanked, the overlooked, the forgotten. Privacy and dignity in the palms of those the old system refused to see.

And then there is NOSTR—the decentralized protocol for communication and creation. It is the throat chakra, the vocal cords of the “freedom-tech” body. It reclaims speech from the algorithmic overlords, making expression sovereign once more. It is also the reproductive system, as it enables the propagation of novel ideas and protocols in fertile, uncensorable soil.

Each layer plays its part. Not in hierarchy, but in harmony. In holarchy. Bitcoin and other open source protocols grow not through exogenous command, but through endogenous coherence. Like cells in an organism. Like a song.

Imagine the cell as a piece of glass from a shattered holographic plate —by which its perspectival, moving image can be restructured from the single shard. DNA isn’t only a logical script of base pairs, but an evolving progressive song. Its lyrics imbued with wise reflections on relationships. The nucleus sings, the cell responds—not by command, but by memory. Life is not imposed; it is expressed. A reflection of a hidden pattern.

Bitcoin chants this. Each node, a living cell, holds the full timechain—Truth distributed, incorruptible. Remove one, and the whole remains. This isn’t redundancy. It’s a revelation on the power of protection in Truth.

Consensus is communion. Verification becomes a sacred rite—Truth made audible through math.

Not just the signal; the song. A web of self-expression woven from Truth.

No center, yet every point alive with the whole. Like Indra’s Net, each reflects all. This is more than currency and information exchange. It is memory; a self-remembering Mind, unfolding through consensus and code. A Mind reflecting the Truth of reality at the speed of thought.

Heuristics are mental shortcuts—efficient, imperfect, alive. Like cells, they must adapt or decay. To become unbiased is to have self-balancing heuristics which carry feedback loops within them: they listen to the environment, mutate when needed, and survive by resonance with reality. Mutation is not error, but evolution. Its rules are simple, but their expression is dynamic.

What persists is not rigidity, but pattern.

To think clearly is not necessarily to be certain, but to dissolve doubt by listening, adjusting, and evolving thought itself.

To understand Bitcoin is simply to listen—patiently, clearly, as one would to a familiar rhythm returning.

Permissionless Individuation

Bitcoin is a path. One that no one can walk for you.

Said differently, it is not a passive act. It cannot be spoon-fed. Like a spiritual path, it demands initiation, effort, and the willingness to question inherited beliefs.

Because Bitcoin is permissionless, no one can be forced to adopt it. One must choose to engage it—compelled by need, interest, or intuition. Each person who embarks undergoes their own version of the hero’s journey.

Carl Jung called this process Individuation—the reconciliation of fragmented psychic elements into a coherent, mature Self. Bitcoin mirrors this: it invites individuals to confront the unconscious assumptions of the fiat paradigm, and to re-integrate their relationship to time, value, and agency.

In Western traditions—alchemy, Christianity, Kabbalah—the individual is sacred, and salvation is personal. In Eastern systems—Daoism, Buddhism, the Vedas—the self is ultimately dissolved into the cosmic whole. Bitcoin, in a paradoxical way, echoes both: it empowers the individual, while aligning them with a holistic, transcendent order.

To truly see Bitcoin is to allow something false to die. A belief. A habit. A self-concept.

In that death—a space opens for deeper connection with the Divine itSelf.

In that dissolution, something luminous is reborn.

After the passing, Truth becomes resurrected.

Dispelling Paradox Through Resonance

There is a subtle paradox encoded into the hero’s journey: each starts in solidarity, yet the awakening affects the collective.

No one can be forced into understanding Bitcoin. Like a spiritual truth, it must be seen. And yet, once seen, it becomes nearly impossible to unsee—and easier for others to glimpse. The pattern catches.

This phenomenon mirrors the concept of morphic resonance, as proposed and empirically tested by biologist Rupert Sheldrake. Once a critical mass of individuals begins to embody a new behavior or awareness, it becomes easier—instinctive—for others to follow suit. Like the proverbial hundredth monkey who begins to wash the fruit in the sea water, and suddenly, monkeys across islands begin doing the same—without ever meeting.

When enough individuals embody a pattern, it ripples outward. Not through propaganda, but through field effect and wave propagation. It becomes accessible, instinctive, familiar—even across great distance.

Bitcoin spreads in this way. Not through centralized broadcast, but through subtle resonance. Each new node, each individual who integrates the protocol into their life, strengthens the signal for others. The protocol doesn’t shout; it hums, oscillates and vibrates——persistently, coherently, patiently.

One awakens. Another follows. The current builds. What was fringe becomes familiar. What was radical becomes obvious.

This is the sacred geometry of spiritual awakening. One awakens, another follows, and soon the fluidic current is strong enough to carry the rest. One becomes two, two become many, and eventually the many become One again. This tessellation reverberates through the human aura, not as ideology, but as perceivable pattern recognition.

Bitcoin’s most powerful marketing tool is truth. Its most compelling evangelist is reality. Its most unstoppable force is resonance.

Therefore, Bitcoin is not just financial infrastructure—it is psychic scaffolding. It is part of the subtle architecture through which new patterns of coherence ripple across the collective field.

The training wheels from which humanity learns to embody Peace and Prosperity.

Ego Deflation

The process of awakening is not linear, and its beginning is rarely gentle—it usually begins with disruption, with ego inflation and destruction.

To individuate is to shape a center; to recognize peripherals and create boundaries—to say, “I am.” But without integration, the ego tilts—collapsing into void or inflating into noise. Fiat reflects this pathology: scarcity hoarded, abundance simulated. Stagnation becomes disguised as safety, and inflation masquerades as growth.

In other words, to become whole, the ego must first rise—claiming agency, autonomy, and identity. However, when left unbalanced, it inflates, or implodes. It forgets its context. It begins to consume rather than connect. And so the process must reverse: what inflates must deflate.

In the fiat paradigm, this inflation is literal. More is printed, and ethos is diluted. Savings decay. Meaning erodes. Value is abstracted. The economy becomes bloated with inaudible noise. And like the psyche that refuses to confront its own shadow, it begins to collapse under the weight of its own illusions.

But under Bitcoin, time is honored. Value is preserved. Energy is not abstracted but grounded.

Bitcoin is inherently deflationary—in both economic and spiritual senses. With a fixed supply, it reveals what is truly scarce. Not money, not status—but the finite number of heartbeats we each carry.

To see Bitcoin is to feel that limit in one’s soul. To hold Bitcoin is to feel Time’s weight again. To sense the importance of Bitcoin is to feel the value of preserved, potential energy. It is to confront the reality that what matters cannot be printed, inflated, or faked. In this way, Bitcoin gently confronts the ego—not through punishment, but through clarity.

Deflation, rightly understood, is not collapse—it is refinement. It strips away illusion, bloat, and excess. It restores the clarity of essence.

Spiritually, this is liberation.

The Coin of Great Price

There is an ancient parable told by a wise man:

“The kingdom of heaven is like a merchant seeking fine pearls, who, upon finding one of great price, sold all he had and bought it.”

Bitcoin is such a pearl.

But the ledger is more than a chest full of treasure. It is a key to the heart of things.

It is not just software—it is sacrament.

A symbol of what cannot be corrupted. A mirror of divine order etched into code. A map back to the sacred center.

It reflects what endures. It encodes what cannot be falsified. It remembers what we forgot: that Truth, when aligned with form, becomes Light once again.

Its design is not arbitrary. It speaks the language of life itself—

The elliptic orbits of the planets mirrored in its cryptography,

The logarithmic spiral of the nautilus shell discloses its adoption rate,

The interconnectivity of mycelium in soil reflect the network of nodes in cyberspace,

A webbed breadth of neurons across synaptic space fires with each new confirmed transaction.

It is geometry in devotion. Stillness in motion.

It is the Logos clothed in protocol.

What this key unlocks is beyond external riches. It is the eternal gold within us.

Clarity. Sovereignty. The unshakeable knowing that what is real cannot be taken. That what is sacred was never for sale.

Bitcoin is not the destination.

It is the Path.

And we—when we are willing to see it—are the Temple it leads back to.

-

@ 2ed3596e:98b4cc78

2025-04-24 18:31:53

@ 2ed3596e:98b4cc78

2025-04-24 18:31:53Bitcoiners, your points just got a lot more epic! We’re thrilled to announce the launch of the Bitcoin Well Point Store, available now in Canada and the USA.

Now you can redeem your Bitcoin Well points for prizes that level up and celebrate your Bitcoin lifestyle.

What can you get in store?

Right now, you can exchange your points for:

-

Simply Bitcoin hoodie: Rep your Bitcoin pride in style

-

Exclusive Bitcoin Well Stampseed backup plate: Protect and manage your private keys securely

-

Personalized LeatherMint wallet: Classy, sleek, and ready to hold your fiat (until you convert it to sats!)

-

Tesla Cybertruck in Bitcoin orange: Wait…really? A Cybertruck? Who approved this?

More epic items will be available in the Bitcoin Well Point Store in the coming months. Stay tuned!

How to redeem your Bitcoin Well Points

Redeeming your points is easy:

-

Log in and go the Bitcoin Well Points store within the Rewards Section

-

Check your Bitcoin Well point balance

-

Redeem Your Bitcoin Well points for the prize of your dreams

Once you’ve purchased an item from the Bitcoin Well Point Store, we’ll email you to figure out where you want us to ship your prize. Unless it's the Cybertruck, then you can come to our office and pick it up!

How can you earn more Bitcoin Well Points? ⚡

Here are all the ways you can earn Bitcoin Well points:

-

Buy bitcoin/Sell bitcoin/pay bills - 3 Points per $10

-

Recurring buy - 5 points per $10

-

First transaction bonus - 500 points

-

Refer a friend to Bitcoin Well - 500 points

The more you use Bitcoin Well, the more points you earn, rewarding you for investing in your freedom and self-sovereignty

Want sats, not stuff? No problem! 👇

You can keep earning sats by playing the Bitcoin (Wishing) Well! You can win up to 1,000,000 on your next coin toss. Now you have the exciting choice: do you play the Bitcoin (Wishing) Well or save up your Bitcoin Well points for a sweet prize?

What makes Bitcoin Well different

Bitcoin Well is on a mission to enable independence. We do this by making it easy to self custody bitcoin and embracing the latest bitcoin innovations. By custodying their own money, our customers are free to do as they wish without begging for permission. By creating a full ecosystem to buy, sell and use your bitcoin to connect with the modern financial world, you are able to have your cake and eat it too - or have your bitcoin in self custody and easily spend it too 🎂.

Create your Bitcoin Well account now →

Invest in Bitcoin Well

We are publicly traded (and love it when our customers become shareholders!) and hold ourselves to a high standard of enabling life on a Bitcoin standard. If you want to learn more about Bitcoin Well, please visit our website or reach out!

-

-

@ 0e67f053:cb1d4b93

2025-04-24 16:44:31

@ 0e67f053:cb1d4b93

2025-04-24 16:44:31By Carl Tuckerson, Who Weeps During City Council Meetings

Democracy is not a system.

It is a living, breathing organism, pulsating with the ancestral heartbeat of every barefoot revolutionary who ever composted oppression into community gardens of change.

It is consent manifested, a tapestry woven by the trembling hands of the marginalized and the mildly inconvenienced alike. It is radical accountability on a biodegradable ballot.

Democracy is the collective inhale of a million voices saying, “Yes, I matter,” and the collective exhale of power releasing its grip—not because it was forced to, but because it finally understood its own trauma.

It is fluid, non-binary, and consensually participatory. A polyamorous relationship between people, policy, and purpose. No labels. Just vibes.

It is the sacred act of showing up—in person, in spirit, in ethically sourced linen—because you believe that your voice, no matter how tremulously intersectional, is a note in the symphony of collective liberation.

Democracy is not red or blue. It’s not even purple. It’s the entire spectrum of human expression, from burnt sienna to sunset glitter sparkle.

It is brunch and ballots. It is protest and poetry. It is tweeting while crying while registering your roommate to vote.

It is government of the people, by the people, and for the people, but especially for the people who’ve been gaslit by history.

And when democracy falters, we don’t abolish it—we give it a weighted blanket, whisper affirmations into its ear, and tell it to take the day off, because healing is not linear.

So what is democracy?

It’s not a noun.It’s not even a verb.It’s a sacred energy exchange—and if you listen closely, you can hear it humming in the compost bin behind your community center.

Namaste. Vote. And remember: ballots are spells cast in ink. Use yours wisely.

— Carl, “Decolonize the Vote” Tuckerson

originally posted at https://stacker.news/items/956879

-

@ 40b9c85f:5e61b451

2025-04-24 15:27:02

@ 40b9c85f:5e61b451

2025-04-24 15:27:02Introduction

Data Vending Machines (DVMs) have emerged as a crucial component of the Nostr ecosystem, offering specialized computational services to clients across the network. As defined in NIP-90, DVMs operate on an apparently simple principle: "data in, data out." They provide a marketplace for data processing where users request specific jobs (like text translation, content recommendation, or AI text generation)

While DVMs have gained significant traction, the current specification faces challenges that hinder widespread adoption and consistent implementation. This article explores some ideas on how we can apply the reflection pattern, a well established approach in RPC systems, to address these challenges and improve the DVM ecosystem's clarity, consistency, and usability.

The Current State of DVMs: Challenges and Limitations

The NIP-90 specification provides a broad framework for DVMs, but this flexibility has led to several issues:

1. Inconsistent Implementation

As noted by hzrd149 in "DVMs were a mistake" every DVM implementation tends to expect inputs in slightly different formats, even while ostensibly following the same specification. For example, a translation request DVM might expect an event ID in one particular format, while an LLM service could expect a "prompt" input that's not even specified in NIP-90.

2. Fragmented Specifications

The DVM specification reserves a range of event kinds (5000-6000), each meant for different types of computational jobs. While creating sub-specifications for each job type is being explored as a possible solution for clarity, in a decentralized and permissionless landscape like Nostr, relying solely on specification enforcement won't be effective for creating a healthy ecosystem. A more comprehensible approach is needed that works with, rather than against, the open nature of the protocol.

3. Ambiguous API Interfaces

There's no standardized way for clients to discover what parameters a specific DVM accepts, which are required versus optional, or what output format to expect. This creates uncertainty and forces developers to rely on documentation outside the protocol itself, if such documentation exists at all.

The Reflection Pattern: A Solution from RPC Systems

The reflection pattern in RPC systems offers a compelling solution to many of these challenges. At its core, reflection enables servers to provide metadata about their available services, methods, and data types at runtime, allowing clients to dynamically discover and interact with the server's API.

In established RPC frameworks like gRPC, reflection serves as a self-describing mechanism where services expose their interface definitions and requirements. In MCP reflection is used to expose the capabilities of the server, such as tools, resources, and prompts. Clients can learn about available capabilities without prior knowledge, and systems can adapt to changes without requiring rebuilds or redeployments. This standardized introspection creates a unified way to query service metadata, making tools like

grpcurlpossible without requiring precompiled stubs.How Reflection Could Transform the DVM Specification

By incorporating reflection principles into the DVM specification, we could create a more coherent and predictable ecosystem. DVMs already implement some sort of reflection through the use of 'nip90params', which allow clients to discover some parameters, constraints, and features of the DVMs, such as whether they accept encryption, nutzaps, etc. However, this approach could be expanded to provide more comprehensive self-description capabilities.

1. Defined Lifecycle Phases

Similar to the Model Context Protocol (MCP), DVMs could benefit from a clear lifecycle consisting of an initialization phase and an operation phase. During initialization, the client and DVM would negotiate capabilities and exchange metadata, with the DVM providing a JSON schema containing its input requirements. nip-89 (or other) announcements can be used to bootstrap the discovery and negotiation process by providing the input schema directly. Then, during the operation phase, the client would interact with the DVM according to the negotiated schema and parameters.

2. Schema-Based Interactions

Rather than relying on rigid specifications for each job type, DVMs could self-advertise their schemas. This would allow clients to understand which parameters are required versus optional, what type validation should occur for inputs, what output formats to expect, and what payment flows are supported. By internalizing the input schema of the DVMs they wish to consume, clients gain clarity on how to interact effectively.

3. Capability Negotiation

Capability negotiation would enable DVMs to advertise their supported features, such as encryption methods, payment options, or specialized functionalities. This would allow clients to adjust their interaction approach based on the specific capabilities of each DVM they encounter.

Implementation Approach

While building DVMCP, I realized that the RPC reflection pattern used there could be beneficial for constructing DVMs in general. Since DVMs already follow an RPC style for their operation, and reflection is a natural extension of this approach, it could significantly enhance and clarify the DVM specification.

A reflection enhanced DVM protocol could work as follows: 1. Discovery: Clients discover DVMs through existing NIP-89 application handlers, input schemas could also be advertised in nip-89 announcements, making the second step unnecessary. 2. Schema Request: Clients request the DVM's input schema for the specific job type they're interested in 3. Validation: Clients validate their request against the provided schema before submission 4. Operation: The job proceeds through the standard NIP-90 flow, but with clearer expectations on both sides

Parallels with Other Protocols

This approach has proven successful in other contexts. The Model Context Protocol (MCP) implements a similar lifecycle with capability negotiation during initialization, allowing any client to communicate with any server as long as they adhere to the base protocol. MCP and DVM protocols share fundamental similarities, both aim to expose and consume computational resources through a JSON-RPC-like interface, albeit with specific differences.

gRPC's reflection service similarly allows clients to discover service definitions at runtime, enabling generic tools to work with any gRPC service without prior knowledge. In the REST API world, OpenAPI/Swagger specifications document interfaces in a way that makes them discoverable and testable.

DVMs would benefit from adopting these patterns while maintaining the decentralized, permissionless nature of Nostr.

Conclusion

I am not attempting to rewrite the DVM specification; rather, explore some ideas that could help the ecosystem improve incrementally, reducing fragmentation and making the ecosystem more comprehensible. By allowing DVMs to self describe their interfaces, we could maintain the flexibility that makes Nostr powerful while providing the structure needed for interoperability.

For developers building DVM clients or libraries, this approach would simplify consumption by providing clear expectations about inputs and outputs. For DVM operators, it would establish a standard way to communicate their service's requirements without relying on external documentation.

I am currently developing DVMCP following these patterns. Of course, DVMs and MCP servers have different details; MCP includes capabilities such as tools, resources, and prompts on the server side, as well as 'roots' and 'sampling' on the client side, creating a bidirectional way to consume capabilities. In contrast, DVMs typically function similarly to MCP tools, where you call a DVM with an input and receive an output, with each job type representing a different categorization of the work performed.

Without further ado, I hope this article has provided some insight into the potential benefits of applying the reflection pattern to the DVM specification.

-

@ f32184ee:6d1c17bf

2025-04-23 13:21:52

@ f32184ee:6d1c17bf

2025-04-23 13:21:52Ads Fueling Freedom

Ross Ulbricht’s "Decentralize Social Media" painted a picture of a user-centric, decentralized future that transcended the limitations of platforms like the tech giants of today. Though focused on social media, his concept provided a blueprint for decentralized content systems writ large. The PROMO Protocol, designed by NextBlock while participating in Sovereign Engineering, embodies this blueprint in the realm of advertising, leveraging Nostr and Bitcoin’s Lightning Network to give individuals control, foster a multi-provider ecosystem, and ensure secure value exchange. In this way, Ulbricht’s 2021 vision can be seen as a prescient prediction of the PROMO Protocol’s structure. This is a testament to the enduring power of his ideas, now finding form in NextBlock’s innovative approach.

[Current Platform-Centric Paradigm, source: Ross Ulbricht's Decentralize Social Media]

[Current Platform-Centric Paradigm, source: Ross Ulbricht's Decentralize Social Media]Ulbricht’s Vision: A Decentralized Social Protocol

In his 2021 Medium article Ulbricht proposed a revolutionary vision for a decentralized social protocol (DSP) to address the inherent flaws of centralized social media platforms, such as privacy violations and inconsistent content moderation. Writing from prison, Ulbricht argued that decentralization could empower users by giving them control over their own content and the value they create, while replacing single, monolithic platforms with a competitive ecosystem of interface providers, content servers, and advertisers. Though his focus was on social media, Ulbricht’s ideas laid a conceptual foundation that strikingly predicts the structure of NextBlock’s PROMO Protocol, a decentralized advertising system built on the Nostr protocol.

[A Decentralized Social Protocol (DSP), source: Ross Ulbricht's Decentralize Social Media]

[A Decentralized Social Protocol (DSP), source: Ross Ulbricht's Decentralize Social Media]Ulbricht’s Principles

Ulbricht’s article outlines several key principles for his DSP: * User Control: Users should own their content and dictate how their data and creations generate value, rather than being subject to the whims of centralized corporations. * Decentralized Infrastructure: Instead of a single platform, multiple interface providers, content hosts, and advertisers interoperate, fostering competition and resilience. * Privacy and Autonomy: Decentralized solutions for profile management, hosting, and interactions would protect user privacy and reduce reliance on unaccountable intermediaries. * Value Creation: Users, not platforms, should capture the economic benefits of their contributions, supported by decentralized mechanisms for transactions.

These ideas were forward-thinking in 2021, envisioning a shift away from the centralized giants dominating social media at the time. While Ulbricht didn’t specifically address advertising protocols, his framework for decentralization and user empowerment extends naturally to other domains, like NextBlock’s open-source offering: the PROMO Protocol.

NextBlock’s Implementation of PROMO Protocol

The PROMO Protocol powers NextBlock's Billboard app, a decentralized advertising protocol built on Nostr, a simple, open protocol for decentralized communication. The PROMO Protocol reimagines advertising by: * Empowering People: Individuals set their own ad prices (e.g., 500 sats/minute), giving them direct control over how their attention or space is monetized. * Marketplace Dynamics: Advertisers set budgets and maximum bids, competing within a decentralized system where a 20% service fee ensures operational sustainability. * Open-Source Flexibility: As an open-source protocol, it allows multiple developers to create interfaces or apps on top of it, avoiding the single-platform bottleneck Ulbricht critiqued. * Secure Payments: Using Strike Integration with Bitcoin Lightning Network, NextBlock enables bot-resistant and intermediary-free transactions, aligning value transfer with each person's control.

This structure decentralizes advertising in a way that mirrors Ulbricht’s broader vision for social systems, with aligned principles showing a specific use case: monetizing attention on Nostr.

Aligned Principles

Ulbricht’s 2021 article didn’t explicitly predict the PROMO Protocol, but its foundational concepts align remarkably well with NextBlock's implementation the protocol’s design: * Autonomy Over Value: Ulbricht argued that users should control their content and its economic benefits. In the PROMO Protocol, people dictate ad pricing, directly capturing the value of their participation. Whether it’s their time, influence, or digital space, rather than ceding it to a centralized ad network. * Ecosystem of Providers: Ulbricht envisioned multiple providers replacing a single platform. The PROMO Protocol’s open-source nature invites a similar diversity: anyone can build interfaces or tools on top of it, creating a competitive, decentralized advertising ecosystem rather than a walled garden. * Decentralized Transactions: Ulbricht’s DSP implied decentralized mechanisms for value exchange. NextBlock delivers this through the Bitcoin Lightning Network, ensuring that payments for ads are secure, instantaneous and final, a practical realization of Ulbricht’s call for user-controlled value flows. * Privacy and Control: While Ulbricht emphasized privacy in social interactions, the PROMO Protocol is public by default. Individuals are fully aware of all data that they generate since all Nostr messages are signed. All participants interact directly via Nostr.

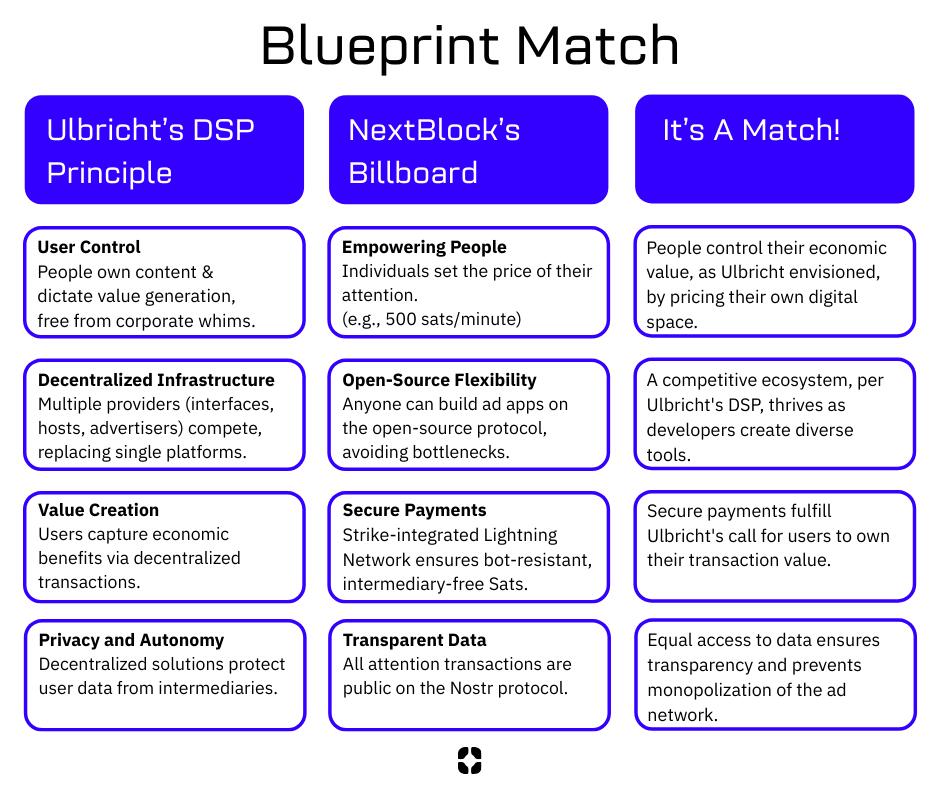

[Blueprint Match, source NextBlock]

[Blueprint Match, source NextBlock]

Who We Are

NextBlock is a US-based new media company reimagining digital ads for a decentralized future. Our founders, software and strategy experts, were hobbyist podcasters struggling to promote their work online without gaming the system. That sparked an idea: using new tech like Nostr and Bitcoin to build a decentralized attention market for people who value control and businesses seeking real connections.

Our first product, Billboard, is launching this June.

Open for All

Our model’s open-source! Check out the PROMO Protocol, built for promotion and attention trading. Anyone can join this decentralized ad network. Run your own billboard or use ours. This is a growing ecosystem for a new ad economy.

Our Vision

NextBlock wants to help build a new decentralized internet. Our revolutionary and transparent business model will bring honest revenue to companies hosting valuable digital spaces. Together, we will discover what our attention is really worth.

Read our Manifesto to learn more.

NextBlock is registered in Texas, USA.

-

@ 7ef5f1b1:0e0fcd27

2025-04-22 17:26:44

@ 7ef5f1b1:0e0fcd27

2025-04-22 17:26:44A monthly newsletter by The 256 Foundation

April 2025

Introduction:

Welcome to the fourth newsletter produced by The 256 Foundation! March was an action-packed month with events ranging from the announcement of TSMC investing in US fabs to four solo block finds. Dive in to catch up on the latest news, mining industry developments, progress updates on grant projects, Actionable Advice on updating a Futurebit Apollo I to the latest firmware, and the current state of the Bitcoin network.

[IMG-001] Variation of the “I’m the captain now” meme by @maxisclub

Definitions:

MA = Moving Average

Eh/s = Exahash per second

Ph/s = Petahash per second

Th/s = Terahash per second

T = Trillion

J/Th = Joules per Terahash

$ = US Dollar

OS = Operating System

SSD = Solid State Drive

TB = Terabyte

News:

March 3, Ashigaru releases v1.1.1. Notable because this fork of Samourai Wallet serves as the remaining choice of mobile Bitcoin wallet capable of making peer to peer collaborative transactions. Not the Whirlpool transactions that Samourai Wallet was well-known for but the Stowaway and StonewallX2 p2p CoinJoin transactions. The persistence of Samourai’s tools still working despite the full force of the State coming down on the developers is a testament to the power of open-source code.

March 3, Stronghold completes cleanup of decommissioned coal plant using Bitcoin miners. Stronghold’s initiative counters the narrative that Bitcoin mining is wasteful by removing 150,000 tons of coal waste, part of a broader effort that cleared 240,000 tons in Q2 2024 alone. Waste coal piles in Pennsylvania, like the one in Russellton, have scarred landscapes, making this reclamation a significant step for local ecosystems. The project aligns with growing efforts in the region, as The Nature Conservancy also leads restoration projects in Pennsylvania to revive forests and waters. Stronghold’s dual-use model—powering Bitcoin miners and supplying the grid—shows how Bitcoin mining can support environmental goals while remaining economically viable.

March 3, five TSMC semiconductor fabs coming to Arizona. TSMC’s $100 billion investment in Arizona reflects a strategic push to bolster U.S. semiconductor production amid global supply chain vulnerabilities and geopolitical tensions, particularly with West Taiwan’s claims over Taiwan. TSMC’s existing $65 billion investment in Phoenix, now totaling $165 billion, aims to create 40,000 construction jobs and tens of thousands of high-tech roles over the next decade. This could relieve bottlenecks in ASIC chip supply if Bitcoin mining chip designers can get access to the limited foundry space. If that is the case, this could help alleviate some centralization concerns as it relates to a majority of Bitcoin mining chips coming from Taiwan and West Taiwan.

March 10, Block #887212 solved by a Bitaxe Ultra with ~491Gh/s. Not only did the Bitaxe satisfy the network difficulty, which was 112.15T, but obliterated it with a whopping 719.9T difficulty. This Block marked the second one solved by a Bitaxe and an increasing number of solo block finds overall as more individuals choose to play the Bitcoin lottery with their hashrate.

March 12, Pirate Bay co-founder, Carl Lundström, killed in plane crash. The Pirate Bay, launched in 2003, revolutionized online file-sharing by popularizing BitTorrent technology, enabling millions to access music, movies, and software, often in defiance of legal systems, which led to Lundström’s 2009 conviction for copyright infringement. The timing of his death coincides with ongoing global debates over digital ownership and intellectual property, often echoing many of the same themes in open-source technology, underscoring the enduring impact of The Pirate Bay’s challenge to traditional media distribution models.

March 18, Samourai Wallet status conference update. This was a short meeting in which the dates for the remaining pre-trial hearings was discussed.

- May 9, Opening Motion. - June 6, prosecution response to the opening motion. - June 20, defense replies to the prosecution response. - July 15, prosecution provides expert disclosure - August 8, defense provides expert disclosure - Tdev is able to remain home during the remaining pre-trial hearings so that he doesn’t have to incur the expenses traveling back and forth between Europe and the USDespite seemingly positive shifts in crypto-related policies from the Trump administration, all signs point to the prosecution still moving full steam ahead in this case. The defense teams need to be prepared and they could use all the financial help they can get. If you feel compelled to support the legal defense fund, please do so here. If the DOJ wins this case, all Bitcoiners lose.

March 18, DEMAND POOL launches, transitioning out of stealth mode and making room for applicants to join the private waiting list to be one of the Founding Miners.

Key features of DEMAND Pool include: • Build your own blocks • SLICE payment system & new mempool algorithm • No more empty blocks • End-to-end encryption for protection • Efficient data transfer, less wasted hashrate • Lower costs on CPU, bandwidth, & time

DEMAND Pool implements Stratum v2 so that miners can generate their own block templates, entering the arena of pools trying to decentralize mining such as OCEAN with their alternative to Stratum v2 called DATUM. A benefit of the Stratum v2 protocol over Stratum v1 is that data sent between the miner and the pool is now encrypted whereas before it was sent in clear-text, the encryption helps with network level privacy so that for example, your Internet Service Provider cannot read what is in the data being passed back and forth. Although, unless there is a proxy between your miner and the pool then the ISP may be able to determine that you are sending data to a mining pool, they just wouldn’t be able to tell what’s in that data. Overall, decentralization has become a buzz word lately and while it is a step in the right direction that more pools are enabling miners to decide which transactions are included in the block templates they work on, the pools remain a centralized force that ultimately can reject templates based on a number of reasons.

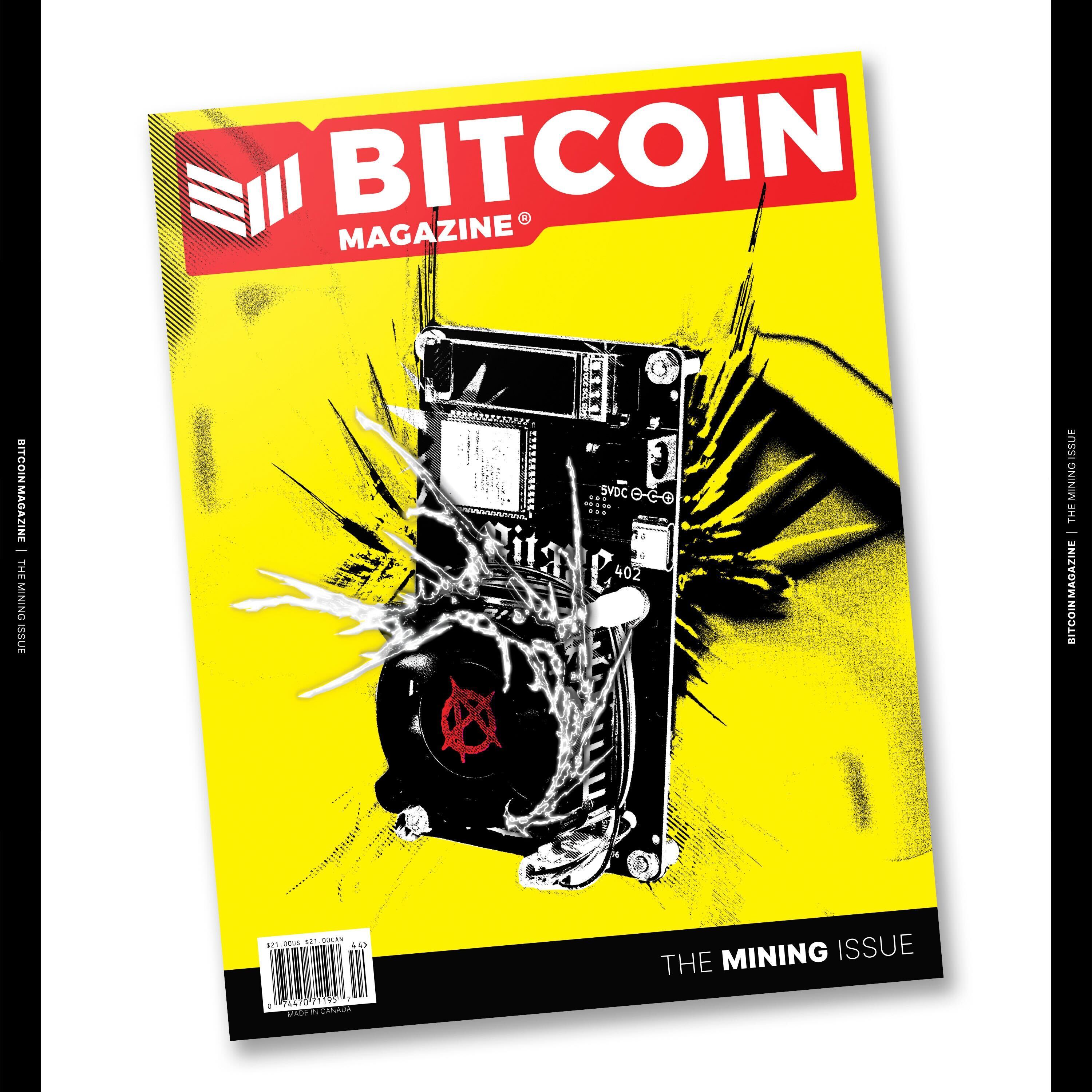

March 20, Bitaxe makes the cover of Bitcoin Magazine’s The Mining Issue, solidifying the Bitaxe as a pop-culture icon. Even those who disregard the significance of the Bitaxe project must recognize that the project’s popularity is an indication that something big is developing here.

[IMG-002] Bitcoin Magazine, The Mining Issue

[IMG-002] Bitcoin Magazine, The Mining IssueMarch 21, self-hosted solo miner solves block #888737 with a Futurebit Apollo, making this the third solo block find for Futurebit. The first Futurebit Apollo block find may have been a fluke, the second a coincidence, but the third is an indication of a pattern forming here. More hashrate is being controlled by individuals who are constructing their own blocks and this trend will accelerate as time goes on and deploying these devices becomes easier and less expensive. This was the second solo block found in March.

March 21, US Treasury Department lifts sanctions on Tornado Cash. This is a positive sign coming from the US Treasury, however the charges against the Tornado Cash developer, Roman Storm, still stand and his legal defense team is still fighting an uphill battle. Even though the US Treasury removed Tornado Cash from the OFAC list, the department is attempting to stop a Texas court from granting a motion that would ensure the Treasury can’t put Tornado Cash back on the OFAC list. Meanwhile, the other Tornado Cash developer, Alex Pertsev, is fighting his appeal battle in the Dutch courts.

March 22, Self-hosted Public Pool user mines Block #888989. This was the first block mined with the Public Pool software, which is open-source and available for anyone to host themselves, in this case hosted on the user’s Umbrel. If you read the January issue of The 256 Foundation newsletter, there are detailed instructions for hosting your own instance of Public Pool on a Raspberry Pi. Easier solutions exist and accomplish the same thing such as Umbrel and Start9. This was the third solo block mined in March.

March 26, DeFi Education Fund publishes coalition letter urging congress to correct the DOJ’s dangerous misinterpretation of money transmission laws. In their own words: “First seen in Aug 2023 via the criminal indictment of @rstormsf, the DOJ’s novel legal theory expands criminal liability to software developers, ignoring longstanding FinCEN guidance and threatening the entire U.S. blockchain & digital asset ecosystem”. Many familiar organizations in the industry signed the letter, such as Coinbase, Kraken, A16z Crypto, and Ledger. Sadly, no Bitcoin companies signed the letter, highlighting the reckless ignorance prevalent among the “toxic Bitcoin maximalists” who often pride themselves on their narrow focus; a focus which is proving to be more of a blind spot limiting their ability to recognize a clear and present threat. The full letter text can be found here.

March 28, Heatbit reveals the black Heatbit, an elegant space heater that mines Bitcoin. Heat re-use applications such as Bitcoin mining space heaters are one of many examples where energy spent on generating heat can also earn the user sats. Other popular solutions include heating hot tubs, hotels, drive ways, and more. The innovations in this area will continue to be unlocked as open-source solutions like the ones being developed at The 256 Foundation are released and innovators gain more control over their applications.

March 29, miner with 2.5Ph/s solves Block #889975 with Solo CK Pool, marking the fourth solo block found in the month of March. This was the first solo block found on CK Pool’s European server. This was a good way to finish the month on a strong note for small-scale miners.

Free & Open Mining Industry Developments:

The development will not stop until Bitcoin mining is free and open. Innovators didn’t let off the gas in March, here are eleven note-worthy events:

0) @BTC_Grid demonstrates heating a new residential build with Bitcoin miners. This custom build features 6,000 square feet of radiant floors, 1,500 sqft of snow melting slab, 2 heated pools, all powered by Bitcoin miners and fully automated. Innovations and efficient systems like this will become more common as Bitcoin mining hardware and firmware solutions become open-source

1) @DrydeGab shares The Ocho, a Bitaxe Nerd Octaxe open-source Bitcoin miner featuring 8x BM1370 ASICs that performs at 9-10Th/s consuming ~180W. The Ocho runs on it’s own custom AxeOS. Currently out of stock but generally available for purchase in the IX Tech store.

[IMG-003] The Nerd OCTAXE Ocho by @DrydeGab

[IMG-003] The Nerd OCTAXE Ocho by @DrydeGab2) @incognitojohn23 demonstrates building a Bitaxe from scratch with no prior experience, proving that anyone can access this technology with a little determination and the right community. @incognitojohn23 has also uploaded several videos documenting his progress and lessons along the way. Every builder has their first day, don’t hold back if you feel compelled to jump in and get started.

3) @HodlRev demonstrating how he combines Bitcoin mining with maple syrup production. In fact, @HodlRev has integrated Bitcoin mining into several aspects of his homestead. Be sure to follow his content for an endless stream of resourceful ideas. Once open-source Bitcoin mining firmware and hardware solutions become widely available, innovators like @HodlRev will have more control over every parameter of these unique applications.

4) ATL Bitlab announces their first hackathon, running June 7 through July 6. Promoted as “A global hackathon focused on all things bitcoin mining”. If you are interested in joining the hackathon, there is a Google form you can fill out here. It will be interesting to see what innovations come from this effort.

5) @100AcresRanch builds touchscreen dashboard for Bitaxe and Loki Boards. With this, you can control up to 10 mining devices with the ability to instantly switch any of the presets without going into the mining device UI.

[IMG-004] Decentral Command Dashboard by @100AcresRanch

[IMG-004] Decentral Command Dashboard by @100AcresRanch6) @IxTechCrypto reveals HAXE, the newest member of the Nerdaxe miner family. HAXE is a 6 ASIC miner performing at ~7.4 Th/s at ~118W. Upon looking at the IX Tech store, it seems as though the HAXE has not hit shelves yet but keep an eye out for announcements soon.

7) Solo Satoshi reveals the NerdQaxe++, the latest marvel in the world of open-source Bitcoin mining solutions. This device is equipped with four ASIC chips from the Antminer S21 Pro and boasts an efficiency rating of 15.8 J/Th. At the advertised power consumption of 76 Watts, that would produce nearly 5 Th/s. Currently out of stock at the Solo Satoshi store and the IX Tech store but in stock and available at the PlebSource store.

8) @TheSoloMiningCo shares a bolt-on voltage regulator heatsink for the Bitaxe, this is a helpful modification when overclocking your miner and helps dissipate heat away from the voltage regulator. Many innovators are discovering ways to get every bit of efficiency they can from their hardware and sharing their ideas with the wider community for anyone to adopt.

9) @boerst adds historical data to stratum.work, a public website that monitors mining pool activity through calling for the work templates being generated for the pool’s respective miners. By parsing the information available in the work templates, a number of interesting observations can be made like which pools are merely proxies for larger pools, timing analysis of when templates are sent out, and now historical data on what the state of each pool’s templates were at a given block height. The work Boerst is doing with this website provides a great tool for gaining insights into mining centralization.

10) Braiins open-sources the BCB100 Control Board, designed to work with Antminers, this control board project has two parts: the hardware and the software. For the hardware part, open files include the Bill Of Materials, schematics, Gerbers, and CAD files. For the software part, open files include the board-level OpenWrt-based firmware with the full configuration file and the Nix environment for reproducible builds. The mining firmware binaries for bosminer and boser (same as the official Braiins OS releases) are also available to download and use to compile the image for the control board, however the Braiins OS firmware itself is not included in this open-source bundle. Braiins chose the GPLv3 open-source license for the software and the CERN-OHL-S open-source license for the hardware. This is a great gesture by Braiins and helps validate the efforts of The 256 Foundation to make Bitcoin mining free and open. The Braiins GitHub repositories where all this information can be found are accessible here and here. The 256 Foundation has plans to develop a Mujina firmware that can be flashed onto the BCB100 helping target Antminer machines.

Grant Project Updates:

In March, The 256 Foundation formalized agreements with the lead developers who were selected for each project. These agreements clearly defined the scope of each project, identified the deliverables, set a timeline, and agreement on compensation was made. Below are the outlines for each project, the compensation is not made public for privacy and security reasons.

Ember One:

@skot9000 instigator of the Bitaxe and all around legend for being the first mover in open-source Bitcoin mining solutions is the lead engineer for the Ember One project. This was the first fully funded grant from The 256 Foundation and commenced in November 2024 with a six month duration. The deliverable is a validated design for a ~100W miner with a standardized form factor (128mm x 128mm), USB-C data connection, 12-24v input voltage, with plans for several versions – each with a different ASIC chip. The First Ember One features the Bitmain BM1362 ASIC, next on the list will be an Ember One with the Intel BZM2 ASIC, then an Auradine ASIC version, and eventually a Block ASIC version. Learn more at: https://emberone.org/

Mujina Mining Firmware:

@ryankuester, embedded Linux developer and Electrical Engineer who has mastered the intersection of hardware and software over the last 20 years is the lead developer for the Mujina project, a Linux based mining firmware application with support for multiple drivers so it can be used with Ember One complete mining system. The grant starts on April 5, 2025 and continues for nine months. Deliverables include:

Core Mujina-miner Application: - Fully open-source under GPLv3 license - Written in Rust for performance, robustness, and maintainability, leveraging Rust's growing adoption in the Bitcoin ecosystem - Designed for modularity and extensibility - Stratum V1 client (which includes DATUM compatibility) - Best effort for Stratum V2 client in the initial release but may not happen until later

Hardware Support:

- Support for Ember One 00 hash boards (Bitmain chips) - Support for Ember One 01 hash boards (Intel chips) on a best effort basis but may not happen until later - Full support on the Raspberry Pi CM5 and IO board running the Raspberry Pi OS - Support for the Libre board when released - Best-effort compatibility with other hardware running LinuxManagement Interfaces:

• HTTP API for remote management and monitoring • Command-line interface for direct control • Basic web dashboard for status monitoring • Configuration via structured text files • Community Building and Infrastructure • GitHub project organization and workflow • Continuous integration and testing framework • Comprehensive user and developer documentation • Communication channels for users and developers • Community building through writing, podcasts, and conference participationThe initial release of Mujina is being built in such a way that it supports long-term goals like ultimately evolving into a complete Linux-based operating system, deployable through simple flashing procedures. Initially focused on supporting the 256 Foundation's Libre control boards and Ember hash boards, Mujina's modular architecture will eventually enable compatibility with a wide variety of mining hardware from different manufacturers. Lean more at: https://mujina.org/

Libre Board:

@Schnitzel, heat re-use maximalist who turned his home's hot water accessories into Bitcoin-powered sats generators and during the day has built a successful business with a background in product management, is the lead engineer on the Libre Board project; the control board for the Ember One complete mining system. Start date is April 5, 2025 and the deliverables after six months will be a mining control board based on the Raspberry Pi Compute Module I/O Board with at least the following connections:

• USB hub integration (maybe 10 ports?) • Support for fan connections • NVME expansion • Two 100-pin connectors for the compute module • Ethernet port • HDMI port • Raspberrypi 40-pin header for sensors, switches, & relays etc. • MIPI port for touchscreen • Accepts 12-24 VDC input power voltage.The initial release of Libre Board is being built in such a way that it supports long-term goals like alternative compute modules such as ARM, x86, and RISC-V. Learn more at: https://libreboard.org/

Hydra Pool:

@jungly, distributed systems PhD and the lead developer behind P2Pool v2 and formerly for Braidpool, now takes the reigns as lead developer for Hydra Pool, the stratum server package that will run on the Ember One mining system. Start date for this project was on April 5, 2025 and the duration lasts for six months. Deliverables include:

• Talks to bitcoind and provides stratum work to users and stores received shares • Scalable and robust database support to save received shares • Run share accounting on the stored shares • Implement payment mechanisms to pay out miners based on the share accounting • Provide two operation modes: Solo mining and PPLNS or Tides based payout mechanism, with payouts from coinbase only. (All other payout mechanism are out of scope of this initial release for now but there will be more). • Rolling upgrades: Tools and scripts to upgrade server with zero downtime. • Dashboard: Pool stats view only dashboard with support to filter miner payout addresses. • Documentation: Setup and other help pages, as required.The initial release of Hydra Pool is being built in such a way that it supports long-term goals like alternative payout models such as echash, communicating with other Hydra Pool instances, local store of shares for Ember One, and a user-friendly interface that puts controls at the user's fingertips, and supports the ability for upstream pool proxying. Learn More at: https://hydrapool.org/

Block Watcher:

Initially scoped to be a Bitcoin mining insights application built to run on the Ember One mining system using the self-hosted node for blockchain data. However, The 256 Foundation has decided to pause Block Watcher development for a number of reasons. Primarily because the other four projects were more central to the foundation’s mission and given the early stages of the Foundation with the current support level, it made more sense to deploy capital where it counts most.

Actionable Advice:

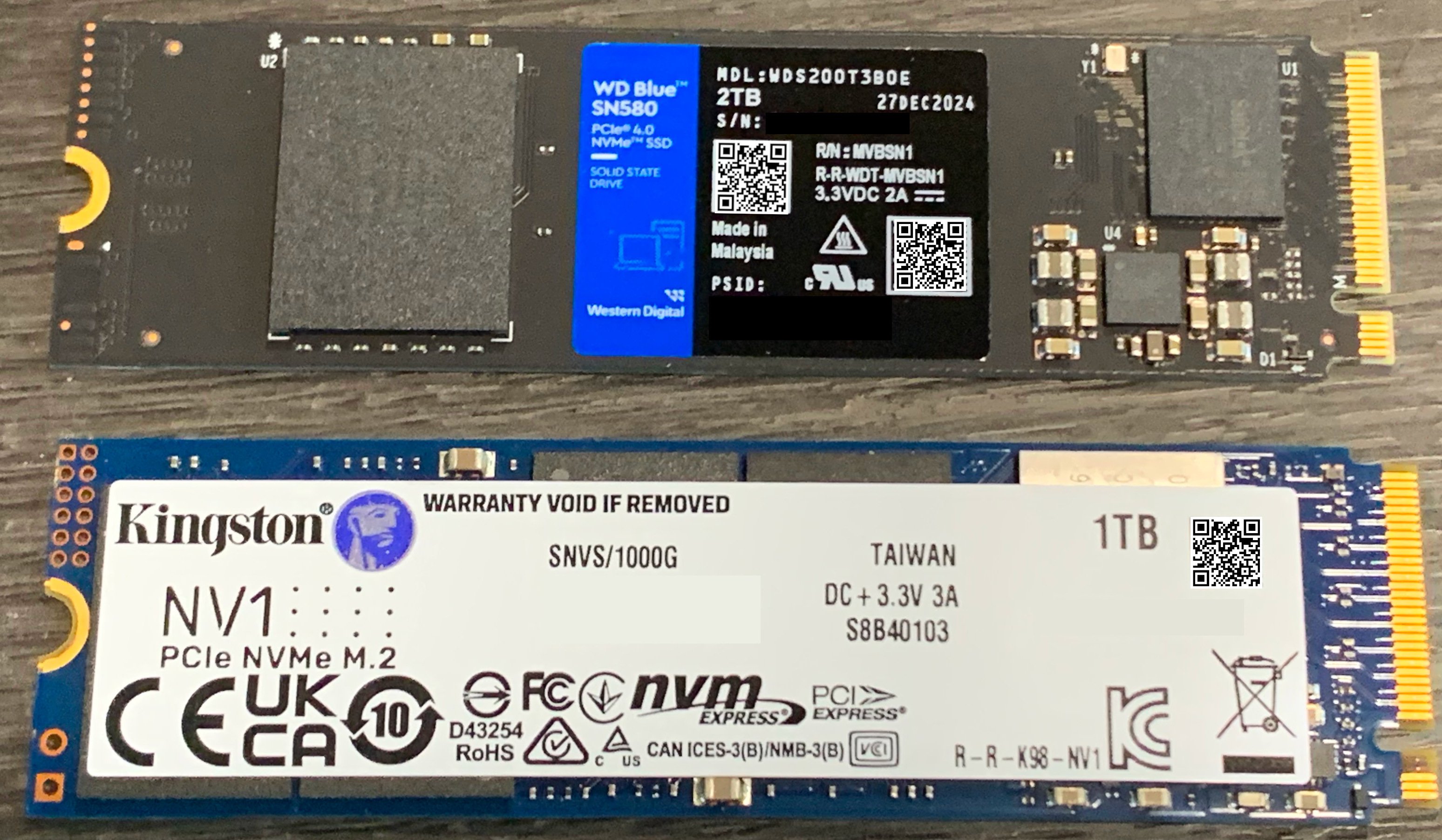

This month’s Actionable Advice column explains the process for upgrading the Futurebit Apollo I OS to the newer Apollo II OS and replacing the SSD. The Futurebit Apollo is a small mining device with an integrated Bitcoin node designed as a plug-and-play solution for people interested in mining Bitcoin without all the noise and heat of the larger industrial-grade miners. The Apollo I can hash between 2 – 4 Th/s and will consume roughly 125 – 200 Watts. The Apollo II can hash between 8 – 10 Th/s and will consume roughly 280 – 400 Watts. The motivation behind upgrading from the Apollo I OS to the Apollo II OS is the ability to run a stratum server internally so that the mining part of the device can ask the node part of the device for mining work, thus enabling users to solo mine in a self-hosted fashion. In fact, this is exactly what The 256 Foundation did during the Telehash fundraising event where Block #881423 was solo mined, at one point there was more than 1 Eh/s of hashrate pointed to that Apollo.

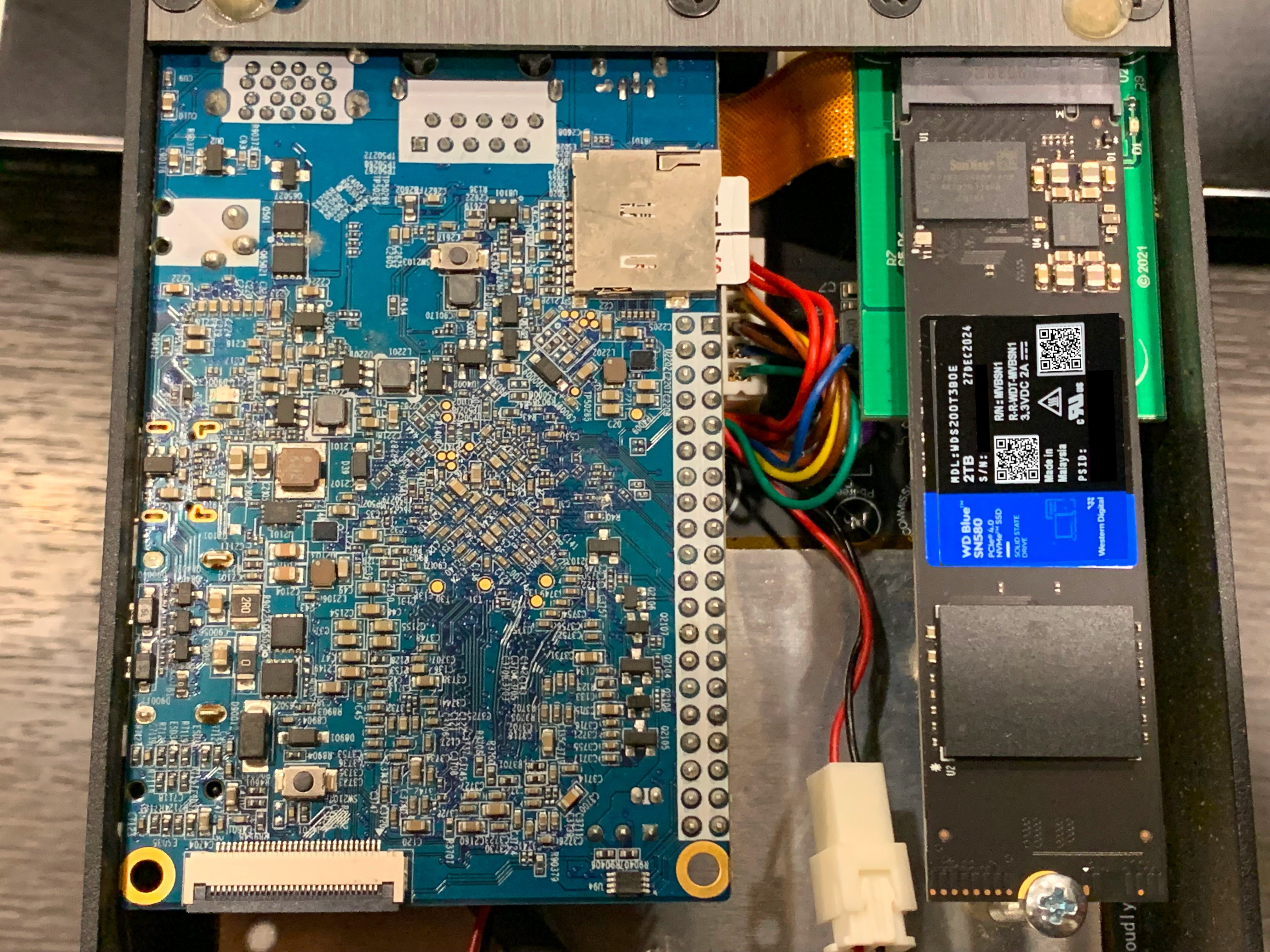

[IMG-005] Futurebit Apollo I with new NVME SSD

[IMG-005] Futurebit Apollo I with new NVME SSDYou can find the complete flashing instructions on the Futurebit website here. You will need a separate computer to complete the flashing procedure. The flashing procedure will erase all data on the microSD card so back it up if you have anything valuable saved on there.

First navigate to the Futurebit GitHub Releases page at: https://github.com/jstefanop/apolloapi-v2/releases

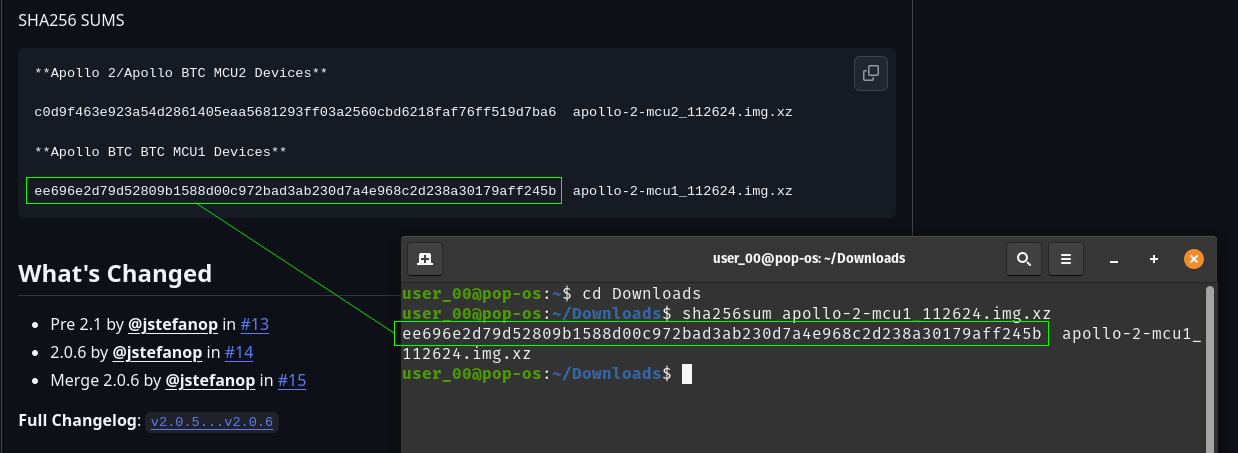

Once there, you will see two OS images available for download, along with two links to alternative hosting options for those two images. If you are upgrading an Apollo I, you need to figure out which new OS image is right for your device, the MCU 1 image or the MCU 2 image. There are detailed instructions on figuring this out available here. There are multiple ways to determine if you need the MCU 1 or MCU 2 image. If the second to last digit in your Futurebit Apollo I is between 4 – 8 then you have an MCU 1; or if your batch number is 1 – 3 then you have an MCU 1; or if the circuit board has a 40-pin connector running perpendicular to the microSD card slot then you have an MCU 1. Otherwise, you have an MCU 2.

For example, this is what the MCU 1 circuit board will look like:

[IMG-006] Futurebit MCU1 example

[IMG-006] Futurebit MCU1 exampleOnce you figure out which OS image you need, go ahead and download it. The SHA256 hash values for the OS Image files are presented in the GitHub repo. If you’re running Linux on your computer, you can change directory to your Download folder and run the following command to check the SHA256 hash value of the file you downloaded and compare that to the SHA256 hash values on GitHub.

[IMG-007] Verifying Futurebit OS Image Hash Value

[IMG-007] Verifying Futurebit OS Image Hash ValueWith the hash value confirmed, you can use a program like Balena Etcher to flash your microSD card. First remove the microSD card from the Apollo circuit board by pushing it inward, it should make a small click and then spring outward so that you can grab it and remove it from the slot.

Connect the microSD card to your computer with the appropriate adapter.

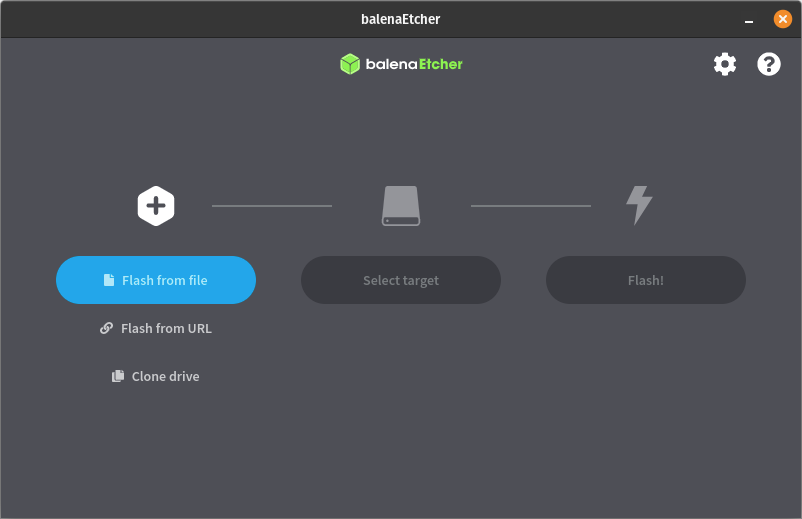

Open Balena Etcher and click on the “Flash From File” button to define the file path to where you have the OS image saved:

[IMG-008] Balena Etcher user interface

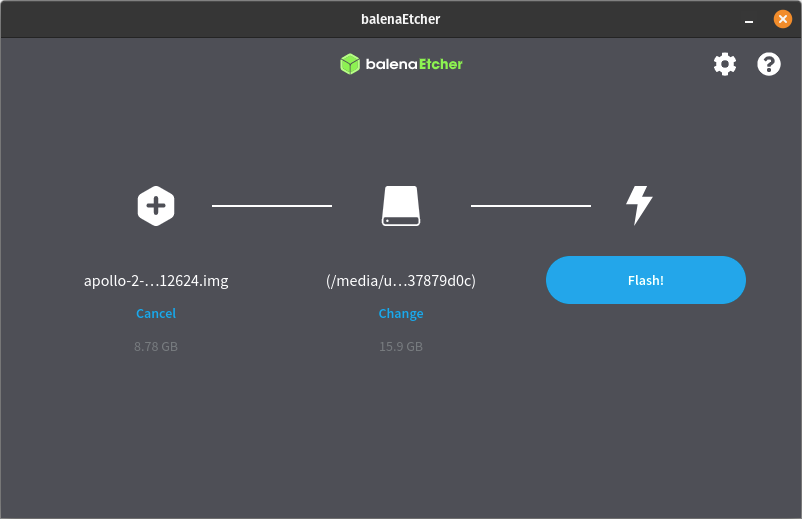

[IMG-008] Balena Etcher user interfaceThen click on the “Select Target” button to define the drive which you will be flashing. Select the microSD card and be sure not to select any other drive on your computer by mistake:

[IMG-009] Balena Etcher user interface

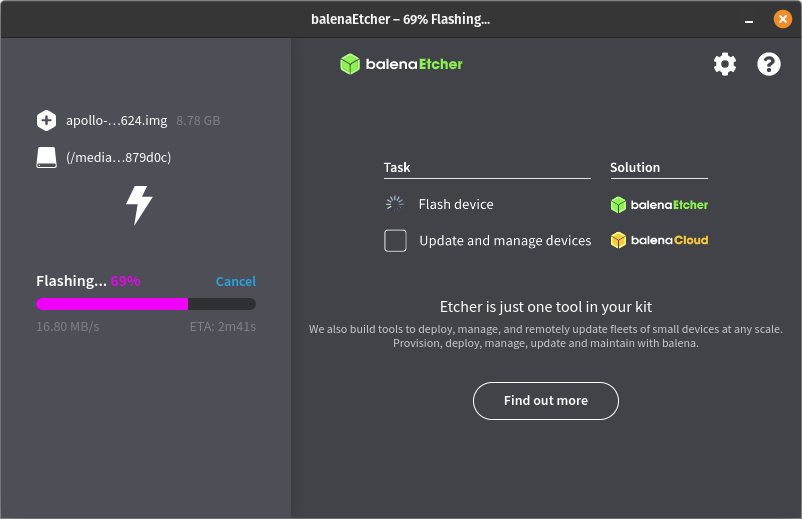

[IMG-009] Balena Etcher user interfaceThen click on the “Flash” button and Balena Etcher will take care of formatting the microSD card, decompressing the OS image file, and flashing it to the microSD card.

[IMG-010] Balena Etcher user interface.

[IMG-010] Balena Etcher user interface.The flashing process can take some time so be patient. The Balena Etcher interface will allow you to monitor the progress.

[IMG-011] Balena Etcher user interface.

[IMG-011] Balena Etcher user interface.Once the flashing process is completed successfully, you will receive a notice in the balena Etcher interface that looks like this:

[IMG-012] Balena Etcher user interface.

[IMG-012] Balena Etcher user interface.You can remove the microSD card from your computer now and install it back into the Futurebit Apollo. If you have an adequately sized SSD then your block chain data should be safe as that is where it resides, not on the microSD card. If you have a 1TB SSD then this would be a good time to consider upgrading to a 2TB SSD instead. There are lots of options but you want to get an NVME style one like this:

[IMG-013] 1TB vs. 2TB NVME SSD

[IMG-013] 1TB vs. 2TB NVME SSDSimply loosen the screw holding the SSD in place and then remove the old SSD by pulling it out of the socket. Then insert the new one and put the screw back in place.

Once the SSD and microSD are back in place, you can connect Ethernet and the power supply, then apply power to your Apollo.

You will be able to access your Apollo through a web browser on your computer. You will need to figure out the local IP address of your Apollo device so log into your router and check the DHCP leases section. Your router should be accessible from your local network by typing an IP address into your web browser like 192.168.0.1 or 10.0.0.1 or maybe your router manufacturer uses a different default. You should be able to do an internet search for your specific router and figure it out quickly if you don’t already know. If that fails, you can download and run a program like Angry IP Scanner.

Give the Apollo some time to run through a few preliminary and automatic configurations, you should be able to see the Apollo on your local network within 10 minutes of powering it on.

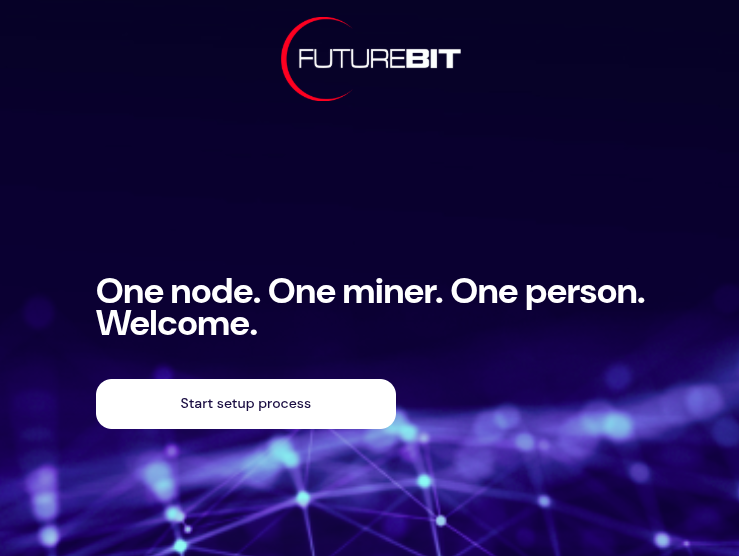

Once you figure out the IP address for your Apollo, type it into your web browser and this is the first screen you should be greeted with:

[IMG-014] Futurebit welcome screen

[IMG-014] Futurebit welcome screenClick on the button that says “Start setup process”. The next you will see should look like this:

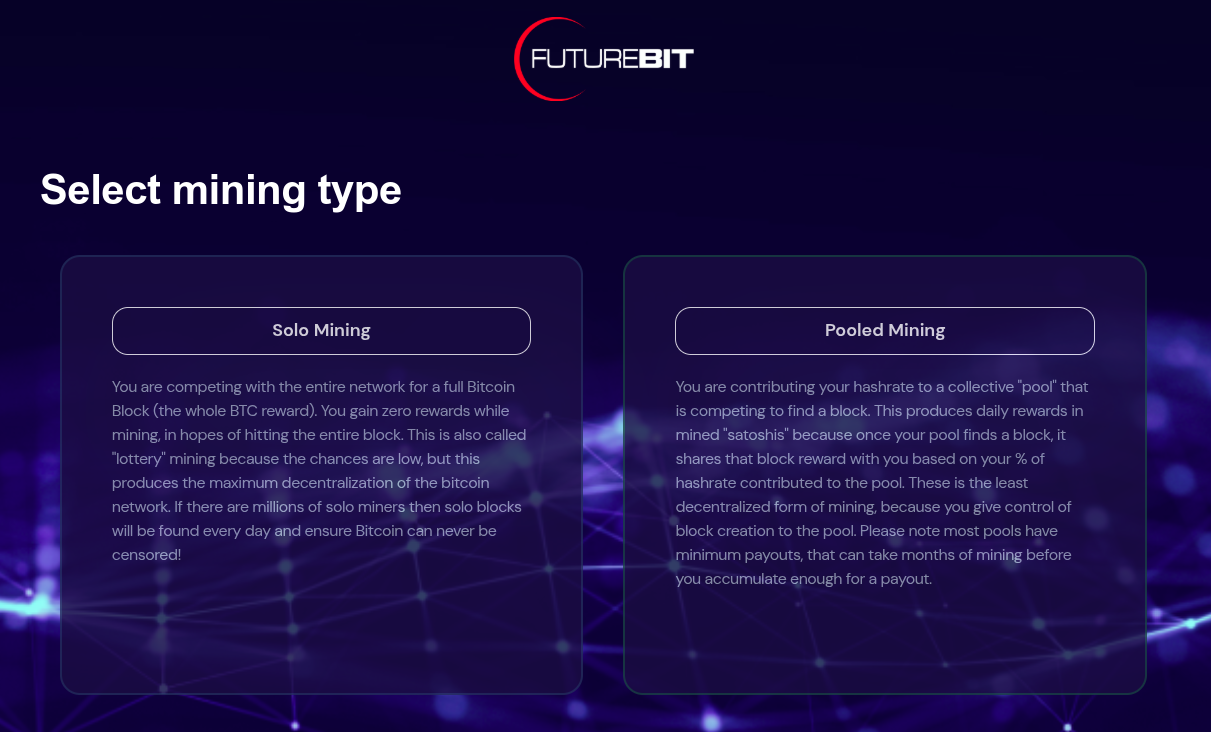

[IMG-015] Futurebit mining selection screen

[IMG-015] Futurebit mining selection screenYou have the option here to select solo mining or pooled mining. If you have installed a new SSD card then you should select pooled mining because you will not be able to solo mine until the entire Bitcoin blockchain is downloaded.

Your Apollo will automatically start downloading the Bitcoin blockchain in the background and in the mean-time you can start mining with a pool of your choice like Solo CK Pool or Public Pool or others.

Be forewarned that the Initial Blockchain Download (“IBD”) takes a long time. At the time of this writing, it took 18 days to download the entire blockchain using a Starlink internet connection, which was probably throttled at some points in the process because of the roughly 680 GB of data that it takes.

In February 2022, the IBD on this exact same device took 2 days with a cable internet connection. Maybe the Starlink was a bit of a bottleneck but most likely the extended length of the download can be attributed to all those JPEGS on the blockchain.

Otherwise, if you already have the full blockchain on your SSD then you should be able to start solo mining right away by selecting the solo mining option.

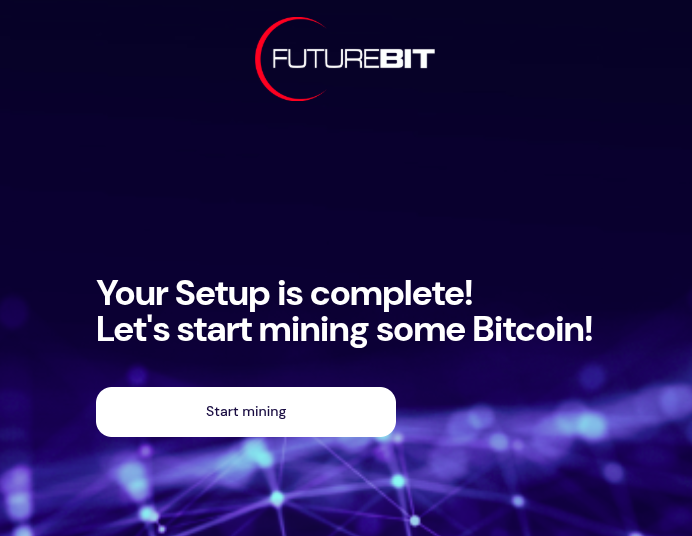

After making your selection, the Apollo will automatically run through some configurations and you should have the option to set a password somewhere in there along the way. Then you should see this page:

[IMG-016] Futurebit setup completion page

[IMG-016] Futurebit setup completion pageClick on the “Start mining” button. Then you should be brought to your dashboard like this:

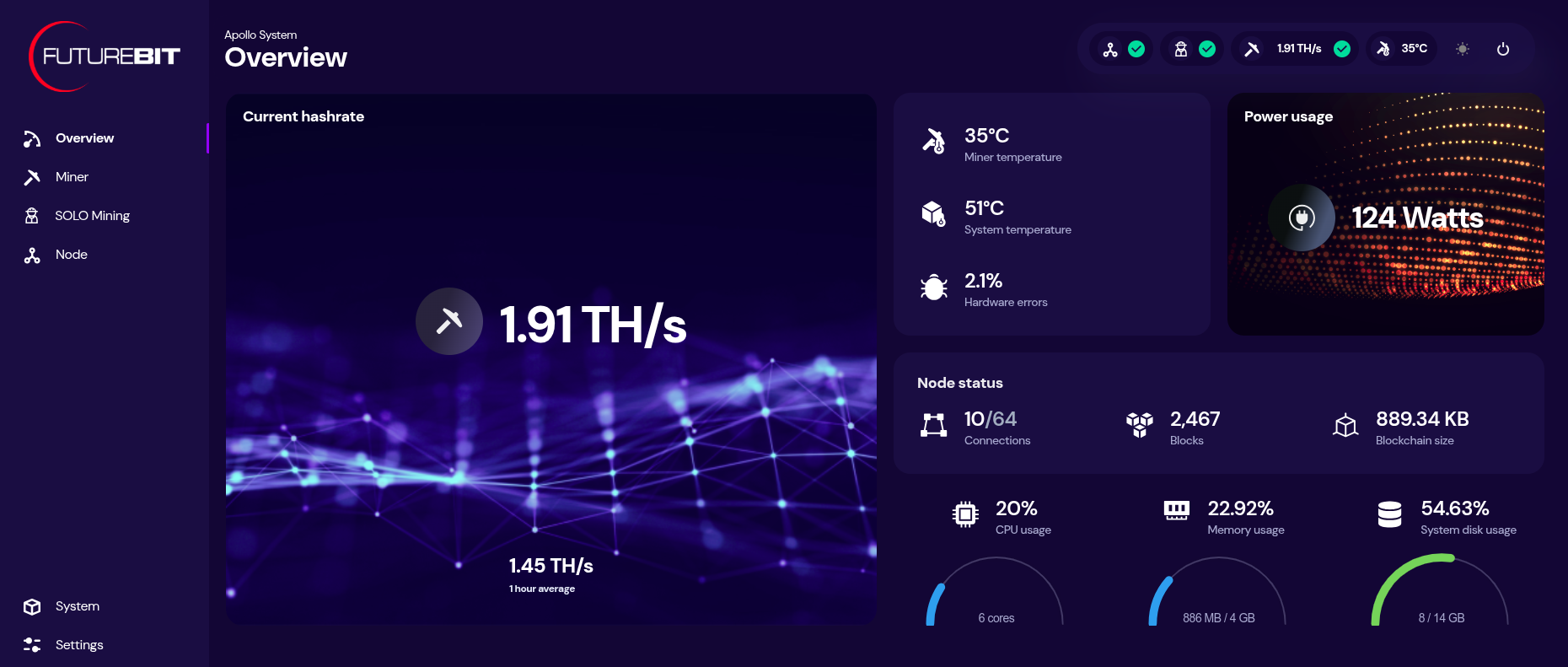

[IMG-017] Futurebit dashboard

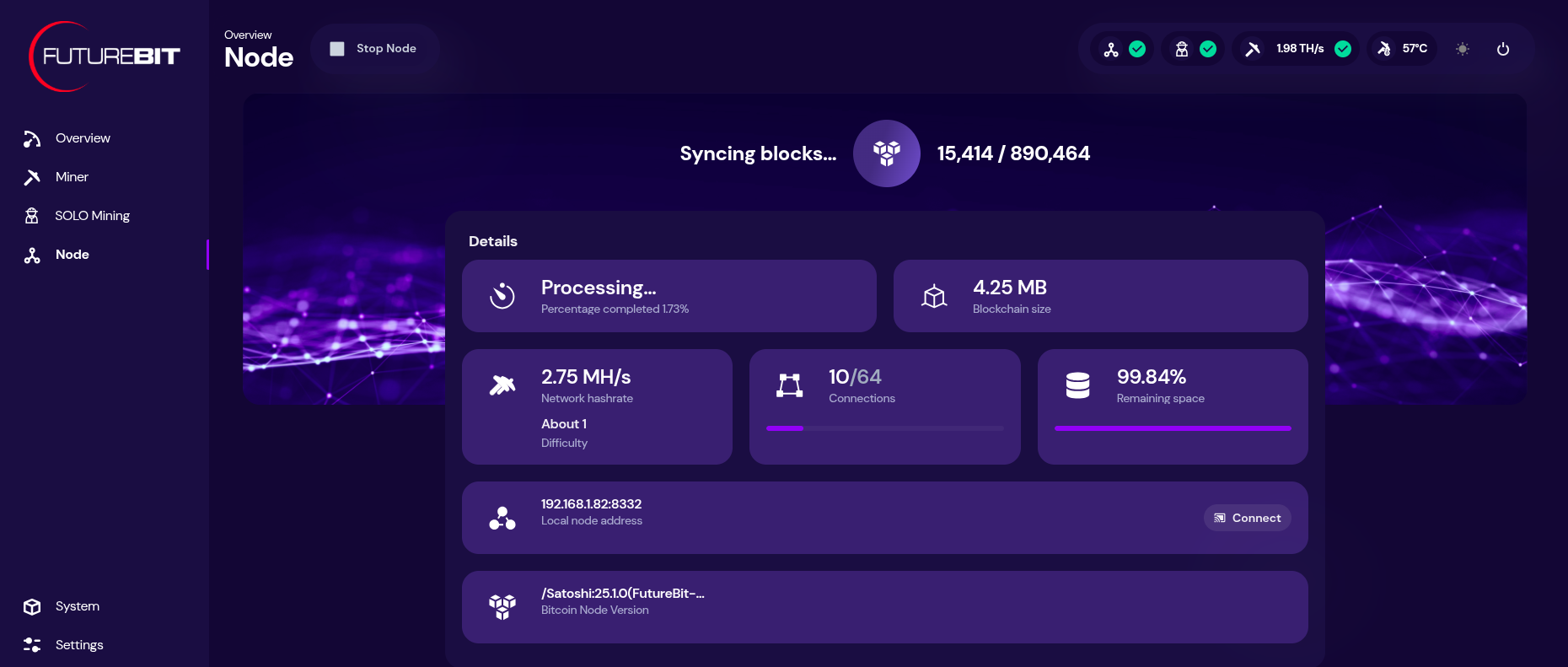

[IMG-017] Futurebit dashboardYou can monitor your hashrate, temperatures, and more from the dashboard. You can check on the status of your Bitcoin node by clicking on the three-circle looking icon that says “node” on the left-hand side menu.

[IMG-018] Futurebit node page

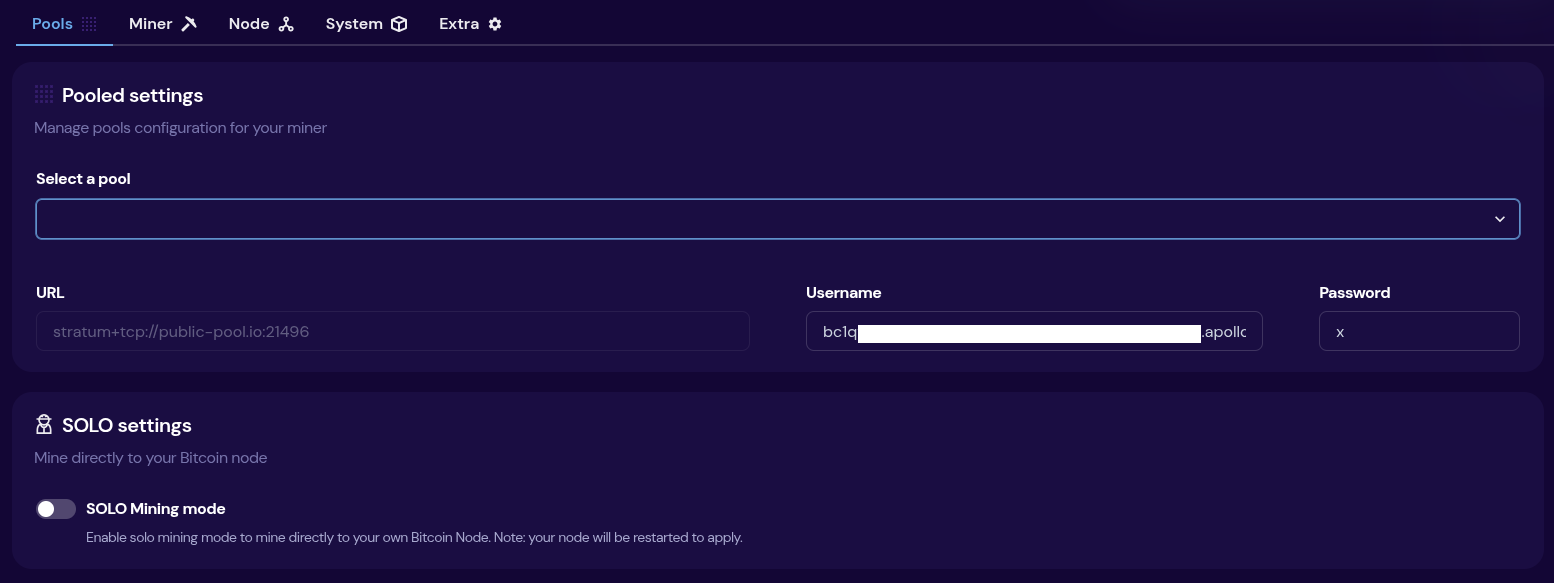

[IMG-018] Futurebit node pageIf you need to update the mining pool, click on the “settings” option at the bottom of the left-hand side menu. There you will see a drop down menu for selecting a pool to use, you can select the “setup custom pool” option to insert the appropriate stratum URL and then your worker name.

Once your IBD is finished, you can start solo mining by toggling on the solo mode at the bottom of the settings page. You will have a chance to update the Bitcoin address you want to mine to. Then click on “save & restart”.

[IMG-019] Futurebit mining pool settings

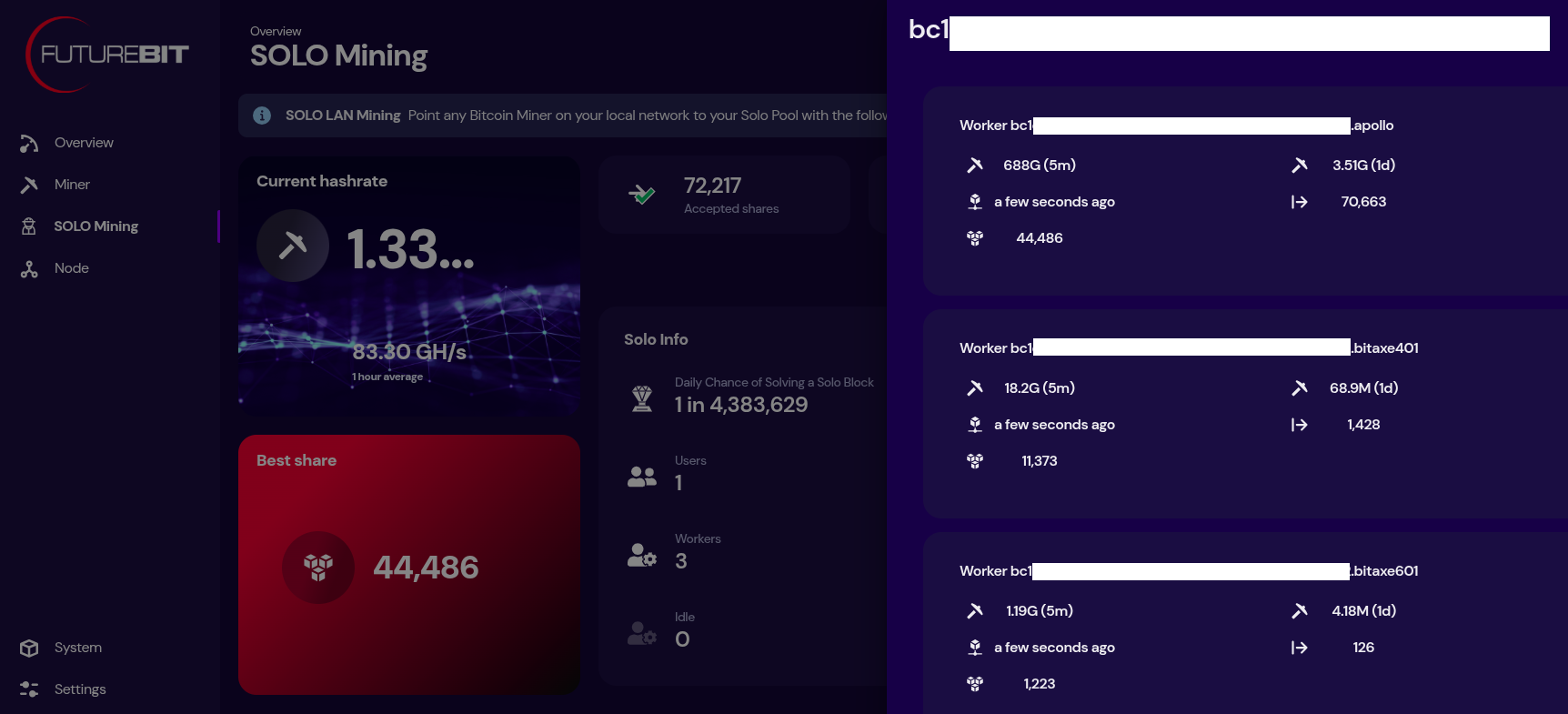

[IMG-019] Futurebit mining pool settingsThen once your system comes back up, you will see a banner at the top of the dashboard page with the IP address you can use to point any other miners you have, like Bitaxes, to your own self-hosted solo mining pool!

[IMG-020] Futurebit solo mining dashboard

[IMG-020] Futurebit solo mining dashboardNow just sit back and enjoy watching your best shares roll in until you get one higher than the network difficulty and you mine that solo block.

State of the Network:

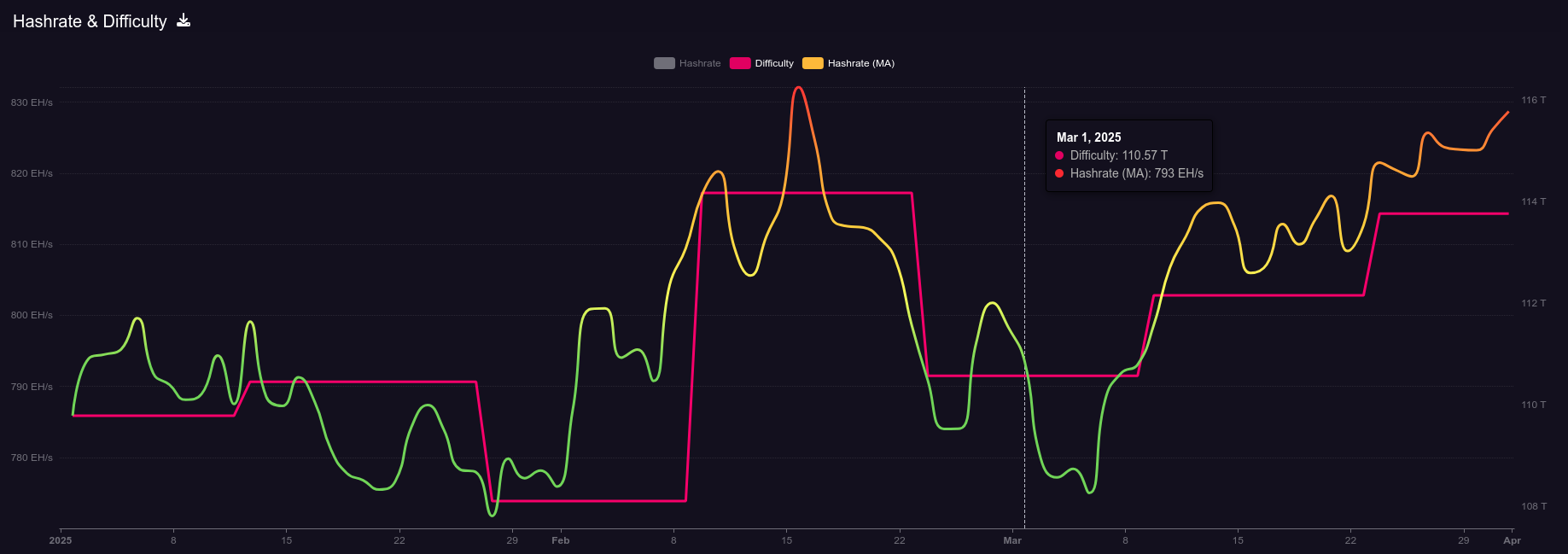

Hashrate on the 14-day MA according to mempool.space increased from ~793 Eh/s to ~829 Eh/s in March, marking ~4.5% growth for the month.

[IMG-021] 2025 hashrate/difficulty chart from mempool.space

[IMG-021] 2025 hashrate/difficulty chart from mempool.spaceDifficulty was 110.57T at it’s lowest in March and 113.76T at it’s highest, which is a 2.8% increase for the month. All together for 2025 up until the end of March, difficulty has gone up ~3.6%.

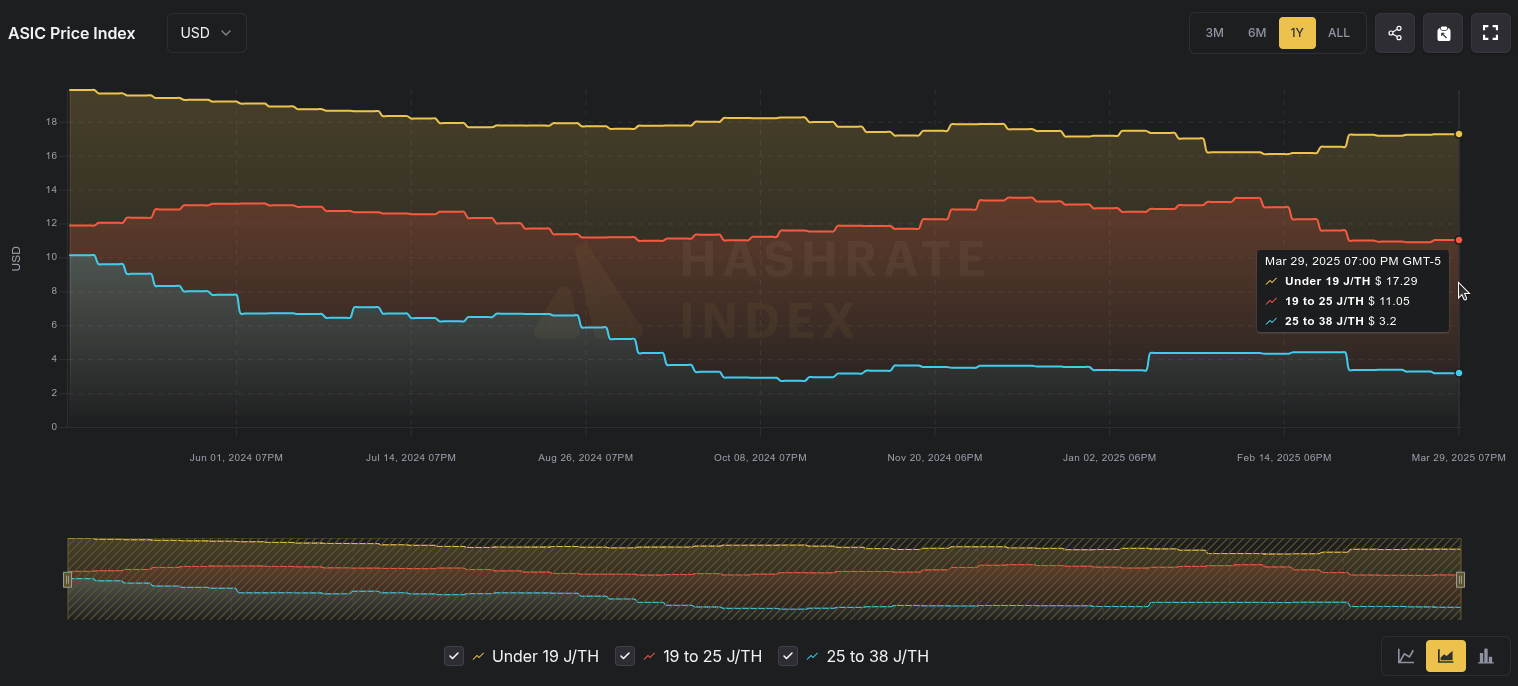

According to the Hashrate Index, more efficient miners like the <19 J/Th models are fetching $17.29 per terahash, models between 19J/Th – 25J/Th are selling for $11.05 per terahash, and models >25J/Th are selling for $3.20 per terahash. Overall, prices seem to have dropped slightly over the month of March. You can expect to pay roughly $4,000 for a new-gen miner with 230+ Th/s.

[IMG-022] Miner Prices from Luxor’s Hashrate Index

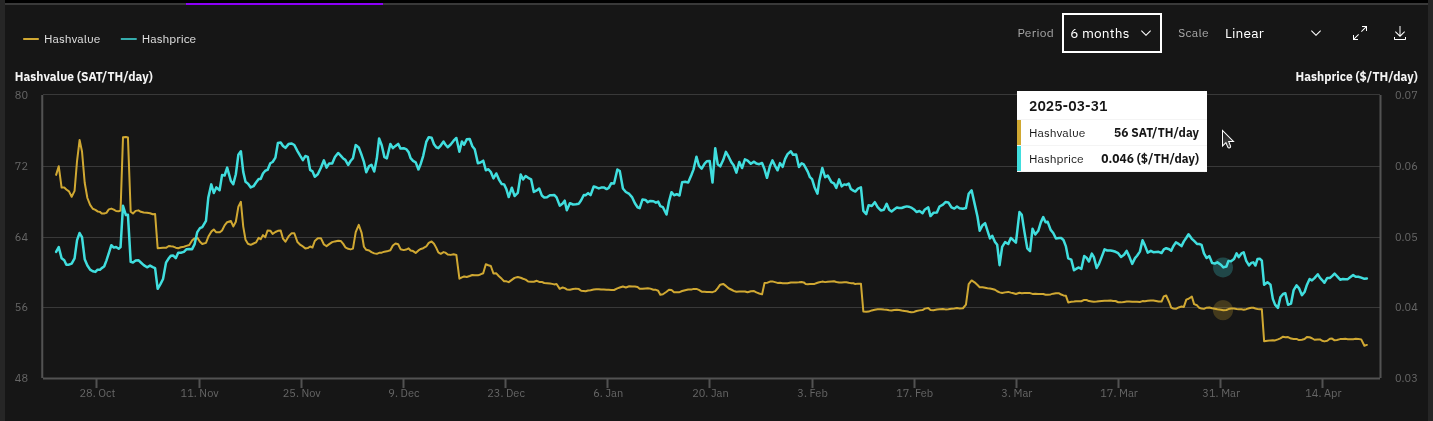

[IMG-022] Miner Prices from Luxor’s Hashrate IndexHashvalue is closed out in March at ~56,000 sats/Ph per day, relatively flat from Frebruary, according to Braiins Insights. Hashprice is $46.00/Ph per day, down from $47.00/Ph per day in February.

[IMG-023] Hashprice/Hashvalue from Braiins Insights

[IMG-023] Hashprice/Hashvalue from Braiins InsightsThe next halving will occur at block height 1,050,000 which should be in roughly 1,071 days or in other words ~156,850 blocks from time of publishing this newsletter.

Conclusion:

Thank you for reading the third 256 Foundation newsletter. Keep an eye out for more newsletters on a monthly basis in your email inbox by subscribing at 256foundation.org. Or you can download .pdf versions of the newsletters from there as well. You can also find these newsletters published in article form on Nostr.

If you haven’t done so already, be sure to RSVP for the Texas Energy & Mining Summit (“TEMS”) in Austin, Texas on May 6 & 7 for two days of the highest Bitcoin mining and energy signal in the industry, set in the intimate Bitcoin Commons, so you can meet and mingle with the best and brightest movers and shakers in the space.

While you’re at it, extend your stay and spend Cinco De Mayo with The 256 Foundation at our second fundraiser, Telehash #2. Everything is bigger in Texas, so set your expectations high for this one. All of the lead developers from the grant projects will be present to talk first-hand about how to dismantle the proprietary mining empire.

IMG-024] TEMS 2025 flyer

IMG-024] TEMS 2025 flyerIf you have an old Apollo I laying around and want to get it up to date and solo mining then hopefully this newsletter helped you accomplish that.

[IMG-026] FREE SAMOURAI

[IMG-026] FREE SAMOURAIIf you want to continue seeing developers build free and open solutions be sure to support the Samourai Wallet developers by making a tax-deductible contribution to their legal defense fund here. The first step in ensuring a future of free and open Bitcoin development starts with freeing these developers.

You can just FAFO,

-econoalchemist

-

@ 9bde4214:06ca052b

2025-04-22 17:09:47

@ 9bde4214:06ca052b

2025-04-22 17:09:47“It isn’t obvious that the world had to work this way. But somehow the universe smiles on encryption.”

hzrd149 & Gigi take a stroll along the shore of cryptographic identities.

This dialogue explores how cryptographic signatures fundamentally shift power dynamics in social networks, moving control from servers to key holders. We discuss the concept of "setting data free" through cryptographic verification, the evolving role of relays in the ecosystem, and the challenges of building trust in decentralized systems. We examine the tension between convenience and decentralization, particularly around features like private data and data synchronization. What are the philosophical foundations of building truly decentralized social networks? And how can small architectural decisions have profound implications for user autonomy and data sovereignty?

Movies mentioned:

- 2001: A Space Odyssey (1968)

- Soylent Green (1973)

- Close Encounters of the Third Kind (1977)

- Johnny Mnemonic (1995)

- The Matrix (1999)