-

@ 21335073:a244b1ad

2025-05-09 13:56:57

@ 21335073:a244b1ad

2025-05-09 13:56:57Someone asked for my thoughts, so I’ll share them thoughtfully. I’m not here to dictate how to promote Nostr—I’m still learning about it myself. While I’m not new to Nostr, freedom tech is a newer space for me. I’m skilled at advocating for topics I deeply understand, but freedom tech isn’t my expertise, so take my words with a grain of salt. Nothing I say is set in stone.

Those who need Nostr the most are the ones most vulnerable to censorship on other platforms right now. Reaching them requires real-time awareness of global issues and the dynamic relationships between governments and tech providers, which can shift suddenly. Effective Nostr promoters must grasp this and adapt quickly.

The best messengers are people from or closely tied to these at-risk regions—those who truly understand the local political and cultural dynamics. They can connect with those in need when tensions rise. Ideal promoters are rational, trustworthy, passionate about Nostr, but above all, dedicated to amplifying people’s voices when it matters most.

Forget influencers, corporate-backed figures, or traditional online PR—it comes off as inauthentic, corny, desperate and forced. Nostr’s promotion should be grassroots and organic, driven by a few passionate individuals who believe in Nostr and the communities they serve.

The idea that “people won’t join Nostr due to lack of reach” is nonsense. Everyone knows X’s “reach” is mostly with bots. If humans want real conversations, Nostr is the place. X is great for propaganda, but Nostr is for the authentic voices of the people.

Those spreading Nostr must be so passionate they’re willing to onboard others, which is time-consuming but rewarding for the right person. They’ll need to make Nostr and onboarding a core part of who they are. I see no issue with that level of dedication. I’ve been known to get that way myself at times. It’s fun for some folks.

With love, I suggest not adding Bitcoin promotion with Nostr outreach. Zaps already integrate that element naturally. (Still promote within the Bitcoin ecosystem, but this is about reaching vulnerable voices who needed Nostr yesterday.)

To promote Nostr, forget conventional strategies. “Influencers” aren’t the answer. “Influencers” are not the future. A trusted local community member has real influence—reach them. Connect with people seeking Nostr’s benefits but lacking the technical language to express it. This means some in the Nostr community might need to step outside of the Bitcoin bubble, which is uncomfortable but necessary. Thank you in advance to those who are willing to do that.

I don’t know who is paid to promote Nostr, if anyone. This piece isn’t shade. But it’s exhausting to see innocent voices globally silenced on corporate platforms like X while Nostr exists. Last night, I wondered: how many more voices must be censored before the Nostr community gets uncomfortable and thinks creatively to reach the vulnerable?

A warning: the global need for censorship-resistant social media is undeniable. If Nostr doesn’t make itself known, something else will fill that void. Let’s start this conversation.

-

@ 21335073:a244b1ad

2025-05-01 01:51:10

@ 21335073:a244b1ad

2025-05-01 01:51:10Please respect Virginia Giuffre’s memory by refraining from asking about the circumstances or theories surrounding her passing.

Since Virginia Giuffre’s death, I’ve reflected on what she would want me to say or do. This piece is my attempt to honor her legacy.

When I first spoke with Virginia, I was struck by her unshakable hope. I had grown cynical after years in the anti-human trafficking movement, worn down by a broken system and a government that often seemed complicit. But Virginia’s passion, creativity, and belief that survivors could be heard reignited something in me. She reminded me of my younger, more hopeful self. Instead of warning her about the challenges ahead, I let her dream big, unburdened by my own disillusionment. That conversation changed me for the better, and following her lead led to meaningful progress.

Virginia was one of the bravest people I’ve ever known. As a survivor of Epstein, Maxwell, and their co-conspirators, she risked everything to speak out, taking on some of the world’s most powerful figures.

She loved when I said, “Epstein isn’t the only Epstein.” This wasn’t just about one man—it was a call to hold all abusers accountable and to ensure survivors find hope and healing.

The Epstein case often gets reduced to sensational details about the elite, but that misses the bigger picture. Yes, we should be holding all of the co-conspirators accountable, we must listen to the survivors’ stories. Their experiences reveal how predators exploit vulnerabilities, offering lessons to prevent future victims.

You’re not powerless in this fight. Educate yourself about trafficking and abuse—online and offline—and take steps to protect those around you. Supporting survivors starts with small, meaningful actions. Free online resources can guide you in being a safe, supportive presence.

When high-profile accusations arise, resist snap judgments. Instead of dismissing survivors as “crazy,” pause to consider the trauma they may be navigating. Speaking out or coping with abuse is never easy. You don’t have to believe every claim, but you can refrain from attacking accusers online.

Society also fails at providing aftercare for survivors. The government, often part of the problem, won’t solve this. It’s up to us. Prevention is critical, but when abuse occurs, step up for your loved ones and community. Protect the vulnerable. it’s a challenging but a rewarding journey.

If you’re contributing to Nostr, you’re helping build a censorship resistant platform where survivors can share their stories freely, no matter how powerful their abusers are. Their voices can endure here, offering strength and hope to others. This gives me great hope for the future.

Virginia Giuffre’s courage was a gift to the world. It was an honor to know and serve her. She will be deeply missed. My hope is that her story inspires others to take on the powerful.

-

@ 52b4a076:e7fad8bd

2025-04-28 00:48:57

@ 52b4a076:e7fad8bd

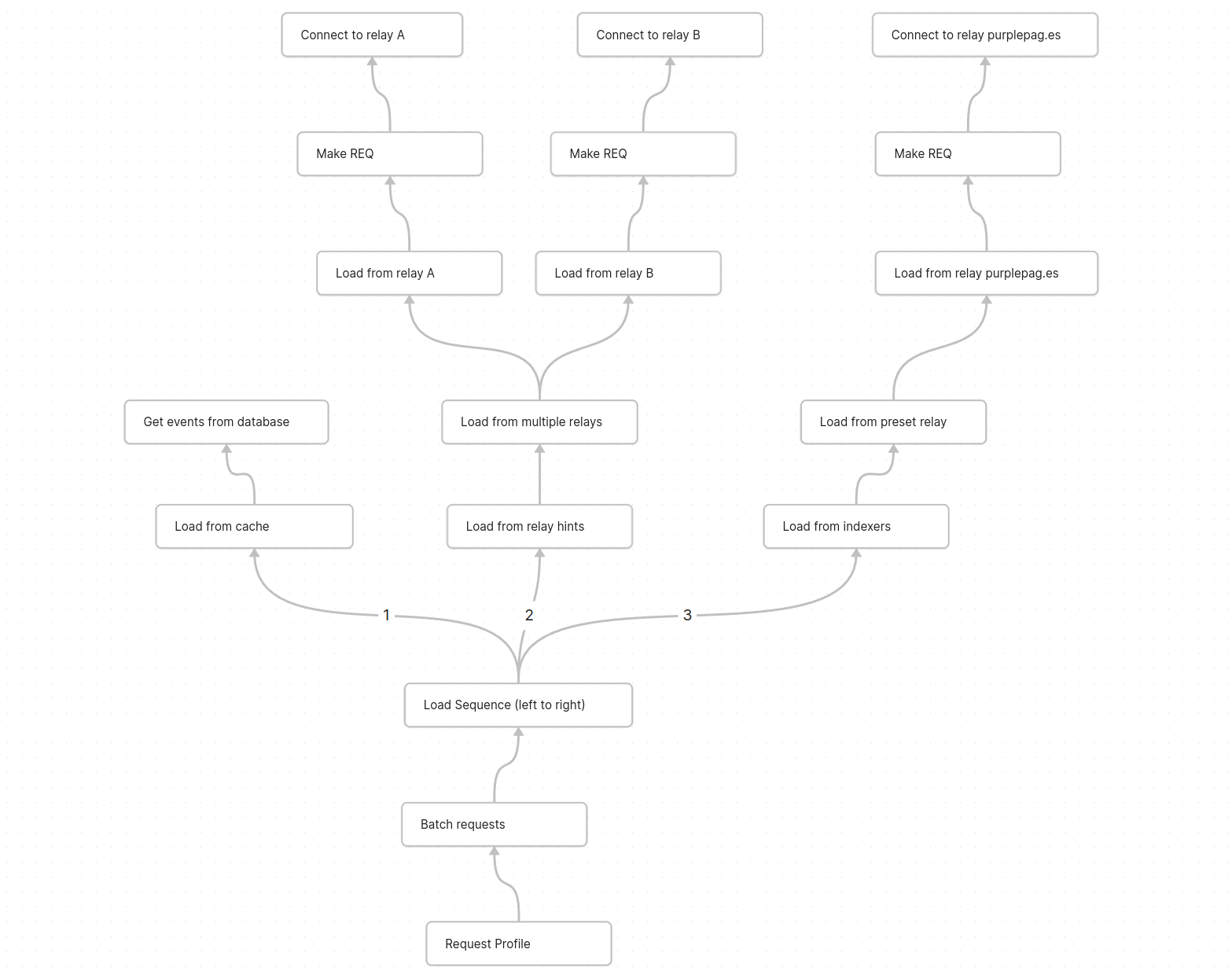

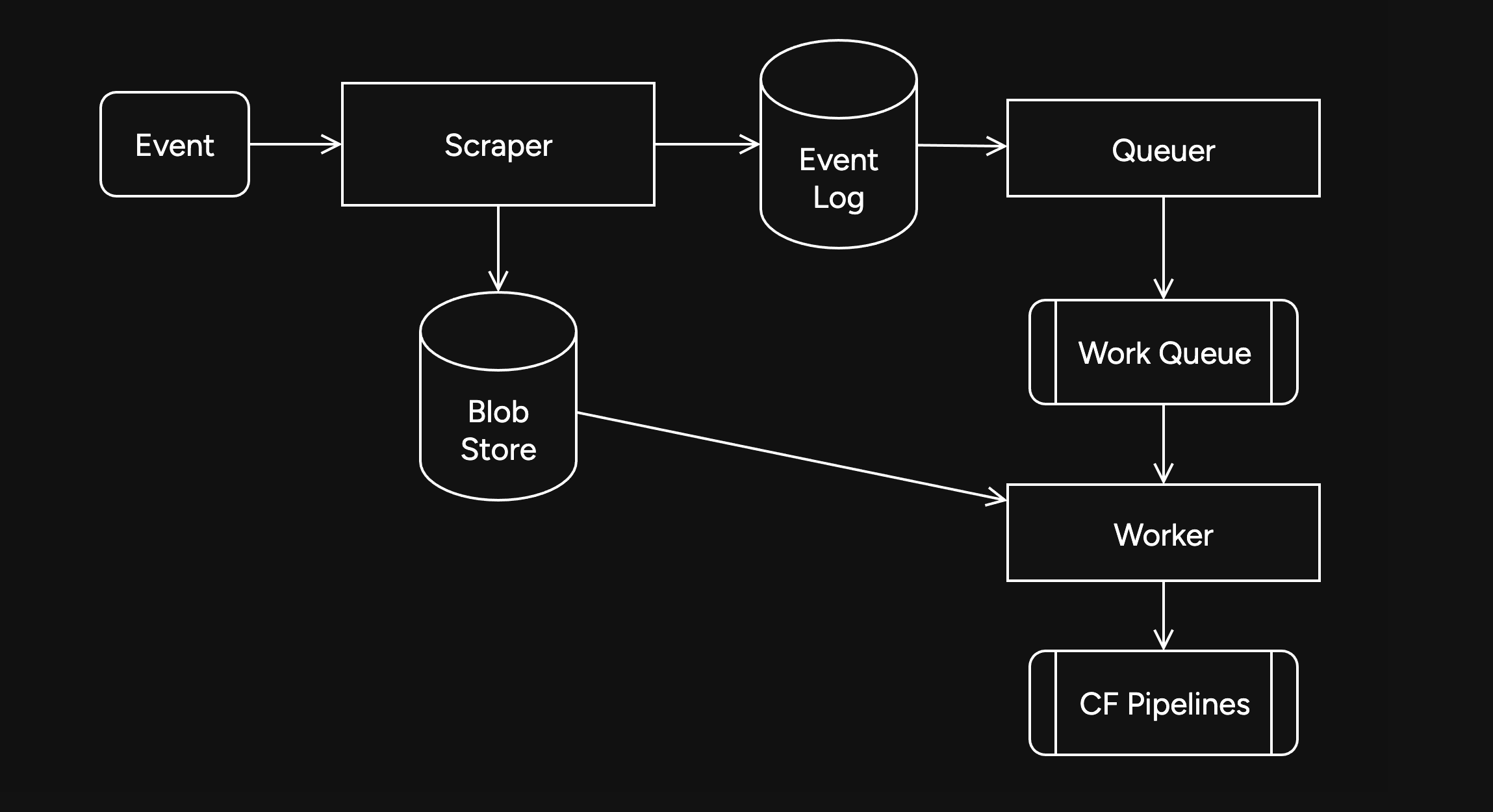

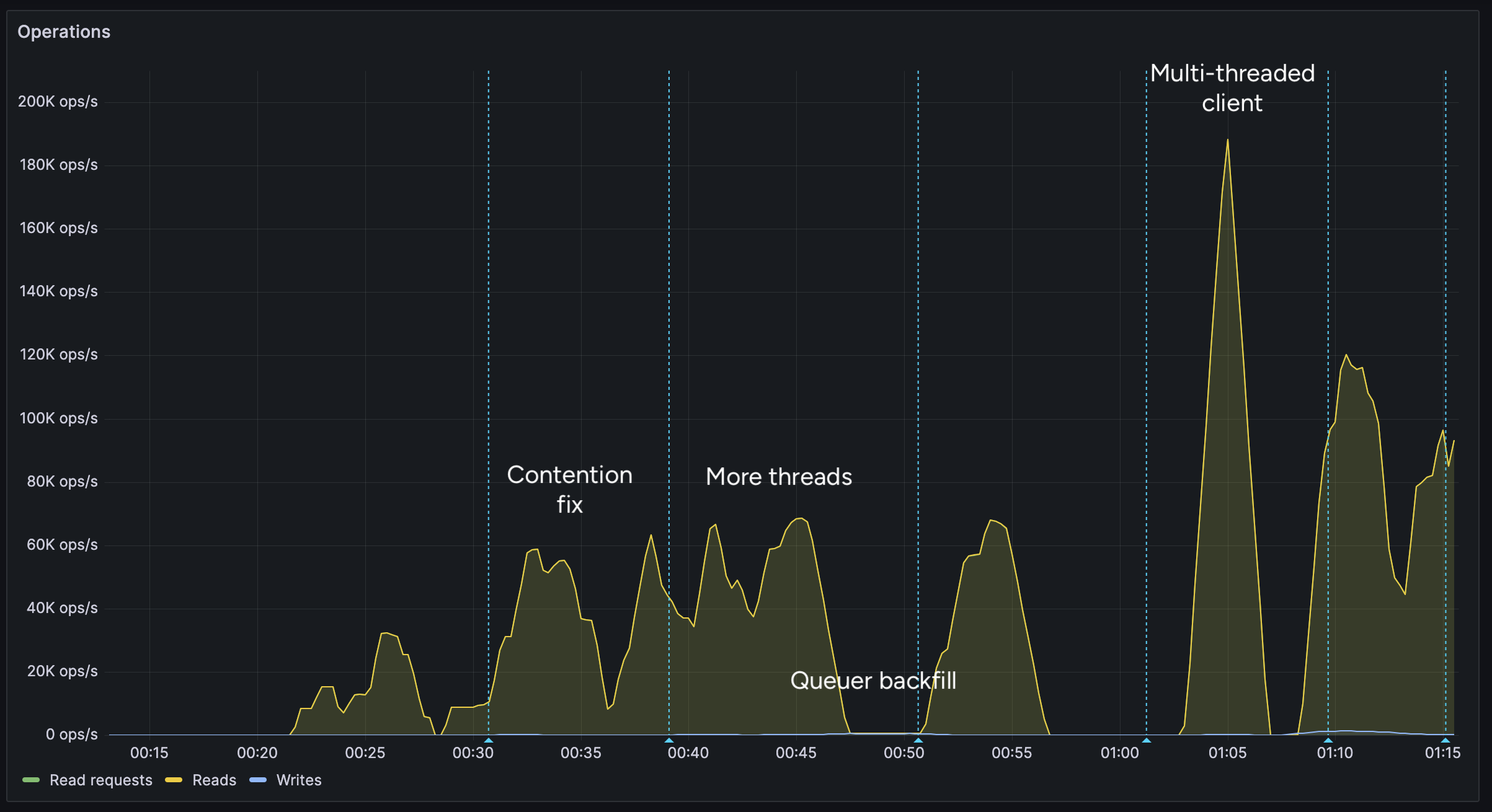

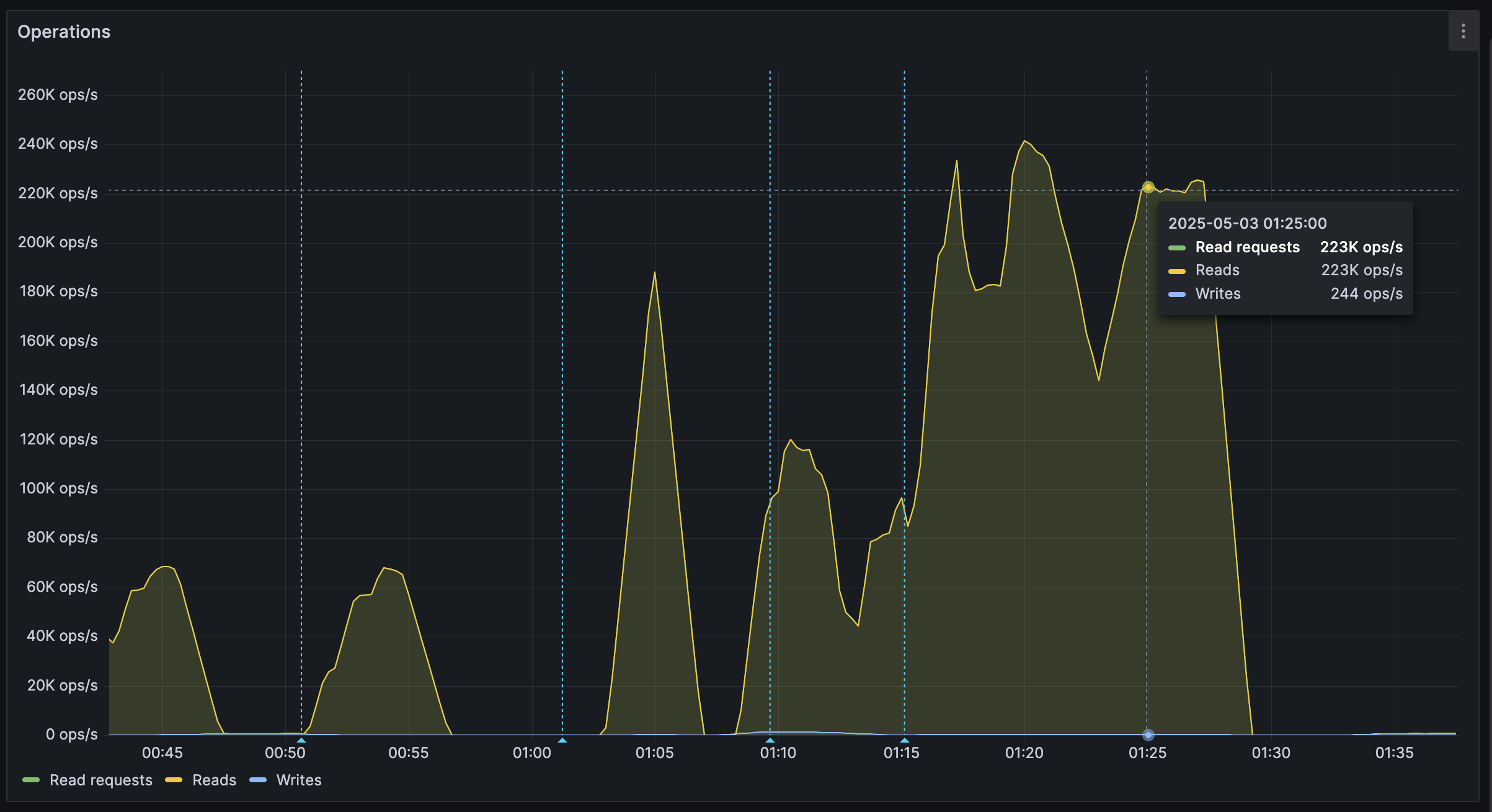

2025-04-28 00:48:57I have been recently building NFDB, a new relay DB. This post is meant as a short overview.

Regular relays have challenges

Current relay software have significant challenges, which I have experienced when hosting Nostr.land: - Scalability is only supported by adding full replicas, which does not scale to large relays. - Most relays use slow databases and are not optimized for large scale usage. - Search is near-impossible to implement on standard relays. - Privacy features such as NIP-42 are lacking. - Regular DB maintenance tasks on normal relays require extended downtime. - Fault-tolerance is implemented, if any, using a load balancer, which is limited. - Personalization and advanced filtering is not possible. - Local caching is not supported.

NFDB: A scalable database for large relays

NFDB is a new database meant for medium-large scale relays, built on FoundationDB that provides: - Near-unlimited scalability - Extended fault tolerance - Instant loading - Better search - Better personalization - and more.

Search

NFDB has extended search capabilities including: - Semantic search: Search for meaning, not words. - Interest-based search: Highlight content you care about. - Multi-faceted queries: Easily filter by topic, author group, keywords, and more at the same time. - Wide support for event kinds, including users, articles, etc.

Personalization

NFDB allows significant personalization: - Customized algorithms: Be your own algorithm. - Spam filtering: Filter content to your WoT, and use advanced spam filters. - Topic mutes: Mute topics, not keywords. - Media filtering: With Nostr.build, you will be able to filter NSFW and other content - Low data mode: Block notes that use high amounts of cellular data. - and more

Other

NFDB has support for many other features such as: - NIP-42: Protect your privacy with private drafts and DMs - Microrelays: Easily deploy your own personal microrelay - Containers: Dedicated, fast storage for discoverability events such as relay lists

Calcite: A local microrelay database

Calcite is a lightweight, local version of NFDB that is meant for microrelays and caching, meant for thousands of personal microrelays.

Calcite HA is an additional layer that allows live migration and relay failover in under 30 seconds, providing higher availability compared to current relays with greater simplicity. Calcite HA is enabled in all Calcite deployments.

For zero-downtime, NFDB is recommended.

Noswhere SmartCache

Relays are fixed in one location, but users can be anywhere.

Noswhere SmartCache is a CDN for relays that dynamically caches data on edge servers closest to you, allowing: - Multiple regions around the world - Improved throughput and performance - Faster loading times

routerd

routerdis a custom load-balancer optimized for Nostr relays, integrated with SmartCache.routerdis specifically integrated with NFDB and Calcite HA to provide fast failover and high performance.Ending notes

NFDB is planned to be deployed to Nostr.land in the coming weeks.

A lot more is to come. 👀️️️️️️

-

@ 91bea5cd:1df4451c

2025-04-26 10:16:21

@ 91bea5cd:1df4451c

2025-04-26 10:16:21O Contexto Legal Brasileiro e o Consentimento

No ordenamento jurídico brasileiro, o consentimento do ofendido pode, em certas circunstâncias, afastar a ilicitude de um ato que, sem ele, configuraria crime (como lesão corporal leve, prevista no Art. 129 do Código Penal). Contudo, o consentimento tem limites claros: não é válido para bens jurídicos indisponíveis, como a vida, e sua eficácia é questionável em casos de lesões corporais graves ou gravíssimas.

A prática de BDSM consensual situa-se em uma zona complexa. Em tese, se ambos os parceiros são adultos, capazes, e consentiram livre e informadamente nos atos praticados, sem que resultem em lesões graves permanentes ou risco de morte não consentido, não haveria crime. O desafio reside na comprovação desse consentimento, especialmente se uma das partes, posteriormente, o negar ou alegar coação.

A Lei Maria da Penha (Lei nº 11.340/2006)

A Lei Maria da Penha é um marco fundamental na proteção da mulher contra a violência doméstica e familiar. Ela estabelece mecanismos para coibir e prevenir tal violência, definindo suas formas (física, psicológica, sexual, patrimonial e moral) e prevendo medidas protetivas de urgência.

Embora essencial, a aplicação da lei em contextos de BDSM pode ser delicada. Uma alegação de violência por parte da mulher, mesmo que as lesões ou situações decorram de práticas consensuais, tende a receber atenção prioritária das autoridades, dada a presunção de vulnerabilidade estabelecida pela lei. Isso pode criar um cenário onde o parceiro masculino enfrenta dificuldades significativas em demonstrar a natureza consensual dos atos, especialmente se não houver provas robustas pré-constituídas.

Outros riscos:

Lesão corporal grave ou gravíssima (art. 129, §§ 1º e 2º, CP), não pode ser justificada pelo consentimento, podendo ensejar persecução penal.

Crimes contra a dignidade sexual (arts. 213 e seguintes do CP) são de ação pública incondicionada e independem de representação da vítima para a investigação e denúncia.

Riscos de Falsas Acusações e Alegação de Coação Futura

Os riscos para os praticantes de BDSM, especialmente para o parceiro que assume o papel dominante ou que inflige dor/restrição (frequentemente, mas não exclusivamente, o homem), podem surgir de diversas frentes:

- Acusações Externas: Vizinhos, familiares ou amigos que desconhecem a natureza consensual do relacionamento podem interpretar sons, marcas ou comportamentos como sinais de abuso e denunciar às autoridades.

- Alegações Futuras da Parceira: Em caso de término conturbado, vingança, arrependimento ou mudança de perspectiva, a parceira pode reinterpretar as práticas passadas como abuso e buscar reparação ou retaliação através de uma denúncia. A alegação pode ser de que o consentimento nunca existiu ou foi viciado.

- Alegação de Coação: Uma das formas mais complexas de refutar é a alegação de que o consentimento foi obtido mediante coação (física, moral, psicológica ou econômica). A parceira pode alegar, por exemplo, que se sentia pressionada, intimidada ou dependente, e que seu "sim" não era genuíno. Provar a ausência de coação a posteriori é extremamente difícil.

- Ingenuidade e Vulnerabilidade Masculina: Muitos homens, confiando na dinâmica consensual e na parceira, podem negligenciar a necessidade de precauções. A crença de que "isso nunca aconteceria comigo" ou a falta de conhecimento sobre as implicações legais e o peso processual de uma acusação no âmbito da Lei Maria da Penha podem deixá-los vulneráveis. A presença de marcas físicas, mesmo que consentidas, pode ser usada como evidência de agressão, invertendo o ônus da prova na prática, ainda que não na teoria jurídica.

Estratégias de Prevenção e Mitigação

Não existe um método infalível para evitar completamente o risco de uma falsa acusação, mas diversas medidas podem ser adotadas para construir um histórico de consentimento e reduzir vulnerabilidades:

- Comunicação Explícita e Contínua: A base de qualquer prática BDSM segura é a comunicação constante. Negociar limites, desejos, palavras de segurança ("safewords") e expectativas antes, durante e depois das cenas é crucial. Manter registros dessas negociações (e-mails, mensagens, diários compartilhados) pode ser útil.

-

Documentação do Consentimento:

-

Contratos de Relacionamento/Cena: Embora a validade jurídica de "contratos BDSM" seja discutível no Brasil (não podem afastar normas de ordem pública), eles servem como forte evidência da intenção das partes, da negociação detalhada de limites e do consentimento informado. Devem ser claros, datados, assinados e, idealmente, reconhecidos em cartório (para prova de data e autenticidade das assinaturas).

-

Registros Audiovisuais: Gravar (com consentimento explícito para a gravação) discussões sobre consentimento e limites antes das cenas pode ser uma prova poderosa. Gravar as próprias cenas é mais complexo devido a questões de privacidade e potencial uso indevido, mas pode ser considerado em casos específicos, sempre com consentimento mútuo documentado para a gravação.

Importante: a gravação deve ser com ciência da outra parte, para não configurar violação da intimidade (art. 5º, X, da Constituição Federal e art. 20 do Código Civil).

-

-

Testemunhas: Em alguns contextos de comunidade BDSM, a presença de terceiros de confiança durante negociações ou mesmo cenas pode servir como testemunho, embora isso possa alterar a dinâmica íntima do casal.

- Estabelecimento Claro de Limites e Palavras de Segurança: Definir e respeitar rigorosamente os limites (o que é permitido, o que é proibido) e as palavras de segurança é fundamental. O desrespeito a uma palavra de segurança encerra o consentimento para aquele ato.

- Avaliação Contínua do Consentimento: O consentimento não é um cheque em branco; ele deve ser entusiástico, contínuo e revogável a qualquer momento. Verificar o bem-estar do parceiro durante a cena ("check-ins") é essencial.

- Discrição e Cuidado com Evidências Físicas: Ser discreto sobre a natureza do relacionamento pode evitar mal-entendidos externos. Após cenas que deixem marcas, é prudente que ambos os parceiros estejam cientes e de acordo, talvez documentando por fotos (com data) e uma nota sobre a consensualidade da prática que as gerou.

- Aconselhamento Jurídico Preventivo: Consultar um advogado especializado em direito de família e criminal, com sensibilidade para dinâmicas de relacionamento alternativas, pode fornecer orientação personalizada sobre as melhores formas de documentar o consentimento e entender os riscos legais específicos.

Observações Importantes

- Nenhuma documentação substitui a necessidade de consentimento real, livre, informado e contínuo.

- A lei brasileira protege a "integridade física" e a "dignidade humana". Práticas que resultem em lesões graves ou que violem a dignidade de forma não consentida (ou com consentimento viciado) serão ilegais, independentemente de qualquer acordo prévio.

- Em caso de acusação, a existência de documentação robusta de consentimento não garante a absolvição, mas fortalece significativamente a defesa, ajudando a demonstrar a natureza consensual da relação e das práticas.

-

A alegação de coação futura é particularmente difícil de prevenir apenas com documentos. Um histórico consistente de comunicação aberta (whatsapp/telegram/e-mails), respeito mútuo e ausência de dependência ou controle excessivo na relação pode ajudar a contextualizar a dinâmica como não coercitiva.

-

Cuidado com Marcas Visíveis e Lesões Graves Práticas que resultam em hematomas severos ou lesões podem ser interpretadas como agressão, mesmo que consentidas. Evitar excessos protege não apenas a integridade física, mas também evita questionamentos legais futuros.

O que vem a ser consentimento viciado

No Direito, consentimento viciado é quando a pessoa concorda com algo, mas a vontade dela não é livre ou plena — ou seja, o consentimento existe formalmente, mas é defeituoso por alguma razão.

O Código Civil brasileiro (art. 138 a 165) define várias formas de vício de consentimento. As principais são:

Erro: A pessoa se engana sobre o que está consentindo. (Ex.: A pessoa acredita que vai participar de um jogo leve, mas na verdade é exposta a práticas pesadas.)

Dolo: A pessoa é enganada propositalmente para aceitar algo. (Ex.: Alguém mente sobre o que vai acontecer durante a prática.)

Coação: A pessoa é forçada ou ameaçada a consentir. (Ex.: "Se você não aceitar, eu termino com você" — pressão emocional forte pode ser vista como coação.)

Estado de perigo ou lesão: A pessoa aceita algo em situação de necessidade extrema ou abuso de sua vulnerabilidade. (Ex.: Alguém em situação emocional muito fragilizada é induzida a aceitar práticas que normalmente recusaria.)

No contexto de BDSM, isso é ainda mais delicado: Mesmo que a pessoa tenha "assinado" um contrato ou dito "sim", se depois ela alegar que seu consentimento foi dado sob medo, engano ou pressão psicológica, o consentimento pode ser considerado viciado — e, portanto, juridicamente inválido.

Isso tem duas implicações sérias:

-

O crime não se descaracteriza: Se houver vício, o consentimento é ignorado e a prática pode ser tratada como crime normal (lesão corporal, estupro, tortura, etc.).

-

A prova do consentimento precisa ser sólida: Mostrando que a pessoa estava informada, lúcida, livre e sem qualquer tipo de coação.

Consentimento viciado é quando a pessoa concorda formalmente, mas de maneira enganada, forçada ou pressionada, tornando o consentimento inútil para efeitos jurídicos.

Conclusão

Casais que praticam BDSM consensual no Brasil navegam em um terreno que exige não apenas confiança mútua e comunicação excepcional, mas também uma consciência aguçada das complexidades legais e dos riscos de interpretações equivocadas ou acusações mal-intencionadas. Embora o BDSM seja uma expressão legítima da sexualidade humana, sua prática no Brasil exige responsabilidade redobrada. Ter provas claras de consentimento, manter a comunicação aberta e agir com prudência são formas eficazes de se proteger de falsas alegações e preservar a liberdade e a segurança de todos os envolvidos. Embora leis controversas como a Maria da Penha sejam "vitais" para a proteção contra a violência real, os praticantes de BDSM, e em particular os homens nesse contexto, devem adotar uma postura proativa e prudente para mitigar os riscos inerentes à potencial má interpretação ou instrumentalização dessas práticas e leis, garantindo que a expressão de sua consensualidade esteja resguardada na medida do possível.

Importante: No Brasil, mesmo com tudo isso, o Ministério Público pode denunciar por crime como lesão corporal grave, estupro ou tortura, independente de consentimento. Então a prudência nas práticas é fundamental.

Aviso Legal: Este artigo tem caráter meramente informativo e não constitui aconselhamento jurídico. As leis e interpretações podem mudar, e cada situação é única. Recomenda-se buscar orientação de um advogado qualificado para discutir casos específicos.

Se curtiu este artigo faça uma contribuição, se tiver algum ponto relevante para o artigo deixe seu comentário.

-

@ b83a28b7:35919450

2025-05-16 19:26:56

@ b83a28b7:35919450

2025-05-16 19:26:56This article was originally part of the sermon of Plebchain Radio Episode 111 (May 2, 2025) that nostr:nprofile1qyxhwumn8ghj7mn0wvhxcmmvqyg8wumn8ghj7mn0wd68ytnvv9hxgqpqtvqc82mv8cezhax5r34n4muc2c4pgjz8kaye2smj032nngg52clq7fgefr and I did with nostr:nprofile1qythwumn8ghj7ct5d3shxtnwdaehgu3wd3skuep0qyt8wumn8ghj7ct4w35zumn0wd68yvfwvdhk6tcqyzx4h2fv3n9r6hrnjtcrjw43t0g0cmmrgvjmg525rc8hexkxc0kd2rhtk62 and nostr:nprofile1qyxhwumn8ghj7mn0wvhxcmmvqyg8wumn8ghj7mn0wd68ytnvv9hxgqpq4wxtsrj7g2jugh70pfkzjln43vgn4p7655pgky9j9w9d75u465pqahkzd0 of the nostr:nprofile1qythwumn8ghj7ct5d3shxtnwdaehgu3wd3skuep0qyt8wumn8ghj7etyv4hzumn0wd68ytnvv9hxgtcqyqwfvwrccp4j2xsuuvkwg0y6a20637t6f4cc5zzjkx030dkztt7t5hydajn

Listen to the full episode here:

<<https://fountain.fm/episode/Ln9Ej0zCZ5dEwfo8w2Ho>>

Bitcoin has always been a narrative revolution disguised as code. White paper, cypherpunk lore, pizza‑day legends - every block is a paragraph in the world’s most relentless epic. But code alone rarely converts the skeptic; it’s the camp‑fire myth that slips past the prefrontal cortex and shakes hands with the limbic system. People don’t adopt protocols first - they fall in love with protagonists.

Early adopters heard the white‑paper hymn, but most folks need characters first: a pizza‑day dreamer; a mother in a small country, crushed by the cost of remittance; a Warsaw street vendor swapping złoty for sats. When their arcs land, the brain releases a neurochemical OP_RETURN which says, “I belong in this plot.” That’s the sly roundabout orange pill: conviction smuggled inside catharsis.

That’s why, from 22–25 May in Warsaw’s Kinoteka, the Bitcoin Film Fest is loading its reels with rebellion. Each documentary, drama, and animated rabbit‑hole is a stealth wallet, zipping conviction straight into the feels of anyone still clasped within the cold claw of fiat. You come for the plot, you leave checking block heights.

Here's the clip of the sermon from the episode:

nostr:nevent1qvzqqqqqqypzpwp69zm7fewjp0vkp306adnzt7249ytxhz7mq3w5yc629u6er9zsqqsy43fwz8es2wnn65rh0udc05tumdnx5xagvzd88ptncspmesdqhygcrvpf2

-

@ 04c915da:3dfbecc9

2025-05-16 18:06:46

@ 04c915da:3dfbecc9

2025-05-16 18:06:46Bitcoin has always been rooted in freedom and resistance to authority. I get that many of you are conflicted about the US Government stacking but by design we cannot stop anyone from using bitcoin. Many have asked me for my thoughts on the matter, so let’s rip it.

Concern

One of the most glaring issues with the strategic bitcoin reserve is its foundation, built on stolen bitcoin. For those of us who value private property this is an obvious betrayal of our core principles. Rather than proof of work, the bitcoin that seeds this reserve has been taken by force. The US Government should return the bitcoin stolen from Bitfinex and the Silk Road.

Using stolen bitcoin for the reserve creates a perverse incentive. If governments see bitcoin as a valuable asset, they will ramp up efforts to confiscate more bitcoin. The precedent is a major concern, and I stand strongly against it, but it should be also noted that governments were already seizing coin before the reserve so this is not really a change in policy.

Ideally all seized bitcoin should be burned, by law. This would align incentives properly and make it less likely for the government to actively increase coin seizures. Due to the truly scarce properties of bitcoin, all burned bitcoin helps existing holders through increased purchasing power regardless. This change would be unlikely but those of us in policy circles should push for it regardless. It would be best case scenario for American bitcoiners and would create a strong foundation for the next century of American leadership.

Optimism

The entire point of bitcoin is that we can spend or save it without permission. That said, it is a massive benefit to not have one of the strongest governments in human history actively trying to ruin our lives.

Since the beginning, bitcoiners have faced horrible regulatory trends. KYC, surveillance, and legal cases have made using bitcoin and building bitcoin businesses incredibly difficult. It is incredibly important to note that over the past year that trend has reversed for the first time in a decade. A strategic bitcoin reserve is a key driver of this shift. By holding bitcoin, the strongest government in the world has signaled that it is not just a fringe technology but rather truly valuable, legitimate, and worth stacking.

This alignment of incentives changes everything. The US Government stacking proves bitcoin’s worth. The resulting purchasing power appreciation helps all of us who are holding coin and as bitcoin succeeds our government receives direct benefit. A beautiful positive feedback loop.

Realism

We are trending in the right direction. A strategic bitcoin reserve is a sign that the state sees bitcoin as an asset worth embracing rather than destroying. That said, there is a lot of work left to be done. We cannot be lulled into complacency, the time to push forward is now, and we cannot take our foot off the gas. We have a seat at the table for the first time ever. Let's make it worth it.

We must protect the right to free usage of bitcoin and other digital technologies. Freedom in the digital age must be taken and defended, through both technical and political avenues. Multiple privacy focused developers are facing long jail sentences for building tools that protect our freedom. These cases are not just legal battles. They are attacks on the soul of bitcoin. We need to rally behind them, fight for their freedom, and ensure the ethos of bitcoin survives this new era of government interest. The strategic reserve is a step in the right direction, but it is up to us to hold the line and shape the future.

-

@ e3ba5e1a:5e433365

2025-04-15 11:03:15

@ e3ba5e1a:5e433365

2025-04-15 11:03:15Prelude

I wrote this post differently than any of my others. It started with a discussion with AI on an OPSec-inspired review of separation of powers, and evolved into quite an exciting debate! I asked Grok to write up a summary in my overall writing style, which it got pretty well. I've decided to post it exactly as-is. Ultimately, I think there are two solid ideas driving my stance here:

- Perfect is the enemy of the good

- Failure is the crucible of success

Beyond that, just some hard-core belief in freedom, separation of powers, and operating from self-interest.

Intro

Alright, buckle up. I’ve been chewing on this idea for a while, and it’s time to spit it out. Let’s look at the U.S. government like I’d look at a codebase under a cybersecurity audit—OPSEC style, no fluff. Forget the endless debates about what politicians should do. That’s noise. I want to talk about what they can do, the raw powers baked into the system, and why we should stop pretending those powers are sacred. If there’s a hole, either patch it or exploit it. No half-measures. And yeah, I’m okay if the whole thing crashes a bit—failure’s a feature, not a bug.

The Filibuster: A Security Rule with No Teeth

You ever see a firewall rule that’s more theater than protection? That’s the Senate filibuster. Everyone acts like it’s this untouchable guardian of democracy, but here’s the deal: a simple majority can torch it any day. It’s not a law; it’s a Senate preference, like choosing tabs over spaces. When people call killing it the “nuclear option,” I roll my eyes. Nuclear? It’s a button labeled “press me.” If a party wants it gone, they’ll do it. So why the dance?

I say stop playing games. Get rid of the filibuster. If you’re one of those folks who thinks it’s the only thing saving us from tyranny, fine—push for a constitutional amendment to lock it in. That’s a real patch, not a Post-it note. Until then, it’s just a vulnerability begging to be exploited. Every time a party threatens to nuke it, they’re admitting it’s not essential. So let’s stop pretending and move on.

Supreme Court Packing: Because Nine’s Just a Number

Here’s another fun one: the Supreme Court. Nine justices, right? Sounds official. Except it’s not. The Constitution doesn’t say nine—it’s silent on the number. Congress could pass a law tomorrow to make it 15, 20, or 42 (hitchhiker’s reference, anyone?). Packing the court is always on the table, and both sides know it. It’s like a root exploit just sitting there, waiting for someone to log in.

So why not call the bluff? If you’re in power—say, Trump’s back in the game—say, “I’m packing the court unless we amend the Constitution to fix it at nine.” Force the issue. No more shadowboxing. And honestly? The court’s got way too much power anyway. It’s not supposed to be a super-legislature, but here we are, with justices’ ideologies driving the bus. That’s a bug, not a feature. If the court weren’t such a kingmaker, packing it wouldn’t even matter. Maybe we should be talking about clipping its wings instead of just its size.

The Executive Should Go Full Klingon

Let’s talk presidents. I’m not saying they should wear Klingon armor and start shouting “Qapla’!”—though, let’s be real, that’d be awesome. I’m saying the executive should use every scrap of power the Constitution hands them. Enforce the laws you agree with, sideline the ones you don’t. If Congress doesn’t like it, they’ve got tools: pass new laws, override vetoes, or—here’s the big one—cut the budget. That’s not chaos; that’s the system working as designed.

Right now, the real problem isn’t the president overreaching; it’s the bureaucracy. It’s like a daemon running in the background, eating CPU and ignoring the user. The president’s supposed to be the one steering, but the administrative state’s got its own agenda. Let the executive flex, push the limits, and force Congress to check it. Norms? Pfft. The Constitution’s the spec sheet—stick to it.

Let the System Crash

Here’s where I get a little spicy: I’m totally fine if the government grinds to a halt. Deadlock isn’t a disaster; it’s a feature. If the branches can’t agree, let the president veto, let Congress starve the budget, let enforcement stall. Don’t tell me about “essential services.” Nothing’s so critical it can’t take a breather. Shutdowns force everyone to the table—debate, compromise, or expose who’s dropping the ball. If the public loses trust? Good. They’ll vote out the clowns or live with the circus they elected.

Think of it like a server crash. Sometimes you need a hard reboot to clear the cruft. If voters keep picking the same bad admins, well, the country gets what it deserves. Failure’s the best teacher—way better than limping along on autopilot.

States Are the Real MVPs

If the feds fumble, states step up. Right now, states act like junior devs waiting for the lead engineer to sign off. Why? Federal money. It’s a leash, and it’s tight. Cut that cash, and states will remember they’re autonomous. Some will shine, others will tank—looking at you, California. And I’m okay with that. Let people flee to better-run states. No bailouts, no excuses. States are like competing startups: the good ones thrive, the bad ones pivot or die.

Could it get uneven? Sure. Some states might turn into sci-fi utopias while others look like a post-apocalyptic vidya game. That’s the point—competition sorts it out. Citizens can move, markets adjust, and failure’s a signal to fix your act.

Chaos Isn’t the Enemy

Yeah, this sounds messy. States ignoring federal law, external threats poking at our seams, maybe even a constitutional crisis. I’m not scared. The Supreme Court’s there to referee interstate fights, and Congress sets the rules for state-to-state play. But if it all falls apart? Still cool. States can sort it without a babysitter—it’ll be ugly, but freedom’s worth it. External enemies? They’ll either unify us or break us. If we can’t rally, we don’t deserve the win.

Centralizing power to avoid this is like rewriting your app in a single thread to prevent race conditions—sure, it’s simpler, but you’re begging for a deadlock. Decentralized chaos lets states experiment, lets people escape, lets markets breathe. States competing to cut regulations to attract businesses? That’s a race to the bottom for red tape, but a race to the top for innovation—workers might gripe, but they’ll push back, and the tension’s healthy. Bring it—let the cage match play out. The Constitution’s checks are enough if we stop coddling the system.

Why This Matters

I’m not pitching a utopia. I’m pitching a stress test. The U.S. isn’t a fragile porcelain doll; it’s a rugged piece of hardware built to take some hits. Let it fail a little—filibuster, court, feds, whatever. Patch the holes with amendments if you want, or lean into the grind. Either way, stop fearing the crash. It’s how we debug the republic.

So, what’s your take? Ready to let the system rumble, or got a better way to secure the code? Hit me up—I’m all ears.

-

@ 04c915da:3dfbecc9

2025-05-16 17:59:23

@ 04c915da:3dfbecc9

2025-05-16 17:59:23Recently we have seen a wave of high profile X accounts hacked. These attacks have exposed the fragility of the status quo security model used by modern social media platforms like X. Many users have asked if nostr fixes this, so lets dive in. How do these types of attacks translate into the world of nostr apps? For clarity, I will use X’s security model as representative of most big tech social platforms and compare it to nostr.

The Status Quo

On X, you never have full control of your account. Ultimately to use it requires permission from the company. They can suspend your account or limit your distribution. Theoretically they can even post from your account at will. An X account is tied to an email and password. Users can also opt into two factor authentication, which adds an extra layer of protection, a login code generated by an app. In theory, this setup works well, but it places a heavy burden on users. You need to create a strong, unique password and safeguard it. You also need to ensure your email account and phone number remain secure, as attackers can exploit these to reset your credentials and take over your account. Even if you do everything responsibly, there is another weak link in X infrastructure itself. The platform’s infrastructure allows accounts to be reset through its backend. This could happen maliciously by an employee or through an external attacker who compromises X’s backend. When an account is compromised, the legitimate user often gets locked out, unable to post or regain control without contacting X’s support team. That process can be slow, frustrating, and sometimes fruitless if support denies the request or cannot verify your identity. Often times support will require users to provide identification info in order to regain access, which represents a privacy risk. The centralized nature of X means you are ultimately at the mercy of the company’s systems and staff.

Nostr Requires Responsibility

Nostr flips this model radically. Users do not need permission from a company to access their account, they can generate as many accounts as they want, and cannot be easily censored. The key tradeoff here is that users have to take complete responsibility for their security. Instead of relying on a username, password, and corporate servers, nostr uses a private key as the sole credential for your account. Users generate this key and it is their responsibility to keep it safe. As long as you have your key, you can post. If someone else gets it, they can post too. It is that simple. This design has strong implications. Unlike X, there is no backend reset option. If your key is compromised or lost, there is no customer support to call. In a compromise scenario, both you and the attacker can post from the account simultaneously. Neither can lock the other out, since nostr relays simply accept whatever is signed with a valid key.

The benefit? No reliance on proprietary corporate infrastructure.. The negative? Security rests entirely on how well you protect your key.

Future Nostr Security Improvements

For many users, nostr’s standard security model, storing a private key on a phone with an encrypted cloud backup, will likely be sufficient. It is simple and reasonably secure. That said, nostr’s strength lies in its flexibility as an open protocol. Users will be able to choose between a range of security models, balancing convenience and protection based on need.

One promising option is a web of trust model for key rotation. Imagine pre-selecting a group of trusted friends. If your account is compromised, these people could collectively sign an event announcing the compromise to the network and designate a new key as your legitimate one. Apps could handle this process seamlessly in the background, notifying followers of the switch without much user interaction. This could become a popular choice for average users, but it is not without tradeoffs. It requires trust in your chosen web of trust, which might not suit power users or large organizations. It also has the issue that some apps may not recognize the key rotation properly and followers might get confused about which account is “real.”

For those needing higher security, there is the option of multisig using FROST (Flexible Round-Optimized Schnorr Threshold). In this setup, multiple keys must sign off on every action, including posting and updating a profile. A hacker with just one key could not do anything. This is likely overkill for most users due to complexity and inconvenience, but it could be a game changer for large organizations, companies, and governments. Imagine the White House nostr account requiring signatures from multiple people before a post goes live, that would be much more secure than the status quo big tech model.

Another option are hardware signers, similar to bitcoin hardware wallets. Private keys are kept on secure, offline devices, separate from the internet connected phone or computer you use to broadcast events. This drastically reduces the risk of remote hacks, as private keys never touches the internet. It can be used in combination with multisig setups for extra protection. This setup is much less convenient and probably overkill for most but could be ideal for governments, companies, or other high profile accounts.

Nostr’s security model is not perfect but is robust and versatile. Ultimately users are in control and security is their responsibility. Apps will give users multiple options to choose from and users will choose what best fits their need.

-

@ 91bea5cd:1df4451c

2025-04-15 06:27:28

@ 91bea5cd:1df4451c

2025-04-15 06:27:28Básico

bash lsblk # Lista todos os diretorios montados.Para criar o sistema de arquivos:

bash mkfs.btrfs -L "ThePool" -f /dev/sdxCriando um subvolume:

bash btrfs subvolume create SubVolMontando Sistema de Arquivos:

bash mount -o compress=zlib,subvol=SubVol,autodefrag /dev/sdx /mntLista os discos formatados no diretório:

bash btrfs filesystem show /mntAdiciona novo disco ao subvolume:

bash btrfs device add -f /dev/sdy /mntLista novamente os discos do subvolume:

bash btrfs filesystem show /mntExibe uso dos discos do subvolume:

bash btrfs filesystem df /mntBalancea os dados entre os discos sobre raid1:

bash btrfs filesystem balance start -dconvert=raid1 -mconvert=raid1 /mntScrub é uma passagem por todos os dados e metadados do sistema de arquivos e verifica as somas de verificação. Se uma cópia válida estiver disponível (perfis de grupo de blocos replicados), a danificada será reparada. Todas as cópias dos perfis replicados são validadas.

iniciar o processo de depuração :

bash btrfs scrub start /mntver o status do processo de depuração Btrfs em execução:

bash btrfs scrub status /mntver o status do scrub Btrfs para cada um dos dispositivos

bash btrfs scrub status -d / data btrfs scrub cancel / dataPara retomar o processo de depuração do Btrfs que você cancelou ou pausou:

btrfs scrub resume / data

Listando os subvolumes:

bash btrfs subvolume list /ReportsCriando um instantâneo dos subvolumes:

Aqui, estamos criando um instantâneo de leitura e gravação chamado snap de marketing do subvolume de marketing.

bash btrfs subvolume snapshot /Reports/marketing /Reports/marketing-snapAlém disso, você pode criar um instantâneo somente leitura usando o sinalizador -r conforme mostrado. O marketing-rosnap é um instantâneo somente leitura do subvolume de marketing

bash btrfs subvolume snapshot -r /Reports/marketing /Reports/marketing-rosnapForçar a sincronização do sistema de arquivos usando o utilitário 'sync'

Para forçar a sincronização do sistema de arquivos, invoque a opção de sincronização conforme mostrado. Observe que o sistema de arquivos já deve estar montado para que o processo de sincronização continue com sucesso.

bash btrfs filsystem sync /ReportsPara excluir o dispositivo do sistema de arquivos, use o comando device delete conforme mostrado.

bash btrfs device delete /dev/sdc /ReportsPara sondar o status de um scrub, use o comando scrub status com a opção -dR .

bash btrfs scrub status -dR / RelatóriosPara cancelar a execução do scrub, use o comando scrub cancel .

bash $ sudo btrfs scrub cancel / ReportsPara retomar ou continuar com uma depuração interrompida anteriormente, execute o comando de cancelamento de depuração

bash sudo btrfs scrub resume /Reportsmostra o uso do dispositivo de armazenamento:

btrfs filesystem usage /data

Para distribuir os dados, metadados e dados do sistema em todos os dispositivos de armazenamento do RAID (incluindo o dispositivo de armazenamento recém-adicionado) montados no diretório /data , execute o seguinte comando:

sudo btrfs balance start --full-balance /data

Pode demorar um pouco para espalhar os dados, metadados e dados do sistema em todos os dispositivos de armazenamento do RAID se ele contiver muitos dados.

Opções importantes de montagem Btrfs

Nesta seção, vou explicar algumas das importantes opções de montagem do Btrfs. Então vamos começar.

As opções de montagem Btrfs mais importantes são:

**1. acl e noacl

**ACL gerencia permissões de usuários e grupos para os arquivos/diretórios do sistema de arquivos Btrfs.

A opção de montagem acl Btrfs habilita ACL. Para desabilitar a ACL, você pode usar a opção de montagem noacl .

Por padrão, a ACL está habilitada. Portanto, o sistema de arquivos Btrfs usa a opção de montagem acl por padrão.

**2. autodefrag e noautodefrag

**Desfragmentar um sistema de arquivos Btrfs melhorará o desempenho do sistema de arquivos reduzindo a fragmentação de dados.

A opção de montagem autodefrag permite a desfragmentação automática do sistema de arquivos Btrfs.

A opção de montagem noautodefrag desativa a desfragmentação automática do sistema de arquivos Btrfs.

Por padrão, a desfragmentação automática está desabilitada. Portanto, o sistema de arquivos Btrfs usa a opção de montagem noautodefrag por padrão.

**3. compactar e compactar-forçar

**Controla a compactação de dados no nível do sistema de arquivos do sistema de arquivos Btrfs.

A opção compactar compacta apenas os arquivos que valem a pena compactar (se compactar o arquivo economizar espaço em disco).

A opção compress-force compacta todos os arquivos do sistema de arquivos Btrfs, mesmo que a compactação do arquivo aumente seu tamanho.

O sistema de arquivos Btrfs suporta muitos algoritmos de compactação e cada um dos algoritmos de compactação possui diferentes níveis de compactação.

Os algoritmos de compactação suportados pelo Btrfs são: lzo , zlib (nível 1 a 9) e zstd (nível 1 a 15).

Você pode especificar qual algoritmo de compactação usar para o sistema de arquivos Btrfs com uma das seguintes opções de montagem:

- compress=algoritmo:nível

- compress-force=algoritmo:nível

Para obter mais informações, consulte meu artigo Como habilitar a compactação do sistema de arquivos Btrfs .

**4. subvol e subvolid

**Estas opções de montagem são usadas para montar separadamente um subvolume específico de um sistema de arquivos Btrfs.

A opção de montagem subvol é usada para montar o subvolume de um sistema de arquivos Btrfs usando seu caminho relativo.

A opção de montagem subvolid é usada para montar o subvolume de um sistema de arquivos Btrfs usando o ID do subvolume.

Para obter mais informações, consulte meu artigo Como criar e montar subvolumes Btrfs .

**5. dispositivo

A opção de montagem de dispositivo** é usada no sistema de arquivos Btrfs de vários dispositivos ou RAID Btrfs.

Em alguns casos, o sistema operacional pode falhar ao detectar os dispositivos de armazenamento usados em um sistema de arquivos Btrfs de vários dispositivos ou RAID Btrfs. Nesses casos, você pode usar a opção de montagem do dispositivo para especificar os dispositivos que deseja usar para o sistema de arquivos de vários dispositivos Btrfs ou RAID.

Você pode usar a opção de montagem de dispositivo várias vezes para carregar diferentes dispositivos de armazenamento para o sistema de arquivos de vários dispositivos Btrfs ou RAID.

Você pode usar o nome do dispositivo (ou seja, sdb , sdc ) ou UUID , UUID_SUB ou PARTUUID do dispositivo de armazenamento com a opção de montagem do dispositivo para identificar o dispositivo de armazenamento.

Por exemplo,

- dispositivo=/dev/sdb

- dispositivo=/dev/sdb,dispositivo=/dev/sdc

- dispositivo=UUID_SUB=490a263d-eb9a-4558-931e-998d4d080c5d

- device=UUID_SUB=490a263d-eb9a-4558-931e-998d4d080c5d,device=UUID_SUB=f7ce4875-0874-436a-b47d-3edef66d3424

**6. degraded

A opção de montagem degradada** permite que um RAID Btrfs seja montado com menos dispositivos de armazenamento do que o perfil RAID requer.

Por exemplo, o perfil raid1 requer a presença de 2 dispositivos de armazenamento. Se um dos dispositivos de armazenamento não estiver disponível em qualquer caso, você usa a opção de montagem degradada para montar o RAID mesmo que 1 de 2 dispositivos de armazenamento esteja disponível.

**7. commit

A opção commit** mount é usada para definir o intervalo (em segundos) dentro do qual os dados serão gravados no dispositivo de armazenamento.

O padrão é definido como 30 segundos.

Para definir o intervalo de confirmação para 15 segundos, você pode usar a opção de montagem commit=15 (digamos).

**8. ssd e nossd

A opção de montagem ssd** informa ao sistema de arquivos Btrfs que o sistema de arquivos está usando um dispositivo de armazenamento SSD, e o sistema de arquivos Btrfs faz a otimização SSD necessária.

A opção de montagem nossd desativa a otimização do SSD.

O sistema de arquivos Btrfs detecta automaticamente se um SSD é usado para o sistema de arquivos Btrfs. Se um SSD for usado, a opção de montagem de SSD será habilitada. Caso contrário, a opção de montagem nossd é habilitada.

**9. ssd_spread e nossd_spread

A opção de montagem ssd_spread** tenta alocar grandes blocos contínuos de espaço não utilizado do SSD. Esse recurso melhora o desempenho de SSDs de baixo custo (baratos).

A opção de montagem nossd_spread desativa o recurso ssd_spread .

O sistema de arquivos Btrfs detecta automaticamente se um SSD é usado para o sistema de arquivos Btrfs. Se um SSD for usado, a opção de montagem ssd_spread será habilitada. Caso contrário, a opção de montagem nossd_spread é habilitada.

**10. descarte e nodiscard

Se você estiver usando um SSD que suporte TRIM enfileirado assíncrono (SATA rev3.1), a opção de montagem de descarte** permitirá o descarte de blocos de arquivos liberados. Isso melhorará o desempenho do SSD.

Se o SSD não suportar TRIM enfileirado assíncrono, a opção de montagem de descarte prejudicará o desempenho do SSD. Nesse caso, a opção de montagem nodiscard deve ser usada.

Por padrão, a opção de montagem nodiscard é usada.

**11. norecovery

Se a opção de montagem norecovery** for usada, o sistema de arquivos Btrfs não tentará executar a operação de recuperação de dados no momento da montagem.

**12. usebackuproot e nousebackuproot

Se a opção de montagem usebackuproot for usada, o sistema de arquivos Btrfs tentará recuperar qualquer raiz de árvore ruim/corrompida no momento da montagem. O sistema de arquivos Btrfs pode armazenar várias raízes de árvore no sistema de arquivos. A opção de montagem usebackuproot** procurará uma boa raiz de árvore e usará a primeira boa que encontrar.

A opção de montagem nousebackuproot não verificará ou recuperará raízes de árvore inválidas/corrompidas no momento da montagem. Este é o comportamento padrão do sistema de arquivos Btrfs.

**13. space_cache, space_cache=version, nospace_cache e clear_cache

A opção de montagem space_cache** é usada para controlar o cache de espaço livre. O cache de espaço livre é usado para melhorar o desempenho da leitura do espaço livre do grupo de blocos do sistema de arquivos Btrfs na memória (RAM).

O sistema de arquivos Btrfs suporta 2 versões do cache de espaço livre: v1 (padrão) e v2

O mecanismo de cache de espaço livre v2 melhora o desempenho de sistemas de arquivos grandes (tamanho de vários terabytes).

Você pode usar a opção de montagem space_cache=v1 para definir a v1 do cache de espaço livre e a opção de montagem space_cache=v2 para definir a v2 do cache de espaço livre.

A opção de montagem clear_cache é usada para limpar o cache de espaço livre.

Quando o cache de espaço livre v2 é criado, o cache deve ser limpo para criar um cache de espaço livre v1 .

Portanto, para usar o cache de espaço livre v1 após a criação do cache de espaço livre v2 , as opções de montagem clear_cache e space_cache=v1 devem ser combinadas: clear_cache,space_cache=v1

A opção de montagem nospace_cache é usada para desabilitar o cache de espaço livre.

Para desabilitar o cache de espaço livre após a criação do cache v1 ou v2 , as opções de montagem nospace_cache e clear_cache devem ser combinadas: clear_cache,nosapce_cache

**14. skip_balance

Por padrão, a operação de balanceamento interrompida/pausada de um sistema de arquivos Btrfs de vários dispositivos ou RAID Btrfs será retomada automaticamente assim que o sistema de arquivos Btrfs for montado. Para desabilitar a retomada automática da operação de equilíbrio interrompido/pausado em um sistema de arquivos Btrfs de vários dispositivos ou RAID Btrfs, você pode usar a opção de montagem skip_balance .**

**15. datacow e nodatacow

A opção datacow** mount habilita o recurso Copy-on-Write (CoW) do sistema de arquivos Btrfs. É o comportamento padrão.

Se você deseja desabilitar o recurso Copy-on-Write (CoW) do sistema de arquivos Btrfs para os arquivos recém-criados, monte o sistema de arquivos Btrfs com a opção de montagem nodatacow .

**16. datasum e nodatasum

A opção datasum** mount habilita a soma de verificação de dados para arquivos recém-criados do sistema de arquivos Btrfs. Este é o comportamento padrão.

Se você não quiser que o sistema de arquivos Btrfs faça a soma de verificação dos dados dos arquivos recém-criados, monte o sistema de arquivos Btrfs com a opção de montagem nodatasum .

Perfis Btrfs

Um perfil Btrfs é usado para informar ao sistema de arquivos Btrfs quantas cópias dos dados/metadados devem ser mantidas e quais níveis de RAID devem ser usados para os dados/metadados. O sistema de arquivos Btrfs contém muitos perfis. Entendê-los o ajudará a configurar um RAID Btrfs da maneira que você deseja.

Os perfis Btrfs disponíveis são os seguintes:

single : Se o perfil único for usado para os dados/metadados, apenas uma cópia dos dados/metadados será armazenada no sistema de arquivos, mesmo se você adicionar vários dispositivos de armazenamento ao sistema de arquivos. Assim, 100% do espaço em disco de cada um dos dispositivos de armazenamento adicionados ao sistema de arquivos pode ser utilizado.

dup : Se o perfil dup for usado para os dados/metadados, cada um dos dispositivos de armazenamento adicionados ao sistema de arquivos manterá duas cópias dos dados/metadados. Assim, 50% do espaço em disco de cada um dos dispositivos de armazenamento adicionados ao sistema de arquivos pode ser utilizado.

raid0 : No perfil raid0 , os dados/metadados serão divididos igualmente em todos os dispositivos de armazenamento adicionados ao sistema de arquivos. Nesta configuração, não haverá dados/metadados redundantes (duplicados). Assim, 100% do espaço em disco de cada um dos dispositivos de armazenamento adicionados ao sistema de arquivos pode ser usado. Se, em qualquer caso, um dos dispositivos de armazenamento falhar, todo o sistema de arquivos será corrompido. Você precisará de pelo menos dois dispositivos de armazenamento para configurar o sistema de arquivos Btrfs no perfil raid0 .

raid1 : No perfil raid1 , duas cópias dos dados/metadados serão armazenadas nos dispositivos de armazenamento adicionados ao sistema de arquivos. Nesta configuração, a matriz RAID pode sobreviver a uma falha de unidade. Mas você pode usar apenas 50% do espaço total em disco. Você precisará de pelo menos dois dispositivos de armazenamento para configurar o sistema de arquivos Btrfs no perfil raid1 .

raid1c3 : No perfil raid1c3 , três cópias dos dados/metadados serão armazenadas nos dispositivos de armazenamento adicionados ao sistema de arquivos. Nesta configuração, a matriz RAID pode sobreviver a duas falhas de unidade, mas você pode usar apenas 33% do espaço total em disco. Você precisará de pelo menos três dispositivos de armazenamento para configurar o sistema de arquivos Btrfs no perfil raid1c3 .

raid1c4 : No perfil raid1c4 , quatro cópias dos dados/metadados serão armazenadas nos dispositivos de armazenamento adicionados ao sistema de arquivos. Nesta configuração, a matriz RAID pode sobreviver a três falhas de unidade, mas você pode usar apenas 25% do espaço total em disco. Você precisará de pelo menos quatro dispositivos de armazenamento para configurar o sistema de arquivos Btrfs no perfil raid1c4 .

raid10 : No perfil raid10 , duas cópias dos dados/metadados serão armazenadas nos dispositivos de armazenamento adicionados ao sistema de arquivos, como no perfil raid1 . Além disso, os dados/metadados serão divididos entre os dispositivos de armazenamento, como no perfil raid0 .

O perfil raid10 é um híbrido dos perfis raid1 e raid0 . Alguns dos dispositivos de armazenamento formam arrays raid1 e alguns desses arrays raid1 são usados para formar um array raid0 . Em uma configuração raid10 , o sistema de arquivos pode sobreviver a uma única falha de unidade em cada uma das matrizes raid1 .

Você pode usar 50% do espaço total em disco na configuração raid10 . Você precisará de pelo menos quatro dispositivos de armazenamento para configurar o sistema de arquivos Btrfs no perfil raid10 .

raid5 : No perfil raid5 , uma cópia dos dados/metadados será dividida entre os dispositivos de armazenamento. Uma única paridade será calculada e distribuída entre os dispositivos de armazenamento do array RAID.

Em uma configuração raid5 , o sistema de arquivos pode sobreviver a uma única falha de unidade. Se uma unidade falhar, você pode adicionar uma nova unidade ao sistema de arquivos e os dados perdidos serão calculados a partir da paridade distribuída das unidades em execução.

Você pode usar 1 00x(N-1)/N % do total de espaços em disco na configuração raid5 . Aqui, N é o número de dispositivos de armazenamento adicionados ao sistema de arquivos. Você precisará de pelo menos três dispositivos de armazenamento para configurar o sistema de arquivos Btrfs no perfil raid5 .

raid6 : No perfil raid6 , uma cópia dos dados/metadados será dividida entre os dispositivos de armazenamento. Duas paridades serão calculadas e distribuídas entre os dispositivos de armazenamento do array RAID.

Em uma configuração raid6 , o sistema de arquivos pode sobreviver a duas falhas de unidade ao mesmo tempo. Se uma unidade falhar, você poderá adicionar uma nova unidade ao sistema de arquivos e os dados perdidos serão calculados a partir das duas paridades distribuídas das unidades em execução.

Você pode usar 100x(N-2)/N % do espaço total em disco na configuração raid6 . Aqui, N é o número de dispositivos de armazenamento adicionados ao sistema de arquivos. Você precisará de pelo menos quatro dispositivos de armazenamento para configurar o sistema de arquivos Btrfs no perfil raid6 .

-

@ 04c915da:3dfbecc9

2025-05-16 17:51:54

@ 04c915da:3dfbecc9

2025-05-16 17:51:54In much of the world, it is incredibly difficult to access U.S. dollars. Local currencies are often poorly managed and riddled with corruption. Billions of people demand a more reliable alternative. While the dollar has its own issues of corruption and mismanagement, it is widely regarded as superior to the fiat currencies it competes with globally. As a result, Tether has found massive success providing low cost, low friction access to dollars. Tether claims 400 million total users, is on track to add 200 million more this year, processes 8.1 million transactions daily, and facilitates $29 billion in daily transfers. Furthermore, their estimates suggest nearly 40% of users rely on it as a savings tool rather than just a transactional currency.

Tether’s rise has made the company a financial juggernaut. Last year alone, Tether raked in over $13 billion in profit, with a lean team of less than 100 employees. Their business model is elegantly simple: hold U.S. Treasuries and collect the interest. With over $113 billion in Treasuries, Tether has turned a straightforward concept into a profit machine.

Tether’s success has resulted in many competitors eager to claim a piece of the pie. This has triggered a massive venture capital grift cycle in USD tokens, with countless projects vying to dethrone Tether. Due to Tether’s entrenched network effect, these challengers face an uphill battle with little realistic chance of success. Most educated participants in the space likely recognize this reality but seem content to perpetuate the grift, hoping to cash out by dumping their equity positions on unsuspecting buyers before they realize the reality of the situation.

Historically, Tether’s greatest vulnerability has been U.S. government intervention. For over a decade, the company operated offshore with few allies in the U.S. establishment, making it a major target for regulatory action. That dynamic has shifted recently and Tether has seized the opportunity. By actively courting U.S. government support, Tether has fortified their position. This strategic move will likely cement their status as the dominant USD token for years to come.

While undeniably a great tool for the millions of users that rely on it, Tether is not without flaws. As a centralized, trusted third party, it holds the power to freeze or seize funds at its discretion. Corporate mismanagement or deliberate malpractice could also lead to massive losses at scale. In their goal of mitigating regulatory risk, Tether has deepened ties with law enforcement, mirroring some of the concerns of potential central bank digital currencies. In practice, Tether operates as a corporate CBDC alternative, collaborating with authorities to surveil and seize funds. The company proudly touts partnerships with leading surveillance firms and its own data reveals cooperation in over 1,000 law enforcement cases, with more than $2.5 billion in funds frozen.

The global demand for Tether is undeniable and the company’s profitability reflects its unrivaled success. Tether is owned and operated by bitcoiners and will likely continue to push forward strategic goals that help the movement as a whole. Recent efforts to mitigate the threat of U.S. government enforcement will likely solidify their network effect and stifle meaningful adoption of rival USD tokens or CBDCs. Yet, for all their achievements, Tether is simply a worse form of money than bitcoin. Tether requires trust in a centralized entity, while bitcoin can be saved or spent without permission. Furthermore, Tether is tied to the value of the US Dollar which is designed to lose purchasing power over time, while bitcoin, as a truly scarce asset, is designed to increase in purchasing power with adoption. As people awaken to the risks of Tether’s control, and the benefits bitcoin provides, bitcoin adoption will likely surpass it.

-

@ 04c915da:3dfbecc9

2025-05-16 17:12:05

@ 04c915da:3dfbecc9

2025-05-16 17:12:05One of the most common criticisms leveled against nostr is the perceived lack of assurance when it comes to data storage. Critics argue that without a centralized authority guaranteeing that all data is preserved, important information will be lost. They also claim that running a relay will become prohibitively expensive. While there is truth to these concerns, they miss the mark. The genius of nostr lies in its flexibility, resilience, and the way it harnesses human incentives to ensure data availability in practice.

A nostr relay is simply a server that holds cryptographically verifiable signed data and makes it available to others. Relays are simple, flexible, open, and require no permission to run. Critics are right that operating a relay attempting to store all nostr data will be costly. What they miss is that most will not run all encompassing archive relays. Nostr does not rely on massive archive relays. Instead, anyone can run a relay and choose to store whatever subset of data they want. This keeps costs low and operations flexible, making relay operation accessible to all sorts of individuals and entities with varying use cases.

Critics are correct that there is no ironclad guarantee that every piece of data will always be available. Unlike bitcoin where data permanence is baked into the system at a steep cost, nostr does not promise that every random note or meme will be preserved forever. That said, in practice, any data perceived as valuable by someone will likely be stored and distributed by multiple entities. If something matters to someone, they will keep a signed copy.

Nostr is the Streisand Effect in protocol form. The Streisand effect is when an attempt to suppress information backfires, causing it to spread even further. With nostr, anyone can broadcast signed data, anyone can store it, and anyone can distribute it. Try to censor something important? Good luck. The moment it catches attention, it will be stored on relays across the globe, copied, and shared by those who find it worth keeping. Data deemed important will be replicated across servers by individuals acting in their own interest.

Nostr’s distributed nature ensures that the system does not rely on a single point of failure or a corporate overlord. Instead, it leans on the collective will of its users. The result is a network where costs stay manageable, participation is open to all, and valuable verifiable data is stored and distributed forever.

-

@ 57c631a3:07529a8e

2025-04-07 13:17:50

@ 57c631a3:07529a8e

2025-04-07 13:17:50What is Growth Engineering? Before we start: if you’ve already filled out the What is your tech stack? survey: thank you! If you’ve not done so, your help will be greatly appreciated. It takes 5-15 minutes to complete. Those filling out will receive results before anyone else, and additional analysis from myself and Elin. Fill out this survey here.**

npub1sg6plzptd64u62a878hep2kev88swjh3tw00gjsfl8f237lmu63q0uf63m

Growth engineering was barely known a decade ago, but today, most scaleups and many publicly traded tech companies have dedicated growth teams staffed by growth engineers. However, some software engineers are still suspicious of this new area because of its reputation for hacky code with little to no code coverage.

For this reason and others, I thought it would be interesting to learn more from an expert who can tell us all about the practicalities of this controversial domain. So I turned to Alexey Komissarouk, who’s been in growth engineering since 2016, and was in charge of it at online education platform, MasterClass. These days, Alexey lives in Tokyo, Japan, where he advises on growth engineering and teaches the Growth Engineering course at Reforge.

In today’s deep dive, Alexey covers:

- What is Growth Engineering? In the simplest terms: writing code to help a company make more money. But there are details to consider: like the company size where it makes sense to have a dedicated team do this.

- What do Growth Engineers work on? Business-facing work, empowerment and platform work are the main areas.

- Why Growth Engineers move faster than Product Engineers. Product Engineers ship to build: Growth Engineers ship to learn. Growth Engineers do take shortcuts that would make no sense when building for longevity – doing this on purpose.

- Tech stack. Common programming languages, monitoring and oncall, feature flags and experimentation, product analytics, review apps, and more.

- What makes a good Growth Engineer? Curiosity, “build to learn” mindset and a “Jack of all trades” approach.

- Where do Growth Engineers fit in? Usually part of the engineering department, either operating as with an “owner” or a “hitchiker” model.

- Becoming a Growth Engineer. A great area if you want to eventually become a founder or product manager – but even if not, it can accelerate your career growth. Working in Growth forces you to learn more about the business.

With that, it’s over to Alexey:

I’ll never forget the first time I made my employer a million dollars.

I was running a push notification A/B test for meal delivery startup Sprig, trying to boost repeat orders.

A push notification similar to what we tested to boost repeat orders

Initial results were unpromising; the push notification was not receiving many opens. Still, I wanted to be thorough: before concluding the idea was a failure, I wrote a SQL query to compare order volume for subsequent weeks between customers in test vs control.

The SQL used to figure out the push notification’s efficiency

As it turned out, our test group “beat” the control group by around 10%:

‘review_5_push’ was the new type of push notification. Roughly the same amount of users clicked it, but they placed 10% more in orders

I plugged the numbers into a significance calculator, which showed it was statistically significant – or “stat-sig” – and therefore highly unlikely to be a coincidence. This meant we had a winner on our hands! But how meaningful was it, really, and what would adding the push notification mean for revenue, if rolled out to 100% of users?

It turned out this experiment created an additional $1.5 million dollars, annually, with just one push notification. Wow!

I was hooked. Since that day, I've shipped hundreds of experimental “winners” which generated hundreds of millions of incremental revenue for my employers. But you never forget the first one. Moments like this is what growth engineering is all about.

1. What is Growth Engineering?

Essentially, growth engineering is the writing of code to make a company money. Of course, all code produced by a business on some level serves this purpose, but while Product Engineers focus on creating a Product worth paying for, Growth Engineers instead focus on making that good product have a good business. To this end, they focus on optimizing and refining key parts of the customer journey, such as:

- Getting more people to consider the product

- Converting them into paying customers

- Keeping them as customers for longer, and spending more

What kinds of companies employ Growth Engineers? Places you’ve heard of, like Meta, LinkedIn, DoorDash, Coinbase, and Dropbox, are some of the ones I’ve had students from. There’s also OpenAI, Uber, Tiktok, Tinder, Airbnb, Pinterest… the list of high-profile companies goes on. Most newer public consumer companies you’ve heard have a growth engineering org, too.

Typically, growth engineering orgs are started by companies at Series B stage and beyond, so long as they are selling to either consumers or businesses via SaaS. These are often places trying to grow extremely fast, and have enough software engineers that some can focus purely on growth. Before the Series B stage, a team is unlikely to be ready for growth for various reasons; likely that it hasn’t found product-market fit, or has no available headcount, or lacks the visitor traffic required to run A/B tests.

Cost is a consideration. A fully-loaded growth team consisting of a handful of engineers, a PM, and a designer costs approximately 1 million dollars annually. To justify this, a rule of thumb is to have at least $5 million dollars in recurring revenue – a milestone often achieved at around the Series B stage.

Despite the presence of growth engineering at many public consumer tech companies, the field itself is still quite new, as a discipline and as a proper title.

Brief history of growth engineering

When I joined Opendoor in 2016, there was a head of growth but no dedicated growth engineers, but there were by the time I left in 2020. At MasterClass soon after, there was a growth org and a dozen dedicated growth engineers. So when did growth engineering originate?

The story is that its origins lie at Facebook in 2007. The team was created by then-VP of platform and monetization Chamath Palihapitiya. Reforce founder and CEO Brian Balfour shares:

“Growth (the kind found on an org chart) began at Facebook under the direction of Chamath Palihapitiya. In 2007, he joined the early team in a nebulous role that fell somewhere between Product, Marketing, and Operations. According to his retelling of the story on Recode Decode, after struggling to accomplish anything meaningful in his first year on the job, he was on the verge of being fired.Sheryl Sandberg joined soon after him, and in a hail mary move he pitched her the game-changing idea that led to the creation of the first-ever growth team. This idea not only saved his job, but earned him the lion’s share of the credit for Facebook’s unprecedented growth.At the time, Sheryl and Mark asked him, “What do you call this thing where you help change the product, do some SEO and SEM, and algorithmically do this or that?”His response: “I don’t know, I just call that, like, Growth, you know, we’re going to try to grow. I’ll be the head of growing stuff."And just like that, Growth became a thing.”

Rather than focus on a particular product or feature, the growth team at Facebook focused on moving the needle, and figuring out which features to work on. These days, Meta employs hundreds if not thousands of growth engineers.

2. What do Growth Engineers work on?

Before we jump into concrete examples, let’s identify three primary focus areas that a growth engineer’s work usually involves.

- Business-facing work – improving the business directly

- Empowerment work – enabling other teams to improve the business

- Platform work – improving the velocity of the above activities

Let’s go through all three:

Business-facing work

This is the bread and butter of growth engineering, and follows a common pattern:

- Implement an idea. Try something big or small to try and move a key business metric, which differs by team but is typically related to conversion rate or retention.

- Quantify impact. Usually via A/B testing.

- Analyze impact. Await results, analyze impact, ship or roll back – then go back to the first step.

Experiments can lead to sweeping or barely noticeable changes. A famous “I can’t believe they needed to test this” was when Google figured out which shade of blue generates the most clicks. At MasterClass, we tested things across the spectrum:

- Small: should we show the price right on the homepage, was that a winner? Yes, but we framed it in monthly terms of $15/month, not $180/year.

- Medium: when browsing a course page, should we include related courses, or more details about the course itself? Was it a winner? After lengthy experimentation, it was hard to tell: both are valuable and we needed to strike the right balance.

- Large: when a potential customer is interested, do we take them straight to checkout, or encourage them to learn more? Counterintuitively, adding steps boosted conversion!

Empowerment

One of the best ways an engineer can move a target metric is by removing themselves as a bottleneck, so colleagues from marketing can iterate and optimize freely. To this end, growth engineers can either build internal tools or integrate self-serve MarTech (Marketing Technology) vendors.

With the right tool, there’s a lot that marketers can do without engineering’s involvement:

- Build and iterate on landing pages (Unbounce, Instapage, etc)

- Draft and send email, SMS and Push Notifications (Iterable, Braze, Customer.io, etc)

- Connect new advertising partners (Google Tag Manager, Segment, etc)

We go more into detail about benefits and applications in the MarTech section of Tech Stack, below.

Platform work

As a business scales, dedicated platform teams help improve stability and velocity for the teams they support. Within growth, this often includes initiatives like:

- Experiment Platform. Many parts of running an experiment can be standardized, from filtering the audience, to bucketing users properly, to observing statistical methodology. Historically, companies built reusable Experiment Platforms in-house, but more recently, vendors such as Eppo and Statsig have grown in popularity with fancy statistical methodologies like “Controlled Using Pre-Experiment Data” (CUPED) that give more signal with less data.

- Reusable components. Companies with standard front-end components for things like headlines, buttons, and images, dramatically reduce the time required to spin up a new page. No more "did you want 5 or 6 pixels here" with a designer; instead growth engineers rely on tools like Storybook to standardize and share reusable React components.

- Monitoring. Growth engineering benefits greatly from leveraging monitoring to compensate for reduced code coverage. High-quality business metric monitoring tools can detect bugs before they cause damage.

When I worked at MasterClass, having monitoring at the ad layer prevented at least one six-figure incident. One Friday, a marketer accidentally broadened the audience for a particular ad from US-only, to worldwide. In response, the Facebook Ad algorithm went on a spending spree, bringing in plenty of visitors from places like Brazil and India, whom we knew from past experience were unlikely to purchase the product. Fortunately, our monitoring noticed the low-performing campaign within minutes, and an alert was sent to the growth engineer on-call, who immediately reached out to the marketer and confirmed the change was unintentional, and then shut down the campaign.

Without this monitoring, a subtle targeting error like this could have gone unnoticed all weekend and would have eaten up $100,000+ of marketing budget. This episode shows that platform investment can benefit everyone; and since growth needs them most, it’s often the growth platform engineering team which implements them.

As the day-to-day work of a Growth Engineer shows, A/B tests are a critical tool to both measure success and learn. It’s a numbers game: the more A/B tests a team can run in a given quarter, the more of them will end up winners, making the team successful. It’s no wonder, then, that Growth Engineering will pull out all the stops to improve velocity.

3. Why Growth Engineers move faster than Product Engineers

On the surface, growth engineering teams look like product engineering ones; writing code, shipping pull requests, monitoring on-call, etc. So how do they move so much faster? The big reason lies in philosophy and focus, not technology. To quote Elena Verna, head of growth at Dropbox:

“Product Engineering teams ship to build; Growth Engineering teams ship to learn.”

Real-world case: price changes at Masterclass

A few years ago at MasterClass, the growth team wanted to see if changing our pricing model to multiple tiers would improve revenue.

Inspired in part by multiple pricing tiers for competitors such as Netflix (above), Disney Plus, and Hulu.

The “multiple pricing tier” proposal for MasterClass.

From a software engineering perspective, this was a highly complex project because:

- Backend engineering work: the backend did not yet support multiple pricing options, requiring a decent amount of engineering, and rigorous testing to make sure existing customers weren’t affected.

- Client app changes: on the device side, multiple platforms (iOS, iPad, Android, Roku, Apple TV, etc) would each need to be updated, including each relevant app store.

The software engineering team estimated that becoming a “multi-pricing-tier” company would take months across numerous engineering teams, and engineering leadership was unwilling to greenlight that significant investment.

We in growth engineering took this as a challenge. As usual, our goal was not just to add the new pricing model, but to learn how much money it might bring in. The approach we ended up proposing was a Fake Door test, which involves offering a not-yet-available option to customers to gauge interest level. This was risky, as taking a customer who’s ready to pay and telling them to join some kind of waiting list is a colossal waste, and risks making them feel like the target of a “bait and switch” trick.