-

@ 9b308fda:b6c7310d

2025-05-22 18:30:19

@ 9b308fda:b6c7310d

2025-05-22 18:30:19@15/05/2025 ✨ Week 0 – Getting Started with My Internship at Formstr (Onboarding)

I’m excited to share that I’ve been selected as a Summer of Bitcoin intern at Formstr!

After the final exams wrapped up on May 4th, I took a short, well-deserved break while traveling back home from college for the summer. Once settled in, I quickly transitioned into internship mode and began diving into the project assigned to me at Formstr.

It’s been a great start so far, and I’m looking forward to learning, building, and sharing more along the way.

@22/05/2025 — Week 01 – Building Features and Brainstorming at Formstr

This week at Formstr was packed with development and discussions.

The major highlight was completing the row popup view for form responses — now, clicking on any response row shows a clean and complete view of that user's submission. I'm happy to share that the pull request has been merged! It feels great to contribute something that improves the user experience so visibly.

Alongside that, I started brainstorming the LLM-Analysis feature. We had a productive discussion during the weekly developer meeting on Signal, where I shared my initial thoughts and got valuable input from the team. There's a lot of potential in this, and it’s exciting to shape it from the ground up.

I also worked on improving relay management in the form settings to reduce redundancy. The changes are in progress, and it’s almost done — just final touches left before merging.

Another topic we tackled was the “Form Filler with AI” feature. There are still some open questions around implementation and user flow, so we’ve decided to continue discussions with more team members before finalizing the plan.

We’ve also agreed to hold weekly team meetings going forward to keep everyone aligned on ideas, progress, and blockers. I’m glad to be part of such a collaborative and thoughtful team!

-

@ bd4ae3e6:1dfb81f5

2025-05-20 08:46:08

@ bd4ae3e6:1dfb81f5

2025-05-20 08:46:08 -

@ 7e6f9018:a6bbbce5

2025-05-22 18:17:57

@ 7e6f9018:a6bbbce5

2025-05-22 18:17:57Governments and the press often publish data on the population’s knowledge of Catalan. However, this data only represents one stage in the linguistic process and does not accurately reflect the state of the language, since a language only has a future if it is used. Knowledge is a necessary step toward using a language, but it is not the final stage — that stage is actual use.

So what is the state of Catalan usage? If we look at data on regular use, we see that the Catalan language has remained stagnant over the past hundred years, with nearly the same number of regular speakers. In 1930, there were around 2.5 million speakers, and in 2018, there were 2.7 million.

Regular use of Catalan in Catalonia, in millions of speakers. The dotted segments are an estimate of the trend, based on the statements of Joan Coromines and adjusted according to Catalonia’s population growth.

Regular use of Catalan in Catalonia, in millions of speakers. The dotted segments are an estimate of the trend, based on the statements of Joan Coromines and adjusted according to Catalonia’s population growth.These figures wouldn’t necessarily be negative if the language’s integrity were strong, that is, if its existence weren’t threatened by other languages. But the population of Catalonia has grown from 2.7 million in 1930 to 7.5 million in 2018. This means that today, regular Catalan speakers make up only 36% of Catalonia’s population, whereas in 1930, they represented 90%.

Regular use of Catalan in Catalonia, as a percentage of speakers. The dotted segments are an estimate of the trend, based on the statements of Joan Coromines and adjusted according to Catalonia’s population growth.

Regular use of Catalan in Catalonia, as a percentage of speakers. The dotted segments are an estimate of the trend, based on the statements of Joan Coromines and adjusted according to Catalonia’s population growth.The language that has gained the most ground is mainly Spanish, which went from 200,000 speakers in 1930 to 3.8 million in 2018. Moreover, speakers of other foreign languages (500,000 speakers) have also grown more than Catalan speakers over the past hundred years.

Notes, Sources, and Methodology

The data from 2003 onward is taken from Idescat (source). Before 2003, there are no official statistics, but we can make interpretations based on historical evidence. The data prior to 2003 is calculated based on two key pieces of evidence:

-

1st Interpretation: In 1930, 90% of the population of Catalonia spoke Catalan regularly. Source and evidence: The Romance linguist Joan Coromines i Vigneaux, a renowned 20th-century linguist, stated in his 1950 work "El que s'ha de saber de la llengua catalana" that "In this territory [Greater Catalonia], almost the entire population speaks Catalan as their usual language" (1, 2).\ While "almost the entire population" is not a precise number, we can interpret it quantitatively as somewhere between 80% and 100%. For the sake of a moderate estimate, we assume 90% of the population were regular Catalan speakers, with the remaining 10% being immigrants and officials of the Spanish state.

-

2nd Interpretation: Regarding population growth between 1930 and 1998, on average, 60% is due to immigration (mostly adopting or already using Spanish language), while 40% is natural growth (likely to acquire Catalan language from childhood). Source and evidence: Between 1999 and 2019, when more detailed data is available, immigration accounted for 68% of population growth. From 1930 to 1998, there was a comparable wave of migration, especially between 1953 and 1973, largely of Spanish-speaking origin (3, 4, 5, 6). To maintain a moderate estimate, we assume 60% of population growth during that period was due to immigration, with the ratio varying depending on whether the period experienced more or less total growth.

-

-

@ bd4ae3e6:1dfb81f5

2025-05-20 08:46:06

@ bd4ae3e6:1dfb81f5

2025-05-20 08:46:06 -

@ c230edd3:8ad4a712

2025-04-11 16:02:15

@ c230edd3:8ad4a712

2025-04-11 16:02:15Chef's notes

Wildly enough, this is delicious. It's sweet and savory.

(I copied this recipe off of a commercial cheese maker's site, just FYI)

I hadn't fully froze the ice cream when I took the picture shown. This is fresh out of the churner.

Details

- ⏲️ Prep time: 15 min

- 🍳 Cook time: 30 min

- 🍽️ Servings: 4

Ingredients

- 12 oz blue cheese

- 3 Tbsp lemon juice

- 1 c sugar

- 1 tsp salt

- 1 qt heavy cream

- 3/4 c chopped dark chocolate

Directions

- Put the blue cheese, lemon juice, sugar, and salt into a bowl

- Bring heavy cream to a boil, stirring occasionally

- Pour heavy cream over the blue cheese mix and stir until melted

- Pour into prepared ice cream maker, follow unit instructions

- Add dark chocolate halfway through the churning cycle

- Freeze until firm. Enjoy.

-

@ c230edd3:8ad4a712

2025-04-09 00:33:31

@ c230edd3:8ad4a712

2025-04-09 00:33:31Chef's notes

I found this recipe a couple years ago and have been addicted to it since. Its incredibly easy, and cheap to prep. Freeze the sausage in flat, single serving portions. That way it can be cooked from frozen for a fast, flavorful, and healthy lunch or dinner. I took inspiration from the video that contained this recipe, and almost always pan fry the frozen sausage with some baby broccoli. The steam cooks the broccoli and the fats from the sausage help it to sear, while infusing the vibrant flavors. Serve with some rice, if desired. I often use serrano peppers, due to limited produce availability. They work well for a little heat and nice flavor that is not overpowering.

Details

- ⏲️ Prep time: 25 min

- 🍳 Cook time: 15 min (only needed if cooking at time of prep)

- 🍽️ Servings: 10

Ingredients

- 4 lbs ground pork

- 12-15 cloves garlic, minced

- 6 Thai or Serrano peppers, rough chopped

- 1/4 c. lime juice

- 4 Tbsp fish sauce

- 1 Tbsp brown sugar

- 1/2 c. chopped cilantro

Directions

- Mix all ingredients in a large bowl.

- Portion and freeze, as desired.

- Sautè frozen portions in hot frying pan, with broccoli or other fresh veggies.

- Serve with rice or alone.

-

@ 00000001:b0c77eb9

2025-02-14 21:24:24

@ 00000001:b0c77eb9

2025-02-14 21:24:24مواقع التواصل الإجتماعي العامة هي التي تتحكم بك، تتحكم بك بفرض أجندتها وتجبرك على اتباعها وتحظر وتحذف كل ما يخالفها، وحرية التعبير تنحصر في أجندتها تلك!

وخوارزمياتها الخبيثة التي لا حاجة لها، تعرض لك مايريدون منك أن تراه وتحجب ما لا يريدونك أن تراه.

في نوستر انت المتحكم، انت الذي تحدد من تتابع و انت الذي تحدد المرحلات التي تنشر منشوراتك بها.

نوستر لامركزي، بمعنى عدم وجود سلطة تتحكم ببياناتك، بياناتك موجودة في المرحلات، ولا احد يستطيع حذفها او تعديلها او حظر ظهورها.

و هذا لا ينطبق فقط على مواقع التواصل الإجتماعي العامة، بل ينطبق أيضاً على الـfediverse، في الـfediverse انت لست حر، انت تتبع الخادم الذي تستخدمه ويستطيع هذا الخادم حظر ما لا يريد ظهوره لك، لأنك لا تتواصل مع بقية الخوادم بنفسك، بل خادمك من يقوم بذلك بالنيابة عنك.

وحتى إذا كنت تمتلك خادم في شبكة الـfediverse، إذا خالفت اجندة بقية الخوادم ونظرتهم عن حرية الرأي و التعبير سوف يندرج خادمك في القائمة السوداء fediblock ولن يتمكن خادمك من التواصل مع بقية خوادم الشبكة، ستكون محصوراً بالخوادم الأخرى المحظورة كخادمك، بالتالي انت في الشبكة الأخرى من الـfediverse!

نعم، يوجد شبكتان في الكون الفدرالي fediverse شبكة الصالحين التابعين للأجندة الغربية وشبكة الطالحين الذين لا يتبعون لها، إذا تم إدراج خادمك في قائمة fediblock سوف تذهب للشبكة الأخرى!

-

@ 8bad92c3:ca714aa5

2025-05-22 18:02:41

@ 8bad92c3:ca714aa5

2025-05-22 18:02:41Key Takeaways

In this episode of TFTC, Andrew Myers, founder of Satoshi Energy, explores the convergence of AI, humanoid robots, Bitcoin, and decentralized energy, warning of a near future where self-replicating machines dominate energy and labor. Myers argues that Bitcoin’s decentralized nature offers a critical check against centralized AI power, enabling autonomous agents to transact freely and protecting individual sovereignty. Through his company’s work and its software BitCurrent, Myers promotes Bitcoin as both a tool for energy market efficiency and a foundation for preserving liberty in an AI-driven world.

Best Quotes

“Humanoid robots are going to not only replace most of the jobs people do today… they're going to be able to recreate themselves and self-replicate faster than that.”

“For me the key value proposition of Bitcoin is leveling the economic playing field. Rather than those who control the money printer making the economic decisions, it's everyday people.”

“AI energy demand is infinite. Bitcoin has a Nakamoto point… AI doesn’t.”

“Satoshi Energy’s mission is to enable every electric power company to use Bitcoin by block 1,050,000.”

“If you're a Bitcoiner and you're not using Fold, what are you doing? You're leaving sats on the table.”

“Tesla said machines would eventually fight wars for us. When that happens, nation-states become spectators. Bitcoin is how we avoid centralized control of those machines.”

“There’s already an energy company in Texas using Bitcoin as collateral in a power contract.”

“Are we auditioning for a galactic federation? Maybe. Even if not, we should still be acting like we are.”

Conclusion

Andrew Myers delivers a compelling vision of the future where exponential AI and energy growth demand a decentralized response—one rooted in Bitcoin as more than money, but as critical infrastructure for freedom. Through Satoshi Energy and tools like BitCurrent, Myers bridges big ideas with tangible actions, advocating for bottom-up sovereignty across energy and finance. His message is clear: decentralization is no longer optional—it’s essential for preserving human agency in an increasingly automated world.

Timestamps

0:00 - Intro

0:34 - Tesla’s AI energy theory

8:59 - Bitcoin and decentralization fixes AI

13:02 - Fold & Bitkey

14:38 - How Satoshi Energy is using AI

19:28 - Bit Current

23:13 - Unchained

23:42 - Revealing inefficiency

32:57 - Proliferating OS AI with bitcoin

36:26 -Apple of Eden and Antichrist

45:11 - Iberian outage

48:48 - Defense tech

54:51 - UFOs, Atlantis and remote viewingTranscript

(00:00) Humanoid robots are advancing so quickly. They're going to not only replace most of the jobs that people do today, probably the next 5 to 10 years, but they're going to be able to recreate themselves and self-replicate even faster than that. With AI, the energy demand is infinite. It's going to 10x and 10x and 10x again in terms of global energy consumption, and that's just going to completely change the world we live in.

(00:21) If there's a sufficiently advanced AI, is it going to listen to a politician that says, "No, you can't have that energy." Or is it going to say, "Fuck you. Send the drone. You can hear us loud and clear. Loud and clear. I have to put this in front of my face so I'm not leaning. Yeah, vibe coding. There may be some securityities.

(00:45) I do want to hand it off to a developer who actually understands this stuff to say, am I am I going to am I going to leak any information or like be Yeah, I should probably do that before I release to the public. Now, let me say that. does seem pretty simple though. It's just getting the data on the page, getting the price of Bitcoin, using Coin Gecko API, and then running the math of how much Bitcoin is this worth at this point in time.

(01:13) We're not collecting any data either. I don't think that you know of. No, this is AI once. This is the problem of vibe coding. Are you bearish on AI? Uh, I think we're at a fork in the road and on one side I'm very bullish. You shamed me for for admitting that I was turning my kids into Legos via or turning myself into Lego in this. I was channeling my inner Marty.

(01:36) What would Marty do? Well, that's what uh that's what precipitated this. You hit me up. Was it two weeks ago now at this point? this week with your tweet about Nicola Tesla essentially predicting AI and him not factoring in sound money to the inevitable future that he foresaw. Yeah, it kind of came up uh in the work we're doing at Satoshi Energy where we're developing sites for data centers and a lot of those were were Bitcoin data centers for the last five six years and then in the last couple of years just increasingly demand

(02:20) from AI data centers in some cases like a project that we sold to a Bitcoin miner then becomes an AI site and then start to have questions within the team about what is our AI strategy and it was always in the back of my mind as part of the strategy which we'll get into like what is this fork in the road which directions could it go but I hadn't ever really communicated it to our team uh until recently because it's such a big idea that like on top of thinking about sound money and energy like we're already thinking about enough but as the

(02:57) team's growing as people are starting to ask these questions and like in some cases feeling conflicted about um should we be serving this AI market and in some cases large institutional investors and tech companies uh really like felt the need to put the the pen to paper and and talk about this and talk about how AI fits into our overall strategy.

(03:20) Uh, and part of that reminded me of this uh, essay that Nicola Tesla wrote called um, the problem of human energy, which was kind of a cheeky title. Uh, because clearly he thought, you know, energy would liberate humanity. Uh, but it get you get a lot more readers if you, you know, if you name it, the problem of human energy, especially a lot more of the critics who you're trying to convince otherwise.

(03:44) And one of the biggest things, biggest takeaways for me in that in that essay is he he basically says at some point man will create machines that fight wars for us and limit the the loss of human life to the point where the different parties, nation states, other powerful people u that were fighting wars with each other will once it's sort of this this machine to machine battle, they'll just become interested spectators.

(04:13) and eventually lead to world peace. So I think that's the path we want to be on. Not the path where it becomes a very centralized AI and we ultimately become enslaved. Uh but on the path to world peace or or keeping ourselves on that path to world peace. I think that's where Bitcoin plays a role. it keeps the economic playing field level uh and keeps this technology sufficiently decentralized where Bitcoin is that protocol for you know decentralized AI agents communicating with each other.

(04:46) So we can go in any direction you want from there but it's a big idea. No, this is in line with something I wrote about earlier this week that was inspired by a tweet that Paul Otoy from Stack put out basically not explaining this exact problem but just giving his thoughts on how he's viewing the state of AI and where it will go in the future.

(05:10) And Paul, the team at stack and sphinx are highly focused on enabling the open- source AI as opposed to closed source AI. I I think based on what you just said, I think it's very line what Paul was saying in that tweet, which is we're reaching the point with MCP with these sort of protocols where you can store context that agents can plug into and begin communicating with each other.

(05:39) We're at the point where agentic models are getting are actually usable. And I think that's where you have this like critical tipping point of okay that's really going to dictate which direction in the fork in the road we go down because once the agents are able to go do these tasks you right have these network effects that take hold and it's very important that we thread the needle of making sure that it's open and incentivized properly.

(06:10) Yes. Yes, we had this idea of time preference in the Bitcoin community where you know we think with sound money we should have a low time preference meaning we think longer term uh we don't need need to make sort of quick rash decisions into investments today but then you have this tidal wave of AI coming our our direction it almost forces you back into that high time preference mindset of like I need to address this problem now um and Then from like an energy perspective, it's interesting too.

(06:44) Uh you have like Drew's concept of the Nakamoto point for Bitcoin. Like how much of of human energy of global energy will will Bitcoin mining consume? And like say it's between 1 and 10% of of human energy. If it becomes 100% then uh that doesn't make any sense because then you're just like worshiping Bitcoin.

(07:03) And if all of the energy is going towards that, it means you're not putting any energy towards any other sort of economic pursuit or uh you know human need. But with AI, the energy demand is infinite. I don't think there is a Nakamoto point. It's just like it's going to 10x and 10x and 10x again in terms of g global energy consumption.

(07:23) Uh and that's just going to completely change the world we live in. Another thing on sort of the high time preference concept is like humanoid robots are advancing so quickly. They're going to not only replace all of the job most of the jobs that people do today, very quickly within probably the next 5 to 10 years max, but they're going to be able to rec -

@ 3ad01248:962d8a07

2025-05-22 17:18:25

@ 3ad01248:962d8a07

2025-05-22 17:18:25With the price of Bitcoin skyrocketing as of late maybe its time that we go over some rules as a Bitcoiner because someone just got robbed in the UK of the Bitcoin wealth by a fake Uber driver. I fear this will become more common place as time goes on unless certain rules are followed.

Rule 1: Never talk about your Bitcoin holdings to people you don't know or don't trust

This will easily make you a target. If you are out in public saying you have 5 Bitcoin what do you think is going to happen when the wrong person finds out. They will follow you home, tie you up and take your shit. You can avoid this by not talking about your Bitcoin in public spaces, you never know how is listening. Hell I wouldn't even share it with your spouse to be honest. You don't know who she is talking to either. Keep your wealth private.

Rule 2: Stay Humble/Live Below Your means

Resist the urge to spend your new found wealth on something extravagent like a lambo or something that is going to draw unwanted attention. Not saying that you shouldn't enjoy your life but be aware that not everyone is going to be happy about your new found wealth. The best thing you can do is drive an unassuming car and live in regular home.

Rule 3: Don't Carry Your Wealth In Your Pocket

It is definitely a bad idea to walk around with your wealth stored on your phone. This is how people are getting robbed of their wealth. They leave their holding on some centralized exchange where all you need is a password to access their account. When you are under duress that isn't going to stop anyone from stealing your money. Self custody your Bitcoin and keep it in cold storage! Can't stress that enough.

Rule 5: Practice Good Digital Hygiene

With more and more of our lives online, especially social media it is a good idea to practice good digital hygiene. The internet is rife with scammers looking to access your private information to learn everything about you. Use a VPN if possible. You should probably get in the habit of creating multiple email address or use a service that creates fake ones for you. It is safe to assume that some database with your information will get hacked at some point. Better to have a random email get stolen versus the primary one that you use. A second phone line couldn't hurt as well.

Rule 6: Keep Your Circle Small

This kind of ties back in with the first rule. The more people you allow into your inner circle the more you open yourself up to attack. You can't always be sure of someone's motives especially people that you recent met. Be wary of people that just show up out of the blue wanting to be your best friend. This applies to family as well, if they somehow know that you own Bitcoin and see that you are doing well you can't assume that just because they are family you can't trust them. In fact these are the people you have to worry about the most.

It's better to be safe than sorry in my opinion. Keep your circle of trust small and you won't have problems.

These are six rules that I think can help keep you safe and you Bitcoin wealth in your hands. I'm sure there are more, if you think of more comment below!!

-

@ f1989a96:bcaaf2c1

2025-05-22 17:09:23

@ f1989a96:bcaaf2c1

2025-05-22 17:09:23Good morning, readers!

Today, we begin in China, where the central bank injected $138 billion into the economy and expanded the money supply by 12.5% year-over-year. As the regime eases monetary conditions to prop up a decelerating economy, Chinese citizens are rushing to preserve their savings, evidenced by Bitcoin/CNY trading activity jumping over 20% on the news. But while some escape to harder money, others remain trapped. In Hunan, an elderly Chinese woman died outside a bank after being forced to appear in person in order to withdraw her own money for medical care.\ \ In Central America, Salvadoran President Bukele revived a “foreign agents” bill that would impose a 30% tax on foreign-funded NGOs, threatening to financially crush organizations that hold those in power accountable and protect journalists and civil society. The proposal mirrors laws used in Russia, China, Belarus, and beyond to suppress dissent. And it arrives amid Bukele’s authoritarian drift and increasing threats to independent journalists.\ \ In open-source news, we highlight a new tool called ChapSmart, a Bitcoin-powered remittance service that allows users to send Bitcoin to citizens and families in Tanzania and have it disbursed in Tanzanian shillings (TZS) via M-PESA. This tool is increasingly helpful as the Tanzanian regime tightens control over foreign currency, mandating that all transactions be conducted in TZS. ChapSmart provides an accessible way for nonprofits and dissidents to access value from abroad using Bitcoin.\ \ We end with an Ask Me Anything (AMA) with Bitcoin educator Anita Posch on Stacker News, who shares her thoughts, experiences, and views from her time conducting Bitcoin education in authoritarian regimes in Africa. We also feature an article from Togolese human rights advocate Farida Nabourema, who critiques Nigeria’s new investment act for classifying Bitcoin as a security and for the regulatory hurdles this will impose on the grassroots adoption of freedom tech in the country.

Be sure to tune in next week at 2 p.m. Oslo time on Wednesday, May 28, as the Oslo Freedom Forum’s Freedom Tech track airs on Bitcoin Magazine’s livestream channels, headlined by speakers Ziya Sadr, Abubakr Nur Khalil, Amiti Uttarwar, Calle, Sarah Kreps, Ben Perrin, and many more.

Now, let’s read on!

SUBSCRIBE HERE

GLOBAL NEWS

El Salvador | Bukele Reintroduces Foreign Agents Bill

In El Salvador, President Nayib Bukele revived a controversial “foreign agents” bill that threatens to severely restrict the finances and operations of NGOs. While the bill is not finalized, Bukele shared on X that the proposal would impose a 30% tax on donations to NGOs receiving foreign funding. This punitive financial measure alone would severely restrict Salvadoran organizations that protect independent journalism, advocate for human rights, and hold the government accountable. In neighboring Nicaragua, a similar foreign agents law has enabled the closure of more than 3,500 NGOs. El Salvador’s foreign agents bill arrives alongside other alarming moves, including arrest warrants against El Faro journalists, the arrest of human rights lawyer Ruth López, and the detention of more than 200 Venezuelan migrants under dubious claims of gang affiliation.

China | Injects Billions to Stabilize Economy

The Chinese Communist Party (CCP) has injected $138 billion in liquidity through interest rate cuts and a 0.5% reduction in banks’ reserve requirements, in effect expanding the money supply by 12.5% year-over-year. While the state eases monetary conditions to prop up a fragile system, ordinary citizens are left scrambling to preserve the value of their savings. Bitcoin/CNY trading volumes jumped over 20% in response, as people sought refuge from a weakening yuan. But while some can quietly escape to harder money, others are trapped in a system that treats access to money as a privilege. In Hunan, an elderly woman in a wheelchair died outside a bank after being forced to appear in person to withdraw her own money for medical care. Too weak to pass mandatory facial recognition scans, she collapsed after repeated failed attempts.

World | Authoritarian Regimes Lead CBDC Push, Study Finds

A new international study from the Nottingham Business School, part of Nottingham Trent University in England, set out to understand what is driving countries to pursue central bank digital currencies (CBDCs). Researchers found the answer lies mostly in political motives. Analyzing 68 countries, the report revealed that authoritarian governments are pushing CBDCs most aggressively, using their centralized power to hastily roll out CBDCs that can monitor transactions, restrict the movement of money, and suppress dissent. On the other hand, the report found democracies are moving more cautiously, weighing concerns over privacy, transparency, and public trust. The study also noted a correlation: countries with high levels of perceived corruption are more likely to explore CBDCs, often framing them as tools to fight illicit finance. These findings are consistent with HRF’s research, revealing nearly half the global population lives under an authoritarian regime experimenting with a CBDC.

Thailand | Plans to Issue New “Investment Token”

Thailand’s Ministry of Finance plans to issue 5 billion baht ($151 million) worth of “G-Tokens,” a new digital investment scheme that allows Thais to buy government bonds for as little as 100 baht ($3). Officials claim the project will democratize access to state-backed investments and offer higher returns than traditional bank deposits. But in a country rapidly advancing central bank digital currency (CBDC) infrastructure, this initiative raises apparent concerns. The move closely follows Thailand’s repeated digital cash handouts via a state-run wallet app, which restricts spending, tracks user behavior, and enforces expiration dates on money, all clear hallmarks of a CBDC. Luckily, the Thai government postponed the latest handout, but the infrastructure remains. Framing this project as inclusionary masks the reality: Thailand is building state-run digital systems that give the regime more power over citizens’ savings and spending.

Russia | Outlaws Amnesty International

Russia officially banned Amnesty International, designating it as an “undesirable organization” and criminalizing cooperation with the global human rights group. Russian officials claim Amnesty promotes “Russophobic projects” and undermines national security. This adds to the Kremlin’s assault on dissent, targeting human rights advocates, independent journalists, and civil society in the years since the 2022 full-scale invasion of Ukraine. The designation exposes anyone financially, publicly, or privately supporting Amnesty’s work to prosecution and imprisonment up to five years. With more than 220 organizations now blacklisted, Russia is systematically cutting off avenues for international accountability and isolating Russians from external support.

BITCOIN AND FREEDOM TECH NEWS

ChapSmart | Permissionless Remittances in Tanzania

ChapSmart is a Bitcoin-powered remittance service that allows users to send money to individuals and families in Tanzania while having it disbursed in Tanzanian shillings (TZS) via M-PESA. With ChapSmart, no account is needed: just enter your name, email, and the recipient’s M-Pesa details. Choose how much USD to send, pay in bitcoin via the Lightning Network, and ChapSmart delivers Tanzanian shillings instantly to the recipient's M-Pesa account with zero fees. This tool is especially useful as Tanzania’s regime enacts restrictions on foreign currencies, banning most citizens from quoting prices or accepting payment in anything other than TZS. ChapSmart offers a practical and accessible way for families, nonprofits, and individuals to access value from abroad using Bitcoin, even as the state tries to shut out financial alternatives.

Bitkey | Multisignature for Families Protecting Wealth from State Seizure

Decades ago, Ivy Galindo’s family lost their savings overnight when the Brazilian government froze citizens’ bank accounts to “fight inflation.” That moment shaped her understanding of financial repression and why permissionless tools like Bitcoin are essential. When her parents later chose to start saving in Bitcoin, Ivy knew a wallet with a single private key wasn’t enough, as it can be lost, stolen, or handed over under pressure or coercion from corrupt law enforcement or state officials. Multisignature (multisig) wallets, which require approval from multiple private keys to move funds, offer stronger protection against this loss and coercion and eliminate any single points of failure in a Bitcoin self-custody setup. But multisig setups are often too technical for everyday families. Enter Bitkey. This multisig device offered Ivy’s family a simple, secure way to share custody of their Bitcoin in the face of financial repression. In places where wealth confiscation and frozen bank accounts are a lived reality, multisignature wallets can help families stay in full control of their savings.

Parasite Pool | New Zero-Fee, Lightning Native Bitcoin Mining Pool

Parasite Pool is a new open-source Bitcoin mining pool built for home miners who want to contribute to Bitcoin’s decentralization without relying on the large and centralized mining pools. It charges zero fees and offers Lightning-native payouts with a low 10-satoshi threshold, allowing individuals to earn directly and instantly. Notably, it has a “pleb eat first” reward structure, which allocates 1 BTC to the block finder and splits the remaining 2.125 BTC plus fees among all non-winning participants via Lightning. This favors small-scale miners, who can earn outsized rewards relative to their hashpower, inverting the corporate bias of legacy mining pools. This makes Parasite Pool especially attractive for small scale miners, such as those operating in authoritarian contexts who need to mine discreetly and independently. In turn, these very same miners contribute to the Bitcoin network’s resistance to censorship, regulatory capture, and corporate control, ensuring it remains a tool for freedom and peaceful resistance for those who need it most. Learn more about the mining pool here.

Cake Wallet | Implements Payjoin V2

Cake Wallet, a non-custodial, privacy-focused, and open-source mobile Bitcoin wallet, released version 4.28, bringing Payjoin V2 to its user base. Payjoin is a privacy technique that allows two users to contribute an input to a Bitcoin transaction, breaking the common chain analysis heuristic that assumes a sender owns all inputs. This makes it harder for dictators to trace payments or link the identities of activists or nonprofits. Unlike the original Payjoin, which required both the sender and recipient to be online and operate a Payjoin server, Payjoin v2 removes both barriers and introduces asynchronous transactions and serverless communication. This means users can now conduct private transactions without coordination or technical setup, making private Bitcoin transactions much more accessible and expanding the tools dissidents have to transact in the face of censorship, extortion, and surveillance. HRF is pleased to have sponsored the Payjoin V2 specification with a bounty and is happy to see this functionality now in the wild.

Mi Primer Bitcoin | Receives Grant from startsmall

Mi Primer Bitcoin, a nonprofit organization supporting independent Bitcoin education in Central America, announced that it received a $1 million grant from Jack Dorsey’s startsmall public fund. This support will accelerate Mi Primer Bitcoin’s impartial, community-led, Bitcoin-only education. The initiative has trained tens of thousands of students while supporting over 65 grassroots projects across 35+ countries through its Independent Bitcoin Educators Node Network, pushing financial freedom forward where needed most. The Mi Primer Bitcoin (MPB) team stresses the importance of remaining free from government or corporate influence to preserve the integrity of their mission. As founder John Dennehy puts it, “Education will be captured by whoever funds it… We need to create alternative models for the revolution of Bitcoin education to realize its full potential.” MPB has been adopted by many education initiatives working under authoritarian regimes.

Phoenix Wallet | Introduces Unlimited BOLT 12 Offers and Manual Backup Options

Phoenix Wallet, a mobile Bitcoin Lightning wallet, introduced support for unlimited BOLT 12 offers in its v2.6.0 update, allowing users to generate as many reusable Lightning invoices as they like. These offers, which function like static Bitcoin addresses, remain permanently valid and can now include a custom description and amount — ideal for nonprofits or dissidents who need to receive regular donations discreetly. The update also introduces manual export and import of the payments database on Android, enabling users to securely transfer their payment history to new devices. These updates strengthen Phoenix’s position as one of the most user-friendly and feature-complete non-custodial Lightning wallets. BOLT 12 — once a pipe dream — is now a usable activist tool on popularly accessible mobile wallets.

RECOMMENDED CONTENT

Bitcoin Is Not a Security: Why Nigeria’s New Investment and Security Act Misses the Mark by Farida Nabourema

In this article, Togolese human rights advocate Farida Nabourema critiques Nigeria’s 2025 Investment and Securities Act for classifying Bitcoin as a security. Nabourema argues this approach is flawed, economically damaging, disconnected from the realities of Bitcoin usage and innovation across Africa, and an attempt to constrict a human rights tool. She warns that this regulatory framework risks stifling builders and harming the very communities that Bitcoin is helping in a context of widespread currency devaluations, inflation, and exclusion. Read it here.

Ask Me Anything with Anita Posch on Stacker News

After spending five months traveling through countries like Kenya and Zimbabwe, Bitcoin for Fairness Founder Anita Posch joined Stacker News for an Ask Me Anything (AMA) to discuss her view on Bitcoin adoption across the continent. She highlighted major progress since 2020, noting that several grassroots initiatives she supported have become self-sufficient and are now running their own education programs. Despite persistent challenges, like wallet usability, high on-chain fees, and Bitcoin’s misunderstood reputation, she shared stories of real-life impact, including cross-border remittances using mobile airtime and widespread Lightning use via apps like Tando in Kenya. Read the full conversation here.

If this article was forwarded to you and you enjoyed reading it, please consider subscribing to the Financial Freedom Report here.

Support the newsletter by donating bitcoin to HRF’s Financial Freedom program via BTCPay.\ Want to contribute to the newsletter? Submit tips, stories, news, and ideas by emailing us at ffreport @ hrf.org

The Bitcoin Development Fund (BDF) is accepting grant proposals on an ongoing basis. The Bitcoin Development Fund is looking to support Bitcoin developers, community builders, and educators. Submit proposals here.

-

@ 7e6f9018:a6bbbce5

2025-05-22 16:33:07

@ 7e6f9018:a6bbbce5

2025-05-22 16:33:07Per les xarxes socials es parla amb efusivitat de que Bitcoin arribarà a valer milions de dòlars. El mateix Hal Finney allà pel 2009, va estimar el potencial, en un cas extrem, de 10 milions $:

\> As an amusing thought experiment, imagine that Bitcoin is successful and becomes the dominant payment system in use throughout the world. Then the total value of the currency should be equal to the total value of all the wealth in the world. Current estimates of total worldwide household wealth that I have found range from $100 trillion to $300 trillion. Withn 20 million coins, that gives each coin a value of about $10 million. <https://satoshi.nakamotoinstitute.org/emails/bitcoin-list/threads/4/>

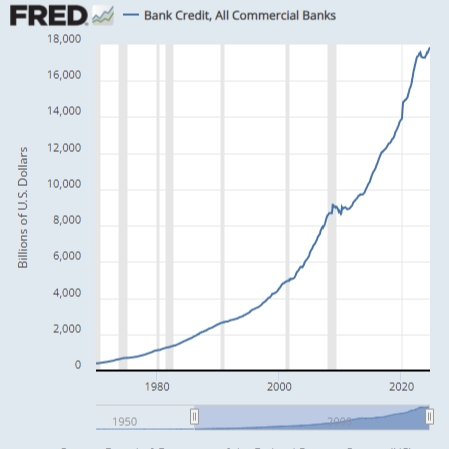

No estic d'acord amb els càlculs del bo d'en Hal, ja que no consider que la valoració d'una moneda funcioni així. En qualsevol cas, el 2009 la capitalització de la riquesa mundial era de 300 bilions $, avui és de 660 bilions $, és a dir ha anat pujant un 5,3% de manera anual,

$$(660/300)^{1/15} = 1.053$$La primera apreciació amb aquest augment anual del 5% és que si algú llegeix aquest article i té diners que no necessita aturats al banc (estalvis), ara és bon moment per començar a moure'ls, encara sigui amb moviments defensius (títols de deute governamental o la propietat del primer habitatge). La desagregació per actius dels 660 bilions és:

-

Immobiliari residencial = 260 bilions $

-

Títols de deute = 125 bilions $

-

Accions = 110 bilions

-

Diners fiat = 78 bilions $

-

Terres agrícoles = 35 bilions $

-

Immobiliari comercial = 32 bilions $

-

Or = 18 bilions $

-

Bitcoin = 2 bilions $

La riquesa mundial és major que 660 bilions, però aquests 8 actius crec que són els principals, ja que s'aprecien a dia d'avui. El PIB global anual és de 84 bilions $, que no són bromes, però aquest actius creats (cotxes, ordinadors, roba, aliments...), perden valor una vegada produïts, aproximant-se a 0 passades unes dècades.

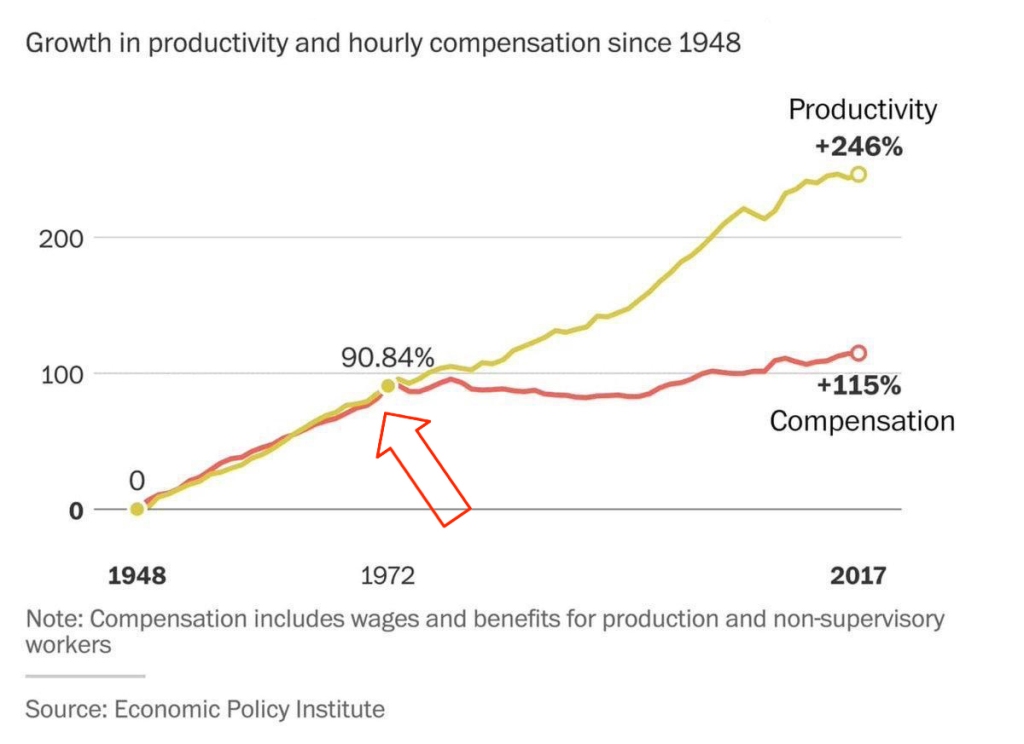

Partint d'aquest nombres com a vàlids, la meva posició base respecte de Bitcoin, ja des de fa un parell d'anys, és que te capacitat per posar-se al nivell de capitalització de l'or, perquè conceptualment s'emulen bé, i perquè tot i que Bitcoin no té un valor tangible industrial com pot tenir l'or, sí que te un valor intangible tecnològic, que és pales en tot l'ecosistema que s'ha creat al seu voltant:

-

Creació de tecnologies de pagament instantani: la Lightning Network, Cashu i la Liquid Network.

-

Producció d'aplicacions amb l'íntegrament de pagaments instantanis. Especialment destacar el protocol de Nostr (Primal, Amethyst, Damus, Yakihonne, 0xChat...)

-

Industria energètica: permet estabilitzar xarxes elèctriques i emprar energia malbaratada (flaring gas), amb la generació de demanda de hardware i software dedicat.

-

Educació financera i defensa de drets humans. És una eina de defensa contra governs i estats repressius. La Human Rights Foundation fa una feina bastant destacada d'educació.

Ara posem el potencial en nombres:

-

Si iguala l'empresa amb major capitalització, que és Apple, arribaria a uns 160 mil dòlars per bitcoin.

-

Si iguala el nivell de l'or, arribaria a uns 800 mil dòlars per bitcoin.

-

Si iguala el nivell del diner fiat líquid, arribaria a un 3.7 milions de dòlars per bitcoin.

Crec que igualar la capitalització d'Apple és probable en els pròxims 5 - 10 anys. També igualar el nivell de l'or en els pròxims 20 anys em sembla una fita possible. Ara bé, qualsevol fita per sota d'aquesta capitalització ha d'implicar tota una serie de successos al món que no sóc capaç d'imaginar. Que no vol dir que no pugui passar.

-

-

@ da8b7de1:c0164aee

2025-05-22 16:19:52

@ da8b7de1:c0164aee

2025-05-22 16:19:52Technológiai és fejlesztési hírek

- Észtország SMR-tervei:

Észtország hivatalosan elindította a nemzeti tervezési folyamatot és a környezeti hatásvizsgálatot egy 600 MW-os kis moduláris reaktor (SMR) atomerőmű létesítésére, GE Hitachi BWRX-300 technológiával. A projektet a Fermi Energia vezeti, a lakosság körében mérsékelt támogatottság mellett. Az építési engedélykérelem benyújtását 2029-re tervezik, a cél az ország energiabiztonságának és klímacéljainak erősítése.

- Olkiluoto-1 csökkentett teljesítménnyel üzemel:

Finnországban az Olkiluoto-2 egységben a generátor rotorjának cseréje miatt a termelés májusban újraindul, de a teljesítményt 735 MW-ra korlátozzák (a teljes kapacitás 890 MW). A csökkentett teljesítmény 2026-ig marad érvényben. Az Olkiluoto-1 egység normálisan működik, az Olkiluoto-3 pedig éves karbantartáson van.

Ipari és pénzügyi fejlemények

- Kanada–Argentína nehézvíz-együttműködés:

A kanadai Candu Energy (AtkinsRéalis) és az argentin Nemzeti Atomenergia Bizottság (CNEA) memorandumot írt alá a nehézvíz-termelés fellendítéséről. Ez magában foglalja az argentin PIAP nehézvízgyár újraindítását és potenciálisan új üzemek építését Kanadában. A fejlesztés támogatja a meglévő és tervezett CANDU reaktorok működését világszerte, és illeszkedik a COP28 utáni globális nukleáris bővüléshez.

- USA: nukleáris adókedvezményekért folyó lobbizás:

Az amerikai nukleáris ipar intenzív lobbitevékenységet folytat, hogy megőrizze a Biden-adminisztráció által bevezetett, az Inflációcsökkentő Törvény (IRA) szerinti nukleáris adókedvezményeket. Az új, republikánus többségű költségvetési törvényjavaslat jelentősen lerövidítené a tiszta energia (szél, nap, akkumulátor) támogatásokat, de a nukleáris ipar számára bizonyos kedvezmények megmaradnának, bár a 45U nukleáris adókedvezmény is három évvel korábban, 2031-ben lejárhat.

- Háztartási és ipari érdekek:

Az amerikai ház költségvetési törvényjavaslata megszüntetné a legtöbb tiszta energiához kapcsolódó adókedvezményt, kivéve néhány nukleáris projektet, és szigorítaná a kínai kapcsolatokkal rendelkező projektek támogatását. Ez várhatóan visszaveti a megújuló energiaipar beruházásait, miközben a nukleáris szektor relatív pozíciója javulhat.

Politikai és társadalmi fejlemények

- Tajvan: népszavazás a nukleáris energia sorsáról:

Tajvan parlamentje megszavazta, hogy népszavazást tartsanak a Maanshan atomerőmű újraindításáról, miután az ország utolsó működő reaktorát is leállították. A referendum nem azonnali újraindításról szól, hanem arról, hogy a lakosság döntsön a meghosszabbításról, ha a hatóságok biztonságosnak találják az üzemet.

- Pennsylvania kormányzója a nukleáris energia mellett:

Josh Shapiro, Pennsylvania kormányzója, a „Lightning Plan” keretében hangsúlyozta, hogy az állam energiabiztonsága és gazdasági fejlődése érdekében kulcsszerepet szán a nukleáris energiának, valamint más megbízható energiaforrásoknak. A terv célja a munkahelyteremtés, a fogyasztói költségek csökkentése és az engedélyezési folyamatok gyorsítása.

- TMI névváltás:

Az amerikai Nukleáris Szabályozó Hatóság (NRC) jóváhagyta a Three Mile Island (TMI) atomerőmű nevének megváltoztatását Christopher M. Crane-re, az Exelon volt vezérigazgatójának emlékére. A létesítmény a jövőben a Microsoft AI műveleteit is ellátja majd árammal, és 2028-tól 835 MW szén-dioxid-mentes áramot termelhet.

Nemzetközi szakmai események

- NEA konferencia Londonban:

Az OECD NEA 2025. június 18–19-én Londonban rendezi meg az „Excellence in Nuclear Construction” nemzetközi konferenciát. A rendezvény célja, hogy a nukleáris ipar szereplői megosszák tapasztalataikat a nukleáris beruházások gyorsabb, kiszámíthatóbb és költséghatékonyabb megvalósítása érdekében, különös tekintettel a mérnöki, beszerzési és kivitelezési (EPC) kihívásokra.

Hivatkozások

- https://www.nucnet.org

- https://www.world-nuclear-news.org

- https://www.neimagazine.com

- https://www.oecd-nea.org

- https://www.iaea.org

- https://www.reuters.com/business/energy

- https://www.utilitydive.com

- https://www.atkinsrealis.com

- https://www.candu.com

-

@ dfa02707:41ca50e3

2025-05-22 17:02:04

@ dfa02707:41ca50e3

2025-05-22 17:02:04Contribute to keep No Bullshit Bitcoin news going.

News

- Spiral welcomes Ben Carman. The developer will work on the LDK server and a new SDK designed to simplify the onboarding process for new self-custodial Bitcoin users.

- Spiral renews support for Dan Gould and Joschisan. The organization has renewed support for Dan Gould, who is developing the Payjoin Dev Kit (PDK), and Joschisan, a Fedimint developer focused on simplifying federations.

- The Bitcoin Dev Kit Foundation announced new corporate members for 2025, including AnchorWatch, CleanSpark, and Proton Foundation. The annual dues from these corporate members fund the small team of open-source developers responsible for maintaining the core BDK libraries and related free and open-source software (FOSS) projects.

- The European Central Bank is pushing for amendments to the European Union's Markets in Crypto Assets legislation (MiCA), just months after its implementation. According to Politico's report on Tuesday, the ECB is concerned that U.S. support for cryptocurrency, particularly stablecoins, could cause economic harm to the 27-nation bloc.

- Slovenia is considering a 25% capital gains tax on Bitcoin profits for individuals. The Ministry of Finance has proposed legislation to impose this tax on gains from cryptocurrency transactions, though exchanging one cryptocurrency for another would remain exempt. At present, individual 'crypto' traders in Slovenia are not taxed.

- The Virtual Asset Service Providers (VASP) Bill 2025 introduced in Kenya. The new legislation aims to establish a comprehensive legal framework for licensing, regulating, and supervising virtual asset service providers (VASPs), with strict penalties for non-compliant entities.

- Circle, BitGo, Coinbase, and Paxos plan to apply for U.S. bank charters or licenses. According to a report in The Wall Street Journal, major crypto companies are planning to apply for U.S. bank charters or licenses. These firms are pursuing limited licenses that would permit them to issue stablecoins, as the U.S. Congress deliberates on legislation mandating licensing for stablecoin issuers.

"Established banks, like Bank of America, are hoping to amend the current drafts of [stablecoin] legislation in such a way that nonbanks are more heavily restricted from issuing stablecoins," people familiar with the matter told The Block.

- Paul Atkins has officially assumed the role of the 34th Chairman of the US Securities and Exchange Commission (SEC). This is a return to the agency for Atkins, who previously served as an SEC Commissioner from 2002 to 2008 under the George W. Bush administration. He has committed to advancing the SEC’s mission of fostering capital formation, safeguarding investors, and ensuring fair and efficient markets.

- Federal Reserve retracts guidance discouraging banks from engaging in 'crypto.' The U.S. Federal Reserve withdrew guidance that discouraged banks from crypto and stablecoin activities, as announced by its Board of Governors on Thursday. This includes rescinding a 2022 supervisory letter requiring prior notification of crypto activities and 2023 stablecoin requirements.

"As a result, the Board will no longer expect banks to provide notification and will instead monitor banks' crypto-asset activities through the normal supervisory process," reads the FED statement.

- Russian government to launch a cryptocurrency exchange. The country's Ministry of Finance and Central Bank announced plans to establish a trading platform for "highly qualified investors" that "will legalize crypto assets and bring crypto operations out of the shadows."

- Twenty One Capital is set to launch with over 42,000 BTC in its treasury. This new Bitcoin-native firm, backed by Tether and SoftBank, is planned to go public via a SPAC merger with Cantor Equity Partners and will be led by Jack Mallers, co-founder and CEO of Strike. According to a report by the Financial Times, the company aims to replicate the model of Michael Saylor with his company, MicroStrategy.

- Strategy increases Bitcoin holdings to 538,200 BTC. In the latest purchase, the company has spent more than $555M to buy 6,556 coins through proceeds of two at-the-market stock offering programs.

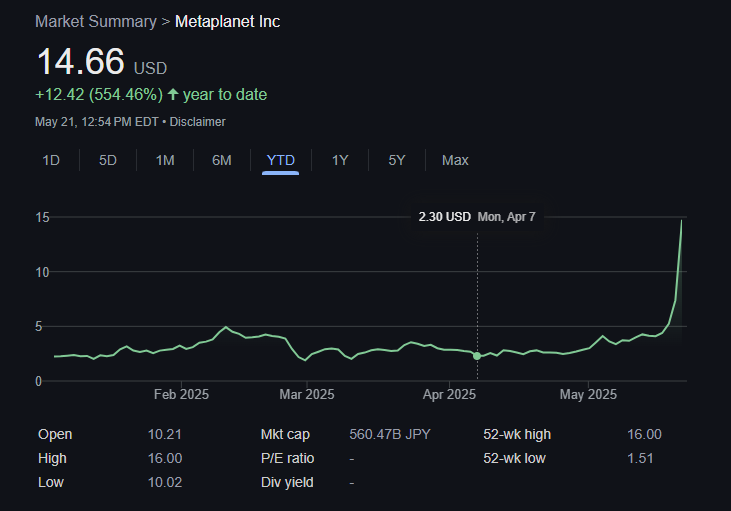

- Metaplanet buys another 145 BTC. The Tokyo-listed company has purchased an additional 145 BTC for $13.6 million. Their total bitcoin holdings now stand at 5,000 coins, worth around $428.1 million.

- Semler Scientific has increased its bitcoin holdings to 3,303 BTC. The company acquired an additional 111 BTC at an average price of $90,124. The purchase was funded through proceeds from an at-the-market offering and cash reserves, as stated in a press release.

- Tesla still holds nearly $1 billion in bitcoin. According to the automaker's latest earnings report, the firm reported digital asset holdings worth $951 million as of March 31.

- Spar supermarket experiments with Bitcoin payments in Zug, Switzerland. The store has introduced a new payment method powered by the Lightning Network. The implementation was facilitated by DFX Swiss, a service that supports seamless conversions between bitcoin and legacy currencies.

- Charles Schwab to launch spot Bitcoin trading by 2026. The financial investment firm, managing over $10 trillion in assets, has revealed plans to introduce spot Bitcoin trading for its clients within the next year.

- Arch Labs has secured $13 million to develop "ArchVM" and integrate smart-contract functionality with Bitcoin. The funding round, valuing the company at $200 million, was led by Pantera Capital, as announced on Tuesday.

- Citrea deployed its Clementine Bridge on the Bitcoin testnet. The bridge utilizes the BitVM2 programming language to inherit validity from Bitcoin, allegedly providing "the safest and most trust-minimized way to use BTC in decentralized finance."

- UAE-based Islamic bank ruya launches Shari’ah-compliant bitcoin investing. The bank has become the world’s first Islamic bank to provide direct access to virtual asset investments, including Bitcoin, via its mobile app, per Bitcoin Magazine.

- Solosatoshi.com has sold over 10,000 open-source miners, adding more than 10 PH of hashpower to the Bitcoin network.

"Thank you, Bitaxe community. OSMU developers, your brilliance built this. Supporters, your belief drives us. Customers, your trust powers 10,000+ miners and 10PH globally. Together, we’re decentralizing Bitcoin’s future. Last but certainly not least, thank you@skot9000 for not only creating a freedom tool, but instilling the idea into thousands of people, that Bitcoin mining can be for everyone again," said the firm on X.

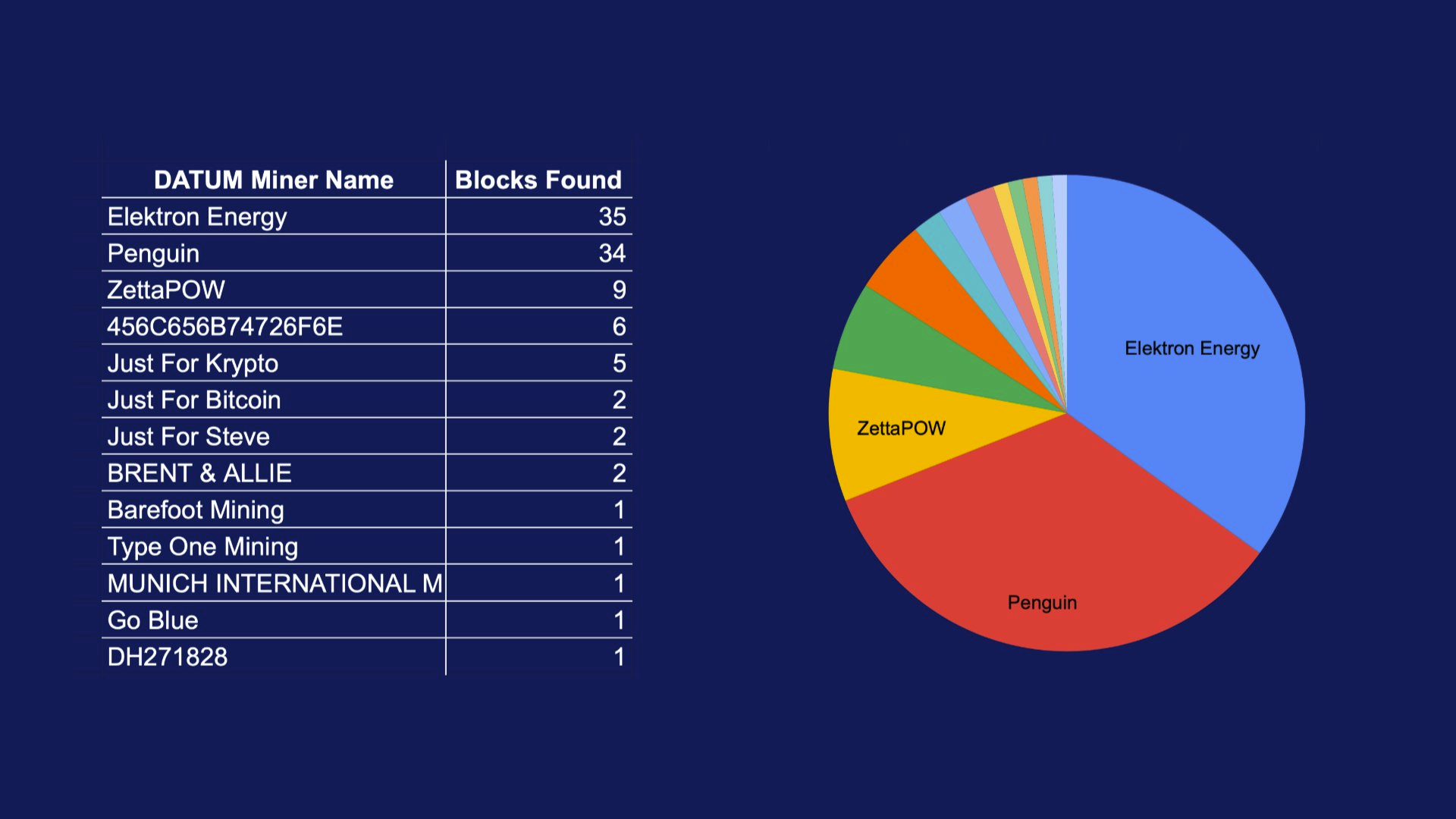

- OCEAN's DATUM has found 100 blocks. "Over 65% of OCEAN’s miners are using DATUM, and that number is growing every day. This means block template construction is making its way back into the hands of the miners, which is not only the most profitable

-

@ dfa02707:41ca50e3

2025-05-22 17:02:04

@ dfa02707:41ca50e3

2025-05-22 17:02:04Contribute to keep No Bullshit Bitcoin news going.

- RoboSats v0.7.7-alpha is now available!

NOTE: "This version of clients is not compatible with older versions of coordinators. Coordinators must upgrade first, make sure you don't upgrade your client while this is marked as pre-release."

- This version brings a new and improved coordinators view with reviews signed both by the robot and the coordinator, adds market price sources in coordinator profiles, shows a correct warning for canceling non-taken orders after a payment attempt, adds Uzbek sum currency, and includes package library updates for coordinators.

Source: RoboSats.

- siggy47 is writing daily RoboSats activity reviews on stacker.news. Check them out here.

- Stay up-to-date with RoboSats on Nostr.

What's new

- New coordinators view (see the picture above).

- Available coordinator reviews signed by both the robot and the coordinator.

- Coordinators now display market price sources in their profiles.

Source: RoboSats.

- Fix for wrong message on cancel button when taking an order. Users are now warned if they try to cancel a non taken order after a payment attempt.

- Uzbek sum currency now available.

- For coordinators: library updates.

- Add docker frontend (#1861).

- Add order review token (#1869).

- Add UZS migration (#1875).

- Fixed tests review (#1878).

- Nostr pubkey for Robot (#1887).

New contributors

Full Changelog: v0.7.6-alpha...v0.7.7-alpha

-

@ dfa02707:41ca50e3

2025-05-22 17:02:03

@ dfa02707:41ca50e3

2025-05-22 17:02:03Contribute to keep No Bullshit Bitcoin news going.

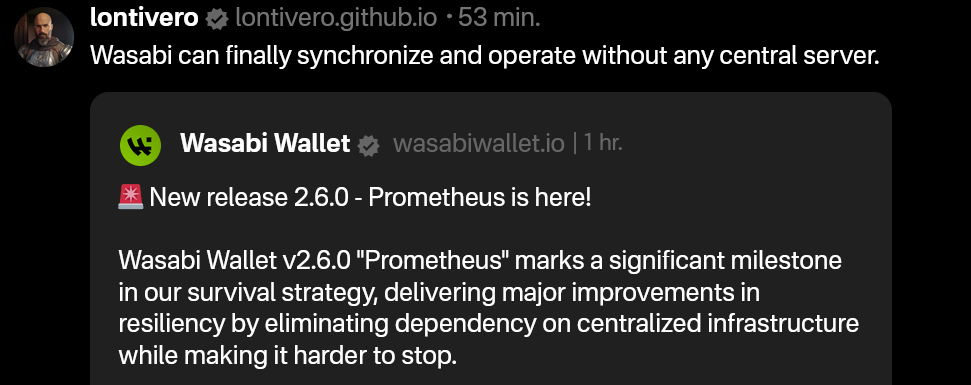

- Wasabi Wallet v2.6.0 "Prometheus" is a major update for the project, focused on resilience and independence from centralized systems.

- Key features include support for BIP 158 block filters for direct node synchronization, a revamped full node integration for easier setup without third-party reliance, SLIP 39 share backups for flexible wallet recovery (sponsored by Trezor), and a Nostr-based update manager for censorship-resistant updates.

- Additional improvements include UI bug fixes, a new fallback for transaction broadcasting, updated code signing, stricter JSON serialization, and options to avoid third-party rate providers, alongside various under-the-hood enhancements.

This new version brings us closer to our ultimate goal: ensuring Wasabi is future-proof," said the developers, while also highlighting the following key areas of focus for the project:

- Ensuring users can always fully and securely use their client.

- Making contribution and forks easy through a codebase of the highest quality possible: understandable, maintainable, and improvable.

"As we achieve our survival goals, expect more cutting-edge improvements in Bitcoin privacy and self-custody. Thank you for the trust you place in us by using Wasabi," was stated in the release notes.

What's new

- Support for Standard BIP 158 Block Filters. Wasabi now syncs using BIP 158 filters without a backend/indexer, connecting directly to a user's node. This boosts sync speed, resilience, and allows full sovereignty without specific server dependency.

- Full Node Integration Rework. The old integration has been replaced with a simpler, more adaptable system. It’s not tied to a specific Bitcoin node fork, doesn’t need the node on the same machine as Wasabi, and requires no changes to the node’s setup.

- "Simply enable the RPC server on your node and point Wasabi to it," said the developers. This ensures all Bitcoin network activities—like retrieving blocks, fee estimations, block filters, and transaction broadcasting—go through your own node, avoiding reliance on third parties.

- Create & Recover SLIP 39 Shares. Users now create and recover wallets with multiple share backups using SLIP 39 standard.

"Special thanks to Trezor (SatoshiLabs) for sponsoring this amazing feature."

- Nostr Update Manager. This version implements a pioneering system with the Nostr protocol for update information and downloads, replacing reliance on GitHub. This enhances the project's resilience, ensuring updates even if GitHub is unavailable, while still verifying updates with the project's secure certificate.

- Updated Avalonia to v11.2.7, fixes for UI bugs (including restoring Minimize on macOS Sequoia).

- Added a configurable third-party fallback for broadcasting transactions if other methods fail.

- Replaced Windows Code Signing Certificate with Azure Trusted Signing.

- Many bug fixes, improved codebase, and enhanced CI pipeline.

- Added the option to avoid using any third-party Exchange Rate and Fee Rate providers (Wasabi can work without them).

- Rebuilt all JSON Serialization mechanisms avoiding default .NET converters. Serialization is now stricter.

Full Changelog: v2.5.1...v2.6.0

-

@ dfa02707:41ca50e3

2025-05-22 17:02:03

@ dfa02707:41ca50e3

2025-05-22 17:02:03Contribute to keep No Bullshit Bitcoin news going.

- "Today we're launching the beta version of our multiplatform Nostr browser! Think Google Chrome but for Nostr apps. The beta is our big first step toward this vision," announced Damus.

- This version comes with the Dave Nostr AI assistant, support for zaps and the Nostr Wallet Connect (NWC) wallet interface, full-text note search, GIFs and fullscreen images, multiple media uploads, user tagging, relay list and mute list support, along with a number of other improvements."

"Included in the beta is the Dave, the Nostr AI assistant (its Grok for Nostr). Dave is a new Notedeck browser app that can search and summarize notes from the network. For a full breakdown of everything new, check out our beta launch video."

What's new

- Dave Nostr AI assistant app.

- GIFs.

- Fulltext note search.

- Add full screen images, add zoom, and pan.

- Zaps! NWC/ Wallet UI.

- Introduce last note per pubkey feed (experimental).

- Allow multiple media uploads per selection.

- Major Android improvements (still WIP).

- Added notedeck app sidebar.

- User Tagging.

- Note truncation.

- Local network note broadcast, broadcast notes to other notedeck notes while you're offline.

- Mute list support (reading).

- Relay list support.

- Ctrl-enter to send notes.

- Added relay indexing (relay columns soon).

- Click hashtags to open hashtag timeline.

- Fixed timelines sometimes not updating (stale feeds).

- Fixed UI bounciness when loading profile pictures

- Fixed unselectable post replies.

-

@ dfa02707:41ca50e3

2025-05-22 17:02:03

@ dfa02707:41ca50e3

2025-05-22 17:02:03Contribute to keep No Bullshit Bitcoin news going.

-

Version 1.3 of Bitcoin Safe introduces a redesigned interactive chart, quick receive feature, updated icons, a mempool preview window, support for Child Pays For Parent (CPFP) and testnet4, preconfigured testnet demo wallets, as well as various bug fixes and improvements.

-

Upcoming updates for Bitcoin Safe include Compact Block Filters.

"Compact Block Filters increase the network privacy dramatically, since you're not asking an electrum server to give you your transactions. They are a little slower than electrum servers. For a savings wallet like Bitcoin Safe this should be OK," writes the project's developer Andreas Griffin.

- Learn more about the current and upcoming features of Bitcoin Safe wallet here.

What's new in v1.3

- Redesign of Chart, Quick Receive, Icons, and Mempool Preview (by @design-rrr).

- Interactive chart. Clicking on it now jumps to transaction, and selected transactions are now highlighted.

- Speed up transactions with Child Pays For Parent (CPFP).

- BDK 1.2 (upgraded from 0.32).

- Testnet4 support.

- Preconfigured Testnet demo wallets.

- Cluster unconfirmed transactions so that parents/children are next to each other.

- Customizable columns for all tables (optional view: Txid, Address index, and more)

- Bug fixes and other improvements.

Announcement / Archive

Blog Post / Archive

GitHub Repo

Website -

-

@ dfa02707:41ca50e3

2025-05-22 17:02:02

@ dfa02707:41ca50e3

2025-05-22 17:02:02News

- Wallet of Satoshi teases a comeback in the US market with a non-custodial product. According to an announcement on X, the widely popular custodial Lightning wallet is preparing to re-enter the United States market with a non-custodial wallet. It is unclear whether the product will be open-source, but the project has clarified that "there will be no KYC on any Wallet of Satoshi, ever!" Wallet of Satoshi ceased serving customers in the United States in November 2023.

- Vulnerability disclosure: Remote crash due to addr message spam in Bitcoin Core versions before v29. Bitcoin Core developer Antoine Poinsot disclosed an integer overflow bug that crashes a node if spammed with addr messages over an extended period. A fix was released on April 14, 2025, in Bitcoin Core v29.0. The issue is rated Low severity.

- Coinbase Know Your Customer (KYC) data leak. The U.S. Department of Justice, including its Criminal Division in Washington, is investigating a cyberattack on Coinbase. The incident involved cybercriminals attempting to extort $20 million from Coinbase to prevent stolen customer data from being leaked online. Although the data breach affected less than 1% of the exchange's users, Coinbase now faces at least six lawsuits following the revelation that some customer support agents were bribed as part of the extortion scheme.

- Fold has launched Bitcoin Gift Cards, enabling users to purchase bitcoin for personal use or as gifts, redeemable via the Fold app. These cards are currently available on Fold’s website and are planned to expand to major retailers nationwide later this year.

"Our mission is to make bitcoin simple and approachable for everyone. The Bitcoin Gift Card brings bitcoin to millions of Americans in a familiar way. Available at the places people already shop, the Bitcoin Gift Card is the best way to gift bitcoin to others," said Will Reeves, Chairman and CEO of Fold.

- Corporate treasuries hold nearly 1.1 million BTC, representing about 5.5% of the total circulating supply (1,082,164 BTC), per BitcoinTreasuries.net data. Recent purchases include Strategy adding 7,390 BTC (total: 576,230 BTC), Metplanet acquiring 1,004 BTC (total: 7,800 BTC), Tether holding over 100,521 BTC, and XXI Capital, led by Jack Mallers, starting with 31,500 BTC.

- Meanwhile, a group of investors has filed a class action lawsuit against Strategy and its executive Michael Saylor. The lawsuit alleges that Strategy made overly optimistic projections using fair value accounting under new FASB rules while downplaying potential losses.

- The U.S. Senate voted to advance the GENIUS stablecoin bill for further debate before a final vote to pass it. Meanwhile, the House is crafting its own stablecoin legislation to establish a regulatory framework for stablecoins and their issuers in the U.S, reports CoinDesk.

- French 'crypto' entrepreneurs get priority access to emergency police services. French Minister of the Interior, Bruno Retailleau, agreed on measures to enhance security for 'crypto' professionals during a meeting on Friday. This follows a failed kidnapping attempt on Tuesday targeting the family of a cryptocurrency exchange CEO, and two other kidnappings earlier this year.

- Brussels Court declares tracking-based ads illegal in EU. The Brussels Court of Appeal ruled tracking-based online ads illegal in the EU due to an inadequate consent model. Major tech firms like Microsoft, Amazon, Google, and X are affected by the decision, as their consent pop-ups fail to protect privacy in real-time bidding, writes The Record.

- Telegram shares data on 22,777 users in Q1 2025, a significant increase from the 5,826 users' data shared during the same period in 2024. This significant increase follows the arrest of CEO and founder Pavel Durov last year.

- An Australian judge has ruled that Bitcoin is money, potentially exempting it from capital gains tax in the country. If upheld on appeal, this interim decision could lead to taxpayer refunds worth up to $1 billion, per tax lawyer Adrian Cartland.

Use the tools

- Bitcoin Safe v1.3.0 a secure and user-friendly Bitcoin savings wallet for beginners and advanced users, introduces an interactive chart, Child Pays For Parent (CPFP) support, testnet4 compatibility, preconfigured testnet demo wallets, various bug fixes, and other improvements.

- BlueWallet v7.1.8 brings numerous bug fixes, dependency updates, and a new search feature for addresses and transactions.

- Aqua Wallet v0.3.0 is out, offering beta testing for the reloadable Dolphin card (in partnership with Visa) for spending bitcoin and Liquid BTC. It also includes a new Optical Character Recognition (OCR) text scanner to read text addresses like QR codes, colored numbers on addresses for better readability, a reduced minimum for spending and swapping Liquid Bitcoin to 100 sats, plus other fixes and enhancements.

Source: Aqua wallet.

- The latest firmware updates for COLDCARD Mk4 v5.4.3 and Q v1.3.3 are now available, featuring the latest enhancements and bug fixes.

- Nunchuk Android v1.9.68.1 and iOS v1.9.79 introduce support for custom blockchain explorers, wallet archiving, re-ordering wallets on the home screen via long-press, and an anti-fee sniping setting.

- BDK-cli v1.0.0, a CLI wallet library and REPL tool to demo and test the BDK library, now uses bdk_wallet 1.0.0 and integrates Kyoto, utilizing the Kyoto protocol for compact block filters. It sets SQLite as the default database and discontinues support for sled.

- publsp is a new command-line tool designed for Lightning node runners or Lightning Service Providers (LSPs) to advertise liquidity offers over Nostr.

"LSPs advertise liquidity as addressable Kind 39735 events. Clients just pull and evaluate all those structured events, then NIP-17 DM an LSP of their choice to coordinate a liquidity purchase," writes developer smallworlnd.

-

Lightning Blinder by Super Testnet is a proof-of-concept privacy tool for the Lightning Network. It enables users to mislead Lightning Service Providers (LSPs) by making it appear as though one wallet is the sender or recipient, masking the original wallet. Explore and try it out here.

-

Mempal v1.5.3, a Bitcoin mempool monitoring and notification app for Android, now includes a swipe-down feature to refresh the dashboard, a custom time option for widget auto-update frequency, and a

-

@ dfa02707:41ca50e3

2025-05-22 17:02:02

@ dfa02707:41ca50e3

2025-05-22 17:02:02Contribute to keep No Bullshit Bitcoin news going.

- This release introduces Payjoin v2 functionality to Bitcoin wallets on Cake, along with several UI/UX improvements and bug fixes.

- The Payjoin v2 protocol enables asynchronous, serverless coordination between sender and receiver, removing the need to be online simultaneously or maintain a server. This simplifies privacy-focused transactions for regular users.

"I cannot speak highly enough of how amazing it has been to work with @bitgould and Jaad from the@payjoindevkit team, they're doing incredible work. None of this would be possible without them and their tireless efforts. PDK made it so much easier to ship Payjoin v2 than it would have been otherwise, and I can't wait to see other wallets jump in and give back to PDK as they implement it like we did," said Seth For Privacy, VP at Cake Wallet.

How to started with Payjoin in Cake Wallet:

- Open the app menu sidebar and click

Privacy. - Toggle the

Use Payjoinoption. - Now on your receive screen you'll see an option to copy a Payjoin URL

- Bull Bitcoin Wallet v0.4.0 introduced Payjoin v2 support in late December 2024. However, the current implementations are not interoperable at the moment, an issue that should be addressed in the next release of the Bull Bitcoin Wallet.

- Cake Wallet was one of the first wallets to introduce Silent Payments back in May 2024. However, users may encounter sync issues while using this feature at present, which will be resolved in the next release of Cake Wallet.

What's new

- Payjoin v2 implementation.

- Wallet group improvements: Enhanced management of multiple wallets.

- Various bug fixes: improving overall stability and user experience.

- Monero (XMR) enhancements.

Learn more about using, implementing, and understanding BIP 77: Payjoin Version 2 using the

payjoincrate in Payjoin Dev Kit here. -

@ dfa02707:41ca50e3

2025-05-22 17:02:02

@ dfa02707:41ca50e3

2025-05-22 17:02:02Contribute to keep No Bullshit Bitcoin news going.

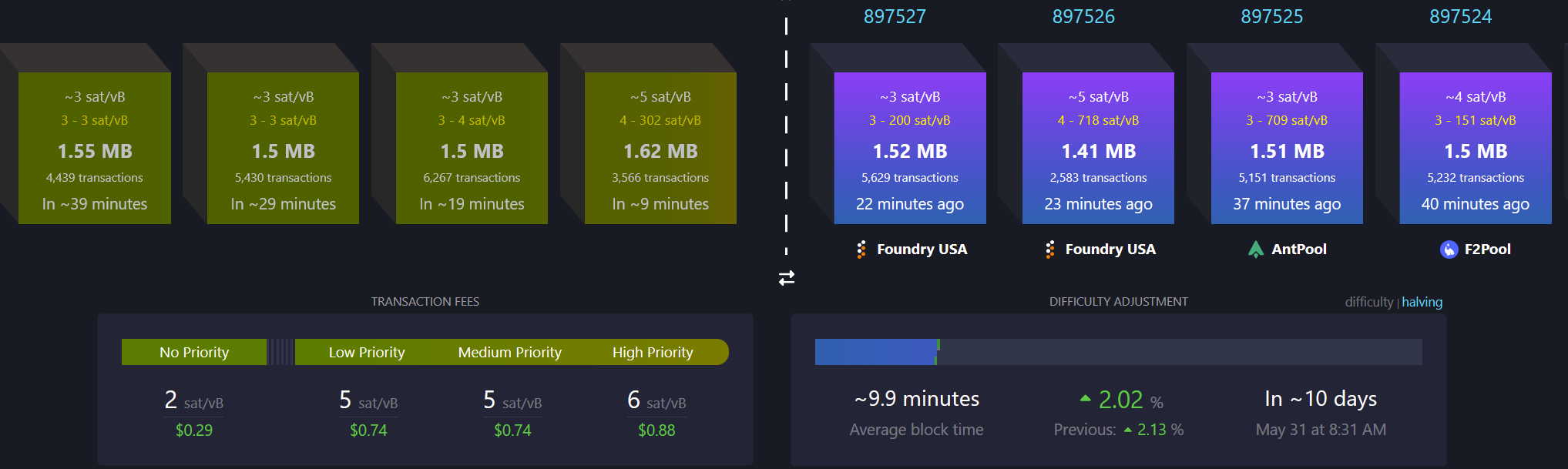

This update brings key enhancements for clarity and usability:

- Recent Blocks View: Added to the Send tab and inspired by Mempool's visualization, it displays the last 2 blocks and the estimated next block to help choose fee rates.

- Camera System Overhaul: Features a new library for higher resolution detection and mouse-scroll zoom support when available.

- Vector-Based Images: All app images are now vectorized and theme-aware, enhancing contrast, especially in dark mode.

- Tor & P2A Updates: Upgraded internal Tor and improved support for pay-to-anchor (P2A) outputs.

- Linux Package Rename: For Linux users, Sparrow has been renamed to sparrowwallet (or sparrowserver); in some cases, the original sparrow package may need manual removal.

- Additional updates include showing total payments in multi-payment transaction diagrams, better handling of long labels, and other UI enhancements.

- Sparrow v2.2.1 is a bug fix release that addresses missing UUID issue when starting Tor on recent macOS versions, icons for external sources in Settings and Recent Blocks view, repackaged

.debinstalls to use older gzip instead of zstd compression, and removed display of median fee rate where fee rates source is set to Server.

Learn how to get started with Sparrow wallet:

Release notes (v2.2.0)

- Added Recent Blocks view to Send tab.

- Converted all bitmapped images to theme aware SVG format for all wallet models and dialogs.

- Support send and display of pay to anchor (P2A) outputs.

- Renamed

sparrowpackage tosparrowwalletandsparrowserveron Linux. - Switched camera library to openpnp-capture.

- Support FHD (1920 x 1080) and UHD4k (3840 x 2160) capture resolutions.

- Support camera zoom with mouse scroll where possible.

- In the Download Verifier, prefer verifying the dropped file over the default file where the file is not in the manifest.

- Show a warning (with an option to disable the check) when importing a wallet with a derivation path matching another script type.

- In Cormorant, avoid calling the

listwalletdirRPC on initialization due to a potentially slow response on Windows. - Avoid server address resolution for public servers.

- Assume server address is non local for resolution failures where a proxy is configured.

- Added a tooltip to indicate truncated labels in table cells.

- Dynamically truncate input and output labels in the tree on a transaction tab, and add tooltips if necessary.

- Improved tooltips for wallet tabs and transaction diagrams with long labels.

- Show the address where available on input and output tooltips in transaction tab tree.

- Show the total amount sent in payments in the transaction diagram when constructing multiple payment transactions.

- Reset preferred table column widths on adjustment to improve handling after window resizing.

- Added accessible text to improve screen reader navigation on seed entry.

- Made Wallet Summary table grow horizontally with dialog sizing.

- Reduced tooltip show delay to 200ms.

- Show transaction diagram fee percentage as less than 0.01% rather than 0.00%.

- Optimized and reduced Electrum server RPC calls.

- Upgraded Bouncy Castle, PGPainless and Logback libraries.

- Upgraded internal Tor to v0.4.8.16.

- Bug fix: Fixed issue with random ordering of keystore origins on labels import.

- Bug fix: Fixed non-zero account script type detection when signing a message on Trezor devices.

- Bug fix: Fixed issue parsing remote Coldcard xpub encoded on a different network.

- Bug fix: Fixed inclusion of fees on wallet label exports.

- Bug fix: Increase Trezor device libusb timeout.

Linux users: Note that the

sparrowpackage has been renamed tosparrowwalletorsparrowserver, and in some cases you may need to manually uninstall the originalsparrowpackage. Look in the/optfolder to ensure you have the new name, and the original is removed.What's new in v2.2.1

- Updated Tor library to fix missing UUID issue when starting Tor on recent macOS versions.

- Repackaged

.debinstalls to use older gzip instead of zstd compression. - Removed display of median fee rate where fee rates source is set to Server.

- Added icons for external sources in Settings and Recent Blocks view

- Bug fix: Fixed issue in Recent Blocks view when switching fee rates source

- Bug fix: Fixed NPE on null fee returned from server

-

@ 7e6f9018:a6bbbce5

2025-05-22 15:44:12

@ 7e6f9018:a6bbbce5

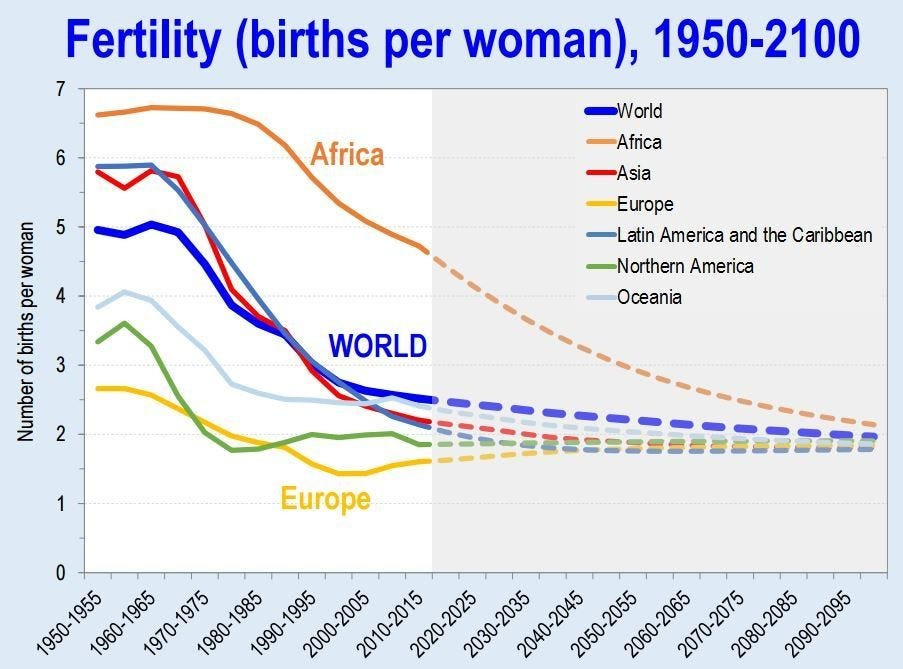

2025-05-22 15:44:12Over the last decade, birth rates in Spain have dropped by 30%, from 486,000 births in 2010 to 339,000 in 2020, a decline only comparable to that seen in Japan and the Four Asian Tigers.

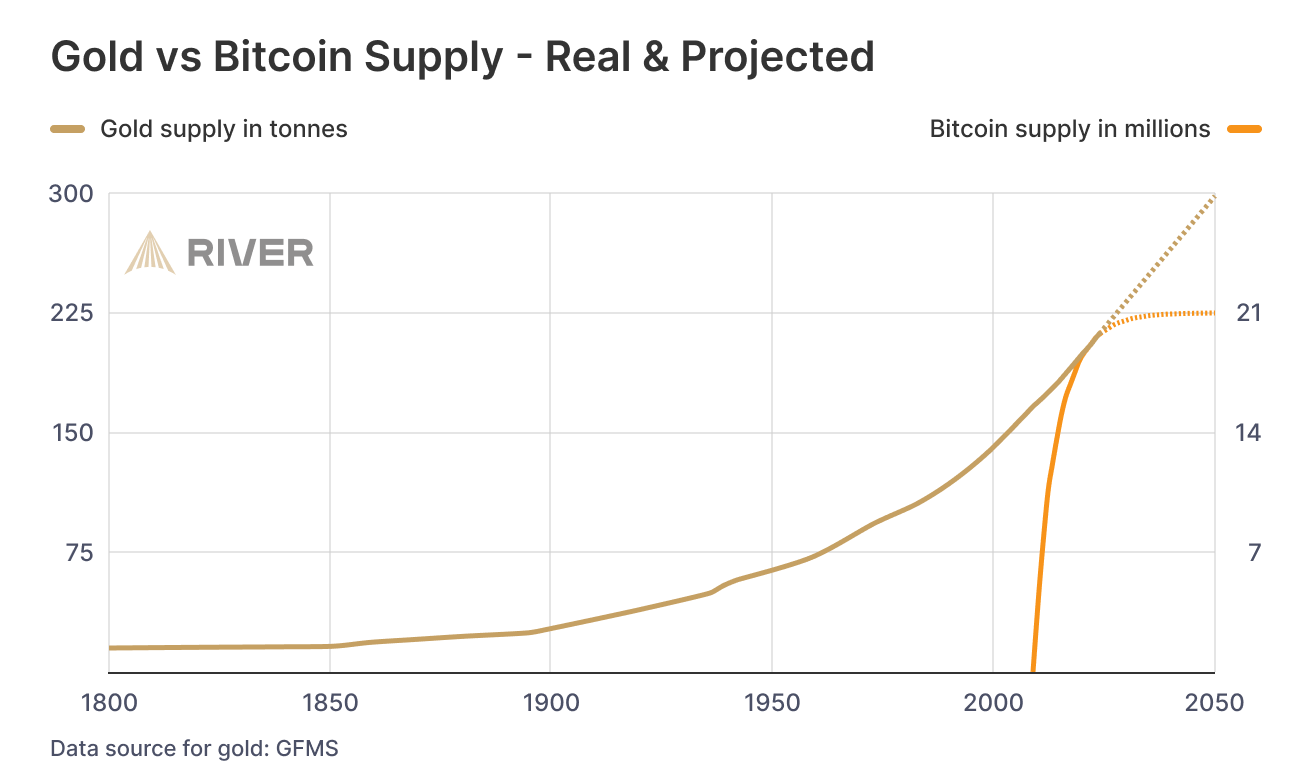

The main cause seems to stem from two major factors: (1) the widespread use of contraceptive methods, which allow for pregnancy control without reducing sexual activity, and (2) women's entry into the labor market, leading to a significant shift away from traditional maternal roles.

In this regard, there is a phenomenon of demographic inertia that I believe could become significant. When a society ages and the population pyramid inverts, the burden this places on the non-dependent population could further contribute to a deeper decline in birth rates.

The more resources (time and money) non-dependent individuals have to dedicate to the elderly (dependents), the less they can allocate to producing new births (also dependents):

- An only child who has to care for both parents will bear a burden of 2 (2 ÷ 1).

- Three siblings who share the responsibility of caring for their parents will bear a burden of 0.6 (2 ÷ 3).

This burden on only children could, in many cases, be significant enough to prevent them from having children of their own.

In Spain, the generation of only children reached reproductive age in 2019(*), this means that right now the majority of people in reproductive age in Spain are only child (or getting very close to it).

If this assumption is correct, and aging feeds on itself, then, given that Spain has one of the worst demographic imbalances in the world, this phenomenon is likely to manifest through worsening birth rates. Spain’s current birth rate of 1.1 may not yet have reached its lowest point.

(*)Birth rate table and the year in which each generation reaches 32 years of age, Spain.

| Year of birth | Birth rate | Year in which the generation turns 32 | | ------------------ | -------------- | ----------------------------------------- | | 1971 | 2.88 | 2003 | | 1972 | 2.85 | 2004 | | 1973 | 2.82 | 2005 | | 1974 | 2.81 | 2006 | | 1975 | 2.77 | 2007 | | 1976 | 2.77 | 2008 | | 1977 | 2.65 | 2009 | | 1978 | 2.54 | 2010 | | 1979 | 2.37 | 2011 | | 1980 | 2.21 | 2012 | | 1981 | 2.04 | 2013 | | 1982 | 1.94 | 2014 | | 1983 | 1.80 | 2015 | | 1984 | 1.72 | 2016 | | 1985 | 1.64 | 2017 | | 1986 | 1.55 | 2018 | | 1987 | 1.49 | 2019 | | 1988 | 1.45 | 2020 | | 1989 | 1.40 | 2021 | | 1990 | 1.36 | 2022 | | 1991 | 1.33 | 2023 | | 1992 | 1.31 | 2024 | | 1993 | 1.26 | 2025 | | 1994 | 1.19 | 2026 | | 1995 | 1.16 | 2027 | | 1996 | 1.14 | 2028 | | 1997 | 1.15 | 2029 | | 1998 | 1.13 | 2030 | | 1999 | 1.16 | 2031 | | 2000 | 1.21 | 2032 | | 2001 | 1.24 | 2033 | | 2002 | 1.25 | 2034 | | 2003 | 1.30 | 2035 | | 2004 | 1.32 | 2036 | | 2005 | 1.33 | 2037 | | 2006 | 1.36 | 2038 | | 2007 | 1.38 | 2039 | | 2008 | 1.44 | 2040 | | 2009 | 1.38 | 2041 | | 2010 | 1.37 | 2042 | | 2011 | 1.34 | 2043 | | 2012 | 1.32 | 2044 | | 2013 | 1.27 | 2045 | | 2014 | 1.32 | 2046 | | 2015 | 1.33 | 2047 | | 2016 | 1.34 | 2048 | | 2017 | 1.31 | 2049 | | 2018 | 1.26 | 2050 | | 2019 | 1.24 | 2051 | | 2020 | 1.19 | 2052 |

-

@ 4fa5d1c4:fd6c6e41

2025-05-22 15:30:43

@ 4fa5d1c4:fd6c6e41

2025-05-22 15:30:43🧠 Entwickelt von OECD & EU-Kommission – jetzt zur Rückmeldung freigegeben:\ 👉 https://ailiteracyframework.org/