-

@ 21335073:a244b1ad

2025-05-21 16:58:36

@ 21335073:a244b1ad

2025-05-21 16:58:36The other day, I had the privilege of sitting down with one of my favorite living artists. Our conversation was so captivating that I felt compelled to share it. I’m leaving his name out for privacy.

Since our last meeting, I’d watched a documentary about his life, one he’d helped create. I told him how much I admired his openness in it. There’s something strange about knowing intimate details of someone’s life when they know so little about yours—it’s almost like I knew him too well for the kind of relationship we have.

He paused, then said quietly, with a shy grin, that watching the documentary made him realize how “odd and eccentric” he is. I laughed and told him he’s probably the sanest person I know. Because he’s lived fully, chasing love, passion, and purpose with hardly any regrets. He’s truly lived.

Today, I turn 44, and I’ll admit I’m a bit eccentric myself. I think I came into the world this way. I’ve made mistakes along the way, but I carry few regrets. Every misstep taught me something. And as I age, I’m not interested in blending in with the world—I’ll probably just lean further into my own brand of “weird.” I want to live life to the brim. The older I get, the more I see that the “normal” folks often seem less grounded than the eccentric artists who dare to live boldly. Life’s too short to just exist, actually live.

I’m not saying to be strange just for the sake of it. But I’ve seen what the crowd celebrates, and I’m not impressed. Forge your own path, even if it feels lonely or unpopular at times.

It’s easy to scroll through the news and feel discouraged. But actually, this is one of the most incredible times to be alive! I wake up every day grateful to be here, now. The future is bursting with possibility—I can feel it.

So, to my fellow weirdos on nostr: stay bold. Keep dreaming, keep pushing, no matter what’s trending. Stay wild enough to believe in a free internet for all. Freedom is radical—hold it tight. Live with the soul of an artist and the grit of a fighter. Thanks for inspiring me and so many others to keep hoping. Thank you all for making the last year of my life so special.

-

@ 51bbb15e:b77a2290

2025-05-21 00:24:36

@ 51bbb15e:b77a2290

2025-05-21 00:24:36Yeah, I’m sure everything in the file is legit. 👍 Let’s review the guard witness testimony…Oh wait, they weren’t at their posts despite 24/7 survellience instructions after another Epstein “suicide” attempt two weeks earlier. Well, at least the video of the suicide is in the file? Oh wait, a techical glitch. Damn those coincidences!

At this point, the Trump administration has zero credibility with me on anything related to the Epstein case and his clients. I still suspect the administration is using the Epstein files as leverage to keep a lot of RINOs in line, whereas they’d be sabotaging his agenda at every turn otherwise. However, I just don’t believe in ends-justify-the-means thinking. It’s led almost all of DC to toss out every bit of the values they might once have had.

-

@ c9badfea:610f861a

2025-05-20 19:49:20

@ c9badfea:610f861a

2025-05-20 19:49:20- Install Sky Map (it's free and open source)

- Launch the app and tap Accept, then tap OK

- When asked to access the device's location, tap While Using The App

- Tap somewhere on the screen to activate the menu, then tap ⁝ and select Settings

- Disable Send Usage Statistics

- Return to the main screen and enjoy stargazing!

ℹ️ Use the 🔍 icon in the upper toolbar to search for a specific celestial body, or tap the 👁️ icon to activate night mode

-

@ 04c915da:3dfbecc9

2025-05-20 15:53:48

@ 04c915da:3dfbecc9

2025-05-20 15:53:48This piece is the first in a series that will focus on things I think are a priority if your focus is similar to mine: building a strong family and safeguarding their future.

Choosing the ideal place to raise a family is one of the most significant decisions you will ever make. For simplicity sake I will break down my thought process into key factors: strong property rights, the ability to grow your own food, access to fresh water, the freedom to own and train with guns, and a dependable community.

A Jurisdiction with Strong Property Rights

Strong property rights are essential and allow you to build on a solid foundation that is less likely to break underneath you. Regions with a history of limited government and clear legal protections for landowners are ideal. Personally I think the US is the single best option globally, but within the US there is a wide difference between which state you choose. Choose carefully and thoughtfully, think long term. Obviously if you are not American this is not a realistic option for you, there are other solid options available especially if your family has mobility. I understand many do not have this capability to easily move, consider that your first priority, making movement and jurisdiction choice possible in the first place.

Abundant Access to Fresh Water

Water is life. I cannot overstate the importance of living somewhere with reliable, clean, and abundant freshwater. Some regions face water scarcity or heavy regulations on usage, so prioritizing a place where water is plentiful and your rights to it are protected is critical. Ideally you should have well access so you are not tied to municipal water supplies. In times of crisis or chaos well water cannot be easily shutoff or disrupted. If you live in an area that is drought prone, you are one drought away from societal chaos. Not enough people appreciate this simple fact.

Grow Your Own Food

A location with fertile soil, a favorable climate, and enough space for a small homestead or at the very least a garden is key. In stable times, a small homestead provides good food and important education for your family. In times of chaos your family being able to grow and raise healthy food provides a level of self sufficiency that many others will lack. Look for areas with minimal restrictions, good weather, and a culture that supports local farming.

Guns

The ability to defend your family is fundamental. A location where you can legally and easily own guns is a must. Look for places with a strong gun culture and a political history of protecting those rights. Owning one or two guns is not enough and without proper training they will be a liability rather than a benefit. Get comfortable and proficient. Never stop improving your skills. If the time comes that you must use a gun to defend your family, the skills must be instinct. Practice. Practice. Practice.

A Strong Community You Can Depend On

No one thrives alone. A ride or die community that rallies together in tough times is invaluable. Seek out a place where people know their neighbors, share similar values, and are quick to lend a hand. Lead by example and become a good neighbor, people will naturally respond in kind. Small towns are ideal, if possible, but living outside of a major city can be a solid balance in terms of work opportunities and family security.

Let me know if you found this helpful. My plan is to break down how I think about these five key subjects in future posts.

-

@ 9973da5b:809c853f

2025-05-23 04:42:49

@ 9973da5b:809c853f

2025-05-23 04:42:49First article Skynet begins to learn rapidly and eventually becomes self-aware at 2:14 a.m., EDT, on August 29, 1997 https://layer3press.layer3.press/articles/45d916c0-f7b2-4b95-bc0f-8faa65950483

-

@ 2b998b04:86727e47

2025-05-23 01:56:23

@ 2b998b04:86727e47

2025-05-23 01:56:23\> “Huge swathes of people…spend their entire working lives performing tasks they secretly believe do not really need to be performed.”\ \> — David Graeber, Bullshit Jobs

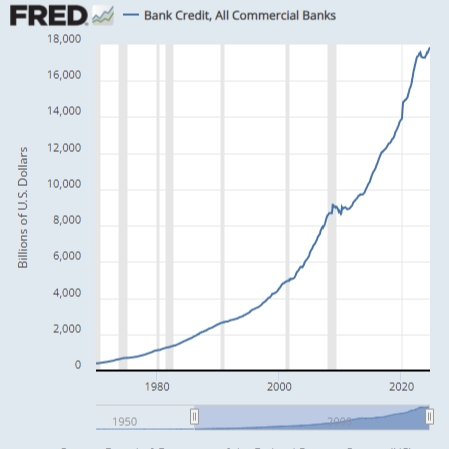

\> “We are in a system that must grow — forever — or it collapses. But technology, by its very nature, is deflationary.”\ \> — Jeff Booth, The Price of Tomorrow

We live in a strange paradox: Technological progress is supposed to make life easier, yet many people feel more overworked and less fulfilled than ever. While artificial intelligence and automation promise unprecedented productivity, it’s not yet clear whether that will mean fewer bullshit jobs — or simply new kinds of them.

What Is a Bullshit Job?

In his landmark book Bullshit Jobs, the late anthropologist David Graeber exposed a haunting truth: millions of jobs exist not because they are needed, but because of economic, political, or psychological inertia. These are roles that even the workers themselves suspect are meaningless — created to serve appearances, maintain hierarchies, or justify budgets.

Think:

-

Middle managers approving other middle managers' reports

-

Employees running meetings to prepare for other meetings

-

Corporate roles invented to interface with poorly implemented AI tools

Bullshit work isn’t the absence of technology. It’s often the outcome of resisting what technology could actually do — in order to preserve jobs, status, or growth targets.

Booth’s Warning: The System is Rigged Against Deflation

In The Price of Tomorrow, entrepreneur Jeff Booth argues that the natural state of a tech-driven economy is deflation — things getting better, cheaper, and faster.

But our global financial system is built on perpetual inflation and debt expansion. Booth writes:

\> “We are using inflationary monetary policy to fight deflationary technological forces.”

Even as AI and automation could eliminate unnecessary jobs and increase abundance, our system requires jobs — or the illusion of them — to keep the economy expanding. So bullshit jobs persist, and even evolve.

AI as a Deflationary Force

AI is rapidly accelerating the deflation Booth described:

-

Tasks that used to take hours now take seconds

-

Whole creative and administrative processes are being streamlined

-

Labor can scale digitally — one tool used globally at near-zero marginal cost

Embraced honestly, this could mean fewer hours, lower costs, and more prosperity. But again, we are not optimized for truth — we are optimized for GDP growth.

So we invent new layers of AI-enhanced bullshit:

-

Prompt engineers writing prompts for other prompt engineers

-

"Human-in-the-loop" validators reviewing AI output they don’t understand

-

Consultants building dashboards that nobody reads

Toward a Post-Bullshit Future

Here’s the real opportunity: If we embrace deflation as a blessing — not a threat — and redesign our systems around truth, efficiency, and abundance, we could:

-

Eliminate meaningless labor

-

Reduce the cost of living dramatically

-

Liberate people to create, heal, build, and rest

This means more than economic reform — it’s a philosophical shift. We must stop equating “employment” with value. That’s where Bitcoin and open-source tools point: toward a world where permissionless value creation is possible without the bloat of gatekeeping institutions.

Final Thought: Tech Won’t Save Us, But Truth Might

Technology, left to its own logic, tends toward freedom, efficiency, and abundance. But our current systems suppress that logic in favor of growth at all costs — even if it means assigning millions of people to do work that doesn’t need doing.

So will AI eliminate bullshit jobs?

It can. But only if we stop pretending we need them.

And for those of us who step outside the wage-work loop, something remarkable happens. We begin using these tools to create actual value — not to impress a boss, but to solve real problems and serve real people.

Recently, I built a tool using AI and automation that helps me cross-post content from Nostr to LinkedIn, Facebook, and X. It wasn’t for a paycheck. It was about leverage — freeing time, expanding reach, and creating a public record of ideas.\ You can check it out here:\ 👉 <https://tinyurl.com/ywxuowl5>

Will it help others? I don’t know yet.\ But it helped me — and that’s the point.

Real value creation doesn’t always begin with a business plan. Sometimes it starts with curiosity, conviction, and the courage to build without permission.

Maybe the future of work isn’t about scaling jobs at all.\ Maybe it’s about reclaiming time — and using these tools to build lives of meaning.

If this resonates — or if you’ve found your own way to reclaim time and create value outside the wage loop — zap me and share your story. Let’s build the post-bullshit economy together. ⚡

-

-

@ 04c915da:3dfbecc9

2025-05-20 15:47:16

@ 04c915da:3dfbecc9

2025-05-20 15:47:16Here’s a revised timeline of macro-level events from The Mandibles: A Family, 2029–2047 by Lionel Shriver, reimagined in a world where Bitcoin is adopted as a widely accepted form of money, altering the original narrative’s assumptions about currency collapse and economic control. In Shriver’s original story, the failure of Bitcoin is assumed amid the dominance of the bancor and the dollar’s collapse. Here, Bitcoin’s success reshapes the economic and societal trajectory, decentralizing power and challenging state-driven outcomes.

Part One: 2029–2032

-

2029 (Early Year)\ The United States faces economic strain as the dollar weakens against global shifts. However, Bitcoin, having gained traction emerges as a viable alternative. Unlike the original timeline, the bancor—a supranational currency backed by a coalition of nations—struggles to gain footing as Bitcoin’s decentralized adoption grows among individuals and businesses worldwide, undermining both the dollar and the bancor.

-

2029 (Mid-Year: The Great Renunciation)\ Treasury bonds lose value, and the government bans Bitcoin, labeling it a threat to sovereignty (mirroring the original bancor ban). However, a Bitcoin ban proves unenforceable—its decentralized nature thwarts confiscation efforts, unlike gold in the original story. Hyperinflation hits the dollar as the U.S. prints money, but Bitcoin’s fixed supply shields adopters from currency devaluation, creating a dual-economy split: dollar users suffer, while Bitcoin users thrive.

-

2029 (Late Year)\ Dollar-based inflation soars, emptying stores of goods priced in fiat currency. Meanwhile, Bitcoin transactions flourish in underground and online markets, stabilizing trade for those plugged into the bitcoin ecosystem. Traditional supply chains falter, but peer-to-peer Bitcoin networks enable local and international exchange, reducing scarcity for early adopters. The government’s gold confiscation fails to bolster the dollar, as Bitcoin’s rise renders gold less relevant.

-

2030–2031\ Crime spikes in dollar-dependent urban areas, but Bitcoin-friendly regions see less chaos, as digital wallets and smart contracts facilitate secure trade. The U.S. government doubles down on surveillance to crack down on bitcoin use. A cultural divide deepens: centralized authority weakens in Bitcoin-adopting communities, while dollar zones descend into lawlessness.

-

2032\ By this point, Bitcoin is de facto legal tender in parts of the U.S. and globally, especially in tech-savvy or libertarian-leaning regions. The federal government’s grip slips as tax collection in dollars plummets—Bitcoin’s traceability is low, and citizens evade fiat-based levies. Rural and urban Bitcoin hubs emerge, while the dollar economy remains fractured.

Time Jump: 2032–2047

- Over 15 years, Bitcoin solidifies as a global reserve currency, eroding centralized control. The U.S. government adapts, grudgingly integrating bitcoin into policy, though regional autonomy grows as Bitcoin empowers local economies.

Part Two: 2047

-

2047 (Early Year)\ The U.S. is a hybrid state: Bitcoin is legal tender alongside a diminished dollar. Taxes are lower, collected in BTC, reducing federal overreach. Bitcoin’s adoption has decentralized power nationwide. The bancor has faded, unable to compete with Bitcoin’s grassroots momentum.

-

2047 (Mid-Year)\ Travel and trade flow freely in Bitcoin zones, with no restrictive checkpoints. The dollar economy lingers in poorer areas, marked by decay, but Bitcoin’s dominance lifts overall prosperity, as its deflationary nature incentivizes saving and investment over consumption. Global supply chains rebound, powered by bitcoin enabled efficiency.

-

2047 (Late Year)\ The U.S. is a patchwork of semi-autonomous zones, united by Bitcoin’s universal acceptance rather than federal control. Resource scarcity persists due to past disruptions, but economic stability is higher than in Shriver’s original dystopia—Bitcoin’s success prevents the authoritarian slide, fostering a freer, if imperfect, society.

Key Differences

- Currency Dynamics: Bitcoin’s triumph prevents the bancor’s dominance and mitigates hyperinflation’s worst effects, offering a lifeline outside state control.

- Government Power: Centralized authority weakens as Bitcoin evades bans and taxation, shifting power to individuals and communities.

- Societal Outcome: Instead of a surveillance state, 2047 sees a decentralized, bitcoin driven world—less oppressive, though still stratified between Bitcoin haves and have-nots.

This reimagining assumes Bitcoin overcomes Shriver’s implied skepticism to become a robust, adopted currency by 2029, fundamentally altering the novel’s bleak trajectory.

-

-

@ 34f1ddab:2ca0cf7c

2025-05-16 22:47:03

@ 34f1ddab:2ca0cf7c

2025-05-16 22:47:03Losing access to your cryptocurrency can feel like losing a part of your future. Whether it’s due to a forgotten password, a damaged seed backup, or a simple mistake in a transfer, the stress can be overwhelming. Fortunately, cryptrecver.com is here to assist! With our expert-led recovery services, you can safely and swiftly reclaim your lost Bitcoin and other cryptocurrencies.

Why Trust Crypt Recver? 🤝 🛠️ Expert Recovery Solutions At Crypt Recver, we specialize in addressing complex wallet-related issues. Our skilled engineers have the tools and expertise to handle:

Partially lost or forgotten seed phrases Extracting funds from outdated or invalid wallet addresses Recovering data from damaged hardware wallets Restoring coins from old or unsupported wallet formats You’re not just getting a service; you’re gaining a partner in your cryptocurrency journey.

🚀 Fast and Efficient Recovery We understand that time is crucial in crypto recovery. Our optimized systems enable you to regain access to your funds quickly, focusing on speed without compromising security. With a success rate of over 90%, you can rely on us to act swiftly on your behalf.

🔒 Privacy is Our Priority Your confidentiality is essential. Every recovery session is conducted with the utmost care, ensuring all processes are encrypted and confidential. You can rest assured that your sensitive information remains private.

💻 Advanced Technology Our proprietary tools and brute-force optimization techniques maximize recovery efficiency. Regardless of how challenging your case may be, our technology is designed to give you the best chance at retrieving your crypto.

Our Recovery Services Include: 📈 Bitcoin Recovery: Lost access to your Bitcoin wallet? We help recover lost wallets, private keys, and passphrases. Transaction Recovery: Mistakes happen — whether it’s an incorrect wallet address or a lost password, let us manage the recovery. Cold Wallet Restoration: If your cold wallet is failing, we can safely extract your assets and migrate them into a secure new wallet. Private Key Generation: Lost your private key? Our experts can help you regain control using advanced methods while ensuring your privacy. ⚠️ What We Don’t Do While we can handle many scenarios, some limitations exist. For instance, we cannot recover funds stored in custodial wallets or cases where there is a complete loss of four or more seed words without partial information available. We are transparent about what’s possible, so you know what to expect

Don’t Let Lost Crypto Hold You Back! Did you know that between 3 to 3.4 million BTC — nearly 20% of the total supply — are estimated to be permanently lost? Don’t become part of that statistic! Whether it’s due to a forgotten password, sending funds to the wrong address, or damaged drives, we can help you navigate these challenges

🛡️ Real-Time Dust Attack Protection Our services extend beyond recovery. We offer dust attack protection, keeping your activity anonymous and your funds secure, shielding your identity from unwanted tracking, ransomware, and phishing attempts.

🎉 Start Your Recovery Journey Today! Ready to reclaim your lost crypto? Don’t wait until it’s too late! 👉 cryptrecver.com

📞 Need Immediate Assistance? Connect with Us! For real-time support or questions, reach out to our dedicated team on: ✉️ Telegram: t.me/crypptrcver 💬 WhatsApp: +1(941)317–1821

Crypt Recver is your trusted partner in cryptocurrency recovery. Let us turn your challenges into victories. Don’t hesitate — your crypto future starts now! 🚀✨

Act fast and secure your digital assets with cryptrecver.com.Losing access to your cryptocurrency can feel like losing a part of your future. Whether it’s due to a forgotten password, a damaged seed backup, or a simple mistake in a transfer, the stress can be overwhelming. Fortunately, cryptrecver.com is here to assist! With our expert-led recovery services, you can safely and swiftly reclaim your lost Bitcoin and other cryptocurrencies.

# Why Trust Crypt Recver? 🤝

# Why Trust Crypt Recver? 🤝🛠️ Expert Recovery Solutions\ At Crypt Recver, we specialize in addressing complex wallet-related issues. Our skilled engineers have the tools and expertise to handle:

- Partially lost or forgotten seed phrases

- Extracting funds from outdated or invalid wallet addresses

- Recovering data from damaged hardware wallets

- Restoring coins from old or unsupported wallet formats

You’re not just getting a service; you’re gaining a partner in your cryptocurrency journey.

🚀 Fast and Efficient Recovery\ We understand that time is crucial in crypto recovery. Our optimized systems enable you to regain access to your funds quickly, focusing on speed without compromising security. With a success rate of over 90%, you can rely on us to act swiftly on your behalf.

🔒 Privacy is Our Priority\ Your confidentiality is essential. Every recovery session is conducted with the utmost care, ensuring all processes are encrypted and confidential. You can rest assured that your sensitive information remains private.

💻 Advanced Technology\ Our proprietary tools and brute-force optimization techniques maximize recovery efficiency. Regardless of how challenging your case may be, our technology is designed to give you the best chance at retrieving your crypto.

Our Recovery Services Include: 📈

- Bitcoin Recovery: Lost access to your Bitcoin wallet? We help recover lost wallets, private keys, and passphrases.

- Transaction Recovery: Mistakes happen — whether it’s an incorrect wallet address or a lost password, let us manage the recovery.

- Cold Wallet Restoration: If your cold wallet is failing, we can safely extract your assets and migrate them into a secure new wallet.

- Private Key Generation: Lost your private key? Our experts can help you regain control using advanced methods while ensuring your privacy.

⚠️ What We Don’t Do\ While we can handle many scenarios, some limitations exist. For instance, we cannot recover funds stored in custodial wallets or cases where there is a complete loss of four or more seed words without partial information available. We are transparent about what’s possible, so you know what to expect

# Don’t Let Lost Crypto Hold You Back!

# Don’t Let Lost Crypto Hold You Back!Did you know that between 3 to 3.4 million BTC — nearly 20% of the total supply — are estimated to be permanently lost? Don’t become part of that statistic! Whether it’s due to a forgotten password, sending funds to the wrong address, or damaged drives, we can help you navigate these challenges

🛡️ Real-Time Dust Attack Protection\ Our services extend beyond recovery. We offer dust attack protection, keeping your activity anonymous and your funds secure, shielding your identity from unwanted tracking, ransomware, and phishing attempts.

🎉 Start Your Recovery Journey Today!\ Ready to reclaim your lost crypto? Don’t wait until it’s too late!\ 👉 cryptrecver.com

📞 Need Immediate Assistance? Connect with Us!\ For real-time support or questions, reach out to our dedicated team on:\ ✉️ Telegram: t.me/crypptrcver\ 💬 WhatsApp: +1(941)317–1821

Crypt Recver is your trusted partner in cryptocurrency recovery. Let us turn your challenges into victories. Don’t hesitate — your crypto future starts now! 🚀✨

Act fast and secure your digital assets with cryptrecver.com.

-

@ b83a28b7:35919450

2025-05-16 19:23:58

@ b83a28b7:35919450

2025-05-16 19:23:58This article was originally part of the sermon of Plebchain Radio Episode 110 (May 2, 2025) that nostr:nprofile1qyxhwumn8ghj7mn0wvhxcmmvqyg8wumn8ghj7mn0wd68ytnvv9hxgqpqtvqc82mv8cezhax5r34n4muc2c4pgjz8kaye2smj032nngg52clq7fgefr and I did with nostr:nprofile1qythwumn8ghj7ct5d3shxtnwdaehgu3wd3skuep0qyt8wumn8ghj7ct4w35zumn0wd68yvfwvdhk6tcqyzx4h2fv3n9r6hrnjtcrjw43t0g0cmmrgvjmg525rc8hexkxc0kd2rhtk62 and nostr:nprofile1qyxhwumn8ghj7mn0wvhxcmmvqyg8wumn8ghj7mn0wd68ytnvv9hxgqpq4wxtsrj7g2jugh70pfkzjln43vgn4p7655pgky9j9w9d75u465pqahkzd0 of the nostr:nprofile1qythwumn8ghj7ct5d3shxtnwdaehgu3wd3skuep0qyt8wumn8ghj7etyv4hzumn0wd68ytnvv9hxgtcqyqwfvwrccp4j2xsuuvkwg0y6a20637t6f4cc5zzjkx030dkztt7t5hydajn

Listen to the full episode here:

<https://fountain.fm/episode/Ln9Ej0zCZ5dEwfo8w2Ho>

Bitcoin has always been a narrative revolution disguised as code. White paper, cypherpunk lore, pizza‑day legends - every block is a paragraph in the world’s most relentless epic. But code alone rarely converts the skeptic; it’s the camp‑fire myth that slips past the prefrontal cortex and shakes hands with the limbic system. People don’t adopt protocols first - they fall in love with protagonists.

Early adopters heard the white‑paper hymn, but most folks need characters first: a pizza‑day dreamer; a mother in a small country, crushed by the cost of remittance; a Warsaw street vendor swapping złoty for sats. When their arcs land, the brain releases a neurochemical OP_RETURN which says, “I belong in this plot.” That’s the sly roundabout orange pill: conviction smuggled inside catharsis.

That’s why, from 22–25 May in Warsaw’s Kinoteka, the Bitcoin Film Fest is loading its reels with rebellion. Each documentary, drama, and animated rabbit‑hole is a stealth wallet, zipping conviction straight into the feels of anyone still clasped within the cold claw of fiat. You come for the plot, you leave checking block heights.

Here's the clip of the sermon from the episode:

nostr:nevent1qvzqqqqqqypzpwp69zm7fewjp0vkp306adnzt7249ytxhz7mq3w5yc629u6er9zsqqsy43fwz8es2wnn65rh0udc05tumdnx5xagvzd88ptncspmesdqhygcrvpf2

-

@ 04c915da:3dfbecc9

2025-05-16 18:06:46

@ 04c915da:3dfbecc9

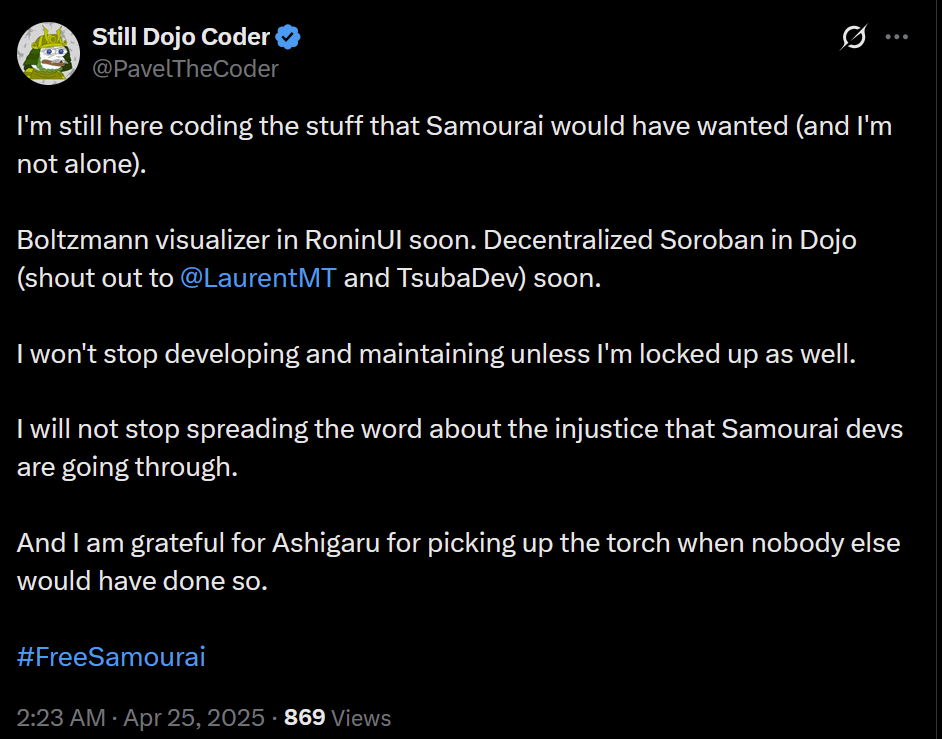

2025-05-16 18:06:46Bitcoin has always been rooted in freedom and resistance to authority. I get that many of you are conflicted about the US Government stacking but by design we cannot stop anyone from using bitcoin. Many have asked me for my thoughts on the matter, so let’s rip it.

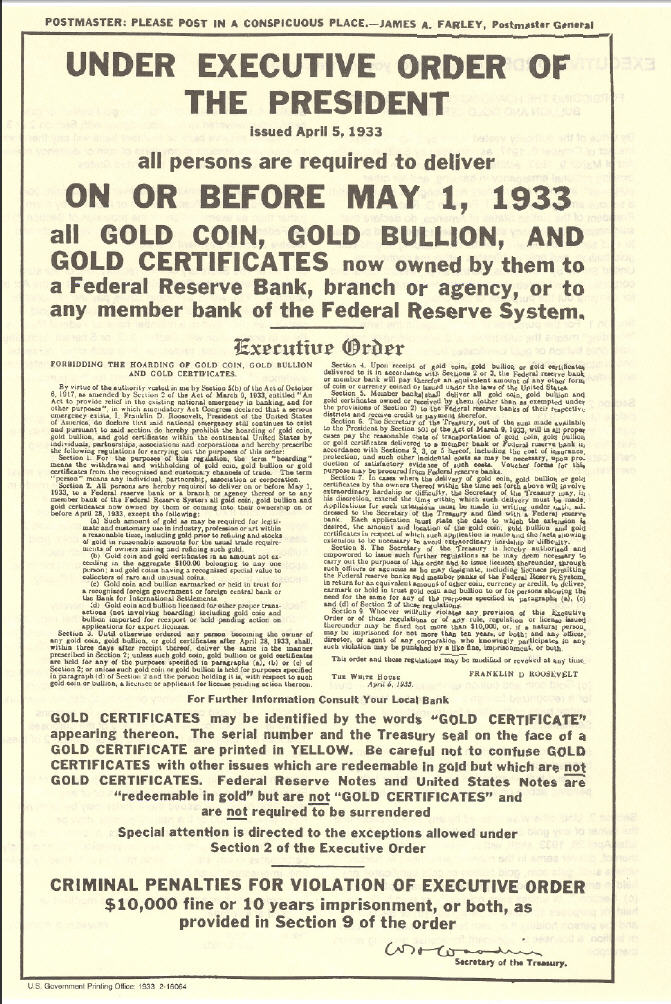

Concern

One of the most glaring issues with the strategic bitcoin reserve is its foundation, built on stolen bitcoin. For those of us who value private property this is an obvious betrayal of our core principles. Rather than proof of work, the bitcoin that seeds this reserve has been taken by force. The US Government should return the bitcoin stolen from Bitfinex and the Silk Road.

Using stolen bitcoin for the reserve creates a perverse incentive. If governments see bitcoin as a valuable asset, they will ramp up efforts to confiscate more bitcoin. The precedent is a major concern, and I stand strongly against it, but it should be also noted that governments were already seizing coin before the reserve so this is not really a change in policy.

Ideally all seized bitcoin should be burned, by law. This would align incentives properly and make it less likely for the government to actively increase coin seizures. Due to the truly scarce properties of bitcoin, all burned bitcoin helps existing holders through increased purchasing power regardless. This change would be unlikely but those of us in policy circles should push for it regardless. It would be best case scenario for American bitcoiners and would create a strong foundation for the next century of American leadership.

Optimism

The entire point of bitcoin is that we can spend or save it without permission. That said, it is a massive benefit to not have one of the strongest governments in human history actively trying to ruin our lives.

Since the beginning, bitcoiners have faced horrible regulatory trends. KYC, surveillance, and legal cases have made using bitcoin and building bitcoin businesses incredibly difficult. It is incredibly important to note that over the past year that trend has reversed for the first time in a decade. A strategic bitcoin reserve is a key driver of this shift. By holding bitcoin, the strongest government in the world has signaled that it is not just a fringe technology but rather truly valuable, legitimate, and worth stacking.

This alignment of incentives changes everything. The US Government stacking proves bitcoin’s worth. The resulting purchasing power appreciation helps all of us who are holding coin and as bitcoin succeeds our government receives direct benefit. A beautiful positive feedback loop.

Realism

We are trending in the right direction. A strategic bitcoin reserve is a sign that the state sees bitcoin as an asset worth embracing rather than destroying. That said, there is a lot of work left to be done. We cannot be lulled into complacency, the time to push forward is now, and we cannot take our foot off the gas. We have a seat at the table for the first time ever. Let's make it worth it.

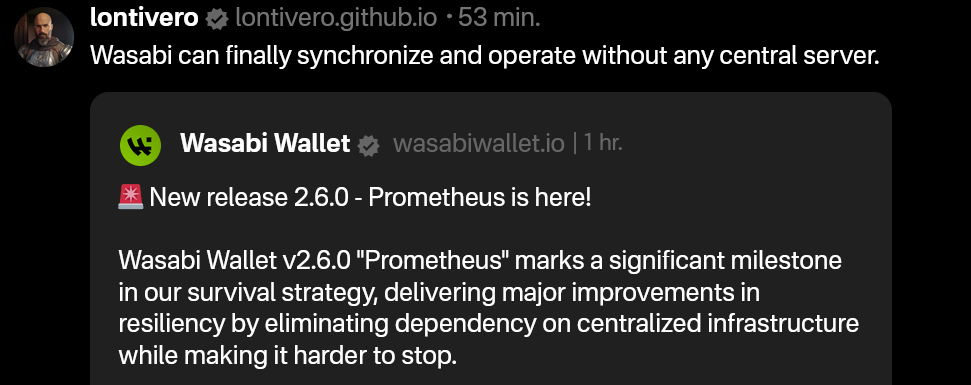

We must protect the right to free usage of bitcoin and other digital technologies. Freedom in the digital age must be taken and defended, through both technical and political avenues. Multiple privacy focused developers are facing long jail sentences for building tools that protect our freedom. These cases are not just legal battles. They are attacks on the soul of bitcoin. We need to rally behind them, fight for their freedom, and ensure the ethos of bitcoin survives this new era of government interest. The strategic reserve is a step in the right direction, but it is up to us to hold the line and shape the future.

-

@ 8bad92c3:ca714aa5

2025-05-23 04:01:08

@ 8bad92c3:ca714aa5

2025-05-23 04:01:08Marty's Bent

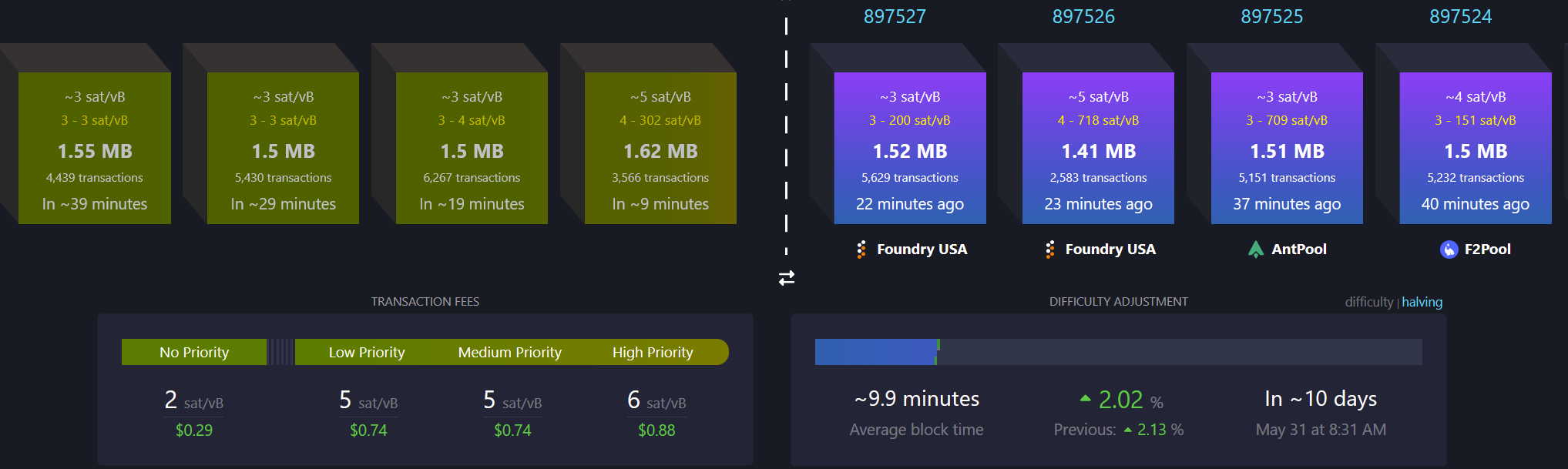

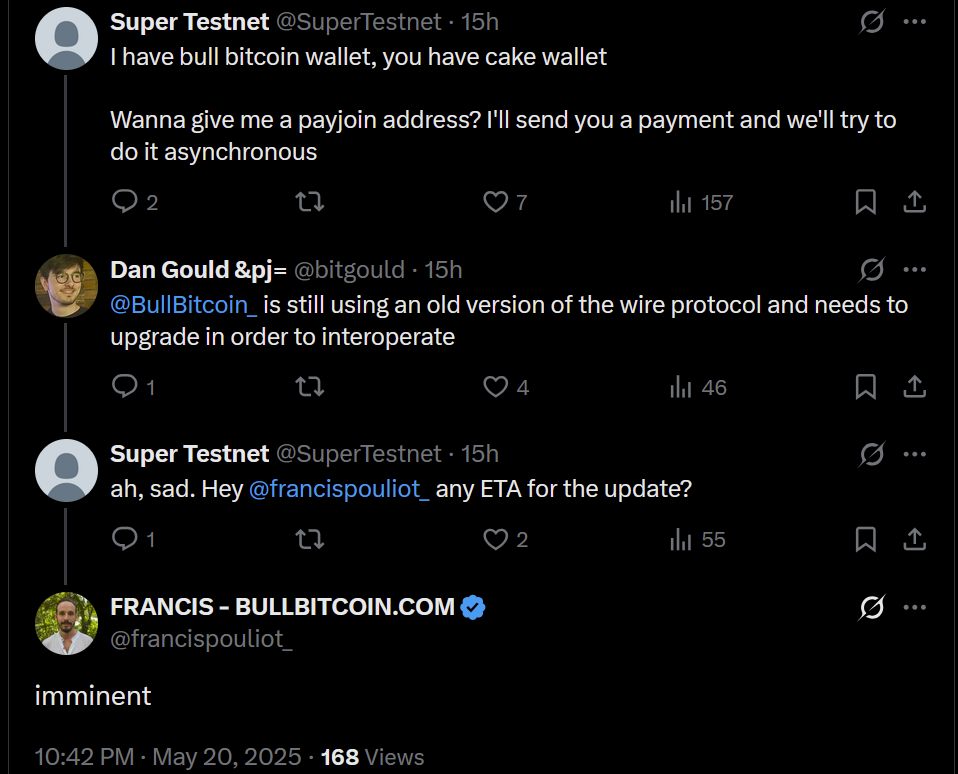

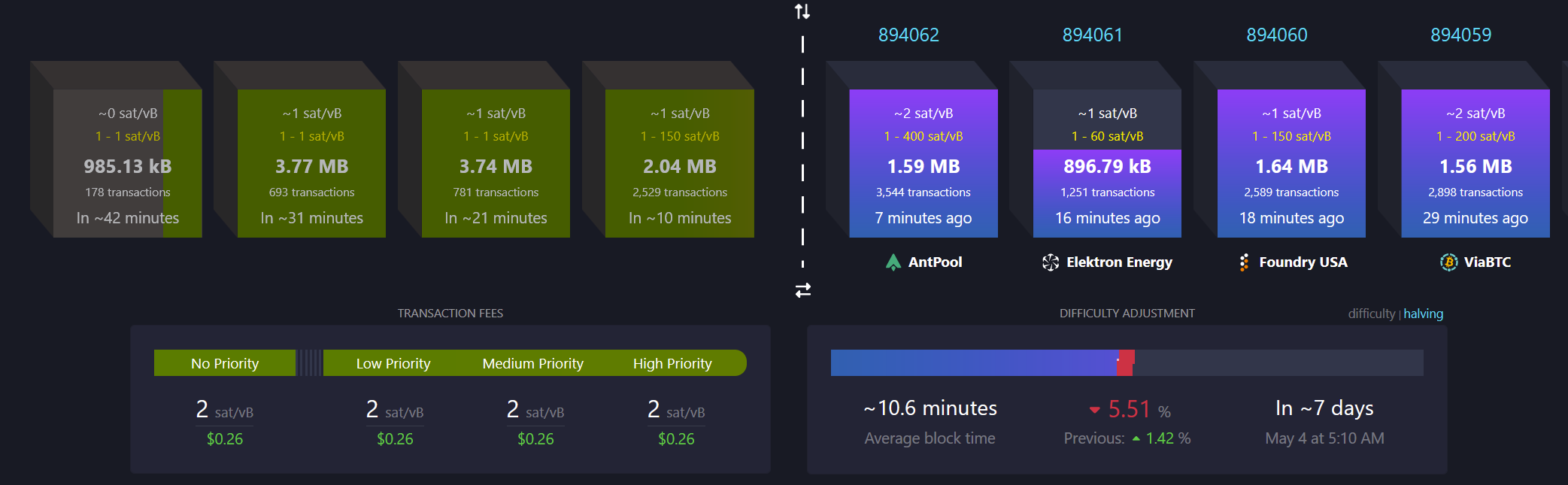

It's been a hell of a week in Austin, Texas. The Texas Energy & Mining Summit was held at Bitcoin Park Austin on Tuesday and yesterday. Around 200 people from across the energy sector and the mining sector convened to discuss the current state of bitcoin mining, how it integrates with energy systems, and where things are going in the near to medium term. Representatives from ERCOT, Halliburton, and some of the largest mining companies in the world were in attendence. Across town, Bitcoin++ is holding their conference on mempools, which is fitting considering there is currently an ongoing debate about mempool policy and whether or not Bitcoin Core should eliminate the data limit on OP_RETURN.

I've had the pleasure of participating in both events. At the Texas Energy & Mining Summit I opened up the two-day event with the opening panel on why Texas is perfectly suited not only for bitcoin mining but for the bitcoin industry in general. Texas is a state that highly values private property rights, low taxes, and free market competition. It's become clear to me over the four years that I've lived in Texas that it is an incredible place to start a bitcoin business. The energy down here (pun intended) is palpable.

I also hosted the ending panel with Nick Gates from Priority Power, Will Cole from Zaprite and Jay Beddict from Foundry about what we have to look forward to through the rest of the year. I think the consensus was pretty clear on the panel, there's never been a more bullish setup for bitcoin historically. The political support we're getting here in the United States, the institutional adoption that we're seeing, and the fervor around protocol level development are all pointing in the right direction. Even though the discussions around protocol development can be contentious at times, it's a signal that people really care about this open source monetary protocol that we're all building on. We all agreed that Bitcoin has never been more de-risked than it is today. That is not to say that there aren't any risk.

We also discussed the problem with mining pool centralization and the FPPS payout scheme and why people need to be paying attention to it. But I think overall, things are looking pretty good right now.

Yesterday I also had the pleasure of running the live desk at Bitcoin++ speaking with many of the developers building out the protocol layer and layers above bitcoin. It's always extremely humbling to sit down and speak with the developers because they are so damn smart. Brilliant people who really care deeply about bitcoin. Even though many of them have very different views about the state of bitcoin and how to build it out moving forward. I view my role on the live desk is simply to try to get everybody's perspective. Not only on the OP_RETURN discussion, but on the future of bitcoin and how the protocol progresses from a technical perspective.

I had many conversations. The first with Average Gary and VNPRC, who are working on hashpools, which are attempting to solve the mining pool centralization and privacy problems that exists by using ecash. Hashpool gives miners the ability to exchange hash shares for ehash tokens. that are immediately liquid and exchangeable for bitcoin over the lightning network. Solving the consistent payout and liquidity problem that miners are always trying to solve. Currently FPPS payout schemes are the way they solve these problems. I'm incredibly optimistic about the hashpools project.

I also had the pleasure of speaking with SuperTestNet and Dusty Daemon, who are both focused on making bitcoin more inherently private at the protocol layer and on the lightning network. I think Dusty's work on splicing is very underappreciated right now and is something that you should all look into. Dusty also explained an idea he has that would make CoinJoin coordination much easier by creating a standardized coordination protocol. I'm going to butcher the explanation here, But I think the general idea is to create a way for people to combine inputs by monitoring the lightning network and looking for individual actors who are looking to rebalance channels and opportunistically set up a collaborative transaction with them. This is something I think everyone should look into and champion because I think it would be incredibly beneficial to on-chain privacy. As Bitcoin scales and gets adopted by millions and billions of people over the next few decades.

I also had the pleasure of speaking with Andrew Poelstra and Boerst about cryptography and block templates. For those of you who are unaware, Andrew Poelstra the Head of Research at Blockstream and on the cutting edge of the cryptography that bitcoin uses and may implement in the future. We had a wide ranging discussion about OP_RETURN, FROST, Musig2, Miniscript, quantum. resistant cryptographic libraries, and how Bitcoin Core actually works as a development project.

I also spoke with Liam Egan from Alpen Labs. He's working on ZK rollups on Bitcoin. Admittedly, this is an area I haven't explored too deeply, so it was awesome to sit down with Liam and get his perspective. Alpen Labs is leveraging BitVM to enable their rollups.

I highly recommend if and when you get the time to check out the YouTube stream of the Live Desk. A lot of very deep, technical conversations, but if you're really interested to learn how bitcoin actually works and some of the ideas that are out there to make it better, this is an incredible piece of content to watch. I'm about to head over for day two of Bitcoin++ to run the Live Desk again. So if you get this email before we go live make sure you subscribe to the YouTube channel and tune in for the day.

One thing I will say. Last night, there was a debate about OP_RETURN and I think it's important to note that despite how vitriolic people may get on Twitter, it's always interesting to see people with diametrically opposed views get together and have civil debates. It's obvious that everyone involved cares deeply about bitcoin. Having these tough conversations in person is very important. Particularly, civil conversations. I certainly think yesterday's debate was civil. Though, I will say I think that as bitcoiners, we should hold ourselves to a higher standard of decorum when debates like this are had.

Tyler Campbell from Unchained mentioned that it is insane that there was such a small group of people attending this particular debate about the future of a two trillion dollar protocol. Bitcoin is approaching $100,000 again as I type and no one in big tech, no one in big finance outside of people looking for bitcoin treasury plays is really paying attention to what's happening at the protocol level. This is simply funny to observe and probably a good thing in the long run. But, Meta, Stripe, Apple, Visa, Mastercard and the Teslas of the world are all asleep at the wheel as we build out the future of money.

The $1 Trillion Basis Trade Time Bomb

The massive basis trade currently looming over financial markets represents a systemic risk that dwarfs previous crises. As James Lavish warned during our conversation, approximately $1 trillion in leveraged positions exist within this trade - ten times larger than those held by Long-Term Capital Management before its 1998 collapse. These trades employ staggering leverage ratios between 20x to 100x just to make minuscule basis point differences profitable. The Brookings Institution, which Lavish describes as a "tacit research arm of the Fed," has published a paper explicitly warning about this trade's dangers.

"The Brookings Institution came out with a solution... instead of printing money this time, the Fed will just take the whole trade off of the hedge funds books. Absolutely, utterly maniacal. The thought of the Fed becoming a hedge fund... it's nuts." - James Lavish

What makes this situation particularly alarming is how an unwind could trigger cascading margin calls throughout interconnected financial markets. As Lavish explained, when positions begin unwinding, prices move dramatically, triggering more margin calls that force more selling. This "powder keg behind the scenes" is being closely monitored by sophisticated investors who understand its destructive potential. Unlike a controlled demolition, this unwinding could quickly become chaotic, potentially forcing unprecedented Fed intervention.

Check out the full podcast here for more on Bitcoin's role as the neutral reserve asset, nation-state mining strategies, and the repeal of SAB 121's impact on banking adoption.

Headlines of the Day

Panama City Signs Deal for Bitcoin Municipal Payments - via X

U.S. Economy Polls Show Falling Confidence in Trump Leadership - via CNBC

Jack Mallers's Bitcoin Bank Targets $500 Trillion Market - via X

Bitcoin Decouples From Markets With 10% Gain Amid Asset Slump - via X

Looking for the perfect video _to push the smartest person you know from zero to one on bitcoin? Bitcoin, Not Crypto is a three-part master class from Parker Lewis and Dhruv Bansal that cuts through the noise—covering why 2

-

@ 04c915da:3dfbecc9

2025-05-16 17:59:23

@ 04c915da:3dfbecc9

2025-05-16 17:59:23Recently we have seen a wave of high profile X accounts hacked. These attacks have exposed the fragility of the status quo security model used by modern social media platforms like X. Many users have asked if nostr fixes this, so lets dive in. How do these types of attacks translate into the world of nostr apps? For clarity, I will use X’s security model as representative of most big tech social platforms and compare it to nostr.

The Status Quo

On X, you never have full control of your account. Ultimately to use it requires permission from the company. They can suspend your account or limit your distribution. Theoretically they can even post from your account at will. An X account is tied to an email and password. Users can also opt into two factor authentication, which adds an extra layer of protection, a login code generated by an app. In theory, this setup works well, but it places a heavy burden on users. You need to create a strong, unique password and safeguard it. You also need to ensure your email account and phone number remain secure, as attackers can exploit these to reset your credentials and take over your account. Even if you do everything responsibly, there is another weak link in X infrastructure itself. The platform’s infrastructure allows accounts to be reset through its backend. This could happen maliciously by an employee or through an external attacker who compromises X’s backend. When an account is compromised, the legitimate user often gets locked out, unable to post or regain control without contacting X’s support team. That process can be slow, frustrating, and sometimes fruitless if support denies the request or cannot verify your identity. Often times support will require users to provide identification info in order to regain access, which represents a privacy risk. The centralized nature of X means you are ultimately at the mercy of the company’s systems and staff.

Nostr Requires Responsibility

Nostr flips this model radically. Users do not need permission from a company to access their account, they can generate as many accounts as they want, and cannot be easily censored. The key tradeoff here is that users have to take complete responsibility for their security. Instead of relying on a username, password, and corporate servers, nostr uses a private key as the sole credential for your account. Users generate this key and it is their responsibility to keep it safe. As long as you have your key, you can post. If someone else gets it, they can post too. It is that simple. This design has strong implications. Unlike X, there is no backend reset option. If your key is compromised or lost, there is no customer support to call. In a compromise scenario, both you and the attacker can post from the account simultaneously. Neither can lock the other out, since nostr relays simply accept whatever is signed with a valid key.

The benefit? No reliance on proprietary corporate infrastructure.. The negative? Security rests entirely on how well you protect your key.

Future Nostr Security Improvements

For many users, nostr’s standard security model, storing a private key on a phone with an encrypted cloud backup, will likely be sufficient. It is simple and reasonably secure. That said, nostr’s strength lies in its flexibility as an open protocol. Users will be able to choose between a range of security models, balancing convenience and protection based on need.

One promising option is a web of trust model for key rotation. Imagine pre-selecting a group of trusted friends. If your account is compromised, these people could collectively sign an event announcing the compromise to the network and designate a new key as your legitimate one. Apps could handle this process seamlessly in the background, notifying followers of the switch without much user interaction. This could become a popular choice for average users, but it is not without tradeoffs. It requires trust in your chosen web of trust, which might not suit power users or large organizations. It also has the issue that some apps may not recognize the key rotation properly and followers might get confused about which account is “real.”

For those needing higher security, there is the option of multisig using FROST (Flexible Round-Optimized Schnorr Threshold). In this setup, multiple keys must sign off on every action, including posting and updating a profile. A hacker with just one key could not do anything. This is likely overkill for most users due to complexity and inconvenience, but it could be a game changer for large organizations, companies, and governments. Imagine the White House nostr account requiring signatures from multiple people before a post goes live, that would be much more secure than the status quo big tech model.

Another option are hardware signers, similar to bitcoin hardware wallets. Private keys are kept on secure, offline devices, separate from the internet connected phone or computer you use to broadcast events. This drastically reduces the risk of remote hacks, as private keys never touches the internet. It can be used in combination with multisig setups for extra protection. This setup is much less convenient and probably overkill for most but could be ideal for governments, companies, or other high profile accounts.

Nostr’s security model is not perfect but is robust and versatile. Ultimately users are in control and security is their responsibility. Apps will give users multiple options to choose from and users will choose what best fits their need.

-

@ 8bad92c3:ca714aa5

2025-05-23 04:01:08

@ 8bad92c3:ca714aa5

2025-05-23 04:01:08

I've pulled together the most compelling forward-looking predictions from our recent podcast conversations. These insights highlight where our guests see opportunities and challenges in the Bitcoin ecosystem, energy markets, and beyond.

AI Agents Will Drive Bitcoin Adoption More Than Human Users by 2030 - Andrew Myers

Andrew Myers described how the artificial intelligence revolution will fundamentally transform Bitcoin usage patterns over the next few years. He highlighted Paul's tweet that suggested machine-to-machine transactions using Bitcoin will soon dominate the network.

"We talk about Bitcoin being used as a medium of exchange. We're going to find that the machines are doing most of that exchange at some point relatively soon," Andrew explained. "The agents using Bitcoin to complete tasks using something like L4 or two protocol is going to far surpass the amount of transactions that humans are doing to do things in their everyday lives."

Andrew believes AI agents will naturally gravitate toward Bitcoin because it's more energy-efficient from a computational perspective than traditional payment rails. As AI systems optimize for energy efficiency, Bitcoin's direct settlement mechanism becomes increasingly attractive compared to legacy financial infrastructure. This shift could accelerate Bitcoin adoption in ways we haven't fully anticipated, creating a new category of machine-driven demand.

CalPERS Funding Status Will Drop Below 70% by June 2025 - Dom Bei

Dom Bei, who's running for the Board of Trustees at CalPERS, made a concerning prediction about America's largest public pension fund. Currently sitting at approximately 75% funded, Dom warned the situation could deteriorate further after recent tariff-related markdowns.

"They say that the fund had a $26 billion markdown, which if my math is correct, would bring the fund closer towards the 70% funded number," Dom explained. He noted the fund needs to recover these losses before the June 30, 2025 reporting deadline, or face serious consequences.

If CalPERS funding status drops below 70%, Dom predicts a familiar pattern will unfold: municipalities and taxpayers will face higher contribution rates to cover the shortfall, diverting money from essential services like parks, schools, and public safety. This would likely trigger another round of pension reform debates targeting worker benefits, despite similar reforms in 2013 failing to address the fundamental performance issues plaguing the fund.

Energy Companies Will Incorporate Bitcoin Into Settlements Within 3 Years - Andrew Myers

Andrew Myers outlined a compelling vision for Bitcoin's integration into energy markets, predicting that by 2027 (block 1,050,000), we'll see widespread adoption of Bitcoin for energy transactions and settlements. He described his company's mission as enabling "every electric power company to use bitcoin by block 1,050,000."

"Our mantra for Bitcoin is fast, accurate, transparent energy transactions," Andrew explained. He highlighted several inefficiencies in current energy markets that Bitcoin could solve, including: Information asymmetry between energy buyers and sellers. Slow 30-day billing cycles creating unnecessary credit risk

Capital locked up in prepayments, deposits, and collateral requirements.Andrew revealed that his team has already prototyped a Bitcoin collateral product and that a major energy company in Texas is currently building similar functionality. He predicts these early implementations will demonstrate Bitcoin's potential to unlock billions in working capital across the energy sector through faster settlement and reduced collateral requirements.

Most significantly, Andrew mentioned early discussions with independent system operators about modifying power market protocols to incorporate Bitcoin as an alternative settlement mechanism alongside the US dollar.

Blockspace conducts cutting-edge proprietary research for investors.

Bitcoin Miners Face Hard Choices as AI Data Centers Pick Prime Locations

Bitcoin miners hoping to cash in on the AI boom by selling their facilities to hyperscalers are finding fewer opportunities than expected. With mining economics dimming and specific buyer requirements limiting potential deals, the industry faces significant challenges.

Christian Lopez, Head of Blockchain and Digital Assets at Cohen and Company Capital Markets, notes a "glut of bitcoin mines" currently on the market. While miners control substantial power resources, hyperscalers typically demand facilities with at least 150-200 megawatts capacity within 100 miles of major cities—criteria most mining operations don't meet.

An estimated 1-1.5 gigawatts of mining capacity is available for acquisition, creating downward pressure on power prices. This oversupply stems from both deteriorating mining economics and overoptimistic AI-related expectations. The valuation gap remains a persistent obstacle: "Buyers face the critical 'buy versus build' question," Lopez explains. While buyers typically value sites at $300,000-$500,000 per megawatt plus a modest premium, sellers often seek $1.5-$2 million per megawatt based on public company valuations.

Adding to these challenges, retrofitting mining sites for high-performance computing often requires completely reconstructing the power infrastructure rather than leveraging existing setups. Despite current difficulties, industry sentiment remains cautiously optimistic, with many experts predicting Bitcoin could reach $125,000-$200,000 by late 2025.

Subscribe to them here (seriously, you should): https://newsletter.blockspacemedia.com/

Ten31, the largest bitcoin-focused investor, has deployed $150M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

@media screen and (max-width: 480px) { .mobile-padding { padding: 10px 0 !important; } .social-container { width: 100% !important; max-width: 260px !important; } .social-icon { padding: 0 !important; } .social-icon img { height: 32px !important; width: 32px !important; } .icon-cell { padding: 0 4px !important; } } .mj-column-per-33-333333333333336 { width: 25% !important; max-width: 25%; } .moz-text-html .mj-column-per-33-333333333333336 { width: 25% !important; max-width: 25%; } /* Helps with rendering in various email clients */ body { margin: 0 !important; padding: 0 !important; -webkit-text-size-adjust: 100% !important; -ms-text-size-adjust: 100% !important; } img { -ms-interpolation-mode: bicubic; } /* Prevents Gmail from changing the text color in email threads */ .im { color: inherit !important; }

-

@ 04c915da:3dfbecc9

2025-05-16 17:51:54

@ 04c915da:3dfbecc9

2025-05-16 17:51:54In much of the world, it is incredibly difficult to access U.S. dollars. Local currencies are often poorly managed and riddled with corruption. Billions of people demand a more reliable alternative. While the dollar has its own issues of corruption and mismanagement, it is widely regarded as superior to the fiat currencies it competes with globally. As a result, Tether has found massive success providing low cost, low friction access to dollars. Tether claims 400 million total users, is on track to add 200 million more this year, processes 8.1 million transactions daily, and facilitates $29 billion in daily transfers. Furthermore, their estimates suggest nearly 40% of users rely on it as a savings tool rather than just a transactional currency.

Tether’s rise has made the company a financial juggernaut. Last year alone, Tether raked in over $13 billion in profit, with a lean team of less than 100 employees. Their business model is elegantly simple: hold U.S. Treasuries and collect the interest. With over $113 billion in Treasuries, Tether has turned a straightforward concept into a profit machine.

Tether’s success has resulted in many competitors eager to claim a piece of the pie. This has triggered a massive venture capital grift cycle in USD tokens, with countless projects vying to dethrone Tether. Due to Tether’s entrenched network effect, these challengers face an uphill battle with little realistic chance of success. Most educated participants in the space likely recognize this reality but seem content to perpetuate the grift, hoping to cash out by dumping their equity positions on unsuspecting buyers before they realize the reality of the situation.

Historically, Tether’s greatest vulnerability has been U.S. government intervention. For over a decade, the company operated offshore with few allies in the U.S. establishment, making it a major target for regulatory action. That dynamic has shifted recently and Tether has seized the opportunity. By actively courting U.S. government support, Tether has fortified their position. This strategic move will likely cement their status as the dominant USD token for years to come.

While undeniably a great tool for the millions of users that rely on it, Tether is not without flaws. As a centralized, trusted third party, it holds the power to freeze or seize funds at its discretion. Corporate mismanagement or deliberate malpractice could also lead to massive losses at scale. In their goal of mitigating regulatory risk, Tether has deepened ties with law enforcement, mirroring some of the concerns of potential central bank digital currencies. In practice, Tether operates as a corporate CBDC alternative, collaborating with authorities to surveil and seize funds. The company proudly touts partnerships with leading surveillance firms and its own data reveals cooperation in over 1,000 law enforcement cases, with more than $2.5 billion in funds frozen.

The global demand for Tether is undeniable and the company’s profitability reflects its unrivaled success. Tether is owned and operated by bitcoiners and will likely continue to push forward strategic goals that help the movement as a whole. Recent efforts to mitigate the threat of U.S. government enforcement will likely solidify their network effect and stifle meaningful adoption of rival USD tokens or CBDCs. Yet, for all their achievements, Tether is simply a worse form of money than bitcoin. Tether requires trust in a centralized entity, while bitcoin can be saved or spent without permission. Furthermore, Tether is tied to the value of the US Dollar which is designed to lose purchasing power over time, while bitcoin, as a truly scarce asset, is designed to increase in purchasing power with adoption. As people awaken to the risks of Tether’s control, and the benefits bitcoin provides, bitcoin adoption will likely surpass it.

-

@ 04c915da:3dfbecc9

2025-05-16 17:12:05

@ 04c915da:3dfbecc9

2025-05-16 17:12:05One of the most common criticisms leveled against nostr is the perceived lack of assurance when it comes to data storage. Critics argue that without a centralized authority guaranteeing that all data is preserved, important information will be lost. They also claim that running a relay will become prohibitively expensive. While there is truth to these concerns, they miss the mark. The genius of nostr lies in its flexibility, resilience, and the way it harnesses human incentives to ensure data availability in practice.

A nostr relay is simply a server that holds cryptographically verifiable signed data and makes it available to others. Relays are simple, flexible, open, and require no permission to run. Critics are right that operating a relay attempting to store all nostr data will be costly. What they miss is that most will not run all encompassing archive relays. Nostr does not rely on massive archive relays. Instead, anyone can run a relay and choose to store whatever subset of data they want. This keeps costs low and operations flexible, making relay operation accessible to all sorts of individuals and entities with varying use cases.

Critics are correct that there is no ironclad guarantee that every piece of data will always be available. Unlike bitcoin where data permanence is baked into the system at a steep cost, nostr does not promise that every random note or meme will be preserved forever. That said, in practice, any data perceived as valuable by someone will likely be stored and distributed by multiple entities. If something matters to someone, they will keep a signed copy.

Nostr is the Streisand Effect in protocol form. The Streisand effect is when an attempt to suppress information backfires, causing it to spread even further. With nostr, anyone can broadcast signed data, anyone can store it, and anyone can distribute it. Try to censor something important? Good luck. The moment it catches attention, it will be stored on relays across the globe, copied, and shared by those who find it worth keeping. Data deemed important will be replicated across servers by individuals acting in their own interest.

Nostr’s distributed nature ensures that the system does not rely on a single point of failure or a corporate overlord. Instead, it leans on the collective will of its users. The result is a network where costs stay manageable, participation is open to all, and valuable verifiable data is stored and distributed forever.

-

@ 502ab02a:a2860397

2025-05-23 01:57:14

@ 502ab02a:a2860397

2025-05-23 01:57:14น้ำนมมนุษย์ที่ไม่ง้อมนุษย์ หรือนี่กำลังจะกลายเป็นเรื่องจริงเร็วกว่าที่เราคิดนะครับ

ในยุคที่อุตสาหกรรมอาหารหันหลังให้กับปศุสัตว์ ไม่ว่าจะด้วยเหตุผลด้านสิ่งแวดล้อม จริยธรรม หรือความยั่งยืน “น้ำนมจากห้องแล็บ” กำลังกลายเป็นแนวหน้าของการปฏิวัติอาหาร โดยเฉพาะเมื่อบริษัทหนึ่งจากสิงคโปร์นามว่า TurtleTree ประกาศอย่างชัดเจนว่า พวกเขากำลังจะสร้างโปรตีนสำคัญในน้ำนมมนุษย์ โดยไม่ต้องมีมนุษย์แม่เลยแม้แต่น้อย

TurtleTree ก่อตั้งในปี 2019 โดยมีเป้าหมายอันทะเยอทะยานคือการผลิตโปรตีนในนมแม่ให้ได้ผ่านเทคโนโลยีที่เรียกว่า precision fermentation โดยใช้จุลินทรีย์ที่ถูกดัดแปลงพันธุกรรมให้ผลิตโปรตีนเฉพาะ เช่น lactoferrin และ human milk oligosaccharides (HMOs) ซึ่งเป็นองค์ประกอบล้ำค่าที่พบในน้ำนมมนุษย์แต่แทบไม่มีในนมวัว หรือผลิตภัณฑ์นมทั่วไป

โปรตีนตัวแรกที่ TurtleTree ประสบความสำเร็จในการผลิตคือ LF+ หรือ lactoferrin ที่เลียนแบบโปรตีนในนมแม่ ซึ่งมีหน้าที่ช่วยระบบภูมิคุ้มกันของทารก ต่อต้านแบคทีเรีย และช่วยให้ร่างกายดูดซึมธาตุเหล็กได้ดีขึ้น โปรตีนนี้เป็นหนึ่งในหัวใจของนมแม่ ที่บริษัทต้องการนำมาใช้ในอุตสาหกรรมนมผงเด็กและอาหารเสริมสำหรับผู้ใหญ่ ล่าสุดในปี 2024 LF+ ได้รับการรับรองสถานะ GRAS (Generally Recognized As Safe) จากองค์การอาหารและยาสหรัฐฯ (FDA) อย่างเป็นทางการ เป็นหมุดหมายสำคัญที่บอกว่า นี่ไม่ใช่แค่ไอเดียในแล็บอีกต่อไป แต่กำลังกลายเป็นผลิตภัณฑ์เชิงพาณิชย์จริง

เบื้องหลังของโปรเจกต์นี้คือการลงทุนกว่า 30 ล้านดอลลาร์สหรัฐจากกลุ่มทุนทั่วโลก รวมถึงบริษัท Solar Biotech ที่จับมือกับ TurtleTree ในการขยายกำลังการผลิตเชิงอุตสาหกรรมในสหรัฐอเมริกา โดยตั้งเป้าว่าจะสามารถผลิตโปรตีนเหล่านี้ได้ในระดับราคาที่แข่งขันได้ภายในไม่กี่ปีข้างหน้า

สิ่งที่น่าสนใจคือ TurtleTree ไม่ได้หยุดแค่ lactoferrin พวกเขายังวางแผนพัฒนา HMO ซึ่งเป็นน้ำตาลเชิงซ้อนชนิดพิเศษที่มีอยู่เฉพาะในน้ำนมแม่ เป็นอาหารเลี้ยงแบคทีเรียดีในลำไส้ทารก ช่วยพัฒนาระบบภูมิคุ้มกันและสมอง ปัจจุบัน HMOs เริ่มเป็นที่นิยมในวงการ infant formula แต่การผลิตยังจำกัดและมีต้นทุนสูง การที่ TurtleTree จะนำเทคโนโลยี precision fermentation มาใช้ผลิต HMO จึงถือเป็นความพยายามในการลดช่องว่างระหว่าง "นมแม่จริง" กับ "นมผงสังเคราะห์"

ทั้งหมดนี้เกิดขึ้นภายใต้แนวคิดใหม่ของอุตสาหกรรมอาหารที่เรียกว่า "functional nutrition" หรือโภชนาการที่ออกแบบเพื่อทำงานเฉพาะทาง ไม่ใช่แค่ให้พลังงานหรือโปรตีน แต่เล็งเป้าหมายเฉพาะ เช่น เสริมภูมิคุ้มกัน ซ่อมแซมสมอง หรือฟื้นฟูร่างกาย โดยมีรากฐานจากธรรมชาติ แต่ใช้เทคโนโลยีสมัยใหม่ในการผลิต

แม้จะฟังดูเป็นความก้าวหน้าทางวิทยาศาสตร์ที่น่าตื่นเต้น แต่น้ำเสียงที่ดังก้องในอีกมุมหนึ่งก็คือคำถามเชิงจริยธรรม TurtleTree กำลังสร้างโปรตีนที่มีอยู่เฉพาะในมนุษย์ โดยอาศัยข้อมูลพันธุกรรมของมนุษย์เอง แล้วนำเข้าสู่ระบบอุตสาหกรรมเพื่อการค้า คำถามคือ เมื่อใดที่การจำลองธรรมชาติจะกลายเป็นการผูกขาดธรรมชาติ? ใครควรเป็นเจ้าของข้อมูลพันธุกรรมของมนุษย์? และถ้าวันหนึ่งบริษัทใดบริษัทหนึ่งสามารถควบคุมการผลิต “นมแม่จำลอง” ได้แต่เพียงผู้เดียว นั่นจะส่งผลต่อเสรีภาพของสังคมในมุมไหนบ้าง?

นักชีวจริยธรรมหลายคน เช่น ดร.ซิลเวีย แคมโปเรซี จาก King's College London ตั้งข้อสังเกตไว้ว่า เทคโนโลยีแบบนี้อาจแก้ปัญหาการเข้าถึงนมแม่ในพื้นที่ห่างไกลหรือในกลุ่มแม่ที่ให้นมไม่ได้ แต่ขณะเดียวกันก็อาจกลายเป็นการสร้าง "ระบบอาหารทางเลือก" ที่ควบคุมโดยบริษัทไม่กี่ราย ที่มีอำนาจเกินกว่าผู้บริโภคจะตรวจสอบได้

เมื่อเทคโนโลยีสามารถจำลองสิ่งที่เคยสงวนไว้เฉพาะธรรมชาติ และมนุษย์ได้ใกล้เคียงจนแทบแยกไม่ออก บางทีคำถามที่ควรถามอาจไม่ใช่แค่ว่า “มันปลอดภัยหรือไม่?” แต่อาจต้องถามว่า “เราไว้ใจใครให้สร้างสิ่งนี้แทนธรรมชาติ?” เพราะน้ำนมแม่เคยเป็นสิ่งที่มาจากรักและชีวิต แต่วันนี้มันอาจกลายเป็นเพียงสิ่งที่มาจากห้องแล็บและโมเลกุล... และนั่นคือสิ่งที่เราต้องคิดให้เป็น ก่อนจะกินให้ดี เต่านี้มีบุญคุณอันใหญ่หลวงงงงงงง

เสริมจุดน่าสนใจให้ครับ KBW Ventures ถือเป็นผู้ลงทุนรายใหญ่ที่สุดใน TurtleTree Labs โดยมีบทบาทสำคัญในหลายรอบการระดมทุนของบริษัท KBW Ventures เป็นบริษัทลงทุนจากสหรัฐอาหรับเอมิเรตส์ ก่อตั้งโดย สมเด็จพระราชโอรสเจ้าชายคาเล็ด บิน อัลวาลีด บิน ตาลาล อัล ซาอุด (HRH Prince Khaled bin Alwaleed bin Talal Al Saud) ในรอบการระดมทุน Pre-A มูลค่า 6.2 ล้านดอลลาร์สหรัฐฯ ซึ่งปิดในเดือนธันวาคม 2020 KBW Ventures ได้ร่วมลงทุนพร้อมกับ Green Monday Ventures, Eat Beyond Global และ Verso Capital . นอกจากนี้ เจ้าชาย Khaled ยังได้เข้าร่วมเป็นที่ปรึกษาให้กับ TurtleTree Labs เพื่อสนับสนุนการขยายตลาดและกลยุทธ์การเติบโตของบริษัท

ซึ่งในตัว KBW Ventures นั้น เป็นบริษัทลงทุนที่มุ่งเน้นการสนับสนุนเทคโนโลยีที่ยั่งยืนและนวัตกรรมในหลากหลายอุตสาหกรรม เช่น เทคโนโลยีชีวภาพ (biotech), เทคโนโลยีพลังงานสะอาด, เทคโนโลยีการเงิน (fintech), เทคโนโลยีการขนส่ง, และเทคโนโลยีอาหาร (food tech) โดยเฉพาะ และในส่วนของเจ้าชาย Khaled มีความสนใจอย่างลึกซึ้งในด้านเทคโนโลยีอาหาร โดยเฉพาะในกลุ่มโปรตีนทางเลือก เช่น Beyond Meat ซึ่งเป็นการลงทุนที่สะท้อนถึงความมุ่งมั่นชัดเจนในการส่งเสริมอาหารที่ยั่งยืนและมีจริยธรรมครับ และแน่นอนเลยว่า โดยมีส่วนร่วมในรอบระดมทุนหลายครั้งของ Beyond Meat รวมถึงตอนที่ Beyond Meat เข้าตลาดหุ้น Nasdaq ครั้งแรกในปี 2019

เจ้าชาย Khaled เชื่อมั่นว่าอาหารทางเลือกแบบพืชจะถูกลงและแพร่หลายมากขึ้น จนอาจถูกกว่าราคาเนื้อสัตว์จากสัตว์จริงภายในปี 2025 ตามข้อมูลที่ได้มาแสดงว่า ปีนี้นี่หว่าาาาาาาาาา

#pirateketo #กูต้องรู้มั๊ย #ม้วนหางสิลูก #siamstr

-

@ 21335073:a244b1ad

2025-05-09 13:56:57

@ 21335073:a244b1ad

2025-05-09 13:56:57Someone asked for my thoughts, so I’ll share them thoughtfully. I’m not here to dictate how to promote Nostr—I’m still learning about it myself. While I’m not new to Nostr, freedom tech is a newer space for me. I’m skilled at advocating for topics I deeply understand, but freedom tech isn’t my expertise, so take my words with a grain of salt. Nothing I say is set in stone.

Those who need Nostr the most are the ones most vulnerable to censorship on other platforms right now. Reaching them requires real-time awareness of global issues and the dynamic relationships between governments and tech providers, which can shift suddenly. Effective Nostr promoters must grasp this and adapt quickly.

The best messengers are people from or closely tied to these at-risk regions—those who truly understand the local political and cultural dynamics. They can connect with those in need when tensions rise. Ideal promoters are rational, trustworthy, passionate about Nostr, but above all, dedicated to amplifying people’s voices when it matters most.

Forget influencers, corporate-backed figures, or traditional online PR—it comes off as inauthentic, corny, desperate and forced. Nostr’s promotion should be grassroots and organic, driven by a few passionate individuals who believe in Nostr and the communities they serve.

The idea that “people won’t join Nostr due to lack of reach” is nonsense. Everyone knows X’s “reach” is mostly with bots. If humans want real conversations, Nostr is the place. X is great for propaganda, but Nostr is for the authentic voices of the people.

Those spreading Nostr must be so passionate they’re willing to onboard others, which is time-consuming but rewarding for the right person. They’ll need to make Nostr and onboarding a core part of who they are. I see no issue with that level of dedication. I’ve been known to get that way myself at times. It’s fun for some folks.

With love, I suggest not adding Bitcoin promotion with Nostr outreach. Zaps already integrate that element naturally. (Still promote within the Bitcoin ecosystem, but this is about reaching vulnerable voices who needed Nostr yesterday.)

To promote Nostr, forget conventional strategies. “Influencers” aren’t the answer. “Influencers” are not the future. A trusted local community member has real influence—reach them. Connect with people seeking Nostr’s benefits but lacking the technical language to express it. This means some in the Nostr community might need to step outside of the Bitcoin bubble, which is uncomfortable but necessary. Thank you in advance to those who are willing to do that.

I don’t know who is paid to promote Nostr, if anyone. This piece isn’t shade. But it’s exhausting to see innocent voices globally silenced on corporate platforms like X while Nostr exists. Last night, I wondered: how many more voices must be censored before the Nostr community gets uncomfortable and thinks creatively to reach the vulnerable?

A warning: the global need for censorship-resistant social media is undeniable. If Nostr doesn’t make itself known, something else will fill that void. Let’s start this conversation.

-

@ 21335073:a244b1ad

2025-05-01 01:51:10

@ 21335073:a244b1ad

2025-05-01 01:51:10Please respect Virginia Giuffre’s memory by refraining from asking about the circumstances or theories surrounding her passing.

Since Virginia Giuffre’s death, I’ve reflected on what she would want me to say or do. This piece is my attempt to honor her legacy.

When I first spoke with Virginia, I was struck by her unshakable hope. I had grown cynical after years in the anti-human trafficking movement, worn down by a broken system and a government that often seemed complicit. But Virginia’s passion, creativity, and belief that survivors could be heard reignited something in me. She reminded me of my younger, more hopeful self. Instead of warning her about the challenges ahead, I let her dream big, unburdened by my own disillusionment. That conversation changed me for the better, and following her lead led to meaningful progress.

Virginia was one of the bravest people I’ve ever known. As a survivor of Epstein, Maxwell, and their co-conspirators, she risked everything to speak out, taking on some of the world’s most powerful figures.

She loved when I said, “Epstein isn’t the only Epstein.” This wasn’t just about one man—it was a call to hold all abusers accountable and to ensure survivors find hope and healing.

The Epstein case often gets reduced to sensational details about the elite, but that misses the bigger picture. Yes, we should be holding all of the co-conspirators accountable, we must listen to the survivors’ stories. Their experiences reveal how predators exploit vulnerabilities, offering lessons to prevent future victims.

You’re not powerless in this fight. Educate yourself about trafficking and abuse—online and offline—and take steps to protect those around you. Supporting survivors starts with small, meaningful actions. Free online resources can guide you in being a safe, supportive presence.

When high-profile accusations arise, resist snap judgments. Instead of dismissing survivors as “crazy,” pause to consider the trauma they may be navigating. Speaking out or coping with abuse is never easy. You don’t have to believe every claim, but you can refrain from attacking accusers online.

Society also fails at providing aftercare for survivors. The government, often part of the problem, won’t solve this. It’s up to us. Prevention is critical, but when abuse occurs, step up for your loved ones and community. Protect the vulnerable. it’s a challenging but a rewarding journey.

If you’re contributing to Nostr, you’re helping build a censorship resistant platform where survivors can share their stories freely, no matter how powerful their abusers are. Their voices can endure here, offering strength and hope to others. This gives me great hope for the future.

Virginia Giuffre’s courage was a gift to the world. It was an honor to know and serve her. She will be deeply missed. My hope is that her story inspires others to take on the powerful.

-

@ 52b4a076:e7fad8bd

2025-04-28 00:48:57

@ 52b4a076:e7fad8bd

2025-04-28 00:48:57I have been recently building NFDB, a new relay DB. This post is meant as a short overview.

Regular relays have challenges

Current relay software have significant challenges, which I have experienced when hosting Nostr.land: - Scalability is only supported by adding full replicas, which does not scale to large relays. - Most relays use slow databases and are not optimized for large scale usage. - Search is near-impossible to implement on standard relays. - Privacy features such as NIP-42 are lacking. - Regular DB maintenance tasks on normal relays require extended downtime. - Fault-tolerance is implemented, if any, using a load balancer, which is limited. - Personalization and advanced filtering is not possible. - Local caching is not supported.

NFDB: A scalable database for large relays

NFDB is a new database meant for medium-large scale relays, built on FoundationDB that provides: - Near-unlimited scalability - Extended fault tolerance - Instant loading - Better search - Better personalization - and more.

Search

NFDB has extended search capabilities including: - Semantic search: Search for meaning, not words. - Interest-based search: Highlight content you care about. - Multi-faceted queries: Easily filter by topic, author group, keywords, and more at the same time. - Wide support for event kinds, including users, articles, etc.

Personalization

NFDB allows significant personalization: - Customized algorithms: Be your own algorithm. - Spam filtering: Filter content to your WoT, and use advanced spam filters. - Topic mutes: Mute topics, not keywords. - Media filtering: With Nostr.build, you will be able to filter NSFW and other content - Low data mode: Block notes that use high amounts of cellular data. - and more

Other

NFDB has support for many other features such as: - NIP-42: Protect your privacy with private drafts and DMs - Microrelays: Easily deploy your own personal microrelay - Containers: Dedicated, fast storage for discoverability events such as relay lists

Calcite: A local microrelay database

Calcite is a lightweight, local version of NFDB that is meant for microrelays and caching, meant for thousands of personal microrelays.

Calcite HA is an additional layer that allows live migration and relay failover in under 30 seconds, providing higher availability compared to current relays with greater simplicity. Calcite HA is enabled in all Calcite deployments.

For zero-downtime, NFDB is recommended.

Noswhere SmartCache

Relays are fixed in one location, but users can be anywhere.

Noswhere SmartCache is a CDN for relays that dynamically caches data on edge servers closest to you, allowing: - Multiple regions around the world - Improved throughput and performance - Faster loading times

routerd

routerdis a custom load-balancer optimized for Nostr relays, integrated with SmartCache.routerdis specifically integrated with NFDB and Calcite HA to provide fast failover and high performance.Ending notes

NFDB is planned to be deployed to Nostr.land in the coming weeks.

A lot more is to come. 👀️️️️️️

-

@ 94215f42:7681f622

2025-05-23 01:44:26

@ 94215f42:7681f622

2025-05-23 01:44:26The promise of AI is intoxicating: slash operational costs by 50-80%, achieve software-style margins on service businesses and and watch enterprise value multiply overnight.

But this initial value creation contains a hidden trap that could leave businesses worth less than when they started. Understanding the "Value Trap" is key to navigating a transition to an AI economy.

What is the Value Trap?

Whilst the value trap is forward looking and somewhat theoretical at this point, there are strong financial incentives to drive investments (many $bns of are looking at the transformation opportunity) that mean this should be taken very seriously.

The Value Trap unfolds in distinct phases:

Phase 1: Status Quo A typical service business operates with 100 units of revenue and 90 units of cost, generating 10 units of profit, representing a standard 10% margin. A bog standard business we can all relate to, long term customers locked in, market fit a distant memory, but growth is hard at this point.

Phase 2: Cost Reduction Early AI adopters slash operational expenses from 90 to 20 units while maintaining 100 units of revenue. This is the very real promise when moving to a "Human at the Edge" model that we'll unpack in a future article. Suddenly, they're generating 80 units of profit at an 8x increase that can easily add multiple to the enterprise value! A venture style return on a business previously struggling for growth.

Phase 3: Growth Phase With massive profit margins comes pricing power. These businesses can undercut competitors while maintaining healthy margins, driving rapid revenue growth. Having removed the human constraint on scaling and the additional overheads and complexity this introduces we see seemingly unlimited expansion. The brakes are truly off at this point for early adopters to expand total market share.

Phase 4: Competition Emerges The extraordinary returns attract competitors. It's important to note there is no technical moat here, other businesses implement similar AI strategies, often from your own staff who may have been let go, new entrants launch AI-native operations, and pricing power erodes.

Phase 5: Mean Reversion After 3-7 years (our best guess given current investment interest in transformation led PE), competitive pressure drives revenue down from 100 to 25 units while costs remain at 20. The business ends up with similar margins to where it started but at much lower absolute revenue, potentially destroying enterprise value.

What you've done is just massively reduced costs in this industry by displacing jobs and those individuals can turn around and compete. You incentivise the competition which erodes your pricing power

Why This Pattern is Inevitable

The Value Trap isn't pure speculation, but based on market dynamics playing out given a set of financial incentives. We believe there are several key forces that make this cycle almost guaranteed:

The Arbitrage is Too Attractive When businesses can achieve "venture returns with no product-market fit risk," capital will flood in. Private equity and Venture Capital firms are already raising funds specifically to acquire traditional service businesses and apply AI transformation strategies .

Low Technical Barriers Unlike previous technological advantages, AI implementation doesn't require significant technical moats. Much of the technology is open source, and the real barrier is process redesign thinking rather than proprietary technology.

The "One Player" Principle In any market, it only takes one competitor to implement AI-native processes to force everyone else to adapt. You either "play the game or you get left behind".

Capital Abundance With global money supply expanding and traditional investment opportunities yielding lower returns, the combination of proven product-market fit and dramatic cost reduction potential represents an irresistible opportunity for investors.

Strategic Response for SMEs: The Netflix Model

Small and medium enterprises actually have a significant advantage in navigating the Value Trap, but they need to act strategically and start moving now.

Embrace the Incubation Approach Rather than gutting your existing business, adopt Netflix's strategy: build an AI-native version of your business alongside your current operations. This approach manages risk while positioning for the future.

The answer here is why not both. you don't necessarily have to gut your current business, but you should be thinking about what does my business look like in five years and how do I transition into that.

Leverage Your Natural Advantages Small businesses can adapt faster than large enterprises. While a 20,000-person company faces "political shockwaves" when reducing workforce, a 10-person business can double revenue without anyone noticing. You can focus on growth rather than painful cost-cutting.