-

@ f6488c62:c929299d

2025-05-23 09:48:20

@ f6488c62:c929299d

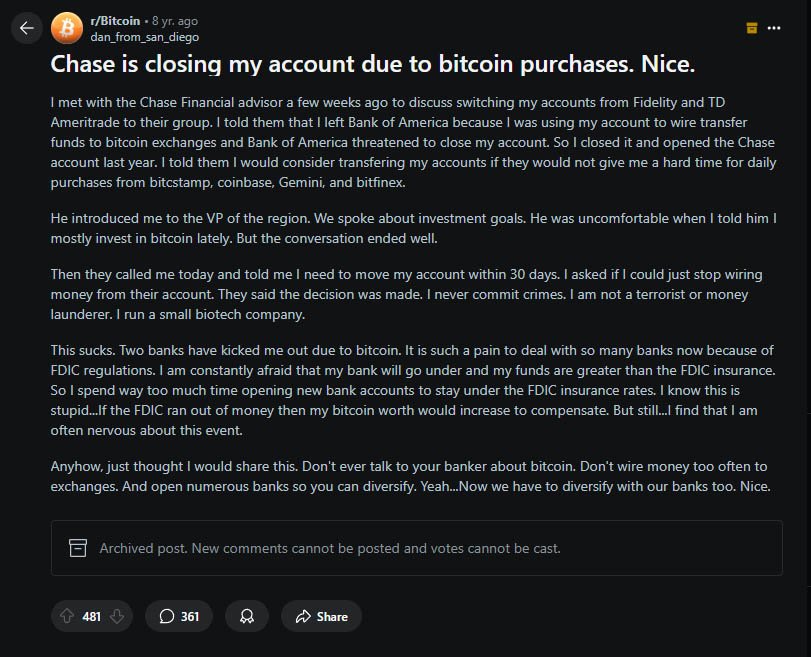

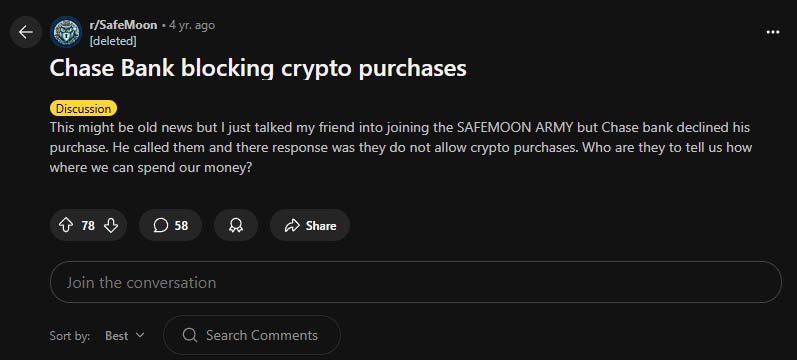

2025-05-23 09:48:20ในวันที่ 23 พฤษภาคม 2568 The Wall Street Journal รายงานข่าวที่น่าสนใจว่า ธนาคารยักษ์ใหญ่ของสหรัฐฯ เช่น JPMorgan Chase, Bank of America, Citigroup และ Wells Fargo กำลังพิจารณาความเป็นไปได้ในการพัฒนา Stablecoin ร่วมกัน เพื่อก้าวเข้าสู่โลกของคริปโตเคอเรนซีอย่างเต็มตัว การเคลื่อนไหวครั้งนี้ไม่เพียงสะท้อนถึงการยอมรับสินทรัพย์ดิจิทัลในระบบการเงินกระแสหลัก แต่ยังเป็นก้าวสำคัญในการรักษาความเป็นผู้นำของเงินดอลลาร์สหรัฐในยุคการเงินดิจิทัล.

Stablecoin: อนาคตของการชำระเงินดิจิทัล Stablecoin เป็นสกุลเงินดิจิทัลที่ออกแบบมาเพื่อลดความผันผวนโดยผูกมูลค่ากับสินทรัพย์ที่มีเสถียรภาพ เช่น เงินดอลลาร์สหรัฐ ทำให้เหมาะสำหรับการใช้ในระบบการชำระเงิน การโอนเงินข้ามพรมแดน และการเงินแบบกระจายศูนย์ (DeFi). การที่ธนาคารใหญ่ของสหรัฐฯ หันมาสนใจ Stablecoin ร่วมกัน แสดงถึงความพยายามในการปรับตัวให้เข้ากับความต้องการของผู้บริโภคยุคใหม่ที่ต้องการความรวดเร็วและประหยัดต้นทุนในการทำธุรกรรมทางการเงิน.

ทำไมธนาคารถึงสนใจ Stablecoin? ในปี 2568 ตลาดคริปโตเคอเรนซีกำลังร้อนแรง โดยมูลค่าตลาดรวมของคริปโตทั่วโลกอยู่ที่ 3.64 ล้านล้านดอลลาร์ ซึ่งในจำนวนนี้ Bitcoin มีมูลค่าตลาดสูงสุดที่ 2.2 ล้านล้านดอลลาร์ และราคา Bitcoin ล่าสุดพุ่งแตะ 111,160.66 ดอลลาร์ (ข้อมูล ณ วันที่ 23 พฤษภาคม 2568 เวลา 16:44 น. ตามเขตเวลา +07) นอกจากนี้ ยังมีเม็ดเงินไหลเข้าสู่กองทุนสินทรัพย์ดิจิทัลในสหรัฐฯ กว่า 7.5 พันล้านดอลลาร์ การที่ธนาคารยักษ์ใหญ่ที่มีมูลค่ารวมกันถึง 8 ล้านล้านดอลลาร์เข้ามาในสนามนี้ แสดงถึงศักยภาพในการเปลี่ยนแปลงภูมิทัศน์ของอุตสาหกรรมการเงิน. นโยบายที่เอื้ออำนวยต่อคริปโตในยุคของประธานาธิบดีโดนัลด์ ทรัมป์ และการลดดอกเบี้ยนโยบายของ Fed ยังเป็นปัจจัยสนับสนุนที่สำคัญ.

โอกาสและความท้าทาย การพัฒนา Stablecoin ร่วมกันของธนาคารเหล่านี้เปิดโอกาสให้สหรัฐฯ รักษาความเป็นผู้นำในระบบการเงินดิจิทัล และเพิ่มประสิทธิภาพในระบบการชำระเงินทั่วโลก อย่างไรก็ตาม ความท้าทายที่รออยู่คือการแข่งขันกับ Stablecoin ที่ครองตลาด เช่น USDT และ USDC รวมถึงความไม่แน่นอนด้านกฎระเบียบและความผันผวนของเศรษฐกิจโลกจากนโยบายการค้าของสหรัฐฯ. ธนาคารจะต้องลงทุนในโครงสร้างพื้นฐานที่ปลอดภัยและสอดคล้องกับกฎหมาย เพื่อสร้างความไว้วางใจจากผู้ใช้.

มองไปข้างหน้า การที่ธนาคารชั้นนำของสหรัฐฯ หันมาสนใจ Stablecoin เป็นสัญญาณที่ชัดเจนว่าโลกการเงินกำลังเปลี่ยนผ่านสู่ยุคดิจิทัลอย่างเต็มรูปแบบ การเคลื่อนไหวครั้งนี้อาจเป็นจุดเปลี่ยนที่ทำให้คริปโตเคอเรนซีกลายเป็นส่วนสำคัญของระบบการเงินกระแสหลัก อย่างไรก็ตาม ความสำเร็จจะขึ้นอยู่กับความสามารถในการสร้างนวัตกรรมที่ตอบโจทย์ผู้บริโภคและการจัดการกับความท้าทายด้านกฎระเบียบและการแข่งขันในตลาด. ในอนาคตอันใกล้ Stablecoin จากธนาคารยักษ์ใหญ่อาจกลายเป็นตัวเปลี่ยนเกมในวงการการเงินโลก และเป็นเครื่องมือสำคัญในการเชื่อมโยงระบบการเงินแบบดั้งเดิมเข้ากับโลกดิจิทัล นักลงทุนและผู้บริโภคควรจับตาดูความคืบหน้าของโครงการนี้อย่างใกล้ชิด เพราะมันอาจเป็นก้าวแรกสู่การปฏิวัติครั้งใหญ่ในวงการการเงิน.

-

@ 3eba5ef4:751f23ae

2025-05-23 09:33:55

@ 3eba5ef4:751f23ae

2025-05-23 09:33:55The article below brings together some of the Q&A from our recent AMA on Reddit. Thanks so much for sending in your questions—we love chatting with you and being part of this awesome community!

Meepo Hardfork Features

What does Meepo bring to CKB, in simple terms?

Imagine upgrading from wooden blocks to LEGO bricks. That’s what the

spawnsyscall in Meepo does for CKB smart contracts, enabling script interoperability.Spawn and a series of related syscalls are introduced as a major upgrade to CKB-VM, enabling interoperability, modularity, and better developer experience, by letting scripts call other scripts, like modular apps in an operating system.

Key features of the upgraded VM?

The upgraded CKB-VM Meepo version unlocks true decoupling and reuse of CKB scripts, enhancing modularity and reusability in smart contract development.

For instance, before Meepo, if developers wanted to build a new time lock in CKB, they had to bundle all necessary functionalities—like signature algorithms—directly into a single lock or type script. This often led to bloated scripts where most of the code was unrelated to the developer's original design goal (time lock). With the spawn syscall, scripts can now delegate tasks—such as signature checks—to other on-chain scripts. As new algorithms emerge, the time lock can adopt them without being redeployed—just by calling updated signature scripts, as long as a shared protocol is followed.

This separation allows developers to: - Focus solely on their core logic. - Reuse independently deployed signature verification scripts. - Upgrade cryptographic components without modifying the original script. - Embrace a more OS-like model where smart contracts can call each other to perform specialized tasks.

By enabling true decoupling and reuse, the spawn syscall makes CKB scripts significantly more composable, maintainable, and adaptable.

Besides Spawn, other improvements in Meepo include:

- Block Extension Fields: Enables reading extension fields in blocks, opening new possibilities like community voting on hardforks (as this ckb-zero-lock prototype). More use cases are expected.

- CKB-VM Optimization: Reduces cycle consumption for common compiler-generated code, making scripts faster and more efficient.

A practical example: IPC on Spawn

Here's an example building an entire Inter-Process Communication (IPC) layer on top of spawn syscalls: - GitHub Repo - Blog post: Transforming IPC in CKB On-Chain Script: Spawn and the Custom Library for Simplified Communication

What does “every wallet will become a CKB wallet because of ckb-auth” mean?

Current CKB-VM already comes with the power to build omnilock / ckb-auth, spawn just makes them easier to reuse in new scripts through decoupling and improved modularity.

Upgrade Compatibility Concerns

Will Meepo require a new address format?

No. Meepo does not introduce breaking changes like address format switching. The only required upgrade is support for a new hash type (

data2). We aim to keep upgrades smooth and backwards-compatible wherever possible.RISC-V & CKB’s Long-Term Design Philosophy

Ethereum is exploring RISC-V—CKB has been doing this for years. What’s your take?

The discussion about RISC-V in Ethereum, is partly about the ease of building zk solutions on Ethereum. And it's easy to mix two different use cases of RISC-V in zk:

- Use RISC-V as the language to write programs running in a zk engine. In this case, we use zero knowledge algorithms to build a RISC-VM and prove programs running inside these RISC-V VMs.

- Use RISC-V as the underlying engine to run cryptographic algorithms, we then compile the verifier / prover code of zero knowledge algorithm into RISC-V, then we run those verifiers / provers inside RISC-V. Essentially, we run the verifying / proving algorithms of zero knowledge algorithms in RISC-V, the programs running inside ZK VMs can be written in other languages suiting the zk algorithms.

When most people talk about RISC-V in zk, they mean the first point above. As a result, we see a lot of arguments debating if RISC-V fits in zk circuits. I couldn't get a direct confirmation from Vitalik, but based on what I read, when Vitalik proposes the idea of RISC-V in Ethereum, he's at least partly thinking about the second point here. The original idea is to introduce RISC-V in Ethereum, so we can just compile zk verifiers / provers into RISC-V code, so there is no need to introduce any more precompiles so as to support different zk algorithms in Ethereum. This is indeed a rare taken path, but I believe it is a right path, it is also the path CKB chose 7 years ago for the initial design of CKB-VM.

CKB believes that a precompile-free approach is the only viable path if we’re serious about building a blockchain that can last for decades—or even centuries. Cryptographic algorithms evolve quickly; new ones emerge every few years, making it unsustainable for blockchains to keep adding them as precompiles. In contrast, hardware evolves more slowly and lives longer.

By choosing RISC-V, we’ve committed to a model that can better adapt to future cryptographic developments. CKB may be on an uncommon path, but I believe it's the right one—and it's encouraging to see Ethereum now moving in a similar direction. Hopefully, more will follow.

CKB already stands out as the only blockchain VM built on RISC-V and entirely free from cryptographic precompiles. Meepo, with its spawn syscall, builds on this foundation—pushing for even greater modularity and reuse. We're also closely watching progress in the RISC-V ecosystem, with the goal of integrating hardware advances into CKB-VM, making it even more future-proof and a state-of-the-art execution environment for blockchain applications.

Will CKB run directly on RISC-V chips? What are the implications?

The "CKB on RISC-V"comes in several stages:

- For now, CKB-VM can already be compiled into RISC-V architecture and run on a RISC-V CPU (e.g. StarFive board), though optimized native implementations are still in development.

- That said, one key issue in the previous stage was that CKB-VM lacks a high-performance, assembly based VM on RISC-V architecture. Ironically, despite CKB-VM being based on RISC-V, we ended up running a Rust-based VM interpreter on RISC-V CPUs—which is far from ideal.

The root of the problem is that RISC-V CPUs come in many configurations, each supporting a different set of extensions. Porting CKB-VM to run natively on real RISC-V chips isn’t trivial—some extensions used by CKB-VM might not be available on the target hardware. With enough time and effort, a performant native implementation could be built, but it’s a non-trivial challenge that still needs significant work.

How do you see the RISC-V narrative expanding?

We are delighted to see the growing recognition of RISC-V in the blockchain space. For CKB, we firmly believe RISC-V is the best choice. Consensus is costly, so only essential data should be on-chain, with the chain serving as a universal verification layer—this is CKBʼs philosophy, and we have consistently designed and developed in this direction.

CKB Roadmap & Ecosystem Growth

Any plan to boost the usage of the CKB network in the next 6 - 24 months?

Growth starts with better developer experience. Spawn in Meepo significantly lowers the barrier to building complex apps. With better tools and documentation, more devs can experiment on CKB, leading to better apps and more users.

What would you focus on if the secondary issuance budget was huge?

If funding were abundant, we'd expand the Spark Program, support more grassroots projects, and even evolve toward a fully decentralized DAO structure—aligning with our long-term vision of a permissionless, community-owned network.

What’s next for Nervos after Meepo?

We're exploring new RISC-V extensions like CFI, which could boost script security and defend against ROP attacks. Still early-stage, but promising. Check out this: Against ROP Attacks: A Blockchain Architect’s Take on VM-Level Security.

Resources

Take a deeper look at the VM upgrades introduced in the Meepo hardfork:

Explore the CFI (Control Flow Integrity) extension on RISC-V:

Check out the Inter-Process Communication (IPC) layer built on top of spawn syscalls:

-

@ 82b30d30:40c6c003

2025-05-23 09:02:28

@ 82b30d30:40c6c003

2025-05-23 09:02:28nostr:nevent1qqsyeyycax9qgrr4qvtty4h62x96vc6lydh8yg7jl5er99zg7wlpdrch4np3n nostr:nevent1qqs0sqhtzc4p3vysz5k7l29x2lcnedeys55t7mqp2mz7ugrmw0v725cskvqau nostr:nevent1qqsq74xd6qzp9fp8nt8wqpredynnx9t59w9gmzs69jemwu24vjvx78c7wqsl6 nostr:nevent1qqsx6uaegtvy8y47w4fn4dsa0dzkrkjhmwyz9kgq8zw7s3hcg6fuhqg9yywsj nostr:nevent1qqspze6lekfau8063lcup5z0sq62fjhjgr5qjhqy29th28ghsjdendgpvh0ev nostr:nevent1qqsds5j8zk2cx0z4c7ndmq7pgnhtt9hxxu3ee8lq7j69xkpf68u44xgx0v9ux nostr:nevent1qqs20740qquqtt7mrxsqdhftg6rghselqmz8ewp7xsr4v3ltw8ha64scu0suh nostr:nevent1qqsr6sekrmed9g6m7fussfeg4ye5wupplx2wkrul6u8w7yykq6gs7cgz5lwj9 nostr:nevent1qqsfthry2n8yrevtuu8e83gjz2cjv9yh5p43t992h9dx8zy7xs49npq5rp89x nostr:nevent1qqs2rsq8g63z86vw5ta6rcjhtm94u92hhgdv5u7l6ymhy6nulq4awwq58f2af nostr:nevent1qqsdjqf2rwen0sqxvftqg9r6k6404n6ufhl89rn0kyga890ssx7a9pqhvw9z7 nostr:nevent1qqs9j53hpsdpt08f258hnm2sjrgx2anvd7qdrrvqx6ryppslr6lcqdqnammt4 nostr:nevent1qqsx2cs5gf2mlk4a524k2fk0f2fs80t7ryppe0qxyzvexyyh0z2xq0q9ckpgk nostr:nevent1qqsvtkg68twtgm6659v76rxc703qruq6awdxjfdjjcvlwu2r3k4r27sa9qexz nostr:nevent1qqs82g7s2u3560xu95zf55yf4suw52zy5sa6d3p7x2rt8trhcneul7qyze3qd nostr:nevent1qqs2zypn5lpuprgede5ncv0z23ewy8wqf8hqx8ltsdhkmv29jgg3svgc7rv4x nostr:nevent1qqsr9mpqw59703y5dltlycd7yxx9ndkx7xe80emd74nzv7f8uvj9y9saugvlp nostr:nevent1qqsr707sa8jns2ppuyh7kp2jxv6ax4vq7c2y5c2a57y0ewhw2qmpgjc935qgp nostr:nevent1qqsv8gj48n085jtqrr2kaygzcltq026cdn4p448h6s9u25eje8ytvfgu6yyh9 nostr:nevent1qqst2zc68sad5kvklacaqwrh09ghderycqreszwc9schd9zt6z8snzcxzwnwq nostr:nevent1qqszq6fhmm7vuva5ptyflkdstdcknvamlt3j3jj829s59x9d8qw65vslvs39k nostr:nevent1qqst7e22rz3m23mweqdv7ra2mwd7zf4cm3wmvr3hvlc3n2ep6peqjfs753ple nostr:nevent1qqs94rt2exfeuh9v03lftw0s67s0ymuxn8d9vahm08kf2adpwn0h3kgzmfrqw nostr:nevent1qqsysaa7s4apg77tgdx449zwrh86cgrrgm8nl75rk5ezfhk08gemcfq7m7kde nostr:nevent1qqs29glqa5sf3d6nrapqhdlqmmj64xdejf4ky5902s0rcfzyr34gx5s6z9vh2 nostr:nevent1qqswnwcakyyef405uq84u529axlftmc2hq6ejgkefpha38t9fg0tf7ceqarnt nostr:nevent1qqsgpztjppvz0e4lackz9zgutvgtszl9hw6dahlfrmg0u7p3epk9lvgutulpm nostr:nevent1qqszqlx6a695hjnv3m2hwphx2vmu6euw0rmnzqzdgy9d6ud97d9etqshlw6zv nostr:nevent1qqsgfesj07k75v7y5sx070808kd6rr4nf8ptsx685z8kwem7quhk3uc2nhlre nostr:nevent1qqs9qq0tu5t2mrpe8n0f98zewvednrdzqdwsj9vhja9sjtuyjfkmlcswxmjz6 nostr:nevent1qqsfjsjkeq9ux0mjlpzkkcl26vdk7p96paxzlmnp0uckzd3gwtsf9gc32t9ya nostr:nevent1qqs0clwat2zwn4nurlgx9ghlrly8jkk6094hjsz0hd2esxfnkqhcdscnv0xuq nostr:nevent1qqs9vvydt9y0ph230at8mgd4x4juqw89wze2sjthmr4h0rsrg0vmwkc68fass nostr:nevent1qqs8gg9rqrw05hx4a2nmjc7kgc4fxrsd0fqpvz4hg73qel3pxz7yqecwefmha nostr:nevent1qqs9lmvurhnyp0pr8x0ckxnjpt9c6dtnwc0tuczl7uujsc2mf7drfvgjm7s5t nostr:nevent1qqs9n0fvpjl4qmp6nq7s697trhlp9cqydmfwtv0hyevfmnkkjq53ldcp2ue30 nostr:nevent1qqstphjtlec767x53cd0hycul0up5nccje54gyxdakp6rj6jdczw66st3rh78 nostr:nevent1qqstk68pvck7lv6dqlgx9eszmx4h3vyurfxwjgwgg2fw258ws7y7u0s0k28re nostr:nevent1qqs8m2sql8nnzfzpmgqer3vhaxejjeqsyam4q7dt5h58czzezffnsrq7tf2e7 nostr:nevent1qqs2gxp2p69m4xn0z8fmhg7s7krhcu60yszes3sapa9rz89qt8t6zas56lwvq nostr:nevent1qqs9esesyzs2mq93tkcy3wcvtu85rwj5e4m8dh4mk6zma86zz9vv06scurxue nostr:nevent1qqswprrqxz0smcrzn8qexp480jhkg4zjd0n0uphc2wx8pyte4dfavjqjyg7rn nostr:nevent1qqspltzt54qxxu3yjpazxyssm3s6xl8gwxr5eyvuvl8c8epj02e7dkclx3xy7 nostr:nevent1qqsp5ye5klfkf5fzapwscq26jaq84emcd8lku0q2vdky2spf0rhh2as83nnjn nostr:nevent1qqsxsrjh8m77eh3lpn9kacssn7k0mza4z4e9g68q70mqa78p4xjv2tqx28avg nostr:nevent1qqs2h9sg90jxzs08qancaj08qzeu7hh8lss32ny8uaww5m96xp25uus9z5rkz nostr:nevent1qqs2w7us0ef22ervcpya2rk24q5zcjaccae3d5rh9tt5jphfwax493c9pjs86 nostr:nevent1qqs2zr67e5pca9m3lqjw9w72v2h9507d62eya53n8pysle0fhu7adfqkd6hrq nostr:nevent1qqs87zlw6cas3my02fndu2rnfxyzrayqa7g5ptyhsjr37ewmk9jaqwclnp9n5 nostr:nevent1qqsqwpjhgp02jp878c5ftuuxt6czwf5sxcp25ma7p6y9x0sagpwz4tck0cjrt nostr:nevent1qqsyvtujm282xpmstttexzz2u0jxuts0e88t4vcnvg327vw5ju4x74q4wwjh7 nostr:nevent1qqsx6ulpc88x7nqpur3gagkp5uewn3t3a6qelzflejfy86j2y4pqv8gugmhu9 nostr:nevent1qqs9xgvwqy4ephxmfne62d7vucg6mvt8r9vlajw660eq590xnhrg5agv8q4s4 nostr:nevent1qqs9wpg4d0xd8dksnejdewus562f2t2vepyp8fdm6fft4k8t3j4tasguatjx5 nostr:nevent1qqs8lp0skjc83ky4lysegx3cnzxfvy3myskdfwcqs9v7564970ru29qsyc0np nostr:nevent1qqs2vle2yawtsrfftltp9nnzs65vcl4qjtyakap7qkvzd5mg8va4jjqtys34s nostr:nevent1qqsxm5q0xvnrlseh9x2t4k3cr207hzv9veyyt4vtht04yxlgcjk9cpq60l7jw nostr:nevent1qqsvqez6v63mglzj0xwy5d2tqy4956edvtqctncmmhxthgufefsw6wshuvlza nostr:nevent1qqsvk95ngt7u9jfx8l9det80qx39vrlfgkatn3cz3y5pk0g7qu7p2fctqrd2r nostr:nevent1qqsrknzln82etu0pqzhtakemt4c4thszw7kh9zzc85wx9q7y2ltee7gcl4gpu nostr:nevent1qqspws9jvjsj3lzksqvxtche9tvnz55lvurund04pltq92cyrpm3dzqe4zxzt nostr:nevent1qqsf2cmj0txt9l23a2jx9jr0pwsmsr7js2nztgygknltu3alad8mpxqmkm75p nostr:nevent1qqsdh8zc5ydx4nvv4vxgg40xuatg5vdccdy5pn8nqz4x8gchke6sqns2v5ed2 nostr:nevent1qqsptqnt63mntkthndn8ganaatjh08xqrz6fx8y28r85elgrwfk97qsnasax5 nostr:nevent1qqsqp4l0mw3lm0mznvn37dk7wfxsr3e9fvp220v4zjy7fs5u3km5h6cl2u28m nostr:nevent1qqs09m70m33lkafu89xjfpyjft9p3dmcywjsmm7tx30ppxzwy6t3aaq959lff nostr:nevent1qqswpnrgahzcxnqg886gx9vgvsf7tenxgw9uqmtsv95r38m4xu90zwgaekq5s

-

@ a3c6f928:d45494fb

2025-05-23 09:01:16

@ a3c6f928:d45494fb

2025-05-23 09:01:16As artificial intelligence becomes more embedded in our lives, it reshapes the way we understand and exercise freedom. AI holds immense potential to enhance liberty—by automating tasks, expanding access to information, and enabling personalized experiences. Yet it also introduces complex challenges that demand careful consideration.

The Promises of AI for Freedom

-

Empowerment through Information: AI democratizes knowledge by curating and delivering information more effectively than ever before. This helps individuals make informed decisions and engage more deeply with society.

-

Efficiency and Liberation: By handling repetitive tasks, AI frees humans to focus on creativity, strategic thinking, and emotional intelligence—areas where freedom of thought thrives.

-

Accessibility and Inclusion: AI-powered tools can break down barriers for people with disabilities, improve language translation, and provide personalized education—broadening freedom for all.

Risks and Responsibilities

-

Surveillance and Privacy: When AI is used for mass surveillance, it threatens personal freedom and autonomy. The right to privacy must be protected.

-

Bias and Discrimination: AI systems can reflect and amplify societal biases, leading to unfair outcomes. Ensuring fairness and transparency is crucial.

-

Autonomy and Control: As AI makes more decisions on our behalf, we risk ceding control. Freedom means preserving human agency in AI-driven systems.

Building an Ethical AI Future

-

Transparent Design: Developers must prioritize clarity and accountability in how AI systems make decisions.

-

Inclusive Development: Involving diverse voices ensures AI serves all communities, not just a privileged few.

-

Regulation and Oversight: Thoughtful policy can protect rights while fostering innovation.

The Road Ahead

AI is neither inherently liberating nor oppressive—it depends on how we use it. The challenge before us is to shape AI in ways that support freedom rather than constrain it. This requires vision, vigilance, and values.

“Technology is a useful servant but a dangerous master.” — Christian Lous Lange

Let’s ensure AI remains a tool for expanding freedom, not restricting it.

-

-

@ 975e4ad5:8d4847ce

2025-05-23 08:47:08

@ 975e4ad5:8d4847ce

2025-05-23 08:47:08Bitcoin Is Not Just an Asset

When Satoshi Nakamoto introduced Bitcoin in 2009, the vision was clear: a decentralized currency for everyday transactions, from buying coffee to paying bills. It was designed to bypass banks and governments, empowering individuals with financial freedom. But when Bitcoin is treated as “digital gold” and locked away in wallets, it fails to fulfill this vision. Instead of replacing fiat currencies, it becomes just another investment, leaving people reliant on dollars, euros, or other traditional currencies for their daily needs.

The Problem with HODLing and Loans

Some Bitcoin enthusiasts advocate holding their coins indefinitely and taking loans against them rather than spending. This approach may seem financially savvy—Bitcoin’s value often rises over time, and loans provide liquidity without selling. But this prioritizes personal gain over the broader goal of financial revolution. Someone who holds Bitcoin while spending fiat isn’t supporting Bitcoin’s mission; they’re merely using it to stay wealthy within the existing system. This undermines the dream of a decentralized financial future.

Lightning Network: Fast and Cheap Transactions

One common argument against using Bitcoin for daily purchases is the high fees and slow transaction times on the main blockchain. Enter the Lightning Network, a second-layer solution that enables near-instant transactions with minimal fees. Imagine paying for groceries or ordering a pizza with Bitcoin, quickly and cheaply. This technology makes Bitcoin practical for everyday use, paving the way for widespread adoption.

Why Using Bitcoin Matters

If Bitcoin is only hoarded and not spent, it will remain a niche asset that shields against inflation but doesn’t challenge the fiat system. For Bitcoin to become a true alternative currency, it must be used everywhere—in stores, online platforms, and peer-to-peer exchanges. The more people and businesses accept Bitcoin, the closer we get to a world where decentralized currency is the norm. This isn’t just an investment; it’s a movement for financial freedom.\ \ Bitcoin wasn’t created to sit idly in wallets or serve as collateral for loans. It’s a tool for change that demands active use. If we want a world where individuals control their finances, we must start using Bitcoin—not just to avoid poverty, but to build a new financial reality.

-

@ eb0157af:77ab6c55

2025-05-23 08:01:20

@ eb0157af:77ab6c55

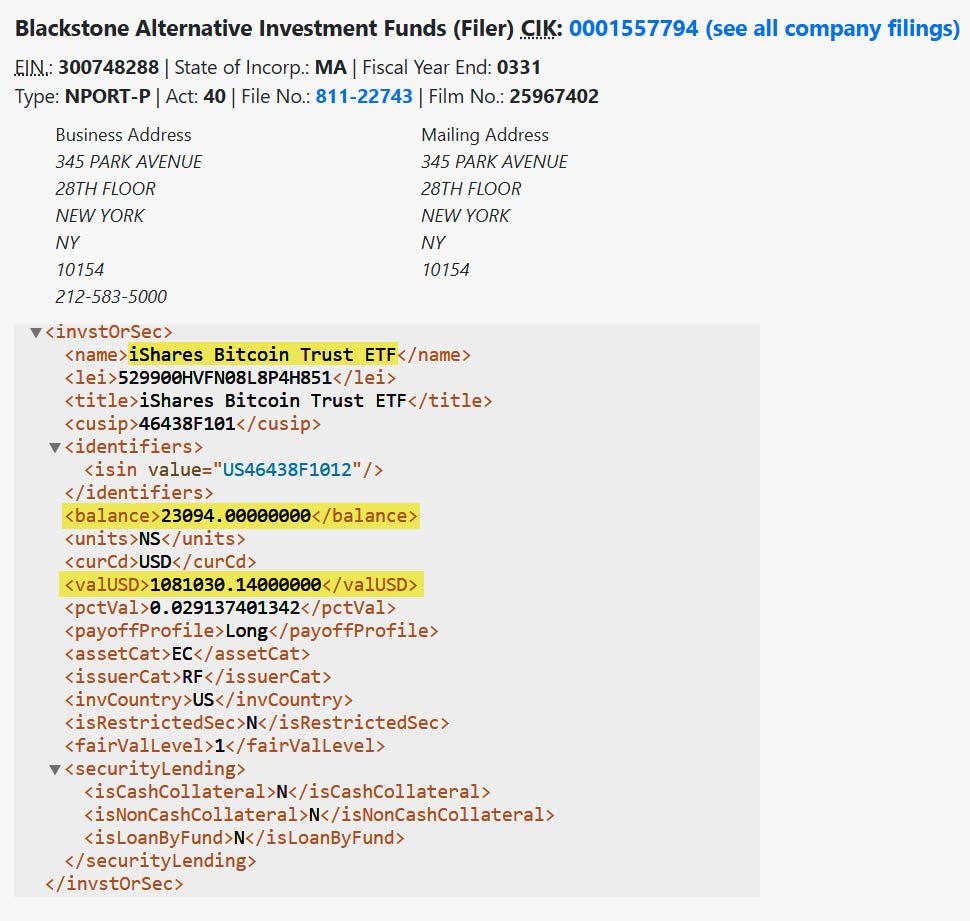

2025-05-23 08:01:20According to CEO Jamie Dimon, the banking giant will open the door to spot Bitcoin ETFs.

As reported by CNBC, JPMorgan has announced that it will allow its clients to buy Bitcoin, without offering custody services. The bank will give clients access to exchange-traded funds (spot ETFs) on Bitcoin, according to sources familiar with the matter.

During a recent investor event, CEO Jamie Dimon confirmed that the bank will open up to Bitcoin for its clients, while refraining from taking on the responsibility of asset custody. “I am not a fan” of Bitcoin, Dimon clarified during the event.

This decision marks a shift from the position Dimon held in 2017, when he labeled Bitcoin a “fraud,” compared it to the tulip mania bubble, and predicted its imminent collapse. At the time, Dimon had even threatened to fire any JPMorgan employee caught trading Bitcoin, calling such activity “stupid” and against company policy.

Despite this operational turnaround, Dimon continues to personally maintain a skeptical stance toward the cryptocurrency. In a 2024 interview with CNBC, he stated he no longer wanted to discuss Bitcoin publicly, emphasizing that, in his view, it lacks “intrinsic value” and is used for criminal activities such as sex trafficking, money laundering, and ransomware.

These comments from Dimon contrast with the recent optimism shown by JPMorgan analysts regarding Bitcoin’s market prospects. According to reports from the bank, Bitcoin could continue gaining ground at the expense of gold in the second half of the year, driven by rising corporate demand and growing support from various U.S. states.

The post JPMorgan to allow clients to buy Bitcoin ETFs: no custody services appeared first on Atlas21.

-

@ 662f9bff:8960f6b2

2025-05-23 07:38:51

@ 662f9bff:8960f6b2

2025-05-23 07:38:51I have been really busy this week with work - albeit back in Madeira - so I had little time to read or do much other than work. In the coming weeks I should have more time - I am taking a few weeks off work and have quite a list of things to do.

First thing is to relax a bit and enjoy the pleasant weather here in Funchal for a few days. With 1st May tomorrow it does seem that there will be quite a bit to do..

Some food for thought for you. Who takes and makes your decisions? Do you make them yourself based on information that you have and know to be true or do you allow other people to take and make decisions for you? For example - do you allow governments or unaccountable beaureaucrats and others to decide for you and even to compell you?

In theory Governments should respect Consent of the Governed and the 1948 Universal Declaration of Human Rights states that "The will of the people shall be the basis of the authority of government". For you to decide if and to what extent governments today are acting in line with these principles. If not, what can you do about it? I dive into this below and do refer back to letter 9 - section: So What can you do about it.

First, a few things to read, watch and listen to

-

I Finance the Current Thing by Allen Farrington - when money is political, everything is political...

-

Prediction for 2030 (the Great Reset). Sorelle explains things pretty clearly if you care to watch and listen...

-

The Global Pandemic Treaty: What You Need to Know . James Corbett is pretty clear too... is this being done with your support? Did you miss something?

-

Why the Past 10 Years of American Life Have Been Uniquely Stupid - fascinating thinking on how quite a few recent things came about...

And a few classics - you ought to know these already and the important messages in them should be much more obvious now...

-

1984 by George Orwell - look for the perpetual war & conflict, ubiquitous surveillance and censorship not to mention Room 101

-

Animal farm - also by George Orwell - note how the pigs end up living in the farmhouse exceeding all the worst behaviour of the farmer and how the constitution on the wall changes. Things did not end well for loyal Boxer.

-

Brave New World by Aldous Huxley- A World State, inhabited by genetically modified citizens and an intelligence-based social hierarchy - the novel anticipates large scale psychological manipulation and classical conditioning that are combined to make a dystopian society which is challenged by only a single individual who does not take the Soma.

For more - refer to the References and Reading List

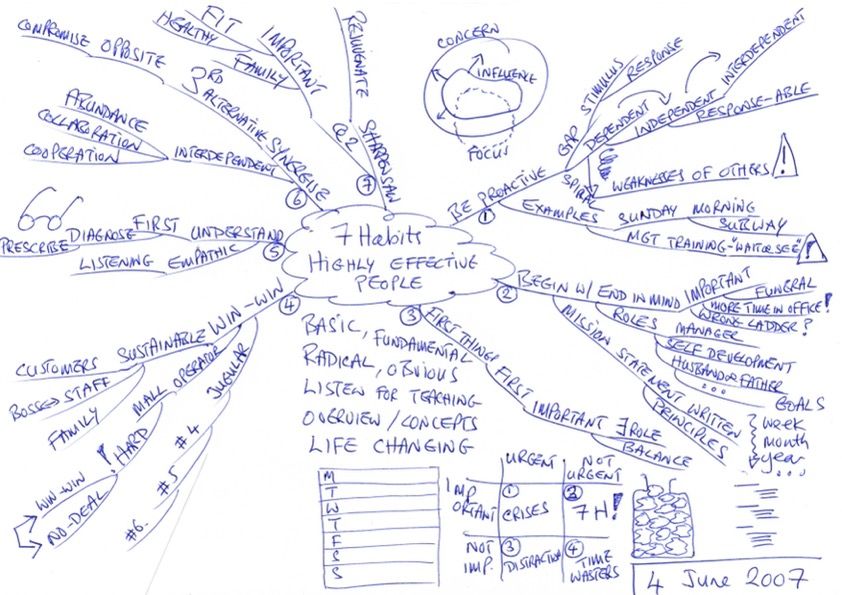

The 7 Habits of Highly Effective People

One of the most transformative books that I ever read was 7 Habits of Highly Effective People by Steven Covey. Over many years and from researching hstorical literature he found seven traits that successful people typically display. By default everyone does the opposite of each of these! Check how you do - be honest...

-

Habits 1-3 are habits of Self - they determine how you behave and feel

-

Habits 4-6 are habits of interpersonal behaviour - they determine how you deal with and interact with others

-

Habit 7 is about regeneration and self care - foundation for happy and healthy life and success

One: Be proactive

Choose your responses to all situations and provocations - your reaction to a situation determines how you feel about it.

By default people will be reactive and this controls their emotions

Two: Begin with the end in mind

When you start to work on something, have a clear view of the goal to be achieved; it should be something substantial that you need and will value.

By default people will begin with what is in front of them or work on details that they can do or progress without having a clear view on the end result to be achieved

Three: Put First things First

Be clear on, and begin with, the Big Rocks- the most important things. If you do not put the Big Rocks into your planning daily activities, your days will be full of sand and gravel! All things can be categorised as Urgent or Not-Urgent and Important or Not-Important.

By Default people will focus on Urgent regardless of importance - all of the results come from focusing on Important Non-Urgent things. All of the 7 Habits are in this category!

Four: Seek Win-Win in all dealings with people and in all negotiations

This is the only sustainable outcome; if you cannot achieve Win-Win then no-deal is the sustainable alternative.

By default people will seek Win-Loose - this leads to failed relationships

Five: Seek first to understand - only then to be understood.

Once you visibly understand the needs and expectations of your counterpart they will be open to listening to your point of view and suggestions/requests - not before!

By default people will expound their point of view or desired result causing their counterpart to want to do the same - this ends in "the dialogue of the deaf"

Six: Synergise - Seek the 3rd alternative in all problems and challenges

Work together to find a proposal that is better than what each of you had in mind

By default people will focus on their own desired results and items, regardless of what the other party could bring to help/facilitate or make available

Seven: Sharpen the saw

Take time to re-invigorate and to be healthy - do nothing to excess. Do not be the forrester who persists in cutting the tree with a blunt saw bcause sharpening it is inconvenient or would "take too much time"!

By default people tend to persist on activities and avoid taking time to reflect, prepare and recover

Mindaps - a technique by Tony Buzan

Many years ago I summarised this in a Mind Map (another technique that was transformative for me - a topic for another Letter from around the world!) see below. Let me know if this interests you - happy to do an explainer video on this!

That's it!

No one can be told what The Matrix is.\ You have to see it for yourself.**

Do share this newsletter with any of your friends and family who might be interested.

You can also email me at: LetterFrom@rogerprice.me

💡Enjoy the newsletters in your own language : Dutch, French, German, Serbian, Chinese Traditional & Simplified, Thai and Burmese.

-

-

@ 502ab02a:a2860397

2025-05-23 07:35:13

@ 502ab02a:a2860397

2025-05-23 07:35:13แหม่ ต้องรีบแวะมาเขียนไว้ก่อน ของกำลังร้อนๆ #ตัวหนังสือมีเสียง เพลง ลานกรองมันส์ นั้นเรื่องที่มาที่ไปน่าจะไปตามอ่านในเพจ ลานกรองมันส์ ได้ครับ recap คร่าวๆคือมันคือ พื้นที่สร้างสรรค์ที่เปิดให้มาทำกิจกรรมต่างๆนานากันได้ครับ

วันนี้เลยจะมาเล่าเรื่องวิธีการใช้คำ ซึ่งมันส์ดีตามชื่อลาน ฮาๆๆๆ ผมตั้งโจทย์ไว้เลยว่า ต้องมีคำว่า ลานกรองมันส์ แน่ๆแล้ว เพราะเป็นชื่อสถานที่ จากนั้นก็เอาคำว่า ลานกองมัน มาแตกขยายความเพราะมันคือต้นกำเนิดเดิมของพื้นที่นั้น คือเป็นลานที่เอาหัวมันมากองกันเอาไว้ รอนำไปผลิตต่อเป็นสินค้าการเกษตรต่างๆ

ตอนนี้เขาเลิกทำไปแล้ว จึงกลายมาเป็น ลานกรองมันส์ ที่เอาชื่อเดิมมาแปลง

เมื่อได้คำหลักๆแล้วผมก็เอาพยัญชนะเลย ลอลิง กอไก่ มอม้า คือตัวหลักของเพลง

โทนดนตรีไม่ต้องเลือกเลยหนีไม่พ้นสามช่าแน่นอน โทนมันมาตั้งแต่เริ่มคิดจะเขียนเลยครับ ฮาๆๆๆ

ผมพยายามแบ่งวรรคไว้ชัดๆ เผื่อไว้เลยว่าอนาคตอาจมีการทำดนตรีแบบแบ่งกันร้อง วรรคของมันเลยเป็น หมู่ เดี่ยว หมู่ เดี่ยว หมู่ เดี่ยว หมู่ แบบสามโทนเลย

ท่อนหมู่นั้น คิดแบบหลายชั้นมากครับ โดยเฉพาะคำว่า มัน เอามันมากอง มันที่ว่าได้ทั้งเป็นคำกิริยา คือ เอามันมากองๆ หรือ มันที่ว่าอาจหมายถึงตัวความฝันเองเป็นคำลักษณะนามเรียกความฝัน "ลานกรองมันส์ เรามาลองกัน มาร่วมกันมอง ลานกรองมันส์ มาร่วมสร้างฝัน เอามันมากอง"

หรือแม้แต่ท่อนต่างๆ ก็เล่นคำว่า มัน กอง เพื่อให้รู้สึกย้ำท่อนหมู่ ที่มีคำว่ามัน เป็นพระเอกหลายหน้า ทั้งความสนุก ทั้งลักษณะนามความฝัน ทั้งกิริยา "ทุกคน ต่างมี ความฝัน เอามา รวมกัน ให้มันเป็นกอง"

อีกท่อนที่ชอบมากตอนเขียนคือ ทำที่ ลานกรองมันส์ idea for fun everyone can do เพราะรู้สึกว่า การพูดภาษาอังกฤษสำเนียงไทยๆ มันตูดหมึกดี ฮาๆๆๆๆ

หัวใจของเพลงคือจะบอกว่า ใครมีฝันก็มาเลย มาทำฝันกัน เรามีที่ให้คุณ ไม่ต้องกลัวอะไรที่จะทำฝันของตัวเอง เล็กใหญ่ ผิดถูก ขอให้ทำมัน อย่าให้ใครหยุดฝันของคุณ นอกจากตัวคุณเอง

เพลงนี้ไม่ได้ลงแพลทฟอร์ม เพราะส่งมอบให้ทาง ลานกรองมันส์เขาครับ ใช้ตามอิสระไปเลย ดังนั้นก็อาจต้องฟังในโพสนี้ หรือ ในยูทูปนะครับ https://youtu.be/W-1OH3YldtM?si=36dFbHgKjiI_9DI8

เนื้อเพลง "ลานกรองมันส์"

ลานกรองมันส์ ขอเชิญทุกท่าน มามันกันดู นะโฉมตรู มาลองดูกัน อ๊ะ มาลันดูกอง

มีงาน คุยกัน สังสรรค์ ดื่มนม ชมจันทร์ ปันฝัน กันเพลิน ทุกคน ต่างล้วน มีดี เรานั้น มีที่ พี่นี้มีโชว์ เอ้า

ลานกรองมันส์ เรามาลองกัน มาร่วมกันมอง ลานกรองมันส์ มาร่วมสร้างฝัน เอามันมากอง

จะเล็ก จะใหญ่ ให้ลอง เราเป็น พี่น้อง เพื่อนพ้อง ต้องตา ทุกคน ต่างมี ความฝัน เอามา รวมกัน ให้มันเป็นกอง เอ้า

ลานกรองมันส์ เรามาลองกัน มาร่วมกันมอง ลานกรองมันส์ มาร่วมสร้างฝัน เอามันมากอง

ชีวิต เราคิดเราทำ ทุกสิ่งที่ย้ำ คือทำสุดใจ จะเขียน จะเรียน จะรำ ทำที่ ลานกรองมันส์ idea for fun everyone can do

ลานกรองมันส์ เรามาลองกัน มาร่วมกันมอง ลานกรองมันส์ มาร่วมสร้างฝัน เอามันมากอง

เรามา ลั่นกลองให้มัน เฮไหนเฮกัน ที่ลานกรองมันส์ ให้ฝัน บันเทิง…

ตัวหนังสือมีเสียง #pirateketo #siamstr

-

@ e97aaffa:2ebd765d

2025-05-23 07:30:53

@ e97aaffa:2ebd765d

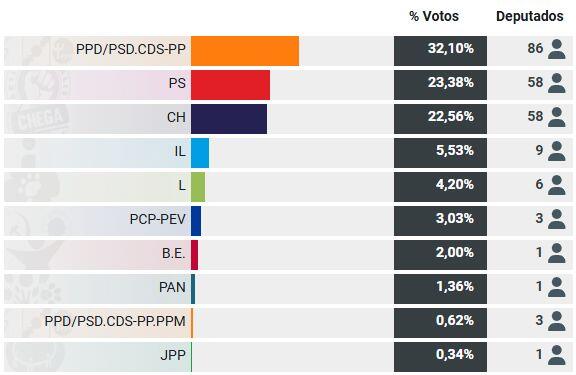

2025-05-23 07:30:53Passou alguns dias, após as eleições legislativas, a cabeça está mais fria, é um bom momento para um rescaldo e para um pouco de futurologia. Esta análise vai ser limitada apenas aos grandes partidos.

Podemos resumir esta eleição, numa única palavra: Terramoto.

A AD ganhou, mas o grande destaque foi a queda do PS e a subida do Chega. Se a governação do país estava difícil, agora com este novo desenho da assembleia, será quase impossível, piorou bastante. Neste momento, ainda falta contabilizar os votos da emigração, mas o mais provável é o Chega ultrapassar o PS.

A queda do PS foi tremenda, ninguém esperava tal coisa, o partido está em estado de choque. O partido vai necessitar de tempo para estabilizar e para se reconstruir.

Devido a motivos constitucionais (6 meses antes e 6 meses depois da eleição do presidente da República) só poderá existir eleições no final do próximo ano, isso garante que o novo governo da AD vai estar no poder pelo menos um ano. Isso vai obrigar a aprovação do próximo orçamento de estado, como o PS necessita de tirar os holofotes sobre si, vai facilitar o governo. Provavelmente vai existir um acordo de cavalheiro, um pacto de não agressão entre o governo e o PS, o PS vai se abster na votação do orçamento de estado e a governo não fará revisão constituicional sem o consentimento do PS e também não fará reformas nas leis ou políticas que sejam contra os princípios básicos do partido socialista. Em suma, não haverá grandes reformas, será um governo de gestão com ligeiramente mais poderes.

Não será um governo de bloco central, nem um governo da AD com apoio PS, será apenas um governo da AD com uma falsa oposição do PS. Um governo de bloco central, é uma bomba nuclear, ainda seria demasiado cedo para utilizá-la.

O Partido Socialista sabe que, para ter algumas hipóteses de vencer a próxima eleição, necessita de estar bem e o governo da AD tem que demonstrar algum desgaste, uma queda na popularidade. Eu não acredito que um ano seja suficiente, talvez, seja necessário 2 anos. Isto significa que o país poderá ficar estagnado 1 ou 2 anos, se o governo não conseguir fazer grandes reformas, se os cidadãos não virem/sentirem sinais de mudança, vai dar ainda mais força ao Chega.

Eu acredito que o ponto chave, é a imigração, o governo terá que demonstrar muito trabalho e minimizar o problema, para “esvaziar” um pouco o Chega, caso não faça será um problema.

XXVI Governo

Assim, nessa próxima eleição, talvez em 2027, acredito que as percentagens ficarão mais ou menos como esta eleição, com um partido ligeiramente à frente e os outros dois mais equilibrados. Só que o vencedor seria o Chega, ficando a AD(provavelmente o PSD) e o PS a disputa pelo 2º lugar.

Seria um novo terramoto, mas aqui seria necessário utilizar a bomba nuclear, iria surgir uma nova geringonça. Apesar da vitória do Ventura, iria surgir o governo bloco central, com o PSD e PS, não haveria outra alternativa.

O governo de bloco central, teria que ser muito competente, porque se não o for, iria para novas eleições. Se o governo for um fiasco, PS corre o risco de ser esvaziado, cairá ainda mais, correrá um risco de existência, poderá tornar-se num partido insignificante na nossa política.

XXVII Governo

Agora o terramoto ainda maior, nessa futura eleição, o Chega venceria com maioria absoluta, aí sim, seria um verdadeiro terramoto, ao nível de 1755.

O Chega tem o tempo a seu fazer, tem uma forte penetração nos jovens. Cada jovem que faça 18 anos, existe uma forte possibilidade de ser eleitor do Chega, o seu oposto, acontece com o PCP e o PS, os mais velhos vão morrendo, não existe renovação geracional. Mas o ponto fulcral é a ausência de competência generalizada nos partidos e políticos que têm governado o nosso país nos últimos anos, o descontentamento da população é completo. Esses políticos vivem na sua bolha, não tem noção do mundo real, nem compreendem quais são os problemas das pessoas simples, do cidadão comum.

Ventura

Na minha opinião só existirá três situações, que poderão travar as ascensão do André Ventura a primeiro-ministro:

- Ou existe um óptimo governo, que crie um bom crescimento na qualidade de vida das pessoas e que resolva os 3 problemas que mais anseiam actualmente os portugueses: Habitação, Saúde e Imigração. A probabilidade de isso acontecer é quase nula.

- Ou se o André Ventura desistir, a batalha será muito longa e ele poderá ficar cansado. Pouco provável.

- Ou então, um Argumentum ad hominem, terá que surgir algo, factos concretos que manche a imagem do André Ventura, que destrua por completo a sua reputação.

É a minha a linha leitura da bola de cristal, poderão dizer é uma visão pessimista, eu acho que é realista e pragmática, não vejo qualquer competência na classe política para resolver os problemas do país. Esta é a opinião de um recorrente crítico do Chega.

-

@ eb0157af:77ab6c55

2025-05-23 07:01:38

@ eb0157af:77ab6c55

2025-05-23 07:01:38A group of users has filed a class action lawsuit against Coinbase, claiming that its identity verification checks violate the state’s biometric privacy law.

According to plaintiffs Scott Bernstein, Gina Greeder, and James Lonergan in the lawsuit filed on May 13 in a federal court, Coinbase’s “indiscriminate collection” of facial biometric data for Know Your Customer (KYC) requirements breaches Illinois’ Biometric Information Privacy Act (BIPA).

The group argued that the exchange failed to notify users in writing about the collection, storage, or sharing of their biometric data, as well as the purpose and retention schedule for such data. “Coinbase does not publicly provide a retention schedule or guidelines for permanently destroying Plaintiffs’ biometric identifiers as specified by BIPA,” they alleged.

The complaint claims that Coinbase requires users to verify their identity by uploading a government-issued ID and a selfie, which is then sent to third-party facial recognition software to scan and extract facial geometry. This process captures biometric identifiers without the users’ informed written consent, thus violating BIPA, according to the lawsuit.

Additionally, the group alleged that Coinbase unlawfully shared biometric data with third-party verification providers such as Jumio, Onfido, Au10tix, and Solaris without users’ consent. “Coinbase ‘obtains’ biometric data in violation of [BIPA] because it explicitly directed the Third Party Verification Providers to use its software to verify and authenticate users, including Plaintiffs, and its software does so by collecting biometric data,” the complaint read.

The group also stated that over 10,000 individuals have filed arbitration demands on these issues with the American Arbitration Association, but Coinbase allegedly refused to pay the required arbitration fees, causing the claims to be dismissed.

Legal demands

The lawsuit brings three counts of biometric privacy law violations and one count of consumer fraud under the Illinois Consumer Fraud and Deceptive Business Practices Act. The group seeks $5,000 for each intentional or reckless violation, $1,000 for each negligent violation, along with injunctive relief and litigation costs.

Coinbase was also recently hit by at least six lawsuits following the May 15 disclosure that some of its customer support agents were allegedly bribed to leak user data.

The post Lawsuit against Coinbase for biometric privacy violations in Illinois appeared first on Atlas21.

-

@ 9c9d2765:16f8c2c2

2025-05-23 06:10:53

@ 9c9d2765:16f8c2c2

2025-05-23 06:10:53CHAPTER TWENTY SIX

"The streets teach you a lot. It teaches you how to survive, how to fight, how to bend the world to your will. But there’s something else it teaches you how to rise above the petty battles and claim the empire that’s rightfully yours."

Just then, the door opened again, and Charles entered, his usual calm demeanor replaced with a rare air of urgency.

"James," he said, his voice serious. "There’s something you need to know. The press is getting more aggressive. They’ve caught wind of your plans, and they’re pushing for an exclusive interview. They want the story of how you rose from nothing to everything. It’s becoming a media frenzy."

James didn’t flinch. His eyes remained steady as he absorbed the news.

"Let them come," he said. "They can write whatever they want. Let the world see how I turned my destiny around. But they’ll never write the full story. They’ll never know the price I paid to get here."

Charles raised an eyebrow, impressed by James’s unshakable resolve. "And what about Mark and Helen?"

James’s expression darkened, the calm facade cracking just enough to reveal the fire beneath. "They’ll face the consequences of their actions. And I’ll make sure they do."

Rita stepped forward, her tone soft yet firm. "But there’s still a part of you that wants more than just their downfall. You want to rebuild this company, don’t you?"

James glanced at her, his eyes hardening.

"Rebuilding is just the beginning," he replied. "I didn’t fight for what’s mine just to watch it crumble. JP Enterprises will become something greater. Something unbreakable. A legacy that no one can touch, no one can tarnish."

The sound of footsteps echoed through the hallway, and moments later, Mrs. JP entered the room. There was a subtle weight in her posture, but also a sense of pride in her eyes.

"You’ve handled this situation with strength and wisdom, James," she said, her voice full of warmth. "Your father and I could never be prouder. You’ve surpassed every expectation we ever had."

James met her gaze and nodded. "Thank you. But this isn’t just about your approval. It’s about proving to myself in the world that I’m not the man I was before. I’m the man I’ve chosen to be."

Mrs. JP smiled, her eyes softening. "And you’ve become that man with grace. You’ve earned everything that’s come your way."

James’s gaze lingered for a moment before he spoke again. "It’s not over yet. There’s still work to be done. We have to ensure that JP Enterprises remains strong, remains untouchable. This is just the first step."

Charles exchanged a knowing look with Rita, then turned back to James. "We’re with you, every step of the way."

The room fell into a brief, heavy silence. Outside, the city continued to hum, indifferent to the dramatic shifts taking place within the walls of JP Enterprises. But James knew that the storm was far from over. He had won the battle, but the war was only just beginning.

As he looked around at the people who now stood by him, he realized that this victory was more than just personal; it was a turning point for the entire legacy of the JP name.

"James, how does it feel to be the talk of an entire city?" Charles asked, leaning against the polished oak desk in James’s expansive office.

James stood by the window, his hands clasped behind his back, watching the sun descend beyond the city skyline. The room was silent for a moment, filled only with the distant hum of the city below.

"It feels... inevitable," James replied, his tone calm but layered with meaning. "People always talk when someone they counted out rewrites the rules of the game."

Charles chuckled lightly, walking over to pour himself a glass of water. "Well, you haven’t just rewritten the rules, James. You’ve rewritten the entire playbook."

James turned, a shadow of a smile on his face. "And yet, some still believe they can undermine me. Manipulate the truth. Twist it until the entire narrative collapses."

Just then, Rita entered, holding a folder tightly in her hands. There was tension in her posture, controlled, but evident.

"You need to see this," she said, handing James the folder. "It's an internal memo that was intercepted. Apparently, Mark and Helen aren’t done. They’ve secured a secret meeting with a major competitor Wellington Holdings."

James flipped through the documents, his eyes narrowing. "Wellington? So, they’ve moved from sabotage to outright betrayal.

"They’re desperate," Rita added. "Their reputations are in ruins, and with the public backlash after the failed stunt at the anniversary, they’re looking for anything to reclaim their influence."

James’s jaw tightened. "Let them try. I’ve weathered storms far greater than the games of disgraced traitors."

Rita hesitated before continuing. "There’s more. Tracy’s gone quiet. She’s removed all traces of her involvement. But I have reason to believe she’s still communicating with Helen... through an encrypted channel."

James closed the folder and walked slowly to his desk. His movements were deliberate, filled with the confidence of someone who had faced betrayal before and emerged stronger.

"Then it’s time we end this," he said. "Not with anger. Not with revenge. But with undeniable, irreversible justice."

He looked up at Charles and Rita. "I want full surveillance on Wellington. Legal is to prepare a formal complaint if they attempt to interfere with any JP enterprise contract. And I want every associate of Mark and Helen cross-checked. If there’s even a whisper of conspiracy, I want it recorded."

Charles nodded. "Consider it done. We’ll strike with precision."

As they left the room to carry out their tasks, James sat behind his desk, momentarily still. His mind drifted to the days when he had nothing, no name, no wealth, no influence. How far he had come. And yet, how familiar the shadows still felt.

Later that evening, as the city lights glowed brighter, a new headline took over the news:

“JP Enterprises President Set to Announce Major Expansion, Exclusive Projects to Redefine the City’s Economic Landscape.”

It wasn’t about the slander anymore. It wasn’t about revenge. It was about legacy.

The silence in Mark’s penthouse was nearly deafening. Once a space of elite grandeur and sophisticated indulgence, it now felt hollow like the echo of a reputation lost. Mark sat slouched on his couch, the flickering television casting shadows across his unshaven face. He clenched a glass of scotch, half-empty, its contents trembling ever so slightly with each beat of his agitated heart.

The news was relentless. Story after story painted him in a less-than-flattering light. What had once been a carefully crafted image of charm and corporate poise had been shredded by public disgrace. And now, the city wasn’t just ignoring him, they were laughing at him.

“This can’t be it,” he muttered under his breath, his voice raspy. “It can’t end like this.”

Just then, Helen burst into the room. Her heels clicked loudly on the marble floor, a sharp contrast to the dull haze Mark had wrapped himself in. She threw a tabloid magazine onto the coffee table. The headline screamed at them:

“Ray Empire Architect of Scandal: Helen Ray and Ex-Exec Mark Linked to Fraud, Defamation and Bribery.”

-

@ dfc7c785:4c3c6174

2025-05-23 09:42:37

@ dfc7c785:4c3c6174

2025-05-23 09:42:37Where do I even start? Sometimes it's best to just begin writing whatever comes into your head. What do I do for a living? It used to be easy to explain, I write JavaScript, I build front-end code, in order to build apps. I am more than that though. Over the past eight years, I moved from writing Angular, to React and then to Vue. However my background was originally in writing full-stack projects, using technologies such as .NET and PHP. The thing is - the various jobs I've had recently have pigeon-holed me as front-end developer but nowadays I am starting to feel distracted by a multitude of other interesting, pivotal technologies both in my "day job" and across my wider experience as a Technologist; a phrase I prefer to use in order to describe who I am, more gernerally.

I have used untype.app to write this today, it looks great.

More to come...

-

@ 9ca447d2:fbf5a36d

2025-05-23 06:01:38

@ 9ca447d2:fbf5a36d

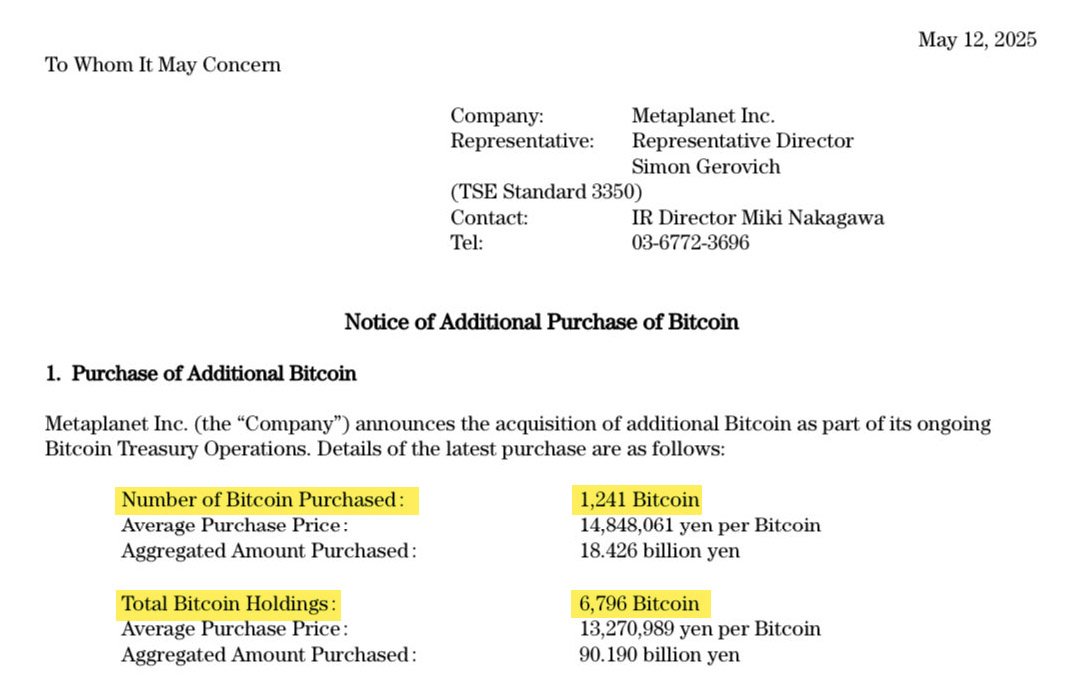

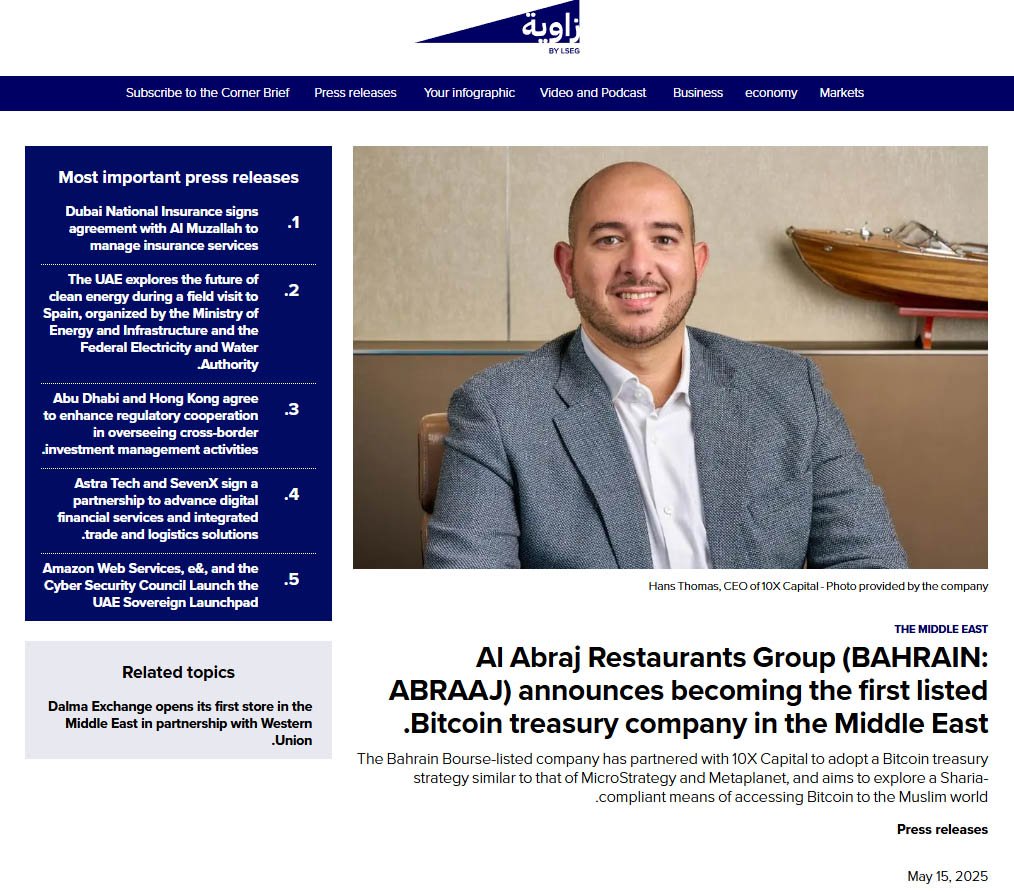

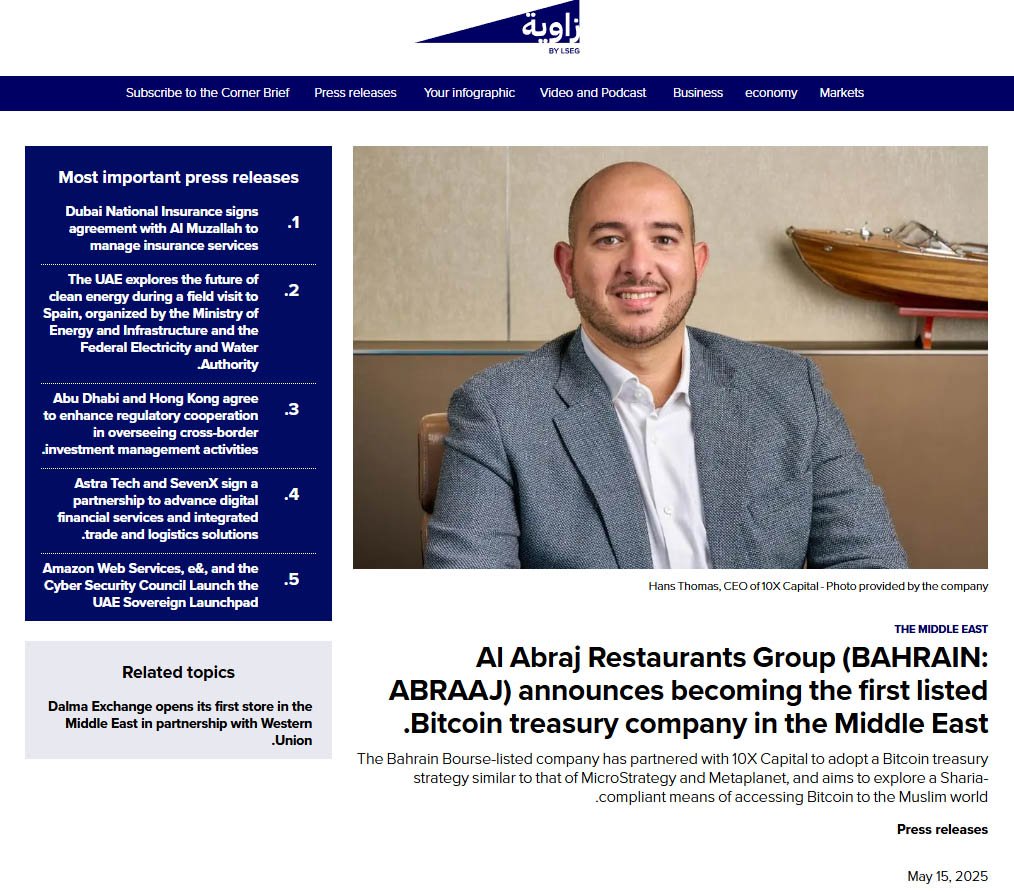

2025-05-23 06:01:38Tokyo-listed investment firm Metaplanet has officially surpassed El Salvador in bitcoin holdings after its biggest-ever single purchase of the scarce digital asset.

On May 12, 2025, the company announced it had bought 1,241 Bitcoin (BTC) for approximately $123.8 million, or ¥18.4 billion. The average price per coin was about $102,111, marking the firm’s largest purchase to date.

This latest buy brings Metaplanet’s total bitcoin reserves to 6,796 BTC, worth over $700 million.

Metaplanet on X

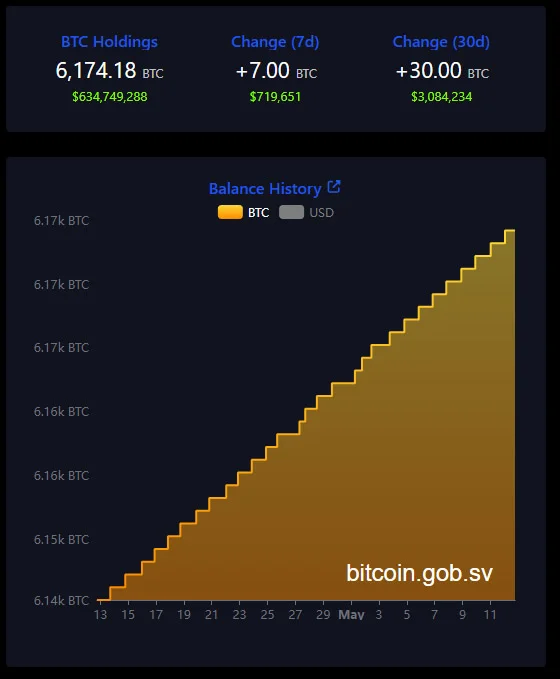

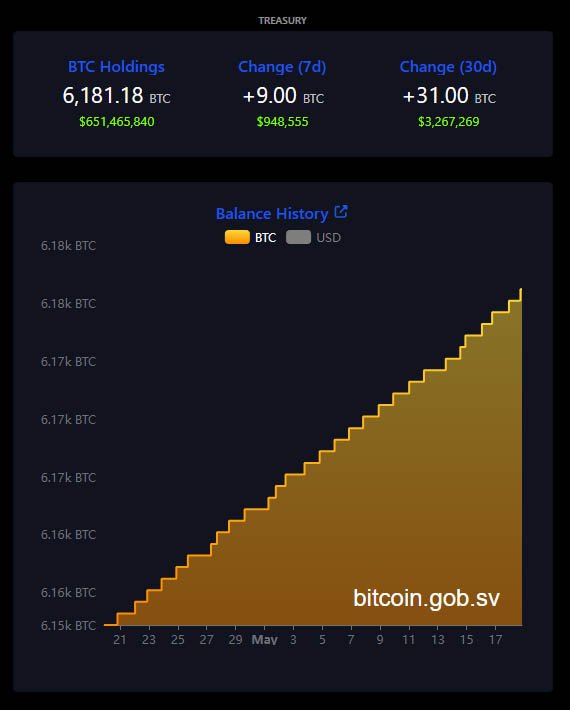

That puts Metaplanet ahead of El Salvador, the Central American nation that made headlines in 2021 for adopting bitcoin as legal tender. According to its National Bitcoin Office, El Salvador currently holds 6,174 BTC, worth roughly $642 million.

El Salvador bitcoin holdings — bitcoin.gob.sv

“Metaplanet now holds more bitcoin than El Salvador. From humble beginnings to rivaling nation-states, we’re just getting started,” said CEO Simon Gerovich on X after the company’s announcement.

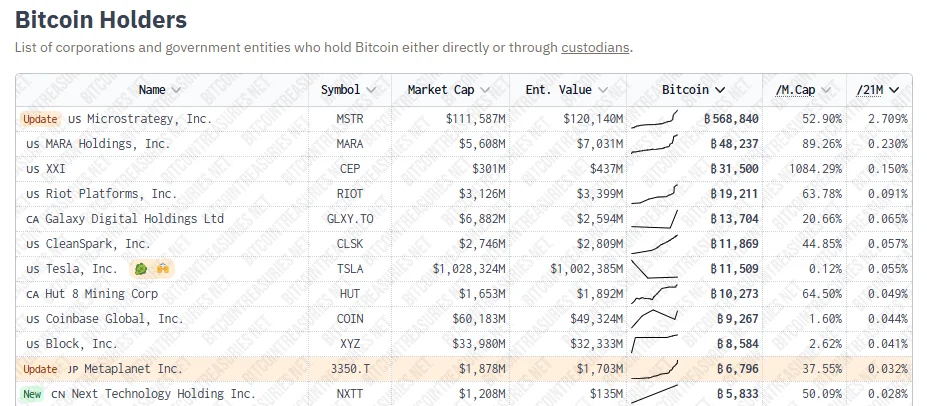

The Japanese investment company started its bitcoin treasury strategy in April 2024 and has become the largest corporate holder of bitcoin in Asia and 11th globally. It aims to hold 10,000 BTC by the end of 2025.

Metaplanet is now the 11th largest corporate holder of bitcoin — BitcoinTreasuries

To fund these purchases, the firm has turned to bond issuances, including zero-percent bonds. In early May, Metaplanet issued $25 million worth of 0% bonds under its EVO FUND program to finance bitcoin buys without diluting shares or taking on traditional debt.

And Metaplanet’s strategy seems to be working. Its BTC Yield — a proprietary metric that measures bitcoin accumulation per share — is 38% for Q2 2025 so far. In previous quarters, the firm reported 95.6% in Q1 and a whopping 309.8% in Q4 2024.

The stock price has also gone up 1,800% since May 2024 and 51% in 2025 alone, currently trading above 550 JPY.

Metaplanet is often called “Japan’s MicroStrategy”, a reference to the U.S.-based company Strategy (formerly MicroStrategy) led by Bitcoin advocate Michael Saylor. Strategy is the world’s largest corporate bitcoin holder with over 568,840 BTC in its coffers, worth more than $58 billion.

Like Strategy, Metaplanet is using creative financing tools such as convertible bonds and non-dilutive bond issuance to build a big bitcoin treasury. These financial instruments give the company the ability to fund further bitcoin purchases without diluting shareholders’ value.

Metaplanet is buying bitcoin very rapidly. This has become a trend in the corporate world, where private companies are challenging nation-states in the digital asset space.

Unlike governments which face regulatory and political hurdles, corporations like Metaplanet can move quickly and decisively. Since 2020 over 80 publicly traded companies have collectively bought more than 632,000 BTC worth over $65 billion.

This is a fundamental shift in how companies manage their treasuries — moving away from cash or bonds and towards the digital scarcity that bitcoin presents.

This creates a new form of financial power where corporations can hold a significant portion of a finite asset, unlike fiat currencies which governments can print to infinity.

-

@ cae03c48:2a7d6671

2025-05-23 10:00:57

@ cae03c48:2a7d6671

2025-05-23 10:00:57Bitcoin Magazine

H100 Group Became The First Publicly Listed Bitcoin Treasury Company In SwedenH100 Group AB has announced it has become Sweden’s first publicly listed health technology company to adopt Bitcoin as a treasury reserve asset, announcing the purchase of 4.39 BTC for 5 million NOK (approximately $475,000) as part of its long-term Bitcoin Treasury Strategy.

The Stockholm-based company, which provides AI-powered automation and digital solutions for healthcare providers, joins a growing roster of public companies adding Bitcoin to their balance sheets in 2025. The purchase was executed at an average price of 1,138,737 NOK per Bitcoin (roughly $108,200).

JUST IN:

H100 Group buys 4.39 BTC and becomes Sweden's first publicly listed #Bitcoin treasury company. pic.twitter.com/pNXe9XT2a7

H100 Group buys 4.39 BTC and becomes Sweden's first publicly listed #Bitcoin treasury company. pic.twitter.com/pNXe9XT2a7— Bitcoin Magazine (@BitcoinMagazine) May 22, 2025

“This addition to H100’s Bitcoin Treasury Strategy follows an increasing number of tech-oriented growth companies holding Bitcoin on their balance sheet,” said CEO Sander Andersen. “And I believe the values of individual sovereignty highly present in the Bitcoin community aligns well with, and will appeal to, the customers and communities we are building the H100 platform for.”

The move comes amid a surge in corporate Bitcoin adoption, with many public companies announcing Bitcoin treasury programs in the first five months of 2025. Notable recent entrants include Twenty One Capital, Strive and several others.

H100 Group emphasized that the Bitcoin purchase does not affect its core operations in the health and longevity industry. The company views the investment as a strategic deployment of excess liquidity to strengthen its financial position while aligning with its values of individual sovereignty.

The announcement reflects a broader shift in corporate treasury management, as companies seek to diversify their holdings beyond traditional cash reserves.

At press time, Bitcoin trades at $111,108, up 1.28% over the past 24 hours, as institutional adoption continues to drive market momentum. H100 Group’s shares closed up 1.37% at 0.89 SEK on the NGM Nordic SME exchange following the announcement.

This post H100 Group Became The First Publicly Listed Bitcoin Treasury Company In Sweden first appeared on Bitcoin Magazine and is written by Vivek Sen.

-

@ 58537364:705b4b85

2025-05-23 05:46:31

@ 58537364:705b4b85

2025-05-23 05:46:31“สุขเวทนา” ที่แท้ก็คือ “มายา”

เป็นเหมือนลูกคลื่นลูกหนึ่ง

ที่เกิดขึ้นเพราะน้ำถูกลมพัด

เดี๋ยวมันก็แตกกระจายไป

หากต้องการจะมีชีวิตอย่างเกษมแล้ว

ก็ต้องอาศัยความรู้เรื่อง อนิจจัง ทุกขัง อนัตตา ให้สมบูรณ์

มันจะต่อต้านกันได้กับอารมณ์ คือ รูป เสียง กลิ่น รส สัมผัส ที่มากระทบ

ไม่ให้ไปหลงรัก หรือหลงเกลียดเรื่องวุ่นวายมีอยู่ ๒ อย่างเท่านั้น

- ไปหลงรัก อย่างหนึ่ง

- ไปหลงเกลียด อย่างหนึ่ง

ซึ่งเป็นเหตุให้หัวเราะและต้องร้องไห้

ถ้าใครมองเห็นว่า หัวเราะก็กระหืดกระหอบ มันเหนื่อยเหมือนกัน

ร้องไห้ก็กระหืดกระหอบ เหมือนกัน

สู้อยู่เฉย ๆ ดีกว่า อย่าต้องหัวเราะ อย่าต้องร้องไห้

นี่แหละ! มันเป็นความเกษมเราอย่าได้ตกไปเป็นทาสของอารมณ์

จนไปหัวเราะหรือร้องไห้ตามที่อารมณ์มายั่ว

เราเป็นอิสระแก่ตัว หยุดอยู่ หรือเกษมอยู่อย่างนี้ดีกว่า

ใช้ อนิจจัง ทุกขัง อนัตตา เป็นเครื่องมือกำกับชีวิต

- รูป เสียง กลิ่น รส สัมผัส เป็น มายา เป็น illusion

- "ตัวกู-ของกู" ก็เป็น illusion

- เพราะ "ตัวกู-ของกู" มันเกิดมาจากอารมณ์

- "ตัวกู-ของกู" เป็นมายา อารมณ์ทั้งหลายก็เป็นมายา

เห็นได้ด้วยหลัก อนิจจัง ทุกขัง อนัตตา

...ความทุกข์ก็ไม่เกิด

เราจะตัดลัดมองไปดูสิ่งที่เป็น “สุขเวทนา”

สุขเวทนา คือ ความสุขสนุกสนาน เอร็ดอร่อย

ที่เป็นสุขนั้นเรียกว่า “สุขเวทนา”แต่สุขเวทนา เป็นมายา

เพราะมันเป็นเหมือนลูกคลื่นที่เกิดขึ้นเป็นคราว ๆ

ไม่ใช่ตัวจริงอะไรที่พูดดังนี้ก็เพราะว่า

ในบรรดาสิ่งทั้งปวงในโลกทั้งหมดทุกโลก

ไม่ว่าโลกไหน มันมีค่าอยู่ก็ตรงที่ให้เกิดสุขเวทนาลองคิดดูให้ดีว่า...

- ท่านศึกษาเล่าเรียนทำไม?

- ท่านประกอบอาชีพ หน้าที่การงานทำไม?

- ท่านสะสมทรัพย์สมบัติ เกียรติยศ ชื่อเสียง พวกพ้องบริวารทำไม?มันก็เพื่อสุขเวทนาอย่างเดียว

เพราะฉะนั้น แปลว่า อะไร ๆ มันก็มารวมจุดอยู่ที่สุขเวทนาหมดฉะนั้น ถ้าเรามีความรู้ในเรื่องนี้

จัดการกับเรื่องนี้ให้ถูกต้องเพียงเรื่องเดียวเท่านั้น

ทุกเรื่องมันถูกหมดเพราะฉะนั้น จึงต้องดูสุขเวทนาให้ถูกต้องตามที่เป็นจริงว่า

มันก็เป็น “มายา” ชนิดหนึ่งเราจะต้องจัดการให้สมกันกับที่มันเป็นมายา

ไม่ใช่ว่า จะต้องไปตั้งข้อรังเกียจ เกลียดชังมัน

อย่างนั้นมันยิ่ง บ้าบอที่สุดถ้าเข้าไปหลงรัก หลงเป็นทาสมัน

ก็เป็นเรื่อง บ้าบอที่สุดแต่ว่าไปจัดการกับมันอย่างไรให้ถูกต้อง

นั้นแหละเป็นธรรมะ

เป็น ลูกศิษย์ของพระพุทธเจ้า

ที่จะเอาชนะความทุกข์ได้ และไม่ต้องเป็น โรคทางวิญญาณ

สุขเวทนา ที่แท้ก็คือ มายา

มันก็ต้องทำโดยวิธีที่พิจารณาให้เห็นว่า

“สุขเวทนา” นี้ ที่แท้ก็คือ “มายา”เป็นเหมือน ลูกคลื่นลูกหนึ่ง

ที่เกิดขึ้นเพราะ น้ำถูกลมพัดหมายความว่า

เมื่อ รูป เสียง กลิ่น รส ฯ เข้ามา

แล้ว ความโง่ คือ อวิชชา โมหะ ออกรับ

กระทบกันแล้วเป็นคลื่นกล่าวคือ สุขเวทนาเกิดขึ้นมา

แต่ เดี๋ยวมันก็แตกกระจายไป

ถ้ามองเห็นอย่างนี้แล้ว

เราก็ไม่เป็นทาสของสุขเวทนา

เราสามารถ ควบคุม จะจัด จะทำกับมันได้

ในวิธีที่ ไม่เป็นทุกข์- ตัวเองก็ไม่เป็นทุกข์

- ครอบครัวก็ไม่เป็นทุกข์

- เพื่อนบ้านก็ไม่เป็นทุกข์

- คนทั้งโลกก็ไม่พลอยเป็นทุกข์

เพราะมีเราเป็นมูลเหตุ

ถ้าทุกคนเป็นอย่างนี้

โลกนี้ก็มีสันติภาพถาวร

เป็นความสุขที่แท้จริงและถาวรนี่คือ อานิสงส์ของการหายโรคโดยวิธีต่าง ๆ กัน

ไม่เป็นโรค “ตัวกู” ไม่เป็นโรค “ของกู”

พุทธทาสภิกขุ

ที่มา : คำบรรยายชุด “แก่นพุทธศาสน์”

ปีพุทธศักราช ๒๕๐๔

ครั้งที่ ๑

หัวข้อเรื่อง “ใจความทั้งหมดของพระพุทธศาสนา”

ณ ศิริราชพยาบาล มหาวิทยาลัยมหิดล

เมื่อวันที่ ๑๗ ธันวาคม ๒๕๐๔ -

@ 0e9491aa:ef2adadf

2025-05-23 05:01:30

@ 0e9491aa:ef2adadf

2025-05-23 05:01:30Will not live in a pod.

Will not eat the bugs.

Will not get the chip.

Will not get a blue check.

Will not use CBDCs.Live Free or Die.

Why did Elon buy twitter for $44 Billion? What value does he see in it besides the greater influence that undoubtedly comes with controlling one of the largest social platforms in the world? We do not need to speculate - he made his intentions incredibly clear in his first meeting with twitter employees after his takeover - WeChat of the West.

To those that do not appreciate freedom, the value prop is clear - WeChat is incredibly powerful and successful in China.

To those that do appreciate freedom, the concern is clear - WeChat has essentially become required to live in China, has surveillance and censorship integrated at its core, and if you are banned from the app your entire livelihood is at risk. Employment, housing, payments, travel, communication, and more become extremely difficult if WeChat censors determine you have acted out of line.

The blue check is the first step in Elon's plan to bring the chinese social credit score system to the west. Users who verify their identity are rewarded with more reach and better tools than those that do not. Verified users are the main product of Elon's twitter - an extensive database of individuals and complete control of the tools he will slowly get them to rely on - it is easier to monetize cattle than free men.

If you cannot resist the temptation of the blue check in its current form you have already lost - what comes next will be much darker. If you realize the need to resist - freedom tech provides us options.

If you found this post helpful support my work with bitcoin.

-

@ db39407c:a36c161e

2025-05-22 10:37:27

@ db39407c:a36c161e

2025-05-22 10:37:27123BET trải nghiệm giải trí online đang trở thành điểm đến lý tưởng cho cộng đồng yêu thích cá cược trực tuyến tại Việt Nam nhờ sự kết hợp giữa công nghệ hiện đại và dịch vụ người dùng xuất sắc. Với định hướng phát triển lâu dài và bền vững, 123BET không chỉ cung cấp hàng trăm trò chơi hấp dẫn từ slot game, baccarat, tài xỉu, bắn cá, roulette đến live casino mà còn tích hợp hệ thống cá cược thể thao đỉnh cao, đem lại sự đa dạng và linh hoạt trong lựa chọn giải trí cho người chơi. Giao diện website và ứng dụng được thiết kế tối ưu cho người Việt, dễ sử dụng, tốc độ mượt mà, tương thích hoàn toàn với mọi hệ điều hành như iOS, Android, Windows… chỉ với một tài khoản duy nhất, bạn có thể dễ dàng đăng nhập và tận hưởng mọi dịch vụ cá cược không giới hạn mọi lúc, mọi nơi. 123BET đặc biệt chú trọng đến tính minh bạch, khi toàn bộ trò chơi đều được chứng nhận bởi các tổ chức kiểm định quốc tế, đảm bảo công bằng tuyệt đối trong từng ván cược.

Ngoài hệ thống trò chơi phong phú, 123BET còn sở hữu nền tảng công nghệ bảo mật hàng đầu, giúp người chơi yên tâm tuyệt đối về thông tin cá nhân và giao dịch tài chính. Hệ thống thanh toán được hỗ trợ 24/7, với nhiều phương thức linh hoạt như chuyển khoản ngân hàng, ví điện tử, thẻ cào và cả mã QR, giúp người chơi dễ dàng nạp tiền và rút thưởng một cách nhanh chóng, chỉ trong vài phút. Đặc biệt, người chơi không cần thông qua bên trung gian mà hoàn toàn có thể giao dịch trực tiếp trên nền tảng với độ an toàn cao, hạn chế tối đa rủi ro bị lộ thông tin hoặc lừa đảo. Đội ngũ kỹ thuật và chăm sóc khách hàng của 123BET hoạt động chuyên nghiệp, tận tâm, hỗ trợ trực tuyến liên tục cả ngày lẫn đêm thông qua nhiều kênh như chat trực tuyến, Zalo, Telegram, Hotline. Mọi thắc mắc và sự cố kỹ thuật đều được xử lý nhanh chóng và hiệu quả, đảm bảo trải nghiệm không bị gián đoạn. Nhờ vào dịch vụ chăm sóc người chơi chuyên biệt và tận tâm, 123BET ngày càng khẳng định vị thế dẫn đầu của mình trên thị trường cá cược trực tuyến Việt Nam.

Không dừng lại ở đó, 123BET còn liên tục triển khai các chương trình khuyến mãi hấp dẫn nhằm tri ân người chơi mới và gắn bó lâu dài. Ngay từ khi đăng ký tài khoản, người chơi sẽ nhận được nhiều phần thưởng hấp dẫn như tiền cược miễn phí, vòng quay may mắn và các mã thưởng nạp đầu giá trị. Ngoài ra, chương trình VIP của 123BET được xây dựng theo mô hình tích điểm nâng hạng với các cấp bậc từ Thành viên, Bạc, Vàng cho đến Kim Cương – mỗi cấp đều đi kèm các đặc quyền riêng như hoàn tiền cược hàng tuần, tỷ lệ nạp cao hơn, rút tiền nhanh hơn và được ưu tiên hỗ trợ riêng biệt. Những sự kiện hot theo tháng, các giải đấu nội bộ cũng được tổ chức thường xuyên với phần thưởng tiền mặt, điện thoại, xe máy hoặc các phần quà có giá trị khác, giúp người chơi luôn có cảm hứng mới khi tham gia. Với định hướng không ngừng đổi mới và lấy người dùng làm trung tâm, 123BET trải nghiệm giải trí online không chỉ là một nhà cái, mà còn là người đồng hành đáng tin cậy trong hành trình giải trí và kiếm thưởng của hàng triệu người Việt mỗi ngày.

-

@ fbf0e434:e1be6a39

2025-05-22 06:52:22

@ fbf0e434:e1be6a39

2025-05-22 06:52:22Hackathon 概要

AI BUIDL Lab: 基于提示工程(Prompt Engineering)在 Rootstock 上构建真实 Web3 应用的黑客松 近日收官,共有 211 名开发者注册并提交 22 个项目。本次活动旨在鼓励开发者借助 AI 驱动的工作流程,在 Rootstock 平台开发 Web3 应用。参与者聚焦三大领域:去中心化金融(DeFi)与支付、商业与零工经济,以及 Web3 身份与声誉体系,通过 AI 技术加速去中心化应用(dApps)的创新迭代。

活动产出丰硕成果,包括去中心化金融解决方案、AI 增强型身份管理系统等,凸显了 AI 与 Web3 集成的潜力。赛事奖金池包含 1.5 万美元的 RIF 代币,用于奖励在创意性和技术执行力方面表现突出的顶尖项目。

本次黑客松不仅印证了 AI 在简化去中心化应用开发中的价值,也展现了 Web3 生态系统的进阶成果。活动与 thirdweb、Alchemy 及 RootstockLabs 的合作,为开发者高效参与及产出创新项目提供了有力支持。

Hackathon 获奖者

DeFi 和支付奖项得主

- ProtectedPay_Rootstock:一个在 CrossFi 链上的 DeFi 平台,通过先进的区块链功能促进安全转账、群体支付和智能储蓄。

- AIFi: AI-Powered DeFi Hub on Rootstock:利用 AI 提供汇款、信用评分和用户界面改善,提高拉丁美洲的金融可访问性。

商业和零工经济奖项得主

Web3 中的身份和声誉奖项得主

- AgenticID:提供自我主权身份验证,结合区块链和 AI,使用零知识证明进行安全的用户认证。

- TrustScan:使用 AI 分析 Rootstock 上的钱包活动,生成信誉和身份评分,加强信任。

赏金最佳 AI 提示使用

- AuditFi_Rootstock:提供 AI 驱动的智能合约安全审计,通过链上验证增强透明度和信任。

- RSK Smart Yield Engine:一个 AI 驱动的 DeFi 协议收益优化器,通过智能合约和 AI 管理资金和制定策略。

有关所有项目的更多信息,请访问 DoraHacks。

关于组织者

Rootstock

Rootstock - 比特币 DeFi 层 - 专注于将比特币强大的网络与以太坊的智能合约功能相结合,提升区块链的互操作性。Rootstock 以技术专长著称,已经创建了一个支持去中心化金融应用的平台。该组织致力于通过扩展在金融服务中智能合约的可访问性和功能性来推动区块链领域的创新。

-

@ 0e9491aa:ef2adadf

2025-05-23 05:01:29

@ 0e9491aa:ef2adadf

2025-05-23 05:01:29

Humanity's Natural State Is Chaos

Without order there is chaos. Humans competing with each other for scarce resources naturally leads to conflict until one group achieves significant power and instates a "monopoly on violence."Power Brings Stability

Power has always been the key means to achieve stability in societies. Centralized power can be incredibly effective in addressing issues such as crime, poverty, and social unrest efficiently. Unfortunately this power is often abused and corrupted.Centralized Power Breeds Tyranny

Centralized power often leads to tyrannical rule. When a select few individuals hold control over a society, they tend to become corrupted. Centralized power structures often lack accountability and transparency, and rely too heavily on trust.Distributed Power Cultivates Freedom

New technology that empowers individuals provide us the ability to rebuild societies from the bottom up. Strong individuals that can defend and provide for themselves will help build strong local communities on a similar foundation. The result is power being distributed throughout society rather than held by a select few.In the short term, relying on trust and centralized power is an easy answer to mitigating chaos, but freedom tech tools provide us the ability to build on top of much stronger distributed foundations that provide stability while also cultivating individual freedom.

The solution starts with us. Empower yourself. Empower others. A grassroots freedom tech movement scaling one person at a time.

If you found this post helpful support my work with bitcoin.

-

@ fbf0e434:e1be6a39

2025-05-22 06:41:25

@ fbf0e434:e1be6a39

2025-05-22 06:41:25Hackathon 概要

JAMHacks 9 于 2025 年 5 月 16 日至 18 日在滑铁卢大学举办。作为 JAMHacks 系列的第九届黑客松,该活动汇聚了 170 名高中黑客爱好者,最终评审通过 49 个项目,充分彰显了年轻开发者的技术实力。此次黑客松旨在为高中生打造培育成长的平台,搭配工作坊与互动活动,助力提升技术能力并拓展社交网络。

参与者带来了丰富的项目成果:基于 Pico-8 的创意开发、运用 MongoDB Atlas 的创新应用,以及展示新兴技术应用的生成式 AI 模型项目。活动设置多个奖项类别,包括最佳新手项目、最佳开发者工具、生成式 AI 最佳应用等。奖品涵盖智能手表、无人机、QuillBot 连帽衫,以及其他黑客松的参赛资格。

除技术成果外,JAMHacks 9 同样注重营造趣味互动体验,特别举办扑克之夜、社交派对等活动。此次黑客松成功为年轻开发者搭建了技能提升、创意孵化与专业联结的平台,切实践行其推动科技行业包容性与可及性的愿景。

Hackathon 获奖者

总奖项获奖者

- Mr. Goose:一个有趣的VS Code扩展,为初学者提供提示和鼓励,促进学习而不直接解决问题。

- Guideline:一个基于AR的工具,通过增强现实引导初学电子爱好者进行面包板组装。

- ARmatica:将2D硬件示意图转换为3D AR模型,通过改进可视化增强工程和原型设计过程。

初学者赛道奖项获奖者

- Duedle:一个任务管理应用,利用AI将大型任务分解为可管理的小任务,并提供进度跟踪以提高生产力。

单人赛道奖项获奖者

- Lofied:一个Python应用程序,将Spotify播放列表变为lo-fi版本,具有音乐分离和乐谱生成功能。

女性赛道奖项获奖者

- Doomlings:结合游戏化和教育任务,通过战斗游戏界面提高学生的学习和参与。

Warp 赛道奖项获奖者

Hack Canada 赛道奖项获奖者

- Dionysus:一个用于组织协作活动和参与的平台,提供实时活动管理的统一界面。

MLH 赛道奖项获奖者

- Karma:一个记录和分享积极行动的社交平台,促进自我提升和环境保护,以鼓励社区参与。

- helpidontknowhowtonetworkin.tech:一个使用面部识别和LinkedIn数据的AI驱动网络助手,帮助在活动中建立专业联系。

- SnapCAD:从图像或图纸生成可定制的3D模型,简化工程项目的集成。

PEX Labs 奖项获奖者

- Arctic Explorer:一个Pico-8开放世界游戏,通过探索北极环境促进可持续实践,可以扩展附加小游戏和地图。

查看所有项目 JAMHacks 9。

关于组织者

JAMHacks

JAMHacks 在科技和区块链领域因促进技术爱好者之间的创新与合作而备受认可。该组织擅长举办Hackathon,为开发现实世界挑战的实际解决方案提供了一个平台。JAMHacks 聚焦于技术赋权,已组织多场活动,吸引了来自不同背景的参与者。他们的倡议强调技术技能发展和网络拓展,充分体现了他们致力于推进技术教育和培养一个包容的社区,为有抱负的技术人员和开发者服务。

-

@ 2a7cc007:ce0cc497

2025-05-22 06:41:14

@ 2a7cc007:ce0cc497

2025-05-22 06:41:14A era digital transformou completamente a forma como as pessoas se divertem, e a plataforma 5542 é um exemplo claro dessa evolução. Com uma proposta inovadora, acessível e repleta de possibilidades, a 5542 vem conquistando milhares de usuários brasileiros que buscam entretenimento seguro, moderno e de alta qualidade.

Desde o primeiro acesso, a 5542 impressiona pela interface intuitiva e pelo seu desempenho fluido tanto em computadores quanto em dispositivos móveis. Isso garante uma experiência agradável para todos os perfis de usuários, desde os mais experientes até os iniciantes no mundo dos jogos online.

Variedade que Encanta Um dos grandes destaques da 5542 é sua ampla gama de opções de jogos. A plataforma oferece títulos que agradam a diferentes gostos e estilos, desde clássicos consagrados até novidades empolgantes. Todos os jogos são desenvolvidos por fornecedores reconhecidos internacionalmente, garantindo gráficos de alta qualidade, trilhas sonoras envolventes e mecânicas de jogo equilibradas.

Jogos de cartas, roletas, slots e modalidades ao vivo com interação em tempo real são apenas alguns dos destaques que fazem parte do portfólio da 5542. Essa diversidade é um dos motivos pelos quais a plataforma se mantém em constante crescimento e atrai cada vez mais usuários em todo o Brasil.

Segurança e Confiabilidade A segurança é um fator primordial na escolha de uma plataforma de entretenimento online, e a 5542 leva isso muito a sério. O site utiliza tecnologia de criptografia de ponta para proteger os dados pessoais e financeiros dos usuários, além de contar com um sistema rigoroso de verificação de identidade, garantindo um ambiente confiável e livre de fraudes.

Além disso, a 5542 é comprometida com o jogo responsável, oferecendo ferramentas para que os usuários possam definir limites de tempo e de gastos. Essa abordagem mostra o compromisso da plataforma com o bem-estar dos seus participantes.

Promoções e Bônus Atrativos Outro diferencial da 5542 são suas promoções constantes e bônus generosos. Desde o momento do cadastro, os usuários já são recebidos com vantagens especiais, como bônus de boas-vindas e giros grátis em jogos selecionados. A plataforma também realiza campanhas temáticas e sorteios com prêmios reais, tornando a experiência ainda mais envolvente e recompensadora.

Essas promoções são atualizadas com frequência e muitas vezes incluem eventos sazonais, o que incentiva os jogadores a retornarem sempre e aproveitarem novas oportunidades.

Suporte de Qualidade e Atendimento em Português Um ponto que merece destaque é o suporte ao cliente da 5542. Disponível em português e com atendimento 24 horas por dia, a equipe está sempre pronta para ajudar os usuários com dúvidas, problemas técnicos ou qualquer necessidade. Esse suporte eficiente e humanizado faz toda a diferença, especialmente para quem está começando.

Conclusão A plataforma 5542 se estabelece como uma das líderes no mercado de entretenimento digital no Brasil. Sua combinação de tecnologia de ponta, variedade de jogos, promoções generosas e compromisso com a segurança oferece uma experiência completa para quem busca diversão online com praticidade e confiabilidade.

Se você está em busca de uma plataforma moderna, segura e cheia de opções envolventes, a 5542 é a escolha certa. Explore, jogue e aproveite uma nova forma de se divertir, tudo isso sem sair de casa.

-

@ 8bad92c3:ca714aa5

2025-05-23 04:01:08

@ 8bad92c3:ca714aa5

2025-05-23 04:01:08

I've pulled together the most compelling forward-looking predictions from our recent podcast conversations. These insights highlight where our guests see opportunities and challenges in the Bitcoin ecosystem, energy markets, and beyond.

AI Agents Will Drive Bitcoin Adoption More Than Human Users by 2030 - Andrew Myers

Andrew Myers described how the artificial intelligence revolution will fundamentally transform Bitcoin usage patterns over the next few years. He highlighted Paul's tweet that suggested machine-to-machine transactions using Bitcoin will soon dominate the network.

"We talk about Bitcoin being used as a medium of exchange. We're going to find that the machines are doing most of that exchange at some point relatively soon," Andrew explained. "The agents using Bitcoin to complete tasks using something like L4 or two protocol is going to far surpass the amount of transactions that humans are doing to do things in their everyday lives."

Andrew believes AI agents will naturally gravitate toward Bitcoin because it's more energy-efficient from a computational perspective than traditional payment rails. As AI systems optimize for energy efficiency, Bitcoin's direct settlement mechanism becomes increasingly attractive compared to legacy financial infrastructure. This shift could accelerate Bitcoin adoption in ways we haven't fully anticipated, creating a new category of machine-driven demand.

CalPERS Funding Status Will Drop Below 70% by June 2025 - Dom Bei

Dom Bei, who's running for the Board of Trustees at CalPERS, made a concerning prediction about America's largest public pension fund. Currently sitting at approximately 75% funded, Dom warned the situation could deteriorate further after recent tariff-related markdowns.

"They say that the fund had a $26 billion markdown, which if my math is correct, would bring the fund closer towards the 70% funded number," Dom explained. He noted the fund needs to recover these losses before the June 30, 2025 reporting deadline, or face serious consequences.

If CalPERS funding status drops below 70%, Dom predicts a familiar pattern will unfold: municipalities and taxpayers will face higher contribution rates to cover the shortfall, diverting money from essential services like parks, schools, and public safety. This would likely trigger another round of pension reform debates targeting worker benefits, despite similar reforms in 2013 failing to address the fundamental performance issues plaguing the fund.

Energy Companies Will Incorporate Bitcoin Into Settlements Within 3 Years - Andrew Myers

Andrew Myers outlined a compelling vision for Bitcoin's integration into energy markets, predicting that by 2027 (block 1,050,000), we'll see widespread adoption of Bitcoin for energy transactions and settlements. He described his company's mission as enabling "every electric power company to use bitcoin by block 1,050,000."

"Our mantra for Bitcoin is fast, accurate, transparent energy transactions," Andrew explained. He highlighted several inefficiencies in current energy markets that Bitcoin could solve, including: Information asymmetry between energy buyers and sellers. Slow 30-day billing cycles creating unnecessary credit risk

Capital locked up in prepayments, deposits, and collateral requirements.Andrew revealed that his team has already prototyped a Bitcoin collateral product and that a major energy company in Texas is currently building similar functionality. He predicts these early implementations will demonstrate Bitcoin's potential to unlock billions in working capital across the energy sector through faster settlement and reduced collateral requirements.

Most significantly, Andrew mentioned early discussions with independent system operators about modifying power market protocols to incorporate Bitcoin as an alternative settlement mechanism alongside the US dollar.

Blockspace conducts cutting-edge proprietary research for investors.

Bitcoin Miners Face Hard Choices as AI Data Centers Pick Prime Locations

Bitcoin miners hoping to cash in on the AI boom by selling their facilities to hyperscalers are finding fewer opportunities than expected. With mining economics dimming and specific buyer requirements limiting potential deals, the industry faces significant challenges.

Christian Lopez, Head of Blockchain and Digital Assets at Cohen and Company Capital Markets, notes a "glut of bitcoin mines" currently on the market. While miners control substantial power resources, hyperscalers typically demand facilities with at least 150-200 megawatts capacity within 100 miles of major cities—criteria most mining operations don't meet.

An estimated 1-1.5 gigawatts of mining capacity is available for acquisition, creating downward pressure on power prices. This oversupply stems from both deteriorating mining economics and overoptimistic AI-related expectations. The valuation gap remains a persistent obstacle: "Buyers face the critical 'buy versus build' question," Lopez explains. While buyers typically value sites at $300,000-$500,000 per megawatt plus a modest premium, sellers often seek $1.5-$2 million per megawatt based on public company valuations.

Adding to these challenges, retrofitting mining sites for high-performance computing often requires completely reconstructing the power infrastructure rather than leveraging existing setups. Despite current difficulties, industry sentiment remains cautiously optimistic, with many experts predicting Bitcoin could reach $125,000-$200,000 by late 2025.

Subscribe to them here (seriously, you should): https://newsletter.blockspacemedia.com/

Ten31, the largest bitcoin-focused investor, has deployed $150M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

@media screen and (max-width: 480px) { .mobile-padding { padding: 10px 0 !important; } .social-container { width: 100% !important; max-width: 260px !important; } .social-icon { padding: 0 !important; } .social-icon img { height: 32px !important; width: 32px !important; } .icon-cell { padding: 0 4px !important; } } .mj-column-per-33-333333333333336 { width: 25% !important; max-width: 25%; } .moz-text-html .mj-column-per-33-333333333333336 { width: 25% !important; max-width: 25%; } /* Helps with rendering in various email clients */ body { margin: 0 !important; padding: 0 !important; -webkit-text-size-adjust: 100% !important; -ms-text-size-adjust: 100% !important; } img { -ms-interpolation-mode: bicubic; } /* Prevents Gmail from changing the text color in email threads */ .im { color: inherit !important; }

-

@ 8bad92c3:ca714aa5

2025-05-23 03:01:01

@ 8bad92c3:ca714aa5

2025-05-23 03:01:01Marty's Bent

Last week we covered the bombshell developments in the Samourai Wallet case. For those who didn't read that, last Monday the world was made aware of the fact that the SDNY was explicitly told by FinCEN that the federal regulator did not believe that Samourai Wallet was a money services business six months before arresting the co-founders of Samourai Wallet for conspiracy to launder money and illegally operating a money services business. This was an obvious overstep by the SDNY that many believed would be quickly alleviated, especially considering the fact that the Trump administration via the Department of Justice has made it clear that they do not intend to rule via prosecution.