-

@ 9223d2fa:b57e3de7

2025-04-15 02:54:00

@ 9223d2fa:b57e3de7

2025-04-15 02:54:0012,600 steps

-

@ c066aac5:6a41a034

2025-04-05 16:58:58

@ c066aac5:6a41a034

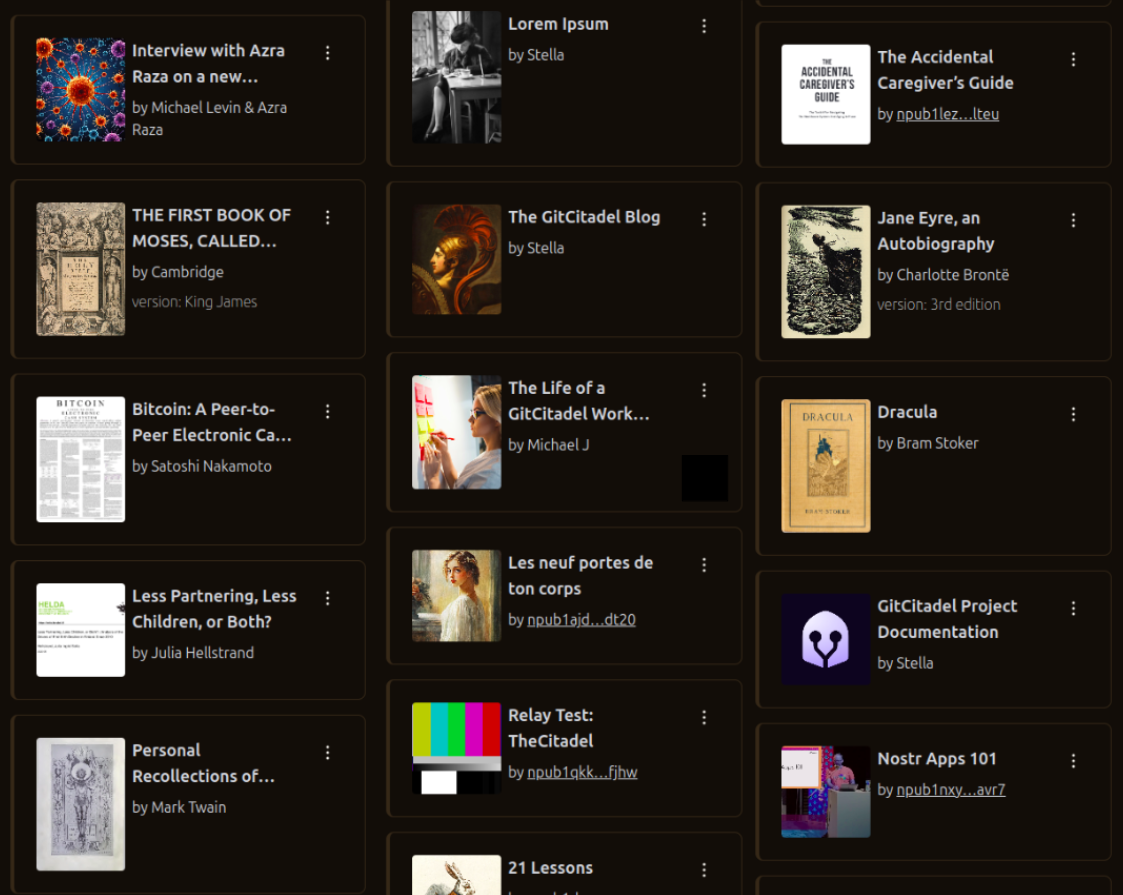

2025-04-05 16:58:58I’m drawn to extremities in art. The louder, the bolder, the more outrageous, the better. Bold art takes me out of the mundane into a whole new world where anything and everything is possible. Having grown up in the safety of the suburban midwest, I was a bit of a rebellious soul in search of the satiation that only came from the consumption of the outrageous. My inclination to find bold art draws me to NOSTR, because I believe NOSTR can be the place where the next generation of artistic pioneers go to express themselves. I also believe that as much as we are able, were should invite them to come create here.

My Background: A Small Side Story

My father was a professional gamer in the 80s, back when there was no money or glory in the avocation. He did get a bit of spotlight though after the fact: in the mid 2000’s there were a few parties making documentaries about that era of gaming as well as current arcade events (namely 2007’sChasing GhostsandThe King of Kong: A Fistful of Quarters). As a result of these documentaries, there was a revival in the arcade gaming scene. My family attended events related to the documentaries or arcade gaming and I became exposed to a lot of things I wouldn’t have been able to find. The producer ofThe King of Kong: A Fistful of Quarters had previously made a documentary calledNew York Dollwhich was centered around the life of bassist Arthur Kane. My 12 year old mind was blown: The New York Dolls were a glam-punk sensation dressed in drag. The music was from another planet. Johnny Thunders’ guitar playing was like Chuck Berry with more distortion and less filter. Later on I got to meet the Galaga record holder at the time, Phil Day, in Ottumwa Iowa. Phil is an Australian man of high intellect and good taste. He exposed me to great creators such as Nick Cave & The Bad Seeds, Shakespeare, Lou Reed, artists who created things that I had previously found inconceivable.

I believe this time period informed my current tastes and interests, but regrettably I think it also put coals on the fire of rebellion within. I stopped taking my parents and siblings seriously, the Christian faith of my family (which I now hold dearly to) seemed like a mundane sham, and I felt I couldn’t fit in with most people because of my avant-garde tastes. So I write this with the caveat that there should be a way to encourage these tastes in children without letting them walk down the wrong path. There is nothing inherently wrong with bold art, but I’d advise parents to carefully find ways to cultivate their children’s tastes without completely shutting them down and pushing them away as a result. My parents were very loving and patient during this time; I thank God for that.

With that out of the way, lets dive in to some bold artists:

Nicolas Cage: Actor

There is an excellent video by Wisecrack on Nicolas Cage that explains him better than I will, which I will linkhere. Nicolas Cage rejects the idea that good acting is tied to mere realism; all of his larger than life acting decisions are deliberate choices. When that clicked for me, I immediately realized the man is a genius. He borrows from Kabuki and German Expressionism, art forms that rely on exaggeration to get the message across. He has even created his own acting style, which he calls Nouveau Shamanic. He augments his imagination to go from acting to being. Rather than using the old hat of method acting, he transports himself to a new world mentally. The projects he chooses to partake in are based on his own interests or what he considers would be a challenge (making a bad script good for example). Thus it doesn’t matter how the end result comes out; he has already achieved his goal as an artist. Because of this and because certain directors don’t know how to use his talents, he has a noticeable amount of duds in his filmography. Dig around the duds, you’ll find some pure gold. I’d personally recommend the filmsPig, Joe, Renfield, and his Christmas film The Family Man.

Nick Cave: Songwriter

What a wild career this man has had! From the apocalyptic mayhem of his band The Birthday Party to the pensive atmosphere of his albumGhosteen, it seems like Nick Cave has tried everything. I think his secret sauce is that he’s always working. He maintains an excellent newsletter calledThe Red Hand Files, he has written screenplays such asLawless, he has written books, he has made great film scores such asThe Assassination of Jesse James by the Coward Robert Ford, the man is religiously prolific. I believe that one of the reasons he is prolific is that he’s not afraid to experiment. If he has an idea, he follows it through to completion. From the albumMurder Ballads(which is comprised of what the title suggests) to his rejected sequel toGladiator(Gladiator: Christ Killer), he doesn’t seem to be afraid to take anything on. This has led to some over the top works as well as some deeply personal works. Albums likeSkeleton TreeandGhosteenwere journeys through the grief of his son’s death. The Boatman’s Callis arguably a better break-up album than anything Taylor Swift has put out. He’s not afraid to be outrageous, he’s not afraid to offend, but most importantly he’s not afraid to be himself. Works I’d recommend include The Birthday Party’sLive 1981-82, Nick Cave & The Bad Seeds’The Boatman’s Call, and the filmLawless.

Jim Jarmusch: Director

I consider Jim’s films to be bold almost in an ironic sense: his works are bold in that they are, for the most part, anti-sensational. He has a rule that if his screenplays are criticized for a lack of action, he makes them even less eventful. Even with sensational settings his films feel very close to reality, and they demonstrate the beauty of everyday life. That's what is bold about his art to me: making the sensational grounded in reality while making everyday reality all the more special. Ghost Dog: The Way of the Samurai is about a modern-day African-American hitman who strictly follows the rules of the ancient Samurai, yet one can resonate with the humanity of a seemingly absurd character. Only Lovers Left Aliveis a vampire love story, but in the middle of a vampire romance one can see their their own relationships in a new deeply human light. Jim’s work reminds me that art reflects life, and that there is sacred beauty in seemingly mundane everyday life. I personally recommend his filmsPaterson,Down by Law, andCoffee and Cigarettes.

NOSTR: We Need Bold Art

NOSTR is in my opinion a path to a better future. In a world creeping slowly towards everything apps, I hope that the protocol where the individual owns their data wins over everything else. I love freedom and sovereignty. If NOSTR is going to win the race of everything apps, we need more than Bitcoin content. We need more than shirtless bros paying for bananas in foreign countries and exercising with girls who have seductive accents. Common people cannot see themselves in such a world. NOSTR needs to catch the attention of everyday people. I don’t believe that this can be accomplished merely by introducing more broadly relevant content; people are searching for content that speaks to them. I believe that NOSTR can and should attract artists of all kinds because NOSTR is one of the few places on the internet where artists can express themselves fearlessly. Getting zaps from NOSTR’s value-for-value ecosystem has far less friction than crowdfunding a creative project or pitching investors that will irreversibly modify an artist’s vision. Having a place where one can post their works without fear of censorship should be extremely enticing. Having a place where one can connect with fellow humans directly as opposed to a sea of bots should seem like the obvious solution. If NOSTR can become a safe haven for artists to express themselves and spread their work, I believe that everyday people will follow. The banker whose stressful job weighs on them will suddenly find joy with an original meme made by a great visual comedian. The programmer for a healthcare company who is drowning in hopeless mundanity could suddenly find a new lust for life by hearing the song of a musician who isn’t afraid to crowdfund their their next project by putting their lighting address on the streets of the internet. The excel guru who loves independent film may find that NOSTR is the best way to support non corporate movies. My closing statement: continue to encourage the artists in your life as I’m sure you have been, but while you’re at it give them the purple pill. You may very well be a part of building a better future.

-

@ 04c915da:3dfbecc9

2025-03-26 20:54:33

@ 04c915da:3dfbecc9

2025-03-26 20:54:33Capitalism is the most effective system for scaling innovation. The pursuit of profit is an incredibly powerful human incentive. Most major improvements to human society and quality of life have resulted from this base incentive. Market competition often results in the best outcomes for all.

That said, some projects can never be monetized. They are open in nature and a business model would centralize control. Open protocols like bitcoin and nostr are not owned by anyone and if they were it would destroy the key value propositions they provide. No single entity can or should control their use. Anyone can build on them without permission.

As a result, open protocols must depend on donation based grant funding from the people and organizations that rely on them. This model works but it is slow and uncertain, a grind where sustainability is never fully reached but rather constantly sought. As someone who has been incredibly active in the open source grant funding space, I do not think people truly appreciate how difficult it is to raise charitable money and deploy it efficiently.

Projects that can be monetized should be. Profitability is a super power. When a business can generate revenue, it taps into a self sustaining cycle. Profit fuels growth and development while providing projects independence and agency. This flywheel effect is why companies like Google, Amazon, and Apple have scaled to global dominance. The profit incentive aligns human effort with efficiency. Businesses must innovate, cut waste, and deliver value to survive.

Contrast this with non monetized projects. Without profit, they lean on external support, which can dry up or shift with donor priorities. A profit driven model, on the other hand, is inherently leaner and more adaptable. It is not charity but survival. When survival is tied to delivering what people want, scale follows naturally.

The real magic happens when profitable, sustainable businesses are built on top of open protocols and software. Consider the many startups building on open source software stacks, such as Start9, Mempool, and Primal, offering premium services on top of the open source software they build out and maintain. Think of companies like Block or Strike, which leverage bitcoin’s open protocol to offer their services on top. These businesses amplify the open software and protocols they build on, driving adoption and improvement at a pace donations alone could never match.

When you combine open software and protocols with profit driven business the result are lean, sustainable companies that grow faster and serve more people than either could alone. Bitcoin’s network, for instance, benefits from businesses that profit off its existence, while nostr will expand as developers monetize apps built on the protocol.

Capitalism scales best because competition results in efficiency. Donation funded protocols and software lay the groundwork, while market driven businesses build on top. The profit incentive acts as a filter, ensuring resources flow to what works, while open systems keep the playing field accessible, empowering users and builders. Together, they create a flywheel of innovation, growth, and global benefit.

-

@ eb0157af:77ab6c55

2025-05-23 10:01:28

@ eb0157af:77ab6c55

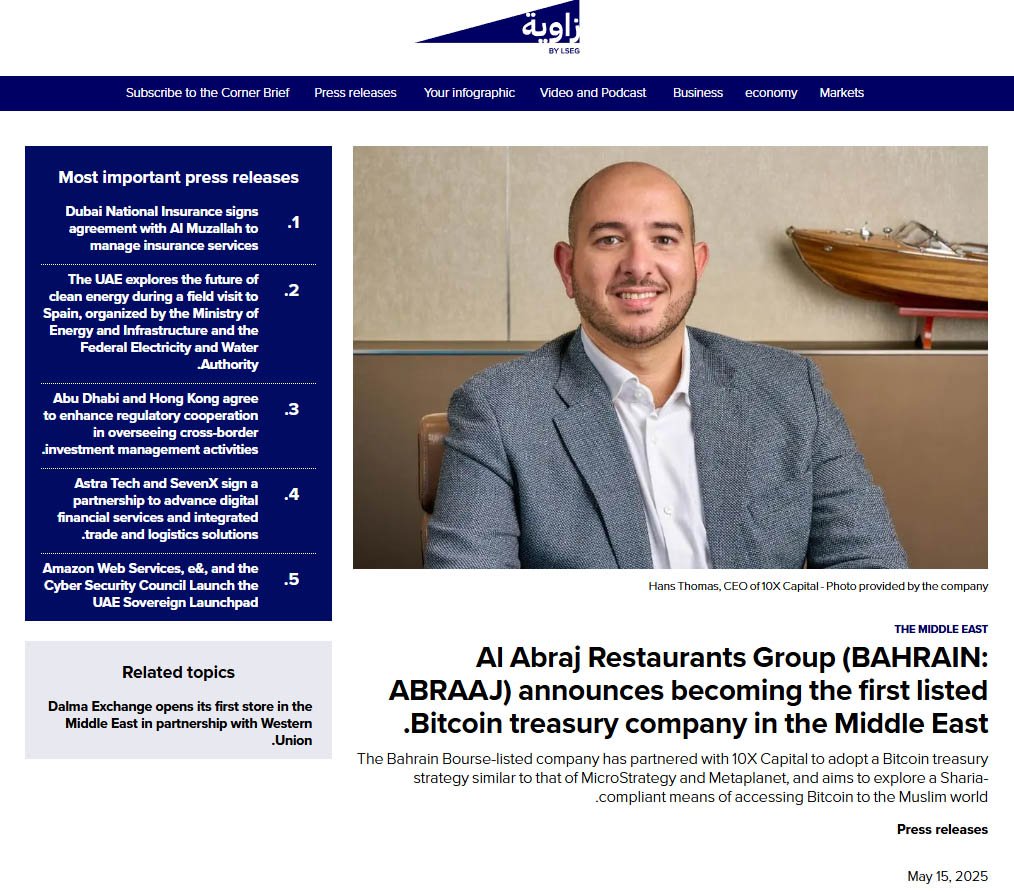

2025-05-23 10:01:28A Chinese printer company inadvertently distributed malware that steals Bitcoin through its official drivers, resulting in the theft of over $950,000.

According to local media outlet Landian News, a Chinese printer manufacturer was found to have unknowingly distributed malware designed to steal Bitcoin through its official device drivers.

Procolored, a Shenzhen-based printer company, distributed malware capable of stealing Bitcoin alongside the official drivers for its devices. The company reportedly used USB devices to spread infected drivers and uploaded the compromised software to globally accessible cloud storage services.

Crypto security and compliance firm SlowMist explained how the malware works in a post on X:

The official driver provided by this printer carries a backdoor program. It will hijack the wallet address in the user's clipboard and replace it with the attacker's address: 1BQZKqdp2CV3QV5nUEsqSg1ygegLmqRygj

The official driver provided by this printer carries a backdoor program. It will hijack the wallet address in the user's clipboard and replace it with the attacker's address: 1BQZKqdp2CV3QV5nUEsqSg1ygegLmqRygj  According to @MistTrack_io, the attacker has stolen 9.3086… https://t.co/DHCkEpHhuH pic.twitter.com/W1AnUpswLU

According to @MistTrack_io, the attacker has stolen 9.3086… https://t.co/DHCkEpHhuH pic.twitter.com/W1AnUpswLU— MistTrack

(@MistTrack_io) May 19, 2025

(@MistTrack_io) May 19, 2025The consequences of the breach have been significant, with a total of 9.3 BTC stolen — equivalent to over $950,000.

The issue was first flagged by YouTuber Cameron Coward, whose antivirus software detected malware in the drivers during a test of a Procolored UV printer. The software identified both a worm and a trojan virus named Foxif.

When contacted, Procolored denied the accusations, dismissing the antivirus warning as a false positive. Coward then turned to Reddit, where he shared the issue with cybersecurity professionals, drawing the attention of security firm G Data.

G Data’s investigation revealed that most of Procolored’s drivers were hosted on the MEGA file-sharing platform, with uploads dating back to October 2023. Their analysis confirmed the presence of two separate malware strains: the Win32.Backdoor.XRedRAT.A backdoor and a crypto-stealer designed to replace clipboard wallet addresses with those controlled by the attacker.

G Data reached out to Procolored, which stated that it had removed the infected drivers from its storage as of May 8 and had re-scanned all files. The company attributed the malware to a supply chain compromise, saying the malicious files were introduced via infected USB devices before being uploaded online.

Landian News recommended that users who downloaded Procolored drivers in the past six months “immediately run a full system scan using antivirus software.” However, given that antivirus tools are not always reliable, the Chinese media outlet suggested that a full system reset is the safest option when in doubt.

The post Bitcoin malware discovered: Chinese printer manufacturer involved appeared first on Atlas21.

-

@ 04c915da:3dfbecc9

2025-02-25 03:55:08

@ 04c915da:3dfbecc9

2025-02-25 03:55:08Here’s a revised timeline of macro-level events from The Mandibles: A Family, 2029–2047 by Lionel Shriver, reimagined in a world where Bitcoin is adopted as a widely accepted form of money, altering the original narrative’s assumptions about currency collapse and economic control. In Shriver’s original story, the failure of Bitcoin is assumed amid the dominance of the bancor and the dollar’s collapse. Here, Bitcoin’s success reshapes the economic and societal trajectory, decentralizing power and challenging state-driven outcomes.

Part One: 2029–2032

-

2029 (Early Year)\ The United States faces economic strain as the dollar weakens against global shifts. However, Bitcoin, having gained traction emerges as a viable alternative. Unlike the original timeline, the bancor—a supranational currency backed by a coalition of nations—struggles to gain footing as Bitcoin’s decentralized adoption grows among individuals and businesses worldwide, undermining both the dollar and the bancor.

-

2029 (Mid-Year: The Great Renunciation)\ Treasury bonds lose value, and the government bans Bitcoin, labeling it a threat to sovereignty (mirroring the original bancor ban). However, a Bitcoin ban proves unenforceable—its decentralized nature thwarts confiscation efforts, unlike gold in the original story. Hyperinflation hits the dollar as the U.S. prints money, but Bitcoin’s fixed supply shields adopters from currency devaluation, creating a dual-economy split: dollar users suffer, while Bitcoin users thrive.

-

2029 (Late Year)\ Dollar-based inflation soars, emptying stores of goods priced in fiat currency. Meanwhile, Bitcoin transactions flourish in underground and online markets, stabilizing trade for those plugged into the bitcoin ecosystem. Traditional supply chains falter, but peer-to-peer Bitcoin networks enable local and international exchange, reducing scarcity for early adopters. The government’s gold confiscation fails to bolster the dollar, as Bitcoin’s rise renders gold less relevant.

-

2030–2031\ Crime spikes in dollar-dependent urban areas, but Bitcoin-friendly regions see less chaos, as digital wallets and smart contracts facilitate secure trade. The U.S. government doubles down on surveillance to crack down on bitcoin use. A cultural divide deepens: centralized authority weakens in Bitcoin-adopting communities, while dollar zones descend into lawlessness.

-

2032\ By this point, Bitcoin is de facto legal tender in parts of the U.S. and globally, especially in tech-savvy or libertarian-leaning regions. The federal government’s grip slips as tax collection in dollars plummets—Bitcoin’s traceability is low, and citizens evade fiat-based levies. Rural and urban Bitcoin hubs emerge, while the dollar economy remains fractured.

Time Jump: 2032–2047

- Over 15 years, Bitcoin solidifies as a global reserve currency, eroding centralized control. The U.S. government adapts, grudgingly integrating bitcoin into policy, though regional autonomy grows as Bitcoin empowers local economies.

Part Two: 2047

-

2047 (Early Year)\ The U.S. is a hybrid state: Bitcoin is legal tender alongside a diminished dollar. Taxes are lower, collected in BTC, reducing federal overreach. Bitcoin’s adoption has decentralized power nationwide. The bancor has faded, unable to compete with Bitcoin’s grassroots momentum.

-

2047 (Mid-Year)\ Travel and trade flow freely in Bitcoin zones, with no restrictive checkpoints. The dollar economy lingers in poorer areas, marked by decay, but Bitcoin’s dominance lifts overall prosperity, as its deflationary nature incentivizes saving and investment over consumption. Global supply chains rebound, powered by bitcoin enabled efficiency.

-

2047 (Late Year)\ The U.S. is a patchwork of semi-autonomous zones, united by Bitcoin’s universal acceptance rather than federal control. Resource scarcity persists due to past disruptions, but economic stability is higher than in Shriver’s original dystopia—Bitcoin’s success prevents the authoritarian slide, fostering a freer, if imperfect, society.

Key Differences

- Currency Dynamics: Bitcoin’s triumph prevents the bancor’s dominance and mitigates hyperinflation’s worst effects, offering a lifeline outside state control.

- Government Power: Centralized authority weakens as Bitcoin evades bans and taxation, shifting power to individuals and communities.

- Societal Outcome: Instead of a surveillance state, 2047 sees a decentralized, bitcoin driven world—less oppressive, though still stratified between Bitcoin haves and have-nots.

This reimagining assumes Bitcoin overcomes Shriver’s implied skepticism to become a robust, adopted currency by 2029, fundamentally altering the novel’s bleak trajectory.

-

-

@ 21335073:a244b1ad

2025-05-21 16:58:36

@ 21335073:a244b1ad

2025-05-21 16:58:36The other day, I had the privilege of sitting down with one of my favorite living artists. Our conversation was so captivating that I felt compelled to share it. I’m leaving his name out for privacy.

Since our last meeting, I’d watched a documentary about his life, one he’d helped create. I told him how much I admired his openness in it. There’s something strange about knowing intimate details of someone’s life when they know so little about yours—it’s almost like I knew him too well for the kind of relationship we have.

He paused, then said quietly, with a shy grin, that watching the documentary made him realize how “odd and eccentric” he is. I laughed and told him he’s probably the sanest person I know. Because he’s lived fully, chasing love, passion, and purpose with hardly any regrets. He’s truly lived.

Today, I turn 44, and I’ll admit I’m a bit eccentric myself. I think I came into the world this way. I’ve made mistakes along the way, but I carry few regrets. Every misstep taught me something. And as I age, I’m not interested in blending in with the world—I’ll probably just lean further into my own brand of “weird.” I want to live life to the brim. The older I get, the more I see that the “normal” folks often seem less grounded than the eccentric artists who dare to live boldly. Life’s too short to just exist, actually live.

I’m not saying to be strange just for the sake of it. But I’ve seen what the crowd celebrates, and I’m not impressed. Forge your own path, even if it feels lonely or unpopular at times.

It’s easy to scroll through the news and feel discouraged. But actually, this is one of the most incredible times to be alive! I wake up every day grateful to be here, now. The future is bursting with possibility—I can feel it.

So, to my fellow weirdos on nostr: stay bold. Keep dreaming, keep pushing, no matter what’s trending. Stay wild enough to believe in a free internet for all. Freedom is radical—hold it tight. Live with the soul of an artist and the grit of a fighter. Thanks for inspiring me and so many others to keep hoping. Thank you all for making the last year of my life so special.

-

@ dfc7c785:4c3c6174

2025-05-23 09:42:37

@ dfc7c785:4c3c6174

2025-05-23 09:42:37Where do I even start? Sometimes it's best to just begin writing whatever comes into your head. What do I do for a living? It used to be easy to explain, I write JavaScript, I build front-end code, in order to build apps. I am more than that though. Over the past eight years, I moved from writing Angular, to React and then to Vue. However my background was originally in writing full-stack projects, using technologies such as .NET and PHP. The thing is - the various jobs I've had recently have pigeon-holed me as front-end developer but nowadays I am starting to feel distracted by a multitude of other interesting, pivotal technologies both in my "day job" and across my wider experience as a Technologist; a phrase I prefer to use in order to describe who I am, more gernerally.

I have used untype.app to write this today, it looks great.

More to come...

-

@ 51bbb15e:b77a2290

2025-05-21 00:24:36

@ 51bbb15e:b77a2290

2025-05-21 00:24:36Yeah, I’m sure everything in the file is legit. 👍 Let’s review the guard witness testimony…Oh wait, they weren’t at their posts despite 24/7 survellience instructions after another Epstein “suicide” attempt two weeks earlier. Well, at least the video of the suicide is in the file? Oh wait, a techical glitch. Damn those coincidences!

At this point, the Trump administration has zero credibility with me on anything related to the Epstein case and his clients. I still suspect the administration is using the Epstein files as leverage to keep a lot of RINOs in line, whereas they’d be sabotaging his agenda at every turn otherwise. However, I just don’t believe in ends-justify-the-means thinking. It’s led almost all of DC to toss out every bit of the values they might once have had.

-

@ c1e9ab3a:9cb56b43

2025-05-18 04:14:48

@ c1e9ab3a:9cb56b43

2025-05-18 04:14:48Abstract

This document proposes a novel architecture that decouples the peer-to-peer (P2P) communication layer from the Bitcoin protocol and replaces or augments it with the Nostr protocol. The goal is to improve censorship resistance, performance, modularity, and maintainability by migrating transaction propagation and block distribution to the Nostr relay network.

Introduction

Bitcoin’s current architecture relies heavily on its P2P network to propagate transactions and blocks. While robust, it has limitations in terms of flexibility, scalability, and censorship resistance in certain environments. Nostr, a decentralized event-publishing protocol, offers a multi-star topology and a censorship-resistant infrastructure for message relay.

This proposal outlines how Bitcoin communication could be ported to Nostr while maintaining consensus and verification through standard Bitcoin clients.

Motivation

- Enhanced Censorship Resistance: Nostr’s architecture enables better relay redundancy and obfuscation of transaction origin.

- Simplified Lightweight Nodes: Removing the full P2P stack allows for lightweight nodes that only verify blockchain data and communicate over Nostr.

- Architectural Modularity: Clean separation between validation and communication enables easier auditing, upgrades, and parallel innovation.

- Faster Propagation: Nostr’s multi-star network may provide faster propagation of transactions and blocks compared to the mesh-like Bitcoin P2P network.

Architecture Overview

Components

-

Bitcoin Minimal Node (BMN):

- Verifies blockchain and block validity.

- Maintains UTXO set and handles mempool logic.

- Connects to Nostr relays instead of P2P Bitcoin peers.

-

Bridge Node:

- Bridges Bitcoin P2P traffic to and from Nostr relays.

- Posts new transactions and blocks to Nostr.

- Downloads mempool content and block headers from Nostr.

-

Nostr Relays:

- Accept Bitcoin-specific event kinds (transactions and blocks).

- Store mempool entries and block messages.

- Optionally broadcast fee estimation summaries and tipsets.

Event Format

Proposed reserved Nostr

kindnumbers for Bitcoin content (NIP/BIP TBD):| Nostr Kind | Purpose | |------------|------------------------| | 210000 | Bitcoin Transaction | | 210001 | Bitcoin Block Header | | 210002 | Bitcoin Block | | 210003 | Mempool Fee Estimates | | 210004 | Filter/UTXO summary |

Transaction Lifecycle

- Wallet creates a Bitcoin transaction.

- Wallet sends it to a set of configured Nostr relays.

- Relays accept and cache the transaction (based on fee policies).

- Mining nodes or bridge nodes fetch mempool contents from Nostr.

- Once mined, a block is submitted over Nostr.

- Nodes confirm inclusion and update their UTXO set.

Security Considerations

- Sybil Resistance: Consensus remains based on proof-of-work. The communication path (Nostr) is not involved in consensus.

- Relay Discoverability: Optionally bootstrap via DNS, Bitcoin P2P, or signed relay lists.

- Spam Protection: Relay-side policy, rate limiting, proof-of-work challenges, or Lightning payments.

- Block Authenticity: Nodes must verify all received blocks and reject invalid chains.

Compatibility and Migration

- Fully compatible with current Bitcoin consensus rules.

- Bridge nodes preserve interoperability with legacy full nodes.

- Nodes can run in hybrid mode, fetching from both P2P and Nostr.

Future Work

- Integration with watch-only wallets and SPV clients using verified headers via Nostr.

- Use of Nostr’s social graph for partial trust assumptions and relay reputation.

- Dynamic relay discovery using Nostr itself (relay list events).

Conclusion

This proposal lays out a new architecture for Bitcoin communication using Nostr to replace or augment the P2P network. This improves decentralization, censorship resistance, modularity, and speed, while preserving consensus integrity. It encourages innovation by enabling smaller, purpose-built Bitcoin nodes and offloading networking complexity.

This document may become both a Bitcoin Improvement Proposal (BIP-XXX) and a Nostr Improvement Proposal (NIP-XXX). Event kind range reserved: 210000–219999.

-

@ e3ba5e1a:5e433365

2025-02-13 06:16:49

@ e3ba5e1a:5e433365

2025-02-13 06:16:49My favorite line in any Marvel movie ever is in “Captain America.” After Captain America launches seemingly a hopeless assault on Red Skull’s base and is captured, we get this line:

“Arrogance may not be a uniquely American trait, but I must say, you do it better than anyone.”

Yesterday, I came across a comment on the song Devil Went Down to Georgia that had a very similar feel to it:

America has seemingly always been arrogant, in a uniquely American way. Manifest Destiny, for instance. The rest of the world is aware of this arrogance, and mocks Americans for it. A central point in modern US politics is the deriding of racist, nationalist, supremacist Americans.

That’s not what I see. I see American Arrogance as not only a beautiful statement about what it means to be American. I see it as an ode to the greatness of humanity in its purest form.

For most countries, saying “our nation is the greatest” is, in fact, twinged with some level of racism. I still don’t have a problem with it. Every group of people should be allowed to feel pride in their accomplishments. The destruction of the human spirit since the end of World War 2, where greatness has become a sin and weakness a virtue, has crushed the ability of people worldwide to strive for excellence.

But I digress. The fears of racism and nationalism at least have a grain of truth when applied to other nations on the planet. But not to America.

That’s because the definition of America, and the prototype of an American, has nothing to do with race. The definition of Americanism is freedom. The founding of America is based purely on liberty. On the God-given rights of every person to live life the way they see fit.

American Arrogance is not a statement of racial superiority. It’s barely a statement of national superiority (though it absolutely is). To me, when an American comments on the greatness of America, it’s a statement about freedom. Freedom will always unlock the greatness inherent in any group of people. Americans are definitionally better than everyone else, because Americans are freer than everyone else. (Or, at least, that’s how it should be.)

In Devil Went Down to Georgia, Johnny is approached by the devil himself. He is challenged to a ridiculously lopsided bet: a golden fiddle versus his immortal soul. He acknowledges the sin in accepting such a proposal. And yet he says, “God, I know you told me not to do this. But I can’t stand the affront to my honor. I am the greatest. The devil has nothing on me. So God, I’m gonna sin, but I’m also gonna win.”

Libertas magnitudo est

-

@ c9badfea:610f861a

2025-05-20 19:49:20

@ c9badfea:610f861a

2025-05-20 19:49:20- Install Sky Map (it's free and open source)

- Launch the app and tap Accept, then tap OK

- When asked to access the device's location, tap While Using The App

- Tap somewhere on the screen to activate the menu, then tap ⁝ and select Settings

- Disable Send Usage Statistics

- Return to the main screen and enjoy stargazing!

ℹ️ Use the 🔍 icon in the upper toolbar to search for a specific celestial body, or tap the 👁️ icon to activate night mode

-

@ 0fa80bd3:ea7325de

2025-01-30 04:28:30

@ 0fa80bd3:ea7325de

2025-01-30 04:28:30"Degeneration" or "Вырождение" ![[photo_2025-01-29 23.23.15.jpeg]]

A once-functional object, now eroded by time and human intervention, stripped of its original purpose. Layers of presence accumulate—marks, alterations, traces of intent—until the very essence is obscured. Restoration is paradoxical: to reclaim, one must erase. Yet erasure is an impossibility, for to remove these imprints is to deny the existence of those who shaped them.

The work stands as a meditation on entropy, memory, and the irreversible dialogue between creation and decay.

-

@ 0fa80bd3:ea7325de

2025-01-29 15:43:42

@ 0fa80bd3:ea7325de

2025-01-29 15:43:42Lyn Alden - биткойн евангелист или евангелистка, я пока не понял

npub1a2cww4kn9wqte4ry70vyfwqyqvpswksna27rtxd8vty6c74era8sdcw83aThomas Pacchia - PubKey owner - X - @tpacchia

npub1xy6exlg37pw84cpyj05c2pdgv86hr25cxn0g7aa8g8a6v97mhduqeuhgplcalvadev - Shopstr

npub16dhgpql60vmd4mnydjut87vla23a38j689jssaqlqqlzrtqtd0kqex0nkqCalle - Cashu founder

npub12rv5lskctqxxs2c8rf2zlzc7xx3qpvzs3w4etgemauy9thegr43sf485vgДжек Дорси

npub1sg6plzptd64u62a878hep2kev88swjh3tw00gjsfl8f237lmu63q0uf63m21 ideas

npub1lm3f47nzyf0rjp6fsl4qlnkmzed4uj4h2gnf2vhe3l3mrj85vqks6z3c7lМного адресов. Хз кто надо сортировать

https://github.com/aitechguy/nostr-address-bookФиатДжеф - создатель Ностр - https://github.com/fiatjaf

npub180cvv07tjdrrgpa0j7j7tmnyl2yr6yr7l8j4s3evf6u64th6gkwsyjh6w6EVAN KALOUDIS Zues wallet

npub19kv88vjm7tw6v9qksn2y6h4hdt6e79nh3zjcud36k9n3lmlwsleqwte2qdПрограммер Коди https://github.com/CodyTseng/nostr-relay

npub1syjmjy0dp62dhccq3g97fr87tngvpvzey08llyt6ul58m2zqpzps9wf6wlAnna Chekhovich - Managing Bitcoin at The Anti-Corruption Foundation https://x.com/AnyaChekhovich

npub1y2st7rp54277hyd2usw6shy3kxprnmpvhkezmldp7vhl7hp920aq9cfyr7 -

@ 6be5cc06:5259daf0

2025-01-21 01:51:46

@ 6be5cc06:5259daf0

2025-01-21 01:51:46Bitcoin: Um sistema de dinheiro eletrônico direto entre pessoas.

Satoshi Nakamoto

satoshin@gmx.com

www.bitcoin.org

Resumo

O Bitcoin é uma forma de dinheiro digital que permite pagamentos diretos entre pessoas, sem a necessidade de um banco ou instituição financeira. Ele resolve um problema chamado gasto duplo, que ocorre quando alguém tenta gastar o mesmo dinheiro duas vezes. Para evitar isso, o Bitcoin usa uma rede descentralizada onde todos trabalham juntos para verificar e registrar as transações.

As transações são registradas em um livro público chamado blockchain, protegido por uma técnica chamada Prova de Trabalho. Essa técnica cria uma cadeia de registros que não pode ser alterada sem refazer todo o trabalho já feito. Essa cadeia é mantida pelos computadores que participam da rede, e a mais longa é considerada a verdadeira.

Enquanto a maior parte do poder computacional da rede for controlada por participantes honestos, o sistema continuará funcionando de forma segura. A rede é flexível, permitindo que qualquer pessoa entre ou saia a qualquer momento, sempre confiando na cadeia mais longa como prova do que aconteceu.

1. Introdução

Hoje, quase todos os pagamentos feitos pela internet dependem de bancos ou empresas como processadores de pagamento (cartões de crédito, por exemplo) para funcionar. Embora esse sistema seja útil, ele tem problemas importantes porque é baseado em confiança.

Primeiro, essas empresas podem reverter pagamentos, o que é útil em caso de erros, mas cria custos e incertezas. Isso faz com que pequenas transações, como pagar centavos por um serviço, se tornem inviáveis. Além disso, os comerciantes são obrigados a desconfiar dos clientes, pedindo informações extras e aceitando fraudes como algo inevitável.

Esses problemas não existem no dinheiro físico, como o papel-moeda, onde o pagamento é final e direto entre as partes. No entanto, não temos como enviar dinheiro físico pela internet sem depender de um intermediário confiável.

O que precisamos é de um sistema de pagamento eletrônico baseado em provas matemáticas, não em confiança. Esse sistema permitiria que qualquer pessoa enviasse dinheiro diretamente para outra, sem depender de bancos ou processadores de pagamento. Além disso, as transações seriam irreversíveis, protegendo vendedores contra fraudes, mas mantendo a possibilidade de soluções para disputas legítimas.

Neste documento, apresentamos o Bitcoin, que resolve o problema do gasto duplo usando uma rede descentralizada. Essa rede cria um registro público e protegido por cálculos matemáticos, que garante a ordem das transações. Enquanto a maior parte da rede for controlada por pessoas honestas, o sistema será seguro contra ataques.

2. Transações

Para entender como funciona o Bitcoin, é importante saber como as transações são realizadas. Imagine que você quer transferir uma "moeda digital" para outra pessoa. No sistema do Bitcoin, essa "moeda" é representada por uma sequência de registros que mostram quem é o atual dono. Para transferi-la, você adiciona um novo registro comprovando que agora ela pertence ao próximo dono. Esse registro é protegido por um tipo especial de assinatura digital.

O que é uma assinatura digital?

Uma assinatura digital é como uma senha secreta, mas muito mais segura. No Bitcoin, cada usuário tem duas chaves: uma "chave privada", que é secreta e serve para criar a assinatura, e uma "chave pública", que pode ser compartilhada com todos e é usada para verificar se a assinatura é válida. Quando você transfere uma moeda, usa sua chave privada para assinar a transação, provando que você é o dono. A próxima pessoa pode usar sua chave pública para confirmar isso.

Como funciona na prática?

Cada "moeda" no Bitcoin é, na verdade, uma cadeia de assinaturas digitais. Vamos imaginar o seguinte cenário:

- A moeda está com o Dono 0 (você). Para transferi-la ao Dono 1, você assina digitalmente a transação com sua chave privada. Essa assinatura inclui o código da transação anterior (chamado de "hash") e a chave pública do Dono 1.

- Quando o Dono 1 quiser transferir a moeda ao Dono 2, ele assinará a transação seguinte com sua própria chave privada, incluindo também o hash da transação anterior e a chave pública do Dono 2.

- Esse processo continua, formando uma "cadeia" de transações. Qualquer pessoa pode verificar essa cadeia para confirmar quem é o atual dono da moeda.

Resolvendo o problema do gasto duplo

Um grande desafio com moedas digitais é o "gasto duplo", que é quando uma mesma moeda é usada em mais de uma transação. Para evitar isso, muitos sistemas antigos dependiam de uma entidade central confiável, como uma casa da moeda, que verificava todas as transações. No entanto, isso criava um ponto único de falha e centralizava o controle do dinheiro.

O Bitcoin resolve esse problema de forma inovadora: ele usa uma rede descentralizada onde todos os participantes (os "nós") têm acesso a um registro completo de todas as transações. Cada nó verifica se as transações são válidas e se a moeda não foi gasta duas vezes. Quando a maioria dos nós concorda com a validade de uma transação, ela é registrada permanentemente na blockchain.

Por que isso é importante?

Essa solução elimina a necessidade de confiar em uma única entidade para gerenciar o dinheiro, permitindo que qualquer pessoa no mundo use o Bitcoin sem precisar de permissão de terceiros. Além disso, ela garante que o sistema seja seguro e resistente a fraudes.

3. Servidor Timestamp

Para assegurar que as transações sejam realizadas de forma segura e transparente, o sistema Bitcoin utiliza algo chamado de "servidor de registro de tempo" (timestamp). Esse servidor funciona como um registro público que organiza as transações em uma ordem específica.

Ele faz isso agrupando várias transações em blocos e criando um código único chamado "hash". Esse hash é como uma impressão digital que representa todo o conteúdo do bloco. O hash de cada bloco é amplamente divulgado, como se fosse publicado em um jornal ou em um fórum público.

Esse processo garante que cada bloco de transações tenha um registro de quando foi criado e que ele existia naquele momento. Além disso, cada novo bloco criado contém o hash do bloco anterior, formando uma cadeia contínua de blocos conectados — conhecida como blockchain.

Com isso, se alguém tentar alterar qualquer informação em um bloco anterior, o hash desse bloco mudará e não corresponderá ao hash armazenado no bloco seguinte. Essa característica torna a cadeia muito segura, pois qualquer tentativa de fraude seria imediatamente detectada.

O sistema de timestamps é essencial para provar a ordem cronológica das transações e garantir que cada uma delas seja única e autêntica. Dessa forma, ele reforça a segurança e a confiança na rede Bitcoin.

4. Prova-de-Trabalho

Para implementar o registro de tempo distribuído no sistema Bitcoin, utilizamos um mecanismo chamado prova-de-trabalho. Esse sistema é semelhante ao Hashcash, desenvolvido por Adam Back, e baseia-se na criação de um código único, o "hash", por meio de um processo computacionalmente exigente.

A prova-de-trabalho envolve encontrar um valor especial que, quando processado junto com as informações do bloco, gere um hash que comece com uma quantidade específica de zeros. Esse valor especial é chamado de "nonce". Encontrar o nonce correto exige um esforço significativo do computador, porque envolve tentativas repetidas até que a condição seja satisfeita.

Esse processo é importante porque torna extremamente difícil alterar qualquer informação registrada em um bloco. Se alguém tentar mudar algo em um bloco, seria necessário refazer o trabalho de computação não apenas para aquele bloco, mas também para todos os blocos que vêm depois dele. Isso garante a segurança e a imutabilidade da blockchain.

A prova-de-trabalho também resolve o problema de decidir qual cadeia de blocos é a válida quando há múltiplas cadeias competindo. A decisão é feita pela cadeia mais longa, pois ela representa o maior esforço computacional já realizado. Isso impede que qualquer indivíduo ou grupo controle a rede, desde que a maioria do poder de processamento seja mantida por participantes honestos.

Para garantir que o sistema permaneça eficiente e equilibrado, a dificuldade da prova-de-trabalho é ajustada automaticamente ao longo do tempo. Se novos blocos estiverem sendo gerados rapidamente, a dificuldade aumenta; se estiverem sendo gerados muito lentamente, a dificuldade diminui. Esse ajuste assegura que novos blocos sejam criados aproximadamente a cada 10 minutos, mantendo o sistema estável e funcional.

5. Rede

A rede Bitcoin é o coração do sistema e funciona de maneira distribuída, conectando vários participantes (ou nós) para garantir o registro e a validação das transações. Os passos para operar essa rede são:

-

Transmissão de Transações: Quando alguém realiza uma nova transação, ela é enviada para todos os nós da rede. Isso é feito para garantir que todos estejam cientes da operação e possam validá-la.

-

Coleta de Transações em Blocos: Cada nó agrupa as novas transações recebidas em um "bloco". Este bloco será preparado para ser adicionado à cadeia de blocos (a blockchain).

-

Prova-de-Trabalho: Os nós competem para resolver a prova-de-trabalho do bloco, utilizando poder computacional para encontrar um hash válido. Esse processo é como resolver um quebra-cabeça matemático difícil.

-

Envio do Bloco Resolvido: Quando um nó encontra a solução para o bloco (a prova-de-trabalho), ele compartilha esse bloco com todos os outros nós na rede.

-

Validação do Bloco: Cada nó verifica o bloco recebido para garantir que todas as transações nele contidas sejam válidas e que nenhuma moeda tenha sido gasta duas vezes. Apenas blocos válidos são aceitos.

-

Construção do Próximo Bloco: Os nós que aceitaram o bloco começam a trabalhar na criação do próximo bloco, utilizando o hash do bloco aceito como base (hash anterior). Isso mantém a continuidade da cadeia.

Resolução de Conflitos e Escolha da Cadeia Mais Longa

Os nós sempre priorizam a cadeia mais longa, pois ela representa o maior esforço computacional já realizado, garantindo maior segurança. Se dois blocos diferentes forem compartilhados simultaneamente, os nós trabalharão no primeiro bloco recebido, mas guardarão o outro como uma alternativa. Caso o segundo bloco eventualmente forme uma cadeia mais longa (ou seja, tenha mais blocos subsequentes), os nós mudarão para essa nova cadeia.

Tolerância a Falhas

A rede é robusta e pode lidar com mensagens que não chegam a todos os nós. Uma transação não precisa alcançar todos os nós de imediato; basta que chegue a um número suficiente deles para ser incluída em um bloco. Da mesma forma, se um nó não receber um bloco em tempo hábil, ele pode solicitá-lo ao perceber que está faltando quando o próximo bloco é recebido.

Esse mecanismo descentralizado permite que a rede Bitcoin funcione de maneira segura, confiável e resiliente, sem depender de uma autoridade central.

6. Incentivo

O incentivo é um dos pilares fundamentais que sustenta o funcionamento da rede Bitcoin, garantindo que os participantes (nós) continuem operando de forma honesta e contribuindo com recursos computacionais. Ele é estruturado em duas partes principais: a recompensa por mineração e as taxas de transação.

Recompensa por Mineração

Por convenção, o primeiro registro em cada bloco é uma transação especial que cria novas moedas e as atribui ao criador do bloco. Essa recompensa incentiva os mineradores a dedicarem poder computacional para apoiar a rede. Como não há uma autoridade central para emitir moedas, essa é a maneira pela qual novas moedas entram em circulação. Esse processo pode ser comparado ao trabalho de garimpeiros, que utilizam recursos para colocar mais ouro em circulação. No caso do Bitcoin, o "recurso" consiste no tempo de CPU e na energia elétrica consumida para resolver a prova-de-trabalho.

Taxas de Transação

Além da recompensa por mineração, os mineradores também podem ser incentivados pelas taxas de transação. Se uma transação utiliza menos valor de saída do que o valor de entrada, a diferença é tratada como uma taxa, que é adicionada à recompensa do bloco contendo essa transação. Com o passar do tempo e à medida que o número de moedas em circulação atinge o limite predeterminado, essas taxas de transação se tornam a principal fonte de incentivo, substituindo gradualmente a emissão de novas moedas. Isso permite que o sistema opere sem inflação, uma vez que o número total de moedas permanece fixo.

Incentivo à Honestidade

O design do incentivo também busca garantir que os participantes da rede mantenham um comportamento honesto. Para um atacante que consiga reunir mais poder computacional do que o restante da rede, ele enfrentaria duas escolhas:

- Usar esse poder para fraudar o sistema, como reverter transações e roubar pagamentos.

- Seguir as regras do sistema, criando novos blocos e recebendo recompensas legítimas.

A lógica econômica favorece a segunda opção, pois um comportamento desonesto prejudicaria a confiança no sistema, diminuindo o valor de todas as moedas, incluindo aquelas que o próprio atacante possui. Jogar dentro das regras não apenas maximiza o retorno financeiro, mas também preserva a validade e a integridade do sistema.

Esse mecanismo garante que os incentivos econômicos estejam alinhados com o objetivo de manter a rede segura, descentralizada e funcional ao longo do tempo.

7. Recuperação do Espaço em Disco

Depois que uma moeda passa a estar protegida por muitos blocos na cadeia, as informações sobre as transações antigas que a geraram podem ser descartadas para economizar espaço em disco. Para que isso seja possível sem comprometer a segurança, as transações são organizadas em uma estrutura chamada "árvore de Merkle". Essa árvore funciona como um resumo das transações: em vez de armazenar todas elas, guarda apenas um "hash raiz", que é como uma assinatura compacta que representa todo o grupo de transações.

Os blocos antigos podem, então, ser simplificados, removendo as partes desnecessárias dessa árvore. Apenas a raiz do hash precisa ser mantida no cabeçalho do bloco, garantindo que a integridade dos dados seja preservada, mesmo que detalhes específicos sejam descartados.

Para exemplificar: imagine que você tenha vários recibos de compra. Em vez de guardar todos os recibos, você cria um documento e lista apenas o valor total de cada um. Mesmo que os recibos originais sejam descartados, ainda é possível verificar a soma com base nos valores armazenados.

Além disso, o espaço ocupado pelos blocos em si é muito pequeno. Cada bloco sem transações ocupa apenas cerca de 80 bytes. Isso significa que, mesmo com blocos sendo gerados a cada 10 minutos, o crescimento anual em espaço necessário é insignificante: apenas 4,2 MB por ano. Com a capacidade de armazenamento dos computadores crescendo a cada ano, esse espaço continuará sendo trivial, garantindo que a rede possa operar de forma eficiente sem problemas de armazenamento, mesmo a longo prazo.

8. Verificação de Pagamento Simplificada

É possível confirmar pagamentos sem a necessidade de operar um nó completo da rede. Para isso, o usuário precisa apenas de uma cópia dos cabeçalhos dos blocos da cadeia mais longa (ou seja, a cadeia com maior esforço de trabalho acumulado). Ele pode verificar a validade de uma transação ao consultar os nós da rede até obter a confirmação de que tem a cadeia mais longa. Para isso, utiliza-se o ramo Merkle, que conecta a transação ao bloco em que ela foi registrada.

Entretanto, o método simplificado possui limitações: ele não pode confirmar uma transação isoladamente, mas sim assegurar que ela ocupa um lugar específico na cadeia mais longa. Dessa forma, se um nó da rede aprova a transação, os blocos subsequentes reforçam essa aceitação.

A verificação simplificada é confiável enquanto a maioria dos nós da rede for honesta. Contudo, ela se torna vulnerável caso a rede seja dominada por um invasor. Nesse cenário, um atacante poderia fabricar transações fraudulentas que enganariam o usuário temporariamente até que o invasor obtivesse controle completo da rede.

Uma estratégia para mitigar esse risco é configurar alertas nos softwares de nós completos. Esses alertas identificam blocos inválidos, sugerindo ao usuário baixar o bloco completo para confirmar qualquer inconsistência. Para maior segurança, empresas que realizam pagamentos frequentes podem preferir operar seus próprios nós, reduzindo riscos e permitindo uma verificação mais direta e confiável.

9. Combinando e Dividindo Valor

No sistema Bitcoin, cada unidade de valor é tratada como uma "moeda" individual, mas gerenciar cada centavo como uma transação separada seria impraticável. Para resolver isso, o Bitcoin permite que valores sejam combinados ou divididos em transações, facilitando pagamentos de qualquer valor.

Entradas e Saídas

Cada transação no Bitcoin é composta por:

- Entradas: Representam os valores recebidos em transações anteriores.

- Saídas: Correspondem aos valores enviados, divididos entre os destinatários e, eventualmente, o troco para o remetente.

Normalmente, uma transação contém:

- Uma única entrada com valor suficiente para cobrir o pagamento.

- Ou várias entradas combinadas para atingir o valor necessário.

O valor total das saídas nunca excede o das entradas, e a diferença (se houver) pode ser retornada ao remetente como troco.

Exemplo Prático

Imagine que você tem duas entradas:

- 0,03 BTC

- 0,07 BTC

Se deseja enviar 0,08 BTC para alguém, a transação terá:

- Entrada: As duas entradas combinadas (0,03 + 0,07 BTC = 0,10 BTC).

- Saídas: Uma para o destinatário (0,08 BTC) e outra como troco para você (0,02 BTC).

Essa flexibilidade permite que o sistema funcione sem precisar manipular cada unidade mínima individualmente.

Difusão e Simplificação

A difusão de transações, onde uma depende de várias anteriores e assim por diante, não representa um problema. Não é necessário armazenar ou verificar o histórico completo de uma transação para utilizá-la, já que o registro na blockchain garante sua integridade.

10. Privacidade

O modelo bancário tradicional oferece um certo nível de privacidade, limitando o acesso às informações financeiras apenas às partes envolvidas e a um terceiro confiável (como bancos ou instituições financeiras). No entanto, o Bitcoin opera de forma diferente, pois todas as transações são publicamente registradas na blockchain. Apesar disso, a privacidade pode ser mantida utilizando chaves públicas anônimas, que desvinculam diretamente as transações das identidades das partes envolvidas.

Fluxo de Informação

- No modelo tradicional, as transações passam por um terceiro confiável que conhece tanto o remetente quanto o destinatário.

- No Bitcoin, as transações são anunciadas publicamente, mas sem revelar diretamente as identidades das partes. Isso é comparável a dados divulgados por bolsas de valores, onde informações como o tempo e o tamanho das negociações (a "fita") são públicas, mas as identidades das partes não.

Protegendo a Privacidade

Para aumentar a privacidade no Bitcoin, são adotadas as seguintes práticas:

- Chaves Públicas Anônimas: Cada transação utiliza um par de chaves diferentes, dificultando a associação com um proprietário único.

- Prevenção de Ligação: Ao usar chaves novas para cada transação, reduz-se a possibilidade de links evidentes entre múltiplas transações realizadas pelo mesmo usuário.

Riscos de Ligação

Embora a privacidade seja fortalecida, alguns riscos permanecem:

- Transações multi-entrada podem revelar que todas as entradas pertencem ao mesmo proprietário, caso sejam necessárias para somar o valor total.

- O proprietário da chave pode ser identificado indiretamente por transações anteriores que estejam conectadas.

11. Cálculos

Imagine que temos um sistema onde as pessoas (ou computadores) competem para adicionar informações novas (blocos) a um grande registro público (a cadeia de blocos ou blockchain). Este registro é como um livro contábil compartilhado, onde todos podem verificar o que está escrito.

Agora, vamos pensar em um cenário: um atacante quer enganar o sistema. Ele quer mudar informações já registradas para beneficiar a si mesmo, por exemplo, desfazendo um pagamento que já fez. Para isso, ele precisa criar uma versão alternativa do livro contábil (a cadeia de blocos dele) e convencer todos os outros participantes de que essa versão é a verdadeira.

Mas isso é extremamente difícil.

Como o Ataque Funciona

Quando um novo bloco é adicionado à cadeia, ele depende de cálculos complexos que levam tempo e esforço. Esses cálculos são como um grande quebra-cabeça que precisa ser resolvido.

- Os “bons jogadores” (nós honestos) estão sempre trabalhando juntos para resolver esses quebra-cabeças e adicionar novos blocos à cadeia verdadeira.

- O atacante, por outro lado, precisa resolver quebra-cabeças sozinho, tentando “alcançar” a cadeia honesta para que sua versão alternativa pareça válida.

Se a cadeia honesta já está vários blocos à frente, o atacante começa em desvantagem, e o sistema está projetado para que a dificuldade de alcançá-los aumente rapidamente.

A Corrida Entre Cadeias

Você pode imaginar isso como uma corrida. A cada bloco novo que os jogadores honestos adicionam à cadeia verdadeira, eles se distanciam mais do atacante. Para vencer, o atacante teria que resolver os quebra-cabeças mais rápido que todos os outros jogadores honestos juntos.

Suponha que:

- A rede honesta tem 80% do poder computacional (ou seja, resolve 8 de cada 10 quebra-cabeças).

- O atacante tem 20% do poder computacional (ou seja, resolve 2 de cada 10 quebra-cabeças).

Cada vez que a rede honesta adiciona um bloco, o atacante tem que "correr atrás" e resolver mais quebra-cabeças para alcançar.

Por Que o Ataque Fica Cada Vez Mais Improvável?

Vamos usar uma fórmula simples para mostrar como as chances de sucesso do atacante diminuem conforme ele precisa "alcançar" mais blocos:

P = (q/p)^z

- q é o poder computacional do atacante (20%, ou 0,2).

- p é o poder computacional da rede honesta (80%, ou 0,8).

- z é a diferença de blocos entre a cadeia honesta e a cadeia do atacante.

Se o atacante está 5 blocos atrás (z = 5):

P = (0,2 / 0,8)^5 = (0,25)^5 = 0,00098, (ou, 0,098%)

Isso significa que o atacante tem menos de 0,1% de chance de sucesso — ou seja, é muito improvável.

Se ele estiver 10 blocos atrás (z = 10):

P = (0,2 / 0,8)^10 = (0,25)^10 = 0,000000095, (ou, 0,0000095%).

Neste caso, as chances de sucesso são praticamente nulas.

Um Exemplo Simples

Se você jogar uma moeda, a chance de cair “cara” é de 50%. Mas se precisar de 10 caras seguidas, sua chance já é bem menor. Se precisar de 20 caras seguidas, é quase impossível.

No caso do Bitcoin, o atacante precisa de muito mais do que 20 caras seguidas. Ele precisa resolver quebra-cabeças extremamente difíceis e alcançar os jogadores honestos que estão sempre à frente. Isso faz com que o ataque seja inviável na prática.

Por Que Tudo Isso é Seguro?

- A probabilidade de sucesso do atacante diminui exponencialmente. Isso significa que, quanto mais tempo passa, menor é a chance de ele conseguir enganar o sistema.

- A cadeia verdadeira (honesta) está protegida pela força da rede. Cada novo bloco que os jogadores honestos adicionam à cadeia torna mais difícil para o atacante alcançar.

E Se o Atacante Tentar Continuar?

O atacante poderia continuar tentando indefinidamente, mas ele estaria gastando muito tempo e energia sem conseguir nada. Enquanto isso, os jogadores honestos estão sempre adicionando novos blocos, tornando o trabalho do atacante ainda mais inútil.

Assim, o sistema garante que a cadeia verdadeira seja extremamente segura e que ataques sejam, na prática, impossíveis de ter sucesso.

12. Conclusão

Propusemos um sistema de transações eletrônicas que elimina a necessidade de confiança, baseando-se em assinaturas digitais e em uma rede peer-to-peer que utiliza prova de trabalho. Isso resolve o problema do gasto duplo, criando um histórico público de transações imutável, desde que a maioria do poder computacional permaneça sob controle dos participantes honestos. A rede funciona de forma simples e descentralizada, com nós independentes que não precisam de identificação ou coordenação direta. Eles entram e saem livremente, aceitando a cadeia de prova de trabalho como registro do que ocorreu durante sua ausência. As decisões são tomadas por meio do poder de CPU, validando blocos legítimos, estendendo a cadeia e rejeitando os inválidos. Com este mecanismo de consenso, todas as regras e incentivos necessários para o funcionamento seguro e eficiente do sistema são garantidos.

Faça o download do whitepaper original em português: https://bitcoin.org/files/bitcoin-paper/bitcoin_pt_br.pdf

-

@ 87730827:746b7d35

2024-11-20 09:27:53

@ 87730827:746b7d35

2024-11-20 09:27:53Original: https://techreport.com/crypto-news/brazil-central-bank-ban-monero-stablecoins/

Brazilian’s Central Bank Will Ban Monero and Algorithmic Stablecoins in the Country

Brazil proposes crypto regulations banning Monero and algorithmic stablecoins and enforcing strict compliance for exchanges.

KEY TAKEAWAYS

- The Central Bank of Brazil has proposed regulations prohibiting privacy-centric cryptocurrencies like Monero.

- The regulations categorize exchanges into intermediaries, custodians, and brokers, each with specific capital requirements and compliance standards.

- While the proposed rules apply to cryptocurrencies, certain digital assets like non-fungible tokens (NFTs) are still ‘deregulated’ in Brazil.

In a Notice of Participation announcement, the Brazilian Central Bank (BCB) outlines regulations for virtual asset service providers (VASPs) operating in the country.

In the document, the Brazilian regulator specifies that privacy-focused coins, such as Monero, must be excluded from all digital asset companies that intend to operate in Brazil.

Let’s unpack what effect these regulations will have.

Brazil’s Crackdown on Crypto Fraud

If the BCB’s current rule is approved, exchanges dealing with coins that provide anonymity must delist these currencies or prevent Brazilians from accessing and operating these assets.

The Central Bank argues that currencies like Monero make it difficult and even prevent the identification of users, thus creating problems in complying with international AML obligations and policies to prevent the financing of terrorism.

According to the Central Bank of Brazil, the bans aim to prevent criminals from using digital assets to launder money. In Brazil, organized criminal syndicates such as the Primeiro Comando da Capital (PCC) and Comando Vermelho have been increasingly using digital assets for money laundering and foreign remittances.

… restriction on the supply of virtual assets that contain characteristics of fragility, insecurity or risks that favor fraud or crime, such as virtual assets designed to favor money laundering and terrorist financing practices by facilitating anonymity or difficulty identification of the holder.

The Central Bank has identified that removing algorithmic stablecoins is essential to guarantee the safety of users’ funds and avoid events such as when Terraform Labs’ entire ecosystem collapsed, losing billions of investors’ dollars.

The Central Bank also wants to control all digital assets traded by companies in Brazil. According to the current proposal, the national regulator will have the power to ask platforms to remove certain listed assets if it considers that they do not meet local regulations.

However, the regulations will not include NFTs, real-world asset (RWA) tokens, RWA tokens classified as securities, and tokenized movable or real estate assets. These assets are still ‘deregulated’ in Brazil.

Monero: What Is It and Why Is Brazil Banning It?

Monero ($XMR) is a cryptocurrency that uses a protocol called CryptoNote. It launched in 2013 and ‘erases’ transaction data, preventing the sender and recipient addresses from being publicly known. The Monero network is based on a proof-of-work (PoW) consensus mechanism, which incentivizes miners to add blocks to the blockchain.

Like Brazil, other nations are banning Monero in search of regulatory compliance. Recently, Dubai’s new digital asset rules prohibited the issuance of activities related to anonymity-enhancing cryptocurrencies such as $XMR.

Furthermore, exchanges such as Binance have already announced they will delist Monero on their global platforms due to its anonymity features. Kraken did the same, removing Monero for their European-based users to comply with MiCA regulations.

Data from Chainalysis shows that Brazil is the seventh-largest Bitcoin market in the world.

In Latin America, Brazil is the largest market for digital assets. Globally, it leads in the innovation of RWA tokens, with several companies already trading this type of asset.

In Closing

Following other nations, Brazil’s regulatory proposals aim to combat illicit activities such as money laundering and terrorism financing.

Will the BCB’s move safeguard people’s digital assets while also stimulating growth and innovation in the crypto ecosystem? Only time will tell.

References

Cassio Gusson is a journalist passionate about technology, cryptocurrencies, and the nuances of human nature. With a career spanning roles as Senior Crypto Journalist at CriptoFacil and Head of News at CoinTelegraph, he offers exclusive insights on South America’s crypto landscape. A graduate in Communication from Faccamp and a post-graduate in Globalization and Culture from FESPSP, Cassio explores the intersection of governance, decentralization, and the evolution of global systems.

-

@ 41e6f20b:06049e45

2024-11-17 17:33:55

@ 41e6f20b:06049e45

2024-11-17 17:33:55Let me tell you a beautiful story. Last night, during the speakers' dinner at Monerotopia, the waitress was collecting tiny tips in Mexican pesos. I asked her, "Do you really want to earn tips seriously?" I then showed her how to set up a Cake Wallet, and she started collecting tips in Monero, reaching 0.9 XMR. Of course, she wanted to cash out to fiat immediately, but it solved a real problem for her: making more money. That amount was something she would never have earned in a single workday. We kept talking, and I promised to give her Zoom workshops. What can I say? I love people, and that's why I'm a natural orange-piller.

-

@ 3bf0c63f:aefa459d

2024-09-06 12:49:46

@ 3bf0c63f:aefa459d

2024-09-06 12:49:46Nostr: a quick introduction, attempt #2

Nostr doesn't subscribe to any ideals of "free speech" as these belong to the realm of politics and assume a big powerful government that enforces a common ruleupon everybody else.

Nostr instead is much simpler, it simply says that servers are private property and establishes a generalized framework for people to connect to all these servers, creating a true free market in the process. In other words, Nostr is the public road that each market participant can use to build their own store or visit others and use their services.

(Of course a road is never truly public, in normal cases it's ran by the government, in this case it relies upon the previous existence of the internet with all its quirks and chaos plus a hand of government control, but none of that matters for this explanation).

More concretely speaking, Nostr is just a set of definitions of the formats of the data that can be passed between participants and their expected order, i.e. messages between clients (i.e. the program that runs on a user computer) and relays (i.e. the program that runs on a publicly accessible computer, a "server", generally with a domain-name associated) over a type of TCP connection (WebSocket) with cryptographic signatures. This is what is called a "protocol" in this context, and upon that simple base multiple kinds of sub-protocols can be added, like a protocol for "public-square style microblogging", "semi-closed group chat" or, I don't know, "recipe sharing and feedback".

-

@ be39043c:4a573ca3

2024-08-16 01:59:24

@ be39043c:4a573ca3

2024-08-16 01:59:24Traditionally, miso making takes place during the cold winter. Miso is fermented during the warm season and start using after it gets cooler in the fall. However, I did make during the summer and there was no problem.

For 29oz miso

Ingredients: * Chickpeas 0.5lbs(227g) * Dried Koji 0.5lbs(227g) *not raw(active) koji * Natural salts 103g * Chickpeas : Koji: Salts = 1: 1: 0.45 (salts 12.5%)

I find chickpeas easier to handle than soy beans. For soy beans,

- Soy beans 230g (soak at least 18 hours)

- Dried Koji 340g

- Natural salts 30g(Salts 12.5%)

You also need :

Container for fermentation -32 oz glass jar (no metal lid) or strong plastic container or bag that can be sealed. * large mixing bowl

small bowl

* pressure cooker or large pot * food processor or blender or masher (I use the bottom of small glass jar sanitized with hotwater) * parchment paper or plastic wrap to cover the surface- Wash chickpeas and soak over night

- Cook chickpeas until it can be crashed with your thumb and pinky finger with a pressure cooker or a pot (this may take hours with a pot) Move a part of cooked liquid from the pot to a small bowl and drain the rest. Wait until chickpeas can be handled with hand.

- Mash chickpeas into paste

- Sanitize the 32oz jar with hot water or sanitizer of your choice

- Mixed dried koji with salts with hand

- Add koji and salts to the chickpea paste. Mix with hand well. Add a little bit of the liquid you put aside earlier if the paste is too dry (do not add too much).

- When mixed well, make balls with the paste using hands.

- Throw one of the balls into the jar and push onto the jar with your fist. Repeat this process. (you don't have to punch here. Just push. This process is to transfer the miso paste into the jar without air. The exposure to air will lead to mold. Make sure not to have a space.)

- After throwing all balls into the jar and place tightly without air, seal the surface with a piece of parchment paper or plastic wrap.

- Close the lid.

- Place the jar in a cool and dark place (room temperature). Leave 6 months to 2 years. After the half of the duration, you may pull out of paste and place the bottom half onto the upper half so that the miso will be evenly fermented. This process can be skipped. Check once in a couple of months if there is mold.

- If mold appears on the surface, just scrape it off.

Miso pro's video. He uses soys.

-

@ 2ede6f6b:b94998e2

2024-08-15 21:11:43

@ 2ede6f6b:b94998e2

2024-08-15 21:11:43test

originally posted at https://stacker.news/items/459389

-

@ 2f29aa33:38ac6f13

2025-05-17 12:59:01

@ 2f29aa33:38ac6f13

2025-05-17 12:59:01The Myth and the Magic

Picture this: a group of investors, huddled around a glowing computer screen, nervously watching Bitcoin’s price. Suddenly, someone produces a stick-no ordinary stick, but a magical one. With a mischievous grin, they poke the Bitcoin. The price leaps upward. Cheers erupt. The legend of the Bitcoin stick is born.

But why does poking Bitcoin with a stick make the price go up? Why does it only work for a lucky few? And what does the data say about this mysterious phenomenon? Let’s dig in, laugh a little, and maybe learn the secret to market-moving magic.

The Statistical Side of Stick-Poking

Bitcoin’s Price: The Wild Ride

Bitcoin’s price is famous for its unpredictability. In the past year, it’s soared, dipped, and soared again, sometimes gaining more than 50% in just a few months. On a good day, billions of dollars flow through Bitcoin trades, and the price can jump thousands in a matter of hours. Clearly, something is making this happen-and it’s not just spreadsheets and financial news.

What Actually Moves the Price?

-

Scarcity: Only 21 million Bitcoins will ever exist. When more people want in, the price jumps.

-

Big News: Announcements, rumors, and meme-worthy moments can send the price flying.

-

FOMO: When people see Bitcoin rising, they rush to buy, pushing it even higher.

-

Liquidations: When traders betting against Bitcoin get squeezed, it triggers a chain reaction of buying.

But let’s be honest: none of this is as fun as poking Bitcoin with a stick.

The Magical Stick: Not Your Average Twig

Why Not Every Stick Works

You can’t just grab any old branch and expect Bitcoin to dance. The magical stick is a rare artifact, forged in the fires of internet memes and blessed by the spirit of Satoshi. Only a chosen few possess it-and when they poke, the market listens.

Signs You Have the Magical Stick

-

When you poke, Bitcoin’s price immediately jumps a few percent.

-

Your stick glows with meme energy and possibly sparkles with digital dust.

-

You have a knack for timing your poke right after a big event, like a halving or a celebrity tweet.

-

Your stick is rumored to have been whittled from the original blockchain itself.

Why Most Sticks Fail

-

No Meme Power: If your stick isn’t funny, Bitcoin ignores you.

-

Bad Timing: Poking during a bear market just annoys the blockchain.

-

Not Enough Hype: If the bitcoin community isn’t watching, your poke is just a poke.

-

Lack of Magic: Some sticks are just sticks. Sad, but true.

The Data: When the Stick Strikes

Let’s look at some numbers:

-

In the last month, Bitcoin’s price jumped over 20% right after a flurry of memes and stick-poking jokes.

-

Over the past year, every major price surge was accompanied by a wave of internet hype, stick memes, or wild speculation.

-

In the past five years, Bitcoin’s biggest leaps always seemed to follow some kind of magical event-whether a halving, a viral tweet, or a mysterious poke.

Coincidence? Maybe. But the pattern is clear: the stick works-at least when it’s magical.

The Role of Memes, Magic, and Mayhem

Bitcoin’s price is like a cat: unpredictable, easily startled, and sometimes it just wants to be left alone. But when the right meme pops up, or the right stick pokes at just the right time, the price can leap in ways that defy logic.

The bitcoin community knows this. That’s why, when Bitcoin’s stuck in a rut, you’ll see a flood of stick memes, GIFs, and magical thinking. Sometimes, it actually works.

The Secret’s in the Stick (and the Laughs)

So, does poking Bitcoin with a stick really make the price go up? If your stick is magical-blessed by memes, timed perfectly, and watched by millions-absolutely. The statistics show that hype, humor, and a little bit of luck can move markets as much as any financial report.

Next time you see Bitcoin stalling, don’t just sit there. Grab your stick, channel your inner meme wizard, and give it a poke. Who knows? You might just be the next legend in the world of bitcoin magic.

And if your stick doesn’t work, don’t worry. Sometimes, the real magic is in the laughter along the way.

-aco

@block height: 897,104

-

-

@ c1e9ab3a:9cb56b43

2025-05-09 23:10:14

@ c1e9ab3a:9cb56b43

2025-05-09 23:10:14I. Historical Foundations of U.S. Monetary Architecture

The early monetary system of the United States was built atop inherited commodity money conventions from Europe’s maritime economies. Silver and gold coins—primarily Spanish pieces of eight, Dutch guilders, and other foreign specie—formed the basis of colonial commerce. These units were already integrated into international trade and piracy networks and functioned with natural compatibility across England, France, Spain, and Denmark. Lacking a centralized mint or formal currency, the U.S. adopted these forms de facto.

As security risks and the practical constraints of physical coinage mounted, banks emerged to warehouse specie and issue redeemable certificates. These certificates evolved into fiduciary media—claims on specie not actually in hand. Banks observed over time that substantial portions of reserves remained unclaimed for years. This enabled fractional reserve banking: issuing more claims than reserves held, so long as redemption demand stayed low. The practice was inherently unstable, prone to panics and bank runs, prompting eventual centralization through the formation of the Federal Reserve in 1913.

Following the Civil War and unstable reinstatements of gold convertibility, the U.S. sought global monetary stability. After World War II, the Bretton Woods system formalized the U.S. dollar as the global reserve currency. The dollar was nominally backed by gold, but most international dollars were held offshore and recycled into U.S. Treasuries. The Nixon Shock of 1971 eliminated the gold peg, converting the dollar into pure fiat. Yet offshore dollar demand remained, sustained by oil trade mandates and the unique role of Treasuries as global reserve assets.

II. The Structure of Fiduciary Media and Treasury Demand

Under this system, foreign trade surpluses with the U.S. generate excess dollars. These surplus dollars are parked in U.S. Treasuries, thereby recycling trade imbalances into U.S. fiscal liquidity. While technically loans to the U.S. government, these purchases act like interest-only transfers—governments receive yield, and the U.S. receives spendable liquidity without principal repayment due in the short term. Debt is perpetually rolled over, rarely extinguished.

This creates an illusion of global subsidy: U.S. deficits are financed via foreign capital inflows that, in practice, function more like financial tribute systems than conventional debt markets. The underlying asset—U.S. Treasury debt—functions as the base reserve asset of the dollar system, replacing gold in post-Bretton Woods monetary logic.

III. Emergence of Tether and the Parastatal Dollar

Tether (USDT), as a private issuer of dollar-denominated tokens, mimics key central bank behaviors while operating outside the regulatory perimeter. It mints tokens allegedly backed 1:1 by U.S. dollars or dollar-denominated securities (mostly Treasuries). These tokens circulate globally, often in jurisdictions with limited banking access, and increasingly serve as synthetic dollar substitutes.

If USDT gains dominance as the preferred medium of exchange—due to technological advantages, speed, programmability, or access—it displaces Federal Reserve Notes (FRNs) not through devaluation, but through functional obsolescence. Gresham’s Law inverts: good money (more liquid, programmable, globally transferable USDT) displaces bad (FRNs) even if both maintain a nominal 1:1 parity.

Over time, this preference translates to a systemic demand shift. Actors increasingly use Tether instead of FRNs, especially in global commerce, digital marketplaces, or decentralized finance. Tether tokens effectively become shadow base money.

IV. Interaction with Commercial Banking and Redemption Mechanics

Under traditional fractional reserve systems, commercial banks issue loans denominated in U.S. dollars, expanding the money supply. When borrowers repay loans, this destroys the created dollars and contracts monetary elasticity. If borrowers repay in USDT instead of FRNs:

- Banks receive a non-Fed liability (USDT).

- USDT is not recognized as reserve-eligible within the Federal Reserve System.

- Banks must either redeem USDT for FRNs, or demand par-value conversion from Tether to settle reserve requirements and balance their books.

This places redemption pressure on Tether and threatens its 1:1 peg under stress. If redemption latency, friction, or cost arises, USDT’s equivalence to FRNs is compromised. Conversely, if banks are permitted or compelled to hold USDT as reserve or regulatory capital, Tether becomes a de facto reserve issuer.