-

@ 21335073:a244b1ad

2025-05-09 13:56:57

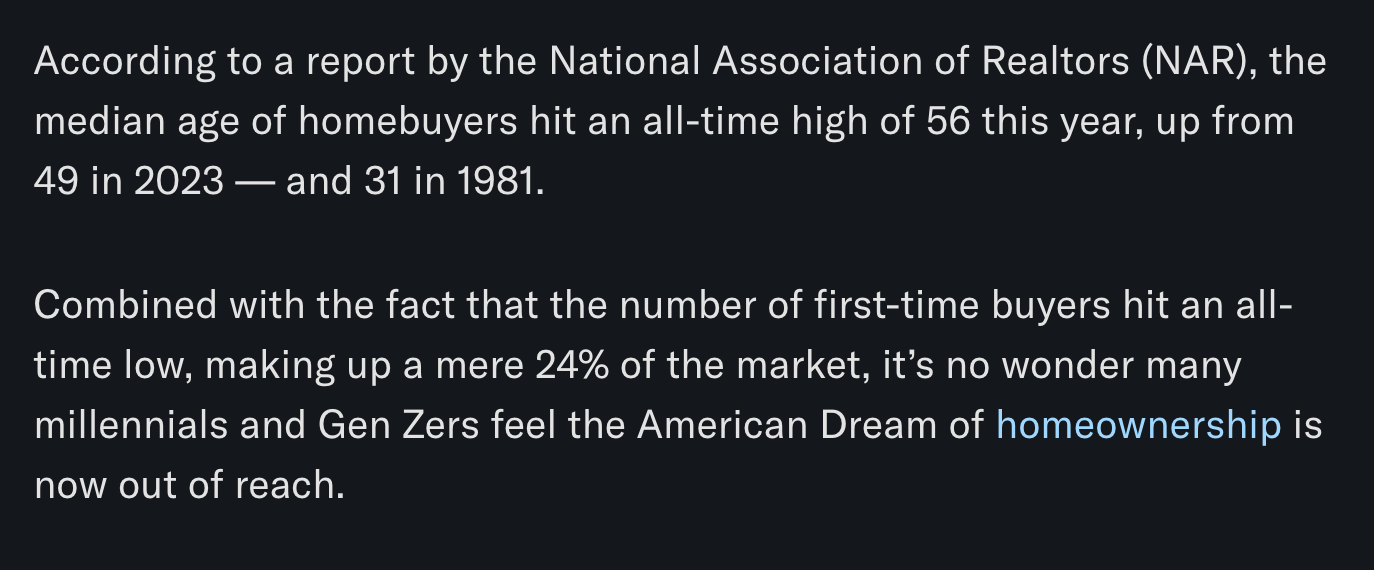

@ 21335073:a244b1ad

2025-05-09 13:56:57Someone asked for my thoughts, so I’ll share them thoughtfully. I’m not here to dictate how to promote Nostr—I’m still learning about it myself. While I’m not new to Nostr, freedom tech is a newer space for me. I’m skilled at advocating for topics I deeply understand, but freedom tech isn’t my expertise, so take my words with a grain of salt. Nothing I say is set in stone.

Those who need Nostr the most are the ones most vulnerable to censorship on other platforms right now. Reaching them requires real-time awareness of global issues and the dynamic relationships between governments and tech providers, which can shift suddenly. Effective Nostr promoters must grasp this and adapt quickly.

The best messengers are people from or closely tied to these at-risk regions—those who truly understand the local political and cultural dynamics. They can connect with those in need when tensions rise. Ideal promoters are rational, trustworthy, passionate about Nostr, but above all, dedicated to amplifying people’s voices when it matters most.

Forget influencers, corporate-backed figures, or traditional online PR—it comes off as inauthentic, corny, desperate and forced. Nostr’s promotion should be grassroots and organic, driven by a few passionate individuals who believe in Nostr and the communities they serve.

The idea that “people won’t join Nostr due to lack of reach” is nonsense. Everyone knows X’s “reach” is mostly with bots. If humans want real conversations, Nostr is the place. X is great for propaganda, but Nostr is for the authentic voices of the people.

Those spreading Nostr must be so passionate they’re willing to onboard others, which is time-consuming but rewarding for the right person. They’ll need to make Nostr and onboarding a core part of who they are. I see no issue with that level of dedication. I’ve been known to get that way myself at times. It’s fun for some folks.

With love, I suggest not adding Bitcoin promotion with Nostr outreach. Zaps already integrate that element naturally. (Still promote within the Bitcoin ecosystem, but this is about reaching vulnerable voices who needed Nostr yesterday.)

To promote Nostr, forget conventional strategies. “Influencers” aren’t the answer. “Influencers” are not the future. A trusted local community member has real influence—reach them. Connect with people seeking Nostr’s benefits but lacking the technical language to express it. This means some in the Nostr community might need to step outside of the Bitcoin bubble, which is uncomfortable but necessary. Thank you in advance to those who are willing to do that.

I don’t know who is paid to promote Nostr, if anyone. This piece isn’t shade. But it’s exhausting to see innocent voices globally silenced on corporate platforms like X while Nostr exists. Last night, I wondered: how many more voices must be censored before the Nostr community gets uncomfortable and thinks creatively to reach the vulnerable?

A warning: the global need for censorship-resistant social media is undeniable. If Nostr doesn’t make itself known, something else will fill that void. Let’s start this conversation.

-

@ 21335073:a244b1ad

2025-05-01 01:51:10

@ 21335073:a244b1ad

2025-05-01 01:51:10Please respect Virginia Giuffre’s memory by refraining from asking about the circumstances or theories surrounding her passing.

Since Virginia Giuffre’s death, I’ve reflected on what she would want me to say or do. This piece is my attempt to honor her legacy.

When I first spoke with Virginia, I was struck by her unshakable hope. I had grown cynical after years in the anti-human trafficking movement, worn down by a broken system and a government that often seemed complicit. But Virginia’s passion, creativity, and belief that survivors could be heard reignited something in me. She reminded me of my younger, more hopeful self. Instead of warning her about the challenges ahead, I let her dream big, unburdened by my own disillusionment. That conversation changed me for the better, and following her lead led to meaningful progress.

Virginia was one of the bravest people I’ve ever known. As a survivor of Epstein, Maxwell, and their co-conspirators, she risked everything to speak out, taking on some of the world’s most powerful figures.

She loved when I said, “Epstein isn’t the only Epstein.” This wasn’t just about one man—it was a call to hold all abusers accountable and to ensure survivors find hope and healing.

The Epstein case often gets reduced to sensational details about the elite, but that misses the bigger picture. Yes, we should be holding all of the co-conspirators accountable, we must listen to the survivors’ stories. Their experiences reveal how predators exploit vulnerabilities, offering lessons to prevent future victims.

You’re not powerless in this fight. Educate yourself about trafficking and abuse—online and offline—and take steps to protect those around you. Supporting survivors starts with small, meaningful actions. Free online resources can guide you in being a safe, supportive presence.

When high-profile accusations arise, resist snap judgments. Instead of dismissing survivors as “crazy,” pause to consider the trauma they may be navigating. Speaking out or coping with abuse is never easy. You don’t have to believe every claim, but you can refrain from attacking accusers online.

Society also fails at providing aftercare for survivors. The government, often part of the problem, won’t solve this. It’s up to us. Prevention is critical, but when abuse occurs, step up for your loved ones and community. Protect the vulnerable. it’s a challenging but a rewarding journey.

If you’re contributing to Nostr, you’re helping build a censorship resistant platform where survivors can share their stories freely, no matter how powerful their abusers are. Their voices can endure here, offering strength and hope to others. This gives me great hope for the future.

Virginia Giuffre’s courage was a gift to the world. It was an honor to know and serve her. She will be deeply missed. My hope is that her story inspires others to take on the powerful.

-

@ 52b4a076:e7fad8bd

2025-04-28 00:48:57

@ 52b4a076:e7fad8bd

2025-04-28 00:48:57I have been recently building NFDB, a new relay DB. This post is meant as a short overview.

Regular relays have challenges

Current relay software have significant challenges, which I have experienced when hosting Nostr.land: - Scalability is only supported by adding full replicas, which does not scale to large relays. - Most relays use slow databases and are not optimized for large scale usage. - Search is near-impossible to implement on standard relays. - Privacy features such as NIP-42 are lacking. - Regular DB maintenance tasks on normal relays require extended downtime. - Fault-tolerance is implemented, if any, using a load balancer, which is limited. - Personalization and advanced filtering is not possible. - Local caching is not supported.

NFDB: A scalable database for large relays

NFDB is a new database meant for medium-large scale relays, built on FoundationDB that provides: - Near-unlimited scalability - Extended fault tolerance - Instant loading - Better search - Better personalization - and more.

Search

NFDB has extended search capabilities including: - Semantic search: Search for meaning, not words. - Interest-based search: Highlight content you care about. - Multi-faceted queries: Easily filter by topic, author group, keywords, and more at the same time. - Wide support for event kinds, including users, articles, etc.

Personalization

NFDB allows significant personalization: - Customized algorithms: Be your own algorithm. - Spam filtering: Filter content to your WoT, and use advanced spam filters. - Topic mutes: Mute topics, not keywords. - Media filtering: With Nostr.build, you will be able to filter NSFW and other content - Low data mode: Block notes that use high amounts of cellular data. - and more

Other

NFDB has support for many other features such as: - NIP-42: Protect your privacy with private drafts and DMs - Microrelays: Easily deploy your own personal microrelay - Containers: Dedicated, fast storage for discoverability events such as relay lists

Calcite: A local microrelay database

Calcite is a lightweight, local version of NFDB that is meant for microrelays and caching, meant for thousands of personal microrelays.

Calcite HA is an additional layer that allows live migration and relay failover in under 30 seconds, providing higher availability compared to current relays with greater simplicity. Calcite HA is enabled in all Calcite deployments.

For zero-downtime, NFDB is recommended.

Noswhere SmartCache

Relays are fixed in one location, but users can be anywhere.

Noswhere SmartCache is a CDN for relays that dynamically caches data on edge servers closest to you, allowing: - Multiple regions around the world - Improved throughput and performance - Faster loading times

routerd

routerdis a custom load-balancer optimized for Nostr relays, integrated with SmartCache.routerdis specifically integrated with NFDB and Calcite HA to provide fast failover and high performance.Ending notes

NFDB is planned to be deployed to Nostr.land in the coming weeks.

A lot more is to come. 👀️️️️️️

-

@ cae03c48:2a7d6671

2025-06-02 17:00:57

@ cae03c48:2a7d6671

2025-06-02 17:00:57Bitcoin Magazine

Sberbank, Russia’s Biggest Bank, Launches Structured Bond Tied to BitcoinSberbank, the largest bank in Russia, has launched a new structured bond that ties investor returns to the performance of Bitcoin and the U.S. dollar-to-ruble exchange rate. This new financial product represents one of the first moves by a major Russian institution to offer Bitcoin-linked investments under recently updated national regulations.

BREAKING:

Russia's largest bank Sberbank launches structured bonds linked to Bitcoin. pic.twitter.com/LtD26jPS0x

Russia's largest bank Sberbank launches structured bonds linked to Bitcoin. pic.twitter.com/LtD26jPS0x— Bitcoin Magazine (@BitcoinMagazine) June 2, 2025

The structured bond is initially available over the counter to a limited group of qualified investors. According to the announcement, it allows investors to earn based on two factors: the price performance of BTC in U.S. dollars and any strengthening of the dollar compared to the Russian ruble.

Unlike typical Bitcoin investments, this product does not require the use of a Bitcoin wallet or foreign platforms. “All transactions [are] processed in rubles within Russia’s legal and infrastructure systems,” Sberbank stated, highlighting compliance with domestic financial protocols.

In addition to the bond, Sberbank has announced plans to launch similar structured investment products with Bitcoin exposure on the Moscow Exchange. The bank also revealed it will introduce a Bitcoin futures product via its SberInvestments platform on June 4, aligning with the product’s debut on the Moscow Exchange.

These developments follow a recent policy change by the Bank of Russia, which now permits financial institutions to offer Bitcoin-linked instruments to qualified investors. This shift opens the door for Bitcoin within the country’s traditional financial markets.

While Russia has previously taken a cautious approach to digital assets, Sberbank’s launch of a Bitcoin-linked bond and upcoming futures product marks a new phase of adoption—one that blends Bitcoin exposure with existing financial infrastructure.

The bank’s structured bond may signal a growing interest in regulated access to Bitcoin, especially within large financial institutions.

This post Sberbank, Russia’s Biggest Bank, Launches Structured Bond Tied to Bitcoin first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ e516ecb8:1be0b167

2025-06-02 15:22:40

@ e516ecb8:1be0b167

2025-06-02 15:22:40Bitcoin was born as a middle finger to the financial establishment. Its 2008 whitepaper, penned by the enigmatic Satoshi Nakamoto, promised a peer-to-peer (P2P) electronic cash system—a decentralized rebellion against state-controlled money, sparked in the ashes of the global financial crisis. It was a cypherpunk dream: a currency free from banks, governments, and middlemen. But somewhere along the way, Bitcoin lost its soul. What was meant to be a fluid, practical currency has morphed into a clunky, expensive digital vault—a gilded cage for your wealth. Let’s unpack why Bitcoin is broken, why its fixes are flimsy, and why its rebellious spirit is fading into a state-backed shadow of its former self.

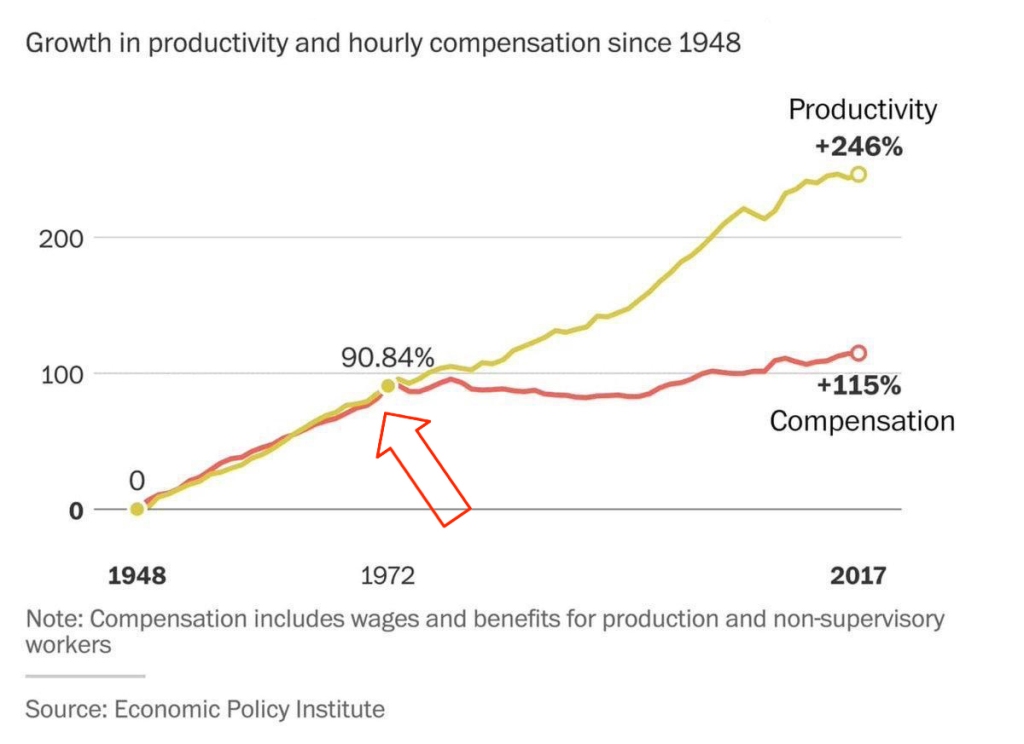

The P2P Promise: Shattered by Sky-High Fees Bitcoin’s core idea was simple: send money directly to anyone, anywhere, without a bank skimming off the top. Fast forward to today, and that vision is in tatters. Imagine you’ve got $34 in Bitcoin to send to a friend. By the time it arrives, after transaction fees, they might get a measly $2. According to data from BitInfoCharts, the average Bitcoin transaction fee in early 2025 hovers around $20–$30, with spikes as high as $60 during network congestion. For context, that’s more than the cost of a Venmo transfer or even some international wire fees.

This isn’t a one-off issue. Wallets like Guarda, Exodus, or even hardware wallets like Ledger face the same problem: Bitcoin’s base layer (Layer 1) is so congested that fees make small transactions absurdly impractical. Want to buy a $5 coffee with Bitcoin? You’d lose more in fees than the coffee’s worth. This isn’t P2P money—it’s confiscatory, inefficient, and anything but user-friendly.

Lightning Network: A Band-Aid on a Broken System Cue the Bitcoin maximalists: “But we have the Lightning Network!” Sure, Lightning was introduced as a second-layer solution to scale Bitcoin for smaller, faster transactions. It’s a network of off-chain payment channels designed to handle microtransactions with lower fees. Sounds great, right? Except it’s a patchwork fix that betrays Bitcoin’s original vision.

First, Lightning wasn’t part of Satoshi’s plan—it’s an afterthought, a kludge to address the base layer’s limitations. Second, it’s not universally adopted. According to 1ML, as of early 2025, only about 15% of Bitcoin wallets natively support Lightning. Major wallets like Coinbase Wallet and Trust Wallet still require workarounds or third-party integrations. Why? Because implementing Lightning is complex, and for most users, it involves trusting third-party nodes or custodians to route payments. So much for “be your own bank.”

Worse, running your own Lightning node requires technical know-how—think Linux commands, channel management, and constant monitoring. A 2024 survey by Bitcoin Magazine found that only 8% of Bitcoin users run their own nodes, Lightning or otherwise. For the average person, Lightning isn’t a solution; it’s a hurdle. And if you’re relying on a third party, you’re back to square one: trusting someone else with your money.

Take Adrián Bernabeu, author of Bitcoinismo, who preaches the gospel of self-custody while simultaneously hyping Lightning for micropayments. It’s a contradiction. You can’t champion “not your keys, not your crypto” while pushing a system that often requires third-party intermediaries for practical use. It’s like telling someone to live off-grid but handing them a generator that only works with a utility company’s permission.

A Gilded Cage: Bitcoin as a Store of Value So, if Bitcoin isn’t practical for payments, what’s it good for? The narrative has shifted: Bitcoin is now a “store of value,” a digital gold. Its price has soared—hitting $80,000 in late 2024, per CoinGecko—and its fixed supply of 21 million coins makes it a hedge against inflation. But this shift isn’t just about market dynamics; it’s a consequence of Bitcoin’s own flaws.

Moving Bitcoin is so expensive that it’s often smarter to hodl than to spend. Your wallet becomes an orange-tinted cage, trapping your wealth in a system where transferring value eats away at your holdings. Sure, you could wait for fees to drop, but that’s another nail in the P2P coffin. Real money doesn’t make you wait for a discount to use it. Imagine telling someone, “Hold off on buying groceries until the dollar’s transaction fees go down.” It’s absurd.

OP_RETURN and the Spam Problem: A Network Clogged with Junk Bitcoin’s blockchain isn’t just struggling with fees; it’s also drowning in digital clutter. The OP_RETURN function, meant for embedding small amounts of data (like metadata for smart contracts), has become a dumping ground for everything from NFT inscriptions to random spam. In 2023, Glassnode reported that OP_RETURN transactions accounted for nearly 20% of Bitcoin’s block space during peak periods, crowding out legitimate transactions and driving up fees.

Proposed fixes from Bitcoin Core and Knots—like limiting OP_RETURN data size or tweaking mempool rules—are more Band-Aids. They don’t address the root issue: Bitcoin’s block size limit. Capped at 1MB (or roughly 4MB with SegWit), Bitcoin can only process about 3–7 transactions per second, compared to Visa’s 24,000. Increasing the block size could ease congestion and lower fees, but Bitcoin Core developers have resisted this for years, citing concerns about centralization.

Here’s the kicker: Bitcoin Cash (BCH), a 2017 fork of Bitcoin, raised its block size to 32MB and processes transactions at a fraction of the cost. BCH’s average fee in 2025 is under $0.01, per BitInfoCharts. Bitcoin maximalists dismiss BCH as a failed experiment, but it’s hard to argue with the numbers. A larger block size reduces spam’s impact because legitimate transactions dominate. Admitting this, though, would mean conceding defeat in a years-long ideological battle. And Bitcoiners hate losing.

From Rebellion to Regulatory Lapdog Bitcoin’s cypherpunk roots are fading fast. What started as a revolt against state control is cozying up to governments. El Salvador made Bitcoin legal tender in 2021, but its state-backed Chivo wallet (built on Lightning) is riddled with bugs and usability issues, according to a 2024 Reuters report. Meanwhile, Bitcoin Core developers have lobbied for institutional adoption, with figures like Michael Saylor advocating for Bitcoin as a strategic reserve asset for governments and corporations.

This is a far cry from Satoshi’s vision. A 2023 post on X revealed that Core developers met with U.S. regulators to discuss Bitcoin’s role in national reserves—a move that reeks of compromise. The same system Bitcoin was meant to disrupt is now being courted. If governments start subsidizing Bitcoin mining to protect their reserves, as some speculate, the irony will be complete: a decentralized dream bankrolled by fiat.

The Looming Threats: Quantum and Mining Woes Bitcoin’s problems don’t end with fees and politics. Quantum computing looms on the horizon. A 2024 MIT Technology Review article estimated that quantum computers capable of breaking Bitcoin’s ECDSA cryptography could emerge by 2030. This threatens “Satoshi-era” wallets—those holding early, unspent coins—potentially undermining trust in the entire blockchain.

Then there’s mining. Bitcoin’s proof-of-work system is energy-intensive, with global mining consuming 150 TWh annually, per the Cambridge Bitcoin Electricity Consumption Index. As block rewards halve (the next halving is in 2028), miners will rely more on transaction fees. Higher fees mean even less practicality for P2P payments, locking Bitcoin further into its “digital gold” trap. If states step in to subsidize mining, as some X posts have speculated, Bitcoin’s anti-establishment ethos will be dead in the water.

The Final Irony: Paying for Freedom with Fiat Bitcoin promised to replace fiat currency, but its flaws are pushing it toward a bizarre dependency on the very system it sought to destroy. If governments subsidize mining or adopt Bitcoin as a reserve asset, we’ll be left with a bitter irony: a supposedly revolutionary asset propped up by fiat. The cypherpunk dream will have come full circle, not as a triumph, but as a compromise.

So, is Bitcoin broken? Yes. It’s a victim of its own success—too valuable to spend, too clunky to use, and too compromised to stay true to its roots. The question isn’t whether Bitcoin can be fixed; it’s whether its community has the courage to admit what’s wrong. Until then, your Bitcoin wallet remains a shiny, orange prison—a relic of a rebellion that forgot how to fight.

-

@ 91bea5cd:1df4451c

2025-04-26 10:16:21

@ 91bea5cd:1df4451c

2025-04-26 10:16:21O Contexto Legal Brasileiro e o Consentimento

No ordenamento jurídico brasileiro, o consentimento do ofendido pode, em certas circunstâncias, afastar a ilicitude de um ato que, sem ele, configuraria crime (como lesão corporal leve, prevista no Art. 129 do Código Penal). Contudo, o consentimento tem limites claros: não é válido para bens jurídicos indisponíveis, como a vida, e sua eficácia é questionável em casos de lesões corporais graves ou gravíssimas.

A prática de BDSM consensual situa-se em uma zona complexa. Em tese, se ambos os parceiros são adultos, capazes, e consentiram livre e informadamente nos atos praticados, sem que resultem em lesões graves permanentes ou risco de morte não consentido, não haveria crime. O desafio reside na comprovação desse consentimento, especialmente se uma das partes, posteriormente, o negar ou alegar coação.

A Lei Maria da Penha (Lei nº 11.340/2006)

A Lei Maria da Penha é um marco fundamental na proteção da mulher contra a violência doméstica e familiar. Ela estabelece mecanismos para coibir e prevenir tal violência, definindo suas formas (física, psicológica, sexual, patrimonial e moral) e prevendo medidas protetivas de urgência.

Embora essencial, a aplicação da lei em contextos de BDSM pode ser delicada. Uma alegação de violência por parte da mulher, mesmo que as lesões ou situações decorram de práticas consensuais, tende a receber atenção prioritária das autoridades, dada a presunção de vulnerabilidade estabelecida pela lei. Isso pode criar um cenário onde o parceiro masculino enfrenta dificuldades significativas em demonstrar a natureza consensual dos atos, especialmente se não houver provas robustas pré-constituídas.

Outros riscos:

Lesão corporal grave ou gravíssima (art. 129, §§ 1º e 2º, CP), não pode ser justificada pelo consentimento, podendo ensejar persecução penal.

Crimes contra a dignidade sexual (arts. 213 e seguintes do CP) são de ação pública incondicionada e independem de representação da vítima para a investigação e denúncia.

Riscos de Falsas Acusações e Alegação de Coação Futura

Os riscos para os praticantes de BDSM, especialmente para o parceiro que assume o papel dominante ou que inflige dor/restrição (frequentemente, mas não exclusivamente, o homem), podem surgir de diversas frentes:

- Acusações Externas: Vizinhos, familiares ou amigos que desconhecem a natureza consensual do relacionamento podem interpretar sons, marcas ou comportamentos como sinais de abuso e denunciar às autoridades.

- Alegações Futuras da Parceira: Em caso de término conturbado, vingança, arrependimento ou mudança de perspectiva, a parceira pode reinterpretar as práticas passadas como abuso e buscar reparação ou retaliação através de uma denúncia. A alegação pode ser de que o consentimento nunca existiu ou foi viciado.

- Alegação de Coação: Uma das formas mais complexas de refutar é a alegação de que o consentimento foi obtido mediante coação (física, moral, psicológica ou econômica). A parceira pode alegar, por exemplo, que se sentia pressionada, intimidada ou dependente, e que seu "sim" não era genuíno. Provar a ausência de coação a posteriori é extremamente difícil.

- Ingenuidade e Vulnerabilidade Masculina: Muitos homens, confiando na dinâmica consensual e na parceira, podem negligenciar a necessidade de precauções. A crença de que "isso nunca aconteceria comigo" ou a falta de conhecimento sobre as implicações legais e o peso processual de uma acusação no âmbito da Lei Maria da Penha podem deixá-los vulneráveis. A presença de marcas físicas, mesmo que consentidas, pode ser usada como evidência de agressão, invertendo o ônus da prova na prática, ainda que não na teoria jurídica.

Estratégias de Prevenção e Mitigação

Não existe um método infalível para evitar completamente o risco de uma falsa acusação, mas diversas medidas podem ser adotadas para construir um histórico de consentimento e reduzir vulnerabilidades:

- Comunicação Explícita e Contínua: A base de qualquer prática BDSM segura é a comunicação constante. Negociar limites, desejos, palavras de segurança ("safewords") e expectativas antes, durante e depois das cenas é crucial. Manter registros dessas negociações (e-mails, mensagens, diários compartilhados) pode ser útil.

-

Documentação do Consentimento:

-

Contratos de Relacionamento/Cena: Embora a validade jurídica de "contratos BDSM" seja discutível no Brasil (não podem afastar normas de ordem pública), eles servem como forte evidência da intenção das partes, da negociação detalhada de limites e do consentimento informado. Devem ser claros, datados, assinados e, idealmente, reconhecidos em cartório (para prova de data e autenticidade das assinaturas).

-

Registros Audiovisuais: Gravar (com consentimento explícito para a gravação) discussões sobre consentimento e limites antes das cenas pode ser uma prova poderosa. Gravar as próprias cenas é mais complexo devido a questões de privacidade e potencial uso indevido, mas pode ser considerado em casos específicos, sempre com consentimento mútuo documentado para a gravação.

Importante: a gravação deve ser com ciência da outra parte, para não configurar violação da intimidade (art. 5º, X, da Constituição Federal e art. 20 do Código Civil).

-

-

Testemunhas: Em alguns contextos de comunidade BDSM, a presença de terceiros de confiança durante negociações ou mesmo cenas pode servir como testemunho, embora isso possa alterar a dinâmica íntima do casal.

- Estabelecimento Claro de Limites e Palavras de Segurança: Definir e respeitar rigorosamente os limites (o que é permitido, o que é proibido) e as palavras de segurança é fundamental. O desrespeito a uma palavra de segurança encerra o consentimento para aquele ato.

- Avaliação Contínua do Consentimento: O consentimento não é um cheque em branco; ele deve ser entusiástico, contínuo e revogável a qualquer momento. Verificar o bem-estar do parceiro durante a cena ("check-ins") é essencial.

- Discrição e Cuidado com Evidências Físicas: Ser discreto sobre a natureza do relacionamento pode evitar mal-entendidos externos. Após cenas que deixem marcas, é prudente que ambos os parceiros estejam cientes e de acordo, talvez documentando por fotos (com data) e uma nota sobre a consensualidade da prática que as gerou.

- Aconselhamento Jurídico Preventivo: Consultar um advogado especializado em direito de família e criminal, com sensibilidade para dinâmicas de relacionamento alternativas, pode fornecer orientação personalizada sobre as melhores formas de documentar o consentimento e entender os riscos legais específicos.

Observações Importantes

- Nenhuma documentação substitui a necessidade de consentimento real, livre, informado e contínuo.

- A lei brasileira protege a "integridade física" e a "dignidade humana". Práticas que resultem em lesões graves ou que violem a dignidade de forma não consentida (ou com consentimento viciado) serão ilegais, independentemente de qualquer acordo prévio.

- Em caso de acusação, a existência de documentação robusta de consentimento não garante a absolvição, mas fortalece significativamente a defesa, ajudando a demonstrar a natureza consensual da relação e das práticas.

-

A alegação de coação futura é particularmente difícil de prevenir apenas com documentos. Um histórico consistente de comunicação aberta (whatsapp/telegram/e-mails), respeito mútuo e ausência de dependência ou controle excessivo na relação pode ajudar a contextualizar a dinâmica como não coercitiva.

-

Cuidado com Marcas Visíveis e Lesões Graves Práticas que resultam em hematomas severos ou lesões podem ser interpretadas como agressão, mesmo que consentidas. Evitar excessos protege não apenas a integridade física, mas também evita questionamentos legais futuros.

O que vem a ser consentimento viciado

No Direito, consentimento viciado é quando a pessoa concorda com algo, mas a vontade dela não é livre ou plena — ou seja, o consentimento existe formalmente, mas é defeituoso por alguma razão.

O Código Civil brasileiro (art. 138 a 165) define várias formas de vício de consentimento. As principais são:

Erro: A pessoa se engana sobre o que está consentindo. (Ex.: A pessoa acredita que vai participar de um jogo leve, mas na verdade é exposta a práticas pesadas.)

Dolo: A pessoa é enganada propositalmente para aceitar algo. (Ex.: Alguém mente sobre o que vai acontecer durante a prática.)

Coação: A pessoa é forçada ou ameaçada a consentir. (Ex.: "Se você não aceitar, eu termino com você" — pressão emocional forte pode ser vista como coação.)

Estado de perigo ou lesão: A pessoa aceita algo em situação de necessidade extrema ou abuso de sua vulnerabilidade. (Ex.: Alguém em situação emocional muito fragilizada é induzida a aceitar práticas que normalmente recusaria.)

No contexto de BDSM, isso é ainda mais delicado: Mesmo que a pessoa tenha "assinado" um contrato ou dito "sim", se depois ela alegar que seu consentimento foi dado sob medo, engano ou pressão psicológica, o consentimento pode ser considerado viciado — e, portanto, juridicamente inválido.

Isso tem duas implicações sérias:

-

O crime não se descaracteriza: Se houver vício, o consentimento é ignorado e a prática pode ser tratada como crime normal (lesão corporal, estupro, tortura, etc.).

-

A prova do consentimento precisa ser sólida: Mostrando que a pessoa estava informada, lúcida, livre e sem qualquer tipo de coação.

Consentimento viciado é quando a pessoa concorda formalmente, mas de maneira enganada, forçada ou pressionada, tornando o consentimento inútil para efeitos jurídicos.

Conclusão

Casais que praticam BDSM consensual no Brasil navegam em um terreno que exige não apenas confiança mútua e comunicação excepcional, mas também uma consciência aguçada das complexidades legais e dos riscos de interpretações equivocadas ou acusações mal-intencionadas. Embora o BDSM seja uma expressão legítima da sexualidade humana, sua prática no Brasil exige responsabilidade redobrada. Ter provas claras de consentimento, manter a comunicação aberta e agir com prudência são formas eficazes de se proteger de falsas alegações e preservar a liberdade e a segurança de todos os envolvidos. Embora leis controversas como a Maria da Penha sejam "vitais" para a proteção contra a violência real, os praticantes de BDSM, e em particular os homens nesse contexto, devem adotar uma postura proativa e prudente para mitigar os riscos inerentes à potencial má interpretação ou instrumentalização dessas práticas e leis, garantindo que a expressão de sua consensualidade esteja resguardada na medida do possível.

Importante: No Brasil, mesmo com tudo isso, o Ministério Público pode denunciar por crime como lesão corporal grave, estupro ou tortura, independente de consentimento. Então a prudência nas práticas é fundamental.

Aviso Legal: Este artigo tem caráter meramente informativo e não constitui aconselhamento jurídico. As leis e interpretações podem mudar, e cada situação é única. Recomenda-se buscar orientação de um advogado qualificado para discutir casos específicos.

Se curtiu este artigo faça uma contribuição, se tiver algum ponto relevante para o artigo deixe seu comentário.

-

@ e3ba5e1a:5e433365

2025-04-15 11:03:15

@ e3ba5e1a:5e433365

2025-04-15 11:03:15Prelude

I wrote this post differently than any of my others. It started with a discussion with AI on an OPSec-inspired review of separation of powers, and evolved into quite an exciting debate! I asked Grok to write up a summary in my overall writing style, which it got pretty well. I've decided to post it exactly as-is. Ultimately, I think there are two solid ideas driving my stance here:

- Perfect is the enemy of the good

- Failure is the crucible of success

Beyond that, just some hard-core belief in freedom, separation of powers, and operating from self-interest.

Intro

Alright, buckle up. I’ve been chewing on this idea for a while, and it’s time to spit it out. Let’s look at the U.S. government like I’d look at a codebase under a cybersecurity audit—OPSEC style, no fluff. Forget the endless debates about what politicians should do. That’s noise. I want to talk about what they can do, the raw powers baked into the system, and why we should stop pretending those powers are sacred. If there’s a hole, either patch it or exploit it. No half-measures. And yeah, I’m okay if the whole thing crashes a bit—failure’s a feature, not a bug.

The Filibuster: A Security Rule with No Teeth

You ever see a firewall rule that’s more theater than protection? That’s the Senate filibuster. Everyone acts like it’s this untouchable guardian of democracy, but here’s the deal: a simple majority can torch it any day. It’s not a law; it’s a Senate preference, like choosing tabs over spaces. When people call killing it the “nuclear option,” I roll my eyes. Nuclear? It’s a button labeled “press me.” If a party wants it gone, they’ll do it. So why the dance?

I say stop playing games. Get rid of the filibuster. If you’re one of those folks who thinks it’s the only thing saving us from tyranny, fine—push for a constitutional amendment to lock it in. That’s a real patch, not a Post-it note. Until then, it’s just a vulnerability begging to be exploited. Every time a party threatens to nuke it, they’re admitting it’s not essential. So let’s stop pretending and move on.

Supreme Court Packing: Because Nine’s Just a Number

Here’s another fun one: the Supreme Court. Nine justices, right? Sounds official. Except it’s not. The Constitution doesn’t say nine—it’s silent on the number. Congress could pass a law tomorrow to make it 15, 20, or 42 (hitchhiker’s reference, anyone?). Packing the court is always on the table, and both sides know it. It’s like a root exploit just sitting there, waiting for someone to log in.

So why not call the bluff? If you’re in power—say, Trump’s back in the game—say, “I’m packing the court unless we amend the Constitution to fix it at nine.” Force the issue. No more shadowboxing. And honestly? The court’s got way too much power anyway. It’s not supposed to be a super-legislature, but here we are, with justices’ ideologies driving the bus. That’s a bug, not a feature. If the court weren’t such a kingmaker, packing it wouldn’t even matter. Maybe we should be talking about clipping its wings instead of just its size.

The Executive Should Go Full Klingon

Let’s talk presidents. I’m not saying they should wear Klingon armor and start shouting “Qapla’!”—though, let’s be real, that’d be awesome. I’m saying the executive should use every scrap of power the Constitution hands them. Enforce the laws you agree with, sideline the ones you don’t. If Congress doesn’t like it, they’ve got tools: pass new laws, override vetoes, or—here’s the big one—cut the budget. That’s not chaos; that’s the system working as designed.

Right now, the real problem isn’t the president overreaching; it’s the bureaucracy. It’s like a daemon running in the background, eating CPU and ignoring the user. The president’s supposed to be the one steering, but the administrative state’s got its own agenda. Let the executive flex, push the limits, and force Congress to check it. Norms? Pfft. The Constitution’s the spec sheet—stick to it.

Let the System Crash

Here’s where I get a little spicy: I’m totally fine if the government grinds to a halt. Deadlock isn’t a disaster; it’s a feature. If the branches can’t agree, let the president veto, let Congress starve the budget, let enforcement stall. Don’t tell me about “essential services.” Nothing’s so critical it can’t take a breather. Shutdowns force everyone to the table—debate, compromise, or expose who’s dropping the ball. If the public loses trust? Good. They’ll vote out the clowns or live with the circus they elected.

Think of it like a server crash. Sometimes you need a hard reboot to clear the cruft. If voters keep picking the same bad admins, well, the country gets what it deserves. Failure’s the best teacher—way better than limping along on autopilot.

States Are the Real MVPs

If the feds fumble, states step up. Right now, states act like junior devs waiting for the lead engineer to sign off. Why? Federal money. It’s a leash, and it’s tight. Cut that cash, and states will remember they’re autonomous. Some will shine, others will tank—looking at you, California. And I’m okay with that. Let people flee to better-run states. No bailouts, no excuses. States are like competing startups: the good ones thrive, the bad ones pivot or die.

Could it get uneven? Sure. Some states might turn into sci-fi utopias while others look like a post-apocalyptic vidya game. That’s the point—competition sorts it out. Citizens can move, markets adjust, and failure’s a signal to fix your act.

Chaos Isn’t the Enemy

Yeah, this sounds messy. States ignoring federal law, external threats poking at our seams, maybe even a constitutional crisis. I’m not scared. The Supreme Court’s there to referee interstate fights, and Congress sets the rules for state-to-state play. But if it all falls apart? Still cool. States can sort it without a babysitter—it’ll be ugly, but freedom’s worth it. External enemies? They’ll either unify us or break us. If we can’t rally, we don’t deserve the win.

Centralizing power to avoid this is like rewriting your app in a single thread to prevent race conditions—sure, it’s simpler, but you’re begging for a deadlock. Decentralized chaos lets states experiment, lets people escape, lets markets breathe. States competing to cut regulations to attract businesses? That’s a race to the bottom for red tape, but a race to the top for innovation—workers might gripe, but they’ll push back, and the tension’s healthy. Bring it—let the cage match play out. The Constitution’s checks are enough if we stop coddling the system.

Why This Matters

I’m not pitching a utopia. I’m pitching a stress test. The U.S. isn’t a fragile porcelain doll; it’s a rugged piece of hardware built to take some hits. Let it fail a little—filibuster, court, feds, whatever. Patch the holes with amendments if you want, or lean into the grind. Either way, stop fearing the crash. It’s how we debug the republic.

So, what’s your take? Ready to let the system rumble, or got a better way to secure the code? Hit me up—I’m all ears.

-

@ 91bea5cd:1df4451c

2025-04-15 06:27:28

@ 91bea5cd:1df4451c

2025-04-15 06:27:28Básico

bash lsblk # Lista todos os diretorios montados.Para criar o sistema de arquivos:

bash mkfs.btrfs -L "ThePool" -f /dev/sdxCriando um subvolume:

bash btrfs subvolume create SubVolMontando Sistema de Arquivos:

bash mount -o compress=zlib,subvol=SubVol,autodefrag /dev/sdx /mntLista os discos formatados no diretório:

bash btrfs filesystem show /mntAdiciona novo disco ao subvolume:

bash btrfs device add -f /dev/sdy /mntLista novamente os discos do subvolume:

bash btrfs filesystem show /mntExibe uso dos discos do subvolume:

bash btrfs filesystem df /mntBalancea os dados entre os discos sobre raid1:

bash btrfs filesystem balance start -dconvert=raid1 -mconvert=raid1 /mntScrub é uma passagem por todos os dados e metadados do sistema de arquivos e verifica as somas de verificação. Se uma cópia válida estiver disponível (perfis de grupo de blocos replicados), a danificada será reparada. Todas as cópias dos perfis replicados são validadas.

iniciar o processo de depuração :

bash btrfs scrub start /mntver o status do processo de depuração Btrfs em execução:

bash btrfs scrub status /mntver o status do scrub Btrfs para cada um dos dispositivos

bash btrfs scrub status -d / data btrfs scrub cancel / dataPara retomar o processo de depuração do Btrfs que você cancelou ou pausou:

btrfs scrub resume / data

Listando os subvolumes:

bash btrfs subvolume list /ReportsCriando um instantâneo dos subvolumes:

Aqui, estamos criando um instantâneo de leitura e gravação chamado snap de marketing do subvolume de marketing.

bash btrfs subvolume snapshot /Reports/marketing /Reports/marketing-snapAlém disso, você pode criar um instantâneo somente leitura usando o sinalizador -r conforme mostrado. O marketing-rosnap é um instantâneo somente leitura do subvolume de marketing

bash btrfs subvolume snapshot -r /Reports/marketing /Reports/marketing-rosnapForçar a sincronização do sistema de arquivos usando o utilitário 'sync'

Para forçar a sincronização do sistema de arquivos, invoque a opção de sincronização conforme mostrado. Observe que o sistema de arquivos já deve estar montado para que o processo de sincronização continue com sucesso.

bash btrfs filsystem sync /ReportsPara excluir o dispositivo do sistema de arquivos, use o comando device delete conforme mostrado.

bash btrfs device delete /dev/sdc /ReportsPara sondar o status de um scrub, use o comando scrub status com a opção -dR .

bash btrfs scrub status -dR / RelatóriosPara cancelar a execução do scrub, use o comando scrub cancel .

bash $ sudo btrfs scrub cancel / ReportsPara retomar ou continuar com uma depuração interrompida anteriormente, execute o comando de cancelamento de depuração

bash sudo btrfs scrub resume /Reportsmostra o uso do dispositivo de armazenamento:

btrfs filesystem usage /data

Para distribuir os dados, metadados e dados do sistema em todos os dispositivos de armazenamento do RAID (incluindo o dispositivo de armazenamento recém-adicionado) montados no diretório /data , execute o seguinte comando:

sudo btrfs balance start --full-balance /data

Pode demorar um pouco para espalhar os dados, metadados e dados do sistema em todos os dispositivos de armazenamento do RAID se ele contiver muitos dados.

Opções importantes de montagem Btrfs

Nesta seção, vou explicar algumas das importantes opções de montagem do Btrfs. Então vamos começar.

As opções de montagem Btrfs mais importantes são:

**1. acl e noacl

**ACL gerencia permissões de usuários e grupos para os arquivos/diretórios do sistema de arquivos Btrfs.

A opção de montagem acl Btrfs habilita ACL. Para desabilitar a ACL, você pode usar a opção de montagem noacl .

Por padrão, a ACL está habilitada. Portanto, o sistema de arquivos Btrfs usa a opção de montagem acl por padrão.

**2. autodefrag e noautodefrag

**Desfragmentar um sistema de arquivos Btrfs melhorará o desempenho do sistema de arquivos reduzindo a fragmentação de dados.

A opção de montagem autodefrag permite a desfragmentação automática do sistema de arquivos Btrfs.

A opção de montagem noautodefrag desativa a desfragmentação automática do sistema de arquivos Btrfs.

Por padrão, a desfragmentação automática está desabilitada. Portanto, o sistema de arquivos Btrfs usa a opção de montagem noautodefrag por padrão.

**3. compactar e compactar-forçar

**Controla a compactação de dados no nível do sistema de arquivos do sistema de arquivos Btrfs.

A opção compactar compacta apenas os arquivos que valem a pena compactar (se compactar o arquivo economizar espaço em disco).

A opção compress-force compacta todos os arquivos do sistema de arquivos Btrfs, mesmo que a compactação do arquivo aumente seu tamanho.

O sistema de arquivos Btrfs suporta muitos algoritmos de compactação e cada um dos algoritmos de compactação possui diferentes níveis de compactação.

Os algoritmos de compactação suportados pelo Btrfs são: lzo , zlib (nível 1 a 9) e zstd (nível 1 a 15).

Você pode especificar qual algoritmo de compactação usar para o sistema de arquivos Btrfs com uma das seguintes opções de montagem:

- compress=algoritmo:nível

- compress-force=algoritmo:nível

Para obter mais informações, consulte meu artigo Como habilitar a compactação do sistema de arquivos Btrfs .

**4. subvol e subvolid

**Estas opções de montagem são usadas para montar separadamente um subvolume específico de um sistema de arquivos Btrfs.

A opção de montagem subvol é usada para montar o subvolume de um sistema de arquivos Btrfs usando seu caminho relativo.

A opção de montagem subvolid é usada para montar o subvolume de um sistema de arquivos Btrfs usando o ID do subvolume.

Para obter mais informações, consulte meu artigo Como criar e montar subvolumes Btrfs .

**5. dispositivo

A opção de montagem de dispositivo** é usada no sistema de arquivos Btrfs de vários dispositivos ou RAID Btrfs.

Em alguns casos, o sistema operacional pode falhar ao detectar os dispositivos de armazenamento usados em um sistema de arquivos Btrfs de vários dispositivos ou RAID Btrfs. Nesses casos, você pode usar a opção de montagem do dispositivo para especificar os dispositivos que deseja usar para o sistema de arquivos de vários dispositivos Btrfs ou RAID.

Você pode usar a opção de montagem de dispositivo várias vezes para carregar diferentes dispositivos de armazenamento para o sistema de arquivos de vários dispositivos Btrfs ou RAID.

Você pode usar o nome do dispositivo (ou seja, sdb , sdc ) ou UUID , UUID_SUB ou PARTUUID do dispositivo de armazenamento com a opção de montagem do dispositivo para identificar o dispositivo de armazenamento.

Por exemplo,

- dispositivo=/dev/sdb

- dispositivo=/dev/sdb,dispositivo=/dev/sdc

- dispositivo=UUID_SUB=490a263d-eb9a-4558-931e-998d4d080c5d

- device=UUID_SUB=490a263d-eb9a-4558-931e-998d4d080c5d,device=UUID_SUB=f7ce4875-0874-436a-b47d-3edef66d3424

**6. degraded

A opção de montagem degradada** permite que um RAID Btrfs seja montado com menos dispositivos de armazenamento do que o perfil RAID requer.

Por exemplo, o perfil raid1 requer a presença de 2 dispositivos de armazenamento. Se um dos dispositivos de armazenamento não estiver disponível em qualquer caso, você usa a opção de montagem degradada para montar o RAID mesmo que 1 de 2 dispositivos de armazenamento esteja disponível.

**7. commit

A opção commit** mount é usada para definir o intervalo (em segundos) dentro do qual os dados serão gravados no dispositivo de armazenamento.

O padrão é definido como 30 segundos.

Para definir o intervalo de confirmação para 15 segundos, você pode usar a opção de montagem commit=15 (digamos).

**8. ssd e nossd

A opção de montagem ssd** informa ao sistema de arquivos Btrfs que o sistema de arquivos está usando um dispositivo de armazenamento SSD, e o sistema de arquivos Btrfs faz a otimização SSD necessária.

A opção de montagem nossd desativa a otimização do SSD.

O sistema de arquivos Btrfs detecta automaticamente se um SSD é usado para o sistema de arquivos Btrfs. Se um SSD for usado, a opção de montagem de SSD será habilitada. Caso contrário, a opção de montagem nossd é habilitada.

**9. ssd_spread e nossd_spread

A opção de montagem ssd_spread** tenta alocar grandes blocos contínuos de espaço não utilizado do SSD. Esse recurso melhora o desempenho de SSDs de baixo custo (baratos).

A opção de montagem nossd_spread desativa o recurso ssd_spread .

O sistema de arquivos Btrfs detecta automaticamente se um SSD é usado para o sistema de arquivos Btrfs. Se um SSD for usado, a opção de montagem ssd_spread será habilitada. Caso contrário, a opção de montagem nossd_spread é habilitada.

**10. descarte e nodiscard

Se você estiver usando um SSD que suporte TRIM enfileirado assíncrono (SATA rev3.1), a opção de montagem de descarte** permitirá o descarte de blocos de arquivos liberados. Isso melhorará o desempenho do SSD.

Se o SSD não suportar TRIM enfileirado assíncrono, a opção de montagem de descarte prejudicará o desempenho do SSD. Nesse caso, a opção de montagem nodiscard deve ser usada.

Por padrão, a opção de montagem nodiscard é usada.

**11. norecovery

Se a opção de montagem norecovery** for usada, o sistema de arquivos Btrfs não tentará executar a operação de recuperação de dados no momento da montagem.

**12. usebackuproot e nousebackuproot

Se a opção de montagem usebackuproot for usada, o sistema de arquivos Btrfs tentará recuperar qualquer raiz de árvore ruim/corrompida no momento da montagem. O sistema de arquivos Btrfs pode armazenar várias raízes de árvore no sistema de arquivos. A opção de montagem usebackuproot** procurará uma boa raiz de árvore e usará a primeira boa que encontrar.

A opção de montagem nousebackuproot não verificará ou recuperará raízes de árvore inválidas/corrompidas no momento da montagem. Este é o comportamento padrão do sistema de arquivos Btrfs.

**13. space_cache, space_cache=version, nospace_cache e clear_cache

A opção de montagem space_cache** é usada para controlar o cache de espaço livre. O cache de espaço livre é usado para melhorar o desempenho da leitura do espaço livre do grupo de blocos do sistema de arquivos Btrfs na memória (RAM).

O sistema de arquivos Btrfs suporta 2 versões do cache de espaço livre: v1 (padrão) e v2

O mecanismo de cache de espaço livre v2 melhora o desempenho de sistemas de arquivos grandes (tamanho de vários terabytes).

Você pode usar a opção de montagem space_cache=v1 para definir a v1 do cache de espaço livre e a opção de montagem space_cache=v2 para definir a v2 do cache de espaço livre.

A opção de montagem clear_cache é usada para limpar o cache de espaço livre.

Quando o cache de espaço livre v2 é criado, o cache deve ser limpo para criar um cache de espaço livre v1 .

Portanto, para usar o cache de espaço livre v1 após a criação do cache de espaço livre v2 , as opções de montagem clear_cache e space_cache=v1 devem ser combinadas: clear_cache,space_cache=v1

A opção de montagem nospace_cache é usada para desabilitar o cache de espaço livre.

Para desabilitar o cache de espaço livre após a criação do cache v1 ou v2 , as opções de montagem nospace_cache e clear_cache devem ser combinadas: clear_cache,nosapce_cache

**14. skip_balance

Por padrão, a operação de balanceamento interrompida/pausada de um sistema de arquivos Btrfs de vários dispositivos ou RAID Btrfs será retomada automaticamente assim que o sistema de arquivos Btrfs for montado. Para desabilitar a retomada automática da operação de equilíbrio interrompido/pausado em um sistema de arquivos Btrfs de vários dispositivos ou RAID Btrfs, você pode usar a opção de montagem skip_balance .**

**15. datacow e nodatacow

A opção datacow** mount habilita o recurso Copy-on-Write (CoW) do sistema de arquivos Btrfs. É o comportamento padrão.

Se você deseja desabilitar o recurso Copy-on-Write (CoW) do sistema de arquivos Btrfs para os arquivos recém-criados, monte o sistema de arquivos Btrfs com a opção de montagem nodatacow .

**16. datasum e nodatasum

A opção datasum** mount habilita a soma de verificação de dados para arquivos recém-criados do sistema de arquivos Btrfs. Este é o comportamento padrão.

Se você não quiser que o sistema de arquivos Btrfs faça a soma de verificação dos dados dos arquivos recém-criados, monte o sistema de arquivos Btrfs com a opção de montagem nodatasum .

Perfis Btrfs

Um perfil Btrfs é usado para informar ao sistema de arquivos Btrfs quantas cópias dos dados/metadados devem ser mantidas e quais níveis de RAID devem ser usados para os dados/metadados. O sistema de arquivos Btrfs contém muitos perfis. Entendê-los o ajudará a configurar um RAID Btrfs da maneira que você deseja.

Os perfis Btrfs disponíveis são os seguintes:

single : Se o perfil único for usado para os dados/metadados, apenas uma cópia dos dados/metadados será armazenada no sistema de arquivos, mesmo se você adicionar vários dispositivos de armazenamento ao sistema de arquivos. Assim, 100% do espaço em disco de cada um dos dispositivos de armazenamento adicionados ao sistema de arquivos pode ser utilizado.

dup : Se o perfil dup for usado para os dados/metadados, cada um dos dispositivos de armazenamento adicionados ao sistema de arquivos manterá duas cópias dos dados/metadados. Assim, 50% do espaço em disco de cada um dos dispositivos de armazenamento adicionados ao sistema de arquivos pode ser utilizado.

raid0 : No perfil raid0 , os dados/metadados serão divididos igualmente em todos os dispositivos de armazenamento adicionados ao sistema de arquivos. Nesta configuração, não haverá dados/metadados redundantes (duplicados). Assim, 100% do espaço em disco de cada um dos dispositivos de armazenamento adicionados ao sistema de arquivos pode ser usado. Se, em qualquer caso, um dos dispositivos de armazenamento falhar, todo o sistema de arquivos será corrompido. Você precisará de pelo menos dois dispositivos de armazenamento para configurar o sistema de arquivos Btrfs no perfil raid0 .

raid1 : No perfil raid1 , duas cópias dos dados/metadados serão armazenadas nos dispositivos de armazenamento adicionados ao sistema de arquivos. Nesta configuração, a matriz RAID pode sobreviver a uma falha de unidade. Mas você pode usar apenas 50% do espaço total em disco. Você precisará de pelo menos dois dispositivos de armazenamento para configurar o sistema de arquivos Btrfs no perfil raid1 .

raid1c3 : No perfil raid1c3 , três cópias dos dados/metadados serão armazenadas nos dispositivos de armazenamento adicionados ao sistema de arquivos. Nesta configuração, a matriz RAID pode sobreviver a duas falhas de unidade, mas você pode usar apenas 33% do espaço total em disco. Você precisará de pelo menos três dispositivos de armazenamento para configurar o sistema de arquivos Btrfs no perfil raid1c3 .

raid1c4 : No perfil raid1c4 , quatro cópias dos dados/metadados serão armazenadas nos dispositivos de armazenamento adicionados ao sistema de arquivos. Nesta configuração, a matriz RAID pode sobreviver a três falhas de unidade, mas você pode usar apenas 25% do espaço total em disco. Você precisará de pelo menos quatro dispositivos de armazenamento para configurar o sistema de arquivos Btrfs no perfil raid1c4 .

raid10 : No perfil raid10 , duas cópias dos dados/metadados serão armazenadas nos dispositivos de armazenamento adicionados ao sistema de arquivos, como no perfil raid1 . Além disso, os dados/metadados serão divididos entre os dispositivos de armazenamento, como no perfil raid0 .

O perfil raid10 é um híbrido dos perfis raid1 e raid0 . Alguns dos dispositivos de armazenamento formam arrays raid1 e alguns desses arrays raid1 são usados para formar um array raid0 . Em uma configuração raid10 , o sistema de arquivos pode sobreviver a uma única falha de unidade em cada uma das matrizes raid1 .

Você pode usar 50% do espaço total em disco na configuração raid10 . Você precisará de pelo menos quatro dispositivos de armazenamento para configurar o sistema de arquivos Btrfs no perfil raid10 .

raid5 : No perfil raid5 , uma cópia dos dados/metadados será dividida entre os dispositivos de armazenamento. Uma única paridade será calculada e distribuída entre os dispositivos de armazenamento do array RAID.

Em uma configuração raid5 , o sistema de arquivos pode sobreviver a uma única falha de unidade. Se uma unidade falhar, você pode adicionar uma nova unidade ao sistema de arquivos e os dados perdidos serão calculados a partir da paridade distribuída das unidades em execução.

Você pode usar 1 00x(N-1)/N % do total de espaços em disco na configuração raid5 . Aqui, N é o número de dispositivos de armazenamento adicionados ao sistema de arquivos. Você precisará de pelo menos três dispositivos de armazenamento para configurar o sistema de arquivos Btrfs no perfil raid5 .

raid6 : No perfil raid6 , uma cópia dos dados/metadados será dividida entre os dispositivos de armazenamento. Duas paridades serão calculadas e distribuídas entre os dispositivos de armazenamento do array RAID.

Em uma configuração raid6 , o sistema de arquivos pode sobreviver a duas falhas de unidade ao mesmo tempo. Se uma unidade falhar, você poderá adicionar uma nova unidade ao sistema de arquivos e os dados perdidos serão calculados a partir das duas paridades distribuídas das unidades em execução.

Você pode usar 100x(N-2)/N % do espaço total em disco na configuração raid6 . Aqui, N é o número de dispositivos de armazenamento adicionados ao sistema de arquivos. Você precisará de pelo menos quatro dispositivos de armazenamento para configurar o sistema de arquivos Btrfs no perfil raid6 .

-

@ 3a7c74bb:bbdd5960

2025-06-02 11:48:00

@ 3a7c74bb:bbdd5960

2025-06-02 11:48:00- The Foundation (12th Century)

The territory that would become Portugal was originally part of the Kingdom of León and Castile. But in 1128, the young nobleman Afonso Henriques confronted his own mother at the Battle of São Mamede, taking control of the County of Portugal (Condado Portucalense).

In 1139, after winning the Battle of Ourique, he declared himself King of Portugal. Independence was recognized in 1143 by the King of León and confirmed by the Pope in 1179.

- Expansion and the discoveries (14th–16th Centuries)

In the following centuries, Portugal consolidated its territory and set out to sea. The 15th century marked the beginning of the Portuguese Discoveries:

🚢 1419–1420 – Discovery of Madeira and the Azores 🚢 1488 – Bartolomeu Dias rounds the Cape of Good Hope 🚢 1498 – Vasco da Gama reaches India 🚢 1500 – Pedro Álvares Cabral discovers Brazil

During this period, Portugal created a vast maritime empire with colonies in Africa, the Americas, Asia, and Oceania.

- Iberian Union and the restoration (1580–1640)

In 1580, after a dynastic crisis caused by the death of King Sebastian, Portugal came under Spanish rule in what is known as the Iberian Union. For 60 years, the Spanish kings ruled Portugal until, in 1640, a revolt led by John IV restored Portuguese independence.

- The decline of the Empire and the 1755 earthquake

The 18th century was marked by the Lisbon earthquake of 1755, one of the greatest disasters of its time, which destroyed much of the capital. The Marquis of Pombal led the country’s reconstruction and modernization.

The empire began to weaken, culminating in the independence of Brazil in 1822.

- Wars, republic, and dictatorship (19th–20th Centuries)

Portugal faced internal crises and took part in World War I. In 1910, the monarchy fell and the Portuguese Republic was proclaimed.

In the 20th century, the country lived under the Estado Novo dictatorship (1933–1974), led by António de Oliveira Salazar. In 1974, the Carnation Revolution brought democracy, and the following year, the last African colonies gained independence.

- Modern Portugal (21st Century)

In 1986, Portugal joined the European Union, marking a period of growth and modernization. Today, it is a democratic country with a rich culture and a history that continues to inspire the world.

- And what about the islands?

The Autonomous Regions of Madeira and the Azores play a fundamental role in Portuguese identity. Discovered in the 15th century, they have been part of Portugal ever since and have their own regional governments.

Madeira is known for its wine and stunning landscapes, while the Azores are famous for their volcanic nature and unique culture.

Thank you very much for reading this far. I hope everything is well with you, and sending a big hug from your favorite writer from Madeira. Long live freedom!

-

@ 58537364:705b4b85

2025-06-01 16:46:42

@ 58537364:705b4b85

2025-06-01 16:46:42ความสุขทางโลก ลัทธิสุขนิยมยกย่อง แต่ลัทธิทรมานตนประณาม หากไม่มองว่ากามสุขเป็นพรจากพระผู้เป็นเจ้า คนก็มักมองว่ากามสุขเป็นเครื่องลวงล่อของซาตาน ในเรื่องนี้พระพุทธศาสนาเลือกเดินสายกลาง โดยสอนว่าเราควรทำความเข้าใจกามสุขให้แจ่มแจ้ง ทั้งในแง่เสน่ห์เย้ายวน ข้อจำกัดและข้อบกพร่องทั้งหลาย

เพื่อให้เข้าใจกามสุขอย่างแจ่มแจ้ง เราอาจตั้งคำถามดังนี้: กามสุขสนองตอบความต้องการทางจิตใจแบบใดได้บ้าง และไม่อาจตอบสนองความต้องการแบบใดได้ เพราะเหตุใด

ความต้องการในส่วนที่กามสุขไม่อาจตอบสนองได้ เราควรปฏิบัติอย่างไร

เราหลงเพลิดเพลินและยึดติดในกามสุขมากเพียงใด และกามสุขมีอิทธิพลเหนือจิตใจเราเพียงใด

เราเคยทำหรือพูดสิ่งที่ไม่ถูกต้องเนื่องด้วยปรารถนาในกามสุขหรือไม่

เราเคยเบียดเบียนผู้อื่นเนื่องด้วยปรารถนาในกามสุขหรือไม่

บ่อยครั้งเพียงใดที่สุขทางโลกสร้างความผิดหวังให้เรา

ความคาดหวังมีผลกระทบอย่างไรต่อความสุขทางโลก การทำอะไรซ้ำๆ และความเคยชินส่งผลต่อความสุขทางโลกอย่างไร

เรารู้สึกอย่างไร ยามไม่ได้กามสุขที่เราปรารถนา

กามสุขมีความเกี่ยวข้องกับความซึมเศร้าหรือไม่ กับความวิตกกังวลด้วยหรือไม่

เรารู้สึกอย่างไร เมื่อนึกถึงอนาคตว่า จะต้องพลัดพรากจากสุขทางโลก เนื่องด้วยความเจ็บไข้ ความแก่ และความตาย

การพลัดพรากจากความสุขทางโลกรู้สึกอย่างไรบ้าง

เราตั้งคำถามได้มากมาย และยังตั้งคำถามได้มากไปกว่านี้

หลักสำคัญ คือ ยิ่งเห็นชัดแจ้งในกามสุข เราจะยิ่งเกิดปัญญาและเข้าถึงความสงบมากขึ้นธรรมะคำสอน โดย พระอาจารย์ชยสาโร แปลถอดความ โดย ปิยสีโลภิกขุ

-

@ dfa02707:41ca50e3

2025-06-02 11:01:37

@ dfa02707:41ca50e3

2025-06-02 11:01:37

Good morning (good night?)! The No Bullshit Bitcoin news feed is now available on Moody's Dashboard! A huge shoutout to sir Clark Moody for integrating our feed.

Headlines

- Spiral welcomes Ben Carman. The developer will work on the LDK server and a new SDK designed to simplify the onboarding process for new self-custodial Bitcoin users.

- The Bitcoin Dev Kit Foundation announced new corporate members for 2025, including AnchorWatch, CleanSpark, and Proton Foundation. The annual dues from these corporate members fund the small team of open-source developers responsible for maintaining the core BDK libraries and related free and open-source software (FOSS) projects.

- Strategy increases Bitcoin holdings to 538,200 BTC. In the latest purchase, the company has spent more than $555M to buy 6,556 coins through proceeds of two at-the-market stock offering programs.

- Spar supermarket experiments with Bitcoin payments in Zug, Switzerland. The store has introduced a new payment method powered by the Lightning Network. The implementation was facilitated by DFX Swiss, a service that supports seamless conversions between bitcoin and legacy currencies.

- The Bank for International Settlements (BIS) wants to contain 'crypto' risks. A report titled "Cryptocurrencies and Decentralised Finance: Functions and Financial Stability Implications" calls for expanding research into "how new forms of central bank money, capital controls, and taxation policies can counter the risks of widespread crypto adoption while still fostering technological innovation."

- "Global Implications of Scam Centres, Underground Banking, and Illicit Online Marketplaces in Southeast Asia." According to the United Nations Office on Drugs and Crime (UNODC) report, criminal organizations from East and Southeast Asia are swiftly extending their global reach. These groups are moving beyond traditional scams and trafficking, creating sophisticated online networks that include unlicensed cryptocurrency exchanges, encrypted communication platforms, and stablecoins, fueling a massive fraud economy on an industrial scale.

- Slovenia is considering a 25% capital gains tax on Bitcoin profits for individuals. The Ministry of Finance has proposed legislation to impose this tax on gains from cryptocurrency transactions, though exchanging one cryptocurrency for another would remain exempt. At present, individual 'crypto' traders in Slovenia are not taxed.

- Circle, BitGo, Coinbase, and Paxos plan to apply for U.S. bank charters or licenses. According to a report in The Wall Street Journal, major crypto companies are planning to apply for U.S. bank charters or licenses. These firms are pursuing limited licenses that would permit them to issue stablecoins, as the U.S. Congress deliberates on legislation mandating licensing for stablecoin issuers.

"Established banks, like Bank of America, are hoping to amend the current drafts of [stablecoin] legislation in such a way that nonbanks are more heavily restricted from issuing stablecoins," people familiar with the matter told The Block.

- Charles Schwab to launch spot Bitcoin trading by 2026. The financial investment firm, managing over $10 trillion in assets, has revealed plans to introduce spot Bitcoin trading for its clients within the next year.

Use the tools

- Bitcoin Safe v1.2.3 expands QR SignMessage compatibility for all QR-UR-compatible hardware signers (SpecterDIY, KeyStone, Passport, Jade; already supported COLDCARD Q). It also adds the ability to import wallets via QR, ensuring compatibility with Keystone's latest firmware (2.0.6), alongside other improvements.

- Minibits v0.2.2-beta, an ecash wallet for Android devices, packages many changes to align the project with the planned iOS app release. New features and improvements include the ability to lock ecash to a receiver's pubkey, faster confirmations of ecash minting and payments thanks to WebSockets, UI-related fixes, and more.

- Zeus v0.11.0-alpha1 introduces Cashu wallets tied to embedded LND wallets. Navigate to Settings > Ecash to enable it. Other wallet types can still sweep funds from Cashu tokens. Zeus Pay now supports Cashu address types in Zaplocker, Cashu, and NWC modes.

- LNDg v1.10.0, an advanced web interface designed for analyzing Lightning Network Daemon (LND) data and automating node management tasks, introduces performance improvements, adds a new metrics page for unprofitable and stuck channels, and displays warnings for batch openings. The Profit and Loss Chart has been updated to include on-chain costs. Advanced settings have been added for users who would like their channel database size to be read remotely (the default remains local). Additionally, the AutoFees tool now uses aggregated pubkey metrics for multiple channels with the same peer.

- Nunchuk Desktop v1.9.45 release brings the latest bug fixes and improvements.

- Blockstream Green iOS v4.1.8 has renamed L-BTC to LBTC, and improves translations of notifications, login time, and background payments.

- Blockstream Green Android v4.1.8 has added language preference in App Settings and enables an Android data backup option for disaster recovery. Additionally, it fixes issues with Jade entry point PIN timeout and Trezor passphrase input.

- Torq v2.2.2, an advanced Lightning node management software designed to handle large nodes with over 1000 channels, fixes bugs that caused channel balance to not be updated in some cases and channel "peer total local balance" not getting updated.

- Stack Wallet v2.1.12, a multicoin wallet by Cypher Stack, fixes an issue with Xelis introduced in the latest release for Windows.

- ESP-Miner-NerdQAxePlus v1.0.29.1, a forked version from the NerdAxe miner that was modified for use on the NerdQAxe+, is now available.

- Zark enables sending sats to an npub using Bark.

- Erk is a novel variation of the Ark protocol that completely removes the need for user interactivity in rounds, addressing one of Ark's key limitations: the requirement for users to come online before their VTXOs expire.

- Aegis v0.1.1 is now available. It is a Nostr event signer app for iOS devices.

- Nostash is a NIP-07 Nostr signing extension for Safari. It is a fork of Nostore and is maintained by Terry Yiu. Available on iOS TestFlight.

- Amber v3.2.8, a Nostr event signer for Android, delivers the latest fixes and improvements.

- Nostur v1.20.0, a Nostr client for iOS, adds

-

@ fd06f542:8d6d54cd

2025-04-15 02:38:14

@ fd06f542:8d6d54cd

2025-04-15 02:38:14排名随机, 列表正在增加中。

Cody Tseng

jumble.social 的作者

https://jumble.social/users/npub1syjmjy0dp62dhccq3g97fr87tngvpvzey08llyt6ul58m2zqpzps9wf6wl

- Running [ wss://nostr-relay.app ] (free & WoT) 💜⚡️

- Building 👨💻:

- https://github.com/CodyTseng/jumble

- https://github.com/CodyTseng/nostr-relay-tray

- https://github.com/CodyTseng/danmakustr

- https://github.com/CodyTseng/nostr-relay-nestjs

- https://github.com/CodyTseng/nostr-relay

- https://github.com/CodyTseng

阿甘

- @agan0

- 0xchat.com

- canidae40@coinos.io

- https://jumble.social/users/npub13zyg3zysfylqc6nwfgj2uvce5rtlck2u50vwtjhpn92wzyusprfsdl2rce

joomaen

- Follows you

- joomaen.com

-

95aebd@wallet.yakihonne.com

-

nobot

- https://joomaen.filegear-sg.me/

- https://jumble.social/users/npub1wlpfd84ymdx2rpvnqht7h2lkq5lazvkaejywrvtchlvn3geulfgqp74qq0

颜值精选官

- wasp@ok0.org

- 专注分享 各类 图片与视频,每日为你带来颜值盛宴,心动不止一点点。欢迎关注,一起发现更多美好!

- https://jumble.social/users/npub1d5ygkef6r0l7w29ek9l9c7hulsvdshms2qh74jp5qpfyad4g6h5s4ap6lz

6svjszwk

- 6svjszwk@ok0.org

- 83vEfErLivtS9to39i73ETeaPkCF5ejQFbExoM5Vc2FDLqSE5Ah6NbqN6JaWPQbMeJh2muDiHPEDjboCVFYkHk4dHitivVi

-

low-time-preference

-

anarcho-capitalism

-

libertarianism

-

bitcoin #monero

- https://jumble.social/users/npub1sxgnpqfyd5vjexj4j5tsgfc826ezyz2ywze3w8jchd0rcshw3k6svjszwk

𝘌𝘷𝘦𝘳𝘺𝘥𝘢𝘺 𝘔𝘰𝘳𝘯𝘪𝘯𝘨 𝘚𝘵𝘢𝘳

- everyday@iris.to

- 虽然现在对某些事情下结论还为时尚早,但是从趋势来看,邪恶抬头已经不可避免。

- 我们要做的就是坚持内心的那一份良知,与邪恶战斗到底。

- 黑暗森林时代,当好小透明。

- bc1q7tuckqhkwf4vgc64rsy3rxy5qy6pmdrgxewcww

- https://jumble.social/users/npub1j2pha2chpr0qsmj2f6w783200upa7dvqnnard7vn9l8tv86m7twqszmnke

nostr_cn_dev

npub1l5r02s4udsr28xypsyx7j9lxchf80ha4z6y6269d0da9frtd2nxsvum9jm@npub.cash

Developed the following products: - NostrBridge, 网桥转发 - TaskQ5, 分布式多任务 - NostrHTTP, nostr to http - Postr, 匿名交友,匿名邮局 - nostrclient (Python client) . -nostrbook, (nostrbook.com) 用nostr在线写书 * https://www.duozhutuan.com nostrhttp demo * https://github.com/duozhutuan/NostrBridge * * https://jumble.social/users/npub1l5r02s4udsr28xypsyx7j9lxchf80ha4z6y6269d0da9frtd2nxsvum9jm *

CXPLAY

- lightning@cxplay.org

- 😉很高兴遇到你, 你可以叫我 CX 或 CXPLAY, 这个名字没有特殊含义, 无需在意.

- ©本账号下所有内容如未经特殊声明均使用 CC BY-NC-SA 4.0 许可协议授权.

- 🌐如果您在 Fediverse 收到本账号的内容则说明您的实例已与 Mostr.pub 或 Momostr.pink Bridge 互联, 您所看到的账号为镜像, 所有账号内容正在跨网传递. 如有必要请检查原始页面.

- 🧑💻正在提供中文本地化(i10n): #Amethyst #Amber #Citrine #Soapbox #Ditto #Alby

- https://cx.ms/

https://jumble.social/users/npub1gd8e0xfkylc7v8c5a6hkpj4gelwwcy99jt90lqjseqjj2t253s2s6ch58h

w

- 0xchat的作者

- 0xchat@getalby.com

- Building for 0xchat

- https://www.0xchat.com/

- https://jumble.social/users/npub10td4yrp6cl9kmjp9x5yd7r8pm96a5j07lk5mtj2kw39qf8frpt8qm9x2wl

Michael

- highman@blink.sv

- Composer Artist | Musician

- 🎹🎼🎤🏸🏝️🐕❤️

- 在這裡可以看到「我看世界」的樣子

- 他是光良

- https://jumble.social/users/npub1kr5vqlelt8l47s2z0l47z4myqg897m04vrnaqks3emwryca3al7sv83ry3

-

@ 0970cf17:135aa040

2025-05-31 18:32:00

@ 0970cf17:135aa040

2025-05-31 18:32:00{"pattern":{"kick":[true,false,true,false,true,false,true,false,true,false,true,false,true,false,true,false],"snare":[false,true,false,true,false,true,false,true,false,true,false,true,false,true,false,true],"hihat":[true,false,true,true,false,false,true,true,false,false,true,true,false,false,true,true],"openhat":[true,false,false,true,false,false,false,false,true,false,false,true,false,false,true,false],"crash":[false,false,true,false,false,false,true,false,false,false,false,true,false,false,true,false],"ride":[false,false,true,false,false,false,false,true,false,false,false,true,false,false,true,false],"tom1":[false,true,false,false,true,false,false,true,false,false,true,false,true,false,true,false],"tom2":[true,false,false,false,true,false,false,false,false,true,false,true,false,false,true,false]},"bpm":220,"swing":0,"timeSignature":"4/4","drumKit":"standard","timestamp":1748716320785}

-

@ 84b0c46a:417782f5

2025-06-01 23:36:42

@ 84b0c46a:417782f5

2025-06-01 23:36:425/24 nostr:nevent1qvzqqqqqqypzpvly86xv0ekl7gar8kfp8glfztvftvwrusjsys8qexwmal3sdz6lqywhwumn8ghj7mn0wd68ytnrdakhq6tvv5kk2unjdaezumn9wsq3wamnwvaz7tmwdaehgu3wd968gctwd4hjumt9dcqs6amnwvaz7tmev9382tndv5qjqamnwvaz7tmjv4kxz7fddfczumn0wd68ytnhd9ex2erwv46zu6nsqywhwumn8ghj7un9d3shjtnwdaehgu3wwa5hyetydejhgtn2wqq3zamnwvaz7tmwveex2mrp0yhxzursqyfhwumn8ghj7am0wshxummnw3ezumn9wsqzqxk47yl7vwqu0yrv4fljymp4m2vf0gtesmel4cgg638h82rt4hdn6yyejn

nostr:nevent1qvzqqqqqqypzpvly86xv0ekl7gar8kfp8glfztvftvwrusjsys8qexwmal3sdz6lqyxhwumn8ghj77tpvf6jumt9qys8wumn8ghj7un9d3shjtt2wqhxummnw3ezuamfwfjkgmn9wshx5uqpr4mhxue69uhhyetvv9ujumn0wd68ytnhd9ex2erwv46zu6nsqyghwumn8ghj7mnxwfjkccte9eshquqpzdmhxue69uhhwmm59ehx7um5wghxuet5qqs8msrjypjuvhwaarkq72739wl5rewl49vx0ku6s3u3y03anmau5dscqjj0l

nostr:nevent1qvzqqqqqqypzqnza2du6qe3nnjy0dcgpu0kmr7awunk78m4rtl7x78rxfvay8qlwqyxhwumn8ghj77tpvf6jumt9qys8wumn8ghj7un9d3shjtt2wqhxummnw3ezuamfwfjkgmn9wshx5uqpr4mhxue69uhhyetvv9ujumn0wd68ytnhd9ex2erwv46zu6nsqyghwumn8ghj7mnxwfjkccte9eshquqpzdmhxue69uhhwmm59ehx7um5wghxuet5qqs0fzqwr2xt044zglcwcj3dnnxuk0vlcmwcw0sdzw7yhzfsn009ttss5pv6k

こていたんさんのアイコン

5/25 nostr:nevent1qvzqqqqqqypzqnza2du6qe3nnjy0dcgpu0kmr7awunk78m4rtl7x78rxfvay8qlwqyxhwumn8ghj77tpvf6jumt9qys8wumn8ghj7un9d3shjtt2wqhxummnw3ezuamfwfjkgmn9wshx5uqpr4mhxue69uhhyetvv9ujumn0wd68ytnhd9ex2erwv46zu6nsqyghwumn8ghj7mnxwfjkccte9eshquqpzdmhxue69uhhwmm59ehx7um5wghxuet5qqs0ku3qs4zskmclvtqm0lt707jwn2ylz9v2xj2qakznyp86j4p7fzqd85kfq

nostr:nevent1qvzqqqqqqypzqnza2du6qe3nnjy0dcgpu0kmr7awunk78m4rtl7x78rxfvay8qlwqyxhwumn8ghj77tpvf6jumt9qys8wumn8ghj7un9d3shjtt2wqhxummnw3ezuamfwfjkgmn9wshx5uqpr4mhxue69uhhyetvv9ujumn0wd68ytnhd9ex2erwv46zu6nsqyghwumn8ghj7mnxwfjkccte9eshquqpzdmhxue69uhhwmm59ehx7um5wghxuet5qqs8054fh3l8qtngdfpdwxfl84r36ju3f65zmhjvjy67y7gjj0mhjks2c7w80

nostr:nevent1qvzqqqqqqypzqnza2du6qe3nnjy0dcgpu0kmr7awunk78m4rtl7x78rxfvay8qlwqyxhwumn8ghj77tpvf6jumt9qys8wumn8ghj7un9d3shjtt2wqhxummnw3ezuamfwfjkgmn9wshx5uqpr4mhxue69uhhyetvv9ujumn0wd68ytnhd9ex2erwv46zu6nsqyghwumn8ghj7mnxwfjkccte9eshquqpzdmhxue69uhhwmm59ehx7um5wghxuet5qqsr8nycy3gvjfdn3rqjc49j2gwhwjdhu6d5ms6uxx7y44kzf0u2ftsc8r3c3

nostr:nevent1qvzqqqqqqypzpvly86xv0ekl7gar8kfp8glfztvftvwrusjsys8qexwmal3sdz6lqywhwumn8ghj7mn0wd68ytnrdakhq6tvv5kk2unjdaezumn9wsq3wamnwvaz7tmwdaehgu3wd968gctwd4hjumt9dcqs6amnwvaz7tmev9382tndv5qjqamnwvaz7tmjv4kxz7fddfczumn0wd68ytnhd9ex2erwv46zu6nsqywhwumn8ghj7un9d3shjtnwdaehgu3wwa5hyetydejhgtn2wqq3zamnwvaz7tmwveex2mrp0yhxzursqyfhwumn8ghj7am0wshxummnw3ezumn9wsqzpmcs4xzsusg9s6cn2acasjsam2pwmf6m8h0z08kfca56f8aqwyf2fjwv7w

nostr:nevent1qvzqqqqqqypzphu0pfjqc0lap83f8xv6e73en5zhfjzsrlx6hnk22pewugzhmpa9qqsvh305tpg0xesw6n4eu2kmumgx0mcv0cn64zznyydzpezzsazdugcyrfqm0

nostr:nevent1qvzqqqqqqypzpvly86xv0ekl7gar8kfp8glfztvftvwrusjsys8qexwmal3sdz6lqywhwumn8ghj7mn0wd68ytnrdakhq6tvv5kk2unjdaezumn9wsq3wamnwvaz7tmwdaehgu3wd968gctwd4hjumt9dcqs6amnwvaz7tmev9382tndv5qjqamnwvaz7tmjv4kxz7fddfczumn0wd68ytnhd9ex2erwv46zu6nsqywhwumn8ghj7un9d3shjtnwdaehgu3wwa5hyetydejhgtn2wqq3zamnwvaz7tmwveex2mrp0yhxzursqyfhwumn8ghj7am0wshxummnw3ezumn9wsqzq2aq2l9cq04ygjjk4tq8zfjmuezvckcav8cfqv6z745744nfd2nqlxpq04

nostr:nevent1qvzqqqqqqypzphu0pfjqc0lap83f8xv6e73en5zhfjzsrlx6hnk22pewugzhmpa9qqs05f8xz5uahsdzceq9d0mp860hck3ash8s3ssp3paxxu620tw4ufssk6ntz

nostr:nevent1qvzqqqqqqypzpvly86xv0ekl7gar8kfp8glfztvftvwrusjsys8qexwmal3sdz6lqywhwumn8ghj7mn0wd68ytnrdakhq6tvv5kk2unjdaezumn9wsq3wamnwvaz7tmwdaehgu3wd968gctwd4hjumt9dcqs6amnwvaz7tmev9382tndv5qjqamnwvaz7tmjv4kxz7fddfczumn0wd68ytnhd9ex2erwv46zu6nsqywhwumn8ghj7un9d3shjtnwdaehgu3wwa5hyetydejhgtn2wqq3zamnwvaz7tmwveex2mrp0yhxzursqyfhwumn8ghj7am0wshxummnw3ezumn9wsqzppyeyt0xt0fps85hxv4evdhgy35m9zfzhsqtnq93rsy4arnw3n853sc0u7

nostr:nevent1qvzqqqqqqypzpvly86xv0ekl7gar8kfp8glfztvftvwrusjsys8qexwmal3sdz6lqywhwumn8ghj7mn0wd68ytnrdakhq6tvv5kk2unjdaezumn9wsq3wamnwvaz7tmwdaehgu3wd968gctwd4hjumt9dcqs6amnwvaz7tmev9382tndv5qjqamnwvaz7tmjv4kxz7fddfczumn0wd68ytnhd9ex2erwv46zu6nsqywhwumn8ghj7un9d3shjtnwdaehgu3wwa5hyetydejhgtn2wqq3zamnwvaz7tmwveex2mrp0yhxzursqyfhwumn8ghj7am0wshxummnw3ezumn9wsqzq7emnt7e67h5cygnyvz922x2m4f3x30hpvns3yxls2v4t2uy0vrc6060ek

nostr:nevent1qvzqqqqqqypzplnr7nuypscwtkhtmqaakpyw4cqgtqm5klcyc6qqcmzf6296zrcfqqspu5ny2laxuqtrryffsf455fldpnluw5ladrq32cfveu6mjjgmuxsynheu3

nostr:nevent1qvzqqqqqqypzphla8l7r42mzjvdgevy0pg4y3rd8gupaprgaa7fcdzhrpaddu7lpqqsyhjuxzjkgzp5d8xt8wg8vzekcnaw6ud7htrnqppy2xmpeajrhqncs0rv4c

nostr:nevent1qvzqqqqqqypzphu0pfjqc0lap83f8xv6e73en5zhfjzsrlx6hnk22pewugzhmpa9qqswm6wxhc3h426py80vjm9jj03j8vhvrnhwmalunlxm0pq5xvxqs5qpr2kq7

nostr:nevent1qvzqqqqqqypzplnr7nuypscwtkhtmqaakpyw4cqgtqm5klcyc6qqcmzf6296zrcfqqsgehqf8cl5sp0wfw0fzl982lvhmy9j23vpus70wddtytkr4qygxlchprwv6

nostr:nevent1qvzqqqqqqypzqnza2du6qe3nnjy0dcgpu0kmr7awunk78m4rtl7x78rxfvay8qlwqqsvkrvnh8lzw4rfx87278rwxp2uymej2alputzn2nl525p85c3703cmrgkfn

nostr:nevent1qvzqqqqqqypzqnza2du6qe3nnjy0dcgpu0kmr7awunk78m4rtl7x78rxfvay8qlwqyxhwumn8ghj77tpvf6jumt9qys8wumn8ghj7un9d3shjtt2wqhxummnw3ezuamfwfjkgmn9wshx5uqpz9mhxue69uhkuenjv4kxz7fwv9c8qqgawaehxw309aex2mrp0yhxummnw3ezuamfwfjkgmn9wshx5uqpzdmhxue69uhhwmm59ehx7um5wghxuet5qqsf2u5larth503yh236mhssn2tes4shvawnv4kufzh3889cr9dt4wculcv6w

nostr:nevent1qvzqqqqqqypzqnza2du6qe3nnjy0dcgpu0kmr7awunk78m4rtl7x78rxfvay8qlwqqspnfvau4ylywwk2f7nrm68ue6c86j9p4y0cu4parfwapun0nsw97sad9jwf

nostr:nevent1qvzqqqqqqypzplnr7nuypscwtkhtmqaakpyw4cqgtqm5klcyc6qqcmzf6296zrcfqqs2y7lha9uy30wwdt9yn47s6krqv3e8duj6nqrl27e2s6dl465xssg5gt4ue

nostr:nevent1qvzqqqqqqypzplnr7nuypscwtkhtmqaakpyw4cqgtqm5klcyc6qqcmzf6296zrcfqqsyf8peg4zggp858zfha6dt4mjxss4nhc3k4szqynh0u53j22asx6sdhpfwc

nostr:nevent1qvzqqqqqqypzphla8l7r42mzjvdgevy0pg4y3rd8gupaprgaa7fcdzhrpaddu7lpqqsr0s5ger5l8aapw63yyve5sne5rge0ractks4v4l0yn3ezcvq3f4s8wthq8

nostr:nevent1qvzqqqqqqypzphu0pfjqc0lap83f8xv6e73en5zhfjzsrlx6hnk22pewugzhmpa9qqs93gfz3kskw2lcxadwu3dvanyq7xstaj39vfqmppnng0nvz5gjm8syq9p8p