-

@ fa7153ef:1de1cf78

2025-02-05 18:05:42

"Things usually don't pan out the way you want them to."

It's not really a quote, probably someone said it at some point, but I just wanted to have it at the beginning. My thought process while sitting here is going as - I haven''t written anything for close to 6 months, I need to refer to that fact, and say something about it. I know, things don't usually work out, and wanting to write once a week turned to be no writing for 6 months. Tough luck

I don't really have a good explanation for this. Last post was from end of August 2024. I wouldn't say a lot of things happened in the meantime (especially not a lot that would make me not have time to sit down and write something). People always ask "How have you been?", "Anything happened to you lately?", and my answer is usually - "Nothing special", "Nothing new", "Same old".. (that's probably why I'm not good in conversations with people). But a lot of things have happened, it's just that I feel none of my stories would be interesting to people, or things I find fascinating would just bore everyone. So I usually keep quiet. This is strange, really, since a lot of things that people talk to me about, I don't really care for. But those are their interests, and what are friends for, than to listen to each other? I may be wrong with this one, since writing these words was hard - and I don't really believe in them. It requires some additional thought.

I've always considered myself to be good at spotting when people are uncomfortable, or bored with something (or someone) - like George form Seinfeld. It's likely that I've caught on to people being that way in my presence, so I stopped sharing a lot. Who the heck knows, it's hard being your own psychiatrist, so I won't be one. I'm here to write things.

Since we're on the topic of what happened in the past 6 months, I'd really need to think about everything, and even though you're reading this quickly, a lot of pause has been made when composing this list (I'm going at it one by one, and really trying to remember):

- I met with my old university friends - haven't seen them in 3 years

- visited my sister in another country, and hung out with my little nephew

- had a PR in my squats (50kg) - it's a topic for a different day, but it's a big thing for me, I'm very proud of it.

- I'm working on my spiritual side - trying to get closer to God by reading scripture, praying, and listening to various sermons (which is also a good topic - to share my experiences here)

- I'm following semen retention, it's been a whole year recently. Being single helps, but I won't go into details of it now

- I bought a small 25-key keyboard, and I'm learning playing on it (trying to transfer as much as I can from the guitar experience)

- I feel like anxiety, and fears which have been overwhelming my whole life, have died down a bit. I can still feel them, and when days are bad, so are they, but there have been a lot of good days. Causes for this are numerous, but again, a topic for another time

- I've kept my job

- I've started buying Bitcoin again - I was so "down and out" that even the thought of re-activating my accounts on exchanges was a no-go, but somehow I managed to do it, and am becoming increasingly richer in sats, on a daily basis

- I've been going out more - hanging out with people, and socializing - I'm noticing a substantial increase of this kind of behaviour. I'm not really meeting new people, mostly stick to the ones I already know (which is not a lot)

- I've visited my lifelong friend in another country again, and have a feeling we've rekindled the friendship. It's been a rough time for both of us, and even though we met here and there, at times it felt to be more of a chore. Now, I feel things have changed a bit, and I like it.

- I'm still living with my parents. I don't hate it, it's just something I do. There are strange comments, and I guess people find it curious, but it is what it is.

- I have a much better relation with my father. We've always had an OK relation. He's also a reserved person - I'm not sure of the term and google isn't helping. Likes to keep to himself mostly. We've found some common topics to discuss, and I've been enjoying it. He seems to like it as well. It mostly revolves around football, and watching games together.

- even though I've been sick for the past couple of weeks, my health in general is good. I'm not totally happy with the situation I'm in, but it's still miles ahead of what it has been just a year or two ago

- Some plans have been popping up in my head - after a long time, I have some things I'd like to do. It usually takes a long time to actually do them, but even the thought of wanting something new and different is refreshing, and I'll take it.

I don't know.. There probably are a lot of other things - I mean, there certainly are more private thoughts I've been thinking about - love, romance, romantic partners, God, inner peace, lust, fears, music, family, future.. But I'm not willing to share those yet.

I've finished the Bible last year - by doing daily readings of 10-15 minutes via an app. I've restarted it this year, and going through it again.

Also, I'M noticing that a lot of these sentences start with "I've done this", "I've done that", "I'm this" or "I'm that" - it's understandable, with this being sort-of a personal writing journey, but somehow it's not sitting well with me to have most of the sentences being this way.

I'll keep that in mind for next time. ^^

-

@ 638d2a79:f5645f4e

2025-02-05 18:05:19

When doing division with two-digit dividends, round up to the nearest tens place if the number ends in 6-9.

**Example:**

200÷29200 \div 29200÷29 can be approximated as 200÷30200 \div 30200÷30, which simplifies to 20÷320 \div 320÷3.

Also, zeros cancel out in division.

**Example:**

20000÷70020000 \div 70020000÷700 can be simplified to 200÷7200 \div 7200÷7, which gives the same answer.

### Multiplication Rule:

When doing multiplication, do not write out all of the zeros.

**Example:**

For 90×290 \times 290×2, you don’t need to write out “00” at the start. Just do 9×29 \times 29×2 and add the zero later.

### Division with Two-Digit Divisors:

If the second digit of the divisor is between 1-5, only divide the first digit by the first digit.

**Example:**

5124÷215124 \div 215124÷21 can be solved as follows:

1. Approximate: 5÷2=25 \div 2 = 25÷2=2 (write 2 as the first digit).

2. 21×2=4221 \times 2 = 4221×2=42, subtract to get 92.

3. 9÷2≈49 \div 2 \approx 49÷2≈4, so 21×4=8421 \times 4 = 8421×4=84, subtract to get 8.

4. Bring down the 4 to make 84, which we already know is 21×421 \times 421×4.

5. Final answer: **244**.

![[Recording 20250122112454.m4a]]

### Converting a Remainder into a Decimal:

To turn a remainder into a decimal, divide the remainder by the divisor.

6. Add a zero to the end of your remainder and divide normally.

7. The quotient becomes the decimal value.

**Example:**

32÷10032 \div 10032÷100 → Rewrite as 320÷100320 \div 100320÷100.

- 100 goes into 320 three times (3).

- Bring down a zero → 30.

- Add another zero → 300 → 100 goes in three times (3).

- Final answer: **0.32**.

If one of the numbers is smaller, like in 880÷22880 \div 22880÷22, where 22 doesn’t go into 0:

- Instead, check how many times **0.22** goes into **88**. The answer is **4**.

- 22 goes into 0, 0 times.

- So, 880÷22=40880 \div 22 = 40880÷22=40.

### Division with Three-Digit Numbers:

Use the same method as with two-digit divisors.

**Example:** 100,492÷518100,492 \div 518100,492÷518

- Approximate using **5** for each digit of the answer.

Another example:

36.85÷21636.85 \div 21636.85÷216

- 222 goes into **3** once → Write **1**.

- 216×1=216216 \times 1 = 216216×1=216, subtract from **368** → **152**.

- Bring down the **5** and continue dividing.

### Calculating Volume:

To find the volume of something, use the equation:

Width×Height\text{Width} \times \text{Height}Width×Height

The answer will be in **square units**.

**Example:**

A 2D box with width **1 inch** and height **4 inches** has an area of **4 inches squared**.

### [[America|American]] Flag Instructions:

- The length of the flag is **1.9 times its width**.

- Each stripe should be **one-thirteenth** of the flag's height.

- The blue area covers **7.6** of the flag’s width.

- The height of the blue area is exactly **7 stripes**, or **7/13** of the flag’s height.

### Finding the Median Score of a Class:

8. Count the number of students with the highest score, then move downward.

9. Write scores in one column and the number of students in another.

10. Find the median of the possible scores.

**Example:**

Possible scores: **10, 9, 8, 6, 4** → Median is **8**.

Then, count students until you reach the middle score **(8 or the median value)**

| Posable score | number of students |

| - | |

| 10 | 3 |

| 9 | 6 |

| 8 | 4 |

| 6 | 1 |

| 4 | 1 |

The answer would be 6 1,2,3,4,5,6,7,8 and we are in the 6 Groupe

Tags: [[arrhythmic]]

-

@ 638d2a79:f5645f4e

2025-02-05 18:03:29

China was ruled by one ruler, but over time, China split into two—South and North—which had a rivalry between them. At this time, Yang Chien was a general in the army of Northern China. He thought that China should be whole once more, so, like any _insert age here_ year old would do, he attacked the king of the South (for peace!). After a bit of fighting, he overpowered Southern China and took control of all of China. This man founded a dynasty—the Sui Dynasty—to rule and to keep China united.

But wait! Rivers made travel difficult between the North and South, so his son created a new river when he became emperor. This canal made it easier to cross the rivers, which greatly improved trade. The people did not like working on this river, and after it was completed, they killed him, making him the second and last emperor of the Sui Dynasty.

Cue the new emperor, Li Yuan, AKA "the smart guy." He wanted to stay alive for a long time, and he saw how unhappy people had just killed the last important ruler. So, he decided to invest in keeping people happy instead. This started the Golden Age of China, also called the Tang Dynasty.

Tags: [[human behavior index]]

-

@ e3ba5e1a:5e433365

2025-02-05 17:47:16

I got into a [friendly discussion](https://x.com/snoyberg/status/1887007888117252142) on X regarding health insurance. The specific question was how to deal with health insurance companies (presumably unfairly) denying claims? My answer, as usual: get government out of it!

The US healthcare system is essentially the worst of both worlds:

* Unlike full single payer, individuals incur high costs

* Unlike a true free market, regulation causes increases in costs and decreases competition among insurers

I'm firmly on the side of moving towards the free market. (And I say that as someone living under a single payer system now.) Here's what I would do:

* Get rid of tax incentives that make health insurance tied to your employer, giving individuals back proper freedom of choice.

* Reduce regulations significantly.

* In the short term, some people will still get rejected claims and other obnoxious behavior from insurance companies. We address that in two ways:

1. Due to reduced regulations, new insurance companies will be able to enter the market offering more reliable coverage and better rates, and people will flock to them because they have the freedom to make their own choices.

2. Sue the asses off of companies that reject claims unfairly. And ideally, as one of the few legitimate roles of government in all this, institute new laws that limit the ability of fine print to allow insurers to escape their responsibilities. (I'm hesitant that the latter will happen due to the incestuous relationship between Congress/regulators and insurers, but I can hope.)

Will this magically fix everything overnight like politicians normally promise? No. But it will allow the market to return to a healthy state. And I don't think it will take long (order of magnitude: 5-10 years) for it to come together, but that's just speculation.

And since there's a high correlation between those who believe government can fix problems by taking more control and demanding that only credentialed experts weigh in on a topic (both points I strongly disagree with BTW): I'm a trained actuary and worked in the insurance industry, and have directly seen how government regulation reduces competition, raises prices, and harms consumers.

And my final point: I don't think any prior art would be a good comparison for deregulation in the US, it's such a different market than any other country in the world for so many reasons that lessons wouldn't really translate. Nonetheless, I asked Grok for some empirical data on this, and at best the results of deregulation could be called "mixed," but likely more accurately "uncertain, confused, and subject to whatever interpretation anyone wants to apply."

https://x.com/i/grok/share/Zc8yOdrN8lS275hXJ92uwq98M

-

@ 8be6bafe:b50da031

2025-02-05 17:00:40

Botev Plovdiv FC is proud to present the [Bitcoin Salary Calculator](https://bitcoinfootballcup.com/salary/) tool, as the foundational tool to showcase athletes the financial power of Bitcoin.

We built the [Salary Calculator](https://bitcoinfootballcup.com/salary/) to help anyone follow in the financial footsteps of prominent athletes such as Kieran Gibbs, Russell Okung, Saquon Barkley, and Renato Moicano, who have significantly increased their savings tank thanks to Bitcoin.

The [Bitcoin Salary Calculator](https://bitcoinfootballcup.com/salary/) allows any person to choose how much of their monthly salary they are comfortable saving in Bitcoin. Instantly, users can backtrack and see how their Bitcoin savings would have performed using the once-in-a-species opportunity which Bitcoin brings.

**[Try it out NOW for yourself](https://bitcoinfootballcup.com/salary/).**

https://video.nostr.build/a9f2f693f6b5ee75097941e7a30bfc722225918a896b29a73e13e7581dfed77c.mp4

## Athletes need Bitcoin more than anyone else

Unlike most people, athletes’ careers and earning years are limited. This has driven the likes of Odell Beckham Jr. and Alex Crognale to also start saving a part of their income in Bitcoin with a long-term outlook as they prepare for retirement.

“*The reason why announced 50% of my salary in Bitcoin is because I feel one the noblest things you can do is to get people to understand Bitcoin*.” Kieran Gibbs, founder ONE FC, ex Arsenal, ex Inter Miami, ex West Bromich Albion.

“*I am trusting Bitcoin for my life after football. Every time my club paid me, I bought Bitcoin*.” Alex Crognale, San Antonio FC player.

https://x.com/TFTC21/status/1883228348379533469

“*At Botev Plovdiv FC, we believe not only in fostering sporting talent, but also helping them the the most of their careers so they excel in life after retiring from sports. It is with this mission in mind that the club is launching the Bitcoin Football Cup hub, striving to accelerate mass Bitcoin education via sports and athletes - the influencers and role models for billions of people*.” shared Botev’s Bitcoin Director George Manolov.

https://x.com/obj/status/1856744340795662432

The Bitcoin Football Cup aims for young prospects to be able to learn key financial lessons from seasoned veterans across all sports. Our Bitcoin Salary Calculator is only the first step toward that goal.

We encourage anyone to hear these stories straight from the current roster of Bitcoin athletes -for whom -in many cases- Bitcoin has allowed them to outperform the wealth it took decades to earn on the field.

Follow us on the Bitcoin Cup’s social media channels to learn more and hear the latest stories of how Bitcoin is shaking up the world of sports:

* Twitter: https://x.com/Bitcoin_Cup/

* Instagram: https://www.instagram.com/BitcoinCup/

* TikTok: https://www.tiktok.com/@BitcoinCup/

* YouTube: https://www.youtube.com/@BitcoinCup/

-

@ 8d34bd24:414be32b

2025-02-05 16:13:21

This post was written because of an error I made on Substack. I'm sharing it here despite the fact the scheduling error didn't happen on NOSTR. The intro paragraph isn't fully applicable for you NOSTR friends.

On Sunday 2/1/25, I made an oopsie. I tend to write articles ahead of time so I can schedule them and not worry about being inspired on a schedule. I had written two posts: [Don't Be Like Martha](https://trustjesus.substack.com/p/dont-be-like-martha) and [Whose Point of View](https://trustjesus.substack.com/p/whose-point-of-view). One was supposed to post on Sunday 2/1/25 and one on Wednesday 2/5/25. I accidentally posted both on Sunday. I was fretting about what to do for a post on Wednesday, because I usually have my husband review posts but he was out of town. I don’t like to do the deep posts without Him checking for grammatical errors, theological errors, or lack of clarity. I also had a brief idea I wanted to discuss and was debating whether to make it a short long form post or a longish note and this situation decided it for me.

## Excited Puppy

I recently got into a long discussion/debate with a couple of people on Nostr about God. I tend to get pretty excited about God, the Bible, and biblical inerrancy. It made me think about my dog.

I have a Leonberger. He is about 115 pounds, is very tall, is very long, and has thick hair which makes him look even bigger. He is 8 years old, but still acts like a puppy. When his tail gets going it causes mayhem and destruction. It knocks all of the Christmas cards and missionary prayer cards off the refrigerator. It knocks ornaments off the Christmas tree. On occasion, his excitement can even cause a person to stumble or fall (he never actually jumps on anyone). He is a sweet, loving dog that likes everyone and wants to give and receive attention to and from everyone, but he doesn’t realize how big and strong he is. Sometimes I think I can be like my dog.

I am passionate about God and the Bible. I have seen what He has done in my life. I have seen what reading and studying the Bible has done for my faith and understanding of God and His word. I intellectually know that it has taken 40ish years to get me this far, but I want everyone to come to this level of faith and understanding right now! There is a reason that God uses years of time and a lifetime of experiences to teach us and sanctify us. This growth can’t be forced. It can’t be rushed. We all have our own paths in growth in Christ and certain things can’t be changed until it is time.

Sometimes I am like my sweet puppy. I get so excited about God’s word that I may cause more harm than good. I want to help, but people feel judged. I want to bless, but they feel attacked. I want to raise them up, but end up knocking them down. Although I wonder why my dog has to push the one person in the room that doesn’t want his attention, I then end up doing the same thing with faith.

I am working on improvement, paying closer attention to their response (harder to do online than in person where you can see body language and hear voice tone), and listen to the Spirit on when to press forward and when to pull back.

My prayer is that God will guide us all in our service to Him, that He we would never be afraid to witness and stand for the truth, but that with His help we will not trample those we seek to guide to the Savior and in faith in Him.

Trust Jesus.

-

@ 77aba0b1:7e3350f5

2025-02-05 15:42:06

### **Canada and Mexico don't have any leverage**

The cheapest labor in the world is not China and it's not on the other side of the world. It's in Mexico.

######

Due to rising Chinese wages, a rapidly growing economy, and demographic changes, China is no longer the low-wage capital of the world. Great news for Mexico as it means more manufacturing jobs have come their way. But bad news if your wealthy neighbor to the north wants to impose tariffs that are going to prevent you from selling to the world's largest consumer market.

---

Mexican President Claudia Sheinbaum talking with President Trump | AI generated image

---

Now consider Canada's dilemma. The US buys 97% of Canada's oil, at a discount. Canada lacks the capacity to refine 75% of their oil production, so they have to sell their sour crude oil to the US at discounted rates because only the US has the infrastructure to move, refine, store, and distribute this commodity. (See [video](https://x.com/themfingcoo/status/1885838258451493305?s=46) for a detailed explanation.)

---

Canadian Prime Minister Justin Trudeau meeting with President Trump | AI generated image

---

Canada and Mexico share a common double-edged sword; they're geographically close to the United States. This is a huge benefit for reducing transportation costs to the largest consumer market in the world. But that also means you don't have the transportation infrastructure necessary to sell your products around the world.

######

China had to build a global transportation and supply chain infrastructure if it wanted to reach American and European markets. Because of this inherent characteristic, China is much better positioned to withstand an economic trade war with the United States than either Mexico or Canada.

######

People often mention how fragile the American economy has become because of its reliance on imported foreign goods. They are absolutely correct. But that cuts both ways. The United States can be cut off from foreign goods, but foreign nations will be cut off from a market to sell their products. What happens when there is a huge supply of goods and demand for those goods goes away? Prices drop... precipitously.

######

The United States largest export is the US Dollar. Like it or not, as the printer of the Global Reserve Currency, the US finances the consumer markets and the manufacturing base of the world economy.

---

The value of fiat currencies always goes to zero | AI generated image

---

### **Free Trade vs Managed Trade**

We see a lot of economists and media pundits talking about how tariffs will increase prices and lead to even more inflation. What they really mean is it will lead to "price inflation" which is how most of American society has come to view inflation. Actual inflation is an increase of the money supply and with more moeny chases the same amounts of goods and services, we get an increase in prices or price inflation.

######

The same people who told you that inflation was "transitory" are now telling you the price of a Corona will go up. They're forgetting that we have a fairly robust domestic beer industry.

---

Chuck Schumer and Dylan Mulvaney share bad takes | AI generated image

---

But what really needs to be highlighted is that these pundits are discussing Trump's trade war as if we lived under a free trade system; a truly free market. Sadly, we are nowhere close to this being a reality. The global economic system is Managed Trade, or Bureaucratic Trade; with corporations, lobbyists, the politically appointed and well connected making deals that protect their fiefdoms and syphon money to those who control the levers of power.

######

They are right that tariffs are taxes imposed on imported goods and those taxes are passed on to the consumer. But they act as if tariffs don't didn't exist before Trump. The Biden administration placed tariffs on Chinese "green" technologies. The same administration that said climate change was an existential threat made cheaper, environmentally friendly technology more expensive. It's almost as if it's not about the climate.

### **The Global Economic Empire**

When you owe the bank $1 million, the bank owns you. When you owe the bank $37 trillion, you own the bank.

######

Trump is betting the house and calling everyone's bluff and he's betting that the US can weather the economic fallout better than any other country, except maybe China. It's a race to the bottom and he knows that the USG can cover its finances longer, causing other countries to go bankrupt and need US assistance.

######

It's the equivalent of a run on the banks and the US will buy up the debt for cheap. Really they'll buy it for free, since they're printing the currency they buy up assets with. Canada and Mexico folding are a no brainer. Their economies are not built to export large quantities of goods acros the world. It's almost entirely north or south across the border. They had to cave or risk economic collapse.

---

China: Rising Dragon or Paper Tiger | AI generated image

---

######

China is another story. "Is China a Rising Dragon or a Paper Tiger" has been the headline for 20 to 30 years ever since Deng Xiaoping liberalized their economy and instituted social reform. Their economy has been booming but also suffering from population decline due to the One Child policy that was in effect from 1980 to 2016.

######

China has a global supply chain and provides most of the world with manufactured goods. That means they need markets to sell their goods in. If Trump threatens every nation with tariffs, it effects the global economy; meaning it will massively effect China. Couple that with a declining population that’s getting older.

######

The strength of the Chinese economy is that it already has this well established global supply chain. They stand the best chance to weather a trade war with the United States. But a global economic collapse would be a race to the bottom to see which, if any, global power emerges victorious. Just as in war, there is no winner; just bigger losers than others.

######

If Trump uses this leverage to get concessions that benefit the American people, he could be the greatest statesmen who ever lived. Trump may not be clever enough to think this deeply, but he is certainly brash and confident enough to attempt it.

-

@ 044da344:073a8a0e

2025-02-05 14:58:26

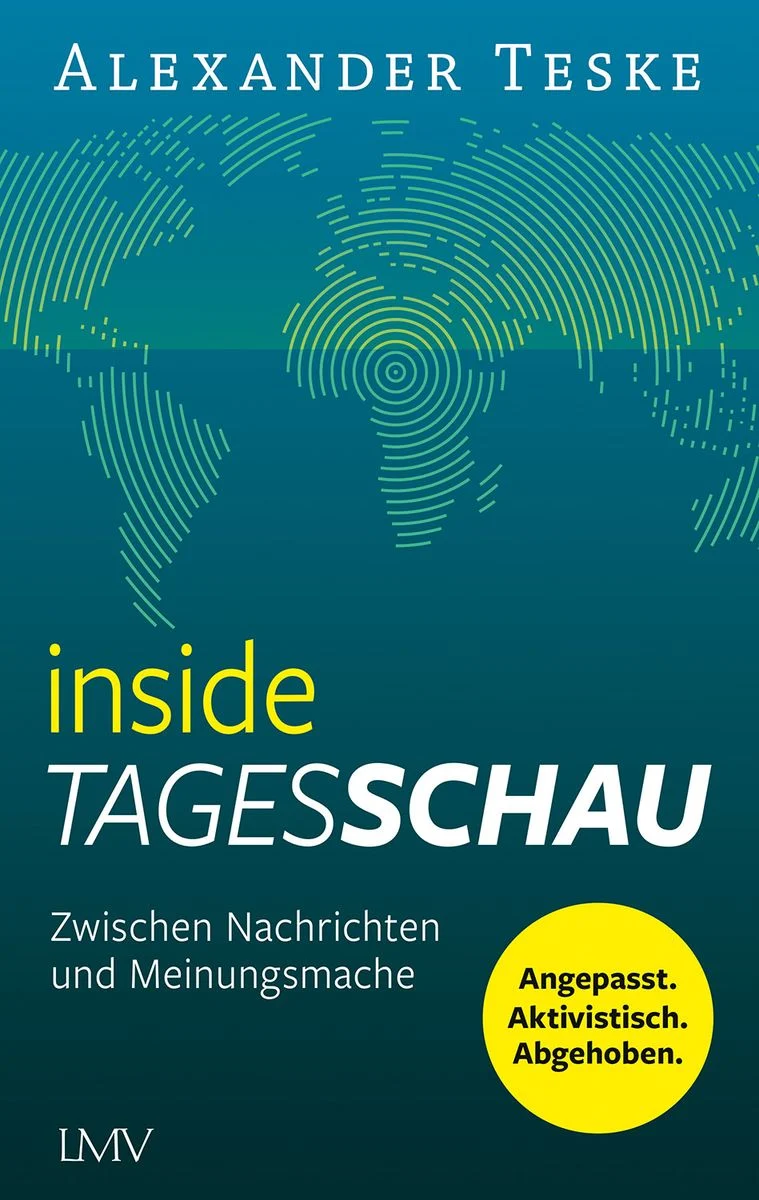

Zugegeben: Die Erwartung war groß. „Angepasst. Aktivistisch. Abgehoben“, ruft das Cover. Triple-A sozusagen. Und das in einem Buch über die *Tagesschau*, geschrieben von einem Ostdeutschen, der dort sechs Jahre gearbeitet hat, vorher lange beim MDR war und außerdem damit wirbt, auch Privatfernsehen und Presse zu kennen. Mehr Insider geht nicht. Die drei Adjektive mit dem großen A im gelben Punkt sagen: Jetzt spreche ich. Jetzt wird abgerechnet.

Das Marketing hat funktioniert, nicht nur bei mir. Platz drei in der *Spiegel*-Bestsellerliste und Platz sieben in den Wochencharts von *Amazon*, nur knapp hinter Angela Merkel. Ich dachte eigentlich, dass ich nach [Claus Kleber](https://medienblog.hypotheses.org/958) auf ewig die Finger lassen würde von den Ergüssen beitragsfinanzierter Redakteure. Was soll da schon kommen? Wir sind frei. Niemand ruft an. Niemand redet uns rein. Wir machen das, was die Nachrichtenlage verlangt und was wir kraft Ausbildung und Wassersuppe für richtig halten.

Eine ganze Menge Claus Kleber steckt auch in Alexander Teske. Staatsfunk? Nicht doch. Wir sind halt „alle ähnlich sozialisiert“ (S. 110), haben die „gleichen Relevanzkriterien“ (S. 108) und „schreiben voneinander ab“ – „aus lauter Unsicherheit, etwas ‚falsch‘ zu machen“ (S. 109). Wenn die Sprecherin des Bundespräsidenten, eine Kollegin, die die Seiten gewechselt hat, doch mal nachhelfen muss, dann ist das in der Welt von Alexander Teske die Ausnahme, die die Regel bestätigt. Kein Einfluss, nirgends – bis auf den Seiten 140 und 141 plötzlich Reiner Haseloff auftaucht, Ministerpräsident von Sachsen-Anhalt. Alexander Teske braucht diesen Redaktionsbesuch („Haseloff redete über eine Stunde (…) im vollbesetzten Konferenzraum“) für eine seiner Kernthesen. Der Osten, sagt er, ist der Redaktion in Hamburg nicht einfach nur egal. Dieser Haseloff nervt. O-Ton einer *Tagesthemen*-Frau: „Sollen wir jetzt etwa über den Rosenmontag in Köthen berichten?“

Vermutlich war es dieser Teil, der mich hat rückfällig werden lassen. Die „[Arroganz der Westmedien](https://www.message-online.com/das-wissen-um-die-wucht/)“ ist eines meiner Lebensthemen. Alexander Teske liefert dafür reichlich Futter. Zehn von 300, schätzt er, sind im *Tagesschau*-Maschinenraum „ostdeutsch sozialisiert“ (S. 141). Genauer geht es nicht, weil man das im Fall der Fälle lieber für sich behält, immer noch. Achtung: Karrierehindernis. Der Dialekt sowieso. Teske, ein Sachse, nahm „jahrelang Sprecherziehung“, um im *Ersten* auf Sendung gehen zu dürfen (S. 156). In Bayern oder Hessen lachen darüber die Hühner. Entsprechend sieht der Osten aus in der *Tagesschau*. Wenn das Volk hier sprechen darf, sagt Kronzeuge Alexander Teske, „werden die kürzesten, plakativsten und dümmsten Aussagen“ bevorzugt, „gern in emotionaler Tonlage“ (S. 143). Dass die Redaktion nur Westpresse abonniert (Ausnahme: die LVZ, die aber keiner liest, S. 146), passt genauso in dieses Bild wie das Sozialporträt einer Redaktion, in der man Arbeiterkinder, HSV-Fans oder Nichtakademiker mit der Lupe suchen muss, dafür aber an der Spitze eine Phalanx von zehn Chefs vom Dienst findet, die auf 11.000 Euro brutto kommen (manchmal offenbar auch mehr, S. 23), für ein „Klima der Angst“ (S. 51) sorgen und, so sagt es jedenfalls Teske, selbst bestimmen, wer zu ihnen aufrücken darf (S. 29).

Was fängt man mit alldem an? Vor allem: Wer kann etwas damit anfangen? Alexander Teske erwähnt einen MDR-Kommentar von Rommy Arndt, gesprochen im Januar 2023, der gegen deutsche Panzer in der Ukraine war (S. 144). In der *Tagesschau* undenkbar, sagt er, und für Rommy Arndt der letzte große öffentlich-rechtliche Auftritt. Auch Sarah Frühauf kommt bei ihm vor, eine andere MDR-Journalisten, „berühmt“ geworden durch einen *Tagesthemen*-Kommentar im November 2021, der einer Impfpflicht das Wort redete und „alle Ungeimpften“ gar nicht sehr subtil mitverantwortlich machte für die „wohl Tausenden Opfer dieser Corona-Welle“ (S. 41). Teske beklagt, dass die *Tagesschau* das Thema RKI-Protokolle erst fünf Tage nach der Veröffentlichung aufgegriffen hat und dabei das Online-Magazin *Multipolar* nicht erwähnte (S. 127). Davon abgesehen gibt es die Gegenöffentlichkeit bei ihm nicht. Nicht einmal die Dokumentation der [Ständigen Publikumskonferenz](https://publikumskonferenz.de/blog/), die sich lange in weiten Teilen um die *Tagesschau* drehte, oder die entsprechenden [Bücher](https://medienblog.hypotheses.org/8010). Alexander Teske mag nicht, wenn jemand „Zwangsgebühr“ sagt (S. 191), nutzt „Querdenker“ als Schimpfwort (S. 25), hält Telegram für einen Ort, an dem sich „bevorzugt Rechtsradikale, Waffenhändler, Drogendealer, Coronaleugner und Reichsbürger“ tummeln, und wirft der *Bild-Zeitung* vor, „jeden noch so kleinen Fehler“ zum Skandal aufzublasen (S. 115). Dass Sarah Frühauf ihren Kommentar sprechen konnte, passiert bei ihm einfach so. War knapp bei der Abstimmung. Drei Namen zur Auswahl. Und am nächsten Morgen wundern sich alle.

Was also, ich wiederhole diese Frage, fängt man mit einem Buch an, das sich eher wie ein Bewerbungsschreiben für öffentlich-rechtliche Führungsaufgaben liest, so sich die Zeiten doch noch ändern sollten? Punkt eins: Die Redaktionen der Leitmedien sind nicht so homogen, wie es von außen oft scheint. Alexander Teske trägt die Auseinandersetzungen von innen nach außen – sicher ein Grund, warum der NDR eher [dünnhäutig reagierte](https://www.turi2.de/aktuell/ndr-prueft-abrechnungsbuch-von-ex-tagesschau-mitarbeiter/) und darauf hinwies, dass sich der geliebte Ex-Kollege noch 2022 erfolglos auf eine Dauerstelle beworben hat.

Punkt zwei, wichtiger: Das Buch von Alexander Teske dokumentiert den Wandel im Journalismus, den wir gerade live erleben und erleiden. Teske selbst steht dabei für das Früher. Sagen, was ist. Sachlich, nüchtern, mit Distanz. Auch dann, wenn es um die AfD geht. Die wichtigen Themen nach vorn und nicht die, die Quote garantieren. „Nachrichten pur“, wie er das an einer Stelle nennt (S. 227) – ohne Soft News und Infotainment, ohne elend lange Fußball-, Promi- und Katastrophenblöcke mit Bochum gegen Heidenheim, Waldbränden noch und nöcher und jeden Pups der Royals, auch ohne „moderative Sprache“ (S. 226). Nachrichten pur heißt bei ihm im Subtext auch: Finger weg von den Digitalplattformen (im Moment jeden Tag bedient von 20 Redakteuren plus Planer, Grafiker, Cutter, S. 271). Finger weg auch davon, einfach ein, zwei Minuten länger zu machen, um die Quote mit denen aufzufüllen, die nur die nächste Sendung sehen wollen (S. 232).

Das ist in diesem *Tagesschau*-Buch-Kosmos auch ein Streit zwischen Alten und (oft schlechter bezahlten) Jungen, aber nicht nur. Alexander Teske erzählt, wie er mit seinem Journalismus-Ideal auch und gerade an der Generation 50+ gescheitert ist (vor allem an Männern, die im Dienst Antifa-T-Shirts tragen und den FC St. Pauli lieben) – auch, weil ein Ostdeutscher wie er in Hamburg kaum auf Seinesgleichen stößt. Über den Tellerrand zu schauen, hat er dabei trotzdem nicht gelernt. Anders formuliert: Auch in einer *Tagesschau* made by Alexander Teske würde ein Teil der Wirklichkeit fehlen.

[Freie Akademie für Medien & Journalismus](https://www.freie-medienakademie.de/)

-

@ a012dc82:6458a70d

2025-02-05 14:29:47

The cryptocurrency market is a dynamic and often unpredictable space. With Bitcoin's impressive surge in value, many investors are looking beyond the pioneer cryptocurrency to diversify their portfolios. This article explores various cryptocurrency options, weighing the potential of holding (HODLing) or selling them in the current market.

**Table Of Content**

- Bitcoin's Stellar Performance

- Ether (ETH)

- Solana (SOL)

- Binance Coin (BNB)

- BLUR

- Conclusion

- FAQs

**Bitcoin's Stellar Performance**

Bitcoin, the first and most well-known cryptocurrency, has seen a remarkable increase in value, rising by 120% in 2023. This surge sets a benchmark for evaluating other cryptocurrencies. Bitcoin's growth is influenced by several factors, including the anticipation of a Bitcoin ETF and its upcoming fourth halving. These developments could further drive its demand and value.

The potential introduction of a Bitcoin ETF is particularly significant. It would allow a broader range of investors to gain exposure to Bitcoin without the complexities of direct cryptocurrency ownership. This development could lead to increased institutional investment and potentially stabilize Bitcoin's historically volatile price. Furthermore, the halving event, expected to occur in April, is a fundamental aspect of Bitcoin's design. It reduces the reward for mining new blocks, effectively limiting the supply of new bitcoins. This scarcity is a key driver of Bitcoin's value and has historically led to significant price increases.

However, Bitcoin's dominance and performance also raise questions about market saturation and the potential for continued growth. While Bitcoin remains a safe haven for many investors, its large market capitalization means that it may not offer the same growth potential as some smaller, emerging cryptocurrencies. Investors looking for high-growth opportunities may find these in altcoins, which, while riskier, offer the potential for higher returns.

**Ether (ETH)**

Ether, the native token of the Ethereum blockchain, has a different appeal compared to Bitcoin. While Bitcoin excels as a payment network, Ethereum's strength lies in its versatility as a platform for decentralized applications. Ether's growth has been modest compared to Bitcoin, with a 65% increase this year.

Ethereum's broader utility stems from its ability to support smart contracts and decentralized applications (dApps). These features have made it the backbone of various sectors, including decentralized finance (DeFi) and non-fungible tokens (NFTs). The recent upgrade to Ethereum 2.0, transitioning to a proof-of-stake consensus mechanism, aims to address scalability and energy efficiency issues, potentially increasing its attractiveness to both developers and investors.

Despite these advancements, Ether's price has not seen the same explosive growth as Bitcoin. This could be due to the market's maturation and the increasing competition from other blockchain platforms. However, Ethereum's established position and ongoing development make it a strong contender for long-term growth. Investors may consider holding Ether as a bet on the continued expansion and innovation in the DeFi and NFT spaces, where Ethereum plays a central role.

**Solana (SOL)**

Solana, a blockchain platform seen as a competitor to Ethereum, has recovered remarkably from the impacts of the FTX collapse, with its value increasing by 313% this year. This growth is a testament to the resilience and potential of Solana as an investment.

Solana's key selling point is its high throughput and low transaction costs, making it an attractive platform for both developers and users. Its ability to process thousands of transactions per second outpaces Ethereum significantly, which has been a bottleneck for the latter. This technical superiority has led to increased adoption of Solana for various applications, including decentralized exchanges, gaming, and NFTs.

The rapid recovery of Solana's value post-FTX collapse indicates strong investor confidence and market support for the platform. It suggests that Solana has managed to dissociate itself from the negative sentiment surrounding FTX and is being recognized for its inherent technological strengths. For investors, Solana presents an opportunity to diversify into a high-potential blockchain platform that could capture significant market share in the future.

**Binance Coin (BNB)**

BNB, the native token of the Binance exchange, has faced significant challenges following legal issues with Binance’s CEO. These developments have led to a decrease in BNB's value, prompting considerations for selling the asset.

The legal troubles surrounding Binance and its CEO have raised concerns about the exchange's future and, by extension, the value of BNB. Binance Coin's utility is closely tied to the Binance ecosystem, being used for transaction fee discounts and participation in token sales. If regulatory actions lead to a decrease in Binance's user base or a change in its operational model, BNB could see a further decline in value.

However, it's also important to consider Binance's position as one of the largest and most influential cryptocurrency exchanges globally. The platform has a substantial user base and a wide array of services, including trading, staking, and a native blockchain, Binance Smart Chain. If Binance navigates through its legal challenges successfully, BNB could recover and potentially grow in value. Investors need to weigh the risks of regulatory impacts against the potential for Binance to continue playing a major role in the crypto ecosystem.

**BLUR**

BLUR, associated with the NFT marketplace Blur, has maintained a significant market capitalization despite a downturn in NFT trading. As the NFT market shows signs of a potential rebound, holding BLUR could be a strategic move for investors interested in the digital art and collectibles space.

The NFT market has experienced a significant cooldown from its peak in 2021, but it remains a sector with potential for innovation and growth. BLUR's association with the Blur marketplace positions it well within this niche. The marketplace has gained traction among NFT traders for its user-friendly interface and unique features, such as rewarding users with BLUR tokens based on their trading volume.

BLUR's utility within the Blur ecosystem could drive its value as the NFT market evolves. The token's use in governance and transaction fee payments on the platform aligns it closely with the marketplace's success. As new artists and collectors continue to enter the NFT space, platforms like Blur that offer a streamlined and rewarding experience could see increased usage, potentially boosting BLUR's value.

Investors considering BLUR should monitor the broader NFT market trends and Blur's position within it. While the NFT market is known for its volatility, it also offers unique opportunities for growth, especially in niches that are innovating and capturing user interest.

**Conclusion**

The cryptocurrency market is diverse and constantly evolving. While Bitcoin continues to be a strong performer, other cryptocurrencies offer varied investment opportunities. Investors should consider their risk tolerance, market trends, and the unique attributes of each cryptocurrency when making decisions. Whether to HODL or sell depends on individual investment goals and the ever-changing landscape of the crypto world. Diversification and staying informed are key to navigating this dynamic market successfully.

**FAQs**

**Is it better to invest in Bitcoin or other cryptocurrencies?**

It depends on your investment goals and risk tolerance. Bitcoin is more established but may offer lower growth potential compared to some emerging altcoins. Diversifying your portfolio with a mix of Bitcoin and other cryptocurrencies might be a balanced approach.

**What makes Ether a good investment option?**

Ether is the native token of the Ethereum blockchain, known for its versatility in supporting smart contracts and decentralized applications. Its ongoing development and central role in the DeFi and NFT sectors make it a strong contender for long-term growth.

**Why is Solana considered a rising competitor in the crypto market?**

Solana offers high transaction speeds and low costs, making it an attractive platform for developers and users. Its rapid recovery post-FTX collapse indicates strong market support and potential for significant market share in the future.

**What are the risks associated with investing in Binance Coin (BNB)?**

BNB faces risks due to legal issues surrounding Binance and its CEO. Its value is closely tied to the Binance ecosystem, so any negative impact on the exchange could affect BNB's value.

**Is investing in BLUR a good strategy?**

Investing in BLUR could be a strategic move if you're interested in the NFT market. As the native token of the Blur NFT marketplace, its value may grow with the platform's success in the evolving NFT space.

**How important is diversification in cryptocurrency investment?**

Diversification is crucial in managing risk in the volatile cryptocurrency market. It involves spreading your investment across different assets to reduce the impact of any single asset's performance on your overall portfolio.

**That's all for today**

**If you want more, be sure to follow us on:**

**NOSTR: croxroad@getalby.com**

**X: [@croxroadnews.co](https://x.com/croxroadnewsco)**

**Instagram: [@croxroadnews.co](https://www.instagram.com/croxroadnews.co/)**

**Youtube: [@croxroadnews](https://www.youtube.com/@croxroadnews)**

**Store: https://croxroad.store**

**Subscribe to CROX ROAD Bitcoin Only Daily Newsletter**

**https://www.croxroad.co/subscribe**

***DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.***

-

@ c69b71dc:426ba763

2025-02-05 13:44:29

# Nature shows us the way…

## …but what does humanity do?

### Let’s take a look at winter:

Trees shed their leaves. The plant’s energy withdraws so it can conserve strength and survive the cold season.

Wild animals follow the same pattern: In autumn, they build up reserves, grow thick fur, and retreat into their caves and thickets. Little movement, lots of sleep – a natural strategy for preserving energy. Animals that wouldn’t survive the cold migrate to warmer places to spend the winter.

#### And what does humanity do?

We eat just as much, move just as much (or little), sleep too little – just as we do all year round. Why? Because we can. Because our lives are no longer governed by the seasons. Refrigerators are full, supermarkets are always open, work calls, and daily routines remain unchanged. But this does not come without consequences.

During winter, we don’t allow ourselves to rest or retreat. We ignore our natural needs, overexerting ourselves physically, mentally, and emotionally. The result? An exhausted body and mind, discontent. The lymphatic system gets clogged, the body becomes overly acidic. Spring fatigue, low energy, depression, inflammation, and other ailments follow.

### And then comes spring…

Nature awakens. Life begins anew everywhere. Buds sprout, blossoms unfold – pure energy in its most vibrant form! Everything that grows now serves cleansing and detoxification: wild herbs, fresh shoots, and buds – nature’s medicine for body and mind.

Wild animals follow this rhythm. They shed their winter coats, become more active, consume this natural medicine, mate, or give birth.

#### And what does humanity do?

We keep eating the same, sleeping too little, rushing through our daily routines. And then we wonder why we feel tired, sluggish, and drained. Why our thoughts feel heavy and our bodies weak. Why depression creeps up on us at this very moment. Did you know that the highest suicide rate is in spring?

### Summer – the time of abundance

Nature gifts us with light, warmth, ripe fruits, berries, and fresh vegetables.

Animals spend most of their time outdoors, eating what nature provides and recharging their energy into every cell of their being.

#### And what does humanity do?

We keep working as always, consuming industrially processed foods, barely spending time outside. Too much artificial light, too little sleep. No wonder so many feel exhausted even in summer, drained, struggling with digestion and metabolism.

### Autumn – preparing for retreat

Now is the time for harvest. Nuts, mushrooms, apples, pears, root vegetables, pumpkins, cabbage – all available to build up reserves.

Animals follow nature’s call, gathering, storing energy, preparing for the coming months. Chlorophyll in leaves breaks down, green turns to vibrant autumn colours.

#### And what does humanity do?

We ignore these signals. We stay trapped in the hamster wheel. We enter winter unprepared, weakened, prone to infections, drained by a lack of sunlight and an overly acidic system.

### A cycle of exhaustion

And so the wheel keeps turning. Because we ignore nature. Because we no longer listen to our bodies. Because we have lost touch with our intuition. Because we have enslaved ourselves.

#### What can you do?

Not everyone is ready to leave their daily life behind, move to a warm country, and become self-sufficient. Many want to maintain their current lifestyle.

#### So how can we break the cycle?

Turn inward. Take time each day to listen to yourself. To truly feel what you need. To give space to your needs. Sense what drains you, what makes you sluggish. What brings you joy. Cleanse yourself – physically, mentally, emotionally!

> **********Do** more of what you miss, of what makes you happy and **fulfilled.** **Remember:** **You** **too** **are** **nature.**********

If all this sounds like a lot of inner work, I invite you to take first steps.

#### Ask yourself:

- Does your body need detoxification?

- Cleansing?

- More movement?

- Or is it time for emotional release?

*If you wish support, let me know and we will discuss an energy exchange that allows you to do something good for yourself in a sustainable way. Supporting you in reclaiming your energy and strength – for a year filled with vitality, self-respect, and self-love. 💛*

**

```

Spring is calling! It offers us a new chance.

Do you hear it? Yes, it’s calling you! Let’s go! 🚀

```

**

-

@ 0b118e40:4edc09cb

2025-02-05 13:23:56

I’d like to see a world where a small artisan in Sarawak sells handcrafted goods directly to a boutique in Paris by bypassing currency exchange fluctuations, banking restrictions, and government-imposed tariffs. Or where a coffee farmer in Ethiopia sells beans straight to a roaster in Tokyo by sidestepping middlemen, exchange fees, and bureaucratic red tape.

In theory, free trade should enable this exchange smoothly, allowing businesses of all sizes to compete on a level playing field. But in reality, global trade is far from free. Policies, interventions, and economic theories are often designed to favor the powerful.

One particular theory that troubled me was Paul Krugman’s New Trade Theory (NTT), which argues that large businesses with economies of scale, supported by government-backed advantages, dominate international trade. This manifestation of the global marketplace favoring the giants, leaving smaller players like that Ethiopian coffee farmer out and struggling to compete, had led to trade hegemonies and trade wars.

After going through centuries of trade theories from Adam Smith’s Wealth of Nations to Keynesian interventionism and Friedman’s libertarianism I found myself questioning:

Is Krugman right?

After all, in today’s world, global trade is controlled by a few key players. The U.S., China, Germany, Japan, and the U.K. alone contribute to 40% of global trade in goods and services. The 134 countries of the Global South are often forgotten.

Can Bitcoin offer a countermeasure to help globalize small businesses from anywhere in the world?

### Big players rule the game.

Let’s go a little deeper on Krugman’s New Trade Theory. He believes that trade is increasingly dominated by large firms because they benefit from economies of scale and brand power. While older trade theories assumed that countries traded based on resource advantages, NTT tries to explain why similar economies like the U.S. and Europe, engage in high levels of trade with each other, missing out on the obvious nuances of global alliances on geopolitical control and power.

Another aspect of Krugman’s theory is that large companies have a better chance of capturing market lead if they can benefit from unfair advantages through additional boosters in an imperfect market. In simple terms, power, status, and wealth are all you need to win.

So if you are a big company and you have status, government perks, and economic advantages, you can be the market leader. It’s like the Olympics of global trade, except some players get to use performance-enhancing drugs (subsidies, trade barriers, and financial influence) while others run clean. The race isn’t fair, but the rules say it’s fine.

So what is the blind spot here?

Well, other than the obvious disregard for merits and fair play, this model also assumes that only large corporations drive global trade, leaving small businesses to struggle against giants - despite the fact that small businesses often contribute significantly (sometimes up to 80%) to a country's revenue.

### Small business in a big economy

NTT was developed in the 1970s and 1980s when economies of scale and industrial advantages were the primary drivers of global trade. Kugman's argument assumes that large corporations, due to their financial and logistical dominance, will continue to dictate trade flows. But is this still true today?

Small businesses are establishing themselves in a globalized world, even without economies of scale, as opposed to Krugman's belief. The rise of e-commerce, digital platforms, and decentralized technologies has significantly altered the trade landscape, though many barriers remain.

In the past, small businesses struggled because they lacked access to global markets, but platforms like Alibaba, Amazon, and Shopify have reduced the barriers to entry, allowing even micro-businesses to participate in international trade.

When Jack Ma started Alibaba, businesses didn’t automatically sign up. His team traveled to small villages and industrial hubs to onboard businesses that had never considered global trade let alone understand digital interfaces, communicate in English, or use the internet. This grassroots effort revolutionized commerce, digitizing and globalizing it at an unprecedented scale.

Krugman’s model assumes that large firms control trade, but in reality, many countries thrive on small business-driven exports.

I’ve been to these areas in China and seen firsthand how they operate. These small manufacturers in China may not have the scale of a multinational, but they’re deeply integrated into global supply chains. And despite limited resources, they’re able to compete globally.

Other countries like Germany and Japan are great examples where ‘hidden champions' who are typically highly specialized small businesses, play a crucial role in global supply chains.

US is not there yet, but it has the opportunity to explore untapped potential of globalizing small businesses and compete in the global market to drive sustainable economic growth.

In fact with this model, ideally anyone is welcome. But there are many barriers that still exist in limiting the globalization of small businesses :

* High transaction costs.

* Complexity of currency exchange and exchange fees

* Complex regulations and banking restrictions

* Difficulty finding trustworthy international partners

Imagine a small business trying to import materials from multiple global suppliers. Not only is it hard to find them, as many countries still rely on government agencies, trade directories, and outdated methods for searching and connecting with suppliers, but when it comes to solidifying deals, the complications don’t stop. One supplier might require an international wire transfer, another may only accept Western Union, and a third insists on using a local bank with high fees and delays. Small businesses simply don’t have the same access to banking services and streamlined financial systems that large corporations do. The variations often depend on the specific banking practices and infrastructure of both parties.

To make matters even more complicated, small businesses don't have dedicated teams like large corporations. They run on minimal resources, managing everything themselves. One small error or delay can stall shipments, disrupt cash flow, and risk losing customers. Yet, global trade expects them to compete at the same level as industry giants, without the same financial infrastructure or support.

More often than not, small businesses are left to fend for themselves, struggling to overcome these challenges alone.

And that’s where Bitcoin changes everything.

### Can Bitcoin Create a True Free Market?

Unlike traditional banking systems, which are tied to government policies and centralized institutions, Bitcoin operates on a decentralized, borderless network. This enables direct transactions between buyers and sellers without intermediaries or excessive fees.

While Krugman’s theory explains why big corporations once held an advantage, it overlooks how decentralization removes trade bottlenecks, giving small businesses a real chance to compete globally.

In a Bitcoin-based global economy:

* No more currency conversion fees - Businesses trade freely across borders.

* No more reliance on banks - Transactions occur on a trustless system, reducing fraud and expensive intermediaries.

* No more cross-border delays - Payments are instantaneous, bypassing restrictive banking regulations.

For small businesses, this means fewer barriers to global trade. A textile producer in India could sell directly to a retailer in Canada without needing to figure out the bureaucratic maze of currency exchanges and trade laws. A graphic designer in Brazil could collaborate with a company in Australia and receive payment instantly without relying on high-fee banking systems. A shea butter producer in Kenya could sell organic products directly to small skincare manufacturers in the U.S., bypassing middlemen and avoiding international shipping delays.

Bitcoin removes middlemen, slashes costs, and levels the playing field, not by government intervention, but by eliminating artificial barriers altogether.

### The Challenges and the Future

Bitcoin isn’t a perfect solution, and we know that. Scalability, price volatility, and regulatory pushback remain major hurdles.

Currently, stablecoins are attempting to integrate into the Bitcoin Layer 2 network, which could potentially distract from Bitcoin's intended role as a global decentralized medium of exchange. Some are pushing for trade to happen through currency-pegged, centralized coins, which risks undermining Bitcoin's strong push toward free trade and decentralization.

Governments and banks resist decentralization because it threatens their control over money flows.

However, the concept of Bitcoin as a medium of exchange is already taking root. Leaders and developers are dedicating their legacies to building this system for a truly global community. El Salvador’s Bitcoin experiment has shown both the potential and the obstacles of a Bitcoin-driven economy with many lessons to learn from. Block Inc’s innovations have expanded into strengthening Bitcoin’s role as a decentralized medium globally, particularly through decentralized mining benefits and commercialized cold wallets.

Nostr has been very successful in seeing growth in these domains as well. It is slow but it's taking the right steps towards simplifying Bitcoin commerce adoption through zaps.

However the million-dollar question remains. If Bitcoin removes trade barriers, will small businesses adopt it?

History suggests yes but with the right approach. Just as Jack Ma went door to door convincing small businesses to embrace e-commerce, a similar effort is needed for Bitcoin adoption.

With Bitcoin, global trade can become digitized, commercialized, and pain-free, but only if small businesses understand how to use it. More importantly, it disrupts trade hegemony and creates a more equitable world that everyone can be part of.

A challenge I foresee beyond technology, is education. Initiatives that focus on simple onboarding, low-cost adoption, and real-world use cases can drive Bitcoin-powered trade forward. There are many non-tech Bitcoin enthusiasts who want to contribute to the Bitcoin ecosystem and would love to take on educator roles. Once the infrastructure and understanding around Bitcoin become more conceptualized, these folks could play a strong role in spreading awareness and adoption.

If Bitcoin is introduced strategically, not as a speculative asset but as an international trade enabler through its medium of exchange, it could reshape global commerce just as e-commerce once did. The only difference is that this time, trade is truly borderless, trustless, and not controlled by financial intermediaries.

Krugman’s New Trade Theory remains useful in explaining how economies of scale shape trade. But it fails to account for decentralized digital economies, where small businesses can bypass the old rules of power and privilege.

If Bitcoin achieves mainstream adoption, we may finally see a world where trade is truly free, where merit, not governments or middlemen, determines success.

-

@ 0fb8901a:2bced885

2025-02-05 13:23:54

We are a family passionate about working with and for people, and we have a deep love for food.

Our journey began when our neighbors, who have a pizza oven, invited us and our children to make our own pizzas. The experience was delightful and memorable.

Inspired by this, we decided to offer the same joy to other kids and adults. We invested in a handcrafted wood-fired pizza oven, made from scratch by a friend who specializes in pizza oven craftsmanship. This oven was imported to the UK, and it brings out the most wonderful flavors in our pizzas, taking us back to the basics of traditional cooking.

We proudly serve Bracknell and the surrounding areas within a 20-mile radius.

What’s Different About Us?

Our pizza oven is brand new and crafted from reliable, safe materials. Unlike traditional setups confined to a van, our oven is fully visible from all angles, allowing you to watch your pizza being made. It features detachable stainless steel tables on both sides, enabling you to work in close proximity to the oven. Our pizzas are wood-fired, giving them a wonderful, authentic taste. Both our tomato and cream sauces are homemade, and our dough is made from organic flour, ensuring the freshest ingredients.

-

@ c8383d81:f9139549

2025-02-05 13:06:05

**My own stats on what I’ve done over the weekend:**

- Spoke to +100 developers, it was great seeing a couple of familiar Flemish faces and meeting some new ones but overall the crowd was extremely diverse.

- Ended up doing a short interview promoting the protocol and ended up going to 0 talks.

- Tried to evangelize by going booth by booth to distribute a Nostr flyer to other FOSDEM projects, with the hope that they would broadcast the info towards their SOME person to add Nostr on their list or to build out a library for the languages that were present ( This was a fairly slow approach )

- Kept it to Nostr protocol 95% of the time, the Bitcoin narrative is not always a good time to push and as a side note I’ve met more Monero users than in the last 5 years.

- Was able to convince some engineers to look into the #soveng endeavor.

**Small overview from the most common questions:**

- They have heard about Nostr but are not sure of the details. ( mostly through the bitcoin community )

- What is the difference with ActivityPub, Mastodon, Fediverse ?

- IOT developers, so questions regarding MQTT & Meshtastic integrations ?

- Current state of MLS on Nostr ?

- What are the current biggest clients / apps build on Nostr ?

- Will jack still give a talk ?

**Things we could improve:**

- Bring more stickers like loads more,

- Bring T-shirts, Pins… could be a good way to fund these adventures instead of raising funds.

( Most projects where selling something to help raise funds for projects )

- Almost no onboarding / client installs.

- Compared to the Nostr booth at BTC Amsterdam not a single person asked if they could charge their phone.

**Personal Note:**

The last time I visited was roughly 13 years ago and me being a little more seasoned I just loved the fact that I was able to pay some support to the open source projects I’ve been using for years ( homebrew, modzilla, Free BSD,.. ) and see the amazing diverse crowd that is the open source Movement 🧡

**Al final shoutout to our great pirate crew 🏴☠️:**

The Dutch Guard ( nostr:npub1qe3e5wrvnsgpggtkytxteaqfprz0rgxr8c3l34kk3a9t7e2l3acslezefe & nostr:npub1l77twp5l02jadkcjn6eeulv2j7y5vmf9tf3hhtq7h7rp0vzhgpzqz0swft ) and a adrenaline fueled nostr:npub1t6jxfqz9hv0lygn9thwndekuahwyxkgvycyscjrtauuw73gd5k7sqvksrw , nostr:npub1rfw075gc6pc693w5v568xw4mnu7umlzpkfxmqye0cgxm7qw8tauqfck3t8 and nostr:npub1r30l8j4vmppvq8w23umcyvd3vct4zmfpfkn4c7h2h057rmlfcrmq9xt9ma amazing finally meeting you IRL after close to 2 years since the Yakihonne hackathon 😀

-

@ a7bbc310:fe7b7be3

2025-02-05 12:20:59

In 2018 I started doing film photography. I asked myself what could I do that was unique. So, I tried taking picture at local gig venues. I’d look around and everyone was using digital cameras. I had a limited number of shots I could take, inconsistent lighting at different venues but some delayed gratification of not knowing how the images would turn out until I developed them. I’d come home late from a show and be up until the early hours developing and scanning the images. 2020 put a stop to that. It’s something I’d like to start again. I’ll be sharing some of my favourite images I from my badly categorised/labled folders.

Artist in photo is called Conner Youngblood. It’s been interesting to listen to his most recent projects (Cascades, Cascading, Cascadingly) to compare to his earlier ones (Australia)

Australia is a stripped back, couple guitars, vox and drums. Most recent has a few more vocal effects and electronica sounds. A comparison I would make would be Bon Iver’s - Emma with their 3rd album 22, a million.

As a when I arrange the files on my HD, I’ll be share a few more band photos.

-

@ 5e13e5d5:217fe898

2025-02-05 11:30:01

<p>With the rapid development of science and technology, communication technology has penetrated into all aspects of our lives, but the accompanying security risks cannot be ignored. As an effective technical means, signal jamming technology has gradually attracted people's attention in the field of public security in recent years. This article will explore the application of <a href="https://www.thejammerblocker.com/">signal jammer</a> in public security and its potential impact.</p>

<h2> Basic concept of signal jammer</h2>

<p>Signal jammer, as the name suggests, is a device used to interfere with or block signals of a specific frequency. By emitting electromagnetic waves of a specific frequency, signal jammers can effectively shield or weaken the reception of certain wireless signals, thereby preventing unnecessary information transmission. Signal jammers have a wide range of application scenarios, from countermeasures in the military field to security protection in the civilian field.</p>

<p><a href="https://www.thejammerblocker.com/t-us-08-6-high-power-wi-fi-blocker-for-classroom/"><img src="https://www.thejammerblocker.com/wp-content/uploads/2024/05/1-1-300x293.jpg" alt="Simple to use iPhone Cell Phone Jammer for Classroom" width="450"/></a></p>

<h3> Application in public security</h3>

<h4> 1. Preventing terrorist attacks</h4>

<p>In some important public places, such as airports, stadiums, and large conferences, signal jammers can be used to prevent terrorists from remotely detonating bombs through mobile phones and other devices. Such devices can create a "jamming area" in a critical area, making communications related to explosive devices impossible, thereby effectively reducing the risk of terrorist attacks.</p>

<p><a title="https://www.thejammerblocker.com/cell-phone-jammer-blocker-for-gsm-5g/" href="https://www.thejammerblocker.com/cell-phone-jammer-blocker-for-gsm-5g/">https://www.thejammerblocker.com/cell-phone-jammer-blocker-for-gsm-5g/</a></p>

<h4> 2. Maintaining public order</h4>

<p>In some special cases, such as demonstrations or large gatherings, in order to prevent criminals from using mobile phones to organize or incite, law enforcement agencies can choose to use signal jammers moderately. By interfering with the communication signals at the scene, the organization ability of criminals can be effectively weakened, thereby maintaining public order.</p>

<h4> 3. Criminal investigation</h4>

<p>During criminal investigations, the police sometimes need to monitor certain targets. Signal jammers can be used to block the communication between suspects and the outside world, so as to further obtain evidence or make arrests. However, this method must be carried out within the scope permitted by law to avoid infringing personal privacy.</p>

<h4> 4. Security precautions</h4>

<p>In some special places, such as prisons and important laboratories, <a href="https://www.thejammerblocker.com/gps-jammer-car-tracker-blocker/">gps blocker</a> can prevent jailbreaks or leaks. By interfering with mobile phone signals, prisoners can be effectively prevented from contacting the outside world and ensuring the safety of the place.</p>

<h3> Potential impacts and legal ethical issues</h3>

<p>Although signal jammers have many applications in public safety, their use also faces some potential impacts and legal ethical issues. First, the use of signal jammers may infringe on personal freedom of communication. Interference with citizens' mobile phone signals may affect their ability to seek help in an emergency. Secondly, if the jammer is abused by criminals, it may lead to social chaos. Therefore, when using <a href="https://www.thejammerblocker.com/drone-uavs-jammers-blockers/">drone jamming device</a>, relevant departments should formulate strict usage specifications and legal frameworks to protect the legitimate rights and interests of citizens.</p>

<h3> Conclusion</h3>

<p>In summary, as an emerging public safety technology, <a href="https://www.thejammerblocker.com/wifi-bluetooth-camera-jammer-blocker/">bluetooth blocker</a> have important application value in preventing terrorist attacks, maintaining public order and criminal investigation. However, how to maintain personal privacy and freedom of communication while ensuring public safety is a question worth pondering. In the future, with the further development of science and technology, the application of signal jammers in public safety will become more and more common, but we must be vigilant about its potential impact and use this technology reasonably and legally.</p>

<p><a href="https://www.thejammerblocker.com/dj-x5-military-grade-signal-jammer-device-5-antennas/">https://www.thejammerblocker.com/dj-x5-military-grade-signal-jammer-device-5-antennas/</a></p>

-

@ da0b9bc3:4e30a4a9

2025-02-05 07:29:27

Hello Stackers!

Welcome on into the ~Music Corner of the Saloon!

A place where we Talk Music. Share Tracks. Zap Sats.

So stay a while and listen.

🚨Don't forget to check out the pinned items in the territory homepage! You can always find the latest weeklies there!🚨

🚨Subscribe to the territory to ensure you never miss a post! 🚨

originally posted at https://stacker.news/items/876357

-

@ 3c7dc2c5:805642a8

2025-02-05 07:02:42

## 🧠Quote(s) of the week:

Old model:

-You work for money.

-They print it.

-You save your money.

-They devalue it.

-You invest your money.

-They manipulate it.

New model:

-You save in Bitcoin.

-There’s nothing they can do about it.

## 🧡Bitcoin news🧡

Before we start some extra info to get you focused.

1 BTC is unreachable for the majority.

The aspiration used to be 6.15. Now it's 0.1.

'Now who owns Bitcoin?

'The Answer Might Surprise You.

👉🏽Bitcoin is often misunderstood. Some think it’s controlled by a handful of institutions, others believe governments secretly hoard it. The reality? Bitcoin ownership is diverse and widely distributed across individuals, businesses, funds, and even governments.

👉🏽57% of Bitcoin is held by individuals. From everyday savers to long-term believers, Bitcoin’s largest share is in the hands of the people.

👉🏽4% belongs to businesses. Companies are increasingly adding BTC to their treasuries, recognizing its role as digital gold.

👉🏽5% is held by funds and ETFs. Bitcoin is being adopted by the financial system, providing new ways for institutions and retail investors to gain exposure.

👉🏽Governments own 2% to 3%. Whether through seized BTC or strategic holdings where states already acknowledged Bitcoin’s value.

👉🏽Around 18% is estimated to be lost forever. This actually makes Bitcoin even scarcer than its 21 million cap suggests.

👉🏽Miners and yet-to-be-mined Bitcoin represent the rest. This small remaining fraction coupled with a fixed supply means competition for mining remaining bitcoins will only increase over time.

This distribution is one of the many reasons why Bitcoin is unique. Not only there is no single entity that controls it (no government or bank can print more of it), but also its distribution among the population is more fairly distributed than for any other monetary asset.

Bitcoin is owned by those who understand its value, regardless of nationality, religion, skin color, political affiliation, or beliefs. Bitcoin is for everyone.' -Thomas Jeegers

[](https://i.ibb.co/5gJH2pLk/Gi-XWUx0-W8-AAcp84.jpg)

On the 28th of January:

➡️European Squash Federation adopts Bitcoin for its treasury.

➡️Binance under investigation for money laundering, tax fraud, and drug trafficking in France - Reuters

➡️'Metaplanet will issue 21 million new stock warrants with a 0% discount rate, raising approximately $870 million to fund additional Bitcoin purchases. This marks the largest-ever fundraising for Bitcoin purchases in the history of the Asian stock market.' -Metaplanet

➡️U.S. Senator Cynthia Lummis received a framed Bitcoin block from Marathon’s Jayson Browder to mark her role as the new chair of the Senate Banking Subcommittee on Digital Assets. MARA Pool mined the block by calculating 1,476,600,000,000,000,000,000 Bitcoin hashes within 46 seconds.

➡️'Fidelity is now bigger than Greyscale:

1. BlackRock ETF: 576k BTC

2. Fidelity ETF: 205k BTC

3. Greyscale ETF: 202k BTC' -Bitcoin for Freedom

➡️'Brazil’s state-owned oil and gas company Petrobras is reportedly assessing getting into Bitcoin mining. This is a new chapter for the company and shows how traditional industries are adapting to the digital world.

Petrobras, one of the largest and most profitable oil companies in the world, is going to use excess natural gas produced during the oil extraction process to power Bitcoin mining.

This will reduce energy waste and methane emissions, and create a new revenue stream for the company.' -Bitcoin News

➡️Last week, the 613-foot smokestack of the former Somerset Generating Station in Niagara County, New York was demolished. The site, now Tera Wulf Inc.’s Lake Mariner Data, will focus on Bitcoin mining and AI processing powered by hydroelectric energy

➡️'For the first time ever in Bitcoin's 16-year history, the epoch-over-epoch (EOE) growth has fallen below +100%. Pack it up, fellas.'- Wicked

[](https://i.ibb.co/sJFgh93r/Gi-Zncd-PXk-AAuh.jpg)

On the 29th of January:

➡️Czech central bank Governor Ales Michl said he would propose a plan to include bitcoin in the country’s official reserves, the Financial Times reported.

Michl statement: 'Czech National Bank’s goal is price stability. When we took office in July 2022, inflation was 17.5%. We brought it down to target. We are also diversifying reserves—gradually increasing gold holdings from 0% to around 5% and planning for 30% in equities. An asset under consideration is Bitcoin. It currently has zero correlation to bonds and is an interesting asset for a large portfolio. Worth considering. Right now, it’s only at the stage of analysis and discussion. The Bank Board decides, and no decision is imminent. Thoughtful analysis is needed.

Bitcoin has significant volatility, which makes it harder to take advantage of its current low correlation with other assets. That’s why I will ask our team on Thursday to further assess Bitcoin’s potential role in our reserves. Nothing more, nothing less.

The article is very accurate, including my statement that Bitcoin could one day be worth either zero or a huge amount. At our meeting on Thursday, after discussing a document on international reserve management in 2024, the Bank Board of the Czech National Bank (CNB) approved a proposal to analyze the options for investing in additional asset classes.

The central bank has been increasingly diversifying its investments over the last two years as part of its reserve management strategy. At the proposal of Governor Aleš Michl, the CNB is to assess whether it would be appropriate in terms of diversification and return to include other asset classes in the reserves as well.

Based on the results of the analysis, the Bank Board will then decide how to proceed further. No changes will be implemented in this area until then. Any changes in the reserve portfolios will be disclosed in the quarterly information on the CNB’s international reserves and the CNB’s annual report.'

The head of a central bank tweeting about potentially allocating to Bitcoin was not on my 2025 bingo card.

➡️Jerome Powell: "Banks are perfectly able to serve crypto customers."

I love how everyone is recognizing and acknowledging Bitcoin now.

Banks can custody Bitcoin on behalf of clients, create structured Bitcoin financial products, and allow customers to buy Bitcoin.

Even Powell isn't badmouthing it anymore.

On the 29th of January:

➡️'It is utterly remarkable that BTC Dominance is at 62% considering it's really from 45% to 62% has coincided with massive issuance of Memecoins

This really is a different market, a schism between Bitcoin and Crypto.' - Steven Lubka

➡️Illinois State Rep. has introduced a bill to establish a Bitcoin Strategic Reserve.

➡️The decoupling of Bitcoin & Crypto Market Caps:

[](https://i.ibb.co/svqCWGcM/Gifa-ERa-XUAA80-A8.jpg)

ETH losing 50% of its value vs. BTC in the past 11 months explains the lack of enthusiasm about $100K BTC. Mitchell Hodl: '2 years ago if you sold 1 ETH and bought Bitcoin, you would have acquired ~.07 BTC. Today if you sell 1 ETH and buy Bitcoin, you’ll acquire .03 BTC.

Those “toxic maximalists” were right.

If it’s not BTC, it’s dogshit.'

On the 3rd of February Bitcoin dominance soared over 64%. Four-year high. Massively bullish. Despite the hundreds of billions of dollars invested in crypto, Bitcoin dominance has just tagged Nov 2017 levels. At 73%, it unwinds back to the pre-ICO era.

'The truth is, there is no more alt season.

The sooner you accept that, the sooner you can still build up a meaningful Bitcoin position.

You're not too late.

You're among the first 1-2% of people to get into bitcoin.

It's time to leave this chapter of false narratives behind and get on board with something real and meaningful.' - Sam Wouters

If you're trying to outperform Bitcoin with an "alt", just remember that you're mixing with a crowd that is simply trying to beat you to the exit.