-

@ a2eddb26:e2868a80

2025-02-20 20:28:46

In personal finance, the principles of financial independence and time sovereignty (FITS) empower individuals to escape the debt-based cycle that forces them into perpetual work. What if companies could apply the same principles? What if businesses, instead of succumbing to the relentless push for infinite growth, could optimize for real demand?

This case study of the GPU industry aims to show that fiat-driven incentives distort technological progress and imagines an alternative future built on sound money.

### **Fiat Business: Growth or Death**

Tech companies no longer optimize for efficiency, longevity, or real user needs. Instead, under a fiat system, they are forced into a perpetual growth model. If NVIDIA, AMD, or Intel fail to show revenue expansion, their stock price tanks. Let's take NVIDIA's GPUs as an example. The result is predictable:

- GPUs that nobody actually needs but everyone is told to buy.

- A focus on artificial benchmarks instead of real-world performance stability.

- Endless FPS increases that mean nothing for 99% of users.

The RTX 5090 is not for gamers. It is for NVIDIA’s quarterly earnings. This is not a surprise on a fiat standard.

### **Fiat Marketing: The Illusion of Need and the Refresh Rate Trap**

Benchmarks confirm that once a GPU maintains 120+ FPS in worst-case scenarios, additional performance gains become irrelevant for most players. This level of capability was reached years ago. The problem is that efficiency does not sell as easily as bigger numbers.

This extends beyond raw GPU power and into the display market, where increasing refresh rates and resolutions are marketed as critical upgrades, despite diminishing real-world benefits for most users. While refresh rates above 120Hz may offer marginal improvements for competitive esports players, the average user sees little benefit beyond a certain threshold. Similarly, 8K resolutions are pushed as the next frontier, even though 4K remains underutilized due to game optimization and hardware constraints. This is why GPUs keep getting bigger, hotter, and more expensive, even when most gamers would be fine with a card from five years ago. It is why every generation brings another “must-have” feature, regardless of whether it impacts real-world performance.

Marketing under fiat operates on the principle of making people think they need something they do not. The fiat standard does not just distort capital allocation. It manufactures demand by exaggerating the importance of specifications that most users do not truly need.

The goal is not technological progress but sales volume. True innovation would focus on meaningful performance gains that align with actual gaming demands, such as improving latency, frame-time consistency, and efficient power consumption. Instead, marketing convinces consumers they need unnecessary upgrades, driving them into endless hardware cycles that favor stock prices over user experience.

They need the next-gen cycle to maintain high margins. The hardware is no longer designed for users. It is designed for shareholders. A company operating on sound money would not rely on deceptive marketing cycles. It would align product development with real user needs instead of forcing artificial demand.

### **The Shift to AI**

For years, GPUs were optimized for gaming. Then AI changed everything. OpenAI, Google, and Stability AI now outbid consumers for GPUs. The 4090 became impossible to find, not because of gamers, but because AI labs were hoarding them.

The same companies that depended on the consumer upgrade cycle now see their real profits coming from data centers. Yet, they still push gaming hardware aggressively. However, legitimate areas for improvement do exist. While marketing exaggerates the need for higher FPS at extreme resolutions, real gaming performance should focus on frame stability, low latency, and efficient rendering techniques. These are the areas where actual innovation should be happening. Instead, the industry prioritizes artificial performance milestones to create the illusion of progress, rather than refining and optimizing for the gaming experience itself. Why?

### **Gamers Fund the R&D for AI and Bear the Cost of Scalping**

NVIDIA still needs gamers, but not in the way most think. The gaming market provides steady revenue, but it is no longer the priority. With production capacity shifting toward AI and industrial clients, fewer GPUs are available for gamers. This reduced supply has led to rampant scalping, where resellers exploit scarcity to drive up prices beyond reasonable levels. Instead of addressing the issue, NVIDIA benefits from the inflated demand and price perception, creating an even stronger case for prioritizing enterprise sales. Gaming revenue subsidizes AI research. The more RTX cards they sell, the more they justify pouring resources into data-center GPUs like the H100, which generate significantly higher margins than gaming hardware.

AI dictates the future of GPUs. If NVIDIA and AMD produced dedicated gamer-specific GPUs in higher volumes, they could serve that market at lower prices. But in the fiat-driven world of stockholder demands, maintaining artificially constrained supply ensures maximum profitability. Gamers are left paying inflated prices for hardware that is no longer built with them as the primary customer. That is why GPU prices keep climbing. Gamers are no longer the main customer. They are a liquidity pool.

### **The Financial Reality**

The financial reports confirm this shift: **NVIDIA’s 2024 fiscal year** saw a 126% revenue increase, reaching \$60.9 billion. The data center segment alone grew 217%, generating \$47.5 billion. ([Source](https://investor.nvidia.com/news/press-release-details/2024/NVIDIA-Announces-Financial-Results-for-Fourth-Quarter-and-Fiscal-2024/))

The numbers make it clear. The real money is in AI and data centers, not gaming. NVIDIA has not only shifted its focus away from gamers but has also engaged in financial engineering to maintain its dominance. The company has consistently engaged in substantial stock buybacks, a hallmark of fiat-driven financial practices. In August 2023, NVIDIA announced a \$25 billion share repurchase program, surprising some investors given the stock's significant rise that year. ([Source](https://www.reuters.com/technology/nvidias-25-billion-buyback-a-head-scratcher-some-shareholders-2023-08-25/)) This was followed by an additional \$50 billion buyback authorization in 2024, bringing the total to \$75 billion over two years. ([Source](https://www.marketwatch.com/story/nvidias-stock-buyback-plan-is-one-of-the-biggest-of-2024-is-that-a-good-thing-9beba5c5))

These buybacks are designed to return capital to shareholders and can enhance earnings per share by reducing the number of outstanding shares. However, they also reflect a focus on short-term stock price appreciation rather than long-term value creation. Instead of using capital for product innovation, NVIDIA directs it toward inflating stock value, ultimately reducing its long-term resilience and innovation potential. In addition to shifting production away from consumer GPUs, NVIDIA has also enabled AI firms to use its chips as collateral to secure massive loans. Lambda, an AI cloud provider, secured a \$500 million loan backed by NVIDIA's H200 and Blackwell AI chips, with financing provided by Macquarie Group and Industrial Development Funding. ([Source](https://www.reuters.com/technology/lambda-secures-500-mln-loan-with-nvidia-chips-collateral-2024-04-04/))

This practice mirrors the way Bitcoin miners have used mining hardware as collateral, expecting continuous high returns to justify the debt. GPUs are fast-depreciating assets that lose value rapidly as new generations replace them. Collateralizing loans with such hardware is a high-risk strategy that depends on continued AI demand to justify the debt. AI firms borrowing against them are placing a leveraged bet on demand staying high. If AI market conditions shift or next-generation chips render current hardware obsolete, the collateral value could collapse, leading to cascading loan defaults and liquidations.

This is not a sound-money approach to business. It is fiat-style quicksand financialization, where loans are built on assets with a limited shelf life. Instead of focusing on sustainable capital allocation, firms are leveraging their future on rapid turnover cycles. This further shifts resources away from gamers, reinforcing the trend where NVIDIA prioritizes high-margin AI sales over its original gaming audience.

At the same time, NVIDIA has been accused of leveraging anti-competitive tactics to maintain its market dominance. The GeForce Partner Program (GPP) launched in 2018 sought to lock hardware partners into exclusive deals with NVIDIA, restricting consumer choice and marginalizing AMD. Following industry backlash, the program was canceled. ([Source](https://en.wikipedia.org/wiki/GeForce_Partner_Program))

NVIDIA is not merely responding to market demand but shaping it through artificial constraints, financialization, and monopolistic control. The result is an industry where consumers face higher prices, limited options, and fewer true innovations as companies prioritize financial games over engineering excellence.

On this basis, short-term downturns fueled by stock buybacks and leveraged bets create instability, leading to key staff layoffs. This forces employees into survival mode rather than fostering long-term innovation and career growth. Instead of building resilient, forward-looking teams, companies trapped in fiat incentives prioritize temporary financial engineering over actual product and market development.

### **A Sound Money Alternative: Aligning Incentives**

Under a sound money system, consumers would become more mindful of purchases as prices naturally decline over time. This would force businesses to prioritize real value creation instead of relying on artificial scarcity and marketing hype. Companies would need to align their strategies with long-term customer satisfaction and sustainable engineering instead of driving demand through planned obsolescence.

Imagine an orange-pilled CEO at NVIDIA. Instead of chasing infinite growth, they persuade the board to pivot toward sustainability and long-term value creation. The company abandons artificial product cycles, prioritizing efficiency, durability, and cost-effectiveness. Gaming GPUs are designed to last a decade, not three years. The model shifts to modular upgrades instead of full replacements. Pricing aligns with real user needs, not speculative stock market gains.

Investors initially panic. The stock takes a temporary hit, but as consumers realize they no longer need to upgrade constantly, brand loyalty strengthens. Demand stabilizes, reducing volatility in production and supply chains. Gamers benefit from high-quality products that do not degrade artificially. AI buyers still access high-performance chips but at fair market prices, no longer subsidized by forced consumer churn.

This is not an abstract vision. Businesses could collateralize loans with Bitcoin. Companies could also leverage highly sought-after end products that maintain long-term value. Instead of stock buybacks or anti-competitive practices, companies would focus on building genuine, long-term value. A future where Bitcoin-backed reserves replace fiat-driven financial engineering would stabilize capital allocation, preventing endless boom-bust cycles. This shift would eliminate the speculative nature of AI-backed loans, fostering financial stability for both borrowers and lenders.

Sound money leads to sound business. When capital allocation is driven by real value rather than debt-fueled expansion, industries focus on sustainable innovation rather than wasteful iteration.

### **Reclaiming Time Sovereignty for Companies**

The fiat system forces corporations into unsustainable growth cycles. Companies that embrace financial independence and time sovereignty can escape this trap and focus on long-term value.

GPU development illustrates this distortion. The RTX 3080 met nearly all gaming needs, yet manufacturers push unnecessary performance gains to fuel stock prices rather than improve usability. GPUs are no longer designed for gamers but for AI and enterprise clients, shifting NVIDIA’s priorities toward financial engineering over real innovation.

This cycle of GPU inflation stems from fiat-driven incentives—growth for the sake of stock performance rather than actual demand. Under a sound money standard, companies would build durable products, prioritizing efficiency over forced obsolescence.

Just as individuals can reclaim financial sovereignty, businesses can do the same. Embracing sound money fosters sustainable business strategies, where technology serves real needs instead of short-term speculation.

#Bitcoin

#FITS

#Marketing

#TimeSovereignty

#BitcoinFixesThis

#OptOut

#EngineeringNotFinance

#SoundBusiness

-

@ 000002de:c05780a7

2025-02-20 20:06:20

> The argument for liberty is not an argument against organization, which is one of the most powerful tools human reason can employ, but an argument against all exclusive, privileged, monopolistic organization, against the use of coercion to prevent others from doing better.

~ Friedrich August von Hayek, The Constitution of Liberty

originally posted at https://stacker.news/items/892255

-

@ e5de992e:4a95ef85

2025-02-20 19:56:02

**The Illusion of Opportunity**

A trader who focuses primarily on "making money" will often see opportunities that do not truly exist. This mindset leads to impulsive decision-making, overtrading, and unnecessary risk exposure. Successful trading is not about chasing profits but about executing a well-structured process that leads to consistent, sustainable results over time.

Traders who prioritize money over process often fall into the trap of forcing trades that do not meet their criteria. They see potential where the market does not support a trade, leading to poor risk-reward decisions. This psychological bias creates a cycle of frustration and loss, as each forced trade compounds previous mistakes.

**The Shift From Profit to Process**

The best traders focus on refining their strategy rather than constantly monitoring their profit and loss (P&L). By shifting attention from financial gain to execution quality, traders develop the discipline required to succeed in various market conditions.

**Key Principles to Maintain Focus on Process:**

***Trade Selection***: Every trade must align with a predefined strategy. If a setup does not meet strict criteria, it should be ignored, regardless of perceived opportunity.

***Risk Management***: Prioritizing risk over reward ensures longevity in the market. Traders who focus only on making money often ignore stop-loss discipline, leading to significant drawdowns.

***Emotional Control:*** The desire to profit can cloud judgment, making traders more susceptible to market traps. Avoiding emotional trading requires a structured plan and a mindset that prioritizes long-term consistency.

**The Pitfalls of Profit-Driven Trading**

When the primary goal is making money rather than executing well-structured trades, several common mistakes emerge:

1. **Overtrading**

Traders who are focused on profit often believe that more trades equate to more opportunities. In reality, overtrading leads to higher transaction costs, increased exposure to market noise, and a greater likelihood of errors.

Example: A trader sees multiple setups in a choppy market and takes unnecessary trades, resulting in minor losses that accumulate over time. A disciplined trader, in contrast, waits for high-probability setups and executes fewer trades with precision.

2. **Ignoring Market Conditions**

Markets move through different phases—trending, ranging, and volatile conditions. A trader fixated on making money may ignore these dynamics and attempt to force trades in an unfavorable environment.

Example: A momentum trader who performs well in trending markets struggles when conditions turn choppy. Instead of adjusting their approach or stepping back, they continue to take the same trades, leading to repeated losses.

3. **Chasing Trades**

Traders focused on quick profits often enter trades late, fearing they will miss out on a move. This "chasing" behavior results in poor entry points and reduces the overall risk-reward ratio.

Example: A stock makes a strong breakout, and a trader jumps in at an overextended price. The stock then retraces, forcing them to exit at a loss. Had they waited for a proper entry, they could have positioned themselves for a lower-risk trade.

4. **Neglecting Risk-Reward Ratios**

Traders who prioritize making money tend to focus on potential gains while disregarding downside risks. Without a proper risk-reward framework, a few bad trades can wipe out previous gains.

Example: A trader takes multiple high-risk trades aiming for large profits. While some work out, one significant loss erases weeks of gains. A trader who prioritizes risk management would avoid such scenarios by ensuring all trades maintain a favorable risk-reward ratio.

**Developing a Sustainable Trading Mindset**

To succeed in trading, the mindset must shift from short-term profit to long-term process optimization. This involves creating a structured approach that removes emotional bias and ensures consistency.

**Steps to Improve Trading Discipline:**

*Follow a Trading Plan* – Define entry and exit rules, risk management parameters, and position sizing.

Track and Review Performance – Maintain a trading journal to assess past decisions and identify patterns in behavior.

*Limit the Number of Trades* – Focus on quality over quantity to avoid unnecessary exposure and reduce emotional trading.

*Develop Patience* – Wait for high-probability setups instead of reacting impulsively to market movements.

*Separate Money From Execution* – Judge success based on adherence to a strategy rather than daily profit and loss fluctuations.

**Conclusion: Process Over Profit**

Traders who focus exclusively on making money often fall into patterns of impulsive decision-making, overtrading, and poor risk management. The key to long-term success lies in developing a structured process that prioritizes disciplined execution over immediate financial gains.

By refining strategy, managing risk, and maintaining emotional discipline, traders can build a sustainable approach that leads to consistent profitability. Instead of seeking opportunities everywhere, traders should focus on executing only the best setups, ensuring that every decision aligns with a well-defined plan.

-

@ 000002de:c05780a7

2025-02-20 19:45:50

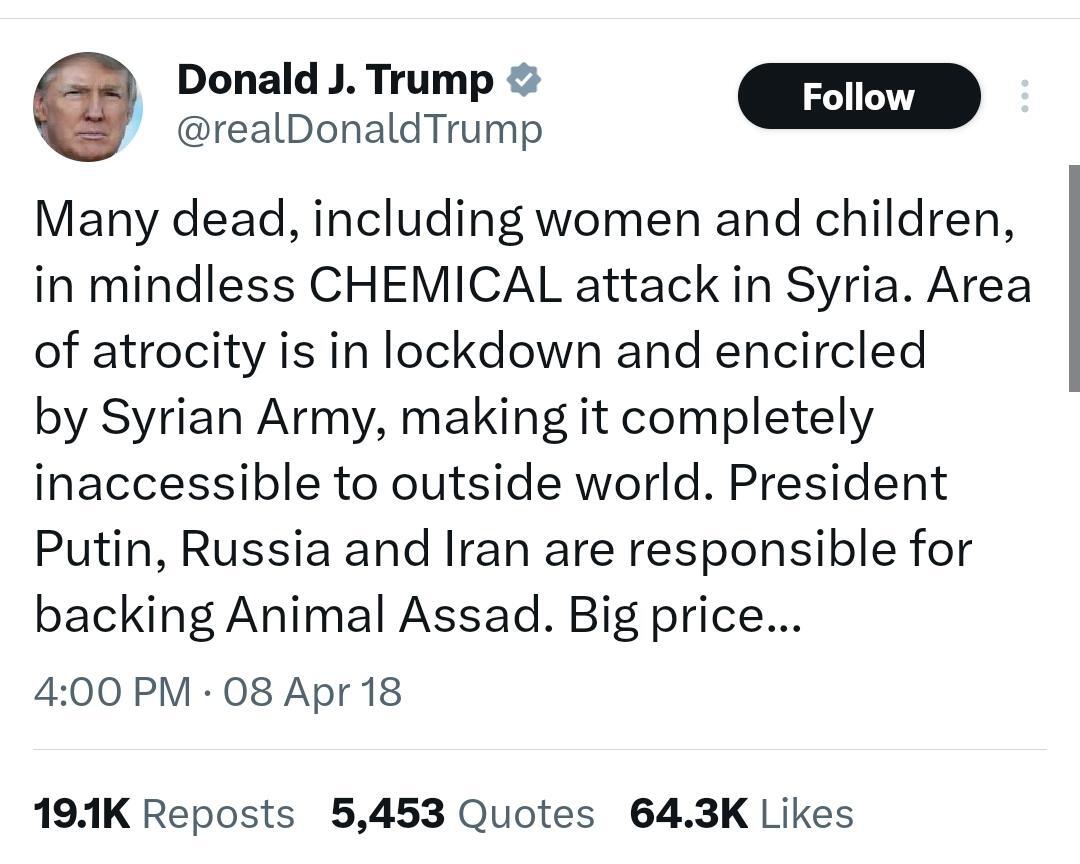

Are you seeing it? Been oddly quiet for me but I have friends that are seeing people come unglued. Think its hard to sustain that level if outrage. It's not healthy for sure. I was so angry during Covid and realized it wasn't worth it.

What's your experience. Not online but IRL.

originally posted at https://stacker.news/items/892219

-

@ 4857600b:30b502f4

2025-02-20 19:09:11

Mitch McConnell, a senior Republican senator, announced he will not seek reelection.

At 83 years old and with health issues, this decision was expected. After seven terms, he leaves a significant legacy in U.S. politics, known for his strategic maneuvering.

McConnell stated, “My current term in the Senate will be my last.” His retirement marks the end of an influential political era.

-

@ 94a6a78a:0ddf320e

2025-02-19 21:10:15

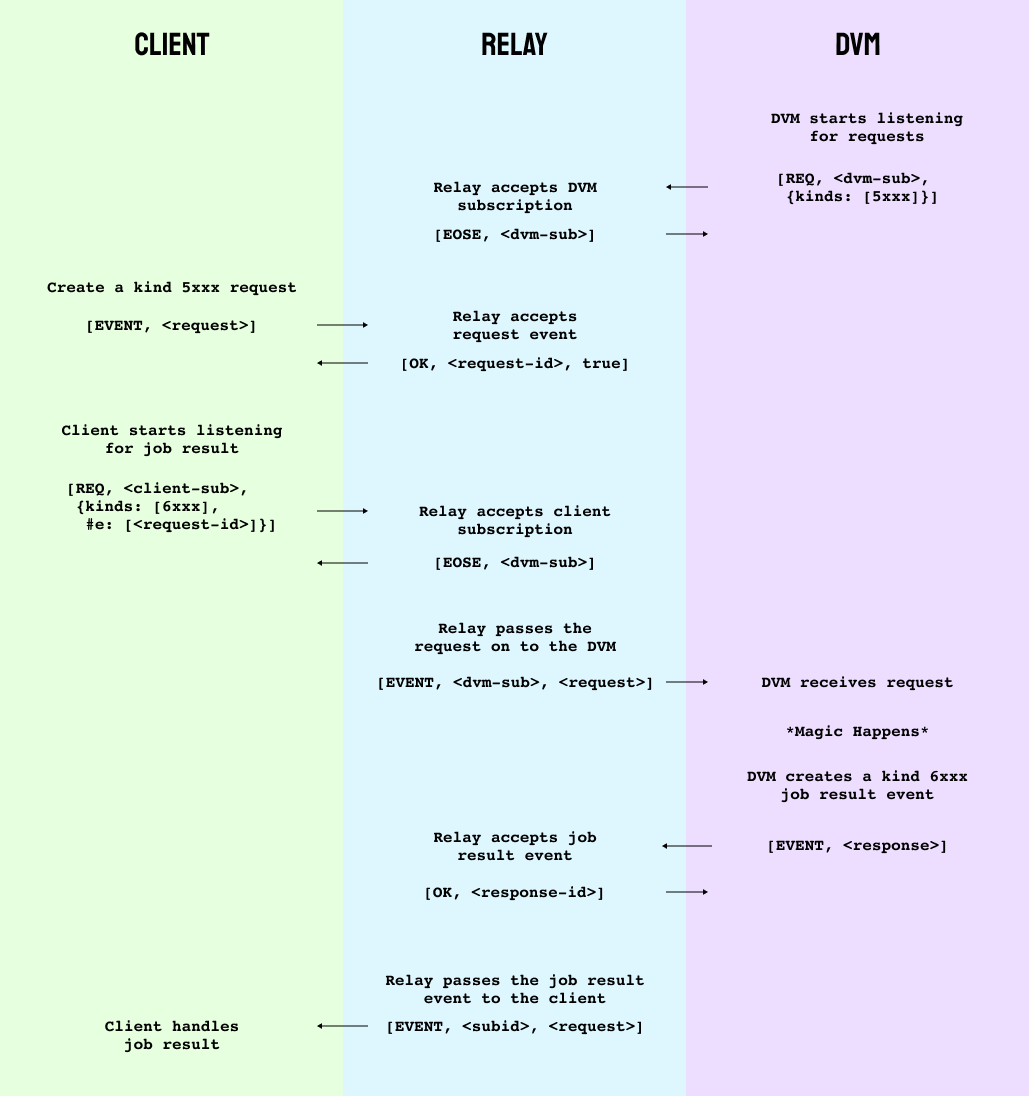

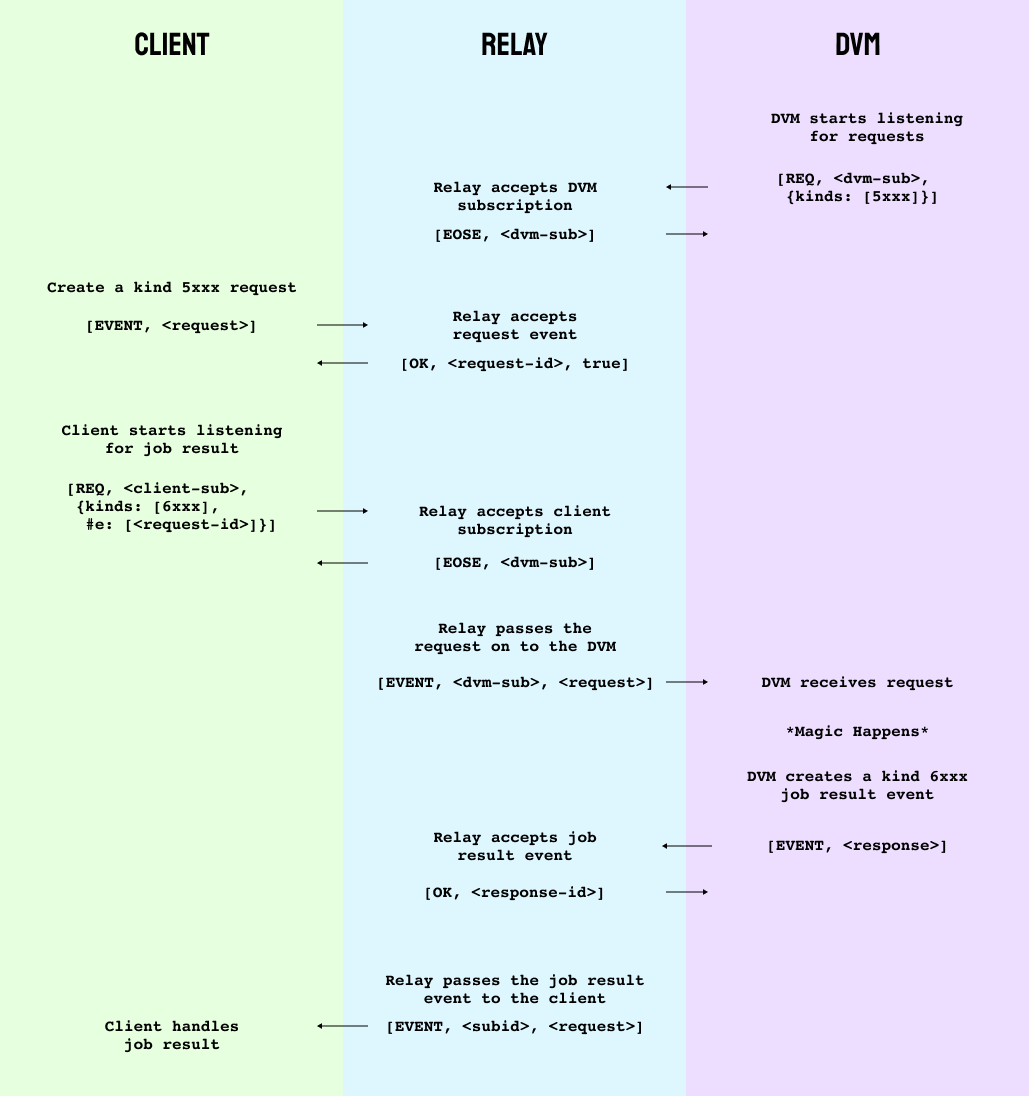

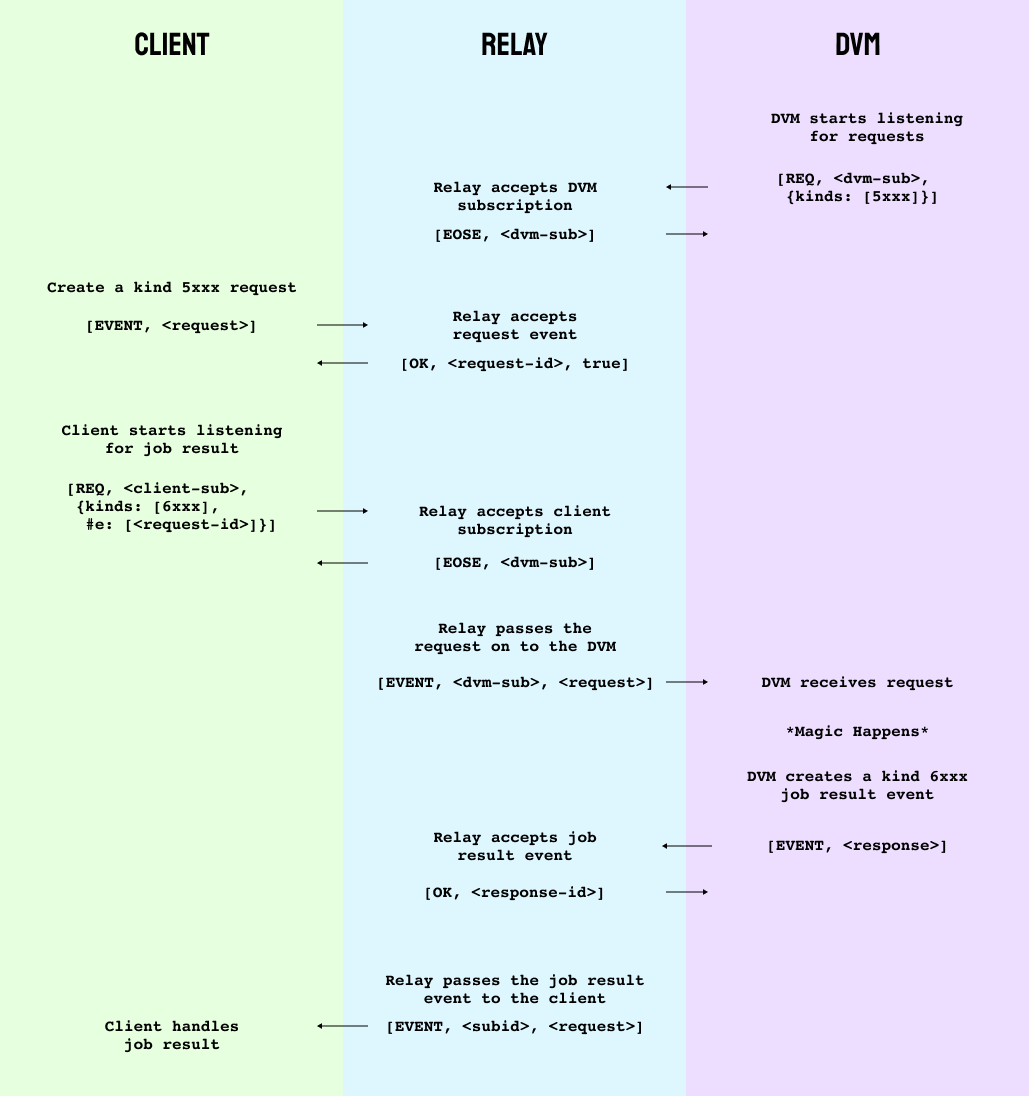

Nostr is a revolutionary protocol that enables **decentralized, censorship-resistant communication**. Unlike traditional social networks controlled by corporations, Nostr operates without central servers or gatekeepers. This openness makes it incredibly powerful—but also means its success depends entirely on **users, developers, and relay operators**.

If you believe in **free speech, decentralization, and an open internet**, there are many ways to support and strengthen the Nostr ecosystem. Whether you're a casual user, a developer, or someone looking to contribute financially, **every effort helps build a more robust network**.

Here’s how you can get involved and make a difference.

---

## **1️⃣ Use Nostr Daily**

The simplest and most effective way to contribute to Nostr is by **using it regularly**. The more active users, the stronger and more valuable the network becomes.

✅ **Post, comment, and zap** (send micro-payments via Bitcoin’s Lightning Network) to keep conversations flowing.\

✅ **Engage with new users** and help them understand how Nostr works.\

✅ **Try different Nostr clients** like Damus, Amethyst, Snort, or Primal and provide feedback to improve the experience.

Your activity **keeps the network alive** and helps encourage more developers and relay operators to invest in the ecosystem.

---

## **2️⃣ Run Your Own Nostr Relay**

Relays are the **backbone of Nostr**, responsible for distributing messages across the network. The more **independent relays exist**, the stronger and more censorship-resistant Nostr becomes.

✅ **Set up your own relay** to help decentralize the network further.\

✅ **Experiment with relay configurations** and different performance optimizations.\

✅ **Offer public or private relay services** to users looking for high-quality infrastructure.

If you're not technical, you can still **support relay operators** by **subscribing to a paid relay** or donating to open-source relay projects.

---

## **3️⃣ Support Paid Relays & Infrastructure**

Free relays have helped Nostr grow, but they **struggle with spam, slow speeds, and sustainability issues**. **Paid relays** help fund **better infrastructure, faster message delivery, and a more reliable experience**.

✅ **Subscribe to a paid relay** to help keep it running.\

✅ **Use premium services** like media hosting (e.g., Azzamo Blossom) to decentralize content storage.\

✅ **Donate to relay operators** who invest in long-term infrastructure.

By funding **Nostr’s decentralized backbone**, you help ensure its **longevity and reliability**.

---

## **4️⃣ Zap Developers, Creators & Builders**

Many people contribute to Nostr **without direct financial compensation**—developers who build clients, relay operators, educators, and content creators. **You can support them with zaps!** ⚡

✅ **Find developers working on Nostr projects** and send them a zap.\

✅ **Support content creators and educators** who spread awareness about Nostr.\

✅ **Encourage builders** by donating to open-source projects.

Micro-payments via the **Lightning Network** make it easy to directly **support the people who make Nostr better**.

---

## **5️⃣ Develop New Nostr Apps & Tools**

If you're a developer, you can **build on Nostr’s open protocol** to create new apps, bots, or tools. Nostr is **permissionless**, meaning anyone can develop for it.

✅ **Create new Nostr clients** with unique features and user experiences.\

✅ **Build bots or automation tools** that improve engagement and usability.\

✅ **Experiment with decentralized identity, authentication, and encryption** to make Nostr even stronger.

With **no corporate gatekeepers**, your projects can help shape the future of decentralized social media.

---

## **6️⃣ Promote & Educate Others About Nostr**

Adoption grows when **more people understand and use Nostr**. You can help by **spreading awareness** and creating educational content.

✅ **Write blogs, guides, and tutorials** explaining how to use Nostr.\

✅ **Make videos or social media posts** introducing new users to the protocol.\

✅ **Host discussions, Twitter Spaces, or workshops** to onboard more people.

The more people **understand and trust Nostr**, the stronger the ecosystem becomes.

---

## **7️⃣ Support Open-Source Nostr Projects**

Many Nostr tools and clients are **built by volunteers**, and open-source projects thrive on **community support**.

✅ **Contribute code** to existing Nostr projects on GitHub.\

✅ **Report bugs and suggest features** to improve Nostr clients.\

✅ **Donate to developers** who keep Nostr free and open for everyone.

If you're not a developer, you can still **help with testing, translations, and documentation** to make projects more accessible.

---

## **🚀 Every Contribution Strengthens Nostr**

Whether you:

✔️ **Post and engage daily**\

✔️ **Zap creators and developers**\

✔️ **Run or support relays**\

✔️ **Build new apps and tools**\

✔️ **Educate and onboard new users**

**Every action helps make Nostr more resilient, decentralized, and unstoppable.**

Nostr isn’t just another social network—it’s **a movement toward a free and open internet**. If you believe in **digital freedom, privacy, and decentralization**, now is the time to get involved.

-

@ 5de23b9a:d83005b3

2025-02-19 03:47:19

In a digital era that is increasingly controlled by large companies, the emergence of Nostr (Notes and Other Stuff Transmitted by Relays) is a breath of fresh air for those who crave freedom of expression.

Nostr is a cryptography-based protocol that allows users to send and receive messages through a relay network. Unlike conventional social media such as Twitter or Facebook

1.Full Decentralization: No company or government can remove or restrict content.

2.Sensor-Resistant: Information remains accessible despite blocking attempts.

3.Privacy and Security: Uses cryptography to ensure that only users who have the keys can access their messages.* **

-

@ 9e69e420:d12360c2

2025-02-17 17:12:01

President Trump has intensified immigration enforcement, likening it to a wartime effort. Despite pouring resources into the U.S. Immigration and Customs Enforcement (ICE), arrest numbers are declining and falling short of goals. ICE fell from about 800 daily arrests in late January to fewer than 600 in early February.

Critics argue the administration is merely showcasing efforts with ineffectiveness, while Trump seeks billions more in funding to support his deportation agenda. Increased involvement from various federal agencies is intended to assist ICE, but many lack specific immigration training.

Challenges persist, as fewer immigrants are available for quick deportation due to a decline in illegal crossings. Local sheriffs are also pressured by rising demands to accommodate immigrants, which may strain resources further.

-

@ a012dc82:6458a70d

2025-02-20 15:02:29

The Financial Accounting Standards Board (FASB) has recently introduced a groundbreaking ruling that significantly alters the way Bitcoin and other cryptocurrencies are accounted for in financial statements. This new development is poised to transform the landscape of crypto accounting, bringing in more transparency and alignment with traditional financial practices. Let's delve into the details of this pivotal change.

**Table of Contents**

- Introduction to the New FASB Ruling

- The Shift to Fair Value Accounting

- Understanding Fair Value Accounting

- Impact on Financial Reporting

- Advantages of the New Approach

- Enhanced Transparency and Accuracy

- Positive Implications for Companies

- Challenges and Considerations

- Dealing with Volatility

- Auditor Expertise

- Industry Response and Future Outlook

- Embracing the Change

- Long-Term Implications

- Conclusion

- FAQs

**Introduction to the New FASB Ruling**

The FASB, the principal body responsible for establishing accounting standards in the United States, announced a new set of rules concerning the accounting of cryptocurrencies like Bitcoin. This announcement marks a significant shift from the previous accounting practices for digital assets. Previously, the lack of clear guidelines led to inconsistencies and uncertainties in how companies reported their crypto holdings. The new ruling aims to standardize these practices and reflects the growing importance of cryptocurrencies in the financial world.

**The Shift to Fair Value Accounting**

**Understanding Fair Value Accounting**

Under the new FASB rules, companies are now required to account for cryptocurrencies at their fair value. Fair value accounting involves assessing assets and liabilities based on their current market value, rather than their historical cost. This approach is expected to provide a more accurate and real-time reflection of a company's financial status. It marks a significant departure from the traditional cost-based accounting methods, which often do not reflect the current market realities, especially in the case of highly volatile assets like cryptocurrencies.

**Impact on Financial Reporting**

This shift to fair value accounting means that companies holding cryptocurrencies will report the value of these assets based on their market prices at the end of each reporting period. This move is a departure from the previous method where Bitcoin was treated as an intangible asset, leading to certain limitations in financial reporting. For instance, under the old rules, if the value of Bitcoin fell below its purchase price, companies had to report a loss, but they couldn't report an increase in value unless the asset was sold. The new approach allows for a more dynamic and responsive reporting system that better reflects the economic realities of holding cryptocurrencies.

**Advantages of the New Approach**

**Enhanced Transparency and Accuracy**

One of the primary benefits of this new ruling is the increased transparency and accuracy it brings to financial reporting. Companies can now reflect the actual market value of their crypto holdings, providing a clearer picture of their financial health. This change is particularly significant given the volatile nature of cryptocurrencies. By reporting the fair market value, companies can provide stakeholders with a more accurate depiction of their financial standing, which is crucial for informed decision-making by investors, regulators, and other stakeholders.

**Positive Implications for Companies**

Companies are likely to welcome this change as it allows them to report unrealized gains and losses on cryptocurrencies. This could encourage more businesses to add cryptocurrencies like Bitcoin to their balance sheets, as they can now recognize the appreciation in value without needing to sell the assets. This change could also lead to a broader acceptance of cryptocurrencies as a legitimate and valuable asset class, potentially spurring further investment and innovation in the crypto space.

**Challenges and Considerations**

**Dealing with Volatility**

The inherent volatility of cryptocurrencies like Bitcoin poses a significant challenge in fair value accounting. Companies will need to develop robust methods to accurately assess the market value of these assets, which can fluctuate widely. This volatility requires continuous monitoring and frequent valuation adjustments, which can be resource-intensive and complex. Companies will need to invest in sophisticated valuation models and possibly seek external expertise to ensure accuracy and compliance.

**Auditor Expertise**

Another challenge lies in the need for auditors to acquire expertise in valuing cryptocurrencies. Assessing the fair market value of digital assets is a complex task that requires specific knowledge and skills. Auditors will need to stay abreast of the rapidly evolving crypto market and develop new methodologies for valuation. This requirement not only adds a layer of complexity to the audit process but also underscores the need for ongoing education and training in this emerging field.

**Industry Response and Future Outlook**

**Embracing the Change**

The industry's response to the FASB's ruling has been largely positive. Industry leaders view this as a step towards mainstream acceptance of cryptocurrencies and a move that aligns digital assets with traditional financial reporting standards. This ruling is seen as a validation of the growing role of cryptocurrencies in the financial sector and a sign that regulatory bodies are beginning to recognize and adapt to the unique characteristics of these digital assets.

**Long-Term Implications**

In the long run, this ruling could lead to greater institutional adoption of cryptocurrencies. As financial reporting becomes more standardized and transparent, it may foster greater trust and confidence among investors and regulators. This could pave the way for more widespread use of cryptocurrencies in various financial transactions and potentially influence the development of new financial products and services centered around digital assets.

**Conclusion**

The FASB's latest ruling on cryptocurrency accounting is a landmark decision that aligns the treatment of digital assets with traditional financial practices. While it presents certain challenges, particularly in terms of volatility and the need for specialized auditor expertise, the overall impact is expected to be profoundly positive. This change not only enhances transparency and accuracy in financial reporting but also paves the way for broader acceptance and integration of cryptocurrencies in the mainstream financial world. As the industry adapts to these new rules, we can expect to see a more mature and robust crypto market, potentially leading to innovative financial solutions and greater economic opportunities.

**FAQs**

**When will the new FASB rules take effect?**

The new rules are set to take effect from December 15, 2024, but companies have the option to apply them earlier.

**How does fair value accounting affect financial reporting?**

Fair value accounting allows companies to report the value of cryptocurrencies based on current market prices, providing a more accurate and real-time reflection of a company's financial status.

**What are the benefits of the new FASB ruling?**

The new ruling enhances transparency and accuracy in financial reporting and encourages more businesses to add cryptocurrencies to their balance sheets by allowing them to report unrealized gains and losses.

**What challenges does the new ruling present?**

The main challenges include dealing with the volatility of cryptocurrencies in fair value accounting and the need for auditors to develop expertise in valuing these digital assets.

**What is the industry's response to the new ruling?**

The industry has largely responded positively, viewing it as a step towards mainstream acceptance of cryptocurrencies and alignment with traditional financial reporting standards.

**That's all for today**

**If you want more, be sure to follow us on:**

**NOSTR: croxroad@getalby.com**

**X: [@croxroadnews.co](https://x.com/croxroadnewsco)**

**Instagram: [@croxroadnews.co](https://www.instagram.com/croxroadnews.co/)**

**Youtube: [@croxroadnews](https://www.youtube.com/@croxroadnews)**

**Store: https://croxroad.store**

**Subscribe to CROX ROAD Bitcoin Only Daily Newsletter**

**https://www.croxroad.co/subscribe**

***DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.***

-

@ d360efec:14907b5f

2025-02-20 10:16:03

**ภาพรวม BTCUSDT (OKX):**

Bitcoin (BTCUSDT) ยังคงแสดงความผันผวนและแนวโน้มที่ไม่ชัดเจน แม้ว่าแนวโน้มระยะยาว (TF Day) จะยังคงมีลักษณะเป็นขาขึ้น (แต่*อ่อนแรงลงอย่างมาก*) แนวโน้มระยะกลาง (TF4H) และระยะสั้น (TF15) เป็นขาลง การวิเคราะห์ครั้งนี้จะเน้นไปที่การระบุระดับราคาที่ Smart Money อาจจะเข้ามามีส่วนร่วม และการประเมินความแข็งแกร่งของแนวโน้ม

**วิเคราะห์ทีละ Timeframe:**

**(1) TF Day (รายวัน):**

* **แนวโน้ม:** ขาขึ้น (Uptrend) *อ่อนแรงลงอย่างมาก, มีความเสี่ยงที่จะเปลี่ยนแนวโน้ม*

* **SMC:**

* Higher Highs (HH) และ Higher Lows (HL) *เริ่มไม่ชัดเจน, ราคาหลุด Low ก่อนหน้า*

* Break of Structure (BOS) ด้านบน *แต่มีการปรับฐานที่รุนแรง*

* **Liquidity:**

* มี Sellside Liquidity (SSL) อยู่ใต้ Lows ก่อนหน้า (บริเวณ 85,000 - 90,000)

* มี Buyside Liquidity (BSL) อยู่เหนือ High เดิม

* **ICT:**

* **Order Block:** ราคาหลุด Order Block ขาขึ้น (บริเวณแท่งเทียนสีเขียวก่อนหน้านี้) *สัญญาณลบ*

* **EMA:**

* ราคา *หลุด* EMA 50 (สีเหลือง) ลงมาแล้ว

* EMA 200 (สีขาว) เป็นแนวรับถัดไป

* **Money Flow (LuxAlgo):**

* *สีแดงยาว* แสดงถึงแรงขายที่แข็งแกร่ง

* **Trend Strength (AlgoAlpha):**

* สีแดง (เมฆแดง) แสดงถึงแนวโน้มขาลง *และไม่มีสัญญาณซื้อ/ขายปรากฏ*

* **Volume Profile:** Volume ค่อนข้างเบาบาง

* **แท่งเทียน:** แท่งเทียนล่าสุดเป็นสีแดง แสดงถึงแรงขาย

* **แนวรับ:** EMA 200, บริเวณ 85,000 - 90,000 (SSL)

* **แนวต้าน:** EMA 50, High เดิม

* **สรุป:** แนวโน้มขาขึ้นอ่อนแรงลงอย่างมาก, *สัญญาณอันตรายหลายอย่าง*, Money Flow และ Trend Strength เป็นลบ, *หลุด Order Block และ EMA 50*

**(2) TF4H (4 ชั่วโมง):**

* **แนวโน้ม:** ขาลง (Downtrend)

* **SMC:**

* Lower Highs (LH) และ Lower Lows (LL)

* Break of Structure (BOS) ด้านล่าง

* **Liquidity:**

* มี SSL อยู่ใต้ Lows ก่อนหน้า

* มี BSL อยู่เหนือ Highs ก่อนหน้า

* **ICT:**

* **Order Block:** ราคาไม่สามารถผ่าน Order Block ขาลงได้

* **EMA:**

* ราคาอยู่ใต้ EMA 50 และ EMA 200

* **Money Flow (LuxAlgo):**

* สีแดง แสดงถึงแรงขาย

* **Trend Strength (AlgoAlpha):**

* สีเขียว (เมฆเขียว) *แต่ไม่มีสัญญาณซื้อ/ขายปรากฏ*

* **Volume Profile:**

* Volume ค่อนข้างสูง

* **แนวรับ:** บริเวณ Low ล่าสุด

* **แนวต้าน:** EMA 50, EMA 200, บริเวณ Order Block

* **สรุป:** แนวโน้มขาลงชัดเจน, แรงขายมีอิทธิพล, *Trend Strength ขัดแย้งกับ Price Action*

**(3) TF15 (15 นาที):**

* **แนวโน้ม:** ขาลง (Downtrend) *แต่เริ่มเห็นสัญญาณ Sideways*

* **SMC:**

* Lower Highs (LH) และ Lower Lows (LL) *เริ่มเห็นการยก Low เล็กน้อย*

* Break of Structure (BOS) ด้านล่าง

* **ICT:**

* **Order Block:** ราคา Sideways ใกล้ Order Block

* **EMA:**

* EMA 50 และ EMA 200 เป็นแนวต้าน

* **Money Flow (LuxAlgo):**

* แดงสลับเขียว *แต่ส่วนใหญ่ยังเป็นสีแดง*

* **Trend Strength (AlgoAlpha):**

* สีแดง (เมฆแดง) แสดงถึงแนวโน้มขาลง *แต่มีสัญญาณ Bullish Divergence (ราคาทำ Lower Low แต่ Trend Strength ยก Low)*

* **Volume Profile:**

* Volume ค่อนข้างสูง

* **แนวรับ:** บริเวณ Low ล่าสุด

* **แนวต้าน:** EMA 50, EMA 200, Order Block

* **สรุป:** แนวโน้มขาลง, เริ่มพักตัว, Money Flow เริ่มมีความไม่แน่นอน, *Trend Strength มี Divergence*

**สรุปภาพรวมและกลยุทธ์ (BTCUSDT):**

* **แนวโน้มหลัก (Day):** ขาขึ้น (*อ่อนแรงลงอย่างมาก, เสี่ยงที่จะเปลี่ยนแนวโน้ม*)

* **แนวโน้มรอง (4H):** ขาลง

* **แนวโน้มระยะสั้น (15m):** ขาลง (เริ่มพักตัว, *มี Divergence*)

* **Liquidity:** มี SSL ทั้งใน Day, 4H, และ 15m

* **Money Flow:** เป็นลบในทุก Timeframes

* **Trend Strength:** Day/15m เป็นขาลง, 4H เป็นขาขึ้น *แต่ไม่มีสัญญาณ*

* **กลยุทธ์:**

1. **Wait & See (ดีที่สุด):** รอความชัดเจน *โดยเฉพาะการ Breakout หรือ Breakdown จากกรอบ Sideways ใน TF15*

2. **Short (เสี่ยง):** ถ้าไม่สามารถ Breakout EMA/แนวต้านใน TF ใดๆ ได้, หรือเมื่อเกิดสัญญาณ Bearish Continuation

3. ***ไม่แนะนำให้ Buy:*** จนกว่าจะมีสัญญาณกลับตัวที่ชัดเจนมากๆ

**Day Trade & การเทรดรายวัน:**

* **Day Trade (TF15):**

* **Short Bias:** หาจังหวะ Short เมื่อราคาเด้งขึ้นไปทดสอบแนวต้าน (EMA, Order Block)

* **Stop Loss:** เหนือแนวต้านที่เข้า Short

* **Take Profit:** แนวรับถัดไป (Low ล่าสุด)

* **ระวัง:** Bullish Divergence ใน Trend Strength

* **ไม่แนะนำให้ Long**

* **Swing Trade (TF4H):**

* **Short Bias:** รอจังหวะ Short เมื่อราคาไม่สามารถผ่านแนวต้าน EMA หรือ Order Block ได้

* **Stop Loss:** เหนือแนวต้านที่เข้า Short

* **Take Profit:** แนวรับถัดไป

* **ไม่แนะนำให้ Long**

**สิ่งที่ต้องระวัง:**

* **Sellside Liquidity (SSL):** มีโอกาสสูงที่ราคาจะถูกลากลงไปแตะ SSL

* **False Breakouts:** ระวัง

* **Volatility:** สูง

* **Divergence (TF15):** อาจเป็นสัญญาณเริ่มต้นของการกลับตัว *แต่ต้องรอการยืนยัน*

* **Trend Strength (TF4H):** ไม่มีสัญญาณซื้อ/ขาย ต้องระวัง

**Setup Day Trade แบบ SMC (ตัวอย่าง):**

1. **ระบุ Order Block:** หา Order Block ขาลง (Bearish Order Block) ใน TF15 (แท่งเทียนสีเขียวก่อนที่ราคาจะลงแรง)

2. **รอ Pullback:** รอให้ราคา Pullback ขึ้นไปทดสอบ Order Block นั้น

3. **หา Bearish Entry:**

* **Rejection:** รอ Price Action ปฏิเสธ Order Block (เช่น เกิด Pin Bar, Engulfing)

* **Break of Structure:** รอให้ราคา Break โครงสร้างย่อยๆ ใน TF ที่เล็กกว่า (เช่น 1m, 5m) หลังจากที่ทดสอบ Order Block

* **Money Flow:** ดู Money Flow ให้เป็นสีแดง

4. **ตั้ง Stop Loss:** เหนือ Order Block

5. **ตั้ง Take Profit:** แนวรับถัดไป (เช่น Low ล่าสุด) หรือ Order Block ขาขึ้น (Bullish Order Block) ใน TF ที่ใหญ่กว่า

**คำแนะนำ:**

* **ความขัดแย้งของ Timeframes:** มีอยู่ แต่แนวโน้มระยะกลาง-สั้น เป็นลบ

* **Money Flow:** เป็นลบในทุก Timeframes

* **Trend Strength:** เริ่มมี Divergence ใน TF15

* **Order Block TF Day:** หลุด Order Block ขาขึ้นแล้ว

* **ถ้าไม่แน่ใจ อย่าเพิ่งเข้าเทรด**

**Disclaimer:** การวิเคราะห์นี้เป็นเพียงความคิดเห็นส่วนตัว ไม่ถือเป็นคำแนะนำในการลงทุน ผู้ลงทุนควรศึกษาข้อมูลเพิ่มเติมและตัดสินใจด้วยความรอบคอบ

-

@ d360efec:14907b5f

2025-02-20 10:12:37

**Overall Assessment:**

Bitcoin (BTCUSDT) on OKX remains highly volatile and shows conflicting signals. The long-term trend (Daily chart) is technically still an uptrend, *but it has weakened considerably* and is showing significant signs of a potential reversal. The 4-hour and 15-minute charts are in confirmed downtrends. The focus of this analysis is on identifying potential areas of Smart Money activity (liquidity pools and order blocks) and assessing trend strength.

**Detailed Analysis by Timeframe:**

**(1) TF Day (Daily):**

* **Trend:** Uptrend (Significantly Weakening, *at risk of reversing*).

* **SMC (Smart Money Concepts):**

* Higher Highs (HH) and Higher Lows (HL) structure is *becoming less defined*. The recent price action has broken previous lows.

* Prior Breaks of Structure (BOS) to the upside, but the current pullback is very deep.

* **Liquidity:**

* **Sellside Liquidity (SSL):** Significant SSL rests below previous lows in the 85,000 - 90,000 range. This is a likely target for Smart Money.

* **Buyside Liquidity (BSL):** BSL is present above the all-time high.

* **ICT (Inner Circle Trader Concepts):**

* **Order Block:** The price has *broken below* the prior bullish Order Block (the large green candle before a significant up-move). This is a *major bearish signal*.

* **EMA (Exponential Moving Average):**

* Price has *broken below* the 50-period EMA (yellow), a bearish signal.

* The 200-period EMA (white) is the next major support level.

* **Money Flow (LuxAlgo):**

* A *long red bar* indicates strong selling pressure.

* **Trend Strength (AlgoAlpha):**

* Red Cloud indicating Downtrend, *No Buy/Sell Signal*

* **Volume Profile:** Relatively low volume on the recent decline.

* **Candlesticks:** The most recent candlestick is red, confirming selling pressure.

* **Support:** EMA 200, 85,000-90,000 (SSL area).

* **Resistance:** EMA 50, Previous All-Time High.

* **Summary:** The Daily chart's uptrend is significantly weakening. The break below the 50 EMA *and* the bullish Order Block, combined with the negative Money Flow and bearish Trend Strength, are all major warning signs.

**(2) TF4H (4-Hour):**

* **Trend:** Downtrend.

* **SMC:**

* Lower Highs (LH) and Lower Lows (LL).

* BOS to the downside.

* **Liquidity:**

* **SSL:** Below previous lows.

* **BSL:** Above previous highs.

* **ICT:**

* **Order Block:** The price rallied up to, and was rejected by, a *bearish* Order Block.

* **EMA:**

* Price is below both the 50-period and 200-period EMAs (bearish).

* **Money Flow (LuxAlgo):**

* Predominantly red, confirming selling pressure.

* **Trend Strength (AlgoAlpha):**

* Green Cloud, *But No Buy/Sell Signal.* This indicates a potential *retracement* within the downtrend, or a period of consolidation, *not* a trend reversal.

* **Volume Profile:**

* Relatively High volume

* **Support:** Recent lows.

* **Resistance:** EMA 50, EMA 200, Order Block.

* **Summary:** The 4-hour chart is in a confirmed downtrend. The Money Flow is bearish, and the price was rejected by a key Order Block. The green Trend Strength cloud *without* a buy signal suggests a potential *temporary* relief rally or consolidation, *not* a trend change.

**(3) TF15 (15-Minute):**

* **Trend:** Downtrend (with some signs of *possible* stabilization).

* **SMC:**

* Lower Highs (LH) and Lower Lows (LL) – *but the most recent low is slightly higher, a potential early sign of a change*.

* BOS to the downside.

* **ICT:**

* **Order Block:** Price has reacted to bearish Order Block.

* **EMA:**

* The 50-period and 200-period EMAs are acting as resistance.

* **Money Flow (LuxAlgo):**

* Red and green alternating , showing some buying pressure has appeared, but sellers are still in control overall.

* **Trend Strength (AlgoAlpha):**

* Red Cloud (Bearish), *BUT* there's a *bullish divergence* (price made a lower low, but the Trend Strength indicator made a higher low). This is a *potential* early warning sign of a reversal, but it needs *strong confirmation*.

* **Volume Profile:**

* relatively high volume.

* **Support:** Recent lows.

* **Resistance:** EMA 50, EMA 200, Order Block.

* **Summary:** The 15-minute chart is in a downtrend, but there are *very early* and *tentative* signs of a possible stabilization or even a minor bounce. The bullish divergence on the Trend Strength is important to note, but it's not a buy signal on its own.

**Overall Strategy and Recommendations (BTCUSDT):**

* **Primary Trend (Day):** Uptrend (Significantly Weakening).

* **Secondary Trend (4H):** Downtrend.

* **Short-Term Trend (15m):** Downtrend (Potential Early Reversal Signals).

* **Liquidity:** Significant SSL zones exist below the current price on all timeframes.

* **Money Flow:** Negative on all timeframes, although the 15m is showing *some* buying pressure returning.

* **Trend Strength:** Bearish on Day and 15m. Bullish on 4H, *but without a buy/sell signal*, indicating a likely retracement or consolidation, not a trend change.

* **Strategies:**

1. **Wait & See (Best Option):** The conflicting signals (especially the 4H Trend Strength) and the strong bearish momentum on the shorter timeframes make waiting the most prudent approach. Look for:

* **Bearish Confirmation:** A decisive break below the recent lows on the 15m and 4H charts, with increasing volume and continued negative Money Flow. This would confirm the continuation of the downtrend.

* **Bullish Confirmation:** A strong, sustained break above the 15m EMAs, a shift in the 15m Money Flow to green, *and* a bullish signal on the 4H Trend Strength. This would be a *very early* sign of a potential reversal, but it would need further confirmation on the 4H chart (price above EMAs, positive Money Flow).

2. **Short (High Risk):** This is the more likely scenario *at this moment*, given the 4H and 15m downtrends.

* **Entry:** On rallies towards resistance levels (EMAs on 15m/4H, previous support levels that have turned into resistance).

* **Stop Loss:** Above recent highs on the chosen timeframe.

* **Target:** The next support levels (recent lows on 15m, then the Daily Order Block area around 92,000-94,000).

3. **Buy on Dip (Extremely High Risk - Not Recommended):** Do *not* attempt to buy until there are *very strong and consistent* bullish reversal signals across *all* timeframes, including a definitive shift in market structure on the 4H and 15m charts, positive Money Flow, and a clear break above resistance levels.

**Key Recommendations:**

* **Conflicting Signals:** The most important factor is the conflict between the still *technically* bullish Daily chart and the bearish 4H and 15m charts. The 4H Trend Strength being bullish *without a signal* adds to the uncertainty.

* **Money Flow:** The predominantly negative Money Flow is a major bearish factor.

* **15m Trend Strength Divergence:** This is a *potential* early warning, but it's *not* a buy signal on its own. It needs *much* more confirmation.

* **Daily Order Block:** The *break* of the bullish Order Block on the Daily chart is a significant bearish development.

* **Sellside Liquidity (SSL):** Be aware that Smart Money may target the SSL zones below. This increases the risk of stop-loss hunting.

* **Risk Management:** Due to the high uncertainty and volatility, *strict risk management is absolutely critical.* Use tight stop-losses, do not overtrade, and be prepared for rapid price swings.

* **Volume:** Confirm any breakout with volume.

**Day Trading and Intraday Trading Strategies:**

* **Day Trade (TF15 focus):**

* **Short Bias:** Given the current 15m downtrend and negative Money Flow, the higher probability is to look for shorting opportunities.

* **Entry:** Look for price to rally to resistance levels (EMAs, Order Blocks, previous support levels that have become resistance) and then show signs of rejection (bearish candlestick patterns, increasing volume on the downside).

* **Stop Loss:** Place a stop-loss order above the resistance level where you enter the short position.

* **Take Profit:** Target the next support level (recent lows).

* **Be very cautious:** The bullish divergence on the Trend Strength indicator suggests a potential bounce *could* occur. Don't be aggressive with shorts until this divergence is invalidated.

* **Avoid Long positions:** Until there's a *clear* and *confirmed* bullish reversal on the 15m chart (break above EMAs, positive Money Flow, bullish market structure).

* **Swing Trade (TF4H focus):**

* **Short Bias:** The 4H chart is in a downtrend.

* **Entry:** Wait for price to rally to resistance levels (EMAs, Order Blocks) and show signs of rejection.

* **Stop Loss:** Above the resistance level where you enter the short position.

* **Take Profit:** Target the next support levels (e.g., the 200 EMA on the Daily chart, SSL zones).

* **Avoid long position:** Until there's a *clear* and *confirmed* bullish reversal on the 4H chart.

**SMC Day Trade Setup Example (TF15 - Bearish):**

1. **Identify Bearish Order Block:** Locate a bearish Order Block on the TF15 chart (a bullish candle before a strong downward move). *We have already identified this in previous analyses.*

2. **Wait for Pullback:** Wait for the price to pull back up to test the Order Block.

3. **Bearish Entry:**

* **Rejection:** Look for price action to reject the Order Block (e.g., a pin bar, engulfing pattern, or other bearish candlestick pattern).

* **Break of Structure:** Look for a break of a minor support level on a *lower* timeframe (e.g., 1-minute or 5-minute) after the price tests the Order Block. This confirms weakening bullish momentum.

* **Money Flow:** Confirm that Money Flow remains negative (red).

4. **Stop Loss:** Place a stop-loss order *above* the Order Block.

5. **Take Profit:** Target the next support level (e.g., recent lows) or a bullish Order Block on a higher timeframe.

**In conclusion, BTCUSDT is currently in a high-risk, uncertain environment. The short-term and medium-term trends are bearish, while the long-term trend is weakening. The best approach for most traders is to wait for clearer signals. Shorting is the higher-probability trade *at this moment*, but only for experienced traders who can manage risk aggressively. Buying is extremely risky and not recommended at this time.** The bullish divergence on the 15m Trend Strength is a *potential* early warning of a change, but it needs *much* more confirmation before acting on it. The 4-hour chart showing a green cloud with *no* buy/sell signal adds to the uncertainty, suggesting a possible retracement/consolidation *within* the downtrend.

**Disclaimer:** This analysis is for informational purposes only and represents a personal opinion. It is not financial advice. Investing in cryptocurrencies involves significant risk. Investors should conduct their own research and exercise due diligence before making any investment decisions.

-

@ 000002de:c05780a7

2025-02-20 01:52:34

Due to some some org changes at my employer I may be moving to a team that uses Python heavily. I have never written Python professionally but I've dabbled. I think its used heavily in certain fields and is likely a marketable language to have on the CV. Am I correct in that summary?

Is it growing? Is it evolving? I know its alive and well but I just don't hear much about it anymore. Has it just matured like many languages over the years?

originally posted at https://stacker.news/items/891251

-

@ 16f1a010:31b1074b

2025-02-19 20:57:59

In the rapidly evolving world of Bitcoin, running a Bitcoin node has become more accessible than ever. Platforms like Umbrel, Start9, myNode, and Citadel offer user-friendly interfaces to simplify node management. However, for those serious about maintaining a robust and efficient Lightning node ⚡, relying solely on these platforms may not be the optimal choice.

Let’s delve into why embracing **Bitcoin Core** and mastering the command-line interface (CLI) can provide a **more reliable, sovereign, and empowering** experience.

### Understanding Node Management Platforms

#### What Are Umbrel, Start9, myNode, and Citadel?

Umbrel, Start9, myNode, and Citadel are platforms designed to streamline the process of running a Bitcoin node. They offer graphical user interfaces (GUIs) that allow users to manage various applications, including Bitcoin Core and Lightning Network nodes, through a web-based dashboard 🖥️.

These platforms often utilize Docker containers 🐳 to encapsulate applications, providing a modular and isolated environment for each service.

#### The Appeal of Simplified Node Management

The primary allure of these platforms lies in their simplicity. With minimal command-line interaction, users can deploy a full Bitcoin and Lightning node, along with a suite of additional applications.

✅ **Easy one-command installation**

✅ **Web-based GUI for management**

✅ **Automatic app updates** *(but with delays, as we’ll discuss)*

However, while this convenience is attractive, it comes **at a cost**.

### The Hidden Complexities of Using Node Management Platforms

While the user-friendly nature of these platforms is advantageous, it can also introduce several challenges that may hinder advanced users or those seeking greater control over their nodes.

#### 🚨 Dependency on Maintainers for Updates

One significant concern is the reliance on platform maintainers for updates. Since these platforms manage applications through Docker containers, users must wait for the maintainers to update the container images before they can access new features or security patches.

🔴 **Delayed Bitcoin Core updates = potential security risks**

🔴 **Lightning Network updates are not immediate**

🔴 **Bugs and vulnerabilities may persist longer**

Instead of waiting on a third party, **why not update Bitcoin Core & LND yourself instantly**?

#### ⚙️ Challenges in Customization and Advanced Operations

For users aiming to perform advanced operations, such as:

* Custom backups 📂

* Running specific CLI commands 🖥️

* Optimizing node settings ⚡

…the **abstraction layers introduced by these platforms become obstacles**.

Navigating through nested directories and issuing commands inside Docker containers **makes troubleshooting a nightmare**. Instead of a simple `bitcoin-cli` command, you must figure out how to execute it inside the container, adding unnecessary complexity.

#### Increased Backend Complexity

To achieve **frontend simplicity**, these platforms make the backend more complex.

🚫 Extra layers of abstraction

🚫 Hidden logs and settings

🚫 Harder troubleshooting

The use of **multiple Docker containers**, **custom scripts**, and **unique file structures** can **make system maintenance and debugging a pain**.

This **complication defeats the purpose** of “making running a node easy.”

## ✅ Advantages of Using Bitcoin Core and Command-Line Interface (CLI)

By installing Bitcoin Core directly and using the command-line interface (CLI), you gain several key advantages that make managing a Bitcoin and Lightning node more efficient and empowering.

#### Direct Control and Immediate Updates

One of the biggest downsides of package manager-based platforms is the reliance on third-party maintainers to release updates. Since Bitcoin Core, Lightning implementations (such as LND, Core Lightning, or Eclair), and other related software evolve rapidly, waiting for platform-specific updates can leave you running outdated or vulnerable versions.

By installing Bitcoin Core directly, you remove this dependency. You can update immediately when new versions are released, ensuring your node benefits from the latest features, security patches, and bug fixes. The same applies to Lightning software—being able to install and update it yourself gives you full autonomy over your node’s performance and security.

#### 🛠 Simplified System Architecture

Platforms like Umbrel and myNode introduce extra complexity by running Bitcoin Core and Lightning inside Docker containers. This means:

* The actual files and configurations are stored inside Docker’s filesystem, making it **harder to locate and manage them manually**.

* If something breaks, **troubleshooting is more difficult** due to the added layer of abstraction.

* Running commands requires jumping through Docker shell sessions, adding unnecessary friction to what should be a straightforward process.

Instead, a direct installation of Bitcoin Core, Lightning, and Electrum Server (if needed) results in a **cleaner, more understandable system**. The software runs natively on your machine, without containerized layers making things more convoluted.

Additionally, setting up your own systemd service files for Bitcoin and Lightning** is not as complicated as it seems**. Once configured, these services will run automatically on boot, offering the same level of convenience as platforms like Umbrel but without the unnecessary complexity.

#### Better Lightning Node Management

If you’re running a **Lightning Network node**, using CLI-based tools provides far more flexibility than relying on a GUI like the ones bundled with node management platforms.

🟢 **Custom Backup Strategies** – Running Lightning through a GUI-based node manager often means backups are handled in a way that is opaque to the user. With CLI tools, you can easily script automatic backups of your channels, wallets, and configurations.

🟢 **Advanced Configuration** – Platforms like Umbrel force certain configurations by default, limiting how you can customize your Lightning node. With a direct install, you have full control over:

* Channel fees 💰

* Routing policies 📡

* Liquidity management 🔄

🟢 **Direct Access to LND, Core Lightning, or Eclair** – Instead of issuing commands through a GUI (which is often limited in functionality), you can use:

* `lncli` (for LND)

* `lightning-cli` (for Core Lightning)

…to interact with your node at a deeper level.

#### Enhanced Learning and Engagement

A crucial aspect of running a Bitcoin and Lightning node is **understanding how it works**.

Using an abstraction layer like Umbrel may get a node running in a few clicks, but **it does little to teach users how Bitcoin actually functions**.

By setting up Bitcoin Core, Lightning, and related software manually, you will:

✅ Gain practical knowledge of Bitcoin nodes, networking, and system performance.

✅ Learn how to configure and manage RPC commands.

✅ Become less reliant on third-party developers and more confident in troubleshooting.

🎯 **Running a Bitcoin node is about sovereignty – learn how to control it yourself**.

## Become more sovereign TODAY

Many guides make this process **straightforward**

[K3tan](https://k3tan.com/about) has a fantastic guide on running Bitcoin Core, Electrs, LND and more.

- [Ministry of Nodes Guide 2024](https://www.youtube.com/playlist?list=PLCRbH-IWlcW0g0HCrtI06_ZdVVolUWr39)

- You can find him on nostr

nostr:npub1txwy7guqkrq6ngvtwft7zp70nekcknudagrvrryy2wxnz8ljk2xqz0yt4x

Even with the best of guides, if you are running this software,

📖 **READ THE DOCUMENTATION**

This is all just software at the end of the day. Most of it is very well documented. Take a moment to actually read through the documentation for yourself when installing. The documentation has step by step guides on setting up the software.

Here is a helpful list:

* [Bitcoin.org Bitcoin Core Linux install instructions](https://bitcoin.org/en/full-node#linux-instructions)

* [Bitcoin Core Code Repository](https://github.com/bitcoin/bitcoin)

* [Electrs Installation](https://github.com/romanz/electrs/blob/master/doc/install.md)

* [LND Documentation](https://docs.lightning.engineering/)

* [LND Code Repository](https://github.com/lightningnetwork/lnd)

* [CLN Documentation](https://docs.corelightning.org/docs/home)

* [CLN Code Repository](https://github.com/ElementsProject/lightning)

*If you have any more resources or links I should add, please comment them . I want to add as much to this article as I can.*

-

@ f33c8a96:5ec6f741

2025-02-19 20:47:43

<div style="position:relative;padding-bottom:56.25%;height:0;overflow:hidden;max-width:100%;"><iframe src="https://www.youtube.com/embed/kFUIfaCpXzA?enablejsapi=1" style="position:absolute;top:0;left:0;width:100%;height:100%;border:0;" allowfullscreen></iframe></div>

-

@ 42342239:1d80db24

2025-02-16 08:39:59

Almost 150 years ago, the British newspaper editor William Thomas Stead wrote that "the editorial pen is a [sceptre of power](https://archive.org/details/GovernmentByJournalismWilliamThomasStead), compared with which the sceptre of many a monarch is but a gilded lath". He had begun to regard journalism as something more than just conveying information - **the journalist or editor could become a ruler.**

Times had certainly changed compared to a few hundred years earlier. Before [Gutenberg's invention of the printing press](https://underorion.se/en/posts/gutenberg/), it was mainly the church that controlled the dissemination of information in Europe, but when Stead put pen to paper, this control had shifted to newspapers, schools, and universities. Eventually, technologies like radio and TV entered the scene, but the power dynamics remained asymmetrical - only a few could send information to the many.

However, with the emergence of the internet, and especially with the spread of social media, a significant change followed. Instead of only a few being able to send information to the many, many could send to many. Almost anyone could now create their own newspaper, radio, or TV channel. **The power over information dissemination was decentralised.**

[Ten years ago](https://www.di.se/ditv/rikets-affarer-medierna-ar-splittrade/), Roberta Alenius, who was then press secretary for Sweden's Prime Minister Fredrik Reinfeldt of the Moderate Party, shared her experiences with Social Democratic and Moderate Party internet activists on social media. She reported that social media played a significant role in how news "comes out" and is shaped, and that **journalism was now downstream of social media**. [Five years later](https://www.nato.int/cps/en/natohq/opinions_166392.htm), NATO's then-Secretary-General Jens Stoltenberg said that "NATO must be prepared for both conventional and hybrid threats: **from tanks to tweets**." This finally underscores the importance of social media.

Elon Musk, who took over X (formerly Twitter) in 2022, has claimed that "it's absolutely fundamental and transformative that the people actually get to decide the news and narrative and what's important," and that [citizen journalism is the future](https://x.com/elonmusk/status/1870485116474278240).

While his platform allows most expressions - for better or worse - the reach of messages is instead limited ("[freedom of speech does not mean freedom of reach](https://www.youtube.com/shorts/R9TuhTz0vmo) "). X has also opened its recommendation algorithm to the outside world by making it open-source. Although this is a welcome step, the fact remains that **it's impossible to know which code is actually used** and what adjustments are made by humans or algorithms.

William Thomas Stead's "sceptre of power", which has wandered from the church to newspaper and TV editorial offices, and now to citizens according to Elon Musk, risks being transferred to algorithms' opaque methods?

Instead of talking about "toxic algorithms" and TikTok bans, like the so many do today, we should ask ourselves more fundamental questions. What happens when algorithms are no longer objective (how can they ever be?), but instead become tools for shaping our reality? **Perhaps our greatest challenge today is not deciding who should govern the information landscape, but instead recognising that no one is up to the task** - not even well-ventilated computers.

-

@ 9e69e420:d12360c2

2025-02-15 20:24:09

Ukraine's President Volodymyr Zelensky called for an "army of Europe" to defend against Russian threats, emphasizing that the US may not continue its traditional support for Europe. Speaking at the Munich Security Conference, he warned against peace deals made without Ukraine's involvement.

US Vice President JD Vance echoed this sentiment, urging Europe to enhance its defense efforts.

Zelensky stated, "I really believe the time has come - the armed forces of Europe must be created." He highlighted changing dynamics in US-Europe relations and noted that "the old days are over" regarding American support.

Despite discussions around NATO, Zelensky stated he wouldn't rule out NATO membership for Ukraine.

-

@ fd208ee8:0fd927c1

2025-02-15 07:37:01

E-cash are coupons or tokens for Bitcoin, or Bitcoin debt notes that the mint issues. The e-cash states, essentially, "IoU 2900 sats".

They're redeemable for Bitcoin on Lightning (hard money), and therefore can be used as cash (softer money), so long as the mint has a good reputation. That means that they're less fungible than Lightning because the e-cash from one mint can be more or less valuable than the e-cash from another. If a mint is buggy, offline, or disappears, then the e-cash is unreedemable.

It also means that e-cash is more anonymous than Lightning, and that the sender and receiver's wallets don't need to be online, to transact. Nutzaps now add the possibility of parking transactions one level farther out, on a relay. The same relays that cannot keep npub profiles and follow lists consistent will now do monetary transactions.

What we then have is

* a **transaction on a relay** that triggers

* a **transaction on a mint** that triggers

* a **transaction on Lightning** that triggers

* a **transaction on Bitcoin**.

Which means that every relay that stores the nuts is part of a wildcat banking system. Which is fine, but relay operators should consider whether they wish to carry the associated risks and liabilities. They should also be aware that they should implement the appropriate features in their relay, such as expiration tags (nuts rot after 2 weeks), and to make sure that only expired nuts are deleted.

There will be plenty of specialized relays for this, so don't feel pressured to join in, and research the topic carefully, for yourself.

https://github.com/nostr-protocol/nips/blob/master/60.md

https://github.com/nostr-protocol/nips/blob/master/61.md

-

@ 8d34bd24:414be32b

2025-02-19 16:43:17

Last night I was reading Jeremiah 24 and I read the parable of the figs. I’ve read this passage many times, but suddenly I saw the irony of the situation.

## The Story of the Good and Bad Figs

> After Nebuchadnezzar king of Babylon had carried away captive Jeconiah the son of Jehoiakim, king of Judah, and the officials of Judah with the craftsmen and smiths from Jerusalem and had brought them to Babylon, the Lord showed me: behold, two baskets of figs set before the temple of the Lord! One basket had very good figs, like first-ripe figs, and the other basket had very bad figs which could not be eaten due to rottenness. Then the Lord said to me, “What do you see, Jeremiah?” And I said, “Figs, the good figs, very good; and the bad figs, very bad, which cannot be eaten due to rottenness.”

>

> Then the word of the Lord came to me, saying, “Thus says the Lord God of Israel, ‘**Like these good figs, so I will regard as good the captives of Judah, whom I have sent out of this place into the land of the Chaldeans. For I will set My eyes on them for good, and I will bring them again to this land; and I will build them up and not overthrow them**, and I will plant them and not pluck them up. I will give them a heart to know Me, for I am the Lord; and they will be My people, and I will be their God, for they will return to Me with their whole heart.

>

> ‘**But like the bad figs which cannot be eaten due to rottenness**—indeed, thus says the Lord—so I will abandon Zedekiah king of Judah and his officials, and **the remnant of Jerusalem who remain in this land and the ones who dwell in the land of Egypt. I will make them a terror and an evil for all the kingdoms of the earth, as a reproach and a proverb, a taunt and a curse in all places where I will scatter them.** I will send the sword, the famine and the pestilence upon them until they are destroyed from the land which I gave to them and their forefathers.’ ” (Jeremiah 24:1-10) {Emphasis mine}

God tells Jeremiah about two baskets of figs, one very good and one very bad. He then goes on to describe those Israelites who were kidnapped by Nebuchadnezzar and hauled off to Babylon and those that got to remain in Israel in their homes. Who would you think God was blessing and who would you think God was punishing? I would think the person hauled off into captivity was being punished and the one that got to stay in their comfortable home was being blessed, but it was the opposite.

God said, “‘*Like these good figs, so I will regard as good the captives of Judah, whom I have sent out of this place into the land of the Chaldeans. For I will set My eyes on them for good, and I will bring them again to this land; and I will build them up and not overthrow them, and I will plant them and not pluck them up*.” (Jeremiah 24:5b-6) Those that got hauled away were being blessed. They were being protected from the judgment that God was about to bestow on Israel for their sin. It would have been very easy for the captives to moan, “Woe is us. Why would God do such horrible things to us?” even though God was protecting them. It would have been very easy for those who remained to think, “Those captives must have sinned very badly. Luckily, God doesn’t have any problems with me.”

Instead God was punishing those who remained in Israel. He said,

> But like the bad figs which cannot be eaten due to rottenness—indeed, thus says the Lord—so I will abandon Zedekiah king of Judah and his officials, and the remnant of Jerusalem who remain in this land and the ones who dwell in the land of Egypt. **I will make them a terror and an evil for all the kingdoms of the earth**, as a reproach and a proverb, a taunt and a curse in all places where I will scatter them. **I will send the sword, the famine and the pestilence upon them until they are destroyed from the land** which I gave to them and their forefathers.’ (Jeremiah 24:8-10) {Emphasis mine}

While those who weren’t dragged away into captivity were congratulating themselves, the judgment of God fell upon them because they had rejected their God and were depending on the blessings promised to their ancestors.

Those who were hauled into captivity were blessed and multiplied and then brought back to the promised land 70 years later. Even when they were not feeling blessed, God told them how to live in order to be blessed.

> “Thus says the Lord of hosts, the God of Israel, to all the exiles whom I have sent into exile from Jerusalem to Babylon, ‘Build houses and live in them; and plant gardens and eat their produce. Take wives and become the fathers of sons and daughters, and take wives for your sons and give your daughters to husbands, that they may bear sons and daughters; and multiply there and do not decrease. **Seek the welfare of the city where I have sent you into exile, and pray to the Lord on its behalf; for in its welfare you will have welfare.** (Jeremiah 29:4-7)

They were told to be fruitful and multiply in both a financial and a familial way. They were told to work hard while waiting for the fulfillment of God’s promises and in 70 years they and/or their families would return to the promised land.

In a like manner, we are to be fruitful and multiply in whatever situation or in whatever country God has placed us. We are to stay faithful to Him and to honor Him in all we do wherever He has placed us. Whether we are literal exiles in a foreign country or not, we are all exiles from heaven waiting for Jesus to return and call us home. We are called to be productive while we wait.

## A Real Life Example of the Good Figs

I got to see a similar example in my own life. I went through what most people would call a hellish year in 2015, but every thing that happened was for a blessing and not for a curse. I got to see how trusting in the Lord with all my heart led to blessings I couldn’t imagine.

Technically our rough year started in November of 2014 with a flood and that is kind of how the next year felt. We had a house with hot water heat. Our family room had a large volume because the ceiling was two stories high. The room only had two heat registers. When we would get sub zero (F) temperatures, the room would drop in temperature, so we put in a wood and coal stove. It did a such a great job of heating the house that the heat wasn’t turning on and the pipes in the back office froze and burst the pipes. While we were at work, the temperatures warmed up, the pipes defrosted, and the water started streaming out flooding our entire downstairs. We then had get everything off the floor, flood cut the whole downstairs, and put in giant fans for 6 weeks to dry the wet floors and walls. It sounded like a 747 jet was sitting in the living room. I couldn’t hear myself think. It was very stressful, but that was just the beginning.

We had a fight with the insurance company for \~8 months. They agreed about everything needing to be fixed, but wanted to pay only about half the cost to fix it. We finally had to break down and hire a lawyer. We settled with the insurance company writing us a check for 90% of the price of repairs. This settlement was a blessing in disguise.

Because of the problems with our insurance company, we decided to switch to a new insurer. We set up to switch when our current policy expired. Ten days into our new policy, our house burnt down in a grass fire fueled by 60+ mph winds. In the main part of the house the only things recognizable were the coal stove and a 3 hour rated gun safe (that now looked like a cheap metal cabinet onto which someone dropped a nuclear bomb). We lost all of our physical possessions, but God had a plan.

The new insurance company sent their insurance adjuster out right away. In one month they had paid for the house, the trees, the barn, and a year’s rent in a nice rental house. We had more than half of the settlement left from the flood (we had bought a few supplies for fixing the house). Exactly one year and one month later, we moved into our paid off dream home (with a very fire resistant exterior). Of course God didn’t finish His blessings and lessons with the fire, there was more to come.

We moved into the rental house. (Ironically I was excited about all of the closet space even though I could fit all of my worldly possessions in a small suitcase. We humans are not always logical and we don’t let go of our physical possessions easily.) A month later, my husband’s car engine blew up. A month after that, my husband ruptured his Achilles tendon, had to go through surgery, and we were unable to travel to see family for Christmas as planned. It seemed like hardship, but the previous hardships had prepared us for this one.