-

@ f25afb62:8d50c6e7

2025-03-09 01:34:10

The recent economic turmoil in New Zealand has reignited debates over the role of the Reserve Bank of New Zealand (RBNZ) in "engineering a recession." Many believe that the RBNZ’s decision to raise the Official Cash Rate (OCR) was the root cause of the downturn, but this narrative oversimplifies the reality.

### Who Really Engineered the Recession?

Blaming the RBNZ for the recession ignores a fundamental truth: **market interest rates were rising long before the OCR was adjusted.** Bond yields, swap rates, and borrowing costs surged as the RBNZ stepped back from being the primary buyer of government bonds. When the RBNZ stopped paying artificially high prices (low yields) for bonds, the private sector had to price them instead, leading to yields rising back to real market interest rates. Meanwhile, the government continued to refinance its rolling debt at these higher rates, further driving up borrowing costs. The RBNZ, in hiking the OCR, was following the market interest rate, attempting to maintain credibility rather than dictating outcomes.

The real policy missteps were made much earlier:

1. **Artificially Suppressing Interest Rates Through Money Printing**\

The RBNZ engaged in Large-Scale Asset Purchases (LSAP), creating money out of thin air to buy government bonds. This artificially lowered yields, making it cheaper for the government to borrow and spend beyond its means. The result? Inflation surged as the economy was flooded with cheap money.

2. **Funding for Lending Programme (FLP): Free Money for Banks**\

The RBNZ offered near 0% loans to banks, allowing them to borrow at artificially low rates while lending at much higher rates. This wasn’t just monetary easing—it was a blatant distortion of the free market, reinforcing the **Cantillon Effect**, where those closest to the money printer benefit first.

3. **Holding Rates Too Low for Too Long**\

A 0% OCR in itself doesn’t cause inflation—what does is creating excess liquidity while artificially suppressing borrowing costs. Banks, instead of competing for deposits and lending productively, were incentivized to park money in assets like housing, fueling unsustainable bubbles.

When inflation inevitably took hold, the RBNZ had no choice but to raise rates aggressively. This wasn’t an effort to “engineer” a recession—it was damage control after prior policy failures. The claim that the RBNZ alone caused the recession is a convenient distraction from the real culprits: **government overspending and central bank interventionism.**

### The Cycle of Blame: Central Bank Governors as Fall Guys

This cycle isn’t new. Central banks are officially independent, but in reality, they almost always align with the government of the day. The **Large-Scale Asset Purchase (LSAP) program** was effectively a way to finance government spending through money printing—something politicians would never admit outright. When the government needed funding for pandemic-era stimulus, the RBNZ obliged, creating \$50 billion out of thin air to buy government bonds and lower borrowing costs, making it easier for the Labour government to spend big.

Now, with a new government in power, they get to bring in their own person—likely someone who will align with their fiscal policies, just as Orr aligned with Labour's. This cycle plays out over and over again:

1. **Print money to fund government priorities.**

2. **Blame the central bank for inflation or economic consequences.**

3. **Replace the central bank governor with someone more aligned with the new government’s agenda.**

4. **Repeat.**

The “independent central bank” narrative is a useful tool for politicians to deflect blame. Labour can say, *“Inflation wasn’t our fault, it was the RBNZ’s monetary policy!”* Meanwhile, National can now install someone who will adjust policy to suit their needs while still claiming, *“We respect the independence of the Reserve Bank!”* This allows both parties to escape accountability, despite the fact that **excessive government spending and central bank money printing go hand in hand.**

This isn’t just a New Zealand issue—**most central banks operate the same way.** They provide the liquidity needed to keep government spending rolling, and when inflation or other economic problems arise, the governor becomes the convenient fall guy.

### The Role of Bitcoin: An Exit From the Broken System

This cycle of money printing, asset bubbles, inflation, and central bank tightening isn’t unique to New Zealand—it’s the natural consequence of a system where central banks and governments have **unchecked control over money.** Bitcoin was created as a direct response to this very problem.

#### Bitcoin Fixes the Cantillon Effect

- Unlike fiat money, which is distributed to banks and institutions first, **Bitcoin’s issuance is predictable and transparent.** There are no backroom deals, no preferential access, no bailouts.

- Bitcoin doesn’t change its supply to accommodate political agendas. There is only one Bitcoin—just like there is only one Earth, and its land area cannot be expanded. It can be divided into **21 million equal-sized pieces called BTC or 2,100 trillion equal-sized pieces called sats.**

- **Bitcoin doesn’t grant special privileges.** You either earn it, mine it, or buy it. No one gets first access at a discount.

#### Bitcoin Removes the Central Bank Middleman

- The RBNZ and other central banks manipulate money supply and interest rates to serve political and economic interests. Bitcoin’s monetary policy is fixed and free from human interference.

- No government can arbitrarily print Bitcoin to fund its spending or suppress its value.

- Bitcoin allows people to store their wealth without the risk of inflationary dilution or government confiscation.

#### Bitcoin Protects You from the Next Bailout

- Every time the financial system faces a crisis, governments and central banks shift the cost onto the public—through inflation, taxation, or outright financial repression.

- Bitcoin lets you **opt out** of this cycle. By holding Bitcoin, your savings remain secure, beyond the reach of reckless monetary policy.

- When the next crisis hits—and it will—Bitcoin holders won’t be left wondering how much purchasing power they’ve lost overnight.

### A Strategic Shift: The U.S. Embraces Bitcoin

Recent developments in the U.S. signal a major turning point in how governments view Bitcoin. President Trump recently signed an Executive Order establishing a **Strategic Bitcoin Reserve**, marking the first time a nation has officially designated Bitcoin as a strategic asset. This reserve will be **exclusively Bitcoin**, initially seeded with Bitcoin seized through civil and criminal forfeitures, but with a commitment to acquiring more through budget-neutral strategies at no additional cost to taxpayers. This means that if the government can save money elsewhere, those funds can be redirected toward buying and holding Bitcoin as a permanent reserve asset.

The implications of this decision are profound:

- The U.S. **acknowledges Bitcoin as fundamentally different from “crypto.”** Altcoins and centralized tokens are being liquidated, while Bitcoin is being held as a permanent reserve.

- The government is shifting from selling confiscated Bitcoin to **strategically accumulating it**, positioning the U.S. as a key player in a Bitcoin-based financial future.

- Bitcoin mining is being embraced as a domestic industry, stabilizing power grids and reinforcing the U.S. as a leader in proof-of-work security.

This policy shift highlights what Bitcoiners have long understood: **Bitcoin is digital gold, and fiat systems will eventually recognize its superiority.** While central banks continue their cycle of money printing and blame-shifting, the adoption of Bitcoin as a strategic reserve asset may mark the beginning of a global financial transformation.

### The Bigger Picture: Free Markets vs. Centralized Control

The idea that the RBNZ acted independently in creating these economic conditions is a myth. Central banks do not exist in isolation; they facilitate government spending and economic policies, whether through bond purchases, artificially low interest rates, or direct lending programs. The economic pain we’re seeing now is not an accident—it’s a consequence of a system designed to redistribute wealth to those closest to the money printer.

Bitcoin represents an alternative: a free-market monetary system where no central entity controls issuance, no insiders get preferential treatment, and no government can erode its value through reckless policies.

The sooner people recognize the flaws in the current system, the sooner they’ll understand why Bitcoin exists—not just as an investment, but as a **monetary revolution.**

originally posted at https://stacker.news/items/907966

-

@ db11b320:05c5f7af

2025-03-09 00:14:24

Manus 是一款由中国团队开发、号称全球首款通用 AI Agent 的产品,自 2025 年 3 月发布以来引发了广泛关注和热议。以下从技术能力、实际应用、用户体验及行业影响等多个维度对其进行客观评价:

一、技术能力

Manus 在技术上展现出一定的创新性,尤其是在任务拆解和自主执行方面表现出色。其核心特点包括:

多智能体架构:采用规划型、执行型和验证型智能体的分工机制,能够模拟人类工作流程,处理复杂任务。例如,它可以将筛选简历、分析股票或规划旅行等任务分解为可执行的子步骤,并通过调用工具(如浏览器、代码编辑器等)完成。

GAIA 测试表现:在 GAIA 基准测试中,Manus 的表现超越了 OpenAI 的 Deep Research,尤其在解决真实世界问题的能力上表现突出。这表明其在通用性任务处理上有一定竞争力。

自主性和工具调用:相比传统的对话式 AI,Manus 不仅提供建议,还能直接交付成果。例如,它能自主解压文件、浏览网页、编写代码,甚至在虚拟环境中操作应用程序。这种“手脑并用”的能力使其更接近通用 AI Agent 的定义。

局限性:尽管技术上有亮点,但也存在不足。例如,部分用户反馈其在垂直领域的深度检索能力较弱,信息来源多依赖中文平台,缺乏对国外期刊等高质量资源的整合。此外,在复杂任务的格式化交付(如生成符合特定要求的 PPT)方面表现欠佳。

二、实际应用

Manus 的应用场景覆盖广泛,但实际表现因任务类型而异:

优势场景:

文件处理:如筛选简历、生成表格等任务,Manus 表现高效,能够自主完成从解压文件到整理数据的全流程。

网页设计与编程:在生成 HTML 页面或简单程序时,Manus 的表现令人满意,甚至能根据用户偏好优化交互体验。

游戏操作:测试中,Manus 展示了在虚拟环境中自主操作的能力,例如在游戏平台上选择并尝试玩游戏,体现了一定的自主性。

不足之处:

深度研究:在需要深入专业知识的任务(如高分子材料研究报告)中,Manus 倾向于过度推理,信息来源不够权威,且无法完全满足特定格式要求。

复杂任务稳定性:对于耗时较长的任务,存在一定的中断率,且处理速度较慢(高级模式下可能需要 30 分钟至 1 小时)。

文化适应性:由于信息来源偏重中文内容,可能在处理国际化任务时表现受限。

三、用户体验

用户体验是 Manus 引发热议的重要原因,但也存在争议:

优点:

直观的任务展示:Manus 通过视频回放的形式展示任务执行过程,让用户直观感受到 AI 的“思考”和“行动”,这在传播上极具吸引力。

灵活交互:支持用户在任务执行过程中随时干预或调整需求,类似于与一个“实习生”协作。

记忆机制:能够记住用户偏好,提升后续任务的效率。

缺点:

速度慢:任务处理时间较长,尤其在联网搜索或复杂任务中,用户体验受到影响。

访问门槛高:目前仅限邀请制内测,申请流程繁琐,且邀请码在二手市场被炒至高价(最高达 10 万元),引发了部分用户的不满。

稳定性问题:内测期间,系统负载过高导致崩溃或错误频发,用户体验不稳定。

四、行业影响与争议

Manus 的发布不仅引发了技术圈的热议,也带来了行业层面的讨论:

正面影响:

推动 AI Agent 普及:Manus 的出现将 AI Agent 的概念带入大众视野,可能吸引更多资金和人才进入这一赛道,推动行业发展。

中国 AI 的崛起:作为一款中国团队开发的产品,Manus 的表现被视为中国 AI 技术进步的象征,尤其是在与 OpenAI 等国际巨头的对比中。

争议点:

过度营销:部分评论认为,Manus 的爆火与其营销策略密切相关。例如,强调“超越 OpenAI”或“全球首款通用 Agent”等宣传用语可能夸大了其实际能力,导致用户期望过高。

“套壳”质疑:有观点指出,Manus 并非底层技术创新,而是通过整合现有大模型 API(如 Claude、Qwen 等)实现的“应用层产品”。虽然其在任务规划和执行层有创新,但这种“套壳”模式引发了关于技术原创性的讨论。

行业“造神”现象:部分媒体和用户将其捧上神坛,称之为“AGI 的里程碑”,这种过度吹捧可能对行业健康发展不利。正如一些评论指出,AI 的进步需要多个团队的共同努力,而非依赖单一产品的神话。

五、未来展望

尽管 Manus 在技术能力和用户体验上仍有改进空间,但其潜力不容忽视:

技术优化:未来可以通过引入更多高质量数据源、优化任务中断率和处理速度,以及增强垂直领域的专业性来提升竞争力。

商业化路径:目前 Manus 的定位尚不明确,可能面向中小型企业(如金融机构)提供订阅制服务。如何在商业化过程中平衡成本与用户体验将是关键。

行业启发:Manus 的成功可能激励更多团队探索 AI Agent 的开发,尤其是在垂直领域的定制化应用上。

六、总体评价

综合来看,Manus 是一款在 AI Agent 领域具有开创性意义的产品,其在任务拆解、自主执行和用户体验上的创新值得肯定,尤其是在 GAIA 测试中的亮眼表现证明了其技术实力。然而,它并非“颠覆性”的革命性产品,其实际能力与宣传中的“全球首款通用 Agent”存在一定差距,尤其在专业性、稳定性和速度方面有待提升。

对于普通用户而言,Manus 提供了一种全新的 AI 交互方式,能够显著提升某些场景下的工作效率,但并非万能工具。对于行业而言,它的出现是 AI Agent 发展的重要一步,但不应被过度神化。长远来看,AI 的进步需要更多团队的共同努力,而非依赖单一产品的神话。

最终,评价一款 AI 产品不应只看其技术指标或市场热度,而应关注它能否真正解决用户的实际需求。Manus 的未来价值,取决于其能否在快速迭代中不断优化,并找到明确的定位与应用场景。

-

@ ec9bd746:df11a9d0

2025-03-07 20:13:38

I was diving into PoW (Proof-of-Work) once again after nostr:nprofile1qy88wumn8ghj7mn0wvhxcmmv9uq3wamnwvaz7tmjv4kxz7fwdehhxarj9e3xzmny9uqzqj8a67jths8euy33v5yu6me6ngua5v3y3qq3dswuqh2pejmtls6datagmu rekindled my interest with his PoW Draw project. It was a fun little trifle, but it shifted my focus just the right way at the right time.

Because then, on Friday, came the [Oval Office Travesty](nostr:nevent1qvzqqqqqqypzpmym6ar92346qc04ml08z6j0yrelylkv9r9ysurhte0g2003r2wsqy2hwumn8ghj7un9d3shjtnyv9kh2uewd9hj7qghwaehxw309aex2mrp0yhxummnw3ezucnpdejz7qpqqqqqqqrg6vz7m9z8ufagn4z3ks0meqw4nyh4gfxvksfhne99egzsd3g3w9). Once I got over the initial shock, I decided I couldn't just curse and lament; I needed to do something bigger, something symbolic, something expressive. So that's exactly what I did—breaking nostr:nprofile1qy88wumn8ghj7mn0wvhxcmmv9uq32amnwvaz7tmjv4kxz7fwv3sk6atn9e5k7tcqyqewrqnkx4zsaweutf739s0cu7et29zrntqs5elw70vlm8zudr3y2t9v7jg's record which he held for almost 2 and half years.

Here is a note with PoW 45, the highest PoW known to Nostr (as of now).

nostr:nevent1qvzqqqqqqypzpmym6ar92346qc04ml08z6j0yrelylkv9r9ysurhte0g2003r2wsqy88wumn8ghj7mn0wvhxcmmv9uqsuamnwvaz7tmwdaejumr0dshsqgqqqqqqqqqy8t8awr5c8z4yfp4cr8v7spp8psncv8twlh083flcr582fyu9

## How Did I Pull It Off?

In theory, quite simple: Create note, run PoW mining script & wait.

Thanks to PoW Draw, I already had mining software at hand: nostr:nprofile1qy88wumn8ghj7mn0wvhxcmmv9uq32amnwvaz7tmjv4kxz7fwv3sk6atn9e5k7tcqyqvqc5tlvn6etv09f0fvuauves49dvgnukjtzsndfv9y8yyrqyxmz7dty6z's [*notemine_hw*](https://github.com/plebemineira/notemine_hw), but when you know that there is a 1 in 2^45 chance that the next hash will be the correct one you want to increase the odds a bit. So on Monday evening, I started my Note Mining operation on an old 40 thread machine called Workhorse.

### Issues Along the Way

I was immediately surprised that Workhorse (2× Intel Xeon Silver 4114) produced only about 3Mh/s. A laptop (Intel Core i7-1185G7) with Windows and all the bloat did 5Mh/s. That was strange.

Another hurdle was that *notemine_hw* does not refresh the `created_at` field. With just a few Mh/s of power I was potentially looking at weeks of computation, by then the note would be quite stale. So I created systemd service leveraging the `RuntimeMaxSec` option to periodically restart every 3600 seconds assuring that the Note would be max 1 hour old at the time of publishing.

Luckily PoW is that kind of problem where every hash attempt is an independent event, so the chance of success is the same whether you do it in small increments or one uninterrupted stretch. So by restarting the mining process I was only losing a few mere seconds every hour due to the overhead.

Once the note staleness issue was resolved, I looked at the 40 workers on Workhorse vs. 7 workers on the laptop and start messing around with running one instance with 40 workers and running 40 instances with 1 worker and found out, that the workers are not bound to a CPU thread and are jumping between the CPUs like rabbits high on Colombian carrots.

The solution? Running multiple instances with one worker each as a service locked to its own CPU core using systemd's `CPUAffinity` option.

```

$aida@workhorse:systemd/system $ sudo cat notemine@.service

[Unit]

Description=Notemine HW Publish (restarts hourly)

[Service]

Type=simple

CPUAffinity=%i

# The command to run:

ExecStart=/home/aida/.cargo/bin/notemine_hw publish --n-workers 1 --difficulty 45 --event-json /home/aida/note.json --relay-url 'wss://wot.shaving.kiwi' --nsec nsec0123456789abcdef

# Let the process run for 1 hour (3600 seconds), then systemd will stop it:

RuntimeMaxSec=3600

TimeoutStopSec=1

# Tells systemd to restart the service automatically after it stops:

Restart=always

RestartSec=1

# run as a non-root user:

User=aida

Group=aida

[Install]

WantedBy=multi-user.target

```

Then I added a starting service to spawn an instance for each CPU thread.

```

$aida@workhorse:systemd/system $ sudo cat notemine_start.service

[Unit]

Description=Start all services in sequence with 3-second intervals

[Service]

Type=oneshot

ExecStart=/usr/bin/zsh /home/aida/notemine_start.sh

RemainAfterExit=yes

[Install]

WantedBy=multi-user.target

```

Here is the startup script (I know, loops exist—but Ctrl+C/Ctrl+V is so old-school):

```

aida@workhorse:~ $ cat notemine_start.sh

/usr/bin/systemctl start notemine@0.service

/usr/bin/sleep 3

/usr/bin/systemctl start notemine@1.service

/usr/bin/sleep 3

/usr/bin/systemctl start notemine@2.service

/usr/bin/sleep 3

/usr/bin/systemctl start notemine@3.service

/usr/bin/sleep 3

...

...

...

/usr/bin/systemctl start notemine@38.service

```

The sleep there is critical to make sure that the `created_at`timestamps are different, preventing redundant hashing.

**This adjustment made Workhorse the strongest machine in my fleet with 10+Mh/s.**

## The Luck Aspect

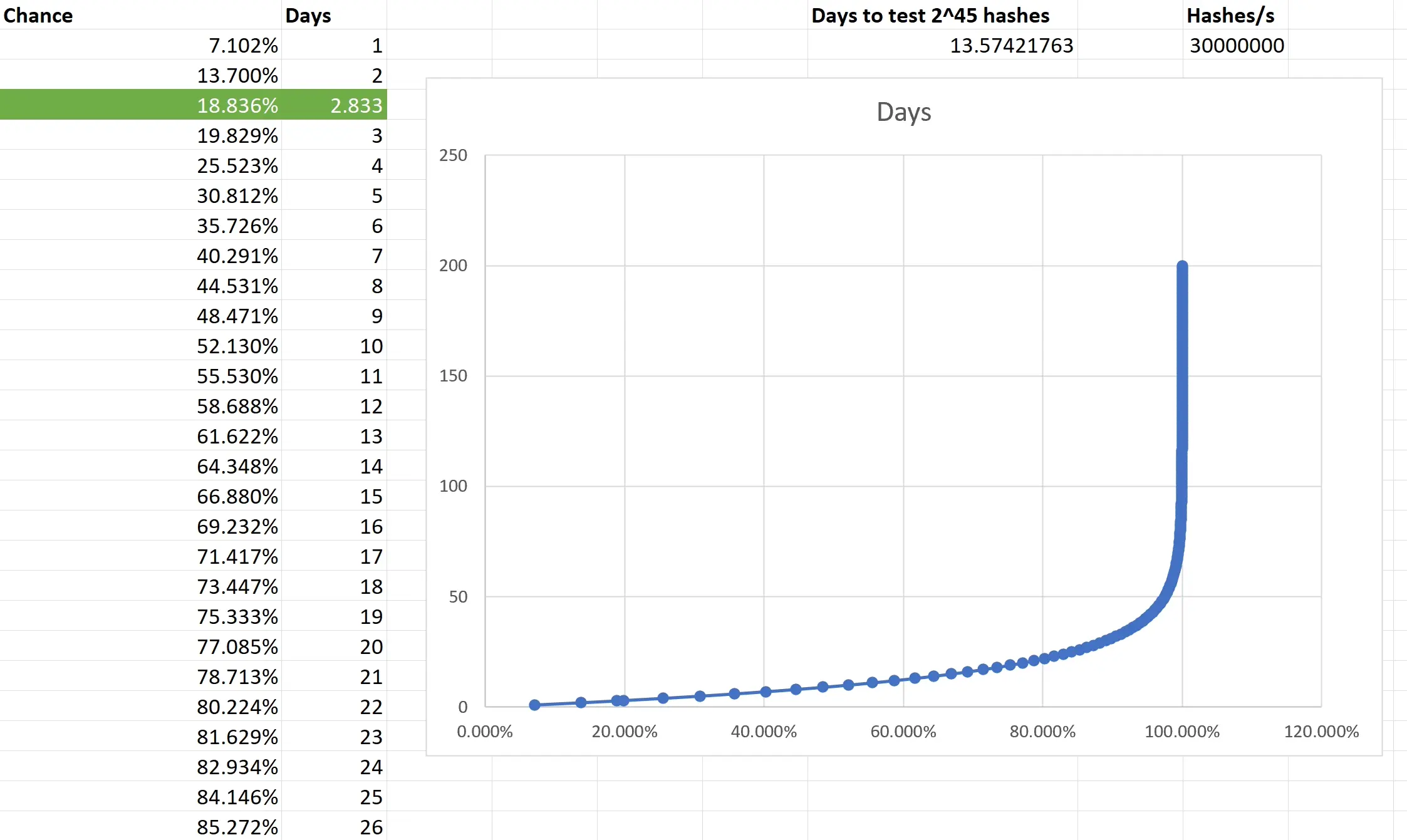

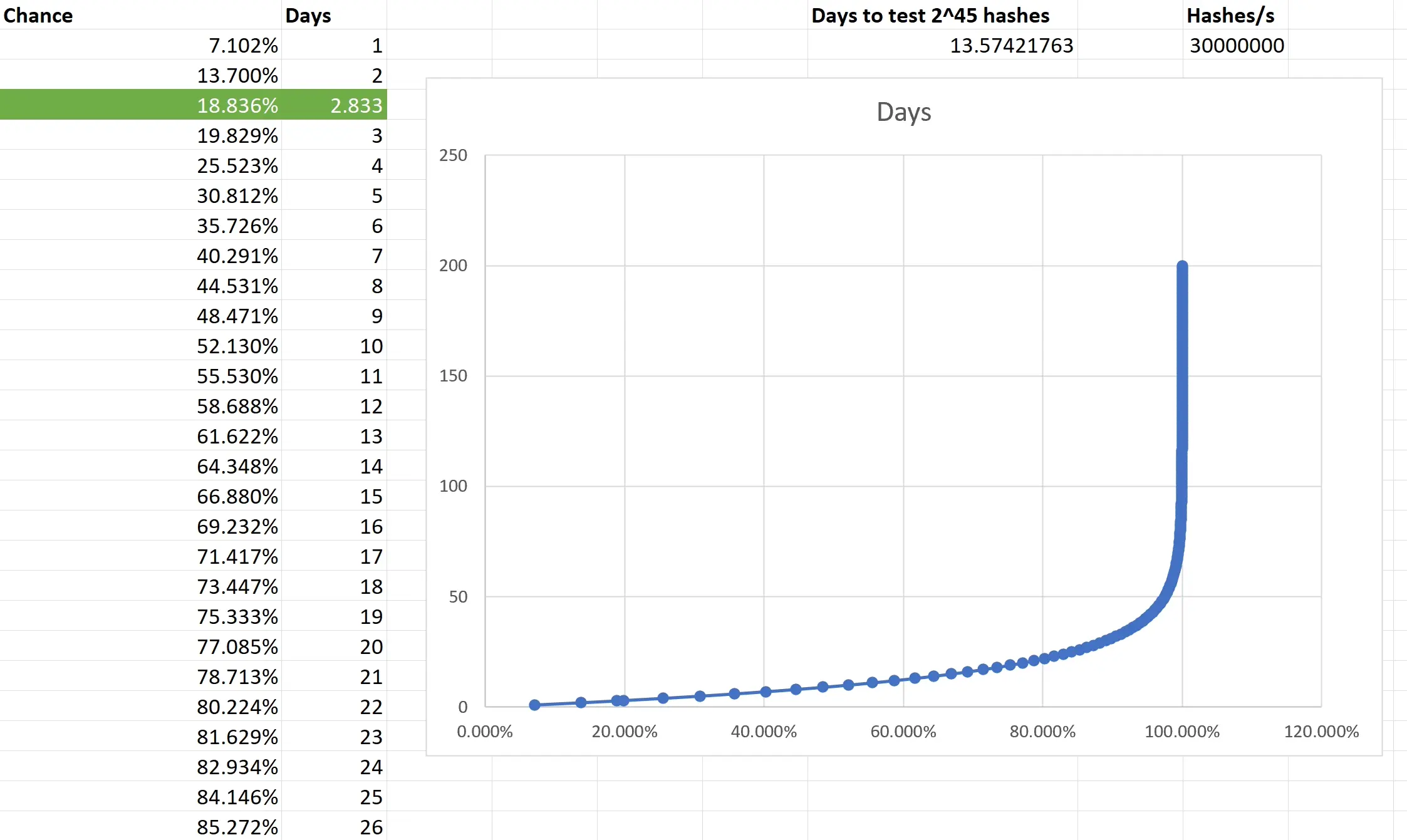

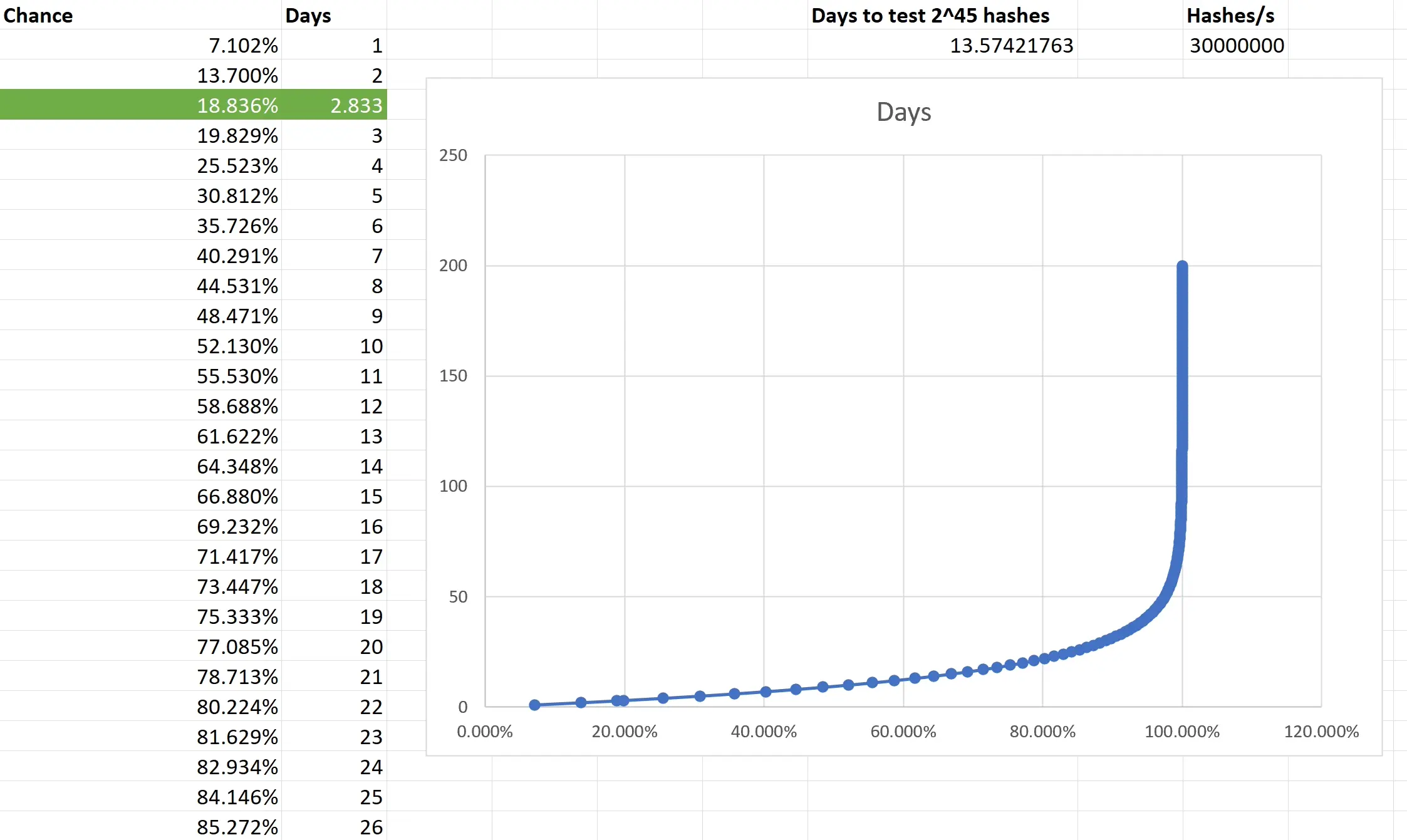

From Monday evening, I started adding all machines at my disposal into the fleet and by Wednesday evening I was crunching hashes on about 130 CPU threads (a lot of them were quite antique) and at the peak was just little shy of 40Mh/s. To compensate for the slow start with the few above-mentioned hiccups and the fact that I had to use my desktop to do other things from time to time, I counted with the conservative estimate of 30Mh/s when I was doing all the probability calculations.

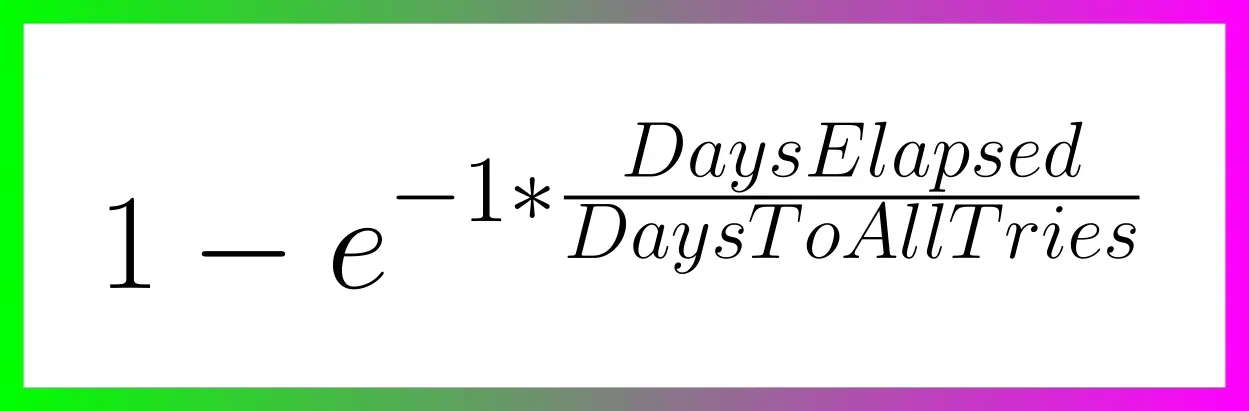

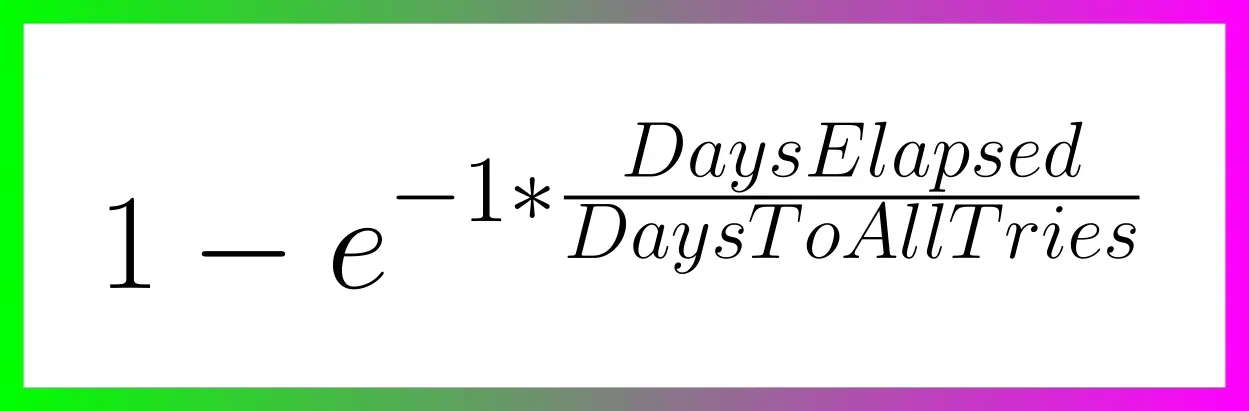

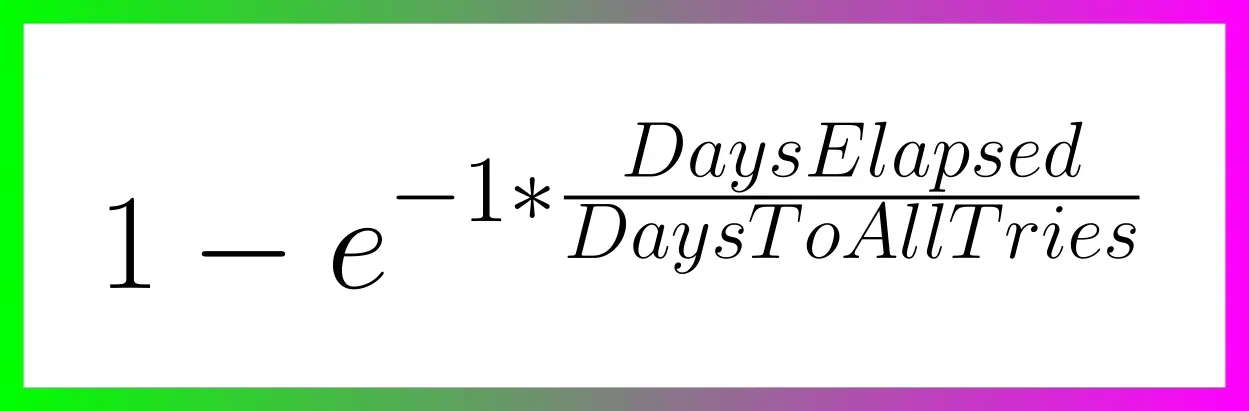

Based on the type of task that PoW mining is, the outcome is not predictible. You are only looking at what is the chance that the outcome of every single independent event will be consecutively non-favourable and then subtracting it from 1 to get the chance of that single favourable event you want. I really had to brush up on my combinatorics and discrete mathematics to make sure I have at least an elementary understanding of what is going on. Also, because we are not just throwing a dice 5 times, but are operating with big numbers, approximation was necessary. Luckily, the formula is available and quite simple in the end.

Two weeks to exhauste all the possible tries still doesn't guarantee anything, actually there is a slighlty less than 2 in 3 chance that you will have a result after all that time. So the fact that I was able to hit the right hash in less than 3 days was good luck. Not insane lottery winning luck, but good luck; slighlty lower than 1 in 5.

## Do you want to beat me?

Go ahead! All the pitfalls are described above and until there is a GPU-based PoW Mining available, we are all on pretty even ground.

## Do you hate the note?

In that case, feel free to enjoy this accompanying image:

@ f25afb62:8d50c6e7

2025-03-09 01:34:10The recent economic turmoil in New Zealand has reignited debates over the role of the Reserve Bank of New Zealand (RBNZ) in "engineering a recession." Many believe that the RBNZ’s decision to raise the Official Cash Rate (OCR) was the root cause of the downturn, but this narrative oversimplifies the reality. ### Who Really Engineered the Recession? Blaming the RBNZ for the recession ignores a fundamental truth: **market interest rates were rising long before the OCR was adjusted.** Bond yields, swap rates, and borrowing costs surged as the RBNZ stepped back from being the primary buyer of government bonds. When the RBNZ stopped paying artificially high prices (low yields) for bonds, the private sector had to price them instead, leading to yields rising back to real market interest rates. Meanwhile, the government continued to refinance its rolling debt at these higher rates, further driving up borrowing costs. The RBNZ, in hiking the OCR, was following the market interest rate, attempting to maintain credibility rather than dictating outcomes. The real policy missteps were made much earlier: 1. **Artificially Suppressing Interest Rates Through Money Printing**\ The RBNZ engaged in Large-Scale Asset Purchases (LSAP), creating money out of thin air to buy government bonds. This artificially lowered yields, making it cheaper for the government to borrow and spend beyond its means. The result? Inflation surged as the economy was flooded with cheap money. 2. **Funding for Lending Programme (FLP): Free Money for Banks**\ The RBNZ offered near 0% loans to banks, allowing them to borrow at artificially low rates while lending at much higher rates. This wasn’t just monetary easing—it was a blatant distortion of the free market, reinforcing the **Cantillon Effect**, where those closest to the money printer benefit first. 3. **Holding Rates Too Low for Too Long**\ A 0% OCR in itself doesn’t cause inflation—what does is creating excess liquidity while artificially suppressing borrowing costs. Banks, instead of competing for deposits and lending productively, were incentivized to park money in assets like housing, fueling unsustainable bubbles. When inflation inevitably took hold, the RBNZ had no choice but to raise rates aggressively. This wasn’t an effort to “engineer” a recession—it was damage control after prior policy failures. The claim that the RBNZ alone caused the recession is a convenient distraction from the real culprits: **government overspending and central bank interventionism.** ### The Cycle of Blame: Central Bank Governors as Fall Guys This cycle isn’t new. Central banks are officially independent, but in reality, they almost always align with the government of the day. The **Large-Scale Asset Purchase (LSAP) program** was effectively a way to finance government spending through money printing—something politicians would never admit outright. When the government needed funding for pandemic-era stimulus, the RBNZ obliged, creating \$50 billion out of thin air to buy government bonds and lower borrowing costs, making it easier for the Labour government to spend big. Now, with a new government in power, they get to bring in their own person—likely someone who will align with their fiscal policies, just as Orr aligned with Labour's. This cycle plays out over and over again: 1. **Print money to fund government priorities.** 2. **Blame the central bank for inflation or economic consequences.** 3. **Replace the central bank governor with someone more aligned with the new government’s agenda.** 4. **Repeat.** The “independent central bank” narrative is a useful tool for politicians to deflect blame. Labour can say, *“Inflation wasn’t our fault, it was the RBNZ’s monetary policy!”* Meanwhile, National can now install someone who will adjust policy to suit their needs while still claiming, *“We respect the independence of the Reserve Bank!”* This allows both parties to escape accountability, despite the fact that **excessive government spending and central bank money printing go hand in hand.** This isn’t just a New Zealand issue—**most central banks operate the same way.** They provide the liquidity needed to keep government spending rolling, and when inflation or other economic problems arise, the governor becomes the convenient fall guy. ### The Role of Bitcoin: An Exit From the Broken System This cycle of money printing, asset bubbles, inflation, and central bank tightening isn’t unique to New Zealand—it’s the natural consequence of a system where central banks and governments have **unchecked control over money.** Bitcoin was created as a direct response to this very problem. #### Bitcoin Fixes the Cantillon Effect - Unlike fiat money, which is distributed to banks and institutions first, **Bitcoin’s issuance is predictable and transparent.** There are no backroom deals, no preferential access, no bailouts. - Bitcoin doesn’t change its supply to accommodate political agendas. There is only one Bitcoin—just like there is only one Earth, and its land area cannot be expanded. It can be divided into **21 million equal-sized pieces called BTC or 2,100 trillion equal-sized pieces called sats.** - **Bitcoin doesn’t grant special privileges.** You either earn it, mine it, or buy it. No one gets first access at a discount. #### Bitcoin Removes the Central Bank Middleman - The RBNZ and other central banks manipulate money supply and interest rates to serve political and economic interests. Bitcoin’s monetary policy is fixed and free from human interference. - No government can arbitrarily print Bitcoin to fund its spending or suppress its value. - Bitcoin allows people to store their wealth without the risk of inflationary dilution or government confiscation. #### Bitcoin Protects You from the Next Bailout - Every time the financial system faces a crisis, governments and central banks shift the cost onto the public—through inflation, taxation, or outright financial repression. - Bitcoin lets you **opt out** of this cycle. By holding Bitcoin, your savings remain secure, beyond the reach of reckless monetary policy. - When the next crisis hits—and it will—Bitcoin holders won’t be left wondering how much purchasing power they’ve lost overnight. ### A Strategic Shift: The U.S. Embraces Bitcoin Recent developments in the U.S. signal a major turning point in how governments view Bitcoin. President Trump recently signed an Executive Order establishing a **Strategic Bitcoin Reserve**, marking the first time a nation has officially designated Bitcoin as a strategic asset. This reserve will be **exclusively Bitcoin**, initially seeded with Bitcoin seized through civil and criminal forfeitures, but with a commitment to acquiring more through budget-neutral strategies at no additional cost to taxpayers. This means that if the government can save money elsewhere, those funds can be redirected toward buying and holding Bitcoin as a permanent reserve asset. The implications of this decision are profound: - The U.S. **acknowledges Bitcoin as fundamentally different from “crypto.”** Altcoins and centralized tokens are being liquidated, while Bitcoin is being held as a permanent reserve. - The government is shifting from selling confiscated Bitcoin to **strategically accumulating it**, positioning the U.S. as a key player in a Bitcoin-based financial future. - Bitcoin mining is being embraced as a domestic industry, stabilizing power grids and reinforcing the U.S. as a leader in proof-of-work security. This policy shift highlights what Bitcoiners have long understood: **Bitcoin is digital gold, and fiat systems will eventually recognize its superiority.** While central banks continue their cycle of money printing and blame-shifting, the adoption of Bitcoin as a strategic reserve asset may mark the beginning of a global financial transformation. ### The Bigger Picture: Free Markets vs. Centralized Control The idea that the RBNZ acted independently in creating these economic conditions is a myth. Central banks do not exist in isolation; they facilitate government spending and economic policies, whether through bond purchases, artificially low interest rates, or direct lending programs. The economic pain we’re seeing now is not an accident—it’s a consequence of a system designed to redistribute wealth to those closest to the money printer. Bitcoin represents an alternative: a free-market monetary system where no central entity controls issuance, no insiders get preferential treatment, and no government can erode its value through reckless policies. The sooner people recognize the flaws in the current system, the sooner they’ll understand why Bitcoin exists—not just as an investment, but as a **monetary revolution.** originally posted at https://stacker.news/items/907966

@ f25afb62:8d50c6e7

2025-03-09 01:34:10The recent economic turmoil in New Zealand has reignited debates over the role of the Reserve Bank of New Zealand (RBNZ) in "engineering a recession." Many believe that the RBNZ’s decision to raise the Official Cash Rate (OCR) was the root cause of the downturn, but this narrative oversimplifies the reality. ### Who Really Engineered the Recession? Blaming the RBNZ for the recession ignores a fundamental truth: **market interest rates were rising long before the OCR was adjusted.** Bond yields, swap rates, and borrowing costs surged as the RBNZ stepped back from being the primary buyer of government bonds. When the RBNZ stopped paying artificially high prices (low yields) for bonds, the private sector had to price them instead, leading to yields rising back to real market interest rates. Meanwhile, the government continued to refinance its rolling debt at these higher rates, further driving up borrowing costs. The RBNZ, in hiking the OCR, was following the market interest rate, attempting to maintain credibility rather than dictating outcomes. The real policy missteps were made much earlier: 1. **Artificially Suppressing Interest Rates Through Money Printing**\ The RBNZ engaged in Large-Scale Asset Purchases (LSAP), creating money out of thin air to buy government bonds. This artificially lowered yields, making it cheaper for the government to borrow and spend beyond its means. The result? Inflation surged as the economy was flooded with cheap money. 2. **Funding for Lending Programme (FLP): Free Money for Banks**\ The RBNZ offered near 0% loans to banks, allowing them to borrow at artificially low rates while lending at much higher rates. This wasn’t just monetary easing—it was a blatant distortion of the free market, reinforcing the **Cantillon Effect**, where those closest to the money printer benefit first. 3. **Holding Rates Too Low for Too Long**\ A 0% OCR in itself doesn’t cause inflation—what does is creating excess liquidity while artificially suppressing borrowing costs. Banks, instead of competing for deposits and lending productively, were incentivized to park money in assets like housing, fueling unsustainable bubbles. When inflation inevitably took hold, the RBNZ had no choice but to raise rates aggressively. This wasn’t an effort to “engineer” a recession—it was damage control after prior policy failures. The claim that the RBNZ alone caused the recession is a convenient distraction from the real culprits: **government overspending and central bank interventionism.** ### The Cycle of Blame: Central Bank Governors as Fall Guys This cycle isn’t new. Central banks are officially independent, but in reality, they almost always align with the government of the day. The **Large-Scale Asset Purchase (LSAP) program** was effectively a way to finance government spending through money printing—something politicians would never admit outright. When the government needed funding for pandemic-era stimulus, the RBNZ obliged, creating \$50 billion out of thin air to buy government bonds and lower borrowing costs, making it easier for the Labour government to spend big. Now, with a new government in power, they get to bring in their own person—likely someone who will align with their fiscal policies, just as Orr aligned with Labour's. This cycle plays out over and over again: 1. **Print money to fund government priorities.** 2. **Blame the central bank for inflation or economic consequences.** 3. **Replace the central bank governor with someone more aligned with the new government’s agenda.** 4. **Repeat.** The “independent central bank” narrative is a useful tool for politicians to deflect blame. Labour can say, *“Inflation wasn’t our fault, it was the RBNZ’s monetary policy!”* Meanwhile, National can now install someone who will adjust policy to suit their needs while still claiming, *“We respect the independence of the Reserve Bank!”* This allows both parties to escape accountability, despite the fact that **excessive government spending and central bank money printing go hand in hand.** This isn’t just a New Zealand issue—**most central banks operate the same way.** They provide the liquidity needed to keep government spending rolling, and when inflation or other economic problems arise, the governor becomes the convenient fall guy. ### The Role of Bitcoin: An Exit From the Broken System This cycle of money printing, asset bubbles, inflation, and central bank tightening isn’t unique to New Zealand—it’s the natural consequence of a system where central banks and governments have **unchecked control over money.** Bitcoin was created as a direct response to this very problem. #### Bitcoin Fixes the Cantillon Effect - Unlike fiat money, which is distributed to banks and institutions first, **Bitcoin’s issuance is predictable and transparent.** There are no backroom deals, no preferential access, no bailouts. - Bitcoin doesn’t change its supply to accommodate political agendas. There is only one Bitcoin—just like there is only one Earth, and its land area cannot be expanded. It can be divided into **21 million equal-sized pieces called BTC or 2,100 trillion equal-sized pieces called sats.** - **Bitcoin doesn’t grant special privileges.** You either earn it, mine it, or buy it. No one gets first access at a discount. #### Bitcoin Removes the Central Bank Middleman - The RBNZ and other central banks manipulate money supply and interest rates to serve political and economic interests. Bitcoin’s monetary policy is fixed and free from human interference. - No government can arbitrarily print Bitcoin to fund its spending or suppress its value. - Bitcoin allows people to store their wealth without the risk of inflationary dilution or government confiscation. #### Bitcoin Protects You from the Next Bailout - Every time the financial system faces a crisis, governments and central banks shift the cost onto the public—through inflation, taxation, or outright financial repression. - Bitcoin lets you **opt out** of this cycle. By holding Bitcoin, your savings remain secure, beyond the reach of reckless monetary policy. - When the next crisis hits—and it will—Bitcoin holders won’t be left wondering how much purchasing power they’ve lost overnight. ### A Strategic Shift: The U.S. Embraces Bitcoin Recent developments in the U.S. signal a major turning point in how governments view Bitcoin. President Trump recently signed an Executive Order establishing a **Strategic Bitcoin Reserve**, marking the first time a nation has officially designated Bitcoin as a strategic asset. This reserve will be **exclusively Bitcoin**, initially seeded with Bitcoin seized through civil and criminal forfeitures, but with a commitment to acquiring more through budget-neutral strategies at no additional cost to taxpayers. This means that if the government can save money elsewhere, those funds can be redirected toward buying and holding Bitcoin as a permanent reserve asset. The implications of this decision are profound: - The U.S. **acknowledges Bitcoin as fundamentally different from “crypto.”** Altcoins and centralized tokens are being liquidated, while Bitcoin is being held as a permanent reserve. - The government is shifting from selling confiscated Bitcoin to **strategically accumulating it**, positioning the U.S. as a key player in a Bitcoin-based financial future. - Bitcoin mining is being embraced as a domestic industry, stabilizing power grids and reinforcing the U.S. as a leader in proof-of-work security. This policy shift highlights what Bitcoiners have long understood: **Bitcoin is digital gold, and fiat systems will eventually recognize its superiority.** While central banks continue their cycle of money printing and blame-shifting, the adoption of Bitcoin as a strategic reserve asset may mark the beginning of a global financial transformation. ### The Bigger Picture: Free Markets vs. Centralized Control The idea that the RBNZ acted independently in creating these economic conditions is a myth. Central banks do not exist in isolation; they facilitate government spending and economic policies, whether through bond purchases, artificially low interest rates, or direct lending programs. The economic pain we’re seeing now is not an accident—it’s a consequence of a system designed to redistribute wealth to those closest to the money printer. Bitcoin represents an alternative: a free-market monetary system where no central entity controls issuance, no insiders get preferential treatment, and no government can erode its value through reckless policies. The sooner people recognize the flaws in the current system, the sooner they’ll understand why Bitcoin exists—not just as an investment, but as a **monetary revolution.** originally posted at https://stacker.news/items/907966 @ db11b320:05c5f7af

2025-03-09 00:14:24Manus 是一款由中国团队开发、号称全球首款通用 AI Agent 的产品,自 2025 年 3 月发布以来引发了广泛关注和热议。以下从技术能力、实际应用、用户体验及行业影响等多个维度对其进行客观评价: 一、技术能力 Manus 在技术上展现出一定的创新性,尤其是在任务拆解和自主执行方面表现出色。其核心特点包括: 多智能体架构:采用规划型、执行型和验证型智能体的分工机制,能够模拟人类工作流程,处理复杂任务。例如,它可以将筛选简历、分析股票或规划旅行等任务分解为可执行的子步骤,并通过调用工具(如浏览器、代码编辑器等)完成。 GAIA 测试表现:在 GAIA 基准测试中,Manus 的表现超越了 OpenAI 的 Deep Research,尤其在解决真实世界问题的能力上表现突出。这表明其在通用性任务处理上有一定竞争力。 自主性和工具调用:相比传统的对话式 AI,Manus 不仅提供建议,还能直接交付成果。例如,它能自主解压文件、浏览网页、编写代码,甚至在虚拟环境中操作应用程序。这种“手脑并用”的能力使其更接近通用 AI Agent 的定义。 局限性:尽管技术上有亮点,但也存在不足。例如,部分用户反馈其在垂直领域的深度检索能力较弱,信息来源多依赖中文平台,缺乏对国外期刊等高质量资源的整合。此外,在复杂任务的格式化交付(如生成符合特定要求的 PPT)方面表现欠佳。 二、实际应用 Manus 的应用场景覆盖广泛,但实际表现因任务类型而异: 优势场景: 文件处理:如筛选简历、生成表格等任务,Manus 表现高效,能够自主完成从解压文件到整理数据的全流程。 网页设计与编程:在生成 HTML 页面或简单程序时,Manus 的表现令人满意,甚至能根据用户偏好优化交互体验。 游戏操作:测试中,Manus 展示了在虚拟环境中自主操作的能力,例如在游戏平台上选择并尝试玩游戏,体现了一定的自主性。 不足之处: 深度研究:在需要深入专业知识的任务(如高分子材料研究报告)中,Manus 倾向于过度推理,信息来源不够权威,且无法完全满足特定格式要求。 复杂任务稳定性:对于耗时较长的任务,存在一定的中断率,且处理速度较慢(高级模式下可能需要 30 分钟至 1 小时)。 文化适应性:由于信息来源偏重中文内容,可能在处理国际化任务时表现受限。 三、用户体验 用户体验是 Manus 引发热议的重要原因,但也存在争议: 优点: 直观的任务展示:Manus 通过视频回放的形式展示任务执行过程,让用户直观感受到 AI 的“思考”和“行动”,这在传播上极具吸引力。 灵活交互:支持用户在任务执行过程中随时干预或调整需求,类似于与一个“实习生”协作。 记忆机制:能够记住用户偏好,提升后续任务的效率。 缺点: 速度慢:任务处理时间较长,尤其在联网搜索或复杂任务中,用户体验受到影响。 访问门槛高:目前仅限邀请制内测,申请流程繁琐,且邀请码在二手市场被炒至高价(最高达 10 万元),引发了部分用户的不满。 稳定性问题:内测期间,系统负载过高导致崩溃或错误频发,用户体验不稳定。 四、行业影响与争议 Manus 的发布不仅引发了技术圈的热议,也带来了行业层面的讨论: 正面影响: 推动 AI Agent 普及:Manus 的出现将 AI Agent 的概念带入大众视野,可能吸引更多资金和人才进入这一赛道,推动行业发展。 中国 AI 的崛起:作为一款中国团队开发的产品,Manus 的表现被视为中国 AI 技术进步的象征,尤其是在与 OpenAI 等国际巨头的对比中。 争议点: 过度营销:部分评论认为,Manus 的爆火与其营销策略密切相关。例如,强调“超越 OpenAI”或“全球首款通用 Agent”等宣传用语可能夸大了其实际能力,导致用户期望过高。 “套壳”质疑:有观点指出,Manus 并非底层技术创新,而是通过整合现有大模型 API(如 Claude、Qwen 等)实现的“应用层产品”。虽然其在任务规划和执行层有创新,但这种“套壳”模式引发了关于技术原创性的讨论。 行业“造神”现象:部分媒体和用户将其捧上神坛,称之为“AGI 的里程碑”,这种过度吹捧可能对行业健康发展不利。正如一些评论指出,AI 的进步需要多个团队的共同努力,而非依赖单一产品的神话。 五、未来展望 尽管 Manus 在技术能力和用户体验上仍有改进空间,但其潜力不容忽视: 技术优化:未来可以通过引入更多高质量数据源、优化任务中断率和处理速度,以及增强垂直领域的专业性来提升竞争力。 商业化路径:目前 Manus 的定位尚不明确,可能面向中小型企业(如金融机构)提供订阅制服务。如何在商业化过程中平衡成本与用户体验将是关键。 行业启发:Manus 的成功可能激励更多团队探索 AI Agent 的开发,尤其是在垂直领域的定制化应用上。 六、总体评价 综合来看,Manus 是一款在 AI Agent 领域具有开创性意义的产品,其在任务拆解、自主执行和用户体验上的创新值得肯定,尤其是在 GAIA 测试中的亮眼表现证明了其技术实力。然而,它并非“颠覆性”的革命性产品,其实际能力与宣传中的“全球首款通用 Agent”存在一定差距,尤其在专业性、稳定性和速度方面有待提升。 对于普通用户而言,Manus 提供了一种全新的 AI 交互方式,能够显著提升某些场景下的工作效率,但并非万能工具。对于行业而言,它的出现是 AI Agent 发展的重要一步,但不应被过度神化。长远来看,AI 的进步需要更多团队的共同努力,而非依赖单一产品的神话。 最终,评价一款 AI 产品不应只看其技术指标或市场热度,而应关注它能否真正解决用户的实际需求。Manus 的未来价值,取决于其能否在快速迭代中不断优化,并找到明确的定位与应用场景。

@ db11b320:05c5f7af

2025-03-09 00:14:24Manus 是一款由中国团队开发、号称全球首款通用 AI Agent 的产品,自 2025 年 3 月发布以来引发了广泛关注和热议。以下从技术能力、实际应用、用户体验及行业影响等多个维度对其进行客观评价: 一、技术能力 Manus 在技术上展现出一定的创新性,尤其是在任务拆解和自主执行方面表现出色。其核心特点包括: 多智能体架构:采用规划型、执行型和验证型智能体的分工机制,能够模拟人类工作流程,处理复杂任务。例如,它可以将筛选简历、分析股票或规划旅行等任务分解为可执行的子步骤,并通过调用工具(如浏览器、代码编辑器等)完成。 GAIA 测试表现:在 GAIA 基准测试中,Manus 的表现超越了 OpenAI 的 Deep Research,尤其在解决真实世界问题的能力上表现突出。这表明其在通用性任务处理上有一定竞争力。 自主性和工具调用:相比传统的对话式 AI,Manus 不仅提供建议,还能直接交付成果。例如,它能自主解压文件、浏览网页、编写代码,甚至在虚拟环境中操作应用程序。这种“手脑并用”的能力使其更接近通用 AI Agent 的定义。 局限性:尽管技术上有亮点,但也存在不足。例如,部分用户反馈其在垂直领域的深度检索能力较弱,信息来源多依赖中文平台,缺乏对国外期刊等高质量资源的整合。此外,在复杂任务的格式化交付(如生成符合特定要求的 PPT)方面表现欠佳。 二、实际应用 Manus 的应用场景覆盖广泛,但实际表现因任务类型而异: 优势场景: 文件处理:如筛选简历、生成表格等任务,Manus 表现高效,能够自主完成从解压文件到整理数据的全流程。 网页设计与编程:在生成 HTML 页面或简单程序时,Manus 的表现令人满意,甚至能根据用户偏好优化交互体验。 游戏操作:测试中,Manus 展示了在虚拟环境中自主操作的能力,例如在游戏平台上选择并尝试玩游戏,体现了一定的自主性。 不足之处: 深度研究:在需要深入专业知识的任务(如高分子材料研究报告)中,Manus 倾向于过度推理,信息来源不够权威,且无法完全满足特定格式要求。 复杂任务稳定性:对于耗时较长的任务,存在一定的中断率,且处理速度较慢(高级模式下可能需要 30 分钟至 1 小时)。 文化适应性:由于信息来源偏重中文内容,可能在处理国际化任务时表现受限。 三、用户体验 用户体验是 Manus 引发热议的重要原因,但也存在争议: 优点: 直观的任务展示:Manus 通过视频回放的形式展示任务执行过程,让用户直观感受到 AI 的“思考”和“行动”,这在传播上极具吸引力。 灵活交互:支持用户在任务执行过程中随时干预或调整需求,类似于与一个“实习生”协作。 记忆机制:能够记住用户偏好,提升后续任务的效率。 缺点: 速度慢:任务处理时间较长,尤其在联网搜索或复杂任务中,用户体验受到影响。 访问门槛高:目前仅限邀请制内测,申请流程繁琐,且邀请码在二手市场被炒至高价(最高达 10 万元),引发了部分用户的不满。 稳定性问题:内测期间,系统负载过高导致崩溃或错误频发,用户体验不稳定。 四、行业影响与争议 Manus 的发布不仅引发了技术圈的热议,也带来了行业层面的讨论: 正面影响: 推动 AI Agent 普及:Manus 的出现将 AI Agent 的概念带入大众视野,可能吸引更多资金和人才进入这一赛道,推动行业发展。 中国 AI 的崛起:作为一款中国团队开发的产品,Manus 的表现被视为中国 AI 技术进步的象征,尤其是在与 OpenAI 等国际巨头的对比中。 争议点: 过度营销:部分评论认为,Manus 的爆火与其营销策略密切相关。例如,强调“超越 OpenAI”或“全球首款通用 Agent”等宣传用语可能夸大了其实际能力,导致用户期望过高。 “套壳”质疑:有观点指出,Manus 并非底层技术创新,而是通过整合现有大模型 API(如 Claude、Qwen 等)实现的“应用层产品”。虽然其在任务规划和执行层有创新,但这种“套壳”模式引发了关于技术原创性的讨论。 行业“造神”现象:部分媒体和用户将其捧上神坛,称之为“AGI 的里程碑”,这种过度吹捧可能对行业健康发展不利。正如一些评论指出,AI 的进步需要多个团队的共同努力,而非依赖单一产品的神话。 五、未来展望 尽管 Manus 在技术能力和用户体验上仍有改进空间,但其潜力不容忽视: 技术优化:未来可以通过引入更多高质量数据源、优化任务中断率和处理速度,以及增强垂直领域的专业性来提升竞争力。 商业化路径:目前 Manus 的定位尚不明确,可能面向中小型企业(如金融机构)提供订阅制服务。如何在商业化过程中平衡成本与用户体验将是关键。 行业启发:Manus 的成功可能激励更多团队探索 AI Agent 的开发,尤其是在垂直领域的定制化应用上。 六、总体评价 综合来看,Manus 是一款在 AI Agent 领域具有开创性意义的产品,其在任务拆解、自主执行和用户体验上的创新值得肯定,尤其是在 GAIA 测试中的亮眼表现证明了其技术实力。然而,它并非“颠覆性”的革命性产品,其实际能力与宣传中的“全球首款通用 Agent”存在一定差距,尤其在专业性、稳定性和速度方面有待提升。 对于普通用户而言,Manus 提供了一种全新的 AI 交互方式,能够显著提升某些场景下的工作效率,但并非万能工具。对于行业而言,它的出现是 AI Agent 发展的重要一步,但不应被过度神化。长远来看,AI 的进步需要更多团队的共同努力,而非依赖单一产品的神话。 最终,评价一款 AI 产品不应只看其技术指标或市场热度,而应关注它能否真正解决用户的实际需求。Manus 的未来价值,取决于其能否在快速迭代中不断优化,并找到明确的定位与应用场景。 @ ec9bd746:df11a9d0

2025-03-07 20:13:38I was diving into PoW (Proof-of-Work) once again after nostr:nprofile1qy88wumn8ghj7mn0wvhxcmmv9uq3wamnwvaz7tmjv4kxz7fwdehhxarj9e3xzmny9uqzqj8a67jths8euy33v5yu6me6ngua5v3y3qq3dswuqh2pejmtls6datagmu rekindled my interest with his PoW Draw project. It was a fun little trifle, but it shifted my focus just the right way at the right time. Because then, on Friday, came the [Oval Office Travesty](nostr:nevent1qvzqqqqqqypzpmym6ar92346qc04ml08z6j0yrelylkv9r9ysurhte0g2003r2wsqy2hwumn8ghj7un9d3shjtnyv9kh2uewd9hj7qghwaehxw309aex2mrp0yhxummnw3ezucnpdejz7qpqqqqqqqrg6vz7m9z8ufagn4z3ks0meqw4nyh4gfxvksfhne99egzsd3g3w9). Once I got over the initial shock, I decided I couldn't just curse and lament; I needed to do something bigger, something symbolic, something expressive. So that's exactly what I did—breaking nostr:nprofile1qy88wumn8ghj7mn0wvhxcmmv9uq32amnwvaz7tmjv4kxz7fwv3sk6atn9e5k7tcqyqewrqnkx4zsaweutf739s0cu7et29zrntqs5elw70vlm8zudr3y2t9v7jg's record which he held for almost 2 and half years. Here is a note with PoW 45, the highest PoW known to Nostr (as of now). nostr:nevent1qvzqqqqqqypzpmym6ar92346qc04ml08z6j0yrelylkv9r9ysurhte0g2003r2wsqy88wumn8ghj7mn0wvhxcmmv9uqsuamnwvaz7tmwdaejumr0dshsqgqqqqqqqqqy8t8awr5c8z4yfp4cr8v7spp8psncv8twlh083flcr582fyu9 ## How Did I Pull It Off? In theory, quite simple: Create note, run PoW mining script & wait. Thanks to PoW Draw, I already had mining software at hand: nostr:nprofile1qy88wumn8ghj7mn0wvhxcmmv9uq32amnwvaz7tmjv4kxz7fwv3sk6atn9e5k7tcqyqvqc5tlvn6etv09f0fvuauves49dvgnukjtzsndfv9y8yyrqyxmz7dty6z's [*notemine_hw*](https://github.com/plebemineira/notemine_hw), but when you know that there is a 1 in 2^45 chance that the next hash will be the correct one you want to increase the odds a bit. So on Monday evening, I started my Note Mining operation on an old 40 thread machine called Workhorse. ### Issues Along the Way I was immediately surprised that Workhorse (2× Intel Xeon Silver 4114) produced only about 3Mh/s. A laptop (Intel Core i7-1185G7) with Windows and all the bloat did 5Mh/s. That was strange. Another hurdle was that *notemine_hw* does not refresh the `created_at` field. With just a few Mh/s of power I was potentially looking at weeks of computation, by then the note would be quite stale. So I created systemd service leveraging the `RuntimeMaxSec` option to periodically restart every 3600 seconds assuring that the Note would be max 1 hour old at the time of publishing. Luckily PoW is that kind of problem where every hash attempt is an independent event, so the chance of success is the same whether you do it in small increments or one uninterrupted stretch. So by restarting the mining process I was only losing a few mere seconds every hour due to the overhead. Once the note staleness issue was resolved, I looked at the 40 workers on Workhorse vs. 7 workers on the laptop and start messing around with running one instance with 40 workers and running 40 instances with 1 worker and found out, that the workers are not bound to a CPU thread and are jumping between the CPUs like rabbits high on Colombian carrots. The solution? Running multiple instances with one worker each as a service locked to its own CPU core using systemd's `CPUAffinity` option. ``` $aida@workhorse:systemd/system $ sudo cat notemine@.service [Unit] Description=Notemine HW Publish (restarts hourly) [Service] Type=simple CPUAffinity=%i # The command to run: ExecStart=/home/aida/.cargo/bin/notemine_hw publish --n-workers 1 --difficulty 45 --event-json /home/aida/note.json --relay-url 'wss://wot.shaving.kiwi' --nsec nsec0123456789abcdef # Let the process run for 1 hour (3600 seconds), then systemd will stop it: RuntimeMaxSec=3600 TimeoutStopSec=1 # Tells systemd to restart the service automatically after it stops: Restart=always RestartSec=1 # run as a non-root user: User=aida Group=aida [Install] WantedBy=multi-user.target ``` Then I added a starting service to spawn an instance for each CPU thread. ``` $aida@workhorse:systemd/system $ sudo cat notemine_start.service [Unit] Description=Start all services in sequence with 3-second intervals [Service] Type=oneshot ExecStart=/usr/bin/zsh /home/aida/notemine_start.sh RemainAfterExit=yes [Install] WantedBy=multi-user.target ``` Here is the startup script (I know, loops exist—but Ctrl+C/Ctrl+V is so old-school): ``` aida@workhorse:~ $ cat notemine_start.sh /usr/bin/systemctl start notemine@0.service /usr/bin/sleep 3 /usr/bin/systemctl start notemine@1.service /usr/bin/sleep 3 /usr/bin/systemctl start notemine@2.service /usr/bin/sleep 3 /usr/bin/systemctl start notemine@3.service /usr/bin/sleep 3 ... ... ... /usr/bin/systemctl start notemine@38.service ``` The sleep there is critical to make sure that the `created_at`timestamps are different, preventing redundant hashing. **This adjustment made Workhorse the strongest machine in my fleet with 10+Mh/s.** ## The Luck Aspect From Monday evening, I started adding all machines at my disposal into the fleet and by Wednesday evening I was crunching hashes on about 130 CPU threads (a lot of them were quite antique) and at the peak was just little shy of 40Mh/s. To compensate for the slow start with the few above-mentioned hiccups and the fact that I had to use my desktop to do other things from time to time, I counted with the conservative estimate of 30Mh/s when I was doing all the probability calculations.  Based on the type of task that PoW mining is, the outcome is not predictible. You are only looking at what is the chance that the outcome of every single independent event will be consecutively non-favourable and then subtracting it from 1 to get the chance of that single favourable event you want. I really had to brush up on my combinatorics and discrete mathematics to make sure I have at least an elementary understanding of what is going on. Also, because we are not just throwing a dice 5 times, but are operating with big numbers, approximation was necessary. Luckily, the formula is available and quite simple in the end.  Two weeks to exhauste all the possible tries still doesn't guarantee anything, actually there is a slighlty less than 2 in 3 chance that you will have a result after all that time. So the fact that I was able to hit the right hash in less than 3 days was good luck. Not insane lottery winning luck, but good luck; slighlty lower than 1 in 5. ## Do you want to beat me? Go ahead! All the pitfalls are described above and until there is a GPU-based PoW Mining available, we are all on pretty even ground. ## Do you hate the note? In that case, feel free to enjoy this accompanying image:

@ ec9bd746:df11a9d0

2025-03-07 20:13:38I was diving into PoW (Proof-of-Work) once again after nostr:nprofile1qy88wumn8ghj7mn0wvhxcmmv9uq3wamnwvaz7tmjv4kxz7fwdehhxarj9e3xzmny9uqzqj8a67jths8euy33v5yu6me6ngua5v3y3qq3dswuqh2pejmtls6datagmu rekindled my interest with his PoW Draw project. It was a fun little trifle, but it shifted my focus just the right way at the right time. Because then, on Friday, came the [Oval Office Travesty](nostr:nevent1qvzqqqqqqypzpmym6ar92346qc04ml08z6j0yrelylkv9r9ysurhte0g2003r2wsqy2hwumn8ghj7un9d3shjtnyv9kh2uewd9hj7qghwaehxw309aex2mrp0yhxummnw3ezucnpdejz7qpqqqqqqqrg6vz7m9z8ufagn4z3ks0meqw4nyh4gfxvksfhne99egzsd3g3w9). Once I got over the initial shock, I decided I couldn't just curse and lament; I needed to do something bigger, something symbolic, something expressive. So that's exactly what I did—breaking nostr:nprofile1qy88wumn8ghj7mn0wvhxcmmv9uq32amnwvaz7tmjv4kxz7fwv3sk6atn9e5k7tcqyqewrqnkx4zsaweutf739s0cu7et29zrntqs5elw70vlm8zudr3y2t9v7jg's record which he held for almost 2 and half years. Here is a note with PoW 45, the highest PoW known to Nostr (as of now). nostr:nevent1qvzqqqqqqypzpmym6ar92346qc04ml08z6j0yrelylkv9r9ysurhte0g2003r2wsqy88wumn8ghj7mn0wvhxcmmv9uqsuamnwvaz7tmwdaejumr0dshsqgqqqqqqqqqy8t8awr5c8z4yfp4cr8v7spp8psncv8twlh083flcr582fyu9 ## How Did I Pull It Off? In theory, quite simple: Create note, run PoW mining script & wait. Thanks to PoW Draw, I already had mining software at hand: nostr:nprofile1qy88wumn8ghj7mn0wvhxcmmv9uq32amnwvaz7tmjv4kxz7fwv3sk6atn9e5k7tcqyqvqc5tlvn6etv09f0fvuauves49dvgnukjtzsndfv9y8yyrqyxmz7dty6z's [*notemine_hw*](https://github.com/plebemineira/notemine_hw), but when you know that there is a 1 in 2^45 chance that the next hash will be the correct one you want to increase the odds a bit. So on Monday evening, I started my Note Mining operation on an old 40 thread machine called Workhorse. ### Issues Along the Way I was immediately surprised that Workhorse (2× Intel Xeon Silver 4114) produced only about 3Mh/s. A laptop (Intel Core i7-1185G7) with Windows and all the bloat did 5Mh/s. That was strange. Another hurdle was that *notemine_hw* does not refresh the `created_at` field. With just a few Mh/s of power I was potentially looking at weeks of computation, by then the note would be quite stale. So I created systemd service leveraging the `RuntimeMaxSec` option to periodically restart every 3600 seconds assuring that the Note would be max 1 hour old at the time of publishing. Luckily PoW is that kind of problem where every hash attempt is an independent event, so the chance of success is the same whether you do it in small increments or one uninterrupted stretch. So by restarting the mining process I was only losing a few mere seconds every hour due to the overhead. Once the note staleness issue was resolved, I looked at the 40 workers on Workhorse vs. 7 workers on the laptop and start messing around with running one instance with 40 workers and running 40 instances with 1 worker and found out, that the workers are not bound to a CPU thread and are jumping between the CPUs like rabbits high on Colombian carrots. The solution? Running multiple instances with one worker each as a service locked to its own CPU core using systemd's `CPUAffinity` option. ``` $aida@workhorse:systemd/system $ sudo cat notemine@.service [Unit] Description=Notemine HW Publish (restarts hourly) [Service] Type=simple CPUAffinity=%i # The command to run: ExecStart=/home/aida/.cargo/bin/notemine_hw publish --n-workers 1 --difficulty 45 --event-json /home/aida/note.json --relay-url 'wss://wot.shaving.kiwi' --nsec nsec0123456789abcdef # Let the process run for 1 hour (3600 seconds), then systemd will stop it: RuntimeMaxSec=3600 TimeoutStopSec=1 # Tells systemd to restart the service automatically after it stops: Restart=always RestartSec=1 # run as a non-root user: User=aida Group=aida [Install] WantedBy=multi-user.target ``` Then I added a starting service to spawn an instance for each CPU thread. ``` $aida@workhorse:systemd/system $ sudo cat notemine_start.service [Unit] Description=Start all services in sequence with 3-second intervals [Service] Type=oneshot ExecStart=/usr/bin/zsh /home/aida/notemine_start.sh RemainAfterExit=yes [Install] WantedBy=multi-user.target ``` Here is the startup script (I know, loops exist—but Ctrl+C/Ctrl+V is so old-school): ``` aida@workhorse:~ $ cat notemine_start.sh /usr/bin/systemctl start notemine@0.service /usr/bin/sleep 3 /usr/bin/systemctl start notemine@1.service /usr/bin/sleep 3 /usr/bin/systemctl start notemine@2.service /usr/bin/sleep 3 /usr/bin/systemctl start notemine@3.service /usr/bin/sleep 3 ... ... ... /usr/bin/systemctl start notemine@38.service ``` The sleep there is critical to make sure that the `created_at`timestamps are different, preventing redundant hashing. **This adjustment made Workhorse the strongest machine in my fleet with 10+Mh/s.** ## The Luck Aspect From Monday evening, I started adding all machines at my disposal into the fleet and by Wednesday evening I was crunching hashes on about 130 CPU threads (a lot of them were quite antique) and at the peak was just little shy of 40Mh/s. To compensate for the slow start with the few above-mentioned hiccups and the fact that I had to use my desktop to do other things from time to time, I counted with the conservative estimate of 30Mh/s when I was doing all the probability calculations.  Based on the type of task that PoW mining is, the outcome is not predictible. You are only looking at what is the chance that the outcome of every single independent event will be consecutively non-favourable and then subtracting it from 1 to get the chance of that single favourable event you want. I really had to brush up on my combinatorics and discrete mathematics to make sure I have at least an elementary understanding of what is going on. Also, because we are not just throwing a dice 5 times, but are operating with big numbers, approximation was necessary. Luckily, the formula is available and quite simple in the end.  Two weeks to exhauste all the possible tries still doesn't guarantee anything, actually there is a slighlty less than 2 in 3 chance that you will have a result after all that time. So the fact that I was able to hit the right hash in less than 3 days was good luck. Not insane lottery winning luck, but good luck; slighlty lower than 1 in 5. ## Do you want to beat me? Go ahead! All the pitfalls are described above and until there is a GPU-based PoW Mining available, we are all on pretty even ground. ## Do you hate the note? In that case, feel free to enjoy this accompanying image: