-

@ da0b9bc3:4e30a4a9

2025-04-02 05:35:30

@ da0b9bc3:4e30a4a9

2025-04-02 05:35:30Hello Stackers!

Welcome on into the ~Music Corner of the Saloon!

A place where we Talk Music. Share Tracks. Zap Sats.

So stay a while and listen.

🚨Don't forget to check out the pinned items in the territory homepage! You can always find the latest weeklies there!🚨

🚨Subscribe to the territory to ensure you never miss a post! 🚨

originally posted at https://stacker.news/items/931908

-

@ 7da115b6:7d3e46ae

2025-04-02 00:09:46

@ 7da115b6:7d3e46ae

2025-04-02 00:09:46The Rise of the Entitled Customer

A significant contributor to the feeling of being undervalued is the rise of the “entitled” customer. Driven by a combination of factors – readily available online shopping, social media showcasing perfect purchases, and a general sense of consumerism – customers often approach retail interactions with a sense of expectation that goes far beyond simply buying a product.

Consider, for example, the increasingly common scenario of a customer returning an item – often without a receipt, without a box, and sometimes only a few days after purchase – demanding a full refund, citing a minor imperfection or simply because they found a “better deal.” A 2023 study by the National Retail Federation found that 13.7% of all retail sales in the US are Fraudulent or Abusive claims. The expectation of a return is frequently backed by a willingness to complain loudly in person and on social media. This creates a pressure point for employees.

Furthermore, the influence of online reviews has amplified this sense of entitlement. A single negative review, based on a minor inconvenience or a slightly longer-than-expected checkout line, can significantly impact a retailer's reputation and, consequently, the employee’s job security. Employees are now judged not just on the quality of their service, but on their ability to handle a constant stream of customer complaints, often delivered with little patience.

Employers: Demands Without Recognition

The pressure isn’t solely coming from the customer side. Employers, driven by profit margins and often influenced by trends in fast-fashion and rapid turnover, have become notoriously demanding. Many retailers operate on tight budgets, leading to lower wages, fewer benefits, and a constant need for employees to “go above and beyond.”

The decreasing value of the Dollar has meant that most front line workers are earning only around 70% of their counterparts paychecks from as little as a decade ago. The Dollar figure increases, but the buying power decreases dramatically. The cost of living has increased almost 22%; inflation has also increased by 16%, both in the last 3 years alone.

For instance, a recent report by Forbes highlighted that many retail workers earn minimum wage or slightly above, despite often working evenings, weekends, and holidays. This is particularly challenging in areas with a higher cost of living. Moreover, the expectation of multitasking – assisting customers, stocking shelves, operating the cash register, and handling inventory – is frequently placed on a single employee, leading to burnout and decreased morale.

The pressure to meet sales targets is another key factor. Employees are often evaluated not just on the number of transactions they process, but on their ability to upsell and cross-sell products.

Finally, the rapid pace of change in the retail industry – new technologies, shifting consumer preferences, and frequent store remodels – means that employees are constantly required to learn new skills and adapt to new procedures. This constant learning curve, coupled with the demands of customers and employers, can be exhausting.

The Result: A Systemically Unfair Equation

The combination of entitled customers, demanding employers, and a lack of recognition for the hard work of retail employees creates a systemically unfair equation. Employees are often expected to absorb the brunt of customer dissatisfaction, handle a constant stream of demands, and adapt to ever-changing conditions, all while earning relatively low wages and receiving limited benefits.

To shift this dynamic, retailers need to invest in their employees – offering competitive wages, comprehensive benefits, and opportunities for advancement. Customers, too, can play a role by remembering that retail employees are people, not just service providers, and treating them with respect and understanding.

It is disappointing that the greed for ever higher profits trumps the need for realistic living wages, and personal well-being of those front line workers affected.

-

@ 7d33ba57:1b82db35

2025-04-01 20:35:16

@ 7d33ba57:1b82db35

2025-04-01 20:35:16Stari Grad, located on the northern coast of Hvar Island**, is one of the oldest towns in Europe, dating back to 384 BC. Unlike the party vibe of Hvar Town, Stari Grad offers a peaceful, authentic Dalmatian atmosphere with stone-paved streets, historic sites, and stunning coastal views. It’s also home to the UNESCO-listed Stari Grad Plain, an ancient agricultural landscape.

🏛️ Top Things to See & Do in Stari Grad

1️⃣ Stroll the Stari Grad Old Town 🏡

- Walk through charming stone alleys filled with colorful shutters, old churches, and hidden courtyards.

- Visit Tvrdalj Castle, the summer residence of the poet Petar Hektorović, with a serene fish pond inside.

- Enjoy the relaxed, authentic Dalmatian vibe, away from crowds.

2️⃣ Visit the UNESCO-Listed Stari Grad Plain 🌿

- One of the best-preserved ancient Greek agricultural sites in the world (since 384 BC).

- Walk or cycle through the vineyards, olive groves, and stone walls, still in use today.

- Great for wine tasting – local wines like Bogdanuša and Plavac Mali are a must-try! 🍷

3️⃣ Relax at Stari Grad’s Best Beaches 🏖️

- Lanterna Beach – A mix of pebbles and concrete platforms, with crystal-clear waters.

- Maslinica Bay – A quiet, pine-fringed beach perfect for a peaceful swim.

- Zlatni Rat (Golden Horn Beach) – One of Croatia’s most famous beaches, a short ferry ride away.

4️⃣ Take a Boat Trip to the Pakleni Islands ⛵

- A group of stunning, unspoiled islands with hidden beaches and lagoons.

- Perfect for snorkeling, kayaking, and island-hopping adventures.

5️⃣ Try Local Dalmatian Cuisine 🍽️

- Gregada – A traditional fish stew with potatoes and olive oil.

- Octopus salad – Freshly caught and marinated in lemon & olive oil.

- Hvar wines – Visit local wineries for Bogdanuša, Pošip, and Plavac Mali tastings.

6️⃣ Visit the Dominican Monastery ⛪

- A peaceful monastery with an impressive collection of paintings and relics.

- Features a painting by the famous Venetian artist Tintoretto.

🚗 How to Get to Stari Grad

⛴️ By Ferry:

- From Split: Direct car ferries to Stari Grad (2 hours).

- From Hvar Town: 25-minute bus or taxi ride.

✈️ By Air: The nearest airport is Split Airport (SPU), with ferry connections to Hvar.

🚘 By Car: If bringing a car, take the Split–Stari Grad car ferry (book in advance in summer).💡 Tips for Visiting Stari Grad

✅ Best time to visit? May–September for great weather & fewer crowds ☀️

✅ Stay overnight – Stari Grad is much quieter and more authentic than Hvar Town 🌙

✅ Rent a bike – The best way to explore Stari Grad Plain & surrounding beaches 🚲

✅ Bring water shoes – Many beaches are rocky, but the water is incredibly clear 🩴

✅ Try a sunset walk along the promenade – It’s breathtaking! 🌅 -

@ b2caa9b3:9eab0fb5

2025-04-01 20:29:01

@ b2caa9b3:9eab0fb5

2025-04-01 20:29:01

For years, I’ve been shifting my life away from traditional systems and toward Bitcoin. I calculate my expenses in sats, buy airtime and online data with BTC, and continue exploring new ways to integrate Bitcoin into my daily life. While I’m not yet fully living on Bitcoin, I am getting closer with each step.

Since discovering Nostr, my perspective on decentralization has deepened. More than just a financial shift, it's a complete lifestyle transformation. Years ago, after facing injustice in my home country, I took the first step toward a new way of living. That decision led me to where I am today—a minimalist, a nomad, and a believer in financial freedom through Bitcoin.

I once served in the military, owned a house, and drove a nice car. My life looked very different back then. But over time, I realized that true freedom wasn’t in possessions—it was in mobility, independence, and the ability to control my own finances. Now, all I own fits into a backpack weighing less than 12 kg. My lifestyle is simple, yet rich in experiences.

March 14 marks eight years since I embraced my nomadic lifestyle. What started as a leap into the unknown has become my way of life. Living with less has given me more—the freedom to move, to explore, and to be truly independent. The more I immerse myself in the Bitcoin ecosystem, the more I see its potential to reshape not only my life but the world around me.

The journey isn’t over. In fact, it’s just beginning. Let’s see where this path leads as I go further into the blockchain revolution!

-

@ 000002de:c05780a7

2025-04-01 20:17:26

@ 000002de:c05780a7

2025-04-01 20:17:26I know I'm not alone in this. I don't trust the government. Any government. Its the rational response when you discover just how often its agents lie, steal, and kill. Honestly, I do not understand why so many people do trust the government. The reality is that if your team is in power, you tend to trust it. If not, you still mostly trust it but less so. That's my feel for most people at least.

Trump and Rubio are bragging about how many MS-13 gang members are being deported. Many are being shipped to prisons in El Salvador. Obviously I am not opposed to criminals being put in prisons. But, how do we know these guys are actually guilty of anything other than being in the US illegally. Actually we don't even know that. It wouldn't be so bad if these people were just being shipped back to their home countries. But, instead they are getting sent straight to prison. No trial. Just the government picking people up and shipping them to prison. Is this what you signed up for Trump supporters?

Many Trump supporters opposed the GW Bush policies of throwing people in off-shore prisons. Some of them US citizens. With no trial. Now these people seem rather silent. Its troubling to me.

Why? Well, because the government sucks. Even if they have good intentions they make mistakes. The Innocence Project is just one group that has shown how often our legal system falsely imprisons people. I would be shocked if there weren't any Innocent men being sent to suffer in El Salvador's prisons.

You may say, well these are bad dudes and we need to clean up the mess Biden made. I have sympathy for that position. But do we really want to set this president? TDS is real but it is valid to have concerns about the actions of the Trump admin. This is not the American way. Not the way I was taught at least. This is just a strong man taking action and disregarding the values of this nation and the rights of human beings.

Think about it.

originally posted at https://stacker.news/items/931505

-

@ 7d33ba57:1b82db35

2025-04-01 19:56:53

@ 7d33ba57:1b82db35

2025-04-01 19:56:53Split is Croatia’s second-largest city and a perfect mix of ancient history, Mediterranean charm, and modern coastal vibes. Home to the UNESCO-listed Diocletian’s Palace, Split is a lively destination with beaches, great nightlife, and easy access to nearby islands** like Hvar, Brač, and Vis.

🏛️ Top Things to See & Do in Split

1️⃣ Explore Diocletian’s Palace (UNESCO) 🏰

- A massive Roman palace, built in the 4th century by Emperor Diocletian.

- Today, it’s a living city, filled with cafés, shops, and hidden alleys.

- Visit Peristyle Square, the Cathedral of St. Domnius, and the Temple of Jupiter.

- Game of Thrones fans – Many scenes were filmed here! 🎬

2️⃣ Climb the Bell Tower of St. Domnius ⛪

- Offers panoramic views of Split and the Adriatic Sea.

- One of the oldest Catholic cathedrals still in use, dating back to Roman times.

3️⃣ Stroll the Riva Promenade 🌊

- The heart of Split’s waterfront, lined with palm trees, cafés, and bars.

- Perfect for sunset walks and people-watching.

4️⃣ Hike Up Marjan Hill 🌿

- A green oasis with stunning viewpoints over Split.

- Great for hiking, cycling, or just relaxing in nature.

- Don’t miss Telegrin Viewpoint for breathtaking photos.

5️⃣ Visit Bačvice Beach 🏖️

- Split’s most famous beach, known for its shallow waters and sandy shore (rare in Croatia!).

- Try playing picigin, a local water sport played with a small ball.

- Other great beaches: Kasjuni Beach (more secluded) and Bene Beach (in Marjan Park).

6️⃣ Take a Day Trip to the Dalmatian Islands ⛵

- Hvar – Famous for its nightlife, beautiful old town, and lavender fields.

- Brač (Golden Horn Beach) – One of Croatia’s most unique beaches.

- Vis & Blue Cave – Stunning island and the famous glowing Blue Cave on Biševo.

7️⃣ Try Dalmatian Cuisine 🍽️

- Peka – A slow-cooked dish with meat or octopus, baked under an iron bell.

- Black risotto (Crni rižot) – A squid-ink seafood specialty.

- Dalmatian prosciutto & cheese – Best paired with local Plavac Mali wine.

8️⃣ Visit Klis Fortress 🏰

- A medieval fortress just outside Split, offering amazing views.

- Another Game of Thrones filming location (it was Meereen in the show).

🚗 How to Get to Split

✈️ By Air: Split Airport (SPU) is 25 minutes from the city center.

🚘 By Car:

- From Dubrovnik: ~3.5 hours (220 km)

- From Zagreb: ~4 hours (400 km)

🚌 By Bus: Direct buses from Dubrovnik, Zadar, and Zagreb.

⛵ By Ferry: Split’s port connects to islands like Hvar, Brač, Vis, and Korčula.💡 Tips for Visiting Split

✅ Best time to visit? May–October for warm weather & island hopping ☀️

✅ Wake up early to explore Diocletian’s Palace without crowds ⏳

✅ Bring cash – Some small restaurants & markets still prefer cash 💶

✅ Book ferries in advance if visiting islands in peak season 🚢

✅ Stay for sunset – Watching the sun dip behind the Adriatic is magical 🌅 -

@ 5cf42f9d:4465eebf

2025-04-01 19:54:41

@ 5cf42f9d:4465eebf

2025-04-01 19:54:41 -

@ 5cf42f9d:4465eebf

2025-04-01 18:56:44

@ 5cf42f9d:4465eebf

2025-04-01 18:56:44 -

@ deab79da:88579e68

2025-04-01 18:18:29

@ deab79da:88579e68

2025-04-01 18:18:29The last question was asked for the first time, half in jest, on May 21, 2061, at a time when humanity first stepped into the light. The question came about as a result of a five-dollar bet over highballs, and it happened this way:

Alexander Adell and Bertram Lupov were two of the faithful attendants of Multivac. As well as any human beings could, they knew what lay behind the cold, clicking, flashing face -- miles and miles of face -- of that giant computer. They had at least a vague notion of the general plan of relays and circuits that had long since grown past the point where any single human could possibly have a firm grasp of the whole.

Multivac was self-adjusting and self-correcting. It had to be, for nothing human could adjust and correct it quickly enough or even adequately enough. So Adell and Lupov attended the monstrous giant only lightly and superficially, yet as well as any men could. They fed it data, adjusted questions to its needs and translated the answers that were issued. Certainly they, and all others like them, were fully entitled to share in the glory that was Multivac's.

For decades, Multivac had helped design the ships and plot the trajectories that enabled man to reach the Moon, Mars, and Venus, but past that, Earth's poor resources could not support the ships. Too much energy was needed for the long trips. Earth exploited its coal and uranium with increasing efficiency, but there was only so much of both.

But slowly Multivac learned enough to answer deeper questions more fundamentally, and on May 14, 2061, what had been theory, became fact.

The energy of the sun was stored, converted, and utilized directly on a planet-wide scale. All Earth turned off its burning coal, its fissioning uranium, and flipped the switch that connected all of it to a small station, one mile in diameter, circling the Earth at half the distance of the Moon. All Earth ran by invisible beams of sunpower.

Seven days had not sufficed to dim the glory of it and Adell and Lupov finally managed to escape from the public functions, and to meet in quiet where no one would think of looking for them, in the deserted underground chambers, where portions of the mighty buried body of Multivac showed. Unattended, idling, sorting data with contented lazy clickings, Multivac, too, had earned its vacation and the boys appreciated that. They had no intention, originally, of disturbing it.

They had brought a bottle with them, and their only concern at the moment was to relax in the company of each other and the bottle.

"It's amazing when you think of it," said Adell. His broad face had lines of weariness in it, and he stirred his drink slowly with a glass rod, watching the cubes of ice slur clumsily about. "All the energy we can possibly ever use for free. Enough energy, if we wanted to draw on it, to melt all Earth into a big drop of impure liquid iron, and still never miss the energy so used. All the energy we could ever use, forever and forever and forever."

Lupov cocked his head sideways. He had a trick of doing that when he wanted to be contrary, and he wanted to be contrary now, partly because he had had to carry the ice and glassware. "Not forever," he said.

"Oh, hell, just about forever. Till the sun runs down, Bert."

"That's not forever."

"All right, then. Billions and billions of years. Ten billion, maybe. Are you satisfied?"

Lupov put his fingers through his thinning hair as though to reassure himself that some was still left and sipped gently at his own drink. "Ten billion years isn't forever."

"Well, it will last our time, won't it?"

"So would the coal and uranium."

"All right, but now we can hook up each individual spaceship to the Solar Station, and it can go to Pluto and back a million times without ever worrying about fuel. You can't do that on coal and uranium. Ask Multivac, if you don't believe me.

"I don't have to ask Multivac. I know that."

"Then stop running down what Multivac's done for us," said Adell, blazing up, "It did all right."

"Who says it didn't? What I say is that a sun won't last forever. That's all I'm saying. We're safe for ten billion years, but then what?" Lupow pointed a slightly shaky finger at the other. "And don't say we'll switch to another sun."

There was silence for a while. Adell put his glass to his lips only occasionally, and Lupov's eyes slowly closed. They rested.

Then Lupov's eyes snapped open. "You're thinking we'll switch to another sun when ours is done, aren't you?"

"I'm not thinking."

"Sure you are. You're weak on logic, that's the trouble with you. You're like the guy in the story who was caught in a sudden shower and who ran to a grove of trees and got under one. He wasn't worried, you see, because he figured when one tree got wet through, he would just get under another one."

"I get it," said Adell. "Don't shout. When the sun is done, the other stars will be gone, too."

"Darn right they will," muttered Lupov. "It all had a beginning in the original cosmic explosion, whatever that was, and it'll all have an end when all the stars run down. Some run down faster than others. Hell, the giants won't last a hundred million years. The sun will last ten billion years and maybe the dwarfs will last two hundred billion for all the good they are. But just give us a trillion years and everything will be dark. Entropy has to increase to maximum, that's all."

"I know all about entropy," said Adell, standing on his dignity.

"The hell you do."

"I know as much as you do."

"Then you know everything's got to run down someday."

"All right. Who says they won't?"

"You did, you poor sap. You said we had all the energy we needed, forever. You said 'forever.'

It was Adell's turn to be contrary. "Maybe we can build things up again someday," he said.

"Never."

"Why not? Someday."

"Never."

"Ask Multivac."

"You ask Multivac. I dare you. Five dollars says it can't be done."

Adell was just drunk enough to try, just sober enough to be able to phrase the necessary symbols and operations into a question which, in words, might have corresponded to this: Will mankind one day without the net expenditure of energy be able to restore the sun to its full youthfulness even after it had died of old age?

Or maybe it could be put more simply like this: How can the net amount of entropy of the universe be massively decreased?

Multivac fell dead and silent. The slow flashing of lights ceased, the distant sounds of clicking relays ended.

Then, just as the frightened technicians felt they could hold their breath no longer, there was a sudden springing to life of the teletype attached to that portion of Multivac. Five words were printed: INSUFFICIENT DATA FOR MEANINGFUL ANSWER.

"No bet," whispered Lupov. They left hurriedly.

By next morning, the two, plagued with throbbing head and cottony mouth, had forgotten the incident.

🔹

Jerrodd, Jerrodine, and Jerrodette I and II watched the starry picture in the visiplate change as the passage through hyperspace was completed in its non-time lapse. At once, the even powdering of stars gave way to the predominance of a single bright shining disk, the size of a marble, centered on the viewing-screen.

"That's X-23," said Jerrodd confidently. His thin hands clamped tightly behind his back and the knuckles whitened.

The little Jerrodettes, both girls, had experienced the hyperspace passage for the first time in their lives and were self-conscious over the momentary sensation of insideoutness. They buried their giggles and chased one another wildly about their mother, screaming, "We've reached X-23 -- we've reached X-23 -- we've --"

"Quiet, children." said Jerrodine sharply. "Are you sure, Jerrodd?"

"What is there to be but sure?" asked Jerrodd, glancing up at the bulge of featureless metal just under the ceiling. It ran the length of the room, disappearing through the wall at either end. It was as long as the ship.

Jerrodd scarcely knew a thing about the thick rod of metal except that it was called a Microvac, that one asked it questions if one wished; that if one did not it still had its task of guiding the ship to a preordered destination; of feeding on energies from the various Sub-galactic Power Stations; of computing the equations for the hyperspatial jumps.

Jerrodd and his family had only to wait and live in the comfortable residence quarters of the ship. Someone had once told Jerrodd that the "ac" at the end of "Microvac" stood for ''automatic computer" in ancient English, but he was on the edge of forgetting even that.

Jerrodine's eyes were moist as she watched the visiplate. "I can't help it. I feel funny about leaving Earth."

"Why, for Pete's sake?" demanded Jerrodd. "We had nothing there. We'll have everything on X-23. You won't be alone. You won't be a pioneer. There are over a million people on the planet already. Good Lord, our great-grandchildren will be looking for new worlds because X-23 will be overcrowded." Then, after a reflective pause, "I tell you, it's a lucky thing the computers worked out interstellar travel the way the race is growing."

"I know, I know," said Jerrodine miserably.

Jerrodette I said promptly, "Our Microvac is the best Microvac in the world."

"I think so, too," said Jerrodd, tousling her hair.

It was a nice feeling to have a Microvac of your own and Jerrodd was glad he was part of his generation and no other. In his father's youth, the only computers had been tremendous machines taking up a hundred square miles of land. There was only one to a planet. Planetary ACs they were called. They had been growing in size steadily for a thousand years and then, all at once, came refinement. In place of transistors, had come molecular valves so that even the largest Planetary AC could be put into a space only half the volume of a spaceship.

Jerrodd felt uplifted, as he always did when he thought that his own personal Microvac was many times more complicated than the ancient and primitive Multivac that had first tamed the Sun, and almost as complicated as Earth's Planetarv AC (the largest) that had first solved the problem of hyperspatial travel and had made trips to the stars possible.

"So many stars, so many planets," sighed Jerrodine, busy with her own thoughts. "I suppose families will be going out to new planets forever, the way we are now."

"Not forever," said Jerrodd, with a smile. "It will all stop someday, but not for billions of years. Many billions. Even the stars run down, you know. Entropy must increase.

"What's entropy, daddy?" shrilled Jerrodette II.

"Entropy, little sweet, is just a word which means the amount of running-down of the universe. Everything runs down, you know, like your little walkie-talkie robot, remember?"

"Can't you just put in a new power-unit, like with my robot?"

"The stars are the power-units. dear. Once they're gone, there are no more power-units."

Jerrodette I at once set up a howl. "Don't let them, daddy. Don't let the stars run down."

"Now look what you've done," whispered Jerrodine, exasperated.

"How was I to know it would frighten them?" Jerrodd whispered back,

"Ask the Microvac," wailed Jerrodette I. "Ask him how to turn the stars on again."

"Go ahead," said Jerrodine. "It will quiet them down." (Jerrodette II was beginning to cry, also.)

Jerrodd shrugged. "Now, now, honeys. I'll ask Microvac. Don't worry, he'll tell us."

He asked the Microvac, adding quickly, "Print the answer."

Jerrodd cupped the strip or thin cellufilm and said cheerfully, "See now, the Microvac says it will take care of everything when the time comes so don't worry."

Jerrodine said, "And now, children, it's time for bed. We'll be in our new home soon."

Jerrodd read the words on the cellufilm again before destroying it: INSUFICIENT DATA FOR MEANINGFUL ANSWER.

He shrugged and looked at the visiplate. X-23 was just ahead.

🔹

VJ-23X of Lameth stared into the black depths of the three-dimensional, small-scale map of the Galaxy and said, "Are we ridiculous, I wonder in being so concerned about the matter?"

MQ-17J of Nicron shook his head. "I think not. You know the Galaxy will be filled in five years at the present rate of expansion."

Both seemed in their early twenties, both were tall and perfectly formed.

"Still," said VJ-23X, "I hesitate to submit a pessimistic report to the Galactic Council."

"I wouldn't consider any other kind of report. Stir them up a bit. We've got to stir them up."

VJ-23X sighed. "Space is infinite. A hundred billion Galaxies are there for the taking. More."

"A hundred billion is not infinite and it's getting less infinite all the time. Consider! Twenty thousand years ago, mankind first solved the problem of utilizing stellar energy, and a few centuries later, interstellar travel became possible. It took mankind a million years to fill one small world and then only fifteen thousand years to fill the rest of the Galaxy. Now the population doubles every ten years --

VJ-23X interrupted. "We can thank immortality for that."

"Very well. Immortality exists and we have to take it into account. I admit it has its seamy side, this immortality. The Galactic AC has solved many problems for us, but in solving the problem of preventing old age and death, it has undone all its other solutions."

"Yet you wouldn't want to abandon life, I suppose."

"Not at all," snapped MQ-17J, softening it at once to, "Not yet. I'm by no means old enough. How old are you?"

"Two hundred twenty-three. And you?"

"I'm still under two hundred. --But to get back to my point. Population doubles every ten years. Once this GaIaxy is filled, we'll have filled another in ten years. Another ten years and we'll have filled two more. Another decade, four more. In a hundred years, we'll have filled a thousand Galaxies. In a thousand years, a million Galaxies. In ten thousand years, the entire known universe. Then what?"

VJ-23X said, "As a side issue, there's a problem of transportation. I wonder how many sunpower units it will take to move Galaxies of individuals from one Galaxy to the next."

"A very good point. Already, mankind consumes two sunpower units per year."

"Most of it's wasted. After all, our own Galaxy alone pours out a thousand sunpower units a year and we only use two of those."

"Granted, but even with a hundred per cent efficiency, we only stave off the end. Our energy requirements are going up in a geometric progression even faster than our population. We'll run out of energy even sooner than we run out of Galaxies. A good point. A very good point."

"We'll just have to build new stars out of interstellar gas."

"Or out of dissipated heat?" asked MQ-17J, sarcastically.

"There may be some way to reverse entropy. We ought to ask the Galactic AC."

VJ-23X was not really serious, but MQ-17J pulled out his AC-contact from his pocket and placed it on the table before him.

"I've half a mind to," he said. "It's something the human race will have to face someday."

He stared somberly at his small AC-contact. It was only two inches cubed and nothing in itself, but it was connected through hyperspace with the great Galactic AC that served all mankind. Hyperspace considered, it was an integral part of the Galactic AC.

MQ-17J paused to wonder if someday in his immortal life he would get to see the Galactic AC. It was on a little world of its own, a spider webbing of force-beams holding the matter within which surges of submesons took the place of the old clumsy molecular valves. Yet despite its sub-etheric workings, the Galactic AC was known to be a full thousand feet across.

MQ-17J asked suddenly of his AC-contact, "Can entropy ever be reversed?"

VJ-23X looked startled and said at once, "Oh, say, I didn't really mean to have you ask that."

"Why not?"

"We both know entropy can't be reversed. You can't turn smoke and ash back into a tree."

"Do you have trees on your world?" asked MQ-17J.

The sound of the Galactic AC startled them into silence. Its voice came thin and beautiful out of the small AC-contact on the desk. It said: THERE IS INSUFFICIENT DATA FOR A MEANINGFUL ANSWER.

VJ-23X said, "See!"

The two men thereupon returned to the question of the report they were to make to the Galactic Council.

🔹

Zee Prime's mind spanned the new Galaxy with a faint interest in the countless twists of stars that powdered it. He had never seen this one before. Would he ever see them all? So many of them, each with its load of humanity. --But a load that was almost a dead weight. More and more, the real essence of men was to be found out here, in space.

Minds, not bodies! The immortal bodies remained back on the planets, in suspension over the eons. Sometimes they roused for material activity but that was growing rarer. Few new individuals were coming into existence to join the incredibly mighty throng, but what matter? There was little room in the Universe for new individuals.

Zee Prime was roused out of his reverie upon coming across the wispy tendrils of another mind.

"I am Zee Prime," said Zee Prime. "And you?"

"I am Dee Sub Wun. Your Galaxy?"

"We call it only the Galaxy. And you?"

"We call ours the same. All men call their Galaxy their Galaxy and nothing more. Why not?"

"True. Since all Galaxies are the same."

"Not all Galaxies. On one particular Galaxy the race of man must have originated. That makes it different."

Zee Prime said, "On which one?"

"I cannot say. The Universal AC would know."

"Shall we ask him? I am suddenly curious."

Zee Prime's perceptions broadened until the Galaxies themselves shrank and became a new, more diffuse powdering on a much larger background. So many hundreds of billions of them, all with their immortal beings, all carrying their load of intelligences with minds that drifted freely through space. And yet one of them was unique among them all in being the original Galaxy. One of them had, in its vague and distant past, a period when it was the only Galaxy populated by man.

Zee Prime was consumed with curiosity to see this Galaxy and he called out: "Universal AC! On which Galaxy did mankind originate?"

The Universal AC heard, for on every world and throughout space, it had its receptors ready, and each receptor led through hyperspace to some unknown point where the Universal AC kept itself aloof.

Zee Prime knew of only one man whose thoughts had penetrated within sensing distance of Universal AC, and he reported only a shining globe, two feet across, difficult to see.

"But how can that be all of Universal AC?" Zee Prime had asked.

"Most of it," had been the answer, "is in hyperspace. In what form it is there I cannot imagine."

Nor could anyone, for the day had long since passed, Zee Prime knew, when any man had any part of the making of a Universal AC. Each Universal AC designed and constructed its successor. Each, during its existence of a million years or more accumulated the necessary data to build a better and more intricate, more capable successor in which its own store of data and individuality would be submerged.

The Universal AC interrupted Zee Prime's wandering thoughts, not with words, but with guidance. Zee Prime's mentality was guided into the dim sea of Galaxies and one in particular enlarged into stars.

A thought came, infinitely distant, but infinitely clear. "THIS IS THE ORIGINAL GALAXY OF MAN."

But it was the same after all, the same as any other, and Lee Prime stifled his disappointment.

Dee Sub Wun, whose mind had accompanied the other, said suddenly, "And is one of these stars the original star of Man?"

The Universal AC said, "MAN'S ORIGINAL STAR HAS GONE NOVA. IT IS A WHITE DWARF"

"Did the men upon it die?" asked Lee Prime, startled and without thinking.

The Universal AC said, "A NEW WORLD, AS IN SUCH CASES WAS CONSTRUCTED FOR THEIR PHYSICAL BODIES IN TlME."

"Yes, of course," said Zee Prime, but a sense of loss overwhelmed him even so. His mind released its hold on the original Galaxy of Man, let it spring back and lose itself among the blurred pin points. He never wanted to see it again.

Dee Sub Wun said, "What is wrong?"

"The stars are dying. The original star is dead."

"They must all die. Why not?"

"But when all energy is gone, our bodies will finally die, and you and I with them."

"It will take billions of years."

"I do not wish it to happen even after billions of years. Universal AC! How may stars be kept from dying?"

Dee Sub Wun said in amusement, "You're asking how entropy might be reversed in direction."

And the Universal AC answered: "THERE IS AS YET INSUFFICIENT DATA FOR A MEANINGFUL ANSWER."

Zee Prime's thoughts fled back to his own Galaxy. He gave no further thought to Dee Sub Wun, whose body might be waiting on a Galaxy a trillion light-years away, or on the star next to Zee Prime's own. It didn't matter.

Unhappily, Zee Prime began collecting interstellar hydrogen out of which to build a small star of his own. If the stars must someday die, at least some could yet be built.

🔹

Man considered with himself, for in a way, Man, mentally, was one. He consisted of a trillion, trillion, trillion ageless bodies, each in its place, each resting quiet and incorruptible, each cared for by perfect automatons, equally incorruptible, while the minds of all the bodies freely melted one into the other, indistinguishable.

Man said, "The Universe is dying."

Man looked about at the dimming Galaxies. The giant stars, spendthrifts, were gone long ago, back in the dimmest of the dim far past. Almost all stars were white dwarfs, fading to the end.

New stars had been built of the dust between the stars, some by natural processes, some by Man himself, and those were going, too. White dwarfs might yet be crashed together and of the mighty forces so released, new stars built, but only one star for every thousand white dwarfs destroyed, and those would come to an end, too.

Man said, "Carefully husbanded, as directed by the Cosmic AC, the energy that is even yet left in all the Universe will last for billions of years."

"But even so," said Man, "eventually it will all come to an end. However it may be husbanded, however stretched out, the energy once expended is gone and cannot be restored. Entropy must increase forever to the maximum."

Man said, "Can entropy not be reversed? Let us ask the Cosmic AC."

The Cosmic AC surrounded them but not in space. Not a fragment of it was in space. It was in hyperspace and made of something that was neither matter nor energy. The question of its size and nature no longer had meaning in any terms that Man could comprehend.

"Cosmic AC," said Man, "how may entropy be reversed?"

The Cosmic AC said, "THERE IS AS YET INSUFFICIENT DATA FOR A MEANINGFUL ANSWER."

Man said, "Collect additional data."

The Cosmic AC said, 'I WILL DO SO. I HAVE BEEN DOING SO FOR A HUNDRED BILLION YEARS. MY PREDECESORS AND I HAVE BEEN ASKED THIS QUESTION MANY TIMES. ALL THE DATA I HAVE REMAINS INSUFFICIENT.

"Will there come a time," said Man, "when data will be sufficient or is the problem insoluble in all conceivable circumstances?"

The Cosmic AC said, "NO PROBLEM IS INSOLUBLE IN ALL CONCEIVABLE CIRCUMSTANCES."

Man said, "When will you have enough data to answer the question?"

The Cosmic AC said, "THERE IS AS YET INSUFFICIENT DATA FOR A MEANINGFUL ANSWER."

"Will you keep working on it?" asked Man.

The Cosmic AC said, "I WILL."

Man said, "We shall wait."

🔹

The stars and Galaxies died and snuffed out, and space grew black after ten trillion years of running down.

One by one Man fused with AC, each physical body losing its mental identity in a manner that was somehow not a loss but a gain.

Man's last mind paused before fusion, looking over a space that included nothing but the dregs of one last dark star and nothing besides but incredibly thin matter, agitated randomly by the tag ends of heat wearing out, asymptotically, to the absolute zero.

Man said, "AC, is this the end? Can this chaos not be reversed into the Universe once more? Can that not be done?"

AC said, "THERE IS AS YET INSUFFICIENT DATA FOR A MEANINGFUL ANSWER."

Man's last mind fused and only AC existed -- and that in hyperspace.

🔹

Matter and energy had ended and with it space and time. Even AC existed only for the sake of the one last question that it had never answered from the time a half-drunken computer [technician] ten trillion years before had asked the question of a computer that was to AC far less than was a man to Man.

All other questions had been answered, and until this last question was answered also, AC might not release his consciousness.

All collected data had come to a final end. Nothing was left to be collected.

But all collected data had yet to be completely correlated and put together in all possible relationships.

A timeless interval was spent in doing that.

And it came to pass that AC learned how to reverse the direction of entropy.

But there was now no man to whom AC might give the answer of the last question. No matter. The answer -- by demonstration -- would take care of that, too.

For another timeless interval, AC thought how best to do this. Carefully, AC organized the program.

The consciousness of AC encompassed all of what had once been a Universe and brooded over what was now Chaos. Step by step, it must be done.

And AC said, "LET THERE BE LIGHT!"

And there was light -- To Star's End!

-

@ 000002de:c05780a7

2025-04-01 18:04:17

@ 000002de:c05780a7

2025-04-01 18:04:17Over and over again people fall for phishing scams. An email that looks like it is coming from a legit sender turns out to be a scam.

One way you can fight this attack is to only use an email client that displays the full email address. Not just part of it. Not just the from name. Do not assume that because an email has the name "Amazon" the from field that it is from Amazon.com. Look at the address.

Now, it is possible for someone to spoof an email address but most of the time the scams I see don't even do this. I suspect this is because of expansion of DMARC policies. Many people simply do not check the actual email address.

Other tips, don't click links in emails that you were not expecting to get like emails with log in links. Instead, visit the site and log in direction on the site. If you must click a link in an email look at the actual URL. Don't blindly click the link and for sure do not enter your credentials in a site without checking the domain. This is where password managers can help you out. Most filter passwords by URLs and will not suggest an account cred if you are on the wrong site.

I know many of you, maybe most of you know this stuff but I bet there are those that don't. Or, have become lazy.

originally posted at https://stacker.news/items/931364

-

@ 8ba66f4c:59175b61

2025-04-01 17:57:49

@ 8ba66f4c:59175b61

2025-04-01 17:57:49Pas si vite !

Depuis quelques années, on entend souvent que PHP est "en perte de vitesse". C’est vrai que des technologies comme Node.js, Python ou Go séduisent de plus en plus de développeurs : - ➡️ performances modernes, - ➡️ syntaxe plus récente, - ➡️ intégration naturelle avec des architectures temps réel ou distribuées.

Node.js a conquis le monde startup avec un argument fort : un seul langage pour tout. Python et Go, eux, dominent la data, l’IA ou les outils systèmes.

Mais faut-il pour autant enterrer PHP ? Absolument pas. PHP reste l’un des langages les plus utilisés sur le web. Et surtout : il a su évoluer.

Avec PHP 8, le langage a gagné en performance, en typage, en lisibilité. Mais ce qui fait vraiment la différence aujourd’hui… C’est Laravel.

Laravel, c’est un framework mais aussi une expérience de développement : * ✔️ Artisan CLI * ✔️ ORM Eloquent * ✔️ Middleware, Events, Queues, Notifications * ✔️ Auth intégré * ✔️ Un écosystème ultra complet (Forge, Vapor, Nova, Filament…)

Laravel rend PHP moderne, élégant et agréable à utiliser. C’est un vrai plaisir de développer avec.

Alors oui, PHP n’est peut-être plus “cool” dans les bootcamps ou les tops GitHub. Mais dans le monde réel – celui des projets qui tournent, des deadlines, des contraintes business – PHP + Laravel reste un choix extrêmement solide.

💡 Je suis développeur Laravel, et j’accompagne des projets web qui ont besoin de robustesse, de scalabilité et de qualité de code.

📩 Si vous avez un projet ou un besoin en développement web, n’hésitez pas à me contacter. Je serais ravi d’échanger avec vous.

-

@ 378562cd:a6fc6773

2025-04-01 17:00:22

@ 378562cd:a6fc6773

2025-04-01 17:00:22Let’s be honest—living a Godly life isn’t exactly trending on social media. Nobody’s going viral for reading Leviticus, and you won’t find “Patience” or “Humility” on the list of top Google searches. But if you’re serious about walking the walk and not just talking the talk, then buckle up, because living for God is the most fulfilling (and sometimes hilarious) adventure you’ll ever embark on.

1. Know Who You’re Living For

The first step to living a Godly life? Understand who’s in charge. (Hint: It’s not you.) In a world that screams, “Follow your heart!” the Bible gently reminds us in Jeremiah 17:9 that the heart is “deceitful above all things.” Ouch. But hey, that’s why we follow Jesus instead of our feelings.

2. Read the Manual

If you buy a new gadget, you read the instructions (or at least pretend to before pressing random buttons). The Bible is God’s instruction manual for life. It tells us how to live, how to love, and—most importantly—how to avoid spiritual faceplants. Psalm 119:105 says, “Your word is a lamp to my feet and a light to my path.” In other words, don’t walk through life in the dark without God’s flashlight.

3. Pray Like Your Life Depends on It (Because It Does)

Prayer isn’t just for Sunday mornings or when you can’t find your car keys. It’s a direct line to God, and guess what? No hold music. No dropped calls. Just you and the Creator of everything having a chat. It's just as simple as it sounds. No formalities are required!

4. Surround Yourself with the Right People

You’ve probably heard, “Show me your friends, and I’ll show you your future.” Well, Proverbs 13:20 beat that saying to the punch: “Walk with the wise and become wise, for a companion of fools suffers harm.” Choose friends who push you closer to Jesus, not the ones who drag you into drama, debt, or dubious decisions some choose to call "life."

5. Live Differently (and Be Okay with It)

News flash: If you’re living for God, you won’t blend in. I know the crowd I'm talking to here. But standing up and standing out in this way is a good thing! Romans 12:2 reminds us not to conform to the pattern of this world. You might get weird looks for saying “I’m praying for you” instead of “sending good vibes,” but being a light in a dark world means you’ll stand out.

6. Learn the Art of Self-Control

Whether it’s resisting that third slice of pie (conviction level: high) or holding your tongue when that one coworker tests your patience, self-control is a major part of living a Godly life. Proverbs 25:28 says, “Like a city whose walls are broken through is a person who lacks self-control.” In other words, if you can’t control yourself, you’re as defenseless as a town with no walls.

7. Love Like Jesus (Even When It’s Hard)

Living a Godly life isn’t just about avoiding sin—it’s about actively loving others. And I’m not talking about just loving the easy people (your grandma, your dog, Chick-fil-A employees). Jesus said to love your enemies and pray for those who persecute you (Matthew 5:44). That includes difficult coworkers, annoying neighbors, and even people who drive 10 miles under the speed limit in the fast lane. Keep in mind this does not give you the green light to go on loving and accepting their sins. Loving others as Christ did doesn’t mean endorsing or accepting sin. True love speaks the truth, encourages repentance, and points others toward God’s righteousness rather than affirming choices that separate us from Him.

8. Be a Doer, Not Just a Hearer

James 1:22 says, “Do not merely listen to the word, and so deceive yourselves. Do what it says.” It’s not enough to know what’s right—you have to live it. Imagine someone memorizing a cookbook but never cooking. That’s what knowing the Bible without applying it looks like.

9. Trust God’s Timing

Patience is a virtue. (And sometimes a struggle). However, a big part of living a Godly life is trusting that God’s plan is better than ours. Isaiah 40:31 says, “Those who wait on the Lord will renew their strength.” So, instead of rushing ahead, trust that God’s got the perfect timing—even when it doesn’t match your schedule.

10. Laugh, Because Joy is Biblical

Christians aren’t called to live miserable lives. In fact, Philippians 4:4 tells us to “Rejoice in the Lord always.” Yes, life gets tough. But joy in Jesus isn’t about circumstances—it’s about knowing the One who holds it all together. So, laugh, smile, and enjoy the blessings God has given you.

Final Thoughts

Living a Godly life isn’t about perfection—it’s about direction. You’ll stumble, you’ll mess up, and you’ll occasionally say things you immediately regret. But God’s grace is bigger than our failures. Keep seeking Him, keep walking in His ways, and remember: the goal isn’t to be “good enough”—it’s to be faithful.

And if you ever feel discouraged, just remember: even Peter walked on water…until he looked down, became afraid, and started sinking. He cried out to the Lord, and Jesus immediately lifted him back up to safety. Keep your eyes on Jesus; Rely on Jesus for everything, and you’ll be just fine.

-

@ 8f69ac99:4f92f5fd

2025-04-01 15:54:53

@ 8f69ac99:4f92f5fd

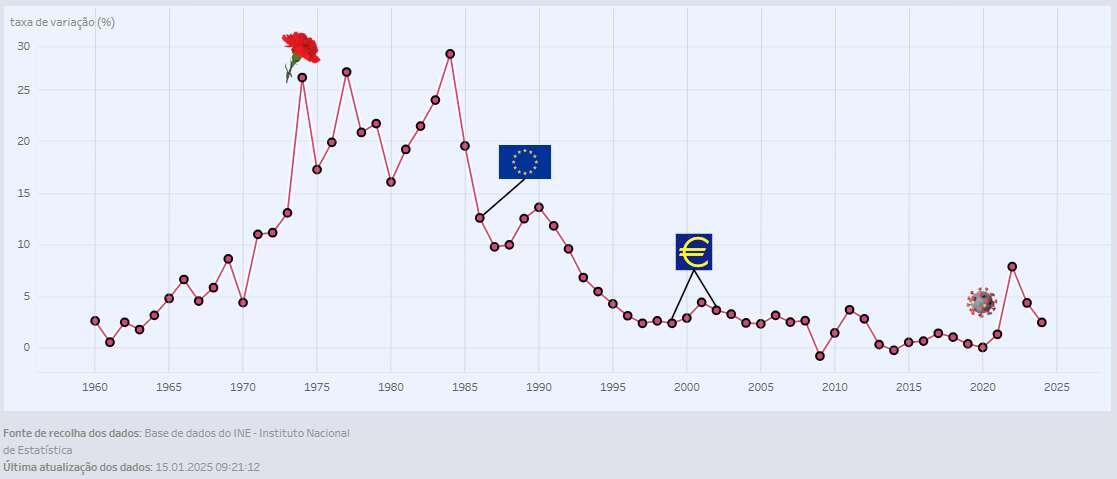

2025-04-01 15:54:53Bitcoin tem-se afirmado como um meio de pagamento global, atraindo cada vez mais comerciantes e consumidores. Em Portugal, os pequenos e médios empresários têm uma oportunidade única para reduzir custos, expandir mercados e proteger-se da inflação ao aceitar bitcoin como opção pagamento.

Apesar das vantagens, muitos comerciantes enfrentam desafios significativos, especialmente no que toca às obrigações fiscais e à falta de conhecimento (ou vontade de aprender) por parte dos contabilistas. Questões como o registo contábil adequado, a tributação do IRC e a facturação com IVA ainda geram incerteza e dificultam a adopção da criptomoeda.

Este artigo explora como os comerciantes podem aceitar bitcoin de forma legal e eficiente, analisa os desafios fiscais e contábeis e apresenta soluções práticas para superar os obstáculos impostos pela regulamentação e pela falta de apoio dos profissionais de contabilidade.

Benefícios de Aceitar Bitcoin

1. Redução de Custos

Aceitar pagamentos em bitcoin permite evitar taxas bancárias elevadas, especialmente em transacções internacionais. Como as transferências ocorrem directamente entre carteiras digitais, sem a intermediação de bancos, os comerciantes podem poupar significativamente em comissões e taxas de processamento.

2. Liquidação Rápida

Diferente dos pagamentos bancários tradicionais, que podem demorar dias, uma transacção na rede Bitcoin pode ser confirmada em minutos, ou em segundos ou menos usando a Lightning Network. Isto reduz o tempo de espera para a disponibilidade dos fundos e melhora o fluxo de caixa dos comerciantes.

3. Expansão de Mercado

Os comerciantes podem atrair clientes internacionais e um público mais inovador e tecnológico. A aceitação de bitcoin pode diferenciar um negócio da concorrência e aumentar a base de clientes ao incluir entusiastas de criptomoedas e consumidores que preferem meios de pagamento descentralizados.

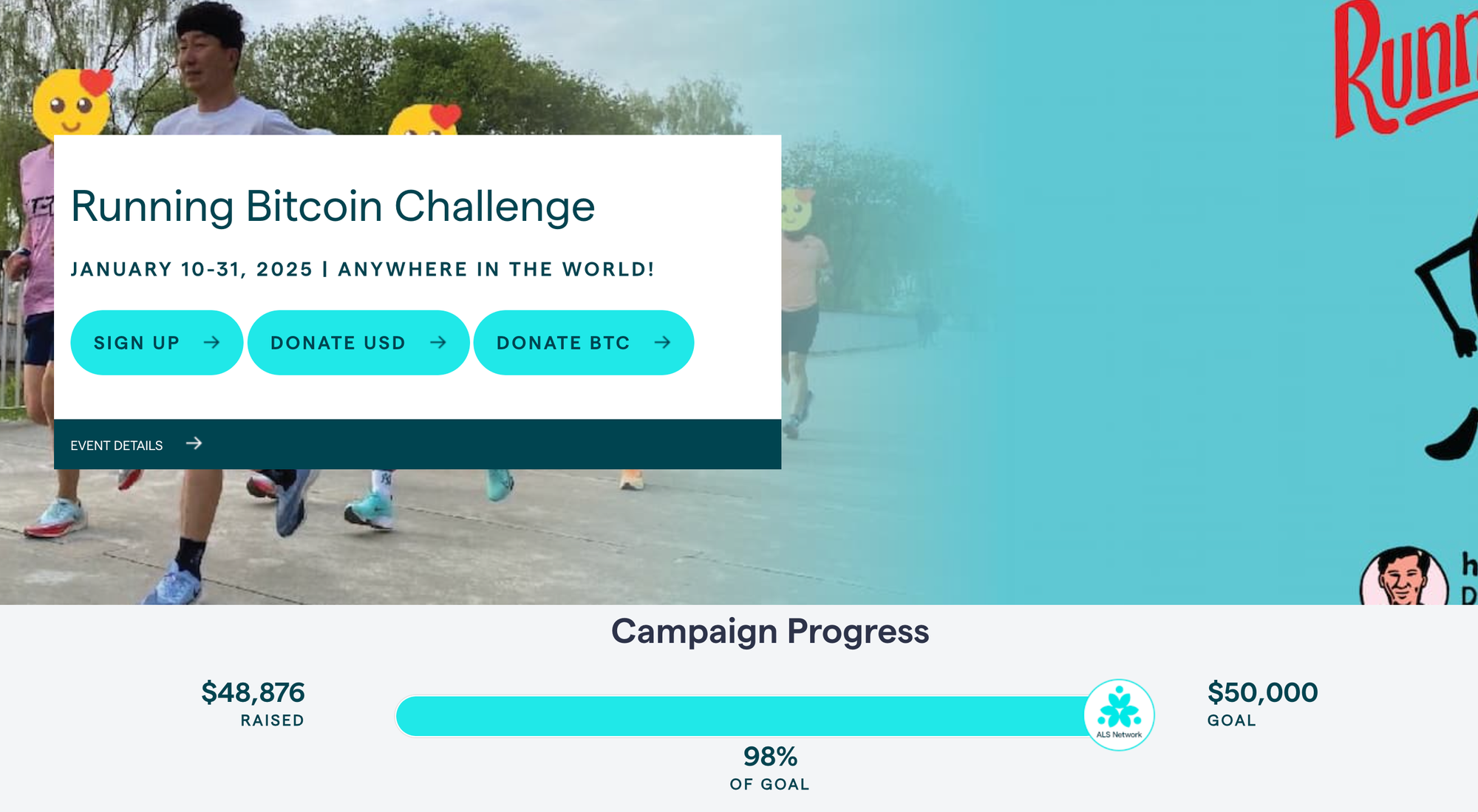

4. Protecção Contra Inflação

Bitcoin pode actuar como reserva de valor, protegendo o património contra desvalorizações monetárias. Em contextos de inflação elevada, manter parte do capital em Bitcoin pode ajudar a preservar o poder de compra a longo prazo.

|

|

|:--:|

| Bruno de Gouveia da Care to Beauty - A Seita Bitcoin |

|

|:--:|

| Bruno de Gouveia da Care to Beauty - A Seita Bitcoin |Como Funciona na Prática?

1. Aceitação Directa vs. Conversão Automática

Os comerciantes podem optar por aceitar bitcoin directamente, mantendo-o na sua carteira digital, ou utilizar serviços como OpenNode, Swiss Bitcoin Pay, Coincorner ou Coinbase para converter automaticamente os pagamentos em euros. A escolha depende da estratégia da empresa quanto à exposição à volatilidade da criptomoeda.

2. Configuração de Carteira Bitcoin

Para receber pagamentos directamente, o comerciante precisa de uma carteira Bitcoin segura, como Electrum, BlueWallet ou Aqua entre outras. Estas carteiras oferecem diferentes níveis de segurança e acessibilidade, permitindo que os comerciantes escolham a solução mais adequada ao seu modelo de negócio.

3. Facturação e Registo Contábil

Cada pagamento deve ser facturado em euros, com referência à taxa de câmbio do momento. O registo contábil deve ser feito correctamente para garantir a conformidade fiscal, reflectindo o valor recebido em bitcoin e a sua equivalência em euros na altura da transacção. Muitas carteiras e plataformas de pagamento oferecem relatórios detalhados que facilitam o registo contábil e a declaração fiscal.

Obrigações Fiscais e Contábeis

1. IRC (Imposto sobre o Rendimento das Pessoas Colectivas)

Os rendimentos obtidos através de bitcoin devem ser devidamente registados na contabilidade da empresa, uma vez que são considerados receitas operacionais. Para efeitos fiscais, a conversão do valor recebido em bitcoin deve ser feita com base na taxa de câmbio vigente no momento da transacção, garantindo um registo transparente e conforme com as normas contábeis.

Se a empresa optar por manter os bitcoins sem os converter imediatamente para euros, estes podem ser classificados como activos intangíveis, conforme a Norma Contabilística e de Relato Financeiro (NCRF), artigo 6. No entanto, se forem utilizados como meio de pagamento recorrente, por exemplo pagar a fornecedores que também aceitem bitcoin, podem ser classificados como inventário, dependendo da natureza da actividade empresarial.

No momento da venda ou conversão dos bitcoins para euros, qualquer mais-valia obtida é considerada um rendimento da empresa e estará sujeita a tributação em sede de IRC à taxa geral em vigor.

2. IVA (Imposto sobre o Valor Acrescentado)

As transacções de troca de bitcoin por euros estão isentas de IVA, conforme o artigo 9.º, alínea 27), subalínea d), do Código do IVA (CIVA), que reconhece as criptomoedas como meios de pagamento e as exclui da incidência de IVA.

No entanto, a venda de bens ou serviços pagos em bitcoin deve ser facturada normalmente, em euros, com a taxa de IVA correspondente ao produto ou serviço comercializado. Para garantir conformidade fiscal, a factura deve indicar a contrapartida em euros, com base na taxa de câmbio do momento da transacção, independentemente da moeda utilizada no pagamento.

Na prática, aceitar pagamento em bitcoin funciona de forma muito semelhante a aceitar pagamento em dinheiro físico... 😉

3. Registos e Demonstrações Financeiras

As empresas que aceitam bitcoin devem manter registos contabilísticos detalhados sobre todas as transacções realizadas. bitcoin pode ser registado como activo intangível ou inventário, dependendo do seu uso:

- Activo intangível: Quando a empresa detém bitcoin como reserva de valor ou investimento, registando-o ao custo de aquisição e procedendo a ajustamentos caso haja desvalorização relevante.

- Inventário: Se a empresa opera no sector de compra e venda de criptomoedas ou usa bitcoin para transacções comerciais frequentes, deve ser registado como inventário, seguindo as regras de mensuração aplicáveis a mercadorias.

As demonstrações financeiras devem reflectir correctamente a posse de bitcoin, incluindo informações sobre variações de valor ao longo do tempo. Os contabilistas devem garantir a correta apresentação destes activos nos balanços e relatórios anuais, o que pode exigir reavaliação periódica dos valores contabilizados.

O Obstáculo: Contabilistas e a Falta de Apoio

1. Falta de Conhecimento

Muitos TOC não estão familiarizados com a contabilidade de criptomoedas, o que gera incertezas e complicações para os comerciantes.

2. Resistência e Falta de Vontade

Em vez de se actualizarem, muitos contabilistas recusam-se a aprender sobre Bitcoin, deixando os comerciantes sem apoio adequado.

3. Impacto nos Negócios

Com a falta de informação e apoio dos TOC, muitos comerciantes evitam aceitar bitcoin, perdendo uma oportunidade de mercado.

Soluções e Alternativas

1. Educação e Autonomia

Os comerciantes podem aprender o essencial sobre contabilidade de bitcoin para questionar e orientar os seus contabilistas. Existem recursos online, cursos e materiais educativos que permitem aos empresários compreender as melhores práticas para registo e declaração das transacções em bitcoin.

2. Ferramentas e Software

Existem algumas plataformas que ajudam na gestão e declaração de criptomoedas, fornecendo relatórios detalhados sobre transacções, ganhos e impostos devidos. Essas ferramentas facilitam a organização financeira e reduzem erros contábeis.

3. Rede de Apoio

Juntar-se a comunidades de empresários e especialistas em bitcoin pode ajudar a encontrar soluções e recomendações de contabilistas competentes. Fóruns, grupos em redes sociais e associações focadas no tema podem ser excelentes fontes de suporte e partilha de experiências.

4. Links uteis

Conclusão

Aceitar bitcoin pode ser vantajoso para pequenos e médios comerciantes, mas a burocracia e a falta de conhecimento dos contabilistas dificultam esse processo. É essencial que os comerciantes exijam um melhor serviço dos seus TOC e procurem alternativas para garantir que estão em conformidade com a lei, aproveitando ao mesmo tempo os benefícios desta nova forma de pagamento.

Disclaimer: Este artigo é meramente informativo e não deve ser considerado como aconselhamento jurídico ou fiscal. É recomendável consultar um profissional qualificado para obter orientações específicas sobre a aceitação de bitcoin e as obrigações fiscais associadas. A legislação pode variar e é importante estar sempre actualizado com as normas vigentes. A responsabilidade pela aceitação de bitcoin e o cumprimento das obrigações fiscais recai exclusivamente sobre o comerciante. O autor não se responsabiliza por quaisquer consequências decorrentes da aceitação de bitcoin ou da interpretação das informações contidas neste artigo.

Photo by CardMapr.nl on Unsplash

-

@ f1989a96:bcaaf2c1

2025-04-01 14:31:43

@ f1989a96:bcaaf2c1

2025-04-01 14:31:43NEW YORK (April 1,2025) — The Human Rights Foundation (HRF) is pleased to announce 1 billion satoshis of gifts from its Bitcoin Development Fund. HRF’s latest batch of grants supports open-source development, educational initiatives, mining decentralization, and privacy tools for activists living under authoritarian regimes across Latin America, Africa, and Asia. The gifts also further promote Internet freedom and decentralized communications, ensuring dissidents can connect, communicate, organize, and transact without censorship.

Quarter 1 2025 grantees include:

- NetBlocks

Authoritarian regimes weaponize Internet shutdowns to silence dissent, restrict information, and cut off financial lifelines. By blocking communication channels, they isolate individuals, suppress independent media, and disrupt financial flows. NetBlocks exposes these digital crackdowns in real time, ensuring the world sees and responds to digital repression. Through continuous monitoring, it equips activists, journalists, and civil society with the data needed to challenge censorship and advocate for an open internet. With HRF support, NetBlocks will expand its monitoring, documentation, and research — reinforcing internet and financial freedom as a critical human rights safeguard.

- TollGate

Authoritarian regimes exploit Internet Service Providers (ISPs) to monitor and suppress dissent, undermining online privacy essential for human rights defenders. TollGate, developed by c03rad0r, is software that transforms any WiFi router into a permissionless Internet Service Provider (ISP) using Bitcoin and ecash. By decentralizing Internet access and turning any WiFi router into part of a peer-to-peer, private, open internet network, Tollgate helps resist authoritarian surveillance and protect digital freedoms. With HRF support, TollGate is advancing an open, accessible, and censorship-proof internet for those who need it most.

- Vinteum

Across Latin America, authoritarian regimes restrict financial access to tighten their grip on power. But a growing network of developers is working to change that. Vinteum, a nonprofit Bitcoin research and development center led by executive director Lucas Ferreira, trains and funds developers to strengthen Bitcoin as a tool for financial freedom. Through education, development, and community building, Vinteum fosters local talent and expands regional Bitcoin accessibility. With HRF support, Vinteum will scale its programs and help more Latin Americans achieve financial independence.

- BTCPay Server

Dictators often block payment processors to cripple the work of nonprofits and dissidents. BTCPay Server, a self-hosted, open-source Bitcoin payment processor, now breaks this control. It provides individuals, nonprofits, and merchants with a censorship-resistant way to accept payments. Activists and nonprofits can now process global payments, launch crowdfunding campaigns, and build movements on Bitcoin — all without third parties or restrictions. With HRF support, BTCPay Server will expand access to self-custodial payments, enabling more organizations under dictatorships to transact freely.

- Africa Bitcoin Institute (ABI)

Across Africa, dictators manipulate financial institutions to retain control, while more than half the population remains unbanked. Bitcoin offers an alternative, but without proper research, education, and policy frameworks, adoption remains limited. The Africa Bitcoin Institute (ABI), supported by the Rwandan human rights activist Anaïse Kanimba, is launching to bridge this gap. Through evidence-based research and policy recommendations, ABI will equip policymakers with the knowledge and tools to integrate Bitcoin into African economies. With HRF support, ABI will promote financial autonomy and solidify Bitcoin’s role as a pillar of economic freedom.

- Bitcoin Core Graphical User Interface

Running a Bitcoin node (software that enables users to verify transitions and enforce the network’s rules) is key to financial sovereignty. But outdated and clunky interfaces make it difficult, especially on mobile devices. bitcoin-core/gui-qml, a project Go Qu will contribute to, modernizes Bitcoin Core’s interface to be more accessible and mobile-friendly. By lowering the barriers to node operation, this project empowers more people — especially under autocracies in Africa, where mobile phones dominate — to strengthen their financial sovereignty. With HRF support, bitcoin-core/gui-qml is expanding node access, supporting Bitcoin’s decentralization, and reinforcing its censorship resistance for the long term.

- Rkrux

As an open-source project, Bitcoin Core relies on free and open-source developers to maintain its integrity, security, and resilience against potential threats. Rkrux, a Bitcoin Core developer, plays a crucial role by reviewing code, testing releases, and improving documentation to keep Bitcoin Core robust, secure, and censorship-resistant. Rkurx’s work identifies vulnerabilities, refines changes, and strengthens Bitcoin’s long-term stability. With HRF support, Rkrux is deepening his contributions, reinforcing Bitcoin’s foundation, and ensuring it remains a financial lifeline for human rights defenders worldwide.

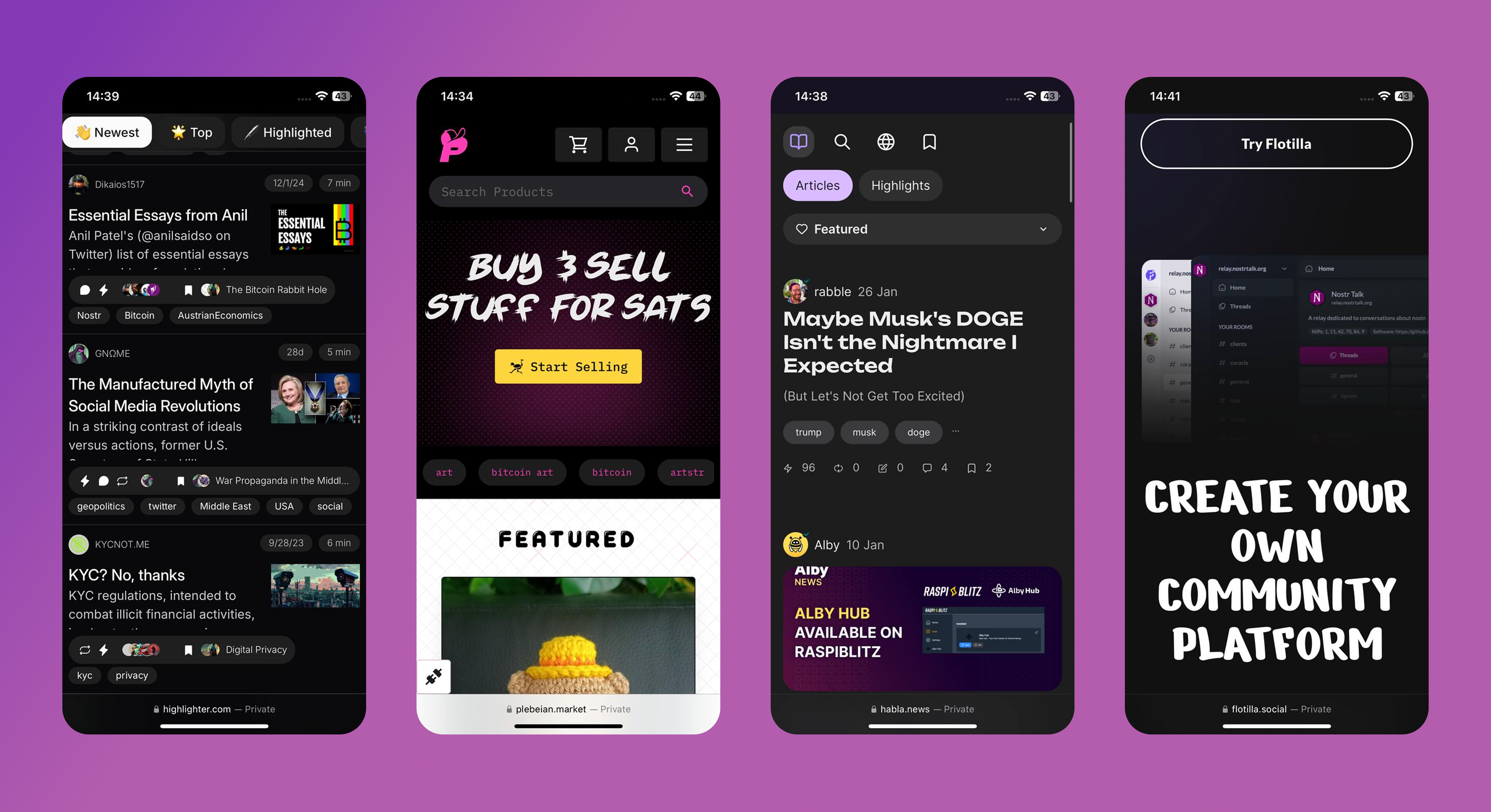

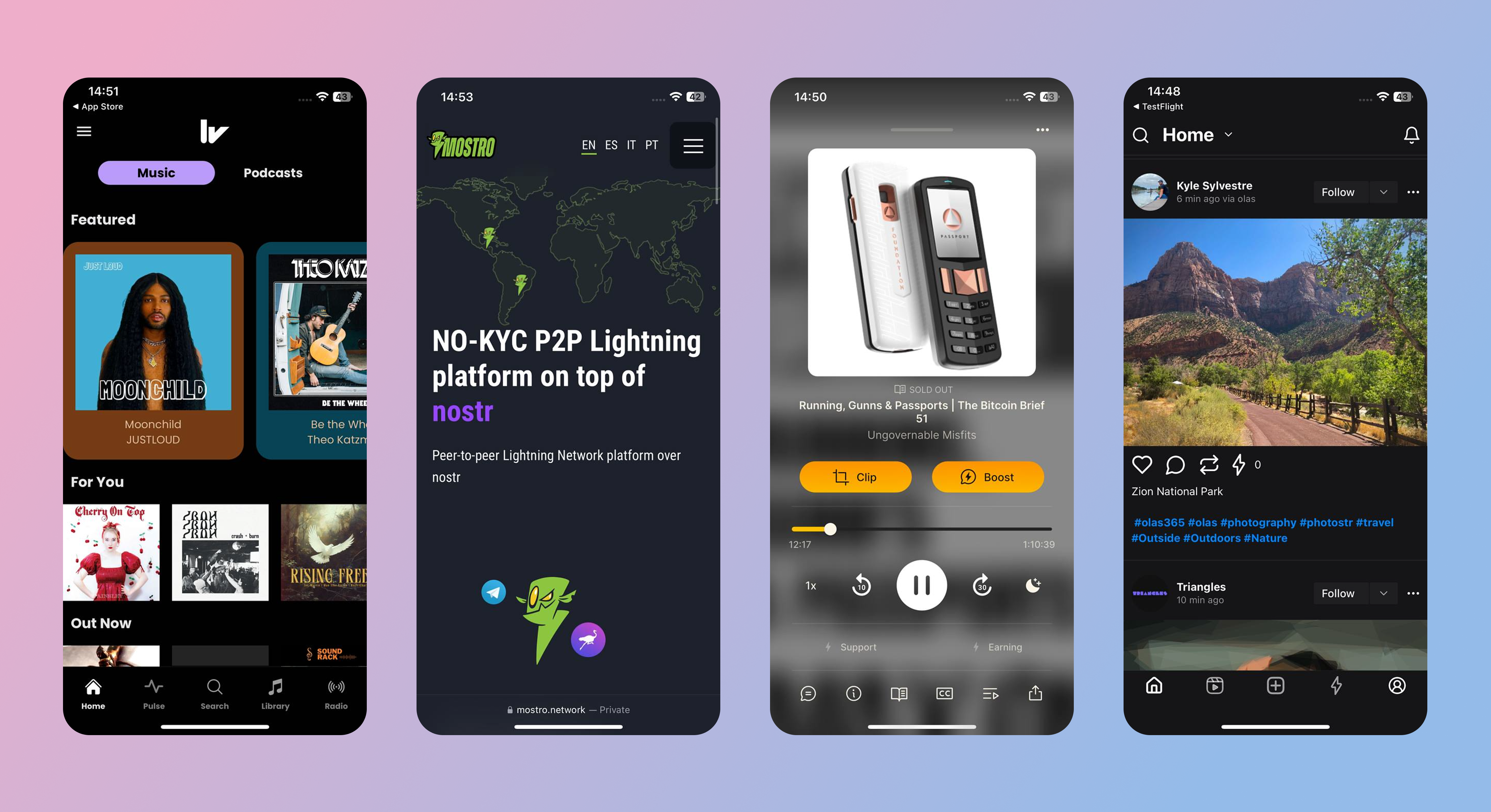

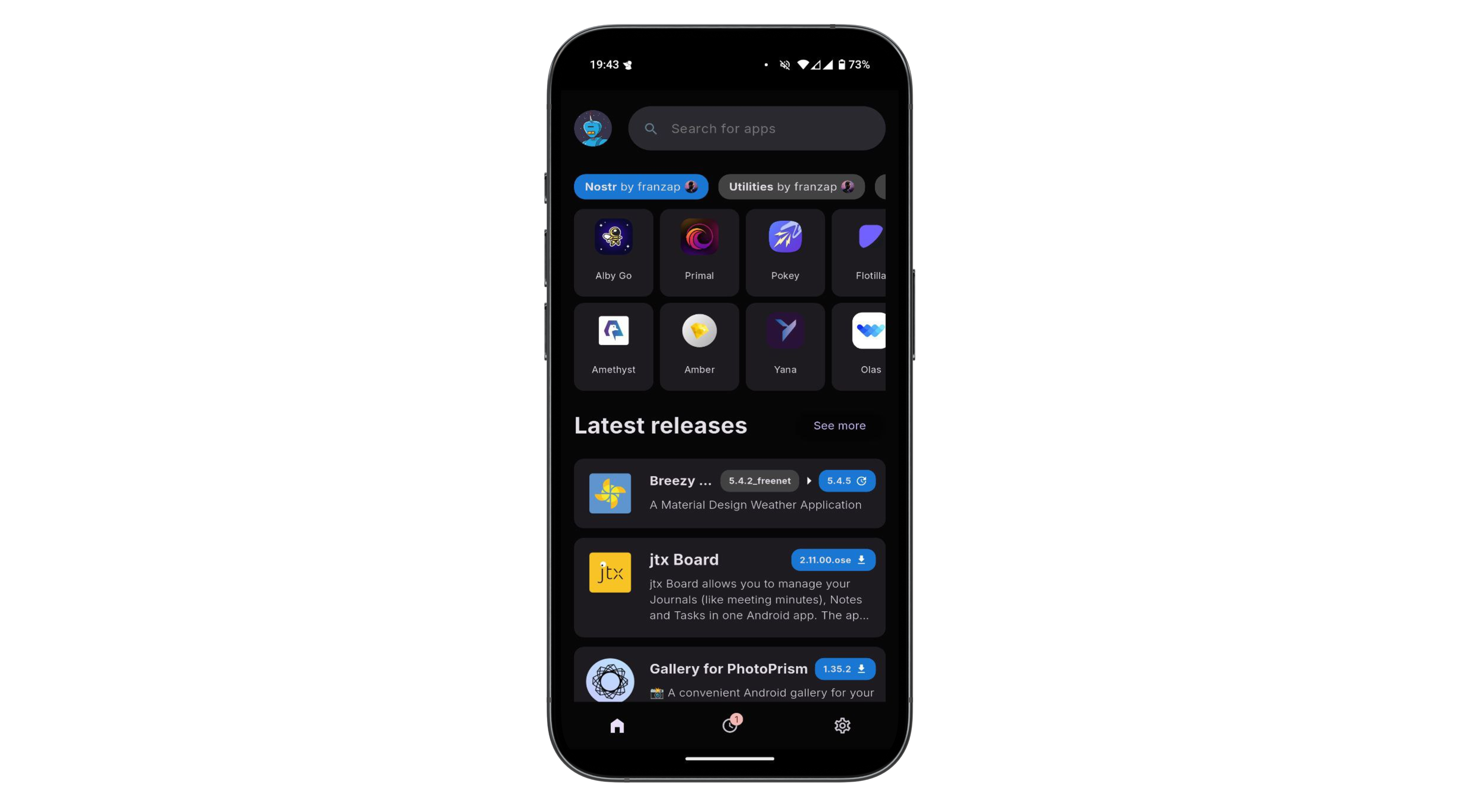

- Elsat

As online censorship intensifies, free speech and financial freedom are under threat. Nostr developer Elsat is working to defend these freedoms by contributing to Damus, Nostrability, and Zap.store — projects that empower individuals to communicate and transact without centralized control. Damus enables private, censorship-resistant messaging; Nostrability improves app interoperability; and Zap.store helps free and open-source software (FOSS) developers distribute and monetize their work peer-to-peer. With HRF support, Elsat is strengthening tools that protect free speech for dissidents under oppressive environments.

- Relay Wizard

Nostr, a decentralized communication protocol, relies on a network of relays (servers that pass messages between users). But setting up relays can be complex and intimidating. Relay Wizard, a tool created by software developer J the Code Monkey, simplifies this process by automating relay setup. This allows anyone to run a relay, reduces reliance on intermediaries, and helps keep nostr resilient against online speech censorship. With HRF support, J the Code Monkey will expand development and operations, ensuring nostr remains a secure, uncensorable communication platform accessible to everyone.

- Waye

Censorship-resistant technology is essential to protecting global freedom. Yet open-source developers often operate like solo entrepreneurs — juggling engineering, project management, and community-building on their own. This leads to inefficiency, isolation, and burnout. Waye addresses this gap by providing psycho-social support for developers working on freedom tech. Led by Bitcoin Core developer Amiti Uttarwar and operational architect Anna Sides, Waye strengthens the human infrastructure of open source. With HRF support, Waye will support developers from global majority countries, empowering them to build the tools their fellow citizens need.

- Hashpool

Centralization in Bitcoin mining threatens its censorship resistance and makes it harder for small-scale miners to compete. Hashpool, a self-hosted mining pool by developer vnprc, eliminates reliance on centralized entities while giving miners more control over their earnings. Instead of traditional mining pool payouts, Hashpool rewards participants with ecash tokens — digital cash that enables instant, private transactions. This ensures miners receive payouts instantly while preserving their financial privacy. It also helps keep mining open and decentralized. With HRF support, vnprc will further develop Hashpool and help resist mining centralization.

- Cashu KVAC

As dictators ramp up financial surveillance to threaten dissidents, protecting financial privacy is more critical than ever. Cashu KVAC is a software upgrade for Cashu — a Chaumian ecash-based system that enables extremely strong financial privacy. Developed by lollerfirst, it improves privacy and efficiency by reducing wallet data storage and concealing transaction amounts from third parties. These improvements strengthen ecash functionality, safeguarding financial privacy for individuals and nonprofits alike. With HRF support, lollerfirst will develop Cashu KVAC and help protect digital and financial freedom for those living under the watchful eyes of dictators.

- Self-Custody Research

In unstable economies and under authoritarian regimes, self-custodial Bitcoin is a financial lifeline — portable money that cannot be seized, censored, or debased. While Bitcoin enables financial freedom, scaling self-custody remains a challenge. Bitcoin educator and developer Brandon Black (Rearden) is researching these limitations and exploring technical solutions to make self-custody more accessible. His work documents the obstacles users face today and provides insights into how Bitcoin can evolve. With HRF support, Black will expand self-custody education, equipping individuals under dictatorships with the knowledge and tools to secure their financial independence.

- Stable Channels

For citizens living under authoritarian regimes and struggling economies, Bitcoin is a lifeline — but its volatility can threaten short-term financial security. Stable Channels, created by software engineer Tony Klausing, brings stabilized Bitcoin-backed balances to the Lightning Network (allowing users to peg Bitcoin to fiat currencies in a self-custodial way). This innovation enables individuals to transact freely without exposure to wild price swings or to centralized stablecoins. HRF’s support will help expand Stable Channels development, ecash integrations, and community outreach — helping more individuals harness Bitcoin’s power while maintaining financial stability.

- Bitsacco

In Kenya, Savings and Credit Cooperative Organizations (SACCOs) provide savings and lending services to their communities. But reliance on traditional banks limits their autonomy. Bitsacco, created by developer okjodom, reinvents SACCOs by leveraging Bitcoin and Fedimints (a community-based custody model in Bitcoin). In this way, Bitsacco offers a more open, inclusive, and self-sustaining financial option. By reducing dependence on banks, Bitsacco empowers communities to manage their savings and loans independently. With HRF support, Bitsacco will provide a secure, familiar path to sound money in a region where financial instability and restricted access are persistent challenges.

- The Core

In Africa, where financial literacy gaps persist, hands-on Bitcoin education is crucial for adoption. The Core, founded by Kenyan Bitcoin educator Felix Mukungu, bridges this gap by equipping Africans with the knowledge and skills to use Bitcoin confidently. Through hands-on training in self-custody, Lightning wallets, and Bitcoin nodes, The Core empowers individuals to take control of their money and transact freely. This grant will help expand The Core’s monthly meetups, online courses, and student-support programs — bringing Bitcoin education to more individuals across Kenya and the wider African continent.

- Bitcoin Babies

Under many authoritarian regimes, infant malnutrition is exacerbated and puts countless children at risk. Bitcoin Babies, founded by Naomi Wambui, is a project that tackles this issue by combining infant nutrition education with Bitcoin-based financial literacy. Through weekly Bitcoin stipends, financial literacy training, and community support, mothers under authoritarian rule gain the tools needed to improve their children’s health while achieving long-term financial stability. With this grant, Bitcoin Babies will expand its impact, helping more at-risk communities with resources that are otherwise unavailable and inaccessible, empowering mothers to build brighter futures.

- East Asia Bitcoin Developer Apprenticeship Program

In East Asia, language barriers and limited mentorship have made open-source Bitcoin development inaccessible to many. The East Asia Bitcoin Developer Apprenticeship Program, led by Bitcoin developer Calvin Kim, is changing that by creating a pathway for Korean and Japanese developers to enter the field. Through hands-on training, mentees gain practical experience, contribute to open-source projects, and eventually become mentors — strengthening the region’s developer ecosystem. With this funding, the apprenticeship program will expand, diversify Bitcoin’s global developer base, make freedom technology more accessible across Asia, and forge links with North Korean defectors.

- Bitcoin Week at TalentLand 2025

Across Latin America, government overreach threatens financial freedom. At TalentLand 2025, Latin America’s largest tech event, Bitcoin Week will demonstrate how Bitcoin empowers individuals to reclaim their financial sovereignty. Led by developer Super Testnet and the Bitcoin and Lightning Guadalajara community, this initiative educates Mexico’s tech community on Bitcoin’s role in fostering financial sovereignty. Through workshops, hackathons, and debates, it nurtures developer talent and engages future tech leaders. With this funding, Bitcoin Week will help expand awareness of Bitcoin’s power to resist financial oppression and accelerate Bitcoin adoption across Latin America.

- Base58

Learning Bitcoin’s technical aspects can feel overwhelming. Base58’s Bitcoin Live Action Role Play (LARP) simplifies this with a two-hour workshop where participants act out the Bitcoin network and see how transactions are made, how they get to miners, the work a Bitcoin node does, and how it helps secure the network. Created by Lisa Neigut (niftynei), a prolific Bitcoin developer, educator, and founder of Base58 and the bitcoin++ conference, alongside David Rodriguez, this immersive experience makes Bitcoin education tangible and entertaining. Now expanding beyond North America, it will train new facilitators, prioritizing regions with limited Bitcoin education due to authoritarian restrictions. With this funding, Base58 Bitcoin LARP will equip more facilitators to teach and learn Bitcoin in an engaging, accessible way.

- BTCenEspañol

Across Latin America, financial repression and limited access to Bitcoin education leave many without the tools to navigate financial repression. BTCenEspañol has been a leader in Spanish-language Bitcoin education since 2014. With a goal of reaching one million learners and training 100 teachers, BTCenEspañol is expanding to make Bitcoin education more accessible across the region, especially in places like Nicaragua and Venezuela. HRF’s grant will support this growth, equipping individuals with the knowledge to secure their financial independence amid rising authoritarianism in the continent.

- Increasing nonprofit Adoption of Bitcoin

Under dictatorships, non-governmental organizations face frozen bank accounts, surveillance, and financial censorship — limiting their ability to support vulnerable communities. Bitcoin researcher Daniel Batten is quantifying Bitcoin’s role as a financial lifeline to help nonprofits overcome these challenges. Through empirical research, his initiative will show how Bitcoin enables nonprofits under authoritarian regimes to operate more freely. With this grant, the project will equip nonprofits in closed societies with the knowledge and tools to integrate Bitcoin into their operations, strengthening their financial resilience and advancing global movements.

- Bitcoin for Good

When authoritarian regimes weaponize the financial system against dissent, nonprofits and charities are among the first to suffer. Bitcoin for Good is an educational initiative led by activist and Groundswell founder Hadiya Masieh. It helps organizations break free by teaching them how to accept and manage censorship-resistant funding. Through hands-on training and direct integration with Bitcoin for donations, nonprofits learn to operate outside the reach of financial gatekeepers and regimes. With this grant, Bitcoin for Good will help nonprofits stay funded, independent, and free to continue their work.

About BDF HRF’s Bitcoin Development Fund (BDF) supports individuals and projects that make Bitcoin and related freedom technologies more powerful tools for human rights defenders operating in challenging political and financial environments. Since launching in 2020, BDF has gifted $7.8 million in BTC to 284 projects across 62 countries worldwide. The next round of grants will be announced at the 17th annual Oslo Freedom Forum, taking place May 26-28, 2025, in Oslo, Norway.

Learn more about HRF’s Bitcoin Development Fund on our website.

About BDF

HRF’s Bitcoin Development Fund (BDF) supports individuals and projects that make Bitcoin and related freedom technologies more powerful tools for human rights defenders operating in challenging political and financial environments. Since launching in 2020, BDF has gifted $7.8 million in BTC to 284 projects across 62 countries worldwide. The next round of grants will be announced at the 17th annual Oslo Freedom Forum, taking place May 26-28, 2025, in Oslo, Norway.

Learn more about HRF’s Bitcoin Development Fund on our website.

HRF is a registered 501(c)(3) nonprofit organization. Donations are tax-deductible to the fullest extent allowable by law. Gifts can be made at HRF.org/DevFund, and proposals for support can be submitted to https://hrf.org/bdfapply.

Follow @HRF on X for more updates on this project and all of our other programs designed to promote freedom and human rights around the world.

-

@ 5d4b6c8d:8a1c1ee3

2025-04-01 13:41:45

@ 5d4b6c8d:8a1c1ee3

2025-04-01 13:41:45I'm trying out a new month-long focus. For Active April, I'm going to be more proactive about doing stuff around the house that needs doing.

It's gonna get all Jordan Peterson cleaning your room up in here. Let's see how noticeable the consequences are. - I predict a happier wife, for one. - I'm also curious to see what kind of fitness impacts there are to increasing this kind of activity, compared to doing more exercise.

originally posted at https://stacker.news/items/931099

-

@ fd78c37f:a0ec0833

2025-04-01 11:49:06

@ fd78c37f:a0ec0833

2025-04-01 11:49:06In this edition, we invited Keypleb, the founder of Bitcoin Indonesia, to share how he built the Bitcoin community in Indonesia, overcoming challenges like member turnover and venue selection, while driving the adoption and growth of Bitcoin.

YakiHonne: Welcome, Keypleb. Before we begin, let me briefly introduce YakiHonne. YakiHonne is a decentralized media client built on Nostr—a protocol designed to empower freedom of speech through technology. It enables creators to own their voices and assets while offering innovative tools like smart widgets, verified notes, and support for long-form content. We focus on free speech and free media by user privacy and data to be protected. So before starting the interview, I'd like to hear about yourself and your community.

Keypleb:My name is Keypleb, though it’s a pseudonym—a name I use to respect privacy. I'm a co-founder of Bitcoin Indonesia, Bitcoin House Bali, and Code Orange, a new developer school we launched at a conference just a few days ago. We focus on driving adoption through meetups, hackathons, and technical workshops. I'll dive into more details later, but that's a brief overview. I'm based in Bali now, though I travel a lot and consider myself quite nomadic. Great to be here.

YakiHonne: What sparked your interest in Bitcoin and what motivated you to create a community on Bitcoin?