-

@ 04ed2b8f:75be6756

2025-02-13 08:02:39

Freedom. It’s the word on everyone’s lips, the dream of every soul. We long for it, we chase it, we believe that if we can break free from this chain or that constraint, we will finally be free. **But true freedom is not about external circumstances—it’s about control.**

The truth is, **the most powerful chains are the ones we place on ourselves**. The world can throw its challenges at you, life can dish out its unfair blows, but **if you cannot control yourself, your thoughts, your emotions, your reactions, then you are no different than a prisoner.**

There is no freedom in chaos. There is no freedom in losing control. **Freedom is mastery—mastery of the self.**

## **Freedom Begins Within**

You can have all the money in the world, live in the most luxurious place, and have every material possession your heart desires, but **if you cannot control your impulses, your habits, your desires—none of that will matter.** You are still a slave to your cravings. You are still a puppet to your own emotions, and that is **no real freedom.**

What does freedom look like?

- **It’s the power to act with purpose, not to react out of emotion.**

- **It’s the strength to stay disciplined when every part of you wants to quit.**

- **It’s the courage to say ‘no’ to distractions, to temptation, to things that steer you off course.**

- **It’s the clarity to make choices that serve your growth, not your immediate desires.**

True freedom is the ability to say, “I am in control of myself. I do not let my circumstances control me, nor my emotions rule me. I dictate my actions, my thoughts, my destiny.”

## **Self-Control: The Ultimate Weapon**

The power to control yourself is your greatest weapon. Without it, **you are at the mercy of every challenge, every temptation, and every fleeting emotion**. You may feel like you are “free,” but without self-discipline, you are just a puppet swaying in the wind, vulnerable to every whim that blows your way.

- **The impulse to procrastinate? You overcome it.**

- **The desire to give up? You push through it.**

- **The craving for comfort? You choose growth.**

In the face of any storm, a man with self-control remains grounded, focused, and clear. He doesn’t react in anger or fear—he acts with purpose, with precision, and with vision.

A man who cannot control himself is a man who is owned by his emotions, his desires, his distractions. But the man who conquers his mind, his body, his impulses—he is the one who **owns his life.**

## **The Price of Freedom**

It’s not easy to control yourself. It requires constant effort, relentless discipline, and the courage to face yourself head-on. It means saying ‘no’ to what feels good now, to invest in what will make you stronger later. It means constantly improving, constantly fighting the urge to quit, to give in, to indulge in comfort.

But the price of freedom is worth it. **For when you have control over yourself, no one can take your power.** You become the master of your fate. **You become unshakable.**

## **Freedom Through Discipline**

So, ask yourself: **Are you truly free, or are you simply a slave to your impulses?**

- **Do you control your actions, or do your actions control you?**

- **Are you the master of your emotions, or are they the masters of you?**

Freedom isn’t just about having no chains; it’s about not letting anything control you—least of all yourself. **And when you control yourself, there’s nothing you can’t accomplish.**

A man who cannot control himself is never truly free. But a man who conquers his mind, his habits, his emotions—he is unstoppable.

**Now go and choose to control yourself, and unlock the freedom that’s waiting for you. Or remain a prisoner to your impulses, forever shackled by the chains of your own making. The choice is yours.**

-

@ bf47c19e:c3d2573b

2025-02-13 07:56:50

Originalni tekst na [dvadesetjedan.com](https://dvadesetjedan.com/blog/niko-ne-moze-zabraniti-bitcoin)

###### Autor: [Parker Lewis](https://x.com/parkeralewis) / Prevod na srpski: [Plumsky](https://t.me/Plumski)

---

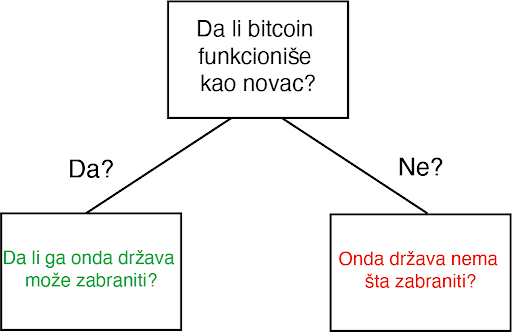

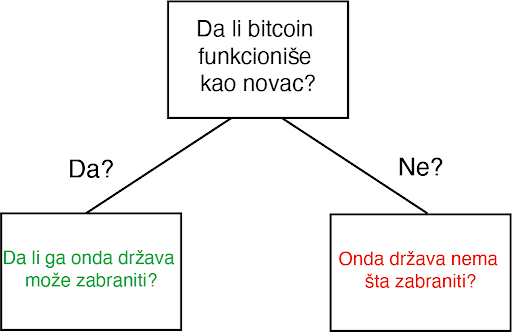

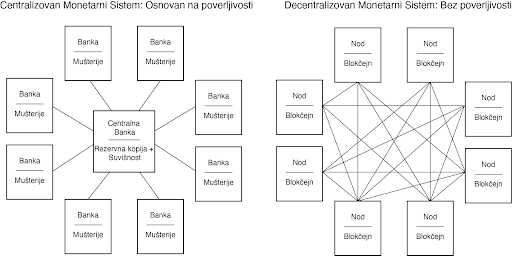

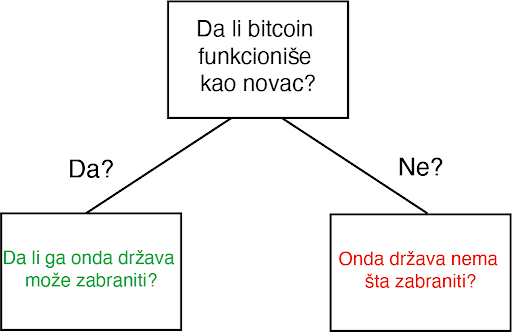

Ideja da država može nekako zabraniti bitcoin je jedna od poslednjih faza tuge, tačno pred prihvatanje realnosti. Posledica ove rečenice je priznanje da bitcoin “funkcioniše”. U stvari, ona predstavlja činjenicu da bitcoin funkcioniše toliko dobro da on preti postojećim državnim monopolima nad novcem i da će zbog toga države da ga unište kroz regulativne prepreke da bi eliminisale tu pretnju. Gledajte na tvrdnju da će države zabraniti bitcoin kao kondicionalnu logiku. Da li bitcoin funkcioniše kao novac? Ako je odgovor „ne“, onda države nemaju šta da zabrane. Ako je odgovor „da“, onda će države da probaju da ga zabrane. Znači, glavna poenta ovog razmišljanja je pretpostavka da bitcoin funkcioiniše kao novac. Onda je sledeće logično pitanje da li intervencija od strane države može uspešno da uništi upravo taj funkcionalan bitcoin.

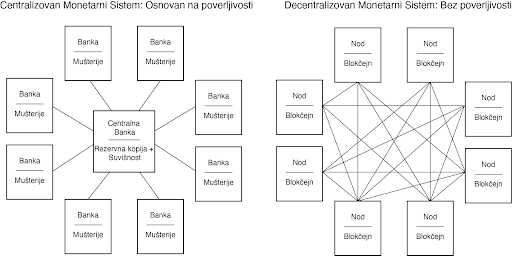

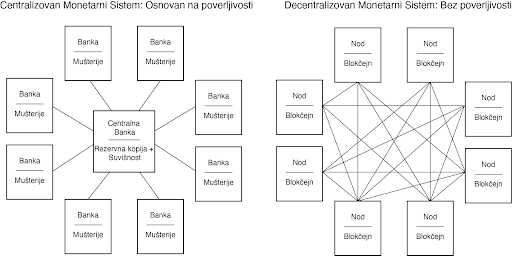

Za početak, svako ko pokušava da razume kako, zašto, ili da li bitcoin funkcioniše mora da proceni ta pitanja potpuno nezavisno od prouzrekovanja državne regulacije ili intervencije. Iako je nesumnjivo da bitcoin mora da postoji uzgred državnih regulativa, zamislite na momenat da države ne postoje. Sam od sebe, da li bi bitcoin funkcionisao kao novac, kad bi se prepustio slobodnom tržištu? Ovo pitanje se širi u dodatna pitanja i ubrzo se pretvara u bunar bez dna. Šta je novac? Šta su svojstva koja čine jednu vrstu novca bolje od druge? Da li bitcoin poseduje ta svojstva? Da li je bitcoin bolja verzija novca po takvim osobinama? Ako je finalni zaključak da bitcoin ne funkcioniše kao novac, implikacije državne intervencije su nebitne. Ali, ako je bitcoin funkcionalan kao novac, ta pitanja onda postaju bitna u ovoj debati, i svako ko o tome razmišlja bi morao imati taj početnički kontekst da bi mogao proceniti da li je uopšte moguće zabraniti. Po svom dizajnu, bitcoin postoji van države. Ali bitcoin nije samo van kontrole države, on u stvari funkcioniše bez bilo kakve saradnje centralizovanih identiteta. On je globalan i decentralizovan. Svako može pristupiti bitcoinu bez potrebe saglasnosti bilo koga i što se više širi sve je teže cenzurisati celokupnu mrežu. Arhitektura bitcoina je namerno izmišljena da bude otporna na bilo koje pokušaje države da ga zabrane. Ovo ne znači da države širom sveta neće pokušavati da ga regulišu, oporezuju ili čak da potpuno zabrane njegovo korišćenje. Naravno da će biti puno bitki i otpora protiv usvajanja bitcoina među građanima. Federal Reserve i Američki Treasury (i njihovi globalni suparnici) se neće ležeći predati dok bitcoin sve više i više ugrožava njihove monopole prihvatljivog novca. Doduše, pre nego što se odbaci ideja da države mogu potpuno zabraniti bitcoin, mora se prvo razumeti posledice tog stava i njegovog glasnika.

#### Progresija poricanja i stepeni tuge

Pripovesti skeptičara se neprestano menjaju kroz vreme. Prvi stepen tuge: bitcoin nikad ne može funkcionisati-njegova vrednost je osnovana ni na čemu. On je moderna verzija tulip manije. Sa svakim ciklusom uzbuđenja, vrednost bitcoina skače i onda vrlo brzo se vraća na dole. Često nazvano kao kraj njegove vrednosti, bitcoin svaki put odbija da umre i njegova vrednost pronađe nivo koji je uvek viši od prethodnih ciklusa globalne usvajanja. Tulip pripovetka postaje stara i dosadna i skeptičari pređu na više nijansirane teme, i time menjaju bazu debate. Drugi stepen tuge predstoji: bitcoin je manjkav kao novac. On je previše volatilan da bi bio valuta, ili je suviše spor da bi se koristio kao sistem plaćanja, ili se ne može proširiti dovoljno da zadovolji sve promete plaćanja na svetu, ili troši isuviše struje. Taj niz kritike ide sve dalje i dalje. Ovaj drugi stepen je progresija poricanja i dosta je udaljen od ideje da je bitcoin ništa više od bukvalno bezvrednog ničega.

Uprkos tim pretpostavnim manjcima, vrednost bitcoin mreže nastavje da raste vremenom. Svaki put, ona ne umire, nasuprot, ona postaje sve veća i jača. Dok se skeptičari bave ukazivanjem na manjke, bitcoin ne prestaje. Rast u vrednosti je prouzrokovan jednostavnom dinamikom tržišta: postoji više kupca nego prodavca. To je sve i to je razlog rasta u adopciji. Sve više i više ljudi shvata zašto postoji fundamentalna potražnja za bitcoinom i zašto/kako on funkcioniše. To je razlog njegovog dugotrajnog rasta. Dokle god ga sve više ljudi koristi za čuvanje vrednosti, neće pasti cena snabdevanja. Zauvek će postojati samo 21 milion bitcoina. Nebitno je koliko ljudi zahtevaju bitcoin, njegova cela količina je uvek ista i neelastična. Dok skeptičari nastavljaju sa svojom starom pričom, mase ljudi nastavljaju da eliminišu zabludu i zahtevaju bitcoin zbog njegovih prednosti u smislu novčanih svojstva. Između ostalog, ne postoji grupa ljudi koja je više upoznata sa svim argumentima protiv bitcoina od samih bitcoinera.

Očajanje počinje da se stvara i onda se debata još jedanput pomera. Sada nije više činjenica je vrednost bitcoina osnovana ni na čemu niti da ima manjke kao valuta; sada se debata centrira na regulaciji državnih autoriteta. U ovom zadnjem stepenu tuge, bitcoin se predstavlja kao u stvari isuviše uspešnom alatkom i zbog toga države ne smeju dozvoliti da on postoji. Zaista? Znači da je genijalnost čoveka ponovo ostvarila funkcionalan novac u tehnološko superiornoj formi, čije su posledice zaista neshvatljive, i da će države upravo taj izum nekako zabraniti. Primetite da tom izjavom skeptičari praktično priznaju svoj poraz. Ovo su poslednji pokušaji u seriji promašenih argumenata. Skeptičari u isto vreme prihvataju da postoji fundamentalna potražnja za bitcoinom a onda se premeštaju na neosnovan stav da ga države mogu zabraniti.

Ajde da se poigramo i tim pitanjem. Kada bih zapravo razvijene države nastupile na scenu i pokušale da zabrane bitcoin? Trenutno, Federal Reserve i Treasury ne smatraju bitcoin kao ozbiljnu pretnju superiornosti dolara. Po njihovom celokupnom mišljenju, bitcoin je slatka mala igračka i ne može da funkcioniše kao novac. Sadašnja kompletna kupovna moć bitcoina je manja od $200 milijardi. Sa druge strane, zlato ima celokupnu vrednost od $8 triliona (40X veću od bitcoina) i količina odštampanog novca (M2) je otprilike 15 triliona (75X veličine bitcoinove vrednosti). Kada će Federal Reserve i Treasury da počne da smatra bitcoin kao ozbiljnu pretnju? Kad bitcoin poraste na $1, $2 ili $3 triliona? Možete i sami da izaberete nivo, ali implikacija je da će bitcoin biti mnogo vredniji, i posedovaće ga sve više ljudi širom sveta, pre nego što će ga državne vlasti shvatiti kao obiljnog protivnika.

Predsednik Tramp & Treasury Sekretar Mnučin o Bitcoinu (2019):

> „Ja neću pričati o bitcoinu za 10 godina, u to možete biti sigurni {…} Ja bi se kladio da čak za 5 ili 6 godina neću više pričati o bitcoinu kao sekretar Trusury-a. Imaću preča posla {…} Mogu vam obećati da ja lično neću biti pun bitcoina.“ – Sekretar Treasury-a Stiv Mnučin

> „Ja nisam ljubitelj bitcoina {…}, koji nije novac i čija vrednost je jako volatilna i osnovana na praznom vazduhu.“ – Predsednik Donald J. Tramp

Znači, logika skeptika ide ovako: bitcoin ne funkcioniše, ali ako funkcioniše, onda će ga država zabraniti. Ali, države slobodnog sveta neće pokušati da ga zabrane dokle god se on ne pokaže kao ozbiljna pretnja. U tom trenutku, bitcoin će biti vredniji i sigurno teži da se zabrani, pošto će ga više ljudi posedovati na mnogo širem geografskom prostoru. Ignorišite fundamentalne činjenice i asimetriju koja je urođena u globalnom dešavanju monetizacije zato što u slučaju da ste u pravu, države će taj proces zabraniti. Na kojoj strani tog argumenta bi radije stajao racionalan ekonomski učesnik? Posedovanje finansijske imovine kojoj vrednost toliko raste da preti globalnoj rezervnoj valuti, ili nasuprot – nemati tu imovinu? Sa pretpostavkom da individualci razumeju zašto je mogućnost (a sve više i verovatnoća) ove realnosti, koji stav je logičniji u ovom scenariju? Asimetrija dve strane ovog argumenta sama od sebe zahteva da je prvi stav onaj istinit i da fundamentalno razumevanje potražnje bitcoina samo još više ojačava to mišljenje.

#### Niko ne moze zabraniti bitcoin

Razmislite šta bitcoin u stvari predstavlja pa onda šta bi predstavljala njegova zabrana. Bitcoin je konverzija subjektivne vrednosti, stvorena i razmenjena u realnošću, u digitalne potpise. Jednostavno rečeno, to je konverzija ljudskog vremena u novac. Kad neko zahteva bitcoin, oni u isto vreme ne zahtevaju neki drugi posed, nek to bio dolar, kuća, auto ili hrana itd. Bitcoin predstavlja novčanu štednju koja sa sobom žrtvuje druge imovine i servise. Zabrana bitcoina bi bio napad na najosnovnije ljudske slobode koje je on upravo stvoren da brani. Zamislite reakciju svih onih koji su prihvatili bitcoin: „Bilo je zabavno, alatka za koju su svi eksperti tvrdili da neće nikad funkcionisati, sada toliko dobro radi i sad ti isti eksperti i autoriteti kažu da mi to nemožemo koristiti. Svi idite kući, predstava je gotova.“verovanje da će svi ljudi koji su učestvovali u bitcoin usvajanju, suverenitetu koji nudi i finansiskoj slobodi, odjednom samo da se predaju osnovnom rušenju njihovih prava je potpuno iracionalna pozicija.

> Novac je jedan od najbitnijih instrumenata za slobodu koji je ikad izmišljen. Novac je to što u postojećem društvu ostvaruje mogućnosti siromašnom čoveku – čiji je domet veći nego onaj koji je bio dostižan bogatim ljudima pre ne toliko puno generacija.“ – F. A. Hajek

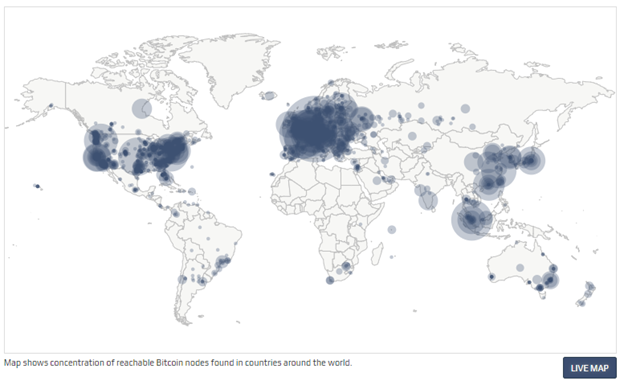

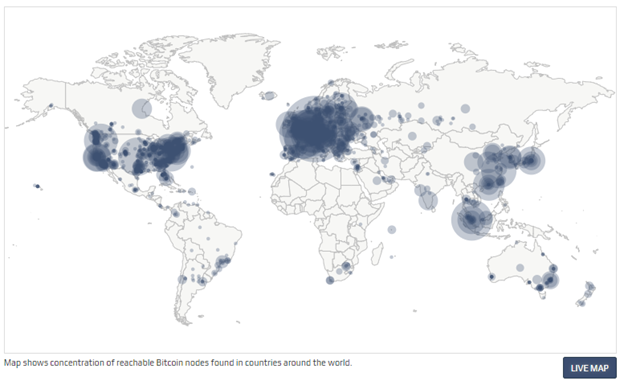

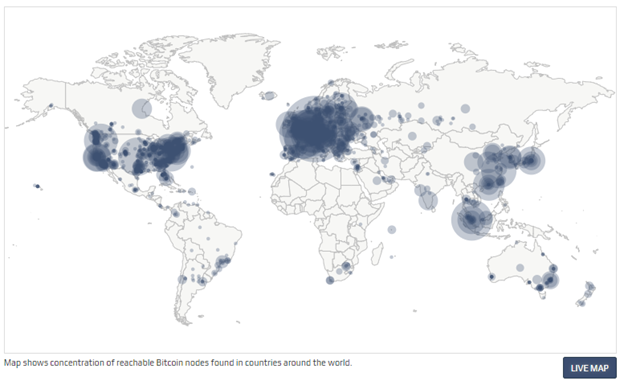

Države nisu uspele da zabrane konzumiranje alkohola, droga, kupovinu vatrenog oružja, pa ni posedovanje zlata. Država može samo pomalo da uspori pristup ili da deklariše posedovanje ilegalnim, ali ne može da uništi nešto što veliki broj raznovrsnih ljudi smatra vrednim. Kada je SAD zabranila privatno posedovanje zlata 1933., zlato nije palo u vrednosti ili nestalo sa finansijskog tržišta. Ono je u stvari poraslo u vrednosti u poređenju sa dolarom, i samo trideset godina kasnije, zabrana je bila ukinuta. Ne samo da bitcoin nudi veću vrednosno obećanje od bilo kog drugog dobra koje su države pokušale da zabrane (uključujući i zlato); nego po svojim osobinama, njega je mnogo teže zabraniti. Bitcoin je globalan i decentralizovan. On ne poštuje granice i osiguran je mnoštvom nodova i kriptografskim potpisima. Sam postupak zabrane bi zahtevao da se u isto vreme zaustavi „open source“ softver koji emituje i izvršava slanje i potvrđivanje digitalno enkriptovanih ključeva i potpisa. Ta zabrana bi morala biti koordinisana između velikog broja zemalja, sa tim da je nemoguće znati gde se ti nodovi i softver nalazi ili da se zaustavi instaliranje novih nodova u drugim pravnim nadležnostima. Da ne pominjemo i ustavske pitanja, bilo bi tehnički neizvodljivo da se takva zabrana primeni na bilo kakav značajan način.

Čak kada bih sve zemlje iz G-20 grupe koordinisale takvu zabranu u isto vreme, to ne bi uništilo bitcoin. U stvari, to bi bilo samoubistvo za fiat novčani sistem. To bi još više prikazalo masama da je bitcoin u stvari novac koji treba shvatiti ozbiljno, i to bi samo od sebe započelo globalnu igru vatanje mačke za rep. Bitcoin nema centralnu tačku za napad; bitcoin rudari, nodovi i digitalni potpisi su rasejani po celom svetu. Svaki aspekt bitcoina je decentralizovan, zato su glavni stubovi njegove arhitekture da učesnici uvek treba kontrolisati svoje potpise i upravljati svojim nodom. Što više digitalnih potpisa i nodova koji postoje, to je više bitcoin decentralizovan, i to je više odbranjiva njegova mreža od strane neprijatelja. Što je više zemalja gde rudari izvršavaju svoj posao, to je manji rizik da jedan nadležni identitet može uticati na njegov bezbednosni sistem. Koordinisan internacionalni napad na bitcoin bi samo koristio da bitcoin još više ojača svoj imuni sistem. Na kraju krajeva, to bi ubrzalo seobu iz tradicionalnog finansijskog sistema (i njegovih valuta) a i inovaciju koja postoji u bitcoin ekosistemu. Sa svakom bivšom pretnjom, bitcoin je maštovito pronalazio način da ih neutrališe pa i koordinisan napad od strane država ne bi bio ništa drugačiji.

Inovacija u ovoj oblasti koja se odlikuje svojom „permissionless“ (bez dozvole centralnih identiteta) osobinom, omogućava odbranu od svakojakih napada. Sve varijante napada koje su bile predvidjene je upravo to što zahteva konstantnu inovaciju bitcoina. To je ona Adam Smitova nevidljiva ruka, ali dopingovana. Pojedinačni učesnici mogu da veruju da su motivisani nekim većim uzrokom, ali u stvari, korisnost kaja je ugrađena u bitcoin stvara kod učesnika dovoljno snažan podsticaj da omogući svoje preživljavanje. Sopstveni interes milione, ako ne milijarde, nekoordinisanih ljudi koji se jedino slažu u svojom međusobnom potrebom za funkcionalnim novcem podstiče inovacije u bitcoinu. Danas, možda to izgleda kao neka kul nova tehnologija ili neki dobar investment u finansijskom portfoliju, ali čak i ako to mnogi ne razumeju, bitcoin je apsolutna nužnost u svetu. To je tako zato što je novac nužnost a historijski priznate valute se fundamentalno raspadaju. Pre dva meseca, tržište američkih državnih obveznica je doživeo kolaps na šta je Federal Reserve reagovao time što je povećao celokupnu količinu dolara u postojanju za $250 milijardi, a još više u bliskoj budućnosti. Tačno ovo je razlog zašto je bitcoin nužnost a ne samo luksuzni dodatak. Kada inovacija omogućava bazično funkcionisanje ekonomije ne postoji ni jedna država na svetu koja može da zaustavi njenu adopciju i rast. Novac je nužnost a bitcoin znatno poboljšava sistem novca koji je ikada postojao pre njega.

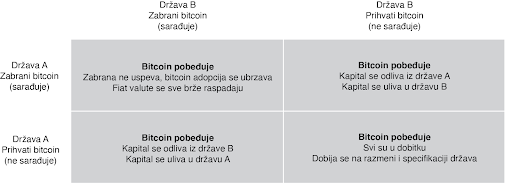

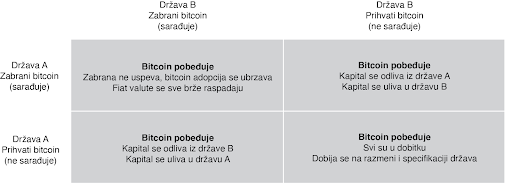

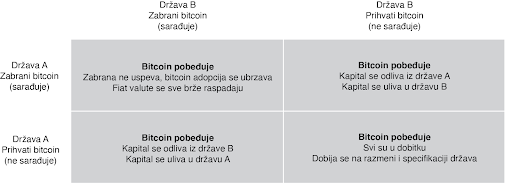

Sa više praktične strane, pokušaj zabranjivanja bitcoina ili njegove velike regulacije od nadležnosti bi direktno bilo u korist susedne nadležnih organa. Podsticaj da se odustane od koordinisanog napada na bitcoin bi bio isuviše veliki da bi takvi dogovori bili uspešni. Kada bi SAD deklarisovale posed bitcoina ilegalnim sutra, da li bi to zaustavilo njegov rast, razvoj i adopciji i da li bi to smanjilo vrednost celokupne mreže? Verovatno. Da li bi to uništilo bitcoin? Ne bi. Bitcoin predstavlja najpokretljivije kapitalno sredstvo na svetu. Zemlje i nadležne strukture koje kreiraju regulativnu strukturu koja najmanje ustručava korišćenje bitcoina će biti dobitnici velike količine uliva kapitala u svoje države.

#### Zabrana Bitcoinove Zatvoreničke Dileme

U praksi, zatvorenička dilema nije igra jedan na jedan. Ona je multidimenzijska i uključuje mnoštvo nadležnosti, čiji se interesi nadmeću međusobno, i to uskraćuje mogućnosti bilo kakve mogućnosti zabrane. Ljudski kapital, fizički kapital i novčani kapital će sav ići u pravcu država i nadležnosti koje najmanje ustručuju bitcoin. To se možda neće desiti sve odjednom, ali pokušaji zabrane su isto za badava koliko bi bilo odseći sebi nos u inat svom licu. To ne znači da države to neće pokušati. India je već probala da zabrani bitcoin. Kina je uvela puno restrikcija. Drugi će da prate njihove tragove. Ali svaki put kada država preduzme takve korake, to ima nepredvidljive efekte povećanja bitcoin adopcije. Pokušaji zabranjivanja bitcoina su jako efektivne marketing kampanje. Bitcoin postoji kao sistem nevezan za jednu suverenu državu i kao novac je otporan na cenzuru. On je dizajniran da postoji van državne kontrole. Pokušaji da se taj koncept zabrani samo još više daje njemu razlog i logiku za postojanje.

#### Jedini Pobednički Potez je da se Uključiš u Igru

Zabrana bitcoina je trošenje vremena. Neki će to pokušati; ali svi će biti neuspešni. Sami ti pokušaji će još više ubrzati njegovu adopciju i širenje. Biće to vetar od 100 km/h koji raspaljuje vatru. To će ojačati bitcoin sve više i doprineće njegovoj pouzdanosti. U svakom slučaju, verovanje da će države zabraniti bitcoin u momentu kada on postane dovoljno velika pretnja rezervnim valutam sveta, je iracionalan razlog da se on no poseduje kao instrument štednje novca. To ne samo da podrazumeva da je bitcoin novac, ali u isto vreme i ignoriše glavne razloge zašto je to tako: on je decentralizovan i otporan na cenzure. Zamislite da razumete jednu od nojvećih tajni današnjice i da u isto vreme tu tajnu asimetrije koju bitcoin nudi ne primenjujete u svoju korist zbog straha od države. Pre će biti, neko ko razume zašto bitcoin funkcioniše i da ga država ne može zaustaviti, ili nepuno znanje postoji u razumevanju kako bitcoin uopšte funckioniše. Počnite sa razmatranjem fundamentalnih pitanja, a onda primenite to kao temelj da bi procenili bilo koji potencijalan rizik od strane budućih regulacija ili restrikcija državnih organa. I nikad nemojte da zaboravite na vrednost asimetrije između dve strane ovde prezentiranih argumenata. Jedini pobednički potez je da se uključite u igru.

Stavovi ovde prezentirani su samo moji i ne predstavljaju Unchained Capital ili moje kolege. Zahvaljujem se Fil Gajgeru za razmatranje teksta i primedbe.

[Originalni tekst](https://unchained.com/blog/bitcoin-cannot-be-banned/)

-

@ da0b9bc3:4e30a4a9

2025-02-13 06:36:12

Hello Stackers!

Welcome on into the ~Music Corner of the Saloon!

A place where we Talk Music. Share Tracks. Zap Sats.

So stay a while and listen.

🚨Don't forget to check out the pinned items in the territory homepage! You can always find the latest weeklies there!🚨

🚨Subscribe to the territory to ensure you never miss a post! 🚨

originally posted at https://stacker.news/items/884478

-

@ e3ba5e1a:5e433365

2025-02-13 06:16:49

My favorite line in any Marvel movie ever is in “Captain America.” After Captain America launches seemingly a hopeless assault on Red Skull’s base and is captured, we get [this line](https://www.youtube.com/shorts/kqsomjpz7ok):

“Arrogance may not be a uniquely American trait, but I must say, you do it better than anyone.”

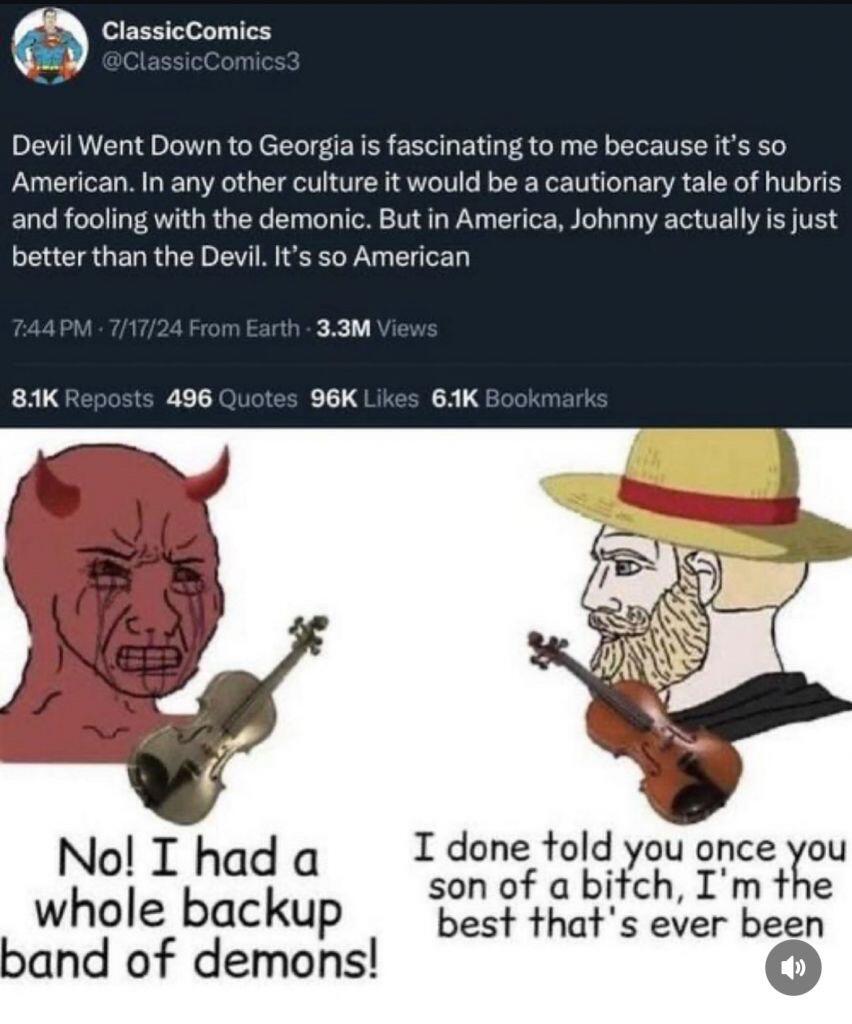

Yesterday, I came across a comment on the song [Devil Went Down to Georgia](https://youtu.be/ut8UqFlWdDc) that had a very similar feel to it:

America has seemingly always been arrogant, in a uniquely American way. Manifest Destiny, for instance. The rest of the world is aware of this arrogance, and mocks Americans for it. A central point in modern US politics is the deriding of racist, nationalist, supremacist Americans.

That’s not what I see. I see American Arrogance as not only a beautiful statement about what it means to be American. I see it as an ode to the greatness of humanity in its purest form.

For most countries, saying “our nation is the greatest” *is*, in fact, twinged with some level of racism. I still don’t have a problem with it. Every group of people *should* be allowed to feel pride in their accomplishments. The destruction of the human spirit since the end of World War 2, where greatness has become a sin and weakness a virtue, has crushed the ability of people worldwide to strive for excellence.

But I digress. The fears of racism and nationalism at least have a grain of truth when applied to other nations on the planet. But not to America.

That’s because the definition of America, and the prototype of an American, has nothing to do with race. The definition of Americanism is *freedom*. The founding of America is based purely on liberty. On the God-given rights of every person to live life the way they see fit.

American Arrogance is not a statement of racial superiority. It’s barely a statement of national superiority (though it absolutely is). To me, when an American comments on the greatness of America, it’s a statement about freedom. Freedom will always unlock the greatness inherent in any group of people. Americans are *definitionally* better than everyone else, because Americans are freer than everyone else. (Or, at least, that’s how it should be.)

In *Devil Went Down to Georgia*, Johnny is approached by the devil himself. He is challenged to a ridiculously lopsided bet: a golden fiddle versus his immortal soul. He acknowledges the sin in accepting such a proposal. And yet he says, “God, I know you told me not to do this. But I can’t stand the affront to my honor. I am the greatest. The devil has nothing on me. So God, I’m gonna sin, but I’m also gonna win.”

*Libertas magnitudo est*

-

@ d360efec:14907b5f

2025-02-13 05:54:17

**ภาพรวม LUNCUSDT (OKX):**

LUNCUSDT กำลังอยู่ในช่วงที่ *มีความผันผวนสูงและมีความไม่แน่นอนมาก* แม้ว่าในอดีต (TF Day) จะเคยมีสัญญาณของการพยายามกลับตัวเป็นขาขึ้น (Breakout EMA 50 และเกิด Golden Cross) แต่ปัจจุบันแรงซื้อเหล่านั้นเริ่มอ่อนแรงลง และมีแรงขายเข้ามาในตลาดมากขึ้น ทำให้เกิดความขัดแย้งระหว่าง Timeframes ต่างๆ

**สถานะปัจจุบัน:**

* **แนวโน้ม:**

* **TF Day:** เริ่มไม่แน่นอน (จากเดิมที่เป็น Early Uptrend) - แม้ว่าราคาจะยังอยู่เหนือ EMA 50/200 แต่ Money Flow เริ่มแสดงสัญญาณเตือน

* **TF4H:** เริ่มไม่แน่นอน (พักตัว, ทดสอบแนวรับ EMA 50) - Money Flow บ่งบอกถึงแรงขายที่เข้ามา

* **TF15:** ผันผวนสูง, ไม่มีทิศทางชัดเจน (Sideways) - Money Flow แสดงถึงแรงขาย แต่ก็มีแรงซื้อกลับเข้ามาบ้าง

* **Money Flow (LuxAlgo):**

* **TF Day:** แรงซื้อเริ่มอ่อนแรงลงอย่างมีนัยสำคัญ, มีแรงขายเข้ามา

* **TF4H:** แรงขายมีมากกว่าแรงซื้อ

* **TF15:** แรงขายและแรงซื้อผสมกัน, โดยรวมแรงขายยังมากกว่า

* **EMA:**

* **TF Day:** EMA 50/200 เป็นแนวรับ/แนวต้าน

* **TF4H:** EMA 50 กำลังถูกทดสอบ, EMA 200 เป็นแนวต้าน

* **TF15:** EMA 50/200 เป็นแนวต้าน

**โครงสร้างราคา (SMC):**

| Timeframe | Break of Structure (BOS) | Change of Character (CHoCH) | Higher High (HH) & Higher Low (HL) | Equal Highs (EQH) / Equal Lows (EQL) |

| :-------- | :----------------------- | :--------------------------- | :----------------------------------- | :------------------------------------- |

| Day | ด้านบนและล่าง | ด้านบน | เริ่มก่อตัว (แต่ไม่แข็งแกร่ง) | - |

| 4H | ด้านบน | ด้านบน | เริ่มก่อตัว (แต่ไม่ชัดเจน) | มี EQH หลายจุด |

| 15m | ด้านบนและล่าง | มีทั้งบนและล่าง | Lower Highs (LH) & Lower Lows (LL) | มี EQH และ EQL หลายจุด |

**แนวรับ-แนวต้านสำคัญ:**

| Timeframe | แนวรับ | แนวต้าน |

| :-------- | :----------------------------------------------------------- | :--------------------------------------------------------------------- |

| Day | EMA 50 (≈0.00010000), EMA 200 (≈0.00008000), 0.00006000-0.00007000 | 0.00017953 (High ล่าสุด), 0.00014000 (Volume Profile) |

| 4H | EMA 50 (≈0.00007000), 0.00006000-0.00007000 | EMA 200 (≈0.00008000), 0.00008132, บริเวณ 0.00010000-0.00012000 (EQH) |

| 15m | บริเวณ Low ล่าสุด | EMA 50, EMA 200, บริเวณ 0.000075-0.000076 (EQH) |

**กลยุทธ์ (LUNCUSDT):**

1. **Wait & See (ทางเลือกที่ดีที่สุด):**

* **เหตุผล:** ความขัดแย้งระหว่าง Timeframes สูงมาก, แนวโน้มไม่ชัดเจน, Money Flow ใน TF4H และ TF15 เป็นลบ

* รอให้ราคาแสดงทิศทางที่ชัดเจนกว่านี้ (ยืนเหนือ EMA 50 ใน TF4H ได้, Breakout แนวต้านใน TF15)

2. **Buy on Dip (Day, 4H) - *ความเสี่ยงสูงมาก ไม่แนะนำ*:**

* **เหตุผล:** แนวโน้มระยะยาวอาจจะยังเป็นขาขึ้นได้ (ถ้าไม่หลุดแนวรับสำคัญ)

* **เงื่อนไข:** *ต้อง* รอสัญญาณการกลับตัวใน TF15 ก่อน

* **จุดเข้า:** พิจารณาเฉพาะบริเวณแนวรับที่แข็งแกร่งมากๆ (EMA ของ Day/4H) *และต้องดู TF15 ประกอบ*

* **Stop Loss:** ต่ำกว่า Low ล่าสุดของ TF15

3. **Short (15, ความเสี่ยงสูงมาก):**

* **เหตุผล:** แนวโน้ม TF15 เป็นขาลง, Money Flow เป็นลบ

* **เงื่อนไข:** ราคาไม่สามารถ Breakout EMA หรือแนวต้านอื่นๆ ใน TF15 ได้

* **จุดเข้า:** บริเวณ EMA หรือแนวต้านของ TF15

* **Stop Loss:** เหนือ High ล่าสุดของ TF15

**คำแนะนำ (เน้นย้ำ):**

* **LUNC เป็นเหรียญที่มีความเสี่ยงสูงมาก (High Risk):** มีความผันผวนสูง และอาจมีการเปลี่ยนแปลงอย่างรวดเร็ว

* **ความขัดแย้งของ Timeframes:** สถานการณ์ของ LUNCUSDT มีความขัดแย้งสูงมาก และมีความเสี่ยงสูง

* **Money Flow:** บ่งบอกถึงแรงขายที่เริ่มเข้ามา และแนวโน้มขาขึ้น (ระยะกลาง-ยาว) ที่อ่อนแอลง

* **ถ้าไม่แน่ใจ อย่าเพิ่งเข้าเทรด:** "รอ" เป็นกลยุทธ์ที่ดีที่สุด

* **Risk Management:** สำคัญที่สุด ไม่ว่าจะเลือกกลยุทธ์ใด ต้องมีการบริหารความเสี่ยงที่ดี

**สรุป:** LUNCUSDT กำลังอยู่ในช่วงเวลาที่ยากลำบากและมีความเสี่ยงสูงมากที่สุดในบรรดา 3 เหรียญที่เราวิเคราะห์กันมา การตัดสินใจที่ผิดพลาดอาจนำไปสู่การขาดทุนได้ ควรพิจารณาอย่างรอบคอบก่อนเข้าเทรดทุกครั้ง และ "รอ" จนกว่าจะมีสัญญาณที่ชัดเจนกว่านี้ เป็นทางเลือกที่ปลอดภัยที่สุดสำหรับนักลงทุนส่วนใหญ่ค่ะ

**Disclaimer:** การวิเคราะห์นี้เป็นเพียงความคิดเห็นส่วนตัว ไม่ถือเป็นคำแนะนำในการลงทุน ผู้ลงทุนควรศึกษาข้อมูลเพิ่มเติมและตัดสินใจด้วยความรอบคอบ

-

@ d360efec:14907b5f

2025-02-13 05:27:39

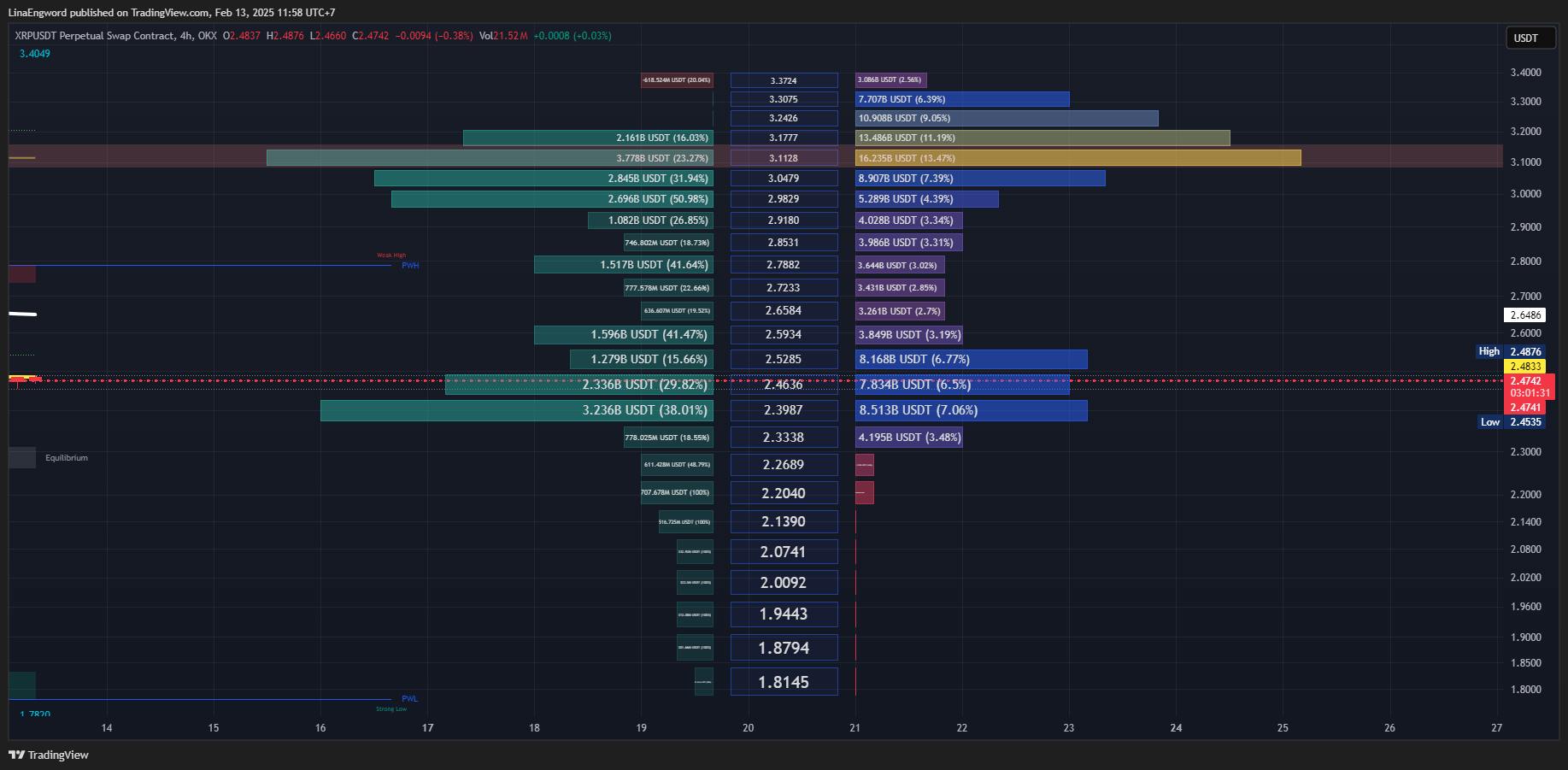

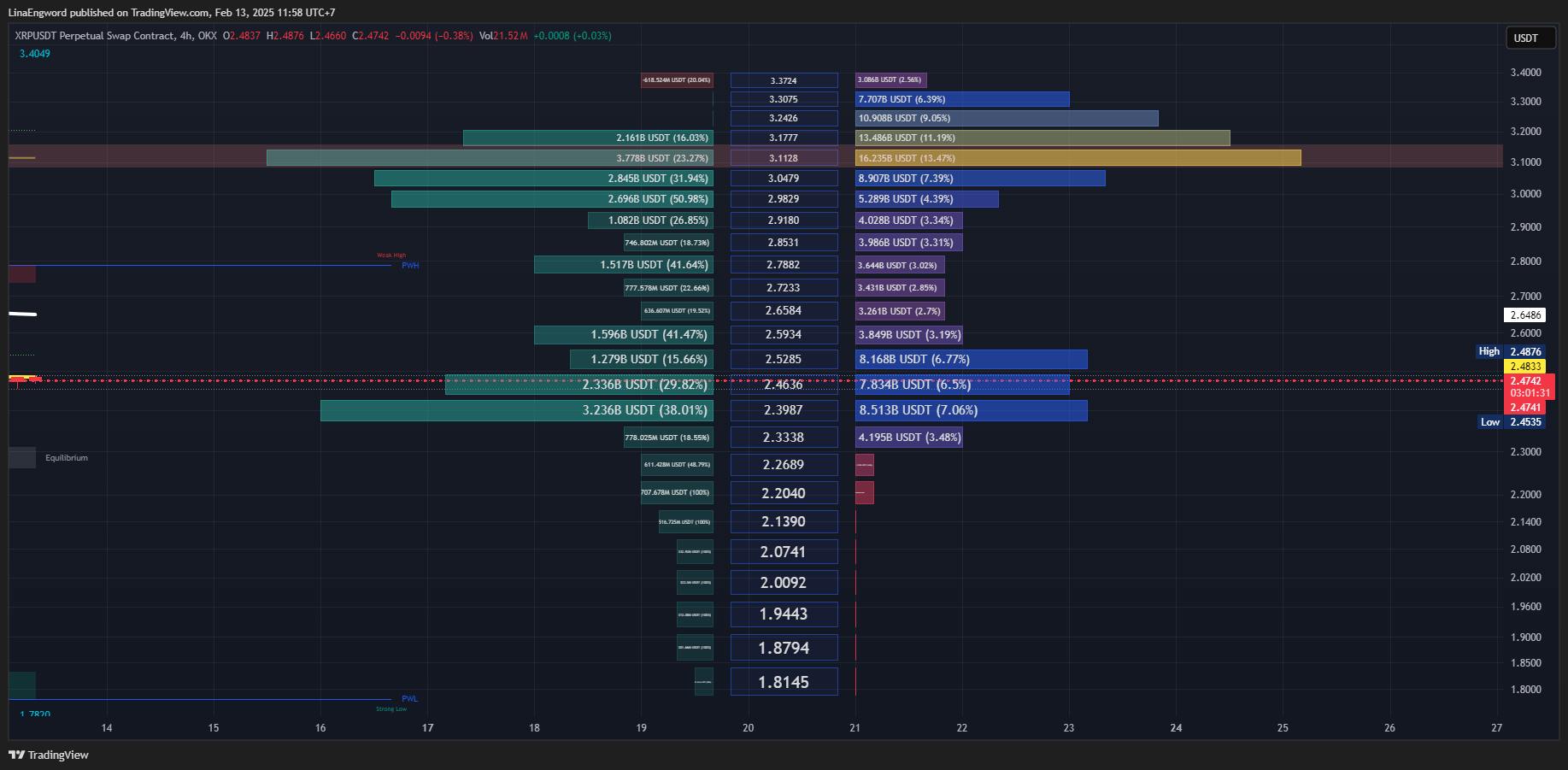

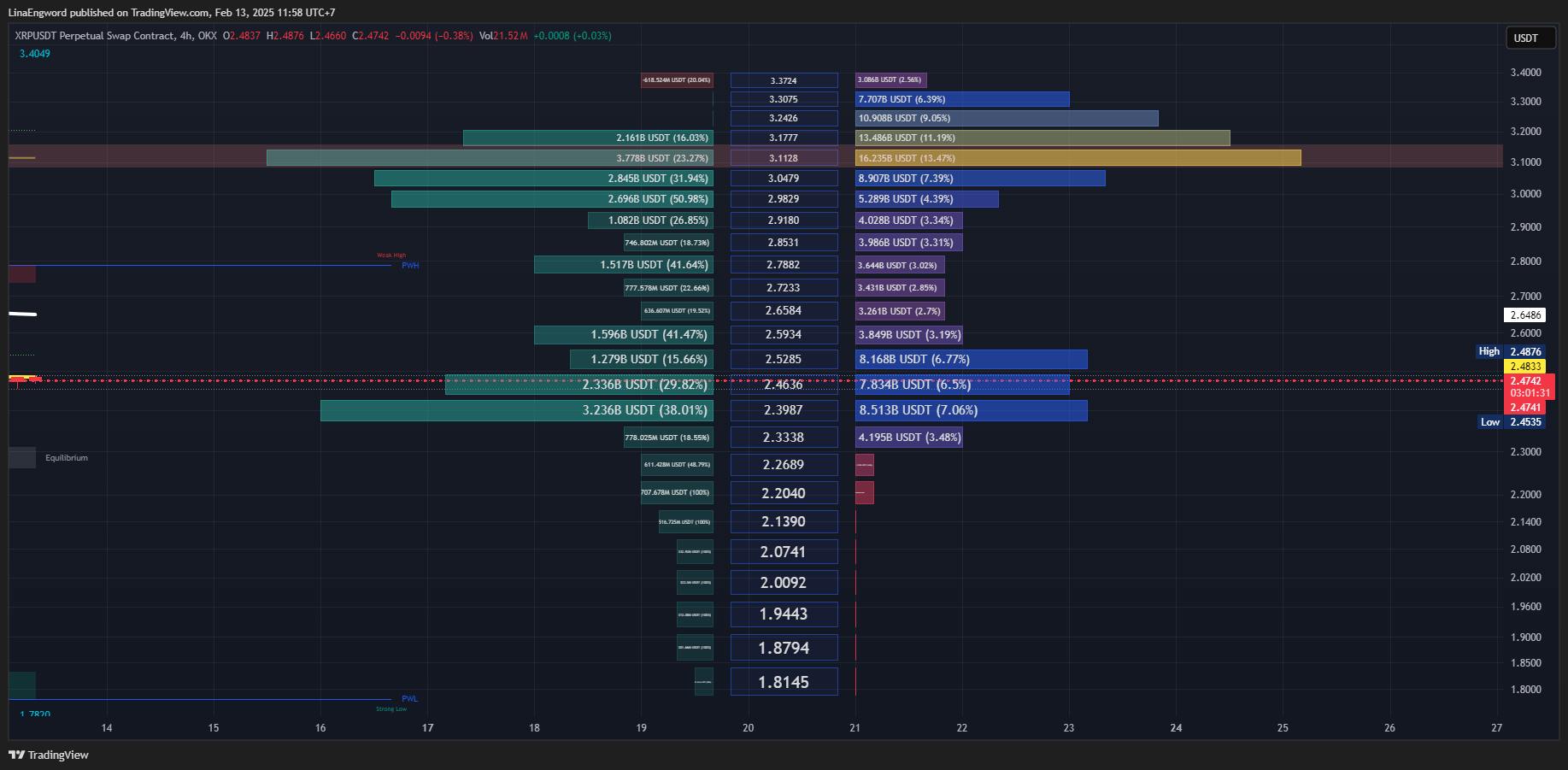

**ภาพรวม XRPUSDT (OKX):**

XRPUSDT กำลังอยู่ในช่วงสำคัญ แนวโน้มระยะยาว (TF Day) เริ่มมีสัญญาณบวกของการเป็นขาขึ้น (Early Uptrend) หลังราคา Breakout EMA 50 และ Money Flow สนับสนุน อย่างไรก็ตาม แนวโน้มระยะกลาง (TF4H) เริ่มแสดงความอ่อนแอลง โดยราคาพักตัวลงมาทดสอบแนวรับสำคัญ และ Money Flow บ่งชี้ถึงแรงซื้อที่ลดลงและแรงขายที่เพิ่มขึ้น ส่วนแนวโน้มระยะสั้นมาก (TF15) เป็นขาลงชัดเจน

**แนวโน้ม:**

* **TF Day:** เริ่มเป็นขาขึ้น (Early Uptrend) - Breakout EMA 50, Money Flow เป็นบวก

* **TF4H:** เริ่มไม่แน่นอน (พักตัว, ทดสอบแนวรับ EMA 50 และ EQL) - Money Flow เริ่มเป็นลบ

* **TF15:** ขาลง (Downtrend) ระยะสั้นมาก - ราคาหลุด EMA, โครงสร้างราคาเป็น Lower Highs/Lows, Money Flow เป็นลบ

**โครงสร้างราคา (SMC):**

| Timeframe | Break of Structure (BOS) | Change of Character (CHoCH) | Higher High (HH) & Higher Low (HL) | Equal Highs (EQH) / Equal Lows (EQL) |

| :-------- | :----------------------- | :--------------------------- | :----------------------------------- | :------------------------------------- |

| Day | ด้านบน (Breakout EMA 50) | ไม่ชัดเจน | เริ่มก่อตัว (แต่ยังไม่ชัดเจน) | - |

| 4H | ด้านบน | ไม่ชัดเจน | เริ่มก่อตัว (แต่ไม่ชัดเจน) | EQH: 3.00-3.20, EQL: 2.2667 |

| 15m | ด้านล่าง | มีทั้งบนและล่าง | Lower Highs (LH) & Lower Lows (LL) | EQH: 2.48-2.50, EQL: 2.38 |

**Money Flow (LuxAlgo):**

* **TF Day:** แรงซื้อแข็งแกร่ง

* **TF4H:** แรงซื้อเริ่มอ่อนแรงลง, แรงขายเริ่มเข้ามา

* **TF15:** แรงขายมีอิทธิพลเหนือกว่า

**EMA (Exponential Moving Average):**

* **TF Day:** EMA 50 & 200 เป็นแนวรับ

* **TF4H:** EMA 50 กำลังถูกทดสอบ, EMA 200 เป็นแนวรับถัดไป

* **TF15:** EMA 50 & 200 เป็นแนวต้าน

**แนวรับ-แนวต้านสำคัญ:**

| Timeframe | แนวรับ | แนวต้าน |

| :-------- | :----------------------------------------------------- | :----------------------------------------------------------------------- |

| Day | EMA 50 (≈1.56), EMA 200 (≈1.08) | 3.4049 (High), 3.00-3.20 (EQH) |

| 4H | EMA 50 (≈2.20), *2.2667 (EQL)*, EMA 200, 1.7820 | 3.4049, 2.3987 (Volume Profile), 3.00-3.20 (EQH) |

| 15m | 2.38 (EQL, Volume Profile), 2.3274 | EMA 50, EMA 200, 2.4196, Equilibrium (≈2.44), 2.48-2.50 (EQH) |

**กลยุทธ์ (XRPUSDT):**

1. **Wait & See (ทางเลือกที่ดีที่สุด):**

* **เหตุผล:** ความขัดแย้งระหว่าง Timeframes สูง, TF4H กำลังทดสอบแนวรับสำคัญ, Money Flow ใน TF4H และ TF15 เป็นลบ

* รอให้ราคาแสดงทิศทางที่ชัดเจน (ยืนเหนือ EMA 50 ใน TF4H ได้ หรือ Breakout แนวต้านใน TF15)

2. **Buy on Dip (Day, 4H) - *ความเสี่ยงสูงมาก*:**

* **เหตุผล:** แนวโน้มระยะยาวยังมีโอกาสเป็นขาขึ้น, Money Flow ใน TF Day เป็นบวก

* **เงื่อนไข (สำคัญมาก):** *ต้อง* รอสัญญาณการกลับตัวใน TF15 ก่อน เช่น:

* Breakout แนวต้านย่อยๆ พร้อม Volume

* Money Flow (TF15) เปลี่ยนเป็นสีเขียว

* Bullish Candlestick Patterns

* **จุดเข้า (Day):** EMA 50, EMA 200 (*ดู TF15 ประกอบ*)

* **จุดเข้า (4H):** EMA 50, *2.2667 (EQL)* (*ดู TF15 ประกอบ*)

* **Stop Loss:** ต่ำกว่า Low ล่าสุดของ TF15 หรือต่ำกว่าแนวรับที่เข้าซื้อ

3. **Short (15, ความเสี่ยงสูงมาก):**

* **เหตุผล:** แนวโน้ม TF15 เป็นขาลง, Money Flow เป็นลบ

* **เงื่อนไข:** ราคาไม่สามารถกลับขึ้นไปยืนเหนือ EMA ของ TF15 ได้

* **จุดเข้า:** บริเวณ EMA ของ TF15 หรือแนวต้านอื่นๆ

* **Stop Loss:** เหนือ High ล่าสุดของ TF15

**คำแนะนำ:**

* **ความขัดแย้งของ Timeframes:** XRPUSDT มีความขัดแย้งสูงมาก และมีความเสี่ยงสูง

* **Money Flow:** Day เป็นบวก, 4H เริ่มเป็นลบ, 15m เป็นลบ

* **EMA 50 (TF4H) & EQL 2.2667:** จุดชี้ชะตา

* **ถ้าไม่แน่ใจ อย่าเพิ่งเข้าเทรด:** "รอ" ดีที่สุด

* **Risk Management:** สำคัญที่สุด

**สรุป:** สถานการณ์ของ XRPUSDT ตอนนี้มีความเสี่ยงสูงมาก และไม่เหมาะกับนักลงทุนที่รับความเสี่ยงได้ต่ำ การ "รอ" จนกว่าจะมีสัญญาณที่ชัดเจนกว่านี้ เป็นทางเลือกที่ปลอดภัยที่สุดค่ะ

Disclaimer: การวิเคราะห์นี้เป็นเพียงความคิดเห็นส่วนตัว ไม่ถือเป็นคำแนะนำในการลงทุน ผู้ลงทุนควรศึกษาข้อมูลเพิ่มเติมและตัดสินใจด้วยความรอบคอบ

-

@ d360efec:14907b5f

2025-02-13 04:47:20

**ภาพรวม BTCUSDT :**

Bitcoin (BTCUSDT) กำลังอยู่ในช่วงสำคัญ แม้ว่าแนวโน้มหลักในระยะกลางถึงยาว (TF Day & 4H) จะยังคงเป็นขาขึ้นที่แข็งแกร่ง แต่ในระยะสั้นมาก (TF15) กลับแสดงสัญญาณของความอ่อนแอและการปรับฐานลงมา ทำให้เกิดความไม่แน่นอนในทิศทางของราคา อย่างไรก็ตาม *Money Flow ใน TF Day บ่งชี้ว่าแรงซื้อโดยรวมยังคงแข็งแกร่ง*

**แนวโน้ม:**

* **TF Day:** ขาขึ้น (Uptrend) แข็งแกร่ง – ราคาอยู่เหนือ EMA 50 และ EMA 200, โครงสร้างราคาเป็น Higher Highs (HH) และ Higher Lows (HL), *Money Flow เป็นบวก (แรงซื้อ)*

* **TF4H:** ขาขึ้น (Uptrend) – ราคาอยู่เหนือ EMA, มีการพักตัวลงมา (Pullback) แต่ยังไม่เสียโครงสร้างขาขึ้น, *Money Flow เริ่มอ่อนแรง (แรงซื้อลดลง, แรงขายเพิ่มขึ้น)*

* **TF15:** ขาลง (Downtrend) ระยะสั้นมาก – ราคาหลุด EMA และแนวรับย่อย, โครงสร้างราคาเป็น Lower Highs (LH) และ Lower Lows (LL), *Money Flow เป็นลบ (แรงขาย)*

**โครงสร้างราคา (SMC):**

* **TF Day:** ยืนยันแนวโน้มขาขึ้น (HH, HL, BOS)

* **TF4H:** ยืนยันแนวโน้มขาขึ้น (HH, HL, BOS), มี Equal Highs (EQH) ที่เป็นแนวต้าน

* **TF15:** บ่งบอกถึงแนวโน้มขาลงระยะสั้น (BOS ด้านล่าง, LH, LL), มี EQH เป็นแนวต้าน

**Money Flow (LuxAlgo) - สรุป:**

* **TF Day:** แรงซื้อยังคงแข็งแกร่งอย่างชัดเจน

* **TF4H:** แรงซื้อเริ่มอ่อนแรงลง, มีแรงขายเข้ามา

* **TF15:** แรงขายมีอิทธิพลเหนือกว่า

**EMA (Exponential Moving Average):**

* **TF Day & 4H:** EMA 50 & 200 เป็นแนวรับสำคัญ

* **TF15:** EMA 50 & 200 กลายเป็นแนวต้าน

**แนวรับ-แนวต้านสำคัญ:**

| Timeframe | แนวรับ | แนวต้าน |

| :-------- | :------------------------------------------------------------------------- | :-------------------------------------------------------------- |

| Day | EMA 50, EMA 200, 96,000-98,000, 85,724.7 | 109,998.9 (High เดิม) |

| 4H | EMA 50, EMA 200, 96,000-98,000, 89,037.0 | 109,998.9 (EQH, High เดิม) |

| 15m | 95,200 (Low ล่าสุด), 94,707.4 (Low ก่อนหน้า) | EMA 50, EMA 200, บริเวณ 96,000, 96,807.8, 97,000-97,200 |

**กลยุทธ์ (BTCUSDT):**

1. **Buy on Dip (Day, 4H) - *มีความน่าเชื่อถือมากขึ้น แต่ยังคงต้องระมัดระวัง*:**

* **เหตุผล:** แนวโน้มหลักยังเป็นขาขึ้น, Money Flow ใน TF Day แข็งแกร่ง

* **เงื่อนไข:** *ยังคงต้องรอสัญญาณการกลับตัวของราคาใน TF15 ก่อน* (Breakout แนวต้านย่อย, Money Flow TF15 เป็นบวก, Bullish Candlestick Patterns)

* **จุดเข้า (Day):** EMA 50, EMA 200, บริเวณ 96,000-98,000

* **จุดเข้า (4H):** EMA 50

* **Stop Loss:** ต่ำกว่า Low ล่าสุดของ TF15 หรือต่ำกว่าแนวรับที่เข้าซื้อ

2. **Short (15, ความเสี่ยงสูงมาก):**

* **เหตุผล:** แนวโน้ม TF15 เป็นขาลง, Money Flow TF15 เป็นลบ

* **เงื่อนไข:** ราคาไม่สามารถกลับขึ้นไปยืนเหนือ EMA ของ TF15 ได้

* **จุดเข้า:** บริเวณ EMA ของ TF15 หรือแนวต้านอื่นๆ

* **Stop Loss:** เหนือ High ล่าสุดของ TF15

3. **Wait & See (ทางเลือกที่ปลอดภัย):**

* **เหตุผล:** ความขัดแย้งระหว่าง Timeframes ยังคงมีอยู่

* รอให้ตลาดเฉลยทิศทางที่ชัดเจนกว่านี้

**คำแนะนำ (เน้นย้ำ):**

* **Money Flow ใน TF Day:** เป็นปัจจัยบวกที่สำคัญ ทำให้กลยุทธ์ Buy on Dip มีน้ำหนักมากขึ้น

* **ความขัดแย้งของ Timeframes:** ยังคงต้องระวัง TF15 ที่เป็นขาลง

* **Volume:** การ Breakout/Breakdown ใดๆ ควรมี Volume สนับสนุน

* **Risk Management:** สำคัญที่สุด

**สรุป:**

สถานการณ์ของ BTCUSDT โดยรวมยังคงเป็นบวก (ขาขึ้น) แต่มีความเสี่ยงในระยะสั้นจาก TF15 การตัดสินใจลงทุนควรพิจารณาจาก Timeframe ที่เหมาะสมกับสไตล์การเทรดของคุณ และอย่าลืมบริหารความเสี่ยงเสมอค่ะ

**Disclaimer:** การวิเคราะห์นี้เป็นเพียงความคิดเห็นส่วนตัว ไม่ถือเป็นคำแนะนำในการลงทุน ผู้ลงทุนควรศึกษาข้อมูลเพิ่มเติมและตัดสินใจด้วยความรอบคอบ

-

@ 2183e947:f497b975

2025-02-13 04:44:45

# How Coinpools Improve Bitcoin

# Problems with bitcoin

UX problems with base layer payments include:

- Mining fees are sometimes high

- Confirmations usually take several minutes

- Using it privately requires running a coinjoin server

UX problems with lightning payments include:

- Setup fees are sometimes high

- Payments frequently fail

- Payments aren't asynchronous (the recipient has to stand there with their device open waiting to do a revoke_and_ack on their old state -- unless they use a custodian)

- Payments that *do* succeed occasionally take more than 30 seconds (due to stuck payments, automatic retries, and no ability to say "stop retrying" in any existing wallets that I'm aware of)

- Using it privately requires manual channel management

# Solutions

A lot of my recent work focuses on non-interactive coinpools. I figured out a way to do them on bitcoin if we had CTV + CSFS, and then, with a bit more thought, I figured out that my model didn't actually require those things, so I am now working on an implementation. But my model does benefit a lot from CTV (less sure about CSFS at this point) so let me outline how non-interactive coinpools fix the above problems and along the way I will share how CTV specifically improves coinpools.

## "Mining fees are sometimes high"

Coinpools improve the problem of "mining fees are sometimes high" by letting you bypass them in more cases. If you're in a coinpool and pay someone else in the same coinpool, your payment does not show up on the base layer, it just involves modifying some unilateral withdrawal transactions such that the sender can withdraw less and the recipient can withdraw more. The transactions are off-chain, like LN transactions, so you can do that without paying a base layer fee.

## "Confirmations usually take several minutes"

Coinpools improve the problem of "confirmations usually take several minutes" in a similar manner. Payments *inside* a coinpool (i.e. to another pool user) merely involve modifying off-chain data (and revoking an old state), so they can be as fast as lightning. In most cases I expect them to be a bit faster because there's less need for pathfinding or negotiating with a variety of routing nodes. If the sender and the recipient are in the same pool, they only need to talk to each other and, in my model, a coordinator.

## "Using the base layer privately requires running a coinjoin server"

Coinpools improve the problem of "using the base layer privately requires running a coinjoin server" in two ways: first, if you're in a coinpool and you send money to a bitcoin address, the blockchain doesn't know which coinpool user sent that payment. Analysts might be able to trace the payment to the coinpool, but from the blockchain's perspective, that's just a multisig; the actual person *inside* the multisig who sent the money is not revealed. However, my model uses a coordinator, and the coordinator probably knows which user sent the payment. Still, only 1 person knowing is better than having everyone on the blockchain know.

Second, if you send money to someone *inside* the coinpool, in my model, the only people who know about your payment are the sender, the recipient, and the coordinator, and the recipient does not know who the sender is. Moreover, my model allows users to act as bridges from LN to other pool users, so even the coordinator doesn't know if the person who *looks* like the sender was the *real* sender or just a bridge node, with the *real* sender being someone on lightning.

## "Setup fees on lightning are sometimes high"

Coinpools improve the problem of "setup fees are sometimes high" by having multiple users share the setup cost. My model allows a single bitcoin transaction to fund a coinpool with a number of members between 1 and probably about 100. (The max I've actually successfully tested is 11.) If the users share the cost of that transaction, then even in a high fee scenario, where bitcoin transactions cost $50, each user only has to pay a fraction of that, where the fraction is determined by how many users are joining the pool. If 10 people are joining, each user would pay $5 instead of $50. If 50 people are joining, each user would pay $1. If 100 people are joining, each user would pay 50¢.

## Sidebar: how CTV improves my coinpool model

The setup is also where CTV greatly improves my model. For my model to work, the users have to coordinate to create the pool in something I call a "signing ceremony," which is very similar to a coinjoin. The signing ceremony has to be scheduled and each user has to show up for it or they won't get into the pool. With CTV, you could fix this: instead of a signing ceremony, an exchange could autosend your money into a coinpool on e.g. a monthly basis and email you the data you need to perform your unilateral exit. All they need from you is a pubkey, and they can do everything else.

## "Lightning payments frequently fail"

Coinpools improve the problem of "payments frequently fail" by reducing the need for pathfinding, which is a typical cause of failure on lightning. If you are paying someone in the same pool as you, you always know an exact path: it will be you -> coordinator -> recipient. These short paths also reduce the likelihood of routing nodes having insufficient capacity to forward the payment. You've only got one "routing node" to worry about -- the coordinator.

## "Lightning payments aren't asynchronous"

Coinpools *in general* don't improve the problem of "payments aren't asynchronous" but my model in particular *does* improve that problem because I am combining it with my hedgehog protocol from last year, which *does* allow for asynchronous lightning-like payments. Relatedly, my coinpool model technically has a network model, it's just a hub-and-spoke network: the coordinator is connected to every user of the pool and can forward asynchronous hedgehog payments to them. This means you can send money to someone when they are offline; they'll get it whenever they *do* get online, even if *you* went offline in the meantime.

## "Lightning payments sometimes take too long"

Coinpools improve the problem of "stuck" lightning payments by reducing the number of hops along the route. As above, a payment inside the pool (per my model) is always just sender -> coordinator -> recipient. Due to only having 1 hop, there are fewer opportunities for a node to have a network issue and cause a delay.

## "Channel management is a pain"

Coinpools have multiple ways of improving the problem of manual channel management. In particular, not all coinpool models *have* channels, so channel management is not always needed in a coinpool. My model, however, does have channels, so channel management is still a thing.

Nonetheless, my model improves channel management in two ways: first, the setup costs are lower for the reasons given above. Second, payment asynchronicity helps for the following reason:

The worst pain point in channel management *today* occurs when someone sends you a payment but it fails because you didn't have enough inbound capacity. That doesn't happen in my coinpool model because payments are asynchronous. If you don't have enough inbound capacity, the payment doesn't fail, it just remains pending. So all you have to do is open a new channel (i.e. enter a new pool) and *then* finalize the payment.

## Zap me

I hope this essay clarifies why coinpools improve the problems I outlined and why CTV improves coinpools. I also hope this gets you a bit excited for my latest coinpool invention, which I hope to release soon :D (It really is very close to demo-ready.) If you liked this essay, consider zapping me: supertestnet@coinos.io

-

@ a012dc82:6458a70d

2025-02-13 04:00:01

In the dynamic world of global finance, the interplay between traditional monetary policy and the burgeoning digital asset market is becoming increasingly prominent. The U.S. Federal Reserve's recent pivot towards a more accommodative monetary policy has sparked intense discussion among investors, economists, and cryptocurrency enthusiasts. This shift, characterized by an expected reduction in interest rates, is not just a routine adjustment but a significant move that could have far-reaching implications for various asset classes, including cryptocurrencies like Bitcoin. As we delve into this topic, we aim to unravel the complexities of the Fed's policy change and its potential ripple effects on Bitcoin, a digital asset that has been a subject of much intrigue and speculation.

**Table Of Content**

- Understanding the Fed's Policy Shift

- Impact on Traditional Financial Markets

- Bitcoin's Response to Monetary Easing

- Analyzing the Economic Backdrop

- Bitcoin: A Safe Haven or Risk Asset?

- Risks and Opportunities

- Conclusion

- FAQs

**Understanding the Fed's Policy Shift**

The Federal Reserve, the guardian of the U.S. monetary system, wields immense influence over global financial markets. Its recent signaling of a dovish turn – an expectation of 75 basis points in rate cuts by 2024 – marks a significant departure from its previous stance. This change is reflective of the Fed's response to a confluence of macroeconomic factors, such as fluctuating inflation rates, global economic uncertainties, and domestic financial stability concerns. The Fed's decisions are closely monitored as they set the tone for economic growth, inflation control, and financial market stability. In this context, the anticipated rate cuts suggest a strategic move to stimulate economic activity by making borrowing cheaper, thereby potentially boosting investment and consumption. However, this policy shift is not without its complexities and nuances, as it must balance the fine line between stimulating growth and controlling inflation.

**Impact on Traditional Financial Markets**

The ripple effects of the Fed's policy announcement were immediately felt across traditional financial markets. Stock markets, often seen as a barometer of economic sentiment, reacted positively, with indices like the Dow Jones Industrial Average reaching new heights. This surge reflects investors' optimism about the potential for increased corporate profits and economic growth in a lower interest rate environment. Similarly, the bond market experienced a significant rally, with yields on government securities falling as bond prices rose. This movement in the bond market is indicative of investors' expectations of a more accommodative monetary policy, which typically leads to lower yields on fixed-income securities. These market reactions underscore the pivotal role of central bank policies in shaping investor sentiment and the direction of financial markets. They also highlight the interconnectedness of various asset classes, as changes in monetary policy can have cascading effects across different sectors of the economy.

**Bitcoin's Response to Monetary Easing**

Bitcoin's reaction to the Fed's dovish turn has been a subject of keen interest. The cryptocurrency, which had been experiencing volatility, showed signs of recovery following the Fed's announcement. This response is indicative of Bitcoin's increasing correlation with broader financial market trends, a significant development given its history as an uncorrelated asset. Bitcoin's sensitivity to macroeconomic factors like central bank policies points to its growing integration into the mainstream financial ecosystem. However, this integration also means that Bitcoin is increasingly exposed to the same macroeconomic risks and uncertainties that affect traditional assets. The Fed's policy shift could potentially make Bitcoin more attractive to investors seeking non-traditional assets in a low-interest-rate environment. However, Bitcoin's complex dynamics, including its decentralized nature, limited supply, and regulatory landscape, add layers of complexity to its response to monetary policy changes.

**Analyzing the Economic Backdrop**

The economic backdrop against which the Fed's policy shift occurs is multifaceted and dynamic. On one hand, the U.S. economy has demonstrated resilience, with robust GDP growth and positive retail sales figures suggesting underlying strength. On the other hand, inflation, though moderated from its peak, remains a concern, hovering above the Fed's target. This economic duality presents a challenging scenario for policymakers, who must navigate the delicate balance between stimulating growth and containing inflation. For investors and market participants, this creates an environment of uncertainty, as they must decipher mixed signals from economic data and policy announcements. In this context, Bitcoin's role and response become even more intriguing, as it operates at the intersection of technology, finance, and macroeconomics.

**Bitcoin: A Safe Haven or Risk Asset?**

The debate over Bitcoin's classification as a safe haven or a risk asset is intensified by the Fed's easing stance. Traditionally, in a low-interest-rate environment, investors seek assets that can serve as hedges against inflation and currency devaluation. Gold has historically played this role, and Bitcoin, with its fixed supply and digital scarcity, has drawn comparisons to gold. However, Bitcoin's relatively short history and high volatility make it a more complex and potentially riskier asset. The Fed's dovish policy could enhance Bitcoin's appeal as an alternative investment, especially if traditional assets like bonds offer lower returns. However, Bitcoin's classification as a safe haven is still a matter of debate, with opinions divided on its long-term stability and value retention capabilities.

**Risks and Opportunities**

Investors considering Bitcoin in light of the Fed's policy change face a landscape filled with both risks and opportunities. The potential for a Bitcoin rally in a low-interest-rate environment is counterbalanced by the cryptocurrency's inherent volatility and regulatory uncertainties. Bitcoin's price movements can be dramatic and unpredictable, influenced by a range of factors from technological developments to geopolitical events. Additionally, the regulatory environment for cryptocurrencies is still evolving, with potential changes posing risks to Bitcoin's accessibility and value. Investors must also consider the broader global economic context, including actions by other central banks and international trade dynamics, which can impact Bitcoin's market movement.

**Conclusion**

The Federal Reserve's shift towards a more accommodative monetary policy in 2024 presents a fascinating scenario for Bitcoin and the broader cryptocurrency market. This development underscores the increasing relevance of digital assets in the global financial landscape and highlights the complex interplay between traditional monetary policies and emerging financial technologies. As Bitcoin continues to evolve and gain acceptance, its response to macroeconomic factors like central bank policies will be a critical area of focus for investors. In navigating this dynamic and uncertain environment, a cautious and well-informed approach is essential for those looking to explore the opportunities and navigate the challenges of cryptocurrency investments. The coming years promise to be a pivotal period in the maturation of Bitcoin as it responds to the shifting tides of global finance.

**FAQs**

**How does the Federal Reserve's easing stance impact Bitcoin?**

The Fed's shift towards lower interest rates can make riskier assets like Bitcoin more attractive to investors. This is because lower rates often lead to reduced yields on traditional investments, prompting investors to seek higher returns elsewhere.

**What is the significance of the Fed's 'dot plot' for Bitcoin investors?**

The 'dot plot' is a projection of interest rate movements by Federal Reserve members. A shift towards lower rates, as indicated in the recent dot plot, can signal a more accommodative monetary policy, potentially impacting Bitcoin's market as investors adjust their portfolios.

**Can Bitcoin be considered a safe haven asset in light of the Fed's policy?**

Bitcoin's role as a safe haven asset is debated. While its fixed supply and digital nature offer some safe haven characteristics, its volatility and regulatory uncertainties make it a complex choice compared to traditional safe havens like gold.

**What risks should Bitcoin investors consider in the context of the Fed's easing policy?**

Investors should be aware of Bitcoin's volatility, regulatory changes, and its sensitivity to macroeconomic factors. Additionally, global economic conditions and actions by other central banks can also influence Bitcoin's market.

**How does the economic backdrop influence Bitcoin's response to the Fed's policy?**

Economic factors like GDP growth, inflation rates, and retail sales impact investor sentiment and risk appetite, which in turn can affect Bitcoin's market. A strong economy might reduce the appeal of risk assets like Bitcoin, while economic uncertainties can increase their attractiveness.

**That's all for today**

**If you want more, be sure to follow us on:**

**NOSTR: croxroad@getalby.com**

**X: @croxroadnews.co**

**Instagram: @croxroadnews.co**

**Youtube: @croxroadnews**

**Store: https://croxroad.store**

**Subscribe to CROX ROAD Bitcoin Only Daily Newsletter**

**https://www.croxroad.co/subscribe**

***DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.***

-

@ 57d1a264:69f1fee1

2025-02-13 03:45:23

**What You Will Learn:**

- Understanding the concept of cybersecurity

- Networking Basics

- Operating Systems Overview

- Introduction to Kali Linux

- Threat Actors and Cyber Threats

- Ethical Hacking Techniques and Tools.

**How to Register:**

Use this link to Register.

https://forms.gle/L8AGLCWU4djwUXxz9

originally posted at https://stacker.news/items/884407

-

@ f6488c62:c929299d

2025-02-13 02:39:41

Lowering interest rates is one of the tools that central banks use to manage the economy, especially during periods of inflation, which causes the prices of goods and services to rise. Lowering interest rates not only helps stimulate spending but can also foster sustainable growth in businesses and labor markets.

Access to Capital and Economic Stimulation

When interest rates are lowered, the public can access capital more easily. With lower interest rates, borrowing becomes less burdensome, giving individuals and businesses the opportunity to start new ventures or expand existing businesses. This leads to increased investment and spending, which in turn keeps the economy circulating and growing.

For instance, when people can easily borrow money to start a new business—such as an online store or a product manufacturing business—the increase in entrepreneurs and the availability of goods in the market will ensure that the supply is sufficient to meet consumer demand. This, in turn, prevents prices from rising too much due to a lack of supply.

Reducing Inflation by Increasing Supply

Increasing the supply of goods and services in the market can significantly help in controlling inflation. When there are more goods or services available to meet market demand, competition among producers will naturally drive prices down. This is the basic principle of market dynamics: when there’s enough supply, prices are less likely to increase, even in times of high demand.

In addition, increasing supply helps address shortages, which are one of the key drivers of rising prices. When there is enough product available to satisfy demand, inflationary pressures can be relieved, and prices can stabilize.

Redistributing Income and Reducing Inequality

Lower interest rates also play a crucial role in redistributing income within society. By making access to capital easier, especially for those with lower or middle incomes, the public’s purchasing power increases, which can stimulate spending on essential goods and services.

When people have more money in hand, they are better able to access necessary products. This boosts demand in the market. However, alongside this increased demand, sufficient supply is needed to prevent prices from rising uncontrollably, which can lead to inflation.

Moreover, supporting the population through welfare programs or initiatives that allow everyone to access education and investment opportunities helps individuals create products and value in the market. A diverse market with a variety of products increases production efficiency and helps mitigate economic inequality, ensuring a more balanced and inclusive economy.

Conclusion

Lowering interest rates and redistributing income effectively can stimulate economic growth and reduce inflation. This works by ensuring there is sufficient supply to meet market demand, while also providing capital that allows the public to start new businesses and generate new products in the market.

For sustainable long-term economic growth, managing inflation should go hand in hand with investing in infrastructure and ensuring wealth distribution. This ensures that everyone has equal access to opportunities, leading to steady economic growth without negatively impacting the majority of society.

In summary, lowering interest rates is a key tool in stimulating the economy and reducing inflation, especially when the economy faces imbalances. It not only increases supply, but also promotes income redistribution and the creation of an economy that is more equitable in the long run.

@ 04ed2b8f:75be6756

2025-02-13 08:02:39Freedom. It’s the word on everyone’s lips, the dream of every soul. We long for it, we chase it, we believe that if we can break free from this chain or that constraint, we will finally be free. **But true freedom is not about external circumstances—it’s about control.** The truth is, **the most powerful chains are the ones we place on ourselves**. The world can throw its challenges at you, life can dish out its unfair blows, but **if you cannot control yourself, your thoughts, your emotions, your reactions, then you are no different than a prisoner.** There is no freedom in chaos. There is no freedom in losing control. **Freedom is mastery—mastery of the self.** ## **Freedom Begins Within** You can have all the money in the world, live in the most luxurious place, and have every material possession your heart desires, but **if you cannot control your impulses, your habits, your desires—none of that will matter.** You are still a slave to your cravings. You are still a puppet to your own emotions, and that is **no real freedom.** What does freedom look like? - **It’s the power to act with purpose, not to react out of emotion.** - **It’s the strength to stay disciplined when every part of you wants to quit.** - **It’s the courage to say ‘no’ to distractions, to temptation, to things that steer you off course.** - **It’s the clarity to make choices that serve your growth, not your immediate desires.** True freedom is the ability to say, “I am in control of myself. I do not let my circumstances control me, nor my emotions rule me. I dictate my actions, my thoughts, my destiny.” ## **Self-Control: The Ultimate Weapon** The power to control yourself is your greatest weapon. Without it, **you are at the mercy of every challenge, every temptation, and every fleeting emotion**. You may feel like you are “free,” but without self-discipline, you are just a puppet swaying in the wind, vulnerable to every whim that blows your way. - **The impulse to procrastinate? You overcome it.** - **The desire to give up? You push through it.** - **The craving for comfort? You choose growth.** In the face of any storm, a man with self-control remains grounded, focused, and clear. He doesn’t react in anger or fear—he acts with purpose, with precision, and with vision. A man who cannot control himself is a man who is owned by his emotions, his desires, his distractions. But the man who conquers his mind, his body, his impulses—he is the one who **owns his life.** ## **The Price of Freedom** It’s not easy to control yourself. It requires constant effort, relentless discipline, and the courage to face yourself head-on. It means saying ‘no’ to what feels good now, to invest in what will make you stronger later. It means constantly improving, constantly fighting the urge to quit, to give in, to indulge in comfort. But the price of freedom is worth it. **For when you have control over yourself, no one can take your power.** You become the master of your fate. **You become unshakable.** ## **Freedom Through Discipline** So, ask yourself: **Are you truly free, or are you simply a slave to your impulses?** - **Do you control your actions, or do your actions control you?** - **Are you the master of your emotions, or are they the masters of you?** Freedom isn’t just about having no chains; it’s about not letting anything control you—least of all yourself. **And when you control yourself, there’s nothing you can’t accomplish.** A man who cannot control himself is never truly free. But a man who conquers his mind, his habits, his emotions—he is unstoppable. **Now go and choose to control yourself, and unlock the freedom that’s waiting for you. Or remain a prisoner to your impulses, forever shackled by the chains of your own making. The choice is yours.**

@ 04ed2b8f:75be6756

2025-02-13 08:02:39Freedom. It’s the word on everyone’s lips, the dream of every soul. We long for it, we chase it, we believe that if we can break free from this chain or that constraint, we will finally be free. **But true freedom is not about external circumstances—it’s about control.** The truth is, **the most powerful chains are the ones we place on ourselves**. The world can throw its challenges at you, life can dish out its unfair blows, but **if you cannot control yourself, your thoughts, your emotions, your reactions, then you are no different than a prisoner.** There is no freedom in chaos. There is no freedom in losing control. **Freedom is mastery—mastery of the self.** ## **Freedom Begins Within** You can have all the money in the world, live in the most luxurious place, and have every material possession your heart desires, but **if you cannot control your impulses, your habits, your desires—none of that will matter.** You are still a slave to your cravings. You are still a puppet to your own emotions, and that is **no real freedom.** What does freedom look like? - **It’s the power to act with purpose, not to react out of emotion.** - **It’s the strength to stay disciplined when every part of you wants to quit.** - **It’s the courage to say ‘no’ to distractions, to temptation, to things that steer you off course.** - **It’s the clarity to make choices that serve your growth, not your immediate desires.** True freedom is the ability to say, “I am in control of myself. I do not let my circumstances control me, nor my emotions rule me. I dictate my actions, my thoughts, my destiny.” ## **Self-Control: The Ultimate Weapon** The power to control yourself is your greatest weapon. Without it, **you are at the mercy of every challenge, every temptation, and every fleeting emotion**. You may feel like you are “free,” but without self-discipline, you are just a puppet swaying in the wind, vulnerable to every whim that blows your way. - **The impulse to procrastinate? You overcome it.** - **The desire to give up? You push through it.** - **The craving for comfort? You choose growth.** In the face of any storm, a man with self-control remains grounded, focused, and clear. He doesn’t react in anger or fear—he acts with purpose, with precision, and with vision. A man who cannot control himself is a man who is owned by his emotions, his desires, his distractions. But the man who conquers his mind, his body, his impulses—he is the one who **owns his life.** ## **The Price of Freedom** It’s not easy to control yourself. It requires constant effort, relentless discipline, and the courage to face yourself head-on. It means saying ‘no’ to what feels good now, to invest in what will make you stronger later. It means constantly improving, constantly fighting the urge to quit, to give in, to indulge in comfort. But the price of freedom is worth it. **For when you have control over yourself, no one can take your power.** You become the master of your fate. **You become unshakable.** ## **Freedom Through Discipline** So, ask yourself: **Are you truly free, or are you simply a slave to your impulses?** - **Do you control your actions, or do your actions control you?** - **Are you the master of your emotions, or are they the masters of you?** Freedom isn’t just about having no chains; it’s about not letting anything control you—least of all yourself. **And when you control yourself, there’s nothing you can’t accomplish.** A man who cannot control himself is never truly free. But a man who conquers his mind, his habits, his emotions—he is unstoppable. **Now go and choose to control yourself, and unlock the freedom that’s waiting for you. Or remain a prisoner to your impulses, forever shackled by the chains of your own making. The choice is yours.** @ bf47c19e:c3d2573b