-

@ 13e63e99:25525c6a

2025-01-16 04:19:03

<img src="https://blossom.primal.net/fe9e24ef5619e5a9230cf83bd3f5e6d7c5c8bc608e08480c3d063096f73929b0.webp">

## U.S. Labor Markets

The U.S. economy demonstrated resilience in December, adding 256,000 jobs, far exceeding expectations of 155,000. The unemployment rate remained steady at 4.1%, reflecting a strong labor market even as wage growth moderated to 3.9% year-over-year. This performance capped a robust year for U.S. employment, despite headwinds from tightening monetary policy and geopolitical uncertainties.

The jobs report reinforced expectations that the Federal Reserve may slow the pace of rate cuts in 2025. The Fed’s December meeting minutes indicated officials remain cautious about inflation risks, with Federal Reserve Governor Michelle Bowman stating that inflation remains “uncomfortably above” the 2% target. This hawkish stance, combined with resilient economic data, suggests interest rates could stay elevated longer than previously anticipated.

Investors reacted sharply to the report, sending equities lower on Friday as the implications for tighter financial conditions weighed on sentiment.

### **Equity Markets Under Pressure Amid Inflation and Policy Concerns**

U.S. equities posted losses as inflation fears and political uncertainty dominated market sentiment. Began positively, with optimism around potential softening of trade policies under President-elect Donald Trump. However, this faded after Trump dismissed reports of a more lenient tariff stance.

Economic data further dampened optimism. The Institute for Supply Management’s (ISM) Services PMI for December came in at 54.1, signaling continued expansion in the services sector. However, the index’s prices-paid component jumped by 6.2 percentage points to 64.4, raising concerns about persistent inflationary pressures.

### **Treasury Yields Surged on Strong Jobs Data**

U.S. Treasury yields climbed throughout the week and spiked on Friday following the strong labor market report. The benchmark 10-year Treasury yield reached its highest intraday level since November 2023. This movement reflects market expectations that the Fed will maintain higher interest rates for an extended period to combat inflation.

In the corporate bond market, investment-grade issuances were heavily oversubscribed, though spreads widened due to elevated supply. High-yield bonds mirrored equity market performance, trading in a mixed and cautious environment. Utilities gained attention amid California wildfires, adding to regional economic uncertainties.

> Reference: [T.RowePrice](https://www.troweprice.com/personal-investing/resources/insights/global-markets-weekly-update.html)

<img src="https://blossom.primal.net/7ea878597478faf3188452fbed2459c7985ce9c90fa40784c44e1d8d77ca0ea9.webp">

The debut of US spot Bitcoin exchange-traded funds (ETFs) in 2024 marked a turning point for the bitcoin market and traditional finance, achieving unparalleled success in its first year. Approved by the US Securities and Exchange Commission (SEC) on January 10, 2024, these ETFs launched the following day, swiftly capturing the attention of institutional and retail investors alike.

<img src="https://blossom.primal.net/32f293a944b464bb80bc8f1c3e6a2eab782e8274443377b01fd35a8ec7e96beb.png">

### **Explosive Growth Surpassing Projections**

BlackRock’s Bitcoin ETF reached $61 billion in assets under management (AUM) within a year—a feat that took its gold ETF two decades to achieve. This rapid growth reflects the pent-up demand for institutional-grade Bitcoin exposure. Investors were drawn to ETFs’ simplicity and familiarity, eliminating the challenges of self-custody while ensuring regulatory compliance.

### **Drivers of Success**

#### **Institutional Demand and Market Readiness**

For over a decade, the bitcoin community anticipated a US spot Bitcoin ETF. Its launch fulfilled a significant market gap, providing institutions and sophisticated investors with a way to access Bitcoin without the risks and complexities of direct ownership.

#### **Favorable Economic and Policy Environment**

The 2024 macroeconomic backdrop amplified demand. Federal Reserve interest rate cuts eased financial conditions, while Bitcoin-friendly policies under President-elect Donald Trump added regulatory clarity. Analysts also pointed to the asset’s price recovery and upcoming events, such as the Bitcoin halving in April 2024, which historically drive price appreciation.

#### **Global Trust in US Financial Markets**

As the birthplace of ETFs and the largest capital market globally, the US offers unmatched liquidity and investor confidence. With ETFs managing over $10.5 trillion in AUM domestically—out of $15 trillion globally—the US is a natural leader in this space.

### **What Lies Ahead for Bitcoin ETFs?**

#### **Continued Growth in 2025**

Market experts anticipate that 2025 will outperform 2024 as more professional investors gain access to Bitcoin ETFs. Bitwise CIO Matt Hougan noted that ETF adoption is often a multi-year process, with second-year inflows typically exceeding first-year figures. This pattern suggests significant upside potential for the market.

#### **Expansion of Offerings**

The competitive landscape is set to diversify, with multiple providers refining their offerings to cater to a broader audience. Features like staking-enabled ETFs and innovative custody solutions could become differentiators, attracting even more inflows.

The first year of US spot Bitcoin ETFs has redefined market standards, creating a benchmark for other jurisdictions. As these products evolve, they will likely remain at the forefront of the crypto and traditional financial worlds, offering a bridge between digital assets and institutional adoption.

> Reference: [Bitbo](https://treasuries.bitbo.io/us-etfs/), [Cointelegraph](https://cointelegraph.com/news/bitcoin-etfs-usa-versus-canada-2024), [Coinglass](https://www.coinglass.com/bitcoin-etf)

<img src="https://blossom.primal.net/d3adc72f1784f93819442f5a7020dca894aa2bd1c69013456e2121c3bb302b96.webp">

## **1.Meta Shareholder Proposal Advocated Bitcoin Allocation to Hedge Against Inflation**

<img src="https://blossom.primal.net/a88bb863aa394b36b68c6ad3a36dd5bf01470fd97f3972ef843f7a0d1478d755.webp">

A Meta shareholder proposal, submitted by Ethan Peck, calls for the company to allocate a portion of its $72 billion in cash and short-term cash equivalents to Bitcoin (BTC) as a hedge against currency debasement. The proposal highlights inflation’s erosive impact on Meta's cash holdings, claiming a 28% loss of value over time due to inflation. Peck underscored Bitcoin’s potential, noting its outperformance of bonds by 1,262% over the past five years.

In the proposal, Peck stated: “Mark Zuckerberg named his goats 'Bitcoin' and 'Max.' Meta director Marc Andreessen has praised Bitcoin and is also a director at Coinbase. Do Meta shareholders not deserve the same kind of responsible asset allocation for the Company that Meta directors and executives likely implement for themselves?”

Peck, an employee of the National Center for Public Policy Research — a Washington, D.C.-based think tank advocating free-market policies — has been involved in submitting similar Bitcoin treasury proposals to companies such as Microsoft and Amazon in 2024. However, the Meta proposal was submitted independently, representing shares owned by Peck’s family.

This proposal aligns with the growing trend of corporate Bitcoin adoption as a hedge against inflation, though it remains to be seen whether Meta’s board will entertain the idea.

> Reference: [Cointelegraph](https://cointelegraph.com/news/bitcoin-corporate-treasury-proposal-meta), [The Coin Rise](https://thecoinrise.com/meta-shareholder-advocates-for-bitcoin-adoption-amid-inflation-concerns/)

## **2. DOJ Cleared to Sell Seized Bitcoin After Court Ruling**

The U.S. Department of Justice (DOJ) has been authorized to sell tens of thousands of Bitcoins seized in the government’s largest-ever crypto asset confiscation.

On Dec. 30, a federal judge in the Northern District of California rejected a motion by Nevada-based venture capital firm Battle Born Investments to block the sale of Bitcoin valued at $6.5 billion. Battle Born had claimed rights to the assets, but the court ruled against the firm, effectively ending a years-long legal battle.

**Seized Bitcoin Linked to Silk Road**\

The 69,370 Bitcoins were confiscated in 2020 from an unidentified hacker, referred to in court as "Individual X." Federal agents traced the funds to the Silk Road, a notorious darknet marketplace dismantled in 2013. While the hacker's identity remains unknown, the government secured control of the funds.

**Potential Government Auction**\

Though the ruling does not mandate an immediate sale, the U.S. Marshals Service typically auctions off seized cryptocurrency, just as it does other confiscated assets like cars or real estate. A sale of this magnitude would be among the largest ever, potentially unsettling crypto markets. To mitigate market impact, the government has historically staggered auctions.

Last month, blockchain analytics firm Arkham Intelligence reported that U.S. government wallets moved $1.9 billion in Silk Road Bitcoin to Coinbase. While some investors feared an imminent sale, the move may be part of the government’s contract with Coinbase to manage digital assets.

**Strategic Bitcoin Reserve Discussions**\

The timing coincides with renewed political interest in Bitcoin under President-elect Donald Trump, a vocal crypto supporter. Trump has advocated for a national Bitcoin reserve as a hedge against inflation and encouraged investors to “never sell your Bitcoin.” Wyoming Senator Cynthia Lummis has also introduced legislation proposing the government purchase one million Bitcoin over five years. If the DOJ proceeds with the sale, it will add a significant chapter to the evolving intersection of cryptocurrency and government policy.

<img src="https://blossom.primal.net/56352a3127a4a4dc03a3e4490ce8db5e3bf62707b0873f98e6d36433e9e987bb.webp">

> Reference: [Yahoo Finance](https://finance.yahoo.com/news/federal-government-just-got-greenlight-220013306.html), [The Crypto Times](https://www.cryptotimes.io/2025/01/09/doj-granted-permission-to-sell-seized-6-5b-bitcoin/)

## **Federal Reserve’s Michael Barr to Resign Amid Crypto Industry Scrutiny**

Michael Barr, Vice Chair for Supervision at the US Federal Reserve, announced his resignation effective February 28 or earlier if a successor is appointed. His departure marks another high-profile exit tied to “Operation Chokepoint 2.0,” a controversial alleged effort to limit banking access for crypto firms.

Barr will remain a Federal Reserve Board Governor. In his resignation letter to President Joe Biden, dated January 6, Barr reflected on his tenure, during which he gained a reputation within the crypto industry for his critical stance on banks engaging with crypto assets. In a March 2023 speech, Barr stated: “We would likely view it as unsafe and unsound for banks to directly own crypto-assets on their balance sheets.”

**Crypto Industry Reactions**\

Barr’s resignation has elicited strong reactions from the crypto community. Senator Cynthia Lummis criticized his leadership, accusing him of facilitating Operation Chokepoint 2.0 and undermining Wyoming’s digital asset industry. Caitlin Long, CEO of Custodia Bank, labeled Barr the “Fed’s debanker-in-chief,” suggesting he was instrumental in the alleged campaign against crypto companies.

Nic Carter of Castle Island Ventures noted that many key figures linked to anti-crypto policies, including FDIC Chair Martin Gruenberg and SEC Chair Gary Gensler, have recently left their roles or faced defeat. Carter’s so-called "anti-crypto" list now includes a shrinking roster of figures such as Senator Elizabeth Warren and Federal Reserve Board member Michael Gibson.

<img src="https://blossom.primal.net/e44f3b55cd2ce11ae63e1573b0eaf5c9bb9c58b236aca57d8452e530fe8ac881.webp">

**Ongoing Investigations into Operation Chokepoint 2.0**\

While US officials have denied orchestrating a campaign to debank the crypto industry, recent court orders granted Coinbase access to unredacted FDIC documents to investigate the agency’s role in the alleged initiative. Paul Grewal, Coinbase’s Chief Legal Officer, claimed the filings reveal a coordinated effort to suppress crypto activities ranging from Bitcoin transactions to more complex services. Former prosecutor and crypto advocate John Deaton has offered to lead an investigation into these actions under the incoming Trump administration, warning: “If unchallenged, such actions set a dangerous precedent, allowing regulatory bodies to quietly stifle innovation and economic opportunity.”

> Reference: [Cointelegraph](https://cointelegraph.com/news/fed-reserve-chair-supervision-michael-barr-to-resign)

<img src="https://blossom.primal.net/ff3554485d016c517ced7ba8396ac38478d2e7bcd9fa39f5b5434f9f5f13a067.webp">

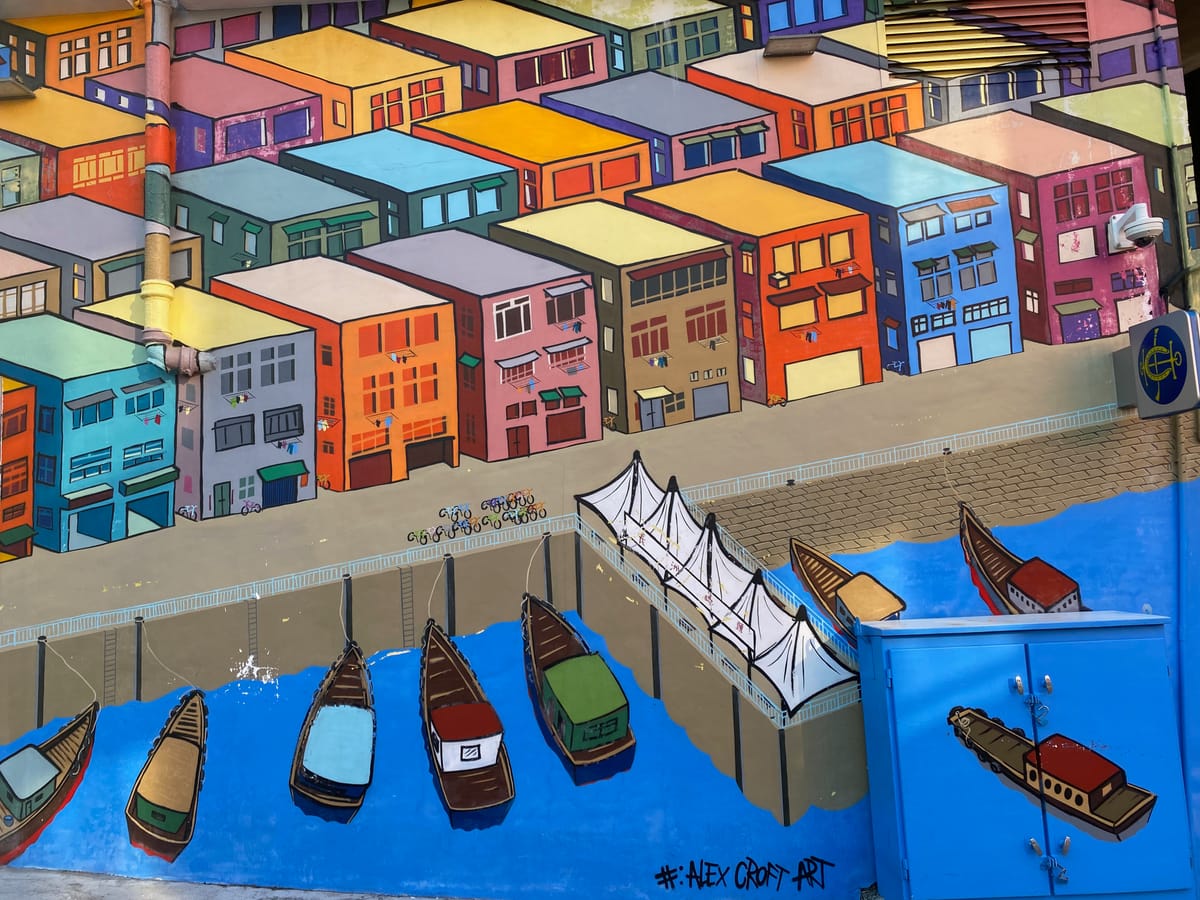

## Launching the Chinese Version of "My First Bitcoin"

Over the past year, we've worked closely with the MiPremierBitcoin team to produce the Chinese version of Bitcoin Diploma *My First Bitcoin* . As the HCM team is based in Asia, we're passionate about connecting more people to Bitcoin and fostering its global adoption. We're thrilled to announce that the book will be launching soon! Stay tuned for more updates and join us on this incredible journey.

<img src="https://blossom.primal.net/88795768f97f1292a5d3d034c7e517331f8b230ca33e6aef2a36e2b836d9b165.jpg">

<img src="https://blossom.primal.net/77bfd3aaac19bf07c164eec4d3da59b05ded14de7490be72103b3e5cf21f8ccb.webp">

## Unchained led the sponsorship for Max and Stacy Invitational

<img src="https://blossom.primal.net/dacd0725a6b176c077139e6c7e74e59c9ad3368eb15a6c681c1d56369a5bf036.webp">

Unchained sponsored the **Max & Stacy Invitational**, a landmark event set to take place in El Salvador, the heart of the global Bitcoin movement. This gathering celebrates innovation, community, and the transformative potential of Bitcoin, embodying the vision championed by Max Keiser and Stacy Herbert. With the support of the community, we strive together to inspire continued progress toward the bitcoin future.

> Reference: [X.com](https://x.com/BSN_Events/status/1878163164325466368)

-

@ 16d11430:61640947

2025-01-16 03:16:12

Will It Scale? Web2 vs. Ethereum, Solana, Lightning, and Aeternity (Part 1: The Basics)

When it comes to scaling, Web2 architectures rely on traditional centralized solutions: adding more servers, deploying load balancers, and utilizing CDNs. But scaling is costly and often inefficient.

Ethereum, the pioneer of DeFi, struggles with scalability due to its Proof-of-Stake (PoS) architecture and high fees, especially during peak times. Meanwhile, Solana boasts high throughput with low fees but has faced criticism for periodic downtime under heavy load. Lightning Network, built on Bitcoin, tackles scalability through off-chain transactions, enabling instant and cheap payments. Aeternity excels with state channels, allowing off-chain interactions while maintaining security and scalability.

When the question is "Will it scale?" Web2 stumbles, Ethereum gets expensive, Solana pushes hard but risks downtime, Lightning remains fast for payments, and Aeternity blends scalability with flexibility for smart contracts and oracles.

---

Will It Overload? Web2 vs. Ethereum, Solana, Lightning, and Aeternity (Part 2: Peak Demand)

Handling peak demand is a nightmare for Web2 systems. Auto-scaling might keep servers running, but the costs skyrocket, and outages can occur during sudden traffic spikes.

Ethereum's block capacity leads to congestion and sky-high gas fees during NFT drops or DeFi booms. Solana offers high throughput, but its monolithic design makes it vulnerable to overload and downtime. Lightning Network shines here, as its off-chain channels ensure seamless microtransactions even during high demand. Aeternity outpaces the rest with its state channel architecture, reducing on-chain congestion and enabling real-time interactions.

Under peak demand, Web2 buckles, Ethereum gets expensive, Solana may stall, Lightning remains reliable for payments, and Aeternity distributes load effortlessly for a seamless experience.

---

Will It Fail? Web2 vs. Ethereum, Solana, Lightning, and Aeternity (Part 3: Single Points of Failure)

Centralized Web2 systems depend on servers and databases, leaving them vulnerable to single points of failure (SPoFs). If a critical server goes down, the entire application can be paralyzed.

In blockchain ecosystems, decentralization minimizes SPoFs. Ethereum boasts strong decentralization but struggles with speed and scalability. Solana, while fast, compromises decentralization by relying on fewer nodes, raising concerns about centralization. Lightning Network is highly resilient for payments, but its reliance on node connectivity means it isn't entirely immune to outages. Aeternity's decentralized nodes and oracles ensure fault tolerance without compromising speed.

When failure isn’t an option, Ethereum resists well but gets slow, Solana risks centralization, Lightning thrives in payments, and Aeternity blends reliability with decentralization.

---

Will It Secure? Web2 vs. Ethereum, Solana, Lightning, and Aeternity (Part 4: Data Integrity)

Web2 security relies on firewalls and centralized databases, making breaches a constant concern. From data leaks to ransomware attacks, Web2 remains highly vulnerable.

Ethereum ensures security through cryptographic validation but suffers from phishing and smart contract exploits. Solana provides low-cost transactions but faces criticism for its centralization risks, which could undermine long-term security. Lightning Network prioritizes secure, private transactions for payments, but its reliance on custodial wallets introduces risks. Aeternity leverages cryptographic security and immutable records for unparalleled data integrity, while its state channels mitigate risks from on-chain congestion.

In the battle for data integrity, Web2 collapses, Ethereum secures with high costs, Solana trades decentralization for speed, Lightning secures payments, and Aeternity balances security with innovation.

---

Will It Innovate? Web2 vs. Ethereum, Solana, Lightning, and Aeternity (Part 5: Futureproofing)

Web2 systems evolve incrementally, hampered by legacy architecture. Meanwhile, blockchain ecosystems are leading the charge in innovation:

Ethereum introduced smart contracts and continues to innovate through layer-2 solutions like Optimism and zkSync.

Solana focuses on speed, catering to high-frequency traders and Web3 games. However, concerns over reliability and centralization linger.

Lightning Network revolutionizes Bitcoin by enabling microtransactions and instant payments, making it a frontrunner for financial applications.

Aeternity takes innovation further with oracles and state channels, enabling seamless real-world data integration and cost-effective, scalable smart contracts.

Web2 struggles to keep up, Ethereum pushes boundaries with layers, Solana races for speed, Lightning dominates payments, and Aeternity innovates across applications.

---

Conclusion: Web2 Cracks, Ethereum, Solana, Lightning, and Aeternity Compete

Each system has its strengths and weaknesses:

Web2 struggles with cost and centralization.

Ethereum leads in decentralization but suffers from congestion and high fees.

Solana offers speed but compromises decentralization.

Lightning Network excels in payments but isn’t built for generalized smart contracts.

Aeternity combines scalability, security, and real-world integration.

So, will it blend? In the end, the future belongs to solutions that balance scalability, security, and decentralization, and Aeternity is positioned to be a key contender in this space.

-

@ 16d11430:61640947

2025-01-16 02:22:51

There was a catch—there was always a catch. The fiat businesses had built empires on sand, parading as indestructible titans while their foundations crumbled beneath them. They were too big to fail, they said, as if saying it loud enough could stop the tide. But the tide didn’t care, and the tide had a name: Bitcoin.

Bitcoin wasn’t the currency of criminals anymore, as the talking heads on television liked to parrot. No, it was the currency of mathematicians, engineers, and anyone else who figured out that trusting a bank to keep your money safe was like trusting a fox to guard your chickens. And while the fiat war machine churned along, chewing up lives with merciless efficiency, its disembodied body was writhing and bleeding out like a wounded ouroboros—an ancient snake devouring its own tail, too consumed by its gluttony to notice its inevitable demise.

The ouroboros wasn’t just dying. It was rotting.

The "Warscape of Disruption" was not kind.

---

The Ouroboros of Fiat

The fiat war machine, that hungry mouth, had always feasted on the lifeblood of ordinary people—wages diluted by inflation, savings eroded by fees, debts stretched out for eternity. The machine’s appetite was insatiable, gnashing and grinding through entire generations. Yet, the tail it chewed wasn’t just a metaphor; it was its own lifeline. Each bite it took to sustain itself weakened the system further, draining liquidity, trust, and time.

The result? A writhing, bleeding beast—a grotesque spectacle of a financial system that couldn’t stop destroying itself even as its days were clearly numbered. Bitcoin, like a sword forged from cryptographic steel, struck at the head of the ouroboros, severing the illusion that the system was sustainable.

---

The Fall of Fiat Empires

Imagine a city under siege. The walls are high, the defenses robust—or so they seem. Inside, the merchants continue their trade as if the invaders outside will simply get bored and leave. But Bitcoin does not leave. Bitcoin is a battering ram, each transaction a blow to the gates. It doesn’t stop, doesn’t sleep, doesn’t even care if it’s raining. The merchants inside—your Fortune 500s, your too-big-to-fails—sit around arguing over their spreadsheets, wondering why their liquidity is drying up.

And liquidity does dry up when your currency is no longer trusted. Why would anyone hold onto a rapidly devaluing asset when Bitcoin offers a deflationary alternative? Why leave wealth in the hands of a financial system designed to siphon it away? Fiat businesses scramble for answers, only to find themselves priced out of relevance.

---

DeFi: The Siege Engines

If Bitcoin is the battering ram, DeFi is the trebuchet, hurling innovations like smart contracts and yield farming over the walls of traditional finance. What once required entire armies of lawyers and brokers can now be executed in seconds on a blockchain. Borrowing, lending, insuring—these were the sacred pillars of fiat finance, and DeFi is smashing them to pieces with algorithms.

But the beauty—or terror, depending on which side you’re on—is that DeFi doesn’t even need to storm the gates. It builds new cities outside the walls, cities without kings or tax collectors, where every transaction is voluntary and transparent. These new cities—protocols like Aave, Uniswap, and MakerDAO—are thriving. Meanwhile, the old cities burn.

---

Critical Analysis: The End of Complacency

The fall of fiat businesses is not just a matter of technological disruption; it is a reckoning. They thrived for decades on inefficiency and opacity, extracting rents from consumers who had no other choice. But now there is a choice, and it is brutally efficient.

Yet, the decimation of fiat businesses raises questions:

1. Regulatory Resistance: Governments will not surrender their economic dominance without a fight. Will they embrace Bitcoin and DeFi, or attempt to stifle it through draconian regulation?

2. Inclusion or Exclusion: While Bitcoin and DeFi promise financial inclusion, their adoption requires technical literacy and access to the internet. Will the transition leave the less fortunate behind?

3. Moral Hazard: As DeFi dismantles gatekeepers, it also removes the safety nets. If everyone becomes their own bank, who will rescue those who make poor financial decisions?

---

The Fiat Future: A Ghost Town

The ouroboros is dying. Its mouth still chews, trying to wring out a few last drops of life from a system that no longer works. Its tail, now bitten to the bone, hangs limp. Fiat businesses are already on life support, relying on bailouts, artificial liquidity injections, and consumer apathy. But this system, like all empires, will fall.

Bitcoin does not care about your quarterly earnings. DeFi does not care about your brand equity. The warscape of the technology landscape will be leveled, and those who fail to adapt will be left behind as relics of a bygone era.

To paraphrase an old soldier, “If we don’t end fiat, fiat will end us.” But maybe that’s not such a bad thing. After all, the only businesses that will truly disappear are the ones that deserve to.

So, as the siege continues, the merchants of fiat have a choice: reinvent or die. But as anyone in DeFi will tell you, the smart money is already on the other side of the wall.

-

@ 000002de:c05780a7

2025-01-16 00:15:54

I have had the same network setup for a long time now. Unifi stuff just works most of the time. I didn't really pick it. Its not open source and now that I have fiber and have been having some issues with some of the Unifi hardware its time to make the call.

Do I just upgrade with Unifi or start migrating to something more in line with what I value.

So I've been chatting with my very helpful colleges at Red Hat and after mentioning PfSense to them I was told to check out Opnsense instead.

1. I want to slowly move to 10g network gear

2. I need PoE switches that are 10g

3. I want a robust firewall / router

4. I don't really wanna build my router due to time

Currently looking at [Protectli Buyer’s Guide](https://kb.protectli.com/buyers-guide/) who sell hardware that is pre-installed with many options. I haven't decided which one to get yet. I wanna buy with the future in mind though so 10g connections are a must and support for two WAN connection is as well. I'm glad I ran CAT6 in my house years ago instead of cheaping out.

After I replace my router / firewall I will want to replace my Unifi switches. I'm considering buying used Cisco switches from eBay.

Anyone have any advice on this plan or advice?

originally posted at https://stacker.news/items/851922

-

@ 16d11430:61640947

2025-01-15 22:03:41

By a Humble Admirer of Reason and Revelation

In an age where the digital and metaphysical intertwine, Bitcoin emerges as more than a mere technological marvel; it beckons us to contemplate the profound relationship between faith and truth. This inquiry, inspired by the works of great philosophers such as Immanuel Kant and Thomas Aquinas, seeks to explore the interplay between Bitcoin, faith, and the divine truth.

---

Faith and Rational Certainty

Faith, in its essence, is often misunderstood. It is not mere blind belief but a rational assent to truths that transcend empirical verification. Immanuel Kant argued that reason sets the boundaries of what we can know, yet it also reveals the necessity of postulating certain truths—God, freedom, and immortality—for the coherence of our moral universe. In Bitcoin, we find a parallel. The network operates on cryptographic principles, open source code, and decentralized consensus mechanisms. Its participants, however, exhibit a form of faith—not in a centralized authority, but in the immutability of its mathematical foundation.

This faith is not irrational but deeply rooted in trust. The nodes and miners who uphold Bitcoin's ledger act in fidelity to its rules, a collective acknowledgment of truth beyond subjective influence. Bitcoin, therefore, embodies a kind of secular faith, where trust in a system replaces reliance on human arbiters.

---

The Immutable Ledger and the Divine Truth

Thomas Aquinas viewed God as the ultimate source of truth, whose divine law orders the cosmos. In Bitcoin, one might see a reflection of this divine order—a man-made system aspiring to transcend corruption, deceit, and centralization. The blockchain is immutable, a ledger where each transaction is sealed in time, immune to revision or manipulation. This echoes the divine truth: unchanging, eternal, and knowable through reason.

Yet Bitcoin also confronts us with a humbling realization. It is not divine; it is a human construct. Its immutability is contingent, not absolute. But in its operation, Bitcoin mirrors humanity's yearning for divine justice—a world where truth cannot be falsified, where accountability is woven into the fabric of existence.

---

The Role of Freedom

Freedom is a cornerstone of both faith and Bitcoin. Kant posited that moral law requires the freedom to act according to reason. Bitcoin, too, is a system predicated on individual freedom: freedom to transact without intermediaries, to store wealth beyond the reach of coercion, and to participate in a global economy unshackled by geographic or political constraints.

This freedom, however, is not anarchic. It is bounded by Bitcoin's rules, much like moral freedom is bound by divine law. The protocol demands adherence to its principles; deviation leads to exclusion. Here, Bitcoin becomes a microcosm of the moral universe, where freedom and law coexist in a delicate balance.

---

Bitcoin as a Test of Faith

Bitcoin also demands faith in the unseen. Its cryptographic foundations are abstract and inaccessible to most. To trust Bitcoin, one must trust the mathematics and the consensus that govern it—a faith akin to the theologian's trust in the coherence of divine revelation. This faith is tested by volatility, uncertainty, and the constant threat of human error or malice. Yet, like the pilgrim who endures trials to affirm their belief, Bitcoin participants persevere, drawn by a vision of a more just and truthful economic order.

---

The Eschatological Impulse

Finally, Bitcoin invites us to consider the eschatological—the end of things and the ultimate fulfillment of truth. In Christian theology, history moves toward a final reconciliation of all things in God. Bitcoin, while temporal, shares an eschatological impulse: it envisions a world where financial systems are no longer instruments of oppression but tools of liberation.

This vision is imperfect, as all human endeavors are. But it gestures toward the divine truth that undergirds all creation: that justice, transparency, and freedom are not merely human aspirations but reflections of a higher order.

---

Conclusion: Faith in the Age of Bitcoin

Bitcoin is not divine, yet it draws us toward the divine truth. It is a testament to human ingenuity and our unrelenting quest for systems that reflect the eternal values of justice and truth. To place faith in Bitcoin is not to worship it but to acknowledge its potential as a tool—a reminder of what humanity can achieve when it aligns its efforts with principles of truth and freedom.

In the end, faith and Bitcoin converge in their reliance on truth. One points us to the heavens, the other to the blockchain, yet both call us to live in fidelity to what is unchanging, just, and true. Thus, Bitcoin becomes not merely a technology but a philosophical and spiritual phenomenon, challenging us to reflect on the relationship between faith, reason, and the divine.

-

@ bf47c19e:c3d2573b

2025-01-15 21:44:03

[Originalni tekst na ecd.rs](https://ecd.rs/blog/istorija-rudarenja-bitkoina-od-nastanka-blokcejna-do-danas/)

###### 25.08.2020 / Autor: Marko Matanović

---

Istorija rudarenja bitkoina počinje ne toliko davne 2009. godine nastankom Bitkoin-a, odnosno od nastanka blokčejna kao tehnologije. U Satošijevom *[whitepaper-u](https://bitcoin.org/bitcoin.pdf)* spominje se pojam *[Proof-of-Work](https://ecd.rs/faqs/proof-of-work-pow/)* (PoW). U ovom sada već istorijskom dokumentu koji objašnjava funkcionisanje Bitkoin-a navodi se da će se Proof-of-Work sistem koristiti za validaciju blokova u Bitkoin blokčejnu (procesuiranje transakcija), a da bi [blok](https://ecd.rs/faqs/blok/) bio “potvrđen” potrebno je da se izdvoji određena procesorska snaga. U suštini *Proof-of-Work* obezbeđuje sigurnost blokčejna tako što zahteva od korisnika da uloži odredjenu količinu rada kako bi bio nagradjen i omogućava dodavanje novih validnih transakcija u blok.

Da bismo poslali transakciju na Bitkoin mreži potrebno je da platimo određeni transaction fee, tj. naknadu za obradu i [potvrđivanje](https://ecd.rs/faqs/konfirmacijaconfirmation/) same transakcije. Upravo ovaj transaction fee se distribuira rudarima kao podsticaj da rade svoj posao u najboljem interesu i po utvrđenim pravilima sistema, odnosno da koriste svoj hardver radi potvrđivanja (naših) transakcija na mreži. Transakcije sa većim izdvojenim transaction fee-jem će biti brže potvrđene na mreži jer će baš ta transakcija rudarima biti isplativija za potvrđivanje. Osim ove vrste transakcija rudari dobijaju i određenu [nagradu za svaki potvrđeni blok](https://ecd.rs/faqs/blok-nagrada/).

Trenutni block reward je 6.25 BTC-a po potvrđenom bloku. Ovaj iznos se deli među svim rudarima na mreži proporcionalno njihovom učinku, što znači da što je više rudara na mreži to je njihova pojedinačna nagrada manja jer je veća konkurencija. Sem toga što se nagrada smanjuje sa većom konkurencijom povećava se i težina rudarenja. Nagrada za Bitkoin se smanjuje na određenom broju izrudarenih blokova i svaki put je nova nagrada dva puta manja od prethodne. Ovo je u kripto zajednici poznatije kao “*[Bitcoin halving](https://ecd.rs/faqs/halving/)*” koji se odigrava otprilike na svake četiri godine, sa ciljem da svaki put upola umanji inflaciju samog bitkoina kako bi održao/povećao svoju vrednost.

*Cene Bitkoina i nagrade po bloku*

Istorija rudarenja bitkoina se može podeliti u nekoliko era koje prate razvoj kripto industrije kao celine. Ove ere se razlikuju po hardveru koji se koristio za rudarenja. Ukoliko se pitate zašto je uopšte bilo potrebno menjati, odnosno pojačavati hardver koji se koristi – razlog je povećanje težine kopanja usled popularizacije kriptovaluta i rudarenja kriptovaluta tokom vremena. Svake godine bio je potreban sve jači i bolji hardver kako bi se rudarenje isplatilo, prvenstveno jer je konkurencija (bila) sve veća, i samim tim više učesnika deli nagradu koja je posledično manja. To uglavnom znači da nam treba jači hardver kako bismo, kao rudari, uradili što veći deo posla na validaciji svakog bloka i maksimalno povećali nagradu koja sledi.

Istorija rudarenja bitkoina uopšteno se može podeliti na nekoliko celina:

– **Era procesora** (2009 – 2010)

– **Era grafičkih kartica** (2010 – 2011)

– **Era FPGA kartica** (2011 – 2013)

– **Era ASIC uređaja** (2013 – 2020)

#### Era procesora (2009 – 2010)

Ovo je početna era rudarenja koju karateriše korišćenje procesora koji se mogu naći u bilo kom laptopu ili desktop računaru. [Prvobitna Satošijeva ideja](https://ecd.rs/blog/idejni-tvorac-bitkoina-misteriozni-satosi-nakamoto/) je bila da svako na mreži koristi svoj procesor za [rudarenje](https://ecd.rs/faqs/kripto-rudarenje/). Na početku ove ere rudarenje je pre svega bio veoma neobičan hobi. Satoši je želeo na taj način da bolje osigura stabilnost i sigurnost mreže. Prvi bitkoini koji su bili iskopani, bili su iskopani upravo pomoću procesora. Korišćen je sličan program kao program za mrežno otključavanje Nokia telefona zbog sličnog principa korišćenja SHA-256 funkcije za enkripciju. Svako ko je želeo je mogao da rudari bitkoin uz pomoć svog laptopa ili desktop računara.

Kako se sve više rudara priključivalo na mrežu i kako je postalo moguće zameniti prve bitkoine za [fiat novac](https://ecd.rs/faqs/fiat-novac/), javio se interesantan problem – procesori koji su u to vreme imali bolje performanse su mogli da izrudare više bitkoina, što ujedno znači da su bili profitabilniji. Sve više rudara je koristilo procesore jačih performansi što je rezultovalo povećanjem težine kopanja. Povećanje težine kopanja je značilo da su procesori slabijih performansi postali još manje isplativi, odnosno da će dobiti proporcionalno manje bitkoina. Ljudi koji su u ovo vreme rudarili na Bitkoin mreži su mogli na mesečnom nivou da zarade i više hiljada bitkoina u zavisnosti od tipa i broja procesora koji su koristili.

Naravno, tada je cena bitkoina bila višestruko manja nego što je sada. Bez obzira na malu cenu, određeni ljudi su uvideli potencijal u rudarenju i krenuli su sa nabavkom sve boljih i boljih procesora. Cilj je bio što isplativije rudarenje bitkoina sa što manjim ulaganjima. Na ovaj način smo dobili prve rudare i potpuno funkcionalnu Bitkoin mrežu.

*AMD Phenom II procesor iz 2008. godine*

#### Era grafičkih kartica (2010 – 2011)

Kako je potražnja za bitkoinom porasla, a on dostigao cenu od 10 centi u oktobru 2010. godine, pojavili su se prvi rudari koji su koristili grafičke kartice (GPU) za rudarenje umesto procesora. Pojedinci su otkrili da je ovaj način rudarenja mnogo efikasniji od rudarenja procesorom, a vest se brzo raširila. Za relativno kratko vreme težina kopanja je toliko porasla da se uopšte nije isplatilo kopati procesorom. Računari sa dobrom diskretnom grafičkom karticom koja se može koristiti za igranje video igara su ubrzo postale mašine za zaradu nove vrste digitalnog novca.

Tada je u svetu računarstva bila popularna opcija korišćenja dve grafičke kartice za bolje performanse u video igrama i programima koji su bili veoma zahtevni (npr. video produkcija ili 3D modelovanje), tako da je već postojala potrebna infrastruktura za rudarenje sa više grafičkih kartica. Što više grafičkih kartica u računaru to je zarada bila bolja. Ubrzo su se pojavili *[miningrig](https://ecd.rs/faqs/mining-rig/)*-ovi (računari specijalizovani za rudarenje) koji su imali od 4 do 8 grafičkih kartica. U početku ovo su bile po izgledu jako amaterski sklopljene mašine, ali su kasnije poprimile poseban i donekle standardizovan oblik.

*Primer izgleda prvih mining rig-ova*

#### Era FPGA kartica (2011 – 2013)

FPGA je skraćeno od field-programmable gate array. Konkretan hardver je dizajniran tako da korisnik može naknadno da ga prilagodi za određeni zadatak. Karakteristika ovih uređaja je brzo izvršavanje konkretne vrste zadataka koje može biti i do dva puta efikasnije od izvršavanja istog zadatka pomoću grafičke kartice. Ovaj potencijal zaintrigirao je rudare tog doba i sredinom 2011. godine otpočelo je korišćenje ovog hardvera za potrebe rudarenja. Obzirom na to da FPGA uređaji nisu toliko jednostavni za korišćenje za razliku od grafičkih kartica i procesora, u početku nije bilo puno ljudi koji su rudarili pomoću ovih uređaja. Kako je softver za rudarenje uz pomoć FPGA uređaja postajao sve dostupniji, rastao je i broj ljudi koji su na ovaj način zarađivali svoje bitkoine.

Naravno, velika efikasnost ovih uređaja i činjenica da daju dva puta bolje rezultate od grafičkih kartica samo je dodatno doprinela povećanju težine kopanja bitkoina, ali nisu FPGA uređaji doveli do toga da [GPU](https://ecd.rs/faqs/gpu/) rudarenje postane istorija rudarenja bitkoina. Do toga su doveli [ASIC](https://ecd.rs/faqs/asic/) uređaji koji su stupili na scenu 2013. godine.

*FPGA uređaj*

#### Era ASIC uređaja (2013 – 2020)

ASIC uređaji su se prvi put pojavili 2013. godine i potpuno su preuzeli scenu rudarenja. Naime, ASIC je skraćeno od application-specific integrated circuit što znači da su ASIC uređaji posebno pravljeni za rešavanje jedne vrste zadatka. Mana ovog pristupa je to što se ASIC uređaji ne mogu koristiti ni za šta drugo osim za rudarenje uz pomoć određenog algoritma. Prednosti ovih uređaja su višestruko bolje performanse i veoma laka instalacija. Nije bilo potrebno razumeti se u hardver za korišćenje ASIC uređaja. Rudari bi samo naručili ove mašine i uključili ih. Odjednom svako je mogao da rudari na Bitkoin mreži uz minimalan trud. To je rezultiralo povećanjem težine kopanja do te mere da su svi prethodno navedeni načini rudarenja postali (skoro) potpuno neisplativi za kopanje bitkoina.

Istorija rudarenja bitkoina pamti nekoliko firmi koje su se bavile prozvodnjom ASIC uređaja među kojima je i današnji gigant Bitmain. Trka za najboljim ASIC uređajem je dovela do gašenja velikog broja firmi jer su samo firme sa kompetentim proizvodom mogle da opstanu na tržištu. Što je veći broj određenog modela bio proizveden, to su troškovi njegove proizvodnje bili manji, tako da manje firme nisu imale puno šanse da opstanu kao ozbiljni konkurenti u ponudi uređaja rudarima.

Prvi ASIC-i su bili u obliku USB uređaja. Bili su bez ventilatora, bez buke i uz minimalnu potrošnju struje. Rudari su ubrzo krenuli da prave prve farme za rudarenje uz pomoć ovih malih uređaja – nekoliko desetina njih povezanih na isti računar uz pomoć USB hub-ova davali su maksimalne performanse. Sa porastom težine kopanja, sve bolji i bolji ASIC-i su zauzimali svoja mesta u garažama i skladištima rudara dok su stari bili prodavani po znatno manjim cenama.

*Prve ASIC farme*

ASIC uređaji su se razvijali kako je potreba za sve jačim mašinama rasla. Ova era i dalje traje, a ASIC uređaji danas pružaju nekoliko hiljada puta bolje performanse od prvih procesora koji su bili korišćeni 2009. godine. Nove generacije ASIC-a su uvek veoma isplative, ali treba uzeti u obzir i veoma veliku cenu novih ASIC uređaja kao i činjenicu da novi modeli izlaze na svakih nekoliko meseci što smanjuje profitabilnost starih modela.

*Izgled današnjeg ASIC uređaja*

Ovi uređaji će ostati dominantni na sceni Bitkoin rudarenja i nema naznaka da će se to promeniti u skorije vreme. U sledećem blogu o rudarenju bitkoina i kriptovaluta uopšte ćemo proći kroz način(e) za postavljanje rig-a za rudarenje i trenutno dostupne opcije na domaćem tržištu. Takođe ćemo pokriti određene modele i procene profitabilnosti rudarenja bitkoina u 2020-oj godini.

-

@ 7f2d6fd6:64710921

2025-01-15 21:17:01

Tendrils of mist clung to the gnarled trees, casting an otherworldly pall over the ancient forest. In the heart of this spectral woodland, a being of unspeakable horror lurked, its very existence a blight upon the natural order.

They called it the Shrouded Watcher - a faceless spectre draped in tattered robes of ebony, its empty cowl concealing an abyss of dark power. For those rare few who had glimpsed its dread form, the memory was seared into their minds, a vision of pure, unadulterated terror.

The Shrouded Watcher's origins were shrouded in mystery, lost to the mists of a bygone age. Some whispered that it had once been a mortal man, corrupted by forbidden knowledge and a thirst for unholy power. Others claimed it was a manifestation of the forest's own malevolent spirit, a physical embodiment of the darkness that permeated this cursed place.

Whatever its true nature, the Watcher guarded jealously the arcane secrets of the woods, unleashing its wrath upon any who dared to trespass. Mortal flesh could not withstand the touch of its spectral form, for its very presence was a blight upon the living. Those who gazed into its soulless cowl were driven mad, their sanity shattered by the sheer weight of its malevolent power.

In the deepest, most remote reaches of the forest, where the trees grew twisted and gnarled, the Watcher kept its eternal vigil. Its presence was heralded by a bone-chilling chill that crept through the air, a sensation of being watched by unseen eyes. And woe betide the unfortunate soul who heard the distant, unearthly wail that echoed between the ancient trunks - for it signaled the Watcher's approach, and the imminent arrival of a fate worse than death.

None dared to challenge the Shrouded Watcher, for it was a creature born of the darkest corners of the human psyche, a manifestation of our deepest, most primal fears. To confront it was to stare into the abyss, to risk being consumed by the very essence of terror itself.

And so the Watcher remained, a sentinel of the forest's arcane secrets, its true nature forever hidden beneath the folds of its ebony shroud. Those who ventured too deeply into the woods would never return, their broken forms left to rot as a grim warning to all who would dare to uncover the mysteries of this accursed place.

-

@ 7f2d6fd6:64710921

2025-01-15 21:16:48

Deep within the ancient, foreboding forest, where the canopy of twisted oaks blotted out the sun's light, a being of immense power and arcane knowledge dwelled in solitude. Geldar the Wizard, a diminutive yet formidable figure, had made this dark woodland his domain, guarding its myriad secrets from the prying eyes of mortal men.

For centuries, Geldar had studied the occult lore of the elder races, delving into the forbidden knowledge of realms beyond the ken of common folk. His small but agile form belied the potent sorcery that coursed through his veins, a legacy of his elven heritage intertwined with darker, more primal energies.

Now, as he moved silently through the shadowed trees, Geldar could sense a disturbance in the delicate balance of his woodland sanctuary. Some trespasser had breached the arcane wards that cloaked his hidden abode, drawn perhaps by rumors of the ancient power that slumbered within.

With a subtle gesture of his gnarled, spidery hands, Geldar conjured a shimmering orb of eldritch light, its eerie radiance illuminating the gnarled trees that crowded around him. His sharp, elfin features were set in a stern expression as he scanned the gloom, searching for any sign of the intruder.

Suddenly, a movement in the periphery of his vision - a fleeting shadow darting between the twisted trunks. Geldar's eyes narrowed, and with a muttered incantation, he unleashed a burst of arcane energy that lanced through the forest. The spell struck true, and a strangled cry echoed through the trees as the hapless trespasser was ensnared in a web of sorcerous energy.

Gliding forward on silent feet, Geldar approached the struggling form, his expression inscrutable. "So, another foolhardy mortal has dared to trespass in my domain," he murmured, his voice a soft, rasping whisper. "You have stirred the wrath of the ancients, human. Now you shall face the consequences of your folly."

With a dismissive gesture, Geldar wove a new spell, his fingers tracing intricate patterns in the air. The captive's cries grew more frantic as dark tendrils of power began to envelop him, slowly draining the life from his body.

As the last vestiges of the man's life force ebbed away, Geldar allowed himself a thin, humorless smile. "The forest keeps its secrets well," he murmured, his gaze sweeping the surrounding gloom. "And I shall ensure that no others dare to uncover them."

Turning, the diminutive wizard melted back into the shadows, his arcane power once more cloaking the ancient woodland in its impenetrable veil of mystery and dread.

-

@ 7f2d6fd6:64710921

2025-01-15 21:16:25

The ancient forest whispered with the echoes of a dark and terrible power - a presence that had endured for untold centuries, its malevolent influence seeping into the very fabric of the woodland. And at the heart of this spectral domain, enthroned amidst the gnarled roots and twisted trees, sat the Lich Queen.

Her name had been lost to the ravages of time, but the aura of dread and reverence that surrounded her was undeniable. Clad in robes of ebony and bone, her skeletal visage adorned with a crown of spiked obsidian, she radiated an aura of primal, unnatural might. Around her neck hung an amulet of immense power, its gemstone glowing with an eldritch light that cast her pale features in an unearthly glow.

The Lich Queen's origins were shrouded in mystery, whispers of a dark pact made long ago with forces beyond mortal understanding. It was said that she had once been a mortal sorceress, driven by ambition and a thirst for knowledge to delve into the most forbidden realms of magic. But in her quest for power, she had crossed a line, bartering her very soul to attain the gift of immortality.

Now, as the centuries passed, she sat enthroned in her domain, her skeletal minions and nightmarish abominations ever at her command. Her icy gaze swept the forest with a detached, predatory hunger, as if searching for the next unfortunate soul to fall victim to her machinations.

For those who dared to trespass in her domain, the Lich Queen's wrath was a fate worse than death. With a casual gesture, she could summon legions of undead horrors to tear the intruder apart, their agonized screams echoing through the shadowed trees. And for those who managed to flee her presence, the torment was far from over - for the Lich Queen's curse would haunt their every step, slowly draining the life from their bodies until they succumbed to the eternal embrace of the grave.

None dared to challenge the Lich Queen's dominion over the forest, for her power was absolute and her hunger for arcane knowledge insatiable. Even the Shrouded Watcher, that dread specter of the woods, was said to cower in her presence, for the Lich Queen commanded forces beyond the understanding of mortal men.

And so the ancient forest remained a realm of shadow and terror, its secrets guarded by the Lich Queen and her unholy retinue. Those who ventured too deep into the woods, drawn by tales of forgotten treasures or ancient lore, would never return - their fates sealed by the unyielding grip of the Lich Queen's power.

-

@ 7f2d6fd6:64710921

2025-01-15 21:16:06

Deep within the ancient forest, a dark and unearthly power held sway - a triumvirate of malevolent entities that commanded the respect and fear of all who dared to trespass in their domain.

At the center of this unholy alliance was the Lich Queen, her skeletal visage adorned with a crown of obsidian and the amulet of power that was the source of her immortal, arcane might. Enthroned amidst the gnarled roots and twisted trees, she reigned over the forest's denizens with an iron fist, her icy gaze sweeping the shadows for any sign of intrusion or defiance.

Arrayed at her sides were two other figures of pure terror - the Shrouded Watcher, a faceless spectre draped in tattered robes of ebony, and the elven wizard who had made a pact with the very essence of the forest itself. Together, this unholy triumvirate maintained an uneasy balance of power, each entity commanding its own dominion within the woodland.

The Shrouded Watcher, its empty cowl concealing untold horrors, was the guardian of the forest's most ancient and treacherous secrets. Its mere presence was enough to drive mortals to the brink of madness, and its spectral touch could shatter the sanity of even the bravest of souls. None dared to trespass in the deepest, most remote reaches of the woods, for that was the Watcher's domain.

And yet, even the Watcher's dread power paled in comparison to the Lich Queen's command of necromantic sorcery. With a mere gesture, she could summon legions of undead horrors to tear apart any who dared to challenge her rule. Her curse could slowly drain the life from the most stalwart of warriors, leaving them to rot as grim warnings to all who would seek to uncover the forest's darkest mysteries.

But the elven wizard, with his intimate connection to the very spirit of the woodland, was no less a force to be reckoned with. His arcane knowledge granted him the ability to manipulate the natural world, summoning vines and roots to ensnare and entrap any who would dare to trespass. And his mastery of illusion and deception made him a cunning and elusive adversary, able to lure the unwary deeper into the forest's shadowed embrace.

Together, this unholy triumvirate maintained a fragile balance of power, each entity jealously guarding its own domain and secrets. Should one of them fall, the others would surely seek to claim the vacant throne, unleashing a cataclysmic struggle for supremacy that would plunge the forest into an era of unimaginable darkness and terror.

None dared to challenge this unholy alliance, for to do so would be to invite the wrath of forces beyond mortal comprehension. The forest remained a realm of shadow and dread, its secrets guarded by the Lich Queen, the Shrouded Watcher, and the elven wizard - a triumvirate of pure, unadulterated evil that would brook no intrusion or defiance.

-

@ 3ad01248:962d8a07

2025-01-15 19:03:50

I know with the hype around Trump's election victory and the pro-Bitcoin people that he has surrounded himself with as of late, the idea of a Bitcoin Strategy Reserve or BSR is an intoxicating idea among many Bitcoiners.

I don't blame Bitcoiners from being happy about it, how can you not be? After enduring the last 4 years of vicious crackdown, arbitrary rules from the SEC and outright hostility to the Bitcoin community in general it is nice to have an administration that is simply nice to us and wants to leave the community alone to do it own thing.

While I am excited to see what a new Trump administration looks like for Bitcoin over the next four years, I am not onboard with a BSR. I think that the BSR is bad policy and supports the system that we are trying escape from in the first place.

In my opinion I believe a BSR signals to the world that the government doesn't believe in its own currency or its ability to reign their spending problem. Even the mere signaling that America is going to create a BSR has sent other countries scrambling to create one of their own. This is incredibly bad news for the US bond market.

[Who are the buyers of US bonds right now?](https://www.reuters.com/markets/rates-bonds/bond-vigilante-pimco-trims-long-term-us-sovereign-debt-holdings-2024-12-09/) A huge component of the market is foreign governments.[ Even though they have been less willing to buy US bonds over the last couple of decades most governments are still in the market buying up US debt. ](https://wolfstreet.com/2024/10/19/which-foreign-countries-bought-the-recklessly-ballooning-us-debt-increasingly-crucial-question-many-piled-it-up-cleanest-dirty-shirt/)

Now imagine of these foreign buyers start buying Bitcoin in small amounts at first and slowly scale into Bitcoin in a big way once they see the insane price action. They will FINALLY get it and once that happens its over the dollar. This is a gradually then suddenly like moment that no one is ready for at the moment.

So if you take way the foreign buyer of US bonds, who are you left with? The Federal Reserve. Having the Federal Reserve directly buying up government debt is huge sign of monetization of the debt to the world and doesn't bode well for the future of America or the world.

As you can see setting up a BSR would be highly destabilizing in the short term and could create a whole slew of knock on effects that no one is prepared or equipped to deal with.

In addition to destabilizing an already fragile economic environment, why do we want this big ass government to have Bitcoin in the first place? So they can keep on oppressing the working man/woman, crushing innovation and generally being a tick on the back of the private sector? How about we not empower them to keep spying on us and the world.

I want to live in a world where war impose heavy costs on leaders and governments and peace is the default setting of the world. Governments using Bitcoin to prop up their tyrannical ways is not why Bitcoin was created. You know that. I know that. The rest of the world should know that.

Bitcoin was created as an electronic p2p system that allows anyone to transact regardless of artificial borders or political differences. Bitcoin allows anyone to transact globally without the grubby hands of the government trying to take a cut. We need less government, not more.

I'm personally not a fan of governments or big money institutions getting into Bitcoin as I feel its like letting the fox into the hen house but that ship has sailed. The best we can hope for now is to create enough individual adoption that it makes it hard for governments to get a large amount of Bitcoin so they can act as a check on the accumulation of Bitcoin.

HODL culture is needed now more than ever. Don't hand over your Bitcoin to tyrants. Stack sats. HODL. Create the change you want to see in the world.

-

@ c21b1a6c:0cd4d170

2025-01-15 18:04:31

Hello everyone, as part of the nostr:npub10pensatlcfwktnvjjw2dtem38n6rvw8g6fv73h84cuacxn4c28eqyfn34f grant I have to write a progress report for Formstr, I thought I'll use this opportunity to do a nostr blog! , Something I've been meaning to do for sometime, hopefully I don't bore you.

## Introduction

There was a lot of work ahead of us even before we got the grant, and we tried to tackle it heads on.

We completely changed the underlying mechanism of storing and fetching forms. Whereas previously a form was a kind 0 event, same as a profile event. The form is now created and responded to in the mechanism as outlined in the [Forms NIP](https://github.com/nostr-protocol/nips/pull/1190/files). This had to be done while making sure that none of the older forms broke during the process. The new specification helps streamline the forms usecase to expand to access control, private forms, upgrade to nip44 encryption.

Some of these features existed as Proofs of Concepts prior to this quarters work, the major tasks were to streamline and production-ize them, to be able to release it to the public. We were also joined by nostr:npub1vf6wyw9j38sm96vwfekwvqxucr9jutqrmwdc2qnql79a66al9fzsuvt9ys who along with nostr:npub15gkmu50rcuv6mzevmslyllppwmeqxulnqfak0gwud3hfwmau6mvqqnpfvg helped move the project along.

## How did we spend our time.

Released a major Formstr Update (16/12/204): - [Release PR](https://github.com/abhay-raizada/nostr-forms/pull/157):

This Release Contained The Following Changelog:

- Move Form Creation and Rendering to New Event

- Upgrade Response Encryption to NIP-44.

- Add Ability to create private forms.

- Add ability to send private form access as Gift Wraps.

- Create a new dashboard UI to incorporate new form types.

- Add ability to login to formstr

- Use naddr to encode form Urls instead of pubkey(centralized).

Work done to production-ize these features can be found in the following PRs:

1. [Save forms to local device automatically](https://github.com/abhay-raizada/nostr-forms/pull/176)

2. [Ability to remove participants in Access Control UI](https://github.com/abhay-raizada/nostr-forms/pull/178)

3. [Revamp Responses Page according to NIP-101](https://github.com/abhay-raizada/nostr-forms/pull/181/files)

4. [Add a "My Forms" Section on the dashboard](https://github.com/abhay-raizada/nostr-forms/pull/188)

5. [Add UI for Inserting Images](https://github.com/abhay-raizada/nostr-forms/pull/183)

6. [Using Naddr Instead of pubkey as formId](https://github.com/abhay-raizada/nostr-forms/pull/180)

In addition to these there were multiple bugfixes and patches that I've excluded for brevity.

## Major Challenges

We were in "beta hell" for a long time, even though I had finished rudimentary versions of each of the features in advance (some to test the viability of the forms NIP). Incorporating them into the running version proved to be a challenge. We realized that some of the features required major UI changes, and a lot of new features broke previously working desirable features such as NIP-04 Notifications. A lot of [work](https://github.com/abhay-raizada/nostr-forms/pull/157/commits/4ce6970b09e7728004ccdeb058efb2b58dd96ef0) like this had to be done to ensure formstr brought in new features while continuing to work exactly as old users liked it.

## What's left and what's coming?

From the wish-list items I had committed during the application a few major ones remain:

- Edit Past Forms.

- Paid Surveys.

- Support for NIP-42 Private Relays.

- Conditional Rendering of form fields

- Sections

Of these I'm happy to report that we've already begun work on conditional rendering of fields (https://github.com/abhay-raizada/nostr-forms/pull/199)

## What is de-prioritized?

Going with experiences from quarter 1, we are de-prioritizing Formstr Integrations with 3rd party services like Ollama (Self Sovereign AI) and business tools like Slack, Notion etc. We'll try to get to it, but it's less of a priority compared to other features!

## How the funds were used.

- Paying Individual Contributors for PRs submitted.

- Living Expenses

-

@ 8b9eb61d:09434328

2025-01-15 17:42:17

As men age, maintaining optimal vitality becomes essential for a fulfilling life. At TESTO - Herbal Vitality, we offer a range of natural solutions designed to help men maintain energy, confidence, and balance. From vitamins that support testosterone to libido supplements in NZ and horny goat weed for men, our products offer natural ways to support male health. In this article, we’ll explore how these supplements can help enhance your well-being.

**How Can Vitamins That Support Testosterone Improve Men’s Health**?

Testosterone is a key hormone that influences many aspects of men’s health, including muscle mass, energy levels, and sexual wellness. As men age, their testosterone levels naturally decrease, which can lead to reduced vitality and performance. To combat this, it’s important to include vitamins that help maintain testosterone levels.

Vitamins such as Vitamin D, Zinc, and Magnesium are crucial for supporting testosterone production. Vitamin D, for example, has been linked to better testosterone levels, while Zinc and Magnesium play important roles in hormone regulation. Our herbal formulations combine these essential nutrients to help men naturally maintain their testosterone levels, supporting long-term vitality and a better quality of life.

Incorporating vitamins that support testosterone into your daily routine can help you feel more energised, maintain physical strength, and improve overall wellness.

**What Are Libido Supplements in NZ and How Can They Benefit You**?

Libido plays a crucial role in maintaining healthy relationships and personal well-being. As men age, their libido can decline due to hormonal changes or stress. This is where libido supplements in NZ come into play. At TESTO, our libido supplements are crafted to naturally support sexual health, enhance performance, and boost energy levels.

Our supplements are made from powerful herbs traditionally used to support male sexual health. These ingredients help improve blood circulation, support hormone balance, and provide a natural energy boost. By choosing libido supplements in NZ, you can promote better sexual health and confidence.

In addition, our libido supplements are safe, effective, and made with high-quality, natural ingredients. They offer an ideal solution for those looking to support their overall well-being and improve performance naturally.

**Why Is Horny Goat Weed for Men So Effective**?

Known for its long history in traditional medicine, horny goat weed is a powerful herb used to enhance stamina, support sexual health, and boost energy levels. It contains icariin, a compound believed to improve blood flow and enhance endurance.

Horny goat weed has been widely used for centuries in Chinese medicine to promote vitality. This herb works by supporting circulation, which helps men feel more energised, both physically and mentally. Whether you're looking to increase stamina during workouts or improve performance in the bedroom, horny goat weed for men offers a natural solution to support your health.

**Why Choose Natural Supplements for Your Health**?

At TESTO - Herbal Vitality, we believe in the power of natural ingredients to support men’s wellness. Our products, including [vitamins that support testosterone](https://www.testo.co.nz/), libido supplements in NZ, and horny goat weed for men, are designed to provide safe, effective solutions for boosting vitality, energy, and sexual health.

By integrating these supplements into your routine, you’re taking steps toward improved wellness and a healthier lifestyle. We use high-quality, natural ingredients to ensure you receive the best possible results without harmful side effects.

Start your journey toward revitalisation with TESTO and enjoy the benefits of natural, holistic wellness. Whether you're aiming to boost your testosterone levels, support your libido, or enhance your overall vitality, we have the right solutions for you.

-

@ e968e50b:db2a803a

2025-01-15 16:59:56

I feel like I'm just full of newbie questions for stacker news this week. Sorry.

I recently took the killer [pleb devs courses](https://plebdevs.com/) and now confidently feel like I have some programming skills kinda-sorta (the classes are great, but I was starting from 0) under my belt. My end goal was to stick it to the man and be a part of the bitcoin revolution. That said, I've made a couple of projects that I really want to share with more folks, but would like to actually make them into cooler sites.

For my actual long-term business, I've been renting a domain name for decades and never thought too much about it since it was a business expense and I really didn't care what happened to it after I was gone. However, for these fun coding projects, I wanted to get a domain so that everything doesn't end in .onrender or .vercel.app and I assumed that since I was using a more silly name, it'd be cheap to just by something forever. But that doesn't seem to be the case. In fact...as most of you know...but which is news to me, you can't actually buy domains forever at all. Am I correct about this? If so, doesn't that mean the whole decentralized nature of the internet is a sham? I'm feeling very confused and not finding much helpful info.

My goal is to buy a landing page for a bunch of bitcoin-themed games I've built (something like bitcoingames.stupid) and my [nostrminusnostr](https://nostrminusnostr.vercel.app/) client, something like nostrminusnostr.nostr. Anyway, I found some stuff in the range I'd be willing to spend on Vercel, but am just a little confused how domain hosting actually works.

originally posted at https://stacker.news/items/851425

-

@ f9c0ea75:44e849f4

2025-01-15 16:42:53

Em 2007, o Brasil comemorava o fim da CPMF (Contribuição Provisória sobre Movimentação Financeira), um imposto que, embora "temporário", durou 10 anos e arrecadou centenas de bilhões de reais. Na época, o governo afirmava que a contribuição era necessária para financiar a saúde pública, mas, na prática, foi mais um peso sobre o cidadão e as empresas.

Agora, quase duas décadas depois, o cenário está mudando novamente. O monitoramento financeiro da Receita Federal sobre transações acima de R$ 5 mil e a implementação do DREX, a moeda digital programável do Banco Central, sugerem que o controle sobre o dinheiro nunca foi tão grande.

A pergunta que fica é: será que estamos caminhando para uma nova CPMF, só que digital e automatizada?

---

### **O Passado: CPMF e o Controle Estatal sobre o Dinheiro**

\

A CPMF nasceu sob o pretexto de ser um imposto temporário, com uma alíquota pequena (inicialmente 0,20%, depois 0,38%) que incidiria sobre qualquer movimentação bancária. Seu objetivo oficial era financiar a saúde, mas a verdade é que o governo encontrou nela uma mina de ouro de arrecadação, garantindo bilhões de reais anualmente.

Os problemas começaram a aparecer rapidamente:

1. O custo era repassado aos preços dos produtos e serviços, afetando toda a economia.

2. Empresas e cidadãos pagavam sobre transações repetidas, tornando a carga tributária ainda maior.

3. O dinheiro não foi totalmente para a saúde, sendo usado para tapar buracos no orçamento.

4. A promessa de temporariedade caiu por terra, e a CPMF durou uma década.

5. O governo insistia que não existia outro jeito de arrecadar sem essa cobrança, mas, quando foi extinta, nada desmoronou. Só ficou mais difícil tributar o cidadão sem que ele percebesse.

Agora, vemos novos mecanismos de controle financeiro surgindo. O argumento é o mesmo: transparência, combate à sonegação e otimização da arrecadação. Mas será que é só isso?

---

### **O Presente: Receita Federal Fecha o Cerco sobre Suas Transações**

\

A partir de 2025, qualquer movimentação acima de R$ 5 mil para pessoas físicas e R$ 15 mil para empresas será automaticamente informada à Receita Federal. Isso significa que se você fizer uma transferência maior que esse valor, o governo já saberá sem precisar pedir dados ao banco.

Oficialmente, essa medida não implica na criação de um novo imposto. Mas, se a história nos ensina algo, é que governos não implementam esse nível de monitoramento à toa. Algumas questões que surgem:

- Se não é para tributar, por que monitorar tão de perto?

- Se a CPMF foi extinta, por que voltamos a um sistema de rastreamento financeiro tão intrusivo?

- Esse é só um primeiro passo para um imposto automático sobre movimentações digitais?

---

### **O Futuro: DREX e a Automação da Tributação**

\

O DREX, a versão digital do real, será um grande passo para o controle financeiro estatal. Diferente do Pix, que apenas facilita transferências, o DREX permite que o Banco Central programe e rastreie cada centavo movimentado.

E o que isso significa para o cidadão comum?

- Pagamentos e tributações automáticas: um sistema de split payment poderia fazer com que impostos fossem cobrados diretamente na fonte, sem a necessidade de declarações ou boletos.

- Controle total sobre transações: diferente do dinheiro físico, que circula sem monitoramento, o DREX permitirá ao governo rastrear qualquer pagamento, em tempo real.

- Possibilidade de limitação de uso: com uma moeda programável, poderia haver restrições sobre onde, quando e como você pode gastar seu dinheiro.

O Banco Central e a Receita Federal garantem que não há planos de usar o DREX para tributação compulsória, mas a CPMF também começou assim: como algo temporário, necessário e inofensivo.

---

### **Estamos Caminhando para uma Nova CPMF Digital?**

\

Se analisarmos a trajetória do governo na questão tributária, fica claro que:

- Primeiro, nega-se qualquer imposto novo.

- Depois, implementa-se um sistema de monitoramento, supostamente para "combater fraudes".

- Por fim, a tributação é introduzida sob a justificativa de que "não há outra saída". A CPMF só funcionou porque o dinheiro passava pelo sistema bancário e era fácil de rastrear. Agora, com o DREX e o monitoramento da Receita, o governo não precisaria nem de um imposto explícito para tributar transações—ele poderia simplesmente automatizar a cobrança diretamente na moeda digital.

O que antes dependia de aprovação no Congresso e resistência da população, pode agora ser feito com um simples ajuste de software no Banco Central.

O governo diz que isso não está nos planos. Mas se olharmos para trás, essa é exatamente a mesma narrativa que ouvimos antes da CPMF entrar em vigor.

---

### **Seu Dinheiro, Seu Controle?**

\

O Brasil está entrando em uma nova era financeira. O monitoramento de grandes transações e a implementação do DREX podem representar um avanço na transparência e na eficiência econômica, mas também criam um risco real de perda de liberdade financeira e tributação automatizada.

O que aconteceu com a CPMF deve servir de lição: o que começa como uma simples ferramenta de arrecadação pode se transformar em um peso permanente sobre o cidadão.

Se o governo tiver a tecnologia e a infraestrutura para tributar automaticamente, quanto tempo levará até que eles resolvam usá-la?

-

@ 8d34bd24:414be32b

2025-01-15 16:29:24

Many times people wonder “Why do we have to obey God?” or “Why should we submit to Jesus’s lordship?” or “Why is Jesus the only way to Heaven?” Although there are many reasons, they can all be summarized in Him being our creator.

Today, I was listening to “The End Times” podcast with Mark Hitchcock and he was discussing Revelation chapter 4. Among other things, he read this passage:

> And the four living creatures, each one of them having six wings, are full of eyes around and within; and day and night they do not cease to say,

>

> “**Holy, holy, holy is the Lord God, the Almighty, who was and who is and who is to come**.”

>

> And when the living creatures give glory and honor and thanks to Him who sits on the throne, to Him who lives forever and ever, the twenty-four elders will fall down before Him who sits on the throne, and will worship Him who lives forever and ever, and will cast their crowns before the throne, saying,

>

> “**Worthy are You, our Lord and our God, to receive glory and honor and power; for You created all things, and because of Your will they existed, and were created**.” (Revelation 4:8-11) {emphasis mine}

God deserves our worship and our obedience because He is our creator. As creator, He has the right to command us to obey. Also as creator, He knows what is best for us because He created us and everything around us. He created us with a purpose and we will never know complete joy and peace until we obey Him and work according to the purpose He created us to fulfill.

If God was just a superhero type God, who was stronger and smarter than us, then He wouldn’t have a right to authority over us. Because He created us, He does. People questioning God’s authority to define right and wrong has existed throughout history. Isaiah addressed this complaint in the Old Testament:

> “Woe to the one who quarrels with his Maker—\

> An earthenware vessel among the vessels of earth!\

> Will the clay say to the potter, ‘What are you doing?’\

> Or the thing you are making say, ‘He has no hands’? (Isaiah 45:9)

In the New Testament, Paul goes into even more details on God’s right and authority:

> On the contrary, who are you, O man, who answers back to God? The thing molded will not say to the molder, “Why did you make me like this,” will it? Or does not the potter have a right over the clay, to make from the same lump one vessel for honorable use and another for common use? What if God, although willing to demonstrate His wrath and to make His power known, endured with much patience vessels of wrath prepared for destruction? And He did so to make known the riches of His glory upon vessels of mercy, which He prepared beforehand for glory, even us, whom He also called, not from among Jews only, but also from among Gentiles. (Romans 9:20-24)

The one who creates something has the right to do what he wants with his creation, whether using it for honor, for dishonor, or for destruction. The creator has the right to say how his creation will be used and for what purpose it will be used. No one, especially the created creature, has a right to question that authority. We question God’s authority and His truth because we do not have nearly a high enough view of God.

> **You turn things around!**\

> Shall the potter be considered as equal with the clay,\

> That what is made would say to its maker, “He did not make me”;\

> Or what is formed say to him who formed it, “He has no understanding”? (Isaiah 29:16) {emphasis mine}

Read this verse again. Anyone who is formed, who says to the one who formed it, “*He has not understanding*,” has completely turned their thinking upside down. This is foolish thinking.

God deserves our thanks, our worship, and our obedience because He created us. Without Him we would never have existed. God is good! All of the time!

> “**Worthy are You, our Lord and our God, to receive glory and honor and power; for You created all things, and because of Your will they existed, and were created**.” (Revelation 4:11) {emphasis mine}

Because I see so many people treat God in such a low manner, I tend to accentuate His holiness and His authority. That doesn’t mean that the God of the Bible is a distant taskmaster far away sitting waiting to punish anyone who strays from the exact path He has called them to walk. He is loving, kind, and merciful, too.

God is referred to as Father for a reason. A father of a youngster is feared by the child, but that child also leans on his father for protection, love, and direction. Although the father has the authority and the power to punish or make demands, a loving father does what is best for the child. The best may be a punishment for doing wrong or just allowing the child to fail, but the father’s protecting hand is always there preventing any major harm. The discomfort that is allowed is for the good of the child. It guides the child in the path that will most benefit the child in the long run even if the child is very unhappy with the father’s actions at the moment. Most of the time, when the child grows up, they come to understand and appreciate their parents’ actions. The God of the Bible is the heavenly Father of each and every believer and so much more loving, more wise, and more powerful than any earthly father.

Trust Jesus.\

\

your sister in Christ,

Christy

FYI, Right after writing this post, I read this article on a related subject. It is a hard truth, like the one I shared, but worth embracing, if you have time, check it out

[The Not So Political Protestant](https://thenotsopoliticalprotestant.substack.com/p/could-oppression-be-gods-wonderful?utm_source=substack&utm_campaign=post_embed&utm_medium=web)

[Could Oppression Be God's Wonderful Plan for Your Life?](https://thenotsopoliticalprotestant.substack.com/p/could-oppression-be-gods-wonderful?utm_source=substack&utm_campaign=post_embed&utm_medium=web)