-

@ fd06f542:8d6d54cd

2025-04-12 02:13:35

@ fd06f542:8d6d54cd

2025-04-12 02:13:35 -

@ fd06f542:8d6d54cd

2025-04-12 01:32:38

@ fd06f542:8d6d54cd

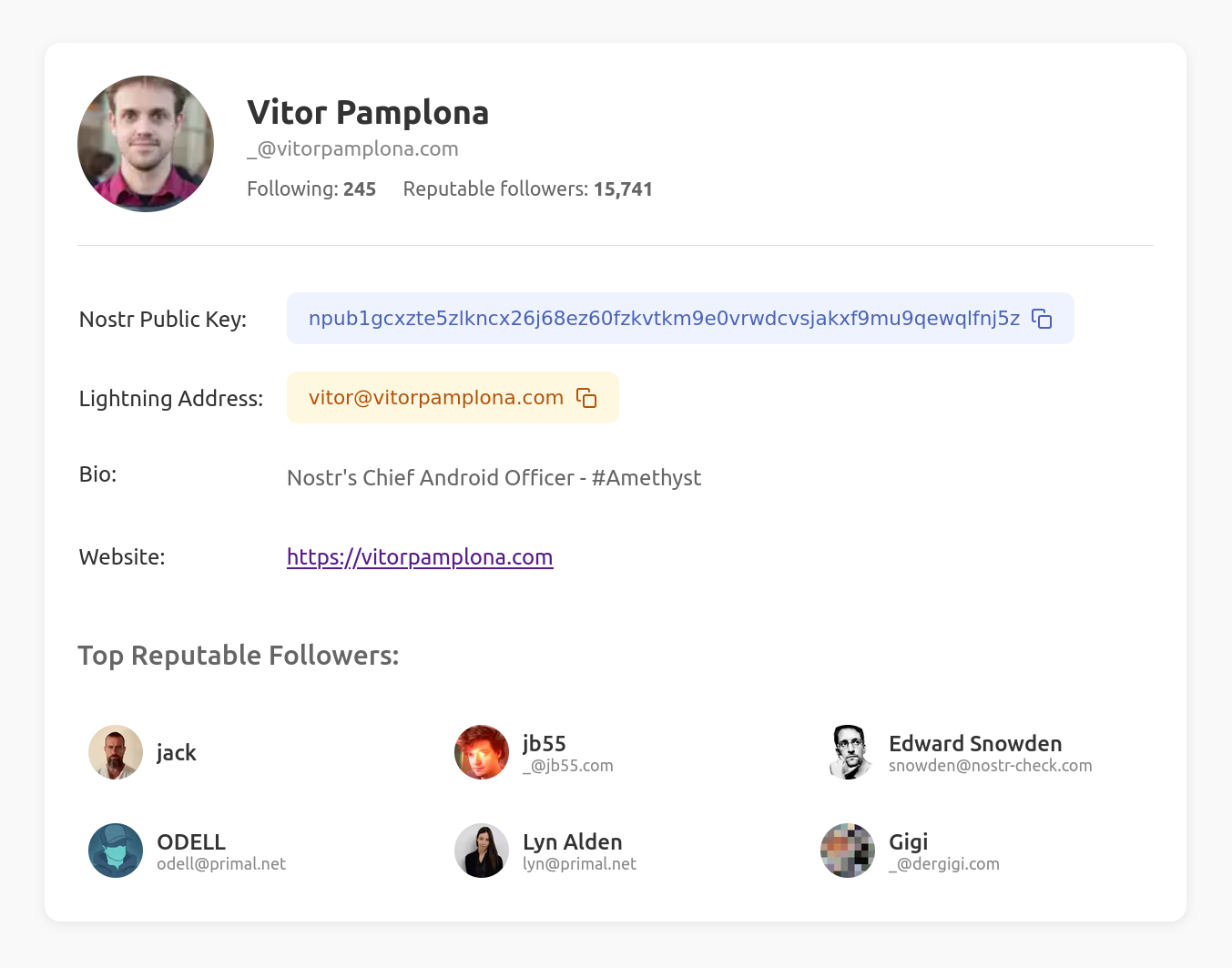

2025-04-12 01:32:38使用nostrbook.com网站

登录和创建用户:

登录按钮 ,可以粘贴 已有的 nsec....账号,完成登录。

登录按钮 ,可以粘贴 已有的 nsec....账号,完成登录。注册:

可以点击红标位置 生成你的账户。 “确定” 完成注册。

可以点击红标位置 生成你的账户。 “确定” 完成注册。创建书籍

封面的上传

创建书籍,可以用 微信截图 后直接 ctrl+v. 粘贴即可。

创建书籍,可以用 微信截图 后直接 ctrl+v. 粘贴即可。或者点击浏览 本地图片文件。

标题和作者

正常填写就可以。 书的作者和上传文件人没有一一绑定。

写书

创建完成后就可以写书了,写书入口在 登录处 “我的书籍” 。点进去会出现你创建的书籍。选择一本就可以写书了。

创建完成后就可以写书了,写书入口在 登录处 “我的书籍” 。点进去会出现你创建的书籍。选择一本就可以写书了。列出你创建的所有的书籍

点击图标,就可以进入开始写作了。例如《nostrbook站点日记》

如图所示有4个部分

- (1)关闭按钮,点击就退出编辑,这时候他会提示你保存,如果不需要保存退出,点击 “不保存退出”

- (2)

大纲是编写 你书籍的大纲,这个参考 docsify文档 下面会有例子。时间排列是 你所有为本书写的章节。但是有些章节你可能废弃了,或者暂时不想展示,都会存在 时间排列里面,就是按照你编写的时间倒序排列的。草稿是你暂时存储的内容,没有上传到网络,存在你本地浏览器的缓存里面。 - (3)这个部分看到的就是你的章节列表,当让你第一次来的这个地方是空的。

新增章节下一次就会有内容了。 - (4)文件名,是我们存储章节的唯一标识。

readme.md和_sidebar.md是系统默认必须有的。因为docsify技术默认需要这2个。

如何编写大纲

如果你是第一次开始,大纲的界面是这样的。

- 点击

增加大纲 - 点击

查看样例 - 修改系统生成的例子,此时 readme.md是必须的readme 对应的名字你可以自己修改

- 点击提交 就可以完成大纲了。

第二次、点击

更新大纲按钮- [首页](/readme.md) - [国人开发者](/01.md) - [中文用户列表](/02.md)大纲例子,“[]” 内是标题,“()”内是 文件名; 标题是是显示在文章的右侧; 文件名的作用是匹配 ‘新增章节’ 里面的markdown的相匹配关联的。

如何编写一个章节,例如:readme.md

* 点击

* 点击 新增章节* 填写标题 * 填写内容 * 关键是 填写文件名,需要和大纲里的名字对应 * 提交?> 如果你写的 章节 并没有在大纲里标识名字 ,用户在浏览的时候,左侧的章节并不会出现。

-

@ fd06f542:8d6d54cd

2025-04-12 01:21:03

@ fd06f542:8d6d54cd

2025-04-12 01:21:03{"coverurl":"https://cdn.nostrcheck.me/fd06f542bc6c06a39881810de917e6c5d277dfb51689a568ad7b7a548d6d54cd/19105641454b483284cf76c42fbdde2ed3f47b1bb2a366a58eaa49630d385027.webp","title":"nostr-examples","author":"nostr-dev"}

-

@ caa88a52:6c226a91

2025-04-11 22:58:40

@ caa88a52:6c226a91

2025-04-11 22:58:40Running Nestr!

-

@ 378562cd:a6fc6773

2025-04-11 22:40:19

@ 378562cd:a6fc6773

2025-04-11 22:40:19Here in the country, we know a thing or two about focus. You can't fix a fence, milk a cow, or hoe a straight row if you're half-distracted or daydreaming about something else. The same applies to anything in life, whether it's trying to finish a project, have a meaningful conversation, or simply sit still long enough to pray. Concentration is a skill that, like all good things, requires a little grit and a lot of practice.

Here’s some practical, common-sense advice to help you buckle down and focus when your mind is spinning a bit too fast.

-

Clear the Mess Before You Start A messy space leads to a messy mind. You wouldn’t gut a deer on the kitchen table, and you shouldn’t expect to think clearly in a cluttered room. Clean up your work area. Put things away. Next, do the same with your mind and jot down everything swirling around in there. Get it out, set it aside, and focus completely on one task at a time.

-

Work Like a Farmer: in Spurts! A farmer doesn’t plow from sunup to sundown without stopping to catch his breath. He works steadily, confidently, but knows when to rest his bones, wipe his brow, and sip a cold drink. That’s the kind of rhythm that gets things done without wearing a man down. Try working in short, focused bursts for about twenty-five minutes, then take a five-minute breather. Stretch your legs, step outside, say a quick prayer, and return to your task. After a few rounds, take a longer break to let your mind cool off. You’ll accomplish more this way and won’t feel worn out by noon.

-

Stop Trying to Juggle Chickens Multitasking may seem impressive, but let’s face it: attempting to accomplish five tasks at once often results in none being done correctly. Concentrate on one task. Give it your all. Then move on. You’ll be more productive and less stressed.

-

Turn Down the Noise Distractions are like flies at a picnic - relentless and annoying. Shoo them away. Keep your phone out of reach. Use apps to block websites that drain your time. Turn off the TV. You cannot harvest peace and quiet if you’re watering weeds.

-

Feed Your Brain Like You Feed Your Livestock Your brain ain’t some spare part you can ignore and still expect to run strong. It needs proper tending, just like the rest of you. So drink plenty of water, not just coffee. Eat real food that grew in the ground or once walked on it, not something cooked up in a lab. Step outside and let the breeze hit your face. Soak up some sunshine and stretch your legs. Move a little; even a short walk can shake the cobwebs loose. It doesn’t take much, but you’ll be surprised what a difference it makes. A well-fed, well-rested mind is a sharp one, ready to do good work and hear what God’s saying through the noise.

-

Start Small, Grow Strong You don’t plant a tree and expect shade the next day. Same with focus. If you can only concentrate for ten minutes at first, that’s fine. Do that. Then, stretch it to fifteen, then thirty. It takes time and a little muscle, like splitting wood or learning to fish.

-

Know Your Why There’s a reason behind everything we do; remembering your reason helps you stay the course. Ask yourself: Why does this matter? Who am I doing this for? What good will come of it? Purpose gives power to your focus.

-

Rest Like It’s Part of the Job—Because It Is Hard work matters, and so does rest. Even the Lord took a day off. Sleep well, take breaks, go for a walk, and let your brain breathe. You don’t have to earn your rest; you just have to honor it. You’ll be sharper when you return.

Final Word from the Porch Concentration ain’t about being superhuman. It’s about making smart choices in small moments. Shut out the noise. Show up for your tasks. Give them your full attention. That’s how fences get mended, stories get written, and lives get changed.

Take it slow. Take it steady. And keep your eye on the prize.

-

-

@ d0aa74cd:603d35cd

2025-04-11 20:24:40

@ d0aa74cd:603d35cd

2025-04-11 20:24:40Experimenting with cat package examples.

Gleam #Gleamlang #cat #Haskell

https://photonsphere.org/post/2025-04-11-gleam-cat/

-

@ 2ed3596e:98b4cc78

2025-04-11 20:13:03

@ 2ed3596e:98b4cc78

2025-04-11 20:13:03Americans can now instantly sell bitcoin directly from their Lightning Wallets. The same auto conversion Bitcoin Well Customers are used for instantly and conveniently selling bitcoin from self-custody now has a Lightning option ready in the Sell bitcoin page of your Bitcoin Well account.

Adding the ability to sell bitcoin from the Lightning Network underscores our commitment to enabling you to get the most out of the freedom and independence Bitcoin has to offer. No longer must you rely on giving up custody of your bitcoin or navigate complicated trading interfaces for fast and convenient sales! Just send sats and receive dollars – Lightning fast.

Selling sats from the Lightning Network is quick and easy:

- From your Bitcoin Well account, go to Sell bitcoin and enter the amount of dollars you want

- Choose your bank, select “Lightning” and then generate a Lightning Invoice

- Pay the Lightning invoice and we’ll send dollars to your bank account

Here are detailed steps to guide you on how to sell sats from the Lightning Network 👇

Get your Lightning Invoice

Navigate to your Sell bitcoin page, enter the amount of dollars you wish to receive, set your destination bank account and select “Lightning”.

Tap ‘Generate invoice’ to create a Lightning invoice. This Lightning invoice will be for the exact amount of sats you need to send for the amount of dollars you want to receive.

Tap ‘Generate invoice’ to create a Lightning invoice. This Lightning invoice will be for the exact amount of sats you need to send for the amount of dollars you want to receive.Send sats to your Lightning Invoice

To instantly sell bitcoin for dollars, simply pay the Lightning Invoice from your Lightning wallet. You can do this by scanning the QR code or by tapping the QR code to copy + paste the invoice into your Lightning wallet. Once received (basically instantly), we automatically convert received sats into dollars and send the dollars to your selected bank account. No waiting for confirmations, no mining fees and no complicated trading interfaces. Just sats in, dollars out. Lightning fast ⚡️

## What is the Lightning Network?

## What is the Lightning Network?The Lightning Network is a second-layer protocol built on top of Bitcoin. It enables fast, cheap, and private bitcoin payments, perfect for small transactions and daily use. Think of it like the relationship between the credit card network and the banking system. While Bitcoin’s base layer is optimized for security, Lightning is optimized for frequent or small, cheap and private payments for everyday transactions — instantly and without bloating the blockchain. The Lightning Network makes it much more convenient to use bitcoin in everyday life, bringing you closer to replacing your bank with bitcoin.

Currently, sats on the Lightning Network cannot be directly sent to an on-chain bitcoin wallet, and vice versa. However, that won’t remain true for Bitcoin Well accounts for long…

Why Does the Lightning Network Matter?

The Lightning Network helps bitcoin reach its full potential as everyday money. While Bitcoin’s base chain is perfect for storing value, it’s not always practical for everyday payments or quick, small transactions. Lightning fills that gap — it’s fast, inexpensive, and built for a world where people use bitcoin as easily as cash. Bitcoin is the future of money. Lightning makes it usable today. We love Lightning, and have some exciting additional products coming that will shock you!

Earn sats over the Lightning Network

Earn sats when you refer your friends! When you add your Lightning Payment address from your personal Lightning Wallet to your Referral page, every time someone you referred transacts on the portal, you get a kickback paid in sats! Of course, we never custody your bitcoin, even when you get a Lightning referral reward! All bitcoin is always sent straight to your wallet. ⚡\ \ Haven’t signed up with Bitcoin Well yet? Sign up here and embrace the Bitcoin Standard.

About Bitcoin Well

Bitcoin Well exists to enable independence. We do this by coupling the convenience of modern banking, with the benefits of bitcoin. In other words, we want to make it easy to use bitcoin in self-custody.

We are publicly traded (and love it when our customers become shareholders!) and hold ourselves to a high standard of enabling life on a Bitcoin standard. If you want to learn more about Bitcoin Well, please visit our website or reach out!

-

@ e111a405:fa441558

2025-04-11 17:15:58

@ e111a405:fa441558

2025-04-11 17:15:58Meritocracy without equality is basically a ladder with missing steps, which only the fortunate few can climb. The rest is basically left at the ground to gaze up.

Furthermore, a pure focus on meritocracy can become a weakness if it’s a zero-sum game. While talents thrive in systems that value it, without fairness, you ultimately get exploitation, resentment, or fragility.

Ergo: meritocracy needs to be balanced with equality, and equality needs to be balanced with meritocracy.

In a meritocratic system, you basically need that the fortunate and the able are compassionate towards those less fortunate and able.

If you are more on the libertarian side, you need the fortunate individuals to compete as capitalists and then be socialists within their communities and families.

If you prefer a state, then the state must encourage meritocratic contribution of everyone that is able, to the best of their ability, while balancing it with a fair welfare system that nurtures and supports those less able and fortunate.

I think this is something Germany did historically quite well, but at one point we lost the balance: we lost the culture of merit by putting too much emphasis on equality – even to a point that Germany now cares for millions of non-citizens that never contributed, when it should instead demand these individuals to contribute to the best of their ability.

If we want to have a state, then we don’t want a welfare state, and – I think – we should also not want a pure capitalistic state. We need balance and thus a social meritocracy.

-

@ c230edd3:8ad4a712

2025-04-11 16:02:15

@ c230edd3:8ad4a712

2025-04-11 16:02:15Chef's notes

Wildly enough, this is delicious. It's sweet and savory.

(I copied this recipe off of a commercial cheese maker's site, just FYI)

I hadn't fully froze the ice cream when I took the picture shown. This is fresh out of the churner.

Details

- ⏲️ Prep time: 15 min

- 🍳 Cook time: 30 min

- 🍽️ Servings: 4

Ingredients

- 12 oz blue cheese

- 3 Tbsp lemon juice

- 1 c sugar

- 1 tsp salt

- 1 qt heavy cream

- 3/4 c chopped dark chocolate

Directions

- Put the blue cheese, lemon juice, sugar, and salt into a bowl

- Bring heavy cream to a boil, stirring occasionally

- Pour heavy cream over the blue cheese mix and stir until melted

- Pour into prepared ice cream maker, follow unit instructions

- Add dark chocolate halfway through the churning cycle

- Freeze until firm. Enjoy.

-

@ 2101a7ec:d9d8f2db

2025-04-11 14:50:45

@ 2101a7ec:d9d8f2db

2025-04-11 14:50:45Ghostty is terminal manager with GPU acceleration and great looks. It works mostly out of the box, but you might want to do some setups to tailor it to your particular needs.

Here is how I set it up.

Installation

I won't spend much time on installation details, I installed it using

brewthere are multiple installation options, surprisingly flatpack is not within the options at the moment. For further details please check ghostty installation instructions.Configuration

Config file is available on these locations

$HOME/Library/Application Support/com.mitchellh.ghostty/config$XDG_CONFIG_HOME/ghostty/configI use

$XDG_CONFIG_HOMEas I keep all my config there.Configuration reference is available on line. And can be generated from the command line doing

ghostty +show-config --default --docsAnd finally to list available themes

ghostty +list-themes.This is my config, it's available with my dotfiles

```config

~/.config/ghostty/config

to show the default configuration with documentation.

ghostty +show-config --default --docs

font-family = "JetBrains Mono"

font-size = 14

Run

ghostty +list-themesto browse available themes.theme = SynthwaveAlpha cursor-style = block

background-opacity = 0.96 background-blur-radius = 40

shell integration.

shell-integration = bash shell-integration-features = cursor, sudo, title

macos-titlebar-style = tabs

Auto-update Ghostty when a new release is available.

auto-update = download

mouse-hide-while-typing = true

keymaps

keybind = global:cmd+`=toggle_quick_terminal

keybind = cmd+left=previous_tab keybind = cmd+right=next_tab

byobu keybinds fix

macos-option-as-alt = left keybind = alt+left=unbind keybind = alt+right=unbind

quit-after-last-window-closed = true window-new-tab-position = end

```

I had some issues with SSH, so I added this to my

~/.ssh/configwhich fixed my issues.ssh Host * # ghostty https://ghostty.org/docs/help/terminfo SetEnv TERM=xterm-256color # end ghostty -

@ 0b118e40:4edc09cb

2025-04-11 14:38:22

@ 0b118e40:4edc09cb

2025-04-11 14:38:22There’s an African proverb that says, “To get lost is to learn the way.”

Humans have always been explorers, searching for connection. To belong. To feel home. You can trace this instinct back to the start of our existence. Whether you start with Adam and Eve or the “Out of Africa” theory, the story is the same. We’ve always moved toward each other, building tribes and forming communities.

But somewhere along the way, something broke. With the rise of empires and organized control, religion and politics divided us into bubbles. We were sorted, labeled, and often pitted against one another. While technology advanced, something fundamental was lost. Our ability to truly connect started to fade.

Then came the internet, a modern-day Silk Road. It rekindled hope. Walls seemed to crumble, distances disappeared, and we dreamed of a truly connected world. For a time, it felt like the answer.

And then it wasn’t.

The history of Internet

The story began around 1830s when Charles Babbage started working on his computer prototype but without moolah he couldn't continue. A century later, after WW2 in the 1950s, the US Department of Defense funded what became known as modern computing.

Back then the military relied on systems like the Navajo Code Talkers. The indigenous code talkers were ingenious but operated under dangerous conditions, always on the frontlines.

In 1969, ARPANET made a revolutionary breakthrough as it connected four university computers for the first time. It was a big deal.

At that time, the internet was about openness. Researchers pushed for universal protocols. This gave rise to hacker culture that valued knowledge-sharing and keeping systems accessible to everyone.

In the 80s, NSFNET (National Science Foundation ) expanded these connections but kept it strictly for academic use only. That caused massive dissatisfaction.

Senator Al Gore pitched the concept of the “information superhighway,” to balance public access with private innovation. But by the 90s, the Clinton administration leaned into privatization. NSFNET’s infrastructure was completely handed off to private companies, and the internet grew into a commercial powerhouse.

The good news is that everyone has internet access now. Bad news is that what started as something free from government and commercial control became completely dominated by both.

Open source vs IP during the early internet days

This part of the story is about Bill Gates and Marc Andreessen.

Tim Berners-Lee invented the World Wide Web, but Marc saw the opportunity to make it user-friendly. He launched Netscape, an open-source browser. It drove the openness of internet culture. Netscape captured 90% of the market by giving its software away for free, and monetizing through other means.

Then came along Bill Gates. Microsoft back then was known for its aggressive tactics to monopolize industries. Gates licensed Mosaic’s code, created Internet Explorer, and bundled it for free with Windows 95. He wasn’t shy about playing dirty, even formed exclusive contracts with manufacturers to block competitors. Even the Department of Justice tried to file an antitrust lawsuit against Microsoft, but by then, it was too late. Netscape’s market share crumbled, and its position in the industry eroded.

Windows 95 brought the internet to the people globally, but it also closed it up.

Marc Andreeson started with open source ideologies, but is now funding altcoin projects.

The Californian ideology

Around this time, the term “Californian Ideology” started floating around. It was an unusual mix of libertarianism, techno-utopianism, and countercultural ideals. A marriage of cultural bohemianism (hippies) with high-tech entrepreneurship (yuppies). This ideology fused left-wing values like freedom of expression and direct democracy with right-wing beliefs in free markets and minimal government interference.

I absolutely love it.

Ironically, the term “Californian Ideology” wasn’t coined as a compliment. Richard Barbrook and Andy Cameron used it to piss on these visionaries for romanticizing the idea that the internet must remain a lawless, egalitarian space.

But many people loved and embraced the Californian ideology. Stewart Brand, who founded The Whole Earth Catalog, connected counterculture with early tech innovation. His work inspired people like Steve Jobs and Steve Wozniak. Steve Wozniak used to share Apple’s early schematics at the Homebrew Computer Club for feedback and collaboration.

EBay’s founder Pierre Omidyar envisioned eBay as a libertarian experiment. He believed the “invisible hand” of the market would ensure fairness. But as eBay grew, fraud, disputes, and dissatisfaction among users forced Omidyar to introduce governance which contradicted his goals.

And this story repeats itself over the years.

Platforms begin with libertarian visions, but as they scale, real-world challenges emerge. Governance (government, corporate charters, advertisers, and investors) is introduced to address safety and trust issues.

But they also chip away at the liberty the internet once promised.

Can Nostr be the solution ?

Yes.

But to appreciate Nostr, let’s first understand how the internet works today. (Note : I am no expert of this section but I'll try my best to explain)

The internet operates through four main layers:

- Application Layer (where apps like browsers, Google, or Zoom live)

- Transport Layer

- Internet Layer

- Network Access Layer

Let’s use a simple example of searching “Pink Panther” on Google.

Step 1: The Application Layer - You open your browser, type "Pink Panther," and hit search. This request is sent using HTTP/HTTPS (a protocol that formats the query and ensures it's secure).

Step 2: The Transport Layer - Think of your search query as a letter being sent. The Transport Layer breaks it into smaller packets (like splitting a long letter into multiple envelopes). TCP (Transmission Control Protocol) ensures all packets arrive and reassemble in the correct order.

Step 3: The Internet Layer - This layer acts like a postal service, assigning each device an address (IP address) to route the packets properly. Your device's IP (e.g., 192.168.1.10) and Google’s server IP (e.g., 142.250.72.238) help routers find the best path to deliver your packets.

Step 4: The Network Access Layer - Finally, the Network Access Layer physically delivers the packets. These travel as electrical signals (over cables), radio waves (Wi-Fi), or light pulses (fiber optics). This is the act of moving envelopes via trucks, planes, or postal workers, just much faster.

So how is data transmitted via Nostr ?

Nostr’s architecture of the Internet

Nostr reimagines the Application Layer while keeping the lower layers (Transport, Internet, and Network Access) largely unchanged.

In the traditional internet stack, the Application Layer is where platforms like Google or Twitter operate. It’s also where most censorship occurs due to single point of failure (centralised servers). Nostr flips this model on its head.

Technically, it’s like building a parallel internet that shares the same foundational layers but diverges at the top.

To borrow from Robert Frost:

"Two roads diverged in a wood, and I—

I took the one less traveled by,

And that has made all the difference."

For Nostr to fully realize its potential, it needs its own ecosystem of apps. Developers can build these tools within the Nostr protocol's framework

Let’s say there is a search engine on Nostr called Noogle.

Here’s how it works:

When you type "Pink Panther" on Noogle, your query is sent to multiple relays (servers) simultaneously. Each relay processes or forwards the query and returns results based on the data it holds.

As Nostr grows, the amount of information on relays will increase, giving Noogle more robust search results. But the biggest win is that compared to Google, Nostr's Noogle will have no ads, no surveillance, just pure, decentralized searching that respects your privacy.

For the transport layer, Nostr still relies on TCP/IP but enhances it with privacy and efficiency. Encrypted messages and simplified protocols enable faster real-time communication. The rest of the layer remains unchanged.

At its core, Nostr takes the internet back to its original ideals: open, uncensored, and decentralized.

Why Nostr matters ?

The internet we use today relies on centralized systems at the application layer. This creates a single point of failure where governments and corporations can control access, censor content, monitor activity, and even shut down entire platforms.

For example, the Malaysian government once proposed routing all web traffic through a centralized system, claiming it was for "security" reasons. In reality, this action allow those in power to block access to specific content or platforms that might threaten their positions.

Centralization weaponizes the internet.

It turns what was meant to be a tool for connection and freedom into a mechanism for control and oppression.

Let's look at DNS and ISPs as examples. DNS (Domain Name System) is like the phonebook of the internet. It helps translate website names (like example.com) into IP addresses so your browser can connect to them. ISPs (Internet Service Providers) are companies that give you access to the internet.

Both are controlled by centralized entities. If a government gains control of either, it can block specific websites or even shut down internet access entirely.

We've seen this happen repeatedly: * India’s internet shutdowns in regions like Kashmir * Turkey’s social media bans during political events * Ethiopia’s internet blackouts * China’s Great Firewall blocking major platforms like Google and Facebook * Even the US, where Edward Snowden revealed massive surveillance programs

This is where Nostr comes in, as the antidote to centralized control.

Instead of relying on centralized servers or platforms, Nostr creates a peer-to-peer network of independent relays. No single entity controls it. There is no central switch governments can flip to block access. If one relay is shut down, users simply connect to others in the network.

Nostr’s decentralized design makes it: * Resistant to censorship: Governments cannot easily block or filter content. * Privacy-preserving: Users can communicate anonymously, even in heavily surveilled environments. * Resilient: With no single point of failure, the network keeps running, even under attack.

And it gets better. Nostr can integrate with privacy tools like Tor to bypass restrictions entirely, making it nearly impossible for governments to stop.

The internet has become a battlefield for control, but Nostr provides a way to reclaim digital freedom. It empowers people to build, connect, and share without fear of being silenced.

How does Nostr overcome the "Californian Ideology" problems?

The Californian Ideology seemed like the blueprint for a utopian internet, libertarian ideals wrapped in Silicon Valley innovation. But as centralized platforms scaled, cracks started to show. Challenges like trust, safety, and accessibility forced governance teams to step in and decide “what’s best for the people.”

This resulted in platforms once built on ideals of freedom in becoming gatekeepers of control.

Nostr breaks this cycle. How?

1. Trust issues - With private keys, you control your identity and data. Moderation is decentralized. You can block or mute others at a personal level or through client tools, not by relying on a central authority. While this system needs refinement to be more user-friendly, it fundamentally shifts the power to users.

2. Funding Without Advertiser - Nostr’s integration of Bitcoin and the Lightning Network eliminates reliance on advertisers or corporate sponsors. Bitcoin enables anyone to contribute without gatekeeping. As more people join and apps mature, this model only gets stronger. For now, we have good souls like Jack seeding it.

3. Resisting Government Control - (refer to the above) Nostr avoids single points of attacks.

So what is Nostr ?

Nostr is internet

The new internet.

The open and free internet.

What can you build on Nostr?

Anything you have seen on the internet, you can recreate on Nostr. Anything you can imagine, you can bring to life here. It is a blank canvas for dreamers, builders, and changemakers.

But the best part is this. You have Bitcoin as its financial backbone. This changes the game entirely.

And with new games, comes new rules. New vibes. New ways.

The way people use this new internet will be different from the traditional internet as control falls back to the people. With Bitcoin as the underlying backbone, the business models will be different.

But there is more to it than just creating. There's that joy of creation, where we invite curiosity and inspire users to experience something new, something revolutionary.

Have you watched “The Last Lecture” by Randy Pausch?

He coined the term “head fake.” He taught his students programming, but not everyone was excited to learn programming. So he created fun projects and performances that pulled them in. The students had so much fun, they didn’t even realize they were learning to code.

What you build on Nostr is that head fake. The apps and projects you create draw people in with fun and utility, subtly reminding them they have a right to their own voice and thoughts.

The work you’re doing is so precious. When everything feels like doom and gloom, it’s these kinds of projects that give people hope.

Through Nostr, you’re making a difference. One project, one connection at a time.

The new Internet era

Centralized systems, like empires of the past, eventually crumble under the weight of their control. Decentralization provides a different path. It is a modern revival of our primal instincts to explore, connect, and build tribes.

By definition, Nostr is a protocol. I think more so, it's a philosophy. It challenges us to rethink how we share, communicate, and create. It is the internet as it was meant to be. Free, open, and governed by no one.

The beauty of Nostr lies in its simplicity. It does not rely on massive infrastructure, corporate giants, or government oversight. It thrives on community, much like the early tribes that defined humanity.

We have come full circle. From wandering continents to building roads, bridges, and networks, our journey has always been about connection and finding our tribe.

As the African proverb reminds us, 'To get lost is to learn the way.' There is finally a way now.

But at the end of the day, it’s entirely up to you what kind of world you want to be part of.

Find your tribe. Build the future. Love them hard.

More info :

On those who played a role in the history of internet and computers

https://hiddenheroes.netguru.com/ -

@ 34ff86e0:dbb6b9fb

2025-04-11 14:35:59

@ 34ff86e0:dbb6b9fb

2025-04-11 14:35:59Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum

-

@ e17e9a18:66d67a6b

2025-04-11 14:00:27

@ e17e9a18:66d67a6b

2025-04-11 14:00:27We wrote this album to explain the inspiration behind Mutiny Brewing, and as a way to share the story of Bitcoin and freedom technologies like nostr. Through these songs, we’ve tried to capture every truth that we believe is essential to understand about money, freedom, trust, and human connection in the internet age. It’s our way of making these ideas real and relatable, and we hope it helps others see the power of taking control of their future through the systems we use.

01. "Tomorrow's Prices on Yesterday's Wage" explores the harsh reality of inflation. As central banks inflate the money supply, prices rise faster than wages, leaving us constantly falling behind. People, expecting prices to keep climbing, borrow more to buy sooner, pushing prices even higher in a vicious cycle. You're always a step behind, forced to pay tomorrow's inflated prices with yesterday's stagnant wages.

https://wavlake.com/track/76a6cd02-e876-4a37-b093-1fe919e9eabe

02. "Everybody Works For The Bank" exposes the hidden truth behind our fiat money system. When banks issue loans, they create new money from debt—but you must pay back both the principal and interest. That interest requires even more money, relying on others to borrow, creating an endless cycle of debt. If borrowing slows, the system falters and governments step in, printing more money to keep banks afloat. Ultimately, we’re all working to service debt, chained to the banks.

“Paying back what they create, working till I break” https://wavlake.com/track/4d94cb4b-ff3b-4423-be6a-03e0be8177d6

03. "Let My People Go" references Moses' demand for freedom but directly draws from Proverbs 6:1–5, exposing the danger of debt based money. Every dollar you hold is actually someone else's debt, making you personally liable—held in the hand of your debtor and at risk of their losses, which you ultimately pay for through inflation or higher taxes. As the song says, "The more you try to save it up, the deeper in you get." The wisdom of Proverbs urges immediate action, pleading urgently to escape this trap and free yourself, like a gazelle from a hunter.

https://wavlake.com/track/76214ff1-f8fd-45b0-a677-d9c285b1e7d6

04. "Mutiny Brewing" embodies Friedrich Hayek's insight: "I don't believe we shall ever have good money again before we take it out of the hands of government... we can't take it violently... all we can do is by some sly roundabout way introduce something they can't stop."

Inspired also by the Cypherpunk manifesto's rallying cry, "We will write the code", the song celebrates Bitcoin as exactly that unstoppable solution.

"Not here to break ya, just here to create our own little world where we determine our fate." https://wavlake.com/track/ba767fc8-6afc-4b0d-be64-259b340432f3

05. "Invisible Wealth" is inspired by The Sovereign Individual, a groundbreaking 1990s book that predicted the rise of digital money and explores how the return on violence shaped civilizations. The song references humanity's vulnerability since agriculture began—where stored wealth attracted violence, forcing reliance on larger governments for protection.

Today, digital privacy enabled by cryptography fundamentally changes this dynamic. When wealth is stored privately, secured by cryptographic keys, violence becomes ineffective. As the song emphasizes, "You can't bomb what you can't see." Cryptography dismantles traditional power structures, providing individuals true financial security, privacy, and freedom from exploitation.

“Violence is useless against cryptography” https://wavlake.com/track/648da3cc-d58c-4049-abe0-d22f9e61fef0

06. "Run A Node" is a rallying cry for Bitcoin's decentralisation. At its heart, it's about personal verification and choice: every node is a vote, every check’s a voice. By running the code yourself, you enforce the rules you choose to follow. This is true digital democracy. When everyone participates, there's no room for collusion, and authority comes directly from transparent code rather than blind trust.

"I verify, therefore I do." https://wavlake.com/track/ee11362b-2e84-4631-b05e-df6d8e6797f8

07. "Leverage is a Liar" warns against gambling with your wealth, but beneath the surface, it's a sharp critique of fractional reserve banking. Fractional reserves inflate asset prices, creating the illusion of wealth built on leverage. This system isn't sustainable and inevitably leads to collapse. Real wealth requires sound money, money that can't be inflated. Trying to gain more through leverage only feeds the lie.

"Watch it burn higher and higher—leverage is a liar." https://wavlake.com/track/67f9c39c-c5e1-4e15-b171-f1f5442f29a5

08. "Don't Get Rekt" serves as a stark warning about trusting custodians with your Bitcoin. Highlighting infamous collapses like Mt.Gox, Celsius, and FTX. These modern failures echo the 1933 Executive Order 6102, where the US government forcibly seized citizens' gold, banned its use, and then promptly devalued the currency exchanged for it. History shows clearly: trusting others with your wealth means risking losing it all.

"Your keys, your life, don't forget." https://wavlake.com/track/fbd9b46d-56fc-4496-bc4b-71dec2043705

09. "One Language" critiques the thousands of cryptocurrencies claiming to be revolutionary. Like languages, while anyone can invent one, getting people to actually use it is another story. Most of these cryptos are just affinity scams, centralized towers built on shaky foundations. Drawing from The Bitcoin Standard, the song argues money naturally gravitates toward a single unit, a universal language understood by all. When the dust settles, only genuine, decentralized currency remains.

"One voice speaking loud and clear, the rest will disappear." https://wavlake.com/track/22fb4705-9a01-4f65-9b68-7e8a77406a16

10. "Key To Life" is an anthem dedicated to nostr, the permissionless, unstoppable internet identity protocol. Unlike mainstream social media’s walled gardens, nostr places your identity securely in a cryptographic key, allowing you total control. Every message or action you sign proves authenticity, verifiable by anyone. This ensures censorship resistant communication, crucial for decentralised coordination around Bitcoin, keeping it free from centralised control.

"I got the key that sets me free—my truth is mine, authentically." https://wavlake.com/track/0d702284-88d2-4d3a-9059-960cc9286d3f

11. "Web Of Trust" celebrates genuine human connections built through protocols like nostr, free from corporate algorithms and their manipulative agendas. Instead of top down control, it champions grassroots sharing of information among trusted peers, ensuring truth and authenticity rise naturally. It's about reclaiming our digital lives, building real communities where trust isn't manufactured by machines, but created by people.

"My filter, my future, my choice to make, real connections no one can fake." https://wavlake.com/track/b383d4e2-feba-4d63-b9f6-10382683b54b

12. "Proof Of Work" is an anthem for fair value creation. In Bitcoin, new money is earned through real work, computing power and electricity spent to secure the network. No shortcuts, no favourites. It's a system grounded in natural law: you reap what you sow. Unlike fiat money, which rewards those closest to power and the printing press, Proof of Work ensures rewards flow to those who put in the effort. Paper castles built on easy money will crumble, but real work builds lasting worth.

"Real work makes real worth, that's the law of this earth." https://wavlake.com/track/01bb7327-0e77-490b-9985-b5ff4d4fdcfc

13. "Stay Humble" is a reminder that true wealth isn’t measured in coins or possessions. It’s grounded in the truth that a man’s life does not consist in the abundance of his possessions. Real wealth is the freedom to use your life and time for what is good and meaningful. When you let go of the obsession with numbers, you make room for gratitude, purpose, and peace. It's not about counting coins, it's about counting your blessings.

"Real wealth ain't what you own, it's gratitude that sets the tone." https://wavlake.com/track/3fdb2e9b-2f52-4def-a8c5-c6b3ee1cd194

-

@ 1bc70a01:24f6a411

2025-04-11 13:50:38

@ 1bc70a01:24f6a411

2025-04-11 13:50:38The heading to be

Testing apps, a tireless quest, Click and swipe, then poke the rest. Crashing bugs and broken flows, Hidden deep where logic goes.

Specs in hand, we watch and trace, Each edge case in its hiding place. From flaky taps to loading spins, The war on regressions slowly wins.

Push the build, review the log, One more fix, then clear the fog. For in each test, truth will unfold— A quiet tale of stable code.

This has been a test. Thanks for tuning in.

- one

- two

- three

Listen a chillTranquility

And leisure

-

@ bf95e1a4:ebdcc848

2025-04-11 11:21:48

@ bf95e1a4:ebdcc848

2025-04-11 11:21:48This is a part of the Bitcoin Infinity Academy course on Knut Svanholm's book Bitcoin: Sovereignty Through Mathematics. For more information, check out our Geyser page!

An Immaculate Conception

Some concepts in nature are harder for us humans to understand than others. How complex things can emerge out of simpler ones is one of those concepts. A termite colony, for instance, has a complex cooling system at its lower levels. No single termite knows how it works. Completely unaware of the end results, they build complex mounds and nests, shelter tubes to protect their paths, and networks of subterranean tunnels to connect their dirt cities. Everything seems organized and designed, but it is not. Evolution has equipped the termite with a pheromone receptor that tells the termite what task he ought to engage himself in by simply counting the number of neighboring termites doing the same thing. If there’s a surplus of workers in an area, nearby termites become warriors, and so on. Complex structures emerge from simple rules. The fractal patterns found all around nature are another example. Fractals look complex, but in reality, they’re not. They’re basically algorithms — the same pattern, repeated over and over again with a slightly modified starting point. The human brain is an excellent example of a complex thing that evolved out of simpler things, and we humans still have a hard time accepting that it wasn’t designed. Religions, which themselves are emergent systems spawned out of human interaction, have come up with a plethora of explanations for how we came to be. All sorts of wild origin stories have been more widely accepted than the simple explanation that our complexities just emerged out of simpler things following a set of rules that nature itself provided our world with.

Complex systems emerge out of human interactions all the time. The phone in your pocket is the result of a century of mostly free global market competition, and no single human could ever have come up with the entire thing. The device, together with its internet connection, is capable of a lot more than the sum of its individual parts. A pocket-sized gadget that can grant instant access to almost all of the world’s literature, music, and film, which fits in your pocket, was an unthinkable science fiction a mere twenty years ago. Bitcoin, first described in Satoshi Nakamoto’s whitepaper ten years before these words were written, was designed to be decentralized. Still, it wasn’t until years later that the network started to show actual proof of this. Sound money, or absolute digital scarcity, emerged out of the network not only because of its technical design. How Bitcoin’s first ten years actually unfolded played a huge part in how true decentralization could emerge, and this is also the main reason why the experiment cannot be replicated. Scarcity on the internet could only be invented once. Satoshi’s disappearance was Bitcoin’s first step towards true decentralization. No marketing whatsoever and the randomness of who hopped onto the train first were the steps that followed. Bitcoin truly had an immaculate conception.

The network has shown a remarkable resistance to change over the last few years especially, and its current state might be its last incarnation given the size of the network and the 95% agreement threshold in its consensus rules. It might never change again. In that case, an entirely new, complex life form will have emerged out of a simple set of rules. Even if small upgrades are implemented in the future, the 21 million coin supply cap is set in stone forever. Bitcoin is not for humans to have opinions about — it exists regardless of what anyone thinks about it, and it ought to be studied rather than discussed. We don’t know what true scarcity and a truly global, anonymous free market will do to our species yet, but we are about to find out. It is naïve to think otherwise. Various futurists and doomsday prophets have been focused on the dangers of the impending general artificial intelligence singularity lately, warning us about the point of no return, whereupon an artificial intelligence will be able to improve itself faster than any human could. Such a scenario could, as news anchor Ron Burgundy would have put it, escalate quickly. This may or may not be of real concern to us, but meanwhile, right under our noses, another type of unstoppable digital life has emerged, and it is already changing the behavior and preferences of millions of people around the globe. This is probably bad news for big corporations and governments but good news for the little guy looking for a little freedom. At least, that’s what those of us who lean towards the ideas of the Austrian school of economics believe. This time around, we will find out whether this is the case or not. No one knows what it will lead to and what new truths will emerge out of this new reality.

Unlike the termite, we humans are able to experience the grandeur of our progress. We can look in awe at the Sistine Chapel or the pyramids, and we can delve into the technicalities and brief history of Bitcoin and discover new ways of thinking about value along the way. Money is the language in which we express value to each other through space and time. Now, that language is spoken by computers. Value expressed in this language can’t be diluted through inflation or counterfeiting any longer. It is a language that is borderless, permissionless, peer-to-peer, anonymous (if you have the skills), unreplicable, completely scarce, non-dilutable, unchangeable, untouchable, undeniable, fungible, and free for everyone on Earth to use. It is a language for the future and it emerged out of a specific set of events in the past. All languages are examples of complex systems emerging out of simpler things, and Bitcoin evolved just as organically as any other human language did.

Decentralization is hard to achieve. Really hard. When it comes to claims of decentralization, a “don’t trust, verify” approach to the validity of such claims will help you filter out the noise. So, how can the validity of Bitcoin’s decentralization be verified? It’s a tricky question because decentralization is not a binary thing, like life or death, but rather a very difficult concept to define. However, the most fundamental concepts in Bitcoin, like the 21 million cap on coin issuance or the ten-minute block interval as a result of the difficulty adjustment and the Proof of Work algorithm, have not changed since very early on in the history of the network. This lack of change, which is arguably Bitcoin’s biggest strength, has been achieved through the consensus rules, which define what the blockchain is. Some special mechanisms (for example, BIP9) are sometimes used to deploy changes to the consensus rules. These mechanisms use a threshold when counting blocks that signal for a certain upgrade. For example, the upgrade “Segregated Witness” activated in a node when 95% or more of the blocks in a retarget period signaled support. Bitcoin has displayed a remarkable immutability through the years, and it is highly unlikely that this would have been the case if the game-theoretical mechanisms that enable its decentralized governance model hadn’t worked, given the many incentives to cheat that always seem to corrupt monetary systems. In other words, the longer the system seems to be working, the higher the likelihood that it actually does.

Satoshi set in stone the length of the halving period — a very important aspect of Bitcoin’s issuance schedule and initial distribution. During the first four years of Bitcoin’s existence, fifty new coins were issued every ten minutes up until the first block reward halving four years later. Every four years, this reward is halved so that the issuance rate goes down by fifty percent. This effectively means that half of all the Bitcoin that will ever exist was mined during the first four years of the network’s life, one fourth during its next four years, and so on. At the time of writing, we’re a little more than a year from the third halving. After that, only 6.25 Bitcoin will be minted every ten minutes as opposed to 50, which was the initial rate. What this seems to do is to create hype cycles for Bitcoin’s adoption. Every time the price of Bitcoin booms and then busts down to a level above where it started, a hype cycle takes place. Bitcoin had no marketing whatsoever, so awareness of it had to be spread through some other mechanism. When a bull run begins, people start talking about it, which leads to even more people buying due to fear of missing out (FOMO), which inevitably causes the price to rise even more rapidly. This leads to more FOMO, and on and on the bull market goes until it suddenly ends, and the price crashes down to somewhere around, or slightly above, the level it was at before the bull run started. Unlike what is true for most other assets, Bitcoin never really crashes all the way. Why? Because every time a hype cycle occurs, some more people learn about Bitcoin’s fundamentals and manage to resist the urge to sell, even when almost all hope seems lost. They understand that these bull markets are a reoccurring thing due to the nature of the protocol. These cycles create new waves of evangelists who start promoting Bitcoin simply because of what they stand to gain from a price increase. In a sense, the protocol itself pays for its own promotion in this way. This organic marketing creates a lot of noise and confusion, too, as a lot of people who don’t seem to understand how Bitcoin works are often very outspoken about it despite their lack of knowledge. Red herrings, such as altcoins and Bitcoin forks, are then weeded out naturally during bear markets. Every time a bull market happens, a new generation of Bitcoiners is born.

The four-year period between halvings seems to serve a deliberate purpose. Satoshi could just as well have programmed a smooth issuance curve into the Bitcoin protocol, but he didn’t. As events unfold, it seems that he had good reason for this since these hype cycles provide a very effective onboarding mechanism, and they seem to be linked to the halvings. They certainly make Bitcoin volatile, but remember that in this early stage, the volatility is needed in order for these hype cycles to happen. Later on, when Bitcoin’s stock-to-flow ratio is higher, the seas will calm, and its volatility level will go down. In truth, it already has. The latest almost 80% price drop was far from the worst we’ve seen in Bitcoin. This technology is still in its infancy, and it is very likely that we’ll see a lot more volatility before mainstream adoption, or hyperbitcoinization, truly happens.

About the Bitcoin Infinity Academy

The Bitcoin Infinity Academy is an educational project built around Knut Svanholm’s books about Bitcoin and Austrian Economics. Each week, a whole chapter from one of the books is released for free on Highlighter, accompanied by a video in which Knut and Luke de Wolf discuss that chapter’s ideas. You can join the discussions by signing up for one of the courses on our Geyser page. Signed books, monthly calls, and lots of other benefits are also available.

-

@ bf95e1a4:ebdcc848

2025-04-11 11:18:42

@ bf95e1a4:ebdcc848

2025-04-11 11:18:42This is a part of the Bitcoin Infinity Academy course on Knut Svanholm's book Bitcoin: Sovereignty Through Mathematics. For more information, check out our Geyser page!

An Immaculate Conception

Some concepts in nature are harder for us humans to understand than others. How complex things can emerge out of simpler ones is one of those concepts. A termite colony, for instance, has a complex cooling system at its lower levels. No single termite knows how it works. Completely unaware of the end results, they build complex mounds and nests, shelter tubes to protect their paths, and networks of subterranean tunnels to connect their dirt cities. Everything seems organized and designed, but it is not. Evolution has equipped the termite with a pheromone receptor that tells the termite what task he ought to engage himself in by simply counting the number of neighboring termites doing the same thing. If there’s a surplus of workers in an area, nearby termites become warriors, and so on. Complex structures emerge from simple rules. The fractal patterns found all around nature are another example. Fractals look complex, but in reality, they’re not. They’re basically algorithms — the same pattern, repeated over and over again with a slightly modified starting point. The human brain is an excellent example of a complex thing that evolved out of simpler things, and we humans still have a hard time accepting that it wasn’t designed. Religions, which themselves are emergent systems spawned out of human interaction, have come up with a plethora of explanations for how we came to be. All sorts of wild origin stories have been more widely accepted than the simple explanation that our complexities just emerged out of simpler things following a set of rules that nature itself provided our world with.

Complex systems emerge out of human interactions all the time. The phone in your pocket is the result of a century of mostly free global market competition, and no single human could ever have come up with the entire thing. The device, together with its internet connection, is capable of a lot more than the sum of its individual parts. A pocket-sized gadget that can grant instant access to almost all of the world’s literature, music, and film, which fits in your pocket, was an unthinkable science fiction a mere twenty years ago. Bitcoin, first described in Satoshi Nakamoto’s whitepaper ten years before these words were written, was designed to be decentralized. Still, it wasn’t until years later that the network started to show actual proof of this. Sound money, or absolute digital scarcity, emerged out of the network not only because of its technical design. How Bitcoin’s first ten years actually unfolded played a huge part in how true decentralization could emerge, and this is also the main reason why the experiment cannot be replicated. Scarcity on the internet could only be invented once. Satoshi’s disappearance was Bitcoin’s first step towards true decentralization. No marketing whatsoever and the randomness of who hopped onto the train first were the steps that followed. Bitcoin truly had an immaculate conception.

The network has shown a remarkable resistance to change over the last few years especially, and its current state might be its last incarnation given the size of the network and the 95% agreement threshold in its consensus rules. It might never change again. In that case, an entirely new, complex life form will have emerged out of a simple set of rules. Even if small upgrades are implemented in the future, the 21 million coin supply cap is set in stone forever. Bitcoin is not for humans to have opinions about — it exists regardless of what anyone thinks about it, and it ought to be studied rather than discussed. We don’t know what true scarcity and a truly global, anonymous free market will do to our species yet, but we are about to find out. It is naïve to think otherwise. Various futurists and doomsday prophets have been focused on the dangers of the impending general artificial intelligence singularity lately, warning us about the point of no return, whereupon an artificial intelligence will be able to improve itself faster than any human could. Such a scenario could, as news anchor Ron Burgundy would have put it, escalate quickly. This may or may not be of real concern to us, but meanwhile, right under our noses, another type of unstoppable digital life has emerged, and it is already changing the behavior and preferences of millions of people around the globe. This is probably bad news for big corporations and governments but good news for the little guy looking for a little freedom. At least, that’s what those of us who lean towards the ideas of the Austrian school of economics believe. This time around, we will find out whether this is the case or not. No one knows what it will lead to and what new truths will emerge out of this new reality.

Unlike the termite, we humans are able to experience the grandeur of our progress. We can look in awe at the Sistine Chapel or the pyramids, and we can delve into the technicalities and brief history of Bitcoin and discover new ways of thinking about value along the way. Money is the language in which we express value to each other through space and time. Now, that language is spoken by computers. Value expressed in this language can’t be diluted through inflation or counterfeiting any longer. It is a language that is borderless, permissionless, peer-to-peer, anonymous (if you have the skills), unreplicable, completely scarce, non-dilutable, unchangeable, untouchable, undeniable, fungible, and free for everyone on Earth to use. It is a language for the future and it emerged out of a specific set of events in the past. All languages are examples of complex systems emerging out of simpler things, and Bitcoin evolved just as organically as any other human language did.

Decentralization is hard to achieve. Really hard. When it comes to claims of decentralization, a “don’t trust, verify” approach to the validity of such claims will help you filter out the noise. So, how can the validity of Bitcoin’s decentralization be verified? It’s a tricky question because decentralization is not a binary thing, like life or death, but rather a very difficult concept to define. However, the most fundamental concepts in Bitcoin, like the 21 million cap on coin issuance or the ten-minute block interval as a result of the difficulty adjustment and the Proof of Work algorithm, have not changed since very early on in the history of the network. This lack of change, which is arguably Bitcoin’s biggest strength, has been achieved through the consensus rules, which define what the blockchain is. Some special mechanisms (for example, BIP9) are sometimes used to deploy changes to the consensus rules. These mechanisms use a threshold when counting blocks that signal for a certain upgrade. For example, the upgrade “Segregated Witness” activated in a node when 95% or more of the blocks in a retarget period signaled support. Bitcoin has displayed a remarkable immutability through the years, and it is highly unlikely that this would have been the case if the game-theoretical mechanisms that enable its decentralized governance model hadn’t worked, given the many incentives to cheat that always seem to corrupt monetary systems. In other words, the longer the system seems to be working, the higher the likelihood that it actually does.

Satoshi set in stone the length of the halving period — a very important aspect of Bitcoin’s issuance schedule and initial distribution. During the first four years of Bitcoin’s existence, fifty new coins were issued every ten minutes up until the first block reward halving four years later. Every four years, this reward is halved so that the issuance rate goes down by fifty percent. This effectively means that half of all the Bitcoin that will ever exist was mined during the first four years of the network’s life, one fourth during its next four years, and so on. At the time of writing, we’re a little more than a year from the third halving. After that, only 6.25 Bitcoin will be minted every ten minutes as opposed to 50, which was the initial rate. What this seems to do is to create hype cycles for Bitcoin’s adoption. Every time the price of Bitcoin booms and then busts down to a level above where it started, a hype cycle takes place. Bitcoin had no marketing whatsoever, so awareness of it had to be spread through some other mechanism. When a bull run begins, people start talking about it, which leads to even more people buying due to fear of missing out (FOMO), which inevitably causes the price to rise even more rapidly. This leads to more FOMO, and on and on the bull market goes until it suddenly ends, and the price crashes down to somewhere around, or slightly above, the level it was at before the bull run started. Unlike what is true for most other assets, Bitcoin never really crashes all the way. Why? Because every time a hype cycle occurs, some more people learn about Bitcoin’s fundamentals and manage to resist the urge to sell, even when almost all hope seems lost. They understand that these bull markets are a reoccurring thing due to the nature of the protocol. These cycles create new waves of evangelists who start promoting Bitcoin simply because of what they stand to gain from a price increase. In a sense, the protocol itself pays for its own promotion in this way. This organic marketing creates a lot of noise and confusion, too, as a lot of people who don’t seem to understand how Bitcoin works are often very outspoken about it despite their lack of knowledge. Red herrings, such as altcoins and Bitcoin forks, are then weeded out naturally during bear markets. Every time a bull market happens, a new generation of Bitcoiners is born.

The four-year period between halvings seems to serve a deliberate purpose. Satoshi could just as well have programmed a smooth issuance curve into the Bitcoin protocol, but he didn’t. As events unfold, it seems that he had good reason for this since these hype cycles provide a very effective onboarding mechanism, and they seem to be linked to the halvings. They certainly make Bitcoin volatile, but remember that in this early stage, the volatility is needed in order for these hype cycles to happen. Later on, when Bitcoin’s stock-to-flow ratio is higher, the seas will calm, and its volatility level will go down. In truth, it already has. The latest almost 80% price drop was far from the worst we’ve seen in Bitcoin. This technology is still in its infancy, and it is very likely that we’ll see a lot more volatility before mainstream adoption, or hyperbitcoinization, truly happens.

About the Bitcoin Infinity Academy

The Bitcoin Infinity Academy is an educational project built around Knut Svanholm’s books about Bitcoin and Austrian Economics. Each week, a whole chapter from one of the books is released for free on Highlighter, accompanied by a video in which Knut and Luke de Wolf discuss that chapter’s ideas. You can join the discussions by signing up for one of the courses on our Geyser page. Signed books, monthly calls, and lots of other benefits are also available.

-

@ fd06f542:8d6d54cd

2025-04-11 11:15:10

@ fd06f542:8d6d54cd

2025-04-11 11:15:10Warning

unrecommended: deprecated in favor of NIP-27NIP-08

Handling Mentions

finalunrecommendedoptionalThis document standardizes the treatment given by clients of inline mentions of other events and pubkeys inside the content of

text_notes.Clients that want to allow tagged mentions they MUST show an autocomplete component or something analogous to that whenever the user starts typing a special key (for example, "@") or presses some button to include a mention etc -- or these clients can come up with other ways to unambiguously differentiate between mentions and normal text.

Once a mention is identified, for example, the pubkey

27866e9d854c78ae625b867eefdfa9580434bc3e675be08d2acb526610d96fbe, the client MUST add that pubkey to the.tagswith the tagp, then replace its textual reference (inside.content) with the notation#[index]in which "index" is equal to the 0-based index of the related tag in the tags array.The same process applies for mentioning event IDs.

A client that receives a

text_noteevent with such#[index]mentions in its.contentCAN do a search-and-replace using the actual contents from the.tagsarray with the actual pubkey or event ID that is mentioned, doing any desired context augmentation (for example, linking to the pubkey or showing a preview of the mentioned event contents) it wants in the process.Where

#[index]has anindexthat is outside the range of the tags array or points to a tag that is not aneorptag or a tag otherwise declared to support this notation, the client MUST NOT perform such replacement or augmentation, but instead display it as normal text. -

@ fd06f542:8d6d54cd

2025-04-11 11:14:36

@ fd06f542:8d6d54cd

2025-04-11 11:14:36- 第三章、NIP-03: OpenTimestamps Attestations for Events

- 第四章、NIP-04: Encrypted Direct Message

- 第五章、NIP-05: Mapping Nostr keys to DNS-based internet identifiers

- 第六章、NIP-06: Basic key derivation from mnemonic seed phrase

- 第七章、NIP-07: window.nostr capability for web browsers

- 第八章、NIP-08: Handling Mentions --- unrecommended: deprecated in favor of NIP-27

-

@ 7d33ba57:1b82db35

2025-04-11 10:08:21

@ 7d33ba57:1b82db35

2025-04-11 10:08:21Rome isn’t just a city—it’s a living, breathing museum where ancient ruins, baroque fountains, and buzzing piazzas come together in beautiful, chaotic harmony. Every cobblestone has a story, every espresso has a punch, and every sunset behind the Colosseum feels like a scene from a movie. Whether it's your first visit or your fifth, Rome never gets old.

🏛️ Top Things to See & Do in Rome

1️⃣ The Colosseum & Roman Forum

- Step inside the iconic arena of gladiators

- Wander through the ruins of the Forum, once the heart of ancient Rome

- Don’t miss Palatine Hill for views over it all

2️⃣ Vatican City

- Home to St. Peter’s Basilica, the Sistine Chapel, and the Vatican Museums

- Climb to the top of the basilica dome for one of the best panoramas in Rome

- Book tickets ahead—it gets packed!

3️⃣ Trevi Fountain

- Toss in a coin to ensure your return to Rome 💧

- Visit early in the morning or late at night to beat the crowds and get that perfect photo

4️⃣ Pantheon

- One of the best-preserved Roman temples—free to enter, awe guaranteed

- Look up: the open oculus in the dome is engineering genius

- Step outside for a coffee in Piazza della Rotonda

5️⃣ Piazza Navona & Campo de’ Fiori

- Piazza Navona: Elegant fountains, artists, street performers

- Campo de’ Fiori: Bustling morning market and lively nightlife

- Great spots to grab an aperitivo or soak up atmosphere

🍕 What to Eat in Rome

- Cacio e Pepe – Pasta with pecorino and black pepper—simple, bold, and pure Rome

- Carbonara – No cream! Just egg, cheese, guanciale, and pepper

- Supplì – Deep-fried rice balls with melted mozzarella inside

- Roman-style pizza – Thin and crispy, often sold by weight

- Gelato – Try real artisan shops like Gelateria del Teatro or Otaleg

🌇 Bonus Rome Moments

- Watch sunset from Pincian Hill or Gianicolo Terrace

- Stroll across the Tiber River to the charming Trastevere neighborhood

- Visit the Jewish Ghetto for history, architecture, and amazing food (hello, fried artichokes!)

- Wander without a map—Rome loves surprising you

🛵 Tips for Visiting

✅ Wear comfy shoes—Rome’s cobbles are beautiful, but brutal on feet

✅ Book major attractions in advance to skip lines

✅ Tap water is fresh—refill from Rome’s historic fountains (nasoni)

✅ Don’t rush—Rome is best enjoyed slowly, with a gelato in hand -

@ f57bac88:6045161e

2025-04-11 08:00:16

@ f57bac88:6045161e

2025-04-11 08:00:16مقدمه\ کتاب پول درهمشکسته نوشته لین الدن، یکی از برجستهترین آثار در زمینه اقتصاد و فناوری مالی است که در تابستان ۱۴۰۲ (۲۰۲۳ میلادی) منتشر شد. این کتاب با نگاهی عمیق به ریشههای پول، کاستیهای نظام مالی کنونی و ظرفیتهای فناوریهای نوین مانند بیتکوین، خوانندگان را به سفری فکری دعوت میکند. الدن با زبانی روان و دیدگاهی چندجانبه، پیچیدگیهای پول را به شکلی ساده اما پرمغز توضیح میدهد و به ما کمک میکند تا درک بهتری از چیستی پول، نقش آن در زندگی و آیندهاش به دست آوریم. این اثر ۵۳۸ صفحهای، با ساختاری جامع، گذشته، حال و آینده پول را در شش بخش اصلی بررسی میکند.

بخش اول: گذشته پول – از دفترهای قدیمی تا بانکداری نوین\ الدن داستان تکامل پول را در دو بخش ابتدایی کتاب روایت میکند. او پول را بهعنوان یک «دفتر حسابداری» معرفی میکند که از ابتدا برای ثبت بدهیها و طلبها در جوامع به کار میرفت. بخش اول به بررسی پولهای کالایی مانند صدف و فلزات گرانبها و ویژگیهای ایدهآل پول میپردازد. بخش دوم به ظهور خدمات بانکی اولیه و بانکداری گسترده اختصاص دارد و نشان میدهد که چگونه فناوریهایی مانند تلگراف در قرن نوزدهم تراکنشها را سریعتر کردند. اما این پیشرفتها، به گفته الدن، با متمرکز شدن کنترل پول در دست بانکهای مرکزی، اغلب به زیان مردم عادی تمام شدند و شکاف طبقاتی را عمیقتر کردند.

بخش دوم: حال پول – چرا سیستم مالی کنونی شکسته است؟\ در دو بخش بعدی، الدن به نقد نظام مالی کنونی میپردازد که بر پایه پول بیپشتوانه (فیات) بنا شده است. او استدلال میکند که این سیستم با مشکلاتی مانند تورم مداوم، نابرابری اقتصادی و سلطه بیشازحد نهادهای مالی دستبهگریبان است. بخش سوم به نظام مالی جهانی از اوایل قرن بیستم، از جمله نظام برتون وودز، میپردازد. بخش چهارم خلق پول مدرن و تأثیرات بدهیهای بیثباتکننده را تحلیل میکند. الدن معتقد است که پول بیپشتوانه بهگونهای طراحی شده که ارزش آن بهمرور کاهش مییابد و ثروت را از جیب مردم عادی بهسوی بانکها و شرکتهای بزرگ هدایت میکند. او با مثالهایی واقعی، مانند بحران اقتصادی لبنان در سال ۱۴۰۱ (۲۰۲۲) یا تورم افسارگسیخته در کشورهایی مانند ترکیه، آرژانتین و ایران، نشان میدهد که این مشکلات چگونه زندگی میلیونها نفر را تحت تأثیر قرار دادهاند.

بخش سوم: آینده پول – نقش نوآوریهای دیجیتال\ در دو بخش پایانی، الدن به بررسی فناوریهای نوین مالی، بهویژه بیتکوین و بلاکچین، میپردازد. بخش پنجم به نوآوریهای دیجیتال قرن بیستویکم، مانند بیتکوین، اختصاص دارد که الدن آن را یک دفتر حسابداری غیرمتمرکز میبیند. این فناوری میتواند قدرت را از نهادهای مرکزی خارج کرده و به افراد بازگرداند. بخش ششم به اخلاقیات پول و نقش رمزنگاری در شبکههای مالی میپردازد و آیندهای را تصور میکند که در آن افراد کنترل بیشتری بر داراییهای خود دارند. بااینحال، الدن به چالشهای بیتکوین، مانند نوسانات شدید قیمت، مصرف بالای انرژی و مشکلات مقیاسپذیری، نیز اشاره میکند. او همچنین به نمونههایی از استفاده بیتکوین در کشورهای درحالتوسعه، مانند السالوادور، اشاره دارد که این ارز بهعنوان ابزاری برای دور زدن محدودیتهای مالی به کار گرفته شده است.

نقاط قوت کتاب\ ۱. سادگی در عین عمق: الدن مفاهیم پیچیدهای مانند تورم، نظام بانکی و بلاکچین را با زبانی قابلفهم برای همگان توضیح میدهد، بدون آنکه از دقت علمی کاسته شود.\ ۲. دیدگاه چندرشتهای: او با ترکیب دانش مهندسی و تحلیل مالی، پول را بهعنوان یک فناوری بررسی میکند که با پیشرفتهای بشری تکامل مییابد.\ ۳. تمرکز بر انسانها: کتاب تنها به آمار و ارقام بسنده نمیکند؛ الدن نشان میدهد که نقصهای نظام مالی چگونه زندگی واقعی مردم را تحت تأثیر قرار داده است.\ ۴. بیطرفی نسبی: اگرچه الدن از طرفداران بیتکوین است، تلاش میکند با بررسی جنبههای مثبت و منفی هر سیستم، از یکجانبهگرایی پرهیز کند.

نقاط ضعف کتاب\ ۱. تمرکز بیشازحد بر بیتکوین: برخی معتقدند که الدن بیشازحد به بیتکوین خوشبین است و به دیگر فناوریهای مالی نوین، مانند اتریوم یا استیبلکوینها، کمتر پرداخته است.\ ۲. پیچیدگی برای تازهکارها: هرچند کتاب برای مخاطب عام نوشته شده، برخی بخشها ممکن است برای افرادی که هیچ آشنایی با اقتصاد یا ارزهای دیجیتال ندارند، دشوار باشد.\ ۳. کمبود راهحلهای عملی: الدن در شناسایی مشکلات موفق است، اما راهحلهای پیشنهادی او گاهی کلی و غیرملموس به نظر میرسند.

چرا این کتاب را بخوانیم؟\ پول درهمشکسته برای هرکسی که میخواهد بداند پول چیست، چرا ارزشش تغییر میکند و آیندهاش چه خواهد شد، یک راهنمای بینظیر است. این کتاب به ما کمک میکند تا به چیزهایی که بدیهی میپنداریم—مانند اسکناسی که هر روز خرج میکنیم—عمیقتر نگاه کنیم. برای خوانندگان ایرانی، که سالهاست با تورم، کاهش ارزش پول ملی و تحریمهای مالی دستوپنجه نرم میکنند، این کتاب پاسخهایی روشنگر به سؤالهایی مانند «چرا پول ما بیارزش میشود؟» یا «آیا راهی برای محافظت از داراییها وجود دارد؟» ارائه میدهد. ساختار ششبخشی کتاب، با پوشش جامع گذشته، حال و آینده، خواننده را به درک کاملی از پول و قدرت آن هدایت میکند.

جمعبندی\ پول درهمشکسته بیش از یک کتاب اقتصادی است؛ دعوتی است به تأمل و تغییر. لین الدن با دانش، دقت و نگاهی انسانی، ما را به سفری از گذشته پول تا آیندهاش میبرد و نشان میدهد که چگونه میتوانیم با آگاهی و انتخابهای درست، بهسوی سیستمی عادلانهتر حرکت کنیم. این کتاب برای هرکسی که به اقتصاد، فناوری یا عدالت اجتماعی علاقهمند است، اثری ضروری و الهامبخش به شمار میرود.

منابع و دسترسی به ترجمه\ بخشهایی از این کتاب به فارسی ترجمه شده و از طریق کانالهای تلگرامی مانند «ترجمهی مقالههای بیتکوین» در دسترس است. برای یافتن ترجمه، میتوانید عبارت «پول درهمشکسته» یا نام نویسنده را در این کانال جستجو کنید. همچنین، پیشنهاد میشود برای ادامه این مسیر و فرهنگ از مترجم و مدیر کانال ترجمه مقالات حمایت مالی کنید

-

@ 34ff86e0:dbb6b9fb

2025-04-11 03:51:31

@ 34ff86e0:dbb6b9fb

2025-04-11 03:51:31test description 2 lang arabic

-

@ 872982aa:8fb54cfe

2025-04-11 03:30:48

@ 872982aa:8fb54cfe

2025-04-11 03:30:48{"coverurl":"https://cdn.nostrcheck.me/872982aa37b864973a389d465bc6ed5045a78586496d104e05f39b8d8fb54cfe/e6d4161955877a472f69b7ed27230e8677da2a3f3fb8ae0b472816852111cb38.webp","title":"设计艺术和配色","author":"彩色盒子"}

-

@ 872982aa:8fb54cfe

2025-04-11 03:20:33

@ 872982aa:8fb54cfe

2025-04-11 03:20:33{"coverurl":"https://cdn.nostrcheck.me/872982aa37b864973a389d465bc6ed5045a78586496d104e05f39b8d8fb54cfe/2d173d2aabda99d75f054da0ac0bf04e67c58b09af84ae0765dcf904516da75d.webp","title":"Nostr protocol4","author":"fiatjaf"}

-

@ 872982aa:8fb54cfe

2025-04-11 02:37:15

@ 872982aa:8fb54cfe

2025-04-11 02:37:15{"coverurl":"https://cdn.nostrcheck.me/872982aa37b864973a389d465bc6ed5045a78586496d104e05f39b8d8fb54cfe/1c39bd6f09aca6e9f20f7399809a547950069d06a68b78f565fbfab4b14ec93c.webp","title":"竹林的声音2","author":"花花的作者"}

-

@ 9a1adc34:9a9d705b

2025-04-11 01:59:19

@ 9a1adc34:9a9d705b

2025-04-11 01:59:19Testing the concept of using Nostr as a personal CMS.

-

@ a7f85dfe:27305a2b

2025-04-11 00:41:45

@ a7f85dfe:27305a2b

2025-04-11 00:41:45 -

@ a7f85dfe:27305a2b

2025-04-11 00:38:51

@ a7f85dfe:27305a2b

2025-04-11 00:38:511.更改bios,usb启动

根据自己电脑的要求进入bios,选择优先usb启动。

2.安装系统

傻瓜式,安装proxmox。网络设置部分,建议直接插线联网,系统会根据现有网络分配IP网关信息,方便服务器开始运行时可其他电脑可以通过IP地址访问。

3.挂载硬盘

安装成功后,通过其他电脑访问服务器IP,进入图形管理界面。可以看到这时将系统盘分为local 跟local-lvm。其他硬盘得先挂载才能进行pve管理。

1.列出可用硬盘及目录地址,如果硬盘有多个分区,需要删除分区的话

fdisk -lfdisk /dev/sda #你硬盘的地址 m #查看文档 d # 列出分区号码,选择删除的分区 n #创建分区 p #创建主分区 w #写入分区2. 格式化分区系统mkfs -t ext4 /dev/sda1- 挂载硬盘

mkdir /mnt/data mount -t ext4 /dev/sda1 /mnt/data

4.开机自动挂载

lsblk #查看硬盘和分区sudo blkid # 查看硬盘的uuidsudo vi /etc/fstab #打开fstab文件添加如下一行UUID=你的硬盘ID /mnt/data ext4 defaults 0 2测试挂载sudo mount -a #如果没有显示错误信息就是挂载正确 - 挂载硬盘

-

@ 378562cd:a6fc6773

2025-04-11 00:02:38

@ 378562cd:a6fc6773

2025-04-11 00:02:38What Happens When You Wean Your Digital Life Way Back?

We’re swimming in screens. Notifications, news, and endless feeds are all designed to keep us plugged in, distracted, and running on digital fumes. But what happens when you stop feeding the machine?

What happens when you step back, shut it off, and just… live?

You might be amazed.

Step One: Wean Way Down

Start simple. No grand declarations, but just a quiet rebellion.

Fewer apps. Fewer tabs. Less time online. Maybe you only use the computer in the mornings. Maybe you can turn your phone off in the evening. Maybe Sunday will become a screen-free Sabbath.

The goal? Clear. Clean. Quiet.

At first, it might feel weird. Like quitting sugar or coffee, you’ll feel the pull. But then? Something shifts.

What Starts to Happen… 1. Your Mind Clears Up You stop bouncing from thought to thought. You breathe. You remember what it feels like to think deeply, uninterrupted. Your brain stops buffering and starts building again.

-

Time Slows Down You realize how much time was slipping through your fingers. Without the digital drag, you suddenly have space. You get stuff done. You notice the birds. You fix the fence. You write a letter. You rest. I've personally done these things. It IS AMAZING!

-

You Hear God More Clearly When the digital static dies down, the whisper of God gets louder. Scripture comes alive again. Prayer feels less like a chore and more like a lifeline. You hear Him in the quiet—and sometimes, even in yourself.

-

People Come Back into Focus You stop skimming people like headlines. You sit down, look up, listen, and be present. You find yourself reaching out more, talking longer, and remembering what a real connection feels like.

-

You Feel Alive Again You get energy back, your hands get busy with real work, your body moves, and your sleep deepens. You feel stronger, clearer, and more grounded like your soul has room to breathe again.

It’s Not About Losing—It’s About Gaining Less screen time isn’t about guilt or rules. It’s about freedom. It’s about trading mindless digital noise for something deeper, like clarity, creativity, peace, and presence.

Will you miss some stuff? Sure. But what you’ll gain is real life. Good life.

Try it. Wean way down. Scale Back! Watch what happens.

-

-

@ 000002de:c05780a7

2025-04-10 22:22:41

@ 000002de:c05780a7

2025-04-10 22:22:41From time to time I will listen to a podcast called "The Dangerous History Podcast" and in the most recent episode he plays some "music" from the WW1 propaganda machine. Its wild how on the nose it is. I think people forget how in your face propaganda was in the past. Its more subtle today and people sometimes act as if news, media and entertainment were once reliable sources of information. When I hear people complaining about bias or propaganda in media today I usually push back and say, its better than it was in the past. At least now we have more choice as well as tools to check things for ourselves.

Don't forget, the state has always been about manipulating you. Sure, it changes its tactics but there really isn't some golden era where this wasn't happening. They have just become more sophisticated as the people get more keen on the old tactics.

originally posted at https://stacker.news/items/940221

-

@ 88cc134b:5ae99079

2025-04-10 15:57:14

@ 88cc134b:5ae99079

2025-04-10 15:57:14article

-

@ f1989a96:bcaaf2c1

2025-04-10 14:25:09

@ f1989a96:bcaaf2c1

2025-04-10 14:25:09Good morning, readers!