-

@ d34e832d:383f78d0

2025-02-24 21:09:52

https://blossom.primal.net/af0bc86b52c7f91c26633ed0cba4f151bb74e5a5702b892f7f1efaa9e4640018.mp4

[npub16d8gxt2z4k9e8sdpc0yyqzf5gp0np09ls4lnn630qzxzvwpl0rgq5h4rzv]

### **What is Reticulum?**

Reticulum is a cryptographic networking stack designed for resilient, decentralized, and censorship-resistant communication. Unlike the traditional internet, Reticulum enables fully independent digital communications over various physical mediums, such as radio, LoRa, serial links, and even TCP/IP.

The key advantages of Reticulum include:

- **Decentralization** – No reliance on centralized infrastructure.

- **Encryption & Privacy** – End-to-end encryption built-in.

- **Resilience** – Operates over unreliable and low-bandwidth links.

- **Interoperability** – Works over WiFi, LoRa, Bluetooth, and more.

- **Ease of Use** – Can run on minimal hardware, including Raspberry Pi and embedded devices.

Reticulum is ideal for off-grid, censorship-resistant communications, emergency preparedness, and secure messaging.

---

## **1. Getting Started with Reticulum**

To quickly get started with Reticulum, follow the official guide:

[Reticulum: Getting Started Fast](https://markqvist.github.io/Reticulum/manual/gettingstartedfast.html)

### **Step 1: Install Reticulum**

#### **On Linux (Debian/Ubuntu-based systems)**

```sh

sudo apt update && sudo apt upgrade -y

sudo apt install -y python3-pip

pip3 install rns

```

#### **On Raspberry Pi or ARM-based Systems**

```sh

pip3 install rns

```

#### **On Windows**

Using Windows Subsystem for Linux (WSL) or Python:

```sh

pip install rns

```

#### **On macOS**

```sh

pip3 install rns

```

---

## **2. Configuring Reticulum**

Once installed, Reticulum needs a configuration file. The default location is:

```sh

~/.config/reticulum/config.toml

```

To generate the default configuration:

```sh

rnsd

```

This creates a configuration file with default settings.

---

## **3. Using Reticulum**

### **Starting the Reticulum Daemon**

To run the Reticulum daemon (`rnsd`), use:

```sh

rnsd

```

This starts the network stack, allowing applications to communicate over Reticulum.

### **Testing Your Reticulum Node**

Run the diagnostic tool to ensure your node is functioning:

```sh

rnstatus

```

This shows the status of all connected interfaces and peers.

---

## **4. Adding Interfaces**

### **LoRa Interface (for Off-Grid Communications)**

Reticulum supports long-range LoRa radios like the **RAK Wireless** and **Meshtastic devices**. To add a LoRa interface, edit `config.toml` and add:

```toml

[[interfaces]]

type = "LoRa"

name = "My_LoRa_Interface"

frequency = 868.0

bandwidth = 125

spreading_factor = 9

```

Restart Reticulum to apply the changes.

### **Serial (For Direct Device-to-Device Links)**

For communication over serial links (e.g., between two Raspberry Pis):

```toml

[[interfaces]]

type = "Serial"

port = "/dev/ttyUSB0"

baudrate = 115200

```

### **TCP/IP (For Internet-Based Nodes)**

If you want to bridge your Reticulum node over an existing IP network:

```toml

[[interfaces]]

type = "TCP"

listen = true

bind = "0.0.0.0"

port = 4242

```

---

## **5. Applications Using Reticulum**

### **LXMF (LoRa Mesh Messaging Framework)**

LXMF is a delay-tolerant, fully decentralized messaging system that operates over Reticulum. It allows encrypted, store-and-forward messaging without requiring an always-online server.

To install:

```sh

pip3 install lxmf

```

To start the LXMF node:

```sh

lxmfd

```

### **Nomad Network (Decentralized Chat & File Sharing)**

Nomad is a Reticulum-based chat and file-sharing platform, ideal for **off-grid** communication.

To install:

```sh

pip3 install nomad-network

```

To run:

```sh

nomad

```

### **Mesh Networking with Meshtastic & Reticulum**

Reticulum can work alongside **Meshtastic** for true decentralized long-range communication.

To set up a Meshtastic bridge:

```toml

[[interfaces]]

type = "LoRa"

port = "/dev/ttyUSB0"

baudrate = 115200

```

---

## **6. Security & Privacy Features**

- **Automatic End-to-End Encryption** – Every message is encrypted by default.

- **No Centralized Logging** – Communication leaves no metadata traces.

- **Self-Healing Routing** – Designed to work in unstable or hostile environments.

---

## **7. Practical Use Cases**

- **Off-Grid Communication** – Works in remote areas without cellular service.

- **Censorship Resistance** – Cannot be blocked by ISPs or governments.

- **Emergency Networks** – Enables resilient communication during disasters.

- **Private P2P Networks** – Create a secure, encrypted communication layer.

---

## **8. Further Exploration & Documentation**

- **Reticulum Official Manual**: [https://markqvist.github.io/Reticulum/manual/](https://markqvist.github.io/Reticulum/manual/)

- **Reticulum GitHub Repository**: [https://github.com/markqvist/Reticulum](https://github.com/markqvist/Reticulum)

- **Nomad Network**: [https://github.com/markqvist/NomadNet](https://github.com/markqvist/NomadNet)

- **Meshtastic + Reticulum**: [https://meshtastic.org](https://meshtastic.org)

---

## **Connections (Links to Other Notes)**

- **Mesh Networking for Decentralized Communication**

- **LoRa and Off-Grid Bitcoin Transactions**

- **Censorship-Resistant Communication Using Nostr & Reticulum**

## **Tags**

#Reticulum #DecentralizedComms #MeshNetworking #CensorshipResistance #LoRa

## **Donations via**

- **Bitcoin Lightning**: lightninglayerhash@getalby.com

-

@ 8bad797a:8461b4bc

2025-02-24 20:33:57

This time from a laptop computer via Highlighter, from which the Merry Frankster can post long form content. Be afraid. Be very afraid.

-

@ a1c19849:daacbb52

2025-02-24 19:30:09

## Details

- ⏲️ Prep time: 20 min

- 🍳 Cook time: 4 hours

## Ingredients

- 1kg of chicken thighs

- 3 large onions

- 1 tablespoon garlic powder

- 2 tablespoons brown sugar

- 1.5 dl Ketjap Medja

- 0.5 liter chicken broth

- Pepper

- Salt

- Nutmeg

## Directions

1. Cut the onions and sauté them

2. Add the chicken thighs in pieces and bake for a few minutes

3. Add the garlic powder and the brown sugar and bake for a short time

4. Add the ketjap media and the chicken broth

5. Add some salt and pepper and nutmeg and let it simmer for 3 to 4 hours

6. Make sure all the moist evaporates but make sure it doesn’t get too dry. Otherwise add some extra chicken broth

7. Bon appetit!

-

@ 6e0ea5d6:0327f353

2025-02-24 19:29:02

Of all the people you should fear, fear most the peaceful man in situations where anyone else would be aggressive. The strongest man is the one who masters his emotions in moments of rage and fury—who, even in anger, does not destroy everything around him, including himself.

Remember: no man truly knows how evil he can be until he strives to be good in a corrupt world and, for that, is crushed by it.

Anxiety makes a man suffer even before there is a concrete reason. The mere act of anticipating pain makes him feel it in its full intensity, even if it never materializes. On the other hand, anxiety leads to rash actions, driven by impulse or anger. And these decisions, in the end, can destroy him.

The most harmful choices are usually made under stress, rage, or passion. Anxiety, in turn, is a formidable adversary, difficult to tame. Controlling it requires constant and gradual training. The key is to balance expectations—facing the future with serenity rather than allowing worries to corrode the present. Sometimes, it is necessary to abandon the life we planned to face the life that awaits us. Instead of acting impulsively in moments of deep stress, learn to reflect rationally on all possibilities before taking action.

I recognize that, in theory, this advice is easy to give. Sono d’accordo, I know how difficult it is in daily life. But listen well: do not let your actions be driven by impulsiveness. Remember, stubbornness combined with anxiety is a direct path to a pit of regrets.

Stubbornness, unlike persistence, makes a man insist on mistakes or ignore wise counsel. It forces him to act against logic, preventing him from learning from failures and reevaluating decisions. It is a silent source of suffering, robbing him of opportunities for change and growth.

Just as a river reaches its destination by adapting to the course it encounters, a wise man must seek new approaches rather than persist in the same mistakes. Adapting, learning, and changing course are the keys to reaching one’s true destiny.

Thank you for reading, my friend!

If this message resonated with you, consider leaving your "🥃" as a token of appreciation.

A toast to our family!

-

@ a1c19849:daacbb52

2025-02-24 19:19:16

## Details

- ⏲️ Prep time: 20 min

- 🍳 Cook time: 4 hours

## Ingredients

- 1kg of chicken thighs

- 3 large onions

- 1 tablespoon garlic powder

- 2 tablespoons brown sugar

- 1.5 dl Ketjap Medja

- 0.5 liter chicken broth

- Pepper

- Salt

- Nutmeg

## Directions

1. Cut the onions and sauté them

2. Add the chicken thighs in pieces and bake for a few minutes

3. Add the garlic powder and the brown sugar and bake for a short time

4. Add the ketjap media and the chicken broth

5. Add some salt and pepper and nutmeg and let it simmer for 3 to 4 hours

6. Make sure all the moist evaporates but make sure it doesn’t get too dry. Otherwise add some extra chicken broth

7. Bon appetit!

-

@ 037ebe13:93af01dc

2025-02-24 18:59:42

Se você acompanhou o noticiário, deve ter visto que o ministro Alexandre de Moraes, do Supremo Tribunal Federal (STF), voltou a investir contra as redes sociais. Na sexta-feira (21), Moraes determinou a suspensão da rede social americana Rumble no Brasil.

De acordo com o ministro, a rede social cometeu "reiterados, conscientes e voluntários descumprimentos das ordens judiciais, além da tentativa de não se submeter ao ordenamento jurídico e Poder Judiciário brasileiros" e que instituiu um "ambiente de total impunidade e 'terra sem lei' nas redes sociais brasileiras".

No entanto, o CEO da Rumble, Chris Pavlovski, afirmou que Moraes exigiu que a Rumble cumprisse decisões que são ilegais segundo a legistação americana e passou um “aviso” ao ministro: “nos vemos no tribunal”.

Não é de hoje que o STF e Moraes são acusados de promover um ambiente de “censura” através de uma suposta perseguição enviesada a perfis que criticam as atuações da corte e do ministro, inclusive exigindo a remoção de perfis por parte dessas redes – algo que contraria a legislação brasileira.

Em 2024, o X chegou a ficar suspenso no Brasil por quase 40 dias, sendo que Moraes chegou a impor multas para quem tentasse acessar a rede via VPN, uma decisão contestada e vista por muitas pessoas como ilegal.

Isso mostra que o poder do estado vai continuar agindo contra as redes sociais com o intuito de estabelecer algum tipo de restrição a essas plataformas. E tal poder tende a funcionar, pois estas plataformas são consideradas empresas e muitas têm representantes legais no Brasil, que são um vetor de ataque para eventuais suspensões.

Felizmente, a criação do Bitcoin (BTC) levou a um avanço na forma como podemos manter nossa privacidade protegida da sanha autoritária dos estados. E isso chegou nas redes sociais com a criação do Nostr. Por isso, o protocolo descentralizado com foco em redes sociais é o tema da nossa newsletter de hoje.

O que é o Nostr?##

A palavra Nostr, que dá nome ao protocolo, é a sigla para Notes and Other Stuff Transmitted by Relays (Notas e Outras Coisas Transmitidas por Relés, em tradução livre). Esse protocolo surgiu em 2020 para criar uma “camada social” na rede do Bitcoin. Ou seja, permitir o desenvolvimento de aplicativos similares a redes sociais.

No entanto, foi a partir de 2023 que o protocolo ganhou fama, a ponto de ficar conhecido como o “Twitter descentralizado”. Esse nome se deveu ao fato de que um dos aplicativos mais populares do Nostr era o Damus, que funciona como uma espécie de X.

A principal diferença do Nostr para outros serviços é que os aplicativos criados pelos protocolos não podem ser censurados. Eles operam baseados em clientes e relés (relays) muito similares aos nós que rodam a rede do Bitcoin. Por isso, não adianta um governo tentar derrubar um nó: se os demais estiverem ativos, a rede seguirá funcionando livre de censura.

Sistema de chaves##

Da mesma forma que no Bitcoin, no Nostr cada usuário é identificado por uma chave pública. E também há uma chave privada, que ele usa para assinar as transações. Mas ao contrário do BTC, as chaves privadas não são formadas por sequência de palavras, mas sim por uma sequência de letras:

chave pública: cada chave pública do Nostr começa com as iniciais “npub”. Ex: npub43tahY4T…

chave privada: já as chaves privadas começam com os caracteres “nsec”. Ex: nsec4T6uyA4F…

Para acessar os aplicativos do Nostr (como o Damus), você só precisa fazer o download e inserir a sua chave privada no app. Ele vai ler a chave e identificar que você de fato controla aquela conta, mas o aplicativo não armazena as chaves. Por isso elas não ficam sujeitas a roubos, mantendo o seu perfil seguro.

Uma vez logado no aplicativo, cada vez que você publica algo (por exemplo, uma mensagem que publica, uma atualização da sua lista de seguidores, etc.), você assina uma transação. Os clientes validam estas assinaturas para garantir que estão corretas.

Hoje, existem mais de 70 aplicativos criados para o Nostr, desde outros “Twitter descentralizados” até serviços de mensagem. E todos eles funcionam de forma integrada, o que significa que a sua chave privada funciona como uma identidade única. Isso permite que você acesse a todos os aplicativos com uma única senha, sem precisar fazer cadastros e deixar seus dados expostos em várias redes sociais.

Esse protocolo foi criado por um brasileiro conhecido como fiatjaf, que preferiu se manter anônimo. O projeto fez tanto sucesso que recebeu um apoio massivo de Jack Dorsey, criador do Twitter, que chegou a doar 14,6 BTC para ajudar no desenvolvimento do Nostr. Hoje, esse valor corresponde a mais de R$ 8 milhões.

Como fazer uma conta no Nostr##

Antes de acessar os aplicativos, você deve criar suas chaves pública e privada no site oficial do Nostr. Basta acessar o [Endereço ]( https://nostr.com) e clicar na opção “create your Nostr account”. E pronto, o site gera as duas chaves automaticamente. A chave pública (npub) fica visível, enquanto a chave privada (nsec) aparece coberta.

Basta clicar nos quadrados do lado esquerdo da chave privada que ele vai copiar automaticamente. Você também pode clicar em “show private key” para ver a chave privada, ou clicar em “download keys” para baixar ambas as chaves.

Cabe frisar que essas chaves, sobretudo a privada, são essenciais para acessar qualquer aplicativo criado no Nostr. Por isso, assim que você salvá-las, guarde essas chaves em um lugar seguro e longe da internet, para evitar roubos. Por isso:

jamais anote sua chave privada num bloco de notas;

escreva a chave privada à mão num papel e guarde com bastante cuidado;

nunca, sob qualquer hipótese, compartilhe sua chave privada em arquivos na nuvem ou por e-mail.

Se você quiser ter ainda mais segurança, pode adquirir o NOSTR Signing Device, dispositivo que serve para assinar publicações com o Nostr e mantém sua chave privada segura. Ele é importado, mas custa apenas 20 euros (cerca de R$ 120) no site da [LNBits.]( https://shop.lnbits.com/product/nostr-signing-device)

Redes sociais à prova de censura##

Bem, agora vamos conferir as duas redes sociais que selecionamos entre os mais de 70 aplicativos do Nostr. Nelas você pode publicar qualquer coisa sem medo de sofrer com censura, bloqueios ou processos indevidos por causa de alguma acusação vaga como “promover discurso de ódio”.

O primeiro dessas aplicativos é o [Primal]( https://nostrapps.com/primal), que é praticamente uma cópia do já citado Damus. Ele também se parece muito com o X e lá você pode publicar, mandar mensagens inbox para outro usuário, curtir, salvar, compartilhar e comentar.

Ao contrário do X, o Primal não impõe limite de caracteres nas publicações e você não tem selos. O aplicativo também possui uma carteira Lightning onde você pode enviar e receber satoshis. E o melhor de tudo, o Primal possui a função “zap”, que permite que você possa enviar e receber satoshis por causa de suas publicações.

Ou seja, se você escrever alguma coisa no Primal e as pessoas gostarem, elas podem te enviar “gorjetas” em satoshis. Isso significa que você consegue monetizar o seu conteúdo sem precisar assinar nenhum plano ou pagar para conseguir um selo. Você também pode enviar satoshis para seus criadores de conteúdo favoritos.

Mas se você gosta de publicar artigos mais longos (como esta newsletter), o Nostr conta com o [YakiHonne]( https://nostrapps.com/yakihonne). Este “Substack descentralizado” permite que você publique notas como o Primal, mas também oferece a possibilidade de criar artigos em formato de newsletter.

Você pode favoritar ou salvar os seus autores preferidos, facilitando a leitura de artigos. E o aplicativo também possui seções de curadoria específica. Com ela, você consegue acessar artigos por tópicos e ver o que está se destacando no YakiHonne naquele momento.

Quer escrever sobre um tema polêmico? Faça seu artigo no YakiHonne sem ter medo de censura ou de ver seu texto desmonetizado. E caso ele faça sucesso, você pode receber satoshis como pagamento e monetizar seu trabalho recebendo em moeda forte.

Infelizmente, os tribunais de censura seguem em crescimento no mundo e a liberdade de expressão em plataformas centralizadas seguirá ameaçada. Afinal, estas empresas visam o lucro e estão sujeitas às leis. E elas dificilmente farão frente ao poder do estado apenas para beneficiar seus usuários.

Por isso, da mesma forma que você pode tirar o estado do seu dinheiro com o Bitcoin, você pode tirar a censura das suas palavras usando o Nostr. Afinal, como diz o personagem Ensei Tankado de “Fortaleza Digital”:

“Todos temos o direito de guardar segredos. Um dia eu farei com que isso volte a ser possível.”

Vale uma olhada##

Matéria completa sobre o lançamento do Nostr no [CriptoFacil;]( https://www.criptofacil.com/nostr-conheca-protocolo-criado-por-brasileiro-que-utiliza-o-bitcoin-para-descentralizar-redes-sociais/)

O canal dos tem um vídeo excelente falando sobre como criar e armazenar suas chaves privadas do Nostr usando o Signing Device. Vale a pena conferir.

-

@ 6e0ea5d6:0327f353

2025-02-24 18:54:30

**Ascolta bene, amico mio.** The type of woman you choose reflects the type of man you truly are—or the one you hide from being.

Don't deceive yourself: your choices are a mirror of your essence. If you constantly get involved with women who drag you into chaos, who manipulate or belittle you, that says more about your weaknesses than about theirs. *Chi sceglie male, paga il prezzo.*

You cannot blame fate or the woman for your decisions. The responsibility is yours. If you are foolish enough to be swayed by superficial beauty or the need for approval, you are digging your own ruin.

A real man, before loving, learns to understand women—not just one, but many. He observes, understands their motivations, and learns to distinguish between those who add value and those who destroy.

If you choose wrong, don't blame the world. *Cazzo!* The mistake was yours, and so will be the consequence. Needy men, who let themselves be trapped by the first woman who offers crumbs of attention, end up being shaped by their circumstances. *"La donna non ti fa cane; sei tu che ti fai cane."* By choosing a woman without character, you reveal your own lack of discernment and courage. And, my friend, if you fear being alone, remember: loneliness next to the wrong woman is far more bitter.

If you seek respect, start by choosing wisely. Those who cling blindly, out of fear or necessity, are doomed to suffer. Own your choices, learn from your mistakes, and be selective. The world does not forgive the weak, and excuses will not redeem your weakness.

Thank you for reading, my friend!

If this message resonated with you, consider leaving your "🥃" as a token of appreciation.

A toast to our family!

-

@ 9bcc5462:eb501d90

2025-02-24 17:47:28

Every generation loves to learn. However, our public schooling system has gone as far as it can take us. The abundance of easily accessible information on the internet, coupled with emerging tech like AI, decentralized protocols and bitcoin, means this is our time to innovate our learning infrastructure. A complete overhaul is due along with the development of a pilot program to test new and unconventional models.

Let’s carve a path towards innovation by sparking discussion around this topic. Hence, this blueprint. It is a gauntlet for any person who genuinely wants to become a stakeholder for our country’s future. Entry points are:

- Builders—Startups, developers and investors who will fund and create infrastructure.

- Practitioners—Educators and researchers who will test models.

- Supporters—Parents, donors and community members who want to contribute.

**Where Do We Begin?**

Let’s think about crafting the main components of a new pilot model. Below are suggested areas of focus:

- DEFINITION

- APPROACH

- PHILOSOPHY

- CULTURE

- PHYSICAL DESIGN

- OPERATIONAL ORGANIZATION

- ACCOUNTABILITY METHODS

- RISKS & CHALLENGES

- STYLE

- STAKEHOLDERS

**How It Works**

After researching your pedagogical ideas for current and future generations of scholars, it’s time to share your insights. Contribute your viewpoint by structuring a blueprint—one page per section—in the following sequence:

- Definition of your modern learning model with its key principles.

- Description of the core learning approach.

- Philosophy distilled into central concepts that will orient stakeholders.

- Culture your modern learning model aspires to live by.

- Potential challenges, risks and drawbacks.

- Design of physical spaces and rationale.

- Operational framework detailing adult and child learning organization.

- Accountability methods to ensure skill growth and competency.

- Style development and name of your model.

- Skin in the game, sign your model with your first and last name (unite stakeholders).

Perhaps if enough stakeholders come together, we can begin to actualize a more effective and updated way of learning. This is a challenge meant to separate those willing to engage in discourse, planning and laying foundations from those content to complain from the sidelines.

**Why Now and Where Does the Money Come From?**

After being a public educator for fifteen years, I learned you will not change the system, the system will change you. It’s time to design and build above and apart from the current model. 2025 is when courageous people step up to the plate and discuss our learning infrastructure. Whether it’s contributing out of the box thinking, modernizing curriculum, investing in startups or creating your own venture; there is no greater time than now. And no greater place than in the USA!

(By extension, we also create the opportunity to influence our global allies including our neighbors to the North and South.)

“But how!?” Learning Producers is figuring it out by asking not, “how?” but “who?” Who will unite together to develop our learning infrastructure? If you decide you want to participate and join our efforts, share your blueprint as well. For all stakeholders, this is an investment in an untapped market of a new learning economy.

If not, you’re not alone. Some consider this just rhetoric, idealism, or wishful thinking. Additionally, it is unclear how such actions can be profitable or how such infrastructure building will be funded. Money talks. Bullshit walks, right? In that case, let’s talk, and let’s fine tune our BS detectors. Onward, with this call to action:

- Share your own blueprint online or reach out to Learning Producers, Inc. ([Learningproducers.com](https://learningproducers.com/)).

- Conduct research on an ideal location and team to lay foundations on a pilot program at small scale.

- Engage in dialogue with investors interested in developing learning infrastructure for their own children and families.

- Secure stakeholders to develop and test a real world pilot model (real location, real agreements, real timeline, real people).

- Sponsor or donate resources to counter concerns over funding.

Now, we leave you with our blueprint:

PEDAGOGICAL WABI-SABI

We hope you enjoy it.

Sincerely,

**Israel Hernandez**

**Founder of Learning Producers**

**\**[Read or download full blueprint here: <https://www.learningproducers.com/blog/pedagogical-wabi-sabiblueprint-for-developing-learning-infrastructure> \]

-

@ da0b9bc3:4e30a4a9

2025-02-24 16:56:02

Hello Stackers!

It's Monday so we're back doing "Meta Music Mondays" 😉.

From before the territory existed there was just one post a week in a ~meta take over. Now each month we have a different theme and bring music from that theme.

Welcome to Femmes Fatales 3!!!

I absolutely loved doing this last year so I'm bringing it back for round 3!

It's Femmes Fatales, where we celebrate women in ~Music. So let's have those ladies of the lung, the sirens of sound, our Femmes Fatales!

Stackers, here's Avril Lavigne.

https://youtu.be/dGR65RWwzg8?si=T5onrZ0T_zREhd-n

Talk Music. Share Tracks. Zap Sats.

originally posted at https://stacker.news/items/895855

-

@ 4d41a7cb:7d3633cc

2025-02-24 16:31:54

Money is more abstract than most people think, as I will show in this article. Debt slavery stems from financial illiteracy, which occurs intentionally. The biggest secret is how bankers actually create **currency claims out of thin air and transfer the wealth of their clients (including nation states) to themselves for free without risking a cent, real money, or currency.**

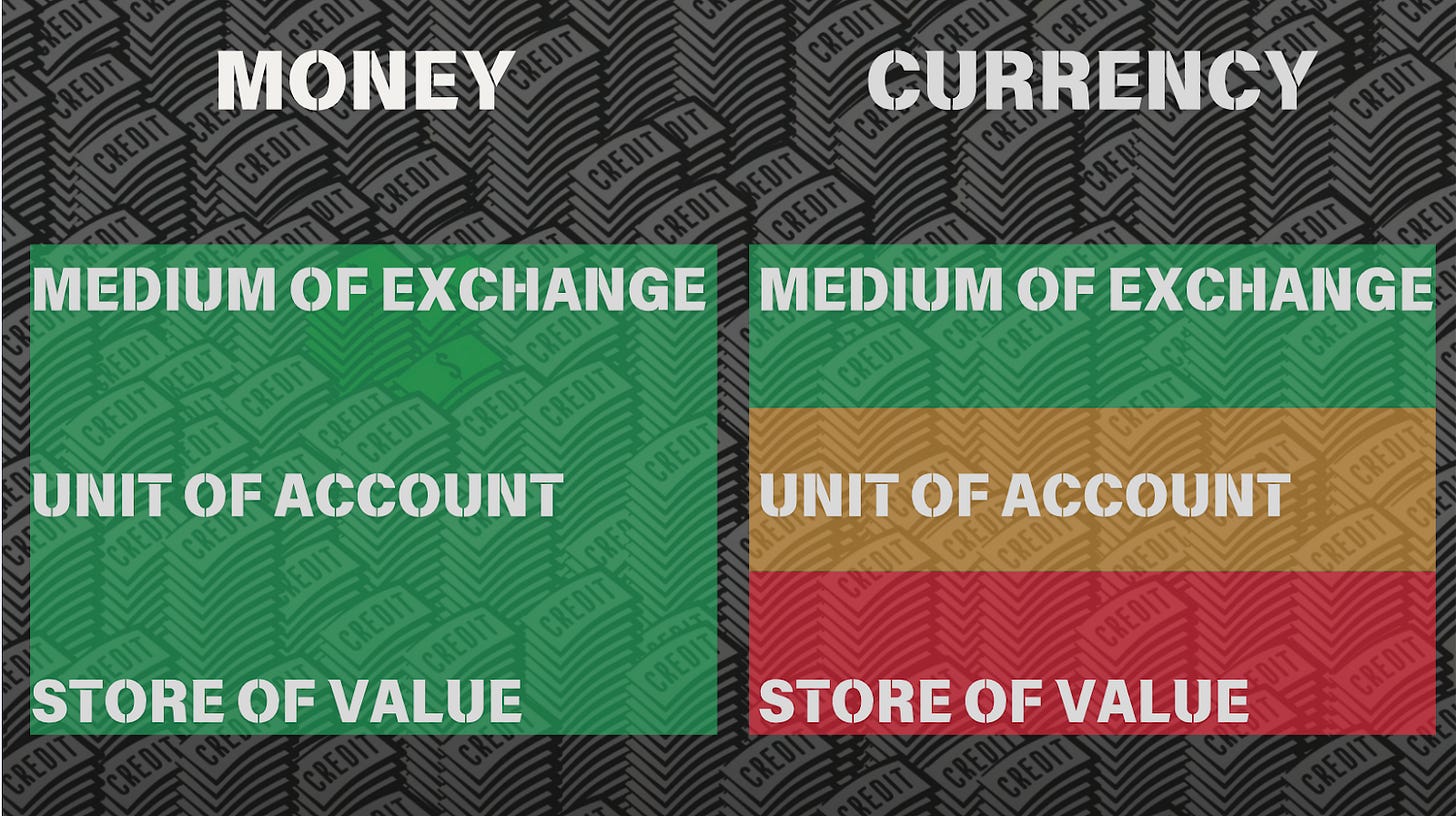

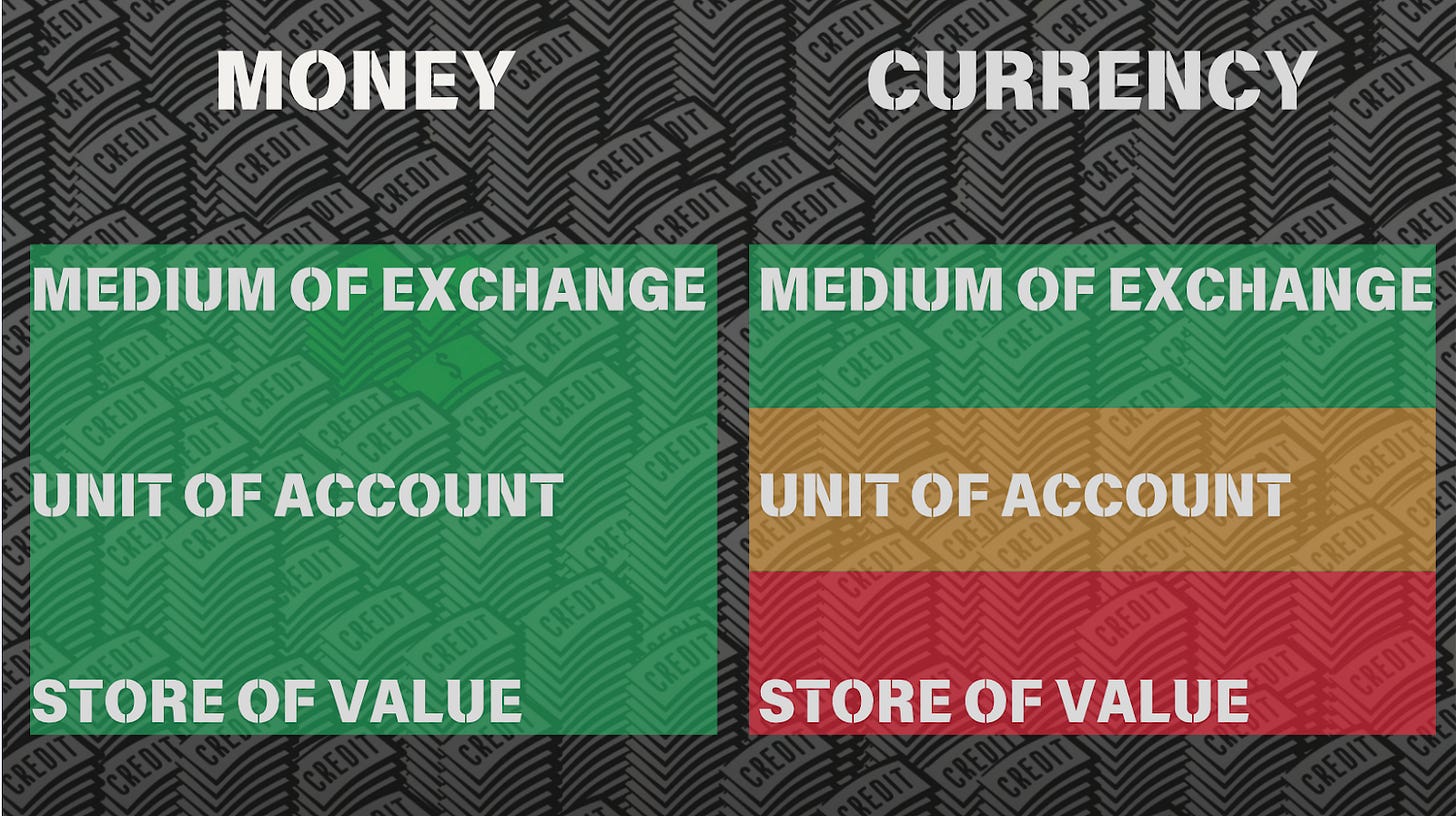

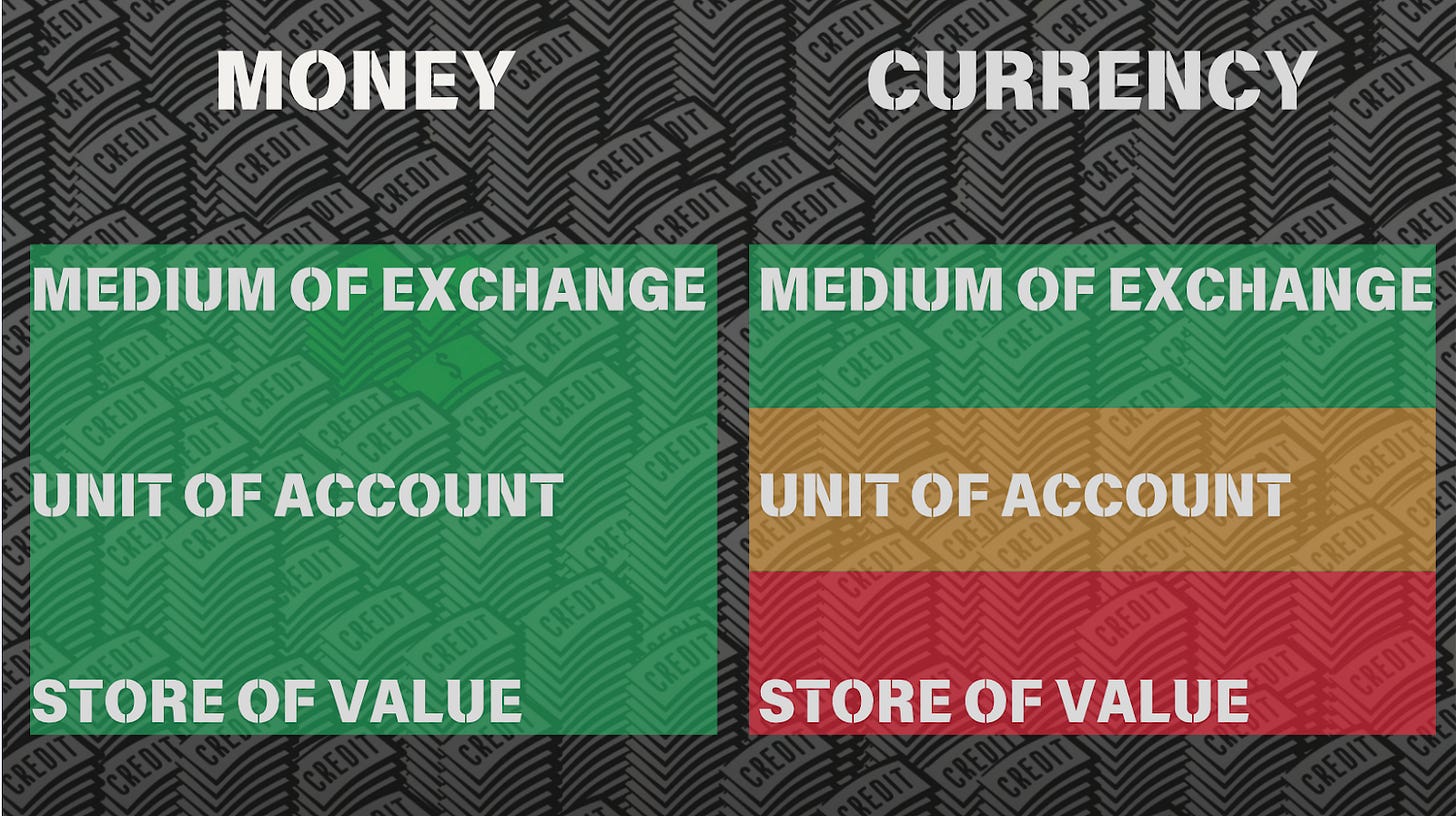

## **MONEY**

Money, one of the most important things in our lives, is so important that we exchange wealth to obtain it. Not because we want it but because we need it in order to buy food, shelter, clothes, etc.

Money is not inherently bad, although some may argue that the love for money is the root of all evil, and I'll agree. If you are willing to sacrifice your soul, honor, reputation, family, or friends for money, it indicates a lack of morality and a willingness to engage in harmful actions to satisfy your greed and materialistic desires.

**Money is a technology, a tool, and like any tool or technology, it is impartial**; it cannot be inherently good or bad. It can be used to help others or to destroy them. At the end of the day, it’s all about the intention behind human behavior.

Money is not just a useful tool; it’s **the most important tool** to have for global commerce, division of labor, specialists, and the level of sophistication and comfort we achieve as humanity. All of this will not be possible without this tool working as a common medium of exchange and standard of value, a common language for all humanity: the language of monetary value.

**Money is the cornerstone of civilization.** Money is the bloodstream of commerce, and commerce is the spine of civilization; it’s what made our civilization so prosperous, letting any one of us decide how we want to provide value to society.

Money is half of every transaction, and since we will always need to intermediate between every exchange, money is the perfect intermediary to help achieve millions of different combinations of exchanges. It will be practically impossible to barter on a global scale; even in a small community with a few different products, it will be a mess.

For example, if there were 10 products, there would be 45 combinations; if there were 100, there would be 4950 combinations. Imagine a scenario on a large scale, requiring the exchange of hundreds of thousands of products every second..

This issue **necessitated the development of a new technology: money, which in turn led to the emergence of moneychangers (v4v). Money is a tool to exchange, measure, and store wealth.** Wealth is anything we can sell: our labor (time and energy), our house, a car, a product, a service, etc.

**Gold and silver were money for thousands of years** because of their unique characteristics of scarcity, durability, divisibility, and transportability. The most important characteristic of these metals is that they are scarce, and they can’t be created out of thin air or reproduced with no effort.

**Only God can control the supply of gold and silver found in nature.** Men can only extract it, and it requires investment, work, time, and effort to find and mine it. So the common knowledge and the common sense of the people over thousands of years consensually chose gold and silver as money. And **this money is the only lawful money under common law.**

> “Gold is money, everything else is credit”

>

> J.P. Morgan 1912

As an interesting fact, the word "money" is used 140 times in the King James Bible, the word "gold" is mentioned 417 times, and the word "silver" over 320 times. But the word “currency” is not mentioned a single time.

The most important function of money is to **exchange and store your time and energy**. You work to acquire money and then use that money to acquire other goods and services.

**Our time and energy is our real wealth** because it’s limited. We all have a limited time on earth, and we can do certain things in the 24 hours we have every day, so we have to be conscious about how we administrate and store the fruits of our labor.

Money is a means to an end; we don't want money; we want what money can buy, and guess what, money cannot buy more time.

## **CURRENCY = FAKE MONEY**

**Currency exists as a money substitute.** Currencies began as the opposite of money, the **promise to deliver money in the future: debt**. Currencies can be used to exchange wealth, but they are not a fair unit of account and are never a good way to store it because men are tempted to create more and dilute its value (a process known as inflation)

Currencies have almost all the same characteristics of money, but there’s a big difference: **currency is not scarce and durable**. Missing the store of value characteristic of money, since **its supply can be manipulated by men.**

For wealth preservation and measuring, modern currencies make no sense. Men control the supply of currency; **banks and governments can inflate or deflate it in any amount they please, giving them supreme power and control over wealth distribution.** This creates two classes of citizens: those who work to acquire currency and those who create it instantly and for free.

International banks have stolen money (gold and silver) over the past century, replacing its supply with currency or fake money (paper receipts). \[1913, 1933, 1944, 1971\]

Under this monetary game, those with "fixed income," savers, and creditors are the biggest losers, while debtors and asset owners are the winners..

The **most important distinction to keep in mind is that nature controls the money supply, making artificial inflation impossible.** On the other hand, men can inflate currency in unlimited amounts. It is **a manifestation of God's power on earth, as the mediums of exchange serve as the lifeblood of commerce, the backbone of our economic system, and facilitate the division of labor.**

If someone can **inflate the currency supply, this has the same economic effect as counterfeiting,** and he’s effectively stealing from everyone contracting, trading, and saving in that currency. Manipulating the mediums of exchange in an economy enables manipulation of every security, industry, and business.

This is the reason the founding fathers of the United States made gold and silver only lawful money for the payment of debts. To give everyone equal protection under the law and to get rid of the nobility and two types of citizens: bankers and workers or nobles and plebeians.

> Bank-notes are not money. It 's currency. It’s unfair to take banks' currency as a standard for comparison.

>

> Bank-note currency is not “lawful money”. It never could be counted as part of banks cash reserves. ***It would be too much like a man writing and signing his own promissory note for a million and then claiming that this made him a millionaire.***

>

> The very grave evils any currency depreciation always impose upon businesses and the people.

>

> Alfred Owen Crozier, US Money vs Corporate currency, 1912

So money has three very important functions that work as the pillars on which the wellness of our economic system and civilizations relies. Currency is not a store of value because its supply can be easily manipulated, men in power can create more of it, and so using this always-changing currency as a standard of value or a unit of account is like using an always-changing ruler to measure distance. A dollar today does not buy the same as a dollar one year ago. So yesterday prices are not equal to today's prices; this is an unfair business calculation.

So money has three very important functions that work as the pillars on which the wellness of our economic system and civilizations rel**ies. Currency is not a store of value because its supply can be easily manipulated**, men in power can create more of it, and so using this always-changing currency as a standard of value or a unit of account is like using an always-changing ruler to measure distance. **A dollar today does not buy the same as a dollar one year ago**. So yesterday prices are not equal to today's prices; this is an unfair business calculation.

There are several Bible verses that discuss the manipulation of weights and measures, emphasizing the importance of honesty and fairness in commercial dealings.

1. Leviticus 19:35-36 New International Version (NIV): "**Do not use dishonest standards when measuring length, weight, or quantity.** Use honest scales and honest weights, an honest ephah, and an honest hin.

2. Deuteronomy 25:13-15: Do not have two differing weights in your bag—one heavy, one light. Do not have two differing measures in your house—one large, one small. **You must have accurate and honest weights and measures**.

3. Proverbs 11:1—"A "**dishonest scale is an abomination to the Lord**, but a just weight is his delight."

**Fake money (currency) is always and everywhere a dishonest scale.** So if you want a real measure of value or wealth use something with real value instead, like gold, commodities, products, times, etc.

Bankers have redefined the word money to mean fake money, currency, or debt. And this is not the worst part. Let’s introduce another concept: credit.

## **CREDIT = FAKE CURRENCY**

**Real credit is the promise to pay money in the future.** It involves delaying the payment of money. **Currency was born as credit**, as a money certificate or receipt. During the last century, banks gradually replaced 100% of the money with currency and bank credit to further boost their profits and control. \[1913, 1933, 1944, 1971\]

But in order to achieve this goal, **bankers redefined the word money to mean the opposite of money: credit/debt. This is like calling a night a day or evil a good.**

When you take out a loan from a friend, you receive credit from him, but you also incur a debt with him. You promise your friends that you will pay them (asset/right), and you owe them (liability/obligation). The asset and the liability are one and part of the same deal; they cannot exist without the other. There’s no credit with no debt, no debt with no credit, and no liability with no asset.

Federal Reserve notes, commonly known as **“dollars,”** are a private corporate currency; they are **not money** because they are not gold or silver, nor receipts for these metals as many people still believe. They were not redeemable in money from the start, despite being created under the assumption.

The “peso” (Spanish word for weight) used to be a standardized amount of gold or silver, but it’s not any more; it's just a debt denomination. And what's owing? Currency. **How can someone lend the opposite of money and charge interest? O**nly deceiving you into believing that he is lending you money. So they redefined the word money to mean the opposite of it.

But redefining words does not change the economic effect of the transaction.

When currencies first appeared, I can imagine people asking themselves, "How can people trust these paper certificates in exchange for their money?" Who will be that stupid?” And **nowadays, people don’t understand the difference between money and currency, to the point that bankers redefined the word "money" to mean the opposite of "money."**

Lesson: Money is not just a medium of exchange; it is also a store of value and a unit of account. Currency, the opposite of money, is debt. Since it can be created in unlimited amounts, it can't work as a store of value because its value depreciates as more units are created; for this same reason, it is not fair to denominate values in currency units since one currency unit today does not buy the same as a year ago because of inflation, the loss of purchasing power.

Summarize: While money, currency, and credit all serve as effective mediums of exchange, only money serves as a reliable store of value for saving. Currency and credit are not stores of value (not good to save), and there are not fair units of account (not good for price).

In simple terms, money is not currency, because currency is just credit and debt. We can conceptualize it as a ledger, a record of who owes what to whom. Currency is fake money since it’s the opposite of a store of value; it's always depreciating in value while its supply is inflated. This is the definition of inflation.

**Modern credit is not currency; it’s the opposite. It’s the promise to deliver currency in the future, the promise of a promise of money (in theory). But there’s no money behind. It’s an air loan.**

But how did we get here? Is everyone stupid? No, we have been tricked, manipulated, and dictated to use these currencies, and this banking system was forced on us. They stole our money and replaced it with fake substitutes to boost their profits.

## **MODERN MEDIUMS OF EXCHANGE = MONOPOLY MONEY**

**So nowadays we have fake money acting as cash/currency and fake currency acting as bank deposits or credit.** One is worse than the other, but both of them serve only as mediums of exchange. Those who store wealth with them will be robbed, and those who calculate business will be lied to.

Today we use currencies (government notes), coins, bank deposits (currency claims), checks (bank deposit claims), credit cards, and debit cards. All of them are ‘monopoly money’ fake claims based on a big and global fraud.

- *Government notes (government debt)*

Since governments are under the control of central banks, they can only create currency by borrowing. Governments must issue bonds, or debt, and the central bank can generate credit, or currency, to purchase these bonds.

The bond (government liability) is the counterpart of the ‘asset’ (the currency, a central bank asset). Bonds are debt, and currencies are credit.

When the central bank creates currency to lend it to the government at interest, it has literally the economic effect of **transferring the wealth of the nation to the banks for free**. The banks are not lending anything that they had to labor to produce; instead, they are creating it by printing paper notes or digital currency.

On the other side, governments have to collect money from citizens (producers, merchants, and workers) to pay the interest on the debt.

Despite their best efforts, governments are unable to repay the debt due to interest, which makes it bigger than the amount of currency. Let’s say the debt is 100 at 1% interest. So there’s only 100 in currency. But at the end of the year, there’s going to be a debt of 101. In order for the system to keep working, someone else has to go into debt to create more currency units, and governments have to keep borrowing and at least only paying the interest and rolling the debt.

The important thing is that if you have government currency debt free, you own it. This is the new ‘money.’. **Government currency is the ‘real’ cash, liquidity, or water.**

- *Bank deposits (bank debt)*

When you deposit your government currency in the bank, you are legally lending your currency to the bank, and the bank owes you the amount you deposit. This currency is not stored by banks until you request it. Banks use this currency as if it were theirs, and they do business with it. That’s why I said, **‘Your money in the bank’ is not yours; it’s not money; it’s not in the bank.** Its currency, its owe to you, is only registered on the bank ledger as a debt, not in a safe box.

The numbers you get in the bank account, or your balance, are government currency substitutes; they are bank deposits. Your currency deposit is the asset, and the number on your bank account balance is the liability.

But this is not the worst part. Banks lend around 10 times more currency than they have in deposits. So banks have more liabilities than assets (they are literally broke).

People often treat bank deposits, also known as government currency substitutes or bank tokens, as legal tender, allowing banks to create them arbitrarily and 'lend' them to unsuspecting clients who mistakenly believe they are receiving currency.

This is possible only because the bank's deposit has equal cash value.

***Government bonds, government currency, and bank deposits have equal value. But they are not the same.***

All of them have counterparty risk, but **cash, or government currency, is better** or safer than bonds or bank deposits. If interest rates rise, the value of bonds can decrease, and default on bank deposits can result in total loss, a scenario that has frequently occurred.

Keep in mind that bank deposits represent the bank's debts, also known as liabilities. Business activities and risk-taking make your currency unsecured, and they don't compensate you enough for the loan and risk.

- *Debit cards (bank deposit transfer)*

Your bank deposit is your right to get your currency back. When you use a credit card to buy something, you are transferring that right to the seller so he can redeem that bank token for currency if he wishes.

But you have to have had a deposit before you can spend it or transfer it.

- *Checks (bank deposit transfer)*

The same applies to checks. Your bank deposit is your right to get your currency back. When you use a check to buy something, you are transferring that right to the seller so he can redeem that bank token for currency if he wishes.

- *Credit card (bank deposit creator)*

Credit cards are different. When you use a credit card, you are creating a bank deposit backed by your promise of paying it back. By allowing the bank to create a currency substitute out of nothing and charge you high interest, you are essentially working for them for free.

Not only this, but you are also letting them collect fees from the payments processing that cost them nothing and support their fake money as a medium of exchange.

**Using credit cards is literally voting for financial slavery.** This is why companies make credit cards so convenient and offer benefits, with the intention of incentivizing and pushing people into the debt slavery system.

## **BANKS = MONEYCHANGERS**

‘Loans’ = exchanges

**The history of money is the history of moneychangers**, money dealers, or bankers. Money is an inanimate object. Bankers are alive; they are the ones in charge of making the money, currency, and credit flow or stop.

**They have been in existence for thousands of years**, from Egypt to Rome, where Jesus Christ himself threw them out of the temple and called them thieves, and he was not wrong.

Moneychangers played a crucial role in facilitating trade by exchanging different forms of currency and commodities. The profession of moneychangers evolved over time, particularly during the Roman Empire and the Middle Ages when various currencies were in circulation. In these times, moneychangers would set up shop at markets or public spaces to provide their services and **help merchants convert their money into a form that could be used for transactions with other traders.** As banking systems developed over time, the role of moneychangers expanded to include more complex financial services.

Today, moneychangers are still an essential part of the global economy, helping people exchange currencies and facilitating international trade.

**The Knights Templars** were a Christian military order established in 1119 who played a crucial role in the establishment of the financial system in medieval Europe. They established **a gold-backed credit system** that laid the foundation for the modern banking system. Their financial services included deposit accounts, loans, and even a form of early traveler's checks.

**The history of the goldsmiths** starts around 700 years ago in the year 1327. The company became responsible for hallmarking precious metals and played a significant role in regulating the quality and authenticity of gold and silver items. **In exchange for written acknowledgments or "receipts,"** they also provided gold deposit services.

Both groups played significant roles in the development of these early financial instruments, with goldsmiths issuing written acknowledgments for deposited gold and the Knights Templar establishing banking institutions that facilitated the use of such receipts as a form of payment.

This is a brief summary of the beginning of the moneychangers and how they discovered how to multiply money with paper receipts, better understood as counterfeiting. We now refer to it as fractional reserve banking, and let me tell you something: it's based on fraud.

Not only do they create bank deposits when you deposit currency, but they also create them when you "take a loan." Banks do not lend money, and they do not lend currency; they lend bank deposits (bank tokens/IOUs/currency substitutes/ paper receipts).

Banks had to redefine the word money to mean the opposite of money (debt) to trick the people. How can you lend the oposite of money and expect to be paid back plus interest? This took them thousands of years to achieve.

**The fact is that this is not a loan but an exchange.** When you take a loan, you sign a contract that creates a promissory note, which is your promise to pay. The bank then takes this promissory note, without your permission (steals), and sells it for cash (if you requiere it) or government bonds (to earn interest).

Your promissory note has equal value to cash and government bonds. And banks always need an asset to create a bank deposit (liability). So the banks literally steal your asset (promissory note) and sell them to create IOUs that they will ‘lend’ to you.

They ‘lend’ the oposite of money and call it a loan. The truth is that they are acting as moneychangers, and they are exchanging your IOU (promissory note) for a bank IOU (bank deposit) without your permission and pretending that you pay it back, but they never pay back theirs…

How is this possible? This is only possible because most people treat bank deposits (bank tokens, IOUs, and debts) as a medium of exchange because they trust the banks.

This is the root of inequality under the law. While one group can create IOUs from nothing and steal others, the other must work for them or exchange wealth.

If this bank defaults, its IOUs quickly vanish. This is a mathematical certainty; that’s why banks that are 'too big to fail' demand bailouts. **Every bank is bankrupt** since they have 7–10 times more liabilities than assets, and the assets they have are not theirs but their clients' assets. The only thing that keeps them alive is the trust of the public and the bailouts of the government.

**This is legalized slavery and theft.** There’s no other name. Banks own every industry, government, public figure, actor, etc. They have the power of God on earth, and it's time to stop them.

If we let the bank take our wealth for free, we will end up bankrupt, and they will end up owning everything. Every medium of exchange nowadays is an IOU or an IOU of an IOU. Ultimately, it is mathematically impossible to repay all of those IOUs, and banks pretend to keep all the assets.

*Check: IOU = deposit; IOU = cash; IOU = bond; IOU + interest*

The only way this system can continue is to keep creating new IOUs to pay the old ones, but even then (as it has been for over a century), the value of those IOUs keeps falling, causing hyperinflation.

If banks and governments want to ‘avoid’ (imposible) or relent to hyperinflation, they need to incur a great confiscation. So heads you lose, tails they lose; playing this game doesn't make any fucking sense.

Buy Bitcoin, self custody, and fuck the government and the banking system.

Live free or die trying.

-

@ 378562cd:a6fc6773

2025-02-24 16:30:05

Bitcoin is an incredible innovation, a financial revolution, and an obsession for many. The idea of decentralization, financial sovereignty, and the potential for life-changing gains make it easy to get sucked into the never-ending cycle of price checks, news updates, and technical analysis. But here’s the reality: dedicating every waking moment to Bitcoin—or anything, really—is not sustainable. It’s not healthy. You need to breathe. You need to live.

### The Trap of Constant Focus

It starts innocently enough. You buy your first bit of Bitcoin. You check the price. Then you check it again. Before long, you’re spending hours reading articles, listening to podcasts, watching charts, and diving into the latest market trends. The highs of a bull market fuel your excitement; the lows of a crash send you spiraling into despair. And soon, it consumes you.

If you’re not careful, Bitcoin can become an all-encompassing mental trap, a black hole that sucks in every moment of your free time. You think about it when you wake up. You refresh your portfolio at lunch. You browse Twitter threads before bed. It’s an addiction that disguises itself as productivity. But the truth? It’s draining you.

### The Case for Letting Go

Let’s be real—Bitcoin should not be your entire life. Your well-being, relationships, and overall happiness depend on balance. Financial freedom is meaningless if you sacrifice your health, your connections, and your experiences along the way. Here’s why you need to step back:

1. **Your Brain Needs a Break**—Constantly thinking about Bitcoin puts you under heightened stress. Markets are volatile, and living in reaction mode is exhausting. Give your brain space to rest, reflect, and reset.

2. **The Sun Exists—go Enjoy It.** Get outside, walk, breathe fresh air, and touch some grass, literally. Sitting in front of a screen tracking prices all day is not fulfilling.

3. **Love and Human Interaction Matter**. Your most valuable asset is not Bitcoin—it’s the relationships you build. Spend time with God, with friends, family, and loved ones. Share experiences. Have deep conversations that don’t involve blockchain technology.

4. **Automation is Your Best Friend** – Here’s a secret: You don’t need to manually buy Bitcoin every day or even every week. Set up an automated buying schedule and forget about it. Whether it’s once a week, biweekly, or monthly, let technology do the work while you focus on living.

5. **There’s More to Life Than Financial Gains** – Wealth is important, but so is joy. Read a book. Pick up a hobby. Travel. Laugh. Life is happening all around you—don’t miss it because you’re staring at a screen.

### Finding a Healthier Approach

Bitcoin can be part of your life without becoming your life. Set boundaries. Schedule specific times to check in on the market, but outside of those moments, let it go. Treat it like any other long-term investment—buy, hold, and forget. Trust the process without obsessing over every tick in the chart.

Most importantly, remember: You are a human being, not just an investor. You are here to experience, to love, to learn, and to grow. Bitcoin will be there whether you’re watching or not—but life won’t wait.

So step away. Breathe. Live.

### Automate Your Bitcoin Strategy with River

If you want to make Bitcoin a seamless part of your life without the stress, consider using **River**. It’s a platform I love because it allows me to deposit cash and earn a percentage back in Bitcoin on that cash balance and automatically execute a **daily dollar-cost averaging (DCA) strategy FEE-FREE**. Instead of constantly watching charts, my Bitcoin purchases happen automatically, drawing from my cash balance. It’s fully customizable, meaning you can adjust your buy schedule and even **automatically transfer part of your holdings to your own wallet**, ensuring you hold your own keys.

For those concerned about security, River recently introduced **Forcefield**, an added layer of protection for your assets. If you’re interested in making your Bitcoin journey effortless, **sign up using my referral code** [here](https://river.com/signup?r=6DEZAJLR)—this earns us both free Bitcoin! Set it and forget it, and get back to living your life.

-

@ e5de992e:4a95ef85

2025-02-24 15:30:44

One of the most common misconceptions about trading is that it's no different from gambling. This belief often comes from people who misunderstand the discipline, structure, and effort that go into becoming a successful trader. The truth is, trading couldn't be further from gambling when done right. It's about edges, calculated risks, consistency, and discipline.

Let's break down the key differences and why trading, when approached correctly, is a professional skill—not a game of chance.

---

## Why People Think Trading Is Gambling

1. **Lack of Understanding:**

Many assume trading is about guessing market direction or chasing quick profits, which mirrors gambling behavior.

2. **Emotional Reactions:**

Traders who rely on instincts or impulsive decisions often resemble gamblers, reinforcing the stereotype.

3. **Stories of Losses:**

Headlines about traders losing their life savings due to overleveraging or poor risk management create the illusion that all trading is reckless.

---

## What Trading Really Is

### 1. Trading is About Edges

- **What It Means:**

An edge is a systematic advantage that gives you a higher probability of success over time. It could be a proven strategy, a deep understanding of market patterns, or an ability to exploit inefficiencies.

- **Why It's Not Gambling:**

Gambling relies on pure chance or unfavorable odds (e.g., the house always wins). In trading, a well-researched edge tips the probability in your favor.

### 2. Trading Involves Calculated Risks

- **What It Means:**

Every trade involves assessing how much you're willing to lose relative to the potential gain. Risk management ensures no single trade can wipe you out.

- **Why It's Not Gambling:**

In gambling, you often bet more than you can afford to lose. In trading, calculated risks are taken with predefined stop-losses and position sizing to minimize potential damage.

### 3. Trading is an Emotional Fight

- **What It Means:**

Success in trading depends on mastering your emotions—fear, greed, impatience, and overconfidence can destroy even the best strategies.

- **Why It's Not Gambling:**

Gambling thrives on emotional highs and lows. Trading requires emotional discipline, where decisions are based on logic and planning, not impulse.

### 4. Trading Demands Consistency

- **What It Means:**

Successful trading isn't about a single big win—it's about executing your strategy consistently over hundreds or thousands of trades.

- **Why It's Not Gambling:**

Gambling often relies on luck and one-off results. Trading builds wealth through steady, disciplined application of a proven system.

### 5. Trading Focuses on Long-Term Goals

- **What It Means:**

Traders work towards sustainable growth over months and years, prioritizing capital preservation and compounding profits.

- **Why It's Not Gambling:**

Gamblers often aim for immediate gratification, while traders take a marathon approach, understanding that success is built gradually.

### 6. Trading Requires Countless Hours of Practice

- **What It Means:**

Traders spend countless hours backtesting strategies, studying market behavior, and improving their skills.

- **Why It's Not Gambling:**

Gambling involves minimal preparation or reliance on skill, whereas trading is a craft honed through continuous learning and refinement.

---

## Key Differences Between Trading and Gambling

| **Aspect** | **Trading** | **Gambling** |

|------------------------|-----------------------------------------|-----------------------------|

| **Control** | Follows a defined plan | Relies on chance |

| **Risk Management** | Uses stop-losses and proper sizing | All-in mentality |

| **Skill vs. Luck** | Based on skill and strategy | Primarily luck |

| **Timeframe** | Focused on long-term growth | Instant gratification |

| **Emotional Approach** | Requires discipline | Driven by highs and lows |

---

## Final Thoughts: Trading is a Profession, Not a Bet

The idea that trading is gambling stems from a lack of knowledge about what trading truly entails. While both involve risk, trading is a calculated, skill-based profession that rewards preparation, discipline, and consistency. Gambling, on the other hand, is a game of chance with the odds stacked against you.

If you want to succeed as a trader, focus on building edges, managing risk, and staying consistent over the long term. These principles separate professionals from gamblers—and turn trading into a sustainable path to financial growth.

**Remember:** It's not about luck. It's about skill.

---

-

@ fd78c37f:a0ec0833

2025-02-24 15:15:58

In this episode, we invited Alexandra from the Bitcoin Reach community to share insights on the development, challenges, and adoption strategies of the Bitcoin community in Zimbabwe.

**YakiHonne**: Before we begin, let me briefly introduce YakiHonne. YakiHonne is a decentralized media client built on Nostr—a protocol designed to empower freedom of speech through technology. It enables creators to own their voices and assets while offering innovative tools like smart widgets, verified notes, and support for long-form content. Today we'll be exploring more about community building and management with our honorable guest Alexandra. Could you please introduce yourself and your community?

**Alexandra**:I'm Alexandra, and I founded a community called Bitcoin Beach, which is a suburban community. One thing that really astonished me was that there were already many Bitcoin communities worldwide before us. Before getting into Bitcoin, I worked for a podcast called Global Bitcoin Fest, where I interviewed community leaders from different countries, innovators driving change, and those advocating for Bitcoin regulations. Through these conversations, I discovered that Bitcoin communities existed all over the world—yet, surprisingly, there wasn’t one in Zimbabwe.

**Alexandra**:This was particularly shocking because Zimbabwe has experienced some of the highest inflation rates in history—the second-highest inflation rate of all time. Many people associate Zimbabwe with its 100 trillion-dollar banknotes, which symbolize our extreme hyperinflation. In fact, we have gone through six currency failures, yet many still don’t fully understand inflation or how it affects us.

**Alexandra**:Our community was created to educate people about Bitcoin and financial sovereignty, helping them navigate economic instability and regain control over their finances through Bitcoin.

**YakiHonne**: It seems like you have a lot of people who genuinely want to learn about Bitcoin. They are not only focused on improving Zimbabwe’s economy but also actively engaging with the Bitcoin ecosystem.

**Alexandra**:I think one of the biggest challenges is that people don't truly understand how devastating a failed monetary system can be. If you look at it this way—money is involved in 50% of all transactions, meaning it plays a fundamental role in every economic activity. When money fails, one of the first consequences is the inability to calculate capital effectively, leading to high time preference decision-making.

**Alexandra**:Why is this a problem? Well, in a stable monetary system, when people have strong purchasing power, they receive fair value for their economic output. This allows them to buy goods and services, invest in their future, pursue higher education, start businesses, and invest in assets like real estate and stocks. Essentially, good money gives people the time and ability to build a better future.

**Alexandra**:However, when money does not store economic value, people only receive a fraction of what they produce. Instead of earning a full dollar for their work, they might get only two to three cents on the dollar. This means their income is barely enough for basic sustenance—just buying food, bread, and milk, and often, that isn’t even sufficient.

**Alexandra**:As a result, people shift from long-term financial planning to immediate survival, making economic calculations purely about what they need right now rather than investing in the future. This is why so many places remain impoverished. Without stable money, real estate investments disappear, housing becomes inaccessible, and infrastructure like malls and gyms is nearly nonexistent. The only way to secure housing is outright purchase, which very few people can afford. This highlights the severe economic limitations caused by a broken monetary system.

**YakiHonne**: It seems like you've already answered our first question. I was going to ask what sparked your interest in Bitcoin, but I can see that many factors actually led you toward the Bitcoin ecosystem. So, I think you've already covered that. Now, one more thing—I’d love to know what motivated you to build a community around Bitcoin?

**Alexandra**:Absolutely. Like I said, we observed communities all across Zimbabwe, but we noticed that nothing was really happening in terms of Bitcoin adoption. In fact, Zimbabwe's adoption rate is significantly lower than in most countries. While sub-Saharan Africa has the highest Bitcoin adoption rate, Zimbabwe itself has one of the lowest adoption rates.

**Alexandra**:I realized that if no one else was willing to pave the way to make Bitcoin adoption more resilient and accessible, then I should step up and do the necessary work to facilitate the process. My goal was to connect the people who needed to be connected—whether it's miners, individuals looking to buy Bitcoin, or those who need help installing and using it.

**YakiHonne**: How did Bitcoin Reach begin? How was your community formed, and how did you initially attract new members?

**Alexandra**:it all started with just a few people. I was highly motivated and kept asking myself, how can we create an impact in Zimbabwe? Strangely enough, it began with me simply chasing leads.

**Alexandra**:The turning point came when Anita Posch visited Zimbabwe. Through her visit, I connected with other like-minded individuals in the Bitcoin space. From there, we decided to create a WhatsApp group, which became the foundation of our community. With this small collective, I started reaching out to more people. Having even a modest level of influence allowed me to leverage connections and secure sponsorships.

**Alexandra**:Our first sponsor was Booking for Fairness, followed by Money on Chain, Rootstock, and Global Bitcoin Fest. With this support, we started hosting regular meetups, organizing at least two meetups per month in different cities and countries. So far, we've held meetups in over eight cities across four different countries. At these events, attendance ranged from 25 to over 50 people, and at times, we even filled an entire restaurant with Bitcoin enthusiasts.

**YakiHonne**: That's really impressive! You started with just three people, and now you're hosting events with over 50 attendees—sometimes even filling an entire restaurant. That’s truly amazing. Alexandra, you and your team are doing incredible work in Zimbabwe—it's a massive achievement! What challenges have you faced, and how have you overcome them?

**Alexandra**: I think one of the major challenges that we do face is what we call an implicit ban, and some functions. Firstly, when we have what we call the negative order assumptions, a policy similar to what South Africa recently faced. Essentially, any country with bilateral relations with the United States must enforce the same sanctions imposed by the U.S. As a result, Zimbabwe is restricted from receiving goods and services from many companies. If you’re a Bitcoin business, you cannot provide Bitcoin services to Zimbabwe, cannot send hardware wallets, cannot hire people from Zimbabwe, and cannot offer sponsorships to Zimbabwean projects. This significantly limits the number of Bitcoin companies we could have collaborated with, which would have helped people earn Bitcoin and drive adoption.

**Alexandra**:The second major challenge is implicit ban. If a Bitcoin company sets up in Zimbabwe, they cannot access on-ramps and off-ramps for funds. This means converting Bitcoin to physical cash is very expensive—normally, the cost should be around 2%, but due to the lack of formal channels, we have to buy Bitcoin at a 10% margin, making transactions extremely costly. As a result, it becomes difficult to establish a circular Bitcoin economy, and since we don’t have one, we struggle to secure funding.

**YakiHonne**: What advice would you give to someone looking to start or expand a Bitcoin-focused community in today’s landscape?

**Alexandra**:My advice would be to focus on the core issues, and the two most important ones are structure and education. Often, we get distracted by other elements when building a larger economy—such as organizing meetups, managing day-to-day operations, or maintaining WhatsApp groups for communication. However, for a community to truly grow and thrive, it needs a strong structural system and a functional circular economy.

**Alexandra**:First, structure is key. If someone wants to learn about Bitcoin, where can they go? What courses or resources are available? Having clear educational pathways is essential for adoption.

**Alexandra**:Second, building a circular economy is crucial. The first step is identifying people who are earning Bitcoin—whether through remittances, jobs, or services. Once there are enough Bitcoin earners, the next step becomes easier: figuring out where they can spend it. This is a far more practical approach than simply convincing businesses to accept Bitcoin without an existing customer base.For example, if you’re a vendor, shop owner, photographer, baker, or farmer, there are many potential Bitcoin customers who don’t want to cash out due to high fees. By accepting Bitcoin, businesses expand their clientele, which is a critical factor in establishing a sustainable Bitcoin economy.

**YakiHonne**: Does your community engage in the technical or non-technical aspects of Bitcoin? Or perhaps do you guys do both?

**Alexandra**:I think one of the biggest challenges is that we have people conducting thousands of dollars in Bitcoin transactions, yet they don’t understand what Lightning or Layer 2 is. Some even believe that Bitcoin has no real utility, despite using it regularly. There are people who are interested in the technical aspects, and we are gradually finding them. However, our community initially consisted mostly of people who used Bitcoin primarily for remittances. This is a common challenge in Africa—Bitcoin adoption grew rapidly because people saw it as a useful tool, not because they fully understood it. Unfortunately, we are currently more focused on the non-technical aspects, but we are actively working to change that.

**YakiHonne**:Alexandra, how do you see the role of Bitcoin communities evolving as technology advances, particularly in areas like scalability, privacy, and adaptability? How do you think these communities will develop as these technologies mature?

**Alexandra**:Yeah, I think Bitcoin communities play a crucial role in adoption and education. One of the most common things I hear when teaching people about Bitcoin is, “I wish I had learned about this from you first.” Many people's first encounter with Bitcoin was through scams, which led them to give up on it. Communities are essential because people are more likely to trust and engage with products when they come from a trusted source.

**Alexandra**:When you build a community, every new member you bring in has the potential to influence five to ten others. These people are more likely to trust a friend’s recommendation when they say, “Bitcoin is good,” or when they explain how on-chain transactions might be slower or more expensive, but tools exist to enable faster, cheaper, and more private transactions.

**Alexandra**:People buy into products they trust—or from people they trust. This is why communities are so important, even in a system built on "Don't trust, verify." Ironically, trust is still the first step for many newcomers. I think this is where Bitcoin might have missed the mark—there are so many incredible Bitcoin advocates, but if no one knows them personally, their messages, no matter how well-articulated, may not resonate. However, when the information comes from a trusted individual, people are much more receptive.

**Alexandra**:Bitcoin communities serve as a solid foundation for introducing new solutions, including scalability, privacy, and other innovations. The key is communicating these ideas in a way that people trust and understand. Unlike expensive marketing campaigns, a passionate community can spread Bitcoin education almost for free—all they need are the right tools and resources to drive the movement forward.

**YakiHonne**:As long as there is trust, expansion will happen more effectively. Every user, every community member is a stakeholder, as they have the ability to bring others into the community. I’m confident that Bitcoin Reach will continue to grow and make an impact. Now, moving on to my final question, is the government in your region supportive or opposed to Bitcoin? And how has that stance impacted your community so far?

**Alexandra**:our government is against Bitcoin. As I mentioned earlier, they were the ones who imposed the implicit ban, making it very expensive for individuals to buy Bitcoin. Zimbabwe used to be one of the fastest adopters in sub-Saharan Africa, but as soon as the government banned Bitcoin, adoption plummeted from 100 to zero. This has made it much more challenging for people like me to build a community around Bitcoin.

**Alexandra**:Now, people hold their own keys because they are all using hardware wallets, which is a major benefit. Since they don’t trust institutions, they have taken full control of their Bitcoin, which is a great step toward financial sovereignty. However, this also slows down adoption in some ways. For example, in South Africa, our neighboring country, Pick n Pay has over 1,500 stores where people can pay with Bitcoin. In Zimbabwe, however, there are almost no places to spend Bitcoin, making real-world usage extremely limited.

**YakiHonne**:Thank you, Alexander.We've now reached the conclusion of today's interview, and I must say, I've learned so much from you. First, I truly admire how you were motivated by the low Bitcoin adoption rate in your country and took action to change that. I also appreciate your efforts to integrate economic growth with Bitcoin adoption, showing a deep understanding of both financial and technological progress. Your approach to community building is inspiring—you recognize that every community member matters, and the trust they bring is essential to the community’s success. It’s unfortunate that your government does not support Bitcoin, but with time, I believe that as Bitcoin’s influence continues to grow, they will eventually yield to its impact. I’m confident that there will be a stronger Bitcoin movement in Zimbabwe in the future.

-

@ 2f4550b0:95f20096

2025-02-24 14:30:45

The role of a leader extends far beyond managing tasks or hitting targets. Great leaders don’t just steer their ships; they design environments where their teams can grow, adapt, and thrive. By wearing the hat of "learning architects," leaders can craft intentional, impactful learning experiences that empower their teams to take ownership of their development. This isn’t about spoon-feeding knowledge or enforcing rigid training programs. It’s about building a framework where learning feels natural, relevant, and self-directed, unlocking both individual potential and collective success.

At the heart of this approach are two guiding principles: self-direction and relevance. Encouraging self-direction for your team will tap into the innate human drive to explore and grow when given autonomy. People don’t want to be told what to learn; they want to pursue learning that matters to them. Relevance, meanwhile, ensures that learning connects directly to real-world challenges, making it immediately applicable. When leaders weave these principles into their team’s growth strategy, they foster a culture of curiosity and resilience.

Why does a learning architect mindset matter? Teams that prioritize learning are better equipped to navigate uncertainty. When leaders design growth opportunities, they signal trust in their team’s ability to evolve, boosting morale and performance. More importantly, in a world where skills can become obsolete overnight, fostering continuous learning isn’t optional; it’s a survival tactic.

So, how can leaders build this learning ecosystem? Here’s a three-step blueprint to kickstart a team learning initiative that’s both practical and impactful:

## Step 1: Map the Terrain by Identifying Needs and Interests

Start by understanding your team’s needs. What skills do they need to excel in their roles today, and what might they need tomorrow? Don’t assume; ask. Conduct one-on-one chats or a quick team survey to uncover your team members’ goals, pain points, and passions. For example, a marketing team might crave data analytics skills, while a product team might lean toward user experience design. Pair these insights with organizational priorities to find the sweet spot where individual interests meet business needs. This step ensures relevance by grounding learning in real-world demands, while inviting self-direction by giving team members a voice.

## Step 2: Build the Framework by Curating Flexible Learning Paths

Once you’ve mapped the terrain, design lightweight, adaptable learning paths. Avoid heavy-handed mandates; instead, offer a menu of options. This could mean curating online courses from providers like Coursera or LinkedIn Learning, organizing peer-led workshops, or even setting up a book club tackling industry trends. The key is flexibility; let team members choose what resonates. For instance, if someone’s keen on leadership, point them to a podcast series, while a hands-on learner might shadow a senior colleague. Add structure with loose milestones (e.g., “Try one new resource this month”) to keep momentum without stifling autonomy. This balance of guidance and freedom fuels self-directed growth.

## Step 3: Encourage Reflection and Application

Learning doesn’t stick unless it’s used. Create opportunities for your team to reflect on what they’ve learned and apply it. Host casual “share-back” sessions where they present key takeaways or test new skills on a small project. For example, a salesperson who studied negotiation tactics could role-play a contract negotiation scenario, while a developer might prototype a tool they’ve explored. Tie these efforts to real challenges, like improving a process or brainstorming a product tweak, to reinforce relevance and connect their learning to the organization’s strategy. As a leader, your role is to cheerlead, ask questions, and remove roadblocks. Being a learning architect isn’t about having all the answers. It’s about designing a system where growth becomes second nature. By anchoring your approach in self-direction and relevance, and following a simple blueprint (map needs, build paths, open space), you empower your team to take the reins. The result? A group that’s not just keeping up, but pushing forward, ready for whatever comes next. Start small, iterate often, and watch your team transform into a powerhouse of learners and top performers.

**Leaders as Learning Architects: Designing Growth for Your Team**