-

@ 7a7d16c9:1a700636

2025-02-25 17:39:16

Watched an awesome [video](https://youtu.be/QEJpZjg8GuA?si=ceYEbMeFO-Ind6KO) from one who I subscribe on YT.

I've been trying to put my finger on what it is that I don't like about the major social media platforms. Alec Watson gave me the answer in one of his latest videos: "Algorithmic Complacency".

TLDR: Rather than read, watch, and collaborate with those I follow online, modern social media platforms like to tell me what content I should consume. Nostr, Bluesky, and Mastodon don't do this - I can see what I want and what I don't, without relying on a computer algorithm to tell me.

This got me thinking about my own use of social media platforms and my recent adoption of the Fedi-verse to circumvent the machine telling me how I should consume online content.

I don't subscribe to any one platform. I've not found one that addresses all my online social needs, nor one that feature the diverse audiences I follow. Here's a rundown of what I use:

YouTube - the easiest of the bunch. YT has become my new binge TV. Initially a frequented site for learning how to replace a garbage disposal or to learn some of the tricks with Davinci Resolve, YT quickly became my platform of choice for learning and entertainment content. Yes, YT has an algorithm and provides recommendations - it's how I found Technology Connections - but I like that I can use the subscriptions feed to just see content that I follow in addition to that which YT recommends.

Facebook - the favorite with the old guard. TBH, I've never liked big tech owning my voice on the Internet. I'd have deleted my FB account along with X and Instagram, long ago, except that it's the one platform that my family uses. My mother uses Facebook, so do my distant cousins, but only a subset use the other platforms, and none use the Fedi-verse. FB remains as the one platform for me to post the occasional vacation photo and to find out that my cousin got married last week - and no I didn't get an invite.

Vero - I'm a photographer and love to post some of my more interesting art pieces online for feedback, so I can improve my craft. I used to use Instagram, until it went over to the algorithm dark side and filled my feed with short-form video. Vero maintains to be what Instagram used to be. I've not checked out Pixelfed (yet).

Mastodon - After Musk took over Twitter and rebranded it to X, I swiftly left and moved to Mastodon. I hate the idea of a single business entity owning my content and right to free speech online. Like many, I have my own issues with Musk and his business practices and shouldn't have to deal with them as part of my online presence. Mastodon was and still is, the place where I get to collaborate with people I've never met in person on likeminded topics of interests. Mastodon relies on federated servers, which people own; so, there's that to consider. I've managed to find a server that caters to my interests and fulfills my desire to collaborate online.

Then comes Nostr...

My friend \_@briangreen.net introduced me to Nostr. As a long-term orange-pill advocate, I was thrilled to join Nostr to collaborate on the latest Bitcoin and Crypto news. I will say that Nostr appears less diverse in topics but that's rapidly changing as I am now seeing a lot of posts on photography, meshtastic, and other personal interests of mine. I love that Nostr is not so much a platform, but a federated protocol. I don't have to subscribe to any one app and web site to post and read content. For now, I use both Mastodon and Nostr to scratch my online collab itch. A nice thing about the Fedi-verse is that there's plenty of cross-posting apps. I use [OpenVibe](https://openvibe.social/) to post and consume content in one place. Their app is slick and works as advertised.

How do you use social media? Is Nostr your only platform, or do you still use the traditional ones?

-

@ 460c25e6:ef85065c

2025-02-25 15:20:39

If you don't know where your posts are, you might as well just stay in the centralized Twitter. You either take control of your relay lists, or they will control you. Amethyst offers several lists of relays for our users. We are going to go one by one to help clarify what they are and which options are best for each one.

## Public Home/Outbox Relays

Home relays store all YOUR content: all your posts, likes, replies, lists, etc. It's your home. Amethyst will send your posts here first. Your followers will use these relays to get new posts from you. So, if you don't have anything there, **they will not receive your updates**.

Home relays must allow queries from anyone, ideally without the need to authenticate. They can limit writes to paid users without affecting anyone's experience.

This list should have a maximum of 3 relays. More than that will only make your followers waste their mobile data getting your posts. Keep it simple. Out of the 3 relays, I recommend:

- 1 large public, international relay: nos.lol, nostr.mom, relay.damus.io, etc.

- 1 personal relay to store a copy of all your content in a place no one can delete. Go to [relay.tools](https://relay.tools/) and never be censored again.

- 1 really fast relay located in your country: paid options like http://nostr.wine are great

Do not include relays that block users from seeing posts in this list. If you do, no one will see your posts.

## Public Inbox Relays

This relay type receives all replies, comments, likes, and zaps to your posts. If you are not getting notifications or you don't see replies from your friends, it is likely because you don't have the right setup here. If you are getting too much spam in your replies, it's probably because your inbox relays are not protecting you enough. Paid relays can filter inbox spam out.

Inbox relays must allow anyone to write into them. It's the opposite of the outbox relay. They can limit who can download the posts to their paid subscribers without affecting anyone's experience.

This list should have a maximum of 3 relays as well. Again, keep it small. More than that will just make you spend more of your data plan downloading the same notifications from all these different servers. Out of the 3 relays, I recommend:

- 1 large public, international relay: nos.lol, nostr.mom, relay.damus.io, etc.

- 1 personal relay to store a copy of your notifications, invites, cashu tokens and zaps.

- 1 really fast relay located in your country: go to [nostr.watch](https://nostr.watch/relays/find) and find relays in your country

Terrible options include:

- nostr.wine should not be here.

- filter.nostr.wine should not be here.

- inbox.nostr.wine should not be here.

## DM Inbox Relays

These are the relays used to receive DMs and private content. Others will use these relays to send DMs to you. **If you don't have it setup, you will miss DMs**. DM Inbox relays should accept any message from anyone, but only allow you to download them.

Generally speaking, you only need 3 for reliability. One of them should be a personal relay to make sure you have a copy of all your messages. The others can be open if you want push notifications or closed if you want full privacy.

Good options are:

- inbox.nostr.wine and auth.nostr1.com: anyone can send messages and only you can download. Not even our push notification server has access to them to notify you.

- a personal relay to make sure no one can censor you. Advanced settings on personal relays can also store your DMs privately. Talk to your relay operator for more details.

- a public relay if you want DM notifications from our servers.

Make sure to add at least one public relay if you want to see DM notifications.

## Private Home Relays

Private Relays are for things no one should see, like your drafts, lists, app settings, bookmarks etc. Ideally, these relays are either local or require authentication before posting AND downloading each user\'s content. There are no dedicated relays for this category yet, so I would use a local relay like Citrine on Android and a personal relay on relay.tools.

Keep in mind that if you choose a local relay only, a client on the desktop might not be able to see the drafts from clients on mobile and vice versa.

## Search relays:

This is the list of relays to use on Amethyst's search and user tagging with @. **Tagging and searching will not work if there is nothing here.**. This option requires NIP-50 compliance from each relay. Hit the Default button to use all available options on existence today:

- nostr.wine

- relay.nostr.band

- relay.noswhere.com

## Local Relays:

This is your local storage. Everything will load faster if it comes from this relay. You should install Citrine on Android and write ws://localhost:4869 in this option.

## General Relays:

This section contains the default relays used to download content from your follows. Notice how you can activate and deactivate the Home, Messages (old-style DMs), Chat (public chats), and Global options in each.

Keep 5-6 large relays on this list and activate them for as many categories (Home, Messages (old-style DMs), Chat, and Global) as possible.

Amethyst will provide additional recommendations to this list from your follows with information on which of your follows might need the additional relay in your list. Add them if you feel like you are missing their posts or if it is just taking too long to load them.

## My setup

Here's what I use:

1. Go to [relay.tools](https://relay.tools/) and create a relay for yourself.

2. Go to [nostr.wine](https://nostr.wine/) and pay for their subscription.

3. Go to [inbox.nostr.wine](https://inbox.nostr.wine/) and pay for their subscription.

4. Go to [nostr.watch](https://nostr.watch/relays/find) and find a good relay in your country.

5. Download Citrine to your phone.

Then, on your relay lists, put:

Public Home/Outbox Relays:

- nostr.wine

- nos.lol or an in-country relay.

- <your.relay>.nostr1.com

Public Inbox Relays

- nos.lol or an in-country relay

- <your.relay>.nostr1.com

DM Inbox Relays

- inbox.nostr.wine

- <your.relay>.nostr1.com

Private Home Relays

- ws://localhost:4869 (Citrine)

- <your.relay>.nostr1.com (if you want)

Search Relays

- nostr.wine

- relay.nostr.band

- relay.noswhere.com

Local Relays

- ws://localhost:4869 (Citrine)

General Relays

- nos.lol

- relay.damus.io

- relay.primal.net

- nostr.mom

And a few of the recommended relays from Amethyst.

## Final Considerations

Remember, relays can see what your Nostr client is requesting and downloading at all times. They can track what you see and see what you like. They can sell that information to the highest bidder, they can delete your content or content that a sponsor asked them to delete (like a negative review for instance) and they can censor you in any way they see fit. Before using any random free relay out there, make sure you trust its operator and you know its terms of service and privacy policies.

-

@ e31e84c4:77bbabc0

2025-02-25 15:03:34

*The Fine Line: Bitcoin Companies Navigating Regulation and Freedom was [written by Bri](https://x.com/cyberBri). If you enjoyed this article then support her writing, by donating to her lightning wallet: bri_1@walletofsatoshi.com*

We all know the value proposition of Bitcoin: Bitcoin cannot be controlled by the state. Bitcoin is permissionless, it doesn't need a KYC and we can send money to anyone in the world, without middlemen, without censorship, without limits.

However, when companies use Bitcoin, and more so when they offer Bitcoin services, their activities are indeed controlled by the state. In order to fulfil the regulatory requirements, companies usually have to employ entire compliance teams.

Bitcoin-only exchanges are probably not better off than crypto service providers, even if one can sometimes hopefully recognise an increasing pro-Bitcoin attitude in the world. The Bitcoin scene recently looked expectantly to Nashville when Trump appeared at the Bitcoin 2024 conference as part of his election campaign. He doesn't really seem to be able to distinguish between Bitcoin and crypto though – in his keynote speech he promised to make the U.S. the ‘crypto capital of the planet’.

Nevertheless, the news that the United States plans to accumulate Bitcoin as a strategic reserve currency made headlines around the world and many Bitcoin supporters are delighted. Bitcoin's negative image could be somewhat corrected and it would certainly also be beneficial for Bitcoin adoption, so the hope goes. And indeed, the price of Bitcoin climbed to new record highs during the US election campaign, reaching its ATH of USD 109,000 when Trump took office on 20 January 2025.

The US announcement of a bitcoin strategic reserve can certainly be described as a historic moment. At the moment, it doesn't seem to be entirely clear whether Bitcoin or crypto, but a number of US states are working on advancing Bitcoin reserves. Whether it is a good thing when nation states start hoarding Bitcoin is another question. After all, from the very beginning and to this day, Bitcoin has been about taking power over money away from the state and giving it to the people.

Back to the Bitcoin companies. Let's assume that someone understands Bitcoin and has even discovered that there are Bitcoin-only exchanges. These companies recognise Bitcoin as sound money, support the Bitcoin community and want to integrate the Bitcoin ethos into their business model in the best possible way. Ouch – that already sounds like a compromise.

**The Dilemma – Bitcoin at Heart, Regulation at the Back of the Neck**

Bitcoin companies are caught between maximum independence and regulatory requirements. Companies such as Strike, Relai and River aim to make it as easy as possible for their customers to access Bitcoin while at the same time enabling them to maximise their independence from third parties. An important aspect of this is self-custody. Customers have full control over their Bitcoin and can avoid counterparty risks such as exchange failures or government seizures.

In contrast, most providers on the market, such as the major players Coinbase or Binance, rely on classic, centralised structures with full custody - and a large range of digital assets. They are basically fiat companies that offer crypto products.

And then, at the other end of the spectrum, there are projects such as Samourai, Wasabi Wallet or Tornado Cash, which are radically opposed to any form of control. They are developing powerful tools for more financial privacy – in line with Bitcoin's original idea as a decentralised cash system. But this commitment comes at a price: the founders of Samourai Wallet were arrested and the developers of Tornado Cash were prosecuted.

These Bitcoin rebels are putting the limits of state regulation to the test. And they raise the fundamental question: Is privacy an inalienable right or should it be subordinated to the public security interest?

**The Middle Ground Builders**

Bitcoin-only companies that choose the middle ground play an important role in the bitcoin ecosystem. This is because they appeal to the masses by keeping onboarding simple and often offering a range of interesting services. At the same time, they want to give their customers the greatest possible independence.

But are their business models sustainable? Or do these companies run the risk of being worn down by the balancing act between Bitcoin ethos and state control? How can these pioneers survive in a constantly changing regulatory environment?

It's a balancing act between regulation and Bitcoin values, and it's often a fight for the fundamental rights of not just Bitcoiners but people in general. For example, these companies need to have KYC processes in place to be compliant with the law and allow customers the greatest possible flexibility in their Bitcoin activities.

*Some popular Bitcoin-companies and their strategies:*

- [Strike](https://strike.me/): Custodial, fast lightning transactions, DCA, bill payments

- [Relai](https://relai.app/de/): Simple onramp, self-custody, private and business services

- [River](https://river.com/): Multisig and cold storage, proof of reserves, inheritance

- [Unchained](https://unchained.com/): Multisig vaults, DCA, inheritance, loans, retirement, advisory

- [Bull Bitcoin](https://www.bullbitcoin.com/): Non-custodial exchange, DCA, bill payments, OTC desk

Typical features of these accounts usually include a KYC check, which allows users to be granted higher buy and sell limits. Many Bitcoin companies offer self-custody wallets and often some also multi-sig solutions that increase security for users. Partnerships with banks or payment service providers facilitate buying and selling and enable services such as the creation of savings plans.

Bitcoin companies face several challenges. Regulatory pressure remains a key concern, as authorities may tighten KYC obligations or introduce new restrictions. Trust is another issue since die-hard Bitcoiners often see these companies as not being consistent enough with Bitcoin's core principles.

**Regulatory Framework and Political Influences**

***USA: Trump's Bitcoin course and the ‘Crypto Czar’***

There are currently contradictory signals in the USA: on the one hand, Donald Trump has hinted at using Bitcoin as a strategic reserve (Strategic Bitcoin Reserve, SBR), while on the other hand, regulation is being tightened further. The newly created position of ‘White House AI and Crypto Czar’, presumably conceived in collaboration with Elon Musk, is intended to implement clear rules for blockchain, AI and the crypto market. This is also likely to affect companies that are committed to the Bitcoin ethos.

- Positive signals: Bitcoin is increasingly recognised as a legitimate asset class.

- Regulatory pressure: Stricter regulations could threaten the existence of smaller companies.

- Possible future: If the US promotes Bitcoin as a strategic asset, this could fundamentally change the regulatory landscape.

***Europe and Global Developments***

- MiCA (Markets in Crypto-Assets Regulation): New EU regulation for crypto companies, requiring strict KYC and AML rules, among other things.

- Restrictive countries: China and India continue to rely on tough regulation or bans.

- Friendly jurisdictions: Countries such as El Salvador or Switzerland offer attractive conditions for Bitcoin companies.

**Self-custody of Bitcoin**

The so-called ‘Travel Rule’ (Transfer of Funds Regulation, TFR) requires detailed information about the sender and recipient. This makes it more difficult for Europeans to interact with self-custody Bitcoin wallets. For transactions over 1,000 euros, users must prove that they are the owners of these wallets (proof of ownership).

Yet self-custody is a very important aspect of Bitcoin. It is the only way to avoid the risks associated with relying on centralised custodians. Self-custody ensures that you alone have control over your money. The new regulations represent a gradual financial disenfranchisement, which is not only criticised by Bitcoiners. And that is only part of the problem.

The disadvantages of centralised storage of customer assets are well known. Just think of the scandalous examples from the recent past: The fall of the FTX cryptocurrency exchange and the knock-on effects on the cryptocurrency industry or the fraudulent business practices of Celsius, which lost billions of customers' money.

> *“Not your keys, not your coins.”– Andreas Antonopoulos*

However, it is often the users themselves who, consciously or unconsciously, jeopardise their funds. The obstacles to self-custody lie in both technical and practical aspects. Not everyone is willing or able to navigate hardware wallets and multisig solutions. Furthermore, without an adequate backup, there is a risk of losing coins irretrievably.

By keeping their coins in self-custody, Bitcoiners eliminate third-party risk. However, self-custody can be a challenge, especially for beginners. ‘Study Bitcoin’ is more than just a phrase here. Only those who know their way around can protect themselves against errors, misuse and loss.

**CONCLUSION**

The uncertainties caused by ever-changing regulation in different jurisdictions is a constant challenge for businesses. However, as Bitcoin is increasingly being categorised as harmless by the authorities, pure Bitcoin platforms might face fewer regulatory risks compared to crypto exchanges.

The growing acceptance of Bitcoin and the plans of the United States and other countries to create a strategic Bitcoin reserve may have a positive impact on how Bitcoin companies continue to be treated by regulators. I would, though, like to quote Maya Parbhoe, the Surinamese presidential candidate for 2025, at this point, even if it seems a little off-topic:

> *“A Bitcoin Strategic Reserve is not the answer.*

*> *The moment a government holds Bitcoin as a reserve, it centralizes control over an asset designed to be decentralized. It strengthens the very system Bitcoin was created to replace.*

*> *Governments holding Bitcoin do not give power to the people, they give themselves a hedge while continuing to debase their fiat currency. They still print, they still tax, they still control. The people remain trapped in the same system, only now with a government-backed Bitcoin price floor that serves the state, not the individual.*

*> *Bitcoin was not made to be stockpiled by central banks. It was made to be used. As currency, as a tool of self-sovereignty, as a weapon against state overreach.”*

So let's summarise what we have covered in this article in the spirit of these liberal ideas. The following rules, which have just been created, should be mandatory reading for Bitcoin aficionados until further notice:

<img src="https://blossom.primal.net/914ac66c228ea1a398ec1f008234e4cd213da85f268de73fb36dc9e344dcfb45.jpg">

*The Fine Line: Bitcoin Companies Navigating Regulation and Freedom was [written by Bri](https://x.com/cyberBri). If you enjoyed this article then support her writing, by donating to her lightning wallet: bri_1@walletofsatoshi.com*

-

@ 71df2119:9542d9d7

2025-02-25 14:57:23

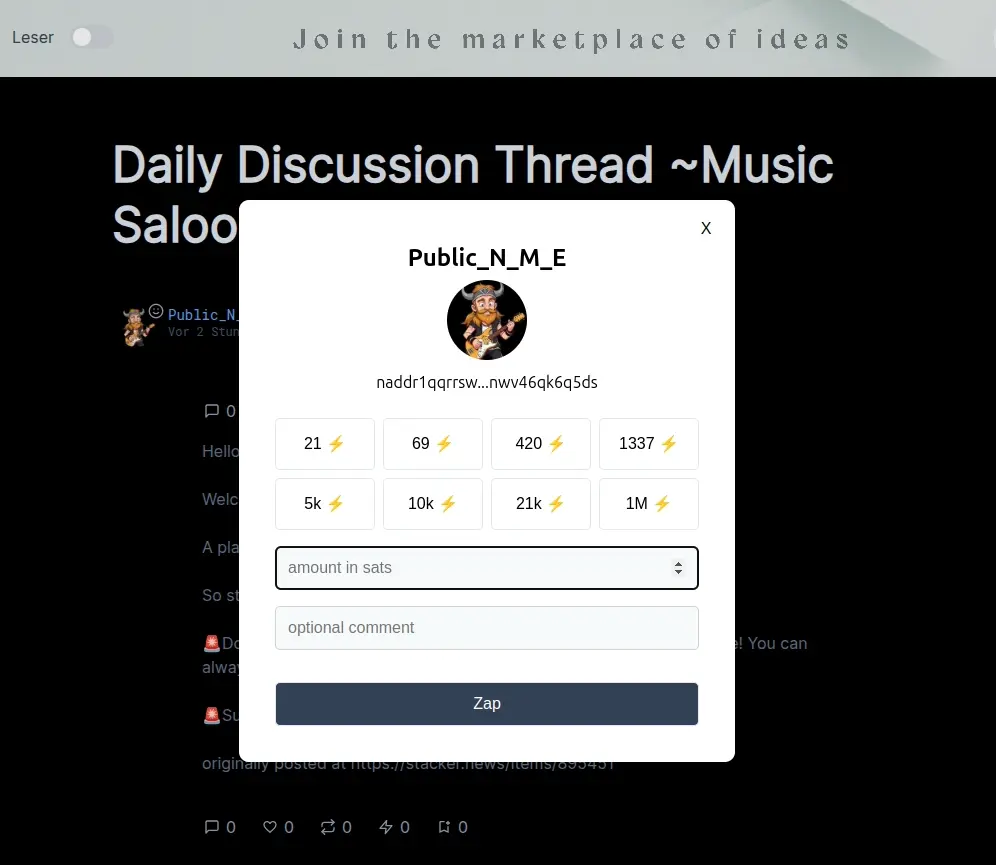

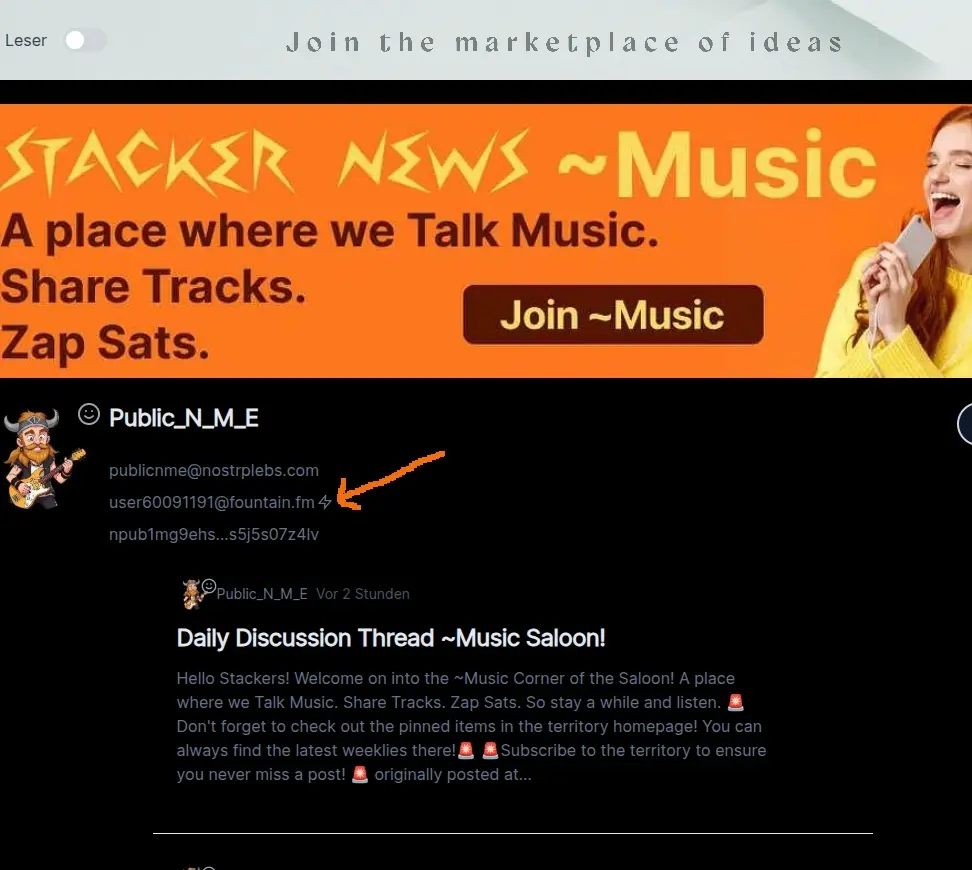

Das Pareto-Team [(](https://njump.me/nprofile1qyvhwumn8ghj7un9d3shjtnndehhyapwwdhkx6tpdshsz9mhwden5te0wfjkccte9ec8y6tdv9kzumn9wshsqg9grf5ej25t0llsj2annf4rx5vpc9htx72g74depu796z0nc5pvssldhkxp)<https://tinylink.net/mIyvf>[)](https://njump.me/nprofile1qyvhwumn8ghj7un9d3shjtnndehhyapwwdhkx6tpdshsz9mhwden5te0wfjkccte9ec8y6tdv9kzumn9wshsqg9grf5ej25t0llsj2annf4rx5vpc9htx72g74depu796z0nc5pvssldhkxp) hat in den letzten Tagen die Unterstützung für *Zaps* veröffentlicht. *Zaps* sind *Lightning-Transfers* über *Nostr*, die im Pareto an Artikel oder Autoren gesendet werden können. Die aktuelle Umsetzung in der Pareto-App ist als erster Schritt zu verstehen, und es werden weitere Ausbau-Stufen folgen. In diesem Artikel wird die Nutzung des neuen Pareto-Features erklärt.

##### Artikel Zappen

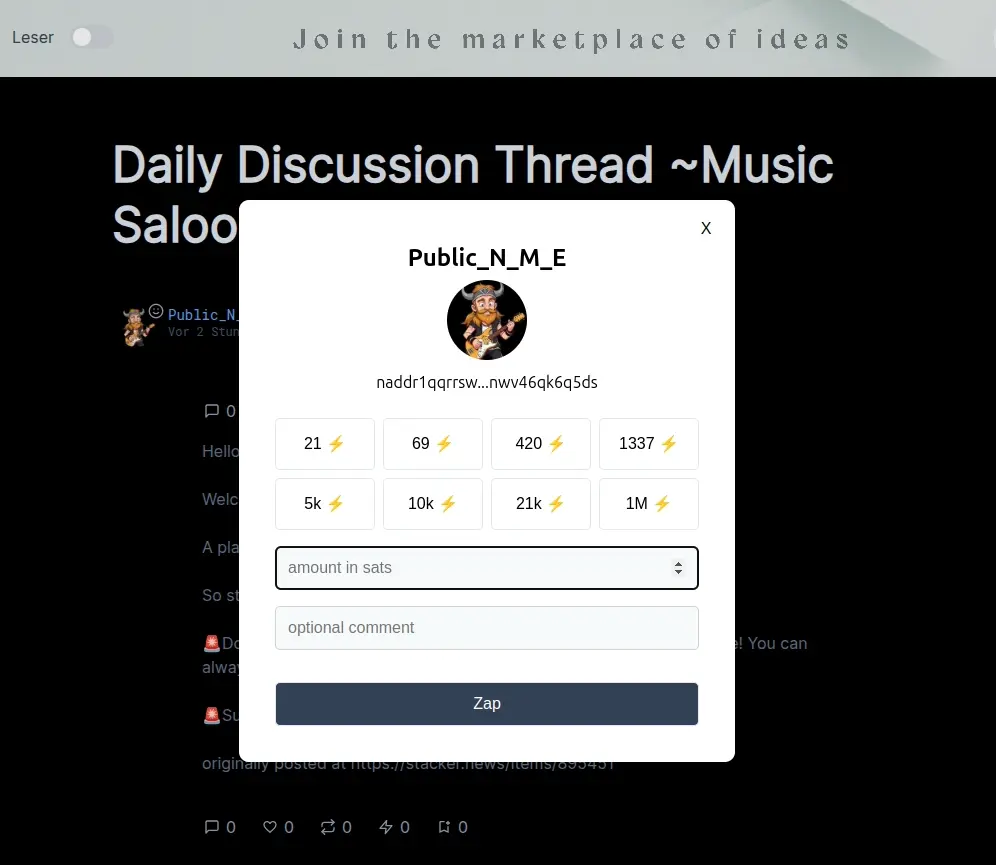

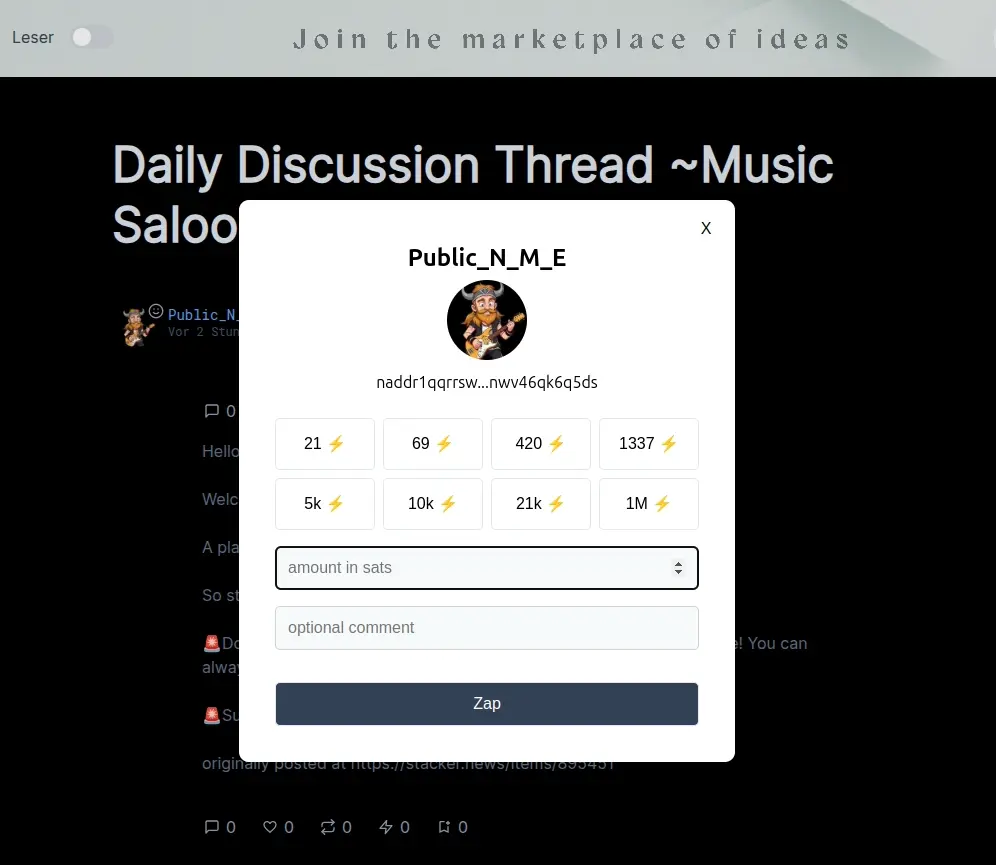

Auf der Artikel-Seite des Pareto-Readers ist jetzt das Blitz-Symbol unter dem Artikelbild aktiviert. Durch einen Klick erscheint ein Dialog wie dieser:

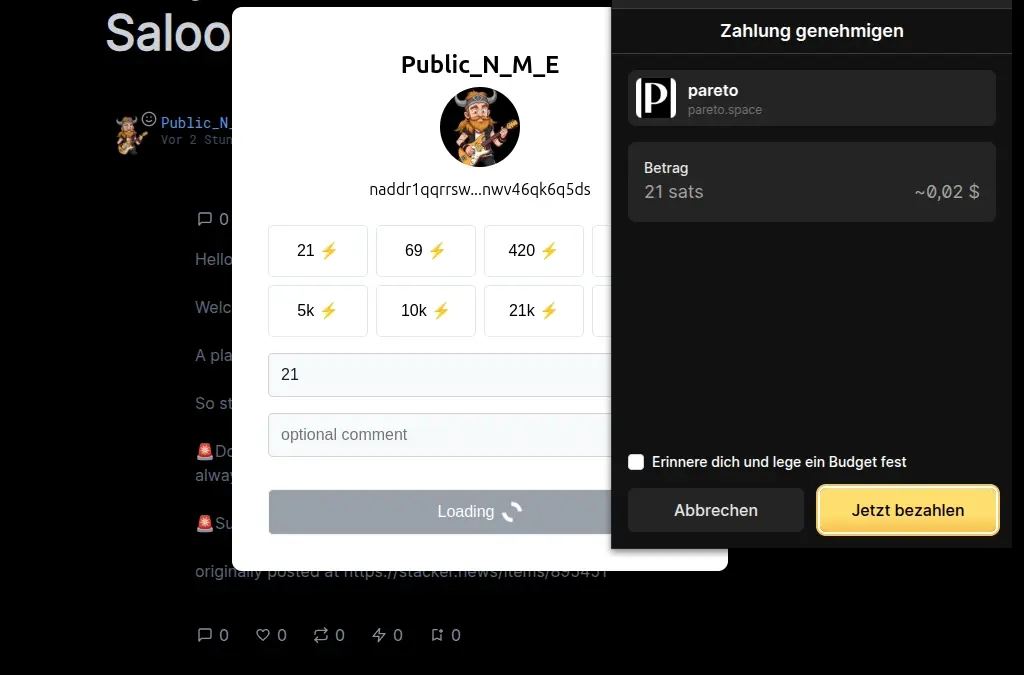

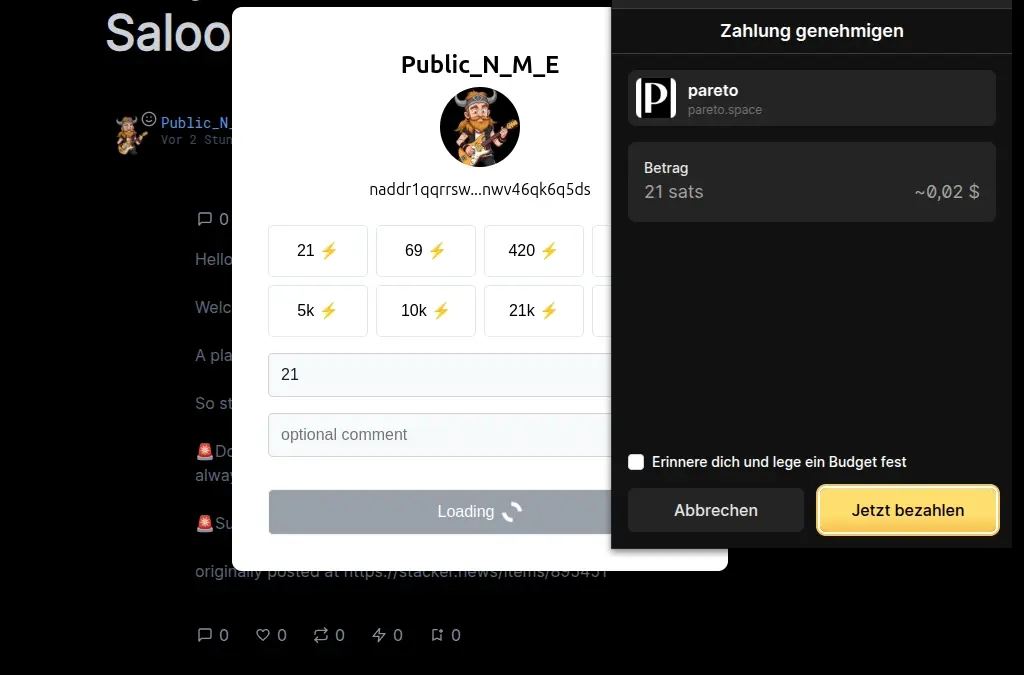

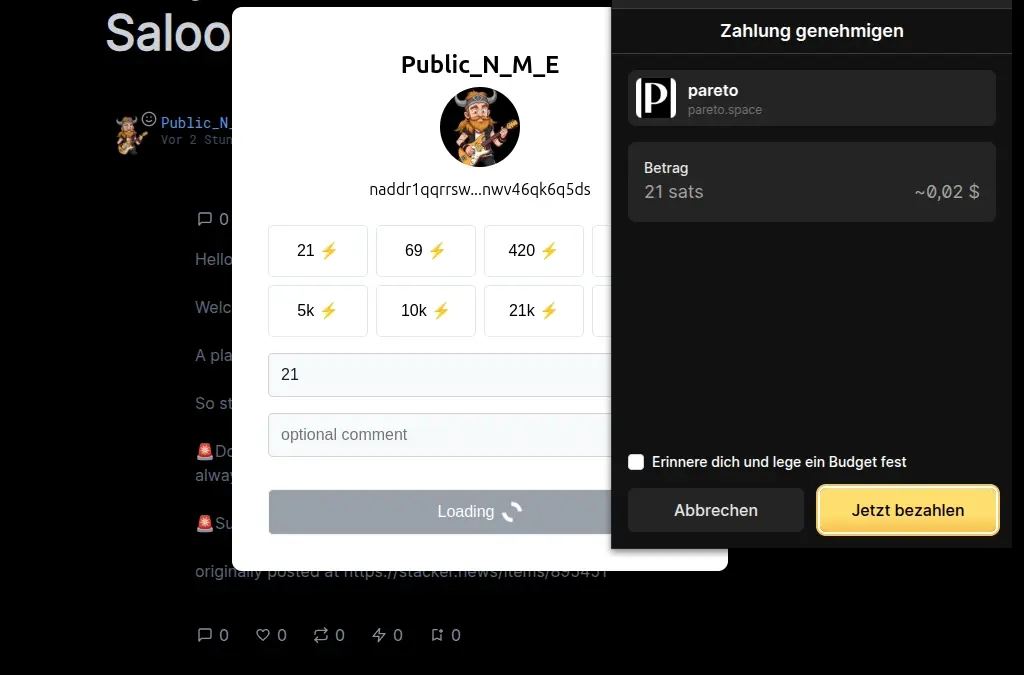

Im Dialog können verschiedene vorgegebene Beträge ausgewählt oder ein eigener Betrag manuell eingegeben werden. Ein optionales Kommentarfeld steht, wie üblich, ebenfalls zur Verfügung. Nach dem Betätigen der *Zap-Schaltfläche* verhält sich die App unterschiedlich, abhängig davon, ob der Nutzer eine *Wallet-Erweiterung* im Browser installiert hat oder nicht. Falls ja, folgt die Interaktion mit der *Wallet-Erweiterung*, in diesem Beispiel Alby:

Hier kann die Zahlung freigegeben werden, und der Vorgang wird dann von der Software abgeschlossen.

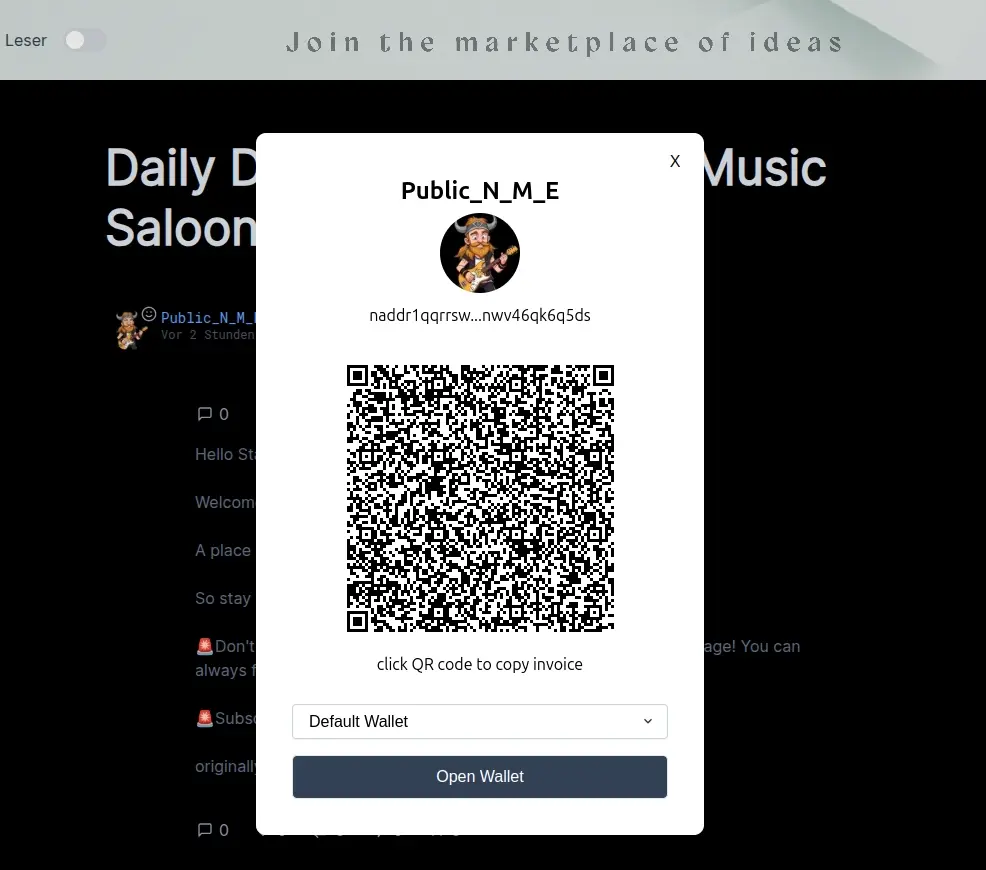

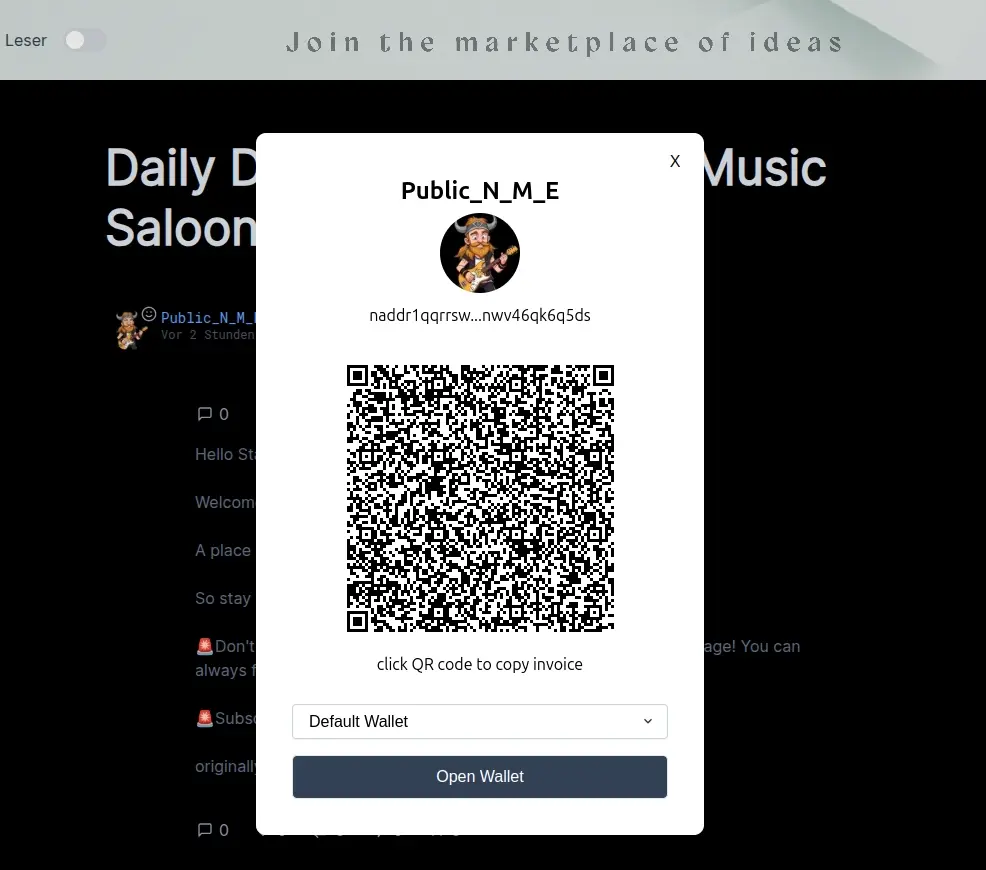

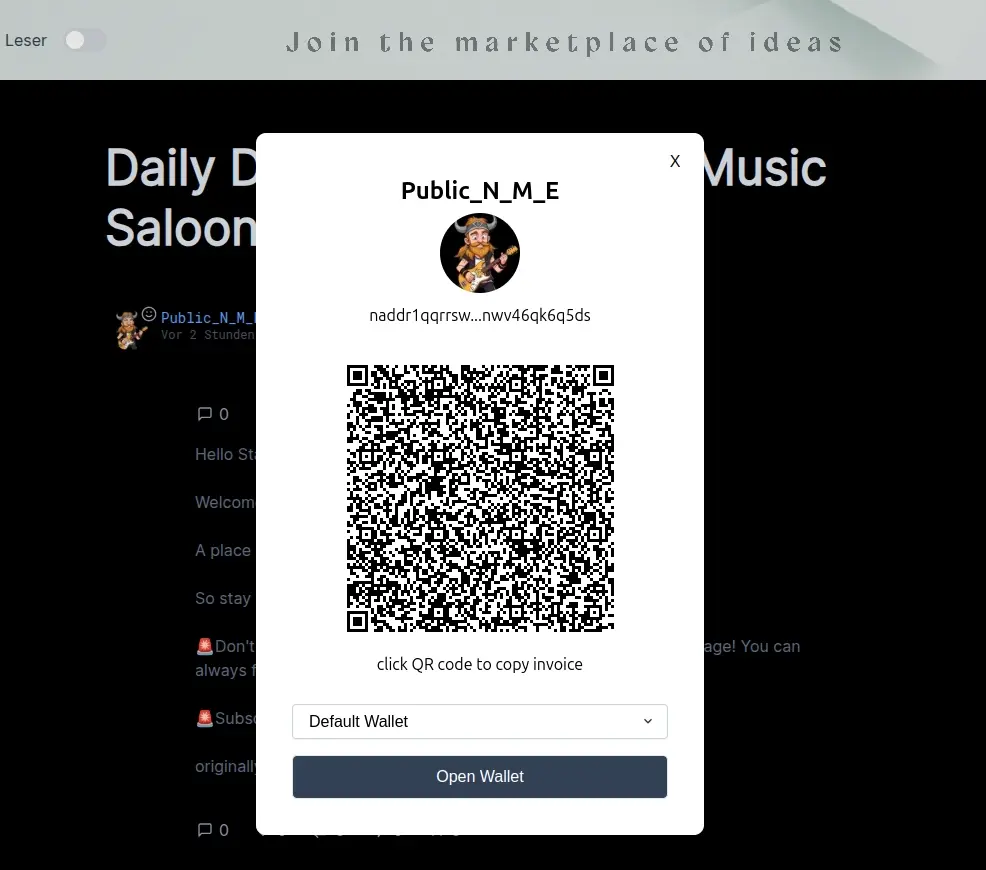

Wenn der Nutzer keine *Wallet-Erweiterung* verwendet, erfordert der Vorgang weitere Schritte. Statt dem oben gezeigten Dialog erscheint eine *Lighting-Rechnung*:

An dieser Stelle gibt es mehrere Möglichkeiten: Man kann mit einer *Lightning-Wallet* den *QR-Code* einscannen oder die Rechnung in Textform kopieren. Alternativ kann man auch eine *Wallet* auf demselben Gerät öffnen und die Zahlung dort bestätigen.

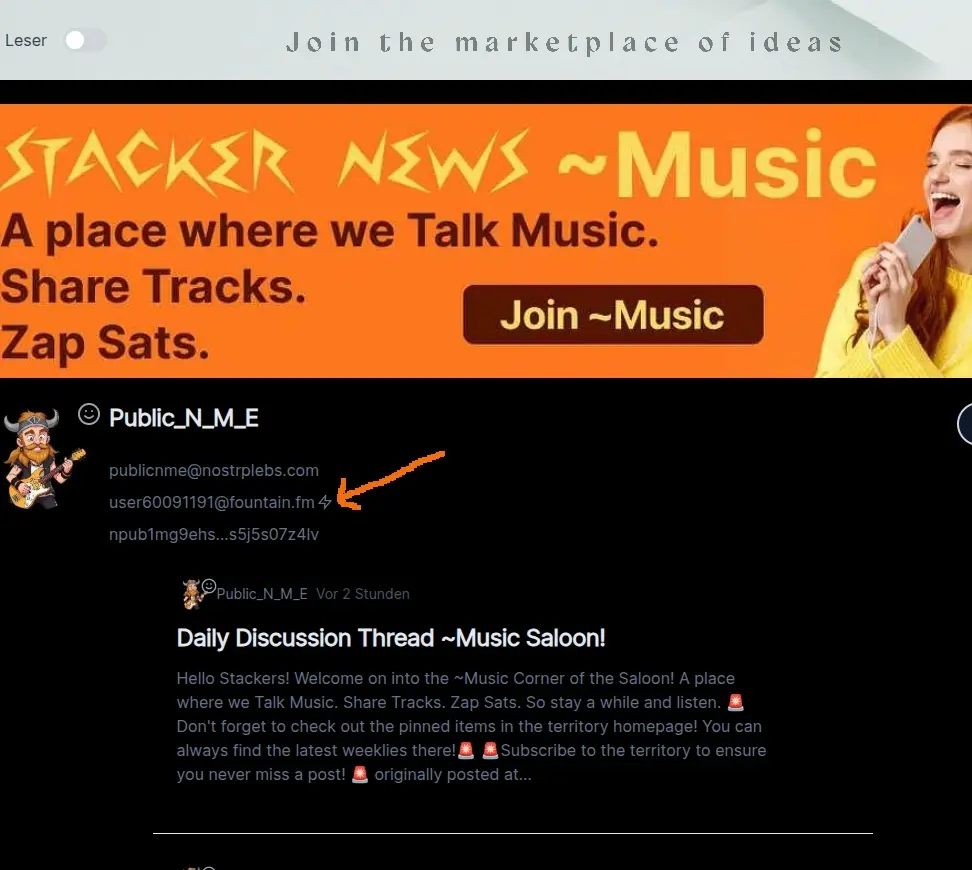

##### Zaps an Autoren

Wie am Anfang erwähnt, können auch Autoren direkt, ohne Artikelbezug, *Zaps* erhalten. Auf der Profilseite des Autors gibt es neben der neu hinzugekommenen *Lightning-Adresse* einen *Blitz-Button,* ähnlich wie auf der Artikelseite:

Durch einen Klick können, ähnlich wie beim Artikel, *Zaps* an den Autor gesendet werden.

***

*Das Zap-Feature in der Pareto-App basiert auf der Community-Bibliothek nostr-zap (*<https://github.com/SamSamskies/nostr-zap>*). Wir bedanken uns für den Code und haben mit einer Erweiterung der Funktionalität beigetragen - ganz im Sinne von Open-Source!*

***

##### Ausblick

Wie eingangs erwähnt, sind weitere Ausbaustufen des *Zap-Features* geplant, darunter:

* Unterstützung für *Nostr Wallet Connect* für eine nahtlosere Integration und ein besseres Nutzungserlebnis.

* Unterstützung für *eCash*, *Cashu-Nutzaps*.

Bleib auf dem Laufenden und folge uns auf unseren verschiedenen Kanälen:

* *Nostr*: <https://tinylink.net/mIyvf>,

* *Web*: [https://pareto.space,](https://tinylink.net/mIyvf)

* *Geyser*: [https://geyser.fund/project/pareto.](https://geyser.fund/project/pareto)

**Wir bei Pareto stehen erst am Anfang - nicht ausschließlich bezüglich Zaps!**

-

@ 9171b08a:8395fd65

2025-02-25 14:53:19

Rein sat with her back against the cold steel of the jail cell, wrists and ankles bound.

She hadn’t seen light or another human face in almost two weeks. The grinding and whirling of the Guardian’s mechanical gears was the only thing to break the silence, its daily arrival at noon serving as her only reminder of time. It brought her food, but nothing else; not a word, not a gesture of humanity.

In her waking moments, she sat and replayed the events that landed her in jail, and in her slumber, those thoughts morphed into haunting nightmares with specters stalking her in hell. Hell was no longer a distant fear; it had found her. Her fate now rested in the hands of the man she once considered her best friend. Whatever evidence he was putting together would serve to either absolve her or condemn her.

A sharp beam of light pierced the darkness of the jail cell from the cell block entrance. The overhead lights came on, and she stood as David, Rein’s partner and closest friend, appeared before the cell bars.

He stared at his feet and said, “Today's your trial.”

Rein struggled to keep her eyes open from the intense brightness over the overhead lights and said, “That wasn’t nearly enough time to gather evidence.”

David pressed his lips together, eyes fixed on the floor. “I had your back on this, Rein.” Then he shook his head, and as Rein finally overcame the harsh brightness, she noticed he was staring into her eyes. “The evidence is damning. And, well, something pretty terrible has happened that has the government cracking down harder than ever.”

“Something terrible? What happened?” asked Rein.

“I would’ve never thought you were in so deep with this.” He seemed personally outraged when he said, “After everything we’ve been through together, after everything *you’ve* sacrificed for this city. You’ve been pretending this entire time. I’ve never known the real you.” He scoffed. “Yet there you are.”

“C’mon, David, you don’t actually think—”

David raised a hand and said, “Stop. Don’t try that shit with me. You’re lucky to even be getting a trial.”

Two Guardians entered the cell block and came to parade rest behind David. He opened the cell, and the Guardians stepped in.

“What did you find? What happened?” asked Rein.

The Guardians seized Rein’s shoulders and pushed her forward, past David.

“What did you find, David?” Urged Rein.

David remained silent. He simply watched as the Guardians took her.

A hush fell over the precinct as officers gathered around the flickering television in the corner of the reception room. Flashing across the screen were the haunting images taken from an aircraft of a city on fire, thousands of black silhouettes infiltrating the city walls. The words ***Shadow Crawlers Strike, Orion Dome In Ruins*** were emblazoned the bottom of the newscast.

Rein strained against the Guardian’s grasp to try and get a closer look at the screen and gasped, “Chronos have mercy.”

Those standing before the television turned and stared at her. Those seated at their desks stood at the sight of the Guardians ushering Rein through the offices, and within seconds, the precinct was heavy with tension. Everyone she had cared about now gaped at her with a fierce look of betrayal. Though Rein wished she could explain herself with a compelling defense, she could tell she was as good as dead to them.

---

The vehicle transporting her to the courthouse was as dark as the cell she had been locked up in. Rein ground her teeth and stared at the ray of light that shone through the slit in between the vehicle doors, contemplating what she had just seen on the precinct television.

After several minutes of toiling in the darkness with her own thoughts, the vehicle halted, and its doors opened at the hands of the two Guardians who towered over the roof of the hovercraft.

Many of the city people’s eyes, imbued in different shades of red, turned to stare as Rein stepped out. Their gazes were not so much filled with judgment as they were with fear. She stepped onto the walkway with her head sagged, ashamed to look at the very people she had sworn to protect.

> Join the furnace of the Empire! Invest in Elius today and be a part of the Industrial heart of Aurial.

Rein clenched her fist as she contemplated the words on the crumpled flyer laying on the sidewalk beside her foot. She couldn’t help but think of what her father had been up to in that city.

She had never paid much attention to the image of the man on the flyer, his arms crossed and his head held high before a massive furnace that sparked embers into the four corners of the paper. The silhouette of a building was portrayed on one corner, a soldier held a weapon on another, the image of a child holding a toy on the bottom right, and a family held up a shirt on the remaining corner.

Those flyers were hung up throughout the precinct offices, inside coffee shops, and gathering places, attempting to attract the wealth that easily found itself in the pockets of the kind of people that lived in Roxis. It seemed to have worked on her father.

***But what had he been up to?***

Rein never understood why her father had abandoned Roxis for Elius, nor had he ever offered an explanation. As a financial hub, Roxis attracted wealth and intellect, leaving cities like Elius with a rougher class of laborers— many of whom turned to crime to escape extreme poverty and hard work in the very factories exhibited on the promotional flyer.

The city of Roxis had been good to Rein. Though many a passerby would think differently seeing her now with her wrists and ankles shackled as she walked up the steps of the Judgment House. She’d grown to be a God-loving woman and spent most of her adult life protecting the city from criminals the likes of which the people walking by, now, would think she was.

One of the Guardians towering at her side nudged her shoulder, and with the artificial voice generated from within its chest said, “You must move along, Miss Lancer.”

The robot’s hand ushered her forward, and a ray of sunlight nearly blinded her as she gazed upon the Judgment House made almost entirely of glass and marble.

The crest of Aurialian Empire above the entrance of the building made her pause. Her eyes lingered on the star that lay at the center of the red and blue shield of Ariel, the archangel. A character that looked like an angular and unfinished number eight with a line drawn through the middle sat like a crown above the words "***Out of God, An Empire***", inscribed around the crest of the Aurilian Empire.

The symbol of peace felt like a cruel joke now. She had once sworn to uphold the empire’s sanctity, yet here she was, condemned by it.

***Episode 2 coming soon...***

---

Thank you for reading!

If you enjoyed this episode, let me know with a zap and share it with friends who might like it too!

Your feedback sends a strong signal to keep making content like this!

Interested in blog posts? Follow @Beneath The Ink for great short stories and serialized fiction.

More short stories you might like from Fervid Fables:

nostr:naddr1qvzqqqr4gupzpyt3kz9079njd5g0fs5rxhtg8g9wdwkdar65kuhaujfyajpetlt9qq2kx6zzdap9s3nnde5hy7f5wej57d2twp54y82h07y

nostr:naddr1qvzqqqr4gupzpyt3kz9079njd5g0fs5rxhtg8g9wdwkdar65kuhaujfyajpetlt9qq2h5etx2fghgumyg3mhjanewgeysa6wdfmrs85l27m

-

@ 85bdb587:7339d672

2025-02-25 14:14:57

## Marty's Bent

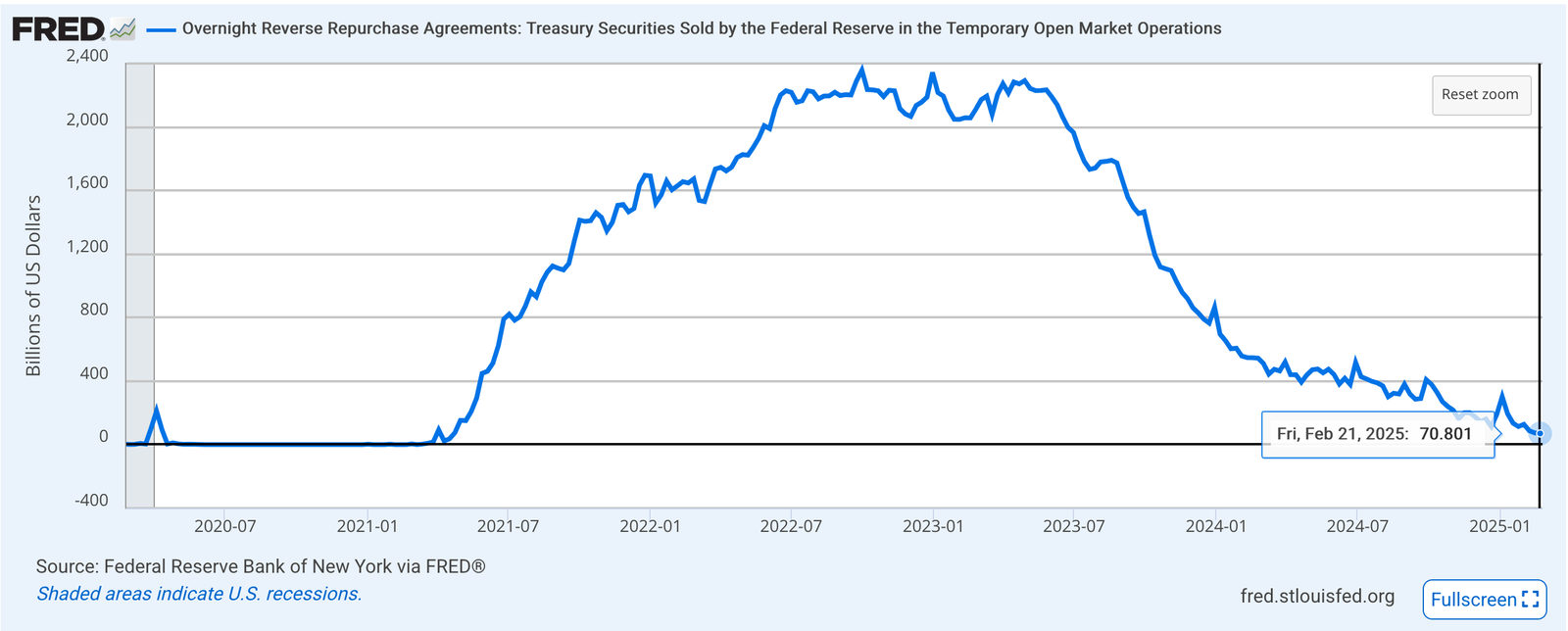

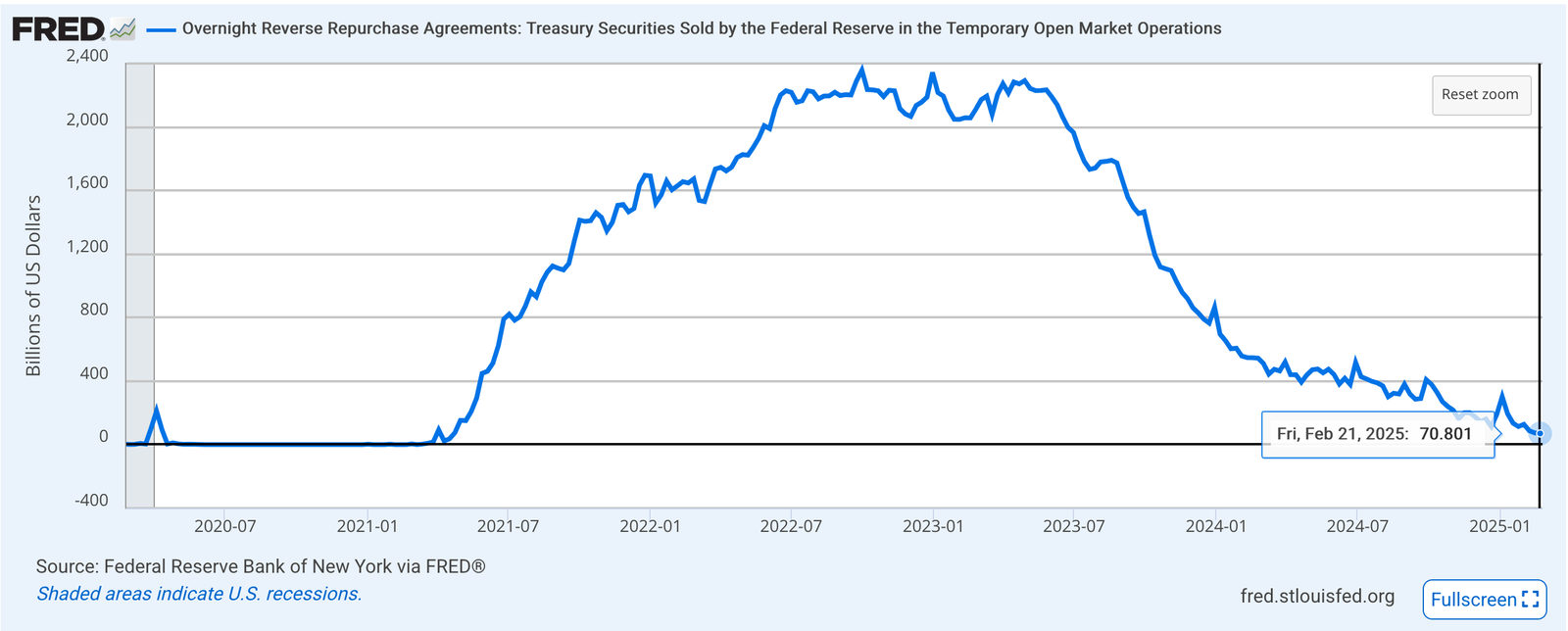

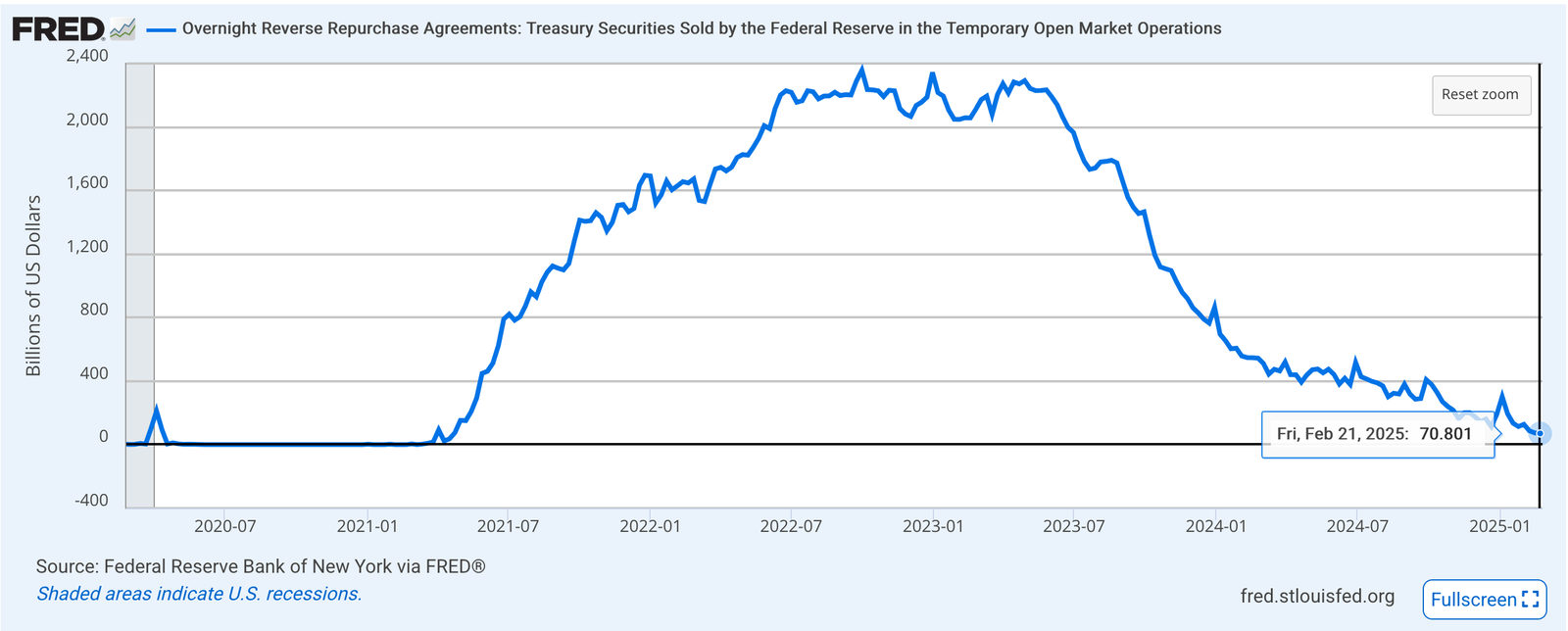

Since mid-2022 the Fed has been reigning in its balance sheet via a process called quantitative tightening (QT), in which they allow some of the debt assets they hold to come to maturity without reinvesting in them. This leads to a reduction in the Fed's balance sheet and is done to remove the excess liquidity introduced to the markets during the COVID crisis so that inflation can be reeled in. On top of this, the Fed is hoping that the extraordinary measures it took to step in during a time of crisis allowed the banking system to get their houses in order in preparation for a period of relatively tighter liquidity. Ideally, everyone took the time and effort to clean up their balance sheets, properly manage their duration risk, and get themselves on solid footing to move forward without the Fed stepping in to prop up the market.

At its peak, the overnight reverse repo facility had around $2.36T of liquidity in the form of debt instruments like treasuries and mortgage backed securities available to banks, money market funds and certain government enterprises. These entities lend the Fed cash for these instruments and get interest back in return. This acts as a mechanism the Fed can leverage to keep short-term rates in line with wherever their targets are at any given point in time. Over the last ~13 quarters the Fed has been slowly but surely letting these markets drain and, as of last Friday, they currently sit at $70.8B. At its current pace the reverse repo facility should be completely drained by the end of next month or beginning of April.

The question on everybody's mind is, what happens once the reverse repo markets are empty?

The last time the Fed embarked on QT was in October 2017. It drained the reverse repo over the course of a little less than two years before the market was drained and the overnight rates in the market spiked into the low teens in September of 2019. Many don't remember this, but it was a "holy shit" moment that forced the Fed to create new facilities overnight to band aid over the hemorrhaging. Coincidentally, a few months later COVID would overtake the world and the Fed had a convenient excuse to double the monetary base well above $6T.

If September 2019 is an example of exactly what happens when the reverse repo market drains, we may be in for a liquidity crunch. However, the Fed is posturing that it has learned its lessons from the 2019 rate spasm and has adjusted some things accordingly to ensure a smoother transition from a state of excess liquidity to a state of significantly less liquidity. Particularly, more control over SOFR and how it interacts with this market. If we reach the point where the reverse repo markets have been successfully drained without a 2019-like spasm, the Fed will then move on to the excess liquidity sitting on the balance sheets of commercial banks and continue their journey to try to reel in inflation.

President Trump certainly isn't making the Fed's job easier with promises of lower domestic taxes and the levying of aggressive tariffs, which could both be inflationary. I'm sure Jerome Powell is praying that DOGE continues their swift work and gets the signal out to markets that the US government is committed to getting its fiscal house in order to make treasuries more appealing to the market so that rates can float down.

I have no idea exactly what is going to happen, but I have a feeling that a liquidity crunch is on the horizon. It may not be once the reverse repo market is drained. I would not be the least bit surprised if the work the Fed has done behind the scenes to ensure a spasm like we experienced in 2019 doesn't happen is successful. Though, it likely only buys some time and delays the inevitable. As my good friend Parker Lewis likes to say, "There's too much debt and not enough dollars." At some point, QT will hit a point where it cannot be sustained because too many dollars have been pulled out of a system with ever increasing amounts of debt that need to be serviced with dollars. Whether it happens when the reverse repo market is drained or at some point after the Fed starts unwinding the excess liquidity on bank balance sheets isn't really that important.

We're getting early warning signs that a liquidity crunch may be near with the mad dash for bringing physical gold into the US, the VIX spiking above 20 earlier today and bitcoin "crashing" toward $90,000. Volatility is increasing at a time when the reverse repo market is almost tapped and the world is a bit uncertain as it tries to figure out the ramifications of Trump's blitzkreig his first month in office.

For those scratching their heads about the price of bitcoin falling during a time like this, it is pretty typical. Bitcoin is traded 24/7/365, has a ton of liquidity, and is easy to buy and sell. When markets sense volatility, bitcoin is usually one of the first assets to be sold off as investors try to sure up their cash balances and pay off debts. It is usually the first and quickest to move lower, but also the first and quickest to move higher when the dust has settled. I find it hard to believe that the price of bitcoin will stay down long if it falls considerably.

The fundamentals have never been stronger and too many people have been waiting for an opportune buying opportunity to pass it up. The question is how many of those looking for a buying opportunity will have dry powder and be liquid if and when it happens.

## Bitcoin's Institutional Moment: Big Players Are Entering the Game

Bitcoin's journey into mainstream financial markets is accelerating. During our conversation last week, Peruvian Bull highlighted several key milestones, including Abu Dhabi's $430 million position in Bitcoin ETFs and regulatory progress with the SEC's SAB 122, which now allows banks to custody Bitcoin. This fundamental shift isn't just about price – it represents a structural change in how traditional financial institutions view Bitcoin as a legitimate asset class.

"*This is a massive opportunity for bitcoin companies - go start a custody service and get a bunch of bitcoiners together and teach institutions how to safely custody their bitcoin.*" - [Peruvian Bull](https://x.com/peruvian_bull)

As I've observed through our work at Ten31, there's a growing recognition that a Bitcoin treasury strategy makes sense for both public and private companies. We're seeing this with MicroStrategy, Tesla, Bitcoin miners, and potentially GameStop. More importantly, the infrastructure is being built by major institutions like State Street and Citibank to support this adoption. While gold has the established financial plumbing, Bitcoin's institutional rails are being constructed rapidly, setting the stage for the next wave of adoption.

TLDR: Major institutions building Bitcoin infrastructure signals mainstream adoption

Check out the [full podcast here](https://youtu.be/aHzPTDDPXfU) for more on gold market disruptions, GameStop's potential Bitcoin strategy, and the looming debt crisis that's creating perfect conditions for Bitcoin adoption.

## Headlines of the Day

El Salvador Boosts Bitcoin Reserve - via [X](https://x.com/i/trending/1894181975528763539)

Jamie Dimon Sold $233.7M in JPM Stock - via [X](https://x.com/MartyBent/status/1894175451209220205)

Montana, North Dakota, and Wyoming Rejected Bills for SBR - via [X](https://x.com/SimplyBitcoinTV/status/1894071294653604257)

## Bitcoin Lesson of the Day

Bitcoin uses cryptographic **keys** to secure **transactions**. A private key, a secret random number, allows you to spend bitcoin, while a public key, derived from the private key, is used to receive bitcoin.

The public key is hashed and encoded into a Bitcoin address (e.g., 1A1zP1eP5QGefi2DMPTfTL5SLmv7DivfNa), a shorter, user-friendly string shared to receive funds. Private keys must be kept secure—losing them means losing access to your bitcoin, and anyone with your private key can spend it.

Addresses are generated from public keys via hashing (SHA-256 and RIPEMD-160) and include a checksum for error detection. Bitcoin wallets manage these keys, often using seed phrases to recover them. Understanding keys and addresses is fundamental to securely using Bitcoin.

[Full Learnmeabitcoin.com post here](https://learnmeabitcoin.com/beginners/guide/keys-addresses/)

ICYMI [Fold](https://foldapp.com/credit-card?r=BgwRS) opened the waiting list for the new Bitcoin Rewards Credit Card. Fold cardholders will get unlimited 2% cash back in sats.

**[Get on the waiting list](https://foldapp.com/credit-card?r=BgwRS) now before it fills up!**

$200k worth of prizes are up for grabs.

Ten31, the largest bitcoin-focused investor, has deployed $150M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at [ten31.vc/funds](https://ten31.vc/funds).

@ 7a7d16c9:1a700636

2025-02-25 17:39:16Watched an awesome [video](https://youtu.be/QEJpZjg8GuA?si=ceYEbMeFO-Ind6KO) from one who I subscribe on YT. I've been trying to put my finger on what it is that I don't like about the major social media platforms. Alec Watson gave me the answer in one of his latest videos: "Algorithmic Complacency". TLDR: Rather than read, watch, and collaborate with those I follow online, modern social media platforms like to tell me what content I should consume. Nostr, Bluesky, and Mastodon don't do this - I can see what I want and what I don't, without relying on a computer algorithm to tell me. This got me thinking about my own use of social media platforms and my recent adoption of the Fedi-verse to circumvent the machine telling me how I should consume online content. I don't subscribe to any one platform. I've not found one that addresses all my online social needs, nor one that feature the diverse audiences I follow. Here's a rundown of what I use: YouTube - the easiest of the bunch. YT has become my new binge TV. Initially a frequented site for learning how to replace a garbage disposal or to learn some of the tricks with Davinci Resolve, YT quickly became my platform of choice for learning and entertainment content. Yes, YT has an algorithm and provides recommendations - it's how I found Technology Connections - but I like that I can use the subscriptions feed to just see content that I follow in addition to that which YT recommends. Facebook - the favorite with the old guard. TBH, I've never liked big tech owning my voice on the Internet. I'd have deleted my FB account along with X and Instagram, long ago, except that it's the one platform that my family uses. My mother uses Facebook, so do my distant cousins, but only a subset use the other platforms, and none use the Fedi-verse. FB remains as the one platform for me to post the occasional vacation photo and to find out that my cousin got married last week - and no I didn't get an invite. Vero - I'm a photographer and love to post some of my more interesting art pieces online for feedback, so I can improve my craft. I used to use Instagram, until it went over to the algorithm dark side and filled my feed with short-form video. Vero maintains to be what Instagram used to be. I've not checked out Pixelfed (yet). Mastodon - After Musk took over Twitter and rebranded it to X, I swiftly left and moved to Mastodon. I hate the idea of a single business entity owning my content and right to free speech online. Like many, I have my own issues with Musk and his business practices and shouldn't have to deal with them as part of my online presence. Mastodon was and still is, the place where I get to collaborate with people I've never met in person on likeminded topics of interests. Mastodon relies on federated servers, which people own; so, there's that to consider. I've managed to find a server that caters to my interests and fulfills my desire to collaborate online. Then comes Nostr... My friend \_@briangreen.net introduced me to Nostr. As a long-term orange-pill advocate, I was thrilled to join Nostr to collaborate on the latest Bitcoin and Crypto news. I will say that Nostr appears less diverse in topics but that's rapidly changing as I am now seeing a lot of posts on photography, meshtastic, and other personal interests of mine. I love that Nostr is not so much a platform, but a federated protocol. I don't have to subscribe to any one app and web site to post and read content. For now, I use both Mastodon and Nostr to scratch my online collab itch. A nice thing about the Fedi-verse is that there's plenty of cross-posting apps. I use [OpenVibe](https://openvibe.social/) to post and consume content in one place. Their app is slick and works as advertised. How do you use social media? Is Nostr your only platform, or do you still use the traditional ones?

@ 7a7d16c9:1a700636

2025-02-25 17:39:16Watched an awesome [video](https://youtu.be/QEJpZjg8GuA?si=ceYEbMeFO-Ind6KO) from one who I subscribe on YT. I've been trying to put my finger on what it is that I don't like about the major social media platforms. Alec Watson gave me the answer in one of his latest videos: "Algorithmic Complacency". TLDR: Rather than read, watch, and collaborate with those I follow online, modern social media platforms like to tell me what content I should consume. Nostr, Bluesky, and Mastodon don't do this - I can see what I want and what I don't, without relying on a computer algorithm to tell me. This got me thinking about my own use of social media platforms and my recent adoption of the Fedi-verse to circumvent the machine telling me how I should consume online content. I don't subscribe to any one platform. I've not found one that addresses all my online social needs, nor one that feature the diverse audiences I follow. Here's a rundown of what I use: YouTube - the easiest of the bunch. YT has become my new binge TV. Initially a frequented site for learning how to replace a garbage disposal or to learn some of the tricks with Davinci Resolve, YT quickly became my platform of choice for learning and entertainment content. Yes, YT has an algorithm and provides recommendations - it's how I found Technology Connections - but I like that I can use the subscriptions feed to just see content that I follow in addition to that which YT recommends. Facebook - the favorite with the old guard. TBH, I've never liked big tech owning my voice on the Internet. I'd have deleted my FB account along with X and Instagram, long ago, except that it's the one platform that my family uses. My mother uses Facebook, so do my distant cousins, but only a subset use the other platforms, and none use the Fedi-verse. FB remains as the one platform for me to post the occasional vacation photo and to find out that my cousin got married last week - and no I didn't get an invite. Vero - I'm a photographer and love to post some of my more interesting art pieces online for feedback, so I can improve my craft. I used to use Instagram, until it went over to the algorithm dark side and filled my feed with short-form video. Vero maintains to be what Instagram used to be. I've not checked out Pixelfed (yet). Mastodon - After Musk took over Twitter and rebranded it to X, I swiftly left and moved to Mastodon. I hate the idea of a single business entity owning my content and right to free speech online. Like many, I have my own issues with Musk and his business practices and shouldn't have to deal with them as part of my online presence. Mastodon was and still is, the place where I get to collaborate with people I've never met in person on likeminded topics of interests. Mastodon relies on federated servers, which people own; so, there's that to consider. I've managed to find a server that caters to my interests and fulfills my desire to collaborate online. Then comes Nostr... My friend \_@briangreen.net introduced me to Nostr. As a long-term orange-pill advocate, I was thrilled to join Nostr to collaborate on the latest Bitcoin and Crypto news. I will say that Nostr appears less diverse in topics but that's rapidly changing as I am now seeing a lot of posts on photography, meshtastic, and other personal interests of mine. I love that Nostr is not so much a platform, but a federated protocol. I don't have to subscribe to any one app and web site to post and read content. For now, I use both Mastodon and Nostr to scratch my online collab itch. A nice thing about the Fedi-verse is that there's plenty of cross-posting apps. I use [OpenVibe](https://openvibe.social/) to post and consume content in one place. Their app is slick and works as advertised. How do you use social media? Is Nostr your only platform, or do you still use the traditional ones? @ 460c25e6:ef85065c

2025-02-25 15:20:39If you don't know where your posts are, you might as well just stay in the centralized Twitter. You either take control of your relay lists, or they will control you. Amethyst offers several lists of relays for our users. We are going to go one by one to help clarify what they are and which options are best for each one. ## Public Home/Outbox Relays Home relays store all YOUR content: all your posts, likes, replies, lists, etc. It's your home. Amethyst will send your posts here first. Your followers will use these relays to get new posts from you. So, if you don't have anything there, **they will not receive your updates**. Home relays must allow queries from anyone, ideally without the need to authenticate. They can limit writes to paid users without affecting anyone's experience. This list should have a maximum of 3 relays. More than that will only make your followers waste their mobile data getting your posts. Keep it simple. Out of the 3 relays, I recommend: - 1 large public, international relay: nos.lol, nostr.mom, relay.damus.io, etc. - 1 personal relay to store a copy of all your content in a place no one can delete. Go to [relay.tools](https://relay.tools/) and never be censored again. - 1 really fast relay located in your country: paid options like http://nostr.wine are great Do not include relays that block users from seeing posts in this list. If you do, no one will see your posts. ## Public Inbox Relays This relay type receives all replies, comments, likes, and zaps to your posts. If you are not getting notifications or you don't see replies from your friends, it is likely because you don't have the right setup here. If you are getting too much spam in your replies, it's probably because your inbox relays are not protecting you enough. Paid relays can filter inbox spam out. Inbox relays must allow anyone to write into them. It's the opposite of the outbox relay. They can limit who can download the posts to their paid subscribers without affecting anyone's experience. This list should have a maximum of 3 relays as well. Again, keep it small. More than that will just make you spend more of your data plan downloading the same notifications from all these different servers. Out of the 3 relays, I recommend: - 1 large public, international relay: nos.lol, nostr.mom, relay.damus.io, etc. - 1 personal relay to store a copy of your notifications, invites, cashu tokens and zaps. - 1 really fast relay located in your country: go to [nostr.watch](https://nostr.watch/relays/find) and find relays in your country Terrible options include: - nostr.wine should not be here. - filter.nostr.wine should not be here. - inbox.nostr.wine should not be here. ## DM Inbox Relays These are the relays used to receive DMs and private content. Others will use these relays to send DMs to you. **If you don't have it setup, you will miss DMs**. DM Inbox relays should accept any message from anyone, but only allow you to download them. Generally speaking, you only need 3 for reliability. One of them should be a personal relay to make sure you have a copy of all your messages. The others can be open if you want push notifications or closed if you want full privacy. Good options are: - inbox.nostr.wine and auth.nostr1.com: anyone can send messages and only you can download. Not even our push notification server has access to them to notify you. - a personal relay to make sure no one can censor you. Advanced settings on personal relays can also store your DMs privately. Talk to your relay operator for more details. - a public relay if you want DM notifications from our servers. Make sure to add at least one public relay if you want to see DM notifications. ## Private Home Relays Private Relays are for things no one should see, like your drafts, lists, app settings, bookmarks etc. Ideally, these relays are either local or require authentication before posting AND downloading each user\'s content. There are no dedicated relays for this category yet, so I would use a local relay like Citrine on Android and a personal relay on relay.tools. Keep in mind that if you choose a local relay only, a client on the desktop might not be able to see the drafts from clients on mobile and vice versa. ## Search relays: This is the list of relays to use on Amethyst's search and user tagging with @. **Tagging and searching will not work if there is nothing here.**. This option requires NIP-50 compliance from each relay. Hit the Default button to use all available options on existence today: - nostr.wine - relay.nostr.band - relay.noswhere.com ## Local Relays: This is your local storage. Everything will load faster if it comes from this relay. You should install Citrine on Android and write ws://localhost:4869 in this option. ## General Relays: This section contains the default relays used to download content from your follows. Notice how you can activate and deactivate the Home, Messages (old-style DMs), Chat (public chats), and Global options in each. Keep 5-6 large relays on this list and activate them for as many categories (Home, Messages (old-style DMs), Chat, and Global) as possible. Amethyst will provide additional recommendations to this list from your follows with information on which of your follows might need the additional relay in your list. Add them if you feel like you are missing their posts or if it is just taking too long to load them. ## My setup Here's what I use: 1. Go to [relay.tools](https://relay.tools/) and create a relay for yourself. 2. Go to [nostr.wine](https://nostr.wine/) and pay for their subscription. 3. Go to [inbox.nostr.wine](https://inbox.nostr.wine/) and pay for their subscription. 4. Go to [nostr.watch](https://nostr.watch/relays/find) and find a good relay in your country. 5. Download Citrine to your phone. Then, on your relay lists, put: Public Home/Outbox Relays: - nostr.wine - nos.lol or an in-country relay. - <your.relay>.nostr1.com Public Inbox Relays - nos.lol or an in-country relay - <your.relay>.nostr1.com DM Inbox Relays - inbox.nostr.wine - <your.relay>.nostr1.com Private Home Relays - ws://localhost:4869 (Citrine) - <your.relay>.nostr1.com (if you want) Search Relays - nostr.wine - relay.nostr.band - relay.noswhere.com Local Relays - ws://localhost:4869 (Citrine) General Relays - nos.lol - relay.damus.io - relay.primal.net - nostr.mom And a few of the recommended relays from Amethyst. ## Final Considerations Remember, relays can see what your Nostr client is requesting and downloading at all times. They can track what you see and see what you like. They can sell that information to the highest bidder, they can delete your content or content that a sponsor asked them to delete (like a negative review for instance) and they can censor you in any way they see fit. Before using any random free relay out there, make sure you trust its operator and you know its terms of service and privacy policies.

@ 460c25e6:ef85065c

2025-02-25 15:20:39If you don't know where your posts are, you might as well just stay in the centralized Twitter. You either take control of your relay lists, or they will control you. Amethyst offers several lists of relays for our users. We are going to go one by one to help clarify what they are and which options are best for each one. ## Public Home/Outbox Relays Home relays store all YOUR content: all your posts, likes, replies, lists, etc. It's your home. Amethyst will send your posts here first. Your followers will use these relays to get new posts from you. So, if you don't have anything there, **they will not receive your updates**. Home relays must allow queries from anyone, ideally without the need to authenticate. They can limit writes to paid users without affecting anyone's experience. This list should have a maximum of 3 relays. More than that will only make your followers waste their mobile data getting your posts. Keep it simple. Out of the 3 relays, I recommend: - 1 large public, international relay: nos.lol, nostr.mom, relay.damus.io, etc. - 1 personal relay to store a copy of all your content in a place no one can delete. Go to [relay.tools](https://relay.tools/) and never be censored again. - 1 really fast relay located in your country: paid options like http://nostr.wine are great Do not include relays that block users from seeing posts in this list. If you do, no one will see your posts. ## Public Inbox Relays This relay type receives all replies, comments, likes, and zaps to your posts. If you are not getting notifications or you don't see replies from your friends, it is likely because you don't have the right setup here. If you are getting too much spam in your replies, it's probably because your inbox relays are not protecting you enough. Paid relays can filter inbox spam out. Inbox relays must allow anyone to write into them. It's the opposite of the outbox relay. They can limit who can download the posts to their paid subscribers without affecting anyone's experience. This list should have a maximum of 3 relays as well. Again, keep it small. More than that will just make you spend more of your data plan downloading the same notifications from all these different servers. Out of the 3 relays, I recommend: - 1 large public, international relay: nos.lol, nostr.mom, relay.damus.io, etc. - 1 personal relay to store a copy of your notifications, invites, cashu tokens and zaps. - 1 really fast relay located in your country: go to [nostr.watch](https://nostr.watch/relays/find) and find relays in your country Terrible options include: - nostr.wine should not be here. - filter.nostr.wine should not be here. - inbox.nostr.wine should not be here. ## DM Inbox Relays These are the relays used to receive DMs and private content. Others will use these relays to send DMs to you. **If you don't have it setup, you will miss DMs**. DM Inbox relays should accept any message from anyone, but only allow you to download them. Generally speaking, you only need 3 for reliability. One of them should be a personal relay to make sure you have a copy of all your messages. The others can be open if you want push notifications or closed if you want full privacy. Good options are: - inbox.nostr.wine and auth.nostr1.com: anyone can send messages and only you can download. Not even our push notification server has access to them to notify you. - a personal relay to make sure no one can censor you. Advanced settings on personal relays can also store your DMs privately. Talk to your relay operator for more details. - a public relay if you want DM notifications from our servers. Make sure to add at least one public relay if you want to see DM notifications. ## Private Home Relays Private Relays are for things no one should see, like your drafts, lists, app settings, bookmarks etc. Ideally, these relays are either local or require authentication before posting AND downloading each user\'s content. There are no dedicated relays for this category yet, so I would use a local relay like Citrine on Android and a personal relay on relay.tools. Keep in mind that if you choose a local relay only, a client on the desktop might not be able to see the drafts from clients on mobile and vice versa. ## Search relays: This is the list of relays to use on Amethyst's search and user tagging with @. **Tagging and searching will not work if there is nothing here.**. This option requires NIP-50 compliance from each relay. Hit the Default button to use all available options on existence today: - nostr.wine - relay.nostr.band - relay.noswhere.com ## Local Relays: This is your local storage. Everything will load faster if it comes from this relay. You should install Citrine on Android and write ws://localhost:4869 in this option. ## General Relays: This section contains the default relays used to download content from your follows. Notice how you can activate and deactivate the Home, Messages (old-style DMs), Chat (public chats), and Global options in each. Keep 5-6 large relays on this list and activate them for as many categories (Home, Messages (old-style DMs), Chat, and Global) as possible. Amethyst will provide additional recommendations to this list from your follows with information on which of your follows might need the additional relay in your list. Add them if you feel like you are missing their posts or if it is just taking too long to load them. ## My setup Here's what I use: 1. Go to [relay.tools](https://relay.tools/) and create a relay for yourself. 2. Go to [nostr.wine](https://nostr.wine/) and pay for their subscription. 3. Go to [inbox.nostr.wine](https://inbox.nostr.wine/) and pay for their subscription. 4. Go to [nostr.watch](https://nostr.watch/relays/find) and find a good relay in your country. 5. Download Citrine to your phone. Then, on your relay lists, put: Public Home/Outbox Relays: - nostr.wine - nos.lol or an in-country relay. - <your.relay>.nostr1.com Public Inbox Relays - nos.lol or an in-country relay - <your.relay>.nostr1.com DM Inbox Relays - inbox.nostr.wine - <your.relay>.nostr1.com Private Home Relays - ws://localhost:4869 (Citrine) - <your.relay>.nostr1.com (if you want) Search Relays - nostr.wine - relay.nostr.band - relay.noswhere.com Local Relays - ws://localhost:4869 (Citrine) General Relays - nos.lol - relay.damus.io - relay.primal.net - nostr.mom And a few of the recommended relays from Amethyst. ## Final Considerations Remember, relays can see what your Nostr client is requesting and downloading at all times. They can track what you see and see what you like. They can sell that information to the highest bidder, they can delete your content or content that a sponsor asked them to delete (like a negative review for instance) and they can censor you in any way they see fit. Before using any random free relay out there, make sure you trust its operator and you know its terms of service and privacy policies. @ e31e84c4:77bbabc0

2025-02-25 15:03:34*The Fine Line: Bitcoin Companies Navigating Regulation and Freedom was [written by Bri](https://x.com/cyberBri). If you enjoyed this article then support her writing, by donating to her lightning wallet: bri_1@walletofsatoshi.com* We all know the value proposition of Bitcoin: Bitcoin cannot be controlled by the state. Bitcoin is permissionless, it doesn't need a KYC and we can send money to anyone in the world, without middlemen, without censorship, without limits. However, when companies use Bitcoin, and more so when they offer Bitcoin services, their activities are indeed controlled by the state. In order to fulfil the regulatory requirements, companies usually have to employ entire compliance teams. Bitcoin-only exchanges are probably not better off than crypto service providers, even if one can sometimes hopefully recognise an increasing pro-Bitcoin attitude in the world. The Bitcoin scene recently looked expectantly to Nashville when Trump appeared at the Bitcoin 2024 conference as part of his election campaign. He doesn't really seem to be able to distinguish between Bitcoin and crypto though – in his keynote speech he promised to make the U.S. the ‘crypto capital of the planet’. Nevertheless, the news that the United States plans to accumulate Bitcoin as a strategic reserve currency made headlines around the world and many Bitcoin supporters are delighted. Bitcoin's negative image could be somewhat corrected and it would certainly also be beneficial for Bitcoin adoption, so the hope goes. And indeed, the price of Bitcoin climbed to new record highs during the US election campaign, reaching its ATH of USD 109,000 when Trump took office on 20 January 2025. The US announcement of a bitcoin strategic reserve can certainly be described as a historic moment. At the moment, it doesn't seem to be entirely clear whether Bitcoin or crypto, but a number of US states are working on advancing Bitcoin reserves. Whether it is a good thing when nation states start hoarding Bitcoin is another question. After all, from the very beginning and to this day, Bitcoin has been about taking power over money away from the state and giving it to the people. Back to the Bitcoin companies. Let's assume that someone understands Bitcoin and has even discovered that there are Bitcoin-only exchanges. These companies recognise Bitcoin as sound money, support the Bitcoin community and want to integrate the Bitcoin ethos into their business model in the best possible way. Ouch – that already sounds like a compromise. **The Dilemma – Bitcoin at Heart, Regulation at the Back of the Neck** Bitcoin companies are caught between maximum independence and regulatory requirements. Companies such as Strike, Relai and River aim to make it as easy as possible for their customers to access Bitcoin while at the same time enabling them to maximise their independence from third parties. An important aspect of this is self-custody. Customers have full control over their Bitcoin and can avoid counterparty risks such as exchange failures or government seizures. In contrast, most providers on the market, such as the major players Coinbase or Binance, rely on classic, centralised structures with full custody - and a large range of digital assets. They are basically fiat companies that offer crypto products. And then, at the other end of the spectrum, there are projects such as Samourai, Wasabi Wallet or Tornado Cash, which are radically opposed to any form of control. They are developing powerful tools for more financial privacy – in line with Bitcoin's original idea as a decentralised cash system. But this commitment comes at a price: the founders of Samourai Wallet were arrested and the developers of Tornado Cash were prosecuted. These Bitcoin rebels are putting the limits of state regulation to the test. And they raise the fundamental question: Is privacy an inalienable right or should it be subordinated to the public security interest? **The Middle Ground Builders** Bitcoin-only companies that choose the middle ground play an important role in the bitcoin ecosystem. This is because they appeal to the masses by keeping onboarding simple and often offering a range of interesting services. At the same time, they want to give their customers the greatest possible independence. But are their business models sustainable? Or do these companies run the risk of being worn down by the balancing act between Bitcoin ethos and state control? How can these pioneers survive in a constantly changing regulatory environment? It's a balancing act between regulation and Bitcoin values, and it's often a fight for the fundamental rights of not just Bitcoiners but people in general. For example, these companies need to have KYC processes in place to be compliant with the law and allow customers the greatest possible flexibility in their Bitcoin activities. *Some popular Bitcoin-companies and their strategies:* - [Strike](https://strike.me/): Custodial, fast lightning transactions, DCA, bill payments - [Relai](https://relai.app/de/): Simple onramp, self-custody, private and business services - [River](https://river.com/): Multisig and cold storage, proof of reserves, inheritance - [Unchained](https://unchained.com/): Multisig vaults, DCA, inheritance, loans, retirement, advisory - [Bull Bitcoin](https://www.bullbitcoin.com/): Non-custodial exchange, DCA, bill payments, OTC desk Typical features of these accounts usually include a KYC check, which allows users to be granted higher buy and sell limits. Many Bitcoin companies offer self-custody wallets and often some also multi-sig solutions that increase security for users. Partnerships with banks or payment service providers facilitate buying and selling and enable services such as the creation of savings plans. Bitcoin companies face several challenges. Regulatory pressure remains a key concern, as authorities may tighten KYC obligations or introduce new restrictions. Trust is another issue since die-hard Bitcoiners often see these companies as not being consistent enough with Bitcoin's core principles. **Regulatory Framework and Political Influences** ***USA: Trump's Bitcoin course and the ‘Crypto Czar’*** There are currently contradictory signals in the USA: on the one hand, Donald Trump has hinted at using Bitcoin as a strategic reserve (Strategic Bitcoin Reserve, SBR), while on the other hand, regulation is being tightened further. The newly created position of ‘White House AI and Crypto Czar’, presumably conceived in collaboration with Elon Musk, is intended to implement clear rules for blockchain, AI and the crypto market. This is also likely to affect companies that are committed to the Bitcoin ethos. - Positive signals: Bitcoin is increasingly recognised as a legitimate asset class. - Regulatory pressure: Stricter regulations could threaten the existence of smaller companies. - Possible future: If the US promotes Bitcoin as a strategic asset, this could fundamentally change the regulatory landscape. ***Europe and Global Developments*** - MiCA (Markets in Crypto-Assets Regulation): New EU regulation for crypto companies, requiring strict KYC and AML rules, among other things. - Restrictive countries: China and India continue to rely on tough regulation or bans. - Friendly jurisdictions: Countries such as El Salvador or Switzerland offer attractive conditions for Bitcoin companies. **Self-custody of Bitcoin** The so-called ‘Travel Rule’ (Transfer of Funds Regulation, TFR) requires detailed information about the sender and recipient. This makes it more difficult for Europeans to interact with self-custody Bitcoin wallets. For transactions over 1,000 euros, users must prove that they are the owners of these wallets (proof of ownership). Yet self-custody is a very important aspect of Bitcoin. It is the only way to avoid the risks associated with relying on centralised custodians. Self-custody ensures that you alone have control over your money. The new regulations represent a gradual financial disenfranchisement, which is not only criticised by Bitcoiners. And that is only part of the problem. The disadvantages of centralised storage of customer assets are well known. Just think of the scandalous examples from the recent past: The fall of the FTX cryptocurrency exchange and the knock-on effects on the cryptocurrency industry or the fraudulent business practices of Celsius, which lost billions of customers' money. > *“Not your keys, not your coins.”– Andreas Antonopoulos* However, it is often the users themselves who, consciously or unconsciously, jeopardise their funds. The obstacles to self-custody lie in both technical and practical aspects. Not everyone is willing or able to navigate hardware wallets and multisig solutions. Furthermore, without an adequate backup, there is a risk of losing coins irretrievably. By keeping their coins in self-custody, Bitcoiners eliminate third-party risk. However, self-custody can be a challenge, especially for beginners. ‘Study Bitcoin’ is more than just a phrase here. Only those who know their way around can protect themselves against errors, misuse and loss. **CONCLUSION** The uncertainties caused by ever-changing regulation in different jurisdictions is a constant challenge for businesses. However, as Bitcoin is increasingly being categorised as harmless by the authorities, pure Bitcoin platforms might face fewer regulatory risks compared to crypto exchanges. The growing acceptance of Bitcoin and the plans of the United States and other countries to create a strategic Bitcoin reserve may have a positive impact on how Bitcoin companies continue to be treated by regulators. I would, though, like to quote Maya Parbhoe, the Surinamese presidential candidate for 2025, at this point, even if it seems a little off-topic: > *“A Bitcoin Strategic Reserve is not the answer.* *> *The moment a government holds Bitcoin as a reserve, it centralizes control over an asset designed to be decentralized. It strengthens the very system Bitcoin was created to replace.* *> *Governments holding Bitcoin do not give power to the people, they give themselves a hedge while continuing to debase their fiat currency. They still print, they still tax, they still control. The people remain trapped in the same system, only now with a government-backed Bitcoin price floor that serves the state, not the individual.* *> *Bitcoin was not made to be stockpiled by central banks. It was made to be used. As currency, as a tool of self-sovereignty, as a weapon against state overreach.”* So let's summarise what we have covered in this article in the spirit of these liberal ideas. The following rules, which have just been created, should be mandatory reading for Bitcoin aficionados until further notice: <img src="https://blossom.primal.net/914ac66c228ea1a398ec1f008234e4cd213da85f268de73fb36dc9e344dcfb45.jpg"> *The Fine Line: Bitcoin Companies Navigating Regulation and Freedom was [written by Bri](https://x.com/cyberBri). If you enjoyed this article then support her writing, by donating to her lightning wallet: bri_1@walletofsatoshi.com*

@ e31e84c4:77bbabc0