-

@ e3ba5e1a:5e433365

2025-02-05 17:47:16

I got into a [friendly discussion](https://x.com/snoyberg/status/1887007888117252142) on X regarding health insurance. The specific question was how to deal with health insurance companies (presumably unfairly) denying claims? My answer, as usual: get government out of it!

The US healthcare system is essentially the worst of both worlds:

* Unlike full single payer, individuals incur high costs

* Unlike a true free market, regulation causes increases in costs and decreases competition among insurers

I'm firmly on the side of moving towards the free market. (And I say that as someone living under a single payer system now.) Here's what I would do:

* Get rid of tax incentives that make health insurance tied to your employer, giving individuals back proper freedom of choice.

* Reduce regulations significantly.

* In the short term, some people will still get rejected claims and other obnoxious behavior from insurance companies. We address that in two ways:

1. Due to reduced regulations, new insurance companies will be able to enter the market offering more reliable coverage and better rates, and people will flock to them because they have the freedom to make their own choices.

2. Sue the asses off of companies that reject claims unfairly. And ideally, as one of the few legitimate roles of government in all this, institute new laws that limit the ability of fine print to allow insurers to escape their responsibilities. (I'm hesitant that the latter will happen due to the incestuous relationship between Congress/regulators and insurers, but I can hope.)

Will this magically fix everything overnight like politicians normally promise? No. But it will allow the market to return to a healthy state. And I don't think it will take long (order of magnitude: 5-10 years) for it to come together, but that's just speculation.

And since there's a high correlation between those who believe government can fix problems by taking more control and demanding that only credentialed experts weigh in on a topic (both points I strongly disagree with BTW): I'm a trained actuary and worked in the insurance industry, and have directly seen how government regulation reduces competition, raises prices, and harms consumers.

And my final point: I don't think any prior art would be a good comparison for deregulation in the US, it's such a different market than any other country in the world for so many reasons that lessons wouldn't really translate. Nonetheless, I asked Grok for some empirical data on this, and at best the results of deregulation could be called "mixed," but likely more accurately "uncertain, confused, and subject to whatever interpretation anyone wants to apply."

https://x.com/i/grok/share/Zc8yOdrN8lS275hXJ92uwq98M

-

@ e3ba5e1a:5e433365

2025-02-04 08:29:42

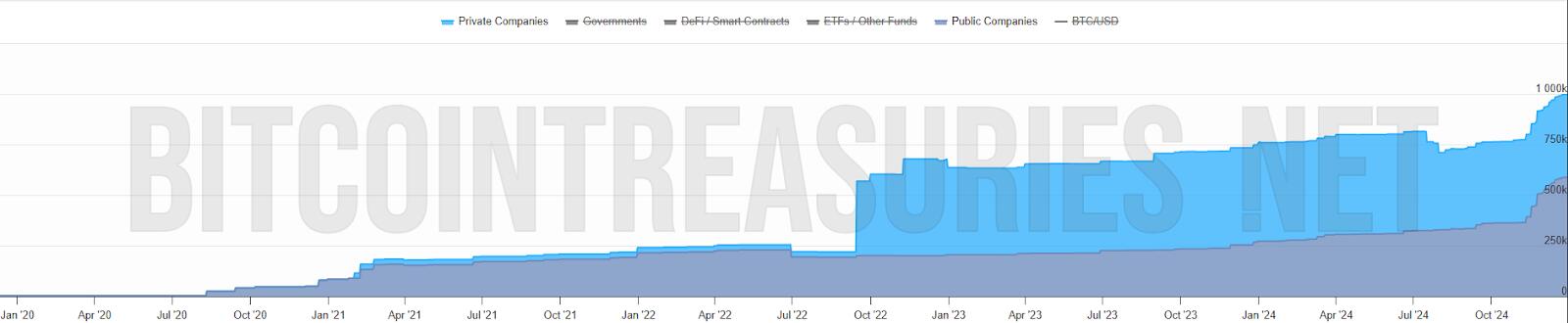

President Trump has started rolling out his tariffs, something I [blogged about in November](https://www.snoyman.com/blog/2024/11/steelmanning-tariffs/). People are talking about these tariffs a lot right now, with many people (correctly) commenting on how consumers will end up with higher prices as a result of these tariffs. While that part is true, I’ve seen a lot of people taking it to the next, incorrect step: that consumers will pay the entirety of the tax. I [put up a poll on X](https://x.com/snoyberg/status/1886035800019599808) to see what people thought, and while the right answer got a lot of votes, it wasn't the winner.

For purposes of this blog post, our ultimate question will be the following:

* Suppose apples currently sell for $1 each in the entire United States.

* There are domestic sellers and foreign sellers of apples, all receiving the same price.

* There are no taxes or tariffs on the purchase of apples.

* The question is: if the US federal government puts a $0.50 import tariff per apple, what will be the change in the following:

* Number of apples bought in the US

* Price paid by buyers for apples in the US

* Post-tax price received by domestic apple producers

* Post-tax price received by foreign apple producers

Before we can answer that question, we need to ask an easier, first question: before instituting the tariff, why do apples cost $1?

And finally, before we dive into the details, let me provide you with the answers to the ultimate question. I recommend you try to guess these answers before reading this, and if you get it wrong, try to understand why:

1. The number of apples bought will go down

2. The buyers will pay more for each apple they buy, but not the full amount of the tariff

3. Domestic apple sellers will receive a *higher* price per apple

4. Foreign apple sellers will receive a *lower* price per apple, but not lowered by the full amount of the tariff

In other words, regardless of who sends the payment to the government, both taxed parties (domestic buyers and foreign sellers) will absorb some of the costs of the tariff, while domestic sellers will benefit from the protectionism provided by tariffs and be able to sell at a higher price per unit.

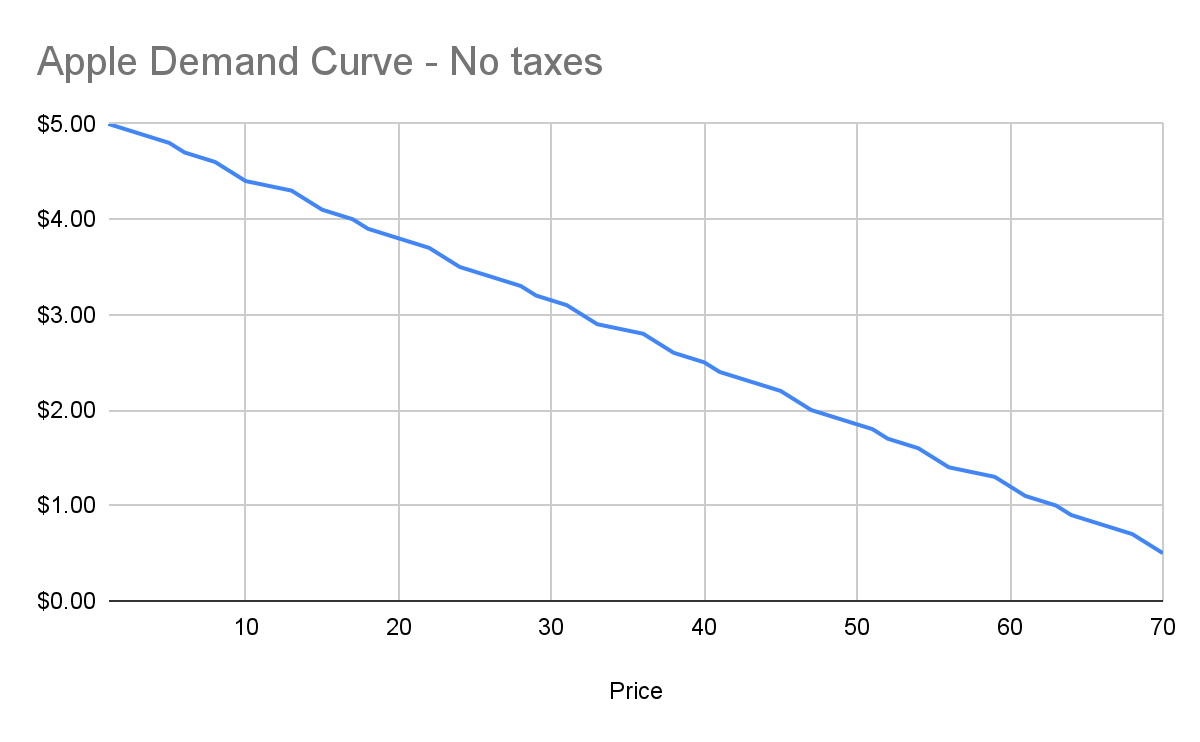

## Marginal benefit

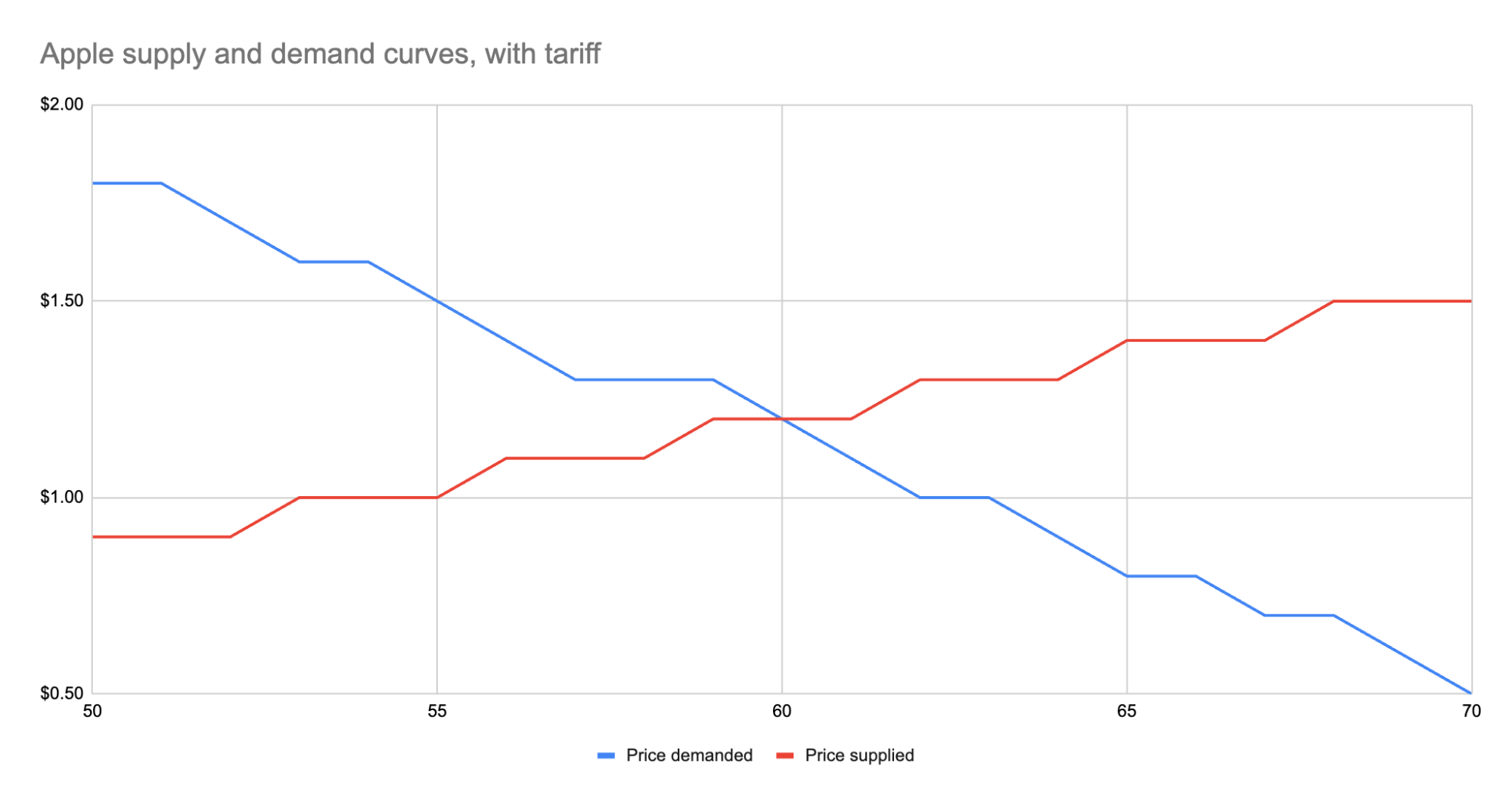

All of the numbers discussed below are part of a [helper Google Sheet](https://docs.google.com/spreadsheets/d/14ZbkWpw1B9Q1UDB9Yh47DmdKQfIafVVBKbDUsSIfGZw/edit?usp=sharing) I put together for this analysis. Also, apologies about the jagged lines in the charts below, I hadn’t realized before starting on this that there are [some difficulties with creating supply and demand charts in Google Sheets](https://superuser.com/questions/1359731/how-to-create-a-supply-demand-style-chart).

Let’s say I absolutely love apples, they’re my favorite food. How much would I be willing to pay for a single apple? You might say “$1, that’s the price in the supermarket,” and in many ways you’d be right. If I walk into supermarket A, see apples on sale for $50, and know that I can buy them at supermarket B for $1, I’ll almost certainly leave A and go buy at B.

But that’s not what I mean. What I mean is: how high would the price of apples have to go *everywhere* so that I’d no longer be willing to buy a single apple? This is a purely personal, subjective opinion. It’s impacted by how much money I have available, other expenses I need to cover, and how much I like apples. But let’s say the number is $5.

How much would I be willing to pay for another apple? Maybe another $5. But how much am I willing to pay for the 1,000th apple? 10,000th? At some point, I’ll get sick of apples, or run out of space to keep the apples, or not be able to eat, cook, and otherwise preserve all those apples before they rot.

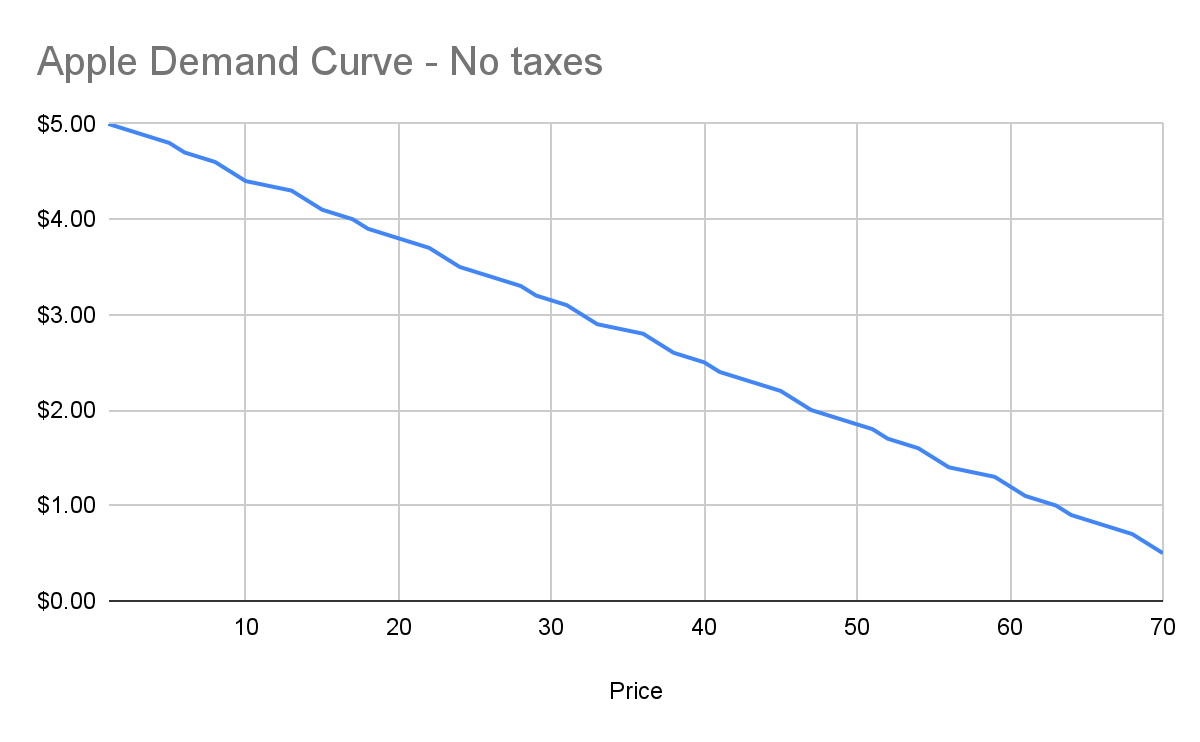

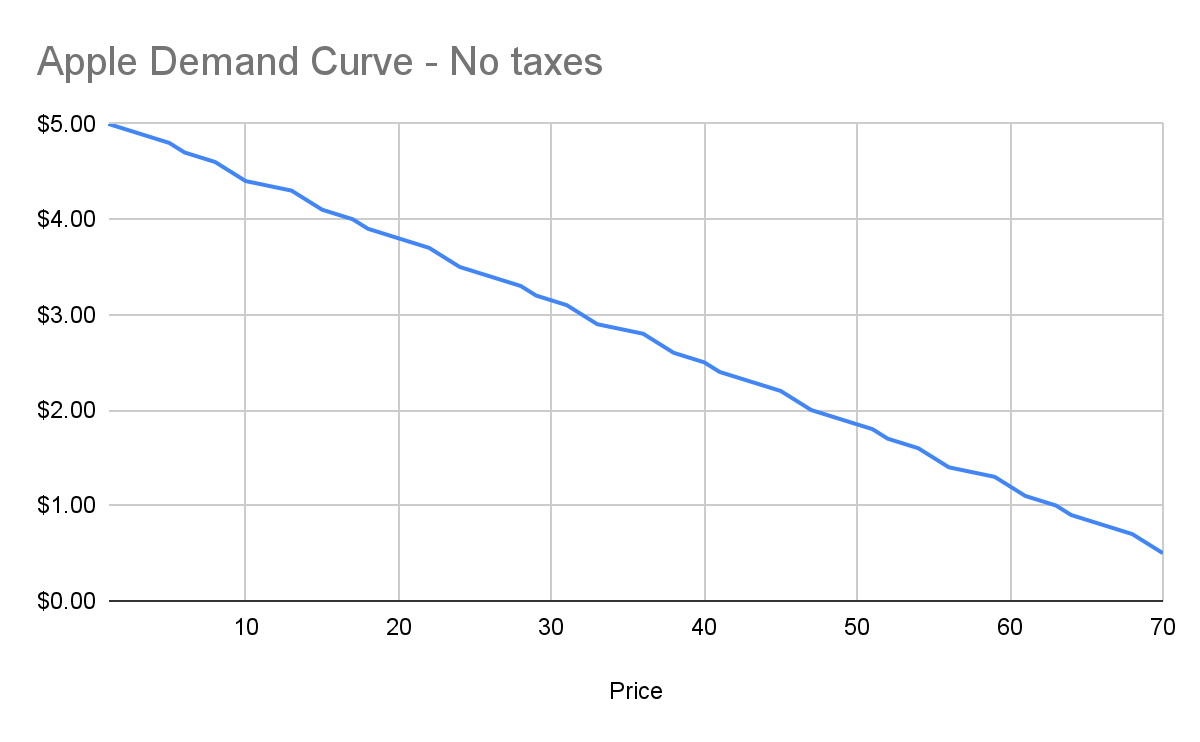

The point being: I’ll be progressively willing to spend less and less money for each apple. This form of analysis is called *marginal benefit*: how much benefit (expressed as dollars I’m willing to spend) will I receive from each apple? This is a downward sloping function: for each additional apple I buy (quantity demanded), the price I’m willing to pay goes down. This is what gives my personal *demand curve*. And if we aggregate demand curves across all market participants (meaning: everyone interested in buying apples), we end up with something like this:

Assuming no changes in people’s behavior and other conditions in the market, this chart tells us how many apples will be purchased by our buyers at each price point between $0.50 and $5. And ceteris paribus (all else being equal), this will continue to be the demand curve for apples.

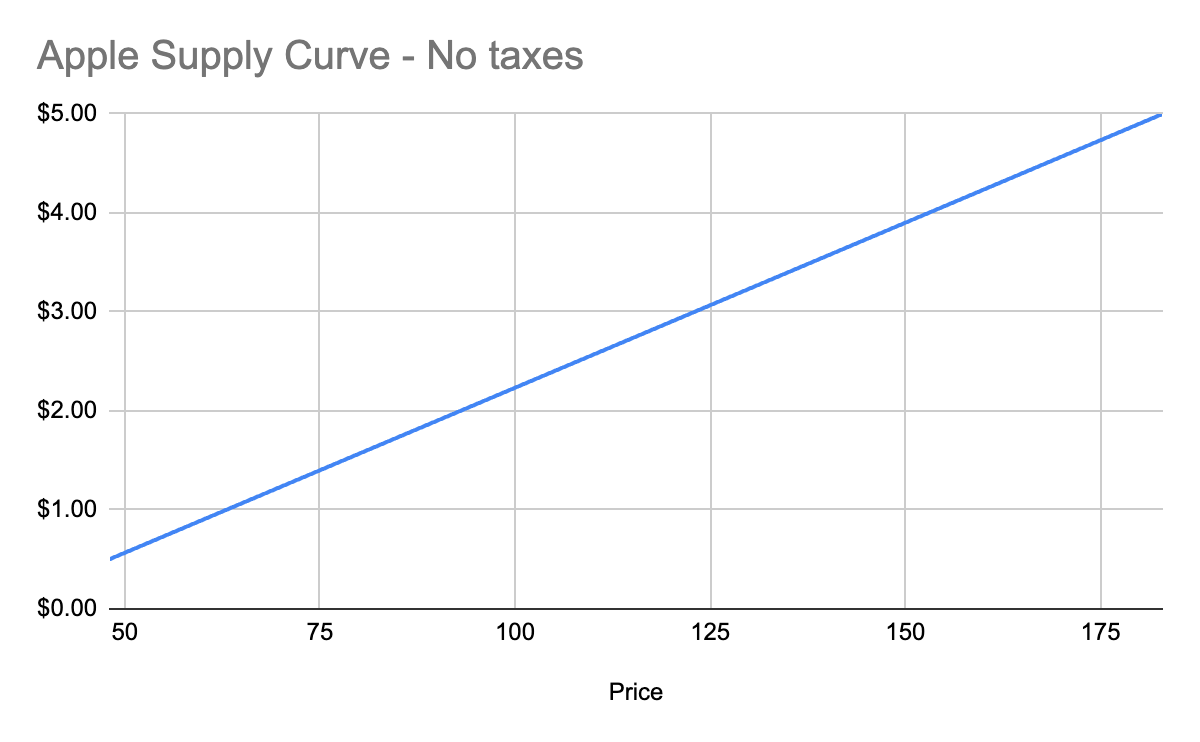

## Marginal cost

Demand is half the story of economics. The other half is supply, or: how many apples will I sell at each price point? Supply curves are upward sloping: the higher the price, the more a person or company is willing and able to sell a product.

Let’s understand why. Suppose I have an apple orchard. It’s a large property right next to my house. With about 2 minutes of effort, I can walk out of my house, find the nearest tree, pick 5 apples off the tree, and call it a day. 5 apples for 2 minutes of effort is pretty good, right?

Yes, there was all the effort necessary to buy the land, and plant the trees, and water them… and a bunch more than I likely can’t even guess at. We’re going to ignore all of that for our analysis, because for short-term supply-and-demand movement, we can ignore these kinds of *sunk costs*. One other simplification: in reality, supply curves often start descending before ascending. This accounts for achieving efficiencies of scale after the first number of units purchased. But since both these topics are unneeded for understanding taxes, I won’t go any further.

Anyway, back to my apple orchard. If someone offers me $0.50 per apple, I can do 2 minutes of effort and get $2.50 in revenue, which equates to a $75/hour wage for me. I’m more than happy to pick apples at that price\!

However, let’s say someone comes to buy 10,000 apples from me instead. I no longer just walk out to my nearest tree. I’m going to need to get in my truck, drive around, spend the day in the sun, pay for gas, take a day off of my day job (let’s say it pays me $70/hour). The costs go up significantly. Let’s say it takes 5 days to harvest all those apples myself, it costs me $100 in fuel and other expenses, and I lose out on my $70/hour job for 5 days. We end up with:

* Total expenditure: $100 \+ $70 \* 8 hours a day \* 5 days \== $2900

* Total revenue: $5000 (10,000 apples at $0.50 each)

* Total profit: $2100

So I’m still willing to sell the apples at this price, but it’s not as attractive as before. And as the number of apples purchased goes up, my costs keep increasing. I’ll need to spend more money on fuel to travel more of my property. At some point I won’t be able to do the work myself anymore, so I’ll need to pay others to work on the farm, and they’ll be slower at picking apples than me (less familiar with the property, less direct motivation, etc.). The point being: at some point, the number of apples can go high enough that the $0.50 price point no longer makes me any money.

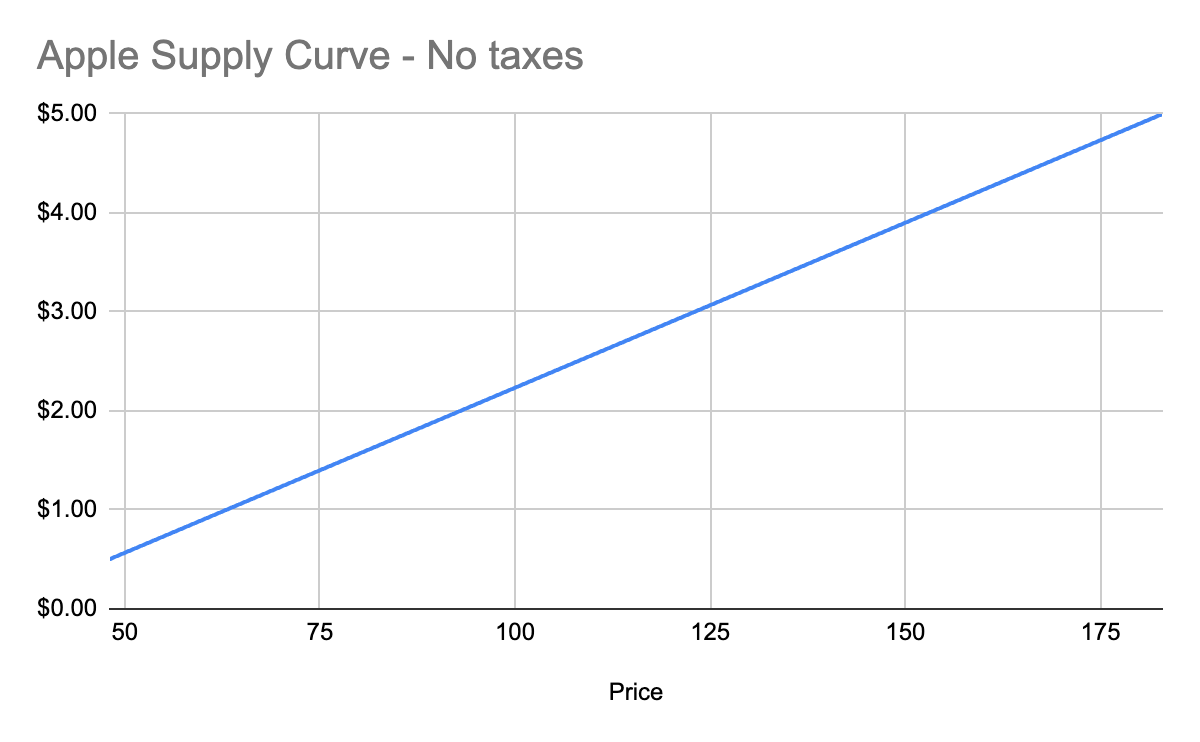

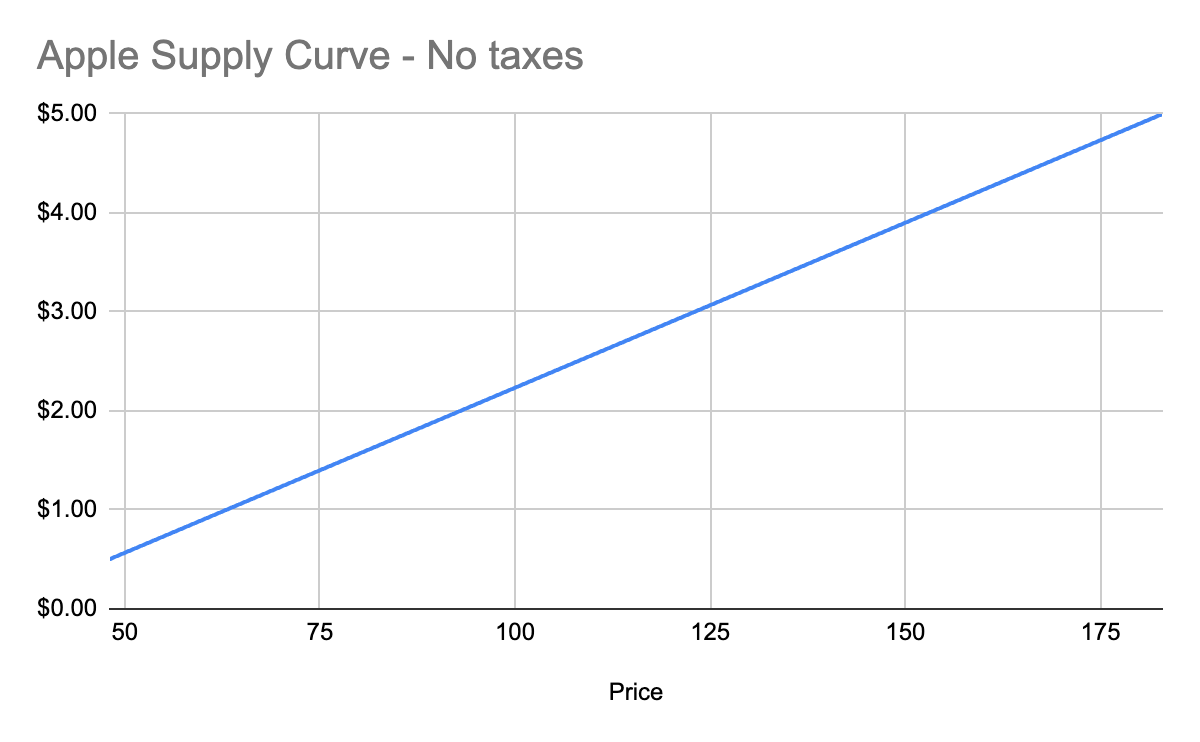

This kind of analysis is called *marginal cost*. It refers to the additional amount of expenditure a seller has to spend in order to produce each additional unit of the good. Marginal costs go up as quantity sold goes up. And like demand curves, if you aggregate this data across all sellers, you get a supply curve like this:

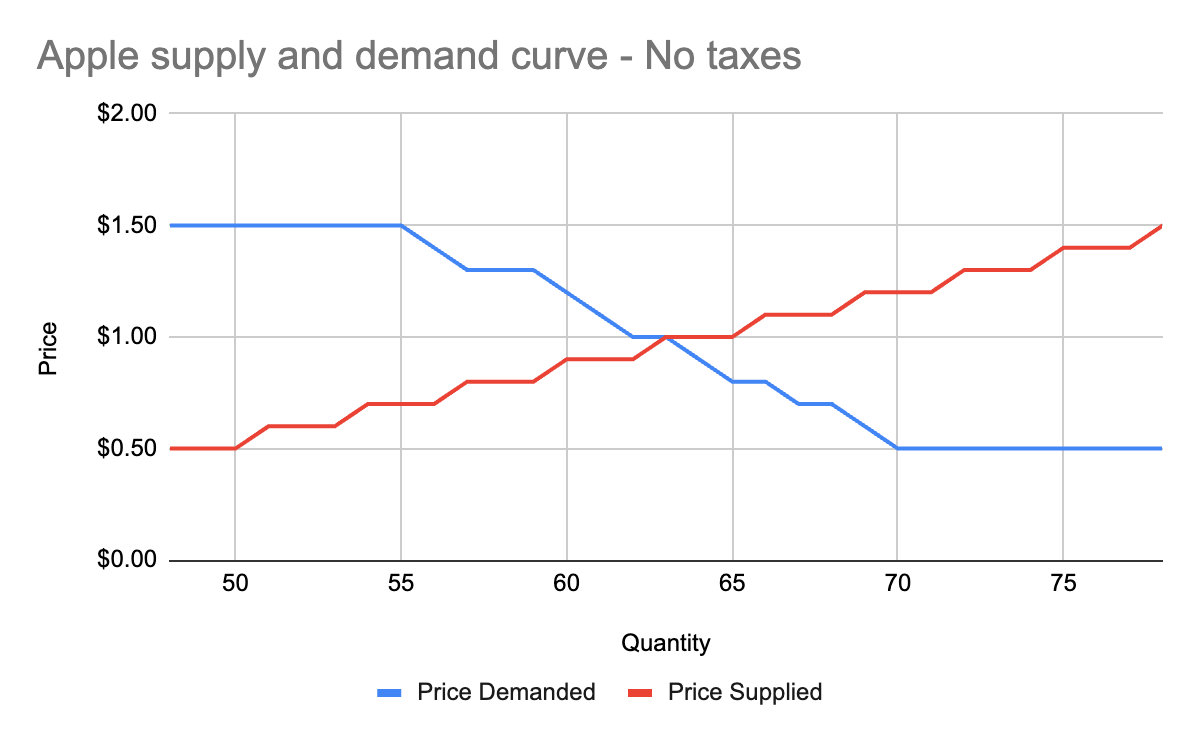

## Equilibrium price

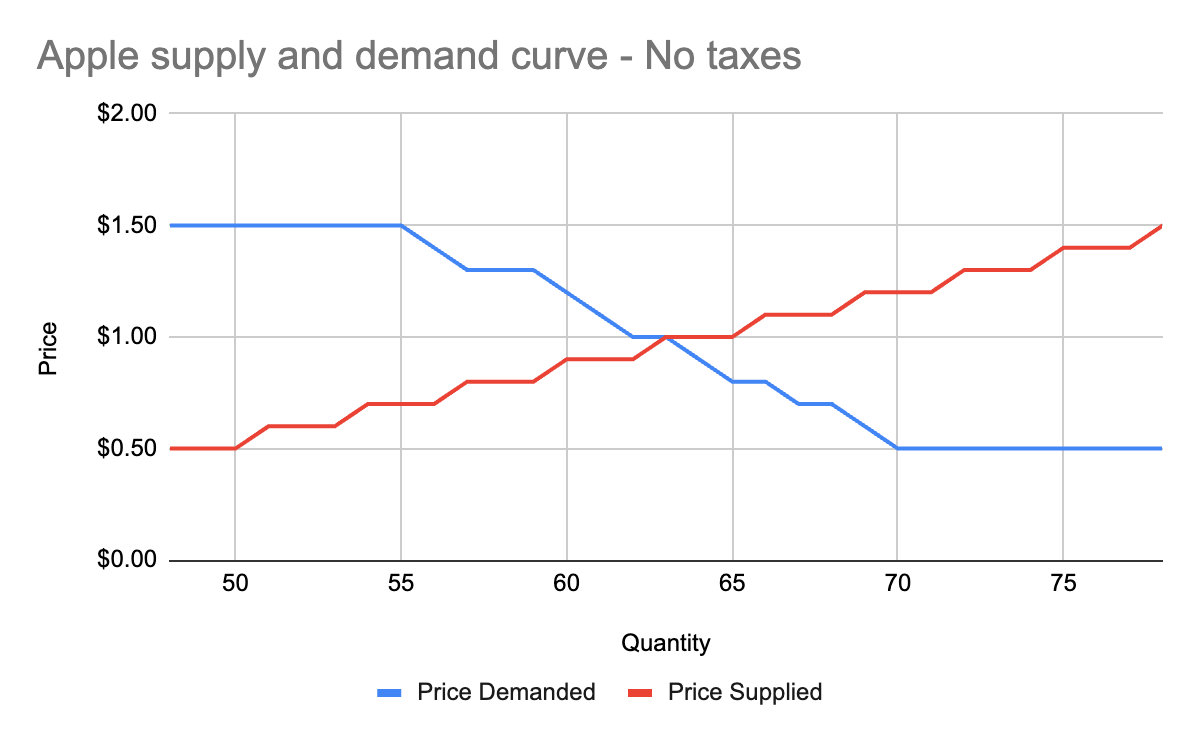

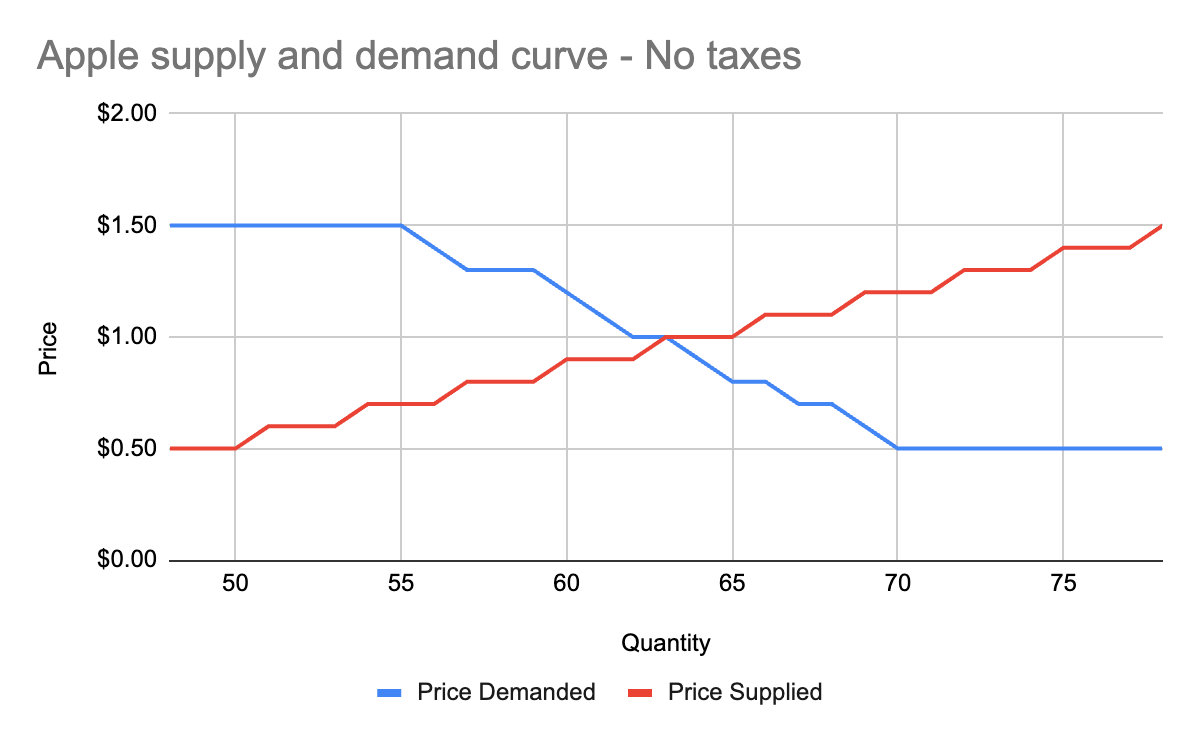

We now know, for every price point, how many apples buyers will purchase, and how many apples sellers will sell. Now we find the equilibrium: where the supply and demand curves meet. This point represents where the marginal benefit a buyer would receive from the next buyer would be less than the cost it would take the next seller to make it. Let’s see it in a chart:

You’ll notice that these two graphs cross at the $1 price point, where 63 apples are both demanded (bought by consumers) and supplied (sold by producers). This is our equilibrium price. We also have a visualization of the *surplus* created by these trades. Everything to the left of the equilibrium point and between the supply and demand curves represents surplus: an area where someone is receiving something of more value than they give. For example:

* When I bought my first apple for $1, but I was willing to spend $5, I made $4 of consumer surplus. The consumer portion of the surplus is everything to the left of the equilibrium point, between the supply and demand curves, and above the equilibrium price point.

* When a seller sells his first apple for $1, but it only cost $0.50 to produce it, the seller made $0.50 of producer surplus. The producer portion of the surplus is everything to the left of the equilibrium point, between the supply and demand curves, and below the equilibrium price point.

Another way of thinking of surplus is “every time someone got a better price than they would have been willing to take.”

OK, with this in place, we now have enough information to figure out how to price in the tariff, which we’ll treat as a negative externality.

## Modeling taxes

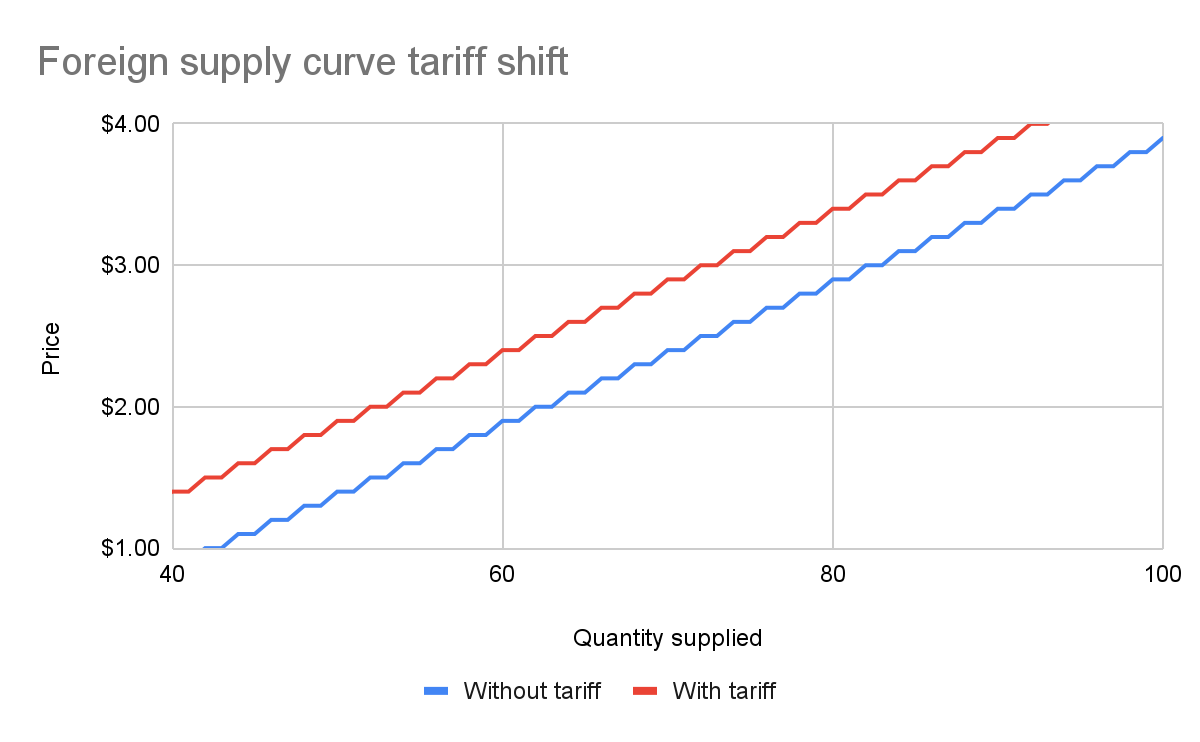

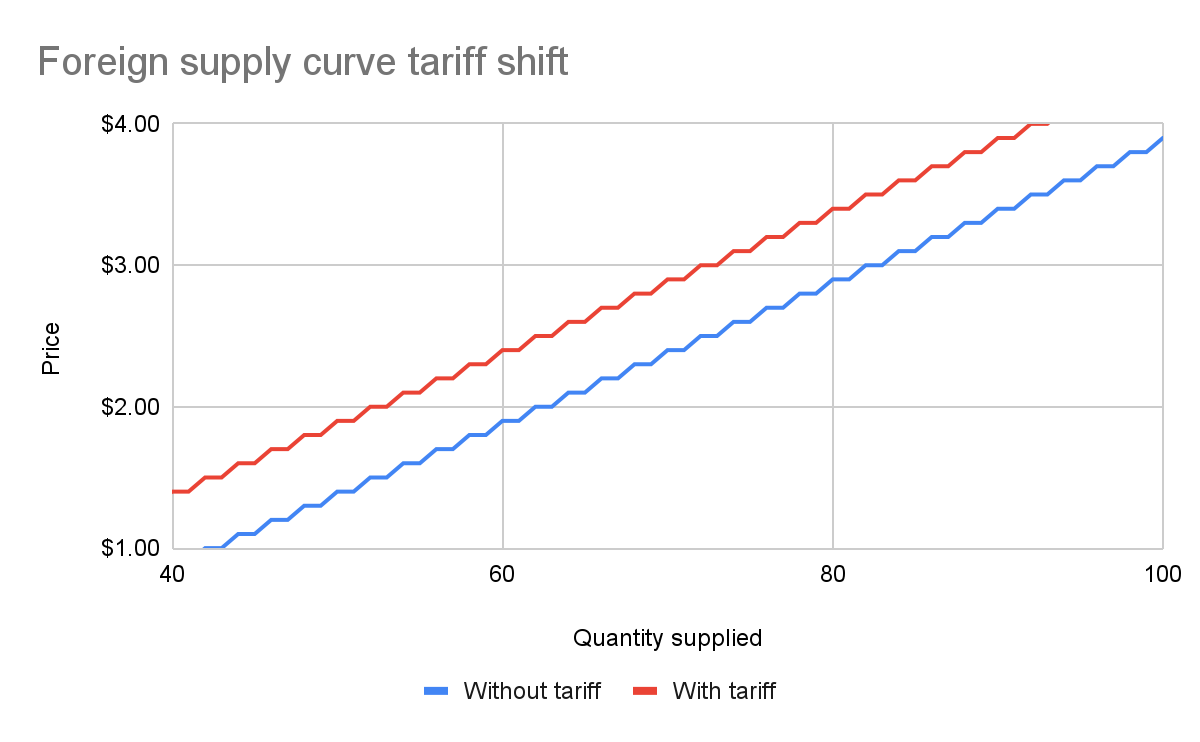

Alright, the government has now instituted a $0.50 tariff on every apple sold within the US by a foreign producer. We can generally model taxes by either increasing the marginal cost of each unit sold (shifting the supply curve up), or by decreasing the marginal benefit of each unit bought (shifting the demand curve down). In this case, since only some of the producers will pay the tax, it makes more sense to modify the supply curve.

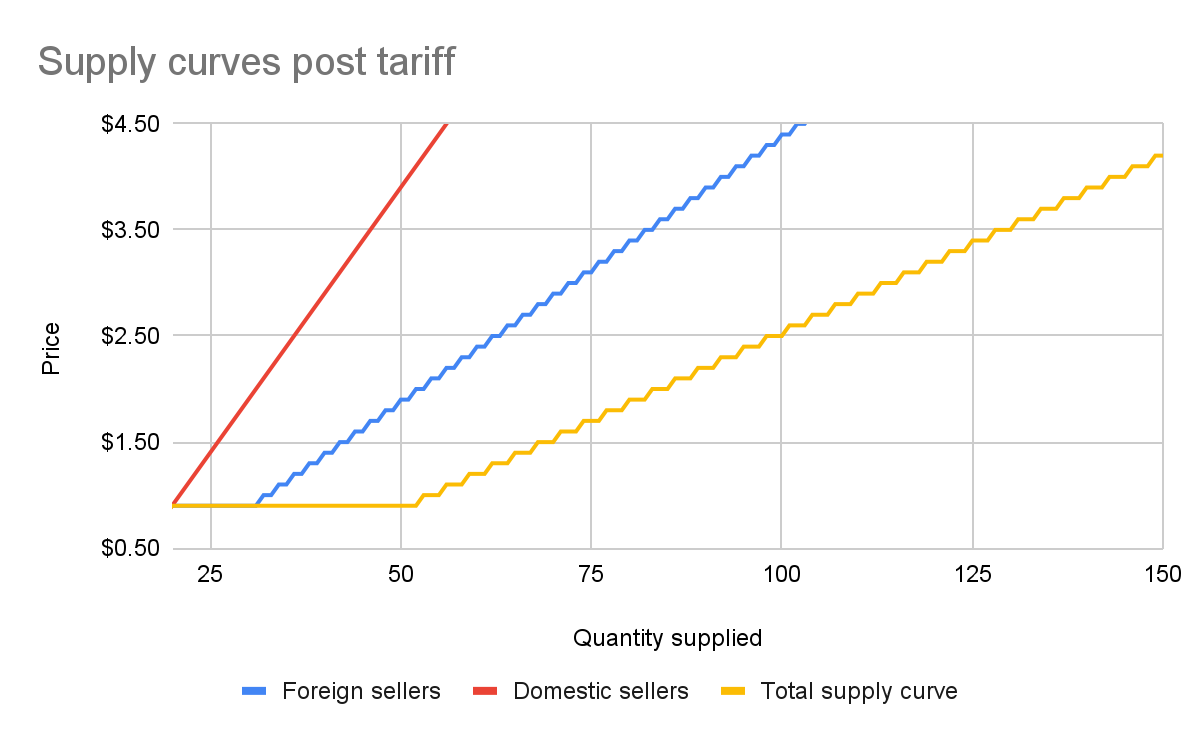

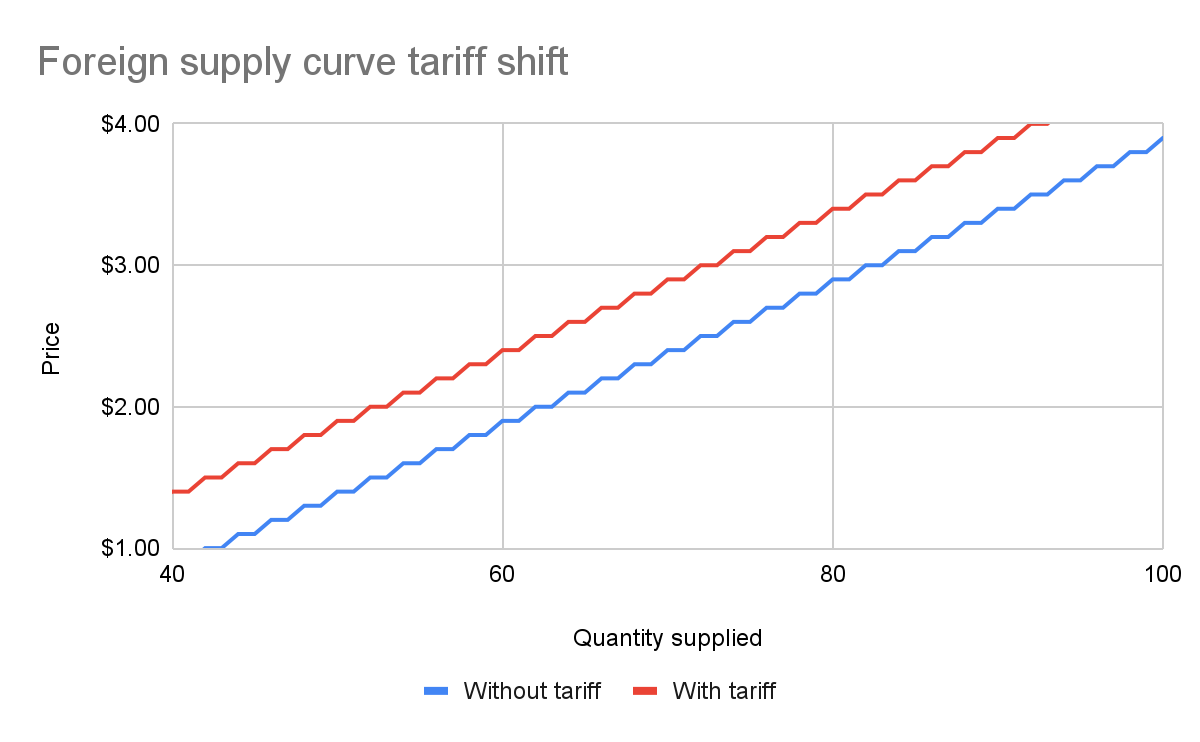

First, let’s see what happens to the foreign seller-only supply curve when you add in the tariff:

With the tariff in place, for each quantity level, the price at which the seller will sell is $0.50 higher than before the tariff. That makes sense: if I was previously willing to sell my 82nd apple for $3, I would now need to charge $3.50 for that apple to cover the cost of the tariff. We see this as the tariff “pushing up” or “pushing left” the original supply curve.

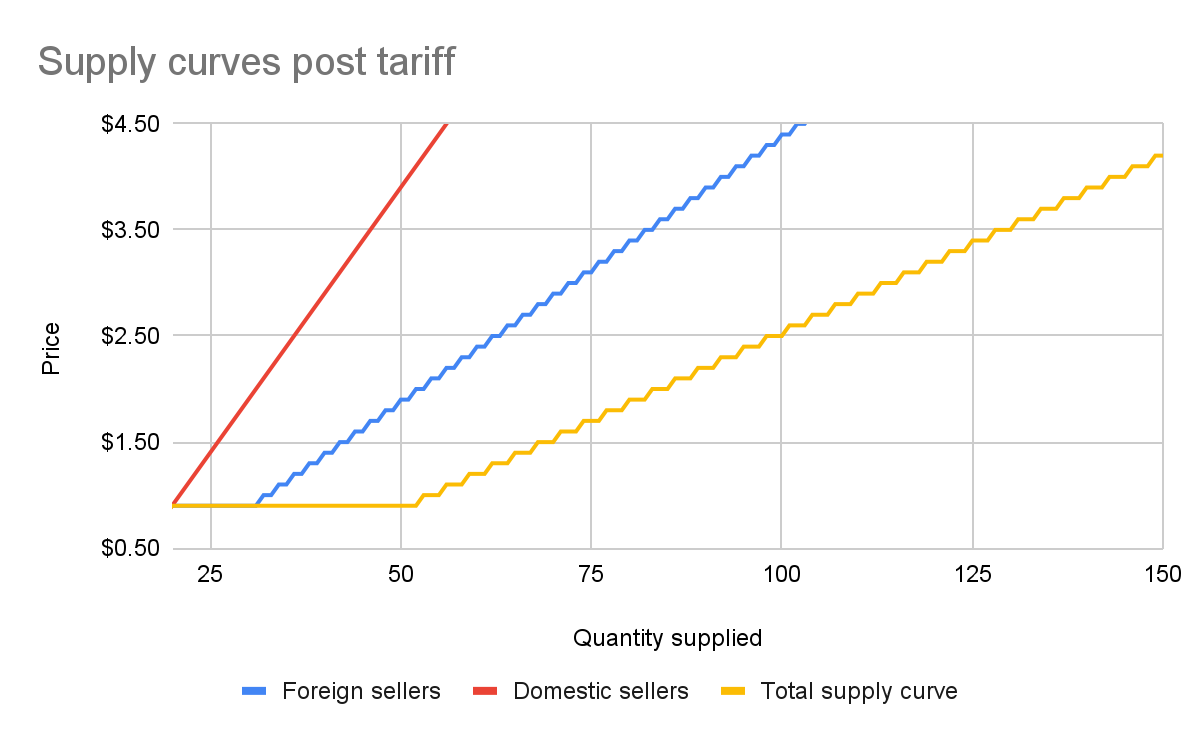

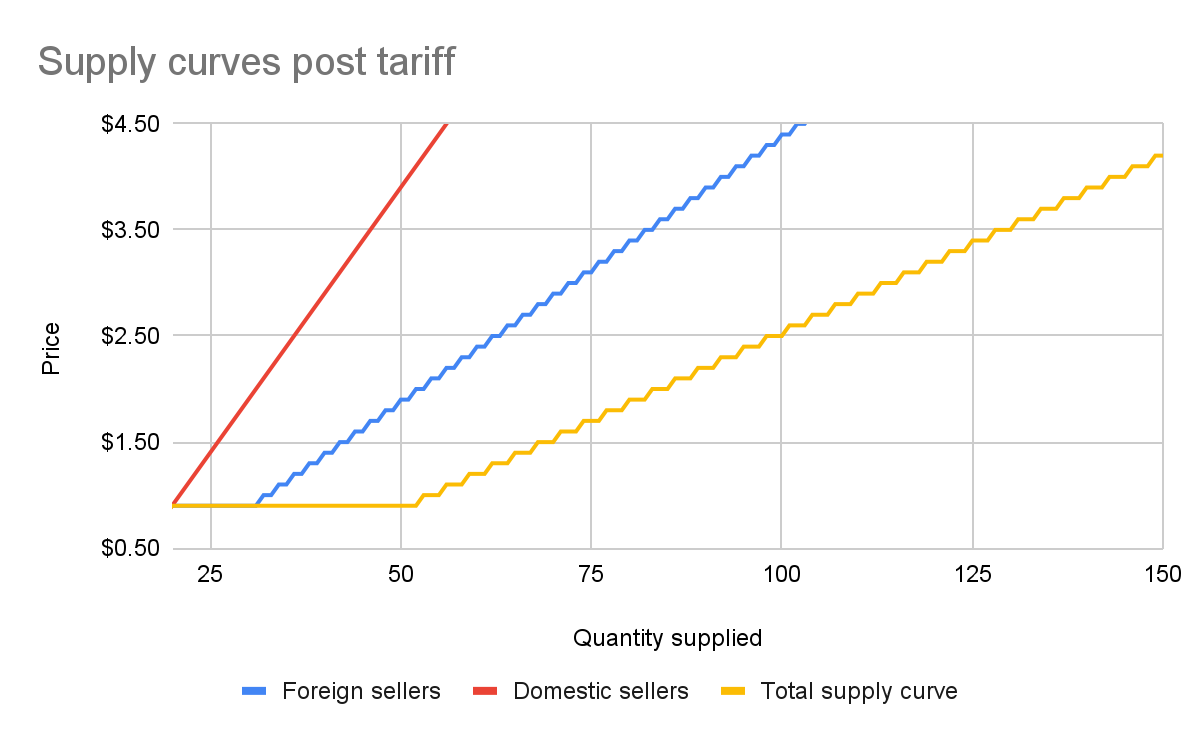

We can add this new supply curve to our existing (unchanged) supply curve for domestic-only sellers, and we end up with a result like this:

The total supply curve adds up the individual foreign and domestic supply curves. At each price point, we add up the total quantity each group would be willing to sell to determine the total quantity supplied for each price point. Once we have that cumulative supply curve defined, we can produce an updated supply-and-demand chart including the tariff:

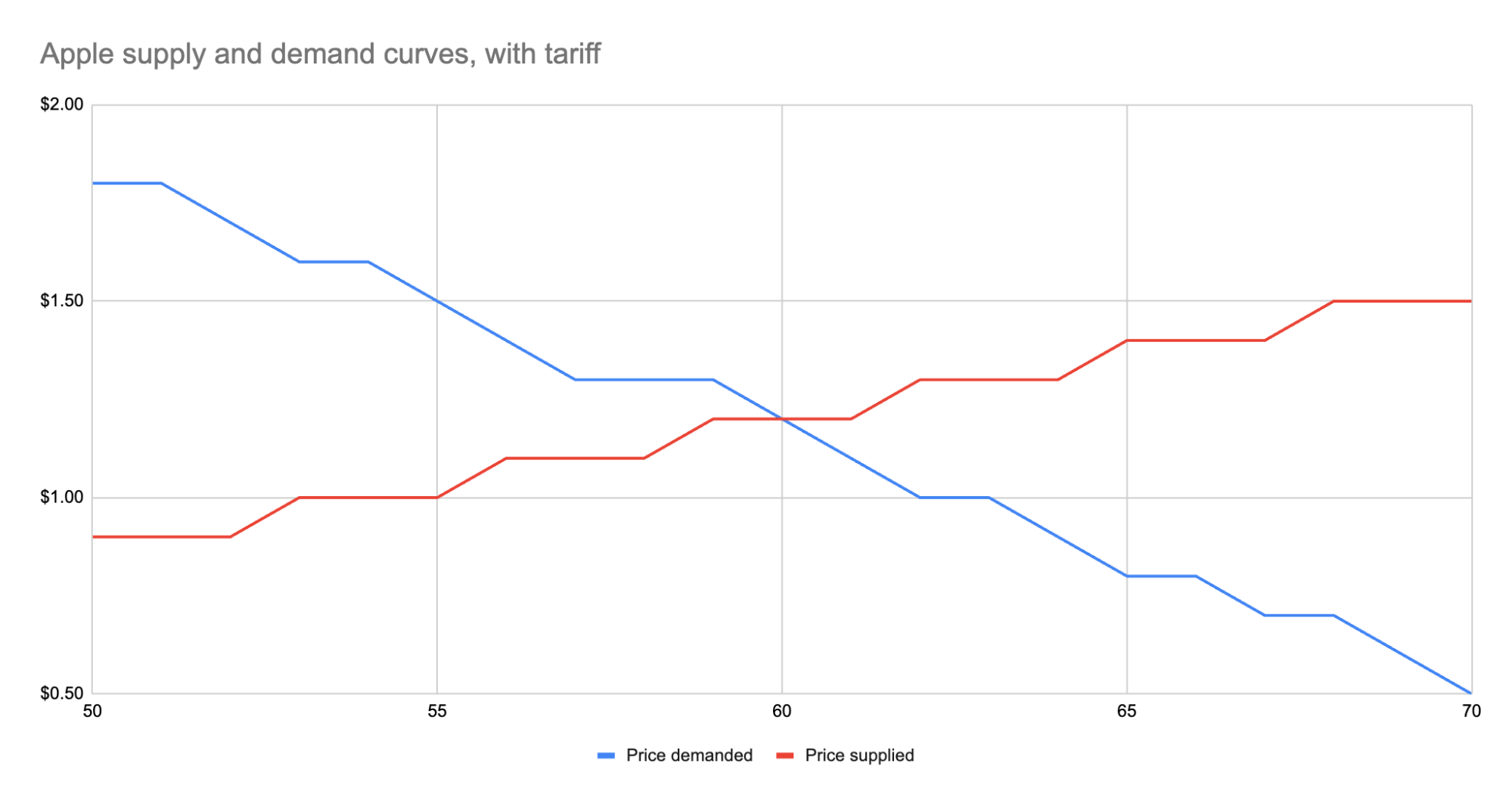

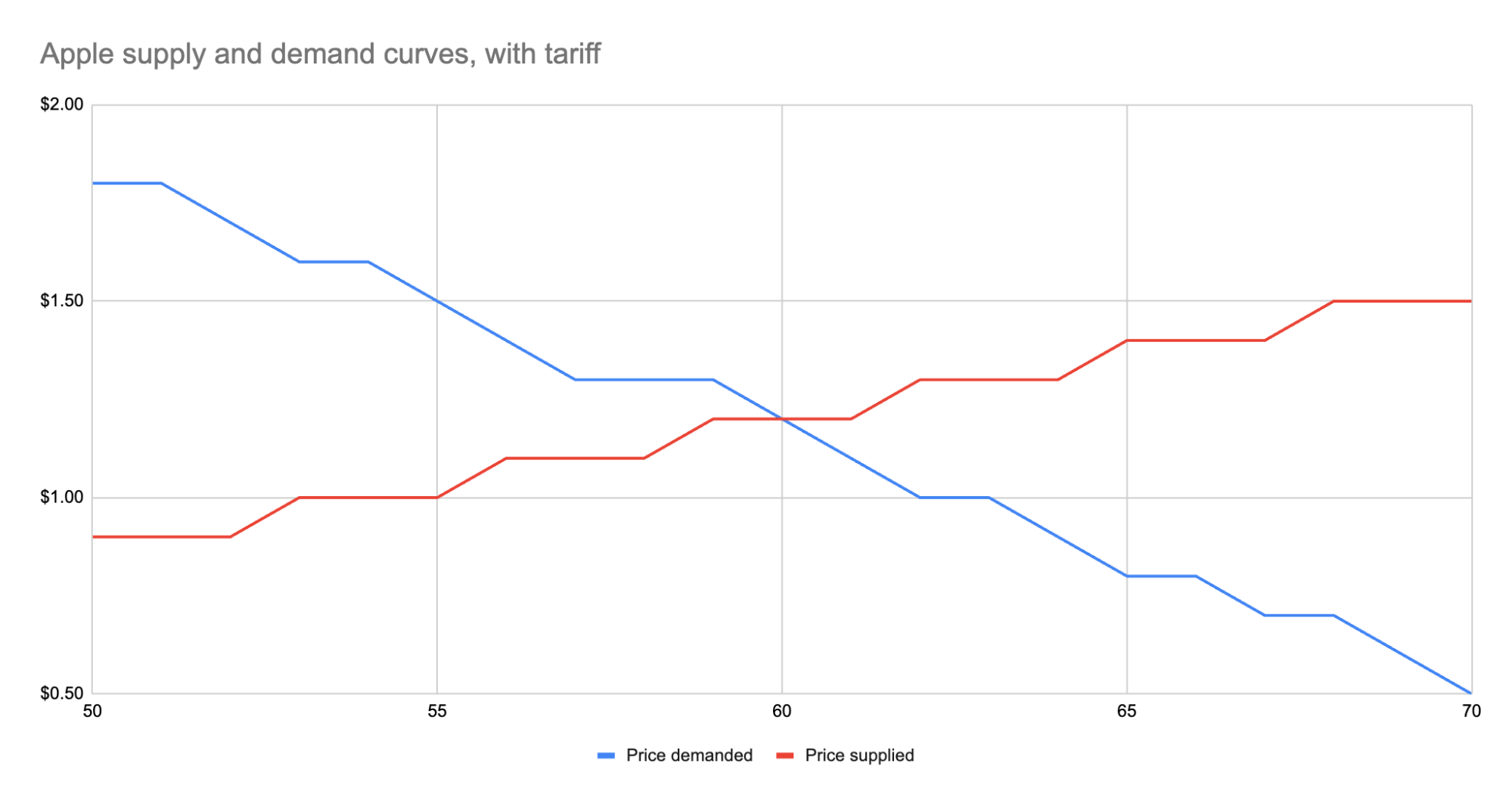

As we can see, the equilibrium has shifted:

* The equilibrium price paid by consumers has risen from $1 to $1.20.

* The total number of apples purchased has dropped from 63 apples to 60 apples.

* Consumers therefore received 3 less apples. They spent $72 for these 60 apples, whereas previously they spent $63 for 3 more apples, a definite decrease in consumer surplus.

* Foreign producers sold 36 of those apples (see the raw data in the linked Google Sheet), for a gross revenue of $43.20. However, they also need to pay the tariff to the US government, which accounts for $18, meaning they only receive $25.20 post-tariff. Previously, they sold 42 apples at $1 each with no tariff to be paid, meaning they took home $42.

* Domestic producers sold the remaining 24 apples at $1.20, giving them a revenue of $28.80. Since they don’t pay the tariff, they take home all of that money. By contrast, previously, they sold 21 apples at $1, for a take-home of $21.

* The government receives $0.50 for each of the 60 apples sold, or in other words receives $30 in revenue it wouldn’t have received otherwise.

We could be more specific about the surpluses, and calculate the actual areas for consumer surplus, producer surplus, inefficiency from the tariff, and government revenue from the tariff. But I won’t bother, as those calculations get slightly more involved. Instead, let’s just look at the aggregate outcomes:

* Consumers were unquestionably hurt. Their price paid went up by $0.20 per apple, and received less apples.

* Foreign producers were also hurt. Their price received went down from the original $1 to the new post-tariff price of $1.20, minus the $0.50 tariff. In other words: foreign producers only receive $0.70 per apple now. This hurt can be mitigated by shifting sales to other countries without a tariff, but the pain will exist regardless.

* Domestic producers scored. They can sell less apples and make more revenue doing it.

* And the government walked away with an extra $30.

Hopefully you now see the answer to the original questions. Importantly, while the government imposed a $0.50 tariff, neither side fully absorbed that cost. Consumers paid a bit more, foreign producers received a bit less. The exact details of how that tariff was split across the groups is mediated by the relevant supply and demand curves of each group. If you want to learn more about this, the relevant search term is “price elasticity,” or how much a group’s quantity supplied or demanded will change based on changes in the price.

## Other taxes

Most taxes are some kind of a tax on trade. Tariffs on apples is an obvious one. But the same applies to income tax (taxing the worker for the trade of labor for money) or payroll tax (same thing, just taxing the employer instead). Interestingly, you can use the same model for analyzing things like tax incentives. For example, if the government decided to subsidize domestic apple production by giving the domestic producers a $0.50 bonus for each apple they sell, we would end up with a similar kind of analysis, except instead of the foreign supply curve shifting up, we’d see the domestic supply curve shifting down.

And generally speaking, this is what you’ll *always* see with government involvement in the economy. It will result in disrupting an existing equilibrium, letting the market readjust to a new equilibrium, and incentivization of some behavior, causing some people to benefit and others to lose out. We saw with the apple tariff, domestic producers and the government benefited while others lost.

You can see the reverse though with tax incentives. If I give a tax incentive of providing a deduction (not paying income tax) for preschool, we would end up with:

* Government needs to make up the difference in tax revenue, either by raising taxes on others or printing more money (leading to inflation). Either way, those paying the tax or those holding government debased currency will pay a price.

* Those people who don’t use the preschool deduction will receive no benefit, so they simply pay a cost.

* Those who do use the preschool deduction will end up paying less on tax+preschool than they would have otherwise.

This analysis is fully amoral. It’s not saying whether providing subsidized preschool is a good thing or not, it simply tells you where the costs will be felt, and points out that such government interference in free economic choice does result in inefficiencies in the system. Once you have that knowledge, you’re more well educated on making a decision about whether the costs of government intervention are worth the benefits.

-

@ cc8d072e:a6a026cb

2025-01-30 17:20:24

Recently, I had the opportunity to work as an advisor for an AI agent project, which is created by team with a lot of fin-tech software develop experience. As we coded together, their real-time questions and challenges provided unique insights into the hurdles software engineers face when transitioning to AI development. They would pause at moments that most AI engineers take for granted - "How can we be sure the agent understood correctly?", "What if the model makes a mistake?", "How do we handle the uncertainty?" These weren't just isolated questions; they represented the fundamental paradigm shift required when moving from traditional software engineering to AI development. And thats why i think it might be worthy to take sometime write down this article and if you are going to start your first AI agent programming, spending 5 min reading t his will save you a lot of time later.

### 1. Shifting from Deterministic to Probabilistic Thinking

- Traditional software engineering deals with deterministic outcomes

- AI systems operate on probability rather than certainty

- Engineers need to adapt from "100% correct" mindset to accepting probabilistic outcomes

- Blockchain developers may find this particularly challenging due to their background in exact, deterministic systems

### 2. Understanding Core AI Concepts

(There are a lot of concepts to understand, but i will focus on the most frequently asked ones)

#### Memory Management

- **Short-term Memory**: Implemented through conversation context

- **Long-term Memory**: Implemented through vector databases (RAG - Retrieval Augmented Generation)

- Context length management is crucial due to LLM token limitations

#### Language Models and Fine-tuning

- Base models (like GPT) provide general intelligence

- Domain-specific knowledge can be added through:

- Fine-tuning with custom datasets

- Adding RAG layers for specific knowledge domains

### 3. Technical Framework Knowledge

#### Essential Tools and Frameworks

- Vercel AI SDK (if you are a typescript guy)

- LangChain (alternative option)

- Different models(openai, claude, gemini, etc, of course, now, deepseek. the temu in llm )

- Understanding of prompt engineering

#### Multi-Agent Systems

- Agents can communicate through natural language

- Inter-agent communication requires careful system design

- Implementation of thought processes and decision-making loops

- Safety considerations for system commands and operations

### 4. Language and Localization Considerations

- System prompts typically work best in English

- Multi-language support requires careful handling:

- Input translation to English

- Processing in English

- Output translation to target language

- Model performance varies across different languages

### 5. Safety and Error Handling

- Implementing validation layers for critical operations

- Understanding model limitations and potential errors

- Building feedback mechanisms to detect misunderstandings

## Conclusion

Transitioning from software engineering to AI engineering requires a significant mindset shift. While traditional software engineering skills remain valuable, understanding probabilistic systems, language models, and AI-specific architectures is crucial. The key is to balance innovation with practical safety considerations, especially when dealing with critical applications.

Remember that AI systems are not perfect, and building robust applications requires careful consideration of their limitations and appropriate safety measures. Start with existing frameworks and gradually build up complexity as you become more comfortable with AI-specific concepts and challenges.(the conclusion part is written by chatgpt, did you notice? :))

-

@ 97c70a44:ad98e322

2025-01-30 17:15:37

There was a slight dust up recently over a website someone runs removing a listing for an app someone built based on entirely arbitrary criteria. I'm not to going to attempt to speak for either wounded party, but I would like to share my own personal definition for what constitutes a "nostr app" in an effort to help clarify what might be an otherwise confusing and opaque purity test.

In this post, I will be committing the "no true Scotsman" fallacy, in which I start with the most liberal definition I can come up with, and gradually refine it until all that is left is the purest, gleamingest, most imaginary and unattainable nostr app imaginable. As I write this, I wonder if anything built yet will actually qualify. In any case, here we go.

# It uses nostr

The lowest bar for what a "nostr app" might be is an app ("application" - i.e. software, not necessarily a native app of any kind) that has some nostr-specific code in it, but which doesn't take any advantage of what makes nostr distinctive as a protocol.

Examples might include a scraper of some kind which fulfills its charter by fetching data from relays (regardless of whether it validates or retains signatures). Another might be a regular web 2.0 app which provides an option to "log in with nostr" by requesting and storing the user's public key.

In either case, the fact that nostr is involved is entirely neutral. A scraper can scrape html, pdfs, jsonl, whatever data source - nostr relays are just another target. Likewise, a user's key in this scenario is treated merely as an opaque identifier, with no appreciation for the super powers it brings along.

In most cases, this kind of app only exists as a marketing ploy, or less cynically, because it wants to get in on the hype of being a "nostr app", without the developer quite understanding what that means, or having the budget to execute properly on the claim.

# It leverages nostr

Some of you might be wondering, "isn't 'leverage' a synonym for 'use'?" And you would be right, but for one connotative difference. It's possible to "use" something improperly, but by definition leverage gives you a mechanical advantage that you wouldn't otherwise have. This is the second category of "nostr app".

This kind of app gets some benefit out of the nostr protocol and network, but in an entirely selfish fashion. The intention of this kind of app is not to augment the nostr network, but to augment its own UX by borrowing some nifty thing from the protocol without really contributing anything back.

Some examples might include:

- Using nostr signers to encrypt or sign data, and then store that data on a proprietary server.

- Using nostr relays as a kind of low-code backend, but using proprietary event payloads.

- Using nostr event kinds to represent data (why), but not leveraging the trustlessness that buys you.

An application in this category might even communicate to its users via nostr DMs - but this doesn't make it a "nostr app" any more than a website that emails you hot deals on herbal supplements is an "email app". These apps are purely parasitic on the nostr ecosystem.

In the long-term, that's not necessarily a bad thing. Email's ubiquity is self-reinforcing. But in the short term, this kind of "nostr app" can actually do damage to nostr's reputation by over-promising and under-delivering.

# It complements nostr

Next up, we have apps that get some benefit out of nostr as above, but give back by providing a unique value proposition to nostr users as nostr users. This is a bit of a fine distinction, but for me this category is for apps which focus on solving problems that nostr isn't good at solving, leaving the nostr integration in a secondary or supporting role.

One example of this kind of app was Mutiny (RIP), which not only allowed users to sign in with nostr, but also pulled those users' social graphs so that users could send money to people they knew and trusted. Mutiny was doing a great job of leveraging nostr, as well as providing value to users with nostr identities - but it was still primarily a bitcoin wallet, not a "nostr app" in the purest sense.

Other examples are things like Nostr Nests and Zap.stream, whose core value proposition is streaming video or audio content. Both make great use of nostr identities, data formats, and relays, but they're primarily streaming apps. A good litmus test for things like this is: if you got rid of nostr, would it be the same product (even if inferior in certain ways)?

A similar category is infrastructure providers that benefit nostr by their existence (and may in fact be targeted explicitly at nostr users), but do things in a centralized, old-web way; for example: media hosts, DNS registrars, hosting providers, and CDNs.

To be clear here, I'm not casting aspersions (I don't even know what those are, or where to buy them). All the apps mentioned above use nostr to great effect, and are a real benefit to nostr users. But they are not True Scotsmen.

# It embodies nostr

Ok, here we go. This is the crème de la crème, the top du top, the meilleur du meilleur, the bee's knees. The purest, holiest, most chaste category of nostr app out there. The apps which are, indeed, nostr indigitate.

This category of nostr app (see, no quotes this time) can be defined by the converse of the previous category. If nostr was removed from this type of application, would it be impossible to create the same product?

To tease this apart a bit, apps that leverage the technical aspects of nostr are dependent on nostr the *protocol*, while apps that benefit nostr exclusively via network effect are integrated into nostr the *network*. An app that does both things is working in symbiosis with nostr as a whole.

An app that embraces both nostr's protocol and its network becomes an organic extension of every other nostr app out there, multiplying both its competitive moat and its contribution to the ecosystem:

- In contrast to apps that only borrow from nostr on the technical level but continue to operate in their own silos, an application integrated into the nostr network comes pre-packaged with existing users, and is able to provide more value to those users because of other nostr products. On nostr, it's a good thing to advertise your competitors.

- In contrast to apps that only market themselves to nostr users without building out a deep integration on the protocol level, a deeply integrated app becomes an asset to every other nostr app by becoming an organic extension of them through interoperability. This results in increased traffic to the app as other developers and users refer people to it instead of solving their problem on their own. This is the "micro-apps" utopia we've all been waiting for.

Credible exit doesn't matter if there aren't alternative services. Interoperability is pointless if other applications don't offer something your app doesn't. Marketing to nostr users doesn't matter if you don't augment their agency _as nostr users_.

If I had to choose a single NIP that represents the mindset behind this kind of app, it would be NIP 89 A.K.A. "Recommended Application Handlers", which states:

> Nostr's discoverability and transparent event interaction is one of its most interesting/novel mechanics. This NIP provides a simple way for clients to discover applications that handle events of a specific kind to ensure smooth cross-client and cross-kind interactions.

These handlers are the glue that holds nostr apps together. A single event, signed by the developer of an application (or by the application's own account) tells anyone who wants to know 1. what event kinds the app supports, 2. how to link to the app (if it's a client), and (if the pubkey also publishes a kind 10002), 3. which relays the app prefers.

_As a sidenote, NIP 89 is currently focused more on clients, leaving DVMs, relays, signers, etc somewhat out in the cold. Updating 89 to include tailored listings for each kind of supporting app would be a huge improvement to the protocol. This, plus a good front end for navigating these listings (sorry nostrapp.link, close but no cigar) would obviate the evil centralized websites that curate apps based on arbitrary criteria._

Examples of this kind of app obviously include many kind 1 clients, as well as clients that attempt to bring the benefits of the nostr protocol and network to new use cases - whether long form content, video, image posts, music, emojis, recipes, project management, or any other "content type".

To drill down into one example, let's think for a moment about forms. What's so great about a forms app that is built on nostr? Well,

- There is a [spec](https://github.com/nostr-protocol/nips/pull/1190) for forms and responses, which means that...

- Multiple clients can implement the same data format, allowing for credible exit and user choice, even of...

- Other products not focused on forms, which can still view, respond to, or embed forms, and which can send their users via NIP 89 to a client that does...

- Cryptographically sign forms and responses, which means they are self-authenticating and can be sent to...

- Multiple relays, which reduces the amount of trust necessary to be confident results haven't been deliberately "lost".

Show me a forms product that does all of those things, and isn't built on nostr. You can't, because it doesn't exist. Meanwhile, there are plenty of image hosts with APIs, streaming services, and bitcoin wallets which have basically the same levels of censorship resistance, interoperability, and network effect as if they weren't built on nostr.

# It supports nostr

Notice I haven't said anything about whether relays, signers, blossom servers, software libraries, DVMs, and the accumulated addenda of the nostr ecosystem are nostr apps. Well, they are (usually).

This is the category of nostr app that gets none of the credit for doing all of the work. There's no question that they qualify as beautiful nostrcorns, because their value propositions are entirely meaningless outside of the context of nostr. Who needs a signer if you don't have a cryptographic identity you need to protect? DVMs are literally impossible to use without relays. How are you going to find the blossom server that will serve a given hash if you don't know which servers the publishing user has selected to store their content?

In addition to being entirely contextualized by nostr architecture, this type of nostr app is valuable because it does things "the nostr way". By that I mean that they don't simply try to replicate existing internet functionality into a nostr context; instead, they create entirely new ways of putting the basic building blocks of the internet back together.

A great example of this is how Nostr Connect, Nostr Wallet Connect, and DVMs all use relays as brokers, which allows service providers to avoid having to accept incoming network connections. This opens up really interesting possibilities all on its own.

So while I might hesitate to call many of these things "apps", they are certainly "nostr".

# Appendix: it smells like a NINO

So, let's say you've created an app, but when you show it to people they politely smile, nod, and call it a NINO (Nostr In Name Only). What's a hacker to do? Well, here's your handy-dandy guide on how to wash that NINO stench off and Become a Nostr.

You app might be a NINO if:

- There's no NIP for your data format (or you're abusing NIP 78, 32, etc by inventing a sub-protocol inside an existing event kind)

- There's a NIP, but no one knows about it because it's in a text file on your hard drive (or buried in your project's repository)

- Your NIP imposes an incompatible/centralized/legacy web paradigm onto nostr

- Your NIP relies on trusted third (or first) parties

- There's only one implementation of your NIP (yours)

- Your core value proposition doesn't depend on relays, events, or nostr identities

- One or more relay urls are hard-coded into the source code

- Your app depends on a specific relay implementation to work (*ahem*, relay29)

- You don't validate event signatures

- You don't publish events to relays you don't control

- You don't read events from relays you don't control

- You use legacy web services to solve problems, rather than nostr-native solutions

- You use nostr-native solutions, but you've hardcoded their pubkeys or URLs into your app

- You don't use NIP 89 to discover clients and services

- You haven't published a NIP 89 listing for your app

- You don't leverage your users' web of trust for filtering out spam

- You don't respect your users' mute lists

- You try to "own" your users' data

Now let me just re-iterate - it's ok to be a NINO. We need NINOs, because nostr can't (and shouldn't) tackle every problem. You just need to decide whether your app, as a NINO, is actually contributing to the nostr ecosystem, or whether you're just using buzzwords to whitewash a legacy web software product.

If you're in the former camp, great! If you're in the latter, what are you waiting for? Only you can fix your NINO problem. And there are lots of ways to do this, depending on your own unique situation:

- Drop nostr support if it's not doing anyone any good. If you want to build a normal company and make some money, that's perfectly fine.

- Build out your nostr integration - start taking advantage of webs of trust, self-authenticating data, event handlers, etc.

- Work around the problem. Think you need a special relay feature for your app to work? Guess again. Consider encryption, AUTH, DVMs, or better data formats.

- Think your idea is a good one? Talk to other devs or open a PR to the [nips repo](https://github.com/nostr-protocol/nips). No one can adopt your NIP if they don't know about it.

- Keep going. It can sometimes be hard to distinguish a research project from a NINO. New ideas have to be built out before they can be fully appreciated.

- Listen to advice. Nostr developers are friendly and happy to help. If you're not sure why you're getting traction, ask!

I sincerely hope this article is useful for all of you out there in NINO land. Maybe this made you feel better about not passing the totally optional nostr app purity test. Or maybe it gave you some actionable next steps towards making a great NINON (Nostr In Not Only Name) app. In either case, GM and PV.

-

@ 9e69e420:d12360c2

2025-01-30 12:23:04

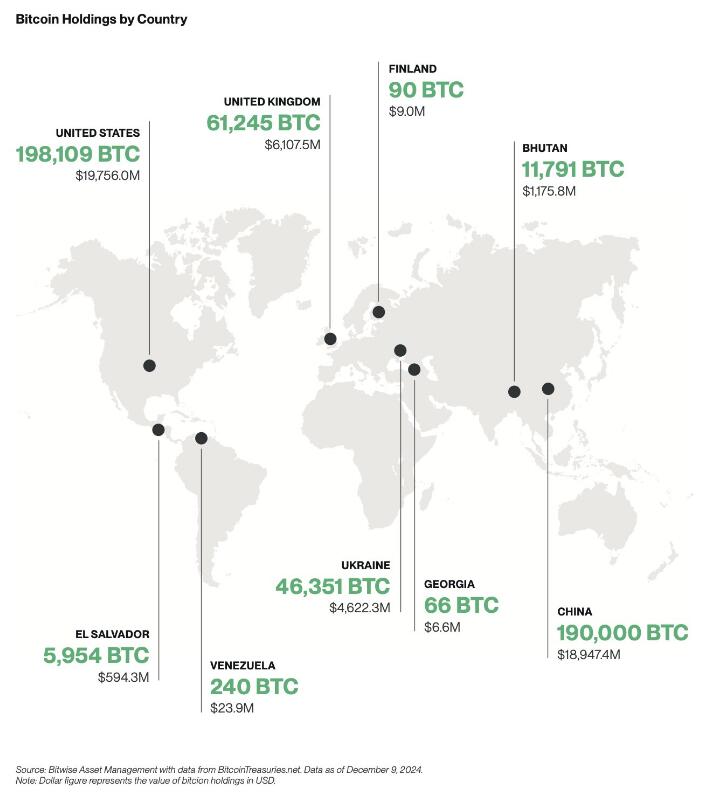

Tech stocks have taken a hit globally after China's DeepSeek launched a competitive AI chatbot at a much lower cost than US counterparts. This has stirred market fears of a $1.2 trillion loss across tech companies when trading opens in New York.

DeepSeek’s chatbot quickly topped download charts and surprised experts with its capabilities, developed for only $5.6 million.

The Nasdaq dropped over 3% in premarket trading, with major firms like Nvidia falling more than 10%. SoftBank also saw losses shortly after investing in a significant US AI venture.

Venture capitalist Marc Andreessen called it “AI’s Sputnik moment,” highlighting its potential impact on the industry.

![] (https://www.telegraph.co.uk/content/dam/business/2025/01/27/TELEMMGLPICT000409807198_17379939060750_trans_NvBQzQNjv4BqgsaO8O78rhmZrDxTlQBjdGLvJF5WfpqnBZShRL_tOZw.jpeg)

-

@ 9e69e420:d12360c2

2025-01-30 12:13:39

Salwan Momika, a Christian Iraqi known for burning the Koran in Sweden, was shot dead during a TikTok livestream in an apartment in Sodertalje. The 38-year-old sparked outrage in the Muslim community for his demonstrations, leading to global condemnation. After being rushed to the hospital, he was pronounced dead.

Authorities arrested five individuals in connection with the incident. Momika's death comes days before a court ruling on his possible incitement of ethnic hatred. The incident highlights the tensions surrounding free speech and religious sentiments, intensifying after his controversial protests in 2023.

[Sauce](https://www.dailymail.co.uk/news/article-14341423/Christian-Iraqi-burnt-Koran-Sweden-shot-dead.html)

-

@ 9e69e420:d12360c2

2025-01-26 15:26:44

Secretary of State Marco Rubio issued new guidance halting spending on most foreign aid grants for 90 days, including military assistance to Ukraine. This immediate order shocked State Department officials and mandates “stop-work orders” on nearly all existing foreign assistance awards.

While it allows exceptions for military financing to Egypt and Israel, as well as emergency food assistance, it restricts aid to key allies like Ukraine, Jordan, and Taiwan. The guidance raises potential liability risks for the government due to unfulfilled contracts.

A report will be prepared within 85 days to recommend which programs to continue or discontinue.

-

@ ec42c765:328c0600

2025-01-26 00:08:54

# カスタム絵文字とは

任意のオリジナル画像を絵文字のように文中に挿入できる機能です。

また、リアクション(Twitterの いいね のような機能)にもカスタム絵文字を使えます。

# カスタム絵文字の対応状況(2024/02/05)

カスタム絵文字を使うためにはカスタム絵文字に対応した[クライアント](https://welcome.nostr-jp.org/tutorial/explore-client.html)を使う必要があります。

※表は一例です。クライアントは他にもたくさんあります。

使っているクライアントが対応していない場合は、クライアントを変更する、対応するまで待つ、開発者に要望を送る(または自分で実装する)などしましょう。

#### 対応クライアント

- [Amethyst](https://play.google.com/store/apps/details?id=com.vitorpamplona.amethyst)

- [FreeFrom](https://freefrom.space/)

- [nostter](https://nostter.app/)

- [Rabbit](https://rabbit.syusui.net/)

- [Snort](https://snort.social/)

- [noStrudel](https://nostrudel.ninja/)

ここではnostterを使って説明していきます。

# 準備

カスタム絵文字を使うための準備です。

- Nostrエクステンション(NIP-07)を導入する

- 使いたいカスタム絵文字をリストに登録する

## Nostrエクステンション(NIP-07)を導入する

Nostrエクステンションは使いたいカスタム絵文字を登録する時に必要になります。

また、環境(パソコン、iPhone、androidなど)によって導入方法が違います。

Nostrエクステンションを導入する端末は、実際にNostrを閲覧する端末と違っても構いません(リスト登録はPC、Nostr閲覧はiPhoneなど)。

Nostrエクステンション(NIP-07)の導入方法は以下のページを参照してください。

[ログイン拡張機能 (NIP-07)を使ってみよう | Welcome to Nostr! ~ Nostrをはじめよう! ~ ](https://welcome.nostr-jp.org/tutorial/nip-07.html)

少し面倒ですが、これを導入しておくとNostr上の様々な場面で役立つのでより快適になります。

## 使いたいカスタム絵文字をリストに登録する

以下のサイトで行います。

[emojito](https://emojito.meme/)

右上の**Get started**からNostrエクステンションでログインしてください。

例として以下のカスタム絵文字を導入してみます。

実際より絵文字が少なく表示されることがありますが、古い状態のデータを取得してしまっているためです。その場合はブラウザの更新ボタンを押してください。

[generalJP | カスタム絵文字](nostr:naddr1qqykwetwv4exzmz22qqs6amnwvaz7tmwdaejumr0dspzpmzzcaj5rzeah8y940ln4z855wa72af4a6aac4zjypql55egcpsqqvzqqqr4fcp4fwv8)

- 右側の**Options**から**Bookmark**を選択

これでカスタム絵文字を使用するためのリストに登録できます。

# カスタム絵文字を使用する

例としてブラウザから使えるクライアント nostter から使用してみます。

[nostter](https://nostter.app/)

nostterにNostrエクステンションでログイン、もしくは秘密鍵を入れてログインしてください。

## 文章中に使用

1. **投稿**ボタンを押して投稿ウィンドウを表示

2. **顔😀**のボタンを押し、絵文字ウィンドウを表示

3. ***タブ**を押し、カスタム絵文字一覧を表示

4. カスタム絵文字を選択

5. : 記号に挟まれたアルファベットのショートコードとして挿入される

この状態で投稿するとカスタム絵文字として表示されます。

カスタム絵文字対応クライアントを使っている他ユーザーにもカスタム絵文字として表示されます。

対応していないクライアントの場合、ショートコードのまま表示されます。

ショートコードを直接入力することでカスタム絵文字の候補が表示されるのでそこから選択することもできます。

## リアクションに使用

1. 任意の投稿の**顔😀**のボタンを押し、絵文字ウィンドウを表示

2. ***タブ**を押し、カスタム絵文字一覧を表示

3. カスタム絵文字を選択

カスタム絵文字リアクションを送ることができます。

# カスタム絵文字を探す

先述した[emojito](https://emojito.meme/)からカスタム絵文字を探せます。

例えば任意のユーザーのページ [emojito ロクヨウ](nostr:npub1a3pvwe2p3v7mnjz6hle63r628wl9w567aw7u23fzqs062v5vqcqqu3sgh3) から探したり、 [emojito Browse all](https://emojito.meme/browse) からnostr全体で最近作成、更新された絵文字を見たりできます。

また、以下のリンクは日本語圏ユーザーが作ったカスタム絵文字を集めたリストです(2024/06/30)

※漏れがあるかもしれません

[日本ユーザー作 カスタム絵文字](nostr:npub17hczqvxtfv3w69wr6lxrttnpdekwdwel55mld60fr24zwjuu6utqtj8mjx)

各絵文字セットにある**Open in emojito**のリンクからemojitoに飛び、使用リストに追加できます。

-----------

以上です。

次:Nostrのカスタム絵文字の**作り方**

Yakihonneリンク [Nostrのカスタム絵文字の作り方](https://yakihonne.com/article/_@lokuyow.github.io/1707912490439)

Nostrリンク nostr:naddr1qqxnzdesxuunzv358ycrgveeqgswcsk8v4qck0deepdtluag3a9rh0jh2d0wh0w9g53qg8a9x2xqvqqrqsqqqa28r5psx3

-----------

# 仕様

[NIP-30 Custom Emoji](https://github.com/nostr-protocol/nips/blob/master/30.md)

[NIP-30 カスタム絵文字(和訳)](https://github.com/nostr-jp/nips-ja/blob/main/30.md)

-

@ 9e69e420:d12360c2

2025-01-25 14:32:21

| Parameters | Dry Mead | Medium Mead | Sweet Mead |

|------------|-----------|-------------|------------|

| Honey | 2 lbs (900 grams) | 3 lbs (1.36 kg) | 4 lbs (1.81 kg) |

| Yeast | ~0.07 oz (2 grams) | ~0.08 oz (2.5 grams) | ~0.10 oz (3 grams) |

| Fermentation | ~4 weeks | 4 to 6 weeks | 6 to 8 weeks |

| Racking | Fortnight or later | 1 month or after | ~2 months and after |

| Specific Gravity | <1.010 | ~1.01 to ~1.025 | >1.025 |

-

@ 434f9799:2d548c15

2025-01-23 23:15:34

**如果你在乎你网上的内容, 请为它们附上版权声明. 如果你在共享你的内容, 请表明你的意图. 否则不要抱怨别人为何不按你的意愿使用, 因为你从没有表明过它.**

同样身为创作者, 但还没有能自诩 "艺术家" 的程度, 从自己生产内容然后公开的开始就是希望被別人看到自己的作品, 并且要让别人知道「这是我创造的东西」, 然后才会有原创, 抄袭和借鉴的争论.

我是从最开始也是从 UGC 平台上逐渐转移到拥有自己 "平台" (从博客开始) 的人, 当时只为了追求所谓「自由」, 自己想写什么就写什么, 这是我的博客凭什么你来指指点点? 然后逐渐意识到当自己的身份从创作者用户过渡到创作者平台, 必须要考虑的事情就会变多, 这也是权利和义务的无条件对等结果, 我自己一个人就要成为平台. 到这时, 能对我指指点点人只会变得更多, 体量只会更大, 范围也会扩大到全世界, 因为这是互联网. 那么生活在在 UGC 平台的人难道就没有这个烦恼吗? 不是的, 只不过是平台已经帮我做了决定, 因为我必须同意他们的使用政策和隐私协议我才能使用, 包括其中顺带同意的版权声明.

作为小到自己都不想称之为一个 "平台" 的独立博客, 也要用自己身为平台应该要做的事情, 我的博客用户是谁? 是所有能够访问到我的博客的人, 机器人甚至伪装为人的机器人.

---

所以我需要:

- 如果我用了 Google Analytics 而我如果要面向的用户当地存在个人数据法, 那就要加上一个 cookie 知情确认通知.

- 如果有机器人来我的博客, 而我不想让它们进来, 那我应该声明 robots.txt.

- 如果我的用户, 我的读者希望能够轻松自如地帮我分享内容而不用时时刻刻都向我发消息确认转发请求, 那么我应该声明版权许可, 那至少也是 CC-BY 的等级.

- 如果我不希望我的内容在沒有许可的情况下被复制, 被重新演绎, 被用作商业用途盈利; 要么实行事后责任制, 请一个版权律师和版权机器人帮我给这些讨厌的东西发律师函, 发给对方的 ASN 管理员, DNS 解析服务器管理员, 域名管理局或者其他所有为它提供基础设施服务的服务商, 期盼他们能够遵守「自己的」法律.

- 如果我不希望某些用户访问我的博客, 我需要使用 WAF 屏蔽他们.

但可惜, 这互联网上最著名的版权法案 DMCA 也存在 "合理使用" 裁定, 各国各地对互联网著作权的处理也不尽相同, 如此大费周章并不能就让所有我想要不能使用我内容的人放弃使用我的内容. 那么真的没有办法了?

没有问题, 还可以同时实行事前责任制, 因为我还有 DRM, 也就是数字版权管理. 我能自己购买, 租用甚至自己开发一套版权管理系统, 只有在我的平台上才能看到我的内容, 别人想要复制我的内容会变得无比艰难, 但也只止步于 "无比艰难" 而已.

我作为平台, 需要这么努力吗? 或者说有必要这么麻烦吗? 手段的升级只会消耗更多的时间和金钱, 我只是一个小小的独立博客, 我只能用上 CC 和 robots.txt, 最多给内容加点水印. 我只是想保护我的内容而已, OpenAI 一众很可能已经在不知不觉中掠夺过我的东西了, 治不了大公司还治不了你吗?!

恭喜你, 你已经拥有成为一个平台的觉悟了.

## 说点实际的

我能在此如此大放厥词完全因为我实际拥有这个博客, 不用担心我会因为一两句话就破坏某些平台的狗屁 "社区守则" 乃至它们左右摇摆的政治立场, 没有别的意思, 这里的「政治」只不过是对于这些平台在社会中所扮演角色的简称.

如果你同意我说的, 那么下面是作为多个「独立平台」管理员**对平台管理员的一些建议**:

1. **如果你愿意为你的内容负责, 请至少为你的独立平台附上版权声明, 哪怕是在页脚加一个 "Copyright © CC-BY" 甚至 "Copyright © All rights reserved".** 当然前提是你的内容全部出自你的手, 或者你的平台有其他用户并且他们同意你的声明.

2. **如果你希望或者不希望被机器人或者某些机器人自动抓取内容, 请为你的独立平台添加 robots.txt.** 所有的机器人都能声称自己是真实的用户代理(User-Agent), 在如今的互联网上, 所有人都默认在没有 robots.txt 声明的情况下机器人可以随意进出你的平台, 尝试获取你的平台内容.

如果你已经是平台内的用户了, 或者你的独立平台需要使用其他平台的内容, **以下对于内容创作者的建议**:

1. **不要尝试使用任何没有版权声明的平台里的实际内容.** 它们比 "保留所有权利" 甚至带有 DRM 的内容更加不确定, 因为它们的创作者不愿意主动表露自己对他人使用自己内容的意图. 除非你愿意到处查找内容创作者或者平台的联系方式, 然后联系上他们请求使用他们的东西. 当然, 直接不使用实际内容就行了, 你可以引用来源乃至完全重新演绎它们, 就像 ChatGPT 一样.

2. **好好阅读平台的版权声明, 使用许可和隐私政策, 大多数时候你的东西是不是你的取决于平台而不是你, 甚至包括你的隐私.** 实际上, 我们处于社会化状态下是被动着去使用某些平台, 要么你说服别人或者强迫别人去使用你想用的平台, 而这又对于追求「人人平等」的现代社会是不可接受的, 除非这种对等关系被打破. 知悉这些条款并且在乎自己内容的创作者能够控制自己可以在这里产生什么东西, 或者是在平台上借助自己的内容和平台达成交易换取自己想要的东西.

## 结语

创作者或者是艺术家的世界对于版权这种事情看起来很在乎, 但实际上没有几个人是亲自去执行的, 大多都是依附于创作平台或者版权公司, 让它们代行自己的权利, 让自己能够专心于创作, 然后拿到自己想要的.

然而在计算机和互联网融合的世界, 构建这个数字世界的 "艺术家" 们早就已经发起了一场颠覆这种局面的政治运动, 名字叫作 "开源", 赋予开源权利的许可叫做 "开源许可", 成就他们理想的叫做 "自由软件", 自由软件基金会和 GPL 许可证由此诞生, 始于 1989 年.

而现实世界的艺术家们呢? 他们创作文学, 绘画, 音乐乃至影片在互联网上获得全世界范围的传播, 但可惜依旧遵守着老一套的规矩, 把自己的作品交给平台, 交给公司管理. 自由软件基金会诞生后的 12 年, 知识共享(Creative Commons, CC)才出现在互联网. 那么在这之前的 12 年间, 互联网上的艺术家们生产的内容难道都是默认公共领域的吗? 我想更多是即使想要保留部分权利但根本没有意识到要声明自己的意图.

而二十多年后的今天, 依旧如此. "书呆子" 程序员无人不知开源, 知道自己的创造的东西需要让别人知道自己的作品能够被如何使用, 即使是 "Copyleft", 是 "All rights reversed" 放弃了全部权利, 也是知道自己一开始就有权利可以对自己的东西这么做.

而那些迷失在意识洪流中的疯狂艺术家们, 对待自己的作品如何被别人使用上还是模棱两可, 暧昧不清. 即使是 CC 和 robots.txt 也都是可有可无地充满艺术感, 他们确实在乎自己的作品, 但是更在乎自己.

> PS: 本文属一时兴起一笔写完, 可能有很多奇怪的地方, 如果需要转载, 请首先遵守本站/账户的版权许可. 欢迎指正和纠错.

## 封面

> Photo by [Aaron Burden](https://unsplash.com/@aaronburden?utm_content=creditCopyText&utm_medium=referral&utm_source=unsplash) on [Unsplash](https://unsplash.com/photos/fountain-pen-on-black-lined-paper-y02jEX_B0O0?utm_content=creditCopyText&utm_medium=referral&utm_source=unsplash)

-

@ 9e69e420:d12360c2

2025-01-23 15:09:56

President Trump has ordered thousands of additional troops to the U.S.-Mexico border as part of an effort to address immigration and security issues. This directive builds on his initial commitment to increase military presence along the border.

Currently, around 2,200 active-duty personnel and approximately 4,500 National Guardsmen are stationed there. The new deployment aims to enhance the capabilities of Joint Task Force-North, allowing troops to assist in operations and provide intelligence support.

Details on specific units remain unclear. The situation is still developing, with updates expected.

[Sauce](https://thepostmillennial.com/breaking-president-trump-orders-thousands-of-troops-to-the-us-border-with-mexico)

-

@ 6be5cc06:5259daf0

2025-01-21 23:17:29

A seguir, veja como instalar e configurar o **Privoxy** no **Pop!_OS**.

---

### **1. Instalar o Tor e o Privoxy**

Abra o terminal e execute:

```bash

sudo apt update

sudo apt install tor privoxy

```

**Explicação:**

- **Tor:** Roteia o tráfego pela rede Tor.

- **Privoxy:** Proxy avançado que intermedia a conexão entre aplicativos e o Tor.

---

### **2. Configurar o Privoxy**

Abra o arquivo de configuração do Privoxy:

```bash

sudo nano /etc/privoxy/config

```

Navegue até a última linha (atalho: **`Ctrl`** + **`/`** depois **`Ctrl`** + **`V`** para navegar diretamente até a última linha) e insira:

```bash

forward-socks5 / 127.0.0.1:9050 .

```

Isso faz com que o **Privoxy** envie todo o tráfego para o **Tor** através da porta **9050**.

Salve (**`CTRL`** + **`O`** e **`Enter`**) e feche (**`CTRL`** + **`X`**) o arquivo.

---

### **3. Iniciar o Tor e o Privoxy**

Agora, inicie e habilite os serviços:

```bash

sudo systemctl start tor

sudo systemctl start privoxy

sudo systemctl enable tor

sudo systemctl enable privoxy

```

**Explicação:**

- **start:** Inicia os serviços.

- **enable:** Faz com que iniciem automaticamente ao ligar o PC.

---

### **4. Configurar o Navegador Firefox**

Para usar a rede **Tor** com o Firefox:

1. Abra o Firefox.

2. Acesse **Configurações** → **Configurar conexão**.

3. Selecione **Configuração manual de proxy**.

4. Configure assim:

- **Proxy HTTP:** `127.0.0.1`

- **Porta:** `8118` (porta padrão do **Privoxy**)

- **Domínio SOCKS (v5):** `127.0.0.1`

- **Porta:** `9050`

5. Marque a opção **"Usar este proxy também em HTTPS"**.

6. Clique em **OK**.

---

### **5. Verificar a Conexão com o Tor**

Abra o navegador e acesse:

```text

https://check.torproject.org/

```

Se aparecer a mensagem **"Congratulations. This browser is configured to use Tor."**, a configuração está correta.

---

### **Dicas Extras**

- **Privoxy** pode ser ajustado para bloquear anúncios e rastreadores.

- Outros aplicativos também podem ser configurados para usar o **Privoxy**.

-

@ 16d11430:61640947

2025-01-21 20:40:22

In a world drowning in Monopoly money, where people celebrate government-mandated inflation as "economic growth," it takes a special kind of clarity—nay, cynicism—to rise above the fiat circus. This is your guide to shedding your fiat f**ks and embracing the serene chaos of sound money, all while laughing at the absurdity of a world gone fiat-mad.

---

1. Don’t Feed the Clowns

You know the clowns I’m talking about: central bankers in their tailored suits and smug smirks, wielding "tools" like interest rates and quantitative easing. Their tools are as real as a magician's wand, conjuring trillions of dollars out of thin air to keep their Ponzi economy afloat.

Rule #1: Don’t engage. If a clown offers you a hot take about the "strength of the dollar," smile, nod, and silently wonder how many cups of coffee their paycheck buys this month. Spoiler: fewer than last month.

---

2. Turn Off the Fiat News

Do you really need another breathless headline about the next trillion-dollar deficit? Or the latest clickbait on why you should care about the stock market's emotional rollercoaster? Mainstream media exists to distract you, to keep you tethered to their illusion of importance.

Turn it off. Replace it with something sound, like the Bitcoin whitepaper. Or Nietzsche. At least Nietzsche knew we were doomed.

---

3. Mock Their Inflationary Gospel

Fiat apologists will tell you that inflation is "necessary" and that 2% a year is a "healthy target." Sure, because a little robbery every year keeps society functioning, right? Ask them this: "If 2% is healthy, why not 20%? Why not 200%? Why not Venezuela?"

Fiat logic is like a bad acid trip: entertaining at first, but it quickly spirals into existential horror.

---

4. Celebrate the Fiat Freakshow

Sometimes, the best way to resist the fiat clown show is to revel in its absurdity. Watch politicians print money like teenagers running up a credit card bill at Hot Topic, then watch the economists applaud it as "stimulus." It’s performance art, really. Andy Warhol could never.

---

5. Build in the Chaos

While the fiat world burns, Bitcoiners build. This is the ultimate "not giving a fiat f**k" move: creating a parallel economy, one satoshi at a time. Run your Lightning node, stack sats, and laugh as the fiat circus consumes itself in a flaming pile of its own debt.

Let them argue about who gets to rearrange the deck chairs on the Titanic. You’re busy designing lifeboats.

---

6. Adopt a Fiat-Free Lifestyle

Fiat-free living means minimizing your entanglement with their clown currency. Buy meat, not ETFs. Trade skills, not IOUs. Tip your barber in Bitcoin and ask if your landlord accepts Lightning. If they say no, chuckle and say, “You’ll learn soon enough.”

Every satoshi spent in the real economy is a slap in the face to the fiat overlords.

---

7. Find the Humor in Collapse

Here’s the thing: the fiat system is unsustainable. You know it, I know it, even the clowns know it. The whole charade is destined to collapse under its own weight. When it does, find solace in the absurdity of it all.

Imagine the central bankers explaining hyperinflation to the public: "Turns out we can't print infinity after all." Pure comedy gold.

---

8. Stay Ruthlessly Optimistic

Despite the doom and gloom, there’s hope. Bitcoin is hope. It’s the lifeboat for humanity, the cheat code to escape the fiat matrix. Cynicism doesn’t mean nihilism; it means seeing the rot for what it is and choosing to build something better.

So, don’t just reject the fiat clown show—replace it. Create a world where money is sound, transactions are sovereign, and wealth is measured in energy, not debt.

---

Final Thought: Burn the Tent Down

Aldous Huxley once envisioned a dystopia where people are so distracted by their own hedonistic consumption that they don’t realize they’re enslaved. Sound familiar? The fiat clown show is Brave New World on steroids, a spectacle designed to keep you pacified while your wealth evaporates.

But here’s the punchline: they can only enslave you if you care. By rejecting their system, you strip them of their power. So let them juggle their debts, inflate their bubbles, and print their trillions. You’ve got Bitcoin, and Bitcoin doesn’t give a fiat f**k.

Welcome to the satirical resistance. Now go stack some sats.

-

@ 9e69e420:d12360c2

2025-01-21 19:31:48

Oregano oil is a potent natural compound that offers numerous scientifically-supported health benefits.

## Active Compounds

The oil's therapeutic properties stem from its key bioactive components:

- Carvacrol and thymol (primary active compounds)

- Polyphenols and other antioxidant

## Antimicrobial Properties

**Bacterial Protection**

The oil demonstrates powerful antibacterial effects, even against antibiotic-resistant strains like MRSA and other harmful bacteria. Studies show it effectively inactivates various pathogenic bacteria without developing resistance.

**Antifungal Effects**

It effectively combats fungal infections, particularly Candida-related conditions like oral thrush, athlete's foot, and nail infections.

## Digestive Health Benefits

Oregano oil supports digestive wellness by:

- Promoting gastric juice secretion and enzyme production

- Helping treat Small Intestinal Bacterial Overgrowth (SIBO)

- Managing digestive discomfort, bloating, and IBS symptoms

## Anti-inflammatory and Antioxidant Effects

The oil provides significant protective benefits through:

- Powerful antioxidant activity that fights free radicals

- Reduction of inflammatory markers in the body

- Protection against oxidative stress-related conditions

## Respiratory Support

It aids respiratory health by:

- Loosening mucus and phlegm

- Suppressing coughs and throat irritation

- Supporting overall respiratory tract function

## Additional Benefits

**Skin Health**

- Improves conditions like psoriasis, acne, and eczema

- Supports wound healing through antibacterial action

- Provides anti-aging benefits through antioxidant properties

**Cardiovascular Health**

Studies show oregano oil may help:

- Reduce LDL (bad) cholesterol levels

- Support overall heart health

**Pain Management**

The oil demonstrates effectiveness in:

- Reducing inflammation-related pain

- Managing muscle discomfort

- Providing topical pain relief

## Safety Note

While oregano oil is generally safe, it's highly concentrated and should be properly diluted before use Consult a healthcare provider before starting supplementation, especially if taking other medications.

-

@ b17fccdf:b7211155

2025-01-21 17:02:21

The past 26 August, Tor [introduced officially](https://blog.torproject.org/introducing-proof-of-work-defense-for-onion-services/) a proof-of-work (PoW) defense for onion services designed to prioritize verified network traffic as a deterrent against denial of service (DoS) attacks.

~ > This feature at the moment, is [deactivate by default](https://gitlab.torproject.org/tpo/core/tor/-/blob/main/doc/man/tor.1.txt#L3117), so you need to follow these steps to activate this on a MiniBolt node:

* Make sure you have the latest version of Tor installed, at the time of writing this post, which is v0.4.8.6. Check your current version by typing

```

tor --version

```

**Example** of expected output:

```

Tor version 0.4.8.6.

This build of Tor is covered by the GNU General Public License (https://www.gnu.org/licenses/gpl-3.0.en.html)

Tor is running on Linux with Libevent 2.1.12-stable, OpenSSL 3.0.9, Zlib 1.2.13, Liblzma 5.4.1, Libzstd N/A and Glibc 2.36 as libc.

Tor compiled with GCC version 12.2.0

```

~ > If you have v0.4.8.X, you are **OK**, if not, type `sudo apt update && sudo apt upgrade` and confirm to update.

* Basic PoW support can be checked by running this command:

```

tor --list-modules

```

Expected output:

```

relay: yes

dirauth: yes

dircache: yes

pow: **yes**

```

~ > If you have `pow: yes`, you are **OK**

* Now go to the torrc file of your MiniBolt and add the parameter to enable PoW for each hidden service added

```

sudo nano /etc/tor/torrc

```

Example:

```

# Hidden Service BTC RPC Explorer

HiddenServiceDir /var/lib/tor/hidden_service_btcrpcexplorer/

HiddenServiceVersion 3

HiddenServicePoWDefensesEnabled 1

HiddenServicePort 80 127.0.0.1:3002

```

~ > Bitcoin Core and LND use the Tor control port to automatically create the hidden service, requiring no action from the user. We have submitted a feature request in the official GitHub repositories to explore the need for the integration of Tor's PoW defense into the automatic creation process of the hidden service. You can follow them at the following links:

* Bitcoin Core: https://github.com/lightningnetwork/lnd/issues/8002

* LND: https://github.com/bitcoin/bitcoin/issues/28499

---

More info:

* https://blog.torproject.org/introducing-proof-of-work-defense-for-onion-services/

* https://gitlab.torproject.org/tpo/onion-services/onion-support/-/wikis/Documentation/PoW-FAQ

---

Enjoy it MiniBolter! 💙

-

@ 6be5cc06:5259daf0

2025-01-21 01:51:46

## Bitcoin: Um sistema de dinheiro eletrônico direto entre pessoas.

Satoshi Nakamoto

satoshin@gmx.com

www.bitcoin.org

---

### Resumo

O Bitcoin é uma forma de dinheiro digital que permite pagamentos diretos entre pessoas, sem a necessidade de um banco ou instituição financeira. Ele resolve um problema chamado **gasto duplo**, que ocorre quando alguém tenta gastar o mesmo dinheiro duas vezes. Para evitar isso, o Bitcoin usa uma rede descentralizada onde todos trabalham juntos para verificar e registrar as transações.

As transações são registradas em um livro público chamado **blockchain**, protegido por uma técnica chamada **Prova de Trabalho**. Essa técnica cria uma cadeia de registros que não pode ser alterada sem refazer todo o trabalho já feito. Essa cadeia é mantida pelos computadores que participam da rede, e a mais longa é considerada a verdadeira.

Enquanto a maior parte do poder computacional da rede for controlada por participantes honestos, o sistema continuará funcionando de forma segura. A rede é flexível, permitindo que qualquer pessoa entre ou saia a qualquer momento, sempre confiando na cadeia mais longa como prova do que aconteceu.

---

### 1. Introdução

Hoje, quase todos os pagamentos feitos pela internet dependem de bancos ou empresas como processadores de pagamento (cartões de crédito, por exemplo) para funcionar. Embora esse sistema seja útil, ele tem problemas importantes porque é baseado em **confiança**.

Primeiro, essas empresas podem reverter pagamentos, o que é útil em caso de erros, mas cria custos e incertezas. Isso faz com que pequenas transações, como pagar centavos por um serviço, se tornem inviáveis. Além disso, os comerciantes são obrigados a desconfiar dos clientes, pedindo informações extras e aceitando fraudes como algo inevitável.

Esses problemas não existem no dinheiro físico, como o papel-moeda, onde o pagamento é final e direto entre as partes. No entanto, não temos como enviar dinheiro físico pela internet sem depender de um intermediário confiável.

O que precisamos é de um **sistema de pagamento eletrônico baseado em provas matemáticas**, não em confiança. Esse sistema permitiria que qualquer pessoa enviasse dinheiro diretamente para outra, sem depender de bancos ou processadores de pagamento. Além disso, as transações seriam irreversíveis, protegendo vendedores contra fraudes, mas mantendo a possibilidade de soluções para disputas legítimas.

Neste documento, apresentamos o **Bitcoin**, que resolve o problema do gasto duplo usando uma rede descentralizada. Essa rede cria um registro público e protegido por cálculos matemáticos, que garante a ordem das transações. Enquanto a maior parte da rede for controlada por pessoas honestas, o sistema será seguro contra ataques.

---

### 2. Transações

Para entender como funciona o Bitcoin, é importante saber como as transações são realizadas. Imagine que você quer transferir uma "moeda digital" para outra pessoa. No sistema do Bitcoin, essa "moeda" é representada por uma sequência de registros que mostram quem é o atual dono. Para transferi-la, você adiciona um novo registro comprovando que agora ela pertence ao próximo dono. Esse registro é protegido por um tipo especial de assinatura digital.

#### O que é uma assinatura digital?

Uma assinatura digital é como uma senha secreta, mas muito mais segura. No Bitcoin, cada usuário tem duas chaves: uma "chave privada", que é secreta e serve para criar a assinatura, e uma "chave pública", que pode ser compartilhada com todos e é usada para verificar se a assinatura é válida. Quando você transfere uma moeda, usa sua chave privada para assinar a transação, provando que você é o dono. A próxima pessoa pode usar sua chave pública para confirmar isso.

#### Como funciona na prática?

Cada "moeda" no Bitcoin é, na verdade, uma cadeia de assinaturas digitais. Vamos imaginar o seguinte cenário:

1. A moeda está com o Dono 0 (você). Para transferi-la ao Dono 1, você assina digitalmente a transação com sua chave privada. Essa assinatura inclui o código da transação anterior (chamado de "hash") e a chave pública do Dono 1.

2. Quando o Dono 1 quiser transferir a moeda ao Dono 2, ele assinará a transação seguinte com sua própria chave privada, incluindo também o hash da transação anterior e a chave pública do Dono 2.

3. Esse processo continua, formando uma "cadeia" de transações. Qualquer pessoa pode verificar essa cadeia para confirmar quem é o atual dono da moeda.

#### Resolvendo o problema do gasto duplo

Um grande desafio com moedas digitais é o "gasto duplo", que é quando uma mesma moeda é usada em mais de uma transação. Para evitar isso, muitos sistemas antigos dependiam de uma entidade central confiável, como uma casa da moeda, que verificava todas as transações. No entanto, isso criava um ponto único de falha e centralizava o controle do dinheiro.

O Bitcoin resolve esse problema de forma inovadora: ele usa uma rede descentralizada onde todos os participantes (os "nós") têm acesso a um registro completo de todas as transações. Cada nó verifica se as transações são válidas e se a moeda não foi gasta duas vezes. Quando a maioria dos nós concorda com a validade de uma transação, ela é registrada permanentemente na blockchain.

#### Por que isso é importante?

Essa solução elimina a necessidade de confiar em uma única entidade para gerenciar o dinheiro, permitindo que qualquer pessoa no mundo use o Bitcoin sem precisar de permissão de terceiros. Além disso, ela garante que o sistema seja seguro e resistente a fraudes.

---

### 3. Servidor Timestamp

Para assegurar que as transações sejam realizadas de forma segura e transparente, o sistema Bitcoin utiliza algo chamado de "servidor de registro de tempo" (timestamp). Esse servidor funciona como um registro público que organiza as transações em uma ordem específica.

Ele faz isso agrupando várias transações em blocos e criando um código único chamado "hash". Esse hash é como uma impressão digital que representa todo o conteúdo do bloco. O hash de cada bloco é amplamente divulgado, como se fosse publicado em um jornal ou em um fórum público.

Esse processo garante que cada bloco de transações tenha um registro de quando foi criado e que ele existia naquele momento. Além disso, cada novo bloco criado contém o hash do bloco anterior, formando uma cadeia contínua de blocos conectados — conhecida como blockchain.

Com isso, se alguém tentar alterar qualquer informação em um bloco anterior, o hash desse bloco mudará e não corresponderá ao hash armazenado no bloco seguinte. Essa característica torna a cadeia muito segura, pois qualquer tentativa de fraude seria imediatamente detectada.

O sistema de timestamps é essencial para provar a ordem cronológica das transações e garantir que cada uma delas seja única e autêntica. Dessa forma, ele reforça a segurança e a confiança na rede Bitcoin.

---

### 4. Prova-de-Trabalho

Para implementar o registro de tempo distribuído no sistema Bitcoin, utilizamos um mecanismo chamado prova-de-trabalho. Esse sistema é semelhante ao Hashcash, desenvolvido por Adam Back, e baseia-se na criação de um código único, o "hash", por meio de um processo computacionalmente exigente.

A prova-de-trabalho envolve encontrar um valor especial que, quando processado junto com as informações do bloco, gere um hash que comece com uma quantidade específica de zeros. Esse valor especial é chamado de "nonce". Encontrar o nonce correto exige um esforço significativo do computador, porque envolve tentativas repetidas até que a condição seja satisfeita.

Esse processo é importante porque torna extremamente difícil alterar qualquer informação registrada em um bloco. Se alguém tentar mudar algo em um bloco, seria necessário refazer o trabalho de computação não apenas para aquele bloco, mas também para todos os blocos que vêm depois dele. Isso garante a segurança e a imutabilidade da blockchain.

A prova-de-trabalho também resolve o problema de decidir qual cadeia de blocos é a válida quando há múltiplas cadeias competindo. A decisão é feita pela cadeia mais longa, pois ela representa o maior esforço computacional já realizado. Isso impede que qualquer indivíduo ou grupo controle a rede, desde que a maioria do poder de processamento seja mantida por participantes honestos.

Para garantir que o sistema permaneça eficiente e equilibrado, a dificuldade da prova-de-trabalho é ajustada automaticamente ao longo do tempo. Se novos blocos estiverem sendo gerados rapidamente, a dificuldade aumenta; se estiverem sendo gerados muito lentamente, a dificuldade diminui. Esse ajuste assegura que novos blocos sejam criados aproximadamente a cada 10 minutos, mantendo o sistema estável e funcional.

---

### 5. Rede

A rede Bitcoin é o coração do sistema e funciona de maneira distribuída, conectando vários participantes (ou nós) para garantir o registro e a validação das transações. Os passos para operar essa rede são:

1. **Transmissão de Transações**: Quando alguém realiza uma nova transação, ela é enviada para todos os nós da rede. Isso é feito para garantir que todos estejam cientes da operação e possam validá-la.

2. **Coleta de Transações em Blocos**: Cada nó agrupa as novas transações recebidas em um "bloco". Este bloco será preparado para ser adicionado à cadeia de blocos (a blockchain).

3. **Prova-de-Trabalho**: Os nós competem para resolver a prova-de-trabalho do bloco, utilizando poder computacional para encontrar um hash válido. Esse processo é como resolver um quebra-cabeça matemático difícil.

4. **Envio do Bloco Resolvido**: Quando um nó encontra a solução para o bloco (a prova-de-trabalho), ele compartilha esse bloco com todos os outros nós na rede.

5. **Validação do Bloco**: Cada nó verifica o bloco recebido para garantir que todas as transações nele contidas sejam válidas e que nenhuma moeda tenha sido gasta duas vezes. Apenas blocos válidos são aceitos.

6. **Construção do Próximo Bloco**: Os nós que aceitaram o bloco começam a trabalhar na criação do próximo bloco, utilizando o hash do bloco aceito como base (hash anterior). Isso mantém a continuidade da cadeia.

#### Resolução de Conflitos e Escolha da Cadeia Mais Longa

Os nós sempre priorizam a cadeia mais longa, pois ela representa o maior esforço computacional já realizado, garantindo maior segurança. Se dois blocos diferentes forem compartilhados simultaneamente, os nós trabalharão no primeiro bloco recebido, mas guardarão o outro como uma alternativa. Caso o segundo bloco eventualmente forme uma cadeia mais longa (ou seja, tenha mais blocos subsequentes), os nós mudarão para essa nova cadeia.

#### Tolerância a Falhas

A rede é robusta e pode lidar com mensagens que não chegam a todos os nós. Uma transação não precisa alcançar todos os nós de imediato; basta que chegue a um número suficiente deles para ser incluída em um bloco. Da mesma forma, se um nó não receber um bloco em tempo hábil, ele pode solicitá-lo ao perceber que está faltando quando o próximo bloco é recebido.

Esse mecanismo descentralizado permite que a rede Bitcoin funcione de maneira segura, confiável e resiliente, sem depender de uma autoridade central.

---

### 6. Incentivo

O incentivo é um dos pilares fundamentais que sustenta o funcionamento da rede Bitcoin, garantindo que os participantes (nós) continuem operando de forma honesta e contribuindo com recursos computacionais. Ele é estruturado em duas partes principais: a recompensa por mineração e as taxas de transação.

#### Recompensa por Mineração

Por convenção, o primeiro registro em cada bloco é uma transação especial que cria novas moedas e as atribui ao criador do bloco. Essa recompensa incentiva os mineradores a dedicarem poder computacional para apoiar a rede. Como não há uma autoridade central para emitir moedas, essa é a maneira pela qual novas moedas entram em circulação. Esse processo pode ser comparado ao trabalho de garimpeiros, que utilizam recursos para colocar mais ouro em circulação. No caso do Bitcoin, o "recurso" consiste no tempo de CPU e na energia elétrica consumida para resolver a prova-de-trabalho.

#### Taxas de Transação

Além da recompensa por mineração, os mineradores também podem ser incentivados pelas taxas de transação. Se uma transação utiliza menos valor de saída do que o valor de entrada, a diferença é tratada como uma taxa, que é adicionada à recompensa do bloco contendo essa transação. Com o passar do tempo e à medida que o número de moedas em circulação atinge o limite predeterminado, essas taxas de transação se tornam a principal fonte de incentivo, substituindo gradualmente a emissão de novas moedas. Isso permite que o sistema opere sem inflação, uma vez que o número total de moedas permanece fixo.

#### Incentivo à Honestidade

O design do incentivo também busca garantir que os participantes da rede mantenham um comportamento honesto. Para um atacante que consiga reunir mais poder computacional do que o restante da rede, ele enfrentaria duas escolhas:

1. Usar esse poder para fraudar o sistema, como reverter transações e roubar pagamentos.

2. Seguir as regras do sistema, criando novos blocos e recebendo recompensas legítimas.

A lógica econômica favorece a segunda opção, pois um comportamento desonesto prejudicaria a confiança no sistema, diminuindo o valor de todas as moedas, incluindo aquelas que o próprio atacante possui. Jogar dentro das regras não apenas maximiza o retorno financeiro, mas também preserva a validade e a integridade do sistema.

Esse mecanismo garante que os incentivos econômicos estejam alinhados com o objetivo de manter a rede segura, descentralizada e funcional ao longo do tempo.

---

### 7. Recuperação do Espaço em Disco

Depois que uma moeda passa a estar protegida por muitos blocos na cadeia, as informações sobre as transações antigas que a geraram podem ser descartadas para economizar espaço em disco. Para que isso seja possível sem comprometer a segurança, as transações são organizadas em uma estrutura chamada "árvore de Merkle". Essa árvore funciona como um resumo das transações: em vez de armazenar todas elas, guarda apenas um "hash raiz", que é como uma assinatura compacta que representa todo o grupo de transações.

Os blocos antigos podem, então, ser simplificados, removendo as partes desnecessárias dessa árvore. Apenas a raiz do hash precisa ser mantida no cabeçalho do bloco, garantindo que a integridade dos dados seja preservada, mesmo que detalhes específicos sejam descartados.

Para exemplificar: imagine que você tenha vários recibos de compra. Em vez de guardar todos os recibos, você cria um documento e lista apenas o valor total de cada um. Mesmo que os recibos originais sejam descartados, ainda é possível verificar a soma com base nos valores armazenados.

Além disso, o espaço ocupado pelos blocos em si é muito pequeno. Cada bloco sem transações ocupa apenas cerca de 80 bytes. Isso significa que, mesmo com blocos sendo gerados a cada 10 minutos, o crescimento anual em espaço necessário é insignificante: apenas 4,2 MB por ano. Com a capacidade de armazenamento dos computadores crescendo a cada ano, esse espaço continuará sendo trivial, garantindo que a rede possa operar de forma eficiente sem problemas de armazenamento, mesmo a longo prazo.

---

### 8. Verificação de Pagamento Simplificada

É possível confirmar pagamentos sem a necessidade de operar um nó completo da rede. Para isso, o usuário precisa apenas de uma cópia dos cabeçalhos dos blocos da cadeia mais longa (ou seja, a cadeia com maior esforço de trabalho acumulado). Ele pode verificar a validade de uma transação ao consultar os nós da rede até obter a confirmação de que tem a cadeia mais longa. Para isso, utiliza-se o ramo Merkle, que conecta a transação ao bloco em que ela foi registrada.

Entretanto, o método simplificado possui limitações: ele não pode confirmar uma transação isoladamente, mas sim assegurar que ela ocupa um lugar específico na cadeia mais longa. Dessa forma, se um nó da rede aprova a transação, os blocos subsequentes reforçam essa aceitação.

A verificação simplificada é confiável enquanto a maioria dos nós da rede for honesta. Contudo, ela se torna vulnerável caso a rede seja dominada por um invasor. Nesse cenário, um atacante poderia fabricar transações fraudulentas que enganariam o usuário temporariamente até que o invasor obtivesse controle completo da rede.

Uma estratégia para mitigar esse risco é configurar alertas nos softwares de nós completos. Esses alertas identificam blocos inválidos, sugerindo ao usuário baixar o bloco completo para confirmar qualquer inconsistência. Para maior segurança, empresas que realizam pagamentos frequentes podem preferir operar seus próprios nós, reduzindo riscos e permitindo uma verificação mais direta e confiável.

---

### 9. Combinando e Dividindo Valor

No sistema Bitcoin, cada unidade de valor é tratada como uma "moeda" individual, mas gerenciar cada centavo como uma transação separada seria impraticável. Para resolver isso, o Bitcoin permite que valores sejam combinados ou divididos em transações, facilitando pagamentos de qualquer valor.

#### Entradas e Saídas

Cada transação no Bitcoin é composta por:

- **Entradas**: Representam os valores recebidos em transações anteriores.

- **Saídas**: Correspondem aos valores enviados, divididos entre os destinatários e, eventualmente, o troco para o remetente.

Normalmente, uma transação contém:

- Uma única entrada com valor suficiente para cobrir o pagamento.

- Ou várias entradas combinadas para atingir o valor necessário.

O valor total das saídas nunca excede o das entradas, e a diferença (se houver) pode ser retornada ao remetente como **troco**.

#### Exemplo Prático

Imagine que você tem duas entradas:

1. 0,03 BTC

2. 0,07 BTC

Se deseja enviar 0,08 BTC para alguém, a transação terá:

- **Entrada**: As duas entradas combinadas (0,03 + 0,07 BTC = 0,10 BTC).

- **Saídas**: Uma para o destinatário (0,08 BTC) e outra como troco para você (0,02 BTC).

Essa flexibilidade permite que o sistema funcione sem precisar manipular cada unidade mínima individualmente.

#### Difusão e Simplificação

A difusão de transações, onde uma depende de várias anteriores e assim por diante, não representa um problema. Não é necessário armazenar ou verificar o histórico completo de uma transação para utilizá-la, já que o registro na blockchain garante sua integridade.

---

### 10. Privacidade

O modelo bancário tradicional oferece um certo nível de privacidade, limitando o acesso às informações financeiras apenas às partes envolvidas e a um terceiro confiável (como bancos ou instituições financeiras). No entanto, o Bitcoin opera de forma diferente, pois todas as transações são publicamente registradas na blockchain. Apesar disso, a privacidade pode ser mantida utilizando **chaves públicas anônimas**, que desvinculam diretamente as transações das identidades das partes envolvidas.

#### Fluxo de Informação