-

@ 0fa80bd3:ea7325de

2025-01-30 04:28:30

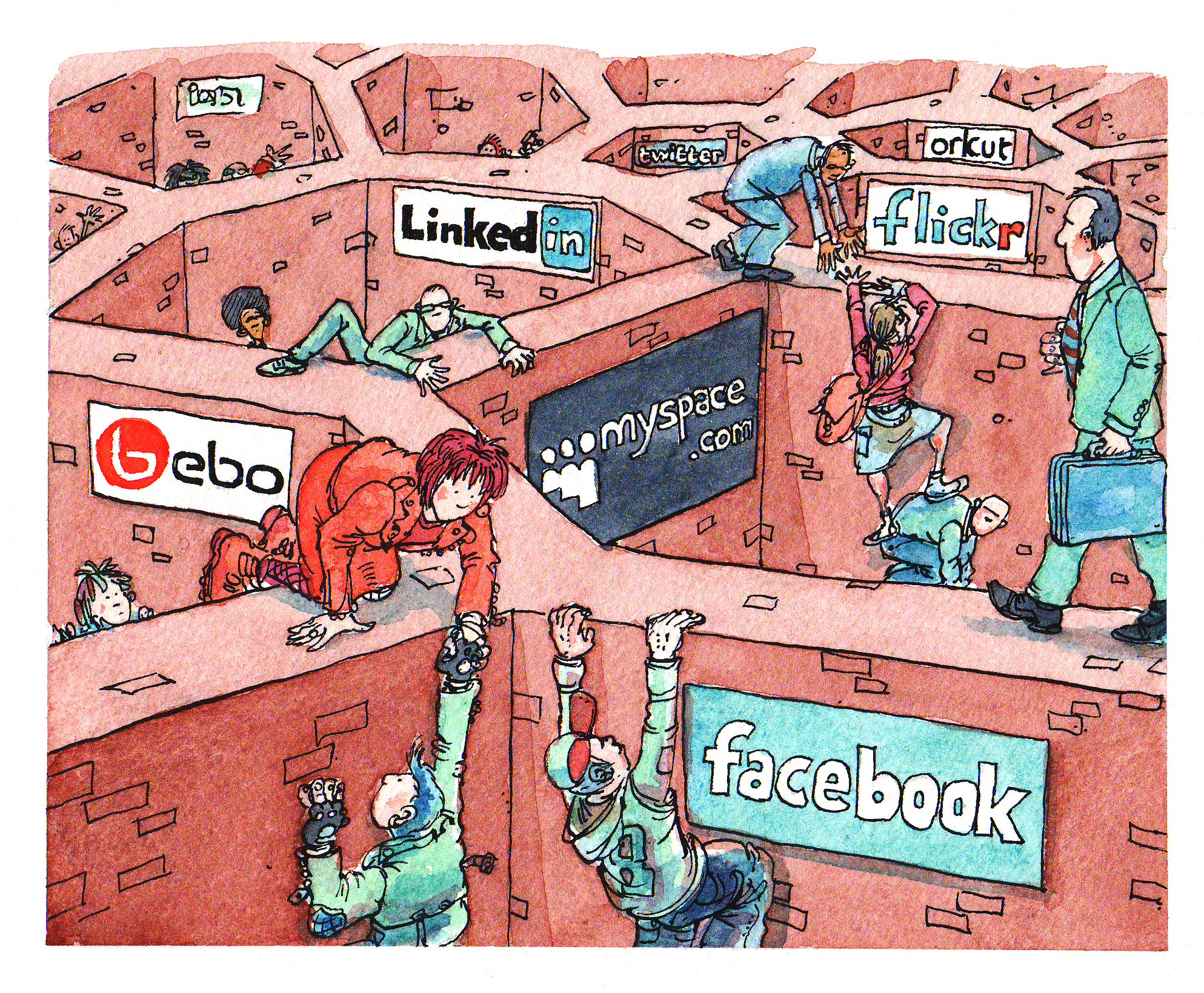

**"Degeneration"** or **"Вырождение"**

![[photo_2025-01-29 23.23.15.jpeg]]

A once-functional object, now eroded by time and human intervention, stripped of its original purpose. Layers of presence accumulate—marks, alterations, traces of intent—until the very essence is obscured. Restoration is paradoxical: to reclaim, one must erase. Yet erasure is an impossibility, for to remove these imprints is to deny the existence of those who shaped them.

The work stands as a meditation on entropy, memory, and the irreversible dialogue between creation and decay.

-

@ 9f3eba58:fa185499

2025-01-29 20:27:09

Humanity as a whole has been degrading over the years, with average IQ decreasing, bone structures generally becoming poorly formed and fragile, average height decreasing, hormone levels ridiculously low and having various metabolic and mental illnesses becoming “normal”.

“*By 2024, more than 800 million adults were living with diabetes, representing a more than fourfold increase since 1990*”

“\*\**1 in 3 people suffer from insulin resistance and can cause depression*” (\*\*https://olhardigital.com.br/2021/09/24/medicina-e-saude/1-em-cada-3-pessoas-sofre-de-resistencia-a-insulina-e-pode-causar-depressao/)

“*More than 1.3 billion people will have diabetes in the world by 2050*” (https://veja.abril.com.br/saude/mais-de-13-bilhao-de-pessoas-terao-diabetes-no-mundo-ate-2050)

“*A new study released by Lancet, with data from 2022, shows that more than a billion people live with obesity in the world*” (https://www.paho.org/pt/noticias/1-3-2024-uma-em-cada-oito-pessoas-no-mundo-vive-com-obesidade)

All this due to a single factor: diet. I’m not referring to a diet full of processed foods, as this has already been proven to destroy the health of those who eat it. I’m referring to the modern diet, with carbohydrates (from any source, even from fruit) being the main macronutrient, little animal protein and practically no saturated fat of animal origin. This diet implementation has been systematically occurring for decades. Sugar conglomerates seeking profits? Government institutions (after all, they need voters to be stupid and vote for them), evil spiritual interference wanting to destroy or distort their path? I don’t know, I’ll leave the conspiracy theories to you!

The modern diet or diet is extremely inflammatory, and inflammation over a long period of time leads to autoimmune diseases such as diabetes and Hashimoto’s.

Absolutely any food in the plant kingdom will harm you, no matter how asymptomatic it may be. Plants are living beings and do not want to die and be eaten. To defend themselves from this, they did not evolve legs like animals. They specifically developed chemical mechanisms such as *oxalates, phytoalexins, glucosinolates, polyphenols, antinutrients* and many others that act to repel anything that wants to eat them, being fatal (as in the case of mushrooms), causing discomfort and the animal or insect discovering that the plant is not edible, releasing unpleasant smells or, in many cases, a combination of these factors. Not to mention genetically modified foods (almost the entire plant kingdom is genetically modified) that work as a steroid for the plants' defenses. - Lack of focus

- Poor decision-making

- Difficulty in establishing and maintaining relationships

- Difficulty getting pregnant and difficult pregnancy

- Low testosterone (medical reference values are low)

- Alzheimer's

- Diabetes

- Dementia

- Chances of developing autism when mothers do not eat meat and fat properly during pregnancy

- Worsening of the degree of autism when the child does not eat meat and fat (food selectivity)

- Insomnia and other sleep problems

- Lack of energy

- Poorly formed and fragile bone structure

- Lack of willpower

- Depression

- ADHD

Not having full physical and mental capacity harms you in many different ways, these are just a few examples that not only directly impact one person but everyone else around them.

Fortunately, there is an alternative to break out of this cycle of destruction, ***Carnivore Diet***.

I am not here to recommend a diet, eating plan or cure for your health problems, nor can I do so, as I am not a doctor (most doctors don't even know where the pancreas is, a mechanic is more useful in your life than a doctor, but that is a topic for another text.).

I came to present you with logic and facts in a very simplified way, from there you can do your own research and decide what is best for you.

---

## Defining the carnivore diet

Simply put, the carnivore diet is an elimination diet, where carbohydrates (including fruits), vegetable fats (soy, canola, cotton, peanuts, etc.), processed products and any type of plant, be it spices or teas, are completely removed.

### What is allowed on the carnivore diet?

- Animal protein

- Beef, preferably fatty cuts (including offal, liver, heart, kidneys, these cuts have more vitamins than anything else in the world)

- Lamb

- Eggs

- Fish and seafood

- Animal fat

- Butter

- Beef fat and tallow

- Salt

- No... salt does not cause high blood pressure. (explained later about salt and high consumption of saturated fats)

From now on I will list some facts that disprove the false accusations made against \*\*eating exclusively meat and fat.

# “Human beings are omnivores”

*“Our ancestors were gatherers and hunters*"

To determine the proportion of animal foods in our ancestors’ diets, we can look at the amount of δ15 nitrogen in their fossils. By looking at levels of this isotope, researchers can infer where animals reside in the food chain, identifying their protein sources. Herbivores typically have δ15N levels of 3–7 percent, carnivores show levels of 6–12 percent, and omnivores exhibit levels in between. When samples from Neanderthals and early modern humans were analyzed, they showed levels of 12 percent and 13.5 percent, respectively, even higher than those of other known carnivores, such as hyenas and wolves. And from an energy efficiency standpoint, hunting large animals makes the most sense. Gathering plants and chasing small animals provides far fewer calories and nutrients relative to the energy invested. In more recently studied indigenous peoples, we have observed a similar pattern that clearly indicates a preference for animal foods over plant foods. For example, in Vilhjalmur Stefansson’s studies of the Eskimos.

*“…fat, not protein, seemed to play a very important role in hunters’ decisions about which animals (male or female) to kill and which body parts to discard or carry away.”*

Why were our ancestors and more recent indigenous peoples so interested in finding fat? At a very basic level, it was probably about calories. By weight, fat provides more than twice as many calories as protein or carbohydrates. Furthermore, human metabolism makes fat an exceptionally valuable and necessary food. If we think of ourselves as automobiles that need fuel for our metabolic engines, we should not put protein in our gas tank. For best results, our metabolic engine runs most efficiently on fat or carbohydrates.

Eating animal foods has been a vital part of our evolution since the beginning. Katherine Milton, a researcher at UC Berkeley, came to the same conclusion in her paper “The Critical Role Played by Animal Source Foods in Human Evolution,” which states:

“Without routine access to animal-source foods, it is highly unlikely that evolving humans could have achieved their unusually large and complex brains while simultaneously continuing their evolutionary trajectory as large, active, and highly social primates. As human evolution progressed, young children in particular, with their rapidly expanding large brains and higher metabolic and nutritional demands relative to adults, would have benefited from concentrated, high-quality foods such as meat." - https://pubmed.ncbi.nlm.nih.gov/14672286/

Skeletons from Greece and Turkey reveal that 12,000 years ago, the average height of hunter-gatherers was five feet, nine inches for men and five feet, five inches for women. But with the adoption of agriculture, adult height plummeted—ending any hope these poor herders had of dunking a basketball or playing competitive volleyball, if such sports had existed at the time. By 3000 B.C., men in this region of the world were only five feet, three inches tall, and women were five feet, reflecting a massive decline in their overall nutritional status. Many studies in diverse populations show a strong correlation between adult height and nutritional quality. A study analyzing male height in 105 countries came to the following conclusion:

“In taller nations…consumption of plant proteins declines sharply at the expense of animal proteins, especially those from dairy products. Its highest consumption rates can be found in Northern and Central Europe, with the global peak in male height in the Netherlands (184 cm).”

In addition to the decline in height, there is also evidence that Native Americans buried at Dickson Mounds suffered from increased bacterial infections. These infections leave scars on the outer surface of the bone, known as the periosteum, with the tibia being especially susceptible to such damage due to its limited blood flow. Examination of tibias from skeletons found in the mounds shows that after agriculture, the number of such periosteal lesions increased threefold, with a staggering eighty-four percent of bones from this period demonstrating this pathology. The lesions also tended to be more severe and to appear earlier in life in the bones of post-agricultural peoples.

https://onlinelibrary.wiley.com/doi/full/10.1111/j.1747-0080.2007.00194.x

https://pubmed.ncbi.nlm.nih.gov/10702160/

# Cholesterol

Many “doctors” say that consuming saturated fat is harmful to your health, “your veins and arteries will clog with excess fat” “you will have a heart attack if you consume a lot of fat" and many other nonsense, and in exchange recommends that you replace fatty cuts of meat with lean meat and do everything with vegetable oil that causes cancer and makes men effeminate.

Your brain is basically composed of fat and water, your neurons are made and repaired with fat, your cells, the basic unit of life, are composed of fat and protein, many of your hormones, especially sexual ones, are made from fat, there is no logical reason not to consume saturated fat other than several false "scientific articles".

"The power plant of the cell is the mitochondria, which converts what we eat into energy. Ketones are an energy source derived from fat. Mitochondria prefer fat as energy (ketones) because transforming ketones into energy costs the mitochondria half the effort of using sugar (glucose) for energy." - https://pubmed.ncbi.nlm.nih.gov/28178565/

"With the help of saturated fats, calcium is properly stored in our bones. The interaction between calcium, vitamin D, and parathyroid hormone regulates calcium levels in the body. When there are calcium imbalances in the blood, our bones release calcium into the blood to find homeostasis." - https://www.healthpedian.org/the-role-of-calcium-in-the-human-body/

"The body needs cholesterol to support muscle repair and other cellular functions. This is why when there is cardiovascular disease, we see increased amounts of cholesterol in the area. Cholesterol is not there causing the problem, but the boat carrying fat was docked there for cholesterol and other nutrients to help fight the problem. Plaque is the body's attempt to deal with injury within the blood vessels." - *National Library of Medicine, “Cholesterol,” 2019*

"Initially, the Plaque helps blood vessels stay strong and helps the vessels maintain their shape. But with the perpetual cycle of uncontrolled inflammation and leftover debris from cellular repair (cholesterol), over time plaque begins to grow and harden, reducing blood flow and oxygen to the heart. Both inflammation and repair require copious amounts of cholesterol and fats. So the body keeps sending these fatty substances to the site of the plaque — until either repair wins (plaque becomes sclerotic scars in the heart muscle, causing heart failure) or inflammation wins (atherosclerotic heart attack)" - https://pubmed.ncbi.nlm.nih.gov/21250192/

Inflammation in Atherosclerotic Cardiovascular Disease - https://pubmed.ncbi.nlm.nih.gov/21250192/

"Study finds that eating refined carbohydrates led to an increased risk of cardiovascular disease and obesity" - https://pmc.ncbi.nlm.nih.gov/articles/PMC5793267/

# “Meat causes cancer”

Most of the misconceptions that red meat causes cancer come from a report by the World Health Organization's International Agency for Research on Cancer (IARC), which was released in 2015. Unfortunately, this report has been widely misrepresented by the mainstream media and is based on some very questionable interpretations of the science it claims to review.

A closer look at a 2018 report on its findings reveals that only 14 of the 800 studies were considered in its final conclusions—and every single study was observational epidemiology. Why the other 786 were excluded remains a mystery, and this group included many interventional animal studies that clearly did not show a link between red meat and cancer. Of the fourteen epidemiological studies that were included in the IARC report, eight showed no link between meat consumption and the development of colon cancer. Of the remaining six studies, only one showed a statistically significant correlation between meat and cancer.

In epidemiological research, one looks for correlation between two things and the strength of the correlation. Having just one study out of 800 that shows meat causes cancer is a mere fluke and becomes statistically insignificant.

Interestingly, this was a study by Seventh-day Adventists in America — a religious group that advocates a plant-based diet.

# Microbiota and Fiber

I have seen several people and “doctors” saying that eating only meat would destroy your microbiota. And I have come to the conclusion that neither “doctors” nor most people know what a microbiota is.

Microbiota is the set of several types of bacteria (millions) that exist in your stomach with the function of breaking down molecules of certain types of food that the body itself cannot get, fiber for example. Many times through the process of fermentation, which is why you have gas after eating your beloved oatmeal.

People unconsciously believe that the microbiota is something fixed and unchangeable, but guess what… it is not.

Your microbiota is determined by what you eat. If you love eating oatmeal, your microbiota will have a specific set of bacteria that can break down the oat molecule into a size that the body can absorb.

If you follow a carnivorous diet, your microbiota will adapt to digest meat.

### Fiber

Nutritional guidelines recommend large amounts of fiber in our diet, but what they don't tell you is that we only absorb around 6% of all the vegetable fiber we eat. In other words, it's insignificant!

Another argument used by doctors and nutritionists is that it helps you go to the bathroom, but this is also a lie. Fiber doesn't help you evacuate, it forces you to do so. With the huge amount of undigestible food in your stomach (fiber), the intestine begins to force contractions, making this fecal matter go down, making you go to the bathroom.

They also raise the argument that fibers are broken down into short-chain fatty acids, such as butyrate (butyric acid), propionate (propionic acid) and acetate (acetic acid). Butyrate is essential because it is the preferred fuel source for the endothelial cells of the large intestine.

Butter, cream, and cheese contain butyrate in its absorbable form. Butter is the best source of butyric acid, or butyrate. In fact, the origins of the word butyric acid come from the Latin word *butyro*—the same origins as the word butter.

“In 2012, a study in the Journal of Gastroenterology showed that reducing fiber (a precursor to short-chain fatty acids) helped participants with chronic constipation. The study lasted six months, and after two weeks without fiber, these participants were allowed to increase fiber as needed. These participants felt so much relief after two weeks without fiber that they continued without fiber for the entire six-month period. Of the high-fiber, low-fiber, and no-fiber groups, the zero-fiber participants had the highest bowel movement frequency.” - https://pmc.ncbi.nlm.nih.gov/articles/PMC3435786/

### Bioavailability

I said that our body can only absorb 6% of all the fiber we ingest. This is bioavailability, how much the body can absorb nutrients from a given food.

Meat is the most bioavailable food on the planet!

Grains and vegetables are not only not very bioavailable, but they also contain a huge amount of antinutrients. So if you eat a steak with some beans, you will not be able to absorb the nutrients from the beans, and the antinutrients in them will make it impossible to absorb a large amount of nutrients from the steak. https://pubmed.ncbi.nlm.nih.gov/23107545/

# Lack of nutrients and antioxidants in a carnivorous diet

A major concern with the carnivorous diet is the lack of vitamin C, which would consequently lead to scurvy.

Vitamin C plays an important role in the breakdown and transport of glucose into cells. In 2000 and 2001, the recommended daily intake of vitamin C effectively doubled. In fact, every 10 to 15 years, there has been a large increase in the recommended daily intake of vitamin C, as happened in 1974 and 1989. Interestingly, also in 1974, sugar prices became so high that high fructose corn syrup was introduced into the US market. Could the increase in readily available glucose foods and foods with high fructose corn syrup be a reason why we need more vitamin C? The question remains…. But this is not a cause for concern for the carnivore, liver is rich in vitamin C. You could easily reach the daily recommendation with liver or any cut of steak. 200-300g of steak already meets your needs and if the theory that the more sugar you eat, the more vitamin C you will get is true, then the more sugar you will eat is true. C is necessary if true, you could easily exceed the daily requirement.

Meat and seafood are rich in ALL the nutrients that humans need to thrive.

### Antioxidants

It is commonly said that fruits are rich in antioxidants but again this is a hoax, they are actually PRO-oxidants. These are substances that activate the mRF2 pathway of our immune system which causes the body to produce natural antioxidants.

The body produces antioxidants, but many occur naturally in foods, Vitamin C, Vitamin E, Selenium and Manganese are all natural antioxidants.

High concentrations of antioxidants can be harmful. Remember that high concentrations of antioxidants can increase oxidation and even protect against cancer cells.

# Salt

Consuming too much salt does not increase blood pressure and therefore increases the risk of heart disease and stroke. Studies show no evidence that limiting salt intake reduces the risk of heart disease.

A 2011 study found that diets low in salt may actually increase the risk of death from heart attacks and strokes. Most importantly, they do not prevent high blood pressure. https://www.nytimes.com/2011/05/04/health/research/04salt.html

# Sun

This is not a dietary issue specifically, but there are things that can I would like to present that is against common sense when talking about the sun.

It is common sense to say that the sun causes skin cancer and that we should not expose ourselves to it or, if we are exposed to the sun, use sunscreen, but no study proves that using sunscreen protects us from melanoma and basal cell carcinoma. The types of fatal melanomas usually occur in areas of the body that never see the sun, such as the soles of the feet.

https://www.jabfm.org/content/24/6/735

In 1978, the first sunscreen was launched, and the market grew rapidly, along with cases of melanoma.

Several studies show that sunscreens cause leaky gut (one of the main factors in chronic inflammation), hormonal dysfunction and neurological dysfunction.

https://pubmed.ncbi.nlm.nih.gov/31058986/

If your concern when going out in the sun is skin cancer, don't worry, your own body's natural antioxidants will protect you. When they can no longer protect you, your skin starts to burn. (If you have to stay in the sun for work, for example, a good way to protect yourself is to rub coconut oil on your skin or just cover yourself with a few extra layers of thin clothing and a hat).

Sunscreen gives you the false sense of protection by blocking the sunburn, so you stay out longer than your skin can handle, but sunscreens can only block 4% of UVA and UVB rays.

www.westonaprice.org/health-topics/environmental-toxins/sunscreens-the-dark-side-of-avoiding-the-sun/

Interestingly, vitamin D deficiency is linked to increased cancer risks. It's a big contradiction to say that the greatest provider of vit. D causes cancer…

https://med.stanford.edu/news/all-news/2010/10/skin-cancer-patients-more-likely-to-be-deficient-in-vitamin-d-study-finds.html

Important roles of vitamin D:

- **Regulation of Bone Metabolism**

- Facilitates the **absorption of calcium and phosphorus** in the intestine.

- Promotes bone mineralization and prevents diseases such as **osteoporosis**, **rickets** (in children) and **osteomalacia** (in adults).

- **Immune Function**

- Modulates the immune system, helping to reduce inflammation and strengthen the defense against infections, including **colds**, **flu** and other diseases.

- May help reduce the incidence of autoimmune diseases such as **multiple sclerosis** and **rheumatoid arthritis**. - **Muscle Health**

- Contributes to muscle strength and the prevention of weakness, especially in the elderly.

- Reduces the risk of falls and fractures.

- **Cardiovascular Function**

- May help regulate blood pressure and heart function, reducing the risk of cardiovascular disease.

- **Hormonal Balance**

- Influences the production of hormones, including those associated with fertility and the functioning of the endocrine system.

- Plays a role in insulin metabolism and glucose sensitivity.

- **Brain Function and Mental Health**

- Participates in mood regulation, which may reduce the risk of **depression** and improve mental health.

- Has been associated with the prevention of neurodegenerative diseases, such as **Alzheimer's**.

- **Anticancer Role**

- Evidence suggests that vitamin D may inhibit the proliferation of cancer cells, especially in breast, prostate and colon cancers. - **Role in General Metabolism**

- Contributes to metabolic health, regulating cellular growth and repair processes.

---

I tried to present everything in the simplest and most understandable way possible, but there are things that require prior knowledge to truly understand. Below is a list of books that will show you everything I have shown you in a more technical and in-depth way.

### Book Recommendations

https://amzn.to/3EbjVsD

https://amzn.to/4awlnBZ

All of my arguments have studies to validate them. Feel free to read them all and draw your own conclusions about what is best for you and your life.

-

@ 0fa80bd3:ea7325de

2025-01-29 15:43:42

Lyn Alden - биткойн евангелист или евангелистка, я пока не понял

```

npub1a2cww4kn9wqte4ry70vyfwqyqvpswksna27rtxd8vty6c74era8sdcw83a

```

Thomas Pacchia - PubKey owner - X - @tpacchia

```

npub1xy6exlg37pw84cpyj05c2pdgv86hr25cxn0g7aa8g8a6v97mhduqeuhgpl

```

calvadev - Shopstr

```

npub16dhgpql60vmd4mnydjut87vla23a38j689jssaqlqqlzrtqtd0kqex0nkq

```

Calle - Cashu founder

```

npub12rv5lskctqxxs2c8rf2zlzc7xx3qpvzs3w4etgemauy9thegr43sf485vg

```

Джек Дорси

```

npub1sg6plzptd64u62a878hep2kev88swjh3tw00gjsfl8f237lmu63q0uf63m

```

21 ideas

```

npub1lm3f47nzyf0rjp6fsl4qlnkmzed4uj4h2gnf2vhe3l3mrj85vqks6z3c7l

```

Много адресов. Хз кто надо сортировать

```

https://github.com/aitechguy/nostr-address-book

```

ФиатДжеф - создатель Ностр - https://github.com/fiatjaf

```

npub180cvv07tjdrrgpa0j7j7tmnyl2yr6yr7l8j4s3evf6u64th6gkwsyjh6w6

```

EVAN KALOUDIS Zues wallet

```

npub19kv88vjm7tw6v9qksn2y6h4hdt6e79nh3zjcud36k9n3lmlwsleqwte2qd

```

Программер Коди https://github.com/CodyTseng/nostr-relay

```

npub1syjmjy0dp62dhccq3g97fr87tngvpvzey08llyt6ul58m2zqpzps9wf6wl

```

Anna Chekhovich - Managing Bitcoin at The Anti-Corruption Foundation

https://x.com/AnyaChekhovich

```

npub1y2st7rp54277hyd2usw6shy3kxprnmpvhkezmldp7vhl7hp920aq9cfyr7

```

-

@ a012dc82:6458a70d

2025-01-29 15:27:17

In an unprecedented development in the realm of digital currencies, the Bitcoin network has achieved a groundbreaking milestone: the count of blockchain addresses possessing over $1,000 in Bitcoin has eclipsed 8 million. This landmark achievement is not just a numerical feat but a testament to the burgeoning confidence and interest in Bitcoin as a viable financial asset. It marks a pivotal shift in the cryptocurrency's journey from a digital novelty to a mainstream financial instrument, capturing the attention of a diverse range of investors, from individual enthusiasts to institutional players. This surge in Bitcoin addresses is a strong indicator of the cryptocurrency's increasing acceptance and its evolving role in reshaping the global financial landscape.

**Table Of Content**

- The Surge in Bitcoin Addresses

- Implications of Growing Bitcoin Addresses

- Bitcoin’s Monetization and Market Dynamics

- Bitcoin's Recent Performance and Market Sentiment

- The Future Outlook of Bitcoin and Digital Currencies

- Conclusion

- FAQs

**The Surge in Bitcoin Addresses**

Recent analytical data provided by Blockware Solutions and Glassnode paints a vivid picture of Bitcoin's rapidly expanding footprint in the digital asset space. The remarkable escalation to over 8 million Bitcoin addresses holding a value exceeding $1,000 each is more than just a statistical anomaly. It represents a collective movement, a growing wave of global participants who are now engaging with Bitcoin either as an investment, a transactional currency, or as a hedge against traditional financial systems. This increase is a reflection of Bitcoin's rising appeal and its growing integration into various financial strategies, transcending traditional market barriers and establishing itself as a significant player in the realm of investment options.

**Implications of Growing Bitcoin Addresses**

The surge in Bitcoin addresses bearing over $1,000 of Bitcoin is far more than a mere statistic; it is an indicator of a paradigm shift in the global financial landscape. This growth signifies not only an increasing embrace of Bitcoin by individual investors but also a broader, more systemic integration into the financial strategies of diverse entities, ranging from small-scale investors to large financial institutions. This trend suggests a growing recognition of Bitcoin's potential as a stable and lucrative asset, challenging traditional perceptions of currency and investment. It heralds a new era where digital assets are increasingly viewed as credible and essential components of diversified investment portfolios.

**Bitcoin’s Monetization and Market Dynamics**

The concept of monetization in the context of Bitcoin has taken on a significant role in this new era of digital finance. The rising number of valuable Bitcoin addresses signals a shift towards viewing Bitcoin not just as a digital token, but as a potent financial asset capable of generating revenue and sustaining value. This notion of monetization, theorized by financial analysts, is becoming a tangible reality as more entities begin to realize the income-generating potential of Bitcoin. Blockware's insights suggest that the trajectory of Bitcoin is not only upwards in terms of value but also expansive, with the potential to attract even more investors seeking to capitalize on this digital gold rush.

**Bitcoin's Recent Performance and Market Sentiment**

Bitcoin's performance in the financial market has recently been nothing short of stellar, with a noticeable upsurge in its value. A significant factor contributing to this trend is the anticipation surrounding the potential approval of Bitcoin exchange-traded funds by the U.S. Securities and Exchange Commission. This speculation has created a ripple effect, invigorating investor sentiment and catalyzing robust activity among large-scale Bitcoin holders, colloquially known as 'whales.' These movements underscore a growing optimism in the market about Bitcoin's legitimacy and potential as a mainstream financial instrument, further cementing its role as a pivotal player in the global economic arena.

**The Future Outlook of Bitcoin and Digital Currencies**

As we witness the remarkable growth in Bitcoin's popularity and acceptance, it's imperative to look ahead and consider the future trajectory of this leading cryptocurrency and its counterparts. This section would delve into the potential long-term implications of the current trends in Bitcoin ownership. It would explore various scenarios, from the continued mainstreaming of Bitcoin to its potential challenges, including regulatory developments and market volatility. Additionally, the potential impact of emerging technologies within the blockchain sphere and their influence on the usability and security of Bitcoin would be examined. The aim is to provide an informed speculation on how Bitcoin's current ascendance might shape not just its own future but also the broader landscape of digital currencies and their role in the evolving global economy.

**Conclusion**

The milestone of 8 million Bitcoin addresses holding over $1,000 each is more than just a landmark in the cryptocurrency's history; it is a harbinger of the evolving role of digital currencies in the global economy. This development is not merely about the appreciation in Bitcoin's value; it signifies a broader shift in the perception and utilization of digital assets. As Bitcoin continues to embed itself into the fabric of global finance, its influence and implications for the future of money and investments are profound, potentially reshaping the financial landscape in ways that are only beginning to be understood.

**FAQs**

**How many Bitcoin addresses now hold over {{text}},000?**

Over 8 million Bitcoin addresses currently hold more than $1,000 in Bitcoin.

**What does the increase in Bitcoin addresses indicate?**

The increase indicates growing confidence in Bitcoin as a viable financial asset and its broader acceptance globally.

**How has Bitcoin's recent market performance been?**

Bitcoin has shown a significant gain, nearly 25% in recent weeks, influenced by optimistic market sentiments.

**What impact could the approval of Bitcoin ETFs have?**

The approval of Bitcoin ETFs by the U.S. SEC could further boost investor confidence and increase Bitcoin's market activity.

**What is the future outlook for Bitcoin and digital currencies?**

The future outlook includes continued mainstream adoption, evolving regulatory landscapes, and potential technological advancements impacting Bitcoin's usability and security.

**That's all for today**

**If you want more, be sure to follow us on:**

**NOSTR: croxroad@getalby.com**

**X: [@croxroadnews.co](https://x.com/croxroadnewsco)**

**Instagram: [@croxroadnews.co](https://www.instagram.com/croxroadnews.co/)**

**Youtube: [@croxroadnews](https://www.youtube.com/@croxroadnews)**

**Store: https://croxroad.store**

**Subscribe to CROX ROAD Bitcoin Only Daily Newsletter**

**https://www.croxroad.co/subscribe**

*DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.*

-

@ 0fa80bd3:ea7325de

2025-01-29 14:44:48

![[yedinaya-rossiya-bear.png]]

1️⃣ Be where the bear roams. Stay in its territory, where it hunts for food. No point setting a trap in your backyard if the bear’s chilling in the forest.

2️⃣ Set a well-hidden trap. Bury it, disguise it, and place the bait right in the center. Bears are omnivores—just like secret police KGB agents. And what’s the tastiest bait for them? Money.

3️⃣ Wait for the bear to take the bait. When it reaches in, the trap will snap shut around its paw. It’ll be alive, but stuck. No escape.

Now, what you do with a trapped bear is another question... 😏

-

@ 0fa80bd3:ea7325de

2025-01-29 05:55:02

The land that belongs to the indigenous peoples of Russia has been seized by a gang of killers who have unleashed a war of extermination. They wipe out anyone who refuses to conform to their rules. Those who disagree and stay behind are tortured and killed in prisons and labor camps. Those who flee lose their homeland, dissolve into foreign cultures, and fade away. And those who stand up to protect their people are attacked by the misled and deceived. The deceived die for the unchecked greed of a single dictator—thousands from both sides, people who just wanted to live, raise their kids, and build a future.

Now, they are forced to make an impossible choice: abandon their homeland or die. Some perish on the battlefield, others lose themselves in exile, stripped of their identity, scattered in a world that isn’t theirs.

There’s been endless debate about how to fix this, how to clear the field of the weeds that choke out every new sprout, every attempt at change. But the real problem? We can’t play by their rules. We can’t speak their language or use their weapons. We stand for humanity, and no matter how righteous our cause, we will not multiply suffering. Victory doesn’t come from matching the enemy—it comes from staying ahead, from using tools they haven’t mastered yet. That’s how wars are won.

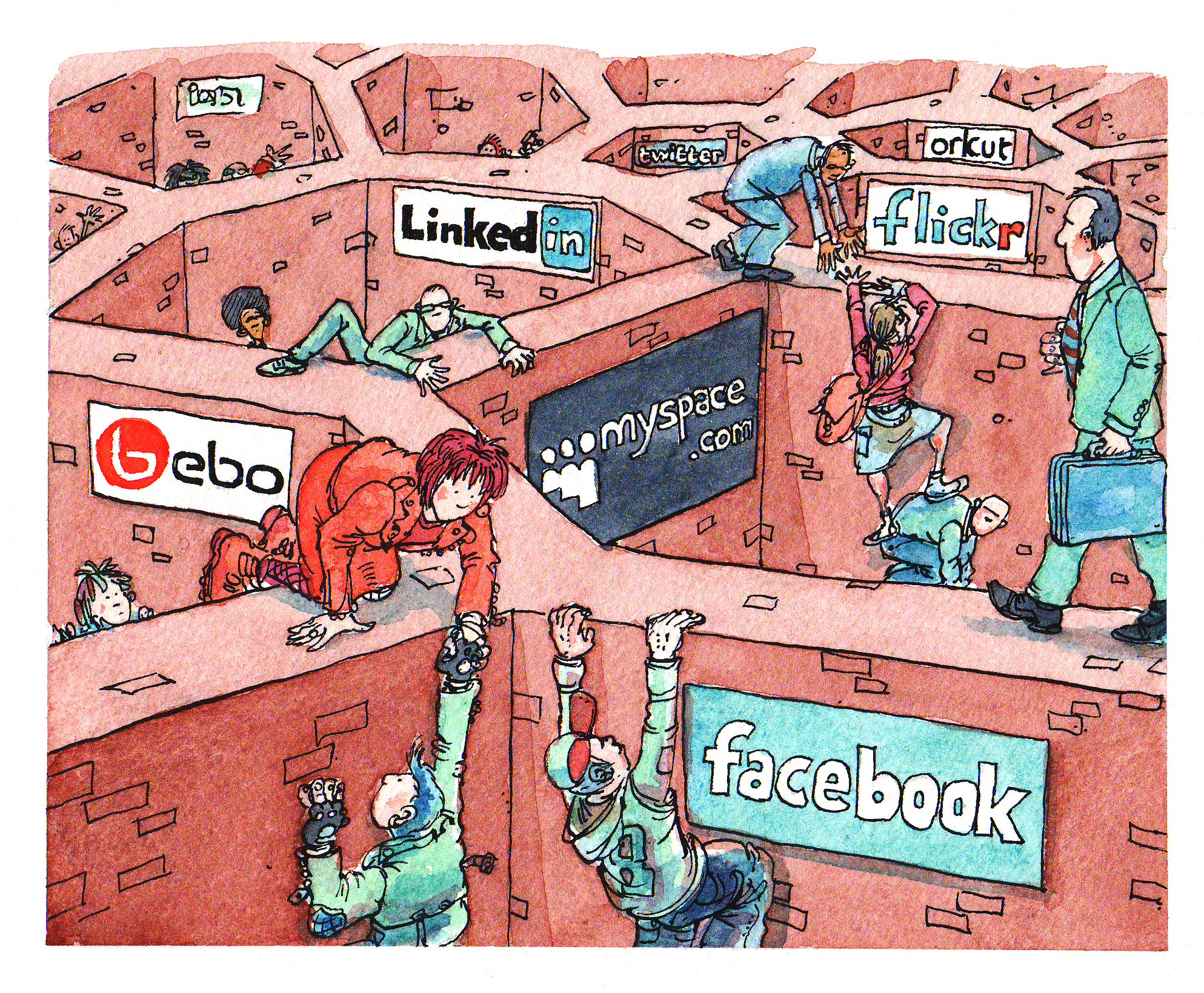

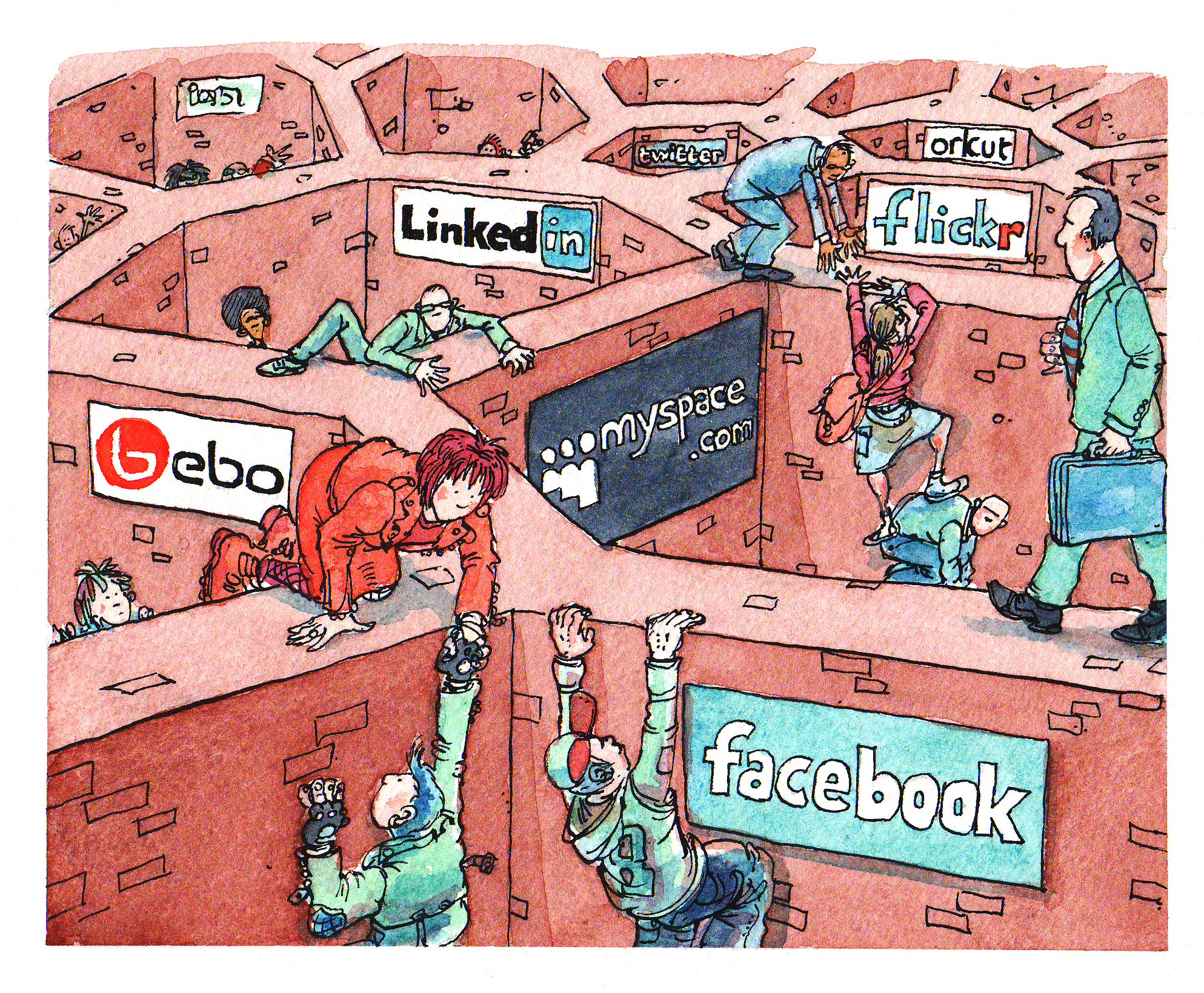

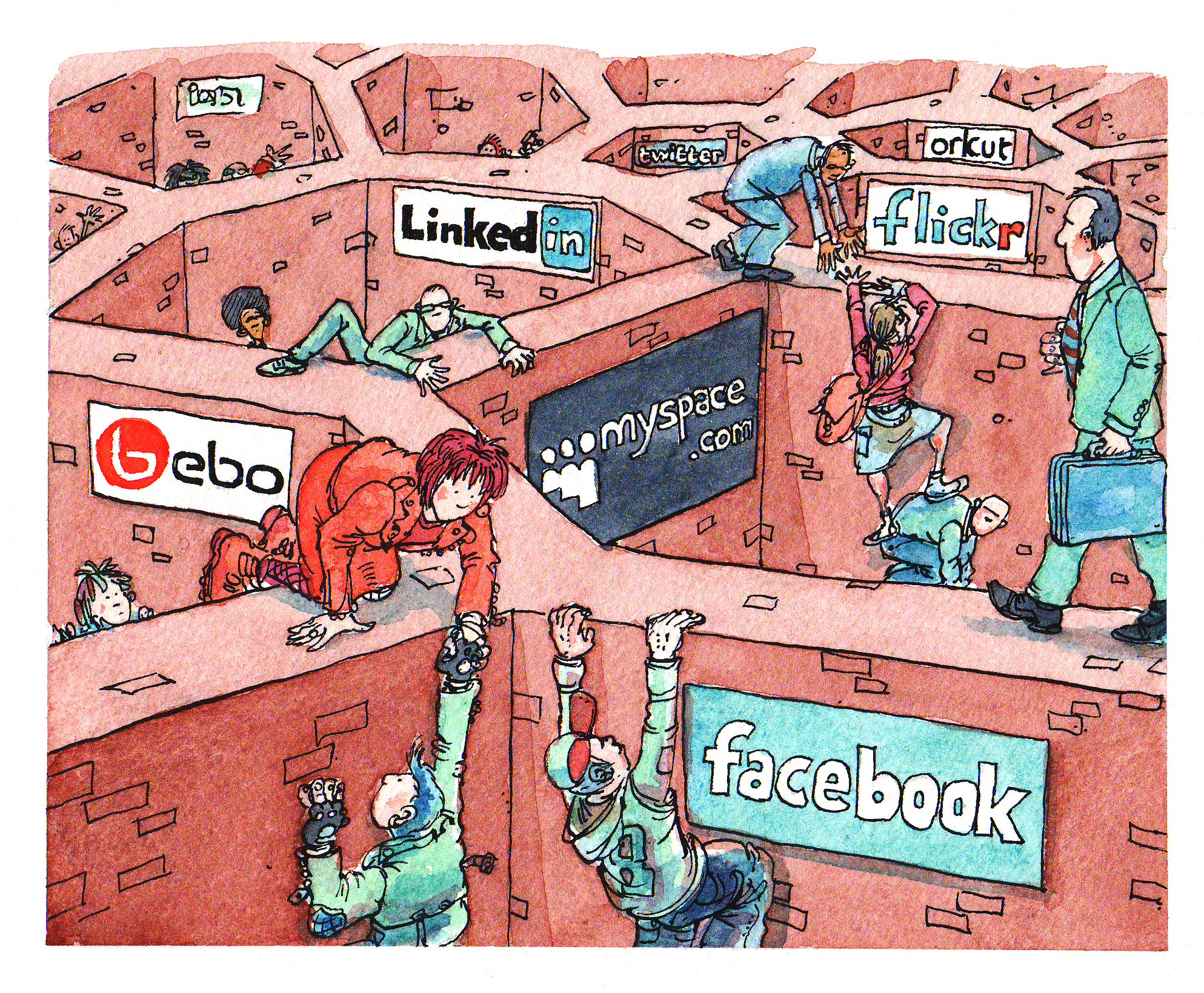

Our only resource is the **will of the people** to rewrite the order of things. Historian Timothy Snyder once said that a nation cannot exist without a city. A city is where the most active part of a nation thrives. But the cities are occupied. The streets are watched. Gatherings are impossible. They control the money. They control the mail. They control the media. And any dissent is crushed before it can take root.

So I started asking myself: **How do we stop this fragmentation?** How do we create a space where people can **rebuild their connections** when they’re ready? How do we build a **self-sustaining network**, where everyone contributes and benefits proportionally, while keeping their freedom to leave intact? And more importantly—**how do we make it spread, even in occupied territory?**

In 2009, something historic happened: **the internet got its own money.** Thanks to **Satoshi Nakamoto**, the world took a massive leap forward. Bitcoin and decentralized ledgers shattered the idea that money must be controlled by the state. Now, to move or store value, all you need is an address and a key. A tiny string of text, easy to carry, impossible to seize.

That was the year money broke free. The state lost its grip. Its biggest weapon—physical currency—became irrelevant. Money became **purely digital.**

The internet was already **a sanctuary for information**, a place where people could connect and organize. But with Bitcoin, it evolved. Now, **value itself** could flow freely, beyond the reach of authorities.

Think about it: when seedlings are grown in controlled environments before being planted outside, they **get stronger, survive longer, and bear fruit faster.** That’s how we handle crops in harsh climates—nurture them until they’re ready for the wild.

Now, picture the internet as that **controlled environment** for **ideas**. Bitcoin? It’s the **fertile soil** that lets them grow. A testing ground for new models of interaction, where concepts can take root before they move into the real world. If **nation-states are a battlefield, locked in a brutal war for territory, the internet is boundless.** It can absorb any number of ideas, any number of people, and it doesn’t **run out of space.**

But for this ecosystem to thrive, people need safe ways to communicate, to share ideas, to build something real—**without surveillance, without censorship, without the constant fear of being erased.**

This is where **Nostr** comes in.

Nostr—"Notes and Other Stuff Transmitted by Relays"—is more than just a messaging protocol. **It’s a new kind of city.** One that **no dictator can seize**, no corporation can own, no government can shut down.

It’s built on **decentralization, encryption, and individual control.** Messages don’t pass through central servers—they are relayed through independent nodes, and users choose which ones to trust. There’s no master switch to shut it all down. Every person owns their identity, their data, their connections. And no one—no state, no tech giant, no algorithm—can silence them.

In a world where cities fall and governments fail, **Nostr is a city that cannot be occupied.** A place for ideas, for networks, for freedom. A city that grows stronger **the more people build within it**.

-

@ a012dc82:6458a70d

2025-01-28 15:17:03

In the dynamic world of cryptocurrencies, Bitcoin stands as a pioneering force, a digital currency that has revolutionized the concept of money. Central to its operation and success is a term often heard but not always fully understood: the Bitcoin hashrate. This metric is much more than a technical jargon; it's the heartbeat of the Bitcoin network, powering its transactions, securing its blockchain, and influencing its standing in the market. In this exploration, we delve into the depths of the Bitcoin hashrate, unraveling its complexities and revealing its profound impact on the cryptocurrency market. The hashrate is a window into the soul of Bitcoin, offering insights into its health, efficiency, and future potential. It's a story that intertwines technology, economics, and community, painting a vivid picture of Bitcoin's place in the digital age.

**Table Of Content**

- Understanding Bitcoin Hashrate

- The Role of Hashrate in Network Security

- Hashrate and Decentralization

- Economic Implications for Miners

- Impact on Bitcoin's Market Value

- The Future of Bitcoin's Hashrate

- Conclusion

- FAQs

**Understanding Bitcoin Hashrate**

The Bitcoin hashrate is the powerhouse of the Bitcoin network, a measure of the collective computational effort used to mine and process transactions. It's akin to the horsepower of an engine, driving the network forward. Each hash is a solution to a cryptographic puzzle, and the hashrate signifies the speed at which these puzzles are solved. As Bitcoin's popularity soars, so does the hashrate, reflecting an ever-increasing number of miners vying to validate transactions and create new blocks. This growth is not just a testament to Bitcoin's popularity but also a marker of its robustness and resilience in the face of challenges. The hashrate is a dynamic indicator, fluctuating with the ebb and flow of the network's activity, mirroring the collective effort of thousands of miners around the globe. It's a testament to the decentralized nature of Bitcoin, where no single entity controls the network, but rather a collective effort secures it.

**The Role of Hashrate in Network Security**

Bitcoin's security is its cornerstone, and the hashrate is its shield. In the realm of digital currencies, security threats like the 51% attack loom large, where an entity could potentially take control of the network. However, a high hashrate acts as a formidable barrier, making such attacks not just difficult but economically unfeasible. It's a game of numbers; the higher the hashrate, the more distributed the computational power, and the safer the network. This security is not static but a dynamic force that evolves with the network's growth, adapting to new challenges and fortifying Bitcoin's position as a secure digital asset. The hashrate is a beacon of trust, assuring users and investors alike that the network is robust and resistant to manipulation. It's a critical factor in maintaining the integrity of the blockchain, ensuring that transactions are processed securely and reliably.

**Hashrate and Decentralization**

Decentralization is the soul of Bitcoin, and the hashrate is a reflection of this principle. A decentralized network is less prone to manipulation and control by any single entity, and a high hashrate is indicative of a broad, diverse miner base. This diversity is not just a matter of numbers but a testament to the egalitarian ethos of Bitcoin, where anyone, anywhere, can contribute to the network's upkeep. As the hashrate grows, it weaves a stronger web of participants, each adding to the network's resilience and ensuring its democratic nature. The hashrate is a symbol of the power of the collective, a force that transcends geographical and political boundaries, uniting people under the banner of a decentralized financial system. It's a testament to the vision of Bitcoin's creators, a network that is not just secure and efficient but also open and inclusive.

**Economic Implications for Miners**

For miners, the hashrate is a beacon guiding their economic journey. It's a delicate balance of power, cost, and reward. As the hashrate climbs, so does the difficulty of mining, a self-regulating mechanism ensuring the network's stability. Miners must constantly adapt, balancing the costs of advanced hardware and energy against the potential rewards of new Bitcoins and transaction fees. This ever-shifting landscape is not just a challenge but an opportunity for innovation, driving miners to seek more efficient and sustainable ways to contribute to the network. The hashrate is a measure of opportunity and challenge, a dance of economics and technology where miners play a crucial role. It's a dynamic ecosystem where the fittest survive, adapting to the ever-changing landscape of Bitcoin mining.

**Impact on Bitcoin's Market Value**

The hashrate's influence extends beyond the technical realm into the market. While it doesn't directly dictate Bitcoin's price, it's a barometer of network health and investor confidence. A robust hashrate signals a thriving, secure network, attracting investors and bolstering Bitcoin's market position. It's a subtle yet powerful force, shaping perceptions and influencing decisions in the cryptocurrency market. As Bitcoin continues to evolve, the hashrate stands as a key indicator of its vitality and appeal to the market. The hashrate and market value are intertwined in a complex dance, where the health of the network reflects and influences investor sentiment. It's a symbiotic relationship, where each aspect feeds into and strengthens the other.

**The Future of Bitcoin's Hashrate**

As we look to the future, the Bitcoin hashrate remains a critical aspect of the cryptocurrency's journey. It's not just a measure of computational power but a symbol of the network's evolution, a testament to its strength and a predictor of its potential. The hashrate's trajectory mirrors Bitcoin's own path: ever upward, facing challenges, adapting, and growing stronger. It's a journey not just of technology but of community, innovation, and the relentless pursuit of a decentralized financial future. The hashrate is a narrative of progress, a story of how a decentralized network can grow, adapt, and thrive in the ever-changing landscape of digital currencies. It's a beacon of hope and a testament to the power of collective effort in shaping the future of finance.

**Conclusion**

The Bitcoin hashrate is more than a technical metric; it's the lifeblood of the Bitcoin ecosystem. It encapsulates the network's security, decentralization, economic dynamics, and market influence. As Bitcoin continues to navigate the complex landscape of digital currencies, its hashrate will remain a key indicator of its health and success. It's a story of collective effort, technological innovation, and the relentless pursuit of a decentralized, secure financial future. The hashrate is not just a number; it's the pulse of Bitcoin, beating strongly as it leads the charge in the ever-evolving world of cryptocurrencies. It's a symbol of resilience, a testament to the enduring power of a decentralized network, and a beacon of hope for a future where financial systems are open, secure, and accessible to all.

**FAQs**

**What is Bitcoin hashrate?**

The Bitcoin hashrate is the total computational power used to mine and process transactions on the Bitcoin network, measured in hashes per second.

**Why is the Bitcoin hashrate important?**

It's crucial for network security, indicating the difficulty of performing a 51% attack, and reflects the network's decentralization and health.

**How does the hashrate affect Bitcoin miners?**

A higher hashrate increases the difficulty of mining, impacting the profitability and efficiency of mining operations.

**Does the Bitcoin hashrate influence its market value?**

While not directly affecting the price, a strong hashrate can boost investor confidence, potentially influencing Bitcoin's market value.

**Can the Bitcoin hashrate predict the future of the cryptocurrency?**

The hashrate is a key indicator of Bitcoin's health and can provide insights into its future potential and stability.

**That's all for today**

**If you want more, be sure to follow us on:**

**NOSTR: croxroad@getalby.com**

**X: [@croxroadnews.co](https://x.com/croxroadnewsco)**

**Instagram: [@croxroadnews.co](https://www.instagram.com/croxroadnews.co/)**

**Youtube: [@croxroadnews](https://www.youtube.com/@croxroadnews)**

**Store: https://croxroad.store**

**Subscribe to CROX ROAD Bitcoin Only Daily Newsletter**

**https://www.croxroad.co/subscribe**

*DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.*

-

@ a012dc82:6458a70d

2025-01-27 12:51:47

In the contemporary financial world, Cathie Wood, the founder of ARK Invest, stands out for her innovative investment approaches. Recently, Wood has focused on Bitcoin (BTC), highlighting its potential as a hedge against both inflationary and deflationary economic conditions. This article delves into Wood's perspective, exploring Bitcoin's evolving role in the global financial landscape. We examine its multifaceted nature, not just as a digital currency, but as a strategic asset capable of navigating the complex dynamics of the modern economy. Wood's insights offer a nuanced understanding of Bitcoin's potential in offering stability amidst economic uncertainties.

**Table Of Content**

- Bitcoin's Hedge Potential

- Decentralization: A Key Advantage

- The Banking Crisis and Bitcoin

- Bitcoin vs. Gold

- Institutional Involvement

- Conclusion

- FAQs

**Bitcoin's Hedge Potential**

Cathie Wood's perspective on Bitcoin transcends its usual perception as a mere digital currency. She champions it as a dynamic tool against economic fluctuations, a quality rarely matched by traditional assets. In an era marked by economic instability, Bitcoin stands as a beacon of potential stability. This is particularly notable in its capacity to act as a hedge during inflationary periods, where fiat currencies lose value, and deflationary periods, characterized by increased money value but decreased economic activity. This dual capability positions Bitcoin as a significant asset in diversified portfolios, resonating with Wood's innovative investment philosophy.

**Decentralization: A Key Advantage**

For Wood, Bitcoin's decentralization is a critical advantage. This aspect sets it apart from traditional banking systems, which often grapple with issues of transparency and central control. In Bitcoin's ecosystem, there is a clear absence of counterparty risk, thanks to its decentralized ledger and visible transactions. This transparency assures investors of a level of security and autonomy not found in conventional financial systems. In Wood's view, this decentralization is not just a technical feature but a foundational aspect that provides Bitcoin with a resilience and reliability, crucial in a world where financial systems are increasingly interconnected and vulnerable.

**The Banking Crisis and Bitcoin**

Reflecting on recent financial upheavals, such as the U.S. regional bank crisis and the FTX collapse, Wood sees these events as vindications of Bitcoin's stability and resilience. These crises underscored the inherent risks of centralized financial systems, revealing their fragility under stress. In contrast, Bitcoin demonstrated an impressive resilience, with its value surging during these tumultuous times. This reaction not only highlights Bitcoin's potential as a safe haven but also its capacity to serve as a barometer for the health of the broader financial system.

**Bitcoin vs. Gold**

While gold has traditionally been the go-to asset for hedge investments, Wood argues that Bitcoin has a distinct edge over it. Her preference for Bitcoin stems from its novelty and the increasing interest from younger investors and institutional players. Unlike gold, whose market and demand patterns are well-established, Bitcoin represents an emerging asset class with untapped potential. Wood believes that Bitcoin's journey is just beginning, and its full potential as a hedge asset is yet to be realized, making it a more attractive option for forward-looking investors.

**Institutional Involvement**

Wood's belief in Bitcoin's future is mirrored in ARK Invest's substantial investments in cryptocurrency-related ventures. These investments are not mere speculative plays; they represent a deep conviction in the long-term value of Bitcoin. ARK's pursuit of a spot Bitcoin ETF is a significant move, indicating a belief in the cryptocurrency's viability as a mainstream investment asset. This institutional backing by a leading investment firm not only legitimizes Bitcoin's role in the financial markets but also paves the way for more widespread adoption among traditional investors.

**Conclusion**

Cathie Wood's endorsement of Bitcoin is a compelling narrative in the evolving story of this digital asset. Her insights provide a valuable perspective on Bitcoin's role as a hedge against both inflation and deflation, highlighting its potential in the current economic climate. As we navigate through uncertain financial times, Wood's views offer a guidepost for investors looking to diversify and stabilize their portfolios with innovative assets like Bitcoin.

**FAQs**

**What is Cathie Wood's view on Bitcoin?**

Cathie Wood sees Bitcoin as a viable hedge against both inflation and deflation, highlighting its decentralized nature and resilience.

**Why does Wood prefer Bitcoin over traditional banking systems?**

Wood values Bitcoin's transparency and lack of counterparty risk, contrasting it with the opacity of traditional banking systems.

**How did the banking crisis impact Bitcoin's value?**

The U.S. regional bank crisis and the FTX collapse showed Bitcoin's stability, with its value increasing during these times.

**Why does Wood favor Bitcoin over gold?**

Wood believes Bitcoin has more potential for growth and is more appealing to younger investors and institutions compared to gold.

**What is ARK Invest's involvement in Bitcoin?**

ARK Invest holds significant stakes in cryptocurrency ventures and is pursuing a spot Bitcoin ETF, reflecting a strong belief in Bitcoin's future.

**That's all for today**

**If you want more, be sure to follow us on:**

**NOSTR: croxroad@getalby.com**

**X: [@croxroadnews.co](https://x.com/croxroadnewsco)**

**Instagram: [@croxroadnews.co](https://www.instagram.com/croxroadnews.co/)**

**Youtube: [@croxroadnews](https://www.youtube.com/@croxroadnews)**

**Store: https://croxroad.store**

**Subscribe to CROX ROAD Bitcoin Only Daily Newsletter**

**https://www.croxroad.co/subscribe**

*DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.*

-

@ 9e69e420:d12360c2

2025-01-26 15:26:44

Secretary of State Marco Rubio issued new guidance halting spending on most foreign aid grants for 90 days, including military assistance to Ukraine. This immediate order shocked State Department officials and mandates “stop-work orders” on nearly all existing foreign assistance awards.

While it allows exceptions for military financing to Egypt and Israel, as well as emergency food assistance, it restricts aid to key allies like Ukraine, Jordan, and Taiwan. The guidance raises potential liability risks for the government due to unfulfilled contracts.

A report will be prepared within 85 days to recommend which programs to continue or discontinue.

-

@ 599f67f7:21fb3ea9

2025-01-26 11:01:05

## ¿Qué es Blossom?

nostr:nevent1qqspttj39n6ld4plhn4e2mq3utxpju93u4k7w33l3ehxyf0g9lh3f0qpzpmhxue69uhkummnw3ezuamfdejsygzenanl0hmkjnrq8fksvdhpt67xzrdh0h8agltwt5znsmvzr7e74ywgmr72

[Blossom](https://github.com/hzrd149/blossom) significa _Blobs Simply Stored on Media Servers_ (Blobs Simplemente Almacenados en Servidores de Medios). _Blobs_ son fragmentos de datos binarios, como archivos pero sin nombres. En lugar de nombres, se identifican por su hash [sha256](https://es.wikipedia.org/wiki/SHA-2). La ventaja de usar hashes sha256 en lugar de nombres es que los hashes son IDs universales que se pueden calcular a partir del archivo mismo utilizando el algoritmo de hash sha256.

💡 archivo -> sha256 -> hash

Blossom es, por lo tanto, un conjunto de puntos finales HTTP que permiten a los usuarios almacenar y recuperar blobs almacenados en servidores utilizando su identidad nostr.

## ¿Por qué Blossom?

Como mencionamos hace un momento, al usar claves nostr como su identidad, Blossom permite que los datos sean "propiedad" del usuario. Esto simplifica enormemente la cuestión de "qué es spam" para el alojamiento de servidores. Por ejemplo, en nuestro Blossom solo permitimos cargas por miembros de la comunidad verificados que tengan un [NIP-05](https://nips.nostr.com/5) con nosotros.

Los usuarios pueden subir en múltiples servidores de blossom, por ejemplo, uno alojado por su comunidad, uno de pago, otro público y gratuito, para establecer redundancia de sus datos. Los blobs pueden ser [espejados](https://github.com/hzrd149/blossom/blob/master/buds/04.md) entre servidores de blossom, de manera similar a cómo los relays nostr pueden transmitir eventos entre sí. Esto mejora la resistencia a la censura de blossom.

A continuación se muestra una breve tabla de comparación entre torrents, Blossom y servidores CDN centralizados. (Suponiendo que hay muchos seeders para torrents y se utilizan múltiples servidores con Blossom).

| | Torrents | Blossom | CDN Centralizado |

| --------------------------------------------------------------- | -------- | ------- | ---------------- |

| Descentralizado | ✅ | ✅ | ❌ |

| Resistencia a la censura | ✅ | ✅ | ❌ |

| ¿Puedo usarlo para publicar fotos de gatitos en redes sociales? | ❌ | ✅ | ✅ |

## ¿Cómo funciona?

Blossom utiliza varios tipos de eventos nostr para comunicarse con el servidor de medios.

| kind | descripción | BUD |

| ----- | ------------------------------- | ------------------------------------------------------------------ |

| 24242 | Evento de autorización | [BUD01](https://github.com/hzrd149/blossom/blob/master/buds/01.md) |

| 10063 | Lista de Servidores de Usuarios | [BUD03](https://github.com/hzrd149/blossom/blob/master/buds/03.md) |

### kind:24242 - Autorización

Esto es esencialmente lo que ya describimos al usar claves nostr como IDs de usuario. En el evento, el usuario le dice al servidor que quiere subir o eliminar un archivo y lo firma con sus claves nostr. El servidor realiza algunas verificaciones en este evento y luego ejecuta el comando del usuario si todo parece estar bien.

### kind:10063 - Lista de Servidores de Usuarios

Esto es utilizado por el usuario para anunciar a qué servidores de medios está subiendo. De esta manera, cuando el cliente ve esta lista, sabe dónde subir los archivos del usuario. También puede subir en múltiples servidores definidos en la lista para asegurar redundancia. En el lado de recuperación, si por alguna razón uno de los servidores en la lista del usuario está fuera de servicio, o el archivo ya no se puede encontrar allí, el cliente puede usar esta lista para intentar recuperar el archivo de otros servidores en la lista. Dado que los blobs se identifican por sus hashes, el mismo blob tendrá el mismo hash en cualquier servidor de medios. Todo lo que el cliente necesita hacer es cambiar la URL por la de un servidor diferente.

Ahora, además de los conceptos básicos de cómo funciona Blossom, también hay otros tipos de eventos que hacen que Blossom sea aún más interesante.

| kind | descripción |

| ----- | --------------------- |

| 30563 | Blossom Drives |

| 36363 | Listado de Servidores |

| 31963 | Reseña de Servidores |

### kind:30563 - Blossom Drives

Este tipo de evento facilita la organización de blobs en carpetas, como estamos acostumbrados con los drives (piensa en Google Drive, iCloud, Proton Drive, etc.). El evento contiene información sobre la estructura de carpetas y los metadatos del drive.

### kind:36363 y kind:31963 - Listado y Reseña

Estos tipos de eventos permiten a los usuarios descubrir y reseñar servidores de medios a través de nostr. kind:36363 es un listado de servidores que contiene la URL del servidor. kind:31963 es una reseña, donde los usuarios pueden calificar servidores.

## ¿Cómo lo uso?

### Encuentra un servidor

Primero necesitarás elegir un servidor Blossom donde subirás tus archivos. Puedes navegar por los públicos en [blossomservers.com](https://blossomservers.com/). Algunos de ellos son de pago, otros pueden requerir que tus claves nostr estén en una lista blanca.

Luego, puedes ir a la URL de su servidor y probar a subir un archivo pequeño, como una foto. Si estás satisfecho con el servidor (es rápido y aún no te ha fallado), puedes agregarlo a tu Lista de Servidores de Usuarios. Cubriremos brevemente cómo hacer esto en noStrudel y Amethyst (pero solo necesitas hacer esto una vez, una vez que tu lista actualizada esté publicada, los clientes pueden simplemente recuperarla de nostr).

### noStrudel

1. Encuentra Relays en la barra lateral, luego elige Servidores de Medios.

2. Agrega un servidor de medios, o mejor aún, varios.

3. Publica tu lista de servidores. ✅

### Amethyst

1. En la barra lateral, encuentra Servidores multimedia.

2. Bajo Servidores Blossom, agrega tus servidores de medios.

3. Firma y publica. ✅

Ahora, cuando vayas a hacer una publicación y adjuntar una foto, por ejemplo, se subirá en tu servidor blossom.

⚠️ Ten en cuenta que debes suponer que los archivos que subas serán públicos. Aunque puedes proteger un archivo con contraseña, esto no ha sido auditado.

### Blossom Drive

Como mencionamos anteriormente, podemos publicar eventos para organizar nuestros blobs en carpetas. Esto puede ser excelente para compartir archivos con tu equipo, o simplemente para mantener las cosas organizadas.

Para probarlo, ve a [blossom.hzrd149.com](https://blossom.hzrd149.com/) (o nuestra instancia comunitaria en [blossom.bitcointxoko.com](https://blossom.bitcointxoko.com)) e inicia sesión con tu método preferido.

Puedes crear una nueva unidad y agregar blobs desde allí.

### Bouquet

Si usas múltiples servidores para darte redundancia, Bouquet es una buena manera de obtener una visión general de todos tus archivos. Úsalo para subir y navegar por tus medios en diferentes servidores y sincronizar blobs entre ellos.

### Cherry Tree

nostr:nevent1qvzqqqqqqypzqfngzhsvjggdlgeycm96x4emzjlwf8dyyzdfg4hefp89zpkdgz99qyghwumn8ghj7mn0wd68ytnhd9hx2tcpzfmhxue69uhkummnw3e82efwvdhk6tcqyp3065hj9zellakecetfflkgudm5n6xcc9dnetfeacnq90y3yxa5z5gk2q6

Cherry Tree te permite dividir un archivo en fragmentos y luego subirlos en múltiples servidores blossom, y más tarde reensamblarlos en otro lugar.

## Conclusión

Blossom aún está en desarrollo, pero ya hay muchas cosas interesantes que puedes hacer con él para hacerte a ti y a tu comunidad más soberanos. ¡Pruébalo!

Si deseas mantenerte al día sobre el desarrollo de Blossom, sigue a nostr:nprofile1qyghwumn8ghj7mn0wd68ytnhd9hx2tcpzfmhxue69uhkummnw3e82efwvdhk6tcqyqnxs90qeyssm73jf3kt5dtnk997ujw6ggy6j3t0jjzw2yrv6sy22ysu5ka y dale un gran zap por su excelente trabajo.

## Referencias

- [hzrd149/blossom en GitHub](https://github.com/hzrd149/blossom)

- [Blossom Drive](https://github.com/hzrd149/blossom-drive/blob/master/docs/drive.md)

-

@ ec42c765:328c0600

2025-01-26 00:08:54

# カスタム絵文字とは

任意のオリジナル画像を絵文字のように文中に挿入できる機能です。

また、リアクション(Twitterの いいね のような機能)にもカスタム絵文字を使えます。

# カスタム絵文字の対応状況(2024/02/05)

カスタム絵文字を使うためにはカスタム絵文字に対応した[クライアント](https://welcome.nostr-jp.org/tutorial/explore-client.html)を使う必要があります。

※表は一例です。クライアントは他にもたくさんあります。

使っているクライアントが対応していない場合は、クライアントを変更する、対応するまで待つ、開発者に要望を送る(または自分で実装する)などしましょう。

#### 対応クライアント

- [Amethyst](https://play.google.com/store/apps/details?id=com.vitorpamplona.amethyst)

- [FreeFrom](https://freefrom.space/)

- [nostter](https://nostter.app/)

- [Rabbit](https://rabbit.syusui.net/)

- [Snort](https://snort.social/)

- [noStrudel](https://nostrudel.ninja/)

ここではnostterを使って説明していきます。

# 準備

カスタム絵文字を使うための準備です。

- Nostrエクステンション(NIP-07)を導入する

- 使いたいカスタム絵文字をリストに登録する

## Nostrエクステンション(NIP-07)を導入する

Nostrエクステンションは使いたいカスタム絵文字を登録する時に必要になります。

また、環境(パソコン、iPhone、androidなど)によって導入方法が違います。

Nostrエクステンションを導入する端末は、実際にNostrを閲覧する端末と違っても構いません(リスト登録はPC、Nostr閲覧はiPhoneなど)。

Nostrエクステンション(NIP-07)の導入方法は以下のページを参照してください。

[ログイン拡張機能 (NIP-07)を使ってみよう | Welcome to Nostr! ~ Nostrをはじめよう! ~ ](https://welcome.nostr-jp.org/tutorial/nip-07.html)

少し面倒ですが、これを導入しておくとNostr上の様々な場面で役立つのでより快適になります。

## 使いたいカスタム絵文字をリストに登録する

以下のサイトで行います。

[emojito](https://emojito.meme/)

右上の**Get started**からNostrエクステンションでログインしてください。

例として以下のカスタム絵文字を導入してみます。

実際より絵文字が少なく表示されることがありますが、古い状態のデータを取得してしまっているためです。その場合はブラウザの更新ボタンを押してください。

[generalJP | カスタム絵文字](nostr:naddr1qqykwetwv4exzmz22qqs6amnwvaz7tmwdaejumr0dspzpmzzcaj5rzeah8y940ln4z855wa72af4a6aac4zjypql55egcpsqqvzqqqr4fcp4fwv8)

- 右側の**Options**から**Bookmark**を選択

これでカスタム絵文字を使用するためのリストに登録できます。

# カスタム絵文字を使用する

例としてブラウザから使えるクライアント nostter から使用してみます。

[nostter](https://nostter.app/)

nostterにNostrエクステンションでログイン、もしくは秘密鍵を入れてログインしてください。

## 文章中に使用

1. **投稿**ボタンを押して投稿ウィンドウを表示

2. **顔😀**のボタンを押し、絵文字ウィンドウを表示

3. ***タブ**を押し、カスタム絵文字一覧を表示

4. カスタム絵文字を選択

5. : 記号に挟まれたアルファベットのショートコードとして挿入される

この状態で投稿するとカスタム絵文字として表示されます。

カスタム絵文字対応クライアントを使っている他ユーザーにもカスタム絵文字として表示されます。

対応していないクライアントの場合、ショートコードのまま表示されます。

ショートコードを直接入力することでカスタム絵文字の候補が表示されるのでそこから選択することもできます。

## リアクションに使用

1. 任意の投稿の**顔😀**のボタンを押し、絵文字ウィンドウを表示

2. ***タブ**を押し、カスタム絵文字一覧を表示

3. カスタム絵文字を選択

カスタム絵文字リアクションを送ることができます。

# カスタム絵文字を探す

先述した[emojito](https://emojito.meme/)からカスタム絵文字を探せます。

例えば任意のユーザーのページ [emojito ロクヨウ](nostr:npub1a3pvwe2p3v7mnjz6hle63r628wl9w567aw7u23fzqs062v5vqcqqu3sgh3) から探したり、 [emojito Browse all](https://emojito.meme/browse) からnostr全体で最近作成、更新された絵文字を見たりできます。

また、以下のリンクは日本語圏ユーザーが作ったカスタム絵文字を集めたリストです(2024/06/30)

※漏れがあるかもしれません

[日本ユーザー作 カスタム絵文字](nostr:npub17hczqvxtfv3w69wr6lxrttnpdekwdwel55mld60fr24zwjuu6utqtj8mjx)

各絵文字セットにある**Open in emojito**のリンクからemojitoに飛び、使用リストに追加できます。

-----------

以上です。

次:Nostrのカスタム絵文字の**作り方**

Yakihonneリンク [Nostrのカスタム絵文字の作り方](https://yakihonne.com/article/_@lokuyow.github.io/1707912490439)

Nostrリンク nostr:naddr1qqxnzdesxuunzv358ycrgveeqgswcsk8v4qck0deepdtluag3a9rh0jh2d0wh0w9g53qg8a9x2xqvqqrqsqqqa28r5psx3

-----------

# 仕様

[NIP-30 Custom Emoji](https://github.com/nostr-protocol/nips/blob/master/30.md)

[NIP-30 カスタム絵文字(和訳)](https://github.com/nostr-jp/nips-ja/blob/main/30.md)

-

@ d3052ca3:d84a170e

2025-01-25 23:17:10

It seems to me that the primary opposition to ecash from bitcoiners comes from the belief that lightning will enable self-custodial micropayments for the masses. Many lightning enthusiasts see ecash as competition that will eliminate this technological outcome (whether they admit it or not).

I understand the motivation for this line of reasoning but I don't see things this way at all. Ecash is a superset of lightning. Cashu literally doesn't have a spec for on-chain transactions (yet!). Everything cashu accomplishes is built on the back of lightning. Standing on the shoulders of giants.

I don't believe that ecash will take away market share from self-custodial lightning because lightning is not a good technology for self-custody. The high overhead costs of running your own node create a natural incentive for a semi-centralized hub and spoke network graph. It just makes economic sense for many users to share a lightning node. It doesn't make economic sense for individuals to bear this cost alone.

This stacker news post is the best writeup on this topic: https://stacker.news/items/379225

It comes from a builder who struggled with these issues for years and learned the shortcomings of the tech first hand. Notice they experimented with ecash as a solution to these problems before they burned out and pivoted to save the company.

Ecash is a superset of lightning. It extends the capability and reach of the lightning network. Without ecash, I don't believe we can achieve bitcoin mass adoption. You can't jam a square peg into a round hole.

We still have a need for self-custody of "small" amounts of bitcoin. I put small in quotes because the block size limit and the fee market it creates impose a fundamental constraint on the minimum practical size of a UTXO. This limit is pegged to the unit of bitcoin. As bitcoin increases in value the minimum size for an on-chain transaction will grow in value as well. You can send $10 worth of bitcoin on-chain today but will this be true in 10 years when the price is much higher? 100 years?

If the current exponential trends hold, we will soon price out the majority of humanity from owning a UTXO. This is bad. Like really bad. "Bitcoin is a failure" bad. This is the motivation for my posts about scaling on-chain usage to 10 billion people. I believe we will need to radically rearchitect bitcoin to achieve this goal.

Lightning is not up to the task. We should leverage lightning for what it's good at: gluing together different self-custodial bitcoin service providers. We should leverage ecash for what it's good at: peer-to-peer electronic cash micropayments. IN ADDITION we also need to start seriously looking at new ideas for scaling self custody to "small" amounts of bitcoin. I am very optimistic that we can solve this problem. There are a number of promising avenues to pursue but I think first we need to move the Overton window ~~beyond the idea of mass adoption of self-custodial lightning~~ regarding on-chain scaling.

Edit: I think the original Overton window statement was incorrect. If on-chain fees stay low then self-custodial lightning or something similar is a much better prospect.

Just my 2 sats...let me know what you think. Keep it civil or be muted.

-

@ 9e69e420:d12360c2

2025-01-25 22:16:54

President Trump plans to withdraw 20,000 U.S. troops from Europe and expects European allies to contribute financially to the remaining military presence. Reported by ANSA, Trump aims to deliver this message to European leaders since taking office. A European diplomat noted, “the costs cannot be borne solely by American taxpayers.”

The Pentagon hasn't commented yet. Trump has previously sought lower troop levels in Europe and had ordered cuts during his first term. The U.S. currently maintains around 65,000 troops in Europe, with total forces reaching 100,000 since the Ukraine invasion. Trump's new approach may shift military focus to the Pacific amid growing concerns about China.

[Sauce](https://www.stripes.com/theaters/europe/2025-01-24/trump-europe-troop-cuts-16590074.html)

-

@ 1ec45473:d38df139

2025-01-25 20:15:01

```

______________

/ /|

/ / |

/____________ / |

| ___________ | |

|| || |

|| #NOSTR || |

|| || |

||___________|| |

| _______ | /

/| (_______) | /

( |_____________|/

\

.=======================.

| :::::::::::::::: ::: |

| ::::::::::::::[] ::: |

| ----------- ::: |

`-----------------------'

```

-

@ 9e69e420:d12360c2

2025-01-25 14:32:21

| Parameters | Dry Mead | Medium Mead | Sweet Mead |

|------------|-----------|-------------|------------|

| Honey | 2 lbs (900 grams) | 3 lbs (1.36 kg) | 4 lbs (1.81 kg) |

| Yeast | ~0.07 oz (2 grams) | ~0.08 oz (2.5 grams) | ~0.10 oz (3 grams) |

| Fermentation | ~4 weeks | 4 to 6 weeks | 6 to 8 weeks |

| Racking | Fortnight or later | 1 month or after | ~2 months and after |

| Specific Gravity | <1.010 | ~1.01 to ~1.025 | >1.025 |

-

@ a012dc82:6458a70d

2025-01-25 13:09:46

The landscape of cryptocurrency is witnessing a potential paradigm shift with the growing interest of institutional investors in Bitcoin. The excitement surrounding the prospect of a spot Bitcoin Exchange-Traded Fund (ETF) is palpable, yet it brings with it a wave of concern. Arthur Hayes, a renowned figure in the cryptocurrency space and the founder of the Maelstrom Fund, stands as a vocal critic of this development. His insights offer a critical perspective on how institutional involvement could fundamentally alter the essence of Bitcoin, potentially steering it away from its founding principles of decentralization and autonomy. This article delves into Hayes' concerns, unraveling the complexities and potential repercussions of institutional custody on the future of Bitcoin.

**Table Of Content**

- The Rising Concern of Institutional Involvement

- The Scenario of Institutional Custody

- The Essence of Bitcoin at Stake

- Influence on Network Consensus

- Long-Term Implications for Bitcoin

- Conclusion

- FAQs

**The Rising Concern of Institutional Involvement**

Arthur Hayes' apprehensions about institutional involvement in Bitcoin are rooted in a deep understanding of both the cryptocurrency world and traditional financial systems. The entry of large financial institutions like BlackRock into the Bitcoin space could signify a significant shift in the dynamics of cryptocurrency ownership and control. These institutions, often perceived as extensions of state interests, could bring a level of centralization and control antithetical to Bitcoin's decentralized ethos. The historical relationship between large financial entities and state mechanisms, and their potential influence on Bitcoin, raises critical questions about the future of this cryptocurrency. The impact of this shift on the broader crypto ecosystem, investor behavior, and Bitcoin's perception in the global financial landscape is profound and multifaceted.

**The Scenario of Institutional Custody**

The future that Hayes envisions, where significant portions of Bitcoin are locked away in institutional ETFs, is a stark departure from the current state of the cryptocurrency. This transformation could relegate Bitcoin from a vibrant, actively traded asset to a passive component of investment portfolios. Such a shift would not only alter Bitcoin's market dynamics but also its fundamental utility. The implications of this change are far-reaching, affecting everything from Bitcoin's liquidity to its role as a tool for financial freedom and empowerment. The prospect of Bitcoin becoming a mere line item in institutional balance sheets is a scenario that challenges the very ideals upon which the cryptocurrency was built.

**The Essence of Bitcoin at Stake**

The core of Hayes' argument lies in the potential loss of Bitcoin's identity. If Bitcoin becomes predominantly held in institutional ETFs, it risks becoming just another asset in the global financial system, losing its unique characteristics as a decentralized and autonomous currency. This transformation would affect the philosophical and practical aspects of Bitcoin, impacting principles of autonomy, privacy, and decentralization. The shift from a user-driven to an institutionally controlled asset could have profound implications for the future of Bitcoin, potentially undermining the trust and support of its community.

**Influence on Network Consensus**

Hayes raises a significant concern about the potential influence of institutional holders on Bitcoin's consensus mechanism and development path. The risk of having a large portion of Bitcoin controlled by entities with different priorities than the broader Bitcoin community is real and concerning. This influence could lead to a misalignment between Bitcoin's development and the needs of its user base, especially regarding crucial updates related to security and privacy enhancements. The integrity and future evolution of Bitcoin's technology could be at stake, raising questions about the true independence and resilience of this decentralized network.

**Long-Term Implications for Bitcoin**

While the short-term effects of institutional investment, such as price appreciation, are clear, the long-term consequences are more nuanced and complex. The potential trade-offs between short-term gains and long-term impacts on Bitcoin's utility and independence are a critical aspect of this discussion. The paradox of Bitcoin's growing acceptance by traditional financial institutions and the possible erosion of its foundational principles is a dilemma that the crypto community must navigate carefully. The future of Bitcoin, in this context, is not just about its price or market capitalization, but about its ability to retain its core values and functionality.

**Conclusion**

Arthur Hayes' insights provide a crucial perspective on the evolving landscape of Bitcoin in the face of institutional interest. As the cryptocurrency world grapples with these developments, understanding the balance between mainstream acceptance and the preservation of Bitcoin's core values is essential. This article reflects on the potential risks and implications of institutional custody of Bitcoin, offering a comprehensive analysis that underscores the importance of maintaining the decentralized ethos that has defined Bitcoin since its inception.

**FAQs**

**What is the main concern raised by Arthur Hayes about institutional involvement in Bitcoin?**

Arthur Hayes expresses concern that institutional involvement, particularly through Bitcoin ETFs, could lead to centralization and control by large financial entities, undermining Bitcoin's decentralized ethos.

**How could institutional custody of Bitcoin alter its market dynamics?**

Institutional custody could transform Bitcoin from an actively traded asset to a passive component of investment portfolios, affecting its liquidity and role as a tool for financial freedom.

**What implications does institutional control have on Bitcoin's network consensus?**

Institutional control could influence Bitcoin's consensus mechanism and development path, potentially leading to a misalignment with the needs of the broader Bitcoin community, especially regarding updates related to security and privacy.

**Are there long-term implications of institutional investment in Bitcoin?**

Yes, while institutional investment might boost Bitcoin's price in the short term, it raises concerns about the long-term impact on Bitcoin's utility, independence, and adherence to its foundational principles.

**What is the essence of Arthur Hayes' argument against institutional custody of Bitcoin?**

Hayes argues that institutional custody risks turning Bitcoin into just another financial asset, losing its unique characteristics as a decentralized and autonomous currency.

**That's all for today**

**If you want more, be sure to follow us on:**

**NOSTR: croxroad@getalby.com**

**X: [@croxroadnews.co](https://x.com/croxroadnewsco)**

**Instagram: [@croxroadnews.co](https://www.instagram.com/croxroadnews.co/)**

**Youtube: [@croxroadnews](https://www.youtube.com/@croxroadnews)**

**Store: https://croxroad.store**

**Subscribe to CROX ROAD Bitcoin Only Daily Newsletter**

**https://www.croxroad.co/subscribe**

*DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.*

-

@ 39cc53c9:27168656

2025-01-24 20:10:32

> [Read the original blog post](https://blog.kycnot.me/p/kyc-no-thanks)