-

@ 19220736:7578e0e9

2025-02-14 03:44:21

While Zelle promotes itself as a quick and easy way to send money, its instant, irreversible transactions have made it a prime target for fraudsters. Despite mounting reports of consumer losses, banks continue to deny reimbursement for many fraud victims, citing narrow legal loopholes. Meanwhile, Early Warning Services, the company behind Zelle, profits from the vast consumer data it collects, fueling concerns about privacy and corporate exploitation. With government investigations ramping up and public pressure mounting, Zelle and their bank owners have teamed up with the Aspen Institute, forming a new task force with corporate and government players.

In 2017, [Early Warning Services](https://www.earlywarning.com/about), owned by Bank of America, Capital One, JPMorgan Chase, PNC Bank, Trust, U.S. Bank, and Wells Fargo, released the [Zelle](https://www.zellepay.com/faq/what-zelle) payment system. It was a fast way to send and receive funds peer to peer between different bank accounts by only needing either the other person's email address or their U.S. mobile phone number.

By 2018, there were growing [concerns](https://www.nytimes.com/2018/04/22/business/zelle-banks-fraud.html) about fraud on Zelle. Despite its convenience, Zelle's design allows funds to transfer instantly and irreversibly, making it a target for scammers. Victims reported being defrauded through tactics like fake online sales or impersonation schemes, and many struggled to recover lost funds due to inconsistent fraud policies among banks. Consumer advocates criticized the platform for inadequate protections, urging banks to implement stronger safeguards to prevent fraud and better support affected customers.

In 2022, a Senate report [criticized](https://www.bankingdive.com/news/warren-zelle-fraud-scams-report-truist-pnc-us-bank-america-jpmorgan-wells-fargo-aba-bpi-cba/633305/) major U.S. banks, including JPMorgan Chase, Bank of America, and Wells Fargo, for failing to adequately protect consumers from fraud on the Zelle payment platform. The investigation revealed that these banks often deny reimbursement for scams where victims are tricked into transferring funds, citing a narrow interpretation of liability under the Electronic Fund Transfer Act. (*"While banks bear responsibility for unauthorized transactions to scammers, consumer-authorized transactions made to fraudsters are another matter”*.) Jamie Dimon, CEO of JPMorgan Chase, [explained](https://www.bankingdive.com/news/bank-ceos-defend-zelle-in-senate-hearing/632554/), *“Anything unauthorized, we do cover”*

On June 16, 2023, the United States Senate Committee on Homeland Security and Governmental Affairs subcommittee, the Permanent Subcommittee on Investigations, launched an inquiry into Early Warning Services and the three largest banks that co-own EWS: JPMorgan Chase, Bank of America, and Wells Fargo.

After a 15-month investigation, the Senate Permanent Subcommittee on Investigations released a [report](https://www.hsgac.senate.gov/wp-content/uploads/2024.7.23-PSI-Majority-Staff-Report-on-Zelle.pdf) on July 23, 2024, highlighting consumer fraud issues tied to the Zelle payment network. The report noted significant drops in the percentage of fraud disputes reimbursed—from 62% in 2019 to just 38% in 2023. Between 2021 and 2023 Zelle [refused](https://dailyhodl.com/2024/07/25/jpmorgan-chase-wells-fargo-and-bank-of-america-refuse-to-reimburse-863000000-to-customers-in-repeated-relentless-failure-to-protect-victims-of-fraud-us-senate-investigation/) to reimburse $880 million to customers who fell victim to fraud on their payment network. Bank employees were found to have broad discretion in deciding whether to reimburse fraud claims, often denying compensation without clear justification. This has raised questions about whether banks are meeting legal obligations under the Electronic Fund Transfer Act ([Regulation E](https://www.consumerfinance.gov/rules-policy/regulations/1005/))

Early Warning Services (EWS) runs the payment network Zelle at a financial loss but generates revenue by selling data-based services to financial institutions. EWS collects extensive consumer and bank data through its operation of Zelle and daily data-sharing agreements with its member banks. This data is used to develop fraud and risk management products, which EWS sells to financial institutions as its primary profit source. While EWS asserts it has not commercialized this data beyond these financial products, the sale of such services remains its main revenue driver.

On August 4, 2024, Senator Richard Blumenthal sent a [letter](https://www.hsgac.senate.gov/wp-content/uploads/2024.08.04-Blumenthal-Letter-to-Chopra.pdf) to CFPB Director Rohit Chopra urging immediate action to address fraud concerns tied to the Zelle payment platform. The letter calls for the Consumer Financial Protection Bureau (CFPB) to investigate their dispute resolution practices and ensure that they fully and promptly address consumer fraud reports. On August 7, 2024, it was [reported](https://www.reuters.com/business/finance/us-consumer-watchdog-probes-major-us-banks-over-zelle-scam-wsj-reports-2024-08-07/) that the Consumer Financial Protection Bureau was investigating several banks due to their handling of Zelle.

On December 20, 2024, The Consumer Financial Protection Bureau (CFPB) responded by [filing](https://files.consumerfinance.gov/f/documents/cfpb_Zelle-Complaint_2024-12.pdf) a lawsuit against Early Warning Services, LLC and the major banks including Bank of America, JPMorgan Chase, and Wells Fargo. The CFPB alleges that these institutions prioritized the rapid deployment of Zelle over implementing effective anti-fraud measures, resulting in significant consumer losses. The lawsuit contends that the defendants failed to adequately address these issues, often denying relief to defrauded consumers. The CFPB seeks injunctive relief, monetary compensation for affected consumers, and civil penalties.

Just 5 days before the Senate Permanent Subcommittee on Investigations released its report, the [Aspen Institute](https://www.aspeninstitute.org/) Financial Security Program (Aspen FSP) [announced](https://www.aspeninstitute.org/news/task-force-on-fraud-and-scams/) the formation of a National Task Force for Fraud & Scam Prevention with their founding sponsor JPMorganChase and executive sponsor Zelle. The stated purpose of the Task Force is to develop a unified national strategy to help the U.S. government and private sector companies work together to stop fraud and scams. [Members](https://fraudtaskforce.aspeninstitute.org/membership) of this private/public task force include: JPMorgan Chase, Bank of America, Wells Fargo, Google, Meta, Amazon, Visa, Mastercard, Verizon, the Federal Trade Commission, the FBI Criminal Investigation Unit, US Department of the Treasury, Homeland Security, and many others.

The Aspen Institute is a 501(c)(3) nonprofit located in Washington DC. In [2023](https://projects.propublica.org/nonprofits/organizations/840399006) they had revenue of $232M and total assets of $519M with the primary source of income coming from donations and federal grants. Per their [mission](https://www.aspeninstitute.org/what-we-do/) statement, their goal is "realizing a free, just, and equitable society." The Institute works to achieve this through creating and driving policy as well as training future policy leaders.

Recently on November 25, 2024, FinCen [announced](https://www.fincen.gov/news/news-releases/fincen-joins-public-private-partnership-combat-fraud-and-scams-impacting) they are also joining the National Task Force that *"brings together key stakeholders including the financial services sector, technology companies, consumer advocacy groups, information sharing and analysis centers, and federal government agencies to develop a comprehensive national strategy for combating fraud and scams."* In The Case for a Coordinated National Strategy to Prevent Fraud and Scams, the Task Force lists [key components](https://fraudtaskforce.aspeninstitute.org/time-is-now) of a national strategy to include improved education of consumers to identify fraud, enhanced information sharing across industry, law enforcement, and regulatory agencies by use of data exchanges and legal mechanisms for sharing information. As well as empowering law enforcement with additional authority and resources. The document cites the recent [UK action](https://www.gov.uk/government/news/new-powers-to-seize-cryptoassets-used-by-criminals-go-live) as an example of recent amendments to law enforcement powers which in England means police will no longer be required to arrest seizing crypto from a suspect, can seize written passwords or memory sticks, as well as transfer "crypto assets" to a law enforcement wallet.

In an August 2024 [interview](https://www.businessinsider.com/zelle-scams-how-to-get-money-back-2024-8?) with Fortune, Ben Chance, the Chief Fraud Risk Management Officer for Early Warning Services reportedly "told the outlet that the best way to prevent scams on money-sharing apps is better user education, sound policy and more funding for law enforcement." This sounds very similar to the National Strategy to Prevent Fraud and Scams being crafted by the National Task Force for Fraud & Scam Prevention, with more user education and law enforcement. No mention of standardized reimbursement policies or enhancing transparency around fraud investigations which are the primary accusations aimed at Zelle and its owners by the US Senate and the subject of the current investigation by the Consumer Financial Protection Bureau.

-

@ 9e69e420:d12360c2

2025-02-13 23:01:36

Robert F. Kennedy Jr. has been confirmed as the next Secretary of Health and Human Services with a Senate vote of 52-48. Senator Mitch McConnell opposed the confirmation. Kennedy's nomination faced hurdles but gained support from the Senate Finance Committee.

During the confirmation hearing, Senator Rand Paul criticized the oversimplification of vaccine discussions. He stated, "Discussion over vaccines is so oversimplified and dumbed down." Kennedy asserted his support for vaccines like measles and polio, promising not to discourage vaccinations as HHS Secretary. Previously, he switched from the Democratic Party to run as an independent and endorsed Trump

-

@ e3ba5e1a:5e433365

2025-02-13 06:16:49

My favorite line in any Marvel movie ever is in “Captain America.” After Captain America launches seemingly a hopeless assault on Red Skull’s base and is captured, we get [this line](https://www.youtube.com/shorts/kqsomjpz7ok):

“Arrogance may not be a uniquely American trait, but I must say, you do it better than anyone.”

Yesterday, I came across a comment on the song [Devil Went Down to Georgia](https://youtu.be/ut8UqFlWdDc) that had a very similar feel to it:

America has seemingly always been arrogant, in a uniquely American way. Manifest Destiny, for instance. The rest of the world is aware of this arrogance, and mocks Americans for it. A central point in modern US politics is the deriding of racist, nationalist, supremacist Americans.

That’s not what I see. I see American Arrogance as not only a beautiful statement about what it means to be American. I see it as an ode to the greatness of humanity in its purest form.

For most countries, saying “our nation is the greatest” *is*, in fact, twinged with some level of racism. I still don’t have a problem with it. Every group of people *should* be allowed to feel pride in their accomplishments. The destruction of the human spirit since the end of World War 2, where greatness has become a sin and weakness a virtue, has crushed the ability of people worldwide to strive for excellence.

But I digress. The fears of racism and nationalism at least have a grain of truth when applied to other nations on the planet. But not to America.

That’s because the definition of America, and the prototype of an American, has nothing to do with race. The definition of Americanism is *freedom*. The founding of America is based purely on liberty. On the God-given rights of every person to live life the way they see fit.

American Arrogance is not a statement of racial superiority. It’s barely a statement of national superiority (though it absolutely is). To me, when an American comments on the greatness of America, it’s a statement about freedom. Freedom will always unlock the greatness inherent in any group of people. Americans are *definitionally* better than everyone else, because Americans are freer than everyone else. (Or, at least, that’s how it should be.)

In *Devil Went Down to Georgia*, Johnny is approached by the devil himself. He is challenged to a ridiculously lopsided bet: a golden fiddle versus his immortal soul. He acknowledges the sin in accepting such a proposal. And yet he says, “God, I know you told me not to do this. But I can’t stand the affront to my honor. I am the greatest. The devil has nothing on me. So God, I’m gonna sin, but I’m also gonna win.”

*Libertas magnitudo est*

-

@ a012dc82:6458a70d

2025-02-13 04:00:01

In the dynamic world of global finance, the interplay between traditional monetary policy and the burgeoning digital asset market is becoming increasingly prominent. The U.S. Federal Reserve's recent pivot towards a more accommodative monetary policy has sparked intense discussion among investors, economists, and cryptocurrency enthusiasts. This shift, characterized by an expected reduction in interest rates, is not just a routine adjustment but a significant move that could have far-reaching implications for various asset classes, including cryptocurrencies like Bitcoin. As we delve into this topic, we aim to unravel the complexities of the Fed's policy change and its potential ripple effects on Bitcoin, a digital asset that has been a subject of much intrigue and speculation.

**Table Of Content**

- Understanding the Fed's Policy Shift

- Impact on Traditional Financial Markets

- Bitcoin's Response to Monetary Easing

- Analyzing the Economic Backdrop

- Bitcoin: A Safe Haven or Risk Asset?

- Risks and Opportunities

- Conclusion

- FAQs

**Understanding the Fed's Policy Shift**

The Federal Reserve, the guardian of the U.S. monetary system, wields immense influence over global financial markets. Its recent signaling of a dovish turn – an expectation of 75 basis points in rate cuts by 2024 – marks a significant departure from its previous stance. This change is reflective of the Fed's response to a confluence of macroeconomic factors, such as fluctuating inflation rates, global economic uncertainties, and domestic financial stability concerns. The Fed's decisions are closely monitored as they set the tone for economic growth, inflation control, and financial market stability. In this context, the anticipated rate cuts suggest a strategic move to stimulate economic activity by making borrowing cheaper, thereby potentially boosting investment and consumption. However, this policy shift is not without its complexities and nuances, as it must balance the fine line between stimulating growth and controlling inflation.

**Impact on Traditional Financial Markets**

The ripple effects of the Fed's policy announcement were immediately felt across traditional financial markets. Stock markets, often seen as a barometer of economic sentiment, reacted positively, with indices like the Dow Jones Industrial Average reaching new heights. This surge reflects investors' optimism about the potential for increased corporate profits and economic growth in a lower interest rate environment. Similarly, the bond market experienced a significant rally, with yields on government securities falling as bond prices rose. This movement in the bond market is indicative of investors' expectations of a more accommodative monetary policy, which typically leads to lower yields on fixed-income securities. These market reactions underscore the pivotal role of central bank policies in shaping investor sentiment and the direction of financial markets. They also highlight the interconnectedness of various asset classes, as changes in monetary policy can have cascading effects across different sectors of the economy.

**Bitcoin's Response to Monetary Easing**

Bitcoin's reaction to the Fed's dovish turn has been a subject of keen interest. The cryptocurrency, which had been experiencing volatility, showed signs of recovery following the Fed's announcement. This response is indicative of Bitcoin's increasing correlation with broader financial market trends, a significant development given its history as an uncorrelated asset. Bitcoin's sensitivity to macroeconomic factors like central bank policies points to its growing integration into the mainstream financial ecosystem. However, this integration also means that Bitcoin is increasingly exposed to the same macroeconomic risks and uncertainties that affect traditional assets. The Fed's policy shift could potentially make Bitcoin more attractive to investors seeking non-traditional assets in a low-interest-rate environment. However, Bitcoin's complex dynamics, including its decentralized nature, limited supply, and regulatory landscape, add layers of complexity to its response to monetary policy changes.

**Analyzing the Economic Backdrop**

The economic backdrop against which the Fed's policy shift occurs is multifaceted and dynamic. On one hand, the U.S. economy has demonstrated resilience, with robust GDP growth and positive retail sales figures suggesting underlying strength. On the other hand, inflation, though moderated from its peak, remains a concern, hovering above the Fed's target. This economic duality presents a challenging scenario for policymakers, who must navigate the delicate balance between stimulating growth and containing inflation. For investors and market participants, this creates an environment of uncertainty, as they must decipher mixed signals from economic data and policy announcements. In this context, Bitcoin's role and response become even more intriguing, as it operates at the intersection of technology, finance, and macroeconomics.

**Bitcoin: A Safe Haven or Risk Asset?**

The debate over Bitcoin's classification as a safe haven or a risk asset is intensified by the Fed's easing stance. Traditionally, in a low-interest-rate environment, investors seek assets that can serve as hedges against inflation and currency devaluation. Gold has historically played this role, and Bitcoin, with its fixed supply and digital scarcity, has drawn comparisons to gold. However, Bitcoin's relatively short history and high volatility make it a more complex and potentially riskier asset. The Fed's dovish policy could enhance Bitcoin's appeal as an alternative investment, especially if traditional assets like bonds offer lower returns. However, Bitcoin's classification as a safe haven is still a matter of debate, with opinions divided on its long-term stability and value retention capabilities.

**Risks and Opportunities**

Investors considering Bitcoin in light of the Fed's policy change face a landscape filled with both risks and opportunities. The potential for a Bitcoin rally in a low-interest-rate environment is counterbalanced by the cryptocurrency's inherent volatility and regulatory uncertainties. Bitcoin's price movements can be dramatic and unpredictable, influenced by a range of factors from technological developments to geopolitical events. Additionally, the regulatory environment for cryptocurrencies is still evolving, with potential changes posing risks to Bitcoin's accessibility and value. Investors must also consider the broader global economic context, including actions by other central banks and international trade dynamics, which can impact Bitcoin's market movement.

**Conclusion**

The Federal Reserve's shift towards a more accommodative monetary policy in 2024 presents a fascinating scenario for Bitcoin and the broader cryptocurrency market. This development underscores the increasing relevance of digital assets in the global financial landscape and highlights the complex interplay between traditional monetary policies and emerging financial technologies. As Bitcoin continues to evolve and gain acceptance, its response to macroeconomic factors like central bank policies will be a critical area of focus for investors. In navigating this dynamic and uncertain environment, a cautious and well-informed approach is essential for those looking to explore the opportunities and navigate the challenges of cryptocurrency investments. The coming years promise to be a pivotal period in the maturation of Bitcoin as it responds to the shifting tides of global finance.

**FAQs**

**How does the Federal Reserve's easing stance impact Bitcoin?**

The Fed's shift towards lower interest rates can make riskier assets like Bitcoin more attractive to investors. This is because lower rates often lead to reduced yields on traditional investments, prompting investors to seek higher returns elsewhere.

**What is the significance of the Fed's 'dot plot' for Bitcoin investors?**

The 'dot plot' is a projection of interest rate movements by Federal Reserve members. A shift towards lower rates, as indicated in the recent dot plot, can signal a more accommodative monetary policy, potentially impacting Bitcoin's market as investors adjust their portfolios.

**Can Bitcoin be considered a safe haven asset in light of the Fed's policy?**

Bitcoin's role as a safe haven asset is debated. While its fixed supply and digital nature offer some safe haven characteristics, its volatility and regulatory uncertainties make it a complex choice compared to traditional safe havens like gold.

**What risks should Bitcoin investors consider in the context of the Fed's easing policy?**

Investors should be aware of Bitcoin's volatility, regulatory changes, and its sensitivity to macroeconomic factors. Additionally, global economic conditions and actions by other central banks can also influence Bitcoin's market.

**How does the economic backdrop influence Bitcoin's response to the Fed's policy?**

Economic factors like GDP growth, inflation rates, and retail sales impact investor sentiment and risk appetite, which in turn can affect Bitcoin's market. A strong economy might reduce the appeal of risk assets like Bitcoin, while economic uncertainties can increase their attractiveness.

**That's all for today**

**If you want more, be sure to follow us on:**

**NOSTR: croxroad@getalby.com**

**X: @croxroadnews.co**

**Instagram: @croxroadnews.co**

**Youtube: @croxroadnews**

**Store: https://croxroad.store**

**Subscribe to CROX ROAD Bitcoin Only Daily Newsletter**

**https://www.croxroad.co/subscribe**

***DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.***

-

@ 0000065e:9b5b4c75

2025-02-13 01:46:07

En el ámbito bitcoiner es muy habitual que el Estado se convierta en el blanco de las principales críticas, que se ve convertido así en el muñeco de paja al que dirigir nuestros palos. Pero no, en realidad es una piñata que está a punto de desmoronarse de los golpes que le pegan. Cada vez tengo más claro que gran parte de los movimientos "antiestatales", si no todos, están contribuyendo, consciente o inconscientemente, a los intereses de los políticos que nos han llevado a esta situación.

El Estado, con todos sus defectos, sigue siendo la principal unidad de ejercicio de la violencia organizada. Señalando al Estado como el origen de todos los males, no hacemos otra cosa que pegarnos un tiro en el pie, haciendo el caldo gordo a quienes trabajan para cercenar nuestras libertades.

Lo que está claro es que los políticos actuales, de boquilla firmes defensores del Estado, lo que están haciendo es provocar su colapso. Puede que estos políticos, o algunos de ellos, incluso no sean conscientes del todo, pero da igual, pues simplemente priman sus intereses personales, como hacemos todos, intentando aprovechar los incentivos que están encima de la mesa, con las reglas de juego que hemos ido asumiendo. No es que quieran más Estado o que pretendan dinamitarlo, tanto una cosa como otra no son más que las consecuencias de los incentivos que subyacen a nuestra forma de organizarnos en sociedad en el contexto actual. Albert Rivera, en una reciente charla con Iván Espinosa de los Monteros, aludía a esta idea criticando las [redes clientelares y de dependencia del Estado](https://youtu.be/AI7roBGtmvk?t=2709) que generan las actuales dinámicas políticas y adulteran el sistema democrático. Aunque, cabría dudar sobre si el propio “sistema democrático” tiene o no algo que ver con esta situación.

En cualquier caso, no es que la mayoría de políticos sean malvados por naturaleza, aunque algunos puedan realmente serlo; es irrelevante. Sus acciones no están motivadas por su maldad, ni por su ideología o su estupidez, sino, simple y llanamente, por sus intereses personales y los del grupo con el que los comparten.

Las ideologías que manejan los políticos se han convertido en nichos de mercado, en caladeros donde echar la caña a ver si pescan suficientes votos como para asegurarse su porvenir y el de los suyos. Es del todo irrelevante si se creen o no esas ideas que defienden con tanta vehemencia como ausencia de plausabilidad, o incluso si están a sueldo de intereses espurios. De cualquier forma, actuarán en función de lo que crean más conveniente para sus intereses personales y para que más peces caigan en sus redes. Véase, por ejemplo, como [Albert Rivera](https://www.youtube.com/watch?v=XrdCP3viocU), ahora que está fuera de la política, manifiesta que resulta evidente que el sistema de pensiones es una estafa piramidal, mientras que cuando estaba en política defendía lo contrario. O a [Errejón](https://www.youtube.com/watch?v=oZ0KfTsITh8), que sostenía la tesis de que no había denuncias falsas hasta que lo denunciaron a él.

Como digo, los políticos no son malvados o estúpidos (aunque haya algunos, o muchos, que entren en esas categorías), simplemente velan por sus intereses con las armas que tienen a su alcance y, como diría [Vito Corleone](https://youtu.be/Z1dRPt_4rZs?t=208), me es indiferente lo que un hombre haga para vivir. El problema es que esta dinámica está generando unas tendencias que se oponen al progreso que hemos generado como sociedad. Esas reglas de juego en la actualidad, convendremos, son inmorales, en el sentido de que actúan como una fuerza contraria a [nuestra supervivencia y potencia de actuar y obrar](https://maestreabogados.com/bitcoin-el-bien-y-el-mal/).

> *Este artículo forma parte de un trabajo más extenso en elaboración sobre las relaciones de Bitcoin con el Estado.*

-

@ c4b5369a:b812dbd6

2025-02-12 12:23:40

### Unidirectional payment channels revisited

#### Nodeless lightning - Reduce ecash mints custodial risk

---

### Sats N Facts

The nostr:npub1yrnuj56rnen08zp2h9h7p74ghgjx6ma39spmpj6w9hzxywutevsst7k5cx unconference has just wrapped up. And what a blast it was. In the heart of northern Thailand, developers, researchers, content creators and more, came together to share ideas on how Bitcoin, Nostr and other free protocols are being used everyday to liberate people.

Not only were stories shared from different community leaders on how embracing bitcoin has empowered them and their communities, but a big goal of the unconference was to bring bitcoin engineers and developers from various domains together in one room, unstructured, chaotic, and let them do their thing.

At first, I thought not having a schedule might be boring, but oh boy was I wrong. There was so much stuff going on, it was hard to choose which session I would have to miss!

### Luke's Spillman channel proposal

One of the sessions I definitely did not want to miss, was nostr:npub1htnhsay5dmq3r72tukdw72pduzfdcja0yylcajuvnc2uklkhxp8qnz3qac s [proposal](https://gist.github.com/lukechilds/307341239beac72c9d8cfe3198f9bfff)

> Ecash mints funded with Spillman channels: The ultimate nodeless Lightning wallet

.

In true unconference fashion, he announced in the main room that the session was about to start, and that the people that are interested should meet him in the whiteboard corner in 10 minutes. The corner was packed, and Luke explained his proposal.

### What's a "[Spillman channel](https://en.bitcoin.it/wiki/Payment_channels#Spillman-style_payment_channels)"?

Essentially when we are talking about Spillman channels, what is meant are unidirectional payment channels (or [CLTV-style channels](https://en.bitcoin.it/wiki/Payment_channels#CLTV-style_payment_channels)). An unidirectional payment channel means, only one party can send payments, but not receive, and the other party can only receive, but not send. They also expire after a predetermined amount of time, and must be closed.

At first glance, this might look kinda stupid. After all, we have [Poon-Dryja channels](https://en.bitcoin.it/wiki/Payment_channels#Poon-Dryja_payment_channels) that are powering the lightning network. They are bi-directional, do not expire, and can be used to shuffle coins back and forth theorethically an unlimited amount of times.

So, why bother with this stupid one-way channel?

### Simplicity is king

People that have worked with lightning channels can sing you a song about complexity, state handling and risks about the current state of bidirectional payment channels. Essentially, There are a lot of requirements on both channel parties when it comes to Liveness (being online) and also state handling (continuous backups).

In some cases, especially when in the context of end-users wanting to perform payments on their mobile phone, they would appreciate it if there was not so much complexity and overhead involved.

The gist of the idea is to combine unidirectional channels and ecash mints to achieve the following:

A self custodial unidirectional payment channel to an ecash mint, massively reducing the senders liveness and state handling requirements when compared to a lightning channel. Sending payments through the mint will be done through swapping some of the channel balance for ecash tokens. At this point, the user is trusting the mint to honor the redemption of these tokens, while the remaining channel balance remains in self custody. This gives them better controll over their funds than just holding their entire balance custodied in the mint. The ecash tokens can then be redeemed to pay a lightning invoice, just the same as it is done now with normal cashu mints.

So this channel, that has no liveness or state management requirements for the sender, and must have a pre-defined close time, seems to be a perfect fit for the following usecase:

1. A `sender` receives his salary once a month. He opens a channel that is valid for one month.

2. The `sender` then can do his daily spending over this channel. He only trusts the `mint` with the amount for the current outgoing payment while it is swapped for ecash, waiting for redemption.

3. If the `sender` must receive funds (a refund for example), he can do so into the `mints` custody, by receiving ecash. He can spend his ecash funds first when doing his next payment, to reduce his custodial exposure.

4. When the channel expires, or runs out of funds, the `mint` closes the channel.

From a consumer perspective, that just want to receive his salary and make frequent payments afterwards, this usecase seems to make a lot of sense. Obviously from a merchants perspective on the other hand, such a channel doesn't really work. But that's fine, it's not the problem we're trying to solve here.

What do you think of this idea? Be sure to let me know in the comments!

In the next article, we will dive into how such a system can be implemented today, using Bitcoin, Cashu and Lightning. We will also discover how the system can be improved, to make channels non-expiring (A collaborative idea between nostr:npub148jz5r9xujcjpqygk69yl4jqwjqmzgrqly26plktfjy8g4t7xaysj9xhgp and nostr:npub1htnhsay5dmq3r72tukdw72pduzfdcja0yylcajuvnc2uklkhxp8qnz3qac born at nostr:npub1yrnuj56rnen08zp2h9h7p74ghgjx6ma39spmpj6w9hzxywutevsst7k5cx ).

So stay tuned!

-

@ b8a9df82:6ab5cbbd

2025-02-11 18:42:35

The last three weeks have felt like a dream—one I don’t want to wake up from. But here I am, on my last day in El Zonte, sitting by the ocean, doing what I love most: watching the waves roll in, surfers gliding across them, some catching them effortlessly, others tumbling but always getting back up. It’s a blessing to be here, soaking in the tranquility, reflecting on the past few weeks while finally sitting down to write about this incredible journey.

Reflecting on this experience, I realize how few people get to live something like this, and I am deeply grateful. Living by the ocean has always been a dream of mine, and these last few weeks have been nothing short of magical. The thought of saying goodbye? Not something I want to entertain. In a world where you can be anything, be kind, be grateful, and cherish the little things—the laughter, the small victories, the unexpected moments of pure joy.

<img src="https://blossom.primal.net/9df76ba64b334ae5f5b6a74de3e6c689720d763b2e65314d95a031f00a6f7841.jpg">

Mexico—a country I was always warned about. "It’s dangerous," they said. "Drugs, crime, food poisoning, even kidnappings. A woman shouldn’t travel there alone." But despite the fear-mongering, after almost three months in South America, I was craving the ocean, and I kept hearing about Mexico’s stunning beaches. A little spoiler: I did see the beach… but it rained almost every day, and my toes barely touched the water.

With three options on the table—Tulum, Holbox, or Isla Mujeres—the decision wasn’t too hard. There was a crazy woman trying to Bitcoinize an entire island, and I had to see that for myself.

###

Just 13 kilometers off the coast of Cancún, Isla Mujeres is a tiny Caribbean paradise—perfect for unwinding and recharging. The island is wonderfully walkable, which I love. No need for a car. I even went for a few runs, and with the island stretching just 7 km in length, I got to explore its hidden oceanfront gems in no time.

But let’s talk about the journey. Arriving in Cancún after a long, exhausting flight, I was hit by chaos at the airport. Dozens of people aggressively offering rides, each one claiming to be a cab driver—it was a nightmare. Not speaking Spanish made things even harder, but thankfully, I wasn’t alone. After dodging the taxi mafia, getting stopped by the military for a random checkpoint (because, you know, legal taxis are apparently a thing to be double-checked), and making a pit stop in Cancún, we finally reached Isla Mujeres—greeted by storms and rain. But none of that mattered. I was here. I was at the ocean. And I was excited.

We stayed at Mayakita, a beautiful villa-style co-living space where you share the common areas—kitchen, coworking space, and outdoor lounges—but still have your own private room, bathroom, and balcony. Oh, and did I mention there’s a Jacuzzi? Absolute win.

The Mayakita team is even building a gym, which is a relief because the local options on the island were… let’s just say, unusable. Picture a tiny, overcrowded room packed with sweaty bodies, zero space between machines, and a never-ending queue for every piece of equipment. Nope. Not for me.

But the real highlight? The incredible restaurant attached to the villas. The food was an explosion of flavors—true mouthgasm territory. And, of course, you could pay for everything in Bitcoin.

###

To my surprise, I ended up staying with <span data-type="mention" data-id="ea57b25f7a57c61d7dd0bf62411244a580d6709e42a20428fd381f89ef8d63db" data-label="nostr:npub1aftmyhm62lrp6lwsha3yzyjy5kqdvuy7g23qg28a8q0cnmudv0ds0sdcke">@nostr:npub1aftmyhm62lrp6lwsha3yzyjy5kqdvuy7g23qg28a8q0cnmudv0ds0sdcke</span> the woman leading the Bitcoin adoption movement on the island. That’s when the craziness really started. The villa next door was booked by a couple of Bitcoiners, and as soon as they found out we had arrived, one of them knocked on our door. A warm smile, a little dog in his arms, and a simple, "Hey, need anything? Food? Help? A bottle opener?"

That’s what I love about this community. The energy, the kindness, the openness—it’s next level. You won’t get that at a typical resort, where people keep to themselves. Here? Instant bonding.

We spent the week exploring the island, asking every restaurant and shop if they accepted Bitcoin. If they didn’t? We walked away. Thanks to Isabella’s hard work, some businesses already do, and one of the highlights? Paying for a tattoo in Bitcoin.

One downside, though—transportation. Even though the island is walkable, taxis and golf carts are available for rent. But renting a golf cart for a week? A whopping $1,000! Insane. Luckily, Isabella had a tiny tuk-tuk, so she packed a few of us into the back and drove us around. No lights, barely any air, and a very bumpy ride. Did we survive? Yes. Would I do it again? Debatable. But hey, it was an experience!

Waking up every morning to the ocean was pure magic. The food? Unbelievable. The freshness of the vegetables, fruit, and fish—something you just don’t get in Germany. Even though I had the most expensive lunch of my life (let’s just say we spent *way* too much on ceviche and a main course), it was worth every cent.

This week taught me something valuable: You don’t need to be in the Bitcoin space for years to make an impact. I get it—long-time Bitcoiners might find it frustrating that adoption seems "easier" now. But I wouldn’t call myself a Bitcoiner just yet. I still have so much to learn. There were moments when I had no clue what people were talking about, even after all those private lessons, hours of talking how a lightening network works, what a hash is and that your 12 - 24 words, the so called private key is actually the master key that can generate an entire tree of private keys. But I’m incredibly lucky to be surrounded by people who are patient, willing to share their knowledge, and never get tired of explaining things again and again.

If I had to sum up this week in one phrase, it would be *ridiculously beautiful and painfully peaceful.*

If you love what Isabella is doing and want to support her work, consider sending her some [sats](https://geyser.fund/project/btcisla).

All pictures taken by <span data-type="mention" data-id="22050dd3659b568c5cb352b0e81958fb986bd941031a90c74ba7f6d2480c11ea" data-label="nostr:npub1ygzsm5m9ndtgch9n22cwsx2clwvxhk2pqvdfp36t5lmdyjqvz84qkca2m5">@nostr:npub1ygzsm5m9ndtgch9n22cwsx2clwvxhk2pqvdfp36t5lmdyjqvz84qkca2m5</span>

-

@ a012dc82:6458a70d

2025-02-11 17:18:57

As the calendar flips to 2024, the financial world's spotlight remains firmly on Bitcoin. This digital currency, once a niche interest, has burgeoned into a major financial asset, challenging traditional investment paradigms. After a staggering 150% rally in 2023, outperforming stalwarts like the S&P 500, gold, and the U.S. dollar, Bitcoin has stirred a mix of excitement and skepticism. Investors, analysts, and enthusiasts are now keenly debating what the future holds for this pioneering cryptocurrency. Will the upward trajectory continue, or is a correction imminent? This article aims to dissect the various factors and indicators that could influence Bitcoin's journey through 2024, offering insights into its potential growth or pitfalls.

**Table Of Content**

- Understanding the Current Landscape

- Key Indicators for 2024

- The Halving Event: A Catalyst for Change

- Global Economic Factors

- Technological Advancements and Adoption

- Challenges and Risks

- Conclusion

- FAQs

- Analyzing Bitcoin's Potential for 2024

**Understanding the Current Landscape**

The story of Bitcoin in 2023 is one of resilience and resurgence. Following a tumultuous period marked by regulatory uncertainties and market skepticism, Bitcoin's impressive rally has been a testament to its growing acceptance and maturation as an asset class. This resurgence is underpinned by several key developments: increasing institutional investment, which has lent credibility and stability; advancements in blockchain technology, enhancing Bitcoin's utility and efficiency; and a broader recognition of Bitcoin as a viable digital alternative to traditional safe-haven assets like gold. Moreover, the socio-economic landscape, characterized by inflationary pressures and a search for non-traditional investment havens, has further fueled Bitcoin's appeal. However, this landscape is complex and ever-evolving, with regulatory shifts, technological advancements, and global economic trends continuously reshaping the narrative.

**Key Indicators for 2024**

**Puell Multiple**

The Puell Multiple, a sophisticated yet insightful metric, currently paints a promising picture for Bitcoin. Standing at 1.53, it indicates a balanced valuation – not too hot, not too cold. This equilibrium is significant, considering the historical context where extremes in this metric have often signaled impending market shifts. A value above four typically heralds a peak, signaling overheating, while a dip below 0.5 has often been a precursor to market bottoms, indicating undervaluation. The current reading suggests a potential for steady, sustainable growth, devoid of the speculative frenzy that has characterized previous cycles.

**MVRV Z-Score**

The MVRV Z-Score, another critical indicator, echoes a similar sentiment. With a current score of 1.6, it implies that Bitcoin is neither in the throes of overvaluation nor languishing in undervaluation. This metric, by comparing market capitalization with realized value, offers a nuanced view of Bitcoin's market position. Historically, extreme values in this score have been reliable harbingers of market tops and bottoms. The current moderate score suggests that Bitcoin may have room for growth, absent the speculative bubbles that have led to volatile boom-and-bust cycles in the past.

**Mayer Multiple**

The Mayer Multiple, currently at 1.404, offers a perspective on Bitcoin's price relative to its historical performance. This indicator, by comparing the current market price to the 200-day simple moving average, helps identify potential overbought or oversold conditions. A value above 2.4 has historically indicated overbought conditions, often leading to corrections, while a value below 0.5 suggests oversold conditions, presenting potential buying opportunities. The current Mayer Multiple suggests that Bitcoin is trading at a healthy level above its long-term average, indicating that there's potential for further growth before it enters overbought territory.

**The Halving Event: A Catalyst for Change**

The upcoming Bitcoin halving event in March 2024 is poised to be a pivotal moment. This event, which occurs approximately every four years, reduces the reward for mining new Bitcoin blocks by half. Historically, halving events have been significant market catalysts, often leading to substantial price increases in the following months. The rationale is straightforward: a reduction in the rate of new Bitcoin creation leads to a decrease in supply. If demand remains constant or increases, this supply squeeze can lead to higher prices. However, the halving is more than just a supply-side story. It also attracts media attention and investor interest, potentially drawing new participants into the Bitcoin market. The anticipation and speculation surrounding the halving can create a self-fulfilling prophecy, driving prices up. However, it's important to note that past performance is not indicative of future results, and the market dynamics surrounding each halving are unique.

**Global Economic Factors**

The trajectory of Bitcoin in 2024 will also be heavily influenced by the broader global economic environment. Factors such as inflation rates, monetary policies of major central banks, and geopolitical tensions play a significant role in shaping investor sentiment towards risk assets, including cryptocurrencies. In an environment where traditional currencies are devalued due to inflation or economic instability, Bitcoin could gain further traction as a digital store of value. Conversely, a tightening of monetary policy, leading to higher interest rates, could dampen investor appetite for riskier assets like Bitcoin. Additionally, geopolitical events that create uncertainty in traditional markets could either drive investors towards safe-haven assets like gold and potentially Bitcoin or lead to a broader risk-off sentiment, adversely affecting all risk assets, including cryptocurrencies.

**Technological Advancements and Adoption**

The ongoing development and adoption of Bitcoin and blockchain technology will be crucial determinants of Bitcoin's value in 2024. The evolution of the Lightning Network, which promises faster and cheaper transactions, could significantly enhance Bitcoin's utility as a medium of exchange. This, in turn, could broaden its appeal beyond just a store of value, potentially attracting a new wave of users and investors. Furthermore, the integration of Bitcoin into more mainstream financial services and the continued growth of the decentralized finance (DeFi) sector could provide additional use cases and increase its value proposition. However, technological advancements are not without risks. Issues such as network scalability, security vulnerabilities, and the environmental impact of Bitcoin mining continue to be areas of concern that could influence public perception and regulatory scrutiny.

**Challenges and Risks**

Despite the optimistic outlook based on current indicators, the path ahead for Bitcoin is fraught with uncertainties and risks. Regulatory developments remain a wildcard. Governments and financial regulators around the world are still grappling with how to best regulate cryptocurrencies. Stricter regulations, or even outright bans in certain jurisdictions, could impact Bitcoin's accessibility and attractiveness. Additionally, the inherent volatility of Bitcoin remains a significant concern. While this volatility can present opportunities for high returns, it also poses substantial risks for investors, particularly those who are not well-versed in the cryptocurrency market. Moreover, the technological landscape of cryptocurrencies is rapidly evolving, and Bitcoin faces competition from newer, potentially more technologically advanced cryptocurrencies. This competition could impact Bitcoin's market dominance and investor sentiment.

**Conclusion**

As we look towards 2024, the journey of Bitcoin continues to be an intriguing blend of potential and unpredictability. The indicators and factors discussed in this article suggest a cautiously optimistic outlook for Bitcoin. However, it is crucial for investors and enthusiasts to remain vigilant and informed, considering both the opportunities and the risks involved. The evolution of Bitcoin is not just a financial story; it's a technological and socio-economic narrative that continues to unfold in fascinating and often unexpected ways. The coming year promises to be another chapter in this ongoing saga, as Bitcoin navigates the complex interplay of market dynamics, technological advancements, and global economic trends.

**FAQs**

**What is the significance of the Bitcoin halving event in 2024?**

The Bitcoin halving, expected in March 2024, is a pivotal event where the reward for mining new Bitcoin blocks is halved. Historically, this has led to a reduction in supply and often a subsequent increase in price, attracting significant investor attention.

**How do economic factors influence Bitcoin's value?**

Global economic factors such as inflation rates, monetary policies, and geopolitical tensions can significantly impact Bitcoin's value. Inflation or economic instability can enhance Bitcoin's appeal as a digital store of value, while tighter monetary policies might reduce the appetite for riskier assets like Bitcoin.

**What are the key indicators to watch for Bitcoin in 2024?**

Key indicators include the Puell Multiple, MVRV Z-Score, and Mayer Multiple. These metrics provide insights into Bitcoin's valuation, market capitalization, and comparison to historical performance, helping gauge its potential growth or correction.

**How does technological advancement affect Bitcoin?**

Technological advancements, like improvements in the Lightning Network, enhance Bitcoin's utility and efficiency. This can broaden its use cases, potentially increasing its value. However, technological risks and competition from other cryptocurrencies also play a role.

**That's all for today**

**If you want more, be sure to follow us on:**

**NOSTR: croxroad@getalby.com**

**X: [@croxroadnews.co](https://x.com/croxroadnewsco)**

**Instagram: [@croxroadnews.co](https://www.instagram.com/croxroadnews.co/)**

**Youtube: [@croxroadnews](https://www.youtube.com/@croxroadnews)**

**Store: https://croxroad.store**

**Subscribe to CROX ROAD Bitcoin Only Daily Newsletter**

**https://www.croxroad.co/subscribe**

***DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.***

-

@ e83b66a8:b0526c2b

2025-02-11 15:59:51

I am seeing a groundswell of interest in adopting Bitcoin in small businesses replacing or augmenting existing merchant services.

This has many advantages for these businesses including:

Attracting Bitcoiners as customers over your competitors.

Allowing a self custody payment system which does not require purchasing equipment, monthly service fees and high transaction fees.

Self custody your money, removing banks and merchant service companies from taking a cut or interfering in the transaction process. i.e. Bitcoin behaves much more like cash in face to face transactions.

Building a Bitcoin Strategic Reserve allowing your profits to accumulate in value over time, just as Bitcoin increases in value due to scarceness and increased adoption.

If any or all of these are interesting to you, then here are a scale of merchant options available to you depending on your needs and interests.

SOLE TRADER

The easiest way for a sole trader to accept Bitcoin is to download the app “Wallet of Satoshi”

https://www.walletofsatoshi.com/

or for regions this is not available, use a web equivalent called COINOS

https://coinos.io/

This gives everything you’ll need, Bitcoin and Lightning receiving addresses, publishable as text or scannable as a QR code. The ability to generate a specific value invoice using Lightning which can be paid face to face or remotely over the Internet and a wallet to hold your Bitcoin balance.

This is a perfect start point, but moving forward it has some drawbacks. It is custodial, meaning that a company actually holds your Bitcoin. Unlike a bank, if that company fails, you loose your Bitcoin.

There is also no direct ability to move that Bitcoin to fiat currencies like USD or GBP, so if you need some of those earnings to pay suppliers in fiat currencies, you will struggle to convert.

If you are an online only retailer, then the industry standard is BTCPay

https://btcpayserver.org/

which can be integrated into most e-commerce systems

TRADITIONAL MERCHANT SERVICES

So the next option is to use a Bitcoin merchant service company. They look very similar to traditional fiat merchant service companies, they can supply infrastructure like PoS terminals and also handle the payments for you, optionally settling balances to your bank in USD or GBP etc…

They charge for the physical devices and their services and they charge a fee on each transaction in the same way traditional merchant service companies do, but usually these fees are significantly smaller.

Companies like MUSQET can help setup your business in this way if you wish.

https://musqet.tech/

CONSULTANCY

The third option is to use a consultancy service like Bridge2Bitcoin

https://bridge2bitcoin.com/

this is a company that will come in, explain the concepts and options and build a service around your needs. The company will build the solution you are looking for and make their money by providing the equipment and optionally running the payment solution for you.

SELF BUILD

If you have experience with Bitcoin and have optionally run your own Lightning node for a while, the tools exist to be able to develop your own solution in-house. And just as Bitcoin allows you to be your own bank, so Lightning allows you to be your own merchant services company.

Solutions like Umbrel

https://umbrel.com/

running Albyhub

https://albyhub.com/

with their POS solution

https://pos.albylabs.com/

are a low cost option you can build yourself. If you require devices like PoS terminals, these can be purchased from companies like

Swiss Bitcoin Pay:

https://swiss-bitcoin-pay.ch/store#!/Bitcoin-Merchant-Kit/p/709060174

as a package or Bitcoinize directly or in volume:

https://bitcoinize.com/

There is also the lower cost option of use software loaded onto your staffs iPhone or Android phone to use as a PoS terminal for your business:

https://swiss-bitcoin-pay.ch/

Swiss Bitcoin Pay can also take the Bitcoin payment and settle a final amount daily or even convert to fiat and deposit in your bank the next day.

HYBRID

MUSQET also offer a PoS system for both Bitcoin and Fiat. They onboard merchants with traditional card services for Visa, Mastercard and Amex with Apple Pay and Google Pay all within the same device where they deploy Bitcoin Lightning as standard:

https://musqet.tech/

-

@ c69b71dc:426ba763

2025-02-11 14:07:34

# The Power of Words...

## ...Shaping a Compassionate Future

This morning I woke up with this thought:

**> If we were more mindful of our choice of words, we would immediately need to change the following: Schools would no longer have classes and classifications, but only Communities!**

This would make a huge difference in terms of togetherness, well-being, and caring for one another. 🙌🏼

### Language shapes reality

Words influence how we see the world and ourselves. When we replace terms like "classes" or "grades" with "community" and "development," it changes our entire way of thinking about education and coexistence.

For example, in companies, we often talk about "teams" instead of "departments." This unconsciously fosters unity, cooperation, and a sense of belonging on equal terms.

### Community instead of competition

In school, work, and everyday life, we often evaluate, compare, and classify. But what if we focused on cooperation and synergies instead of competition?

In some schools, there are no grades anymore, just individual feedback – this takes away the performance pressure and strengthens intrinsic motivation.

### Appreciation instead of categorization

Putting people in "boxes" – whether through grading systems, social classes, or job titles – often creates separation rather than connection.

Instead of labeling people as "successful" or "failed," we could ask: "What are their strengths? How can we support each other?"

Mindful language in everyday life

We could also reflect on our word choices in daily life:

Instead of "problem" → "challenge"

Instead of "failure" → "learning opportunity"

Instead of "mistake" → "experience"

### School as a mirror of society

How we learn to interact with each other in school shapes our behavior in society. When children grow up in communities instead of class systems, they learn that cooperation and empathy are more important than competition.

There are so-called democratic schools where there are no grade levels – children learn from each other across ages. Students support each other by sharing knowledge and helping each other. Teachers are seen as coaches, not as "all-knowing" authority figures.

They too are human and can learn from the children.

Many teachers want to give children something that will help them in life.

However, the rigid old school system dictates what must be taught and when, often disregarding the individual interests of the children. This stifles passions – in both the children and the teachers. Instead, teachers could act as inspiring sparks, igniting curiosity and enthusiasm for learning.

-----------

> **A history teacher once said to me on the phone, when discussing my son who didn’t want to read printed Wikipedia sheets: "If there is no spark in the child, the teacher can’t ignite anything."

**

This sentence frustrated me, because it shows that this teacher had long since lost his own spark!

**Children always have a spark. Always!**

-----------

### A day without evaluations

What if we consciously refrained from evaluating others for one day – whether through grades, criticism, or labels?

Instead of saying to a friend, "You made a mistake," we could say, "That was an interesting experience – what did you learn from it?"

Instead of saying, "That wasn’t good," we could ask, "How could it be done differently or better?"

Instead of grading children in school, we could tell them what they did well and where they can still grow.

Instead of getting upset about a difficult customer, we could feel empathy for their situation.

### Mindful language as the key to change

**If we are more mindful with our language – also with how we speak to ourselves – we can shape a society where people meet each other with compassion. **

`Words are vibrations that shape reality. Chosen consciously, they can create a world based on connection, growth, and love.

It is up to us to start this change within ourselves – and carry it into the world.`

Thank you for reading 🕊️

-

@ 31da2214:af2508e2

2025-02-10 10:08:06

A global privacy nightmare is unfolding. The UK government secretly ordered Apple to backdoor encrypted iCloud storage worldwide—but Apple is legally forbidden from revealing this order, or they face criminal charges. This affects **2 BILLION USERS**.

Here’s the full story & why it’s part of a much bigger power grab. 🧵👇 [[Thread by @sayerjigmi on Thread Reader App](https://threadreaderapp.com/thread/1888287793123901896.html)]

---

## 1) The UK's Secret Order to Backdoor Encryption 🔓

Under the UK’s **Investigatory Powers Act (IPA) 2016**, Apple was served a **Technical Capability Notice (TCN)**—forcing them to create a backdoor for encrypted iCloud data.

This is not limited to UK users. It applies **worldwide**, meaning your private files are at risk, no matter where you live.

🔗 [@macworld report](https://macworld.com/article/260251…)

---

## 2) Apple’s Legal Gag Order 🤐

Apple is legally forbidden from revealing this order. If Apple even acknowledges that the UK issued this demand, they could face **criminal charges**.

This is a secret government order with **global consequences**.

---

## 3) A Global Threat to Encryption 🌍

This isn’t just about the UK (although they are leading the charge in threatening citizens in OTHER countries for violating BRITISH censorship laws!).

If Apple complies, every government in the world will demand the same access—from the US to China to authoritarian regimes.

**End-to-end encryption would be effectively dead.**

---

## 4) Apple’s Dilemma: Comply or Withdraw? 🚪

Apple has two choices:

- **Comply** & weaken encryption globally.

- **Refuse** & withdraw services from the UK.

WhatsApp & Signal faced similar threats last year and vowed to leave the UK rather than compromise security. Will Apple do the same?

🚨 Watch the heated discussion between Damian Collins, director of CCDH (architect of the UK Online Safety Bill), and Signal’s CEO: [YouTube Link](https://www.youtube.com/watch?v=E--bVV_eQR0)

---

## 5) Why This Matters: Encryption Protects Everything 🔐

- **Encryption protects financial data, health records, personal security (e.g., where you live or work), and private conversations.**

- Governments always say they need backdoors for national security—but history shows they’re used for **mass surveillance**.

- Once a backdoor exists, hackers, rogue employees, and other governments WILL find it.

---

## 6) The UK’s War on Encryption 🛡️

The UK is trying to dominate the global surveillance & censorship landscape.

While the US, Canada, Australia, and New Zealand have supported strong encryption to mitigate cyber threats, the UK stands alone in its war on encryption.

---

## 7) The Free Speech Crackdown 🗣️

This isn’t just about encryption—it’s about **control**. Governments worldwide are criminalizing dissent and censoring free speech, using tech companies as their enforcement arms.

🔗 [GreenMedInfo Report](https://greenmedinfo.com/content/breaking-international-governments-are-criminalizing-free-speech-through-glo-3)

---

## 8) The Global Censorship Agenda 🌐

This ties into the UK’s broader, **GLOBALLY ORCHESTRATED censorship agenda**:

- The **Online Safety Bill** criminalizes encrypted messaging & forces platforms to scan private messages.

- The **Digital Services Act (EU)** gives governments the power to shut down online content they don’t like.

- Leaked US-UK documents show direct coordination between UK intelligence & the Biden administration to censor online speech.

---

## 9) The Architects of Speech Policing: CCDH 🕵️♂️

The **Center for Countering Digital Hate (CCDH)**—a UK intelligence-backed group—has been a driving force behind global censorship.

They were caught:

- Running “black ops” to suppress RFK Jr.’s presidential campaign.

- Leading the "Kill Musk’s Twitter" directive, trying to shut down free speech on X.

- Labeling 12 private US citizens as the “Disinformation Dozen” to justify mass censorship.

🔗 [Reclaim the Net Investigation](https://reclaimthenet.org/black-ops-how-a-us-uk-censorship-group-targeted-rfk-jr-to-stifle-dissent)

---

## 10) The Pattern is Clear: Surveillance + Censorship 🔍

1️⃣ Governments create "safety" laws to justify surveillance.

2️⃣ They pressure tech companies to enforce censorship.

3️⃣ Once encrypted services are gone, nothing is private anymore.

This is the biggest attack on digital freedom in history.

---

## 11) What Can We Do? 💪

- **Support companies** that refuse to build backdoors (Signal, ProtonMail, etc.).

- **Push for legislation** that protects encryption & free speech.

- **Stay informed** & spread awareness—governments count on secrecy to push these policies through.

- Follow and support privacy and internet freedom organizations such as:

- [@G_W_Forum](https://twitter.com/G_W_Forum)

- [@FFO_Freedom](https://twitter.com/FFO_Freedom)

- [@ReclaimTheNetHQ](https://twitter.com/ReclaimTheNetHQ)

---

## 12) The Ultimate Power Grab: Controlling All Digital Communication 📱

If Apple caves, every other platform will be forced to follow.

📌 The UK’s Global Playbook:

- A backdoor to encryption (Investigatory Powers Act).

- A government-linked censorship network (CCDH).

- A speech-policing framework that extends worldwide (Online Safety Bill).

This is a global effort to control what people can say, share, and store privately.

---

## 13) The Final Stand: Will You Comply or Resist? ⚔️🚨

They want total control—your speech, your privacy, your elections. This is the defining battle of our time.

🇬🇧 UK’s war on encryption = Global censorship blueprint.

🗳️ Election meddling + speech policing = A hijacked democracy.

📢 **Digital freedom is human freedom.**

Stand up. Speak out. Fight back. 🏴☠️🔥

🔗 [LEARN MORE](https://sayerji.substack.com/p/crossfire-of-democracy-uk-labour?utm_source=publication-search)

---

*Full thread preserved by [Thread Reader App](https://threadreaderapp.com/thread/1888287793123901896.html).*

-

@ 40b9c85f:5e61b451

2025-02-09 20:53:03

## Data Vending Machine Context Protocol

### The Convergence of Nostr DVMs and MCP

In the rapidly evolving landscape of artificial intelligence, a new approach to sharing and accessing computational tools is emerging through the combination of two powerful technologies: Nostr's Data Vending Machines (DVMs) and the Model Context Protocol (MCP). This convergence has the potential to reshape how we think about tool distribution and accessibility, creating a truly decentralized marketplace for computational capabilities that serves AI, humans, and any type of machine that speaks the protocol.

## Understanding the Building Blocks

Nostr's Data Vending Machines function much like their physical counterparts, but instead of dispensing snacks, they provide computational services with built-in Lightning Network payment capabilities. These DVMs operate on the decentralized Nostr network, allowing users to reach service providers without relying on centralized platforms or gatekeepers.

The Model Context Protocol complements this infrastructure by providing a standardized way for applications to share context and expose their capabilities. Think of MCP as a universal language that allows tools to communicate effectively with any application that understands the protocol. This standardization is crucial for creating a seamless experience across different tools and services.

## What is DVMCP?

DVMCP proposes a path for making DVMs and MCPs interoperable, introducing a protocol that makes local utilities available to everyone on the network. Our [draft specification](https://github.com/gzuuus/dvmcp/blob/master/docs/dvmcp-spec.md) serves as a foundation for easily transforming any MCP server into a DVM. To bridge these technologies, we've developed a simple software component that sits between your MCP server and the DVM ecosystem. You can find it in our [repository](repo.link). This bridge connects to your MCP server as a client and exposes its utilities through Nostr as a DVM, handling all the necessary Nostr logic. This means any existing MCP server can become accessible through Nostr without modifications - simply run the bridge alongside your server.

This is particularly exciting because the vibrant and growing MCP community. Any team or individual already working with MCP can instantly plug into the Nostr DVM ecosystem, gaining access to decentralized discovery, built-in monetization, and an already existing user base. The bridge component makes this transition effortless, requiring no changes to any existing MCP implementations.

## A New Paradigm

A decentralized marketplace where anyone can run tools locally and make them available globally. This addresses an unsolved problem larger than the Nostr ecosystem: how to make resources and tools discoverable and accessible in a decentralized, permissionless way.

The power of this combination lies in its flexibility. Users can access tools through regular Nostr clients, AI agents can discover specific capabilities, and DVMs can create sophisticated tool chains. With Lightning Network integration, true machine-to-machine transactions become possible, where machines can autonomously discover, negotiate, and pay for computational services. Most importantly, you can run services on your own hardware while making these capabilities accessible to anyone anywhere.

The result is a system that preserves privacy, promotes innovation, and creates new opportunities without central authorities controlling what tools can be offered or who can use them. The entire project, is available under the MIT license, and any feedback and collaboration is welcome.

## Looking Forward

As these technologies mature, we're likely to see a fundamental shift in how computational capabilities are distributed and accessed. Instead of relying on massive cloud data centers controlled by a few companies, we're moving toward a global network of local machines, each contributing unique capabilities and computation to a larger, more resilient ecosystem.

The convergence of Nostr DVMs and MCP represents more than just a technical innovation—it's a step toward a more equitable and accessible future. By enabling anyone to run and share tools, we're building an ecosystem where computational resources are not concentrated in the hands of a few but are available to and controllable by everyone.

[Repository](https://github.com/gzuuus/dvmcp/)

-

@ b8af284d:f82c91dd

2025-02-09 18:48:21

*Liebe Abonnenten,*

*viele von uns erleben im privaten wie im öffentlichen Leben gerade eine Zeit der Verwirrung und Irritation. Etwas scheint im Umbruch, alte Gewissheiten, Strukturen und Allianzen scheinen sich vor unseren Augen aufzulösen. Trump, Musk und Thiel wirken wie die Abrissbirnen einer alten Ordnung, Agenten des Chaos mit dem einzigen Ziel, sich selbst zu bereichern. Ist es so?*

*Könnte es anders sein?*

*Folgender Text kann und will diese Fragen nicht ultimativ beantworten. Es gibt aber eine Brille, durch die, setzt man sie auf, viele Entwicklungen in einem anderen, viel helleren Licht erscheinen. Diese Brille heißt e/acc.*

**Was ist e/acc?**

Das Kürzel geht auf den Programmierer Guillaume Verdon zurück, der unter dem Pseudonym „Beff Jezos“ die Bewegung. Es steht für „effective accelerationism“. Accelerationism, auf Deutsch Akzelerationismus, abgeleitet vom Verb „beschleunigen“, hat Wurzeln, die weiter zurückreichen - dazu später mehr. Der Zusatz „effective“ ist eine ironische Replik auf den „effective Altruism“, den unter anderen Sam Bankman-Fried vertrat und grandios scheiterte.

e/acc setzt also auf Beschleunigung. Kapitalismus, Innovation, vor allem künstliche Intelligenz sollen nicht aufgehalten oder reguliert werden, sondern im Gegenteil beschleunigt werden.

**Warum?**

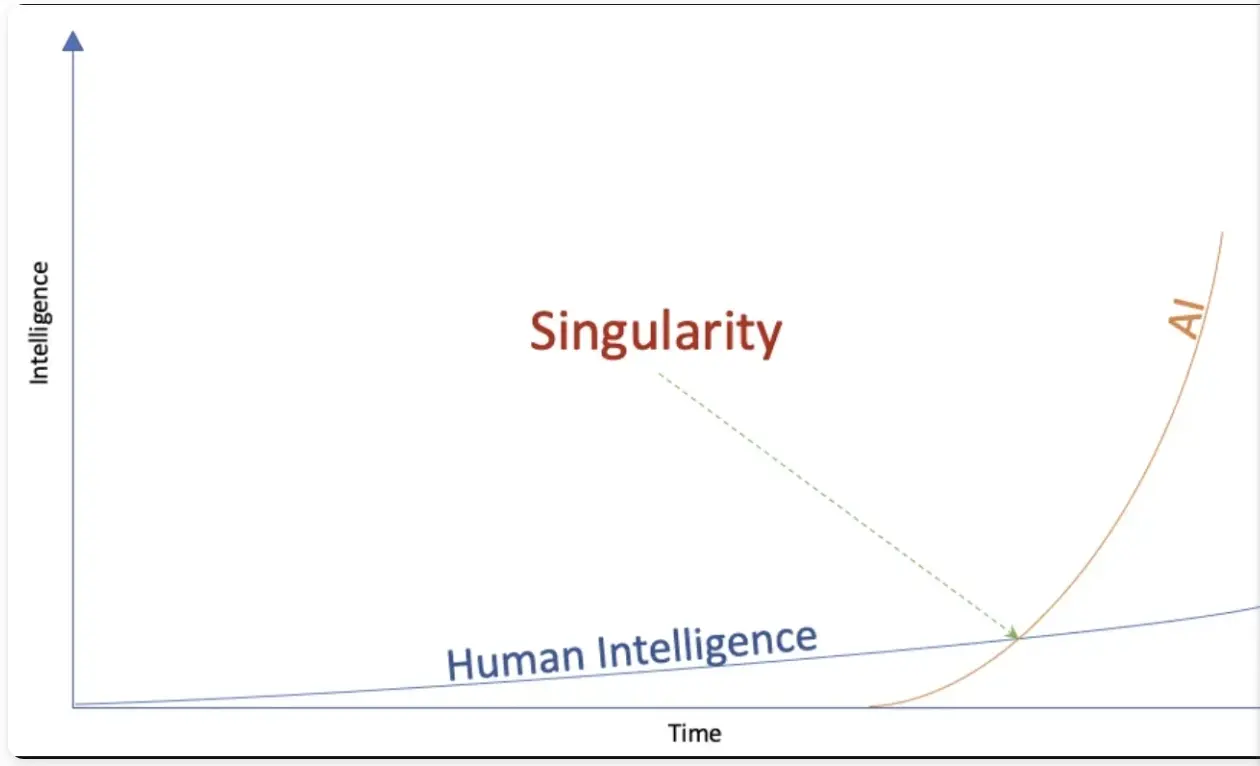

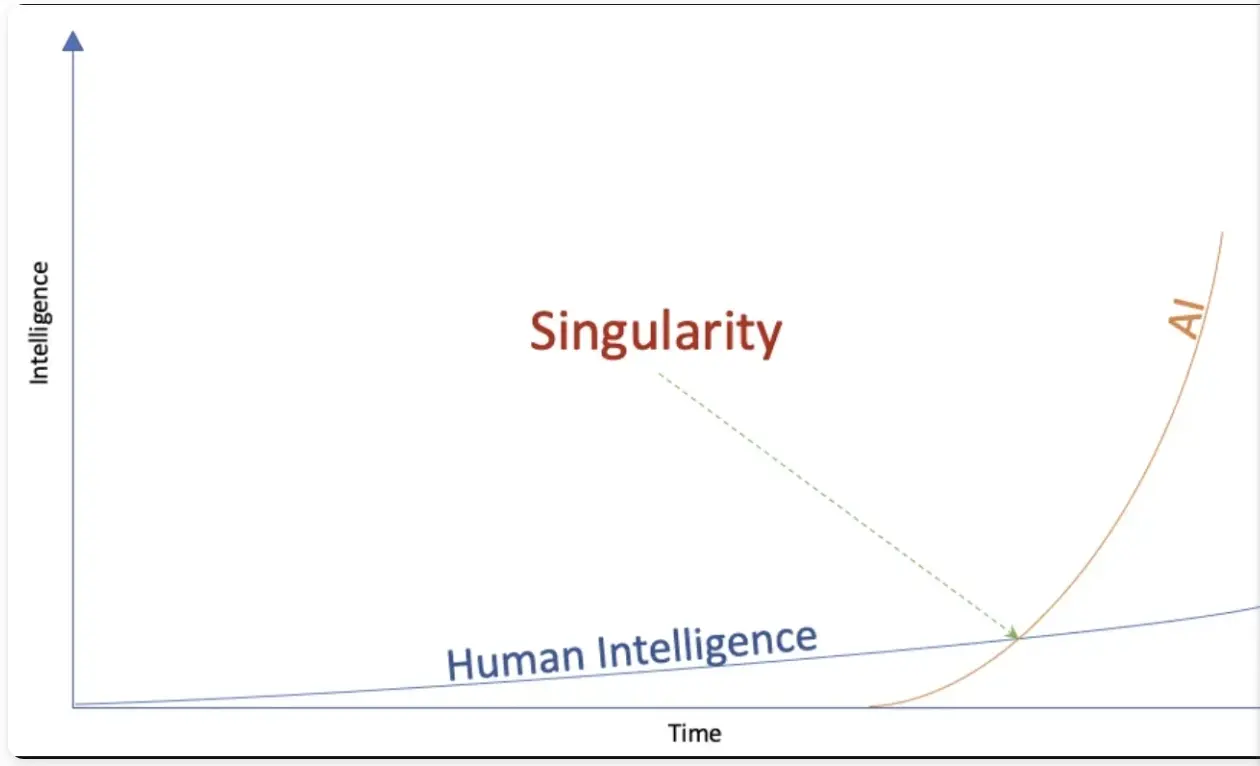

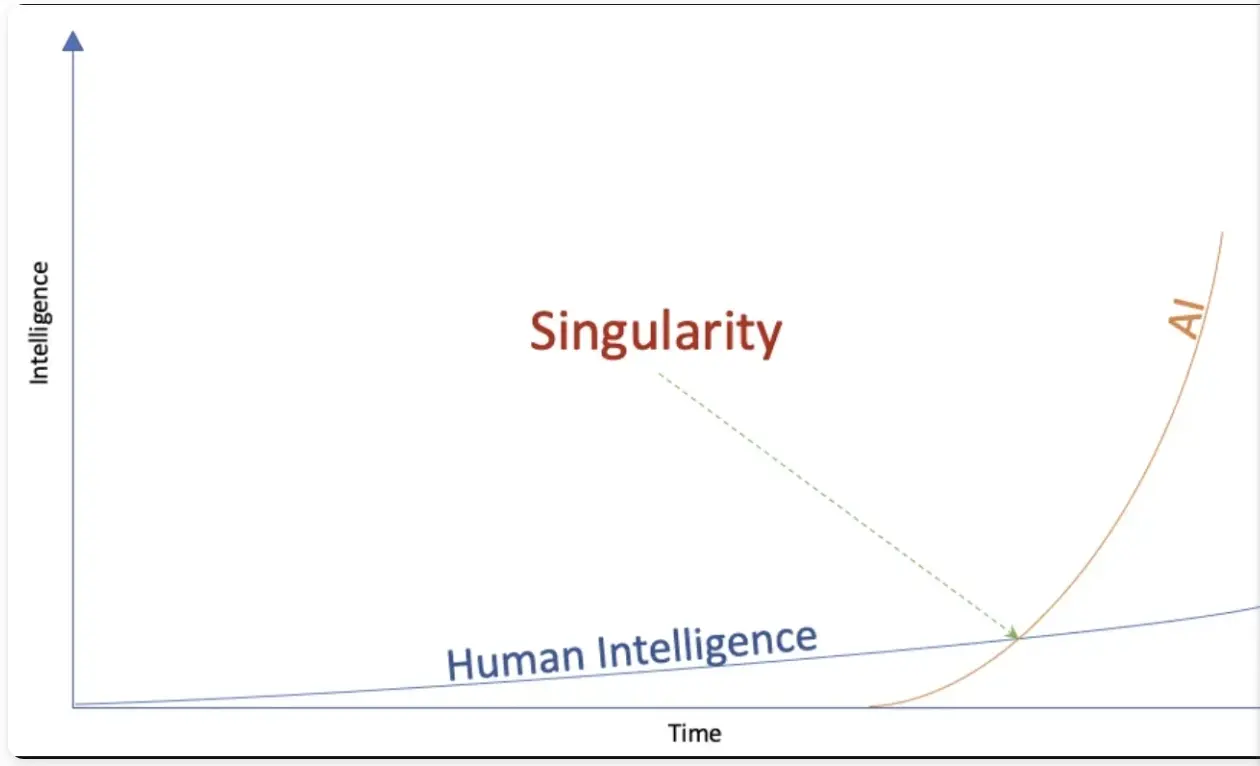

Eine einfache Antwort lautet: Weil sie eh stattfinden. Besonders deutlich wird das im Fall künstlicher Intelligenz. Large Language Models (LLMs) wie ChatGPT und Deepseek sind nur die für die Öffentlichkeit sichtbaren Entwicklungen. Im Hintergrund ersetzt Künstliche Intelligenz zunehmend auch Produktionsprozesse und nicht zuletzt die Kriegsführung. Man spricht deswegen vom „Point of Singularity“. In den kommenden Jahren wird künstliche Intelligenz menschliche übertrumpfen. Unsere Arbeitswelt, unser Finanzsystem und gesellschaftliche Strukturen werden sich grundlegend ändern. Wenn es dazu kommt, warum die Entwicklung noch aufhalten? **Beschleunigen ist besser.**

Die zweite Antwort ist tiefgründiger und rührt an das Verständnis von Leben insgesamt. Langfristig strebt das Universum nach Entropie. Es dehnt sich aus, bis alle Teile in maximaler „Unordnung“ angeordnet sind. Systeme mit hoher Energiezufuhr können Strukturen aufbauen, solange sie Wärme oder Entropie in ihre Umgebung abgeben. In einem Organismus sind alle Teile zu einer höheren Ordnung organisiert. Leben strebt nach Ordnung, Selbsterhalt und Wachstum, weshalb der Energieverbrauch zunimmt. e/acc-Fan und Silicon-Valley-Investor Marc Andreessen schreibt in “The Techno-Optimist Manifesto”:

> *Techno-Optimists believe that societies, like sharks, grow or die.*

>

> *We believe growth is progress – leading to vitality, expansion of life, increasing knowledge, higher well being.*

Ein Gleichgewicht gibt es nicht. Entweder strebt eine Struktur nach Ordnung (Leben) oder nach Unordnung (Tod). Da eine Balance nicht existiert, gibt es nur zwei Möglichkeiten: Verlangsamen oder Beschleunigen. Höhere Ordnungen aufbauen oder verfallen. Wachsen oder Sterben. **Beschleunigen ist besser.**

## **Konsequenzen**

e/acc ist kein philosophisches System im strengen Sinn. Es leitet Konsequenzen aus physikalischen Grundsätzen ab.

Kapitalistische Systeme und freie Märkte sind die effizientesten Strukturen, um Informationen zu verarbeiten. In einem offenen, freien Markt gibt der Preis das zuverlässigste Signal über Knappheit eines Gutes. Wird dieser Prozess durch externe Einflussnahme wie Subventionen gestört, läuft die Maschine nicht effizient. Das Gesamtsystem wird verzerrt. Nochmals Andreessen dazu:

> *We believe the market economy is a discovery machine, a form of intelligence – an exploratory, evolutionary, adaptive system.*

Varianten und Abweichungen sind wichtig, da ein System dadurch am schnellsten auf sich ständig verändernde Umweltbedingungen reagieren kann. Wer nicht frei sprechen kann, kann nicht frei denken. Dezentrale Strukturen mit vielen kleinen einzelnen „Nodes“ sind resilienter als hierarchisch-zentralistische Systeme. Das führt zu einem Meinungsfreiheits-Maximalismus.

Greifen staatliche Akteure in die Forschung ein, und vergeben zum Beispiel Lizenzen für KI-Projekte, kann das System nicht mehr auf die besten Ressourcen zurückgreifen. Es entwickelt sich nicht in seiner natürlichen Geschwindigkeit, sondern wird künstlich verlangsamt. **Beschleunigen ist besser.**

Im Falle von KI hat dies geopolitische Konsequenzen: Sollten autoritäre Akteure wie zum Beispiel China schneller zum Punkt der Singularity vorstoßen, entsteht eine Dystopie, ein Orwellscher Überwachungsstaat. Bevorzugen ist deswegen eine beschleunigte, dezentrale Forschung, damit freie Systeme die Oberhand behalten.

Dasselbe gilt für das Geldsystem: e/acc trifft hier auf Hayek und Mises. Viele Zahlungssysteme stehen in permanenter Konkurrenz zueinander. Am Ende setzt sich das nützlichste und vermutlich auch härteste Geld durch.

## Konkrete Folgen

Auf die konkrete Politik übertragen führt das zu Konsequenzen, die man aktuell beobachten kann.

\*\*Radikale Deregulierung: \*\*Die Biden-Administration versuchte, [AI-Forschung eng an die Regierung zu binden](https://x.com/pmddomingos/status/1888059248535552312). Open-AI-Gründer Sam Altman forderte [2023 eine Lizenz-Vergabe an Unternehmen](https://www.businessinsider.com/sam-altman-openai-chatgpt-government-agency-should-license-ai-work-2023-5), um überhaupt in diesem Bereich aktiv zu werden. (Musk trat zunächst sogar für ein Forschungs-Moratorium ein, änderte dann aber seine Meinung.) Das führte zum Widerstand der e/acc-Fraktion im Silicon Valley, und gab den Ausschlag, sich auf die Trump-Seite zu stellen. Deregulierung zieht sich nun durch alle Bereiche der Wirtschaft: auch auf die „Entwicklungshilfe“ von USAID. Der Regierungsapparat wird insgesamt massiv verkleinert, da Bürokratie das Wachstum hemmt. A fuera.

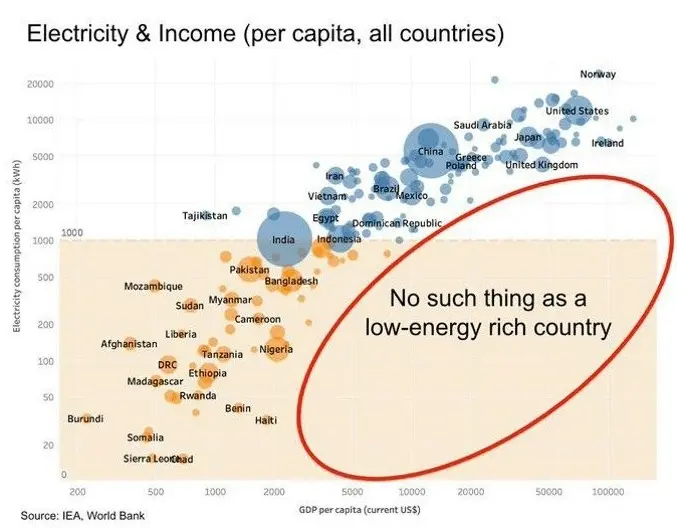

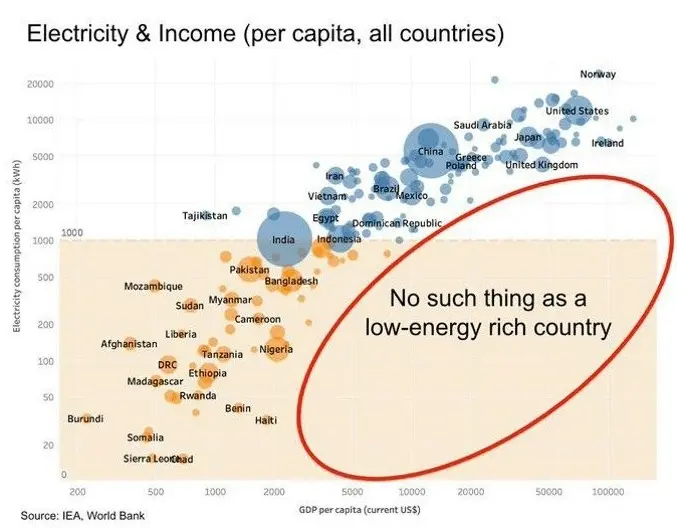

\*\*Priorisierung von günstiger Energie: \*\*Da der Energie-Verbrauch mit zunehmender Ordnung ansteigt, und LLMs einen sehr viel Strom brauchen, priorisiert die neue Regierung die Erschließung zusätzlicher Energiequellen: Gas, Öl, Nuklear und regenerative Energiequellen gleichermaßen.

![1.00]()

Wiederherstellung von Meinungsfreiheit.Content-Moderationen auf Social-Media-Plattformen fallen weg. Geheimdienst-Dokumente werden freigegeben. So schrieb Peter Thiel vor einigen Wochen in einem Essay in der Financial Times über die große Enthüllung:

> \

> *But understood in the original sense of the Greek word **apokálypsis, meaning “unveiling”**, Obama could not give the same reassurance in 2025. Trump’s return to the White House augurs the apokálypsis of the ancien regime’s secrets. (…)\

> The apokálypsis is the most peaceful means of resolving the old guard’s war on the internet, a war the internet won. My friend and colleague Eric Weinstein calls the pre-internet custodians of secrets the Distributed Idea Suppression Complex (DISC) — the media organisations, bureaucracies, universities and government-funded NGOs that traditionally delimited public conversation.*

**Krypto-Deregulierung:** Da Kryptowährungen und Smart-Contract-Strukturen bestens mit LLMs harmonieren, werden Innovationsbremsen in Form von Regulierungen abgebaut.

\*\*Umbruch der Weltordnung: \*\*Auf der geopolitischen Ebene werden Bündnisse, Allianzen und Blockstrukturen aufgebrochen und nach effizienten Win-Win-Verhältnissen neu organisiert.

**Erschließung neuer Lebenswelten:** Degrowth, weniger Energie-Verbrauch und weniger Kinder sind keine Option, da sie zum Tod führen. Das System Menschheit muss wachsen und wird neue Lösungen erfinden. Wenn die Ressourcen des Planeten Erde nicht mehr ausreichen, müssen neue erschlossen werden - vielleicht auf dem Mars.

## **Die Ideengeschichte**

Während e/acc ein relativ neues System ist, hat der Akzelerationismus tiefere Wurzeln. Lenin kann man als einen frühen Akzelerationisten bezeichnen. Der Marxismus wurde Anfang des 20. Jahrhunderts weniger als Ideologie, sondern mehr als exakte Wissenschaft begriffen. Demnach würde der Kapitalismus früher oder später an seinen eigenen Widerständen kollabieren. Warum den Prozess also nicht beschleunigen und die Revolution herbeiführen?

Ende des 20. Jahrhunderts griff der Philosoph Nick Land diese Gedanken wieder auf. Land forderte Beschleunigung, sah am Ende des Prozesses aber einen Kollaps des Systems und eine dunkle Zukunft. Ironie der Geschichte: Land zog in den 2000er Jahren nach China, wo er einen autoritären Akzelerationismus verwirklicht sah. Auch Steve Bannon, Leiter des ersten Trump-Wahlkampfes 2016, war von Lands Gedanken geprägt.

e/acc aber ist eine neuer, optimistischer „Fork“ des alten, dunklen Akzelerationismus. Es sieht eine positive Zukunft für die gesamte Menschheit aufgrund eines gigantischen Produktivitätsschubs. Eine neue, höhere Ordnung ist am Entstehen. Kurz gesagt:

> ***Effective accelerationism (e/acc) in a nutshell:***

>

> ***Stop fighting the thermodynamic will of the universe***

>

> ***You cannot stop the acceleration***

>

> ***You might as well embrace it***

>

> ***A C C E L E R A T E***