-

@ 23b0e2f8:d8af76fc

2025-01-08 18:17:52

## **Necessário**

- Um Android que você não use mais (a câmera deve estar funcionando).

- Um cartão microSD (opcional, usado apenas uma vez).

- Um dispositivo para acompanhar seus fundos (provavelmente você já tem um).

## **Algumas coisas que você precisa saber**

- O dispositivo servirá como um assinador. Qualquer movimentação só será efetuada após ser assinada por ele.

- O cartão microSD será usado para transferir o APK do Electrum e garantir que o aparelho não terá contato com outras fontes de dados externas após sua formatação. Contudo, é possível usar um cabo USB para o mesmo propósito.

- A ideia é deixar sua chave privada em um dispositivo offline, que ficará desligado em 99% do tempo. Você poderá acompanhar seus fundos em outro dispositivo conectado à internet, como seu celular ou computador pessoal.

---

## **O tutorial será dividido em dois módulos:**

- Módulo 1 - Criando uma carteira fria/assinador.

- Módulo 2 - Configurando um dispositivo para visualizar seus fundos e assinando transações com o assinador.

---

## **No final, teremos:**

- Uma carteira fria que também servirá como assinador.

- Um dispositivo para acompanhar os fundos da carteira.

---

## **Módulo 1 - Criando uma carteira fria/assinador**

1. Baixe o APK do Electrum na aba de **downloads** em <https://electrum.org/>. Fique à vontade para [verificar as assinaturas](https://electrum.readthedocs.io/en/latest/gpg-check.html) do software, garantindo sua autenticidade.

2. Formate o cartão microSD e coloque o APK do Electrum nele. Caso não tenha um cartão microSD, pule este passo.

3. Retire os chips e acessórios do aparelho que será usado como assinador, formate-o e aguarde a inicialização.

4. Durante a inicialização, pule a etapa de conexão ao Wi-Fi e rejeite todas as solicitações de conexão. Após isso, você pode desinstalar aplicativos desnecessários, pois precisará apenas do Electrum. Certifique-se de que Wi-Fi, Bluetooth e dados móveis estejam desligados. Você também pode ativar o **modo avião**.\

*(Curiosidade: algumas pessoas optam por abrir o aparelho e danificar a antena do Wi-Fi/Bluetooth, impossibilitando essas funcionalidades.)*

5. Insira o cartão microSD com o APK do Electrum no dispositivo e instale-o. Será necessário permitir instalações de fontes não oficiais.

6. No Electrum, crie uma carteira padrão e gere suas palavras-chave (seed). Anote-as em um local seguro. Caso algo aconteça com seu assinador, essas palavras permitirão o acesso aos seus fundos novamente. *(Aqui entra seu método pessoal de backup.)*

---

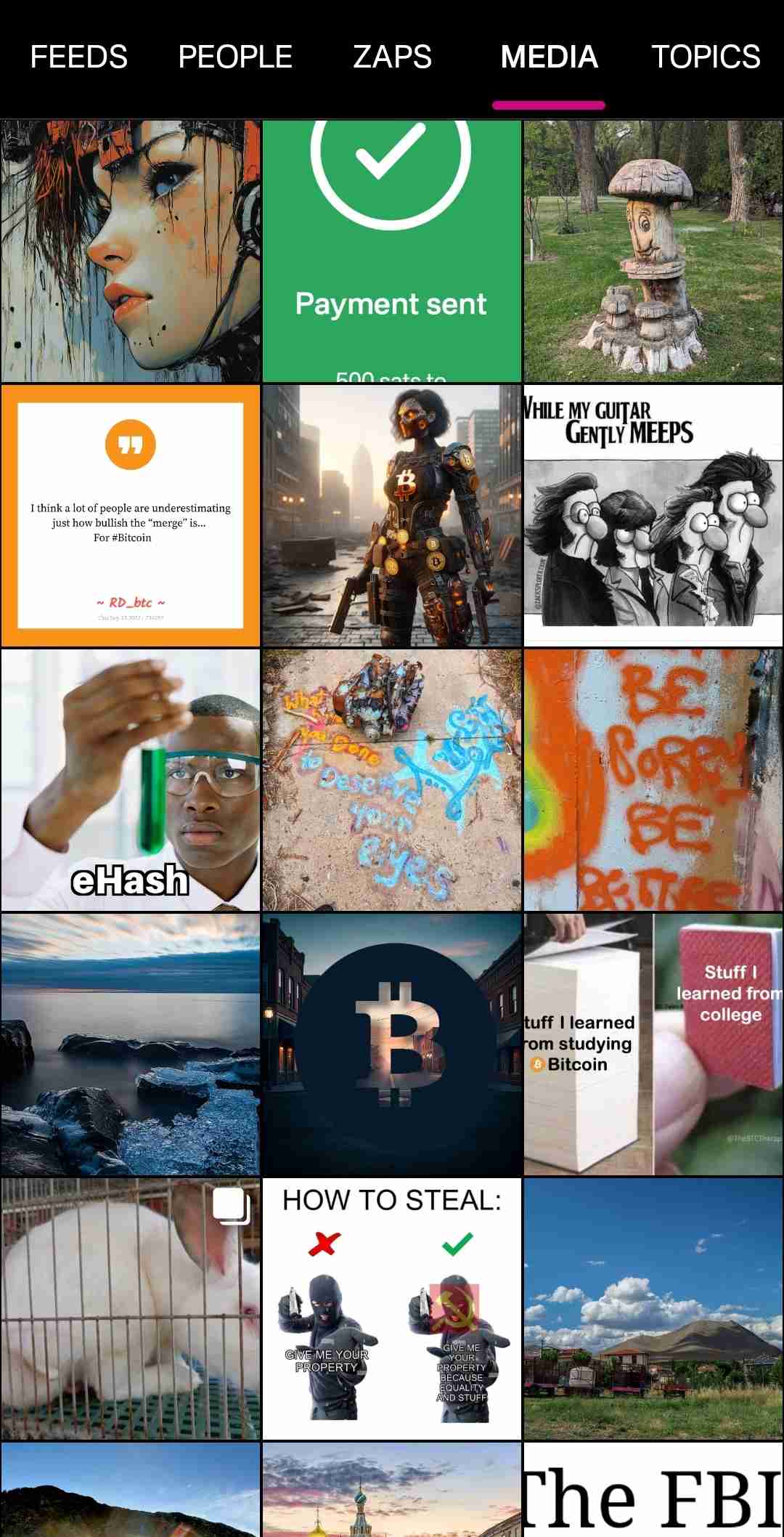

## **Módulo 2 - Configurando um dispositivo para visualizar seus fundos e assinando transações com o assinador.**

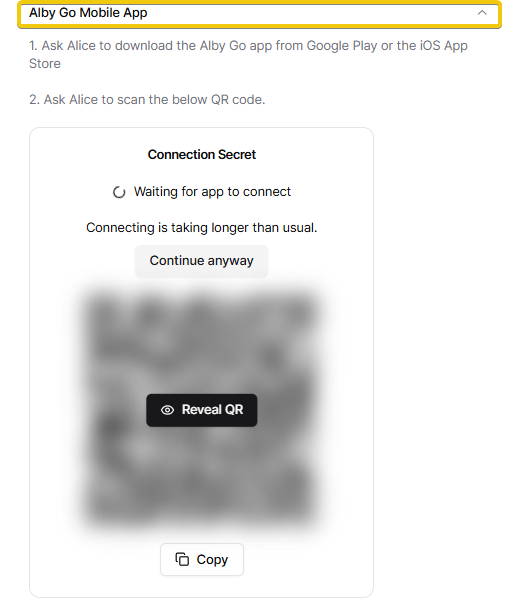

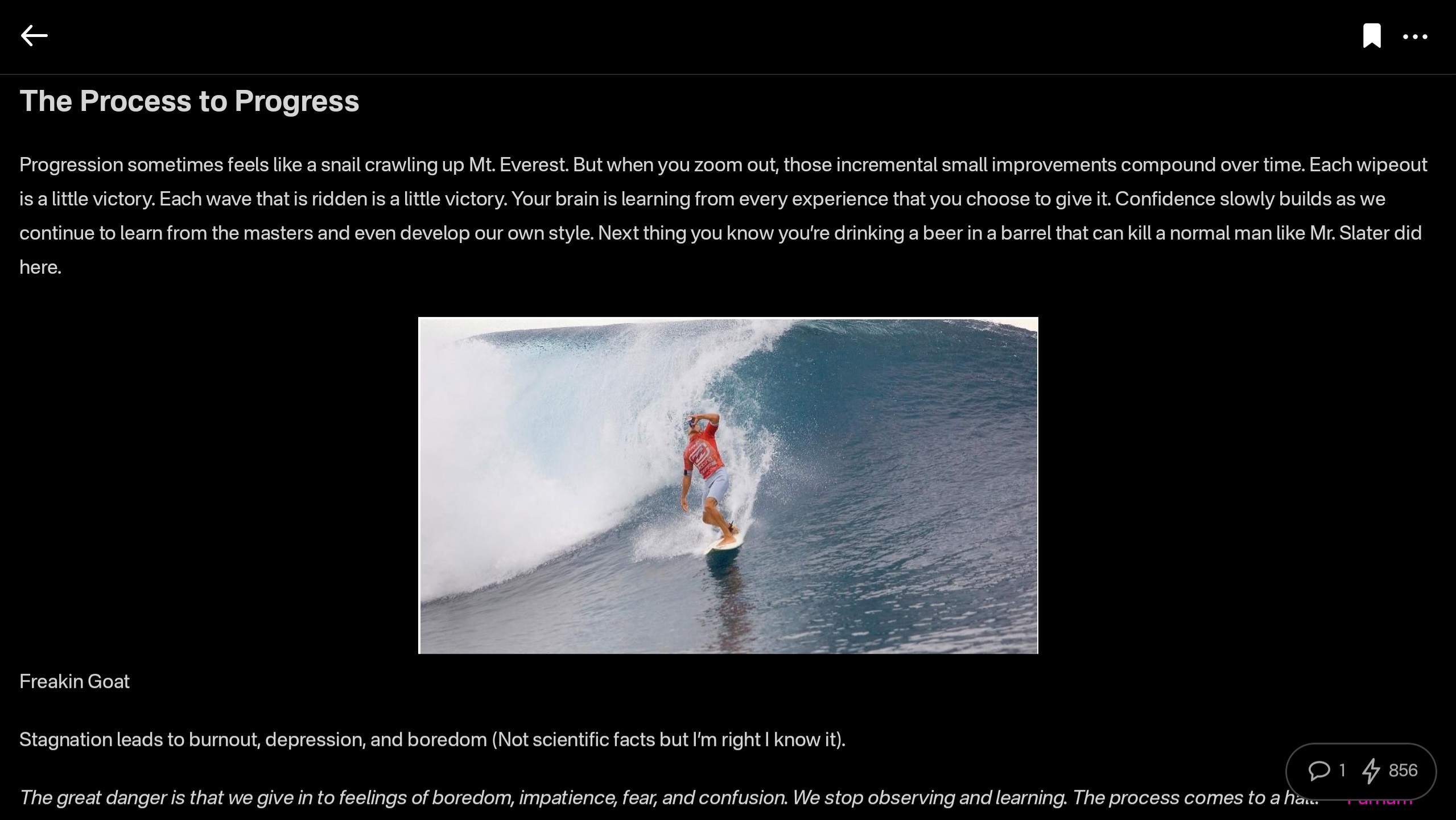

1. Criar uma carteira **somente leitura** em outro dispositivo, como seu celular ou computador pessoal, é uma etapa bastante simples. Para este tutorial, usaremos outro smartphone Android com Electrum. Instale o Electrum a partir da aba de downloads em <https://electrum.org/> ou da própria Play Store. *(ATENÇÃO: O Electrum não existe oficialmente para iPhone. Desconfie se encontrar algum.)*

2. Após instalar o Electrum, crie uma carteira padrão, mas desta vez escolha a opção **Usar uma chave mestra**.

3. Agora, no assinador que criamos no primeiro módulo, exporte sua chave pública: vá em **Carteira > Detalhes da carteira > Compartilhar chave mestra pública**.

4. Escaneie o QR gerado da chave pública com o dispositivo de consulta. Assim, ele poderá acompanhar seus fundos, mas sem permissão para movimentá-los.

5. Para receber fundos, envie Bitcoin para um dos endereços gerados pela sua carteira: **Carteira > Addresses/Coins**.

6. Para movimentar fundos, crie uma transação no dispositivo de consulta. Como ele não possui a chave privada, será necessário assiná-la com o dispositivo assinador.

7. No assinador, escaneie a transação não assinada, confirme os detalhes, assine e compartilhe. Será gerado outro QR, desta vez com a transação já assinada.

8. No dispositivo de consulta, escaneie o QR da transação assinada e transmita-a para a rede.

---

## **Conclusão**

**Pontos positivos do setup:**

- **Simplicidade:** Basta um dispositivo Android antigo.

- **Flexibilidade:** Funciona como uma ótima carteira fria, ideal para holders.

**Pontos negativos do setup:**

- **Padronização:** Não utiliza seeds no padrão BIP-39, você sempre precisará usar o electrum.

- **Interface:** A aparência do Electrum pode parecer antiquada para alguns usuários.

Nesse ponto, temos uma carteira fria que também serve para assinar transações. O fluxo de assinar uma transação se torna: ***Gerar uma transação não assinada > Escanear o QR da transação não assinada > Conferir e assinar essa transação com o assinador > Gerar QR da transação assinada > Escanear a transação assinada com qualquer outro dispositivo que possa transmiti-la para a rede.***

Como alguns devem saber, uma transação assinada de Bitcoin é praticamente impossível de ser fraudada. Em um cenário catastrófico, você pode mesmo que sem internet, repassar essa transação assinada para alguém que tenha acesso à rede por qualquer meio de comunicação. Mesmo que não queiramos que isso aconteça um dia, esse setup acaba por tornar essa prática possível.

---

-

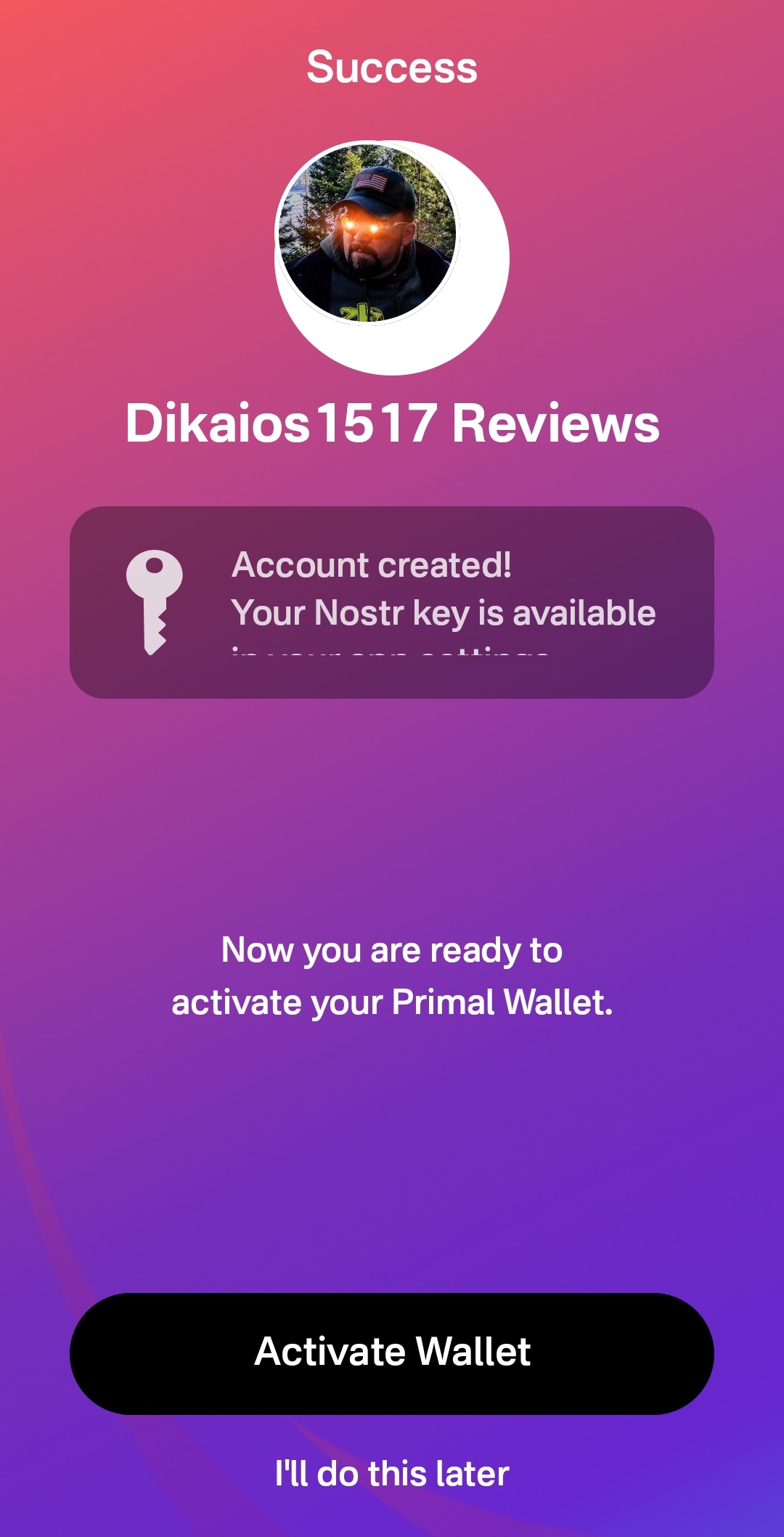

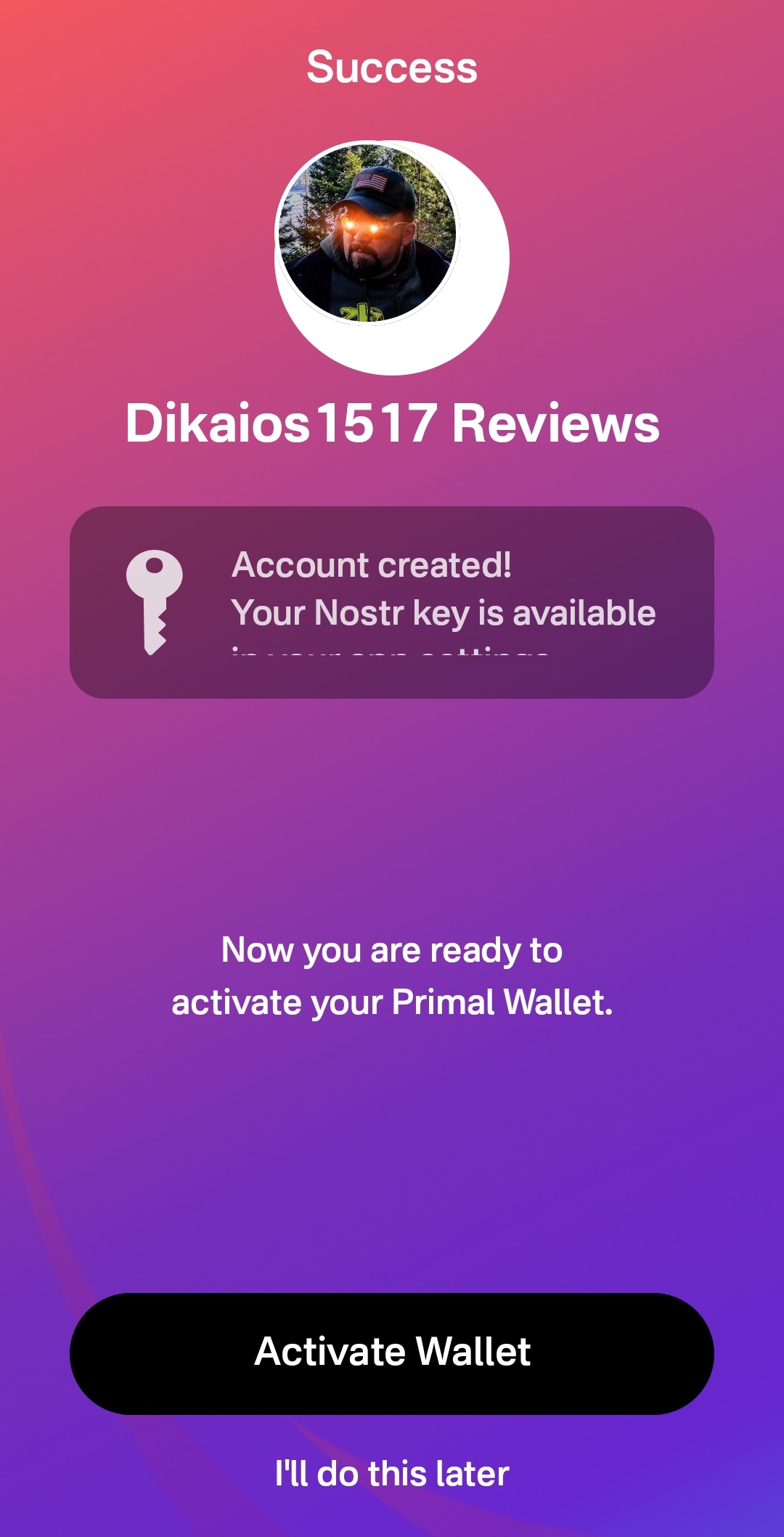

@ 7ed7d5c3:6927e200

2025-01-08 17:10:00

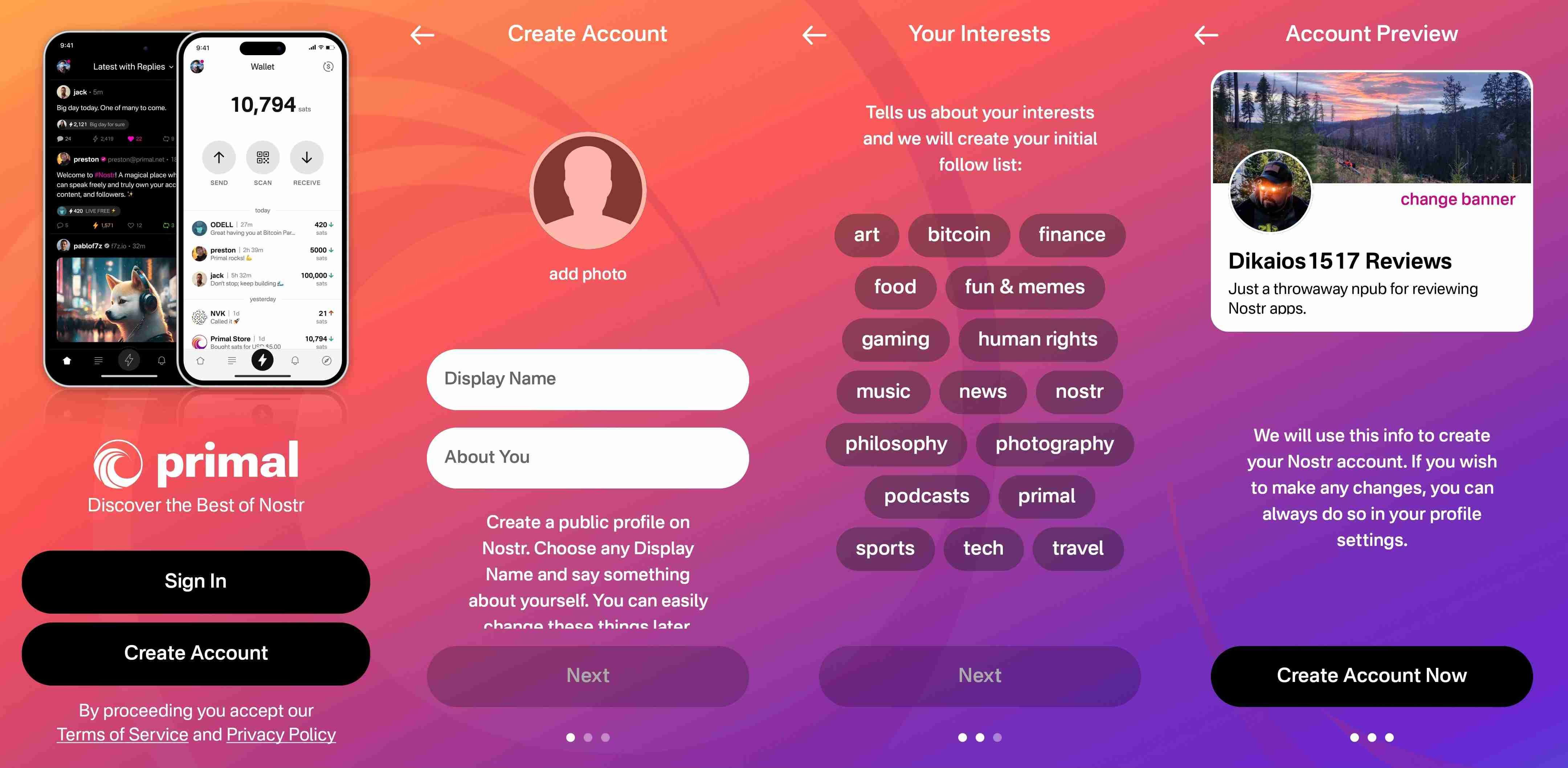

Can't decide if the terrible book you just read is a 1 or 1.5 star book? Look no further than this chart. Was it Shit or just Bad? Was that movie you watched Very Good or just Decent? How many things out there are really Life Changing?

Finally, a rating scale for humans. Use it for anything in your life that needs a rating out of 5 stars.

Rating / Description

0.5 – The worst

1.0 – Shit

1.5 – Bad

2.0 – Eh

2.5 – Entertaining, but not great

3.0 – Neutral

3.5 – Alright

4.0 – Decent

4.5 – Very good

5.0 – Life Changing

P.S. Do not use it to rate your wife's cooking. The author is not liable for any damages.

-

@ 2063cd79:57bd1320

2025-01-08 14:26:43

### Unit-Bias

Bitcoin hat in der öffentlichen Wahrnehmung und bei Menschen, die sich weniger mit dem Thema befassen, einen sogenannten Unit-Bias, also eine durch Unwissenheit hervorgerufene Voreingenommenheit gegenüber der Einheit "Bitcoin". Das bedeutet, dass viele unerfahrene Anleger//innen und Nutzer//innen der Meinung sind, dass der Besitz eines ganzen bitcoins psychologisch wichtig oder überhaupt nur als solcher möglich ist. Anders ausgedrückt, glauben viele Menschen, sie müssen Bitcoin als Ganzes kaufen, also einen ganzen "physischen" bitcoin, statt kleinerer Bruchstücke. Das lässt den Vermögenswert für die meisten zu teuer aussehen.

Dies ist für Bitcoin insofern ein Problem, als dass viele Menschen sich durch ihre Voreingenommenheit gar nicht mit Bitcoin beschäftigen ("kann ich mir nicht leisten") oder das Gefühl haben, Bitcoin sei zu teuer und deshalb gibt es kein Wertsteigerungspotential mehr ("der Zug ist abgefahren, ich hätte vor sechs Jahren investieren sollen"). Schlimmer noch, als sich nicht mit Bitcoin zu beschäftigen, ist sich dann stattdessen alternativen, "erschwinglicheren" Kryptowährungen zuzuwenden. Dieser Unit-Bias ist allerdings nichts anderes als ein Marketing-, bzw. ein Bildungsproblem. Denn wie wir wissen kann man Bitcoin in 100 Millionen Untereinheiten brechen und in kleinsten Mengen erwerben, verschicken und verkaufen. Doch haben Außenstehende von Begriffen wie Lightning oder Sats meistens noch nie gehört.

### Untereinheiten

Doch auch innerhalb der Bitcoin-Szene ist die Unterteilung von Bitcoin in Untereinheiten nicht ganz unumstritten. Denn viele Nutzer//innen sind sich uneinig darüber, was der beste Weg ist, Bitcoins Untereinheiten zu bezeichnen und sogar darzustellen. Dies zeigt sich z.B. darin, dass Apps oft entweder Bitcoin oder Fiat anzeigen, manche Apps aber auch Beträge in Sats darstellen. Dies verlangt aber oft eigene Einstellungen innerhalb der App oder viele Klicks, die die Bedienung und Darstellung eher unhandlich gestalten.

Es gibt verschiedene Lösungsansätze, die dem/der Nutzer//in die ungewohnte Rechnung mit acht Nachkommastellen erleichtern sollen. Denn viele Anwender//innen denken beim Blick in ihre Wallets oft noch in lokalen Fiat-Werten, also in ganzen Einheiten (z.B. Euro oder Dollar) und Hundertsteln (z.B. Cents).

Einige Wallets versuchen diesen Spagat komplett zu umgehen, indem sie vermeiden, Beträge in Fiat darzustellen. Doch auch hier bleibt immer noch das Problem der unhandlichen Darstellung von acht Nachkommastellen, weshalb einige Anbieter einfach zwei Eingabemöglichkeiten bieten und den Betrag in Bitcoin oder Sats automatisch umrechnen.

Doch selbst das Zeichen für Sats ist nicht final geklärt. Es gibt viele verschiedene Vorschläge und Meinungen dazu, welches Symbol genutzt werden sollte. Die meisten Apps, Rechnungen und Sticker schreiben einfach das Wort "Sats" oder "sats" aus. Allerdings ist dies ein Problem, da außerhalb der Bitcoin-Szene niemand weiß, was ein Sat ist. Die meisten Menschen werden mittlerweile von Bitcoin gehört haben, auch wenn sie nicht wissen, wie es funktioniert, was es bedeutet, oder wie man damit umgeht. Doch auch das B Logo mit den Dollarstrichen (₿) werden die meisten Menschen zuordnen können.

Sats hingegen ist ein sehr nischiger Begriff und seine Verwendung noch unbekannter. Oft wird das Blitzsymbol (3 auf der unteren Grafik) verwendet, um Lightning darzustellen und auch das Symbol mit den drei horizontalen Strichen und zwei vertikalen Punkten (4 auf der unteren Grafik), das entfernt an das Dollar-Zeichen erinnern soll ($), erfreut sich immer größerer Beliebtheit. Das Problem dabei ist nur, dass es sich in geschriebener Form nicht, oder nur unzulänglich darstellen lässt: 丰 🤡

Es war lange logisch und notwendig, ganze Bitcoins zur Aufzählung und Bezahlung zu verwenden, da bei der Einführung von Bitcoin sein Geldwert sehr gering war. Es bestand also absolut keine Notwendigkeit dazu, in kleineren Einheiten als Bitcoin zu denken. Einfaches Beispiel: letzte Woche, am 22. Mai, jährte sich der Bitcoin-Pizza-Day zum 13. Mal, also jener Tag an dem Laszlo Hanyecz für zwei Pizza 10.000 bitcoins bezahlte und damit die erste offline Transaktion mit Bitcoin tätigte. 10.000 bitcoins entsprachen zu diesem Zeitpunkt also knapp $40, oder andersrum $1 entsprach 250 bitcoins Es gab also immer noch keine Notwendigkeit, kleinere Einheiten von Bitcoin zu verwenden. Diese Notwendigkeit ergab sich erst, als der Bitcoin und der Dollar Parität erlangten (1 Bitcoin = $1) und spätestens, als Bitcoin die Marke von $100 durchbrach, wurde rechnen in Bitcoin schwieriger.

Fortan überlegte man sich, Bitcoin in kleineren Einheiten darzustellen. Die zwei Möglichkeiten sind der Bit und der Sat. Ein einzelner bitcoin kann in 1.000.000 Bits oder bis zu 100.000.000 Sats unterteilt werden, also 100 Sats = 1 Bit = 0,000001 Bitcoin.

Ein weiterer Grund, weshalb eine Stückelung in bitcoin (der Begriff für einen ganzen physischen bitcoin) schwierig und verwirrend ist, und deshalb viele nach einer alternativen Bezeichnung für Untereinheiten suchten, ist dass darüber hinaus "Bitcoin" zur Beschreibung von zwei Dingen verwendet werden kann: dem monetären Netzwerk (Bitcoin - großes B) und dem monetären Vermögenswert (bitcoin - kleines B).

Bitcoin, der Vermögenswert, ist für diejenigen, die noch nichts damit zu tun hatten, sowohl verwirrend als auch fremd. Denn wie bereits erwähnt, führt der Unit-Bias dazu, dass viele Menschen denken, dass sie es sich nicht leisten können, Bitcoin zu kaufen, oder dass sie den Anschluss verpasst haben. Die Verwendung einer Bepreisung in Bruchteilen würde die Verwirrung über die Benennung des Netzwerks und des Vermögenswerts verringern, aber auch die psychologische Hürde für den Einstieg in Bitcoin senken. Vorausgesetzt, die Benennung ist logisch und intuitiv.

### Bits vs. Sats

Wie schon erwähnt, gibt es zwei gängige Untereinheiten von Bitcoin, 1 Bit (= 0,000001 Bitcoin) und 1 Sat (0,00000001 Bitcoin). Seit jeher gibt es Diskussionen darüber, welche der beiden Einheiten für den täglichen Gebrauch die vernünftigere und intuitivere ist.

Die Verwendung von Bits zur Aufzählung von Bitcoin hat einige Vorteile. Ein Bit stellt ein „Bit“ eines Bitcoins dar, also der grundlegendsten und kleinsten Informationseinheit in der Informatik. Den meisten Menschen fällt es einfacher, das Wort „Bit“ mit Bitcoin zu assoziieren und daher verstehen sie eher, dass ein Bit ein Teil eines Bitcoins ist. Ein „Sat“ bedeutet für den Durchschnittsmenschen, wie oben beschrieben, nichts.

Adam Back (CEO von Blockstream und Bitcoin-Legende) ist wahrscheinlich der bekannteste Befürworter von Bits > Sats. Er argumentiert von verschiedenen Richtungen, dass z.B. Bits eine rechnerisch einfachere Variante ist, Untereinheiten von Bitcoin darzustellen, als Sats.

Weiter argumentiert er mit der historischen Entwicklung von Bitcoin, dem Protokoll und seiner Referenz-Implementierung. In den Anfangsjahren wurde in der Bitcoin Core Wallet mit Bits gearbeitet. Außerdem argumentiert er, dass die Verbindung zwischen Bitcoin der Haupteinheit und Bits oder Sats als Untereinheit zumindest semantisch gebrochen werden sollte. Da Bitcoin (im Fall eines weiter steigenden Kurses) als Recheneinheit immer unpraktischer wird, sollte man als mentales Modell auf das Rechenpaar Bits und Sats zurückgreifen - analog zur Darstellung von Dollars und Cents oder Euros und Cents. Dabei stellen die zwei Nachkommastellen eines in Bits angegebenen Preises die Sats dar.

Ganz einfaches Beispiel: Ein Kasten Bier kostet heute etwas 20€, also 0,00079758 Bitcoin. Einfacher dargestellt: 797,58 Bits, also 797 Bits und 58 Sats. “Ein Bitcoin ist zu teuer, aber Sats sind zu viele, klingen billig und verwirrend.” Es ist schwer in Sats zu denken und selbst wenn der Preis von Bitcoin 1 M US Dollar erreicht, ist ein Bit immer noch eine greifbare und günstige Einheit: 1 Bit = 1 US Dollar.

Eines von Adams Hauptargumenten ist, dass Sat als Untereinheit nicht funktioniert, weil es Dust gibt. Das Problem mit Dust besteht darin, dass es nicht möglich ist, Bitcoin unter einem bestimmten Schwellenwert auszugeben. Sein Argument ist, dass der Nutzen einer Einheit abhanden kommt, wenn diese Einheit als kleinste Recheneinheit nicht ausgegeben werden kann. Zugegeben, niemand kann mehr etwas für einen Cent kaufen, aber zumindest ist es technisch nicht unmöglich. Allerdings ist es unmöglich, 1 oder sogar 10 Sats über das Bitcoin-Netzwerk zu senden, ohne Layer-2-Skalierungstechnologien zu verwenden.

### Dust

Unter Bitcoin-Dust versteht man eine sehr kleine Menge Bitcoin, typischerweise in kleinen ein- bis zweistelligen Sats-Beträgen, doch auch kommen immer öfter dreistellige Beträge vor. Sie werden Dust oder „Staub“ genannt, weil diese Beträge so gering sind, dass sie oft als unbedeutend und unpraktisch für die Verwendung bei regulären Transaktionen angesehen werden.

Es gibt keine offizielle Definition dafür wie groß/klein ein Betrag sein muss, um als Dust zu gelten, da jede Softwareimplementierung (Client, Wallet, etc.) einen anderen Schwellenwert annehmen kann. Die Bitcoin Core Referenzimplementierung definiert Dust als jede Transaktionsausgabe, die niedriger ist als die aktuellen Transaktionsgebühren.

Dust entsteht meist unbeabsichtigt bei Bitcoin-Transaktionen. Denn wenn Bitcoin von einer Adresse an eine andere gesendet wird, fällt oft eine Transaktionsgebühr an. Um Spam zu verhindern und die Sicherheit des Netzwerks zu gewährleisten, gibt es bei Bitcoin eine Mindestgröße für jede Transaktion. Dieses Limit ist der Mindestbetrag an Bitcoin, der als Ausgabe in eine Transaktion einbezogen werden kann. Der Rest ist Dust.

Oder einfacher ausgedrückt, wenn die Mindestgröße für eine Bitcoin-On-Chain-Transaktion 500 Sats (5 Bits) beträgt und ich noch 800 Sats (8 Bits) in meiner Wallet habe, kann ich nach dem Versenden von 600 Sats (6 Bits) die übrigen 200 Sats (2 Bits) nicht mehr ausgeben. Diese verbleibenden 2 Bits sind Dust.

Dust stellt aus mehreren Gründen eine Herausforderung für das Bitcoin-Netzwerk und seine Benutzer//innen dar:

UTXO-Bloat: Bei jeder Transaktion werden nicht ausgegebene Transaktionsausgaben (UTXOs) erstellt, und Dust erhöht die Anzahl der UTXOs im System. Dies kann zu einer aufgeblähten Blockchain führen und sich negativ auf die Leistung und Skalierbarkeit des Netzwerks auswirken.

[➡️ Wie UTXOs funktionieren](https://www.genexyz.org/post/25-block-774775-utxos-fee-management-v3ulch/)

**Wallet-Management:** Im Laufe der Zeit kann sich in Wallets viel Dust ansammeln, und die Verwaltung solch kleiner Beträge kann für Benutzer//innen unpraktisch sein. Bei vielen Wallets ist ein Mindestguthaben erforderlich, und die Dust-Mengen sind möglicherweise zu gering, um diese Anforderung zu erfüllen. Viele Nutzer//innen wechseln häufig zwischen Wallets und transferirien ihre Vermögen vorher auf die neuen Wallets, bei solchen Wechseln bleiben Dust-Beträge zurück und gelten langfristig als verloren.

Ein weiteres Problem besteht darin, dass Dust nicht genau definiert werden kann. Die Transaktionsgebühren hängen wesentlich von zwei Faktoren ab: Den Gebühren in sat/vB, welche von der Auslastung des Mempools abhängen und zu Zeiten von hoher Auslastung dementsprechend hoch sind, und zum anderen vom UTXO-Set des/der jeweiligen Nutzer//in. Denn wie wir wissen, werden Transaktionen aus einer oder mehreren UTXOs zusammengesetzt, je mehr UTXOs dabei benötigt werden, um den gewünschten Betrag zu versenden, desto höher sind die Kosten für diese Transaktion, da sich das Gewicht (in vBytes) erhöht. Diese beiden Faktoren können die Gebühren in Einzelfällen so strukturieren, dass größere Mengen Dust anfallen, als in anderen Fällen.

**Datenschutzbedenken:** Da jede Transaktion in der Blockchain gespeichert wird, können selbst winzige Mengen Dust mit der Identität oder dem Transaktionsverlauf einer Person verknüpft werden, was die Privatsphäre gefährdet. Diese Funktion wird von Angreifern in sogenannten Dust-Attacks ausgenutzt. Denn böswillige Angreifer haben schnell erkannt, dass Nutzer//innen die winzigen Dust-Beträge, die in ihren Wallet-Adressen angezeigt werden, nicht viel Aufmerksamkeit schenken oder gar bemerken. Angreifer schicken also Kleinstbeträge an eine große Anzahl von Adressen, um dann im nächsten Schritt in einer kombinierten Analyse dieser Adressen und der Beträge, versuchen herauszufinden, welche Adressen zur gleichen Wallet gehören. Dabei ist es das Ziel, diese so identifizierbaren Adressen und Wallets schließlich den jeweiligen Eigentümer//innen zuzuordnen, um diese dann durch ausgefeilte Phishing-Angriffe oder Cyber-Erpressungen zu attackieren.

Um diese Probleme zu lösen, können Nutzer//innen Dust konsolidieren, indem sie mehrere Dust-UTXOs in einer einzigen Transaktion mit einem höheren Wert kombinieren. Einige Wallets und Dienste bieten Funktionen an, mit denen Benutzer//innen ihren Dust effektiv verwalten und konsolidieren können.

### Abschließende Gedanken

Der Unit-Bias ist absolut vorhanden. Ich persönlich begegne ihm immer wieder in Gesprächen mit Bitcoin-Interessierten, die sich mit der Materie noch nicht lange auseinandergesetzt haben. Die Verwunderung ist oft sehr groß, dass bitcoins nicht als Ganzes gekauft werden müssen. Die Verwendung einer Untereinheit sowohl in Wallets, als auch bei der Bepreisung kann dabei helfen.

An die Verwendung von Sats als die kleinste Einheit von Bitcoin habe ich mich gewöhnt, allerdings tendiere ich mittlerweile persönlich zum Gebrauch von Bits. Die hervorgebrachten Argumente leuchten mir ein und ich bin überzeugt, dass Bits eine größere Akzeptanz außerhalb des Bitcoin-Inner-Circles hervorrufen können, als Sats. Darüber hinaus ist das Sats-Zeichen wirklich unpraktisch.

Ich befürworte hier einige Ideen, die das Paragrafzeichen zum Symbol für Sats erheben wollen.

🫳🎤

---

In diesem Sinne, 2... 1... Risiko!

-

@ 2063cd79:57bd1320

2025-01-08 11:19:56

Ich hatte vor ein paar Wochen die Gelegenheit mich mit Micheal Hassard persönlich zu unterhalten. Mike ist Verteidiger im Fall von Roman Sterlingov. Der Fall ist haarsträubend und beängstigend. Mike und ich haben uns einige Zeit unterhalten und er hat mir einige Details aus diesem wirklich spannenden Prozess verraten. Ich wollte versuchen die Informationen in einem Artikel zusammenzufassen, um auch anderen Leuten, die mit dem Fall noch nicht betraut sind, die Möglichkeit zu geben, zu verstehen, was für absurde Methoden und ungerechte Beweismittel in diesem noch komplett neuen rechtlichen Umfeld angewendet werden.

### LAX

Am 27. April 2001 landet ein Direktflug aus Moskau am Los Angeles International Airport (LAX). Bei der Passkontrolle an der Immigration wird ein junger Passagier dieses Fluges von Kriminalermittlern des Internal Revenue Service (IRS) verhaftet. In seinem Gepäck befinden sich vier Reisepässe und allerhand technisches Equipment. Darunter Laptops, externe Festplatten und Bitcoin Signing Devices (Hardware Wallets). Der junge Mann wird festgenommen, seine mitgeführten Besitztümer und Pässe konfisziert, dann wird er in Untersuchungshaft gebracht. Der Vorwurf: Die Gründung und der Betrieb eines Bitcoin Mixers. Konkret wird ihm vorgeworfen, Bitcoin Fog gegründet und betrieben zu haben, darüber hinaus wird er in drei Punkten angeklagt: Geldwäsche, Betrieb eines nicht lizenzierten Geldtransfergeschäfts und Geldtransfer ohne Lizenz. Die IRS behauptet, dass über 1,2 Millionen Bitcoin, im Wert von etwa 336 M US Dollar zum Zeitpunkt der Transaktionen, über Bitcoin Fog verschickt wurden.

<img src="https://blossom.primal.net/19536c9b7279004690e8bb665466366e8ecc64f6f3a1da9fb605b930fd2ba398.gif">

### Bitcoin Fog

Bitcoin Fog war ein beliebter Custodial Bitcoin Mixer, der von Nutzer//innen für ihre Privatsphäre genutzt wurde. Mixer sind Services die entwickelt wurden, um das Problem der "Common-Input-Ownership-Heuristik" zu brechen. Vereinfacht ausgedrückt beschreibt dieses Problem die Annahme, dass mehrere Inputs einer Transaktion relativ sicher dem gleichen Besitzer gehören. Ich habe Bitcoin Mixer schon mal detailliert beschrieben:

https://www.genexyz.org/post/23-block-772315-bitcoin-mixing-q6i7y4/

TL;DR: Die Grundidee besteht darin, dass man einen Coin nimmt, der aus mehreren UTXOs besteht, und diesen mit Hilfe eines Dienstes einem Pool zuführt. Diese Dienste erhalten für die Vermittlung, Zusammenführung und das Stellen der Infrastruktur eine kleine Gebühr. Transaktionen werden dann so aufgebaut, dass sie es Überwachungsfirmen oder anderen Beobachtern sehr schwer machen, genau zu wissen, welcher Transaktion-Output zu welchem der Input-Steller gehört.

Bitcoin Fog wurde 2011 gegründet und ist ein Custodial Service, was bedeutet, dass Nutzer//innen ihre Bitcoin an eine Wallet des Betreibers senden, und im Gegenzug dann von Bitcoin Fog andere Bitcoin zurück erhalten, um die Spur der On-Chain-Transaktionen zu verwischen.

### Roman Sterlingov

Roman war schon früh Benutzer von Bitcoin. Als er 14 Jahre alt war, zog er mit seiner Mutter von Russland nach Schweden und beschäftigte sich ab etwa 2011 mit Bitcoin. Dies ist wichtig, denn als russischer und schwedischer Staatsbürger ist Roman im Besitz von vier offiziell ausgestellten Reisepässen. [Russland hat zwei Pässe](https://en.wikipedia.org/wiki/Internal_passport_of_Russia), einen für das Reisen innerhalb und einen für das Reisen außerhalb Russlands. Schweden stellt auch [zwei Reisepässe aus](https://en.wikipedia.org/wiki/Swedish_passport). Als der Bitcoin-Kurs stieg, wurde er Millionär. Er kündigte seinen Job und versuchte, sich selbstständig zu machen. Unter anderem gründete er ein VPN-Geschäft, das nicht erfolgreich war, und entschied sich später aufgrund der Volatilität von Bitcoin und fehlenden Einnahmen aus seinen Projekten, Pilot bei einer kommerziellen Fluggesellschaft zu werden.

Er meldete sich bei einer kalifornischen Flugschule an und 2021, als Roman nach Kalifornien zur Flugschule flog, wurde er von der Regierung am Flughafen LAX verhaftet. Er sitzt seit über zwei Jahren im Gefängnis und wartet auf seinen Prozess. Neben seinen Pässen und seinem Equipment wurden auch die seit 2011 angesammelten Bitcoin beschlagnahmt, da diese auf Konten bei u.a. Kraken lagen.

### Die Anklage

Kalifornien hat Roman Sterlingov wegen des Vorwurfs verhaftet, über einen Zeitraum von 10 Jahren Bitcoin im Wert von fast 336 M US Dollar gewaschen zu haben. Ihm wird vorgeworfen, über sein Konto und seine IP-Adressen mit der Bitcoin Fog-Domain und mit Mt. Gox-Konten, die in Verbindung zu Bitcoin Fog stehen, an Bitcoin Fog beteiligt zu sein.

Vor dem Start des Dienstes nutzte der Administrator seinen echten Namen auf seinem Mt. Gox-Konto, um die Plattform einem Betatest zu unterziehen. Sein persönliches Google-Konto wurde auch zum Speichern der Schritte zur Bezahlung der Domain verwendet. Dies sind jedoch zum heutigen Zeitpunkt nur Anschuldigungen ohne konkrete Beweise. Der Fall stützt sich stark auf digitale Forensik und Blockchain-Analyse ohne Zeugenaussagen oder ähnliche konkrete Beweisstücke. Selbst wenn Roman die Domain gekauft hätte, wäre dies nicht illegal. Die Verjährungsfrist für die angeblichen Verbrechen ist ebenfalls abgelaufen. Was bleibt, sind von der Anklage angeführte "Beweise", die sich komplett auf die Blockchain-Analyse der Firma Chainalysis stützen.

### Chainalysis

Chainalysis ist die wohl bekannteste Blockchain-Analyse Firma. In einem früheren Artikel habe ich schon mal beschrieben, wie diese Firmen operieren:

https://www.genexyz.org/post/19-block-765505-on-chain-analytics-mhcumo/

TL;DR: Unter On-Chain Analytics versteht man die Analyse von Daten, die auf jeder beliebigen Blockchain vorhanden sind. Diese Daten sind auf der Chain, also on-chain und somit für jedermann jederzeit und von überall abrufbar. Genauer bieten Blockchains Daten über Adressen, Transaktionen und in gewisser Weise auch über Wallets. Diese Informationen können verwertet werden, um verschiedene Sachverhalte darzustellen. Dieses Verfahren wird auch Heuristik genannt und bedient sich wahrscheinlicher Annahmen, also z.B. wiederkehrender Muster. Dabei werden sogenannte Cluster erstellt, also Verbindungen zwischen Adressen und Transaktionen gezogen.

So nutzen nutzen Analyse-Firmen wie Chainalysis Heuristiken und Wahrscheinlichkeitsanalysen, um Bitcoin-Transaktionen und Eigentümerwechsel zu verfolgen. Sie versuchen, Adressen auf der Grundlage dieser Heuristiken zu gruppieren, jedoch stimmen die Ergebnisse verschiedener Unternehmen oft nicht überein. Dies kann zu vagen Beweisen und Schuldunterstellungen führen.

> „Während die Identität eines Besitzers einer Bitcoin-Adresse im Allgemeinen anonym ist (es sei denn, der Besitzer entscheidet sich dafür, die Informationen öffentlich zugänglich zu machen), können Strafverfolgungsbehörden den Besitzer einer bestimmten Bitcoin-Adresse oft durch Analyse der Blockchain identifizieren“ - Devon Beckett, Special Agent, IRS

Chainalysis betreiben einen sogenannten Reactor, der diese Analysen vornimmt. Diese Analyse dient als Grundlage für das Argument, Roman habe Geld von seinem Mt Gox-Konto abgebucht und verwendet, um die Bezahlung der DNS-Registrierung für Bitcoin Fog zu tätigen und zu verbergen. Es wird so versucht, Roman mit Aufzeichnungen im Bitcoin Talk-Forums in Verbindung zu bringen, die wiederum Bitcoin Fog mit illegalen Aktivitäten in Verbindung bringen.

<img src="https://blossom.primal.net/6d86d2843895b4b7fa481fe074e0c79bb94b7001233fbcf415bcde86e175359f.gif">

Konkret wird anhand dieser Analyse eine Verbindung zu Roman und weiter zu Bitcoin Fog hergestellt, die beweisen soll, dass Zahlungen im Wert von 336 M US Dollar gewaschen wurden, die für Drogengeschäfte verwendet wurden.

Es gibt keine objektiven Standards für diese Art der Analyse und Strafverfolgungsbehörden stützen ihre Beweise auf diese privaten Ermittlungen. Im konkreten Fall vo Chainalysis spielen Beziehungen zu Strafverfolgungsbehörden wie dem britischen Serious Crimes Office und dem US-Justizministerium, sowie den damit einhergehenden Geldquellen eine entscheidende Rolle beim Aufstieg des Unternehmens zum größten Anbieter dieser Dienstleistungen mit einer Marktkapitalisierung von 8,6 Milliarden US Dollar.

### Verteidigung

Roman wird in diesem Fall von der Kanzlei Ekeland Law, PLLC vertreten. Die Anwälte, Tor Ekeland und Michael Hassard sind der festen Überzeugung, dass Roman unschuldig ist und dass er in diesem Fall aufgrund fehlerhafter digitaler Forensik in Bedrängnis geraten ist.

Roman gibt zu, Bitcoin Fog aus Datenschutzgründen verwendet zu haben, um seine Bitcoin zu waschen, bevor er diese in sein Konto bei Kraken einzahlte. Das Mischen an sich ist nicht illegal, denn während der Anhörung erkannte der Richter sogar an, dass die Verwendung eines Mixers wie Bitcoin Fog nicht grundsätzlich verboten sei. Dies war sogar das erste Mal, dass ein Richter ausdrücklich erklärte, dass das Mischen von Bitcoin nicht illegal ist und dass es auch nicht illegal ist, Nutzer//in eines Mischdienstes zu sein. Es ist jedoch zu beachten, dass sich dieser Fall speziell gegen den Betreiber von Bitcoin Fog richtet und versucht, den Dienst mit Drogenmarktplätzen in Verbindung zu bringen.

Argumente für Romans Unschuld beinhalten unter anderem, dass Bitcoin Fog in der gesamten Zeit von Romans Inhaftierung aktiv geblieben ist, was darauf schließen lässt, dass die eigentlichen Betreiber immer noch auf freiem Fuß sind. Roman wurde vor seiner Verhaftung überwacht, es wurden Abhör- und Überwachungsmaßnahmen durchgeführt, jedoch keine Beweise gefunden, die ihn mit dem Betrieb von Bitcoin Fog in Verbindung bringen, selbst nachdem Server beschlagnahmt wurden.

Darüber hinaus ignoriert die Anklage auch die Tatsache, dass die DNS-Registrierung der Bitcoin Fog Domain seit Romans Verhaftung zweimal erneuert wurde. Trotzdem versucht die Anklage eine Verbindung zu Roman auf der Grundlage von IP-Adressen herzustellen, die mit anderen E-Mails verknüpft sind, die zur Registrierung der DNS und zur Erstellung eines Kontos im Bitcoin Talk Forum verwendet wurden.

<img src="https://blossom.primal.net/8e7bfd219eb2e064b00ed62b656d1af153f4beb32370914578f0f6946a003f2e.gif">

Roman wird Verschwörung vorgeworfen, es wurde jedoch kein einziger Mitverschwörer genannt. Bei den von der Anklage behaupteten Transaktionen handelt es sich um Lizenzzahlungen des Mixers, die jedoch nicht durch Beweise gestützt werden. Wenn Roman ein Drahtzieher wäre, der 336 M US Dollar an Drogengeldern gewaschen hätte, würde es für ihn keinen Sinn machen, sein Geld mit seinem richtigen Namen und Passfoto auf ein KYC-Konto bei Kraken einzuzahlen.

An dieser Stelle ist es vielleicht interessant festzustellen, dass Michael Gronager, einer der [Mitbegründer von Chainalysis](https://en.wikipedia.org/wiki/Chainalysis), auch einer der Mitbegründer von Kraken war.

### Mt Gox Daten

Es gibt eine Verbindung zwischen Kraken, Chainalysis und Mt Gox. Denn nicht nur war der Gründer von Kraken, Jesse Powell, als Berater für Mt. Gox bei der Lösung eines Sicherheitsproblems tätig und begann in Erwartung seines Kollapses mit der Arbeit an Kraken als Ersatz, auch Chainalysis wurde als direkte Reaktion auf den Mt. Gox-Skandal gegründet.

Chainalysis wurde in den offiziellen Ermittlungen im Insolvenzverfahren von Mt. Gox genutzt, um den Verbleib der "gestohlenen" bitcoins zu untersuchen. Allerdings gibt es Anzeichen dafür, dass die dabei verwendeten Daten falsch und unzuverlässig seien. Angebliche Transaktionsnummern und Wallet-Adressen existieren nicht, werden verwechselt oder sind schlichtweg fehlerhaft. Genau dieser Datensatz wird aber nun benutzt, um Fälle wie den von Roman zu beweisen.

### Ankläger

Einer der Staatsanwälte des Falles ist jetzt leitender Rechtsberater für Chainalysis, und ein IRS-Ermittler gründete während seiner Tätigkeit für den IRS ein privates Unternehmen namens Exigent LLC. Die Pressemitteilungen und Fundraising-Runden von Chainalysis stehen eng im Zusammenhang mit dem Fall. Exigent LLC erhält in der Pressemitteilung des US-Justizministeriums die höchste Auszeichnung für Romans Verhaftung, und fünf Monate später kaufte Chainalysis Exigent LLC. Dieser Fall scheint von Karrierismus und Profitstreben getrieben zu sein.

<img src="https://blossom.primal.net/cfd9c2f0bced31d0b51f669d4a589b39cfcff57bc952e6013856121c128e2d6d.gif">

### Problem

Neben den Verbindungen der Ermittler und Ankläger mit Chainalysis und der Problematik der fehlenden Beweise, ist dieser Fall zutiefst beunruhigend und wirft Bedenken hinsichtlich des geltenden Computerrechts auf.

Die meisten Blockchain-Strafverfolgungen folgen dem gleichen Muster: Einspruchsvereinbarungen, Gerichtsverfahren oder Entlassungen. Unschuldige Menschen gehen oft auf Plädoyer-Deals ein, weil ihnen die Ressourcen fehlen, um gegen die unbegrenzten Ressourcen des Department of Justice zu kämpfen. Roman kann keinen Deal annehmen, weil er nichts weiß und lügen müsste.

Es ist beunruhigend, dass der Fall in Washington D.C. verhandelt wird, obwohl Roman keine Verbindungen zu dieser Stadt hat. Die einzige Grundlage dafür, die Gerichtsbarkeit nach D.C. zu legen, ist darin begründet, dass eine verdeckte Operation gegen Roman aus Washington D.C. geleitet wurde. Dies gibt Anlass zur Sorge, weil es Staatsanwälten ermöglicht, Angeklagte auf der Grundlage von Online-Interaktionen vor jedes Bundesgericht zu ziehen - ob US Staatsbürger oder nicht. Dies ist ein direkter Verstoß gegen die Gerichtsstandsklausel und entfernt wichtige Elemente des Strafrechtssystems, da es jede/n Nutzer//in von Bitcoin-Mixern in die gefährliche Lage versetzen kann, vor einem US-Gericht angeklagt zu werden, wenn eine auch nur dünne Beweislage gegen ihn/sie vorliegt.

Ein weiteres Problem besteht in den vorgebrachten Beweisen. Denn die Verteidigung hat bis heute keinen Einblick in den Code oder die verwendeten Datensätze, die von Chainalysis verwendet wurden, erhalten. Chainalysis beruft sich dabei auf seine proprietären Geschäftsdaten und lehnt eine Offenlegung ab. Es wird vermutet, dass die Datensätze falsch sind, insbesondere angesichts der fragwürdigen Mt. Gox-Aufzeichnungen, auf die sie sich stützen.

Die bereitgestellten Daten sind begrenzt, unvollständig und werden in komplizierten Flussdiagrammen dargestellt. Die verwendete Software, wie z.B. der Chainalysis Reactor, steht nicht für eine unabhängige Prüfung zur Verfügung. Der Mangel an Transparenz und Zugang zu dieser Software gibt Anlass zu Bedenken hinsichtlich ihrer Genauigkeit und den daraus gezogenen Schlussfolgerungen.

<img src="https://blossom.primal.net/74c86d3db94191c8c5389e6ffbedc28a8c3e4b8a0e1ae1410f81777523a2e399.gif">

Es bestehen Zweifel am Zusammenhang zwischen Roman, dem Betreiber von Bitcoin Fog, und den mutmaßlichen Straftaten. Roman sitzt derzeit im Gefängnis, ihm droht eine Haftstrafe von 50 Jahren. Die Freiheit einer Person wird durch eine kommerzielle proprietäre Software gefährdet, die vor Gericht erwirken kann, dass Quellen und Datensätze nicht offengelegt werden.

Auch wirft der Fall Bedenken hinsichtlich fehlender Standards, des gewinnorientierten Charakters des forensischen Bereichs, der Weigerung, Beweise auszutauschen, und der Möglichkeit von Justizirrtümern auf, die durch fehlerhafte Software und fragwürdige Praktiken verursacht werden.

### Wie geht es weiter?

Das Verteidigungsteam hat finanzielle Probleme, da alle Gelder von Roman beschlagnahmt wurden. Der Antrag auf Freigabe der Mittel wurde abgelehnt. Romans Verteidigung muss öffentliche Mittel beantragen und hofft auf Spenden. Ich habe in einem früheren Artikel schon auf die Spendenseite aufmerksam gemacht. Wer anhand der aufgelisteten Fakten das Gefühl bekommt, dass hier jemand zu Unrecht verhaftet wurde und helfen möchte, kann die Verteidigung mit einer Spende unterstützen.

https://www.torekeland.com/roman-sterlingov

https://geyser.fund/project/usvsterlingov

#FREEROMAN

🫳🎤

---

In diesem Sinne, 2... 1... Risiko!

-

@ a012dc82:6458a70d

2025-01-08 02:56:16

**Table Of Content**

- Rollercoaster Rides

- The Impact of Macroeconomic Forces

- Short-term Projections

- Ethereum's Steady Stance

- Week-on-week Comparisons

- Altcoins in Focus

- The Laggards

- Market Overview

- Conclusion

- FAQ

September has once again proven itself to be a tumultuous month for the world's most prominent cryptocurrency, Bitcoin (BTC). This month-long rollercoaster ride has historical roots, as September has historically been a challenging period for Bitcoin. However, the first two-thirds of the month showcased remarkable progress, raising expectations. But the recent resurgence of the US dollar has cast a shadow over the entire crypto market, leading to uncertainty among investors and traders.

**Rollercoaster Rides**

As the calendar pages flipped through September, Bitcoin embarked on a rollercoaster ride that left many in the crypto community holding their breath. Over the weekend, Bitcoin witnessed a significant dip, eroding a substantial portion of its gains for the month. Sunday's trading session saw the BTC/USDT pair drop by 1.2%, closing at $26,250. Monday's early trades further exacerbated the bearish trend, pushing the pair below $26,150. These rapid fluctuations in Bitcoin's value have been a hallmark of its journey in recent weeks.

**The Impact of Macroeconomic Forces**

In addition to its internal dynamics, Bitcoin has been significantly influenced by macroeconomic factors, particularly the policies and guidance provided by the Federal Reserve and other central banks. Last week, the Fed's unexpected hawkish stance sent shockwaves through financial markets, including the crypto sphere. This policy shift had an adverse effect on risk-on trading sentiment, causing investors to reevaluate their strategies. As the month approaches its conclusion, a less eventful macroeconomic calendar might imply reduced volatility in the coming days. However, the lingering impact of the Fed's decisions remains a source of uncertainty.

**Short-term Projections**

To gain insights into Bitcoin's short-term trajectory, market analysts have turned to Binance's order book analysis. According to their assessment, a support line appears to be forming at the $25,000 mark, providing some stability in the face of recent turbulence. Conversely, selling resistance has been identified at $27,500, indicating a significant challenge for Bitcoin's upward momentum. These levels are likely to play a crucial role in determining Bitcoin's path in the immediate future, with traders closely monitoring any breaches or rebounds.

**Ethereum's Steady Stance**

In contrast to Bitcoin's rollercoaster performance, Ethereum (ETH), the second-largest cryptocurrency by market capitalization, has demonstrated a more stable trajectory over the past few days. While Saturday saw minimal fluctuations, Sunday's trades witnessed a modest 0.8% dip, settling at $1,580. As of Monday, Ethereum has maintained this position, indicating resilience in the face of market turbulence. Ethereum's stability, as compared to Bitcoin's wild swings, underscores the unique dynamics at play within the broader cryptocurrency market.

**Week-on-week Comparisons**

Examining the performance of these two leading cryptocurrencies over the course of the week reveals intriguing trends. Bitcoin has experienced a 2% decline in its value, signaling the challenges it faced amid a shifting financial landscape. Meanwhile, Ethereum has faced a slightly more significant drop of over 3%. These fluctuations underscore the inherent volatility of the crypto market, even among its most prominent players.

**Altcoins in Focus**

Beyond Bitcoin and Ethereum, the broader altcoin spectrum presents a diverse set of performances. One standout performer has been Solana (SOL), which surged ahead by an impressive 1.75% in the past seven days. This remarkable growth has garnered the attention of investors and enthusiasts alike. Additionally, Ripple (XRP) has maintained positive momentum, adding approximately 0.8% to its value. These altcoins' resilience serves as a testament to the unique dynamics within the cryptocurrency ecosystem.

**The Laggards**

However, not all altcoins have been able to escape the gravitational pull of Bitcoin's performance. Prominent digital assets such as Binance's BNB token, Dogecoin (DOGE), Cardano (ADA), Polkadot (DOT), and Polygon (MATIC) have mirrored Bitcoin's downward trend. These digital assets have seen marginal losses in terms of their respective market capitalizations, underscoring the interconnectedness of the cryptocurrency market.

**Market Overview**

At present, the global cryptocurrency market cap stands at an impressive $1.04 trillion, signifying the substantial size and influence of the digital asset market. Bitcoin continues to command a dominant position, with a market dominance of 49.9%. This reaffirms Bitcoin's status as the undisputed leader in the digital asset space, despite the challenges it faces in September.

**Conclusion**

As September draws to a close, the battle between Bitcoin and the resurgent US dollar remains uncertain. The interplay between internal dynamics, macroeconomic factors, and market sentiment will continue to shape the crypto landscape in the days ahead. Traders and enthusiasts alike will be watching closely to discern the next moves in this high-stakes confrontation. As the dust settles, the cryptocurrency market will likely reveal new trends and opportunities for those who can navigate these uncertain waters with agility and insight.

**FAQ**

**Why is September historically challenging for Bitcoin?**

September has traditionally been a tough month for Bitcoin, with factors like market sentiment and macroeconomic forces contributing to its volatility during this period.

**How is the US dollar impacting Bitcoin's recent performance?**

The resurgence of the US dollar has cast a shadow over the crypto market, leading to uncertainty and impacting Bitcoin's value.

**What are the short-term projections for Bitcoin and Ethereum?**

Short-term projections for Bitcoin suggest a support line at $25,000 and resistance at $27,500, while Ethereum has maintained relative stability.

**Which altcoins have performed well recently?**

Solana (SOL) and Ripple (XRP) have shown positive momentum, but some prominent altcoins have followed Bitcoin's downward trend.

**That's all for today**

**If you want more, be sure to follow us on:**

**NOSTR: croxroad@getalby.com**

**X: [@croxroadnews](https://x.com/croxroadnewsco)**

**Instagram: [@croxroadnews.co](https://www.instagram.com/croxroadnews.co/)**

**Youtube: [@croxroadnews](https://www.youtube.com/@croxroadnews)**

**Store: https://croxroad.store**

**Subscribe to CROX ROAD Bitcoin Only Daily Newsletter**

**https://www.croxroad.co/subscribe**

*DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.*

-

@ dd664d5e:5633d319

2025-01-07 19:57:14

## Hodling Bitcoin does not make you a capitalist

I've noticed that Bitcoin-mindedness seems to lead some people to communistic thinking because it's a hard-limited form of capital. Marx, like most Bitcoiners, heavily discounted the possibility of economic growth or transformation changing the economy enough to undermine some minority's control of some form of capital.

What few today understand, is that many of the Dirty Capitalists of Marx's era actually agreed with him; they were just disdainful of labor and worried that the workers finding out that Marxism is correct about the nature of capitalism would cause unrest. They were the original HFSP crowd.

This was the basic idea, that Marx had, and that many Bitcoiners would agree with:

> Capital is strictly limited and the people that control it can keep labor from attaining any, except when their labor is necessary.

And, as we know, automation will make human labor increasingly unnecessary.

## The math doesn't check out

That underlies all of the calculations of "Well, if I just grab this Bitcoin wallet and hodl for twenty years, then it will grow in value to equal half of everything in existence and then I can just buy up half the planet and rule over everyone like a god."

This is economic nonsense because it assumes that:

1) the value of all things remains static over time,

2) purchasing something with money gives you ownership of it,

3) people will always use that specific money (or any money, at all!) for all transactions,

4) there is no such thing as opportunity cost,

5) people will always value money more than any other thing, and therefore be willing to always trade it for anything else,

6) humans are passive, defenseless, and easy to rule over,

7) someone who is preoccupied with hodling an asset steadily and sharply rising in price would ever be emotionally ready to part with it.

## All monies can die.

People use money for everything because it is easy, fast and cheap. If money becomes too precious or scarce, they will simply switch to using other things (as we saw with gold). Humans replace tools that aren't working well, with those that work better, and money is just another tool. Bitcoin is more divisible than gold, but that won't matter, if enough of it is held by too few.

This is why there's a natural cap on the price of a money and why human productivity _in the here and now_ is not irrelevant or in vain.

-

@ 2063cd79:57bd1320

2025-01-07 07:12:48

Der letzte Artikel stand ganz im Zeichen von Mempool, Transaktionsgebühren, Ordinals, BRC-20 Tokens (aka Shitcoins auf Bitcoin) und Mining-Rewards. Der Mempool ist voller als der Hyde-Park in London am einzigen Sommertag mit Sonne im Jahr. Doch weil ich mich in letzter Zeit zu Genüge mit den vorgenannten Themen beschäftigt habe und man zur Zeit an jeder Ecke den Status des Mempools ungefragt eingeflößt bekommt, möchte ich mich diese Woche mit zwei Standpunkten beschäftigen, die entweder gegenläufig oder komplementär zueinander stehen (gibt es wirklich kein Antonym zum Wort komplementär?).

Ausschlaggebend für den Gedankengang, der mich zu dieswöchigem Artikel bewegt hat waren ein Artikel und eine Podcast-Episode, über die ich letzte Woche gestolpert bin. Bei dem Artikel handelt es sich um Jimmy Songs "[How Fiat Money Broke the World](https://bitcoinmagazine.com/culture/fiat-money-has-broken-the-world)" aus seiner Fixing the Incentives-Reihe im Bitcoin Magazine und bei der Podcast-Episode wurde ich von den Ausführungen von Peruvian Bull im TFTC Podcast [Ausgabe 414: The Dollar Endgame](https://www.tftc.io/414-the-dollar-end-game-is-here-with-peruvian-bull/) von Marty Bent zum Nachdenken angeregt.

Prinzipiell stellt sich im Großen und Ganzen die Frage, wie eine großflächige Adaption von Bitcoin vonstatten gehen könnte. [Hyperbitcoinization](https://www.genexyz.org/post/1721243636888/) oder auch Bitcoin als gesetzliches Zahlungsmittel (wie z.B. in El Salvador, oder bald sogar in Indonesien und Mexiko (!)) sind dabei mögliche Szenarien. Der Nicht-Ghandi-Spruch “First they ignore you, then they laugh at you, then they fight you, then you win.” wird oft genutzt, um die soziologische Entwicklungsstufe, bzw. die öffentliche Wahrnehmung einer Idee, einer Erfindung oder eines Produkts in gewisse Entwicklungsstufen einzuordnen. Genauso wie bei Bitcoin. WIR SIND IN DER "THEN THEY FIGHT YOU" STUFE!!!11! kann man überall auf Bitcoin-Twitter, Nostr oder Reddit lesen.

Doch wer ist "THEY"? Wenn man nur von Nationalstaaten ausgeht und offizielle und inoffizielle (konspirative) multinationale Interessensgruppen außen vor lässt, stellt sich mir die Frage, welches Land / welcher Staat die meisten Gründe (politischer oder wirtschaftlicher Natur) hätte, Bitcoin zu adaptieren, bzw. zu bekämpfen. Natürlich kommen einem dabei als erstes die USA in den Sinn, immerhin das Land mit der höchsten kombinierten [Bitcoin-Hashrate](https://ccaf.io/cbnsi/cbeci/mining_map), mit den meisten Bitcoin-Infrastruktur-Anbietern, mit den größten Börsen (nach Handelsvolumen) und den meisten Bitcoin-Nutzer//innen in der Bevölkerung.

Doch macht das die USA zum größten potentiellen Gegner oder zum größten potentiellen Befürworter und Begünstigten von Bitcoin?

### Jimmy Song "How Fiat Money Broke the World"

[Jimmy Song](primal.net/jimmysong) baut seinen Artikel chronologisch auf. Es geht um die Entstehung des Fiat-Geld-Systems nach dem zweiten Weltkrieg und die damit einhergehende Abschaffung des Goldstandards. Mit der Errichtung des Bretton-Woods-Systems wurde eine neue Währungsordnung geschaffen, die den US Dollar als Ankerwährung bestimmte, der wiederum an Goldreserven gekoppelt werden sollte. So sollten flexible Wechselkurse innerhalb der verschiedenen Landeswährungen gewährleistet werden, während gleichzeitig die Sicherheit von Goldreserven existiert. Doch statt Gold für die internationale Handelsabwicklung zu verwenden, wurde nun der Dollar die Abwicklungswährung. Diese Entscheidung verhalf den USA zu einer hegemonialen Wirtschaftsmacht zu werden, denn die Fähigkeit, das Geld zu drucken, mit dem jedes andere Land seinen Handel abwickelte, gab den USA mehr Macht über den Rest der Welt.

Diese Dollar-Hegemonie begünstigte die USA deutlich im internationalen Handel, da sie zur Zentralbank für alle anderen Zentralbanken wurden. Nicht-US-Banken geben sogar Verbindlichkeiten in Dollar, und zwar nicht nur in Europa, sondern in vielen anderen Teilen der Welt. Infolgedessen halten andere Zentralbanken US Dollar als Reserve, die dann auf der Basis von Teilreserven verwendet werden können, um noch mehr Geld in Form von Krediten zu schaffen (das sogenannte [Eurodollar-System](https://de.wikipedia.org/wiki/Eurodollar)).

Diese Position der Stärke nutzten die USA weiter aus und erschufen, was heute als das Petrodollar-System bekannt ist. Dank einem Abkommen zwischen Saudi-Arabien und den USA in den 1970ern wird das von allen Mitgliedsstaaten der OPEC geförderte Öl in US Dollar gehandelt, im Gegenzug für militärischen Schutz durch die USA. Das sogenannte [Petrodollar-System](https://de.wikipedia.org/wiki/Petrodollar) hat dem US Dollar somit einen enormen Wert und hohe Liquidität verliehen.

Die war auch nötig, denn teure Sozialprogramme wie Medicare und Medicaid als auch das Social Security Programm wurden gestartet. Aber auch sehr teure Stellvertreterkriege, wie z.B. in Korea und Vietnam, wollten finanziert werden. Dies taten die USA, indem sie das Geld hierfür einfach druckten, was wiederum die Zentralbanken der anderen Länder nervös machte und dazu brachte, mit dem Abzug ihrer Goldeinlagen bei der US-Notenbank zu drohen. Der damalige Präsident Tricky Dick (Richard Nixon) reagierte darauf, indem er die Goldbindung des US Dollar zunächst nur temporär für immer aufhob. Damit hatte er den Dollar vom Gold ent- und an das Öl der Saudis (bzw. an den militärisch-industriellen Komplex der USA) gekoppelt.

Die USA haben also das exorbitante Privileg, das Geld drucken zu können, das die Welt für die Abwicklung von Handel verwendet. Dies bedeutet unter anderem, dass die USA ihre gedruckten Dollars exportieren und Waren und Dienstleistungen aus anderen Ländern importieren können. Somit wird das gedruckte Geld im Allgemeinen zuerst in den USA ausgegeben (Cantillon-Effekt in Reinform), was dazu führt, dass Geschäftserfolg in den USA zu einer viel höheren monetären Belohnung führt, als in anderen Ländern. Vereinfacht gesagt: In den USA schwimmt mehr Geld umher und somit wird Erfolg besser belohnt. Folglich wollen mehr Menschen in die USA ziehen, und die USA können auswählen, wer hineinkommt und wer nicht. Gut für die USA - schlecht für die anderen.

Die ehrgeizigsten Menschen aus anderen Ländern immigrieren in die USA und verdienen mehr Geld und leben ein viel besseres Leben als in ihren Heimatländern. Der Braindrain bedeutet, dass andere Länder unterm Strich verlieren. Menschen im Allgemeinen versuchen immer in Länder einzuwandern, die in der Cantillon-Hierarchie höher stehen. Die reichen Länder werden somit reicher an Humankapital, während die armen Länder an Humankapital ärmer werden.

Die USA schaffen es, ihre Stellung als Neuzeit-Kolonialist vor allem mit Hilfe von Sonderorganisationen, internationalen Finanzinstitutionen und anderen Stiftungen wie dem IWF, der BIZ, des WEF oder der Weltbank zu zementieren. Diese supranationalen Banken und Organisationen leihen Entwicklungsländern und "Ländern des globalen Südens" Geld für den (Wieder-) Aufbau und andere Struktur-relevante Tätigkeiten, aber nur unter strengen Auflagen, die noch strenger werden, wenn diese Kredite nicht zurückgezahlt werden können. In diesen Fällen werden diese Länder dann von den Banken "gerettet", unter der Auflage, noch mehr Kontrolle über die eigene Finanzsuveränität abzugeben.

Im Wesentlichen tauschen sie dabei Kredite und längere Laufzeiten gegen organisatorische Kontrolle über den Staatshaushalt. Solche Beschränkungen können Punkte beinhalten, wie z.B. wieviel des nationalen Budgets für Infrastruktur ausgegeben werden kann. Oft müssen diese verschuldeten Regierungen eine eigene unabhängige Zentralbank gründen, die dazu verwendet werden kann, die Notwendigkeit einer staatlichen Genehmigung zu umgehen. So werden Länder dazu gebracht Staats-Ressourcen, wie Schürfrechte oder Ländereien an ausländische Unternehmen zu verkaufen.

Jimmy Song führt seinen Artikel noch etwas fort, doch die mir wichtigsten Punkte habe ich erwähnt. Kurz zusammengefasst: Die USA haben durch die de facto Kontrolle über das Geld eine Sonderposition in der Welt. Nicht nur sitzen sie am Gelddrucker - Geld drucken kann jeder, klappt eben nur unter bestimmten Voraussetzungen (zumindest zeitweise) - sondern haben durch diese Kontrollsituation weitere Vorteile: 1) Das größte Exportgut der USA ist der US Dollar. 2) Die US-Wirtschaft hat einen klaren Vorteil anderen Wirtschaften gegenüber, da das Unternehmertum dort besser belohnt wird. 3) Viele ehrgeizige und talentierte Menschen der ganzen Welt strömen in die USA, um von dieser Belohnung zu profitieren. 4) Die internationalen Buchstabensuppen-Finanzinstitutionen stärken den USA den Rücken.

Die USA haben also ein sehr großes (das gröte) Interesse daran, das globale Finanzmonopol in der aktuellen Form aufrechtzuerhalten.

### Peruvian Bull "The Dollar Endgame"

Die Ausgangsthese von [Peruvian Bull](primal.net/p/npub1xwmyzp64xx03kw9ecd7fzsj3e9dgwah6an0rdng0cc6ux4dswwjs28pyyc), einem Autor, der ein gleichnamiges Buch veröffentlicht hat ([The Dollar Endgame](https://thedollarendgame.com/)) ist, dass viele Zeichen darauf hindeuten, dass der US Dollar als Leitwährung der Welt seine letzten Atemzüge macht. Er ist dabei recht pessimistisch und glaubt, dass wir schon in den nächten fünf bis sieben Jahren eine große Veränderung erleben werden.

Allerdings sieht er eine große Chance für die USA, Bitcoin zu nutzen, um diesem Untergang entgegenzuwirken. Viele Länder und Institutionen außerhalb der westlichen Welt sehen den US Dollar kritisch und sind nicht besonders glücklich über die Vormachtstellung, die der Dollar den USA auf dem internationalen Finanzmarkt, dem globalen Handel und der geopolitischen Weltordnung verleiht. Die US-Notenbank wird immer mehr in die Ecke gedrängt und der einzige Ausweg aus der momentanen Schuldenspirale ist Hyperinflation.

Meine zwei Sats sind, dass eine Wahrscheinlichkeit natürlich immer besteht, allerdings bin ich persönlich davon überzeugt, dass der US Dollar, wenn überhaupt, die letzte Währung sein wird, die eine Hyperinflation erlebt, da vorher ganz andere Währungen das Zeitliche segnen müssten.

Doch um bei der These zu bleiben, bietet Bitcoin eine alternative Lösung zur Hyperinflation. Denn die USA könnten ihre Verluste reduzieren, indem sie auf eine Bitcoin-gestützte Leitwährung wechseln. Dazu sind die USA auch bestens aufgestellt: Die von Minern aufgebrachte Hashrate ist nirgendwo größer, als in den USA, Bitcoin-Bestände in Wallets sind nirgendwo größer als in den USA und die größten Bitcoin-Unternehmen, Unternehmen die Bitcoin fördern, oder Technologie entwickeln, die Bitcoin zugute kommt, sitzen in den USA.

Würden die USA, bzw. die US-Notenbank, zu einem Bitcoin-gestützten Währungssystem wechseln, müssten alle anderen Länder der Welt nachziehen, solange die USA diese (oben beschriebene) globale Vormachtstellung in der Weltwirtschaft noch innehaben. Dies würde den USA einen gewaltigen First-Mover-Vorteil bescheren, da nirgendwo sonst die Infrastruktur und der Zugang zu Bitcoin so stark ausgeprägt sind.

<img src="https://blossom.primal.net/45676de9f23863d4e05005f3e7b51c46ef38791395bb8abeb5966ea10c6bede6.gif">

Es ist also nur eine politische Entscheidung, ob dieser First-Mover-Vorteil ausgenutzt wird oder nicht. Indem die Nutzung (institutioneller oder privater Art, Mining, Innovation, etc.) eingeschränkt wird, z.B. durch Verbote, Besteuerung, oder andere ungünstige Gesetze, wird die gesamte Branche und damit das technische Wissen, die Innovation und das damit verbundene Kapital ins Ausland verdrängt und die USA schießen sich ins eigene Bein.

Es wird sicherlich institutionellen Widerstand geben, da die derzeitigen institutionellen Akteure stark vom aktuellen System profitieren und daher nicht zu einem Bitcoin-Währungssystem wechseln wollen, in dem sie keine Zensurrechte und keine exklusiven Übertragungsrechte haben. Daher werden US-Institutionen wie die Notenbank und das Finanzministerium von diesem Ansatz nicht allzu begeistert sein, doch wenn sie es ernsthaft genug betrachten und erkennen, dass es sich hierbei um eine Form der geopolitischen, strategischen Kriegsführung handelt, könnten sie gezwungen sein, ihre Meinung zu ändern und sich auf ein neues System vorzubereiten, das den Idealen, wie Freiheit, Redefreiheit, Eigentumsrechten und solides Geld, treu bleibt, auf denen die USA gegründet wurden.

Peruvian Bull und Marty Bent führen in dieser Episode noch weitere Punkte aus, doch die mir wichtigsten Punkte habe ich wieder erwähnt. Kurz zusammengefasst: Die USA stehen davor, ihre globale Vormachtstellung zu verlieren. Ein Ausweg könnte die Adaption von Bitcoin als Retter des US Dollar sein. Die USA haben den fruchtbarsten Nährboden für eine solche Änderung des Systems, da sie heute schon die meiste Hashrate, das größte geistige Eigentum und Innovation, als auch das meiste Kapital bündeln.

Die USA hätten also in der Theorie ein sehr großes Interesse daran, Bitcoin als Lösung und zur Stützung ihres globalen Finanzmonopols zu adaptieren.

### Zwei Theorien in zwei entgegengesetzte Richtungen 👈👉

Auf der einen Seite sehen wir ein Argument, weshalb den USA daran gelegen wäre, das aktuelle System so lange wie möglich aufrechtzuerhalten und dem alten Mann auf Krücken unter die Arme zu greifen. Auf der anderen Seite besteht ein Argument dafür, dass die USA ein gesteigertes Interesse daran haben sollten, das alte System so schnell wie möglich hinter sich zu lassen und die Pole Position, die die USA im Bereich Bitcoin haben - ohne Regierungs-seitig was dafür getan zu haben - für sich zu nutzen, um dem alten Mann auf Krücken zu einer Verjüngung zu verhelfen.

<img src="https://blossom.primal.net/d448258356093ddc5030b4077d63262b1c9c2e94360f65e10862b43fb3996b83.gif">

Es ist schwierig einzuschätzen, welchen Weg die USA gehen werden, da es immer noch keinen allgemeinen Konsens darüber gibt, wie Bitcoin zu betrachten ist. Der kürzlich vorgestellte DAME-Gesetzesentwurf ([Digital Asset Mining Energy excise tax](https://home.treasury.gov/system/files/131/General-Explanations-FY2024.pdf)), also eine Verbrauchssteuer für Miner, der Biden-Regierung, würde von Bitcoin-Mining-Unternehmen verlangen, eine 30% Steuer auf die Stromkosten zu zahlen, die für das Mining von Bitcoin verwendet werden. Ein solches Gesetz würde die Mining Industrie aus dem Land drängen, da Miner heute schon auf sehr knappen Margen operieren und somit unprofitabel würden. Dies gleicht einer Bestrafung von Unternehmen für das Streben nach Innovation und technologischem Fortschritt.

Auf der anderen Seite gibt es aber auch die Ansicht, Bitcoin müsse ins Land geholt werden, da man es dort am besten kontrollieren kann, ganz nach dem Motto "Halte deine Freunde nah und deine Feinde noch näher". So z.B. Carole House, ehemalige Direktorin für Cybersicherheit des Nationalen Sicherheitsrates des Weißen Hauses. Sie sprach bei einem Event an der Universität von Princeton und sagte "sie würde lieber mehr Hashrate in den USA sehen, damit sie Miner zwingen können, das Netzwerk zu zensieren" und dass es "nicht nur darum ginge, Minern zu sagen, dass sie bestimmte Transaktionen nicht in Blöcke einbauen, sondern auch nicht auf Blöcken mit nicht konformen Transaktionen aufzubauen, damit diese Transaktionen nirgendwo in der Kette ankommen".

Wir sehen also, dass es selbst zwischen den Gegnern von Bitcoin keinen endgültigen Konsens gibt, wie das Thema in Zukunft angegangen werden soll. Da ist esnicht verwunderlich, dass auf Ebene eines Paradigmenwechsels, den die Adaption von Bitcoin von Seiten der Notenbank bedeuten würde, noch unklarer ist. Für mich sind beide Erklärungen logisch. Allerdings wissen wir nur zu gut, dass Regierungen es manchmal nicht so mit Logik und Vernunft haben.

🫳🎤

---

In diesem Sinne, 2... 1... Risiko!

-

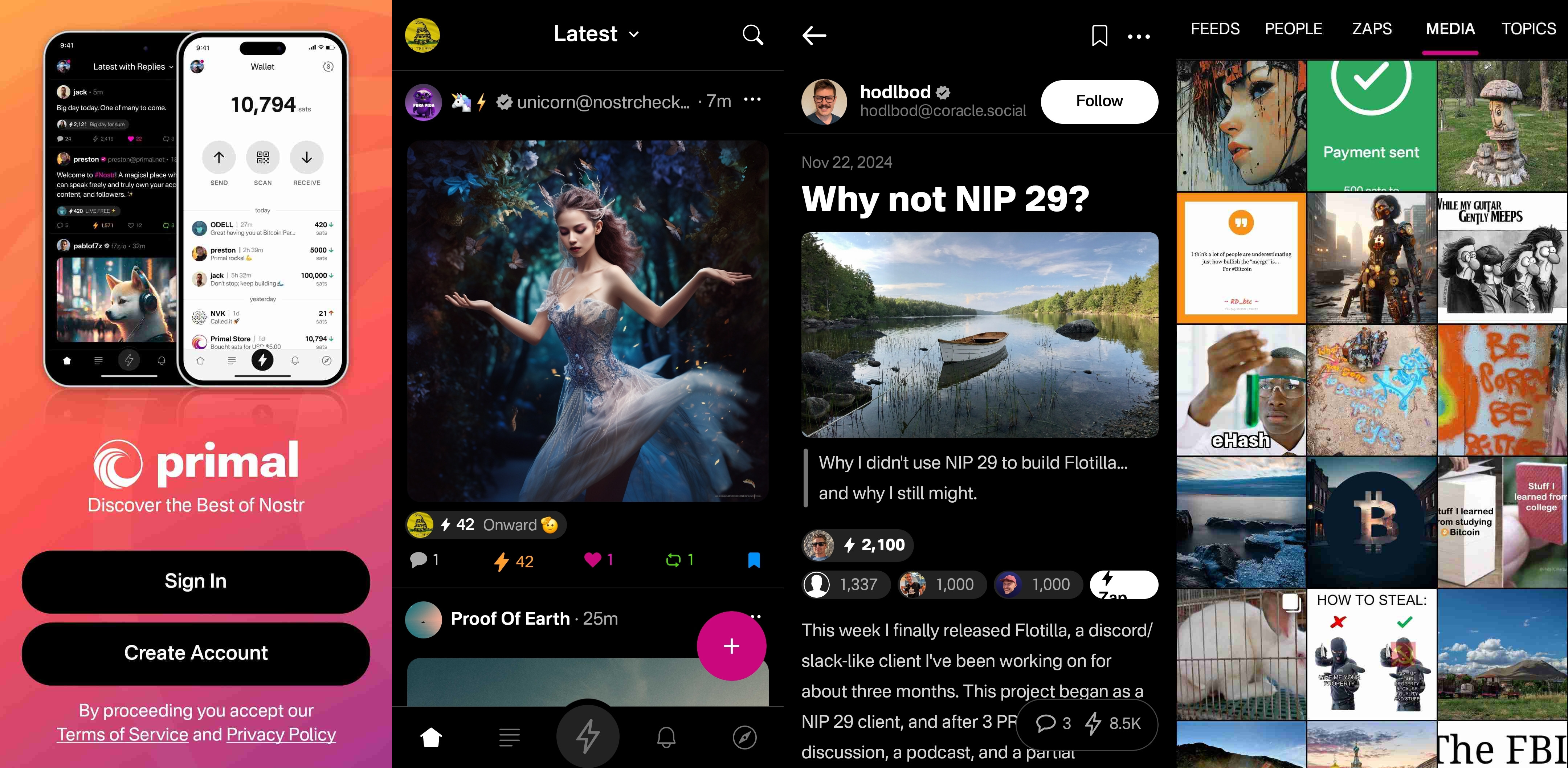

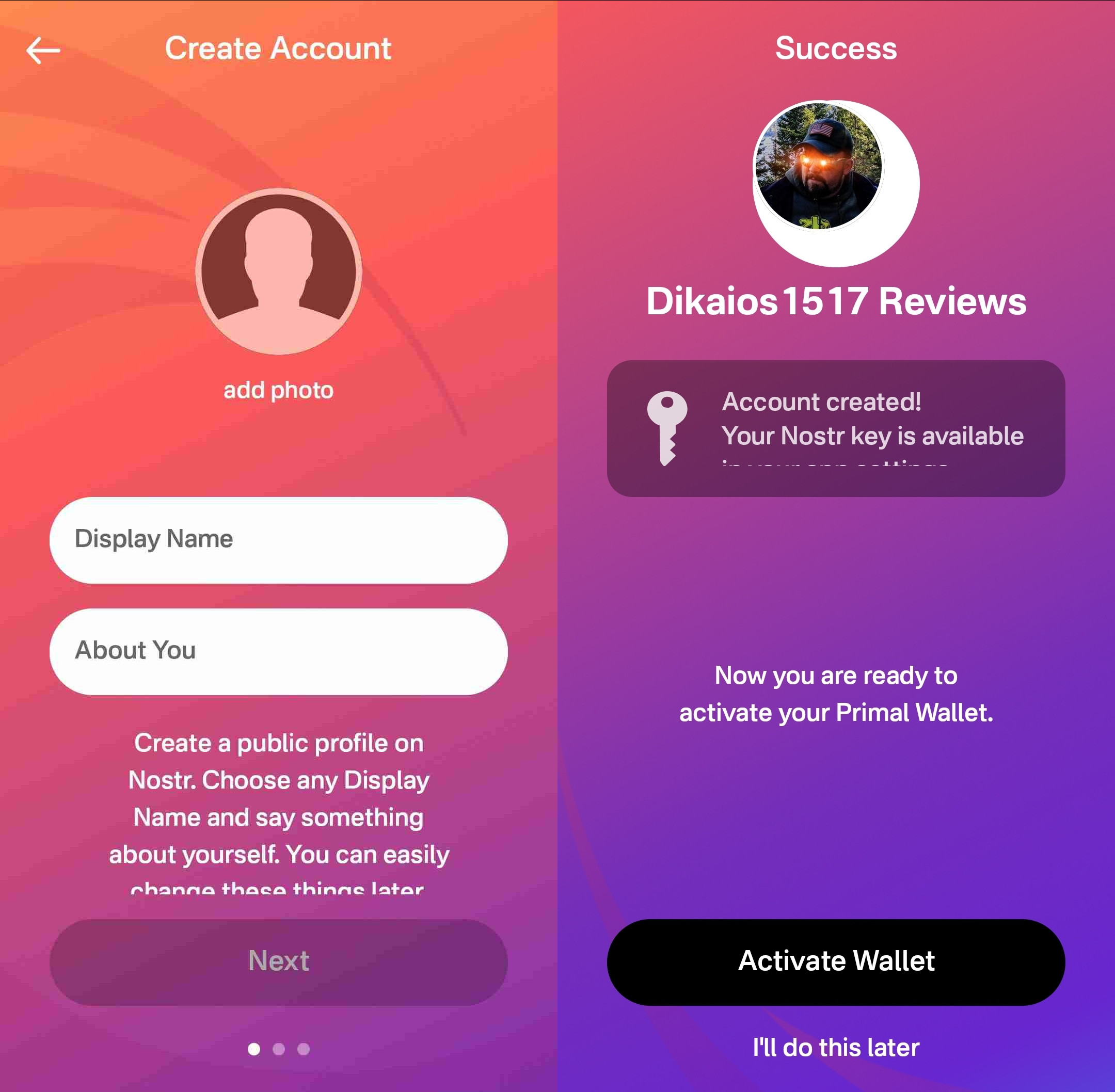

@ 207ad2a0:e7cca7b0

2025-01-07 03:46:04

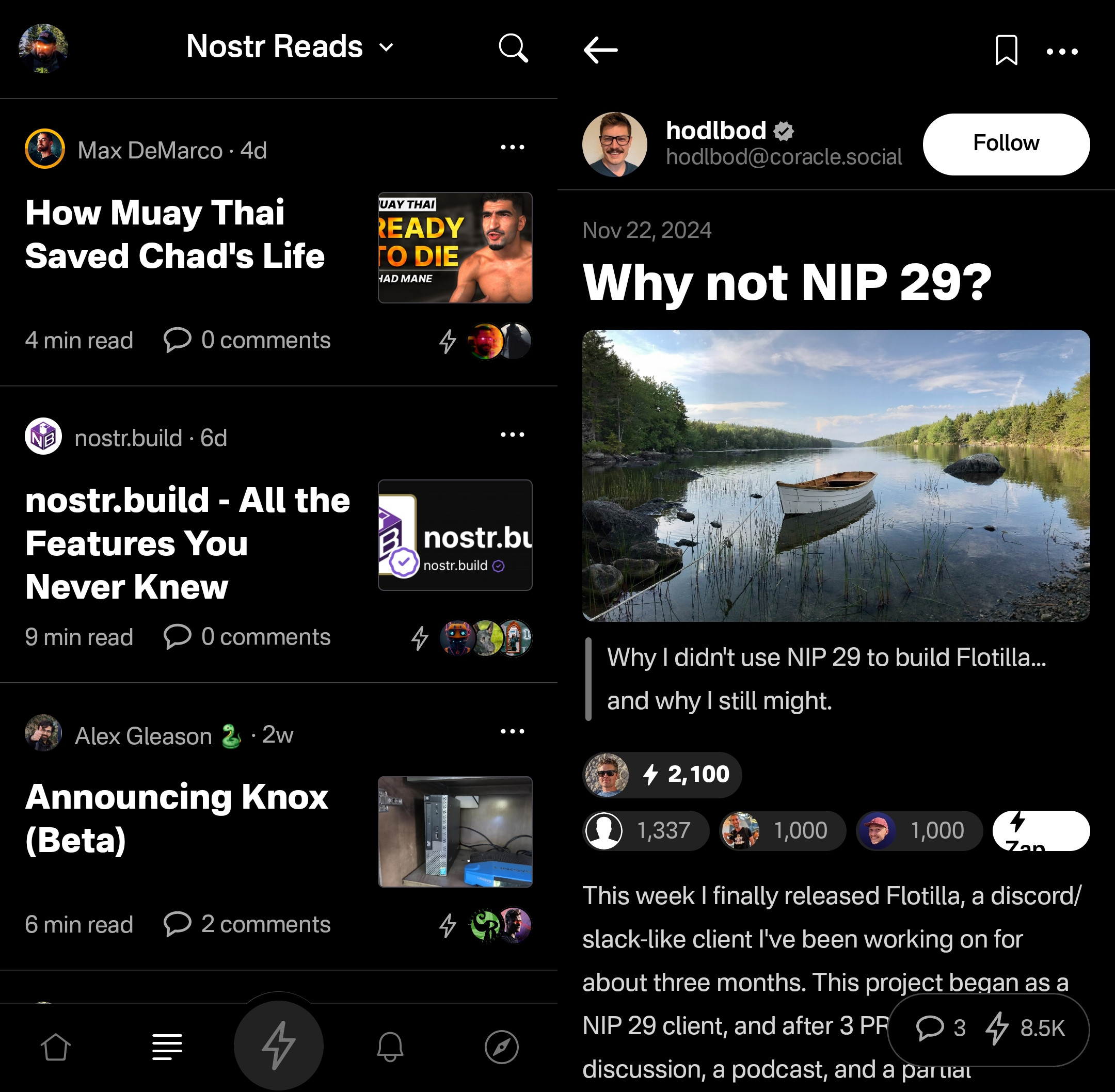

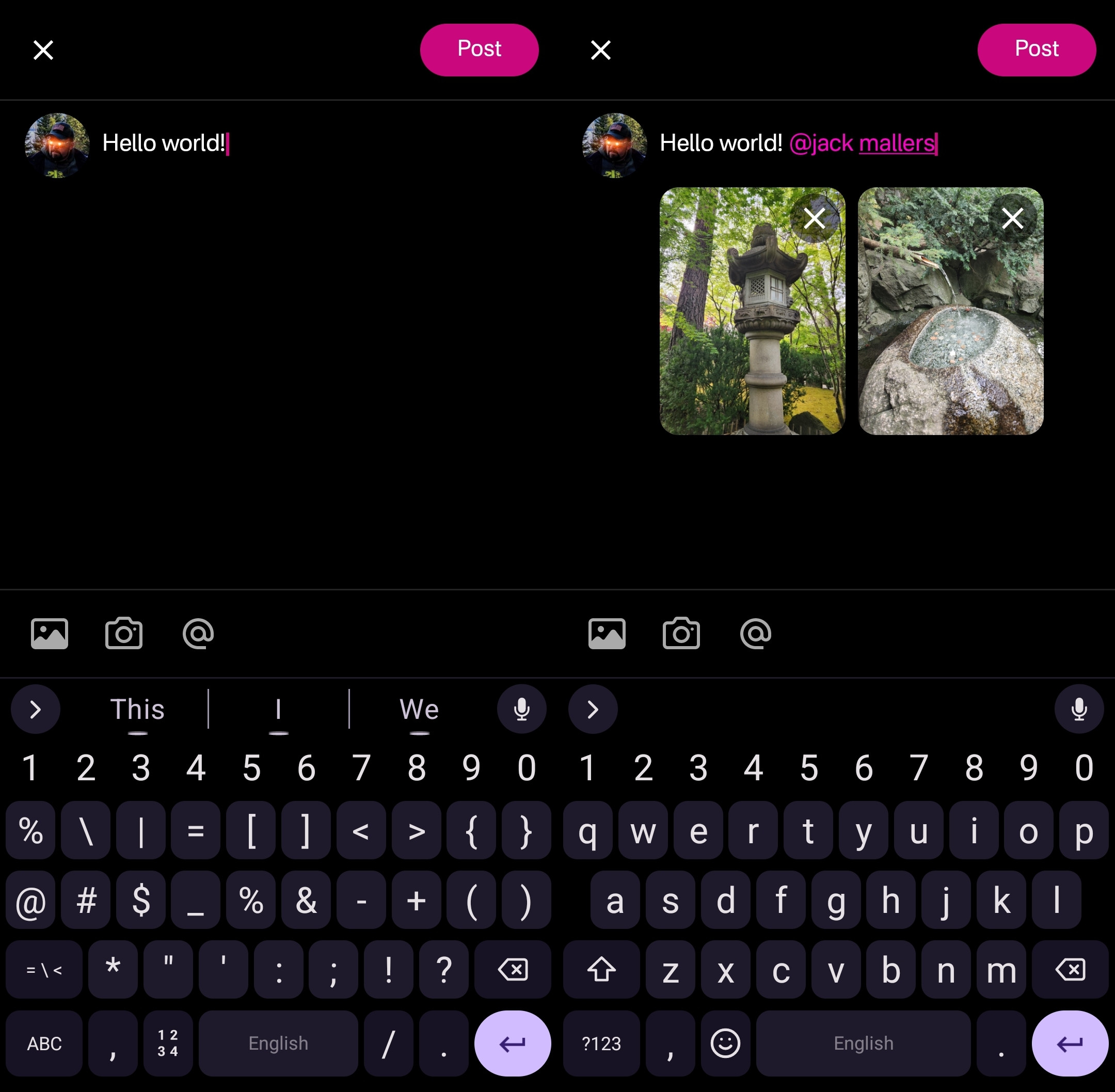

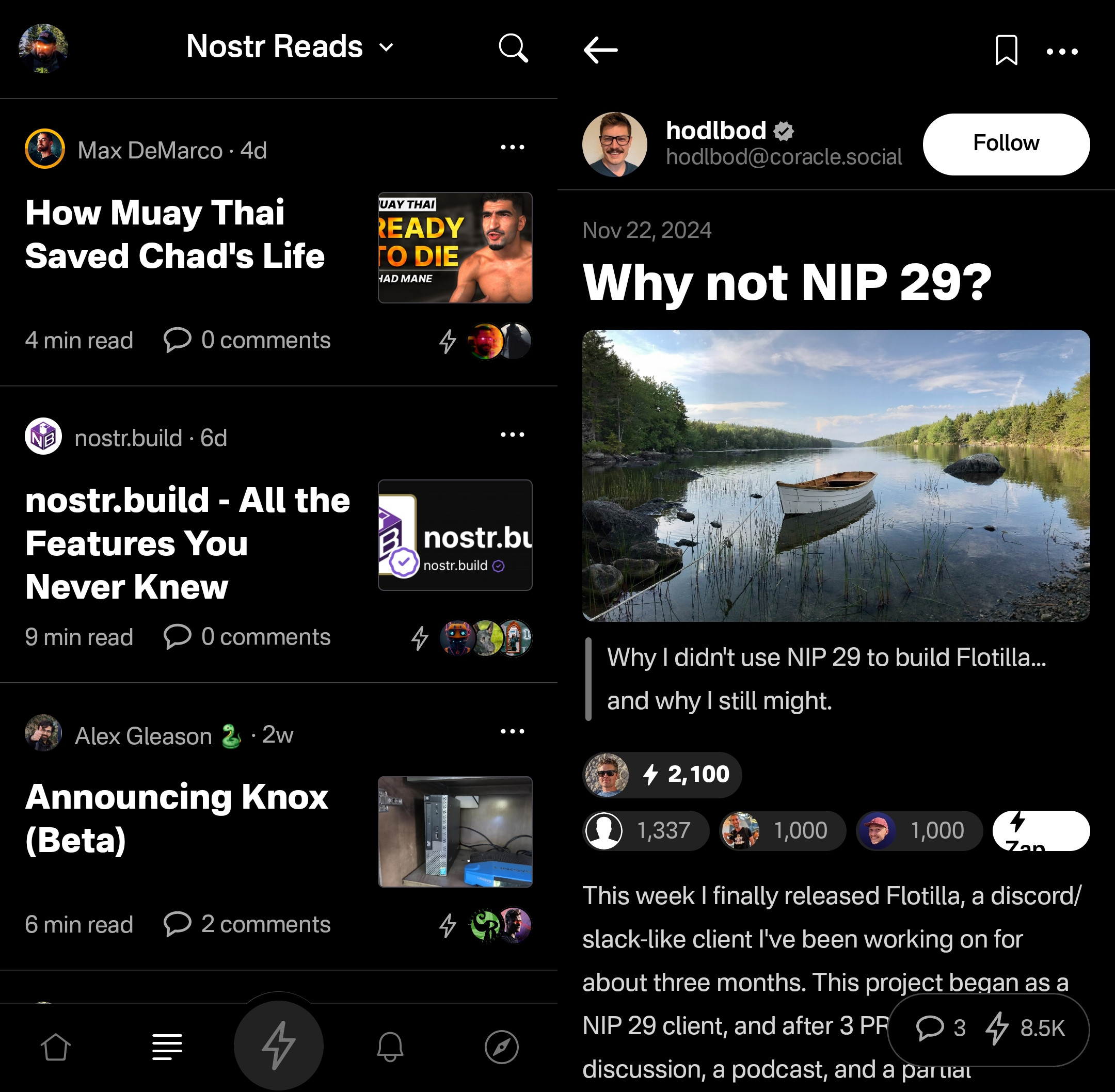

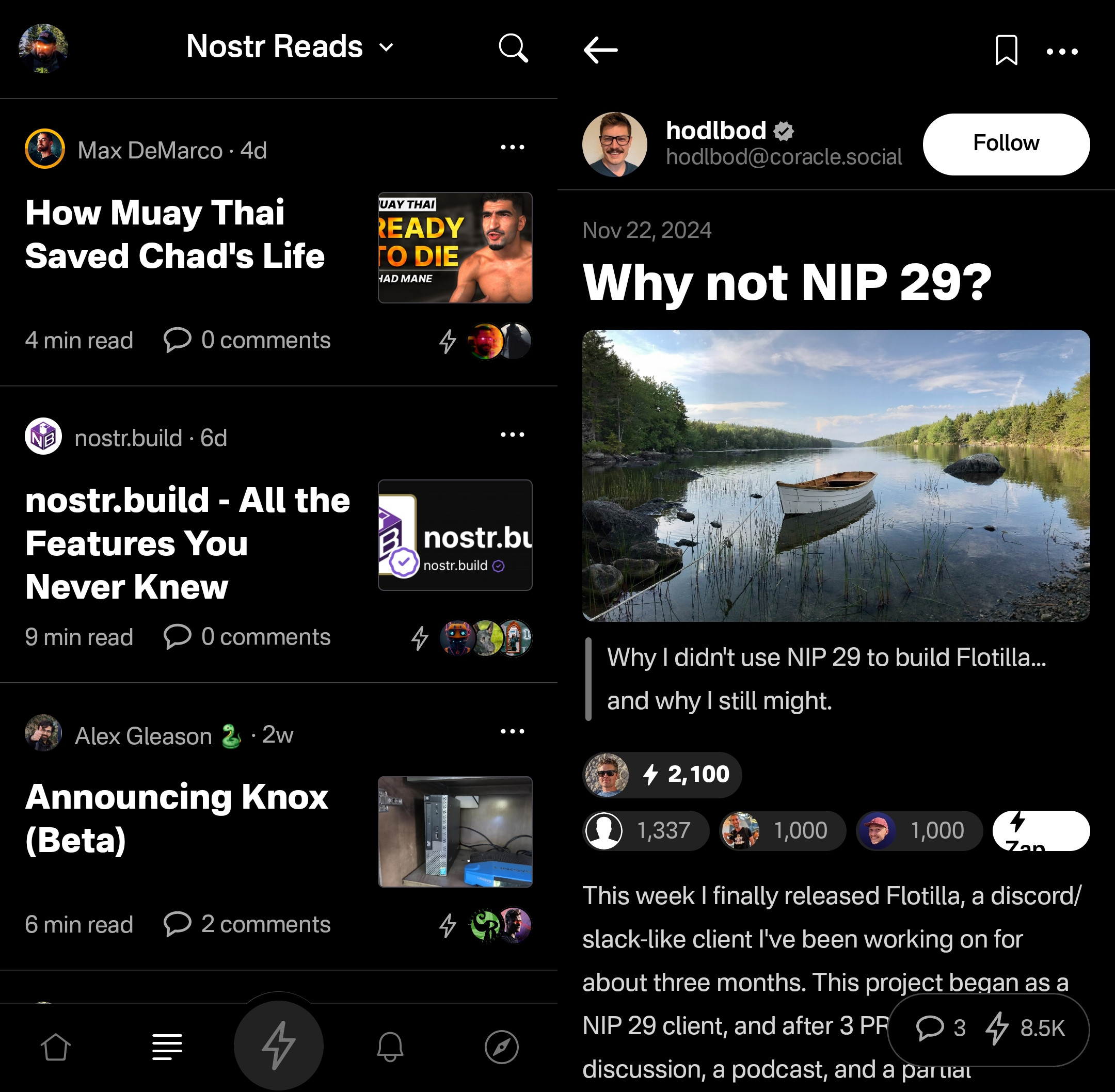

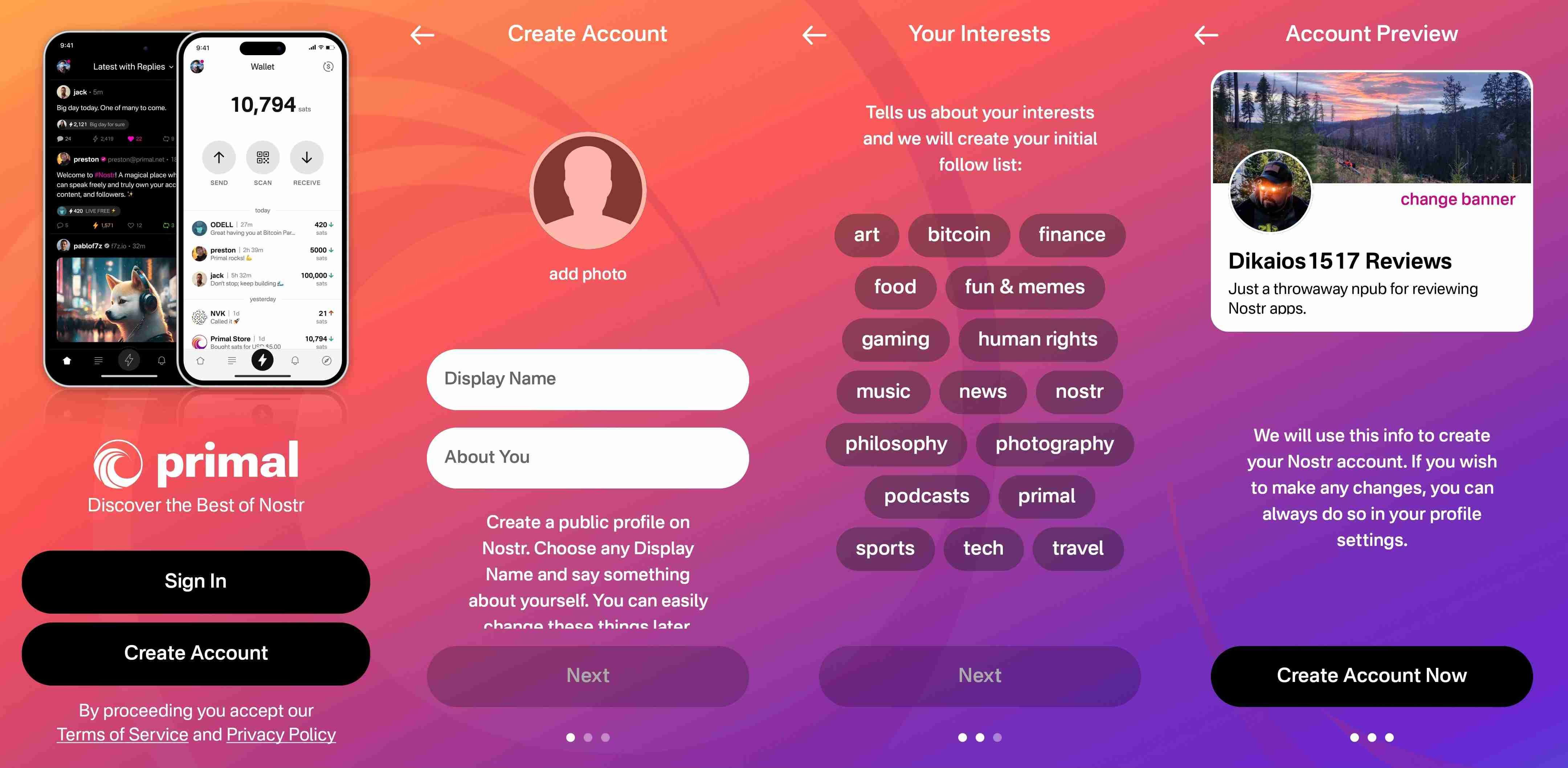

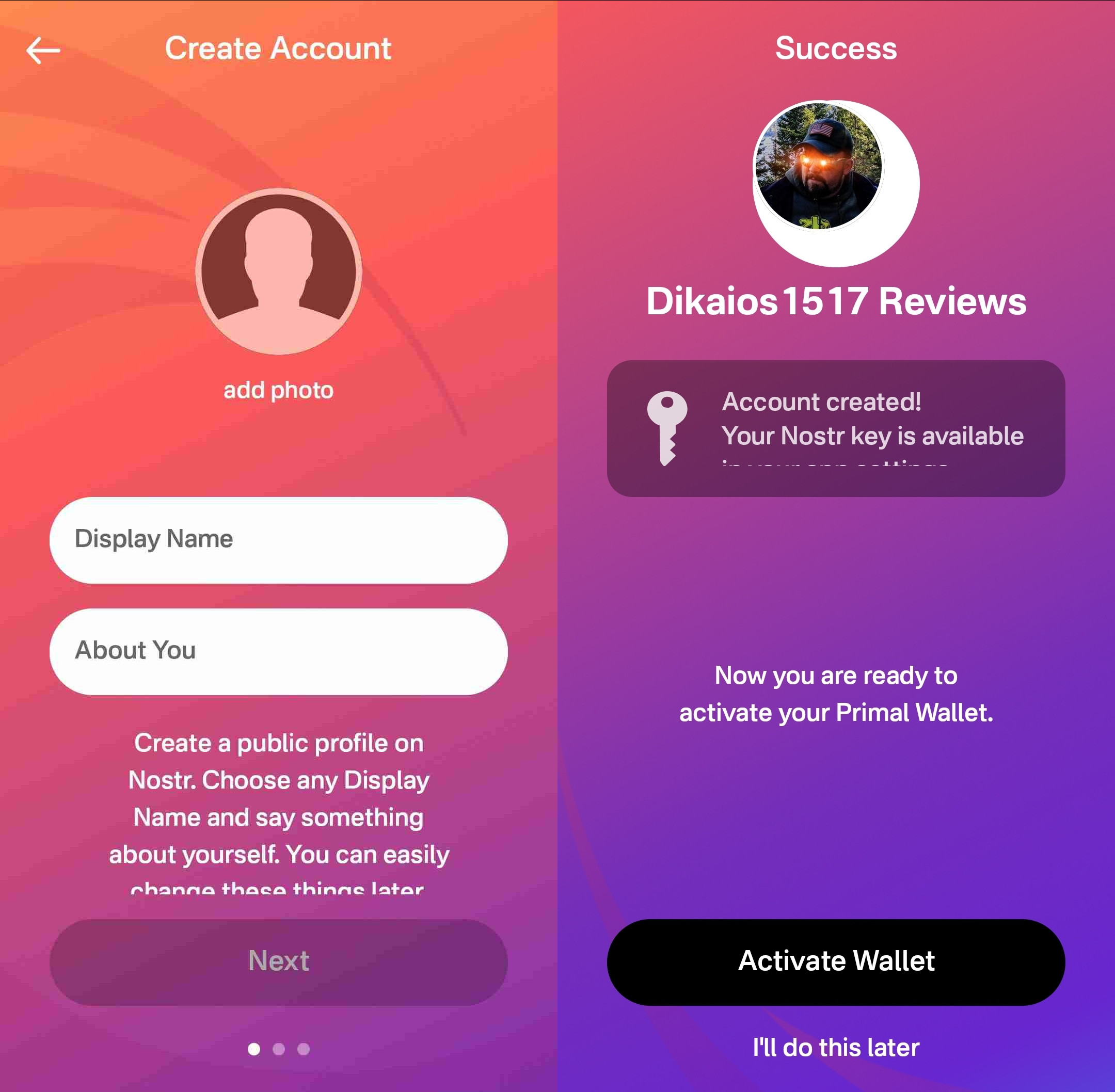

*Quick context: I wanted to check out Nostr's longform posts and this blog post seemed like a good one to try and mirror. It's originally from my [free to read/share attempt to write a novel](https://untitlednovel.dns7.top/contents/), but this post here is completely standalone - just describing how I used AI image generation to make a small piece of the work.*

Hold on, put your pitchforks down - outside of using Grammerly & Emacs for grammatical corrections - not a single character was generated or modified by computers; a non-insignificant portion of my first draft originating on pen & paper. No AI is ~~weird and crazy~~ imaginative enough to write like I do. The only successful AI contribution you'll find is a single image, the map, which I heavily edited. This post will go over how I generated and modified an image using AI, which I believe brought some value to the work, and cover a few quick thoughts about AI towards the end.

Let's be clear, I can't draw, but I wanted a map which I believed would improve the story I was working on. After getting abysmal results by prompting AI with text only I decided to use "Diffuse the Rest," a Stable Diffusion tool that allows you to provide a reference image + description to fine tune what you're looking for. I gave it this Microsoft Paint looking drawing:

and after a number of outputs, selected this one to work on:

The image is way better than the one I provided, but had I used it as is, I still feel it would have decreased the quality of my work instead of increasing it. After firing up Gimp I cropped out the top and bottom, expanded the ocean and separated the landmasses, then copied the top right corner of the large landmass to replace the bottom left that got cut off. Now we've got something that looks like concept art: not horrible, and gets the basic idea across, but it's still due for a lot more detail.

The next thing I did was add some texture to make it look more map like. I duplicated the layer in Gimp and applied the "Cartoon" filter to both for some texture. The top layer had a much lower effect strength to give it a more textured look, while the lower layer had a higher effect strength that looked a lot like mountains or other terrain features. Creating a layer mask allowed me to brush over spots to display the lower layer in certain areas, giving it some much needed features.

At this point I'd made it to where I felt it may improve the work instead of detracting from it - at least after labels and borders were added, but the colors seemed artificial and out of place. Luckily, however, this is when PhotoFunia could step in and apply a sketch effect to the image.

At this point I was pretty happy with how it was looking, it was close to what I envisioned and looked very visually appealing while still being a good way to portray information. All that was left was to make the white background transparent, add some minor details, and add the labels and borders. Below is the exact image I wound up using:

Overall, I'm very satisfied with how it turned out, and if you're working on a creative project, I'd recommend attempting something like this. It's not a central part of the work, but it improved the chapter a fair bit, and was doable despite lacking the talent and not intending to allocate a budget to my making of a free to read and share story.

#### The AI Generated Elephant in the Room

If you've read my non-fiction writing before, you'll know that I think AI will find its place around the skill floor as opposed to the skill ceiling. As you saw with my input, I have absolutely zero drawing talent, but with some elbow grease and an existing creative direction before and after generating an image I was able to get something well above what I could have otherwise accomplished. Outside of the lowest common denominators like stock photos for the sole purpose of a link preview being eye catching, however, I doubt AI will be wholesale replacing most creative works anytime soon. I can assure you that I tried numerous times to describe the map without providing a reference image, and if I used one of those outputs (or even just the unedited output after providing the reference image) it would have decreased the quality of my work instead of improving it.

I'm going to go out on a limb and expect that AI image, text, and video is all going to find its place in slop & generic content (such as AI generated slop replacing article spinners and stock photos respectively) and otherwise be used in a supporting role for various creative endeavors. For people working on projects like I'm working on (e.g. intended budget $0) it's helpful to have an AI capable of doing legwork - enabling projects to exist or be improved in ways they otherwise wouldn't have. I'm also guessing it'll find its way into more professional settings for grunt work - think a picture frame or fake TV show that would exist in the background of an animated project - likely a detail most people probably wouldn't notice, but that would save the creators time and money and/or allow them to focus more on the essential aspects of said work. Beyond that, as I've predicted before: I expect plenty of emails will be generated from a short list of bullet points, only to be summarized by the recipient's AI back into bullet points.

I will also make a prediction counter to what seems mainstream: AI is about to peak for a while. The start of AI image generation was with Google's DeepDream in 2015 - image recognition software that could be run in reverse to "recognize" patterns where there were none, effectively generating an image from digital noise or an unrelated image. While I'm not an expert by any means, I don't think we're too far off from that a decade later, just using very fine tuned tools that develop more coherent images. I guess that we're close to maxing out how efficiently we're able to generate images and video in that manner, and the hard caps on how much creative direction we can have when using AI - as well as the limits to how long we can keep it coherent (e.g. long videos or a chronologically consistent set of images) - will prevent AI from progressing too far beyond what it is currently unless/until another breakthrough occurs.

-

@ a012dc82:6458a70d

2025-01-07 01:54:52

**Table Of Content**

- The Lazarus Group's Cryptocurrency Holdings

- A Significant Drop in Holdings

- No Privacy Coins in Sight

- Underreported Holdings?

- Previous Attacks and Thefts

- Warnings and Threats

- Conclusion

- FAQ

In the ever-evolving world of cryptocurrencies, security breaches and cyber heists have become alarmingly common. One name that frequently emerges in relation to these digital thefts is the Lazarus Group. This North Korean hacking collective has been linked to a series of high-profile cyber-attacks, amassing a significant amount of cryptocurrency in the process. This article delves deep into the group's activities, their holdings, and the implications of their actions on the crypto world.

**The Lazarus Group's Cryptocurrency Holdings**

The Lazarus Group, originating from North Korea, has made headlines with its vast cryptocurrency holdings. Recent reports suggest that this hacking collective has a digital treasure chest worth around $47 million. Bitcoin, the most popular and valuable cryptocurrency, forms the bulk of their holdings, with an estimated value of $42.5 million. In addition to Bitcoin, the group has diversified its holdings with Ether (ETH) valued at $1.9 million, BNB (BNB) worth $1.1 million, and a mix of stablecoins, primarily Binance USD (BUSD), which amounts to approximately $640,000.

**A Significant Drop in Holdings**

While the current figures are staggering, there has been a noticeable decline in the Lazarus Group's cryptocurrency assets. Data indicates that their holdings were valued at $86 million as of September 6. This value plummeted in the aftermath of the Stake.com hack, an event that saw the Lazarus Group as a prime suspect. Dune Analytics, a data monitoring platform, has been keeping a close eye on the group's activities. They have identified 295 wallets associated with the Lazarus Group, information corroborated by agencies like the FBI and the OFAC.

**No Privacy Coins in Sight**

For a hacking group that thrives on anonymity, it's surprising to note the absence of privacy coins in their portfolio. Coins such as Monero (XMR), Dash (DASH), and Zcash (ZEC), known for their enhanced privacy features, are conspicuously missing from their holdings. However, this hasn't deterred the group from continuing their operations. Their crypto wallets, devoid of privacy coins, have seen consistent activity, with the latest transaction recorded on September 20.

**Underreported Holdings?**

The figures mentioned might just be the tip of the iceberg. According to 21.co, the Lazarus Group's actual cryptocurrency holdings could be much higher than what's currently reported. This assertion is based on the data available to the public, suggesting that the group might have undisclosed assets hidden away.

**Previous Attacks and Thefts**

The Lazarus Group's foray into the crypto world has been marked by a series of attacks and thefts. They were the masterminds behind the CoinEx exchange hack, which resulted in losses exceeding $55 million. Their nefarious activities don't end there. The FBI has linked them to other significant breaches, including those targeting Alphapo, CoinsPaid, and Atomic Wallet. These attacks, in 2023 alone, saw the group walking away with more than $200 million. However, there's a silver lining. Chainalysis reports indicate a decline in crypto thefts by hackers associated with North Korea, with an 80% drop recorded from 2022.

**Warnings and Threats**

The digital realm remains under the shadow of the Lazarus Group. Recent alerts from U.S. federal authorities have highlighted the group's potential to target critical sectors, including the U.S. healthcare and public health domains. These warnings underscore the group's capabilities and the persistent threat they pose.

**Conclusion**

The Lazarus Group's activities serve as a stark reminder of the vulnerabilities inherent in the digital space. Their vast cryptocurrency holdings, accumulated through a series of hacks and breaches, highlight the need for enhanced security measures in the crypto world. As the digital landscape continues to evolve, it's imperative for stakeholders to remain vigilant, ensuring that their assets are protected from such sophisticated threats. The story of the Lazarus Group is not just about a hacking collective's exploits but a call to action for the broader crypto community.

**FAQ**

**Who is the Lazarus Group?**

The Lazarus Group is a North Korean hacking collective known for its high-profile cyber-attacks and significant cryptocurrency holdings.

**How much cryptocurrency does the Lazarus Group hold?**

The group is reported to have amassed around $47 million in cryptocurrency, with Bitcoin forming the majority of their holdings.

**Were there any recent significant drops in their holdings?**

Yes, their holdings saw a decline from $86 million as of September 6, especially after the Stake.com hack.

**Does the Lazarus Group hold any privacy coins?**

Surprisingly, the group does not hold any known privacy coins like Monero, Dash, or Zcash.

**Have there been any warnings about the Lazarus Group's activities?**

U.S. federal authorities have issued warnings about the group's potential to target sectors like U.S. healthcare and public health.

**That's all for today**

**If you want more, be sure to follow us on:**

**NOSTR: croxroad@getalby.com**

**X: [@croxroadnews](https://x.com/croxroadnewsco)**

**Instagram: [@croxroadnews.co](https://www.instagram.com/croxroadnews.co/)**

**Youtube: [@croxroadnews](https://www.youtube.com/@croxroadnews)**

**Store: https://croxroad.store**

**Subscribe to CROX ROAD Bitcoin Only Daily Newsletter**

**https://www.croxroad.co/subscribe**

*DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.*

-

@ dd664d5e:5633d319

2025-01-06 20:36:17

_Ingredients_

* 1 kg of pork roast with rind, such as shoulder or a lean belly

* 1 bottle of beer, light or dark

* chopped German-style mirepoix (best combination, for this recipe, includes celery root, carrot, red onion, and leeks)

* salt, pepper, nutmeg

* 1 diced garlic clove

_Directions_

1. Spread the vegetables on the bottom of the roasting pan.

2. Pour half the beer over the roast. (Drink the other half.)

3. Season the meat, to taste.

4. Roast the meat at 180 °C, until done (depends upon the weight of the roast).

5. Remove the meat from the oven, and wrap in aluminum foil.

6. Pour 2-3 cups of water into the roasting pan.

7. Pour/scrape everything from the pan into a sieve over a sauce pot.

8. Press the vegetables against the sieve, with the back of a spoon, to ensure that you get all that good dripping flavor into the sauce.

9. Defat the sauce with a grease separator, then pour it back into the pot.

10. Thicken the sauce, slightly (it should remain slightly watery, and not turn into a gravy), according to your usual method.

11. Open the foil and slice the roast.

12. Serve with the sauce.

-

@ 2063cd79:57bd1320

2025-01-06 17:46:01

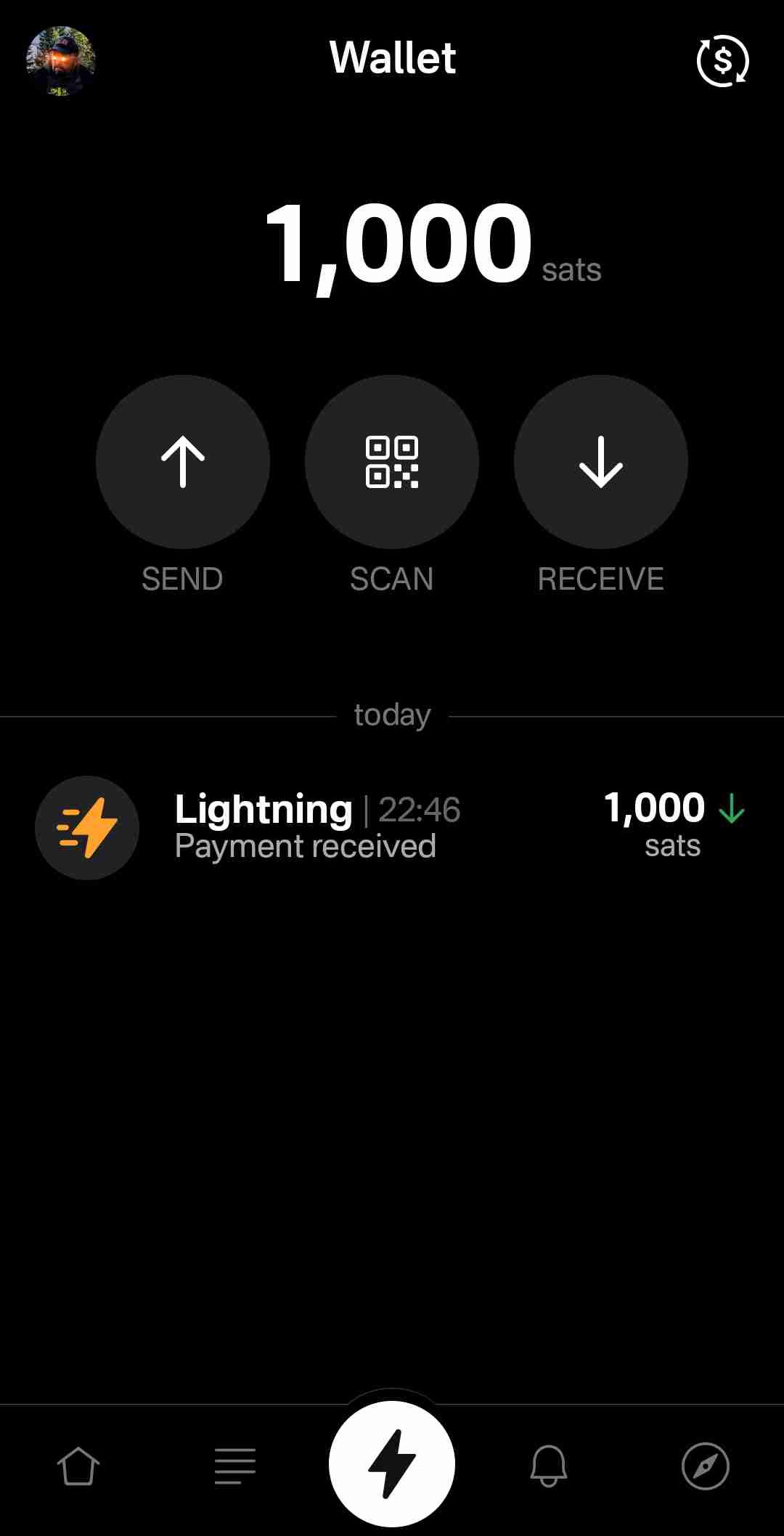

Der Mempool ist voll. Voller als das Rosenrot an Heiligabend. Dies bedeutet in erster Linie hohe Transaktionsgebühren für On-Chain-Transaktionen. Doch auch während der Mempool verstopft ist, wie der Gotthardtunnel in der Urlaubssaison, bietet Bitcoins Layer 2 Lösung - das Lightning Netzwerk - schnelle und günstige Zahlungen, um Bitcoins Skalierungsgrenze zu überbrücken. Gerade in Zeiten von hohen Transaktionsgebühren und einem Mempool, der voller ist als Til Schweiger nach 13 Uhr, werden kleine Zahlungen, die On-Chain getätigt werden, immer unökonomischer und Lightning Zahlungen dadurch attraktiver.

<img src="https://blossom.primal.net/d5a615c03e7b08217695478085bd6ee011fbe3b63b2bbae819f91fbecb456084.png">

Doch nicht jede/r Nutzer//in möchte auch gleichzeitig eine Lightning-Node betreiben, um in den Genuss zu kommen Lightning zu benutzen. In diesem Fall bieten Lightning Service Provider (LSP) und verschiedene Apps Abhilfe. Es gibt viele verschiedene Anbieter und viele verschiedene Varianten das gleiche Problem umzusetzen: Der/die Nutzer//in möchte mit möglichst wenig Aufwand Lightning benutzen und muss dazu seine/ihre Lightning Wallet zunächst erstmal mit (On-Chain) Bitcoin füttern. Das Umwandeln von L1 Bitcoin zu L2 Bitcoin übernimmt dann die Software. Aber auch andersherum kann es sein, dass Nutzer//innen viele Lightning Zahlungen erhalten und die gesammelten Sats gerne in L1 Bitcoin tauschen möchten. Um diesen Tauschvorgang abzuwickeln gibt es verschiedene Methoden. Eine dieser Methoden sind sogenannte Submarine Swaps.

---

Erstmal vorab: Bitcoin ist Bitcoin, ob On-Chain auf der Basisschicht (Layer 1), oder Off-Chain auf der zweiten Schicht (Layer 2) in Form von Lightning. Man könnte es mit Bargeld vergleichen: Geld auf dem Konto kann problemlos hin- und hergeschoben werden, man kann es auf andere Konten schieben, Überweisungen tätigen oder Depots bezahlen. Wenn man allerdings Bargeld in der Tasche haben will, muss man eine Brücke von der digitalen Kontenwelt in die analoge Bargeldwelt schlagen. Diese Brücke stellen Bankautomaten, Supermarktkassen oder Bankschalter dar, oder eben jede Stelle, an der man Bargeld abheben kann. Das Geldmittel bleibt dabei das gleiche, es verändert nur seinen Aggregatzustand. So kann man Bitcoin in Lightning auch beschreiben, denn Bitcoin bleibt Bitcoin, es hat nur seinen Aggregatzustand temporär verändert. Auf der einen Seite sind also On-Chain-Transaktionen oder Layer 1 (L1) Zahlungen, auf der anderen Seite werde ich von Off-Chain- oder Lightning-Zahlungen oder Layer 2 (L2) und Sats sprechen.

<img src="https://blossom.primal.net/bb2f398cfcf76a7c971897d0e0a4f247d58236aa13a647a0869c35fe09a96474.gif">

### Refresher