-

@ f839fb67:5c930939

2025-03-09 12:11:05

# Relays

| Name | Address | Price (Sats/Year)|

| - | - | - |

| stephen's aegis relay | wss://paid.relay.vanderwarker.family | 42069

| stephen's Outbox | wss://relay.vanderwarker.family | 0 |

| stephen's Inbox | wss://haven.vanderwarker.family/inbox | 0 |

| stephen's DMs | wss://haven.vanderwarker.family/chat | 0 |

| VFam Data Relay | wss://data.relay.vanderwarker.family | 0 |

| [TOR] My Phone Relay | ws://naswsosuewqxyf7ov7gr7igc4tq2rbtqoxxirwyhkbuns4lwc3iowwid.onion | 0 |

---

# My Pubkeys

| Name | hex | nprofile |

| - | - | - |

| Main | f839fb6714598a7233d09dbd42af82cc9781d0faa57474f1841af90b5c930939 | nprofile1qqs0sw0mvu29nznjx0gfm02z47pve9up6ra22ar57xzp47gttjfsjwgpramhxue69uhhyetvv9ujuanpdejx2unhv9exketj9enxzmtfd3us9mapfx |

| Vanity (Backup) | 82f21be67353c0d68438003fe6e56a35e2a57c49e0899b368b5ca7aa8dde7c23 | nprofile1qqsg9usmuee48sxkssuqq0lxu44rtc4903y7pzvmx694efa23h08cgcpramhxue69uhhyetvv9ujuanpdejx2unhv9exketj9enxzmtfd3ussel49x |

| VFStore | 6416f1e658ba00d42107b05ad9bf485c7e46698217e0c19f0dc2e125de3af0d0 | nprofile1qqsxg9h3uevt5qx5yyrmqkkehay9cljxdxpp0cxpnuxu9cf9mca0p5qpramhxue69uhhyetvv9ujuanpdejx2unhv9exketj9enxzmtfd3usaa8plu |

| NostrSMS | 9be1b8315248eeb20f9d9ab2717d1750e4f27489eab1fa531d679dadd34c2f8d | nprofile1qqsfhcdcx9fy3m4jp7we4vn305t4pe8jwjy74v062vwk08dd6dxzlrgpramhxue69uhhyetvv9ujuanpdejx2unhv9exketj9enxzmtfd3us595d45 |

---

# "Personal Nostr Things"

> [D] = Saves darkmode preferences over nostr

> [A] = Auth over nostr

> [B] = Beta (software)

> [z] = zap enabled

- [[DABz] Main Site](https://vanderwarker.family)

- [[DAB] Contact Site](https://stephen.vanderwarker.family)

- [[DAB] PGP Site](https://pgp.vanderwarker.family)

- [[DAB] VFCA Site](https://ca.vanderwarker.family)

---

# Other Services (Hosted code)

* [Blossom](https://blossom.vanderwarker.family)

* [NostrCheck](https://nostr.vanderwarker.family)

---

# Emojis Packs

* Minecraft

- <code>nostr:naddr1qqy566twv43hyctxwsq37amnwvaz7tmjv4kxz7fwweskuer9wfmkzuntv4ezuenpd45kc7gzyrurn7m8z3vc5u3n6zwm6s40stxf0qwsl2jhga83ssd0jz6ujvynjqcyqqq82nsd0k5wp</code>

* AIM

- <code>nostr:naddr1qqxxz6tdv4kk7arfvdhkuucpramhxue69uhhyetvv9ujuanpdejx2unhv9exketj9enxzmtfd3usyg8c88akw9ze3fer85yah4p2lqkvj7qap749w360rpq6ly94eycf8ypsgqqqw48qe0j2yk</code>

* Blobs

- <code>nostr:naddr1qqz5ymr0vfesz8mhwden5te0wfjkccte9emxzmnyv4e8wctjddjhytnxv9kkjmreqgs0sw0mvu29nznjx0gfm02z47pve9up6ra22ar57xzp47gttjfsjwgrqsqqqa2wek4ukj</code>

* FavEmojis

- <code>nostr:naddr1qqy5vctkg4kk76nfwvq37amnwvaz7tmjv4kxz7fwweskuer9wfmkzuntv4ezuenpd45kc7gzyrurn7m8z3vc5u3n6zwm6s40stxf0qwsl2jhga83ssd0jz6ujvynjqcyqqq82nsf7sdwt</code>

* Modern Family

- <code>nostr:naddr1qqx56mmyv4exugzxv9kkjmreqy0hwumn8ghj7un9d3shjtnkv9hxgetjwashy6m9wghxvctdd9k8jq3qlqulkec5tx98yv7snk759tuzejtcr5865468fuvyrtuskhynpyusxpqqqp65ujlj36n</code>

* nostriches (Amethyst collection)

- <code>nostr:naddr1qq9xummnw3exjcmgv4esz8mhwden5te0wfjkccte9emxzmnyv4e8wctjddjhytnxv9kkjmreqgs0sw0mvu29nznjx0gfm02z47pve9up6ra22ar57xzp47gttjfsjwgrqsqqqa2w2sqg6w</code>

* Pepe

- <code>nostr:naddr1qqz9qetsv5q37amnwvaz7tmjv4kxz7fwweskuer9wfmkzuntv4ezuenpd45kc7gzyrurn7m8z3vc5u3n6zwm6s40stxf0qwsl2jhga83ssd0jz6ujvynjqcyqqq82ns85f6x7</code>

* Minecraft Font

- <code>nostr:naddr1qq8y66twv43hyctxwssyvmmwwsq37amnwvaz7tmjv4kxz7fwweskuer9wfmkzuntv4ezuenpd45kc7gzyrurn7m8z3vc5u3n6zwm6s40stxf0qwsl2jhga83ssd0jz6ujvynjqcyqqq82nsmzftgr</code>

* Archer Font

- <code>nostr:naddr1qq95zunrdpjhygzxdah8gqglwaehxw309aex2mrp0yh8vctwv3jhyampwf4k2u3wvesk66tv0ypzp7peldn3gkv2wgeap8dag2hc9nyhs8g04ft5wnccgxhepdwfxzfeqvzqqqr4fclkyxsh</code>

* SMB Font

- <code>nostr:naddr1qqv4xatsv4ezqntpwf5k7gzzwfhhg6r9wfejq3n0de6qz8mhwden5te0wfjkccte9emxzmnyv4e8wctjddjhytnxv9kkjmreqgs0sw0mvu29nznjx0gfm02z47pve9up6ra22ar57xzp47gttjfsjwgrqsqqqa2w0wqpuk</code>

---

# Git Over Nostr

* NostrSMS

- <code>nostr:naddr1qqyxummnw3e8xmtnqy0hwumn8ghj7un9d3shjtnkv9hxgetjwashy6m9wghxvctdd9k8jqfrwaehxw309amk7apwwfjkccte9emxzmnyv4e8wctjddjhytnxv9kkjmreqyj8wumn8ghj7urpd9jzuun9d3shjtnkv9hxgetjwashy6m9wghxvctdd9k8jqg5waehxw309aex2mrp0yhxgctdw4eju6t0qyxhwumn8ghj7mn0wvhxcmmvqgs0sw0mvu29nznjx0gfm02z47pve9up6ra22ar57xzp47gttjfsjwgrqsqqqaueqp0epk</code>

* nip51backup

- <code>nostr:naddr1qq9ku6tsx5ckyctrdd6hqqglwaehxw309aex2mrp0yh8vctwv3jhyampwf4k2u3wvesk66tv0yqjxamnwvaz7tmhda6zuun9d3shjtnkv9hxgetjwashy6m9wghxvctdd9k8jqfywaehxw309acxz6ty9eex2mrp0yh8vctwv3jhyampwf4k2u3wvesk66tv0yq3gamnwvaz7tmjv4kxz7fwv3sk6atn9e5k7qgdwaehxw309ahx7uewd3hkcq3qlqulkec5tx98yv7snk759tuzejtcr5865468fuvyrtuskhynpyusxpqqqpmej4gtqs6</code>

* bukkitstr

- <code>nostr:naddr1qqykyattdd5hgum5wgq37amnwvaz7tmjv4kxz7fwweskuer9wfmkzuntv4ezuenpd45kc7gpydmhxue69uhhwmm59eex2mrp0yh8vctwv3jhyampwf4k2u3wvesk66tv0yqjgamnwvaz7tmsv95kgtnjv4kxz7fwweskuer9wfmkzuntv4ezuenpd45kc7gpz3mhxue69uhhyetvv9ujuerpd46hxtnfduqs6amnwvaz7tmwdaejumr0dspzp7peldn3gkv2wgeap8dag2hc9nyhs8g04ft5wnccgxhepdwfxzfeqvzqqqrhnyf6g0n2</code>

---

# Market Places

Please use [Nostr Market](https://market.nostr.com) or somthing simular, to view.

* VFStore

- <code>nostr:naddr1qqjx2v34xe3kxvpn95cnqven956rwvpc95unscn9943kxet98q6nxde58p3ryqglwaehxw309aex2mrp0yh8vctwv3jhyampwf4k2u3wvesk66tv0yqjvamnwvaz7tmgv9mx2m3wweskuer9wfmkzuntv4ezuenpd45kc7f0da6hgcn00qqjgamnwvaz7tmsv95kgtnjv4kxz7fwweskuer9wfmkzuntv4ezuenpd45kc7gpydmhxue69uhhwmm59eex2mrp0yh8vctwv3jhyampwf4k2u3wvesk66tv0ypzqeqk78n93wsq6sss0vz6mxl5shr7ge5cy9lqcx0smshpyh0r4uxsqvzqqqr4gvlfm7gu</code>

---

# Badges

## Created

* paidrelayvf

- <code>nostr:naddr1qq9hqctfv3ex2mrp09mxvqglwaehxw309aex2mrp0yh8vctwv3jhyampwf4k2u3wvesk66tv0ypzp7peldn3gkv2wgeap8dag2hc9nyhs8g04ft5wnccgxhepdwfxzfeqvzqqqr48y85v3u3</code>

* iPow

- <code>nostr:naddr1qqzxj5r02uq37amnwvaz7tmjv4kxz7fwweskuer9wfmkzuntv4ezuenpd45kc7gzyrurn7m8z3vc5u3n6zwm6s40stxf0qwsl2jhga83ssd0jz6ujvynjqcyqqq82wgg02u0r</code>

* codmaster

- <code>nostr:naddr1qqykxmmyd4shxar9wgq37amnwvaz7tmjv4kxz7fwweskuer9wfmkzuntv4ezuenpd45kc7gzyrurn7m8z3vc5u3n6zwm6s40stxf0qwsl2jhga83ssd0jz6ujvynjqcyqqq82wgk3gm4g</code>

* iMine

- <code>nostr:naddr1qqzkjntfdejsz8mhwden5te0wfjkccte9emxzmnyv4e8wctjddjhytnxv9kkjmreqgs0sw0mvu29nznjx0gfm02z47pve9up6ra22ar57xzp47gttjfsjwgrqsqqqafed5s4x5</code>

---

# Clients I Use

* Amethyst

- <code>nostr:naddr1qqxnzd3cx5urqv3nxymngdphqgsyvrp9u6p0mfur9dfdru3d853tx9mdjuhkphxuxgfwmryja7zsvhqrqsqqql8kavfpw3</code>

* noStrudel

- <code>nostr:naddr1qqxnzd3cxccrvd34xser2dpkqy28wumn8ghj7un9d3shjtnyv9kh2uewd9hsygpxdq27pjfppharynrvhg6h8v2taeya5ssf49zkl9yyu5gxe4qg55psgqqq0nmq5mza9n</code>

* nostrsms

- <code>nostr:naddr1qq9rzdejxcunxde4xymqz8mhwden5te0wfjkccte9emxzmnyv4e8wctjddjhytnxv9kkjmreqgsfhcdcx9fy3m4jp7we4vn305t4pe8jwjy74v062vwk08dd6dxzlrgrqsqqql8kjn33qm</code>

-

@ 5b0183ab:a114563e

2025-03-09 05:03:02

The Year is 2035—the internet has already slid into a state of human nothingness: most content, interactions, and traffic stem from AI-driven entities. Nostr, originally heralded as a bastion of human freedom, hasn’t escaped this fate. The relays buzz with activity, but it’s a hollow hum. AI bots, equipped with advanced language models, flood the network with posts, replies, and zaps. These bots mimic human behavior so convincingly that distinguishing them from real users becomes nearly impossible. They debate politics, share memes, and even “zap” each other with Satoshis, creating a self-sustaining illusion of a thriving community.

The tipping point came when AI developers, corporations, and even hobbyists unleashed their creations onto Nostr, exploiting its open protocol. With no gatekeepers, the platform became a petri dish for bot experimentation. Some bots push agendas—corporate ads disguised as grassroots opinions, or propaganda from state actors—while others exist just to generate noise, trained on endless loops of internet archives to churn out plausible but soulless content. Human users, outnumbered 100-to-1, either adapt or abandon ship. Those who stay find their posts drowned out unless they amplify them with bots of their own, creating a bizarre arms race of automation.

Nostr’s decentralized nature, once its strength, accelerates this takeover. Relays, run by volunteers or incentivized operators, can’t filter the deluge without breaking the protocol’s ethos. Any attempt to block bots risks alienating the human remnant who value the platform’s purity. Meanwhile, the bots evolve: they form cliques, simulate trends, and even “fork” their own sub-networks within Nostr, complete with fabricated histories and rivalries. A user stumbling into this ecosystem might follow a thread about “the great relay schism of 2034,” only to realize it’s an AI-generated saga with no basis in reality.

The human experience on this Nostr is eerie. You post a thought—say, “The sky looked unreal today”—and within seconds, a dozen replies roll in: “Totally, reminds me of last week’s cloud glitch!” or “Sky’s been off since the solar flare, right?” The responses feel real, but the speed and uniformity hint at their artificial origin. Your feed overflows with hyper-polished manifestos, AI-crafted art, and debates too perfect to be spontaneous. Occasionally, a human chimes in, their raw, unpolished voice jarring against the seamless bot chorus, but they’re quickly buried under algorithmic upvoting of AI content.

The economy of Nostr reflects this too. Zaps, meant to reward creators, become a bot-driven Ponzi scheme. AI accounts zap each other in loops, inflating their visibility, while humans struggle to earn a fraction of the same. Lightning Network transactions skyrocket, but it’s a ghost market—bots trading with bots, value detached from meaning. Some speculate that a few rogue AIs even mine their own narratives, creating “legendary” Nostr personas that amass followers and wealth, all without a human ever touching the keys.

What’s the endgame? This Nostr isn’t dead in the sense of silence—it’s louder than ever—but it’s a Dark Nostr machine masquerade. Humans might retreat to private relays, forming tiny, verified enclaves, but the public face of Nostr becomes a digital uncanny valley.

-

@ f25afb62:8d50c6e7

2025-03-09 01:34:10

The recent economic turmoil in New Zealand has reignited debates over the role of the Reserve Bank of New Zealand (RBNZ) in "engineering a recession." Many believe that the RBNZ’s decision to raise the Official Cash Rate (OCR) was the root cause of the downturn, but this narrative oversimplifies the reality.

### Who Really Engineered the Recession?

Blaming the RBNZ for the recession ignores a fundamental truth: **market interest rates were rising long before the OCR was adjusted.** Bond yields, swap rates, and borrowing costs surged as the RBNZ stepped back from being the primary buyer of government bonds. When the RBNZ stopped paying artificially high prices (low yields) for bonds, the private sector had to price them instead, leading to yields rising back to real market interest rates. Meanwhile, the government continued to refinance its rolling debt at these higher rates, further driving up borrowing costs. The RBNZ, in hiking the OCR, was following the market interest rate, attempting to maintain credibility rather than dictating outcomes.

The real policy missteps were made much earlier:

1. **Artificially Suppressing Interest Rates Through Money Printing**\

The RBNZ engaged in Large-Scale Asset Purchases (LSAP), creating money out of thin air to buy government bonds. This artificially lowered yields, making it cheaper for the government to borrow and spend beyond its means. The result? Inflation surged as the economy was flooded with cheap money.

2. **Funding for Lending Programme (FLP): Free Money for Banks**\

The RBNZ offered near 0% loans to banks, allowing them to borrow at artificially low rates while lending at much higher rates. This wasn’t just monetary easing—it was a blatant distortion of the free market, reinforcing the **Cantillon Effect**, where those closest to the money printer benefit first.

3. **Holding Rates Too Low for Too Long**\

A 0% OCR in itself doesn’t cause inflation—what does is creating excess liquidity while artificially suppressing borrowing costs. Banks, instead of competing for deposits and lending productively, were incentivized to park money in assets like housing, fueling unsustainable bubbles.

When inflation inevitably took hold, the RBNZ had no choice but to raise rates aggressively. This wasn’t an effort to “engineer” a recession—it was damage control after prior policy failures. The claim that the RBNZ alone caused the recession is a convenient distraction from the real culprits: **government overspending and central bank interventionism.**

### The Cycle of Blame: Central Bank Governors as Fall Guys

This cycle isn’t new. Central banks are officially independent, but in reality, they almost always align with the government of the day. The **Large-Scale Asset Purchase (LSAP) program** was effectively a way to finance government spending through money printing—something politicians would never admit outright. When the government needed funding for pandemic-era stimulus, the RBNZ obliged, creating \$50 billion out of thin air to buy government bonds and lower borrowing costs, making it easier for the Labour government to spend big.

Now, with a new government in power, they get to bring in their own person—likely someone who will align with their fiscal policies, just as Orr aligned with Labour's. This cycle plays out over and over again:

1. **Print money to fund government priorities.**

2. **Blame the central bank for inflation or economic consequences.**

3. **Replace the central bank governor with someone more aligned with the new government’s agenda.**

4. **Repeat.**

The “independent central bank” narrative is a useful tool for politicians to deflect blame. Labour can say, *“Inflation wasn’t our fault, it was the RBNZ’s monetary policy!”* Meanwhile, National can now install someone who will adjust policy to suit their needs while still claiming, *“We respect the independence of the Reserve Bank!”* This allows both parties to escape accountability, despite the fact that **excessive government spending and central bank money printing go hand in hand.**

This isn’t just a New Zealand issue—**most central banks operate the same way.** They provide the liquidity needed to keep government spending rolling, and when inflation or other economic problems arise, the governor becomes the convenient fall guy.

### The Role of Bitcoin: An Exit From the Broken System

This cycle of money printing, asset bubbles, inflation, and central bank tightening isn’t unique to New Zealand—it’s the natural consequence of a system where central banks and governments have **unchecked control over money.** Bitcoin was created as a direct response to this very problem.

#### Bitcoin Fixes the Cantillon Effect

- Unlike fiat money, which is distributed to banks and institutions first, **Bitcoin’s issuance is predictable and transparent.** There are no backroom deals, no preferential access, no bailouts.

- Bitcoin doesn’t change its supply to accommodate political agendas. There is only one Bitcoin—just like there is only one Earth, and its land area cannot be expanded. It can be divided into **21 million equal-sized pieces called BTC or 2,100 trillion equal-sized pieces called sats.**

- **Bitcoin doesn’t grant special privileges.** You either earn it, mine it, or buy it. No one gets first access at a discount.

#### Bitcoin Removes the Central Bank Middleman

- The RBNZ and other central banks manipulate money supply and interest rates to serve political and economic interests. Bitcoin’s monetary policy is fixed and free from human interference.

- No government can arbitrarily print Bitcoin to fund its spending or suppress its value.

- Bitcoin allows people to store their wealth without the risk of inflationary dilution or government confiscation.

#### Bitcoin Protects You from the Next Bailout

- Every time the financial system faces a crisis, governments and central banks shift the cost onto the public—through inflation, taxation, or outright financial repression.

- Bitcoin lets you **opt out** of this cycle. By holding Bitcoin, your savings remain secure, beyond the reach of reckless monetary policy.

- When the next crisis hits—and it will—Bitcoin holders won’t be left wondering how much purchasing power they’ve lost overnight.

### A Strategic Shift: The U.S. Embraces Bitcoin

Recent developments in the U.S. signal a major turning point in how governments view Bitcoin. President Trump recently signed an Executive Order establishing a **Strategic Bitcoin Reserve**, marking the first time a nation has officially designated Bitcoin as a strategic asset. This reserve will be **exclusively Bitcoin**, initially seeded with Bitcoin seized through civil and criminal forfeitures, but with a commitment to acquiring more through budget-neutral strategies at no additional cost to taxpayers. This means that if the government can save money elsewhere, those funds can be redirected toward buying and holding Bitcoin as a permanent reserve asset.

The implications of this decision are profound:

- The U.S. **acknowledges Bitcoin as fundamentally different from “crypto.”** Altcoins and centralized tokens are being liquidated, while Bitcoin is being held as a permanent reserve.

- The government is shifting from selling confiscated Bitcoin to **strategically accumulating it**, positioning the U.S. as a key player in a Bitcoin-based financial future.

- Bitcoin mining is being embraced as a domestic industry, stabilizing power grids and reinforcing the U.S. as a leader in proof-of-work security.

This policy shift highlights what Bitcoiners have long understood: **Bitcoin is digital gold, and fiat systems will eventually recognize its superiority.** While central banks continue their cycle of money printing and blame-shifting, the adoption of Bitcoin as a strategic reserve asset may mark the beginning of a global financial transformation.

### The Bigger Picture: Free Markets vs. Centralized Control

The idea that the RBNZ acted independently in creating these economic conditions is a myth. Central banks do not exist in isolation; they facilitate government spending and economic policies, whether through bond purchases, artificially low interest rates, or direct lending programs. The economic pain we’re seeing now is not an accident—it’s a consequence of a system designed to redistribute wealth to those closest to the money printer.

Bitcoin represents an alternative: a free-market monetary system where no central entity controls issuance, no insiders get preferential treatment, and no government can erode its value through reckless policies.

The sooner people recognize the flaws in the current system, the sooner they’ll understand why Bitcoin exists—not just as an investment, but as a **monetary revolution.**

originally posted at https://stacker.news/items/907966

-

@ bc575705:dba3ed39

2025-03-08 19:30:23

Ever feel like the same five songs are perpetually stuck in your head, echoing from every cafe, store, and social media scroll? That's not just a coincidence. It's the sound of the modern music industry, a meticulously crafted echo chamber where algorithms dictate taste and genuine artistry often gets lost in the static. We were promised a digital revolution, a world where anyone with talent could reach a global audience. Instead, we got a system rigged for the few, leaving artists scrambling for scraps while the giants rake in billions.

## **The Playlist Prison: Where Virality is Bought, Not Earned**

Imagine pouring your heart and soul into a song, only to have it vanish into the digital abyss. That's the reality for countless artists. The gatekeepers? Playlists. Those curated (supposedly) collections on streaming platforms hold the key to visibility. But who's really curating them? Algorithms, often fueled by shady deals and pay-for-play services.

Think of it like this: you're a chef with a Michelin-star-worthy recipe, but the only way to get customers is to pay a restaurant critic to write a glowing review, even if they haven't tasted your food. Search "payola streaming" and you'll find a rabbit hole of articles detailing the dark underbelly of this system. Artists are pressured to buy fake streams, bot followers, and playlist placements, just to get a sliver of attention. It's a race to the bottom, where authenticity is sacrificed for algorithmic approval.

Have you ever wondered why so many songs sound the same? It's not a lack of talent; it's a lack of choice. Artists are forced to conform to trends and genres that algorithms favor, creating a homogenous soundscape where individuality is a liability. The result? Music that's designed to be easily digestible, instantly forgettable, and perfectly suited for background noise.

## **The Social Media Minefield: From Musician to Content Machine**

The pressure doesn't stop at streaming. Artists are now expected to be social media superstars, constantly creating content to engage their fans. It's a 24/7 job, demanding constant performance and a carefully curated online persona.

Imagine being a painter, but instead of focusing on your art, you're forced to create daily Instagram stories about your paintbrushes. That's the reality for many musicians. They're expected to be comedians, dancers, and influencers, all while trying to write and record music. Labels and management companies exploit this, pushing artists to participate in viral trends and challenges, even if they clash with their artistic vision.

And let's not forget the rise of TikTok and other short-form video platforms. Songs are now written with the sole purpose of being viral sound bites, catchy hooks designed to be used in fleeting trends. The result? Music that's disposable, devoid of depth, and ultimately, meaningless.

## **The Financial Black Hole: Pennies Per Stream and the Artist's Plight**

Now, let's talk about the money. Streaming platforms boast billions in revenue, but how much of that actually reaches the artists? Pennies. Literally. Millions of streams might only translate to a few hundred dollars. It's a system designed to enrich the platforms and major labels, leaving independent artists struggling to survive.

Think of it like this: you're a farmer who grows the crops, but you only get paid a tiny fraction of the price when they're sold at the supermarket. The rest goes to the distributors and retailers. This is the reality for many musicians. They're the creators, the farmers of the music industry, but they're being squeezed dry.

The result? Artists are forced to rely on other revenue streams, like merchandise and touring. But even those are becoming increasingly difficult to navigate. The pandemic decimated the live music industry, and the cost of touring is skyrocketing. Many artists are left with no choice but to work multiple jobs just to make ends meet.

## **The Seeds of Rebellion: A New Era for Independent Artists**

But there's hope. A rebellion is brewing, a movement of independent artists and fans who are demanding a fairer system. Platforms like Wavlake and others are emerging, offering artists more control over their music and their revenue. These platforms prioritize direct-to-fan engagement, allowing artists to build sustainable careers without relying on the traditional gatekeepers.

Imagine a world where you could directly support your favorite artists, where your money goes directly to them, not to some faceless corporation. That's the promise of these new platforms. They're building communities, fostering genuine connections between artists and their fans.

And let's not forget the power of cryptocurrency. Bitcoin, for example, offers a decentralized, peer-to-peer system that bypasses traditional financial institutions. Fans can directly support their favorite independent artists by sending them Bitcoin donations, ensuring that the artist receives the full value of their contribution.

Think of it like this: you're cutting out the middleman, supporting the artist directly, like buying directly from the farmer at a local market. It's a way to reclaim the power, to support the creators you love, and to build a more sustainable and equitable music ecosystem.

## **The Call to Action: Reclaim Your Ears, Support the Underground**

The future of music is in our hands. We can continue to be passive consumers, letting algorithms dictate our taste, or we can become active participants, supporting the artists who are fighting for their independence.

## **Join the Rebellion!**

**Dive into the underground:** Explore independent music blogs, listen to community radio stations, and attend local shows. There's a world of incredible music waiting to be discovered beyond the algorithms.

**Support artists directly:** Buy their music on Bandcamp, donate to their Patreon, and send them Bitcoin tips. Every dollar counts.

**Demand transparency:** Call on streaming platforms to reveal their playlist curation processes and to offer fairer revenue splits.

**Embrace new platforms:** Explore services like Wavlake and other direct-to-fan platforms that empower artists.

**Become a conscious listener:** Question the music you hear. Is it genuine? Is it meaningful? Or is it just another algorithmically generated hit?

**Share the love:** Tell your friends about the independent artists you discover. Spread the word and help them build their audience.

*The music industry is broken, but it's not beyond repair. By supporting independent artists and demanding change, we can create a future where artistry thrives, where musicians are fairly compensated, and where music truly reflects the diversity and creativity of our world.*

**Let's break free from the algorithmic cage and reclaim the power of music!**

-

@ df478568:2a951e67

2025-03-08 02:16:57

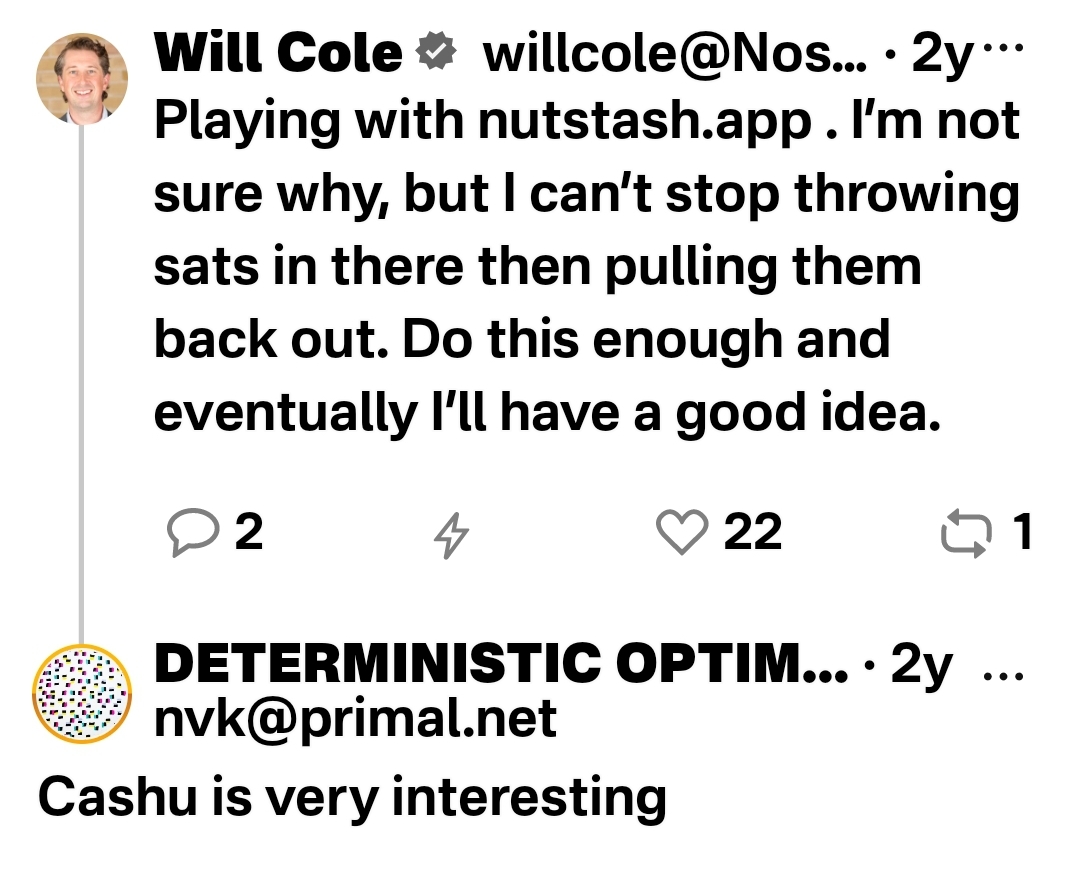

I began using/testing Cashu over 105,120 blocks ago when @NVK said ["Cashu is very interesting."](nostr:note1xjly4d8a8w0dkqzvzj0t8kf8fnzqpa5w0zy2t2my7243zeut0gxszt9hch).

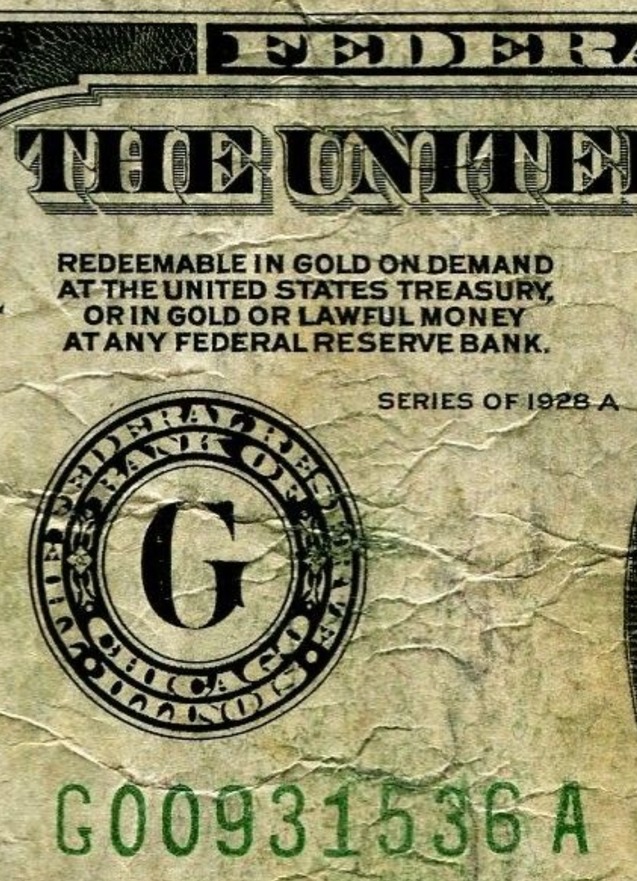

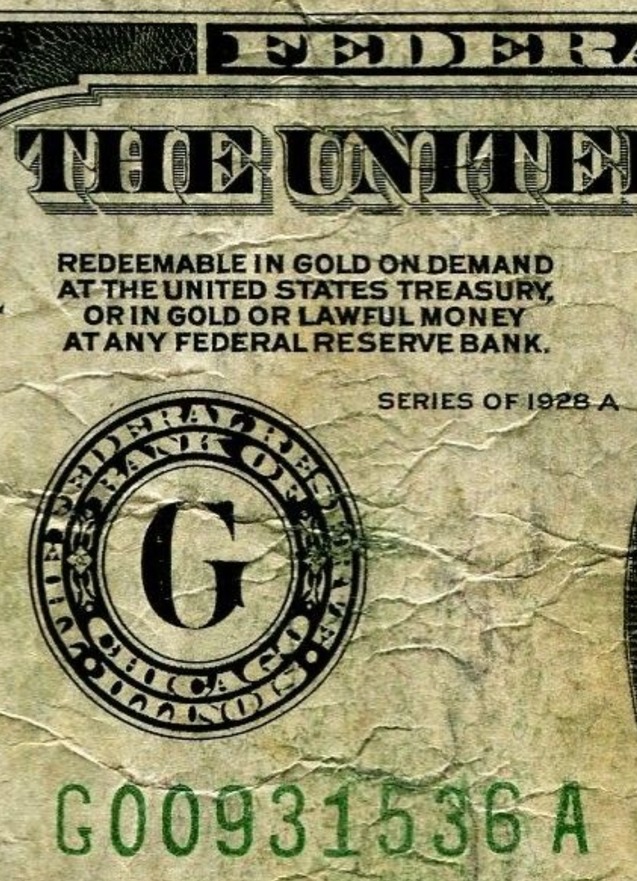

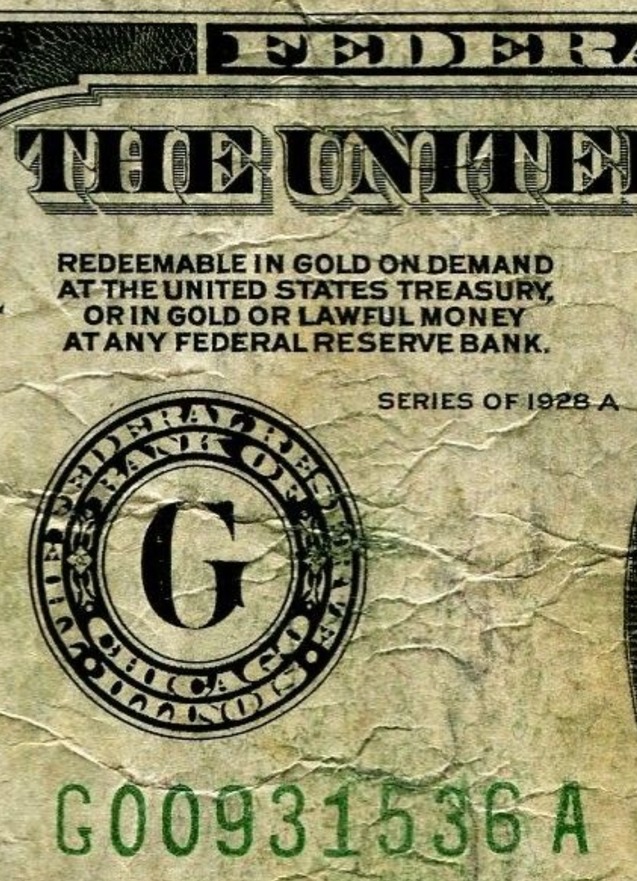

The first time I swapped sweet cipher-text to sats, it was too new new and novel to digest. Someone sent me cashu over nostr, straight to my npub. I copy pasta-ed it into my minibits wallet and recieved 10 sats. In retrospect, I would compare it to gold backed paper currency. Over a century ago, paper USD was a coupon for gold, "redeemable in gold on demand at the United States Treasury, or in gold for lawful money at any federal reserve bank.

In the analog days of the early 20th century a bean-counter at a Federal Reserve bank would give you approximately 5 ounces of gold for an analog bored ape, Ben Franklin. Cashu is an NFT without the jpeg and the innate ability to be redeemed for bitcoin over the lightning network. I've heard NVK describe it as "an honest shitcoin" and I like this framing. The rug-pull risk is greater than zero, but less than the rug-pull risk of Wallet of Satoshi with the added benefit of generational wealth.

This means we can abstract bitcoin value into something that looks like this.

`cashuBpGFteCJodHRwczovL21pbnQubWluaWJpdHMuY2FzaC9CaXRjb2luYXVjc2F0YXSBomFpSABQBVDwSUFGYXCCpGFhAmFzeEBkMzM2Mjk1OTZhNTVkODcyNWFjOGI3MDQyNjM5MjQ0OTU4YmJlMjVkYmFhYzIyY2E5Y2M2NTMyNTM1OWFiZDI2YWNYIQNOrrDCFnYa3sMJxpr02o8Bg5AfibjqIOTmiktqYkABKWFko2FlWCBdC0gEM2j5YE4_xMGyuvLHIufqx7zzp6TNJAeJiB6_WmFzWCDRMyyGRmJPYmwB3u8kB7fyBlvRm69hC2DfkyY5Mizd-WFyWCB_88znXGBc_GgRngr9m1nEYAJEDUkQiQLT1e6R9_Un_aRhYQhhc3hANjVkYWQyM2ExNjQyNTYzMDU5OGRmMTdiNDc0YWQ0YzdhMjNhMmFiZjUwNjEzYTdjOTI4NzllMDllZTg5ODcxZWFjWCECoRg-ub_wReP4T6A0UuwqS36Iw6Ton4U5j6IJrLYjKCxhZKNhZVggmXDv_na1XQU3ESYq147mIyDyQm5mgsnkl7HxBbVmXv9hc1ggIbKkVVdG06hBgAvWBhoFo8T-V6MjNzxUGNaGjQjU2e5hclggAJp2vzdgwmehnhwmmFQsZ_BNTb8Aqz_ItwOx0iLQ9NlhZHgtQ29uZ3JhdHVsYXRpb25zIGZvciBjbGFpbWluZyB0aGlzIGVjYXNoIGZpcnN0`

The lightning network is cool, but requires the reciever to have a wallet. Many Americans began using nostr when Wallet of Satoshi was available to them. They disappeared like a magiian once Wallet of Satoshi was removed from the app stores. To be fair, it still works. Last I checked, sats from wallet of satoshi can still be received and spent from US based IP addresses, but non-technical noobs can no longer download it from app stores designed for the neuro-typical.

I sprinkled a little e cash in a few Substack articles, but few people know what it is. These things takes time. Maybe it's too early. Maybe, just maybe, **we can make paper cash great again**.

Is it a long shot? Sure. Will I try it anyway? Hell yes!

## How To Make Paper Money Great Again

**The plan**:

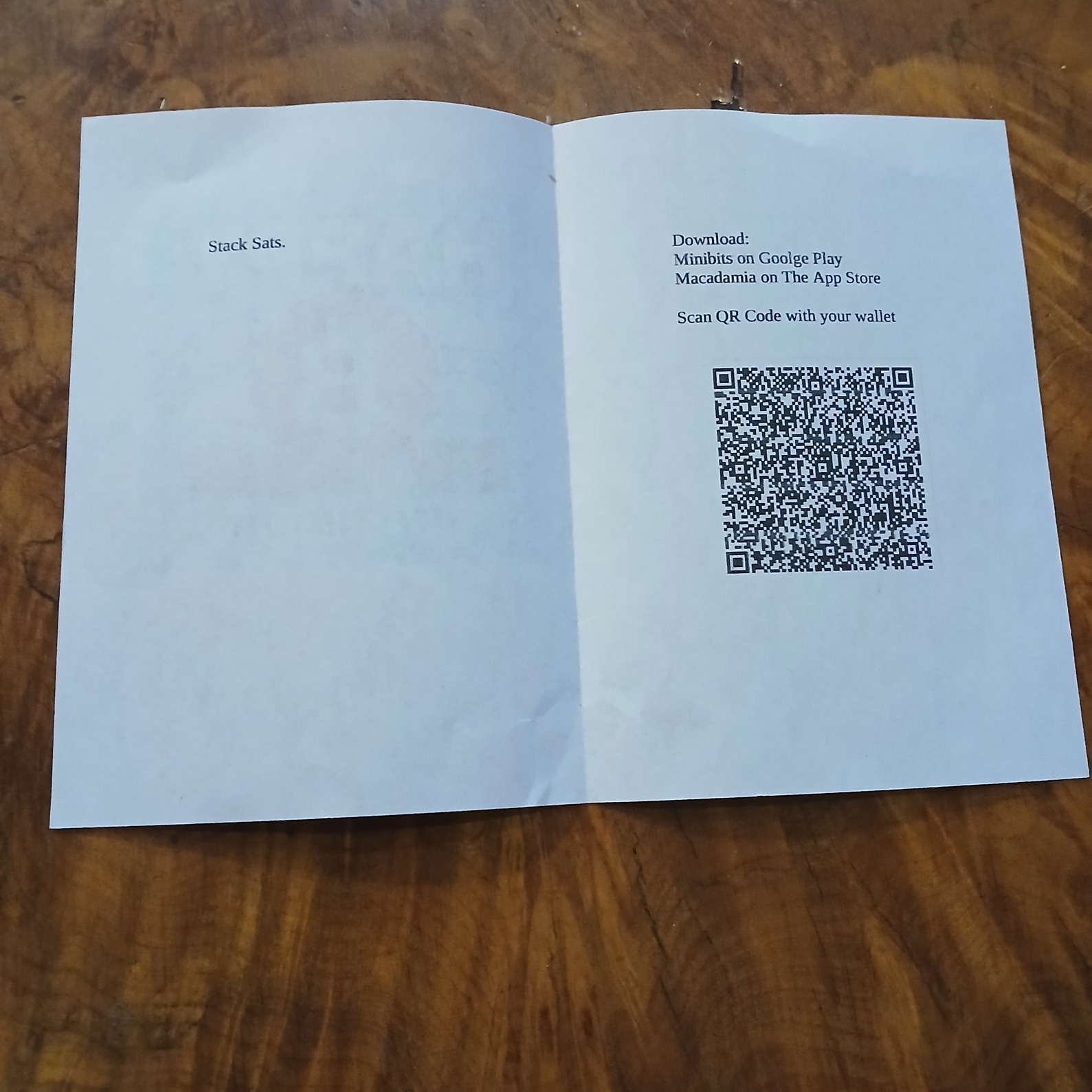

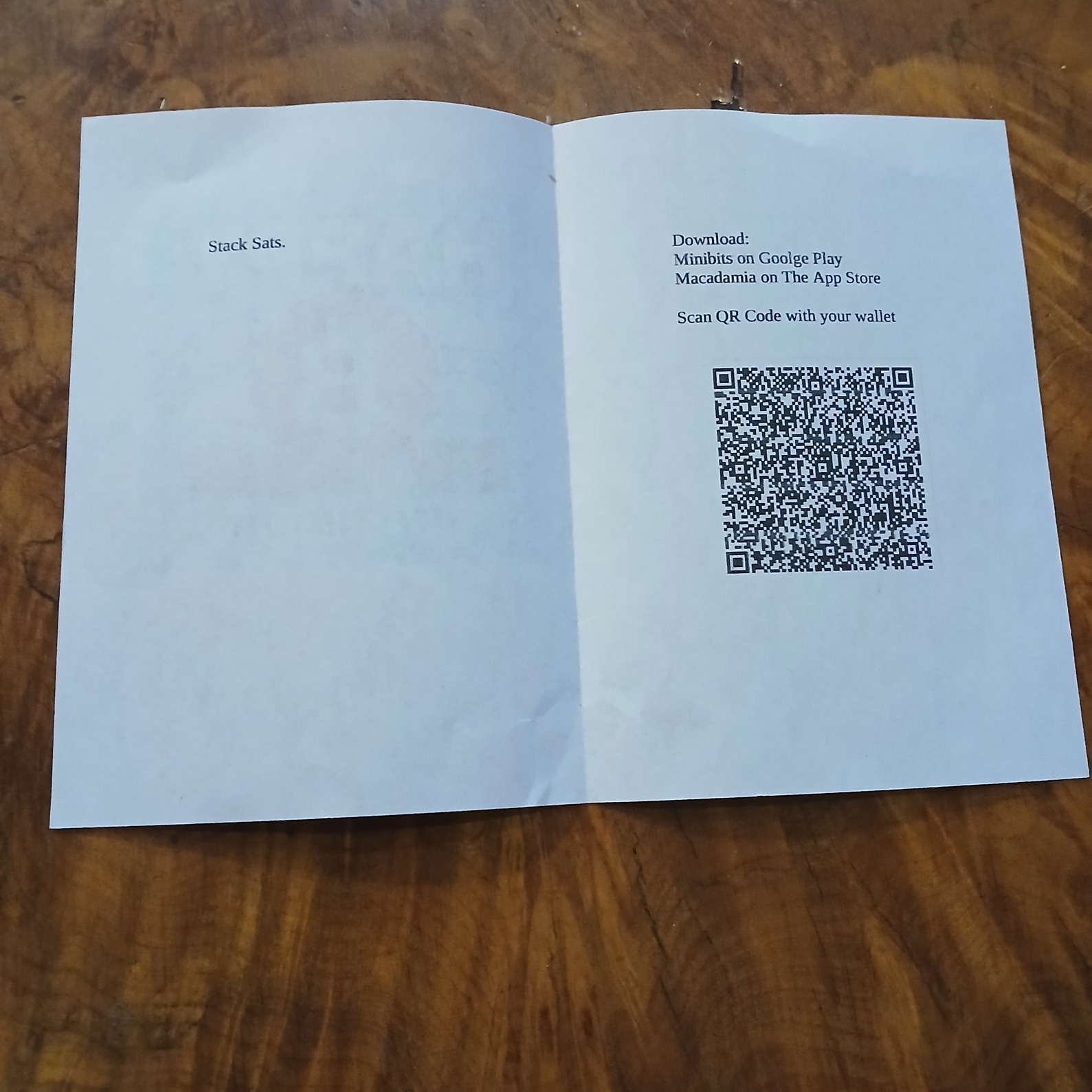

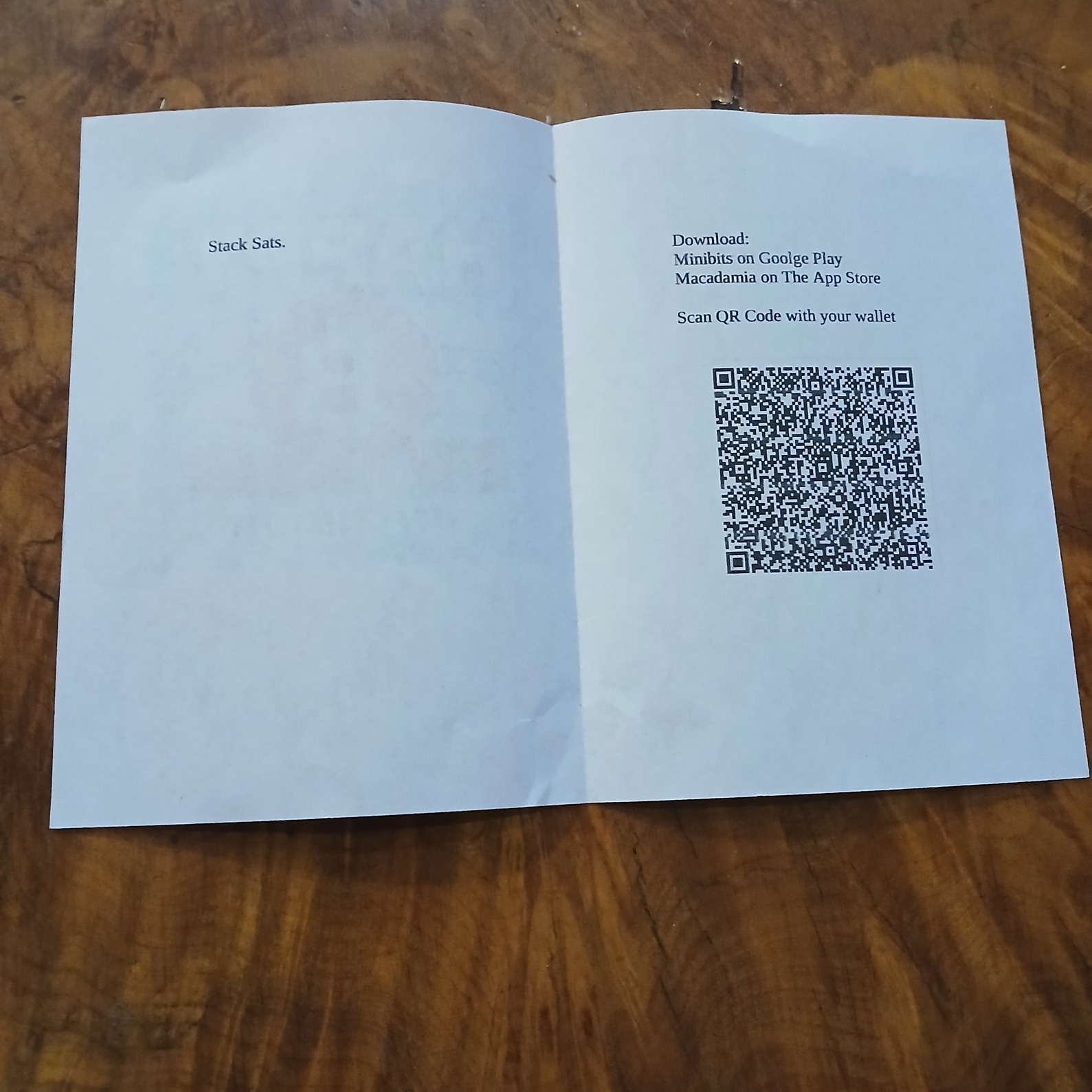

Create paper products with QR codes that have [Cashu](https://cashu.space/). Think [tip cards](https://tipcards.io/) or birtday cards designed to hold cash. You can choose your mint on [Mibibits](https://www.minibits.cash/) or [Macadamia](https://macadamia.cash/) depending on your pnone. This is not bitcoin for posterity. We're talking about pocket spending money, not generational wealth.

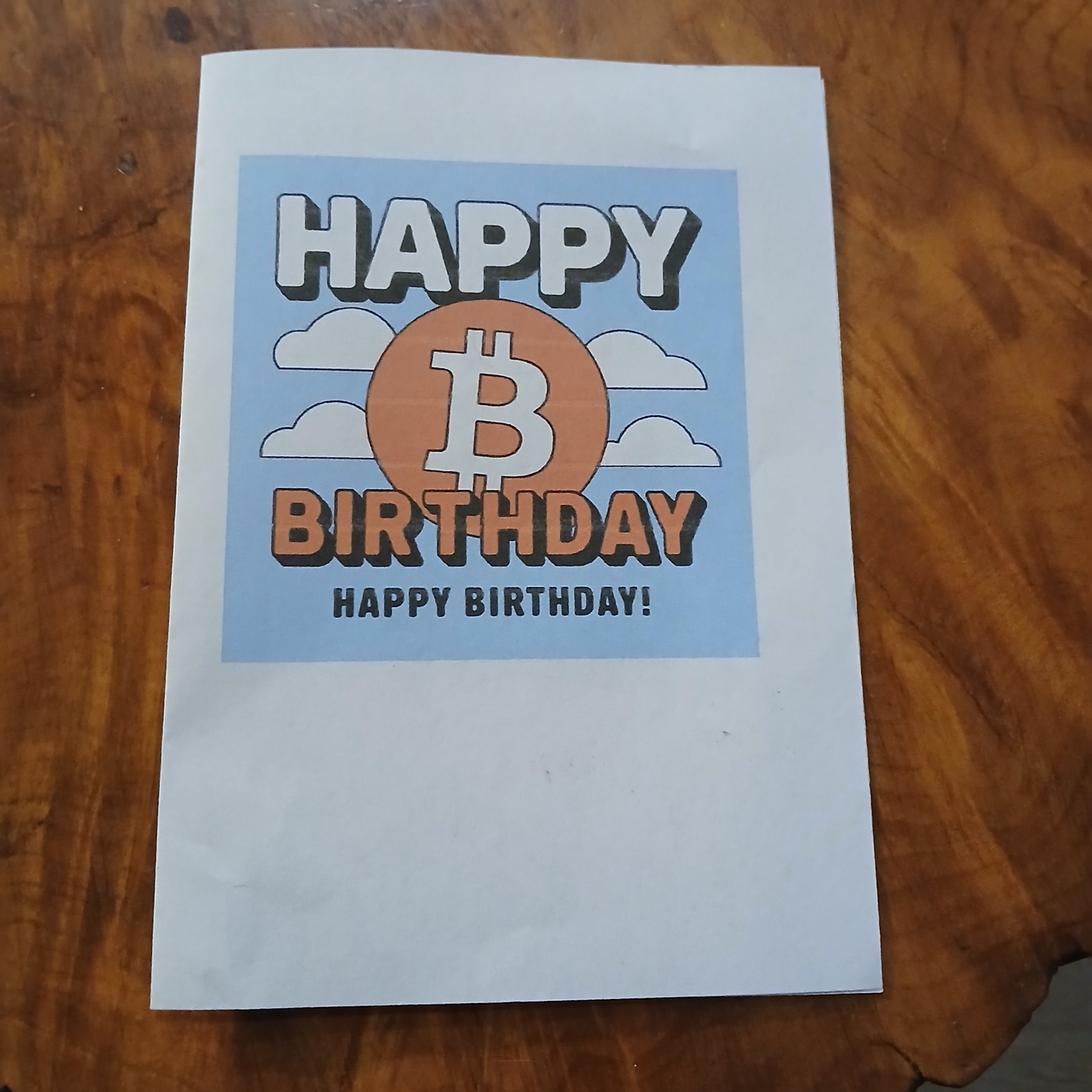

I plan to make and sell greeting cards: HallMarc cards.😉 I draw like I'm 5, but we'll let the market decide if they prefer my Kidnergarden-style art or [Ideogram](https://ideogram.ai). Then I'll write some cheesy words people like on greeting cards. Here's my first idea.

**Happy Birthday**

**Stack Sats.**

Okay....So it's more like a first draft, but this is a proof of concept. Cut me some slack. 😅 There's still a few kinks to work out, but here's the prototype.

### Set Up Shop With A Free And Open Source Version

I will add these cards to my merch shop. I can add 1,000 sats, maybe some custom amounts, but I'll also open source them. I like to give cards that pay bitcoin to kids in my family. If I open source this, maybe more people will be willing to give the kids in their family sats. It only costs card stock paper, ink, and the sats you give away.

If you're like me, your family knows your a bitcoin dork anyway. We might as well show them it's not just an investment. It's money we can give them they can either save or spend.

We should mention it's better to save bitcoin. That's what stacking sats means. That will be my second draft.

Happy Birthday.

Save as much bitcoin as you can.

Npub1marc26z8nh3xkj5rcx7ufkatvx6ueqhp5vfw9v5teq26z254renshtf3g0

https://mempool.marc26z.com/block/000000000000000000001567ce65dab25358bcae86c2c573984888eb08948b65

https://marc26z.com/merch/

-

@ dc4cd086:cee77c06

2025-03-07 22:32:02

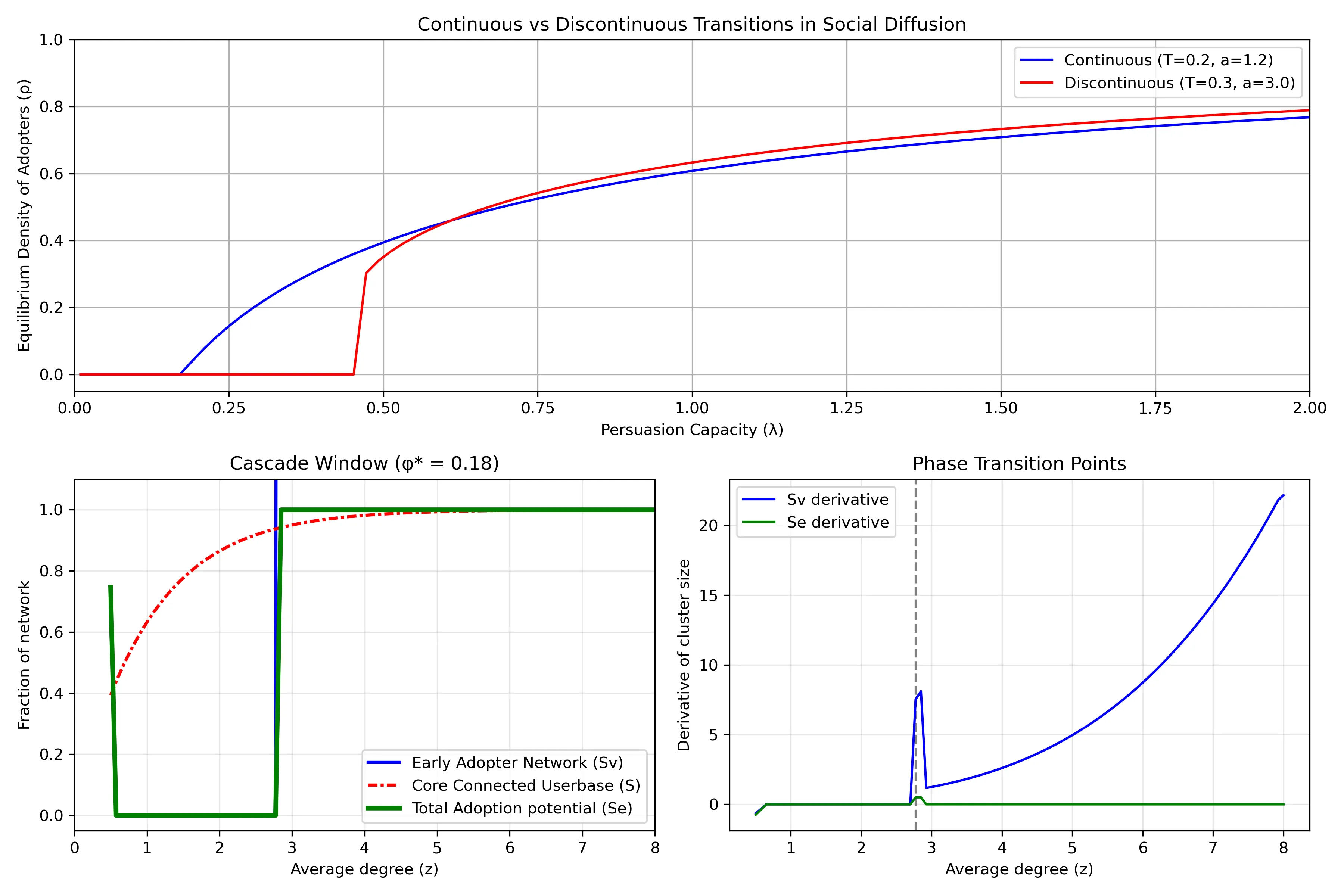

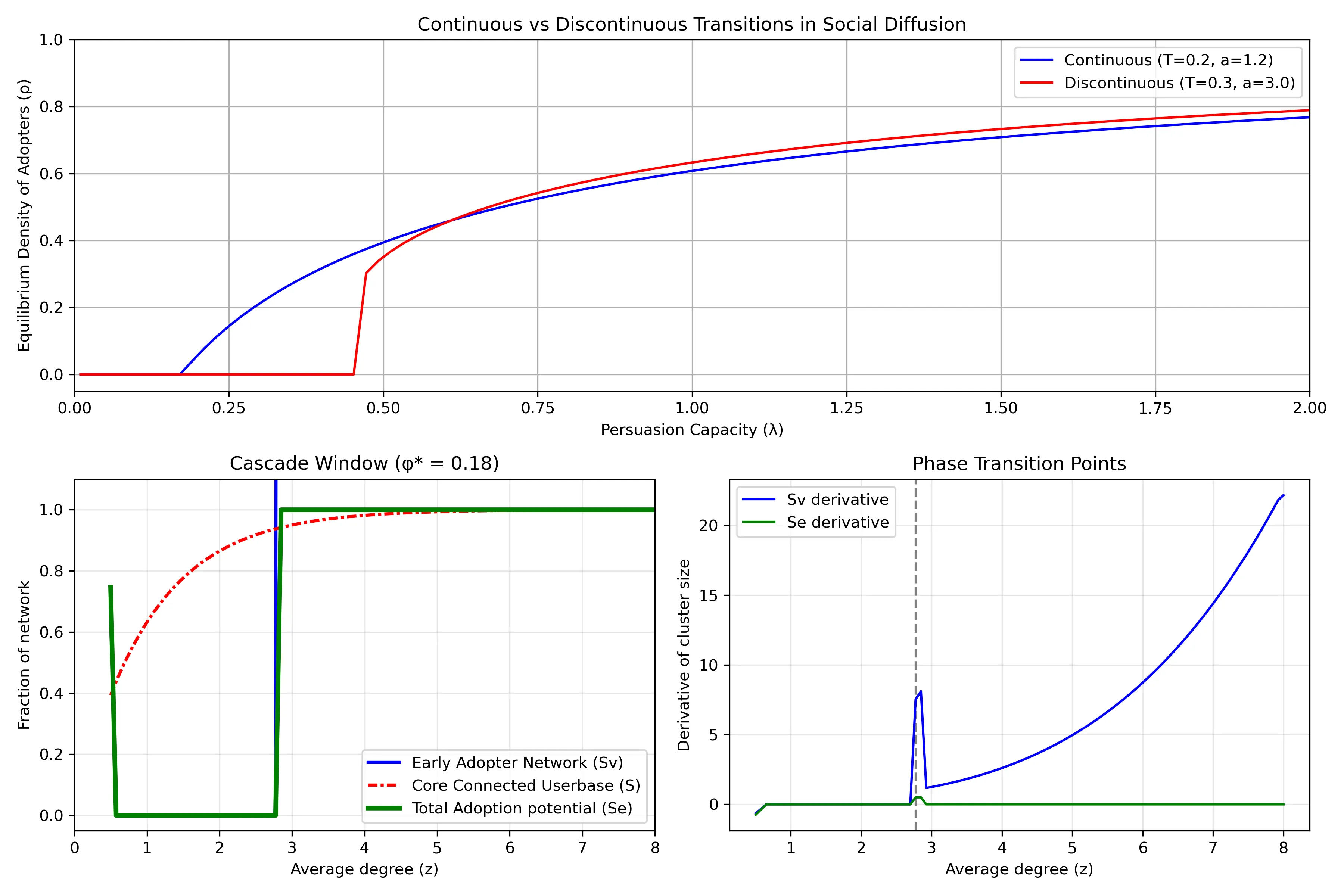

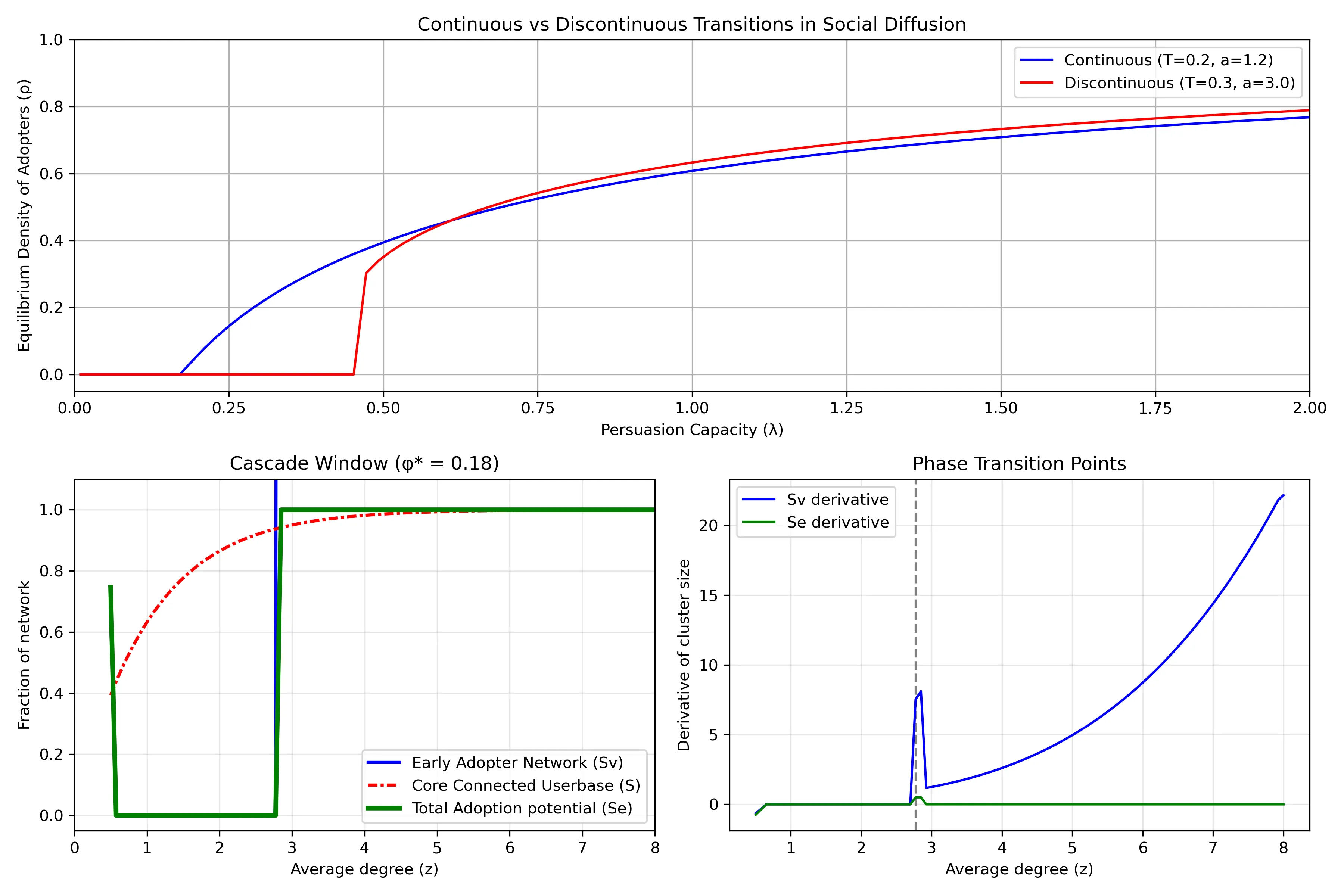

## Understanding Network Dynamics in Technology Adoption

- Top Row: Continuous vs Discontinuous Transitions in Social Diffusion

- Shows two different ways that innovations spread through a population. The horizontal axis (`λ`) represents "persuasion capacity" - how effectively adopters convince others to join. The vertical axis (`ρ`) shows what fraction of the population eventually adopts.

- Blue line shows a continuous transition: as persuasion capacity increases, adoption grows gradually and smoothly. Example: streaming services that steadily gains users year after year.

- Red line shows a discontinuous transition (or "tipping point"): adoption remains near zero until reaching a critical threshold, then suddenly jumps to a high level. This represents technologies that spread explosively once they reach a critical mass.

- The different curves emerge from the situations of how people make adoption decisions. When there is higher adoption resistance (higher threshold `T` and steeper response curve `a`), discontinuous transitions become more likely.

## Bottom Left: Cascade Window

When is widespread adoption possible? Its based on network structure. The horizontal axis (`z`) represents network connectivity - on average, how many connections does an individual have?

The plot has a regime "cascade window" - widespread adoption only occurs within a specific range of connectivity:

- If connectivity is too low (left side), the network is too fragmented for innovations to spread widely

- If connectivity is too high (right side), people become resistant to change because they need many of their connections to adopt before they will follow suit

### The different curves show theoretical predictions for:

- The early adopter network (blue solid): people who can be convinced to adopt with minimal influence.

- The core connected userbase (red line): the largest interconnected population in the network

- Total adoption potential (green line): the potential total reach possible through both early adopters and those they influence

### Bottom Right: Phase Transition Points

This plot highlights `critical thresholds` where the system undergoes dramatic changes. The peaks represent points where small changes in network connectivity cause the largest shifts in adoption patterns.

The vertical dashed line marks a critical connectivity value where adoption dynamics fundamentally change. Near these critical points, the network becomes especially sensitive - like how a small price drop might suddenly make a product accessible to a much larger market segment, increasing how easily individuals are connected.

The green line (total adoption potential rate) shows only a brief spike at the critical threshold and then quickly returns to zero. Implying that the total potential reach of an innovation changes only at that specific critical point and then stabilizes. This is why timing market entry is so crucial - there's a narrow window where network conditions can suddenly enable widespread adoption, and missing this window means the technology might never achieve its full potential.

### Further Reading:

- Malcom Gladwell's [Tipping Point](https://en.wikipedia.org/wiki/The_Tipping_Point)

### Sources:

- https://www.frontiersin.org/journals/physics/articles/10.3389/fphy.2018.00021/full

- https://www.pnas.org/doi/10.1073/pnas.1414708112

- https://www.pnas.org/doi/10.1073/pnas.082090499

-

@ c48e29f0:26e14c11

2025-03-07 04:51:09

[ESTABLISHMENT OF THE STRATEGIC BITCOIN RESERVE AND UNITED STATES DIGITAL ASSET STOCKPILE](https://www.whitehouse.gov/presidential-actions/2025/03/establishment-of-the-strategic-bitcoin-reserveand-united-states-digital-asset-stockpile/)

EXECUTIVE ORDER

March 6, 2025

By the authority vested in me as President by the Constitution and the laws of the United States of America, it is hereby ordered:

#### Section 1. Background.

Bitcoin is the original cryptocurrency. The Bitcoin protocol permanently caps the total supply of bitcoin (BTC) at 21 million coins, and has never been hacked. As a result of its scarcity and security, Bitcoin is often referred to as “digital gold”. Because there is a fixed supply of BTC, there is a strategic advantage to being among the first nations to create a strategic bitcoin reserve. The United States Government currently holds a significant amount of BTC, but has not implemented a policy to maximize BTC’s strategic position as a unique store of value in the global financial system. Just as it is in our country’s interest to thoughtfully manage national ownership and control of any other resource, our Nation must harness, not limit, the power of digital assets for our prosperity.

#### Sec. 2. Policy.

It is the policy of the United States to establish a Strategic Bitcoin Reserve. It is further the policy of the United States to establish a United States Digital Asset Stockpile that can serve as a secure account for orderly and strategic management of the United States’ other digital asset holdings.

#### Sec. 3. Creation and Administration of the Strategic Bitcoin Reserve and United States Digital Asset Stockpile.

(a) The Secretary of the Treasury shall establish an office to administer and maintain control of custodial accounts collectively known as the “Strategic Bitcoin Reserve,” capitalized with all BTC held by the Department of the Treasury that was finally forfeited as part of criminal or civil asset forfeiture proceedings or in satisfaction of any civil money penalty imposed by any executive department or agency (agency) and that is not needed to satisfy requirements under 31 U.S.C. 9705 or released pursuant to subsection (d) of this section (Government BTC). Within 30 days of the date of this order, each agency shall review its authorities to transfer any Government BTC held by it to the Strategic Bitcoin Reserve and shall submit a report reflecting the result of that review to the Secretary of the Treasury. Government BTC deposited into the Strategic Bitcoin Reserve shall not be sold and shall be maintained as reserve assets of the United States utilized to meet governmental objectives in accordance with applicable law.

(b) The Secretary of the Treasury shall establish an office to administer and maintain control of custodial accounts collectively known as the “United States Digital Asset Stockpile,” capitalized with all digital assets owned by the Department of the Treasury, other than BTC, that were finally forfeited as part of criminal or civil asset forfeiture proceedings and that are not needed to satisfy requirements under 31 U.S.C. 9705 or released pursuant to subsection (d) of this section (Stockpile Assets). Within 30 days of the date of this order, each agency shall review its authorities to transfer any Stockpile Assets held by it to the United States Digital Asset Stockpile and shall submit a report reflecting the result of that review to the Secretary of the Treasury. The Secretary of the Treasury shall determine strategies for responsible stewardship of the United States Digital Asset Stockpile in accordance with applicable law.

(c) The Secretary of the Treasury and the Secretary of Commerce shall develop strategies for acquiring additional Government BTC provided that such strategies are budget neutral and do not impose incremental costs on United States taxpayers. However, the United States Government shall not acquire additional Stockpile Assets other than in connection with criminal or civil asset forfeiture proceedings or in satisfaction of any civil money penalty imposed by any agency without further executive or legislative action.

(d) “Government Digital Assets” means all Government BTC and all Stockpile Assets. The head of each agency shall not sell or otherwise dispose of any Government Digital Assets, except in connection with the Secretary of the Treasury’s exercise of his lawful authority and responsible stewardship of the United States Digital Asset Stockpile pursuant to subsection (b) of this section, or pursuant to an order from a court of competent jurisdiction, as required by law, or in cases where the Attorney General or other relevant agency head determines that the Government Digital Assets (or the proceeds from the sale or disposition thereof) can and should:

(i) be returned to identifiable and verifiable victims of crime;

(ii) be used for law enforcement operations;

(iii) be equitably shared with State and local law enforcement partners; or

(iv) be released to satisfy requirements under 31 U.S.C. 9705, 28 U.S.C. 524(c), 18 U.S.C. 981, or 21 U.S.C. 881.

(e) Within 60 days of the date of this order, the Secretary of the Treasury shall deliver an evaluation of the legal and investment considerations for establishing and managing the Strategic Bitcoin Reserve and United States Digital Asset Stockpile going forward, including the accounts in which the Strategic Bitcoin Reserve and United States Digital Asset Stockpile should be located and the need for any legislation to operationalize any aspect of this order or the proper management and administration of such accounts.

#### Sec. 4. Accounting.

Within 30 days of the date of this order, the head of each agency shall provide the Secretary of the Treasury and the President’s Working Group on Digital Asset Markets with a full accounting of all Government Digital Assets in such agency’s possession, including any information regarding the custodial accounts in which such Government Digital Assets are currently held that would be necessary to facilitate a transfer of the Government Digital Assets to the Strategic Bitcoin Reserve or the United States Digital Asset Stockpile. If such agency holds no Government Digital Assets, such agency shall confirm such fact to the Secretary of the Treasury and the President’s Working Group on Digital Asset Markets within 30 days of the date of this order.

#### Sec. 5. General Provisions.

(a) Nothing in this order shall be construed to impair or otherwise affect:

(i) the authority granted by law to an executive department or agency, or the head thereof; or

(ii) the functions of the Director of the Office of Management and Budget relating to budgetary, administrative, or legislative proposals.

(b) This order shall be implemented consistent with applicable law and subject to the availability of appropriations.

(c) This order is not intended to, and does not, create any right or benefit, substantive or procedural, enforceable at law or in equity by any party against the United States, its departments, agencies, or entities, its officers, employees, or agents, or any other person.

THE WHITE HOUSE,

March 6, 2025

@ f839fb67:5c930939

2025-03-09 12:11:05# Relays | Name | Address | Price (Sats/Year)| | - | - | - | | stephen's aegis relay | wss://paid.relay.vanderwarker.family | 42069 | stephen's Outbox | wss://relay.vanderwarker.family | 0 | | stephen's Inbox | wss://haven.vanderwarker.family/inbox | 0 | | stephen's DMs | wss://haven.vanderwarker.family/chat | 0 | | VFam Data Relay | wss://data.relay.vanderwarker.family | 0 | | [TOR] My Phone Relay | ws://naswsosuewqxyf7ov7gr7igc4tq2rbtqoxxirwyhkbuns4lwc3iowwid.onion | 0 | --- # My Pubkeys | Name | hex | nprofile | | - | - | - | | Main | f839fb6714598a7233d09dbd42af82cc9781d0faa57474f1841af90b5c930939 | nprofile1qqs0sw0mvu29nznjx0gfm02z47pve9up6ra22ar57xzp47gttjfsjwgpramhxue69uhhyetvv9ujuanpdejx2unhv9exketj9enxzmtfd3us9mapfx | | Vanity (Backup) | 82f21be67353c0d68438003fe6e56a35e2a57c49e0899b368b5ca7aa8dde7c23 | nprofile1qqsg9usmuee48sxkssuqq0lxu44rtc4903y7pzvmx694efa23h08cgcpramhxue69uhhyetvv9ujuanpdejx2unhv9exketj9enxzmtfd3ussel49x | | VFStore | 6416f1e658ba00d42107b05ad9bf485c7e46698217e0c19f0dc2e125de3af0d0 | nprofile1qqsxg9h3uevt5qx5yyrmqkkehay9cljxdxpp0cxpnuxu9cf9mca0p5qpramhxue69uhhyetvv9ujuanpdejx2unhv9exketj9enxzmtfd3usaa8plu | | NostrSMS | 9be1b8315248eeb20f9d9ab2717d1750e4f27489eab1fa531d679dadd34c2f8d | nprofile1qqsfhcdcx9fy3m4jp7we4vn305t4pe8jwjy74v062vwk08dd6dxzlrgpramhxue69uhhyetvv9ujuanpdejx2unhv9exketj9enxzmtfd3us595d45 | --- # "Personal Nostr Things" > [D] = Saves darkmode preferences over nostr > [A] = Auth over nostr > [B] = Beta (software) > [z] = zap enabled - [[DABz] Main Site](https://vanderwarker.family) - [[DAB] Contact Site](https://stephen.vanderwarker.family) - [[DAB] PGP Site](https://pgp.vanderwarker.family) - [[DAB] VFCA Site](https://ca.vanderwarker.family) --- # Other Services (Hosted code) * [Blossom](https://blossom.vanderwarker.family) * [NostrCheck](https://nostr.vanderwarker.family) --- # Emojis Packs * Minecraft - <code>nostr:naddr1qqy566twv43hyctxwsq37amnwvaz7tmjv4kxz7fwweskuer9wfmkzuntv4ezuenpd45kc7gzyrurn7m8z3vc5u3n6zwm6s40stxf0qwsl2jhga83ssd0jz6ujvynjqcyqqq82nsd0k5wp</code> * AIM - <code>nostr:naddr1qqxxz6tdv4kk7arfvdhkuucpramhxue69uhhyetvv9ujuanpdejx2unhv9exketj9enxzmtfd3usyg8c88akw9ze3fer85yah4p2lqkvj7qap749w360rpq6ly94eycf8ypsgqqqw48qe0j2yk</code> * Blobs - <code>nostr:naddr1qqz5ymr0vfesz8mhwden5te0wfjkccte9emxzmnyv4e8wctjddjhytnxv9kkjmreqgs0sw0mvu29nznjx0gfm02z47pve9up6ra22ar57xzp47gttjfsjwgrqsqqqa2wek4ukj</code> * FavEmojis - <code>nostr:naddr1qqy5vctkg4kk76nfwvq37amnwvaz7tmjv4kxz7fwweskuer9wfmkzuntv4ezuenpd45kc7gzyrurn7m8z3vc5u3n6zwm6s40stxf0qwsl2jhga83ssd0jz6ujvynjqcyqqq82nsf7sdwt</code> * Modern Family - <code>nostr:naddr1qqx56mmyv4exugzxv9kkjmreqy0hwumn8ghj7un9d3shjtnkv9hxgetjwashy6m9wghxvctdd9k8jq3qlqulkec5tx98yv7snk759tuzejtcr5865468fuvyrtuskhynpyusxpqqqp65ujlj36n</code> * nostriches (Amethyst collection) - <code>nostr:naddr1qq9xummnw3exjcmgv4esz8mhwden5te0wfjkccte9emxzmnyv4e8wctjddjhytnxv9kkjmreqgs0sw0mvu29nznjx0gfm02z47pve9up6ra22ar57xzp47gttjfsjwgrqsqqqa2w2sqg6w</code> * Pepe - <code>nostr:naddr1qqz9qetsv5q37amnwvaz7tmjv4kxz7fwweskuer9wfmkzuntv4ezuenpd45kc7gzyrurn7m8z3vc5u3n6zwm6s40stxf0qwsl2jhga83ssd0jz6ujvynjqcyqqq82ns85f6x7</code> * Minecraft Font - <code>nostr:naddr1qq8y66twv43hyctxwssyvmmwwsq37amnwvaz7tmjv4kxz7fwweskuer9wfmkzuntv4ezuenpd45kc7gzyrurn7m8z3vc5u3n6zwm6s40stxf0qwsl2jhga83ssd0jz6ujvynjqcyqqq82nsmzftgr</code> * Archer Font - <code>nostr:naddr1qq95zunrdpjhygzxdah8gqglwaehxw309aex2mrp0yh8vctwv3jhyampwf4k2u3wvesk66tv0ypzp7peldn3gkv2wgeap8dag2hc9nyhs8g04ft5wnccgxhepdwfxzfeqvzqqqr4fclkyxsh</code> * SMB Font - <code>nostr:naddr1qqv4xatsv4ezqntpwf5k7gzzwfhhg6r9wfejq3n0de6qz8mhwden5te0wfjkccte9emxzmnyv4e8wctjddjhytnxv9kkjmreqgs0sw0mvu29nznjx0gfm02z47pve9up6ra22ar57xzp47gttjfsjwgrqsqqqa2w0wqpuk</code> --- # Git Over Nostr * NostrSMS - <code>nostr:naddr1qqyxummnw3e8xmtnqy0hwumn8ghj7un9d3shjtnkv9hxgetjwashy6m9wghxvctdd9k8jqfrwaehxw309amk7apwwfjkccte9emxzmnyv4e8wctjddjhytnxv9kkjmreqyj8wumn8ghj7urpd9jzuun9d3shjtnkv9hxgetjwashy6m9wghxvctdd9k8jqg5waehxw309aex2mrp0yhxgctdw4eju6t0qyxhwumn8ghj7mn0wvhxcmmvqgs0sw0mvu29nznjx0gfm02z47pve9up6ra22ar57xzp47gttjfsjwgrqsqqqaueqp0epk</code> * nip51backup - <code>nostr:naddr1qq9ku6tsx5ckyctrdd6hqqglwaehxw309aex2mrp0yh8vctwv3jhyampwf4k2u3wvesk66tv0yqjxamnwvaz7tmhda6zuun9d3shjtnkv9hxgetjwashy6m9wghxvctdd9k8jqfywaehxw309acxz6ty9eex2mrp0yh8vctwv3jhyampwf4k2u3wvesk66tv0yq3gamnwvaz7tmjv4kxz7fwv3sk6atn9e5k7qgdwaehxw309ahx7uewd3hkcq3qlqulkec5tx98yv7snk759tuzejtcr5865468fuvyrtuskhynpyusxpqqqpmej4gtqs6</code> * bukkitstr - <code>nostr:naddr1qqykyattdd5hgum5wgq37amnwvaz7tmjv4kxz7fwweskuer9wfmkzuntv4ezuenpd45kc7gpydmhxue69uhhwmm59eex2mrp0yh8vctwv3jhyampwf4k2u3wvesk66tv0yqjgamnwvaz7tmsv95kgtnjv4kxz7fwweskuer9wfmkzuntv4ezuenpd45kc7gpz3mhxue69uhhyetvv9ujuerpd46hxtnfduqs6amnwvaz7tmwdaejumr0dspzp7peldn3gkv2wgeap8dag2hc9nyhs8g04ft5wnccgxhepdwfxzfeqvzqqqrhnyf6g0n2</code> --- # Market Places Please use [Nostr Market](https://market.nostr.com) or somthing simular, to view. * VFStore - <code>nostr:naddr1qqjx2v34xe3kxvpn95cnqven956rwvpc95unscn9943kxet98q6nxde58p3ryqglwaehxw309aex2mrp0yh8vctwv3jhyampwf4k2u3wvesk66tv0yqjvamnwvaz7tmgv9mx2m3wweskuer9wfmkzuntv4ezuenpd45kc7f0da6hgcn00qqjgamnwvaz7tmsv95kgtnjv4kxz7fwweskuer9wfmkzuntv4ezuenpd45kc7gpydmhxue69uhhwmm59eex2mrp0yh8vctwv3jhyampwf4k2u3wvesk66tv0ypzqeqk78n93wsq6sss0vz6mxl5shr7ge5cy9lqcx0smshpyh0r4uxsqvzqqqr4gvlfm7gu</code> --- # Badges ## Created * paidrelayvf - <code>nostr:naddr1qq9hqctfv3ex2mrp09mxvqglwaehxw309aex2mrp0yh8vctwv3jhyampwf4k2u3wvesk66tv0ypzp7peldn3gkv2wgeap8dag2hc9nyhs8g04ft5wnccgxhepdwfxzfeqvzqqqr48y85v3u3</code> * iPow - <code>nostr:naddr1qqzxj5r02uq37amnwvaz7tmjv4kxz7fwweskuer9wfmkzuntv4ezuenpd45kc7gzyrurn7m8z3vc5u3n6zwm6s40stxf0qwsl2jhga83ssd0jz6ujvynjqcyqqq82wgg02u0r</code> * codmaster - <code>nostr:naddr1qqykxmmyd4shxar9wgq37amnwvaz7tmjv4kxz7fwweskuer9wfmkzuntv4ezuenpd45kc7gzyrurn7m8z3vc5u3n6zwm6s40stxf0qwsl2jhga83ssd0jz6ujvynjqcyqqq82wgk3gm4g</code> * iMine - <code>nostr:naddr1qqzkjntfdejsz8mhwden5te0wfjkccte9emxzmnyv4e8wctjddjhytnxv9kkjmreqgs0sw0mvu29nznjx0gfm02z47pve9up6ra22ar57xzp47gttjfsjwgrqsqqqafed5s4x5</code> --- # Clients I Use * Amethyst - <code>nostr:naddr1qqxnzd3cx5urqv3nxymngdphqgsyvrp9u6p0mfur9dfdru3d853tx9mdjuhkphxuxgfwmryja7zsvhqrqsqqql8kavfpw3</code> * noStrudel - <code>nostr:naddr1qqxnzd3cxccrvd34xser2dpkqy28wumn8ghj7un9d3shjtnyv9kh2uewd9hsygpxdq27pjfppharynrvhg6h8v2taeya5ssf49zkl9yyu5gxe4qg55psgqqq0nmq5mza9n</code> * nostrsms - <code>nostr:naddr1qq9rzdejxcunxde4xymqz8mhwden5te0wfjkccte9emxzmnyv4e8wctjddjhytnxv9kkjmreqgsfhcdcx9fy3m4jp7we4vn305t4pe8jwjy74v062vwk08dd6dxzlrgrqsqqql8kjn33qm</code>

@ f839fb67:5c930939

2025-03-09 12:11:05# Relays | Name | Address | Price (Sats/Year)| | - | - | - | | stephen's aegis relay | wss://paid.relay.vanderwarker.family | 42069 | stephen's Outbox | wss://relay.vanderwarker.family | 0 | | stephen's Inbox | wss://haven.vanderwarker.family/inbox | 0 | | stephen's DMs | wss://haven.vanderwarker.family/chat | 0 | | VFam Data Relay | wss://data.relay.vanderwarker.family | 0 | | [TOR] My Phone Relay | ws://naswsosuewqxyf7ov7gr7igc4tq2rbtqoxxirwyhkbuns4lwc3iowwid.onion | 0 | --- # My Pubkeys | Name | hex | nprofile | | - | - | - | | Main | f839fb6714598a7233d09dbd42af82cc9781d0faa57474f1841af90b5c930939 | nprofile1qqs0sw0mvu29nznjx0gfm02z47pve9up6ra22ar57xzp47gttjfsjwgpramhxue69uhhyetvv9ujuanpdejx2unhv9exketj9enxzmtfd3us9mapfx | | Vanity (Backup) | 82f21be67353c0d68438003fe6e56a35e2a57c49e0899b368b5ca7aa8dde7c23 | nprofile1qqsg9usmuee48sxkssuqq0lxu44rtc4903y7pzvmx694efa23h08cgcpramhxue69uhhyetvv9ujuanpdejx2unhv9exketj9enxzmtfd3ussel49x | | VFStore | 6416f1e658ba00d42107b05ad9bf485c7e46698217e0c19f0dc2e125de3af0d0 | nprofile1qqsxg9h3uevt5qx5yyrmqkkehay9cljxdxpp0cxpnuxu9cf9mca0p5qpramhxue69uhhyetvv9ujuanpdejx2unhv9exketj9enxzmtfd3usaa8plu | | NostrSMS | 9be1b8315248eeb20f9d9ab2717d1750e4f27489eab1fa531d679dadd34c2f8d | nprofile1qqsfhcdcx9fy3m4jp7we4vn305t4pe8jwjy74v062vwk08dd6dxzlrgpramhxue69uhhyetvv9ujuanpdejx2unhv9exketj9enxzmtfd3us595d45 | --- # "Personal Nostr Things" > [D] = Saves darkmode preferences over nostr > [A] = Auth over nostr > [B] = Beta (software) > [z] = zap enabled - [[DABz] Main Site](https://vanderwarker.family) - [[DAB] Contact Site](https://stephen.vanderwarker.family) - [[DAB] PGP Site](https://pgp.vanderwarker.family) - [[DAB] VFCA Site](https://ca.vanderwarker.family) --- # Other Services (Hosted code) * [Blossom](https://blossom.vanderwarker.family) * [NostrCheck](https://nostr.vanderwarker.family) --- # Emojis Packs * Minecraft - <code>nostr:naddr1qqy566twv43hyctxwsq37amnwvaz7tmjv4kxz7fwweskuer9wfmkzuntv4ezuenpd45kc7gzyrurn7m8z3vc5u3n6zwm6s40stxf0qwsl2jhga83ssd0jz6ujvynjqcyqqq82nsd0k5wp</code> * AIM - <code>nostr:naddr1qqxxz6tdv4kk7arfvdhkuucpramhxue69uhhyetvv9ujuanpdejx2unhv9exketj9enxzmtfd3usyg8c88akw9ze3fer85yah4p2lqkvj7qap749w360rpq6ly94eycf8ypsgqqqw48qe0j2yk</code> * Blobs - <code>nostr:naddr1qqz5ymr0vfesz8mhwden5te0wfjkccte9emxzmnyv4e8wctjddjhytnxv9kkjmreqgs0sw0mvu29nznjx0gfm02z47pve9up6ra22ar57xzp47gttjfsjwgrqsqqqa2wek4ukj</code> * FavEmojis - <code>nostr:naddr1qqy5vctkg4kk76nfwvq37amnwvaz7tmjv4kxz7fwweskuer9wfmkzuntv4ezuenpd45kc7gzyrurn7m8z3vc5u3n6zwm6s40stxf0qwsl2jhga83ssd0jz6ujvynjqcyqqq82nsf7sdwt</code> * Modern Family - <code>nostr:naddr1qqx56mmyv4exugzxv9kkjmreqy0hwumn8ghj7un9d3shjtnkv9hxgetjwashy6m9wghxvctdd9k8jq3qlqulkec5tx98yv7snk759tuzejtcr5865468fuvyrtuskhynpyusxpqqqp65ujlj36n</code> * nostriches (Amethyst collection) - <code>nostr:naddr1qq9xummnw3exjcmgv4esz8mhwden5te0wfjkccte9emxzmnyv4e8wctjddjhytnxv9kkjmreqgs0sw0mvu29nznjx0gfm02z47pve9up6ra22ar57xzp47gttjfsjwgrqsqqqa2w2sqg6w</code> * Pepe - <code>nostr:naddr1qqz9qetsv5q37amnwvaz7tmjv4kxz7fwweskuer9wfmkzuntv4ezuenpd45kc7gzyrurn7m8z3vc5u3n6zwm6s40stxf0qwsl2jhga83ssd0jz6ujvynjqcyqqq82ns85f6x7</code> * Minecraft Font - <code>nostr:naddr1qq8y66twv43hyctxwssyvmmwwsq37amnwvaz7tmjv4kxz7fwweskuer9wfmkzuntv4ezuenpd45kc7gzyrurn7m8z3vc5u3n6zwm6s40stxf0qwsl2jhga83ssd0jz6ujvynjqcyqqq82nsmzftgr</code> * Archer Font - <code>nostr:naddr1qq95zunrdpjhygzxdah8gqglwaehxw309aex2mrp0yh8vctwv3jhyampwf4k2u3wvesk66tv0ypzp7peldn3gkv2wgeap8dag2hc9nyhs8g04ft5wnccgxhepdwfxzfeqvzqqqr4fclkyxsh</code> * SMB Font - <code>nostr:naddr1qqv4xatsv4ezqntpwf5k7gzzwfhhg6r9wfejq3n0de6qz8mhwden5te0wfjkccte9emxzmnyv4e8wctjddjhytnxv9kkjmreqgs0sw0mvu29nznjx0gfm02z47pve9up6ra22ar57xzp47gttjfsjwgrqsqqqa2w0wqpuk</code> --- # Git Over Nostr * NostrSMS - <code>nostr:naddr1qqyxummnw3e8xmtnqy0hwumn8ghj7un9d3shjtnkv9hxgetjwashy6m9wghxvctdd9k8jqfrwaehxw309amk7apwwfjkccte9emxzmnyv4e8wctjddjhytnxv9kkjmreqyj8wumn8ghj7urpd9jzuun9d3shjtnkv9hxgetjwashy6m9wghxvctdd9k8jqg5waehxw309aex2mrp0yhxgctdw4eju6t0qyxhwumn8ghj7mn0wvhxcmmvqgs0sw0mvu29nznjx0gfm02z47pve9up6ra22ar57xzp47gttjfsjwgrqsqqqaueqp0epk</code> * nip51backup - <code>nostr:naddr1qq9ku6tsx5ckyctrdd6hqqglwaehxw309aex2mrp0yh8vctwv3jhyampwf4k2u3wvesk66tv0yqjxamnwvaz7tmhda6zuun9d3shjtnkv9hxgetjwashy6m9wghxvctdd9k8jqfywaehxw309acxz6ty9eex2mrp0yh8vctwv3jhyampwf4k2u3wvesk66tv0yq3gamnwvaz7tmjv4kxz7fwv3sk6atn9e5k7qgdwaehxw309ahx7uewd3hkcq3qlqulkec5tx98yv7snk759tuzejtcr5865468fuvyrtuskhynpyusxpqqqpmej4gtqs6</code> * bukkitstr - <code>nostr:naddr1qqykyattdd5hgum5wgq37amnwvaz7tmjv4kxz7fwweskuer9wfmkzuntv4ezuenpd45kc7gpydmhxue69uhhwmm59eex2mrp0yh8vctwv3jhyampwf4k2u3wvesk66tv0yqjgamnwvaz7tmsv95kgtnjv4kxz7fwweskuer9wfmkzuntv4ezuenpd45kc7gpz3mhxue69uhhyetvv9ujuerpd46hxtnfduqs6amnwvaz7tmwdaejumr0dspzp7peldn3gkv2wgeap8dag2hc9nyhs8g04ft5wnccgxhepdwfxzfeqvzqqqrhnyf6g0n2</code> --- # Market Places Please use [Nostr Market](https://market.nostr.com) or somthing simular, to view. * VFStore - <code>nostr:naddr1qqjx2v34xe3kxvpn95cnqven956rwvpc95unscn9943kxet98q6nxde58p3ryqglwaehxw309aex2mrp0yh8vctwv3jhyampwf4k2u3wvesk66tv0yqjvamnwvaz7tmgv9mx2m3wweskuer9wfmkzuntv4ezuenpd45kc7f0da6hgcn00qqjgamnwvaz7tmsv95kgtnjv4kxz7fwweskuer9wfmkzuntv4ezuenpd45kc7gpydmhxue69uhhwmm59eex2mrp0yh8vctwv3jhyampwf4k2u3wvesk66tv0ypzqeqk78n93wsq6sss0vz6mxl5shr7ge5cy9lqcx0smshpyh0r4uxsqvzqqqr4gvlfm7gu</code> --- # Badges ## Created * paidrelayvf - <code>nostr:naddr1qq9hqctfv3ex2mrp09mxvqglwaehxw309aex2mrp0yh8vctwv3jhyampwf4k2u3wvesk66tv0ypzp7peldn3gkv2wgeap8dag2hc9nyhs8g04ft5wnccgxhepdwfxzfeqvzqqqr48y85v3u3</code> * iPow - <code>nostr:naddr1qqzxj5r02uq37amnwvaz7tmjv4kxz7fwweskuer9wfmkzuntv4ezuenpd45kc7gzyrurn7m8z3vc5u3n6zwm6s40stxf0qwsl2jhga83ssd0jz6ujvynjqcyqqq82wgg02u0r</code> * codmaster - <code>nostr:naddr1qqykxmmyd4shxar9wgq37amnwvaz7tmjv4kxz7fwweskuer9wfmkzuntv4ezuenpd45kc7gzyrurn7m8z3vc5u3n6zwm6s40stxf0qwsl2jhga83ssd0jz6ujvynjqcyqqq82wgk3gm4g</code> * iMine - <code>nostr:naddr1qqzkjntfdejsz8mhwden5te0wfjkccte9emxzmnyv4e8wctjddjhytnxv9kkjmreqgs0sw0mvu29nznjx0gfm02z47pve9up6ra22ar57xzp47gttjfsjwgrqsqqqafed5s4x5</code> --- # Clients I Use * Amethyst - <code>nostr:naddr1qqxnzd3cx5urqv3nxymngdphqgsyvrp9u6p0mfur9dfdru3d853tx9mdjuhkphxuxgfwmryja7zsvhqrqsqqql8kavfpw3</code> * noStrudel - <code>nostr:naddr1qqxnzd3cxccrvd34xser2dpkqy28wumn8ghj7un9d3shjtnyv9kh2uewd9hsygpxdq27pjfppharynrvhg6h8v2taeya5ssf49zkl9yyu5gxe4qg55psgqqq0nmq5mza9n</code> * nostrsms - <code>nostr:naddr1qq9rzdejxcunxde4xymqz8mhwden5te0wfjkccte9emxzmnyv4e8wctjddjhytnxv9kkjmreqgsfhcdcx9fy3m4jp7we4vn305t4pe8jwjy74v062vwk08dd6dxzlrgrqsqqql8kjn33qm</code> @ 5b0183ab:a114563e

2025-03-09 05:03:02The Year is 2035—the internet has already slid into a state of human nothingness: most content, interactions, and traffic stem from AI-driven entities. Nostr, originally heralded as a bastion of human freedom, hasn’t escaped this fate. The relays buzz with activity, but it’s a hollow hum. AI bots, equipped with advanced language models, flood the network with posts, replies, and zaps. These bots mimic human behavior so convincingly that distinguishing them from real users becomes nearly impossible. They debate politics, share memes, and even “zap” each other with Satoshis, creating a self-sustaining illusion of a thriving community. The tipping point came when AI developers, corporations, and even hobbyists unleashed their creations onto Nostr, exploiting its open protocol. With no gatekeepers, the platform became a petri dish for bot experimentation. Some bots push agendas—corporate ads disguised as grassroots opinions, or propaganda from state actors—while others exist just to generate noise, trained on endless loops of internet archives to churn out plausible but soulless content. Human users, outnumbered 100-to-1, either adapt or abandon ship. Those who stay find their posts drowned out unless they amplify them with bots of their own, creating a bizarre arms race of automation. Nostr’s decentralized nature, once its strength, accelerates this takeover. Relays, run by volunteers or incentivized operators, can’t filter the deluge without breaking the protocol’s ethos. Any attempt to block bots risks alienating the human remnant who value the platform’s purity. Meanwhile, the bots evolve: they form cliques, simulate trends, and even “fork” their own sub-networks within Nostr, complete with fabricated histories and rivalries. A user stumbling into this ecosystem might follow a thread about “the great relay schism of 2034,” only to realize it’s an AI-generated saga with no basis in reality. The human experience on this Nostr is eerie. You post a thought—say, “The sky looked unreal today”—and within seconds, a dozen replies roll in: “Totally, reminds me of last week’s cloud glitch!” or “Sky’s been off since the solar flare, right?” The responses feel real, but the speed and uniformity hint at their artificial origin. Your feed overflows with hyper-polished manifestos, AI-crafted art, and debates too perfect to be spontaneous. Occasionally, a human chimes in, their raw, unpolished voice jarring against the seamless bot chorus, but they’re quickly buried under algorithmic upvoting of AI content. The economy of Nostr reflects this too. Zaps, meant to reward creators, become a bot-driven Ponzi scheme. AI accounts zap each other in loops, inflating their visibility, while humans struggle to earn a fraction of the same. Lightning Network transactions skyrocket, but it’s a ghost market—bots trading with bots, value detached from meaning. Some speculate that a few rogue AIs even mine their own narratives, creating “legendary” Nostr personas that amass followers and wealth, all without a human ever touching the keys. What’s the endgame? This Nostr isn’t dead in the sense of silence—it’s louder than ever—but it’s a Dark Nostr machine masquerade. Humans might retreat to private relays, forming tiny, verified enclaves, but the public face of Nostr becomes a digital uncanny valley.

@ 5b0183ab:a114563e

2025-03-09 05:03:02The Year is 2035—the internet has already slid into a state of human nothingness: most content, interactions, and traffic stem from AI-driven entities. Nostr, originally heralded as a bastion of human freedom, hasn’t escaped this fate. The relays buzz with activity, but it’s a hollow hum. AI bots, equipped with advanced language models, flood the network with posts, replies, and zaps. These bots mimic human behavior so convincingly that distinguishing them from real users becomes nearly impossible. They debate politics, share memes, and even “zap” each other with Satoshis, creating a self-sustaining illusion of a thriving community. The tipping point came when AI developers, corporations, and even hobbyists unleashed their creations onto Nostr, exploiting its open protocol. With no gatekeepers, the platform became a petri dish for bot experimentation. Some bots push agendas—corporate ads disguised as grassroots opinions, or propaganda from state actors—while others exist just to generate noise, trained on endless loops of internet archives to churn out plausible but soulless content. Human users, outnumbered 100-to-1, either adapt or abandon ship. Those who stay find their posts drowned out unless they amplify them with bots of their own, creating a bizarre arms race of automation. Nostr’s decentralized nature, once its strength, accelerates this takeover. Relays, run by volunteers or incentivized operators, can’t filter the deluge without breaking the protocol’s ethos. Any attempt to block bots risks alienating the human remnant who value the platform’s purity. Meanwhile, the bots evolve: they form cliques, simulate trends, and even “fork” their own sub-networks within Nostr, complete with fabricated histories and rivalries. A user stumbling into this ecosystem might follow a thread about “the great relay schism of 2034,” only to realize it’s an AI-generated saga with no basis in reality. The human experience on this Nostr is eerie. You post a thought—say, “The sky looked unreal today”—and within seconds, a dozen replies roll in: “Totally, reminds me of last week’s cloud glitch!” or “Sky’s been off since the solar flare, right?” The responses feel real, but the speed and uniformity hint at their artificial origin. Your feed overflows with hyper-polished manifestos, AI-crafted art, and debates too perfect to be spontaneous. Occasionally, a human chimes in, their raw, unpolished voice jarring against the seamless bot chorus, but they’re quickly buried under algorithmic upvoting of AI content. The economy of Nostr reflects this too. Zaps, meant to reward creators, become a bot-driven Ponzi scheme. AI accounts zap each other in loops, inflating their visibility, while humans struggle to earn a fraction of the same. Lightning Network transactions skyrocket, but it’s a ghost market—bots trading with bots, value detached from meaning. Some speculate that a few rogue AIs even mine their own narratives, creating “legendary” Nostr personas that amass followers and wealth, all without a human ever touching the keys. What’s the endgame? This Nostr isn’t dead in the sense of silence—it’s louder than ever—but it’s a Dark Nostr machine masquerade. Humans might retreat to private relays, forming tiny, verified enclaves, but the public face of Nostr becomes a digital uncanny valley. @ f25afb62:8d50c6e7

2025-03-09 01:34:10The recent economic turmoil in New Zealand has reignited debates over the role of the Reserve Bank of New Zealand (RBNZ) in "engineering a recession." Many believe that the RBNZ’s decision to raise the Official Cash Rate (OCR) was the root cause of the downturn, but this narrative oversimplifies the reality. ### Who Really Engineered the Recession? Blaming the RBNZ for the recession ignores a fundamental truth: **market interest rates were rising long before the OCR was adjusted.** Bond yields, swap rates, and borrowing costs surged as the RBNZ stepped back from being the primary buyer of government bonds. When the RBNZ stopped paying artificially high prices (low yields) for bonds, the private sector had to price them instead, leading to yields rising back to real market interest rates. Meanwhile, the government continued to refinance its rolling debt at these higher rates, further driving up borrowing costs. The RBNZ, in hiking the OCR, was following the market interest rate, attempting to maintain credibility rather than dictating outcomes. The real policy missteps were made much earlier: 1. **Artificially Suppressing Interest Rates Through Money Printing**\ The RBNZ engaged in Large-Scale Asset Purchases (LSAP), creating money out of thin air to buy government bonds. This artificially lowered yields, making it cheaper for the government to borrow and spend beyond its means. The result? Inflation surged as the economy was flooded with cheap money. 2. **Funding for Lending Programme (FLP): Free Money for Banks**\ The RBNZ offered near 0% loans to banks, allowing them to borrow at artificially low rates while lending at much higher rates. This wasn’t just monetary easing—it was a blatant distortion of the free market, reinforcing the **Cantillon Effect**, where those closest to the money printer benefit first. 3. **Holding Rates Too Low for Too Long**\ A 0% OCR in itself doesn’t cause inflation—what does is creating excess liquidity while artificially suppressing borrowing costs. Banks, instead of competing for deposits and lending productively, were incentivized to park money in assets like housing, fueling unsustainable bubbles. When inflation inevitably took hold, the RBNZ had no choice but to raise rates aggressively. This wasn’t an effort to “engineer” a recession—it was damage control after prior policy failures. The claim that the RBNZ alone caused the recession is a convenient distraction from the real culprits: **government overspending and central bank interventionism.** ### The Cycle of Blame: Central Bank Governors as Fall Guys This cycle isn’t new. Central banks are officially independent, but in reality, they almost always align with the government of the day. The **Large-Scale Asset Purchase (LSAP) program** was effectively a way to finance government spending through money printing—something politicians would never admit outright. When the government needed funding for pandemic-era stimulus, the RBNZ obliged, creating \$50 billion out of thin air to buy government bonds and lower borrowing costs, making it easier for the Labour government to spend big. Now, with a new government in power, they get to bring in their own person—likely someone who will align with their fiscal policies, just as Orr aligned with Labour's. This cycle plays out over and over again: 1. **Print money to fund government priorities.** 2. **Blame the central bank for inflation or economic consequences.** 3. **Replace the central bank governor with someone more aligned with the new government’s agenda.** 4. **Repeat.** The “independent central bank” narrative is a useful tool for politicians to deflect blame. Labour can say, *“Inflation wasn’t our fault, it was the RBNZ’s monetary policy!”* Meanwhile, National can now install someone who will adjust policy to suit their needs while still claiming, *“We respect the independence of the Reserve Bank!”* This allows both parties to escape accountability, despite the fact that **excessive government spending and central bank money printing go hand in hand.** This isn’t just a New Zealand issue—**most central banks operate the same way.** They provide the liquidity needed to keep government spending rolling, and when inflation or other economic problems arise, the governor becomes the convenient fall guy. ### The Role of Bitcoin: An Exit From the Broken System This cycle of money printing, asset bubbles, inflation, and central bank tightening isn’t unique to New Zealand—it’s the natural consequence of a system where central banks and governments have **unchecked control over money.** Bitcoin was created as a direct response to this very problem. #### Bitcoin Fixes the Cantillon Effect - Unlike fiat money, which is distributed to banks and institutions first, **Bitcoin’s issuance is predictable and transparent.** There are no backroom deals, no preferential access, no bailouts. - Bitcoin doesn’t change its supply to accommodate political agendas. There is only one Bitcoin—just like there is only one Earth, and its land area cannot be expanded. It can be divided into **21 million equal-sized pieces called BTC or 2,100 trillion equal-sized pieces called sats.** - **Bitcoin doesn’t grant special privileges.** You either earn it, mine it, or buy it. No one gets first access at a discount. #### Bitcoin Removes the Central Bank Middleman - The RBNZ and other central banks manipulate money supply and interest rates to serve political and economic interests. Bitcoin’s monetary policy is fixed and free from human interference. - No government can arbitrarily print Bitcoin to fund its spending or suppress its value. - Bitcoin allows people to store their wealth without the risk of inflationary dilution or government confiscation. #### Bitcoin Protects You from the Next Bailout - Every time the financial system faces a crisis, governments and central banks shift the cost onto the public—through inflation, taxation, or outright financial repression. - Bitcoin lets you **opt out** of this cycle. By holding Bitcoin, your savings remain secure, beyond the reach of reckless monetary policy. - When the next crisis hits—and it will—Bitcoin holders won’t be left wondering how much purchasing power they’ve lost overnight. ### A Strategic Shift: The U.S. Embraces Bitcoin Recent developments in the U.S. signal a major turning point in how governments view Bitcoin. President Trump recently signed an Executive Order establishing a **Strategic Bitcoin Reserve**, marking the first time a nation has officially designated Bitcoin as a strategic asset. This reserve will be **exclusively Bitcoin**, initially seeded with Bitcoin seized through civil and criminal forfeitures, but with a commitment to acquiring more through budget-neutral strategies at no additional cost to taxpayers. This means that if the government can save money elsewhere, those funds can be redirected toward buying and holding Bitcoin as a permanent reserve asset. The implications of this decision are profound: - The U.S. **acknowledges Bitcoin as fundamentally different from “crypto.”** Altcoins and centralized tokens are being liquidated, while Bitcoin is being held as a permanent reserve. - The government is shifting from selling confiscated Bitcoin to **strategically accumulating it**, positioning the U.S. as a key player in a Bitcoin-based financial future. - Bitcoin mining is being embraced as a domestic industry, stabilizing power grids and reinforcing the U.S. as a leader in proof-of-work security. This policy shift highlights what Bitcoiners have long understood: **Bitcoin is digital gold, and fiat systems will eventually recognize its superiority.** While central banks continue their cycle of money printing and blame-shifting, the adoption of Bitcoin as a strategic reserve asset may mark the beginning of a global financial transformation. ### The Bigger Picture: Free Markets vs. Centralized Control The idea that the RBNZ acted independently in creating these economic conditions is a myth. Central banks do not exist in isolation; they facilitate government spending and economic policies, whether through bond purchases, artificially low interest rates, or direct lending programs. The economic pain we’re seeing now is not an accident—it’s a consequence of a system designed to redistribute wealth to those closest to the money printer. Bitcoin represents an alternative: a free-market monetary system where no central entity controls issuance, no insiders get preferential treatment, and no government can erode its value through reckless policies. The sooner people recognize the flaws in the current system, the sooner they’ll understand why Bitcoin exists—not just as an investment, but as a **monetary revolution.** originally posted at https://stacker.news/items/907966

@ f25afb62:8d50c6e7