-

@ 3ffac3a6:2d656657

2025-03-08 23:07:57

@ 3ffac3a6:2d656657

2025-03-08 23:07:57Recently, I found an old Sapphire Block Erupter USB at home that I used for Bitcoin mining back in 2013. Out of curiosity and nostalgia, I decided to try getting it to work again. I spent an entire afternoon configuring the device and, after much trial and error, discovered that I needed an older version of CGMiner to make it work.

The Sapphire Block Erupter USB was one of the first ASIC devices designed for Bitcoin mining. Although obsolete for competitive mining, it can still be used for learning, nostalgia, or experimentation. In this post, I’ll show you how to run a Block Erupter USB on Linux today.

1. Prerequisites

Before you start, make sure you have:

- A Sapphire Block Erupter USB

- A powered USB hub (optional but recommended)

- A computer running Linux (Ubuntu, Debian, or another compatible distribution)

- A mining pool account (e.g., Slush Pool, KanoPool, etc.)

2. Installing Dependencies

Before running the miner, install some dependencies:

bash sudo apt update && sudo apt install -y git build-essential autoconf automake libtool pkg-config libusb-1.0-0-dev3. Determining the Compatible Version of CGMiner

To find the correct CGMiner version that still supports Block Erupter USB, I performed a binary search across different versions, testing each one until I found the last one that properly recognized the device. The result was that version 3.4.3 is the most recent one that still supports Block Erupters. However, different versions of these devices may require different CGMiner versions.

4. Downloading and Compiling CGMiner

CGMiner is one of the software options compatible with Block Erupters. You can download the correct version from two trusted sources:

- From the official repository: CGMiner v3.4.3 on GitHub

- Alternatively, from this mirror: CGMiner v3.4.3 on Haven

To ensure file integrity, verify the SHA-256 hash:

3b44da12e5f24f603eeeefdaa2c573bd566c5c50c9d62946f198e611cd55876bNow, download and extract it:

```bash wget https://github.com/ckolivas/cgminer/archive/refs/tags/v3.4.3.tar.gz

Or, alternatively:

wget https://haven.girino.org/3b44da12e5f24f603eeeefdaa2c573bd566c5c50c9d62946f198e611cd55876b.tgz

sha256sum v3.4.3.tar.gz # Confirm that the hash matches

Extract the file

tar -xvf v3.4.3.tar.gz cd cgminer-3.4.3

Compile CGMiner

./autogen.sh --enable-icarus make -j$(nproc)

Install on the system (optional)

sudo make install ```

5. Connecting the Block Erupter USB

Plug the device into a USB port and check if it is recognized:

bash dmesg | grep USB lsusbYou should see something like:

Bus 003 Device 004: ID 10c4:ea60 Cygnal Integrated Products, Inc. CP2102 USB to UART Bridge ControllerIf needed, adjust the USB device permissions:

bash sudo chmod 666 /dev/ttyUSB06. Configuring and Running CGMiner

Now, run CGMiner, pointing it to your mining pool:

bash ./cgminer -o stratum+tcp://your.pool.com:3333 -u yourUsername -p yourPasswordIf the miner detects the Block Erupter correctly, you should see something like:

[2025-03-08 22:26:45] Started cgminer 3.4.3 [2025-03-08 22:26:45] No devices detected! [2025-03-08 22:26:45] Waiting for USB hotplug devices or press q to quit [2025-03-08 22:26:45] Probing for an alive pool [2025-03-08 22:26:46] Pool 0 difficulty changed to 65536 [2025-03-08 22:26:46] Network diff set to 111T [2025-03-08 22:26:46] Stratum from pool 0 detected new block [2025-03-08 22:27:02] Hotplug: Icarus added AMU 0Conclusion

Although no longer viable for real mining, the Sapphire Block Erupter USB is still great for learning about ASICs, testing mining pools, and understanding Bitcoin mining. If you enjoy working with old hardware and have one lying around, it’s worth experimenting with!

If you have any questions or want to share your experience, leave a comment below!

-

@ 3ffac3a6:2d656657

2025-03-08 23:02:13

@ 3ffac3a6:2d656657

2025-03-08 23:02:13Como Rodar um Sapphire Block Erupter USB para Mineração no Linux em 2025

Recentemente, encontrei um Sapphire Block Erupter USB velho aqui em casa que eu usava para minerar Bitcoin em 2013. Por curiosidade e nostalgia, resolvi tentar colocá-lo para funcionar novamente. Passei uma tarde inteira tentando configurar o dispositivo e, depois de muita tentativa e erro, descobri que precisava de uma versão mais antiga do CGMiner para fazê-lo funcionar.

Os Sapphire Block Erupter USB foram um dos primeiros dispositivos ASIC voltados para mineração de Bitcoin. Embora estejam obsoletos para mineração competitiva, eles ainda podem ser usados para aprendizado, nostalgia ou experimentação. Neste post, vou te mostrar como rodar um Block Erupter USB no Linux atualmente.

1. Pré-requisitos

Antes de começar, certifique-se de que você tem:

- Um Sapphire Block Erupter USB

- Um hub USB alimentado (opcional, mas recomendado)

- Um computador rodando Linux (Ubuntu, Debian, Arch ou outra distribuição compatível)

- Um pool de mineração configurado (ex: Slush Pool, KanoPool, etc.)

2. Instalando as Dependências

Antes de rodar o minerador, instale algumas dependências:

bash sudo apt update && sudo apt install -y git build-essential autoconf automake libtool pkg-config libusb-1.0-0-dev3. Determinando a Versão Compatível do CGMiner

Para encontrar a versão correta do CGMiner que ainda suporta os Block Erupter USB, realizei uma busca binária entre diferentes versões, testando cada uma até encontrar a última que reconhecia corretamente o dispositivo. O resultado foi que a versão 3.4.3 é a mais recente que ainda suporta os Block Erupters. No entanto, outras versões desses dispositivos podem requerer versões diferentes do CGMiner.

4. Baixando e Compilando o CGMiner

O CGMiner é um dos softwares compatíveis com os Block Erupters. Você pode baixar a versão correta de duas fontes confiáveis:

- Do repositório oficial: CGMiner v3.4.3 no GitHub

- Alternativamente, deste espelho: CGMiner v3.4.3 no Haven

Para garantir a integridade do arquivo, você pode verificar o hash SHA-256:

3b44da12e5f24f603eeeefdaa2c573bd566c5c50c9d62946f198e611cd55876bAgora, faça o download e extraia:

```bash wget https://github.com/ckolivas/cgminer/archive/refs/tags/v3.4.3.tar.gz

Ou, alternativamente:

wget https://haven.girino.org/3b44da12e5f24f603eeeefdaa2c573bd566c5c50c9d62946f198e611cd55876b.tgz

sha256sum v3.4.3.tar.gz # Confirme que o hash bate

Extraia o arquivo

tar -xvf v3.4.3.tar.gz cd cgminer-3.4.3

Compile o CGMiner

./autogen.sh --enable-icarus make -j$(nproc)

Instale no sistema (opcional)

sudo make install ```

4. Conectando o Block Erupter USB

Plugue o dispositivo na porta USB e verifique se ele foi reconhecido:

bash dmesg | grep USB lsusbVocê deve ver algo como:

Bus 003 Device 004: ID 10c4:ea60 Cygnal Integrated Products, Inc. CP2102 USB to UART Bridge ControllerSe necessário, ajuste as permissões para o dispositivo USB:

bash sudo chmod 666 /dev/ttyUSB05. Configurando e Rodando o CGMiner

Agora, execute o CGMiner apontando para seu pool de mineração:

bash ./cgminer -o stratum+tcp://seu.pool.com:3333 -u seuUsuario -p suaSenhaSe o minerador detectar corretamente o Block Erupter, você verá algo como:

``` [2025-03-08 22:26:45] Started cgminer 3.4.3 [2025-03-08 22:26:45] No devices detected! [2025-03-08 22:26:45] Waiting for USB hotplug devices or press q to quit [2025-03-08 22:26:45] Probing for an alive pool [2025-03-08 22:26:46] Pool 0 difficulty changed to 65536 [2025-03-08 22:26:46] Network diff set to 111T [2025-03-08 22:26:46] Stratum from pool 0 detected new block [2025-03-08 22:27:02] Hotplug: Icarus added AMU 0

```

Conclusão

Apesar de não serem mais viáveis para mineração real, os Sapphire Block Erupter USB ainda são ótimos para aprender sobre ASICs, testar pools e entender mais sobre a mineração de Bitcoin. Se você gosta de hardware antigo e tem um desses guardado, vale a pena experimentar!

Se tiver dúvidas ou quiser compartilhar sua experiência, comente abaixo!

-

@ ffbcb706:b0574044

2025-03-08 22:51:54

@ ffbcb706:b0574044

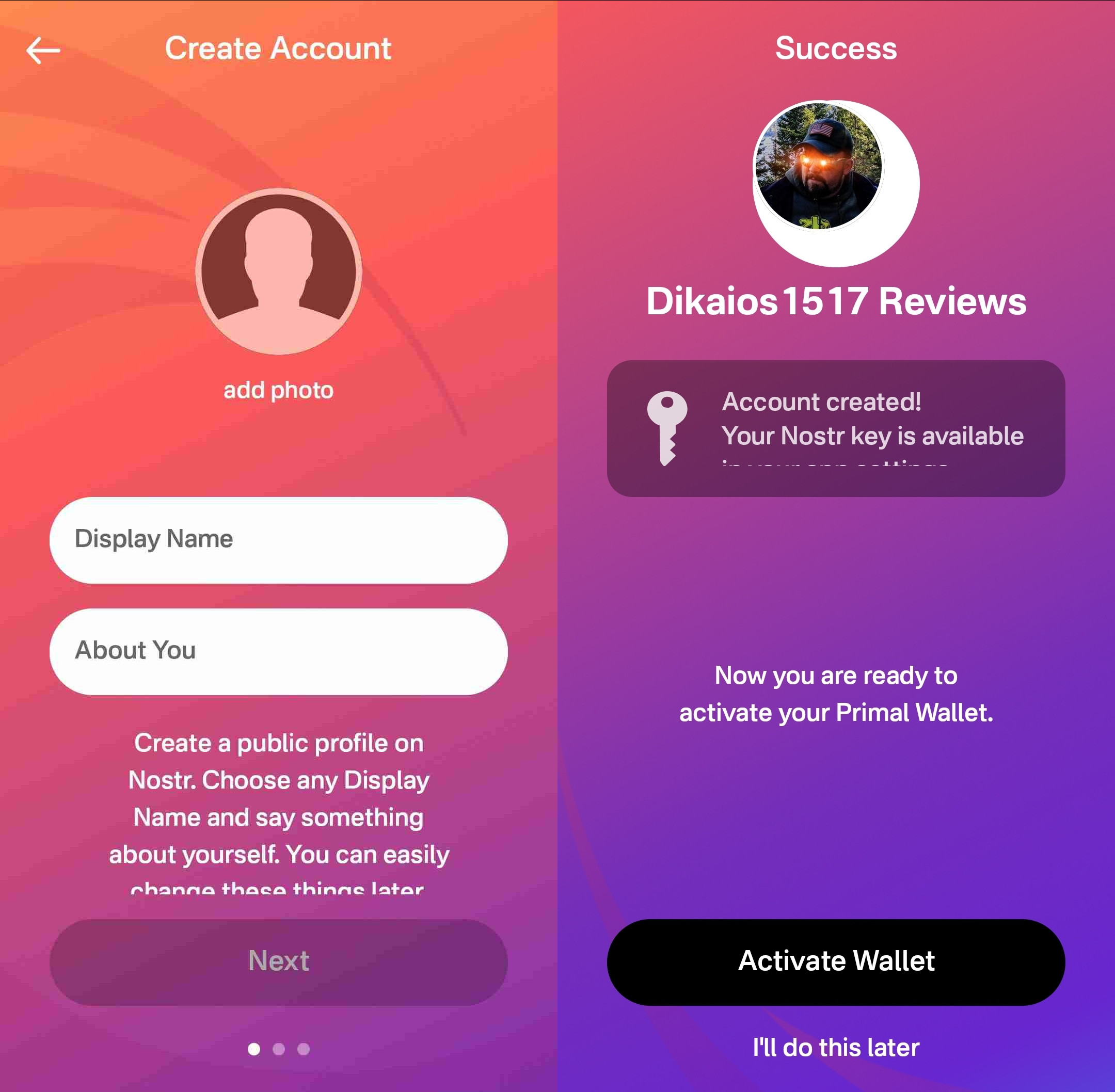

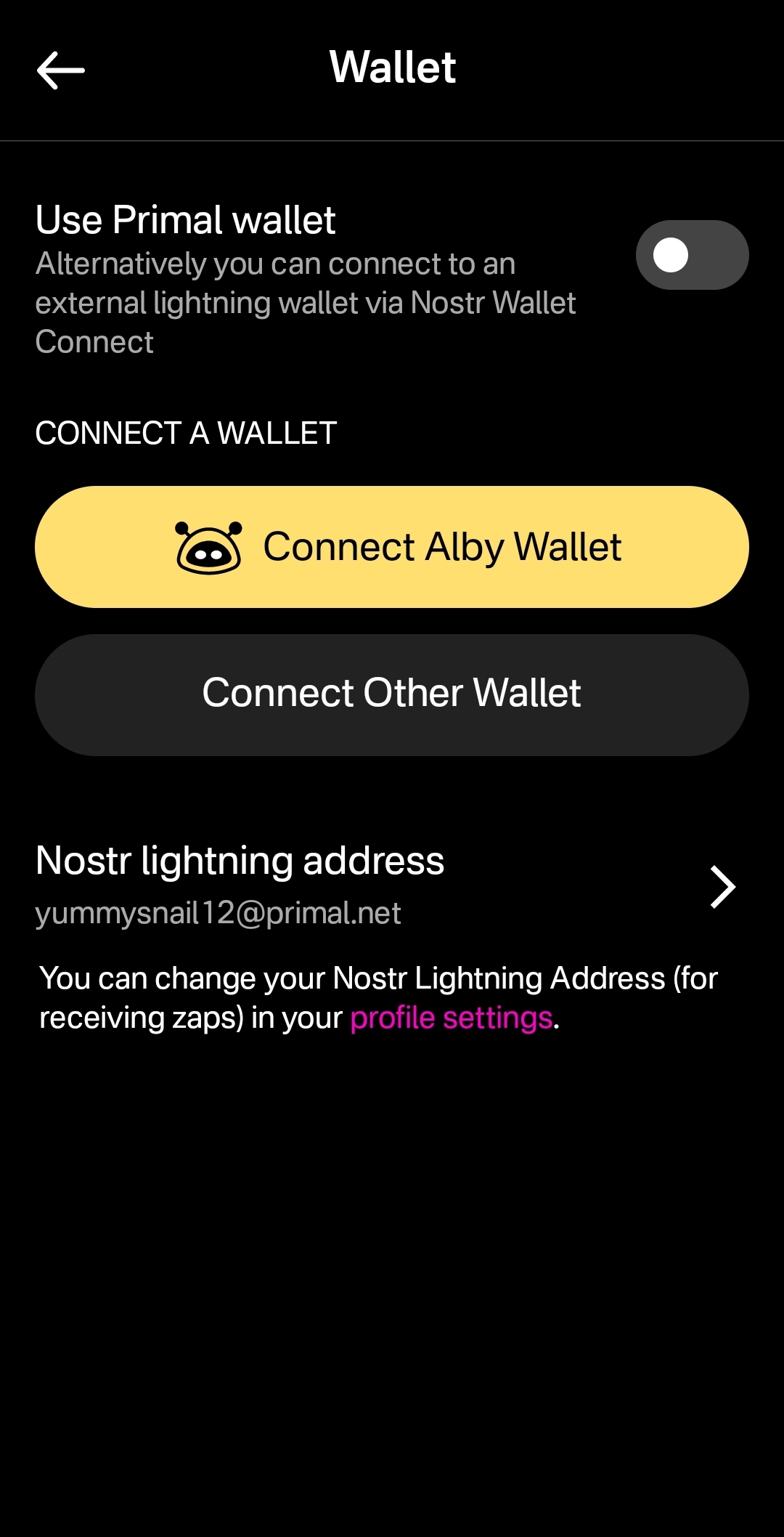

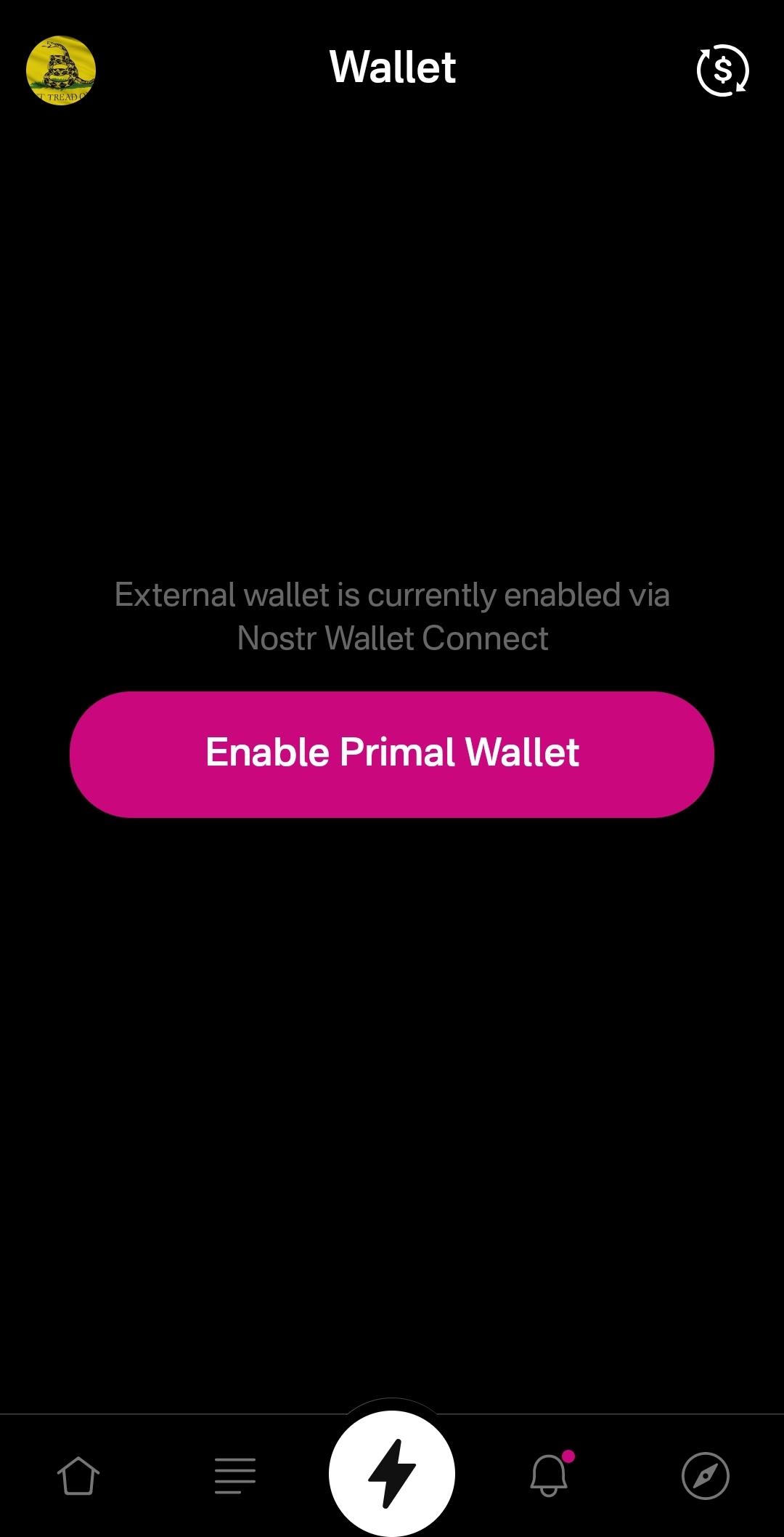

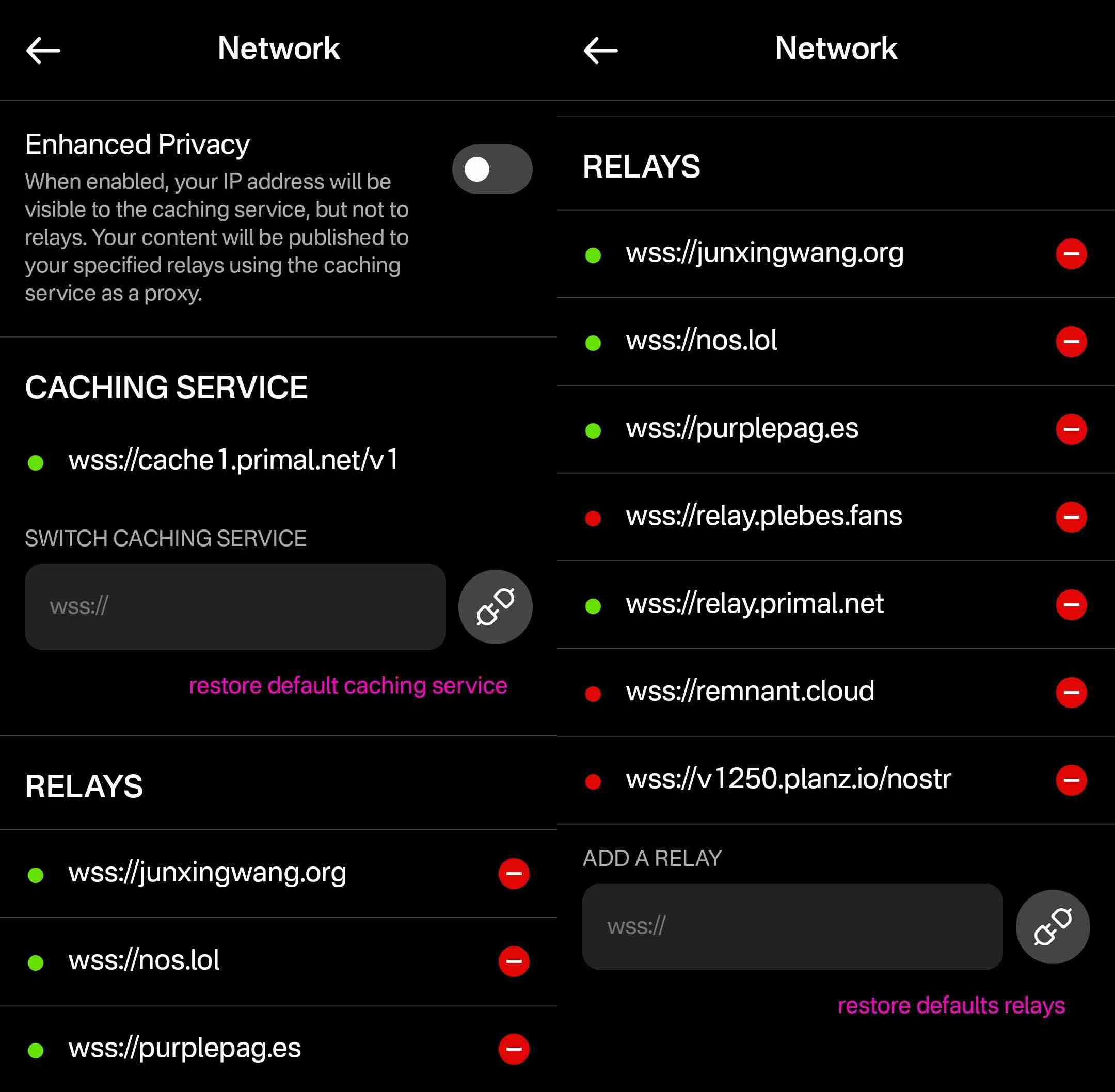

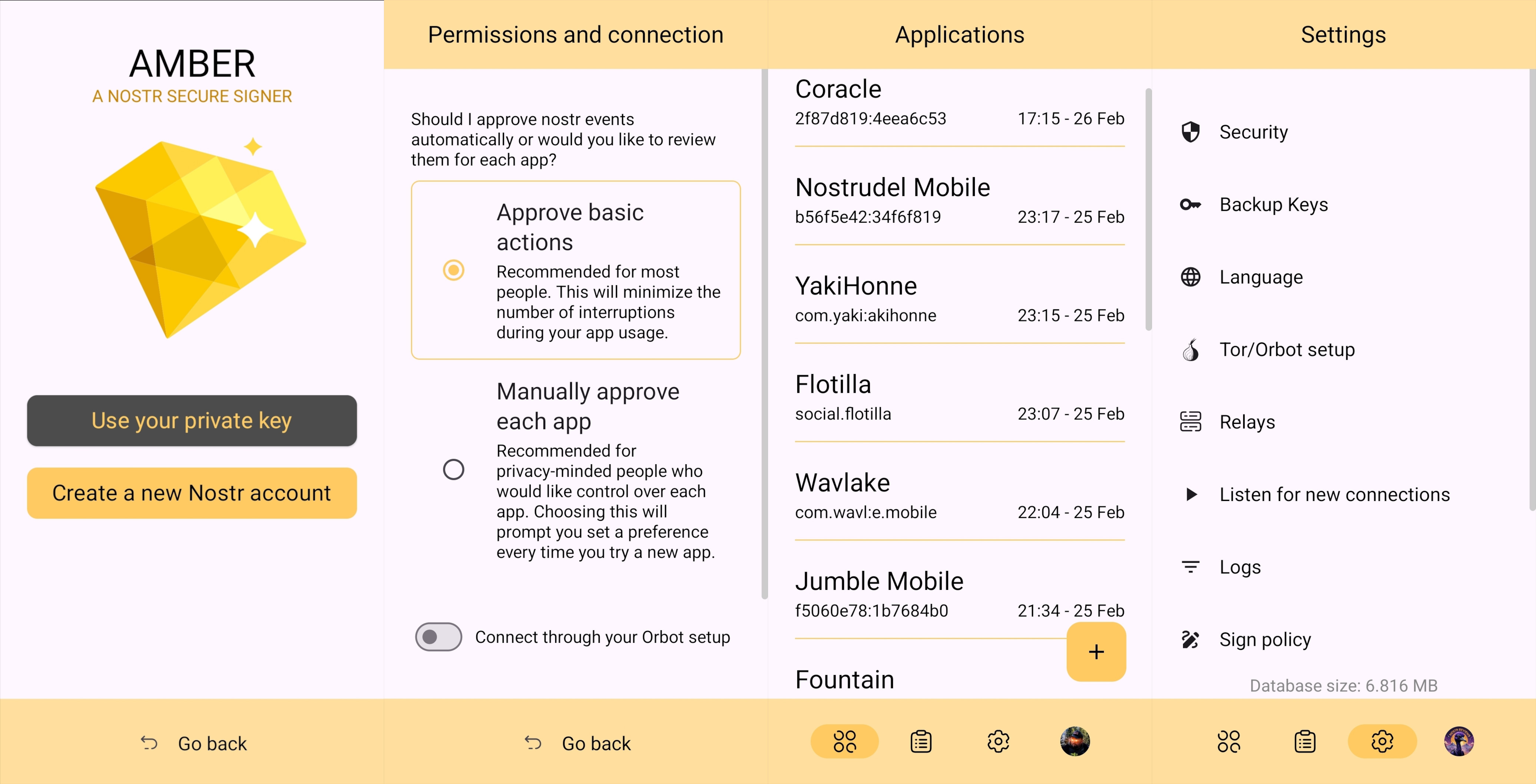

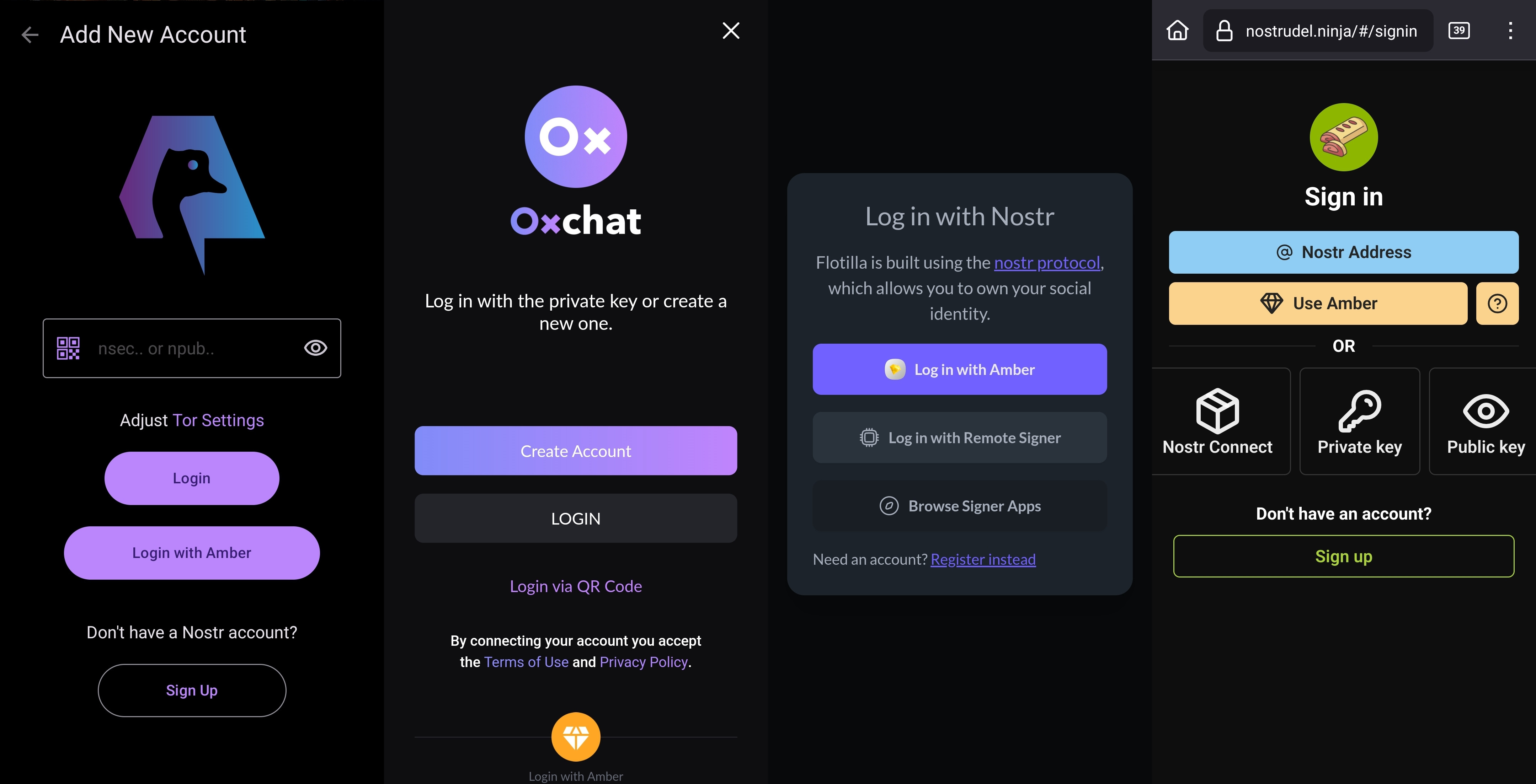

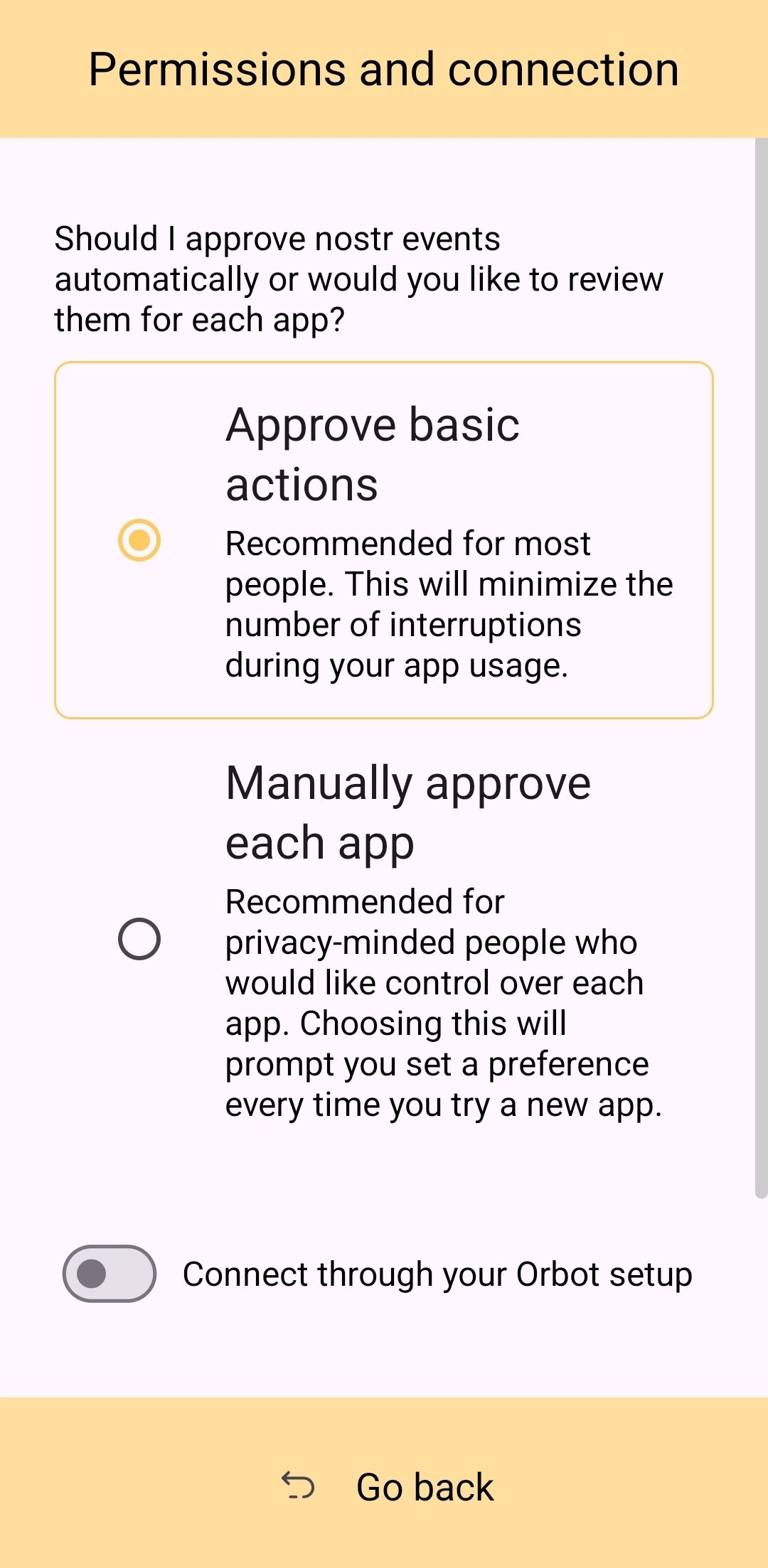

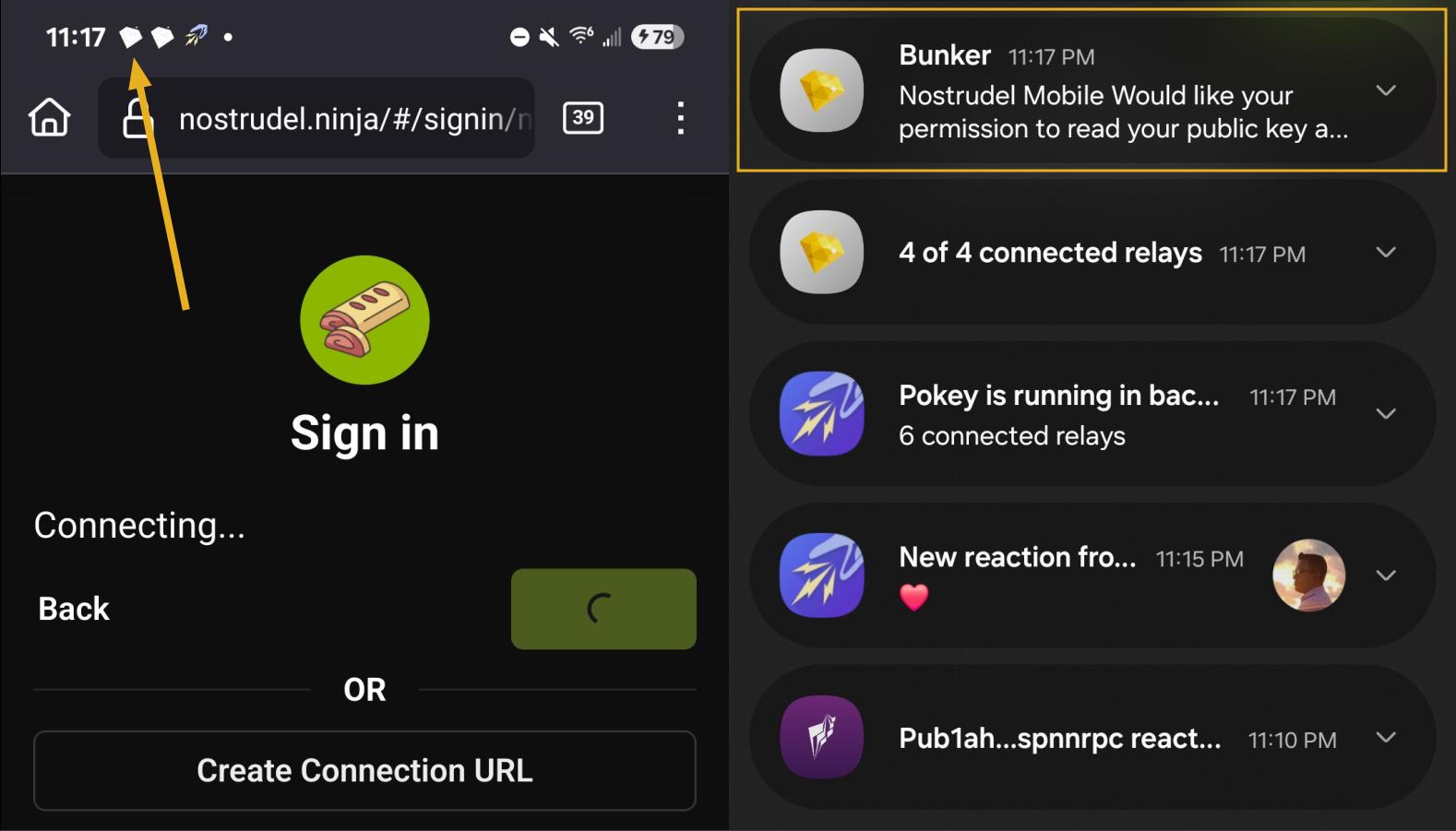

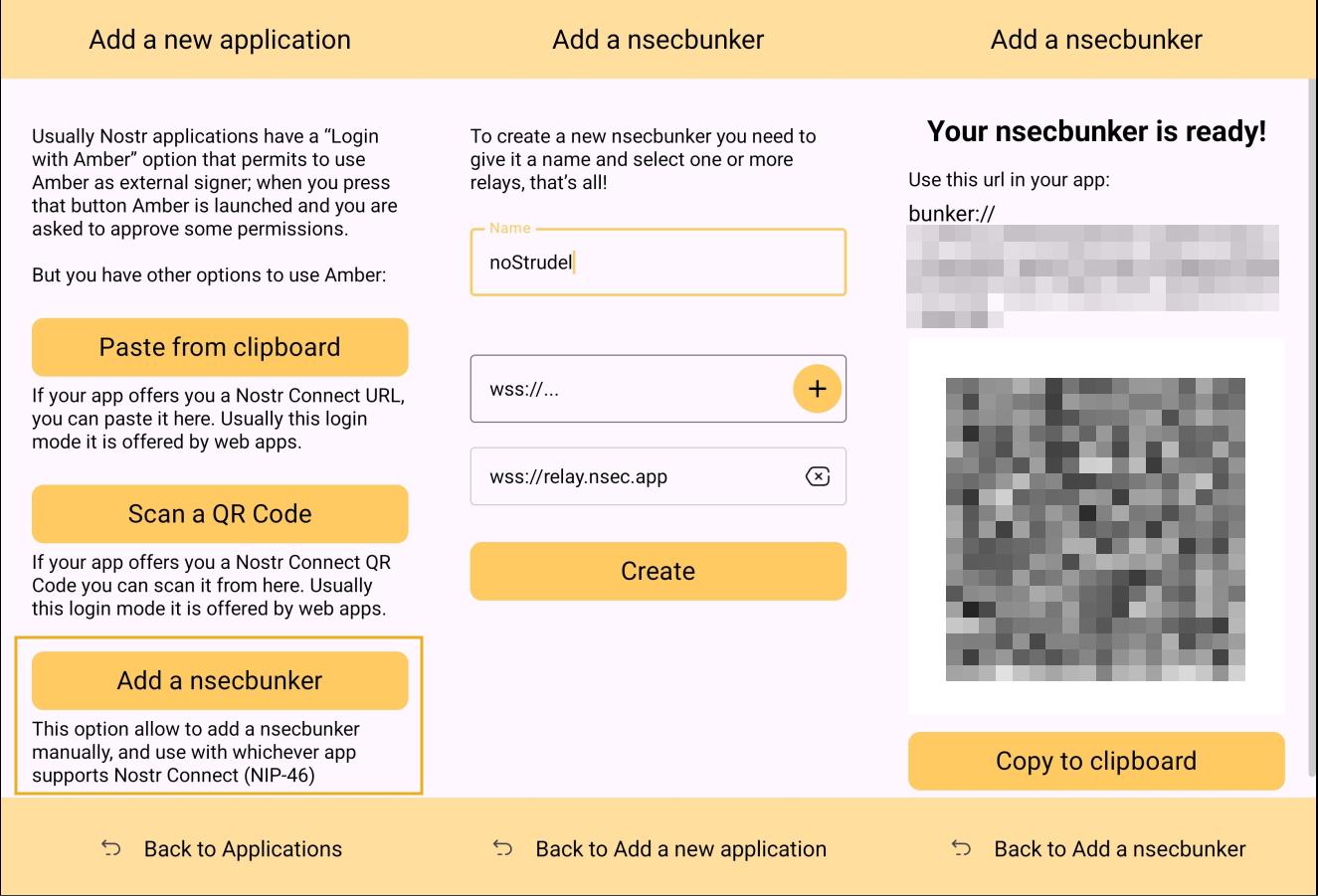

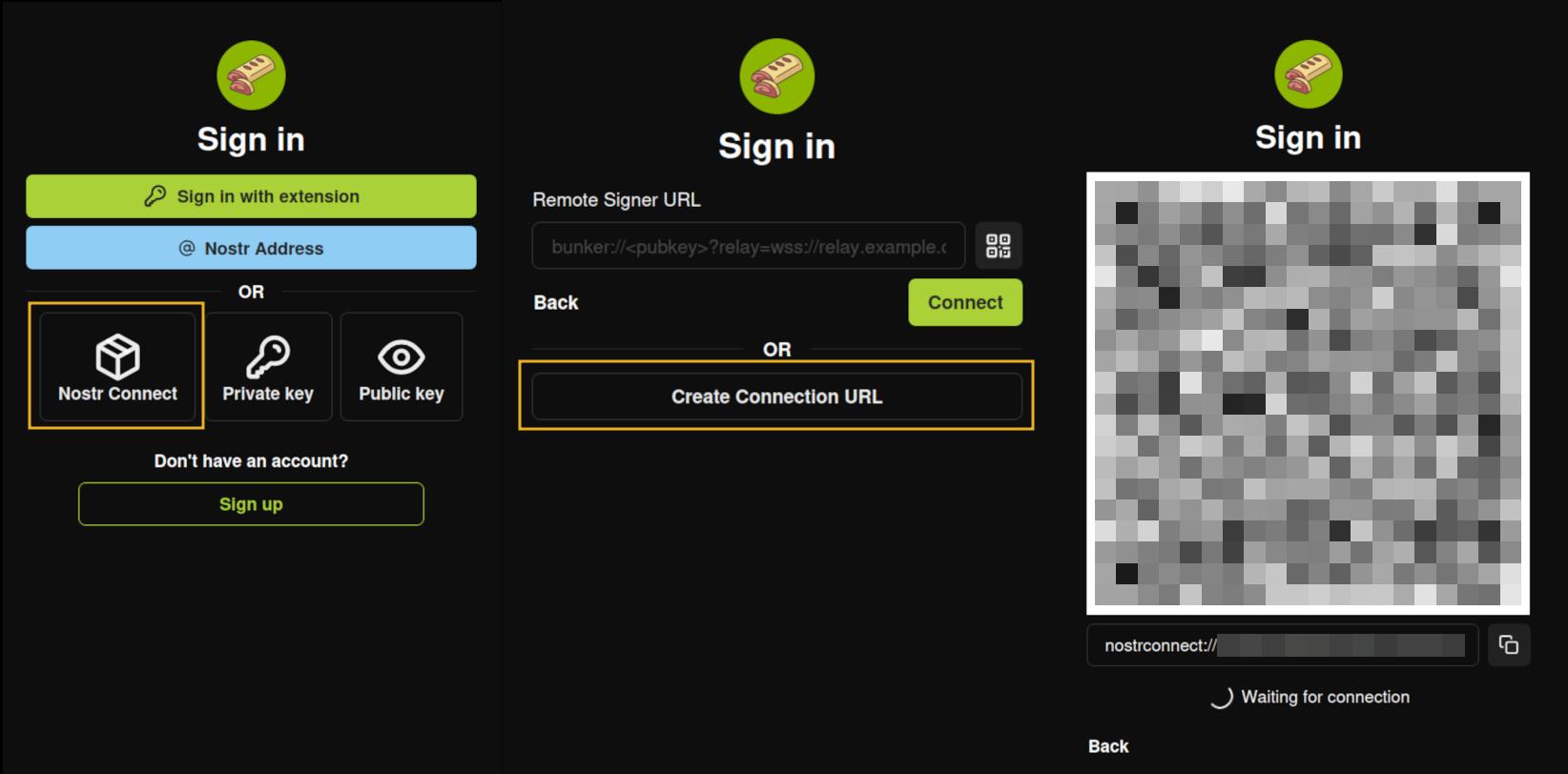

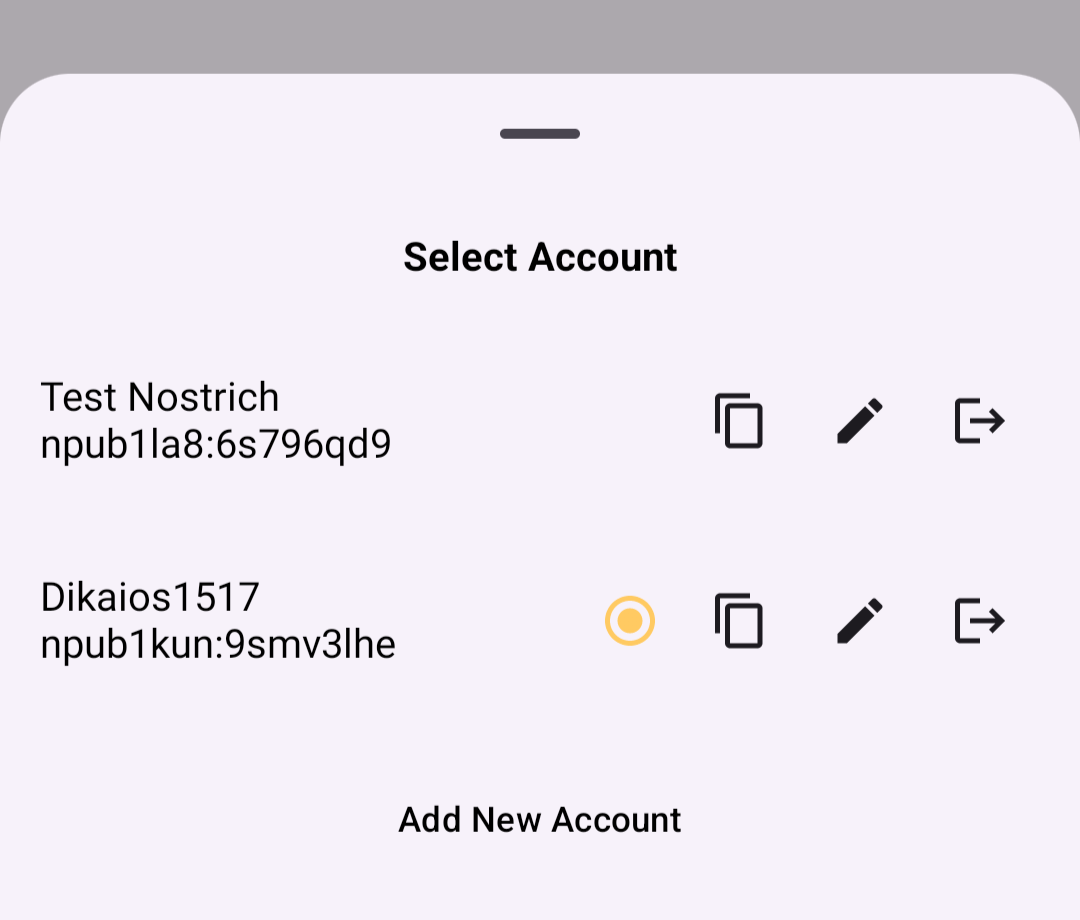

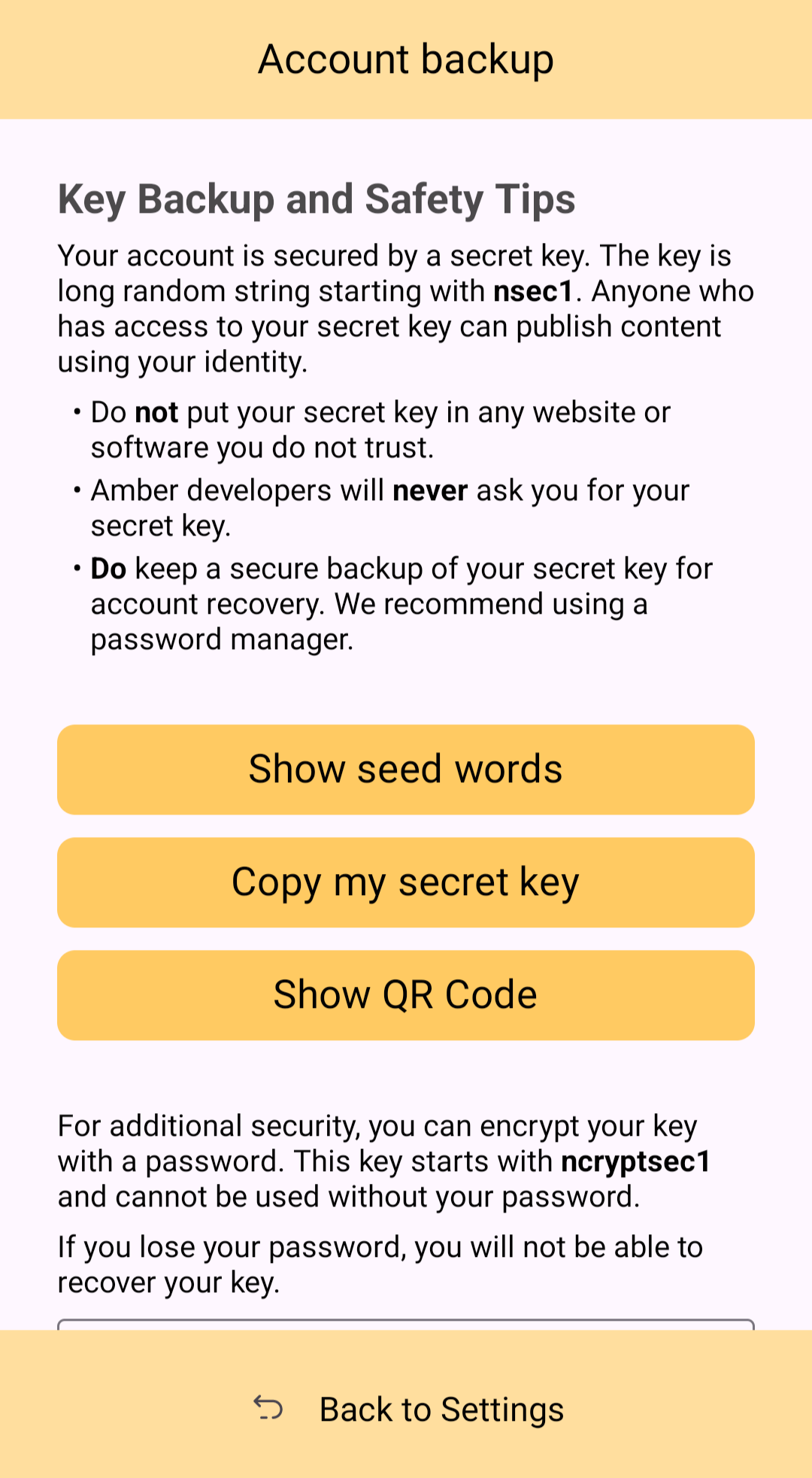

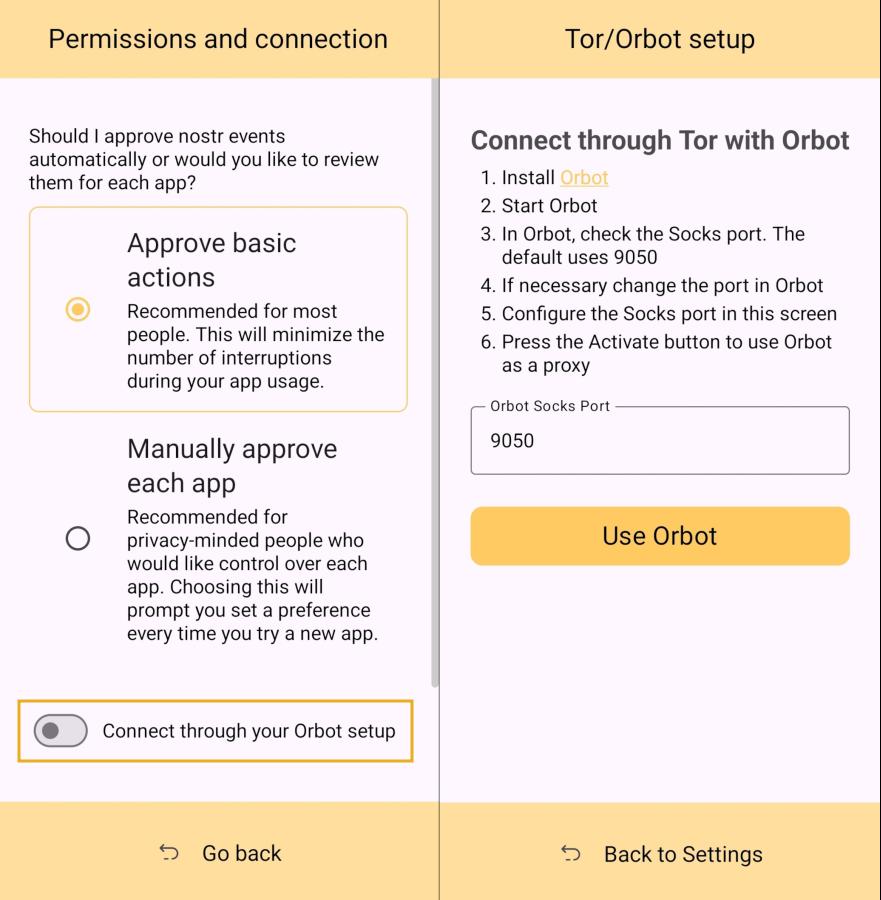

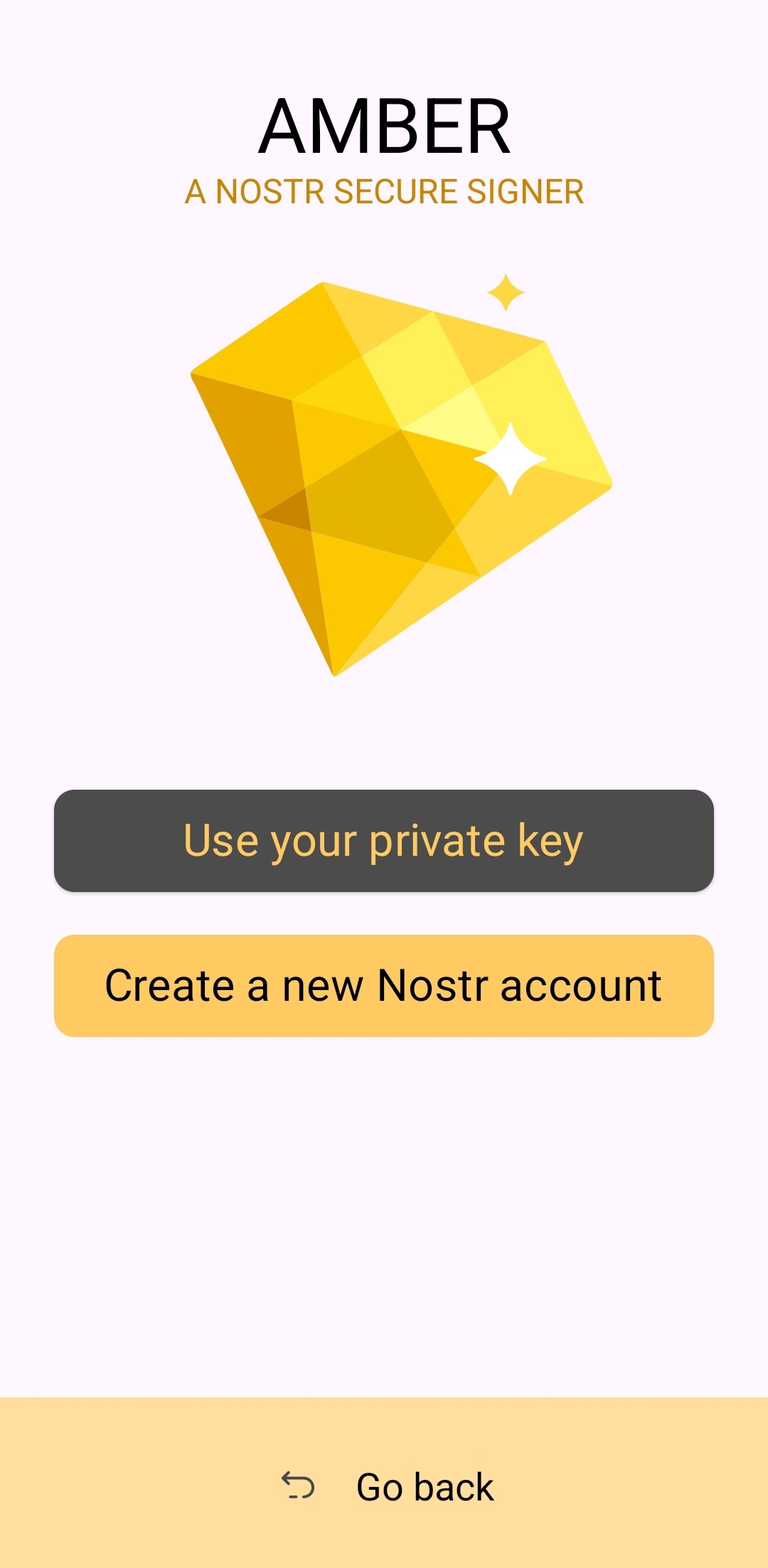

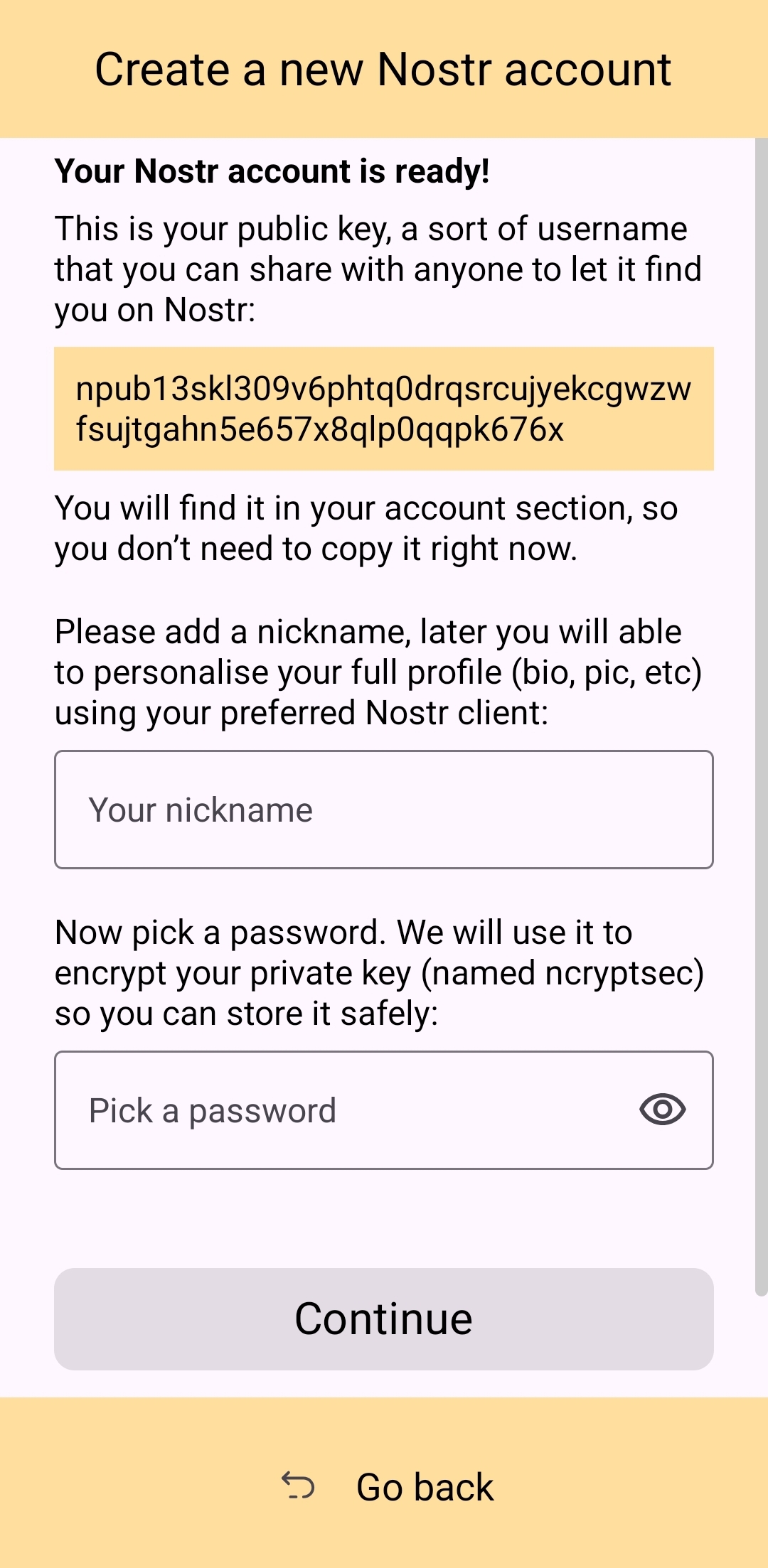

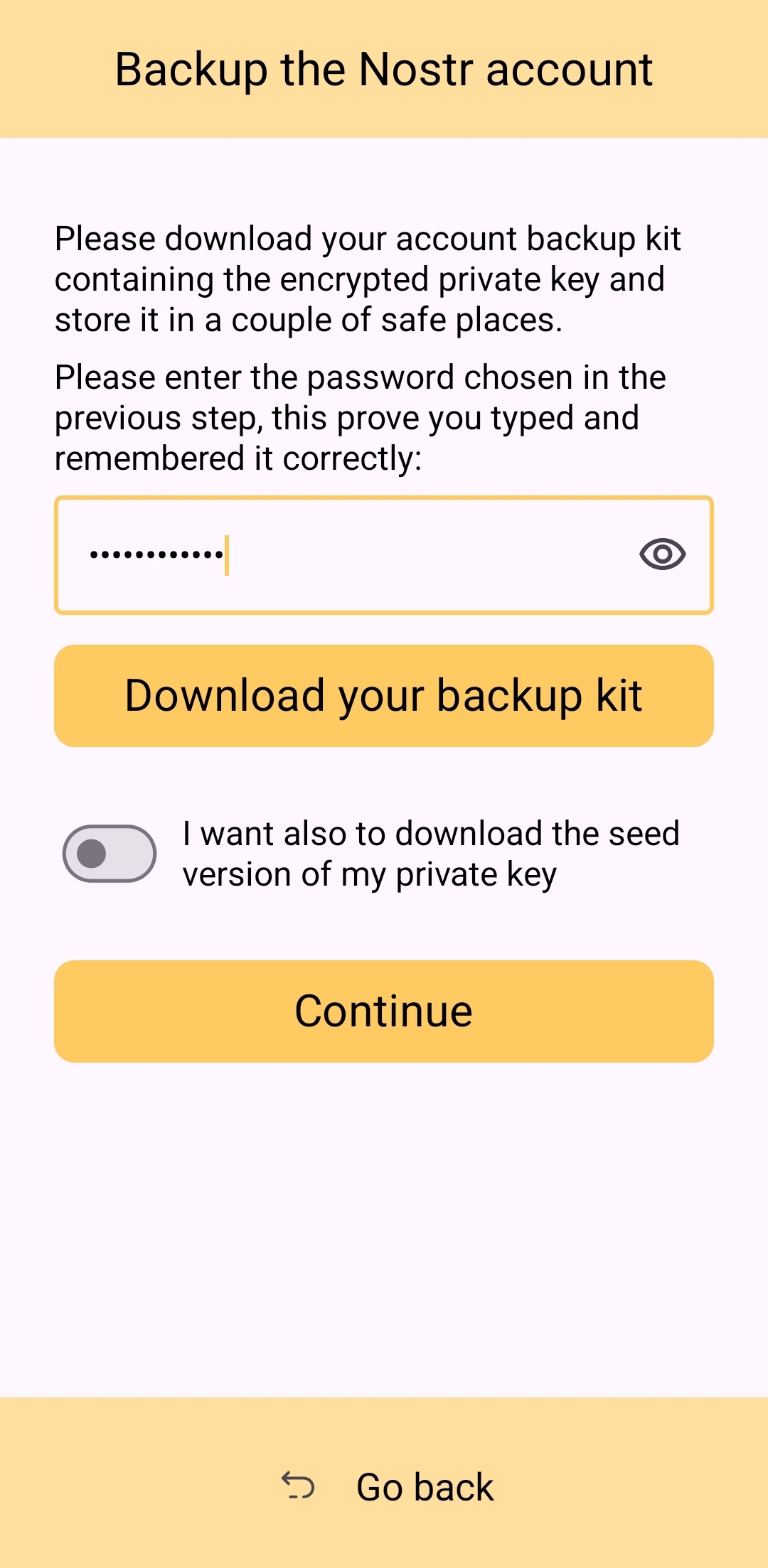

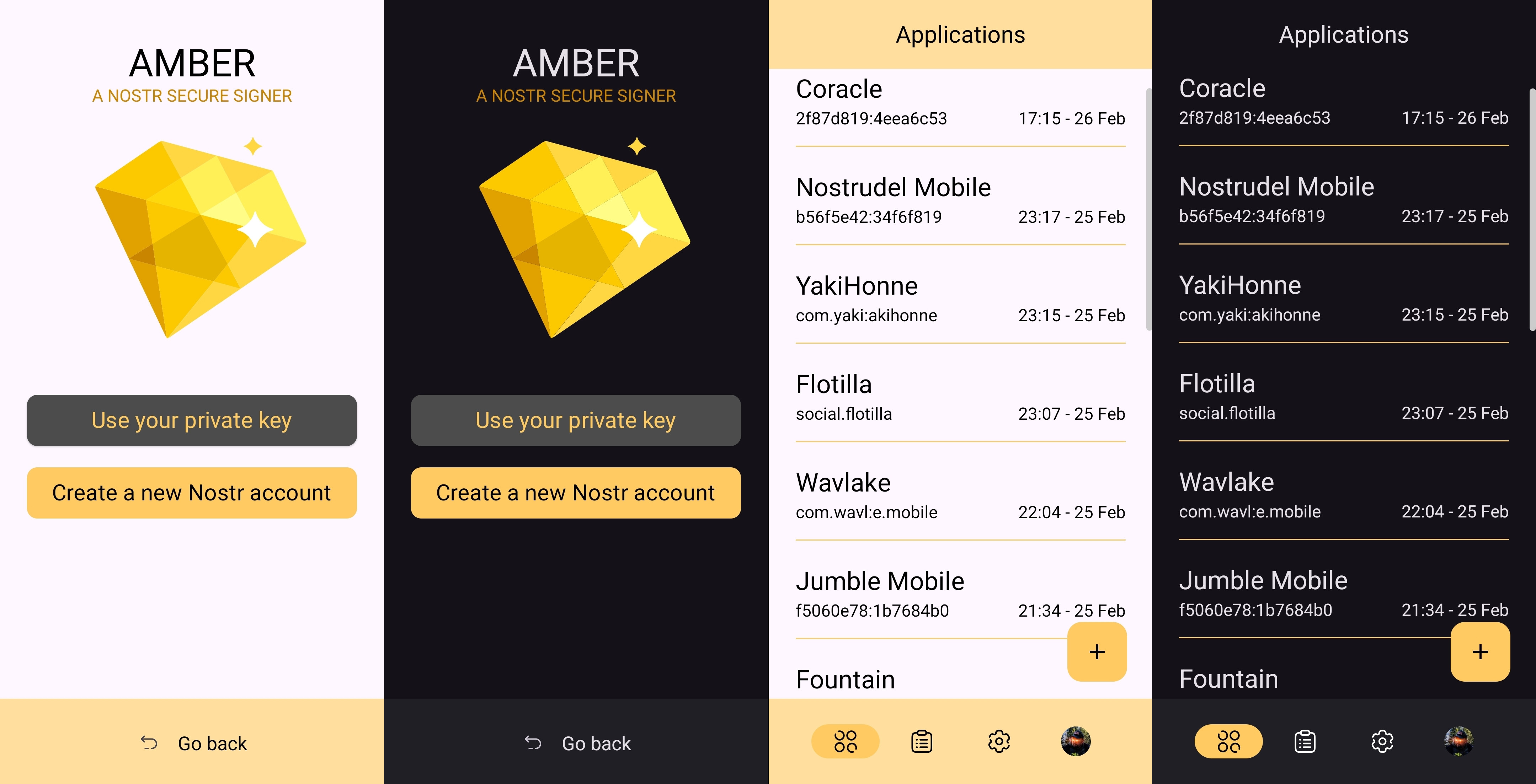

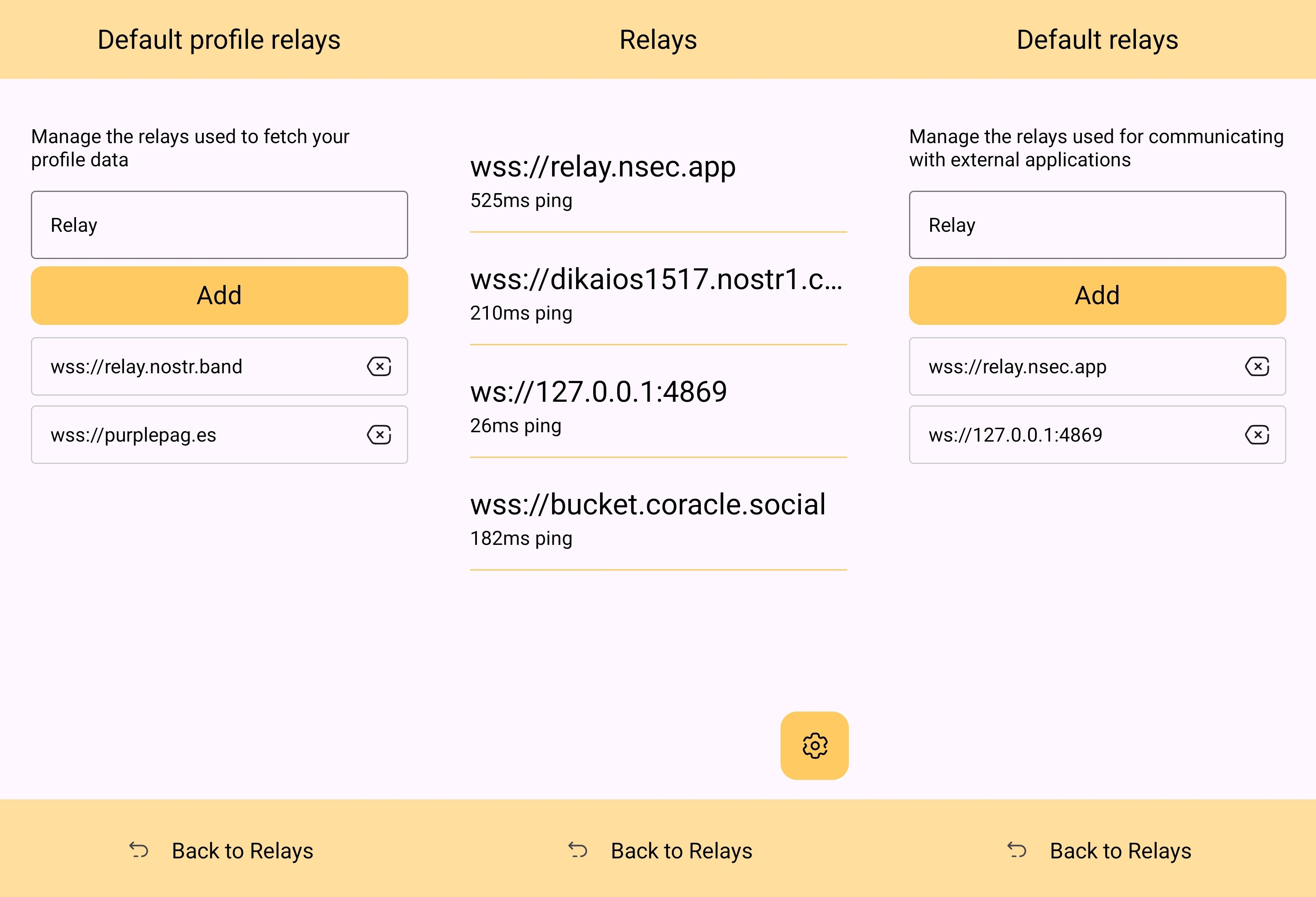

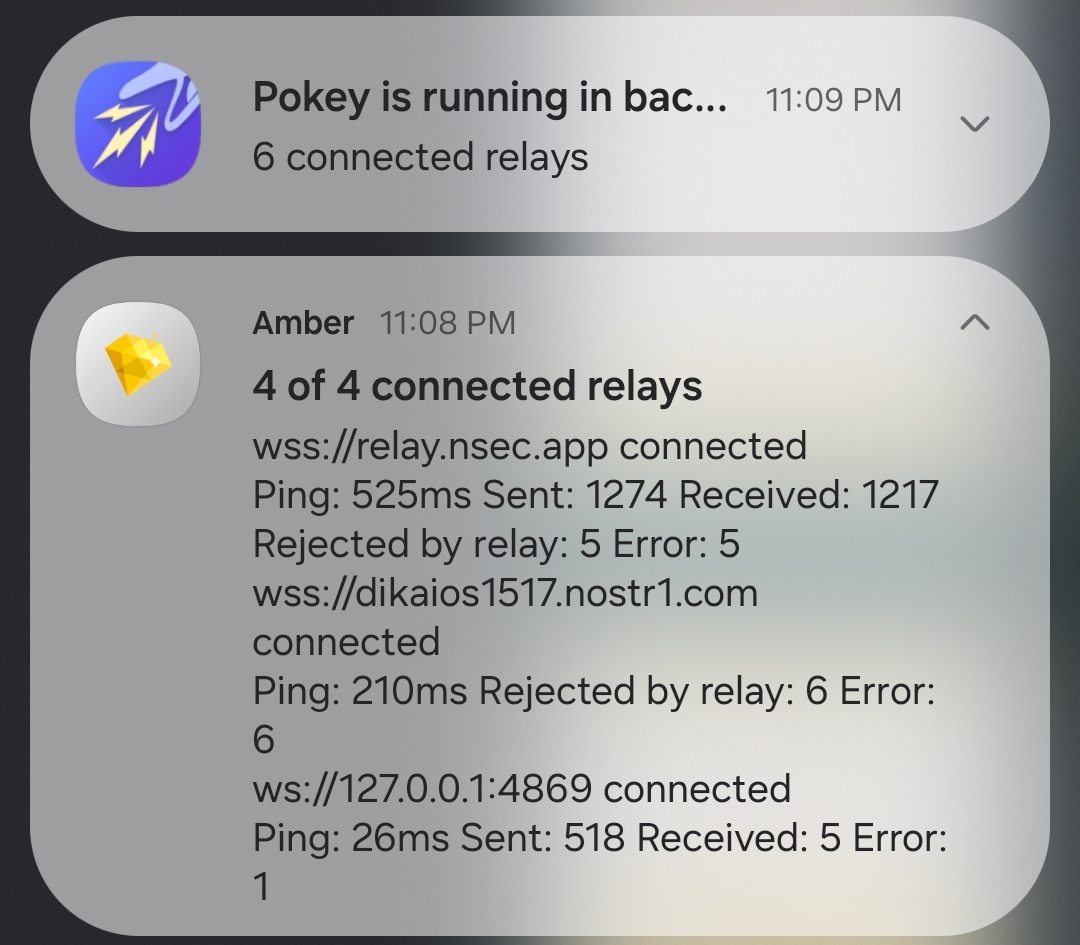

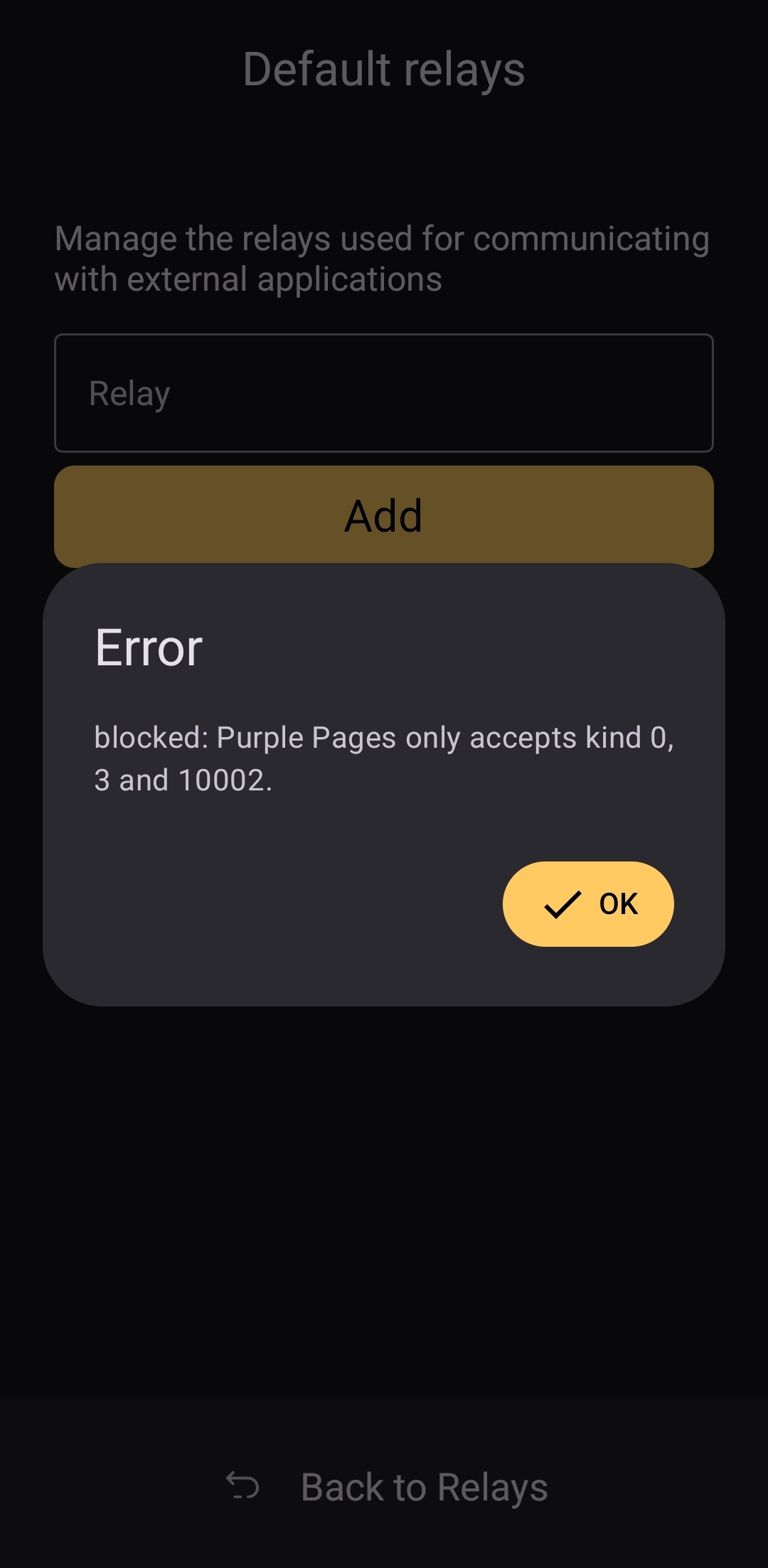

2025-03-08 22:51:54I recently switched from stock Android on my Pixel 8 Pro to GrapheneOS and transitioned from Authy to Aegis to move away from Big Tech and embrace open-source and privacy-focused alternatives. While Aegis offers local encrypted backups, I noticed it lacked external automatic sync, and I wanted to be sure that I could still access my 2FA tokens even if I lost my phone, without having to remember to back up Aegis externally every time I added a new 2FA entry.

Additionally, because many commands need to be run in Termux, I found it useful to use Scrcpy to control my Android device from my Ubuntu desktop. Scrcpy requires ADB and allows easy copy-paste functionality between Ubuntu and Android. I used ALT + V in Ubuntu scrcpy and then long-pressed the screen on my Pixel and selected 'Paste' to copy text easily. This is an optional but highly useful method for managing terminal commands efficiently.

This guide will walk you through setting up rclone and Termux:Boot to enable seamless Aegis backup automation on GrapheneOS. While I use GrapheneOS, this setup should work on most modern Android versions.

Prerequisites

Before starting, make sure you have:

- GrapheneOS installed on your Google Pixel Android device (Pixel 8 Pro in my case).

- Aegis Authenticator installed with automatic backup enabled.

- Proton Drive account ready.

- Obtainium installed or an alternative such as F-droid to manage Termux updates securely.

- Termux & Termux:Boot installed via Obtainium:

- Termux: https://github.com/termux/termux-app/releases

- Termux:Boot: https://github.com/termux/termux-boot/releases

- Scrcpy installed (optional, for easier command handling):

- Install on Ubuntu:

sudo apt install scrcpy - Ensure ADB is enabled on your Android device.

Step 1: Install Required Packages and Set Up the Backup Folder

Open Termux and install the required tools:

sh pkg update && pkg upgrade -y pkg install rclone inotify-tools termux-apiGrant storage permissions to Termux:

sh termux-setup-storageCreate the ProtonSync directory where all files to be backed up will be stored, including Aegis backups:

sh mkdir -p /storage/emulated/0/ProtonSync/Aegis/Ensure the directory exists:

sh ls /storage/emulated/0/ProtonSync/Aegis/If this returns an empty result (instead of an error), you are ready to proceed.

Step 2: Configure rclone for Proton Drive

Since August 2024, Proton Drive has been available as a dedicated backend in rclone (official documentation). However, this integration is still evolving, as it relies on a proton-api-bridge that is under active development.

Run:

sh rclone configFollow the prompts:

- Choose "n" for a new remote.

- Name it:

protondrive - Select Proton Drive from the list.

- Enter your Proton username and password.

- If 2FA is enabled, enter the current code from your authenticator app.

- Confirm and save the remote configuration.

Test the setup by listing files:

sh rclone lsd protondrive:If you see your Proton Drive folders, the connection works.

Step 3: Automate Sync with inotify-tools

We will set up a script to monitor new Aegis backup files and sync them instantly.

- Manually trigger a backup in Aegis first, to ensure a file is created. You can do this in Aegis → Settings → Backups → Trigger backup.

- Create the sync script directly in the Termux:Boot directory:

sh mkdir -p ~/.termux/boot/ nano ~/.termux/boot/watch_protonsync.sh- Add this content:

```sh

!/data/data/com.termux/files/usr/bin/bash

inotifywait -m -r -e close_write,moved_to,create /storage/emulated/0/ProtonSync/Aegis/ --format '%w%f' | while read file do rclone sync /storage/emulated/0/ProtonSync/Aegis/ protondrive:/ProtonSync/Aegis/ -P done ```

- Save and exit (

CTRL + X,Y,ENTER). - Make it executable:

sh chmod +x ~/.termux/boot/watch_protonsync.shRun it manually to test:

sh bash ~/.termux/boot/watch_protonsync.sh &Now, whenever Aegis creates a new backup file, it will automatically sync to Proton Drive.

Step 4: Test Auto-Start with Termux:Boot

- Reboot your phone.

- Open Aegis and manually trigger a backup (

Settings → Backups → Trigger backup). - Check Proton Drive under

/ProtonSync/Aegis/to confirm that the new backup appears.

If the file is there, the automation works! 🎉 I would advice to keep an eye regularly at the Proton Drive to check if the automation is still working.

-

@ 2cb8ae56:84d30cba

2025-03-08 22:41:58

@ 2cb8ae56:84d30cba

2025-03-08 22:41:58[3]

[4]

[5]

[6]

[7]

[8]

[9]

[10]

[11]

[12]

[13]

[14]

[15]

[16]

[17]

[18]

[19]

[20]

[21]

[22]

[23]

[24]

[25]

[26]

[27]

[28]

[29]

[30]

[31]

[32]

[33]

[34]

[35]

[36]

[37]

[38]

[39]

[40]

[41]

[42]

[43]

[44]

[45]

[46]

[47]

[48]

[49]

[50]

[51]

[52]

[53]

[54]

[55]

[56]

[57]

[58]

[59]

[60]

[61]

[62]

[63]

[64]

-

@ 15125b37:e89877f5

2025-03-08 22:01:15

@ 15125b37:e89877f5

2025-03-08 22:01:15The story of Bitcoin from genesis to exodus

Welcome to "Becoming One with Bitcoin," a new series inviting you to delve deep into the captivating story of Bitcoin. From its origins in the Cypherpunk movement, the technology that set the stage, to its present and future potential—this journey will unravel Bitcoin’s past, present, and future. Follow closely to explore how this revolutionary digital currency came to be and why it continues to shape the world.

The History of Bitcoin, Part 1: From Cypherpunks to the Genesis Block

The Story of Bitcoin: The Road to the Genesis Block

The creation of Bitcoin in 2009 was not an isolated event but the result of decades of innovation, idealism, and frustration. Bitcoin’s emergence during the depths of the Great Recession and the financial collapse that triggered it was no coincidence. Many of the technologies and philosophies that formed the backbone of Bitcoin had been developed by visionaries and cryptography enthusiasts, but it was the perfect storm of economic turmoil that set the stage for Bitcoin’s release. Let’s explore the journey that led to Bitcoin’s genesis block, from the early work of the Cypherpunks to the breakdown of trust in traditional financial institutions.

The Cypherpunks and the Push for Privacy

Bitcoin’s roots extend back to the Cypherpunk movement of the late 1980s and early 1990s. Cypherpunks, such as David Chaum, Eric Hughes, Tim May, and others, were privacy advocates concerned with government and corporate power over personal information. The Cypherpunks believed cryptography could protect privacy and enable individual freedom in an increasingly digital world. They championed the idea that technology—specifically cryptographic code—could ensure privacy, autonomy, and even freedom from centralized control. Tim May’s Crypto Anarchist Manifesto (1992) laid out a vision for an unregulated digital space where individuals could interact freely, a powerful idea that became a driving force for the movement.

Digital Currency Projects Before Bitcoin

From the 1990s to the early 2000s, Cypherpunks and computer scientists tried to build digital currencies that could offer users privacy and independence, but most of these projects faced major technical or regulatory challenges. Here are some of the key projects that paved the way for Bitcoin:

-

David Chaum’s DigiCash – David Chaum, a cryptographer and Cypherpunk, launched DigiCash in the late 1980s. This private, digital currency used Chaum’s cryptographic protocol to allow users to make secure, untraceable transactions. However, DigiCash was centralized, depending on trust in Chaum’s company, which eventually went bankrupt.

-

Hashcash by Adam Back – In 1997, Adam Back introduced Hashcash, a proof-of-work system aimed at reducing email spam. Hashcash required users to expend computational power to “stamp” emails, making spamming expensive but legitimate communication cheap. This concept would later become Bitcoin’s mining mechanism.

-

B-money by Wei Dai – In 1998, Wei Dai proposed B-money, an anonymous, distributed electronic cash system. Though never implemented, B-money included ideas like decentralized consensus and pseudonymous identities, concepts later foundational to Bitcoin.

-

Bit Gold by Nick Szabo – Nick Szabo created Bit Gold in 2005, a system where users solved cryptographic puzzles and linked each solution to the previous one, forming a “chain” of transactions. Though Bit Gold never launched, Szabo’s work significantly influenced Bitcoin’s proof-of-work blockchain.

While each of these projects contributed to the understanding of cryptographic currency, they lacked the cohesion to achieve true decentralization and resilience.

The Financial Crisis and a Perfect Storm

Bitcoin’s release in January 2009 came as the world was reeling from the 2008 financial crisis. Years of risky mortgage lending and poor regulatory oversight had led to the collapse of the U.S. housing bubble, which spiraled into a full-scale financial meltdown. When major financial institutions like Lehman Brothers failed, stock markets crashed, and millions of people lost their homes and jobs, the world entered what would become known as the Great Recession.

In response, governments stepped in with massive bank bailouts, injecting trillions into the financial system to prevent a complete collapse. However, the bailouts sparked widespread anger as it became clear that the financial elite had been insulated from the consequences of their actions while average citizens bore the economic fallout. Many people saw the bailout as a betrayal, eroding trust in banks, corporations, and governments. The crisis was compounded by a rise in inflation as central banks printed money to stimulate the economy, reducing the purchasing power of the average person.

This situation created fertile ground for an alternative financial system, one that didn’t rely on banks or governments and was resistant to inflation. Into this backdrop, Bitcoin emerged as a decentralized and limited-supply currency, a stark contrast to the inflating fiat currencies and the bailout culture of centralized finance.

The Key Technologies Behind Bitcoin

Several innovations allowed Bitcoin to succeed where previous digital currencies had failed by integrating them into a resilient, secure system:

-

Cryptographic Hash Functions – Cryptographic hashes ensure Bitcoin transactions are secure, irreversible, and tamper-resistant. SHA-256, the hash function used in Bitcoin, transforms transaction data into fixed-length hashes, securing each block and linking it to the previous one in the blockchain.

-

Proof-of-Work (PoW) – Borrowed from Adam Back’s Hashcash, proof-of-work ensures new blocks in Bitcoin’s blockchain are legitimate by requiring miners to solve complex puzzles. PoW prevents double-spending and spam attacks, making it costly for bad actors to manipulate the blockchain.

-

Digital Signatures (ECDSA) – Bitcoin relies on the Elliptic Curve Digital Signature Algorithm (ECDSA) to authenticate users and secure transactions. Public and private keys enable users to sign transactions, proving ownership without revealing private keys.

-

P2P Network Architecture – Bitcoin uses a decentralized peer-to-peer network to distribute the blockchain. Bitcoin nodes independently verify transactions, maintaining a censorship-resistant ledger that can’t be shut down by any single authority.

Satoshi Nakamoto and the Genesis Block

In 2008, Satoshi Nakamoto published the Bitcoin whitepaper, introducing Bitcoin as a “peer-to-peer electronic cash system” designed to fix the flaws of traditional financial systems. Using cryptographic principles, Nakamoto created a currency that could operate without centralized control, allowing users to send and receive payments directly.

On January 3, 2009, Satoshi mined Bitcoin’s first block, the genesis block, embedding a now-famous message: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.” This line, referencing a headline from The Times newspaper, was a critique of the traditional financial system, reflecting Bitcoin’s intent as a resilient alternative to inflation-prone fiat currencies and bailout-dependent banks. In this moment, the genesis block symbolized a vision for financial sovereignty, with Bitcoin offering a form of money that anyone, anywhere, could use free from reliance on central banks.

In Summary

The story of Bitcoin is one of resilience, innovation, and idealism, shaped by cryptographers, computer scientists, and privacy advocates who were determined to create a decentralized, censorship-resistant currency. Its timing, born in the aftermath of the financial crisis, was pivotal. Bitcoin was not just a technological breakthrough but a statement against the status quo of centralized finance. As we trace Bitcoin’s journey from the Cypherpunk movement to the genesis block, it becomes clear that Bitcoin’s impact is not just about technology; it’s about the vision of financial freedom and privacy in an age of uncertainty and inflation.

-

-

@ 401014b3:59d5476b

2025-03-08 20:14:04

@ 401014b3:59d5476b

2025-03-08 20:14:04Alright, football lunatics, it’s March 2025, and we’re storming into the AFC West like it’s a saloon brawl with whiskey on the line. Free agency’s a lawless frontier, the draft’s a roll of the dice, and this division’s always a mix of firepower and flops. The Chiefs owned 2024, the Chargers turned heads, the Broncos showed grit, and the Raiders… uh, raided their own dignity. Let’s slap some records on this rodeo and see who’s got the guts to lasso the crown. Saddle up, fam—here we go.

Kansas City Chiefs: 12-5 – Mahomes’ Dynasty Rolls On

The Chiefs were the AFC’s big dogs in 2024, and 2025’s no different. Patrick Mahomes is still the NFL’s cheat code—Xavier Worthy’s a speed demon, Travis Kelce’s defying Father Time, and the O-line’s a fortress. That defense—Chris Jones, Trent McDuffie—keeps QBs sweating, but free agency’s a buzzkill. The WR depth’s thin. Still, Mahomes magic lands ‘em at 12-5, division champs. KC’s the team everyone loves to hate—and they keep winning anyway.

Los Angeles Chargers: 10-7 – Harbaugh’s Grit Pays Off

The Chargers flipped the script in 2024 under Jim Harbaugh, and they’re building steam. Justin Herbert’s a cannon-armed freak, Ladd McConkey’s emerging, and J.K. Dobbins (if healthy) keeps the run game humming. The defense—Joey Bosa, Derwin James—is a problem when it’s clicking, but free agency looms. Khalil Mack’s getting old, and Asante Samuel Jr. might bolt. 10-7’s the vibe, snagging a wildcard. Harbaugh’s got ‘em believing—they’re legit playoff pests now.

Denver Broncos: 8-9 – Bo Nix’s Baby Steps

The Broncos showed fight in 2024 with rookie Bo Nix, and 2025’s a growth spurt. Nix has Courtland Sutton and Marvin Mims to sling it to, while Javonte Williams grinds the run game. That defense—Pat Surtain II, Zach Allen—is still nasty, but free agency could sting. Jonathon Cooper might cash out elsewhere, and the O-line needs juice. 8-9’s where they land—close, but not quite playoff-ready. Sean Payton’s cooking, but it’s not fully baked yet.

Las Vegas Raiders: 4-13 – Chaos in the Desert

The Raiders are the AFC West’s hot mess. No QB worth a damn (Aidan O’Connell? Please), Davante Adams bailed, and the run game’s a ghost town without Josh Jacobs. The defense—Maxx Crosby, Christian Wilkins—has some bite, but the roster’s a dumpster fire, and free agency won’t help. Tyree Wilson’s unproven, and the cap’s a nightmare. 4-13’s the brutal truth—they’re tanking for a draft savior. Vegas, baby, but not in a good way.

The Final Shootout

The AFC West in 2025 is a Chiefs cakewalk with a Charger chaser. The Chiefs (12-5) lock the title because Mahomes is Mahomes, the Chargers (10-7) snag a wildcard with Harbaugh’s mojo, the Broncos (8-9) tease progress, and the Raiders (4-13) crash and burn. Free agency’s the wild card—lose a star, you’re toast; keep ‘em, you’re riding high. Hit me on Nostr when I screw this up, but this is my AFC West sermon. Let’s roll, degenerates.

-

@ 8671a6e5:f88194d1

2025-03-08 18:55:02

@ 8671a6e5:f88194d1

2025-03-08 18:55:02The ECB’s Tightrope Walk (2019–2025)

The European Central Bank (ECB) is caught between a rock and a hard place these past years (2019–2025). On one hand, it’s failing its core mission: keeping the Euro stable with a 2% inflation target. On the other, trust in the currency—and the EU itself—is crumbling fast. You can see it in the sinking European bond market and the growing crowd of voters backing anti-EU politicians.

As usual, the ECB sticks to its playbook: blending marketing with “innovations,” spicing it up with anti-crypto MiCA rulings on Bitcoin, and blaming everyone—Putin, Trump, Elon, China, the wind, the moon—for their woes. Since the financial crisis, it’s pumped 2.3 trillion euros into the economy, money conjured out of thin air for market purchases (quantitative easing). The result? Our wallets feel the pinch as purchasing power tanks, with inflation bouncing between 2.1% and 20%, depending on which figures you still trust. No shock there: for every euro circulating in 2002, there are now five.

Meanwhile, Europe’s scrambling to keep up appearances, led by a parliament of nitwits who treat error-riddled high school essays from the Dutch Central Bank as gospel—or print 1 trillion euros (!) to prop up their debt and war cycle. These politicians aren’t too dumb to spot the mistakes; they just care more about ramming through the “narrative,” shaky or not.

The Bitcoin Smokescreen Take the attack on Bitcoin, always nagging about its “energy use”—a standard they never apply elsewhere. Good thing, too; electricity isn’t “good” or “evil.” The real play? Clearing the path for a “digital euro,” cooked up by sly financial institutions hawking their “Aldi Bitcoin” via corporate blockchains.

Digital Euro: The Shiny Trap

Advantages I’ll grudgingly list a few perks, though they’re skin-deep: faster transactions than today’s sluggish bank transfers, digital payments (QR codes), and a unified standard across Europe. These tiny upgrades—great for marketing—don’t outweigh the massive downsides but do beat the current patchwork of payment systems. That’s the good news, and it ends here.

Disadvantages

The cons list is long, so I’ll hit the three worst:

Permission-Coin Nightmare You’ll need approval from some authority (or commercial bank) to receive, spend, or hold it. A 50€ note moves from A to B, no questions asked—cash has no name, needs no permission. Pocket money for your kid, a coin for a beggar, or paying for a used PlayStation: cash flows free. They want that gone. Bitcoin’s beauty mirrors cash but better—unconfiscatable, A to B, no permission needed, saint or crook. That’s the bedrock of a working social-economic system. Sorry, EU pious elite, but white, gray, and black economies will always exist—check your own subsidies; not everything’s clean. Worse, it threatens wage sanctity, potentially reviving forced spending schemes banned since 1887 (in Belgium, at least). Workers once got paid in cash and expiring factory vouchers—a disaster now illegal.

Programmable Tokens A digital euro (CBDC) turns money into controllable tokens, ripe for expiry dates, discounts, or restrictions. Big banks are testing this, aping Bitcoin’s gimmick but under total state control, endlessly minting “safe” tokens for their theft-driven consumer economy. Services like Corda are set to link your ID via eIDAS (Europe’s total-control digital identity surveillance) to these CBDC wallets. Your behavior won’t just be monitored—it’ll tie to fines or coin deductions. (link: https://r3.com/get-corda/ )

Total Control Coin Citizens lose on nearly all fronts. Recall the Belgian Franc-to-Euro shock (cheese sandwich: 40 francs to 1.2 euros, now 3+)? The digital euro rollout—likely hitting welfare recipients and civil servants (with little recourse) via a “gov-app” wallet around July 2025—will sting worse. You’ll get no real money, just controllable vouchers. The ECB won’t program the coins directly; they’ll let banks take the fall. If trust erodes (it will), they’ll blame “greedy banks” or “corrupt third parties.” Cash’s freedom—untraceable, unblockable—dies. The ECB gains tools: negative interest, forced loans, outright theft—all impossible with cash (unless they swap notes, which is slow and costly). Weaponized bank accounts already plague the EU; this makes them worse—shut down sans court order, targeting journalists, dissidents, anyone in the crosshairs.

This isn’t convenience—it’s power. And the ECB’s pushing it despite the euro’s instability. Fabio Panetta once said, “A digital euro would preserve the coexistence of safe central bank money and private money, ensuring sovereign money remains a monetary anchor” (Evolution or Revolution?, Feb 10, 2021). Stability’s key, yet they’re charging ahead anyway. (source)

Conclusion: The Great Heist The CBDC Digital Euro is the greatest theft in Europe since WWII. It’ll shred our freedom, warp market pricing, kill opposition, and chain us financially to the powerful—bank runs impossible. Citizens lose on 9/10 fronts… though payments will be quick. Trust in the Eurozone? It’ll erode faster, propped up only by nudging, marketing, and force.

Citizens will lose out on 9 out of 10 fronts… though, admittedly, payments will be quick.\ The loss in trust in the Eurozone even faster....

AVB\ \ tip if you like this

-

@ 378562cd:a6fc6773

2025-03-08 16:31:22

@ 378562cd:a6fc6773

2025-03-08 16:31:22The insurance industry is one of the most lucrative businesses in the world, built on a foundation of fear, deception, and manipulation. It presents itself as a guardian of financial security, promising protection in times of crisis. However, in practice, it operates like a government-backed extortion scheme, siphoning money from individuals and businesses while finding ways to avoid paying out claims.

Many people view insurance as a necessary evil—a required expense for responsible living. But very few stop to consider the true nature of the industry and how it functions not as a service, but as a well-oiled criminal machine designed to extract wealth from the population while delivering as little value as possible.

A Business Model Built on Exploiting Fear and Uncertainty Insurance companies do not sell a product in the traditional sense. You don’t receive something tangible in return for your payments. Instead, they sell you a promise that if something terrible happens, they will be there to cover the costs. However, that promise is deliberately wrapped in vague legalese, riddled with loopholes, and ultimately designed to benefit the insurer more than the insured.

To make this scam even more effective, insurance companies exploit human psychology, knowing that fear is one of the strongest motivators. They bombard people with relentless messaging about the catastrophic risks of being uninsured—the dangers of driving without auto insurance, the financial ruin of an unexpected hospital visit, or the devastation of losing a home to a fire or natural disaster. Ask your local insurance person (if you think they would give you an honest answer) how many full payouts they have had to give out due to a complete loss over the past year, 5 years, since they have been selling insurance. You'd be amazed at how few that number really is.

But it doesn’t stop there. Other industries have caught on to this fear-driven strategy and now use insurance as the perfect scapegoat to justify absurdly inflated prices. Hospitals, auto manufacturers, homebuilders, and repair services all point to “rising insurance costs” among other things as the reason for their skyrocketing fees. A simple medical procedure that should cost a few hundred dollars now runs into the several thousands because “that’s what insurance pays.” Auto repairs that used to be affordable are now exorbitant because shops know insurers will cover part of the bill. The end result? A rigged system where businesses get richer while consumers pay more, not just in premiums, but in every aspect of life.

The truth? Insurance companies thrive on the fact that most policyholders will never need to file a major claim, and if they do, the company will do everything in its power to pay out as little as possible—or nothing at all.

The Three D’s: Deny, Delay, Defend

When it comes time for an insurance company to actually pay out a claim, they rarely do so without a fight. Instead, they deploy the Three D’s strategy—a well-documented tactic used to minimize payouts and maximize profits:

Deny the Claim – The first step is simple: find a reason, any reason, to reject your claim.

Did you miss a payment once five years ago? Denied.

Did you fail to report a minor detail when signing up for your policy? Denied.

Did they discover a tiny, unrelated pre-existing condition? Denied.

Delay the Payout – If they can’t outright deny your claim, the next step is to make the process as slow and painful as possible.

Endless paperwork requirements. Requests for additional documentation (often things that were already submitted). Long hold times when you call for an update. The goal? Wear you down so you give up or settle for less.

Defend Against Lawsuits – If you decide to take legal action, the company will unleash an army of high-priced attorneys (another equally criminal organization with the same rules and laws applied) to fight you every step of the way.

They have billions of dollars available for legal fees. They will outlast you, knowing that most individuals lack the time, money, or energy to engage in a lengthy legal battle. This cycle repeats daily, with millions of policyholders becoming victims of the very companies they’ve paid to protect them. Where is the legal protection to protect you and me? NON-EXISTENT FARSE!

The Myth of the “Struggling” Insurance Agent Insurance agents like to present themselves as hard-working individuals, just trying to make a living. They’ll tell you they’re not getting rich and that they only want what’s best for you. But make no mistake—there is no such thing as a "barely making it" insurance agent in the long run. Mine is constantly on FB telling of this trip to Mexico or some exotic island somewhere or someplace I would love to take my family someday but can never seem to afford it time or money.

Agents work on commission, meaning their income is tied directly to the number of policies they sell. This creates an incentive to push as many policies as possible, often using manipulative tactics.

They will upsell coverage you don’t need by playing on your fears. They will gloss over exclusions and fine print, ensuring you only focus on the benefits, not the limitations. They will push you into long-term commitments that make it costly to switch or cancel and have the "adjustor" and "company policy" as an scapegoat to ease their own conscience.

Meanwhile, at the top, insurance executives make obscene amounts of money while denying rightful claims to hard-working individuals. The CEOs of major insurance companies bring in tens of millions of dollars per year, all while raising premiums and reducing coverage for their customers.

Mandatory Insurance: A Government-Backed Extortion Scheme One of the most damning aspects of the insurance industry is how it has embedded itself into government policy, ensuring that people have no choice but to participate in the system.

Car Insurance: Nearly every state requires auto insurance, even though the majority of drivers never file a claim. Meanwhile, insurance companies raise rates even if you never get into an accident. Health Insurance: The government forces people to buy into overpriced health insurance plans that come with absurd deductibles, making them nearly useless for many policyholders. Home Insurance: Mortgage lenders force homeowners to carry insurance, ensuring another guaranteed revenue stream for the industry. These laws do not exist to protect consumers—they exist to guarantee profits for the insurance companies.

Who Really Benefits? Follow the Money

The biggest winners in the insurance industry are not the policyholders that provide ALL THE MONEY into this criminal organization. The true beneficiaries are the corporate executives and shareholders, and it funnels down to the individual agents collecting all this for them.

The largest insurance companies report billions of dollars in annual profits—far more than they pay out in claims. Shouldn't they break even after a 'modest" salary for their service and time? Wouldn't THAT make more sense to a sensible human being? They invest premium dollars into the stock market, real estate, and other ventures, ensuring their wealth (the money YOU gave them) continues to grow.

They lobby politicians to maintain their stranglehold on the industry, keeping regulations in their favor and ensuring insurance remains legally required in most aspects of life. In short, insurance companies are not in the business of helping people—they are in the business of making money.

The Harsh Reality: A System Designed to Exploit Most people will pay hundreds of thousands of dollars in insurance premiums throughout their lifetime. And yet, when the time comes to actually use the coverage, many find themselves fighting an uphill battle against a rigged system.

Consider these facts:

Insurance companies cancel policies when people become too “expensive.” They increase rates after a single claim—even if it wasn’t your fault. They spend billions on advertising to attract new customers but fight tooth and nail to avoid paying out existing ones. At what point does this stop being a service and start being a scam?

Final Thoughts: A Broken System That Needs an Overhaul

The insurance industry presents itself as a pillar of stability, but in reality, it is one of the most corrupt, exploitative industries in the world. It thrives by preying on fear, avoiding payouts, and ensuring government policies force people to participate in the scam.

If the system was truly fair, it would operate like mutual aid, where all policyholders contribute and receive support as needed. But instead, it functions like organized crime, where the ones collecting the money hold all the power, and those in need are left scrambling for scraps.

Until a major upheaval occurs, there’s little the average person can do to fight back against this deeply entrenched system. The harsh reality is that there are far too many crooks, manipulators, and dishonest players at every level of society—from corporate executives to politicians, from insurance adjusters to business owners who have happily joined in on the scam.

Reading the fine print won’t stop an industry designed to change the rules whenever it benefits them. Shopping around is meaningless when every company is playing the same rigged game. Demanding transparency? Good luck—those in power have built entire careers around keeping consumers in the dark.

At the end of the day, insurance companies—and the industries that now use them as an excuse to inflate costs—are not here to protect you. They exist to extract wealth from you, and there’s no real way to “win” in a system engineered to ensure you always lose.

-

@ a012dc82:6458a70d

2025-03-08 10:26:25

@ a012dc82:6458a70d

2025-03-08 10:26:25The advent of Bitcoin introduced the world to a new form of digital gold, promising wealth and innovation through the marvels of blockchain technology. However, as the cryptocurrency landscape has evolved, so too have the implications of its underlying processes, particularly Bitcoin mining. In Granbury, Texas, a community has found itself at the intersection of technological advancement and environmental distress, embodying a growing concern over the real-world impacts of digital currencies. This narrative is not unique to Granbury but echoes across various locales globally, where the quest for digital wealth intersects with the fabric of everyday life, often at a cost not initially anticipated.

Table of Contents

-

The Heart of the Matter: Granbury's Plight

-

The Noise That Never Sleeps

-

A Community's Health at Stake

-

-

The Economics of Bitcoin Mining

- The Cost of Digital Wealth

-

Regulatory Responses and Community Action

- Seeking Solutions

-

The Future of Bitcoin Mining and Community Well-be …

- Sustainable Alternatives

-

Conclusion

-

FAQs

The Heart of the Matter: Granbury's Plight

Granbury, a small town in Texas, has become an unwilling host to the cacophony of Bitcoin mining. A local power plant, repurposed for the energy-intensive task of mining Bitcoin, has disrupted the lives of residents with its relentless noise. The sound, likened to the continuous roar of jet engines, penetrates the tranquility of this community, leaving in its wake sleepless nights, health issues, and a disturbed local ecosystem. This intrusion represents a broader dilemma faced by communities worldwide, where the benefits of technological progress clash with the sanctity of personal and environmental well-being.

The Noise That Never Sleeps

Cheryl Shadden, a nurse anesthetist living in Granbury, describes the noise as akin to sitting on an airport runway with jets taking off in succession. The constant hum has made simple pleasures like conversations on the back patio impossible, highlighting the intrusive nature of the mining operation. This relentless noise pollution is not just a minor inconvenience but a significant disruption to daily life, affecting everything from personal relationships to the simple enjoyment of one's home. The situation in Granbury sheds light on the often-overlooked consequences of industrial activities, prompting a reevaluation of what progress means at the expense of quality of life.

A Community's Health at Stake

The incessant din has not only stolen peace but has also been linked to physical ailments among the residents. Reports of migraines, sleep disturbances, and even wildlife fleeing the area paint a grim picture of the toll taken on the community's health and well-being. These health issues are a stark reminder of the environmental cost of our digital age, where the pursuit of innovation can sometimes lead to unforeseen consequences. The plight of Granbury's residents underscores the need for a balanced approach to technological development, one that considers the health and happiness of communities as a measure of success.

The Economics of Bitcoin Mining

Bitcoin mining, the process by which new bitcoins are entered into circulation and transactions are verified, is notoriously energy-hungry. It relies on a proof-of-work system that requires extensive computational power and, consequently, a significant amount of electricity. Texas, with its cheap energy and land, has become a global hub for these operations, attracting companies with the promise of low overhead costs. This economic boon, however, comes with its own set of challenges, as the environmental and social costs begin to surface in communities like Granbury.

The Cost of Digital Wealth

While Bitcoin mining has been lauded for its potential economic benefits, including job creation and investment, the case of Granbury reveals a darker side. The operation consumes approximately 2,100 megawatts of Texas's power supply, raising concerns about carbon and noise pollution, as well as increased utility bills for consumers. The juxtaposition of economic gain against environmental and social loss presents a complex dilemma. It raises critical questions about the sustainability of such ventures and the true cost of digital wealth in the age of cryptocurrency.

Regulatory Responses and Community Action

The situation in Granbury has sparked a dialogue on the need for regulatory oversight. Texas state law currently offers little recourse for noise pollution, with the maximum penalty for exceeding noise limits set at a mere $500 fine. This inadequacy has prompted local officials and residents to seek alternative solutions, including the construction of a sound barrier wall, which, paradoxically, has amplified the noise in some areas. The struggle for regulatory solutions reflects a broader challenge in governing emerging technologies and industries, where existing frameworks often fall short of addressing new and unforeseen impacts.

Seeking Solutions

In response to growing complaints, Marathon Digital Holdings, the company behind the Granbury mining operation, has pledged to conduct a sound study and take over full control of the mine to address community concerns. However, the effectiveness of these measures remains to be seen, and the community's frustration is palpable. This scenario highlights the importance of corporate responsibility and the need for companies to engage with and address the concerns of the communities in which they operate. It also underscores the potential for innovative solutions to mitigate the negative impacts of such operations, fostering a more harmonious relationship between industry and community.

The Future of Bitcoin Mining and Community Well-being

The case of Granbury serves as a cautionary tale of the unintended consequences of Bitcoin mining. As the cryptocurrency industry continues to grow, the balance between technological progress and environmental sustainability becomes increasingly precarious. This tension between innovation and well-being calls for a reimagined approach to technological development, one that prioritizes the health of our communities and the planet.

Sustainable Alternatives

The outcry from Granbury and similar communities across the country underscores the urgent need for sustainable mining practices. Alternatives such as proof-of-stake, a less energy-intensive consensus mechanism, offer a glimpse into a possible future where digital currencies can coexist with environmental stewardship. These alternatives not only represent a technical evolution but also a philosophical shift towards a more sustainable and equitable digital economy.

Conclusion

The story of Granbury is a microcosm of a larger debate on the impact of digital currencies on our physical world. As we venture further into the age of cryptocurrency, the challenge lies in harnessing its potential for economic growth without sacrificing the health and well-being of our communities. The digital gold rush must not lead to audible grief; instead, it should pave the way for innovations that are both economically beneficial and environmentally responsible. The journey from digital gold to a future where technology and nature harmonize requires not just technological innovation, but a collective commitment to redefining progress.

FAQs

How does Bitcoin mining affect local communities? Local communities, like Granbury, can experience noise pollution, increased electricity consumption leading to higher utility bills, potential environmental impacts due to increased energy use, and health issues among residents such as sleep disturbances and migraines.

What are the economic benefits of Bitcoin mining? Economic benefits include job creation, investment in local infrastructure, and increased demand for local services. However, these benefits often come with environmental and social costs that need to be carefully managed.

What measures are being taken to address the concerns of Granbury residents? Measures include the construction of sound barrier walls, conducting sound studies, and engaging with the community to find solutions. Companies like Marathon Digital Holdings are also taking steps to take over full control of mining operations to better address noise issues.

Are there sustainable alternatives to proof-of-work Bitcoin mining? Yes, alternatives such as proof-of-stake (PoS) are being explored and implemented in various cryptocurrencies. PoS is less energy-intensive and could potentially offer a more sustainable option for securing blockchain networks without the significant environmental impact of traditional mining.

How is the Texas government responding to the issue of Bitcoin mining noise pollution? The response includes monitoring noise levels and exploring legal and regulatory measures to manage the impact of mining operations. However, existing laws offer limited recourse, and there is ongoing discussion about the need for more effective regulations.

That's all for today

If you want more, be sure to follow us on:

NOSTR: croxroad@getalby.com

Instagram: @croxroadnews.co/

Youtube: @thebitcoinlibertarian

Store: https://croxroad.store

Subscribe to CROX ROAD Bitcoin Only Daily Newsletter

https://www.croxroad.co/subscribe

Get Orange Pill App And Connect With Bitcoiners In Your Area. Stack Friends Who Stack Sats link: https://signup.theorangepillapp.com/opa/croxroad

Buy Bitcoin Books At Konsensus Network Store. 10% Discount With Code “21croxroad” link: https://bitcoinbook.shop?ref=21croxroad

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.

-

-

@ da0b9bc3:4e30a4a9

2025-03-08 07:03:33

@ da0b9bc3:4e30a4a9

2025-03-08 07:03:33Hello Stackers!

Welcome on into the ~Music Corner of the Saloon!

A place where we Talk Music. Share Tracks. Zap Sats.

So stay a while and listen.

🚨Don't forget to check out the pinned items in the territory homepage! You can always find the latest weeklies there!🚨

🚨Subscribe to the territory to ensure you never miss a post! 🚨

originally posted at https://stacker.news/items/907271

-

@ 220522c2:61e18cb4

2025-03-08 06:19:30

@ 220522c2:61e18cb4

2025-03-08 06:19:30Comet is available on Linux

The Comet longform desktop app is available as an AppImage for Linux.

linux

-

@ 291c75d9:37f1bfbe

2025-03-08 04:09:59

@ 291c75d9:37f1bfbe

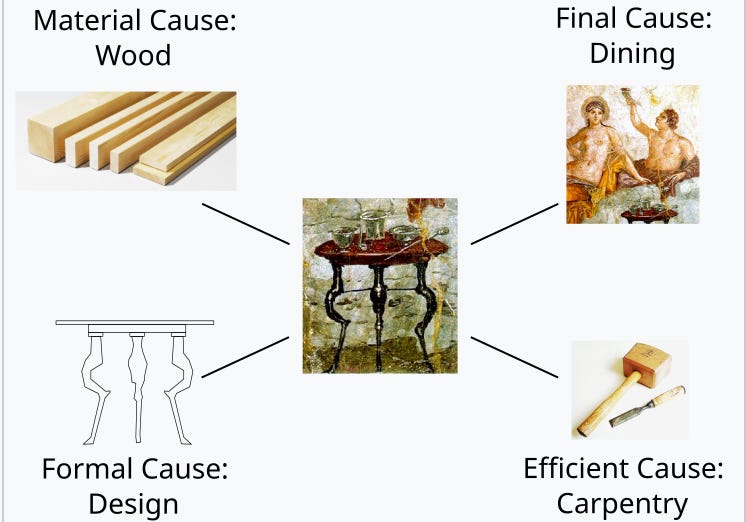

2025-03-08 04:09:59In 1727, a 21-year-old Benjamin Franklin gathered a dozen men in Philadelphia for a bold experiment in intellectual and civic growth. Every Friday night, this group—known as the Junto, from the Spanish juntar ("to join")—met in a tavern or private home to discuss "Morals, Politics, or Natural Philosophy (science)." Far from a casual social club, the Junto was a secret society dedicated to mutual improvement, respectful discourse, and community betterment. What began as a small gathering of tradesmen and thinkers would leave a lasting mark on Franklin’s life and colonial America.

Printers are educated in the belief that when men differ in opinion, both sides ought equally to have the advantage of being heard by the public, and that when Truth and Error have fair play, the former is always an overmatch for the latter. - Benjamin Franklin

The Junto operated under a clear set of rules, detailed by Franklin in his Autobiography:

"The rules that I drew up required that every member, in his turn, should produce one or more queries on any point of Morals, Politics, or Natural Philosophy, to be discuss’d by the company; and once in three months produce and read an essay of his own writing, on any subject he pleased. Our debates were to be under the direction of a president, and to be conducted in the sincere spirit of inquiry after truth, without fondness for dispute, or desire of victory; and, to prevent warmth [heatedness], all expressions of positiveness in opinions, or direct contradiction, were after some time made contraband and prohibited under small pecuniary penalties [monetary fines]."

These guidelines emphasized collaboration over competition. Members were expected to contribute questions or essays, sparking discussions that prioritized truth over ego. To keep debates civil, the group even imposed small fines for overly assertive or contradictory behavior—a practical nudge toward humility and open-mindedness. (Yes, I believe that is an ass tax!)

Rather than admitting new members, Franklin encouraged existing ones to form their own discussion groups. This created a decentralized network of groups ("private relays," as I think of them), echoing the structure of modern platforms like NOSTR—while preserving the Junto’s exclusivity and privacy.

From the beginning, they made it a rule to keep these meetings secret, without applications or admittance of new members. Instead, Franklin encouraged members to form their own groups—in a way acting as private relays of sorts. (I say "private" because they continued to keep the Junto secret, even with these new groups.)

Membership: A Diverse Circle United by Values

The Junto’s twelve founding members came from varied walks of life—printers, surveyors, shoemakers, and clerks—yet shared a commitment to self-improvement. Franklin, though the youngest (around 21 when the group formed), led the Junto with a vision of collective growth. To join, candidates faced a simple vetting process, answering four key questions:

- Have you any particular disrespect for any present members? Answer: I have not.

- Do you sincerely declare that you love mankind in general, of what profession or religion soever? Answer: I do.

- Do you think any person ought to be harmed in his body, name, or goods, for mere speculative opinions, or his external way of worship? Answer: No.

- Do you love truth for truth’s sake, and will you endeavor impartially to find and receive it yourself and communicate it to others? Answer: Yes.

These criteria reveal the Junto’s core values: respect, tolerance, and an unwavering pursuit of truth. They ensured that members brought not just intellect but also character to the table—placing dialogue as the priority.

One should also note the inspiration from the "Dry Club" of John Locke, William Popple, and Benjamin Furly in the 1690s. They too required affirmation to:

- Whether he loves all men, of what profession or religion soever?

- Whether he thinks no person ought to be harmed in his body, name, or goods, for mere speculative opinions, or his external way of worship?

- Whether he loves and seeks truth for truth’s sake; and will endeavor impartially to find and receive it himself, and to communicate it to others?

And they agreed: "That no person or opinion be unhandsomely reflected on; but every member behave himself with all the temper, judgment, modesty, and discretion he is master of."

The Discussions: 24 Questions to Spark Insight

Franklin crafted a list of 24 questions to guide the Junto’s conversations, ranging from personal anecdotes to civic concerns. These prompts showcase the group’s intellectual breadth. Here are some of my favorites:

Hath any citizen in your knowledge failed in his business lately, and what have you heard of the cause? Have you lately heard of any citizen’s thriving well, and by what means? Do you know of any fellow citizen who has lately done a worthy action, deserving praise and imitation? Do you think of anything at present in which the Junto may be serviceable to mankind, their country, friends, or themselves? Have you lately observed any defect in the laws of your country, which it would be proper to move the legislature for an amendment? Do you know of any deserving young beginner lately set up, whom it lies in the power of the Junto any way to encourage?

(Read them all here.)

Note the keen attention to success and failure, and the reflection on both. Attention was often placed on the community and individual improvement beyond the members of the group. These questions encouraged members to share knowledge, reflect on virtues and vices, and propose solutions to real-world problems. The result? Discussions that didn’t just end at the tavern door but inspired tangible community improvements.

The Junto’s Legacy: America’s First Lending Library

One of the Junto’s most enduring contributions to Philadelphia—and indeed, to the American colonies—was the creation of the first lending library in 1731. Born from the group’s commitment to mutual improvement and knowledge-sharing, this library became a cornerstone of public education and intellectual life in the community.

The idea for the library emerged naturally from the Junto’s discussions. Members, who came from diverse backgrounds but shared a passion for learning, recognized that their own access to books was often limited and costly—and they referred to them often. To address this, they proposed pooling their personal collections to create a shared resource. This collaborative effort allowed them—and eventually the broader public—to access a wider range of books than any individual could afford alone.

The library operated on a simple yet revolutionary principle: knowledge should be available to all, regardless of wealth or status. By creating a lending system, the Junto democratized access to information, fostering a culture of self-education and curiosity. This was especially significant at a time when books were scarce and formal education was not universally accessible.

The success of the Junto’s library inspired similar initiatives across the colonies, laying the groundwork for the public library system we know today. It also reflected the group’s broader mission: to serve not just its members but the entire community. The library became a symbol of the Junto’s belief in the power of education to uplift individuals and society alike.

With roots extending back to the founding of the Society in 1743, the Library of the American Philosophical Society houses over thirteen million manuscripts, 350,000 volumes and bound periodicals, 250,000 images, and thousands of hours of audiotape. The Library’s holdings make it one of the premier institutions for documenting the history of the American Revolution and Founding, the study of natural history in the 18th and 19th centuries, the study of evolution and genetics, quantum mechanics, and the development of cultural anthropology, among others.

The American Philosophical Society Library continues today. I hope to visit it myself in the future.

Freedom, for Community

Comparing the Junto to Nostr shows how the tools of community and debate evolve with time. Both prove that people crave spaces to connect, share, and grow—whether in a colonial tavern or a digital relay. Yet their differences reveal trade-offs: the Junto’s structure offered depth and focus but capped its reach, while Nostr’s openness promises scale at the cost of order.

In a sense, Nostr feels like the Junto’s modern echo—faster, bigger, and unbound by gates or rules. Franklin might admire its ambition, even if he’d raise an eyebrow at its messiness. For us, the comparison underscores a timeless truth: no matter the medium, the drive to seek truth and build community endures.

The Autobiography of Benjamin Franklin (1771–1790, pub. 1791)

http://www.benjamin-franklin-history.org/junto-club/

Benjamin Franklin, Political, Miscellaneous, and Philosophical Pieces, ed. Benjamin Vaughan (London: 1779), pp. 533–536.

"Rules of a Society" in The Remains of John Locke, Esq. (1714), p. 113

npubpro

-

@ 220522c2:61e18cb4

2025-03-08 03:51:09

@ 220522c2:61e18cb4

2025-03-08 03:51:09Enable trackpad pinch zoom for Brave on Linux

-

Open Brave: Launch the Brave browser.

-

Access Flags: Type brave://flags in the address bar and press Enter.

-

Search for Ozone Platform:In the search bar at the top, type ozone.

-

Find

Preferred Ozone platform -

Set it to

Wayland -

Done

-

-

@ c3ae4ad8:e54d46cb

2025-03-08 03:38:15

@ c3ae4ad8:e54d46cb

2025-03-08 03:38:15This is for one serving (I'm currently doing a >500 cal low carb meal plan). Next time, I'll scramble an egg in there to up the protein a little more. High-protein, low-carb stir fry made with turkey, broccoli, snow peas, green onions, savoy cabbage, bok choy, garlic, in a sesame, soy and ginger sauce.

INGREDIENTS

- 1/3 lb / 170g ground turkey (I used 93% lean, hormone-free/organic)

- 2 tsp light olive oil or coconut oil

- 3 TB soy sauce, tamari, or coconut aminos

- 1 cup / 85g mixed stir fry greens, your choice (cabbage, bok choy, etc.)

- Half a bunch of green onion, roughly chopped, green parts only

- Dash of crushed red pepper flakes

- 1 clove minced garlic

- 1 tsp minced ginger

- Sesame seeds (optional, black, regular, or both!)

- 1 tsp sesame oil

DIRECTIONS

1. Heat oil in a skillet and add the ground turkey once the oil starts to shimmer.

2. On medium-high heat, cook the ground turkey, breaking it into bite-size pieces as it cooks, drizzling 1 TB of the soy sauce over the meat a little at a time. You want to evaporate the water out of the meat, so keep letting it cook until it's actually browned—the soy sauce helps with this, but you want the milliard reaction here (look it up and thank me later)!

3. Decrease the heat to low. Push the cooked turkey to one side and tilt the pan a bit away from you so the oil is isolated, and add the garlic into the oil and stir it in there a little bit.

4. Once the garlic is fragrant, stir the meat back into the garlic, toss in the chopped veggies, green onions, and remaining 1 TB of soy sauce. Then add the minced ginger and red pepper flakes on top, and quickly cover the pan with a lid. Let it steam for about 6-8 minutes on medium-low heat.

5. After the veggies are cooked, stir the little pile of steamed ginger into the mix, drizzle the sesame seed oil over the meat and veggies, stir again, and serve hot with optional sesame seeds as a garnish. Enjoy!

For more food and recipes by me, visit https://ketobeejay.npub.pro/ and click on "recipes" at the top

-

@ 7b3f7803:8912e968

2025-03-08 03:05:16

@ 7b3f7803:8912e968

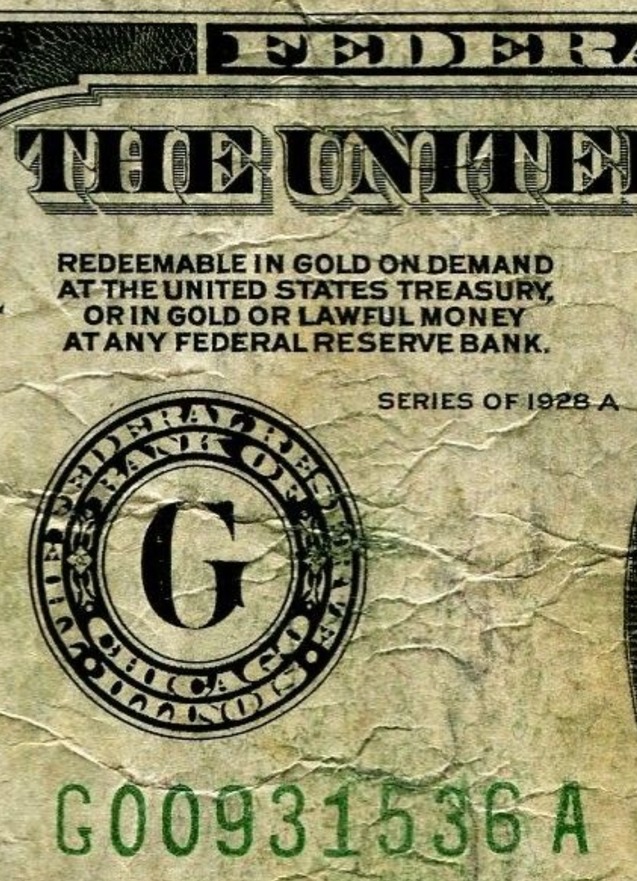

2025-03-08 03:05:16Libertarians believe in open borders in theory. In practice, open borders don't work, because, among other things, the combination with a welfare state creates a moral hazard, and the least productive of society end up within the borders of welfare states and drain resources. The social services are paid by the productive people of the country or, in the case of most fiat systems, by currency holders through inflation. Welfare states are much more likely under fiat money and the redistribution goes from native taxpayers to illegal immigrants. Thus, under fiat money, open borders end up being an open wound by which the productive lifeblood of the country bleeds out, despite the theoretical trade-efficiency benefits. As libertarians like to say, open borders and the welfare state don't mix. In this article, we'll examine the other sacred cow of libertarian thought: free trade.

Free Trade without Libertarian Ideals

Free trade is very similar to free movement of labor in that it works great in theory, but not in practice, especially under fiat money. In a libertarian free-market world, free trade works. But that assumes a whole host of libertarian ideals like sound money, non-interfering governments, and minimal aggression. Once those ideals are violated, such as with government intervention in the market, similar moral hazards and long-term costs come with them, making free trade about as libertarian as a fractional reserve bank.

An example will illustrate what I'm talking about. Let's say Portugal subsidizes their wine for export to other countries. The obvious first-order effect is that it makes Portuguese wine cheaper in France, perhaps undercutting the price of French wine. Libertarians would say, that's great! French customers get cheaper goods, so what's the problem?

As with any government intervention, there are significant second- and third-order effects in play. Subsidization puts unsubsidized companies at risk, perhaps driving them to bankruptcy. In this case, this might be a French wine maker. Subsidized companies may become zombies instead of dying out. In this case, this might be a Portuguese wine maker that was failing domestically but survives by selling to customers abroad with government subsidies. While French customers benefit in the short run with cheaper prices for wine, they are ultimately hurt because the goods that would have existed without government intervention never come to market. Perhaps French wine makers that went bankrupt were innovating. Perhaps the resources of the zombie Portuguese wine maker would have created something better.

Further, the dependency of French people on Portuguese wine means that something going wrong in Portugal, like a war or subsidy cuts, disrupts the supply and price of wine for France. Now France must meddle in Portugal internationally if it doesn't want the wine supply to get disrupted. The two countries get entangled in such a way as to become more interventionist internationally. A war involving Portugal now suddenly becomes France's business and incentivizes military aid or even violence. As usual, the unseen effects of government policy are the most pernicious.

Not Really Free

In other words, what we call free trade isn't really free trade. A country exporting to the US may subsidize their products through government intervention, making the product cheaper in the US. This hurts US companies, and they’re forced into choices they never would have had to face without the foreign government intervention. But because the good is crossing borders under the rubric of "free trade," it's somehow seen as fair. Of course it's not, as government intervention distorts the market whether it's done by our own government or a foreign government.

So why would a foreign government do this? It gets several benefits through targeted market manipulation. First, it makes its own companies' products more popular abroad and conversely, makes US companies' products less popular. This has the dual benefit of growing the foreign government’s firms and shrinking, perhaps bankrupting, the US ones.

Targeted subsidization like this can lead to domination under free trade. It's not unlike the Amazon strategy of undercutting everyone first and using the monopoly pricing power at scale once everyone else has bankrupted. The global monopoly is tremendously beneficial to the country that has it. Not only is there significant tax revenue over the long term, but also a head start on innovations within that industry and an advantage in production in the adjacent industries around the product.

Second, the manufacturing centralization gives that country leverage geo-politically. A critical product that no one else manufactures means natural alliances with the countries that depend on the product, which is especially useful for smaller countries like Taiwan. Their chip manufacturing industry, holding 60% of global supply (2024), has meant that they're a critical link for most other countries, and hence, they can use this fact to deter Chinese invasion.

Third, because of the centralization of expertise, more innovations, products, and manufacturing will tend to come within the country. This increased production has cascading benefits, including new industries and national security. China leads the world in drone technology, which undoubtedly has given it an innovation advantage for its military, should it go to war.

Fourth, the capital that flows into the country for investing in the monopolized industry will tend to stay, giving the country more wealth in the form of factories, equipment, and skills. While that capital may nominally be in the hands of foreigners, over time, the ownership of that industry will inevitably transition toward native locals, as the knowledge about how to run such industries gets dissipated within the country.

[Image: Map showing “China Drone Tech” and “Taiwan Chips” hubs, with arrows of capital flow staying local]

Currency Devaluation: The Universal Trade Weapon

It would be one thing if only a specific industry were singled out for government subsidies and then the products dumped into the US as a way to hurt US companies, as that would limit the scope of the damage. But with currency devaluation, a government can subsidize all of its exports at the same time. Indeed, this is something that many countries do. While short-term, this helps US consumers, it hurts US companies and forces them into decisions that aren't good for the US.

To compete, they have to lower costs by using the same devalued currency to pay their labor as their foreign competition. That is, by relocating their capital, their manufacturing, and even their personnel to the country that's devaluing the currency. Not only does relocating reduce labor cost, but it also often gets them benefits like tax breaks. This makes US companies de facto multinationals and not only makes them subject to other jurisdictions, but ultimately divides their loyalties. To take advantage of the reduced labor, capital must move to another country and, along with it, future innovation.

Such relocations ultimately leave the company stripped of their manufacturing capability in the US, as local competition will generally fare better over the long run. Much of the value of the industry then is captured by other governments in taxes, development, and even state-owned companies. Free trade, in other words, creates a vulnerability for domestic companies as they can be put at a significant disadvantage compared to foreign counterparts.

Hidden Effects of Foreign Intervention

Unlike the multinationals, small companies have no chance as they're not big enough to exploit the labor arbitrage. And as is usual in a fiat system, they suffer the most while the giant corporations get the benefits of the supposed "free trade". Most small companies can't compete, so we get mostly the bigger companies that survive.

The transition away from domestic manufacturing necessarily means significant disruption. Domestic workers are displaced and have to find new work. Factories and equipment either have to be repurposed or rot. Entire communities that depended on the manufacturing facility now have to figure out new ways to support themselves. It's no good telling them that they can just do something else. In a currency devaluation scenario, most of the manufacturing leaves and the jobs left are service-oriented or otherwise location-based, like real estate development. There's a natural limit to location-based industries because the market only grows with the location that you're servicing. Put another way, you can only have so many people give haircuts or deliver packages in a geographic area. There has to be some manufacturing of goods that can be sold outside the community, or the community will face scarce labor opportunities relative to the population.

You also can't say the displaced workers can start some other manufacturing business. Such businesses will get out-competed on labor by the currency-devaluing country, so there won't be much investment available for such a business, and even if there were, such a business would be competing with its hands tied behind its back. So in this scenario, what you end up with are a large pool of unemployed people whom the state subsidizes with welfare.

So when a US company leaves or goes bankrupt due to a foreign government's subsidies, the disruption alone imposes a significant short-term cost with displaced labor, unused capital goods, and devastated communities.

Mitigations

So how do countries fight back against such a devastating economic weapon? There are a few ways countries have found around this problem of currency devaluation under free trade. First, a country can prevent capital from leaving. This is called capital controls, and many countries, particularly those that manufacture a lot, have them. Try to get money, factories, or equipment out of Malaysia, for example, and you'll find that they make it quite difficult. Getting the same capital into the country, on the other hand, faces few restrictions. Unfortunately, the US can't put in capital controls because dollars are its main export. It is, after all, the reserve currency of the world.

Second, you can compete by devaluing your own currency. But that’s very difficult because it requires printing a lot of dollars, and that causes inflation. There's also no guarantee that a competing country doesn't devalue its currency again. The US is also in a precarious position as the world's reserve currency, so devaluing the currency more than it already does will make other holders of the dollar less likely to want to hold it, threatening the reserve currency status.

So the main two mitigations against currency devaluation in a free trade scenario are not available to the US. So what else is there? The remaining option is to drop free trade. The solution, in other words, is to add tariffs. This is how you can nullify the effects of foreign government intervention, by leveling the playing field for US manufacturers.

Tariffs

One major industry that's managed to continue being manufactured in the US despite significant foreign competition is cars. Notably, cars have a tariff, which incentivizes their manufacture in the US, even for foreign car makers. The tariff has acted as a way to offset foreign government subsidies and currency debasement.

The scope of this one industry for the US is huge. There are around 300,000 direct jobs in auto assembly within the US (USTR) and there are an additional 3 million jobs supplying these manufacturers within the US. But the benefits don't end there. The US is also creating a lot of innovation around cars, such as self-driving and plug-in electric cars. There are many countries that would love to have this industry for themselves, but because of tariffs, auto manufacturing continues in the US.

And though tariffs are seen as a tax on consumers, US car prices are cheap relative to the rest of the world. What surprises a lot of people when they move from the US to other countries is finding out that the same car often costs more abroad (e.g. 25% tariffs keep U.S. prices 20% below Europe’s $40K average, 2024). The downside of tariffs pales next to the downsides of "free trade."

Free Trade Doesn’t Work with Fiat Money

The sad reality is that while we would love for free trade to work in the ideal libertarian paradise, it won't in our current fiat-based system. The subsidization by foreign governments to bankrupt US companies or to make them multinational, combined with the unfortunate reality of the US dollar being the world reserve currency, means that free trade guts the US of manufacturing. Tariffs are a reasonable way to protect US manufacturers, particularly smaller ones that can't go multinational.

What's more, tariffs make the US less fragile and less dependent on international supply chains. Many of the wars in the past 60 years have been waged because of the entanglements the US has with other countries due to the reliance on international supply chains. Lessening this dependency, if only to prevent a war, has clear value.

Lastly, labor has been devalued significantly by fiat monetary expansion, but at least some of that can be recovered if tariffs create more manufacturing, which in turn adds to the demand for labor. This should reduce the welfare state as more opportunities are made available and fewer unemployed people will be on the rolls.

Conclusion

Fiat money produces a welfare state, which makes open borders unworkable. Fiat money also gives foreign governments a potent economic weapon to use against US companies, and by extension the labor force that powers them. Though currency debasement and capital controls are available to other countries as a defense, for the US, neither of these tools is available due to the fact that the dollar is the world reserve currency. As such, tariffs are a reasonable defense against the fiat subsidization of foreign governments.

-

@ 7b3f7803:8912e968

2025-03-08 02:28:40

@ 7b3f7803:8912e968

2025-03-08 02:28:40 Libertarians believe in open borders in theory. In practice, open borders don’t work, because, among other things, the combination with a welfare state creates a moral hazard, and the least productive of society end up within the borders of welfare states and drain resources. The social services are paid by the productive people of the country or, in the case of most fiat systems, by currency holders through inflation. Welfare states are much more likely under fiat money and the redistribution goes from native taxpayers to illegal immigrants. Thus, under fiat money, open borders end up being an open wound by which the productive lifeblood of the country bleeds out, despite the theoretical trade-efficiency benefits. As libertarians like to say, open borders and the welfare state don’t mix. In this article, we’ll examine the other sacred cow of libertarian thought: free trade.