-

@ 2e8970de:63345c7a

2025-02-25 17:16:37

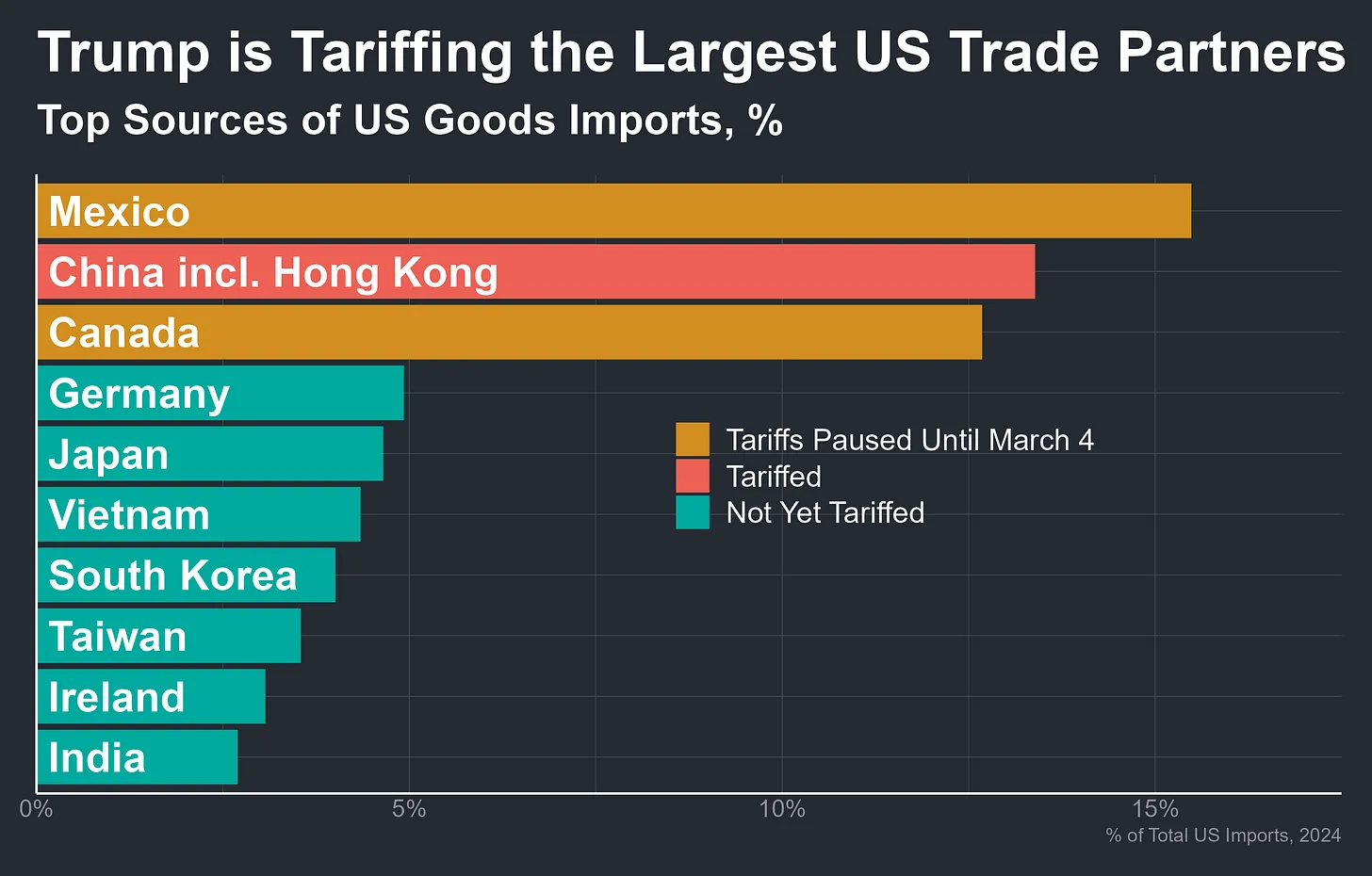

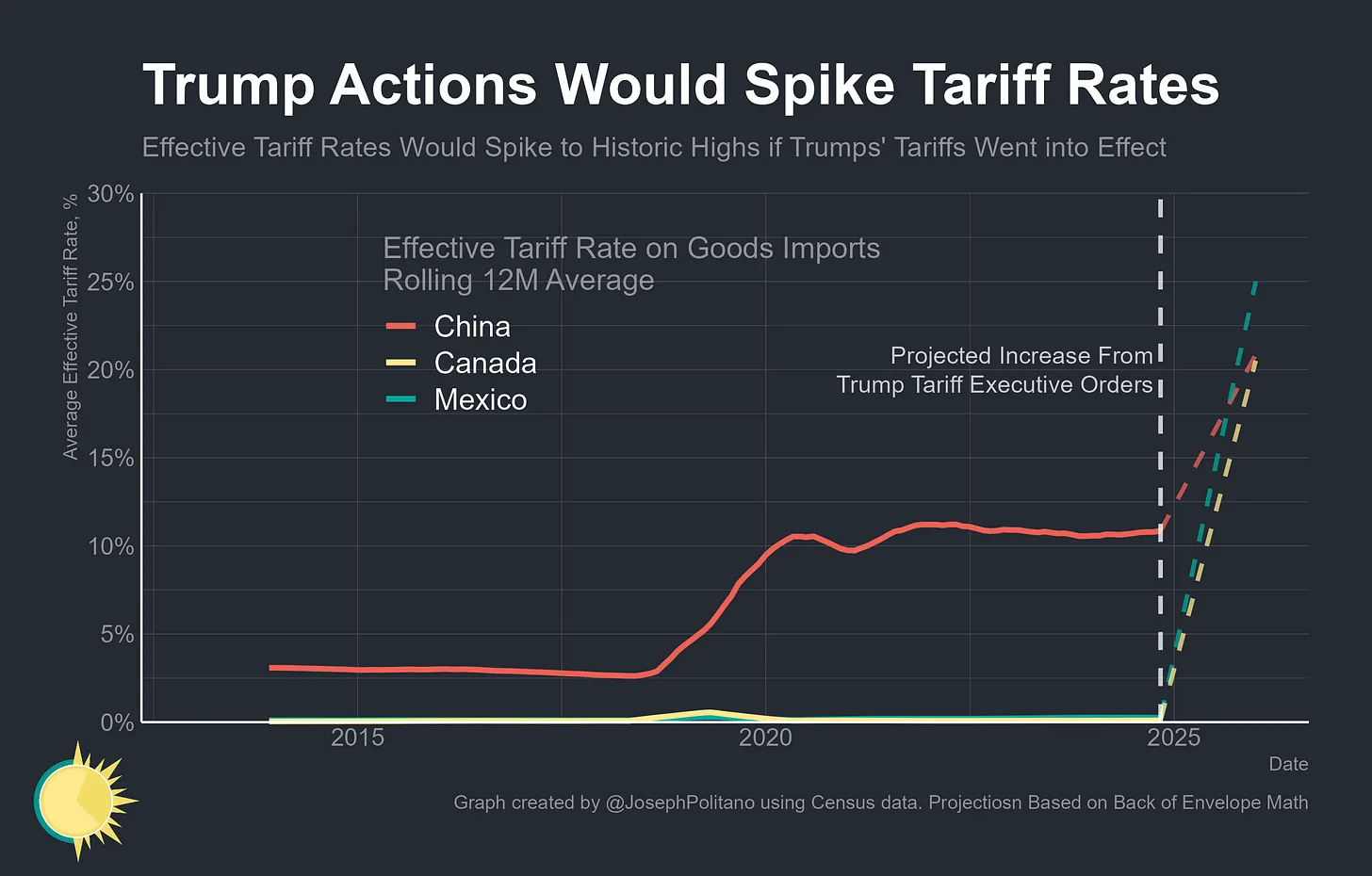

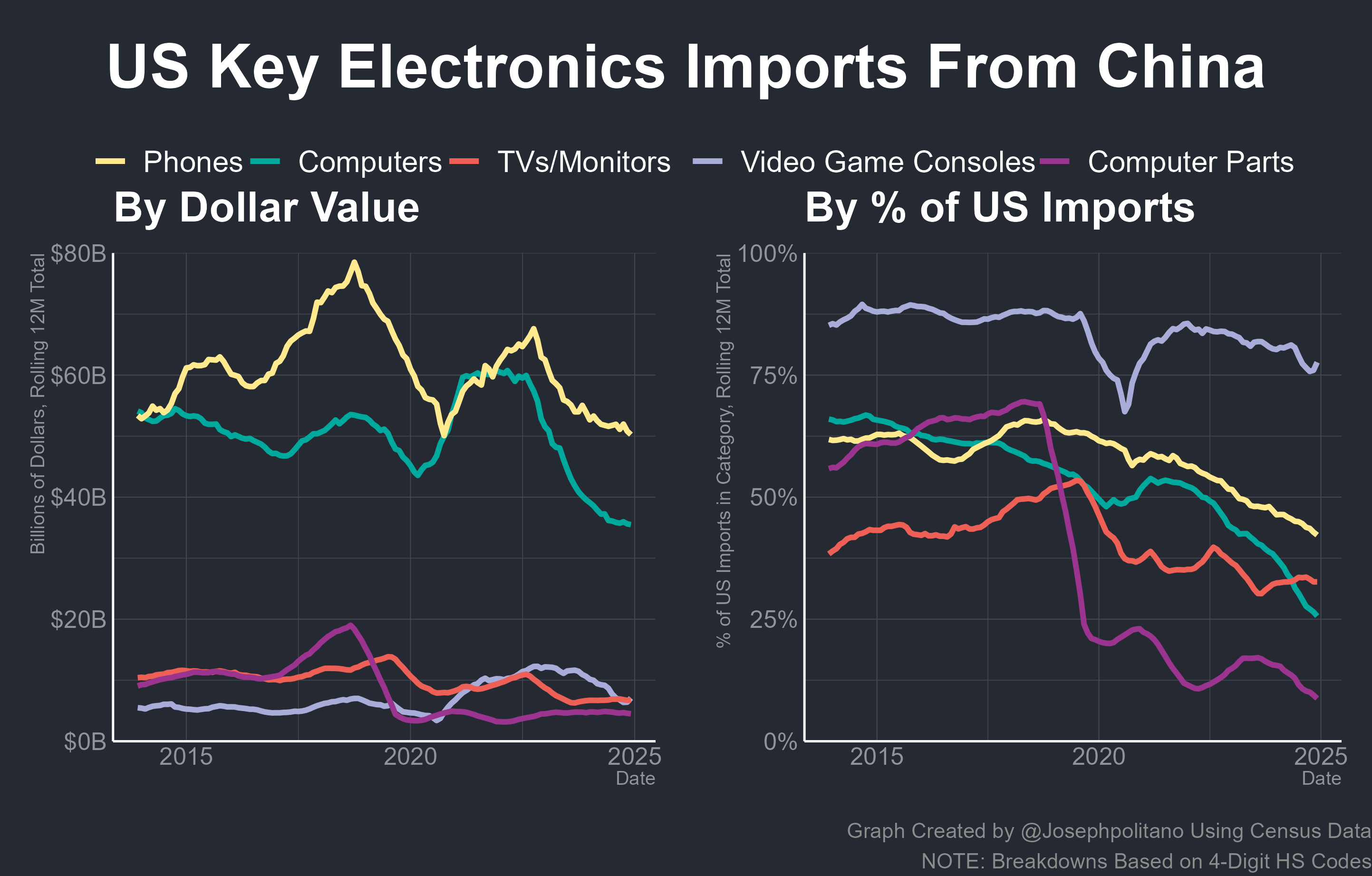

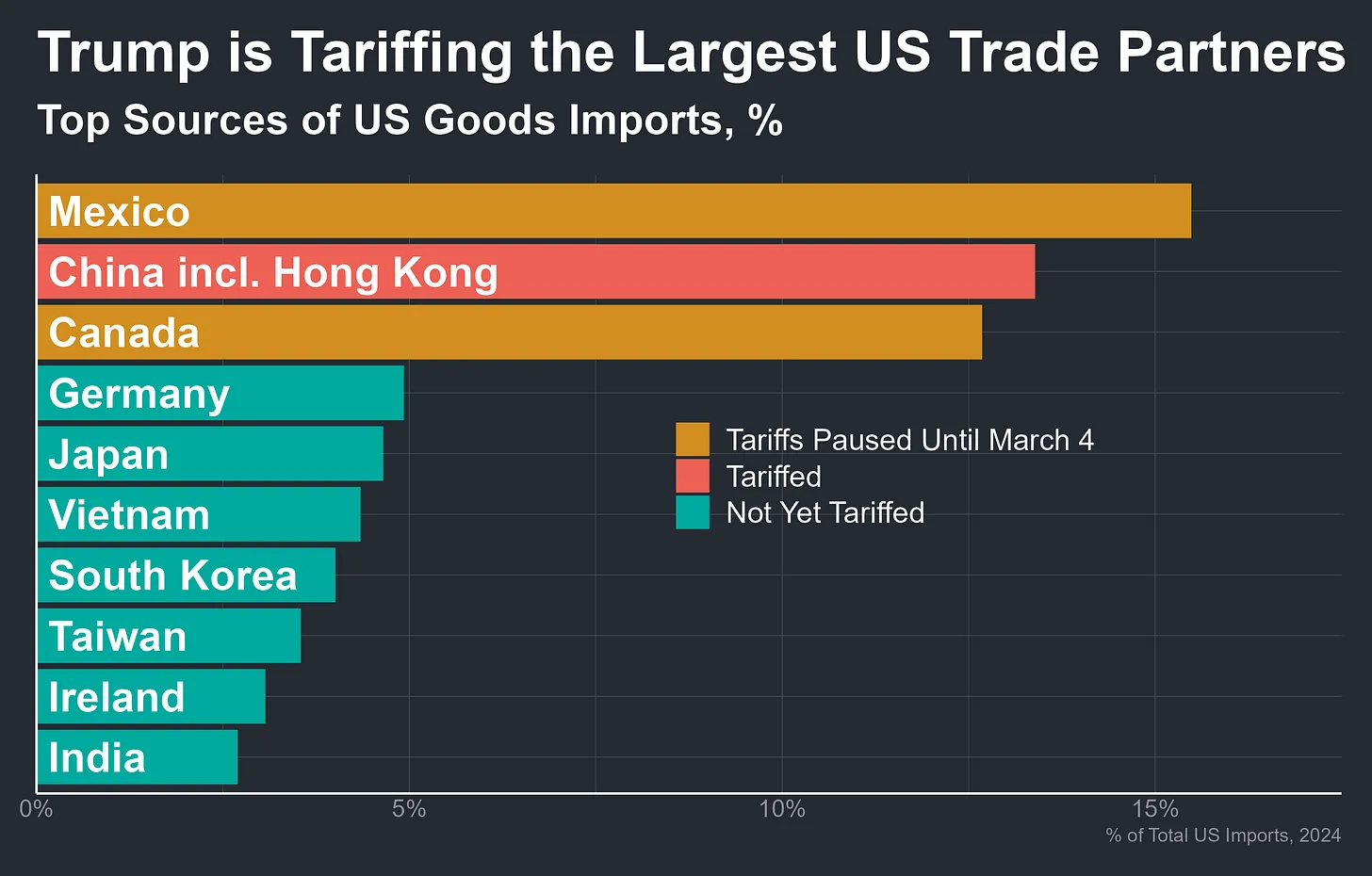

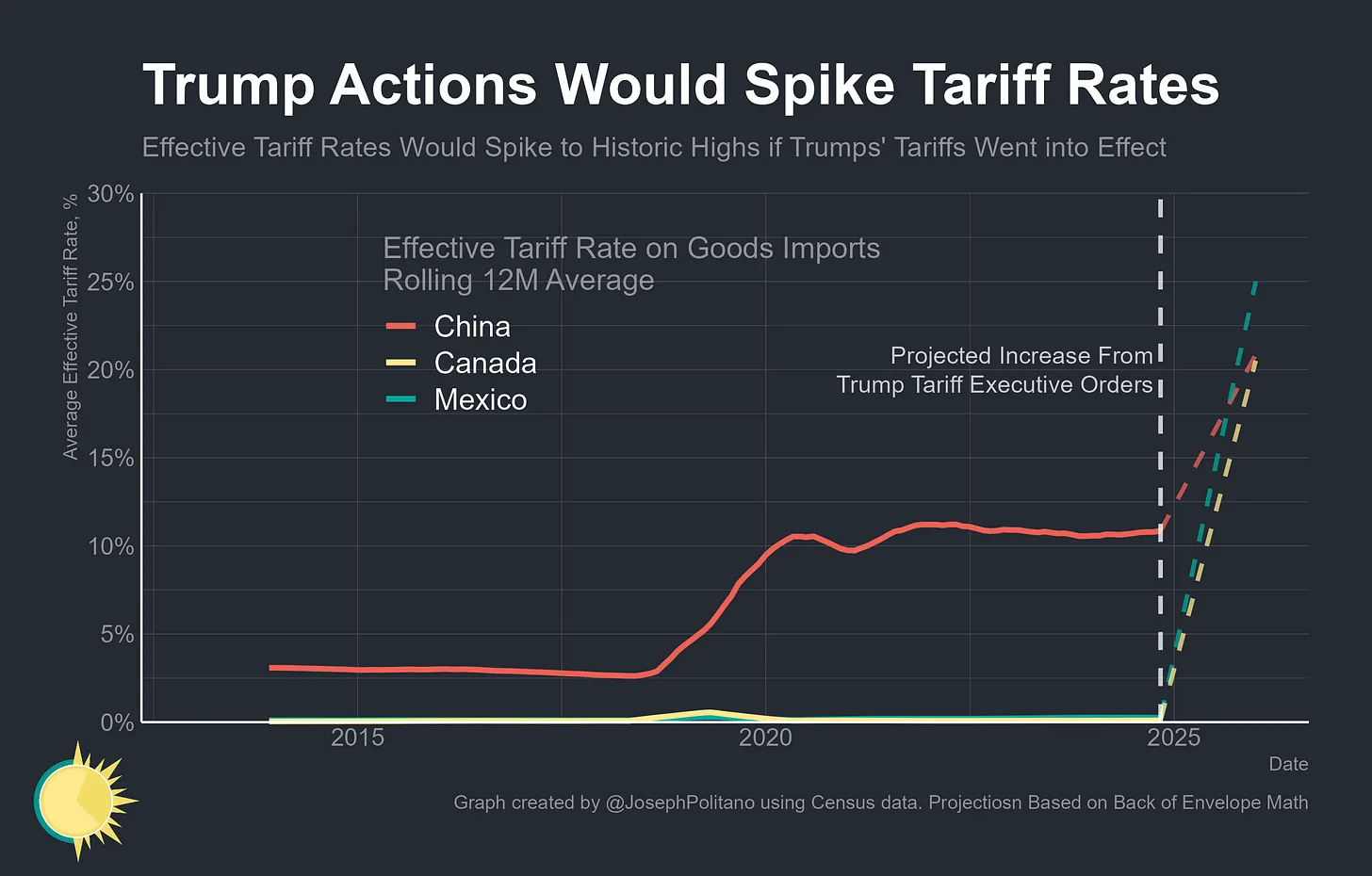

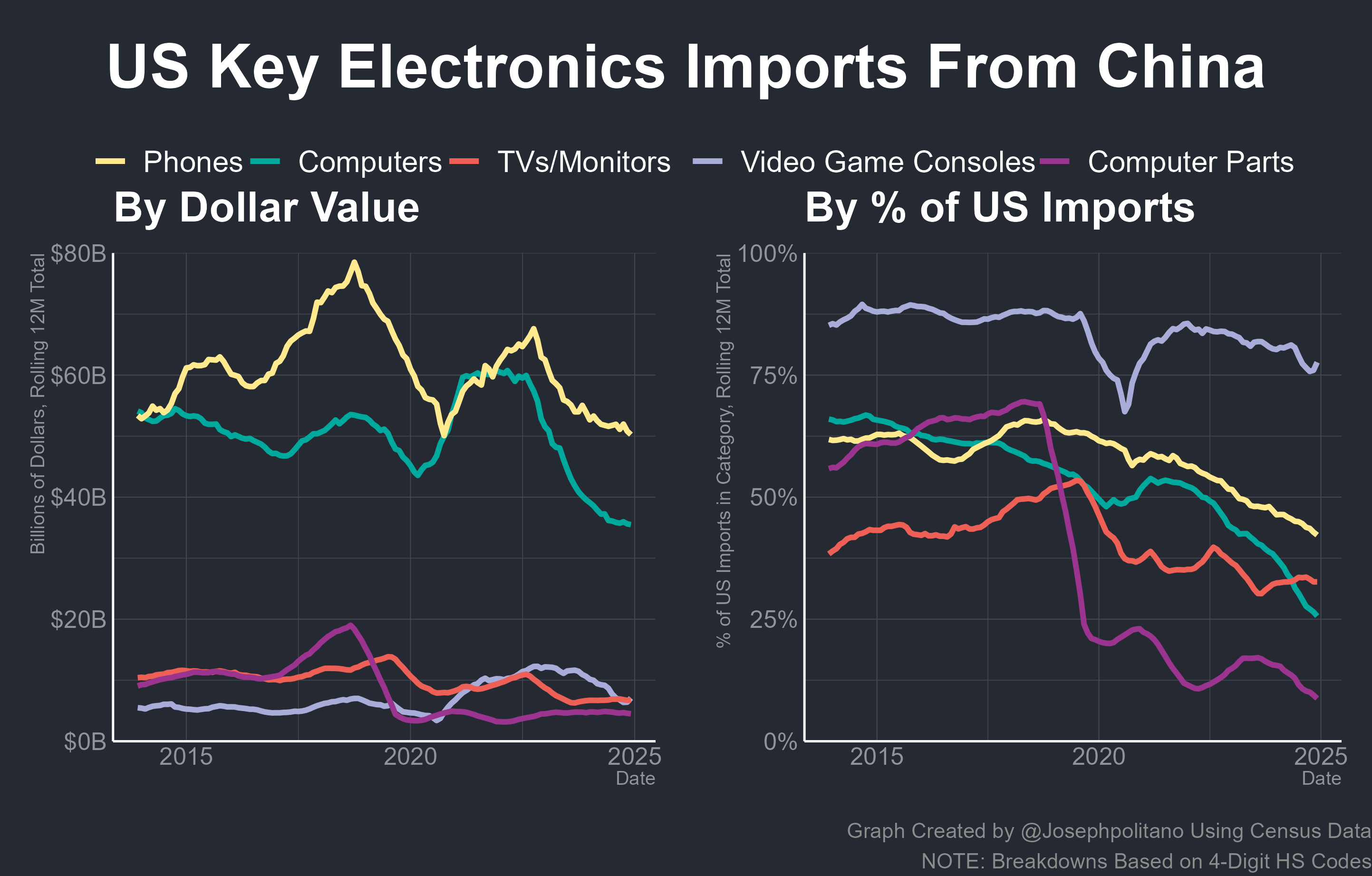

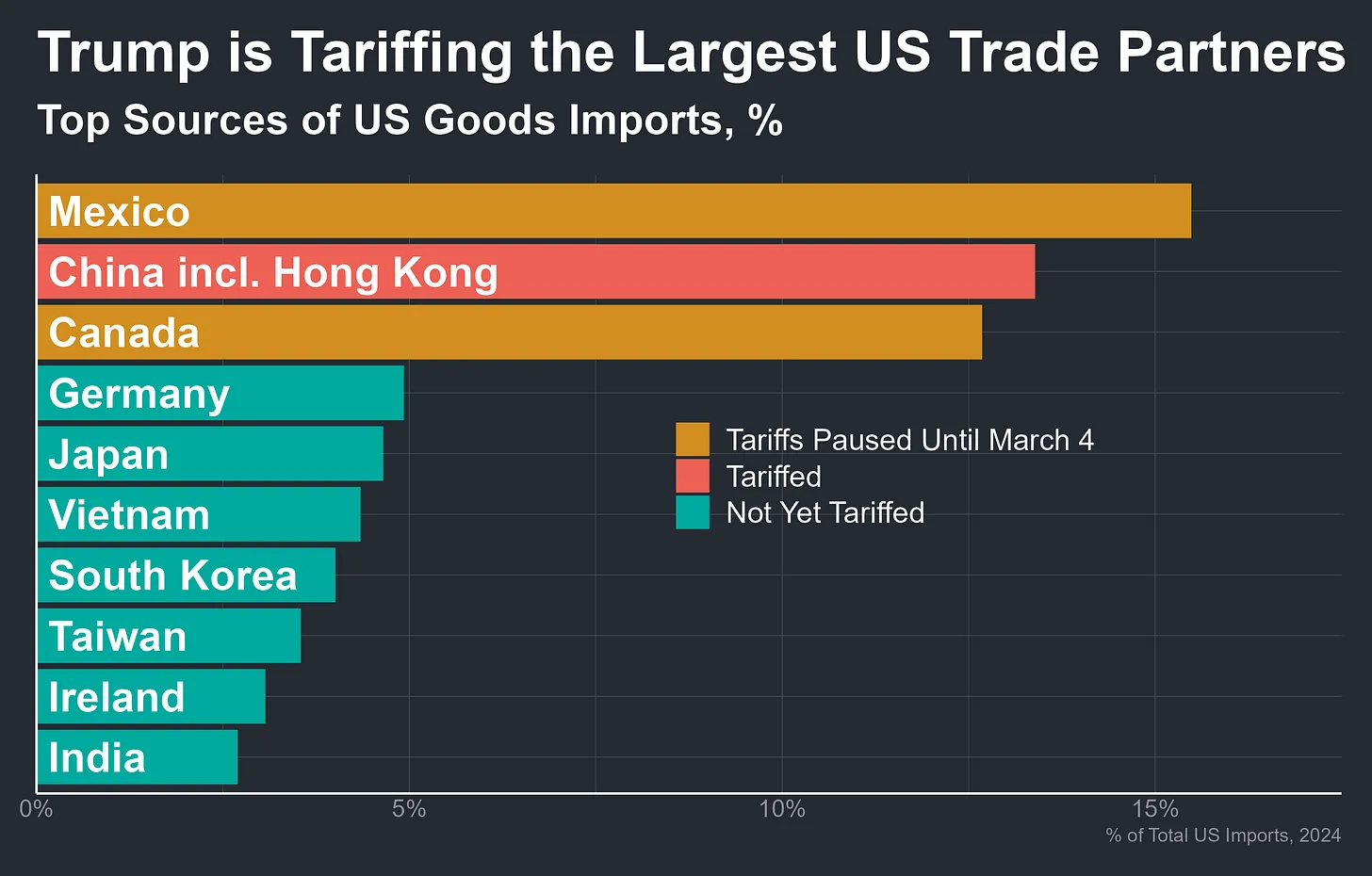

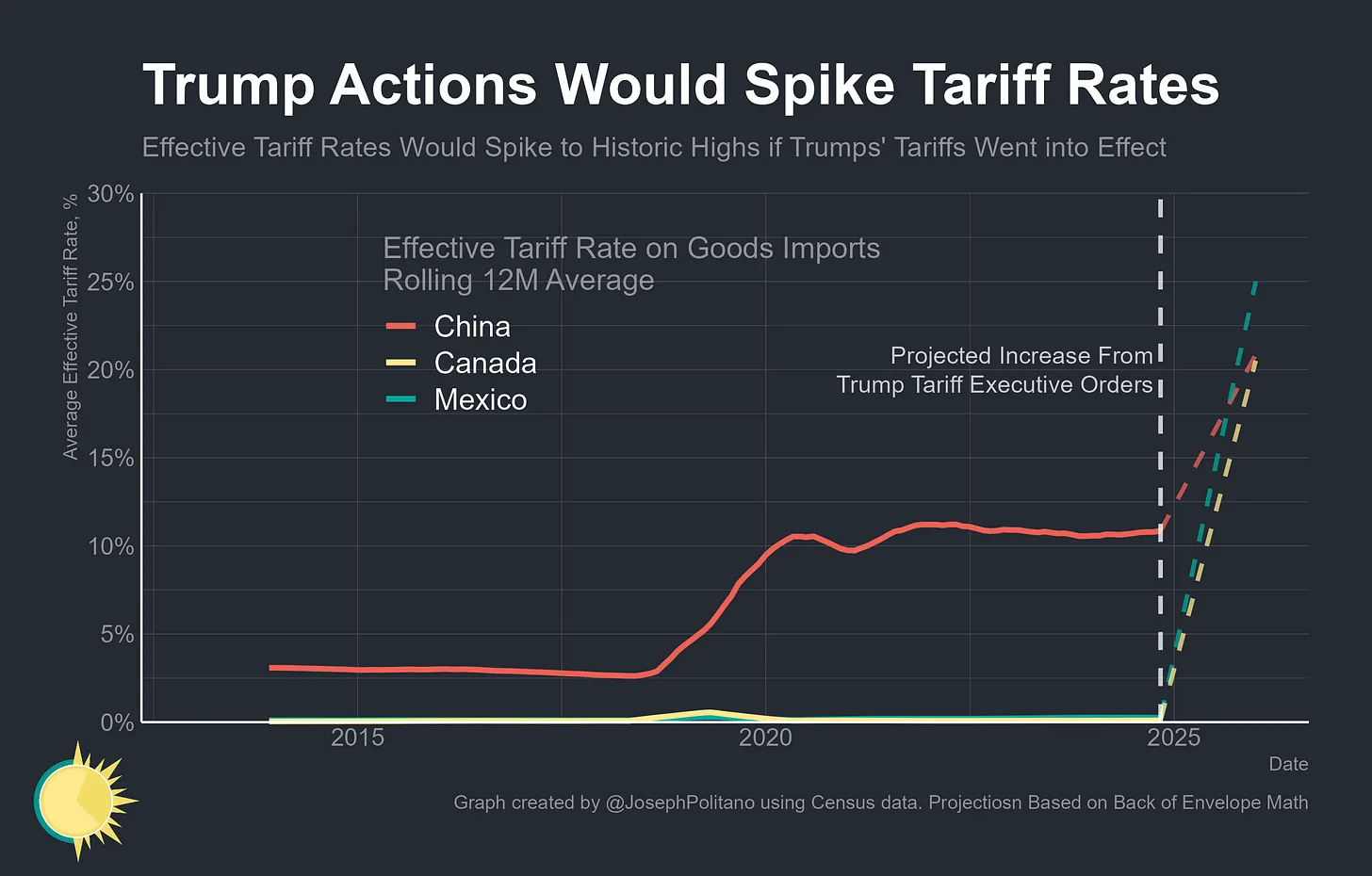

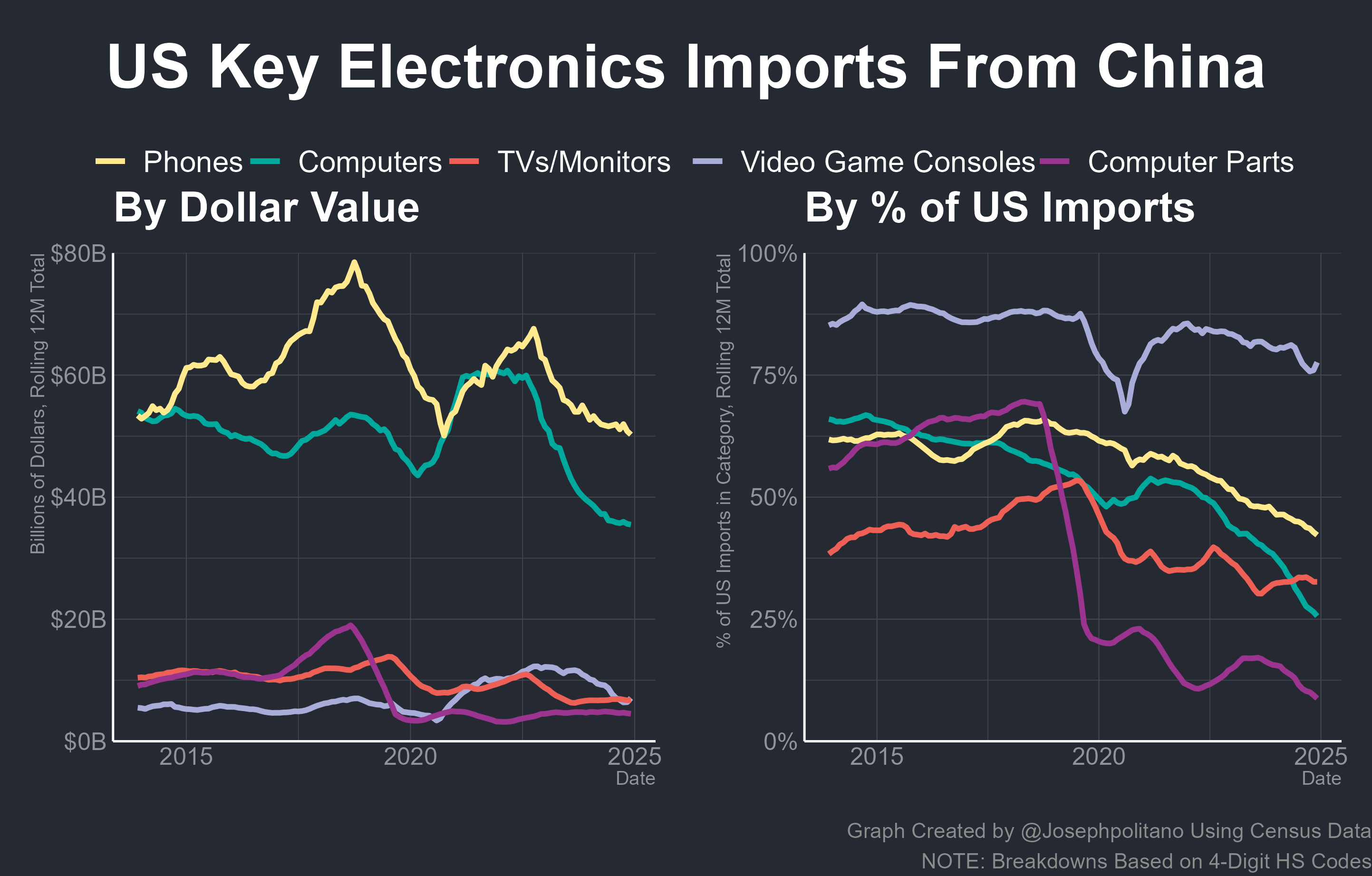

> A Detailed Look at the Economic Impacts of Trump's Wide Ranging New Tariffs on China, Mexico, Canada, Steel, Aluminum, and Much More

https://www.apricitas.io/p/trumps-2nd-trade-war-begins

If you're interested in global trade I recommend looking at the article. It's a real deep dive into many perspectives of US trade esp. with China. What gets imported from China, many individual product categories, what happened in round 1 in 2018 and so so much more. And lots of charts!

originally posted at https://stacker.news/items/896850

-

@ 57d1a264:69f1fee1

2025-02-25 13:24:49

Galoy released a new product called Lana, a platform for bitcoin loans. The team will provide an introduction and then we'll dive into the design.

To get you up to speed, check out the website, slide deck and podcast interview:

- https://www.galoy.io/lana-bitcoin-loans-platform

- https://docs.google.com/presentation/d/1IQocefpCN5_wKX91EWtLa19IpMS_Ye8goNLAgGQbfdU/edit#slide=id.g31d536107ae_0_0

- https://stephanlivera.com/episode/634/

If you get a chance, please take a peek before the call. That makes the design reviews more useful because we need to spend less time going over the basics.

On `Thu Feb 27th · 15:00 – 16:00 CET`

Join from https://meet.jit.si/bitcoindesign

Check your timezone https://everytimezone.com/s/998e22fc

Track https://github.com/BitcoinDesign/Meta/issues/758

originally posted at https://stacker.news/items/896570

-

@ 57d1a264:69f1fee1

2025-02-25 12:38:46

I've been pondering how LSPs (lightning service providers) might pan out over time and how that might affect fees, and I am wondering what everyone else is thinking. Some people will always prefer to manage their own channels, and for some specific use cases, that might be preferable. But I am thinking about the broad userbase that does not want to do that. We will need a massive LSP infrastructure to onboard people and to enable insane amounts of payments.

LSPs will need to efficiently open and adjust channels for users, using their own liquidity or sourcing liquidity from other providers, using just-in-time channels, batching and/or splicing to reduce costs and wait times. Across all this, along with facilitating payments, they need to make their business model work and offer different options for users to pay for their services.

Users might be able to:

1. Pay-as-you-go (pay X for Y more liquidity for Z amount of time)

2. Pay X per month for Y inbound liquidity

3. Pay X per month for unlimited liquidity

4. Nothing for liquidity, but higher transaction fees

A wallet might also automatically choose an appropriate LSP based on what is the best and most appropriate deal at the time.

Let's look at user scenarios:

- If someone sends and receives the same amount every month, they will never need more liquidity. They just draw down the same channel and fill it up again. So they would only pay the LSP for them assigning that fixed amount of liquidity to them. Maybe options 1 and 2 are good for them.

- If someone receives more than they send (they save a certain amount every month), they will need more and more inbound liquidity over time. They might choose option 2.

- An online store that receives a ton and can't really estimate how much, might go for option 3.

- For option 4, it depends if the higher transaction fees are fixed or percentage-based.

It's a bit like choosing a data plan for your phone (or for internet at home). You can get a prepaid card, a regular plan with certain limits, or go unlimited. And there are separate plans for small and large businesses, etc. And there are massive amounts of complex infrastructure behind these service providers to make it all work.

So when someone starts using a lightning wallet, maybe they have to first pick an LSP and a plan before being able to receive. Or maybe they get a first channel for free and pay higher fees, and are then prompted to choose a plan. Maybe they need to wait an hour until the LSP has enough channel opens for a batch/splice, to reduce costs. A complex market at work.

Is that how things might pan out? Am I completely off? Is it worth mocking up different scenarios?

```

#bitcoin #LN #BTC #Lightning #LSP #service #zaps #sats #wallet

```

originally posted at https://stacker.news/items/896520

@ 2e8970de:63345c7a

2025-02-25 17:16:37> A Detailed Look at the Economic Impacts of Trump's Wide Ranging New Tariffs on China, Mexico, Canada, Steel, Aluminum, and Much More     https://www.apricitas.io/p/trumps-2nd-trade-war-begins If you're interested in global trade I recommend looking at the article. It's a real deep dive into many perspectives of US trade esp. with China. What gets imported from China, many individual product categories, what happened in round 1 in 2018 and so so much more. And lots of charts! originally posted at https://stacker.news/items/896850

@ 2e8970de:63345c7a

2025-02-25 17:16:37> A Detailed Look at the Economic Impacts of Trump's Wide Ranging New Tariffs on China, Mexico, Canada, Steel, Aluminum, and Much More     https://www.apricitas.io/p/trumps-2nd-trade-war-begins If you're interested in global trade I recommend looking at the article. It's a real deep dive into many perspectives of US trade esp. with China. What gets imported from China, many individual product categories, what happened in round 1 in 2018 and so so much more. And lots of charts! originally posted at https://stacker.news/items/896850 @ 57d1a264:69f1fee1

2025-02-25 13:24:49 Galoy released a new product called Lana, a platform for bitcoin loans. The team will provide an introduction and then we'll dive into the design. To get you up to speed, check out the website, slide deck and podcast interview: - https://www.galoy.io/lana-bitcoin-loans-platform - https://docs.google.com/presentation/d/1IQocefpCN5_wKX91EWtLa19IpMS_Ye8goNLAgGQbfdU/edit#slide=id.g31d536107ae_0_0 - https://stephanlivera.com/episode/634/ If you get a chance, please take a peek before the call. That makes the design reviews more useful because we need to spend less time going over the basics. On `Thu Feb 27th · 15:00 – 16:00 CET` Join from https://meet.jit.si/bitcoindesign Check your timezone https://everytimezone.com/s/998e22fc Track https://github.com/BitcoinDesign/Meta/issues/758 originally posted at https://stacker.news/items/896570

@ 57d1a264:69f1fee1

2025-02-25 13:24:49 Galoy released a new product called Lana, a platform for bitcoin loans. The team will provide an introduction and then we'll dive into the design. To get you up to speed, check out the website, slide deck and podcast interview: - https://www.galoy.io/lana-bitcoin-loans-platform - https://docs.google.com/presentation/d/1IQocefpCN5_wKX91EWtLa19IpMS_Ye8goNLAgGQbfdU/edit#slide=id.g31d536107ae_0_0 - https://stephanlivera.com/episode/634/ If you get a chance, please take a peek before the call. That makes the design reviews more useful because we need to spend less time going over the basics. On `Thu Feb 27th · 15:00 – 16:00 CET` Join from https://meet.jit.si/bitcoindesign Check your timezone https://everytimezone.com/s/998e22fc Track https://github.com/BitcoinDesign/Meta/issues/758 originally posted at https://stacker.news/items/896570 @ 57d1a264:69f1fee1

2025-02-25 12:38:46I've been pondering how LSPs (lightning service providers) might pan out over time and how that might affect fees, and I am wondering what everyone else is thinking. Some people will always prefer to manage their own channels, and for some specific use cases, that might be preferable. But I am thinking about the broad userbase that does not want to do that. We will need a massive LSP infrastructure to onboard people and to enable insane amounts of payments. LSPs will need to efficiently open and adjust channels for users, using their own liquidity or sourcing liquidity from other providers, using just-in-time channels, batching and/or splicing to reduce costs and wait times. Across all this, along with facilitating payments, they need to make their business model work and offer different options for users to pay for their services. Users might be able to: 1. Pay-as-you-go (pay X for Y more liquidity for Z amount of time) 2. Pay X per month for Y inbound liquidity 3. Pay X per month for unlimited liquidity 4. Nothing for liquidity, but higher transaction fees A wallet might also automatically choose an appropriate LSP based on what is the best and most appropriate deal at the time. Let's look at user scenarios: - If someone sends and receives the same amount every month, they will never need more liquidity. They just draw down the same channel and fill it up again. So they would only pay the LSP for them assigning that fixed amount of liquidity to them. Maybe options 1 and 2 are good for them. - If someone receives more than they send (they save a certain amount every month), they will need more and more inbound liquidity over time. They might choose option 2. - An online store that receives a ton and can't really estimate how much, might go for option 3. - For option 4, it depends if the higher transaction fees are fixed or percentage-based. It's a bit like choosing a data plan for your phone (or for internet at home). You can get a prepaid card, a regular plan with certain limits, or go unlimited. And there are separate plans for small and large businesses, etc. And there are massive amounts of complex infrastructure behind these service providers to make it all work. So when someone starts using a lightning wallet, maybe they have to first pick an LSP and a plan before being able to receive. Or maybe they get a first channel for free and pay higher fees, and are then prompted to choose a plan. Maybe they need to wait an hour until the LSP has enough channel opens for a batch/splice, to reduce costs. A complex market at work. Is that how things might pan out? Am I completely off? Is it worth mocking up different scenarios? ``` #bitcoin #LN #BTC #Lightning #LSP #service #zaps #sats #wallet ``` originally posted at https://stacker.news/items/896520

@ 57d1a264:69f1fee1

2025-02-25 12:38:46I've been pondering how LSPs (lightning service providers) might pan out over time and how that might affect fees, and I am wondering what everyone else is thinking. Some people will always prefer to manage their own channels, and for some specific use cases, that might be preferable. But I am thinking about the broad userbase that does not want to do that. We will need a massive LSP infrastructure to onboard people and to enable insane amounts of payments. LSPs will need to efficiently open and adjust channels for users, using their own liquidity or sourcing liquidity from other providers, using just-in-time channels, batching and/or splicing to reduce costs and wait times. Across all this, along with facilitating payments, they need to make their business model work and offer different options for users to pay for their services. Users might be able to: 1. Pay-as-you-go (pay X for Y more liquidity for Z amount of time) 2. Pay X per month for Y inbound liquidity 3. Pay X per month for unlimited liquidity 4. Nothing for liquidity, but higher transaction fees A wallet might also automatically choose an appropriate LSP based on what is the best and most appropriate deal at the time. Let's look at user scenarios: - If someone sends and receives the same amount every month, they will never need more liquidity. They just draw down the same channel and fill it up again. So they would only pay the LSP for them assigning that fixed amount of liquidity to them. Maybe options 1 and 2 are good for them. - If someone receives more than they send (they save a certain amount every month), they will need more and more inbound liquidity over time. They might choose option 2. - An online store that receives a ton and can't really estimate how much, might go for option 3. - For option 4, it depends if the higher transaction fees are fixed or percentage-based. It's a bit like choosing a data plan for your phone (or for internet at home). You can get a prepaid card, a regular plan with certain limits, or go unlimited. And there are separate plans for small and large businesses, etc. And there are massive amounts of complex infrastructure behind these service providers to make it all work. So when someone starts using a lightning wallet, maybe they have to first pick an LSP and a plan before being able to receive. Or maybe they get a first channel for free and pay higher fees, and are then prompted to choose a plan. Maybe they need to wait an hour until the LSP has enough channel opens for a batch/splice, to reduce costs. A complex market at work. Is that how things might pan out? Am I completely off? Is it worth mocking up different scenarios? ``` #bitcoin #LN #BTC #Lightning #LSP #service #zaps #sats #wallet ``` originally posted at https://stacker.news/items/896520