-

@ 2063cd79:57bd1320

2024-12-01 14:32:29

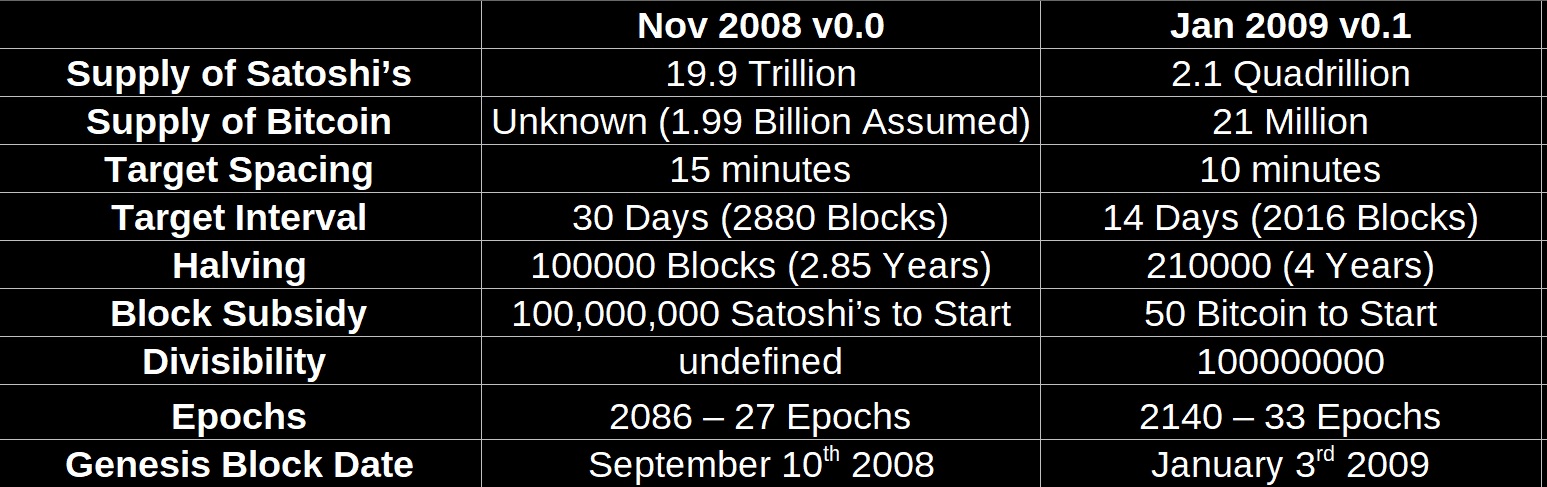

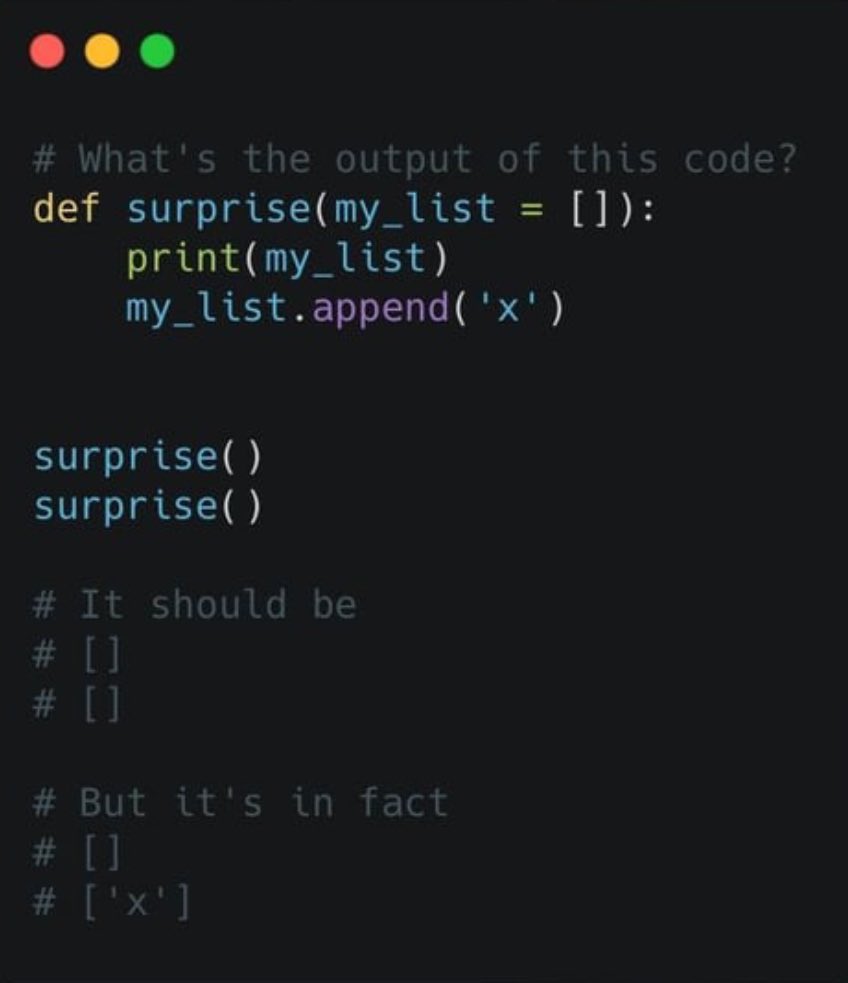

### On-Chain Analytics

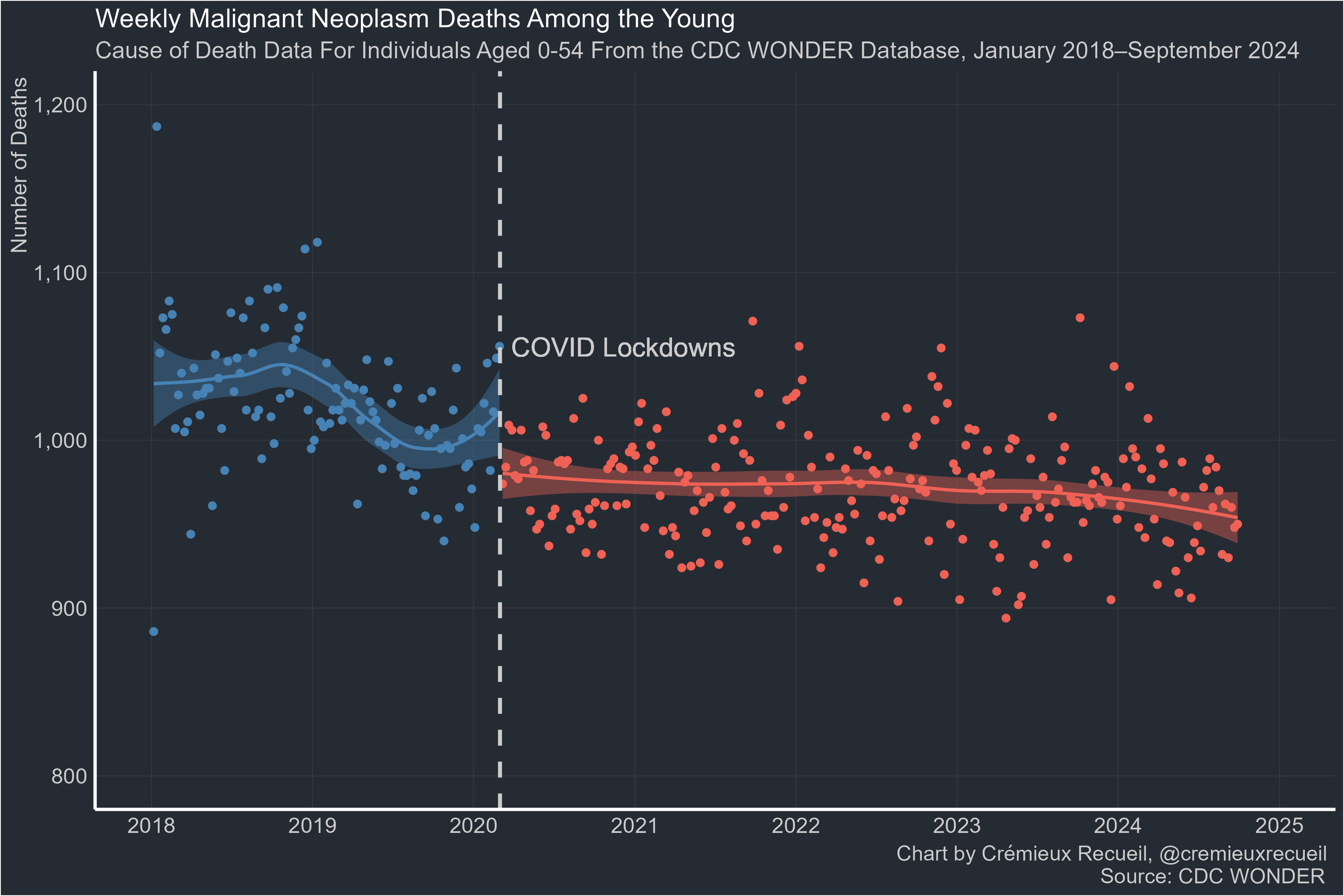

Unter On-Chain Analytics versteht man die Analyse von Daten, die auf jeder beliebigen Blockchain vorhanden sind. Diese Daten sind auf der Chain, also on-chain und somit für jedermann jederzeit und von überall abrufbar. Genauer bieten Blockchains Daten über Adressen, Transaktionen und in gewisser Weise auch über Wallets. Diese Informationen können verwertet werden, um verschiedene Sachverhalte darzustellen. Es gibt unzählige Anwendungsbeispiele, aber nur um eine Handvoll einfacher Anwendungen zu nennen, können Transaktionsvolumen, Preisbewegungen, Verhalten großer Wallets (Whales) oder die Anzahl ruhender oder sich bewegender bitcoins nachvollzogen werden.

Metriken, sind Beispiele dafür, wie z.B. Hashrate, Hashpreis, Realized Price, Mempool, diese Anwendung von Datenanalyse durch Information, die die Blockchain automatisch zur Verfügung stellt, nutzbar macht. Diese vermutliche Transparenz führt dazu, dass in der Theorie jede Bewegung nachverfolgt werden kann, die im digitalen Raum eine direkte Verknüpfung zum realen Raum (also dem sogenannten Meat-Space oder dem "echten Leben”) hat, an dem man ansetzen kann. Ein ganz einfaches Beispiel: Wenn ich eine bestimmt Menge Bitcoin bei einer Börse erwerbe, bei der ich mich zuvor ausweisen musste, um die Dienstleistungen in Anspruch zu nehmen, und mir anschließend diese erworbene Menge Bitcoin auf meine Wallet überweise, um sie in Selbstverwahrung zu halten, ist es gewissen Teilnehmern möglich, meine Wallet zu identifizieren, bzw. mir zuzuordnen. Die Börse, und damit im Zweifelsfall auch ein Gericht oder ein Staat, kennen die Bitcoin-Adresse, die sie meinen Ausweisdaten zuordnen können. Die Transaktion und die damit verbundenen UTXOs sind damit auch mir zuschreibbar und die Wahrscheinlichkeit, dass ich Eigentümer der Zieladresse bin, ist auch sehr hoch. Vor allem, wenn ich öfter Transaktionen von der Börsen-Adresse zu der gleichen Zieladresse ausführe. Dieses Verfahren wird auch Heuristik genannt und bedient sich wahrscheinlicher Annahmen, also z.B. wiederkehrender Muster.

Diese Methode machen sich große Blockchain-Analyse Firmen zu eigen, deren Geschäftsmodell vorsieht, ihren Kunden Dienstleistungen dieser Art zu verkaufen. Services wie Adressen-Screening, Transaktions-Monitoring oder Business Intelligence Tools sollen Blockchain- und Finanzunternehmen, aber auch Regierungseinheiten das Analysieren von Daten auf der Blockchain erleichtern. Bis heute behaupten viele, die Blockchain sei anonym, dabei ist sie bestenfalls pseudonym. Denn natürlich kann man in keinem Block Explorer nach einem im Ausweis geführten Klarnamen suchen; doch wenn einmal die Verbindung zu einer Adresse hergestellt ist, kann man z.B. nach einer Adresse suchen und alle Transaktionen sowohl zu, als auch von dieser Adresse nachvollziehen. Manche Anbieter gehen bei ihren Dienstleistungen dann so weit, dass sie bekannte Adressen labeln und zusammenführen, um damit ein Abbild des gesamten Handels oder Vermögens darzustellen. So assoziiert beispielsweise der Anbieter Nansen verschiedene Adressen mit den Börsen Huobi und Crypto.com:

Huobi

Crypto.com

Was sehr gut ersichtlich wird, sind die Vermögenswerte, die sich in den angegebenen Wallets befinden, und auch werden Verhältnisse grafisch gut aufbereitet, sodass auch ein Laie schnell erkennen kann, dass in diesem Beispiel 20% des Gesamtbestands an Vermögenswerten bei Crypto.com aus Shiba Inu Coins besteht (!!!) - was mir bei einem Gesamtvermögen von 2,3 Milliarden US Dollar nur ein ganz kleines bisschen fragwürdig erscheint!

Und das genau ist das große Problem. Denn was On-Chain-Analyse ermöglicht, ist ein Einblick in das Guthaben verschiedener Wallets. Bleiben wir bei unserem Beispiel Crypto.com: Anhand von Nansens Analyse-Tool können wir schnell sehen, dass die mit Crypto.com assoziierten Adressen knapp unter einem Drittel (gemessen am Gesamtvermögen) an Bitcoin halten, ein gutes Fünftel besteht aus japanischen Hunde-Tokens und knapp ein Viertel aus Stablecoins in Form von Circle-Jerks und Feathers. Cool, konzentrieren wir uns also auf Bitcoin:

Crypto.com

Crypto.com halten (Stand heute) also knapp 46.000 bitcoins in ihren Wallets, bei heutigem Kurs ca. 784 M US Dollar wert. Das sind immerhin 45.999 bitcoins mehr, als FTX in ihren Wallets hatten. Doch sagt uns dies nichts darüber, ob a) dies auch der Menge an bitcoins entspricht, die Nutzer glauben auf Crypto.com eingelagert zu haben (Paper-Bitcoin Problem), oder ob b) diese Anzahl an bitcoins auch komplett unbelastet in einem sicher verwahrten Cold-Storage liegt und nicht als Sicherheit für einen anderen Kredit genutzt wird, oder schlichtweg verliehen wurde (nur weil eine Adresse mit Crypto.com assoziiert wird, heißt es nicht unbedingt, dass nicht auch Dritte Zugriff auf die privaten Schlüssel haben - weil z.B. verliehen, veruntreut, verbummelt).

<img src="https://blossom.primal.net/1cd81fbf24c1d4c5ffdd8703e39f51dfde68dd49b8fba89623b4021969dbd073.gif">

Das allergrößte Problem allerdings besteht in der einseitigen Betrachtung der ganzen Angelegenheit - dazu mehr, wenn wir uns PoR anschauen - denn alles, was wir hier sehen, sind die "Vermögenswerte" bzw. Assets, die in den jeweiligen Wallets liegen. Wir bekommen gar keine Auskunft über die Verbindlichkeiten, die diesen Vermögenswerten gegenüberstehen. Viel schlimmer noch: Wir können uns nicht einmal wirklich sicher sein, dass es sich um tatsächliche Vermögenswerte handelt, da diese ja unter Umständen schon verliehen oder als Sicherheit anderweitig verwendet worden sind. Schließlich bekommen wir ja gar keine Auskunft darüber, was Krypto-Unternehmen-XYZ mit seinen Vermögenswerten anstellt. Es gibt keine Regeln, Gesetze oder anderweitige EInschränkungen, die besagen, dass ein Unternehmen, das teilweise oder sogar nur in minimaler Form Vermögenswerte in Bitcoin oder 💩hält, auch automatisch alle anderen Transaktionen auf einer oder allen Blockchains veröffentlichen muss. Dementsprechend bekommt man vorallem bei hybriden Unternehmen, die irgendwo den Spagat zwischen "Blockchain/ Crypto" und TradFi machen, aber auch bei Blockchain-only fokussierten Unternehmen, ein Gefühl, dass man Transparenz erlangt, wobei dies eigentlich überhaupt nicht der Fall ist.

https://x.com/DylanLeClair\_/status/1594072133147181056

Eine der großen Fragen im Zusammenhang mit dem Mt.Ftx Fiasko ist, warum z.B. große Chain-Analytics Anbieter, wie Chainalysis (kann nur ich so viele Vokale am Stück nicht vernünftig aussprechen?) den großen Schwindel nicht früher erkannt haben. Warum haben diese Firmen nicht früher versucht, ähnlich wie in unserem Beispiel von Crypto.com, Adressen zuzuordnen, um damit festzustellen, dass alleine anhand der Vermögenswerte (zu wenig Bitcoin, zu viel FTT, MAPS, SRM, etc.) irgendetwas am Geschäftsmodell von Alameda/ FTX nicht ganz sauber war?

<img src="https://blossom.primal.net/67902b9fda405178ca83d7ccacfb2ec2d4d785a9e6ebfde23a2922ea327e8e54.gif">

Das Problem ist und bleibt die Heuristik. Man kann nie mit 100%iger Genauigkeit sagen, dass man alle Adressen einem Nutzer, Besitzer, oder Unternehmen komplett und lückenlos zugeordnet hat. Besonders bei vermeintlich großen und vermeintlich ausgeklügelten, der großen Masse voraus schwimmenden, cutting-edge Unternehmen - wie FTX - , ist die Annahme automatisch, dass diese über bessere Privatisierungs- und Sicherheitsmethoden verfügen, als der normale Bitcoin- und/oder Kryptonutzer. Wenn diese Firmen auch noch privat sind, und die einzigen Personen mit Einblick in Pitch-Decks oder vorgebliche Geschäftsberichte, diese aus wettbewerblichen Gründen nicht öffentlich machen, bleibt eben nur das Grundvertrauen, das durch Werbung, durch die vermeintliche Größe des Unternehmens (sprich Aufmacher in Forbes oder Fortune, Super-Bowl-Werbungen mit Tom Brady, etc.), oder durch Shilling (also das Bewerben durch "Bitcoin-Maxis" in Newslettern oder Podcasts, etc.) vermittelt wird, um einem das Gefühl zu geben, dass es mit rechten Dingen zugehen MUSS, wenn so ein riesiges und beliebtes Unternehmen gewisse Behauptungen von sich gibt.

https://www.theblock.co/post/189676/how-much-bitcoin-does-el-salvador-have-good-luck-getting-an-answer

Ganz ähnlich verhält es sich wohl auch bei El Salvador. Genausowenig, wie andere Staaten ihre Kontoauszüge veröffentlichen und jeder interessierten Schnüffelnase Zugang zum Allerheiligsten gewähren, muss man sich auch bei El Salvador auf das Wort des Souveräns verlassen und davon ausgehen, dass die Angaben, sowohl über den aktuellen Stand des gehaltenenen Bitcoin-Vermögens (oder im regulären Fall, der Einnahmen gegenüber der Ausgaben), als auch über die tatsächliche Umsetzung der Ankündigung, jeden Tag einen bitcoin zu erwerben, einer Prüfung standhalten würden.

https://x.com/DylanLeClair\_/status/1596345377154007041

Letzten Endes kann man sagen, dass On-Chain-Analyse natürlich viele Vorteile hat. Gegenüber traditionellen Anlageklassen bringt die Information, bzw. die Möglichkeit der Echtzeit-Datenerhebung ganz, ganz viele Vorteile mit sich. Ein Markt, der 24/7/365 gehandelt werden kann, braucht natürlich Vergleichsdaten in Echtzeit. Allerdings wahrt diese vermeintliche Transparenz in Daten, Verhaltensmustern, Sentiments und Patterns nicht davor, dass die nach außen kommunizierten und vor allem AUF der Blockchain verfestigten Informationen, nicht auch ein nicht veröffentlichtes und nicht auf der Blockchain verankertes Gegengewicht (z.B. in der Form von Sicherheiten) birgen.

https://x.com/BitcoinMagazine/status/1597208278093955072

---

Am Ende bleibt auf jeden Fall zu sagen, dass eine der momentan am wichtigsten zu verfolgenden Metriken, die der Bewegung von bitcoins auf bzw. von Börsen ist. Alleine in den letzten 2 Wochen wurden über 200.000 bitcoins von Börsen genommen. Das bedeutet nicht, dass diese verkauft wurden, sondern, dass diese tatsächlich aus Börsen-assoziierten Adressen in private Adressen verschoben wurden. Der Einzelhandel und kleine Wallets, die Bitcoin in ihren Cold-Storage verlagern, ist die Verkörperung des Bitcoin-Ethos. Dies bestäkrt eigentlich nur, was ich eigentlich diese Woche sagen wollte: Die einzig wirklich sichere und bedeutsame Form von Chain-Analysis ist die der Eingabe der eigenen Keys zur Überprüfung, dass bei der Selbesverwahrung alles im Reinen ist (Analogie zu früher: Kontoauszug ziehen, bzw. PIN überprüfen).

🫳🎤

---

In diesem Sinne, 2... 1... Risiko!

-

@ c11cf5f8:4928464d

2024-12-01 08:58:58

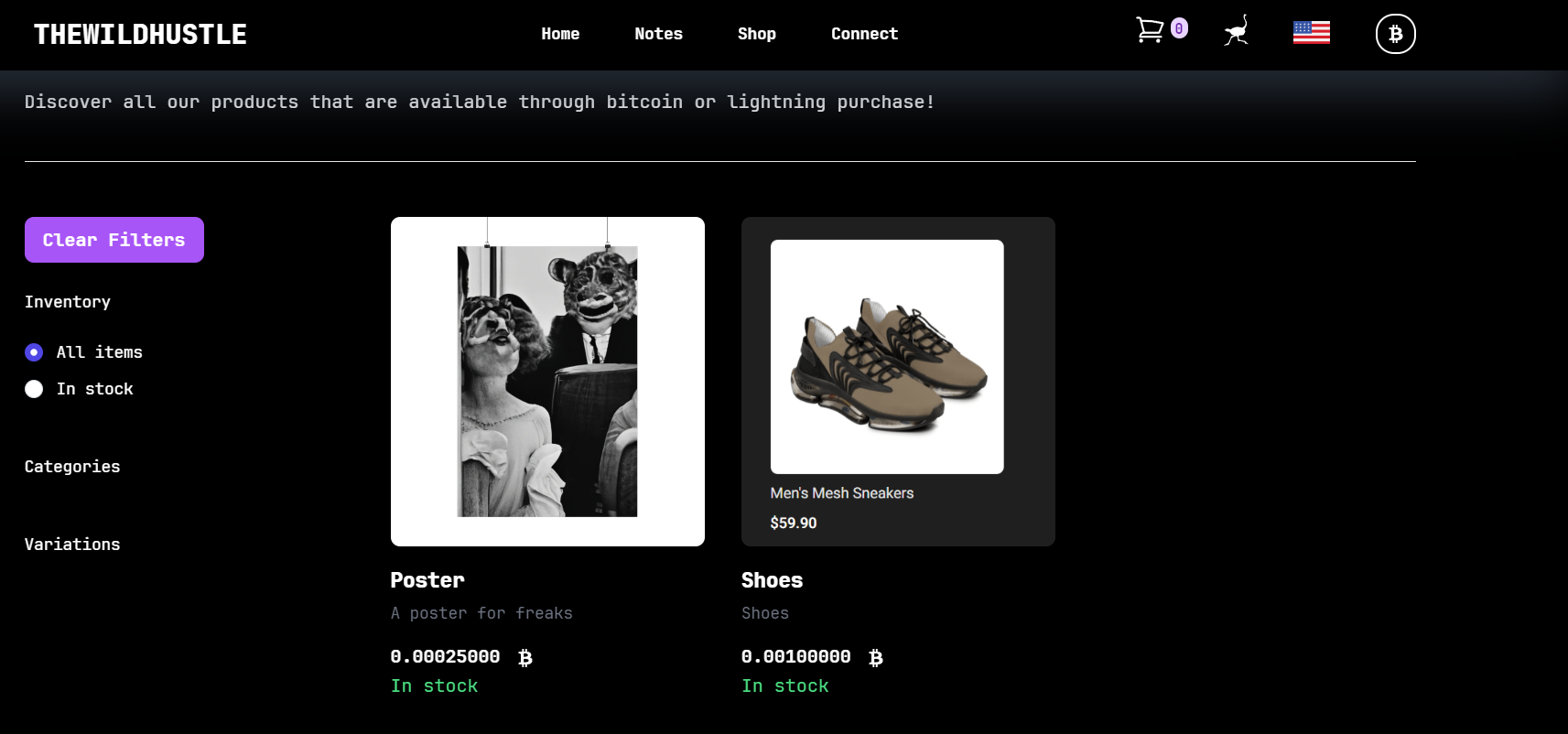

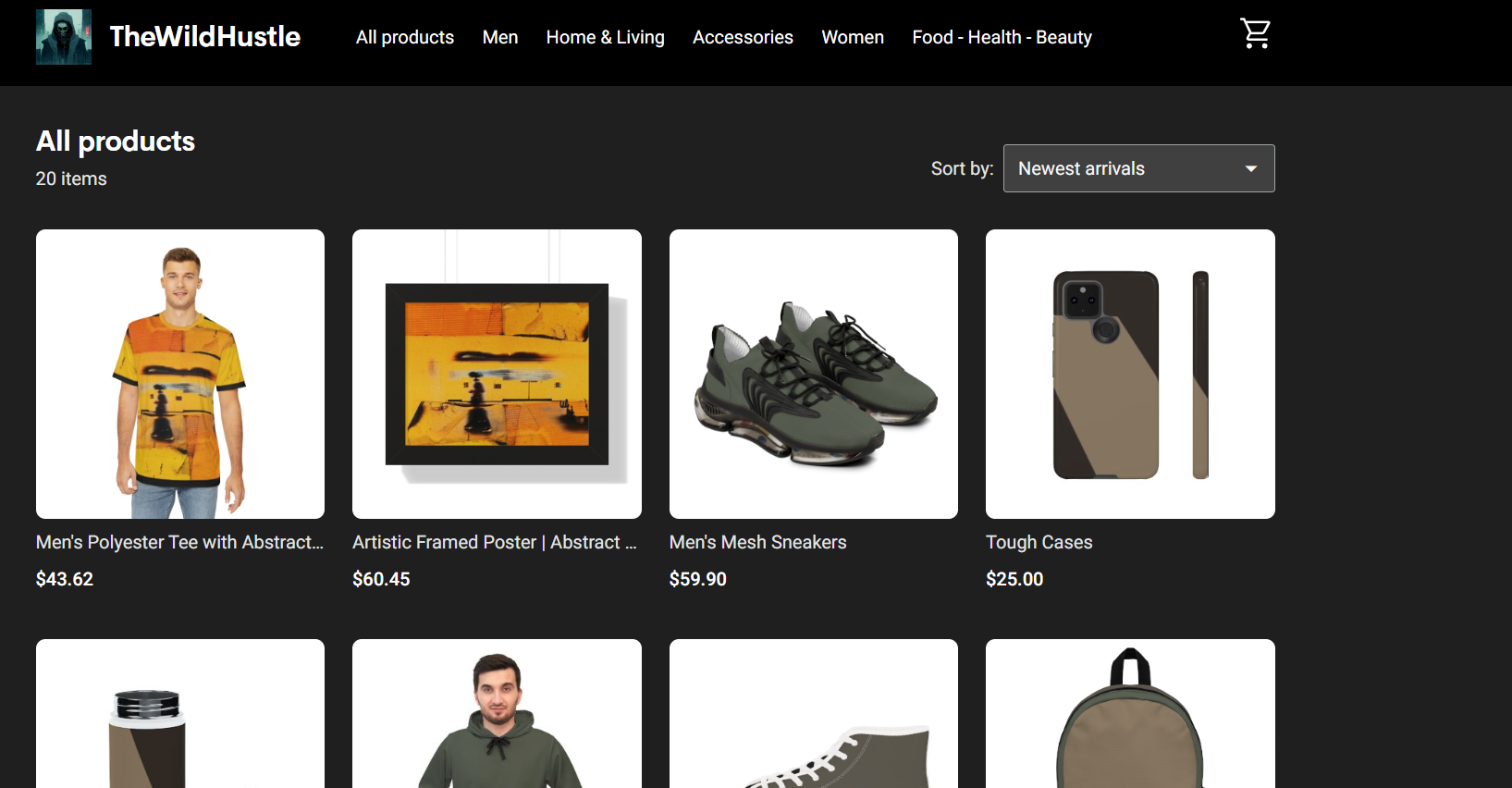

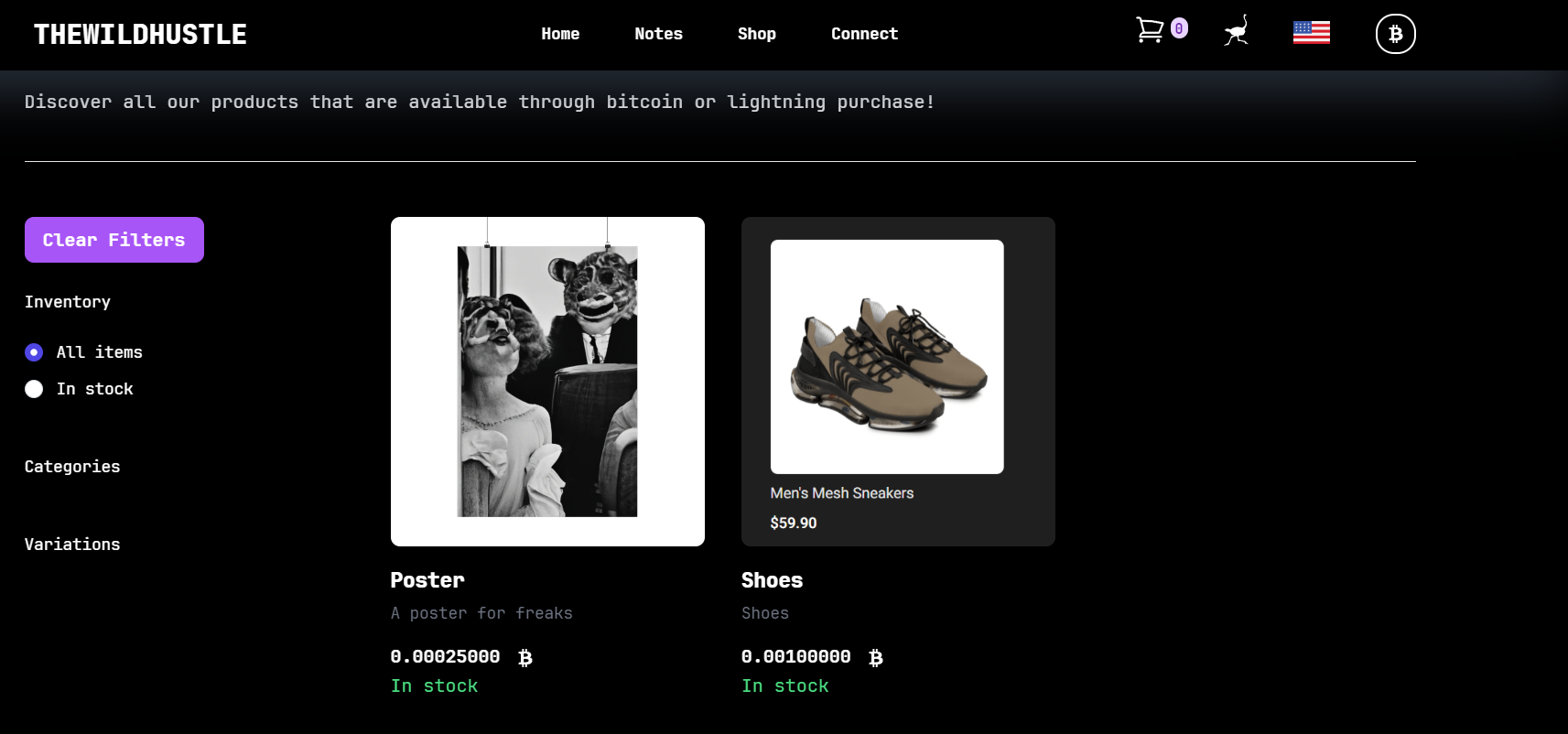

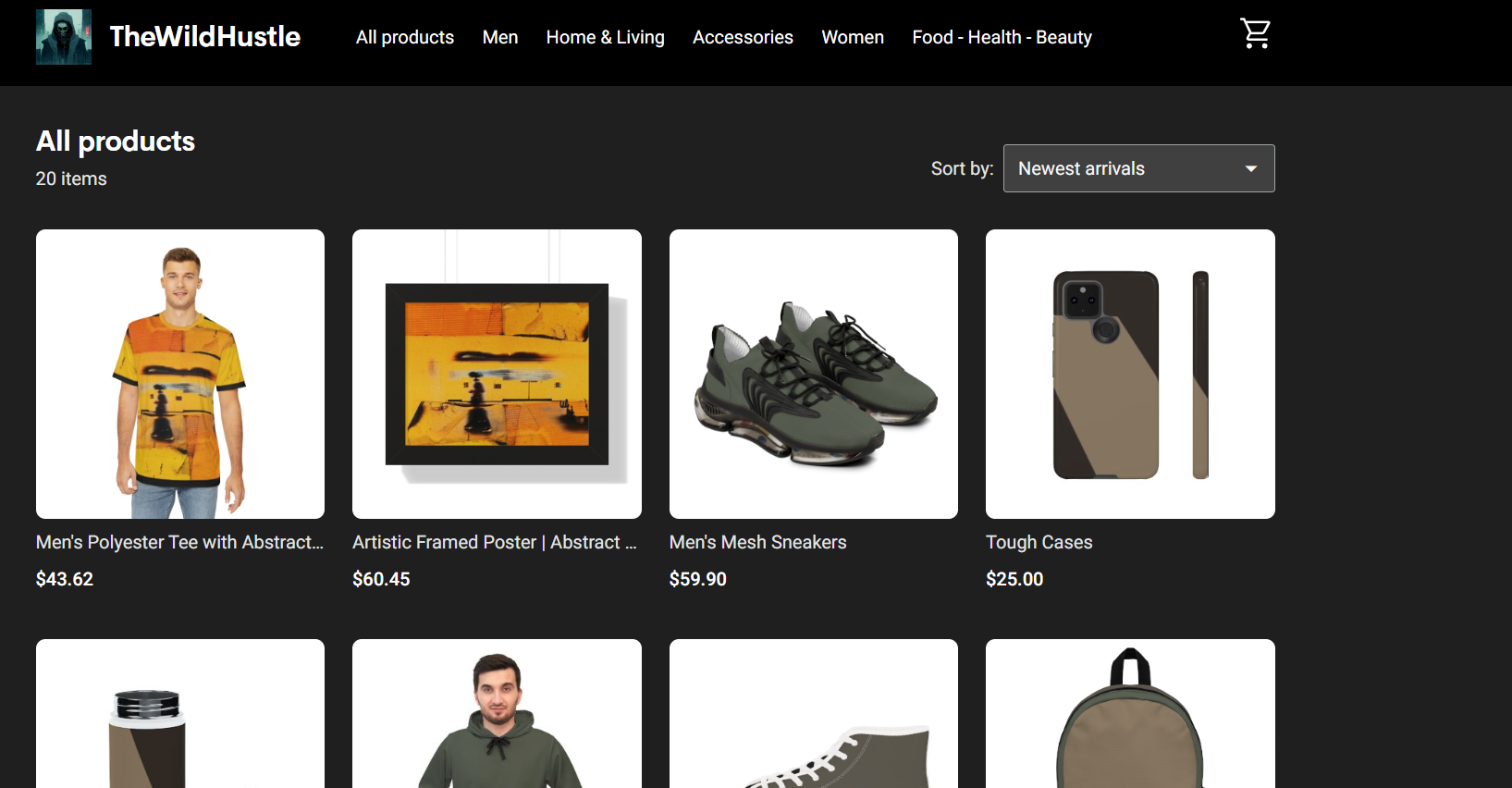

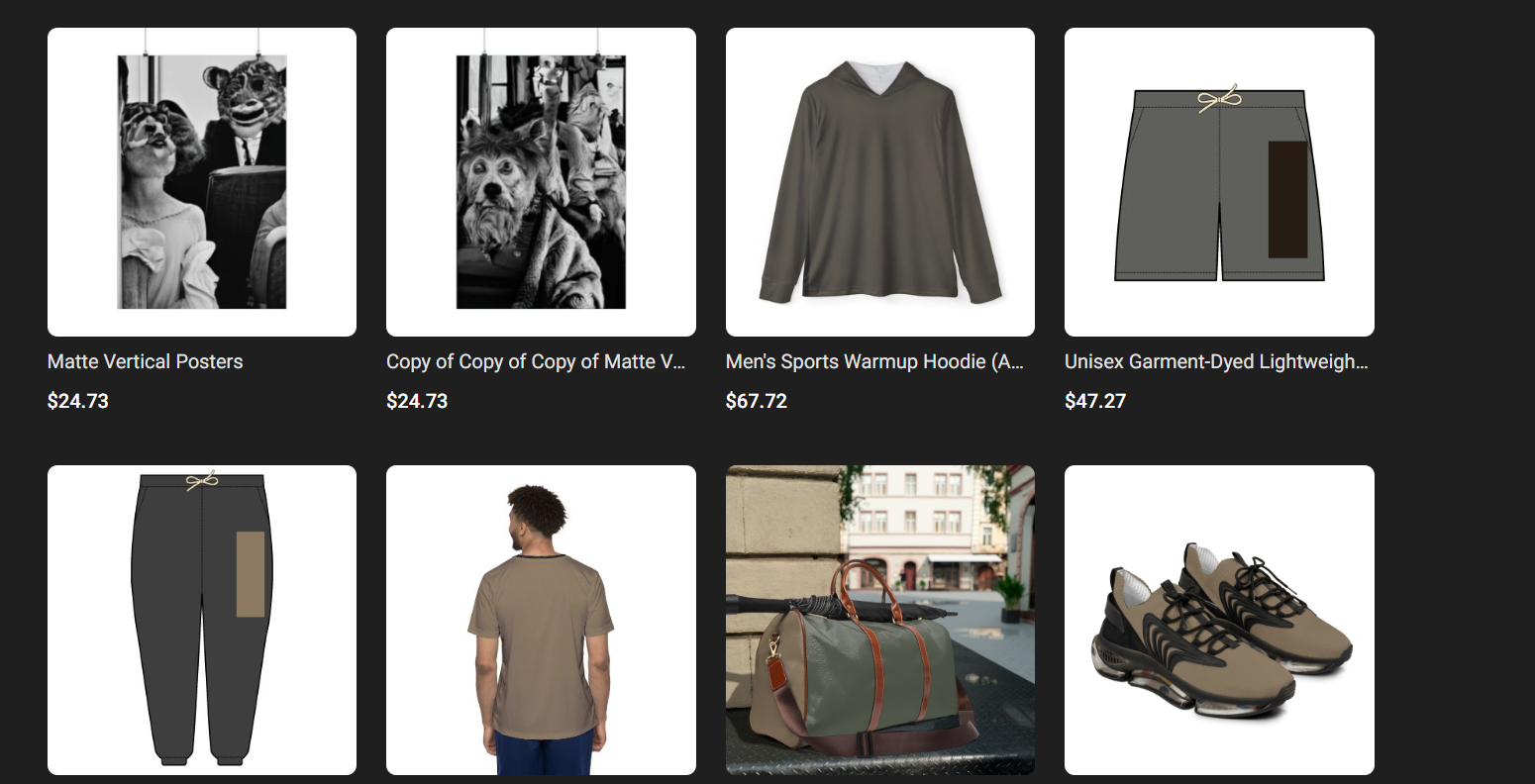

Let's hear some of your latest Bitcoin purchases, feel free to include links to the shops or merchants you bought from too.

If you missed our last thread, [here](https://stacker.news/items/781052/r/AG) are some of the items stackers recently spent their sats on.

originally posted at https://stacker.news/items/789759

-

@ 81cda509:ae345bd2

2024-12-01 06:01:54

@**florian | Photographer**

**Studio-Shoot**

* #[photography](https://yakihonne.com/tags/photography)

* #[picstr](https://yakihonne.com/tags/picstr)

* #[grownostr](https://yakihonne.com/tags/grownostr)

* #[artonnostr](https://yakihonne.com/tags/artonnostr)

“Know thyself” is a phrase attributed to the ancient Greek philosopher Socrates, and it has been a cornerstone of philosophical thought for centuries. It invites an individual to deeply examine their own thoughts, feelings, behaviors, and motivations in order to understand their true nature.

At its core, “Know thyself” encourages self-awareness - an understanding of who you truly are beneath the surface. This process of introspection can uncover your strengths, weaknesses, desires, fears, and values. It invites you to acknowledge your habits, biases, and patterns of thinking, so you can make more conscious choices in life.

Knowing yourself also involves understanding your place in the larger context of existence. It means recognizing how your actions and choices affect others and the world around you. This awareness can lead to greater empathy, a sense of interconnectedness, and a more authentic life, free from the distractions of societal expectations or superficial identities.

In a practical sense, knowing yourself might involve:

1. Self-reflection: Regularly taking time to reflect on your thoughts, feelings, and experiences.

2. Mindfulness: Practicing awareness of the present moment and observing your reactions without judgment.

3. Exploration: Being open to trying new things and learning from both successes and failures.

4. Seeking truth: Engaging in honest inquiry about your motivations, desires, and beliefs.

5. Growth: Continuously learning from your past and striving to align your actions with your inner values.

Ultimately, “Know thyself” is about cultivating a deep, honest understanding of who you are, which leads to a more fulfilled, intentional, and peaceful existence.

-

@ 5d4b6c8d:8a1c1ee3

2024-11-30 23:22:14

We've arrived at the final round of Group Play. Everyone survived this past round, although the Wolves almost let @gnilma down.

This will be the last opportunity to use a rebuy, should your pick lose this round. Once we're into the Knockout Rounds, it's single elimination.

# Friday's Games

75ers @ Hornets

Wizards @ Cavs

Bucks @ Pistons

Magic @ Knicks

Pacers @ Raptors

Jazz @ Thunder

Grizzlies @ Mavs

Spurs @ Suns

Warriors @ Nuggets

Rockets @ Kings

Blazers @ Clippers

# My Pick

Normally, I like to wait until closer to the games, but I know I'm taking the Cavs this round. They've already been eliminated from the tournament and they're playing the lowly Wizards.

If you want to read up on who's likely to make/miss the Knockout Rounds, @gnilma had a detailed [breakdown](https://stacker.news/items/788592/r/Undisciplined) earlier today.

# Prize

We're just shy of 60k, so I'll just commit to the prize being at least 60k.

May the odds be always in your favor.

originally posted at https://stacker.news/items/789403

-

@ 3c827db6:66418fc3

2024-11-30 22:48:41

### The Dystopian Present – Fiat Has Made Us All Digit Addicts

Everyone wants to make you an addict. Some people sell illicit drugs on the black market and want you to become addicted to them so they can profit from you. The dealers naturally focus on drugs that are physically addictive because they are often the hardest to kick. When they do manage to addict you to them that becomes harder and harder over time. For drug lords and dealers, this is heaven. This virtually guarantees that all customers will be regulars, at least for as long as they survive. For the addict, it depletes the quality of their life. They start to live from one fix to the next. The problem for the dealers is the illegality of the product. Staying in business as a dealer requires a lot of care, caution, and expense. Additionally, much of the total addressable market (TAM) is turned off by drugs’ bad reputation. So what do you do?

If the problem is legality, make legal drugs. The drugs sold in pharmacies are legal and in many cases no less addictive. There’s a drug for every complaint and three dozen for the common cold viruses. Some, like a simple nasal spray, are addictive and can lead to a chronic condition which “locks” you in for life. It’s the same basic business model as the street dealer but with less friction, lower risk, and much better optics. The barrier to entry is that the clients have to be "sick".

Now consider supermarkets, where the market is perhaps saturated, but the TAM is almost 100% of the population – everyone eats. Junk food can be quite addictive and can make its users sick. Sick junk food junkies might turn to pharmaceuticals without changing their habits, compounding the problem. Now the cycle is complete. As bad as such addictions might sound, and as widespread as they are, the current global addiction is yet worse: the addiction to digits pandemic.

The first case of addiction to digits is in terms of fiat currencies. They have the benefit of transacting with everyone in a particular country. It is very convenient to use those digits as a medium of exchange. Those digit addicts usually say: "I can't buy anything with bitcoin, so I am not going to buy any." They are saying, “I am addicted to the benefit of a convenient medium of exchange even though my purchasing power will deteriorate.”

Some people realise that money is usually static. It’s active when people are transacting and passive when they’re just keeping it for later. To be an effective store of value, money needs to preserve (or grow!) its purchasing power over time. A person should not earn the same money twice. When I have savings I should not be forced to actively manage it. So whole market segments focus on the passive use of money. It is strange how the system forces you to actively use your money to solve the passive use - it kind of defeats the purpose. Still, you can't let it degrade because of inflation. Here there are a few main categories - bonds, real estate, equities, gold, and art.

The bond's benefit is its promise to return more digits after some period. “Guaranteed” by the state. And they truly do! They give you the benefit of increased digits and at the end of the period even with the more digits, your purchasing power is less than when you started. Still, it beats the ones that just saved. The bond digit addicts will not buy bitcoin because bitcoin in cold storage pays no interest.

The real estate benefit is a digit "yield" in the form of rent and the digit value of the property will be higher. The value of the real estate is a function of the returns it generates every month. The digit value of the building increases because the degrading of the fiat digits happens faster than the degradation of the physical structure. Real-estate addicts will not buy bitcoin because it is not physical and does not pay any digits for rent.

Financial “engineers” invent products for people to bet on against each other. The whole premise of a stock market is that you sell something you have for another thing that may increase in digit value. Each trade has a winner and a loser, but like in a casino, the house always wins in the end. Just another addiction with another kind of dealer. The Bitcoin system is unifying everything into one. In a bitcoin economy, there are no losers because one person’s profit is not necessarily a loss for another. Those addicts would not buy Bitcoin because there is no betting system in Bitcoin and can't do call or put options or other illusionary "engineering" things so the insiders benefit. If you just buy Bitcoin and HODL for when you need it then all the dealers of that addiction will be out of business.

Gold addicts are addicted to the metal without realizing how it can be used against them. How can anyone tell us how much the market cap of gold is if no one can tell us the exact weight digits of gold that it is found? This is the true Schrödinger's cat these days. Now owning gold is represented only by a number on a screen, reducing it to the same status as fiat. With fiat currencies, one piece of paper has the number 1 on top and the other has the number 100 on top. ***We do not care that they are on the same paper value but we value the digits that are written on the paper.*** The gold digit addiction is the same, but it took longer to foster because everyone can measure its weight rather than rely on arbitrary numbers. Nobody can put 100 on top of 1 kilo of gold and tell you that it is 100 kilos. But since digital displays of gold ownership have largely replaced physical possession, it follows the exact same mechanism as paper. Gold addicts say that bitcoin does not have any physical (metal) properties, so it has no value, and they won’t buy it.

How about the art digit addicts? Their views on bitcoin aren’t very well known since they aren’t very active in the discourse. The benefit of art is in the emotions it evokes. When Bitcoin starts to demonetize the art industry, we will see art digit addicts defending its value. Art should be art, it should not be a method for a store of value.

The next digit addiction dominating today's societies is loyalty programs, like air miles, and loyalty points for discounts, promotions, and exclusive offers. Even to this day, my grandma is looking through the brochure of EVERY store in the area to find a discount of 10 cents cheaper bananas per kilo. Because the companies can't print currency digits they print loyalty digits. They not only have much greater purchasing power inflation than currencies (most of the time) but they also have much greater controls over when, where and how to actively use them. The addicts of the loyalty digits start orienting their lives around the loyalty program digits and the dealers love it.

The next digit addiction is social media. People get addicted to subscribers, likes, views, etc. The benefit they provide is the platform, the ability to reach a far greater audience than through face-to-face interactions. This addiction is not directly connected to money, but all those digits are what promoters, sponsors and everyone is looking at sponsors and subscribers automatically convert metrics into value to assign worth in fiat.

The next digit addiction is to video games. Gamers get addicted to the tokens needed to "unlock" the "special" item. They start chasing those token digits so hard in the virtual world that they forget to live in the real one. As young players age, their addictions often graduate from game tokens to other digit dealer systems.

The current FOMO digit addiction is to blockchains. Their benefits include faster transactions, more anonymity, and smart contracts to get you hooked. If the creator is not a direct scammer and truly wants to give those benefits to people he is essentially saying that the benefit that he gives is more important than incorruptible money. The benefit of smart contracts is greater than incorruptibility. That is probably a misunderstanding that secure and decentralised money is the base that gives you certainty to build everything on top. If you want to launch rockets into space you do not change gravity to make your use case easier to achieve. If you do, you will destroy all the sports where people need to jump. All the tall buildings and trees will be collapsing because for winds it will be much easier to tilt them. You destroy the way of life on earth but it is nice that we can go to space. ***If you believe that the benefit is worth it then do the work and build it on Earth without destroying it. Build on Bitcoin!***

The next addiction is to the digits of the custodians. Bitcoin ETFs were hotly anticipated and have received plenty of acclaim. But their custodians are getting the punters hooked on convenience. Give me your bitcoin in my custody because you are inadequate to hold it yourself. Give me your Bitcoin, and I will give you digits.

The common trait among all of these digit addictions is that they offer some benefit in return for dependence on certain digit lords. Once people experience the benefit, it becomes that is the thing that traps them. That is one of the struggles of the Bitcoiners to accept that there are benefits to all of the addictions mentioned above. Bitcoin has its benefits and limitations, but the benefits of Bitcoin do not negate the benefits of other things.

This is the source of the greatest conflict between bitcoiners and crypto bros. Bitcoiners should not dismiss other crypto just because they are shitcoins. Instead, we should enter the arena and out-compete them just like we have been for the past 15 years. Some of them do provide nice benefits to get people hooked to their blockchain digits. When we as bitcoiners do not compete with them and learn what we can, we are going to deprive Bitcoin of those benefits. Bitcoin probably shouldn’t adopt every feature that emerges somewhere in the cryptosphere, but competition fosters improvement. As a former professional athlete, I can say that my skills improved the most after losing to a weaker opponent. When a weaker opponent defeats a stronger one, it only means that he revealed a weak spot. Just because the weaker opponent won does not imply that the rules are unfair and need to be changed or the weakling should be disqualified. That is the tactic of the fiat digit lords. If we want to beat more powerful opponents (i.e. fiat currencies), we must also face the weaker ones. Bitcoin’s obvious weak spot was, until recently, its throughput. Enter Lightning Network.. Privacy? Welcome to eCash on top of Bitcoin.

### The Battle for Control Continues in a New Domain – The Digit Lords Are Capturing Bitcoin Digit Addicts

The addiction is so ingrained in all of us that even when someone understands Bitcoin and its implications, they transfer their digit addiction onto Bitcoin. For them, the addiction manifests in HODLing, and the object of their obsession is "How much do I have??" and “Is the number going up??” I HODL and want the digit value to rise to give me the "fix" that I need. Still intoxicated by other digits, they are the easiest prey for the custodian digit platforms. By contrast, real Bitcoin maximalists value proof of work above all. Their primary goal is to build a better life for everyone through Bitcoin. Unless you’re building, you’re just a digit addict chasing your high with Bitcoin.

Different people get addicted to different digits. But even if someone benefits a lot from their addiction, that does not mean it is right for you. Michael Saylor was instrumental in helping me recover from my fiat addiction and going clean on Bitcoin. At the same time, he’s hooked on the custodians’ digits. After all, he has billions in the custodians’ digit ecosystem. He preaches to people that it is better to have more custodians of bitcoin. Let's go ask all the “gold bugs” how that thing turned out for them. Do not get me wrong all the benefits that he is saying are right and they are benefits so what is the difference?

The difference is in the control. In the addictions described above, the users get the high, but they also get hooked. At the same time, a small group keeps control over the digits the addicts use and claims themselves as digit lords. In all those digit addictions, the mechanism is the same. Fiat digits are controlled by fiat digit lords. Air miles digits are controlled by the airline digit lords. Crypto bros are producing ever more blockchain digits with benefits that Bitcoin does not have (yet) to become the blockchain digit lords. The custodian's digits are controlled by the screen digits lords. They all control the addicts through the digits.

Another reason why the addiction analogy fits so well is that detoxing is so hard. Wonder why "Orange Pilling" is a struggle? Have you tried to take the cocaine away from an addict, or the insulin of a diabetic, or the chocolate from a fat kid? Resistance is natural. A real estate mogul who has spent decades mastering his trade and amassing a fortune is naturally going to resist any force that could demonetise his industry. The HODLer junkies profiting from BlackRock’s ETFs and similar custodians will naturally resist any threat to the number-go-up fix. That is a marriage made in heaven. For the HODL digit addicts, you can see what infrastructure the custodians are setting up to capture you. Check the work of Whitney Webb and Mark Goodwin in their collaborative articles about that topic.

Gold provides a clear example of how the digit custodians work. To analyse gold, you go to a goldsmith who can assess the gold’s weight and purity, not an ETF dealer. The ETF dealer is just the street pusher for the ETF digit lords. They can describe the imaginary trend lines on top of their imaginary digits that are disconnected from the metal. Unless that particular ETF dealer has a direct line to the gold digit lords, his opinion is absolutely worthless. He is just the digit addiction dealer pushing someone else’s product to get his cut. Bitcoin ETFs are no different. ***Bitcoin can be used as a real store of value! In the fiat system, it is mainly “You store my value!”***

The digit lords’ model has its weaknesses. Some try to exploit the model’s mechanics for their own benefit and to avoid becoming addicts. For example:

- counterfeiting fiat

- insider trading in the store of value digits

- hard and soft nepotism in the loyalty digit programs

- hacks in games

- all of the above in blockchains

Even though they are not obeying expected addiction behavior, they are still addicts by chasing the same digits. The difference is that if they succeed they are branded criminals (hackers) by the digit lords. They are using the control system as designed and demonstrating that the whole system is exploitable. The exploiters can attain enormous power by those actions but that is not the intention of the system. The digit lords need control to remain a privilege and guard it jealously so that no one else can own the digits but them. That is why they need us to be hooked: no single person’s effort can overcome control over the digits. That is why any system that is disconnected from work will fail in the Bitcoin era.

Bitcoin is the panacea able to cure all addictions. There is no free lunch in Bitcoin. Once connected to the open and permissionless Bitcoin network, all wallets, all investments, all loyalty promotions, all social media, all gaming tokens, and all blockchains will benefit from bitcoin and their first-mover advantage.

### First Look at The Addiction The Right Way - Then Take Responsibility to Break It and Be Free

Beyond the number go up addicts, analysts are also addicted to the models evaluating all the addiction digits. If Bitcoin is something genuinely new, then why are we using the same old modeling principles? The power-law model fits a number of real-world phenomena, including bitcoin through most of its history. From the growth of cities to metabolic rates and many other correlations relating to energy expenditure, the power law applies in a surprising number of cases. The power law is a functional relationship between two quantities, where a relative change in one quantity results in a relative change in the other quantity proportional to a power of the change, independent of the initial size of those quantities. In other words one quantity varies as a power of another. Funny how the name of the model coincidentally (or not) suggests using it for things connected to power. Bitcoin is inseparable from energy (power), so the power law is probably the proper tool. That is why the power law of the hash rate will never break even if the fiat price power law might.

Since engineers have built Bitcoin, their models explain the technology best. But when it comes, to financial analysts they are not modeling reality - they are trying to model the collective psychology about particular digits. Elon Musk is not going to land a rocket on Mars powered by likes or fanboys. The only way is to model reality and then build it. Reality is uncompromising, and inspiration only takes you so far. Either the model is accurate and the execution works, or the rocket explodes. Over time, reality will defy even the best financial models, but they can accurately capture what the collective psychology values in the short term. That’s why the financial “engeneers” hypnotize the digital addicts and get them hooked. In the meantime, Bitcoin continues to do its thing regardless of what any of us think about its future - it is an uncompromising force of nature.

Perhaps there’s a less fickle way to evaluate companies. Let's take NVIDIA, the current FOMO stock. The digit value unit of a stock is connected to a digit unit of the share. Neither quantity is directly connected to energy and, therefore, can be created at will. But what if someone maps the produced GPUs by NVIDIA? It is just a hunch but it probably follows a power law - the production capacity of the chips is limited by physics. The production of the company can’t break reality to scale but when you cross-reference it with the stock price, you may see when those digits are driven by the current psychology of the “market” or by fundamental value. Giovani Santostasi is the person to do the math on that and say if he can innovate a new way of evaluating stocks with the power law model. I may be talking out of my ass for the stocks valuation application of the model but he proved that this is the only model that maps the journey to hyperbitcoinisation.

And what about digits that no one controls? Some digits are connected to reality, which is very useful: the digits for time, the digits for length, the digits for weight, and the digits for temperature. Reality does not care about what we think about it. Reality just is, and we use digits to understand it. That is the language of the engineers, not economists. The numbers not connected to physical energy are numbers backed by a group's opinion. They can be captured and controlled. Engineers’ digits are free. They resist control. Even those who haven’t mastered them can benefit from those who have. They are the ones building the roads, the computers, and everything else we need in modern life. The difference between open digits and controlled digits is that the addicts of the controlled digits depend on the digit lords for where, when, and how they can benefit. You can't use the digits of one country outside its borders freely. You can't use one company’s loyalty digit points with its competitors. You can't use the token digits from a game to buy a coffee. You can't buy MicroStrategy stock digits without a bank account.

Michael Saylor always says that there is nothing worth buying in Africa even if you had a billion dollars to spend. That is grossly biassed towards the passive use of money – saving their purchasing power. If you are a billionaire it sure is a problem. But if you want humanity to flourish, the most important thing is to build stuff! Africa is a very important part of humanity, and we need to figure out what to build and how to facilitate spending, so they can get to the point of caring about store of value billionaire digit addiction problems and even beyond the addicion. Saving is just a partial view of that one store-of-value use case. My point is not that Saylor is wrong to protect his castle. Rather, we need to build castles for everyone and then they can start protecting them. His blind spot is that the custodians now want to co-opt Bitcoin as a store of value so they can continue the 2% inflation game and remain digit lords. The difference is that with Bitcoin the 2% inflation game runs on a decentralised global standard. Different countries and banks can connect to it and profit, but that attracts the degenerate custodians (companies, banks, and states) that will print digits on top of Bitcoin. At some point, a bank run on the most degenerate custodian digit lord is inevitable. Then the domino effect of bankruptcies that they can stop in the fiat system is not something that they can do in the Bitcoin system. So buckle up! The biggest volatility may lie ahead. ***The people that we call poor do not have access to custodian institutions, but now they can run their own Bitcoin nodes.*** For the first time ever, unprivileged societies have the tools to take back all the purchasing power that was stolen from them by the digit lords without spilling blood.

Take control of the math you use, and take control over the money you use, so you can take control of the life you lead. Otherwise, there will come a time when you will beg someone in control to come and save you. This message is addressed to those without control, but this message is also relevant to those who already realise what Bitcoin is and need to prepare for the day when the addicts come and beg us to save them. ***We need to start working on becoming people of virtue --Alex Svetski***\*.\* We must not become digit lords, but actually detoxify people effectively and cooperate. Do not sit on your hands, just HODLing. Build that future. Anyone who’s been in Bitcoin for more than 4 years (one cycle) should be running a node and taking more control into their hands. Anyone who has profited from Bitcoin’s appreciation should be thinking about what they want and how to integrate Bitcoin into those goals. No coding or technical expertise is required. All the analog infrastructures need to be integrated with the Bitcoin infrastructure. Barbers need to start accepting Bitcoin and telling the community. The barber infrastructure has to be connected to the Bitcoin infrastructure along with all the others.

The digit lord companies should consider replacing air miles with sats? Replace in-game tokens with milisats? The digit lords could do this immediately. This is Bitcoin’s ultimate, imminent network effect. Inflation in all the addiction digits will accelerate. The digit lords will do everything they can to keep addicts in their digit drug ecosystem. At the same time, companies that have already adopted Bitcoin will actually save them from bankruptcy. The digit lords will then serve all of us, and whoever gives the most benefits will be the one that WE choose, and they will fight for our vote and support.

Until you drop the digit addiction, you will never be free. Reality is uncompromising for those (companies or countries) who do not navigate its rules/laws properly. This is exactly the problem that the digit lords face as long as the digits are connected to reality. Someone can always verify the accuracy of the digits. I can lie about today’s date, but you can verify. I can lie about the weight of something, but you can verify - maybe not applicable for gold :). I can lie about your height, but you can verify. I can lie about the temperature, but you can verify. Now, for the first time ever, money digits are connected to reality through Bitcoin, and everyone can verify! Lies won’t last long. Just ask the FTX, Celsius, and Terra Luna digit lords. They may control their closed-digit systems, but no one controls reality. ***That is exactly why we will win --Marty Bent!*** The digit lords are addicted to that control, but people are building solutions to transfer control from the digit lords to individuals. ***Whether the digit lords realise it or not, they are losing ever more digit addicts to a system that is detoxing them.*** Losing addicts is fine if you can get them hooked on another substance. Referring back to the chemical drugs mentioned above, that we looked at at the beginning of the article. This is why digit lords will do anything to keep their addicts hooked on the next digits. Now that people have Bitcoin – money inseparable from reality – we have clear detoxified heads. We will never go back to the addiction. The current dynamic is that the digit lords will chase our attention, but we will never give them back the control. I will happily take a discount on a vacation flight, but I will not serve the digits lords’ agenda. I will not obey the digit lords’ vacation plans for me whatever loyalty digits they offer. They will serve my plans and orient their services around my needs.

One of my favorite phrases from ***Jeff Booth: There is no they; there is only we!*** It is incumbent on all of us to take control and become "we". The digit lords are the "they" people usually refer to. In the current system, there are digit lords, digit dealers, and digit addicts. In the Bitcoin system, addicts detox, dealers build detoxing tools, and no one is a digit lord. And brings us back to Jeff’s statement there is only we in the Bitcoin system!

Congratulations on reaching the end of this article! Few people take any time to digest anything more demanding than a meme, but not you. If these ideas are worth spreading, please share the link. If you think that they are worth discussing on a podcast, tell the podcasters to hit me up, and I would be happy to chat with them. May we all live without addiction and build what we want for ourselves and ***for the kids --Greg Foss*.**

P. S. Love to all the orange brothers and sisters out there. Godspeed!

-

@ 04222fa1:634e9de5

2024-11-30 14:24:20

A little Saturday story I'm sharing...

My Son started at university a couple of months ago

He's quite into lifting and has shown interest using the concept 2 rower at the gym

I kept telling him, join the rowing club, they'll love your size, he's 6'5 well built and has naturally huge legs, which isn't the norm with tall kids

So the other day, he says 'there's a post on insta saying the boat crew will be on campus, if anyone interested pop along for some tests'

So I'm like, you've gotta try it out

So he goes along and they test him on a few exercises and the trainer says, these results are above average, can I get your details and I'll pass them to our racing director

So few days later he gets an email from race director saying, can you come down to the boathouse, we want to see you ASAP

So my Son was a little nervous but he went along and they tested him out

The race director said to him, not gonna lie, these results are Olympic level!

I was really proud of him.

originally posted at https://stacker.news/items/788914

-

@ 5d4b6c8d:8a1c1ee3

2024-11-29 20:16:27

Is anyone watching the Black Friday games?

I'll be watching the Raiders games, but then I'll be eager to catch up on basketball.

The Knicks squeaked out the early game and the Cavs are already trailing the Hawks.

@realBitcoinDog is risking a strike if he doesn't get a pick in.

originally posted at https://stacker.news/items/788007

-

@ 57d1a264:69f1fee1

2024-11-29 11:26:35

Another follow up on @Jon_Hodl post, creating some custom banner designs for SN,

Some others dedicated to territory founders. In this case, ~alter_native for @DesertDave

and ~Design obviously!

In case you missed, there are some [SN Brand assets](https://stacker.news/items/786223/r/Design_r) available. You can access [the figma file](https://www.figma.com/design/ZL3FLItd9j48pzKVi4qlOy/Stacker.News-Media-Kit?node-id=1-3&node-type=canvas&t=Zo2ZpoOhQ5nugxhM-0) and create your own. If unable, shoot out and let's see if some can help you promote your territory :)

FYI: @AGORA @anna @antic @AtlantisPleb @Bell_curve @benwehrman @bitcoinplebdev @BlokchainB @Bitter @ch0k1 @davidw @ek @elvismercury @frostdragon @grayruby @HODLR @inverselarp @jeff @k00b @marks @MaxAWebster @niftynei @nout @OneOneSeven @oracle @PlebLab @Public_N_M_E @RDClark @softsimon @siggy47 @StudentofBitcoin @south_korea_ln @theschoolofbitcoin @UCantDoThatDotNet

originally posted at https://stacker.news/items/787497

-

@ 2063cd79:57bd1320

2024-11-29 07:34:58

Ganz laienhaft gesprochen, sind Derivate Finanzprodukte, die auf einem Basisprodukt basieren (in unserem Fall ist dieses Basisprodukt der Bitcoin-Hashpreis). Derivate werden von diesem Basisprodukt abgeleitet, oder deriviert, damit man das Produkt indirekt handeln kann. Derivate werden meist zu zwei Zwecken gehandelt, entweder zur Absicherung oder zur Spekulation.

https://archive.ph/95gBf

Wie den verlinkten Nachrichten zu entnehmen ist, haben Luxor Technologies einen sogenannten Hashprice NDF lanciert, also einen Non-Deliverable Forward Contract. Bei Derivaten gibt es alle möglichen Formen und Arten von Verträgen, die das Basisprodukt indirekt handeln. Eine gängige Form bilden dabei Terminkontrakte, sogenannte Futures und Forwards.

> 💡 Futures sind eine Form von Derivaten, die Parteien verpflichten, einen Vermögenswert zu einem vorher festgelegten zukünftigen Datum und Preis zu handeln. Hier muss der Käufer den Basiswert zum festgelegten Preis kaufen oder dem Verkäufer verkaufen, unabhängig vom aktuellen Marktpreis zum festgelegten Zeitpunkt der Abwicklung.

>

> Forwards hingegen stellen eine ähnliche Form von Terminkontrakten dar, die auch einen zukünftigen Preis zu einem zukünftigen Datum festlegen, nur dass Forwards außerbörslich (OTC) gehandelt werden. Hinzu kommt, dass Forwards anpassbare Bedingungen haben, die zwischen den Parteien und dem Händler individuell vereinbart werden. Forwards sind im Gegensatz zu Futures nicht standardisiert.

Das heißt, der Luxor Hashprice NDF ist nichts anderes, als ein Vertrag zwischen einem Käufer und einem Verkäufer, die sich verständigen, das Basisprodukt (Bitcoin-Hashpreis) zu einem bestimmten Preis an einem festgelegten Fälligkeitsdatum zu handeln. Da es schwierig ist Hashpreis zwischen Verkäufer und Käufer auszuliefern, wird in diesem Fall ein Non-Deliverable Forward (NDF) genutzt.

> 💡 Ein Non-Deliverable Forward (NDF) ist in der Regel kurzfristiger Terminkontrakt, der in Bar abgerechnet wird. Das zugrunde liegende Produkt wird nie ausgetauscht, daher der Name „nicht lieferbar“. Zwei Parteien einigen sich darauf, gegensätzliche Seiten einer Transaktion für einen festgelegten Geldbetrag zu übernehmen. Dies bedeutet, dass die Parteien die Differenz zwischen dem vertraglich vereinbarten (NDF) Preis und dem tatsächlichen Marktpreis abrechnen. Der Gewinn oder Verlust wird anhand des Nominalbetrags der Vereinbarung berechnet, indem die Differenz zwischen dem vereinbarten Kurs und dem Marktkurs zum Zeitpunkt der Abwicklung genommen wird.

<img src="https://blossom.primal.net/dc7946a8729d0165218955b11f0e9b760e1d49a2d11a1e8e87fadedb99005aa3.gif">

Die gesamte Transaktion wird also anstatt in Bitcoin-Hashpreis in einer konvertierbaren Währung abgerechnet. In diesem Fall ist es möglich, den Vertrag in US Dollars, Bitcoin oder US Dollar Stablecoins zu begleichen. Das bedeutet einfach gesprochen, Verkäufer und Käufer einigen sich auf einen bestimmten Preis in der Referenzwährung für eine bestimmte Höhe an Bitcoin-Hashpreis. Bei Fälligkeit wird der vereinbarte Preis mit dem Referenzpreis des jeweiligen Tages verglichen. Generell kann dies ein vom Herausgeber des Kontrakts festgesetzter Tageskurs sein, Luxor bedient sich hier des Bitcoin Hashprice Index. Dazu gleich mehr. Die Differenz zwischen dem vorab vereinbarten Preis und dem Referenzpreis wird am Fälligkeitstag in der konvertierbaren Währung abgerechnet.

<img src="https://blossom.primal.net/f1a0ac26c5662e6f64e659410d9ae14fbf57676e8136879012d5ffcb436c6544.gif">

Da wir nun die technische Komponente abgehakt haben, können wir uns dem Luxor Hashprice NDF im Detail widmen.

Der Luxor Hashprice NDF soll es Minern ermöglichen, ihr Risiko gegenüber dem Bitcoin-Preis und den steigenden Energiekosten abzusichern, sogenanntes Hedging gegen Verluste aus diesen unbeeinflussbaren Preisfaktoren. Häufig verwenden institutionelle oder Einzelhändler Derivate (vornehmlich Optionen und Terminkontrakte), um Absicherungsstrategien zu entwickeln, die das Risiko einen Kursverlusts des Bitcoin-Preises mindern. Mit diesem Produkt haben jetzt Miner zum ersten Mal Zugriff auf ein Instrument, das speziell auf ihre Bedürfnisse angepasst ist. Luxor gehen davon aus, dass wie traditionelle Rohstoff- und Energieproduzenten, auch Bitcoin-Miner wahrscheinlich zu großen Nutzern von Derivaten werden. Traditionelle Hersteller bedienen sich sehr anspruchsvollen und hoch entwickelten Hedging-Strategien (sei es mit Futures, um Preise zu sichern, oder mit Optionen, um Verluste abzusichern), um sich vor Volatilität bei Vorprodukten, Energiepreisen und Preisschwankungen der eigenen Produkte zu schützen. Außerdem können Miner mit diesem Mittel dringend benötigtes Geld aus dem Verkauf von Wetten auf die zukünftige Produktion erhalten oder ihre zukünftige Produktion zu einem festen Preis sichern.

<img src="https://blossom.primal.net/725dff443abdb858ddd2ba387e5d4c26ae1dda9364e767c1a849cf67086a4920.gif">

Bislang nutzten Miner hauptsächlich Optionen, um Risiken im Zusammenhang mit der Preisvolatilität auszugleichen, indem sie sich die Reserven in ihren Bilanzen zu eigen machten. Allerdings sind Miner nun mehr und mehr gezwungen, ihre Reserven zu liquidieren, um Fälligkeiten zu begleichen und Betriebskosten zu decken, wenn der Preis von Bitcoin, bzw. der Hashpreis, weiter fällt (siehe //Secondi).

Doch nicht nur Miner profitieren von diesem neuen Finanzprodukt, denn auch Händlern wird ermöglicht, auf die von den Minern erzielten Einnahmen zu spekulieren und somit am Mining-Markt zu profitieren, ohne direkt in Mining-Equipment investieren zu müssen. Mit dem Hashprice NDF haben Luxor eine neue Investitionskategorie im Bitcoin-Finanzspektrum geschaffen, dass sicherlich auch Investoren interessieren könnte, die sonst die Nähe zum Mining-Sektor vermieden haben.

> \[H\]ashprice derivatives are the apotheosis of our vision of hashrate as an asset class, something we’ve been pioneering since we introduced hashprice with the launch of Hashrate Index in 2020.” - Nick Hansen, CEO Luxor

Doch wie genau sieht so ein Terminkontrakt genau aus? Zunächst mal wieder ein paar Basisfakten:

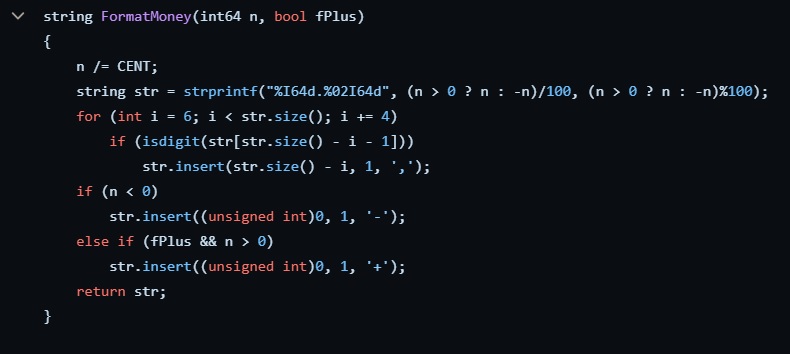

<img src="https://blossom.primal.net/29202c311f4b4929f49e0d0210388918726696421ac2820caa628eaf100e1085.png">

Bei Vertragsabschluss stimmt eine Partei, der Käufer, zu, den Hashpreis zu einem späteren Zeitpunkt zu einem bestimmten Preis vom Verkäufer, dem Miner, zu kaufen. Da der Hashpreis NDF ein OTC-gehandelter Vertrag ist, kommt er mit Hilfe von Luxor zustande, die als Broker fungieren.

> 💡 Ein OTC-gehandelter Vertrag ist ein Finanzkontrakt, der nicht an einer Wertpapierbörse gehandelt wird. OTC-Derivate sind stattdessen private Verträge, die zwischen Kontrahenten ausgehandelt werden, ohne eine Börse oder andere formelle Vermittler zu durchlaufen, obwohl ein Broker/ Makler bei der Organisation des Handels behilflich sein kann.

Luxor kümmert sich dabei neben dem Order-Matchmaking um das Counterparty-Risk und die Zahlungsabwicklung bei Ablauf des Vertrags. Forwards können also von den Vertragsparteien beliebig lang oder kurz laufen, allerdings beträgt die übliche Dauer, laut Matthew Williams, der das Derivategeschäft von Luxor leitet, für einen Hashprice NDF in der Regel 30 Tage.

Luxor haben sowohl den Begriff Hashpreis geprägt, als auch den Bitcoin Hashprice Index erschaffen.

> 💡 Wir wissen der Hashpreis brechnet sich aus Bitcoin Preis / Hashrate. Der von Minern generierte Umsatz pro Tera-Hash.

>

> Beispiel: 0.20 US Dollar pro Tera-Hash/Sekunde pro Tag (0.20/TH/s/day)

Die Terminkontrakte werden anhand dieses Index von Luxor abgerechnet, und Anleger können wählen, ob sie in US Dollars, Bitcoin oder US Dollar Stablecoins abrechnen möchten. Der Einfachheit halber, wird der Index in Peta-Hash dargestellt (Peta-Hash/Sekunde/Tag), da die Darstellung in Tera-Hash/Sekunde/Tag zu kleinteilig wäre.

Wenn der abgeschlossene Vertrag ausläuft, wird der Hashpreis an dem festgelegten Tag mit dem Hashpreis des Vertrags verglichen. Ein Rechenbeispiel: Wenn der Verkäufer/ Miner weiß, dass 30 Tage lang ein Output von 50 Peta-Hash pro Sekunde (PH/s) erzeugt werden kann, kann er 1.500 (PH/s x Tage) Kontrakte zu 100 US Dollar pro PH/s/Tag verkaufen. Wenn bei Vertragsablauf der Abrechnungswert 70 US Dollar pro PH/s/Tag beträgt, profitiert der Miner von 45.000 US Dollar (100 US Dollar Marktpreis - 70 Dollar NDF-Preis = 30 US Dollar x 1.500 Kontrakte).

Andersrum, wenn der Hashpreis 100 US Dollar PH/s/Tag bei Vertragsablauf übersteigt, steckt der Käufer den Gewinn ein und der Verkäufer/ Miner muss die Differenz begleichen. Da der Vertrag Non-Deliverable ist, also das zugrunde liegende Produkt nie tatsächlich ausgetauscht wird, nimmt der Käufer keine physische Lieferung von Hashrate entgegen. Sondern die Differenz wird ausgezahlt.

Soviel erstmal zum Luxor Hashpreis NDF, dem ersten seiner Art auf dem Markt, obwohl das Unternehmen bereits angekündigt hat, es sei „das erste von vielen“ Derivate-Produkten, das Luxor bereits in diesem Jahr einführen will. Es bleibt abzuwarten, ob diese Art von Produkten Anklang findet, jedoch wurde, laut dem Unternehmen, im Vorfeld sehr viel Recherche bei potentiellen Kunden und Partnern betrieben, um eine Nachfrage und ein gewisses Bedürfnis nach Hedging-Möglichkeiten zu stillen. Ob das Produkt jedoch für einige Miner zu spät kommt, werden wir uns im zweiten Teil anschauen.

Einen anderen Weg hat schon vor einiger Zeit FTX, eine der größten Börsen, eingeschlagen, als sie 2020 die Einführung eines Hashrate-Futures ankündigten. Die Futures wurden nach der durchschnittlichen Difficulty pro Quartal bewertet. Um die unlesbaren Zahlen der Difficulty lesbar zu machen, wurde der Kontraktwert berechnet, indem die Difficulty durch 1 Billion geteilt wurde, um eine zweistellige Zahl zu erhalten, die es dem Kunden erleichtern sollte, den Wert nachzuvollziehen. Anders als bei den Luxor Forwards, verhielten sich diese Futures ein bisschen (lies: komplett) wie ein Wettschein auf eine sinkende oder steigende Difficulty im Zeitraum des nächsten Quartals. Doch dieses kurzlebige Unterfangen hielt nur für 3 Quartale, bevor es kommentarlos beendet wurde.

🫳🎤

---

In diesem Sinne, 2... 1... Risiko!

-

@ fe7f6bc6:c42539a3

2024-11-29 01:54:31

A few weeks ago, I sat down with Chad ([full podcast](https://creators.spotify.com/pod/show/proofofhealth/episodes/1-How-Muay-Thai-Fighting-Saved-My-Life---Chad-Mane-e2pnbmp)), a seasoned Muay Thai fighter with over a decade of experience, to talk about life inside and outside the ring. Chad’s story is raw, intense, and unfiltered—a journey of struggle, discipline, and transformation. His insights left me reflecting on how combat sports, especially Muay Thai, can teach us profound lessons about resilience, focus, and the human spirit.

### **The Fight Beyond the Ring**

What struck me most was how Muay Thai isn’t just a sport for Chad—it’s a way of life. He began his journey as a teenager, struggling with family issues and uncertainty about his future. A chance meeting led him to Thailand, where he trained intensely and fought his first bout just 28 days later. Chad told me, “Muay Thai saved my life,” and I could feel the weight behind those words.

For Chad, the ring became a space to confront not just opponents but his own fears and insecurities. The process of training—the relentless hill sprints, countless kicks, and sparring sessions—taught him how to face challenges head-on. Fighting wasn’t about aggression; it was about finding strength in adversity.

---

### **The Beauty in the Brutality**

One of the most fascinating things Chad shared was his perspective on pain and sacrifice. During his career, he’s endured broken ribs, countless stitches, and even fought with a broken nose for eight years before getting it fixed. “Pain is the best teacher,” he said, explaining how injuries forced him to adapt and improve.

What I found most compelling was how this physical suffering seemed to heighten his appreciation for life. Chad described moments after brutal training sessions when even a sunset or a simple breeze felt extraordinary. It’s as if the harshness of the ring makes the world outside it feel brighter, sharper, and more alive. “When you’re ready to die in the ring,” he said, “you start seeing life differently.”

---

### **The Mental Battle**

Chad emphasized the mental aspect of fighting, something I hadn’t fully appreciated before. He talked about the mindset required to step into the ring: the inner dialogue where you convince yourself you’re ready to endure pain and push beyond limits. “You can play football or tennis, but you can’t play Muay Thai,” he said, driving home the seriousness of the sport.

Before a fight, Chad uses visualization to prepare himself for the intensity of combat. He doesn’t shy away from the danger but instead leans into it, fully accepting the risks. This mindset, he believes, is what separates good fighters from great ones.

---

### **Lessons for Life**

While most of us won’t step into a Muay Thai ring, Chad’s experiences offer valuable lessons that apply to all areas of life:

- **Discipline Creates Freedom**: The structure of relentless training gave Chad a sense of purpose and control over his life.

- **Face Your Fears**: Whether it’s an elbow to the face or a difficult decision in life, avoidance only makes things worse.

- **Surround Yourself with the Right People**: Chad stressed the importance of training with people who push you to be better. “Energy matters,” he said, and I couldn’t agree more.

---

### **Final Thoughts**

Chad’s story reminded me why I wanted to take on my own Muay Thai journey. It’s not just about fighting; it’s about testing yourself in ways that reveal who you really are. For Chad, the ring isn’t just a place to compete—it’s a place to grow, to learn, and to become a better version of himself.

After our conversation, I realized that the lessons of Muay Thai go beyond the gym. Whether you’re training for a fight or tackling challenges in everyday life, the principles of resilience, discipline, and self-reflection are universal.

If you’re curious to learn more about Chad’s journey, I highly recommend watching the [documentary](https://youtu.be/GPug-MuCKKY) we worked on together. It’s a glimpse into the raw, unforgiving world of Muay Thai—and the unshakable spirit of those who live it.

Stay Healthy - Max

-

@ 5b862b5d:7dac3251

2024-11-29 01:30:39

asdf

originally posted at https://stacker.news/items/459388

-

@ 384f8226:e2ddb37b

2024-11-29 01:18:31

asdf

originally posted at https://stacker.news/items/459388

-

@ 57d1a264:69f1fee1

2024-11-28 14:41:17

##### _Welcome back to our weekly `JABBB`, **Just Another Bitcoin Bubble Boom**, a comics and meme contest crafted for you, creative stackers!_

If you'd like to learn more, check our welcome post [here](https://stacker.news/items/480740/r/Design_r).

- - -

### This week sticker: `Bitcoin Lyn-Alden`

You can download the source file directly from the [HereComesBitcoin](https://www.herecomesbitcoin.org/) website in [SVG](https://www.herecomesbitcoin.org/assets/Lyn-Alden.svg) and [PNG](https://www.herecomesbitcoin.org/assets/Lyn-Alden.png).

### The task

> Starting from this sticker, design a comic frame or a meme, add a message that perfectly captures the sentiment of the current most hilarious take on the Bitcoin space. You can contextualize it or not, it's up to you, you chose the message, the context and anything else that will help you submit your comic art masterpiece.

> Are you a meme creator? There's space for you too: select the most similar shot from the gifts hosted on the [Gif Station](https://www.herecomesbitcoin.org/) section and craft your best meme... Let's Jabbb!

- - -

If you enjoy designing and memeing, feel free to check our [JABBB archive](https://stacker.news/Design_r#jabbbs--just-another-bitcoin-bubble-boom--comic--meme-contests) and create more to spread Bitcoin awareness to the moon.

Submit each proposal on the relative thread, bounties will be distributed next week together with the release of next JABBB contest.

₿ creative and have fun!

- - -

originally posted at https://stacker.news/items/786238

-

@ 57d1a264:69f1fee1

2024-11-28 14:37:22

Follow up on previous @Jon_Hodl's [post](https://stacker.news/items/783995/r/Design_r), translating everything in vector and providing access to the open source file for everyone to contribute, for territory owners to create their assets, etc...

Also corrected some colors and added icons.

... and memes

# Files & Downloads

### Figma:

https://www.figma.com/design/ZL3FLItd9j48pzKVi4qlOy/Stacker.News-Media-Kit?node-id=0-1&node-type=canvas&t=smAmQgXfj91LnEzs-0

**How to use the Figma templates:**

Export files as follow:

1. Select the item or frame you need,

2. Click on **[Export]** button at the sidebar bottom in right,

3. Select the size (1x, 2x, 3x...) to resize the item,

4. Select the file format:

- - bitmap (PNG, JPG) or

- - scalable vector file (PDF, SVG)

5. Click **[Export “item name”]** button.

### PenPot:

https://design.penpot.app/#/workspace/7ad540b5-8190-815d-8005-5685b9c670bc/7ad540b5-8190-815d-8005-5685c186216e?page-id=2643bc5a-0d34-80b2-8005-58099eabda41

In PenPot there's still some work to have editable text. Also, custom fonts not available for now so shapes are outlined and _vectorialized_.

`₿e Creative and have Fun!`

originally posted at https://stacker.news/items/786223

-

@ 005bc4de:ef11e1a2

2024-11-28 12:43:01

I'm kind of happy to finally get "Kicking" (Satoshi's writings in paperback) for sale in a buy-with-bitcoin format. Listed it on SatStash.io so, hopefully, things will work out.

https://satstash.io/listings/29458f9a-1e5a-41b2-885b-26ec3fddb8dc

(It'll always be free to download digitally at https://hive.blog/@crrdlx/satoshi)

originally posted at https://stacker.news/items/786125

-

@ 2063cd79:57bd1320

2024-11-28 10:24:13

Bitcoins Ruf in der breiten Masse ist eher mittelmäßig: nicht besonders positiv, nicht sehr negativ, viel Spott und Hohn, viel "versteh ich nicht und will ich auch nicht verstehen" und ein bisschen Angst. Der durchschnittliche No-Coiner, also all diejenigen, die aus Überzeugung nichts mit Bitcoin zu tun haben wollen, oder diejenigen, denen der Zugang bisher verwehrt geblieben ist, weiß in der Regel aber zwei Sachen über Bitcoin ganz bestimmt: 1) Mit Bitcoin kann man im Internet illegale Drogen kaufen und 2) Bitcoin braucht viel Energie und Energieverbrauch ist per se erstmal schlecht.

Da wir uns zur Zeit in einer Energie- und in keiner Drogenkrise befinden, wollen wir uns diese Woche dem Energie-FUD widmen. FUD, also Fear, Uncertainty and Doubt (Angst, Unsicherheit und Zweifel) beschreibt laut Wikipedia "eine Werbe- oder Kommunikationsstrategie \[...\], die der gezielten Bekämpfung eines (in der Regel wirtschaftlichen oder politischen) Konkurrenten dient, insbesondere wenn dieser bislang ein gutes Image hat." Bitcoins oft negativ geprägter Ruf durchläuft gewisse Trends und im Moment lässt sich sehr gut beobachten, wie das Thema Energie- und Ressourcenverschwendung eigentlich immer an erster Stelle aufkommt, wenn jemand eine schlechte Nachricht, oder ein negativ gefärbtes Bild von Bitcoin verbreiten will. Aussagen wie "Wir befinden uns in einer Energiekrise, und Bitcoin benutzt zu viel Energie, während wir eigentlich Energie sparen müssen" sind deplatziert und falschrum gedacht. Denn die Energiekrise ist hausgemacht und die selben Menschen, die diese Krise herbeigeführt haben, sind diejenigen, die mit wehenden Fahnen und mit Fackeln und Mistgabeln gegen Bitcoin wettern.

<img src="https://blossom.primal.net/9476dd794c1d746e82af9b6e5dbc88e39eb31524f335989342f29cc2e07895ea.gif">

Auf der einen Seite befinden wir uns momentan in einer ESG-Clownerie-Phase, das heisst, dass Investoren nur in die nächste grüne oder Kohlenstoff-neutrale, oder am liebsten -negative Idee, deren Gründer Tesla fährt, sich ausschließlich von Algenpräparaten und Krombacher (wegen Regenwald und so) ernährt und das Handy am hauseigenen Solarstromstecker lädt, investieren. Dabei wird gerne unterschlagen, dass die Menschheit Energie braucht, um zu prosperieren. Viel Spass beim Rubbeln von dreckiger Kleidung auf einem Waschbrett im Fluss, oder beim Anzünden und Löschen von Kerzen-betriebenen Straßenlaternen jede Nacht. Die meisten Menschen, die ich kenne, waschen ihre Wäsche lieber in der Waschmaschine und fahren auf gut beleuchteten Straßen. Energieverbrauch ist also per se nicht schlecht, im Gegenteil. Je weiter vorangeschritten eine Kultur ist, desto höher ist ihr Energieverbrauch. Genauso verhält es sich auch bei Bitcoin.

Zunächst einmal vorweg, ja - Bitcoin wendet Energie auf und davon nicht zu knapp und sogar immer mehr; und das ist sogar beabsichtigt und ein grundlegender Teil des Designs. Allerdings wird diese Energie aufgewendet, gebraucht oder konsumiert und nicht verschwendet, verbraucht oder vergeudet. Denn, wie schon oft erwähnt, Energie, oder in diesem Fall konkret Strom, ist das Vorprodukt von Bitcoin. Zur Herstellung eines Produkts ist immer ein Vorprodukt, ein Rohstoff oder eben Energie nötig. Output benötigt Input. Im Fall vom Bitcoin Protokoll ist dieser Output bitcoin, also die Coins, und der Input ist Energie in Form von Strom.

Doch wenn diese Argumentationslinie eigentlich so einfach nachzuvollziehen ist, woher rührt dann dieser immerwährende und nicht abreißende Strom von Nachrichten und Schlagzeilen, die genau das Gegenteil behaupten?

<img src="https://blossom.primal.net/f639f824465fa404d5dbf3d0f5765ebfe8f4cacaed0175fd766e6fbf84120fdf.png">

Kaum verwunderlich ist die Tatsache, dass eine grosse Anzahl von Studien und Publikationen, und damit einhergehend viele Artikel in den großen Tageszeitungen, in den letzten Monaten erschienen sind. Praktisch seit das Thema Ethereum Merge, also der Wechsel von PoW zu PoS (💩), ein ganz wichtiger Meilenstein in der Mythenbildung von Ethereum, durch PR-Agenturen weltweit nach vorne gepresst wurde. Selbst Greenpeace haben sich vor den Karren spannen lassen und mit Hilfe von Ripple-Sponsoring die [Change the Code Kampagne](https://cleanupbitcoin.com/) losgetreten, die im Prinyip nur darauf beruht Bitcoins Mining-Prozess zu beschmutzen.

Eine der größeren Schlagzeilen zu diesem Thema hat wohl die Biden Administration geliefert, als letzten Monat der Climate and Energy Implications of Crypto-Assets in the United States, kurz [Crypto-Assets and Climate Report](https://www.whitehouse.gov/wp-content/uploads/2022/09/09-2022-Crypto-Assets-and-Climate-Report.pdf), veröffentlicht wurde. Selbst große Veröffentlichungen, wie die Times, sind sofort auf den Zug aufgesprungen und haben über den Report berichtet, ohne diesen kritisch zu hinterfragen.

https://time.com/6211780/crypto-mining-climate-white-house

Die meisten Artikel wurden am gleichen Tag wie der Report veröffentlicht. Da ist es kaum verwunderlich, dass sich wenig kritisch mit den Inhalten auseinandergesetzt wurde. Deutlich mehr Mühe hat sich Nic Carter gegeben, der sich auf sehr detaillierte und dezidierte Weise mit dem Report auseinandergesetzt hat.

https://medium.com/@nic__carter/comments-on-the-white-house-report-on-the-climate-implications-of-crypto-mining-8d65d30ec942

Er deckt vor allem die Unzulänglichkeiten der akademischen Arbeit auf, mit welcher der Report verfasst wurde. Hauptaugenmerk wirft er hierbei auf die Tatsache, dass die Verfasser hauptsächlich Quellen herangezogen haben, die bekannte PoW Kritiker sind und bestenfalls fragwürdige Positionen vertreten, wohingegen keine Stimmen aus der Mining-Branche selbst zitiert werden. Eines der größten Probleme besteht auch darin, dass ein Großteil der über 200 Quellen aus Alex de Vries Veröffentlichungen und seiner Digiconomist Website zitieren. Übersetzt schreibt Nic:

> "Das Gesamtwerk von De Vries ist weder akademisch, wissenschaftlich noch unvoreingenommen. Er ist ein Blogger, der für die niederländische Zentralbank (eine Anti-Krypto-Institution) arbeitet, eine Zugehörigkeit, die er routinemäßig nicht in seinen Papieren offenlegt. Er behält eine äußerst antagonistische äußere Haltung gegenüber seinem Thema Proof-of-Work-Kryptowährungen bei, was in seinen Tweets deutlich wird. Seine Digiconomist-Website ist genau das – eine persönliche Website."

Alex de Vries ist einer der lautstärksten Kritiker der Branche und wird nicht müde zu argumentieren, dass Mining eine schmutzige Industrie ist, weil sie zu globalen Emissionen und Abfällen beiträgt.

Wie anhand dieses Beispiels offenkundig gezeigt werden kann, gibt es eine große und scheinbar finanziell starke und gut vernetzte Lobby, die gegen Bitcoin-Mining arbeitet. Mit Hilfe von NGOs, wie z.B. Earthjustice (Verfasser von unmissverständlichen Artikeln wie "How Bitcoin is Heating This Lake and Warming the Planet", "Crypto Miners Bought Their Own Power Plant. It's a Climate Disaster.", oder "The Energy Bomb: How Proof-of-Work Cryptocurrency Mining Worsens the Climate Crisis and Harms Communities Now") oder der Environmental Working Group (EWG) ("Ethereum’s energy-efficient ‘merge’ leaves bitcoin as lone cryptocurrency climate polluter") wird aktiv gegen Bitcoin-Mining gearbeitet und Nachrichten veröffentlicht, die das Narrativ von Bitcoin als Energie-Ferkel und Klimasünder aufrecht erhalten, bzw. noch befeuern.

Es ist ja nicht so, als würde Bitcoin keinen Strom verbrauchen. Etwas anderes zu behaupten wäre dumm und falsch. Allerdings muss die richtige Frage lauten: Welche Art von Energie wird von Bitcoin verbraucht? Natürlich wäre es genauso falsch zu behaupten, dass der gesamte Strom, der ins Bitcoin-Netzwerk fließt, aus erneuerbaren, gestrandeten oder überschüssigen Energiequellen stammt. Allerdings wird bereits ein Großteil dieser Energiequellen genutzt und der Trend läuft weiter in diese Richtung. Das Bitcoin-Netzwerk wächst - was an der steigenden Hashrate abgelesen werden kann - und so wird es zukünftig auch einen höheren Stromverbrauch benötigen, doch wie wir schon gesagt haben, korreliert Stromproduktion mit einem erhöhten menschlichen Wohlstand. Denn eine erhöhte Stromproduktion ist an sich nicht schlecht - im Gegenteil. Dennoch ist sehr wichtig, aus welchen Quellen diese zusätzliche Energie gewonnen wird. Geopolitische und klimabedingte Auswirkungen haben in den letzten Jahren gezeigt, dass ein Umdenken und ein Umschwenken durchaus sehr vernünftig sind.

Bitcoin Miner bewegen sich an vorderster Front dieses Umdenkprozesses. Eine Tatsache, die nicht unbedingt durch philanthropische oder weltverbessernde Ideen motiviert ist, sondern vielmehr durch finanzielle Anreize getrieben ist. Denn gerade momentan, in einer Zeit weiter in die Höhe schießender Hashrate und einer Difficulty, die sich infolgedessen immer weiter nach oben anpasst und eines gleichzeitig fallenden Hashpreises, sind die Margen für Miner nur noch hauchdünn. Miner sind also incentiviert, möglichst günstigen Strom einzukaufen (die einzige Variable, die sie aktiv kontrollieren können), oder im besten Fall sogar selbst zu erzeugen. Bitcoin wird damit zum Produzenten von Strom.

https://bitcoinmagazine.com/business/seven-trends-in-bitcoin-mining-and-energy

Ein nicht geringer Teil des erzeugten Stroms für den Erhalt von Bitcoin wird auch zukünftig aus fossilen Energiequellen gewonnen, da viele der erneuerbaren Energien Unterbrechungsprobleme vorweisen (fehlende Sonneneinstrahlung bei Photovoltaik, fehlender Wind bei Windkraft, etc.), sowie oft auch Kohlenstoff-intensive Herstellungsprozesse benötigen und darüber hinaus manchmal fragwürdige Langlebigkeit aufweisen. Fossile Energiequellen sind nicht unbedingt schlecht, wenn sie nachhaltig gefördert werden, z.B., können sie vielerorts sinnvoller umgesetzt werden als alle bislang bekannten erneuerbaren Alternativen. Generell scheint im Moment eine Tendenz zu existieren, alles durch erneuerbare Energie ersetzen zu wollen, ohne zu hinterfragen, ob diese oder jene Methode für den Standort, das Klima, die geopolitische Situation, den Nutzen und die vorliegende Infrastruktur überhaupt passend scheint. Erneuerbare Energien sind Gefangene von Umstand und Geografie - aber das ist ein ganz anderes Thema.

Bitcoin Miner werden also kreativ, was die Beschaffung von günstigem Strom betrifft. Und da viele Miner vom Stromnetz entweder abgeschnitten sind, durch lokale Gesetzgebung, usw. keine günstigen Konditionen erhalten, oder einfach die Kontrolle behalten wollen - also ein autarkes System aufbauen, das sich nicht auf Dritte verlässt - müssen sie oft auf das einzige Mittel zurückgreifen, das ihnen bleibt: Strom selber herstellen. Dabei gibt es ganz viele nachhaltige und vernünftige Ansätze. Um einen kleinen Überblick von jüngsten Trends zu verschaffen, liste ich ein paar Ideen auf. Natürlich kann ich nicht auf jedwede Art der Stromerzeugung ([altes Fritierfett](https://www.reddit.com/r/Bitcoin/comments/xanz0h/bitcoin_mining_powered_by_used_cooking_oil)) für Bitcoin eingehen, doch zwei Paradebeispiele werden oft angebracht:

Anlagen, die aus Biogas Strom erzeugen, sind vollständig autark und erfordern nur wenig Arbeit vor Ort. Betreiber profitieren von einer 100%igen Betriebszeit (keine Unterbrechungsprobleme wie bei anderen Erneuerbaren) und von einer sauberen Energie, da sie durch Vergärung erzeugt wird, spezifisch [anaerobe Vergärung](https://en.wikipedia.org/wiki/Anaerobic_digestion). Bei diesem Prozess wird Energie in Abfallstoffen zur Erzeugung von Biogas freigesetzt. Dieses Gas besteht im Durchschnitt zu 40% bis 50% aus Methan und 30% bis 40% CO2 und kann zum Betrieb eines Gasmotors verwendet werden. Dieses Verfahren reduziert somit den Ausstoß von Treibhausgasen, da der Kohlenstoff im biologisch abbaubarem Material Teil des Kohlenstoffkreislaufs ist und die Verwendung eines Gasmotors erzeugt vor Ort Strom, der zum Mining verwendet, oder an das Stromnetz angeschlossen und verkauft werden kann.

<img src="https://blossom.primal.net/e78cbcef434b71a6b3f6e5161046734e8719b6631c0e14490ed75ceca0cba0bb.gif">

Man geht davon aus, dass beim Flaring täglich etwa 400 Millionen Kubikmeter Erdgas entlüftet oder abgefackelt werden. Schätzungen besagen sogar, dass wahrscheinlich sogar [doppelt so viel Gas](https://blogs.edf.org/energyexchange/2019/01/24/satellite-data-confirms-permian-gas-flaring-is-double-what-companies-report) abgefackelt wird wie gemeldet. Dies ist genug Energie, um die aktuelle Bitcoin-Hashrate zu verdoppeln. Viele Tests gibt es schon, um diese überschüssige Energie zum Mining zu nutzen. ConocoPhilips, Exxon, Crueso, etc. haben Projekte am Laufen, die aus diesem "Abfallprodukt" Energie gewinnen wollen. Alles was Bitcoin benötigt ist Strom, und das ist eine relativ niedrige Hürde, wenn man Energievorkommen hat. Man muss diese nur noch umwandeln.

Bitcoin-Mining wird also immer nachhaltiger und wirklich nachhaltiger. Es nützt der Umwelt und dem Klima sehr wenig, wenn die ESG-Clownbande ihren Stempel auf Unternehmen setzt, die im Gegenzug für irgendwelche windigen Stiftungen, die mit Hilfe von [Klimakompensation durch das Pflanzen von Bäumchen](https://www.youtube.com/watch?v=6p8zAbFKpW0), den eigentlichen Treibhausgas-Austoß ausgleichen, damit diese weiter Investitionen erhalten können. Mit wirklich innovativen Techniken braucht es plötzlich keine Stiftungen mehr, um zu spenden, um den Planeten zu retten, denn dies ist ein selbsttragender Weg, um Verschwendung zu reduzieren.

Darüber hinaus ermächtigt der Mining-Prozess Stromabnehmern die völlig unabhängige Operation vom Netz. Große Stromnetze stellen mächtige regionale Monopole dar, die entscheiden, wer Zugang zu den Energiemärkten hat und wie diese Märkte funktionieren. Mining kann als ein neuer globaler Markt für Strom gesehen werden, der sich stark von den netzbasierten Märkten abhebt und die alten Strukturen langsam umkrempelt. Wir werden sehen, wie große Versorgungsunternehmen selber Bitcoin Miner werden und große Bitcoin Miner über Zeit selbst zu Versorgungsunternehmen werden. Der Markt rückt immer näher aufeinander zu. Dieser neue Strommarkt fügt Wettbewerb wieder in jedes Stromnetz ein, da jeder Produzent entscheidet, ob der Strom verkauft oder für Mining verwendet wird. Darüber hinaus können [Mikro-Netze](https://x.com/hash_bender/status/1577354828551962624) in großem Maßstab entwickelt werden, da der Anschluss an das große monopolisierte Netzwerk nicht nötig ist. Kleine Kommunen können sich autark mit Energie versorgen und überschüssige Energie, kann sofort in Bitcoin verwandelt werden, wenn sie nicht zum Heizen, Leben oder zur Reserve gebraucht wird. Damit wird die Wirtschaftlichkeit von dieser Art Projekten automatisch gesteigert.

<img src="https://blossom.primal.net/c94c80d75f21269cc4111d6cc5ae31cf8fd0f99b5dc2fddac4ff7aa6d5cd6203.gif">

---

Energie-FUD war das Thema. Was ich aufzeigen wollte, ist, dass es ein Interesse gibt, Bitcoin Mining als umweltschädlich und ressourcenverschwendend darzustellen. Es gibt viele Gruppen, denen Bitcoin ein Dorn im Auge ist, weil sie entweder direkte Konkurrenten sind (aus deren Sicht), z.B. Ripple oder Ethereum, weil sie in Bitcoin eine Gefahr für das aktuelle Modell sehen, z.B. Zentralbanken oder gewisse Regierungsfunktionen, oder weil sie ihr Geschäftsmodell angegriffen sehen, z.B. Stromversorger oder Netzbetreiber. Dabei is Bitcoin eigentlich sehr fortschrittlich und energieeffizient, da es spieltheoretisch nur den effizientesten Minern möglich ist profitabel zu sein und dafür müssen sie günstige Stromquellen anzapfen oder selbst erschließen. Der FUD ist demnach unangebracht und nichts anderes als eine Strategie, um die Entwicklung, den Fortschritt und die Adaption von Bitcoin aufzuhalten.

🫳🎤

---

In diesem Sinne, 2... 1... Risiko!

-

@ 000002de:c05780a7

2024-11-27 22:35:14

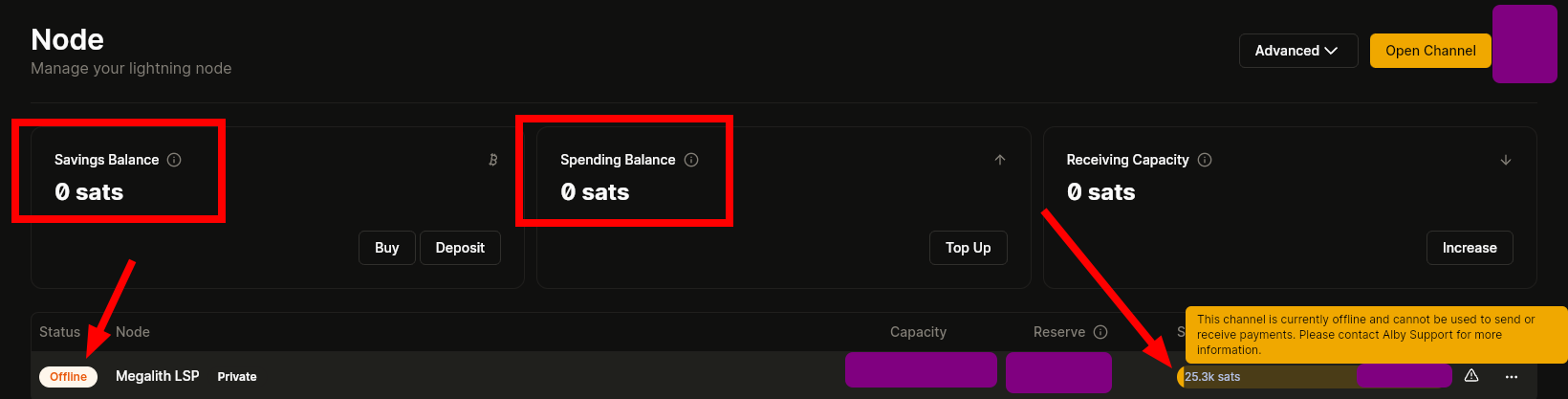

I have been trying to use the device sync for a while now. I forget when it was launched but I think I set it up right after it was launched. I was having issues with it and I could not figure it out. It seemed like one device would work with my external wallet but others would not.

Then today it dawned on me. I'm not even sure how I did this but I had saved by seed and then enabled sync on other devices but was never asked to enter my seed. So I think the issue was cause by me basically enabling sync on different devices and not using the same seed.

The solution was to disable sync on one device. Then log out. Log back in and enable it again. Copy the seed. Repeat this on all other devices. Now it works.

I don't think this is a bug. Maybe it is but it is a UX issue for low IQ users like me. Maybe it could be fixed with more clear instructions about logging out.

If anyone else is having issues maybe try to do what I did.

Thank you @k00b @ek for all your work. Hopefully this feedback is helpful.

originally posted at https://stacker.news/items/785604

-

@ 94a6a78a:0ddf320e

2024-11-27 19:36:12

The backbone of your Nostr experience lies in relays—servers that transmit your notes, zaps, and private messages across the decentralized network. Azzamo offers three specialized relays to suit different user needs, ensuring reliability, performance, and privacy.

### **1. Free Relay**

- **URL:** `wss://nostr.azzamo.net`

- **Overview:** Azzamo’s Free Relay is perfect for newcomers to Nostr. It’s open-access, reliable, and ensures fair use with moderate rate limits.

- **Key Features:**

- Free to use.

- Notes older than one month are purged daily.

- Accessible gateway for decentralized communication.

---

### **2. Paid Relay**

- **URL:** `wss://relay.azzamo.net`