-

@ 1bda7e1f:bb97c4d9

2025-01-02 05:19:08

### Tldr

- Nostr is an open and interoperable protocol

- You can integrate it with workflow automation tools to augment your experience

- n8n is a great low/no-code workflow automation tool which you can host yourself

- Nostrobots allows you to integrate Nostr into n8n

- In this blog I create some workflow automations for Nostr

- A simple form to delegate posting notes

- Push notifications for mentions on multiple accounts

- Push notifications for your favourite accounts when they post a note

- All workflows are provided as open source with MIT license for you to use

### Inter-op All The Things

Nostr is a new open social protocol for the internet. This open nature exciting because of the opportunities for interoperability with other technologies. In [Using NFC Cards with Nostr]() I explored the `nostr:` URI to launch Nostr clients from a card tap.

The interoperability of Nostr doesn't stop there. The internet has many super-powers, and Nostr is open to all of them. Simply, there's no one to stop it. There is no one in charge, there are no permissioned APIs, and there are no risks of being de-platformed. If you can imagine technologies that would work well with Nostr, then any and all of them can ride on or alongside Nostr rails.

My mental model for why this is special is Google Wave ~2010. Google Wave was to be the next big platform. Lars was running it and had a big track record from Maps. I was excited for it. Then, Google pulled the plug. And, immediately all the time and capital invested in understanding and building on the platform was wasted.

This cannot happen to Nostr, as there is no one to pull the plug, and maybe even no plug to pull.

So long as users demand Nostr, Nostr will exist, and that is a pretty strong guarantee. It makes it worthwhile to invest in bringing Nostr into our other applications.

All we need are simple ways to plug things together.

### Nostr and Workflow Automation

Workflow automation is about helping people to streamline their work. As a user, the most common way I achieve this is by connecting disparate systems together. By setting up one system to trigger another or to move data between systems, I can solve for many different problems and become way more effective.

#### n8n for workflow automation

Many workflow automation tools exist. My favourite is [n8n](https://n8n.io/). n8n is a low/no-code workflow automation platform which allows you to build all kinds of workflows. You can use it for free, you can self-host it, it has a user-friendly UI and useful API. Vs Zapier it can be far more elaborate. Vs Make.com I find it to be more intuitive in how it abstracts away the right parts of the code, but still allows you to code when you need to.

Most importantly you can plug anything into n8n: You have built-in nodes for specific applications. HTTP nodes for any other API-based service. And community nodes built by individual community members for any other purpose you can imagine.

#### Eating my own dogfood

It's very clear to me that there is a big design space here just demanding to be explored. If you could integrate Nostr with anything, what would you do?

In my view the best way for anyone to start anything is by solving their own problem first (aka "scratching your own itch" and "eating your own dogfood"). As I get deeper into Nostr I find myself controlling multiple Npubs – to date I have a personal Npub, a brand Npub for a community I am helping, an AI assistant Npub, and various testing Npubs. I need ways to delegate access to those Npubs without handing over the keys, ways to know if they're mentioned, and ways to know if they're posting.

I can build workflows with n8n to solve these issues for myself to start with, and keep expanding from there as new needs come up.

### Running n8n with Nostrobots

I am mostly non-technical with a very helpful AI. To set up n8n to work with Nostr and operate these workflows should be possible for anyone with basic technology skills.

- I have a cheap VPS which currently runs my [HAVEN Nostr Relay](https://rodbishop.npub.pro/post/8ca68889/) and [Albyhub Lightning Node](https://rodbishop.npub.pro/post/setting-up-payments-on-nostr-7o6ls7/) in Docker containers,

- My objective was to set up n8n to run alongside these in a separate Docker container on the same server, install the required nodes, and then build and host my workflows.

#### Installing n8n

Self-hosting n8n could not be easier. I followed n8n's [Docker-Compose installation docs](https://docs.n8n.io/hosting/installation/server-setups/docker-compose/)–

- Install Docker and Docker-Compose if you haven't already,

- Create your ``docker-compose.yml`` and `.env` files from the docs,

- Create your data folder `sudo docker volume create n8n_data`,

- Start your container with `sudo docker compose up -d`,

- Your n8n instance should be online at port `5678`.

n8n is free to self-host but does require a license. Enter your credentials into n8n to get your free license key. You should now have access to the Workflow dashboard and can create and host any kind of workflows from there.

#### Installing Nostrobots

To integrate n8n nicely with Nostr, I used the [Nostrobots](https://github.com/ocknamo/n8n-nodes-nostrobots?tab=readme-ov-file) community node by [Ocknamo](nostr:npub1y6aja0kkc4fdvuxgqjcdv4fx0v7xv2epuqnddey2eyaxquznp9vq0tp75l).

In n8n parlance a "node" enables certain functionality as a step in a workflow e.g. a "set" node sets a variable, a "send email" node sends an email. n8n comes with all kinds of "official" nodes installed by default, and Nostr is not amongst them. However, n8n also comes with a framework for community members to create their own "community" nodes, which is where Nostrobots comes in.

You can only use a community node in a self-hosted n8n instance (which is what you have if you are running in Docker on your own server, but this limitation does prevent you from using n8n's own hosted alternative).

To install a community node, [see n8n community node docs](https://docs.n8n.io/integrations/community-nodes/installation/gui-install/). From your workflow dashboard–

- Click the "..." in the bottom left corner beside your username, and click "settings",

- Cilck "community nodes" left sidebar,

- Click "Install",

- Enter the "npm Package Name" which is `n8n-nodes-nostrobots`,

- Accept the risks and click "Install",

- Nostrobots is now added to your n8n instance.

#### Using Nostrobots

Nostrobots gives you nodes to help you build Nostr-integrated workflows–

- **Nostr Write** – for posting Notes to the Nostr network,

- **Nostr Read** – for reading Notes from the Nostr network, and

- **Nostr Utils** – for performing certain conversions you may need (e.g. from bech32 to hex).

Nostrobots has [good documentation](https://github.com/ocknamo/n8n-nodes-nostrobots?tab=readme-ov-file) on each node which focuses on simple use cases.

Each node has a "convenience mode" by default. For example, the "Read" Node by default will fetch Kind 1 notes by a simple filter, in Nostrobots parlance a "Strategy". For example, with Strategy set to "Mention" the node will accept a pubkey and fetch all Kind 1 notes that Mention the pubkey within a time period. This is very good for quick use.

What wasn't clear to me initially (until Ocknamo helped me out) is that advanced use cases are also possible.

Each node also has an advanced mode. For example, the "Read" Node can have "Strategy" set to "RawFilter(advanced)". Now the node will accept json (anything you like that complies with [NIP-01](https://github.com/nostr-protocol/nips/blob/master/01.md)). You can use this to query Notes (Kind 1) as above, and also Profiles (Kind 0), Follow Lists (Kind 3), Reactions (Kind 7), Zaps (Kind 9734/9735), and anything else you can think of.

#### Creating and adding workflows

With n8n and Nostrobots installed, you can now create or add any kind of Nostr Workflow Automation.

- Click "Add workflow" to go to the workflow builder screen,

- If you would like to build your own workflow, you can start with adding any node. Click "+" and see what is available. Type "Nostr" to explore the Nostrobots nodes you have added,

- If you would like to add workflows that someone else has built, click "..." in the top right. Then click "import from URL" and paste in the URL of any workflow you would like to use (including the ones I share later in this article).

### Nostr Workflow Automations

It's time to build some things!

#### A simple form to post a note to Nostr

I started very simply. I needed to delegate the ability to post to Npubs that I own in order that a (future) team can test things for me. I don't want to worry about managing or training those people on how to use keys, and I want to revoke access easily.

I needed a basic form with credentials that posted a Note.

For this I can use a very simple workflow–

- **A n8n Form node** – Creates a form for users to enter the note they wish to post. Allows for the form to be protected by a username and password. This node is the workflow "trigger" so that the workflow runs each time the form is submitted.

- **A Set node** – Allows me to set some variables, in this case I set the relays that I intend to use. I typically add a Set node immediately following the trigger node, and put all the variables I need in this. It helps to make the workflows easier to update and maintain.

- **A Nostr Write node** (from Nostrobots) – Writes a Kind-1 note to the Nostr network. It accepts Nostr credentials, the output of the Form node, and the relays from the Set node, and posts the Note to those relays.

Once the workflow is built, you can test it with the testing form URL, and set it to "Active" to use the production form URL. That's it. You can now give posting access to anyone for any Npub. To revoke access, simply change the credentials or set to workflow to "Inactive".

It may also be the world's simplest Nostr client.

You can find the [Nostr Form to Post a Note workflow here](https://github.com/r0d8lsh0p/nostr-n8n/blob/main/Nostr_Form_to_Post_a_Note.json).

#### Push notifications on mentions and new notes

One of the things Nostr is not very good at is push notifications. Furthermore I have some unique itches to scratch. I want–

- **To make sure I never miss a note addressed to any of my Npubs** – For this I want a push notification any time any Nostr user mentions any of my Npubs,

- **To make sure I always see all notes from key accounts** – For this I need a push notification any time any of my Npubs post any Notes to the network,

- **To get these notifications on all of my devices** – Not just my phone where my Nostr regular client lives, but also on each of my laptops to suit wherever I am working that day.

I needed to build a Nostr push notifications solution.

To build this workflow I had to string a few ideas together–

- **Triggering the node on a schedule** – Nostrobots does not include a trigger node. As every workflow starts with a trigger we needed a different method. I elected to run the workflow on a schedule of every 10-minutes. Frequent enough to see Notes while they are hot, but infrequent enough to not burden public relays or get rate-limited,

- **Storing a list of Npubs in a Nostr list** – I needed a way to store the list of Npubs that trigger my notifications. I initially used an array defined in the workflow, this worked fine. Then I decided to try Nostr lists ([NIP-51, kind 30000](https://github.com/nostr-protocol/nips/blob/master/51.md)). By defining my list of Npubs as a list published to Nostr I can control my list from within a Nostr client (e.g. [Listr.lol](https://listr.lol/npub1r0d8u8mnj6769500nypnm28a9hpk9qg8jr0ehe30tygr3wuhcnvs4rfsft) or [Nostrudel.ninja](https://nostrudel.ninja/#/lists)). Not only does this "just work", but because it's based on Nostr lists automagically Amethyst client allows me to browse that list as a Feed, and everyone I add gets notified in their Mentions,

- **Using specific relays** – I needed to query the right relays, including my own HAVEN relay inbox for notes addressed to me, and wss://purplepag.es for Nostr profile metadata,

- **Querying Nostr events** (with Nostrobots) – I needed to make use of many different Nostr queries and use quite a wide range of what Nostrobots can do–

- I read the EventID of my Kind 30000 list, to return the desired pubkeys,

- For notifications on mentions, I read all Kind 1 notes that mention that pubkey,

- For notifications on new notes, I read all Kind 1 notes published by that pubkey,

- Where there are notes, I read the Kind 0 profile metadata event of that pubkey to get the displayName of the relevant Npub,

- I transform the EventID into a Nevent to help clients find it.

- **Using the Nostr URI** – As I did with my NFC card article, I created a link with the `nostr:` URI prefix so that my phone's native client opens the link by default,

- **Push notifications solution** – I needed a push notifications solution. I found many with n8n integrations and chose to go with [Pushover](https://pushover.net/) which supports all my devices, has a free trial, and is unfairly cheap with a $5-per-device perpetual license.

Once the workflow was built, lists published, and Pushover installed on my phone, I was fully set up with push notifications on Nostr. I have used these workflows for several weeks now and made various tweaks as I went. They are feeling robust and I'd welcome you to give them a go.

You can find the [Nostr Push Notification If Mentioned here](https://github.com/r0d8lsh0p/nostr-n8n/blob/main/Nostr_Push_Notify_If_Mentioned.json) and [If Posts a Note here](https://github.com/r0d8lsh0p/nostr-n8n/blob/main/Nostr_Push_Notify_If_Post_a_Note.json).

In speaking with other Nostr users while I was building this, there are all kind of other needs for push notifications too – like on replies to a certain bookmarked note, or when a followed Npub starts streaming on zap.stream. These are all possible.

#### Use my workflows

I have open sourced all my workflows at my [Github](https://github.com/r0d8lsh0p/nostr-n8n) with MIT license and tried to write complete docs, so that you can import them into your n8n and configure them for your own use.

To import any of my workflows–

- Click on the workflow of your choice, e.g. "[Nostr_Push_Notify_If_Mentioned.json](https://github.com/r0d8lsh0p/nostr-n8n/blob/main/Nostr_Push_Notify_If_Mentioned.json "Nostr_Push_Notify_If_Mentioned.json")",

- Click on the "raw" button to view the raw JSON, ex any Github page layout,

- Copy that URL,

- Enter that URL in the "import from URL" dialog [mentioned above](#creating-and-adding-workflows).

To configure them–

- Prerequisites, credentials, and variables are all stated,

- In general any variables required are entered into a Set Node that follows the trigger node,

- Pushover has some extra setup but is very straightforward and documented in the workflow.

### What next?

Over my first four blogs I explored creating a good Nostr setup with [Vanity Npub](https://rodbishop.npub.pro/post/mining-your-vanity-pubkey-4iupbf/), [Lightning Payments](https://rodbishop.npub.pro/post/setting-up-payments-on-nostr-7o6ls7/), [Nostr Addresses at Your Domain](https://rodbishop.npub.pro/post/ee8a46bc/), and [Personal Nostr Relay](https://rodbishop.npub.pro/post/8ca68889/).

Then in my latest two blogs I explored different types of interoperability [with NFC cards](https://rodbishop.npub.pro/post/edde8387/) and now n8n Workflow Automation.

Thinking ahead n8n can power any kind of interoperability between Nostr and any other legacy technology solution. On my mind as I write this:

- Further enhancements to posting and delegating solutions and forms (enhanced UI or different note kinds),

- Automated or scheduled posting (such as auto-liking everything [Lyn Alden](nostr:npub1a2cww4kn9wqte4ry70vyfwqyqvpswksna27rtxd8vty6c74era8sdcw83a) posts),

- Further enhancements to push notifications, on new and different types of events (such as notifying me when I get a new follower, on replies to certain posts, or when a user starts streaming),

- All kinds of bridges, such as bridging notes to and from Telegram, Slack, or Campfire. Or bridging RSS or other event feeds to Nostr,

- All kinds of other automation (such as [BlackCoffee](nostr:npub1dqepr0g4t3ahvnjtnxazvws4rkqjpxl854n29wcew8wph0fmw90qlsmmgt) [controlling a coffee machine](https://primal.net/e/note16fzhh5yfc3u4kufx0mck63tsfperdrlpp96am2lmq066cnuqutds8retc3)),

- All kinds of AI Assistants and Agents,

In fact I have already released an open source workflow for an [AI Assistant](https://primal.net/p/npub1ahjpx53ewavp23g5zj9jgyfrpr8djmgjzg5mpe4xd0z69dqvq0kq2lf353), and will share more about that in my next blog.

Please be sure to let me know if you think there's another Nostr topic you'd like to see me tackle.

GM Nostr.

-

@ 79998141:0f8f1901

2025-01-02 05:04:56

Happy new year, Anon.

Thanks for tuning in to whatever this long form post will be. I hope to make these more regular, like journal entries as we travel through "real life" and the Nostrverse together. If I'm making time for this reflective writing, then things are going as planned.

2024 was a wildly transformative year for me for many reasons... there's no way I can possibly fit all of them here. They're not all related to Bitcoin and Nostr- I've got a beautiful life outside of all that which has its own independent arc. My wife and I celebrated 7 years of marriage together, stronger than ever (don't believe that "itch" bullshit). We let go of some negative relationships and embraced some positive ones. We cut some bad habits, and we made some good habits. We worked, we traveled, we saw family, and we partied.

But damn, these two technologies have become a huge part of my life. God willing, this trend will continue until they've both eclipsed my professional capacity through our startup, Conduit BTC.

This was the year I was truly orange pilled. Until late 2023, I had traded (quite profitably) Bitcoin, "crypto", stocks, options, prediction markets and whatever else I could get my hands on that felt undervalued. I did this all in my spare time, grinding out a little financial freedom while I hustled at my fiat ventures to support my little family. I wasn't a true believer- just an opportunist with a knack for spotting where and when a crowd might flock to next. That was right up until I ran face first into Lyn Alden's book "Broken Money".

Something about Lyn's engineer/macro-finance inspired prose clicked with me, lock and key. Total one way function. By the end of the book my laser eyes had burned a hole in my bedroom ceiling. I was all in- and acted accordingly both with my capital and my attention. It wasn't long before I discovered Nostr and dove in here too, falling deep into my current orange and purple polyamorous love affair.

> "If you know the enemy and know yourself, you need not fear the result of a hundred battles."

Despite the passion, through studying Bitcoin's criticisms (from the likes of Mike Green and Nassim Taleb) I found a hole in the utopian plot: none of this works without Bitcoin actually being used as money. Worldwide transactions must skyrocket demand for blockspace to keep the network secure/stable for the long term. Besides, if everyday folks aren't using Bitcoin as money then we haven't done shit to make the world a better place. In that world, we've only replaced old masters with new ones. Fuck that.

Whatever I did in this space needed to increase the usage of Bitcoin as money. Simple. This was bigger than passion, this was purpose. I knew that come hell or high water I would dedicate myself to this mission.

Lucky for me I found a partner and best friend in @aceaspades to go on this adventure with. I'm infinitely grateful for him. He's an incredible man who also happens to be an insanely creative and talented software developer. We'd tried for years to find the right project to focus on together, experimenting with all kinds of new techy ideas as they came across our field. Nothing had ever captured our attention like this. This was different. By March of 2024 we had formed a company and gotten to work iterating on how we could leverage these beautiful protocols and open-source tech to create something that served our mission. This is @ConduitBTC.

I've done well in my fiat career executing plans downstream of someone else's creative vision. I've learned the ins and outs of an established ecosystem and found ways to profit from it. I take plans developed by others, compete to win contracts to build them, and execute on them in a cashflow-positive way. I'm bringing this no bullshit blue collar skillset with me to the Nostrverse whether they like it or not.

The adventure we're embarking on now is totally different though. We're charting a new course - totally creative, highly intuitive and extremely speculative towards a future that doesn't exist yet. There are few established norms. The potential is vast but unknown. We're diving into a strange quest to sell a map to an imaginary place and to simultaneously architect its creation (alongside all the amazing builders here doing the same thing). This is insanely exciting to me.

We're barely getting started but a lot has been invested under the surface which will show itself in 2025. We'll be sharing updates in a proper post on @ConduitBTC soon.

As for my personal 2025 resolutions, here they are:

- zero alcohol for the entire year (did this in 2019 and had a great year, it's time for a rerun)

- more focused presence in the moment: especially with my wife

- more self care and prioritized mental/physical health - this includes daily: naps, prayer, self hypnosis or meditation, sweat, and stretching/massaging (overworked in 2024 with a fiat 9-5, a board/advisor role in a fiat business I have equity in, and my newfound passion here. Two serious burn out episodes experienced this year - zero is the only acceptable number of burnouts for long term health and success.)

- related to the above: get Conduit some mission-aligned funding partners and leave my fiat 9-5. Grow the Conduit team (have put in a serious amount of my personal capital already to get this going, which will show fruit in the new year... but I am not an island)

- more authentic and thoughtful posts on Nostr, with a solid amount of shitposting and organic home grown memes to balance it out... more zaps, more geniune connections and interactions with the curious forward thinking people on here

- more IRL Nostr/Bitcoin events

- more laughter, more jokes

Enough for now. Cheers to you and yours Anon, may 2025 bring you the magic you've been dreaming of.

-

@ 468f729d:5ab4fd5e

2025-01-01 19:00:36

<div style="position:relative;padding-bottom:56.25%;height:0;overflow:hidden;max-width:100%;"><iframe src="https://www.youtube.com/embed/V_fvmyJ91m0?enablejsapi=1" style="position:absolute;top:0;left:0;width:100%;height:100%;border:0;" allowfullscreen></iframe></div>

-

@ 2063cd79:57bd1320

2025-01-01 13:11:30

### Aufgabe von Minern

Wer sich nochmal genau mit dem Ablauf von Mining befassen möchte, dem rate ich Ausgabe #27 zu lesen.

https://www.genexyz.org/post/27-block-779000-was-machen-miner-wirklich-3c8f05/

Wir erinnern uns, dass es im Bitcoin-Ökosystem drei große Gruppen gibt, die sich nicht jeweils ausschließen. Es gibt die Miner, die Node-Betreiber und die Nutzer. Diese schließen sich nicht gegenseitig aus, da man auch in zwei oder sogar drei dieser Gruppen verhaftet sein kann. Die Miner übernehmen Aufgaben, die die anderen zwei Gruppen nicht leisten können und dafür werden sie durch den Anreizmechanismus belohnt. Denn durch ihre Arbeit gewährleisten sie die Sicherung des Netzwerks (je höher die aufgebrachte Hashrate, desto schwieriger werden Angriffe), sie validieren, sortieren und fügen Transaktionen dem Netzwerk hinzu und darüber hinaus helfen sie dabei bitcoins zu verteilen (zumindest bis alle ca. 21 Millionen bitcoins in ca. 100 Jahren erschlossen wurden). Warum die Analogie zum Mining schwierig ist, haben wir schon öfter besprochen, kurz und verständlich auf den Punkt gebracht hat es diese Woche Gigi in einem kurzen Beitrag.

https://dergigi.com/2023/04/12/bitcoins-are-not-mined-they-are-issued-over-time

### Mining Pools

Ich habe Mining-Pools detailliert in einem Artikel letzten September beschrieben. Wer sich mit dem Thema nochmal eingehender beschäftigen möchte, kann das hier tun:

https://www.genexyz.org/post/12-block-753150-bitcoin-mining-pools-vs-dezentralisierung-vytfxv/

Doch TL;DR für all diejenigen, die keine Zeit oder Lust haben, hier in Kürze:

Die immer weiter steigende Hashrate im Netzwerk, ausgelöst durch immer größer werdende Mining-Operationen und immer leistungsfähigere ASIC Chips, führt dazu, dass es kleine und auch mittelgroße Miner immer schwerer haben erfolgreich Bitcoins zu minen, und damit Profite zu erzielen.

Mining-Pools bieten da Abhilfe, indem sie Minern die Möglichkeit bieten, ihre Hashrate zu bündeln und somit eine größere Wahrscheinlichkeit erzeugen, im Wettkampf um die Winner-take-all-Prämie, einen Teil der Belohnung in Form von Block-Subsidy und Gebühren einzustreichen (➡️ Block Reward). Je mehr Miner sich in einem Pool zusammenschließen, um somit die Hashrate zu bündeln, desto wahrscheinlicher wird, dass dieser Zusammenschluss von Minern den nächsten Block findet. Damit sinkt natürlich die einzelne Auszahlung pro Block, jedoch steigt die proportionelle Anzahl der Blocks, die dieser Pool erfolgreich produzieren kann.

<img src="https://blossom.primal.net/4710bbc07d6855d5113a4fff83ced34b32c66c95a3eb3d57c1dd2f17a13f95f9.gif">

Diese Rechnung lohnt sich neben Mining-Farmen auch für die meisten kleinen und mittelgroßen Miner, da so ein stetiger Fluss von Einkommen wahrscheinlicher wird, als ab-und-zu (oder nie) den Jackpot zu knacken. Das Problem bei Mining-Pools besteht in der Bündelung der Hashrate unter einer übersichtlichen Anzahl von Betreibern, denn erstens macht es jede Konzentration einer bestimmten Sache für Angreifer einfacher, diese eine große Einheit ausfindig zu machen und gezielt zu attackieren. Und zweitens verschiebt sich die dezentrale Wahrheitsfindung zugunsten einer zentralisierten Entscheidungsfindung.

<img src="https://blossom.primal.net/38706ef056b6fdbe3512285d8e2bbd30e0e1b6a7aa719ae9370c513ec58f00f1.gif">

Denn bisher sind es die Mining-Pools, die über die Architektur der Blöcke bestimmen, also darüber, welche Transaktionen in den nächsten Blockkandidaten gepackt werden. Dies ermöglicht Mining-Pool-Betreibern sowohl Transaktionen zu zensieren (black listing), als auch Transaktionen auszuwählen, die nicht unbedingt im besten Interesse der Miner (z.B. Transaktionen mit geringen Gebühren, obwohl es welche mit hohen Gebühren gegeben hätte), oder gar des ganzen Netzwerks sind (z.B. leere Blöcke, um das Netzwerk zu verlangsamen) (white listing). Diese vermeintliche Macht der Pool-Betreiber muss nicht unbedingt von ihnen selbst ausgenutzt werden, bietet aber auch Regierungen und anderen Apparaten einen leichten Angriffsvektor, wenn diese versuchen wollen, das Netzwerk, bzw. einzelne Transaktionen gezielt zu zensieren, indem sie Mining-Pools unter Zwang setzen.

<img src="https://blossom.primal.net/8bc2577da8654edf9e3181f6a63d7095ad20c48dded03f44f144a8a033a1b71d.png">

Wie in dieser Grafik leicht ersichtlich, gibt es heute einige wenige Pools, die einen deutlichen Anteil der globalen Hashrate bündeln. 80% (!!!) der Hashrate wird von den größten vier Pools bestimmt, und immerhin 55% (also mehr als die Hälfte - immer noch nicht cool) von den beiden größten. Dies macht Pools natürlich zu einem leicht bestimmbaren Angriffspunkt mit einer riesigen Zielscheibe auf dem Rücken.

<img src="https://blossom.primal.net/a410e95c1eb6db08243d798f0b3bab1d531dde1a7132b42ec92242305322254c.gif">

Besteht überhaupt eine solche theoretische Möglichkeit, dass z.B. Foundry USA im Rahmen einer hypothetischen Verpflichtung durch Dritte (Regierung, Finanzaufsicht, Geheimdienst, etc.) mit der Zensur bestimmter Transaktionen beginnen könnte? Die Antwort ist: theoretisch erstmal ja. Auf technischer Ebene könnte es passieren. Doch Miner würden sehr schnell erkennen, dass etwas im Busch ist und ihre Hashrate auf andere Pools verlagern (dies muss nicht mal aus altruistischen Gründen geschehen, sondern einfach weil theoretische wirtschaftliche Anreize verloren gehen).

### Transaktionsauswahl

Wie schon erwähnt, sind Mining-Pool-Betreiber heute dafür verantwortlich Transaktionen für den nächsten Block vorzuschlagen. Das bedeutet der Betreiber hat die volle Kontrolle darüber, wie der nächste Block im Mining-Prozess aussieht und die Miner und Mining-Farmen werden sozusagen zu Lieferanten von Hashrate, um diesen Vorschlag umzusetzen. Pools stellen den einzigen Koordinierungspunkt zwischen den teilnehmenden Hardware-Betreibern dar. Es bleibt dem Miner natürlich selbst überlassen, welchem Pool er sich anschließt (und ob sich überhaupt einem Pool angeschlossen wird) und auch der Wechsel von einem Pool zum nächsten ist relativ simpel und schnell vollzogen. Es bleibt jedoch dabei - Betreiber sind verantwortlich für die Auswahl von Transaktionen, die in die Kandidaten-Blöcke eingefügt (oder unterlassen, sprich zensiert) werden sollen. Es besteht also eine zusätzliche Bürde für jeden Miner zusätzlich zu kontrollieren, dass keine Transaktionen ausgeschlossen werden, oder Transaktionen sauber ausgewählt werden.

> “Bitcoin is dead.” “Mining is over.” “They will regulate Bitcoin.” “Censorship will come.” - Peter Todd

https://www.coindesk.com/tech/2021/05/07/marathon-miners-have-started-censoring-bitcoin-transactions-heres-what-that-means

Ob nun ein Pool-Betreiber oder Miner durch Zwang dazu geführt wird, individuelle Transaktionen hinzuzufügen, oder auszulassen, oder ob es aus eigenem Antrieb heraus geschieht (wie im obigen Artikel von MARA beschrieben: der von Marathon kontrollierte MARA Pool hatte entschieden, nur Blöcke mit OFAC-konformen Transaktionen zu produzieren und damit Transaktionen von und zu Adressen zu zensieren, die vom US-Finanzministerium auf die schwarze Liste gesetzt wurden, was einen großen Aufstand hervorrief und kein anderer Miner schloss sich dem Beispiel an. MARA veröffentlichten nach nur einem Monat in einer Pressemitteilung, dass keine Transaktionen mehr gefiltert würden.) ist dabei zunächst egal.

Doch eine Umkehrung der Verantwortlichkeit würde die Verantwortung zu den einzelnen tausenden Hardware-Betreibern (Minern) verschieben, die zentrale Entscheidungsgewalt der Pool-Betreiber auflösen und einen großen Angriffspunkt im Netzwerk eliminieren.

Wie alle anderen Computer-Netzwerk, besteht auch Bitcoin aus Protokollen, mit denen die Kommunikation zwischen Teilnehmern und Regeln festgelegt werden und die geschilderten Bedrohungen werden durch das aktuelle Protokoll ermöglicht, das von Minern und Mining-Pools verwendet wird, um miteinander zu kommunizieren: Stratum V1.

### Stratum v2

Wie bei allen Sachen im Bitcoin-Ökosystem, gibt es keine zentrale Organisation, die Verbesserungen im Protokoll oder, wie in diesem Fall, in untergeordneten Protokollen vorschlagen und umsetzen kann. Es bedarf immer einer Gruppe von Entwicklern, die ein Problem im derzeitigen System erkennen und einen passenden Lösungsvorschlag unterbreiten. So auch bei Stratum. Das originale Stratum-Protokoll (v1) wurde 2012 eingeführt und wird seitdem weitgehend unverändert eingesetzt.

Bei der Stratum v2 Reference Implementation (SRI) handelt es sich um eine kostenlose, unabhängige, Open-Source-Variante von Stratum v2. Aber Justus, heißt das etwa, es gibt noch andere Stratum v2 Varianten? Bingo, Zweiter, es können beliebig viele Varianten erstellt werden. Alleine die Mining Pools entscheiden darüber, welches Protokoll, also welche Software, für sie und ihr Geschäftsmodell am besten funktioniert. Und die kürzlich vorgestellte Variante, die SRI, ist das bis dato umfangreichste und am weitesten unterstützte Update des Protokolls. Denn sowohl Braiins, ein Anbieter von Mining-Pools und Mining-Software (inkl. einer eigenen Variante von Stratum v2), als auch Foundry USA, der derzeit größte aller Mining-Pools, sind aktive Unterstützer des Projekts.

SRI ist also das wichtigste Protokoll-Update seit 2012. Aber was genau macht v2 so wichtig und wo liegen die Schwächen von v1?

In der aktuellen Version 1 ist Datenübertragung zwischen Minern, aber auch zwischen Minern und Pool-Betreibern nicht verschlüsselt. In v2 wird Kommunikation verschlüsselt und gewährleistet so Integrität und Vertraulichkeit der übermittelten Informationen. Dies soll vor allem vor sogenannten Man-in-the-Middle-Angriffen schützen, bei denen Dritte die Übertragung von Hashrate zwischen Minern und Pools abfangen (sogenanntes Hashrate-Hijacking), und diese als die eigenen weiterzuleiten und somit Auszahlungen zu stehlen.

<img src="https://blossom.primal.net/4b8c8cd2516f13dddd85a20914e4572d6f45779b4976a9bf8e8c01f0ae73e210.gif">

Das v2 Protokoll ist vollständig binär. Das heißt, Datenübertragungen werden nicht in Menschen-lesbarem Textformat (ASCII Code), sondern in Computer-lesbarem Binärformat vorgenommen, was unnötige Datenmengen eliminiert. Dies und einige andere Leistungsverbesserungen machen den gesamten Prozess bis zu 20% performanter.

Stratum v2 dezentralisiert das Bitcoin-Mining erheblich, denn Miner bekommen die Möglichkeit, die Transaktionen fortan selbst auszuwählen, wodurch das Netzwerk zensurresistenter wird. Dies wird mit Hilfe von weiteren untergeordneten Protokollen erreicht, die es Minern ermöglichen, Transaktionen über ihre Nodes auszuwählen. Dies ist ein wichtiger Meilenstein bei der Demokratisierung der Transaktionsauswahl im gepoolten Mining und eliminiert die oben beschriebenen Risiken.

<img src="https://blossom.primal.net/c0770fc98a4e4773cdf4c9800adc33d4230fd09937ec38e3a4a2739a49355e29.gif">

Konkret haben die Entwickler ein neues dezentralisiertes untergeordnetes Protokoll geschaffen, das sich Job Negotiator (JN) nennt. Achtung, jetzt wird es etwas technisch: Miner betreiben ihre eigenen Knoten, die eine neue Vorlage direkt vom Vorlagenanbieter erhalten. Die neue Vorlage enthält den Merkle-Pfad der Transaktionen, die vom Anbieter ausgewählt wurden. Für den neuen Block muss ein neuer Job erstellt werden, also sendet der JN des Miners eine Nachricht mit einem vorgeschlagenen Satz von Transaktionen an den Pool-Betreiber. Der Betreiber akzeptiert dann die Vorlage oder lehnt sie ab. Wenn der Vorschlag der Miner akzeptiert wird, werden sie benachrichtigt, dass sie mit dem Mining beginnen und ihre anteilige Hashrate an den Pool senden können.

<img src="https://blossom.primal.net/eef7101ea3afc933f89cc3de53f0009974a653c570bad69af29b69161d2e9d98.gif">

Kurz gesagt: Miner schlagen vor, welche Transaktionen in einen Block kommen und nicht andersrum. Alle sind glücklich, alle sind froh und darüber hinaus geschieht dies natürlich blitzschnell, sodass für die Miner und den Pool kein Nachteil gegenüber anderen Mitbewerbern entsteht, denn beim Mining zählt jede Millisekunde, wenn es darum geht erfolgreich den nächsten Block produzieren zu dürfen, oder nicht.

Was sind die Anreize für die Pool-Betreiber, dieses neue Protokoll zu verwenden, wenn sie damit ihr Gewaltmonopol aufgeben?

Relativ einfach: Pool-Betreiber mögen diese Verantwortung eigentlich gar nicht. Sie haben sie irgendwie geerbt und sind mit dieser großen Verpflichtung gegenüber dem Netzwerk und sich selbst irgendwie im Unreinen. Ein bisschen so wie bei Morty, Aaliyah, Djibrail, Laila, Issa, Leonora, Naima und Amaya.

<img src="https://blossom.primal.net/3440f6667f8affc1bae67888b55c302361ff2aa31fb9f0c23595de96a34f1141.gif">

Pool-Betreiber mögen es also nicht so in der Öffentlichkeit zu stehen und permanent angegriffen zu werden, des Weiteren birgt die Transaktionsauswahl auch ein gewisses Haftungsrisiko, das sie gerne von sich weisen würden.

Die beiden anderen grundlegenden Merkmale des Stratum v2 Protokolls sind, wie oben beschrieben, natürlich auch Sicherheits- und Leistungsverbesserung. Alleine für diese Attribute würde es sich schon lohnen, auf das neue Protokoll umzusteigen.

Die neue Variante des Protokolls (SRI) wurde erst kürzlich öffentlich und als Open-Source Code zugänglich gemacht. Es bleibt also nur eine Frage der Zeit, bis sich nach Braiins und Foundry auch die anderen Mining-Pools (sehr wahrscheinlich) nach einer gründlichen Test-Phase dem Update öffnen.

https://www.nobsbitcoin.com/carole-house-censoring-bitcoin

Besonders in Zeiten, in denen Gegner von Bitcoin in halb-öffentlichen Reden über Pläne sprechen, wie man das Bitcoin-Netzwerk kontrollieren, bzw. für seine Zwecke benutzen kann, ist es wichtig die oben besprochenen Angriffs-Vektoren zu minimieren.

Carole House, ehemalige Direktorin für Cybersicherheit des Nationalen Sicherheitsrates des Weißen Hauses, sprach bei einem Event an der Universität von Princeton und sagte "sie würde lieber mehr Hashrate in den USA sehen, damit sie Miner zwingen können, das Netzwerk zu zensieren" und dass es "nicht nur darum ginge, Minern zu sagen, dass sie bestimmte Transaktionen nicht in Blöcke einbauen, sondern auch nicht auf Blöcken mit nicht konformen Transaktionen aufzubauen, damit diese Transaktionen nirgendwo in der Kette ankommen".

Die zeugt davon, dass Menschen wie Carole House ein substantielles Verständnis von der Bitcoin-Technologie besitzen und dieses Fachwissen dafür verwenden werden, Wege und Mittel aufzutun, wie man Bitcoin zumindest attackieren kann.

🫳🎤

---

In diesem Sinne, 2... 1... Risiko!

-

@ a10260a2:caa23e3e

2025-01-01 12:42:22

I’d like to start off by saying that phoenixd has been a great experience so far. The install (on a Linux machine) was as easy as depicted on their [website](https://phoenix.acinq.co/server/get-started).

And the channel I opened via [auto liquidity](https://phoenix.acinq.co/server/auto-liquidity) was super simple. I didn’t have to pick an LSP and I won’t need to manage liquidity.

Unfortunately, the machine I installed the software on started to freeze seconds after every boot. After posting about it [here](https://stacker.news/items/825060/r/thebullishbitcoiner) and getting an answer from nostr:npub1lxktpvp5cnq3wl5ctu2x88e30mc0ahh8v47qvzc5dmneqqjrzlkqpm5xlc, I was surprised at how easy the migration seemed.

It really was just a matter of restoring the seed words on another phoenixd instance. Of course, making sure that the two instances don’t run at the same time.

As easy as it was, I wanted to create this post to give a quick overview for those who might be less tech savvy.

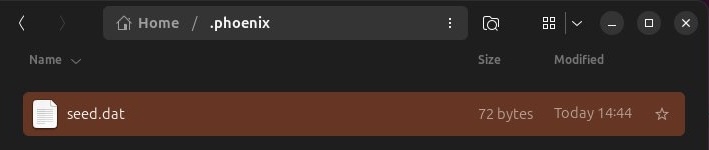

### Step 1

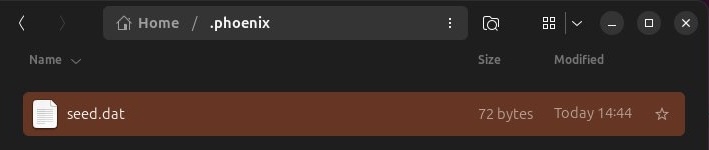

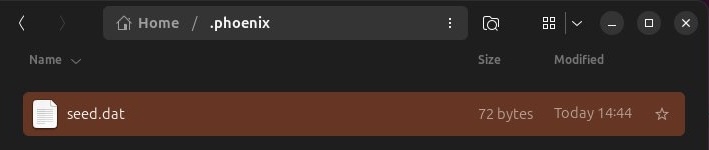

Grab seed words from the `seed.dat` file in hidden`.phoenix` folder on the old machine.

### Step 2

Install phoenixd on the new machine

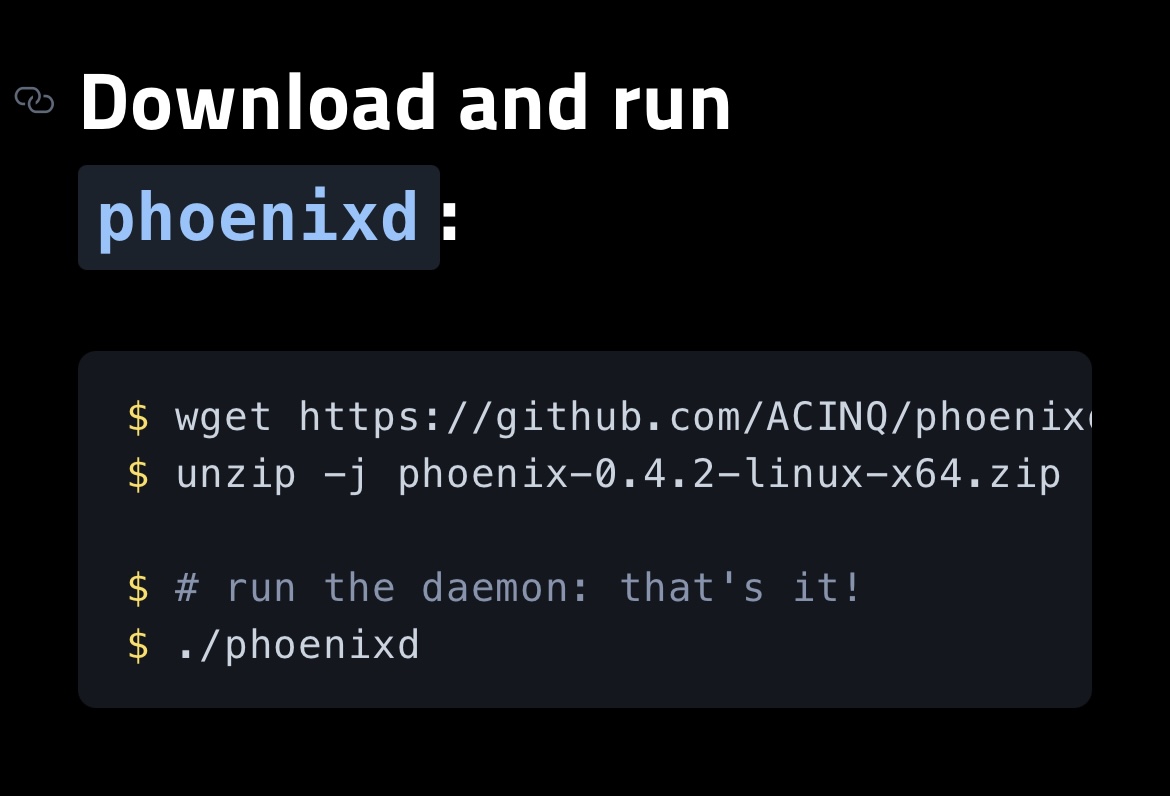

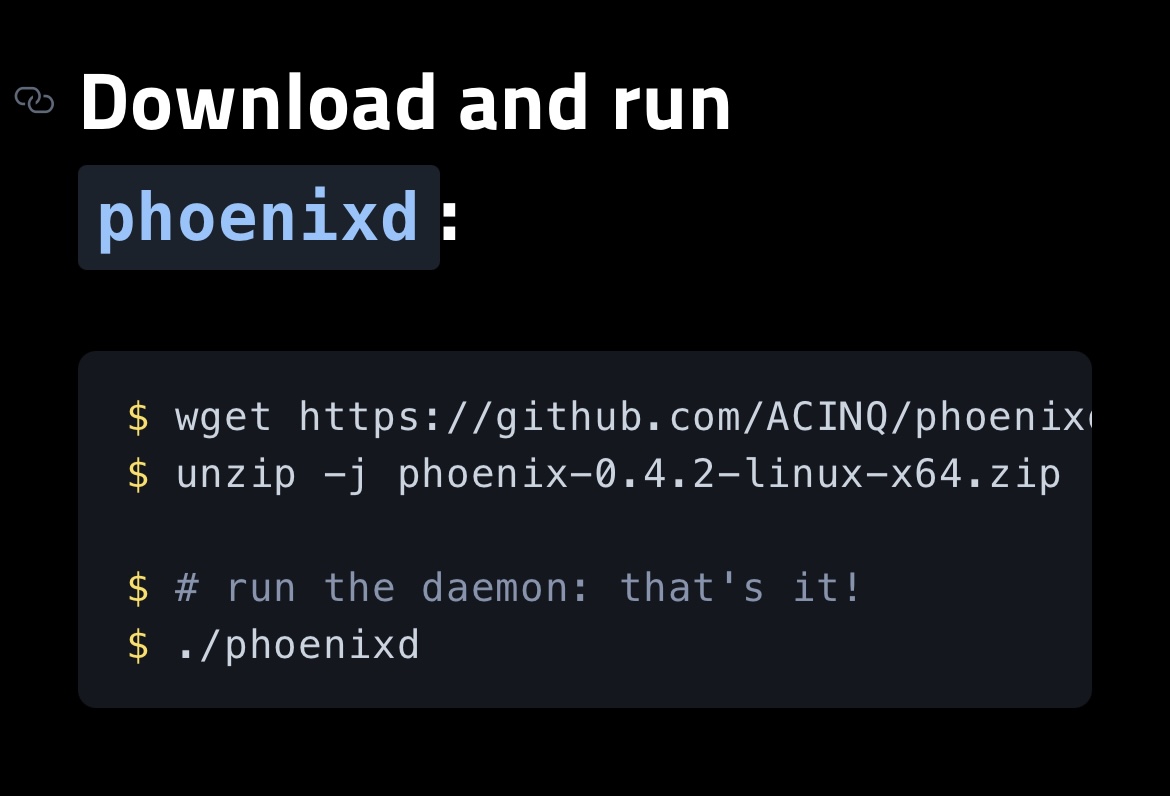

```

$ wget https://github.com/ACINQ/phoenixd/releases/download/v0.4.2/phoenix-0.4.2-linux-x64.zip

$ unzip -j phoenix-0.4.2-linux-x64.zip

$ # run the daemon: that's it!

$ ./phoenixd

```

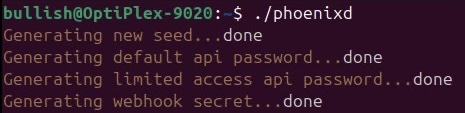

### Step 3

(This is the step that wasn’t super clear and why I wanted to spell it out in this post)

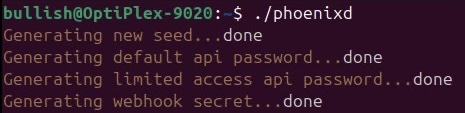

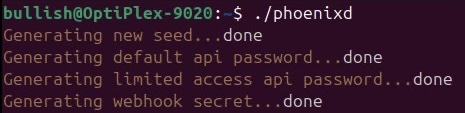

In order to install the software, `./phoenixd` has to be run. This is going to generate a new seed phrase.

Now, all you need to do is replace the seed words in `seed.dat` with the ones from the original install.

In retrospect, I think you can replace the seed words right after unzipping the zip file and before running `./phoenixd`. That will probably achieve the same result.

### Step 4

Once the seed words have been restored. Just run `./phoenixd` again and it’ll start up like nothing happened.

Literally.

There was no indication whatsoever that something had changed, so I ran `./phoenix-cli getinfo` and, voila, there was my 2M-sat channel.

It was quite magical.

originally posted at https://stacker.news/items/829411

### Update (1/1/2025)

Phoenix Support got back to me and confirmed that the migration can be even simpler. You can actually just copy the ~/.phoenix directory onto the new machine and run `./phoenix`!

-

@ b4403b24:83542d4e

2024-12-31 22:24:43

As we bid farewell to 2024, let’s celebrate the memories, lessons, and triumphs it brought us. May 2025 shine even brighter, bringing you joy, success, and endless opportunities.

Here’s to new beginnings, cherished moments, and a year filled with happiness. Cheers to 2025! 🥂

originally posted at https://stacker.news/items/831699

-

@ 468f729d:5ab4fd5e

2024-12-31 22:03:31

<div style="position:relative;padding-bottom:56.25%;height:0;overflow:hidden;max-width:100%;"><iframe src="https://www.youtube.com/embed/V_fvmyJ91m0?enablejsapi=1" style="position:absolute;top:0;left:0;width:100%;height:100%;border:0;" allowfullscreen></iframe></div>

-

@ f9cf4e94:96abc355

2024-12-31 20:18:59

Scuttlebutt foi iniciado em maio de 2014 por Dominic Tarr ( [dominictarr]( https://github.com/dominictarr/scuttlebutt) ) como uma rede social alternativa off-line, primeiro para convidados, que permite aos usuários obter controle total de seus dados e privacidade. Secure Scuttlebutt ([ssb]( https://github.com/ssbc/ssb-db)) foi lançado pouco depois, o que coloca a privacidade em primeiro plano com mais recursos de criptografia.

Se você está se perguntando de onde diabos veio o nome Scuttlebutt:

> Este termo do século 19 para uma fofoca vem do Scuttlebutt náutico: “um barril de água mantido no convés, com um buraco para uma xícara”. A gíria náutica vai desde o hábito dos marinheiros de se reunir pelo boato até a fofoca, semelhante à fofoca do bebedouro.

Marinheiros se reunindo em torno da rixa. ( [fonte]( https://twitter.com/IntEtymology/status/998879578851508224) )

Dominic descobriu o termo boato em um [artigo de pesquisa]( https://www.cs.cornell.edu/home/rvr/papers/flowgossip.pdf) que leu.

Em sistemas distribuídos, [fofocar]( https://en.wikipedia.org/wiki/Gossip_protocol) é um processo de retransmissão de mensagens ponto a ponto; as mensagens são disseminadas de forma análoga ao “boca a boca”.

**Secure Scuttlebutt é um banco de dados de feeds imutáveis apenas para acréscimos, otimizado para replicação eficiente para protocolos ponto a ponto.** **Cada usuário tem um log imutável somente para acréscimos no qual eles podem gravar.** Eles gravam no log assinando mensagens com sua chave privada. Pense em um feed de usuário como seu próprio diário de bordo, como um diário [de bordo]( https://en.wikipedia.org/wiki/Logbook) (ou diário do capitão para os fãs de Star Trek), onde eles são os únicos autorizados a escrever nele, mas têm a capacidade de permitir que outros amigos ou colegas leiam ao seu diário de bordo, se assim o desejarem.

Cada mensagem possui um número de sequência e a mensagem também deve fazer referência à mensagem anterior por seu ID. O ID é um hash da mensagem e da assinatura. A estrutura de dados é semelhante à de uma lista vinculada. É essencialmente um log somente de acréscimo de JSON assinado. **Cada item adicionado a um log do usuário é chamado de mensagem.**

**Os logs do usuário são conhecidos como feed e um usuário pode seguir os feeds de outros usuários para receber suas atualizações.** Cada usuário é responsável por armazenar seu próprio feed. Quando Alice assina o feed de Bob, Bob baixa o log de feed de Alice. Bob pode verificar se o registro do feed realmente pertence a Alice verificando as assinaturas. Bob pode verificar as assinaturas usando a chave pública de Alice.

Estrutura de alto nível de um feed

**Pubs são servidores de retransmissão conhecidos como “super peers”. Pubs conectam usuários usuários e atualizações de fofocas a outros usuários conectados ao Pub. Um Pub é análogo a um pub da vida real, onde as pessoas vão para se encontrar e se socializar.** Para ingressar em um Pub, o usuário deve ser convidado primeiro. Um usuário pode solicitar um código de convite de um Pub; o Pub simplesmente gerará um novo código de convite, mas alguns Pubs podem exigir verificação adicional na forma de verificação de e-mail ou, com alguns Pubs, você deve pedir um código em um fórum público ou chat. Pubs também podem mapear aliases de usuário, como e-mails ou nome de usuário, para IDs de chave pública para facilitar os pares de referência.

Depois que o Pub enviar o código de convite ao usuário, o usuário resgatará o código, o que significa que o Pub seguirá o usuário, o que permite que o usuário veja as mensagens postadas por outros membros do Pub, bem como as mensagens de retransmissão do Pub pelo usuário a outros membros do Pub.

Além de retransmitir mensagens entre pares, os Pubs também podem armazenar as mensagens. Se Alice estiver offline e Bob transmitir atualizações de feed, Alice perderá a atualização. Se Alice ficar online, mas Bob estiver offline, não haverá como ela buscar o feed de Bob. Mas com um Pub, Alice pode buscar o feed no Pub mesmo se Bob estiver off-line porque o Pub está armazenando as mensagens. **Pubs são úteis porque assim que um colega fica online, ele pode sincronizar com o Pub para receber os feeds de seus amigos potencialmente offline.**

Um usuário pode, opcionalmente, executar seu próprio servidor Pub e abri-lo ao público ou permitir que apenas seus amigos participem, se assim o desejarem. Eles também podem ingressar em um Pub público. Aqui está uma lista de [Pubs públicos em que]( https://github.com/ssbc/ssb-server/wiki/Pub-Servers) todos podem participar **.** Explicaremos como ingressar em um posteriormente neste guia. **Uma coisa importante a observar é que o Secure Scuttlebutt em uma rede social somente para convidados significa que você deve ser “puxado” para entrar nos círculos sociais.** Se você responder às mensagens, os destinatários não serão notificados, a menos que estejam seguindo você de volta. O objetivo do SSB é criar “ilhas” isoladas de redes pares, ao contrário de uma rede pública onde qualquer pessoa pode enviar mensagens a qualquer pessoa.

Perspectivas dos participantes

## Scuttlebot

O software Pub é conhecido como servidor Scuttlebutt (servidor [ssb]( https://github.com/ssbc/ssb-server) ), mas também é conhecido como “Scuttlebot” e `sbot`na linha de comando. O servidor SSB adiciona comportamento de rede ao banco de dados Scuttlebutt (SSB). Estaremos usando o Scuttlebot ao longo deste tutorial.

**Os logs do usuário são conhecidos como feed e um usuário pode seguir os feeds de outros usuários para receber suas atualizações.** Cada usuário é responsável por armazenar seu próprio feed. Quando Alice assina o feed de Bob, Bob baixa o log de feed de Alice. Bob pode verificar se o registro do feed realmente pertence a Alice verificando as assinaturas. Bob pode verificar as assinaturas usando a chave pública de Alice.

Estrutura de alto nível de um feed

**Pubs são servidores de retransmissão conhecidos como “super peers”. Pubs conectam usuários usuários e atualizações de fofocas a outros usuários conectados ao Pub. Um Pub é análogo a um pub da vida real, onde as pessoas vão para se encontrar e se socializar.** Para ingressar em um Pub, o usuário deve ser convidado primeiro. Um usuário pode solicitar um código de convite de um Pub; o Pub simplesmente gerará um novo código de convite, mas alguns Pubs podem exigir verificação adicional na forma de verificação de e-mail ou, com alguns Pubs, você deve pedir um código em um fórum público ou chat. Pubs também podem mapear aliases de usuário, como e-mails ou nome de usuário, para IDs de chave pública para facilitar os pares de referência.

Depois que o Pub enviar o código de convite ao usuário, o usuário resgatará o código, o que significa que o Pub seguirá o usuário, o que permite que o usuário veja as mensagens postadas por outros membros do Pub, bem como as mensagens de retransmissão do Pub pelo usuário a outros membros do Pub.

Além de retransmitir mensagens entre pares, os Pubs também podem armazenar as mensagens. Se Alice estiver offline e Bob transmitir atualizações de feed, Alice perderá a atualização. Se Alice ficar online, mas Bob estiver offline, não haverá como ela buscar o feed de Bob. Mas com um Pub, Alice pode buscar o feed no Pub mesmo se Bob estiver off-line porque o Pub está armazenando as mensagens. **Pubs são úteis porque assim que um colega fica online, ele pode sincronizar com o Pub para receber os feeds de seus amigos potencialmente offline.**

Um usuário pode, opcionalmente, executar seu próprio servidor Pub e abri-lo ao público ou permitir que apenas seus amigos participem, se assim o desejarem. Eles também podem ingressar em um Pub público. Aqui está uma lista de [Pubs públicos em que]( https://github.com/ssbc/ssb-server/wiki/Pub-Servers) todos podem participar **.** Explicaremos como ingressar em um posteriormente neste guia. **Uma coisa importante a observar é que o Secure Scuttlebutt em uma rede social somente para convidados significa que você deve ser “puxado” para entrar nos círculos sociais.** Se você responder às mensagens, os destinatários não serão notificados, a menos que estejam seguindo você de volta. O objetivo do SSB é criar “ilhas” isoladas de redes pares, ao contrário de uma rede pública onde qualquer pessoa pode enviar mensagens a qualquer pessoa.

Perspectivas dos participantes

## Pubs - Hubs

### Pubs públicos

| Pub Name | Operator | Invite Code |

| ------------------------------------------------------------ | ------------------------------------------------------------ | ------------------------------------------------------------ |

| `scuttle.us` | [@Ryan]( https://keybase.io/ryan_singer) | `scuttle.us:8008:@WqcuCOIpLtXFRw/9vOAQJti8avTZ9vxT9rKrPo8qG6o=.ed25519~/ZUi9Chpl0g1kuWSrmehq2EwMQeV0Pd+8xw8XhWuhLE=` |

| [pub1.upsocial.com]( https://upsocial.com/) | [@freedomrules]( https://github.com/freedomrules) | `pub1.upsocial.com:8008:@gjlNF5Cyw3OKZxEoEpsVhT5Xv3HZutVfKBppmu42MkI=.ed25519~lMd6f4nnmBZEZSavAl4uahl+feajLUGqu8s2qdoTLi8=` |

| [Monero Pub]( https://xmr-pub.net/) | [@Denis]( https://github.com/Orville2112) | `xmr-pub.net:8008:@5hTpvduvbDyMLN2IdzDKa7nx7PSem9co3RsOmZoyyCM=.ed25519~vQU+r2HUd6JxPENSinUWdfqrJLlOqXiCbzHoML9iVN4=` |

| [FreeSocial]( https://freesocial.co/) | [@Jarland]( https://github.com/mxroute) | `pub.freesocial.co:8008:@ofYKOy2p9wsaxV73GqgOyh6C6nRGFM5FyciQyxwBd6A=.ed25519~ye9Z808S3KPQsV0MWr1HL0/Sh8boSEwW+ZK+8x85u9w=` |

| `ssb.vpn.net.br` | [@coffeverton]( https://about.me/coffeverton) | `ssb.vpn.net.br:8008:@ze8nZPcf4sbdULvknEFOCbVZtdp7VRsB95nhNw6/2YQ=.ed25519~D0blTolH3YoTwSAkY5xhNw8jAOjgoNXL/+8ZClzr0io=` |

| [gossip.noisebridge.info]( https://www.noisebridge.net/wiki/Pub) | [Noisebridge Hackerspace]( https://www.noisebridge.net/wiki/Unicorn) [@james.network]( https://james.network/) | `gossip.noisebridge.info:8008:@2NANnQVdsoqk0XPiJG2oMZqaEpTeoGrxOHJkLIqs7eY=.ed25519~JWTC6+rPYPW5b5zCion0gqjcJs35h6JKpUrQoAKWgJ4=` |

### Pubs privados

Você precisará entrar em contato com os proprietários desses bares para receber um convite.

| Pub Name | Operator | Contact |

| --------------------------------------------- | ------------------------------------------------------------ | ----------------------------------------------- |

| `many.butt.nz` | [@dinosaur]( https://dinosaur.is/) | [mikey@enspiral.com](mailto:mikey@enspiral.com) |

| `one.butt.nz` | [@dinosaur]( https://dinosaur.is/) | [mikey@enspiral.com](mailto:mikey@enspiral.com) |

| `ssb.mikey.nz` | [@dinosaur]( https://dinosaur.is/) | [mikey@enspiral.com](mailto:mikey@enspiral.com) |

| [ssb.celehner.com]( https://ssb.celehner.com/) | [@cel]( https://github.com/ssbc/ssb-server/wiki/@f/6sQ6d2CMxRUhLpspgGIulDxDCwYD7DzFzPNr7u5AU=.ed25519) | [cel@celehner.com](mailto:cel@celehner.com) |

### Pubs muito grandes

*Aviso: embora tecnicamente funcione usar um convite para esses pubs, você provavelmente se divertirá se o fizer devido ao seu tamanho (muitas coisas para baixar, risco para bots / spammers / idiotas)*

| Pub Name | Operator | Invite Code |

| --------------------------------------- | ----------------------------------------------- | ------------------------------------------------------------ |

| `scuttlebutt.de` | [SolSoCoG]( https://solsocog.de/impressum) | `scuttlebutt.de:8008:@yeh/GKxlfhlYXSdgU7CRLxm58GC42za3tDuC4NJld/k=.ed25519~iyaCpZ0co863K9aF+b7j8BnnHfwY65dGeX6Dh2nXs3c=` |

| `Lohn's Pub` | [@lohn]( https://github.com/lohn) | `p.lohn.in:8018:@LohnKVll9HdLI3AndEc4zwGtfdF/J7xC7PW9B/JpI4U=.ed25519~z3m4ttJdI4InHkCtchxTu26kKqOfKk4woBb1TtPeA/s=` |

| [Scuttle Space]( https://scuttle.space/) | [@guil-dot]( https://github.com/guil-dot) | Visit [scuttle.space]( https://scuttle.space/) |

| `SSB PeerNet US-East` | [timjrobinson]( https://github.com/timjrobinson) | `us-east.ssbpeer.net:8008:@sTO03jpVivj65BEAJMhlwtHXsWdLd9fLwyKAT1qAkc0=.ed25519~sXFc5taUA7dpGTJITZVDCRy2A9jmkVttsr107+ufInU=` |

| Hermies | s | net:hermies.club:8008~shs:uMYDVPuEKftL4SzpRGVyQxLdyPkOiX7njit7+qT/7IQ=:SSB+Room+PSK3TLYC2T86EHQCUHBUHASCASE18JBV24= |

## GUI - Interface Gráfica do Utilizador(Usuário)

### Patchwork - Uma GUI SSB (Descontinuado)

[**Patchwork**]( https://github.com/ssbc/patchwork) **é o aplicativo de mensagens e compartilhamento descentralizado construído em cima do SSB** . O protocolo scuttlebutt em si não mantém um conjunto de feeds nos quais um usuário está interessado, então um cliente é necessário para manter uma lista de feeds de pares em que seu respectivo usuário está interessado e seguindo.

Fonte: [scuttlebutt.nz]( https://www.scuttlebutt.nz/getting-started)

**Quando você instala e executa o Patchwork, você só pode ver e se comunicar com seus pares em sua rede local. Para acessar fora de sua LAN, você precisa se conectar a um Pub.** Um pub é apenas para convidados e eles retransmitem mensagens entre você e seus pares fora de sua LAN e entre outros Pubs.

Lembre-se de que você precisa seguir alguém para receber mensagens dessa pessoa. Isso reduz o envio de mensagens de spam para os usuários. Os usuários só veem as respostas das pessoas que seguem. Os dados são sincronizados no disco para funcionar offline, mas podem ser sincronizados diretamente com os pares na sua LAN por wi-fi ou bluetooth.

### Patchbay - Uma GUI Alternativa

Patchbay é um cliente de fofoca projetado para ser fácil de modificar e estender. Ele usa o mesmo banco de dados que [Patchwork]( https://github.com/ssbc/patchwork) e [Patchfoo]( https://github.com/ssbc/patchfoo) , então você pode facilmente dar uma volta com sua identidade existente.

### Planetary - GUI para IOS

[Planetary]( https://apps.apple.com/us/app/planetary-app/id1481617318) é um app com pubs pré-carregados para facilitar integração.

### Manyverse - GUI para Android

[Manyverse]( https://www.manyver.se/) é um aplicativo de rede social com recursos que você esperaria: posts, curtidas, perfis, mensagens privadas, etc. Mas não está sendo executado na nuvem de propriedade de uma empresa, em vez disso, as postagens de seus amigos e todos os seus dados sociais vivem inteiramente em seu telefone .

## Fontes

* https://scuttlebot.io/

* https://decentralized-id.com/decentralized-web/scuttlebot/#plugins

* https://medium.com/@miguelmota/getting-started-with-secure-scuttlebut-e6b7d4c5ecfd

* [**Secure Scuttlebutt**]( http://ssbc.github.io/secure-scuttlebutt/) **:** um protocolo de banco de dados global.

-

@ 3f770d65:7a745b24

2024-12-31 17:03:46

Here are my predictions for Nostr in 2025:

**Decentralization:** The outbox and inbox communication models, sometimes referred to as the Gossip model, will become the standard across the ecosystem. By the end of 2025, all major clients will support these models, providing seamless communication and enhanced decentralization. Clients that do not adopt outbox/inbox by then will be regarded as outdated or legacy systems.

**Privacy Standards:** Major clients such as Damus and Primal will move away from NIP-04 DMs, adopting more secure protocol possibilities like NIP-17 or NIP-104. These upgrades will ensure enhanced encryption and metadata protection. Additionally, NIP-104 MLS tools will drive the development of new clients and features, providing users with unprecedented control over the privacy of their communications.

**Interoperability:** Nostr's ecosystem will become even more interconnected. Platforms like the Olas image-sharing service will expand into prominent clients such as Primal, Damus, Coracle, and Snort, alongside existing integrations with Amethyst, Nostur, and Nostrudel. Similarly, audio and video tools like Nostr Nests and Zap.stream will gain seamless integration into major clients, enabling easy participation in live events across the ecosystem.

**Adoption and Migration:** Inspired by early pioneers like Fountain and Orange Pill App, more platforms will adopt Nostr for authentication, login, and social systems. In 2025, a significant migration from a high-profile application platform with hundreds of thousands of users will transpire, doubling Nostr’s daily activity and establishing it as a cornerstone of decentralized technologies.

-

@ e97aaffa:2ebd765d

2024-12-31 16:47:12

Último dia do ano, momento para tirar o pó da bola de cristal, para fazer reflexões, previsões e desejos para o próximo ano e seguintes.

Ano após ano, o Bitcoin evoluiu, foi ultrapassando etapas, tornou-se cada vez mais _mainstream_. Está cada vez mais difícil fazer previsões sobre o Bitcoin, já faltam poucas barreiras a serem ultrapassadas e as que faltam são altamente complexas ou tem um impacto profundo no sistema financeiro ou na sociedade. Estas alterações profundas tem que ser realizadas lentamente, porque uma alteração rápida poderia resultar em consequências terríveis, poderia provocar um retrocesso.

# Código do Bitcoin

No final de 2025, possivelmente vamos ter um _fork_, as discussões sobre os _covenants_ já estão avançadas, vão acelerar ainda mais. Já existe um consenso relativamente alto, a favor dos _covenants_, só falta decidir que modelo será escolhido. Penso que até ao final do ano será tudo decidido.

Depois dos _covenants,_ o próximo foco será para a criptografia post-quantum, que será o maior desafio que o Bitcoin enfrenta. Criar uma criptografia segura e que não coloque a descentralização em causa.

Espero muito de Ark, possivelmente a inovação do ano, gostaria de ver o Nostr a furar a bolha bitcoinheira e que o Cashu tivesse mais reconhecimento pelos _bitcoiners_.

Espero que surjam avanços significativos no BitVM2 e BitVMX.

Não sei o que esperar das layer 2 de Bitcoin, foram a maior desilusão de 2024. Surgiram com muita força, mas pouca coisa saiu do papel, foi uma mão cheia de nada. Uma parte dos projetos caiu na tentação da _shitcoinagem_, na criação de tokens, que tem um único objetivo, enriquecer os devs e os VCs.

Se querem ser levados a sério, têm que ser sérios.

> “À mulher de César não basta ser honesta, deve parecer honesta”

Se querem ter o apoio dos _bitcoiners_, sigam o _ethos_ do Bitcoin.

Neste ponto a atitude do pessoal da Ark é exemplar, em vez de andar a chorar no Twitter para mudar o código do Bitcoin, eles colocaram as mãos na massa e criaram o protocolo. É claro que agora está meio “coxo”, funciona com uma _multisig_ ou com os _covenants_ na Liquid. Mas eles estão a criar um produto, vão demonstrar ao mercado que o produto é bom e útil. Com a adoção, a comunidade vai perceber que o Ark necessita dos _covenants_ para melhorar a interoperabilidade e a soberania.

É este o pensamento certo, que deveria ser seguido pelos restantes e futuros projetos. É seguir aquele pensamento do J.F. Kennedy:

> “Não perguntem o que é que o vosso país pode fazer por vocês, perguntem o que é que vocês podem fazer pelo vosso país”

Ou seja, não fiquem à espera que o bitcoin mude, criem primeiro as inovações/tecnologia, ganhem adoção e depois demonstrem que a alteração do código camada base pode melhorar ainda mais o vosso projeto. A necessidade é que vai levar a atualização do código.

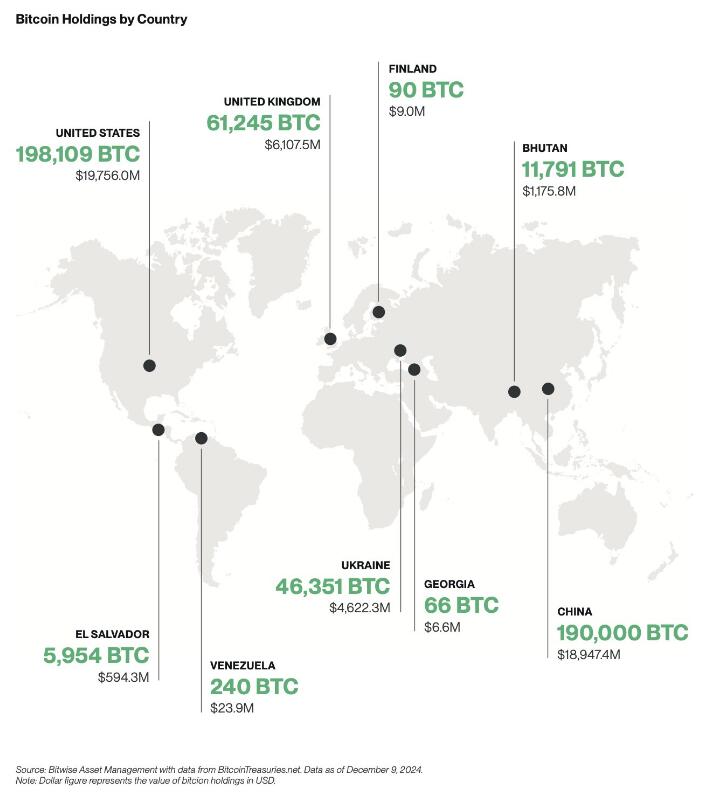

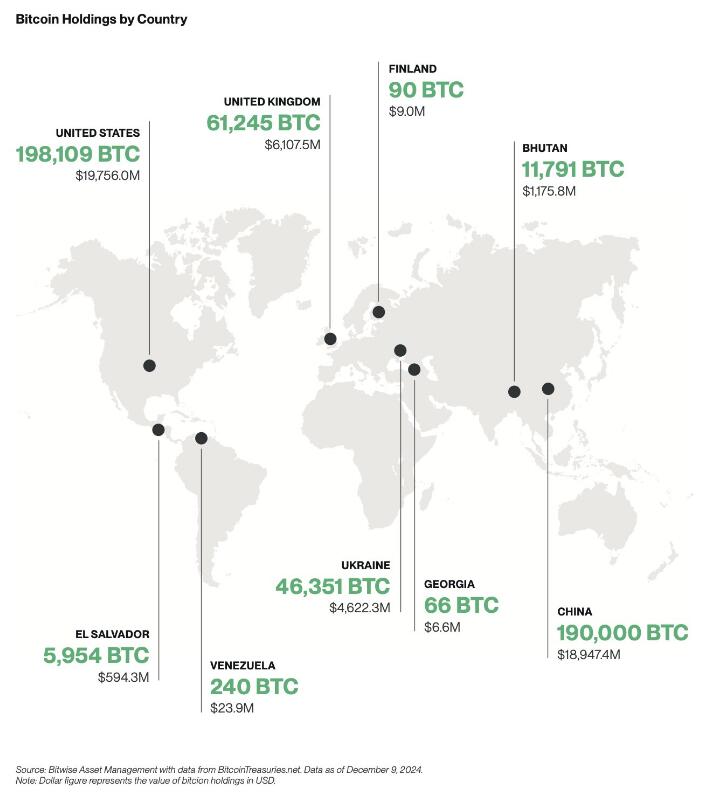

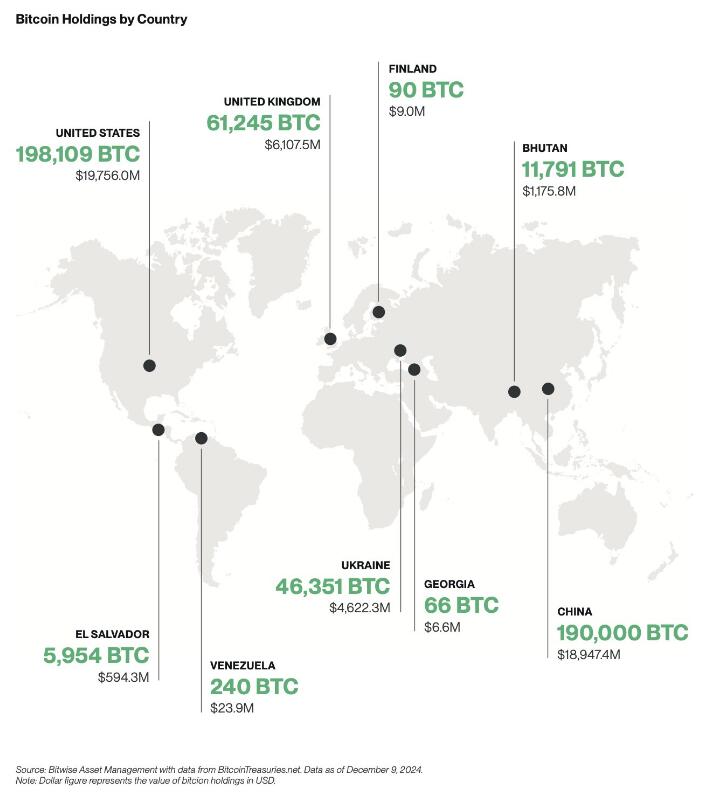

# Reservas Estratégicas de Bitcoin

## Bancos centrais

Com a eleição de Trump, emergiu a ideia de uma Reserva Estratégia de Bitcoin, tornou este conceito _mainstream_. Foi um _pivot_, a partir desse momento, foram enumerados os políticos de todo o mundo a falar sobre o assunto.

A Senadora Cynthia Lummis foi mais além e propôs um programa para adicionar 200 mil bitcoins à reserva ao ano, até 1 milhão de Bitcoin. Só que isto está a criar uma enorme expectativa na comunidade, só que pode resultar numa enorme desilusão. Porque no primeiro ano, o Trump em vez de comprar os 200 mil, pode apenas adicionar na reserva, os 198 mil que o Estado já tem em sua posse. Se isto acontecer, possivelmente vai resultar numa forte queda a curto prazo. Na minha opinião os bancos centrais deveriam seguir o exemplo de El Salvador, fazer um DCA diário.

Mais que comprar bitcoin, para mim, o mais importante é a criação da Reserva, é colocar o Bitcoin ao mesmo nível do ouro, o impacto para o resto do mundo será tremendo, a teoria dos jogos na sua plenitude. Muitos outros bancos centrais vão ter que comprar, para não ficarem atrás, além disso, vai transmitir uma mensagem à generalidade da população, que o Bitcoin é “afinal é algo seguro, com valor”.

Mas não foi Trump que iniciou esta teoria dos jogos, mas sim foi a primeira vítima dela. É o próprio Trump que o admite, que os EUA necessitam da reserva para não ficar atrás da China. Além disso, desde que os EUA utilizaram o dólar como uma arma, com sanção contra a Rússia, surgiram boatos de que a Rússia estaria a utilizar o Bitcoin para transações internacionais. Que foram confirmados recentemente, pelo próprio governo russo. Também há poucos dias, ainda antes deste reconhecimento público, Putin elogiou o Bitcoin, ao reconhecer que “Ninguém pode proibir o bitcoin”, defendendo como uma alternativa ao dólar. A narrativa está a mudar.

Já existem alguns países com Bitcoin, mas apenas dois o fizeram conscientemente (El Salvador e Butão), os restantes têm devido a apreensões. Hoje são poucos, mas 2025 será o início de uma corrida pelos bancos centrais. Esta corrida era algo previsível, o que eu não esperava é que acontecesse tão rápido.

## Empresas

A criação de reservas estratégicas não vai ficar apenas pelos bancos centrais, também vai acelerar fortemente nas empresas em 2025.

Mas as empresas não vão seguir a estratégia do Saylor, vão comprar bitcoin sem alavancagem, utilizando apenas os tesouros das empresas, como uma proteção contra a inflação. Eu não sou grande admirador do Saylor, prefiro muito mais, uma estratégia conservadora, sem qualquer alavancagem. Penso que as empresas vão seguir a sugestão da BlackRock, que aconselha um alocações de 1% a 3%.

Penso que 2025, ainda não será o ano da entrada das 6 magníficas (excepto Tesla), será sobretudo empresas de pequena e média dimensão. As magníficas ainda tem uma cota muito elevada de _shareholders_ com alguma idade, bastante conservadores, que têm dificuldade em compreender o Bitcoin, foi o que aconteceu recentemente com a Microsoft.

Também ainda não será em 2025, talvez 2026, a inclusão nativamente de wallet Bitcoin nos sistema da Apple Pay e da Google Pay. Seria um passo gigante para a adoção a nível mundial.

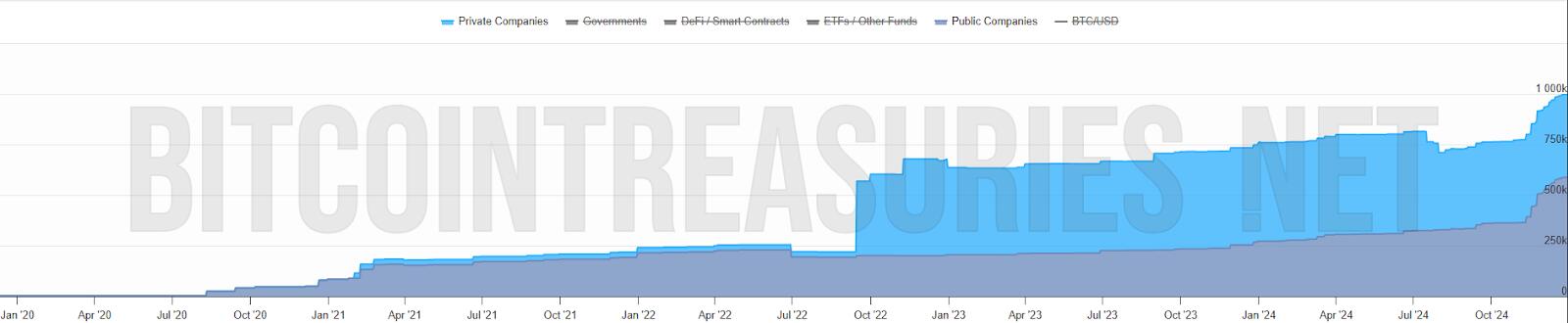

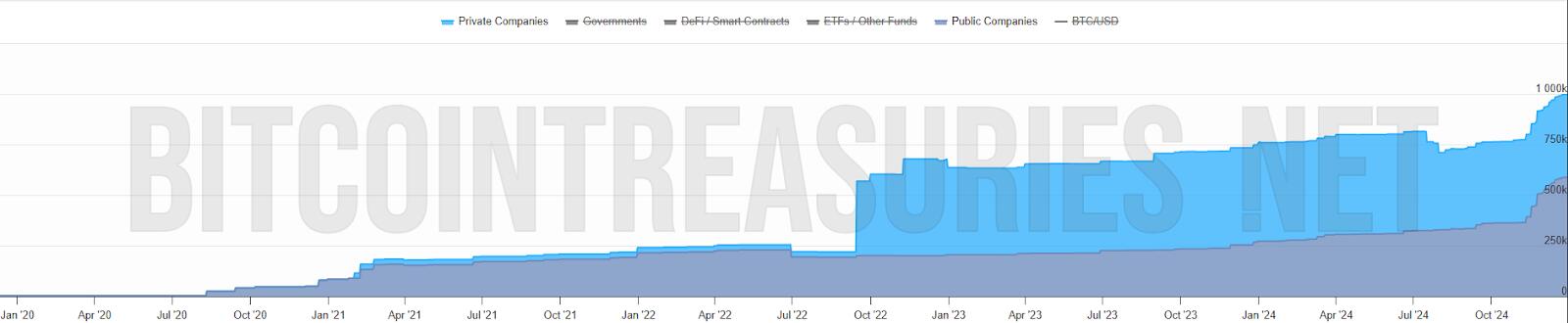

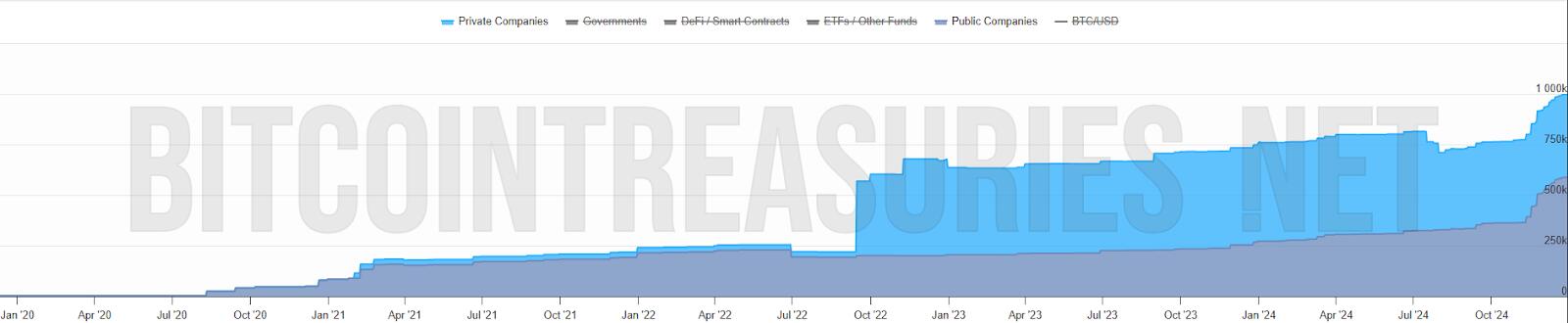

# ETFs

Os ETFs para mim são uma incógnita, tenho demasiadas dúvidas, como será 2025. Este ano os _inflows_ foram superiores a 500 mil bitcoins, o IBIT foi o lançamento de ETF mais bem sucedido da história. O sucesso dos ETFs, deve-se a 2 situações que nunca mais se vão repetir. O mercado esteve 10 anos à espera pela aprovação dos ETFs, a procura estava reprimida, isso foi bem notório nos primeiros meses, os _inflows_ foram brutais.

Também se beneficiou por ser um mercado novo, não existia _orderbook_ de vendas, não existia um mercado interno, praticamente era só _inflows_. Agora o mercado já estabilizou, a maioria das transações já são entre clientes dos próprios ETFs. Agora só uma pequena percentagem do volume das transações diárias vai resultar em _inflows_ ou _outflows_.

Estes dois fenómenos nunca mais se vão repetir, eu não acredito que o número de _inflows_ em BTC supere os número de 2024, em dólares vai superar, mas em btc não acredito que vá superar.

Mas em 2025 vão surgir uma infindável quantidade de novos produtos, derivativos, novos ETFs de cestos com outras criptos ou cestos com ativos tradicionais. O bitcoin será adicionado em produtos financeiros já existentes no mercado, as pessoas vão passar a deter bitcoin, sem o saberem.

Com o fim da operação ChokePoint 2.0, vai surgir uma nova onda de adoção e de produtos financeiros. Possivelmente vamos ver bancos tradicionais a disponibilizar produtos ou serviços de custódia aos seus clientes.

Eu adoraria ver o crescimento da adoção do bitcoin como moeda, só que a regulamentação não vai ajudar nesse processo.

# Preço

Eu acredito que o topo deste ciclo será alcançado no primeiro semestre, posteriormente haverá uma correção. Mas desta vez, eu acredito que a correção será muito menor que as anteriores, inferior a 50%, esta é a minha expectativa. Espero estar certo.

# Stablecoins de dólar

Agora saindo um pouco do universo do Bitcoin, acho importante destacar as _stablecoins_.

No último ciclo, eu tenho dividido o tempo, entre continuar a estudar o Bitcoin e estudar o sistema financeiro, as suas dinâmicas e o comportamento humano. Isto tem sido o meu foco de reflexão, imaginar a transformação que o mundo vai sofrer devido ao padrão Bitcoin. É uma ilusão acreditar que a transição de um padrão FIAT para um padrão Bitcoin vai ser rápida, vai existir um processo transitório que pode demorar décadas.

Com a re-entrada de Trump na Casa Branca, prometendo uma política altamente protecionista, vai provocar uma forte valorização do dólar, consequentemente as restantes moedas do mundo vão derreter. Provocando uma inflação generalizada, gerando uma corrida às _stablecoins_ de dólar nos países com moedas mais fracas. Trump vai ter uma política altamente expansionista, vai exportar dólares para todo o mundo, para financiar a sua própria dívida. A desigualdade entre os pobres e ricos irá crescer fortemente, aumentando a possibilidade de conflitos e revoltas.

> “Casa onde não há pão, todos ralham e ninguém tem razão”

Será mais lenha, para alimentar a fogueira, vai gravar os conflitos geopolíticos já existentes, ficando as sociedade ainda mais polarizadas.

Eu acredito que 2025, vai haver um forte crescimento na adoção das _stablecoins_ de dólares, esse forte crescimento vai agravar o problema sistémico que são as _stablecoins_. Vai ser o início do fim das _stablecoins_, pelo menos, como nós conhecemos hoje em dia.

## Problema sistémico

O sistema FIAT não nasceu de um dia para outro, foi algo que foi construído organicamente, ou seja, foi evoluindo ao longo dos anos, sempre que havia um problema/crise, eram criadas novas regras ou novas instituições para minimizar os problemas. Nestes quase 100 anos, desde os acordos de Bretton Woods, a evolução foram tantas, tornaram o sistema financeiro altamente complexo, burocrático e nada eficiente.

Na prática é um castelo de cartas construído sobre outro castelo de cartas e que por sua vez, foi construído sobre outro castelo de cartas.

As _stablecoins_ são um problema sistémico, devido às suas reservas em dólares e o sistema financeiro não está preparado para manter isso seguro. Com o crescimento das reservas ao longo dos anos, foi se agravando o problema.

No início a Tether colocava as reservas em bancos comerciais, mas com o crescimento dos dólares sob gestão, criou um problema nos bancos comerciais, devido à reserva fracionária. Essas enormes reservas da Tether estavam a colocar em risco a própria estabilidade dos bancos.

A Tether acabou por mudar de estratégia, optou por outros ativos, preferencialmente por títulos do tesouro/obrigações dos EUA. Só que a Tether continua a crescer e não dá sinais de abrandamento, pelo contrário.

Até o próprio mundo cripto, menosprezava a gravidade do problema da Tether/_stablecoins_ para o resto do sistema financeiro, porque o _marketcap_ do cripto ainda é muito pequeno. É verdade que ainda é pequeno, mas a Tether não o é, está no top 20 dos maiores detentores de títulos do tesouros dos EUA e está ao nível dos maiores bancos centrais do mundo. Devido ao seu tamanho, está a preocupar os responsáveis/autoridades/reguladores dos EUA, pode colocar em causa a estabilidade do sistema financeiro global, que está assente nessas obrigações.

Os títulos do tesouro dos EUA são o colateral mais utilizado no mundo, tanto por bancos centrais, como por empresas, é a charneira da estabilidade do sistema financeiro. Os títulos do tesouro são um assunto muito sensível. Na recente crise no Japão, do _carry trade_, o Banco Central do Japão tentou minimizar a desvalorização do iene através da venda de títulos dos EUA. Esta operação, obrigou a uma viagem de emergência, da Secretaria do Tesouro dos EUA, Janet Yellen ao Japão, onde disponibilizou liquidez para parar a venda de títulos por parte do Banco Central do Japão. Essa forte venda estava desestabilizando o mercado.

Os principais detentores de títulos do tesouros são institucionais, bancos centrais, bancos comerciais, fundo de investimento e gestoras, tudo administrado por gestores altamente qualificados, racionais e que conhecem a complexidade do mercado de obrigações.

O mundo cripto é seu oposto, é _naife_ com muita irracionalidade e uma forte pitada de loucura, na sua maioria nem faz a mínima ideia como funciona o sistema financeiro. Essa irracionalidade pode levar a uma “corrida bancária”, como aconteceu com o UST da Luna, que em poucas horas colapsou o projeto. Em termos de escala, a Luna ainda era muito pequena, por isso, o problema ficou circunscrito ao mundo cripto e a empresas ligadas diretamente ao cripto.

Só que a Tether é muito diferente, caso exista algum FUD, que obrigue a Tether a desfazer-se de vários biliões ou dezenas de biliões de dólares em títulos num curto espaço de tempo, poderia provocar consequências terríveis em todo o sistema financeiro. A Tether é grande demais, é já um problema sistémico, que vai agravar-se com o crescimento em 2025.

Não tenham dúvidas, se existir algum problema, o Tesouro dos EUA vai impedir a venda dos títulos que a Tether tem em sua posse, para salvar o sistema financeiro. O problema é, o que vai fazer a Tether, se ficar sem acesso às venda das reservas, como fará o _redeem_ dos dólares?

Como o crescimento do Tether é inevitável, o Tesouro e o FED estão com um grande problema em mãos, o que fazer com o Tether?

Mas o problema é que o atual sistema financeiro é como um curto cobertor: Quanto tapas a cabeça, destapas os pés; Ou quando tapas os pés, destapas a cabeça. Ou seja, para resolver o problema da guarda reservas da Tether, vai criar novos problemas, em outros locais do sistema financeiro e assim sucessivamente.

### Conta mestre

Uma possível solução seria dar uma conta mestre à Tether, dando o acesso direto a uma conta no FED, semelhante à que todos os bancos comerciais têm. Com isto, a Tether deixaria de necessitar os títulos do tesouro, depositando o dinheiro diretamente no banco central. Só que isto iria criar dois novos problemas, com o Custodia Bank e com o restante sistema bancário.

O Custodia Bank luta há vários anos contra o FED, nos tribunais pelo direito a ter licença bancária para um banco com _full-reserves_. O FED recusou sempre esse direito, com a justificativa que esse banco, colocaria em risco toda a estabilidade do sistema bancário existente, ou seja, todos os outros bancos poderiam colapsar. Perante a existência em simultâneo de bancos com reserva fracionária e com _full-reserves_, as pessoas e empresas iriam optar pelo mais seguro. Isso iria provocar uma corrida bancária, levando ao colapso de todos os bancos com reserva fracionária, porque no Custodia Bank, os fundos dos clientes estão 100% garantidos, para qualquer valor. Deixaria de ser necessário limites de fundos de Garantia de Depósitos.

Eu concordo com o FED nesse ponto, que os bancos com _full-reserves_ são uma ameaça a existência dos restantes bancos. O que eu discordo do FED, é a origem do problema, o problema não está nos bancos _full-reserves_, mas sim nos que têm reserva fracionária.

O FED ao conceder uma conta mestre ao Tether, abre um precedente, o Custodia Bank irá o aproveitar, reclamando pela igualdade de direitos nos tribunais e desta vez, possivelmente ganhará a sua licença.

Ainda há um segundo problema, com os restantes bancos comerciais. A Tether passaria a ter direitos similares aos bancos comerciais, mas os deveres seriam muito diferentes. Isto levaria os bancos comerciais aos tribunais para exigir igualdade de tratamento, é uma concorrência desleal. Isto é o bom dos tribunais dos EUA, são independentes e funcionam, mesmo contra o estado. Os bancos comerciais têm custos exorbitantes devido às políticas de _compliance_, como o KYC e AML. Como o governo não vai querer aliviar as regras, logo seria a Tether, a ser obrigada a fazer o _compliance_ dos seus clientes.

A obrigação do KYC para ter _stablecoins_ iriam provocar um terramoto no mundo cripto.

Assim, é pouco provável que seja a solução para a Tether.

### FED

Só resta uma hipótese, ser o próprio FED a controlar e a gerir diretamente as _stablecoins_ de dólar, nacionalizado ou absorvendo as existentes. Seria uma espécie de CBDC. Isto iria provocar um novo problema, um problema diplomático, porque as _stablecoins_ estão a colocar em causa a soberania monetária dos outros países. Atualmente as _stablecoins_ estão um pouco protegidas porque vivem num limbo jurídico, mas a partir do momento que estas são controladas pelo governo americano, tudo muda. Os países vão exigir às autoridades americanas medidas que limitem o uso nos seus respectivos países.

Não existe uma solução boa, o sistema FIAT é um castelo de cartas, qualquer carta que se mova, vai provocar um desmoronamento noutro local. As autoridades não poderão adiar mais o problema, terão que o resolver de vez, senão, qualquer dia será tarde demais. Se houver algum problema, vão colocar a responsabilidade no cripto e no Bitcoin. Mas a verdade, a culpa é inteiramente dos políticos, da sua incompetência em resolver os problemas a tempo.

Será algo para acompanhar futuramente, mas só para 2026, talvez…

É curioso, há uns anos pensava-se que o Bitcoin seria a maior ameaça ao sistema ao FIAT, mas afinal, a maior ameaça aos sistema FIAT é o próprio FIAT(_stablecoins_). A ironia do destino.

Isto é como uma corrida, o Bitcoin é aquele atleta que corre ao seu ritmo, umas vezes mais rápido, outras vezes mais lento, mas nunca pára. O FIAT é o atleta que dá tudo desde da partida, corre sempre em velocidade máxima. Só que a vida e o sistema financeiro não é uma prova de 100 metros, mas sim uma maratona.

# Europa

2025 será um ano desafiante para todos europeus, sobretudo devido à entrada em vigor da regulamentação (MiCA). Vão começar a sentir na pele a regulamentação, vão agravar-se os problemas com os _compliance_, problemas para comprovar a origem de fundos e outras burocracias. Vai ser lindo.

O _Travel Route_ passa a ser obrigatório, os europeus serão obrigados a fazer o KYC nas transações. A _Travel Route_ é uma suposta lei para criar mais transparência, mas prática, é uma lei de controle, de monitorização e para limitar as liberdades individuais dos cidadãos.

O MiCA também está a colocar problemas nas _stablecoins_ de Euro, a Tether para já preferiu ficar de fora da europa. O mais ridículo é que as novas regras obrigam os emissores a colocar 30% das reservas em bancos comerciais. Os burocratas europeus não compreendem que isto coloca em risco a estabilidade e a solvência dos próprios bancos, ficam propensos a corridas bancárias.

O MiCA vai obrigar a todas as exchanges a estar registadas em solo europeu, ficando vulnerável ao temperamento dos burocratas. Ainda não vai ser em 2025, mas a UE vai impor políticas de controle de capitais, é inevitável, as exchanges serão obrigadas a usar em exclusividade _stablecoins_ de euro, as restantes _stablecoins_ serão deslistadas.

Todas estas novas regras do MiCA, são extremamente restritas, não é para garantir mais segurança aos cidadãos europeus, mas sim para garantir mais controle sobre a população. A UE está cada vez mais perto da autocracia, do que da democracia. A minha única esperança no horizonte, é que o sucesso das políticas cripto nos EUA, vai obrigar a UE a recuar e a aligeirar as regras, a teoria dos jogos é implacável. Mas esse recuo, nunca acontecerá em 2025, vai ser um longo período conturbado.

# Recessão

Os mercados estão todos em máximos históricos, isto não é sustentável por muito tempo, suspeito que no final de 2025 vai acontecer alguma correção nos mercados. A queda só não será maior, porque os bancos centrais vão imprimir dinheiro, muito dinheiro, como se não houvesse amanhã. Vão voltar a resolver os problemas com a injeção de liquidez na economia, é empurrar os problemas com a barriga, em de os resolver. Outra vez o efeito Cantillon.

Será um ano muito desafiante a nível político, onde o papel dos políticos será fundamental. A crise política na França e na Alemanha, coloca a UE órfã, sem um comandante ao leme do navio. 2025 estará condicionado pelas eleições na Alemanha, sobretudo no resultado do AfD, que podem colocar em causa a propriedade UE e o euro.

Possivelmente, só o fim da guerra poderia minimizar a crise, algo que é muito pouco provável acontecer.

Em Portugal, a economia parece que está mais ou menos equilibrada, mas começam a aparecer alguns sinais preocupantes. Os jogos de sorte e azar estão em máximos históricos, batendo o recorde de 2014, época da grande crise, não é um bom sinal, possivelmente já existe algum desespero no ar.