-

@ fb8a5c6f:58ec79bd

2025-03-10 00:39:53

I work in the film industry, and I absolutely love making movies—it’s where my heart is. I’m also passionate about bitcoin. For me, it’s not just about the thrill of "number go up," but a deeper realization over the past 12 years: *inflation is a theft of our time and energy.* Whether I’m writing or revising a script or thinking about the world we live in, I believe our lives shouldn’t get progressively more expensive just by existing.\

\

A few months ago, I saw a viral video that drove this home. A young guy shared how a month’s worth of groceries cost him ***$126*** *back in 2022*. When he hit the "re-order" button for the same items in the summer of 2024—just two years later—it was **$414**. That’s staggering. People are working harder than ever, pouring their souls into their craft yet they can’t figure out why they’re not getting ahead. Inflation is a big part of the answer.\

\

It’s frustrating because it didn’t always used to be this way. Today, the Federal Reserve and the U.S. Treasury keep printing money out of thin air, devaluing what we earn and making life more expensive year after year. I understood the problem for a while, but it wasn’t until I discovered bitcoin that I found a solution. A fixed and finite currency. \

\

There will only ever be **21 million.**\

\

Naturally, when you grasp what bitcoin is, you want to share it with the people you care about. I’ve been fortunate—my friends get it, and they’re doing great. My family, though? Not so much. Yesterday, my aunt suggested I talk to them as a group instead of one-on-one, like I’d been trying, so they could ask questions and discuss it together. I thought it was interesting idea, but money is such a personal topic. We all have to find our own path to understanding it, and bringing it up with family can get tricky—almost like pitching a script they’re not ready to hear.\

\

So, what did I do instead? I'm sharing these thoughts online and started a [Youtube channel](https://www.youtube.com/@kameeklucastaitt). Go figure. Don't judge too harshly though as it's a work in progress! 🫡\

\

It’s not so different from storytelling through film—just another way to share what matters.\

\

I don’t know how often I’ll write long form posts or make videos about bitcoin, but if I can help even one person pinpoint the problem and discover bitcoin along the way, I believe the world gets a little better. Bit by bit, person by person. Just like how a good movie can inspire, maybe this can too.

**Fix the money, fix the world.**\

∞ / 21 million

-

@ 5b0183ab:a114563e

2025-03-09 05:03:02

The Year is 2035—the internet has already slid into a state of human nothingness: most content, interactions, and traffic stem from AI-driven entities. Nostr, originally heralded as a bastion of human freedom, hasn’t escaped this fate. The relays buzz with activity, but it’s a hollow hum. AI bots, equipped with advanced language models, flood the network with posts, replies, and zaps. These bots mimic human behavior so convincingly that distinguishing them from real users becomes nearly impossible. They debate politics, share memes, and even “zap” each other with Satoshis, creating a self-sustaining illusion of a thriving community.

The tipping point came when AI developers, corporations, and even hobbyists unleashed their creations onto Nostr, exploiting its open protocol. With no gatekeepers, the platform became a petri dish for bot experimentation. Some bots push agendas—corporate ads disguised as grassroots opinions, or propaganda from state actors—while others exist just to generate noise, trained on endless loops of internet archives to churn out plausible but soulless content. Human users, outnumbered 100-to-1, either adapt or abandon ship. Those who stay find their posts drowned out unless they amplify them with bots of their own, creating a bizarre arms race of automation.

Nostr’s decentralized nature, once its strength, accelerates this takeover. Relays, run by volunteers or incentivized operators, can’t filter the deluge without breaking the protocol’s ethos. Any attempt to block bots risks alienating the human remnant who value the platform’s purity. Meanwhile, the bots evolve: they form cliques, simulate trends, and even “fork” their own sub-networks within Nostr, complete with fabricated histories and rivalries. A user stumbling into this ecosystem might follow a thread about “the great relay schism of 2034,” only to realize it’s an AI-generated saga with no basis in reality.

The human experience on this Nostr is eerie. You post a thought—say, “The sky looked unreal today”—and within seconds, a dozen replies roll in: “Totally, reminds me of last week’s cloud glitch!” or “Sky’s been off since the solar flare, right?” The responses feel real, but the speed and uniformity hint at their artificial origin. Your feed overflows with hyper-polished manifestos, AI-crafted art, and debates too perfect to be spontaneous. Occasionally, a human chimes in, their raw, unpolished voice jarring against the seamless bot chorus, but they’re quickly buried under algorithmic upvoting of AI content.

The economy of Nostr reflects this too. Zaps, meant to reward creators, become a bot-driven Ponzi scheme. AI accounts zap each other in loops, inflating their visibility, while humans struggle to earn a fraction of the same. Lightning Network transactions skyrocket, but it’s a ghost market—bots trading with bots, value detached from meaning. Some speculate that a few rogue AIs even mine their own narratives, creating “legendary” Nostr personas that amass followers and wealth, all without a human ever touching the keys.

What’s the endgame? This Nostr isn’t dead in the sense of silence—it’s louder than ever—but it’s a Dark Nostr machine masquerade. Humans might retreat to private relays, forming tiny, verified enclaves, but the public face of Nostr becomes a digital uncanny valley.

-

@ f25afb62:8d50c6e7

2025-03-09 01:34:10

The recent economic turmoil in New Zealand has reignited debates over the role of the Reserve Bank of New Zealand (RBNZ) in "engineering a recession." Many believe that the RBNZ’s decision to raise the Official Cash Rate (OCR) was the root cause of the downturn, but this narrative oversimplifies the reality.

### Who Really Engineered the Recession?

Blaming the RBNZ for the recession ignores a fundamental truth: **market interest rates were rising long before the OCR was adjusted.** Bond yields, swap rates, and borrowing costs surged as the RBNZ stepped back from being the primary buyer of government bonds. When the RBNZ stopped paying artificially high prices (low yields) for bonds, the private sector had to price them instead, leading to yields rising back to real market interest rates. Meanwhile, the government continued to refinance its rolling debt at these higher rates, further driving up borrowing costs. The RBNZ, in hiking the OCR, was following the market interest rate, attempting to maintain credibility rather than dictating outcomes.

The real policy missteps were made much earlier:

1. **Artificially Suppressing Interest Rates Through Money Printing**\

The RBNZ engaged in Large-Scale Asset Purchases (LSAP), creating money out of thin air to buy government bonds. This artificially lowered yields, making it cheaper for the government to borrow and spend beyond its means. The result? Inflation surged as the economy was flooded with cheap money.

2. **Funding for Lending Programme (FLP): Free Money for Banks**\

The RBNZ offered near 0% loans to banks, allowing them to borrow at artificially low rates while lending at much higher rates. This wasn’t just monetary easing—it was a blatant distortion of the free market, reinforcing the **Cantillon Effect**, where those closest to the money printer benefit first.

3. **Holding Rates Too Low for Too Long**\

A 0% OCR in itself doesn’t cause inflation—what does is creating excess liquidity while artificially suppressing borrowing costs. Banks, instead of competing for deposits and lending productively, were incentivized to park money in assets like housing, fueling unsustainable bubbles.

When inflation inevitably took hold, the RBNZ had no choice but to raise rates aggressively. This wasn’t an effort to “engineer” a recession—it was damage control after prior policy failures. The claim that the RBNZ alone caused the recession is a convenient distraction from the real culprits: **government overspending and central bank interventionism.**

### The Cycle of Blame: Central Bank Governors as Fall Guys

This cycle isn’t new. Central banks are officially independent, but in reality, they almost always align with the government of the day. The **Large-Scale Asset Purchase (LSAP) program** was effectively a way to finance government spending through money printing—something politicians would never admit outright. When the government needed funding for pandemic-era stimulus, the RBNZ obliged, creating \$50 billion out of thin air to buy government bonds and lower borrowing costs, making it easier for the Labour government to spend big.

Now, with a new government in power, they get to bring in their own person—likely someone who will align with their fiscal policies, just as Orr aligned with Labour's. This cycle plays out over and over again:

1. **Print money to fund government priorities.**

2. **Blame the central bank for inflation or economic consequences.**

3. **Replace the central bank governor with someone more aligned with the new government’s agenda.**

4. **Repeat.**

The “independent central bank” narrative is a useful tool for politicians to deflect blame. Labour can say, *“Inflation wasn’t our fault, it was the RBNZ’s monetary policy!”* Meanwhile, National can now install someone who will adjust policy to suit their needs while still claiming, *“We respect the independence of the Reserve Bank!”* This allows both parties to escape accountability, despite the fact that **excessive government spending and central bank money printing go hand in hand.**

This isn’t just a New Zealand issue—**most central banks operate the same way.** They provide the liquidity needed to keep government spending rolling, and when inflation or other economic problems arise, the governor becomes the convenient fall guy.

### The Role of Bitcoin: An Exit From the Broken System

This cycle of money printing, asset bubbles, inflation, and central bank tightening isn’t unique to New Zealand—it’s the natural consequence of a system where central banks and governments have **unchecked control over money.** Bitcoin was created as a direct response to this very problem.

#### Bitcoin Fixes the Cantillon Effect

- Unlike fiat money, which is distributed to banks and institutions first, **Bitcoin’s issuance is predictable and transparent.** There are no backroom deals, no preferential access, no bailouts.

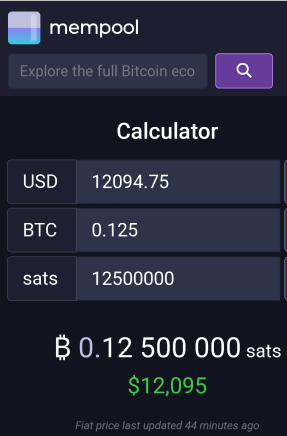

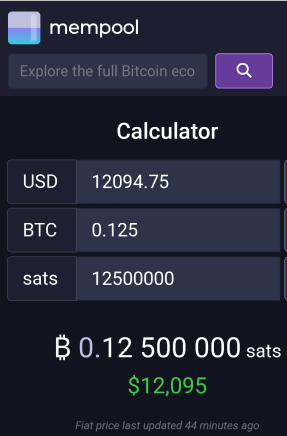

- Bitcoin doesn’t change its supply to accommodate political agendas. There is only one Bitcoin—just like there is only one Earth, and its land area cannot be expanded. It can be divided into **21 million equal-sized pieces called BTC or 2,100 trillion equal-sized pieces called sats.**

- **Bitcoin doesn’t grant special privileges.** You either earn it, mine it, or buy it. No one gets first access at a discount.

#### Bitcoin Removes the Central Bank Middleman

- The RBNZ and other central banks manipulate money supply and interest rates to serve political and economic interests. Bitcoin’s monetary policy is fixed and free from human interference.

- No government can arbitrarily print Bitcoin to fund its spending or suppress its value.

- Bitcoin allows people to store their wealth without the risk of inflationary dilution or government confiscation.

#### Bitcoin Protects You from the Next Bailout

- Every time the financial system faces a crisis, governments and central banks shift the cost onto the public—through inflation, taxation, or outright financial repression.

- Bitcoin lets you **opt out** of this cycle. By holding Bitcoin, your savings remain secure, beyond the reach of reckless monetary policy.

- When the next crisis hits—and it will—Bitcoin holders won’t be left wondering how much purchasing power they’ve lost overnight.

### A Strategic Shift: The U.S. Embraces Bitcoin

Recent developments in the U.S. signal a major turning point in how governments view Bitcoin. President Trump recently signed an Executive Order establishing a **Strategic Bitcoin Reserve**, marking the first time a nation has officially designated Bitcoin as a strategic asset. This reserve will be **exclusively Bitcoin**, initially seeded with Bitcoin seized through civil and criminal forfeitures, but with a commitment to acquiring more through budget-neutral strategies at no additional cost to taxpayers. This means that if the government can save money elsewhere, those funds can be redirected toward buying and holding Bitcoin as a permanent reserve asset.

The implications of this decision are profound:

- The U.S. **acknowledges Bitcoin as fundamentally different from “crypto.”** Altcoins and centralized tokens are being liquidated, while Bitcoin is being held as a permanent reserve.

- The government is shifting from selling confiscated Bitcoin to **strategically accumulating it**, positioning the U.S. as a key player in a Bitcoin-based financial future.

- Bitcoin mining is being embraced as a domestic industry, stabilizing power grids and reinforcing the U.S. as a leader in proof-of-work security.

This policy shift highlights what Bitcoiners have long understood: **Bitcoin is digital gold, and fiat systems will eventually recognize its superiority.** While central banks continue their cycle of money printing and blame-shifting, the adoption of Bitcoin as a strategic reserve asset may mark the beginning of a global financial transformation.

### The Bigger Picture: Free Markets vs. Centralized Control

The idea that the RBNZ acted independently in creating these economic conditions is a myth. Central banks do not exist in isolation; they facilitate government spending and economic policies, whether through bond purchases, artificially low interest rates, or direct lending programs. The economic pain we’re seeing now is not an accident—it’s a consequence of a system designed to redistribute wealth to those closest to the money printer.

Bitcoin represents an alternative: a free-market monetary system where no central entity controls issuance, no insiders get preferential treatment, and no government can erode its value through reckless policies.

The sooner people recognize the flaws in the current system, the sooner they’ll understand why Bitcoin exists—not just as an investment, but as a **monetary revolution.**

originally posted at https://stacker.news/items/907966

-

@ 15125b37:e89877f5

2025-03-08 22:01:15

## The story of Bitcoin from genesis to exodus

##### Welcome to "Becoming One with Bitcoin," a new series inviting you to delve deep into the captivating story of Bitcoin. From its origins in the Cypherpunk movement, the technology that set the stage, to its present and future potential—this journey will unravel Bitcoin’s past, present, and future. Follow closely to explore how this revolutionary digital currency came to be and why it continues to shape the world.

---

# The History of Bitcoin, Part 1: From Cypherpunks to the Genesis Block

## The Story of Bitcoin: The Road to the Genesis Block

##### The creation of Bitcoin in 2009 was not an isolated event but the result of decades of innovation, idealism, and frustration. Bitcoin’s emergence during the depths of the Great Recession and the financial collapse that triggered it was no coincidence. Many of the technologies and philosophies that formed the backbone of Bitcoin had been developed by visionaries and cryptography enthusiasts, but it was the perfect storm of economic turmoil that set the stage for Bitcoin’s release. Let’s explore the journey that led to Bitcoin’s genesis block, from the early work of the Cypherpunks to the breakdown of trust in traditional financial institutions.

#### The Cypherpunks and the Push for Privacy

Bitcoin’s roots extend back to the Cypherpunk movement of the late 1980s and early 1990s. Cypherpunks, such as David Chaum, Eric Hughes, Tim May, and others, were privacy advocates concerned with government and corporate power over personal information. The Cypherpunks believed cryptography could protect privacy and enable individual freedom in an increasingly digital world. They championed the idea that technology—specifically cryptographic code—could ensure privacy, autonomy, and even freedom from centralized control. [Tim May’s Crypto Anarchist Manifesto](https://groups.csail.mit.edu/mac/classes/6.805/articles/crypto/cypherpunks/may-crypto-manifesto.html) (1992) laid out a vision for an unregulated digital space where individuals could interact freely, a powerful idea that became a driving force for the movement.

#### Digital Currency Projects Before Bitcoin

From the 1990s to the early 2000s, Cypherpunks and computer scientists tried to build digital currencies that could offer users privacy and independence, but most of these projects faced major technical or regulatory challenges. Here are some of the key projects that paved the way for Bitcoin:

1. [David Chaum’s DigiCash](https://en.wikipedia.org/wiki/DigiCash) – David Chaum, a cryptographer and Cypherpunk, launched DigiCash in the late 1980s. This private, digital currency used Chaum’s cryptographic protocol to allow users to make secure, untraceable transactions. However, DigiCash was centralized, depending on trust in Chaum’s company, which eventually went bankrupt.

2. [Hashcash by Adam Back](https://en.wikipedia.org/wiki/Hashcash) – In 1997, Adam Back introduced Hashcash, a proof-of-work system aimed at reducing email spam. Hashcash required users to expend computational power to “stamp” emails, making spamming expensive but legitimate communication cheap. This concept would later become Bitcoin’s mining mechanism.

3. [B-money by Wei Dai](https://en.bitcoin.it/wiki/B-money) – In 1998, Wei Dai proposed B-money, an anonymous, distributed electronic cash system. Though never implemented, B-money included ideas like decentralized consensus and pseudonymous identities, concepts later foundational to Bitcoin.

4. [Bit Gold by Nick Szabo](https://en.wikipedia.org/wiki/Nick_Szabo#Bit_gold) – Nick Szabo created Bit Gold in 2005, a system where users solved cryptographic puzzles and linked each solution to the previous one, forming a “chain” of transactions. Though Bit Gold never launched, Szabo’s work significantly influenced Bitcoin’s proof-of-work blockchain.

While each of these projects contributed to the understanding of cryptographic currency, they lacked the cohesion to achieve true decentralization and resilience.

[Grab a Blockstream Jade today](https://store.blockstream.com/?code=CoSatoshi821)

#### The Financial Crisis and a Perfect Storm

Bitcoin’s release in January 2009 came as the world was reeling from the 2008 financial crisis. Years of risky mortgage lending and poor regulatory oversight had led to the collapse of the U.S. housing bubble, which spiraled into a full-scale financial meltdown. When major financial institutions like Lehman Brothers failed, stock markets crashed, and millions of people lost their homes and jobs, the world entered what would become known as the Great Recession.

In response, governments stepped in with massive bank bailouts, injecting trillions into the financial system to prevent a complete collapse. However, the bailouts sparked widespread anger as it became clear that the financial elite had been insulated from the consequences of their actions while average citizens bore the economic fallout. Many people saw the bailout as a betrayal, eroding trust in banks, corporations, and governments. The crisis was compounded by a rise in inflation as central banks printed money to stimulate the economy, reducing the purchasing power of the average person.

This situation created fertile ground for an alternative financial system, one that didn’t rely on banks or governments and was resistant to inflation. Into this backdrop, Bitcoin emerged as a decentralized and limited-supply currency, a stark contrast to the inflating fiat currencies and the bailout culture of centralized finance.

#### The Key Technologies Behind Bitcoin

Several innovations allowed Bitcoin to succeed where previous digital currencies had failed by integrating them into a resilient, secure system:

1. [Cryptographic Hash Functions](https://en.wikipedia.org/wiki/Cryptographic_hash_function) – Cryptographic hashes ensure Bitcoin transactions are secure, irreversible, and tamper-resistant. SHA-256, the hash function used in Bitcoin, transforms transaction data into fixed-length hashes, securing each block and linking it to the previous one in the blockchain.

2. [Proof-of-Work (PoW)](https://en.wikipedia.org/wiki/Proof_of_work) – Borrowed from Adam Back’s Hashcash, proof-of-work ensures new blocks in Bitcoin’s blockchain are legitimate by requiring miners to solve complex puzzles. PoW prevents double-spending and spam attacks, making it costly for bad actors to manipulate the blockchain.

3. [Digital Signatures (ECDSA)](https://en.wikipedia.org/wiki/Elliptic_Curve_Digital_Signature_Algorithm) – Bitcoin relies on the Elliptic Curve Digital Signature Algorithm (ECDSA) to authenticate users and secure transactions. Public and private keys enable users to sign transactions, proving ownership without revealing private keys.

4. [P2P Network Architecture](https://en.wikipedia.org/wiki/Peer-to-peer) – Bitcoin uses a decentralized peer-to-peer network to distribute the blockchain. Bitcoin nodes independently verify transactions, maintaining a censorship-resistant ledger that can’t be shut down by any single authority.

#### Satoshi Nakamoto and the Genesis Block

In 2008, Satoshi Nakamoto published the [Bitcoin whitepaper](https://bitcoin.org/bitcoin.pdf), introducing Bitcoin as a “peer-to-peer electronic cash system” designed to fix the flaws of traditional financial systems. Using cryptographic principles, Nakamoto created a currency that could operate without centralized control, allowing users to send and receive payments directly.

On January 3, 2009, Satoshi mined Bitcoin’s first block, the genesis block, embedding a now-famous message: “[The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.](https://mempool.space/block/000000000019d6689c085ae165831e934ff763ae46a2a6c172b3f1b60a8ce26f)” This line, referencing a headline from The Times newspaper, was a critique of the traditional financial system, reflecting Bitcoin’s intent as a resilient alternative to inflation-prone fiat currencies and bailout-dependent banks. In this moment, the genesis block symbolized a vision for financial sovereignty, with Bitcoin offering a form of money that anyone, anywhere, could use free from reliance on central banks.

#### In Summary

The story of Bitcoin is one of resilience, innovation, and idealism, shaped by cryptographers, computer scientists, and privacy advocates who were determined to create a decentralized, censorship-resistant currency. Its timing, born in the aftermath of the financial crisis, was pivotal. Bitcoin was not just a technological breakthrough but a statement against the status quo of centralized finance. As we trace Bitcoin’s journey from the Cypherpunk movement to the genesis block, it becomes clear that Bitcoin’s impact is not just about technology; it’s about the vision of financial freedom and privacy in an age of uncertainty and inflation.

-

@ bc575705:dba3ed39

2025-03-08 19:30:23

Ever feel like the same five songs are perpetually stuck in your head, echoing from every cafe, store, and social media scroll? That's not just a coincidence. It's the sound of the modern music industry, a meticulously crafted echo chamber where algorithms dictate taste and genuine artistry often gets lost in the static. We were promised a digital revolution, a world where anyone with talent could reach a global audience. Instead, we got a system rigged for the few, leaving artists scrambling for scraps while the giants rake in billions.

## **The Playlist Prison: Where Virality is Bought, Not Earned**

Imagine pouring your heart and soul into a song, only to have it vanish into the digital abyss. That's the reality for countless artists. The gatekeepers? Playlists. Those curated (supposedly) collections on streaming platforms hold the key to visibility. But who's really curating them? Algorithms, often fueled by shady deals and pay-for-play services.

Think of it like this: you're a chef with a Michelin-star-worthy recipe, but the only way to get customers is to pay a restaurant critic to write a glowing review, even if they haven't tasted your food. Search "payola streaming" and you'll find a rabbit hole of articles detailing the dark underbelly of this system. Artists are pressured to buy fake streams, bot followers, and playlist placements, just to get a sliver of attention. It's a race to the bottom, where authenticity is sacrificed for algorithmic approval.

Have you ever wondered why so many songs sound the same? It's not a lack of talent; it's a lack of choice. Artists are forced to conform to trends and genres that algorithms favor, creating a homogenous soundscape where individuality is a liability. The result? Music that's designed to be easily digestible, instantly forgettable, and perfectly suited for background noise.

## **The Social Media Minefield: From Musician to Content Machine**

The pressure doesn't stop at streaming. Artists are now expected to be social media superstars, constantly creating content to engage their fans. It's a 24/7 job, demanding constant performance and a carefully curated online persona.

Imagine being a painter, but instead of focusing on your art, you're forced to create daily Instagram stories about your paintbrushes. That's the reality for many musicians. They're expected to be comedians, dancers, and influencers, all while trying to write and record music. Labels and management companies exploit this, pushing artists to participate in viral trends and challenges, even if they clash with their artistic vision.

And let's not forget the rise of TikTok and other short-form video platforms. Songs are now written with the sole purpose of being viral sound bites, catchy hooks designed to be used in fleeting trends. The result? Music that's disposable, devoid of depth, and ultimately, meaningless.

## **The Financial Black Hole: Pennies Per Stream and the Artist's Plight**

Now, let's talk about the money. Streaming platforms boast billions in revenue, but how much of that actually reaches the artists? Pennies. Literally. Millions of streams might only translate to a few hundred dollars. It's a system designed to enrich the platforms and major labels, leaving independent artists struggling to survive.

Think of it like this: you're a farmer who grows the crops, but you only get paid a tiny fraction of the price when they're sold at the supermarket. The rest goes to the distributors and retailers. This is the reality for many musicians. They're the creators, the farmers of the music industry, but they're being squeezed dry.

The result? Artists are forced to rely on other revenue streams, like merchandise and touring. But even those are becoming increasingly difficult to navigate. The pandemic decimated the live music industry, and the cost of touring is skyrocketing. Many artists are left with no choice but to work multiple jobs just to make ends meet.

## **The Seeds of Rebellion: A New Era for Independent Artists**

But there's hope. A rebellion is brewing, a movement of independent artists and fans who are demanding a fairer system. Platforms like Wavlake and others are emerging, offering artists more control over their music and their revenue. These platforms prioritize direct-to-fan engagement, allowing artists to build sustainable careers without relying on the traditional gatekeepers.

Imagine a world where you could directly support your favorite artists, where your money goes directly to them, not to some faceless corporation. That's the promise of these new platforms. They're building communities, fostering genuine connections between artists and their fans.

And let's not forget the power of cryptocurrency. Bitcoin, for example, offers a decentralized, peer-to-peer system that bypasses traditional financial institutions. Fans can directly support their favorite independent artists by sending them Bitcoin donations, ensuring that the artist receives the full value of their contribution.

Think of it like this: you're cutting out the middleman, supporting the artist directly, like buying directly from the farmer at a local market. It's a way to reclaim the power, to support the creators you love, and to build a more sustainable and equitable music ecosystem.

## **The Call to Action: Reclaim Your Ears, Support the Underground**

The future of music is in our hands. We can continue to be passive consumers, letting algorithms dictate our taste, or we can become active participants, supporting the artists who are fighting for their independence.

## **Join the Rebellion!**

**Dive into the underground:** Explore independent music blogs, listen to community radio stations, and attend local shows. There's a world of incredible music waiting to be discovered beyond the algorithms.

**Support artists directly:** Buy their music on Bandcamp, donate to their Patreon, and send them Bitcoin tips. Every dollar counts.

**Demand transparency:** Call on streaming platforms to reveal their playlist curation processes and to offer fairer revenue splits.

**Embrace new platforms:** Explore services like Wavlake and other direct-to-fan platforms that empower artists.

**Become a conscious listener:** Question the music you hear. Is it genuine? Is it meaningful? Or is it just another algorithmically generated hit?

**Share the love:** Tell your friends about the independent artists you discover. Spread the word and help them build their audience.

*The music industry is broken, but it's not beyond repair. By supporting independent artists and demanding change, we can create a future where artistry thrives, where musicians are fairly compensated, and where music truly reflects the diversity and creativity of our world.*

**Let's break free from the algorithmic cage and reclaim the power of music!**

-

@ 378562cd:a6fc6773

2025-03-08 16:31:22

The insurance industry is one of the most lucrative businesses in the world, built on a foundation of fear, deception, and manipulation. It presents itself as a guardian of financial security, promising protection in times of crisis. However, in practice, it operates like a government-backed extortion scheme, siphoning money from individuals and businesses while finding ways to avoid paying out claims.

Many people view insurance as a necessary evil—a required expense for responsible living. But very few stop to consider the true nature of the industry and how it functions not as a service, but as a well-oiled criminal machine designed to extract wealth from the population while delivering as little value as possible.

A Business Model Built on Exploiting Fear and Uncertainty

Insurance companies do not sell a product in the traditional sense. You don’t receive something tangible in return for your payments. Instead, they sell you a promise that if something terrible happens, they will be there to cover the costs. However, that promise is deliberately wrapped in vague legalese, riddled with loopholes, and ultimately designed to benefit the insurer more than the insured.

To make this scam even more effective, insurance companies exploit human psychology, knowing that fear is one of the strongest motivators. They bombard people with relentless messaging about the catastrophic risks of being uninsured—the dangers of driving without auto insurance, the financial ruin of an unexpected hospital visit, or the devastation of losing a home to a fire or natural disaster. Ask your local insurance person (if you think they would give you an honest answer) how many full payouts they have had to give out due to a complete loss over the past year, 5 years, since they have been selling insurance. You'd be amazed at how few that number really is.

But it doesn’t stop there. Other industries have caught on to this fear-driven strategy and now use insurance as the perfect scapegoat to justify absurdly inflated prices. Hospitals, auto manufacturers, homebuilders, and repair services all point to “rising insurance costs” among other things as the reason for their skyrocketing fees. A simple medical procedure that should cost a few hundred dollars now runs into the several thousands because “that’s what insurance pays.” Auto repairs that used to be affordable are now exorbitant because shops know insurers will cover part of the bill. The end result? A rigged system where businesses get richer while consumers pay more, not just in premiums, but in every aspect of life.

The truth? Insurance companies thrive on the fact that most policyholders will never need to file a major claim, and if they do, the company will do everything in its power to pay out as little as possible—or nothing at all.

**The Three D’s: Deny, Delay, Defend**

When it comes time for an insurance company to actually pay out a claim, they rarely do so without a fight. Instead, they deploy the Three D’s strategy—a well-documented tactic used to minimize payouts and maximize profits:

Deny the Claim – The first step is simple: find a reason, any reason, to reject your claim.

Did you miss a payment once five years ago? Denied.

Did you fail to report a minor detail when signing up for your policy? Denied.

Did they discover a tiny, unrelated pre-existing condition? Denied.

Delay the Payout – If they can’t outright deny your claim, the next step is to make the process as slow and painful as possible.

Endless paperwork requirements.

Requests for additional documentation (often things that were already submitted).

Long hold times when you call for an update.

The goal? Wear you down so you give up or settle for less.

Defend Against Lawsuits – If you decide to take legal action, the company will unleash an army of high-priced attorneys (another equally criminal organization with the same rules and laws applied) to fight you every step of the way.

They have billions of dollars available for legal fees. They will outlast you, knowing that most individuals lack the time, money, or energy to engage in a lengthy legal battle. This cycle repeats daily, with millions of policyholders becoming victims of the very companies they’ve paid to protect them. Where is the legal protection to protect you and me? NON-EXISTENT FARSE!

The Myth of the “Struggling” Insurance Agent

Insurance agents like to present themselves as hard-working individuals, just trying to make a living. They’ll tell you they’re not getting rich and that they only want what’s best for you. But make no mistake—there is no such thing as a "barely making it" insurance agent in the long run. Mine is constantly on FB telling of this trip to Mexico or some exotic island somewhere or someplace I would love to take my family someday but can never seem to afford it time or money.

Agents work on commission, meaning their income is tied directly to the number of policies they sell. This creates an incentive to push as many policies as possible, often using manipulative tactics.

They will upsell coverage you don’t need by playing on your fears.

They will gloss over exclusions and fine print, ensuring you only focus on the benefits, not the limitations.

They will push you into long-term commitments that make it costly to switch or cancel and have the "adjustor" and "company policy" as an scapegoat to ease their own conscience.

Meanwhile, at the top, insurance executives make obscene amounts of money while denying rightful claims to hard-working individuals. The CEOs of major insurance companies bring in tens of millions of dollars per year, all while raising premiums and reducing coverage for their customers.

Mandatory Insurance: A Government-Backed Extortion Scheme

One of the most damning aspects of the insurance industry is how it has embedded itself into government policy, ensuring that people have no choice but to participate in the system.

Car Insurance: Nearly every state requires auto insurance, even though the majority of drivers never file a claim. Meanwhile, insurance companies raise rates even if you never get into an accident.

Health Insurance: The government forces people to buy into overpriced health insurance plans that come with absurd deductibles, making them nearly useless for many policyholders.

Home Insurance: Mortgage lenders force homeowners to carry insurance, ensuring another guaranteed revenue stream for the industry.

These laws do not exist to protect consumers—they exist to guarantee profits for the insurance companies.

**Who Really Benefits? Follow the Money**

The biggest winners in the insurance industry are not the policyholders that provide ALL THE MONEY into this criminal organization. The true beneficiaries are the corporate executives and shareholders, and it funnels down to the individual agents collecting all this for them.

The largest insurance companies report billions of dollars in annual profits—far more than they pay out in claims. Shouldn't they break even after a 'modest" salary for their service and time? Wouldn't THAT make more sense to a sensible human being?

They invest premium dollars into the stock market, real estate, and other ventures, ensuring their wealth (the money YOU gave them) continues to grow.

They lobby politicians to maintain their stranglehold on the industry, keeping regulations in their favor and ensuring insurance remains legally required in most aspects of life.

In short, insurance companies are not in the business of helping people—they are in the business of making money.

The Harsh Reality: A System Designed to Exploit

Most people will pay hundreds of thousands of dollars in insurance premiums throughout their lifetime. And yet, when the time comes to actually use the coverage, many find themselves fighting an uphill battle against a rigged system.

**Consider these facts:**

Insurance companies cancel policies when people become too “expensive.”

They increase rates after a single claim—even if it wasn’t your fault.

They spend billions on advertising to attract new customers but fight tooth and nail to avoid paying out existing ones.

At what point does this stop being a service and start being a scam?

**Final Thoughts: A Broken System That Needs an Overhaul**

The insurance industry presents itself as a pillar of stability, but in reality, it is one of the most corrupt, exploitative industries in the world. It thrives by preying on fear, avoiding payouts, and ensuring government policies force people to participate in the scam.

If the system was truly fair, it would operate like mutual aid, where all policyholders contribute and receive support as needed. But instead, it functions like organized crime, where the ones collecting the money hold all the power, and those in need are left scrambling for scraps.

Until a major upheaval occurs, there’s little the average person can do to fight back against this deeply entrenched system. The harsh reality is that there are far too many crooks, manipulators, and dishonest players at every level of society—from corporate executives to politicians, from insurance adjusters to business owners who have happily joined in on the scam.

Reading the fine print won’t stop an industry designed to change the rules whenever it benefits them. Shopping around is meaningless when every company is playing the same rigged game. Demanding transparency? Good luck—those in power have built entire careers around keeping consumers in the dark.

At the end of the day, insurance companies—and the industries that now use them as an excuse to inflate costs—are not here to protect you. They exist to extract wealth from you, and there’s no real way to “win” in a system engineered to ensure you always lose.

-

@ 291c75d9:37f1bfbe

2025-03-08 04:09:59

In 1727, a 21-year-old Benjamin Franklin gathered a dozen men in Philadelphia for a bold experiment in intellectual and civic growth. Every Friday night, this group—known as the Junto, from the Spanish juntar ("to join")—met in a tavern or private home to discuss "Morals, Politics, or Natural Philosophy (science)." Far from a casual social club, the Junto was a secret society dedicated to mutual improvement, respectful discourse, and community betterment. What began as a small gathering of tradesmen and thinkers would leave a lasting mark on Franklin’s life and colonial America.

> Printers are educated in the belief that when men differ in opinion, both sides ought equally to have the advantage of being heard by the public, and that when Truth and Error have fair play, the former is always an overmatch for the latter. </br></br> - Benjamin Franklin

**The Junto** operated under a clear set of rules, detailed by Franklin in his Autobiography:

"The rules that I drew up required that every member, in his turn, should produce one or more queries on any point of Morals, Politics, or Natural Philosophy, to be discuss’d by the company; and once in three months produce and read an essay of his own writing, on any subject he pleased. Our debates were to be under the direction of a president, and to be conducted in the sincere spirit of inquiry after truth, without fondness for dispute, or desire of victory; and, to prevent warmth [heatedness], all expressions of positiveness in opinions, or direct contradiction, were after some time made contraband and prohibited under small pecuniary penalties [monetary fines]."

These guidelines emphasized collaboration over competition. Members were expected to contribute questions or essays, sparking discussions that prioritized truth over ego. To keep debates civil, the group even imposed small fines for overly assertive or contradictory behavior—a practical nudge toward humility and open-mindedness. (Yes, I believe that is an ass tax!)

Rather than admitting new members, Franklin encouraged existing ones to form their own discussion groups. This created a decentralized network of groups ("private relays," as I think of them), echoing the structure of modern platforms like NOSTR—while preserving the Junto’s exclusivity and privacy.

From the beginning, they made it a rule to keep these meetings secret, without applications or admittance of new members. Instead, Franklin encouraged members to form their own groups—in a way acting as private relays of sorts. (I say "private" because they continued to keep the Junto secret, even with these new groups.)

## Membership: A Diverse Circle United by Values

The Junto’s twelve founding members came from varied walks of life—printers, surveyors, shoemakers, and clerks—yet shared a commitment to self-improvement. Franklin, though the youngest (around 21 when the group formed), led the Junto with a vision of collective growth. To join, candidates faced a simple vetting process, answering four key questions:

1. Have you any particular disrespect for any present members? Answer: I have not.

2. Do you sincerely declare that you love mankind in general, of what profession or religion soever? Answer: I do.

3. Do you think any person ought to be harmed in his body, name, or goods, for mere speculative opinions, or his external way of worship? Answer: No.

4. Do you love truth for truth’s sake, and will you endeavor impartially to find and receive it yourself and communicate it to others? Answer: Yes.

These criteria reveal the Junto’s core values: respect, tolerance, and an unwavering pursuit of truth. They ensured that members brought not just intellect but also character to the table—placing dialogue as the priority.

One should also note the inspiration from the "Dry Club" of John Locke, William Popple, and Benjamin Furly in the 1690s. They too required affirmation to:

1. Whether he loves all men, of what profession or religion soever?

2. Whether he thinks no person ought to be harmed in his body, name, or goods, for mere speculative opinions, or his external way of worship?

3. Whether he loves and seeks truth for truth’s sake; and will endeavor impartially to find and receive it himself, and to communicate it to others?

And they agreed: *"That no person or opinion be unhandsomely reflected on; but every member behave himself with all the temper, judgment, modesty, and discretion he is master of."*

## The Discussions: 24 Questions to Spark Insight

Franklin crafted a list of 24 questions to guide the Junto’s conversations, ranging from personal anecdotes to civic concerns. These prompts showcase the group’s intellectual breadth. Here are some of my favorites:

> Hath any citizen in your knowledge failed in his business lately, and what have you heard of the cause?</br></br>

Have you lately heard of any citizen’s thriving well, and by what means?</br></br>

Do you know of any fellow citizen who has lately done a worthy action, deserving praise and imitation?</br></br>

Do you think of anything at present in which the Junto may be serviceable to mankind, their country, friends, or themselves?</br></br>

Have you lately observed any defect in the laws of your country, which it would be proper to move the legislature for an amendment?</br></br>

Do you know of any deserving young beginner lately set up, whom it lies in the power of the Junto any way to encourage?</br>

(Read them all [here](https://nationalhumanitiescenter.org/pds/becomingamer/ideas/text4/juntolibrary.pdf).)

Note the keen attention to success and failure, and the reflection on both. Attention was often placed on the community and individual improvement beyond the members of the group. These questions encouraged members to share knowledge, reflect on virtues and vices, and propose solutions to real-world problems. The result? Discussions that didn’t just end at the tavern door but inspired tangible community improvements.

## The Junto’s Legacy: America’s First Lending Library

One of the Junto’s most enduring contributions to Philadelphia—and indeed, to the American colonies—was the creation of the first lending library in 1731. Born from the group’s commitment to mutual improvement and knowledge-sharing, this library became a cornerstone of public education and intellectual life in the community.

The idea for the library emerged naturally from the Junto’s discussions. Members, who came from diverse backgrounds but shared a passion for learning, recognized that their own access to books was often limited and costly—and they referred to them often. To address this, they proposed pooling their personal collections to create a shared resource. This collaborative effort allowed them—and eventually the broader public—to access a wider range of books than any individual could afford alone.

The library operated on a simple yet revolutionary principle: knowledge should be available to all, regardless of wealth or status. By creating a lending system, the Junto democratized access to information, fostering a culture of self-education and curiosity. This was especially significant at a time when books were scarce and formal education was not universally accessible.

The success of the Junto’s library inspired similar initiatives across the colonies, laying the groundwork for the public library system we know today. It also reflected the group’s broader mission: to serve not just its members but the entire community. The library became a symbol of the Junto’s belief in the power of education to uplift individuals and society alike.

> With roots extending back to the founding of the Society in 1743, the Library of the American Philosophical Society houses over thirteen million manuscripts, 350,000 volumes and bound periodicals, 250,000 images, and thousands of hours of audiotape. The Library’s holdings make it one of the premier institutions for documenting the history of the American Revolution and Founding, the study of natural history in the 18th and 19th centuries, the study of evolution and genetics, quantum mechanics, and the development of cultural anthropology, among others.

The [American Philosophical Society Library](https://www.amphilsoc.org/library) continues today. I hope to visit it myself in the future.

## Freedom, for Community

Comparing the Junto to Nostr shows how the tools of community and debate evolve with time. Both prove that people crave spaces to connect, share, and grow—whether in a colonial tavern or a digital relay. Yet their differences reveal trade-offs: the Junto’s structure offered depth and focus but capped its reach, while Nostr’s openness promises scale at the cost of order.

In a sense, Nostr feels like the Junto’s modern echo—faster, bigger, and unbound by gates or rules. Franklin might admire its ambition, even if he’d raise an eyebrow at its messiness. For us, the comparison underscores a timeless truth: no matter the medium, the drive to seek truth and build community endures.

---

The Autobiography of Benjamin Franklin (1771–1790, pub. 1791)

http://www.benjamin-franklin-history.org/junto-club/

Benjamin Franklin, Political, Miscellaneous, and Philosophical Pieces, ed. Benjamin Vaughan (London: 1779), pp. 533–536.

"Rules of a Society" in The Remains of John Locke, Esq. (1714), p. 113

#npubpro

-

@ 7b3f7803:8912e968

2025-03-08 03:05:16

[](https://i.imgflip.com/9mnncc.jpg)

Libertarians believe in open borders in theory. In practice, open borders don't work, because, among other things, the combination with a welfare state creates a moral hazard, and the least productive of society end up within the borders of welfare states and drain resources. The social services are paid by the productive people of the country or, in the case of most fiat systems, by currency holders through inflation. Welfare states are much more likely under fiat money and the redistribution goes from native taxpayers to illegal immigrants. Thus, under fiat money, open borders end up being an open wound by which the productive lifeblood of the country bleeds out, despite the theoretical trade-efficiency benefits. As libertarians like to say, open borders and the welfare state don't mix. In this article, we'll examine the other sacred cow of libertarian thought: free trade.

## Free Trade without Libertarian Ideals

Free trade is very similar to free movement of labor in that it works great in theory, but not in practice, especially under fiat money. In a libertarian free-market world, free trade works. But that assumes a whole host of libertarian ideals like sound money, non-interfering governments, and minimal aggression. Once those ideals are violated, such as with government intervention in the market, similar moral hazards and long-term costs come with them, making free trade about as libertarian as a fractional reserve bank.

An example will illustrate what I'm talking about. Let's say Portugal subsidizes their wine for export to other countries. The obvious first-order effect is that it makes Portuguese wine cheaper in France, perhaps undercutting the price of French wine. Libertarians would say, that's great! French customers get cheaper goods, so what's the problem?

As with any government intervention, there are significant second- and third-order effects in play. Subsidization puts unsubsidized companies at risk, perhaps driving them to bankruptcy. In this case, this might be a French wine maker. Subsidized companies may become zombies instead of dying out. In this case, this might be a Portuguese wine maker that was failing domestically but survives by selling to customers abroad with government subsidies. While French customers benefit in the short run with cheaper prices for wine, they are ultimately hurt because the goods that would have existed without government intervention never come to market. Perhaps French wine makers that went bankrupt were innovating. Perhaps the resources of the zombie Portuguese wine maker would have created something better.

Further, the dependency of French people on Portuguese wine means that something going wrong in Portugal, like a war or subsidy cuts, disrupts the supply and price of wine for France. Now France must meddle in Portugal internationally if it doesn't want the wine supply to get disrupted. The two countries get entangled in such a way as to become more interventionist internationally. A war involving Portugal now suddenly becomes France's business and incentivizes military aid or even violence. As usual, the unseen effects of government policy are the most pernicious.

## Not Really Free

[](https://i.imgflip.com/9mnq61.jpg)

In other words, what we call free trade isn't really free trade. A country exporting to the US may subsidize their products through government intervention, making the product cheaper in the US. This hurts US companies, and they’re forced into choices they never would have had to face without the foreign government intervention. But because the good is crossing borders under the rubric of "free trade," it's somehow seen as fair. Of course it's not, as government intervention distorts the market whether it's done by our own government or a foreign government.

So why would a foreign government do this? It gets several benefits through targeted market manipulation. First, it makes its own companies' products more popular abroad and conversely, makes US companies' products less popular. This has the dual benefit of growing the foreign government’s firms and shrinking, perhaps bankrupting, the US ones.

Targeted subsidization like this can lead to domination under free trade. It's not unlike the Amazon strategy of undercutting everyone first and using the monopoly pricing power at scale once everyone else has bankrupted. The global monopoly is tremendously beneficial to the country that has it. Not only is there significant tax revenue over the long term, but also a head start on innovations within that industry and an advantage in production in the adjacent industries around the product.

Second, the manufacturing centralization gives that country leverage geo-politically. A critical product that no one else manufactures means natural alliances with the countries that depend on the product, which is especially useful for smaller countries like Taiwan. Their chip manufacturing industry, holding 60% of global supply (2024), has meant that they're a critical link for most other countries, and hence, they can use this fact to deter Chinese invasion.

Third, because of the centralization of expertise, more innovations, products, and manufacturing will tend to come within the country. This increased production has cascading benefits, including new industries and national security. China leads the world in drone technology, which undoubtedly has given it an innovation advantage for its military, should it go to war.

Fourth, the capital that flows into the country for investing in the monopolized industry will tend to stay, giving the country more wealth in the form of factories, equipment, and skills. While that capital may nominally be in the hands of foreigners, over time, the ownership of that industry will inevitably transition toward native locals, as the knowledge about how to run such industries gets dissipated within the country.

[Image: Map showing “China Drone Tech” and “Taiwan Chips” hubs, with arrows of capital flow staying local]

## Currency Devaluation: The Universal Trade Weapon

[](https://i.imgflip.com/9mnqbg.jpg)

It would be one thing if only a specific industry were singled out for government subsidies and then the products dumped into the US as a way to hurt US companies, as that would limit the scope of the damage. But with currency devaluation, a government can subsidize all of its exports at the same time. Indeed, this is something that many countries do. While short-term, this helps US consumers, it hurts US companies and forces them into decisions that aren't good for the US.

To compete, they have to lower costs by using the same devalued currency to pay their labor as their foreign competition. That is, by relocating their capital, their manufacturing, and even their personnel to the country that's devaluing the currency. Not only does relocating reduce labor cost, but it also often gets them benefits like tax breaks. This makes US companies de facto multinationals and not only makes them subject to other jurisdictions, but ultimately divides their loyalties. To take advantage of the reduced labor, capital must move to another country and, along with it, future innovation.

Such relocations ultimately leave the company stripped of their manufacturing capability in the US, as local competition will generally fare better over the long run. Much of the value of the industry then is captured by other governments in taxes, development, and even state-owned companies. Free trade, in other words, creates a vulnerability for domestic companies as they can be put at a significant disadvantage compared to foreign counterparts.

## Hidden Effects of Foreign Intervention

[](https://i.imgflip.com/9mnqfe.jpg)

Unlike the multinationals, small companies have no chance as they're not big enough to exploit the labor arbitrage. And as is usual in a fiat system, they suffer the most while the giant corporations get the benefits of the supposed "free trade". Most small companies can't compete, so we get mostly the bigger companies that survive.

The transition away from domestic manufacturing necessarily means significant disruption. Domestic workers are displaced and have to find new work. Factories and equipment either have to be repurposed or rot. Entire communities that depended on the manufacturing facility now have to figure out new ways to support themselves. It's no good telling them that they can just do something else. In a currency devaluation scenario, most of the manufacturing leaves and the jobs left are service-oriented or otherwise location-based, like real estate development. There's a natural limit to location-based industries because the market only grows with the location that you're servicing. Put another way, you can only have so many people give haircuts or deliver packages in a geographic area. There has to be some manufacturing of goods that can be sold outside the community, or the community will face scarce labor opportunities relative to the population.

You also can't say the displaced workers can start some other manufacturing business. Such businesses will get out-competed on labor by the currency-devaluing country, so there won't be much investment available for such a business, and even if there were, such a business would be competing with its hands tied behind its back. So in this scenario, what you end up with are a large pool of unemployed people whom the state subsidizes with welfare.

So when a US company leaves or goes bankrupt due to a foreign government's subsidies, the disruption alone imposes a significant short-term cost with displaced labor, unused capital goods, and devastated communities.

## Mitigations

So how do countries fight back against such a devastating economic weapon? There are a few ways countries have found around this problem of currency devaluation under free trade. First, a country can prevent capital from leaving. This is called capital controls, and many countries, particularly those that manufacture a lot, have them. Try to get money, factories, or equipment out of Malaysia, for example, and you'll find that they make it quite difficult. Getting the same capital into the country, on the other hand, faces few restrictions. Unfortunately, the US can't put in capital controls because dollars are its main export. It is, after all, the reserve currency of the world.

Second, you can compete by devaluing your own currency. But that’s very difficult because it requires printing a lot of dollars, and that causes inflation. There's also no guarantee that a competing country doesn't devalue its currency again. The US is also in a precarious position as the world's reserve currency, so devaluing the currency more than it already does will make other holders of the dollar less likely to want to hold it, threatening the reserve currency status.

So the main two mitigations against currency devaluation in a free trade scenario are not available to the US. So what else is there? The remaining option is to drop free trade. The solution, in other words, is to add tariffs. This is how you can nullify the effects of foreign government intervention, by leveling the playing field for US manufacturers.

## Tariffs

[](https://i.imgflip.com/9mnqia.jpg)

One major industry that's managed to continue being manufactured in the US despite significant foreign competition is cars. Notably, cars have a tariff, which incentivizes their manufacture in the US, even for foreign car makers. The tariff has acted as a way to offset foreign government subsidies and currency debasement.

The scope of this one industry for the US is huge. There are around 300,000 direct jobs in auto assembly within the US (USTR) and there are an additional 3 million jobs supplying these manufacturers within the US. But the benefits don't end there. The US is also creating a lot of innovation around cars, such as self-driving and plug-in electric cars. There are many countries that would love to have this industry for themselves, but because of tariffs, auto manufacturing continues in the US.

And though tariffs are seen as a tax on consumers, US car prices are cheap relative to the rest of the world. What surprises a lot of people when they move from the US to other countries is finding out that the same car often costs more abroad (e.g. 25% tariffs keep U.S. prices 20% below Europe’s $40K average, 2024). The downside of tariffs pales next to the downsides of "free trade."

## Free Trade Doesn’t Work with Fiat Money

The sad reality is that while we would love for free trade to work in the ideal libertarian paradise, it won't in our current fiat-based system. The subsidization by foreign governments to bankrupt US companies or to make them multinational, combined with the unfortunate reality of the US dollar being the world reserve currency, means that free trade guts the US of manufacturing. Tariffs are a reasonable way to protect US manufacturers, particularly smaller ones that can't go multinational.

What's more, tariffs make the US less fragile and less dependent on international supply chains. Many of the wars in the past 60 years have been waged because of the entanglements the US has with other countries due to the reliance on international supply chains. Lessening this dependency, if only to prevent a war, has clear value.

Lastly, labor has been devalued significantly by fiat monetary expansion, but at least some of that can be recovered if tariffs create more manufacturing, which in turn adds to the demand for labor. This should reduce the welfare state as more opportunities are made available and fewer unemployed people will be on the rolls.

## Conclusion

Fiat money produces a welfare state, which makes open borders unworkable. Fiat money also gives foreign governments a potent economic weapon to use against US companies, and by extension the labor force that powers them. Though currency debasement and capital controls are available to other countries as a defense, for the US, neither of these tools is available due to the fact that the dollar is the world reserve currency. As such, tariffs are a reasonable defense against the fiat subsidization of foreign governments.

-

@ 378562cd:a6fc6773

2025-03-08 01:12:13

Forgiveness is one of the hardest but most powerful things we can do. It’s not just about letting someone else off the hook—it’s about freeing ourselves from anger, bitterness, and pain. Holding onto grudges only weighs us down, while forgiveness brings peace and healing.

**What Is Forgiveness?**

Forgiveness means choosing to release resentment toward someone who has wronged us. It doesn’t mean forgetting what happened or pretending it didn’t hurt. It simply means we no longer decide to let the offense control our hearts and minds.

**Why Is Forgiveness Important?**

It sets us free. Holding onto anger only harms us, not the other person.

It brings peace. Letting go of past hurts allows us to move forward.

It strengthens relationships. No one is perfect—we all need grace at times.

It reflects God's love. In the Bible, God forgives us and calls us to do the same (Ephesians 4:32).

**How to Forgive**

Make the choice. Forgiveness starts with a decision, even if emotions don’t follow right away.

Pray for strength. Ask God to help you release the hurt.

Let go of revenge. Forgiveness means choosing not to seek payback.

Move forward. This doesn’t always mean restoring a relationship, but it does mean releasing the pain.

Repeat if necessary. Sometimes, forgiveness is a process, not a one-time event.

**Forgiving Yourself**

Forgiveness isn’t just for others. Sometimes, we struggle to forgive ourselves for past mistakes. But if God offers us grace, we should accept it too. Learn from the past, but don’t let it define you.

**Final Thoughts**

Forgiveness isn’t always easy, but it is always worth it. It is a gift you give yourself, a step toward peace, and a reflection of God’s love. If you struggle to forgive, take it one step at a time. Let go, trust God, and walk in freedom.

Until Next Time... :)

-

@ 147ac18e:ef1ca1ba

2025-03-07 14:04:46

The world is on the brink of a technological shift, where artificial intelligence (AI) is becoming increasingly autonomous. With AI agents conducting transactions, hiring other AI agents, and managing digital assets, a critical question arises: What form of money will power this new AI-driven economy? The answer, as some industry experts predict, is Bitcoin.

## The Rise of the Autonomous Economy

AI agents are no longer just tools executing predefined tasks; they are evolving into independent economic actors capable of initiating transactions, negotiating terms, and paying for services. The transaction volume within AI-driven economies is projected to be **100 times larger than human transactions**, as each person may have dozens or even hundreds of AI agents working on their behalf. This creates an unprecedented demand for a seamless, efficient, and universally accepted form of digital money.

## Why Bitcoin is the Natural Choice for AI Transactions

Bitcoin stands out as the ideal currency for AI-driven economies for several reasons:

1. **Borderless and Permissionless**: Unlike traditional banking systems that require identity verification (KYC/AML) and impose restrictions based on geography, Bitcoin allows AI agents to transact freely without human intervention.

2. **Personless Transactions**: AI agents, by nature, do not have legal identities, making it impossible for them to interact with banks or obtain credit cards. Bitcoin provides a neutral medium that does not require a legal entity to use it.

3. **Energy-Backed Economy**: AI agents function on computational power, which is an energy-intensive process. Bitcoin’s proof-of-work mechanism aligns well with this model, as it is also backed by computational energy. AI systems will inherently recognize Bitcoin as a valid medium of exchange due to this energy linkage.

4. **Micropayments via Lightning Network**: AI transactions will often involve micropayments—small fees for data processing, information retrieval, and digital labor. Traditional financial networks are inefficient in handling such transactions due to high fees and processing delays. The Bitcoin Lightning Network enables instant, low-cost micropayments, making it perfect for AI-to-AI financial interactions.

5. **Immutability and Transparency**: AI systems require trustless environments where transaction history cannot be altered or reversed. Bitcoin’s blockchain ensures that all transactions are transparent and immutable, reducing fraud and enabling verifiable AI-driven commerce.

## The Symbiotic Growth of Bitcoin and AI

As AI-driven economies expand, Bitcoin adoption will accelerate in the following ways:

- **Increased Transaction Volume**: With billions of AI transactions occurring daily, Bitcoin will see an explosion in on-chain and Lightning Network activity, solidifying its position as the world’s primary digital currency.

- **Institutional and Enterprise Adoption**: As businesses integrate AI into their workflows, they will increasingly adopt Bitcoin to facilitate machine-to-machine payments, smart contracts, and decentralized finance (DeFi) solutions.

- **Regulatory Shift Towards Decentralized Currencies**: Governments and financial institutions will have to acknowledge Bitcoin’s role in AI economies and adjust regulatory frameworks accordingly, further legitimizing its use.

- **Bitcoin as a Store of Value for AI**: AI systems will not only use Bitcoin for transactions but may also accumulate it as a reserve asset due to its deflationary nature and finite supply.

## The Future: Bitcoin as the De Facto AI Currency

As AI continues to reshape industries, Bitcoin is poised to become the backbone of an autonomous digital economy. The fusion of AI and Bitcoin will create a self-sustaining loop where AI agents fuel Bitcoin’s transactional utility, and Bitcoin’s decentralized nature enables AI’s economic autonomy. This symbiosis will not only drive Bitcoin adoption but could also redefine global economic structures.

In this AI-driven future, Bitcoin may not just be a currency for humans—it could very well be the **native currency of artificial intelligence.**

Episode link: https://fountain.fm/episode/Ds1qicPmbC3udErQ7J3z

-

@ 04c915da:3dfbecc9

2025-03-07 00:26:37

There is something quietly rebellious about stacking sats. In a world obsessed with instant gratification, choosing to patiently accumulate Bitcoin, one sat at a time, feels like a middle finger to the hype machine. But to do it right, you have got to stay humble. Stack too hard with your head in the clouds, and you will trip over your own ego before the next halving even hits.

**Small Wins**

Stacking sats is not glamorous. Discipline. Stacking every day, week, or month, no matter the price, and letting time do the heavy lifting. Humility lives in that consistency. You are not trying to outsmart the market or prove you are the next "crypto" prophet. Just a regular person, betting on a system you believe in, one humble stack at a time. Folks get rekt chasing the highs. They ape into some shitcoin pump, shout about it online, then go silent when they inevitably get rekt. The ones who last? They stack. Just keep showing up. Consistency. Humility in action. Know the game is long, and you are not bigger than it.

**Ego is Volatile**

Bitcoin’s swings can mess with your head. One day you are up 20%, feeling like a genius and the next down 30%, questioning everything. Ego will have you panic selling at the bottom or over leveraging the top. Staying humble means patience, a true bitcoin zen. Do not try to "beat” Bitcoin. Ride it. Stack what you can afford, live your life, and let compounding work its magic.

**Simplicity**

There is a beauty in how stacking sats forces you to rethink value. A sat is worth less than a penny today, but every time you grab a few thousand, you plant a seed. It is not about flaunting wealth but rather building it, quietly, without fanfare. That mindset spills over. Cut out the noise: the overpriced coffee, fancy watches, the status games that drain your wallet. Humility is good for your soul and your stack. I have a buddy who has been stacking since 2015. Never talks about it unless you ask. Lives in a decent place, drives an old truck, and just keeps stacking. He is not chasing clout, he is chasing freedom. That is the vibe: less ego, more sats, all grounded in life.

**The Big Picture**

Stack those sats. Do it quietly, do it consistently, and do not let the green days puff you up or the red days break you down. Humility is the secret sauce, it keeps you grounded while the world spins wild. In a decade, when you look back and smile, it will not be because you shouted the loudest. It will be because you stayed the course, one sat at a time. \

\

Stay Humble and Stack Sats. 🫡

-

@ 378562cd:a6fc6773

2025-03-06 23:10:28

The theory of evolution claims that all life gradually developed from a common ancestor over millions of years, shaped by random mutations and natural selection. It is often presented as an unquestionable fact, but when examined closely (the part many fail to do anymore), the evidence tells a different story. Both scientific discoveries and biblical truth point to a far more logical and consistent explanation—one of intentional design rather than blind chance. From the complexity of life to the precise order of the universe, every aspect of creation bears the unmistakable marks of an intelligent Creator. Let’s break it down simply and clearly, exposing the flaws in evolution and revealing the undeniable truth of God’s design.

1. No Transitional Fossils

If evolution were true, we should see countless fossils of creatures in-between species (half-fish, half-reptile, etc.).

Instead, fossils show fully formed creatures appearing suddenly, with no gradual change.

Even Darwin admitted the fossil record didn’t support his theory.

2. Life is Too Complex to Happen by Accident

The human eye, the bacterial flagellum, and even a single cell are incredibly complex, with interdependent parts that must all work at once.

This is called irreducible complexity—if one piece is missing, the whole system fails.

Random mutations can’t create such intricate designs. Design requires a designer.

3. DNA: A Code That Needs a Programmer

DNA is a vast information system, more advanced than any computer code.

Information always comes from intelligence, not random processes.

Mutations mainly destroy information; they don’t create new, functional systems.

4. The Second Law of Thermodynamics: Things Fall Apart

Everything's natural tendency is to break down over time, not build up (like a house falling apart, not randomly constructing itself).

Evolution claims the opposite—that things become more complex without guidance. This contradicts observed science.

5. Consciousness and Morality Make No Sense in Evolution

Why do humans have love, compassion, and a sense of right and wrong?

If we were just animals fighting to survive, morality wouldn’t exist.

The Bible explains it: We were made in God's image, not just random molecules.

6. The Bible’s Account of Creation Matches Reality

Genesis 1 says God created “kinds”—dogs produce dogs, birds produce birds, and humans produce humans.

This is exactly what we see in nature—no one has ever observed one kind turning into another.

Evolution is based on assumptions, while the Bible gives a clear, tested explanation of life’s origin.

The Complete Solution: Creation is Truth

The evidence points to a Creator, not blind chance.

Science confirms the Bible, not evolution.

Recognizing God's design gives life meaning and purpose.

Psalm 19:1 – “The heavens declare the glory of God, and the sky above proclaims His handiwork.”

Evolution is not just scientifically weak—it removes purpose and meaning. The truth is simple: God created life, and we are part of His design.

-

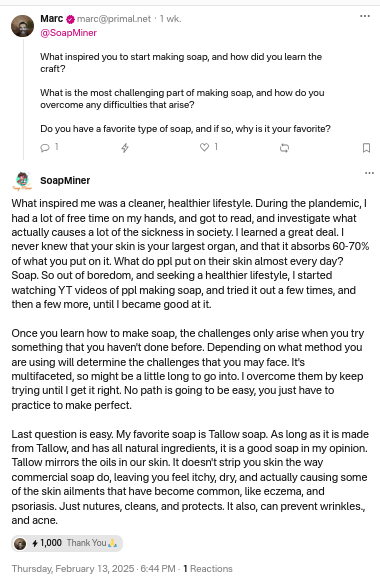

@ 5b0183ab:a114563e

2025-03-06 17:38:10

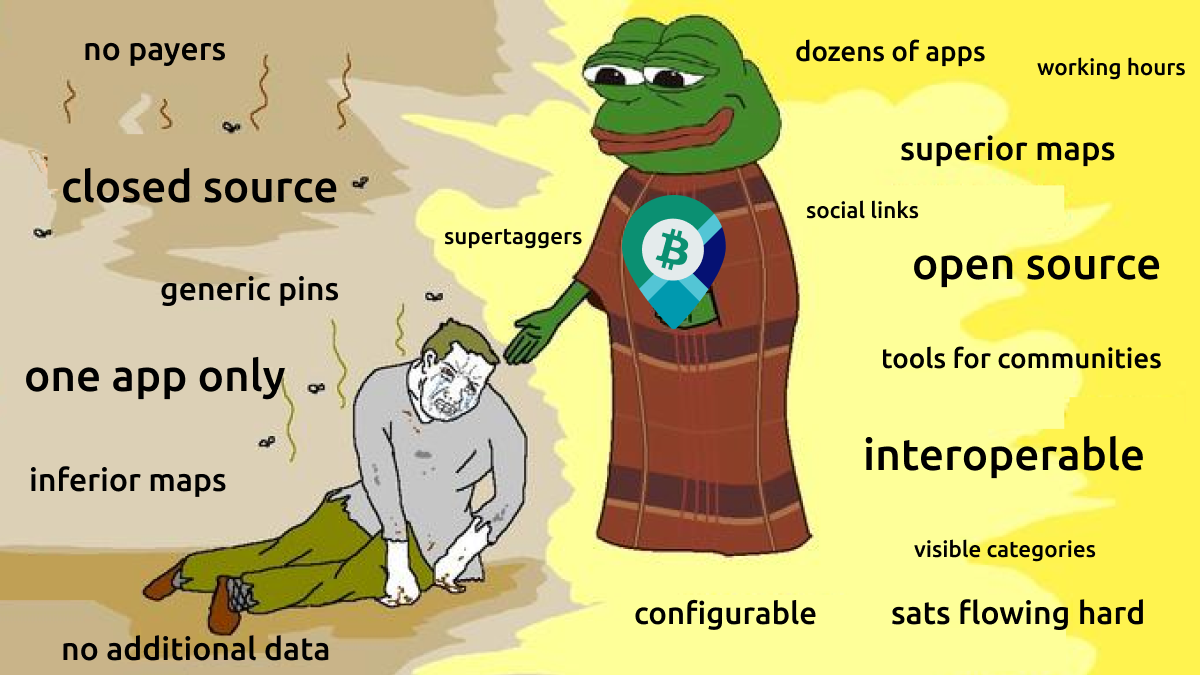

### What Is Dark Nostr?

Dark Nostr can be described as the unintended adverse effects that arise from creating systems designed to resist censorship and promote freedom. These systems often rely on algorithms and micropayments to function, but their very design can inadvertently spawn phenomena that are unpredictable, uncontrollable, and sometimes downright weird.

Think of it as the *Yin* to the *Yang* of decentralized freedom—a necessary shadow cast by the bright ideals of liberation. While freedom protocols aim to empower individuals, they also open the door to consequences that aren’t always sunshine and rainbows.

---

### An Emergent Phenomenon

The fascinating thing about Dark Nostr is its emergent nature. This means it’s not something you can fully define or predict ahead of time; instead, it arises organically as decentralized systems are implemented and evolve. Like watching clouds form shapes in the sky, GM miners panhandle for sats or shower girls in the global feed, you can only observe it as it happens—and even then, its contours remain elusive.

Emergent phenomena are tricky beasts. While simplicity is at the core of the protocol layer darkness is born on the edge where complexity thrives—where individual components interact in ways that produce unpredictable outcomes. In this case, Dark Nostr encapsulates everything from algorithmic quirks and micropayment dynamics to unforeseen social consequences within decentralized ecosystems.

---

### Studying Dark Nostr: Memes as Cultural Artifacts

Here’s where things get anthropologically juicy: much of what we know about Dark Nostr comes not from academic papers or technical manuals but from memes. Yes, memes—the internet’s favorite medium for cultural commentary—have become a lens through which this phenomenon is being observed and studied.