-

@ 234035ec:edc3751d

2024-12-04 16:21:18

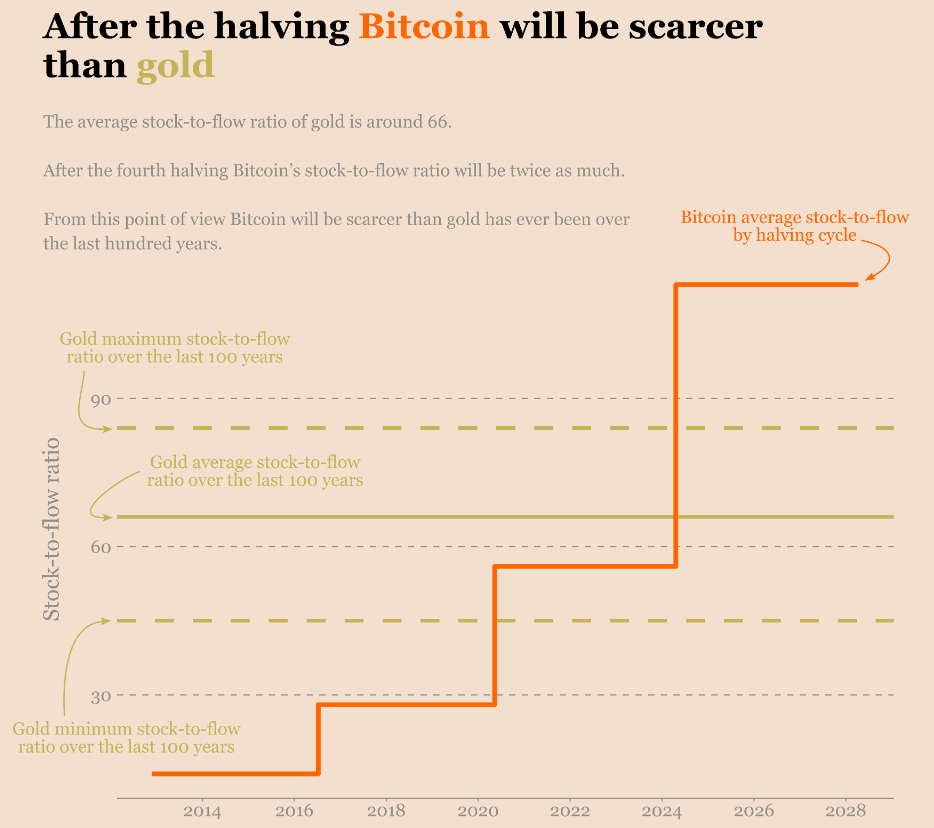

Satoshi Nakamoto emerged from the shadows of the internet, shortly after the Great Financial Crisis in 2008, to bring the world a new form of money known as Bitcoin. By introducing this alternative option to the world, Satoshi gave every human being an escape from the systemic confiscation of wealth that is fiat money.

> “Money is only a tool. It will take you wherever you wish, but it will not replace you as the driver.”

>

> ― **Ayn Rand,** *Atlas Shrugged*

Much like John Galt in Ayn Rand's Magnum Opus "*Atlas Shrugged*", Nakamoto paved the way for all of the productive members of society who have been taken advantage of by the "looters" to exit the corrupt system and let it crumble under its own weight. In our case instead of moving our physical bodies to a secluded gulch, we can simply move our wealth into Bitcoin.

# The Men of the Mind

In the novel, one by one the great industrialists of the era were mysteriously disappearing and giving up on the great enterprises that they had built. People could not understand why these seemingly very successful individuals would leave behind everything they had created. There was however, a common trend amongst these individuals. All of them were highly competent in their field, placed high value on individualism, possessed a strong moral integrity with a bend towards rational self interest. They were fed up with the way that the system was designed to punish the productive individuals in the society and reward those who are least productive.

> "**From each according to his ability, to each according to his needs**"

>

> \-Karl Marx

A form of this has crept its way into every civilization today including the United States which once prided itself on individual liberty and personal responsibility. It was predicted by Ayn Rand in 1957 with Atlas Shrugged depicting exactly how these collectivist ideals corrupt and decay a society by rewarding theft and stifling innovation.

As these productive individuals grew increasingly disenchanted with the status quo they began to look for answers, this leads them to finding John Galt. The mysterious figure that is John Galt would visit these people and explain to them all the things they already felt so so deeply abut their broken society but were never able to quite define. After having their eyes opened to the severity of the problem, they are presented the solution in Galt's Gulch. They are given the option to leave behind the corrupt society that they have been involuntarily fueling with the confiscated product of their efforts.

> “We are on strike, we, the men of the mind.\

> \

> We are on strike against self-immolation. We are on strike against the creed of unearned rewards and unrewarded duties. We are on strike against the dogma that the pursuit of one's happiness is evil. We are on strike against the doctrine that life is guilt.”\

> ― **Ayn Rand, [Atlas Shrugged](https://www.goodreads.com/work/quotes/817219)**

# Satoshi's gift to the world

> “If you saw Atlas, the giant who holds the world on his shoulders, if you saw that he stood, blood running down his chest, his knees buckling, his arms trembling but still trying to hold the world aloft with the last of his strength, and the greater his effort the heavier the world bore down upon his shoulders - What would you tell him?"\

> \

> I…don't know. What…could he do? What would you tell him?"\

> \

> To shrug.”\

> ― **Ayn Rand, [Atlas Shrugged](https://www.goodreads.com/work/quotes/817219)**

When Satoshi Nakamoto created Bitcoin, he did so to solve a problem that he identified in the world around him. He saw the insidious power of central banks and how they create massive inequality and economic distortions. Rather than seek to modify or amend the current system Satoshi built a new and independent system that was built upon sound principals.

After introducing this new protocol for value exchange to the world, Satoshi did one of the most honorable things imaginable and disappeared without a trace. He took no financial reward for his contributions although he would be justified in doing so. By doing this he set a profound example allowing the project and the community around it to flourish.

Today Bitcoin serves as an escape valve for economic value to flow out of the fiat system and into a secure and sound network. Without this option individuals would be trapped into having their purchasing power lowly taxed away or forced to take on risk simply to preserve value. Wealthy individuals under a fiat system must own large amounts of property such as real estate, stocks, bonds, ect because they are able to store value better than their currency. these investments come with risks and drive a monetary premium to the assets which makes housing less affordable, stocks overvalued, and bonds seem less risky than they truly are.

Much like Galt's Gulch those who benefit from or are dependent on the legacy system will be the last to abandon it, even while it falls apart. The first ones to defect are those who are most negatively impacted by the current regime, like Atlas holding the world on their shoulders they are finally offered the chance to shrug the weight off. Those who have been working hard at their job for years but still struggle to save for retirement due to fiat debasement, public figures who have been de-banked for their views, entrepreneurs who are forced to hold toxic government debt on their balance sheets due to regulation, all will clearly see the value the Bitcoin offers.

And so, I salute to all of you who have decided to shrug off the yolk of central bank oppression and build a more prosperous future on the sound foundation the Satoshi gave to us. I hope to meet you all one day in Nakamoto Gulch.

-

@ bc6ccd13:f53098e4

2024-12-03 22:59:45

> It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.

>

> \-Henry Ford

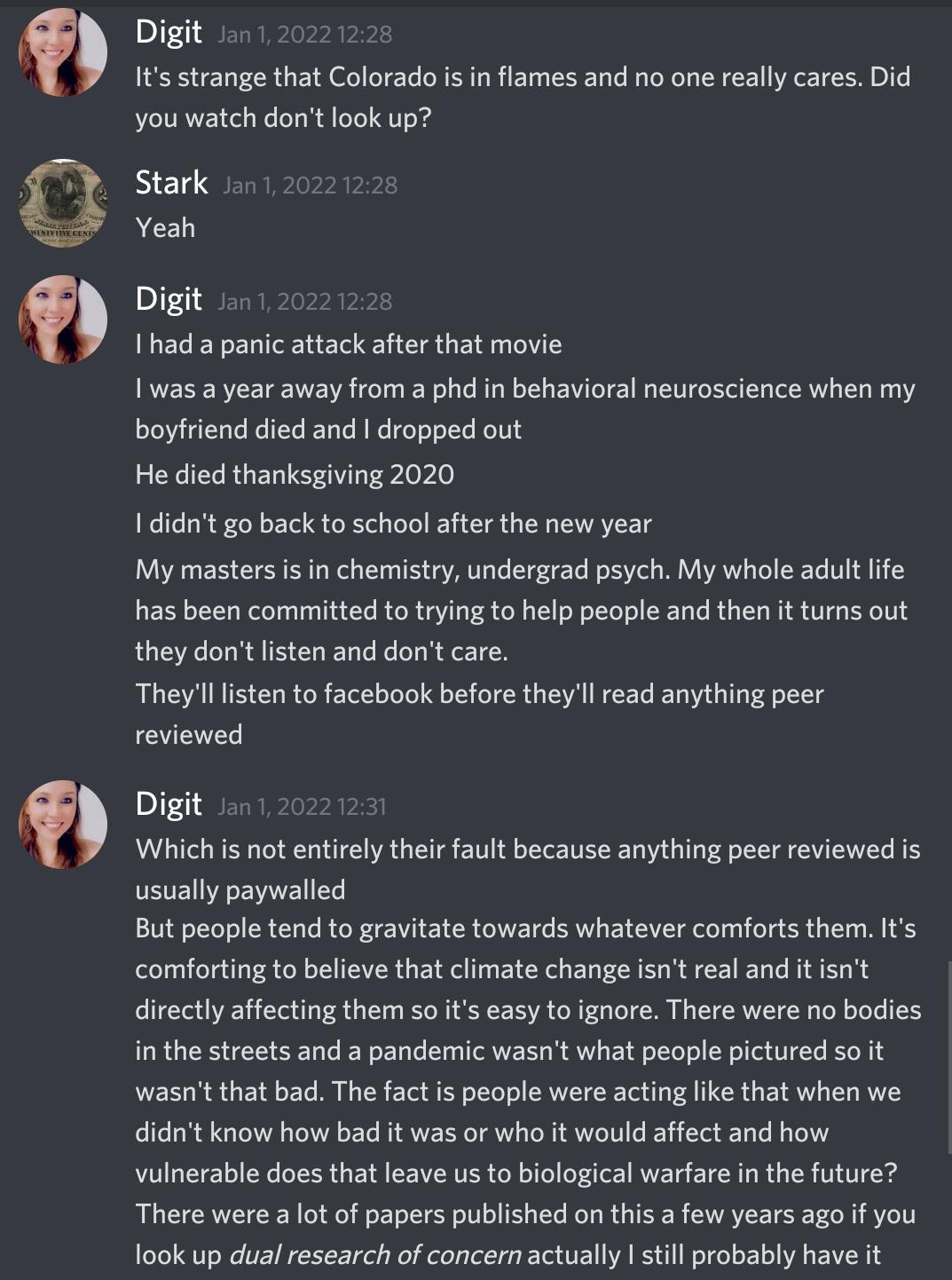

A century later, this quote is still as true as the day it was written. And with all the information available at our fingertips, the overwhelming majority still haven't educated themselves on the function of the banking system. That's a tragedy, given the significant role banking plays in the modern economy, and the corruption at the very base of the industry.

Banking is built on a lie. It's a big lie. Not in the sense of how false it is, but in the sense of the harm caused. It's more of a “weasel words” type of lie, a lie of omission and misdirection, the kind of lie a sleazy lawyer would use to get a guilty client off the hook. My goal is to explain, as clearly as possible, how the modern banking system works. Why you should care will be a topic for another day.

I want to start off with a big thank you to whoever created the website <https://banklies.org/>. If you aren't familiar with this gem, bookmark it now. There's no better place on the internet to get detailed documentation on this particular subject. Everyone should spend an afternoon reading and listening to the information there. You'll never be able to see the world the same way if you absorb it and understand the implications.

### Where Does Money Come From?

There's been a lot of talk since the COVID “pandemic” and associated QE deluge about the Fed and their money printing. Most people have some awareness that “the Fed prints money and that causes inflation.” There's some truth to that idea, but it also misses the real story. Most people don't understand that when someone says “money printing,” the correct response is “which kind of money?”

Banks operate by calling two different things “money,” and hoping everyone treats them the same. The average person might say “I have $100 in my wallet” or “I have $100 in my bank account” without realizing they aren't talking about the same thing at all. They might take the $100 in their wallet and “put it in the bank” without realizing that as soon as they do, that $100 becomes something else entirely.

The $100 bill in your wallet has the words “Federal Reserve Note” printed on it. This is one form of what's known as “base money.” Base money exists in two forms, cash and bank reserves. You can think of bank reserves as electronic cash that only banks can use.

Base money is created by the Federal Reserve. Creating base money is what the Fed does when they “print money.” They create bank reserves electronically by putting the numbers in the ledger at the Fed. The cash is printed by the Treasury, but that's just a technicality, it's printed at the request of the Fed.

The current circulating supply of cash is $2.3 trillion, and bank reserves are about $3.5 trillion. However, if you look at the total amount of US dollars, including money in people’s bank accounts, it’s currently $20.8 trillion dollars. So if base money is $5.8 trillion in total, what is the other $15 trillion? Well, it’s largely made up of bank deposits. So where do bank deposits come from? It can’t be cash people deposit into their accounts, like you might expect from the name, since cash only totals $2.3 trillion and bank deposits are over 6 times larger. The answer is that banks create them.

So as you can see, the largest category of dollars aren’t “printed” by the Fed, they’re created by the banks. And the way banks create dollars is so simple, it almost doesn’t seem real. Banks create money by making loans.

This seems completely counterintuitive to the way most people imagine banks work. That’s understandable, since the way banks work has almost no relation to the way individuals handle their own finances. You might make a loan to someone. Your friend asks to borrow $20 at the restaurant since he forgot his wallet at home. You pull yours out and hand him a $20 bill. In order to make that loan, you had to go to work, accomplish something, get paid, and save that $20 in your wallet. You couldn’t spend the $20, and you can’t spend it now until your friend pays back the loan. Obviously no new money was created to make that loan, work was done and money was saved and then given to the borrower so he can spend it instead of the lender.

Most people assume banks work the same way. They assume that when they deposit some money at the bank, the bank stores that money in a vault somewhere with their name on it. And they assume that when banks make loans, they take some money from a big pile of money stored in a vault somewhere and give it to the borrower. But that isn’t how it works at all.

When someone goes to the bank for a loan, the bank doesn’t draw on some pile of cash they have saved up somewhere. Instead, they use a simple accounting trick. They create a bank account for the borrower, and they type the amount of the loan into the borrower’s account balance. It’s really that simple. That balance becomes a “bank deposit.” Even though that money was never deposited in the bank, and in fact didn’t exist at all until the bank typed those numbers into the computer, it’s still called the same thing as the money you deposit into the bank when you get your paycheck.

So what is a bank deposit? It’s really a promise by the bank to give the account holder money. If you have $100 in your bank account, you expect to be able to go to the bank and withdraw that $100 in cash from your account and put it in your pocket. Remember, that $100 bill is base money, something completely different from the bank deposit in your savings or checking account. The implicit promise by banks is that any money in your bank account, any bank deposit, is as good as cash and can be exchanged for cash at any moment.

But of course that must be a lie, since there are $15 trillion of bank deposits and only $2.3 trillion dollars of cash. That means if everyone in the US went to the bank tomorrow and tried to withdraw their money in cash, the banks would run out of cash while still owing $12.7 trillion dollars to depositors. It’s actually much worse than that, since a lot of the cash is already in peoples’ pockets, much of it circulating in foreign countries outside the US. Banks only hold around $100 billion in their vaults on any given day. So if everyone tried to withdraw their money from their bank accounts, which banks have implicitly promised they can do, each person could get around $0.007 of every dollar on deposit. That’s less than one cent of every dollar. So the promise banks are built on, the promise to give you the money in your account, turns out to be at least 99% a lie.

So how can it continue like this? How do banks keep operating with so little cash and so many promises to give cash? Why does anyone put money in the bank when they keep less than a penny of every dollar you deposit available to withdraw when you need it? The answer is, banks don’t tell you that. And if nobody knows, people won’t all come asking for their money one day. If they did, all the banks would fail instantly. So they do anything in their power to keep that from happening.

### How Do Bank Deposits Work?

The reason most people never question the function of their bank, is that banks do everything possible to make their dishonest “bank deposits” function the same as cash, and actually better than cash in a lot of ways. Instead of having to withdraw cash from your bank and give it to someone, you can just exchange bank deposits. You can do this in a lot of super convenient ways, like writing a check or using a debit card, or more recently even right from your smartphone with an app like Venmo or CashApp. This is very convenient for the customer, and even more convenient for the bank. When you pay someone else using your bank deposit, all they have to do is lower the number in your account and raise the number in the other person’s account by the amount of the transaction. Quick, easy and convenient for everyone involved.

And if you happen to be paying someone who doesn’t have an account at your bank, that’s no problem either. Your bank will just pay the other person’s bank, and they can then change the number in the other person’s account. Now of course banks want real money for their transactions, not the fake bank deposits the commoners use. Remember the bank reserves I mentioned earlier that are like cash for banks only? Well that’s how banks settle transactions between themselves. All banks have an account at the Fed, and the Fed settles up between banks by changing the number of bank reserves in their respective accounts at the Fed. In essence, the Fed is just a bank for banks, another entity that works just like your local bank, but only holds accounts with banks and governments and not with ordinary people.

This convenience discourages people from withdrawing cash from their bank, since it’s actually easier to use the bank deposits than the cash. Besides that, banks use a lot of arbitrary policies to make it difficult for people to withdraw cash, even if they want to. If you didn’t know that, you’ve probably never tried to take $5,000 in cash out of your bank account. If you do, you’ll probably be asked some irrelevant questions about what you plan to do with the money. That’s if they let you withdraw it at all. Ask for $20,000 and you’ll almost certainly have to schedule an appointment to withdraw it in a few days, after the next cash delivery comes in. Most community bank branches only keep around $75,000 in cash on hand at any given time, so you can see how few withdrawals it would take to completely drain their vault.

But increasingly now, the biggest threat to banks isn’t from people withdrawing cash, it’s from people withdrawing to a different bank. Remember, banks have to settle with each other at the end of the day. And since they won’t accept each other’s sketchy “bank deposits” in payment, they have to settle by transferring balances between their respective reserve balances at the Fed. As you can see, banks have loaned into existence $11.5 trillion more in bank deposits than they hold in bank reserves, so it doesn’t take much withdrawal from one bank to drain their reserve balance to zero and cause the bank to fail. Bank runs have been a recurring problem ever since the entire dishonest fractional reserve banking system began, and even in 2023 a few US banks suffered bank runs and collapsed in some of the biggest bank failures in history.

### Why Banking is Legalized Theft

Now that we’ve explained on the most basic level how banks work, let’s briefly explore a few basic implications.

We’ve established that banks create money when they make a loan. How easy would your life be if you could create money at no cost and loan it to people? Is it any wonder that the financial industry is full of extremely wealthy individuals?

Let’s think through for a second why I would categorize what banks do as theft. First off, you need to understand what money is, and more importantly what it is not. I lay out some fundamental principles in this article.

naddr1qvzqqqr4gupzp0rve5f6xtu56djkfkkg7ktr5rtfckpun95rgxaa7futy86npx8yqq247t2dvet9q4tsg4qng36lxe6kc4nftayyy89kua2

Summarized in one sentence, money is a ledger of productive effort with deferred consumption. It represents work someone did for another person, instead of for their own benefit. In a sense, it’s an abstract representation of, or a claim on, the wealth in a society. Having money indicates that you provided value to someone else in the past, and therefore deserve to receive value from someone in the future if you choose to exercise that claim.

Anyone who has money can loan that money to someone. This is a transfer of your claim on wealth to that person. They can then use the money to buy something, and benefit from that loan. But with that type of loan, there is always a tradeoff. The tradeoff is what’s called opportunity cost. While you have the money, you have the option to exercise that claim at any time and buy something you want. If you loan the money to someone, you incur the cost of giving up that option for as long as it takes until the loan is repaid. You already put in the effort to create the wealth that money represents, now you’re sacrificing your opportunity to benefit from that effort by buying something you want.

Bank loans are different. There is no opportunity cost. The bank doesn’t have the money to begin with, because they haven’t put in any effort or created anything of value to deserve it. They just create the money out of thin air. There is no sacrifice on the part of the bank to make that loan possible. They don’t have to forego spending any money to make the loan because the money didn’t exist in the first place.

So when the bank creates money, they’re creating new claims on wealth. Since the bank hasn’t created any wealth, the claims must be claims on wealth that already exists. These new claims have no immediate effect on the people who hold that wealth. Nothing changes for them, the wealth they hold is still theirs as long as they don’t exchange it for money. As long as they don’t sell their wealth, the increase in claims on that wealth changes nothing.

The people who are negatively effected by this increase in money are those who already have money. Since money is a claim on wealth, the value of each unit of money equals \[amount of wealth in existence\] divided by \[amount of money in existence\]. Since the amount of wealth has not changed, but the amount of money has increased, the value of existing money falls. More money spread out over the same amount of wealth means each unit of money will buy less wealth. This is what everyone knows as inflation, and as everyone who has experienced it knows, the money they hold as savings or receive as income becomes less valuable the more inflation occurs.

Who benefits from this? Well, the borrower may benefit in some cases. They receive the newly created money and are able to spend it and acquire wealth they haven’t yet put in the effort to produce. So they get to enjoy unearned rewards now. Also, since it takes time for holders of wealth to realize how much inflation has occurred, they will often exchange their wealth for money at a price lower than the increase in money supply would indicate. So the price of a purchased item will often continue to increase after the borrower acquires it, and they benefit from the increase in prices by paying back their loan with money that is less valuable than it was when they borrowed it. Of course the interest charges negate some of the benefit, but often not all of it, so borrowing money can end up being very beneficial to a borrower in many situations.

The biggest beneficiary is the bank itself. They create the money from nothing, with no opportunity cost or sacrifice necessary. In effect, they are able to use the new money to transfer wealth from holders of wealth to borrowers, at the expense of holders of money. And of course as soon as that transfer is complete, the holders of wealth become new holders of money and begin to suffer the effects of inflation too. Meanwhile the bank requires the borrower to repay the loan, with interest attached.

When an individual makes a loan, the interest charged is payment for the opportunity cost of not being able to enjoy the benefits of spending that money now. However for banks, there is no opportunity cost in making a loan. So the bank receives interest as a reward from the borrower for transferring wealth to them at the expense of holders of money. A kind of sharing of the spoils of theft, if you will. Of course they would never describe it that way, but if you understand what’s actually happening it seems like the only accurate explanation.

So we see who gets rewarded by the banking system, and who gets punished. Those who get rewarded are bankers, who collect interest from loaning out money they didn’t actually have, and are able to enrich themselves by spending that collected interest to purchase real wealth. Sometimes borrowers are also rewarded, meaning the people who consume things they haven’t produced by borrowing the money to buy them get to enjoy immediate gratification, and then over a period of time pay back an amount of money that has lost so much value it would no longer be enough to buy the item they have already been enjoying.

And the people who get punished are those who save and hold money. Those people are the ones who produce value and defer consumption, the ones whose pro-social behavior and delayed gratification make capital formation and modern civilization possible.

The purpose and effect of banking, and creation of new money through bank loans, is to redistribute wealth. The incentive structure means access to wealth is stolen from those with the most socially desirable behavior, the most effective producers and most frugal savers who hold money they’ve earned for future use. The stolen wealth is given to those with the least socially desirable behavior, those who consume more than they produce and live beyond their means, being a net detriment to civilization, and to the parasitic banking class who collect interest as a reward for their theft.

The anti-civilizational outcomes of this perverse incentive structure, and the lie it’s built on (“money in the bank is the same as money in your wallet”) have only become more obvious and harder to ignore over the decades. Without a fundamental change to the basic design and function of the modern financial system, expect this trend to continue.

Forewarned is forearmed.

-

@ 7c765d40:bd121d84

2024-12-03 22:37:00

We have crossed another 1,000 blocks!

Time is flying by.

Seems like just yesterday we were in the 872s.

Today we are talking about some of the opportunities ahead in this crazy world of bitcoin.

Let's start with a little exercise.

Woo hoo - just like in grade school.

Take a pen and paper.

Evernote doesn't count.

Think about the industry you work in.

How could bitcoin improve certain aspects of the industry?

Start writing down some ideas on how bitcoin could shake things up.

If you were having a conversation with someone in the industry about bitcoin, what would you tell them?

Think about your suppliers.

Your customers.

Your marketing strategy.

Your investments.

Your capital expenditures.

Your admin team.

Your payroll.

And don't limit your thinking to be payment related.

Bitcoin changes the payment rails but it also changes the mentality, the efficiency, and the time horizons.

Think about the treasury for businesses within the industry.

The wasted resources.

The decision-making process.

The budgets.

My dad and I were talking about a local business and using their services.

We were going to talk to them about bitcoin and how it could improve the way they do business and get new customers.

But then I thought, why bother?

Both of us are very well-versed in this specific industry AND also have the bitcoin knowledge to implement this without friction.

I spend a lot of time on my daily show talking about how we can help other businesses with bitcoin.

But why wouldn't we just do it ourselves instead?

There will be a time and place for both - but when you can do things just as good but have the bitcoin knowledge, it's a no-brainer.

We need to shift the focus from trying to help everyone else.

We need to realize the opportunity here and make some fucking hay.

I know that goes against the bitcoin way of thinking but it's true.

We have to get a little selfish here if we want some influence in the future.

Something to think about anyways.

And if you’re anything like the fella in the photo, you might even need two pens!

---

PROJECT POTENTIAL - You can now find the expanded audio versions of these on the new podcast - Project Potential! I will be sharing the video versions here for the LITF members but you can also find it for free on Spotify and of course Fountain!

Here is the link to Episode 004 on Fountain: https://fountain.fm/episode/r00ZDxpAdfb7QIQT3TKa

---

Have a great day everyone!

And remember, the only thing more scarce than bitcoin is time!

Jor

-

@ 5af07946:98fca8c4

2024-12-03 16:16:03

Gold was the basis of both the monetary and the measurement systems.

No one knows for sure when gold mining began. Our current estimates are around 4000 BC. That puts it around the same time as Mahabharata. The frequent mentions of gold ornaments among kings and deities and as jewelry among women during the times of the epic, indicate usage of gold as a scarce but in-fashion store of value.

In Mahabharata, there is a clear mention of gold coins being abundantly used. In the fourth book (Viarata Parva), the prince Uttara offered Arjuna (disguised as a transgender named Vrihnnala) a hundred gold coins for saving him (and his bovine wealth) from Kaurvas.

There is evidence of countable units of precious metal being used for exchange from the Vedic period onward. A term Nishka appears in this sense in the Rigveda. A unit called Śatamāna, literally a " hundred standard ", representing 100 krishnalas is mentioned in Satapatha Brahmana. A later commentary on Katyayana Srautasutra explains that a Śatamāna could also be 100 Rattis . A Ratti is the weight equal to seeds of Abrus Precatorius. A hundred of them are almost equal to a Tola that is used for gold trade to date in India. All these units referred to gold currency in some form, though they were later adapted to silver currency.

Barter system was widespread for the smaller transactions. Commoners used fruits and grains to get what they needed. Rich people used copper as a store of value. A one time adult meal was normally considered one copper coin. So was the ride fare. You could hop on and hop off any boat or cart at any place along its route for one copper coin. Super rich used copper for utensils at their home. For them the valuable thing was silver. A silver coin was considered the same as a hundred copper coins. Ultra rich ate their food in Silver utensils. For them the store of value was a gold coin.

A gold coin was equal to a hundred Silver's. The valuation was based on rough order of rigor in mining these metals. Silver was considered hundred times harder to purify than copper, and gold being similar orders of magnitude harder than Silver because of very low yield. In a way "proof of work" was baked in universally acceptable currency.

All states, no matter what their political equations, honored this simple "proof of work" based storage of value. Privacy, self custody and universality were the underpin of trade. Value exchange protocol was owned by people NOT kingdoms though kingdoms could issue coins (currency) aligned to universally accepted methods. It is a well established fact that after the great war of Mahabharta, sixteen main kingdoms (mahapadas) got formed over a couple of centuries. Each one of them issued their own coins, though they were all different shapes or stamps on gold coins. Quarter gold coins (Svarna) are excavated from Gandhara.

Currency was pegged to people's trust in "proof of work". Important point to note here, currency was not pegged to commodities such as iron or wheat. Gold and silver were NOT treated as commodities. Gold's only purpose was value storage and silver was used purely for minting. Copper was primarily used for making utensils for the rich. Copper was supposedly the best metal to store food and water. Eating in silver, though common for the rich, was considered a show-off.

> This simple to understand and time tested system of powers of ten, was later exploited by Aryabhatta to conceptualize zero and decimal system - the very basis of modern arithmetic. The seeds of Abrus precatorius (Ratti) being very consistent were used to weigh gold using a measure where 8 Ratti = 1 Masha; 12 Masha = 1 Tola (12 X 8 = 96 Ratti), or roughly equal to 100 Ratti ( 96 Ratti pure gold and 4 Ratti impurities to solidify the gold). In other words, a Tola's "weight unit" was 100 Ratti while its "price unit" was 96 Ratti. In simple calculations 10 grams (one Tola) of solid gold was worth one kilo of solid silver or hundred kilos of solid copper. Or one Ratti (tiny seed) of gold was equal to one kilo of copper.

The common word used for one Kilo was Ser or Seer- roughly equal to 1.07 kilos in weight units or volume wise roughly equal to one liter. Volume was a preferred way to exchange at a larger scale to weed out as many impurities as possible from molten metals. One Seer is around 80 Tola in weight.

During the days of Mahabharata, a `Tola` was called `Śatamāna` - a Sanskrit word representing the measure of one hundred. And a `Ratti` was called a `Krishnala` - most probably named after `Krishna` the supreme personality of Godhead. In later times of middle eastern empires, a `Tola` was named an `Ashrafi` - The same weight specifications. One Tola of gold - was adopted as Ashrafi - around fourteenth century in Prussia. The weight of an Ashrafi gold coin varies depending on the coin's origin and history:

* Nizam-era gold Ashrafi: A gold Ashrafi coin issued by Nizam VI Mir Mahbub Ali Khan in 1893 CE weighed about 11 grams.

* India-Princely States HYDERABAD Ashrafi : This coin weighed 11.1780 grams and had a fineness of 0.9100.

* Awadh Gold Ashrafi: This coin weighed 10.73 grams and was made of 22-carat gold.

-

@ 472f440f:5669301e

2024-12-03 05:11:52

Uber seed investor and executive producer of the All In podcast Jason Calacanis has been publicly sounding the alarm bell about Microstrategy's bitcoin treasury strategy and the cheer leading exhibited by the company's CEO, Michael Saylor. Calacanis believes that Microstrategy's bitcoin acquisition techniques are a Ponzi scheme waiting to implode. Going as far as to question whether or not Microstrategy is the next FTX.

Earlier today, Jason spent a section of an episode of This Week in Startups to discuss his worries about MSTR's bitcoin treasury strategy, Saylor's overt pumping of the strategy, and the fact that there are other companies like Marathon Holdings beginning to deploy similar convertible debt strategies. While I can see how this can be unnerving for many, I do think there is a fundamental misunderstanding of what Microstrategy is doing. Last week I explained the strategy in a tweet, which I'll reiterate here:

> Whether you like it or not, Saylor and Microstrategy have found a way to give pools of liquidity (particularly pools with mandates to allocate to fixed income) exposure to bitcoin’s volatility via convertible notes. The converts are performing better than any other fixed income product on the market.

Other investors have noticed this and have piled into MSTR as well understanding that demand for the converts will increase and enable Microstrategy to accumulate more bitcoin. Those investors feel comfortable with the premium to mNAV MSTR is trading at because they believe the demand for a high performing fixed income product will remain high and likely increase.

Microstrategy can continue doing this until viable competition comes to market because there is no one else offering this type of bitcoin return exposure to fixed income investors at scale.

Another important detail, the convertible notes have a duration of 5 years or more while bitcoin’s lowest 4-year CAGR is 26% and its 50th percentile 4-year CAGR is 91%. If you think this will continue then this is a pretty safe bet for Microstrategy and the convertible note holders.

In a world were central banks and governments have gone mad with currency debasement and debt expansion it is pretty safe to assume that bitcoin adoption will not only continue but accelerate from here.

What do I think about Microstrategy accumulating this much bitcoin? It makes me a bit uneasy but there’s nothing I can do to stop it and bitcoin will survive in the long run. Even if Microstrategy blows up somehow (I don’t think this is likely). Bitcoin was designed to be anti-fragile.

This is a classic case of “don’t hate the player, hate the game”. Or better yet, join the game. After all, the only winning move is to play.

Essentially, Michael Saylor is taking a long-term bet on bitcoin's continued adoption/monetization and trying to accumulate as much as possible by issuing convertible notes with a 4+ year duration, which should increase the likelihood that Microstrategy is in the black on their bitcoin buys over time as history has shown that anyone who holds bitcoin for more than four years has performed well. This should, in turn, be reflected in their stock price, which should increase alongside bitcoin and convert the debt they've accrued into newly issued shares of MSTR. Through the process, if the strategy is executed successfully, increasing the amount of bitcoin per share for MSTR shareholders. (This is the only metric shareholders should care about in my opinion.)

Yes, this may seem crazy to many and extremely risky to most, but that is the nature of free markets. Every company takes calculated risks in an attempt to increase shareholder value. Michael Saylor and company are betting on the fact that bitcoin will continue to be adopted and are utilizing pools of capital that don't have the ability to buy bitcoin directly, but want exposure to its volatility to achieve their goals. To me it looks like a perfectly symbiotic relationship. Microstrategy is able to accumulate more bitcoin and increase their bitcoin per share while fixed income investors are able to access a product that performs well above their benchmark due to the embedded volatility of the exposure to bitcoin Microstrategy provides.

This won't be a surprise to any of you freaks, but I think it's a pretty smart bet to make. Bitcoin is almost 16-years old. It has established itself as a reserve asset for individuals, companies and countries. A reserve asset that is completely detached from the whims of central planners, transparent, predictable, scarce, and can be transmitted over the Internet. Bitcoin is an idea whose time has come. And more people are beginning to recognize this.

This is one of the beautiful aspects of the public company convertible-note-to-bitcoin strategy that Microstrategy has deployed over the last few years. They are able to harness the benefits of forces that are external to their core business to provide shareholders with value. Michael Saylor could stop buying bitcoin tomorrow and it wouldn't affect bitcoin's adoption in the medium to long-term. He continues to buy bitcoin, and encourages others to do the same, because he recognizes this.

Bitcoin is the apex predator of treasury assets for every individual, company, non-profit or government. The assets competing to be treasury assets are all centrally controlled, easily manipulable, and quickly losing favor. Earlier today, Federal Reserve Board Governor Christopher Waller came out and admitted that inflation is kicking the Fed's ass. They cannot tame it.

Waller may posture by saying that "submission is inevitable", but that doesn't make it true. There is simply too much debt and not enough dollars. The annual interest expense on the US Federal debt is now larger than our spending on national defense. The Fed, whether it wants to admit it or not, is going to have to monetize that debt via the debasement of the dollar. If you are using dollars as a treasury asset it is very important that you understand this and react accordingly by adopting a bitcoin strategy. This is what Michael Saylor is trying to make his peers in public markets understand.

Sure, his marketing tactics may seem a bit uncouth to many and the way in which he's expressing his belief through Microstrategy's accumulation strategy may seem risky, but it's hard to argue that his core thesis is flawed. Especially when you consider the fact that bitcoin has officially climbed to the strata of being seriously considered as a treasury asset for the most powerful nation state in the world.

I listen to the All In podcast quite frequently and genuinely like the show. It is a good way to gain perspective on how Silicon Valley investors view the world. If I were to give Jason any advice it would be to take a step back and to apply one of the most frequently discussed topics of the last on his show, the emergence of AI and the importance of everyone to incorporate AI into their businesses and workflows as quickly as possible before they get left behind. The same mental model applies to the emergence of bitcoin as a dominant reserve asset.

It is imperative that every individual, company and government adopts a bitcoin treasury strategy if they want to be able to succeed moving forward without the inherent resistance that is introduced from storing the fruit of your labor in a money or money-like asset that does not preserve purchasing power over time. Just because Saylor has recognized this, moved aggressively to effectuate his understanding via his company's balance sheet, and vociferously markets the strategy to others doesn't mean he's wrong.

As I said in my tweet last week, I personally prefer to hold actual bitcoin. That doesn't mean that Microstrategy and others haven't honed in on something unique and legitimate given their circumstances and access to certain financial tools.

---

Final thought...

I apologize for the extended hiatus. I hit a hard wall of writer's block over the last month. I think the time away from the keyboard has been good for me and the quality of this rag moving forward.

-

@ a367f9eb:0633efea

2024-12-02 20:49:25

Though Bitcoin was born in the world of computers and code, it was destined to eventually face-off with the legacy banking system.

The first block ever mined on the blockchain, Satoshi’s Genesis block, contained a (then) recent headline from a British newspaper reacting to the 2008/9 financial crisis, inscribing “*The Times 03/Jan/2009 Chancellor on brink of second bailout for banks*”.

As Bitcoin adoption increased from 2009 to 2012, users began exchanging dollars and euros for the digital money, using peer-to-peer exchanges and ATMs and then eventually with business entities acting as full-scale brokerages.

Today, this space is dominated by what we call cryptocurrency exchanges, offering bitcoin and many of its crypto-offspring. On these exchanges, as well as in various custodial solutions, bitcoin is held, bought and sold for traditional currency, and sent to destination wallets.

As these volumes have increased, so has scrutiny from financial authorities and government agencies, defining how this new category of entities exchanging US dollars and bitcoin would be regulated.

###### **The beginning of Bitcoin’s regulatory dance**

In March 2013, the Financial Crimes Enforcement Network (FinCEN), a division of the Treasury Department, updated its [guidance](https://www.fincen.gov/news/news-releases/fincen-issues-guidance-virtual-currencies-and-regulatory-responsibilities) to inform firms that “make a business of exchanging, accepting, and transmitting” virtual currencies would be considered **Money Service Businesses** (MSBs) under the law.

MSBs are distinct from banks and other traditional institutions. This taxonomy usually applies to issuers of travelers checks, check cashing services, and remittance services like Western Union. FinCEN’s guidance, for the first time, applied this to virtual currency services that transmitted funds on behalf of users or offered a fiat on-off ramp.

As an MSB, the law prescribes certain obligations for transaction collection, maintenance, and reporting, as well as identification requirements kept on file, what we call Know Your Customer (KYC) regulations.

The obligations on MSBs [require](https://www.fincen.gov/money-services-business-msb-suspicious-activity-reporting) filing Suspicious Activity reports on all transactions over $2,000 that “do not serve business or apparent lawful purpose” or may otherwise appear to be illegal activity or “structured” so as to try to avoid the spirit of the law.

The specific law that forces these obligations on MSBs, as well as banks, is the **Bank Secrecy Act** of 1970. Though it’s been updated several times over the years, the principal goal of this bill is to partner with banks and financial institutions to try to thwart money laundering and other illicit activity.

###### **BSA and Bitcoin**

The consequences of the BSA and its imposed surveillance have reaped unintended havoc on millions of ordinary Americans. This is especially true for those who have undergone “debanking,” in which bank customers are [deemed](https://www.thomsonreuters.com/en-us/posts/investigation-fraud-and-risk/treasury-de-risking-strategy/) too “high risk” and have accounts closed on them, a function of regulatory pressure – or *jawboning* – faced by financial institutions.

Venture capitalist Marc Andreessen has [provided](https://www.realclearpolitics.com/video/2024/12/01/marc_andreessen_biden_admin_has_been_debanking_politically_exposed_persons_in_privatized_sanctions_regime.html) his own examples of debanking in Silicon Valley, with similar conclusions.

Many Bitcoin and cryptocurrency entrepreneurs have been debanked on the [sole grounds](https://www.axios.com/2024/12/01/debanked-crypto-andreessen-joe-rogan) of being involved in the virtual currency industry, while millions of others have been swept up in the dragnet of the BSA and financial regulators forcibly deputizing banks to cut off customers, often without explanation.

According to FinCEN guidance, financial institutions are [compelled](https://www.fincen.gov/resources/advisories/fincen-advisory-fin-2010-a014) to keep suspicious activity reports confidential, even from customers, or face criminal penalties. This just makes the problems worse.

The [excellent research](https://www.cato.org/policy-analysis/revising-bank-secrecy-act-protect-privacy-deter-criminals) by the team at the Cato Institute’s Center for Monetary and Financial Alternatives provides reams of data on these points. As put by Cato’s **Norbert Michael**, “People get wrapped up in BSA surveillance for simply spending their own money”.

When it comes to bitcoin, the most common understanding for years has been that self-custody options and noncustodial solutions would be exempt from MSB classification, not requiring developers or entrepreneurs to acquire Money Transmission Licenses at either the state or federal level.

FinCEN itself stated this in their guidance [released in 2019](https://www.fincen.gov/sites/default/files/2019-05/FinCEN%20Guidance%20CVC%20FINAL%20508.pdf), and builders developed code based on what the government itself said. In 2023, however, the US Attorneys in the Southern District of New York and the FBI took a different stance.

Beginning with the Ethereum smart contract platform **Tornado Cash**, and then the popular privacy service **Samourai Wallet**, the developers of these projects were [arrested](https://www.justice.gov/usao-sdny/pr/tornado-cash-founders-charged-money-laundering-and-sanctions-violations) and [charged](https://www.justice.gov/usao-sdny/pr/founders-and-ceo-cryptocurrency-mixing-service-arrested-and-charged-money-laundering) with a number of conspiracy and money laundering charges, as well as “conspiracy to operate an unlicensed money transmitting business”. It’s that latter charge that remains the most important to sovereign and noncustodial use of bitcoin going forward.

Though both of these projects are noncustodial by design, and never took control of anyone’s bitcoin or cryptocurrency private keys, the government has charged them with being money service businesses and failing to adhere to the law.

Neither of these trials have yet taken place, but considering the money transmission charges, it stands to reason that anyone advocating for noncustodial bitcoin tools should be worried.

*If you’re interested in donating to the legal defense teams in both of these cases, check out the [**P2P Rights Fund**](https://p2prights.org/).*

If these are the steps law enforcement is willing to take against noncustodial protocols and projects even legal experts determined were out of the scope of MSBs, what about bitcoin exchanges and brokerages?

While we know there is no carve out at the moment, there are some important reforms that could empower entrepreneurs and give more options to Bitcoin users.

###### **An update to BSA would be a powerful reform for Bitcoin**

While we would hope that the majority of people using Bitcoin will practice [self-custody](https://www.btcpolicy.org/articles/self-custody-is-nonnegotiable), which is one of the key advantages of using Satoshi’s innovation, we know that most will not.

Instead, custodial services and exchanges will provide a lot of functionality for users, meaning that more and more Bitcoin activity will fall under the auspices of the Bank Secrecy Act.

One bill that aims to peel back the layers of banking law to restore some measure of financial privacy is the [**Saving Privacy Act**](https://www.lee.senate.gov/2024/9/lee-introduces-the-saving-privacy-act-to-protect-americans-financial-data), introduced by Sens. Mike Lee (R-UT) and Rick Scott (R-FL).

The proposed law aims to maintain the record keeping of financial institutions and money service businesses, but would do away with the automatic reporting limits and requirements without judicial warrants among other important reforms.

It would also ban a Central Bank Digital Currency, [repeal](https://www.therage.co/corporate-transparency-act-privacy-at-risk/) the **Corporate Transparency Act**, scale back the audit powers of the SEC, require Congressional approval for any ID database of Americans, severely punish any government employee who abuses private financial information, and grant a private right of action to any citizen or firm harmed by illicit government activity on financial matters.

It is a beefy bill with aspirational goals to restore consumer financial privacy, and it would no doubt make it much easier for Bitcoin tools and exchanges to operate within the law.

With less of a reporting requirement for custodial bitcoin solutions classified as Money Service Businesses – while still maintaining record keeping – it would be a much more natural balance of innovation and regulatory certainty.

By scaling back the financial surveillance required of banks and all other financial institutions, it is clear that Bitcoin users would benefit.

If there is enough appetite for this bill among various Senators and in the House of Representatives, however, is anyone’s guess. But the issues of our current banking system and its relation to Bitcoin are clear and this is a worthy attempt.

While there are still many regulatory changes needed to fully unleash the sovereign money revolution promised by Bitcoin, we can have some hope that the right ideas are being discussed in the corridors of power. At least for now.

*Originally published on the [website](https://www.btcpolicy.org/articles/downgrading-the-bank-secrecy-act-is-a-powerful-reform-for-bitcoin) of the **Bitcoin Policy Institute**.*

-

@ c4b5369a:b812dbd6

2024-12-01 16:19:21

[Ecash systems](https://en.wikipedia.org/wiki/Ecash) built on top of bitcoin have seen increasing adoption over the last couple of years. They have become a polarising topic in the bitcoin community, due to their centralized and custodial nature. Like any system, ecash comes with a lot of pros and cons when compared to other systems, that are fercely debated in cyber- and meat-space.

I have been working on developing tools and software for the ecash implementation [Cashu](https://cashu.space/) for about 2 years now. I have had countless discussions with various people from different backgrounds about the topic. OG bitcoiners, fiat bankers, friends and family, privacy enthusiast... . As you can imagine the flow and outcome of these discussions varied widely.

Usually, conversations with bitcoiners were the most interesting for me. Their opinions about ecash polarised the most, by far. (excluding the fiat bankers, but that's a story for another day). In this short peice, I want to share some insights from the discussions I had, and maybe clear up some misconceptions about ecash on bitcoin.

### What is Ecash?

If you still don't know what ecash is, sorry, I won't go into much detail explaining it. I recommend reading the [wikipedia article on Ecash](https://en.wikipedia.org/wiki/Ecash) , and then [this article](https://cryptome.org/jya/digicrash.htm) on the rise and fall of digicash, the first and maybe only ecash company that existed. This will bring you up to speed on ecash history up until bitcoin entered the scene. Ecash was pretty much dead from the day after digicash went bankrupt untill it recently saw it's revival in two different spheres:

One of these spheres is obviously the **bitcoin sphere**. Here, ecash got reintroduced with the two open source projects [Fedimint](https://fedimint.org) and [Cashu](https://cashu.space/). In my opinion, the main reason for this revival is the following fact: Unlike an implementation of ecash in the fiat world, that would rely on the permissioned system to "allow" something like ecash to exist, bitcoin does not come with that limitation. The permissionless nature of bitcoin allows for these protocols to exist and interoperate with the existing bitcoin stack.

The second, and maybe lesser known sphere is the revival of **ecash as a CBDC.** Bitcoiners might get scared at the mentioning of that word. Trust me, I don't like it either. Nonetheless, privacy enthusiasts see the opportunity to steer the CBDC-ship in another direction, by using an underlying technology for them that would limit targeted discrimination by the centralized authorithy. Something that works like cash... but in cyberspace... Ecash. One such implementation is [GNU Taler](https://taler.net/en/), another one is [Project Tourbillon](https://www.bis.org/about/bisih/topics/cbdc/tourbillon.htm). Usually, these kind of implementations use a cuck-version of the OG ecash, where only payers are anonymous, but not payees.

Anyway, in this article we will focus on the implementation of **ecash on bitcoin**.

## About self custody

Bitcoin as a whole is about sovereignty and liberation. **If someone else controls your money, they control you**. For the first time since we've stopped using gold, bitcoin allows us to fully take control back of our money. A money that doesn't corrode, a money which supply connot get inflated, and a money that cannot be easily seized. All of this is true for bitcoin. There is only one precondition: **You have to hold and use it self custodially**.

### Using bitcoin self custodially

The problem comes in when using bitcoin in a self custodial fashion. For bitcoin to maintain the monetary properties mentioned above, it has to remain decentralized. This means it is hard to scale, which in turn means the use of bitcoin tends to become more costly as usage increases.

So even if we wish that everyone would use bitcoin self custodially all the time for everything, I fear it is mostly just a dream, at least for the forseable future. Even with trustless second layer protocols like the [Lightning Network](https://en.wikipedia.org/wiki/Lightning_Network), we are running into scaling issues, since at the end of the day, they are bound to the same onchain fee realities as bare-bones bitcoin transactions.

For most of humanity, it is financially not viable to pay even 1$ transaction fees for **every** transaction. Second layer protocol may bring the cost down a bit, but have other requirements. For example in lightning, you have an online assumption, to make sure your channel peers aren't trying to cheat. You need to have inbound liquidity to receive payments. There are cost associated with opening or closing payment channels, or rebalancing liquidity.

Other upcoming second layer protocols like [Ark](https://arklabs.to/) may improve on some of these issues. It is definitely something to look forward to! But they will have their own trade-offs, most likely also cost related. The fact remains that all trustless protocols that use the bitcoin timechain for conflict resolution, will have to deal with this matter. This is the cost of trustlessness.

### Soo... Don't self custody...?

**NO! If you can, you should always use self custody. As much as possible!**

Personally, I use all the tools mentioned above. And I recommend that if you can, you should too.

But the fact is, not everyone can. Many would love to take control over their financial freedom, but the threshold for them to use bitcoin in a sovereign fashion is simply to high. So they will either remain in fiat slavery land, or they will end up using "bitcoin" through a custodian like coinbase, binance, or whatever banking service they have access to.

I will also mention that for some usecases, enjoying the convenience of a custodian is just very attractive. Of course, this is only the case as long as the custodian plays by the book, and doesn't suddenly freeze-, or worse, run away with your deposits.

### The right tool for the right job

I don't beleive that one way of using bitcoin is better than the other. It entirely depends on which problem you are trying to solve.

If the problem is storing or transfering wealth, then of course you would want to do that on chain.

If on the other hand, you want to send and receive frequent small to midsized payments, you might want to get setup with a lightning channel to an LSP. Depending on how deep you want to get involved, you may even set up some infrastructure and become part of the Lightning network.

If you want to receive digital tips that you can later claim into self custody after they reach a certain threshold, you might opt for a custodial solution.

If you require certain properties, like offline peer-to-peer transferability, or cash-like privacy, you might choose an ecash system.

It doesn't mean that if you use one, you cannot use the other. You should use whatever is useful for the current problem you are trying to solve, maybe even using multiple tools in conjuction, if that makes sense.

## Ecash vs Onchain vs L2?

First of all, we have to understand that ecash is neither a replacement for self custody, nor is it a replacement for trustless second layer protocols. They are irreplaceable with something that is custodial in nature, due to the simple fact that **if you lose control over your money, you have lost the control over your life**.

So. No one beleives you should prioritize custodial solutions to secure your wealth. Self custody will always remain king in that regard. Custodial wallets should be thought off as a physical spending wallet you can walk around with, even through the dark alleyways where it might get robbed from you. Keep your cash in there for convenient spending, not worrying about fees, liquidity, data footprints, channel backups, etc. etc. etc... These benefits obviously come at the cost of trust, that the provider doesn't rug-pull your deposit.

I really like the user experience of custodial services. I would never put a lot of money into any one of them though, because I don't trust them. Just like I wouldn't walk around with $10000 in my physical wallet. The risk that it gets stolen is simply to great. At the same time, this risk doesn't mean I will get rid of my physical wallet. I think having a wallet with some cash in it is super useful. I will mittigate the risk by reducing the amount I carry inside that wallet. This is the same way I think about digital money I hold in custodial wallets, be it an ecash service or others.

All things considered, it is hard to argue that self custody comes even close to the UX a custodian can give you, due to the fact that they can take care of all the complexities (mentioned above) for you.

## So then, why ecash?

We now know, that we are **NOT** comparing ecash with the sovereign bitcoin stack. We are comparing it instead to traditional custodial systems. This is the area ecash is trying to improve uppon. **So if you've chosen that the best tool to solve a problem might be a custodial solution, only then should you start to consider using ecash.**

It offers a more privacy preserving, less burdonsome and less censorable way of offering a custody solution.

It offers some neat properties like offline peer-to-peer transactions, programability, de-linkage from personally identifiable information, and more.

**Here is an example, on how ecash could create a fairer environment for online consumers:**

Online services love to offer subscriptions. But for the consumer, this is mostly a trap. As a consumer, I would rather pay for a service right now and be done with it. I don't want to sign up for a 10 year plan, give them my email address, my date of birth , create an account, etc...

One way of doing that, would be for the service provider to accept payments in ecash, instead of having an account and subscription model.

It would work like this:

1. The user creates ecash by paying into the service's mint. Hereby it is not required to use lightning or even bitcoin. It could be done with any other value transfer meduim the service provider accepts (cash, shitcoins, lottery tickets...).

2. You use the issued ecash, to retreive services. This could be anything from video streaming, to AI prompts.

3. Once you are done, you swap your remaining ecash back.

In a system like this, you wouldn't be tracked as a user, and the service provider wouldn't be burdoned with safeguarding your personal information. Just like a cash-for-goods transaction in a convenience store.

I beleive the search engine Kagi is building a system like that, according to [this podcast](https://optoutpod.com/episodes/how-kagi-is-fixing-search-vlad-prelovac/). It has also be demoed by <https://athenut.com/> how it would be implemented, using Cashu.

**Here is another example, on how an event organizer can provide privacy preserving electronic payment rails for a conference or a festival, using ecash:**

If you have been part of organizing a conference or an event, you might have experienced this problem. Onchain payments are too slow and costly. Lightning payments are too flaky.

Do merchants have to setup a lightning channel? Do they have to request inbound liquidity from an LSP? Do they have to splice into the channel once they run out of liquidity? In practice, these are the realities that merchants and event organizers are faced with when they try to set up payment rails for a conference.

Using ecash, it would look like this:

1. Event organizer will run a dedicated ecash mint for the event.

2. Visitors can swap into ecash when ariving at the entrance, using bitcoin, cash, or whatever medium the organizer accepts.

3. The visitor can spend the ecash freely at the merchants. He enjoys good privacy, like with cash. The online requirements are minimal, so it works well in a setting where connectivity is not great.

4. At the end of the event, visitors and merchants swap their ecash back into the preferred medium (cash, bitcoin...).

This would dreastically reduce the complexity and requirements for merchants, while improving the privacy of the visitors.

**A bold experiment: Free banking in the digital age**

Most bitcoiners will run out of the room screaming, if they hear the word **bank**. And fair enough, I don't like them either. I believe in the mantra "unbank the banked", after all. But the reason I do so, is because todays fiat/investment banks just suck. It's the same problem as with the internet platforms today. You, the "customer", is not realy the customer anymore, but the product. You get sold and squeezed, until you have nothing more to give.

I beleive with a sound money basis, these new kind of free banks could once again compete for customers by provididng the best money services they can, and not by who can scam his way to the money printer the best. Maybe this is just a pipe dream. But we all dream a little. Some dream about unlimited onchain transactions (I've had this dream before), and some dream about free banks in cyberspace. In my dream, these banks would use ecash to respect their users privacy.

## Clearing up misconceptions and flawed assumptions about ecash on bitcoin

Not only, but especially when talking with bitcoiners there are a lot of assumptions regarding ecash on bitcoin. I want to take this opportunity to address some of those.

### Ecash is an attack on self custody

As we've mentioned above, ecash is not meant to compete with self custody. It is meant to go where self custodial bitcoin cannot go. Be it due to on-chain limitations, or network/infrastructure requirements. Ecash is completely detached from bitcoin, and can never compete with the trustless properties that only bitcoin can offer.

### Ecash mints will get rugged

100% correct. Every custodial solution, be it multisig or not, will suffer from this risk. It is part of the deal. Act accordingly. Plan for this risk when choosing to use a custodial system.

### Working on ecash is a distraction from what really matters, since it is not self custodial

While it is true that improving self custodial bitcoin is one of the most important things our generation will have to solve, it doesn't mean that everything else becomes irrelevant. We see that today, in a lot of circumstances a fully sovereign setup is just not realistic. At which point most users will revert back to custodial solutions. Having technology in place for users that face these circumstances, to offer them at least some protection are worth the effort, in my opinion.

### Ecash mints will retroactively introduce KYC

Yes it is true that ecash mints can do that. However, what would they learn? They would learn about the amount you were holding in the mint at that time, should you choose to withdraw. They would not be able to learn anything about your past transactions. And needless to say, at which point you should be one and done with this mint as a service provider, and move to someone that respects their users.

### Ecash will be used to "steal" bitcoins self custodial user base

I would argue the oposite. Someone that has realized the power of self custody, would never give it up willingly. On the other hand, someone that got rugged by an ecash mint will forever become a self custody maximalist.

## Closing thoughts...

I hope you enjoyed reading my take on **ecash built on bitcoin**. I beleive it has massive potential, and creators, service providers and consumers can benefit massively from ecash's proposition. Using ecash doesn't mean you reject self custody. It means you have realized that there is more tools than just a hammer, and you intend to use the tool that can best solve the problem at hand. This also means, that to some the tool "ecash" may be useless. After all, not everyone is a carpenter. This is also fine. Use whatever you think is useful, and don't let people tell you otherwise.

Also, please don't take my word for it. Think for yourself.

Best,

Gandlaf

-

@ 7e6f9018:a6bbbce5

2024-11-29 20:52:13

The whole island of Mallorca is filled with tourist spots, but it can be divided into four main types of areas:

1. **Major hotel areas**. These are coastal villages predominantly filled with hotels, which create a vibrant atmosphere during the summer, with plenty of restaurants, bars, and other summer-oriented businesses.

2. **Minor hotel areas**. These are coastal villages, mainly populated by hotels as well, but they are smaller and, therefore, quieter and more relaxing. While there are some restaurants, bars, and other summer-oriented businesses, the offerings are not comparable to those in the major hotel areas.

3. **Vacation rental areas**. These are coastal villages with virtually no hotels; the accommodations primarily consist of vacation rentals. There are only a few restaurants and bars in the village, with limited options beyond that. However, they offer the quietest and most relaxing experience.

4. **Inland areas**. These consist of the Tramuntana mountain region and the rural countryside, typically featuring a balanced mix of small hotels and vacation rentals. The availability of restaurants, bars, and other summer-oriented businesses is decent but not huge, so having a car or a transportation plan may be necessary.

**Important note**: Almost all of these areas are "dead" from November to April, as 80% of businesses are closed and only operate from May to October. If you are visiting from November to April, consider how this can affect your travel plans, and maybe opt for cities that are still populated by residents, such as Palma, Sóller, Pollença, and Alcúdia.

In the following map you can see the **Major hotel areas** (in black numbers) and the **Minor hotel areas** (in purple letters).

*Map of Hotels, each black dot is a hotel.*

The major hotel areas are as follows:

| | Major hotel areas | | Major hotel areas |

|---|---------------------------------------------------|---|-------------------------------------------------------|

| 1 | S'Arenal | 14 | Port de Sóller |

| 2 | Can Pastilla | 15 | Sóller |

| 3 | Ciutat de Palma | 16 | Port de Pollença |

| 4 | Port de Palma | 17 | Port d'Alcúdia |

| 5 | Cala Major | 18 | Platja de Muro |

| 6 | Illetes | 19 | Can Picafort |

| 7 | Portals Nous | 20 | Cala Ratjada |

| 8 | Palmanova | 21 | Cala Millor |

| 9 | Magaluf | 22 | Sa Coma |

| 10 | Santa Ponça | 23 | Cales de Mallorca |

| 11 | Peguera | 24 | Portocolom |

| 12 | Camp de Mar | 25 | Cala d'Or |

| 13 | Port d'Andratx | 26 | Colònia de Sant Jordi |

The minor hotel areas are as follows:

| | Minor hotel areas | | Minor hotel areas |

|---|-------------------------------|---|------------------------|

| a | Cala Gamba / Es Coll d'en Rabassa | h | Canyamel |

| b | El Molinar / Es Portitxol | i | Portocristo |

| c | Cala Vinyes | j | Cala Mendia and Cala Magrana |

| d | Cala Fornells | k | Cala Romàntica |

| e | Sant Elm | l | Portopetro |

| f | Cala Sant Vicenç | m | Cala Mondragó / Barca trencada |

| g | Cala Mesquida | n | Cala Figuera |

If you still want to be in a coastal area but prefer to escape the livelier areas and seek a quiet, low-density spot (with both its advantages and disadvantages), the following map highlights the main **vacation rental** areas.

*Map of vacation rental, each red dot is a rental house.*

The main vacation rental areas are as follows:

| | Main vacation rentals | | Main vacation rentals |

|---|----------------------------------|---|--------------------------|

| 1 | Badia Gran | 6 | Betlem |

| 2 | Cala Pi and Vallgornera | 7 | Colònia de Sant Pere |

| 3 | Sa Ràpita | 8 | Son Serra de Marina |

| 4 | Cala Llombards and Cala Santanyí | 9 | Bonaire and Es Mal Pas |

| 5 | Costa dels pins | 10 | Pollença outskirts |

If you don't mind staying in coastal areas, you could opt for **inland areas**. There are accommodations throughout the entire island, allowing you to choose a location that suits your preferences (goal and budget).

*Map of inland areas. Each black dot is a hotel, each red dot is a vacation rental.*

The most popular villages, and its outskirts, are as follows:

| | Inland areas | | Inland areas |

|---|----------------------------------|---|--------------------------|

| 1 | Artà | 6 | Alaró |

| 2 | Sineu | 7 | Fornalutx |

| 3 | Llubí | 8 | Deià |

| 4 | Sa Pobla | 9 | Valldemossa |

| 5 | Selva | 10 | Puigpunyent |

-

@ 45904b28:c412c1b4

2024-11-29 04:22:44

`draft` `optional`

This proposed NIP introduces hierarchical key management for Nostr, enabling users to create subordinate private keys (`nsub`) derived from the master private key (`nsec`). Events signed by `nsub` keys are cryptographically tied to the same public key (`npub`), ensuring compatibility with the current protocol. The model introduces a delegation proof mechanism, enabling secure delegation and revocation of signing authority to subordinate keys without compromising the master key. This design improves account security, simplifies key recovery, and supports scalable multi-client or multi-user scenarios.

---

## Problem Description

Current Nostr key management relies on a single private key (`nsec`) to authenticate and sign all user events. While this design ensures simplicity, it introduces critical vulnerabilities that can compromise account security and usability. If the `nsec` is exposed — whether through user error, malicious software, or insecure client storage — the account is effectively "burned", and recovery is impossible, forcing abandonment of the associated `npub`. This leads to significant problems:

1. **Account Compromise**:

- A compromised `nsec` allows an attacker to impersonate the user, post malicious events, or delete existing events.

- Once leaked, there is no way to revoke access or mitigate damage, as the `nsec` cannot be invalidated or replaced.

2. **Usability Issues**:

- Users must distribute their `nsec` to multiple clients or devices, increasing the risk of compromise.

- High-value accounts (e.g., organizations, influencers, or businesses) require secure, multi-device setups, but the single-key model cannot adequately support this without significant risk.

3. **Loss of Followers and Content**:

- When an `nsec` is compromised, users often abandon their `npub`, losing all followers, social connections, and previously signed content.

- Migrating to a new account is disruptive and diminishes the user experience, especially for high-profile or corporate accounts.

---

## Proposed Use-case Solution

This proposal seeks to resolve the issues described above by introducing a hierarchical key system with subordinate keys, the `nsub`, and revokable delegation proofs with an optional expiry. This model allows users to:

- Securely distribute unlimited subordinate keys to team members, client applications or tracked devices.

- Revoke compromised or retired keys without abandoning the `npub` account with valuable follower and content connections.

- Support high-value, multi-device, or multi-user scenarios.

This hierarchical model aligns with Nostr’s decentralization principles by reducing reliance on centralized recovery mechanisms while maintaining user control and flexibility.

---

## Specification

### Key Hierarchy

1. **Master Private Key:** `nsec`:

- Root key for generating and managing subordinate keys.

- Must remain secure and offline where possible.

2. **Subordinate Private Keys:** `nsub`

- Deterministically derived from the master private key using a hierarchical deterministic (HD) method (e.g., BIP-32 HD Wallet principles).

- Each `nsub` is associated with a unique path or purpose (e.g., per client or per device).

- Delegation proofs bind each `nsub` to the master `nsec`.

3. **Public Key:** `npub`

- Remains unchanged for the user and maps to all subordinate keys.

---

### Delegation Proofs

Delegation proofs authorize subordinate keys (`nsub`) to sign events on behalf of the master key (`nsec`).

#### Format:

```json

{

"delegator_pubkey": "<master_npub>",

"delegatee_pubkey": "<subordinate_public_key>",

"conditions": {

"event_kinds": [1, 0],

"expiration": "<expiration_timestamp>"

},

"purpose": "Client authentication for mobile device",

"version": 1,

"signature": "<signed_by_nsec>"

}

```

### Fields

- **delegator_pubkey**: The public key of the master key.

- **delegatee_pubkey**: The public key of the subordinate key.

- **conditions**: Restrictions for the subordinate key.

- **event_kinds**: Defines the kinds of events the `nsub` can sign.

- **expiration**: Optional expiration timestamp for the delegation proof.

- **purpose**: Context for the delegation proof (optional).

- **version**: Version number to ensure future extensibility.

- **signature**: Cryptographic signature of the delegation proof generated by the `nsec`.

---

### Event Kind Declarations and Clarifications

To implement hierarchical key management effectively, this NIP introduces two new event kinds: **Delegation Proof Event** and **Revocation Event**. These event kinds are critical to ensuring secure delegation and revocation processes within the Nostr protocol.

#### **Event Kind:** Delegation Proof (kind: 30080)

**Purpose:** Establishes the relationship between the master key (nsec) and subordinate keys (nsub). It sets conditions such as permissions and expiration for the subordinate key’s actions.

Format:

```json

{

"delegator_pubkey": "<master_npub>",

"delegatee_pubkey": "<subordinate_public_key>",

"conditions": {

"event_kinds": [1, 0],

"expiration": "<expiration_timestamp>"

},

"purpose": "Client authentication for mobile device",

"version": 1,

"signature": "<signed_by_nsec>"

}

```

Key Points:

- Cryptographically ties the subordinate key to the master key.

- Specifies conditions like event kinds and expiration to limit the subordinate key’s usage.

- Enables scalable setups for multi-device or multi-user accounts.

#### **Event Kind:** Revocation Event (kind: 30081)

**Purpose:** Allows the master key (nsec) to revoke a subordinate key (nsub), invalidating its signing authority and ensuring account security.

Format:

```json

{

"npub": "<master_npub>",

"revoke_nsub": "<subordinate_public_key>",

"reason": "Key compromised",

"timestamp": "<timestamp>",

"expiration": "<optional_expiration_timestamp>",

"signature": "<signed_by_nsec>"

}

```

Key Points:

- Relays must reject events signed by revoked keys.

- Enables temporary suspensions through the optional expiration field.

- Provides clear reasons for revocation (e.g., key_compromised, expired).

#### Format:

```json

{

"npub": "<master_npub>",

"revoke_nsub": "<subordinate_public_key>",

"reason": "Key compromised",

"timestamp": "<timestamp>",

"expiration": "<optional_expiration_timestamp>",

"signature": "<signed_by_nsec>"

}

```

### Functionality

- **Relays**: Must reject events signed by revoked keys.

- **Clients**: Should mark affected events as invalid or untrusted.

---

### Benefits

- **Enumerated Reasons**: Provides clear context for revocation (`key_compromised`, `expired`, etc.).

- **Temporary Suspensions**: Optional expiration field supports time-bound revocations.

---

### Use Cases

1. **Revoking a Compromised Client Key**:\

A user revokes a compromised `nsub` key and prevents further misuse while maintaining account integrity.

2. **Multi-Device Security**:\

Each device is issued its own `nsub`, isolating risk and ensuring independent security.

3. **Corporate Account Management**:\

Team members use individual `nsub` keys for controlled access. Revoked keys do not affect the entire account.

4. **Mitigating Accidental Exposure**:\

An exposed `nsub` can be revoked while other keys remain valid, reducing the risk of total compromise.

5. **High-Value Accounts**:\

Influencers and organizations can recover from partial compromises without disrupting their presence.

---

## Relay and Client Implementation

### Relay Optimization

To enhance relay performance while supporting delegation proofs and revocation events, two complementary optimization approaches are proposed:

#### **1. Caching Validated Proofs**

- **Description**: Relays cache validated delegation proofs to minimize repetitive cryptographic checks.

- **Implementation**:

- Cache structure stores mappings of `delegatee_pubkey` to their validated conditions (e.g., expiration timestamps, event kinds).

- Example cache entry:

```json